UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | 811-03916 |

Name of Registrant: | Vanguard Specialized Funds |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000 |

Date of fiscal year end: January 31 |

Date of reporting period: February 1, 2018—July 31, 2018 |

Item 1: Reports to Shareholders |

Semiannual Report | July 31, 2018

Vanguard Energy Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Performance at a Glance. | 1 |

| CEO’s Perspective. | 2 |

| Advisors’ Report. | 4 |

| Fund Profile. | 8 |

| Performance Summary. | 10 |

| Financial Statements. | 11 |

| About Your Fund’s Expenses. | 26 |

| Trustees Approve Advisory Arrangements. | 28 |

| Glossary. | 30 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises

or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this

report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Nautical images have been part of Vanguard’s rich heritage since its start in 1975. For an

incoming ship, a lighthouse offers a beacon and safe path to shore. You can similarly depend on Vanguard to put

you first––and light the way––as you strive to meet your financial goals. Our client focus and low costs,

stemming from our unique ownership structure, assure that your interests are paramount.

Your Fund’s Performance at a Glance

• For the six months ended July 31, 2018, Vanguard Energy Fund returned nearly 5%. It outpaced its benchmark, the MSCI ACWI Energy Index, and the average return of its global natural resources peer funds.

• The fund, managed by two advisors, seeks long-term capital appreciation through its multicapitalization exposure to global energy stocks.

• Energy stocks generally posted strong results for the period; oil futures gained more than 20% in the first half of 2018. Natural gas prices continued to be restrained. However, they rallied during the last three months as demand for power generation increased and many coal-fired power plants switched to natural gas.

• Oil and gas exploration and production, oil and gas refining and marketing, and integrated oil and gas were among the best-performing sectors on a relative basis. Results were held back by oil and gas equipment and services and oil and gas drilling.

| |

| Total Returns: Six Months Ended July 31, 2018 | |

| | Total |

| | Returns |

| Vanguard Energy Fund | |

| Investor Shares | 4.83% |

| Admiral™ Shares | 4.87 |

| MSCI ACWI Energy Index | 4.07 |

| Global Natural Resources Funds Average | -0.04 |

| Global Natural Resources Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements. | |

| | | |

| Expense Ratios | | | |

| Your Fund Compared With Its Peer Group | | | |

| | Investor | Admiral | Peer Group |

| | Shares | Shares | Average |

| Energy Fund | 0.38% | 0.30% | 1.36% |

The fund expense ratios shown are from the prospectus dated May 25, 2018, and represent estimated costs for the current fiscal year. For

the six months ended July 31, 2018, the fund’s annualized expense ratios were 0.39% for Investor Shares and 0.31% for Admiral Shares.

The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures information through

year-end 2017.

Peer group: Global Natural Resources Funds.

1

CEO’s Perspective

Tim Buckley

President and Chief Executive Officer

Dear Shareholder,

I feel extremely fortunate to have the chance to lead a company filled with people who come to work every day passionate about Vanguard’s core purpose: to take a stand for all investors, to treat them fairly, and to give them the best chance for investment success.

When I joined Vanguard in 1991, I found a mission-driven team focused on improving lives—helping people retire more comfortably, put their children through college, and achieve financial security. I also found a company with purpose in an industry ripe for improvement.

It was clear, even early in my career, that the cards were stacked against most investors. Hidden fees, performance-chasing, and poor advice were relentlessly eroding investors’ dreams.

We knew Vanguard could be different and, as a result, could make a real difference. We have lowered the costs of investing for our shareholders significantly. And we’re proud of the performance of our funds.

Vanguard is built for Vanguard investors—we focus solely on you, our fund shareholders. Everything we do is designed to give our clients the best chance for investment success. In my role as CEO, I’ll keep this priority

2

front and center. We’re proud of what we’ve achieved, but we’re even more excited about what’s to come.

Steady, time-tested guidance

Our guidance for investors, as always, is to stay the course, tune out the hyperbolic headlines, and focus on your goals and what you can control, such as costs and how much you save. This time-tested advice has served our clients well over the decades.

Regardless of how the markets perform in the short term, I’m incredibly optimistic about the future for our investors. We have a dedicated team serving you, and we will never stop striving to make

Vanguard the best place for you to invest through our high-quality funds and services, advice and guidance to help you meet your financial goals, and an experience that makes you feel good about entrusting us with your hard-earned savings.

Thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

President and Chief Executive Officer

August 16, 2018

| | | |

| Market Barometer | | | |

| | | | Total Returns |

| | | Periods Ended July 31, 2018 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 0.86% | 16.19% | 12.96% |

| Russell 2000 Index (Small-caps) | 6.75 | 18.73 | 11.33 |

| Russell 3000 Index (Broad U. S. market) | 1.30 | 16.39 | 12.83 |

| FTSE All-World ex US Index (International) | -6.57 | 6.19 | 5.97 |

| |

| Bonds | | | |

| Bloomberg Barclays U. S. Aggregate Bond Index | | | |

| (Broad taxable market) | -0.45% | -0.80% | 2.25% |

| Bloomberg Barclays Municipal Bond Index | | | |

| (Broad tax-exempt market) | 1.18 | 0.99 | 3.76 |

| FTSE Three-Month U. S. Treasury Bill Index | 0.83 | 1.41 | 0.41 |

| |

| CPI | | | |

| Consumer Price Index | 1.67% | 2.95% | 1.53% |

3

Advisors’ Report

For the six months ended July 31, 2018, Vanguard Energy Fund returned nearly 5%. It outpaced its benchmark, the MSCI ACWI Energy Index, and the average return of its global natural resources peer funds. Your fund is managed by two advisors, a strategy that enhances fund diversification by providing exposure to distinct yet complementary investment approaches. It’s not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The advisors, the amount and percentage of fund assets each manages, and brief descriptions of their investment strategies are presented in the table below. The advisors also have provided a discussion

of the investment environment that existed during the period and of how their portfolio positioning reflects this assessment. These reports were prepared on August 9, 2018.

Wellington Management Company llp

Portfolio Manager:

Gregory LeBlanc, CFA,

Senior Managing Director,

Global Industry Analyst

The investment environment

Global energy stocks, as measured by the fund’s benchmark, returned 4.07% for the six months. The broader market, as measured by the MSCI All Country World Index, returned –2.60%.

| | | |

| Vanguard Energy Fund Investment Advisors | |

| |

| | Fund Assets Managed | |

| Investment Advisor | % | $ Million | Investment Strategy |

| Wellington Management | 93 | 9,098 | Emphasizes long-term total-return opportunities |

| Company LLP | | | from the various energy subsectors: international |

| | | | oils, foreign integrated oils and foreign producers, |

| | | | North American producers, oil services and |

| | | | equipment, transportation and distribution, and |

| | | | refining and marketing. |

| Vanguard Quantitative Equity | 5 | 485 | Employs a quantitative fundamental management |

| Group | | | approach using models that assess valuation, |

| | | | management decisions, market sentiment, and |

| | | | earnings and balance-sheet quality of companies |

| | | | as compared with their peers. |

| Cash Investments | 2 | 163 | These short-term reserves are invested by |

| | | | Vanguard in equity index products to simulate |

| | | | investments in stock. Each advisor may also |

| | | | maintain a modest cash position. |

4

Early in the period, the energy sector was not immune to market volatility. This continued through the end of June in anticipation of an OPEC meeting, as investors grew increasingly nervous about the impact of a potential production increase. But oil prices subsequently hit highs for the year as the focus shifted to shrinking OPEC spare capacity due to emerging supply disruptions from Libya, Venezuela, and Iran.

