UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-01829 |

|

Columbia Acorn Trust |

(Exact name of registrant as specified in charter) |

|

One Financial Center, Boston, Massachusetts | | 02111 |

(Address of principal executive offices) | | (Zip code) |

|

James R. Bordewick, Jr., Esq. Columbia Management Advisors, LLC One Financial Center Boston, MA 02111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-617-426-3750 | |

|

Date of fiscal year end: | December 31, 2008 | |

|

Date of reporting period: | June 30, 2008 | |

| | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Q2 2008

Columbia Management®

Columbia Acorn Family of Funds

Class Z Shares

Managed by Columbia Wanger Asset Management, L.P.

Semiannual Report

June 30, 2008

n ColumbiaSM

Acorn® Fund

n ColumbiaSM

Acorn International®

n ColumbiaSM

Acorn USA®

n ColumbiaSM

Acorn International SelectSM

n ColumbiaSM

Acorn SelectSM

n ColumbiaSM

Thermostat FundSM

NOT FDIC INSURED

NOT BANK ISSUED

May Lose Value

No Bank Guarantee

The views expressed in the "Squirrel Chatter II" and "In a Nutshell" commentaries reflect the current views of the respective authors. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for a Columbia Acorn Fund are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any particular Columbia Acorn Fund. References to specific company securities should not be construed as a recommendation or investment advice and there can be no assurance that as of the date of publication of this report, the securities mentioned in each Fund's portfolio are still held or that the securities sold have not been repurchased.

You are invited to the 2008 Columbia Acorn Funds Shareholder Information Meeting!

Tuesday, September 23, 2008

12 noon to 1 p.m. Central time

There are two ways to participate in our Annual Shareholder Information Meeting:

1. Via the Web

To view a live webcast of the meeting on September 23, go to www.columbiafunds.com and follow the link under "Product News." If you can't join us at that time, a replay of the webcast will be available through October 24, 2008, and may be accessed the same way.

A test link is currently live on the site. We encourage you to log on and test your ability to access the webcast prior to the meeting date.

2. In Person

The shareholder information meeting will be held at:

Chase Bank Auditorium

10 South Dearborn Street

Chicago, IL 60602

A buffet lunch will be served at 11:30 a.m.

If you plan to join us in Chicago, please RSVP by September 18 by calling (800) 922-6769.

The Chase Bank Auditorium is located within the Chase Tower at the southeast corner of Madison and Dearborn. Use the southernmost entrance on the Dearborn side of the building. Then take the escalators down to the Plaza level and follow the signs to the Chase Bank Auditorium.

Columbia Acorn Fund News

Minimum Initial Investments Reduced for Columbia Acorn Fund,

Columbia Acorn USA and Columbia Acorn Select

Effective August 1, 2008, the minimum initial investment for most investors in Class Z shares was reduced to $2,500 for Columbia Acorn Fund, Columbia Acorn USA and Columbia Acorn Select.

The Columbia Acorn Board of Trustees agreed that lowering the minimum investment was in the best interest of shareholders and would continue to allow Columbia Wanger Asset Management, L.P. ("CWAM"), the Funds' advisor, to align investment decisions with its growth-at-a-reasonable-price strategy.

"CWAM monitors cash flows in the Funds very carefully. When small- and mid-cap valuations increased and inflows were strong, we twice raised minimum investment requirements for our domestic Acorn Funds and successfully slowed cash inflows. At the time, we felt that lower inflows were best for shareholders as we were finding fewer investment opportunities. Currently, the market downturn has created what we believe to be compelling valuations for lots of good businesses. The Funds are fully invested and have had modest outflows. The Funds' portfolio managers would much rather have moderate inflows in order to take advantage of market conditions," said Chuck McQuaid, chief investment officer of CWAM and lead portfolio manager of Columbia Acorn Fund.

Additional information on this change can be found in the supplement to the prospectus for these Funds dated August 1, 2008. If you have questions, you can reach us at (800) 922-6769.

Columbia Acorn Family of Funds

Table of Contents

| Performance At A Glance | | | 2 | | |

|

| Descriptions of Indexes | | | 3 | | |

|

| Squirrel Chatter II: Perceptions of Risk | | | 4 | | |

|

| Understanding Your Expenses | | | 6 | | |

|

| Columbia Acorn Fund | |

|

| In a Nutshell | | | 8 | | |

|

| At a Glance | | | 9 | | |

|

| Major Portfolio Changes | | | 20 | | |

|

| Statement of Investments | | | 22 | | |

|

| Columbia Acorn International | |

|

| In a Nutshell | | | 10 | | |

|

| At a Glance | | | 11 | | |

|

| Major Portfolio Changes | | | 34 | | |

|

| Statement of Investments | | | 36 | | |

|

| Portfolio Diversification | | | 43 | | |

|

| Columbia Acorn USA | |

|

| In a Nutshell | | | 12 | | |

|

| At a Glance | | | 13 | | |

|

| Major Portfolio Changes | | | 44 | | |

|

| Statement of Investments | | | 45 | | |

|

| Columbia Acorn International Select | |

|

| In a Nutshell | | | 14 | | |

|

| At a Glance | | | 15 | | |

|

| Major Portfolio Changes | | | 51 | | |

|

| Statement of Investments | | | 52 | | |

|

| Portfolio Diversification | | | 55 | | |

|

| Columbia Acorn Select | |

|

| In a Nutshell | | | 16 | | |

|

| At a Glance | | | 17 | | |

|

| Major Portfolio Changes | | | 56 | | |

|

| Statement of Investments | | | 57 | | |

|

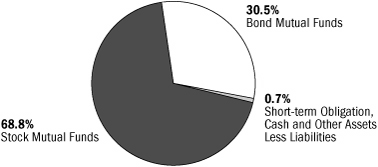

| Columbia Thermostat Fund | |

|

| In a Nutshell | | | 18 | | |

|

| At a Glance | | | 19 | | |

|

| Statement of Investments | | | 60 | | |

|

| Columbia Acorn Family of Funds | |

|

| Statements of Assets and Liabilities | | | 62 | | |

|

| Statements of Operations | | | 63 | | |

|

| Statements of Changes in Net Assets | | | 64 | | |

|

| Financial Highlights | | | 68 | | |

|

| Notes to Financial Statements | | | 71 | | |

|

Management Fee Evaluation

of the Senior Officer | | | 78 | | |

|

| Columbia Acorn Family of Funds Information | | | 85 | | |

|

2008 Mid-Year Distributions

The following table lists the Funds' mid-year distributions per share. The record date was June 10, 2008. The ex-dividend date was June 11, 2008, and the payment date was June 12, 2008.

| | | Short-term

Capital

Gains | | Long-term

Capital

Gains | | Ordinary

Income | | Reinvestment

Price | |

| Columbia Acorn Fund | | $ | 0.0335 | | | $ | 0.5199 | | | | None | | | $ | 27.60 | | |

| Columbia Acorn International | | $ | 0.0574 | | | $ | 0.5434 | | | $ | 0.2054 | | | $ | 40.34 | | |

| Columbia Acorn USA | | | None | | | $ | 0.9554 | | | | None | | | $ | 25.71 | | |

| Columbia Acorn International Select | | $ | 0.0322 | | | $ | 0.5108 | | | $ | 0.0423 | | | $ | 30.36 | | |

| Columbia Acorn Select | | | None | | | $ | 0.6941 | | | | None | | | $ | 26.49 | | |

| Columbia Thermostat Fund | | $ | 0.0222 | | | $ | 0.0496 | | | $ | 0.0403 | | | $ | 11.87 | | |

1

Columbia Acorn Family of Funds

Performance At A Glance Class Z Average Annual Total Returns through 6/30/08

| | | NAV on

6/30/08 | | 2nd

quarter* | | Year

to date* | | 1 year | | 3 years | | 5 years | | 10 years | | Life

of Fund | |

Columbia Acorn Fund

(ACRNX) (6/10/70) | | $ | 26.40 | | | | 0.90 | % | | | -9.05 | % | | | -12.19 | % | | | 7.25 | % | | | 13.95 | % | | | 11.15 | % | | | 15.55 | % | |

| Russell 2500 | | | | | | | 1.39 | % | | | -8.11 | % | | | -14.28 | % | | | 4.94 | % | | | 11.49 | % | | | 7.50 | % | | | NA | | |

| S&P 500 | | | | | | | -2.73 | % | | | -11.91 | % | | | -13.12 | % | | | 4.41 | % | | | 7.58 | % | | | 2.88 | % | | | 11.27 | % | |

| Lipper Small-Cap Core Funds Index | | | | | | | 2.37 | % | | | -7.04 | % | | | -13.50 | % | | | 5.09 | % | | | 11.07 | % | | | 6.95 | % | | | NA | | |

| Lipper Mid-Cap Core Funds Index | | | | | | | 2.66 | % | | | -6.97 | % | | | -10.95 | % | | | 6.44 | % | | | 11.16 | % | | | 7.49 | % | | | NA | | |

