NS Coal Business

Daniel D. Smith

Senior Vice President Energy and Properties

Thank you and I am glad to be with you today. Let’s look into what is going on in the energy markets this year and what we are doing to grow our coal business and enhance our services.

Coal Business Group

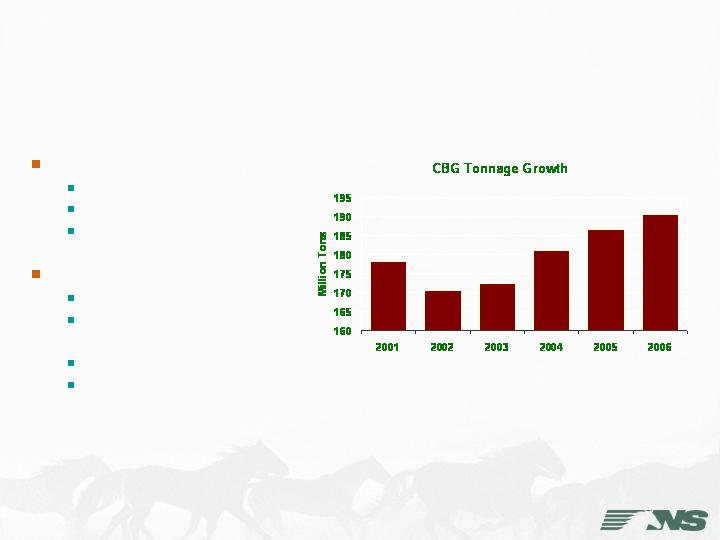

2006 record volume year

190.6 million tons

2.1% increase over 2005

$2.3 billon

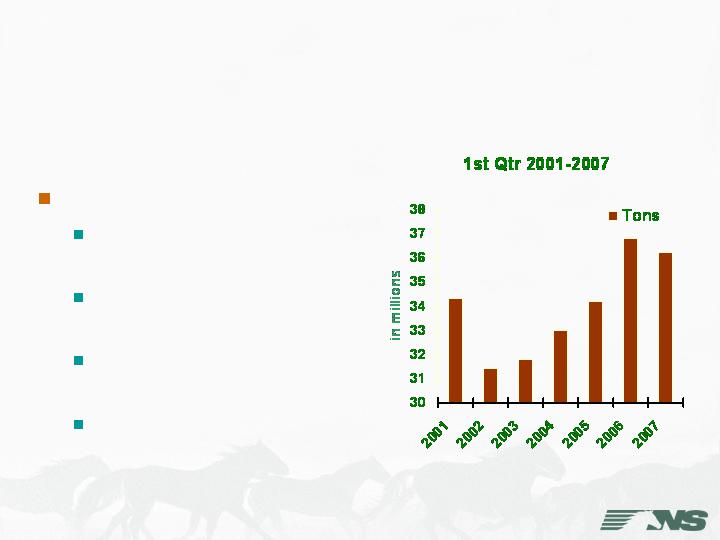

1st Q 2007

45.8 million tons

-2.5% YOY

$557.2 million

-0.2% YOY

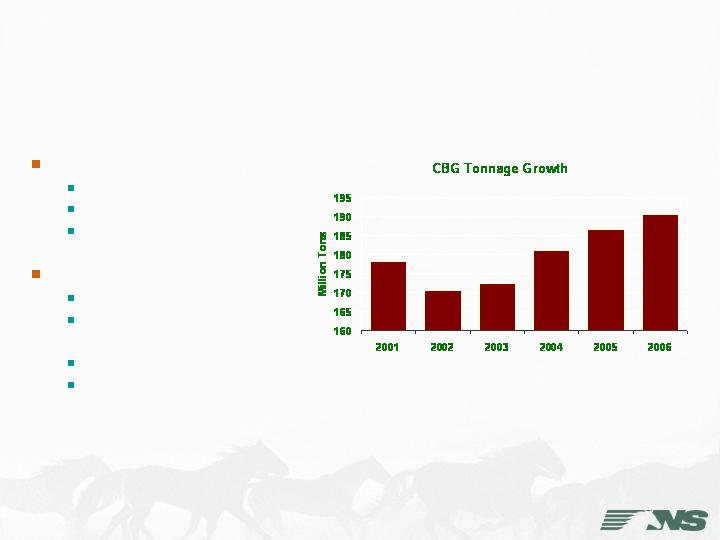

First, a quick look back. 2006 was a record year in many ways for our coal franchise.

It was a record revenue year with revenues of $2.3 billion, which was a 10.2% increase over 2005.

