UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03752

AMG FUNDS III

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 300,

Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600 Steamboat Road, Suite 300,

Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2016 – December 31, 2016

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

| | |

| | ANNUAL REPORT |

AMG Funds

December 31, 2016

AMG Managers Loomis Sayles Bond Fund

(Formerly AMG Managers Bond Fund)

Class S: MGFIX | Class l: MGBIX

AMG Managers Global Income Opportunity Fund

Class S: MGGBX

AMG Managers Special Equity Fund

Class S: MGSEX | Class l: MSEIX

| | |

| | | |

| www.amgfunds.com | | AR078-1216 |

AMG Funds

Annual Report—December 31, 2016

| | | | |

TABLE OF CONTENTS | | PAGE | |

LETTER TO SHAREHOLDERS | | | 2 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| |

PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS,

AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

AMG Managers Loomis Sayles Bond Fund | | | 4 | |

AMG Managers Global Income Opportunity Fund | | | 16 | |

AMG Managers Special Equity Fund | | | 23 | |

| |

NOTES TO SCHEDULES OF PORTFOLIO INVESTMENTS | | | 33 | |

| |

FINANCIAL STATEMENTS | | | | |

| |

Statement of Assets and Liabilities | | | 39 | |

Balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statement of Operations | | | 41 | |

Detail of sources of income, expenses, and realized and unrealized gains (losses) during the year | | | | |

| |

Statements of Changes in Net Assets | | | 42 | |

Detail of changes in assets for the past two years | | | | |

| |

Financial Highlights | | | 43 | |

Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| |

Notes to Financial Highlights | | | 46 | |

| |

Notes to Financial Statements | | | 47 | |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 56 | |

| |

TRUSTEES AND OFFICERS | | | 57 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds family of mutual funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

| | |

| | Letter to Shareholders |

DEAR SHAREHOLDER:

While the year got off to a rocky start, overall U.S. equity investors enjoyed strong positive returns for 2016. The S&P 500 Index, a widely-followed barometer of the U.S. equity market, returned 12.0% during the prior twelve months. Small cap investors were also rewarded with a return of 21.3% for the small cap Russell 2000® Index.

After the market’s initial stumble, investors had to balance a number of noteworthy events, including the U.K.’s planned exit from the European Union (“Brexit”), a contentious U.S. presidential election and the U.S. Federal Reserve’s second rate increase of 25 basis points to 0.50%-0.75%. Following the surprise election of Donald Trump as the 45th President of the United States, investors witnessed a rally in pro-cyclical sectors as the new administration’s plans for tax reform and increased fiscal spending drove anticipation of stronger future economic growth. Along with higher equity prices, long-term interest rates rose and the U.S. Dollar strengthened. Commodity prices collapsed, but then rebounded on indications of an increase in U.S. infrastructure spending and a small uptick in China’s third-quarter Gross Domestic Product (GDP). Oil prices also experienced volatility as they continued their fall from 2015, bottoming in February and subsequently recovering more than 100%. This recovery lent some much needed support to the beleaguered energy industry, which ended the year with the highest returns of any sector in the S&P 500 Index. In total, all sectors but the health care sector were positive for 2016; however, there was significant dispersion in performance across sectors. Energy, telecommunication services and financials returned 27%, 23% and 21%, respectively, while companies within the consumer staples, real estate and health care sectors returned 5%, 4% and (3)%, respectively. Internationally, stocks lagged their U.S. counterparts, returning 4.5%, as measured by the MSCI ACWI ex USA (in U.S. Dollar terms).

The Bloomberg Barclays U.S. Aggregate Bond Index, a broad U.S. bond market benchmark, returned 2.7% for the year ended December 31, 2016. Over the course of the year, interest rates and credit spreads gyrated at times, putting pressure on bond prices. While stocks finished strong, bond prices were less fortunate, as rising interest rates caused yields to rise and bond prices to fall. The 10-year U.S. Treasury note’s yield started the year at 2.24%, bottomed at 1.37% in July, and ended the year much higher at 2.45%. High yield, on the other hand, was very strong, as investor risk appetite improved and spreads tightened 470 basis points. The Bloomberg Barclays U.S. Corporate High Yield Bond Index ended the year with a healthy 17.1% return.

We are excited to announce as of October 1, 2016, the AMG Funds family of mutual funds fully integrated the former Aston Funds. AMG Funds and Aston Funds shareholders will now have access to the differentiated solutions of AMG Funds, which represents a single point of access to one of the largest line-ups of boutique managers and products in the world.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal at AMG Funds is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. By partnering with AMG’s affiliated investment boutiques, AMG Funds provides access to a distinctive array of actively-managed return-oriented investment strategies. Additionally, we oversee and distribute a number of complementary open-architecture mutual funds subadvised by unaffiliated investment managers. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Jeffery Cerutti

President

AMG Funds

| | | | | | | | | | | | | | |

Average Annual Total Returns | | Periods ended

December 31, 2016 | |

Stocks: | | | | 1 Year | | | 3 Years | | | 5 Years | |

| Large Caps | | (S&P 500 Index) | | | 11.96 | % | | | 8.87 | % | | | 14.66 | % |

| Small Caps | | (Russell 2000® Index) | | | 21.31 | % | | | 6.74 | % | | | 14.46 | % |

| International | | (MSCI All Country World ex-USA Index) | | | 4.50 | % | | | (1.78 | )% | | | 5.00 | % |

Bonds: | | | | | | | | | | | | | | |

| Investment Grade | | (Bloomberg Barclays U.S. Aggregate Bond Index) | | | 2.65 | % | | | 3.03 | % | | | 2.23 | % |

| High Yield | | (Bloomberg Barclays U.S. Corporate High Yield Index) | | | 17.13 | % | | | 4.66 | % | | | 7.36 | % |

| Tax-exempt | | (Bloomberg Barclays Municipal Bond Index) | | | 0.25 | % | | | 4.14 | % | | | 3.28 | % |

| Treasury Bills | | (BofA Merrill Lynch 6 month U.S. Treasury Bill) | | | 0.67 | % | | | 0.34 | % | | | 0.27 | % |

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

ACTUAL EXPENSES

The first line of the following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

| Six Months Ended December 31, 2016 | | Expense

Ratio for

the Period | | | Beginning

Account Value

7/01/16 | | | Ending

Account Value

12/31/16 | | | Expenses

Paid During

the Period* | |

AMG Managers Loomis Sayles Bond Fund | | | | | | | | | |

Class S | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.01 | % | | $ | 1,000 | | | $ | 994 | | | $ | 5.06 | |

Hypothetical (5% return before expenses) | | | 1.01 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.13 | |

Class l | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.91 | % | | $ | 1,000 | | | $ | 994 | | | $ | 4.56 | |

Hypothetical (5% return before expenses) | | | 0.91 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.62 | |

AMG Managers Global Income Opportunity Fund | | | | | | | | | |

Class S | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.89 | % | | $ | 1,000 | | | $ | 960 | | | $ | 4.39 | |

Hypothetical (5% return before expenses) | | | 0.89 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.52 | |

AMG Managers Special Equity Fund | | | | | | | | | |

Class S | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.36 | % | | $ | 1,000 | | | $ | 1,135 | | | $ | 7.30 | |

Hypothetical (5% return before expenses) | | | 1.36 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 6.90 | |

Class l | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.11 | % | | $ | 1,000 | | | $ | 1,137 | | | $ | 5.96 | |

Hypothetical (5% return before expenses) | | | 1.11 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.63 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year (184), then divided by 366. |

AMG Managers Loomis Sayles Bond Fund

Portfolio Manager’s Comments (unaudited)

THE YEAR IN REVIEW

The AMG Managers Loomis Sayles Bond Fund)1 (Class S)2 (the “Fund”) returned 5.2% for the year ended December 31, 2016, outperforming the Bloomberg Barclays U.S. Government/Credit Index, which returned 3.1%.

The Fund posted positive absolute returns for the year. Performance can be largely attributed to security selection in high-yield and investment-grade holdings and, secondarily, in sector allocation.

Investment-grade and below-investment securities were additive over the period and, in general, outperformed duration-matched U.S. Treasuries. Security selection and sector allocation proved beneficial in this space. Small allocations to utilities in both spaces proved detrimental to relative return, as a selected name weighed down return.

Relative to the benchmark, the strategy maintained a meaningful underweight to U.S. Treasuries which, combined with a shorter-duration stance, proved beneficial to outperformance.

Our convertible holdings also contributed to overall performance and were led by a selected energy name as equity markets rallied throughout the quarter as well.

Our allocation to non-U.S. Dollar-denominated issues produced negative returns during the period and was a large detractor of relative return within the strategy. Holdings denominated in the Mexican Peso were the largest laggard of excess performance.

LOOKING FORWARD

Markets were in reflation mode during the final weeks of 2016, sending the 10-year U.S. Treasury yield to its highest level in more than two years. While economic indicators have shown modest improvement, most of the rise in yields is built on lofty expectations. In the coming years, we think a strengthening macro backdrop may support modestly higher yields.

The bond bull market, unleashed after former U.S. Federal Reserve (the Fed) Chairman Paul Volcker broke the back of inflation in the early 1980s, pushed U.S. interest rates to record lows in 2016. Over the course of that multi-year rally, there were several head fakes when 10-year yields rose 200

basis points or more over several quarters. Those shocks proved temporary, and the long-term trend remained intact as rates reversed and eventually made new lows. After printing an all-time closing low of 1.36% in mid-2016, the U.S. 10-year yield has risen more than 100 basis points, causing investors to question whether this is the end or just another shock. A mix of economic indicators and the potential for significant pro-business legislation in the U.S. lead us to believe the low in U.S. interest rates is most likely behind us.

