UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811- 524 |

| |

| Dreyfus/Laurel Funds Trust | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| John Pak, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 5/31 | |

Date of reporting period: | 5/31/2013 | |

| | | | | | | |

The following N-CSR relates only to Dreyfus Equity Income Fund and Dreyfus Emerging Markets Debt Local Currency Fund and does not affect the other series of the Registrant, which have different fiscal year ends and, therefore, different N-CSR reporting requirements. Separate N-CSR Forms will be filed for these series, as appropriate.

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus

Emerging Markets Debt

Local Currency Fund

ANNUAL REPORT May 31, 2013

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| |

| Contents |

| |

| | THE FUND |

| 2 | A Letter from the President |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses |

| With Those of Other Funds |

| 9 | Statement of Investments |

| 15 | Statement of Assets and Liabilities |

| 16 | Statement of Operations |

| 17 | Statement of Changes in Net Assets |

| 19 | Financial Highlights |

| 22 | Notes to Financial Statements |

| 40 | Report of Independent Registered |

| | Public Accounting Firm |

| 41 | Information About the Renewal of |

| | the Fund’s Management Agreement |

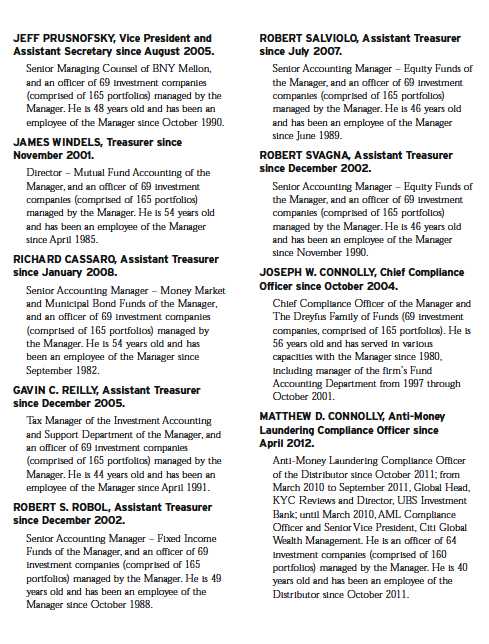

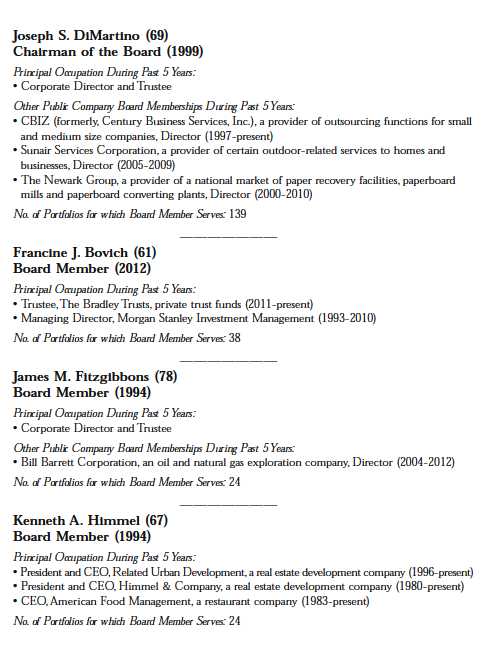

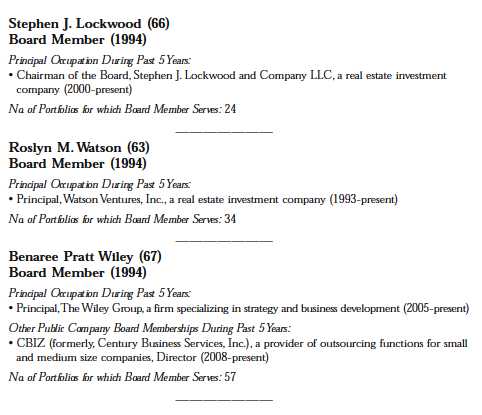

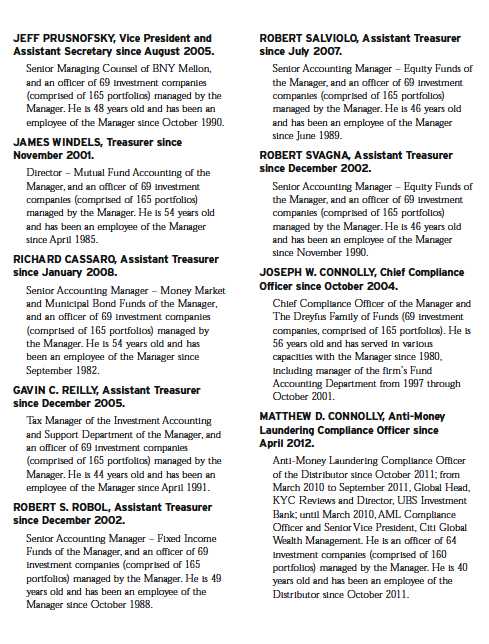

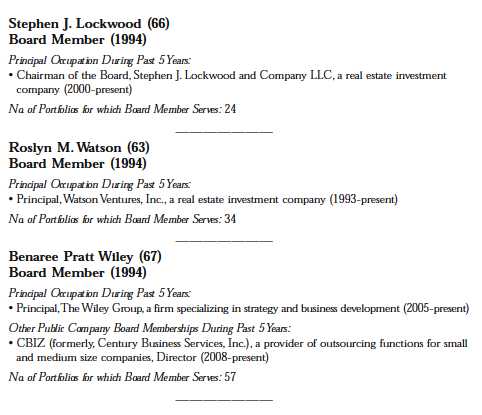

| 46 | Board Members Information |

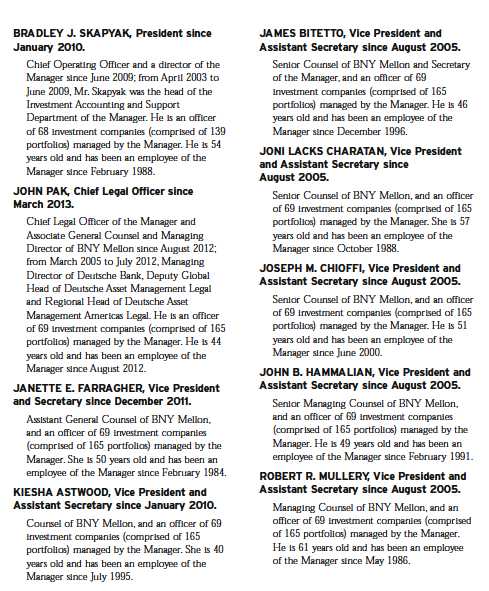

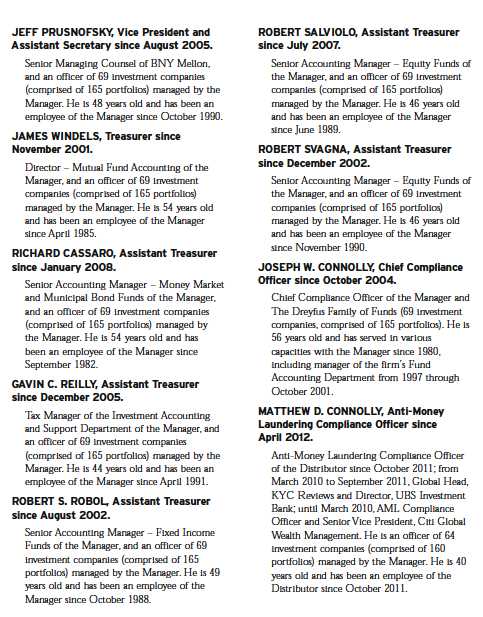

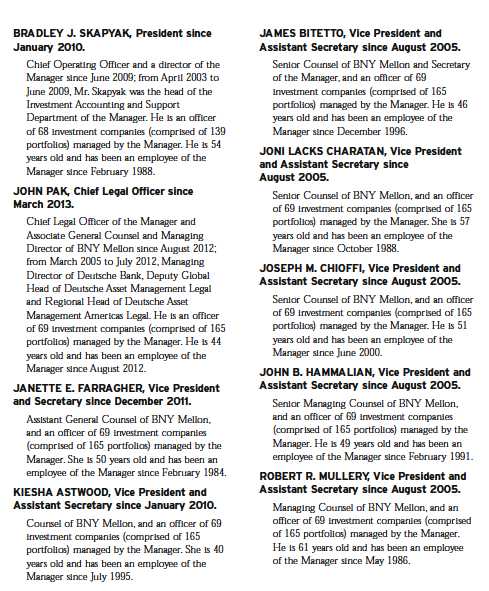

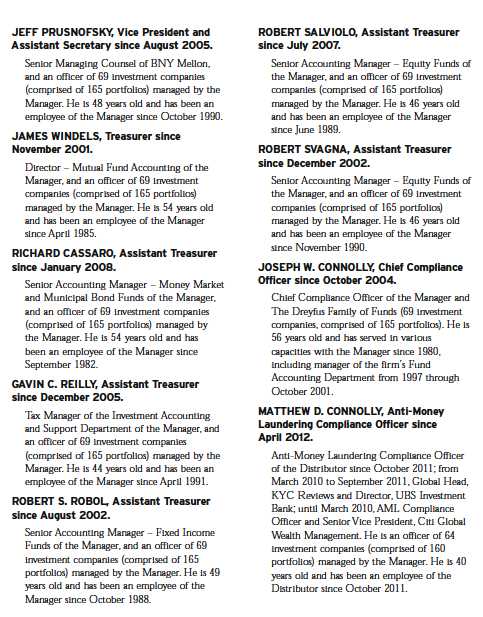

| 48 | Officers of the Fund |

| |

| FOR MORE INFORMATION |

|

| | Back Cover |

Dreyfus

Emerging Markets Debt

Local Currency Fund

The Fund

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Emerging Markets Debt Local Currency Fund, covering the 12-month period from June 1, 2012, through May 31, 2013. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