2006 was also a record volume year with 190.6 million tons, which was a 2.1% increase over 2005 and 7% over 2001.

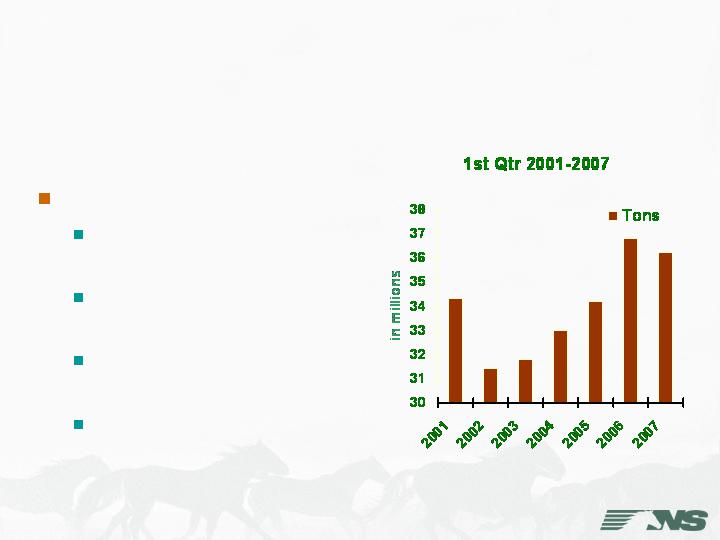

In the first quarter of this year, volume slowed but revenues held relatively steady. Several contracts have been re-priced this year and the longer haul, higher revenue per car, export volumes have been strong, offsetting declines in domestic metallurgical coal.

Coal Business Group:

2006 Tonnage By Market

With respect to the individual market segments within the Coal Business Group, the utility sector represents our biggest, making up almost 78% by volume. While the other sectors are vital, the steady growth in our business has occurred in the utility segment. We think this makes our coal business more ratable as electricity use in this country has increased in all but three out of the last 50 years.

The Coal Group serves 140 different mine locations and delivers coal to many different markets, including utilities, industrial customers and export terminals. This coal network, unlike the Powder River Basin, adds complexity to the operation but, as I will discuss later, we manage it with scheduling and technology.

NS Coal Markets

1st Quarter and Beyond

Utility Markets Mixed

Electric generation is

strong

Utility stockpiles are

leveling off

Serious cooling demand

has yet to arrive

NWS predicts hotter

temperatures

Coal burn for electric generation has been high in comparison to historical demand growth in the first quarter; however stockpiles have remained at or slightly above target levels. According to our information, the coal burn by electric generators in the Mid-Atlantic and South Atlantic regions (covering most of the NS utility franchise) is up 5.1% and 4.9% respectively through mid-May. These are significant increases when compared against total historical electric demand growth which usually is in the range of 1.5 to 2.5% per year, which indicates stockpiles are moderating from 2006 levels.

Serious cooling demand has yet to arrive but the National Weather Service is forecasting a hotter and dryer than normal summer for the southeastern United States, which could lead to higher electricity demand.

NS Coal Markets

1st Qtr and Beyond

Exports Strong

Vessel delays at

Australian ports

Capacity issues in

Canada

Pricing improvements

Looking at exports for first quarter 2007, foreign receivers increased shipments to meet coal supply volume requirements in contracts that expired March 31, 2007. In addition, demand for U.S. coals has been strengthened by long vessel loading delays at Australian and Canadian ports due to capacity issues. Australian coal continues to be impacted by rising energy costs and vessel backups at ports, which is making U. S. metallurgical coals more attractive, especially in a weak dollar environment.

The export contracts are re-priced on April 1 of each year and therefore, we are pricing to the market each year.

NS Coal Markets

1st Quarter and Beyond

Metallurgical challenges

Raw steel production

down 7.2% thru May 26

Coke furnace outages

reduce inbound coal &

outbound coke

Met. Coal, Coke & Iron ore

Without question, the domestic metallurgical coal, coke and iron ore markets have been our greatest challenge this year even though many contracts have been re-priced to the market. Blast furnace outages and a shift in sourcing have weakened NS volumes. A decline in iron ore movements is primarily due to the consolidation of the steel industry. The automotive industry’s market decline is reflected in the reduction of steel production by 7.2% this year and that has reduced both inbound coal to blast furnaces and also outbound coke movements from coke producers.