The threat of global deflation has diminished during the past few quarters. Two of the world’s largest economies, the aggregate Euro Zone countries and Japan, appear to have emerged from price deflation. Euro zone headline inflation has steadily risen from negative territory last April to positive 1.1% in Decembers3. In Japan, the Bank of Japan is determined to reach a 2.0% inflation target and has made some progress recently4. The latest read on headline inflation in Japan indicated a 0.50% rise in November, which is a significant increase relative to the (0.50)% decline last September. China’s economy has been slowing, but at a moderate enough pace to keep fears of a hard landing and deflationary impulse at bay. Headline inflation in China is just above the 2.0% threshold and has risen over the past three months5. The rally in oil prices began to support inflation indicators toward the end of 2016 and provides some evidence that reflation is beginning to take hold. The real rate of interest, the nominal bond yield minus the year-over-year percentage change of headline inflation, declined throughout the multi-decade U.S. Treasury bond rally, along with the absolute level of rates and inflation. During the 35-year bull market, the 10-year real rate averaged 3.10%, but it averaged only 0.77% over the past 5 years6. With inflation slowly picking up, it seems likely that nominal yields can continue moving higher to provide a real rate more in sync with the long-term average, but the transition will likely be slow and uneven.

Domestic economic fundamentals and expectations provide further evidence that modestly-higher bond yields can be sustained in the years ahead. By most standards, the U.S. economy is at or very close to full employment and core personal consumption expenditures, the Fed’s chosen inflation measure, is fairly close to target.

The pace of fed funds rate hikes will likely increase from one hike in 2016 to two hikes in 2017, based on the continued progress of those indicators. Although speculation until signed into law, corporate tax cuts and fiscal stimulus at full employment could put additional upward pressure on inflation, but probably not until 2018. With inflation expected to pick up over the long term, it is reasonable to assume that a greater inflation premium than seen in recent years could be priced into bond yields. However, we believe a majority of the adjustment has already been built in to U.S. Treasury yields and expect the 10-year to rise by less than 20 basis points during 2017.

Ultimately, the performance of most fixed-income asset classes will depend on the pace at which U.S. Treasury yields rise; we do not believe fundamentals dictate a sharp rise in 2017. Economic developments over recent months have been credit-positive, as slightly higher inflation and decent GDP growth are set to boost top-line revenue, though the rise in yields has partially offset those positive trends. U.S. high-yield credit stands to benefit the most from a modest cyclical pickup and further credit repair within the energy sector, which should keep a lid on default rates. U.S. high-yield loans, which have floating interest rates and zero duration, also stand to benefit from an improving economic backdrop and are uniquely isolated from rising rates. In addition to higher GDP growth, U.S. corporate profits have resumed year-over-year growth and we expect that to continue in future quarters, an important tailwind for corporate credit.

| 1 | Prior to October 1, 2016, the Fund was known as AMG Managers Bond Fund. |

| 2 | Prior to October 1, 2016, the Fund’s Class S shares were known as Service Class shares. |

| 4 | Japanese Ministry of Internal Affairs and Communications |

| 5 | National Bureau of Statistics of China |

This commentary reflects the viewpoints of the portfolio manager, Loomis, Sayles & Company, as of December 31, 2016 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

AMG Managers Loomis Sayles Bond Fund

Portfolio Manager’s Comments (continued)

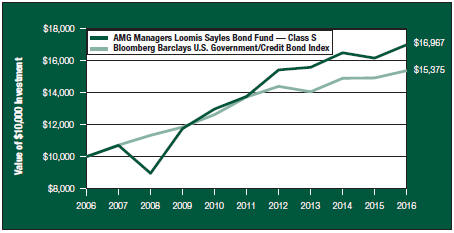

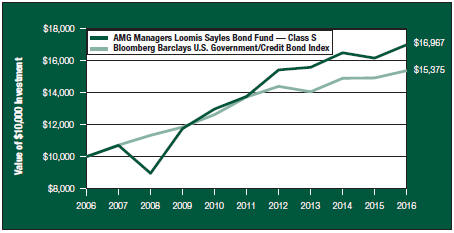

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Managers Loomis Sayles Bond Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG Managers Loomis Sayles Bond Fund Class S (formerly Service Class) on December 31, 2006, to a $10,000 investment made in the Bloomberg Barclays U.S. Government/Credit Bond Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Managers Loomis Sayles Bond Fund and the Bloomberg Barclays U.S. Government/Credit Bond Index for the same time periods ended December 31, 2016.

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date | |

AMG Managers Loomis Sayles Bond Fund 2,3,4,5,6,7 | | | | | |

Class S8 | | | 5.15 | % | | | 4.27 | % | | | 5.43 | % | | | 8.25 | % | | | 6/01/84 | |

Class I8,9 | | | 5.29 | % | | | — | | | | — | | | | 2.24 | % | | | 4/01/13 | |

Bloomberg Barclays U.S. Government/Credit Bond Index10 | | | 3.05 | % | | | 2.29 | % | | | 4.40 | % | | | 7.46 | % | | | 5/31/84 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2016. All returns are in U.S. dollars($). |

| 2 | From time to time, the Fund’s advisor has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtor’s ability to pay its creditors. Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed income securities to fall. |

| 4 | To the extent that the Fund invests in asset-backed or mortgage-backed securities, its exposure to prepayment and extension risks may be greater than investments in other fixed income securities. |

| 5 | The Fund may invest in derivatives such as options and futures; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

| 6 | High-yield bonds (also known as “junk bonds”) may be subject to greater levels of interest rate, credit, and liquidity risk than investments in higher rated securities. These securities are considered predominantly speculative with respect to the issuer’s continuing ability to make principal and interest payments. The issuers of the Fund’s holdings may be involved in bankruptcy proceedings, reorganizations, or financial restructurings, and are not as strong financially as higher-rated issuers. |

| 7 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| 8 | Effective October 1, 2016, the Service Class and Institutional Class of AMG Managers Loomis Sayles Bond Fund were renamed Class S and Class I, respectively. |

| 9 | Commenced operations April 1, 2013. |

| 10 | The Bloomberg Barclays U.S. Government/Credit Bond Index is an index of investment-grade government and corporate bonds with a maturity rate of more than one year. Effective August 24, 2016, the Barclays Indices were renamed Bloomberg Barclays Indices. Unlike the Fund, the Bloomberg Barclays U.S. Government/Credit Bond Index is unmanaged, is not available for investment, and does not incur expenses. |

Not FDIC insured, nor bank guaranteed. May lose value.

AMG Managers Loomis Sayles Bond Fund

Fund Snapshots (unaudited)

December 31, 2016

PORTFOLIO BREAKDOWN

| | | | |

Category | | AMG Managers

Loomis Sayles

Bond Fund* | |

Corporate Bonds and Notes | | | 70.1 | % |

U.S. Government and Agency Obligations | | | 11.3 | % |

Foreign Government Obligations | | | 7.3 | % |

Asset-Backed Securities | | | 4.9 | % |

Municipal Bonds | | | 0.8 | % |

Preferred Stocks | | | 0.7 | % |

Mortgage-Backed Securities | | | 0.5 | % |

Other Assets and Liabilities | | | 4.4 | % |

| * | As a percentage of net assets. |

| | | | |

Rating | | AMG Managers

Loomis Sayles

Bond Fund*** | |

U.S. Government and Agency Obligations | | | 11.7 | % |

Aaa | | | 3.9 | % |

Aa | | | 1.3 | % |

A | | | 19.9 | % |

Baa | | | 52.6 | % |

Ba & lower | | | 10.3 | % |

N/R | | | 0.3 | % |

| *** | As a percentage of market value of fixed-income securities and preferred stocks. |

TOP TEN HOLDINGS

| | | | |

Security Name | | %of

Net Assets | |

U.S. Treasury Notes, 0.625%, 09/30/17** | | | 7.5 | % |

Ford Motor Credit Co. LLC, GMTN, 4.389%, 01/08/26** | | | 3.4 | |

U.S. Treasury Bills, 0.595%, 06/22/17 | | | 2.5 | |

U.S. Treasury Notes, 0.750%, 09/30/18 | | | 2.3 | |

Bank of America Corp., 6.110%, 01/29/37** | | | 2.2 | |

Shenton Aircraft Investment I, Ltd., Series 2015-1A, Class A, 4.750%, 10/15/42** | | | 2.2 | |

Mexican Bonos Bonds, Series M 20, 10.000%, 12/05/24** | | | 2.1 | |

EQT Corp., 6.500%, 04/01/18 | | | 1.9 | |

AT&T, Inc., 4.125%, 02/17/26** | | | 1.8 | |

ONEOK Partners, L.P., 4.900%, 03/15/25** | | | 1.5 | |

| | | | |

Top Ten as a Group | | | 27.4 | % |

| | | | |

| ** | Top Ten Holdings as of June 30, 2016. |

Credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service, Inc. (“Moody’s”). These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

AMG Managers Loomis Sayles Bond Fund

Schedule of Portfolio Investments

December 31, 2016

| | | | | | | | | | | | |

| | | | | | Principal Amount† | | | Value | |

Asset-Backed Securities - 4.9% | | | | | | | | | | | | |

FAN Engine Securitization, Ltd., Series 2013-1A, Class 1A, 4.625%, 10/15/43 (a)2 | | | | | | $ | 12,044,872 | | | $ | 11,906,356 | |

John Deere Owner Trust 2015, | | | | | | | | | | | | |

Series 2015-A, Class A3, 1.320%, 06/17/19 | | | | | | | 10,065,000 | | | | 10,067,548 | |

Series 2015-A, Class A4, 1.650%, 12/15/21 | | | | | | | 3,980,000 | | | | 3,989,995 | |