OECD oil inventories are below their five-year average, and any increase in OPEC production may prevent further tightening of supply/demand balances in the second half of the year. If OPEC and Russia were to raise production by 1 million barrels per day, as discussed at the meeting, spare capacity could fall close to 1% of demand. This would be the lowest level observed since 2008.

Reducing spare capacity to a historically low level could dramatically increase the risk of an unexpected spike in prices from any further supply disruptions. Lower inventories and lower spare capacity forecasts have helped to raise the back end of the oil futures curve, which has been positive for energy equities.

Our investment objective and strategy

Wellington Management’s portion of the fund emphasizes long-term, total-return opportunities from the energy subsectors. These include global integrated oil companies, North American producers, non-North American producers, oil services and equipment, transportation and distribution, and refining and marketing.

Our successes and shortfalls

Security selection drove the portfolio’s outperformance for the period, most notably among refining and marketing and transportation-related companies. Valero Energy, a geographically diversified pure merchant refiner, was a top relative contributor. Strong demand for petroleum products as well as discounted feedstock prices helped maintain healthy refining margins.

Exposure to two German utility and natural gas transport companies, E.ON and Innogy, was also beneficial. We eliminated our position in Innogy after E.ON announced a takeover offer for the company. However, we believe the synergies could be meaningful and have maintained a position in E.ON. An underweight to ExxonMobil also aided relative results.

Security selection in equipment and services was the top relative detractor. Patterson-UTI lagged most because of a slowdown in pressure-pumping demand, particularly in the Permian Basin. Halliburton, one of the world’s largest oil-field service companies, provided a disappointing second-quarter update with reduced guidance after a slowdown in Permian well-completion activity. A lack of oil

5

takeaway capacity has hurt the region over the six months, but we are confident that this will be temporary and have maintained our position.

Heading into the latter half of 2018, we remain encouraged by the positive macro backdrop for oil; inventories are coming down and spare capacity is at a low level. We also see room for improved sentiment as stocks discount prices below the current oil price. Recent company updates suggest that capital discipline continues for U.S. production. Despite pipeline bottlenecks in the near term, we are encouraged that many companies are evolving their business models to include capital return in addition to volume growth.

Vanguard Quantitative Equity Group

Portfolio Managers:

James P. Stetler

Binbin Guo, Principal, Head of

Alpha Equity Investments

The investment environment

Energy stocks rallied as West Texas International (WTI) oil futures rose more than 20% in the first half of 2018. The gain can be attributed to the dispute over oil-marketing rights that is affecting Libya’s export capacity. The White House has also indicated possible sanctions for countries that don’t reduce their imports of Iranian crude to zero by November 4. Iran currently exports around 2.4 million barrels a day.

During the first quarter of 2018, natural gas futures continued their slide, falling more than 7%. However, during the second quarter, they rebounded by nearly 7%. The cold weather at the end of January took the price to $3.661, but it quickly fell back to the $3 level. The higher price was due to increased demand for power generation, partially because many coal-fired plants have switched to natural gas.

Investment objective and strategy

It’s important to understand how our overall performance is affected by the macroeconomic factors we’ve described. However, our approach to investing focuses on specific fundamentals rather than on technical analysis of stock price movements. We compare all stocks in an industry group in order to identify those with characteristics that we believe will outperform over the long run.

To do this, we use a strict quantitative process that systematically focuses on several fundamental factors. We believe that attractive stocks exhibit four key themes: high quality—healthy balance sheets and consistent cash-flow generation; sound management decisions—investment policies that favor internal over external funding; strong market sentiment—market confirmation of our view; and reasonable valuation—avoidance of overpriced stocks. Using these results, we construct our portfolio with the goal of maximizing expected return and minimizing exposure to risks that our research indicates do not improve returns.

6

Our successes and shortfalls

For the six months, our quality, sentiment, and management decisions models boosted performance, but our valuation model detracted.

Our positions in oil and gas exploration, integrated oil and gas, and oil and gas equipment services posted the strongest returns. Results were not as strong for oil and gas refining and marketing, oil and gas storage and transportation, and gas utilities.

Our most successful overweighted holdings were HollyFrontier and Marathon Oil. Our portfolio also benefited from underweights to SK Innovation, Halliburton, and Vestas Wind Systems. Results were dragged down by underweighted allocations to Hess and Andeavor as well as overweights to GS Holdings, Hindustan Petroleum, and GCL-Poly Energy Holdings.

7

Energy Fund

Fund Profile

As of July 31, 2018

| | |

| Share-Class Characteristics | |

| | Investor | Admiral |

| | Shares | Shares |

| Ticker Symbol | VGENX | VGELX |

| Expense Ratio1 | 0.38% | 0.30% |

| 30-Day SEC Yield | 1.80% | 1.88% |

| | | |

| Portfolio Characteristics | | |

| | | | DJ |

| | | | U.S. |

| | | MSCI | Total |

| | | ACWI | Market |

| | Fund | Energy | FA Index |

| Number of Stocks | 133 | 140 | 3,766 |

| Median Market Cap | $51.0B | $74.6B | $67.4B |

| Price/Earnings Ratio | 18.2x | 17.0x | 20.5x |

| Price/Book Ratio | 1.8x | 1.7x | 3.1x |

| Return on Equity | 5.7% | 6.1% | 15.0% |

| Earnings Growth Rate | -15.5% | -13.1% | 8.5% |

| Dividend Yield | 2.5% | 3.3% | 1.7% |

| Foreign Holdings | 33.7% | 50.7% | 0.0% |

| Turnover Rate | | | |

| (Annualized) | 24% | — | — |

| Short-Term Reserves | 2.5% | — | — |

| | |

| Volatility Measures | | |

| | | DJ |

| | MSCI | U.S. Total |

| | ACWI | Market |

| | Energy | FA Index |

| R-Squared | 0.95 | 0.39 |

| Beta | 1.03 | 1.06 |

| These measures show the degree and timing of the fund’s |

| fluctuations compared with the indexes over 36 months. |

| | |

| Ten Largest Holdings (% of total net assets) |

| Exxon Mobil Corp. | Integrated Oil & Gas | 7.8% |

| Chevron Corp. | Integrated Oil & Gas | 6.5 |

| Royal Dutch Shell plc | Integrated Oil & Gas | 5.1 |

| Pioneer Natural | Oil & Gas Exploration | |

| Resources Co. | & Production | 4.4 |

| TOTAL SA | Integrated Oil & Gas | 4.3 |

| EOG Resources Inc. | Oil & Gas Exploration | |

| | & Production | 3.6 |

| BP plc | Integrated Oil & Gas | 3.4 |

| Valero Energy Corp. | Oil & Gas Refining & | |

| | Marketing | 3.2 |

| Diamondback Energy | Oil & Gas Exploration | |

| Inc. | & Production | 2.7 |

| Marathon Petroleum | Oil & Gas Exploration | |

| Corp. | & Production | 2.6 |

| Top Ten | | 43.6% |

| The holdings listed exclude any temporary cash investments and equity index products. |

1 The expense ratios shown are from the prospectus dated May 25, 2018, and represent estimated costs for the current fiscal year. For the six

months ended July 31, 2018, the annualized expense ratios were 0.39% for Investor Shares and 0.31% for Admiral Shares.

