UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22894

INVESTMENT MANAGERS SERIES TRUST II

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

(626) 385-5777

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: September 30, 2021

Item 1. Report to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

AXS All Terrain Opportunity Fund

(Institutional Class: TERIX)

AXS Merger Fund

(Investor Class: GAKAX)

(Class I: GAKIX)

AXS Alternative Value Fund

(Investor Class: COGLX)

(Class I: COGVX)

AXS Market Neutral Fund

(Investor Class: COGMX)

(Class I: COGIX)

ANNUAL REPORT

SEPTEMBER 30, 2021

AXS Funds

Each a series of Investment Managers Series Trust II

Table of Contents

| Shareholder Letters | 1 |

| Fund Performance | 11 |

| Schedule of Investments | 19 |

| Statements of Assets and Liabilities | 44 |

| Statements of Operations | 48 |

| Statements of Changes in Net Assets | 50 |

| Statement of Cash Flows | 54 |

| Financial Highlights | 56 |

| Notes to Financial Statements | 64 |

| Report of Independent Registered Public Accounting Firm | 83 |

| Supplemental Information | 85 |

| Expense Examples | 89 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the AXS Funds. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

www.axsinvestments.com

AXS All Terrain Opportunity Fund Annual Report

Dear Fellow Shareholders,

Over the last year, as of September 30th 2021, the AXS All Terrain Opportunity Fund’s Institutional Class shares returned 3.68% while the HFRX Global Hedge Fund Index was up 8.87 %. The AXS All Terrain Opportunity Fund underperformed its respective benchmark due to lower exposure to risk assets over the course of the year.

Another Year of Historic Market Conditions & Events

Since the pandemic began, equity markets have been very volatile but have since recovered all the losses from the collapse experienced in 2020. While equity markets have recovered, the coronavirus pandemic continues to have negative impacts causing major disruptions globally. The big Central Banks - the Federal Reserve (Fed), European Central Bank (ECB), Bank of England and Bank of Japan (BOJ) - amassed $25.8 trillion dollars in total assets, a new record high. The Fed Balance Sheet equates to a whopping 37.8% of the total U.S. Gross Domestic Product (GDP), up from 33.5% a year ago. The ECB is now up to 69.7% of GDP, up from 56% a year ago. Many are wondering how this fiat money printing experiment will end and what kind of repercussions it will have on future generations. Accordingly, we believe that a tactical "All Terrain" strategy makes sense for this uncertain global environment.

Equity Strategy

Our disciplined VERT process combines Valuations, Economic data, Risk indicators, and Trends, and drives our portfolio allocation. We evaluate global equity markets on an ongoing basis across the world in order to rotate the portfolio according to our unique process. When economic data and trends are deteriorating, the AXS All Terrain Opportunity Fund reduces exposure to equities to potentially preserve capital for investors. In the opposite scenario, when the data is improving and leading indicators are strong, the Fund will allocate more capital to equities and other “risk on” asset classes. Our forecast for equity returns (Valuations) on the U.S. indices remains very anemic with approximate 5% annualized returns for the foreseeable future. However, equity markets continue to make new highs on a sea of fiat currencies.

The Fund’s position in SPY (SPDR S&P 500 ETF) has performed well year to date. The S&P 500 returned 15% as of 9/30/2021, and continues to outperform most other global markets during this economic boom since 2009. We are strong believers in efficient markets when equity markets are trending higher, which allows us to capture the rotations of the market as style shifts have been dramatic in 2021 thus far while not missing out on the constant evolving dynamics of the market.

The Fund also had a position in the Nasdaq 100 ETF (QQQ) that boosted fund performance over the last year. We continue to think that mega-cap technology companies will continue to perform as we move forward beyond the pandemic. Mega Cap technology companies have been the main driver of overall earnings growth for the major indexes over the last 5+ years. The pandemic accelerated the usage of online businesses while brick and mortar retail shops continue to struggle.

In September 2021 technology stocks were hit hard when the market rolled over. We had some positions in the technology sector during the month of September that were impacted by the correction. This caused the overall portfolio to have a larger than normal drawdown, giving back a good portion of the gains for the year. The Morgan Stanley Insight Fund (CPODX) and WCM Focused International Growth (WCMIX) have heavier weightings in growth stocks that suffered more than the overall market during the drawdown in September.

Fixed Income Strategy

Valuations play a large role in the determining which securities are selected for the asset allocation breakdown of the AXS All Terrain Opportunity Fund. As mentioned in the equity section, we anticipate lower than normal equity returns on a forward-looking basis, which directly affects how the portfolio is positioned overall. For this reason, the tactical fixed income allocation in the AXS All Terrain Opportunity Fund has at times remained a significant portion of the Fund’s assets as well as cash. We monitor our bond fund managers by having conference calls to make sure the funds are adhering to the objectives we are looking to achieve. A fund will be sold immediately if we notice any signs of the managers deviating from our outlook. We will also exit the position accordingly if we see any signs of credit contagion spreading and/or the fixed income market breaking down.

One of our best overall performing positions for the Fund in 2021 was our exposure to CLMVX (Columbia Mortgage Opportunities Fund). The fund performed extremely well as interest rates moved higher. The portfolio was positioned for higher rates generating over 6% in the first quarter of 2021. We took profits in the position as interest rates have remained range bound since the first quarter.

Pimco Mortgage Opportunities (PMZIX) was a core position for the AXS All Terrain Opportunity Fund in 2021. Pimco Mortgage has done a great job managing duration and has significantly outperformed the Barclays Aggregate Index over the last year. However, we have pared back our position in the security as we believe interest rates may be forced higher as the Fed begins to tighten in 2022.

The Fund also owns Pimco Income (PIMIX), which has always been one of our core holdings throughout the Fund’s history. PIMIX does a nice job managing duration and looks for tactical opportunities in the bond market when they present themselves. PIMIX has outperformed the Barclays Aggregate over the last year due to its exposure in Non-agency MBS and high yield corporate credit.

The Fund also maintained roughly a 30% cash position at the end of 9/30/2021. We are looking for opportunities that fit our risk profile as we think most fixed income assets are overvalued at this point and are waiting for an overshoot in the overall financial markets.

Positioning and Outlook

Our current view of the global economy remains “cautiously optimistic,” as global tensions are increasingly becoming more unstable. The Federal Reserve looks to be moving towards a more restrictive policy stance as inflation is roaring out of control due to the pandemic related supply chain disruptions and higher oil and gas prices resulting from bad choices coming out of Washington. We believe the side effects of these policies will likely continue to drive investors towards risk assets as investors are being forced to go further out on the risk curve to attempt to generate performance. High quality government securities globally are already negative yielding when factoring in inflation and they continue to push further in to negative territory. The only way we think developed governments will continue to sustain growth is to continue to ramp fiscal deficits to fund economic growth. With global debt to GDP stretched to extreme limits, sovereign bonds, investment grade credit and junk bonds collectively are the most over-valued in history. In addition, many believe equities valuations are also stretched, banking on uncertain future growth.

The Federal Reserve and fiscal powers may appear for now to have come to the rescue of financial markets during the Covid-19 recession, but they have only upped the ante on the imbalances and risks they have allowed to build. In this context, we believe that low interest rates equate to anything but low risk. From a valuation standpoint, in our analysis, the risks presented by US financial asset bubbles today are perhaps the highest in history. Easy money creates financial asset bubbles, and bubbles eventually burst and lead to financial crises.

We are also concerned that growing risks to financial markets could be future inflationary pressures. We are not ruling out stagflation either as global growth may be stagnant or slow to come back in certain areas during this recovery, with zombie companies risking financial aftershocks and industries being decimated by competing new technologies. In addition, significant currency debasement will continue at warp speed as governments try to spend their way out of this global pandemic and amass huge debt, which will not be serviceable if interest rates move higher for the wrong reasons in the future. The global economy is recalibrating from a single-minded focus on cost efficiency and short-term profitability to a system that puts equal weight on long-term resilience.

We have been extremely optimistic on the U.S. housing market long term and continue to believe this is one area that has the potential for tremendous growth for the U.S economy over the next decade. New homes sold are at the highest level in over a decade as people are bailing out of the densely populated cities. COVID has permanently changed the landscape of business and we think companies will continue to let their workforce work remotely as companies realize their workforce can be just as efficient and effective without spending money on leases and lost time commuting. This is our current view on some major drivers that should be very important factors when looking forward. Our proprietary models are projecting lower than expected equity returns in the near future due to overvalued equity markets in the U.S. While these levels are overvalued at the current time, we think there is no other alternative for investors as bond yields are at record lows across the globe. We continue to monitor the situation in global markets as valuations abroad are becoming more attractive on a relative basis to the United States. As market conditions change, the AXS All Terrain Opportunity Fund will adapt and change allocations when deemed necessary.

Sincerely,

|  |

| Al Procaccino | Korey Bauer |

The views in this letter were as of 9/30/2021 and may not necessarily reflect the same views on the date this letter was first published or any time thereafter. These views are intended to help a shareholder in understanding the fund’s investment methodology and do not constitute investment advice.

Investment Considerations: The investment objective is to seek capital appreciation with positive returns in all market conditions. There can be no assurance that the Fund will achieve its objective or that any strategy (risk management or otherwise) will be successful. Stock and bond values fluctuate in price so the value of your investment can go down depending on market conditions. International investing involves special risks including, but not limited to political risks, currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets. Derivatives entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility.

