Ultra Series Fund | December 31, 2010

Table of Contents

| | Page |

| Management’s Discussion of Fund Performance | |

| Economic Overview | 2 |

| Outlook | 2 |

| Conservative Allocation Fund | 4 |

| Moderate Allocation Fund | 6 |

| Aggressive Allocation Fund | 8 |

| Money Market Fund | 10 |

| Bond Fund | 12 |

| High Income Fund | 14 |

| Diversified Income Fund | 16 |

| Equity Income Fund | 18 |

| Large Cap Value Fund | 20 |

| Large Cap Growth Fund | 22 |

| Mid Cap Fund | 24 |

| Small Cap Fund | 26 |

| International Stock Fund | 28 |

| Target Retirement 2020 Fund | 30 |

| Target Retirement 2030 Fund | 32 |

| Target Retirement 2040 Fund | 34 |

| Notes to Management’s Discussion of Fund Performance | 36 |

| Portfolios of Investments | |

| Conservative Allocation Fund | 38 |

| Moderate Allocation Fund | 39 |

| Aggressive Allocation Fund | 40 |

| Money Market Fund | 41 |

| Bond Fund | 42 |

| High Income Fund | 45 |

| Diversified Income Fund | 48 |

| Equity Income Fund | 51 |

| Large Cap Value Fund | 53 |

| Large Cap Growth Fund | 54 |

| Mid Cap Fund | 55 |

| Small Cap Fund | 56 |

| International Stock Fund | 58 |

| Target Retirement 2020 Fund | 60 |

| Target Retirement 2030 Fund | 61 |

| Target Retirement 2040 Fund | 62 |

| Financial Statements | |

| Statements of Assets and Liabilities | 63 |

| Statements of Operations | 66 |

| Statements of Changes in Net Assets | 69 |

| Financial Highlights | 75 |

| Notes to Financial Statements | 91 |

| Report of Independent Registered Public Accounting Firm | 109 |

| Other Information | 110 |

| Trustees and Officers | 115 |

Nondeposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of or guaranteed by any financial institution. For more complete information about Ultra Series Fund, including charges and expenses, request a prospectus from your financial advisor or from CUNA Mutual Insurance Society, 2000 Heritage Way, Waverly, IA 50677. Consider the investment objectives, risks, and charges and expenses of any fund carefully before investing. The prospectus contains this and other information about the investment company. For more current Ultra Series Fund performance information, please call 1-800-670-3600. Current performance may be lower or higher than the performance data quoted within. Past performance does not guarantee future results. Nothing in this report represents a recommendation of a security by the investment adviser. Portfolio holdings may have changed since the date of this report.

Ultra Series Fund | December 31, 2010

Management’s Discussion of Fund Performance

ECONOMIC OVERVIEW

With returns of all the major U.S. stock indices up strongly, 2010 will be remembered as a good year for stock investors. The S&P 500 finished with a total return of 15.1% and mid-cap and small-cap indices outpaced the broader indices, with returns well above 20%. But these returns were mostly a late-year phenomenon and it is easy to forget how rocky returns were for much of the period. After a rally in March and April, investors began to get nervous. The spreading sovereign debt crisis in Europe helped generate widespread fears of a double-dip recession. Throughout much of the summer the S&P 500, widely regarded as the best proxy for the U.S. stock market in general, was showing negative returns for the year.

Within the bond markets, we began this one-year period with a welcome calm. The yield curve was relatively stable, market volatility had moderated, and long-term yields marched higher. In this environment investors turned their attention to debating economic fundamentals while weighing the sustainability of the recent economic upturn. This atmosphere of calm belied persistent and fundamental economic challenges. The housing market continued to struggle, unemployment was persistently high, and European governments came under pressure. Despite these clouds, higher-risk U.S. bonds continued to lead the market.

Fear reemerged in the financial markets during the second quarter of 2010. After nearly a year of consistent gains from risk sectors (stocks, corporate bonds), turmoil in the European Union among sovereign bond issuers and the banks that finance them caused investors to seek the relative safety of the highest quality investments. In the U.S., that meant a sharp rally in Treasury yields, widening risk premiums on corporate bonds and declines in the broad equity indices. Just as the opening mood of the year had dissipated, this atmosphere of fear proved to be short lived as well.

In the year’s final quarter, just as economic indicators began to allay fears of a double-dip recession, the Federal Reserve Board sparked additional confidence with another round of quantitative easing, which became known as QEII. Bernanke essentially linked the Fed’s considerable monetary easing to an anticipated (or at least hoped for) rise in stock prices, which would in turn boost consumer confidence and ultimately spending. It seemed to work in the latter part of 2010, with the S&P 500 advancing 10.8% during the fourth quarter of 2010.

While the economy was not actually strong by historic norms, and the recovery remained sub-par, the probability of recession and deflation became increasingly unlikely. In addition, Europe was straddled with sovereign debt concerns, Japan remained mired in a weak growth/high deficit environment, and China was putting on the economic brakes to contain emerging inflation which provided further support for U.S. financial assets. From the lows in long-term yields in early October, interest rates rose nearly a full percentage point, driving down the value of existing bonds and muting bond returns for the one-year period.

OUTLOOK

Looking forward, we are encouraged by recent economic data. It would appear that moderate economic growth is in the cards for at least the first half of 2011. Generally, this would be considered a good backdrop for investors. Nonetheless, significant and cautionary macroeconomic issues

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Outlook (concluded)

persist. Housing market data continues to disappoint. European sovereign debt issues remain while domestically, state and local governments struggle to meet their financial obligations. As with past economic recoveries, the economic data will likely be volatile and capital markets will respond similarly. Ironically, one of our current concerns is the level of investor complacency that has returned to financial markets. Current stock sentiment is strongly bullish, while volatility has declined to near three-year lows; from our perspective, this is cause for some short-term caution. Despite the jump in bond yields during the fourth quarter, long-term interest rates remain well below our estimate of fair value and we enter 2011 with a conservative bias.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

CONSERVATIVE ALLOCATION FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Conservative Allocation Fund invests primarily in shares of registered investment companies (the "underlying funds"). The fund will be diversified among a number of asset classes and its allocation among underlying funds will be based on an asset allocation model developed by Madison Asset Management, LLC ("Madison"), the fund’s investment adviser.

The team may use multiple analytical approaches to determine the appropriate asset allocation:

| | •Asset allocation optimization analysis – considers the degree to which returns in different asset classes do or do not move together, and the fund’s aim to achieve a favorable overall risk profile for any targeted portfolio return. |

| | •Scenario analysis – historical and expected return data is analyzed to model how individual asset classes and combinations of asset classes would affect the fund under different economic and market conditions. |

| | •Fundamental analysis – draws upon Madison’s investment teams to judge each asset class against current and forecasted market condi-tions. Economic, industry and security analysis is used to develop return and risk expectations that may influence asset class selection. |

In addition, Madison employs a risk management sleeve within the fund for the purpose of risk reduction when and if conditions exist that require reduction of equity exposure.

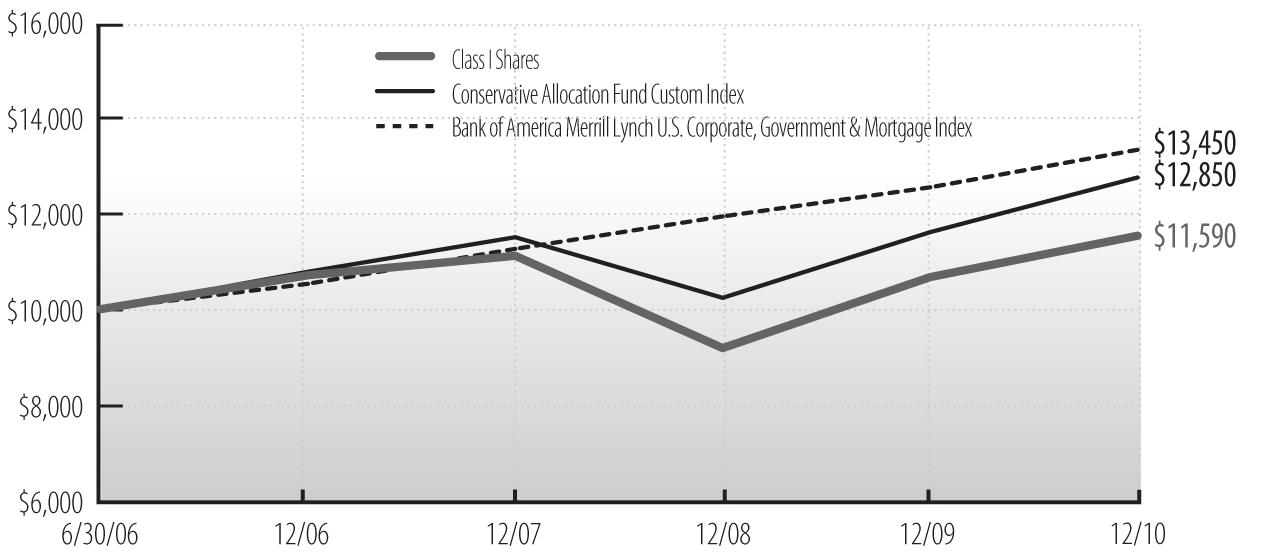

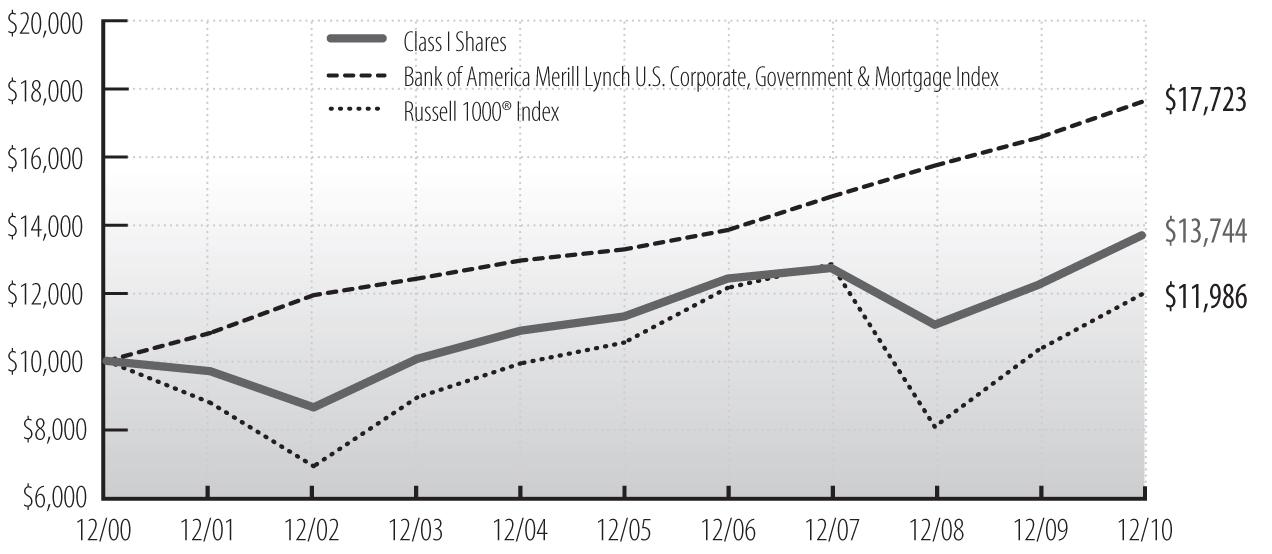

Cumulative Performance of $10,000 Investment Since Inception1,2

Average Annual Total Return through December 31, 20101 |

| | | | | |

| Class I Shares | 8.37% | 1.28% | 3.33% | — |

| Class II Shares | 8.10 | — | — | 13.86% |

| Conservative Allocation Fund Custom Index | 10.15 | 3.60 | 5.72 | 14.52 |

| Bank of America Merrill Lynch U.S. Corporate, Government & Mortgage Index | 6.43 | 5.96 | 6.79 | 6.85 |

See accompanying Notes to Management’s Discussion of Fund Performance.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Conservative Allocation Fund (concluded)

2010 proved to be a very positive year for asset allocation funds. Returns for the year across asset classes were far from uniform. U.S. stocks, as measured by the Russell 3000¨ Index, finished the year up 16.9%, the international equity MSCI EAFE Index returned 8.2%, and the Barclays U.S. Aggregate Bond Index gained 6.5%. However, within each of these asset classes the underlying returns where largely skewed in favor of the riskier stocks and bonds. Here in the U.S., high beta stocks outgained lower beta and high quality stocks by a very wide margin. The same was true for capitalization size where small caps, generally regarded as lower in quality, outpaced large caps by over 11%. In bond land, "junk" bonds returned nearly 9% more than the investment grade Barclays U.S. Aggregate Bond Index. In short, it was a risk takers market in asset allocation for 2010.

PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/10 |

| Bond Funds | 59% |

| Foreign Bond Funds | 8% |

| Stock Funds | 26% |

| Foreign Stock Funds | 5% |

| Money Market Funds and Other Net Assets | 2% |

For the twelve-month period ended December 31, 2010, the Ultra Series Conservative Allocation Fund returned 8.37% (Class I shares), underperforming our Conservative Allocation Custom Index return of 10.15%. The fund’s relative underperformance was attributed to our risk aware posturing and preference for higher quality large cap equities. Despite our preference for higher quality investments, the fund was boosted by moderate positions in some higher risk bond funds with Templeton Global Bond Fund up 13.0% for the year, MEMBERS High Yield Bond Fund Class Y up 11.7%, and PIMCO Investment Grade Corporate Bond Fund up 11.7%. Detractors from performance relative to the index included Madison Mosaic Institutional Bond Fund which returned 4.4% for the year, MEM BERS Bond Fund Class Y which returned 4.9%, and MEMBERS International Stock Fund Class Y which returned 6.5%.

Overall, despite the fund’s relative underperformance, we were pleased with the fund’s absolute return given the moderate level of risk taken. In short, we believe the fund is well-positioned for the economic environment that we are encountering – an economy showing emerging signs of gaining some sustainable traction combined with atypically elevated downside risk potential.

Notable additions to the fund’s holdings this year were: PIMCO Investment Grade Corporate Bond Fund and Madison Mosaic Disciplined Equity Fund. Sold from the portfolio during 2010 were: Dodge & Cox Income Fund and Fairholme Fund.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

MODERATE ALLOCATION FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Moderate Allocation Fund invests primarily in shares of registered investment companies (the "underlying funds"). The fund will be diversified among a number of asset classes and its allocation among underlying funds will be based on an asset allocation model developed by Madison Asset Management, LLC ("Madison"), the fund’s investment adviser.

The team may use multiple analytical approaches to determine the appropriate asset allocation:

| | •Asset allocation optimization analysis – considers the degree to which returns in different asset classes do or do not move together, and the fund’s aim to achieve a favorable overall risk profile for any targeted portfolio return. |

| | •Scenario analysis – historical and expected return data is analyzed to model how individual asset classes and combinations of asset classes would affect the fund under different economic and market conditions. |

| | •Fundamental analysis – draws upon Madison’s investment teams to judge each asset class against current and forecasted market conditions. Economic, industry and security analysis is used to develop return and risk expectations that may influence asset class selection. |

In addition, Madison employs a risk management sleeve within the fund for the purpose of risk reduction when and if conditions exist that require reduction of equity exposure.

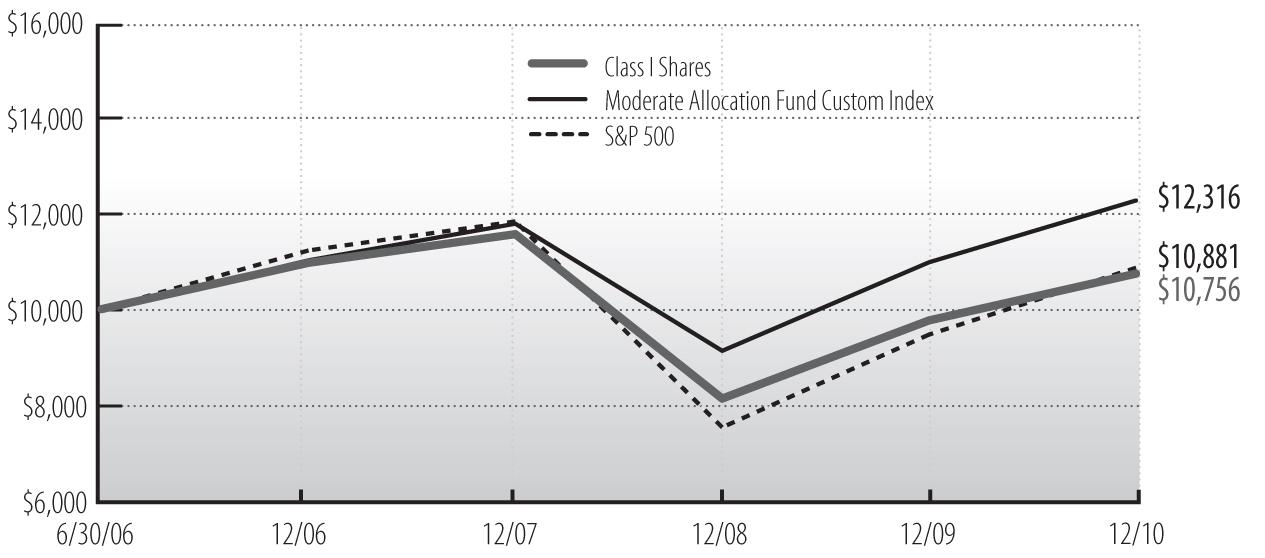

Cumulative Performance of $10,000 Investment Since Inception1,2

Average Annual Total Return through December 31, 20101 |

| | | | | |

| Class I Shares | 10.22% | -2.48% | 1.63% | — |

| Class II Shares | 9.94 | — | — | 17.34% |

| Moderate Allocation Fund Custom Index | 11.97 | 1.38 | 4.73 | 20.16 |

| S&P 500 Index | 15.06 | -2.86 | 1.89 | 27.07 |

See accompanying Notes to Management’s Discussion of Fund Performance.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Moderate Allocation Fund (concluded)

2010 proved to be a very positive year for asset allocation funds. Returns for the year across asset classes were far from uniform. U.S. stocks, as measured by the Russell 3000¨ Index, finished the year up 16.9%, the international equity MSCI EAFE Index returned 8.2%, and the Barclays U.S. Aggregate Bond Index gained 6.5%. However, within each of these asset classes the underlying returns where largely skewed in favor of the riskier stocks and bonds. Here in the U.S., high beta stocks outgained lower beta and high quality stocks by a very wide margin. The same was true for capitalization size where small caps, generally regarded as lower in quality, outpaced large caps by over 11%. In bond land, "junk" bonds returned nearly 9% more than the investment grade Barclays U.S. Aggregate Bond Index. In short, it was a risk takers market in asset allocation for 2010.

PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/10 |

| Bond Funds | 34% |

| Foreign Bond Funds | 5% |

| Stock Funds | 49% |

| Foreign Stock Funds | 10% |

| Money Market Funds and Other Net Assets | 2% |

For the twelve-month period ended December 31, 2010, the Ultra Series Moderate Allocation Fund returned 10.22% (Class I shares), underperforming our Moderate Allocation Custom Index return of 11.97%. The fund’s relative underperformance was attributed to our risk aware posturing and preference for higher quality large cap equities. Despite our preference for higher quality investments, the fund was boosted by modest positions in small and mid caps with MEMBERS Small Cap Fund Class Y up 25.6% for the year and MEMBERS Mid Cap Fund Class Y up 19.6%. Detractors from relative performance included Madison Mosaic Institutional Bond Fund which returned 4.4% for the year, MEMBERS Bond Fund Class Y which returned 4.9%, MEMBERS International Stock Fund Class Y whic h returned 6.5%, and MEMBERS Large Cap Value Fund Class Y which returned 8.3%.

Overall, despite the fund’s relative underperformance, we were pleased with the fund’s absolute return given the moderate level of risk taken. In short, we believe the fund is well-positioned for the economic environment that we are encountering – an economy showing emerging signs of gaining some sustainable traction combined with atypically elevated downside risk potential.

Notable additions to the fund’s holdings this year were: PIMCO Investment Grade Corporate Bond Fund, T. Rowe Price New Era Fund, Matthews Asian Growth & Income Fund, and Yacktman Fund. Sold from the portfolio during 2010 were: Dodge & Cox Income Fund and Fairholme Fund.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

AGGRESSIVE ALLOCATION FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Aggressive Allocation Fund invests primarily in shares of registered investment companies (the "underlying funds"). The fund will be diversified among a number of asset classes and its allocation among underlying funds will be based on an asset allocation model developed by Madison Asset Management, LLC ("Madison"), the fund’s investment adviser.

The team may use multiple analytical approaches to determine the appropriate asset allocation:

| | •Asset allocation optimization analysis – considers the degree to which returns in different asset classes do or do not move together, and the fund’s aim to achieve a favorable overall risk profile for any targeted portfolio return. |

| | •Scenario analysis – historical and expected return data is analyzed to model how individual asset classes and combinations of asset classes would affect the fund under different economic and market conditions. |

| | •Fundamental analysis – draws upon Madison’s investment teams to judge each asset class against current and forecasted market conditions. Economic, industry and security analysis is used to develop return and risk expectations that may influence asset class selection. |

In addition, Madison employs a risk management sleeve within the fund for the purpose of risk reduction when and if conditions exist that require reduction of equity exposure.

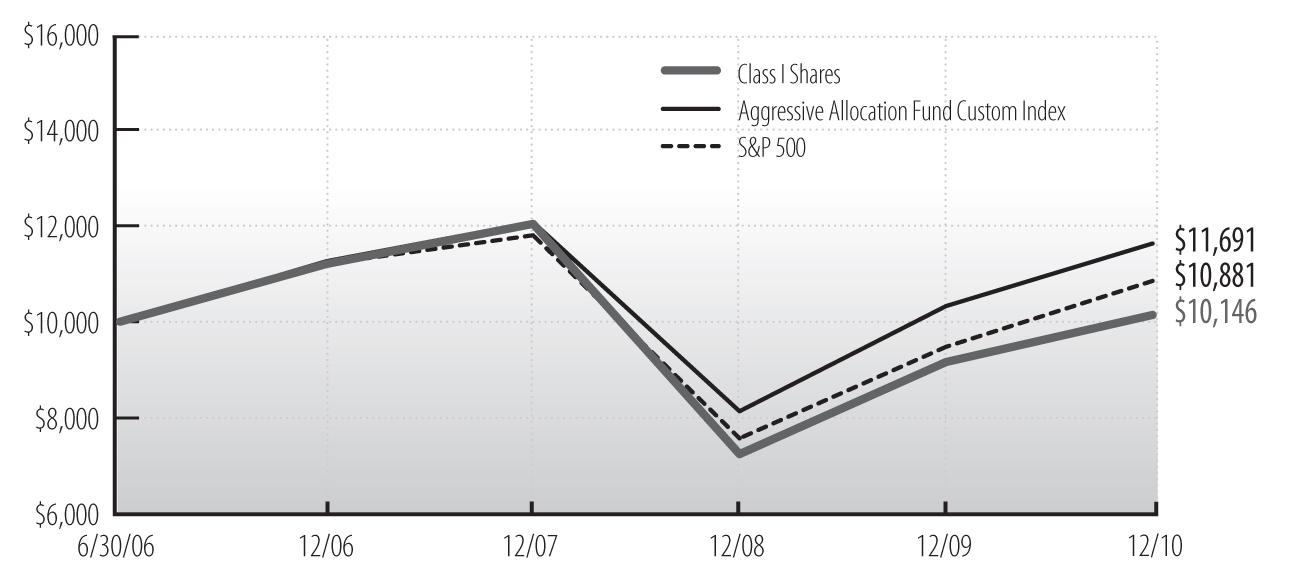

Cumulative Performance of $10,000 Investment Since Inception1,2

Average Annual Total Return through December 31, 20101 |

| | | | | |

| Class I Shares | 11.15% | -5.74% | 0.32% | — |

| Class II Shares | 10.87 | — | — | 21.62% |

| Aggressive Allocation Fund Custom Index | 13.09 | -1.28 | 3.53 | 25.89 |

| S&P 500 Index | 15.06 | -2.86 | 1.89 | 27.07 |

See accompanying Notes to Management’s Discussion of Fund Performance.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Aggressive Allocation Fund (concluded)

2010 proved to be a very positive year for asset allocation funds. Returns for the year across asset classes were far from uniform. U.S. stocks, as measured by the Russell 3000¨ Index, finished the year up 16.9%, the international equity MSCI EAFE Index returned 8.2%, and the Barclays U.S. Aggregate Bond Index gained 6.5%. However, within each of these asset classes the underlying returns where largely skewed in favor of the riskier stocks and bonds. Here in the U.S., high beta stocks outgained lower beta and high quality stocks by a very wide margin. The same was true for capitalization size where small caps, generally regarded as lower in quality, outpaced large caps by over 11%. In bond land, "junk" bonds returned nearly 9% more than the investment grade Barclays U.S. Aggregate Bond Index. In short, it was a risk takers market in asset allocation for 2010.

PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/10 |

| Bond Funds | 7% |

| Foreign Bond Funds | 3% |

| Stock Funds | 74% |

| Foreign Stock Funds | 14% |

| Money Market Funds and Other Net Assets | 2% |

For the twelve-month period ended December 31, 2010, the Ultra Series Aggressive Allocation Fund returned 11.15% (Class I shares), underperforming our Aggressive Allocation Custom Index return of 13.09%. The fund’s relative underperformance was attributed to our risk aware posturing and preference for higher quality large cap equities. Despite our preference for relatively higher quality investments, the fund was boosted by modest positions in small and mid caps with MEMBERS Small Cap Fund Class Y up 25.6% for the year and MEMBERS Mid Cap Fund Class Y up 19.6%. Also contributing positively to the fund’s return was our dedicated energy and natural resources position, T. Rowe Price New Era Fund which returned 21.0%. Detractors from relative performan ce included Hussman Strategic Growth Fund which returned -3.6% for the year, MEMBERS Bond Fund Class Y which returned 4.9%, MEMBERS International Stock Fund Class Y which returned 6.5%, and MEMBERS Large Cap Value Fund Class Y which returned 8.3%.

Overall, despite the fund’s relative underperformance, we were pleased with the fund’s absolute return given the moderate level of risk taken for an aggressive fund. In short, we believe the fund is well-positioned for the economic environment that we are encountering – an economy showing emerging signs of gaining some sustainable traction combined with atypically elevated downside risk potential.

Notable additions to the fund’s holdings this year were: PIMCO Investment Grade Corporate Bond Fund, T. Rowe Price New Era Fund, Matthews Asian Growth & Income Fund, and Yacktman Fund. Fairholme Fund was sold from the portfolio during 2010.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Money Market Fund invests exclusively in U.S. dollar-denominated money market securities maturing in thirteen months or less from the date of purchase. These securities will be obligations of the U.S. Government and its agencies and instrumentalities, but may also include securities issued by U.S. and foreign financial institutions, corporations, municipalities, foreign governments, and multi-national organizations, such as the World Bank. The fund may invest in mortgage-backed and asset-backed securities, including those representing pools of mortgage, commercial, or consumer loans originated by credit unions or other financial institutions.

PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/10 |

| Fannie Mae | 27% |

| Federal Home Loan Bank | 26% |

| Freddie Mac | 24% |

| U.S. Treasury Bills | 8% |

| Commercial Paper | 13% |

| Cash and Other Net Assets | 2% |

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

This page was intentionally left blank.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

INVESTMENT STRATEGY HIGHLIGHTS

Under normal circumstances, the Ultra Series Bond Fund invests at least 80% of its assets in bonds. To keep current income relatively stable and to limit share price volatility, the fund emphasizes investment grade securities and maintains an intermediate (typically 3-6 year) average portfolio duration (a measure of a security’s price sensitivity to changes in interest rates). The fund also strives to minimize risk in the portfolio by making strategic decisions relating to credit risk and yield curve outlook. The fund may invest in corporate debt securities, U.S. Government debt securities, foreign government debt securities, non-rated debt securities, and asset-backed, mortgage-backed and commercial mortgage-backed securities.

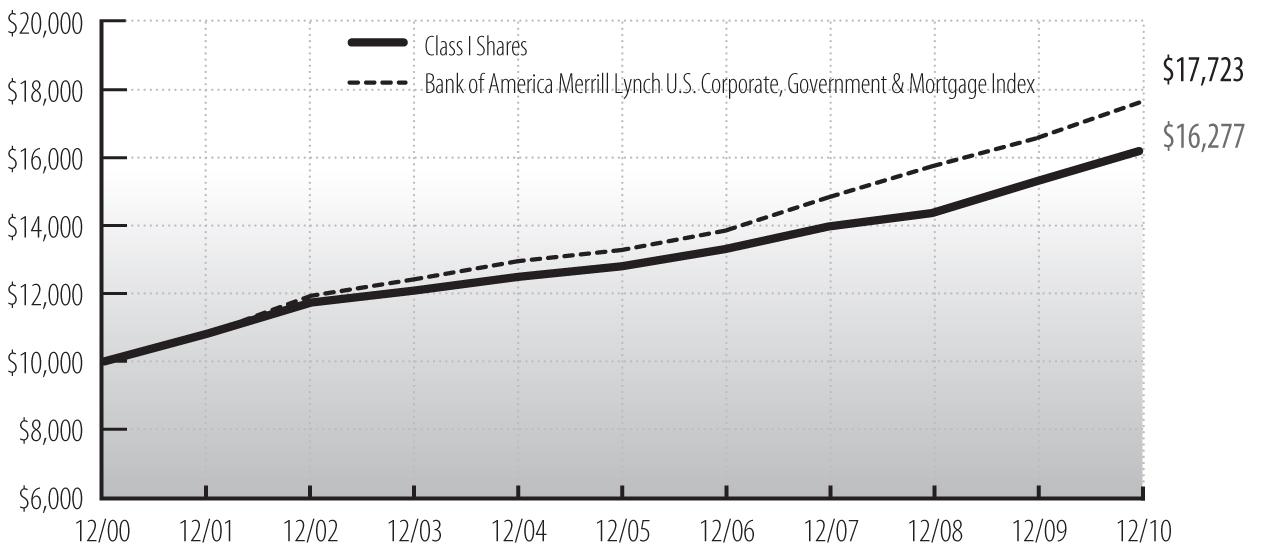

Cumulative Performance of $10,000 Investment Since Inception1

Average Annual Total Return through December 31, 20101 |

| | | | | | |

| Class I Shares | 5.92% | 5.08% | 4.86% | 4.99% | — |

| Class II Shares | 5.66 | — | — | — | 6.74% |

| Bank of America Merrill Lynch U.S. Corporate, Government & Mortgage Index | 6.43 | 5.96 | 5.87 | 5.89 | 6.85 |

See accompanying Notes to Management’s Discussion of Fund Performance.

During the twelve-month period ended December 31, 2010, at times it seemed as if the bond market was playing a game of "gotcha." During much of the middle of the period, the market built in an increased probability of a very soft economy and possible double dip recession. Interest rates rallied and spread products such as mortgage pass-throughs and corporate bonds showed some signs of spread widening. During the fourth quarter of 2010 that largely reversed as data appeared to gradually erase those concerns. We seemed to be more in a range trade that might broadly be defined by yields on the ten year Treasury of 2½ to 4%.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Bond Fund (concluded)

In the final quarter of the period, we believed three events affected market perceptions the most. The first being the November elections. We believed the market interpreted the results causing the government to adopt a more business and economy friendly posture. The ultimate manifestation of that was the agreement in December to extend the "Bush" tax cuts, thereby removing concerns that tax policy would act as a deterrent to growth in the near term. Second, at almost the same time the Fed officially announced it would implement what has become known as QEII, a program to purchase an additional $600 billion of Treasury securities. This clearly signaled a ‘risk on’ trade for risk assets in the mind of the market. It may well have also caused the mar kets to expect increasing inflation expectations which are to some degree evident in the pricing of TIPS (Treasury inflation protected securities). Broadly speaking, both of these events therefore drove interest rates higher. There was an offsetting force: the turmoil in Europe. The bailouts of banking systems in both Ireland and previously Greece raised doubts with regard to the longer term sustainability of the economic and monetary union and European Union. This to a degree capped the risk trade and reminded investors of the safe(r) haven status of the dollar and U.S. Treasuries.

With all the twists and turns, 2010 still turned in a decent year for the portfolio and the market. During the course of the year ten-year Treasury yields declined from 3.84% to 3.29% while two-year Treasuries experienced a similar yield decline from 1.13% to 0.59%. Additionally, spread sectors such as corporate and mortgage securities benefitted from both their incremental yield and yield spread compression to meaningfully outperform Treasuries. As was the case in 2009, the further down the quality spectrum, the better the performance. High yield earned 9.8% in excess of what Treasuries of comparable duration earned. With BBB rated securities, the excess return was 4% while AA rated corporate securities earned ‘only’ 1.5% more than Treasuries. As noted above, the Fed yelled ‘risk on’ and the markets bought it. We do not believe this can be maintained indefinitely and anticipate some correction during 2011.

PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/10 |

| Asset Backed | 2% |

| Corporate Notes and Bonds | 26% |

| Mortgage Backed | 24% |

| U.S. Government and Agency Obligations | 44% |

| Cash and Other Net Assets | 4% |

For the twelve-month period ended December 31, 2010 the Ultra Series Bond Fund returned 5.92% (Class I shares) while the Bank of America Merrill Lynch U.S. Corporate, Government & Mortgage Index returned 6.43%. For the year, performance was negatively impacted the most by factors including the fund’s shorter duration, i.e., less interest rate risk, and to a lesser extent having an underweight position versus the index in mortgage securities and financials. These factors were somewhat offset from having an overweight position versus the index in both corporate bonds in general and BBB rated bonds in particular.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series High Income Fund invests primarily in lower-rated, higher-yielding income bearing securities, such as "junk" bonds. Because the performance of these securities has historically been strongly influenced by economic conditions, the fund may emphasize security selection in business sectors that favor the economic outlook. Under normal market conditions, the fund invests at least 80% of its assets in bonds rated lower than investment grade (BBB/Baa) and their unrated equivalents or other high-yielding securities.

Cumulative Performance of $10,000 Investment Since Inception1

Average Annual Total Return through December 31, 20101 |

| | | | | | | |

| Class I Shares | 11.73% | 8.55% | 7.37% | 7.24% | 7.12% | — |

| Class II Shares | 11.45 | — | — | — | — | 17.50% |

| Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index | 15.07 | 10.36 | 8.83 | 8.75 | 8.37 | 29.93 |

See accompanying Notes to Management’s Discussion of Fund Performance.

The high yield market generated solid returns for the twelve-month period ended December 31, 2010, as the Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index gained 15.07%. The combination of lower default rates, significant refinancing activity and investor focus on yield enhancing strategies were key ingredients to the high yield market’s rally. Over the past twelve months, the U.S. economy has slowly begun to heal as GDP growth turned positive. Moreover, during the last month of the reporting period it became clear that investor sentiment has rotated from a period of "post recession anxiety" to a focus on "post recession recovery."

