UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-03599

Name of Registrant: The Royce Fund

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

Name and address of agent for service:

John E. Denneen, Esq. 745 Fifth Avenue New York, NY 10151 |

Registrant's telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31, 2019

Date of reporting period: January 1, 2019 – June 30, 2019

Item 1. Reports to Shareholders.

| | | JUNE 30, 2019 |

| | | |

| | | |

| | | |

| | | 2019 Semiannual |

| | | Review and Report to Shareholders |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | Royce Dividend Value Fund |

| | | | | |

| | | Royce Global Financial Services Fund |

| | | | | |

| | | Royce International Premier Fund |

| | | | | |

| | | Royce Low-Priced Stock Fund |

| | | | | |

| | | Royce Micro-Cap Fund |

| | | | | |

| | | Royce Opportunity Fund |

| | | | | |

| | | Royce Pennsylvania Mutual Fund |

| | | | | |

| | | Royce Premier Fund |

| | | | | |

| | | Royce Small-Cap Value Fund |

| | | | | |

| | | Royce Smaller-Companies Growth Fund |

| | | | | |

| | | Royce Special Equity Fund |

| | | | | |

| | | Royce Total Return Fund |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on the Funds’ website (www.roycefunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary or, if you are a direct investor with the Funds, by calling 1-800-841-1180. Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1-800-841-1180 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with our fund complex if you invest directly with the Funds. | |

| | | | | |

| | | | | |

| | | roycefunds.com |  |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Table of Contents | | | |

| | | | |

| | | | |

| Semiannual Review | | | |

| | | | |

| Letter to Our Shareholders | | 2 | |

| | | | |

| Performance and Expenses | | 6 | |

| | | | |

| The Royce Funds and Relative Risk-Adjusted Rolling Returns | | 7 | |

| | | | |

| Semiannual Report to Shareholders | | | |

| | | | |

| Managers’ Discussions of Fund Performance | | | |

| | | | |

Royce Dividend Value Fund | | 8 | |

| | | | |

Royce Global Financial Services Fund | | 10 | |

| | | | |

Royce International Premier Fund | | 12 | |

| | | | |

Royce Low-Priced Stock Fund | | 14 | |

| | | | |

Royce Micro-Cap Fund | | 16 | |

| | | | |

Royce Opportunity Fund | | 18 | |

| | | | |

Royce Pennsylvania Mutual Fund | | 20 | |

| | | | |

Royce Premier Fund | | 22 | |

| | | | |

Royce Small-Cap Value Fund | | 24 | |

| | | | |

Royce Smaller-Companies Growth Fund | | 26 | |

| | | | |

Royce Special Equity Fund | | 28 | |

| | | | |

Royce Total Return Fund | | 30 | |

| | | | |

| Schedules of Investments and Financial Statements | | 32 | |

| | | | |

| Notes to Financial Statements | | 78 | |

| | | | |

| Understanding Your Fund’s Expenses | | 90 | |

| | | | |

| Trustees and Officers | | 92 | |

| | | | |

| Board Approval of Investment Advisory Agreements | | 93 | |

| | | | |

| Results of Shareholders Meetings | | 96 | |

| | | | |

| Notes to Performance and Other Important Information | | 97 | |

| This page is not part of the 2019 Semiannual Report to Shareholders | 1 |

Letter to Our Shareholders

A SMOOTH ASCENT AMID HIGH ANXIETY

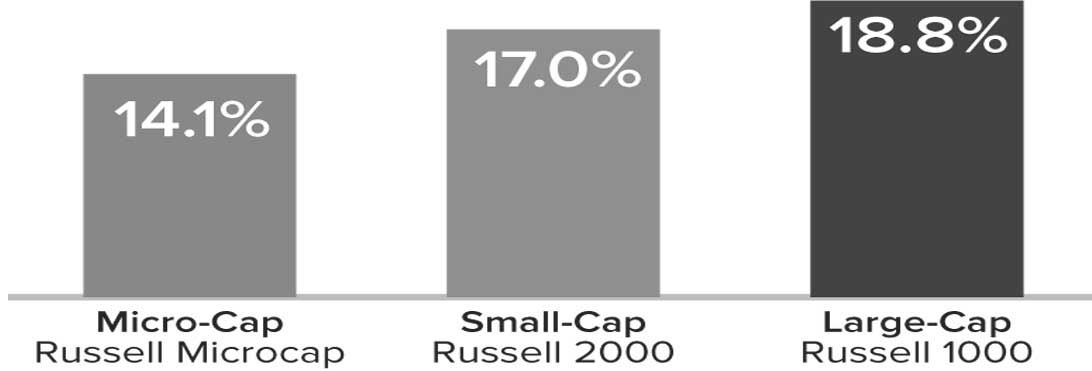

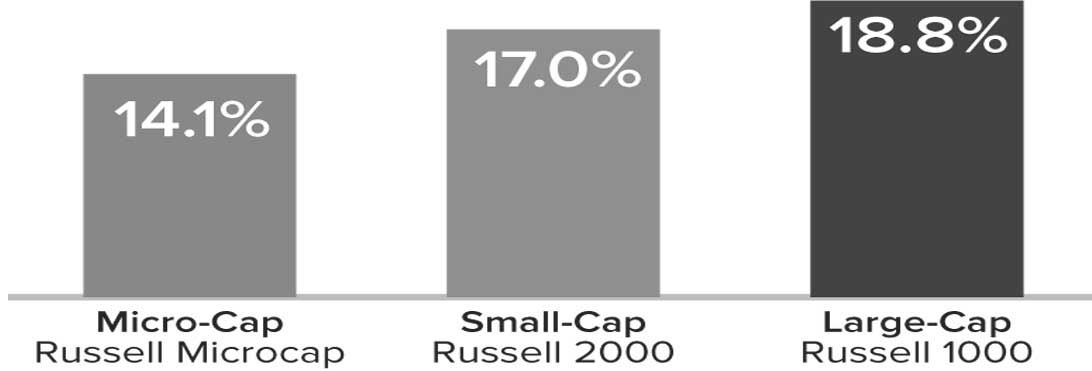

The first six months of 2019 offered equity investors almost everything they could have hoped for following the high anxiety of a recession scare and the bearish fourth quarter of 2018, when the small-cap Russell 2000 Index fell 20.2%. Stocks immediately showed great resilience, and then some, by roaring back in the first half of the year. A highly welcome double-digit rebound in the first quarter was followed by a seesawing second quarter that saw more motion than progress. This was an understandable pause that gave the market time to digest the prior advance. The upshot was a solid advance rise in the year’s first six months, a period that saw low trading volumes and little volatility, which was mostly confined to a small decline in May. During the first half, the Russell 2000 advanced 17.0% while its large-cap sibling, the Russell 1000 Index, was even better, up 18.8%. In fact, performance in the first half generally trended higher the further up the market capitalization scale you traveled.

|

Equity Indexes

Total Returns

Year-to-Date

through 6/30/19 |  |

Some questioned the substance of this rally, observing that the same risks that fueled last year’s decline were still with us. The list is long and, by now, familiar. Most of the anxiety continues to circulate around the issue of global growth—or the widely rumored imminent lack of it—and its probable negative impact on corporate profits. There wasn’t much in the way of fresh answers to these concerns at the end of June beyond the admittedly consequential Fed pivot to a more dovish stance (as well as subsequent and similar actions promised from the European Central Bank). Yet, while the Fed’s words and actions went some way to reassuring investors that it was prepared to give the markets a dose of stimulus, the effect on economic growth was pretty much nil. Moreover, the increasing tensions around trade and tariffs remain an issue at this writing. With no resolution forthcoming, many companies were lowering expectations and/or offering a more muted outlook, with predictably negative effects on the stocks of many economically sensitive businesses.

