UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-03981 |

| |

| Exact name of registrant as specified in charter: | | Prudential World Fund, Inc. |

| |

| Address of principal executive offices: | | Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2007 |

| |

| Date of reporting period: | | 10/31/2007 |

Item 1 – Reports to Stockholders

| | |

| OCTOBER 31, 2007 | | ANNUAL REPORT |

Dryden International Equity Fund

FUND TYPE

Global/International stock

OBJECTIVE

Long-term growth of capital

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

JennisonDryden, Dryden, Prudential Financial and the Rock Prudential logo are registered service marks of The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

December 14, 2007

Dear Shareholder:

We hope you find the annual report for the Dryden International Equity Fund informative and useful. As a JennisonDryden mutual fund shareholder, you may be thinking about where you can find additional growth opportunities. You could invest in last year’s top-performing asset class and hope history repeats itself or you could stay in cash while waiting for the “right moment” to invest.

Instead, we believe it is better to take advantage of developing domestic and global investment opportunities through a diversified portfolio of stock and bond mutual funds. A diversified asset allocation offers two potential advantages. It helps you manage downside risk by not being overly exposed to any particular asset class, plus it gives you a better opportunity to have at least some of your assets in the right place at the right time. Your financial professional can help you create a diversified investment plan that may include mutual funds covering all the basic asset classes and that reflects your personal investor profile and tolerance for risk.

JennisonDryden Mutual Funds gives you a wide range of choices that can help you make progress toward your financial goals. Our funds offer the experience, resources, and professional discipline of four leading asset managers. They are recognized and respected in the institutional market and by discerning investors for excellence in their respective strategies. JennisonDryden equity funds are advised by Jennison Associates LLC, Quantitative Management Associates LLC (QMA), or Prudential Real Estate Investors (PREI). Prudential Investment Management, Inc. (PIM) advises the JennisonDryden fixed income and money market funds. Jennison Associates, QMA, and PIM are registered investment advisers and Prudential Financial companies. PREI is a registered investment adviser and a unit of PIM.

Thank you for choosing JennisonDryden Mutual Funds.

Sincerely,

Judy A. Rice, President

Dryden International Equity Fund

| | |

| Dryden International Equity Fund | | 1 |

Your Fund’s Performance

Fund objective

The investment objective of the Dryden International Equity Fund is long-term growth of capital. There can be no assurance that the Fund will achieve its investment objective.

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.jennisondryden.com or by calling (800) 225-1852. Class A and Class L shares have a maximum initial sales charge of 5.50% and 5.75%, respectively. Gross operating expenses: Class A, 1.39%; Class B, 2.09%; Class C, 2.09%; Class F, 1.84%; Class L, 1.59%; Class M, 2.09%; Class X, 2.09%; Class Z, 1.09%. Net operating expenses apply to: Class A, 1.34%; Class B, 2.09%; Class C, 2.09%; Class F, 1.84%; Class L, 1.59%; Class M, 2.09%; Class X, 2.09%; Class Z, 1.09%, after contractual reduction through 2/28/2008.

| | | | | | | | | |

| Cumulative Total Returns as of 10/31/07 | | | | | | | | | |

| | | One Year | | | Five Years | | | Since Inception1 | |

Class A | | 24.68 | % | | 189.08 | % | | 8.12 | % |

Class B | | 23.73 | | | 177.92 | | | 2.00 | |

Class C | | 23.73 | | | 177.92 | | | 2.00 | |

Class F | | N/A | | | N/A | | | 18.11 | |

Class L | | N/A | | | N/A | | | 17.49 | |

Class M | | N/A | | | N/A | | | 16.92 | |

Class X | | N/A | | | N/A | | | 16.92 | |

Class Z | | 25.05 | | | 192.30 | | | 9.91 | |

MSCI EAFE® ND Index2 | | 24.91 | | | 183.98 | | | ** | |

Lipper International Multi-Cap Growth Funds Avg.3 | | 31.75 | | | 191.34 | | | *** | |

| | | | | | | | | |

| Average Annual Total Returns4 as of 9/30/07 | | | | | | | | | |

| | | One Year | | | Five Years | | | Since Inception1 | |

Class A | | 17.57 | % | | 23.24 | % | | –0.22 | % |

Class B | | 18.52 | | | 23.66 | | | –0.22 | |

Class C | | 22.40 | | | 23.72 | | | –0.23 | |

Class F | | N/A | | | N/A | | | N/A | |

Class L | | N/A | | | N/A | | | N/A | |

Class M | | N/A | | | N/A | | | N/A | |

Class X | | N/A | | | N/A | | | N/A | |

Class Z | | 24.67 | | | 24.90 | | | 0.74 | |

MSCI EAFE® ND Index2 | | 24.86 | | | 23.55 | | | ** | |

Lipper International Multi-Cap Growth Funds Avg.3 | | 28.86 | | | 23.55 | | | *** | |

| | |

| 2 | | Visit our website at www.jennisondryden.com |

The cumulative total returns do not reflect the deduction of applicable sales charges. If reflected, the applicable sales charges would reduce the cumulative total returns performance quoted. The average annual total returns assume the payment of the maximum applicable sales charge. Class A and Class L shares are subject to a maximum front-end sales charge of 5.50% and 5.75%, respectively. Under certain circumstances, Class A shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B, Class C, Class F, Class L, Class M, and Class X shares are subject to a maximum CDSC of 5%, 1%, 5%, 1%, 6%, and 6%, respectively. Class Z shares are not subject to a sales charge.

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

1Inception dates: Class A, Class B, Class C, and Class Z, 3/1/00; Class F, 12/18/06; Class L, Class M, and Class X, 3/19/07. The Since Inception returns for the MSCI EAFE® ND Index and the Lipper International Multi-Cap Growth Funds Average (Lipper Average) are measured from the closest month-end to inception date, and not from the Fund’s actual inception date.

2The Morgan Stanley Capital International Europe, Australasia, and Far East (MSCI EAFE® ND) Index is an unmanaged, weighted index of performance that reflects stock price movements of developed-country markets in Europe, Australasia, and the Far East. The ND version of the MSCI EAFE Index reflects the impact of the maximum withholding taxes on reinvested dividends.

3The Lipper Average represents returns based on an average return of all funds in the Lipper International Multi-Cap Growth Funds category. Funds in the Lipper Average invest in a variety of market-capitalization ranges without concentrating 75% of their equity assets in any one market-capitalization range over an extended period of time. Multi-cap funds typically have 25% to 75% of their assets invested in companies strictly outside of the United States with market capitalizations (on a three-year weighted basis) greater than the 250th largest company in the S&P/Citigroup World ex-U.S. Broad Market Index (BMI). Multi-cap growth funds typically have an above-average price-to-cash flow ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the S&P/Citigroup World ex-U.S. BMI.

