UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03651

Touchstone Strategic Trust – June Funds

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: June 30

Date of reporting period: June 30, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

June 30, 2018

Annual Report

Touchstone Strategic Trust

Touchstone Balanced Fund

Touchstone International Equity Fund

Touchstone Large Cap Focused Fund

Touchstone Small Company Fund

Table of Contents

This report identifies the Funds' investments on June 30, 2018. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Strategic Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Funds, for the seven months ended June 30, 2018.

The global economic recovery, now in its 10th year following the 2008 financial crisis, gained momentum in 2017 as the U.S., Japan, the European Union and China all reported solid economic growth. Despite the overall solid economic fundamentals, market volatility increased in 2018 as tariffs and trade tensions raised the specter of an escalating global trade war. The “synchronized global expansion” showed signs of unraveling because of these growing trade tensions. Monetary policies across the major central banks remained divergent throughout the period as the Bank of Japan and the European Central Bank maintained accommodative stances, while the U.S. Federal Reserve Board (Fed) continued moving toward its goal of monetary policy normalization by raising interest rates three times in the fiscal year. Additionally, the Fed announced and began executing on plans to reduce the size of its balance sheet by selling securities it had acquired during its quantitative easing programs.

Despite the negative impact of widening trade disputes, global equities eked out positive returns, led by the domestic market. While non-U.S. equities produced positive local currency returns, a strengthening U.S. dollar offset those gains and resulted in slight losses for dollar-denominated investors allocating to foreign markets. Within the U.S. equity markets, growth-oriented stocks far outpaced their value-oriented counterparts, while small-capitalization stocks outperformed mid- and large-capitalization stocks.

The Fed’s three interest rate hikes during the fiscal year pushed short-term interest rates higher. Longer-term interest rates also moved higher early in the period before settling into range-bound trading from mid-February on. This rise in interest rates drove negative returns for investment grade bonds. Though non-investment grade bonds also experienced price declines, these were offset by these bonds’ higher coupon payments, enabling the non-investment grade market to produce slightly positive returns in aggregate for the fiscal period.

With 2019 now on the horizon, the post-crisis bull market is approaching its 10 year anniversary. While it has certainly experienced periods of volatility, the length and strength of this market environment only reinforces our view that investing is a long-term endeavor which requires a multi-year approach. A disciplined approach and appropriate time horizon can deter short-termism and reactive decision-making. Your financial advisor can help you by identifying a risk-return profile and developing an investment plan that will help you address your long-term financial goals.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Strategic Trust

Management's Discussion of Fund Performance (Unaudited)

Touchstone Balanced Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Fund seeks to achieve its investment goal of providing investors with capital appreciation and current income by generally investing in a diversified portfolio comprising 60 percent equity securities and 40 percent fixed-income securities.

With respect to equities, the Fund invests primarily in issuers having a market capitalization, at the time of purchase, above $5 billion. Equity securities include common stock and preferred stock. With respect to fixed-income, the Fund invests primarily in bonds, including mortgage-related securities, asset-backed securities, government securities (both U.S. government securities and foreign sovereign debt), and corporate debt securities.

Fund Performance

The Touchstone Balanced Fund (Class A Shares) underperformed its first benchmark, the S&P 500® Index, and outperformed its second benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, for the seven-month period ended June 30, 2018. The Fund’s total return was 1.72 percent (calculated excluding the maximum sales charge) while the total return of the S&P 500® Index was 3.79 percent and the total return of the Bloomberg Barclays U.S. Aggregate Bond Index was -1.17 percent.

Market Environment

The market environment was mixed during the period. In the last quarter of 2017, U.S. equities continued the bull market that began in 2009 as the market experienced low volatility and ended the year near all-time highs. Solid financial conditions and strong profit growth were the key drivers of the market. Markets benefited from an added boost in the later stages of 2017 as the White House and Congressional Republican leaders coalesced around a plan for tax reform. In the first quarter of 2018, the major theme in the U.S. equity market was the return of volatility. The primary drivers were concerns over higher interest rates and uncertainty about trade relations. The U.S. equity market experienced the first correction of 10 percent in more than a year and ended the quarter down slightly. In the second quarter, the U.S. equity market ended slightly higher as solid earnings and elevated corporate buyback activity overshadowed ongoing trade concerns. Sectors that led the S&P 500® Index higher included Information Technology, Consumer Discretionary and Energy. The Consumer Staples, Telecommunication Services, Real Estate, Industrials, Materials, Financials, Health Care and Utilities sectors underperformed the index during the period.

The yield curve continued to flatten over the period with interest rates on the front end of the curve rising at a greater magnitude than the long end. This was driven by the combination of the U.S. Federal Reserve Board continuing to gradually raise short-term rates and lower-than-expected inflation subduing the long-end of the yield curve. U.S. investment grade corporate bonds and Treasuries declined during the period, while U.S. non-investment grade corporate bonds gained due to positive economic data and continued investor demand for high-yield bonds. Emerging Markets debt also declined as a stronger dollar and uncertainty on global trade made the space unappealing to investors.

Portfolio Review

Sectors in which the Fund outperformed the S&P 500® Index included Telecommunication Services, Industrials, Health Care, Financials, Information Technology, Consumer Staples and Real Estate. The Consumer Discretionary, Utilities and Energy sectors were the areas where the Fund underperformed the index. Sector allocation was marginally positive to performance primarily due to the underweights to Utilities, Real Estate, Industrials, and Health Care.

Management's Discussion of Fund Performance (Unaudited) (Continued)

With credit spreads widening during the period, the Fund’s typical overweight to risk assets was detrimental to performance. The Fund’s allocation to investment grade corporate bonds naturally made this segment a primary source of weakness during the period. The Fund’s allocation to U.S. dollar denominated Emerging Markets debt also detracted. Given the negative move in the market overall, the Fund’s holdings in cash contributed to performance over the period.

Outlook

Overall, our outlook supports the Fund’s overweight to risk assets based on steady U.S. economic growth and moderate inflation levels. While broad financial conditions are not tight, they have tightened in recent months amid increased market volatility and higher interest rates.

At the mid-point of a year that has been characterized by strong economic data and corporate earnings overshadowing trade conflicts and rising interest rates, the U.S. equity market is slightly ahead of where we started the year. Our view is that the U.S. equity market is healthy and priced at fair value. We continue to monitor the most common indicators of the end of a bull market – a credit cycle, inflation, and an asset bubble. At this point, these indicators do not give us reason to get defensive. We also look for deteriorating market breadth, which is typically a hallmark of an ensuing market top. Throughout the year, market breadth readings have been solid. As a result, the Fund’s cash position remains near its historical average.

Within fixed income, valuations have adjusted to reflect uncertainty around trade issues, but potential upside to price appreciation remains limited. The team has been taking advantage of opportunities among Securitized Assets when possible, where attractive risk/reward profiles can be found in the Asset-Backed and Non-agency Mortgage-Backed Sectors. We also are attracted to these sectors’ close connection to consumer spending, which continues to be healthy. We believe interest rates are currently fair and do not anticipate a meaningful move higher from here. As a result, the Fund’s portfolio will generally remain duration neutral relative to the Bloomberg Barclays U.S. Aggregate Bond Index, and look to opportunistically take advantage of dislocations in the market as they arise.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Balanced Fund - Class A*, the S&P 500® Index and the Bloomberg Barclays U.S. Aggregate Bond Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares and Class Y shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares and Class Y shares was November 15, 1938, May 4, 1998 and August 27, 2007, respectively. Class C shares and Class Y shares performance information was calculated using the historical performance of Class A shares for periods prior to May 4, 1998 and August 27, 2007, respectively. The returns have been restated for sales loads and fees applicable to Class C and Class Y shares. The launch date of the S&P 500® Index and the Bloomberg Barclays U.S. Aggregate Bond Index was after the inception date of the Fund, therefore there is no return for inception. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. Prior to October 28, 2017, the maximum offering price per share of Class A shares was equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Effective October 28, 2017, the maximum offering price per share of Class A shares is equal to the NAV per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

S&P 500® Index is a group of 500 widely held stocks and is commonly regarded to be representative of the large capitalization stock universe.

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

Management's Discussion of Fund Performance (Unaudited)

Touchstone International Equity Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone International Equity Fund invests primarily in common stocks of established large capitalization companies located in or that conduct their business mainly in one or more foreign countries, which may include emerging markets. The process starts with a regular quantitative screening or bottom up identification of companies that meet the investment profile of high returns on capital, operating margins and strong cash flow generation. These means of identifying companies narrows the investable universe. The Fund analyzes companies based on the following five fundamental factors: business quality, valuation, growth, management and balance sheet strength, focusing on quality at a reasonable price. This approach to portfolio construction seeks to result in a concentrated, high-conviction portfolio.

