UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03462

Meeder Funds Trust

6125 Memorial Drive

Dublin, OH 43017

Bruce McKibben

c/o Meeder Funds Trust

6125 Memorial Drive

Dublin, OH 43017

Registrant’s telephone number, including area code: 800-325-3539

Date of fiscal year end: December 31, 2021

Date of reporting period: December 31, 2021

Item 1. Report to Stockholders.

TABLE OF CONTENTS

| | |

Letter to Shareholders | 1 |

Fund Summaries (Unaudited) | |

Muirfield Fund | 3 |

Spectrum Fund | 5 |

Global Allocation Fund | 7 |

Balanced Fund | 9 |

Moderate Allocation Fund | 11 |

Conservative Allocation Fund | 13 |

Dynamic Allocation Fund | 15 |

Quantex Fund | 17 |

Tactical Income Fund | 19 |

Institutional Prime Money Market Fund | 21 |

Financial Statements | |

Schedule of Investments | 24 |

Statements of Assets and Liabilities | 104 |

Statements of Operations | 106 |

Statements of Changes in Net Assets | 108 |

Financial Highlights | 112 |

Notes to Financial Statements | 122 |

Report of Independent Registered Public Accounting Firm | 140 |

Shareholder Expense Analysis | 141 |

Management of the Trust | 143 |

Other Items | 144 |

This Annual Report is prepared and distributed for the general information of the shareholders of the Funds. This material is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. Investors are advised to consider carefully the investment objectives, risks, charges and expenses of the Fund before investing. The prospectus contains this and other information about the Funds.

Meeder Funds are distributed by Meeder Distribution Services, Inc. (Member FINRA), an affiliate of Meeder Investment Management. An affiliated registered investment adviser, Meeder Asset Management, Inc., serves as the investment adviser to Meeder Funds and is paid a fee for its services.

Letter to Shareholders December 31, 2021

A Historic Year of Transition for Investors

2021 was a year of transition for the global capital markets. While countries have moved away from widespread economic shutdowns, 2021 brought the highest inflation we have experienced in decades, upward pressure on interest rates, supply chain challenges, and lackluster labor participation. Despite these challenges, equities recorded above-average gains with little volatility—while only certain pockets of the bond market were able to avoid negative returns.

Inflation took center stage during the year, with the US Personal Consumption Expenditure (PCE) Index growing at a 7.4% YOY growth rate in December, its highest level since the early 1980s. A combination of massive fiscal-stimulated consumer demand, global supply chain issues, and labor shortages have all contributed to rising inflation.

The beginning of a new Federal Reserve (“the Fed”) tightening cycle is also nearing. While the Fed continued to taper during the fourth quarter, we expect the Fed to increase the federal funds rate shortly after the March FOMC meeting followed by two more rate increases during 2022. This should bring the central bank’s lending rate to just under 1% by the end of the year, with this monetary tightening cycle likely to continue well into 2024.

Our Investment Philosophy

At Meeder, we manage our funds using a systematic approach that guides us in our allocation decisions. A systematic, quantitative process allows for a repeatable and efficient method to achieve long-term appreciation while avoiding common emotional biases. We also apply a holistic approach to investing—analyzing fundamental, technical, macroeconomic, and sentiment factors.

Many of our funds utilize our time-tested Defensive Equity strategy, which follows a rules-based and data-driven approach, based on the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation relative to other asset classes. In addition to our Defensive Equity strategy, we also provide active management for shareholders through global allocation, individual equity selection, and fixed income exposure.

While the degree in which each Meeder Fund utilizes these strategies can vary based on its respective investment strategy and objective, our commitment to providing an unemotional and systematic assessment of the market remains consistent across all our Funds.

Commitment to Improvement

One of the enduring goals throughout Meeder’s history has been to improve investor outcomes by helping investors remain committed to their investment strategy through a full market cycle. While most our Funds performed well in 2021 relative to their respective benchmarks, we want to highlight the notable longer-term performance of one of our oldest funds. Per the 10-year rankings as of December 31, 2021, the Muirfield Fund ranked in the top 3 percent of open-ended mutual funds among the 128 strategies ranked in the Tactical Allocation category, according to Morningstar. While focusing on short-term performance is never a winning strategy, we believe this performance is a validation of our investment process and our commitment to continuous improvement.

As we turn the corner to a new year, we maintain our commitment to continually improve our investment strategies, evolve our offerings, and always maintain a focus on serving our shareholders. Our investment team never stops looking for ways to improve our decision-making process.

With that said, investors enter 2022 with many concerns—including rising interest rates, inflation, uncertainty of future tax rates, and persistent COVID-19 cases. While there is never certainty when it comes to the future, we feel optimistic that our quantitative approach, based on thoughtful research and historical probabilities, will continue to provide a systematic assessment of the market as we navigate the new year.

Sincerely,

Robert S. Meeder

President & CEO

Meeder Asset Management, Inc.

2021 Annual Report | December 31, 2021 | Page 1 |

2021 Annual Report

Fund Summaries

Muirfield Fund

The Meeder Muirfield Fund Institutional Class returned 20.55% for the year ended December 31, 2021, compared to the Morningstar Moderate Target Risk Index benchmark return of 10.19%.

This fund uses our Defensive Equity strategy, which follows a rules-based and data-driven approach to using the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation.

Muirfield achieved positive performance relative to its benchmark in 2021, primarily driven by the Defensive Equity Strategy and its overweight to equities throughout the year. The Defensive Equity Strategy remained 100% invested in equities for the majority of the first six months of 2021, a period of positive momentum for the asset class. During the second half of the year, the fund decreased its equity exposure, finishing the year 67% invested in equities. While the Defensive Equity Strategy maintained a defensive posture to end the year, relative to its benchmark, the strategy remained slightly overweight equities.

Our global equity allocation was a positive contributor to performance this year as well. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within Muirfield’s equity allocation, it maintained an overweight to U.S. and an underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of U.S. equities compared to their international counterparts, the fund’s global equity allocation benefited performance.

The performance of our stock selection strategy was strong in 2021. Within the U.S. portion of Muirfield’s equity allocation, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to stocks displaying strong momentum and profitability were the two primary drivers of positive performance. From a sector perspective, the overweight to Information Technology and Healthcare sectors positively contributed to performance throughout the year, while the increase in allocation to Energy and Financial stocks in the second half of the year also generated positive returns.

