UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03462

Meeder Funds Trust

6125 Memorial Drive

Dublin, OH 43017

Bruce McKibben

c/o Meeder Funds Trust

6125 Memorial Drive

Dublin, OH 43017

Registrant’s telephone number, including area code: 800-325-3539

Date of fiscal year end: December 31, 2020

Date of reporting period: December 31, 2020

Item 1. Report to Stockholders.

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.meederinvestment.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-325-3539 or by sending an email request to meederfunds@meederinvestment.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 1-800-325-3539 or send an email request to meederfunds@meederinvestment.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with the Fund complex if you invest directly with a Fund.

TABLE OF CONTENTS

| | |

Letter to Shareholders | 1 |

Fund Summaries (Unaudited) | |

Muirfield Fund | 4 |

Spectrum Fund | 6 |

Global Allocation Fund | 8 |

Balanced Fund | 10 |

Moderate Allocation Fund | 12 |

Conservative Allocation Fund | 14 |

Dynamic Allocation Fund | 16 |

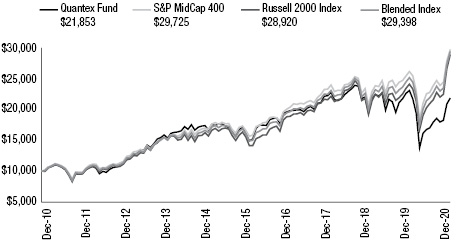

Quantex Fund | 18 |

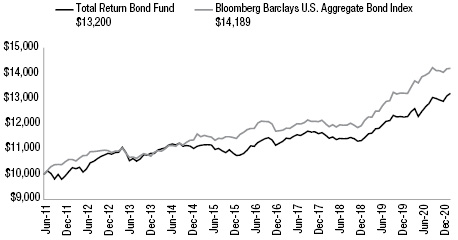

Total Return Bond Fund | 20 |

Prime Money Market Fund | 22 |

Institutional Prime Money Market Fund | 24 |

Financial Statements | |

Schedules of Investments | 27 |

Statements of Assets & Liabilities | 118 |

Statements of Operations | 120 |

Statements of Changes in Net Assets | 122 |

Financial Highlights | 126 |

Notes to Financial Statements | 136 |

Report of Independent Registered Public Accounting Firm | 155 |

Shareholder Expense Analysis | 156 |

Management of the Trust | 158 |

Other Items | 159 |

This Annual Report is prepared and distributed for the general information of the shareholders of the Funds. This material is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. Investors are advised to consider carefully the investment objectives, risks, charges and expenses of the Fund before investing. The prospectus contains this and other information about the Funds.

Meeder Funds are distributed by Meeder Distribution Services, Inc. (f.k.a. Adviser Dealer Services, Inc.) (Member FINRA), an affiliate of Meeder Investment Management. An affiliated registered investment adviser, Meeder Asset Management, Inc., serves as the investment adviser to Meeder Funds and is paid a fee for its services.

Letter to Shareholders December 31, 2020

CAPITAL MARKETS UPDATE: Q4: 2020

For many, the year 2020 could not end quickly enough. The U.S. election and quest to find a COVID-19 vaccine dominated the headlines throughout the year. As scientists learned more about the transmission of the virus, state governments formulated various strategies and companies across the U.S. gradually reopened. Positive news on vaccine advances helped GDP in the 3rd quarter rebound by more than +33%, up from its worst-ever drop of -31.4% in the prior quarter. At the end of December, the FDA approved two different COVID-19 vaccines for emergency use. These events provided a renewed hope that the global economy could reopen sooner than previously expected and helped the Dow Jones Industrial Average, S&P 500, and Russell 2000 Indices reach new all-time highs. Small-cap stocks were the best performing U.S, market cap index for the quarter, followed by mid and large-caps, respectively. WTI oil also reached a 9-month high of $50 a barrel as the world reached another step closer to the global economy reopening.

While it seemed like things were moving back to normal economically, the disconnect between strong stock market performance and a weak economic recovery continues as significant economic problems remain The U.S. unemployment rate remains stagnant at 6.7% as many workers still attempt to regain their footing after being displaced due to the pandemic. Unfortunately, U.S. Non-farm payrolls lost 140,000 jobs in December, making it the first loss since the economy shed almost an unthinkable 21 million jobs in April alone. The continued trend of slowing growth even compelled Congress to pass a stimulus relief bill for those impacted the most by the pandemic. The new administration is also considering an additional stimulus bill for Americans early in 2021.

COVID-19

The FDA approved a COVID-19 vaccine for emergency use developed through a collaboration between Pfizer and BioNTech. The U.S. government provided resources to vaccine manufacturers to begin proactively producing vaccine candidates. Thus, manufacturers created an inventory and began shipping the premade doses around the U.S. within hours of the FDA’s formal approval. The next day, medical facilities received and began administering the vaccine to front-line workers and those in assisted living facilities. Ironically, on the first day of vaccinations, the U.S. crossed 300,000 fatalities from COVID-19, as the country averages roughly 200,000 new contractions each day. On a positive note, Moderna’s COVID-19 vaccine was the second to be approved for emergency use by the FDA. This vaccination provides an efficacy rate of up to 95%. Oxford-AstraZeneca’s vaccine candidate may delay submission for FDA review in the spring of 2021, but is currently being used in the U.K. These vaccines will help provide the medical community with a portfolio of available medicines that fight the virus differently. To date, the virus is responsible for the deaths of more than 368,000 Americans and 1,900,000 lives worldwide.

FEDERAL RESERVE

The Federal Open Market Committee held its meeting in December and kept interest rates near zero. The committee also committed to purchasing a minimum of $120 billion of bonds each month until the economy reaches full employment and inflation expectations. They issued a statement saying, “these asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.” The Federal Reserve (Fed) stated that they would consider many items when determining their outlook, including the global pandemic, labor markets, inflation, and international events. As it stands, a survey of Fed officials revealed the group is committed to keeping rates near zero through 2023.

ELECTION 2020

Joe Biden will be inaugurated as the 46th President of the United States as the electoral college officially certified their votes, providing him with more than the 270 votes needed. Democrats will maintain control of the House of Representatives, but their majority decreased from 38 seats to 10. On January 5, Democrats won both of Georgia’s runoff races. These seats now split the Senate in a 50-50 tie between both parties but gives the incoming Democratic Vice President the tie-breaking majority. Stock market returns have historically been higher with a split Congress, which usually leads to less sweeping policy changes. However, performance of the S&P 500 Index when Democrats have maintained control of the White House and Congress are still above average.

There was a record amount of money spent during this election cycle. The nonpartisan Center of Responsive Politics estimates that the Congressional and Presidential campaigns for the November 2020 elections spent $10.8 billion. Campaigns allocated more than $1 billion to television campaign ads, with $882 million of the total directed to six key battleground states. Despite the record amounts spent by both campaigns, expected market volatility followed a somewhat similar pattern to past elections and rose significantly. This year, the CBOE Volatility Index (VIX) spiked more than 50% during the three months ahead of the election.

BREXIT TRADE DEAL OFFICIAL

In 2016, citizens of Great Britain voted to leave the European Union. Since then, details and logistics of the move prevented this transition from occurring. The event was officially ratified on January 31, 2020; however, Britain agreed to adhere to the E.U.’s terms to finalize the agreement until December 31, 2020. Citizens of Great Britain who travel to the European Union will now need to provide similar documentation as Americans. From a business perspective, the most critical detail in the agreement is that the two entities established a trade deal with no tariffs and no quotas. Thankfully, this resolution is one less thing that investors need to worry about in 2021.