Fund Performance

The Touchstone International Equity Fund (Class A Shares) underperformed its benchmark, the MSCI EAFE Index, for the seven-month period ended June 30, 2018. The Fund’s total return was -3.23 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was -1.19 percent.

Market Environment

The seven-month period ended June 30, 2018 was a tale of two markets. The MSCI EAFE Index declined overall despite the Energy, Materials and Real Estate sector stocks generating positive returns. Conversely, Telecommunication Services, Financials and Industrials sectors each posted negative returns. The steady up market at the end of 2017 culminated in record low volatility and post-financial-crisis highs in global indices in early 2018. January saw a spike in volatility and an initial crash, which led to choppier, generally falling markets for the rest of the period. The dollar recovered sharply in January, benefiting from the risk off trade and further stressed export-oriented markets. As the period ended, there were signs of peaking global economic growth and tightening monetary conditions combined with rising trade tensions, which dampened investor confidence.

Portfolio Review

The Touchstone International Equity Fund underperformance was mainly due to poor stock selection in the Consumer Discretionary, Real Estate and Materials sectors, while an underweight position in the Financials sector and solid stock selection in the Information Technology sector were positive contributors to performance over the seven-month period. Geographically, the Fund’s holdings in Canada and India were the largest performance detractors, while an overweight position in the U.K. and good stock selection within the country contributed to performance. Additionally, the Fund benefited from solid stock selection in its German and Dutch holdings.

Among the detractors from relative performance over the seven-month period were PC Jeweller (Consumer Discretionary sector), SES SA (Consumer Discretionary sector) and Uni-Select Inc. (Consumer Discretionary sector).

Shares of PC Jeweller Ltd., one of India’s leading branded jewelry makers and retailers, experienced a significant decline during the seven-month period. The Indian jewelry market has been going through a structural transition as organized retailers such as PC Jeweller gain market share from the highly fragmented mom and pop segment, thanks in part to the recent introduction of mandatory hallmarking of gold jewelry and a new general sales tax introduced in 2017. As a result, PC Jeweller’s growth began to accelerate as the company expanded its national retail footprint, which led to a strong share price rise during calendar year 2017. The last six months,

Management's Discussion of Fund Performance (Unaudited) (Continued)

however, were considerably less friendly to the company and its shareholders. Several events, which were either completely unrelated to the company or irrelevant to the value of the business, combined with some aggressive and unfounded rumor mongering by short sellers, reduced the value of the stock. We believe the company’s valuation was at the point where its implied value was no longer recognizing any value to the business beyond its inventory on hand. Research and ongoing communication with management suggested there was a fundamental disconnect between the recent share price volatility and the economic reality of the underlying business. Management continued to roll out new, mainly franchised locations and recently announced a share buyback in an effort to help restore confidence among investors.

SES is the Luxembourg-domiciled global leading provider of fixed satellite services, including video broadcasting and broadband services. The company’s share price came under pressure during the latter part of 2017 as the company failed to deliver on expectations over multiple quarters as improvements in data compression technology led to weaker than expected revenue growth. As a result, the position was sold.

Uni-Select, a Canadian-based commercial distributor of automotive parts and paint, reported inconsistent results over recent quarters. The company attributed some of the headwinds to transitory factors, but also admitted to some unfavorable evolving market dynamics, as Axalta Coating Systems, the company’s largest paint supplier in North America, announced a modification in its distribution strategy.

Among the contributors to relative performance over the seven-month period were Aveva Group PLC (Information Technology sector), Wynn Macau Ltd. (Consumer Discretionary sector) and BCA Marketplace PLC (Consumer Discretionary sector).

Aveva Group is a leading industrial software company with a strong market share in computer-aided design and product lifecycle management solutions for the process manufacturing industry. We believe the company’s recent merger with Schneider Software SE should provide unmatched end-to-end capabilities in design, simulation and operations. The market was encouraged by the potential synergies from the combination and its Internet of Things platform (IoT). In addition, the company saw a steady recovery in its key end markets on the back of higher oil prices.

Wynn Macau is the Hong Kong listed subsidiary of Wynn Resorts in Las Vegas. Shares of Wynn Macau continued their winning streak through the early part of 2018, following a stellar 2017. The recovery in the Macau gaming sector accelerated over the course of 2017 as spending on luxury and gaming among Chinese consumers gained momentum. Wynn Macau particularly benefited from the successful opening and market share gain of its high profile premium resort Wynn Palace on Macau’s Cotai Strip. The Fund’s Wynn Macau position was sold in January 2018.

BCA Marketplace operates Europe’s largest used vehicle marketplace. It has more than 50 percent share of the market in the U.K. and Germany and leading positions in many other markets across Europe. The company conducts physical and online auctions. In addition to exhibiting solid growth over the past year, its share price surged after private equity firm Apax Partners Worldwide LLC said it was considering an offer for the company.

During the seven-month period, the Fund sold six holdings and purchased five new positions. Most sales were a result of valuations that exceeded our comfort level, while a few reflected reduced confidence in the Fund’s investment theses due to deteriorating fundamentals. A couple of small positions that were received as a result of spin offs from larger holdings were also sold. Sector and country allocation remained more or less stable over the period.

Outlook

We believe politics is beginning to supplant monetary policy as the primary driver of global markets. That is not to say that monetary conditions are necessarily stable, after all, interest rates continued to rise in the U.S.

Management's Discussion of Fund Performance (Unaudited) (Continued)

and the U.S. Federal Reserve Board’s (Fed’s) balance sheet continued to slowly contract, while it appears likely that Europe will begin, cautiously at first, to wind down quantitative easing soon. Nonetheless, the massive injections of liquidity that helped propel financial markets and economic activity over the past decade are more than likely behind us now, while one political consequence of the long period of easy money, namely the radicalization of economic policy proposals, begins to make itself felt. From rising trade protectionism to the increasing resonance of outright socialism with young voters; from Brexit to the rise of Euroskeptic political parties across Europe, we believe the message is clear: the current combination of policy mix, technological change and globalization is increasingly leaving certain vulnerable citizens behind and resulting in a hollowing out of the political center. How this tension is ultimately resolved is the biggest question facing developed countries, their politicians and investors going forward.

Although some parts of the stock market, in particular the digital disruptors in Information Technology, look pricey by historical standards, a number of the stable growth businesses where we focus our efforts are trading at some of the most attractive valuations in several years. With increasing signs of slowing global growth, we believe an emphasis on high quality businesses with strong balance sheets leaves the Fund well positioned for the potential risks and opportunities ahead.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone

International Equity Fund - Class A* and the MSCI EAFE Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was March 1, 1993, May 4, 1998, August 27, 2007 and October 30, 2017, respectively. Class C shares, Class Y and Institutional Class shares performance information was calculated using the historical performance of Class A shares for periods prior to May 4, 1998, August 27, 2007 and October 30, 2017, respectively. The returns have been restated for sales loads and fees applicable to Class C, Class Y and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. Prior to October 28, 2017, the maximum offering price per share of Class A shares was equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Effective October 28, 2017, the maximum offering price per share of Class A shares is equal to the NAV per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance excluding the U.S. and Canada.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Large Cap Focused Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Fund seeks to invest in companies of large capitalizations that are trading below what is believed to be the estimate of their intrinsic value and have a sustainable competitive advantage or a high barrier to entry in place. The barrier(s) to entry can be created through a cost advantage, economies of scale, high customer loyalty or a government barrier (e.g. license or subsidy). Fort Washington believes that the strongest barrier to entry is the combination of economies of scale and high customer loyalty.

Fund Performance

The Touchstone Large Cap Focused Fund (Class A Shares) outperformed the S&P 500® Index for the seven-month period ended June 30, 2018. The Fund’s total return was 4.74 percent (calculated excluding the maximum sales charge) while the return of its benchmark was 3.79 percent.

Market Environment

The market environment was mixed during the period. In the last quarter of 2017, U.S. equities continued the bull market that began in 2009 as the market experienced low volatility and ended the year near all-time highs. Solid financial conditions and strong profit growth were the key drivers of the market. Markets benefited from an added boost in the later stages of 2017 as the White House and Congressional Republican leaders coalesced around a plan for tax reform. In the first quarter of 2018, the major theme in the U.S. equity market was the return of volatility. The primary drivers were concerns over higher interest rates and uncertainty about trade relations. The U.S. equity market experienced the first correction of 10 percent in more than a year and ended the quarter down slightly. In the second quarter, the U.S. equity market ended slightly higher as solid earnings and elevated corporate buyback activity overshadowed ongoing trade concerns. Sectors that led the S&P 500® Index higher included Information Technology, Consumer Discretionary, and Energy. The Consumer Staples, Telecommunication Services, Real Estate, Industrials, Materials, Financials, Health Care, and Utilities sectors underperformed the benchmark during the period.