The Fund often maintains significant holdings in a proprietary money market fund. We use equity index derivatives, such as stock index futures, to efficiently equitize these cash positions and manage the equity exposure of the portfolio. These derivatives are designed to track their respective market indexes. Investments in equity index derivatives were additive to performance over the past year.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2021

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Muirfield Fund Retail Class | 20.20% | 10.54% | 10.49% | 8/10/88 |

Muirfield Fund Institutional Class | 20.55% | 10.93% | 10.70% | 10/31/16 |

Muirfield Fund Adviser Class | 20.61% | 10.83% | 10.65% | 10/31/16 |

Morningstar Moderate Target Risk Index | 10.19% | 10.07% | 8.75% | — |

Blended Index | 16.59% | 11.53% | 10.13% | — |

Top 10 Holdings

as of December 31, 2021

1. | Microsoft Corp. | 4.0% |

2. | Apple, Inc. | 3.1% |

3. | Amazon.com, Inc. | 1.9% |

4. | Alphabet, Inc. - Class C | 1.6% |

5. | Alphabet, Inc. - Class A | 1.4% |

6. | Tesla, Inc. | 1.3% |

7. | Meta Platforms, Inc. | 1.2% |

8. | Johnson & Johnson | 1.2% |

9. | NVIDIA Corp. | 1.1% |

10. | UnitedHealth Group, Inc. | 1.1% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2021 Annual Report | December 31, 2021 | Page 3 |

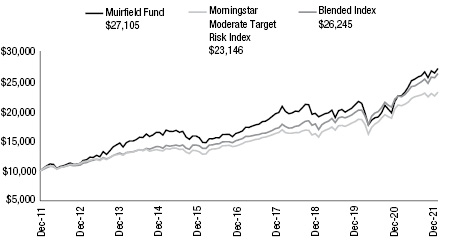

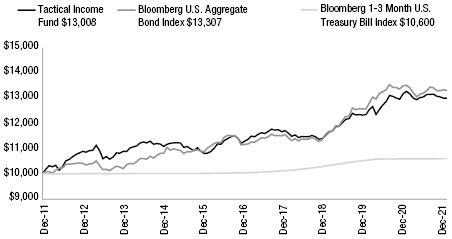

Growth of $10,000

as of December 31, 2021

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Sector Concentration

as of December 31, 2021

Information Technology | 29.5% |

Healthcare | 18.7% |

Financials | 11.9% |

Consumer Discretionary | 11.0% |

Communication Services | 8.8% |

Industrials | 6.5% |

Real Estate Investment Trust | 3.6% |

Energy | 3.6% |

Consumer Staples | 3.0% |

Utilities | 2.2% |

Materials | 1.2% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2021

Common Stocks (United States) | 66.9% |

Money Market Registered Investment Companies | 31.6% |

Bank Obligations | 0.1% |

Other Assets/Liabilities (Net) | 1.4% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

The Blended Index is comprised 60% of the S&P 500 Index and 40% of 90-day T-bills.

Page 4 | 2021 Annual Report | December 31, 2021 |

Spectrum Fund

The Meeder Spectrum Fund Institutional Class returned 20.98% for the year ended December 31, 2021, compared to the Morningstar Moderate Target Risk Index benchmark return of 10.19%.

This fund uses our Defensive Equity strategy, which follows a rules-based and data-driven approach to using the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation. In addition, the fund also can use derivatives to allocate up to 130% to equities during extremely low risk periods.

The Meeder Spectrum Fund achieved positive performance relative to its benchmark in 2021, primarily driven by the Defensive Equity Strategy and its overweight to equities throughout the year. The Defensive Equity Strategy remained 100% invested in equities for the majority of the first six months of 2021, a period of positive momentum for the asset class. During the second half of the year, the fund decreased its equity exposure, finishing the year 67% invested in equities. While the Defensive Equity Strategy maintained a defensive posture to end the year, relative to its benchmark, the strategy remained slightly overweight equities.

Our global equity allocation was a positive contributor to performance this year as well. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within Spectrum’s equity allocation, it maintained an overweight to U.S. and an underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of U.S. equities compared to their international counterparts, the fund’s global equity allocation benefited performance.

The performance of our stock selection strategy was also strong in 2021. Within the U.S. portion of Spectrum’s equity allocation, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to stocks displaying strong momentum and profitability were the two primary drivers of positive performance. From a sector perspective, the overweight to Information Technology and Healthcare sectors positively contributed to performance throughout the year, while the increase in allocation to Energy and Financial stocks in the second half of the year also generated positive returns.

The Fund often maintains significant holdings in a proprietary money market fund. We use equity index derivatives, such as stock index futures, to efficiently equitize these cash positions and manage the equity exposure of the portfolio. These derivatives are designed to track their respective market indexes. Investments in equity index derivatives were additive to performance over the past year.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2021

| 1

Year | 5

Year | Since

Inception | Share Class

Inception

Date |

Spectrum Fund Retail Class | 20.58% | 9.27% | 7.39% | 1/2/15 |

Spectrum Fund Institutional Class | 20.98% | 9.72% | 7.72% | 10/31/16 |

Spectrum Fund Adviser Class | 21.07% | 9.61% | 7.64% | 10/31/16 |

Morningstar Moderate Target Risk Index | 10.19% | 10.07% | 8.10% | — |

Blended Index | 16.59% | 11.53% | 9.37% | — |

Top 10 Holdings

as of December 31, 2021

1. | Microsoft Corp. | 5.8% |

2. | Apple, Inc. | 2.5% |

3. | Alphabet, Inc. - Class C | 2.5% |

4. | Amazon.com, Inc. | 2.0% |

5. | Johnson & Johnson | 1.8% |

6. | Tesla, Inc. | 1.4% |

7. | Intuit, Inc. | 1.4% |

8. | Meta Platforms, Inc. | 1.4% |

9. | NVIDIA Corp. | 1.1% |

10. | Lowe’s Cos., Inc. | 1.0% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2021 Annual Report | December 31, 2021 | Page 5 |

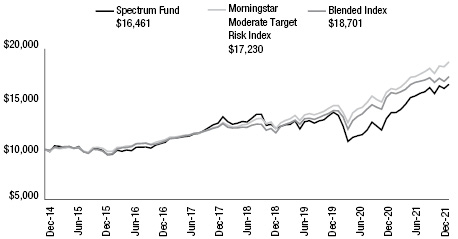

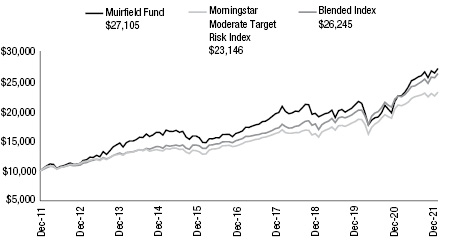

Growth of $10,000

as of December 31, 2021

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Sector Concentration

as of December 31, 2021

Information Technology | 30.0% |

Healthcare | 19.6% |

Consumer Discretionary | 10.2% |

Financials | 12.4% |

Communication Services | 8.1% |

Industrials | 6.2% |

Real Estate Investment Trust | 3.6% |

Energy | 4.0% |

Consumer Staples | 2.9% |

Utilities | 1.8% |

Materials | 1.2% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2021

Common Stocks (United States) | 72.6% |

Money Market Registered Investment Companies | 25.6% |

Other Assets/Liabilities (Net) | 1.8% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

The Blended Index is comprised 60% of the S&P 500 Index and 40% of 90-day T-bills.

