Searchable text section of graphics shown above

[LOGO]

Executing

The Regulatory Plan

Financial |

Performance |

| | |

Regulators/ |

Legislators |

| | |

Value to | | Environmental |

Customers | | Stewardship |

| | |

Invest in Regulated Utility Business |

Dave Sparby Vice President – Government and Regulatory Affairs

Safe Harbor

This material includes forward-looking statements that are subject to certain risks, uncertainties and assumptions. Such forward-looking statements include projected earnings, cash flows, capital expenditures and other statements and are identified in this document by the words “anticipate,” “estimate,” “expect,” “projected,” “objective,” “outlook,” “possible,” “potential” and similar expressions. Actual results may vary materially. Factors that could cause actual results to differ materially include, but are not limited to: general economic conditions, including the availability of credit, actions of rating agencies and their impact on capital expenditures; business conditions in the energy industry; competitive factors; unusual weather; effects of geopolitical events, including war and acts of terrorism; changes in federal or state legislation; regulation; final approval and implementation of the pending settlement of the securities, ERISA and derivative litigation; costs and other effects of legal administrative proceedings, settlements, investigations and claims including litigation related to company-owned life insurance (COLI); actions of accounting regulatory bodies; risks associated with the California power market; the higher degree of risk associated with Xcel Energy’s nonregulated businesses compared with Xcel Energy’s regulated business; and other risk factors listed from time to time by Xcel Energy in reports filed with the SEC, including Exhibit 99.01 to Xcel Energy’s report on Form 10-K for year 2004.

Well-Positioned for Regulatory Success

• Constructive regulation

• Innovative regulatory recovery

• Competitive rates due to strong cost management

• Increase investment to meet customer requirements

• Environmental stewardship

An Experienced Regulatory Team

| | | | Years | |

| | | | | |

Xcel Energy | | Dave Sparby | | 25 | |

| | | | | |

(Cross Functional) | | Debbie Blair | | 23 | |

| | | | | |

| | Ron Darnell | | 22 | |

| | | | | |

NSP (M) | | Scott Wilensky | | 20 | |

| | Judy Poferl | | 20 | |

| | | | | |

NSP (W) | | Don Reck | | 26 | |

| | | | | |

PSCo | | Fred Stoffel | | 26 | |

| | | | | |

SPS | | David Hudson | | 22 | |

Key Regulatory Initiatives

• Minnesota electric rate case

• Minnesota rate rider recovery and resource planning

• Monticello nuclear plant relicensing

• Wisconsin gas and electric rate cases

• Colorado gas and electric rate cases

• Texas electric rate case

• North Dakota electric rate case

Minnesota Regulatory Structure

• Public Utilities Commission

• Five members

• Six-year terms

• Appointed by Governor

• Balanced party affiliations

• Department of Commerce

• Public advocate and enforcement agency for Commission

• Office of the Attorney General

• Represents residential and commercial customers

Minnesota Regulatory Practice

• Provides direct recovery for state-supported initiatives (conservation, renewable energy, transmission)

• Provides monthly forecast fuel and purchased energy cost recovery

• Provides interim rates 60 days after rate case filing and decision in 10 months