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

High Income Fund (concluded)

The technical underpinnings of the high yield market remained solid for most of the past twelve months as record new issuance was readily absorbed by investors’ near insatiable demand for income producing assets. During the reporting period, high yield new issue supply set an all-time record as 653 new issues, totaling $302 billion, flooded the market. The vast majority of the new issuance was used to refinance existing debt. The significant access to capital for high yield issuers was a key contributor to lower default expectations. In fact, default rates declined further during the reporting period with Moody’s calculating a latest twelve month trailing default rate of 3.1% as of December 31, 2010.

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS |

Consumer Discretionary | 30% |

| Consumer Staples | 6% |

| Energy | 8% |

| Financials | 2% |

| Health Care | 8% |

| Industrials | 17% |

| Information Technology | 6% |

| Materials | 6% |

| Telecommunication Services | 7% |

| Utilities | 5% |

| Cash and Other Net Assets | 5% |

Consumer Discretionary includes securities in the following industries: Auto Components; Consumer Finance; Hotels, Restaurants & Leisure; Household Durables; Leisure Equipment & Products; Media;Multiline Retail; Specialty Retail; and Textiles, Apparel & Luxury Goods. |

The Ultra Series High Income Fund gained 11.73% (Class I shares) for the twelve-month period ended December 31, 2010. For the same time period, the Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index returned 15.07%. Detracting from the fund’s relative performance versus the index was the portfolio’s significant underweight position in the Financial sector (2.1% vs. 11.4%), and significant underweight position in Discount Bonds (0.5% vs. 5.6%), as these two sectors were among the best performing sectors within the Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index. Also detracting from the performance was the fund’s average cash weighting of approximately 2.6% during the period. Key contributors to the fund’s strong absolute performance during the reporting period were the fund’s bond holdings in the automotive, gaming, industrial and broadcast areas. Each of these industry holdings gained over 14.5% during the period. The fund’s convertible holdings also generated strong returns during the period, in excess of 19%.

Over the last twelve months, the fund was an active participant in the new issue market by adding 46 new issues to the portfolio. The fund also increased its weighting in convertible bonds during the reporting period and its exposure to the Health Care, Media and Energy sectors. During the reporting period, the average price of the fund’s securities increased from $100.25 to $103.66, while the average credit rating remained at B/B2. At period end, the portfolio had no securities with a price less than $89. The top five industry weightings as of December 31, 2010 were Support Services, Health Care, Telecom, Diversified Media and Energy.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Diversified Income Fund seeks income by investing in a broadly diversified array of securities including bonds, common stocks, real estate securities, foreign market bonds and stocks and money market instruments. Bonds, stock and cash components will vary, reflecting the portfolio managers’ judgments of the relative availability of attractively yielding and priced stocks and bonds. Generally, however, bonds will constitute up to 80% of the fund’s assets, stocks will constitute up to 60% of the fund’s assets, real estate securities will constitute up to 25% of the fund’s assets, foreign stocks and bonds will constitute up to 25% of the fund’s assets and money market instruments may constitute up to 25% of the fund& #8217;s assets. The fund intends to limit the investment in lower credit quality bonds to less than 50% of the fund’s assets. The balance between the two strategies of the fund (fixed income and equity investing) is determined after reviewing the risks associated with each type of investment, with the goal of meaningful risk reduction as market conditions demand. The fund typically sells a stock when the fundamental expectations for producing competitive yields at an acceptable level of price risk no longer apply, the price exceeds the intrinsic value or other stocks appear more attractive.

Cumulative Performance of $10,000 Investment Since Inception1

Average Annual Total Return through December 31, 20101 |

| | | | | | |

| Class I Shares | 12.04% | 2.48% | 3.95% | 3.23% | — |

| Class II Shares | 11.77 | — | — | — | 15.86% |

| Bank of America Merrill Lynch U.S. Corporate, Government & Mortgage Index | 6.43 | 5.96 | 5.87 | 5.89 | 6.85 |

| Russell 1000¨ Index | 16.10 | -2.37 | 2.59 | 1.83 | 28.07 |

See accompanying Notes to Management’s Discussion of Fund Performance.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Diversified Income Fund (concluded)

2010 was a year that can be divided into thirds. During the first third of the year, the Russell 1000¨ Index rose at its high by about 10%. Riskier assets were greatly sought after as the "risk-on" trade was in favor. During the second third, or middle of the year, the Russell 1000¨ Index corrected by over 15% at its low as the economy faltered, and the "risk-off" trade was back in favor. In the final third of the year, when the Fed’s QE2 program was put into action, the Russell 1000¨ Index rallied by 25% through year-end, as the "risk-on" trade was once again back in favor.

PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/10 |

| Asset Backed | 1% |

| Common Stocks | 52% |

| Corporate Notes and Bonds | 19% |

| Mortgage Backed | 11% |

| U.S. Government and Agency Obligations | 13% |

| Cash and Other Net Assets | 4% |

For the twelve-month period ended December 31, 2010, the Ultra Series Diversified Income Fund returned 12.04% (Class I shares), while the Bank of America Merrill Lynch U.S. Corporate, Government & Mortgage Index (the fund’s bond portion index) returned 6.43% and the Russell 1000¨ Index (the fund’s stock portion index) returned 16.10% . The fund’s representative market index is represented by these two separate indexes as a better reflection of the types of stocks and bonds typically held by the fund as described in the prospectus. For the period, we are pleased that the stock portion of the fund outperformed its index due to strong stock selection in most sectors and that, combined with strong bond performance, the fund’s overa ll performance reflects its blend of investments.

Within the stock portion of the fund (approximately 52% on December 31, 2010), Health Care sector holdings detracted from performance, while performance was boosted by our significant weighting and strong performance in the Consumer Staples, Financials, Energy, and Information Technology sectors. The fund’s higher quality stock holdings lagged during the risk-taking rallies while low quality stocks led the market, but held up much better during the correction period. Specifically, performance was led by Boeing Co., ConocoPhillips, Philip Morris International Inc., Microsoft Corp., and Honeywell International Inc.. Detracting from performance were Health Care stocks Pfizer Inc., Johnson & Johnson, and Merck & Co. Inc., which saw their earnings fal l short of expectations. In addition, Utility firm FirstEnergy Corp. saw its profits slip due to lower natural gas prices, and Lockheed Martin Corp. fell short of profit potential as it had large pension expenses.

The performance of the bond portion of the fund was significantly bolstered by its income orientation. More specifically, its overweighted allocation relative to the market to BBB rated securities and corporate bonds in general added both income and relative price appreciation in excess of the bond market.

During 2010 the stock portion of the fund increased its weight in Energy and Information Technology, while decreasing its weight in the rallying Industrial sector. A midyear bond market rally gave us the opportunity to reduce the weights in the Utilities and Telecom sectors.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Equity Income Fund invests primarily in common stocks of large-and mid-capitalization companies that are, in the view of the fund’s investment adviser, selling at a reasonable price in relation to their long-term earnings growth rates. The portfolio managers will allocate the fund’s assets among stocks in sectors of the economy based upon their expected earnings growth rates, adjusted to reflect their views on economic and market conditions and sector risk factors.

The fund will seek to generate current earnings from option premiums by writing (selling) covered call options on a substantial portion of its portfolio securities. The fund seeks to produce a high level of current income and current gains generated from option writing premiums and, to a lesser extent, from dividends. The extent of option writing activity will depend upon market conditions and the portfolio manager’s ongoing assessment of the attractiveness of writing call options on the fund’s stock holdings. In addition to providing income, covered call writing helps to reduce the volatility (and risk profile) of the fund by providing downside protection.

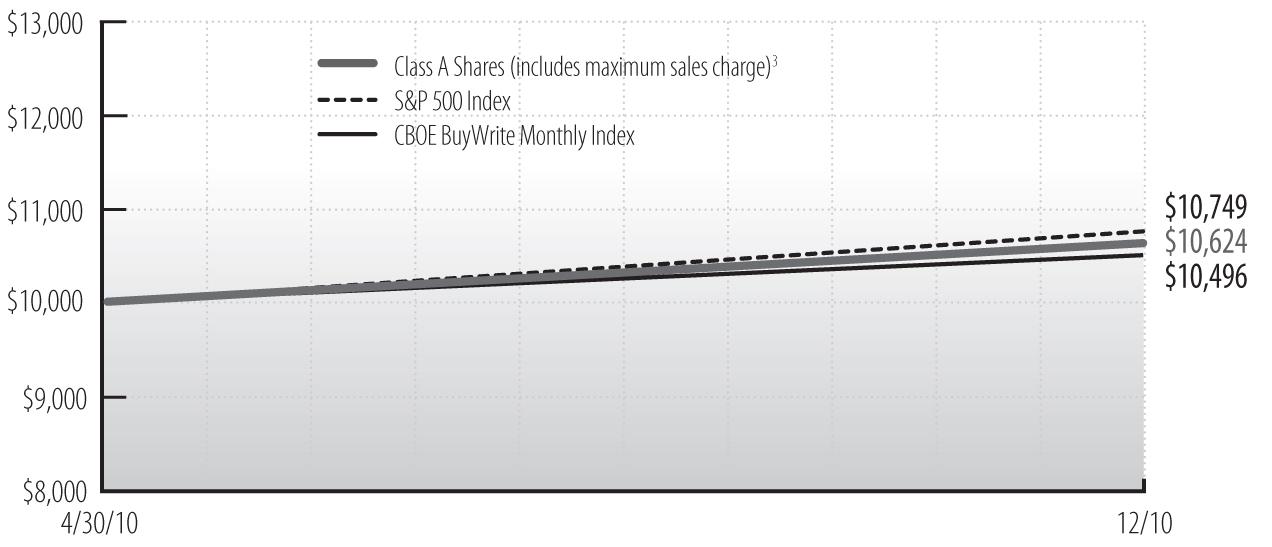

Cumulative Performance of $10,000 Investment Since Inception1,2

Average Annual Total Return through October 31, 20102 |

| | |

| Class I Shares | 6.24% |

| Class II Shares | 6.07 |

| S&P 500 Index | 7.49 |

| CBOE BuyWrite Monthly Index | 4.96 |

See accompanying Notes to Management’s Discussion of Fund Performance.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Equity Income Fund (concluded)

The Ultra Series Equity Income Fund began its existence on April 30, 2010 and the subsequent correction in equity prices, which lasted through the end of June, provided an opportunity to become fully invested at attractive levels. Following the correction, equities recovered quite strongly through year end. The upward surge, particularly during the fourth quarter, hindered the ability of the fund to keep pace as many underlying stock positions moved above the strike prices on their call options (the prices at which the holder of a stock option may purchase the stock) . In addition, as stocks moved higher, a number of stock positions were called away on option expirations. This led to an increase in the fund’s cash position which was reinvested in a cauti ously opportunistic fashion but proved to be a head wind in a fast rising market. These factors primarily attributed to the fund underperforming the S&P 500 from the inception day through year end.

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS |

| | Fund | S&P 500 |

| Consumer Discretionary | 13% | 10% |

| Consumer Staples | – | 11% |

| Energy | 11% | 12% |

| Financials | 19% | 16% |

| Health Care | 18% | 11% |

| Industrials | 2% | 11% |

| Information Technology | 22% | 19% |

| Materials | – | 4% |

| Telecommunication Services | – | 3% |

| Utilities | – | 3% |

| Exchange-Traded Fund | 4% | – |

| Cash and Other Net Assets | 11% | – |

For the period ended December 31, 2010, the fund outperformed the CBOE Buy-Write Index (BXM) which is the passive benchmark for a covered call strategy on the S&P 500. From inception through period end, the fund rose 6.24% versus a 4.96% return for the CBOE Buy-Write Index and a 7.49% return for the S&P 500 Index.

