UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-01829 |

|

Columbia Acorn Trust |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer

5228 Ameriprise Financial Center

Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2011 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Q4 2011

Columbia Acorn Family of Funds

Class Z Shares

Managed by Columbia Wanger Asset Management, LLC

Annual Report

December 31, 2011

n Columbia

Acorn® Fund

n Columbia

Acorn International®

n Columbia

Acorn USA®

n Columbia

Acorn International SelectSM

n Columbia

Acorn SelectSM

n Columbia

Thermostat FundSM

n Columbia

Acorn Emerging Markets FundSM

n Columbia

Acorn European FundSM

Not FDIC insured • No bank guarantee • May lose value

Columbia Acorn Family of Funds

Descriptions of Indexes Included in this Report

• 50/50 Blended Benchmark, established by the Fund's adviser, is an equally weighted custom composite of Columbia Thermostat Fund's primary equity and primary debt benchmarks, the S&P 500 Index and the Barclays Capital U.S. Aggregate Bond Index, respectively. The percentage of the Fund's assets allocated to underlying stock and bond portfolio funds will vary, and accordingly the composition of the Fund's portfolio will not always reflect the composition of the 50/50 Blended Benchmark.

• Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

• HSBC Smaller European Companies (inc UK) Index is a weighted combination of two indexes: the HSBC Smaller Europe (ex UK) Index and the HSBC Smaller UK Index. The index is rebalanced on a quarterly basis.

• Lipper Indexes include the largest funds tracked by Lipper, Inc. in the named category. Lipper Mid-Cap Growth Funds Index, 30 largest mid-cap growth funds, including Columbia Acorn Fund and Columbia Acorn Select; Lipper International Small/Mid Growth Funds Index, 10 largest non-U.S. small/mid growth funds, including Columbia Acorn International; Lipper Small-Cap Growth Funds Index, 30 largest small-cap growth funds, including Columbia Acorn USA; Lipper Flexible Portfolio Funds Index, an equal-weighted index of the 30 largest mutual funds within the Flexible Portfolio fund classification, as defined by Lipper. Lipper Emerging Markets Index, 30 largest emerging markets funds; Lipper European Region Index, 10 largest European funds.

• Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index (Net) is a capitalization-weighted index that tracks the total return of common stocks in 22 developed-market countries within Europe, Australasia and the Far East. The returns of the MSCI EAFE Index (Net) are presented net of the withholding tax rate applicable to foreign non-resident institutional investors in the foreign companies included in the index who do not benefit from double taxation treaties.

• MSCI Emerging Markets Small Cap Index, a widely recognized international benchmark, is a free float-adjusted market capitalization index that is designed to measure small-cap emerging market equity performance. The MSCI Emerging Markets Small Cap Index currently consists of the following 21 emerging market country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

• Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

• Russell 2500 Index measures the performance of the 2,500 smallest companies in the Russell 3000 Index, which represents approximately 17% of the total market capitalization of the Russell 3000 Index.

• Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

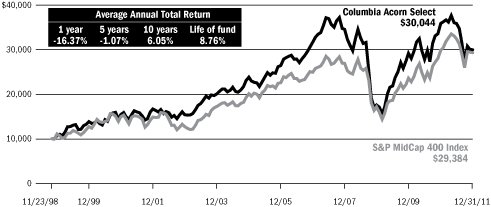

• Standard & Poor's (S&P) MidCap 400 Index is a market value-weighted index that tracks the performance of 400 mid-cap U.S. companies.

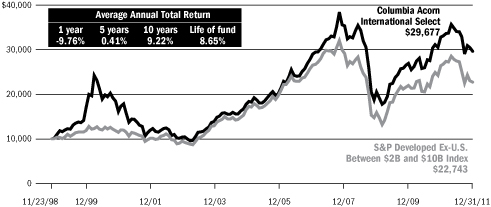

• S&P Developed Ex-U.S. Between $2B and $10B Index is a subset of the broad market selected by the index sponsor representing the mid-cap developed market, excluding the United States.

• S&P Emerging Markets Between $500M and $5B Index represents the institutionally investable capital of emerging market countries with market caps ranging between $500 million to $5 billion, as selected by S&P. The index currently consists of the following 21 emerging market country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

• S&P Europe Between $500M and $5B Index represents the institutionally investable capital of European countries with market caps ranging between $500 million to $5 billion, as selected by S&P. The index currently consists of the following 17 developed market country indexes: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom.

• S&P Global Ex-U.S. SmallCap Index consists of the bottom 20% of institutionally investable capital of developed and emerging countries, excluding the United States.

• S&P Global Ex-U.S. Between $500M and $5B Index is a subset of the broad market selected by the index sponsor representing the mid- and small-cap developed and emerging markets, excluding the United States.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

The views expressed in the "Squirrel Chatter II" and "In a Nutshell" commentaries reflect the current views of the respective authors. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective authors disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for a Columbia Acorn Fund are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any particular Columbia Acorn Fund. References to specific company's securities should not be construed as a recommendation or investment advice and there can be no assurance that as of the date of publication of this report, the securities mentioned in each Fund's portfolio are still held or that the securities sold have not been repurchased.

Acorn®, Acorn USA® and Acorn International® are service marks owned and registered by Columbia Acorn Trust. ColumbiaSM, Columbia Management®, and the Columbia Management Logo® are service marks owned and/or registered by Ameriprise Financial, Inc.

Letter to Shareholders from the

Columbia Acorn Board of Trustees

Stewardship and Growth

Fellow Shareholders:

Last June, I was elected the independent Chair of the Columbia Acorn Trust Board of Trustees. I am honored to continue a long and distinguished tradition of stewardship and advocacy for our shareholders. Stewardship is defined as the careful and responsible management of those things entrusted to one's care. While Trustees cannot influence the volatility of markets, they can maintain standards of excellence in stewardship and take steps to foster the continued vitality of the adviser that manages the Funds' investments, Columbia Wanger Asset Management (CWAM). I am pleased to report that your Board has worked hard towards both this year.

Stewardship requires that we maintain our independence. It also requires that we promote a culture at CWAM that places investment results ahead of all other considerations, that retains and motivates talented individuals, and that continues to employ the investment philosophy established by Ralph Wanger over 40 years ago. Our Board is composed entirely of Trustees who are independent of CWAM, with the exception of Chuck McQuaid, CWAM's Chief Investment Officer.1 The CWAM team serves our shareholders under the ownership of Columbia Management Investment Advisers, LLC (Columbia Management), a subsidiary of Ameriprise Financial, Inc. The Board has taken the steps necessary to ensure CWAM's autonomy in managing the Acorn Funds, while securing the advantages of the larger Ameriprise organization. On February 15, 2012, the president of Columbia Management, to whom CWAM reported, resigned. Columbia Management has assured the Board that this departure will not impact CWAM's independence.

One important signpost for stewardship is the willingness to have "skin in the game." All of our Trustees are investors in the Acorn Funds. Moreover, your portfolio managers have significant personal investments in the Acorn Funds and CWAM continues to compensate its professionals using incentives that reward investment performance. At present, five CWAM portfolio managers each have over $1 million of their own money invested in the Funds they manage. These five Funds represent approximately 85% of the assets currently under management at CWAM. As a result, your portfolio managers are motivated to achieve outstanding investment results for you.

For the first time since 2002, the Board approved the launch of two new Acorn Funds: Columbia Acorn Emerging Markets Fund and Columbia Acorn European Fund. Both Funds are managed by experienced professionals who have established track records as CWAM analysts, and both invest using the "growth at a reasonable price" philosophy that guides the other Acorn Funds. The new Funds were primarily seeded with the personal investments of their portfolio managers and other CWAM professionals. The launch of these Funds demonstrates the Board's commitment to encouraging growth through developing and retaining investment talent while maintaining our investment principles and furthering the stewardship values that protect our shareholders. We are confident that these two new Funds will be outstanding additions to the Acorn Fund family.

Thank you for your continued confidence in the Acorn Funds.

Laura M. Born

Independent Chair of the Board of Trustees

Columbia Acorn Trust

1 Mr. David Rudis became a disinterested Trustee on January 1, 2012. Ralph Wanger, CWAM's founder, serves as non-voting Trustee Emeritus.