Portfolio Review

Sectors in which the Fund outperformed the benchmark included Telecommunication Services, Industrials, Health Care, Financials, Information Technology, Consumer Staples, and Real Estate. The Consumer Discretionary, Utilities, and Energy sectors were the areas where the Fund underperformed its benchmark. The cash position detracted from performance given the positive move in the S&P 500® Index during the period. Sector allocation was marginally positive to performance primarily due to the underweights to Utilities, Real Estate, Industrials, and Health Care.

Stock selection was the primary driver of the Fund’s outperformance relative to the benchmark. The three largest contributors to performance were S&P Global, Inc. (Financials sector), Boeing Co. (Industrials sector), and Visa Inc. (Information Technology sector). The three largest detractors for the period were McDonald’s Corp., Comcast Corp., and Amazon.com, Inc. (all from the Consumer Discretionary sector).

Outlook

At the mid-point of a year that has been characterized by strong economic data and corporate earnings overshadowing trade conflicts and rising interest rates, the U.S. equity market is slightly ahead of where we started the year. Our view is that the U.S. equity market is healthy and priced at fair value with the assumption that the market should achieve seven to eight percent returns going forward. We continue to monitor the most common indicators of the end of a bull market – a credit cycle, inflation, and an asset bubble. At this point, these indicators do

Management's Discussion of Fund Performance (Unaudited) (Continued)

not give us reason to get defensive. We also look for deteriorating market breadth, which is typically a hallmark of an ensuing market top. Throughout the year, market breadth readings have been solid. As a result, the Fund’s cash position remains near its historical average.

While we do not see signs of what typically causes a severe pullback, the Fund’s positioning reflects the sub-advisor’s belief that we are in the later stages of the market cycle. The team continues to look for businesses that it believes are mispriced by the market. The Fund currently emphasizes larger cap, Franchise Value businesses with higher barriers to entry.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Large Cap

Focused Fund - Class A* and the S&P 500® Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was January 12, 1934, May 4, 1998, May 4, 2007 and December 23, 2014, respectively. Class C shares, Class Y shares and Institutional Class shares performance was calculated using the historical performance of Class A shares for the periods prior to May 4, 1998, May 4, 2007 and December 23, 2014, respectively. The returns have been restated for sales loads and fees applicable to Class C, Class Y and Institutional Class shares. The launch date of the S&P 500® Index was after the inception date of the Fund, therefore there is no return for inception. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. Prior to October 28, 2017, the maximum offering price per share of Class A shares was equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Effective October 28, 2017, the maximum offering price per share of Class A shares is equal to the NAV per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

S&P 500® Index is a group of 500 widely held stocks and is commonly regarded to be representative of the large capitalization stock universe.

Management's Discussion of Fund Performance (Unaudited)

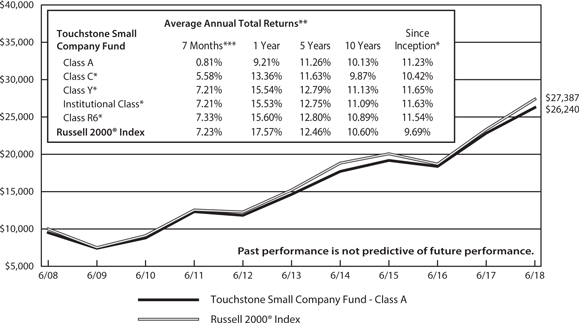

Touchstone Small Company Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Fund seeks to provide investors with growth of capital by investing primarily in common stocks of small companies that the sub-advisor believes are high quality, have superior business models, solid management teams, sustainable growth potential and are attractively valued.

Fund Performance

The Touchstone Small Company Fund (Class A Shares) underperformed its benchmark, the Russell 2000® Index, for the seven-month period ended June 30, 2018. The Fund’s total return was 6.89 percent (calculated excluding the maximum sales charge) while the return of the benchmark was 7.23 percent.

Market Environment

U.S. equity markets experienced solid returns for the seven-month period ended June 30, 2018. At the beginning of the period, the overall economic environment was stable and positive. We believe the primary catalyst for market gains in late 2017 was anticipation of corporate tax reform legislation, which was ultimately passed in December. The market’s upward momentum carried over to the first quarter of 2018 with the benchmark marching to all-time highs in January. However, the favorable trading conditions gave way to a significant increase in volatility in February and March and economic growth remained solid in early 2018, with continued strength in the labor market and moderate inflation levels. This positive economic environment combined with strong corporate profits re-energized markets in the second quarter of 2018.

While most sectors generated positive absolute returns during the seven-month period, value-oriented sectors generally underperformed their growth counterparts. Traditional growth sectors such as Health Care, Information Technology, and Consumer Discretionary were among the top performing are as of the market, while the value-oriented Financials sector underperformed. Bond proxies (i.e., Utilities, Real Estate, and Telecommunication Services) detracted from performance during a period in which interest rates rose sharply.

Portfolio Review

The Information Technology sector was the Fund’s largest weight on an absolute and relative basis. In a period when Information Technology was one of the benchmark’s strongest performing sectors, this positioning was beneficial to the Fund’s relative returns. Strong security selection in the sector also contributed. Technology Hardware and Equipment was an area of particular strength, with the Fund’s holdings significantly outperforming their benchmark peers. Plantronics Inc. was among the Fund’s top performers. A designer and manufacturer of phone headsets and headset accessories, Plantronics announced a pending acquisition of Polycom Inc., which will allow the company to expand into new areas such as web conferencing and desktop calling. The market recognized the strategic benefits of this acquisition and drove Plantronics’ stock price in the period.

The Fund’s stock selections in the Semiconductor space also added to relative performance. One example was ON Semiconductor Corp. We initiated this position in 2013 when the company was in the early stages of the equity investment cycle with low market expectations. Our research led us to believe that a focus on automotive and industrial end markets where semiconductor content is growing would lead to better than industry revenue growth. Additionally, we were encouraged by a number of corporate initiatives to expand margins, increase free cash flow conversion, and improve the capital structure. This long-term holding delivered positive results as the investment thesis came to fruition.

Though providing strong absolute returns, the Fund’s Software & Services positions slightly lagged the benchmark’s return for this segment of the Information Technology sector. Bottomline Technologies Inc. was among the

Management's Discussion of Fund Performance (Unaudited) (Continued)

Fund’s top performers in the group. Bottomline Technologies is a provider of business and financial software with primarily a subscription based business model. A year ago, the company was experiencing falling market expectations as the cost and time to implement large new digital banking sales were greater than anticipated. We viewed these cost and timing issues as transitory, and we believed that once implemented, they would drive higher and more consistent revenue growth and profitability levels. Consistent with our investment thesis, we believe the management team has executed well, and the stock has appreciated on higher market expectations for the company. However, not all of the Fund’s Software and Services positions met expectations. Nuance Communications Inc. was one of the more challenging positions in the fiscal period and detracted from performance. Nuance Communications provides voice and language software solutions for businesses and consumers across the Health Care, Enterprise, Automotive, and Mobile markets. The company’s IT network was impacted by a global malware incident, which resulted in lost healthcare business segment revenue and remediation costs. The company successfully resolved the issue and future bookings were not impacted. However, more recently, demand has been weak for certain components of its non-core mobile and imaging segments, causing the company to lower its organic growth targets. We have reevaluated our investment thesis and the Fund continues to hold a position in the company given its compelling industry positions (particularly in Health Care and Automotive), high margins, and strong free cash flow conversion. Lastly, we are optimistic that the newly appointed CEO will make positive changes going forward.

The Health Care sector was the Fund’s second largest weight. While the Fund’s holdings generated returns in excess of the broader small cap market, they trailed the benchmark’s Health Care sector, the best performing segment of the market for the seven months ended June 30, 2018. Nuvasive Inc., a leading provider of spine surgical products, detracted from performance. The company experienced a deceleration in revenue growth from its above market growth to rates more in line with the market over the last year, which has compressed the valuation multiple of the business. Additionally, the transition to in-source manufacturing and resulting margin improvement benefits has taken longer than anticipated. We assessed our investment thesis and the Fund continued to hold the stock. We believe that the company’s leading position in the development of minimally-disruptive spine surgical options continued to place it at the forefront of gaining market share, and that while delayed, the margin improvement initiatives will ultimately come to fruition.

Despite the broad underperformance of the Fund’s Health Care positions, there were several successes in the sector. One of the Fund’s top performing stocks in the period, Haemonetics Corp., was in the Health Care space. The company is a provider of hematology products and solutions for plasma collection, blood centers, and hospitals. The company hired a new CEO and CFO two years ago in the summer of 2016. The new leadership executed several initiatives to stabilize the business model which we believe will start to drive better revenue growth and margin improvement. Additionally, it successfully executed the FDA approval of its next generation plasma collection device and software, the NexSys PCS. This product and software materially improves plasma collection efficiencies that are expected to drive significant improvements in the company’s business model over the coming years. The stock price has positively reacted in anticipation of these expected improvements. Similarly, the recent portfolio purchase of Tactile Systems Technology Inc. contributed to performance. The company is a leader in developing at-home therapy devices that treat chronic swelling conditions such as lymphedema and chronic venous insufficiency. We believe it has the leading technology and distribution strategy in an underpenetrated industry. This is a classic small company growth stock which we believe was undervalued given the characteristics of the business model.