• Allows forecast test year

Minnesota Electric Case Highlights

• Requested $168 million increase, based on forecasted 2006 test year

• 11% return on common equity

• $141 million interim rate increase, expected January 1, 2006

• Customer impact

• Base rate increase of 8%

• Interim rate increase of 6.9%

• Final decision expected third quarter 2006

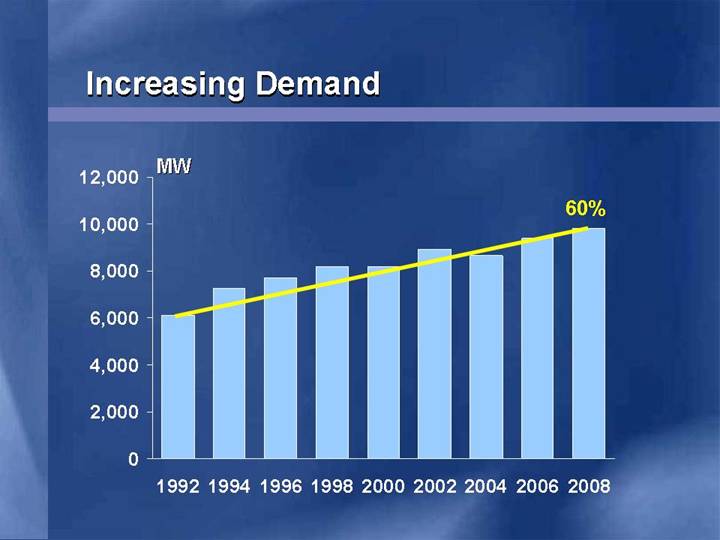

Increasing Demand

[CHART]

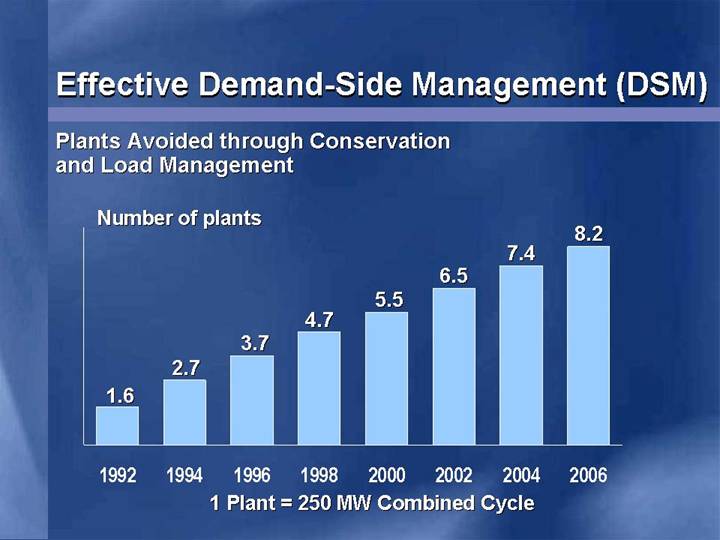

Effective Demand-Side Management (DSM)

Plants Avoided through Conservation and Load Management

[CHART]

1 Plant = 250 MW Combined Cycle

Careful Management of Costs Minnesota O&M Expenses

[CHART]

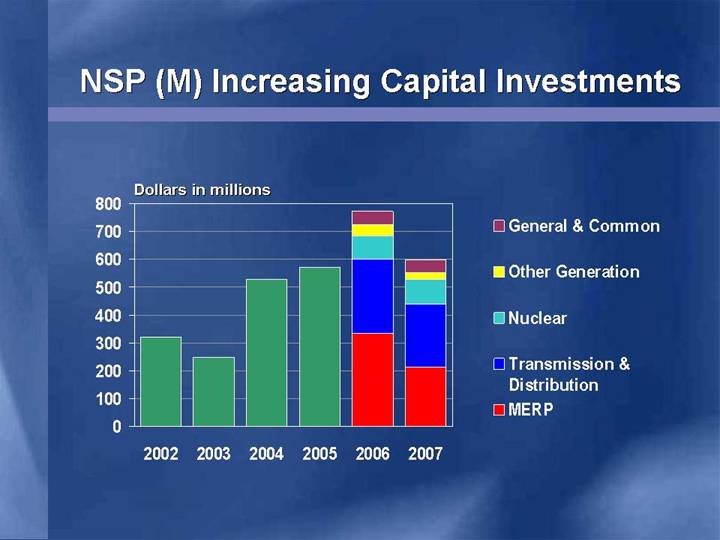

NSP (M) Increasing Capital Investments

[CHART]