Columbia Acorn Family of Funds

Table of Contents

| Performance At A Glance | | | 1 | | |

Squirrel Chatter II: Vaccines, Medicine's

Greatest Lifesaver | | | 2 | | |

| Understanding Your Expenses | | | 6 | | |

| Columbia Acorn Fund | |

| In a Nutshell | | | 8 | | |

| At a Glance | | | 9 | | |

| Major Portfolio Changes | | | 24 | | |

| Statement of Investments | | | 26 | | |

| Columbia Acorn International | |

| In a Nutshell | | | 10 | | |

| At a Glance | | | 11 | | |

| Major Portfolio Changes | | | 39 | | |

| Statement of Investments | | | 41 | | |

| Portfolio Diversification | | | 50 | | |

| Columbia Acorn USA | |

| In a Nutshell | | | 12 | | |

| At a Glance | | | 13 | | |

| Major Portfolio Changes | | | 51 | | |

| Statement of Investments | | | 52 | | |

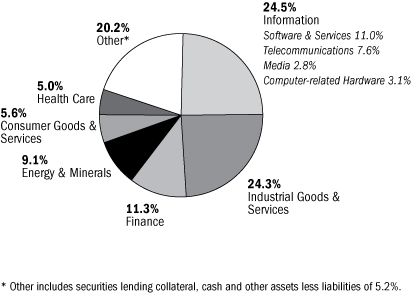

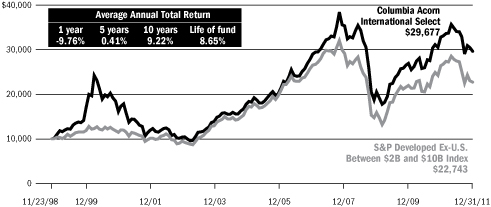

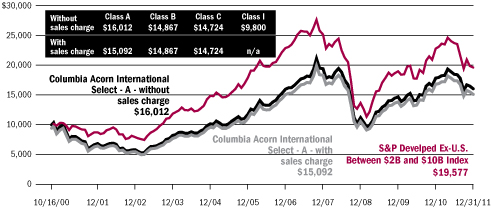

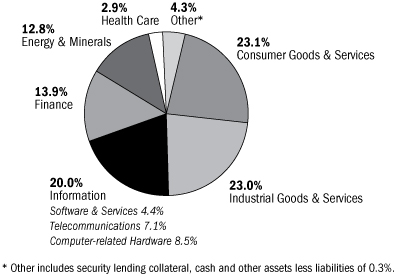

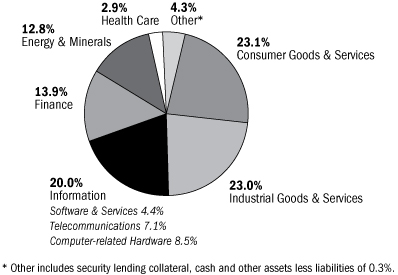

| Columbia Acorn International Select | |

| In a Nutshell | | | 14 | | |

| At a Glance | | | 15 | | |

| Major Portfolio Changes | | | 59 | | |

| Statement of Investments | | | 60 | | |

| Portfolio Diversification | | | 64 | | |

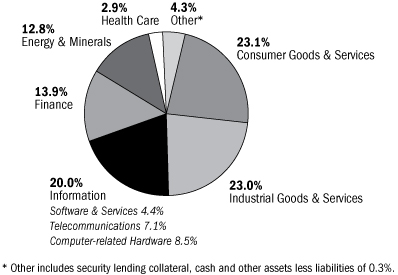

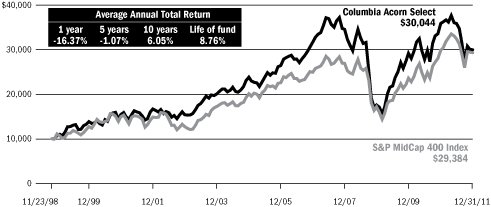

| Columbia Acorn Select | |

| In a Nutshell | | | 16 | | |

| At a Glance | | | 17 | | |

| Major Portfolio Changes | | | 65 | | |

| Statement of Investments | | | 66 | | |

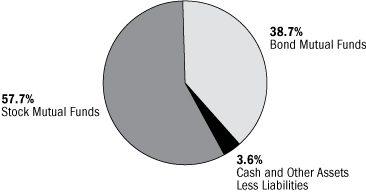

| Columbia Thermostat Fund | |

| In a Nutshell | | | 18 | | |

| At a Glance | | | 19 | | |

| Statement of Investments | | | 71 | | |

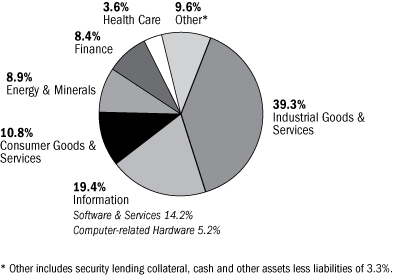

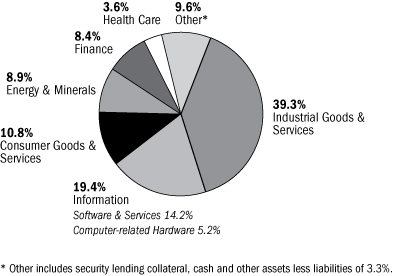

| Columbia Acorn Emerging Markets Fund | |

| In a Nutshell | | | 20 | | |

| At a Glance | | | 21 | | |

| Major Portfolio Changes | | | 72 | | |

| Statement of Investments | | | 73 | | |

| Portfolio Diversification | | | 76 | | |

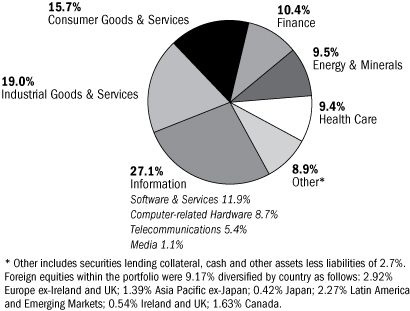

| Columbia Acorn European Fund | |

| In a Nutshell | | | 22 | | |

| At a Glance | | | 23 | | |

| Major Portfolio Changes | | | 77 | | |

| Statement of Investments | | | 78 | | |

| Portfolio Diversification | | | 81 | | |

| Columbia Acorn Family of Funds | |

| Statements of Assets and Liabilities | | | 82 | | |

| Statements of Operations | | | 84 | | |

| Statements of Changes in Net Assets | | | 86 | | |

| Financial Highlights | | | 92 | | |

| Notes to Financial Statements | | | 96 | | |

Report of Independent Registered

Public Accounting Firm | | | 107 | | |

| Federal Income Tax Information | | | 108 | | |

Board of Trustees and Management

of Columbia Acorn Funds | | | 109 | | |

| Columbia Acorn Family of Funds Information | | | 113 | | |

2011 Year-end Distributions

The following table details the year-end distributions for the Columbia Acorn Funds. For all Funds except Columbia Thermostat Fund, the record date was December 6, 2011, and the ex-dividend and payable date was December 7, 2011. For Columbia Thermostat Fund, the record date was December 21, 2011, and the ex-dividend and payable date was December 22, 2011.

| | | Short-term

Capital

Gains | | Long-term

Capital

Gains | | Ordinary

Income | | Reinvestment

Price | |

| Columbia Acorn Fund | | | None | | | $ | 0.88962 | | | | None | | | $ | 27.98 | | |

| Columbia Acorn International | | | None | | | | None | | | | None | | | | N/A | | |

| Columbia Acorn USA | | | None | | | $ | 0.16883 | | | | None | | | $ | 27.45 | | |

| Columbia Acorn International Select | | | None | | | $ | 0.39302 | | | $ | 0.37430 | | | $ | 25.10 | | |

| Columbia Acorn Select | | | None | | | | None | | | | None | | | | N/A | | |

| Columbia Thermostat Fund | | | None | | | | None | | | $ | 0.21327 | | | $ | 12.60 | | |

| Columbia Acorn Emerging Markets Fund | | | None | | | | None | | | | None | | | | N/A | | |

| Columbia Acorn European Fund | | $ | 0.01544 | | | | None | | | $ | 0.06861 | | | $ | 9.67 | | |

Columbia Acorn Family of Funds

Performance At A Glance Class Z Average Annual Total Returns through 12/31/11

| | | NAV on

12/31/11 | | 4th

quarter* | | 1 year | | 5 years | | 10 years | | Life

of Fund | |

| Columbia Acorn Fund (ACRNX) (6/10/70) | | $ | 27.56 | | | | 10.78 | % | | | -4.61 | % | | | 2.12 | % | | | 8.24 | % | | | 14.50 | % | |

| Russell 2500 Index | | | | | 14.52 | % | | | -2.51 | % | | | 1.24 | % | | | 6.57 | % | | | N/A | | |

| S&P 500 Index** | | | | | 11.82 | % | | | 2.11 | % | | | -0.25 | % | | | 2.92 | % | | | 10.44 | % | |

| Lipper Mid-Cap Growth Funds Index | | | | | 10.30 | % | | | -5.30 | % | | | 2.89 | % | | | 4.48 | % | | | N/A | | |

| Columbia Acorn International (ACINX) (9/23/92) | | $ | 34.31 | | | | 2.02 | % | | | -14.06 | % | | | 0.20 | % | | | 10.27 | % | | | 10.63 | % | |

| S&P Global Ex-U.S. Between $500M and $5B Index | | | | | 0.75 | % | | | -16.94 | % | | | -0.58 | % | | | 11.10 | % | | | 7.90 | % | |

| S&P Global Ex-U.S. SmallCap Index | | | | | 1.15 | % | | | -17.40 | % | | | -2.14 | % | | | 10.33 | % | | | 7.10 | % | |

| Lipper International Small/Mid Growth Funds Index | | | | | 2.88 | % | | | -14.22 | % | | | -1.73 | % | | | 8.98 | % | | | N/A | | |

| Columbia Acorn USA (AUSAX) (9/4/96) | | $ | 26.98 | | | | 11.94 | % | | | -4.95 | % | | | 0.82 | % | | | 6.30 | % | | | 9.49 | % | |

| Russell 2000 Index | | | | | 15.47 | % | | | -4.18 | % | | | 0.15 | % | | | 5.62 | % | | | 6.74 | % | |

| Russell 2500 Index | | | | | 14.52 | % | | | -2.51 | % | | | 1.24 | % | | | 6.57 | % | | | 8.34 | % | |

| Lipper Small-Cap Growth Funds Index | | | | | 12.88 | % | | | -3.40 | % | | | 1.14 | % | | | 3.65 | % | | | 5.21 | % | |

| Columbia Acorn Int'l Select (ACFFX) (11/23/98) | | $ | 24.46 | | | | 1.93 | % | | | -9.76 | % | | | 0.41 | % | | | 9.22 | % | | | 8.65 | % | |

| S&P Developed Ex-U.S. Between $2B and $10B Index | | | | | 0.99 | % | | | -14.01 | % | | | -3.06 | % | | | 8.41 | % | | | 6.47 | % | |

| MSCI EAFE Index | | | | | 3.33 | % | | | -12.14 | % | | | -4.72 | % | | | 4.67 | % | | | 2.64 | % | |

| Lipper International Small/Mid Growth Funds Index | | | | | 2.88 | % | | | -14.22 | % | | | -1.73 | % | | | 8.98 | % | | | 9.15 | % | |

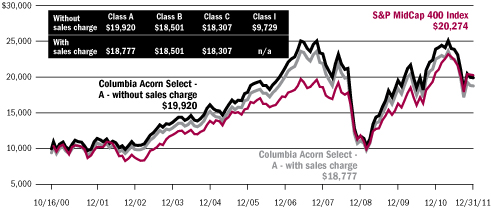

| Columbia Acorn Select (ACTWX) (11/23/98) | | $ | 23.62 | | | | 9.35 | % | | | -16.37 | % | | | -1.07 | % | | | 6.05 | % | | | 8.76 | % | |

| S&P MidCap 400 Index | | | | | 12.98 | % | | | -1.73 | % | | | 3.32 | % | | | 7.04 | % | | | 8.57 | % | |

| S&P 500 Index** | | | | | 11.82 | % | | | 2.11 | % | | | -0.25 | % | | | 2.92 | % | | | 2.42 | % | |

| Lipper Mid-Cap Growth Funds Index | | | | | 10.30 | % | | | -5.30 | % | | | 2.89 | % | | | 4.48 | % | | | 5.55 | % | |

