UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-1530

Name of Registrant: Vanguard Explorer Fund

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: November 1, 2007–October 31, 2008

Item 1: Reports to Shareholders

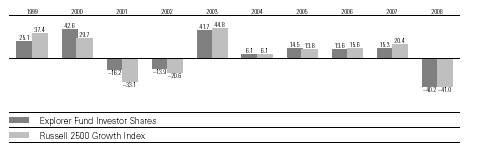

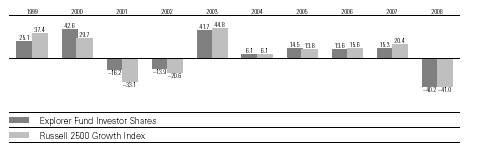

> For fiscal year 2008, Vanguard Explorer Fund returned about –40%, a disappointing result that nevertheless was a bit better than the returns of the fund’s comparative standards.

> All sectors posted double-digit declines as stocks suffered their worst losses since the 2000–2002 bear market.

> Information technology stocks, the fund’s largest position, were among the worst performers.

Contents | |

| |

Your Fund’s Total Returns | 1 |

President’s Letter | 2 |

Advisors’ Report | 7 |

Fund Profile | 13 |

Performance Summary | 14 |

Financial Statements | 16 |

Your Fund’s After-Tax Returns | 31 |

About Your Fund’s Expenses | 32 |

Glossary | 34 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Fiscal Year Ended October 31, 2008 | | |

| Ticker | Total |

| Symbol | Returns |

Vanguard Explorer Fund | | |

Investor Shares | VEXPX | –40.17% |

AdmiralTM Shares1 | VEXRX | –40.07 |

Russell 2500 Growth Index | | –41.00 |

Average Small-Cap Growth Fund2 | | –42.01 |

Your Fund’s Performance at a Glance |

October 31, 2007–October 31, 2008 | | | | |

| | | Distributions Per Share |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard Explorer Fund | | | | |

Investor Shares | $83.93 | $45.54 | $0.310 | $6.786 |

Admiral Shares | 78.25 | 42.45 | 0.427 | 6.316 |

1 A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

2 Derived from data provided by Lipper Inc.

1

President’s Letter

Dear Shareholder,

For the fiscal year ended October 31, 2008, Vanguard Explorer Fund returned –40.17% for Investor Shares and –40.07% for Admiral Shares. Although these results are disappointing in absolute terms—as were most equity returns for the period—they demonstrate relative strength.

After trailing the benchmark Russell 2500 Growth Index by more than 2 percentage points during the fiscal first half, Explorer finished the year ahead of the benchmark and retained a lead over its peer-group average. The advisors’ valuation-conscious approach to selecting growth stocks moderated the fund’s decline in the period’s tumultuous final months.

Effective August 7, the fund was reopened to all investors and the $25,000 annual investment limit was removed. Given the changes in the financial markets, Vanguard concluded that it was no longer necessary to restrict cash flows into the fund.

If you own shares of the fund in a taxable account, see page 31 for a report on after-tax returns for the 12 months, based on the highest tax bracket.

Stock prices fell sharply in a global upheaval

Global stock markets started the 12-month period near all-time highs, but then declined sharply, laid low by the financial crisis that originated in the fixed income markets. The descent traced a series of jagged ups and downs. During the week ended October 10, for example, the U.S. stock market returned about –18%. When

2

Wall Street opened the following Monday, stocks surged, returning more than 10% over the next six and a half hours.

For the full 12 months, the broad U.S. stock market returned –36.43%; international stocks returned –48.27%. The pain was especially acute in emerging markets—among the strongest performers in recent years—as investors became increasingly risk-averse.

Bond market averages masked disparate returns

The broad U.S. taxable bond market registered an unremarkable return of 0.30% for the 12 months, but by its own typically sedate standards, the dislocations were extreme. The strong performance of U.S. Treasury and government securities was offset by double-digit declines in the corporate bond market. These dynamics led to unusually large differences between the yields of Treasuries and their corresponding private-sector securities—both a reflection and a cause of the credit market’s distress. Despite their generally high creditworthiness, municipal bonds also fell in price, with the broad tax-exempt market registering a 12-month return of –3.30%.

The U.S. Federal Reserve Board responded to the turmoil with new lending programs and a dramatic easing of monetary policy. Over the full 12 months, the Fed reduced its target for the federal funds rate from 4.50% to 1.00%.

Market Barometer | | | |

| Average Annual Total Returns |

| Periods Ended October 31, 2008 |

| One Year | Three Years | Five Years |

Stocks | | | |

Russell 1000 Index (Large-caps) | –36.80% | –5.51% | 0.37% |

Russell 2000 Index (Small-caps) | –34.16 | –4.79 | 1.57 |

Dow Jones Wilshire 5000 Index (Entire market) | –36.43 | –5.10 | 0.81 |

MSCI All Country World Index ex USA (International) | –48.27 | –3.93 | 5.05 |

| | | |

| | | |

Bonds | | | |

Lehman U.S. Aggregate Bond Index (Broad taxable market) | 0.30% | 3.60% | 3.48% |

Lehman Municipal Bond Index | –3.30 | 1.71 | 2.73 |

Citigroup 3-Month Treasury Bill Index | 2.31 | 3.93 | 3.10 |

| | | |

| | | |

CPI | | | |

Consumer Price Index | 3.66% | 2.83% | 3.20% |

3

In the face of stiff headwinds, stock selection had mixed results

Information technology stocks—often regarded as “classic” growth stocks—continued to be the largest-weighted sector in the Explorer Fund, averaging almost one-quarter of the portfolio during the year. These stocks fell sharply as investors became anxious about the tech sector’s prospects, in view of both slower global economic growth and the major losses sustained by financial services firms, which are heavy users of technology.

The fund’s tech holdings returned –48%, accounting for more than one-quarter of the 12-month decline. Distress was widespread among the various technology segments, especially semiconductors, software, data processing, and communications equipment.

A sizable position in industrial stocks suffered a similar fate (–45%). The waning of the global boom in construction and infrastructure development weakened the performance of a wide range of equipment manufacturers. Even those involved in the burgeoning market for solar power were beaten back.

Health care holdings, the fund’s second-largest position during the year, offered scant relief. Bolstered by double-digit gains in several biotechnology companies, this sector (–30%) declined less than most.

Expense Ratios1 | | | |

Your Fund Compared With Its Peer Group | | | |

| | | Average |

| Investor | Admiral | Small-Cap |

| Shares | Shares | Growth Fund |

Explorer Fund | 0.41% | 0.23% | 1.61% |

1 The fund expense ratios shown are from the prospectus dated August 18, 2008. For the fiscal year ended October 31, 2008, the fund’s expense ratios were 0.44% for Investor Shares and 0.26% for Admiral Shares. The peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2007.

