UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03651

Touchstone Strategic Trust

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-638-8194

Date of fiscal year end: November 30

Date of reporting period: November 30, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

November 30, 2017

Annual Report

Touchstone Strategic Trust

Touchstone Balanced Fund

Touchstone International Equity Fund

Touchstone Large Cap Focused Fund

Touchstone Small Company Fund

Table of Contents

This report identifies the Funds' investments on November 30, 2017. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Strategic Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Funds, for the 12 months ended November 30, 2017.

In a year of considerable geopolitical uncertainty, steady but unspectacular economic growth provided the support needed for global capital markets to continue moving higher. The effects of 2016’s biggest political events (e.g., Brexit, President Trump’s election) extended into 2017 as the focus shifted from politics to policy. In the U.S., the much anticipated stimulus from infrastructure spending and tax reform failed to arrive in substantive form during the fiscal year. Meanwhile across the Atlantic, the United Kingdom and the European Union continue to debate the exact form of their future, post-Brexit relationship. In both cases, policy disappointments and political risks were overshadowed by solid economic growth and an improvement in corporate fundamentals. These same factors were the impetus for continued monetary policy normalization by the U.S. Federal Reserve Board (Fed), which raised short-term interest rates three times during the fiscal year and announced plans for reducing its $4.5 trillion balance sheet.

Global equity markets posted strong results during the period with most major U.S. and non-U.S. indexes generating double-digit returns. Investors’ increased appetite for risk was apparent, as emerging market equities led global equities. After trailing value-oriented stocks during much of 2016, growth stocks returned to favor and significantly outperformed across the market capitalization spectrum.

While the Fed pushed toward a normalization of U.S. monetary policy, other developed market central banks continued to provide accommodative monetary conditions in an attempt to solidify positive economic trends. After a sharp move upward following the presidential election, U.S. interest rates fluctuated in 2017, but ended the fiscal period at levels that were little changed from a year ago. Meanwhile, credit-exposed securities enjoyed the same tailwinds of a stable economy and improving corporate earnings that boosted equity prices. Corporate bonds across the credit quality spectrum generated positive returns with non-investment grade securities leading the way.

As we close out 2017 and enter 2018, the turning of the year provides a natural point to assess the recent past and to look toward the future. From a financial perspective, it has been yet another period of strong returns across many asset classes. This makes it a particularly timely juncture to take stock of your current financial situation, and with the help of your financial advisor, reassess your plans for the year – and years – ahead.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Strategic Trust

Management's Discussion of Fund Performance (Unaudited)

Touchstone Balanced Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Effective October 28, 2017, the Sentinel Balanced Fund was reorganized into the Touchstone Balanced Fund. At that time,Touchstone Advisors, Inc. and Fort Washington Investment Advisors, Inc. were respectively appointed as advisor and sub-advisor to the Fund.

Investment Philosophy

The Fund seeks to achieve its investment goal of providing investors with capital appreciation and current income by generally investing in a diversified portfolio comprising 60% equity securities and 40% fixed-income securities.

With respect to equities, the Fund invests primarily in issuers having a market capitalization, at the time of purchase, above $5 billion. Equity securities include common stock and preferred stock. With respect to fixed-income, the Fund will invest primarily in bonds, including mortgage-related securities, asset-backed securities, government securities (both U.S. government securities and foreign sovereign debt), and corporate debt securities.

Fund Performance

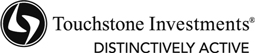

The Touchstone Balanced Fund (Class A Shares) underperformed the S&P 500® Index and outperformed the Bloomberg Barclays U.S. Aggregate Bond Index for the 12-month period ended November 30, 2017. The Fund’s total return was 15.95 percent (calculated excluding the maximum sales charge) while the total return of the S&P 500® Index was 22.87 percent and the total return of the Bloomberg Barclays U.S. Aggregate Bond Index was 3.21 percent.

Market Environment

For the trailing 12-month period ended November 30, 2017, U.S. equities continued the bull market that began in 2009 as the market ended the period near all-time highs. Solid financial conditions and strong profit growth were the key drivers of the market. Consumer and business confidence remained high despite stalled healthcare legislation in the first half of the year. Markets benefited from an added boost in the later stages of 2017 on reports that the White House and Congressional Republican leaders were coalescing around a plan to cut the corporate tax rate. Leading the S&P 500® Index higher was Information Technology returning 41% over the period. Health Care, Utilities and Financials also outperformed the broader index over the period. Underperforming sectors included Energy and Telecommunication Services. Consumer Staples, Consumer Discretionary, Industrials, Materials and Real Estate also lagged.

Within fixed income, U.S. investment grade corporates outperformed U.S. Treasuries and securitized assets. The yield curve flattened over the twelve months with short-term rates rising as intermediate and long-term rates fell. This was driven by the combination of the U.S. Federal Reserve Board continuing to gradually raise short-term rates and lower-than-expected inflation subduing the long-end of the yield curve.

Portfolio Review

Both the equity and fixed-income portions of the portfolio contributed to Fund performance. Among equity sectors, the Fund benefited from positions in Real Estate, Industrials, Consumer Staples, Energy, Materials, Telecommunication Services and Financials. Consumer Discretionary and Health Care performed in line with the S&P 500® Index and InformationTechnology underperformed. Sector allocation was neutral to performance primarily due to offsetting underweights in the Information Technology sector, which outperformed the S&P 500® Index, and the Real Estate and Telecommunication Services sectors, which underperformed.

Management's Discussion of Fund Performance (Unaudited) (Continued)

The low interest rate environment and steady economic growth created demand for yield which provided a tailwind to spread sectors. The Fund’s allocations to U.S. Agency bonds and U.S. Corporate Credit relative to the Bloomberg Barclays U.S. Aggregate Bond Index were positive contributors to performance. Given the positive move in the market overall, the Fund’s holdings in cash detracted from performance over the period.

Outlook

In our view, the equity market is priced at fair value. Three things typically stop a bull market: a credit cycle, higher inflation or an asset bubble. On the credit side, households, corporations, the public sector and emerging markets are all doing reasonably well at this point. With regard to higher inflation, the balance of power between capital and labor is key. We believe labor costs, which comprise approximately 70 percent of corporate expenses and dominate income statements, are causing the bulk of profit erosion in the late stages of the business cycle. Wage growth is running at around 2.5 percent today.

To address asset bubbles, many point to the stocks of Facebook Inc. (InformationTechnology sector), Amazon.com Inc. (Consumer Discretionary sector), Netflix Inc (Consumer Discretionary sector) and Alphabet Inc. (Information Technology sector), the “FAANGs,” as an issue. We believe the FAANGs are undervalued to fairly valued. The makeup of these companies is a far cry from the negative earnings, price-per-click valuation based stocks of the late 1990s. The sectors where below-average discount rates must be used to justify current valuation levels are Consumer Staples, Utilities and part of the Real Estate sector, which are areas where investors typically put their money as a bond substitute. Lastly, the breadth of the market is doing well at this juncture which is a sign of a healthy market. In summary, we believe there will still be attractive returns going forward, we are not concerned about a credit crisis or higher inflation creating a top, and market breadth doesn’t seem to be an issue at this juncture.

Within fixed income, credit spreads and interest rates are at historically low levels, likely limiting total return potential to income, with little room for price appreciation. Risky assets, such as high yield corporate credit, appear rich while safe haven assets, such as U.S. Treasuries, provide little return potential with much greater downside risk.

Management's Discussion of Fund Performance (Unaudited) (Continued)

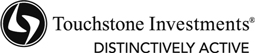

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Balanced Fund - Class A*, the S&P 500® Index and the Bloomberg Barclays U.S. Aggregate Bond index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares and Class Y shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares and Class Y shares was November 15, 1938, May 4, 1998 and August 27, 2007, respectively. Class C shares and Class Y shares performance information was calculated using the historical performance of Class A shares for periods prior to May 4, 1998 and August 27, 2007, respectively. The returns have been restated for sales loads and fees applicable to Class C and Class Y shares. The launch date of the S&P 500® Index and the Bloomberg Barclays U.S. Aggregate Bond Index was after the inception date of the Fund, therefore there is no return for inception. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. Prior to October 28, 2017, the maximum offering price per share of Class A shares was equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Effective October 28, 2017, the maximum offering price per share of Class A shares is equal to the NAV per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

S&P 500® Index is a group of 500 widely held stocks and is commonly regarded to be representative of the large capitalization stock universe.

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

Management's Discussion of Fund Performance (Unaudited)

Touchstone International Equity Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Effective October 28, 2017, the Sentinel International Equity Fund was reorganized into theTouchstone International Equity Fund. At that time, Touchstone Advisors, Inc. and Fort Washington Investment Advisors, Inc. were respectively appointed as advisor and sub-advisor to the Fund.

Investment Philosophy

The Touchstone International Equity Fund invests primarily in common stocks of established companies across the capitalization spectrum located in or that conduct their business mainly in one or more foreign countries, which may include emerging markets. The process starts with a regular quantitative screening or bottom up identification of companies that meet the investment profile of high returns on capital, operating margins, and strong cash flow generation. Together, these two means of identifying companies narrows the investible universe.The Fund analyzes companies based on the following five fundamental factors: business quality, valuation, growth, management and balance sheet strength, focusing on quality at a reasonable price. Its index-agnostic portfolio construction approach seeks to result in a concentrated, high-conviction portfolio.