In 2010, the fund benefitted from the strong moves in many underlying holdings as call options were written (sold) meaningfully out-of-the-money (option’s strike price is higher than the market price of the underlying stock) in the early portion of the period. Although not fully capturing the entirety of stock’s gains, significantly more upside was captured relative to a strategy focusing only on achieving the highest premium income. Many fund positions achieved returns greater that the S&P 500 Index despite having call option strike prices which limited their upside potential. Such holdings included, Varian Semiconductor, Google, Mylan Labs, Goldman Sachs and Morgan Stanley. These positions also benefitted from option premium income in additio n to the gains in stock price. Some weakness was observed in holdings which had disappointing earnings releases such as Best Buy, EOG Resources and Cisco Systems. Similarly, the downside of weaker holdings was buffeted by the presence of call options written.

The primary change to the fund during the period was to increase the percentage of the fund covered by call options as the stock market moved higher. As of year-end, 89.2% of the fund’s holding were covered by call options as opposed to 68.9% at the end of June. In addition, call options most recently have been written closer-to-the-money (when the price of the underlying stock surpasses the strike price) in observance of the strong rally which we have witnessed over the past five months. At year-end, the fund was conservatively positioned in advance of what we believe will be a more volatile period ahead.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Large Cap Value Fund will, under normal market conditions, invest primarily in large cap stocks. The fund follows a "value" approach, meaning the portfolio managers seek to invest in stocks at prices below their perceived intrinsic value as estimated based on fundamental analysis of the issuing company and its prospects. By investing in value stocks, the fund attempts to limit the downside risk over time but may also produce smaller gains than other stock funds if their intrinsic values are not realized by the market or if growth-oriented investments are favored by investors. The fund will diversify its holdings among various industries and among companies within those industries. The fund typically sells a stock when the fundamental expectati ons for buying it no longer apply, the price exceeds its intrinsic value or other stocks appear more attractively priced relative to their intrinsic values.

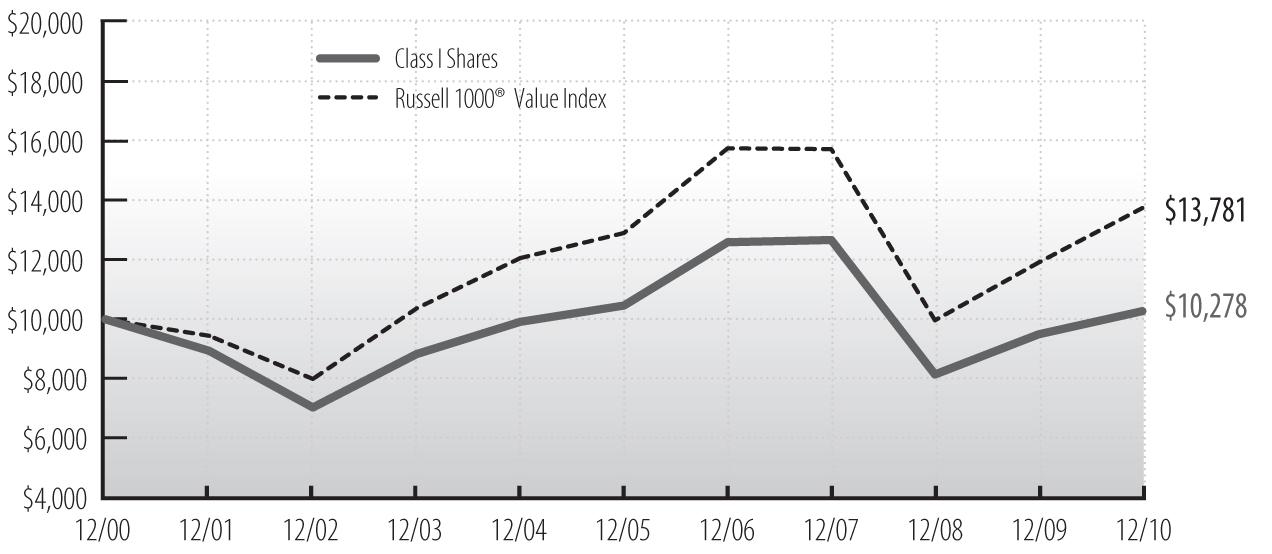

Cumulative Performance of $10,000 Investment Since Inception1

Average Annual Total Return through December 31, 20101 |

| | | | | | |

| Class I Shares | 8.29% | -6.80% | -0.37% | 0.27% | — |

| Class II Shares | 8.02 | — | — | — | 20.31% |

| Russell 1000¨ Value Index | 15.51 | -4.42 | 1.28 | 3.26 | 27.47 |

See accompanying Notes to Management’s Discussion of Fund Performance.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Large Cap Value Fund (concluded)

2010 was a year that can be viewed in thirds. During the first third of 2010 the Russell 1000¨ Value Index rose by over 10%. Riskier assets such as stocks of highly levered firms rallied sharply, and the "risk-on" trade was rewarded. During the second third, or middle of the year, the Value Index experienced a 15% correction, and the "risk-off" trade outperformed riskier assets. In the final third of the year, when the Fed’s QE2 program was put into action, the Value Index rallied by over 20% from its midyear low, and the "risk-on" trade was once again rewarded.

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS |

| | Fund | Russell 1000¨ Value Index |

| Consumer Discretionary | 6% | 8% |

| Consumer Staples | 10% | 10% |

| Energy | 16% | 13% |

| Financials | 20% | 28% |

| Health Care | 15% | 12% |

| Industrials | 9% | 9% |

| Information Technology | 13% | 5% |

| Materials | 3% | 3% |

| Telecommunication Services | 3% | 5% |

| Utilities | 3% | 7% |

| Cash and Other Net Assets | 2% | – |

For the twelve-month period ended December 31, 2010, the Ultra Series Large Cap Value Fund return of 8.29% lagged the Russell 1000¨ Value Index return 15.51%. Much of the fund’s lag versus the benchmark built up during the early portion of the year, and the fund was unable to completely close the gap during the subsequent midyear correction when the market shifted to higher quality stocks. The fund’s underperformance gap further increased during the last third of the year when riskier assets once again found favor.

Energy stocks were the biggest detriment to performance during the period. While the fund’s larger oil related issues performed well, its holdings in natural gas related firms, as well as energy equipment and services stocks underperformed. The largest individual detractors from fund performance included the Energy firms Southwestern Energy Co. and Noble Corp. An abundance of industry-wide production kept natural gas prices low, which crimped Southwestern Energy Co.’s profits, while the disruption in drilling activity in the Gulf of Mexico hurt Noble Corp.’s profits. The Utility firm Exelon Corp. also detracted from performance, as lower natural gas prices brought profits down in their wholesale business. In addition, fund performance versus the index was weak in the Industrial, Financial, and Information Technology sectors.

Offsetting some of the losses include strong performance from several fund holdings. Stocks which aided performance included Berkshire Hathaway Inc. Class B, and the mid-sized firms AutoZone, Inc., KeyCorp, and Darden Restaurants Inc.

During the period the fund reduced its sector weight in the Energy and Consumer Discretionary sectors. Conversely, the fund increased its sector weight in Information Technology and Consumer Staples. Although Treasury interest rates fell and dividend yields generally fell as stock prices rose, the fund found many attractive above average dividend yield stocks to purchase, and the dividend yield on the fund’s stocks rose from 2.3% to 2.6% during 2010.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Large Cap Growth Fund invests primarily in common stocks of larger companies and will, under normal market conditions, maintain at least 80% of its assets in large cap stocks. The fund follows a "growth" approach, meaning the portfolio managers seek stocks that have low market prices relative to their perceived growth capabilities as estimated based on fundamental analysis of the issuing companies and their prospects. The fund typically seeks higher earnings growth capabilities in the stocks it purchases, and may include some companies undergoing more significant changes in their operations or experiencing significant changes in their markets. The fund will diversify its holdings among various industries and among companies within those indust ries. The fund has an active trading strategy which will lead to more portfolio turnover than a more passively-managed fund. The fund typically sells a stock when the fundamental expectations for buying it no longer apply, the price exceeds its perceived value or other stocks appear more attractively priced relative to their prospects.

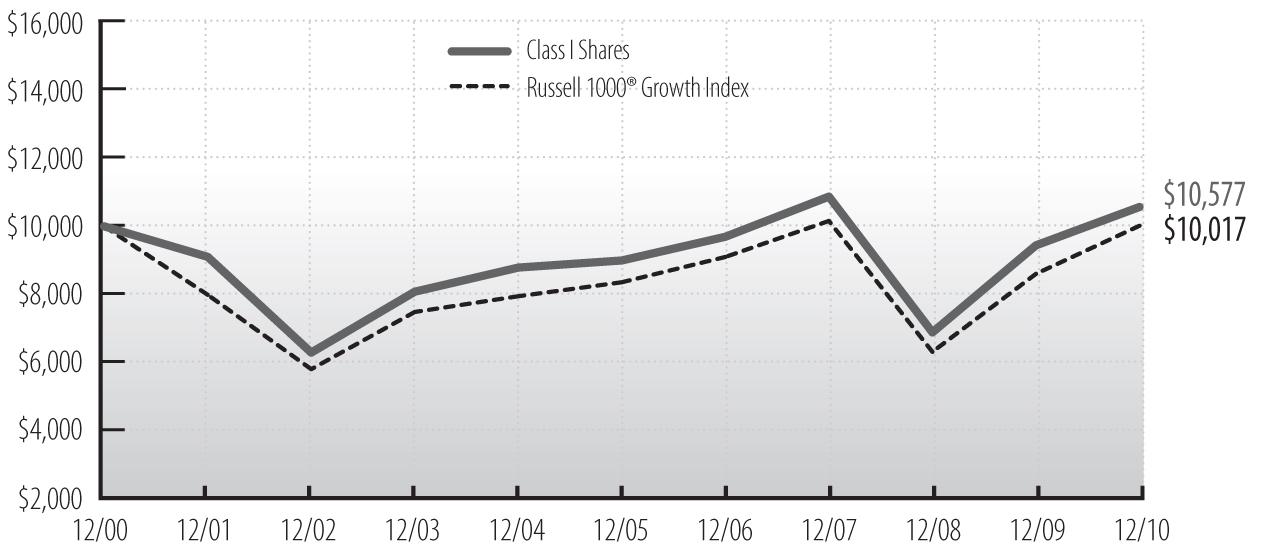

Cumulative Performance of $10,000 Investment Since Inception1

Average Annual Total Return through December 31, 20101 |

| | | | | | |

| Class I Shares | 12.13% | -0.96% | 3.32% | 0.56% | — |

| Class II Shares | 11.85 | — | — | — | 22.91% |

| Russell 1000¨ Growth Index | 16.71 | -0.47 | 3.75 | 0.02 | 28.67 |

See accompanying Notes to Management’s Discussion of Fund Performance.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Large Cap Growth Fund (concluded)

"Risk on, Risk off, Risk on again" best describes the 2010 stock market environment. Large, macroeconomic issues were key drivers of stock prices last year: sovereign debt crisis, foreclosures, saber rattling, regulatory reform, QE2, and elections dominated headlines. While the market ended up for the year, insight into how these large factors influenced individual companies was often limited. Generally, lower quality, more cyclical stocks led the advance.

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS |

| | Fund | Russell 1000¨ Growth Index |

| Consumer Discretionary | 6% | 15% |

| Consumer Staples | 10% | 9% |

| Energy | 16% | 11% |

| Financials | 20% | 5% |

| Health Care | 15% | 10% |

| Industrials | 9% | 13% |

| Information Technology | 13% | 31% |

| Materials | 3% | 5% |

| Telecommunication Services | 3% | 1% |

| Utilities | 3% | – |

| Cash and Other Net Assets | 2% | – |

We had positive returns in excess of 10%, but a disappointment relative to benchmark returns exceeding 15%. For the twelve-month period ended December 31, 2010 the Ultra Series Large Cap Growth Fund returned 12.13% (Class I shares), trailing the Russell 1000 Growth Index return of 16.71%. Not owning any gold or copper stocks within the fund was a detriment as was our modest commitment to the consumer. Commodities by definition are highly cyclical and difficult to analyze correctly. Generally we avoid areas of the market where we have little meaningful insight. The strength in consumer stocks surprised many market participants given the high unemployment rate and reduced home equity. As a growth manager, generally we seek investments with strong fundamental dri vers of earnings.