8

Energy Fund

| | |

| Subindustry Diversification (% of equity | |

| exposure) | | |

| | | MSCI |

| | | ACWI |

| | Fund | Energy |

| Coal & Consumable Fuels | 0.0% | 0.9% |

| Industrials | 0.1 | 0.0 |

| Information Technology | 0.3 | 0.0 |

| Integrated Oil & Gas | 41.3 | 52.6 |

| Oil & Gas Drilling | 0.7 | 0.3 |

| Oil & Gas Equipment & | | |

| Services | 6.4 | 6.2 |

| Oil & Gas Exploration & | | |

| Production | 32.4 | 20.3 |

| Oil & Gas Refining & | | |

| Marketing | 11.0 | 10.8 |

| Oil & Gas Storage & | | |

| Transportation | 3.0 | 8.9 |

| Utilities | 4.2 | 0.0 |

| Other | 0.6 | 0.0 |

Sector categories are based on the Global Industry Classification

Standard (“GICS”), except for the “Other” category (if applicable),

which includes securities that have not been provided a GICS

classification as of the effective reporting period.

| |

| Market Diversification (% of equity exposure) |

| |

| Europe | |

| United Kingdom | 8.7% |

| France | 4.4 |

| Italy | 3.0 |

| Portugal | 1.4 |

| Other | 2.3 |

| Subtotal | 19.8% |

| Pacific | |

| Japan | 0.9% |

| Other | 0.1 |

| Subtotal | 1.0% |

| Emerging Markets | |

| Russia | 3.5% |

| India | 1.9 |

| China | 1.6 |

| Other | 1.1 |

| Subtotal | 8.1% |

| North America | |

| United States | 65.6% |

| Canada | 5.5 |

| Subtotal | 71.1% |

9

Energy Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

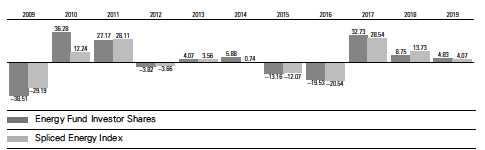

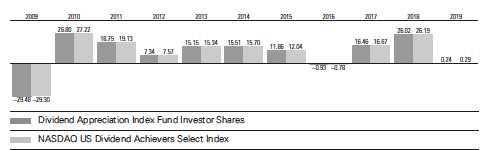

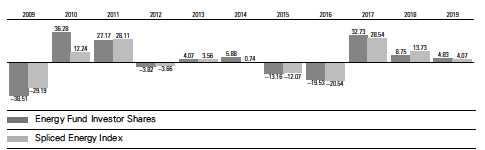

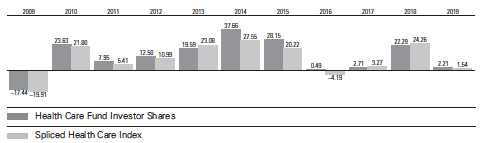

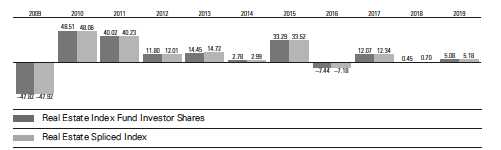

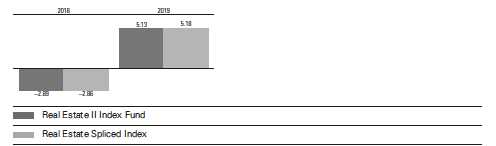

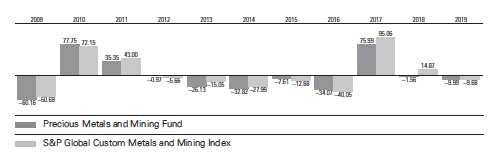

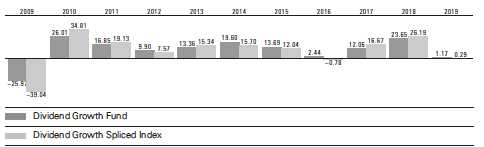

Fiscal-Year Total Returns (%): January 31, 2008, Through July 31, 2018

For a benchmark description, see the Glossary.

Note: For 2019, performance data reflect the six months ended July 31, 2018.

Average Annual Total Returns: Periods Ended June 30, 2018

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Investor Shares | 5/23/1984 | 21.77% | 2.37% | -0.83% |

| Admiral Shares | 11/12/2001 | 21.89 | 2.44 | -0.76 |

See Financial Highlights for dividend and capital gains information.

10

Energy Fund

Financial Statements (unaudited)

Statement of Net Assets

As of July 31, 2018

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| Common Stocks (96.5%)1 | | |

