Arthur C. Delibert, Esq.

1601 K Street, N.W.

Washington, D.C. 20006-1600

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”) (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE,

Washington, DC 20549 0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Report to Shareholders.

Following are copies of the annual reports transmitted to shareholders pursuant to Rule 30e-1 under the Act.

Neuberger Berman

Advisers Management Trust

Absolute Return

Multi-Manager Portfolio

S Class Shares

Annual Report

December 31, 2016

Absolute Return Multi-Manager Portfolio Commentary (Unaudited)

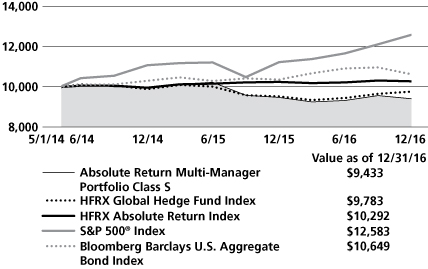

The Neuberger Berman Advisers Management Trust Absolute Return Multi-Manager Portfolio Class S posted a –0.65% total return for the 12 months ended December 31, 2016, underperforming its primary benchmark, the HFRX Global Hedge Fund Index, which returned 2.50% for the same period. (Performance for all benchmarks is provided in the table following this letter.)

Equity markets declined sharply to start the year and then rallied strongly, led by the U.S., as developed markets generally outperformed emerging markets. Meanwhile, U.S. Treasury yields followed a similar path, moving higher following the Trump victory. The U.S. dollar materially strengthened in 2016, most notably versus the yen and euro. Energy prices recovered, particularly following the decision by Organization of the Petroleum Exporting Countries (OPEC) to cut output.

Gains from the Portfolio's allocation to merger arbitrage/event driven, credit and long/short equity strategies were offset by losses from the allocation to managed futures strategies.

Gains from the allocation to merger arbitrage/event driven strategies were driven primarily by spread tightening for a number of deals that successfully closed in 2016. This offset smaller losses from a few deals that broke and where, in hindsight, the Portfolio's positions were sized appropriately, in our opinion.

Positive contributions from the corporate credit long/short strategy were driven by long positions in bank loans and bonds, which outpaced losses from short positions and hedges.

The allocation to long/short equity strategies was up for the year despite struggling during the first quarter equity market selloff and the fourth quarter sector rotation. Gains from long positions outpaced losses from short positions.

The managed futures allocation detracted for the year. Gains from interest rate positioning were offset by losses from commodity, equity and currency trading.

The subadvisers' aggregate use of swaps, forwards, futures and options detracted from performance during the reporting period.

Looking ahead, we believe we have positioned the Portfolio to potentially benefit from a number of factors that we anticipate will dominate markets, particularly those related to rising interest rates. Broadly speaking, rising rates have historically been a significant headwind for fixed income and a tailwind for hedge fund strategies we typically utilize. We believe factors such as rising rates and higher growth in the U.S. on the one hand and monetary easing and slow growth in areas of Europe and Asia on the other hand have the potential to induce elevated volatility, if as we expect, these trends continue. This backdrop has historically been beneficial to managed futures strategies. From a spread perspective, if the so-called risk-free rate increases in accordance with policies that the U.S. Federal Reserve recently laid out, we would anticipate seeing wider and therefore more attractive spreads across the board. Finally, we believe that the long/short equity allocation has the potential to benefit from both longs and shorts without taking aggressive directional market views, as we think dispersion may rise in a new political and policy era.

Sincerely,

David Kupperman And Jeff Majit

Portfolio Managers

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers and subadvisers. The opinions are as of the date of this report, and are subject to change without notice.

1

Absolute Return Multi-Manager Portfolio (Unaudited)

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets) | |

| | | Long | | Short | |

Common Stocks | | | 50.6 | % | | | (18.0 | )% | |

Convertible Bonds | | | 1.0 | | | | — | | |

Corporate Bonds | | | 5.3 | | | | (2.5 | ) | |

Exchange Traded Funds | | | — | | | | (2.8 | ) | |

Exchange Traded Note | | | — | | | | (0.3 | ) | |

Loan Assignments | | | 7.4 | | | | — | | |

Master Limited Partnerships | | | 4.6 | | | | (0.8 | ) | |

Options Purchased | | | 0.0 | | | | — | | |

Rights | | | 0.1 | | | | — | | |

U.S. Treasury Obligations | | | 0.2 | | | | — | | |

Warrants | | | 0.0 | | | | — | | |

Short-Term Investments | | | 28.1 | | | | — | | |

Other Assets Less Liabilities | | | 27.1 | * | | | — | | |

Total | | | 124.4 | % | | | (24.4 | )% | |

* Percentage includes appreciation/depreciation from derivatives, if any.

PERFORMANCE HIGHLIGHTS3

| | | Inception | | Average Annual Total Return

Ended 12/31/2016 | |

| | | Date | | 1-Year | | Life of Fund | |

Absolute Return Multi-Manager

Portfolio Class S | | |

05/01/2014 | | | | –0.65 | % | | | –2.16 | % | |

| HFRX Global Hedge Fund Index1,2,* | | | | | 2.50 | % | | | –0.82 | % | |

| HFRX Absolute Return Index1,2 | | | | | 0.31 | % | | | 1.08 | % | |

| S&P 500® Index1,2 | | | | | 11.96 | % | | | 8.97 | % | |

Bloomberg Barclays U.S. Aggregate

Bond Index1,2 | | | | | | | 2.65 | % | | | 2.38 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit http://www.nb.com/amtportfolios/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. The results do not reflect fees and expenses of the variable annuity and variable life insurance policies or the qualified pension and retirement plans whose proceeds are invested in the Fund.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

* The Fund's primary benchmark changed during the reporting period; the prior benchmark was the HFRX Absolute Return Index. The benchmark was modified because the HFRX Global Hedge Fund Index is believed to be a fairer representation of the Fund's investment universe.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class

(of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratio for fiscal year 2015 was 7.24% for Class S shares (before expense reimbursements and/or fee waivers, if any). The expense ratio was 3.26% for Class S shares after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended December 31, 2016 can be found in the Financial Highlights section of this report.

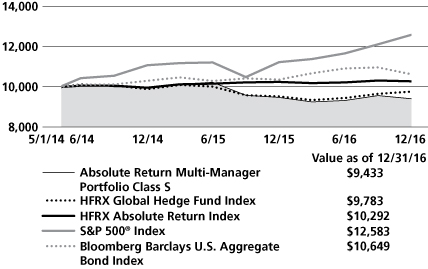

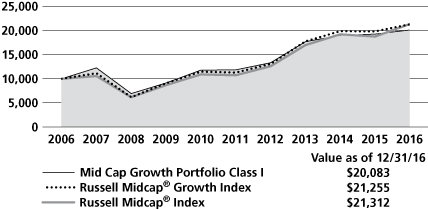

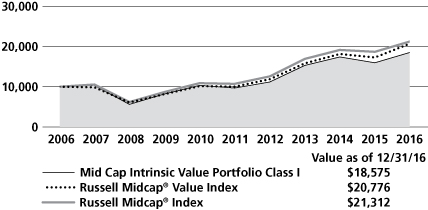

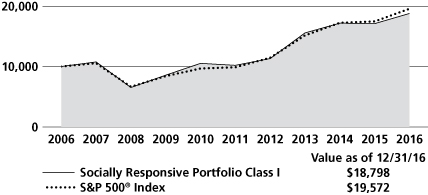

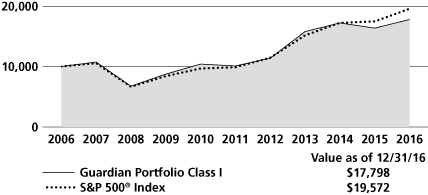

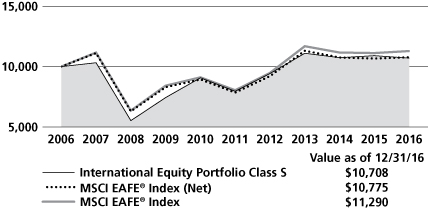

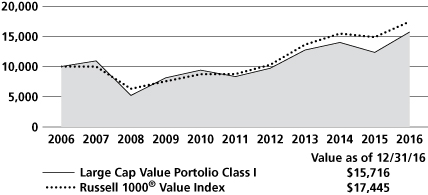

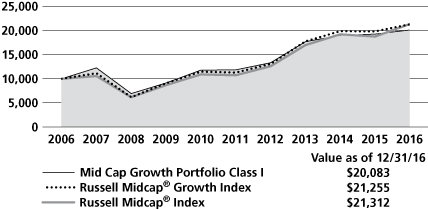

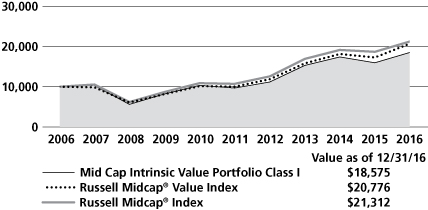

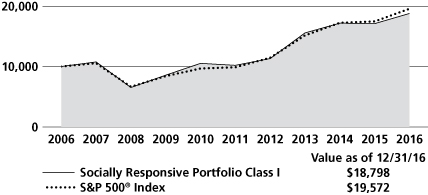

COMPARISON OF A $10,000 INVESTMENT

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. The S&P 500® and Bloomberg Barclays U.S. Aggregate Bond indices do not take into account any fees, expenses or tax consequences of investing in the individual securities they track. The HFRX Absolute Return Index and HFRX Global Hedge Fund Index do take into account fees and expenses of investing since it is based on the underlying hedge funds' net returns. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. The results do not reflect fees and expenses of the variable annuity and variable life insurance policies or the qualified pension and retirement plans whose proceeds are invested in the Fund. Results represent past performance and do not indicate future results.

Please see Endnotes for additional information.

2

1 The date used to calculate Life of Fund performance for the index is May 1, 2014, the Fund's commencement of operations.

2 The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. The HFRX Absolute Return Index is designed to be representative of the overall composition of the hedge fund universe. The index comprises all eligible hedge fund strategies including, but not limited to, convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The index employs a constituent weighting methodology that selects constituent funds which characteristically exhibit lower volatilities and lower correlations to standard directional benchmarks of equity market and hedge fund industry performance. Constituent funds for each HFRX Index are selected from an eligible pool of the more than 7,500 funds worldwide that report to the Hedge Fund Research (HFR) Database. Constituent funds must meet all of the following criteria: report monthly; report performance net of all fees; be U.S. dollar-denominated; be active and accepting new investments; have a minimum 24 months track record; and the fund's manager must have at least $50 million in assets under management. Each HFRX Index is rebalanced quarterly. The S&P 500® Index is a float-adjusted market capitalization-weighted index that focuses on the large-cap segment of the U.S. equity market, and includes a significant portion of the total value of the market. The Bloomberg Barclays U.S. Aggregate Bond Index measures the investment grade, U.S. dollar-denominated, fixed-rate, taxable bond market and includes Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid adjustable rate mortgage (ARM) pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS) (agency and non-agency). On August 24, 2016, Bloomberg acquired the Barclays fixed income benchmark indices from Barclays. Barclays and Bloomberg have agreed to co-brand the indices as the Bloomberg Barclays Indices for an initial term of five years. For more information, please visit www.bloombergindices.com/. Please note that individuals cannot invest directly in any index. The S&P 500 and the Bloomberg Barclays U.S. Aggregate Bond indices do not take into account any fees, expenses or tax consequences of investing in the individual securities that they track. The HFRX Absolute Return Index and HFRX Global Hedge Fund Index do take into account fees and expenses of investing since each is based on the underlying hedge funds' net returns. Data about the performance of an index are prepared or obtained by Neuberger Berman Investment Advisers LLC* ("Management") and reflect the reinvestment of income dividends and other distributions, if any. The Fund may invest in securities not included in a described index and generally does not invest in all securities included in a described index.