Individually, performance was impeded by the fund’s significant investment in Visa. The stock was down in an up market in reaction to surprisingly negative federal regulatory reform. We believe Visa will be able to successfully manage through the imposed changes and therefore remain committed to the stock.

Stock selection in financial services helped performance. We sought to avoid credit problems by investing in Axis Holdings, an insurance company. The stock rose more than 25% last year. We also correctly anticipated a shift in the flow of funds out of bonds and into stocks. Our investment in TRowe Price rose more than 25% for the year.

We believe consumer spending will continue to be limited due to credit constraints. Consequently we are retaining only modest portfolio exposure in the Consumer sectors. Alternatively, many corporations have large cash balances which we think will begin to be deployed in 2011. Consequently, we tend to favor stocks related more to business spending over those related to consumer spending. We also are favoring the Energy and Industrial sectors given our perception of the durability of the global economic recovery as well as the absence of onerous regulation in many of these industries. Lastly, we are interested in many areas of innovation in technology. Profitable growth opportunities appear likely in some internet related businesses as social network ing and mobile computing continue to develop.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Mid Cap Fund generally invests in common stocks of midsize companies and will, under normal market conditions, maintain at least 80% of its assets in mid cap securities. However, the fund will not automatically sell a stock because its market capitalization has changed and such positions may be increased through additional purchases. The fund seeks attractive long-term returns through bottom-up security selection based on fundamental analysis in a diversified portfolio of high-quality growth companies with attractive valuations. These will typically be industry leading companies in niches with strong growth prospects. The fund’s portfolio managers believe in selecting stocks for the fund that show steady, sustainable growth and reasonabl e valuations. As a result, stocks of issuers that are believed to have a blend of both value and growth potential will be selected for investment. Stocks are generally sold when target prices are reached, company fundamentals deteriorate or more attractive stocks are identified.

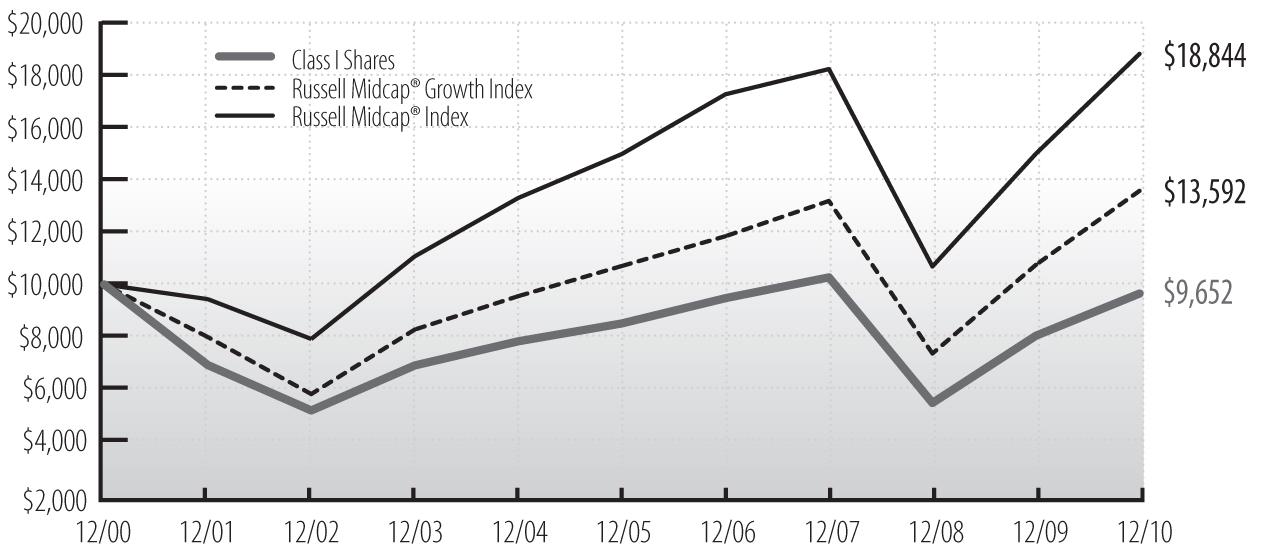

Cumulative Performance of $10,000 Investment Since Inception1

Average Annual Total Return through December 31, 20101 |

| | | | | | |

| Class I Shares | 20.12% | -2.06% | 2.56% | -0.35% | — |

| Class II Shares | 19.82 | — | — | — | 28.03% |

| Russell Midcap¨ Growth Index | 26.38 | 0.97 | 4.88 | 3.12 | 36.17 |

| Russell Midcap¨ Index | 25.48 | 1.05 | 4.66 | 6.54 | 36.33 |

See accompanying Notes to Management’s Discussion of Fund Performance.

During the twelve-month period ended December 31, 2010, mid cap stocks performed well despite a multi-month correction that occurred over the summer. The period began with a continuation of the 2009 rally where investors embraced prospects of an economic recovery. That rally paused as a correction began in April. Investors worried about the sovereign debt crisis in Europe, the scope of financial reform and the tragic oil spill in the Gulf

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Mid Cap Fund (concluded)

of Mexico. These issues were put on the back burner in September as the Federal Reserve announced its intentions to provide another round of quantitative easing. With the Fed once again likely to print money, investors embraced riskier cyclical assets including securities with volatile earnings histories, and stock markets rallied strongly to finish the year.

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS |

| | Fund | Russell Midcap¨ Index |

| Consumer Discretionary | 14% | 15% |

| Consumer Staples | 4% | 6% |

| Energy | 9% | 9% |

| Financials | 22% | 19% |

| Health Care | 13% | 9% |

| Industrials | 14% | 13% |

| Information Technology | 12% | 14% |

| Materials | 6% | 6% |

| Telecommunication Services | 2% | 3% |

| Utilities | 0% | 6% |

| Cash and Other Net Assets | 4% | – |

For the twelve-month period ended December 31, 2010, the Ultra Series Mid Cap Fund increased 20.12% (Class I shares), underperforming the Russell Midcap¨ Index return of 25.48%. Even though we produced strong absolute returns, the period was challenging for the fund as cyclical stocks performed better than stocks with more consistent earnings profiles.

Our holdings in the Energy and Industrial sectors accounted for almost all of the fund’s relative underperformance. Low natural gas prices hurt exploration & production companies Southwestern Energy Co. and EOG Resources Inc. The Deepwater Horizon oil spill and the subsequent drilling moratorium negatively impacted Noble Corp., which has assets in the Gulf of Mexico. Used construction equipment auctioneer Ritchie Bros Auctioneers, Inc., engineering and construction firm Jacobs Engineering Group, Inc. and used car auctioneer Copart, Inc. were notable underperformers in the Industrial sector. Our assessments of these companies remains positive, and we added to many of the aforementioned underperformers.

Partially offsetting the underperformance, our Financial and Consumer stocks performed well relative to the index. Commercial real estate operating company Brookfield Properties Corp. and global infrastructure asset manager Brookfield Asset Management, Inc., Class A contributed nicely to performance. Consumer Staples stock picking was another area of strength as retail pharmacy Walgreen, spice manufacturer McCormick & Co., Inc. and Brown-Forman Corp., a multi-national spirits company, were additive to returns.

Our exposure to Financial stocks increased during the period, particularly in insurance and asset management. We added to insurance broker Brown & Brown, Inc., and specialty insurer Markel Corp. Other additions included Brookfield Asset Management, Inc., Class A and SEI Investments Co. We maintain an overweight position in Financials as we believe valuations are attractive.

The combination of rising valuations and heightened investor expectations caused us to reduce our exposure to more cyclical sectors such as Industrials and Consumer Discretionary stocks during the period.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Small Cap Fund invests primarily in a diversified mix of common stocks of small cap U.S. companies that are believed to be undervalued by various measures and offer sound prospects for capital appreciation. The portfolio managers employ a value-oriented investment approach in selecting stocks, using proprietary fundamental research to identify securities of companies they believe have attractive valuations. The portfolio managers focus on companies with a record of above average rates of profitability that sell at a discount relative to the overall small cap market. Through fundamental research, the portfolio managers seek to identify those companies that possess one or more of the following characteristics: sustainable competitive advantages within a market niche; strong profitability and free cash flows; strong market share positions and trends; quality of and share ownership by management; and financial structures that are more conservative than the relevant industry average.

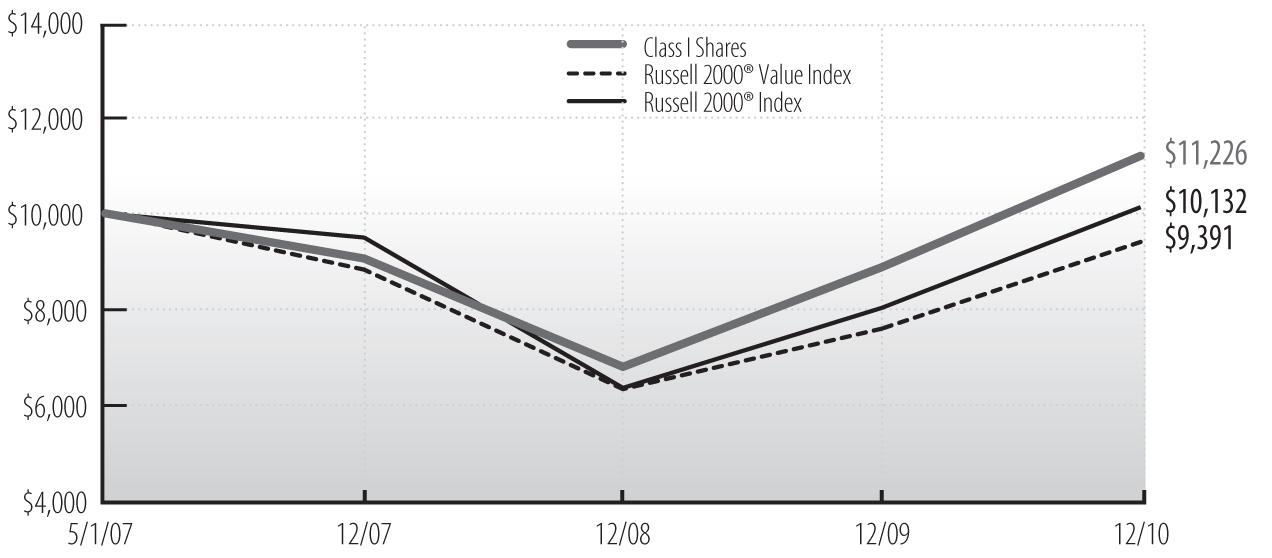

Cumulative Performance of $10,000 Investment Since Inception1

Average Annual Total Return through December 31, 20101 |

| | | | | |

| Class I Shares | 26.80% | 7.49% | 3.20% | — |

| Class II Shares | 26.48 | — | — | 35.63% |

| Russell 2000¨ Value Index | 24.50 | 2.19 | -1.70 | 33.08 |

| Russell 2000¨ Index | 26.85 | 2.22 | 0.36 | 34.59 |

See accompanying Notes to Management’s Discussion of Fund Performance.

U.S. equities were volatile during the twelve-month period ended December 31, 2010, moving higher early in the period on strong corporate earnings and generally favorable economic data before succumbing in the second quarter to escalating global growth concerns and sovereign debt challenges in Europe. Equity markets rebounded in the third quarter and continued their ascent through the end of the year as investors shrugged off sovereign debt fears in Europe and embraced strong earnings growth, generally improving

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Small Cap Fund (concluded)

economic data, the extension of US tax cuts, and continued high levels of global liquidity. Returns were strong across capitalizations and styles. Growth stocks (+29.1%) outperformed value (+24.5%), while small cap stocks (+26.9%) led their larger peers (+15.1%), as measured by the Russell 2000 Growth, Russell 2000 Value, Russell 2000, and S&P 500 indices, respectively. Sector performance was strong, with all sectors of the benchmark posting double-digit gains for the period. Information Technology, Materials, and Consumer Discretionary led the market higher while Health Care and Telecommunication Services posted more modest gains.