Rise, Ltd., Series 2014-1, Class A, 4.750%, 02/15/392,3 | | | | | | | 19,228,505 | | | | 18,843,935 | |

Shenton Aircraft Investment I, Ltd., Series 2015-1A, Class A, 4.750%, 10/15/42 (a) | | | | | | | 43,830,597 | | | | 44,036,662 | |

Trinity Rail Leasing, L.P., | | | | | | | | | | | | |

Series 2009-1A, Class A, 6.657%, 11/16/39 (a) | | | | | | | 3,619,490 | | | | 3,759,267 | |

Series 2012-1A, Class A1, 2.266%, 01/15/43 (a) | | | | | | | 2,041,382 | | | | 1,951,491 | |

Trip Rail Master Funding LLC, Series 2011-1A, Class A1A, 4.370%, 07/15/41 (a) | | | | | | | 4,288,564 | | | | 4,332,092 | |

Total Asset-Backed Securities (cost $98,671,568) | | | | | | | | | | | 98,887,346 | |

Corporate Bonds and Notes - 70.1% | | | | | | | | | | | | |

Financials - 26.3% | | | | | | | | | | | | |

Ally Financial, Inc., | | | | | | | | | | | | |

4.125%, 02/13/22 | | | | | | | 7,915,000 | | | | 7,845,744 | |

8.000%, 11/01/31 | | | | | | | 1,267,000 | | | | 1,469,618 | |

Alta Wind Holdings LLC, 7.000%, 06/30/35 (a) | | | | | | | 6,169,945 | | | | 6,731,867 | |

American International Group, Inc., 4.875%, 06/01/22 | | | | | | | 560,000 | | | | 611,954 | |

Bank of America Corp., | | | | | | | | | | | | |

6.110%, 01/29/37 | | | | | | | 38,050,000 | | | | 44,605,863 | |

EMTN, 4.625%, 09/14/18 | | | EUR | | | | 1,750,000 | | | | 1,980,404 | |

MTN, 4.250%, 10/22/26 | | | | | | | 2,610,000 | | | | 2,641,597 | |

MTN, Series C, 6.050%, 06/01/34 | | | | | | | 22,100,000 | | | | 24,713,656 | |

Camden Property Trust, 5.700%, 05/15/17 | | | | | | | 5,205,000 | | | | 5,282,534 | |

Citigroup, Inc., | | | | | | | | | | | | |

5.130%, 11/12/19 | | | NZD | | | | 5,835,000 | | | | 4,166,171 | |

6.250%, 06/29/17 | | | NZD | | | | 37,108,000 | | | | 26,154,660 | |

Cooperatieve Centrale Raiffeisen-Boerenleenbank, | | | | | | | | | | | | |

1.700%, 03/19/18 | | | | | | | 2,000,000 | | | | 2,000,176 | |

3.875%, 02/08/22 | | | | | | | 9,090,000 | | | | 9,597,349 | |

3.950%, 11/09/22 | | | | | | | 2,190,000 | | | | 2,252,895 | |

Duke Realty, L.P., 6.500%, 01/15/18 | | | | | | | 4,660,000 | | | | 4,878,573 | |

Equifax, Inc., 7.000%, 07/01/37 | | | | | | | 4,421,000 | | | | 5,339,476 | |

First Industrial, L.P., 5.950%, 05/15/17 | | | | | | | 15,000,000 | | | | 15,229,365 | |

General Electric Capital Corp., | | | | | | | | | | | | |

GMTN, 4.250%, 01/17/18 | | | NZD | | | | 5,010,000 | | | | 3,520,069 | |

GMTN, 5.500%, 02/01/17 | | | NZD | | | | 6,250,000 | | | | 4,351,806 | |

The Goldman Sachs Group, Inc., | | | | | | | | | | | | |

6.750%, 10/01/37 | | | | | | | 14,590,000 | | | | 18,016,418 | |

| | |

| | | |

| The accompanying notes are an integral part of these financial statements. |

|

| 7 |

AMG Managers Loomis Sayles Bond Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | | | | | |

| | | | | | Principal Amount† | | | Value | |

Financials - 26.3% (continued) | | | | | | | | | | | | |

MPLE, 3.375%, 02/01/18 | | | CAD | | | | 1,700,000 | | | $ | 1,292,881 | |

Highwoods Realty, L.P., | | | | | | | | | | | | |

5.850%, 03/15/17 | | | | | | | 3,680,000 | | | | 3,711,114 | |

7.500%, 04/15/18 | | | | | | | 2,405,000 | | | | 2,565,873 | |

ICICI Bank, Ltd., 6.375%, 04/30/22 (a)3 | | | | | | | 900,000 | | | | 902,217 | |

Jefferies Group LLC, 5.125%, 01/20/23 | | | | | | | 8,800,000 | | | | 9,209,561 | |

JPMorgan Chase & Co., | | | | | | | | | | | | |

4.125%, 12/15/26 | | | | | | | 14,350,000 | | | | 14,646,414 | |

4.250%, 11/02/18 | | | NZD | | | | 7,360,000 | | | | 5,171,762 | |

EMTN, 0.816%, 05/30/173 | | | GBP | | | | 1,500,000 | | | | 1,845,121 | |

Lloyds Banking Group PLC, | | | | | | | | | | | | |

4.500%, 11/04/24 | | | | | | | 18,500,000 | | | | 18,826,507 | |

4.582%, 12/10/25 | | | | | | | 20,972,000 | | | | 21,073,379 | |

Marsh & McLennan Cos., Inc., 5.875%, 08/01/33 | | | | | | | 8,295,000 | | | | 9,832,652 | |

MBIA Insurance Corp., 12.140%, 01/15/33 (01/17/17) (a) | | | | | | | 525,000 | | | | 241,500 | |

Morgan Stanley, | | | | | | | | | | | | |

GMTN, 3.750%, 02/25/23 | | | | | | | 17,265,000 | | | | 17,733,641 | |

GMTN, 4.350%, 09/08/26 | | | | | | | 5,000,000 | | | | 5,123,740 | |

GMTN, 8.000%, 05/09/17 | | | AUD | | | | 8,100,000 | | | | 5,949,900 | |

MTN, 4.100%, 05/22/23 | | | | | | | 12,910,000 | | | | 13,252,399 | |

MTN, 6.250%, 08/09/26 | | | | | | | 11,000,000 | | | | 13,145,682 | |

Mutual of Omaha Insurance Co., 6.800%, 06/15/36 (a) | | | | | | | 13,925,000 | | | | 16,587,293 | |

National City Bank of Indiana, 4.250%, 07/01/18 | | | | | | | 6,310,000 | | | | 6,518,590 | |

National City Corp., 6.875%, 05/15/19 | | | | | | | 1,905,000 | | | | 2,096,805 | |

National Life Insurance Co., 10.500%, 09/15/39 (a)2 | | | | | | | 5,000,000 | | | | 7,457,725 | |

Navient Corp., 5.500%, 01/25/23 | | | | | | | 18,070,000 | | | | 17,527,900 | |

Old Republic International Corp., | | | | | | | | | | | | |

3.750%, 03/15/185 | | | | | | | 15,805,000 | | | | 19,776,006 | |

4.875%, 10/01/24 | | | | | | | 4,915,000 | | | | 5,120,963 | |

The Penn Mutual Life Insurance Co., 7.625%, 06/15/40 (a) | | | | | | | 8,885,000 | | | | 10,985,112 | |

Quicken Loans, Inc., 5.750%, 05/01/25 (a) | | | | | | | 3,895,000 | | | | 3,787,888 | |

Realty Income Corp., 5.750%, 01/15/21 | | | | | | | 2,125,000 | | | | 2,357,182 | |

Royal Bank of Scotland Group PLC, 6.125%, 12/15/22 | | | | | | | 4,650,000 | | | | 4,944,498 | |

Santander Issuances SAU, 5.179%, 11/19/25 | | | | | | | 27,800,000 | | | | 28,061,403 | |

Societe Generale, S.A., | | | | | | | | | | | | |

4.750%, 11/24/25 (a) | | | | | | | 11,000,000 | | | | 11,065,318 | |

5.200%, 04/15/21 (a) | | | | | | | 7,000,000 | | | | 7,684,775 | |

Springleaf Finance Corp., | | | | | | | | | | | | |

5.250%, 12/15/19 | | | | | | | 12,890,000 | | | | 12,986,675 | |

8.250%, 10/01/23 | | | | | | | 11,505,000 | | | | 12,022,725 | |

| | |

| | | |

| The accompanying notes are an integral part of these financial statements. |

|

| 8 |

AMG Managers Loomis Sayles Bond Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | | | | | |

| | | | | | Principal Amount† | | | Value | |

Financials - 26.3% (continued) | | | | | | | | | | | | |

Weyerhaeuser Co., | | | | | | | | | | | | |

6.875%, 12/15/33 | | | | | | $ | 12,890,000 | | | $ | 15,675,864 | |

7.375%, 10/01/19 | | | | | | | 3,915,000 | | | | 4,394,924 | |

7.375%, 03/15/32 | | | | | | | 1,930,000 | | | | 2,444,092 | |

Total Financials | | | | | | | | | | | 527,410,276 | |

Industrials - 40.5% | | | | | | | | | | | | |

Alcatel-Lucent USA, Inc., 6.500%, 01/15/28 | | | | | | | 305,000 | | | | 314,912 | |

America Movil SAB de CV, 6.450%, 12/05/22 | | | MXN | | | | 169,300,000 | | | | 7,401,385 | |

American Airlines 2013-1 Class A Pass Through Trust, 4.000%, 07/15/25 | | | | | | | 2,041,173 | | | | 2,102,408 | |