The U.S. economic recovery gained traction over the reporting period, but remained slower than historical norms. On one hand, the expansion has been fueled by gradually falling unemployment, recovering housing markets, rapid growth in domestic oil and gas production, and, perhaps most significant, the aggressively stimulative monetary policy of the Federal Reserve Board (the “Fed”). On the other hand, several factors have weighed on the nation’s economic growth rate, including relatively sluggish demand for exports to Europe and the emerging markets, higher tax rates for some Americans, and more restrictive fiscal policies stemming from sequestration. However, despite a deceleration in economic activity that took place during the first half of this year, emerging market economies are still expected to grow, on average, at faster rates than developed economies for the foreseeable future.

In our analysis, real GDP growth seems poised to accelerate modestly over the remainder of 2013. In fact, we expect the relatively mild economic expansion to remain intact domestically and globally over the next several years. The moderate pace of the recovery implies that the risks of consumer price inflation are limited, making it unlikely that the Fed will adopt expansion-threatening, restrictive policies anytime soon. As always, we encourage you to discuss our observations with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

J. Charles Cardona

President

The Dreyfus Corporation

June 17, 2013

2

DISCUSSION OF FUND PERFORMANCE

For the period of June 1, 2012 through May 31, 2013, as provided by Alexander Kozhemiakin and Javier Murcio, Primary Portfolio Managers

Fund and Market Performance Overview

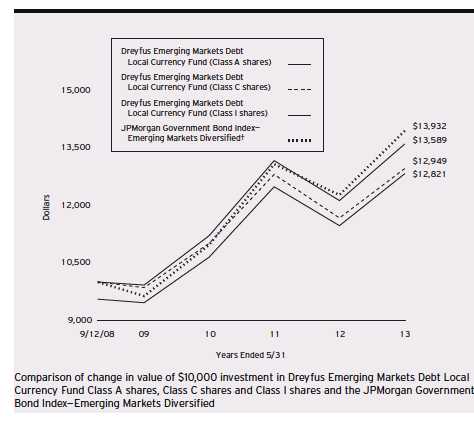

For the 12-month period ended May 31, 2013, Dreyfus Emerging Markets Debt Local Currency Fund’s Class A shares produced a total return of 11.83%, Class C shares returned 10.98%, and Class I shares returned 12.18%.1 In comparison, the fund’s benchmark, the JPMorgan Government Bond Index – Emerging Markets Diversified (the “Index”), produced a 13.56% total return for the same period.2

Despite heightened volatility over the second half of the reporting period, emerging market currencies and bonds generally posted strong results overall.The fund produced lower returns than its benchmark, mainly due to underweighted exposure to bonds in Indonesia, Colombia and Russia (which were not fully investable at the time) over the reporting period’s first half, and weakness in the Peruvian currency, which we were overweighted during the second half.

The Fund’s Investment Approach

The fund seeks to maximize total return.To pursue its goal, the fund normally invests at least 80% of its assets in emerging market bonds and other debt instruments denominated in the local currency of issue, and in derivative instruments that provide investment exposure to such securities.

When choosing investments, we employ in-depth fundamental country analysis supported by the discipline of quantitative valuation models.A “top down” analysis of macroeconomics and financial and political variables guides country and currency allocations.We also consider technical market factors and the global risk environment. We seek to identify shifts in country fundamentals and consider the risk-adjusted attractiveness of currency and duration returns for each emerging market country.

2012 Rallies Partly Offset by Market Weakness in 2013

At the start of the reporting period, investor confidence in riskier markets was undermined by a number of global macroeconomic worries. Some of these concerns soon moderated, however, when the head of the European Central Bank stated a firm

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

commitment to supporting the euro and central banks throughout the world adopted aggressively accommodative monetary policies. In anticipation of greater stability in the regions’ key export markets, emerging market currencies and bonds generally rallied during the fall of 2012 and into the first quarter of 2013, accounting for the bulk of the Index’s gains for the reporting period.

The first five months of 2013 saw dramatically different results as investors’ perception changed regarding liquidity conditions in the emerging markets. Remarks by Federal Reserve Board (the “Fed”) Chairman Ben Bernanke were widely interpreted as a signal that the Fed would begin to back away from its quantitative easing program earlier than expected. Meanwhile investors anticipated that newly stimulative monetary and fiscal policies in Japan would spark increased capital flows to the emerging markets, a development that failed to materialize. These factors led to worries that investment capital might instead flow to Europe or Japan, sparking heightened volatility in the emerging markets toward the reporting period’s end.

Currency Strategies Weighed on Relative Results

Although the fund participated to a significant degree in the emerging markets’ gains, its relative performance over the final months of 2012 was undercut by relatively heavy exposure to the Peruvian nuevo sol and Russian ruble, and underweighted positions in the Polish zloty and Hungarian forint. Results in 2013 were hindered by modestly overweighted exposure to the South African rand and local currency-denominated bonds in Peru.

The fund achieved better results through overweighted exposure to the Mexican peso, which buoyed relative performance throughout the reporting period when investors responded positively to solid economic fundamentals and an attractive valuation. Sovereign bonds in South Africa and inflation-linked bonds in Brazil and Turkey fared well early in the reporting period. During the reporting period’s second half, an underweighted position in the Peruvian nuevo sol helped cushion the currency’s weakness, and the fund further benefited from investments in short-term bonds in Nigeria.

Fundamentals Strong Despite Recent Volatility

In our analysis, recent concerns regarding changing U.S. monetary policy generally have been overblown. Although short-term interest rates eventually will rise, we

4

believe that the Fed’s accommodative stance will remain in place for some time to come. Indeed, recent market volatility has produced what we believe to be opportunities to invest in emerging markets currencies and debt instruments at attractive valuations. Moreover, economic and market fundamentals remain sound in most regions where the fund invests.

However, over the near term, emerging market bonds and currencies are likely to continue to respond primarily to changes in investor sentiment. Therefore, we have adopted a more cautious investment posture, focusing on attractively valued markets with sound fiscal policies, subdued inflationary pressures, and the potential for declining bond yields.We recently have found opportunities meeting these criteria in Mexico, Peru, Russia, and to a lesser degree, in Brazil and Nigeria. Conversely, we have identified fewer opportunities in Asia, the Middle East, South Africa, Poland, and Hungary.

June 17, 2013

Bond funds are subject generally to interest rate, credit, liquidity and market risks, to varying degrees, all of which are

more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related

to interest-rate changes, and rate increases can cause price declines.

Foreign bonds are subject to special risks including exposure to currency fluctuations, changing political and economic

conditions, and potentially less liquidity. Investments in foreign currencies are subject to the risk that those currencies

will decline in value relative to the U.S. dollar. Foreign currencies are also subject to risks caused by inflation, interest

rates, budget deficits and low savings rate, political factors and government control.The fixed income securities of issuers

located in emerging markets can be more volatile and less liquid than those of issuers in more mature economies and

emerging markets generally have less diverse and less mature economic structures and less stable political systems than

those of developed countries.The securities of issuers located or doing substantial business in emerging markets are

often subject to rapid and large changes in price.

The fund may use derivative instruments, such as options, futures and options on futures, forward contracts, swaps

(including credit default swaps on corporate bonds and asset-backed securities), options on swaps and other credit

derivatives.A small investment in derivatives could have a potentially large impact on the fund’s performance.

1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the

maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed

on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past

performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption,

fund shares may be worth more or less than their original cost.

2 SOURCE: FACTSET — The JPMorgan Government Bond Index – Emerging Markets Diversified is a

comprehensive global local emerging markets index, and consists of regularly traded, liquid fixed-rate, domestic currency

government bonds.The Index does not include fund fees and expenses to which the fund is subject. Investors cannot

invest directly in any index.