Fund Performance

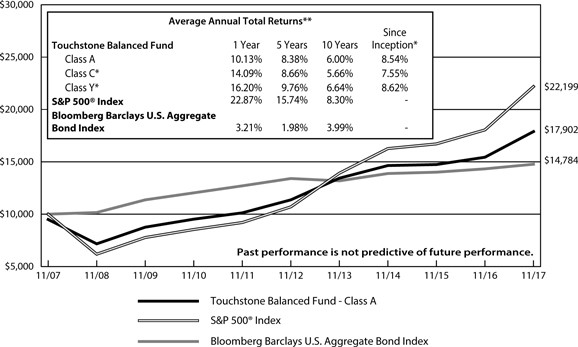

The Touchstone International Equity Fund (Class A Shares) outperformed the MSCI EAFE Index for the 12-month period ended November 30, 2017. The Fund’s total return was 27.39 percent (calculated excluding the maximum sales charge) while the return of its benchmark was 27.27 percent.

Market Environment

Following three years of drifting stock prices, international markets finally regained their footing in the past year, surpassing pre-financial-crisis highs for the first time. Helped in part by generally rising currencies, a number of which had been trading near multi-decade lows against the U.S. dollar in real terms as the period began, the MSCI EAFE Index rose strongly in U.S. dollar terms for the 12 months ended November 30, 2017. Emerging markets stocks performed even better, rising nearly 33 percent, led by China and South Korea. Stock prices were aided by continued monetary easing in Europe and Japan, as well as investor-friendly election results in Germany and France.

Portfolio Review

TheTouchstone International Equity Fund’s relative performance benefited from outperformance in Information Technology, Health Care and Consumer Discretionary sectors. On the other hand, Financials and Energy sectors detracted from relative performance. Both sector allocation and security selection contributed to relative performance. Looking at the Fund broken down by geography, Asia Pacific was the notable driver of outperformance as the Fund benefited from its holdings in Japan, South Korea, Hong Kong and India. Europe was mixed with solid contributions in Switzerland and Italy, offset by detractors in the U.K., Netherlands, France and Germany. With the positive momentum in the broader market over the past 12 months, the Fund’s cash position detracted from relative performance.

During the 12-month period ,PC Jeweller Ltd. (Consumer Discretionary sector), Tencent Holdings Ltd. (Information Technology sector) and Savills PLC (Real Estate sector) were among the top contributors to performance. PC Jeweller, one of India’s leading branded jewelry makers and retailers, continued its growth path by expanding its national retail foot print. The company benefited as organized retailers continued to take market share from the highly fragmented, unorganized mom & pop segment. Tencent Holdings, operator of China’s dominant social networking sites, continued to deliver impressive growth. The market continued to support its share price on prospects for further monetization of its massive user base and the network effect from the secular

Management's Discussion of Fund Performance (Unaudited) (Continued)

growth of China’s on-demand economy. Savills PLC is a U.K.-based global property consultancy that provides transactional and non-transactional advisory services to commercial and residential property sectors throughout the world. The company’s strong balance sheet, quality franchise and diverse business model continued to deliver despite some macro volatility.

Stocks that detracted from performance were Aurelius Equity Opportunities SE & Co. KGaA (Financials sector), SES SA and WPP PLC (both Consumer Discretionary sector). Aurelius is a German-based private equity firm that focuses on the acquisition and turnaround of special-situation companies in Europe. We believe the company has an impressive track record of creating shareholder value. However, its share price came under pressure during the first quarter after a short seller questioned the validity of Aurelius’ business model. SES is a leading provider of fixed satellite services globally, including video broadcasting, broadband services, maritime communications and government reconnaissance.The share price came under pressure in the third and fourth quarters as improvements in data compression technology led to weaker than expected revenue growth. WPP PLC, the UK-based advertising holding company, saw its shares fall after a series of sales warnings. The company’s key clients, the global consumer goods companies, slowed their marketing spend driven by relentless cost cutting, which resulted in a de-rating for WPP and the rest of the sector.

During the 12–month period, the Fund sold ten holdings and added seven new positions. Overall sector and country exposures were mostly unchanged, though price increases of several of the Fund’s Emerging Markets holdings led to rising exposures to India and Hong Kong/China. Pressure on pharmaceutical prices and the increasing threat of competition from biosimilar drugs led to the sale of a couple of the Fund’s Health Care positions. Most of the remaining sales were a result of valuations that surpassed our comfort level.

Meanwhile, continued softness in traditional media stocks allowed us to add to the Fund’s exposure in broadcasting and advertising related businesses. A small basket of gold miners was also purchased which, in addition to meeting the Fund’s criteria in terms of valuation, growth profile, management track record and strength of balance sheet, provided the Fund with what we believe is somewhat of a hedge in the event that inflation begins to accelerate following many years of easy monetary policy across the developed world.

Outlook

The primary driver of financial markets since the end of the global financial crisis, in our opinion, has been the easy monetary policy pursued by the world’s central banks, which have collectively added an average of more than $1 trillion per annum to demand for securities since 2009. And while the Bank of Japan (BoJ) and European Central Bank (ECB) continue to grow their balance sheets, the U.S. Federal Reserve Board (Fed) has begun to unwind its own, leading to a fairly rapid slowing of central bank balance sheet growth rates in aggregate. Measures of money supply growth, which lead economic demand by long and variable lags, have begun to slow sharply in the United States and China, the world’s two largest economies. If the Europeans decide that the continuing boom in much of that region, led notably by Germany, entails more inflationary risk than economic benefit, we believe we may see them join the policy trend toward monetary tightening in 2018. The contradictions inherent in the euro, which have been masked by zero interest rates, could soon re-emerge. Although we think it is unlikely that central banks will ever actually shrink their balance sheets substantially,the transition period from the current market friendly environment to some eventual new, non-inflationary equilibrium has the potential to be tricky.

We believe the political picture is mixed if improving, with unease on the Korean peninsula and an upending of the status quo in Saudi Arabia, balanced by faster than expected progress on negotiating the terms of Brexit, a reformist government in France, renewed calm in Catalonia and stability in Germany and Japan. It should also be noted that the civil war in Syria, which has been a source of political instability in Europe due to the influx of refugees, appears to be winding down.

Management's Discussion of Fund Performance (Unaudited) (Continued)

From a stock perspective, although portions of the market, particularly in the Information Technology sector undoubtedly appeared bubbly in recent months, many of the stable growth businesses where we concentrate our attention appear reasonably valued if not cheap. We continue to find no shortage of opportunities to add to existing holdings and research potential new additions to the Fund among the universe of high quality international businesses trading at attractive prices.

Management's Discussion of Fund Performance (Unaudited) (Continued)

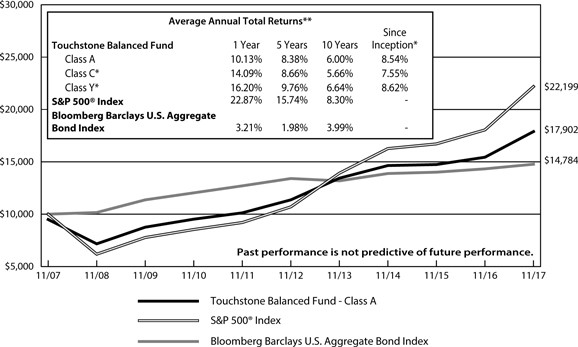

Comparison of the Change in Value of a $10,000 Investment in the Touchstone

International Equity Fund - Class A* and the MSCI EAFE Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was March 1, 1993, May 4, 1998, August 27, 2007 and October 30, 2017, respectively. Class C shares, Class Y and Institutional Class shares performance information was calculated using the historical performance of Class A shares for periods prior to May 4, 1998, August 27, 2007 and October 30, 2017, respectively. The returns have been restated for sales loads and fees applicable to Class C, Class Y and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. Prior to October 28, 2017, the maximum offering price per share of Class A shares was equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Effective October 28, 2017, the maximum offering price per share of Class A shares is equal to the NAV per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance excluding the U.S. and Canada.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Large Cap Focused Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Effective October 28, 2017, the Sentinel Common Stock Fund was reorganized into the Touchstone Large Cap Focused Fund. At that time, Touchstone Advisors, Inc. and Fort Washington Investment Advisors, Inc. were respectively appointed as advisor and sub-advisor to the Fund.

Investment Philosophy

The Fund seeks to invest at least 80 percent of its assets in large capitalization securities. The Fund’s sub-advisor, Fort Washington Investment Advisors, Inc., seeks to invest in companies that are trading below what is believed to be the estimate of the companies’ intrinsic value and have a sustainable competitive advantage or a high barrier to entry in place. The barrier(s) to entry can be created through a cost advantage, economies of scale, high customer loyalty or a government barrier (e.g. license or subsidy). Fort Washington believes that the strongest barrier to entry is the combination of economies of scale and high customer loyalty.

