UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03462

Meeder Funds Trust

6125 Memorial Drive

Dublin, OH 43017

Bruce McKibben

c/o Meeder Funds Trust

6125 Memorial Drive

Dublin, OH 43017

Registrant’s telephone number, including area code: 800-325-3539

Date of fiscal year end: December 31, 2022

Date of reporting period: December 31, 2022

Item 1. Report to Stockholders.

TABLE OF CONTENTS

| | |

Letter to Shareholders | 1 |

Fund Summaries (Unaudited) | |

Muirfield Fund | 3 |

Spectrum Fund | 5 |

Global Allocation Fund | 7 |

Balanced Fund | 9 |

Moderate Allocation Fund | 11 |

Conservative Allocation Fund | 13 |

Dynamic Allocation Fund | 15 |

Quantex Fund | 17 |

Tactical Income Fund | 19 |

Institutional Prime Money Market Fund | 21 |

Financial Statements | |

Schedules of Investments | 24 |

Statements of Assets and Liabilities | 74 |

Statements of Operations | 76 |

Statements of Changes in Net Assets | 78 |

Financial Highlights | 82 |

Notes to Financial Statements | 92 |

Report of Independent Registered Public Accounting Firm | 110 |

Shareholder Expense Analysis | 111 |

Management of the Trust | 113 |

Other Items | 114 |

This Annual Report is prepared and distributed for the general information of the shareholders of the Funds. This material is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. Investors are advised to consider carefully the investment objectives, risks, charges and expenses of the Fund before investing. The prospectus contains this and other information about the Funds.

Meeder Funds are distributed by Meeder Distribution Services, Inc. (Member FINRA), an affiliate of Meeder Investment Management. An affiliated registered investment adviser, Meeder Asset Management, Inc., serves as the investment adviser to Meeder Funds and is paid a fee for its services.

Letter to Shareholders

December 31, 2022

A Very Difficult Year for Stocks and Bonds

The term “historic” is frequently used and often misplaced for anyone who is a regular reader of financial news. Patterns and events may sometimes feel unique after reading eye-catching headlines and articles, intended only to capture a reader’s attention. While acknowledging the overuse of this term, I feel confident in stating that 2022 was a historic year for capital markets.

Over the long term, stocks and bonds are typically thought of as uncorrelated assets that are a complement for each other in a portfolio. When bonds aren’t earning significant income, stocks will be there to provide growth. When stocks have a tough year, income from bonds will cushion the fall. It’s a perfect duo. And while this may often be the case, 2022 showed us that uncorrelated is very different than never correlated.

2022 marked the worst performance by U.S. investment-grade bonds since 1931, with investment-grade corporate bonds down –14.5%. Stocks fared worse, with the S&P 500 Index finishing at a loss of -18.0%, experiencing a maximum drawdown of -22.7% at its October 2022 low. In the past 94 years, there have only been two years, 1931 and 1969, that the total return of both stocks and bonds finished negative in the same calendar year.

Inflation also reached its highest level since 1981, with the Consumer Price Index (CPI) 12-month growth peaking at 9.1% in June. While inflation began rearing its head in 2021, the Federal Reserve (the “Fed”) did not respond until 2022...and did they respond. The Fed increased the Fed Funds rate seven times during the year, from an upper bound of 0.25% at the start of the year to 4.50% at their last meeting in December. It was the fastest rate hike cycle since 1974, leaving investors with few places to hide.

Navigating 2022 with Meeder’s Tactical Funds

Meeder’s tactical approach allowed most of our Funds to outperform their respective benchmarks. Our cautious approach entering 2022, which led to a significant defensive position throughout the year, was a significant contributor to the relative outperformance of many of our funds that utilize the Defensive Equity strategy. Many of our funds also favored value-oriented equities within our U.S. stock selection strategy, which also positively contributed to several of our Fund’s strong performance. With respect to fixed income, having a shorter duration than many of our benchmarks allowed several Meeder Funds to be positioned well during a challenging interest rate environment.

Meeder’s Investment Philosophy

At Meeder, we manage our funds using a systematic approach that guides us in our allocation decisions. A systematic, quantitative process allows for a repeatable and efficient method to achieve long-term appreciation while avoiding common emotional biases. We also apply a holistic approach to investing;analyzing fundamental, technical, macroeconomic, and sentiment factors.

Many of our funds utilize our time-tested Defensive Equity strategy, which follows a rules-based and data-driven approach, based on the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation relative to other asset classes. In addition to our Defensive Equity strategy, we also provide active management for shareholders through global allocation, individual equity selection, and fixed income exposure.

The Coast is Not Clear

One of the enduring goals throughout Meeder’s history has been to improve investor outcomes by helping investors remain committed to their investment strategy through a full market cycle. While most of our Funds performed well in 2022 relative to their respective benchmarks, we want to highlight the notable longer-term performance of one of our oldest funds. Per the 10-year rankings as of December 31, 2022, the Muirfield Fund ranked in the top 2 percent of open-ended mutual funds among the 163 strategies ranked in the Tactical Allocation category, according to Morningstar.

As we turn the corner to 2023, we maintain our commitment to continually improving our investment strategies and always maintaining a focus on serving our shareholders. Our investment team never stops looking for ways to improve our investment decision-making process.

While a new year brings new challenges; including the highest interest rates since 2007, lingering inflation, and the looming threat of an economic recession, we remain committed to our tactical approach. The direction of the winds may change, but our philosophy remains firmly planted in the ground. We feel optimistic that our approach, rooted in minimizing behavioral biases and leaning on history as a guide, will help us navigate the coming years ahead.

Sincerely,

Robert S. Meeder

President & CEO

Data Source: Bloomberg, as of May 31, 2022. Notes: The return of bonds are based on the annual return of Bloomberg U.S. Aggregate Bond Index from 1976 to 2022. Prior to 1976, the returns are based on the 10-year U.S. Treasury Bond. Stocks are represented by the S&P 500 Index from 1957 to 2022. Prior to 1957, the returns are based on the price changes in the S&P Composite Index. Index performance shown for illustrative purposes only. You cannot invest into an index. Past performance is no guarantee of future results.

2022 Annual Report | December 31, 2022 | Page 1 |

2022 Annual Report

Fund Summaries

Muirfield Fund

The Meeder Muirfield Fund Institutional Class returned –10.93% for the year ended December 31, 2022, compared to the Morningstar Moderate Target Risk Index benchmark return of –14.77%.

This fund uses Meeder’s Defensive Equity strategy, which follows a rules-based and data-driven approach to using the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation.

Muirfield achieved positive performance relative to its benchmark in 2022, primarily driven by the Defensive Equity Strategy and its underweight to equities and overweight to cash throughout the year. The Defensive Equity Strategy entered the year with a significant defensive position of 33% cash and a 67% allocation to equities. The Fund remained defensive for the entirety of the year, averaging only a 50% allocation to equity throughout 2022 and ending the year with a 51% equity allocation.