It’s not surprising, then, that equity investors showed a marked preference for safety in the form of large-cap stocks, or chose to bet on better times further down the road by vacuuming up shares of growth issues regardless of capitalization size. Some additional context is also important: large-caps, growth stocks, and defensive areas (that is, bond proxies) have historically done better in low or declining interest rate environments, an atmosphere that has characterized much of the decade following the Financial Crisis, with its record-low interest rates (and the |

For details on The Royce Funds’ performance in the period, please turn to the Managers’ Discussions that begin on page 8. Past performance is no guarantee of future results.

| 2 | This page is not part of the 2019 Semiannual Report to Shareholders |

LETTER TO OUR SHAREHOLDERS

| ‘easy money’ that came with them). With rates still near historic lows, these same stocks have led the market over the last two-plus years. All of this notwithstanding, we believe that the long-term case for small-cap stocks is strong, as we will explain through the course of this letter. |

| |

| PESSIMISTS, OPTIMISTS—AND US |

| By periodically inverting the otherwise mostly flat yield curve, the bond market maintained its saturnine insistence that the economy was slowing and potentially, perhaps inevitably, moving toward recession. To be sure, many observers point to the inverted yield curve as iron-clad proof that the current slackening momentum in the pace of growth in the U.S., along with the advanced age of the expansion, is a prelude to a recession. More optimistic voices argue that large-cap stocks spent much of the first half making new all-time highs, that the labor market continues to strengthen, and that the economy continues to expand in spite of a raft of dismal headlines. |

| Our own cautiously constructive view is rooted not so much in the macro factors that dominate the headlines but in our own research into companies, their industry dynamics, and our conversations with management teams. We do, however, agree with those who think the U.S. economy is not heading toward recession; we see periodic slowdowns and accelerations in the pace of growth as historically typical. As for the yield curve, the market appears to have figured out before the Fed that persistently low inflation exerts a powerful flattening effect on the curve. To make our case, we have taken up arms—or at least data points—against this sea of troubles to argue for the long-term appeal of fundamentally sound small-cap cyclicals. We see good reasons for investors to be optimistic about the prospects for small-cap stocks, specifically those cyclical areas that populate our portfolios. |

| THE CASE FOR SMALL-CAP LEADERSHIP |

| Our first argument is in favor of small-cap returning to market leadership. We make it on the grounds of reversion to the mean, one of our longest-held investment principles. Looking at first-half performance, the resilience of small-cap stocks seemed both apropos and encouraging to us given that we continue to see solid fundamentals for many companies, attractively joined with historically average, or below average, valuation levels. However, small-caps lagged large-caps not only in the first half but also for the one-year period ended June 30, 2019, when the Russell 2000 fell 3.3% versus a gain of 10.0% for the large-cap index. This performance divergence has created a historical oddity that can be seen in the spread between small- and large-cap |

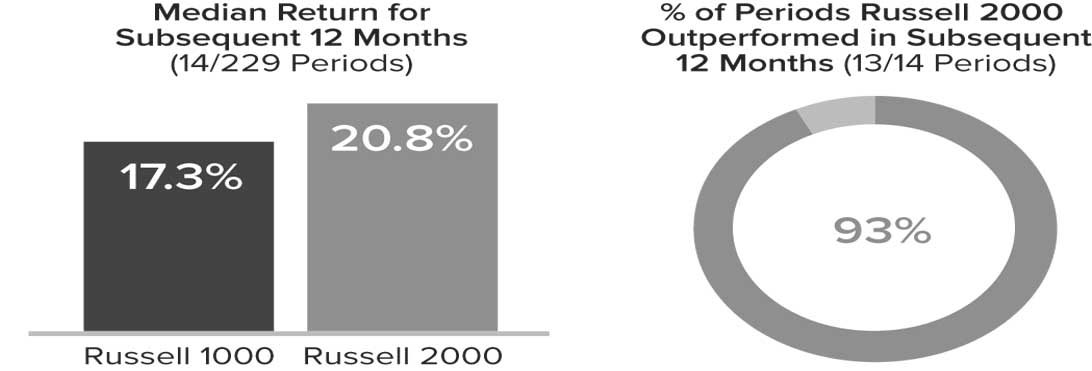

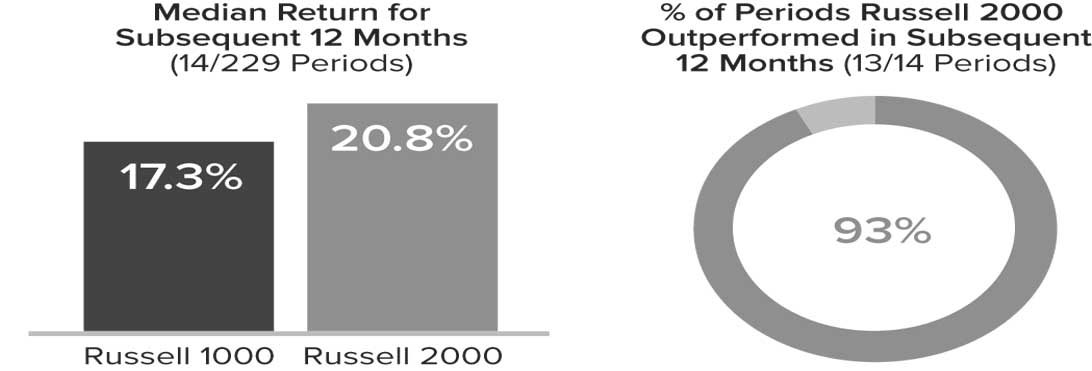

returns. It rarely happens over the course of a 12-month period that small-caps are in the red while large-caps are in the black. In fact, it’s happened less than 7% of the time over the past 20 years—in 16 out of 229 monthly rolling 12-month periods.

What are the implications of this peculiar divergence in performance? In 93% of the following 12-month periods—only 13 of the 14 currently have subsequent periods to measure—small-caps bounced back to outpace large-caps. It’s true that small-caps have historically tended to lag their large-cap siblings when yields are falling—and have often done the same when economic growth is slowing. The resumption of small-cap leadership, then, is contingent on these conditions changing. When rates rise (or simply normalize) and/or the economy reaccelerates, and history strongly suggests that both should, we would expect small-cap to recapture leadership. |

| |

What Happened After 12-Month Periods When Large-Caps Rose and Small-Caps Fell?

16 out of 229 Trailing 1-Year Periods from 6/30/99 to 6/30/19 |

One additional observation on relative performance: From December 31, 1978 through June 30, 2019, the five-year monthly rolling average return was 10.6% for the Russell 2000 and 11.7% for the Russell 1000, while the five-year average annual total returns for the small- and large-cap indexes for the period ended June 30, 2019 were 7.1% and 10.5%, respectively. With small-caps well below their long-term average, we expect performance to improve to a greater degree than for large-caps, which finished June much closer to their long-term average.

Our confidence in mean reversion is further grounded in the relative valuation spread between the Russell 2000 and the Russell 1000 at the end of June, which was significantly below its long-term average based on each index’s median last 12-months’ EV/EBIT (enterprise value over earnings before interest and taxes). In fact, small-caps have lagged large-caps for such an extended period of time that they finished June at their cheapest relative to large-caps since 2001. |

| This page is not part of the 2019 Semiannual Report to Shareholders | 3 |

LETTER TO OUR SHAREHOLDERS

| So while no one thinks that stocks are currently bargain priced, it’s also true that the vast and diverse universe of small-cap stocks contains a considerable number of attractive risk/reward opportunities based on the combination of reasonable to attractive valuations (again measured by median EV/EBIT) and profitability. |

| |

THE VALUATION SITUATION

When looking for investment candidates, we typically survey the small-cap market for what looks to us like excess pessimism—which is precisely what we’ve been seeing in certain cyclical areas over the last couple of years. Our practice is to then investigate how much of that negative sentiment is already reflected in the current stock price of a given company. So it was significant that at the end of June, cyclical stocks were selling at a greater discount to the Russell 2000 than they had during the fall of 2008—in the teeth of the Financial Crisis. To us, that is the very definition of excess pessimism. |

| |

Small-Cap Cyclical Discount

Russell 2000 Relative Median

EV/EBIT1 (Ex Negative EBIT)

Cyclical/Russell 2000 |

Source: FactSet

| We suspect that these relatively inexpensive valuations are in large part the result of investors placing undue emphasis on daily macro headlines when trying to understand or anticipate small-cap market movements. (The frequently missed distinction between slower economic growth and a recession is an example of the trouble this can lead to.) We think that investors often fail to fully appreciate the “reaction function,” the response of businesses, central banks, and governments to slowdowns. While we are by no means macro forecasters, it would not surprise us if the global economy grew a little faster over the next year. If history is any guide, this reacceleration could boost small-cap stocks, which have done well on both an absolute and relative basis, especially versus large-caps, when the ISM Manufacturing Index (a common proxy for economic conditions) is on the rise. As unlikely as it currently seems, additional growth could come from a U.S.-China |

| |

Small-Cap’s Relative Valuation Is Significantly Below Its Long-Term Average

Russell 2000 vs. Russell 1000 Median LTM EV/EBIT1 (ex. Negative EBIT Companies) from 12/31/01 to 6/30/19 |

Source: FactSet

trade deal that addresses tariffs and stokes even modest growth in China, which would likely spur increased activity in Europe as well.