3 The Fund was relatively small prior to December 31, 2014, which could have impacted Fund performance. The same techniques used to produce returns in a small fund may not work to produce similar returns in a larger fund.

* On January 1, 2016, Neuberger Berman Management LLC ("NBM") transferred to Neuberger Berman Fixed Income LLC ("NBFI") their rights and obligations pertaining to all services they provided to any Fund under any investment management, investment sub-advisory, and/or administration agreement, as applicable (the "Agreements"). Following such transfer, NBFI was renamed Neuberger Berman Investment Advisers LLC ("NBIA" or "Management"). In addition, on the date of the transfer, the services previously provided by NB Alternative Investment Management LLC ("NBAIM") are provided by NBIA. Following the consolidation, the investment professionals of NBM and NBAIM who provided services to any Fund under the Agreements continue to provide the same services, except that they provide those services in their new capacities as investment professionals of NBIA. Further, the consolidation did not result in any change in the investment processes employed by any Fund, the nature or level of services provided to any Fund, or the fees any Fund pays under its Agreements.

3

On July 1, 2016, NBM was reorganized into "Neuberger Berman" (the "Reorganization"). Upon the completion of the Reorganization, Neuberger Berman assumed all rights and obligations pertaining to all services NBM provided to any Fund under any distribution agreement or distribution and services agreement (the "Agreements") or plan adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended, (the "Plans"). Accordingly, after the Reorganization, Neuberger Berman became each Fund's distributor and the services previously provided by NBM under the Agreements and Plans are provided by Neuberger Berman.

Following the Reorganization, the employees of NBM provide the same services to each Fund under the Agreements and Plans, except that they provide those services in their capacities as employees of Neuberger Berman. Further, the Reorganization did not result in any change in the nature or level of services provided to each Fund, or the fees, if any, each Fund pays under the Agreements or the Plans.

Please note, effective July 1, 2016, Neuberger Berman Management LLC was reorganized with and into Neuberger Berman LLC, a registered broker-dealer, Member FINRA and the Fund's distributor, which changed its name to Neuberger Berman BD LLC on January 1, 2017.

The investments for the Fund are managed by the same portfolio manager(s) and subadvisers who manage one or more other registered funds that have names, investment objectives and investment styles that are similar to those of the Fund.

You should be aware that the Fund is likely to differ from those other mutual fund(s) in size, cash flow pattern and tax matters. Accordingly, the holdings and performance of the Fund can be expected to vary from those of the other mutual fund(s).

Shares of the separate Neuberger Berman Advisers Management Trust Portfolios, including the Fund, are not available to the general public. Shares of the Fund may be purchased only by life insurance companies to be held in their separate accounts, which fund variable annuity and variable life insurance policies, and by qualified pension and retirement plans.

Statistics and projections in this report are derived from sources deemed to be reliable but cannot be regarded as a representation of future results of the Fund. This report is prepared for the general information of shareholders and is not an offer of shares of the Fund. Shares are sold only through the currently effective prospectus, which must precede or accompany this report.

The "Neuberger Berman" name and logo and "Neuberger Berman Investment Advisers LLC" are registered service marks of Neuberger Berman Group LLC. The individual Fund name in this piece is either a service mark or registered service mark of Neuberger Berman Investment Advisers LLC , an affiliate of Neuberger Berman BD LLC, distributor, member FINRA. © 2017 Neuberger Berman BD LLC. All rights reserved.

4

Information About Your Fund's Expenses (Unaudited)

As a Fund shareholder, you incur two types of costs: (1) transaction costs such as fees and expenses that are, or may be, imposed under your variable contract or qualified pension plan; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees (if applicable), and other Fund expenses. This example is intended to help you understand your ongoing costs (in U.S. dollars) of investing in the Fund and compare these costs with the ongoing costs of investing in other mutual funds.

This table is designed to provide information regarding costs related to your investments. The following examples are based on an investment of $1,000 made at the beginning of the six month period ended December 31, 2016 and held for the entire period. The table illustrates the Fund's costs in two ways:

Actual Expenses and Performance: | | The first section of the table provides information about actual account values and actual expenses in dollars, based on the Fund's actual performance during the period indicated. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section of the table under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid over the period. | |

Hypothetical Example for

Comparison Purposes: | | The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return at 5% per year before expenses. This return is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in this Fund versus other funds. To do so, compare the expenses shown in this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. | |

Please note that the expenses in the table are meant to highlight your ongoing costs only and do not include any transaction costs, such as fees and expenses that are, or may be, imposed under your variable contract or qualified pension plan. Therefore, the information under the heading "Hypothetical (5% annual return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

NEUBERGER BERMAN ADVISERS MANAGEMENT TRUST ABSOLUTE RETURN MULTI-MANAGER PORTFOLIO

Actual | | Beginning Account

Value

7/1/2016 | | Ending Account

Value

12/31/2016 | | Expenses Paid

During the Period

7/1/2016 – 12/31/2016 | |

Class S | | $ | 1,000.00 | | | $ | 1,009.70 | | | $ | 16.37 | * | |

Hypothetical (5% annual return before expenses) | |

Class S | | $ | 1,000.00 | | | $ | 1,008.85 | | | $ | 16.36 | ** | |

* Expenses are equal to the annualized expense ratio of 3.24%, multiplied by the average account value over the period, multiplied by 184/366 (to refelect the one-half year period shown).

** Hypothetical expenses are equal to the annualized expense ratio of 3.24%, multiplied by the average account value over the period (assuming a 5% annual return), multiplied by 184/366 (to reflect the one-half year period shown).

5

Schedule of Investments Absolute Return Multi-Manager Portfolio December 31, 2016