Our global equity allocation was a negative contributor to performance this year. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within Muirfield’s equity allocation, it maintained an overweight to U.S. and underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of international equities in 2022 compared to their U.S. counterparts, the fund’s global equity allocation detracted from performance.

The performance of our stock selection strategy was very positive in 2022. Within the U.S. portion of Muirfield’s equity allocation, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to value stocks, along with our overweight to company’s displaying strong profitability, positively contributed to performance. From a sector perspective, the overweight to the Health Care and Energy sectors positively contributed to performance throughout the year, while the underweight to interest-rate sensitive sectors like Utilities and REITs also benefited performance.

In the fund, we will often use equity index derivatives, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the portfolio. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact on the fund’s relative performance. The use of equity index futures to reduce equity exposure in the fund’s Defensive Equity exposure was additive to performance relative to the benchmark in 2022.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2022

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Muirfield Fund Retail Class | -11.19% | 4.03% | 7.92% | 8/10/88 |

Muirfield Fund Institutional Class | -10.93% | 4.40% | 8.15% | 10/31/16 |

Muirfield Fund Adviser Class | -10.85% | 4.35% | 8.11% | 10/31/16 |

Morningstar Moderate Target Risk Index | -14.77% | 3.73% | 5.82% | — |

Top 10 Holdings

as of December 31, 2022

1. | Apple, Inc. | 3.0% |

2. | Microsoft Corp. | 2.8% |

3. | Chevron Corp. | 1.7% |

4. | Exxon Mobil Corp. | 1.7% |

5. | Alphabet, Inc. | 1.3% |

6. | Berkshire Hathaway, Inc. | 1.2% |

7. | UnitedHealth Group, Inc. | 1.1% |

8. | Johnson & Johnson | 1.0% |

9. | Eli Lilly & Co. | 0.8% |

10. | NVIDIA Corp. | 0.8% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2022 Annual Report | December 31, 2022 | Page 3 |

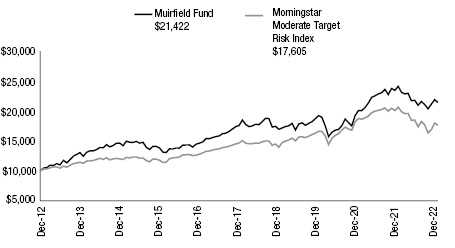

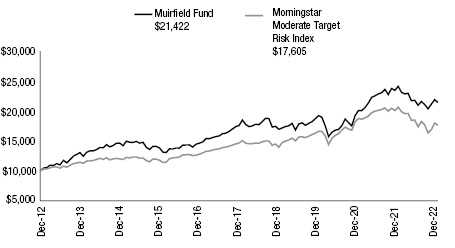

Growth of $10,000

as of December 31, 2022

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Common Stock Sector Concentration

as of December 31, 2022

Information Technology | 26.0% |

Healthcare | 16.3% |

Energy | 14.4% |

Consumer Discretionary | 13.4% |

Financials | 8.7% |

Industrials | 8.4% |

Consumer Staples | 4.4% |

Communication Services | 3.8% |

Materials | 3.6% |

Utilities | 0.9% |

Real Estate Investment Trust | 0.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2022

Common Stocks (United States) | 57.2% |

Money Market Registered Investment Companies | 42.6% |

Bank Obligations | 0.1% |

Other Assets/Liabilities (Net) | 0.1% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Page 4 | 2022 Annual Report | December 31, 2022 |

Spectrum Fund

The Meeder Spectrum Fund Institutional Class returned –11.19% for the year ended December 31, 2022, compared to the Morningstar Moderate Target Risk Index benchmark return of –14.77%.

This fund uses our Defensive Equity strategy, which follows a rules-based and data-driven approach to using the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation.

Spectrum achieved positive performance relative to its benchmark in 2022, primarily driven by the Defensive Equity Strategy and its underweight to equities and overweight to cash throughout the year. The Defensive Equity Strategy entered the year with a significant defensive position of 33% cash and a 67% allocation to equities. The Fund remained defensive for the entirety of the year, averaging only a 50% allocation to equity throughout 2022 and ending the year with a 51% equity allocation.

Global equity allocation was a negative contributor to performance in 2022. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within Spectrum’s equity allocation, it maintained an overweight to U.S. and underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of international equities in 2022 compared to their U.S. counterparts, the fund’s global equity allocation detracted from performance.

The performance of our stock selection strategy was very positive in 2022. Within the U.S. portion of Spectrum’s equity allocation, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to value stocks, along with our overweight to company’s displaying strong profitability, positively contributed to performance. From a sector perspective, the overweight to the Health Care and Energy sectors positively contributed to performance throughout the year, while the underweight to interest-rate sensitive sectors like Utilities and REITs also benefited performance.

In the fund, we will often use equity index derivatives, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the portfolio. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact on the fund’s relative performance. The use of equity index futures to reduce equity exposure in the fund’s Defensive Equity exposure was additive to performance relative to the benchmark in 2022.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2022

| 1

Year | 5

Year | Since

Inception | Share Class

Inception

Date |

Spectrum Fund Retail Class | -11.52% | 2.93% | 4.82% | 1/2/15 |

Spectrum Fund Institutional Class | -11.19% | 3.35% | 5.15% | 10/31/16 |

Spectrum Fund Adviser Class | -11.08% | 3.29% | 5.09% | 10/31/16 |

Morningstar Moderate Target Risk Index | -14.77% | 3.73% | 4.93% | — |

Top 10 Holdings

as of December 31, 2022

1. | Microsoft Corp. | 3.8% |

2. | Apple, Inc. | 2.1% |

3. | Berkshire Hathaway, Inc. | 1.6% |

4. | Johnson & Johnson | 1.1% |

5. | UnitedHealth Group, Inc. | 1.1% |

6. | Copart, Inc. | 1.0% |

7. | Exxon Mobil Corp. | 0.9% |

8. | Chevron Corp. | 0.9% |

9. | Eli Lilly & Co. | 0.8% |

10. | Mastercard, Inc. | 0.7% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2022 Annual Report | December 31, 2022 | Page 5 |