2020 Annual Report | December 31, 2020 | Page 1 |

HOW IS THIS IMPACTING PORTFOLIOS?

At Meeder, we manage investment solutions across different risk profiles and time horizons. Meeder manages strategies using a systematic approach that guides us in the allocation of our portfolios. Many of these solutions employ one or more of our core investment strategies: Growth, Defensive Equity and Fixed Income.

GROWTH

Investment portfolios comprised of the Growth Strategy maintain a more aggressive objective and typically remain invested in the stock market. In the fourth quarter, investors got significantly more clarity about the future. Certified election results provided investors with a better idea of what they might expect regarding future policy shifts. At the end of December, the FDA approved two different COVID-19 vaccines for emergency use. This renewed hope that the global economy might be reopening sooner than previously expected helped major indices like the Dow Jones, S&P 500, and Russell 2000 Indices reach new all-time highs. Small-cap stocks were the best performing market cap for the quarter, followed by mid and large-caps, respectively. Those investors that remained invested in the Growth Strategy portfolios, despite the market volatility in the fourth quarter, received the highest returns of all our risk-based portfolios.

DEFENSIVE EQUITY

Portfolios that utilize the Defensive Equity Strategy follow a rules-based and data-driven approach using the Meeder Investment Positioning System (IPS) model. This model is used to determine the risk relative to reward in the marketplace and identifies when we should be increasing or decreasing the portfolio’s target equity exposure.

At the beginning of the fourth quarter, the IPS model indicated that we should have an equity target exposure of 86%. Short-term trends were robust as many stocks participated in the stock market rally. The IPS guided us to gradually increase our target equity exposure to 100% by the middle of October. As the U.S. election drew near, the stock market’s expected volatility climbed to its highest level since early June. During higher periods of volatility, historically, there are increased odds of equity drawdowns and this is one reason the IPS guided us to reduce the target equity exposure to 88%. After the U.S. election occurred, market risk declined significantly as investors gained clarity about potential future policy shifts.

The long-term model’s score continued to improve as the broad strength of the underlying trend of many sectors and industries. This caused us to gradually increase our target equity exposure to 100% in the middle of November. In December, bullish option activity was extremely high and was near an optimistic extreme. Since we view this from a contrarian perspective, this was a detractor from the intermediate-term model score. The IPS also identified a decline in the percentage of world markets in uptrends, but neither of these events was significant enough to reduce our equity exposure. The Defensive Equity strategy remained 100% invested through the end of 2020.

FIXED INCOME

The Meeder Fixed Income Strategy tactically shifts portfolio exposure utilizing our proprietary investment models. These models are designed to actively monitor factors to guide us in determining the credit quality, emerging market debt exposure, and the portfolio’s U.S. Treasury duration. Our quantitative model signaled strength in momentum, volatility, and macroeconomic factors in high-yield and emerging market debt sectors in the fourth quarter. This risk-on signal led us to increase the allocation and ultimately overweight these sectors while underweighting investment-grade bonds and U.S. Treasuries for the majority of the quarter. High-yield bonds led the risk-on rally to substantially outperform their investment-grade peers, as yields reached a record low of 4.18% at the end of the year. The overweight allocation to emerging market bonds also contributed to portfolio performance, as the sector benefited from the U.S. dollar’s weakness in December. The Meeder fixed income strategy maintained a duration in line with its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index.

A NEW YEAR

The events of 2020 made history for our country and in the markets that we will likely not forget. Despite all the twists and turns, I want to take a moment to congratulate everyone for navigating through one of the most turbulent market environments ever. It is essential to reflect on what an historic year it has been and all that we have accomplished together in such an unusual time. On behalf of all of us at Meeder Investment Management, I would like to wish each of you a happy, healthy, and prosperous new year.

Sincerely,

Robert S. Meeder

President & CEO

Meeder Asset Management, Inc.

Page 2 | 2020 Annual Report | December 31, 2020 |

2020 Annual Report

Fund Summaries

Muirfield Fund

The Meeder Muirfield Fund Institutional Class returned 4.66% for the year ended December 31, 2020, compared to the Morningstar Moderate Target Risk Index benchmark return of 12.82%. This fund maintains exposure to the Meeder Defensive Equity Strategy.

The Meeder Defensive Equity Strategy follows a rules-based and data-driven approach using the Meeder Investment Positioning System (IPS) model. This model is used to determine the risk relative to reward in the marketplace and identifies when we should be increasing or decreasing the portfolio’s target equity exposure. The Defensive Equity tactical portfolio began the first quarter with a target of 100% exposure to the stock market since our investment model’s reward value was higher than the risk value. The S&P 500 Index plummeted -34% from its high on February 19th, to its low on March 23rd. The economic impact of the COVID-19 pandemic rocked the stock market as initial jobless claims spiked as high as 6.8 million in just one week, before gradually trending lower. A sharp increase in market risk identified by our IPS models indicated that we should have a target exposure of 30% at the end of March. The percentage of world markets trading above their 50-day moving average increased in the long-term model. Markets remained rangebound until the May non-farm payroll report showed that the U.S. added a record-high 2.5 million jobs when it was expected to lose more than -8.3 million. This led us to increase the target exposure to the stock market to 62%. The intermediate-term model improved, as significant fund flow activity demonstrated an increase in institutional demand causing us to increase our equity target to as high as 91%. With the Fed remaining extremely accommodative and stating they will keep interest rates near zero until at least 2023, the long-term model score significantly improved this quarter. Institutional demand factors in our intermediate-term model continued to show a lack of significant fund flow activity during September. After the U.S. election in November, market risk declined significantly as investors gained clarity about potential future policy shifts. The long-term model’s score continued to improve as the broad strength of the underlying trend of many sectors and industries. This caused us to gradually increase our target equity exposure to 100% in mid-November and remained there through the end of 2020.

Our shifts within equity markets include international versus domestic holdings, as well as allocating among market capitalization ranges in addition to sector overweight and/or underweight positions. Due primarily to relative momentum factors, our exposure to international holdings among both developed international and emerging market securities was underweight relative to the benchmark. Our underweight exposure to international markets contributed to performance relative to the benchmark in 2020.

Within our stock selection process, we attempt to gain exposure to companies with strong profitability that are priced at reasonable valuations relative to their industry peers and are trading with positive price momentum. For the year ending 2020, securities with strong fundamentals, such as strong profitability, contributed to performance. In addition, the fund’s investment in companies with low leverage also contributed to performance. The fund’s exposure to companies with low valuations detracted from performance in 2020.