American Airlines 2016-1 Class B Pass Through Trust, Series B, 5.250%, 01/15/24 | | | | | | | 24,142,454 | | | | 24,746,015 | |

American Airlines 2016-2 Class B Pass Through Trust, 4.375%, 06/15/24 (a) | | | | | | | 25,000,000 | | | | 24,750,000 | |

APL, Ltd., 8.000%, 01/15/242 | | | | | | | 250,000 | | | | 161,563 | |

ArcelorMittal, | | | | | | | | | | | | |

7.750%, 03/01/41 (b)4 | | | | | | | 11,065,000 | | | | 11,784,225 | |

8.000%, 10/15/39 (b) | | | | | | | 6,604,000 | | | | 7,246,833 | |

AT&T, Inc., | | | | | | | | | | | | |

3.400%, 05/15/25 | | | | | | | 13,530,000 | | | | 13,040,525 | |

3.950%, 01/15/25 | | | | | | | 4,345,000 | | | | 4,352,526 | |

4.125%, 02/17/26 | | | | | | | 35,605,000 | | | | 36,052,412 | |

CenturyLink, Inc., | | | | | | | | | | | | |

Series P, 7.600%, 09/15/39 | | | | | | | 9,335,000 | | | | 8,144,788 | |

Series S, 6.450%, 06/15/21 | | | | | | | 13,395,000 | | | | 14,098,238 | |

Chesapeake Energy Corp., | | | | | | | | | | | | |

2.500%, 05/15/375 | | | | | | | 453,000 | | | | 454,699 | |

6.625%, 08/15/20 | | | | | | | 55,000 | | | | 55,550 | |

6.875%, 11/15/20 | | | | | | | 85,000 | | | | 85,000 | |

Choice Hotels International, Inc., 5.700%, 08/28/20 | | | | | | | 11,900,000 | | | | 12,822,250 | |

Continental Airlines, Inc., | | | | | | | | | | | | |

1999-1 Class B Pass Through Trust, Series 991B, 6.795%, 08/02/18 | | | | | | | 2,740 | | | | 2,815 | |

2000-1 Class A-1 Pass Through Trust, Series 00A1, 8.048%, 11/01/20 | | | | | | | 43,934 | | | | 48,821 | |

2007-1 Class A Pass Through Trust, Series 071A, 5.983%, 04/19/224 | | | | | | | 13,681,930 | | | | 15,118,532 | |

2007-1 Class B Pass Through Trust, Series 071B, 6.903%, 04/19/22 | | | | | | | 2,761,861 | | | | 2,890,563 | |

Continental Resources, Inc., | | | | | | | | | | | | |

3.800%, 06/01/24 | | | | | | | 2,025,000 | | | | 1,868,063 | |

4.500%, 04/15/23 | | | | | | | 385,000 | | | | 377,300 | |

Corning, Inc., | | | | | | | | | | | | |

6.850%, 03/01/294 | | | | | | | 9,142,000 | | | | 11,071,876 | |

7.250%, 08/15/36 | | | | | | | 1,185,000 | | | | 1,399,102 | |

Cox Communications, Inc., 4.800%, 02/01/35 (a) | | | | | | | 3,369,000 | | | | 3,138,143 | |

| | |

| | | |

| The accompanying notes are an integral part of these financial statements. |

|

| 9 |

AMG Managers Loomis Sayles Bond Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | | | | | |

| | | | | | Principal Amount† | | | Value | |

Industrials - 40.5% (continued) | | | | | | | | | | | | |

Cummins, Inc., 5.650%, 03/01/98 | | | | | | $ | 6,460,000 | | | $ | 6,666,571 | |

Darden Restaurants, Inc., 6.000%, 08/15/35 | | | | | | | 2,635,000 | | | | 2,716,569 | |

Delta Air Lines, Inc., 2007-1 Class B Pass Through Trust, Series 071B, 8.021%, 08/10/22 | | | | | | | 6,737,190 | | | | 7,739,683 | |

Devon Energy Corp., | | | | | | | | | | | | |

3.250%, 05/15/224 | | | | | | | 5,256,000 | | | | 5,222,651 | |

5.850%, 12/15/254 | | | | | | | 5,694,000 | | | | 6,469,164 | |

Diamond 1 Finance Corp. / Diamond 2 Finance Corp., | | | | | | | | | | | | |

6.020%, 06/15/26 (a) | | | | | | | 3,270,000 | | | | 3,542,378 | |

8.100%, 07/15/36 (a) | | | | | | | 5,470,000 | | | | 6,507,014 | |

8.350%, 07/15/46 (a) | | | | | | | 2,990,000 | | | | 3,681,551 | |

Dillard’s, Inc., 7.000%, 12/01/28 | | | | | | | 225,000 | | | | 252,000 | |

Embarq Corp., 7.995%, 06/01/36 | | | | | | | 5,830,000 | | | | 5,465,625 | |

Enbridge Energy Partners L.P., | | | | | | | | | | | | |

5.875%, 10/15/254 | | | | | | | 6,145,000 | | | | 6,851,183 | |

7.375%, 10/15/45 | | | | | | | 4,595,000 | | | | 5,699,390 | |

Enterprise Products Operating LLC, | | | | | | | | | | | | |

3.900%, 02/15/24 | | | | | | | 6,400,000 | | | | 6,600,806 | |

4.050%, 02/15/22 | | | | | | | 2,219,000 | | | | 2,339,232 | |

EQT Corp., 6.500%, 04/01/18 | | | | | | | 35,420,000 | | | | 37,292,230 | |

ERAC USA Finance LLC, | | | | | | | | | | | | |

6.375%, 10/15/17 (a) | | | | | | | 4,910,000 | | | | 5,087,472 | |

6.700%, 06/01/34 (a) | | | | | | | 1,250,000 | | | | 1,515,959 | |

7.000%, 10/15/37 (a) | | | | | | | 19,033,000 | | | | 24,115,877 | |

Foot Locker, Inc., 8.500%, 01/15/22 | | | | | | | 570,000 | | | | 671,346 | |

Ford Motor Co., 6.375%, 02/01/29 | | | | | | | 1,990,000 | | | | 2,269,939 | |

Ford Motor Credit Co. LLC, GMTN, 4.389%, 01/08/26 | | | | | | | 68,075,000 | | | | 68,992,311 | |

General Motors Co., | | | | | | | | | | | | |

5.200%, 04/01/45 | | | | | | | 1,030,000 | | | | 992,829 | |

6.750%, 04/01/46 | | | | | | | 1,730,000 | | | | 2,028,754 | |

General Motors Financial Co., Inc., 5.250%, 03/01/26 | | | | | | | 9,680,000 | | | | 10,168,753 | |

Georgia-Pacific LLC, 5.400%, 11/01/20 (a) | | | | | | | 5,175,000 | | | | 5,689,286 | |

HCA, Inc., | | | | | | | | | | | | |

4.500%, 02/15/27 | | | | | | | 3,040,000 | | | | 2,986,800 | |

7.500%, 11/06/33 | | | | | | | 75,000 | | | | 79,500 | |

Hewlett Packard Enterprise Co., 6.350%, 10/15/45 (b) | | | | | | | 2,243,000 | | | | 2,261,967 | |

Intel Corp., 3.250%, 08/01/395 | | | | | | | 11,615,000 | | | | 20,478,697 | |

INVISTA Finance LLC, 4.250%, 10/15/19 (a) | | | | | | | 14,000,000 | | | | 13,879,530 | |

Kinder Morgan Energy Partners, L.P., | | | | | | | | | | | | |

3.500%, 09/01/23 | | | | | | | 6,685,000 | | | | 6,593,416 | |

| | |

| | | |

| The accompanying notes are an integral part of these financial statements. |

|

| 10 |

AMG Managers Loomis Sayles Bond Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | | | | | |

| | | | | | Principal Amount† | | | Value | |

Industrials - 40.5% (continued) | | | | | | | | | | | | |

4.150%, 03/01/22 | | | | | | $ | 5,620,000 | | | $ | 5,766,738 | |

4.150%, 02/01/24 | | | | | | | 14,000,000 | | | | 14,191,058 | |

5.300%, 09/15/20 | | | | | | | 1,415,000 | | | | 1,519,890 | |

5.800%, 03/01/21 | | | | | | | 4,320,000 | | | | 4,734,236 | |

KLA-Tencor Corp., 5.650%, 11/01/34 | | | | | | | 4,590,000 | | | | 4,795,031 | |

Macy’s Retail Holdings, Inc., 4.500%, 12/15/34 | | | | | | | 170,000 | | | | 151,970 | |

Marks & Spencer PLC, 7.125%, 12/01/37 (a) | | | | | | | 4,725,000 | | | | 5,425,018 | |

Masco Corp., | | | | | | | | | | | | |

6.500%, 08/15/32 | | | | | | | 955,000 | | | | 1,035,812 | |

7.125%, 03/15/20 | | | | | | | 6,315,000 | | | | 7,104,375 | |

7.750%, 08/01/29 | | | | | | | 1,070,000 | | | | 1,309,529 | |

MeadWestvaco Corp., 7.550%, 03/01/472 | | | | | | | 970,000 | | | | 1,144,233 | |

Methanex Corp., 5.250%, 03/01/22 | | | | | | | 350,000 | | | | 360,964 | |

Missouri Pacific Railroad Co., 5.000%, 01/01/452 | | | | | | | 825,000 | | | | 748,673 | |

New Albertsons, Inc., | | | | | | | | | | | | |

7.450%, 08/01/29 | | | | | | | 3,195,000 | | | | 3,019,275 | |

7.750%, 06/15/26 | | | | | | | 915,000 | | | | 905,850 | |

MTN, Series C, 6.625%, 06/01/28 | | | | | | | 1,015,000 | | | | 908,425 | |

Newell Rubbermaid, Inc., 4.000%, 12/01/24 | | | | | | | 3,085,000 | | | | 3,155,147 | |