| United States (62.8%) | | |

| Electric Utilities (1.5%) | | |

| | OGE Energy Corp. | 1,576,990 | 57,150 |

| | Avangrid Inc. | 978,292 | 48,974 |

| | Edison International | 626,749 | 41,760 |

| | | | 147,884 |

| Energy Equipment & Services (6.0%) | |

| | Schlumberger Ltd. | 3,539,082 | 238,959 |

| | Halliburton Co. | 4,441,687 | 188,416 |

| | Patterson-UTI Energy | | |

| | Inc. | 3,117,397 | 53,619 |

| ^,* | Liberty Oilfield Services | | |

| | Inc. Class A | 1,893,411 | 37,111 |

| | Baker Hughes a GE Co. | 941,898 | 32,571 |

| * | ProPetro Holding Corp. | 1,674,009 | 27,521 |

| | Nabors Industries Ltd. | 1,182,902 | 7,074 |

| | | | 585,271 |

| Multi-Utilities (1.2%) | | |

| | Sempra Energy | 958,015 | 110,737 |

| |

| Oil, Gas & Consumable Fuels (53.5%) | |

| | Integrated Oil & Gas (16.6%) | |

| | Exxon Mobil Corp. | 9,368,619 | 763,636 |

| | Chevron Corp. | 5,048,547 | 637,480 |

| | Occidental Petroleum | | |

| | Corp. | 2,537,918 | 213,008 |

| |

| | Oil & Gas Exploration & Production (26.0%) |

| | Pioneer Natural | | |

| | Resources Co. | 2,273,217 | 430,252 |

| | EOG Resources Inc. | 2,726,237 | 351,521 |

| | Diamondback Energy | | |

| | Inc. | 2,005,329 | 264,603 |

| | ConocoPhillips | 1,971,867 | 142,310 |

| * | Concho Resources Inc. | 954,811 | 139,259 |

| | | |

| | Anadarko Petroleum | | |

| | Corp. | 1,877,387 | 137,331 |

| * | Newfield Exploration | | |

| | Co. | 4,432,423 | 127,299 |

| | Hess Corp. | 1,873,948 | 122,987 |

| | Cabot Oil & Gas Corp. | 3,911,477 | 91,920 |

| | EQT Corp. | 1,643,392 | 81,644 |

| * | Callon Petroleum Co. | 7,309,868 | 78,654 |

| | Devon Energy Corp. | 1,717,994 | 77,327 |

| | Noble Energy Inc. | 2,123,325 | 76,631 |

| * | Antero Resources Corp. | 3,400,935 | 69,855 |

| * | SRC Energy Inc. | 4,929,015 | 55,796 |

| * | Extraction Oil & Gas Inc. | 3,101,044 | 46,888 |

| * | WPX Energy Inc. | 2,439,344 | 45,787 |

| | Marathon Oil Corp. | 2,112,933 | 44,625 |

| * | Parsley Energy Inc. | | |

| | Class A | 1,260,269 | 39,610 |

| * | Centennial Resource | | |

| | Development Inc. | | |

| | Class A | 1,947,776 | 34,982 |

| ^,* | Jagged Peak Energy Inc. | 2,185,666 | 31,255 |

| * | Alta Mesa Resources | | |

| | Inc. | 5,064,382 | 30,589 |

| * | QEP Resources Inc. | 346,302 | 3,598 |

| | Murphy Oil Corp. | 101,903 | 3,389 |

| * | Continental Resources | | |

| | Inc. | 51,461 | 3,287 |

| * | Viper Energy Partners LP | 78,533 | 2,511 |

| |

| | Oil & Gas Refining & Marketing (9.1%) |

| | Valero Energy Corp. | 2,669,662 | 315,954 |

| | Marathon Petroleum | | |

| | Corp. | 3,160,274 | 255,445 |

| | Phillips 66 | 1,647,866 | 203,248 |

| | Delek US Holdings Inc. | 1,786,553 | 95,259 |

| | Andeavor | 106,230 | 15,941 |

| | HollyFrontier Corp. | 62,567 | 4,666 |

11

Energy Fund

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| Oil & Gas Storage & Transportation (1.8%) |