Moreover, we expect profitable companies in select cyclical areas to do better regardless of which route the global economy takes in the short term. For example, and in spite of reports of revisions, earnings prospects for the second half of 2019 look solid for many of our small-cap cyclical holdings, especially given the relatively weaker third and fourth quarters of 2018 with which 2019’s two second-half quarters will be compared.

We often seek to identify opportunities at the intersection of quality and value—that is, companies with average or better profitability and lower-than-average valuations. There were three cyclical sectors that had higher-than-average profitability and lower-than-average valuations at the end of June—Industrials, Consumer Discretionary, and Materials.2 The relative attractiveness of these and other cyclical areas dovetails nicely with our bottom-up approaches, where the search for fundamentally sound, well-managed companies with solid growth potential has more recently led us overwhelmingly to cyclical businesses. |

SMALL-CAP STOCKS AND THE URGE TO MERGE

The appeal of small-cap stocks can also be seen in recent merger & acquisition (M&A) activity. The number of small-cap M&A deals in the U.S. hit a 10-year high in June, with 503 transactions announced for the trailing four quarters through the end of that month, according to Bloomberg data. This is the largest number of deals in the asset class since before the Financial Crisis. We anticipate that this trend will |

| 1 | Enterprise Value/Earnings before interest and taxes. |

| 2 | Based on the relation between each sector’s average return on equity (ROE) for the five years ended 6/30/19 (excluding companies with negative ROE) and median EV/EBIT (excluding companies with negative earnings). |

| Cyclicals are defined as follows: Communication Services, Consumer Discretionary, Energy, Financials, Industrials, Information Technology, and Materials. |

| 4 | This page is not part of the 2019 Semiannual Report to Shareholders |

LETTER TO OUR SHAREHOLDERS

continue for a variety of reasons. CEO’s are under relentless pressure to grow profits. If they believe organic growth opportunities are limited, then inorganic paths such as acquisitions begin to make sense. Along similar lines, the CEO of a small-cap company might look more favorably on a buyout offer at a significant stock price premium if he or she sees limited opportunities for their own organic growth. However paradoxical, we can see how a further deceleration in economic growth could lead to an acceleration in M&A deals. With their attractive relative valuations, many small-cap companies should continue to be attractive takeover targets. We also think that many better-managed small-cap businesses will continue to be active as acquirers. We meet with many management teams that run companies with strong balance sheets and are eager to find ways to grow. With interest rates so low, many acquisitions are likely to be accretive, which increases their attraction to a potential buyer.

THE NEXT LEG OF THE JOURNEY

Disagreements about the condition of the market and state of the economy have created opportunities for active managers and other discerning stock pickers because there’s so little consensus about what constitutes value or quality. Somewhat counterintuitively, this has made us generally quite comfortable with what we’re holding in each of our strategies.

Of course, our overall cyclical tilt would not immunize any of our portfolios from a recession. However, the market has provided opportunities to build portfolios that we think are not only inexpensive, but that we think should also provide healthy returns going forward in our most valuation-sensitive strategies. We also expect that many of our high-quality holdings (specifically those in Industrials and Information Technology) could outperform cyclicals in general in the event of a recession thanks to their status as market leaders in global niches as opposed to being one of many players in a highly fragmented commodity business.

Across all of our strategies, we’ve been adding or holding positions in areas such as technology, industrials, and many other areas that we |

think should do well under present or improved conditions. Equally important, many of these holdings already have valuations that seem to reflect a high probability of an imminent recession. Any economic news that shows improvement—or simply the absence of worsening conditions—may lift these stocks.

In framing this promising picture of the long-term possibilities for small-cap cyclicals, we also recognize that the lengthy list of current risks is creating an even higher level of uncertainty than usual. However, having done this for as long as we have—four decades and counting—we are also highly aware that the markets seldom do what’s most expected. Given today’s widespread concerns about slowing growth, increasing trade tensions, and the extended economic cycle, the most surprising outcome—as we’ve suggested—might be a rally catalyzed by improved growth.

When looking forward, we believe it’s appropriate to be humble about our own forecasts and respectful of those that differ from ours. With what seems like ever increasing tariff and trade tensions, there is a plausible negative scenario of slowing Chinese growth that tips languishing European economies into recession and pushes global yields even lower. This would in all likelihood lead to greater instability in global financial markets as well as breeding heightened risk aversion. While we think this outcome is less likely than others, we also believe that investors should remain mindful of the reaction function we mentioned earlier. Additionally, environments that feature increased uncertainty, turbulence, and market volatility often provide opportunities for companies with leading market positions and strong balance sheets to solidify or expand market share. Volatile environments have also been historically favorable for active small-cap managers. We also see four favorable factors in the current market environment—low inflation, modest valuations, moderate growth, and increased access to capital—that we think support solid-to-strong small-cap performance in the intermediate term regardless of current anxieties. These four factors paint an attractive picture in our view, one that small-cap investors might be at risk of missing if they pay more attention to the macro picture than to company fundamentals, where we think the real action is. |

| |  | |  |

| Charles M. Royce | | Christopher D. Clark | | Francis D. Gannon |

| Chairman, | | Chief Executive Officer, and | | Co-Chief Investment Officer, |

| Royce & Associates, LP | | Co-Chief Investment Officer, | | Royce & Associates, LP |

| | | Royce & Associates, LP | | |

| | | | | |

| July 31, 2019 | | | | |

| This page is not part of the 2019 Semiannual Report to Shareholders | 5 |

Performance and Expenses

| |

| Performance and Expenses | | | | | | | | | | | | | |

| | | | | | | | | | | | | | ANNUAL OPERATING EXPENSES (%) |

| | | YTD1 | | 1-YR | | 5-YR | | 10-YR | | 15-YR | | 20-YR | | 45-YR/SINCE

INCEPTION | | INCEPTION DATE | | | GROSS | | NET |

| |

| Royce Dividend Value Fund | | 20.71 | | 3.19 | | 5.02 | | 11.97 | | 8.54 | | N/A | | 8.49 | | 5/3/04 | | | 1.43 | | 1.34 |

| |

| Royce Global Financial Services Fund | | 16.26 | | -1.92 | | 5.78 | | 11.11 | | 8.08 | | N/A | | 7.88 | | 12/31/03 | | | 1.77 | | 1.58 |

| |

| Royce International Premier Fund | | 21.38 | | 9.26 | | 8.64 | | N/A | | N/A | | N/A | | 7.84 | | 12/31/10 | | | 1.59 | | 1.44 |

| |

| Royce Low-Priced Stock Fund | | 14.53 | | -5.00 | | 0.98 | | 7.14 | | 5.20 | | 8.16 | | 9.61 | | 12/15/93 | | | 1.53 | | 1.49 |

| |

| Royce Micro-Cap Fund | | 10.59 | | -8.64 | | 0.90 | | 7.31 | | 5.74 | | 8.55 | | 10.24 | | 12/31/91 | | | 1.25 | | 1.24 |

| |

| Royce Opportunity Fund | | 15.63 | | -11.06 | | 4.11 | | 13.38 | | 7.69 | | 10.63 | | 11.44 | | 11/19/96 | | | 1.20 | | 1.20 |

| |

| Royce Pennsylvania Mutual Fund | | 17.81 | | 0.68 | | 6.16 | | 12.29 | | 8.32 | | 9.77 | | 14.14 | | N/A | | | 0.92 | | 0.92 |

| |

| Royce Premier Fund | | 21.69 | | 6.28 | | 6.68 | | 12.47 | | 9.59 | | 10.70 | | 11.60 | | 12/31/91 | | | 1.17 | | 1.17 |

| |

| Royce Small-Cap Value Fund | | 8.88 | | -5.64 | | 1.96 | | 8.76 | | 7.30 | | N/A | | 8.82 | | 6/14/01 | | | 1.53 | | 1.49 |