In the portfolio, we will often use equity index derivatives in the fund, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the fund. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact to the fund’s relative performance. The use of stock index futures to manage equity exposure of the fund had a negative impact on the performance of the fund relative to the benchmark index during 2020.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2020

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Muirfield Fund Retail Class | 4.36% | 7.74% | 7.62% | 8/10/88 |

Muirfield Fund Institutional Class | 4.66% | 8.09% | 7.80% | 10/31/16 |

Muirfield Fund Adviser Class | 4.67% | 7.98% | 7.74% | 10/31/16 |

Morningstar Moderate Target Risk Index | 12.82% | 9.75% | 7.77% | — |

Blended Index | 11.77% | 9.69% | 8.62% | — |

Top 10 Holdings

as of December 31, 2020

1. | Apple, Inc. | 4.8% |

2. | Microsoft Corp. | 4.1% |

3. | Amazon.com, Inc. | 2.8% |

4. | Facebook, Inc. | 1.6% |

5. | Berkshire Hathaway, Inc. - Class B | 1.5% |

6. | Johnson & Johnson | 1.5% |

7. | Alphabet, Inc. - Class C | 1.4% |

8. | Tesla, Inc. | 1.2% |

9. | Merck & Co., Inc. | 0.9% |

10. | Alphabet, Inc. - Class A | 0.9% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Page 4 | 2020 Annual Report | December 31, 2020 |

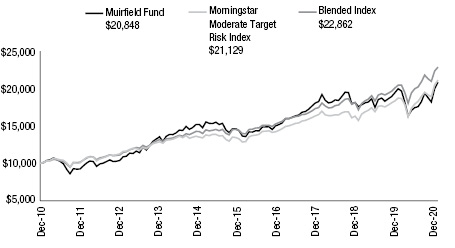

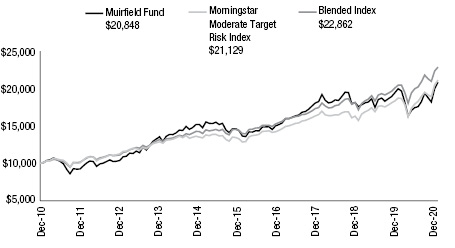

Growth of $10,000

as of December 31, 2020

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Sector Concentration

as of December 31, 2020

Information Technology | 28.7% |

Healthcare | 18.9% |

Consumer Discretionary | 12.7% |

Communication Services | 10.1% |

Financials | 8.9% |

Industrials | 8.7% |

Real Estate Investment Trust | 3.1% |

Materials | 3.0% |

Consumer Staples | 2.7% |

Utilities | 2.2% |

Energy | 1.0% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2020

Common Stocks | 79.9% |

Money Market Registered Investment Companies | 18.1% |

Bank Obligations | 0.1% |

Other Assets/Liabilities (Net) | 1.9% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund.

The Blended Index is comprised 60% of the S&P 500 Index and 40% of 90-day T-bills.

2020 Annual Report | December 31, 2020 | Page 5 |

Spectrum Fund

The Meeder Spectrum Fund Institutional Class returned 0.25% for the year ended December 31, 2020, compared to the Morningstar Moderate Target Risk Index benchmark return of 12.82%. This fund maintains exposure to the Meeder Defensive Equity Strategy.

The Meeder Defensive Equity Strategy follows a rules-based and data-driven approach using the Meeder Investment Positioning System (IPS) model. This model is used to determine the risk relative to reward in the marketplace and identifies when we should be increasing or decreasing the portfolio’s target equity exposure. The Defensive Equity tactical portfolio began the first quarter with a target of 100% exposure to the stock market since our investment model’s reward value was higher than the risk value. The S&P 500 Index plummeted -34% from its high on February 19th, to its low on March 23rd. The economic impact of the COVID-19 pandemic rocked the stock market as initial jobless claims spiked as high as 6.8 million in just one week, before gradually trending lower. A sharp increase in market risk identified by our IPS models indicated that we should have a target exposure of 30% at the end of March. The percentage of world markets trading above their 50-day moving average increased in the long-term model. Markets remained rangebound until the May non-farm payroll report showed that the U.S. added a record-high 2.5 million jobs when it was expected to lose more than -8.3 million. This led us to increase the target exposure to the stock market to 62%. The intermediate-term model improved, as significant fund flow activity demonstrated an increase in institutional demand causing us to increase our equity target to as high as 91%. With the Fed remaining extremely accommodative and stating they will keep interest rates near zero until at least 2023, the long-term model score significantly improved this quarter. Institutional demand factors in our intermediate-term model continued to show a lack of significant fund flow activity during September. After the U.S. election in November, market risk declined significantly as investors gained clarity about potential future policy shifts. The long-term model’s score continued to improve as the broad strength of the underlying trend of many sectors and industries. This caused us to gradually increase our target equity exposure to 100% in mid-November and remained there through the end of 2020.

Our shifts within equity markets include international versus domestic holdings, as well as allocating among market capitalization ranges in addition to sector overweight and/or underweight positions. Due primarily to relative momentum factors, our exposure to international holdings among both developed international and emerging market securities was underweight relative to the benchmark. Our underweight exposure to international markets contributed to performance relative to the benchmark in 2020.

Within our stock selection process, we attempt to gain exposure to companies with strong profitability that are priced at reasonable valuations relative to their industry peers and are trading with positive price momentum. For the year ending 2020, securities with strong fundamentals, such as strong profitability, contributed to performance. In addition, the fund’s investment in companies with low leverage also contributed to performance. The fund’s exposure to companies with low valuations detracted from performance in 2020.

In the portfolio, we will often use equity index derivatives in the fund, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the fund. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact to the fund’s relative performance. The use of stock index futures to manage equity exposure of the fund had a negative impact on the performance of the fund relative to the benchmark index during 2020.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2020

| 1

Year | 5

Year | Since

Inception | Share Class

Inception

Date |

Spectrum Fund Retail Class | -0.23% | 6.68% | 5.33% | 1/1/15 |

Spectrum Fund Institutional Class | 0.25% | 7.07% | 5.65% | 10/31/16 |

Spectrum Fund Adviser Class | 0.18% | 6.94% | 5.54% | 10/31/16 |

Morningstar Moderate Target Risk Index | 12.82% | 9.75% | 7.75% | — |

Blended Index | 11.77% | 9.69% | 8.21% | — |

Top 10 Holdings

as of December 31, 2020

1. | Apple, Inc. | 5.5% |

2. | Microsoft Corp. | 4.7% |

3. | Amazon.com, Inc. | 2.8% |

4. | Johnson & Johnson | 1.9% |

5. | Facebook, Inc. | 1.7% |

6. | Berkshire Hathaway, Inc. - Class B | 1.5% |

7. | Alphabet, Inc. - Class C | 1.4% |

8. | Tesla, Inc. | 1.3% |

9. | Merck & Co., Inc. | 1.3% |

10. | Intuit, Inc. | 1.2% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Page 6 | 2020 Annual Report | December 31, 2020 |

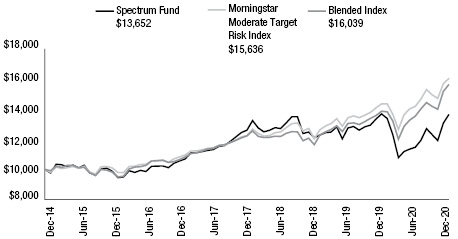

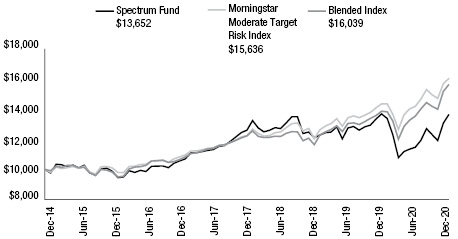

Growth of $10,000

as of December 31, 2020

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Sector Concentration

as of December 31, 2020

Information Technology | 30.7% |

Healthcare | 19.3% |

Consumer Discretionary | 12.5% |

Communication Services | 9.6% |

Financials | 8.6% |

Industrials | 7.9% |

Real Estate Investment Trust | 3.1% |

Materials | 3.0% |

Consumer Staples | 2.9% |

Utilities | 1.5% |

Energy | 0.9% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2020

Common Stocks | 81.6% |

Money Market Registered Investment Companies | 15.8% |

Other Assets/Liabilities (Net) | 2.6% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund.

The Blended Index is comprised 60% of the S&P 500 Index and 40% of 90-day T-bills.