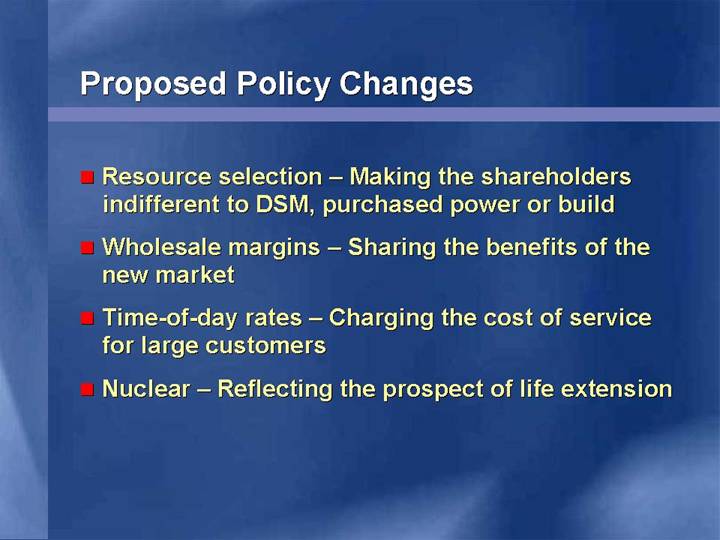

Proposed Policy Changes

• Resource selection – Making the shareholders indifferent to DSM, purchased power or build

• Wholesale margins – Sharing the benefits of the new market

• Time-of-day rates – Charging the cost of service for large customers

• Nuclear – Reflecting the prospect of life extension

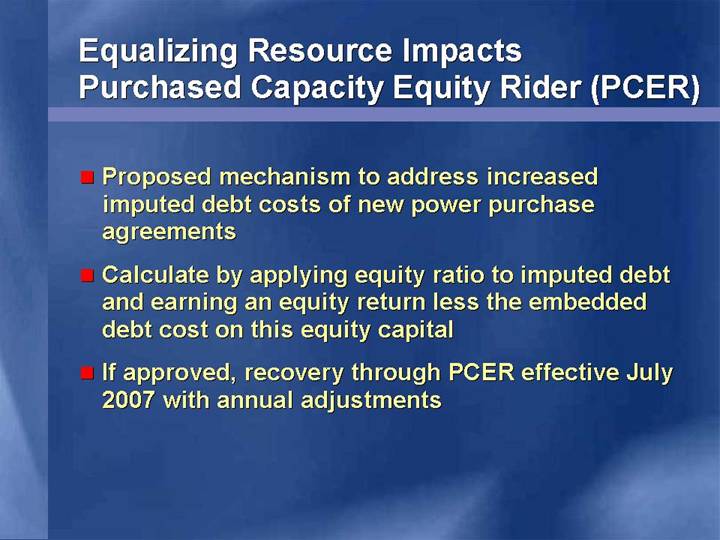

Equalizing Resource Impacts Purchased Capacity Equity Rider (PCER)

• Proposed mechanism to address increased imputed debt costs of new power purchase agreements

• Calculate by applying equity ratio to imputed debt and earning an equity return less the embedded debt cost on this equity capital

• If approved, recovery through PCER effective July 2007 with annual adjustments

DSM Financial Neutrality Factor

• Proposed annual recovery of reduced earnings growth resulting from avoided plant investments

• Supplement existing DSM mechanism

• Calculation based on equity return on avoided capital investment

• Supports accomplishment of expansion of DSM goals

Short-Term Wholesale Margin

• Proposed pass through of proceeds from traditional wholesale margins up to a set threshold

• First $16 million of short-term wholesale margin flows through fuel clause to customer

• Allow for 50/50 sharing beyond threshold amount

• Reduces exposure by using fuel clause to pass through actual results rather than forecasting a base rate credit

Average Residential Rate

[CHART]

Average rate (675 KWh monthly use) has increased 17% during the same period.