Fund Performance

The Touchstone Large Cap Focused Fund (Class A Shares) outperformed its benchmark, the S&P 500® Index, for the 12-month period ended November 30, 2017. The Fund’s total return was 23.67 percent (calculated excluding the maximum sales charge) while the return of the benchmark was 22.87 percent.

Market Environment

For the trailing twelve-month period ended November 30, 2017, U.S. equities continued the bull market that began in 2009 as the market ended the period near all-time highs. Solid financial conditions and strong profit growth were the key drivers of the market. Consumer and business confidence remained high despite stalled healthcare legislation in the first half of the year. Markets benefited from an added boost in the later stages of 2017 on reports that the White House and Congressional Republican leaders were coalescing around a plan to cut the corporate tax rate. Leading the benchmark higher was the Information Technology sector returning 41 percent over the period. The Health Care, Utilities and Financials sectors also outperformed the broader benchmark over the period. Underperforming the benchmark by the largest margin were the Energy and Telecommunication Services sectors. The Consumer Staples, Consumer Discretionary, Industrials, Materials, and Real Estate sectors also lagged the benchmark.

Portfolio Review

Within the Fund’s holdings, sectors in which the Fund outperformed its benchmark included Real Estate, Industrials, Consumer Staples, Energy, Materials, Telecommunication Services, Health Care and Financials, while the Consumer Discretionary and Information Technology sectors underperformed. The Fund did not hold any Utilities sector stocks during the 12-month period ended November 30, 2017. Stock selection represented the largest contributor to the Fund’s outperformance while sector allocation provided a small detraction to relative performance. Top contributing stocks included Boeing Co. (Industrials sector),The Estee Lauder Companies, Inc. (Consumer Staples sector), Marriott International, Inc. (Consumer Discretionary sector), Marathon Petroleum Corp. (Energy sector), and Honeywell International, Inc. (Industrials sector). Stock holdings that detracted the most from relative performance included Amazon.com, Inc., Omnicom Group, Inc., TJX Companies, Inc. (all Consumer Discretionary sector), Merck & Co., Inc. (Health Care sector), and Signature Bank (Financials sector). Given the positive move in the market overall, holdings in cash detracted from performance over the period.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Outlook

In our view, the equity market is priced at fair value. Three things typically stop a bull market: a credit cycle, higher inflation or an asset bubble. On the credit side, households, corporations, the public sector and emerging markets are all doing reasonably well at this point. With regard to higher inflation, the balance of power between capital and labor is key. We believe labor costs, which comprise approximately 70 percent of corporate expenses and dominate income statements, are causing the bulk of profit erosion in the late stages of the business cycle. Wage growth is running at around 2.5 percent today.

To address asset bubbles, many point to the stocks of Facebook Inc. (InformationTechnology sector), Amazon.com Inc. (Consumer Discretionary sector), Netflix Inc. (Consumer Discretionary sector) and Alphabet Inc. (Information Technology sector), the “FAANGs,” as an issue. We believe the FAANGs are undervalued to fairly valued. The makeup of these companies is a far cry from the negative earnings, price-per-click valuation based stocks of the late 1990s. The sectors where below-average discount rates must be used to justify current valuation levels are Consumer Staples, Utilities and part of the Real Estate sector, which are areas where investors typically put their money as a bond substitute. Lastly, the breadth of the market is doing well at this juncture which is a sign of a healthy market. In summary, we believe there will still be attractive returns going forward, we are not concerned about a credit crisis or higher inflation creating a top, and market breadth doesn’t seem to be an issue at this juncture.

Management's Discussion of Fund Performance (Unaudited) (Continued)

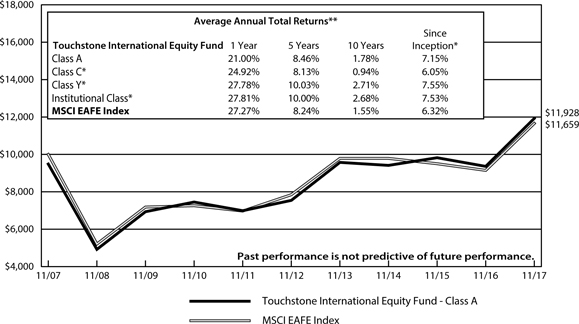

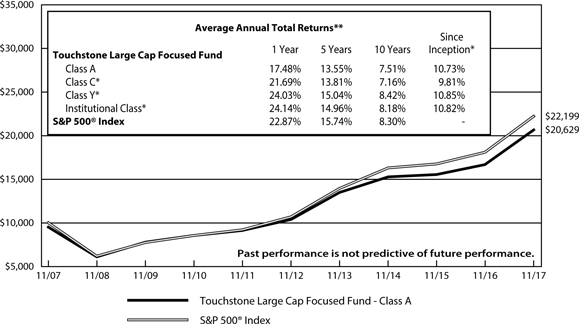

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Large Cap

Focused Fund - Class A* and the S&P 500® Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was January 12, 1934, May 4, 1998, May 4, 2007 and December 23, 2014, respectively. Class C shares, Class Y shares and Institutional Class shares performance was calculated using the historical performance of Class A shares for the periods prior to May 4, 1998, May 4, 2007 and December 23, 2014, respectively. The returns have been restated for sales loads and fees applicable to Class C, Class Y and Institutional Class shares. The launch date of the S&P 500® Index was after the inception date of the Fund, therefore there is no return for inception. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. Prior to October 28, 2017, the maximum offering price per share of Class A shares was equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Effective October 28, 2017, the maximum offering price per share of Class A shares is equal to the NAV per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

S&P 500® Index is a group of 500 widely held stocks and is commonly regarded to be representative of the large capitalization stock universe.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Small Company Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Effective October 28, 2017, the Sentinel Small Company Fund was reorganized into the Touchstone Small Company Fund. At that time, Touchstone Advisors, Inc. and Fort Washington Investment Advisors, Inc. were respectively appointed as advisor and sub-advisor to the Fund.

Investment Philosophy

The Fund seeks to provide investors with growth of capital by investing primarily in common stocks of small companies that the sub-advisor believes are high quality, have superior business models, solid management teams, sustainable growth potential and are attractively valued.

Fund Performance

The Touchstone Small Company Fund (Class A Shares) underperformed its benchmark, the Russell 2000® Index, for the 12-month period ended November 30, 2017. The Fund’s total return was 17.95 percent (calculated excluding the maximum sales charge) while the return of the benchmark was 18.34 percent.

Market Environment

U.S. small equities returned a strong 18.3 percent for the 12-month period ended November 30, 2017. The small cap market traded in a narrow range for the majority of the year until mid-August, then rallied 15 percent into the end of November to close at all-time highs. While attributing the exact cause of market movements is difficult, we believe that the primary catalyst was the increased potential for corporate tax reform out of Washington.

The overall market and macroeconomic backdrop were favorable for risk assets, including small cap equities. However, U.S. small cap companies are only growing earnings in the low single digits. With this relatively low earnings growth rate, market returns have principally been driven by expansion of the market’s valuation multiples, which rose from about 18 times forward earnings to over 21 times forward earnings. Volatility remained low in 2017.

U.S. small cap performance was balanced across sectors. The Health Care, Information Technology, Telecommunication Services, and Industrials sectors led the market, though Financials, Consumer Discretionary, Materials and Real Estate also produced solid performance during the 12-month period. Energy was the only sector that experienced negative returns in the fiscal year.

Portfolio Review

The Consumer Discretionary sector was the top contributor to the Fund’s relative returns versus the benchmark during the fiscal year. With a relatively small exposure within the Fund, positioning in the Media industry was an area of particular strength. Solid performance in the Consumer Durables & Apparel and Consumer Services spaces more than offset the relative underperformance of the Fund’s Retail holdings.

The Information Technology sector also contributed positive relative performance and was another strong performing sector versus the benchmark. Semiconductors led the way and Software & Services increased while Technology hardware and equipment industry declined.

Energy was the benchmark’s only sector with negative returns during the year. The Fund’s stock selection within the Energy sector detracted from relative performance, though this was partially offset by a modest underweight to the sector. Ironically, the largest detractor to Fund performance in this fiscal year was not specific stocks in the Fund, but rather a lack of exposure to the broad market. In a year of double digit returns for the Russell 2000® Index, the Fund’s cash position was the largest detractor to relative performance. The Fund’s cash

Management's Discussion of Fund Performance (Unaudited) (Continued)

balance over the course of the year increased, driven up by infusions of cash from liquidating several positions that had either been acquired in mergers and acquisitions (M&A) deals or that no longer met the Fund’s market capitalization criteria. We were cautious in redeploying capital into a market that in our opinion appeared to be stretched from a valuation perspective.

Penn National Gaming Inc. (Consumer Discretionary sector), an owner and operator of regional gaming and racing facilities, more than doubled during the year. Gaming industry trends improved in 2017, and Penn capitalized on the industry tailwind as the continued ramp up of newer properties and business segments performed ahead of expectations. Additionally, speculation (which was eventually confirmed by Penn) for potential industry consolidation favorably impacted the stock price.