Page 6 | 2021 Annual Report | December 31, 2021 |

Global Allocation Fund

The Meeder Global Allocation Fund Institutional Class returned 13.05% for the year ended December 31, 2021, compared to the Morningstar Global Allocation Index benchmark return of 9.31%.

A portion (90%) of the fund uses our Defensive Equity strategy, which follows a rules-based and data-driven approach to using the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation. The remaining portion (10%) of the fund is allocated to fixed income securities.

The Meeder Global Allocation Fund achieved positive performance relative to its benchmark in 2021, primarily driven by the Defensive Equity Strategy and its overweight to equities throughout the year. The fund remained 90% invested in equities for the majority of the first six months of 2021, a period of positive momentum for the asset class. During the second half of the year, the Global Allocation Fund decreased its equity exposure, finishing the year 67% invested in equities.

Our global equity allocation was a positive contributor to performance this year as well. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within the Global Allocation Fund’s equity allocation, it maintained an overweight to U.S. and an underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of U.S. equities compared to their international counterparts, the fund’s global equity allocation benefited performance.

The performance of our stock selection strategy was also strong in 2021. Within the U.S. portion of the Global Allocation Fund’s equity allocation, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to stocks displaying strong momentum and profitability were the two primary drivers of positive performance. From a sector perspective, the overweight to Information Technology and Healthcare sectors positively contributed to performance throughout the year, while the increase in allocation to Energy and Financial stocks in the second half of the year also generated positive returns.

While fixed income returns were negative, the Global Allocation Fund’s fixed income allocation outperformed the fixed income portion of the benchmark. The fund’s allocation to fixed income tactically shifts portfolio exposure utilizing quantitative models designed to actively manage the credit quality, emerging market bond exposure, and duration of U.S. Treasury holdings. The rise in interest rates throughout the year led to negative returns in both U.S. Investment Grade and U.S. Treasury holdings, as 2021 proved to be a challenging year for most fixed income assets. Relative to the benchmark, exposure to High Yield bonds, security selection in Investment Grade bonds, and duration positioning in U.S. Treasuries contributed to its outperformance.

The Fund often maintains significant holdings in a proprietary money market fund. We use equity index derivatives, such as stock index futures, to efficiently equitize these cash positions and manage the equity exposure of the portfolio. These derivatives are designed to track their respective market indexes. Investments in equity index derivatives were additive to performance over the past year.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2021

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Global Allocation Fund Retail Class | 12.58% | 8.35% | 7.85% | 1/31/06 |

Global Allocation Fund Institutional Class | 13.05% | 8.85% | 8.10% | 10/31/16 |

Global Allocation Fund Adviser Class | 12.90% | 8.68% | 8.02% | 10/31/16 |

Morningstar Global Allocation Index | 9.31% | 10.23% | 8.44% | — |

Blended Index | 9.61% | 8.66% | 7.02% | — |

Top 10 Holdings

as of December 31, 2021

1. | iShares Core MSCI EAFE ETF | 7.0% |

2. | iShares 3-7 Year Treasury Bond ETF | 2.6% |

3. | Microsoft Corp. | 2.1% |

4. | iShares Core MSCI Emerging Markets ETF | 1.6% |

5. | Apple, Inc. | 1.6% |

6. | Vanguard Short-Term Bond ETF | 1.2% |

7. | iShares JP Morgan USD Emerging Markets Bond ETF | 1.0% |

8. | Amazon.com, Inc. | 0.9% |

9. | Alphabet, Inc. - Class C | 0.8% |

10. | Alphabet, Inc. - Class A | 0.7% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2021 Annual Report | December 31, 2021 | Page 7 |

Growth of $10,000

as of December 31, 2021

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Sector Concentration

as of December 31, 2021

Information Technology | 28.7% |

Healthcare | 18.6% |

Financials | 11.7% |

Consumer Discretionary | 11.1% |

Communication Services | 8.8% |

Industrials | 6.5% |

Energy | 4.7% |

Real Estate Investment Trust | 3.6% |

Consumer Staples | 3.0% |

Utilities | 2.1% |

Materials | 1.2% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company Geographic Concentration

as of December 31, 2021

U.S. Fixed Income | 42.2% |

International Fixed Income | 5.8% |

International Equity | 52.0% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Asset Allocation

as of December 31, 2021

Common Stocks (United States) | 34.3% |

Equity Registered Investment Companies | 8.6% |

Fixed Income Registered Investment Companies | 8.0% |

Money Market Registered Investment Companies | 43.8% |

Bank Obligations | 1.6% |

Other Assets/Liabilities (Net) | 3.7% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

The Blended Index is comprised of 54% MSCI ACWI Index, 36% of 90 day T-Bills and 10% Bloomberg U.S. Aggregate Bond Index.

Page 8 | 2021 Annual Report | December 31, 2021 |

Balanced Fund

The Meeder Balanced Fund Institutional Class returned 13.71% for the year ended December 31, 2021, compared to the Morningstar Moderate Target Risk Index benchmark return of 10.19%.

A portion (70%) of the fund uses our Defensive Equity strategy, which follows a rules-based and data-driven approach to using the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation. The remaining portion (30%) of the fund is allocated to fixed income securities.

The Meeder Balanced Fund achieved positive performance relative to its benchmark in 2021, primarily driven by the Defensive Equity Strategy and its overweight to equities throughout the year. The fund remained 70% invested in equities for the majority of the first six months of 2021, a period of positive momentum for the asset class. During the second half of the year, the Balanced Fund decreased its equity exposure, finishing the year 48% invested in equities. While it finished the year underweight equities relative to its benchmark, the overweight for most of 2021 was a primary driver of its outperformance.

Our global equity allocation was a positive contributor to performance this year as well. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within the Balanced Fund’s equity allocation, it maintained an overweight to U.S. and an underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of U.S. equities compared to their international counterparts, the fund’s global equity allocation benefited performance.

The performance of our stock selection strategy was also strong in 2021. Within the U.S. portion of the Balanced Fund’s equity allocation, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to stocks displaying strong momentum and profitability were the two primary drivers of positive performance. From a sector perspective, the overweight to Information Technology and Healthcare sectors positively contributed to performance throughout the year, while the increase in allocation to Energy and Financial stocks in the second half of the year also generated positive returns.