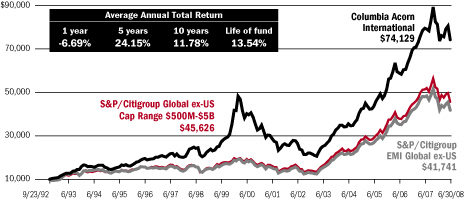

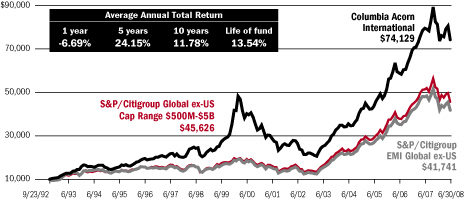

Columbia Acorn International

(ACINX) (9/23/92) | | $ | 38.97 | | | | -1.85 | % | | | -8.83 | % | | | -6.69 | % | | | 19.39 | % | | | 24.15 | % | | | 11.78 | % | | | 13.54 | % | |

S&P/Citigroup Global

ex-US Cap Range $500M-$5B | | | | | | | -4.05 | % | | | -11.68 | % | | | -11.29 | % | | | 16.25 | % | | | 22.71 | % | | | 11.24 | % | | | 10.10 | % | |

| S&P/Citigroup EMI Global ex-US | | | | | | | -3.31 | % | | | -11.16 | % | | | -13.08 | % | | | 15.73 | % | | | 22.07 | % | | | 10.23 | % | | | 9.48 | % | |

| MSCI EAFE Index | | | | | | | -2.25 | % | | | -10.96 | % | | | -10.61 | % | | | 12.84 | % | | | 16.67 | % | | | 5.83 | % | | | 7.97 | % | |

| Lipper Int'l Small-Cap Funds Index | | | | | | | -2.39 | % | | | -10.77 | % | | | -14.62 | % | | | 14.47 | % | | | 21.40 | % | | | 11.64 | % | | | NA | | |

Columbia Acorn USA

(AUSAX) (9/4/96) | | $ | 24.68 | | | | 2.10 | % | | | -8.48 | % | | | -13.53 | % | | | 3.17 | % | | | 11.36 | % | | | 7.61 | % | | | 11.57 | % | |

| Russell 2000 | | | | | | | 0.58 | % | | | -9.37 | % | | | -16.19 | % | | | 3.79 | % | | | 10.29 | % | | | 5.53 | % | | | 7.71 | % | |

| Lipper Small-Cap Core Funds Index | | | | | | | 2.37 | % | | | -7.04 | % | | | -13.50 | % | | | 5.09 | % | | | 11.07 | % | | | 6.95 | % | | | 8.90 | % | |

| S&P 500 | | | | | | | -2.73 | % | | | -11.91 | % | | | -13.12 | % | | | 4.41 | % | | | 7.58 | % | | | 2.88 | % | | | 7.58 | % | |

Columbia Acorn Int'l Select

(ACFFX) (11/23/98) | | $ | 30.49 | | | | 5.17 | % | | | -2.94 | % | | | 5.79 | % | | | 22.94 | % | | | 24.43 | % | | | — | | | | 13.73 | % | |

S&P/Citigroup World

ex-US Cap Range $2-10B | | | | | | | -2.73 | % | | | -10.42 | % | | | -12.18 | % | | | 14.54 | % | | | 20.26 | % | | | — | | | | 10.52 | % | |

| MSCI EAFE Index | | | | | | | -2.25 | % | | | -10.96 | % | | | -10.61 | % | | | 12.84 | % | | | 16.67 | % | | | — | | | | 6.14 | % | |

| Lipper International Funds Index | | | | | | | -1.90 | % | | | -11.15 | % | | | -8.94 | % | | | 14.16 | % | | | 16.91 | % | | | — | | | | 7.43 | % | |

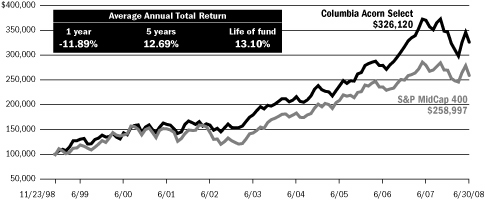

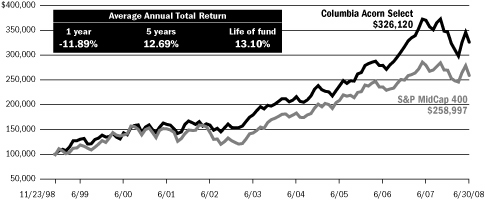

Columbia Acorn Select

(ACTWX) (11/23/98) | | $ | 26.08 | | | | 9.42 | % | | | -5.80 | % | | | -11.89 | % | | | 11.05 | % | | | 12.69 | % | | | — | | | | 13.10 | % | |

| S&P MidCap 400 | | | | | | | 5.43 | % | | | -3.90 | % | | | -7.34 | % | | | 7.45 | % | | | 12.61 | % | | | — | | | | 10.42 | % | |

| Lipper Mid-Cap Growth Index | | | | | | | 5.00 | % | | | -8.43 | % | | | -3.08 | % | | | 10.93 | % | | | 12.52 | % | | | — | | | | 7.24 | % | |

| S&P 500 | | | | | | | -2.73 | % | | | -11.91 | % | | | -13.12 | % | | | 4.41 | % | | | 7.58 | % | | | — | | | | 2.66 | % | |

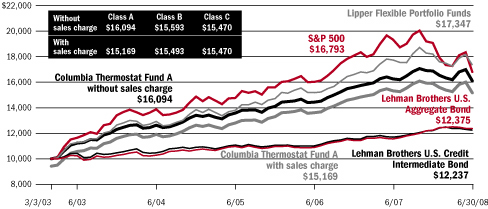

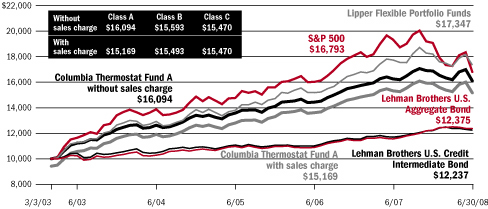

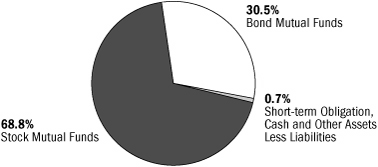

Columbia Thermostat Fund

(COTZX) (9/25/02)† | | $ | 11.59 | | | | -0.60 | % | | | -4.57 | % | | | -0.86 | % | | | 6.07 | % | | | 7.75 | % | | | — | | | | 9.06 | % | |

| S&P 500 | | | | | | | -2.73 | % | | | -11.91 | % | | | -13.12 | % | | | 4.41 | % | | | 7.58 | % | | | — | | | | 10.07 | % | |

Lehman Brothers

U.S. Aggregate Bond Index | | | | | | | -1.02 | % | | | 1.13 | % | | | 7.12 | % | | | 4.09 | % | | | 3.86 | % | | | — | | | | 4.34 | % | |

Lehman Brothers

U.S. Credit Intermediate Bond Index | | | | | | | -1.00 | % | | | 0.27 | % | | | 4.55 | % | | | 3.38 | % | | | 3.26 | % | | | — | | | | 4.48 | % | |

| Lipper Flexible Portfolio Funds Index | | | | | | | 0.52 | % | | | -4.65 | % | | | -2.16 | % | | | 7.94 | % | | | 8.99 | % | | | — | | | | 10.58 | % | |

| 50/50 Blended Benchmark | | | | | | | -1.75 | % | | | -5.41 | % | | | -3.24 | % | | | 4.41 | % | | | 5.85 | % | | | — | | | | 7.36 | % | |

*Not annualized.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value of an investment in a Fund will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Please visit columbiamanagement.com for daily and most recent month-end updates. Net asset value (NAV) returns do not include sales charges or contingent deferred sales charges (CDSC). If they were included, returns would have been lower. Class Z shares are sold only at NAV with no Rule 12b-1 fee. Only eligible investors may purchase Class Z shares of the Funds, directly or by exchange. Please see each Fund's prospectus for eligibility and other details. Class Z shares have limited eligibility and the investment minimum requirement may vary.