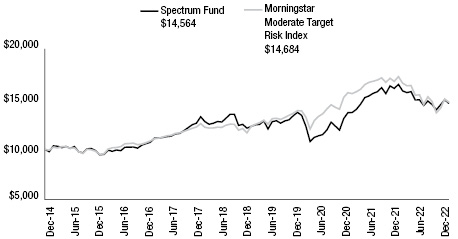

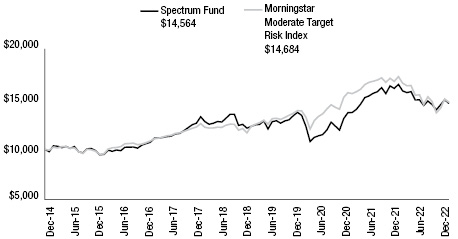

Growth of $10,000

as of December 31, 2022

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Common Stock Sector Concentration

as of December 31, 2022

Information Technology | 29.4% |

Healthcare | 15.9% |

Consumer Discretionary | 13.1% |

Financials | 11.5% |

Industrials | 9.3% |

Energy | 7.7% |

Materials | 6.0% |

Communication Services | 3.4% |

Consumer Staples | 3.0% |

Utilities | 0.6% |

Real Estate Investment Trust | 0.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2022

Common Stocks (United States) | 47.8% |

Money Market Registered Investment Companies | 52.7% |

Other Assets/Liabilities (Net) | -0.5% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Page 6 | 2022 Annual Report | December 31, 2022 |

Global Allocation Fund

The Meeder Global Allocation Fund Institutional Class returned –12.56% for the year ended December 31, 2022, compared to the Morningstar Global Allocation Index benchmark return of –17.10%.

A portion (90%) of the Fund uses our Defensive Equity strategy, which follows a rules-based and data-driven approach to using the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation. The remaining portion (10%) of the fund is allocated to fixed income securities.

The Meeder Global Allocation Fund achieved positive performance relative to its benchmark in 2022, primarily driven by the Defensive Equity Strategy and its underweight to equities and overweight to cash throughout the year. The Defensive Equity Strategy entered the year with a significant defensive position of 33% cash and a 67% allocation to equities. The Fund remained defensive for the entirety of the year.

Our global equity allocation was a detractor to performance this year. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within the Global Allocation Fund’s equity holdings, it maintained an overweight to U.S. and underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of international equities in 2022 compared to their U.S. counterparts, the fund’s global equity allocation detracted from performance.

The performance of our stock selection strategy was also strong in 2022. Within the U.S. portion of the Global Allocation Fund’s equity allocation, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to common stocks displaying strong momentum and profitability were the two primary drivers of positive performance. From a sector perspective, the overweight to Information Technology and Healthcare sectors positively contributed to performance throughout the year, while the increase in allocation to Energy and Financial stocks in the second half of the year also generated positive returns.

While fixed income returns were negative, the Global Allocation Fund’s fixed income allocation outperformed the fixed income portion of the benchmark. The fund’s allocation to fixed income tactically shifts portfolio exposure utilizing quantitative models designed to actively manage credit quality, emerging market bond exposure, and duration of its holdings. In 2022, the Federal Reserve increased interest rates at its fastest rate in more than four decades. The historic rise in rates led to negative returns throughout the fixed income asset class. Despite the challenging environment, tactical shifts in the emerging market sector were a positive contributor to its outperformance. Relative to the benchmark, exposure to shorter duration bonds primarily benefited performance too.

In the fund, we will often use equity index derivatives, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the portfolio. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact on the fund’s relative performance. The use of equity index futures to reduce equity exposure in the fund’s Defensive Equity exposure was additive to performance relative to the benchmark in 2022.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2022

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Global Allocation Fund Retail Class | -12.94% | 1.23% | 5.06% | 1/31/06 |

Global Allocation Fund Institutional Class | -12.56% | 1.66% | 5.35% | 10/31/16 |

Global Allocation Fund Adviser Class | -12.52% | 1.55% | 5.28% | 10/31/16 |

Morningstar Global Allocation Index | -17.10% | 2.86% | 5.20% | — |

Top 10 Holdings

as of December 31, 2022

1. | iShares Core MSCI EAFE ETF | 8.2% |

2. | iShares Core MSCI Emerging Markets ETF | 1.8% |

3. | Apple, Inc. | 1.7% |

4. | Berkshire Hathaway, Inc. | 1.7% |

5. | Chevron Corp. | 1.6% |

6. | Microsoft Corp. | 1.5% |

7. | iShares Core U.S. Aggregate Bond ETF | 1.5% |

8. | iShares JP Morgan USD Emerging Markets Bond ETF | 1.2% |

9. | SPDR Bloomberg High Yield Bond ETF | 1.1% |

10. | Copart, Inc. | 0.8% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2022 Annual Report | December 31, 2022 | Page 7 |

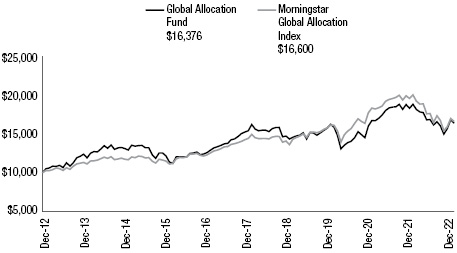

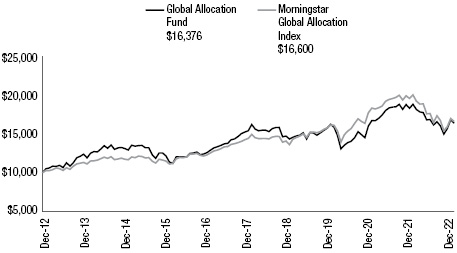

Growth of $10,000

as of December 31, 2022

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Common Stock Sector Concentration

as of December 31, 2022

Information Technology | 25.6% |

Healthcare | 17.6% |

Energy | 14.4% |

Financials | 13.7% |

Consumer Discretionary | 10.4% |

Industrials | 8.6% |

Consumer Staples | 4.0% |

Communication Services | 2.7% |

Materials | 2.6% |

Utilities | 0.3% |

Real Estate Investment Trust | 0.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company Geographic Concentration

as of December 31, 2022

U.S. Fixed Income | 34.2% |

International Fixed Income | 6.7% |

International Equity | 59.1% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Asset Allocation

as of December 31, 2022

Common Stocks (United States) | 26.3% |

Equity Registered Investment Companies | 10.1% |

Fixed Income Registered Investment Companies | 6.9% |

Money Market Registered Investment Companies | 52.7% |

Bank Obligations | 1.6% |

Other Assets/Liabilities (Net) | 2.4% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Page 8 | 2022 Annual Report | December 31, 2022 |

Balanced Fund

The Meeder Balanced Fund Institutional Class returned –10.80% for the year ended December 31, 2022, compared to the Morningstar Moderate Target Risk Index benchmark return of –14.77%.

A portion (70%) of the fund uses our Defensive Equity strategy, which follows a rules-based and data-driven approach to using the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation. The remaining portion (30%) of the fund is allocated to fixed income securities.