September 30, 2021

Dear Fellow Shareholders:

The AXS Merger Fund (the “Fund”) returned 2.52% and 2.75% for the Investor Class and Class I, respectively, for fiscal year ended September 30, 2021.

Portfolio Review

In 2021, the Fund invested in approximately 109 different merger situations and was heavily concentrated in North America. Strategic deals dominated the portfolio, making up between 85% and 90% of the Fund’s holdings, on average.

Robust deal activity continued with $1.52 trillion in deal announcements in the quarter ending September 30th, the highest third quarter total on record. With volumes up 98% from last year, the $4.3 trillion in activity through the first three quarters has already broken the annual record of $4.1 trillion set in 2007. Mega deals slowed in the quarter as advisors and bankers digested the new regulatory regime in Washington and recalculated deal odds on large transactions. Deals in the $2 billion to $10 billion range doubled year-over-year as deals of this size tend to garner less scrutiny. U.S. deal activity was up 32% to $581 billion in the third quarter and hit $1.95 trillion for the year, making up almost half of all global activity. The largest strategic transactions announced in the U.S. during the year were AstraZeneca Plc’s $38.6 billion deal for Alexion Pharmaceuticals Inc., S&P Global Inc.’s $38.3 billion deal for IHS Markit Ltd., Advanced Micro Devices $33.7 billion transaction for Xilinx Inc and salesforce.com Inc.’s $26.5 billion deal for Slack Technologies. Activity in Europe doubled in the third quarter with $4.5 billion in announced transactions. The largest deal announced was Vonovia SE’s takeover of German property owner Deutsche Wohen SE for $15.8 billion. Parker-Hannifin Corp. will buy Meggitt Plc for $8.7 billion and NortonLifeLock Inc. will purchase Avast Plc for $8.6 billion. Private Equity continued its frenetic pace with $818.4 billion in transactions announced over the first nine months, up 133% over the same period last year. The largest U.S. leverage buyouts for the year belonged to Thoma Bravo LLC which purchased Proofpoint Inc. for $10.2 billion and RealPage Inc. for $9.1 billion. With the move up in the market from last year, private equity buyers have pivoted away from opportunistic buys during the depths of COVID to thematic investments that enhance companies already in their portfolios.

Performance

As is typical for our strategy, there were many deals that contributed positively to the Fund’s performance. The biggest gain for the year came from our position in the deal between LVMH Moet Hennessey Louis Vuitton SE (LVMH) and Tiffany & Co. (TIF). The $17.4 billion deal was announced in November 2019 and was moving smoothly through the process heading into 2020. As COVID fears entered the market and TIF shut down its stores, there were concerns that this deal would become another casualty of the virus. As we moved from spring into summer, speculation began that LVMH was unhappy with the pre-COVID premium it agreed to pay for TIF and was looking for ways to renegotiate the price. TIF continued to operate within the confines of the merger agreement, leaving LVMH little room for negotiation. In September the LVMH board unexpectedly said that it received a letter of “request” from the French European and Foreign Affairs Minister “which, in reaction to the threat of taxes on French products by the US, directed the Group to defer the acquisition of Tiffany until after January 6th, 2021,” a request that TIF pointed out had not been made of any other French company. This delay would push the close past the termination date of November 24th, allowing LVMH the ability to walk away from the deal. In response, TIF immediately filed a lawsuit in Delaware court accusing LVMH of slow-walking the regulatory approval process. The merger agreement stated that LVMH must use “reasonable best efforts to take all actions to consummate the transactions including preparing and filing as promptly as practicable with any Governmental Entity.” LVMH “miraculously” finished the filings within days of TIF’s filing of the lawsuit. We believed that LVMH acted in bad faith and its Chairman and CEO Bernard Arnault was using this novel approach and his tremendous influence within the French government to gain leverage to extract a price concession from TIF. Reports began to surface that the French government was not happy with this development, and that Arnault first approached the French Finance Minister to ask for help in getting out of the transaction but was denied. Interestingly, LVMH’s counter suit focused more on the deterioration and handling of TIF’s business during the pandemic and less on the French letter, their original reason for trying to get out of the merger. TIF did a great job of neutralizing these types of claims by renegotiating debt covenants, maintaining liquidity ratios, and operating the business in due course. With the pressure of the deal close approaching, LVMH needed a way to bring TIF to the negotiating table. We believed the Delaware Chancery Court would be sympathetic to TIF as LVMH did not present a valid reason for terminating the contract, in our opinion. The companies came to an agreement a month and a half before they were set to meet in court. TIF accepted a reduced price of $131.50, down from the original $135 that was agreed upon in November 2019, avoiding costly and unpredictable litigation. The 2.6% revision was reduced by half when factoring in the dividends that TIF paid during the time the two sides were bickering. We had always been of the conviction that TIF was a prized asset that LVMH wanted to own and that LVMH’s hesitation was solely on the premium they were paying considering COVID-19 and the changing retail environment. We believed the involvement of the French government and the slow walking of the regulatory process were all used as a means to get TIF to the bargaining table. Much to TIF’s credit, they held strong to the end of the process and were able to close the deal with minimal damage to the ultimate price they received.

P.O. Box 1627 | New York, NY 10150 | 212 350-0200 | www.kellnercap.com

Another positive contributor was when Simon Property Group (SPG) and Taubman Centers Inc. (TCO) renegotiated their $2.6 billion merger. In June of 2020, SPG claimed it was exercising its contractual rights to terminate its agreement with TCO alleging that TCO’s business suffered a Material Adverse Change (MAC) that was disproportionate to its peers. SPG also claimed that TCO breached its obligations under the agreement in failing to take steps to mitigate the impact of the pandemic by not making essential cuts in operating expenses and capital expenditures. By way of background, the TCO/SPG contract was considered one of the tightest merger agreements in any of the deals affected by the pandemic. It specifically prohibited using pandemic-related issues as a means of terminating the deal unless the effect was disproportionate to its peers (their first claim). In addition, this deal was structured amid the beginnings of the pandemic (February 10th, 2020) after SPG had already closed some of its own malls in China. In fact, SPG was able to lower the price (from $57 down to $52.50) during negotiations as it realized that businesses were going to have to be shut down. We believed that SPG’s claim of a MAC that was disproportionate to its peers was highly subjective and would require them to assemble a competitor profile that had weathered the crisis better than TCO, which we believed would be difficult. Its second claim was dubious in that TCO was in a no-win situation; if they had cut capital expenditures and operating expenses, SPG could claim that doing so was outside the ordinary course of its business. With a week left to go before the trial start date, the companies came to an agreement at $43 per share, down roughly 18% from the $52.50 that they agreed to back in February. While we thought the strength of TCO’s contract could prevail in court or lead to a settlement in the mid-high $40 range, the outcome was satisfactory for both parties by avoiding the uncertainty of going to court. The settlement allowed us to recover a lot of the loss we saw in early 2020.

Another positive contributor was the closing of the $39 billion cash and stock deal between Alexion Pharmaceuticals Inc. and AstraZenaca Plc. In mid-April, the Federal Trade Commission (FTC) notified the companies that the deal had cleared without the need for a second request. The market was surprised that the FTC was not going to take an in-depth look at the deal given the incoming administration had made it clear that large pharmaceutical mergers were a big antitrust priority. The spread collapsed as the most difficult approval was obtained, leaving only the European Commission (EC) and UK regulators to approve the deal, which they did, and the deal closed in late July.

The Fund suffered a loss when government decided to bring a lawsuit against Aon Plc’s (AON) $30 billion stock deal with Willis Towers Watson Plc (WLTW). The Department of Justice (DOJ) filed a 35-page complaint laying out the five markets they believed would lessen competition because of the merger. The parties came to an agreement on divestitures in three of the markets. In the remaining two markets, Property, Casualty & Financial Risk broking for large customers in the U.S. and Health Benefits broking for large customers in the U.S., divestitures were offered, but not enough to appease the DOJ. AON confirmed they were not given a “last rites” meeting with the DOJ that is typical in these types of situations, where the companies are able to make their best divestiture offer. In its complaint, the DOJ mentioned AON’s offer would not be sufficient, indicating that the issues may be solvable with the proper divestitures. A trial date had been set for December. Despite the companies offering additional divestitures to the government after it filed its lawsuit in June, AON concluded that the new administration may have been looking to make a statement by taking this case to court. With the merger agreement set to expire in September and insurance brokerage stocks rallying, AON was in a position where WLTW would likely be looking for additional compensation to extend the agreement past its termination date. AON also faced the prospect of having to make additional divestitures, which we assume was too much for them. We believed, along with the market, that this lawsuit would be settled with the government prior to the trial. The unwind of the trade pushed the stocks to an unprecedented spread level on a relative value basis. This discrepancy was underscored as two large activist funds, Starboard Value LP and Elliott Management Corp., have since taken stakes in WLTW.