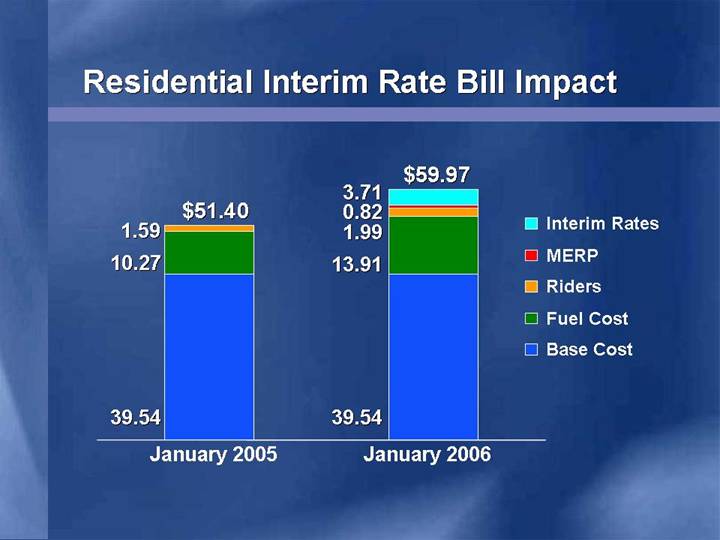

Residential Interim Rate Bill Impact

[CHART]

Next Steps in Minnesota

| | Interim | | | | | | |

Acceptance | | Rates | | Hearings | | Settlement | | Decision |

| | | | | | (Possible) | | |

| | | | | | | | |

November/ | | January | | Spring | | | | August |

December | | 2006 | | 2006 | | | | 2006 |

2005 | | | | | | | | |

Other Minnesota Initiatives

• New transmission cost recovery tariff

• Allowed by law

• Effective for costs post rate case

• Resource Plan

• Identifies base load need mid-decade

• Sets up build/buy/conserve decisions

• Expanded DSM, wind resources

• Monticello Certificate of Need/Relicensing

• Community-based energy development

• Required to purchase by law

• Assists in meeting renewable energy objective

Wisconsin Regulatory Structure

• Public Service Commission (PSCW)

• Three members

• Six-year terms

• Non-partisan office, appointed by Governor

• Consumer and environmental groups as well as large C&I customers typically intervene

• Wisconsin has an intervenor compensation fund

Wisconsin Regulatory Practices

• File rate cases every odd year

• Forecast test year

• Rates effective at beginning of test year

• Electric fuel cost recovery cases filed if actual cost varies by + 2% from base amount

• Full recovery of public benefits charge (DSM, low-income assistance)