| |

| Royce Smaller-Companies Growth Fund | | 21.08 | | -1.53 | | 6.54 | | 11.09 | | 7.79 | | N/A | | 10.95 | | 6/14/01 | | | 1.52 | | 1.49 |

| |

| Royce Special Equity Fund | | 4.59 | | -5.42 | | 3.53 | | 9.66 | | 6.89 | | 9.25 | | 8.46 | | 5/1/98 | | | 1.18 | | 1.18 |

| |

| Royce Total Return Fund | | 15.32 | | 0.36 | | 5.74 | | 11.83 | | 7.72 | | 9.06 | | 10.40 | | 12/15/93 | | | 1.20 | | 1.20 |

| |

| |

| INDEX | | | | | | | | | | | | | | | | | | | | | |

| Russell 2000 | | 16.98 | | -3.31 | | 7.06 | | 13.45 | | 8.15 | | 7.77 | | N/A | | N/A | | | N/A | | N/A |

| |

| Russell Microcap | | 14.15 | | -10.39 | | 5.52 | | 12.54 | | 6.28 | | N/A | | N/A | | N/A | | | N/A | | N/A |

| |

| Russell 2000 Value | | 13.47 | | -6.24 | | 5.39 | | 12.40 | | 7.28 | | 8.64 | | N/A | | N/A | | | N/A | | N/A |

| |

| Russell 2500 | | 19.25 | | 1.77 | | 7.66 | | 14.44 | | 9.07 | | 8.92 | | N/A | | N/A | | | N/A | | N/A |

| |

| MSCI ACWI ex USA Small Cap | | 11.60 | | -5.94 | | 2.77 | | 8.48 | | 7.40 | | 6.89 | | N/A | | N/A | | | N/A | | N/A |

| |

Important Performance, Expense, and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Investment and Service Class shares redeemed within 30 days of purchase may be subject to a 1% redemption fee payable to the Fund (2% for Royce International Premier Fund). Redemption fees are not reflected in the performance shown above; if they were, performance would be lower. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. All performance and expense information reflects results of the Funds’ oldest share Class (Investment Class or Service Class, as the case may be). Price and total return information is based on net asset values calculated for shareholder transactions. Certain immaterial adjustments were made to the net assets of Royce Pennsylvania Mutual and Premier Funds at 6/30/19 for financial reporting purposes, and as a result the calendar year total returns based on those net assets values differ from the adjusted net values and calendar year total returns reported in the Financial Highlights. Gross annual operating expenses reflect the Fund’s gross total annual operating expenses and include management fees, any 12b-1 distribution and service fees, other expenses, and any applicable acquired fund fees and expenses. Net annual operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus. Royce & Associates has contractually agreed to waive fees and/or reimburse operating expenses, excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business, to the extent necessary to maintain net operating expenses at or below: 1.24% for Royce Micro-Cap Fund; 1.34% for Royce Dividend Value Fund; 1.44% for Royce International Premier Fund; 1.49% for Royce Global Financial Services, Low-Priced Stock, Small-Cap Value, and Smaller-Companies Growth Funds through April 30, 2020.

Service Class shares bear an annual distribution expense that is not borne by the Funds’ Investment Class. If such distribution expenses had been reflected for Funds showing Investment Class performance, returns would have been lower. Investments in securities of micro-cap, small-cap, and/or mid-cap companies may involve considerably more risk than investments in securities of larger-cap companies. (Please see “Primary Risks for Fund Investors” in the prospectus.) Certain Funds invest a significant portion of their respective assets in foreign companies that may be subject to different risks than investments in securities of U.S. companies, including adverse political, social, economic, or other developments that are unique to a particular country or region. (Please see “Investing in Foreign Securities” in the prospectus.) Therefore, the prices of securities of foreign companies in particular countries or regions may, at times, move in a different direction than those of securities of U.S. companies. (Please see “Primary Risk of Fund Investors” in the prospectus.) Certain Funds generally invest a significant portion of their assets in a limited number of stocks, which may involve considerably more risk than a more broadly diversified portfolio because a decline in the value of any of these stocks would cause their overall value to decline to a greater degree. A broadly diversified portfolio, however, does not ensure a profit or guarantee against loss. This Review and Report must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell 2000 Index is an unmanaged, capitalization-weighted index of domestic small-cap stocks. It measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index along with the next smallest eligible securities as determined by Russell. The Russell 2000 Value Index consists of the respective value stocks within the Russell 2000 as determined by Russell Investments. The Russell 2500 is an unmanaged, capitalization-weighted index of the 2,500 smallest publicly traded U.S. companies in the Russell 3000 index. The Russell 1000 is an unmanaged, capitalization-weighted index of domestic large-cap stocks. It measures the performance of the 1,000 largest publicly traded U.S. companies in the Russell 3,000 Index. The MSCI ACWI ex USA Small Cap Index is an unmanaged, capitalization-weighted index of global small-cap stocks, excluding the United States. The performance of an index does not represent exactly any particular investment as you cannot invest directly in an index. Distributor: Royce Fund Services, LLC.

| 6 | This page is not part of the 2019 Semiannual Report to Shareholders |

The Royce Funds and Relative Risk-Adjusted Rolling Returns

We have always believed that a long-term perspective is crucial for determining the success of an investment approach.

| Flourishing in an up market is wonderful, but surviving a bear market by losing less (or not at all) is equally desirable, making results over bull and bear periods the true tests of a portfolio’s mettle. This is why we prefer to examine results that include up and down market phases—primarily by looking at rolling return periods. |

| Our rationale for using long-term rolling periods is based on the fact that investors buy and sell at many times throughout any given year. In our view, examining performance over a larger series of dates using rolling returns provides a more comprehensive picture of performance, providing a more in-depth measure than calendar-based annualized periods. This allows an investor to evaluate the consistency of performance over time—including the ups and downs of market cycles. |

| Closely related to this preference for rolling period analysis is the idea that the success of an investment approach should also be evaluated based on the return it generates compared with the amount |

| of risk taken. We aim to achieve strong, long-term absolute and relative returns on both a traditional and risk-adjusted basis. We use Sharpe ratios, a widely used measure of return per unit of risk that measures the volatility of returns to gauge how our major domestic strategies with more than 20 years of history have fared versus their benchmark, the Russell 2000 Index. We calculate the Sharpe Ratio for each relevant Fund and the index for each rolling five- and 10-year period over the past 20 years and then show both the average Sharpe ratio for these periods as well as each Fund’s batting average—that is, the number and percentage of times the Fund beat the index over the total number of periods—as a measure of that Fund’s success. |

| We are very pleased that on a monthly rolling risk-adjusted basis, our four largest Funds had higher average Sharpe Ratios than the Russell 2000 for the majority of both the 10- and 5-year periods for the 20 years ended 6/30/19. |

| |

| Royce Funds Relative Risk Adjusted Returns: Monthly Rolling Sharpe Ratios |

| 5- and 10-Year Monthly Rolling Sharpe Ratios–20 Years through 6/30/19 |

| FUND | | PERIODS BEATING THE INDEX | | | FUND

AVERAGE | | RUSSELL 2000

AVERAGE |

| |

| Royce Special Equity Fund |

| |

| 10-Year | | 114/121 | | | | | | | | | | | | 94% | | | | 0.58 | | 0.41 |

| |

| 5-Year | | 113/181 | | | | | | | | | | | | 62% | | | | 0.65 | | 0.51 |

| |

| Royce Total Return Fund |

| |

| 10-Year | | 112/121 | | | | | | | | | | | | 93% | | | | 0.49 | | 0.41 |

| |

| 5-Year | | 147/181 | | | | | | | | | | | | 81% | | | | 0.64 | | 0.51 |

| |

| Royce Premier Fund |

| |

| 10-Year | | 105/121 | | | | | | | | | | | | 87% | | | | 0.55 | | 0.41 |

| |

| 5-Year | | 115/181 | | | | | | | | | | | | 64% | | | | 0.65 | | 0.51 |

| |

| Royce Pennsylvania Mutual Fund |

| |

| 10-Year | | 67/121 | | | | | | | | | | | | 55% | | | | 0.47 | | 0.41 |

| |

| 5-Year | | 106/181 | | | | | | | | | | | | 59% | | | | 0.59 | | 0.51 |

| |

| Royce Opportunity Fund |

| |

| 10-Year | | 53/121 | | | | | | | | | | | | 44% | | | | 0.43 | | 0.41 |

| |

| 5-Year | | 106/181 | | | | | | | | | | | | 59% | | | | 0.53 | | 0.51 |

| |

| Included are all Royce Funds benchmarked against the Russell 2000 with at least 20 years of history. |

| |

| TheSharpe Ratio is calculated for a specified period by dividing the fund or index’s average excess returns by its annualized standard deviation. The higher the Sharpe Ratio, the better the fund or index’s historical risk-adjusted performance.Standard Deviation is a statistical measure within which a fund or index’s total returns have varied over time. The greater the standard deviation, the greater a fund or index’s volatility. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. |