The Fund 5

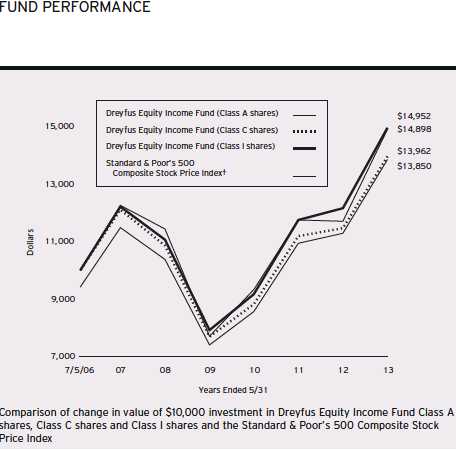

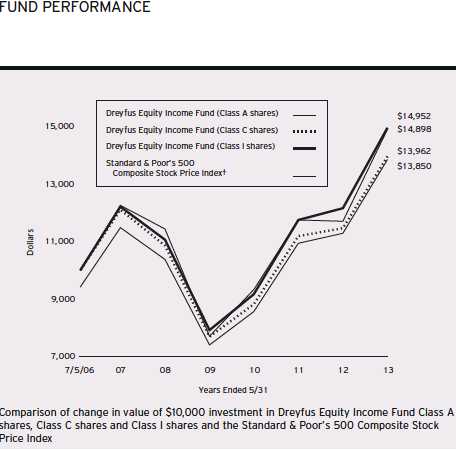

FUND PERFORMANCE

† Source: FactSet

Past performance is not predictive of future performance.

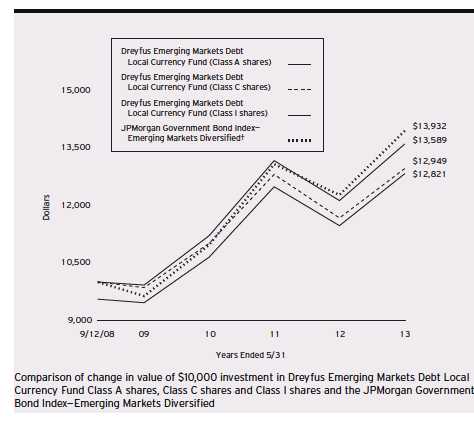

The above graph compares a $10,000 investment made in each of the Class A, Class C and Class I shares of Dreyfus Emerging Markets Debt Local Currency Fund on 9/12/08 (inception date) to a $10,000 investment made in the JPMorgan Government Bond Index-Emerging Markets Diversified (the “Index”) on that date.All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes.The Index is a comprehensive global local emerging markets index, and consists of regularly traded, liquid fixed-rate, domestic currency government bonds. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | |

| Average Annual Total Returns as of 5/31/13 | | | | | |

| |

| | Inception | | | From | |

| | Date | 1 | Year | Inception | |

| Class A shares | | | | | |

| with maximum sales charge (4.5%) | 9/12/08 | 6.78 | % | 5.41 | % |

| without sales charge | 9/12/08 | 11.83 | % | 6.44 | % |

| Class C shares | | | | | |

| with applicable redemption charge † | 9/12/08 | 9.98 | % | 5.63 | % |

| without redemption | 9/12/08 | 10.98 | % | 5.63 | % |

| Class I shares | 9/12/08 | 12.18 | % | 6.71 | % |

| JPMorgan Government Bond Index— | | | | | |

| Emerging Markets Diversified | 8/31/08 | 13.56 | % | 7.23 | %†† |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not

reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the

date of purchase.

For comparative purposes, the value of the Index as of 8/31/08 is used as the beginning value on 9/12/08.

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Emerging Markets Debt Local Currency Fund from December 1, 2012 to May 31, 2013. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended May 31, 2013

| | | | | | |

| | | Class A | | Class C | | Class I |

| Expenses paid per $1,000† | $ | 6.08 | $ | 9.87 | $ | 4.70 |

| Ending value (after expenses) | $ | 983.80 | $ | 980.00 | $ | 985.10 |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended May 31, 2013

| | | | | | |

| | | Class A | | Class C | | Class I |

| Expenses paid per $1,000† | $ | 6.19 | $ | 10.05 | $ | 4.78 |

| Ending value (after expenses) | $ | 1,018.80 | $ | 1,014.96 | $ | 1,020.19 |

† Expenses are equal to the fund’s annualized expense ratio of 1.23% for Class A, 2.00% for Class C and .95%

for Class I, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half

year period).

8

STATEMENT OF INVESTMENTS

May 31, 2013

| | | | | | |

| | | Coupon | Maturity | Principal | | |

| Bonds and Notes—86.2% | | Rate (%) | Date | Amount ($)a | Value ($) |

| Foreign/Governmental | | | | | | |

| AHML Finance, | | | | | | |

| Unscd. Notes | RUB | 7.75 | 2/13/18 | 332,200,000 | b | 10,570,225 |

| AHML Finance, | | | | | | |

| Unscd. Notes | RUB | 7.75 | 2/13/18 | 1,501,500,000 | | 47,776,015 |

| Bank of Thailand, | | | | | | |

| Treasury Bills, Ser. 363 | THB | 0.00 | 8/1/13 | 3,868,000,000 | c | 127,262,119 |

| Brazil Notas do | | | | | | |

| Tesouro Nacional, | | | | | | |

| Notes, Ser. B | BRL | 6.00 | 8/15/22 | 50,710,000 | d | 60,518,732 |

| Brazil Notas do | | | | | | |

| Tesouro Nacional, | | | | | | |

| Notes, Ser. B | BRL | 6.00 | 5/15/45 | 2,750,000 | d | 3,443,116 |

| Brazil Nota do | | | | | | |

| Tesouro Nacional | | | | | | |

| Notes, Ser. B | BRL | 6.00 | 8/15/50 | 9,500,000 | d | 12,041,310 |

| Colombian Government, | | | | | | |

| Sr. Unscd. Bonds | COP | 4.38 | 3/21/23 | 38,613,000,000 | | 19,529,421 |

| Colombian Government, | | | | | | |

| Sr. Unscd. Bonds | COP | 9.85 | 6/28/27 | 66,202,000,000 | | 50,033,524 |

| Colombian Government, | | | | | | |

| Bonds, Ser. B | COP | 11.00 | 7/24/20 | 115,330,500,000 | | 79,208,610 |

| Eskom Holdings, | | | | | | |

| Sr. Scd. Bonds | ZAR | 0.00 | 12/31/18 | 373,600,000 | c | 24,316,424 |

| Hungarian Government, | | | | | | |

| Bonds, Ser. 23/A | HUF | 6.00 | 11/24/23 | 23,301,620,000 | | 105,797,304 |

| Hungarian Government, | | | | | | |

| Bonds, Ser. 19/A | HUF | 6.50 | 6/24/19 | 7,541,440,000 | | 35,443,972 |

| Hungarian Government, | | | | | | |

| Bonds, Ser. 22/A | HUF | 7.00 | 6/24/22 | 3,410,220,000 | | 16,495,281 |

| Hungarian Government, | | | | | | |

| Bonds, Ser. 20/A | HUF | 7.50 | 11/12/20 | 6,072,330,000 | | 30,283,572 |

| Malaysian Government, | | | | | | |

| Sr. Unscd. Bonds, | | | | | | |

| Ser. 0312 | MYR | 3.20 | 10/15/15 | 25,800,000 | | 8,369,465 |

| Malaysian Government, | | | | | | |

| Sr. Unscd. Bonds, | | | | | | |

| Ser. 0213 | MYR | 3.26 | 3/1/18 | 22,225,000 | | 7,158,128 |

| Malaysian Government, | | | | | | |

| Sr. Unscd. Bonds, | | | | | | |

| Ser. 0512 | MYR | 3.31 | 10/31/17 | 47,000,000 | | 15,186,460 |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

| | | | | | |

| | | Coupon | Maturity | Principal | | |

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | Value ($) |

| Foreign/Governmental | | | | | | |

| (continued) | | | | | | |

| Malaysian Government, | | | | | | |

| Sr. Unscd. Bonds, | | | | | | |

| Ser. 0112 | MYR | 3.42 | 8/15/22 | 88,910,000 | | 28,689,183 |

| Malaysian Government, | | | | | | |

| Sr. Unscd. Bonds, | | | | | | |

| Ser. 0211 | MYR | 3.43 | 8/15/14 | 491,375,000 | | 159,460,305 |

| Malaysian Government, | | | | | | |

| Sr. Unscd. Bonds, | | | | | | |

| Ser. 0313 | MYR | 3.48 | 3/15/23 | 224,205,000 | | 72,804,551 |

| Malaysian Government, | | | | | | |

| Sr. Unscd. Bonds, | | | | | | |

| Ser. 0110 | MYR | 3.84 | 8/12/15 | 96,170,000 | | 31,595,119 |

| Malaysian Government, | | | | | | |

| Sr. Unscd. Bonds, | | | | | | |

| Ser. 0212 | MYR | 3.89 | 3/15/27 | 56,000,000 | | 18,855,556 |

| Malaysian Government, | | | | | | |

| Sr. Unscd. Bonds, | | | | | | |

| Ser. 1/06 | MYR | 4.26 | 9/15/16 | 320,760,000 | | 106,597,273 |

| Malaysian Government, | | | | | | |

| Sr. Unscd. Bonds, | | | | | | |

| Ser. 2/04 | MYR | 5.09 | 4/30/14 | 196,440,000 | | 64,645,621 |

| Mexican Government, | | | | | | |

| Bonds | MXN | 4.00 | 11/15/40 | 51,547,000 | | 24,151,683 |

| Mexican Government, | | | | | | |

| Bonds, Ser. M | MXN | 7.75 | 5/29/31 | 451,945,000 | | 41,395,732 |

| Mexican Government, | | | | | | |

| Bonds, Ser. M | MXN | 7.75 | 11/13/42 | 545,000,000 | | 49,627,937 |

| Mexican Government, | | | | | | |

| Bonds, Ser. M 30 | MXN | 8.50 | 11/18/38 | 144,940,000 | | 14,304,361 |

| Mexican Government, | | | | | | |

| Bonds, Ser. M 30 | MXN | 10.00 | 11/20/36 | 532,990,000 | | 59,745,308 |

| Nigerian Government, | | | | | | |

| Treasury Bills, Ser. 364d | NGN | 0.00 | 10/24/13 | 1,195,000,000 | c | 7,197,345 |