4The average annual total returns take into account applicable sales charges. Class A, Class B, Class C, Class F, Class L, Class M, and Class X shares are subject to an annual distribution and service (12b-1) fee of up to 0.30%, 1.00%, 1.00%, 0.75%, 0.50%, 1.00%, and 1.00%, respectively. Approximately seven years after purchase, Class B shares will automatically convert to Class A shares on a quarterly basis. Class Z shares are not subject to a 12b-1 fee. The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

**MSCI EAFE® ND Index Closest Month-End to Inception cumulative total returns as of 10/31/2007 are 65.68% for Class A, Class B, Class C, and Class Z; 17.60% for Class F; and 12.99% for Class L, Class M, and Class X. MSCI EAFE® ND Index Closest Month-End to Inception average annual total returns as of 9/30/07 are 6.34% for Class A, Class B, Class C, and Class Z. Class F, Class L, Class M, and Class X shares have been in existence for less than one year and have no average annual total return performance information available.

***Lipper International Multi-Cap Growth Funds Average Closest Month-End to Inception cumulative total returns as of 10/31/07 are 41.04% for Class A, Class B, Class C, and Class Z; 23.17% for Class F; and 19.27% for Class L, Class M, and Class X. Lipper International Multi-Cap Growth Funds Average Closest Month-End to Inception average annual total returns as of 9/30/07 are 3.39% for Class A, Class B, Class C, and Class Z. Class F, Class L, Class M, and Class X shares have been in existence for less than one year and have no average annual total return performance information available.

| | |

| Dryden International Equity Fund | | 3 |

Your Fund’s Performance (continued)

Investors cannot invest directly in an index. The returns for the MSCI EAFE® ND Index and the Lipper Average would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | |

Five Largest Holdings in Long-Term Portfolio expressed as a percentage of net assets

as of 10/31/07 | | | |

Nokia Oyj, Communications Equipment | | 1.6 | % |

Toyota Motor Corp., Automobiles | | 1.5 | |

Vodafone Group PLC, Wireless Telecommunication Services | | 1.5 | |

BHP Billiton, Ltd., Metals & Mining | | 1.5 | |

Banco Santander SA, Commercial Banks | | 1.5 | |

Holdings are subject to change.

| | | |

Five Largest Industries in Long-Term Portfolio expressed as a percentage of net assets

as of 10/31/07 | |

Commercial Banks | | 14.9 | % |

Oil, Gas & Consumable Fuels | | 7.4 | |

Metals & Mining | | 6.4 | |

Insurance | | 5.6 | |

Pharmaceuticals | | 4.4 | |

Industry weightings are subject to change.

| | |

| 4 | | Visit our website at www.jennisondryden.com |

Strategy and Performance Overview

How did the Fund perform?

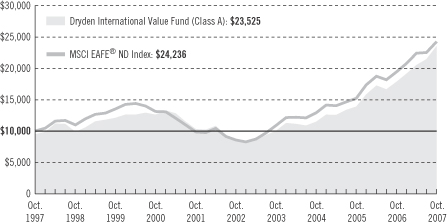

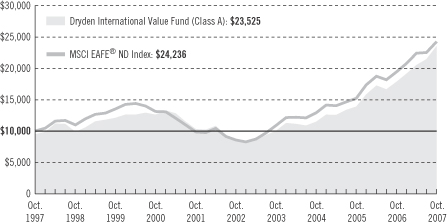

The Dryden International Equity Fund’s Class A shares returned 24.7% for the 12-month reporting period ended October 31, 2007, in line with the 24.9% return of the benchmark MSCI EAFE ND Index (the Index) but lagging the 31.75% return of the Lipper International Multi-Cap Growth Funds Average.

What were conditions like in the international stock markets?

The global economic expansion continued during the reporting period. By the end of 2006, the global economy recorded its strongest cumulative gross domestic product growth in a decade, lifting stock market indexes worldwide. This bullish trend held through the beginning of the summer of 2007. However, a crisis in debt securities tied to U.S. subprime mortgages (home loans made to borrowers with poor credit histories) began to rattle world equity markets in July, and then continued to intensify in August. A major European bank temporarily stopped withdrawals from three of its investment funds with exposure to the risky mortgages and some hedge funds suffered losses and sold assets.

Signs of market distress in early August prompted the European Central Bank, the U.S. Federal Reserve (the Fed), the Bank of Japan, and the Reserve Bank of Australia to inject massive amounts of cash into their banking systems. In mid-August, the Fed reduced the discount rate it charges banks to borrow from it by a half point. In mid-September, the Fed cut its target for the federal funds rate on overnight loans between banks and the discount rate by a half point. Finally, in late October, it cut both short-term rates by another quarter point, which lowered its target for the federal funds rate to 4.50% and the discount rate to 5.00%.

Global stock markets rebounded sharply in response to the Fed rate cuts, helping the Index return 24.9 % for the reporting period. The best performing region was the Nordic area comprised of Sweden, Norway, Denmark, and its frontrunner, Finland. Heavily weighted nations in the Index such as the United Kingdom and France posted returns consistent with the performance of the Index, but Germany outperformed. The Pacific region, home to some of the world’s most dynamic economies, ironically lagged the Index. The main factor contributing to the region’s lower returns was weakness in the Japanese stock market. As the Index’s most heavily weighted Asian country, Japan took hits on several fronts, including the recent market turmoil, its sluggish domestic economic growth, and a spiking yen that made its exports less competitive. Bright spots, such as Hong Kong and Singapore recorded new highs, but were unable to lift the Index. Australia’s economy soared in tandem with natural resources stocks.

| | |

| Dryden International Equity Fund | | 5 |

Strategy and Performance Overview (continued)

Most sectors in the Index finished the reporting period firmly in positive territory. Like the previous year, materials outpaced other sectors. Industries within the materials and energy sectors benefited from rising commodity prices and strong global demand, particularly in nations such as China and India, whose economies expanded rapidly. The telecommunication services sector climbed out of last year’s doldrums amidst the prospect of industry consolidation and product innovation. Information technology companies providing Internet and mobile services to China faired well, but the sector’s overall performance was less than stellar. Among consumer-oriented stocks, the consumer staples sector, made up of industries that tend to do well even when an economy slows, performed better than the more cyclical consumer discretionary sector. In the latter, consumer durables and apparel posted a modest return but automobiles and components gained sharply.

Financials and healthcare were the weakest sectors in the Index. Banking stocks experienced severe distress due to the subprime mortgage crisis and the related global credit crunch. Real estate, while closing the period with positive returns and leading the financials sector, showed weakness due to the ripple effects of the crisis in mortgage lending. Healthcare stocks found support in equipment and service companies. However, disappointing results in pharmaceutical and biotechnology holdings effectively suppressed returns, which were nominally positive but by less than a full percentage point.

How is the Fund managed?

Quantitative Management Associates LLC (QMA) tries to outperform the Index by actively managing the Fund via a quantitative process that evaluates 1,000 stocks. Investing in both rapidly and slowly growing companies limits the Fund’s exposure to any particular style of investing and may reduce its volatility relative to the Index. When selecting stocks of more rapidly growing companies, QMA places a heavier emphasis on “news” or signals about their future growth prospects. For example, upward revisions in earnings forecasts by Wall Street analysts are used as an indication of good news. For slowly growing companies, QMA emphasizes attractive valuations and invests more heavily in stocks that are priced cheaply relative to their firms’ earnings prospects and book values.

Among rapidly growing companies, which stocks or related-group of stocks contributed most and detracted most from the Fund’s return?