4

Purveyors of medical equipment and supplies, managed care companies, and life sciences systems and services companies were among the notably poor performers.

In an environment lacking many bright spots, the advisors’ selections among consumer staples and energy stocks kept the fund a few steps ahead of its benchmark. And, even though household budgets were under stress, the fund’s consumer discretionary holdings also held up better. Together, these three sectors added more than 2 percentage points to the fund’s return over its benchmark.

Over the fiscal year, two advisor-related changes were made, one of which was noted in the semiannual report.

In February, Vanguard Quantitative Equity Group added to its portion of the fund by assuming primary responsibility for the assets previously managed by Grantham, Mayo, Van Otterloo & Co. LLC. In June, Century Capital Management, LLC, joined the fund’s team of investment advisors. For more information on the fund’s positioning and performance during the year, please see the Advisors’ Report, which begins on page 7.

Risk/reward trade-offs are always part of investing

For the ten years ended October 31, 2008, Explorer Fund’s Investor Shares returned an average of 5.66% annually, a seemingly modest result that was nevertheless about 2 percentage points better than the benchmark index return and the average

Total Returns | |

Ten Years Ended October 31, 2008 | |

| Average |

| Annual Return |

Explorer Fund Investor Shares | 5.66% |

Russell 2500 Growth Index | 3.10 |

Average Small-Cap Growth Fund1 | 3.84 |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

1 Derived from data provided by Lipper Inc.

5

return of small-cap growth funds. Your fund benefited from the skills of a diverse set of investment advisors with different, yet complementary, strategies, and also from its low expenses.

As shareholders, you know that Vanguard encourages investors not to evaluate a fund based on its short-term results, which can be quite volatile. But even long-term results can vary widely depending on when measurement begins and ends. Seemingly small shifts in starting and ending dates can produce significant changes in returns.

The decade through October 2008 is a case in point. The steep bear market of 2008 has joined the 2000–2002 bear market in the ten-year calculation. The impact of this one-year shift is dramatic: A year ago, Explorer Fund’s ten-year average annual return was a more robust 9.92%.

Some have dubbed the past ten years a “lost decade,” because bonds significantly outperformed most stocks, and many have noted the similarities with the decade ended in 1979. Such periods serve as an uncomfortable but useful reminder that, while stocks can be expected to outperform less-risky asset classes over time, they do not always do so.

Nevertheless, we believe that the case for long-term equity investing remains sound, and that recent experience should not fundamentally alter an investor’s long-term asset allocation target.

Although the stock market’s occasional rough patches can shake an investor’s confidence, history suggests that following the time-tested principles of diversification and balance among the major asset classes can put you in a good position to benefit from the market’s long-term opportunities. By offering exceptionally broad diversification—across small-cap growth-oriented stocks and across active investment strategies—the Explorer Fund can play a useful role in a well-designed portfolio.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

President and Chief Executive Officer

November 12, 2008

6

Advisors’ Report

For the fiscal year ended October 31, 2008, Vanguard Explorer Fund returned –40.17% for Investor Shares (–40.07% for the lower-cost Admiral Shares). Your fund is managed by seven independent advisors. This provides exposure to distinct, yet complementary, investment approaches, enhancing the fund’s diversification.

The table on page 12 lists the advisors, the amount and percentage of fund assets each manages, and brief descriptions of their investment strategies. The advisors have also provided comments on their assessment of the investment environment during the past 12 months and the notable successes and shortfalls in their portfolios. These comments were prepared on November 11, 2008.

Granahan Investment

Management, Inc.

Portfolio Manager:

Jack Granahan, Managing Partner

Investment environment: The credit issues that surfaced in mid-2007 have turned concern into a severe global slowdown. Although the massive monetary injections by governments could eventually help, it appears that lower asset prices will be necessary to stabilize effective demand. Current trends in employment are not encouraging. Positive factors for equities still include generally good corporate balance sheets and very conservative guidance by most management teams; time will tell whether they have been sufficiently conservative. The sharp reduction in equity prices probably reflects most of these lower expectations, thus possibly offering significant investment potential in the few companies that can show growth.

Successes: We generally measure success this year in relative rather than absolute terms. Only 12% of the companies in our portion of the portfolio had gains, and only one of our ten industry sectors produced absolute gains—consumer staples. Our largest sector, health care, did have several significant winners, including Rigel Pharmaceuticals, with good clinical results for a rheumatoid arthritis drug; Axcan Pharma, which was acquired; and Haemonetics, on the strength of its accelerating earnings case. We kept Haemonetics and sold the other two. Our strategy in health care is to emphasize companies that reduce costs, improve patient outcome, and have low reimbursement risk.

Shortfalls: In a reversal from last year, our technology stocks faced severe pressure as the slowdown in enterprise spending on information technology spread from the United States to Europe, which has been a solid source of growth. This caused us to shift our overweighted position to benchmark-neutral. Company-specific factors affected firms such as VeriFone Holdings, only now emerging from issues with a new enterprise resource system, and Cadence Design Systems, with weak demand for its design software combined with changed product pricing. Ciena was cyclically affected as its telecommunications customers pushed out orders. We added to VeriFone, reduced our position in Cadence, and eliminated Ciena.

7

Kalmar Investment Advisers

Portfolio Manager: Ford B. Draper, Jr.,

President and Chief Investment Officer

Investment environment: With central bankers and governments around the world pulling out all policy stops to resolve the financial crisis and revive growth, the credit freeze should gradually thaw. Meanwhile, the real economy will get worse before it improves. As stock markets come to grips with the decline in earnings prospects, they will stabilize and start to rise well before the economy; indeed, markets may have discounted much of the earnings decline already. Taking a longer-term perspective, from today’s very depressed levels, we believe the stock market represents a generational opportunity for exceptional future returns.

Successes: Our holdings in energy—notably, exploration and production companies—and in IT, consumer discretionary, and industrial firms such as equipment makers, generally held up better than the market because of their stronger business prospects and finances. Our best gain resulted from the takeover of Longs Drug Stores.

Shortfalls: Most of our other sector exposures generally kept pace with the declining market, though we suffered by owning no biotech companies, which were among the few stocks that rose. Our biggest disappointment was Chicago Bridge & Iron, which incurred losses on two significant liquefied natural gas construction projects.

Wellington Management Company, LLP

Portfolio Manager:

Kenneth L. Abrams,

Senior Vice President and Partner

Investment environment: Equity markets fell sharply in the period amid a significant deterioration in both credit-market conditions and investor confidence. Forced deleveraging by financial institutions triggered an unprecedented set of bank failures and mergers, reshaping the global financial map. Impaired access to capital spilled over into the real economy, and reduced expectations for global growth forced energy and commodity prices sharply lower.