Past performance is no guarantee of future results. For more information on performance please see page 6. |

| This page is not part of the 2019 Semiannual Report to Shareholders | 7 |

| MANAGERS’ DISCUSSION |

| |

| Royce Dividend Value Fund (RDV) |

|

Chuck Royce

Jay Kaplan, CFA |

| FUND PERFORMANCE |

| Royce Dividend Value Fund gained 20.7% for the year-to-date period ended June 30, 2019, outperforming its benchmarks, the Russell 2000 and Russell 2500 Indexes, which rose 17.0% and 19.2%, respectively, for the same period. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

| Nine of the 10 equity sectors in which the Fund had investments finished the first half in the black. Industrials and Financials were the portfolio’s biggest sectors at the end of June, accounting for nearly 60% of its total assets. Unsurprisingly, then, they were also the top-contributing sectors for 2019’s first half by a comfortable margin. Materials and Information Technology also made solid positive impacts, while Consumer Staples detracted modestly, and Utilities and Real Estate made the smallest contribution. |

| At the industry level, we were happy to see sector diversity among the largest contributors, with the top five groups coming from four different sectors. Capital markets (Financials) made an outsized impact consistent with its status as our largest industry weight during the first half. Machinery and aerospace & defense (both from Industrials), metals & mining (Materials), and electronic equipment, instruments & components (Information Technology) followed. Only two of the portfolio’s 36 industries detracted from performance—food & staples retailing (Consumer Staples) and specialty retail (Consumer Discretionary) while a third—hotels, restaurants & leisure (also from Consumer Discretionary)—was essentially flat. |

Each of the Fund’s five top-contributing positions finished June as one if its 10 biggest holdings. HEICO Corporation, which manufacturers replacement aerospace parts, saw its shares reach higher altitudes after the company reported strong organic sales and expanding margins, lifted by strength in its flight support and electronics segments. These developments led HEICO to raise guidance for the rest of the year. Technology and services provider KBR operates in three segments: Government Services, Technology, and Hydrocarbons Services. Its shares benefited from improved revenues that were chiefly driven by its government-facing and technology businesses. Consumer dispensing systems specialist AptarGroup acquired a packing technology company late in 2018. Along with impressive growth in its core business, the acquisition has helped the company to post improved sales and earnings so far in 2019.

Agricultural equipment supplier Lindsay Corporation was the only one of the portfolio’s nine machinery holdings to finish the first half in the red. The company faced several challenges, including lower farming incomes that have crimped capital spending and led to ongoing weakness in its core market, excess rainfall and flooding in the Midwest, and tariff and trade war woes. In early July, however, Lindsay noted an uptick in domestic irrigation sales, while recent improvement in key crop prices such as corn have brightened agricultural sentiment. In addition, the outlook for international irrigation demand remains favorable. We trimmed our stake in the first half. We acted similarly with our position in FamilyMart UNY Holdings, a Japanese convenience store franchise chain. While the Japanese economy has been improving, its pace has not been vigorous enough to help many retailers. Intensifying competition, skittish consumer confidence, and labor shortages at stores and in logistics also played a role in the decline of its shares during the first half. The stock of footwear manufacturer and retailer Caleres was itself hurt by several factors, including reduced traffic and same-store sales growth at the firm’s Famous Footwear retailer. Our long-term perspective and high regard for its stable of well-known brands, such as Sam Edelman and Allen-Edmonds, led us to begin adding shares in June.

Relative to the Russell 2000, the Fund’s advantage came almost entirely from stock selection, though sector allocation made a small contribution. Boosted mostly by stock picking (with our overweight helping to a lesser degree), Industrials was the biggest source of outperformance in the first half. Stock selection in aerospace & defense was especially additive. Financials followed with an advantage driven by stock selection in capital markets. Conversely, our cash position was the largest source of underperformance. With equity returns running high, even the Fund’s 3.0% average weight was enough to hamper relative results. Consumer Discretionary also detracted, as ineffective stock picks in household durables and specialty retail hurt results versus the Russell 2000. |

| Top Contributors to Performance | | | |

| Year-to-Date Through 6/30/191 | | | |

| | | | |

| HEICO Corporation Cl. A | | 1.87 | |

| |

| KBR | | 1.07 | |

| |

| AptarGroup | | 0.90 | |

| |

| KKR & Co. Cl. A | | 0.84 | |

| |

| IDEX Corporation | | 0.84 | |

| |

| 1 Includes dividends | | | |

| Top Detractors from Performance | | | |

| Year-to-Date Through 6/30/192 | | | |

| | | | |

| Lindsay Corporation | | -0.31 | |

| |

| FamilyMart UNY Holdings | | -0.15 | |

| |

| Caleres | | -0.10 | |

| |

| State Street | | -0.08 | |

| |

| American Eagle Outfitters | | -0.07 | |

| |

| 2 Net of dividends | | | |

| CURRENT POSITIONING AND OUTLOOK |

| Markets are very good at surprising most investors. Today, given widespread concerns about slowing growth, increasing trade tensions, and the extended economic cycle, the most surprising outcome might be a rally. We see four favorable factors in the current market environment—low inflation, modest valuations, moderate growth, and increasing liquidity. When taken together, we see these factors as painting an attractive picture for small-cap investors. With so much attention on negative macro issues, we think investors may be missing this positive picture. We see highly promising select opportunities in dividend-paying small-cap cyclicals, particularly in Industrials, Financials, and Materials. |

| 8 | The Royce Funds 2019 Semiannual Report to Shareholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | TICKER SYMBOLS RYDVX RDVIX RDIIX RDVCX |

| |

Performance and Expenses

Average Annual Total Return (%) Through 6/30/19 |

| | | JAN-JUN 20191 | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | SINCE INCEPTION (5/3/04) |

| |

| RDV | | 20.71 | | 3.19 | | 11.09 | | 5.02 | | 11.97 | | 8.54 | | 8.49 |

| |

| Annual Gross Operating Expenses: 1.43% Annual Net Operating Expenses: 1.34% |

| |

| 1 Not annualized | | | | | | | | | | | | | | |

| |

Relative Risk Adjusted Returns: Monthly Rolling Sharpe Ratios

Since Inception Through 6/30/19

On a monthly rolling risk-adjusted basis, the Fund outperformed the Russell 2000 in 94% of all 10-year periods and 53% of all 5-year periods. |

| |

| | | PERIODS BEATING THE INDEX | | | | | FUND AVG (%)1 | | INDEX AVG (%)1 |

| |

| 10-year | | 58/62 | | | | | | 94% | | 0.53 | | 0.49 |

| |

| 5-year | | 65/122 | | | | | | 53% | | 0.57 | | 0.54 |

| |

1Average of monthly rolling Sharpe Ratios over the specified periods.