| | Kinder Morgan Inc. | 5,418,652 | 96,344 |

| | Targa Resources Corp. | 1,452,860 | 74,197 |

| | ONEOK Inc. | 26,831 | 1,890 |

| | Williams Cos. Inc. | 39,182 | 1,166 |

| | | | 5,212,144 |

| Other (0.6%) | | |

| ^,2 | Vanguard Energy ETF | 578,000 | 61,395 |

| |

| Semiconductors & Semiconductor | |

| Equipment (0.0%) | | |

| * | First Solar Inc. | 53,000 | 2,774 |

| Total United States | | 6,120,205 |

| International (33.7%) | | |

| Australia (0.1%) | | |

| * | Santos Ltd. | 864,666 | 4,096 |

| | Woodside Petroleum Ltd. | 41,425 | 1,110 |

| | | | 5,206 |

| Austria (0.0%) | | |

| | OMV AG | 63,433 | 3,585 |

| |

| Brazil (0.9%) | | |

| | Petroleo Brasileiro SA | | |

| | ADR | 6,825,153 | 80,059 |

| | Petroleo Brasileiro SA | 874,062 | 5,109 |

| | Petroleo Brasileiro SA | | |

| | Preference Shares | 678,500 | 3,565 |

| | | | 88,733 |

| Canada (5.4%) | | |

| | Suncor Energy Inc. | 3,994,547 | 168,330 |

| | Canadian Natural | | |

| | Resources Ltd. | 3,489,178 | 127,844 |

| | TransCanada Corp. | 1,973,183 | 88,695 |

| | Encana Corp. | 6,439,477 | 86,547 |

| ^ | PrairieSky Royalty Ltd. | 750,694 | 14,242 |

| | Suncor Energy Inc. | 194,828 | 8,204 |

| | Encana Corp. | 477,850 | 6,594 |

| | Enbridge Inc. | 184,515 | 6,553 |

| | Canadian Natural | | |

| | Resources Ltd. | 113,792 | 4,181 |

| | TransCanada Corp. | 81,466 | 3,664 |

| | Husky Energy Inc. | 212,598 | 3,615 |

| | PrairieSky Royalty Ltd. | 93,253 | 1,721 |

| | | | 520,190 |

| China (1.5%) | | |

| | CNOOC Ltd. ADR | 711,498 | 119,532 |

| | CNOOC Ltd. | 3,991,717 | 6,687 |

| | China Petroleum & | | |

| | Chemical Corp. | 6,603,600 | 6,348 |

| | PetroChina Co. Ltd. | 6,384,000 | 4,862 |

| | China Longyuan Power | | |

| | Group Corp. Ltd. | 3,427,000 | 3,192 |

| | |

| Huaneng Renewables | | |

| Corp. Ltd. | 7,720,000 | 2,872 |

| Kunlun Energy Co. Ltd. | 3,188,000 | 2,758 |

| * GCL-Poly Energy | | |

| Holdings Ltd. | 25,611,000 | 2,258 |

| | | 148,509 |

| Colombia (0.0%) | | |

| Ecopetrol SA ADR | 153,228 | 3,274 |

| |

| Finland (0.1%) | | |

| Neste Oyj | 51,833 | 4,276 |

| |

| France (4.3%) | | |

| TOTAL SA ADR | 6,106,540 | 398,452 |

| TOTAL SA | 315,432 | 20,574 |

| | | 419,026 |

| Germany (0.2%) | | |

| E.ON SE | 2,026,209 | 22,860 |

| |

| Greece (0.0%) | | |

| Motor Oil Hellas Corinth | | |

| Refineries SA | 87,469 | 1,858 |

| Hellenic Petroleum SA | 209,231 | 1,750 |

| | | 3,608 |

| Hungary (0.0%) | | |

| MOL Hungarian Oil & | | |

| Gas plc | 309,769 | 3,035 |

| |

| India (1.8%) | | |

| Reliance Industries Ltd. | 6,229,285 | 107,959 |

| Power Grid Corp. of | | |

| India Ltd. | 23,828,048 | 63,436 |

| Indian Oil Corp. Ltd. | 1,059,502 | 2,549 |

| Oil & Natural Gas | | |

| Corp. Ltd. | 784,211 | 1,895 |

| GAIL India Ltd. | 142,599 | 781 |

| Oil India Ltd. | 102,493 | 313 |

| | | 176,933 |

| Israel (0.0%) | | |

| Oil Refineries Ltd. | 5,898,844 | 2,717 |

| |

| Italy (2.9%) | | |

| ^ Eni SPA ADR | 5,200,318 | 201,044 |

| Tenaris SA ADR | 1,952,702 | 71,742 |

| Eni SPA | 515,331 | 9,920 |

| | | 282,706 |

| Japan (0.9%) | | |

| Inpex Corp. | 6,112,979 | 67,114 |

| JXTG Holdings Inc. | 884,200 | 6,482 |

| Idemitsu Kosan Co. Ltd. | 95,000 | 4,279 |

| Cosmo Energy Holdings | | |

| Co. Ltd. | 79,700 | 2,813 |

12

Energy Fund

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| | Japan Petroleum | | |

| | Exploration Co. Ltd. | 87,000 | 2,061 |

| | Showa Shell Sekiyu KK | 27,300 | 448 |

| | | | 83,197 |

| Norway (0.8%) | | |

| ^,* | Equinor ASA ADR | 2,474,830 | 65,484 |

| | Equinor ASA | 250,030 | 6,634 |

| | Aker BP ASA | 82,254 | 2,939 |

| | | | 75,057 |

| Poland (0.0%) | | |

| | Grupa Lotos SA | 171,571 | 3,065 |

| |

| Portugal (1.4%) | | |

| | Galp Energia SGPS SA | 6,411,038 | 131,672 |

| |

| Russia (3.4%) | | |

| | Lukoil PJSC ADR | 3,152,254 | 226,115 |

| | Rosneft Oil Co. | | |

| | PJSC GDR | 13,205,623 | 87,236 |

| | Gazprom PJSC | 2,455,004 | 5,655 |

| ^ | Tatneft PJSC ADR | 49,800 | 3,433 |

| | AK Transneft OAO | | |

| | Preference Shares | 1,109 | 2,886 |

| | Surgutneftegas PJSC | 3,903,300 | 1,812 |

| | Tatneft PJSC | 155,950 | 1,802 |

| | LUKOIL PJSC | 23,865 | 1,706 |

| | Surgutneftegas OAO | | |

| | Preference Shares | 2,971,833 | 1,648 |

| | Gazprom PJSC ADR | 105,605 | 474 |

| | Surgutneftegas | | |

| | PJSC ADR | 38,700 | 177 |

| | | | 332,944 |

| South Korea (0.0%) | | |

| | GS Holdings Corp. | 60,163 | 2,896 |

| |

| Spain (0.5%) | | |

| * | Iberdrola SA | 5,582,844 | 43,407 |

| * | Repsol SA | 307,796 | 6,105 |

| | | | 49,512 |

| Sweden (0.8%) | | |

| | Lundin Petroleum AB | 2,342,170 | 77,225 |

| |

| Thailand (0.2%) | | |

| * | PTT Exploration and | | |

| | Production PCL (Local) | 854,100 | 3,546 |

| * | PTT PCL (Foreign) | 2,200,000 | 3,390 |

| | IRPC PCL (Foreign) | 14,898,900 | 2,891 |

| | Thai Oil PCL (Foreign) | 1,128,200 | 2,722 |

| * | PTT PCL | 1,648,400 | 2,540 |

| | | | 15,089 |

| | |

| United Kingdom (8.5%) | | |

| Royal Dutch Shell plc | | |

| ADR | 6,533,913 | 446,724 |

| BP plc ADR | 6,813,712 | 307,230 |

| BP plc | 3,333,029 | 25,049 |

| Royal Dutch Shell plc | | |

| Class B | 637,782 | 22,340 |

| Royal Dutch Shell plc | | |

| Class A | | |

| (Amsterdam Shares) | 381,491 | 13,067 |

| Royal Dutch Shell plc | | |

| Class A | 353,369 | 12,109 |

| Petrofac Ltd. | 308,868 | 2,484 |

| | | 829,003 |

| Total International | | 3,284,318 |

| Total Common Stocks | | |

| (Cost $5,418,403) | | 9,404,523 |

| Temporary Cash Investments (4.3%)1 | |

| Money Market Fund (1.7%) | | |

| 3,4 Vanguard Market | | |

| Liquidity Fund, | | |

| 2.145% | 1,624,896 | 162,490 |

| |

| | Face | |

| | Amount | |

| | ($000) | |

| Repurchase Agreements (2.5%) | |

| RBS Securities, Inc. | | |

| 1.910%, 8/1/18 (Dated | | |

| 7/31/18, Repurchase | | |

| Value $178,509,000, | | |

| collateralized by U. S. | | |

| Treasury Note/Bond | | |

| 0.750%–2.750%, | | |

| 2/15/42–8/15/47, | | |

| with a value of | | |

| $182,070,000) | 178,500 | 178,500 |

| Societe Generale | | |

| 1.900%, 8/1/18 (Dated | | |

| 7/31/18, Repurchase | | |

| Value $70,204,000, | | |

| collateralized by U. S. | | |

| Treasury Note/Bond | | |

| 0.000%–8.125%, | | |

| 12/06/18–11/15/44, | | |

| with a value of | | |

| $71,604,000) | 70,200 | 70,200 |

| | | 248,700 |

13

Energy Fund

| | | |

| | | Face | Market |

| | | Amount | Value• |

| | | ($000) | ($000) |

| U.S. Government and Agency Obligations (0.1%) |

| | United States Treasury Bill, | | |

| | 1.833%, 8/2/18 | 2,000 | 2,000 |

| 5 | United States Treasury Bill, | | |

| | 1.941%, 9/27/18 | 160 | 159 |

| | United States Treasury Bill, | | |

| | 1.934%, 10/11/18 | 100 | 100 |

| 5 | United States Treasury Bill, | | |

| | 2.078%, 11/15/18 | 5,000 | 4,970 |

| | | | 7,229 |

| Total Temporary Cash Investments | |

| (Cost $418,416) | | 418,419 |

| Total Investments (100.8%) | | |

| (Cost $5,836,819) | | 9,822,942 |

| |

| | | | Amount |

| | | | ($000) |

| Other Assets and Liabilities (-0.8%) | |

| Other Assets | | |

| Investment in Vanguard | | 511 |

| Receivables for Accrued Income | 10,696 |

| Receivables for Capital Shares Issued | 20,270 |

| Variation Margin Receivable— | | |

| | Futures Contracts | | 543 |

| Other Assets | | 3,919 |

| Total Other Assets | | 35,939 |

| Liabilities | | |

| Payables for Investment Securities | |

| | Purchased | | (5,043) |

| Payables to Investment Advisor | | (3,810) |

| Collateral for Securities on Loan | | (62,106) |

| Payables for Capital Shares Redeemed | (24,321) |

| Payables to Vanguard | | (15,437) |

| Other Liabilities | | (2,750) |

| Total Liabilities | | (113,467) |

| Net Assets (100%) | | 9,745,414 |

| |

| At July 31, 2018, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 6,434,582 |

| Undistributed Net Investment Income | 68,840 |

| Accumulated Net Realized Losses | (742,721) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 3,984,097 |

| Futures Contracts | 626 |

| Foreign Currencies | (10) |

| Net Assets | 9,745,414 |

| |

| |

| Investor Shares—Net Assets | |

| Applicable to 49,140,552 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 2,860,998 |

| Net Asset Value Per Share— | |

| Investor Shares | $58.22 |

| |

| |

| Admiral Shares—Net Assets | |

| Applicable to 63,014,348 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 6,884,416 |

| Net Asset Value Per Share— | |

| Admiral Shares | $109.25 |

• See Note A in Notes to Financial Statements.