Mergers and acquisitions (M&A) activity remained a theme in the Fund for the period. There were five companies involved with M&A in the Information Technology sector. Microsemi Corp., a long-term semiconductor holding, was acquired by Microchip Technology Inc., and Broadsoft, a software provider to the unified communications market, was bought by Cisco Systems Inc. Additionally, three Fund positions were involved in private equity acquisitions - Barracuda Networks Inc., a security software provider; Blackhawk Network Holdings Inc., a

Management's Discussion of Fund Performance (Unaudited) (Continued)

provider of physical and digital gift cards; and VeriFone Systems Inc., a leading provider of point-of sale (POS) hardware and software. Outside of the Information Technology sector, Regal Entertainment & Consultants Ltd., a leading theater operator in the United States, was acquired by the United Kingdom’s largest theater operator. We invested in all of these companies in the early stages of their growth cycles. As the management teams executed initiatives to improve the business model, the companies became attractive targets in the later stages of the investment cycle to both strategic and financial buyers.

Outlook

The broader economic environment remains conducive to small company stocks and their earnings growth prospects. Additionally, U.S. corporate tax reform was a positive development, in the immediate form of higher earnings, and longer-term potential value creation from increased cash flows. Furthermore, it should accelerate M&A activity, which is a hallmark to investing in small company stocks, and has also been a driver of portfolio returns.

We remain focused on executing our fundamental stock selection and portfolio management process. We believe that stocks experience a four stage investment cycle and our research process is focused on the dynamics that apply to each stage of the investment cycle. We believe that excess returns and lower volatility are driven by the ability to successfully identify a stock’s current stage and the potential for it to transition to a different stage of its investment cycle.

Management's Discussion of Fund Performance (Unaudited) (Continued)

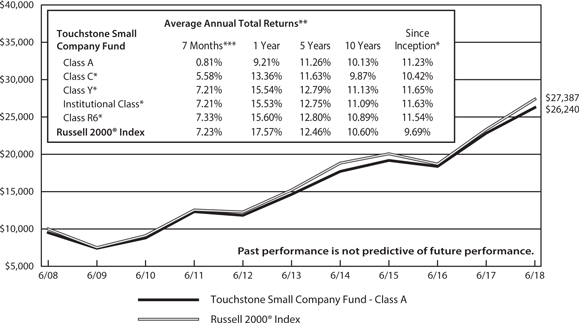

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Small

Company Fund - Class A* and the Russell 2000® Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares, Institutional Class shares and Class R6 shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares, Institutional Class shares and Class R6 shares was March 1, 1993, July 9, 2001, May 4, 2007, October 30, 2017 and December 23, 2014, respectively. Class C shares, Class Y shares, Institutional Class shares and Class R6 shares performance was calculated using the historical performance of Class A shares for the periods prior to July 9, 2001, May 4, 2007, October 30, 2017 and December 23, 2014, respectively. The returns have been restated for sales loads and fees applicable to Class C, Class Y, Institutional Class and Class R6 shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. Prior to October 28, 2017, the maximum offering price per share of Class A shares was equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Effective October 28, 2017, the maximum offering price per share of Class A shares is equal to the NAV per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares, Institutional Class shares and Class R6 shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

This page intentionally left blank.

Tabular Presentation of Portfolios of Investments (Unaudited)

June 30, 2018

The tables below provide each Fund’s geographic allocation, credit quality and/or sector allocation. We hope it will be useful to shareholders as it summarizes key information about each Fund’s investments.

| Touchstone Balanced Fund | | | |

| Credit Quality* | | (% of Fixed Income Securities) | |

| AAA/Aaa | | | 52.1 | % |

| AA/Aa | | | 4.0 | |

| A/A | | | 13.5 | |

| BBB/Baa | | | 27.9 | |

| BB/Ba | | | 1.0 | |

| Not Rated | | | 1.5 | |

| | | | 100.0 | % |

| Sector Allocation** | | (% of Net Assets) | |

| Fixed Income Securities | | | 28.7 | % |

| Common Stocks | | | | |

| Information Technology | | | 17.5 | |

| Health Care | | | 10.5 | |

| Financials | | | 9.8 | |

| Consumer Discretionary | | | 8.8 | |

| Industrials | | | 7.1 | |

| Consumer Staples | | | 5.5 | |

| Energy | | | 4.6 | |

| Telecommunication Services | | | 1.5 | |

| Materials | | | 1.4 | |

| Real Estate | | | 0.8 | |

| Exchange-Traded Funds | | | 2.2 | |

| Preferred Stock | | | 0.0 | |

| Short-Term Investment Fund | | | 1.5 | |

| Other Assets/Liabilities (Net) | | | 0.1 | |

| Total | | | 100.0 | % |

| Touchstone International Equity Fund | | | |

| Geographic Allocation | | (% of Net Assets) | |

| Common Stocks | | | | |

| United Kingdom | | | 30.0 | % |

| France | | | 8.7 | |

| Switzerland | | | 7.7 | |

| Canada | | | 6.3 | |

| Germany | | | 5.7 | |

| Ireland | | | 5.1 | |

| India | | | 4.3 | |

| Japan | | | 3.8 | |

| China | | | 3.1 | |

| Spain | | | 2.8 | |

| Denmark | | | 2.5 | |

| Netherlands | | | 2.3 | |

| Mexico | | | 2.3 | |

| Greece | | | 2.3 | |

| South Korea | | | 1.7 | |

| United States | | | 1.6 | |

| Australia | | | 1.5 | |

| Jersey | | | 1.4 | |

| Short-Term Investment Funds | | | 9.5 | |

| Other Assets/Liabilities (Net) | | | (2.6 | ) |

| Total | | | 100.0 | % |

| * | Credit quality ratings are from Standard & Poor's (“S&P”) and Moody's Investors Service (“Moody's”). If agency ratings differ, the higher rating will be used. Where no rating has been assigned, it may be for reasons unrelated to the creditworthiness of the issuer. |

| ** | Sector classifications are based upon the Global Industry Classification Standard (GICS®). |

Tabular Presentation of Portfolios of Investments (Unaudited) (Continued)

| Touchstone Large Cap Focused Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Information Technology | | | 25.6 | % |

| Financials | | | 14.3 | |

| Consumer Discretionary | | | 13.3 | |

| Health Care | | | 13.0 | |

| Consumer Staples | | | 8.4 | |

| Industrials | | | 8.2 | |

| Energy | | | 6.9 | |

| Telecommunication Services | | | 2.2 | |

| Materials | | | 1.8 | |

| Real Estate | | | 1.3 | |

| Exchange-Traded Funds | | | 4.8 | |

| Short-Term Investment Fund | | | 0.6 | |

| Other Assets/Liabilities (Net) | | | (0.4 | ) |

| Total | | | 100.0 | % |

| Touchstone Small Company Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Information Technology | | | 25.3 | % |

| Industrials | | | 19.6 | |

| Health Care | | | 19.1 | |

| Consumer Discretionary | | | 12.6 | |

| Financials | | | 10.8 | |

| Real Estate | | | 3.3 | |

| Energy | | | 1.5 | |

| Consumer Staples | | | 1.4 | |

| Telecommunication Services | | | 1.4 | |

| Materials | | | 1.3 | |

| Short-Term Investment Fund | | | 4.0 | |

| Other Assets/Liabilities (Net) | | | (0.3 | ) |

| Total | | | 100.0 | % |

| * | Sector classifications are based upon the Global Industry Classification Standard (GICS®). |