The Balanced Fund achieved positive performance relative to its benchmark in 2022, primarily driven by the Defensive Equity Strategy and its underweight to equities and overweight to cash throughout the year. The Defensive Equity Strategy entered the year with a significant defensive position of 23% cash and a 47% allocation to equities. The Fund remained defensive for the entirety of the year, averaging only a 35% allocation to equity throughout 2022 and ending the year with a 36% equity allocation.

Our global equity allocation was a detractor to performance this year. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within the Balanced Fund’s equity allocation, it maintained an overweight to U.S. and underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of international equities in 2022 compared to their U.S. counterparts, the fund’s global equity allocation detracted from performance.

The performance of our stock selection strategy was very positive in 2022. Within the U.S. portion of the Balanced Fund’s equity allocation, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to value stocks, along with our overweight to company’s displaying strong profitability, positively contributed to performance. From a sector perspective, the overweight to the Health Care and Energy sectors positively contributed to performance throughout the year, while the underweight to interest-rate sensitive sectors like Utilities and REITs also benefited performance.

While fixed income returns were negative, the Balanced Fund’s fixed income allocation outperformed the fixed income portion of the benchmark. The fund’s allocation to fixed income tactically shifts portfolio exposure utilizing quantitative models designed to actively manage credit quality, emerging market bond exposure, and duration of its holdings. In 2022, the Federal Reserve increased interest rates at its fastest rate in more than four decades. The historic rise in rates led to negative returns throughout the fixed income asset class. Despite the challenging environment, tactical shifts in the emerging market sector were a positive contributor to its outperformance. Relative to the benchmark, exposure to shorter duration bonds primarily benefited performance too.

In the fund, we will often use equity index derivatives, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the portfolio. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact on the fund’s relative performance. The use of equity index futures to gain equity exposure in the fund’s Defensive Equity exposure was additive to performance relative to the benchmark in 2022.

Investment Objective

The investment objective of the Fund is to provide income and long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2022

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Balanced Fund Retail Class | -11.09% | 2.86% | 5.58% | 1/31/06 |

Balanced Fund Institutional Class | -10.80% | 3.27% | 5.85% | 10/31/16 |

Balanced Fund Adviser Class | -10.77% | 3.21% | 5.80% | 10/31/16 |

Morningstar Moderate Target Risk Index | -14.77% | 3.73% | 5.82% | — |

Top 10 Holdings

as of December 31, 2022

1. | iShares Core U.S. Aggregate Bond ETF | 4.5% |

2. | iShares JP Morgan USD Emerging Markets Bond ETF | 3.6% |

3. | SPDR Bloomberg High Yield Bond ETF | 3.5% |

4. | Apple, Inc. | 2.7% |

5. | Microsoft Corp. | 2.4% |

6. | Berkshire Hathaway, Inc. | 1.7% |

7. | Diamond Hill Short Duration Securitized Bond Fund - Class Y | 1.5% |

8. | PGIM Short-Term Corporate Bond Fund - Class Q | 1.5% |

9. | Chevron Corp. | 1.4% |

10. | Copart, Inc. | 1.1% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2022 Annual Report | December 31, 2022 | Page 9 |

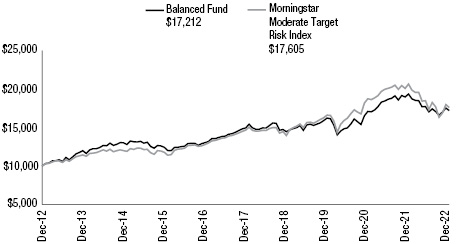

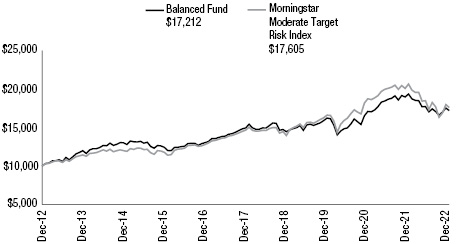

Growth of $10,000

as of December 31, 2022

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Common Stock Sector Concentration

as of December 31, 2022

Information Technology | 27.1% |

Healthcare | 17.1% |

Consumer Discretionary | 12.9% |

Financials | 12.1% |

Energy | 11.9% |

Industrials | 9.9% |

Materials | 3.3% |

Communication Services | 2.8% |

Consumer Staples | 2.5% |

Utilities | 0.3% |

Real Estate Investment Trust | 0.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company Geographic Concentration

as of December 31, 2022

U.S. Fixed Income | 82.6% |

International Fixed Income | 17.4% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Asset Allocation

as of December 31, 2022

Common Stocks (United States) | 41.7% |

Equity Registered Investment Companies | 3.6% |

Fixed Income Registered Investment Companies | 16.9% |

Money Market Registered Investment Companies | 37.4% |

Bank Obligations | 0.1% |

Other Assets/Liabilities (Net) | 0.3% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Page 10 | 2022 Annual Report | December 31, 2022 |

Moderate Allocation Fund

The Meeder Moderate Allocation Fund Institutional Class returned –10.39% for the year ended December 31, 2022, compared to the Morningstar Moderately Conservative Target Risk Index benchmark return of –13.85%.

A portion (50%) of the fund uses our Defensive Equity strategy, which follows a rules-based and data-driven approach to using the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation. The remaining portion (50%) of the fund is allocated to fixed income securities.

The Meeder Moderate Allocation Fund achieved positive performance relative to its benchmark in 2022, primarily driven by the Defensive Equity Strategy and its underweight to equities and overweight to cash throughout the year. The Defensive Equity Strategy entered the year with a significant defensive position of 16% cash and a 34% allocation to equities. The Fund remained defensive for the entirety of the year, averaging only a 25% allocation to equity throughout 2022 and ending the year with a 26% equity allocation.

Our global equity allocation was a detractor to performance this year. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within Moderate Allocation’s equity holdings, it maintained an overweight to U.S. and underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of international equities in 2022 compared to their U.S. counterparts, the fund’s global equity allocation detracted from performance.

The performance of our stock selection strategy was very positive in 2022. Within the U.S. portion of Moderate Allocation’s equity holdings, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to value stocks, along with our overweight to company’s displaying strong profitability, positively contributed to performance. From a sector perspective, the overweight to the Health Care and Energy sectors positively contributed to performance throughout the year, while the underweight to interest-rate sensitive sectors like Utilities and REITs also benefited performance.

While fixed income returns were negative, the Moderate Allocation Fund’s fixed income allocation outperformed the fixed income portion of the benchmark. The fund’s allocation to fixed income tactically shifts portfolio exposure utilizing quantitative models designed to actively manage credit quality, emerging market bond exposure, and duration of its holdings. In 2022, the Federal Reserve increased interest rates at its fastest rate in more than four decades. The historic rise in rates led to negative returns throughout the fixed income asset class. Despite the challenging environment, tactical shifts in the emerging market sector were a positive contributor to its outperformance. Relative to the benchmark, exposure to shorter duration bonds primarily benefited performance too.