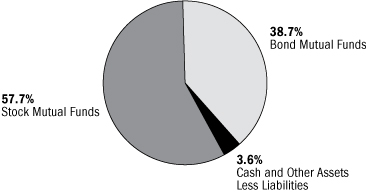

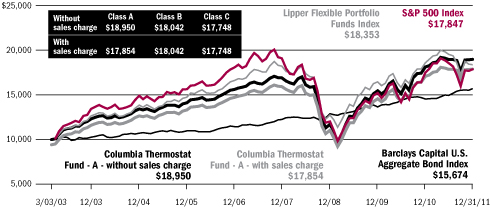

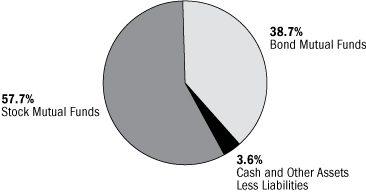

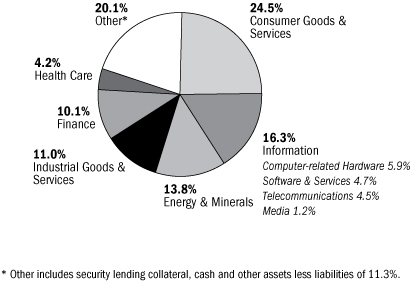

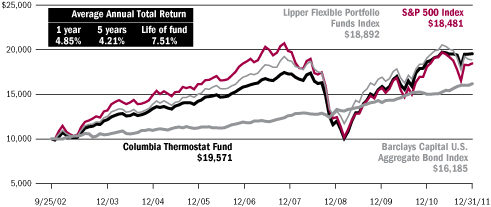

| Columbia Thermostat Fund (COTZX) (9/25/02)† | | $ | 12.67 | | | | 7.64 | % | | | 4.85 | % | | | 4.21 | % | | | — | | | | 7.51 | % | |

| S&P 500 Index | | | | | 11.82 | % | | | 2.11 | % | | | -0.25 | % | | | — | | | | 6.85 | % | |

| Barclays Capital U.S. Aggregate Bond Index | | | | | 1.12 | % | | | 7.84 | % | | | 6.50 | % | | | — | | | | 5.33 | % | |

| Lipper Flexible Portfolio Funds Index | | | | | 6.28 | % | | | -1.16 | % | | | 2.02 | % | | | — | | | | 7.10 | % | |

| 50/50 Blended Benchmark | | | | | 6.47 | % | | | 5.28 | % | | | 3.54 | % | | | — | | | | 6.43 | % | |

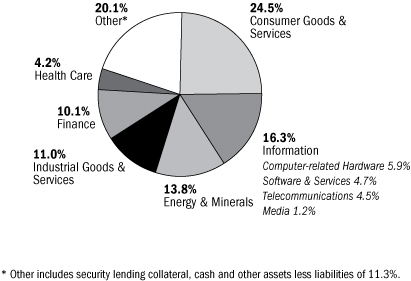

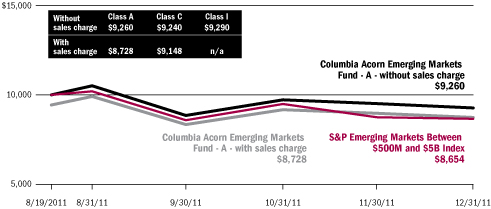

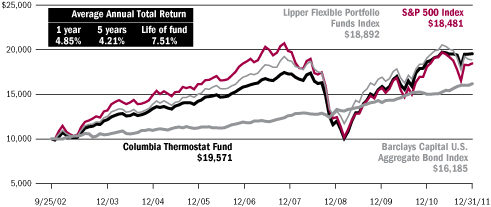

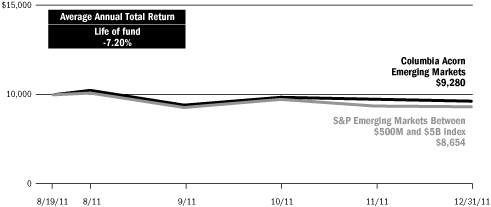

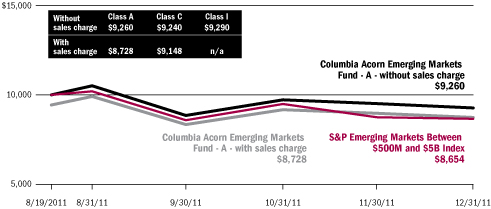

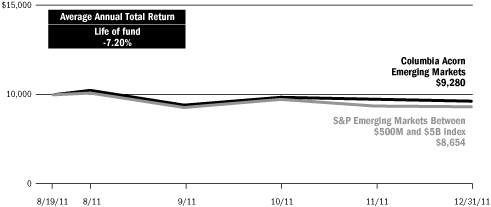

Columbia Acorn Emerging Markets Fund

(CEFZX) (8/19/11) | | | $9.28 | | | | 4.98 | % | | | — | | | | — | | | | — | | | | -7.20 | %* | |

| S&P Emerging Markets Between $500M and $5B Index | | | | | 0.96 | % | | | — | | | | — | | | | — | | | | -13.46 | %* | |

| MSCI Emerging Markets Small Cap Index | | | | | -0.66 | % | | | — | | | | — | | | | — | | | | -16.65 | %* | |

| Lipper Emerging Markets Index | | | | | 5.09 | % | | | — | | | | — | | | | — | | | | -6.81 | %* | |

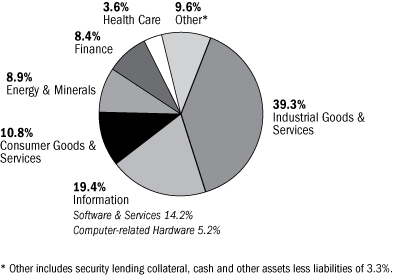

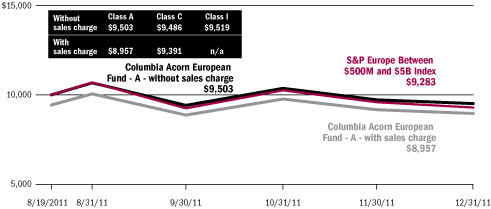

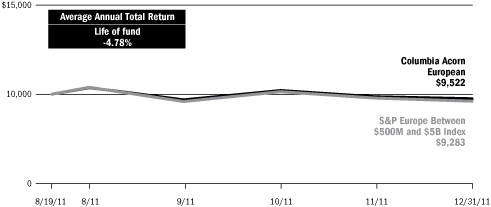

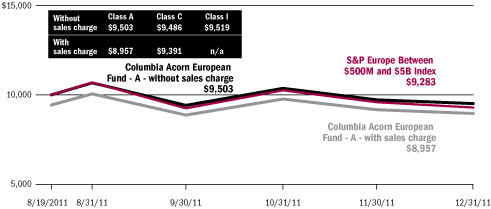

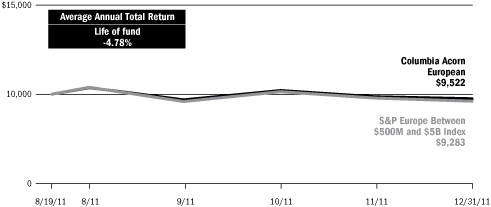

| Columbia Acorn European Fund (CAEZX) (8/19/11) | | $ | 9.44 | | | | 1.19 | % | | | — | | | | — | | | | — | | | | -4.78 | %* | |

| S&P Europe Between $500M and $5B Index | | | | | 0.41 | % | | | — | | | | — | | | | — | | | | -7.17 | %* | |

| HSBC Smaller European Companies Index | | | | | -0.94 | % | | | — | | | | — | | | | — | | | | -9.54 | %* | |

| Lipper European Region Index | | | | | 5.89 | % | | | — | | | | — | | | | — | | | | -1.24 | %* | |

*Not annualized.

**Although the Fund typically invests in small- and mid-sized companies, the comparison to the S&P 500 Index is presented to show performance against a widely recognized market index over the life of the Fund.

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment adviser (Columbia Wanger Asset Management, LLC ("CWAM")) and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower. Current performance may be lower or higher than the performance data shown. Please visit columbiamanagement.com for daily and most recent month-end updates.

Net asset value (NAV) returns do not include sales charges or contingent deferred sales charges (CDSC). If they were included, returns would have been lower. Class Z shares are sold only at NAV with no distribution and service (Rule 12b-1) fees. Only eligible investors may purchase Class Z shares of the Funds, directly or by exchange. Please see each Fund's prospectus for eligibility and other details. Class Z shares have limited eligibility and the investment minimum requirement may vary.

Annual operating expense ratios are stated as of each Fund's current prospectus and differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and expense reimbursements as well as different time periods used in calculating the ratios for Class Z shares. Columbia Acorn Fund: 0.76%. Columbia Acorn International: 0.98%. Columbia Acorn USA: 1.01%. Columbia Acorn International Select: 1.16%. Columbia Acorn Select: 0.97%. Columbia Thermostat Fund has a contractual fee waiver and expense reimbursement agreement with CWAM that expires April 30, 2012; expense ratios without and with the contractual waiver/reimbursement, including fees and expenses associated with the Fund's investments in other investment companies (underlying funds), are 1.16% and 1.04%, respectively. Columbia Acorn Emerging Markets Fund has a contractual fee waiver and expense reimbursement agreement with CWAM that expires April 30, 2013; expense ratios without and with the contractual waiver/reimbursement are 1.58%. Columbia Acorn European Fund has a contractual fee waiver and expense reimbursement agreement with CWAM that expires April 30, 2013; expense ratios without and with the contractual waiver/reimbursement are 1.51% and 1.50%, respectively. See Page 101 for more information about the Funds' fees and expenses.

†A "fund of funds" bears its allocable share of the costs and expenses of the underlying funds in which it invests. Such funds are thus subject to two levels of fees and potentially higher expense ratios than would be associated with an investment in a fund that invests and trades directly in financial instruments under the direction of a single manager.

All results shown assume reinvestment of distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. Unlike mutual funds, indexes are not actively managed and do not incur fees or expenses. It is not possible to invest directly in an index.

1

Squirrel Chatter II: Vaccines, Medicine's Greatest Lifesaver

I recently read several books on the history of vaccines. As one of the authors put it, "Of all of the benefits of medical science, vaccination is at or near the summit."1

I recently read several books on the history of vaccines. As one of the authors put it, "Of all of the benefits of medical science, vaccination is at or near the summit."1

Deadly Diseases

"Bring out your dead!" cries a wretched man pulling a cart of bodies in Monty Python and the Holy Grail. Set in the middle ages, the movie makes fun of the impact of communicable disease at that time. In reality, such diseases were no laughing matter. Once mankind transitioned from isolated bands of nomadic hunter-gatherers to more densely populated groups of farmers, epidemic diseases began to ravage civilization.

Remarkable progress has been made as fatal, communicable disease has now become rare in the developed world. Clearly, improved sanitation and nutrition have helped, but much of the credit goes to the development of vaccines.

The First Vaccine

Dating back to at least the time of the Pharaohs, waves of smallpox epidemics ravaged mankind. In populations previously subject to the disease, mortality rates for those infected could be more than 30% and, for other populations, much more.2 North American Indians had little immunity to the disease. Their population decreased 99% between Columbus's voyage in 1492 and the year 1800, and smallpox was the largest killer.3

People observed that the disease was communicable and one who survived a smallpox infection became immune to the next epidemic of the disease. In ancient China and more recently in Asia and Africa, a crude form of vaccination called variolation developed whereby fluid from a smallpox pustule or parts of smallpox scabs were scraped into the skin of a healthy person. In most cases, immunity would build up before the disease reached a vital organ and the individual would survive.