Tower Semiconductor Ltd. (Information Technology sector), a global leader in specialty semiconductor foundry services, also exhibited strong returns, nearly doubling in value during the year. The semiconductor industry experienced a strong up cycle in 2017, with demand acceleration and industry consolidation benefiting all players. Tower Semiconductor outperformed the industry with its focus on specialized niche markets that drove organic growth over 20 percent, with higher earnings and cash flow growth.

The Fund’s bottom two performing stocks were in the challenged Retail industry. Tile Shop Holdings Inc. (Consumer Discretionary sector), an operator of specialty flooring stores, executed poorly on new product introductions at the same time it was experiencing a deceleration in sales trends and margin compression. The stock lost more than half of its value during the period. Meanwhile, specialty nutrition store operator Vitamin Shoppe Inc. (Consumer Discretionary sector) declined significantly after missing earnings expectations multiple times during the year. We exited both stocks.

There were no significant changes to the Fund’s positioning during the 12-month period. Sector weights remained consistent, with Information Technology being the largest weight averaging 26 percent over the year compared to 17 percent in the benchmark. Health Care was the Fund’s second largest sector weight at 17 percent, compared to 13 percent for the benchmark. The Financials sector remained the Fund’s largest underweight at 9 percent, approximately half the size of the benchmark’s weight.

Outlook

U.S. small cap equities have experienced significant appreciation off their February 2016 market bottom, rising over 60 percent and achieving all-time highs. We believe much of the recent appreciation has been driven by the expectation of corporate tax reform. Meaningful corporate tax reform would be a positive development for U.S. small caps given their larger degree of exposure to domestic activity and earnings. M&A activity has historically been a driver of small cap and Fund returns. We believe the current environment is conducive to M&A activity and companies would gain additional impetus for deal-making should corporate taxes be reduced.

In this environment, we will continue to remain focused on executing our fundamental stock selection and portfolio construction process. We believe that an attractive risk/reward profile can be generated by investing in quality small cap companies that are poised to benefit from improvements in their business model, leadership teams, and/or industry positioning. We believe disciplined valuation analysis is needed to identify favorable entry and exit points. Our process has historically added value for shareholders and we continue to believe in its ability to drive returns going forward.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Small

Company Fund - Class A* and the Russell 2000® Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares, Institutional Class shares and Class R6 shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares, Institutional Class shares and Class R6 shares was March 1, 1993, July 9, 2001, May 4, 2007, October 30, 2017 and December 23, 2014, respectively. Class C shares, Class Y shares, Institutional Class shares and Class R6 shares performance was calculated using the historical performance of Class A shares for the periods prior to July 9, 2001, May 4, 2007, October 30, 2017 and December 23, 2014, respectively. The returns have been restated for sales loads and fees applicable to Class C, Class Y, Institutional Class and Class R6 shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. Prior to October 28, 2017, the maximum offering price per share of Class A shares was equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Effective October 28, 2017, the maximum offering price per share of Class A shares is equal to the NAV per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares, Institutional Class shares and Class R6 shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

Russell 2000®Index measures the performance of the small-cap segment of the U.S. equity universe.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Tabular Presentation of Portfolios of Investments (Unaudited)

November 30, 2017

The tables below provides each Fund’s geographic allocation, credit quality or sector allocation. We hope it will be useful to shareholders as it summarizes key information about each Fund’s investments.

| Touchstone Balanced Fund | | | |

| Credit Quality* | | (% of Fixed Income Securities) | |

| AAA/Aaa | | | 87.7 | % |

| AA/Aa | | | 2.6 | |

| A/A | | | 3.0 | |

| BBB/Baa | | | 6.5 | |

| BB/Ba | | | 0.2 | |

| | | | 100.0 | % |

| Sector Allocation** | | (% of Net Assets) | |

| Fixed Income Securities | | | 23.9 | % |

| Common Stocks | | | | |

| Information Technology | | | 15.9 | |

| Health Care | | | 10.9 | |

| Financials | | | 10.0 | |

| Consumer Discretionary | | | 7.7 | |

| Consumer Staples | | | 7.0 | |

| Industrials | | | 6.8 | |

| Energy | | | 3.9 | |

| Materials | | | 1.4 | |

| Telecommunication Services | | | 1.1 | |

| Real Estate | | | 0.9 | |

| Exchange-Traded Funds | | | 9.3 | |

| Short-Term Investment Fund | | | 1.2 | |

| Other Assets/Liabilities (Net) | | | 0.0 | |

| Total | | | 100.0 | % |

| Touchstone International Equity Fund | | | |

| Geographic Allocation | | (% of Net Assets) | |

| Common Stocks | | | | |

| United Kingdom | | | 30.0 | % |

| Japan | | | 8.6 | |

| France | | | 7.9 | |

| India | | | 7.1 | |

| Canada | | | 6.7 | |

| United States | | | 5.5 | |

| Germany | | | 5.3 | |

| Switzerland | | | 4.8 | |

| Cayman Island | | | 4.4 | |

| Spain | | | 2.6 | |

| Greece | | | 2.5 | |

| Luxembourg | | | 2.5 | |

| Netherlands | | | 2.0 | |

| Denmark | | | 1.9 | |

| Italy | | | 1.7 | |

| Jersey | | | 1.6 | |

| Australia | | | 1.1 | |

| Cyprus | | | 0.8 | |

| Short-Term Investment Funds | | | 5.1 | |

| Other Assets/Liabilities (Net) | | | (2.1 | ) |

| Total | | | 100.0 | % |

| * | Credit quality ratings are from Standard & Poor's (“S&P”) and Moody's Investors Service (“Moody's”). If agency ratings differ, the higher rating will be used. Where no rating has been assigned, it may be for reasons unrelated to the creditworthiness of the issuer. |

| ** | Sector classifications are based upon the Global Industry Classification Standard (GICS®). |

Tabular Presentation of Portfolios of Investments (Unaudited) (Continued)

| Touchstone Large Cap Focused Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Information Technology | | | 22.9 | % |

| Financials | | | 15.1 | |

| Health Care | | | 12.3 | |

| Consumer Discretionary | | | 10.9 | |

| Industrials | | | 8.9 | |

| Consumer Staples | | | 8.1 | |

| Energy | | | 5.9 | |

| Telecommunication Services | | | 1.8 | |

| Materials | | | 1.7 | |

| Real Estate | | | 1.4 | |

| Exchange-Traded Funds | | | 8.0 | |

| Short-Term Investment Fund | | | 3.2 | |

| Other Assets/Liabilities (Net) | | | (0.2 | ) |

| Total | | | 100.0 | % |

| Touchstone Small Company Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Information Technology | | | 28.7 | % |

| Health Care | | | 19.8 | |

| Consumer Discretionary | | | 17.0 | |

| Industrials | | | 12.9 | |

| Financials | | | 10.0 | |

| Energy | | | 2.5 | |

| Real Estate | | | 2.4 | |

| Telecommunication Services | | | 1.2 | |

| Materials | | | 0.9 | |

| Short-Term Investment Funds | | | 6.9 | |

| Other Assets/Liabilities (Net) | | | (2.3 | ) |

| Total | | | 100.0 | % |

| * | Sector classifications are based upon the Global Industry Classification Standard (GICS®). |

Portfolio of Investments

Touchstone Balanced Fund – November 30, 2017

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks — 65.6% | | | | | | | | |

| | | | | | | | | |

| Information Technology — 15.9% | | | | | | | | |

| Accenture PLC (Ireland) - Class A | | | 30,000 | | | $ | 4,440,300 | |

| Alphabet, Inc. - Class C* | | | 6,000 | | | | 6,128,460 | |

| Apple, Inc. | | | 48,000 | | | | 8,248,800 | |

| Check Point Software Technologies Ltd. (Israel)* | | | 20,000 | | | | 2,085,800 | |

| Cisco Systems, Inc. | | | 100,000 | | | | 3,730,000 | |

| Cognizant Technology Solutions Corp. - Class A | | | 33,000 | | | | 2,385,240 | |