In the fund, we will often use equity index derivatives, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the portfolio. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact on the fund’s relative performance. The use of equity index futures to reduce equity exposure in the fund’s Defensive Equity exposure was additive to performance relative to the benchmark in 2022.

Investment Objective

The investment objective of the Fund is to provide total return, including capital appreciation, and current income.

Average Annual Total Returns

as of December 31, 2022

| 1

Year | 5

Year | Since

Inception | Share Class

Inception

Date |

Moderate Allocation Fund Retail Class | -10.75% | 2.09% | 4.40% | 6/30/15 |

Moderate Allocation Fund Institutional Class | -10.39% | 2.47% | 4.74% | 10/31/16 |

Moderate Allocation Fund Adviser Class | -10.39% | 2.43% | 4.69% | 10/31/16 |

Morningstar Moderately Conservative Target Risk Index | -13.85% | 2.79% | 3.92% | — |

Top 10 Holdings

as of December 31, 2022

1. | iShares Core U.S. Aggregate Bond ETF | 7.5% |

2. | iShares JP Morgan USD Emerging Markets Bond ETF | 5.9% |

3. | SPDR Bloomberg High Yield Bond ETF | 5.9% |

4. | Diamond Hill Short Duration Securitized Bond Fund - Class Y | 2.5% |

5. | PGIM Short-Term Corporate Bond Fund - Class Q | 2.5% |

6. | Segall Bryant & Hamill Plus Bond Fund - Class I | 1.8% |

7. | DoubleLine Total Return Bond Fund - Class I | 1.7% |

8. | Xtrackers USD High Yield Corporate Bond ETF | 1.5% |

9. | Baird Core Plus Bond Fund - Class I | 1.5% |

10. | Berkshire Hathaway, Inc. | 1.3% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2022 Annual Report | December 31, 2022 | Page 11 |

Growth of $10,000

as of December 31, 2022

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Common Stock Sector Concentration

as of December 31, 2022

Information Technology | 25.6% |

Healthcare | 17.4% |

Financials | 14.5% |

Energy | 12.7% |

Consumer Discretionary | 11.2% |

Industrials | 8.6% |

Consumer Staples | 4.6% |

Materials | 2.9% |

Communication Services | 2.1% |

Utilities | 0.3% |

Real Estate Investment Trust | 0.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company Geographic Concentration

as of December 31, 2022

U.S. Fixed Income | 82.6% |

International Fixed Income | 17.4% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Asset Allocation

as of December 31, 2022

Common Stocks (United States) | 21.6% |

Equity Registered Investment Companies | 5.9% |

Fixed Income Registered Investment Companies | 28.1% |

Money Market Registered Investment Companies | 44.2% |

Bank Obligations | 0.2% |

Other Assets/Liabilities (Net) | 0.0% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Page 12 | 2022 Annual Report | December 31, 2022 |

Conservative Allocation Fund

The Meeder Conservative Allocation Fund Institutional Class returned –10.00% for the year ended December 31, 2022, compared to the Morningstar Conservative Target Risk Index benchmark return of –13.15%.

A portion (30%) of the fund uses our Defensive Equity strategy, which follows a rules-based and data-driven approach to using the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation. The remaining portion (70%) of the fund is allocated to fixed income securities.

The Meeder Conservative Allocation Fund achieved positive performance relative to its benchmark in 2022, partially driven by the Defensive Equity Strategy and its underweight to equities and overweight to cash throughout the year. The Defensive Equity Strategy entered the year with a significant defensive position of 10% cash and a 20% allocation to equities. The Fund remained defensive for the entirety of the year, averaging only a 15% allocation to equity throughout 2022 and ending the year with a 15% equity allocation.

Our global equity allocation was a negative contributor to performance this year. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within Conservative Allocation’s equity holdings, it maintained an overweight to U.S. and underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of international equities in 2022 compared to their U.S. counterparts, the fund’s global equity allocation detracted from performance.

The performance of our stock selection strategy was very positive in 2022. Within the U.S. portion of Conservative Allocation’s equity holdings, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to value stocks, along with our overweight to company’s displaying strong profitability, positively contributed to performance. From a sector perspective, the overweight to the Health Care and Energy sectors positively contributed to performance throughout the year, while the underweight to interest-rate sensitive sectors like Utilities and REITs also benefited performance.

While fixed income returns were negative, the Conservative Allocation Fund’s fixed income allocation outperformed the fixed income portion of the benchmark. The fund’s allocation to fixed income tactically shifts portfolio exposure utilizing quantitative models designed to actively manage credit quality, emerging market bond exposure, and duration of its holdings. In 2022, the Federal Reserve increased interest rates at its fastest rate in more than four decades. The historic rise in rates led to negative returns throughout the fixed income asset class. Despite the challenging environment, tactical shifts in the emerging market sector were a positive contributor to its outperformance. Relative to the benchmark, exposure to shorter duration bonds primarily benefited performance too.

In the fund, we will often use equity index derivatives, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the portfolio. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact on the fund’s relative performance. The use of equity index futures to reduce equity exposure in the fund’s Defensive Equity exposure was additive to performance relative to the benchmark in 2022.

Investment Objective

The investment objective of the Fund is to provide income and long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2022

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Conservative Allocation Fund Retail Class | -10.24% | 1.39% | 4.95% | 6/21/95 |

Conservative Allocation Fund Institutional Class | -10.00% | 1.72% | 5.17% | 10/31/16 |

Conservative Allocation Fund Adviser Class | -9.94% | 1.69% | 5.15% | 10/31/16 |

Morningstar Conservative Target Risk Index | -13.15% | 1.38% | 2.38% | — |

Top 10 Holdings

as of December 31, 2022

1. | iShares Core U.S. Aggregate Bond ETF | 10.5% |

2. | iShares JP Morgan USD Emerging Markets Bond ETF | 8.4% |

3. | SPDR Bloomberg High Yield Bond ETF | 8.3% |

4. | Diamond Hill Short Duration Securitized Bond Fund - Class Y | 3.5% |

5. | PGIM Short-Term Corporate Bond Fund - Class Q | 3.4% |

6. | Segall Bryant & Hamill Plus Bond Fund - Class I | 2.5% |

7. | DoubleLine Total Return Bond Fund - Class I | 2.4% |

8. | Xtrackers USD High Yield Corporate Bond ETF | 2.1% |

9. | Baird Core Plus Bond Fund - Class I | 2.1% |

10. | Frost Total Return Bond Fund - Class I | 1.4% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2022 Annual Report | December 31, 2022 | Page 13 |