^ Includes partial security positions on loan to broker-dealers.

The total value of securities on loan is $60,409,000.

* Non-income-producing security.

1 The fund invests a portion of its cash reserves in equity

markets through the use of index futures contracts. After

giving effect to futures investments, the fund’s effective

common stock and temporary cash investment positions

represent 97.6% and 3.2%, respectively, of net assets.

2 Considered an affiliated company of the fund as the issuer

is another member of The Vanguard Group.

3 Affiliated money market fund available only to Vanguard

funds and certain trusts and accounts managed by Vanguard.

Rate shown is the 7-day yield.

4 Includes $62,106,000 of collateral received for securities

on loan.

5 Securities with a value of $4,633,000 have been segregated

as initial margin for open futures contracts.

ADR—American Depositary Receipt.

GDR—Global Depositary Receipt.

14

Energy Fund

| | | | |

| Derivative Financial Instruments Outstanding as of Period End | | |

| Futures Contracts | | | | |

| | | | | ($000) |

| | | | | Value and |

| | | Number of | | Unrealized |

| | | Long (Short) | Notional | Appreciation |

| | Expiration | Contracts | Amount | (Depreciation) |

| Long Futures Contracts | | | | |

| E-mini S&P 500 Index | September 2018 | 782 | 110,149 | 626 |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

See accompanying Notes, which are an integral part of the Financial Statements.

15

Statement of Operations

| |

| | Six Months Ended |

| | July 31, 2018 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends Received from Unaffiliated Issuers1 | 123,123 |

| Dividends Received from Affiliated Issuers | 716 |

| Interest Received from Unaffiliated Issuers | 2,180 |

| Interest Received from Affiliated Issuers | 994 |

| Securities Lending—Net | 946 |

| Total Income | 127,959 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 6,786 |

| Performance Adjustment | 448 |

| The Vanguard Group—Note C | |

| Management and Administrative—Investor Shares | 2,767 |

| Management and Administrative—Admiral Shares | 4,172 |

| Marketing and Distribution—Investor Shares | 186 |

| Marketing and Distribution—Admiral Shares | 156 |

| Custodian Fees | 934 |

| Shareholders’ Reports—Investor Shares | 38 |

| Shareholders’ Reports—Admiral Shares | 21 |

| Trustees’ Fees and Expenses | 8 |

| Total Expenses | 15,516 |

| Net Investment Income | 112,443 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold—Unaffiliated Issuers | 103,707 |

| Investment Securities Sold—Affiliated Issuers | (38) |

| Futures Contracts | (2,383) |

| Foreign Currencies | (77) |

| Realized Net Gain (Loss) | 101,209 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities—Unaffiliated Issuers 2 | 227,181 |

| Investment Securities—Affiliated Issuers | 2,418 |

| Futures Contracts | (2,878) |

| Foreign Currencies | (59) |

| Change in Unrealized Appreciation (Depreciation) | 226,662 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 440,314 |

| 1 Dividends are net of foreign withholding taxes of $9,441,000. | |

| 2 The change in unrealized appreciation (depreciation) is net of deferred foreign capital gains taxes of $2,026,000. |

| See accompanying Notes, which are an integral part of the Financial Statements. | |

16

Energy Fund

Statement of Changes in Net Assets

| | |

| | Six Months Ended | Year Ended |

| | July 31, | January 31, |

| | 2018 | 2018 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 112,443 | 279,233 |

| Realized Net Gain (Loss) | 101,209 | 74,710 |

| Change in Unrealized Appreciation (Depreciation) | 226,662 | 400,546 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 440,314 | 754,489 |

| Distributions | | |

| Net Investment Income | | |

| Investor Shares | (4,035) | (84,836) |

| Admiral Shares | (10,632) | (197,679) |

| Realized Capital Gain | | |

| Investor Shares | — | — |

| Admiral Shares | — | — |

| Total Distributions | (14,667) | (282,515) |

| Capital Share Transactions | | |

| Investor Shares | (232,419) | (619,766) |

| Admiral Shares | (211,538) | (771,839) |

| Net Increase (Decrease) from Capital Share Transactions | (443,957) | (1,391,605) |

| Total Increase (Decrease) | (18,310) | (919,631) |

| Net Assets | | |

| Beginning of Period | 9,763,724 | 10,683,355 |

| End of Period1 | 9,745,414 | 9,763,724 |

| 1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $68,840,000 and ($28,829,000). |

See accompanying Notes, which are an integral part of the Financial Statements.

17

Energy Fund

Financial Highlights

| | | | | | |

| Investor Shares | | | | | | |

| Six Months | | | | | |

| | Ended | | | | | |

| For a Share Outstanding | July 31, | Year Ended January 31, |

| Throughout Each Period | 2018 | 2018 | 2017 | 2016 | 2015 | 2014 |

| Net Asset Value, Beginning of Period | $55.62 | $52.70 | $40.43 | $51.53 | $63.85 | $62.66 |

| Investment Operations | | | | | | |

| Net Investment Income | .6451 | 1.4771,2 | .982 | 1.096 | 1.276 | 1.291 |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments | 2.033 | 3.035 | 12.275 | (11.118) | (9.436) | 2.413 |

| Total from Investment Operations | 2.678 | 4.512 | 13.257 | (10.022) | (8.160) | 3.704 |

| Distributions | | | | | | |

| Dividends from Net Investment Income | (.078) | (1.592) | (.987) | (1.078) | (1.206) | (1.277) |

| Distributions from Realized Capital Gains | — | — | — | — | (2.954) | (1.237) |

| Total Distributions | (.078) | (1.592) | (.987) | (1.078) | (4.160) | (2.514) |

| Net Asset Value, End of Period | $58.22 | $55.62 | $52.70 | $40.43 | $51.53 | $63.85 |

| |

| Total Return 3 | 4.83% | 8.75% | 32.73% | -19.53% | -13.16% | 5.88% |

| |

| Ratios/Supplemental Data | | | | | | |

| Net Assets, End of Period (Millions) | $2,861 | $2,968 | $3,452 | $2,693 | $3,334 | $4,138 |

| Ratio of Total Expenses to Average | | | | | | |

| Net Assets4 | 0.39% | 0.38% | 0.41% | 0.37% | 0.37% | 0.38% |

| Ratio of Net Investment Income to | | | | | | |

| Average Net Assets | 2.35% | 2.86%2 | 1.97% | 2.20% | 1.84% | 1.97% |

| Portfolio Turnover Rate | 24% | 24% | 29% | 23% | 31% | 17% |

The expense ratio, net investment income ratio, and turnover rate for the current period have been annualized.