| Facebook, Inc. - Class A* | | | 6,000 | | | | 1,063,080 | |

| Microsoft Corp. | | | 123,000 | | | | 10,352,910 | |

| Synopsys, Inc.* | | | 30,000 | | | | 2,711,400 | |

| Texas Instruments, Inc. | | | 60,000 | | | | 5,837,400 | |

| Visa, Inc. - Class A | | | 53,000 | | | | 5,967,270 | |

| | | | | | | | 52,950,660 | |

| | | | | | | | | |

| Health Care — 10.9% | | | | | | | | |

| Amgen, Inc. | | | 15,000 | | | | 2,634,900 | |

| Becton Dickinson and Co. | | | 13,000 | | | | 2,966,730 | |

| Biogen, Inc.* | | | 5,000 | | | | 1,610,850 | |

| Bristol-Myers Squibb Co. | | | 45,000 | | | | 2,843,550 | |

| Danaher Corp. | | | 18,000 | | | | 1,698,480 | |

| Eli Lilly & Co. | | | 25,000 | | | | 2,116,000 | |

| Johnson & Johnson | | | 23,000 | | | | 3,204,590 | |

| Medtronic PLC (Ireland) | | | 45,000 | | | | 3,695,850 | |

| Merck & Co., Inc. | | | 70,000 | | | | 3,868,900 | |

| Roche Holding AG ADR | | | 55,000 | | | | 1,736,900 | |

| Stryker Corp. | | | 15,000 | | | | 2,340,000 | |

| UnitedHealth Group, Inc. | | | 20,000 | | | | 4,563,400 | |

| Zoetis, Inc. | | | 40,000 | | | | 2,891,600 | |

| | | | | | | | 36,171,750 | |

| | | | | | | | | |

| Financials — 10.0% | | | | | | | | |

| American Express Co. | | | 25,000 | | | | 2,442,750 | |

| Chubb Ltd.(Switzerland) | | | 20,000 | | | | 3,042,200 | |

| CME Group, Inc. | | | 18,000 | | | | 2,691,720 | |

| Comerica, Inc. | | | 29,000 | | | | 2,415,990 | |

| Discover Financial Services | | | 18,000 | | | | 1,270,800 | |

| JPMorgan Chase & Co. | | | 39,000 | | | | 4,076,280 | |

| Morgan Stanley | | | 100,000 | | | | 5,161,000 | |

| PNC Financial Services Group, Inc. (The) | | | 27,000 | | | | 3,795,120 | |

| S&P Global, Inc. | | | 20,000 | | | | 3,309,600 | |

| Travelers Cos., Inc. (The) | | | 30,000 | | | | 4,067,100 | |

| Webster Financial Corp. | | | 18,000 | | | | 1,032,660 | |

| | | | | | | | 33,305,220 | |

| | | | | | | | | |

| Consumer Discretionary — 7.7% | | | | | | | | |

| Amazon.com, Inc.* | | | 1,000 | | | | 1,176,750 | |

| Comcast Corp. - Class A | | | 120,000 | | | | 4,504,800 | |

| Home Depot, Inc. (The) | | | 15,000 | | | | 2,697,300 | |

| Marriott International, Inc. - Class A | | | 31,100 | | | | 3,949,700 | |

| McDonald's Corp. | | | 33,000 | | | | 5,675,010 | |

| Omnicom Group, Inc. | | | 31,000 | | | | 2,214,640 | |

| Time Warner, Inc. | | | 20,000 | | | | 1,830,200 | |

| TJX Cos (The), Inc. | | | 45,000 | | | | 3,399,750 | |

| | | | | | | | 25,448,150 | |

| | | | | | | |

| Consumer Staples — 7.0% | | | | | | | | |

| CVS Health Corp. | | | 10,000 | | | | 766,000 | |

| Estee Lauder Cos., Inc. (The) - Class A | | | 28,000 | | | | 3,495,240 | |

| Kraft Heinz Co. (The) | | | 30,000 | | | | 2,441,100 | |

| PepsiCo, Inc. | | | 40,000 | | | | 4,660,800 | |

| Philip Morris International, Inc. | | | 40,000 | | | | 4,110,000 | |

| Procter & Gamble Co. (The) | | | 40,000 | | | | 3,599,600 | |

| Unilever NV (Netherlands) | | | 70,000 | | | | 4,041,800 | |

| | | | | | | | 23,114,540 | |

| | | | | | | | | |

| Industrials — 6.8% | | | | | | | | |

| 3M Co. | | | 6,500 | | | | 1,580,410 | |

| Boeing Co. (The) | | | 20,000 | | | | 5,536,000 | |

| Canadian National Railway Co. (Canada) | | | 32,000 | | | | 2,495,360 | |

| General Dynamics Corp. | | | 14,000 | | | | 2,900,240 | |

| Honeywell International, Inc. | | | 35,000 | | | | 5,458,600 | |

| United Technologies Corp. | | | 22,000 | | | | 2,671,900 | |

| Verisk Analytics, Inc.* | | | 20,000 | | | | 1,928,400 | |

| | | | | | | | 22,570,910 | |

| | | | | | | | | |

| Energy — 3.9% | | | | | | | | |

| Chevron Corp. | | | 20,000 | | | | 2,379,800 | |

| EOG Resources, Inc. | | | 25,000 | | | | 2,558,000 | |

| Exxon Mobil Corp. | | | 38,000 | | | | 3,165,020 | |

| Marathon Petroleum Corp. | | | 40,000 | | | | 2,505,200 | |

| Schlumberger Ltd. (Curacao) | | | 37,700 | | | | 2,369,445 | |

| | | | | | | | 12,977,465 | |

| | | | | | | | | |

| Materials — 1.4% | | | | | | | | |

| DowDuPont, Inc. | | | 38,460 | | | | 2,767,582 | |

| Praxair, Inc. | | | 12,000 | | | | 1,847,040 | |

| | | | | | | | 4,614,622 | |

| | | | | | | | | |

| Telecommunication Services — 1.1% | | | | | | | | |

| Verizon Communications, Inc. | | | 75,000 | | | | 3,816,750 | |

| Real Estate — 0.9% | | | | | | | | |

| Equinix, Inc. REIT | | | 6,500 | | | | 3,019,185 | |

| Total Common Stocks | | | | | | $ | 217,989,252 | |

| Principal | | | | | | |

| Amount | | | | | | |

| | | | | | | |

| U.S. Treasury Obligations — 12.4% | | | | |

| $ | 2,885,000 | | | U.S. Treasury Bond, 2.750%, 8/15/47 | | | 2,835,865 | |

| | 24,400,000 | | | U.S. Treasury Note, 2.000%, 10/31/22 | | | 24,243,688 | |

| | 2,555,000 | | | U.S. Treasury Note, 2.250%, 8/15/27 | | | 2,514,779 | |

| | 11,720,000 | | | United States Treasury Inflation | | | | |

| | | | | Indexed Bonds, 0.375%, 7/15/27 | | | 11,628,087 | |

| | | | | Total U.S. Treasury Obligations | | $ | 41,222,419 | |

Touchstone Balanced Fund (Continued)

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Exchange-Traded Funds — 9.3% | | | | | | | | |

| United States — 9.3% | | | | | | | | |

| iShares Core S&P Mid-Cap ETF | | | 15,000 | | | $ | 2,846,700 | |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | | | 210,929 | | | | 25,452,802 | |