P.O. Box 1627 | New York, NY 10150 | 212 350-0200 | www.kellnercap.com

Outlook

2021 was a transition year for the strategy as several of the legacy transactions from the pandemic were renegotiated and completed. We were also tasked with adjusting to the incoming administration. As with all new administrations, this one is taking its time with appointments at several of the agencies that are pertinent to our strategy. This, along with the fact that they have made enhanced regulatory enforcement a priority, has lengthened the timeline for deals to close. We, of course, will factor this into our analysis to make sure we are being compensated for these delays. The M&A cycle has been robust since the doldrums of the pandemic. The uncertainty around regulatory approvals and possible changes in corporate tax policy don’t seem to be slowing down activity. Investment bankers continue to talk of endless conversations with clients about potential deals. All the ingredients for continued activity remain. Since the pandemic, companies have been hoarding cash and raising emergency funds and now sit with close to $4 trillion in cash. This does not include all the dry powder private equity has, and continues to raise at a record pace, that could further fuel activity. Pressure from investors for companies to grow their businesses continues with M&A being an efficient way to accomplish this. With interest rates still at historic lows and strong investor demand for debt, the rebound in the economy should continue driving deal volumes for the next few years. Since merger arbitrage is a strategy that benefits in a rising rate environment, we look forward to the Federal Reserve beginning to tighten the monetary supply. That being said, the current spread environment continues to be favorable, especially in this low interest rate environment. This leaves us excited about the prospects for the Fund as we head into the new year.

We are grateful for your continued trust and support.

Sincerely,

The Investment Team at Kellner Management, LP

The views in this letter were as of September 30, 2021 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

P.O. Box 1627 | New York, NY 10150 | 212 350-0200 | www.kellnercap.com

Dear Shareholder,

This Annual Report covers the AXS Alternative Value Fund (“the Value Fund”), and the AXS Market Neutral Fund (“the Market Neutral Fund”) for the fiscal year ending September 30, 2021. We appreciate this opportunity to offer insight into the funds’ investment strategies and to offer commentary on performance and evolving global market conditions.

Market Commentary

The trailing twelve months ended September 30, 2021 was a strong period of return in the equity market, as the rally from the pandemic-inspired March lows continued in earnest. Value stocks that had underperformed the growth stocks in the previous twelve month period had a robust recovery from a lower market low. This explains the outperformance of the Russell 1000 Value Index over the S&P 500.

The Value Fund

While value stocks outperformed growth stocks over the past twelve months, the wide valuation dispersion between growth and value stocks discussed in the June 30, 2020 shareholder letter remains prominent. The overall valuation of the market appears elevated, but perhaps justifiable, especially considering the very low rates on U.S. Treasuries. However, valuations for growth stocks are very high. As of September 30, 2021, the quoted price to earnings ratio for the iShares Russell 1000 Growth ETF, an index fund that designed to replicate the performance of the Russell 1000 Growth Index, was 44.92x and the price to book ratio was 14.16x, both high relative to historical norms. The price to earnings ratio for the iShares Russell 1000 Value ETF, an index fund Russell 1000 Value Index was 24.39x and the price to book ratio was 2.63x. The spread between the ratios at 20.53x has been wider in the past, but it is higher than the approximate 10.0x average spread over the past 20 years.

The macroeconomic view upon which our value strategies are based is what we consider to be a straightforward model of market behavior over time. This model is based on the belief that corporate profits, market multiples, and interest rates drive stock price returns over very long periods of time. However, this is not to say that a market correction or crash will occur in the near future. Should an adverse market event occur, we believe the Value and Market Neutral Funds are well positioned to mitigate volatility relative to their respective benchmarks.

Performance Commentary

The Value Fund invests in high quality companies that trade at attractive valuations relative to the broader market. We utilize our proprietary ROTA/ROME® investment selection and portfolio construction methodology to execute this strategy. ROTA/ROME® focuses on a company’s Return on Total Assets (“ROTA”) and Return on Market Value of Equity (“ROME”) in order to identify companies whose per share intrinsic value has diverged significantly from the current market price of its stock. We believe that companies that exhibit sustainable long-term high ROTA are higher quality companies that most likely have a competitive advantage within the marketplace. ROME is a measure of profit yield, and like a yield on a bond, the higher the ROME, the more likely that shares in the company can be purchased at a better valuation compared to a company with a lower ROME.

3965 West 83rd Street • #348 • Prairie Village, KS 66208

913.214.5001

www.cognios.com

| | Return 1-Yr | Annualized Rate of Return (AROR) Since Inception (10/3/2016 to 9/30/2021) |

| AXS Alternative Value Fund - CL I | 25.47% | 12.93% |

| AXS Alternative Value Fund - Investor Class | 25.08% | 12.76% |

| S&P 500 Index | 30.00% | 17.00% |

During the fiscal year ended September 30, 2021, the total return for the Institutional Class Shares (COGVX) was 25.47% and the total return for the Investor Class Shares (COGLX) was 25.08%, lagging the Russell 1000 Value Index. Over the course of the last fiscal year, the Value Fund maintained investment positions in one hundred fifty-one positions. Of those investment positions, one hundred five were profitable resulting in a .695 batting average. The tables below display the top five positions that contributed to gross profit:

| Top 5 Investment Positions by Contribution to Gross Profit |

| Ticker | Company | Contribution to Gross Profit |

| L | L Brands, Inc. (Pre-transaction with BBWI) | 4.3% |

| ORCL | Oracle Corp. | 4.1% |

| AJG | Arthur J. Gallagher & Co. | 4.0% |

| MSI | Motorola Solutions, Inc. | 3.9% |

| CPRI | Capri Holdings Limited | 3.6% |

| Total | | 19.9% |

AXS Market Neutral Fund

The AXS Market Neutral Large Cap Fund employs a Beta -adjusted market neutral investment strategy that seeks to provide investors with returns that are non-correlated to, or independent of, the returns of the global equity and fixed income markets. By attempting to hedge out all of the market Beta, the Fund’s returns over time should be essentially “pure Alpha” (i.e., Alpha is the excess return of a portfolio after considering its Beta exposure.) Additionally, by hedging out the general market movements in this Beta-adjusted market neutral fashion, we believe that the total returns of the Fund will be independent of those broad “systemic” risk factors and macro events that move the entire stock market either positively or negatively over time.

Performance Commentary

The Market Neutral Fund invests long in high quality companies that trade at attractive valuations relative to the broader market. We utilize our proprietary ROTA/ROME® investment selection and portfolio construction methodology, very similar to the Value Fund. Conversely, The Market Neutral Fund sells short shares in companies that demonstrate poor qualities based on our proprietary ROTA/ROME® investment selection and portfolio construction methodology.

| | Return 1-Yr | Annualized Rate of Return (AROR) Since Inception (12/31/2012 to 9/30/2021) |

| AXS Market Neutral Fund - CL I | -2.78% | 2.53% |

| AXS Market Neutral Fund - Investor Class | -2.93% | 2.30% |

| S&P 500 Index | 30.00% | 17.00% |

For the twelve months ended September 30, 2021, the total return for the Institutional Class Shares (COGIX) was -2.78% and the total return for the Investor Class Shares (COGMX) was -2.93%, underperforming the Morningstar Equity Market Neutral Category return 3.91% (COGIX). Over the course of the last fiscal year, the Market Neutral Fund held two hundred twenty-four long positions, of which one hundred eighteen were profitable resulting in a .527 batting average. The table below displays the top five positions that contributed to gross profit for the long positions:

| Top 5 Long Positions by Contribution to Long Gross Profit of the Market Neutral Fund |

| Ticker | Company | Contribution to Gross Loss* |

| RMD | ResMed, Inc. | 32.7% |

| LLY | Eli Lilly and Company | 29.1% |

| CVS | CVS Health Corporation | 26.0% |

| OMC | Omnicom Group Inc. | 24.5% |

| ABBV | AbbVie Inc. | 24.4% |

| Total | | 136.7% |

| * | The positive Contribution to Gross Loss percentages represent a negative return to the Fund. |

Over the course of the last fiscal year, the Market Neutral Fund held two hundred one short positions, of which fifty-one were profitable resulting in a .254 batting average. The table below displays the top five positions that contributed to gross profit for the short positions:

| Top 5 Short Positions by Contribution to Short Gross Profit of the Market Neutral Fund |

| Ticker | Company | Contribution to Gross Loss** |

| LVS | Las Vegas Sands Corp. | -4.9% |

| INCY | Incyte Corp. | -4.3% |

| ENPH | Enphase Energy, Inc. | -4.3% |

| APD | Air Products and Chemicals, Inc. | -3.9% |

| NEM | Newmont Corporation | -3.7% |

| Total | | -21.1% |

| * | The negative Contribution to Gross Loss percentages represent a positive return to the Fund. |

We look forward to future opportunities to connect with our shareholders. We strive to continuously add value to your investment experience by providing access to fund information, portfolio updates and straightforward commentary.

We thank you for investing with us and for the trust you have placed in us.

Sincerely,

|  | |

| Jonathan Angrist | Brian Machtley | |

Portfolio Managers

Cognios Capital

Disclosures

The information provided herein represents the opinion of the Funds’ manager, is subject to change at any time, is not guaranteed and should not be considered investment advice.

Performance data quoted represents past performance; past performance does not guarantee future results.

The Funds’ holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy and sell any security. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

Mutual funds involve risk including possible loss of principal. There is no assurance that the Fund will achieve its investment objective.