While fixed income returns were negative, the Balanced Fund’s fixed income allocation outperformed the fixed income portion of the benchmark. The fund’s allocation to fixed income tactically shifts portfolio exposure utilizing quantitative models designed to actively manage the credit quality, emerging market bond exposure, and duration of U.S. Treasury holdings. The rise in interest rates throughout the year led to negative returns in both U.S. Investment Grade and U.S. Treasury holdings, as 2021 proved to be a challenging year for most fixed income assets. Relative to the benchmark, exposure to High Yield bonds, security selection in Investment Grade bonds, and duration positioning in U.S. Treasuries contributed to its outperformance.

The Fund often maintains significant holdings in a proprietary money market fund. We use equity index derivatives, such as stock index futures, to efficiently equitize these cash positions and manage the equity exposure of the portfolio. These derivatives are designed to track their respective market indexes. Investments in equity index derivatives were additive to performance over the past year.

Investment Objective

The investment objective of the Fund is to provide income and long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2021

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Balanced Fund Retail Class | 13.23% | 8.24% | 7.89% | 1/31/06 |

Balanced Fund Institutional Class | 13.71% | 8.70% | 8.13% | 10/31/16 |

Balanced Fund Adviser Class | 13.71% | 8.62% | 8.08% | 10/31/16 |

Morningstar Moderate Target Risk Index | 10.19% | 10.07% | 8.75% | — |

Blended Index | 10.90% | 9.20% | 8.00% | — |

Top 10 Holdings

as of December 31, 2021

1. | iShares 3-7 Year Treasury Bond ETF | 8.1% |

2. | Vanguard Short-Term Bond ETF | 3.5% |

3. | iShares JP Morgan USD Emerging Markets Bond ETF | 3.0% |

4. | Microsoft Corp. | 2.9% |

5. | Apple, Inc. | 2.4% |

6. | Amazon.com, Inc. | 1.4% |

7. | Frost Total Return Bond Fund - Class I | 1.2% |

8. | Lord Abbett High Yield Fund - Class I | 1.2% |

9. | Alphabet, Inc. - Class C | 1.2% |

10. | Alphabet, Inc. - Class A | 1.1% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2021 Annual Report | December 31, 2021 | Page 9 |

Growth of $10,000

as of December 31, 2021

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Sector Concentration

as of December 31, 2021

Information Technology | 29.2% |

Healthcare | 18.7% |

Financials | 12.1% |

Consumer Discretionary | 10.8% |

Communication Services | 9.3% |

Industrials | 6.4% |

Real Estate Investment Trust | 3.6% |

Energy | 3.4% |

Consumer Staples | 3.1% |

Utilities | 2.2% |

Materials | 1.2% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company Geographic Concentration

as of December 31, 2021

U.S. Fixed Income | 87.9% |

International Fixed Income | 12.1% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Asset Allocation

as of December 31, 2021

Common Stocks (United States) | 48.8% |

Fixed Income Registered Investment Companies | 24.4% |

Money Market Registered Investment Companies | 25.4% |

Bank Obligations | 0.2% |

Other Assets/Liabilities (Net) | 1.2% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

The Blended Index is comprised 42% of the S&P 500 Index, 28% of the average 90-day T-bills, and 30% of the Bloomberg U.S. Aggregate Bond Index.

Page 10 | 2021 Annual Report | December 31, 2021 |

Moderate Allocation Fund

The Meeder Moderate Fund Institutional Class returned 9.05% for the year ended December 31, 2021, compared to the Morningstar Moderate Conservative Target Risk Index benchmark return of 6.36%.

A portion (50%) of the fund uses our Defensive Equity strategy, which follows a rules-based and data-driven approach to using the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation. The remaining portion (50%) of the fund is allocated to fixed income securities.

The Meeder Moderate Fund achieved positive performance relative to its benchmark in 2021, primarily driven by the Defensive Equity Strategy and its overweight to equities throughout the year. The fund remained 50% invested in equities for the majority of the first six months of 2021, a period of positive momentum for the asset class. During the second half of the year, the Moderate Fund decreased its equity exposure, finishing the year 35% invested in equities. While it finished the year underweight equities relative to its benchmark, the overweight for most of 2021 was a primary driver of its outperformance.

Our global equity allocation was a positive contributor to performance this year as well. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within the Moderate Fund’s equity allocation, it maintained an overweight to U.S. and an underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of U.S. equities compared to their international counterparts, the fund’s global equity allocation benefited performance.

The performance of our stock selection strategy was also strong in 2021. Within the U.S. portion of the Moderate Fund’s equity allocation, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to stocks displaying strong momentum and profitability were the two primary drivers of positive performance. From a sector perspective, the overweight to Information Technology and Healthcare sectors positively contributed to performance throughout the year, while the increase in allocation to Energy and Financial stocks in the second half of the year also generated positive returns.

While fixed income returns were negative, the Moderate Allocation Fund’s fixed income allocation outperformed the fixed income portion of the benchmark. The fund’s allocation to fixed income tactically shifts portfolio exposure utilizing quantitative models designed to actively manage the credit quality, emerging market bond exposure, and duration of U.S. Treasury holdings. The rise in interest rates throughout the year led to negative returns in both U.S. Investment Grade and U.S. Treasury holdings, as 2021 proved to be a challenging year for most fixed income assets. Relative to the benchmark, exposure to High Yield bonds, security selection in Investment Grade bonds, and duration positioning in U.S. Treasuries contributed to its outperformance.

The Fund often maintains significant holdings in a proprietary money market fund. We use equity index derivatives, such as stock index futures, to efficiently equitize these cash positions and manage the equity exposure of the portfolio. These derivatives are designed to track their respective market indexes. Investments in equity index derivatives were additive to performance over the past year.

Investment Objective

The investment objective of the Fund is to provide total return, including capital appreciation, and current income.

Average Annual Total Returns

as of December 31, 2021

| 1

Year | 5

Year | Since

Inception | Share Class

Inception

Date |

Moderate Allocation Fund Retail Class | 8.74% | 7.58% | 6.94% | 6/30/15 |

Moderate Allocation Fund Institutional Class | 9.05% | 8.00% | 7.28% | 10/31/16 |

Moderate Allocation Fund Adviser Class | 9.15% | 7.93% | 7.22% | 10/31/16 |

Morningstar Moderate Conservative Target Risk Index | 6.36% | 8.11% | 6.96% | — |

Blended Index | 7.23% | 7.61% | 6.68% | — |

Top 10 Holdings

as of December 31, 2021

1. | iShares 3-7 Year Treasury Bond ETF | 13.6% |

2. | Vanguard Short-Term Bond ETF | 5.9% |

3. | iShares JP Morgan USD Emerging Markets Bond ETF | 5.0% |

4. | Microsoft Corp. | 2.1% |

5. | Frost Total Return Bond Fund - Class I | 2.0% |

6. | Lord Abbett High Yield Fund - Class I | 2.0% |

7. | Segall Bryant & Hamill Plus Bond Fund - Class I | 1.8% |

8. | DoubleLine Total Return Bond Fund - Class I | 1.7% |

9. | SPDR Bloomberg Barclays Short Term High Yield Bond ETF | 1.7% |

10. | Apple, Inc. | 1.6% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2021 Annual Report | December 31, 2021 | Page 11 |