| iShares Russell Midcap Value Index Fund | | | 11,000 | | | | 973,610 | |

| SPDR S&P MidCap 400 ETF Trust | | | 4,300 | | | | 1,487,413 | |

| Total Exchange-Traded Funds | | | | | | $ | 30,760,525 | |

| Principal | | | | | | |

| Amount | | | | | | |

| | | | | | | |

| | | | | U.S. Government Mortgage-Backed | | | | |

| | | | | Obligations — 8.3% | | | | |

| $ | 4,395 | | | FHLMC, Pool #G08062, 5.000%, 6/1/35 | | | 4,785 | |

| | 721,657 | | | FHLMC, Pool #G08637, 4.000%, 4/1/45 | | | 754,038 | |

| | 1,212 | | | FHLMC, Pool #G18091, | | | | |

| | | | | 6.000%, 12/1/20 | | | 1,249 | |

| | 16,730 | | | FHLMC, Pool #P00020, | | | | |

| | | | | 6.500%, 10/1/22 | | | 16,875 | |

| | 2,868,862 | | | FHLMC, Pool #Q02664, 4.500%, 8/1/41 | | | 3,061,562 | |

| | 4,437,842 | | | FHLMC, Pool #Q29056, | | | | |

| | | | | 4.000%, 10/1/44 | | | 4,637,217 | |

| | 1,877,353 | | | FHLMC, Pool #Q29260, | | | | |

| | | | | 4.000%, 10/1/44 | | | 1,961,859 | |

| | 1,468,104 | | | FHLMC REMIC, Ser 3859 Class JB, | | | | |

| | | | | 5.000%, 5/15/41 | | | 1,578,120 | |

| | 839 | | | FNMA, Pool #254907, 5.000%, 10/1/18 | | | 854 | |

| | 2,286 | | | FNMA, Pool #255273, 4.500%, 6/1/19 | | | 2,325 | |

| | 642 | | | FNMA, Pool #255358, 5.000%, 9/1/19 | | | 655 | |

| | 34 | | | FNMA, Pool #687301, 6.000%, 11/1/32 | | | 38 | |

| | 1,279 | | | FNMA, Pool #690305, 5.500%, 3/1/33 | | | 1,406 | |

| | 829,493 | | | FNMA, Pool #725423, 5.500%, 5/1/34 | | | 924,956 | |

| | 765,100 | | | FNMA, Pool #725610, 5.500%, 7/1/34 | | | 853,141 | |

| | 93,811 | | | FNMA, Pool #748895, 6.000%, 12/1/33 | | | 100,898 | |

| | 439,998 | | | FNMA, Pool #AD9193, 5.000%, 9/1/40 | | | 477,300 | |

| | 938,338 | | | FNMA, Pool #AH8925, 4.500%, 3/1/41 | | | 1,005,076 | |

| | 1,092,488 | | | FNMA, Pool #AL2860, 3.000%, 12/1/42 | | | 1,095,809 | |

| | 494,737 | | | FNMA, Pool #AL5718, 3.500%, 9/1/44 | | | 510,369 | |

| | 726,421 | | | FNMA, Pool #AR9195, 3.000%, 3/1/43 | | | 728,630 | |

| | 1,270,731 | | | FNMA, Pool #AS4707, 3.500%, 4/1/45 | | | 1,312,592 | |

| | 1,684,939 | | | FNMA, Pool #AS8703, 2.500%, 2/1/32 | | | 1,683,026 | |

| | 2,117,960 | | | FNMA, Pool #AZ7347, 3.000%, 11/1/45 | | | 2,115,005 | |

| | 2,202,858 | | | FNMA, Pool #BC1809, 3.500%, 5/1/46 | | | 2,260,448 | |

| | 1,473,062 | | | GNMA, Pool #5175, 4.500%, 9/20/41 | | | 1,568,456 | |

| | 750,000 | | | GNMA, Ser 2010-169, Class AW, | | | | |

| | | | | 4.500%, 12/20/40 | | | 797,324 | |

| | 7,689,889 | | | GNMA, Ser 2012-147, Class IO, | | | | |

| | | | | 0.568%, 4/16/54(A)(B)(C) | | | 264,247 | |

| | | | | Total U.S. Government | | | | |

| | | | | Mortgage-Backed Obligations | | $ | 27,718,260 | |

| | | | | Corporate Bonds — 3.2% | | | | |

| | | | | Financials — 0.7% | | | | |

| 110,000 | | | American Express Co., | | | | |

| | | | | 3.000%, 10/30/24 | | | 109,477 | |

| | 298,000 | | | AvalonBay Communities, Inc. MTN, | | | | |

| | | | | 3.200%, 1/15/28 | | | 294,979 | |

| | 225,000 | | | Bank of America Corp. MTN, | | | | |

| | | | | 4.000%, 1/22/25 | | | 232,163 | |

| | 390,000 | | | Boston Properties LP, 3.200%, 1/15/25 | | | 388,509 | |

| | 57,000 | | | Chubb INA Holdings, Inc., | | | | |

| | | | | 4.350%, 11/3/45 | | | 62,948 | |

| | 84,000 | | | Citigroup, Inc., 3.300%, 4/27/25 | | | 84,491 | |

| | 52,000 | | | Citigroup, Inc., 4.750%, 5/18/46 | | | 55,997 | |

| | 65,000 | | | Digital Realty Trust LP, 2.750%, 2/1/23 | | | 64,357 | |

| | 85,000 | | | Fifth Third Bancorp, 2.875%, 7/27/20 | | | 85,997 | |

| | 150,000 | | | Goldman Sachs Group, Inc. (The), | | | | |

| | | | | 3.691%, 6/5/28 | | | 151,368 | |

| | 68,000 | | | JPMorgan Chase & Co., | | | | |

| | | | | 3.250%, 9/23/22 | | | 69,526 | |

| | 73,000 | | | Mid-America Apartments LP, | | | | |

| | | | | 3.750%, 6/15/24 | | | 74,833 | |

| | 102,000 | | | Morgan Stanley, 3.950%, 4/23/27 | | | 103,298 | |

| | 65,000 | | | Prudential Financial, Inc., | | | | |

| | | | | 5.625%, 6/15/43 | | | 70,444 | |

| | 65,000 | | | Sabra Health Care LP. REIT, | | | | |

| | | | | 5.125%, 8/15/26 | | | 66,067 | |

| | 110,000 | | | SL Green Operating Partnership LP, | | | | |

| | | | | 3.250%, 10/15/22 | | | 109,823 | |

| | 91,000 | | | State Street Corp., (3M LIBOR | | | | |

| | | | | +1.000%), 2.320%, 6/15/47(A) | | | 83,038 | |

| | 77,000 | | | Ventas Realty LP, 3.500%, 2/1/25 | | | 77,537 | |

| | 140,000 | | | Wells Fargo & Co., 4.125%, 8/15/23 | | | 147,339 | |

| | 63,000 | | | Wells Fargo & Co. MTN, 4.100%, 6/3/26 | | | 65,508 | |

| | | | | | | | 2,397,699 | |

| | | | | | | | | |

| | | | | Information Technology — 0.6% | | | | |

| | 105,000 | | | Activision Blizzard, Inc., 144a, | | | | |

| | | | | 6.125%, 9/15/23 | | | 110,872 | |

| | 899,000 | | | Apple, Inc., 2.750%, 1/13/25 | | | 890,356 | |

| | 110,000 | | | Apple, Inc., 4.650%, 2/23/46 | | | 125,612 | |

| | 100,000 | | | Dell International LLC / EMC Corp., | | | | |

| | | | | 144a, 6.020%, 6/15/26 | | | 109,931 | |

| | 53,000 | | | Microsoft Corp., 3.500%, 2/12/35 | | | 54,175 | |

| | 86,000 | | | Oracle Corp., 2.650%, 7/15/26 | | | 83,397 | |

| | 601,000 | | | Oracle Corp., 3.250%, 11/15/27 | | | 608,108 | |

| | 85,000 | | | QUALCOMM, Inc., 3.450%, 5/20/25 | | | 84,521 | |

| | 77,000 | | | Visa, Inc., 4.150%, 12/14/35 | | | 84,254 | |

| | | | | | | | 2,151,226 | |

| | | | | | | | | |

| | | | | Health Care — 0.4% | | | | |

| | 105,000 | | | Abbott Laboratories, | | | | |

| | | | | 3.750%, 11/30/26 | | | 106,855 | |

| | 95,000 | | | AbbVie, Inc., 4.450%, 5/14/46 | | | 99,984 | |

| | 65,000 | | | Allergan Funding SCS (Luxembourg), | | | | |

| | | | | 3.800%, 3/15/25 | | | 65,533 | |

| | 79,000 | | | Celgene Corp., 5.000%, 8/15/45 | | | 86,948 | |

| | 82,000 | | | Express Scripts Holding Co., | | | | |

| | | | | 3.300%, 2/25/21 | | | 83,393 | |

Touchstone Balanced Fund (Continued)