The value of the Fund’s assets will fluctuate as the equity market fluctuates, although the beta-adjusted market neutral focus of the Fund should reduce the effect of general market fluctuations on the valuation of the Fund as a whole. Utilization of leverage, such as borrowings and shorting positions, involves certain risks to the Fund’s shareholders, including potential for higher volatility of the net asset value (“NAV”) of the Fund’s shares and the relatively greater effect of portfolio holdings on the NAV of the shares. The Fund may not always be able to close out a short position on favorable terms. Short sales involve the risk that the Fund will incur a loss by subsequently buying a security at a higher price than the price at which it sold the security short. Value investing is subject to the risk that the market will not recognize a security’s inherent value for a long time or at all, or that a stock judged to be undervalued may actually be appropriately priced or overvalued. The prices of foreign securities may be more volatile than the prices of securities of U.S. issuers because of economic and social conditions abroad, political developments and changes in the regulatory environments of foreign countries.

You cannot invest directly in an index.

Index performance is not indicative of a fund’s performance.

Must be preceded or accompanied by a prospectus.

Distributed by IMST Distributors, LLC, which is not affiliated with AXS.

AXS All Terrain Opportunity Fund

FUND PERFORMANCE at September 30, 2021 (Unaudited)

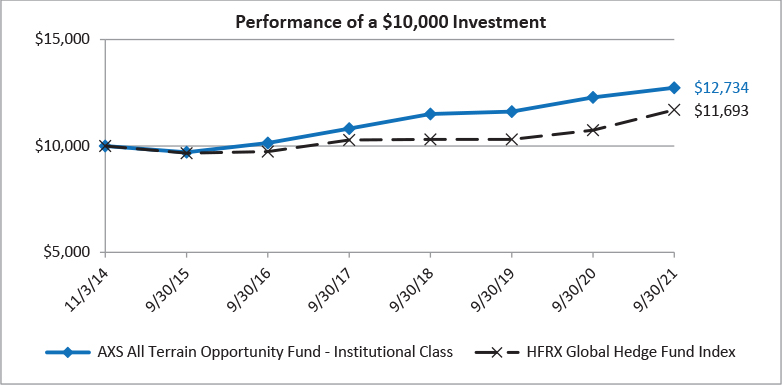

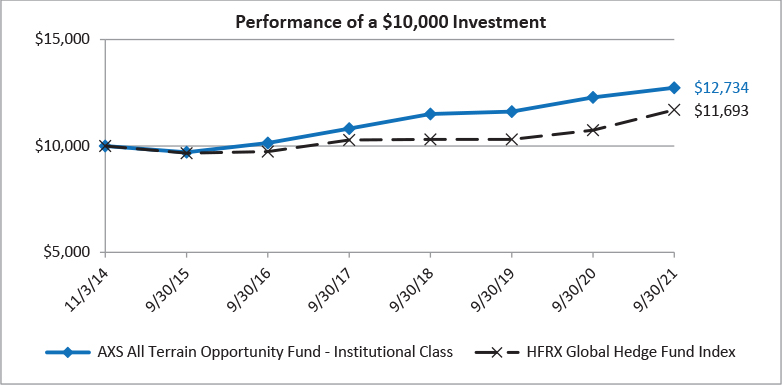

This graph compares a hypothetical $10,000 investment in the Fund’s Institutional Class shares, made at its inception, with a similar investment in the HFRX Global Hedge Fund Index. Results include the reinvestment of all dividends and capital gains.

HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. The index does not reflect expenses, fees, or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

| Average Annual Total Returns as of September 30, 2021 | 1 Year | 5 Years | Since Inception | Inception Date |

| Institutional Class1 | 3.68% | 4.67% | 3.56% | 11/03/14 |

| HFRX Global Hedge Fund Index | 8.87% | 3.75% | 2.29% | 11/03/14 |

| 1 | Prior to September 16, 2016, the Institutional Class shares of the Fund were designated as Class A shares and subject to a distribution fee pursuant to Rule 12b-1 Plan and a 5.75% sales charge. Returns would have been lower had sales charge been reflected. The distribution fee is reflected in the Fund’s performance for periods prior to September 16, 2016. |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (833) 297-2587.

Gross and net expense ratios for the Fund’s Institutional Class shares were 2.57% and 1.93%, respectively, which were the amounts stated in the current prospectus dated March 1, 2021. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s Advisor has contractually agreed to waive fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding any taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses as determined in accordance with Form N-1A, expenses incurred in connection with any merger or reorganization, or extraordinary expenses such as litigation expenses) do not exceed 1.60% of the average daily net assets of Institutional Class shares of the Fund. This agreement is in effect until February 28, 2022 and may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

AXS All Terrain Opportunity Fund

FUND PERFORMANCE at September 30, 2021 (Unaudited) - Continued

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares redeemed within 60 days of purchase will be charged a redemption fee of 1.00%.

AXS Merger Fund

FUND PERFORMANCE at September 30, 2021 (Unaudited)

This graph compares a hypothetical $10,000 investment in the Fund’s Class I shares, made at its inception, with a similar investment in the ICE BofA Merrill Lynch 3-Month Treasury Bill Index and HFRX ED: Merger Arbitrage Index. The performance graph above is shown for the Fund’s Class I shares. Investor Class shares performance may vary. Results include the reinvestment of all dividends and capital gains.

The ICE BofA Merrill Lynch 3-Month Treasury Bill Index is an unmanaged index that measures returns of three-month Treasury Bills. The HFRX ED: Merger Arbitrage Index is an investment process primarily focused on opportunities in equity and equity related instruments of companies. The indexes do not reflect expenses, fees or sales charge, which would lower performance. The indexes are unmanaged and are not available for investment.

| Average Annual Total Returns as of September 30, 2021 | 1 Year | 5 Years | Since Inception | Inception Date |

| Class I | 2.75% | 1.99% | 2.43% | 06/29/12 |

| Investor Class | 2.52% | 1.74% | 2.12% | 06/29/12 |

| ICE BofA Merrill Lynch 3-Month Treasury Bill Index | 0.07% | 1.16% | 0.68% | 06/29/12 |

| HFRX ED: Merger Arbitrage Index | 8.24% | 1.87% | 2.91% | 06/29/12 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (833) 297-2587.

The Fund acquired the assets and liabilities of the Kellner Merger Fund, a series of the Advisors Series Trust (the “Predecessor Fund”) on January 22, 2021. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the graph and the performance table above for the periods prior to January 22, 2021, reflect the performance of the Predecessor Fund.

Gross and net expense ratios for the Investor Class shares were 2.41% and 2.24%, respectively, and the Class I shares were 2.16% and 1.99%, respectively, which were stated in the current prospectus dated May 1, 2021. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s Advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding any taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses as determined in accordance with Form N-1A, expenses incurred in connection with any merger or reorganization, or extraordinary expenses such as litigation expenses) do not exceed 1.75% and 1.50% of the average daily net assets of the Fund’s Investor Class and Class I shares, respectively. This agreement is in effect until January 22, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

AXS Merger Fund

FUND PERFORMANCE at September 30, 2021 (Unaudited) – Continued

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. Shares redeemed within 30 days of purchase will be charged 1.00% redemption fee.

AXS Alternative Value Fund

FUND PERFORMANCE at September 30, 2021 (Unaudited)

This graph compares a hypothetical $10,000 investment in the Fund’s Class I shares, made at its inception, with a similar investment in the S&P 500 Total Return Index. The performance graph above is shown for the Fund’s Class I shares. Investor Class shares performance may vary. Results include the reinvestment of all dividends and capital gains.

The S&P 500 Total Return Index is a broad unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and is not available for investment.

| Average Annual Total Returns as of September 30, 2021 | 1 Year | Since Inception | Inception Date |

| Class I | 25.47% | 12.93% | 10/03/16 |

| Investor Class | 25.08% | 12.76% | 10/03/16 |

| S&P 500 Total Return Index | 30.00% | 17.00% | 10/03/16 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (833) 297-2587.

The Fund acquired the assets and liabilities of the AXS Alternative Value Fund (formerly, Cognios Large Cap Value Fund), a series of the M3Sixty Funds Trust (the “Predecessor Fund”) on March 5, 2021. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the graph and the performance table above for the periods prior to March 5, 2021, reflect the performance of the Predecessor Fund.

Gross and net expense ratios for the Investor Class shares were 2.65% and 2.02%, respectively, and the Class I shares were 2.40% and 1.77%, respectively, which were stated in the current prospectus dated November 1, 2021. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s Advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding any taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses as determined in accordance with Form N-1A, expenses incurred in connection with any merger or reorganization, or extraordinary expenses such as litigation expenses) do not exceed 1.10% and 0.85% of the average daily net assets of the Fund’s Investor Class and Class I shares, respectively. This agreement is in effect until March 5, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

AXS Alternative Value Fund

FUND PERFORMANCE at September 30, 2021 (Unaudited) – Continued

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. Shares redeemed within 30 days of purchase will be charged 1.00% redemption fee.

