UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-01829 |

|

Columbia Acorn Trust |

(Exact name of registrant as specified in charter) |

|

One Financial Center, Boston, Massachusetts | | 02111 |

(Address of principal executive offices) | | (Zip code) |

|

James R. Bordewick, Jr., Esq. Columbia Management Advisors, LLC One Financial Center Boston, MA 02111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-617-426-3750 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2009 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Q2 2009

Columbia Management®

Columbia Acorn Family of Funds

Class Z Shares

Managed by Columbia Wanger Asset Management, L.P.

Semiannual Report

June 30, 2009

n ColumbiaSM

Acorn® Fund

n ColumbiaSM

Acorn International®

n ColumbiaSM

Acorn USA®

n ColumbiaSM

Acorn International SelectSM

n ColumbiaSM

Acorn SelectSM

n ColumbiaSM

Thermostat FundSM

NOT FDIC INSURED

NOT BANK ISSUED

May Lose Value

No Bank Guarantee

You are invited to the 2009 Columbia Acorn Funds Shareholder Information Meeting!

When: Wednesday, September 30, 2009

12 noon to 1 p.m. Central time

Where: Chase Bank Auditorium, Plaza Level

10 South Dearborn Street

Chicago, Illinois

A buffet lunch will be served at 11:30 a.m.

If you plan to join us in Chicago, please RSVP by September 25

by calling (800) 922-6769.

The Chase Bank Auditorium is located within the Chase Tower at the corner of Madison St. and Dearborn St. After entering the building, please take the escalators down to the plaza level and follow the signs to the Chase Bank Auditorium.

View a Replay on our Website

For those who are unable to join us in Chicago, a webcast replay of the meeting will be available from October 7 through October 31, 2009, at www.columbiafunds.com. Look under "New and Noteworthy" on our home page for more information.

The views expressed in the "Squirrel Chatter II" and "In a Nutshell" commentaries reflect the current views of the respective authors. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective authors disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for a Columbia Acorn Fund are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any particular Columbia Acorn Fund. References to specific company securities should not be construed as a recommendation or investment advice and there can be no assurance that as of the date of publication of this report, the securities mentioned in each Fund's portfolio are still held or that the securities sold have not been repurchased.

Robert E. Nason Remembered

Robert E. Nason

On June 27, 2009, Columbia Acorn Funds Board of Trustees chairman Robert Nason passed away. Bob was a man of great personal integrity who maintained the independence of the Board and worked to promote the interests of shareholders. He joined the Acorn Funds Board in November of 1998, became vice chairman in March 2001 and was named chairman in October of 2001. He served in that capacity until his death.

Bob was the second chairman of the Columbia Acorn Trust; he succeeded Irving Harris, who was chairman from its inception in 1970. Bob had impressive credentials, having served as CEO of the accounting firm Grant Thornton where he worked for 40 years.

Bob's tenure as Trust chairman occurred during a period of change in the regulatory environment and several changes involving the Fund's advisor. Throughout, he served shareholders well and his letters to shareholders in the Funds' annual reports were thoughtful and informative.

As regulators pushed mutual fund boards toward more independence from fund advisors, Bob successfully maintained the Columbia Acorn Board's history of independence. Under Bob's tenure, the Board hired a chief compliance officer, who vigilantly pursues shareholder interests. Several safeguards against market timing were implemented, including restrictions on frequent trading and statistical fair valuation of foreign stocks.

Also during Bob's tenure, the Trust's advisor, Columbia Wanger Asset Management (CWAM), had ownership changes and retirements of founder Ralph Wanger and portfolio manager Leah Zell. Bob and the Board saw to it that CWAM stayed the course, maintaining its time-tested investment process, developing and keeping talented investment professionals, and sustaining its autonomous and creative environment.

When cash inflows approached levels that could have threatened performance, Bob and the Board acted to increase investment minimums. Under his leadership, fee breakpoints were implemented, causing shareholders to benefit from growth and economies of scale. The Board, in addition, reduced 12b-1 fees and after intensive analysis, successfully initiated securities lending.

Bob is survived by his wife Carol, son Steven (Abbie Baynes), daughter Jill and grandchildren Sara and Ben.

We are fortunate to have known Bob and we will miss him. He was a man of great vision and we will strive to build on the momentum he created and to maintain the legacies of the Columbia Acorn Trust.

Allan Muchin

Vice Chairman of the Board of Trustees

Columbia Acorn Trust

Charles McQuaid

President and Chief Investment Officer

Columbia Wanger Asset Management, L.P.

Columbia Acorn Family of Funds

Table of Contents

| Performance At A Glance | | | 1 | | |

|

| Description of Indexes | | | 2 | | |

|

| Squirrel Chatter II: Agriculture's Amazing Progress | | | 3 | | |

|

| Understanding Your Expenses | | | 6 | | |

|

| Columbia Acorn Fund | |

|

| In a Nutshell | | | 8 | | |

|

| At a Glance | | | 9 | | |

|

| Major Portfolio Changes | | | 20 | | |

|

| Statement of Investments | | | 23 | | |

|

| Columbia Acorn International | |

|

| In a Nutshell | | | 10 | | |

|

| At a Glance | | | 11 | | |

|

| Major Portfolio Changes | | | 35 | | |

|

| Statement of Investments | | | 37 | | |

|

| Portfolio Diversification | | | 44 | | |

|

| Columbia Acorn USA | |

|

| In a Nutshell | | | 12 | | |

|

| At a Glance | | | 13 | | |

|

| Major Portfolio Changes | | | 45 | | |

|

| Statement of Investments | | | 47 | | |

|

| Columbia Acorn International Select | |

|

| In a Nutshell | | | 14 | | |

|

| At a Glance | | | 15 | | |

|

| Major Portfolio Changes | | | 55 | | |

|

| Statement of Investments | | | 57 | | |

|

| Portfolio Diversification | | | 60 | | |

|

| Columbia Acorn Select | |

|

| In a Nutshell | | | 16 | | |

|

| At a Glance | | | 17 | | |

|

| Major Portfolio Changes | | | 61 | | |

|

| Statement of Investments | | | 62 | | |

|

| Columbia Thermostat Fund | |

|

| In a Nutshell | | | 18 | | |

|

| At a Glance | | | 19 | | |

|

| Statement of Investments | | | 66 | | |

|

| Columbia Acorn Family of Funds | |

|

| Statements of Assets and Liabilities | | | 68 | | |

|

| Statements of Operations | | | 69 | | |

|

| Statements of Changes in Net Assets | | | 70 | | |

|

| Financial Highlights | | | 74 | | |

|

| Notes to Financial Statements | | | 77 | | |

|

Management Fee Evaluation

of the Senior Officer | | | 85 | | |

|

| Board Approval of the Advisory Agreement | | | 90 | | |

|

| Columbia Acorn Family of Funds Information | | | 93 | | |

|

2009 Mid-Year Distributions

The following table lists the mid-year per share distributions for Columbia Acorn International, Columbia Acorn International Select and Columbia Thermostat Fund. The other Columbia Acorn Funds did not have mid-year distributions. The record date was June 9, 2009. The ex-dividend date was June 10, 2009, and the payable date was June 11, 2009.

| | | Short-term

Capital

Gains | | Long-term

Capital

Gains | | Ordinary

Income | | Reinvestment

Price | |

| Columbia Acorn International – Class Z | | None | | None | | $ | 0.5309 | | | $ | 27.62 | | |

| Columbia Acorn International Select – Class Z | | None | | None | | $ | 0.2359 | | | $ | 19.72 | | |

| Columbia Thermostat Fund – Class Z | | None | | None | | $ | 0.0290 | | | $ | 8.99 | | |