Successes: In the consumer discretionary sector, DreamWorks Animation shares gained on solid first-quarter earnings that exceeded expectations. People’s United Financial shares benefited from management’s ability to avoid subprime loans and much of the resulting credit crisis.

Shortfalls: Shares of managed care provider Health Net fell after management lowered its fiscal year earnings forecast due to disappointing third-quarter results. In the industrials sector, shares of Hong Kong-based China Everbright International—an environmental

8

protection investment firm—fell after the company reported lower-than-expected third-quarter earnings.

Vanguard Quantitative Equity Group

Portfolio Manager:

James D. Troyer, CFA, Principal

Investment environment: The stock market return for January–October 2008 was among the worst-five calendar-year results since 1926. Mid- and small-cap growth stocks declined more than their value-oriented counterparts. In our model, the valuation component added the most value to our portion of the portfolio; the market-sentiment and earnings-quality components were neutral for the 12 months.

Successes: Health care, especially equipment providers, was one of our best-performing sectors. Longs Drug Stores and respiratory-device-maker Respironics posted gains. Consumer staples companies—notably, retailers of food and other household staples—were also among our best performers.

Shortfalls: As it was during the fiscal first half, capital goods was our worst-performing industry for the year. Manitowoc, a diversified manufacturer of industrial equipment, was our worst pick.

AXA Rosenberg Investment Management LLC

Portfolio Manager: William E. Ricks, Ph.D.

Americas Chief Executive and Chief

Investment Officer

Investment environment: Equity markets in the United States and around the globe tumbled as the U.S. financial crisis entered a critical crossroads and extreme volatility and economic uncertainty dominated markets. Valuation differentials between companies have expanded, and investors have increasingly taken disparate views on individual companies’ earnings and return potential. We remain focused on fundamental stock selection driven by earnings and valuations.

Successes: Our portion of the portfolio had a persistent, albeit modest, underweighting to consumer discretionary stocks, which proved to be among the weakest performers for the 12 months. Stock selection within the sector also added significant value: We overweighted Priceline.com and underweighted Sirius XM Radio and Goodyear Tire & Rubber. Stock selection in the financial and health care sectors also added to our performance. In financials, persistent underweighting to banks, broker/dealers, and real estate investment trusts (REITs) paid off.

9

Shortfalls: Global cyclicals sold off sharply on the depressed economic outlook. Our stock selection was weak in the energy and industrial sectors, particularly with overweightings in ATP Oil & Gas, Rowan Companies, and Manitowoc: All three suffered significant share price drops.

Chartwell Investment Partners, L.P.

Portfolio Managers:

Edward N. Antoian,

CFA, CPA, Managing Partner

John A. Heffern, Managing Partner

Investment Environment: “Change” is the big theme for the period just ended and for the quarters ahead: change in political direction, economic conditions, climate patterns, global order, and market leadership. In many important areas of our lives, change has arrived or is on the way, and few are prepared. This change ushers in another important theme: “adaptation.” Managements, companies, even social orders are buffeted by change, but ultimately most will adapt to new realities, eventually grow, and thrive.

Successes: On a relative basis, providers of business services were our top performers. FTI Consulting posted a gain, as its outsourced services were in great demand during the economic downturn. Low exposure to consumer cyclicals also added value.

Shortfalls: Stock selection in capital spending and basic industry significantly detracted from the performance of our portion of the portfolio. AerCap Holdings, an integrated global aviation company whose principal business activity is aircraft leasing, was hindered by the unprecedented rise in commodity prices during late spring and early summer. We expect the stock to rebound, as oil prices have fallen to levels that are profitable for the airline industry.

Century Capital Management, LLC

Portfolio Manager:

Alexander L.Thorndike,

Chief Investment Officer and

Managing Partner

Investment Environment: It will take time to assess the U.S. government’s management of the financial bailout plan announced in October, as well as its fiscal stimulus packages and the Federal Reserve Board’s interest rate cuts. We expect these actions will eventually stabilize the capital markets and lubricate the wheels of a sustainable recovery. We do, however, believe that increased regulation and oversight will redefine the relationship between commerce and government. Patience and persistence are required during the current downturn. We continue to believe that future corporate earnings expectations remain too high, but we are encouraged that equity valuations appear to be at 30-year lows. We are cautiously optimistic that current market

10

conditions may allow us to invest in tomorrow’s leadership franchises at today’s laggard valuations.

Successes: Since Century Capital Management became an investment advisor to the Explorer Fund in early June, the information technology and consumer staples sectors have contributed most to the performance of our portion of the portfolio. Websense and Ralcorp Holdings were among our best-performing stocks. Websense recently reported better-than-expected quarterly earnings and raised expectations for 2008. Ralcorp benefited from a “trade-down” trend by cost-conscious consumers from branded to private-label products.

Shortfalls: The health care and industrials sectors detracted most from our performance. Bruker and General Cable were among the worst performers for the period. Bruker recently reported below-expectation sales for its scientific instruments, and General Cable was hurt by the global economic slowdown in infrastructure spending.

11

Vanguard Explorer Fund Investment Advisors | | |

| | | |

| Fund Assets Managed | |

Investment Advisor | % | $ Million | Investment Strategy |

Granahan Investment | 26 | 1,857 | Bases its investment process on the beliefs that |

Management, Inc. | | | earnings drive stock prices and that small, dynamic |

| | | companies with exceptional growth prospects have the |

| | | greatest long-term potential. A bottom-up, fundamental |

| | | approach places companies in one of three life-cycle |

| | | categories: pioneer, core growth, and special situation. |

| | | In each, the process looks for companies with strong |

| | | earnings growth and leadership in their markets. |

Kalmar Investment Advisers | 14 | 1,002 | Employs a “growth with value” strategy using creative, |

| | | bottom-up research to uncover vigorously growing, |

| | | high-quality businesses. The process also seeks out |

| | | stocks that are inefficiently valued or that offer value |

| | | through longer-term company ownership. The strategy |

| | | has a dual objective of superior returns with lower risk. |

Wellington Management | 14 | 993 | Conducts research and analysis of individual companies |

Company, LLP | | | to select stocks believed to have exceptional growth |

| | | potential relative to their market valuations. Each stock |

| | | is considered individually before purchase, and company |

| | | developments are continually monitored for comparison |

| | | with expectations for growth. |

Vanguard Quantitative | 14 | 974 | Employs a quantitative fundamental management |

Equity Group | | | approach, using models that assess valuation, market |

| | | sentiment, and earnings quality of companies as |

| | | compared with their peers. |

AXA Rosenberg Investment | 12 | 878 | Employs an investment philosophy grounded in funda- |