AXS Market Neutral Fund

FUND PERFORMANCE at September 30, 2021 (Unaudited)

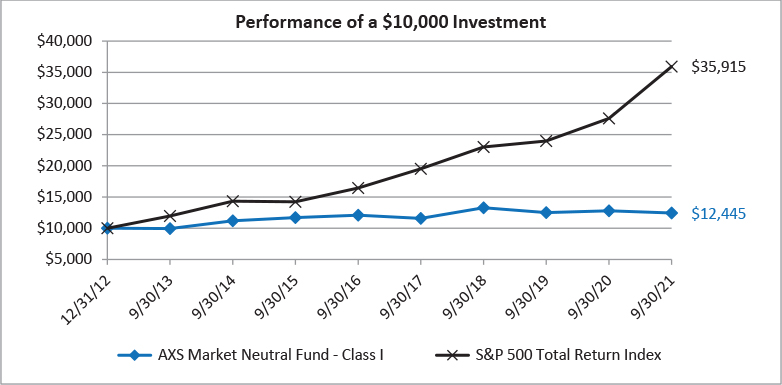

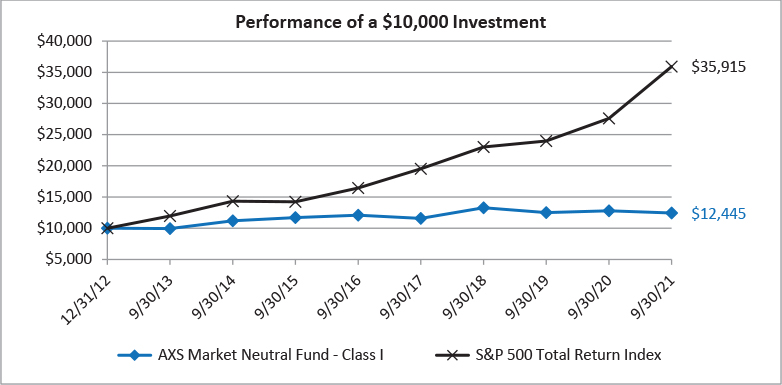

This graph compares a hypothetical $10,000 investment in the Fund’s Class I shares, made at its inception, with a similar investment in the S&P 500 Total Return Index. The performance graph above is shown for the Fund’s Class I shares. Investor Class shares performance may vary. Results include the reinvestment of all dividends and capital gains.

The S&P 500 Total Return Index is a broad unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and is not available for investment.

| Average Annual Total Returns as of September 30, 2021 | 1 Year | 5 Years | Since Inception | Inception Date |

| Class I | -2.78% | 0.57% | 2.53% | 12/31/12 |

| Investor Class | -2.93% | 0.34% | 2.30% | 12/31/12 |

| S&P 500 Total Return Index | 30.00% | 16.90% | 15.74% | 12/31/12 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (833) 297-2587.

The Fund acquired the assets and liabilities of the AXS Market Neutral Fund (formerly, Cognios Market Neutral Large Cap Fund), a series of the M3Sixty Funds Trust (the “Predecessor Fund”) on March 5, 2021. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the graph and the performance table above for the periods prior to March 5, 2021, reflect the performance of the Predecessor Fund.

Gross and net expense ratios for the Investor Class shares were 4.69% and 4.35%, respectively, and the Class I shares were 4.44% and 4.10%, respectively, which were stated in the current prospectus dated November 1, 2021. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s Advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding any taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses as determined in accordance with Form N-1A, expenses incurred in connection with any merger or reorganization, or extraordinary expenses such as litigation expenses) do not exceed 1.70% and 1.45% of the average daily net assets of the Fund’s Investor Class and Class I shares, respectively. This agreement is in effect until March 5, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

AXS Market Neutral Fund

FUND PERFORMANCE at September 30, 2021 (Unaudited) – Continued

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares. Shares redeemed within 30 days of purchase will be charged 1.00% redemption fee.

AXS All Terrain Opportunity Fund

SCHEDULE OF INVESTMENTS

As of September 30, 2021

| Number of Shares | | | | | Value | |

| | | | | COMMON STOCKS — 2.5% | | | | |

| | | | | CONSUMER STAPLES — 1.0% | | | | |

| | 620 | | | Costco Wholesale Corp. | | $ | 278,597 | |

| | | | | REAL ESTATE — 1.1% | | | | |

| | 1,500 | | | Mid-America Apartment Communities, Inc. - REIT | | | 280,125 | |

| | | | | TECHNOLOGY — 0.4% | | | | |

| | 200 | | | MicroStrategy, Inc. - Class A* | | | 115,680 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $710,324) | | | 674,402 | |

| | | | | EXCHANGE-TRADED FUNDS — 27.2% | | | | |

| | | | | EQUITY FUNDS — 27.2% | | | | |

| | 3,000 | | | Amplify Transformational Data Sharing ETF | | | 133,920 | |

| | 20,000 | | | ETFMG Alternative Harvest ETF | | | 287,800 | |

| | 5,700 | | | ETFMG Prime Cyber Security ETF | | | 346,674 | |

| | 6,000 | | | First Trust NASDAQ Cybersecurity ETF | | | 292,320 | |

| | 3,200 | | | Invesco QQQ Trust Series 1 | | | 1,145,472 | |

| | 3,600 | | | Invesco S&P 500 Equal Weight ETF | | | 539,352 | |

| | 18,000 | | | iShares Core Dividend Growth ETF | | | 904,320 | |

| | 4,500 | | | iShares U.S. Medical Devices ETF | | | 282,510 | |

| | 6,000 | | | ProShares S&P 500 Dividend Aristocrats ETF | | | 531,180 | |

| | 6,000 | | | Real Estate Select Sector SPDR Fund | | | 266,700 | |

| | 5,000 | | | SPDR S&P 500 ETF Trust | | | 2,145,700 | |

| | 3,500 | | | Technology Select Sector SPDR Fund | | | 522,620 | |

| | | | | | | | 7,398,568 | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS | | | | |

| | | | | (Cost $7,593,814) | | | 7,398,568 | |

| | | | | MUTUAL FUNDS — 31.7% | | | | |

| | | | | EQUITY FUNDS — 9.6% | | | | |

| | 5,865 | | | Morgan Stanley Insight Fund - Class I | | | 560,235 | |

| | 75,261 | | | WCM Focused International Growth Fund - Class Institutional | | | 2,063,655 | |

| | | | | | | | 2,623,890 | |

| | | | | FIXED INCOME FUNDS — 22.1% | | | | |

| | 248,139 | | | PIMCO Income Fund - Class Institutional | | | 2,987,593 | |

| | 277,321 | | | PIMCO Mortgage Opportunities and Bond Fund - Class Institutional | | | 3,028,346 | |

| | | | | | | | 6,015,939 | |

| | | | | TOTAL MUTUAL FUNDS | | | | |

| | | | | (Cost $8,636,665) | | | 8,639,829 | |

AXS All Terrain Opportunity Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2021

| Number of Contracts | | | | | Value | |

| | | | | PURCHASED OPTIONS CONTRACTS — 0.1% | | | | |

| | | | | CALL OPTIONS — 0.1% | | | | |

| | 100 | | | SPDR S&P 500 ETF Trust

Exercise Price: $450, Notional Amount $4,500,000

Expiration Date: November 19, 2021 | | $ | 23,400 | |

| | | | | TOTAL CALL OPTIONS | | | | |

| | | | | (Cost $42,404) | | | 23,400 | |

| | | | | TOTAL PURCHASED OPTIONS CONTRACTS | | | | |

| | | | | (Cost $42,404) | | | 23,400 | |

| Number of Shares | | | | | | |

| | | | | SHORT-TERM INVESTMENTS — 29.1% | | | | |

| | 7,920,915 | | | Fidelity Investments Money Market Funds - Treasury Portfolio - Class I, 0.010%1 | | | 7,920,915 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | | (Cost $7,920,915) | | | 7,920,915 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 90.6% | | | | |

| | | | | (Cost $24,904,122) | | | 24,657,114 | |

| | | | | | | | | |

| | | | | Other Assets in Excess of Liabilities — 9.4% | | | 2,554,471 | |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 27,211,585 | |

| ETF – | Exchange-Traded Fund |

| REIT – | Real Estate Investment Trusts |

| * | Non-income producing security. |

| 1 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

AXS All Terrain Opportunity Fund

SUMMARY OF INVESTMENTS

As of September 30, 2021

| Security Type/Sector | Percent of Total

Net Assets |

| Common Stocks | |

| Real Estate | 1.1% |

| Consumer Staples | 1.0% |

| Technology | 0.4% |

| Total Common Stocks | 2.5% |

| Exchange-Traded Funds | |

| Equity Funds | 27.2% |

| Total Exchange-Traded Funds | 27.2% |

| Mutual Funds | |

| Fixed Income Funds | 22.1% |

| Equity Funds | 9.6% |

| Total Mutual Funds | 31.7% |

| Purchased Options Contracts | |

| Call Options | 0.1% |

| Total Purchased Options Contracts | 0.1% |

| Short-Term Investments | 29.1% |

| Total Investments | 90.6% |

| Other Assets in Excess of Liabilities | 9.4% |

| Total Net Assets | 100.0% |

See accompanying Notes to Financial Statements.