2020 Annual Report | December 31, 2020 | Page 7 |

Global Allocation Fund

The Meeder Global Allocation Fund Institutional Class returned 3.43% for the year ended December 31, 2020, compared to the Morningstar Global Allocation Index benchmark return of 13.55%. This fund maintains exposure to both the Meeder Defensive Equity Strategy and to the Meeder Fixed Income Strategy. It invests in domestic equity markets but will generally hold securities in emerging market and developed international equities as well. We alter the allocation to the international markets based on indications from our quantitative models. Additionally, the strategy can reduce equity exposure when it is deemed to be a high-risk market environment.

The Meeder Defensive Equity Strategy follows a rules-based and data-driven approach using the Meeder Investment Positioning System (IPS) model. This model is used to determine the risk relative to reward in the marketplace and identifies when we should be increasing or decreasing the portfolio’s target equity exposure. The Defensive Equity tactical portfolio began the first quarter with a target of 100% exposure to the stock market since our investment model’s reward value was higher than the risk value. The S&P 500 Index plummeted -34% from its high on February 19th, to its low on March 23rd. The economic impact of the COVID-19 pandemic rocked the stock market as initial jobless claims spiked as high as 6.8 million in just one week, before gradually trending lower. A sharp increase in market risk identified by our IPS models indicated that we should have a target exposure of 30% at the end of March. The percentage of world markets trading above their 50-day moving average increased in the long-term model. Markets remained rangebound until the May non-farm payroll report showed that the U.S. added a record-high 2.5 million jobs when it was expected to lose more than -8.3 million. This led us to increase the target exposure to the stock market to 62%. The intermediate-term model improved, as significant fund flow activity demonstrated an increase in institutional demand causing us to increase our equity target to as high as 91%. With the Fed remaining extremely accommodative and stating they will keep interest rates near zero until at least 2023, the long-term model score significantly improved this quarter. Institutional demand factors in our intermediate-term model continued to show a lack of significant fund flow activity during September. After the U.S. election in November, market risk declined significantly as investors gained clarity about potential future policy shifts. The long-term model’s score continued to improve as the broad strength of the underlying trend of many sectors and industries. This caused us to gradually increase our target equity exposure to 100% in mid-November and remained there through the end of 2020.

Our shifts within equity markets include international versus domestic holdings, as well as allocating among market capitalization ranges in addition to sector overweight and/or underweight positions. Due primarily to relative momentum factors, our exposure to international holdings among both developed international and emerging market securities was underweight relative to the benchmark. Our underweight exposure to international markets contributed to performance relative to the benchmark in 2020.

The Meeder Fixed Income Strategy tactically shifts portfolio exposure utilizing quantitative models designed to actively monitor the credit quality, emerging market bond exposure, and the U.S. Treasury duration of the portfolio. Our fixed income models added significant value during the coronavirus-driven drawdown. Volatility and macroeconomic factors in our models turned uniformly negative in the middle of March, while momentum factors turned negative toward the end of the first quarter. This caused us to reduce our high-yield and emerging market exposure before the market meltdown in March. The Federal Reserve stepped in to provide liquidity by reducing short-term interest rates to zero, as well as providing other quantitative easing measures to calm fixed income markets. During this period, our portfolio maintained a high-quality bias, which contributed to its overall performance during this market volatility. In early April, momentum and volatility factors showed strength in high-yield bonds, while macroeconomic factors signaled potential weakness. All model factors related to emerging market bonds were uniformly positive. In response to our models signaling an improvement in market conditions, we increased exposure to high-yield bonds and emerging market bonds in our tactical portfolio over the first few weeks of the second quarter. This risk-on signal led us to ultimately overweight these sectors while reducing exposure to U.S. investment-grade bonds and U.S. Treasuries. Since then, high-yield bonds led the risk-on rally to substantially outperform their investment-grade peers. The overweight allocation to emerging market bonds also contributed to portfolio performance, as the sector benefited from the U.S. dollar’s weakness. At the end of the year, the Meeder fixed income strategy maintained a duration in line with its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index.

Within our stock selection process, we attempt to gain exposure to companies with strong profitability that are priced at reasonable valuations relative to their industry peers and are trading with positive price momentum. For the year ending 2020, securities with strong fundamentals, such as strong profitability, contributed to performance. In addition, the fund’s investment in companies with low leverage also contributed to performance. The fund’s exposure to companies with low valuations detracted from performance in 2020.

In the portfolio, we will often use equity index derivatives in the fund, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the fund. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact to the fund’s relative performance. The use of stock index futures to manage equity exposure of the fund had a negative impact on the performance of the fund relative to the benchmark index during 2020.

Page 8 | 2020 Annual Report | December 31, 2020 |

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2020

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Global Allocation Fund Retail Class | 2.96% | 6.55% | 5.65% | 1/31/06 |

Global Allocation Fund Institutional Class | 3.43% | 6.98% | 5.86% | 10/31/16 |

Global Allocation Fund Adviser Class | 3.42% | 6.84% | 5.79% | 10/31/16 |

Morningstar Global Allocation Index | 13.55% | 9.76% | 7.22% | — |

Blended Index | 10.29% | 7.67% | 5.73% | — |

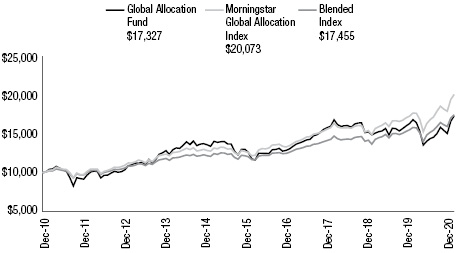

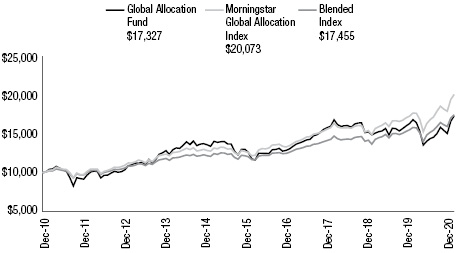

Growth of $10,000

as of December 31, 2020

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Top 10 Holdings

as of December 31, 2020

1. | iShares Core MSCI EAFE ETF | 6.4% |

2. | Apple, Inc. | 2.4% |

3. | Microsoft Corp. | 2.0% |

4. | iShares Core MSCI Emerging Markets ETF | 1.7% |

5. | Amazon.com, Inc. | 1.4% |

6. | iShares JP Morgan USD Emerging Markets Bond ETF | 1.4% |

7. | Xtrackers USD High Yield Corporate Bond ETF | 1.3% |

8. | SPDR Bloomberg Barclays High Yield Bond ETF | 1.0% |

9. | Facebook, Inc. | 0.9% |

10. | Alphabet, Inc. - Class C | 0.8% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Sector Concentration

as of December 31, 2020

Information Technology | 28.9% |

Healthcare | 18.7% |

Consumer Discretionary | 12.8% |

Communication Services | 10.8% |

Financials | 8.6% |

Industrials | 8.6% |

Real Estate Investment Trust | 3.1% |

Materials | 3.0% |

Consumer Staples | 2.9% |

Utilities | 1.7% |

Energy | 0.9% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2020

Common Stocks | 39.9% |

Equity Registered Investment Companies | 8.1% |

Fixed Income Registered Investment Companies | 9.5% |

Money Market Registered Investment Companies | 34.4% |

Bank Obligations | 1.6% |

Other Assets/Liabilities (Net) | 6.5% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund.

The Blended Index is comprised of 54% MSCI ACWI, 36% of 90 day T-Bills and 10% Bloomberg Barclays US Aggregate Bond Index.