SHARES | | | | VALUE | |

Long Positions 97.3% | | | |

Common Stocks 50.6% | | | |

Air Freight & Logistics 0.4% | | | |

| | 325 | | | FedEx Corp.(a) | | $ | 60,515 | | |

Banks 0.5% | | | |

| | 3,842 | | | Barclays plc (United Kingdom)(a) | | | 10,580 | | |

| | 900 | | | Cascade Bancorp* | | | 7,308 | | |

| | 930 | | | PrivateBancorp, Inc.(b) | | | 50,397 | | |

| | 229 | | | Societe Generale SA (France)(a) | | | 11,268 | | |

| | | | 79,553 | | |

Biotechnology 2.5% | | | |

| | 475 | | | Alexion Pharmaceuticals, Inc.*(a) | | | 58,116 | | |

| | 1,574 | | | Clovis Oncology, Inc.*(a) | | | 69,917 | | |

| | 576 | | | Incyte Corp.*(a) | | | 57,756 | | |

| 4,066 | | | Ironwood Pharmaceuticals,

Inc.*(a) | | | 62,169 | | |

| | 329 | | | Shire plc, ADR(a) | | | 56,055 | | |

| | 472 | | | TESARO, Inc.*(a) | | | 63,475 | | |

| | | | 367,488 | | |

Building Products 0.6% | | | |

| 2,199 | | | Johnson Controls

International plc(a) | | | 90,577 | | |

| Capital Markets 0.0%(c) | | | |

| 3,261 | | | Aretec Group, Inc.,

Class A*(d)(e)(f) | | | — | | |

| | 25 | | | Intertrust NV (Netherlands)(a)(g) | | | 440 | | |

| | | | 440 | | |

Chemicals 2.8% | | | |

| | 515 | | | Air Products & Chemicals, Inc.(a) | | | 74,067 | | |

| | 3,040 | | | Canexus Corp. (Canada)* | | | 3,691 | | |

| | 1,282 | | | Chemtura Corp.*(a) | | | 42,562 | | |

| 329 | | | Croda International plc

(United Kingdom)(a) | | | 12,959 | | |

| | 200 | | | Monsanto Co.(b) | | | 21,042 | | |

| | 545 | | | PPG Industries, Inc.(a) | | | 51,644 | | |

| 900 | | | Syngenta AG, ADR

(Switzerland)(b) | | | 71,145 | | |

| | 700 | | | Valspar Corp. (The)(b) | | | 72,527 | | |

| | 755 | | | WR Grace & Co.(a) | | | 51,068 | | |

| | | | 400,705 | | |

Commercial Services & Supplies 0.2% | | | |

| | 275 | | | G&K Services, Inc., Class A | | | 26,524 | | |

Communications Equipment 1.2% | | | |

| 2,400 | | | Brocade Communications

Systems, Inc.(a) | | | 29,976 | | |

SHARES | | | | VALUE | |

| | 100 | | | Digi International, Inc.*(b) | | $ | 1,375 | | |

| | 770 | | | Harris Corp.(a) | | | 78,902 | | |

| | 450 | | | Palo Alto Networks, Inc.*(a) | | | 56,272 | | |

| | | | 166,525 | | |

Construction Materials 0.6% | | | |

| | 2,242 | | | Forterra, Inc.* | | | 48,562 | | |

| | 600 | | | Headwaters, Inc.* | | | 14,112 | | |

| 220 | | | HeidelbergCement AG

(Germany)(a) | | | 20,525 | | |

| | | | 83,199 | | |

Containers & Packaging 0.3% | | | |

| | 175 | | | AEP Industries, Inc.(b) | | | 20,317 | | |

| | 283 | | | Ball Corp.(a) | | | 21,245 | | |

| | | | 41,562 | | |

Diversified Consumer Services 0.5% | | | |

| | 725 | | | Apollo Education Group, Inc.*(b) | | | 7,177 | | |

| | 2,500 | | | LifeLock, Inc.*(b) | | | 59,800 | | |

| | | | 66,977 | | |

Diversified Financial Services 0.5% | | | |

| | 6,200 | | | Pace Holdings Corp.*(a) | | | 66,650 | | |

Diversified Telecommunication

Services 0.2% | | | |

| | 325 | | | Inteliquent, Inc.(b) | | | 7,449 | | |

| | 350 | | | Level 3 Communications, Inc.*(b) | | | 19,726 | | |

| | | | 27,175 | | |

Electric Utilities 1.5% | | | |

| | 198 | | | ALLETE, Inc. | | | 12,710 | | |

| | 497 | | | Great Plains Energy, Inc. | | | 13,593 | | |

| | 912 | | | NextEra Energy, Inc.(a) | | | 108,947 | | |

| | 543 | | | PG&E Corp. | | | 32,998 | | |

| | 800 | | | Westar Energy, Inc.(b) | | | 45,080 | | |

| | | | 213,328 | | |

Electronic Equipment, Instruments &

Components 0.1% | | | |

| 200 | | | Axis Communications AB

(Sweden)(a) | | | 7,477 | | |

| | 600 | | | InvenSense, Inc.* | | | 7,674 | | |

| | | | 15,151 | | |

Energy Equipment & Services 0.1% | | | |

| | 200 | | | Seventy Seven Energy, Inc.*(b) | | | 9,000 | | |

| | 196 | | | US Silica Holdings, Inc. | | | 11,109 | | |

| | | | 20,109 | | |

See Notes to Financial Statements

6

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

SHARES | | | | VALUE | |

Equity Real Estate Investment

Trusts (REITs) 0.2% | | | |

| | 3,038 | | | New York REIT, Inc.(a) | | $ | 30,745 | | |

Food & Staples Retailing 1.0% | | | |

| 381 | | | Cia Brasileira de Distribuicao,

ADR (Brazil)(a) | | | 6,306 | | |

| | 375 | | | Magnit PJSC, GDR (Russia)(a) | | | 16,556 | | |

| | 9,950 | | | Rite Aid Corp.*(b) | | | 81,988 | | |

| 4,588 | | | Wal-Mart de Mexico SAB de CV

(Mexico)(a) | | | 8,200 | | |

| 942 | | | X5 Retail Group NV, GDR

(Russia)*(a) | | | 30,568 | | |

| | | | 143,618 | | |

Food Products 1.5% | | | |

| | 2,650 | | | Flowers Foods, Inc. | | | 52,920 | | |

| | 717 | | | Mead Johnson Nutrition Co.(a) | | | 50,735 | | |

| | 1,950 | | | WhiteWave Foods Co. (The)*(b) | | | 108,420 | | |

| | | | 212,075 | | |

Gas Utilities 0.1% | | | |

| | 241 | | | Atmos Energy Corp. | | | 17,870 | | |

Health Care Equipment & Supplies 4.1% | | | |

| | 1,625 | | | Alere, Inc.*(a) | | | 63,326 | | |

| | 2,622 | | | Boston Scientific Corp.*(a) | | | 56,714 | | |

| | 276 | | | CR Bard, Inc. | | | 62,006 | | |

| | 542 | | | Edwards Lifesciences Corp.*(a) | | | 50,785 | | |

| | 1,440 | | | Hologic, Inc.* | | | 57,773 | | |

| | 764 | | | ResMed, Inc. | | | 47,406 | | |

| 207 | | | Smith & Nephew plc

(United Kingdom)(a) | | | 3,115 | | |

| | 1,650 | | | St Jude Medical, Inc.(b) | | | 132,314 | | |

| | 665 | | | STERIS plc(a) | | | 44,814 | | |

| | 225 | | | Vascular Solutions, Inc.*(b) | | | 12,623 | | |

| | 620 | | | Zimmer Biomet Holdings, Inc. | | | 63,984 | | |

| | | | 594,860 | | |

Health Care Providers & Services 1.4% | | | |

| | 313 | | | Humana, Inc.(b) | | | 63,861 | | |

| 447 | | | Laboratory Corp. of America

Holdings*(a) | | | 57,386 | | |

| 2,995 | | | Shanghai Pharmaceuticals

Holding Co. Ltd., Class H

(China)(a) | | | 6,836 | | |

| 1,681 | | | Sinopharm Group Co. Ltd.,

Class H (China)(a) | | | 6,889 | | |

| | 1,275 | | | Team Health Holdings, Inc.*(b) | | | 55,399 | | |

| | 1,830 | | | Universal American Corp.*(b) | | | 18,208 | | |

| | | | 208,579 | | |

SHARES | | | | VALUE | |

Hotels, Restaurants & Leisure 1.1% | | | |

| | 3,030 | | | Bloomin' Brands, Inc.(a) | | $ | 54,631 | | |

| | 1,845 | | | Hilton Worldwide Holdings, Inc. | | | 50,184 | | |

| | 315 | | | Vail Resorts, Inc. | | | 50,813 | | |

| | | | 155,628 | | |

Household Durables 0.8% | | | |

| 425 | | | Harman International

Industries, Inc.(b) | | | 47,243 | | |

| | 500 | | | Lennar Corp., Class B(b) | | | 17,250 | | |

| | 200 | | | Mohawk Industries, Inc.*(a) | | | 39,936 | | |

| | 475 | | | WCI Communities, Inc.*(b) | | | 11,139 | | |

| | | | 115,568 | | |

Independent Power & Renewable

Electricity Producers 0.5% | | | |

| | 1,727 | | | Dynegy, Inc.* | | | 14,611 | | |

| | 934 | | | NextEra Energy Partners LP | | | 23,854 | | |

| | 1,628 | | | Pattern Energy Group, Inc.(a) | | | 30,916 | | |

| | | | 69,381 | | |

| Industrial Conglomerates 0.0%(c) | | | |

| 256 | | | Smiths Group plc

(United Kingdom)(a) | | | 4,467 | | |

Insurance 1.4% | | | |

| 273 | | | Admiral Group plc

(United Kingdom)(a) | | | 6,147 | | |

| | 7,786 | | | AIA Group Ltd. (Hong Kong)(a) | | | 43,616 | | |

| 500 | | | Allied World Assurance

Co. Holdings AG | | | 26,855 | | |

| 600 | | | Endurance Specialty

Holdings Ltd.(a) | | | 55,440 | | |

| 1,060 | | | Hartford Financial Services

Group, Inc. (The)(a) | | | 50,509 | | |

| 1,949 | | | RSA Insurance Group plc

(United Kingdom)(a) | | | 14,075 | | |

| | 1,021 | | | Syncora Holdings Ltd.*(a) | | | 1,981 | | |

| | | | 198,623 | | |

Internet & Direct Marketing Retail 0.5% | | | |

| | 12 | | | Amazon.com, Inc.*(a) | | | 8,999 | | |

| | 148 | | | ASOS plc (United Kingdom)*(a) | | | 9,054 | | |

| | 222 | | | Expedia, Inc.(a) | | | 25,148 | | |

| | 18 | | | Priceline Group, Inc. (The)*(a) | | | 26,389 | | |

| | | | 69,590 | | |

Internet Software & Services 2.1% | | | |

| 457 | | | Alibaba Group Holding Ltd.,

ADR (China)*(a) | | | 40,129 | | |

| | 75 | | | Alphabet, Inc., Class A*(a) | | | 59,434 | | |

| | 77 | | | Baidu, Inc., ADR (China)*(a) | | | 12,660 | | |

| | 920 | | | Cornerstone OnDemand, Inc.*(a) | | | 38,925 | | |

| | 250 | | | EarthLink Holdings Corp. | | | 1,410 | | |

See Notes to Financial Statements

7

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

SHARES | | | | VALUE | |

| | 513 | | | eBay, Inc.*(a) | | $ | 15,231 | | |

| | 387 | | | Facebook, Inc., Class A*(a) | | | 44,524 | | |

| | 150 | | | Intralinks Holdings, Inc.* | | | 2,028 | | |

| 299 | | | Mail.Ru Group Ltd., GDR

(Russia)*(a) | | | 5,487 | | |

| | 112 | | | MercadoLibre, Inc. (Argentina)(a) | | | 17,488 | | |

| | 1,028 | | | Tencent Holdings Ltd. (China)(a) | | | 24,926 | | |

| | 1,038 | | | Yahoo!, Inc.*(b) | | | 40,139 | | |

| | 326 | | | Yandex NV, Class A (Russia)*(a) | | | 6,562 | | |

| | | | 308,943 | | |

IT Services 0.7% | | | |

| | 200 | | | Datalink Corp.* | | | 2,252 | | |

| | 100 | | | Lionbridge Technologies, Inc.*(b) | | | 580 | | |

| | 450 | | | NeuStar, Inc., Class A*(b) | | | 15,030 | | |

| | 511 | | | PayPal Holdings, Inc.*(a) | | | 20,169 | | |

| | 1,170 | | | Total System Services, Inc.(a) | | | 57,365 | | |

| | | | 95,396 | | |

Life Sciences Tools & Services 0.7% | | | |

| | 547 | | | Gerresheimer AG (Germany)(a) | | | 40,663 | | |

| | 2,308 | | | QIAGEN NV*(a) | | | 64,670 | | |

| | | | 105,333 | | |

Machinery 1.0% | | | |

| | 475 | | | CLARCOR, Inc. | | | 39,173 | | |

| | 652 | | | EnPro Industries, Inc.(a) | | | 43,919 | | |

| | 2,050 | | | Joy Global, Inc.(a)(b) | | | 57,400 | | |

| | | | 140,492 | | |

Media 3.2% | | | |

| 1 | | | AMC Entertainment

Holdings, Inc., Class A | | | 25 | | |

| 1,400 | | | CBS Corp. (Non-Voting),

Class B(a) | | | 89,068 | | |

| 1,000 | | | Crown Media Holdings, Inc.,