AXS Merger Fund

SCHEDULE OF INVESTMENTS

As of September 30, 2021

| Number of Shares | | | | | Value | |

| | | | | COMMON STOCKS — 83.1% | | | | |

| | | | | BANKS — 8.3% | | | | |

| | 10,500 | | | Atlantic Capital Bancshares, Inc.* | | $ | 278,145 | |

| | 76,300 | | | Cadence BanCorp. | | | 1,675,548 | |

| | 85,700 | | | CIT Group, Inc. | | | 4,452,115 | |

| | 1 | | | Prosperity Bancshares, Inc. | | | 71 | |

| | | | | | | | 6,405,879 | |

| | | | | BUILDING MATERIALS — 0.1% | | | | |

| | 1,800 | | | Forterra, Inc.* | | | 42,408 | |

| | | | | CHEMICALS — 0.5% | | | | |

| | 8,800 | | | Kraton Corp.* | | | 401,632 | |

| | | | | COMMERCIAL SERVICES — 15.1% | | | | |

| | 99,800 | | | IHS Markit Ltd. | | | 11,638,676 | |

| | | | | ELECTRONICS — 0.6% | | | | |

| | 1,900 | | | Coherent, Inc.* | | | 475,171 | |

| | | | | ENTERTAINMENT — 0.4% | | | | |

| | 30,900 | | | Cineplex, Inc.* | | | 320,564 | |

| | | | | ENVIRONMENTAL CONTROL — 0.6% | | | | |

| | 23,900 | | | Covanta Holding Corp. | | | 480,868 | |

| | | | | FOREST PRODUCTS & PAPER — 4.1% | | | | |

| | 57,700 | | | Domtar Corp.* | | | 3,146,958 | |

| | | | | HEALTHCARE-SERVICES — 6.1% | | | | |

| | 40,800 | | | Magellan Health, Inc.* | | | 3,857,640 | |

| | 17,500 | | | PPD, Inc.* | | | 818,825 | |

| | | | | | | | 4,676,465 | |

| | | | | INSURANCE — 11.5% | | | | |

| | 16,100 | | | Athene Holding Ltd. - Class A* | | | 1,108,807 | |

| | 33,215 | | | Willis Towers Watson PLC | | | 7,721,159 | |

| | | | | | | | 8,829,966 | |

| | | | | INTERNET — 1.2% | | | | |

| | 8,300 | | | Score Media and Gaming, Inc. - Class A* | | | 284,109 | |

| | 2,000 | | | Stamps.com, Inc.* | | | 659,580 | |

| | | | | | | | 943,689 | |

| | | | | MINING — 0.0% | | | | |

| | 2 | | | Newmont Corp. | | | 108 | |

AXS Merger Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2021

| Number of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | MISCELLANEOUS MANUFACTURING — 1.2% | | | | |

| | 15,000 | | | Lydall, Inc.* | | $ | 931,350 | |

| | | | | REAL ESTATE — 0.8% | | | | |

| | 10,100 | | | Deutsche Wohnen S.E.* | | | 618,893 | |

| | | | | REITS — 7.3% | | | | |

| | 40,400 | | | Columbia Property Trust, Inc. - REIT | | | 768,408 | |

| | 1 | | | Digital Realty Trust, Inc. - REIT | | | 144 | |

| | 2 | | | Prologis, Inc. - REIT | | | 251 | |

| | 106,700 | | | VEREIT, Inc. - REIT | | | 4,826,041 | |

| | | | | | | | 5,594,844 | |

| | | | | SAVINGS & LOANS — 1.7% | | | | |

| | 52,600 | | | Sterling Bancorp | | | 1,312,896 | |

| | | | | SEMICONDUCTORS — 6.0% | | | | |

| | 30,400 | | | Xilinx, Inc. | | | 4,590,096 | |

| | | | | SOFTWARE — 14.6% | | | | |

| | 12,700 | | | Change Healthcare, Inc.* | | | 265,938 | |

| | 43,400 | | | Cloudera, Inc.* | | | 693,098 | |

| | 61,000 | | | Cornerstone OnDemand, Inc.* | | | 3,492,860 | |

| | 28,600 | | | Medallia, Inc.* | | | 968,682 | |

| | 82,600 | | | Nuance Communications, Inc.* | | | 4,546,304 | |

| | 61,000 | | | Sciplay Corp. - Class A* | | | 1,262,090 | |

| | | | | | | | 11,228,972 | |

| | | | | TRANSPORTATION — 3.0% | | | | |

| | 8,400 | | | Kansas City Southern | | | 2,273,376 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $58,975,781) | | | 63,912,811 | |

| Number of Contracts | | | | | | |

| | | | | PURCHASED OPTIONS CONTRACTS — 0.0% | | | | |

| | | | | CALL OPTIONS — 0.0% | | | | |

| | 49 | | | Five9, Inc.

Exercise Price: $170.00, Notional Amount: $833,000,

Expiration Date: November 19, 2021 | | | 29,890 | |

| | | | | TOTAL CALL OPTIONS | | | | |

| | | | | (Cost $36,801) | | | 29,890 | |

| | | | | TOTAL PURCHASED OPTIONS CONTRACTS | | | | |

| | | | | (Cost $36,801) | | | 29,890 | |

AXS Merger Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2021

| Number of Shares | | | | | Value | |

| | | | | SHORT-TERM INVESTMENTS — 26.9% | | | | |

| | 20,706,379 | | | Fidelity Investments Money Market Treasury Portfolio - Institutional Class, 0.01%1 | | $ | 20,706,379 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | | (Cost $20,706,379) | | | 20,706,379 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 110.0% | | | | |

| | | | | (Cost $79,718,961) | | | 84,649,080 | |

| | | | | | | | | |

| | | | | Liabilities in Excess of Other Assets — (10.0)% | | | (7,702,060 | ) |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 76,947,020 | |

| | | | | | | | | |

| | | | | SECURITIES SOLD SHORT — (55.9)% | | | | |

| | | | | COMMON STOCKS — (55.9)% | | | | |

| | | | | BANKS — (10.1)% | | | | |

| | (53,410 | ) | | BancorpSouth Bank | | | (1,590,550 | ) |

| | (5,372 | ) | | First Citizens BancShares, Inc. - Class A | | | (4,529,509 | ) |

| | (8 | ) | | Huntington Bancshares, Inc. | | | (124 | ) |

| | (3,780 | ) | | SouthState Corp. | | | (282,253 | ) |

| | (24,353 | ) | | Webster Financial Corp. | | | (1,326,264 | ) |

| | | | | | | | (7,728,700 | ) |

| | | | | COMMERCIAL SERVICES — (15.7)% | | | | |

| | (28,324 | ) | | S&P Global, Inc. | | | (12,034,584 | ) |

| | | | | DIVERSIFIED FINANCIAL SERVICES — (1.5)% | | | | |

| | (18,499 | ) | | Apollo Global Management, Inc. - Class A | | | (1,139,353 | ) |

| | | | | ELECTRONICS — (0.1)% | | | | |

| | (1,729 | ) | | II-VI, Inc.* | | | (102,634 | ) |

| | | | | ENTERTAINMENT — (1.8)% | | | | |

| | (1,990 | ) | | Penn National Gaming, Inc.* | | | (144,195 | ) |

| | (15,250 | ) | | Scientific Games Corp. - Class A* | | | (1,266,818 | ) |

| | | | | | | | (1,411,013 | ) |

| | | | | INSURANCE — (12.3)% | | | | |

| | (33,215 | ) | | Aon PLC | | | (9,491,851 | ) |

| | | | | REITS — (6.3)% | | | | |

| | (75,198 | ) | | Realty Income Corp. - REIT | | | (4,877,342 | ) |

| | | | | SEMICONDUCTORS — (7.0)% | | | | |

| | (52,389 | ) | | Advanced Micro Devices, Inc.* | | | (5,390,828 | ) |

AXS Merger Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2021

| Number of Shares | | | | | Value | |

| | | | | SECURITIES SOLD SHORT (Continued) | | | | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | TRANSPORTATION — (1.1)% | | | | |

| | (12,690 | ) | | Canadian Pacific Railway Ltd. | | $ | (825,738 | ) |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Proceeds $37,918,673) | | | (43,002,043 | ) |

| | | | | | | | | |

| | | | | TOTAL SECURITIES SOLD SHORT | | | | |

| | | | | (Proceeds $37,918,673) | | $ | (43,002,043 | ) |

Number of Contracts | | | | | | |

| | | | | WRITTEN OPTIONS CONTRACTS — (0.0)% | | | | |

| | | | | CALL OPTIONS — (0.0)% | | | | |

| | (49 | ) | | Five9, Inc.

Exercise Price: $180.00, Notional Amount: $(882,000),

Expiration Date: November 19, 2021 | | | (17,150 | ) |

| | | | | TOTAL CALL OPTIONS | | | | |

| | | | | (Proceeds $19,549) | | | (17,150 | ) |

| | | | | PUT OPTIONS — (0.0)% | | | | |

| | (49 | ) | | Five9, Inc.