Portfolio of Investments

Touchstone Balanced Fund – June 30, 2018

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks — 67.5% | | | | | | | | |

| | | | | | | | | |

| Information Technology — 17.5% | | | | | | | | |

| Accenture PLC (Ireland) - Class A | | | 30,000 | | | $ | 4,907,700 | |

| Alphabet, Inc. - Class C* | | | 6,000 | | | | 6,693,900 | |

| Apple, Inc. | | | 48,000 | | | | 8,885,280 | |

| Check Point Software Technologies Ltd. (Israel)* | | | 20,000 | | | | 1,953,600 | |

| Facebook, Inc. - Class A* | | | 17,266 | | | | 3,355,129 | |

| Microsoft Corp. | | | 123,000 | | | | 12,129,030 | |

| Synopsys, Inc.* | | | 30,000 | | | | 2,567,100 | |

| Texas Instruments, Inc. | | | 60,000 | | | | 6,615,000 | |

| Visa, Inc. - Class A | | | 53,000 | | | | 7,019,850 | |

| | | | | | | | 54,126,589 | |

| | | | | | | | | |

| Health Care — 10.5% | | | | | | | | |

| AmerisourceBergen Corp. | | | 23,954 | | | | 2,042,558 | |

| Amgen, Inc. | | | 15,000 | | | | 2,768,850 | |

| Becton Dickinson and Co. | | | 13,000 | | | | 3,114,280 | |

| Biogen, Inc.* | | | 5,000 | | | | 1,451,200 | |

| Bristol-Myers Squibb Co. | | | 45,000 | | | | 2,490,300 | |

| CVS Health Corp. | | | 10,000 | | | | 643,500 | |

| Johnson & Johnson | | | 23,000 | | | | 2,790,820 | |

| Merck & Co., Inc. | | | 70,000 | | | | 4,249,000 | |

| Novartis AG (Switzerland) ADR | | | 28,756 | | | | 2,172,228 | |

| Stryker Corp. | | | 15,000 | | | | 2,532,900 | |

| UnitedHealth Group, Inc. | | | 20,000 | | | | 4,906,800 | |

| Zoetis, Inc. | | | 40,000 | | | | 3,407,600 | |

| | | | | | | | 32,570,036 | |

| | | | | | | | | |

| Financials — 9.8% | | | | | | | | |

| American Express Co. | | | 25,000 | | | | 2,450,000 | |

| Chubb Ltd. (Switzerland) | | | 20,000 | | | | 2,540,400 | |

| CME Group, Inc. | | | 18,000 | | | | 2,950,560 | |

| JPMorgan Chase & Co. | | | 39,000 | | | | 4,063,800 | |

| Morgan Stanley | | | 100,000 | | | | 4,740,000 | |

| PNC Financial Services Group, Inc. (The) | | | 27,000 | | | | 3,647,700 | |

| S&P Global, Inc. | | | 20,000 | | | | 4,077,800 | |

| Signature Bank/NewYork NY* | | | 17,239 | | | | 2,204,523 | |

| Travelers Cos., Inc. (The) | | | 30,000 | | | | 3,670,200 | |

| | | | | | | | 30,344,983 | |

| | | | | | | | | |

| Consumer Discretionary — 8.8% | | | | | | | | |

| Amazon.com, Inc.* | | | 1,000 | | | | 1,699,800 | |

| Carnival Corp. | | | 8,592 | | | | 492,408 | |

| Comcast Corp. - Class A | | | 120,000 | | | | 3,937,200 | |

| Home Depot, Inc. (The) | | | 15,000 | | | | 2,926,500 | |

| JD.com, Inc. (China) ADR* | | | 52,764 | | | | 2,055,158 | |

| Marriott International, Inc. - Class A | | | 31,100 | | | | 3,937,260 | |

| McDonald's Corp. | | | 33,000 | | | | 5,170,770 | |

| Omnicom Group, Inc. | | | 31,000 | | | | 2,364,370 | |

| Starbucks Corp. | | | 9,643 | | | | 471,061 | |

| TJX Cos., Inc. (The) | | | 45,000 | | | | 4,283,100 | |

| | | | | | | | 27,337,627 | |

| | | | | | | | | |

| Industrials — 7.1% | | | | | | | | |

| Boeing Co. (The) | | | 20,000 | | | | 6,710,200 | |

| Canadian National Railway Co. (Canada) | | | 32,000 | | | | 2,616,000 | |

| General Dynamics Corp. | | | 14,000 | | | | 2,609,740 | |

| Honeywell International, Inc. | | | 35,000 | | | | 5,041,750 | |

| United Technologies Corp. | | | 22,000 | | | | 2,750,660 | |

| Verisk Analytics, Inc.* | | | 20,000 | | | | 2,152,800 | |

| | | | | | | | 21,881,150 | |

| | | | | | | | | |

| Consumer Staples — 5.5% | | | | | | | | |

| Kraft Heinz Co. (The) | | | 30,000 | | | | 1,884,600 | |

| Monster Beverage Corp.* | | | 9,714 | | | | 556,612 | |

| PepsiCo, Inc. | | | 40,000 | | | | 4,354,800 | |

| Philip Morris International, Inc. | | | 40,000 | | | | 3,229,600 | |

| Procter & Gamble Co. (The) | | | 40,000 | | | | 3,122,400 | |

| Unilever NV (United Kingdom) | | | 70,000 | | | | 3,900,400 | |

| | | | | | | | 17,048,412 | |

| | | | | | | | | |

| Energy — 4.6% | | | | | | | | |

| Chevron Corp. | | | 20,000 | | | | 2,528,600 | |

| EOG Resources, Inc. | | | 25,000 | | | | 3,110,750 | |

| Exxon Mobil Corp. | | | 38,000 | | | | 3,143,740 | |

| Marathon Petroleum Corp. | | | 40,000 | | | | 2,806,400 | |

| Schlumberger Ltd. | | | 37,700 | | | | 2,527,031 | |

| | | | | | | | 14,116,521 | |

| | | | | | | | | |

| Telecommunication Services — 1.5% | | | | | | | | |

| AT&T, Inc. | | | 28,740 | | | | 922,841 | |

| Verizon Communications, Inc. | | | 75,000 | | | | 3,773,250 | |

| | | | | | | | 4,696,091 | |

| | | | | | | | | |

| Materials — 1.4% | | | | | | | | |

| DowDuPont, Inc. | | | 38,460 | | | | 2,535,283 | |

| Praxair, Inc. | | | 12,000 | | | | 1,897,800 | |

| | | | | | | | 4,433,083 | |

| | | | | | | | | |

| Real Estate — 0.8% | | | | | | | | |

| Jones Lang LaSalle, Inc. | | | 7,564 | | | | 1,255,548 | |

| Simon Property Group, Inc. REIT | | | 6,587 | | | | 1,121,042 | |

| | | | | | | | 2,376,590 | |

| Total Common Stocks | | | | | | $ | 208,931,082 | |

| Principal | | | | |

| Amount | | | | |

| | | | | |

| | | | | Corporate Bonds — 12.5% | | | | |

| | | | | | | | | |

| | | | | Financials — 3.6% | | | | |

| $ | 440,000 | | | American Express Co., | | | | |

| | | | | 3.000%, 10/30/24 | | | 419,826 | |

| | 355,000 | | | Bank of America Corp., | | | | |

| | | | | 3.705%, 4/24/28 | | | 342,373 | |

| | 535,000 | | | Bank of America Corp. MTN, | | | | |

| | | | | 4.000%, 1/22/25 | | | 528,127 | |

| | 390,000 | | | Bank of Montreal (Canada), | | | | |

| | | | | 3.803%, 12/15/32 | | | 361,261 | |

| | 449,000 | | | Bank of New York Mellon Corp. (The) | | | | |

| | | | | MTN, 2.950%, 1/29/23 | | | 438,829 | |

Touchstone Balanced Fund (Continued)