Class A*(d)(e) | | | 5,050 | | |

| | 639 | | | DISH Network Corp., Class A*(a) | | | 37,017 | | |

| | 2,843 | | | Gray Television, Inc.* | | | 30,847 | | |

| | 10,421 | | | ITV plc (United Kingdom)(a) | | | 26,508 | | |

| 476 | | | Liberty Global plc, Series C

(United Kingdom)*(a) | | | 14,137 | | |

| 65 | | | Liberty Global plc LiLAC,

Series C (United Kingdom)*(a) | | | 1,376 | | |

| 1,100 | | | Loral Space & Communications,

Inc.*(b) | | | 45,155 | | |

| | 2,550 | | | Media General, Inc.*(b) | | | 48,016 | | |

| 239 | | | Nexstar Broadcasting Group,

Inc., Class A | | | 15,129 | | |

| 850 | | | Sirius XM Canada Holdings,

Inc. (Canada)(a) | | | 3,216 | | |

| 1,863 | | | Stroeer SE & Co. KGaA

(Germany)(a) | | | 81,787 | | |

| | 405 | | | Time Warner, Inc.(b) | | | 39,095 | | |

| | 411 | | | Tribune Media Co., Class A | | | 14,377 | | |

SHARES | | | | VALUE | |

| 250 | | | Twenty-First Century Fox, Inc.,

Class B(b) | | $ | 6,812 | | |

| | | | 457,615 | | |

Metals & Mining 0.6% | | | |

| 5,170 | | | Constellium NV, Class A

(Netherlands)*(a) | | | 30,503 | | |

| | 830 | | | Nucor Corp. | | | 49,402 | | |

| | | | 79,905 | | |

Multiline Retail 0.4% | | | |

| | 750 | | | Dollar General Corp.(a) | | | 55,552 | | |

Multi-Utilities 1.2% | | | |

| | 306 | | | Avista Corp. | | | 12,237 | | |

| | 1,523 | | | Black Hills Corp.(a) | | | 93,421 | | |

| | 294 | | | CMS Energy Corp. | | | 12,236 | | |

| | 179 | | | DTE Energy Co. | | | 17,633 | | |

| | 424 | | | Sempra Energy | | | 42,672 | | |

| | | | 178,199 | | |

Oil, Gas & Consumable Fuels 2.8% | | | |

| | 2,435 | | | Callon Petroleum Co.*(a) | | | 37,426 | | |

| | 1,391 | | | Cheniere Energy, Inc.*(a) | | | 57,629 | | |

| | 487 | | | Enbridge, Inc. (Canada) | | | 20,512 | | |

| | 910 | | | Golar LNG Ltd. | | | 20,875 | | |

| | 450 | | | InterOil Corp. (Singapore)*(b) | | | 21,411 | | |

| | 2,251 | | | Kinder Morgan, Inc.(a) | | | 46,618 | | |

| | 679 | | | Midstates Petroleum Co., Inc.* | | | 14,083 | | |

| | 160 | | | Phillips 66 | | | 13,826 | | |

| | 275 | | | Pioneer Natural Resources Co.(a) | | | 49,519 | | |

| | 197 | | | SemGroup Corp., Class A | | | 8,225 | | |

| | 761 | | | Targa Resources Corp.(a) | | | 42,669 | | |

| | 498 | | | TransCanada Corp. (Canada) | | | 22,485 | | |

| | 1,529 | | | Williams Cos., Inc. (The) | | | 47,613 | | |

| | | | 402,891 | | |

Pharmaceuticals 2.0% | | | |

| | 672 | | | Allergan plc*(a) | | | 141,127 | | |

| | 895 | | | Bristol-Myers Squibb Co. | | | 52,304 | | |

| | 1,843 | | | Dermira, Inc.*(a) | | | 55,898 | | |

| 302 | | | Dr Reddy's Laboratories Ltd.,

ADR (India)(a) | | | 13,675 | | |

| 502 | | | Hikma Pharmaceuticals plc

(Jordan)(a) | | | 11,711 | | |

| | 129 | | | Mylan NV*(a) | | | 4,921 | | |

| 165 | | | Teva Pharmaceutical Industries

Ltd., ADR (Israel)(a) | | | 5,981 | | |

| | | | 285,617 | | |

Professional Services 0.5% | | | |

| | 590 | | | Dun & Bradstreet Corp. (The)(a) | | | 71,579 | | |

See Notes to Financial Statements

8

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

SHARES | | | | VALUE | |

Road & Rail 0.9% | | | |

| 345 | | | Canadian Pacific Railway Ltd.

(Canada)(a) | | $ | 49,256 | | |

| | 790 | | | Norfolk Southern Corp.(a) | | | 85,375 | | |

| | | | 134,631 | | |

Semiconductors & Semiconductor

Equipment 2.7% | | | |

| | 137 | | | Applied Micro Circuits Corp.*(b) | | | 1,130 | | |

| | 309 | | | Broadcom Ltd. (Singapore)(a) | | | 54,622 | | |

| | 1,000 | | | Intersil Corp., Class A(a) | | | 22,300 | | |

| | 1,050 | | | Lattice Semiconductor Corp.*(b) | | | 7,728 | | |

| | 1,050 | | | Linear Technology Corp.(b) | | | 65,467 | | |

| 2,475 | | | NXP Semiconductors NV

(Netherlands)*(b) | | | 242,575 | | |

| | | | 393,822 | | |

Software 0.7% | | | |

| | 1,600 | | | Mentor Graphics Corp.(b) | | | 59,024 | | |

| | 970 | | | PTC, Inc.*(a) | | | 44,882 | | |

| | | | 103,906 | | |

Specialty Retail 2.0% | | | |

| | 102 | | | AutoZone, Inc.*(a) | | | 80,559 | | |

| | 875 | | | Cabela's, Inc.*(a) | | | 51,231 | | |

| | 1,065 | | | CST Brands, Inc.(a) | | | 51,280 | | |

| 1,186 | | | Hennes & Mauritz AB, Class B

(Sweden)(a) | | | 32,987 | | |

| 466 | | | Pets at Home Group plc

(United Kingdom)(a) | | | 1,373 | | |

| 1,200 | | | Restoration Hardware

Holdings, Inc.*(a) | | | 36,840 | | |

| 10,966 | | | Sports Direct International plc

(United Kingdom)*(a) | | | 37,651 | | |

| | | | 291,921 | | |

Technology Hardware, Storage &

Peripherals 1.2% | | | |

| | 463 | | | Apple, Inc.(a) | | | 53,624 | | |

| 4,005 | | | Hewlett Packard

Enterprise Co.(a)(b) | | | 92,676 | | |

| 35 | | | Samsung Electronics Co. Ltd.,

GDR (South Korea)(a) | | | 26,145 | | |

| | | | 172,445 | | |

Textiles, Apparel & Luxury Goods 1.5% | | | |

| 112 | | | Burberry Group plc

(United Kingdom)(a) | | | 2,066 | | |

| | 725 | | | Coach, Inc.(a) | | | 25,390 | | |

| | 875 | | | Deckers Outdoor Corp.*(a) | | | 48,466 | | |

| | 1,385 | | | G-III Apparel Group Ltd.*(a) | | | 40,941 | | |

| | 446 | | | Michael Kors Holdings Ltd.*(a) | | | 19,169 | | |

| | 622 | | | NIKE, Inc., Class B(a) | | | 31,616 | | |

| | 490 | | | PVH Corp.(a) | | | 44,218 | | |

| | | | 211,866 | | |

SHARES | | | | VALUE | |

Thrifts & Mortgage Finance 0.3% | | | |

| | 610 | | | Astoria Financial Corp.(b) | | $ | 11,377 | | |

| | 1,525 | | | EverBank Financial Corp.(a) | | | 29,661 | | |

| | | | 41,038 | | |

Trading Companies & Distributors 0.5% | | | |

| | 1,393 | | | Brenntag AG (Germany)(a) | | | 77,423 | | |

Transportation Infrastructure 0.6% | | | |

| | 1,140 | | | Macquarie Infrastructure Corp.(a) | | | 93,138 | | |

Water Utilities 0.4% | | | |

| | 624 | | | American Water Works Co., Inc. | | | 45,153 | | |

| | 449 | | | Aqua America, Inc. | | | 13,488 | | |

| | | | 58,641 | | |

| | | | | Total Common Stocks

(Cost $7,183,950) | | | 7,307,835

| | |

PRINCIPAL AMOUNT | | | | | |

| Loan Assignments 7.4%(h) | | | |

Auto Components 0.1% | | | |

$ | 14,000 | | | Innovative Xcessories &

Services LLC, Term Loan B

5.75%, 11/22/2022 | | | 14,070 | | |

| Capital Markets 0.0%(c) | | | |

| 5,478 | | | Lightstone Generation LLC,

Term Loan B

12/15/2023(i) | | | 5,540 | | |

| 522 | | | Lightstone Generation LLC,

Term Loan C

12/15/2023(i) | | | 528 | | |

| | | | 6,068 | | |

Chemicals 0.1% | | | |

| 7,000 | | | Huntsman International LLC,

Term Loan B

3.96%, 4/1/2023 | | | 7,067 | | |

Commercial Services & Supplies 0.1% | | | |

| 12,904 | | | GCA Services Group, Inc.,

1st Lien Term Loan

6.25%, 11/25/2020 | | | 12,495 | | |

Containers & Packaging 0.1% | | | |

| 18,000 | | | Flex Acquisition Co., Inc.,

Term Loan

12/29/2023 | | | 18,150 | | |

| 3,636 | | | TricorBraun, Inc., Term Loan

4.75%, 11/30/2023 | | | 3,670 | | |

| | | | 21,820 | | |

See Notes to Financial Statements

9

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

PRINCIPAL AMOUNT | | | | VALUE | |

Diversified Consumer Services 0.5% | | | |

$ | 77,265 | | | Affinion Group, Inc.,

1st Lien Term Loan B

6.75%, 4/30/2018 | | $ | 76,763 | | |

Diversified Financial Services 0.3% | | | |

| 50,000 | | | Environmental Resources

Management, 1st Lien Term Loan

5.00%, 5/14/2021(e) | | | 44,500 | | |

Diversified Telecommunication

Services 0.7% | | | |

| 18,000 | | | Consolidated Communications,

Inc., Initial Term Loan 10/5/2023 | | | 18,093 | | |

| 30,000 | | | Global Eagle Entertainment,

Inc., Term Loan 12/22/2022(i) | | | 29,400 | | |

| 10,000 | | | Global Telcom Link Corp.,

2nd Lien Term Loan

9.00%, 11/23/2020 | | | 9,687 | | |

| 12,000 | | | Telesat Canada, Term Loan B

4.50%, 11/9/2023 | | | 12,154 | | |

| 23,000 | | | Virgin Media Investment

Holdings Ltd., Term Loan

1/31/2025 | | | 23,089 | | |

| | | | 92,423 | | |

| Electric Utilities 0.0%(c) | | | |

| | 1,629 | | | Texas Competitive Electric

Holdings Co. LLC,

DIP Term Loan B

5.00%, 8/4/2023 | | | 1,647

| | |

| | 371 | | | Texas Competitive Electric

Holdings Co. LLC, Term Loan

5.00%, 8/4/2023 | | | 376

| | |

| | | | 2,023 | | |

Energy Equipment & Services 0.6% | | | |

| 5,000 | | | C&J Energy Services Ltd.,

Initial Tranche Term Loan B-1

3/24/2020(i) | | | 5,666 | | |

| 55,652 | | | CGG Holding US, Inc.,

1st Lien Term Loan

6.50%, 5/15/2019 | | | 50,202 | | |

| 14,992 | | | Pacific Drilling SA, Term Loan

4.50%, 5/18/2018(i) | | | 5,262 | | |

| 29,000 | | | Vertiv Co., Term Loan B

6.00%, 11/30/2023(i) | | | 29,363 | | |

| | | | 90,493 | | |

Health Care Providers & Services 0.7% | | | |

| 28,650 | | | 21st Century Oncology, Inc.,

Term Loan 7.12%, 4/30/2022 | | | 26,286 | | |

| 11,790 | | | Beacon Health Strategies LLC,

Term Loan B 5.00%, 12/23/2021 | | | 11,436 | | |

| 31,000 | | | Highland Acquisition Holdings

LLC, Term Loan B

11/23/2022(i) | | | 29,398 | | |

PRINCIPAL AMOUNT | | | | VALUE | |

$ | 27,741 | | | Quorum Health Corp.,

Term Loan B 6.75%, 4/29/2022 | | $ | 27,139 | | |

| | | | 94,259 | | |

Hotels, Restaurants & Leisure 0.6% | | | |

| 28,928 | | | Bowlmor AMF Corp., 1st Lien

Term Loan 6.00%, 9/19/2023 | | | 28,837 | | |

| 9,000 | | | Bowlmor AMF Corp., 2nd Lien

Term Loan 11.00%, 3/17/2024 | | | 9,158 | | |

| 36,908 | | | Diamond Resorts International,

Inc., Term Loan B

6.62%, 8/17/2023 | | | 36,908 | | |

| | | | 74,903 | | |

| Household Products 0.0%(c) | | | |

| 6,000 | | | Hoffmaster Group, Inc.,

Term Loan B 5.50%, 11/21/2023 | | | 6,060 | | |

Independent Power & Renewable

Electricity Producers 0.1% | | | |

| 15,960 | | | Star West Generation LLC,

Term Loan B 5.75%, 3/13/2020 | | | 13,486 | | |

Insurance 1.1% | | | |

| 15,000 | | | Asurion LLC (Fka Asurion Corp.)