Exercise Price: $145.00, Notional Amount: $(710,500),

Expiration Date: November 19, 2021 | | | (20,825 | ) |

| | | | | TOTAL PUT OPTIONS | | | | |

| | | | | (Proceeds $17,589) | | | (20,825 | ) |

| | | | | | | | | |

| | | | | TOTAL WRITTEN OPTIONS CONTRACTS | | | | |

| | | | | (Proceeds $37,138) | | $ | (37,975 | ) |

PLC – Public Limited Company

REIT – Real Estate Investment Trusts

| * | Non-income producing security. |

| 1 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

AXS Merger Fund

SUMMARY OF INVESTMENTS

As of September 30, 2021

| Security Type/Industry | Percent of Total

Net Assets |

| Common Stocks | |

| Commercial Services | 15.1% |

| Software | 14.6% |

| Insurance | 11.5% |

| Banks | 8.3% |

| REITS | 7.3% |

| Healthcare-Services | 6.1% |

| Semiconductors | 6.0% |

| Forest Products & Paper | 4.1% |

| Transportation | 3.0% |

| Savings & Loans | 1.7% |

| Miscellaneous Manufacturing | 1.2% |

| Internet | 1.2% |

| Real Estate | 0.8% |

| Electronics | 0.6% |

| Environmental Control | 0.6% |

| Chemicals | 0.5% |

| Entertainment | 0.4% |

| Building Materials | 0.1% |

| Mining | 0.0% |

| Total Common Stocks | 83.1% |

| Short-Term Investments | 26.9% |

| Total Investments | 110.0% |

| Liabilities in Excess of Other Assets | (10.0)% |

| Total Net Assets | 100.0% |

See accompanying Notes to Financial Statements.

AXS Alternative Value Fund

SCHEDULE OF INVESTMENTS

As of September 30, 2021

| Number of Shares | | | | | Value | |

| | | | | COMMON STOCKS — 149.5% | | | | |

| | | | | ADVERTISING — 1.1% | | | | |

| | 205 | | | Omnicom Group, Inc.1 | | $ | 14,854 | |

| | | | | AEROSPACE/DEFENSE — 2.6% | | | | |

| | 61 | | | L3Harris Technologies, Inc.1 | | | 13,434 | |

| | 66 | | | Northrop Grumman Corp.1 | | | 23,770 | |

| | | | | | | | 37,204 | |

| | | | | AGRICULTURE — 2.9% | | | | |

| | 595 | | | Altria Group, Inc.1 | | | 27,085 | |

| | 141 | | | Philip Morris International, Inc.1 | | | 13,365 | |

| | | | | | | | 40,450 | |

| | | | | BEVERAGES — 3.1% | | | | |

| | 76 | | | Brown-Forman Corp. - Class B1 | | | 5,093 | |

| | 193 | | | Coca-Cola Co.1 | | | 10,126 | |

| | 185 | | | PepsiCo, Inc.1 | | | 27,826 | |

| | | | | | | | 43,045 | |

| | | | | BIOTECHNOLOGY — 8.9% | | | | |

| | 90 | | | Amgen, Inc.1 | | | 19,139 | |

| | 95 | | | Biogen, Inc.*,1 | | | 26,884 | |

| | 398 | | | Gilead Sciences, Inc.1 | | | 27,800 | |

| | 47 | | | Regeneron Pharmaceuticals, Inc.*,1 | | | 28,443 | |

| | 122 | | | Vertex Pharmaceuticals, Inc.*,1 | | | 22,130 | |

| | | | | | | | 124,396 | |

| | | | | COMMERCIAL SERVICES — 1.9% | | | | |

| | 154 | | | Rollins, Inc.1 | | | 5,441 | |

| | 108 | | | Verisk Analytics, Inc.1 | | | 21,629 | |

| | | | | | | | 27,070 | |

| | | | | COSMETICS/PERSONAL CARE — 4.4% | | | | |

| | 333 | | | Colgate-Palmolive Co.1 | | | 25,168 | |

| | 30 | | | Estee Lauder Cos., Inc. - Class A1 | | | 8,998 | |

| | 192 | | | Procter & Gamble Co.1 | | | 26,842 | |

| | | | | | | | 61,008 | |

| | | | | DISTRIBUTION/WHOLESALE — 0.8% | | | | |

| | 27 | | | Pool Corp.1 | | | 11,729 | |

| | | | | DIVERSIFIED FINANCIAL SERVICES — 7.0% | | | | |

| | 268 | | | Cboe Global Markets, Inc.1 | | | 33,195 | |

| | 146 | | | CME Group, Inc.1 | | | 28,233 | |

| | 246 | | | Intercontinental Exchange, Inc.1 | | | 28,246 | |

AXS Alternative Value Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2021

| Number of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | DIVERSIFIED FINANCIAL SERVICES (Continued) | | | | |

| | 46 | | | Nasdaq, Inc.1 | | $ | 8,879 | |

| | | | | | | | 98,553 | |

| | | | | ELECTRIC — 3.9% | | | | |

| | 430 | | | AES Corp.1 | | | 9,817 | |

| | 212 | | | DTE Energy Co.1 | | | 23,682 | |

| | 54 | | | Entergy Corp.1 | | | 5,363 | |

| | 94 | | | Evergy, Inc.1 | | | 5,847 | |

| | 366 | | | PPL Corp.1 | | | 10,204 | |

| | | | | | | | 54,913 | |

| | | | | ELECTRONICS — 0.7% | | | | |

| | 29 | | | Waters Corp.*,1 | | | 10,362 | |

| | | | | ENVIRONMENTAL CONTROL — 4.6% | | | | |

| | 267 | | | Republic Services, Inc.1 | | | 32,056 | |

| | 213 | | | Waste Management, Inc.1 | | | 31,814 | |

| | | | | | | | 63,870 | |

| | | | | FOOD — 17.8% | | | | |

| | 558 | | | Campbell Soup Co.1 | | | 23,330 | |

| | 449 | | | Conagra Brands, Inc.1 | | | 15,208 | |

| | 434 | | | General Mills, Inc.1 | | | 25,962 | |

| | 168 | | | Hershey Co.1 | | | 28,434 | |

| | 420 | | | Hormel Foods Corp.1 | | | 17,220 | |

| | 168 | | | J M Smucker Co.1 | | | 20,165 | |

| | 410 | | | Kellogg Co.1 | | | 26,207 | |

| | 604 | | | Kroger Co.1 | | | 24,420 | |

| | 384 | | | Lamb Weston Holdings, Inc.1 | | | 23,566 | |

| | 232 | | | McCormick & Co., Inc.1 | | | 18,799 | |

| | 324 | | | Tyson Foods, Inc. - Class A1 | | | 25,576 | |

| | | | | | | | 248,887 | |

| | | | | GAS — 0.8% | | | | |

| | 476 | | | NiSource, Inc.1 | | | 11,533 | |

| | | | | HEALTHCARE-PRODUCTS — 5.2% | | | | |

| | 58 | | | Danaher Corp.1 | | | 17,658 | |

| | 51 | | | ResMed, Inc.1 | | | 13,441 | |

| | 118 | | | STERIS PLC1,2 | | | 24,105 | |

| | 31 | | | Thermo Fisher Scientific, Inc.1 | | | 17,711 | |

| | | | | | | | 72,915 | |

| | | | | HEALTHCARE-SERVICES — 3.6% | | | | |

| | 249 | | | Centene Corp.*,1 | | | 15,515 | |

AXS Alternative Value Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2021

| Number of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | HEALTHCARE-SERVICES (Continued) | | | | |

| | 15 | | | Humana, Inc.1 | | $ | 5,837 | |

| | 75 | | | UnitedHealth Group, Inc.1 | | | 29,306 | |

| | | | | | | | 50,658 | |

| | | | | HOUSEHOLD PRODUCTS/WARES — 5.2% | | | | |

| | 299 | | | Church & Dwight Co., Inc.1 | | | 24,688 | |

| | 136 | | | Clorox Co.1 | | | 22,523 | |

| | 190 | | | Kimberly-Clark Corp.1 | | | 25,164 | |

| | | | | | | | 72,375 | |

| | | | | INSURANCE — 15.1% | | | | |

| | 296 | | | Aflac, Inc.1 | | | 15,430 | |

| | 163 | | | Allstate Corp.1 | | | 20,752 | |

| | 53 | | | Aon PLC - Class A1,2 | | | 15,146 | |

| | 216 | | | Arthur J. Gallagher & Co.1 | | | 32,108 | |

| | 52 | | | Berkshire Hathaway, Inc.*,1 | | | 14,193 | |

| | 61 | | | Chubb Ltd.1,2 | | | 10,582 | |

| | 146 | | | Cincinnati Financial Corp.1 | | | 16,676 | |

| | 42 | | | Everest Re Group Ltd.1,2 | | | 10,533 | |

| | 41 | | | Marsh & McLennan Cos., Inc.1 | | | 6,209 | |

| | 285 | | | Progressive Corp.1 | | | 25,761 | |

| | 102 | | | Travelers Cos., Inc.1 | | | 15,505 | |

| | 75 | | | W R Berkley Corp.1 | | | 5,489 | |

| | 98 | | | Willis Towers Watson PLC1,2 | | | 22,781 | |

| | | | | | | | 211,165 | |

| | | | | INTERNET — 1.5% | | | | |

| | 102 | | | VeriSign, Inc.*,1 | | | 20,911 | |

| | | | | OIL & GAS — 2.2% | | | | |

| | 1,437 | | | Cabot Oil & Gas Corp.1 | | | 31,269 | |

| | | | | PACKAGING & CONTAINERS — 0.7% | | | | |

| | 871 | | | Amcor PLC1,2 | | | 10,095 | |

| | | | | PHARMACEUTICALS — 13.9% | | | | |

| | 266 | | | AbbVie, Inc.1 | | | 28,693 | |

| | 94 | | | AmerisourceBergen Corp.1 | | | 11,228 | |

| | 339 | | | Bristol-Myers Squibb Co.1 | | | 20,059 | |

| | 61 | | | Cigna Corp.1 | | | 12,210 | |

| | 369 | | | CVS Health Corp.1 | | | 31,313 | |

| | 147 | | | Eli Lilly & Co.1 | | | 33,964 | |

| | 166 | | | Johnson & Johnson1 | | | 26,809 | |

| | 70 | | | McKesson Corp.1 | | | 13,957 | |

| | 159 | | | Organon & Co.1 | | | 5,214 | |

AXS Alternative Value Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2021

| Number of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | PHARMACEUTICALS (Continued) | | | | |