In 1790, Lady Montague, the wife of the British ambassador to the Ottoman Empire, introduced variolation to Britain. The process was far riskier than vaccines today; most people suffered severe side effects and up to about 3% of those treated died as a result.4 But these were much better odds than for those infected with smallpox.

Edward Jenner, a pharmacist in England, learned that milkmaids were immune to smallpox because they often suffered blisters from cowpox, a related disease. In 1796, Jenner began experimenting with variolating using fluid from a milkmaid's cowpox blisters, rather than smallpox sores. When his subjects were later variolated with smallpox fluid, no reaction occurred, indicating that they were immune from smallpox. Immunization using cowpox fluids rose rapidly and protected millions of people.5

A cowpox-derived vaccine for smallpox continued to be used well into the 20th century, including use by six million New Yorkers who were inoculated during a smallpox scare in 1947. Smallpox was eradicated from nature; the last case occurred in India in 1975.6 Smallpox immunizations ended when health authorities judged the risk of side effects from the vaccine exceeded the risk of the disease returning.

The Golden Age of Vaccines

Beginning in the 1860s, tremendous scientific advances were made. Robert Koch's laboratory in Germany identified bacteria as the source of many diseases and proved that bacteria grown in a lab could cause disease.7 Koch's lab created some vaccines, including those for diphtheria and tetanus.

In France, Louis Pasteur stunned the world by developing the first rabies vaccine in 1885; until then rabies infections resulted in horrible deaths. His mantra was to "isolate, attenuate and vaccinate" the pathogen causing a disease.8 He attenuated a germ by having it reproduce in petri dishes or animal cells where it would evolve in order to optimize in its new environment. Once it evolved to the point it would no longer thrive in and harm humans, it was injected into humans with the hope that the subject would build immunity to full power germs. The Goldilocks' trick, of course, was to make the attenuated germ weak enough so as not to cause harm, but strong enough to create immunity.

2

While scientific understanding of disease increased rapidly, it was primitive compared to modern times. Diagnostic tools were poor. Bacteria could be seen by optical microscopes, but viruses were unseen until the development of the electron microscope in the 1930s. Viruses were inferred to exist as a result of an 1898 experiment by Danish professor Martinus Beijerinck, who filtered bacteria out through unglazed porcelain containers, but observed remaining, and much smaller, disease-causing elements. Scientists learned how to grow viruses in laboratories only in the late 1940s.9

Early vaccines were dangerous and unreliable by today's standards, though far less dangerous than the underlying diseases they prevented. Vaccines did not stop the great influenza epidemic of 1918-1919. Of a worldwide population of one billion, an estimated 500 million were infected and more than 50 million people died.10 This virus was unusual in that it had high mortality among young, healthy people.

Vaccines continued to progress. During World War II, all 11 million U.S. soldiers were vaccinated for typhoid, tetanus, smallpox, cholera and plague. Vaccines, coupled with antibiotics, drastically improved their health. Disease deaths outnumbered battle deaths by 13:1 in the Spanish American War, matched them in World War I and were outnumbered by 1:85 in World War II.11

Maurice Hilleman's Mission

Maurice Hilleman had a role in creating more vaccines than anyone else in history, some three dozen. As noted by Arthur Allen, author of Vaccine, The Controversial Story of Medicine's Greatest Lifesaver, "...his products undoubtedly saved more lives than those of any other individual in the past half-century."12

Hilleman grew up in Montana and earned a Ph.D. in microbiology at the University of Chicago, where he discovered that chlamydia is a tiny bacteria rather than a virus. He then stunned his mentors by departing academia to work in industry. At Squibb, he developed a vaccine against Japanese B encephalitis to protect American Pacific troops during World War II. In 1948, he joined the Walter Reed Army Medical Center, then a hub of vaccine development.

In 1957, Hilleman moved to Merck, where he continued to develop vaccines well past his official retirement in 1984. He had a tremendous work ethic, often working seven days a week and expecting the same from his staff. He and his team were on a mission to rid the world of disease. They developed eight of 14 now common vaccines for measles, mumps, hepatitis A and B, chickenpox, meningitis, pneumonia and Hib (hemophilus influenza, which harms infants and young children).13 One of his accomplishments was the combination MMR (measles, mumps and rubella) vaccine.

Hilleman discovered that the influenza virus is particularly difficult to deal with due to frequent minor drifts in its surface, which each year makes the last year's vaccine obsolete. Periodically, the virus shifts its surface characteristics substantially, becoming much more virulent. Hilleman inferred that a shift occurred in Hong Kong in 1957 and, by having Merck produce 40 million doses of vaccine, saved thousands of lives in America. Potential future shifts keep virologists up at night.

Hilleman helped develop the first two anti-cancer vaccines. One vaccine prevents hepatitis B, the third most common known cause of cancer in the world (after sunlight and smoking).14 It was the first vaccine utilizing recombinant technology and the first made by a single protein. His innovations helped create a vaccine to prevent HPV (human papillomavirus), the cause of cervical cancer. Hilleman had high integrity, as he refused to risk changes in manufacturing processes in order to enhance yields and profits.15 He died in 2005 at age 85.

Vaccine Scares

Two notable scares set back progress on vaccine usage.

In 1982, a TV station in Washington D.C. aired "Vaccine Roulette," a story highlighting risks of the DTP (diphtheria, tetanus and pertussis) vaccine. It showed reactions well known to physicians, including cases of seizures, high fevers and fainting. In a case of ambush journalism, it edited doctors' comments out of context and failed to mention that none of the victims portrayed suffered permanent damage. Other media quoted the story further out of context, claiming permanent damage. The media also failed to mention the consequences of contracting the underlying diseases.16

In 1998, the British medical journal The Lancet published a paper alleging a link between the MMR vaccine

3

and autism.17 It claimed that, in some cases, the vaccine caused the measles virus to lodge in the intestines and create leakage, allowing opioid peptides to escape and penetrate the brain, causing autism. The paper was under fire by scientists immediately. The opioid causation theory had already been widely discredited, the findings of measles in intestines could not be duplicated by other scientists and there was no comparison between autism rates of children who got the vaccine and those who did not. A review by 37 experts found that the theories were "biologically implausible," and the conclusions essentially worthless.18

Fourteen separate groups of investigators did statistical studies that also refuted the link.19 One notable study covered 530,000 children in Denmark from 1991-1998, comparing vaccinated and unvaccinated children. It showed "strong evidence against the hypothesis that MMR vaccination causes autism."20 By 2004, 10 of the original 12 authors of The Lancet article withdrew their support of the paper.21 The Lancet formally retracted the paper in 2010 and, that same year, the primary author of the paper had his U.K. medical license revoked.

Once the MMR-autism link was largely discredited, vaccine opponents claimed a link between mercury in vaccines and autism. Minute amounts of ethyl mercury were utilized in vaccines, usually less than the more toxic methyl mercury infants get exposed to from the environment. Combined, in some cases, the dosage did exceed government guidelines, so the mercury was removed. Studies showed that reported rates of autism continued to climb once mercury was removed from vaccines.22 "In spite of all the concern...there has not been a single case of proven mercury toxicity from vaccines...," writes Kurt Link, author of The Vaccine Controversy: The History, Use, and Safety of Vaccinations.23

Unfortunately, many people appear to rely on one-sided scares and opinions expressed in talk shows and by celebrity activists, rather than on scientific evidence. Immunization rates around the world have fluctuated with publicity, funding for inoculations, public policy and legal requirements. Where immunizations have dropped, outbreaks have occurred. A diphtheria epidemic hit the former Soviet Union in 1993, causing 4,000 deaths.24 In Japan, where pertussis immunizations fell from 80% in 1974 to 10% in 1976, a 1979 epidemic of that disease resulted in 13,000 infections and 41 deaths.25 In the United States, where pockets of low immunization rates exist, outbreaks occur. Some of the Chicago suburbs are currently experiencing a whooping cough outbreak.26

Perspectives on Risks

There have been mistakes in vaccine development, production and use that have resulted in injuries and deaths. However, those numbers pale in comparison to the injuries and deaths caused by the underlying diseases that are being conquered by vaccines. While rare vaccine side effects continue to exist, drugs and vaccines come with disclosures of the known side effects and risks, however unlikely. Diseases don't.

Many people believe some vaccine-preventable diseases to be fairly benign and some are, in most cases. Yet measles is one of the most contagious viruses and has killed more children than any other disease in history.27 It hospitalized 48,000 Americans yearly in the 1960s and killed 400 during a 1964 epidemic.28

Chickenpox is perceived to be a mild disease and it usually is. Acquiring chickenpox creates lifetime immunity to the disease (though susceptibility to shingles) so some question the usefulness of the vaccine. However, Paul Offit, author of Vaccinated, One Man's Quest to Defeat the World's Deadliest Diseases, points out that chickenpox creates risk of encephalitis, hepatitis, pneumonia and Group A streptococci, the "flesh-eating bacteria." He notes that, before the vaccine, some 10,000 people a year were hospitalized and 100 died annually in the United States due to the disease or related illnesses.29

German measles (rubella) was considered a benign illness featuring a rash and a low fever until Australian ophthalmologist Sir Norman McAllister Gregg discovered a link to birth defects. When striking a mother in her first trimester, rubella causes fetal anomalies in 90% of pregnancies. In 1964-65, prior to the rubella vaccine, the last major epidemic in the United States caused thousands of birth defects.30 Hilleman's MMR vaccine was approved in

4

1971 and the number dropped to seven U.S. cases in 1983.31

Whooping cough (pertussis) is a horrible disease for babies and small children. Babies have died because of outbreaks when vaccination rates declined as a result of scares. The underlying vaccine has changed since the "Vaccine Roulette" television program, to an acellular version with fewer side effects.32 That is why the combination vaccine is now called DTaP rather than DTP.

While no vaccine is 100% effective, the fact remains that if the vast majority of people are vaccinated, a disease cannot infect enough victims to spread. Link writes, "In the prevaccine era, every family lost a child or knew of one so lost due to vaccine-preventable diseases. Today in the USA, the death of a child is an unexpected tragedy; in the past it was an expected sorrow."33 American life expectancies increased 30 years during the 20th century, largely due to vaccines.34

Charles P. McQuaid

President and Chief Investment Officer

Columbia Wanger Asset Management, LLC

The information and data provided in this analysis are derived from sources that we deem to be reliable and accurate. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. The views/opinions expressed in "Squirrel Chatter II" are those of the author and not of the Columbia Acorn Trust Board, are subject to change at any time based upon economic, market or other conditions, may differ from views expressed by other Columbia Management associates and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Acorn Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Acorn Fund.