| Nigerian Government, | | | | | | |

| Treasury Bills, Ser. 364d | NGN | 0.00 | 11/7/13 | 1,044,000,000 | c | 7,843,315 |

| Nigerian Government, | | | | | | |

| Treasury Bills, Ser. 364D | NGN | 0.00 | 11/21/13 | 1,206,480,000 | c | 7,200,672 |

| Nigerian Government, | | | | | | |

| Bonds, Ser. 5YR | NGN | 15.10 | 4/27/17 | 4,017,560,000 | | 27,785,161 |

10

| | | | | | |

| | | Coupon | Maturity | Principal | | |

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | | Value ($) |

| Foreign/Governmental | | | | | | |

| (continued) | | | | | | |

| Nigerian Government, | | | | | | |

| Bonds, Ser. 7 | NGN | 16.00 | 6/29/19 | 7,825,155,000 | | 56,898,077 |

| Nigerian Government, | | | | | | |

| Bonds, Ser. 10YR | NGN | 16.39 | 1/27/22 | 10,550,405,000 | | 83,102,779 |

| Peruvian Government, | | | | | | |

| Bonds | PEN | 6.85 | 2/12/42 | 32,345,000 | | 13,351,818 |

| Peruvian Government, | | | | | | |

| Sr. Unscd. Bonds | PEN | 6.90 | 8/12/37 | 147,120,000 | | 60,842,847 |

| Peruvian Government, | | | | | | |

| Gtd. Bonds | PEN | 6.95 | 8/12/31 | 233,300,000 | | 96,976,607 |

| Peruvian Government, | | | | | | |

| Bonds | PEN | 7.84 | 8/12/20 | 55,425,000 | | 24,058,915 |

| Peruvian Government, | | | | | | |

| Bonds | PEN | 8.20 | 8/12/26 | 200,185,000 | | 94,598,084 |

| Petroleos Mexicanos, | | | | | | |

| Gtd. Notes | MXN | 7.65 | 11/24/21 | 875,700,000 | b | 76,116,838 |

| Philippine Government, | | | | | | |

| Sr. Unscd. Bonds | PHP | 4.95 | 1/15/21 | 3,563,000,000 | | 92,299,148 |

| Philippine Government, | | | | | | |

| Sr. Unscd. Bonds | PHP | 6.25 | 1/14/36 | 538,000,000 | | 15,973,267 |

| Polish Government, | | | | | | |

| Bonds, Ser. 1023 | PLN | 4.00 | 10/25/23 | 61,800,000 | | 19,479,721 |

| Polish Government, | | | | | | |

| Bonds, Ser. 0416 | PLN | 5.00 | 4/25/16 | 152,500,000 | | 49,213,591 |

| Polish Government, | | | | | | |

| Bonds, Ser. 1017 | PLN | 5.25 | 10/25/17 | 79,000,000 | | 26,190,674 |

| Polish Government, | | | | | | |

| Bonds, Ser. 1020 | PLN | 5.25 | 10/25/20 | 63,565,000 | | 21,716,000 |

| Polish Government, | | | | | | |

| Bonds, Ser. 0415 | PLN | 5.50 | 4/25/15 | 21,000,000 | | 6,714,279 |

| Polish Government, | | | | | | |

| Bonds, Ser. 0922 | PLN | 5.75 | 9/23/22 | 112,270,000 | | 40,104,011 |

| Polish Government, | | | | | | |

| Bonds, Ser. 1015 | PLN | 6.25 | 10/24/15 | 97,720,000 | | 32,092,894 |

| Romanian Government, | | | | | | |

| Bonds, Ser. 5Y | RON | 5.90 | 7/26/17 | 175,080,000 | | 53,988,119 |

| RusHydro, | | | | | | |

| Sr. Unscd. Notes | RUB | 7.88 | 10/28/15 | 1,098,900,000 | | 34,466,724 |

The Fund 11

STATEMENT OF INVESTMENTS (continued)