Among rapidly growing companies, the largest contributors were shares of Hong Kong Exchanges & Clearing Ltd. (+329%), CSL Ltd. (+136%), and WorleyParsons Ltd. (+223%). The largest detractors were shares of Matsushita Electric Industrial Co. (-8%), Tokyo Electron Ltd. (-21%), and Foxconn International Holdings Ltd. (-17%).

| | |

| 6 | | Visit our website at www.jennisondryden.com |

Among slowly growing companies, which stocks or related-group of stocks contributed most and detracted most from the Fund’s return?

Among slowly growing companies, the largest contributors were shares of Vodafone Group PLC (+60%), E.ON AG (+67%), and Nokia Corp. (+103%). The largest detractors were shares of Chuo Mitsui Trust Holdings (-32%), AstraZeneca PLC (-14%), and Mizuho Financial Group Inc. (-28%).

The Portfolio of Investments following this report shows the size of the Fund’s positions at period-end.

| | |

| Dryden International Equity Fund | | 7 |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on May 1, 2007, at the beginning of the period, and held through the six-month period ended October 31, 2007. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to Individual Retirement Accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of JennisonDryden Funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and

| | |

| 8 | | Visit our website at www.jennisondryden.com |

expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads). Therefore the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Dryden International

Equity Fund | | Beginning Account

Value

May 1, 2007 | | Ending Account

Value October 31, 2007 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | $ | 1,090.40 | | 1.36 | % | | $ | 7.17 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,018.35 | | 1.36 | % | | $ | 6.92 |

| | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | $ | 1,086.10 | | 2.11 | % | | $ | 11.09 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,014.57 | | 2.11 | % | | $ | 10.71 |

| | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | $ | 1,086.10 | | 2.11 | % | | $ | 11.09 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,014.57 | | 2.11 | % | | $ | 10.71 |

| | | | | | | | | | | | | | |

| Class F | | Actual | | $ | 1,000.00 | | $ | 1,088.30 | | 1.86 | % | | $ | 9.79 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,015.83 | | 1.86 | % | | $ | 9.45 |

| | | | | | | | | | | | | | |

| Class L | | Actual | | $ | 1,000.00 | | $ | 1,089.40 | | 1.61 | % | | $ | 8.48 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,017.09 | | 1.61 | % | | $ | 8.19 |

| | | | | | | | | | | | | | |

| Class M | | Actual | | $ | 1,000.00 | | $ | 1,086.10 | | 2.11 | % | | $ | 11.09 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,014.57 | | 2.11 | % | | $ | 10.71 |

| | | | | | | | | | | | | | |

| Class X | | Actual | | $ | 1,000.00 | | $ | 1,086.10 | | 2.11 | % | | $ | 11.09 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,014.57 | | 2.11 | % | | $ | 10.71 |

| | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | $ | 1,092.80 | | 1.11 | % | | $ | 5.86 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,019.61 | | 1.11 | % | | $ | 5.55 |

| | | | | | | | | | | | | | |

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2007, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2007 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| Dryden International Equity Fund | | 9 |

Portfolio of Investments

as of October 31, 2007

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

LONG-TERM INVESTMENTS 97.9% | | | |

COMMON STOCKS 97.4% | | | | | |

| |

Australia 6.7% | | | |

| 61,979 | | AGL Energy, Ltd. | | $ | 698,696 |

| 10,262 | | Australia and New Zealand Banking Group, Ltd. | | | 289,719 |

| 64,621 | | Babcock & Brown, Ltd. | | | 1,871,135 |

| 396,507 | | BHP Billiton, Ltd. | | | 17,265,828 |

| 122,495 | | Centro Properties Group | | | 806,365 |

| 269,238 | | Challenger Financial Services Group, Ltd. | | | 1,608,908 |

| 3,714 | | Cochlear, Ltd. | | | 238,819 |

| 244,086 | | CSL, Ltd. | | | 8,385,459 |

| 186,970 | | Downer EDI, Ltd. | | | 1,165,917 |

| 747,158 | | Goodman Fielder, Ltd. | | | 1,471,271 |

| 231,032 | | GPT Group | | | 999,585 |

| 616,927 | | ING Industrial Fund | | | 1,616,672 |

| 340,551 | | Macquarie Airports | | | 1,399,558 |

| 35,639 | | Macquarie Bank, Ltd. | | | 2,846,347 |

| 548,881 | | Macquarie Infrastructure Group | | | 1,629,309 |

| 470,115 | | Mirvac Group | | | 2,549,472 |

| 54,996 | | National Australian Bank, Ltd. | | | 2,225,025 |

| 53,426 | | Origin Energy, Ltd. | | | 458,493 |

| 349,046 | | Pacific Brands, Ltd. | | | 1,128,932 |

| 1,060,301 | | Quantas Airways, Ltd. | | | 5,863,915 |

| 56,839 | | Santos, Ltd. | | | 750,231 |

| 94,301 | | Stockland | | | 792,166 |

| 36,556 | | Suncorp-Metway, Ltd. | | | 694,525 |

| 172,697 | | Westfield Group | | | 3,531,121 |

| 186,293 | | Westpac Banking Corp. | | | 5,228,885 |

| 235,639 | | Woolworths, Ltd. | | | 7,385,337 |

| 127,166 | | WorleyParsons, Ltd. | | | 5,748,309 |

| | | | | |

| | | | | 78,649,999 |

| |

Austria 0.1% | | | |

| 9,112 | | Voestalpine AG | | | 819,268 |

| |

Belgium 2.0% | | | |

| 112,874 | | Belgacom SA | | | 5,393,950 |

| 201,481 | | Dexia SA | | | 6,461,634 |

| 133,446 | | Fortis | | | 4,264,241 |

| 79,794 | | InBev NV | | | 7,531,509 |

| | | | | |

| | | | | 23,651,334 |

See Notes to Financial Statements.

| | |

| Dryden International Equity Fund | | 11 |

Portfolio of Investments

as of October 31, 2007 continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

China | | | |

| 41,000 | | Tencent Holdings, Ltd. | | $ | 351,472 |

| |

Denmark 1.0% | | | |

| 10,050 | | Carlsberg A/S | | | 1,353,581 |

| 7,850 | | Danisco A/S | | | 604,157 |

| 175,132 | | Danske Bank A/S | | | 7,717,879 |

| 11,400 | | Det Ostasiatiske Kompagni A/S (The East Asiatic Company, Ltd.) | | | 918,363 |

| 31,000 | | H Lundbeck A/S | | | 887,160 |

| 17,430 | | Sydbank A/S | | | 801,996 |

| | | | | |

| | | | | 12,283,136 |

| |

Finland 2.3% | | | |

| 5,602 | | Konecranes Oyj | | | 250,745 |

| 89,621 | | Neste Oil Oyj | | | 3,220,826 |

| 472,008 | | Nokia Oyj | | | 18,699,817 |

| 87,262 | | OKO Bank PLC | | | 1,870,758 |

| 75,917 | | Outokumpu Oyj (Class A) | | | 2,831,698 |

| 10,384 | | Rautaruukki Oyj | | | 594,145 |

| | | | | |

| | | | | 27,467,989 |

| |

France 10.3% | | | |

| 108,480 | | Air France-KLM | | | 4,123,293 |

| 170,843 | | AXA SA | | | 7,637,017 |

| 115,261 | | BNP Paribas | | | 12,704,004 |

| 8,175 | | Business Objects SA(a) | | | 491,199 |

| 10,314 | | Casino Guichard Perrachon SA | | | 1,151,744 |

| 15,356 | | CNP Assurances | | | 1,957,231 |

| 81,829 | | Compagnie de Saint-Gobain | | | 8,770,229 |

| 9,998 | | Compagnie Generale des Etablissements Michelin (Class B) | | | 1,338,618 |