Performance results reflect any voluntary waivers or reimbursement of Fund expenses by the investment advisor and/or any of its affiliates. Absent these waivers or reimbursement arrangements, performance results would have been lower.

Annual operating expense ratios are as stated in each Fund prospectus that is current as of the date of this report and differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and reimbursements as well as different time periods used in calculating the ratios. Columbia Acorn Fund Class Z: 0.74%. Columbia Acorn International Class Z: 0.91%. Columbia Acorn USA Class Z: 0.98%. Columbia Acorn International Select Class Z: 1.18%. Columbia Acorn Select Class Z: 0.91%. Columbia Thermostat Fund has a contractual expense waiver or reimbursement that expires April 30, 2009. Expense ratios without and with the contractual waiver, including fees and expenses associated with the Fund's investments in other investment companies, for Class Z shares are 1.10% and 0.95%, respectively. Absent the waiver or reimbursement, performance results would have been lower.

†A "fund of funds" bears its allocable share of the costs and expenses of the underlying funds in which it invests. Such funds are thus subject to two levels of fees and potentially higher expense ratios than would be associated with an investment in a fund that invests and trades directly in financial instruments under the direction of a single manager. Effective July 1, 2008, Columbia Thermostat Fund changed its primary benchmark for debt securities to the Lehman Brothers U.S. Aggregate Bond Index and added a custom supplemental benchmark, the 50/50 Blended Benchmark, established by the Advisor. The Advisor believes these changes allow for more appropriate comparison to the Fund's investments.

All results shown assume reinvestment of distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Unlike mutual funds, indexes are not actively managed and do not incur fees or expenses. It is not possible to invest directly in an index. For index definitions, see Page 3.

2

Descriptions of Indexes Included in this Report

• Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

• Standard & Poor's (S&P) MidCap 400 Index is a market value-weighted index that tracks the performance of 400 mid-cap U.S. companies.

• Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

• Russell 2500TM Index measures the performance of the 2,500 smallest companies in the Russell 3000 Index, which represents approximately 17% of the total market capitalization of the Russell 3000 Index.

• S&P/Citigroup EMI Global ex-US Index is an unmanaged index consisting of the bottom 20% of institutionally investable capital of developed and emerging countries, outside the United States.

• S&P/Citigroup Global ex-US Cap Range $500M-$5B Index is a subset of the broad market selected by the index sponsor representing the mid- and small-cap developed and emerging markets, excluding the United States.

• Morgan Stanley Capital International Europe, Australia, Far East (MSCI EAFE) Index is a capitalization-weighted index that tracks the total return of common stocks in 21 developed-market countries within Europe, Australia and the Far East.

• S&P/Citigroup World ex-US Cap Range $2–10B Index is a subset of the broad market selected by the index sponsor representing the mid-cap developed market, excluding the United States.

• Lipper Indexes include the largest funds tracked by Lipper, Inc. in the named category. Lipper Mid-Cap Growth Index, 30 mid-cap growth funds; Lipper Mid-Cap Core Funds Index, 30 mid-cap core funds; Lipper International Funds Index, 30 largest non-U.S. funds, not including non-U.S. small-cap funds; Lipper International Small-Cap Funds Index, 10 largest non-U.S. funds investing in small-cap companies, including Columbia Acorn International; Lipper Small-Cap Core Funds Index, 30 largest small-cap core funds, including Columbia Acorn Fund; Lipper Flexible Portfolio Funds Index, an equal-weighted index of the 30 largest mutual funds within the Flexible Portfolio fund classification, as defined by Lipper.

• Lehman Brothers U.S. Credit Intermediate Bond Index is the intermediate component of the U.S. Credit Index. The U.S. Credit Index includes publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements.

• Lehman Brothers U.S. Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

• 50/50 Blended Benchmark, established by the Advisor, is an equally weighted custom composite of Columbia Thermostat Fund's primary equity and primary debt benchmarks. The percentage of the Fund's assets allocated to stock and bond portfolio funds will vary, and accordingly the composition of the Fund's portfolio will not always reflect the composition of the 50/50 Blended Benchmark.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

3

Squirrel Chatter II: Perceptions of Risk

Most people tend to calibrate risk poorly. We overestimate the likelihood of being harmed by the things that make the evening news and underestimate those that don't. In a survey, people estimated that the chance of death by accident matched the chance of death by disease. In fact, disease causes 17-times more deaths than accidents.1

Most people tend to calibrate risk poorly. We overestimate the likelihood of being harmed by the things that make the evening news and underestimate those that don't. In a survey, people estimated that the chance of death by accident matched the chance of death by disease. In fact, disease causes 17-times more deaths than accidents.1

Dan Gardner's, Risk, The Science and Politics of Fear,2 explains why our views and actions are often so distorted. It seems our perceptions are most influenced by preconceived notions, reinforced by recent information. Accidents are newsworthy, as are catastrophes. If fatalities occur in large numbers in a single event—instead of in small numbers dispersed over time—our perception of risk rises.3

Besides catastrophes, it won't shock too many parents to learn that we tend to worry a lot about our children. Other things that we can't control, like airplane flights, can be worrisome, while things that we can control, such as automobiles, evoke less fear despite higher risks. Things that we don't understand such as trace chemicals,4 and other man-made risks like nuclear power, are also feared. Many people worry about radiation from cell phones, while ignoring the real hazard of driving while using cell phones. Many non-headline risks caused by nature, such as radon gas, which kills an estimated 41,000 people a year in the U.S. and Europe,5 tend to be downplayed.

Gardner notes that we are living longer in the safest era ever known to mankind. Horrible diseases like smallpox have been eliminated while others have been drastically curtailed. Childhood mortality has especially plunged and accident rates are also down.

Fear Mongering Profiteers

So who is putting the scary thoughts into our heads? The media is an obvious culprit because sensational stories sell newspapers and increase viewership. Companies trying to sell certain health care products or security services and devices also find fear mongering to be profitable. The number of companies lobbying homeland security officials rose from 15 in 2001 to 861 in 2004 as fears of terrorist attacks swelled.6 Trial lawyers reaping the rewards of questionable lawsuits, politicians pandering for votes and special interest groups seeking funding also try to keep people scared.

Fear can end up increasing risks. People need to remember the classic definition of risk: probability times consequences. Avoiding immunizations or weight loss treatments due to possible side effects can be ill advised. Diabetes, a disease linked to obesity, has been diagnosed in 24 million Americans. That's eight percent of the total population.7

The American Council on Science and Health is dedicated to separating real health risks from unfounded health scares, tracking health scares reported by the press and debunking them. Among the top scares in 2007 were allegations that lipstick, fluoridated water, roses and water bottles are hazardous. Among the top scares of all time were cranberries (1959), DDT (1962), cyclamates (1969), Alar (1989), cellular phone radiation (1993) and trace PCBs in farmed salmon (2003).8 Fumes from new shower curtains may make the list this year!

Rational Understanding of Risk

Peter L. Bernstein's, Against The Gods, The Remarkable Story of Risk,9 is a fascinating review of mankind's history of approaching risk, and how to understand, measure and deal with it. He reviews the advances in probability theory, which enabled the creation of insurance and, in turn, facilitated trade and investment. He states that managing risks depends on the use of three assumptions originated by Jacob Bernoulli around the year 1700: full information, independent trials and relevance of quantitative valuation.

Bernstein explores additional progress in risk management, particularly in investing. Diversification may reduce risk. However, some quantitative techniques for investing have failed. "Portfolio insurance," a quantitative approach to reduce equity holdings in market declines via the purchase of put options, intensified the market collapse of 1987. Subsequent to the book's publication, numerous quant managers have claimed that "six sigma" events (one in a million chance of occurring) caused huge losses in their funds. These failures occurred because the investment models violated Bernoulli's "independent trials"

4

assumption stated above. Stock price movements may look independent, until numerous people attempt the same strategies or until human emotions result in lots of investors reacting in similar manners.

Stock Market Risks

Sentiment in the stock market seems to gyrate between greed and fear, creating bull and bear markets. Because the S&P 500 Index has fallen more than 20% from its peak, a bear market has been proclaimed. This suggests that the market is currently focusing on fear.

I recall a long-ago brokerage firm ad listing people's fears each year for decades. The list likely included events like the Cuban Missile Crisis and Three Mile Island. It noted that there seemed to be a reason to avoid investing in stocks each year. But starting with $1,000 50 years ago, an investment in the S&P 500 would have resulted in $140,364 as of June 30, 2008, vs. $13,619 if invested in super safe treasury bills. Meanwhile, inflation would require $7,535 to buy in 2008 what $1,000 bought in 1958.10 This example suggests that staying out of stocks would have been a very bad decision.