2020 Annual Report | December 31, 2020 | Page 9 |

Balanced Fund

The Meeder Balanced Fund Institutional Class returned 5.71% for the year ended December 31, 2020, compared to the Morningstar Moderate Target Risk Index benchmark return of 12.82%. This fund maintains exposure to both the Meeder Defensive Equity Strategy and to the Meeder Fixed Income Strategy.

The Meeder Defensive Equity Strategy follows a rules-based and data-driven approach using the Meeder Investment Positioning System (IPS) model. This model is used to determine the risk relative to reward in the marketplace and identifies when we should be increasing or decreasing the portfolio’s target equity exposure. The Defensive Equity tactical portfolio began the first quarter with a target of 100% exposure to the stock market since our investment model’s reward value was higher than the risk value. The S&P 500 Index plummeted -34% from its high on February 19th, to its low on March 23rd. The economic impact of the COVID-19 pandemic rocked the stock market as initial jobless claims spiked as high as 6.8 million in just one week, before gradually trending lower. A sharp increase in market risk identified by our IPS models indicated that we should have a target exposure of 30% at the end of March. The percentage of world markets trading above their 50-day moving average increased in the long-term model. Markets remained rangebound until the May non-farm payroll report showed that the U.S. added a record-high 2.5 million jobs when it was expected to lose more than -8.3 million. This led us to increase the target exposure to the stock market to 62%. The intermediate-term model improved, as significant fund flow activity demonstrated an increase in institutional demand causing us to increase our equity target to as high as 91%. With the Fed remaining extremely accommodative and stating they will keep interest rates near zero until at least 2023, the long-term model score significantly improved this quarter. Institutional demand factors in our intermediate-term model continued to show a lack of significant fund flow activity during September. After the U.S. election in November, market risk declined significantly as investors gained clarity about potential future policy shifts. The long-term model’s score continued to improve as the broad strength of the underlying trend of many sectors and industries. This caused us to gradually increase our target equity exposure to 100% in mid-November and remained there through the end of 2020.

Our shifts within equity markets include international versus domestic holdings, as well as allocating among market capitalization ranges in addition to sector overweight and/or underweight positions. Due primarily to relative momentum factors, our exposure to international holdings among both developed international and emerging market securities was underweight relative to the benchmark. Our underweight exposure to international markets contributed to performance relative to the benchmark in 2020.

The Meeder Fixed Income Strategy tactically shifts portfolio exposure utilizing quantitative models designed to actively monitor the credit quality, emerging market bond exposure, and the U.S. Treasury duration of the portfolio. Our fixed income models added significant value during the coronavirus-driven drawdown. Volatility and macroeconomic factors in our models turned uniformly negative in the middle of March, while momentum factors turned negative toward the end of the first quarter. This caused us to reduce our high-yield and emerging market exposure before the market meltdown in March. The Federal Reserve stepped in to provide liquidity by reducing short-term interest rates to zero, as well as providing other quantitative easing measures to calm fixed income markets. During this period, our portfolio maintained a high-quality bias, which contributed to its overall performance during this market volatility. In early April, momentum and volatility factors showed strength in high-yield bonds, while macroeconomic factors signaled potential weakness. All model factors related to emerging market bonds were uniformly positive. In response to our models signaling an improvement in market conditions, we increased exposure to high-yield bonds and emerging market bonds in our tactical portfolio over the first few weeks of the second quarter. This risk-on signal led us to ultimately overweight these sectors while reducing exposure to U.S. investment-grade bonds and U.S. Treasuries. Since then, high-yield bonds led the risk-on rally to substantially outperform their investment-grade peers. The overweight allocation to emerging market bonds also contributed to portfolio performance, as the sector benefited from the U.S. dollar’s weakness. At the end of the year, the Meeder fixed income strategy maintained a duration in line with its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index.

Within our stock selection process, we attempt to gain exposure to companies with strong profitability that are priced at reasonable valuations relative to their industry peers and are trading with positive price momentum. For the year ending 2020, securities with strong fundamentals, such as strong profitability, contributed to performance. In addition, the fund’s investment in companies with low leverage also contributed to performance. The fund’s exposure to companies with low valuations detracted from performance in 2020.

In the portfolio, we will often use equity index derivatives in the fund, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the fund. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact to the fund’s relative performance. The use of stock index futures to manage equity exposure of the fund had a negative impact on the performance of the fund relative to the benchmark index during 2020.

Page 10 | 2020 Annual Report | December 31, 2020 |

Investment Objective

The investment objective of the Fund is to provide income and long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2020

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Balanced Fund Retail Class | 5.27% | 6.59% | 6.07% | 1/31/06 |

Balanced Fund Institutional Class | 5.71% | 6.97% | 6.26% | 10/31/16 |

Balanced Fund Adviser Class | 5.66% | 6.87% | 6.21% | 10/31/16 |

Morningstar Moderate Target Risk Index | 12.82% | 9.75% | 7.77% | — |

Blended Index | 10.66% | 8.20% | 7.26% | — |

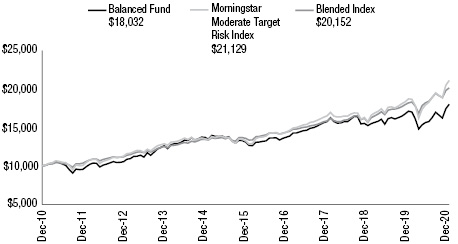

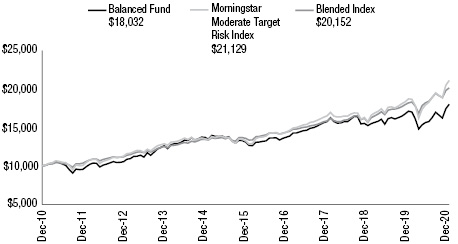

Growth of $10,000

as of December 31, 2020

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Top 10 Holdings

as of December 31, 2020

1. | iShares JP Morgan USD Emerging Markets Bond ETF | 4.4% |

2. | Xtrackers USD High Yield Corporate Bond ETF | 4.2% |

3. | Apple, Inc. | 3.3% |

4. | SPDR Bloomberg Barclays High Yield Bond ETF | 3.0% |

5. | Microsoft Corp. | 2.8% |

6. | iShares Core U.S. Aggregate Bond ETF | 2.6% |

7. | Vanguard Total Bond Market ETF | 2.2% |

8. | Amazon.com, Inc. | 2.0% |

9. | Baird Core Plus Bond Fund - Class I | 1.9% |

10. | Lord Abbett High Yield Fund - Class I | 1.8% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Sector Concentration

as of December 31, 2020

Information Technology | 28.4% |

Healthcare | 18.9% |

Consumer Discretionary | 12.9% |

Communication Services | 10.0% |

Financials | 8.8% |

Industrials | 8.8% |

Real Estate Investment Trust | 3.1% |

Materials | 3.0% |

Consumer Staples | 2.9% |

Utilities | 2.1% |

Energy | 1.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2020

Common Stocks | 55.3% |

Fixed Income Registered Investment Companies | 29.6% |

Money Market Registered Investment Companies | 13.0% |

Bank Obligations | 0.2% |

Other Assets/Liabilities (Net) | 1.9% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund.

The Blended Index is comprised 42% of the S&P 500 Index, 28% of the average 90-day T-bills, and 30% of the Bloomberg Barclays US Aggregate Bond Index.