Growth of $10,000

as of December 31, 2022

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Common Stock Sector Concentration

as of December 31, 2022

Information Technology | 21.1% |

Healthcare | 18.8% |

Energy | 16.1% |

Financials | 11.2% |

Consumer Discretionary | 11.1% |

Industrials | 10.3% |

Consumer Staples | 4.5% |

Communication Services | 3.8% |

Materials | 2.5% |

Utilities | 0.5% |

Real Estate Investment Trust | 0.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company Geographic Concentration

as of December 31, 2022

U.S. Fixed Income | 82.6% |

International Fixed Income | 17.4% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Asset Allocation

as of December 31, 2022

Common Stocks (United States) | 14.7% |

Equity Registered Investment Companies | 8.3% |

Fixed Income Registered Investment Companies | 39.7% |

Money Market Registered Investment Companies | 37.0% |

Other Assets/Liabilities (Net) | 0.3% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Page 14 | 2022 Annual Report | December 31, 2022 |

Dynamic Allocation Fund

The Meeder Dynamic Allocation Fund Institutional Class returned –15.26% for the year ended December 31, 2022, compared to the Morningstar Aggressive Target Risk Index benchmark return of –15.93%.

The Dynamic Allocation Fund maintains a more aggressive objective and remains nearly fully invested (95%) in the stock market. Our global equity allocation was a detractor to performance this year. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within the Dynamic Allocation Fund’s equity holdings, it maintained an overweight to U.S. and underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of international equities in 2022 compared to their U.S. counterparts, the fund’s global equity allocation detracted from performance.

The performance of our stock selection strategy was very positive in 2022. Within the U.S. portion of the Dynamic Allocation Fund’s equity allocation, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to value stocks, along with our overweight to company’s displaying strong profitability, positively contributed to performance. From a sector perspective, the overweight to the Health Care and Energy sectors positively contributed to performance throughout the year, while the underweight to interest-rate sensitive sectors like Utilities and REITs also benefited performance.

A small portion of the fund (5%) is allocated to fixed income. While fixed income returns were negative, the Dynamic Allocation Fund’s fixed income allocation outperformed the fixed income portion of the benchmark. The fund’s allocation to fixed income tactically shifts portfolio exposure utilizing quantitative models designed to actively manage credit quality, emerging market bond exposure, and duration of its holdings. In 2022, the Federal Reserve increased interest rates at its fastest rate in more than four decades. The historic rise in rates led to negative returns throughout the fixed income asset class. Despite the challenging environment, tactical shifts in the emerging market sector were a positive contributor to its outperformance. Relative to the benchmark, exposure to shorter duration bonds primarily benefited performance too.

In the fund, we will often use equity index derivatives, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the portfolio. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact on the fund’s relative performance.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2022

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Dynamic Allocation Fund Retail Class | -15.53% | 5.70% | 9.22% | 2/29/00 |

Dynamic Allocation Fund Institutional Class | -15.26% | 6.11% | 9.47% | 10/31/16 |

Dynamic Allocation Fund Adviser Class | -15.23% | 6.04% | 9.42% | 10/31/16 |

Morningstar Aggressive Target Risk Index | -15.93% | 5.25% | 8.38% | — |

Top 10 Holdings

as of December 31, 2022

1. | Apple, Inc. | 4.2% |

2. | Microsoft Corp. | 3.9% |

3. | Berkshire Hathaway, Inc. | 3.6% |

4. | iShares Core U.S. Aggregate Bond ETF | 1.8% |

5. | Copart, Inc. | 1.6% |

6. | UnitedHealth Group, Inc. | 1.6% |

7. | Exxon Mobil Corp. | 1.4% |

8. | Johnson & Johnson | 1.3% |

9. | Chevron Corp. | 1.3% |

10. | Costco Wholesale Corp. | 1.1% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2022 Annual Report | December 31, 2022 | Page 15 |

Growth of $10,000

as of December 31, 2022

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Common Stock Sector Concentration

as of December 31, 2022

Information Technology | 26.4% |

Healthcare | 18.2% |

Consumer Discretionary | 13.8% |

Financials | 13.0% |

Industrials | 9.2% |

Energy | 9.2% |

Consumer Staples | 4.0% |

Materials | 3.5% |

Communication Services | 2.2% |

Utilities | 0.4% |

Real Estate Investment Trust | 0.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company Geographic Concentration

as of December 31, 2022

U.S. Fixed Income | 71.6% |

International Fixed Income | 15.6% |

International Equity | 12.8% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Asset Allocation

as of December 31, 2022

Common Stocks (United States) | 70.1% |

Fixed Income Registered Investment Companies | 2.4% |

Equity Registered Investment Companies | 1.1% |

Money Market Registered Investment Companies | 25.4% |

Bank Obligations | 0.2% |

Other Assets/Liabilities (Net) | 0.8% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Page 16 | 2022 Annual Report | December 31, 2022 |

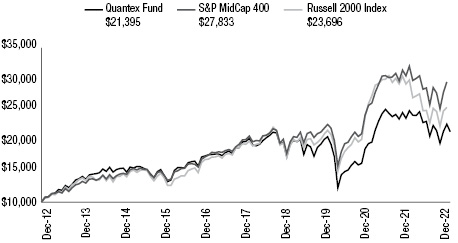

Quantex Fund

The Meeder Quantex Fund Institutional Class returned –13.58% for the year ended December 31, 2022, compared to the S&P MidCap 400 Index benchmark return of –13.06%.

The fund maintains a more aggressive objective and remains fully invested (100%) in the U.S. stock market, primarily in U.S. midcap stocks. While the fund utilizes a quantitative strategy to identify small- and mid-cap stocks that have significant growth potential, it can also tactically allocate up to 40% of the portfolio to U.S. large-cap equities based on our expectations of market cap segments.

The performance of our stock selection strategy for this fund was favorable in 2022, allowing the fund to outperform its benchmark. With value stocks outperforming, the fund’s holdings in the Energy sector were profitable, including positions in ConocoPhillips, Marathon Oil, and APA Corp. Our underweight to Software and Equity REITs also positively contributed to performance. Travel stocks, including Wynn Resorts and Norwegian Cruise Line Holdings were among the largest detractors during the year. The Fund’s tactical allocation to U.S. large-cap equities during the year detracted from performance. This was primarily related to a strong year from U.S. mid-cap equities, which outpaced both their U.S. large- and small-cap peers.