The information included on Pages 2-5 of this report is unaudited.

1 Link, M.D., Kurt, The Vaccine Controversy, The History, Use, And Safety of Vaccinations, (Westport, Connecticut, Praeger Publishers 2005) p. 38.

2 Mnookin, Seth, The Panic Virus, A True Story of Medicine, Science, and Fear, (New York, New York, Simon & Schuster 2011) p. 30.

3 Offit, M.D., Paul A., Vaccinated, One Man's Quest to Defeat the World's Deadliest Diseases, (New York, New York, HarperCollins Publishers 2007) pg. 32.

4 Link, M.D., Kurt, op. cit., p. 12.

5 Allen, Arthur, Vaccine, The Controversial Story of Medicines Greatest Lifesaver, (New York, New York, W. W. Norton & Company 2007) p. 49-50.

6 Ibid., p. 115, 303.

7 Offit, M.D., Paul A., op. cit., p. 144.

8 Allen, Arthur, op. cit., p. 65, 121.

9 Offit, M.D., Paul A., op. cit., p. 37, 41-42.

10 Ibid., p. 2-3.

11 Allen, Arthur, op. cit., p. 119, 159.

12 Ibid., p. 221.

13 Link, M.D., Kurt, op. cit., p. 101.

14 Offit, M.D., Paul A., op. cit., p. 115.

15 Ibid., p. 130, 156.

16 Allen, Arthur, op. cit., p. 251-256.

17 Wakefield, Andrew J., et al., "Ileal-lymphoid-nodular Hyperplasia, Non-Specific Colitis, and Pervasive Developmental Disorders in Children," The Lancet 351, Issue 9103 (1998), p. 637-41.

18 Mnookin, Seth, op. cit., p. 106-107, 114.

19 Offit, M.D., Paul A., op. cit., p. 167.

20 Mnookin, Seth, op. cit., p. 163.

21 Murch, Simon H., et al., "Retraction of an Interpretation," The Lancet 363, Issue 9411 (2004), p. 750.

22 Mnookin, Seth, op. cit., p. 167.

23 Link, M.D., Kurt, op. cit., p. 21.

24 Ibid., p. 57.

25 Mnookin, Seth, op. cit., p. 277.

26 Synett, Lawerence, "Whooping Cough Strikes Collar Counties," Chicago Tribune, December 6, 2011.

27 Mnookin, Seth, op. cit., p. 19.

28 Allen, Arthur, op. cit., p. 217.

29 Offit, M.D., Paul A., op. cit., p. 102.

30 Link, M.D., Kurt, op. cit., p. 82-84.

31 Allen, Arthur, op. cit., p. 240.

32 Ibid., p. 352, 286.

33 Link, M.D., Kurt, op. cit., p. 163.

34 Offit, M.D., Paul A., op. cit., p. xiv.

5

Understanding Your Expenses

As a shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and service (Rule 12b-1) fees, and other Fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in Class Z shares of the Funds during the period. The actual and hypothetical information in the tables is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Funds' actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Funds' actual return) and then applies the Funds' actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare With Other Funds" below for details on how to use the hypothetical data.

In addition to the ongoing expenses which the Funds bear directly, Columbia Thermostat Fund's shareholders indirectly bear the Fund's allocable share of the costs and expenses of each underlying fund in which the Fund invests. You can also estimate the effective expenses paid during the period, which includes the indirect fees associated with investing in the underlying funds, by using the amounts listed in the effective expenses paid during the period column in the "Fund of Funds" table below.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Funds with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

6

July 1, 2011 – December 31, 2011

| | | Account value at

the beginning of

the period ($) | | Account value at

the end of

the period ($) | | Expenses paid

during period ($) | | Fund's

annualized

expense

ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class Z Shares | |

| Columbia Acorn Fund | | | 1,000.00 | | | | 1,000.00 | | | | 890.00 | | | | 1,021.26 | | | | 3.60 | | | | 3.85 | | | | 0.76 | | |

| Columbia Acorn International | | | 1,000.00 | | | | 1,000.00 | | | | 834.20 | | | | 1,020.41 | | | | 4.28 | | | | 4.71 | | | | 0.93 | | |

| Columbia Acorn USA | | | 1,000.00 | | | | 1,000.00 | | | | 870.90 | | | | 1,020.00 | | | | 4.74 | | | | 5.11 | | | | 1.01 | | |

| Columbia Acorn International Select | | | 1,000.00 | | | | 1,000.00 | | | | 869.80 | | | | 1,019.35 | | | | 5.34 | | | | 5.77 | | | | 1.14 | | |

| Columbia Acorn Select | | | 1,000.00 | | | | 1,000.00 | | | | 836.10 | | | | 1,020.21 | | | | 4.46 | | | | 4.91 | | | | 0.97 | | |

| Columbia Acorn Emerging Markets Fund | | | 1,000.00 | | | | 1,000.00 | | | | 928.00 | | | | 1,013.00 | | | | 5.17 | | | | 7.37 | | | | 1.46 | | |

| Columbia Acorn European Fund | | | 1,000.00 | | | | 1,000.00 | | | | 952.20 | | | | 1,013.33 | | | | 4.91 | | | | 6.91 | | | | 1.37 | | |

Expenses do not include fees and expenses incurred indirectly by the Fund from the underlying funds in which the Fund may invest (also referred to as "acquired funds"), including affiliated and non-affiliated pooled investments vehicles (including mutual funds and exchange traded funds).

Fund of Funds—Columbia Thermostat Fund

July 1, 2011 – December 31, 2011

| | | Account value at

the beginning of

the period ($) | | Account value at

the end of

the period ($) | | Expenses paid

during period ($) | | Fund's

annualized

expense

ratio (%) | | Effective

expenses

paid during

the period | | Fund's

effective

annualized

expense

ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Actual | | Hypothetical | | Actual | |

| Class Z Shares | |

Columbia

Thermostat Fund | | | 1,000.00 | | | | 1,000.00 | | | | 1,001.90 | | | | 1,023.82 | | | | 1.25 | | | | 1.27 | | | | 0.25 | | | | 4.52 | | | | 4.57 | | | | 0.90 | | |

Expenses paid during the period are equal to the annualized expense ratio, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 365.

In the case of Columbia Thermostat Fund, effective expenses paid during the period and the Fund's effective annualized expense ratio include expenses borne directly to the class plus the Fund's pro rata portion of the ongoing expenses charged by the underlying funds using the expense ratio of each class of the underlying funds as of the underlying fund's most recent shareholder report.

Had the investment adviser and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

7

Columbia Acorn Fund

In a Nutshell

| |  | |

|

| Charles P. McQuaid | | Robert A. Mohn | |

|

| Lead Portfolio Manager | | Co-Portfolio Manager | |

|

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data shown. Please visit columbiamanagement.com for daily and most recent month-end performance updates.

Fund Positions

in Mentioned Holdings

As a percentage of net assets, as of 12/31/11

| FMC Technologies | | | 1.9 | % | |

| Donaldson | | | 1.8 | % | |

| Ametek | | | 1.7 | % | |

| lululemon athletica | | | 1.6 | % | |

| Alexion Pharmaceuticals | | | 1.4 | % | |

| tw telecom | | | 1.1 | % | |

| Abercrombie & Fitch | | | 1.0 | % | |

| SBA Communications | | | 1.0 | % | |

| Fugro | | | 0.7 | % | |

| Pall | | | 0.6 | % | |

| Pacific Rubiales Energy | | | 0.5 | % | |

| Shutterfly | | | 0.4 | % | |

| Delphi Financial Group | | | 0.3 | % | |

| True Religion Apparel | | | 0.3 | % | |

| InterMune | | | 0.2 | % | |

| Diamond Foods | | | 0.2 | % | |

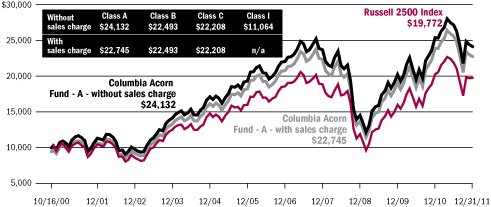

Columbia Acorn Fund rose 10.78% in the fourth quarter of 2011, but ended the year down 4.61%. The Fund underperformed its primary benchmark, the Russell 2500 Index, by 3.74% during the quarter and 2.10% for the year. Performance was hurt by the underperformance of the Fund's international stocks. During both periods, Columbia Acorn Fund slightly beat its peers, as measured by the Lipper Mid-Cap Growth Funds Index.

Telecom stocks called in good gains during both periods. Tower company SBA Communications appreciated 25% in the quarter and 5% for the year as demand improved and the AT&T/T-Mobile merger was abandoned. Fiber optic voice and data services provider tw telecom accelerated growth; its stock rose 17% during the quarter and 14% for the year. PAETEC, a provider of telephone and data services, jumped 49% from the start of the year until its takeover by Windstream was completed on December 1.

Industrial stocks provided fine absolute returns during the quarter. Filter makers Donaldson and Pall rose 25% and 35%, respectively, on better than expected earnings. Instrument maker Ametek also posted fine results and its stock rose 28% in the quarter.

Energy stocks were mixed, providing generally good returns for the quarter but poor returns for the year. Oil and gas wellhead manufacturer FMC Technologies was one exception, rising 39% for the quarter and 18% for the year on improving demand for its products. Pacific Rubiales Energy was another exception, down 13% for the quarter and 45% for the year on substantial, but less than expected, progress on oil production and exploration in Colombia. Netherlands-based Fugro, a provider of sub-sea oilfield services, was up 14% for the quarter but off 27% for the year. Higher oil prices in the quarter improved expectations with respect to demand and earnings growth.

Consumer discretionary stocks were also mixed. Premium activewear retailer lululemon athletica reported excellent growth for both periods, but corrected 4% in the quarter on concerns about inventory levels, reducing its yearly gain to 38%. Internet photo-centric retailer Shutterfly plunged 45% in the quarter and 35% during the year as apparently desperate competitors cut prices. Teen apparel retailer Abercrombie & Fitch was discounted 20% in the quarter and 14% for the year as profits fell short of expectations due to weak margins in the United States and disappointing European sales. True Religion Apparel jumped 55% for the year on excellent sales gains.