Market strategist Steve Leuthold provides lots of data and perspectives. Based on his estimate of "operating" (recurring) earnings, the S&P 500 at its July 11, 2008, close of 1,239 was selling at about 14.5-times earnings. That multiple matched the depths of the 2002-2003 bear market and was below the market's average price-earnings (PE) ratio11 of 16.5-times, calculated since 1926. Leuthold notes that market price-earnings ratios vary a lot, and that inflation is a major driver of PE ratios. When inflation has varied between zero and 5%, PE ratios averaged 18- to 19-times. When inflation has been between 5% and 7%, PE ratios averaged 13.8-times, and when inflation was 7% or more, PE ratios averaged 11.4-times.12

Inflation has been boosted by fuel and food prices, and the Consumer Price Index recently spiked up to a 5% year-over-year gain. Some are concerned that we may be returning to a period of big government and stagflation. Future inflation is indeed unpredictable, but continued surges in fuel and food prices from current lofty levels seem unlikely. Low unit labor cost increases, continued globalization and the continued success of capitalism all suggest that inflation may slow. If inflation does slow, Leuthold's data suggests that PE ratios and stock prices can rise a lot.

We are stock pickers rather than economists, and we are now seeing what we believe to be many more excellent investment opportunities than we've seen for several years. Consequently, focusing on fear seems like a mistake and taking a longer term perspective seems to be more rational.

Charles P. McQuaid

President and Chief Investment Officer

Columbia Wanger Asset Management, L.P.

The information and data provided in this analysis are derived from sources that we deem to be reliable and accurate. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. The views/opinions expressed in "Squirrel Chatter II" are those of the author and not of the Columbia Acorn Trust Board, are subject to change at any time based upon economic, market or other conditions, may differ from views expressed by other Columbia Management associates or other divisions of Bank of America and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Acorn Fund are based on numerous factors, may not be relied on as an indication of trading intent on beha lf of any particular Columbia Acorn Fund.

1 Gardner, Dan, Risk, the Science and Politics of Fear, (Virgin Book Ltd, 2008), pg. 13.

2 In addition to Gardner's book on the subject of risk, I also recommend Panicology written by statisticians Simon Briscoe and Hugh Aldersey-Williams (Viking/Penguin Books, 2008).

3 Gardner, Dan, op. cit., pgs. 62-76.

4 Gardner notes that our ability to find trace chemicals has never been better. Today we have the technology to dissect the components of drinking water, for example, to the level of one part per billion—equivalent to a single grain of sugar in an Olympic-size swimming pool. While it's true that the elements in trace chemicals can cause cancer, science and testing almost never look at such trace amounts.

5 Gardner, Dan, op. cit., pg. 81.

6 Ibid, pg. 281.

7 Source: American Council on Science and Health, "ACSH Morning Dispatch," June 25, 2008.

8 The study titled, "Fact Versus Fears (Fourth Edition)" is available on the American Council on Science and Health website at www.acsh.org.

9 Bernstein, Peter L., Against the Gods, The Remarkable Story of Risk, (John Wiley & Sons, Inc., 1996).

10 Figures include the reinvestment of dividends and are pretax.

11 The price-earnings (PE) ratio reflects the price of a stock divided by earnings per share. This ratio gives investors an idea of how much they are paying for a company's earning power. In general, the higher the PE, the more investors are paying, and therefore the more earnings growth they are expecting.

12 Leuthold Weeden Institutional Research, "Perception For The Professional," August 2008, Vol. 28 No. 8.

5

Understanding Your Expenses

As a Fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory fees, Rule 12b-1 fees (distribution and service fees) and other Fund expenses. The following information is intended to help you understand your ongoing costs of investing in the Columbia Acorn Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in the Class Z shares of the Columbia Acorn Family of Funds for the last six months. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different results. The amount listed in the "Actual" column is calculated using each Fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column assumes that the return each year is 5% before expenses and then applies each Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the reporting period. See the "Compare With Other Funds" information for details on using the hypothetical data.

January 1, 2008 – June 30, 2008

| | | Account value at

the beginning of

the period ($) | | Account value at

the end of

the period ($) | | Expenses paid

during the period ($) | | Fund's

annualized

expense

ratio (%)* | |

| Class Z Shares | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Columbia Acorn Fund | | | 1,000.00 | | | | 1,000.00 | | | | 909.50 | | | | 1,021.13 | | | | 3.56 | | | | 3.77 | | | | 0.75 | | |

| Columbia Acorn International | | | 1,000.00 | | | | 1,000.00 | | | | 911.69 | | | | 1,020.29 | | | | 4.37 | | | | 4.62 | | | | 0.92 | | |

| Columbia Acorn USA | | | 1,000.00 | | | | 1,000.00 | | | | 915.22 | | | | 1,019.89 | | | | 4.76 | | | | 5.02 | | | | 1.00 | | |

| Columbia Acorn International Select | | | 1,000.00 | | | | 1,000.00 | | | | 970.61 | | | | 1,019.05 | | | | 5.73 | | | | 5.87 | | | | 1.17 | | |

| Columbia Acorn Select | | | 1,000.00 | | | | 1,000.00 | | | | 942.02 | | | | 1,020.29 | | | | 4.44 | | | | 4.62 | | | | 0.92 | | |

| Columbia Thermostat Fund | | | 1,000.00 | | | | 1,000.00 | | | | 954.30 | | | | 1,023.62 | | | | 1.21 | | | | 1.26 | | | | 0.25 | | |

Expenses paid during the period are equal to each Fund's annualized expense ratio, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half-year and divided by 366.

Had the investment advisor and/or any of its affiliates not waived fees or reimbursed a portion of expenses, account value at the end of the period would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the Funds and do not reflect any transaction costs, such as sales charges, redemption or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning different funds. If these transaction costs were included, your costs would have been higher.

Columbia Thermostat Fund's expenses do not include fees and expenses incurred by the Fund from the underlying portfolio funds in which it invests.

*For the six months ended June 30, 2008.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Funds with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the continuing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees.

6

Estimating Your Actual Expenses

To estimate the expenses that you actually paid over the period, first you will need your account balance at the end of the period:

• For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at (800) 922-6769.

• For shareholders who receive their account statements from their brokerage firm, contact your brokerage firm to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table titled "Expenses paid during the period," locate the amount for your Fund. You will find this number is in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

7

Columbia Acorn Fund

In a Nutshell

Charles P. McQuaid

Lead Portfolio Manager

Robert A. Mohn

Co-Portfolio Manager

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Performance may reflect any voluntary waivers or reimbursements of fund expenses by the Advisor or its affiliates. Absent these waivers, or reimbursement arrangements, performance results may be lower. Please visit columbiamanagement.com for daily and most recent month-end performance updates.

Fund's Positions

in Mentioned Holdings

As a percentage of net assets, as of 6/30/08

| FMC Technologies | | | 2.4 | % | |

| Fugro | | | 2.0 | % | |

| Ultra Petroleum | | | 1.5 | % | |

| Flir Systems | | | 1.4 | % | |

| Abercrombie & Fitch | | | 1.1 | % | |

| ITT Educational Services | | | 1.1 | % | |

| Southwestern Energy | | | 1.0 | % | |

| Bally Technologies | | | 0.7 | % | |

| Sociedad Quimica y Minera de Chile | | | 0.5 | % | |

| Expedia | | | 0.4 | % | |

| Pacific Rubiales Energy | | | 0.4 | % | |

| Penn National Gaming | | | 0.3 | % | |

| International Game Technology | | | 0.3 | % | |

| Pinnacle Entertainment | | | 0.2 | % | |

| Hong Kong Exchanges and Clearing | | | 0.2 | % | |

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

Columbia Acorn Fund fell 9.05% in the first half of 2008, performing somewhat worse than its primary benchmark, the Russell 2500 Index, which dropped 8.11%. The Fund underperformed other small- and mid-cap benchmarks, but beat the large-cap S&P 500, which dropped 11.91%. Columbia Acorn Fund rose 0.90% in the second quarter, a bit less than the Russell 2500's 1.39% gain, and mixed against other benchmarks, as shown on Page 2.