In the fund, we will often use equity index derivatives, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the portfolio. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact on the fund’s relative performance.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2022

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Quantex Fund Retail Class | -13.75% | 1.54% | 7.90% | 3/20/85 |

Quantex Fund Institutional Class | -13.58% | 1.78% | 8.08% | 10/31/16 |

Quantex Fund Adviser Class | -13.55% | 1.72% | 8.03% | 10/31/16 |

S&P MidCap 400 Index | -13.06% | 6.71% | 10.78% | — |

Russell 2000 Index | -20.44% | 4.13% | 9.01% | — |

Top 10 Holdings

as of December 31, 2022

1. | Quanta Services, Inc. | 1.0% |

2. | AES Corp./The | 0.9% |

3. | Howmet Aerospace, Inc. | 0.9% |

4. | Lamb Weston Holdings, Inc. | 0.9% |

5. | Leidos Holdings, Inc. | 0.9% |

6. | FMC Corp. | 0.9% |

7. | Huntington Ingalls Industries, Inc. | 0.9% |

8. | Cardinal Health, Inc. | 0.9% |

9. | Rollins, Inc. | 0.9% |

10. | Mosaic Co./The | 0.9% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2022 Annual Report | December 31, 2022 | Page 17 |

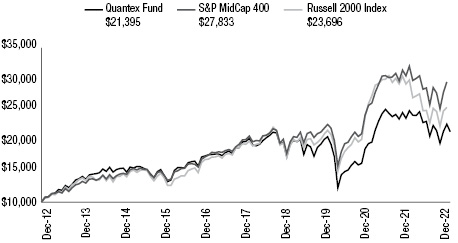

Growth of $10,000

as of December 31, 2022

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Common Stock Sector Concentration

as of December 31, 2022

Industrials | 18.0% |

Financials | 13.3% |

Consumer Discretionary | 12.3% |

Information Technology | 11.4% |

Utilities | 8.4% |

Materials | 8.1% |

Healthcare | 7.4% |

Real Estate Investment Trust | 6.5% |

Consumer Staples | 5.4% |

Communication Services | 5.1% |

Energy | 4.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2022

Common Stocks (United States) | 61.0% |

Money Market Registered Investment Companies | 37.1% |

Other Assets/Liabilities (Net) | 1.9% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Page 18 | 2022 Annual Report | December 31, 2022 |

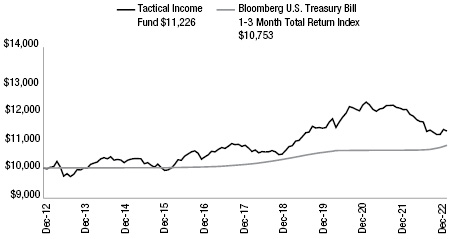

Tactical Income Fund

The Meeder Tactical Income Institutional Class returned –5.70% for the year ended December 31, 2022, compared to the Bloomberg U.S. Treasury Bill 1-3 Month Index benchmark return of 1.52%.

This fund tactically shifts portfolio exposure utilizing quantitative models designed to actively manage the credit quality, emerging market bond exposure, and duration of U.S. Treasury holdings. In 2022, the Federal Reserve increased interest rates at its fastest rate in more than four decades. The historic rise in rates led to negative returns throughout the fixed income asset class. While the Fund performed favorable relative to its peer group average, relative to the Bloomberg U.S. Treasury Bill 1-3 Month Index benchmark, exposure to longer duration securities, high yield and emerging markets sectors detracted from performance.

Investment Objective

The investment objective of the Fund is to provide long-term total return and income.

Average Annual Total Returns

as of December 31, 2022

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Tactical Income Fund Retail Class | -5.99% | 0.86% | 1.16% | 6/30/11 |

Tactical Income Fund Institutional Class | -5.70% | 1.25% | 1.41% | 10/31/16 |

Tactical Income Fund Adviser Class | -5.65% | 1.20% | 1.37% | 10/31/16 |

Bloomberg U.S. Treasury Bill 1-3 Month Total Return Index | 1.52% | 1.22% | 0.73% | — |

Top 10 Holdings

as of December 31, 2022

1. | iShares Core 1-5 Year USD Bond ETF | 19.7% |

2. | iShares JP Morgan USD Emerging Markets Bond ETF | 11.9% |

3. | SPDR Bloomberg High Yield Bond ETF | 11.9% |

4. | BBH Limited Duration Fund - Class I | 7.0% |

5. | iShares Trust iShares 1-5 Year Investment Grade Corporate Bond ETF | 5.8% |

6. | Diamond Hill Short Duration Securitized Bond Fund - Class Y | 3.1% |

7. | Xtrackers USD High Yield Corporate Bond ETF | 3.0% |

8. | Frost Total Return Bond Fund - Class I | 2.5% |

9. | iShares Core U.S. Aggregate Bond ETF | 2.0% |

10. | PGIM Short-Term Corporate Bond Fund - Class Q | 1.4% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2022 Annual Report | December 31, 2022 | Page 19 |

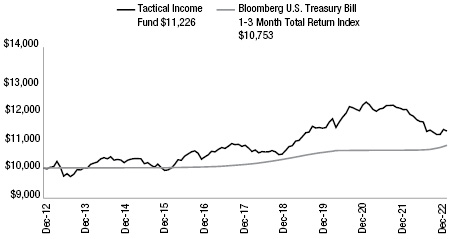

Growth of $10,000

as of December 31, 2022

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Fixed Income Sector Concentration

as of December 31, 2022

Investment Grade | 68.3% |

Cash & Equivalents | 31.7% |

Total | 100.0% |

As a percentage of total fixed income securities. Concentrations are subject to change.

Page 20 | 2022 Annual Report | December 31, 2022 |

Institutional Prime Money Market Fund

The Meeder Institutional Prime Money Market Fund (the Fund) reported a 7-day net yield of 4.36% as of December 31, 2022. The total return for the Fund was 1.63% for the full year period.

The Fund offers a floating net asset value (FNAV). A FNAV fund is characterized by a net asset value which could vary incrementally above or below $1.0000 per share. The objective of this fund is to maintain a FNAV near $1.0000 per share while offering a safe investment vehicle and competitive returns to shareholders. A FNAV was reported at year-end 2022 as $1.0000. The advisor to the Fund accomplished the objective by investing in short-term, high-quality money market debt obligations. Money market debt obligations may be offered by the U.S. Government and its agencies but may also include obligations of fundamentally sound corporate issuers.

Over the years, investors have demonstrated confidence in the money market fund industry because of two key features. Safety and liquidity are at the core of money fund investment strategy. Safety is expressed through the selection of investments which are anticipated to provide minimal principal volatility. While liquidity is generated by maintaining high quality investments and ample funds to accommodate investor requests to redeem shares. These attributes proved important once again as the industry faced a long-awaited shift in the Federal Open Market Committee’s (FOMC) interest rate policy. Early in 2022 the FOMC embarked on an aggressive restrictive monetary policy stance to combat accelerating inflation.