2020 Annual Report | December 31, 2020 | Page 11 |

Moderate Allocation Fund

The Meeder Moderate Allocation Fund Institutional Class returned 6.02% compared to the Morningstar Moderate Conservative Target Risk Index benchmark return of 11.86%. This fund maintains exposure to the Meeder Defensive Equity Strategy and to the Meeder Fixed Income Strategy.

The Meeder Defensive Equity Strategy follows a rules-based and data-driven approach using the Meeder Investment Positioning System (IPS) model. This model is used to determine the risk relative to reward in the marketplace and identifies when we should be increasing or decreasing the portfolio’s target equity exposure. The Defensive Equity tactical portfolio began the first quarter with a target of 100% exposure to the stock market since our investment model’s reward value was higher than the risk value. The S&P 500 Index plummeted -34% from its high on February 19th, to its low on March 23rd. The economic impact of the COVID-19 pandemic rocked the stock market as initial jobless claims spiked as high as 6.8 million in just one week, before gradually trending lower. A sharp increase in market risk identified by our IPS models indicated that we should have a target exposure of 30% at the end of March. The percentage of world markets trading above their 50-day moving average increased in the long-term model. Markets remained rangebound until the May non-farm payroll report showed that the U.S. added a record-high 2.5 million jobs when it was expected to lose more than -8.3 million. This led us to increase the target exposure to the stock market to 62%. The intermediate-term model improved, as significant fund flow activity demonstrated an increase in institutional demand causing us to increase our equity target to as high as 91%. With the Fed remaining extremely accommodative and stating they will keep interest rates near zero until at least 2023, the long-term model score significantly improved this quarter. Institutional demand factors in our intermediate-term model continued to show a lack of significant fund flow activity during September. After the U.S. election in November, market risk declined significantly as investors gained clarity about potential future policy shifts. The long-term model’s score continued to improve as the broad strength of the underlying trend of many sectors and industries. This caused us to gradually increase our target equity exposure to 100% in mid-November and remained there through the end of 2020.

Our shifts within equity markets include international versus domestic holdings, as well as allocating among market capitalization ranges in addition to sector overweight and/or underweight positions. Due primarily to relative momentum factors, our exposure to international holdings among both developed international and emerging market securities was underweight relative to the benchmark. Our underweight exposure to international markets contributed to performance relative to the benchmark in 2020.

The Meeder Fixed Income Strategy tactically shifts portfolio exposure utilizing quantitative models designed to actively monitor the credit quality, emerging market bond exposure, and the U.S. Treasury duration of the portfolio. Our fixed income models added significant value during the coronavirus-driven drawdown. Volatility and macroeconomic factors in our models turned uniformly negative in the middle of March, while momentum factors turned negative toward the end of the first quarter. This caused us to reduce our high-yield and emerging market exposure before the market meltdown in March. The Federal Reserve stepped in to provide liquidity by reducing short-term interest rates to zero, as well as providing other quantitative easing measures to calm fixed income markets. During this period, our portfolio maintained a high-quality bias, which contributed to its overall performance during this market volatility. In early April, momentum and volatility factors showed strength in high-yield bonds, while macroeconomic factors signaled potential weakness. All model factors related to emerging market bonds were uniformly positive. In response to our models signaling an improvement in market conditions, we increased exposure to high-yield bonds and emerging market bonds in our tactical portfolio over the first few weeks of the second quarter. This risk-on signal led us to ultimately overweight these sectors while reducing exposure to U.S. investment-grade bonds and U.S. Treasuries. Since then, high-yield bonds led the risk-on rally to substantially outperform their investment-grade peers. The overweight allocation to emerging market bonds also contributed to portfolio performance, as the sector benefited from the U.S. dollar’s weakness. At the end of the year, the Meeder fixed income strategy maintained a duration in line with its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index.

Within our stock selection process, we attempt to gain exposure to companies with strong profitability that are priced at reasonable valuations relative to their industry peers and are trading with positive price momentum. For the year ending 2020, securities with strong fundamentals, such as strong profitability, contributed to performance. In addition, the fund’s investment in companies with low leverage also contributed to performance. The fund’s exposure to companies with low valuations detracted from performance in 2020.

In the portfolio, we will often use equity index derivatives in the fund, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the fund. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact to the fund’s relative performance. The use of stock index futures to manage equity exposure of the fund had a negative impact on the performance of the fund relative to the benchmark index during 2020.

Page 12 | 2020 Annual Report | December 31, 2020 |

Investment Objective

The investment objective of the Fund is to provide total return, including capital appreciation, and current income.

Average Annual Total Returns

as of December 31, 2020

| 1

Year | 5

Year | Since

Inception | Share Class

Inception

Date |

Moderate Allocation Fund Retail Class | 5.55% | 8.23% | 6.62% | 6/30/15 |

Moderate Allocation Fund Institutional Class | 6.02% | 8.61% | 6.96% | 10/31/16 |

Moderate Allocation Fund Adviser Class | 6.04% | 8.51% | 6.88% | 10/31/16 |

Morningstar Moderate Conservative Target Risk Index | 11.86% | 8.17% | 7.07% | — |

Blended Index | 9.86% | 7.16% | 6.58% | — |

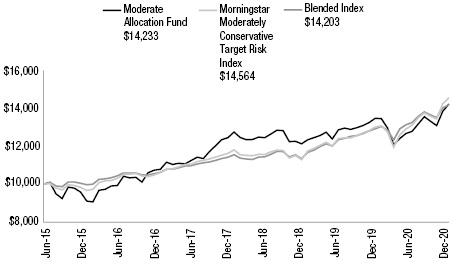

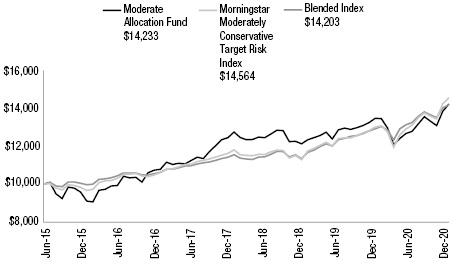

Growth of $10,000

as of December 31, 2020

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Top 10 Holdings

as of December 31, 2020

1. | iShares JP Morgan USD Emerging Markets Bond ETF | 7.3% |

2. | Xtrackers USD High Yield Corporate Bond ETF | 7.0% |

3. | SPDR Bloomberg Barclays High Yield Bond ETF | 4.9% |

4. | iShares Core U.S. Aggregate Bond ETF | 4.2% |

5. | Vanguard Total Bond Market ETF | 3.6% |

6. | Baird Core Plus Bond Fund - Class I | 3.1% |

7. | Lord Abbett High Yield Fund - Class I | 3.0% |

8. | PGIM Total Return Bond Fund - Class R6 | 2.6% |

9. | Dodge & Cox Income Fund | 2.6% |

10. | Segall Bryant & Hamill Plus Bond Fund - Class I | 2.2% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Sector Concentration

as of December 31, 2020

Information Technology | 29.0% |

Healthcare | 18.7% |

Consumer Discretionary | 13.1% |

Communication Services | 10.3% |

Industrials | 8.9% |

Financials | 8.3% |

Real Estate Investment Trust | 3.1% |

Materials | 3.0% |

Consumer Staples | 3.0% |

Utilities | 1.7% |

Energy | 0.9% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2020

Common Stocks | 36.4% |

Fixed Income Registered Investment Companies | 49.3% |

Money Market Registered Investment Companies | 12.3% |

Bank Obligations | 0.1% |

Other Assets/Liabilities (Net) | 1.9% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund.

The Blended Index is comprised 30% of the S&P 500 Index, 20% of the average 90-day T-bills, and 50% of the Bloomberg Barclays US Aggregate Bond Index.