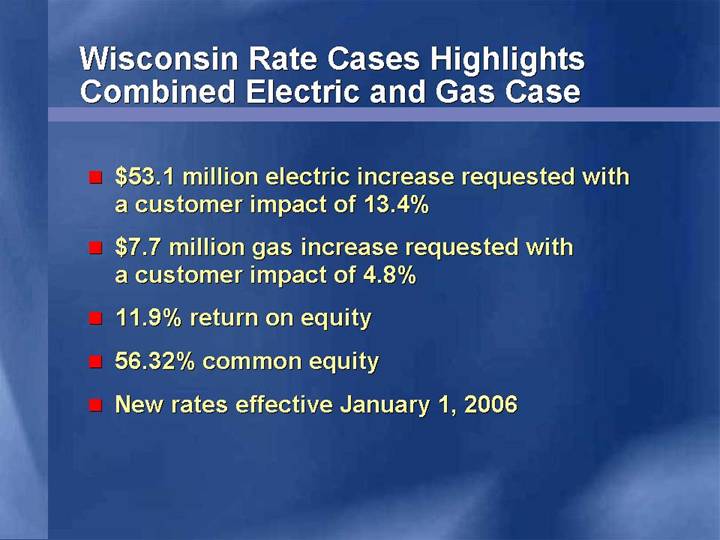

Wisconsin Rate Cases Highlights Combined Electric and Gas Case

• $53.1 million electric increase requested with a customer impact of 13.4%

• $7.7 million gas increase requested with a customer impact of 4.8%

• 11.9% return on equity

• 56.32% common equity

• New rates effective January 1, 2006

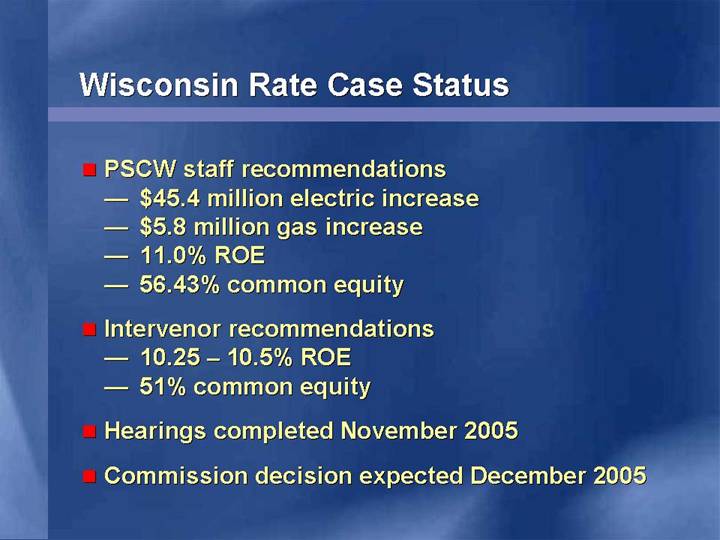

Wisconsin Rate Case Status

• PSCW staff recommendations

• $45.4 million electric increase

• $5.8 million gas increase

• 11.0% ROE

• 56.43% common equity

• Intervenor recommendations

• 10.25 – 10.5% ROE

• 51% common equity

• Hearings completed November 2005

• Commission decision expected December 2005

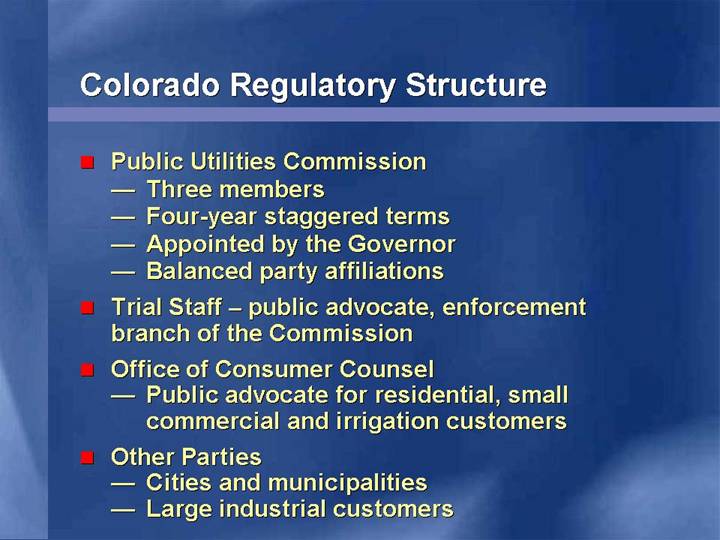

Colorado Regulatory Structure

• Public Utilities Commission

• Three members

• Four-year staggered terms