| | | | | | |

| | | Coupon | Maturity | Principal | | |

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | | Value ($) |

| Foreign/Governmental | | | | | | |

| (continued) | | | | | | |

| Russian Agricultural Bank, | | | | | | |

| Sr. Unscd. Notes | RUB | 7.88 | 2/7/18 | 938,300,000 | | 29,404,274 |

| Russian Agricultural Bank, | | | | | | |

| Sr. Unscd. Notes | RUB | 8.63 | 2/17/17 | 690,700,000 | | 22,226,044 |

| Russian Agricultural Bank, | | | | | | |

| Sr. Unscd. Notes | RUB | 8.70 | 3/17/16 | 1,456,800,000 | | 47,346,029 |

| Russian Government, | | | | | | |

| Bonds, Ser. 5075 | RUB | 6.88 | 7/15/15 | 786,265,000 | | 25,067,303 |

| Russian Government, | | | | | | |

| Bonds, Ser. 5079 | RUB | 7.00 | 6/3/15 | 1,907,380,000 | | 60,810,123 |

| Russian Government, | | | | | | |

| Bonds, Ser. 6212 | RUB | 7.05 | 1/19/28 | 602,575,000 | | 18,220,247 |

| Russian Government, | | | | | | |

| Bonds, Ser. 6204 | RUB | 7.50 | 3/15/18 | 395,735,000 | | 12,920,265 |

| Russian Government, | | | | | | |

| Bonds, Ser. 6208 | RUB | 7.50 | 2/27/19 | 965,500,000 | | 31,429,416 |

| Russian Government, | | | | | | |

| Bonds, Ser. 6205 | RUB | 7.60 | 4/14/21 | 1,381,075,000 | | 44,657,891 |

| Russian Government, | | | | | | |

| Bonds, Ser. 6209 | RUB | 7.60 | 7/20/22 | 948,500,000 | | 30,744,580 |

| Russian Government, | | | | | | |

| Bonds, Ser. 6207 | RUB | 8.15 | 2/3/27 | 2,039,610,000 | | 68,027,987 |

| South African Government, | | | | | | |

| Bonds, Ser. R212 | ZAR | 2.75 | 1/31/22 | 126,250,000 | e | 17,266,850 |

| South African Government, | | | | | | |

| Sr. Unscd. Bonds, | | | | | | |

| Ser. R209 | ZAR | 6.25 | 3/31/36 | 441,045,000 | | 34,223,807 |

| South African Government, | | | | | | |

| Bonds, Ser. R214 | ZAR | 6.50 | 2/28/41 | 250,000,000 | | 19,502,457 |

| South African Government, | | | | | | |

| Sr. Unscd. Bonds, | | | | | | |

| Ser. R208 | ZAR | 6.75 | 3/31/21 | 48,850,000 | | 4,823,673 |

| South African Government, | | | | | | |

| Bonds, Ser. R213 | ZAR | 7.00 | 2/28/31 | 326,635,000 | | 28,981,712 |

| South African Government, | | | | | | |

| Bonds, Ser. R207 | ZAR | 7.25 | 1/15/20 | 473,455,000 | | 48,348,456 |

12

| | | | | | |

| | | Coupon | Maturity | Principal | | |

| Bonds and Notes (continued) | Rate (%) | Date | Amount ($)a | | Value ($) |

| Foreign/Governmental | | | | | | |

| (continued) | | | | | | |

| South African Government, | | | | | | |

| Bonds, Ser. R204 | ZAR | 8.00 | 12/21/18 | 392,435,000 | | 41,672,186 |

| South African Government, | | | | | | |

| Bonds, Ser. R203 | ZAR | 8.25 | 9/15/17 | 758,660,000 | | 80,784,798 |

| South African Government, | | | | | | |

| Bonds, Ser. R201 | ZAR | 8.75 | 12/21/14 | 450,000 | | 46,910 |

| South African Government, | | | | | | |

| Bonds, Ser. 2048 | ZAR | 8.75 | 2/28/48 | 142,800,000 | | 14,396,801 |

| South African Government, | | | | | | |

| Bonds, Ser. R186 | ZAR | 10.50 | 12/21/26 | 560,370,000 | | 69,207,710 |

| Turkish Government, | | | | | | |

| Bonds | TRY | 4.00 | 4/29/15 | 98,835,000 | f | 69,855,258 |

| Turkish Government, | | | | | | |

| Bonds | TRY | 8.00 | 1/29/14 | 125,500,000 | | 68,329,640 |

| Turkish Government, | | | | | | |

| Bonds | TRY | 8.00 | 6/4/14 | 175,255,000 | | 95,606,399 |

| Turkish Government, | | | | | | |

| Bonds | TRY | 9.00 | 1/27/16 | 81,540,000 | | 46,267,690 |

| Turkish Government, | | | | | | |

| Bonds, Ser. 2YR | TRY | 10.00 | 12/4/13 | 205,000,000 | | 111,942,590 |

| Turkish Government, | | | | | | |

| Bonds | TRY | 10.00 | 6/17/15 | 57,500,000 | | 32,826,435 |

| Turkish Government, | | | | | | |

| Bonds | TRY | 11.00 | 8/6/14 | 113,660,000 | | 64,129,127 |

| Turkish Government, | | | | | | |

| Bonds | TRY | 16.00 | 8/28/13 | 5,500,000 | | 3,022,430 |

| Uruguayan Government, | | | | | | |

| Sr. Unscd. Bonds | UYU | 5.00 | 9/14/18 | 84,250,000 | | 8,101,832 |

| Total Bonds and Notes | | | | | | |

| (cost $3,629,597,429) | | | | | | 3,523,708,113 |

| |

| Short-Term Investments—.2% | | | | | |

| U.S. Treasury Bills; | | | | | | |

| 0.08%, 7/25/13 | | | | | | |

| (cost $8,768,886) | | | | 8,770,000 | g | 8,769,719 |

The Fund 13

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Other Investment—6.7% | Shares | | | Value ($) |

| Registered Investment Company; | | | | |

| Dreyfus Institutional Preferred Plus Money Market Fund | | | | |

| (cost $272,304,675) | 272,304,675 | | h | 272,304,675 |

| |

| Total Investments (cost $3,910,670,990) | 93.1 | % | | 3,804,782,507 |

| Cash and Receivables (Net) | 6.9 | % | | 282,822,987 |

| Net Assets | 100.0 | % | | 4,087,605,494 |

a Principal amount stated in U.S. Dollars unless otherwise noted.

BRL—Brazilian Real

COP—Colombian Peso

HUF—Hungarian Forint

MXN—Mexican New Peso

MYR—Malaysian Ringgit

NGN— Nigerian Naira

PEN—Peruvian New Sol

PHP—Philippine Peso

PLN—Polish Zloty

RON—Romanian Leu

RUB—Russian Ruble

THB—Thai Baht

TRY—Turkish Lira

UYU—Uruguayan New Peso

ZAR—South African Rand

b Securities exempt from registration pursuant to Rule 144A under the Securities Act of 1933.These securities may be

resold in transactions exempt from registration, normally to qualified institutional buyers.At May 31, 2013, these

securities were valued at $86,687,063 or 2.1% of net assets.

c Security issued with a zero coupon. Income is recognized through the accretion of discount.

d Principal amount for accrual purposes is periodically adjusted based on changes in the Brazilian Consumer Price Index.

e Principal amount for accrual purposes is periodically adjusted based on changes in the South African Consumer

Price Index.

f Principal amount for accrual purposes is periodically adjusted based on changes in the Turkish Consumer Price Index.

g Held by a broker as collateral for open forward foreign currency exchange contracts and swap agreements.

h Investment in affiliated money market mutual fund.

| | | |

| Portfolio Summary (Unaudited)† | | |

| |

| | Value (%) | | Value (%) |

| Malaysia | 12.5 | Poland | 4.8 |

| Turkey | 12.0 | Hungary | 4.6 |

| Russia | 11.8 | Colombia | 3.6 |

| South Africa | 9.4 | Thailand | 3.1 |

| Peru | 7.1 | Philippines | 2.6 |

| Short-Term/ | | Brazil | 1.9 |

| Money Market Investments | 6.9 | Romania | 1.3 |

| Mexico | 6.5 | Uruguay | .2 |

| Nigeria | 4.8 | | 93.1 |

| |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

14

STATEMENT OF ASSETS AND LIABILITIES

May 31, 2013

| | | | |

| | | Cost | Value | |

| Assets ($): | | | | |

| Investments in securities—See Statement of Investments: | | | |

| Unaffiliated issuers | | 3,638,366,315 | 3,532,477,832 | |

| Affiliated issuers | | 272,304,675 | 272,304,675 | |

| Cash | | | 14,910,940 | |

| Cash denominated in foreign currencies | | 21,084,002 | 20,728,008 | |

| Receivable for investment securities sold | | | 228,048,093 | |

| Dividends and interest receivable | | | 84,648,186 | |

| Unrealized appreciation on forward foreign | | | | |

| currency exchange contracts—Note 4 | | | 19,984,711 | |

| Receivable for shares of Beneficial Interest subscribed | | 6,872,711 | |

| Prepaid expenses | | | 57,862 | |

| | | | 4,180,033,018 | |

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | | 3,964,322 | |

| Payable for investment securities purchased | | | 56,956,487 | |

| Unrealized depreciation on forward foreign | | | | |

| currency exchange contracts—Note 4 | | | 26,748,687 | |

| Payable for shares of Beneficial Interest redeemed | | | 2,796,477 | |

| Unrealized depreciation on swap agreements—Note 4 | | 1,569,920 | |

| Accrued expenses | | | 391,631 | |

| | | | 92,427,524 | |

| Net Assets ($) | | | 4,087,605,494 | |

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | 4,156,743,152 | |

| Accumulated distributions in excess of investment income—net | | (11,956,582 | ) |

| Accumulated net realized gain (loss) on investments | | | 62,746,973 | |

| Accumulated net unrealized appreciation (depreciation) on | | | |

| investments, swap transactions and foreign currency transactions | (119,928,049 | ) |

| Net Assets ($) | | | 4,087,605,494 | |

| |

| |

| Net Asset Value Per Share | | | | |

| | Class A | Class C | Class I | |

| Net Assets ($) | 89,326,723 | 26,463,306 | 3,971,815,465 | |

| Shares Outstanding | 6,129,770 | 1,843,844 | 271,960,934 | |

| Net Asset Value Per Share ($) | 14.57 | 14.35 | 14.60 | |

| |

| See notes to financial statements. | | | | |

The Fund 15

| | |

| STATEMENT OF OPERATIONS | | |

| Year Ended May 31, 2013 | | |

| |

| |

| |

| |

| Investment Income ($): | | |

| Income: | | |

| Interest (net of $565,265 foreign taxes withheld at source) | 175,881,426 | |

| Dividends; | | |

| Affiliated issuers | 272,519 | |

| Total Income | 176,153,945 | |

| Expenses: | | |

| Management fee—Note 3(a) | 24,962,435 | |

| Custodian fees—Note 3(c) | 3,468,332 | |

| Shareholder servicing costs—Note 3(c) | 2,175,490 | |

| Prospectus and shareholders’ reports | 329,898 | |

| Trustees’ fees and expenses—Note 3(d) | 229,663 | |

| Registration fees | 212,642 | |

| Professional fees | 198,327 | |

| Distribution fees—Note 3(b) | 192,913 | |

| Loan commitment fees—Note 2 | 26,119 | |

| Miscellaneous | 73,067 | |

| Total Expenses | 31,868,886 | |

| Less—reduction in fees due to earnings credits—Note 3(c) | (10,290 | ) |

| Net Expenses | 31,858,596 | |

| Investment Income—Net | 144,295,349 | |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

| Net realized gain (loss) on investments and foreign currency transactions | 44,160,457 | |

| Net realized gain (loss) on swap transactions | 7,517,341 | |

| Net realized gain (loss) on forward foreign currency exchange contracts | 49,095,266 | |

| Net Realized Gain (Loss) | 100,773,064 | |

| Net unrealized appreciation (depreciation) on | | |

| investments and foreign currency transactions | 28,221,267 | |

| Net unrealized appreciation (depreciation) on swap transactions | (3,585,137 | ) |

| Net unrealized appreciation (depreciation) on | | |

| forward foreign currency exchange contracts | 8,010,384 | |

| Net Unrealized Appreciation (Depreciation) | 32,646,514 | |

| Net Realized and Unrealized Gain (Loss) on Investments | 133,419,578 | |

| Net Increase in Net Assets Resulting from Operations | 277,714,927 | |

| |

| See notes to financial statements. | | |

16

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | | | Year Ended May 31, | |

| | 2013 | | 2012 | |

| Operations ($): | | | | |

| Investment income—net | 144,295,349 | | 136,363,717 | |

| Net realized gain (loss) on investments | 100,773,064 | | (149,593,927 | ) |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | 32,646,514 | | (238,773,501 | ) |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | 277,714,927 | | (252,003,711 | ) |