2020 Annual Report | December 31, 2020 | Page 13 |

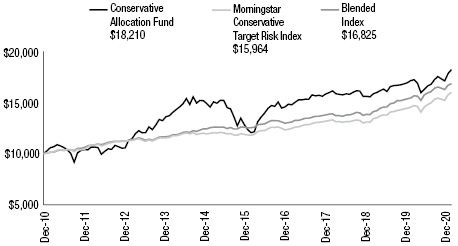

Conservative Allocation Fund

The Meeder Conservative Allocation Fund Institutional Class returned 6.68% compared to the Morningstar Conservative Target Risk Index return of 9.75%. This fund maintains exposure to the Meeder Defensive Equity Strategy and to the Meeder Fixed Income Strategy.

The Meeder Defensive Equity Strategy follows a rules-based and data-driven approach using the Meeder Investment Positioning System (IPS) model. This model is used to determine the risk relative to reward in the marketplace and identifies when we should be increasing or decreasing the portfolio’s target equity exposure. The Defensive Equity tactical portfolio began the first quarter with a target of 100% exposure to the stock market since our investment model’s reward value was higher than the risk value. The S&P 500 Index plummeted -34% from its high on February 19th, to its low on March 23rd. The economic impact of the COVID-19 pandemic rocked the stock market as initial jobless claims spiked as high as 6.8 million in just one week, before gradually trending lower. A sharp increase in market risk identified by our IPS models indicated that we should have a target exposure of 30% at the end of March. The percentage of world markets trading above their 50-day moving average increased in the long-term model. Markets remained rangebound until the May non-farm payroll report showed that the U.S. added a record-high 2.5 million jobs when it was expected to lose more than -8.3 million. This led us to increase the target exposure to the stock market to 62%. The intermediate-term model improved, as significant fund flow activity demonstrated an increase in institutional demand causing us to increase our equity target to as high as 91%. With the Fed remaining extremely accommodative and stating they will keep interest rates near zero until at least 2023, the long-term model score significantly improved this quarter. Institutional demand factors in our intermediate-term model continued to show a lack of significant fund flow activity during September. After the U.S. election in November, market risk declined significantly as investors gained clarity about potential future policy shifts. The long-term model’s score continued to improve as the broad strength of the underlying trend of many sectors and industries. This caused us to gradually increase our target equity exposure to 100% in mid-November and remained there through the end of 2020.

Our shifts within equity markets include international versus domestic holdings, as well as allocating among market capitalization ranges in addition to sector overweight and/or underweight positions. Due primarily to relative momentum factors, our exposure to international holdings among both developed international and emerging market securities was underweight relative to the benchmark. Our underweight exposure to international markets contributed to performance relative to the benchmark in 2020.

The Meeder Fixed Income Strategy tactically shifts portfolio exposure utilizing quantitative models designed to actively monitor the credit quality, emerging market bond exposure, and the U.S. Treasury duration of the portfolio. Our fixed income models added significant value during the coronavirus-driven drawdown. Volatility and macroeconomic factors in our models turned uniformly negative in the middle of March, while momentum factors turned negative toward the end of the first quarter. This caused us to reduce our high-yield and emerging market exposure before the market meltdown in March. The Federal Reserve stepped in to provide liquidity by reducing short-term interest rates to zero, as well as providing other quantitative easing measures to calm fixed income markets. During this period, our portfolio maintained a high-quality bias, which contributed to its overall performance during this market volatility. In early April, momentum and volatility factors showed strength in high-yield bonds, while macroeconomic factors signaled potential weakness. All model factors related to emerging market bonds were uniformly positive. In response to our models signaling an improvement in market conditions, we increased exposure to high-yield bonds and emerging market bonds in our tactical portfolio over the first few weeks of the second quarter. This risk-on signal led us to ultimately overweight these sectors while reducing exposure to U.S. investment-grade bonds and U.S. Treasuries. Since then, high-yield bonds led the risk-on rally to substantially outperform their investment-grade peers. The overweight allocation to emerging market bonds also contributed to portfolio performance, as the sector benefited from the U.S. dollar’s weakness. At the end of the year, the Meeder fixed income strategy maintained a duration in line with its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index.

Within our stock selection process, we attempt to gain exposure to companies with strong profitability that are priced at reasonable valuations relative to their industry peers and are trading with positive price momentum. For the year ending 2020, securities with strong fundamentals, such as strong profitability, contributed to performance. In addition, the fund’s investment in companies with low leverage also contributed to performance. The fund’s exposure to companies with low valuations detracted from performance in 2020.

In the portfolio, we will often use equity index derivatives in the fund, such as stock index futures, to efficiently equitize our cash positions as well as manage the equity exposure of the fund. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact to the fund’s relative performance. The use of stock index futures to manage equity exposure of the fund had a negative impact on the performance of the fund relative to the benchmark index during 2020.

Page 14 | 2020 Annual Report | December 31, 2020 |

Investment Objective

The investment objective of the Fund is to provide income and long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2020

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Conservative Allocation Fund Retail Class | 6.28% | 8.04% | 6.18% | 6/21/95 |

Conservative Allocation Fund Institutional Class | 6.68% | 8.38% | 6.34% | 10/31/16 |

Conservative Allocation Fund Adviser Class | 6.69% | 8.29% | 6.30% | 10/31/16 |

Morningstar Conservative Target Risk Index | 9.75% | 6.20% | 4.79% | — |

Blended Index | 8.98% | 6.09% | 5.34% | — |

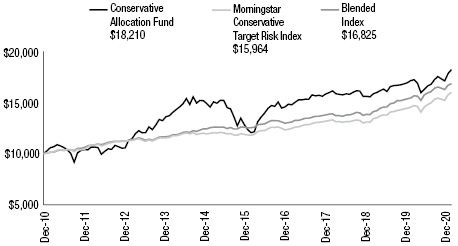

Growth of $10,000

as of December 31, 2020

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

Top 10 Holdings

as of December 31, 2020

1. | iShares JP Morgan USD Emerging Markets Bond ETF | 10.2% |

2. | Xtrackers USD High Yield Corporate Bond ETF | 9.7% |

3. | SPDR Bloomberg Barclays High Yield Bond ETF | 6.9% |

4. | iShares Core U.S. Aggregate Bond ETF | 5.9% |

5. | Vanguard Total Bond Market ETF | 5.0% |

6. | Baird Core Plus Bond Fund - Class I | 4.3% |

7. | Lord Abbett High Yield Fund - Class I | 4.3% |

8. | PGIM Total Return Bond Fund - Class R6 | 3.7% |

9. | Dodge & Cox Income Fund | 3.6% |

10. | Segall Bryant & Hamill Plus Bond Fund - Class I | 3.1% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Sector Concentration

as of December 31, 2020

Information Technology | 28.9% |

Healthcare | 18.6% |

Consumer Discretionary | 12.8% |

Communication Services | 10.7% |

Industrials | 8.9% |

Financials | 8.5% |

Real Estate Investment Trust | 3.1% |

Materials | 3.0% |

Consumer Staples | 2.9% |

Utilities | 1.7% |

Energy | 0.9% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2020

Common Stocks | 22.1% |

Fixed Income Registered Investment Companies | 69.2% |

Money Market Registered Investment Companies | 7.4% |

Other Assets/Liabilities (Net) | 1.3% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund.

The Blended Index is comprised 18% of the S&P 500 Index, 12% of the average 90-day T-bills, and 70% of the Bloomberg Barclays US Aggregate Bond Index.