NS Coal Markets

1st Quarter and Beyond

Industrial strong

New business in 2007

Strong pricing

Tied to GDP growth

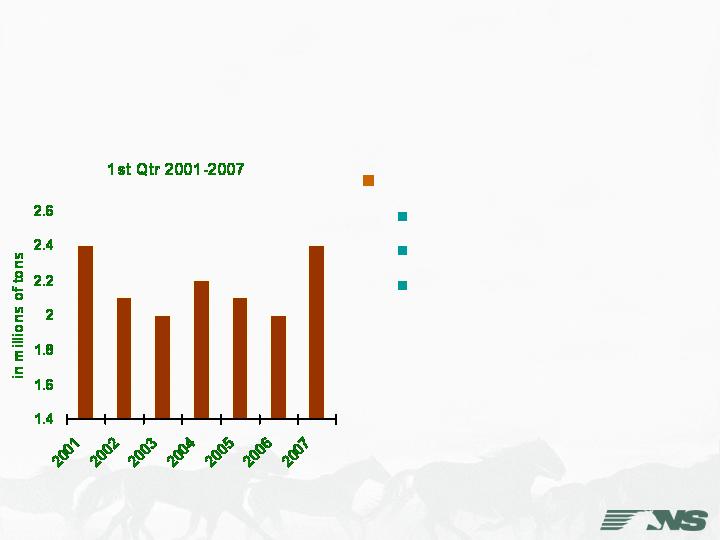

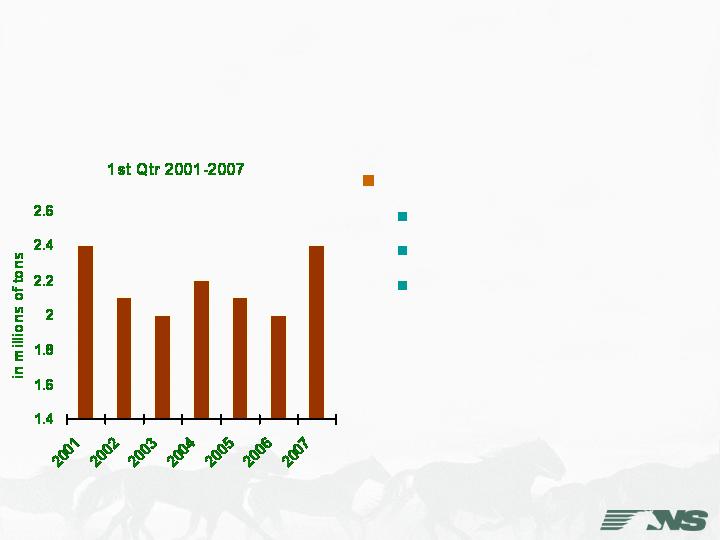

Our comparatively small industrial coal market includes coal shipments to industries like Eastman Chemical and corn processors like ADM. Volume growth from 2005 to 2007 is a reflection of new business and growth in GDP, which has increased moderately this year.

NS Coal Yields

Pricing

Still strong environment

Tons/Car

New cars accelerate

Mix of business

More short haul

Overall +3.4%

Effect on

$$ Yield

Year-to-date, we have seen strong pricing and improvements in the tons loaded per car, which have raised yields. At the same time, changes in mix favoring lower than average yields have reduced yields such that we have seen a RPU increase of about 3.4% through the 1st Quarter.

We continue to re-price expiring contracts to reflect current market conditions and we are finding that the environment remains strong.