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Class A Shares | (1,936,327 | ) | (3,566,478 | ) |

| Class C Shares | (422,203 | ) | (712,889 | ) |

| Class I Shares | (82,908,789 | ) | (109,784,543 | ) |

| Net realized gain on investments: | | | | |

| Class A Shares | — | | (654,477 | ) |

| Class C Shares | — | | (183,442 | ) |

| Class I Shares | — | | (21,938,188 | ) |

| Total Dividends | (85,267,319 | ) | (136,840,017 | ) |

| Beneficial Interest Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A Shares | 44,956,693 | | 73,341,024 | |

| Class C Shares | 10,135,628 | | 19,101,101 | |

| Class I Shares | 1,932,479,050 | | 1,692,413,545 | |

| Dividends reinvested: | | | | |

| Class A Shares | 1,554,917 | | 3,896,784 | |

| Class C Shares | 176,981 | | 532,710 | |

| Class I Shares | 18,880,289 | | 25,343,170 | |

| Cost of shares redeemed: | | | | |

| Class A Shares | (41,981,442 | ) | (65,351,990 | ) |

| Class C Shares | (10,173,846 | ) | (6,990,192 | ) |

| Class I Shares | (947,073,528 | ) | (866,548,694 | ) |

| Increase (Decrease) in Net Assets from | | | | |

| Beneficial Interest Transactions | 1,008,954,742 | | 875,737,458 | |

| Total Increase (Decrease) in Net Assets | 1,201,402,350 | | 486,893,730 | |

| Net Assets ($): | | | | |

| Beginning of Period | 2,886,203,144 | | 2,399,309,414 | |

| End of Period | 4,087,605,494 | | 2,886,203,144 | |

| Distributions in excess of | | | | |

| investment income—net | (11,956,582 | ) | (41,472,485 | ) |

The Fund 17

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | | |

| | | | Year Ended May 31, | |

| | 2013 | | 2012 | |

| Capital Share Transactions: | | | | |

| Class Aa | | | | |

| Shares sold | 2,981,461 | | 5,063,302 | |

| Shares issued for dividends reinvested | 102,433 | | 273,024 | |

| Shares redeemed | (2,838,012 | ) | (4,705,776 | ) |

| Net Increase (Decrease) in Shares Outstanding | 245,882 | | 630,550 | |

| Class Ca | | | | |

| Shares sold | 679,141 | | 1,332,234 | |

| Shares issued for dividends reinvested | 11,805 | | 37,930 | |

| Shares redeemed | (697,358 | ) | (512,575 | ) |

| Net Increase (Decrease) in Shares Outstanding | (6,412 | ) | 857,589 | |

| Class I | | | | |

| Shares sold | 127,248,526 | | 118,078,816 | |

| Shares issued for dividends reinvested | 1,241,984 | | 1,798,107 | |

| Shares redeemed | (65,179,355 | ) | (62,330,908 | ) |

| Net Increase (Decrease) in Shares Outstanding | 63,311,155 | | 57,546,015 | |

a During the period ended May 31, 2013, 7,260 Class C shares representing $110,715 were exchanged for 7,152

Class A shares.

See notes to financial statements.

18

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | | | | | | |

| | | | Year Ended May 31, | | | |

| Class A Shares | 2013 | | 2012 | | 2011 | | 2010 | | 2009 | a |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 13.32 | | 15.22 | | 13.39 | | 12.11 | | 12.50 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—netb | .61 | | .67 | | .65 | | .55 | | .45 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | .98 | | (1.87 | ) | 1.61 | | .96 | | (.59 | ) |

| Total from Investment Operations | 1.59 | | (1.20 | ) | 2.26 | | 1.51 | | (.14 | ) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.34 | ) | (.59 | ) | (.36 | ) | (.18 | ) | (.25 | ) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | — | | (.11 | ) | (.07 | ) | (.05 | ) | — | |

| Total Distributions | (.34 | ) | (.70 | ) | (.43 | ) | (.23 | ) | (.25 | ) |

| Net asset value, end of period | 14.57 | | 13.32 | | 15.22 | | 13.39 | | 12.11 | |

| Total Return (%)c | 11.83 | | (8.12 | ) | 17.21 | | 12.56 | | (.95 | )d |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | 1.24 | | 1.22 | | 1.27 | | 1.50 | | 3.08 | e |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | 1.24 | | 1.22 | | 1.27 | | 1.32 | | 1.35 | e |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | 4.09 | | 4.64 | | 4.48 | | 4.22 | | 5.67 | e |

| Portfolio Turnover Rate | 58.82 | | 112.87 | | 97.99 | | 74.25 | | 108.46 | d |

| Net Assets, end of period ($ x 1,000) | 89,327 | | 78,351 | | 79,957 | | 38,428 | | 17,469 | |

a From September 12, 2008 (commencement of operations) to May 31, 2009.

b Based on average shares outstanding at each month end.

c Exclusive of sales charge.

d Not annualized.

e Annualized.

See notes to financial statements.

The Fund 19

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | |

| | | | Year Ended May 31, | | | |

| Class C Shares | 2013 | | 2012 | | 2011 | | 2010 | | 2009 | a |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 13.14 | | 15.06 | | 13.29 | | 12.07 | | 12.50 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—netb | .48 | | .55 | | .53 | | .46 | | .39 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | .97 | | (1.85 | ) | 1.60 | | .95 | | (.59 | ) |

| Total from Investment Operations | 1.45 | | (1.30 | ) | 2.13 | | 1.41 | | (.20 | ) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.24 | ) | (.51 | ) | (.29 | ) | (.14 | ) | (.23 | ) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | — | | (.11 | ) | (.07 | ) | (.05 | ) | — | |

| Total Distributions | (.24 | ) | (.62 | ) | (.36 | ) | (.19 | ) | (.23 | ) |

| Net asset value, end of period | 14.35 | | 13.14 | | 15.06 | | 13.29 | | 12.07 | |

| Total Return (%)c | 10.98 | | (8.83 | ) | 16.28 | | 11.73 | | (1.49 | )d |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | 2.00 | | 1.96 | | 1.99 | | 2.27 | | 3.84 | e |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | 2.00 | | 1.96 | | 1.99 | | 2.09 | | 2.10 | e |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | 3.25 | | 3.84 | | 3.65 | | 3.53 | | 4.92 | e |

| Portfolio Turnover Rate | 58.82 | | 112.87 | | 97.99 | | 74.25 | | 108.46 | d |

| Net Assets, end of period ($ x 1,000) | 26,463 | | 24,306 | | 14,953 | | 1,888 | | 966 | |

a From September 12, 2008 (commencement of operations) to May 31, 2009.

b Based on average shares outstanding at each month end.

c Exclusive of sales charge.

d Not annualized.

e Annualized.

See notes to financial statements.

20

| | | | | | | | | | |

| | | | | | Year Ended May 31, | | | |

| Class I Shares | 2013 | | 2012 | | 2011 | | 2010 | | 2009 | a |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 13.34 | | 15.25 | | 13.42 | | 12.12 | | 12.50 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—netb | .65 | | .70 | | .69 | | .41 | | .47 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | .99 | | (1.88 | ) | 1.62 | | 1.14 | | (.59 | ) |

| Total from Investment Operations | 1.64 | | (1.18 | ) | 2.31 | | 1.55 | | (.12 | ) |

| Distributions: | | | | | | | | | | |

| Dividends from | | | | | | | | | | |

| investment income—net | (.38 | ) | (.62 | ) | (.41 | ) | (.20 | ) | (.26 | ) |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | — | | (.11 | ) | (.07 | ) | (.05 | ) | — | |

| Total Distributions | (.38 | ) | (.73 | ) | (.48 | ) | (.25 | ) | (.26 | ) |

| Net asset value, end of period | 14.60 | | 13.34 | | 15.25 | | 13.42 | | 12.12 | |

| Total Return (%) | 12.18 | | (7.94 | ) | 17.45 | | 12.94 | | (.79 | )c |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | .94 | | .93 | | .97 | | 1.02 | | 2.84 | d |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | .94 | | .93 | | .97 | | 1.01 | | 1.10 | d |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | 4.35 | | 4.88 | | 4.73 | | 3.60 | | 5.92 | d |

| Portfolio Turnover Rate | 58.82 | | 112.87 | | 97.99 | | 74.25 | | 108.46 | c |

| Net Assets, end of period | | | | | | | | | | |

| ($ x 1,000) | 3,971,815 | | 2,783,546 | | 2,304,400 | | 561,401 | | 970 | |

a From September 12, 2008 (commencement of operations) to May 31, 2009.

b Based on average shares outstanding at each month end.

c Not annualized.

d Annualized.

See notes to financial statements.