PIK Unsecured Term Loan

10.00%, 8/31/2021 | | | 15,413 | | |

| 44,000 | | | Asurion LLC, 2nd Lien

Term Loan 8.50%, 2/19/2021(i) | | | 44,688 | | |

| 20,000 | | | Confie Seguros Holding II Co.,

2nd Lien Term Loan

10.50%, 5/8/2019 | | | 19,800 | | |

| 28,000 | | | Confie Seguros Holding II Co.,

Term Loan B 5.75%, 4/19/2022 | | | 28,091 | | |

| 47,723 | | | Cunningham Lindsey US, Inc.,

1st Lien Term Loan

5.00%, 12/10/2019(i) | | | 39,920 | | |

| 17,961 | | | Hyperion Insurance Group Ltd.,

Term Loan B 5.50%, 4/29/2022 | | | 17,983 | | |

| | | | 165,895 | | |

Internet Software & Services 0.1% | | | |

| 12,000 | | | Ancestry.com, Inc., Term Loan

5.25%, 10/19/2023 | | | 12,109 | | |

IT Services 0.1% | | | |

| 17,000 | | | Evo Payments International LLC,

1st Lien Term Loan 12/8/2023(i) | | | 17,085 | | |

| Machinery 0.0%(c) | | | |

| 1,995 | | | Crosby Worldwide Ltd.,

1st Lien Term Loan

4.00%, 11/23/2020 | | | 1,782 | | |

See Notes to Financial Statements

10

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

PRINCIPAL AMOUNT | | | | VALUE | |

Media 0.1% | | | |

$ | 7,000 | | | Cirque du Soleil, Inc., 2nd Lien

Term Loan 9.25%, 7/10/2023 | | $ | 6,807 | | |

| 4,000 | | | Vestcom International, Inc.

(Fka Vector Investment

Holdings, Inc.), Term Loan

12/15/2023 | | | 4,000 | | |

| | | | 10,807 | | |

Oil, Gas & Consumable Fuels 0.1% | | | |

| 16,958 | | | Gulf Finance LLC, Term Loan B

6.25%, 8/25/2023 | | | 17,000 | | |

Pharmaceuticals 0.5% | | | |

| 65,741 | | | Valeant Pharmaceuticals

International, Inc., Term Loan

5.50%, 4/1/2022(i) | | | 65,753 | | |

Professional Services 0.1% | | | |

| 15,750 | | | Duff & Phelps Corp., 2nd Lien

Term Loan 9.50%, 4/23/2021 | | | 15,593 | | |

Semiconductors & Semiconductor

Equipment 0.4% | | | |

| 27,582 | | | SunEdison, Inc., 1st Lien DIP

Term Loan 11.50%, 4/26/2017(i) | | | 27,720 | | |

| 14,000 | | | SunEdison, Inc., 2nd Lien Term

Loan A2 7/2/2018(j) | | | 6,160 | | |

| 29,000 | | | SunEdison, Inc., Initial Tranche

Term Loan A 4/21/2017(i) | | | 29,121 | | |

| | | | 63,001 | | |

Software 0.6% | | | |

| 11,000 | | | Aptean, Inc., 1st Lien Term Loan

12/14/2022 | | | 11,064 | | |

| 3,000 | | | Aptean, Inc., 2nd Lien Term Loan

12/20/2023 | | | 2,985 | | |

| 36,000 | | | Epiq Systems, Inc., Term Loan

6.25%, 9/23/2023 | | | 35,460 | | |

| 7,000 | | | Greeneden U.S. Holdings II LLC,

Term Loan B 11/17/2023(i) | | | 7,118 | | |

| 9,000 | | | Information Resources, Inc.

(Fka Symphonyiri Group),

Term Loan 1/18/2024(i) | | | 9,056 | | |

| | | | 65,683 | | |

Technology Hardware, Storage &

Peripherals 0.4% | | | |

| 59,869 | | | Eastman Kodak Co., Term Loan

7.25%, 9/3/2019 | | | 59,981 | | |

| | | | | Total Loan Assignments | | | 1,051,119

(Cost $1,045,283) | | |

PRINCIPAL AMOUNT | | | | VALUE | |

Corporate Bonds 5.3% | | | |

| Chemicals 0.0%(c) | | | |

$ | 3,000 | | | Momentive Performance

Materials, Inc. Escrow

10.00%, 10/15/2020(d)(e)(j) | | $ | — | (k) | |

Commercial Services & Supplies 0.2% | | | |

| 27,000 | | | Constellis Holdings LLC

9.75%, 5/15/2020(g) | | | 27,675 | | |

Diversified Telecommunication

Services 1.0% | | | |

| 100,000 | | | FairPoint Communications, Inc.

8.75%, 8/15/2019(g) | | | 104,375 | | |

| 26,000 | | | Gogo Intermediate Holdings LLC

12.50%, 7/1/2022(g) | | | 28,210 | | |

| 13,000 | | | Telesat Canada (Canada)

8.88%, 11/15/2024(g) | | | 13,553 | | |

| | | | 146,138 | | |

Food & Staples Retailing 0.1% | | | |

| | 10,000 | | | BI-LO LLC 9.25%, 2/15/2019(g) | | | 8,475 | | |

Independent Power & Renewable

Electricity Producers 0.6% | | | |

| 29,000 | | | Dynegy, Inc. 6.75%, 11/1/2019

GenOn Energy, Inc. | | | 29,508 | | |

| | 22,000 | | | 9.50%, 10/15/2018 | | | 15,551 | | |

| | 54,000 | | | 9.88%, 10/15/2020 | | | 36,855 | | |

| | | | 81,914 | | |

Insurance 0.3% | | | |

| 36,888 | | | Ambac Assurance Corp.

5.10%, 6/7/2020(g) | | | 44,635 | | |

| 481 | | | Syncora Guarantee, Inc.,

5.00% Short-Term Surplus Notes

6/7/2023(a) | | | 452 | | |

| 2,053 | | | Syncora Guarantee, Inc.,

6.00% Long-Term Surplus Notes

6/7/2023 | | | 1,765 | | |

| | | | 46,852 | | |

Internet & Direct Marketing Retail 0.2% | | | |

| 30,000 | | | Netflix, Inc.

4.38%, 11/15/2026(g) | | | 29,100 | | |

Media 0.8% | | | |

| 25,000 | | | Cengage Learning, Inc.

9.50%, 6/15/2024(g) | | | 22,188 | | |

| 108,000 | | | Cenveo Corp.

6.00%, 8/1/2019(g) | | | 96,390 | | |

| | | | 118,578 | | |

See Notes to Financial Statements

11

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

PRINCIPAL AMOUNT | | | | VALUE | |

Metals & Mining 0.3% | | | |

$ | 44,000 | | | Wise Metals Group LLC

8.75%, 12/15/2018(g) | | $ | | 45,760 | |

Oil, Gas & Consumable Fuels 0.6% | | | |

| | | | | Cobalt International Energy, Inc. | | | | | |

| | 53,000 | | | 10.75%, 12/1/2021(g) | | | 51,118 | | |

| | 14,000 | | | 7.75%, 12/1/2023(g) | | | 7,770 | | |

| 18,000 | | | Midstates Petroleum Co., Inc.

Escrow 10.00%, 6/1/2020(d)(e)(j) | | | — | | |

| 23,000 | | | Niska Gas Storage Ltd.

6.50%, 4/1/2019 | | | 23,115 | | |

| | | | 82,003 | | |

Pharmaceuticals 0.3% | | | |

| | 38,000 | | | Endo Ltd. 6.50%, 2/1/2025(g) | | | 31,635 | | |

| 21,000 | | | Valeant Pharmaceuticals

International, Inc.

6.13%, 4/15/2025(g) | | | 15,776 | | |

| | | | 47,411 | | |

Professional Services 0.6% | | | |

| 80,000 | | | Corporate Risk Holdings LLC

9.50%, 7/1/2019(g) | | | 82,200 | | |

Trading Companies & Distributors 0.3% | | | |

| 44,000 | | | United Rentals North America,

Inc. 4.63%, 7/15/2023 | | | 44,880 | | |

| | | | Total Corporate Bonds

(Cost $752,518) | | | 760,986 | | |

SHARES | | | | | |

Master Limited Partnerships 4.6% | | | |

Energy Equipment & Services 0.1% | | | |

| | 944 | | | USA Compression Partners LP | | | 16,331 | | |

Oil, Gas & Consumable Fuels 4.5% | | | |

| | 1,547 | | | Antero Midstream Partners LP | | | 47,771 | | |

| | 2,677 | | | Boardwalk Pipeline Partners LP | | | 46,473 | | |

| | 95 | | | Buckeye Partners LP | | | 6,285 | | |

| | 607 | | | Enable Midstream Partners LP | | | 9,548 | | |

| | 83 | | | Enbridge Energy Partners LP | | | 2,115 | | |

| | 2,365 | | | Energy Transfer Equity LP(a) | | | 45,668 | | |

| | 1,117 | | | Energy Transfer Partners LP | | | 40,000 | | |

| | 173 | | | EnLink Midstream Partners LP | | | 3,187 | | |

| | 1,652 | | | Enterprise Products Partners LP | | | 44,670 | | |

| | 955 | | | EQT GP Holdings LP | | | 24,076 | | |

| | 348 | | | EQT Midstream Partners LP | | | 26,685 | | |

| | 166 | | | MPLX LP | | | 5,747 | | |

| | 292 | | | Noble Midstream Partners LP* | | | 10,512 | | |

| | 1,027 | | | NuStar GP Holdings LLC(a) | | | 29,680 | | |

| | 602 | | | ONEOK Partners LP | | | 25,892 | | |

| | 1,296 | | | Plains All American Pipeline LP(a) | | | 41,848 | | |

SHARES | | | | VALUE | |

| | 714 | | | Rice Midstream Partners LP(a) | | $ | 17,550 | | |

| | 1,688 | | | Shell Midstream Partners LP | | | 49,104 | | |

| | 99 | | | Summit Midstream Partners LP | | | 2,490 | | |

| | 1,156 | | | Valero Energy Partners LP | | | 51,176 | | |

| | 1,017 | | | Western Gas Equity Partners LP | | | 43,070 | | |

| | 575 | | | Western Gas Partners LP | | | 33,787 | | |

| | 2,048 | | | Western Refining Logistics LP | | | 43,725 | | |

| | 167 | | | Williams Partners LP | | | 6,351 | | |

| | | | 657,410 | | |

| | | | Total Master Limited Partnerships

(Cost $621,901) | | | 673,741 | | |

PRINCIPAL AMOUNT | | | | | |

Convertible Bonds 1.0% | | | |

Capital Markets 0.1% | | | |

$ | 12,000 | | | Walter Investment

Management Corp.