| Principal | | | | | Market | |

| Amount | | | | | Value | |

| | | | | | | |

| | | | | Corporate Bonds — 12.5% (Continued) | | | | |

| | | | | | | | | |

| | | | | Financials — (Continued) | | | | |

| $ | 435,000 | | | Barclays PLC (United Kingdom), | | | | |

| | | | | 3.250%, 1/12/21 | | $ | 428,769 | |

| | 380,000 | | | BB&T Corp. MTN, 2.850%, 10/26/24 | | | 360,559 | |

| | 217,000 | | | Chubb INA Holdings, Inc., | | | | |

| | | | | 4.350%, 11/3/45 | | | 222,088 | |

| | 330,000 | | | Citigroup, Inc., 3.300%, 4/27/25 | | | 316,387 | |

| | 197,000 | | | Citigroup, Inc., 4.750%, 5/18/46 | | | 187,332 | |

| | 305,000 | | | Credit Suisse AG/New York NY | | | | |

| | | | | (Switzerland) MTN, 3.625%, 9/9/24 | | | 299,902 | |

| | 345,000 | | | Fifth Third Bancorp, 2.875%, 7/27/20 | | | 343,059 | |

| | 385,000 | | | General Motors Financial Co., Inc., | | | | |

| | | | | 3.200%, 7/13/20 | | | 383,184 | |

| | 440,000 | | | Goldman Sachs Group, Inc. (The), (3M | | | | |

| | | | | LIBOR +1.000%), 3.359%, 7/24/23(A) | | | 441,608 | |

| | 150,000 | | | Goldman Sachs Group, Inc. (The), | | | | |

| | | | | 3.691%, 6/5/28 | | | 142,197 | |

| | 350,000 | | | Goldman Sachs Group, Inc. (The), | | | | |

| | | | | 5.250%, 7/27/21 | | | 367,826 | |

| | 335,000 | | | HSBC Holdings PLC (United Kingdom), | | | | |

| | | | | 3.900%, 5/25/26 | | | 327,573 | |

| | 562,000 | | | Huntington Bancshares, Inc., | | | | |

| | | | | 4.000%, 5/15/25 | | | 563,649 | |

| | 350,000 | | | JPMorgan Chase & Co., (3M LIBOR | | | | |

| | | | | +0.730%), 3.092%, 4/23/24(A) | | | 348,189 | |

| | 270,000 | | | JPMorgan Chase & Co., | | | | |

| | | | | 3.250%, 9/23/22 | | | 267,497 | |

| | 425,000 | | | JPMorgan Chase & Co., | | | | |

| | | | | 3.509%, 1/23/29 | | | 402,668 | |

| | 416,000 | | | Lloyds Banking Group PLC (United | | | | |

| | | | | Kingdom), 3.574%, 11/7/28 | | | 383,814 | |

| | 148,000 | | | Morgan Stanley, 3.737%, 4/24/24 | | | 147,112 | |

| | 470,000 | | | Morgan Stanley, 3.950%, 4/23/27 | | | 448,047 | |

| | 232,000 | | | New York Life Global Funding, 144a, | | | | |

| | | | | 3.000%, 1/10/28 | | | 217,617 | |

| | 300,000 | | | Northwestern Mutual Life Insurance | | | | |

| | | | | Co. (The), 144a, 3.850%, 9/30/47 | | | 274,707 | |

| | 370,000 | | | PNC Bank NA, 2.700%, 11/1/22 | | | 355,673 | |

| | 339,000 | | | Prudential Financial, Inc., | | | | |

| | | | | 5.625%, 6/15/43 | | | 349,594 | |

| | 434,000 | | | Royal Bank of Canada (Canada) MTN, | | | | |

| | | | | 3.200%, 4/30/21 | | | 433,813 | |

| | 380,000 | | | SunTrust Banks, Inc., 4.000%, 5/1/25 | | | 381,811 | |

| | 285,000 | | | Wells Fargo & Co., 2.100%, 7/26/21 | | | 273,849 | |

| | 270,000 | | | Wells Fargo & Co., 4.125%, 8/15/23 | | | 271,460 | |

| | 63,000 | | | Wells Fargo & Co. MTN, 4.100%, 6/3/26 | | | 61,734 | |

| | | | | | | | 11,092,134 | |

| | | | | | | | | |

| | | | | Energy — 1.4% | | | | |

| | 224,000 | | | Boardwalk Pipelines LP, | | | | |

| | | | | 4.450%, 7/15/27 | | | 217,508 | |

| | 333,000 | | | Cenovus Energy, Inc. (Canada), | | | | |

| | | | | 4.250%, 4/15/27 | | | 320,744 | |

| | 301,000 | | | Columbia Pipeline Group, Inc., | | | | |

| | | | | 4.500%, 6/1/25 | | | 300,309 | |

| | 266,000 | | | Concho Resources, Inc., | | | | |

| | | | | 3.750%, 10/1/27 | | | 255,877 | |

| | 418,000 | | | Enbridge, Inc. (Canada), (3M LIBOR | | | | |

| | | | | +0.700%), 3.041%, 6/15/20(A) | | | 419,635 | |

| | 243,000 | | | Energy Transfer Partners LP, | | | | |

| | | | | 4.950%, 6/15/28 | | | 242,245 | |

| | 264,000 | | | EOG Resources, Inc., 3.900%, 4/1/35 | | | 256,126 | |

| | 440,000 | | | Kinder Morgan Energy Partners LP, | | | | |

| | | | | 3.500%, 9/1/23 | | | 427,535 | |

| | 106,000 | | | Midcontinent Express Pipeline LLC, | | | | |

| | | | | 144a, 6.700%, 9/15/19 | | | 109,127 | |

| | 89,000 | | | NGPL PipeCo LLC, 144a, | | | | |

| | | | | 7.768%, 12/15/37 | | | 104,575 | |

| | 307,000 | | | Petroleos Mexicanos (Mexico), | | | | |

| | | | | 4.500%, 1/23/26 | | | 288,027 | |

| | 53,000 | | | Petroleos Mexicanos (Mexico), 144a, | | | | |

| | | | | 5.350%, 2/12/28 | | | 50,180 | |

| | 345,000 | | | Sabine Pass Liquefaction LLC, | | | | |

| | | | | 5.000%, 3/15/27 | | | 350,585 | |

| | 100,000 | | | Shell International Finance BV | | | | |

| | | | | (Netherlands), 1.875%, 5/10/21 | | | 96,948 | |

| | 286,000 | | | Valero Energy Corp., 4.350%, 6/1/28 | | | 284,735 | |

| | 526,000 | | | Williams Cos., Inc. (The), | | | | |

| | | | | 3.700%, 1/15/23 | | | 508,905 | |

| | | | | | | | 4,233,061 | |

| | | | | | | | | |

| | | | | Health Care — 1.2% | | | | |

| | 202,000 | | | Abbott Laboratories, | | | | |

| | | | | 3.750%, 11/30/26 | | | 198,550 | |

| | 365,000 | | | AbbVie, Inc., 4.450%, 5/14/46 | | | 349,032 | |

| | 260,000 | | | Allergan Funding SCS (Luxembourg), | | | | |

| | | | | 3.800%, 3/15/25 | | | 252,472 | |

| | 322,000 | | | Allergan Sales LLC, 144a, | | | | |

| | | | | 5.000%, 12/15/21 | | | 333,156 | |

| | 299,000 | | | Celgene Corp., 5.000%, 8/15/45 | | | 292,778 | |

| | 475,000 | | | CVS Health Corp., 4.300%, 3/25/28 | | | 468,544 | |

| | 230,000 | | | CVS Health Corp., 5.125%, 7/20/45 | | | 233,054 | |

| | 327,000 | | | Express Scripts Holding Co., | | | | |

| | | | | 3.300%, 2/25/21 | | | 325,801 | |

| | 270,000 | | | Thermo Fisher Scientific, Inc., | | | | |

| | | | | 3.600%, 8/15/21 | | | 271,474 | |

| | 442,000 | | | UnitedHealth Group, Inc., | | | | |

| | | | | 2.375%, 10/15/22 | | | 424,985 | |

| | 287,000 | | | Zimmer Biomet Holdings, Inc., | | | | |

| | | | | 3.150%, 4/1/22 | | | 281,748 | |

| | 26,000 | | | Zimmer Biomet Holdings, Inc., | | | | |

| | | | | 3.375%, 11/30/21 | | | 25,793 | |

| | 139,000 | | | Zoetis, Inc., 3.250%, 2/1/23 | | | 136,856 | |

| | | | | | | | 3,594,243 | |

| | | | | | | | | |

| | | | | Telecommunication Services — 1.1% | | | | |

| | 552,000 | | | AT&T, Inc., 3.800%, 3/15/22 | | | 552,942 | |

| | 88,000 | | | AT&T, Inc., 4.350%, 6/15/45 | | | 74,548 | |

| | 410,000 | | | Booking Holdings, Inc., 3.600%, 6/1/26 | | | 398,974 | |

| | 368,000 | | | Charter Communications Operating | | | | |

| | | | | LLC / Charter Communications | | | | |

| | | | | Operating Capital, | | | | |

| | | | | 6.484%, 10/23/45 | | | 387,885 | |

| | 367,000 | | | Comcast Corp., 2.850%, 1/15/23 | | | 354,860 | |

Touchstone Balanced Fund (Continued)