Looking at stocks outside of the above sectors, Delphi Financial Group surged 108% in the quarter and 56% for the year on a takeover by Tokio Marine. Snack food distributor Diamond Foods turned bad in the quarter on an accounting controversy, plunging 60%. For the year, Alexion Pharmaceuticals, a biotech company, was the Fund's largest dollar winner, jumping 77% as its drug Soliris appeared effective for treating a neurological condition. However, another biotech company, InterMune, plunged 40% during the quarter and 67% for the year as Germany set disappointing reimbursement rates for the company's pulmonary fibrosis drug.

Columbia Acorn Fund's international stocks rose just 3.22% in the quarter and were off 23.71% for the year. Besides Pacific Rubiales Energy and Fugro, mentioned above, a number of small international energy and materials stocks performed poorly. Foreign stocks accounted for 12.6% of the Fund's assets at the beginning of 2011 and 9.2% of assets at year end.

Stocks were highly correlated with each other in 2011, suggesting to us that good company fundamentals were not adequately rewarded. We continue to believe that buying good companies at reasonable prices will result in long-term outperformance.

Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments.

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

8

Columbia Acorn Fund (ACRNX)

At a Glance

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment adviser and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results would have been lower. Please visit columbiamanagement.com for daily and most recent month-end updates.

Pretax and After-tax Average Annual Total Returns (Class Z)

through December 31, 2011

| Inception 6/10/70 | | 1 year | | 5 years | | 10 years | |

| Returns before taxes | | | -4.61 | % | | | 2.12 | % | | | 8.24 | % | |

| Returns after taxes on distributions | | | -5.23 | | | | 1.58 | | | | 7.66 | | |

Returns after taxes on distributions and sale of

fund shares | | | -2.13 | | | | 1.81 | | | | 7.25 | | |

| Russell 2500 Index (pretax)* | | | -2.51 | | | | 1.24 | | | | 6.57 | | |

All results shown assume reinvestment of distributions.

*The Fund's primary benchmark.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Returns after taxes on distributions and sale of Fund shares reflect the additional tax impact of long-term gains or losses realized when Fund shares are sold. The returns are taxed at the maximum rate and assume shares were purchased at the beginning of the period. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class Z shares only; after-tax returns for other share classes will vary. Indexes do not reflect any deduction for fees, expenses or taxes.

The Fund's Class Z annual operating expense ratio, as stated in the current prospectus, is 0.76%.

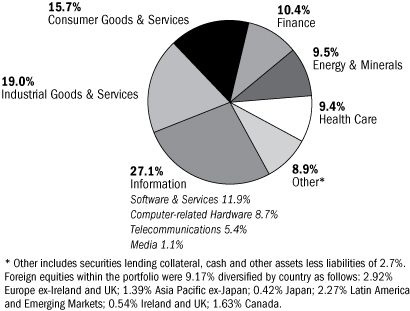

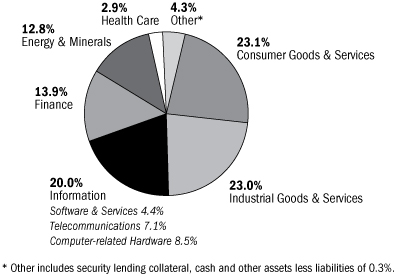

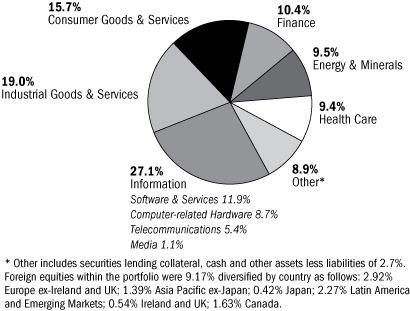

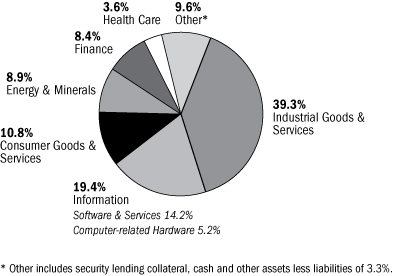

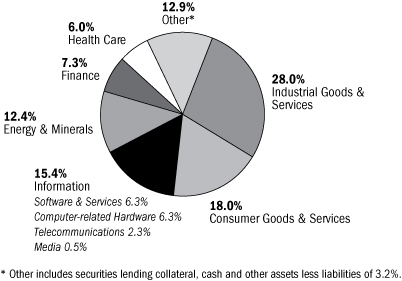

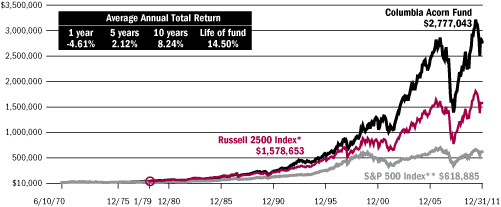

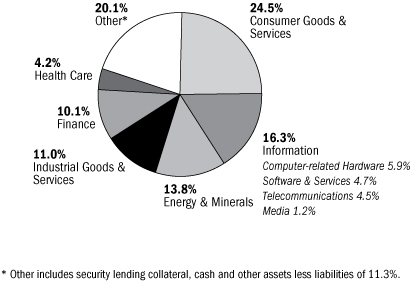

Columbia Acorn Fund Portfolio Diversification

as a percentage of net assets, as of 12/31/11

Columbia Acorn Fund Top 10 Holdings

as a percentage of net assets, as of 12/31/11

| 1. | | FMC Technologies

Oil & Gas Wellhead Manufacturer | | | 1.9

| % | |

| 2. | | Donaldson

Industrial Air Filtration | | | 1.8

| % | |

| 3. | | Ametek

Aerospace/Industrial Instruments | | | 1.7

| % | |

| 4. | | lululemon athletica

Premium Active Apparel Retailer | | | 1.6

| % | |

| 5. | | Mettler Toledo

Laboratory Equipment | | | 1.4

| % | |

| 6. | | Alexion Pharmaceuticals

Biotech Focused on Orphan Diseases | | | 1.4

| % | |

| 7. | | Crown Castle International

Communications Towers | | | 1.3

| % | |

| 8. | | tw telecom

Fiber Optic Telephone/Data Services | | | 1.1

| % | |

| 9. | | Informatica

Enterprise Data Integration Software | | | 1.1

| % | |

| 10. | | Abercrombie & Fitch

Teen Apparel Retailer | | | 1.0

| % | |

The Fund's top 10 holdings and portfolio diversification vary with changes in portfolio investments. See the Statement of Investments for a complete list of the Fund's holdings.

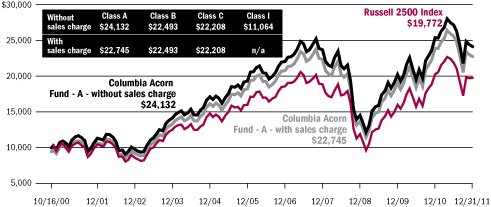

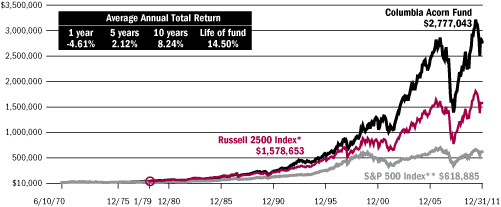

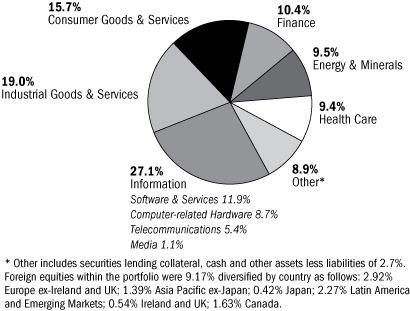

The Growth of a $10,000 Investment in Columbia Acorn Fund (Class Z)

June 10, 1970 through December 31, 2011

This graph compares the results of $10,000 invested in Columbia Acorn Fund at inception on June 10, 1970 to the S&P 500 Index and to an initial $31,777 investment in the Russell 2500 Index on the index's December 31, 1978 inception date. Although the indexes are provided for use in assessing the Fund's performance, the Fund's holdings may differ significantly from those in the indexes. The indexes are unmanaged and returns for both the indexes and the Fund include reinvested dividends and capital gains. It is not possible to invest directly in an index. The graph does not reflect taxes that a shareholder would pay on Fund distributions or on a sale of Fund shares.

Total Net Assets of the Fund: $16.3 billion

* A $10,000 investment in Columbia Acorn Fund at inception appreciated to $31,777 on December 31, 1978, the inception date of the Russell 2500 Index. For comparison with the Russell 2500 Index, we assigned the index the same value as the Fund at index inception.

**Although the Fund typically invests in small- and mid-sized companies, the comparison to the S&P 500 Index is presented to show performance against a widely recognized market index over the life of the Fund.

9

Columbia Acorn International

In a Nutshell

| |  | |

|

| P. Zachary Egan | | Louis J. Mendes III | |

|

| Co-Portfolio Manager | | Co-Portfolio Manager | |

|

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data shown. Please visit columbiamanagement.com for daily and most recent month-end performance updates.

Fund's Positions

in Mentioned Holdings

As a percentage of net assets, as of 12/31/11

| Novozymes | | | 0.9 | % | |

| Gree | | | 0.7 | % | |

| Rheinmetall | | | 0.6 | % | |

| Start Today | | | 0.2 | % | |

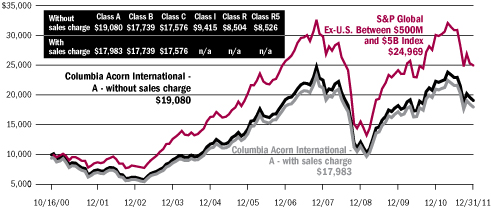

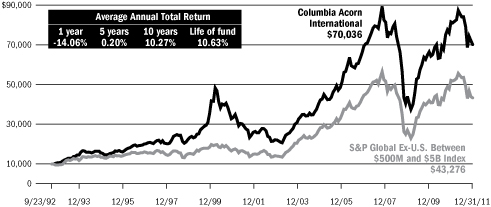

Columbia Acorn International returned 2.02% in the fourth quarter of 2011, 1.27% ahead of its primary benchmark, the S&P Global Ex-U.S. Between $500M and $5B Index. For 2011, the Fund fell 14.06%, which was 2.88% ahead of its benchmark. International small-cap stocks underperformed larger-cap stocks in a year marked by extreme volatility and high correlation among most risk assets. For comparison, the large-cap developed international market, as tracked by the MSCI EAFE Index, declined 12.14% during the year.

In 2010, the economic schism between stagnant, deflating developed economies and the high-growth inflationary emerging economies bore out in the strong performance of emerging market stocks. In 2011, fears of a renewed global recession dragged down all markets tied to economic growth, especially those of Europe and the emerging markets. Although early concerns over inflation in China, India and Brazil abated as the year progressed, they were replaced by the far greater concerns of potential sovereign debt defaults in Europe. European banks are important lenders in Asia and Latin America. Investors worried that the banks could serve as a transmission mechanism of European credit contraction.