Growth of $10,000

as of December 31, 2021

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Sector Concentration

as of December 31, 2021

Information Technology | 28.7% |

Healthcare | 18.7% |

Consumer Discretionary | 11.5% |

Financials | 11.3% |

Communication Services | 8.8% |

Industrials | 6.8% |

Energy | 4.9% |

Real Estate Investment Trust | 3.6% |

Consumer Staples | 2.8% |

Utilities | 1.7% |

Materials | 1.2% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company Geographic Concentration

as of December 31, 2021

U.S. Fixed Income | 87.8% |

International Fixed Income | 12.2% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Asset Allocation

as of December 31, 2021

Common Stocks (United States) | 34.4% |

Fixed Income Registered Investment Companies | 40.8% |

Money Market Registered Investment Companies | 23.6% |

Bank Obligations | 0.1% |

Other Assets/Liabilities (Net) | 1.1% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

The Blended Index is comprised 30% of the S&P 500 Index, 20% of the average 90-day T-bills, and 50% of the Bloomberg U.S. Aggregate Bond Index.

Page 12 | 2021 Annual Report | December 31, 2021 |

Conservative Allocation Fund

The Meeder Conservative Fund Institutional Class returned 4.94% for the year ended December 31, 2021, compared to the Morningstar Conservative Target Risk Index benchmark return of 2.26%.

A portion (30%) of the fund uses our Defensive Equity strategy, which follows a rules-based and data-driven approach to using the Meeder Investment Positioning (IPS) model. This model is used to determine the reward relative to the risk of the stock market and identifies when a respective fund should be increasing or decreasing its equity allocation. The remaining portion (70%) of the fund is allocated to fixed income securities.

The Meeder Conservative Fund achieved positive performance relative to its benchmark in 2021, primarily driven by the Defensive Equity Strategy and its overweight to equities throughout the year. The fund remained 30% invested in equities for the majority of the first six months of 2021, a period of positive momentum for the asset class. During the second half of the year, the Conservative Fund decreased its equity exposure, finishing the year 22% invested in equities.

Our global equity allocation was a positive contributor to performance this year as well. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within Conservative Fund’s equity allocation, it maintained an overweight to U.S. and an underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of U.S. equities compared to their international counterparts, the fund’s global equity allocation benefited performance.

The performance of our stock selection strategy was also strong in 2021. Within the U.S. portion of the Conservative Fund’s equity allocation, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to stocks displaying strong momentum and profitability were the two primary drivers of positive performance. From a sector perspective, the overweight to Information Technology and Healthcare sectors positively contributed to performance throughout the year, while the increase in allocation to Energy and Financial stocks in the second half of the year also generated positive returns.

While fixed income returns were negative, the Conservative Allocation Fund’s fixed income allocation outperformed the fixed income portion of the benchmark. The fund’s allocation to fixed income tactically shifts portfolio exposure utilizing quantitative models designed to actively manage the credit quality, emerging market bond exposure, and duration of U.S. Treasury holdings. The rise in interest rates throughout the year led to negative returns in both U.S. Investment Grade and U.S. Treasury holdings, as 2021 proved to be a challenging year for most fixed income assets. Relative to the benchmark, exposure to High Yield bonds, security selection in Investment Grade bonds, and duration positioning in U.S. Treasuries contributed to its outperformance.

The Fund often maintains significant holdings in a proprietary money market fund. We use equity index derivatives, such as stock index futures, to efficiently equitize these cash positions and manage the equity exposure of the portfolio. These derivatives are designed to track their respective market indexes. Investments in equity index derivatives were additive to performance over the past year.

Investment Objective

The investment objective of the Fund is to provide income and long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2021

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Conservative Allocation Fund Retail Class | 4.64% | 5.15% | 6.25% | 6/21/95 |

Conservative Allocation Fund Institutional Class | 4.94% | 5.52% | 6.45% | 10/31/16 |

Conservative Allocation Fund Adviser Class | 5.04% | 5.45% | 6.41% | 10/31/16 |

Morningstar Conservative Target Risk Index | 2.26% | 5.70% | 4.57% | — |

Blended Index | 3.65% | 6.00% | 5.10% | — |

Top 10 Holdings

as of December 31, 2021

1. | iShares 3-7 Year Treasury Bond ETF | 19.2% |

2. | Vanguard Short-Term Bond ETF | 8.4% |

3. | iShares JP Morgan USD Emerging Markets Bond ETF | 7.0% |

4. | Frost Total Return Bond Fund - Class I | 2.9% |

5. | Lord Abbett High Yield Fund - Class I | 2.8% |

6. | Segall Bryant & Hamill Plus Bond Fund - Class I | 2.5% |

7. | DoubleLine Total Return Bond Fund - Class I | 2.4% |

8. | SPDR Bloomberg Barclays Short Term High Yield Bond ETF | 2.4% |

9. | iShares 0-5 Year High Yield Corporate Bond ETF | 2.1% |

10. | Pioneer Bond Fund - Class K | 2.1% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2021 Annual Report | December 31, 2021 | Page 13 |

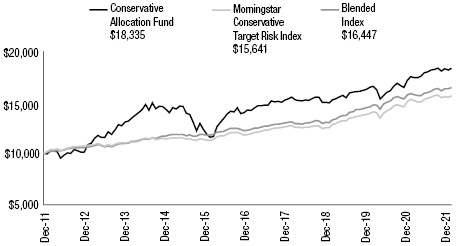

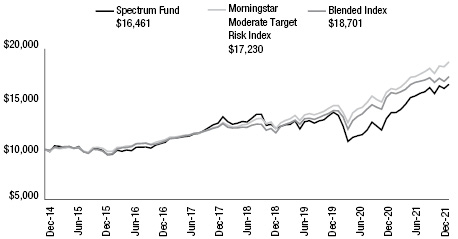

Growth of $10,000

as of December 31, 2021

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Sector Concentration

as of December 31, 2021

Information Technology | 29.0% |

Healthcare | 18.6% |

Financials | 11.9% |

Consumer Discretionary | 10.9% |

Communication Services | 8.6% |

Industrials | 6.4% |

Energy | 4.9% |

Real Estate Investment Trust | 3.6% |

Consumer Staples | 2.9% |

Utilities | 2.0% |

Materials | 1.2% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company Geographic Concentration

as of December 31, 2021

U.S. Fixed Income | 87.9% |

International Fixed Income | 12.1% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Asset Allocation

as of December 31, 2021

Common Stocks (United States) | 19.2% |

Fixed Income Registered Investment Companies | 57.6% |

Money Market Registered Investment Companies | 22.4% |

Other Assets/Liabilities (Net) | 0.8% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

The Blended Index is comprised 18% of the S&P 500 Index, 12% of the average 90-day T-bills, and 70% of the Bloomberg U.S. Aggregate Bond Index.