Columbia Acorn Family of Funds

Performance At A Glance Class Z Average Annual Total Returns through 6/30/09

| | | NAV on

6/30/09 | | 2nd

quarter* | | Year

to date* | | 1 year | | 3 years | | 5 years | | 10 years | | Life

of Fund | |

Columbia Acorn Fund

(ACRNX) (6/10/70) | | $ | 19.44 | | | | 20.90 | % | | | 9.77 | % | | | -25.83 | % | | | -7.72 | % | | | 0.95 | % | | | 7.25 | % | | | 14.25 | % | |

| Russell 2500 Index | | | | | | | 20.27 | % | | | 6.52 | % | | | -26.72 | % | | | -9.31 | % | | | -0.93 | % | | | 3.67 | % | | | NA | | |

| S&P 500 Index | | | | | | | 15.93 | % | | | 3.16 | % | | | -26.21 | % | | | -8.22 | % | | | -2.24 | % | | | -2.22 | % | | | 10.11 | % | |

| Lipper Small-Cap Core Index | | | | | | | 22.23 | % | | | 8.23 | % | | | -25.01 | % | | | -8.74 | % | | | -0.93 | % | | | 4.32 | % | | | NA | | |

| Lipper Mid-Cap Growth Index | | | | | | | 19.10 | % | | | 13.91 | % | | | -30.39 | % | | | -6.29 | % | | | 0.39 | % | | | 0.29 | % | | | NA | | |

Columbia Acorn International

(ACINX) (9/23/92) | | $ | 27.53 | | | | 33.30 | % | | | 21.31 | % | | | -28.00 | % | | | -3.22 | % | | | 8.47 | % | | | 6.96 | % | | | 10.50 | % | |

S&P Global Ex-U.S. Between

$500 Million and $5 Billion Index | | | | | | | 34.15 | % | | | 24.54 | % | | | -26.45 | % | | | -4.02 | % | | | 7.13 | % | | | 6.80 | % | | | 7.49 | % | |

| S&P Global Ex-U.S. SmallCap Index | | | | | | | 35.88 | % | | | 24.20 | % | | | -29.89 | % | | | -6.09 | % | | | 5.69 | % | | | 5.95 | % | | | 6.61 | % | |

| MSCI EAFE Index | | | | | | | 25.43 | % | | | 7.95 | % | | | -31.35 | % | | | -7.98 | % | | | 2.31 | % | | | 1.18 | % | | | 5.09 | % | |

Lipper International Small/

Mid Growth Index | | | | | | | 33.20 | % | | | 23.05 | % | | | -32.90 | % | | | -7.44 | % | | | 5.22 | % | | | 6.42 | % | | | NA | | |

Columbia Acorn USA

(AUSAX) (9/4/96) | | $ | 17.71 | | | | 19.42 | % | | | 8.05 | % | | | -28.24 | % | | | -10.37 | % | | | -1.81 | % | | | 4.02 | % | | | 7.79 | % | |

| Russell 2000 Index | | | | | | | 20.69 | % | | | 2.64 | % | | | -25.01 | % | | | -9.89 | % | | | -1.71 | % | | | 2.38 | % | | | 4.71 | % | |

| Russell 2500 Index | | | | | | | 20.27 | % | | | 6.52 | % | | | -26.72 | % | | | -9.31 | % | | | -0.93 | % | | | 3.67 | % | | | 6.31 | % | |

| S&P 500 Index | | | | | | | 15.93 | % | | | 3.16 | % | | | -26.21 | % | | | -8.22 | % | | | -2.24 | % | | | -2.22 | % | | | 4.46 | % | |

| Lipper Small-Cap Growth Index | | | | | | | 20.60 | % | | | 13.14 | % | | | -25.73 | % | | | -9.04 | % | | | -2.32 | % | | | 1.16 | % | | | 3.03 | % | |

Columbia Acorn Int'l Select

(ACFFX) (11/23/98) | | $ | 19.70 | | | | 23.44 | % | | | 9.60 | % | | | -34.62 | % | | | -2.25 | % | | | 7.10 | % | | | 5.54 | % | | | 7.94 | % | |

S&P Developed Ex-U.S. Between

$2 Billion and $10 Billion Index | | | | | | | 28.70 | % | | | 14.93 | % | | | -30.16 | % | | | -7.29 | % | | | 4.30 | % | | | 5.24 | % | | | 5.84 | % | |

| MSCI EAFE Index | | | | | | | 25.43 | % | | | 7.95 | % | | | -31.35 | % | | | -7.98 | % | | | 2.31 | % | | | 1.18 | % | | | 1.87 | % | |

| Lipper International Funds Index | | | | | | | 25.64 | % | | | 10.11 | % | | | -30.14 | % | | | -6.52 | % | | | 3.35 | % | | | 2.44 | % | | | 3.15 | % | |

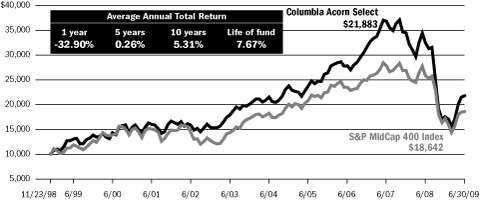

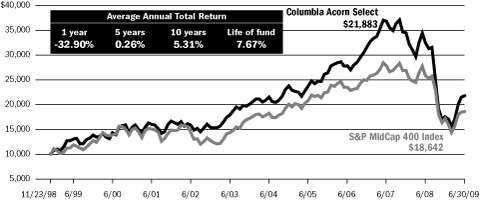

Columbia Acorn Select

(ACTWX) (11/23/98) | | $ | 17.50 | | | | 28.11 | % | | | 24.38 | % | | | -32.90 | % | | | -7.81 | % | | | 0.26 | % | | | 5.31 | % | | | 7.67 | % | |

| S&P MidCap 400 Index | | | | | | | 18.75 | % | | | 8.47 | % | | | -28.02 | % | | | -7.54 | % | | | 0.36 | % | | | 4.62 | % | | | 6.05 | % | |

| S&P 500 Index | | | | | | | 15.93 | % | | | 3.16 | % | | | -26.21 | % | | | -8.22 | % | | | -2.24 | % | | | -2.22 | % | | | -0.49 | % | |

| Lipper Mid-Cap Growth Index | | | | | | | 19.10 | % | | | 13.91 | % | | | -30.39 | % | | | -6.29 | % | | | 0.39 | % | | | 0.29 | % | | | 2.96 | % | |

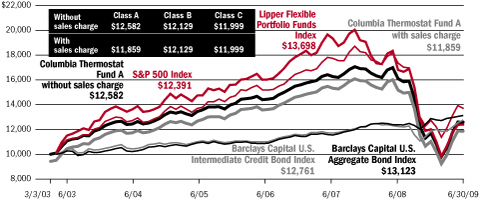

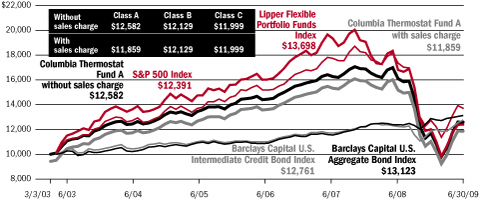

Columbia Thermostat Fund

(COTZX) (9/25/02)† | | $ | 8.79 | | | | 19.33 | % | | | 7.67 | % | | | -21.62 | % | | | -4.28 | % | | | 0.17 | % | | | — | | | | 3.86 | % | |

| S&P 500 Index | | | | | | | 15.93 | % | | | 3.16 | % | | | -26.21 | % | | | -8.22 | % | | | -2.24 | % | | | — | | | | 3.75 | % | |

Barclays Capital U.S.

Aggregate Bond Index | | | | | | | 1.78 | % | | | 1.90 | % | | | 6.05 | % | | | 6.43 | % | | | 5.01 | % | | | — | | | | 4.59 | % | |

Barclays Capital U.S. Intermediate

Credit Bond Index | | | | | | | 7.59 | % | | | 7.53 | % | | | 4.28 | % | | | 5.05 | % | | | 4.04 | % | | | — | | | | 4.45 | % | |

| Lipper Flexible Portfolio Funds Index | | | | | | | 13.00 | % | | | 7.59 | % | | | -21.04 | % | | | -3.36 | % | | | 1.16 | % | | | — | | | | 5.21 | % | |

| 50/50 Blended Benchmark†† | | | | | | | 8.76 | % | | | 2.95 | % | | | -10.69 | % | | | -0.73 | % | | | 1.63 | % | | | — | | | | 4.48 | % | |

*Not annualized.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value of an investment in a Fund will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Please visit columbiafunds.com for daily and most recent month-end updates. Net asset value (NAV) returns do not include sales charges or contingent deferred sales charges (CDSC). If they were included, returns would have been lower. Class Z shares are sold only at NAV with no Rule 12b-1 fee. Only eligible investors may purchase Class Z shares of the Funds, directly or by exchange. Please see each Fund's prospectus for eligibility and other details. Class Z shares have limited eligibility and the investment minimum requirement may vary.

Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

Annual operating expense ratios are as stated in each Fund prospectus that is current as of the date of this report and differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and expense reimbursements as well as different time periods used in calculating the ratios. Columbia Acorn Fund Class Z: 0.76%. Columbia Acorn International Class Z: 0.96%. Columbia Acorn USA Class Z: 1.01%. Columbia Acorn International Select Class Z: 1.21%. Columbia Acorn Select Class Z: 0.95%. Columbia Thermostat Fund has a contractual expense waiver or reimbursement that expires April 30, 2010. Expense ratios without and with the contractual waiver, including fees and expenses associated with the Fund's investments in other investment companies, for Class Z shares are 1.05% and 0.97%, respectively. Absent the waiver or reimbursement, performance results would have been lower.

†A "fund of funds" bears its allocable share of the costs and expenses of the underlying funds in which it invests. Such funds are thus subject to two levels of fees and potentially higher expense ratios than would be associated with an investment in a fund that invests and trades directly in financial instruments under the direction of a single manager.

††The 50/50 Blended Benchmark is a custom supplemental benchmark established by the advisor.

All results shown assume reinvestment of distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

Unlike mutual funds, indexes are not actively managed and do not incur fees or expenses. It is not possible to invest directly in an index. For index definitions, see Page 2.

The dates in parentheses are the inception dates for each respective Fund.

1

Columbia Acorn Family of Funds

Descriptions of Indexes Included in this Report

• 50/50 Blended Benchmark, established by the Fund's advisor, is an equally weighted custom composite of Columbia Thermostat Fund's primary equity and primary debt benchmarks, the S&P 500 Index and the Barclays Capital U.S. Aggregate Bond Index, respectively. The percentage of the Fund's assets allocated to underlying stock and bond portfolio funds will vary, and accordingly the composition of the Fund's portfolio will not always reflect the composition of the 50/50 Blended Benchmark.

• Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

• Barclays Capital U.S. Intermediate Credit Bond Index is the intermediate component of the Barclay's Capital U.S. Credit Index. The Barclay's Capital U.S. Credit Index includes publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements.

• Lipper Indexes include the largest funds tracked by Lipper, Inc. in the named category. Lipper Small-Cap Core Funds Index, 30 largest small-cap core funds; Lipper Mid-Cap Growth Index, 30 largest mid-cap growth funds; Lipper International Small/Mid Growth Index, 10 largest non-U.S. small/mid growth funds, including Col umbia Acorn International; Lipper Small-Cap Growth Index, 30 largest small-cap growth funds; Lipper International Funds Index, 30 largest non-U.S. funds, excluding non-U.S. small-cap funds; Lipper Flexible Portfolio Funds Index, an equal-weighted index of the 30 largest mutual funds within the Flexible Portfolio fund classification, as defined by Lipper.

• Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index is a capitalization-weighted index that tracks the total return of common stocks in 21 developed-market countries within Europe, Australasia and the Far East.

• Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

• Russell 2500 Index measures the performance of the 2,500 smallest companies in the Russell 3000 Index, which represents approximately 17% of the total market capitalization of the Russell 3000 Index.

• Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

• Standard & Poor's (S&P) MidCap 400 Index is a market value-weighted index that tracks the performance of 400 mid-cap U.S. companies.

• S&P Developed Ex-U.S. Between $2 Billion and $10 Billion Index is a subset of the broad market selected by the index sponsor representing the mid-cap developed market, excluding the United States.

• S&P Global Ex-U.S. SmallCap Index is an unmanaged index consisting of the bottom 20% of institutionally investable capital of developed and emerging countries, outside the United States.

• S&P Global Ex-U.S. Between $500 Million and $5 Billion Index is a subset of the broad market selected by the index sponsor representing the mid- and small-cap developed and emerging markets, excluding the United States.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

2

Squirrel Chatter II: Agriculture's Amazing Progress

Following a conversation with two of our analysts regarding the prospects for several fertilizer companies, I decided to learn more about the history and current state of agriculture. According to Marcel Mazoyer and Laurence Roudart's, A History of World Agriculture,1 farming began about 10,000 years ago. One would think that mankind is far down the learning curve in agriculture, and that productivity gains are ending. Surprisingly, quite the opposite is true. Most of the improvements in agriculture have occurred in the last 80 years.

Following a conversation with two of our analysts regarding the prospects for several fertilizer companies, I decided to learn more about the history and current state of agriculture. According to Marcel Mazoyer and Laurence Roudart's, A History of World Agriculture,1 farming began about 10,000 years ago. One would think that mankind is far down the learning curve in agriculture, and that productivity gains are ending. Surprisingly, quite the opposite is true. Most of the improvements in agriculture have occurred in the last 80 years.

Mazoyer and Roudart's history explains six dominant agricultural processes. The first two of these were employed during the first 8,000 years of agricultural history, obviously a time of very slow progress. Agriculture began with slash and burn techniques, whereby forest segments were successively burned and farmed for a few years until nutrients were depleted. Then, beginning in about 2500 B.C., farmers began using animal drawn scratch-plows and annually rotating land from planted to fallow in an attempt to maintain soil fertility. Other than in exceptionally fertile areas such as the lands replenished by the Nile River, these techniques barely enabled one farmer to feed one family.

Medieval farmers utilized better tools and techniques. They kept more animals and, with the help of wheeled carts and plows, used more animal-based fertilizers. Beginning in the sixteenth century, farmers began planting legumes to enhance nitrogen in the soil, further improving fertility by organic means and eliminating the need for fallowing. Productivity per farmer doubled with each of these developments, enabling the best farmers by the eighteenth century to feed an average of 20 people.

Farms became more mechanized after 1800, using metal plows, sowers, reapers and threshing machines. Transportation also improved allowing better fertilizers, that contained minerals like phosphate and potassium, to reach farmers. These minerals along with nitrogen helped to sustain crop yields. While mechanization doubled the acreage a farmer could cultivate, United States Department of Agriculture (USDA) data indicates that yields per acre of corn and wheat in the United States were flat from 1866, the date of data inception, well into the 1930s.

In the first half of the twentieth century, North American farmers started using motorized equipment, synthetic fertilizers and hybrid seeds. According to Giovanni Federico's, Feeding the World,2 by 1950 farms in the United States and Canada had one tractor for every two farmers. Utilization of fertilizer grew six fold from 1900 to 1950. Hybrid wheat was grown on 87% of the planted acres in the United States in 1921, up from 14% in 1914. Hybrid corn crops jumped from 2% to 90% of acres planted from 1936 to 1945.3

After World War II these innovations spread. Worldwide chemical fertilizer usage grew nearly tenfold from 1950 to 2000. In most continents, over half of wheat, rice and corn acres were sown with high yield varieties by the year 2000. From 1950 to 2000, world agriculture production tripled, far outpacing population growth.4 USDA data indicates that from 1998 to 2008, wheat yields per acre averaged 41 bushels, triple the rate of 100 years ago, and corn yields quintupled to an average of 144 bushels. The best equipped farmers can now produce over four million pounds of grain and feed thousands!5

Launching a "Green Revolution" in Developing Countries

Rich countries had the means to adopt modern agricultural processes while poor regions struggled to advance. Leon Hesser's book, The Man Who Fed the World,6 describes how Dr. Norman Borlaug helped create the Green Revolution7 in many developing countries by improving plant varieties and increasing crop yields. For his efforts, Borlaug won a Nobel Peace Prize, the only one awarded in the twentieth century for work in agriculture.

Mexico redistributed land to poor peasants after its political revolution ended in 1918. However, its peasants remained poor and hungry for decades. In 1940, U.S. vice president elect, Henry Wallace, who had founded Hi-Bred Corn Company (now Pioneer Hi-Bred, a DuPont subsidiary), toured Mexico and was appalled by conditions there. He convinced the Rockefeller Foundation to sponsor efforts to adapt hybrid wheat and corn for Mexico and in 1943, the Mexican Government-Rockefeller Foundation Cooperative Agricultural Program was established.