Management LLC | | | mental analysis using a two-part quantitative model: |

| | | a valuation model, which compares a stock’s price to |

| | | its fair value, and an earnings forecast model, which |

| | | identifies companies likely to have superior earnings. |

Chartwell Investment Partners, L.P. | 9 | 601 | Uses a bottom-up, fundamental, research-driven stock- |

| | | selection strategy focusing on companies with sustain- |

| | | able growth, strong management teams, competitive |

| | | positions, and outstanding product and service offerings. |

| | | These companies should continually demonstrate |

| | | growth in earnings per share. |

Century Capital Management, LLC | 6 | 394 | Employs a fundamental, bottom-up approach that |

| | | attempts to identify reasonably priced companies that |

| | | will grow faster than the overall market. Companies |

| | | also must have a superior return on equity, high |

| | | recurring revenues, and improving margins. |

Cash Investments | 5 | 350 | These short-term reserves are invested by Vanguard |

| | | in equity index products to simulate investment in |

| | | stocks. Each advisor also may maintain a modest cash |

| | | position. |

| | | | | |

12

Explorer Fund

Fund Profile

As of October 31, 2008

Portfolio Characteristics | | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Number of Stocks | 991 | 1,516 | 4,647 |

Median Market Cap | $1.7B | $1.7B | $27.5B |

Price/Earnings Ratio | 16.2x | 17.5x | 12.8x |

Price/Book Ratio | 1.9x | 2.2x | 1.8x |

Yield3 | | 0.9% | 2.6% |

Investor Shares | 0.3% | | |

Admiral Shares | 0.5% | | |

Return on Equity | 15.4% | 16.3% | 20.4% |

Earnings Growth Rate | 23.0% | 21.4% | 17.8% |

Foreign Holdings | 3.1% | 0.0% | 0.0% |

Turnover Rate | 112% | — | — |

Expense Ratio | | | |

(10/31/2007)4 | | — | — |

Investor Shares | 0.41% | | |

Admiral Shares | 0.23% | | |

Short-Term Reserves | 2.5% | — | — |

Sector Diversification (% of equity exposure) |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Consumer Discretionary | 12.8% | 15.0% | 8.8% |

Consumer Staples | 4.1 | 3.5 | 11.1 |

Energy | 7.2 | 8.2 | 12.5 |

Financials | 7.6 | 6.2 | 16.7 |

Health Care | 20.8 | 22.0 | 13.7 |

Industrials | 16.8 | 19.5 | 11.1 |

Information Technology | 24.6 | 19.2 | 15.6 |

Materials | 4.4 | 4.5 | 3.4 |

Telecommunication | | | |

Services | 0.8 | 1.1 | 3.0 |

Utilities | 0.9 | 0.8 | 4.1 |

Volatility Measures5 | |

| Fund Versus | Fund Versus |

| Comparative Index1 | Broad Index2 |

R-Squared | 0.99 | 0.93 |

Beta | 0.95 | 1.20 |

Ten Largest Holdings6 (% of portfolio) | |

| | |

Cephalon, Inc. | biotechnology | 1.4% |

Microsemi Corp. | semiconductors | 1.0 |

O'Reilly Automotive, Inc. | automotive retail | 0.8 |

DeVry, Inc. | education services | 0.7 |

Polycom, Inc. | communications | |

| equipment | 0.7 |

AptarGroup Inc. | metal and glass | |

| containers | 0.7 |

Henry Schein, Inc. | health care | |

| distributors | 0.7 |

The Dun & Bradstreet Corp. | diversified | |

| commercial and | |

| professional services | 0.7 |

Alliance Data Systems Corp. | data processing and | |

| outsourced services | 0.7 |

Stericycle, Inc. | environmental and | |

| facilities services | 0.6 |

Top Ten | | 8.0% |

1 Russell 2500 Growth Index.

2 Dow Jones Wilshire 5000 Index.

3 30-day SEC yield for the fund; annualized dividend yield for the indexes. See the Glossary.

4 The expense ratios shown are from the prospectus dated August 18, 2008. For the fiscal year ended October 31, 2008, expense ratios were 0.44% for Investor Shares and 0.26% for Admiral Shares.

5 For an explanation of R-squared, beta, and other terms used here, see the Glossary.

6 The holdings listed exclude any temporary cash investments and equity index products.

13

Explorer Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: October 31, 1998–October 31, 2008

Initial Investment of $10,000

| Average Annual Total Returns | Final Value |

| Periods Ended October 31, 2008 | of a $10,000 |

| One Year | Five Years | Ten Years | Investment |

Explorer Fund Investor Shares1 | –40.17% | –0.98% | 5.66% | $17,347 |

Dow Jones Wilshire 5000 Index | –36.43 | 0.81 | 1.27 | 11,350 |

Russell 2500 Growth Index | –41.00 | –0.17 | 3.10 | 13,574 |

Average Small-Cap Growth Fund2 | –42.01 | –2.04 | 3.84 | 14,572 |

| | | | Final Value |

| | | Since | of a $100,000 |

| One Year | Five Years | Inception3 | Investment |

Explorer Fund Admiral Shares | –40.07% | –0.81% | 1.78% | $113,058 |

Dow Jones Wilshire 5000 Index | –36.43 | 0.81 | 0.94 | 106,766 |

Russell 2500 Growth Index | –41.00 | –0.17 | 1.34 | 109,738 |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 Derived from data provided by Lipper Inc.

3 Performance for the fund’s Admiral Shares and comparative standards is calculated since the Admiral Shares’ inception: November 12, 2001.

14

Explorer Fund

Fiscal-Year Total Returns (%): October 31, 1998–October 31, 2008

Average Annual Total Returns: Periods Ended September 30, 2008

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| Inception Date | One Year | Five Years | Ten Years |

Investor Shares1 | 12/11/1967 | –22.57% | 5.51% | 8.87% |

Admiral Shares | 11/12/2001 | –22.44 | 5.68 | 5.292 |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 Return since inception.

Note: See Financial Highlights tables for dividend and capital gains information.

15

Explorer Fund

Financial Statements

Statement of Net Assets—Investments Summary

As of October 31, 2008

This Statement summarizes the fund’s holdings by asset type (common stocks, bonds, etc.) and by industry sector. Details are reported for each of the fund’s 50 largest individual holdings and for investments that, in total for any issuer, represent more than 1% of the fund’s net assets. The total value of smaller holdings is reported as a single amount within each category.