Newfield Exploration Co., 5.625%, 07/01/24 | | | | | | | 6,320,000 | | | | 6,588,600 | |

Noble Energy, Inc., 3.900%, 11/15/244 | | | | | | | 3,670,000 | | | | 3,697,969 | |

ONEOK Partners, L.P., | | | | | | | | | | | | |

4.900%, 03/15/25 | | | | | | | 28,736,000 | | | | 30,822,808 | |

6.200%, 09/15/43 | | | | | | | 245,000 | | | | 272,404 | |

Owens Corning, 7.000%, 12/01/36 | | | | | | | 4,685,000 | | | | 5,554,789 | |

Panhandle Eastern Pipe Line Co., L.P., | | | | | | | | | | | | |

6.200%, 11/01/17 | | | | | | | 5,520,000 | | | | 5,680,902 | |

7.000%, 06/15/18 | | | | | | | 26,505,000 | | | | 27,961,026 | |

Petrobras Global Finance BV, 5.625%, 05/20/43 | | | | | | | 580,000 | | | | 428,736 | |

Plains All American Pipeline, L.P. / PAA Finance Corp, | | | | | | | | | | | | |

6.125%, 01/15/17 | | | | | | | 1,770,000 | | | | 1,772,161 | |

6.500%, 05/01/18 | | | | | | | 8,975,000 | | | | 9,484,511 | |

Portugal Telecom International Finance, B.V., EMTN, 4.500%, 06/16/2511 | | | EUR | | | | 500,000 | | | | 159,001 | |

The Priceline Group, Inc., 0.900%, 09/15/214,5 | | | | | | | 11,970,000 | | | | 12,643,312 | |

PulteGroup, Inc., | | | | | | | | | | | | |

6.000%, 02/15/35 | | | | | | | 8,860,000 | | | | 8,505,600 | |

6.375%, 05/15/33 | | | | | | | 5,135,000 | | | | 5,122,162 | |

Qwest Capital Funding, Inc., | | | | | | | | | | | | |

6.500%, 11/15/18 | | | | | | | 620,000 | | | | 657,975 | |

| | |

| | | |

| The accompanying notes are an integral part of these financial statements. |

|

| 11 |

AMG Managers Loomis Sayles Bond Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | | | | | |

| | | | | | Principal Amount† | | | Value | |

Industrials - 40.5% (continued) | | | | | | | | | | | | |

6.875%, 07/15/28 | | | | | | $ | 1,190,000 | | | $ | 1,079,925 | |

7.625%, 08/03/21 | | | | | | | 2,135,000 | | | | 2,209,725 | |

Qwest Corp., | | | | | | | | | | | | |

6.875%, 09/15/33 | | | | | | | 6,161,000 | | | | 5,882,591 | |

7.250%, 09/15/25 | | | | | | | 1,185,000 | | | | 1,271,205 | |

7.250%, 10/15/35 | | | | | | | 2,165,000 | | | | 2,050,158 | |

Regency Energy Partners L.P. / Regency Energy Finance Corp., 4.500%, 11/01/23 | | | | | | | 700,000 | | | | 710,308 | |

Reliance Holdings USA, Inc., 5.400%, 02/14/22 (a) | | | | | | | 3,250,000 | | | | 3,513,582 | |

Rowan Cos., Inc., 7.875%, 08/01/194 | | | | | | | 993,000 | | | | 1,089,818 | |

Samsung Electronics Co., Ltd., 7.700%, 10/01/27 (a) | | | | | | | 2,420,000 | | | | 2,968,687 | |

Sealed Air Corp., 5.500%, 09/15/25 (a) | | | | | | | 1,580,000 | | | | 1,631,350 | |

Telecom Italia Capital, S.A., | | | | | | | | | | | | |

6.000%, 09/30/34 | | | | | | | 5,965,000 | | | | 5,517,625 | |

6.375%, 11/15/33 | | | | | | | 4,865,000 | | | | 4,646,075 | |

Telefonica Emisiones SAU, 4.570%, 04/27/23 | | | | | | | 900,000 | | | | 944,219 | |

Telekom Malaysia Bhd, 7.875%, 08/01/25 (a) | | | | | | | 250,000 | | | | 313,518 | |

Texas Eastern Transmission, L.P., 6.000%, 09/15/17 (a) | | | | | | | 3,000,000 | | | | 3,088,608 | |

Time Warner Cable, Inc., 5.500%, 09/01/41 | | | | | | | 805,000 | | | | 818,372 | |

The Toro Co., 6.625%, 05/01/372 | | | | | | | 6,810,000 | | | | 7,469,051 | |

Transcontinental Gas Pipe Line Co. LLC, 7.850%, 02/01/26 (a) | | | | | | | 15,140,000 | | | | 19,091,025 | |

Transocean, Inc., 7.375%, 04/15/184 | | | | | | | 500,000 | | | | 507,500 | |

UAL 2007-1 Pass Through Trust, Series 071A, 6.636%, 07/02/22 | | | | | | | 10,552,274 | | | | 11,370,076 | |

United Airlines 2014-1 Class A Pass Through Trust, Series A, 4.000%, 04/11/26 | | | | | | | 8,456,585 | | | | 8,625,717 | |

United States Steel Corp., 6.650%, 06/01/37 | | | | | | | 3,595,000 | | | | 3,100,688 | |

US Airways 2011-1 Class A Pass Through Trust, Series A, 7.125%, 10/22/23 | | | | | | | 2,674,803 | | | | 3,076,023 | |

Vale Overseas, Ltd., 6.875%, 11/21/36 | | | | | | | 3,665,000 | | | | 3,610,025 | |

Verizon Communications, Inc., | | | | | | | | | | | | |

3.500%, 11/01/24 | | | | | | | 27,900,000 | | | | 27,810,497 | |

4.862%, 08/21/46 | | | | | | | 25,890,000 | | | | 26,234,182 | |

Viacom, Inc., 4.850%, 12/15/34 | | | | | | | 1,725,000 | | | | 1,537,789 | |

Virgin Australia 2013-1A Trust, 5.000%, 10/23/23 (a) | | | | | | | 1,003,103 | | | | 1,048,242 | |

Western Digital Corp., 7.375%, 04/01/23 (a) | | | | | | | 5,845,000 | | | | 6,429,500 | |

Total Industrials | | | | | | | | | | | 811,661,288 | |

Utilities - 3.3% | | | | | | | | | | | | |

Abu Dhabi National Energy Co. PJSC, 7.250%, 08/01/18 (a) | | | | | | | 21,130,000 | | | | 22,716,102 | |

Allegheny Energy Supply Co. LLC, 6.750%, 10/15/39 (a)4 | | | | | | | 3,285,000 | | | | 2,956,500 | |

Bruce Mansfield Unit 1 2007 Pass Through Trust, 6.850%, 06/01/342 | | | | | | | 7,509,632 | | | | 2,252,890 | |

DCP Midstream LLC, 6.450%, 11/03/36 (a) | | | | | | | 870,000 | | | | 870,000 | |

EDP Finance, B.V., 4.900%, 10/01/19 (a) | | | | | | | 600,000 | | | | 628,730 | |

Empresa Nacional de Electricidad S.A., 7.875%, 02/01/27 | | | | | | | 2,900,000 | | | | 3,637,667 | |

| | |

| | | |

| The accompanying notes are an integral part of these financial statements. |

|

| 12 |

AMG Managers Loomis Sayles Bond Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | | | | | |

| | | | | | Principal Amount† | | | Value | |

Utilities - 3.3% (continued) | | | | | | | | | | | | |

Enel Finance International N.V., | | | | | | | | | | | | |

5.125%, 10/07/19 (a) | | | | | | $ | 3,700,000 | | | $ | 3,955,204 | |

6.000%, 10/07/39 (a) | | | | | | | 18,382,000 | | | | 20,536,003 | |

EMTN, 5.750%, 09/14/40 | | | GBP | | | | 210,000 | | | | 341,961 | |

Mackinaw Power LLC, 6.296%, 10/31/23 (a)2 | | | | | | | 4,007,100 | | | | 4,250,295 | |

Nisource Finance Corp., 6.125%, 03/01/22 | | | | | | | 2,020,000 | | | | 2,329,599 | |

Tenaga Nasional Bhd, 7.500%, 11/01/25 (a) | | | | | | | 2,000,000 | | | | 2,488,202 | |

Total Utilities | | | | | | | | | | | 66,963,153 | |

Total Corporate Bonds and Notes (cost $1,305,271,425) | | | | | | | | | | | 1,406,034,717 | |

Foreign Government Obligations - 7.3% | | | | | | | | | | | | |

Brazilian Government International Bonds, | | | | | | | | | | | | |

8.500%, 01/05/24 | | | BRL | | | | 6,650,000 | | | | 1,787,799 | |

10.250%, 01/10/28 | | | BRL | | | | 5,750,000 | | | | 1,636,384 | |

Canadian Government Notes, | | | | | | | | | | | | |

0.250%, 05/01/17 | | | CAD | | | | 14,775,000 | | | | 10,994,013 | |

0.750%, 09/01/20 | | | CAD | | | | 15,225,000 | | | | 11,239,614 | |

European Investment Bank Bonds, 2.524%, 03/10/216 | | | AUD | | | | 5,000,000 | | | | 3,144,334 | |

Iceland Government International Notes, 5.875%, 05/11/22 (a) | | | | | | | 5,800,000 | | | | 6,615,248 | |