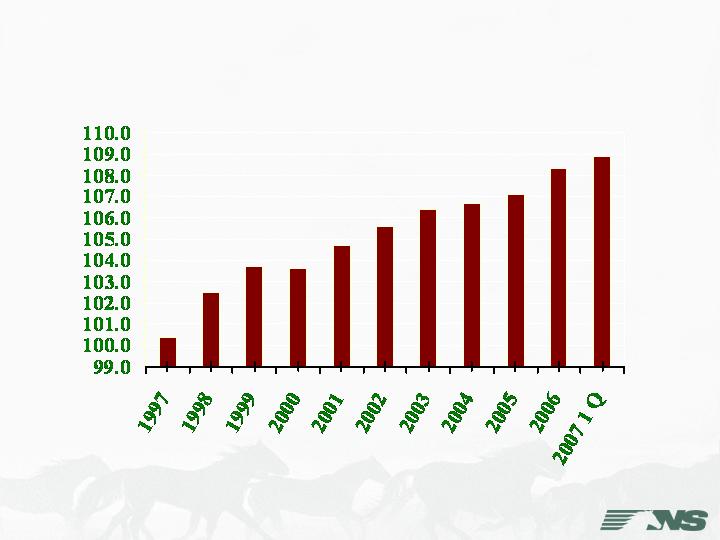

Average Lading Weights

All Cars

Tons/Car

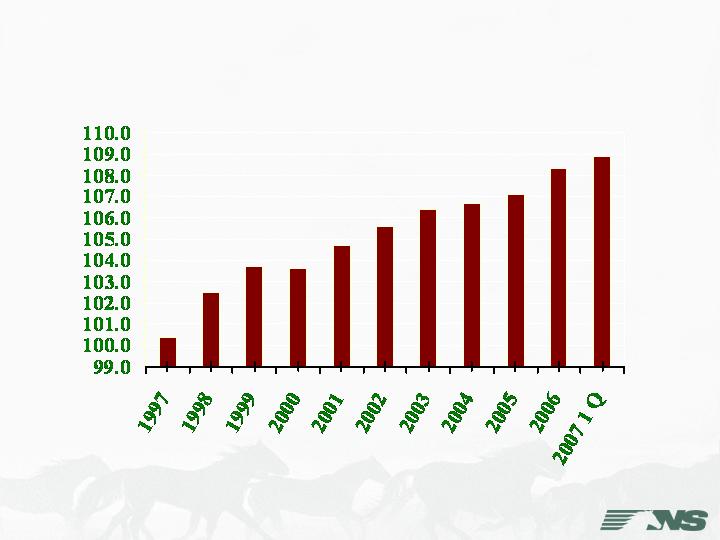

Average total lading weights for our coal business have grown by 4.2% since 2001 and almost 9% over the last 10 years.

Raising coal payloads delivers significant efficiencies, which in turn adds capacity to the rail network. Higher payloads can also significantly reduce the number of trains required to move the same amount of coal tonnage.

Customer Service

Argus Survey

Customer service ranked 1st or 2nd place in last eight

quarters

15% improvement 1st qtr 2007 over 1st qtr 2006

Tied closely to shipment performance

Customer service continues to be important to us. Argus Rail Business publishes a quarterly customer service survey of BNSF, UP, CSXT and NS coal customers. The 1st Qtr 2007 results show NS ratings for customer service continue to compare well to the rest of the industry. For the eighth quarter in a row, NS ranked 1st or 2nd in customer service, with 1 st quarter 2007 showing a 15% improvement over 1st quarter 2006.

Customer Service-

NS Loaded Transit Times

Data through May 31, 2007 vs. same period last year

Utility

South: 24.3%

improvement

North: 14.2% poorer

Industrial

38.8% improvement

Domestic Metallurgical

13.1% improvement

CTMS on accessNS

Using the tools available in our web-based Coal Transportation Management System, we manage all shipments within the coal network. Our customers have the same visibility and access to performance data for the loaded and empty shipments that we utilize on a daily basis.

As an initiative to improve customer service and asset utilization, we monitor the loaded transit times for our largest customers in each of our market segments. As you can see here we have made impressive improvements this year. Loaded transit times for trains have improved with the exception of Utility North, which was negatively impacted by harsh weather in February and March.

Customer Service-

Scheduled Coal Trains

Scheduled coal train service

Five scheduled trains from Central

Appalachia

Various Southeastern customers

began scheduled service

Plans to expand service

Benefits

Improved locomotive and crew

availability

Quicker transit times

More reliable and predictable

service

NS has been implementing scheduled train service for some of our bulk coal shipments.

As you can see, our transportation team has already begun implementing schedules for many coal customers with good results. By scheduling these trains, we can improve locomotive and crew availability, cut transit times and produce a more reliable and predictable product. A benefit to the improvement in transit times will be reduction in car requirements and associated capital purchases.

We are constantly looking for opportunities to expand applications of the scheduled coal trains, improving our profits on existing traffic.

Customer Service-

Coal Handling Terminals

B.R.I.M. Technology

Software + Readers Track

Inventories

Ease of Use/Efficient

Improves Demurrage

Accuracy

Provides Coal Car Visibility

Helps Manage Vessel &

Barge Loading

Standardizes Terminal

Handling

We are also implementing a new Bulk Rail Inventory Management system (BRIM) that will become the main platform for managing coal moving through our coal unloading terminals at Sandusky, Ashtabula, Wheelersburg and Lamberts Point.

BRIM will, among other benefits, help customers manage coal stocks within the terminals, help with blending, and sharpen demurrage applications by simplifying the process and standardizing calculations.