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/10 |

| | Fund | Russell 2000¨ Index |

| Consumer Discretionary | 17% | 14% |

| Consumer Staples | 3% | 3% |

| Energy | 4% | 6% |

| Financials | 23% | 20% |

| Health Care | 8% | 12% |

| Industrials | 23% | 16% |

| Information Technology | 8% | 19% |

| Materials | 5% | 6% |

| Telecommunication Services | 0% | 1% |

| Utilities | 5% | 3% |

| Cash and Other Net Assets | 4% | – |

For the twelve-month period ended December 31, 2010, the Ultra Series Small Cap Fund returned 26.80% (Class I shares), in-line with the Russell 2000¨ Index, which returned 26.85%.

The Fund benefited from strong security selection among our Consumer Staples and Industrials holdings. Positive results in the Consumer Staples sector were driven by investments in Herbalife, a direct marketer of health and nutrition products, and Midwest convenience store operator Casey’s General Stores. In Industrials, Belden, a producer of electronic cables and connectivity products for the specialty electronics and data-networking markets, was a leading contributor to relative performance. Radio ratings firm Arbitron (Consumer Discretionary) was also among the Fund’s top performers.

Among the largest sources of relative weakness were the fund’s Materials and Information Technology holdings. In both sectors relative performance suffered due to not holding several benchmark names that outperformed, and due to a position that gained but trailed its sector peers. In Materials the holding was cleaning products company Zep; in Information Technology it was ATM provider Diebold. Health Care was another source of underperformance. Investments in ICU Medical, a manufacturer of safety medical systems to prevent bloodstream infections and accidental needlesticks, and health care facilities firm Amsurg had a negative impact. Other sources of relative weakness included Penn Virginia (Energy), MB Financial (Financials), and Lance (Consumer Staple s).

Relative performance also was negatively impacted by relative sector exposures, a residual of our bottom-up stock selection process. A below-benchmark weight in the Information Technology sector and an above-benchmark weight in the Financials sectors detracted from relative results.

The fund’s investment approach emphasizes individual stock selection; sector weights are a residual of our bottom-up investment process. We do, however, carefully consider diversification across economic sectors to limit risk. Based on bottom-up stock decisions, exposure to Financials increased and exposure to Information Technology fell. In Financials, we established new positions in Northwest Bancshares and Amerisafe and added to our position in Reinsurance Group of America. Exposure to Information Technology declined as we eliminated Xyratex and trimmed our investments in Maximus and Electronics for Imaging.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series International Stock Fund will invest, under normal market conditions, primarily in foreign equity securities. Typically, a majority of the fund’s assets are invested in relatively large capitalization stocks of companies located or operating in developed countries. The fund may also invest up to 30% of its assets in securities of companies whose principal business activities are located in emerging market countries. The portfolio managers typically maintain this segment of the fund’s portfolio in such stocks which it believes have a low market price relative to their perceived value based on fundamental analysis of the issuing company and its prospects. The fund may also invest in foreign debt and other income bearing securities at times when it believes that income bearing securities have greater capital appreciation potential than equity securities.

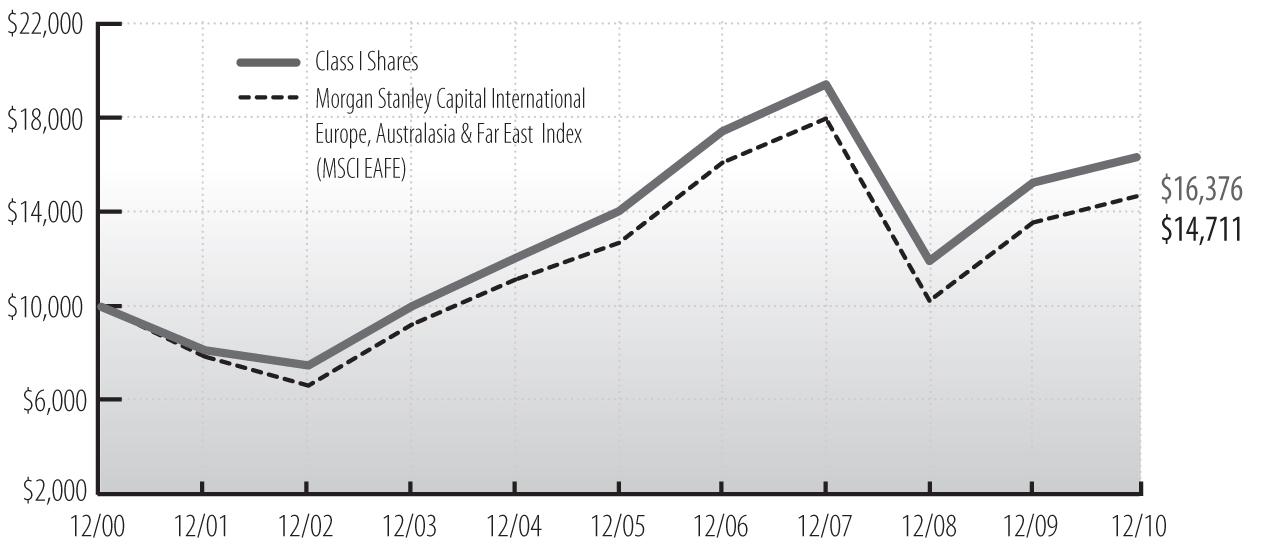

Cumulative Performance of $10,000 Investment Since Inception1

Average Annual Total Return through December 31, 20101 |

| | | | | | |

| Class I Shares | 7.09% | -5.62% | 3.07% | 5.06% | — |

| Class II Shares | 6.83 | — | — | — | 23.00% |

| MSCI EAFE Index | 8.21 | -6.55 | 2.94 | 3.94 | 26.07 |

See accompanying Notes to Management’s Discussion of Fund Performance.

International equity markets followed the strong rebound of 2009 with another strong rise in 2010. The economic environment was broadly stable in most developed markets, while growth in emerging markets remained strong. Low equity valuations were sufficient to drive shares up during the year, especially in the fourth quarter, as macroeconomic concerns eased and we saw continued unconventional policy measures from the U.S. Federal Reserve.

In Europe, governments began to address their weak fiscal position. In the United Kingdom and in a number of Eurozone countries, notably Greece, Ireland, and Spain, the proposals have been aggressive. The year saw increasing

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

International Stock Fund (concluded)

pressure on the Eurozone, as the lack of a common fiscal policy exposed deep divisions on how to respond to a debt crisis within one of its members. So far, the response has been one of crisis management, as Greece and then Ireland received financial assistance, but a permanent solution is still required.

In this environment, the strongest performers of 2010 were many emerging market stocks, and the more cyclical stocks in developed markets. In emerging markets, the focus was on low-valued consumer stocks. In developed markets, industrials, materials, and automobile stocks rose strongly, especially in the later part of the year. Less cyclical sectors, such as health care and utilities, made little progress. Despite low valuations, banks were generally weak during 2010, especially if they had exposure to the Eurozone.

GEOGRAPHICAL ALLOCATION AS A PERCENTAGE OF NET ASSETS |

| Europe (excluding United Kingdom) | 35% |

| Japan | 18% |

| Latin America | 4% |

| Pacific Basin | 6% |

| United Kingdom | 28% |

| Other Countries | 6% |

| Cash and Other Net Assets | 3% |

For the twelve-month period ended December 31, 2010, the Ultra Series International Stock Fund returned 7.09%, slightly underperforming the MSCI EAFE Index which returned 8.21%.

The largest drag on the fund’s performance over the year was low exposure to and stock selection in the Industrials sector, which performed well on improved global demand and capital expenditure growth. Within the sector, positions in Atlantia and TNT hurt performance. Additionally, the fund’s low exposure to the Materials sector detracted from returns, as the sector performed well on renewed demand and commodity price strength. Stock selection partially offset the negative allocation effect as positions in Xstrata and Potash Corp. of Saskatchewan, which were purchased at the beginning of the year, performed well. Potash’s performance was due partly to receiving a take-out bid from BHP.

Although Financials generally performed poorly, partly due to concerns over sovereign debt, stock selection in this sector helped performance. Stock selection in the banks and real estate industries were among the drivers of positive performance. Positions in U.K. banks Barclays and Lloyds, emerging markets bank Banco do Brasil, and Japanese real estate company Daito Trust Construction contributed to positive returns. Stock selection in the Energy sector also contributed to positive relative returns. Selling BP, soon after the oil spill in the Gulf of Mexico, proved to be a wise decision. Positions in oil services companies Aker Solutions and Technip were also beneficial, as they benefited from increased confidence i n expected capital spending.

Throughout the year, the biggest changes in our active sector weights were increases in Consumer Discretionary and Information Technology and decreases in Industrials and Telecom Services. The biggest changes in our active regional weights were increases in the U.K. and in Japan and decreases in Continental Europe and Asia ex-Japan. Both sets of changes were the result of our bottom-up stock selection process as positions were bought and sold, based on our fundamental analysis of individual securities. Examples include purchases of automobile parts company Valeo and Japanese retailer Don Quijote and sales of Swiss bank Credit Suisse and Turkish telecom services company Turkcell.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

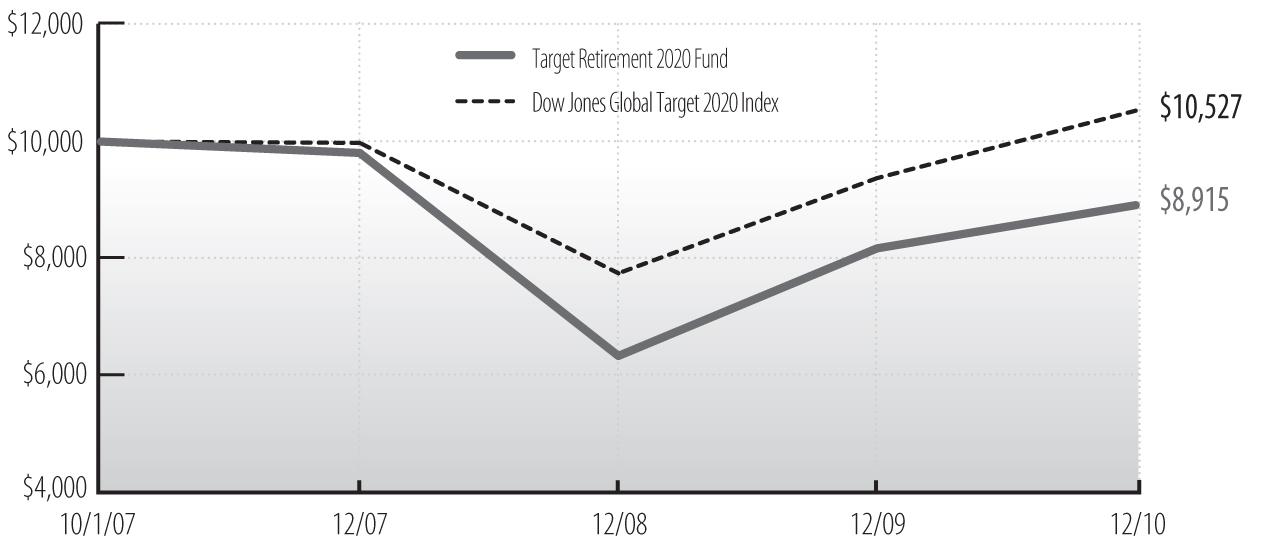

TARGET RETIREMENT 2020 FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Target Retirement 2020 Fund invests primarily in shares of registered investment companies (the "underlying funds") according to an asset allocation strategy developed by Madison Asset Management, LLC ("Madison"), the fund’s investment adviser, for investors planning to retire in or within a few years of 2020. Over time, the fund’s asset allocation will become more conservative until it reaches approximately 15-30% in stock funds and 70-85% in bond funds. The asset allocation strategy is designed to reduce the volatility of investment returns in the later years while still providing the potential for higher total returns over the target period.