Gaming stocks continued their losing streak and accounted for four of the 10 largest dollar droppers in the first half of 2008. Regional casino operators Pinnacle Entertainment and Penn National Gaming plunged 55% and 45%, respectively, in the half. Penn dropped 26% during the second quarter on rumors, which were subsequently confirmed, that its sellout would be aborted. Gaming equipment manufacturer Bally Technologies reported fine earnings, but dropped 32% in the half. Competitor International Game Technology reported disappointing results on lower slot machine shipments; its stock fell 43% in the half and 38% in the quarter. While gaming revenues are apparently becoming more cyclical, we continue to believe that the industry will grow over the long term.

Other consumer stocks were also weak. Teen apparel retailer Abercrombie & Fitch fell 21% in the half and 14% in the quarter, largely due to macroeconomic factors and concerns. Online travel services company Expedia plunged 42% in the half, also on macroeconomic concerns, despite fine earnings growth.

Energy stocks dominated the dollar winners list in both periods. Deepwater well systems provider FMC Technologies was the Fund's top dollar winner for the half and the quarter, rising about 35% each period. Natural gas and oil producers Ultra Petroleum and Southwestern Energy remained hot, ranking second and third for the half and in the top five for the quarter, on increased reserve estimates and higher gas prices.

Infrared camera producer Flir Systems was the Fund's fourth most profitable stock in the half and third in the quarter, rising 29% and 35%, respectively, on excellent earnings and lots of large new military orders. Potash producer Sociedad Quimica y Minera de Chile was the Fund's top percentage gainer in both periods, rising 166% in the half and doubling during the second quarter. Higher grain prices have boosted the demand for and price of potash products and alternative energy bulls have noticed that this company has the world's largest and lowest-cost lithium reserves. ITT Educational Services jumped 80% in the quarter, taking second place in both percentage and dollar gains. Improved earnings and reduced student loan concerns caused a sharp rebound in the stock, which had dropped 46% in the first quarter.

Columbia Acorn Fund's international stocks outperformed the Fund in both periods, falling only 3.11% in the half and rising 5.89% in the quarter. Sociedad Quimica y Minera de Chile, mentioned above, helped international results substantially. Offshore energy services company Fugro rose 12% in the quarter and 14% in the half while oil producer Pacific Rubiales Energy jumped more than 50% in the half. Hong Kong Exchanges and Clearing continued to reflect the downdraft in Chinese stocks, falling 45% in the half. At the end of the period, foreign stocks were 9.2% of Columbia Acorn Fund, down from 9.4% last quarter and 11.5% a year ago.

Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments.

8

Columbia Acorn Fund (ACRNX)

At a Glance

Performance data quoted represents past performance and current performance may be higher or lower. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Performance may reflect any voluntary waivers or reimbursements of Fund expenses by the Advisor or any of its affiliates. Absent these waivers or reimbursement arrangements, performance results may be lower. Visit columbiamanagement.com for daily and most recent month-end updates.

Pretax and After-tax Average Annual Total Returns (Class Z)

through June 30, 2008

| Inception 6/10/70 | | Year

to date* | | 1 year | | 5 years | | 10 years | |

| Returns before taxes | | | -9.05 | % | | | -12.19 | % | | | 13.95 | % | | | 11.15 | % | |

| Returns after taxes on distributions | | | -9.34 | | | | -13.31 | | | | 13.01 | | | | 9.73 | | |

Returns after taxes on distributions

and sale of fund shares | | | -5.52 | | | | -6.29 | | | | 12.22 | | | | 9.35 | | |

| Russell 2500 (pretax) | | | -8.11 | | | | -14.28 | | | | 11.49 | | | | 7.50 | | |

| S&P 500 (pretax) | | | -11.91 | | | | -13.12 | | | | 7.58 | | | | 2.88 | | |

All results shown assume reinvestment of distributions.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Returns after taxes on distributions and sale of Fund shares reflect the additional tax impact of long-term gains or losses realized when Fund shares are sold. The returns are taxed at the maximum rate and assume shares were purchased at the beginning of the period. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class Z shares only; after-tax returns for other share classes will vary. Indexes do not reflect any deduction for fees, expenses or taxes.

The Fund's Class Z shares annual operating expense ratio, as stated in the current prospectus, is 0.74%.

*Year to date data is not annualized.

Columbia Acorn Fund Portfolio Diversification

as a percentage of net assets as of 6/30/08

Columbia Acorn Fund Top 10 Holdings

as a percentage of net assets as of 6/30/08

| | 1. | | | FMC Technologies

Oil & Gas Wellhead Manufacturer | | 2.4%

| |

| | 2. | | | Fugro (Netherlands)

Oilfield Services | | 2.0%

| |

| | 3. | | | Ultra Petroleum

Oil & Gas Producer | | 1.5%

| |

| | 4. | | | Flir Systems

Infrared Cameras | | 1.4%

| |

| | 5. | | | Expeditors International of Washington

International Freight Forwarder | | 1.4%

| |

| | 6. | | | Ametek

Aerospace/Industrial Instruments | | 1.4%

| |

| | 7. | | | Coach

Designer & Retailer of Branded Leather Accessories | | 1.2%

| |

| | 8. | | | People's United

Connecticut Savings & Loan | | 1.2%

| |

| | 9. | | | Abercrombie & Fitch

Teen Apparel Retailer | | 1.1%

| |

| | 10. | | | Donaldson

Industrial Air Filtration | | 1.1%

| |

Portfolio holdings are subject to change periodically and may not be representative of current holdings. See the Statement of Investments for a complete list of the Fund's holdings.

The Growth of a $75,000 Investment in Columbia Acorn Fund (Class Z)

June 10, 1970 through June 30, 2008

This graph compares the results of $75,000 invested in Columbia Acorn Fund at inception on June 10, 1970 to the S&P 500 Index and to an initial $238,325 investment in the Russell 2500 on the index's December 31, 1978 inception date. The indexes are unmanaged and returns for both the indexes and the Fund include reinvested dividends and capital gains. It is not possible to invest directly in an index. The graph does not reflect taxes that a shareholder would pay on Fund distributions or on a sale of Fund shares.

Total Net Assets of the Fund: $17.2 billion

*A $75,000 investment in Columbia Acorn Fund at inception appreciated to $238,325 on December 31, 1978, the inception date of the Russell 2500. For comparison with the Russell 2500, we assigned the index the same value as the Fund at index inception.

9

Columbia Acorn International

In a Nutshell

P. Zachary Egan

Co-Portfolio Manager

Louis J. Mendes III

Co-Portfolio Manager

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Performance may reflect any voluntary waivers or reimbursements of fund expenses by the Advisor or its affiliates. Absent these waivers, or reimbursement arrangements, performance results may be lower. Please visit columbiamanagement.com for daily and most recent month-end performance updates.

Fund's Positions

in Mentioned Holdings

As a percentage of net assets, as of 6/30/08

| Atwood Oceanics | | | 1.5 | % | |

| Sociedad Quimica y Minera de Chile | | | 1.4 | % | |

| ShawCor | | | 1.2 | % | |

| FMC Technologies | | | 1.1 | % | |

| Novolipetsk Steel | | | 0.8 | % | |

| Informa Group | | | 0.7 | % | |

| Park24 | | | 0.4 | % | |

| Taylor Nelson Sofres | | | 0.3 | % | |

| Point | | | 0.3 | % | |

| Expro International Group | | | 0.2 | % | |

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

Columbia Acorn International fell 1.85% in the second quarter of 2008. This compares with a 4.05% drop by the Fund's primary benchmark, the S&P/Citigroup Global ex-US Cap Range $500M-$5B Index. The Fund also posted a slightly better return than the large-cap MSCI EAFE Index, which was down 2.25%. Year to date through June, the Fund was down 8.83%, which was 2.85 basis points ahead of its primary benchmark.

The most important positive contributors to the Fund's absolute and relative returns fall into three groups: oil services stocks; basic materials stocks; and UK companies that were the subject of bid activity.

For several years the Fund has maintained a modest overweight in energy-related stocks, with an emphasis on service companies that provide equipment and technology to the major oil companies. Many of these service providers have enjoyed strong volume growth and pricing power as exploration, drilling, and pipeline projects have proliferated and grown more complex amid higher energy prices. Canadian company ShawCor is a beneficiary of this trend, as it controls processes for coating pipeline with materials that affect properties such as corrosion, thermal insulation and buoyancy. Similarly, Atwood Oceanics, FMC Technologies (both U.S. companies generating a majority of their revenues outside of the United States), and Expro International Group, based in the UK, have been beneficiaries of the recent growth in the number of deepwater wells. All four of these stocks posted 30% or greater returns during the quarter. Expro was acquired by a private equity fund shortly before the close of the quarter.