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the complete listing of the fund’s holdings is available electronically on Vanguard.com and on the Securities and Exchange Commission’s website (www.sec.gov), or you can have it mailed to you without charge by calling 800-662-7447. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | Market | Percentage |

| | | Value• | of Net |

| | Shares | ($000) | Assets |

Common Stocks | | | |

Consumer Discretionary | | | |

* | O’Reilly Automotive, Inc. | 2,043,012 | 55,386 | 0.8% |

| DeVry, Inc. | 901,870 | 51,127 | 0.7% |

* | Dollar Tree, Inc. | 901,451 | 34,273 | 0.5% |

| Service Corp. International | 4,801,600 | 33,131 | 0.5% |

* | DreamWorks Animation SKG, Inc. | 997,967 | 28,043 | 0.4% |

| Ross Stores, Inc. | 810,297 | 26,489 | 0.4% |

* | WMS Industries, Inc. | 1,025,099 | 25,627 | 0.4% |

† | Consumer Discretionary—Other | | 583,337 | 8.2% |

| | | 837,413 | 11.9% |

Consumer Staples | | | |

*,^ | Chattem, Inc. | 349,383 | 26,438 | 0.4% |

| Church & Dwight, Inc. | 440,640 | 26,037 | 0.4% |

* | Ralcorp Holdings, Inc. | 380,100 | 25,725 | 0.4% |

† | Consumer Staples—Other | | 188,492 | 2.6% |

| | | 266,692 | 3.8% |

Energy | | | |

* | Ultra Petroleum Corp. | 656,350 | 30,553 | 0.4% |

* | Comstock Resources, Inc. | 617,303 | 30,507 | 0.4% |

* | Atwood Oceanics, Inc. | 992,540 | 27,275 | 0.4% |

* | Southwestern Energy Co. | 755,580 | 26,914 | 0.4% |

† | Energy—Other | | 356,242 | 5.1% |

| | | 471,491 | 6.7% |

Exchange-Traded Funds | | | |

1 | Vanguard Small-Cap ETF | 1,165,083 | 54,304 | 0.8% |

1 | Vanguard Small-Cap Growth ETF | 713,200 | 32,893 | 0.4% |

| | | 87,197 | 1.2% |

16

Explorer Fund

| | | Market | Percentage |

| | | Value• | of Net |

| | Shares | ($000) | Assets |

Financials | | | |

| Cash America International Inc. | 965,000 | 34,132 | 0.5% |

| People’s United Financial Inc. | 1,619,975 | 28,350 | 0.4% |

2 | Advanta Corp. Class A | 1,023,300 | 2,425 | 0.0% |

† | Financials—Other | | 386,579 | 5.5% |

| | | 451,486 | 6.4% |

Health Care | | | |

* | Cephalon, Inc. | 1,353,105 | 97,045 | 1.4% |

* | Henry Schein, Inc. | 1,016,292 | 47,573 | 0.7% |

* | Edwards Lifesciences Corp. | 702,820 | 37,137 | 0.5% |

* | IDEXX Laboratories Inc. | 1,007,150 | 35,442 | 0.5% |

| DENTSPLY International Inc. | 1,086,989 | 33,023 | 0.5% |

* | ResMed Inc. | 960,360 | 32,902 | 0.5% |

* | Alexion Pharmaceuticals, Inc. | 802,440 | 32,699 | 0.5% |

| Pharmaceutical Product Development, Inc. | 1,041,456 | 32,264 | 0.5% |

* | Psychiatric Solutions, Inc. | 955,750 | 31,817 | 0.5% |

* | Regeneron Pharmaceuticals, Inc. | 1,638,064 | 31,615 | 0.5% |

* | Haemonetics Corp. | 479,400 | 28,313 | 0.4% |

* | Alkermes, Inc. | 2,819,600 | 27,858 | 0.4% |

* | Endo Pharmaceuticals Holdings, Inc. | 1,428,740 | 26,432 | 0.4% |

| PDL BioPharma Inc. | 2,540,768 | 24,772 | 0.4% |

† | Health Care—Other | | 860,537 | 11.9% |

| | | 1,379,429 | 19.6% |

Industrials | | | |

| The Dun & Bradstreet Corp. | 634,100 | 46,727 | 0.7% |

* | Stericycle, Inc. | 778,680 | 45,498 | 0.7% |

| MSC Industrial Direct Co., Inc. Class A | 1,016,340 | 36,446 | 0.5% |

* | Kansas City Southern | 887,351 | 27,393 | 0.4% |

* | RBC Bearings Inc. | 1,041,518 | 24,715 | 0.4% |

† | Industrials—Other | | 919,201 | 12.9% |

| | | 1,099,980 | 15.6% |

| Information Technology | | | |

* | Microsemi Corp. | 3,113,380 | 67,685 | 1.0% |

* | Polycom, Inc. | 2,342,445 | 49,215 | 0.7% |

* | Alliance Data Systems Corp. | 921,404 | 46,218 | 0.7% |

* | Mettler-Toledo International Inc. | 547,131 | 41,877 | 0.6% |

* | Ariba, Inc. | 3,517,009 | 37,632 | 0.5% |

* | FEI Co. | 1,602,502 | 33,669 | 0.5% |

| FactSet Research Systems Inc. | 784,550 | 30,433 | 0.4% |

^ | Heartland Payment Systems, Inc. | 1,706,992 | 29,719 | 0.4% |

* | VeriFone Holdings, Inc. | 2,396,300 | 27,222 | 0.4% |

* | ON Semiconductor Corp. | 5,071,025 | 25,913 | 0.4% |

* | Riverbed Technology, Inc. | 1,987,900 | 24,908 | 0.4% |

† | Information Technology—Other | | 1,225,844 | 17.3% |

| | | 1,640,335 | 23.3% |

Materials | | | |

| AptarGroup Inc. | 1,579,600 | 47,893 | 0.7% |

| Sensient Technologies Corp. | 1,273,300 | 32,125 | 0.5% |

| Albemarle Corp. | 1,021,170 | 24,866 | 0.4% |

† | Materials—Other | | 182,141 | 2.5% |

| | | 287,025 | 4.1% |

| | | | |

† Telecommunication Services | | 48,438 | 0.7% |

| | | | |

† Utilities | | 46,243 | 0.6% |

Total Common Stocks (Cost $8,676,933) | | 6,615,729 | 93.9%3 |

17

Explorer Fund

| | | Market | Percentage |

| | | Value• | of Net |

| | Shares | ($000) | Assets |

Temporary Cash Investments | | | |

Money Market Fund | | | |

4,5 | Vanguard Market Liquidity Fund, 2.217% | 460,318,555 | 460,319 | 6.5% |

| | | | |

| | | | |

| | Face | | |

| | Amount | | |

| | ($000) | | |

Repurchase Agreement | | | |

| JPMorgan Securities Inc. 0.230%, 11/3/08 | | | |

| (Dated 10/31/08, Repurchase Value $41,901,000, | | | |

| collateralized by Federal National Mortgage Assn. | | | |

| 5.500%, 9/1/35–6/1/38) | 41,900 | 41,900 | 0.6% |

| | | | |

†6U.S. Government Agency Obligations | | 26,984 | 0.4% |

Total Temporary Cash Investments (Cost $529,196) | | 529,203 | 7.5%3 |

Total Investments (Cost $9,206,129) | | 7,144,932 | 101.4% |

Other Assets and Liabilities | | | |

Other Assets | | 83,310 | 1.2% |

Liabilities5 | | (179,169) | (2.6%) |

| | | (95,859) | (1.4%) |

Net Assets | | 7,049,073 | 100.0% |

18

Explorer Fund

At October 31, 2008, net assets consisted of: | |

| Amount |

| ($000) |

Paid-in Capital | 9,943,754 |

Undistributed Net Investment Income | 13,262 |

Accumulated Net Realized Losses | (834,803) |

Unrealized Appreciation (Depreciation) | |

Investment Securities | (2,061,197) |

Futures Contracts | (11,848) |

Foreign Currencies | (95) |

Net Assets | 7,049,073 |

| |

| |

Investor Shares—Net Assets | |

Applicable to 110,366,834 outstanding $.001 par value shares of | |

beneficial interest (unlimited authorization) | 5,025,715 |

Net Asset Value Per Share—Investor Shares | $45.54 |