On a periodic basis, Madison will evaluate and sometimes revise the fund’s asset allocations, including revising the asset class weightings and adding and/or removing underlying funds. Madison will also monitor the underlying funds on an ongoing basis and may increase or decrease the fund’s investment in one or several underlying funds. The underlying fund selections are made based on several considerations, including the fund’s style or asset class exposures, portfolio characteristics, risk profile, and investment process.

Cumulative Performance of $10,000 Investment Since Inception1

Average Annual Total Return through December 31, 20101 |

| | | | |

| Ultra Series Target Retirement 2020, Class I | 9.01% | -3.13% | -3.47% |

| Dow Jones Global Target 2020 Index | 12.26 | 1.80 | 1.59 |

See accompanying Notes to Management’s Discussion of Fund Performance.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Target Retirement 2020 Fund (concluded)

2010 proved to be a very positive year for asset allocation funds. However, returns for the year across asset classes were far from uniform. U.S. stocks, as measured by the Russell 3000¨ Index, finished the year up 16.9%, the international equity MSCI EAFE Index returned 8.2%, and the Barclays U.S. Aggregate Bond Index gained 6.5%. However, within each of these asset classes the underlying returns where largely skewed in favor of the riskier stocks and bonds. Here in the U.S., high beta stocks outgained lower beta and high quality stocks by a very wide margin. The same was true for capitalization size where small caps, generally regarded as lower in quality, outpaced large caps by over 11%. In bond land, "junk" bonds returned nearly 9% more than the inves tment grade Barclays U.S. Aggregate Bond Index. In short, it was a risk takers market in asset allocation for 2010.

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS |

| Bond Funds | 35% |

| Foreign Bond Funds | 7% |

| Stock Funds | 47% |

| Foreign Stock Funds | 8% |

| Money Market Funds and Other Net Assets | 3% |

For twelve-month period ended December 31, 2010, the Ultra Series Target Retirement 2020 Fund returned 9.01% (Class I shares), underperforming the Dow Jones Global Target 2020 Index return of 12.26%. The fund’s relative underperformance was attributed to our risk aware posturing, conservative glide path, and preference for higher quality large cap equities. Despite our preference for higher quality investments, the fund was boosted by modest positions in small caps with MEMBERS Small Cap Fund Class Y up 25.6% for the year, in addition to our energy and natural resources position in T. Rowe Price New Era which returned 21.0%. Detractors from performance relative to the index included Hussman Strategic Growth which returned -3.6% for the year, MEMBERS Bond Fund Class Y which returned 4.9%, MEMBERS International Stock Fund Class Y which returned 6.5%, and MEMBERS Large Cap Value Fund Class Y which returned 8.3%.

Overall, despite the fund’s relative underperformance, we were pleased with the fund’s absolute return given the moderate level of risk taken. In short, we believe the fund is well-positioned for the economic environment that we are encountering – an economy showing emerging signs of gaining some sustainable traction combined with atypically elevated downside risk potential.

Notable additions to the fund’s holdings this year were: PIMCO Investment Grade Corporate Bond Fund, Madison Mosaic Disciplined Equity Fund, T. Rowe Price New Era Fund, Matthews Asian Growth & Income Fund, and Yacktman Fund. Sold from the portfolio during 2010 were: Dodge & Cox Income Fund and Fairholme Fund.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

TARGET RETIREMENT 2030 FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Target Retirement 2030 Fund invests primarily in shares of registered investment companies (the "underlying funds") according to an asset allocation strategy developed by Madison Asset Management, LLC ("Madison"), the fund’s investment adviser, for investors planning to retire in or within a few years of 2030. Over time, the fund’s asset allocation will become more conservative until it reaches approximately 15-30% in stock funds and 70-85% in bond funds. The asset allocation strategy is designed to reduce the volatility of investment returns in the later years while still providing the potential for higher total returns over the target period.

On a periodic basis, Madison will evaluate and sometimes revise the fund’s asset allocations, including revising the asset class weightings and adding and/or removing underlying funds. Madison will also monitor the underlying funds on an ongoing basis and may increase or decrease the fund’s investment in one or several underlying funds. The underlying fund selections are made based on several considerations, including the fund’s style or asset class exposures, portfolio characteristics, risk profile, and investment process.

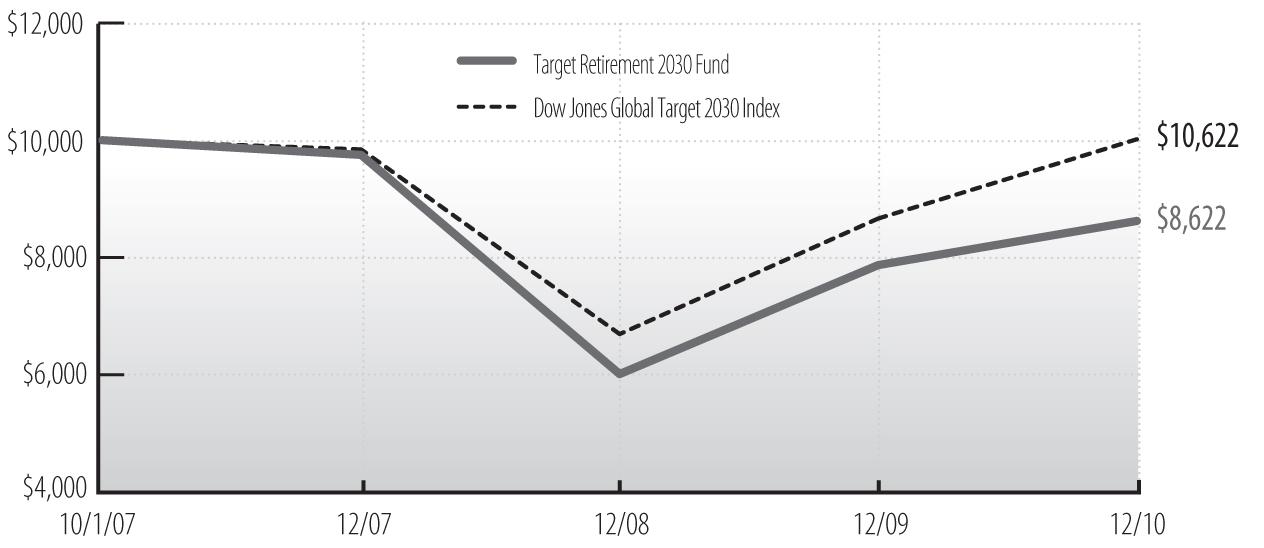

Cumulative Performance of $10,000 Investment Since Inception1

Average Annual Total Return through December 31, 20101 |

| | | | |

| Ultra Series Target Retirement 2030, Class I | 9.56% | -4.01% | -4.46% |

| Dow Jones Global Target 2030 Index | 15.60 | 0.58 | 0.05 |

See accompanying Notes to Management’s Discussion of Fund Performance.

Ultra Series Fund | Management’s Discussion of Fund Performance | December 31, 2010

Target Retirement 2030 Fund (concluded)

2010 proved to be a very positive year for asset allocation funds. However, returns for the year across asset classes were far from uniform. U.S. stocks, as measured by the Russell 3000¨ Index, finished the year up 16.9%, the international equity MSCI EAFE Index returned 8.2%, and the Barclays U.S. Aggregate Bond Index gained 6.5%. However, within each of these asset classes the underlying returns where largely skewed in favor of the riskier stocks and bonds. Here in the U.S., high beta stocks outgained lower beta and high quality stocks by a very wide margin. The same was true for capitalization size where small caps, generally regarded as lower in quality, outpaced large caps by over 11%. In bond land, "junk" bonds returned nearly 9% more than the inves tment grade Barclays U.S. Aggregate Bond Index. In short, it was a risk takers market in asset allocation for 2010.

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS |

| Bond Funds | 26% |

| Foreign Bond Funds | 6% |

| Stock Funds | 54% |

| Money Market Funds and Other Net Assets | 3% |

| Foreign Stock Funds | 11% |

For twelve-month period ended December 31, 2010, the Ultra Series Target Retirement 2030 Fund returned 9.56% (Class I shares), underperforming the Dow Jones Global Target 2030 Index return of 15.60%. The fund’s relative underperformance was attributed to our risk aware posturing, conservative glide path, and preference for higher quality large cap equities. Despite our preference for higher quality investments, the fund was boosted by modest positions in small caps with MEMBERS Small Cap Fund Class Y up 25.6% for the year, in addition to our energy and natural resources position in T. Rowe Price New Era which returned 21.0%. Detractors included Hussman Strategic Growth Fund which returned -3.6% for the year, MEMBERS Bond Fund Class Y which returned 4.9%, MEMBERS International Stock Fund Class Y which returned 6.5%, and MEMBERS Large Cap Value Fund Class Y which returned 8.3%.

Overall, despite the fund’s relative underperformance, we were pleased with the fund’s absolute return given the moderate level of risk taken. In short, we believe the fund is well-positioned for the economic environment that we are encountering – an economy showing emerging signs of gaining some sustainable traction combined with atypically elevated downside risk potential.

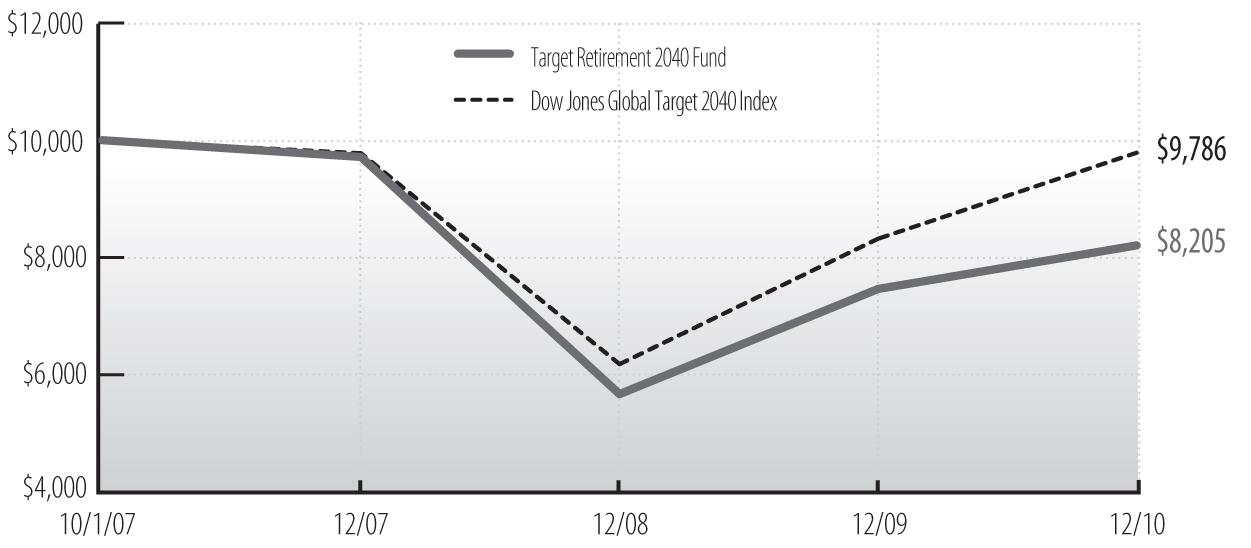

Notable additions to the fund’s holdings this year were: PIMCO Investment Grade Corporate Bond Fund, Madison Mosaic Disciplined Equity Fund, T. Rowe Price New Era Fund, Matthews Asian Growth & Income Fund, and Yacktman Fund. Sold from the portfolio during 2010 were: Dodge & Cox Income Fund, Fairholme Fund, and Principal Emerging Markets Fund.