After proving merely defensive in a down market in the first quarter, in the second quarter the Fund's basic materials stocks together generated a modest positive return. Sociedad Quimica y Minera de Chile was up over 100% as fertilizer prices nearly tripled over the last year. Rising raw materials costs in the steel industry pushed up selling prices, rewarding integrated producers like Russia's Novolipetsk Steel, which was up over 30% for the quarter.

Though the UK market was a loser in the quarter, the Fund's returns there were buoyed by bid activity. Market researcher Taylor Nelson Sofres was up 51% after WPP, the London-based advertising and public relations firm, attempted to derail a possible merger with competitor GfK by making a hostile bid. We elected to clear out of the position at a price that we believe fully valued the franchise, particularly in an uncertain credit environment. A similar pattern of events drove UK publisher Informa Group up over 35% in the quarter. After Informa entered discussions with United Business Media regarding a possible merger, a consortium of private equity investors made an offer for the company, which is still under consideration by the company's supervisory board.

Japanese consumer stocks weighed on performance. Park24, a parking lot operator, was down 39%, as the company struggled to get its pricing policy right. Point, an apparel retailer, was down 40% on a disappointing sales trend. The Fund's stocks were weak elsewhere in Asia as investors worried about how high energy and food prices might affect consumer spending. Fortunately, the Fund's losses here were mitigated by good stock selection.

The potential sources of anxiety in global markets now appear to be manifold. High input prices are stressing profitability in some areas. While this sort of disruption can represent a threat, it can also open up spaces for agile companies to gain traction with products and services better suited to the changed operating environment, as the energy service companies described above have done. It is on these sorts of situations that we, as longer-term investors, focus our research efforts. We are also somewhat encouraged by valuations, which we believe in many cases appear to reflect overly pessimistic scenarios.

International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments. Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility.

10

Columbia Acorn International (ACINX)

At a Glance

Performance data quoted represents past performance and current performance may be higher or lower. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Performance may reflect any voluntary waivers or reimbursements of Fund expenses by the Advisor or any of its affiliates. Absent these waivers or reimbursement arrangements, performance results may be lower. Visit columbiamanagement.com for daily and most recent month-end updates.

Pretax and After-tax Average Annual Total Returns (Class Z)

through June 30, 2008

| Inception 9/23/92 | | Year

to date* | | 1 year | | 5 years | | 10 years | |

| Returns before taxes | | | -8.83 | % | | | -6.69 | % | | | 24.15 | % | | | 11.78 | % | |

| Returns after taxes on distributions | | | -9.22 | | | | -7.98 | | | | 23.28 | | | | 10.76 | | |

Returns after taxes on distributions

and sale of fund shares | | | -5.48 | | | | -2.48 | | | | 21.62 | | | | 10.20 | | |

S&P/Citigroup Global

ex-US Cap Range $500M-$5B† | | | -11.68 | | | | -11.29 | | | | 22.71 | | | | 11.24 | | |

S&P/Citigroup EMI Global ex-US

(pretax) | | | -11.16 | | | | -13.08 | | | | 22.07 | | | | 10.23 | | |

All results shown assume reinvestment of distributions.

†Effective January 1, 2008, the Fund changed its primary benchmark to the S&P/Citigroup Global ex-US Cap Range $500M-$5B Index.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Returns after taxes on distributions and sale of Fund shares reflect the additional tax impact of long-term gains or losses realized when Fund shares are sold. The returns are taxed at the maximum rate and assume shares were purchased at the beginning of the period. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class Z shares only; after-tax returns for other share classes will vary. Indexes do not reflect any deduction for fees, expenses or taxes.

The Fund's Class Z annual operating expense ratio, as stated in the current prospectus, is 0.91%.

*Year to date data is not annualized.

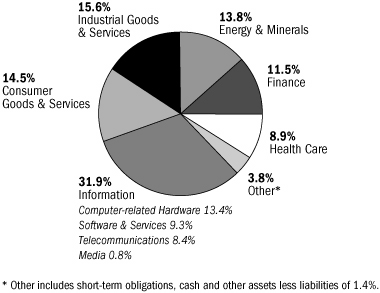

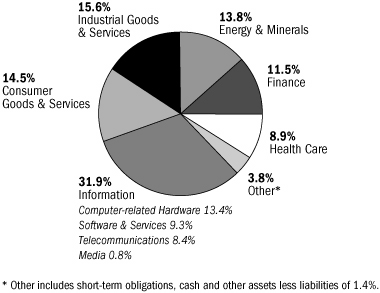

Columbia Acorn International Portfolio Diversification

as a percentage of net assets as of 6/30/08

Columbia Acorn International Top 10 Holdings

as a percentage of net assets as of 6/30/08

| | 1. | | | Fugro (Netherlands)

Oilfield Services | | 2.3%

| |

| | 2. | | | Atwood Oceanics (United States)

Offshore Drilling Contractor | | 1.5%

| |

| | 3. | | | Sociedad Quimica y Minera de Chile (Chile)

Producer of Specialty Fertilizers, Lithium & Iodine | | 1.4%

| |

| | 4. | | | Suzano (Brazil)

Brazilian Pulp & Paper Producer | | 1.3%

| |

| | 5. | | | ShawCor (Canada)

Oil & Gas Pipeline Products | | 1.2%

| |

| | 6. | | | Hexagon (Sweden)

Measurement Equipment & Polymers | | 1.2%

| |

| | 7. | | | Intralot (Greece)

Lottery & Gaming Systems & Services | | 1.2%

| |

| | 8. | | | FMC Technologies (United States)

Oil & Gas Wellhead Manufacturer | | 1.1%

| |

| | 9. | | | Rhoen-Klinikum (Germany)

Health Care Services | | 1.1%

| |

| | 10. | | | Kansai Paint (Japan)

Paint Producer in Japan, India, China & Southeast Asia | | 1.1%

| |

Portfolio holdings are subject to change periodically and may not be representative of current holdings. See the Statement of Investments for a complete list of the Fund's holdings.

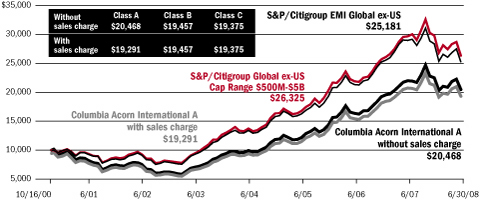

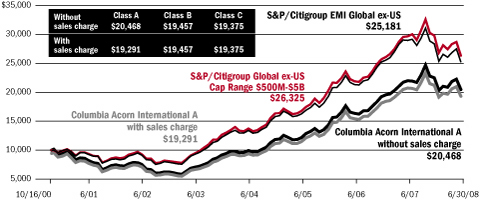

The Growth of a $10,000 Investment in Columbia Acorn International (Class Z)

September 23, 1992 through June 30, 2008

This graph compares the results of $10,000 invested in Columbia Acorn International at inception on September 23, 1992 to the S&P/Citigroup EMI Global ex-US and the S&P/Citigroup Global ex-US Cap Range $500M-$5B indexes. The Fund changed its primary benchmark effective January 1, 2008, because the Advisor believes that the S&P/Citigroup Global ex-US Cap Range $500M-$5B is more consistent with the market capitalization of the companies in which the Fund invests. These indexes are unmanaged and returns for both the indexes and the Fund include reinvested dividends and capital gains. It is not possible to invest directly in an index. The graph does not reflect taxes that a shareholder would pay on Fund distributions or on a sale of Fund shares.

Total Net Assets of the Fund: $5.4 billion

11

Columbia Acorn USA

In a Nutshell

Robert A. Mohn

Lead Portfolio Manager

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Performance may reflect any voluntary waivers or reimbursements of fund expenses by the Advisor or its affiliates. Absent these waivers, or reimbursement arrangements, performance results may be lower. Please visit columbiamanagement.com for daily and most recent month-end performance updates.

Fund's Positions

in Mentioned Holdings

As a percentage of net assets, as of 6/30/08

| FMC Technologies | | | 4.0 | % | |

| Quicksilver Resources | | | 2.9 | % | |

| Flir Systems | | | 2.5 | % | |

| ITT Educational Services | | | 2.1 | % | |

| Nordson | | | 1.9 | % | |

| Atwood Oceanics | | | 1.9 | % | |

| True Religion Apparel | | | 1.8 | % | |

| Carrizo Oil & Gas | | | 1.5 | % | |

| Southwestern Energy | | | 0.9 | % | |

| Champion Enterprises | | | 0.9 | % | |

| MB Financial | | | 0.7 | % | |

| TCF Financial | | | 0.6 | % | |

| Pinnacle Entertainment | | | 0.3 | % | |

| Old Second Bancorp | | | 0.2 | % | |

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

Columbia Acorn USA gained 2.10% in the second quarter of 2008, outperforming the 0.58% return of the Russell 2000 Index. Year to date through June, the Fund was down 8.48%, holding up somewhat better than the Russell 2000's 9.37% decline.