2020 Annual Report | December 31, 2020 | Page 15 |

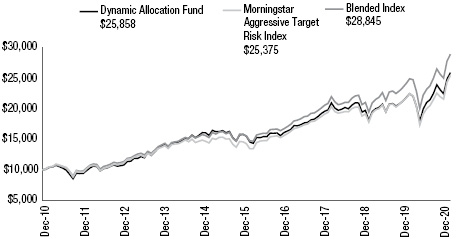

Dynamic Allocation Fund

The Meeder Dynamic Allocation Fund Institutional Class returned 15.94% for the year ended December 31, 2020, compared to the Morningstar Aggressive Target Risk Index benchmark return of 13.26%. This fund maintains exposure to both the Meeder Growth Strategy and to the Meeder Fixed Income Strategy.

The Meeder Growth Strategy maintains a more aggressive objective and typically remains invested in the stock market. Therefore, investors experienced significant volatility as the market declined from its all-time high on February 19th. The S&P 500 experienced more than a 30% decline before the end of the first quarter. The stock market reversed course from the lows experienced on March 23rd and moved higher to capture significant gains, ultimately reaching a new all-time high in August. Certified election results provided investors with a better idea of what they might expect regarding future policy shifts. At the end of December, the FDA approved two different COVID-19 vaccines for emergency use. The renewed hope that the global economy might be reopening sooner than previously expected helped major indices like the Dow Jones, S&P 500, and Russell 2000 Indices reach new all-time highs. Investors that remained invested in the Growth Strategy despite the market volatility, received the highest returns of all our risk-based portfolios.

Our shifts within equity markets include international versus domestic holdings, as well as allocating among market capitalization ranges in addition to sector overweight and/or underweight positions. Due primarily to relative momentum factors, our exposure to international holdings among both developed international and emerging market securities was underweight relative to the benchmark. Our underweight exposure to international markets contributed to performance relative to the benchmark in 2020.

We maintain at least a 5% allocation to the Meeder Fixed Income Strategy in the fund. The Meeder Fixed Income Strategy tactically shifts portfolio exposure utilizing quantitative models designed to actively monitor the credit quality, emerging market bond exposure, and the U.S. Treasury duration of the portfolio. Our fixed income models added significant value during the coronavirus-driven drawdown. Volatility and macroeconomic factors in our models turned uniformly negative in the middle of March, while momentum factors turned negative toward the end of the first quarter. This caused us to reduce our high-yield and emerging market exposure before the market meltdown in March. The Federal Reserve stepped in to provide liquidity by reducing short-term interest rates to zero, as well as providing other quantitative easing measures to calm fixed income markets. During this period, our portfolio maintained a high-quality bias, which contributed to its overall performance during this market volatility. In early April, momentum and volatility factors showed strength in high-yield bonds, while macroeconomic factors signaled potential weakness. All model factors related to emerging market bonds were uniformly positive. In response to our models signaling an improvement in market conditions, we increased exposure to high-yield bonds and emerging market bonds in our tactical portfolio over the first few weeks of the second quarter. This risk-on signal led us to ultimately overweight these sectors while reducing exposure to U.S. investment-grade bonds and U.S. Treasuries. Since then, high-yield bonds led the risk-on rally to substantially outperform their investment-grade peers. The overweight allocation to emerging market bonds also contributed to portfolio performance, as the sector benefited from the U.S. dollar’s weakness. At the end of the year, the Meeder fixed income strategy maintained a duration in line with its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index.

Within our stock selection process, we attempt to gain exposure to companies with strong profitability that are priced at reasonable valuations relative to their industry peers and are trading with positive price momentum. For the year ending 2020, securities with strong fundamentals, such as strong profitability, contributed to performance. In addition, the fund’s investment in companies with low leverage also contributed to performance. The fund’s exposure to companies with low valuations detracted from performance in 2020.

In the portfolio, we will often use equity index derivatives in the fund, such as stock index futures, to efficiently equitize our cash positions. Regarding equitizing cash positions, these derivatives are designed to track their respective stock index, so there was no discernible impact to the fund’s relative performance.

Investment Objective

The investment objective of the Fund is to provide long-term capital appreciation.

Average Annual Total Returns

as of December 31, 2020

| 1

Year | 5

Year | 10

Year | Share Class

Inception

Date |

Dynamic Allocation Fund Retail Class | 15.37% | 10.79% | 9.97% | 2/29/00 |

Dynamic Allocation Fund Institutional Class | 15.94% | 11.16% | 10.15% | 10/31/16 |

Dynamic Allocation Fund Adviser Class | 15.85% | 11.04% | 10.09% | 10/31/16 |

Morningstar Aggressive Target Risk Index | 13.26% | 12.20% | 9.76% | — |

Blended Index | 16.08% | 13.17% | 11.17% | — |

Top 10 Holdings

as of December 31, 2020

1. | Apple, Inc. | 4.7% |

2. | Microsoft Corp. | 3.8% |

3. | Amazon.com, Inc. | 2.6% |

4. | iShares JP Morgan USD Emerging Markets Bond ETF | 2.3% |

5. | Xtrackers USD High Yield Corporate Bond ETF | 2.3% |

6. | Facebook, Inc. | 1.5% |

7. | Alphabet, Inc. - Class C | 1.4% |

8. | Berkshire Hathaway, Inc. - Class B | 1.4% |

9. | Johnson & Johnson | 1.4% |

10. | Tesla, Inc. | 1.2% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Page 16 | 2020 Annual Report | December 31, 2020 |

Sector Concentration

as of December 31, 2020

Information Technology | 29.5% |

Healthcare | 18.9% |

Consumer Discretionary | 12.9% |

Communication Services | 10.0% |

Financials | 8.5% |

Industrials | 8.4% |

Real Estate Investment Trust | 3.1% |

Consumer Staples | 3.1% |

Materials | 2.9% |

Utilities | 1.8% |

Energy | 0.9% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Asset Allocation

as of December 31, 2020

Common Stocks | 74.1% |

Money Market Registered Investment Companies | 18.4% |

Fixed Income Registered Investment Companies | 4.6% |

Equity Registered Investment Companies | 0.6% |

Bank Obligations | 0.4% |

Other Assets/Liabilities (Net) | 1.9% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund.

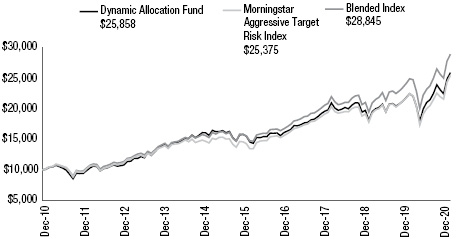

Growth of $10,000

as of December 31, 2020

The Growth of $10,000 chart compares the performance of the Fund’s Retail Share Class over the period shown with dividends and capital gains reinvested to the Fund’s benchmarks. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

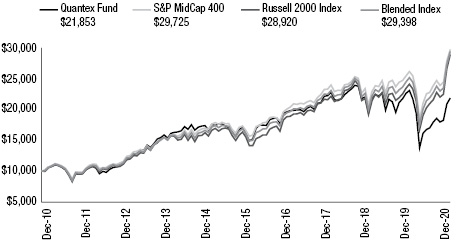

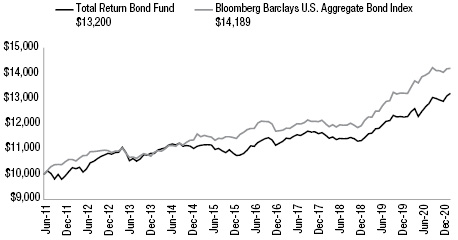

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.