| 167,122 | | France Telecom SA | | | 6,163,433 |

| 47,499 | | Lafarge SA | | | 7,723,275 |

| 22,995 | | Lagardere SCA | | | 1,943,258 |

| 81,009 | | Peugeot SA | | | 7,507,722 |

| 2,112 | | PPR | | | 418,576 |

| 14,161 | | Renault SA | | | 2,377,432 |

| 64,148 | | Safran SA | | | 1,627,046 |

| 145,961 | | Sanofi-Aventis | | | 12,799,998 |

| 19,389 | | Schneider Electric SA | | | 2,669,551 |

| 54,200 | | SCOR SE | | | 1,476,005 |

| 40,968 | | Societe Generale | | | 6,875,574 |

| 52,469 | | Suez SA | | | 3,412,556 |

| 7,459 | | Thales SA | | | 464,817 |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.jennisondryden.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

| 207,843 | | Total SA | | $ | 16,754,492 |

| 228,567 | | Vivendi | | | 10,290,233 |

| | | | | |

| | | | | 120,677,303 |

| |

Germany 8.6% | | | |

| 62,769 | | Allianz SE | | | 14,140,413 |

| 29,886 | | Altana AG | | | 724,693 |

| 87,202 | | BASF AG | | | 12,097,249 |

| 182,294 | | Commerzbank AG | | | 7,742,247 |

| 23,291 | | Continental AG | | | 3,518,869 |

| 18,643 | | Daimler AG | | | 2,067,514 |

| 67,780 | | Deutsche Bank AG | | | 9,080,861 |

| 55,770 | | Deutsche Lufthansa AG | | | 1,648,824 |

| 81,773 | | E.ON AG | | | 15,998,060 |

| 6,992 | | Heidelberger Druckmaschinen AG | | | 286,425 |

| 56,714 | | Hypo Real Estate Holding AG | | | 3,382,220 |

| 1,783 | | MAN AG | | | 318,582 |

| 42,596 | | Muenchener Rueckversicherungs-Gesellschaft AG | | | 8,144,669 |

| 36,997 | | RWE AG | | | 5,042,975 |

| 18,218 | | Salzgitter AG | | | 3,582,376 |

| 23,919 | | Siemens AG | | | 3,270,045 |

| 132,894 | | ThyssenKrupp AG | | | 8,830,083 |

| 17,839 | | Wincor Nixdorf AG | | | 1,771,367 |

| | | | | |

| | | | | 101,647,472 |

| |

Greece 0.9% | | | |

| 22,041 | | Alpha Bank AE | | | 815,423 |

| 30,186 | | Coca-Cola Hellenic Bottling Co. SA | | | 1,873,207 |

| 81,948 | | National Bank of Greece SA | | | 5,695,465 |

| 41,378 | | OPAP SA | | | 1,690,244 |

| | | | | |

| | | | | 10,074,339 |

| |

Hong Kong 1.9% | | | |

| 139,000 | | Cheung Kong Infrastructure Holdings, Ltd. | | | 544,595 |

| 288,000 | | Esprit Holdings, Ltd. | | | 4,809,980 |

| 206,652 | | Hong Kong Exchanges and Clearing, Ltd. | | | 6,898,556 |

| 114,000 | | Hong Kong Electric Holdings, Ltd. | | | 586,099 |

| 208,000 | | Hopewell Holdings | | | 1,077,808 |

| 208,000 | | Li & Fung, Ltd. | | | 987,033 |

| 88,000 | | Orient Overseas International, Ltd. | | | 908,497 |

See Notes to Financial Statements.

| | |

| Dryden International Equity Fund | | 13 |

Portfolio of Investments

as of October 31, 2007 continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

| 192,500 | | Swire Pacific, Ltd. (Class A) | | $ | 2,749,260 |

| 692,000 | | Wharf Holdings, Ltd. | | | 4,172,402 |

| | | | | |

| | | | | 22,734,230 |

| |

Ireland 0.3% | | | |

| 47,743 | | Allied Irish Banks PLC | | | 1,192,277 |

| 61,603 | | Anglo Irish Bank Corp. PLC | | | 1,035,120 |

| 21,766 | | Bank of Ireland | | | 401,679 |

| 6,461 | | CRH PLC | | | 246,517 |

| 3,409 | | Irish Life & Permanent PLC | | | 77,261 |

| | | | | |

| | | | | 2,952,854 |

| |

Italy 2.9% | | | |

| 413,081 | | Enel SpA | | | 4,945,483 |

| 181,173 | | ENI SpA | | | 6,613,398 |

| 165,699 | | Fiat SpA | | | 5,347,684 |

| 12,875 | | Fondiaria-SAI SpA | | | 624,587 |

| 19,510 | | Italcementi SpA | | | 448,220 |

| 2,076,380 | | Telecom Italia SpA | | | 5,365,774 |

| 1,242,360 | | UniCredito Italiano SpA | | | 10,635,689 |

| 23,660 | | Union di Banche Italiane SCPA | | | 657,689 |

| | | | | |

| | | | | 34,638,524 |

| |

Japan 18.8% | | | |

| 99,300 | | Aisin Seiki Co., Ltd. | | | 4,080,251 |

| 22,000 | | Ajinomoto Co., Inc. | | | 248,490 |

| 155,000 | | Amada Co., Ltd. | | | 1,568,366 |

| 23,100 | | Asahi Breweries, Ltd. | | | 382,030 |

| 44,700 | | Astellas Pharma, Inc. | | | 1,984,296 |

| 111,300 | | Bridgestone Corp. | | | 2,463,711 |

| 254,000 | | Chiba Bank, Ltd. (The) | | | 2,038,669 |

| 53,000 | | Chuo Mitsui Trust Holdings, Inc. | | | 424,080 |

| 52,400 | | Coca-Cola West Holdings Co., Ltd. | | | 1,213,088 |

| 83,000 | | COMSYS Holdings Corp. | | | 813,728 |

| 147,000 | | Dainippon Ink & Chemicals, Inc. | | | 705,313 |

| 46,000 | | Daito Trust Construction Co., Ltd. | | | 2,132,798 |

| 55,900 | | Denso Corp. | | | 2,270,942 |

| 141,700 | | FUJIFILM Holdings Corp. | | | 6,778,193 |

| 69,000 | | Hachijuni Bank, Ltd. (The) | | | 527,058 |

| 60,000 | | Hino Motors, Ltd. | | | 432,568 |

| 39,600 | | Hitachi Construction Machinery Co., Ltd. | | | 1,624,220 |

| 70,353 | | Hokkaido Electric Power Co., Inc. | | | 1,518,143 |

| 124,474 | | Honda Motor Co., Ltd. | | | 4,661,160 |

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.jennisondryden.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