Energy was one of the few market sectors that increased in value. FMC Technologies and Atwood Oceanics were both up over 35% for the quarter. Increasing interest in offshore oil exploration fueled demand for FMC's deep water oil production systems and Atwood's deep water drilling rigs. For the half year, FMC was up 36% and Atwood Oceanics posted a 24% gain. Also strong in the half were natural gas and oil producers Quicksilver Resources, Southwestern Energy and Carrizo Oil & Gas. With year to date returns ranging from 24% to 71%, these companies benefited from rising natural gas prices as well as their ability to increase production and reserves.

Other strong performers included ITT Educational Services, which rebounded 80% in the quarter. As mentioned in the previous report, concerns over student loan availability were crushing this stock. Naysayers were silenced, however, when ITT announced first quarter year-over-year enrollment growth of 10%. Flir Systems, a manufacturer of infrared cameras, was also up on strong earnings growth. The stock increased 35% in the second quarter and was up 30% for the half year thanks to continued success in winning new military contracts.

Retail stocks struggled along in the first half but True Religion Apparel, a maker of premium jeans, bucked the trend. The company is opening new retail stores and enjoying strong revenue growth. Its stock gained 44% in the quarter and was up 25% for the half. Finally, Nordson, a market leader in the production of adhesive and coating dispensing machines, gained 36% in the quarter and 27% for the half year.

Many of the Fund's losing stocks were housing-related businesses. Champion Enterprises, a leader in manufactured housing, fell 42% in the quarter and was off 38% for the half. Its business is concentrated in states like California and Arizona, where the housing market has plummeted not only for site-built homes but also for manufactured homes. Small-cap community banks also got clobbered in the second quarter. TCF Financial, MB Financial and Old Second Bancorp fell between 27% and 55% on worries about the impact of increasing home foreclosure rates and home developer bankruptcies.

Regional casino operator Pinnacle Entertainment fell 55% for the half on weak gaming revenues and the elimination of its takeout premium as private equity money for hotel/casino acquisitions dried up.

Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

12

Columbia Acorn USA (AUSAX)

At a Glance

Performance data quoted represents past performance and current performance may be higher or lower. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Performance may reflect any voluntary waivers or reimbursements of Fund expenses by the Advisor or any of its affiliates. Absent these waivers or reimbursement arrangements, performance results may be lower. Visit columbiamanagement.com for daily and most recent month-end updates.

Pretax and After-tax Average Annual Total Returns (Class Z)

through June 30, 2008

| Inception 9/4/96 | | Year

to date* | | 1 year | | 5 years | | 10 years | |

| Returns before taxes | | | -8.48 | % | | | -13.53 | % | | | 11.36 | % | | | 7.61 | % | |

| Returns after taxes on distributions | | | -8.98 | | | | -14.62 | | | | 10.79 | | | | 6.88 | | |

Returns after taxes on distributions

and sale of fund shares | | | -4.82 | | | | -7.19 | | | | 9.95 | | | | 6.45 | | |

| Russell 2000 (pretax) | | | -9.37 | | | | -16.19 | | | | 10.29 | | | | 5.53 | | |

All results shown assume reinvestment of distributions.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Returns after taxes on distributions and sale of Fund shares reflect the additional tax impact of long-term gains or losses realized when Fund shares are sold. The returns are taxed at the maximum rate and assume shares were purchased at the beginning of the period. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class Z shares only; after-tax returns for other share classes will vary. Indexes do not reflect any deduction for fees, expenses or taxes.

The Fund's Class Z annual operating expense ratio, as stated in the current prospectus, is 0.98%.

*Year to date data is not annualized.

Columbia Acorn USA Portfolio Diversification

as a percentage of net assets as of 6/30/08

Columbia Acorn USA Top 10 Holdings

as a percentage of net assets as of 6/30/08

| | 1. | | | FMC Technologies

Oil & Gas Wellhead Manufacturer | | 4.0%

| |

| | 2. | | | Quicksilver Resources

Natural Gas & Coal Seam Gas Producer | | 2.9%

| |

| | 3. | | | Crown Castle International

Communications Towers | | 2.8%

| |

| | 4. | | | Flir Systems

Infrared Cameras | | 2.5%

| |

| | 5. | | | Ametek

Aerospace/Industrial Instruments | | 2.3%

| |

| | 6. | | | ESCO Technologies

Automatic Electric Meter Readers | | 2.2%

| |

| | 7. | | | ITT Educational Services

Post-secondary Degree Services | | 2.1%

| |

| | 8. | | | Nordson

Dispensing Systems for Adhesives & Coatings | | 1.9%

| |

| | 9. | | | Atwood Oceanics

Offshore Drilling Contractor | | 1.9%

| |

| | 10. | | | True Religion Apparel

Premium Denim | | 1.8%

| |

Portfolio holdings are subject to change periodically and may not be representative of current holdings. See the Statement of Investments for a complete list of the Fund's holdings.

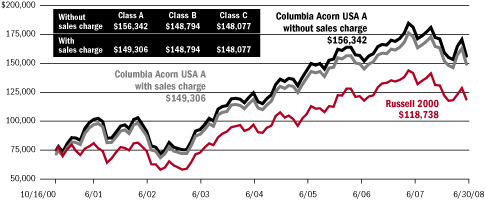

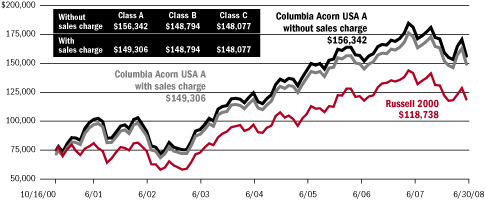

The Growth of a $75,000 Investment in Columbia Acorn USA (Class Z)

September 4, 1996 through June 30, 2008

This graph compares the results of $75,000 invested in Columbia Acorn USA at inception on September 4, 1996 to the Russell 2000. The index is unmanaged and returns for both the index and the Fund include reinvested dividends and capital gains. It is not possible to invest directly in an index. The graph does not reflect taxes that a shareholder would pay on Fund distributions or on a sale of Fund shares.

Total Net Assets of the Fund: $1.4 billion

13

Columbia Acorn International Select

In a Nutshell

Christopher J. Olson

Lead Portfolio Manager

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Performance may reflect any voluntary waivers or reimbursements of fund expenses by the Advisor or its affiliates. Absent these waivers, or reimbursement arrangements, performance results may be lower. Please visit columbiamanagement.com for daily and most recent month-end performance updates.

Fund's Positions

in Mentioned Holdings

As a percentage of net assets, as of 6/30/08

| Fugro | | | 5.4 | % | |

| Potash Corp. of Saskatchewan | | | 4.7 | % | |

| Israel Chemicals | | | 4.5 | % | |

| Sociedad Quimica y Minera de Chile | | | 2.9 | % | |

| Diamond Offshore | | | 2.9 | % | |

| Pacific Rubiales Energy | | | 2.2 | % | |

| Ibiden | | | 1.7 | % | |

| Vopak | | | 1.5 | % | |

| SBM Offshore | | | 1.1 | % | |

| Zumtobel | | | 0.8 | % | |

| Hong Kong Exchanges and Clearing | | | 0.6 | % | |

| Singapore Exchange | | | 0.5 | % | |

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

Columbia Acorn International Select ended the second quarter of 2008 up 5.17%, strongly outperforming its benchmark, the S&P/Citigroup World ex-US Cap Range $2-10B Index, which fell 2.73%. For the half year ended June 30, 2008, the Fund was also well ahead of the benchmark, down 2.94% vs. a 10.42% decline for the index.

Fund performance benefited from strong gains in fertilizer stocks. Fertilizer prices have soared on the back of higher crop prices, which have risen due to improving diets in the developing world and a global push toward biofuels. This growing demand and limited fertilizer supply have kept prices high. Potash Corp. of Saskatchewan, Sociedad Quimica y Minera de Chile and Israel Chemicals were the Fund's top three contributors in the quarter and for the half year. All produce potash or other natural chemical components used in fertilizer. Gains for these holdings ranged from 47% to 139% over both periods.