Notwithstanding the horrific news related to the Japanese tsunami and associated nuclear catastrophe in the spring, Japanese equities proved to be among the best performers globally in 2011. The Fund's Japanese holdings, which represented on average 18% of the portfolio, fell less than 1% in U.S. dollar terms, buoyed in part by an appreciating yen. Internet-related companies Gree (a social networking game developer) and Start Today (an online apparel retailer) posted 182% and 82% gains, respectively, for the year and both were up roughly 12% in the fourth quarter. Investors became enthusiastic about their innovative business models, prospective near-term earnings growth in excess of 50% and high valuations assigned in transactions involving internet-related companies elsewhere in the world. We like these businesses and remain invested, but took some money off the table in both cases to fund more attractively valued new ideas.

As mentioned above, the European debt crisis became the overriding political and economic development affecting global risk premiums in the year and did take a toll on the Fund's equity holdings. Continental European holdings were off over 17%. Danish enzyme manufacturer Novozymes was an exception and up almost 12% for the year and 9% in the fourth quarter. On the downside, German auto supplier and defense contractor Rheinmetall was off more than 40% for the year and 6% in the fourth quarter despite solid improvements and respectable growth in its exhaust-system business, where fuel efficiency and tightening emission standards are creating opportunity. In the age of European austerity, however, the outlook for defense spending has soured, which explains the disappointing share price movement as earnings multiples of European defense stocks contracted.

Emerging market small-cap stocks, strong performers in 2010, were the worst performing equity class in 2011. The Fund's Brazilian holdings declined more than 30%, Chinese holdings more than 35% and Indian holdings more than 53%. At the end of the year, emerging market stocks represented about 24% of the Fund's assets, which compares with a benchmark weight of 25%. Our full weight here reflects our conviction in the long-term underlying opportunities offered by emerging market small-cap stocks as these emerging societies continue to negotiate the transition from informal to formal economies and raise the purchasing power and living standards of millions of people.

2012 has several major catalysts that we believe will affect global risk and the opportunity for continued growth in international small-cap equities. In the beginning of the year, all eyes will continue to look toward Europe for a resolution on the euro debt crisis. This is expected to be resolved before the high rhetoric associated with major elections of new governments in both China and the United States in the fall. As always, we will continue to work hard to find and invest in dynamic growth companies for you, our shareholders. Thank you for your continued investment in the Fund.

International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments. Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility.

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

10

Columbia Acorn International (ACINX)

At a Glance

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment adviser and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results would have been lower. Please visit columbiamanagement.com for daily and most recent month-end updates.

Pretax and After-tax Average Annual Total Returns (Class Z)

through December 31, 2011

| Inception 9/23/92 | | 1 year | | 5 years | | 10 years | |

| Returns before taxes | | | -14.06 | % | | | 0.20 | % | | | 10.27 | % | |

| Returns after taxes on distributions | | | -14.63 | | | | -0.32 | | | | 9.71 | | |

Returns after taxes on distributions and sale of

fund shares | | | -8.88 | | | | 0.20 | | | | 9.18 | | |

S&P Global Ex-U.S. Between $500M and

$5B Index* | | | -16.94 | | | | -0.58 | | | | 11.10 | | |

All results shown assume reinvestment of distributions.

*The Fund's primary benchmark.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Returns after taxes on distributions and sale of Fund shares reflect the additional tax impact of long-term gains or losses realized when Fund shares are sold. The returns are taxed at the maximum rate and assume shares were purchased at the beginning of the period. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class Z shares only; after-tax returns for other share classes will vary. Indexes do not reflect any deduction for fees, expenses or taxes.

The Fund's Class Z shares annual operating expense ratio, as stated in the current prospectus, is 0.98%.

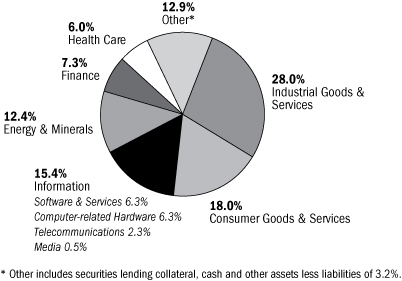

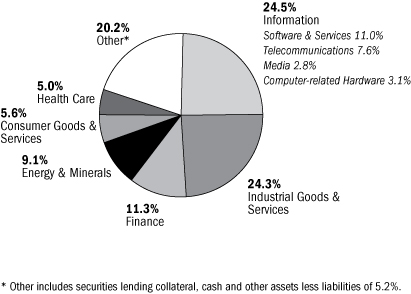

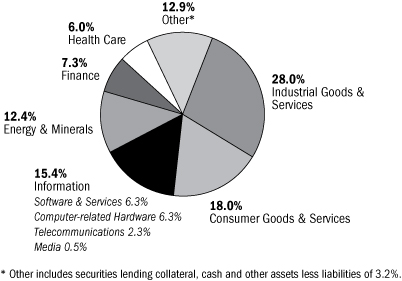

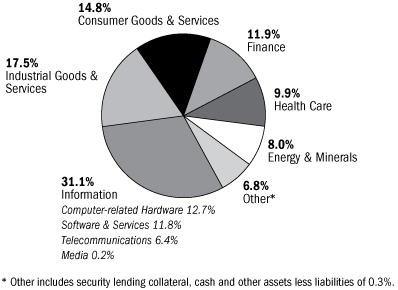

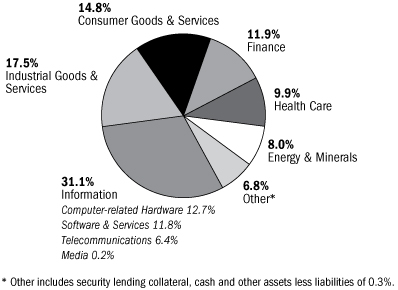

Columbia Acorn International Portfolio Diversification

as a percentage of net assets, as of 12/31/11

Columbia Acorn International Top 10 Holdings

as a percentage of net assets, as of 12/31/11

| 1. | | Far Eastone Telecom (Taiwan)

Taiwan's Third Largest Mobile Operator | | | 1.3

| % | |

| 2. | | Melco Crown Entertainment - ADR (Hong Kong)

Macau Casino Operator | | | 1.2

| % | |

| 3. | | Kansai Paint (Japan)

Paint Producer in Japan, India, China & Southeast Asia | | | 1.2

| % | |

| 4. | | Hexagon (Sweden)

Design, Measurement & Visualization Software & Equipment | | | 1.1

| % | |

| 5. | | Gemalto (France)

Digital Security Solutions | | | 1.1

| % | |

| 6. | | Zhaojin Mining Industry (China)

Gold Mining & Refining in China | | | 1.0

| % | |

| 7. | | Localiza Rent A Car (Brazil)

Car Rental | | | 1.0

| % | |

| 8. | | Olam International (Singapore)

Agriculture Supply Chain Manager | | | 1.0

| % | |

| 9. | | Naspers (South Africa)

Media in Africa, China, Russia & Other Emerging Markets | | | 0.9

| % | |

| 10. | | Novozymes (Denmark)

Industrial Enzymes | | | 0.9

| % | |

The Fund's top 10 holdings and portfolio diversification vary with changes in portfolio investments. See the Statement of Investments for a complete list of the Fund's holdings.

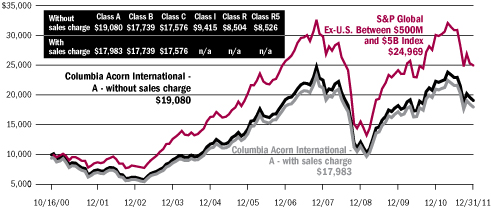

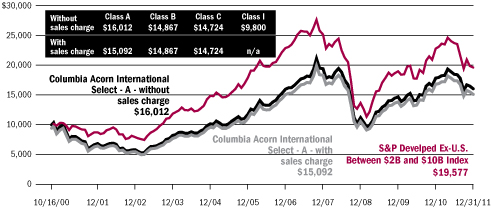

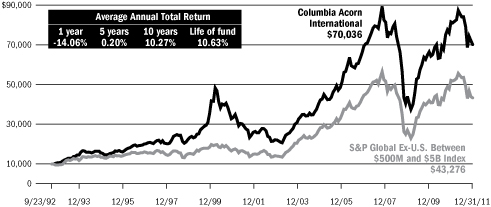

The Growth of a $10,000 Investment in Columbia Acorn International (Class Z)

September 23, 1992 through December 31, 2011

This graph compares the results of $10,000 invested in Columbia Acorn International at inception on September 23, 1992 to the S&P Global Ex-U.S. Between $500M and $5B Index. Although the index is provided for use in assessing the Fund's performance, the Fund's holdings may differ significantly from those in the index. The index is unmanaged and returns for both the index and Fund include reinvested dividends and capital gains. It is not possible to invest directly in an index. The graph does not reflect taxes that a shareholder would pay on Fund distributions or on a sale of Fund shares.

Total Net Assets of the Fund: $5.4 billion

11

Columbia Acorn USA

In a Nutshell

| | | |

|

| Robert A. Mohn | | | |

|

| Lead Portfolio Manager | | | |

|

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data shown. Please visit columbiamanagement.com for daily and most recent month-end performance updates.

Fund's Positions

in Mentioned Holdings

As a percentage of net assets, as of 12/31/11

| FMC Technologies | | | 2.8 | % | |

| Ametek | | | 2.5 | % | |

| lululemon athletica | | | 2.2 | % | |

| Donaldson | | | 1.9 | % | |

| Bally Technologies | | | 1.7 | % | |

| World Acceptance | | | 1.6 | % | |

| Abercrombie & Fitch | | | 1.5 | % | |

| Extra Space Storage | | | 1.4 | % | |

| Gaylord Entertainment | | | 1.3 | % | |

| Alexion Pharmaceuticals | | | 1.3 | % | |

| IPG Photonics | | | 1.1 | % | |

| Atmel | | | 1.0 | % | |

| Acuity Brands | | | 1.0 | % | |

| Finisar | | | 0.8 | % | |

| Shutterfly | | | 0.4 | % | |

| Quicksilver Resources | | | 0.3 | % | |

| TriQuint Semiconductor | | | 0.3 | % | |

| InterMune | | | 0.3 | % | |

| Diamond Foods | | | 0.1 | % | |

Columbia Acorn USA ended the fourth quarter of 2011 up 11.94%, underperforming the 15.47% return of its primary benchmark, the Russell 2000 Index. For the annual period, Fund performance was more in line with the benchmark, though still below it, with the Fund down 4.95% vs. the Russell 2000's 4.18% decline. Relative Fund performance was strong through the end of October, but returns for the final two months of the year were hard hit by the poor performance of the Fund's consumer stocks.