4.50%, 11/1/2019 | | | 8,400 | | |

Diversified Consumer Services 0.1% | | | |

| 24,000 | | | Ascent Capital Group, Inc.

4.00%, 7/15/2020 | | | 18,000 | | |

| Energy Equipment & Services 0.0%(c) | | | |

| 7,000 | | | Hornbeck Offshore Services, Inc.

1.50%, 9/1/2019 | | | 4,966 | | |

Internet Software & Services 0.2% | | | |

| | 33,000 | | | Twitter, Inc. 0.25%, 9/15/2019 | | | 30,855 | | |

Media 0.4% | | | |

| 55,000 | | | DISH Network Corp.

3.38%, 8/15/2026(g) | | | 62,597 | | |

Oil, Gas & Consumable Fuels 0.1% | | | |

| 25,000 | | | Cobalt International Energy, Inc.

3.13%, 5/15/2024 | | | 7,000 | | |

Semiconductors & Semiconductor

Equipment 0.1% | | | |

| 30,000 | | | SunEdison, Inc.

5.00%, 7/2/2018(g)(j) | | | 11,400 | | |

| | | | Total Convertible Bonds

(Cost $144,875) | | | 143,218 | | |

U.S. Treasury Obligations 0.2% | | | |

| 8,000 | | | U.S. Treasury Bond

2.50%, 5/15/2046 | | | 7,092 | | |

| 22,000 | | | U.S. Treasury Note

1.50%, 8/15/2026 | | | 20,201 | | |

| | | | Total U.S. Treasury Obligations

(Cost $29,570) | | | 27,293 | | |

See Notes to Financial Statements

12

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

NO. OF RIGHTS | | | | VALUE | |

Rights 0.1% | | | |

| Biotechnology 0.0%(c) | | | |

| 500 | | | Chelsea Therapeutics, Inc.

Escrow (H Lundbeck A/S)

(Denmark)*(d)(e) | | $ | 55 | | |

| | 500 | | | Dyax Corp.*(e) | | | 625 | | |

| | 225 | | | Tobira Therapeutics, Inc.*(d)(e) | | | 3,091 | | |

| | | | 3,771 | | |

| Energy Equipment & Services 0.0%(c) | | | |

| 54 | | | C&J Energy Services Ltd.,

expiring 12/31/2017*(d) | | | 733 | | |

| Food & Staples Retailing 0.0%(c) | | | |

| | 1,000 | | | Safeway, Inc. (Casa Ley)*(e) | | | 250 | | |

| 1,000 | | | Safeway, Inc. (Property

Development Centers)*(e) | | | 20 | | |

| | | | 270 | | |

| Health Care Providers & Services 0.0%(c) | | | |

| 204 | | | Community Health Systems,

Inc.*(b) | | | 1 | | |

Semiconductors & Semiconductor

Equipment 0.1% | | | |

| 34,893 | | | SunEdison, Inc., 2nd Lien

DIP Roll Up Rights* | | | 15,702 | | |

| | | | Total Rights

(Cost $10,696) | | | 20,477 | | |

NO. OF CONTRACTS | | | | | |

| Options Purchased 0.0%(c) | | | |

| Call Option 0.0%(c) | | | |

| Food Products 0.0%(c) | | | |

| 5 | | | Mondelez International, Inc.

1/20/2017 @ 45.00 | | | 525 | | |

| Put Options 0.0%(c) | | | |

| Air Freight & Logistics 0.0%(c) | | | |

| 1 | | | FedEx Corp.

1/20/2017 @ 190.00 | | | 565 | | |

| Exchange Traded Funds 0.0%(c) | | | |

| 8 | | | iShares Russell 2000 Fund

6/30/2017 @ 123.00 | | | 3,160 | | |

| 8 | | | iShares Russell 2000 Fund

3/31/2017 @ 126.00 | | | 2,068 | | |

| | | | 5,228 | | |

NO. OF CONTRACTS | | | | VALUE | |

| Industrial Conglomerates 0.0%(c) | | | |

| 2 | | | Icahn Enterprises LP

1/20/2017 @ 60.00 | | $ | 355 | | |

| 1 | | | Icahn Enterprises LP

1/20/2017 @ 50.00(d) | | | 15 | | |

| | | | 370 | | |

| Media 0.0%(c) | | | |

| | 7 | | | CBS Corp. 3/17/2017 @ 60.00 | | | 1,165 | | |

| | | | | Total Put Options | | | 7,328 | | |

| | | | | Total Options Purchased | | | 7,853

(Cost $11,673) | | |

NO. OF WARRANTS | | | | | |

| Warrants 0.0%(c) | | | |

| Biotechnology 0.0%(c) | | | |

| | 11,740 | | | Novelion Therapeutics, Inc. (Canada)*(d)(e)

(Cost $—) | | | — | | |

SHARES | | | | | |

Short-Term Investments 28.1% | | | |

Investment Companies 28.1% | | | |

| 58,018 | | | AQR Managed Futures Strategy

HV Fund Institutional Class(a) | | | 539,563 | | |

| 3,523,065 | | | Morgan Stanley Institutional

Liquidity Fund Treasury

Portfolio Institutional Class,

0.35%(a)(l) | | | 3,523,065 | | |

| | | | Total Investments Companies

(Cost $4,143,139) | | | 4,062,628 | | |

| | | | Total Long Positions

(Cost $13,943,605) | | | 14,055,150 | | |

| Short Positions (24.4)%(m) | | | |

Common Stocks (18.0)% | | | |

Aerospace & Defense (0.2)% | | | |

| | (50 | ) | | TransDigm Group, Inc. | | | (12,448 | ) | |

| | (895 | ) | | Triumph Group, Inc. | | | (23,717 | ) | |

| | | | (36,165 | ) | |

Air Freight & Logistics (0.2)% | | | |

| | (5,060 | ) | | Royal Mail plc (United Kingdom) | | | (28,816 | ) | |

Airlines (0.3)% | | | |

| (2,900 | ) | | Deutsche Lufthansa AG

(Germany) | | | (37,456 | ) | |

See Notes to Financial Statements

13

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

SHARES | | | | VALUE | |

Auto Components (0.3)% | | | |

| | (308 | ) | | Autoliv, Inc. (Sweden) | | $ | (34,850 | ) | |

| (234 | ) | | Goodyear Tire & Rubber Co.