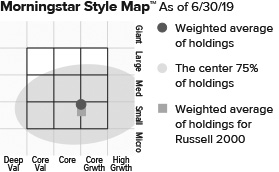

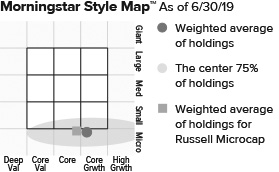

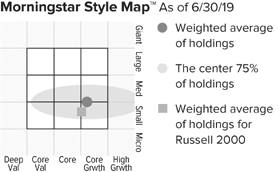

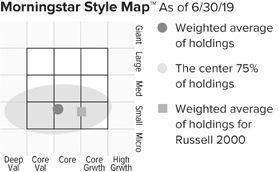

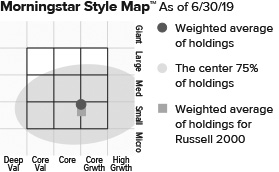

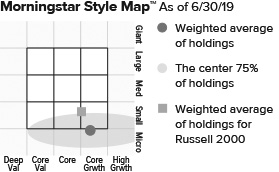

The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 97 for additional information. |

Value of $10,000Invested on 5/3/04 as of 6/30/19 ($)

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| HEICO Corporation Cl. A | | 4.3 |

| |

| AptarGroup | | 3.3 |

| |

| FLIR Systems | | 3.2 |

| |

| KKR & Co. Cl. A | | 3.1 |

| |

| Quaker Chemical | | 3.0 |

| |

| IDEX Corporation | | 2.7 |

| |

| Reliance Steel & Aluminum | | 2.4 |

| |

| KBR | | 2.4 |

| |

| Spirax-Sarco Engineering | | 2.3 |

| |

| Graco | | 2.3 |

| |

| |

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Industrials | | 29.3 |

| |

| Financials | | 28.2 |

| |

| Materials | | 14.3 |

| |

| Information Technology | | 9.0 |

| |

| Consumer Discretionary | | 7.3 |

| |

| Energy | | 6.2 |

| |

| Health Care | | 2.2 |

| |

| Utilities | | 1.5 |

| |

| Real Estate | | 0.4 |

| |

| Consumer Staples | | 0.4 |

| |

| Cash and Cash Equivalents | | 1.2 |

| |

| |

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RDV |

| |

| 2018 | | -16.2 |

| |

| 2017 | | 21.7 |

| |

| 2016 | | 16.4 |

| |

| 2015 | | -5.7 |

| |

| 2014 | | -2.1 |

| |

| 2013 | | 30.7 |

| |

| 2012 | | 16.9 |

| |

| 2011 | | -4.5 |

| |

| 2010 | | 30.1 |

| |

| 2009 | | 37.7 |

| |

| 2008 | | -31.5 |

| |

| 2007 | | -0.0 |

| |

| 2006 | | 19.9 |

| |

| 2005 | | 7.3 |

| |

| |

| Upside/Downside Capture Ratios |

| Periods Ended 6/30/19 (%) |

| | | UPSIDE | | DOWNSIDE |

| |

| 10-Year | | 87 | | 84 |

| |

| From 6/30/04 (Start of Fund’s First Full Quarter) | | 89 | | 78 |

| |

| |

| Portfolio Diagnostics | | | |

| | | | |

| Fund Net Assets | | $110 million | |

| |

| Number of Holdings | | 86 | |

| |

| Turnover Rate | | 6% | |

| |

| Average Market Capitalization1 | | $4,420 million | |

| |

| Weighted Average P/E Ratio2,3 | | 17.4x | |

| |

| Weighted Average P/B Ratio2 | | 2.6x | |

| |

| Active Share4 | | 97% | |

| |

| U.S. Investments (% of Net Assets) | | 67.6% | |

| |

| Non-U.S. Investments (% of Net Assets) | | 31.2% | |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (2% of portfolio holdings as of 6/30/19). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

| Important Performance and Expense Information |

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Shares redeemed within 30 days of purchase may be subject to a 1% redemption fee payable to the Fund, which is not reflected in the performance shown above; if it were, performance would be lower. Current month-end performance may be higher or lower than performance quoted and may be obtained at www.roycefunds.com. All performance and risk information reflects results of the Service Class (its oldest class). Certain immaterial adjustments were made to the net assets of Royce Dividend Value Fund at 6/30/15 for financial reporting purposes, and as a result the net asset values for shareholder transactions on that date and the calendar year Total Returns (%) based on those net asset values differ from the adjusted net asset values and calendar year total returns reported in the Financial Highlights. Gross operating expenses reflect the Fund’s total gross annual operating expenses for the Service Class and include management fees, 12b-1 distribution and service fees, and other expenses. Net operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus. Royce & Associates has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Service Class’s net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.34% through April 30, 2020. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2019. The Sharpe Ratio is calculated for a specified period by dividing a fund’s annualized excess returns by its annualized standard deviation. The higher the Sharpe ratio, the better the fund’s historical risk-adjusted performance. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s benchmark (Russell 2000). It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters.

|

| The Royce Funds 2019 Semiannual Report to Shareholders | 9 |

| MANAGERS’ DISCUSSION |

| |

| Royce Global Financial Services Fund (RFS) |

|

Chuck Royce

Chris Flynn |

| FUND PERFORMANCE |

| Royce Global Financial Services Fund enjoyed a strong first half on an absolute basis, though it trailed its benchmarks for the period. For the year-to-date period ended June 30, 2019, the Fund increased 16.3%, while its U.S.-based benchmarks, the Russell 2000 Index and the Russell 2500 Financial Services Index, posted respective gains of 17.0% and 17.5% for the same period. For additional context in light of the Fund’s global embrace, the MSCI ACWI Small Cap Index was up 15.0% in the first half of 2019. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

| Relative results notwithstanding, we were pleased that gains were widespread through the portfolio. Seventeen of the 22 subindustries in which the Fund had investments contributed to year-to-date returns. As is often the case, the two largest subindustries, asset management & custody banks and regional banks, were the two largest contributors. At the other end of the scale, application software and diversified capital markets were the largest subindustry detractors. A somewhat similar level of broad gains could be found at the country level, where 12 of 18 countries made positive contributions to first-half returns. Outside the U.S.—our largest weighting and the biggest contributor by country— notable positive impacts came from holdings headquartered in Canada and the U.K. while positions headquartered in France, India, and South Africa detracted most, though on a modest scale. |

MarketAxess Holdings, which operates an electronic, multi-dealer trading platform for investment grade and high-yield corporate and emerging market bonds, was the largest contributor at the position level in the first half. Recent results demonstrated an acceleration in market share gains in high-yield and emerging market bonds, which suggested that the company’s total addressable market may be larger than previously thought. The next two contributors reflected the Fund’s positioning pivot a few years ago within asset management stocks. Seeing certain seismic shifts in the industry, we trained our sights on traditional managers with specialties that we thought were sustainable over the long term while also beginning to research and investigate alternative asset management companies. An example of the latter, Ares Management is a market leader in managing private credit pools. Its stock advanced during the first half as it continued to benefit from strong fundraising and yield-hungry investors favoring investments that deliver attractive amounts in a period with generally low interest rates. Based in London but with a global investment reach, Ashmore Group is the leader in emerging market debt investing and an example of a specialist asset manager with a core business that we really like. So far this year, the company has seen strong inflows for its products while also benefiting from an investment rebound in its asset class.

Benefitfocus, a cloud-based software provider of benefits solutions to employers and brokers, was the largest detractor for the year-to-date period. The company reported two consecutive disappointing quarters, particularly regarding expectations in achieving profitability. Along with a large insider sale and the resignation of the CFO, all of this spooked investors. We retained our shares because we are optimistic about the company’s long-term prospects to help its customers manage benefits costs efficiently. Virtu Financial, a market maker and liquidity provider, suffered through a difficult market environment for its business model, which tends to do best when equity trading volumes are rising and volatility levels are moderate to high, which was precisely the opposite of what happened in the first half, which featured both low trading volumes and (aside from May) low volatility. We expect these market conditions to normalize, ultimately supporting growing profits for Virtu. National Western Life Group, a life insurer, also detracted. The company reported a decline in fourth-quarter revenue due to shuttering their international insurance operations. |

| Top Contributors to Performance | | | |

| Year-to-Date Through 6/30/19 (%)1 | | | |

| | | | |

| MarketAxess Holdings | | 1.30 | |

| |

| Ares Management Cl. A | | 0.97 | |

| |

| Ashmore Group | | 0.97 | |

| |

| Sprott | | 0.96 | |

| |

| FirstService Corporation | | 0.95 | |

| |

| 1 Includes dividends | | | |

| Top Detractors from Performance | | | |

| Year-to-Date Through 6/30/19 (%)2 | | | |

| | | | |

| Benefitfocus | | -0.48 | |

| |

| Virtu Financial Cl. A | | -0.42 | |

| |

| National Western Life Group Cl. A | | -0.22 | |

| |

| Rothschild & Co | | -0.16 | |

| |

| JSE | | -0.13 | |

| |

| 2 Net of dividends | | | |

| CURRENT POSITIONING AND OUTLOOK |

| The financial sector is undergoing meaningful change due to the convergence of several important factors, such as persistently low interest rates, the increasing popularity of passive investment vehicles, low equity market volatility, and low equity trading volumes. These conditions have created difficulties for many traditional financial business models, including banks, insurers, brokerages, and traditional asset managers. As a result, we have evolved our positioning to include companies that we believe can prosper if current conditions persist. One example is the preference we mentioned earlier for both traditional asset managers with a sustainable specialty and alternative asset managers. We are also attracted to certain specialty lenders that look capable of thriving in the current low-rate environment and selected service companies that are using technology to deliver superior service or lower prices. While we still expect an eventual return to normalization, one that will include higher rates and higher volatility that should benefit many of the Fund’s holdings, we also want to own stocks that can do well if “normal” takes a longer time to arrive than we initially anticipated. |