| |

| |

Admiral Shares—Net Assets | |

Applicable to 47,668,092 outstanding $.001 par value shares of | |

beneficial interest (unlimited authorization) | 2,023,358 |

Net Asset Value Per Share—Admiral Shares | $42.45 |

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. The total value of securities on loan is $82,936,000.

† Represents the aggregate value, by category, of securities that are not among the 50 largest holdings and, in total for any issuer, represent 1% or less of net assets.

1 Considered an affiliated company of the fund as the issuer is another member of The Vanguard Group.

2 Considered an affiliated company of the fund as the fund owns more than 5% of the outstanding voting securities of such company.

3 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 97.6% and 3.8%, respectively, of net assets.

4 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

5 Includes $84,415,000 of collateral received for securities on loan.

6 Securities with a value of $26,984,000 have been segregated as initial margin for open futures contracts.

See accompanying Notes, which are an integral part of the Financial Statements.

19

Explorer Fund

Statement of Operations

| Year Ended |

| October 31, 2008 |

| ($000) |

Investment Income | |

Income | |

Dividends1,2 | 58,761 |

Interest2 | 18,290 |

Security Lending | 8,613 |

Total Income | 85,664 |

Expenses | |

Investment Advisory Fees—Note B | |

Basic Fee | 17,981 |

Performance Adjustment | (2,213) |

The Vanguard Group—Note C | |

Management and Administrative—Investor Shares | 18,898 |

Management and Administrative—Admiral Shares | 2,208 |

Marketing and Distribution—Investor Shares | 1,621 |

Marketing and Distribution—Admiral Shares | 794 |

Custodian Fees | 88 |

Auditing Fees | 34 |

Shareholders’ Reports—Investor Shares | 237 |

Shareholders’ Reports—Admiral Shares | 112 |

Trustees’ Fees and Expenses | 17 |

Total Expenses | 39,777 |

Expenses Paid Indirectly | (529) |

Net Expenses | 39,248 |

Net Investment Income | 46,416 |

Realized Net Gain (Loss) | |

Investment Securities Sold2 | (701,538) |

Futures Contracts | (94,115) |

Covered Call Options Written | 835 |

Foreign Currencies | (257) |

Realized Net Gain (Loss) | (795,075) |

Change in Unrealized Appreciation (Depreciation) | |

Investment Securities | (4,085,912) |

Futures Contracts | (27,274) |

Covered Call Options Written | — |

Foreign Currencies | (108) |

Change in Unrealized Appreciation (Depreciation) | (4,113,294) |

Net Increase (Decrease) in Net Assets Resulting from Operations | (4,861,953) |

1 Dividends are net of foreign withholding taxes of $541,000.

2 Dividend income, interest income, and realized net gain (loss) from affiliated companies of the fund were $2,001,000, $15,907,000, and ($11,440,000), respectively.

See accompanying Notes, which are an integral part of the Financial Statements.

20

Explorer Fund

Statement of Changes in Net Assets

| Year Ended October 31, |

| 2008 | 2007 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net Investment Income | 46,416 | 59,448 |

Realized Net Gain (Loss) | (795,075) | 1,101,439 |

Change in Unrealized Appreciation (Depreciation) | (4,113,294) | 583,721 |

Net Increase (Decrease) in Net Assets Resulting from Operations | (4,861,953) | 1,744,608 |

Distributions | | |

Net Investment Income | | |

Investor Shares | (32,844) | (33,478) |

Admiral Shares | (19,834) | (18,985) |

Realized Capital Gain1 | | |

Investor Shares | (718,966) | (776,690) |

Admiral Shares | (293,376) | (300,195) |

Total Distributions | (1,065,020) | (1,129,348) |

Capital Share Transactions | | |

Investor Shares | 294,591 | (19,018) |

Admiral Shares | 92,430 | 211,543 |

Net Increase (Decrease) from Capital Share Transactions | 387,021 | 192,525 |

Total Increase (Decrease) | (5,539,952) | 807,785 |

Net Assets | | |

Beginning of Period | 12,589,025 | 11,781,240 |

End of Period2 | 7,049,073 | 12,589,025 |

1 Includes fiscal 2008 and 2007 short-term gain distributions totaling $233,468,000 and $122,716,000, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

2 Net Assets—End of Period includes undistributed net investment income of $13,262,000 and $18,187,000. See accompanying Notes, which are an integral part of the Financial Statements.

21

Explorer Fund

Financial Highlights

Investor Shares | | | | | |

| | | | | |

| | | | | |

| | | | |

For a Share Outstanding | Year Ended October 31, |

Throughout Each Period | 2008 | 2007 | 2006 | 2005 | 2004 |

Net Asset Value, Beginning of Period | $83.93 | $80.26 | $76.67 | $67.01 | $63.17 |

Investment Operations | | | | | |

Net Investment Income (Loss) | .295 | .362 | .302 | .111 | (.050) |

Net Realized and Unrealized Gain (Loss) | | | | | |

on Investments | (31.589) | 11.052 | 9.724 | 9.622 | 3.890 |

Total from Investment Operations | (31.294) | 11.414 | 10.026 | 9.733 | 3.840 |

Distributions | | | | | |

Dividends from Net Investment Income | (.310) | (.320) | (.230) | — | — |

Distributions from Realized Capital Gains | (6.786) | (7.424) | (6.206) | (.073) | — |

Total Distributions | (7.096) | (7.744) | (6.436) | (.073) | — |

Net Asset Value, End of Period | $45.54 | $83.93 | $80.26 | $76.67 | $67.01 |

| | | | | |

| | | | | |

Total Return1 | –40.17% | 15.31% | 13.59% | 14.53% | 6.08% |

| | | | | |

| | | | | |

Ratios/Supplemental Data | | | | | |

Net Assets, End of Period (Millions) | $5,026 | $8,937 | $8,517 | $7,836 | $7,302 |

Ratio of Total Expenses to | | | | | |

Average Net Assets2 | 0.44% | 0.41% | 0.46% | 0.51% | 0.57% |

Ratio of Net Investment Income (Loss) to | | | | | |

Average Net Assets | 0.40% | 0.44% | 0.36% | 0.16% | (0.11%) |

Portfolio Turnover Rate | 112% | 90% | 96% | 80% | 82% |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 Includes performance-based investment advisory fee increases (decreases) of (0.02%), (0.04%), (0.03%), (0.01%), and 0.02%. See accompanying Notes, which are an integral part of the Financial Statements.