1 Calculated based on average shares outstanding.

2 Net investment income per share and the ratio of net investment income to average net assets include $.342 and 0.67%, respectively,

from income received as a result of the General Electric Co. and Baker Hughes Inc. merger in July 2017.

3 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information

about any applicable account service fees.

4 Includes performance-based investment advisory fee increases (decreases) of 0.01%, 0.00%, 0.03%, 0.03%, 0.03%, and 0.04%.

See accompanying Notes, which are an integral part of the Financial Statements.

18

Energy Fund

Financial Highlights

| | | | | | |

| Admiral Shares | | | | | | |

| Six Months | | | | | |

| | Ended | | | | | |

| For a Share Outstanding | July 31, | Year Ended January 31, |

| Throughout Each Period | 2018 | 2018 | 2017 | 2016 | 2015 | 2014 |

| Net Asset Value, Beginning of Period | $104.35 | $98.88 | $75.85 | $96.69 | $119.83 | $117.63 |

| Investment Operations | | | | | | |

| Net Investment Income | 1.2451 | 2.8151,2 | 1.918 | 2.113 | 2.479 | 2.530 |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments | 3.822 | 5.730 | 23.035 | (20.872) | (17.726) | 4.491 |

| Total from Investment Operations | 5.067 | 8.545 | 24.953 | (18.759) | (15.247) | 7.021 |

| Distributions | | | | | | |

| Dividends from Net Investment Income | (.167) | (3.075) | (1.923) | (2.081) | (2.351) | (2.500) |

| Distributions from Realized Capital Gains | — | — | — | — | (5.542) | (2.321) |

| Total Distributions | (.167) | (3.075) | (1.923) | (2.081) | (7.893) | (4.821) |

| Net Asset Value, End of Period | $109.25 | $104.35 | $98.88 | $75.85 | $96.69 | $119.83 |

| |

| Total Return 3 | 4.87% | 8.84% | 32.83% | -19.48% | -13.11% | 5.94% |

| |

| Ratios/Supplemental Data | | | | | | |

| Net Assets, End of Period (Millions) | $6,884 | $6,796 | $7,231 | $5,428 | $6,569 | $7,540 |

| Ratio of Total Expenses to | | | | | | |

| Average Net Assets4 | 0.31% | 0.30% | 0.33% | 0.31% | 0.31% | 0.32% |

| Ratio of Net Investment Income to | | | | | | |

| Average Net Assets | 2.43% | 2.94%2 | 2.05% | 2.26% | 1.90% | 2.03% |

| Portfolio Turnover Rate | 24% | 24% | 29% | 23% | 31% | 17% |

The expense ratio, net investment income ratio, and turnover rate for the current period have been annualized.

1 Calculated based on average shares outstanding.

2 Net investment income per share and the ratio of net investment income to average net assets include $.643 and 0.67%, respectively,

from income received as a result of the General Electric Co. and Baker Hughes Inc. merger in July 2017.

3 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information

about any applicable account service fees.

4 Includes performance-based investment advisory fee increases (decreases) of 0.01%, 0.00%, 0.03%, 0.03%, 0.03%, and 0.04%.

See accompanying Notes, which are an integral part of the Financial Statements.

19

Energy Fund

Notes to Financial Statements

Vanguard Energy Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in securities of foreign issuers, which may subject it to investment risks not normally associated with investing in securities of U.S. corporations. The fund offers two classes of shares: Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market-or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The

20

Energy Fund

clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract. Any assets pledged as initial margin for open contracts are noted in the Statement of Net Assets.

Futures contracts are valued at their quoted daily settlement prices. The notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the six months ended July 31, 2018, the fund’s average investments in long and short futures contracts represented 1% and 0% of net assets, respectively, based on the average of the notional amounts at each quarter-end during the period.

4. Repurchase Agreements: The fund enters into repurchase agreements with institutional counterparties. Securities pledged as collateral to the fund under repurchase agreements are held by a custodian bank until the agreements mature, and in the absence of a default, such collateral cannot be repledged, resold, or rehypothecated. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. The fund further mitigates its counterparty risk by entering into repurchase agreements only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master repurchase agreements with its counterparties. The master repurchase agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any repurchase agreements with that counterparty, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund. Such action may be subject to legal proceedings, which may delay or limit the disposition of collateral.

5. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (January 31, 2015–2018), and for the period ended July 31, 2018, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

6. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

7. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled before the opening of the market on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the event of a default, the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard

21

Energy Fund

Market Liquidity Fund, and records a liability in the Statement of Net Assets for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

8. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard���) participate in a $3.1 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

The fund had no borrowings outstanding at July 31, 2018, or at any time during the period then ended.

9. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Taxes on foreign dividends and capital gains have been provided for in accordance with the fund’s understanding of the applicable countries’ tax rules and rates. Foreign capital gains tax is accrued daily based upon net unrealized gains. The fund has filed tax reclaims for previously withheld taxes on dividends earned in certain European Union countries. These filings are subject to various administrative and judicial proceedings within these countries. Such tax reclaims received during the year, if any, are included in dividend income. No other amounts for additional tax reclaims are reflected in the financial statements due to the uncertainty as to the ultimate resolution of proceedings, the likelihood of receipt of these reclaims, and the potential timing of payment.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses), shareholder reporting, and the proxy. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. The investment advisory firm Wellington Management Company LLP provides investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fee is subject to quarterly adjustments based on performance relative to the MSCI ACWI Energy Index for the preceding three years.

22

Energy Fund

Vanguard provides investment advisory services to a portion of the fund as described below; the fund paid Vanguard advisory fees of $288,000 for the six months ended July 31, 2018.

For the six months ended July 31, 2018, the aggregate investment advisory fee paid to all advisors represented an effective annual basic rate of 0.15% of the fund’s average net assets, before an increase of $448,000 (0.01%) based on performance.

C. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets. All other costs of operations payable to Vanguard are generally settled twice a month.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At July 31, 2018, the fund had contributed to Vanguard capital in the amount of $511,000, representing 0.01% of the fund’s net assets and 0.20% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine

the fair value of investments). Any investments valued with significant unobservable inputs are

noted on the Statement of Net Assets.

The following table summarizes the market value of the fund’s investments as of July 31, 2018, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks—United States | 6,120,205 | — | — |

| Common Stocks—International | 2,222,405 | 1,061,913 | — |

| Temporary Cash Investments | 162,490 | 255,929 | — |

| Futures Contracts—Assets1 | 543 | — | — |

| Total | 8,505,643 | 1,317,842 | — |

| 1 Represents variation margin on the last day of the reporting period. |

23

Energy Fund

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year. For tax purposes, at January 31, 2018, the fund had available capital losses totaling $839,189,000 that may be carried forward indefinitely to offset future net capital gains. The fund will use these capital losses to offset net taxable capital gains, if any, realized during the year ending January 31, 2019; should the fund realize net capital losses for the year, the losses will be added to the loss carryforward balance above.