We expect to improve coal car utilization with this new system.

Customer Service-

New Coal Car Technology

118 TPC

We have an aging coal car fleet and have made significant and detailed plans to replace over 27,000 coal cars in an orderly fashion over the next decade. In working with car builders, we have developed replacement coal cars that will significantly increase the carrying capacity therefore reducing the amount of cars needed in replacement. Further operating benefits include a reduction in crews, locomotives, and congestion to handle the same volumes. Currently, our car fleet has an average lading of 102 tons per car. This fleet handles roughly 50% of the volume we move with the other half in private cars. The new replacement gondola car will have a carrying capacity of 118 tons per car.

Customer Service-

Coal Car Fleet Investment

Private cars

Lowers revenue

Drastically reduces car distribution flexibility

Move to specific customer

Haul specific qualities

System cars

High return on investment

Better serve complex coal network

Flexibility to meet customer car demands

We’ve decided to maintain the current ratio of NS owned cars, rather than encourage more private cars. The private cars are all owned by certain utilities, which effectively lower those customers' contract rates to compensate for the cost of the cars. While those contracts have served us well, increasing the amount of private cars in our system would have a negative effect in supplying our customer needs. Many of the mines we serve in Central Appalachia, produce coal that moves in the export, domestic metallurgical, industrial and utility markets, which moves through the same load outs. Having NS owned cars gives the mines and NS flexibility to ship coal of varying qualities to many different customers without delay. Private cars, on the other hand, have to move to a specific customer and haul specific qualities of coal.

As to whether NS owns or leases coal cars, we believe we are best served by investing the capital as it maximizes the return over the long term. Given the profit requirements of the leasing companies, the expected growth of coal over the coming decades which drives the need for these cars well into the future and our current private car mix, we have concluded that we should own the coal car replacements as the fleet is replaced over the next decade.

Energy Markets

COAL: +63%

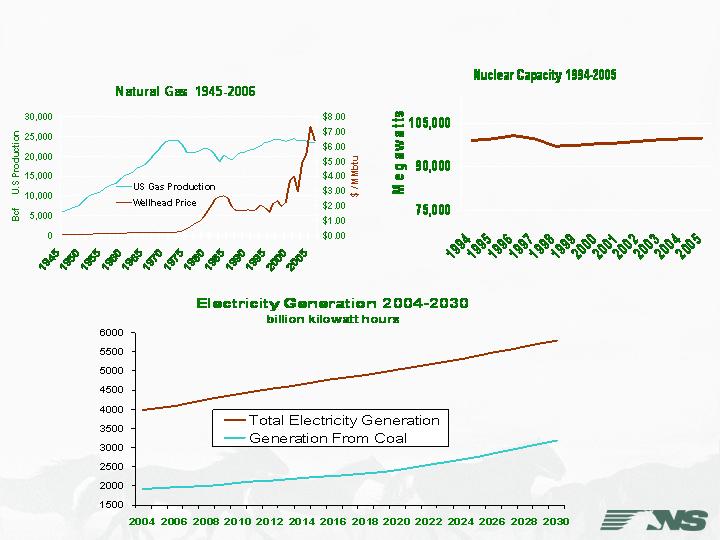

Looking forward, the energy markets indicate a promising future for coal.

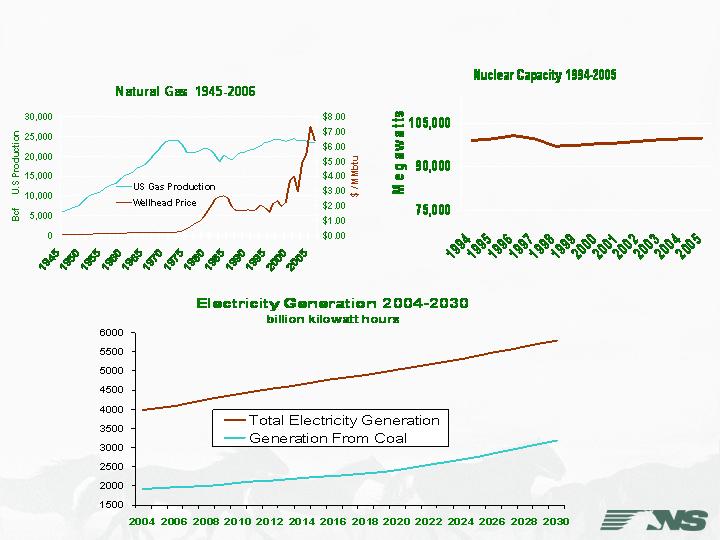

First, in the utility market, we anticipate continued high natural gas prices, mostly at levels that remain uncompetitive with coal on a strictly long-term economic basis. We know that capacity at the current nuclear generation facilities has peaked and that there is very little room for growth there.