| 3,100 | | Idemitsu Kosan Co., Ltd. | | $ | 361,024 |

| 591,000 | | ITOCHU Corp. | | | 7,468,189 |

| 104,000 | | JGC Corp. | | | 2,082,687 |

| 94,000 | | Joyo Bank, Ltd. (The) | | | 582,927 |

| 39,100 | | JS Group Corp. | | | 633,403 |

| 158,000 | | Kamigumi Co., Ltd. | | | 1,286,495 |

| 325,000 | | Kawasaki Kisen Kaisha, Ltd. | | | 4,511,082 |

| 307 | | KDDI Corp. | | | 2,318,672 |

| 2,200 | | Keyence Corp. | | | 506,992 |

| 287,700 | | Komatsu, Ltd. | | | 9,645,619 |

| 40,000 | | Komori Co. | | | 1,057,938 |

| 14,000 | | Konica Minolta Holdings, Inc. | | | 245,078 |

| 60,500 | | Kuraray Co., Ltd. | | | 790,003 |

| 27,200 | | Kyocera Corp. | | | 2,311,950 |

| 148,000 | | Kyowa Hakko Kogyo Co., Ltd. | | | 1,615,723 |

| 63,600 | | Makita Corp. | | | 3,064,042 |

| 476,222 | | Marubeni Corp. | | | 4,089,058 |

| 630,343 | | Mitsubishi Chemical Holdings Corp. | | | 5,215,492 |

| 97,000 | | Mitsubishi Gas Chemical Co., Inc. | | | 971,171 |

| 118,000 | | Mitsubishi Heavy Industries, Ltd. | | | 687,209 |

| 173,000 | | Mitsubishi Materials Corp. | | | 1,012,847 |

| 59,600 | | Mitsubishi UFJ Financial Group, Inc. | | | 596,366 |

| 263,000 | | Mitsui & Co., Ltd. | | | 6,821,710 |

| 458,000 | | Mitsui O.S.K. Lines, Ltd. | | | 7,569,609 |

| 115,000 | | Nikon Corp. | | | 3,690,552 |

| 18,900 | | Nintendo Co., Ltd. | | | 12,002,987 |

| 379,000 | | Nippon Mining Holdings, Inc. | | | 3,584,720 |

| 771,000 | | Nippon Oil Corp. | | | 6,828,505 |

| 134,000 | | Nippon Sheet Glass Co., Ltd. | | | 818,065 |

| 66,000 | | Nippon Shokubai Co., Ltd. | | | 652,254 |

| 759 | | Nippon Telegraph and Telephone Corp. | | | 3,473,671 |

| 45,000 | | Nippon Yusen KK | | | 464,588 |

| 168,500 | | Nissan Motor Co., Ltd. | | | 1,933,161 |

| 29,000 | | Nisshinbo Industries, Inc. | | | 395,784 |

| 41,000 | | NOK Corp. | | | 915,969 |

| 158,753 | | NSK, Ltd. | | | 1,407,541 |

| 76 | | NTT Data Corp. | | | 346,572 |

| 23,000 | | Olympus Corp. | | | 957,828 |

| 90,700 | | Omron Corp. | | | 2,230,747 |

| 318,000 | | Ricoh Co., Ltd. | | | 6,285,445 |

| 153,000 | | Sanwa Holdings Corp. | | | 806,897 |

| 89 | | Sapporo Hokuyo Holdings, Inc. | | | 916,044 |

| 42,000 | | Seino Holdings Corp. | | | 360,639 |

See Notes to Financial Statements.

| | |

| Dryden International Equity Fund | | 15 |

Portfolio of Investments

as of October 31, 2007 continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

| 306,000 | | Sekisui Chemical Co., Ltd. | | $ | 2,094,225 |

| 394,000 | | Sekisui House, Ltd. | | | 5,040,610 |

| 32,100 | | Shin-Etsu Chemical Co., Ltd. | | | 2,059,088 |

| 18,000 | | Shiseido Co., Ltd. | | | 433,340 |

| 36,600 | | Stanley Electric Co., Ltd. | | | 813,952 |

| 48,400 | | Sumco Corp. | | | 1,766,464 |

| 222,400 | | Sumitomo Corp. | | | 3,875,078 |

| 84,000 | | Sumitomo Electric Industries, Ltd. | | | 1,359,983 |

| 77,000 | | Sumitomo Heavy Industries, Ltd. | | | 1,017,235 |

| 1,271,000 | | Sumitomo Metal Industries, Ltd. | | | 6,290,955 |

| 139,000 | | Sumitomo Metal Mining Co., Ltd. | | | 3,101,766 |

| 827 | | Sumitomo Mitsui Financial Group, Inc. | | | 6,774,225 |

| 11,000 | | Sumitomo Realty & Development Co., Ltd. | | | 388,247 |

| 7,000 | | Suzuken Co., Ltd. | | | 225,997 |

| 18,200 | | Takeda Pharmaceutical Co., Ltd. | | | 1,136,854 |

| 31,700 | | TDK Corp. | | | 2,601,606 |

| 51,200 | | Tokai Rika Co., Ltd. | | | 1,514,236 |

| 38,400 | | Tokyo Electron, Ltd. | | | 2,255,085 |

| 324,000 | | Tokyo Tatemono Co., Ltd. | | | 4,168,311 |

| 28,000 | | Toshiba Corp. | | | 237,112 |

| 302,000 | | Tosoh Corp. | | | 1,932,933 |

| 30,000 | | Toyo Suisan Kaisha, Ltd. | | | 521,558 |

| 9,100 | | Toyota Industries Corp. | | | 389,689 |

| 318,034 | | Toyota Motor Corp. | | | 18,205,602 |

| 14,480 | | USS Co., Ltd. | | | 948,449 |

| 68,300 | | Yamaha Corp. | | | 1,588,586 |

| 13,700 | | Yamaha Motor Co., Ltd. | | | 391,211 |

| 29,000 | | Zeon Corp. | | | 273,848 |

| | | | | |

| | | | | 220,790,604 |

| |

Luxembourg 0.2% | | | |

| 30,100 | | Oriflame Cosmetics SA | | | 1,819,633 |

| |

Netherlands 6.0% | | | |

| 241,294 | | Aegon NV | | | 4,984,214 |

| 37,601 | | European Aeronautic Defence and Space Co. NV | | | 1,276,697 |

| 25,849 | | Fugro NV | | | 2,265,321 |

| 7,897 | | Heineken NV | | | 552,510 |

| 272,718 | | ING Groep NV | | | 12,262,137 |

| 18,540 | | Koninklijke Ahold NV | | | 278,228 |

| 109,154 | | Koninklijke DSM NV | | | 6,188,582 |

| 357,344 | | Royal Dutch Shell PLC | | | 15,640,718 |

| 360,197 | | Royal Dutch Shell PLC (Class B) | | | 15,690,697 |

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.jennisondryden.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