Page 14 | 2021 Annual Report | December 31, 2021 |

Dynamic Allocation Fund

The Meeder Dynamic Allocation Fund Institutional Class returned 19.88% for the year ended December 31, 2021, compared to the Morningstar Aggressive Target Index benchmark return of 17.30%.

Dynamic Allocation maintains a more aggressive objective and remains nearly fully invested (95%) in the stock market. Our global equity allocation was a positive contributor to performance this year. The fund allocates to different regions of the global equity markets, including U.S., Developed International ex-US., and Emerging Markets. Within the Dynamic Allocation Fund’s equity allocation, it maintained an overweight to U.S. and underweight to both Developed International ex-U.S. and Emerging Markets equities relative to its benchmark. Given the outperformance of U.S. equities compared to their international counterparts, the fund’s global equity allocation benefited performance.

The performance of our stock selection strategy for this fund was also strong in 2021. Within the U.S. portion of the Dynamic Allocation Fund’s equity allocation, we use a proprietary equity selection model that selects stocks based on value, momentum, quality, stability, and sentiment factors. In general, we favor companies that display positive momentum relative to their peers, strong balance sheets, consistent earnings growth, along with attractive valuations and positive near-term sentiment. Our overweight to stocks displaying strong momentum and profitability were the two primary drivers of positive performance. From a sector perspective, the overweight to Information Technology and Healthcare sectors positively contributed to performance throughout the year, while the increase in allocation to Energy and Financial stocks in the second half of the year also generated positive returns.

A small portion of the fund (5%) is allocated to fixed income. While fixed income returns were negative, the Dynamic Allocation Fund’s fixed income allocation outperformed the fixed income portion of the benchmark. The fund’s allocation to fixed income tactically shifts portfolio exposure utilizing quantitative models designed to actively manage credit quality and emerging market bond exposure. The rise in interest rates throughout the year led to negative returns in U.S. Investment Grade holdings, as 2021 proved to be a challenging year for most fixed income assets. Relative to the benchmark, exposure to High Yield bonds contributed to its outperformance during the year.

The Fund often maintains significant holdings in a proprietary money market fund. We use equity index derivatives, such as stock index futures, to efficiently equitize these cash positions and manage the equity exposure of the portfolio. These derivatives are designed to track their respective market indexes. Investments in equity index derivatives were additive to performance over the past year.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2021

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Dynamic Allocation Fund Retail Class | 19.54% | 13.62% | 12.60% | 2/29/00 |

Dynamic Allocation Fund Institutional Class | 19.88% | 14.06% | 12.82% | 10/31/16 |

Dynamic Allocation Fund Adviser Class | 20.02% | 13.94% | 12.77% | 10/31/16 |

Morningstar Aggressive Target Risk Index | 17.30% | 13.38% | 11.93% | — |

Blended Index | 21.63% | 15.54% | 13.57% | — |

Top 10 Holdings

as of December 31, 2021

1. | Microsoft Corp. | 4.0% |

2. | Apple, Inc. | 3.0% |

3. | iShares JP Morgan USD Emerging Markets Bond ETF | 2.2% |

4. | iShares Core U.S. Aggregate Bond ETF | 2.2% |

5. | Amazon.com, Inc. | 1.8% |

6. | Alphabet, Inc. - Class C | 1.6% |

7. | Alphabet, Inc. - Class A | 1.5% |

8. | Tesla, Inc. | 1.4% |

9. | UnitedHealth Group, Inc. | 1.2% |

10. | Johnson & Johnson | 1.2% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2021 Annual Report | December 31, 2021 | Page 15 |

Sector Concentration

as of December 31, 2021

Information Technology | 28.8% |

Healthcare | 18.7% |

Financials | 11.8% |

Consumer Discretionary | 11.2% |

Communication Services | 8.6% |

Industrials | 6.7% |

Energy | 4.8% |

Real Estate Investment Trust | 3.6% |

Consumer Staples | 2.8% |

Utilities | 1.8% |

Materials | 1.2% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company Geographic Concentration

as of December 31, 2021

U.S. Fixed Income | 45.0% |

International Fixed Income | 45.1% |

International Equity | 9.9% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Asset Allocation

as of December 31, 2021

Common Stocks (United States) | 66.9% |

Fixed Income Registered Investment Companies | 4.5% |

Equity Registered Investment Companies | 0.5% |

Money Market Registered Investment Companies | 24.5% |

Bank Obligations | 0.3% |

Other Assets/Liabilities (Net) | 3.3% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

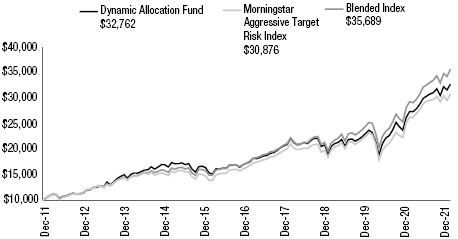

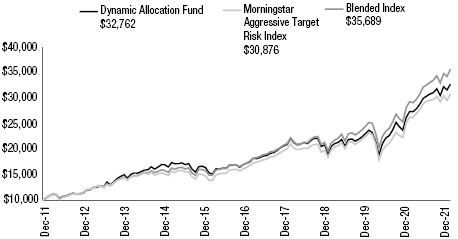

Growth of $10,000

as of December 31, 2021

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

The Blended Index is comprised of 70% S&P 500 Index, 25% MSCI ACWI ex USA Index, and 5% Bloomberg U.S. Aggregate Bond Index.

Page 16 | 2021 Annual Report | December 31, 2021 |

Quantex Fund

The Meeder Quantex Fund Institutional Class returned 27.63% for the year ended December 31, 2021, compared to the S&P Midcap 400 Index benchmark return of 24.76%.

The fund maintains a more aggressive objective and remains fully invested (100%) in the U.S. stock market, primarily in U.S. midcap stocks. While the fund utilizes a quantitative strategy to identify small- and mid-cap stocks that have significant growth potential, it can also tactically allocate up to 40% of the portfolio to U.S. large-cap equities based on our expectations of market cap segments.

The performance of our stock selection strategy for this fund was good in 2021, allowing the fund to outperform its benchmark. With value stocks outperforming, the fund’s holdings in the Energy sector were profitable, including positions in Devon Energy, Marathon Oil, and Diamondback Energy. Our overweight to Chemicals and Equity REIT stocks were also positive contributors to performance. Travel stocks Wynn Resorts and Norwegian Cruise Line Holdings were among the detractors during the year. Our tactical exposure to U.S. large-cap equities during the second half of the year slightly detracted from performance, as US mid-cap stocks outperformed their large-cap peers between August through mid-November, with large-cap stocks regaining ground through the end of the year.