3

The program hired Borlaug as its plant pathologist. Borlaug learned that a plant disease called wheat stem rust had halved Mexico's wheat production from 1939 to 1942. He set out to create high yielding hybrid wheat that was resistant to the disease. His program introduced three innovations. First, he planted successive hybrid crops in two locations each year, which both doubled the pace of progress and resulted in crops tolerant to varying conditions. Next, Borlaug crossed thousands of varieties of wheat, working to find the most resistant hybrids. He eventually developed 40 rust resistant varieties.

Third, Borlaug changed the architecture of wheat. He knew that many wheat varieties responded well to fertilizer but when yields exceeded roughly two tons per acre, plants became top-heavy and collapsed. Borlaug crossed over 20,000 varieties of wheat from around the world in his efforts to create high yielding wheat with shorter, stronger stems. He finally succeeded in 1953 by crossing rust-resistant Mexican seeds with Japanese dwarf wheat. Under ideal conditions, four tons of wheat per acre could be achieved. Mexico became self sufficient in wheat in 1956.

Having achieved success in Mexico, the Rockefeller Foundation pursued progress elsewhere, in partnership with the Ford Foundation, the United Nations and local governments. Pakistan and India were major beneficiaries. By 1970, 55% of Pakistan's wheat acreage and 35% of India's wheat acreage were sown with Mexican varieties. The Rockefeller and Ford Foundations also created the International Rice Research Institute, which began in 1960. By 1966 it developed a sturdy short-stemmed rice plant that, when fertilized sufficiently, yielded two- to three-times the rice it replaced. This rice was quickly adopted in India.

Borlaug was personally involved with the implementation of these programs. He understood that in addition to better seeds, farmers need fertilizer, credit and fair prices for their crops. Governments largely complied. As a result of the Green Revolution, many developing countries were substantial contributors to world agricultural growth.

Recent Conditions and Future Prospects

After reading so much about the amazing progress that has been made in agriculture, it was somewhat surprising to find an article in the June 2009 National Geographic titled, "The End of Plenty, The Global Food Crisis." It noted that global grain consumption exceeded production for seven of the last nine years and grain stockpiles plunged to a 20-year low of 61-days supply in 2007 prior to recovering to a meager 70-days supply in 2008. The price of wheat and corn tripled from 2005 to 2008, and the price of rice quintupled.

Demand recently grew more quickly than supply for several reasons. First, people in developing countries are becoming more prosperous and are eating more meat, causing grain consumption by livestock to rise rapidly. Second, use of ethanol as a gasoline additive or substitute has jumped. Some 30% of the 2008 U.S. corn crop was converted to ethanol instead of being available as food. Third, while world grain production hit records in 2008, growth in grain production has slowed somewhat since the year 2000 compared to prior decades.

Still, agriculture continues to find ways to meet the rising demand. Advancements in hybrid crops continue, and biotechnology is now creating crops with whole new characteristics. While conventional plant breeding is limited to crossing closely related species, biotech methods utilize genes from distant species. To date, two types of biotech crops have been commercialized, those resistant to herbicides and those resistant to insects.

Biotech crops were first made available in 1996 and by 2008 were planted in over 300 million acres, some 8% of global cropland in 25 countries, including 15 developing countries. That year, 85% of the corn crop in the United States came from biotech seeds. Farmers seem satisfied with biotech crops; nearly 100% keep planting biotech once they begin.8 Use of biotech versions of soybean, cotton, corn, canola and other crops increased farm income an estimated $10 billion in 2007 and biotech corn and soybean yields appear to be roughly 10% higher than conventional crops.9 The National Geographic story quotes a scientist with agricultural company Monsanto who predicts that biotechnology will double corn, soybean and cotton yields by 2030.

National Geographic also pointed out the downside of the Green Revolution. Yields in India have flattened since the mid-90s, and hybrid plant needs for water, fertilizer and pesticides have resulted in aquifer depletion, salinized soils and contamination of drinking water. However, new versions of biotech plants are in development, including versions likely to provide still higher yields, drought tolerance and salinized soil tolerance.

4

Not everyone agrees with the use of biotech crops. Critics have expressed doubts about productivity gains and have concerns about the possibility of a "Frankenfood" becoming toxic or creating an ecological disaster should some new plant become invasive. But numerous safeguards are in place, including rigorous approval processes. Countries that had prohibited biotech crops are now slowly introducing them. Increased adoption of biotech plants has had positive ecological effects, as higher yields reduce needs for additional crop acres and related deforestation, insect resistance reduces needs for pesticides, and herbicide resistance reduces fuel consumption and soil erosion by requiring less tillage.

Mankind's progress in agriculture has been truly amazing. We cannot revert back to previous agricultural processes, which are insufficient to feed a worldwide population of 6.7 billion. Instead, substantial investments in agriculture, and judicious use of new technologies, are needed to maintain impressive production gains in the future.

Columbia Acorn Funds News

Resumption of Securities Lending

Columbia Acorn Funds restarted its securities lending program during the second quarter. The domestic Funds briefly participated in securities lending in the third quarter of last year but suspended lending activities due to the turmoil in the financial markets at that time. As market conditions have stabilized somewhat, the Columbia Acorn Trust Board and Columbia Wanger Asset Management (CWAM) made the decision to begin securities lending again in June.

Securities lending has come under media scrutiny recently so we want to clearly state how CWAM administers the lending program. Fund shareholders receive all of the income generated by our lending program, net of modest fees charged by the lending agent to operate the program. The securities lending income benefits Fund shareholders by offsetting a portion of the Funds' operating expenses, which increases the Funds' total returns. The advisor charges no additional fees for administering this program.

As mentioned in our third quarter report last year, securities lending is the temporary lending of a Fund's portfolio securities to broker/dealers and other institutional investors. The Fund retains the benefits of owning the securities, including receipt of dividends or interest generated by the security. The Fund also receives a fee for the loan. The Fund may recall the loans at any time and may do so in order to vote proxies or to sell the loaned securities. Furthermore, borrowers provide the Fund with cash collateral that exceeds the value of the securities on loan. The Fund could lose money if it incurred a loss on the reinvestment of the cash collateral. To minimize this risk, cash collateral for the program is invested in the Dreyfus Government Cash Management Fund, a money market mutual fund. The securities lending agent is Goldman Sachs Agency Lending. Thus far, shareholders have received modest benefits and incurred no losses from the program.

Charles P. McQuaid

President and Chief Investment Officer

Columbia Wanger Asset Management, L.P.

The information and data provided in this analysis are derived from sources that we deem to be reliable and accurate. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. The views/opinions expressed in "Squirrel Chatter II" are those of the author and not of the Columbia Acorn Trust Board, are subject to change at any time based upon economic, market or other conditions, may differ from views expressed by other Columbia Management associates or other divisions of Bank of America and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Acorn Fund are based on numerous factors, may not be relied on as an indication of trading intent on beha lf of any particular Columbia Acorn Fund.

1 Mazoyer, Marcel and Roudart, Laurence, A History of World Agriculture, (New York, NY, Monthly Review Press, 2006).

2 Federico, Giovanni, Feeding The World, (Princeton and Oxford, Princeton University Press, 2005).

3 Ibid, pg. 97.

4 Ibid, pgs. 55, 19.

5 Mazoyer, Marcel and Roudart, Laurence, op. cit., pg 11.

6 Hesser, Leon, The Man Who Fed The World, (Dallas, TX, Durban House, 2006).

7 The Green Revolution is defined by Mazoyer and Roudart as, "a variant of the contemporary agricultural revolution but without the large-scale motorization and mechanization, developed widely in the developing countries."

8 ISAAA Brief 39-2008: Executive Summary, "Global Status of Commercialized Biotech/GM Crops: 2008, The First Thirteen Years, 1996 to 2008," available at www.isaaa.org.

9 "GM crops: global, socio-economic and environmental impacts 1996-2007," a research paper written by Graham Brookes and Peter Barfoot of PG Economics Ltd, Dorchester, U.K., May 2009.

5

Understanding Your Expenses

As a Fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other Fund expenses. The following information is intended to help you understand your ongoing costs of investing in the Columbia Acorn Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in the Class Z shares of the Columbia Acorn Funds for the last six months. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different results. The amount listed in the "Actual" column is calculated using each Fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column assumes that the return each year is 5% before expenses and then applies each Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the reporting period. See the "Compare With Other Funds" information for details on using the hypothetical data.