The Fund 21

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

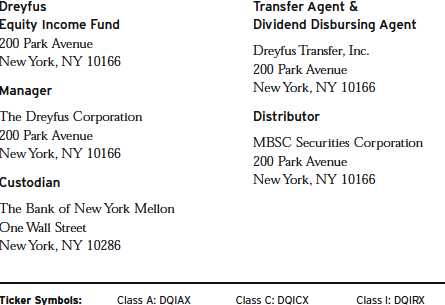

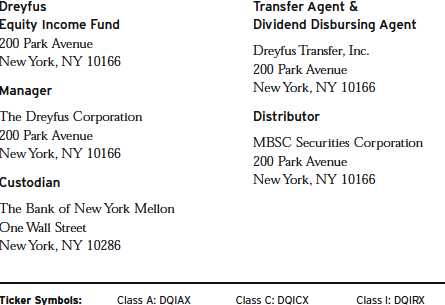

Dreyfus Emerging Markets Debt Local Currency Fund (the “fund”) is a separate non-diversified series of The Dreyfus/Laurel Funds Trust (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company offering five series, including the fund.The fund’s investment objective seeks to maximize total return.The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Class A, Class C and Class I. Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear a Distribution and/or Shareholder Services Plan fees. Class A shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I shares are sold primarily to bank trust departments and other financial service providers (including The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, and its affiliates), acting on behalf of customers having a qualified trust or investment account or relationship at such institution, and bear no Distribution or Shareholder Services Plan fees. Class I shares are offered without a front-end sales charge or CDSC. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

22

The sales charge may be reduced or waived for certain purchases of Class A shares. Effective April 1, 2013, pursuant to new/modified front-end sales charge waivers, Class A shares of the fund may be purchased at net asset value without payment of a sales charge by (a) investors who participate in a self-directed investment brokerage account program offered by financial intermediaries that have entered into an agreement with the fund’s Distributor (financial intermediaries offering self-directed investment brokerage accounts may or may not charge their customers a transaction fee) and (b) investors who purchase Class A shares directly through the fund’s Distributor, and either (i) have, or whose spouse or minor children have, beneficially owned shares and continuously maintained an open account with the Distributor in a Dreyfus-managed fund since on or before February 28, 2006, or (ii) such purchase is for a self-directed investment account that may or may not be subject to a transaction fee.

On April 24-25, 2013, the Trust’s Board of Trustees (the “Board”) authorized the fund to offer Class Y shares, as a new class of shares, to certain investors, including certain institutional investors. Effective July 1, 2013, ClassY shares will be offered at net asset value and will not be subject to certain fees, including Distribution Plan and Shareholder Services Plan fees.

The Trust accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC

The Fund 23

NOTES TO FINANCIAL STATEMENTS (continued)

registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

24

Registered investment companies that are not traded on an exchange are valued at their net asset value and are categorized within Level 1 of the fair value hierarchy.

Investments in securities, excluding short-term investments (other than U.S. Treasury Bills) and forward foreign currency exchange contracts (“forward contracts”) are valued each business day by an independent pricing service (the “Service”) approved by the Board. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are valued as determined by the Service, based on methods which include consideration of the following: yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions.These securities are generally categorized within Level 2 of the fair value hierarchy.

U.S. Treasury Bills are valued at the mean price between quoted bid prices and asked prices by the Service. These securities are generally categorized within Level 2 of the fair value hierarchy.

The Service’s procedures are reviewed by Dreyfus under the general supervision of the Board.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature

The Fund 25

NOTES TO FINANCIAL STATEMENTS (continued)

and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers.These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

Investments in swap transactions are valued each business day by the Service. Swaps are valued by the Service by using a swap pricing model which incorporates among other factors, default probabilities, recovery rates, credit curves of the underlying issuer and swap spreads on interest rates. These securities are generally categorized within Level 2 of the fair value hierarchy. Forward contracts are valued at the forward rate.These securities are generally categorized within Level 2 of the fair value hierarchy.

The following is a summary of the inputs used as of May 31, 2013 in valuing the fund’s investments:

| | | | |

| | | Level 2—Other | Level 3— | |

| | Level 1— | Significant | Significant | |

| | Unadjusted | Observable | Unobservable | |

| | Quoted Prices | Inputs | Inputs | Total |

| Assets ($) | | | | |

| Investments in Securities: | | | |

| Foreign | | | | |

| Government | — | 3,523,708,113 | — | 3,523,708,113 |

| Mutual Funds | 272,304,675 | — | — | 272,304,675 |

| U.S. Treasury | — | 8,769,719 | — | 8,769,719 |

| Other Financial | | | | |

| Instruments: | | | | |

| Forward Foreign | | | | |

| Currency Exchange | | | |

| Contracts† | — | 19,984,711 | — | 19,984,711 |

26

| | | | | | |

| | | Level 2—Other | | Level 3— | | |

| | Level 1— | Significant | | Significant | | |

| | Unadjusted | Observable | | Unobservable | | |

| | Quoted Prices | Inputs | | Inputs | Total | |

| Liabilities ($) | | | | | | |

| Other Financial | | | | | | |

| Instruments: | | | | | | |

| Forward Foreign | | | | | | |

| Currency Exchange | | | | | |

| Contracts† | — | (26,748,687 | ) | — | (26,748,687 | ) |

| Swaps† | — | (1,569,920 | ) | — | (1,569,920 | ) |

| |

| † Amount shown represents unrealized appreciation (depreciation) at period end. | | |

At May 31, 2013, there were no transfers between Level 1 and Level 2 of the fair value hierarchy.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest

The Fund 27

NOTES TO FINANCIAL STATEMENTS (continued)

income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” under the Act. Investments in affiliated investment companies during the period ended May 31, 2013 were as follows:

| | | | | | |

| Affiliated | | | | | | |

| Investment | Value | | | | Value | Net |

| Company | 5/31/2012 | ($) | Purchases ($) | Sales | ($) 5/31/2013 ($) | Assets (%) |

| Dreyfus | | | | | | |

| Institutional | | | | | |

| Preferred | | | | | | |

| Plus Money | | | | | |

| Market | | | | | | |

| Fund | 298,418,584 | | 2,318,058,636 | | 2,344,172,545 272,304,675 | 6.7 |

(e) Risk: The fund invests primarily in debt securities. Failure of an issuer of the debt securities to make timely interest or principal payments, or a decline or the perception of a decline in the credit quality of a debt security, can cause the debt security’s price to fall, potentially lowering the fund’s share price. In addition, the value of debt securities may decline due to general market conditions that are not specifically related to a particular issuer, such as real or perceived adverse economic conditions, changes in outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment.They may also decline because of factors that affect a particular industry or country.

Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S. These risks include revaluation of currencies, high rates of inflation, repatriation restrictions on income and capital, and adverse political and economic developments. Moreover, securities issued in these markets may be less liquid, subject to government ownership controls and delayed settlements, and their prices may be more volatile than those of comparable securities in the U.S.

(f) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net are normally

28

declared and paid quarterly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended May 31, 2013, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended May 31, 2013 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At May 31, 2013, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $44,707,187, undistributed capital gains $11,691,864 and unrealized depreciation $125,536,709.

The tax character of distributions paid to shareholders during the fiscal periods ended May 31, 2013 and May 31, 2012 were as follows: ordinary income $85,267,319 and $123,728,177, and long-term capital gains $0 and $13,111,840, respectively.

The Fund 29

NOTES TO FINANCIAL STATEMENTS (continued)

During the period ended May 31, 2013, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign currency gains and losses and swap periodic payments, the fund decreased accumulated undistributed investment income-net by $29,512,127 and increased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

(h) New Accounting Pronouncement: In January 2013, FASB issued Accounting Standards Update No. 2013-01 (“ASU 2013-01”), “Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities”, which replaced Accounting Standards Update No. 2011-11 (“ASU 2011-11”), “Disclosures about Offsetting Assets and Liabilities”. ASU 2013-01 is effective for fiscal years beginning on or after January 1, 2013, and interim periods within those annual periods.ASU 2011-11 was intended to enhance disclosure requirements on the offsetting of financial assets and liabilities.ASU 2013-01 limits the scope of the new balance sheet offsetting disclosures to derivatives, repurchase agreements, and securities lending transactions to the extent that they are (1) offset in the financial statements or (2) subject to an enforceable master netting arrangement or similar agreement. Management is currently evaluating the application of ASU 2013-01 and its impact on the fund’s financial statements.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $210 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to October 10, 2012, the unsecured credit facility with Citibank, N.A. was $225 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is

30

charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended May 31, 2013, the fund did not borrow under the Facilities.

NOTE 3—Management Fee and Other Transactions With Affiliates:

(a) Pursuant to a management agreement between the Manager and the fund, the fund has agreed to pay the Manager a management fee computed at the annual rate of .75% of the value of the fund’s average daily net assets and is payable monthly.The Manager had contractually agreed, from June 1, 2012 through October 1, 2012, to waive receipt of its fees and/or assume the expenses of the fund, so that the expenses of none of the classes (excluding Rule 12b-1 Distribution Plan fees, Shareholder Services Plan fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceeded 1.10% of the value of the fund’s average daily net assets. During the period ended May 31, 2013, there was no reduction in expenses pursuant to the undertaking.

During the period ended May 31, 2013, the Distributor retained $9,069 from commissions earned on sales of the fund’s Class A shares and $11,724 from CDSCs on redemptions of the fund’s Class C shares.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. During the period ended May 31, 2013, Class C shares were charged $192,913 pursuant to the Distribution Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as

The Fund 31

NOTES TO FINANCIAL STATEMENTS (continued)

answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts.The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended May 31, 2013, Class A and Class C shares were charged $212,737 and $64,305, respectively, pursuant to the Shareholder Services Plan.