Inter-American Development Bank Bonds, EMTN, 6.000%, 12/15/17 | | | NZD | | | | 4,215,000 | | | | 3,022,143 | |

Mexican Bonos Bonds, | | | | | | | | | | | | |

Series M, 7.750%, 05/29/31 | | | MXN | | | | 49,000,000 | | | | 2,359,405 | |

Series M, 8.000%, 12/07/23 | | | MXN | | | | 122,500,000 | | | | 6,129,772 | |

Series M 20, 7.500%, 06/03/27 | | | MXN | | | | 111,000,000 | | | | 5,329,107 | |

Series M 20, 8.500%, 05/31/29 | | | MXN | | | | 36,000,000 | | | | 1,847,126 | |

Series M 20, 10.000%, 12/05/24 | | | MXN | | | | 761,500,000 | | | | 42,510,234 | |

New South Wales Treasury Corp. Notes, Series 18, 6.000%, 02/01/18 | | | AUD | | | | 19,850,000 | | | | 14,958,859 | |

New Zealand Government Notes, Series 319, 5.000%, 03/15/19 | | | NZD | | | | 14,845,000 | | | | 10,922,951 | |

Norway Government Bonds, | | | | | | | | | | | | |

Series 472, 4.250%, 05/19/17 (a) | | | NOK | | | | 13,230,000 | | | | 1,552,754 | |

Series 473, 4.500%, 05/22/19 (a) | | | NOK | | | | 18,955,000 | | | | 2,389,188 | |

Series 474, 3.750%, 05/25/21 (a) | | | NOK | | | | 13,210,000 | | | | 1,703,501 | |

Queensland Treasury Corp. Notes, 7.125%, 09/18/17 (a) | | | NZD | | | | 7,500,000 | | | | 5,378,797 | |

Saudi Government International Bond, | | | | | | | | | | | | |

2.375%, 10/26/21 (a) | | | | | | | 4,045,000 | | | | 3,927,436 | |

3.250%, 10/26/26 (a) | | | | | | | 8,995,000 | | | | 8,527,476 | |

Total Foreign Government Obligations (cost $197,641,171) | | | | | | | | | | | 145,976,141 | |

| | |

| | | |

| The accompanying notes are an integral part of these financial statements. |

|

| 13 |

AMG Managers Loomis Sayles Bond Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | | | | | |

| | | | | | Principal Amount† | | | Value | |

Mortgage-Backed Securities - 0.5% | | | | | | | | | | | | |

CDGJ Commercial Mortgage Trust, Series 2014-BXCH, Class C, 3.039%, 12/15/27 (01/15/17) (a)1 | | | | | | $ | 8,000,000 | | | $ | 7,969,885 | |

COMM Mortgage Trust, Series 2014-FL4, Class AR1, 2.404%, 05/13/31 (01/13/17) (a)1,2 | | | | | | | 668,728 | | | | 665,774 | |

Credit Suisse Commercial Mortgage Trust, Series 2007-C5, Class A4, 5.695%, 09/15/403 | | | | | | | 1,124,597 | | | | 1,140,669 | |

JPMorgan Chase Commercial Mortgage Securities Trust, Series 2007-LD11, Class A4, 5.753%, 06/15/493 | | | | | | | 65,434 | | | | 65,828 | |

WFRBS Commercial Mortgage Trust, Series 2011-C3, Class D, 5.640%, 03/15/44 (a)3 | | | | | | | 435,000 | | | | 446,808 | |

Total Mortgage-Backed Securities (cost $9,791,121) | | | | | | | | | | | 10,288,964 | |

Municipal Bonds - 0.8% | | | | | | | | | | | | |

Illinois State General Obligation, Series 2003, 5.100%, 06/01/33 | | | | | | | 1,070,000 | | | | 945,687 | |

Michigan Tobacco Settlement Finance Authority, Series 2006-A, 7.309%, 06/01/34 | | | | | | | 2,775,000 | | | | 2,554,804 | |

Virginia Tobacco Settlement Financing Corp., Series 2007 A-1, 6.706%, 06/01/46 | | | | | | | 16,290,000 | | | | 12,973,519 | |

Total Municipal Bonds (cost $19,493,067) | | | | | | | | | | | 16,474,010 | |

U.S. Government and Agency Obligations - 11.4% | | | | | | | | | | | | |

Federal Home Loan Mortgage Corporation - 0.0%# | | | | | | | | | | | | |

FHLMC Gold, 5.000%, 12/01/31 | | | | | | | 23,280 | | | | 25,430 | |

Federal National Mortgage Association - 0.1% | | | | | | | | | | | | |

FNMA, | | | | | | | | | | | | |

3.000%, 07/01/27 | | | | | | | 2,224,191 | | | | 2,287,627 | |

6.000%, 07/01/29 | | | | | | | 1,661 | | | | 1,898 | |

Total Federal National Mortgage Association | | | | | | | | | | | 2,289,525 | |

U.S. Treasury Obligations - 11.3% | | | | | | | | | | | | |

U.S. Treasury Notes, | | | | | | | | | | | | |

0.625%, 09/30/17 | | | | | | | 150,000,000 | | | | 149,789,100 | |

0.750%, 09/30/18 | | | | | | | 46,000,000 | | | | 45,689,132 | |

0.875%, 05/31/18 | | | | | | | 30,000,000 | | | | 29,941,410 | |

Total U.S. Treasury Obligations | | | | | | | | | | | 225,419,642 | |

Total U.S. Government and Agency Obligations (cost $228,265,874) | | | | | | | | | | | 227,734,597 | |

| | | |

Preferred Stocks - 0.7% | | | | | | | | | | | | |

| | | |

| | | | | | Shares | | | | |

Financials - 0.7% | | | | | | | | | | | | |

Arconic, Inc., 5.375% 10/01/175 | | | | | | | 98,605 | | | | 2,972,941 | |

Bank of America Corp., Series 3, 6.375% | | | | | | | 20,000 | | | | 500,600 | |

Bank of America Corp., Series L, 7.250%5 | | | | | | | 7,808 | | | | 9,110,374 | |

Navient Corp., 6.000%4 | | | | | | | 41,250 | | | | 915,956 | |

Total Financials | | | | | | | | | | | 13,499,871 | |

| | |

| | | |

| The accompanying notes are an integral part of these financial statements. |

|

| 14 |

AMG Managers Loomis Sayles Bond Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

Utilities - 0.0%# | | | | | | | | | | | | |

Entergy New Orleans, Inc., 4.750% | | | | | | | 482 | | | $ | 47,863 | |

Entergy New Orleans, Inc., 5.560% | | | | | | | 100 | | | | 10,000 | |

Wisconsin Electric Power Co., 3.600% | | | | | | | 3,946 | | | | 346,301 | |

Total Utilities | | | | | | | | | | | 404,164 | |

Total Preferred Stocks (cost $13,331,765) | | | | | | | | | | | 13,904,035 | |

| | | |

Short-Term Investments - 4.3% | | | | | | | | | | | | |

| | | |

| | | | | | Principal Amount | | | | |

Repurchase Agreements - 0.9%7 | | | | | | | | | | | | |

Citigroup Global Markets, Inc., dated 12/30/16, due 01/03/17, 0.530% total to be received $4,180,622 (collateralized by various U.S. Government Agency Obligations, 2.000% - 8.500%, 12/01/17 - 01/01/47, totaling $4,263,983) | | | | | | $ | 4,180,376 | | | | 4,180,376 | |

Daiwa Capital Markets America, dated 12/30/16, due 01/03/17, 0.520% total to be received $4,180,618 (collateralized by various U.S. Government Agency Obligations, 0.000% - 6.500%, 03/02/17 - 02/01/49, totaling $4,263,984) | | | | | | | 4,180,376 | | | | 4,180,376 | |

Merrill Lynch Pierce Fenner & Smith, Inc., dated 12/30/16, due 01/03/17, 0.500% total to be received $879,803 (collateralized by various U.S. Government Agency Obligations, 0.685% - 2.000%, 10/31/18 - 11/30/22, totaling $897,349) | | | | | | | 879,754 | | | | 879,754 | |

Nomura Securities International, Inc., dated 12/30/16, due 01/03/17, 0.500% total to be received $4,180,608 (collateralized by various U.S. Government Agency Obligations, 0.000% - 9.500%, 01/15/17 - 08/20/66, totaling $4,263,984) | | | | | | | 4,180,376 | | | | 4,180,376 | |

RBC Dominion Securities, Inc., dated 12/30/16, due 01/03/17, 0.520% total to be received $4,180,618 (collateralized by various U.S. Government Agency Obligations, 0.875% - 7.000%, 02/13/17 - 01/01/47, totaling $4,263,984) | | | | | | | 4,180,376 | | | | 4,180,376 | |

Total Repurchase Agreements | | | | | | | | | | | 17,601,258 | |

U.S. Treasury Bills - 2.5% | | | | | | | | | | | | |

U.S. Treasury Bills, 0.595%, 06/22/176 | | | | | | | 50,000,000 | | | | 49,853,750 | |

Total U.S. Treasury Bills | | | | | | | | | | | 49,853,750 | |

| | | |

| | | | | | Shares | | | | |

Other Investment Companies - 0.9%8 | | | | | | | | | | | | |

Dreyfus Government Cash Management Fund, Institutional Class Shares, 0.45% | | | | | | | 18,302,178 | | | | 18,302,178 | |

Total Other Investment Companies | | | | | | | | | | | 18,302,178 | |

Total Short-Term Investments

(cost $85,750,189) | | | | | | | | | | | 85,757,186 | |

Total Investments - 100.0% (cost $1,958,216,180) | | | | | | | | | | | 2,005,056,996 | |

Other Assets, less Liabilities - 0.0% | | | | | | | | | | | 953,902 | |

Net Assets - 100.0% | | | | | | | | | | $ | 2,006,010,898 | |

| | |

| | | |

| The accompanying notes are an integral part of these financial statements. |

|

| 15 |

AMG Managers Global Income Opportunity Fund

Portfolio Manager’s Comments (unaudited)

THE YEAR IN REVIEW

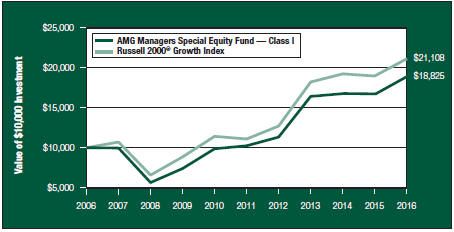

AMG Managers Global Income Opportunity Fund (Class S)1 (the “Fund”) returned 4.8% during the year ended December 31, 2016, compared with the 2.1% return for the Bloomberg Barclays Global Aggregate Index.