| 10 | The Royce Funds 2019 Semiannual Report to Shareholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | TICKER SYMBOLS RYFSX RGFIX |

| Performance and Expenses |

| Average Annual Total Return (%) Through 6/30/19 |

| | | JAN-JUN 20191 | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | SINCE INCEPTION (12/31/03) |

| |

| RFS | | 16.26 | | -1.92 | | 11.47 | | 5.78 | | 11.11 | | 8.08 | | 7.88 |

| |

| Annual Gross Operating Expenses: 1.77% Annual Net Operating Expenses: 1.58% |

| |

| 1 Not annualized | | | | | | | | | | | | |

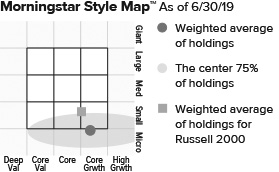

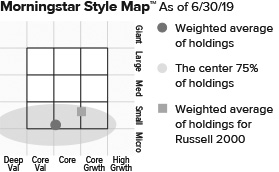

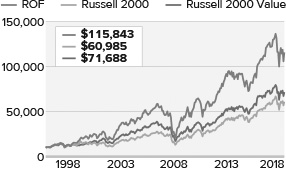

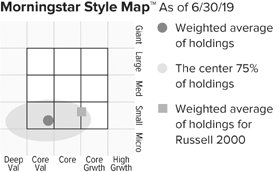

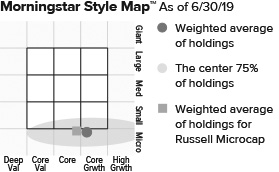

The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 97 for additional information. |

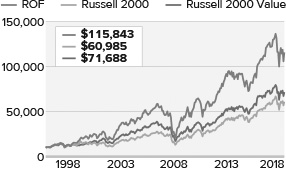

Value of $10,000Invested on 12/31/03 as of 6/30/19 ($)

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| MarketAxess Holdings | | 3.6 |

| |

| Franco-Nevada | | 3.6 |

| |

| Sprott | | 3.3 |

| |

| Popular | | 3.2 |

| |

| FirstService Corporation | | 3.1 |

| |

| First Citizens BancShares Cl. A | | 2.9 |

| |

| E-L Financial | | 2.6 |

| |

| Virtu Financial Cl. A | | 2.6 |

| |

| Ares Management Cl. A | | 2.6 |

| |

| Ashmore Group | | 2.6 |

| |

|

| Portfolio Industry Breakdown | | |

| % of Net Assets (Subject to Change) | | |

| | | |

| Capital Markets | | 48.6 |

| |

| Banks | | 18.8 |

| |

| Real Estate Management & Development | | 7.4 |

| |

| Insurance | | 6.6 |

| |

| Metals & Mining | | 3.5 |

| |

| Software | | 2.9 |

| |

| Professional Services | | 2.5 |

| |

| Trading Companies & Distributors | | 2.0 |

| |

| IT Services | | 1.8 |

| |

| Diversified Financial Services | | 1.4 |

| |

| Hotels, Restaurants & Leisure | | 0.8 |

| |

| Consumer Finance | | 0.5 |

| |

| Cash and Cash Equivalents | | 3.2 |

| |

|

| Upside/Downside Capture Ratios | | | | |

| Periods Ended 6/30/19 (%) | | | | |

| | | UPSIDE | | DOWNSIDE |

| |

| 10-Year | | 83 | | 85 |

| |

| Fund’s First Full Quarter (12/31/03) | | 85 | | 78 |

| |

|

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RFS |

| |

| 2018 | | -13.4 |

| |

| 2017 | | 22.5 |

| |

| 2016 | | 12.9 |

| |

| 2015 | | -4.7 |

| |

| 2014 | | 3.5 |

| |

| 2013 | | 42.0 |

| |

| 2012 | | 20.7 |

| |

| 2011 | | -11.3 |

| |

| 2010 | | 18.5 |

| |

| 2009 | | 32.1 |

| |

| 2008 | | -35.4 |

| |

| 2007 | | -4.7 |

| |

| 2006 | | 24.8 |

| |

| 2005 | | 12.2 |

| |

| 2004 | | 15.1 |

| |

|

| Portfolio Country Breakdown1,2 | | |

| % of Net Assets | | |

| | | |

| |

| United States | | 55.3 |

| |

| Canada | | 19.8 |

| |

| United Kingdom | | 7.7 |

| |

| India | | 2.6 |

| |

| France | | 2.3 |

| |

| South Africa | | 1.8 |

| |

| Brazil | | 1.5 |

| |

| 1 | Represents countries that are 1.5% or more of net assets. |

| 2 | Securities are categorized by the country of their headquarters. |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $39 million |

| |

| Number of Holdings | | 70 |

| |

| Turnover Rate | | 1% |

| |

| Average Market Capitalization1 | | $2,205 million |

| |

| Weighted Average P/E Ratio2,3 | | 14.7x |

| |

| Weighted Average P/B Ratio2 | | 1.8x |

| |

| Active Share4 | | 99% |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (11% of portfolio holdings as of 6/30/19). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

| Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Shares redeemed within 30 days of purchase may be subject to a 1% redemption fee payable to the Fund, which is not reflected in the performance shown above; if it were, performance would be lower. Current month-end performance may be higher or lower than performance quoted and may be obtained at www.roycefunds.com. Gross operating expenses reflect the Fund’s gross total annual operating expenses for the Service Class and include management fees, 12b-1 distribution and service fees, other expenses and acquired fund fees and expenses. Net operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus. Royce & Associates has contractually agreed to waive fees and/or reimburse expenses to the extent necessary to maintain the Fund’s net annual operating expenses, (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business), at or below 1.49% through April 30, 2020. Acquired fund fees and expenses reflect the estimated amount of the fees and expenses incurred indirectly by the Fund through its investments in mutual funds, hedge funds, private equity funds, and other investment companies. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2019. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s benchmark (Russell 2000). It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters.

|

| The Royce Funds 2019 Semiannual Report to Shareholders | 11 |

| | | MANAGERS’ DISCUSSION |

| Royce International Premier Fund (RIP) | | |

|

David Nadel

Mark Rayner, CA |

FUND PERFORMANCE

Royce International Premier Fund gained 21.4% for the year-to-date period ended June 30, 2019, significantly ahead of its benchmark, the MSCI ACWI ex-US Small Cap Index, which was up 11.6% for the same period. This strong absolute and relative performance helped our Quality-at-a-Reasonable-Price strategy to outpace the benchmark for the one-, three-, five-year, and since inception (12/31/10) periods ended June 30, 2019. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

| All eight equity sectors in which the Fund had investments made a positive impact on first-half returns, as did 16 of 18 countries. Industrials was by far the top-contributing sector, followed by Information Technology, while Materials and Consumer Discretionary contributed least. Based on each country’s headquarters, stocks in Japan and Switzerland made the largest contributions, while only China and India detracted from portfolio returns. |

Based in Brazil—and buoyed in part by that nation’s economic and market recoveries—TOTVS provides enterprise resource planning and supply chain management software solutions. The company made the biggest positive contribution to first-half returns on the position level as analysts showed more confidence in its growth opportunities in FinTech. In addition, TOTVS recently completed a follow-on equity raise that strengthened its seemingly fortress-like balance sheet, providing the company with more-than-ample capital for strategic acquisitions. Kardex is a Swiss intralogistics company that manufactures automated storage and materials handling systems. Its stock began to climb in early March following the report of strong full-year earnings, which helped its shares to recover from a steep price decline in 2018’s fourth quarter. Spirax-Sarco is a U.K. company that makes steam management systems and peristaltic pumps whose outstanding record of consistent long-term organic growth and profitability first drew our attention. Its shares rose in May when it announced impressive organic growth rates so far in 2019 despite some softening in global industrial production.