January 1, 2009 – June 30, 2009

| | | Account value at

the beginning of

the period ($) | | Account value at

the end of

the period ($) | | Expenses paid

during the period ($) | | Fund's

annualized

expense

ratio (%)* | |

| Class Z Shares | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Columbia Acorn Fund | | | 1,000.00 | | | | 1,000.00 | | | | 1,097.69 | | | | 1,020.83 | | | | 4.16 | | | | 4.01 | | | | 0.80 | | |

| Columbia Acorn International | | | 1,000.00 | | | | 1,000.00 | | | | 1,213.08 | | | | 1,019.64 | | | | 5.71 | | | | 5.21 | | | | 1.04 | | |

| Columbia Acorn USA | | | 1,000.00 | | | | 1,000.00 | | | | 1,080.48 | | | | 1,019.54 | | | | 5.47 | | | | 5.31 | | | | 1.06 | | |

| Columbia Acorn International Select | | | 1,000.00 | | | | 1,000.00 | | | | 1,096.00 | | | | 1,018.74 | | | | 6.34 | | | | 6.11 | | | | 1.22 | | |

| Columbia Acorn Select | | | 1,000.00 | | | | 1,000.00 | | | | 1,243.78 | | | | 1,019.64 | | | | 5.79 | | | | 5.21 | | | | 1.04 | | |

| Columbia Thermostat Fund | | | 1,000.00 | | | | 1,000.00 | | | | 1,076.71 | | | | 1,023.55 | | | | 1.29 | | | | 1.25 | | | | 0.25 | | |

Expenses paid during the period are equal to each Fund's annualized expense ratio, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half-year and divided by 365.

Had the investment advisor and/or any of its affiliates not waived fees or reimbursed a portion of expenses, account value at the end of the period would have been reduced for Columbia Thermostat Fund.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the Funds and do not reflect any transaction costs, such as sales charges, redemption or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning different funds. If these transaction costs were included, your costs would have been higher.

Columbia Thermostat Fund's expenses do not include fees and expenses incurred by the Fund from the underlying portfolio funds in which it invests.

*For the six months ended June 30, 2009.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Funds with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the continuing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees.

6

Estimating Your Actual Expenses

To estimate the expenses that you actually paid over the period, first you will need your account balance at the end of the period:

• For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at columbiafunds.com or by calling Shareholder Services at (800) 922-6769.

• For shareholders who receive their account statements from their brokerage firm, contact your brokerage firm to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table titled "Expenses paid during the period," locate the amount for your Fund. You will find this number is in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

7

Columbia Acorn Fund

In a Nutshell

| |  | |

|

| Charles P. McQuaid | | Robert A. Mohn | |

|

| Lead Portfolio Manager | | Co-Portfolio Manager | |

|

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit columbiafunds.com for daily and most recent month-end performance updates.

Fund's Positions

in Mentioned Holdings

As a percentage of net assets,

as of 6/30/09

| Coach | | | 1.4 | % | |

| ITT Educational Services | | | 1.2 | % | |

| Southwestern Energy | | | 1.2 | % | |

| People's United | | | 1.1 | % | |

| Bally Technologies | | | 1.0 | % | |

| Fugro | | | 1.0 | % | |

| FMC Technologies | | | 1.0 | % | |

| AmeriCredit | | | 0.8 | % | |

| Myriad Genetics | | | 0.6 | % | |

| OLAM International | | | 0.4 | % | |

| Hexagon | | | 0.4 | % | |

| Pacific Rubiales Energy | | | 0.4 | % | |

The stock market did well in the second quarter, jumping up from what appeared to be oversold levels. Columbia Acorn Fund returned 20.90%, earning its best quarterly gain since the fourth quarter of 1999! The Fund returned somewhat more than its primary benchmark, the Russell 2500, which rose 20.27%. During the first half of 2009, the Fund grew 9.77%, nicely outperforming the 6.52% gain of the Russell 2500. As shown on Page 1, Columbia Acorn Fund also beat most other benchmarks in both periods.

As might be expected during a market reversal, several important stocks changed direction during the second quarter. Handbag and accessories designer and retailer Coach was the Fund's largest dollar winner in the quarter, up 62% as the company cut costs and repositioned its product line, which resulted in earnings dropping less than most analysts expected. Used car lender AmeriCredit achieved second place dollar winnings for both the quarter and the half, up 131% and 77% respectively, on news of a successful refinancing. Gaming machine maker Bally Technologies scored a more than 60% gain in the second quarter, earning third place dollar winnings thanks to its strong new product pipeline. All three stocks had been down 20% to 23% in the first quarter.

In contrast, three stocks that we cited as fine performers in the first quarter ended up as Columbia Acorn Fund's largest dollar losers in the second quarter. ITT Educational Services, People's United and Myriad Genetics each fell 15% to 20%. While ITT Educational's earnings were excellent, fears about student loan financing and additional regulation resurfaced. Connecticut bank People's United reported rising credit defaults. Default rates remained under half the rates of the bank's peers, but the news was bad, and the stock dropped. Myriad fell in response to disappointing revenue growth; sales of its genetic tests appear to be more sensitive to the economy than expected. We cut positions in each by over 20% in the first half, reducing dollar losses.

Energy stocks did well in both the quarter and the half as oil prices jumped. FMC Technologies rose 20% in the quarter, and its 55% gain in the half lifted it into the Fund's largest dollar winner position. Fugro, another offshore oil service company, gained 38% in the quarter and 53% in the half, earning the fourth place dollar winner position year to date. Gas producer Southwestern Energy was also hot, rising 31% in the quarter and 34% in the half, taking fifth place in dollar gains for the half.

Foreign stocks outperformed in both the second quarter and the first half of the year. Energy stocks helped a lot; Fugro was the top foreign dollar winner in both periods. Oil producer Pacific Rubiales Energy surged more than 110% in the quarter and more than 350% in the half on expectations that production will rise rapidly. Measurement equipment company Hexagon jumped over 80% in both the quarter and the half as business appeared to be bottoming or improving in several countries. Agricultural supply chain manager OLAM International's stock surged over 70% in both periods as fears about customers' abilities to finance purchases abated. Foreign stocks were 9.5% of the Fund's assets at the end of the second quarter, up from 7.1% at the end of March.

Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments.

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

8

Columbia Acorn Fund (ACRNX)

At a Glance

Performance data quoted represents past performance and current performance may be higher or lower. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower. Please visit columbiafunds.com for daily and most recent month-end updates.

Pretax and After-tax Average Annual Total Returns (Class Z)

through June 30, 2009

| Inception 6/10/70 | | Year

to date* | | 1 year | | 5 years | | 10 years | |

| Returns before taxes | | | 9.77 | % | | | -25.83 | % | | | 0.95 | % | | | 7.25 | % | |

| Returns after taxes on distributions | | | 9.77 | | | | -25.91 | | | | 0.11 | | | | 6.01 | | |

Returns after taxes on distributions

and sale of fund shares | | | 6.35 | | | | -16.70 | | | | 1.01 | | | | 6.09 | | |

| Russell 2500 Index (pretax)** | | | 6.52 | | | | -26.72 | | | | -0.93 | | | | 3.67 | | |

All results shown assume reinvestment of distributions.

**The Fund's primary benchmark.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Returns after taxes on distributions and sale of Fund shares reflect the additional tax impact of long-term gains or losses realized when Fund shares are sold. The returns are taxed at the maximum rate and assume shares were purchased at the beginning of the period. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class Z shares only; after-tax returns for other share classes will vary. Indexes do not reflect any deduction for fees, expenses or taxes.

The Fund's Class Z shares annual operating expense ratio, as stated in the current prospectus, is 0.76%.

*Year to date data is not annualized.