The overweight stance in corporate credit drove the positive relative return during the 12-month period. Market weakness in late 2015 and early 2016 was used as an opportunity to selectively add beaten down yet reasonably sound credits. This strategy helped to provide an additional boost to returns when market sentiment improved in February 2016, leading to solid out performance by corporate bonds compared to government issues throughout much of the period. Near the end of the period, we began to slowly reduce our overweight stance in corporates. Much of this reduction has been driven as much by bottom-up valuation review on an issuer-by-issuer basis and reductions or outright sales of issuers across many industry groups and quality grades.

Preference among U.S. corporate, namely banking, capital goods, communications and electric names, contributed positively. Selection among energy and basic industry names were also particularly advantageous as commodity prices rebounded throughout the year. Additionally, allocation to BBB-rated and high-yield corporate bonds also lifted results, as they generally outpaced higher-grade names. Hard currency Emerging Markets credits from Latin America particularly Colombia, Argentina, Brazil and Chileadded value due to progress on reforms and receding commodity headwinds.

Overweight allocation to some of the better performing sectors proved beneficial during the 2016 calendar year, specifically, basic industry, energy and communication overweight’s added value. An underweight allocation to global treasuries was another source of positive excess returns.

Currency and hedging weighed on relative returns during the year. Mexico Peso exposure

underperformed as the currency lost value versus the U.S. Dollar on geopolitical concerns and fears over policies under a Trump administration. Our underweight exposure to the Japanese Yen, coupled with an overweight to the Euro and Polish Zloty, also detracted. On a positive note, an underweight to the British Pound Sterling contributed positively, as the currency was pushed weaker as it battled concerns surrounding Brexit proceedings for much of the period. Exposure to Brazilian Real, Canadian Dollar and Russian Ruble were all also additive.

LOOKING FORWARD

We do not expect the U.S. Dollar to surge; however, higher U.S. yields should favor the Dollar against the Yen and the Euro as capital may continue to leak out of markets offering negligible yields. Many Emerging Market currencies have become increasingly attractive on a valuation basis; however, they must overcome an uncertain global trade environment and a historical tendency to suffer when the U.S. Dollar is strong. We are cautiously bullish on the currencies of selected Emerging countries where reform momentum pairs with improving growth, inflation and current account dynamics; however, we require attractive entry levels to compensate for liquidity and macroeconomic headwinds.

In Italy, the expected referendum defeat did not unsettle markets. A lack of executive direction in Italy is arguably not unusual, and Italian spreads have narrowed since the vote. We still expect a recapitalization of the weakest Italian banks and would use any broader weakness in European bank spreads to add to positions in what we view as the strongest names.

We have trimmed credit exposure slightly since August, given the extent of the rally in spreads during 2016 and global risks related to Brexit, Chinese growth, European populism, global trade and geopolitics. Nonetheless, we believe Euro and Sterling market spreads will continue to benefit from central bank support. Minimal leveraging in Euro Zone corporates should offer ongoing fundamental support, while a better profits picture

in the U.S. can potentially extend the favorable environment for credit. We favor U.S. credit over European issues, given their relative yield advantage, but remain focused on individual security selection across markets.

The U.S. federal government looks inclined to implement a number of policies with inflationary ramifications. However, the recent breakneck rise in U.S. yields is not expected to continue. While most policies should not directly impact the economy until 2018, we believe the coming few quarters should still see a positive revenue and profit environment.

We remain concerned about China even though it has been more stable than expected since early 2016. Growth momentum will be challenged as stimulus wears off and the government focuses more on reform.

OPEC’s recent agreement to cut output should support oil prices, but a sharp price increase is unlikely given a potential return of production.

Brazil, Argentina, South Africa and Russia–the Emerging world’s recessionary laggards in 2016–could see a much improved 2017. Although not back to boom times, the focus in 2017 should be more on improving economics than the unstable political situations that have held back many of these countries in recent years.

| 1 | Effective October 1, 2016, the shares of AMG Managers Global Income Opportunity Fund were reclassified and redesignated as Class S shares. |

This commentary reflects the viewpoints of the portfolio manager, Loomis, Sayles & Company, as of December 31, 2016 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

AMG Managers Global Income Opportunity Fund

Portfolio Manager’s Comments (continued)

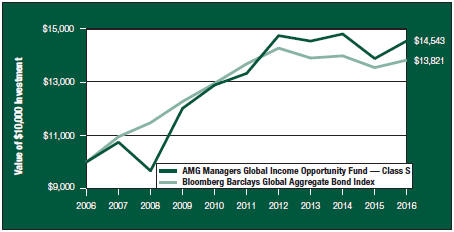

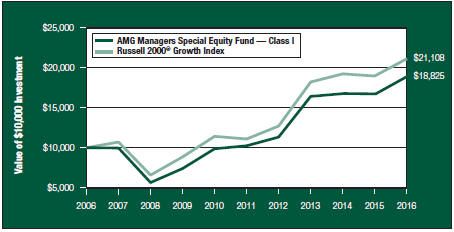

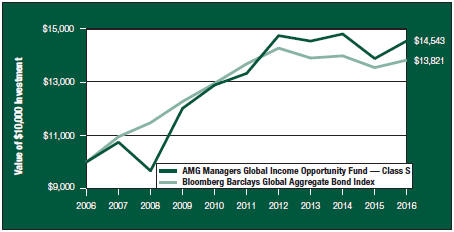

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Managers Global Income Opportunity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in AMG Managers Global Income Opportunity Fund Class S (formerly Service Class) on December 31, 2006, to a $10,000 investment made in the Bloomberg Barclays Global Aggregate Bond Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Managers Global Income Opportunity Fund and the Bloomberg Barclays Global Aggregate Bond Index for the same time periods ended December 31, 2016.

| | | | | | | | | | | | |

| Average Annual Total Returns1 | | One Year | | | Five Years | | | Ten Years | |

AMG Managers Global Income Opportunity Fund 2,3,4,5,6,7 | |

Class S8 | | | 4.79 | % | | | 1.77 | % | | | 3.82 | % |

Bloomberg Barclays Global Aggregate Bond Index9 | | | 2.09 | % | | | 0.21 | % | | | 3.29 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. |

| | Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2016. All returns are in U.S. dollars($). |

| 2 | From time to time the Fund’s advisor has waived it’s fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Fund is subject to currency risk resulting from fluctuations in exchange rates that may affect the total loss or gain on a non-U.S. Dollar investment when converted back to U.S. Dollars. |

| 4 | The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtor’s ability to pay its creditors. Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed income securities to fall. |

| 5 | High-yield bonds (also known as “junk bonds”) may be subject to greater levels of interest rate, credit, and liquidity risk than investments in higher rated securities. These securities are considered predominantly speculative with respect to the issuer’s continuing ability to make principal and interest payments. The issuers of the Fund’s holdings may be involved in bankruptcy proceedings, reorganizations, or financial restructurings, and are not as strong financially as higher-rated issuers. |

| 6 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| 7 | A short-term redemption fee of 1% will be charged on redemptions of fund shares held for 60 days or less. |

| 8 | Effective October 1, 2016, the shares of the AMG Managers Global Income Opportunity Fund were reclassified and redesignated as Class S shares. |

| 9 | The Bloomberg Barclays Global Aggregate Bond Index provides a broad-based measure of the global investment-grade fixed income markets. The three major components of this index are the U.S. Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. The Index also includes Eurodollar and Euro-Yen corporate bonds, Canadian government, agency and corporate securities, and USD investment-grade 144A securities. Unlike the Fund, the Bloomberg Barclays Global Aggregate Bond Index is unmanaged, is not available for investment, and does not incur expenses. |

Not FDIC insured, nor bank guaranteed. May lose value.