Throughout 2022, the FOMC increased its target interest rate 4.25% over the course of nine months. To accommodate the shift in policy, the advisor adopted a strategy to increase investments with shorter average maturities. This was additive to performance and supported the objective of minimizing downward pressure on the FNAV. Prior to the FOMC meeting in March 2022, the Fund reported a 7-day net yield of 0.05% versus a year end rate of 4.36%. In similar fashion, the Fund’s FNAV was $0.9993 prior to the FOMC’s March movement while ending the year at $1.0000. The shorter average maturity of the fund allowed faster reinvestment of maturing proceeds in order to take advantage of base interest rates moving higher. The average maturity of the Fund was managed down from 35 days to 15 days.

The advisor addressed fund safety directly through a strategy focused on exceeding required liquidity limits and investing in securities which historically perform favorably in the aforementioned interest rate environment. The Fund maintained daily liquid assets of nearly 30% and weekly liquid assets of almost 50%. This far exceed required levels of 10% and 30%, respectively. Investments which added value to the portfolio were purchased with shorter average maturities.

As we move forward, our efforts will be focused on any supplementary monetary adjustments by the FOMC and the resulting impact of these actions may have on the economy. The strategies implemented in 2022, we believe, were prudent and provided shareholders with exceptional safety as interest rates moved higher. Currently, we believe the Fund should be positioned to maintain stability through 2023. In the event our view changes, we will review our strategy relative to market opportunities and act in the best interest of our shareholders.

Investment Objective

The investment objective of the Fund is to provide current income consistent with liquidity and the preservation of capital.

Average Annual Total Returns

as of December 31, 2022

| 1

Year | 5

Year | 10

Year |

Institutional Prime Money Market Fund | 1.63% | 1.29% | 0.81% |

Yields

as of December 31, 2022

| | 7-Day

Subsidized

Yield | 7-Day

Unsubsidized

Yield |

Institutional Prime Money Market Fund | 4.36% | 4.09% |

Top 10 Holdings

as of December 31, 2022

1. | Federated Hermes Government Obligations Fund, 4.15% | 10.6% |

2. | StoneX Repo, 4.48%, due 1/3/2023 | 7.2% |

3. | Truist Repo, 4.34%, due 1/3/2023 | 7.2% |

4. | South Street Repo, 4.33%, due 1/3/2023 | 6.5% |

5. | Halkin Finance, LLC, 4.31%, 1/3/2023 | 2.9% |

6. | Anglesea Funding, 4.37%, 2/1/2023 | 2.6% |

7. | Anglesea Funding, 4.43%, 2/7/2023 | 2.4% |

8. | South Street Repo, 4.28%, due 1/3/2023 | 2.2% |

9. | Halkin Finance, LLC, 4.32%, 1/5/2023 | 2.2% |

10. | ANZ New Zealand Int’l, LTD, 4.88%, 1/5/2023 | 1.8% |

As a percentage of total net assets.

2022 Annual Report | December 31, 2022 | Page 21 |

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s performance prior to October 7, 2016 reflects the performance of a predecessor fund, the Institutional Class of the Meeder Prime Money Market Fund, which was distributed and transferred to the Institutional Prime Money Market Fund upon its inception. The subsidized 7-day current yield is the current annualized net yield of the Fund. The unsubsidized 7-day current yield does not reflect the effect of any fee waivers or expense reimbursements made by the Fund’s investment adviser. The 7-day current yield more closely reflects the current earnings of the Fund than total return.

You could lose money by investing in the Fund. Because the share price of the Fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them. The Fund may impose a fee upon sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

Sector Concentration

as of December 31, 2022

Commercial Paper | 31.8% |

Certificates of Deposit | 31.6% |

Repurchase Agreements | 23.1% |

Money Market Registered Investment Companies | 10.6% |

Corporate Obligations | 2.2% |

Variable Rate Demand Notes | 0.9% |

Other Assets/Liabilities (Net) | -0.2% |

Total | 100.0% |

As a percentage of total net assets. Concentrations are subject to change.

Page 22 | 2022 Annual Report | December 31, 2022 |

2022 Annual Report

Fund Holdings & Financial Statements

Schedules of Investments

December 31, 2022

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) — 57.2% |

Communication Services — 2.2% | | | | | | | | |

Alphabet, Inc. (1) | | | 89,979 | | | | 7,983,837 | |

AT&T, Inc. | | | 192 | | | | 3,535 | |

Cable One, Inc. | | | 136 | | | | 96,813 | |

Comcast Corp. | | | 14,624 | | | | 511,401 | |

Entravision Communications Corp. | | | 1,883 | | | | 9,038 | |

IDT Corp. (1) | | | 16,073 | | | | 452,776 | |

Liberty TripAdvisor Holdings, Inc. (1) | | | 8,364 | | | | 5,601 | |

Meta Platforms, Inc. (1) | | | 8,412 | | | | 1,012,300 | |

Netflix, Inc. (1) | | | 283 | | | | 83,451 | |

Roku, Inc. (1) | | | 5,846 | | | | 237,932 | |

Telephone and Data Systems, Inc. | | | 3,121 | | | | 32,739 | |

T-Mobile US, Inc. (1) | | | 21,221 | | | | 2,970,940 | |

Trade Desk, Inc./The (1) | | | 8,551 | | | | 383,341 | |

Verizon Communications, Inc. | | | 802 | | | | 31,599 | |

| | | | | | | | 13,815,303 | |

| | | | | | | | | |

Consumer Discretionary — 7.7% | | | | | | | | |

ADT, Inc. | | | 769 | | | | 6,975 | |

Amazon.com, Inc. (1) | | | 5,647 | | | | 474,348 | |

AutoZone, Inc. (1) | | | 559 | | | | 1,378,595 | |

Best Buy Co., Inc. | | | 29,266 | | | | 2,347,426 | |

Bloomin’ Brands, Inc. | | | 2,397 | | | | 48,228 | |

Booking Holdings, Inc. (1) | | | 817 | | | | 1,646,484 | |

BorgWarner, Inc. | | | 32,732 | | | | 1,317,463 | |

Buckle, Inc./The | | | 1,116 | | | | 50,611 | |

Burlington Stores, Inc. (1) | | | 4,763 | | | | 965,746 | |

Cavco Industries, Inc. (1) | | | 160 | | | | 36,200 | |

Chegg, Inc. (1) | | | 15,741 | | | | 397,775 | |

Citi Trends, Inc. (1) | | | 732 | | | | 19,383 | |

Dana, Inc. | | | 3,684 | | | | 55,739 | |

Dillard’s, Inc. | | | 11 | | | | 3,555 | |

DR Horton, Inc. | | | 24,027 | | | | 2,141,767 | |

Everi Holdings, Inc. (1) | | | 566 | | | | 8,122 | |

Frontdoor, Inc. (1) | | | 3,994 | | | | 83,075 | |