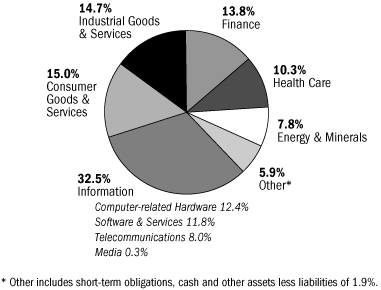

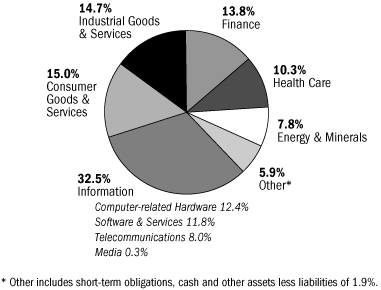

Columbia Acorn Fund Portfolio Diversification

as a percentage of net assets, as of 6/30/09

Columbia Acorn Fund Top 10 Holdings

as a percentage of net assets, as of 6/30/09

| | 1. | | | Coach

Designer & Retailer of Branded Leather Accessories | | 1.4%

| |

| | 2. | | | Crown Castle International

Communications Towers | | 1.4%

| |

| | 3. | | | Ametek

Aerospace/Industrial Instruments | | 1.3%

| |

| | 4. | | | Donaldson

Industrial Air Filtration | | 1.2%

| |

| | 5. | | | ITT Educational Services

Post-secondary Degree Services | | 1.2%

| |

| | 6. | | | Expeditors International of Washington

International Freight Forwarder | | 1.2%

| |

| | 7. | | | Southwestern Energy

Oil & Gas Producer | | 1.2%

| |

| | 8. | | | People's United

Connecticut Savings & Loan | | 1.1%

| |

| | 9. | | | Alexion Pharmaceuticals

Biotech Focused on Orphan Diseases | | 1.1%

| |

| | 10. | | | Bally Technologies

Slot Machines & Software | | 1.0%

| |

The Fund's top 10 holdings and portfolio diversification vary with changes in portfolio investments. See the Statement of Investments for a complete list of the Fund's holdings.

The Growth of a $10,000 Investment in Columbia Acorn Fund (Class Z)

June 10, 1970 through June 30, 2009

This graph compares the results of $10,000 invested in Columbia Acorn Fund at inception on June 10, 1970 to the S&P 500 Index and to an initial $31,777 investment in the Russell 2500 Index on the index's December 31, 1978 inception date. Although the indexes are provided for use in assessing the Fund's performance, the Fund's holdings may differ significantly from those in the indexes. The indexes are unmanaged and returns for both the indexes and the Fund include reinvested dividends and capital gains. It is not possible to invest directly in an index. The graph does not reflect taxes that a shareholder would pay on Fund distributions or on a sale of Fund shares.

Total Net Assets of the Fund: $11.7 billion

*A $10,000 investment in Columbia Acorn Fund at inception appreciated to $31,777 on December 31, 1978, the inception date of the Russell 2500 Index. For comparison with the Russell 2500 Index, we assigned the index the same value as the Fund at index inception.

**Although the Fund typically invests in small- and mid-sized companies, the comparison to the S&P 500 Index is presented to show performance against a widely recognized market index over the life of the Fund.

9

Columbia Acorn International

In a Nutshell

| |  | |

|

| P. Zachary Egan | | Louis J. Mendes III | |

|

| Co-Portfolio Manager | | Co-Portfolio Manager | |

|

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit columbiafunds.com for daily and most recent month-end performance updates.

Fund's Positions

in Mentioned Holdings

As a percentage of net assets,

as of 6/30/09

| Serco | | | 1.1 | % | |

| Capita Group | | | 1.1 | % | |

| Educomp Solutions | | | 0.9 | % | |

| Central European Distribution | | | 0.8 | % | |

| Jain Irrigation Systems | | | 0.7 | % | |

| RexLot Holdings | | | 0.6 | % | |

Columbia Acorn International rose 33.30% in the second quarter, slightly trailing the 34.15% rise of its primary benchmark, the S&P Global Ex-U.S. Between $500 Million and $5 Billion Index. Year to date, the Fund was up 21.31%, 3.23% behind its primary benchmark. Small-cap international stocks led larger-cap international stocks, as exemplified by the MSCI EAFE Index, which was up 25.43% in the quarter and 7.95% year to date.

While coming on the heels of a severe sell-off in 2008, an absolute return north of 30% in a single quarter is always pleasing. This remarkable reversal in market sentiment in the second quarter appears to reflect decreasing anxiety about our economic future, as credit markets show signs of life, in a context of attractive valuations. While the stock market has historically done a good job of anticipating changes in economic fundamentals by several quarters, it is worth noting that the majority of the companies we follow have reported few sightings of "green shoots" presaging a return to global growth. Indeed, the International Monetary Fund expects global economic activity to contract by 1.4% in 2009 before expanding 2.5% in 2010. The major exception to this has been the emerging markets of non-Japan Asia and Latin America. In these economies the sentiment is now distinctly upbeat. The rapid implementation of a sizeable governm ent stimulus package in China, and an election outcome in India perceived to endorse further economic liberalization, drove this enthusiasm.

Investments in emerging markets, which constitute about one quarter of the Fund's assets, posted the strongest returns, with the Fund's holdings in Asia ex-Japan up nearly 50% in the quarter and roughly 45% year to date. The Fund's Indian stocks were up just short of 80% in the quarter and 66% in the half year, led by Jain Irrigation Systems. Jain is the country's leading manufacturer of micro-irrigation systems and is a beneficiary of government policies that support efficient irrigation. Educomp Solutions provides multimedia educational content to Indian classrooms and is a recent addition to the portfolio. Its stock was also a big winner. Consumer stocks in developing markets, a long-time theme in the Fund, were also notable standouts: Central European Distribution, a Polish spirits company, more than doubled in the quarter after renegotiating agreements and financing related to a Russian acquisition. In the half year this st ock was up 35%. RexLot Holdings, which provides systems and services to the Chinese lottery market, tripled after several punishing quarters on evidence of tangible progress in its core business. Its stock was up 224% through June 30, 2009.

While still making a positive contribution to absolute return, the Fund's overweight position in health care stocks failed to keep up with a buoyant market. These companies' fortunes tend to be less correlated with actual or perceived changes in economic activity. Stock selection, however, was decidedly unhelpful in the pharmaceutical and biotech sectors, where after the quarter end, we made some changes. Japan was a drag on absolute return in the half year and the quarter, but keep in mind that Japan fell substantially less than most regions in 2008 and, therefore, had less ground to make up.

The Fund's holdings in the United Kingdom and Ireland fell short in the half year. The Fund held large positions in Serco and Capita Group, service providers with highly predictable revenues and considerable exposure to government contracts. Their comparatively low risk profiles proved to be a liability in an environment in which the riskiest stocks rallied the most.

On earnings adjusted for cyclicality and on other valuations measures, we believe that international small-cap stocks now trade at a modest discount to their 10-year average.

International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments. Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility.

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

10

Columbia Acorn International (ACINX)

At a Glance

Performance data quoted represents past performance and current performance may be higher or lower. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower. Please visit columbiafunds.com for daily and most recent month-end updates.

Pretax and After-tax Average Annual Total Returns (Class Z)

through June 30, 2009

| Inception 9/23/92 | | Year

to date* | | 1 year | | 5 years | | 10 years | |

| Returns before taxes | | | 21.31 | % | | | -28.00 | % | | | 8.47 | % | | | 6.96 | % | |

| Returns after taxes on distributions | | | 20.51 | | | | -28.47 | | | | 7.59 | | | | 5.95 | | |

Returns after taxes on distributions

and sale of fund shares | | | 13.85 | | | | -18.20 | | | | 7.58 | | | | 5.96 | | |

S&P Global Ex-U.S. Between

$500 Million and $5 Billion

Index (pretax)** | | | 24.54 | | | | -26.45 | | | | 7.13 | | | | 6.80 | | |

All results shown assume reinvestment of distributions.

**The Fund's primary benchmark.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Returns after taxes on distributions and sale of Fund shares reflect the additional tax impact of long-term gains or losses realized when Fund shares are sold. The returns are taxed at the maximum rate and assume shares were purchased at the beginning of the period. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class Z shares only; after-tax returns for other share classes will vary. Indexes do not reflect any deduction for fees, expenses or taxes.

The Fund's Class Z annual operating expense ratio, as stated in the current prospectus, is 0.96%.

*Year to date data is not annualized.