The Fund often maintains significant holdings in a proprietary money market fund. We use equity index derivatives, such as stock index futures, to efficiently equitize these cash positions and manage the equity exposure of the portfolio. These derivatives are designed to track their respective market indexes. Investments in equity index derivatives were additive to performance over the past year.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2021

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Quantex Fund Retail Class | 27.34% | 7.26% | 11.24% | 3/20/85 |

Quantex Fund Institutional Class | 27.63% | 7.55% | 11.40% | 10/31/16 |

Quantex Fund Adviser Class | 27.68% | 7.44% | 11.34% | 10/31/16 |

S&P MidCap 400 Index | 24.76% | 13.09% | 14.20% | — |

Russell 2000 Index | 14.82% | 12.02% | 13.23% | — |

Blended Index | 19.79% | 12.59% | 13.76% | — |

Top 10 Holdings

as of December 31, 2021

1. | CF Industries Holdings, Inc. | 0.9% |

2. | Devon Energy Corp. | 0.8% |

3. | Marathon Oil Corp. | 0.8% |

4. | Diamondback Energy, Inc. | 0.8% |

5. | F5, Inc. | 0.8% |

6. | Juniper Networks, Inc. | 0.8% |

7. | Comerica, Inc. | 0.8% |

8. | CH Robinson Worldwide, Inc. | 0.8% |

9. | A O Smith Corp. | 0.8% |

10. | Quanta Services, Inc. | 0.8% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2021 Annual Report | December 31, 2021 | Page 17 |

Growth of $10,000

as of December 31, 2021

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Sector Concentration

as of December 31, 2021

Consumer Discretionary | 19.1% |

Industrials | 16.5% |

Financials | 15.1% |

Information Technology | 8.7% |

Real Estate Investment Trust | 7.9% |

Energy | 7.8% |

Materials | 7.5% |

Utilities | 7.1% |

Healthcare | 4.4% |

Communication Services | 4.1% |

Consumer Staples | 1.8% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2021

Common Stocks (United States) | 64.0% |

Money Market Registered Investment Companies | 32.6% |

Other Assets/Liabilities (Net) | 3.4% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

The Blended Index consists of 50% of the Russell 2000 Index and 50% of the S&P MidCap 400 Index.

Page 18 | 2021 Annual Report | December 31, 2021 |

Tactical Income Fund

The Meeder Tactical Income Institutional Class returned -1.62% for the year ended December 31, 2021, compared to the Bloomberg U.S. Treasury Bill 1-3 Month Index benchmark return of 0.04%. In April, the fund altered its name, strategy, and principal benchmark to reflect a change in strategy from one that emphasized investment grade securities to one in which the adviser tactically manages the portfolio across foreign or domestic fixed income securities of any credit quality or duration. In connection with the change in strategy, the fund changed its benchmark from the Bloomberg U.S. Aggregate Total Return Index to the Bloomberg U.S. Treasury Bill 1-3 Month Index.

With the new strategy, this fund tactically shifts portfolio exposure utilizing quantitative models designed to actively manage the credit quality, emerging market bond exposure, and duration of U.S. Treasury holdings. The fund significantly decreased its duration after the portfolio shift, ending the year at 3.9 years. Since the strategy was introduced, the Tactical Income Institutional Class returned 0.71% from April 6 through December 31, 2021, compared to the Bloomberg U.S. Treasury Bill 1-3 Month Index benchmark return of 0.02%.

The rise in interest rates throughout the year led to negative returns in both U.S. Investment Grade and U.S. Treasury holdings, as 2021 proved to be a challenging year for most fixed income assets. Relative to the benchmark, exposure to High Yield bonds and security selection in Investment Grade bonds contributed to performance, while exposure to Emerging Market bonds and U.S. Treasuries detracted from performance since June 1.

Investment Objective

The investment objective of the Fund is to provide long-term total return and income.

Average Annual Total Returns

as of December 31, 2021

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Tactical Income Fund Retail Class | -2.01% | 2.86% | 2.66% | 6/30/11 |

Tactical Income Fund Institutional Class | -1.62% | 3.30% | 2.89% | 10/31/16 |

Tactical Income Fund Adviser Class | -1.60% | 3.20% | 2.84% | 10/31/16 |

Bloomberg 1-3 Month U.S. Treasury Bill Index | 0.04% | 1.08% | 0.58% | — |

Bloomberg U.S. Aggregate Bond Index | -1.54% | 3.57% | 2.90% | — |

Top 10 Holdings

as of December 31, 2021

1. | iShares 3-7 Year Treasury Bond ETF | 27.4% |

2. | Vanguard Short-Term Bond ETF | 10.3% |

3. | iShares JP Morgan USD Emerging Markets Bond ETF | 10.0% |

4. | Lord Abbett High Yield Fund | 4.0% |

5. | Frost Total Return Bond Fund - Class I | 3.9% |

6. | Segall Bryant & Hamill Plus Bond Fund - Class I | 3.5% |

7. | DoubleLine Total Return Bond Fund - Class I | 3.5% |

8. | SPDR Bloomberg Barclays Short Term High Yield Bond ETF | 3.5% |

9. | Pioneer Bond Fund - Class K | 3.0% |

10. | iShares 0-5 Year High Yield Corporate Bond ETF | 3.0% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

2021 Annual Report | December 31, 2021 | Page 19 |

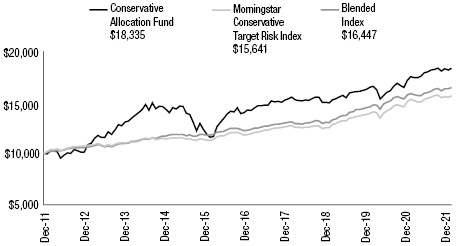

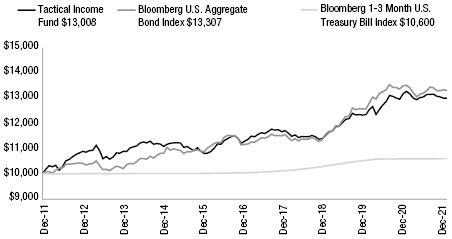

Growth of $10,000

as of December 31, 2021

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Fixed Income Sector Concentration

as of December 31, 2021

Investment Grade | 32.5% |

U.S. Government | 27.5% |

Cash & Equivalents | 19.6% |

High-Yield | 10.4% |

Emerging Markets | 10.0% |

Total | 100.0% |

As a percentage of total fixed income securities. Concentrations are subject to change.