At July 31, 2018, the cost of investment securities for tax purposes was $5,861,468,000. Net unrealized appreciation of investment securities for tax purposes was $3,959,448,000, consisting of unrealized gains of $4,043,500,000 on securities that had risen in value since their purchase and $84,052,000 in unrealized losses on securities that had fallen in value since their purchase.

F. During the six months ended July 31, 2018, the fund purchased $1,104,739,000 of investment securities and sold $1,388,465,000 of investment securities, other than temporary cash investments.

G. Capital share transactions for each class of shares were:

| | | | |

| | Six Months Ended | Year Ended |

| | July 31, 2018 | January 31, 2018 |

| | Amount | Shares | Amount | Shares |

| | ($000) | (000) | ($000) | (000) |

| Investor Shares | | | | |

| Issued | 212,854 | 3,832 | 425,153 | 8,257 |

| Issued in Lieu of Cash Distributions | 3,792 | 72 | 79,692 | 1,521 |

| Redeemed | (449,065) | (8,128) | (1,124,611) | (21,913) |

| Net Increase (Decrease) —Investor Shares | (232,419) | (4,224) | (619,766) | (12,135) |

| Admiral Shares | | | | |

| Issued | 484,933 | 4,648 | 954,935 | 9,930 |

| Issued in Lieu of Cash Distributions | 9,719 | 99 | 180,333 | 1,835 |

| Redeemed | (706,190) | (6,855) | (1,907,107) | (19,772) |

| Net Increase (Decrease) —Admiral Shares | (211,538) | (2,108) | (771,839) | (8,007) |

24

Energy Fund

H. Transactions during the period in investments where the issuer is another member of The Vanguard Group were as follows:

| | | | | | | | |

| | | Current Period Transactions | |

| | Jan. 31, | | Proceeds | Net | Change | | | July 31, |

| | 2018 | | from | Realized | in Net | | Capital Gain | 2018 |

| | Market | Purchases | Securities | Gain | Unrealized | | Distributions | Market |

| | Value | at Cost | Sold | (Loss) | App. (Dep.) | Income | Received | Value |

| | ($000) | ($000) | ($000) | ($000) | ($000) | ($000) | ($000) | ($000) |

| Vanguard Energy | | | | | | | | |

| ETF | 58,996 | — | — | — | 2,399 | 716 | — | 61,395 |

| Vanguard Market | | | | | | | | |

| Liquidity Fund | 192,265 | NA1 | NA1 | (38) | 19 | 994 | — | 162,490 |

| Total | 251,261 | | | (38) | 2,418 | 1,710 | — | 223,885 |

| 1 Not applicable—purchases and sales are for temporary cash investment purposes. |

I. Management has determined that no events or transactions occurred subsequent to July 31, 2018, that would require recognition or disclosure in these financial statements.

25

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

26

| | | |

| Six Months Ended July 31, 2018 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Energy Fund | 1/31/2018 | 7/31/2018 | Period |

| Based on Actual Fund Return | | | |

| Investor Shares | $1,000.00 | $1,048.30 | $1.98 |

| Admiral Shares | 1,000.00 | 1,048.73 | 1.57 |

| Based on Hypothetical 5% Yearly Return | | | |

| Investor Shares | $1,000.00 | $1,022.86 | $1.96 |

| Admiral Shares | 1,000.00 | 1,023.26 | 1.56 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for

that period are 0.39% for Investor Shares and 0.31% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the

annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent

six-month period, then divided by the number of days in the most recent 12-month period (181/365).

27

Trustees Approve Advisory Arrangements

The board of trustees of Vanguard Energy Fund has renewed the fund’s investment advisory arrangements with The Vanguard Group, Inc. (Vanguard), through its Quantitative Equity Group, and Wellington Management Company LLP (Wellington Management). The board determined that renewing the fund’s advisory arrangements was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of each advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisor oversight and product management. The Portfolio Review Department met regularly with the advisors and made monthly presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received monthly reports, which included a Market and Economic Report, a Fund Dashboard Monthly Summary, and a Fund Performance Report.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangements. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board reviewed the quality of the fund’s investment management services over both the short and long term and took into account the organizational depth and stability of each advisor. The board considered the following: Vanguard. Vanguard has been managing investments for more than four decades. The Quantitative Equity Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth. Vanguard has managed a portion of the fund since 2005.

Wellington Management. Founded in 1928, Wellington Management is among the nation’s oldest and most respected institutional investment managers. The investment team uses a bottom-up approach in which stocks are selected based on the advisor’s estimates of fundamental investment value. Fundamental research focuses on the quality of a company’s assets, its internal reinvestment opportunities, and management quality. The firm has advised the fund since its inception in 1984.

The board concluded that each advisor’s experience, stability, depth, and performance, among other factors, warranted the continuation of the advisory arrangements.

28

Investment performance

The board considered the short- and long-term performance of the fund and each advisor, including any periods of outperformance or underperformance compared with a relevant benchmark index and peer group. The board concluded that the performance was such that the advisory arrangements should continue. Information about the fund’s most recent performance can be found in the Performance Summary section of this report.

Cost

The board concluded that the fund’s expense ratio was well below the average expense ratio charged by funds in its peer group and that the fund’s advisory expense rate was also well below the peer-group average. Information about the fund’s expenses appears in the About Your Fund’s Expenses section of this report as well as in the Financial Statements section, which also includes information about the fund’s advisory expense rate.

The board did not consider the profitability of Wellington Management in determining whether to approve the advisory fee, because Wellington Management is independent of Vanguard and the advisory fee is the result of arm’s-length negotiations. The board does not conduct a profitability analysis of Vanguard because of Vanguard’s unique “at-cost” structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees and produces “profits” only in the form of reduced expenses for fund shareholders.

The benefit of economies of scale

The board concluded that the fund’s shareholders benefit from economies of scale because of breakpoints in the fund’s advisory fee schedule for Wellington Management. The breakpoints reduce the effective rate of the fee as the fund’s assets managed by Wellington Management increase. The board also concluded that the fund’s at-cost arrangement with Vanguard ensures that the fund will realize economies of scale as it grows, with the cost to shareholders declining as the fund’s assets managed by Vanguard increase.

The board will consider whether to renew the advisory arrangements again after a one-year period.

29

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (for bonds), its actual income (for asset-backed securities), or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. A fund’s total annual operating expenses expressed as a percentage of the fund’s average net assets. The expense ratio includes management and administrative expenses, but does not include the transaction costs of buying and selling portfolio securities.

Foreign Holdings. The percentage of a fund represented by securities or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share.

For a fund, the weighted average price/book ratio of the stocks it holds.

30

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.