Columbia Acorn International Portfolio Diversification

as a percentage of net assets, as of 6/30/09

Columbia Acorn International Top 10 Holdings

as a percentage of net assets, as of 6/30/09

| | 1. | | | Naspers (South Africa)

Media in Africa & Other Emerging Markets | | 1.6%

| |

| | 2. | | | OLAM International (Singapore)

Agriculture Supply Chain Manager | | 1.5%

| |

| | 3. | | | Kansai Paint (Japan)

Paint Producer in Japan, India, China & Southeast Asia | | 1.4%

| |

| | 4. | | | Hong Kong Exchanges and Clearing (Hong Kong)

Hong Kong Equity & Derivatives Market Operator | | 1.3%

| |

| | 5. | | | Serco (United Kingdom)

Facilities Management | | 1.1%

| |

| | 6. | | | Intertek Group (United Kingdom)

Testing, Inspection & Certification Services | | 1.1%

| |

| | 7. | | | Capita Group (United Kingdom)

White Collar, Back Office Outsourcing | | 1.1%

| |

| | 8. | | | Imtech (Netherlands)

Engineering & Technical Services | | 1.1%

| |

| | 9. | | | Hexagon (Sweden)

Measurement Equipment | | 1.1%

| |

| | 10. | | | Singapore Exchange (Singapore)

Singapore Equity & Derivatives Market Operator | | 1.0%

| |

The Fund's top 10 holdings and portfolio diversification vary with changes in portfolio investments. See the Statement of Investments for a complete list of the Fund's holdings.

The Growth of a $10,000 Investment in Columbia Acorn International (Class Z)

September 23, 1992 through June 30, 2009

This graph compares the results of $10,000 invested in Columbia Acorn International at inception on September 23, 1992 to the S&P Global Ex-U.S. Between $500 Million and $5 Billion Index. Although the index is provided for use in assessing the Fund's performance, the Fund's holdings may differ significantly from those in the index. The index is unmanaged and returns for both the index and Fund include reinvested dividends and capital gains. It is not possible to invest directly in an index. The graph does not reflect taxes that a shareholder would pay on Fund distributions or on a sale of Fund shares.

Total Net Assets of the Fund: $3.3 billion

11

Columbia Acorn USA

In a Nutshell

Robert A. Mohn

Lead Portfolio Manager

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit columbiafunds.com for daily and most recent month-end performance updates.

Fund's Positions

in Mentioned Holdings

As a percentage of net assets,

as of 6/30/09

| FMC Technologies | | | 2.1 | % | |

| ITT Educational Services | | | 1.9 | % | |

| Atwood Oceanics | | | 1.6 | % | |

| Micros Systems | | | 1.6 | % | |

| Bally Technologies | | | 1.6 | % | |

| AmeriCredit | | | 1.4 | % | |

| Mettler Toleldo | | | 1.3 | % | |

| Valley National Bancorp | | | 1.0 | % | |

| FLIR Systems | | | 1.0 | % | |

| Lakeland Financial | | | 0.7 | % | |

| Cephalon | | | 0.6 | % | |

| Myriad Genetics | | | 0.6 | % | |

| Berkshire Hills Bancorp | | | 0.5 | % | |

| MB Financial | | | 0.4 | % | |

| Associated Banc-Corp | | | 0.2 | % | |

| Immucor | | | 0.2 | % | |

Columbia Acorn USA ended the second quarter up 19.42%. This compares to a 20.69% gain by the Fund's primary benchmark, the Russell 2000 Index. Year to date, the Fund's 8.05% return was well ahead of the benchmark, which gained 2.64%. Small-cap stocks significantly outperformed large caps. The large-cap focused S&P 500 Index gained 15.93% in the quarter, 4.76% behind the Russell 2000 Index.

Winners for the quarter and half year came from a variety of sectors. Auto lender AmeriCredit returned from the near-dead as the market reacted favorably to its positive earnings announcement and to news that the company was able to renegotiate its bank credit lines. The stock was up 131% in the second quarter and 77% year to date. Bally Technologies, a slot machine manufacturer, gained more than 60% in the quarter, and was up 25% for the half year as the market recognized its strong new product pipeline. Atwood Oceanics, an offshore drilling contractor, was helped by the rebound in oil prices, which fueled a 53% gain in the quarter and a 69% return for the half year. FMC Technologies, an oil and gas wellhead manufacturer, also benefited from the oil price bounce, gaining 20% in the quarter and topping 55% for the half year.

Mettler Toledo had a strong second quarter, gaining 50%. This manufacturer of laboratory equipment has been hurt by the weak economy, but implemented a dramatic cost reduction program that boosted earnings. Cost controls also helped at Micros Systems, a provider of information systems for restaurants and hotels. Micros's earnings were down just a penny from the prior year. This ability to nearly maintain earnings, while operating in an extremely strained sector, got a positive nod from the market. Its stock gained 35% in the quarter and 55% for the half year.

Our health care stocks were weak in the quarter. Myriad Genetics produces genetic diagnostic tests and has seen its sales growth rate fall as patients defer elective tests to save money. Immucor, a maker of blood typing and screening products, saw its stock collapse when news broke that it was under investigation for potential anti-trust violations. Pharmaceutical company Cephalon fell on fears that pending legislation and regulatory actions could have a negative impact on pharmaceutical companies.

The largest detractor from performance in the quarter was ITT Educational Services, which was off 17%. A cloud is hanging over private education companies as proposed legislation could negatively impact these organizations.

Year to date, Fund bank holdings came up short. Community banks MB Financial, Valley National Bancorp, Berkshire Hills Bancorp, Lakeland Financial and Associated Banc-Corp all made the Fund's loser list as high default rates took down the whole group. Losses in these stocks ranged from 19% to 63%. Infrared camera manufacturer FLIR Systems also declined after failing to win a new military contract. Its stock fell 26%.

The second quarter brought springtime to the United States and to the stock and bond markets. Debt markets loosened up quite a bit during the quarter, with some corporate bond spreads dropping back below levels of one year ago. Credit markets led the stock market down last year; they may be leading us the other way in 2009.

Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

12

Columbia Acorn USA (AUSAX)

At a Glance

Performance data quoted represents past performance and current performance may be higher or lower. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower. Please visit columbiafunds.com for daily and most recent month-end updates.

Pretax and After-tax Average Annual Total Returns (Class Z)

through June 30, 2009

| Inception 9/4/96 | | Year

to date* | | 1 year | | 5 years | | 10 years | |

| Returns before taxes | | | 8.05 | % | | | -28.24 | % | | | -1.81 | % | | | 4.02 | % | |

| Returns after taxes on distributions | | | 8.05 | | | | -28.24 | | | | -2.31 | | | | 3.50 | | |

Returns after taxes on distributions

and sale of fund shares | | | 5.23 | | | | -18.36 | | | | -1.35 | | | | 3.48 | | |

| Russell 2000 Index (pretax)** | | | 2.64 | | | | -25.01 | | | | -1.71 | | | | 2.38 | | |

All results shown assume reinvestment of distributions.

**The Fund's primary benchmark.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Returns after taxes on distributions and sale of Fund shares reflect the additional tax impact of long-term gains or losses realized when Fund shares are sold. The returns are taxed at the maximum rate and assume shares were purchased at the beginning of the period. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class Z shares only; after-tax returns for other share classes will vary. Indexes do not reflect any deduction for fees, expenses or taxes.

The Fund's Class Z annual operating expense ratio, as stated in the current prospectus, is 1.01%.

*Year to date data is not annualized.

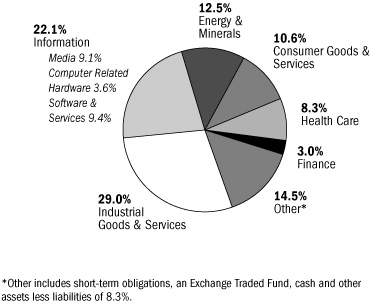

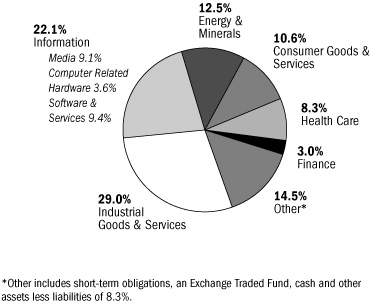

Columbia Acorn USA Portfolio Diversification

as a percentage of net assets, as of 6/30/09

Columbia Acorn USA Top 10 Holdings

as a percentage of net assets, as of 6/30/09

| | 1. | | | Crown Castle International

Communications Towers | | 2.8%

| |

| | 2. | | | ESCO Technologies

Automatic Electric Meter Readers | | 2.6%

| |

| | 3. | | | FMC Technologies

Oil & Gas Wellhead Manufacturer | | 2.1%

| |

| | 4. | | | Ametek

Aerospace/Industrial Instruments | | 2.0%

| |

| | 5. | | | tw telecom

Fiber Optic Telephone/Data Services | | 1.9%

| |

| | 6. | | | ITT Educational Services

Post-secondary Degree Services | | 1.9%

| |

| | 7. | | | Informatica

Enterprise Data Integration Software | | 1.7%

| |

| | 8. | | | Global Payments

Credit Card Processor | | 1.7%

| |

| | 9. | | | Atwood Oceanics

Offshore Drilling Contractor | | 1.6%

| |

| | 10. | | | Micros Systems

Information Systems for Restaurants & Hotels | | 1.6%

| |

The Fund's top 10 holdings and portfolio diversification vary with changes in portfolio investments. See the Statement of Investments for a complete list of the Fund's holdings.