| Principal | | | | | Market | |

| Amount | | | | | Value | |

| | | | | | | |

| | | | | Corporate Bonds — 3.2% (Continued) | | | | |

| | | | | Health Care — (Continued) | | | | |

| $ | 82,000 | | | Forest Laboratories LLC, 144a, | | | | |

| | | | | 5.000%, 12/15/21 | | $ | 88,038 | |

| | 400,000 | | | Johnson & Johnson, 2.900%, 1/15/28 | | | 399,691 | |

| | 76,000 | | | Medtronic Global Holdings SCA | | | | |

| | | | | (Luxembourg), 3.350%, 4/1/27 | | | 77,440 | |

| | 72,000 | | | Zimmer Biomet Holdings, Inc., | | | | |

| | | | | 3.150%, 4/1/22 | | | 72,186 | |

| | 26,000 | | | Zimmer Biomet Holdings, Inc., | | | | |

| | | | | 3.375%, 11/30/21 | | | 26,344 | |

| | 139,000 | | | Zoetis, Inc., 3.250%, 2/1/23 | | | 141,312 | |

| | | | | | | | 1,247,724 | |

| | | | | | | | | |

| | | | | Telecommunication Services — 0.3% | | | | |

| | 552,000 | | | AT&T, Inc., 3.800%, 3/15/22 | | | 570,984 | |

| | 90,000 | | | AT&T, Inc., 3.900%, 8/14/27 | | | 89,452 | |

| | 88,000 | | | AT&T, Inc., 4.350%, 6/15/45 | | | 79,571 | |

| | 98,000 | | | Charter Communications Operating | | | | |

| | | | | LLC / Charter Communications | | | | |

| | | | | Operating Capital, | | | | |

| | | | | 6.484%, 10/23/45 | | | 112,697 | |

| | 115,000 | | | Qwest Corp., 6.750%, 12/1/21 | | | 122,781 | |

| | 105,000 | | | Verizon Communications, Inc., | | | | |

| | | | | 5.012%, 4/15/49 | | | 108,858 | |

| | | | | | | | 1,084,343 | |

| | | | | | | | | |

| | | | | Energy — 0.3% | | | | |

| | 55,000 | | | Canadian Natural Resources Ltd. | | | | |

| | | | | (Canada), 3.850%, 6/1/27 | | | 55,482 | |

| | 78,000 | | | Cenovus Energy, Inc. (Canada), 144a, | | | | |

| | | | | 4.250%, 4/15/27 | | | 77,164 | |

| | 66,000 | | | Concho Resources, Inc., | | | | |

| | | | | 3.750%, 10/1/27 | | | 66,331 | |

| | 64,000 | | | EOG Resources, Inc., 3.900%, 4/1/35 | | | 64,665 | |

| | 106,000 | | | Midcontinent Express Pipeline LLC, | | | | |

| | | | | 144a, 6.700%, 9/15/19 | | | 111,035 | |

| | 77,000 | | | Petroleos Mexicanos (Mexico), | | | | |

| | | | | 4.500%, 1/23/26 | | | 76,985 | |

| | 89,000 | | | Rockies Express Pipeline LLC, 144a, | | | | |

| | | | | 6.875%, 4/15/40 | | | 100,236 | |

| | 89,000 | | | Sabine Pass Liquefaction LLC, | | | | |

| | | | | 5.000%, 3/15/27 | | | 94,775 | |

| | 100,000 | | | Shell International Finance BV | | | | |

| | | | | (Netherlands), 1.875%, 5/10/21 | | | 98,550 | |

| | 224,000 | | | Western Gas Partners LP, | | | | |

| | | | | 3.950%, 6/1/25 | | | 224,039 | |

| | 90,000 | | | Williams Cos., Inc. (The), | | | | |

| | | | | 3.700%, 1/15/23 | | | 90,000 | |

| | | | | | | | 1,059,262 | |

| | | | | | | | | |

| | | | | Consumer Discretionary — 0.3% | | | | |

| | 88,000 | | | Amazon.com, Inc., 144a, | | | | |

| | | | | 2.800%, 8/22/24 | | | 87,613 | |

| | 100,000 | | | Anheuser-Busch InBev Finance, Inc., | | | | |

| | | | | 4.900%, 2/1/46 | | | 112,894 | |

| | 105,000 | | | Aptiv PLC (Jersey), 3.150%, 11/19/20 | | | 106,962 | |

| | 89,000 | | | AutoNation, Inc., 5.500%, 2/1/20 | | | 94,283 | |

| 92,000 | | | Comcast Corp., 2.850%, 1/15/23 | | | 92,869 | |

| | 60,000 | | | Ford Motor Co., 4.750%, 1/15/43 | | | 59,441 | |

| | 150,000 | | | General Motors Financial Co., Inc., | | | | |

| | | | | 3.950%, 4/13/24 | | | 153,706 | |

| | 85,000 | | | Home Depot, Inc. (The), | | | | |

| | | | | 5.950%, 4/1/41 | | | 112,349 | |

| | 72,000 | | | Time Warner, Inc., 3.800%, 2/15/27 | | | 71,791 | |

| | 105,000 | | | Wal-Mart Stores, Inc., | | | | |

| | | | | 2.350%, 12/15/22 | | | 104,384 | |

| | | | | | | | 996,292 | |

| | | | | | | | | |

| | | | | Utilities — 0.2% | | | | |

| | 98,000 | | | Dominion Energy, Inc., | | | | |

| | | | | 2.000%, 8/15/21 | | | 96,042 | |

| | 62,000 | | | Duke Energy Progress, Inc., | | | | |

| | | | | 4.150%, 12/1/44 | | | 66,303 | |

| | 79,000 | | | Fortis, Inc. (Canada), 3.055%, 10/4/26 | | | 76,230 | |

| | 100,000 | | | NextEra Energy Capital Holdings, Inc., | | | | |

| | | | | (3M LIBOR +2.125%), | | | | |

| | | | | 3.445%, 6/15/67(A) | | | 94,250 | |

| | 76,000 | | | Oncor Electric Delivery Co. LLC, 144a, | | | | |

| | | | | 3.800%, 9/30/47 | | | 77,542 | |

| | 125,000 | | | PacifiCorp, 5.750%, 4/1/37 | | | 160,503 | |

| | | | | | | | 570,870 | |

| | | | | | | | | |

| | | | | Consumer Staples — 0.1% | | | | |

| | 70,000 | | | Constellation Brands, Inc., | | | | |

| | | | | 2.650%, 11/7/22 | | | 69,216 | |

| | 60,000 | | | CVS Health Corp., 5.125%, 7/20/45 | | | 65,972 | |

| | 70,000 | | | Kraft Heinz Foods Co., 6.875%, 1/26/39 | | | 89,907 | |

| | 35,000 | | | Kroger Co. (The), 5.000%, 4/15/42 | | | 36,069 | |

| | 66,000 | | | Mead Johnson Nutrition Co., | | | | |

| | | | | 4.125%, 11/15/25 | | | 70,165 | |

| | 29,000 | | | Moody's Corp., 2.750%, 12/15/21 | | | 29,077 | |

| | 91,000 | | | Reynolds American, Inc., | | | | |

| | | | | 4.450%, 6/12/25 | | | 97,010 | |

| | | | | | | | 457,416 | |

| | | | | | | | | |

| | | | | Industrials — 0.1% | | | | |

| | 113,000 | | | Burlington Northern Santa Fe LLC, | | | | |

| | | | | 5.750%, 5/1/40 | | | 144,224 | |

| | 75,000 | | | FedEx Corp., 5.100%, 1/15/44 | | | 84,802 | |

| | 72,000 | | | Roper Technologies, Inc., | | | | |

| | | | | 3.000%, 12/15/20 | | | 73,108 | |

| | | | | | | | 302,134 | |

| | | | | | | | | |

| | | | | Real Estate — 0.1% | | | | |

| | 103,000 | | | Crown Castle International Corp., | | | | |

| | | | | 3.650%, 9/1/27 | | | 102,121 | |

| | 95,000 | | | Vornado Realty LP REIT, | | | | |

| | | | | 5.000%, 1/15/22 | | | 102,313 | |

| | | | | | | | 204,434 | |

| | | | | | | | | |

| | | | | Materials — 0.1% | | | | |

| | 166,000 | | | Westlake Chemical Corp., | | | | |

| | | | | 4.375%, 11/15/47 | | | 167,685 | |

| | | | | Total Corporate Bonds | | $ | 10,639,085 | |

Touchstone Balanced Fund (Continued)

| Principal | | | | | Market | |

| Amount | | | | | Value | |

| | | | | | | |

| | | | | Sovereign Government Obligation — 0.0% | | | | |

| $ | 89,000 | | | Province of Alberta Canada, 2.200%, | | | | |

| | | | | 7/26/22 | | $ | 87,889 | |

| | | Shares | | | | |

| Short-Term Investment Fund — 1.2% | | | | | | | | |

| Dreyfus Government Cash | | | | | | | | |

| Management, Institutional Shares, | | | | | | | | |

| 0.96%∞Ω | | | 3,801,676 | | | $ | 3,801,676 | |

| Total Investment Securities —100.0% | | | | |

| (Cost $205,533,662) | | $ | 332,219,106 | |

| | | | | |

| Other Assets in Excess of Liabilities — 0.0% | | | 74,212 | |

| | | | | |

| Net Assets — 100.0% | | $ | 332,293,318 | |

| (A) | Variable rate security - Rate reflected is the rate in effect as of November 30, 2017. |

| (B) | Interest only security - This type of security represents the right to receive the monthly interest payments on an underlying pool of mortgages. Payments of principal on the pool reduce the value of the “interest only” holding. |

| (C) | Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. |

| * | Non-income producing security. |

| Ω | Represents the 7-day SEC yield as of November 30, 2017. |

Portfolio Abbreviations:

ADR - American Depositary Receipt

ETF - Exchange-Traded Fund

FHLMC - Federal Home Loan Mortgage Association

FNMA - Federal National Mortgage Association

GNMA - Government National Mortgage Association

LIBOR - London Inter Bank Offered Rate

LLC - Limited Liability Company

LP - Limited Partnership

MTN - Medium Term Note

PLC - Public Limited Company

REIT - Real Estate Investment Trust

REMIC - Real Estate Mortgage Investment Conduit

SPDR - Standard & Poor's Depositary Receipt

144a - This is a restricted security that was sold in a transaction qualifying for the exemption under Rule 144A of the Securities Act of 1933. This security may be sold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2017, these securities were valued at $762,431 or 0.2% of net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Trustees.

Touchstone Balanced Fund (Continued)

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

| | | Valuation inputs at Reporting Date: | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | | | | | | | | | | |

| Common Stocks | | $ | 217,989,252 | | | $ | — | | | $ | — | | | $ | 217,989,252 | |

| U.S. Treasury Obligations | | | — | | | | 41,222,419 | | | | — | | | | 41,222,419 | |

| Exchange-Traded Funds | | | 30,760,525 | | | | — | | | | — | | | | 30,760,525 | |

| U.S. Government Mortgage-Backed Obligations | | | — | | | | 27,718,260 | | | | — | | | | 27,718,260 | |

| Corporate Bonds | | | — | | | | 10,639,085 | | | | — | | | | 10,639,085 | |

| Sovereign Government Obligation | | | — | | | | 87,889 | | | | — | | | | 87,889 | |

| Short-Term Investment Fund | | | 3,801,676 | | | | — | | | | — | | | | 3,801,676 | |

| Total | | $ | 252,551,453 | | | $ | 79,667,653 | | | $ | — | | | $ | 332,219,106 | |

At November 30, 2017, equity securities valued at $1,736,900 were transferred from Level 2 to Level 1. Transfers from Level 1 to Level 2 are due to movements of a designated U.S. market index, triggering a systematic valuation model, provided by an independent third party, when required confidence levels are achieved to fair value the international equity securities. Transfers from Level 2 to Level 1 occur when there is no longer movement of the designated U.S. market index or required confidence levels were not reached in the systematic model.