The Fund’s top detractor in the first half was TravelSky Technology, a Hong Kong listed company that dominates Global Distribution Systems (GDS) services to the Chinese aviation and travel industry primarily by connecting airline ticket suppliers, hotels, rental cars, etc. with the agencies making customer reservations. The company announced disappointing earnings for fiscal 2018 in March. While its revenues grew robustly, net profits were disappointing due to increased costs. Thinking that these were solvable, short-term issues, we added shares. Consort Medical is a U.K.-based Contract Development & Manufacturing Organization that makes high-volume, disposable drug delivery devices primarily for respiratory treatments. Full-year results announced in June showed revenues and operating profits both down, but in line with the reduced expectations set by management in December 2018. The company has also reported mixed news on the development of a relatively narrow, though expanding, portfolio of commercialized and in-development projects, which has made the stock disappointingly volatile for some time. Adding to its challenges was an explosion in its Northumberland facility in July, though we began to reduce our position in June. We chose to exit our position in SH Kelkar & Company, as this India-based, family-run fragrance producer continued to struggle.

The Fund’s outperformance versus the MSCI ACWI ex USA Small Cap came largely from stock selection, though sector allocation was also positive. Industrials contributed most, with professional services as its leading industry. Information Technology also had a notably strong impact on first-half outperformance, courtesy of strong results for the software industry, where the Fund had seven holdings and was significantly overweight versus the benchmark. The Fund’s cash position was the largest source of relative underperformance. While our 5.7% average cash level in the first half was not high, almost any amount is a meaningful drag on performance when returns are as strong as they were. Materials also detracted from relative returns, as stock selection had a negative impact. |

| | Top Contributors to Performance

Year-to-Date Through 6/30/19 (%)1 | | |

| | | |

| TOTVS | | 1.12 |

| |

| Kardex | | 1.11 |

| |

| Spirax-Sarco Engineering | | 0.92 |

| |

| IMCD | | 0.89 |

| |

| Partners Group Holding | | 0.83 |

| |

| 1 Includes dividends | | |

| | Top Detractors from Performance

Year-to-Date Through 6/30/19 (%)2 | | |

| | | |

| TravelSky Technology | | -0.40 |

| |

| Consort Medical | | -0.15 |

| |

| SH Kelkar & Company | | -0.15 |

| |

| Burkhalter Holding | | -0.04 |

| |

| Croda International | | -0.01 |

| |

| 2 Net of dividends | | |

| CURRENT POSITIONING AND OUTLOOK |

| After peaking in January 2018, the MSCI ACWI ex USA Small Cap Index declined to a point 15% shy of its prior high at the end of June. Global Manufacturing PMI’s were in decline over this same period, and sat at less than 50 on June 30, reflecting a contraction in global manufacturing. While we are grateful that the Fund delivered a modest positive return during this difficult 18-month period, we would also welcome more hospitable conditions for international small-cap stocks. That scenario may be approaching. Central banks appear ready to resume their accommodative positions, which will likely include increasing financial market liquidity, a development that should help small-caps. It seemed reasonable at the end of June to conclude that most, if not all, of the recent macroeconomic pessimism is fully reflected in valuations. In the absence of worsening global macroeconomic conditions, we suspect that the combination of increased central bank support, continued modest inflation, and low interest rates may all be supportive for international small-caps. |

| 12 | The Royce Funds 2019 Semiannual Report to Shareholders | |

| PERFORMANCE AND PORTFOLIO REVIEW | | TICKER SYMBOLS RYIPX RIPNX RINPX RIPIX |

| Performance and Expenses |

| Average Annual Total Return (%) Through 6/30/19 |

| | | JAN-JUN 20191 | | 1-YR | | 3-YR | | 5-YR | | SINCE INCEPTION (12/31/10) |

| |

| RIP | | 21.38 | | 9.26 | | 13.28 | | 8.64 | | 7.84 |

| |

| Annual Gross Operating Expenses: 1.59% Annual Net Operating Expenses: 1.44% |

| |

| 1 Not annualized | | | | | | | | | | |

| |

Relative Returns: Monthly Rolling Average Annual Return Periods

Since Inception Through 6/30/19

On a monthly rolling basis, the Fund outperformed the MSCI ACWI x USA SC in 100% of all 5-year periods; 84% of all 3-year periods; and 69% of all 1-year periods. |

| |

| | | PERIODS BEATING THE INDEX | | | | | FUND AVG (%)1 | | INDEX AVG (%)1 |

| |

| 5-year | | 43/43 | | | | | | 100% | | 8.5 | | 6.1 |

| |

| 3-year | | 56/67 | | | | | | 84% | | 9.1 | | 6.8 |

| |

| 1-year | | 63/91 | | | | | | 69% | | 8.6 | | 5.9 |

| |

1Average of monthly rolling average annual total returns over the specified periods.

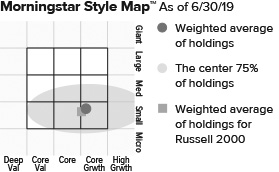

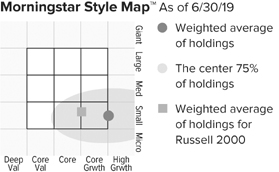

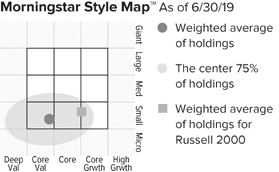

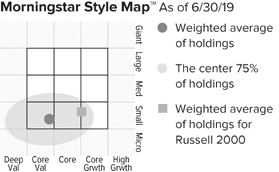

The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 97 for additional information. |

Value of $10,000Invested on 12/31/10 as of 6/30/19 ($)

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| IMCD | | 3.0 |

| |

| Meitec Corporation | | 2.9 |

| |

| Partners Group Holding | | 2.8 |

| |

| Victrex | | 2.7 |

| |

| Daifuku | | 2.7 |

| |

| Hexpol | | 2.7 |

| |

| Intertrust | | 2.5 |

| |

| Spirax-Sarco Engineering | | 2.4 |

| |

| Loomis Cl. B | | 2.4 |

| |

| TKC Corporation | | 2.3 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Industrials | | 36.9 |

| |

| Information Technology | | 22.0 |

| |

| Health Care | | 13.0 |

| |

| Materials | | 7.4 |

| |

| Financials | | 7.0 |

| |

| Energy | | 4.2 |

| |

| Real Estate | | 3.6 |

| |

| Preferred Stock | | 2.1 |

| |

| Cash and Cash Equivalents | | 3.8 |

| |

|

| Upside/Downside Capture Ratios | | | | |

| Periods Ended 6/30/19 (%) | | | | |

| | | UPSIDE | | DOWNSIDE |

| |

| Fund’s First Full Quarter (12/31/10) | | 108 | | 76 |

| |

|

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RIP |

| |

| 2018 | | -12.8 |

| |

| 2017 | | 39.8 |

| |

| 2016 | | -1.1 |

| |

| 2015 | | 16.2 |

| |

| 2014 | | -8.2 |

| |

| 2013 | | 18.3 |

| |

| 2012 | | 23.4 |

| |

| 2011 | | -16.8 |

| |

|

| Portfolio Country Breakdown1,2 | | |

| % of Net Assets | | |

| |

| Japan | | 18.1 |

| |

| United Kingdom | | 11.7 |

| |

| Switzerland | | 8.8 |

| |

| Australia | | 8.7 |

| |

| Sweden | | 8.5 |

| |

| Germany | | 7.3 |

| |

| Canada | | 5.9 |

| |

| Netherlands | | 5.5 |

| |

| France | | 4.7 |

| |

| Brazil | | 4.4 |

| |

| 1 | Represents countries that are 3% or more of net assets. |

| 2 | Securities are categorized by the country of their headquarters. |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $606 million |

| |

| Number of Holdings | | 51 |

| |

| Turnover Rate | | 14% |

| |

| Average Market Capitalization1 | | $2,042 million |

| |

| Weighted Average P/E Ratio2,3 | | 24.7x |

| |

| Weighted Average P/B Ratio2 | | 3.7x |

| |

| Active Share4 | | 99% |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (2% of portfolio holdings as of 6/30/19). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

| Important Performance and Expense Information