| 166,307 | | TNT NV | | $ | 6,803,085 |

| 135,932 | | Unilever NV | | | 4,408,659 |

| | | | | |

| | | | | 70,350,848 |

|

New Zealand 0.3% |

| 150,996 | | Fletcher Building, Ltd. | | | 1,387,316 |

| 784,679 | | Telecom Corp. of New Zealand, Ltd. | | | 2,635,858 |

| | | | | |

| | | | | 4,023,174 |

| | |

Norway 0.4% | | | | | |

| 193,109 | | DnB NOR ASA | | | 3,184,421 |

| 38,430 | | Orkla ASA | | | 713,921 |

| 12,850 | | Petroleum Geo-Services ASA | | | 378,307 |

| | | | | |

| | | | | 4,276,649 |

| |

Portugal 0.8% | | | |

| 273,131 | | Banco BPI SA | | | 2,389,674 |

| 228,597 | | Banco Espirito Santo SA | | | 5,536,528 |

| 58,136 | | Cimpor Cimentos de Portugal SGPS SA | | | 527,169 |

| 41,652 | | Portugal Telecom SGPS SA | | | 574,959 |

| 5,866 | | PT Multimedia Servicos de Telecomunicacoes e Multimedia SGPS SA | | | 79,788 |

| 169,040 | | Sonae SGPS SA | | | 494,620 |

| | | | | |

| | | | | 9,602,738 |

| |

Singapore 1.3% | | | |

| 89,000 | | CapitaLand, Ltd. | | | 501,109 |

| 64,000 | | City Developments, Ltd. | | | 706,646 |

| 72,000 | | DBS Group Holdings, Ltd. | | | 1,126,928 |

| 6,000 | | Haw Par Corp., Ltd. | | | 32,996 |

| 105,004 | | Jardine Cycle & Carriage, Ltd. | | | 1,539,407 |

| 332,000 | | Keppel Corp, Ltd. | | | 3,412,672 |

| 300,000 | | SembCorp Industries, Ltd. | | | 1,239,154 |

| 878,800 | | SembCorp Marine, Ltd. | | | 2,728,366 |

| 93,000 | | Singapore Exchange, Ltd. | | | 1,019,057 |

| 221,000 | | Singapore Petroleum Co., Ltd. | | | 1,262,053 |

| 123,000 | | Singapore Press Holdings, Ltd. | | | 391,507 |

| 98,000 | | UOL Group, Ltd. | | | 359,599 |

| 92,000 | | Venture Corp., Ltd. | | | 892,535 |

| | | | | |

| | | | | 15,212,029 |

| |

South Africa | | | |

| 16,930 | | Mondi, Ltd. | | | 171,611 |

See Notes to Financial Statements.

| | |

| Dryden International Equity Fund | | 17 |

Portfolio of Investments

as of October 31, 2007 continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

Spain 4.9% | | | |

| 50,178 | | Acerinox SA | | $ | 1,479,864 |

| 73,188 | | ACS Actividades Cons y Serv | | | 4,527,934 |

| 268,684 | | Banco Bilbao Vizcaya Argentaria SA | | | 6,760,398 |

| 115,450 | | Banco Popular Espanol SA | | | 2,015,170 |

| 788,577 | | Banco Santander SA | | | 17,134,286 |

| 77,476 | | Ebro Puleva SA | | | 1,596,992 |

| 4,775 | | Fomento de Construcciones y Contratas SA | | | 415,699 |

| 31,937 | | Gas Natural SDG SA | | | 1,963,824 |

| 55,042 | | Gestevision Telecinco SA | | | 1,582,652 |

| 44,911 | | Inditex SA | | | 3,340,595 |

| 117,275 | | Repsol YPF SA | | | 4,629,165 |

| 281,360 | | Telefonica SA | | | 9,288,324 |

| 47,101 | | Union Fenosa SA | | | 3,132,334 |

| | | | | |

| | | | | 57,867,237 |

| |

Sweden 2.4% | | | |

| 11,900 | | Alfa Laval AB | | | 942,326 |

| 90,750 | | Boliden AB | | | 1,600,113 |

| 74,067 | | Husqvarna AB (Class B) | | | 892,015 |

| 251,918 | | Sandvik AB | | | 4,759,119 |

| 156,287 | | Skandinaviska Enskilda Banken AB (Class A) | | | 4,785,514 |

| 285,300 | | Svenska Cellulosa AB (Class B) | | | 5,030,439 |

| 231,800 | | Svenska Handelbanken AB (Class A) | | | 7,681,599 |

| 99,300 | | Swedish Match AB | | | 2,219,850 |

| | | | | |

| | | | | 27,910,975 |

| |

Switzerland 6.2% | | | |

| 434,494 | | ABB, Ltd. | | | 13,067,827 |

| 168,483 | | Credit Suisse Group | | | 11,330,133 |

| 28,593 | | Nestle SA | | | 13,193,162 |

| 76,430 | | Novartis AG | | | 4,064,302 |

| 2,077 | | Rieter Holding AG | | | 1,203,993 |

| 47,588 | | Roche Holding AG | | | 8,117,566 |

| 31,014 | | Swatch Group AG | | | 1,947,746 |

| 6,885 | | Swiss Life Holding | | | 1,901,934 |

| 76,358 | | Swiss Reinsurance Co. | | | 7,165,154 |

| 5,507 | | Swisscom AG | | | 2,035,888 |

| 55,951 | | UBS AG | | | 2,992,200 |

| 18,212 | | Zurich Financial Services AG | | | 5,482,938 |

| | | | | |

| | | | | 72,502,843 |

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.jennisondryden.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

United Kingdom 19.1% | | | |

| 46,124 | | 3i Group PLC | | $ | 1,040,578 |

| 62,087 | | Anglo American PLC | | | 4,278,301 |

| 213,784 | | AstraZeneca PLC | | | 10,548,509 |

| 122,922 | | Aviva PLC | | | 1,931,000 |

| 38,377 | | Balfour Beatty PLC | | | 394,998 |

| 336,323 | | Barclays PLC | | | 4,223,881 |

| 149,760 | | Barratt Developments PLC | | | 2,031,863 |

| 62,455 | | Bellway PLC | | | 1,396,027 |

| 279,337 | | BHP Billiton PLC | | | 10,634,937 |

| 47,226 | | Bovis Homes Group PLC | | | 651,539 |

| 854,257 | | BP PLC | | | 11,101,629 |

| 75,258 | | British Airways PLC(a) | | | 696,746 |

| 52,379 | | British American Tobacco PLC | | | 1,993,088 |

| 52,041 | | British Land Co. PLC | | | 1,172,987 |

| 976,855 | | BT Group PLC | | | 6,621,644 |

| 201,580 | | Capita Group PLC | | | 3,139,405 |

| 1,074,763 | | Centrica PLC | | | 8,240,677 |

| 96,441 | | Charter PLC(a) | | | 2,173,748 |

| 48,426 | | Close Brothers Group PLC | | | 773,318 |

| 61,006 | | Daily Mail & General Trust | | | 777,591 |

| 59,810 | | Firstgroup PLC | | | 988,688 |

| 425,240 | | GlaxoSmithKline PLC | | | 10,946,440 |

| 160,310 | | Hays PLC | | | 457,500 |

| 479,577 | | HBOS PLC | | | 8,705,440 |

| 507,232 | | Home Retail Group | | | 4,598,448 |

| 497,725 | | HSBC Holdings PLC | | | 9,842,107 |

| 20,083 | | IMI PLC | | | 234,475 |

| 177,863 | | Imperial Tobacco Group PLC | | | 8,997,997 |

| 19,363 | | Inchcape PLC | | | 189,330 |

| 71,323 | | International Power PLC | | | 725,198 |

| 48,973 | | Investec PLC | | | 591,631 |

| 542,033 | | Kingfisher PLC | | | 2,223,673 |

| 816,244 | | Legal & General Group PLC | | | 2,377,805 |

| 280,194 | | Lloyds TSB Group PLC | | | 3,178,130 |

| 40,829 | | Marks & Spencer Group PLC | | | 553,521 |

| 141,007 | | Michael Page International PLC | | | 1,284,201 |

| 147,309 | | Mondi PLC | | | 1,365,334 |

| 237,933 | | National Grid PLC | | | 3,965,303 |

| 61,257 | | Next PLC | | | 2,812,373 |

| 19,232 | | Northern Rock PLC | | | 73,780 |

| 437,638 | | Old Mutual PLC | | | 1,674,368 |

See Notes to Financial Statements.