Under its terms, the Distribution Plan and Shareholder Services Plan shall remain in effect from year to year, provided such continuance is approved annually by a vote of a majority of those Trustees who are not “interested persons” of the Trust and who have no direct or indirect financial interest in the operation of or in any agreement related to the Distribution Plan or Shareholder Services Plan.

The fund has arrangements with the transfer agent and the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency and custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates DreyfusTransfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing transfer agency services for the fund and cash management services related to fund subscriptions and redemptions. During the period ended May 31, 2013, the fund was charged $1,344,514 for transfer agency services and $68,600 for cash management services. Cash management fees were partially offset by earnings credits of $9,945. These fees are included in Shareholder servicing costs in the Statement of Operations.

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended May 31, 2013, the fund was charged $3,468,332 pursuant to the custody agreement.

32

The fund compensates The Bank of New York Mellon under a cash management agreement for performing certain cash management services related to fund subscriptions and redemptions. During the period ended May 31, 2013, the fund was charged $42,606 pursuant to the cash management agreement, which is included in Shareholder servicing costs in the Statement of Operations.These fees were partially offset by earnings credits of $345.

During the period ended May 31, 2013, the fund was charged $8,527 for services performed by the Chief Compliance Officer and his staff.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $2,702,013, Distribution Plan fees $17,897, Shareholder Services Plan fees $26,113, custodian fees $984,155, Chief Compliance Officer fees $3,830 and transfer agency fees $230,314.

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

(e) A 2% redemption fee is charged and retained by the fund on certain shares redeemed within sixty days following the date of issuance, subject to exceptions, including redemptions made through use of the fund’s exchange privilege. During the period ended May 31, 2013, redemption fees charged and retained by the fund amounted to $198,397.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, forward contracts and swap transactions, during the period ended May 31, 2013, amounted to $2,900,763,579 and $1,736,423,523, respectively.

Derivatives: A derivative is a financial instrument whose performance is derived from the performance of another asset. Each type of deriv-

The Fund 33

NOTES TO FINANCIAL STATEMENTS (continued)

ative instrument that was held by the fund during the period ended May 31, 2013 is discussed below.

The following tables show the fund’s exposure to different types of market risk as it relates to the Statement of Assets and Liabilities and the Statement of Operations, respectively.

Fair value of derivative instruments as of May 31, 2013 is shown below:

| | | | | |

| | | Derivative | | Derivative | |

| | | Assets ($) | | Liabilities ($) | |

| Interest rate risk | — | Interest rate risk1 | (1,569,920 | ) |

| Foreign exchange risk2 | 19,984,711 | Foreign exchange risk3 | (26,748,687 | ) |

| Gross fair value of | | | | |

| | derivatives contracts | 19,984,711 | | (28,318,607 | ) |

| |

| Statement of Assets and Liabilities location: | | | |

| 1 | Unrealized depreciation on swap agreements. | | | |

| 2 | Unrealized appreciation on forward foreign currency exchange contracts. | | |

| 3 | Unrealized depreciation on forward foreign currency exchange contracts. | | |

The effect of derivative instruments in the Statement of Operations during the period ended May 31, 2013 is shown below:

| | | |

| | Amount of realized gain (loss) on derivatives recognized in income ($) |

| | Forward | Swap | |

| Underlying risk | Contracts4 | Transactions5 | Total |

| Interest rate | — | 7,517,341 | 7,517,341 |

| Foreign exchange | 49,095,266 | — | 49,095,266 |

| Total | 49,095,266 | 7,517,341 | 56,612,607 |

Change in unrealized appreciation (depreciation) on derivatives recognized in income ($)

| | | | | |

| | Forward | Swap | | | |

| Underlying risk | Contracts6 | Transactions7 | | Total | |

| Interest rate | — | (3,585,137 | ) | (3,585,137 | ) |

| Foreign exchange | 8,010,384 | — | | 8,010,384 | |

| Total | 8,010,384 | (3,585,137 | ) | 4,425,247 | |

Statement of Operations location:

4 Net realized gain (loss) on forward foreign currency exchange contracts.

5 Net realized gain (loss) on swap transactions.

6 Net unrealized appreciation (depreciation) on forward foreign currency exchange contracts.

7 Net unrealized appreciation (depreciation) on swap transactions.

34

Forward Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle foreign currency transactions or as a part of its investment strategy. When executing forward contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward contracts, the fund incurs a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract decreases between those dates.With respect to purchases of forward contracts, the fund incurs a loss if the value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract increases between those dates. Any realized or unrealized gains or losses which occurred during the period are reflected in the Statement of Operations. The fund is exposed to foreign currency risk as a result of changes in value of underlying financial instruments.The fund is also exposed to credit risk associated with counterparty nonperformance on these forward contracts, which is typically limited to the unrealized gain on each open contract.The following summarizes open forward contracts at May 31, 2013:

| | | | | | | |

| | | | Foreign | | | Unrealized | |

| Forward Foreign Currency | Currency | | | Appreciation | |

| Exchange Contracts | Amounts | Cost ($) | Value ($) (Depreciation) ($) | |

| Purchases: | | | | | | | |

| Brazilian Real, | | | | | | | |

| Expiring: | | | | | | | |

| 6/4/2013 | a | 11,660,000 | 5,799,552 | 5,439,882 | (359,670 | ) |

| 6/4/2013 | b | 77,640,000 | 38,569,430 | 36,222,341 | (2,347,089 | ) |

| 7/2/2013 | c | 343,110,000 | 166,586,556 | 159,106,261 | (7,480,295 | ) |

| Chilean Peso, | | | | | | | |

| Expiring | | | | | | | |

| 6/28/2013 | d | 12,693,175,000 | 26,034,612 | 25,209,102 | (825,510 | ) |

| Euro, | | | | | | | |

| Expiring: | | | | | | | |

| 6/28/2013 | d | | 8,840,000 | 11,412,148 | 11,491,569 | 79,421 | |

| 6/28/2013 | e | 45,125,000 | 58,223,434 | 58,660,304 | 436,870 | |

The Fund 35

NOTES TO FINANCIAL STATEMENTS (continued)

| | | | | | | |

| | | | Foreign | | | Unrealized | |

| Forward Foreign Currency | Currency | | | Appreciation | |

| Exchange Contracts | Amounts | Cost ($) | Value ($) (Depreciation) ($) | |

| Purchases (continued): | | | | | |

| Hungarian Forint, | | | | | | | |

| Expiring: | | | | | | | |

| 6/28/2013 | b | 18,550,000,000 | 82,415,141 | 81,030,909 | (1,384,232 | ) |

| 6/28/2013 | f | 18,892,675,000 | 83,755,930 | 82,527,796 | (1,228,134 | ) |

| 6/28/2013 | g | 12,533,630,000 | 55,664,202 | 54,749,942 | (914,260 | ) |

| Indian Rupee, | | | | | | | |

| Expiring | | | | | | | |

| 6/28/2013 | e | 2,506,180,000 | 44,819,643 | 44,125,800 | (693,843 | ) |

| Malaysian Ringgit, | | | | | |

| Expiring | | | | | | | |

| 6/28/2013 | f | 281,865,000 | 91,577,049 | 90,766,352 | (810,697 | ) |

| Mexican New Peso, | | | | | |

| Expiring: | | | | | | | |

| 6/4/2013 | d | 15,737,379 | 1,228,392 | 1,231,575 | 3,183 | |

| 6/28/2013 | b | 1,030,160,000 | 83,427,276 | 80,395,025 | (3,032,251 | ) |

| 6/28/2013 | f | 1,594,860,000 | 126,811,985 | 124,464,946 | (2,347,039 | ) |

| Nigerian Naira, | | | | | | | |

| Expiring: | | | | | | | |

| 6/24/2013 | a | 5,480,000,000 | 33,946,918 | 34,342,927 | 396,009 | |

| 7/5/2013 | a | 4,000,000,000 | 24,852,439 | 24,962,046 | 109,607 | |

| 7/19/2013 | a | 6,800,000,000 | 42,500,000 | 42,220,960 | (279,040 | ) |

| 8/9/2013 | f | 5,820,910,000 | 36,036,405 | 35,866,438 | (169,967 | ) |

| Polish Zloty, | | | | | | | |

| Expiring: | | | | | | | |

| 6/28/2013 | a | 56,730,000 | 17,444,909 | 17,211,408 | (233,501 | ) |

| 6/28/2013 | b | 299,940,000 | 92,299,962 | 90,999,293 | (1,300,669 | ) |

| 6/28/2013 | e | 187,050,000 | 57,549,621 | 56,749,409 | (800,212 | ) |

| 6/28/2013 | f | 84,965,000 | 25,931,135 | 25,777,672 | (153,463 | ) |

| 6/28/2013 | h | 148,710,000 | 45,824,603 | 45,117,373 | (707,230 | ) |

| Russian Ruble, | | | | | | | |

| Expiring | | | | | | | |