Energy stocks were also strong in the Fund as oil prices and demand continued to soar. Oil production and exploration company Pacific Rubiales Energy had a market gain of over 50% for both periods. Dutch oilfield services provider Fugro had a 12% quarterly gain and rose over 13% in the half. Also based in the Netherlands, SBM Offshore, a company that builds and leases offshore vessels to process and store crude oil, was up 17% in the quarter and 20% year to date. A third winner from the Netherlands, Vopak, is the world's largest operator of petroleum and chemical storage terminals. The stock posted a 10% gain in the quarter and was up 54% for the half. While not a large contributor to performance for the half year, contract driller Diamond Offshore posted a 21% gain in the second quarter.

On the downside, Ibiden, a Japanese manufacturer of electronic parts and ceramics, was down 47% for the half year and off 7% in the quarter. The company had some production problems and is also suffering from weaker demand in its semiconductor packaging business. Austria's Zumtobel, a maker of lighting systems, fell 38% in the first half of the year and 14% in the second quarter as construction slowed in its European markets. Hong Kong Exchanges and Clearing and Singapore Exchange were both down more than 40% for the half as the economic downturn has raised fears that trading volumes will slow down or decline.

Markets remain extremely volatile and we believe it will be some time before some sort of normality returns. In the meantime, we will continue to focus on companies that we believe have strong competitive positions, competent management and healthy balance sheets.

International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments. Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. Investing in emerging markets may involve greater risks than investing in more developed countries.

14

Columbia Acorn International Select (ACFFX)

At a Glance

Performance data quoted represents past performance and current performance may be higher or lower. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Performance may reflect any voluntary waivers or reimbursements of Fund expenses by the Advisor or any of its affiliates. Absent these waivers or reimbursement arrangements, performance results may be lower. Visit columbiamanagement.com for daily and most recent month-end updates.

Pretax and After-tax Average Annual Total Returns (Class Z)

through June 30, 2008

| Inception 11/23/98 | | Year

to date* | | 1 year | | 5 years | | Life of fund | |

| Returns before taxes | | | -2.94 | % | | | 5.79 | % | | | 24.43 | % | | | 13.73 | % | |

| Returns after taxes on distributions | | | -3.26 | | | | 4.61 | | | | 24.17 | | | | 13.54 | | |

Returns after taxes on distributions

and sale of fund shares | | | -1.59 | | | | 5.41 | | | | 21.93 | | | | 12.39 | | |

S&P/Citigroup World

ex-US Cap Range $2-10B (pretax) | | | -10.42 | | | | -12.18 | | | | 20.26 | | | | 10.52 | | |

All results shown assume reinvestment of distributions.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Returns after taxes on distributions and sale of Fund shares reflect the additional tax impact of long-term gains or losses realized when Fund shares are sold. The returns are taxed at the maximum rate and assume shares were purchased at the beginning of the period. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class Z shares only; after-tax returns for other share classes will vary. Indexes do not reflect any deduction for fees, expenses or taxes.

The Fund's Class Z annual operating expense ratio, as stated in the current prospectus, is 1.18%.

*Year to date data is not annualized.

Columbia Acorn International Select Portfolio Diversification

as a percentage of net assets as of 6/30/08

Columbia Acorn International Select Top 10 Holdings

as a percentage of net assets as of 6/30/08

| | 1. | | | Fugro (Netherlands)

Oilfield Services | | 5.4%

| |

| | 2. | | | Potash Corp. of Saskatchewan (Canada)

Worlds Largest Producer of Potash | | 4.7%

| |

| | 3. | | | Israel Chemicals (Israel)

Producer of Potash, Phosphates, Bromine &

Specialty Chemicals | | 4.5%

| |

| | 4. | | | SES Global (France)

Satellite Broadcasting Services | | 3.6%

| |

| | 5. | | | Informa Group (United Kingdom)

Global Publisher & Event Organizer | | 3.4%

| |

| | 6. | | | Impala Platinum Holdings (South Africa)

Platinum Group Metals Mining & Refining | | 3.4%

| |

| | 7. | | | Intertek Testing (United Kingdom)

Testing, Inspection & Certification Services | | 3.3%

| |

| | 8. | | | Jupiter Telecommunications (Japan)

Largest Cable Service Provider in Japan | | 3.0%

| |

| | 9. | | | Sociedad Quimica y Minera de Chile (Chile)

Producer of Specialty Fertilizers, Lithium & Iodine | | 2.9%

| |

| | 10. | | | Diamond Offshore (United States)

Contract Driller | | 2.9%

| |

Portfolio holdings are subject to change periodically and may not be representative of current holdings. See the Statement of Investments for a complete list of the Fund's holdings.

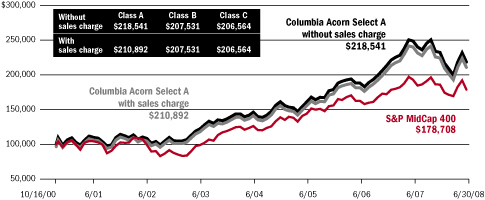

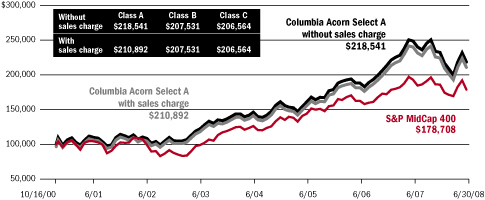

The Growth of a $10,000 Investment in Columbia Acorn International Select (Class Z)

November 23, 1998 through June 30, 2008

This graph compares the results of $10,000 invested in Columbia Acorn International Select at inception on November 23, 1998 to the S&P/Citigroup World ex-US Cap Range $2-10B. The index and Fund returns include reinvested dividends and capital gains. It is not possible to invest directly in an index. The graph does not reflect taxes that a shareholder would pay on Fund distributions or on a sale of Fund shares.

Total Net Assets of the Fund: $288.7 million

15

Columbia Acorn Select

In a Nutshell

Ben Andrews

Lead Portfolio Manager

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Performance may reflect any voluntary waivers or reimbursements of fund expenses by the Advisor or its affiliates. Absent these waivers, or reimbursement arrangements, performance results may be lower. Please visit columbiamanagement.com for daily and most recent month-end performance updates.

Fund's Positions

in Mentioned Holdings

As a percentage of net assets, as of 6/30/08

| Potash Corp. of Saskatchewan | | | 8.1 | % | |

| ITT Educational Services | | | 6.2 | % | |

| Pacific Rubiales Energy | | | 5.2 | % | |

| Tetra Technologies | | | 4.7 | % | |

| Uranium One | | | 3.6 | % | |

| Expedia | | | 2.3 | % | |

| Globalstar | | | 1.1 | % | |

| Israel Chemicals | | | 0.8 | % | |

| Synthesis Energy Systems | | | 0.8 | % | |

| NagaCorp | | | 0.4 | % | |

| Real Goods Solar | | | 0.3 | % | |

| RexCapital Finance | | | 0.0 | %* | |

*Rounds to less than 0.1%.

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

Columbia Acorn Select increased 9.42% in the second quarter of 2008. This compares to a gain in the S&P MidCap 400 Index of 5.43% and a decline of 2.73% for the S&P 500 Index. Year to date our Fund has declined 5.80% vs. a 3.90% decline in the S&P MidCap 400 and an 11.91% decline in the S&P 500.

ITT Educational Services and Potash Corp. of Saskatchewan each added 2.8% of the portfolio return in the quarter. ITT, which cost the Fund 2% last quarter, came back strong as investors figured out that student loans should not be restricted as much as originally thought. Potash Corp. of Saskatchewan has continued to move up on the strong price increases in the potash market. The spot potash price in some international markets is now over $1,000 per ton, which is up about four-fold from the price it was selling at when we first added the stock to the Fund.

On the down side, Globalstar cost the Fund 1.3% of portfolio performance in the quarter. The valuation multiple of the stock has continued to compress over the last few quarters. In this market environment, if a company is not showing solid growth characteristics, no matter what its assets might be worth, its valuation multiple has contracted.

For the six-month period, Fund upside drivers have been Potash Corp. of Saskatchewan, Pacific Rubiales Energy and Tetra Technologies, which all have an energy or raw materials focus. Fund detractors for the half year included Uranium One, Expedia and Globalstar.

We purchased five new names during the quarter and sold two names. New names included RexCapital Finance and NagaCorp, both in gaming. Israel Chemicals, a supplier of bromine and potash, and Real Goods Solar, a residential solar energy installer, were also added. The final new name was Synthesis Energy Systems, a builder and operator of plants that turn coal into liquid fuel. Our sales for the quarter included International Speedway and Herman Miller. Both are fine franchises but we believe we can deploy the capital elsewhere and receive better returns.