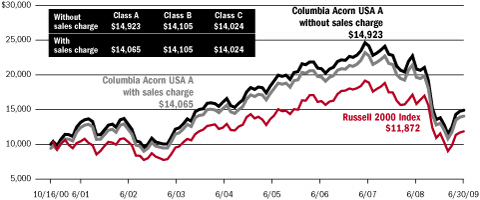

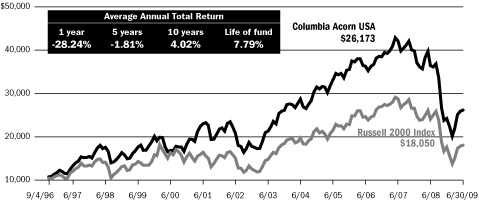

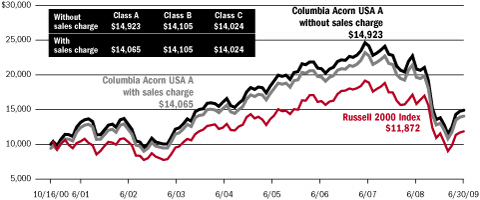

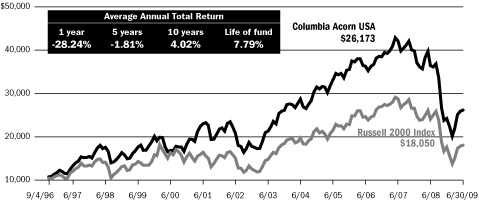

The Growth of a $10,000 Investment in Columbia Acorn USA (Class Z)

September 4, 1996 through June 30, 2009

This graph compares the results of $10,000 invested in Columbia Acorn USA at inception on September 4, 1996 to the Russell 2000 Index. Although the index is provided for use in assessing the Fund's performance, the Fund's holdings may differ significantly from those in the index. The index is unmanaged and returns for both the index and the Fund include reinvested dividends and capital gains. It is not possible to invest directly in an index. The graph does not reflect taxes that a shareholder would pay on Fund distributions or on a sale of Fund shares.

Total Net Assets of the Fund: $1.1 billion

13

Columbia Acorn International Select

In a Nutshell

Christopher J. Olson

Lead Portfolio Manager

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit columbiafunds.com for daily and most recent month-end performance updates.

Fund's Positions

in Mentioned Holdings

As a percentage of net assets,

as of 6/30/09

| Naspers | | | 4.9 | % | |

| Serco | | | 4.7 | % | |

| Pacific Rubiales Energy | | | 3.3 | % | |

| Intertek Group | | | 3.3 | % | |

| Nintendo | | | 2.6 | % | |

| Jupiter Telecommunications | | | 2.0 | % | |

| Hexagon | | | 1.8 | % | |

| Cephalon | | | 1.4 | % | |

Columbia Acorn International Select ended the second quarter up 23.44%, underperforming its primary benchmark, the S&P Developed Ex-U.S. Between $2 Billion and $10 Billion Index, which gained 28.70%. Year to date, the Fund was up 9.60%, while its benchmark posted a 14.93% return. The Fund's less cyclical portfolio, which helped performance during the recent market crash, held the Fund back as investors rushed into riskier assets.

Pacific Rubiales Energy, an oil production and exploration company operating in Colombia, was a top contributor to Fund performance, up 110% in the second quarter and more than 350% year to date. The stock benefited from the rebound in oil prices and on expectations that its production will continue to rise rapidly. Naspers, a media company with assets in South Africa and other emerging markets, was also strong, returning 55% for the quarter and 42% year to date. Naspers announced strong results through the end of March and also benefited from its 35% holding in the rapidly growing Chinese internet company Tencent. U.K. facilities management company Serco ended the quarter up 32% and was up just over 7% year to date. In June, Serco announced a series of major contract wins that continue to drive double-digit revenue growth. Swedish measurement equipment manufacturer Hexagon was up over 80% for the quarter and the half year on ex pectations that we have seen the worst of the economic crisis. Finally, Intertek Group, a U.K. provider of testing, inspection and certification services, rose 39% in the quarter and 56% year to date as increasing government regulations continued to drive growth in its consumer products testing business.

Health care holdings were among the Fund's worst performers as investors moved away from these more defensive businesses. U.S. pharmaceutical company Cephalon, Swiss orthopedic surgery materials manufacturer, Synthes and U.S. biotech company BioMarin fell between 20% and 31% in the half. We opted to sell the Fund's positions in Synthes and BioMarin. Japan's Nintendo, a maker of gaming software and hardware, was also off for both periods, down 5% in the quarter and 27% year to date as growth in its Wii product slowed. Japanese cable service provider Jupiter Telecommunications rebounded in the second quarter with a gain of 13%, but it was not enough to offset first quarter declines. The stock was down 28% year to date as investors sold last year's strong performers to fund purchases of more cyclical stocks.

Volatility has been, and is likely to continue to be, a defining feature of the global equity markets. High debt levels, loose monetary policies, large fiscal stimulus plans, changing government regulations, rapidly evolving business environments and other factors will keep investors guessing. We will continue to focus our efforts on finding those companies that we believe can manage such turbulence and adequately reward shareholders over the long term.

International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments. Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. Investing in emerging markets may involve greater risks than investing in more developed countries.

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

14

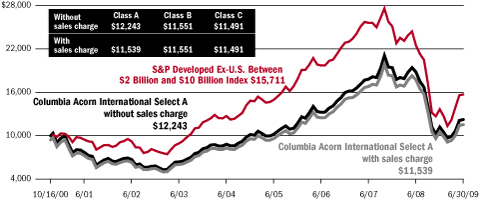

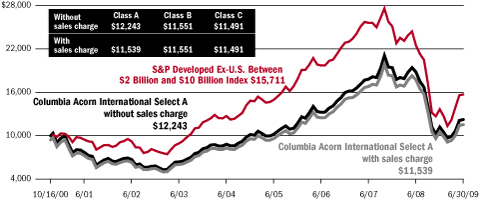

Columbia Acorn International Select (ACFFX)

At a Glance

Performance data quoted represents past performance and current performance may be higher or lower. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower. Please visit columbiafunds.com for daily and most recent month-end updates.

Pretax and After-tax Average Annual Total Returns (Class Z)

through June 30, 2009

| Inception 11/23/98 | | Year

to date* | | 1 year | | 5 years | | 10 years | |

| Returns before taxes | | | 9.60 | % | | | -34.62 | % | | | 7.10 | % | | | 5.54 | % | |

| Returns after taxes on distributions | | | 9.14 | | | | -34.89 | | | | 6.77 | | | | 5.34 | | |

Returns after taxes on distributions

and sale of fund shares | | | 6.24 | | | | -22.50 | | | | 6.30 | | | | 4.92 | | |

S&P Developed Ex-U.S. Between

$2 Billion and $10 Billion

Index (pretax)** | | | 14.93 | | | | -30.16 | | | | 4.30 | | | | 5.24 | | |

All results shown assume reinvestment of distributions.

**The Fund's primary benchmark.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Returns after taxes on distributions and sale of Fund shares reflect the additional tax impact of long-term gains or losses realized when Fund shares are sold. The returns are taxed at the maximum rate and assume shares were purchased at the beginning of the period. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class Z shares only; after-tax returns for other share classes will vary. Indexes do not reflect any deduction for fees, expenses or taxes.

The Fund's Class Z annual operating expense ratio, as stated in the current prospectus, is 1.21%.

*Year to date data is not annualized.