(The) | | | (7,224 | ) | |

| | | | (42,074 | ) | |

Banks (0.4)% | | | |

| (338 | ) | | Canadian Imperial Bank of

Commerce (Canada) | | | (27,581 | ) | |

| (550 | ) | | Canadian Western Bank

(Canada) | | | (12,428 | ) | |

| (134 | ) | | First Interstate BancSystem,

Inc., Class A | | | (5,702 | ) | |

| (320 | ) | | National Bank of Canada

(Canada) | | | (12,996 | ) | |

| | | | (58,707 | ) | |

Beverages (0.2)% | | | |

| | (687 | ) | | Brown-Forman Corp., Class B | | | (30,860 | ) | |

Biotechnology (0.4)% | | | |

| | (316 | ) | | AbbVie, Inc. | | | (19,788 | ) | |

| | (145 | ) | | Amgen, Inc. | | | (21,200 | ) | |

| | (301 | ) | | Gilead Sciences, Inc. | | | (21,555 | ) | |

| | | | (62,543 | ) | |

Building Products (0.2)% | | | |

| | (470 | ) | | Owens Corning | | | (24,233 | ) | |

Capital Markets (0.2)% | | | |

| | (260 | ) | | Moody's Corp. | | | (24,510 | ) | |

Chemicals (0.6)% | | | |

| (260 | ) | | International Flavors &

Fragrances, Inc. | | | (30,636 | ) | |

| | (210 | ) | | Praxair, Inc. | | | (24,610 | ) | |

| | (100 | ) | | Sherwin-Williams Co. (The) | | | (26,874 | ) | |

| | | | (82,120 | ) | |

Containers & Packaging (0.1)% | | | |

| | (220 | ) | | Berry Plastics Group, Inc.* | | | (10,720 | ) | |

Diversified Consumer Services (0.3)% | | | |

| (1,045 | ) | | ServiceMaster Global

Holdings, Inc.* | | | (39,365 | ) | |

Diversified Telecommunication

Services (0.0)%(c) | | | |

| | (100 | ) | | CenturyLink, Inc. | | | (2,378 | ) | |

SHARES | | | | VALUE | |

Electric Utilities (0.8)% | | | |

| | (647 | ) | | Duke Energy Corp. | | $ | (50,220 | ) | |

| | (269 | ) | | Eversource Energy | | | (14,857 | ) | |

| | (993 | ) | | Southern Co. (The) | | | (48,846 | ) | |

| | (108 | ) | | Xcel Energy, Inc. | | | (4,395 | ) | |

| | | | (118,318 | ) | |

Electrical Equipment (0.4)% | | | |

| | (125 | ) | | Acuity Brands, Inc. | | | (28,857 | ) | |

| | (530 | ) | | Regal Beloit Corp. | | | (36,703 | ) | |

| | | | (65,560 | ) | |

Energy Equipment & Services (0.2)% | | | |

| | (240 | ) | | Helmerich & Payne, Inc. | | | (18,576 | ) | |

| | (354 | ) | | Patterson-UTI Energy, Inc. | | | (9,530 | ) | |

| | | | (28,106 | ) | |

Food & Staples Retailing (0.5)% | | | |

| | (328 | ) | | CVS Health Corp. | | | (25,882 | ) | |

| | (835 | ) | | Metro, Inc. (Canada) | | | (24,976 | ) | |

| | (191 | ) | | Walgreens Boots Alliance, Inc. | | | (15,807 | ) | |

| | | | (66,665 | ) | |

Food Products (0.2)% | | | |

| | (795 | ) | | Hormel Foods Corp. | | | (27,674 | ) | |

Health Care Equipment & Supplies (1.5)% | | | |

| | (1,262 | ) | | Abbott Laboratories | | | (48,473 | ) | |

| | (180 | ) | | ABIOMED, Inc.* | | | (20,282 | ) | |

| | (469 | ) | | Baxter International, Inc. | | | (20,796 | ) | |

| | (115 | ) | | Becton Dickinson and Co. | | | (19,038 | ) | |

| | (191 | ) | | Danaher Corp. | | | (14,867 | ) | |

| | (90 | ) | | ICU Medical, Inc.* | | | (13,262 | ) | |

| | (560 | ) | | LivaNova plc* | | | (25,183 | ) | |

| | (289 | ) | | Medtronic plc | | | (20,586 | ) | |

| | (137 | ) | | Stryker Corp. | | | (16,414 | ) | |

| | (204 | ) | | Zimmer Biomet Holdings, Inc. | | | (21,053 | ) | |

| | | | (219,954 | ) | |

Health Care Providers & Services (1.0)% | | | |

| | (262 | ) | | Aetna, Inc. | | | (32,491 | ) | |

| | (219 | ) | | AmerisourceBergen Corp. | | | (17,124 | ) | |

| | (322 | ) | | Cardinal Health, Inc. | | | (23,174 | ) | |

| | (300 | ) | | Express Scripts Holding Co.* | | | (20,637 | ) | |

| | (161 | ) | | McKesson Corp. | | | (22,612 | ) | |

| | (148 | ) | | UnitedHealth Group, Inc. | | | (23,686 | ) | |

| | | | (139,724 | ) | |

Hotels, Restaurants & Leisure (0.2)% | | | |

| | (355 | ) | | Darden Restaurants, Inc. | | | (25,816 | ) | |

| | (179 | ) | | Hilton Grand Vacations, Inc.* | | | (4,654 | ) | |

| | | | (30,470 | ) | |

See Notes to Financial Statements

14

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

SHARES | | | | VALUE | |

Household Durables (0.3)% | | | |

| | (400 | ) | | Lennar Corp., Class A | | $ | (17,172 | ) | |

| | (145 | ) | | Whirlpool Corp. | | | (26,357 | ) | |

| | | | (43,529 | ) | |

Household Products (0.2)% | | | |

| | (610 | ) | | Church & Dwight Co., Inc. | | | (26,956 | ) | |

Independent Power & Renewable

Electricity Producers (0.1)% | | | |

| | (656 | ) | | NRG Yield, Inc., Class C | | | (10,365 | ) | |

| | (500 | ) | | TerraForm Power, Inc., Class A* | | | (6,405 | ) | |

| | | | (16,770 | ) | |

Insurance (0.5)% | | | |

| | (300 | ) | | Axis Capital Holdings Ltd. | | | (19,581 | ) | |

| | (90 | ) | | Everest Re Group Ltd. | | | (19,476 | ) | |

| | (685 | ) | | First American Financial Corp. | | | (25,092 | ) | |

| | (222 | ) | | Primerica, Inc. | | | (15,351 | ) | |

| | | | (79,500 | ) | |

| Internet & Direct Marketing Retail (0.0)%(c) | | | |

| | (152 | ) | | Lands' End, Inc.* | | | (2,303 | ) | |

Internet Software & Services (0.3)% | | | |

| (428 | ) | | Alibaba Group Holding Ltd.,

ADR (China)* | | | (37,583 | ) | |

IT Services (0.6)% | | | |

| (230 | ) | | International Business

Machines Corp. | | | (38,178 | ) | |

| | (2,200 | ) | | Xerox Corp.*(n) | | | (12,826 | ) | |

| | (4,110 | ) | | Xerox Corp. | | | (35,880 | ) | |

| | | | (86,884 | ) | |

Leisure Products (0.1)% | | | |

| | (240 | ) | | Hasbro, Inc. | | | (18,670 | ) | |

Life Sciences Tools & Services (0.3)% | | | |

| | (1,165 | ) | | Bruker Corp. | | | (24,675 | ) | |

| | (123 | ) | | Thermo Fisher Scientific, Inc. | | | (17,355 | ) | |

| | | | (42,030 | ) | |

Machinery (0.1)% | | | |

| | (170 | ) | | Stanley Black & Decker, Inc. | | | (19,497 | ) | |

Media (0.4)% | | | |

| (922 | ) | | New Media Investment

Group, Inc. | | | (14,743 | ) | |

| (275 | ) | | Nexstar Broadcasting

Group, Inc., Class A | | | (17,408 | ) | |

SHARES | | | | VALUE | |

| | (649 | ) | | SES SA, FDR (Luxembourg) | | $ | (14,295 | ) | |

| (250 | ) | | Twenty-First Century Fox, Inc.,

Class A | | | (7,010 | ) | |

| | | | (53,456 | ) | |

Metals & Mining (0.2)% | | | |

| | (740 | ) | | Worthington Industries, Inc. | | | (35,106 | ) | |

Multiline Retail (0.7)% | | | |

| | (365 | ) | | Big Lots, Inc. | | | (18,327 | ) | |

| | (28 | ) | | Dillard's, Inc., Class A | | | (1,755 | ) | |

| | (2,393 | ) | | JC Penney Co., Inc.* | | | (19,886 | ) | |

| | (63 | ) | | Kohl's Corp. | | | (3,111 | ) | |

| | (48 | ) | | Macy's, Inc. | | | (1,719 | ) | |

| | (53 | ) | | Nordstrom, Inc. | | | (2,540 | ) | |

| | (690 | ) | | Target Corp. | | | (49,839 | ) | |

| | | | (97,177 | ) | |

Multi-Utilities (0.8)% | | | |

| | (635 | ) | | Ameren Corp. | | | (33,312 | ) | |

| | (1,100 | ) | | Consolidated Edison, Inc. | | | (81,048 | ) | |

| (153 | ) | | Public Service Enterprise

Group, Inc. | | | (6,714 | ) | |

| | | | (121,074 | ) | |

Oil, Gas & Consumable Fuels (0.3)% | | | |

| | (432 | ) | | ONEOK, Inc. | | | (24,801 | ) | |

| | (181 | ) | | Plains GP Holdings LP, Class A | | | (6,263 | ) | |

| | (290 | ) | | Tallgrass Energy GP LP | | | (7,772 | ) | |

| | | | (38,836 | ) | |

Pharmaceuticals (2.0)% | | | |

| | (1,207 | ) | | Endo International plc* | | | (19,879 | ) | |

| | (531 | ) | | Johnson & Johnson | | | (61,177 | ) | |

| | (321 | ) | | Mallinckrodt plc* | | | (15,992 | ) | |

| | (526 | ) | | Mylan NV* | | | (20,067 | ) | |

| | (317 | ) | | Novartis AG, ADR (Switzerland) | | | (23,090 | ) | |

| | (710 | ) | | Pfizer, Inc. | | | (23,061 | ) | |

| | (275 | ) | | Roche Holding AG (Switzerland) | | | (62,816 | ) | |

| | (510 | ) | | Sanofi, ADR (France) | | | (20,624 | ) | |

| (661 | ) | | Teva Pharmaceutical Industries

Ltd., ADR (Israel) | | | (23,961 | ) | |

| | (217 | ) | | UCB SA (Belgium) | | | (13,913 | ) | |

| | | | (284,580 | ) | |

Road & Rail (0.3)% | | | |

| | (395 | ) | | Union Pacific Corp. | | | (40,954 | ) | |

Semiconductors & Semiconductor

Equipment (0.3)% | | | |

| | (234 | ) | | Analog Devices, Inc. | | | (16,993 | ) | |

| (15 | ) | | MACOM Technology Solutions

Holdings, Inc.* | | | (694 | ) | |

See Notes to Financial Statements

15

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

SHARES | | | | VALUE | |

| | (400 | ) | | QUALCOMM, Inc. | | $ | (26,080 | ) | |

| | | | (43,767 | ) | |

Software (0.5)% | | | |

| | (1,070 | ) | | Fortinet, Inc.* | | | (32,228 | ) | |

| | (550 | ) | | Workday, Inc., Class A* | | | (36,350 | ) | |

| | | | (68,578 | ) | |

Specialty Retail (0.6)% | | | |

| | (44 | ) | | Bed Bath & Beyond, Inc. | | | (1,788 | ) | |

| | (988 | ) | | Best Buy Co., Inc. | | | (42,158 | ) | |

| | (1,650 | ) | | Chico's FAS, Inc. | | | (23,743 | ) | |

| | (47 | ) | | Dick's Sporting Goods, Inc. | | | (2,496 | ) | |

| | (43 | ) | | Foot Locker, Inc. | | | (3,048 | ) | |

| | (133 | ) | | GameStop Corp., Class A | | | (3,360 | ) | |

| | (99 | ) | | Gap, Inc. (The) | | | (2,221 | ) | |

| | (126 | ) | | GNC Holdings, Inc., Class A | | | (1,391 | ) | |

| | (166 | ) | | Hibbett Sports, Inc.* | | | (6,192 | ) | |

| | (26 | ) | | L Brands, Inc. | | | (1,712 | ) | |

| | (33 | ) | | Williams-Sonoma, Inc. | | | (1,597 | ) | |

| | | | (89,706 | ) | |

Textiles, Apparel & Luxury Goods (0.5)% | | | |

| | (710 | ) | | VF Corp. | | | (37,878 | ) | |

| | (1,660 | ) | | Wolverine World Wide, Inc. | | | (36,437 | ) | |

| | | | (74,315 | ) | |

Thrifts & Mortgage Finance (0.5)% | | | |

| | (1,051 | ) | | BofI Holding, Inc.* | | | (30,006 | ) | |

| (260 | ) | | Genworth MI Canada, Inc.

(Canada) | | | (6,518 | ) | |

| (1,064 | ) | | Home Capital Group, Inc.

(Canada) | | | (24,836 | ) | |

| (610 | ) | | New York Community

Bancorp, Inc. | | | (9,705 | ) | |

| | | | (71,065 | ) | |

Trading Companies & Distributors (0.2)% | | | |

| | (425 | ) | | GATX Corp. | | | (26,171 | ) | |

| | | | Total Common Stocks

(Proceeds $(2,598,334)) | | | (2,594,925 | ) | |

Exchange Traded Funds (2.8)% | | | |

| | (6,618 | ) | | Alerian MLP Fund | | | (83,387 | ) | |

| | (700 | ) | | CurrencyShares Euro Trust* | | | (71,582 | ) | |

| | (1,123 | ) | | Energy Select Sector SPDR Fund | | | (84,584 | ) | |

| (650 | ) | | iShares 20+ Year Treasury

Bond Fund | | | (77,434 | ) | |

| | (1,847 | ) | | Utilities Select Sector SPDR Fund | | | (89,709 | ) | |

| | | | Total Exchange Traded Funds

(Proceeds $(393,455)) | | | (406,696 | ) | |

PRINCIPAL AMOUNT | | | | VALUE | |

Corporate Bonds (2.5)% | | | |

Auto Components (0.2)% | | | |

| | $(25,000) Goodyear Tire & Rubber Co. | | | (The) 5.13%, 11/15/2023 | | $ | (26,000 | ) | |

Chemicals (0.1)% | | | |

| (15,000 | ) | | Chemours Co. (The)

6.63%, 5/15/2023 | | | (15,000 | ) | |

Food Products (0.4)% | | | |

| | | | | Flowers Foods, Inc. | | | | | |

| | (26,000 | ) | | 4.38%, 4/1/2022 | | | (27,358 | ) | |

| | (24,000 | ) | | 3.50%, 10/1/2026 | | | (22,904 | ) | |

| | | | (50,262 | ) | |

Hotels, Restaurants & Leisure (0.1)% | | | |

| (13,000 | ) | | Wynn Las Vegas LLC

5.50%, 3/1/2025(g) | | | (12,961 | ) | |

IT Services (0.1)% | | | |

| (21,000 | ) | | Sungard Availability Services

Capital, Inc. 8.75%, 4/1/2022(g) | | | (14,595 | ) | |

Media (0.1)% | | | |

| (20,000 | ) | | Gray Television, Inc.