See accompanying Notes to Financial Statements.

Portfolio of Investments

Touchstone International Equity Fund – November 30, 2017

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks — 97.0% | | | | | | | | |

| | | | | | | | | |

| United Kingdom — 30.0% | | | | | | | | |

| | | | | | | | | |

| Consumer Discretionary — 16.7% | | | | | | | | |

| BCA Marketplace PLC | | | 2,223,000 | | | $ | 6,343,440 | |

| Compass Group PLC | | | 209,615 | | | | 4,251,134 | |

| Delphi Automotive PLC* | | | 45,000 | | | | 4,710,150 | |

| InterContinental Hotels Group PLC | | | 65,000 | | | | 3,824,865 | |

| ITV PLC | | | 2,880,000 | | | | 6,227,932 | |

| WPP PLC | | | 454,000 | | | | 8,012,375 | |

| | | | | | | | 33,369,896 | |

| | | | | | | | | |

| Consumer Staples — 2.1% | | | | | | | | |

| Reckitt Benckiser Group PLC | | | 48,000 | | | | 4,213,298 | |

| | | | | | | | | |

| Health Care — 1.2% | | | | | | | | |

| Indivior PLC* | | | 489,000 | | | | 2,452,175 | |

| | | | | | | | | |

| Industrials — 2.2% | | | | | | | | |

| Experian PLC | | | 205,000 | | | | 4,265,469 | |

| | | | | | | | | |

| Information Technology — 4.5% | | | | | | | | |

| Auto Trader Group PLC, 144a | | | 960,000 | | | | 4,366,174 | |

| AVEVA Group PLC | | | 128,000 | | | | 4,554,427 | |

| | | | | | | | 8,920,601 | |

| | | | | | | | | |

| Real Estate — 3.3% | | | | | | | | |

| Foxtons Group PLC | | | 1,750,000 | | | | 1,644,848 | |

| Savills PLC | | | 392,000 | | | | 4,980,647 | |

| | | | | | | | 6,625,495 | |

| Total United Kingdom | | | | | | | 59,846,934 | |

| | | | | | | | | |

| Japan — 8.6% | | | | | | | | |

| Consumer Discretionary — 4.2% | | | | | | | | |

| CyberAgent, Inc. | | | 120,000 | | | | 4,114,251 | |

| USS Co. Ltd. | | | 202,000 | | | | 4,274,782 | |

| | | | | | | | 8,389,033 | |

| | | | | | | | | |

| Industrials — 2.4% | | | | | | | | |

| FANUC Corp. | | | 19,000 | | | | 4,751,975 | |

| | | | | | | | | |

| Information Technology — 2.0% | | | | | | | | |

| Yahoo Japan Corp. | | | 870,000 | | | | 3,994,358 | |

| Total Japan | | | | | | | 17,135,366 | |

| | | | | | | | | |

| France — 7.9% | | | | | | | | |

| Consumer Discretionary — 5.2% | | | | | | | | |

| JCDecaux SA | | | 123,000 | | | | 5,125,486 | |

| Renault SA | | | 51,000 | | | | 5,178,398 | |

| | | | | | | | 10,303,884 | |

| | | | | | | | | |

| Industrials — 2.7% | | | | | | | | |

| Edenred SA | | | 189,000 | | | | 5,407,968 | |

| Total France | | | | | | | 15,711,852 | |

| | | | | | | | | |

| India — 7.1% | | | | | | | | |

| Consumer Discretionary — 3.9% | | | | | | | | |

| PC Jeweller Ltd. | | | 1,260,000 | | | | 7,726,489 | |

| | | | | | | | | |

| Financials — 3.2% | | | | | | | | |

| Shriram Transport Finance Co. Ltd. | | | 315,000 | | | | 6,485,521 | |

| Total India | | | | | | | 14,212,010 | |

| | | | | | | | | |

| Canada — 6.7% | | | | | | | | |

| Consumer Discretionary — 2.6% | | | | | | | | |

| Uni-Select, Inc. | | | 266,000 | | | | 5,274,022 | |

| | | | | | | | | |

| Information Technology — 2.3% | | | | | | | | |

| BlackBerry Ltd.* | | | 419,000 | | | | 4,512,630 | |

| | | | | | | | | |

| Materials — 1.8% | | | | | | | | |

| Pretium Resources, Inc.* | | | 330,000 | | | | 3,531,000 | |

| Total Canada | | | | | | | 13,317,652 | |

| | | | | | | | | |

| United States — 5.5% | | | | | | | | |

| Health Care — 2.7% | | | | | | | | |

| Medtronic PLC | | | 65,000 | | | | 5,338,450 | |

| | | | | | | | | |

| Information Technology — 2.8% | | | | | | | | |

| Mastercard, Inc. - Class A | | | 38,000 | | | | 5,717,860 | |

| Total United States | | | | | | | 11,056,310 | |

| | | | | | | | | |

| Germany — 5.3% | | | | | | | | |

| | | | | | | | | |

| Industrials — 2.9% | | | | | | | | |

| Brenntag AG | | | 93,000 | | | | 5,794,355 | |

| | | | | | | | | |

| Information Technology — 2.4% | | | | | | | | |

| SAP SE | | | 43,000 | | | | 4,861,246 | |

| Total Germany | | | | | | | 10,655,601 | |

| | | | | | | | | |

| Switzerland — 4.8% | | | | | | | | |

| | | | | | | | | |

| Consumer Staples — 2.7% | | | | | | | | |

| Nestle SA | | | 64,000 | | | | 5,475,172 | |

| | | | | | | | | |

| Industrials — 2.1% | | | | | | | | |

| Adecco Group AG | | | 55,000 | | | | 4,163,681 | |

| Total Switzerland | | | | | | | 9,638,853 | |

| | | | | | | | | |

| Cayman Islands — 4.4% | | | | | | | | |

| | | | | | | | | |

| Consumer Discretionary — 2.5% | | | | | | | | |

| Wynn Macau Ltd. | | | 1,747,000 | | | | 4,999,321 | |

| | | | | | | | | |

| Information Technology — 1.9% | | | | | | | | |

| Tencent Holdings Ltd. | | | 72,000 | | | | 3,686,483 | |

| Total Cayman Islands | | | | | | | 8,685,804 | |

| | | | | | | | | |

| Spain — 2.6% | | | | | | | | |

| | | | | | | | | |

| Utilities — 2.6% | | | | | | | | |

| Red Electrica Corp. SA | | | 225,000 | | | | 5,082,410 | |

Touchstone International Equity Fund (Continued)

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks — 97.0% (Continued) | | | | | | | | |

| | | | | | | | | |

| Greece — 2.5% | | | | | | | | |

| | | | | | | | | |

| Consumer Discretionary — 2.5% | | | | | | | | |

| OPAP SA | | | 410,000 | | | $ | 5,002,021 | |

| | | | | | | | | |

| Luxembourg — 2.5% | | | | | | | | |

| | | | | | | | | |

| Consumer Discretionary — 2.5% | | | | | | | | |

| SES SA | | | 302,000 | | | | 4,987,441 | |

| | | | | | | | | |

| Netherlands — 2.0% | | | | | | | | |

| | | | | | | | | |

| Energy — 2.0% | | | | | | | | |

| Core Laboratories NV† | | | 40,000 | | | | 4,030,000 | |

| | | | | | | | | |

| Denmark — 1.9% | | | | | | | | |

| | | | | | | | | |

| Industrials — 1.9% | | | | | | | | |

| ISS A/S | | | 98,000 | | | | 3,702,701 | |

| | | | | | | | | |

| Italy — 1.7% | | | | | | | | |

| | | | | | | | | |

| Health Care — 1.7% | | | | | | | | |

| DiaSorin SpA | | | 37,000 | | | | 3,408,635 | |

| | | | | | | | | |

| Jersey — 1.6% | | | | | | | | |

| | | | | | | | | |

| Materials — 1.6% | | | | | | | | |

| Randgold Resources Ltd. | | | 34,000 | | | | 3,118,536 | |

| | | | | | | | | |

| Australia — 1.1% | | | | | | | | |

| | | | | | | | | |

| Materials — 1.1% | | | | | | | | |

| Northern Star Resources Ltd. | | | 500,000 | | | | 2,192,833 | |

| | | | | | | | | |

| Cyprus — 0.8% | | | | | | | | |

| | | | | | | | | |

| Financials — 0.8% | | | | | | | | |

| Bank of Cyprus Holdings PLC* | | | 522,424 | | | | 1,608,945 | |

| Total Common Stocks | | | | | | $ | 193,393,904 | |

| | | | | | | | | |

| Short-Term Investment Funds — 5.1% | | | | | | | | |

| Dreyfus Government Cash | | | | | | | | |

| Management, Institutional Shares, | | | | | | | | |

| 0.96%∞Ω | | | 6,176,132 | | | $ | 6,176,132 | |

| Invesco Government & Agency | | | | | | | | |

| Portfolio, Institutional Class, | | | | | | | | |

| 0.98%**∞Ω | | | 4,023,360 | | | | 4,023,360 | |