22

Explorer Fund

Financial Highlights

Admiral Shares | | | | | |

| | | | | |

| | | | |

For a Share Outstanding | Year Ended October 31, |

Throughout Each Period | 2008 | 2007 | 2006 | 2005 | 2004 |

Net Asset Value, Beginning of Period | $78.25 | $74.82 | $71.47 | $62.37 | $58.71 |

Investment Operations | | | | | |

Net Investment Income | .385 | .478 | .422 | .215 | .040 |

Net Realized and Unrealized Gain (Loss) | | | | | |

on Investments | (29.442) | 10.299 | 9.050 | 8.953 | 3.620 |

Total from Investment Operations | (29.057) | 10.777 | 9.472 | 9.168 | 3.660 |

Distributions | | | | | |

Dividends from Net Investment Income | (.427) | (.437) | (.346) | — | — |

Distributions from Realized Capital Gains | (6.316) | (6.910) | (5.776) | (.068) | — |

Total Distributions | (6.743) | (7.347) | (6.122) | (.068) | — |

Net Asset Value, End of Period | $42.45 | $78.25 | $74.82 | $71.47 | $62.37 |

| | | | | |

| | | | | |

Total Return | –40.07% | 15.53% | 13.79% | 14.70% | 6.23% |

| | | | |

| | | | |

Ratios/Supplemental Data | | | | |

Net Assets, End of Period (Millions) | $2,023 | $3,652 | $3,264 | $2,402 | $1,161 |

Ratio of Total Expenses to | | | | | |

Average Net Assets1 | 0.26% | 0.23% | 0.28% | 0.34% | 0.43% |

Ratio of Net Investment Income to | | | | | |

Average Net Assets | 0.58% | 0.62% | 0.54% | 0.33% | 0.04% |

Portfolio Turnover Rate | 112% | 90% | 96% | 80% | 82% |

| | | | | | |

1 Includes performance-based investment advisory fee increases (decreases) of (0.02%), (0.04%), (0.03%), (0.01%), and 0.02%. See accompanying Notes, which are an integral part of the Financial Statements.

23

Explorer Fund

Notes to Financial Statements

Vanguard Explorer Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers two classes of shares: Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, tenure, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Covered Call Options Written: The fund may write covered call options on security holdings that are considered to be attractive long-term investments but are believed to be overvalued in the short-term. When the fund writes options, the premium received by the fund is recorded as an asset with an equal liability that is marked-to-market to reflect the current market value of the options written. Fluctuations in the value of the options are recorded as unrealized appreciation (depreciation) until expired, closed, or exercised, at which time realized gains (losses) are recognized. Options are valued at their latest quoted sales prices. Options not traded on the valuation date are valued at the latest quoted asked prices.

4. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover

24

Explorer Fund

or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

5. Repurchase Agreements: The fund may invest in repurchase agreements. Securities pledged as collateral for repurchase agreements are held by a custodian bank until the agreements mature. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal; however, in the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

6. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken on federal income tax returns for all open tax years (tax years ended October 31, 2005–2008), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

7. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

8. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

9. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. AXA Rosenberg Investment Management LLC, Century Capital Management, LLC, Chartwell Investment Partners, L.P., Granahan Investment Management, Inc., Kalmar Investment Advisers, and Wellington Management Company, LLP, each provide investment advisory services to a portion of the fund for fees calculated at an annual percentage rate of average net assets managed by the advisor. The basic fees of Chartwell Investment Partners, Granahan Investment Management, Inc., Kalmar Investment Advisers, and Wellington Management Company, LLP, are subject to quarterly adjustments based on performance for the preceding three years relative to the Russell 2500 Growth Index. The basic fee for AXA Rosenberg Investment Management LLC is subject to quarterly adjustments based on performance since July 31, 2007, relative to the Russell 2500 Growth Index. In accordance with the

25

Explorer Fund

advisory contract entered into with Century Capital Management, LLC, in June 2008, beginning August 1, 2009, the investment advisory fee will be subject to quarterly adjustments based on performance since October 31, 2008, relative to a 50/50 blend of the Russell 2500 Index and the Russell 2500 Growth Index. Until February 2008, a portion of the fund was managed by Grantham, Mayo, Van Otterloo & Co. LLC. The basic fee paid to Grantham, Mayo, Van Otterloo & Co. LLC was subject to quarterly adjustments based on performance for the preceding three years relative to the Russell 2500 Growth Index.

The Vanguard Group provides investment advisory services to a portion of the fund on an at-cost basis; the fund paid Vanguard advisory fees of $454,000 for the year ended October 31, 2008.

For the year ended October 31, 2008, the aggregate investment advisory fee represented an effective annual basic rate of 0.18% of the fund’s average net assets, before a decrease of $2,213,000 (0.02%) based on performance.

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At October 31, 2008, the fund had contributed capital of $825,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.82% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

D. The fund has asked its investment advisors to direct certain security trades, subject to obtaining the best price and execution, to brokers who have agreed to rebate to the fund part of the commissions generated. Such rebates are used solely to reduce the fund’s management and administrative expenses. The fund’s custodian bank has also agreed to reduce its fees when the fund maintains cash on deposit in the non-interest-bearing custody account. For the year ended October 31, 2008, these arrangements reduced the fund’s management and administrative expenses by $498,000 and custodian fees by $31,000. The total expense reduction represented an effective annual rate of 0.01% of the fund’s average net assets.

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

During the year ended October 31, 2008, the fund realized net foreign currency losses of $257,000, which decreased distributable net income for tax purposes; accordingly, such losses have been reclassified from accumulated net realized losses to undistributed net investment income. Certain of the fund’s investments were in securities considered to be “passive foreign investment companies,” for which any unrealized appreciation and/or realized gains are required to be included in distributable net income for tax purposes. During the year ended October 31, 2008, the fund realized gains on the sale of passive foreign investment companies of $1,594,000, which have been included in current and prior periods’ taxable income; accordingly, such gains have been reclassified from accumulated net realized losses to undistributed net investment income.

26

Explorer Fund

For tax purposes, at October 31, 2008, the fund had $34,524,000 of ordinary income available for distribution. The fund had available realized losses of $784,127,000 to offset future net capital gains through October 31, 2016.