• Appointed by the Governor

• Balanced party affiliations

• Trial Staff – public advocate, enforcement branch of the Commission

• Office of Consumer Counsel

• Public advocate for residential, small commercial and irrigation customers

• Other Parties

• Cities and municipalities

• Large industrial customers

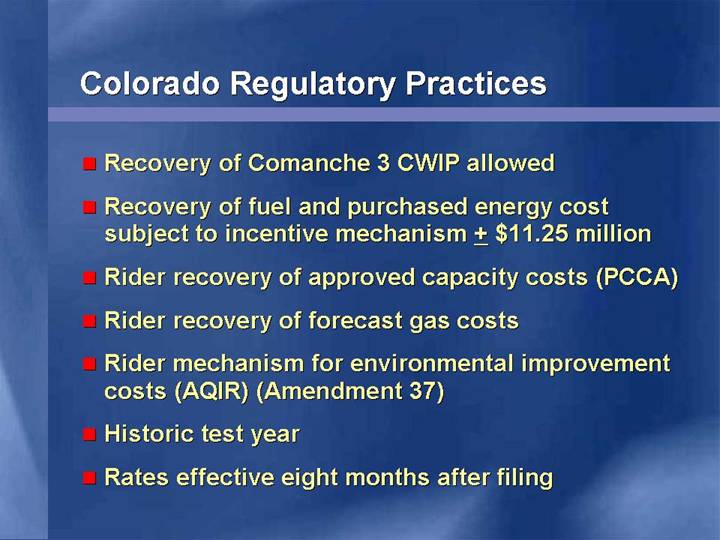

Colorado Regulatory Practices

• Recovery of Comanche 3 CWIP allowed

• Recovery of fuel and purchased energy cost subject to incentive mechanism + $11.25 million

• Rider recovery of approved capacity costs (PCCA)

• Rider recovery of forecast gas costs

• Rider mechanism for environmental improvement costs (AQIR) (Amendment 37)

• Historic test year

• Rates effective eight months after filing

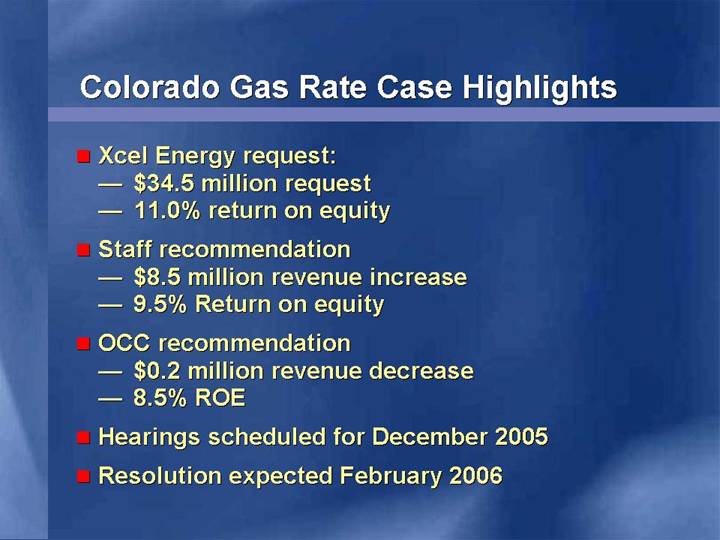

Colorado Gas Rate Case Highlights

• Xcel Energy request:

• $34.5 million request

• 11.0% return on equity

• Staff recommendation

• $8.5 million revenue increase

• 9.5% Return on equity

• OCC recommendation

• $0.2 million revenue decrease

• 8.5% ROE

• Hearings scheduled for December 2005

• Resolution expected February 2006

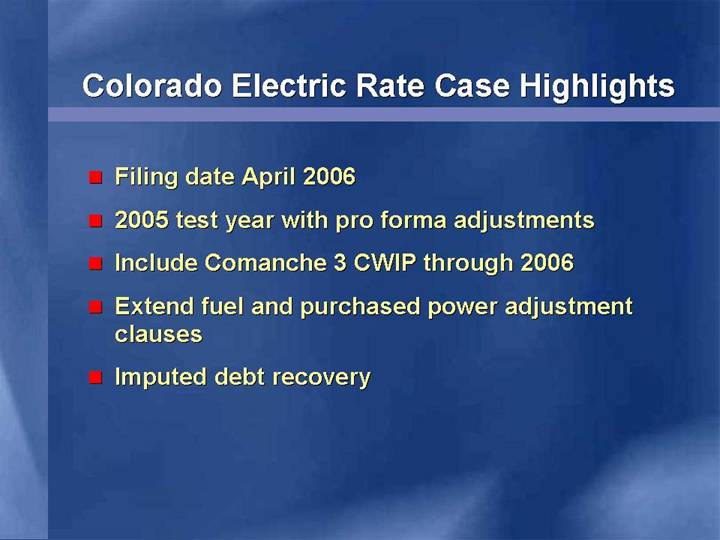

Colorado Electric Rate Case Highlights

• Filing date April 2006

• 2005 test year with pro forma adjustments

• Include Comanche 3 CWIP through 2006

• Extend fuel and purchased power adjustment clauses

• Imputed debt recovery

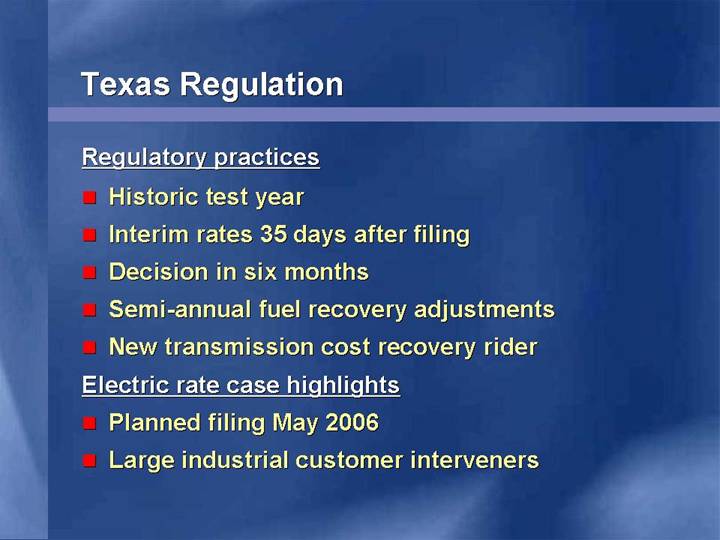

Texas Regulation

Regulatory practices

• Historic test year

• Interim rates 35 days after filing

• Decision in six months

• Semi-annual fuel recovery adjustments

• New transmission cost recovery rider

Electric rate case highlights

• Planned filing May 2006

• Large industrial customer interveners

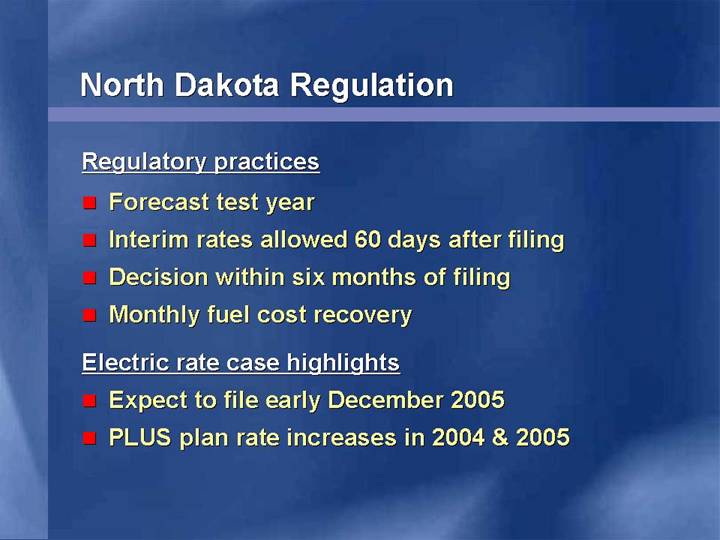

North Dakota Regulation

Regulatory practices

• Forecast test year

• Interim rates allowed 60 days after filing

• Decision within six months of filing

• Monthly fuel cost recovery

Electric rate case highlights

• Expect to file early December 2005

• PLUS plan rate increases in 2004 & 2005

Summary

• Strong basis for rate relief

• Experienced team to execute strategy

• Rate riders will provide bridge between rate cases

• Fuel clause mechanism will provide current recovery

• History of constructive regulatory treatment