| Principal | | | | | Market | |

| Amount | | | | | Value | |

| | | | | | | |

| | | | | Corporate Bonds — 12.5% (Continued) | | | | |

| | | | | | | | | |

| | | | | Telecommunication Services — (Continued) | | | | |

| $ | 232,000 | | | Comcast Corp., 4.000%, 3/1/48 | | $ | 204,396 | |

| | 465,000 | | | Qwest Corp., 6.750%, 12/1/21 | | | 494,808 | |

| | 426,000 | | | Telecom Italia SpA/Milano (Italy), | | | | |

| | | | | 144a, 5.303%, 5/30/24 | | | 420,142 | |

| | 130,000 | | | Verizon Communications, Inc., | | | | |

| | | | | 4.672%, 3/15/55 | | | 115,458 | |

| | 285,000 | | | Verizon Communications, Inc., | | | | |

| | | | | 5.012%, 4/15/49 | | | 277,548 | |

| | 287,000 | | | Warner Media LLC, 3.800%, 2/15/27 | | | 271,035 | |

| | | | | | | | 3,552,596 | |

| | | | | | | | | |

| | | | | Consumer Discretionary — 1.1% | | | | |

| | 380,000 | | | Anheuser-Busch InBev Finance, Inc., | | | | |

| | | | | 4.900%, 2/1/46 | | | 390,784 | |

| | 105,000 | | | Aptiv PLC (Jersey), 3.150%, 11/19/20 | | | 104,238 | |

| | 89,000 | | | AutoNation, Inc., 5.500%, 2/1/20 | | | 91,646 | |

| | 658,000 | | | BMW US Capital LLC, 144a, | | | | |

| | | | | 3.100%, 4/12/21 | | | 653,894 | |

| | 434,000 | | | Dollar Tree, Inc., (3M LIBOR +0.700%), | | | | |

| | | | | 3.055%, 4/17/20(A) | | | 434,887 | |

| | 235,000 | | | Ford Motor Co., 4.750%, 1/15/43 | | | 203,114 | |

| | 434,000 | | | Ford Motor Credit Co. LLC, | | | | |

| | | | | 4.140%, 2/15/23 | | | 433,855 | |

| | 150,000 | | | General Motors Financial Co., Inc., | | | | |

| | | | | 3.950%, 4/13/24 | | | 146,791 | |

| | 279,000 | | | General Motors Financial Co., Inc., | | | | |

| | | | | 4.350%, 4/9/25 | | | 274,998 | |

| | 285,000 | | | Home Depot, Inc. (The), | | | | |

| | | | | 5.950%, 4/1/41 | | | 351,929 | |

| | 434,000 | | | Toyota Motor Credit Corp. MTN, | | | | |

| | | | | 2.950%, 4/13/21 | | | 431,763 | |

| | | | | | | | 3,517,899 | |

| | | | | | | | | |

| | | | | Consumer Staples — 0.9% | | | | |

| | 438,000 | | | Cargill, Inc., 144a, 3.050%, 4/19/21 | | | 435,629 | |

| | 205,000 | | | General Mills, Inc., 3.200%, 4/16/21 | | | 203,937 | |

| | 380,000 | | | Grupo Bimbo SAB de CV (Mexico), | | | | |

| | | | | 144a, 4.500%, 1/25/22 | | | 387,823 | |

| | 475,000 | | | Imperial Brands Finance PLC (United | | | | |

| | | | | Kingdom), 144a, 4.250%, 7/21/25 | | | 472,828 | |

| | 255,000 | | | Kraft Heinz Foods Co., 6.875%, 1/26/39 | | | 300,660 | |

| | 140,000 | | | Kroger Co. (The), 5.000%, 4/15/42 | | | 138,021 | |

| | 244,000 | | | Mondelez International, Inc., | | | | |

| | | | | 4.125%, 5/7/28 | | | 241,915 | |

| | 374,000 | | | Moody's Corp., 2.750%, 12/15/21 | | | 365,279 | |

| | 351,000 | | | Reynolds American, Inc., | | | | |

| | | | | 4.450%, 6/12/25 | | | 353,248 | |

| | | | | | | | 2,899,340 | |

| | | | | | | | | |

| | | | | Real Estate — 0.9% | | | | |

| | 390,000 | | | Boston Properties LP REIT, | | | | |

| | | | | 3.200%, 1/15/25 | | | 371,199 | |

| | 403,000 | | | Crown Castle International Corp. REIT, | | | | |

| | | | | 3.650%, 9/1/27 | | | 374,853 | |

| | 260,000 | | | Digital Realty Trust LP, REIT, | | | | |

| | | | | 2.750%, 2/1/23 | | | 247,651 | |

| | 288,000 | | | Mid-America Apartments LP, REIT, | | | | |

| | | | | 3.750%, 6/15/24 | | | 284,031 | |

| | 149,000 | | | Sabra Health Care LP. REIT, | | | | |

| | | | | 5.125%, 8/15/26 | | | 142,373 | |

| | 110,000 | | | SL Green Operating Partnership LP | | | | |

| | | | | REIT, 3.250%, 10/15/22 | | | 106,894 | |

| | 795,000 | | | VEREIT Operating Partnership LP REIT, | | | | |

| | | | | 4.600%, 2/6/24 | | | 795,295 | |

| | 309,000 | | | Welltower, Inc. REIT, 4.250%, 4/1/26 | | | 305,739 | |

| | | | | | | | 2,628,035 | |

| | | | | | | | | |

| | | | | Information Technology — 0.8% | | | | |

| | 105,000 | | | Activision Blizzard, Inc., 144a, | | | | |

| | | | | 6.125%, 9/15/23 | | | 108,792 | |

| | 899,000 | | | Apple, Inc., 2.750%, 1/13/25 | | | 860,424 | |

| | 110,000 | | | Apple, Inc., 4.650%, 2/23/46 | | | 118,503 | |

| | 235,000 | | | Dell International LLC / EMC Corp., | | | | |

| | | | | 144a, 6.020%, 6/15/26 | | | 246,842 | |

| | 210,000 | | | Microsoft Corp., 3.500%, 2/12/35 | | | 203,489 | |

| | 351,000 | | | Oracle Corp., 2.650%, 7/15/26 | | | 323,704 | |

| | 340,000 | | | QUALCOMM, Inc., 3.450%, 5/20/25 | | | 327,194 | |

| | 297,000 | | | Visa, Inc., 4.150%, 12/14/35 | | | 307,745 | |

| | | | | | | | 2,496,693 | |

| | | | | | | | | |

| | | | | Industrials — 0.8% | | | | |

| | 106,544 | | | Air Canada 2015-1 Class A Pass | | | | |

| | | | | Through Trust (Canada), 144a, | | | | |

| | | | | 3.600%, 3/15/27 | | | 103,103 | |

| | 418,000 | | | Burlington Northern Santa Fe LLC, | | | | |

| | | | | 5.750%, 5/1/40 | | | 495,285 | |

| | 370,000 | | | CRH America Finance, Inc., 144a, | | | | |

| | | | | 4.500%, 4/4/48 | | | 347,088 | |

| | 377,000 | | | Eagle Materials, Inc., 4.500%, 8/1/26 | | | 378,750 | |

| | 280,000 | | | FedEx Corp., 5.100%, 1/15/44 | | | 293,556 | |

| | 395,000 | | | General Electric Co., 4.125%, 10/9/42 | | | 366,858 | |

| | 330,000 | | | Vulcan Materials Co., 4.500%, 4/1/25 | | | 331,629 | |

| | | | | | | | 2,316,269 | |

| | | | | | | | | |

| | | | | Utilities — 0.4% | | | | |

| | 398,000 | | | Dominion Energy, Inc., | | | | |

| | | | | 2.000%, 8/15/21 | | | 379,493 | |

| | 237,000 | | | Duke Energy Progress LLC, | | | | |

| | | | | 4.150%, 12/1/44 | | | 233,892 | |

| | 329,000 | | | Fortis, Inc. (Canada), 3.055%, 10/4/26 | | | 299,753 | |

| | 250,000 | | | NextEra Energy Capital Holdings, Inc., | | | | |

| | | | | 2.800%, 1/15/23 | | | 241,673 | |

| | 76,000 | | | Oncor Electric Delivery Co. LLC, | | | | |

| | | | | 3.800%, 9/30/47 | | | 72,619 | |

| | 125,000 | | | PacifiCorp., 5.750%, 4/1/37 | | | 150,270 | |

| | | | | | | | 1,377,700 | |

| | | | | | | | | |

| | | | | Materials — 0.3% | | | | |

| | 250,000 | | | Braskem America Finance Co., 144a, | | | | |

| | | | | 7.125%, 7/22/41 | | | 280,000 | |

| | 66,000 | | | Newcrest Finance Pty Ltd. (Australia), | | | | |

| | | | | 144a, 4.200%, 10/1/22 | | | 66,073 | |

Touchstone Balanced Fund (Continued)