Winners for the quarter included three industrial names: instrument maker Ametek, industrial air filtration manufacturer Donaldson and commercial lighting manufacturer Acuity Brands. All three companies experienced market share gains and rapid earnings growth, leading to returns between 25% and 47%.

Other winners included FMC Technologies, up 39% for the quarter. FMC benefited from higher oil prices and strong demand for its sub-sea wellhead systems. Bally Technologies, a slot machine manufacturer, gained 47% in the quarter on strong sales of newly released games. Up 31%, lender World Acceptance was boosted by double-digit loan growth and a significant stock buyback. Extra Space Storage, a self-storage facility, gained 31% in the quarter on increasing occupancy and rent hikes.

For the year, Alexion Pharmaceuticals, a biotech company focused on orphan diseases, rose 77% as its primary drug, Soliris, was approved for treating a severe neurological condition. lululemon athletica suffered from a perceived surplus of inventory during the fourth quarter, but still ended the year up 36% in Columbia Acorn USA on strong sales growth driven by increased awareness of its yoga-inspired athletic apparel. FMC Technologies, World Acceptance and Extra Space Storage were also among the Fund's annual winners with gains ranging from 17% to 43% in 2011.

The quarter's primary laggards were consumer stocks. Teen apparel retailer Abercrombie & Fitch dropped 20%, as profits fell short of expectations due to weak margins in the United States and disappointing European sales. Internet photo-centric retailer Shutterfly fell victim to a fierce price war waged by all the internet photo book and photo card companies this holiday season, resulting in a steep stock drop of 45% in the quarter. Down nearly 60%, snack food distributor Diamond Foods was crushed on news of an accounting controversy regarding the timing of payments made to its walnut suppliers.

Outside the consumer sector, IPG Photonics, a manufacturer of fiber lasers, fell 22% during the quarter on decreased orders for low-powered lasers from its Chinese customers. Biotech company InterMune fell more than 40% after receiving a negative ruling from a drug reimbursement board in Germany.

For the annual period, laggards included Gaylord Entertainment, an operator of convention hotels. Its stock fell 33% on poor results at its D.C. and Orlando properties. Quicksilver Resources, a natural gas producer, sank 54% as plans to take the company private fell through and natural gas prices declined. Technology companies Finisar, a manufacturer of telecom equipment, and two semiconductor and related equipment manufacturers, TriQuint Semiconductor and Atmel, saw losses ranging from 34% to 60%. The three stocks soared in 2010, but as sales plateaued in early 2011, the stocks retraced much (and in the case of TriQuint, all) of their prior gains.

Investors spent much of 2011 focused on what could go wrong at home and abroad. Concern is certainly warranted, but we believe that consideration should also be given to the many things that could go right. U.S. economic indicators could keep improving, the unemployment rate could keep dropping, European sovereign debt yields could retreat, and low stock market valuation multiples could jump higher. Last year, it paid to be a pessimist. We believe that sometime soon, the optimists will reign.

Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

12

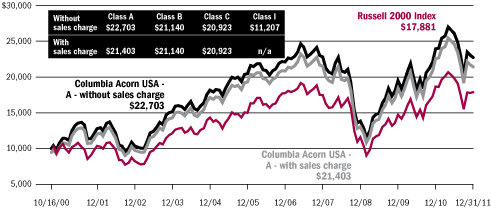

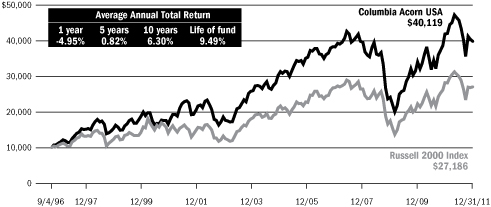

Columbia Acorn USA (AUSAX)

At a Glance

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment adviser and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results would have been lower. Please visit columbiamanagement.com for daily and most recent month-end updates.

Pretax and After-tax Average Annual Total Returns (Class Z)

through December 31, 2011

| Inception 9/4/96 | | 1 year | | 5 years | | 10 years | |

| Returns before taxes | | | -4.95 | % | | | 0.82 | % | | | 6.30 | % | |

| Returns after taxes on distributions | | | -5.04 | | | | 0.52 | | | | 6.02 | | |

Returns after taxes on distributions and sale of

fund shares | | | -3.10 | | | | 0.69 | | | | 5.54 | | |

| Russell 2000 Index (pretax)* | | | -4.18 | | | | 0.15 | | | | 5.62 | | |

All results shown assume reinvestment of distributions.

*The Fund's primary benchmark.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Returns after taxes on distributions and sale of Fund shares reflect the additional tax impact of long-term gains or losses realized when Fund shares are sold. The returns are taxed at the maximum rate and assume shares were purchased at the beginning of the period. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class Z shares only; after-tax returns for other share classes will vary. Indexes do not reflect any deduction for fees, expenses or taxes.

The Fund's Class Z shares annual operating expense ratio, as stated in the current prospectus, is 1.01%.

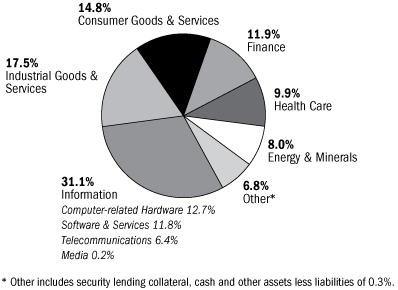

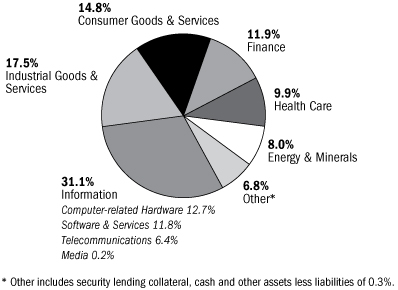

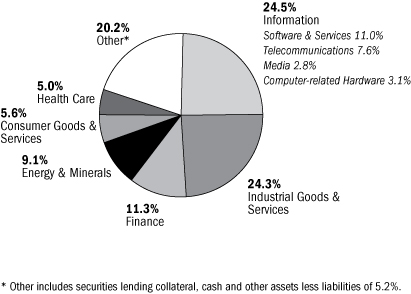

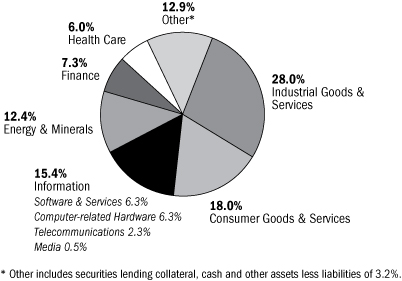

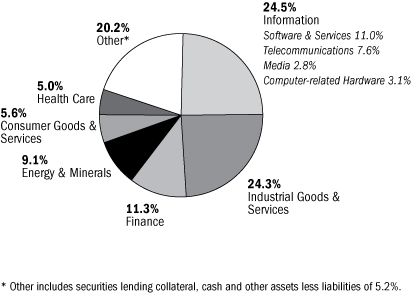

Columbia Acorn USA Portfolio Diversification

as a percentage of net assets, as of 12/31/11

Columbia Acorn USA Top 10 Holdings

as a percentage of net assets, as of 12/31/11

| 1. | | FMC Technologies

Oil & Gas Wellhead Manufacturer | | | 2.8

| % | |

| 2. | | Ametek

Aerospace/Industrial Instruments | | | 2.5

| % | |

| 3. | | lululemon athletica

Premium Active Apparel Retailer | | | 2.2

| % | |

| 4. | | Informatica

Enterprise Data Integration Software | | | 2.2

| % | |

| 5. | | Micros Systems

Information Systems for Hotels, Restaurants & Retailers | | | 2.1

| % | |

| 6. | | Nordson

Dispensing Systems for Adhesives & Coatings | | | 2.0

| % | |

| 7. | | Donaldson

Industrial Air Filtration | | | 1.9

| % | |

| 8. | | Atwood Oceanics

Offshore Drilling Contractor | | | 1.8

| % | |

| 9. | | tw telecom

Fiber Optic Telephone/Data Services | | | 1.8

| % | |

| 10. | | Mettler Toledo

Laboratory Equipment | | | 1.7

| % | |

The Fund's top 10 holdings and portfolio diversification vary with changes in portfolio investments. See the Statement of Investments for a complete list of the Fund's holdings.

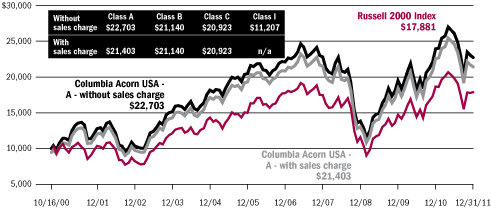

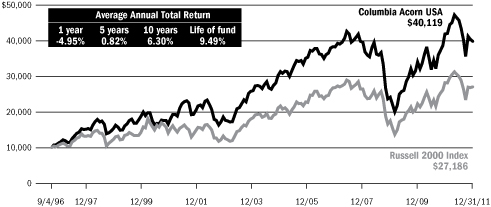

The Growth of a $10,000 Investment in Columbia Acorn USA (Class Z)

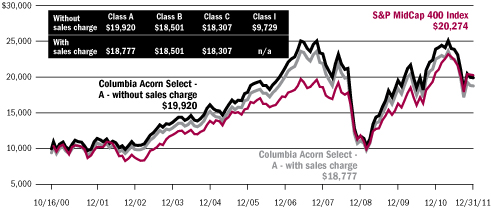

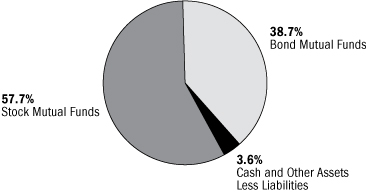

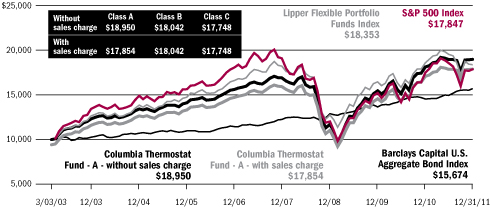

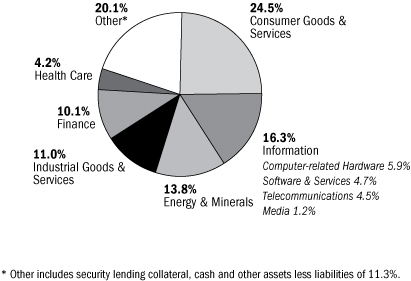

September 4, 1996 through December 31, 2011