The EIA supports our contention that we are in for some longer-term coal fired generation growth. EIA right now is projecting electricity demand to increase each year through 2030, raising coal demand by 63% or 2% per year.

However, we understand that some form of carbon constraints will likely be placed on the coal fired generation industry in future years. We think that technology for capturing and sequestering CO2 can be proven. There are also many opportunities for using coal to make liquid transportation fuels and even hydrogen for an anticipated hydrogen economy. In support of these new technologies, NS is looking at opportunities to rail in and/or out coal and other by- products or supplies.

We are seeing the beginning results of this coal growth, as we work with utilities on plans to build new coal fired power plants.

New Coal-Fired Construction:

35.75 million tons/year

NS/CSX

Rail-CIRR

2011

3.5

GA

Hilton

LS Power

NS

Rail-NS

2012

2.0

VA

St Paul

Dominion Pwr

Seminole Elec

Fla. Mun.Pwr.

Fla. Pwr & L

NRG Energy

PPL

LS Power

NRG Energy

Corona, LLC

WE Energies

WE Energies

Power Producer

Palatka

Perry

Glade Cty

Huntley Unit

Montour 3

W. Deptford

Indian River

Sunbury 5

Elm Road 2

Elm Road 1

Plant

FL

FL

FL

NY

PA

NJ

DE

PA

WI

WI

State

6.5

2.75

6.0

3.0

2.5

1.5

3.0

2.0

1.5

1.5

Tonnage

(Millions)

2012

2012

2012

2013

2012

2012

2012

2011

2009

2008

Target Date

Rail

Rail-NS/CSX

Rail-SCXF

CSX-Lake

Rail-NS

Rail-CR

Rail-NS

Rail-NS

Rail-UP

Rail-UP

Delivery

CSX/NS

NS/CSX

NS/CSX

NS/CSX

NS

NS/CSX

NS

NS

NS/CSX/UP

NS/CSX/UP

Carriers

We anticipate about 36 million tons/year of new coal-consumption facilities over the next 5 or 6 years to come on line in our service territory. On the near term, we will be looking at four major projects.

Coal Opportunities

Sun Coke – Haverhill, OH

1.3 M tons coal & coke

WE Energies – Oak

Creek, WI

3.0 M tons coal

L. S. Power - Hilton, GA

1.5 M tons coal

Florida Municipal Power

Agency - Foley, FL

2.75 M tons coal

We will begin to see the start of this projected tonnage June 2008 at the Haverhill coke plant, which is expected to add 1.3 million tons to the NS coal and coke network. The current plant has already begun construction to double the coke making capacity.

New utility coal plants are planned at Oak Creek, WI, Hilton, GA and Foley, FL. These new facilities, coupled with Haverhill, would give us access to over 8 million tons if completed over the next few years.

Western Coal

2001 = 15.6 M

2006 = 38.5 M

N. App/CenPa/Oh

2001 = 33.4 M

2006 = 43.6 M

Central Appalachia

2001 = 96.6 M

2006 = 78.7 M

Imports

2001 = 134K

2006 = 2.3 M

Coal Sourcing Changes Continue

Illinois/Indiana

2001 =10.6 M

2006 =10.6 M

1/11/07

Coal sourcing has certainly changed over the last several years and will continue to do so as utilities add scrubbers and other technologies, and as mining costs rise in certain areas, particularly Central Appalachia. We maintain contact with producers from all mining regions as well as receivers to determine where future coal sourcing will be. We have seen dramatic shifts from Central Appalachia to PRB and Northern Appalachia. We helped bring on-line an expanded import facility in Charleston, SC to serve customer needs in the southeast, and we continue to talk to producers in the Illinois Basin to see how we might move more of that coal.

In response to expanding markets for coal,

NS will

Implement technology to improve customer

service

Improve reliability and efficiency with coal car

replacement

Study new coal train scheduling to realize

improvements

Summary

We are confident the expanding demand for electricity, coupled with our focus on productivity gains, is a great combination for delivering improved performance. Policies such as CO2 regulations could moderate the growth of coal usage; however, over 50% of the electricity produced in this country comes from coal and it remains a vital domestic resource.

We expect to combine technology, capital investment and coal train schedules to realize improvements in customer service and pricing opportunities.

Thank You

Thank you.