5.88%, 7/15/2026(g) | | | (19,950 | ) | |

Multiline Retail (0.1)% | | | |

| (15,000 | ) | | Macy's Retail Holdings, Inc.

4.50%, 12/15/2034 | | | (13,469 | ) | |

Pharmaceuticals (0.6)% | | | |

| (38,000 | ) | | Endo Finance LLC

5.75%, 1/15/2022(g) | | | (34,200 | ) | |

| | | | | Valeant Pharmaceuticals

International, Inc. | | | | | |

| | (39,000 | ) | | 6.75%, 8/15/2018(g) | | | (37,343 | ) | |

| | (21,000 | ) | | 5.38%, 3/15/2020(g) | | | (17,955 | ) | |

| | | | (89,498 | ) | |

Specialty Retail (0.3)% | | | |

| (41,000 | ) | | Gap, Inc. (The)

5.95%, 4/12/2021 | | | (43,192 | ) | |

Trading Companies & Distributors (0.5)% | | | |

| (29,000 | ) | | International Lease Finance Corp.

5.88%, 8/15/2022 | | | (31,610 | ) | |

| (43,000 | ) | | United Rentals North America,

Inc. 5.75%, 11/15/2024 | | | (45,580 | ) | |

| | | | (77,190 | ) | |

| | | | Total Corporate Bonds

(Proceeds $(359,494)) | | | (362,117 | ) | |

See Notes to Financial Statements

16

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

SHARES | | | | VALUE | |

Master Limited Partnerships (0.8)% | | | |

Gas Utilities (0.1)% | | | |

| | (909 | ) | | Ferrellgas Partners LP | | $ | (6,154 | ) | |

Oil, Gas & Consumable Fuels (0.7)% | | | |

| | (92 | ) | | Crestwood Equity Partners LP | | | (2,351 | ) | |

| | (439 | ) | | DCP Midstream Partners LP | | | (16,849 | ) | |

| (388 | ) | | Golar LNG Partners LP

(United Kingdom) | | | (9,327 | ) | |

| | (274 | ) | | Holly Energy Partners LP | | | (8,784 | ) | |

| | (330 | ) | | Magellan Midstream Partners LP | | | (24,958 | ) | |

| | (827 | ) | | Midcoast Energy Partners LP | | | (5,830 | ) | |

| | (396 | ) | | Spectra Energy Partners LP | | | (18,153 | ) | |

| | (346 | ) | | TC PipeLines LP | | | (20,359 | ) | |

| | | | (106,611 | ) | |

| | | | Total Master Limited Partnerships

(Proceeds $(114,369)) | | | (112,765 | ) | |

Exchange Traded Note (0.3)% | | | |

| (1,496 | ) | | JPMorgan Alerian MLP

Index ETN (Proceeds $(43,215)) | | | (47,289 | ) | |

| | | | Total Short Positions

(Proceeds $(3,508,867)) | | | (3,523,792 | ) | |

| | | | Total Investments 72.9%

(Cost $10,434,738) | | | 10,531,358 | | |

| | | | | Other Assets Less Liabilities 27.1%(o) | | | 3,921,672 | | |

| | | | | Net assets 100.0% | | $ | 14,453,030 | | |

* Non-income producing security.

(a) All or a portion of this security is segregated in connection with obligations for futures, swaps, options written, and/or forward foreign currency contracts with a total value of $7,378,365.

(b) All or a portion of this security is pledged with the custodian for securities sold short and options written.

(c) Represents less than 0.05% of net assets.

See Notes to Financial Statements

17

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

(d) Security fair valued as of December 31, 2016 in accordance with procedures approved by the Board of Trustees. Total value of all such securities at December 31, 2016 amounted to $8,944, which represents 0.1% of net assets of the Fund.

(e) Illiquid security.

(f) Issuer filed for bankruptcy.

(g) Securities were purchased or sold short under Rule 144A of the Securities Act of 1933, as amended (the "1933 Act"), or are otherwise restricted and, unless registered under the 1933 Act or exempted from registration, may only be sold to qualified institutional investors or may have other restrictions on resale. At December 31, 2016, these securities amounted to $683,297 of long positions and $(137,004) of short positions, or 4.7% and (0.9)%, respectively, of net assets for the Fund. Securities denoted with "(g)" but without "(e)" have been deemed by the investment manager to be liquid.

(h) Variable or floating rate security. The interest rate shown was the current rate as of December 31, 2016 and changes periodically.

(i) All or a portion of this security had not settled as of December 31, 2016 and thus may not have an interest rate in effect. Interest rates do not take effect until settlement.

(j) Defaulted security.

(k) Amount less than one dollar.

(l) Represents 7-day effective yield as of December 31, 2016.

(m) At December 31, 2016 the Fund had $3,676,436 deposited in one or more accounts to satisfy collateral requirements for borrowing in connection with securities sold short.

(n) When-issued security. Total value of all such securities at December 31, 2016 amounted to $(12,826), which represents (0.1)% of net assets of the Fund.

(o) Includes the impact of the Fund's open positions in derivatives at December 31, 2016.

Abbreviations

ADR American Depositary Receipt

DIP Debtor-in-Possession

FDR Fiduciary Depositary Receipt

Fka Formerly known as

GDR Global Depositary Receipt

PJSC Public Joint Stock Company

SPDR Standard & Poor's Depositary Receipt

See Notes to Financial Statements

18

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

Derivative Instruments

Futures contracts ("futures")

At December 31, 2016, open positions in futures for the Fund were as follows:

Expiration | | Open Contracts | | Position | | Unrealized

Appreciation/

(Depreciation) | |

3/17/2017 | | 2 S&P 500 E-Mini Index | | Short | | $ | 1,832 | | |

3/17/2017 | | 9 The EURO STOXX 50 Index | | Short | | | (9,038 | ) | |

Total futures | | | | | | $ | (7,206 | ) | |

At December 31, 2016, the notional value of futures for the Fund was $(534,078) for short positions.

For the year ended December 31, 2016, the average notional value of futures for the Fund was $(342,716) for short positions. The Fund had $32,447 deposited in segregated accounts to cover margin requirements on open futures.

Forward foreign currency contracts ("forward contracts")

At December 31, 2016, open forward contracts for the Fund were as follows:

Contracts to Deliver | | In Exchange For | | Counterparty | | Settlement

Date | | Net

Unrealized

Appreciation/

(Depreciation) | |

| | 9,338 | | | Canadian Dollar | | $ | 6,903 | | | JPMorgan Chase Bank, NA | | 3/30/2017 | | $ | (59 | ) | |

| | 224,337 | | | Euro | | | 235,822 | | | JPMorgan Chase Bank, NA | | 1/13/2017 | | | (473 | ) | |

| | 6,248 | | | Euro | | | 6,561 | | | JPMorgan Chase Bank, NA | | 3/30/2017 | | | (45 | ) | |

| | 760,819 | | | Hong Kong Dollar | | | 98,067 | | | JPMorgan Chase Bank, NA | | 1/13/2017 | | | (49 | ) | |

| | 194,710 | | | Mexican Peso | | | 9,428 | | | JPMorgan Chase Bank, NA | | 1/13/2017 | | | 48 | | |

| | 116,495 | | | Pound Sterling | | | 146,016 | | | JPMorgan Chase Bank, NA | | 1/13/2017 | | | 2,402 | | |

| | 353,137 | | | Swedish Krona | | | 38,057 | | | JPMorgan Chase Bank, NA | | 1/13/2017 | | | (734 | ) | |

| | 68,240 | | | Swedish Krona | | | 7,509 | | | JPMorgan Chase Bank, NA | | 3/30/2017 | | | (19 | ) | |

| | 9,950 | | | Swiss Franc | | | 9,729 | | | JPMorgan Chase Bank, NA | | 1/13/2017 | | | (48 | ) | |

| | 5,000 | | | Turkish Lira | | | 1,414 | | | JPMorgan Chase Bank, NA | | 1/13/2017 | | | (1 | ) | |

Total forward contracts to deliver | | | | | | | | | | $ | 1,022 | | |

For the year ended December 31, 2016, the average notional value of forward contracts for the Fund was $652,306.

Equity swap contracts ("equity swaps")

At December 31, 2016, the outstanding equity swaps* for the Fund were as follows:

Counterparty | | Description | | Expiration

Date(s) | | Value | |

JPMorgan Chase

Bank, NA | | The Fund receives the total return on long positions and pays a specified

LIBOR or Federal Funds floating rate, which is denominated in various foreign

currencies based on the local currencies of the positions. The Fund pays the

total return on short positions and receives a specified LIBOR or Federal Funds

floating rate, which is denominated in various foreign currencies based on

the local currencies of the positions. | | 2/2/2017-

12/27/2017 | | $ | 2,604 | | |

* The following table represents the individual long and short positions and related values of the equity swaps with JPMorgan Chase Bank, NA as of December 31, 2016.

See Notes to Financial Statements

19

Schedule of Investments Absolute Return Multi-Manager Portfolio (cont'd)

Reference Entity | | Shares | | Notional

Value(a)(b) | | Net Unrealized

Appreciation/

(Depreciation) | |

Long Positions | |

Australia | |

Bradken Ltd. | | | 6,258 | | | $ | 14,497 | | | $ | 45 | | |

Cover-More Group Ltd. | | | 3,865 | | | | 5,243 | | | | 140 | | |

| | | | | | | | 185 | | |

Germany | |

KUKA AG | | | 50 | | | | 5,639 | | | | 405 | | |

Ireland | |

Fyffes plc | | | 4,924 | | | | 11,559 | | | | 156 | | |

Italy | |

Buzzi Unicem SpA | | | 1,300 | | | | 13,345 | | | | 2,433 | | |

Netherlands | |

Delta Lloyd NV | | | 2,650 | | | | 14,809 | | | | 23 | | |

United Kingdom | |

Brammer plc | | | 500 | | | | 1,020 | | | | (1 | ) | |

Sky plc | | | 2,150 | | | | 26,125 | | | | 133 | | |

| | | | | | | | 132 | | |

United States | |

Reynolds American, Inc. | | | 200 | | | | 10,845 | | | | 363 | | |

Safeway, Inc. | | | 3,007 | | | | 0 | (d) | | | 752 | (c) | |