| Principal | | | | | Market | |

| Amount | | | | | Value | |

| | | | | | | |

| | | | | Corporate Bonds — 12.5% (Continued) | | | | |

| | | | | | | | | |

| | | | | Materials — (Continued) | | | | |

| $ | 121,000 | | | Newcrest Finance Pty Ltd. (Australia), | | | | |

| | | | | 144a, 4.450%, 11/15/21 | | $ | 122,558 | |

| | 470,000 | | | Suzano Austria GmbH (Austria), 144a, | | | | |

| | | | | 5.750%, 7/14/26 | | | 475,452 | |

| | | | | | | | 944,083 | |

| | | | | Total Corporate Bonds | | $ | 38,652,053 | |

| | | | | | | | | |

| | | | | U.S. Government Mortgage-Backed | | | | |

| | | | | Obligations — 7.9% | | | | |

| | 3,984 | | | FHLMC, Pool #G08062, 5.000%, 6/1/35 | | | 4,252 | |

| | 629,782 | | | FHLMC, Pool #G08637, 4.000%, 4/1/45 | | | 644,538 | |

| | 770 | | | FHLMC, Pool #G18091, | | | | |

| | | | | 6.000%, 12/1/20 | | | 783 | |

| | 14,192 | | | FHLMC, Pool #P00020, | | | | |

| | | | | 6.500%, 10/1/22 | | | 14,285 | |

| | 2,587,788 | | | FHLMC, Pool #Q02664, 4.500%, 8/1/41 | | | 2,720,130 | |

| | 3,617,927 | | | FHLMC, Pool #Q29056, | | | | |

| | | | | 4.000%, 10/1/44 | | | 3,702,354 | |

| | 1,777,847 | | | FHLMC, Pool #Q29260, | | | | |

| | | | | 4.000%, 10/1/44 | | | 1,819,396 | |

| | 1,305,229 | | | FHLMC REMIC, Ser 3859 Class JB, | | | | |

| | | | | 5.000%, 5/15/41 | | | 1,400,806 | |

| | 170 | | | FNMA, Pool #254907, 5.000%, 10/1/18 | | | 173 | |

| | 1,113 | | | FNMA, Pool #255273, 4.500%, 6/1/19 | | | 1,121 | |

| | 358 | | | FNMA, Pool #255358, 5.000%, 9/1/19 | | | 364 | |

| | 33 | | | FNMA, Pool #687301, 6.000%, 11/1/32 | | | 36 | |

| | 1,247 | | | FNMA, Pool #690305, 5.500%, 3/1/33 | | | 1,337 | |

| | 740,391 | | | FNMA, Pool #725423, 5.500%, 5/1/34 | | | 805,406 | |

| | 690,881 | | | FNMA, Pool #725610, 5.500%, 7/1/34 | | | 751,595 | |

| | 91,327 | | | FNMA, Pool #748895, 6.000%, 12/1/33 | | | 96,395 | |

| | 378,822 | | | FNMA, Pool #AD9193, 5.000%, 9/1/40 | | | 405,595 | |

| | 802,889 | | | FNMA, Pool #AH8925, 4.500%, 3/1/41 | | | 844,101 | |

| | 1,017,676 | | | FNMA, Pool #AL2860, 3.000%, 12/1/42 | | | 995,088 | |

| | 460,499 | | | FNMA, Pool #AL5718, 3.500%, 9/1/44 | | | 460,924 | |

| | 668,267 | | | FNMA, Pool #AR9195, 3.000%, 3/1/43 | | | 653,204 | |

| | 1,224,380 | | | FNMA, Pool #AS4707, 3.500%, 4/1/45 | | | 1,222,603 | |

| | 1,565,190 | | | FNMA, Pool #AS8703, 2.500%, 2/1/32 | | | 1,521,959 | |

| | 1,977,887 | | | FNMA, Pool #AZ7347, 3.000%, 11/1/45 | | | 1,921,730 | |

| | 2,061,942 | | | FNMA, Pool #BC1809, 3.500%, 5/1/46 | | | 2,058,417 | |

| | 1,302,651 | | | GNMA, Pool #5175, 4.500%, 9/20/41 | | | 1,370,447 | |

| | 750,000 | | | GNMA, Ser 2010-169, Class AW, | | | | |

| | | | | 4.500%, 12/20/40 | | | 776,752 | |

| | 7,498,929 | | | GNMA, Ser 2012-147, Class IO, | | | | |

| | | | | 0.564%, 4/16/54(A)(B)(C) | | | 267,211 | |

| | | | | Total U.S. Government | | | | |

| | | | | Mortgage-Backed Obligations | | $ | 24,461,002 | |

| | | | U.S. Treasury Obligations — 5.5% | | | |

| | 1,790,000 | | | U.S. Treasury Bond, 3.000%, 2/15/48 | | | 1,796,013 | |

| | 2,565,000 | | | U.S. Treasury Note, 2.000%, 10/31/22 | | | 2,490,555 | |

| | 1,095,000 | | | U.S. Treasury Note, 2.500%, 5/31/20 | | | 1,094,487 | |

| | 5,185,000 | | | U.S. Treasury Note, 2.500%, 3/31/23 | | | 5,133,150 | |

| | 6,530,000 | | | U.S. Treasury Note, 2.875%, 5/15/28 | | | 6,543,009 | |

| | | | | Total U.S. Treasury Obligations | | $ | 17,057,214 | |

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Exchange-Traded Funds — 2.2% | | | | | | | | |

| iShares JP Morgan USD Emerging | | | | | | | | |

| Markets Bond ETF | | | 49,202 | | | $ | 5,253,298 | |

| SPDR S&P MidCap 400 ETF Trust | | | 4,300 | | | | 1,526,586 | |

| Total Exchange-Traded Funds | | | | | | $ | 6,779,884 | |

Principal

Amount | | | | | | |

| | | | | | | |

| | | | | Non-Agency Collateralized Mortgage | | | | |

| | | | | Obligations — 1.0% | | | | |

| $ | 788,097 | | | Agate Bay Mortgage Trust, Ser 2015-7, | | | | |

| | | | | Class B1, 144a, | | | | |

| | | | | 3.765%, 10/25/45(A)(C) | | | 784,835 | |

| | 788,732 | | | CSMC Trust, Ser 2015-1, Class B3, 144a, | | | | |

| | | | | 3.943%, 1/25/45(A)(C) | | | 760,749 | |

| | 896,610 | | | CSMC Trust, Ser 2015-WIN1, Class B3, | | | | |

| | | | | 144a, 3.867%, 12/25/44(A)(C) | | | 881,933 | |

| | 790,549 | | | PMT Loan Trust, Ser 2013-J1, Class A11, | | | | |

| | | | | 144a, 3.500%, 9/25/43(A)(C) | | | 776,467 | |

| | | | | Total Non-Agency Collateralized | | | | |

| | | | | Mortgage Obligations | | $ | 3,203,984 | |

| | | | | | | | | |

| | | | | Asset-Backed Securities — 0.9% | | | | |

| | 1,350,000 | | | Hertz Vehicle Financing II LP, Ser | | | | |

| | | | | 2016-4A, Class A, 144a, | | | | |

| | | | | 2.650%, 7/25/22 | | | 1,314,640 | |

| | 1,343,258 | | | Wendy's Funding LLC, Ser 2018-1A, | | | | |

| | | | | Class A2I, 144a, 3.573%, 3/15/48 | | | 1,306,346 | |

| | | | | Total Asset-Backed Securities | | $ | 2,620,986 | |

| | | | | | | | | |

| | | | | Sovereign Government Obligations — 0.5% | | | | |

| | 238,000 | | | Colombia Government International | | | | |

| | | | | Bond, 5.000%, 6/15/45 | | | 234,132 | |

| | 345,000 | | | Mexico Government International | | | | |

| | | | | Bond, 4.350%, 1/15/47 | | | 308,258 | |

| | 359,000 | | | Province of Alberta Canada, 2.200%, | | | | |

| | | | | 7/26/22 | | | 346,654 | |

| | 417,000 | | | Province of Ontario Canada, 1.875%, | | | | |

| | | | | 5/21/20 | | | 409,712 | |

| | 280,000 | | | Uruguay Government International | | | | |

| | | | | Bond, 4.975%, 4/20/55 | | | 271,600 | |

| | | | | Total Sovereign Government | | | | |

| | | | | Obligations | | $ | 1,570,356 | |

| | | | | | | | | |

| | | | | Commercial Mortgage-Backed Security — 0.4% | | | | |

| | 1,400,000 | | | GS Mortgage Securities Trust, Ser | | | | |

| | | | | 2017-FARM, Class B, 144a, | | | | |

| | | | | 3.659%, 1/10/43(A)(C) | | $ | 1,344,700 | |

| | | Shares | | | | |

| | | | | | | |

| Preferred Stock — 0.0% | | | | | | | | |

| | | | | | | | | |

| Utilities — 0.0% | | | | | | | | |

| Integrys Holding, Inc., 6.000%, 8/1/73 | | | 2,000 | | | $ | 52,500 | |

Touchstone Balanced Fund (Continued)

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Short-Term Investment Fund — 1.5% | | | | | | | | |

| Dreyfus Government Cash | | | | | | | | |

| Management, Institutional Shares, | | | | | | | | |

| 1.81%∞Ω | | | 4,511,695 | | | $ | 4,511,695 | |

| | | | | | | | | |

| Total Investment Securities —99.9% | | | | | | | | |

| (Cost $185,585,144) | | | | | | $ | 309,185,456 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.1% | | | | | | | 252,472 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 309,437,928 | |

| (A) | Variable rate security - Rate reflected is the rate in effect as of June 30, 2018. |

| (B) | Interest only security - This type of security represents the right to receive the monthly interest payments on an underlying pool of mortgages. Payments of principal on the pool reduce the value of the “interest only” holding. |

| (C) | Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. |

| * | Non-income producing security. |

| Ω | Represents the 7-day SEC yield as of June 30, 2018. |

Portfolio Abbreviations:

ADR - American Depositary Receipt

ETF - Exchange-Traded Fund

FHLMC - Federal Home Loan Mortgage Corporation