At October 31, 2008, the cost of investment securities for tax purposes was $9,268,828,000. Net unrealized depreciation of investment securities for tax purposes was $2,123,896,000, consisting of unrealized gains of $361,972,000 on securities that had risen in value since their purchase and $2,485,868,000 in unrealized losses on securities that had fallen in value since their purchase.

At October 31, 2008, the aggregate settlement value of open futures contracts expiring in December 2008 and the related unrealized appreciation (depreciation) were:

| | | ($000) |

| Number of | Aggregate | Unrealized |

| Long (Short) | Settlement | Appreciation |

Futures Contracts | Contracts | Value | (Depreciation) |

E-mini Russell 2000 Index | 4,002 | 214,707 | (7,615) |

E-mini S&P MidCap Index | 574 | 32,626 | 1,790 |

S&P MidCap 400 Index | 41 | 11,652 | (4,059) |

E-mini NASDAQ 100 Index | 255 | 6,819 | (1,964) |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

F. During the year ended October 31, 2008, the fund purchased $10,951,394,000 of investment securities and sold $11,531,826,000 of investment securities, other than temporary cash investments.

G. Capital share transactions for each class of shares were:

| | | Year Ended October 31, |

| | 2008 | | | 2007 |

| Amount | Shares | | Amount | Shares |

| ($000) | (000) | | ($000) | (000) |

Investor Shares | | | | | |

Issued | 981,528 | 15,527 | | 1,002,407 | 12,663 |

Issued in Lieu of Cash Distributions | 742,180 | 10,728 | | 798,597 | 10,589 |

Redeemed | (1,429,117) | (22,368) | | (1,820,022) | (22,892) |

Net Increase (Decrease)—Investor Shares | 294,591 | 3,887 | | (19,018) | 360 |

Admiral Shares | | | | | |

Issued | 459,208 | 7,554 | | 762,605 | 10,288 |

Issued in Lieu of Cash Distributions | 293,573 | 4,559 | | 309,959 | 4,415 |

Redeemed | (660,351) | (11,114) | | (861,021) | (11,658) |

Net Increase (Decrease)—Admiral Shares | 92,430 | 999 | | 211,543 | 3,045 |

27

Explorer Fund

H. Certain of the fund’s investments are in companies that are considered to be affiliated companies of the fund because the fund owns more than 5% of the outstanding voting securities of the company. Transactions during the period in securities of these companies were as follows:

| | | Current Period Transactions | |

| Oct. 31, 2007 | | Proceeds from | | Oct. 31, 2008 |

| Market | Purchases | Securities | Dividend | Market |

| Value | at Cost | Sold | Income | Value |

| ($000) | ($000) | ($000) | ($000) | ($000) |

Advanta Corp. | NA1 | 7,992 | 1,403 | 579 | 2,425 |

RBC Bearings Inc. | NA1 | 41,775 | 9,506 | — | NA2 |

The Advisory Board Co. | 60,415 | 22,394 | 34,369 | — | NA2 |

| 60,415 | | | 579 | 2,425 |

I. In September 2006, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 157 (“FAS 157”), “Fair Value Measurements.” FAS 157 establishes a framework for measuring fair value and expands disclosures about fair value measurements in financial statements.

The various inputs that may be used to determine the value of the fund’s investments are summarized in three broad levels. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the fund’s investments as of October 31, 2008, based on the inputs used to value them:

| Investments | Futures |

| in Securities | Contracts |

Valuation Inputs | ($000) | ($000) |

Level 1—Quoted prices | 7,036,532 | (11,848) |

Level 2—Other significant observable inputs | 103,832 | — |

Level 3—Significant unobservable inputs | 4,568 | — |

Total | 7,144,932 | (11,848) |

1 At October 31, 2007, the issuer was not an affiliated company of the fund.

2 At October 31, 2008, the security was still held, but the issuer was no longer an affiliated company of the fund.

28

Explorer Fund

The following table summarizes changes in investments valued based on Level 3 inputs during the year ended October 31, 2008:

| Investments |

| in Securities |

Amount valued based on Level 3 Inputs | ($000) |

Balance as of October 31, 2007 | — |

Transfers in and/or out of Level 3 | 4,568 |

Balance as of October 31, 2008 | 4,568 |

J. The following table summarizes the fund’s covered call options written during the year ended October 31, 2008:

| Number of | Premiums |

| Contracts | Received |

Covered Call Options | Written | ($000) |

Balance at October 31, 2007 | — | — |

Options written | 12,056 | 835 |

Options expired | (8,580) | (402) |

Options closed | (3,476) | (433) |

Options exercised | — | — |

Options open at October 31, 2008 | — | — |

29

Report of Independent Registered

Public Accounting Firm

To the Trustees of Trustees and Shareholders of Vanguard Explorer Fund:

In our opinion, the accompanying statement of net assets—investments summary and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard Explorer Fund (the “Fund”) at October 31, 2008, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2008 by correspondence with the custodians and brokers, and by agreement to the underlying ownership records for Vanguard Market Liquidity Fund, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 19, 2008

Special 2008 tax information (unaudited) for Vanguard Explorer Fund

This information for the fiscal year ended October 31, 2008, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $778,981,000 as capital gain dividends (from net long-term capital gains) to shareholders during the fiscal year.

For nonresident alien shareholders, 100% of short-term capital gain dividends distributed by the fund are qualified short-term capital gains.

The fund distributed $52,888,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders,100.0% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

30

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2008. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

The table shows returns for Investor Shares only; returns for other share classes will differ. Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

Average Annual Total Returns: Explorer Fund Investor Shares1 |

Periods Ended October 31, 2008 | | | |

| One | Five | Ten |

| Year | Years | Years |

Returns Before Taxes | –40.17% | –0.98% | 5.66% |

Returns After Taxes on Distributions | –41.26 | –1.97 | 4.08 |

Returns After Taxes on Distributions and Sale of Fund Shares | –24.43 | –0.58 | 4.52 |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

31

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Six Months Ended October 31, 2008 | | | |

| Beginning | Ending | Expenses |

| Account Value | Account Value | Paid During |

Explorer Fund | 4/30/2008 | 10/31/2008 | Period1 |

Based on Actual Fund Return | | | |

Investor Shares | $1,000.00 | $692.94 | $1.96 |

Admiral Shares | 1,000.00 | 693.51 | 1.20 |

Based on Hypothetical 5% Yearly Return | | | |

Investor Shares | $1,000.00 | $1,022.89 | $2.35 |

Admiral Shares | 1,000.00 | 1,023.79 | 1.43 |

1 The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.46% for Investor Shares and 0.28% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

32

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include the account service fee described in the prospectus. If such a fee were applied to your account, your costs would be higher. Your fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

33

Glossary

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. The percentage of a fund’s average net assets used to pay its annual administrative and advisory expenses. These expenses directly reduce returns to investors.

Foreign Holdings. The percentage of a fund represented by stocks or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.