Page 20 | 2021 Annual Report | December 31, 2021 |

Institutional Prime Money Market Fund

The Meeder Institutional Prime Money Market Fund (the Fund) offers a floating net asset value (FNAV). A FNAV fund is characterized by a net asset value which could vary incrementally above or below $1.00 per share. The objective of this fund is to maintain a FNAV near $1.00 per share while offering competitive returns to shareholders. The adviser to the Fund accomplishes the objective by investing in short-term, high-quality money market debt obligations. Money market debt obligations may be offered by the U.S. Government and its agencies but may also include obligations of fundamentally sound corporate issuers.

Over the years, investors have demonstrated confidence in the money market fund industry because of a couple key features. Safety and liquidity are at the core of money fund investment strategy. Safety is expressed through the selection of investments which are anticipated to provide minimal principal volatility, while liquidity is generated by maintaining ample funds to accommodate investor requests to redeem shares. These attributes would prove important once again as the industry was challenged by an accommodative Federal Open Market Committee’s (FOMC) zero bound interest rate policy.

In 2021, the U.S. economy was on a steady path of recovery but was still faced with headwinds attributed to the Covid-19 pandemic and its variants. This would keep the FOMC on the sideline for the year favoring caution when setting and communicating policy. The stance was proven appropriate as virus variants named Delta and Omicron made their presence felt. But with vaccines in hand (arm), the workforce was more engaged filling job openings in sectors of the economy which were essentially closed the previous year. Consumers continued to showcase their financial health and need for normalcy by traveling, home buying, and welcoming back special events like concerts and festivals. As a result, with every action there is a reaction and, in this case, it would be the emergence of inflation. Supply chain interruptions and businesses struggling with a greater need for workers kick-started the need to raise wages and pay more for goods and services.

By the second half of 2021, market participants were eager to start the conversation surrounding a liftoff from an interest rate target range of 0.00% to 0.25%. It was these conversations and ones which followed that provided for more attractive investment options for money market investment managers. With government securities tied to the actions of the FOMC, high-quality corporate obligations began to offer attractive returns to fund managers. Throughout the year the advisor to the Fund built ample liquidity for opportunities such as this. Investment holdings in the Fund were overweight short-term securities, including but not limited to collateralized obligations. This provided abundant resources for the advisor to deploy assets to high-quality corporate obligations.

During the year, the portfolio management team targeted a weighted average maturity that accommodated the environment. Compliance metrics were well within regulated parameters. This strategy allowed the management team opportunity to alter investments as markets evolved. Currently, we believe the FOMC will start the process of lifting interest rates in 2022 embarking on a new policy cycle which may realize multiple actions throughout the year. We will be monitoring the economy and the FOMC closely for any potential deviations which would alter our strategy. Our sector allocation favors an overweight to high-quality liquid investments which provides the best opportunity to explore investment alternatives in short-term, high-quality corporate debt products without adding undo risk.

As we completed 2021, our belief was that the Fund should be positioned to maintain strong performance into 2022. In the event FOMC policy changes, we believe the portfolio will be positioned to perform in the resulting environment. Going forward we will continuously monitor strategy relative to market opportunities and act in the best interest of our shareholders.

Investment Objective

The investment objective of the Fund is to provide current income consistent with liquidity and the preservation of capital.

Average Annual Total Returns

as of December 31, 2021

| 1

Year | 5

Year | 10

Year |

Institutional Prime Money Market Fund | 0.03% | 1.15% | 0.67% |

Yields

as of December 31, 2021

| | 7-Day

Subsidized

Yield | 7-Day

Unsubsidized

Yield |

Institutional Prime Money Market Fund | 0.05% | -0.30% |

Top 10 Holdings

as of December 31, 2021

1. | South Street Repo, 0.04%, due 1/3/2022 | 10.4% |

2. | StoneX Repo, 0.19%, due 1/3/2022 | 7.2% |

3. | Ebury Finance, LLC, 0.07%, due 1/3/2022 | 4.8% |

4. | South Street Repo, 0.09%, due 1/3/2022 | 3.2% |

5. | Caterpillar Financial Power Investment Floating Rate Demand Note, 0.20% | 2.7% |

6. | Cedar Springs Capital, 0.25%, due 3/21/2022 | 2.4% |

7. | Federated Hermes Government Obligations Fund, 0.03% | 2.0% |

8. | Banco Santander Yankee CD, 0.22%, due 2/7/2022 | 1.6% |

9. | Sumitomo Mitsui Trust Bank LTD/New York, NY Yankee CD, 0.18%, due 2/9/2022 | 1.6% |

10. | MUFG Bank, LTD/New York, NY, 0.09%, due 1/3/2022 | 1.6% |

As a percentage of total net assets.

2021 Annual Report | December 31, 2021 | Page 21 |

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s performance prior to October 7, 2016 reflects the performance of a predecessor fund, the Institutional Class of the Meeder Prime Money Market Fund, which was distributed and transferred to the Institutional Prime Money Market Fund upon its inception. The subsidized 7-day current yield is the current annualized net yield of the Fund. The unsubsidized 7-day current yield does not reflect the effect of any fee waivers or expense reimbursements made by the Fund’s investment adviser. The 7-day current yield more closely reflects the current earnings of the Fund than total return.

You could lose money by investing in the Fund. Because the share price of the Fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them. The Fund may impose a fee upon sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

Sector Concentration

as of December 31, 2021

Commercial Paper | 50.9% |

Repurchase Agreements | 21.5% |

Variable Rate Demand Notes | 10.5% |

Corporate Obligations | 7.4% |

Certificates of Deposit | 5.3% |

Money Market Registered Investment Companies | 2.4% |

U.S. Government and Agency Obligations | 1.5% |

Bank Obligations | 0.5% |

Total | 100.0% |

As a percentage of total net assets. Concentrations are subject to change.

Page 22 | 2021 Annual Report | December 31, 2021 |

2021 Annual Report

Fund Holdings & Financial Statements

Schedule of Investments

December 31, 2021

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) — 66.9% |

Communication Services — 5.9% | | | | | | | | |

Activision Blizzard, Inc. | | | 16,161 | | | | 1,075,191 | |

Alphabet, Inc. - Class C (1) | | | 3,949 | | | | 11,426,787 | |

Alphabet, Inc. - Class A (1) | | | 3,583 | | | | 10,380,094 | |

AMC Entertainment Holdings, Inc. (1) | | | 5,331 | | | | 145,003 | |

AT&T, Inc. | | | 333 | | | | 8,192 | |

Audacy, Inc. (1) | | | 8 | | | | 21 | |

Cargurus, Inc. (1) | | | 2,132 | | | | 71,720 | |

Cars.com, Inc. (1) | | | 2,700 | | | | 43,443 | |

Cinemark Holdings, Inc. (1) | | | 4,135 | | | | 66,656 | |

DHI Group, Inc. (1) | | | 3,808 | | | | 23,762 | |

DISH Network Corp. (1) | | | 246 | | | | 7,980 | |