| | 119 | | | Pfizer, Inc.1 | | $ | 5,118 | |

| | 29 | | | Zoetis, Inc.1 | | | 5,630 | |

| | | | | | | | 194,195 | |

| | | | | REITS — 2.3% | | | | |

| | 107 | | | Public Storage - REIT1 | | | 31,790 | |

| | | | | RETAIL — 13.3% | | | | |

| | 69 | | | Costco Wholesale Corp.1 | | | 31,005 | |

| | 128 | | | Dollar General Corp.1 | | | 27,154 | |

| | 111 | | | Dollar Tree, Inc.*,1 | | | 10,625 | |

| | 49 | | | Domino's Pizza, Inc.1 | | | 23,371 | |

| | 98 | | | McDonald's Corp.1 | | | 23,629 | |

| | 50 | | | Ross Stores, Inc.1 | | | 5,443 | |

| | 46 | | | Target Corp.1 | | | 10,523 | |

| | 85 | | | TJX Cos., Inc.1 | | | 5,608 | |

| | 587 | | | Walgreens Boots Alliance, Inc.1 | | | 27,618 | |

| | 149 | | | Walmart, Inc.1 | | | 20,768 | |

| | | | | | | | 185,744 | |

| | | | | SEMICONDUCTORS — 1.9% | | | | |

| | 500 | | | Intel Corp.1 | | | 26,640 | |

| | | | | SOFTWARE — 13.7% | | | | |

| | 298 | | | Activision Blizzard, Inc.1 | | | 23,062 | |

| | 246 | | | Akamai Technologies, Inc.*,1 | | | 25,729 | |

| | 357 | | | Cerner Corp.1 | | | 25,176 | |

| | 214 | | | Citrix Systems, Inc.1 | | | 22,977 | |

| | 163 | | | Jack Henry & Associates, Inc.1 | | | 26,742 | |

| | 39 | | | Microsoft Corp.1 | | | 10,995 | |

| | 396 | | | Oracle Corp.1 | | | 34,503 | |

| | 151 | | | Take-Two Interactive Software, Inc.*,1 | | | 23,265 | |

| | | | | | | | 192,449 | |

| | | | | TELECOMMUNICATIONS — 6.8% | | | | |

| | 919 | | | AT&T, Inc.1 | | | 24,822 | |

| | 403 | | | Juniper Networks, Inc.1 | | | 11,090 | |

| | 144 | | | Motorola Solutions, Inc.1 | | | 33,454 | |

| | 468 | | | Verizon Communications, Inc.1 | | | 25,277 | |

| | | | | | | | 94,643 | |

| | | | | TRANSPORTATION — 3.6% | | | | |

| | 221 | | | C.H. Robinson Worldwide, Inc.1 | | | 19,227 | |

AXS Alternative Value Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2021

| Number of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | TRANSPORTATION (Continued) | | | | |

| | 258 | | | Expeditors International of Washington, Inc.1 | | $ | 30,735 | |

| | | | | | | | 49,962 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $1,925,346) | | | 2,092,685 | |

| Principal Amount | | | | | | |

| | | | | SHORT-TERM INVESTMENTS — 1.9% | | | | |

| $ | 27,244 | | | UMB Bank demand deposit, 0.01%3 | | | 27,244 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | | (Cost $27,244) | | | 27,244 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 151.4% | | | | |

| | | | | (Cost $1,952,590) | | | 2,119,929 | |

| | | | | | | | | |

| | | | | Liabilities in Excess of Other Assets — (51.4)% | | | (719,879 | ) |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 1,400,050 | |

PLC – Public Limited Company

REIT – Real Estate Investment Trusts

| * | Non-income producing security. |

| 1 | All or a portion of the security is segregated as collateral for line of credit borrowings. As of September 30, 2021, the aggregate value of those securities was $2,092,685, representing 149.5% of net assets. |

| 2 | Foreign security denominated in U.S. Dollars. |

| 3 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

AXS Alternative Value Fund

SUMMARY OF INVESTMENTS

As of September 30, 2021

| Security Type/Industry | Percent of Total

Net Assets |

| Common Stocks | |

| Food | 17.8% |

| Insurance | 15.1% |

| Pharmaceuticals | 13.9% |

| Software | 13.7% |

| Retail | 13.3% |

| Biotechnology | 8.9% |

| Diversified Financial Services | 7.0% |

| Telecommunications | 6.8% |

| Household Products/Wares | 5.2% |

| Healthcare-Products | 5.2% |

| Environmental Control | 4.6% |

| Cosmetics/Personal Care | 4.4% |

| Electric | 3.9% |

| Healthcare-Services | 3.6% |

| Transportation | 3.6% |

| Beverages | 3.1% |

| Agriculture | 2.9% |

| Aerospace/Defense | 2.6% |

| REITS | 2.3% |

| Oil & Gas | 2.2% |

| Semiconductors | 1.9% |

| Commercial Services | 1.9% |

| Internet | 1.5% |

| Advertising | 1.1% |

| Distribution/Wholesale | 0.8% |

| Gas | 0.8% |

| Electronics | 0.7% |

| Packaging & Containers | 0.7% |

| Total Common Stocks | 149.5% |

| Short-Term Investments | 1.9% |

| Total Investments | 151.4% |

| Liabilities in Excess of Other Assets | (51.4)% |

| Total Net Assets | 100.0% |

See accompanying Notes to Financial Statements.

AXS Market Neutral Fund

SCHEDULE OF INVESTMENTS

As of September 30, 2021

| Number of Shares | | | | | Value | |

| | | | | COMMON STOCKS — 138.6% | | | | |

| | | | | AGRICULTURE — 1.7% | | | | |

| | 3,653 | | | Altria Group, Inc.1 | | $ | 166,285 | |

| | | | | BEVERAGES — 5.5% | | | | |

| | 2,610 | | | Brown-Forman Corp. - Class B1 | | | 174,896 | |

| | 3,248 | | | Coca-Cola Co.1 | | | 170,423 | |

| | 1,172 | | | PepsiCo, Inc.1 | | | 176,280 | |

| | | | | | | | 521,599 | |

| | | | | BIOTECHNOLOGY — 8.8% | | | | |

| | 817 | | | Amgen, Inc.1 | | | 173,735 | |

| | 537 | | | Biogen, Inc.*,1 | | | 151,966 | |

| | 2,533 | | | Gilead Sciences, Inc.1 | | | 176,930 | |

| | 272 | | | Regeneron Pharmaceuticals, Inc.*,1 | | | 164,609 | |

| | 920 | | | Vertex Pharmaceuticals, Inc.*,1 | | | 166,879 | |

| | | | | | | | 834,119 | |

| | | | | COMMERCIAL SERVICES — 1.9% | | | | |

| | 905 | | | Verisk Analytics, Inc.1 | | | 181,244 | |

| | | | | COSMETICS/PERSONAL CARE — 3.7% | | | | |

| | 2,349 | | | Colgate-Palmolive Co.1 | | | 177,537 | |

| | 1,280 | | | Procter & Gamble Co.1 | | | 178,944 | |

| | | | | | | | 356,481 | |

| | | | | DIVERSIFIED FINANCIAL SERVICES — 5.6% | | | | |

| | 1,482 | | | Cboe Global Markets, Inc.1 | | | 183,561 | |

| | 909 | | | CME Group, Inc.1 | | | 175,782 | |

| | 1,527 | | | Intercontinental Exchange, Inc.1 | | | 175,330 | |

| | | | | | | | 534,673 | |

| | | | | ELECTRIC — 5.4% | | | | |

| | 7,561 | | | AES Corp.1 | | | 172,618 | |

| | 1,515 | | | DTE Energy Co.1 | | | 169,241 | |

| | 6,223 | | | PPL Corp.1 | | | 173,497 | |

| | | | | | | | 515,356 | |

| | | | | ELECTRONICS — 1.7% | | | | |

| | 443 | | | Waters Corp.*,1 | | | 158,284 | |

| | | | | ENVIRONMENTAL CONTROL — 3.7% | | | | |

| | 1,468 | | | Republic Services, Inc.1 | | | 176,248 | |

| | 1,176 | | | Waste Management, Inc.1 | | | 175,647 | |

| | | | | | | | 351,895 | |

AXS Market Neutral Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2021

| Number of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | FOOD — 18.8% | | | | |

| | 4,435 | | | Campbell Soup Co.1 | | $ | 185,427 | |

| | 5,566 | | | Conagra Brands, Inc.1 | | | 188,521 | |

| | 3,176 | | | General Mills, Inc.1 | | | 189,988 | |

| | 1,029 | | | Hershey Co.1 | | | 174,158 | |

| | 4,034 | | | Hormel Foods Corp.1 | | | 165,394 | |

| | 1,481 | | | J M Smucker Co.1 | | | 177,765 | |