AMG Managers Global Income Opportunity Fund

Fund Snapshots (unaudited)

December 31, 2016

PORTFOLIO BREAKDOWN

| | | | |

Category | | AMG Managers

Global Income

Opportunity

Fund* | |

Corporate Bonds and Notes | | | 58.5 | % |

Foreign Government Obligations | | | 37.7 | % |

Asset-Backed Securities | | | 0.5 | % |

Other Assets and Liabilities | | | 3.3 | % |

| * | As a percentage of net assets. |

| | | | |

Rating | | AMG Managers

Global Income

Opportunity

Fund*** | |

Aaa | | | 11.6 | % |

Aa | | | 4.2 | % |

A | | | 24.0 | % |

Baa | | | 43.4 | % |

Ba & lower | | | 15.9 | % |

N/R | | | 0.9 | % |

| *** | As a percentage of market value of fixed-income securities. |

TOP TEN HOLDINGS

| | | | |

Security Name | | %of

Net Assets | |

New Zealand Government, Bonds, Series 423, 5.500%, 04/15/23** | | | 6.1 | % |

Mexican Bonos, Bonds, Series M, 10.000%, 11/20/36 | | | 4.9 | |

Italy Buoni Poliennali Del Tesoro, Bond, 4.750%, 08/01/23** | | | 4.2 | |

Poland Government, Series 1023, 4.000%, 10/25/23** | | | 3.7 | |

Indonesia Treasury Bond, Series FR69, 7.875%, 04/15/19** | | | 2.3 | |

Corp. Andina de Fomento, Notes, 4.375%, 06/15/22** | | | 1.9 | |

Union Andina de Cementos SAA, 5.875%, 10/30/21 | | | 1.7 | |

General Electric Co., Series D, 5.000%, 12/29/49 | | | 1.7 | |

YPF, S.A., 8.750%, 04/04/24** | | | 1.6 | |

New South Wales Treasury Corp., Bonds, Series 22, 6.000%, 03/01/22** | | | 1.6 | |

| | | | |

Top Ten as a Group | | | 29.7 | % |

| | | | |

| ** | Top Ten Holding as of June 30, 2016. |

Credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service, Inc. (“Moody’s”). These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

AMG Managers Global Income Opportunity Fund

Schedule of Portfolio Investments

December 31, 2016

| | | | | | | | | | | | |

| | | | | | Principal Amount† | | | Value | |

Asset-Backed Securities - 0.5% | | | | | | | | | | | | |

Trinity Rail Leasing, LLC, Series 2010-1A, Class A, 5.194%, 10/16/40 (a) (cost $75,988) | | | | | | $ | 75,988 | | | $ | 74,764 | |

Corporate Bonds and Notes - 58.5% | | | | | | | | | | | | |

Financials - 17.9% | | | | | | | | | | | | |

Ally Financial, Inc., 3.500%, 01/27/19 | | | | | | | 135,000 | | | | 135,675 | |

Banco Latinoamericano de Comercio Exterior, S.A., 3.250%, 05/07/20 (a) | | | | | | | 150,000 | | | | 150,900 | |

Bank of America Corp., MTN, 4.200%, 08/26/24 | | | | | | | 130,000 | | | | 132,432 | |

Bank of Montreal, 1.750%, 06/15/21 (a) | | | | | | | 250,000 | | | | 243,342 | |

Barclays PLC, 3.650%, 03/16/25 | | | | | | | 200,000 | | | | 193,364 | |

Braskem Finance, Ltd., 5.750%, 04/15/21 (a) | | | | | | | 200,000 | | | | 210,500 | |

Citigroup, Inc., | | | | | | | | | | | | |

4.000%, 08/05/24 | | | | | | | 45,000 | | | | 45,349 | |

4.400%, 06/10/25 | | | | | | | 30,000 | | | | 30,692 | |

Commerzbank AG, Series EMTN, 4.000%, 03/23/26 | | | EUR | | | | 40,000 | | | | 43,181 | |

Credit Agricole, S.A., 7.500%, 04/29/493,9 | | | GBP | | | | 100,000 | | | | 123,296 | |

General Motors Financial Co., Inc., 4.000%, 01/15/25 | | | | | | | 120,000 | | | | 117,077 | |

Goodman Australia Industrial Fund Bond Issuer Pty, Ltd., 3.400%, 09/30/26 (a) | | | | | | | 60,000 | | | | 56,515 | |

HSBC Holdings PLC, EMTN, 5.750%, 12/20/27 | | | GBP | | | | 55,000 | | | | 77,983 | |

International Bank for Reconstruction & Development, MTN, 2.500%, 03/12/20 | | | AUD | | | | 160,000 | | | | 115,383 | |

JPMorgan Chase & Co., | | | | | | | | | | | | |

3.875%, 02/01/24 | | | | | | | 75,000 | | | | 77,728 | |

Series X, 6.100%, 10/29/493,9 | | | | | | | 65,000 | | | | 65,772 | |

The Korea Development Bank, Series MTN, 4.500%, 11/22/19 | | | AUD | | | | 60,000 | | | | 44,757 | |

Lloyds Banking Group PLC, | | | | | | | | | | | | |

4.500%, 11/04/24 | | | | | | | 200,000 | | | | 203,530 | |

7.500%, 04/30/493,9 | | | | | | | 70,000 | | | | 72,100 | |

Old Republic International Corp., 4.875%, 10/01/24 | | | | | | | 100,000 | | | | 104,190 | |

Royal Bank of Scotland Group PLC, 7.500%, 12/29/493,4,9 | | | | | | | 200,000 | | | | 189,500 | |

Santander Holdings USA, Inc., 2.650%, 04/17/20 | | | | | | | 215,000 | | | | 213,093 | |

Societe Generale, S.A., 6.750%, 04/07/493,9 | | | EUR | | | | 105,000 | | | | 113,292 | |

Total Financials | | | | | | | | | | | 2,759,651 | |

Industrials - 36.2% | | | | | | | | | | | | |

Air Canada 2015-2 Class A Pass Through Trust, 4.125%, 12/15/27 (a) | | | | | | | 82,950 | | | | 85,024 | |

Alfa, SAB de CV, 5.250%, 03/25/24 (a) | | | | | | | 200,000 | | | | 204,500 | |

America Movil SAB de CV, 6.450%, 12/05/22 | | | MXN | | | | 4,000,000 | | | | 174,870 | |

Anadarko Petroleum Corp., 3.450%, 07/15/24 | | | | | | | 200,000 | | | | 196,329 | |

Anheuser-Busch InBev Finance, Inc., 3.300%, 02/01/23 | | | | | | | 80,000 | | | | 81,419 | |

Anthem, Inc., 3.500%, 08/15/24 | | | | | | | 40,000 | | | | 39,886 | |

AT&T, Inc., 4.750%, 05/15/46 | | | | | | | 113,000 | | | | 107,058 | |

| | |

| | | |

| The accompanying notes are an integral part of these financial statements. |

|

| 19 |

AMG Managers Global Income Opportunity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | | | | | |

| | | | | | Principal Amount† | | | Value | |

Industrials - 36.2% (continued) | | | | | | | | | | | | |

BRF, S.A., 7.750%, 05/22/18 (a) | | | BRL | | | | 300,000 | | | $ | 86,183 | |

Cemex SAB de CV, 5.700%, 01/11/25 (a) | | | | | | | 200,000 | | | | 201,500 | |

Cigna Corp., 3.250%, 04/15/25 | | | | | | | 115,000 | | | | 112,004 | |

Colombia Telecomunicaciones, S.A. ESP, 5.375%, 09/27/22 (a) | | | | | | | 200,000 | | | | 194,500 | |

Continental Resources, Inc., 3.800%, 06/01/24 | | | | | | | 20,000 | | | | 18,450 | |

Corp. Nacional del Cobre de Chile, 4.500%, 09/16/25 (a)4 | | | | | | | 245,000 | | | | 248,711 | |

Daimler Finance North America LLC, 1.750%, 10/30/19 (a) | | | | | | | 150,000 | | | | 148,081 | |

Delta Air Lines 2015-1 Class B Pass Through Trust, Series 15-1, 4.250%, 07/30/23 | | | | | | | 65,447 | | | | 66,592 | |

Ecopetrol, S.A., | | | | | | | | | | | | |

4.125%, 01/16/25 | | | | | | | 165,000 | | | | 154,522 | |

5.875%, 05/28/45 | | | | | | | 135,000 | | | | 116,640 | |

Embraer Netherlands Finance BV, 5.050%, 06/15/25 | | | | | | | 90,000 | | | | 89,460 | |

Energy Transfer Partners, L.P., 4.050%, 03/15/25 | | | | | | | 210,000 | | | | 207,881 | |

Freeport-McMoRan, Inc., | | | | | | | | | | | | |

4.550%, 11/14/244 | | | | | | | 120,000 | | | | 112,500 | |

5.450%, 03/15/43 | | | | | | | 100,000 | | | | 82,752 | |

General Electric Co., Series D, 5.000%, 12/29/493,9 | | | | | | | 246,000 | | | | 255,274 | |

Glencore Finance Canada, Ltd., 5.550%, 10/25/42 (a), (b) | | | | | | | 115,000 | | | | 110,497 | |

Hyundai Capital America, 2.750%, 09/27/26 (a) | | | | | | | 85,000 | | | | 77,210 | |

Intel Corp., 3.700%, 07/29/25 | | | | | | | 100,000 | | | | 105,477 | |

INVISTA Finance LLC, 4.250%, 10/15/19 (a) | | | | | | | 130,000 | | | | 128,881 | |

Israel Chemicals, Ltd., 4.500%, 12/02/24 (a) | | | | | | | 125,000 | | | | 120,851 | |

Kinder Morgan Energy Partners L.P., 4.250%, 09/01/24 | | | | | | | 220,000 | | | | 224,674 | |

KT Corp., 2.500%, 07/18/26 (a) | | | | | | | 200,000 | | | | 184,801 | |

Methanex Corp., 3.250%, 12/15/19 | | | | | | | 105,000 | | | | 103,382 | |

Millicom International Cellular, S.A., 4.750%, 05/22/20 (a) | | | | | | | 200,000 | | | | 202,500 | |

OCP, S.A., 4.500%, 10/22/25 (a) | | | | | | | 215,000 | | | | 205,406 | |

Philippine Long Distance Telephone Co., GMTN, 8.350%, 03/06/17 | | | | | | | 75,000 | | | | 75,656 | |

Southern Copper Corp., 3.875%, 04/23/25 | | | | | | | 130,000 | | | | 128,184 | |

Telecom Italia Capital SA, 7.200%, 07/18/36 | | | | | | | 45,000 | | | | 44,358 | |