| | |

| Dryden International Equity Fund | | 19 |

Portfolio of Investments

as of October 31, 2007 continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

| 30,561 | | Persimmon PLC | | $ | 666,594 |

| 188,786 | | Reckitt Benckiser PLC | | | 10,948,041 |

| 108,995 | | Resolution PLC | | | 1,655,560 |

| 135,717 | | Rio Tinto PLC | | | 12,670,644 |

| 4,812,852 | | Rolls-Royce Group PLC (Class B)(a) | | | 10,007 |

| 119,130 | | Rolls-Royce Group PLC | | | 1,332,667 |

| 1,245,164 | | Royal & Sun Alliance Insurance Group PLC | | | 4,082,972 |

| 1,179,090 | | Royal Bank of Scotland Group PLC | | | 12,662,965 |

| 102,555 | | SABMiller PLC | | | 3,081,363 |

| 67,079 | | Scottish & Southern Energy PLC | | | 2,170,273 |

| 46,213 | | Tate & Lyle PLC | | | 418,476 |

| 512,684 | | Taylor Wimpey PLC | | | 2,638,415 |

| 906,586 | | Tesco PLC | | | 9,199,134 |

| 67,735 | | Trinity Mirror PLC | | | 565,832 |

| 186,044 | | TUI Travel PLC(a) | | | 1,042,540 |

| 37,878 | | Unilever PLC | | | 1,279,848 |

| 4,558,150 | | Vodafone Group PLC | | | 17,913,008 |

| 64,221 | | William Hill PLC | | | 826,582 |

| 102,500 | | WPP Group PLC | | | 1,399,190 |

| 55,210 | | Yell Group PLC | | | 522,333 |

| | | | | |

| | | | | 224,694,652 |

| | | | | |

| | Total common stocks

(cost $903,148,567) | | | 1,145,170,913 |

| | | | | |

| |

PREFERRED STOCK 0.5% | | | |

Germany | | | | | |

| 2,279 | | Porsche AG (cost $3,002,136) | | | 6,077,553 |

| | | | | |

| | Total long-term investments

(cost $906,150,703) | | | 1,151,248,466 |

| | | | | |

| Principal Amount (000) | | | | | |

| | | | | |

SHORT-TERM INVESTMENTS 0.4% | | | |

| |

U.S. Government Security 0.2% | | | |

United States | | | | | |

| $2,550 | | United States Treasury Bills, 3.82%, 12/20/2007(b)(c)

(cost $2,536,742) | | | 2,536,541 |

| | | | | |

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.jennisondryden.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

Affiliated Money Market Mutual Fund 0.2% | | | |

| 2,626,492 | | Dryden Core Investment Fund - Taxable Money Market Series

(cost $2,626,492)(Note 3)(d) | | $ | 2,626,492 |

| | | | | |

| | Total short-term investments

(cost $5,163,234) | | | 5,163,033 |

| | | | | |

| | Total Investments(f) 98.3%

(cost $911,313,937; Note 5) | | | 1,156,411,499 |

| | Other assets in excess of liabilities(e) 1.7% | | | 19,985,827 |

| | | | | |

| | Net Assets 100.0% | | $ | 1,176,397,326 |

| | | | | |

| (a) | Non-income producing security. |

| (b) | Rate quoted represents yield-to-maturity as of purchase date. |

| (c) | All or portion of security segregated as collateral for financial futures contracts. |

| (d) | Prudential Investments LLC, the manager of the Fund also serves as the manager of the Dryden Core Investment Fund - Taxable Money Market Series. |

| (e) | Other assets in excess of liabilities included net unrealized appreciation on financial futures as follows: |

Open future contracts outstanding at October 31, 2007:

| | | | | | | | | | | | | |

Number of

Contracts | | Type | | Expiration

Date | | Value at

October 31, 2007 | | Value at

Trade Date | | Unrealized

Appreciation |

| Long Positions: | | | | | | | | | | | | | |

| 11 | | Hang Seng Stock Index | | Nov. 07 | | $ | 2,219,019 | | $ | 2,138,689 | | $ | 80,330 |

| 122 | | Nikkei 225 Index | | Dec. 07 | | | 10,281,550 | | | 9,747,950 | | | 533,600 |

| 123 | | DJ Euro Stoxx 50 Index | | Dec. 07 | | | 8,024,799 | | | 7,649,933 | | | 374,866 |

| 46 | | FTSE 100 Index | | Dec. 07 | | | 6,454,806 | | | 6,167,460 | | | 287,346 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | $ | 1,276,142 |

| | | | | | | | | | | | | |

| (f) | As of October 31, 2007, 142 securities representing $341,761,508 and 29.6% of the total market value was fair valued in accordance with the policies adopted by the Board of Directors. |

See Notes to Financial Statements.

| | |

| Dryden International Equity Fund | | 21 |

The industry classification of portfolio holdings and other assets in excess of liabilities shown as a percentage of net assets as of October 31 , 2007 was as follows:

| | | |

Commercial Banks | | 14.9 | % |

Oil, Gas & Consumable Fuels | | 7.4 | |

Metals & Mining | | 6.4 | |

Insurance | | 5.6 | |

Pharmaceuticals | | 4.4 | |

Automobiles | | 4.1 | |

Diversified Telecommunication Services | | 3.5 | |

Chemicals | | 2.7 | |

Diversified Financial Services | | 2.5 | |

Electric Utilities | | 2.5 | |

Machinery | | 2.5 | |

Capital Markets | | 2.4 | |

Food Products | | 2.1 | |

Trading Companies & Distributors | | 1.9 | |

Household Durables | | 1.8 | |

Multi-Utilities | | 1.8 | |

Wireless Telecommunication Services | | 1.7 | |

Auto Components | | 1.6 | |

Communications Equipment | | 1.6 | |

Electrical Equipment | | 1.5 | |

Food & Staples Retailing | | 1.5 | |

Media | | 1.5 | |

Beverages | | 1.4 | |

Electronic Equipment & Instruments | | 1.3 | |

Marine | | 1.1 | |

Real Estate Management & Development | | 1.1 | |

Software | | 1.1 | |

Tobacco | | 1.1 | |

Airlines | | 1.0 | |

Real Estate Investment Trusts (REITs) | | 1.0 | |

Specialty Retail | | 1.0 | |

Building Products | | 0.9 | |

Construction Materials | | 0.9 | |

Household Products | | 0.9 | |

Industrial Conglomerates | | 0.8 | |

Biotechnology | | 0.7 | |

Construction & Engineering | | 0.7 | |

Energy Equipment & Services | | 0.7 | |

Air Freight & Logistics | | 0.6 | |

Office Electronics | | 0.6 | |

Paper & Forest Products | | 0.6 | |

Commercial Services & Supplies | | 0.5 | |

Transportation Infrastructure | | 0.5 | |

Aerospace & Defense | | 0.4 | |

Internet & Catalog Retail | | 0.4 | |

| | |

| 22 | | Visit our website at www.jennisondryden.com |

| | | |

Leisure Equipment & Products | | 0.4 | % |

Distributors | | 0.3 | |

Hotels, Restaurants & Leisure | | 0.3 | |

Multiline Retail | | 0.3 | |

Semiconductors & Semiconductor Equipment | | 0.3 | |

Affiliated Money Market Mutual Fund | | 0.2 | |

Computers & Peripherals | | 0.2 | |

Gas Utilities | | 0.2 | |

Personal Products | | 0.2 | |

Textiles, Apparel & Luxury Goods | | 0.2 | |

U.S Government Security | | 0.2 | |

Health Care Equipment & Supplies | | 0.1 | |

Independent Power Producers & Energy Traders | | 0.1 | |

Road & Rail | | 0.1 | |

| | | |

| | 98.3 | |

Other assets in excess of liabilities | | 1.7 | |

| | | |

| | 100.0 | % |

| | | |

See Notes to Financial Statements.

| | |

| Dryden International Equity Fund | | 23 |

Statement of Assets and Liabilities

as of October 31, 2007

| | | | |

Assets | | | | |

Investments, at value: | | | | |

Unaffiliated investments (cost $908,687,445) | | $ | 1,153,785,007 | |

Affiliated investments (cost $2,626,492) | | | 2,626,492 | |

Cash | | | 2 | |

Foreign currency, at value (cost $17,889,274) | | | 18,259,790 | |

Receivables for investments sold | | | 4,619,393 | |

Dividends receivable | | | 2,054,239 | |

Foreign tax reclaim receivable | | | 1,141,081 | |

Receivable for Series shares sold | | | 413,719 | |

Due from broker—variation margin | | | 136,355 | |

Prepaid expenses | | | 49,211 | |

| | | | |

Total assets | | | 1,183,085,289 | |

| | | | |

| |

Liabilities | | | | |

Payable for investments purchased | | | 3,688,174 | |

Payable for Series shares reacquired | | | 1,137,478 | |

Management fee payable | | | 756,021 | |

Accrued expenses | | | 553,982 | |

Distribution fee payable | | | 316,224 | |

Transfer agent fee payable | | | 222,929 | |

Deferred directors’ fees | | | 13,155 | |

| | | | |

Total liabilities | | | 6,687,963 | |

| | | | |

Net Assets | | $ | 1,176,397,326 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 1,126,506 | |

Paid-in capital in excess of par | | | 1,036,073,618 | |

| | | | |

| | | 1,037,200,124 | |

Undistributed net investment income | | | 13,689,008 | |

Accumulated net realized loss on investments and foreign currency transactions | | | (121,368,950 | ) |

Net unrealized appreciation on investments and foreign currencies | | | 246,877,144 | |

| | | | |

Net assets, October 31, 2007 | | $ | 1,176,397,326 | |

| | | | |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.jennisondryden.com |

| | | |

Class A | | | |

Net asset value and redemption price per share | | | |

($557,878,469 ÷ 53,171,698 shares of common stock issued and outstanding) | | $ | 10.49 |

Maximum sales charge (5.50% of offering price) | | | .61 |

| | | |

Maximum offering price to public | | $ | 11.10 |

| | | |

Class B | | | |

Net asset value, offering price and redemption price per share | | | |

($32,905,153 ÷ 3,260,012 shares of common stock issued and outstanding) | | $ | 10.09 |

| | | |

| |

Class C | | | |

Net asset value, offering price and redemption price per share | | | |

($75,010,229 ÷ 7,433,921 shares of common stock issued and outstanding) | | $ | 10.09 |

| | | |

| |

Class F | | | |

Net asset value, offering price and redemption price per share | | | |

($28,727,534 ÷ 2,841,107 shares of common stock issued and outstanding) | | $ | 10.11 |

| | | |

| |

Class L | | | |

Net asset value and redemption price per share | | | |

($34,432,545 ÷ 3,287,055 shares of common stock issued and outstanding) | | $ | 10.48 |

Maximum sales charge (5.75% of offering price) | | | .64 |

| | | |

Maximum offering price to public | | $ | 11.12 |

| | | |

| |

Class M | | | |

Net asset value, offering price and redemption price per share | | | |

($68,244,370 ÷ 6,761,142 shares of common stock issued and outstanding) | | $ | 10.09 |

| | | |

| |

Class X | | | |

Net asset value, offering price and redemption price per share | | | |

($25,427,932 ÷ 2,519,346 shares of common stock issued and outstanding) | | $ | 10.09 |

| | | |

| |

Class Z | | | |

Net asset value, offering price and redemption price per share | | | |

($353,771,094 ÷ 33,376,343 shares of common stock issued and outstanding) | | $ | 10.60 |

| | | |

See Notes to Financial Statements.

| | |

| Dryden International Equity Fund | | 25 |

Statement of Operations

Year Ended October 31, 2007

| | | |

Net Investment Income | | | |

Income | | | |

Unaffiliated dividends (net of foreign withholding taxes of $2,812,563) | | $ | 27,590,571 |

Interest | | | 200,226 |

Affiliated dividend income | | | 56,348 |

Affiliated income from securities loaned, net | | | 45,968 |

| | | |

Total income | | | 27,893,113 |

| | | |

| |

Expenses | | | |

Management fee | | | 7,402,265 |

Distribution fee—Class A | | | 1,095,486 |

Distribution fee—Class B | | | 392,046 |

Distribution fee—Class C | | | 537,654 |

Distribution fee—Class F | | | 217,060 |

Distribution fee—Class L | | | 109,400 |

Distribution fee—Class M | | | 476,630 |

Distribution fee—Class X | | | 157,665 |

Transfer agent’s fees and expenses (including affiliated expense of $1,373,100) | | | 1,934,000 |

Custodian’s fees and expenses | | | 530,000 |

Reports to shareholders | | | 102,000 |

Legal fees and expenses | | | 71,000 |

Registration fees | | | 60,000 |

Loan interest expense (Note 7) | | | 40,144 |

Audit fee | | | 39,000 |

Directors’ fees | | | 33,000 |

Insurance | | | 12,000 |

Miscellaneous | | | 60,730 |

| | | |

Total expenses | | | 13,270,080 |

| | | |

Net investment income | | | 14,623,033 |

| | | |

| |

Realized And Unrealized Gain On Investments, Futures And Foreign Currency Transactions | | | |

Net realized gain on: | | | |

Investment transactions | | | 179,200,218 |

Foreign currency transactions | | | 510,676 |

Financial futures transactions | | | 1,779,429 |

| | | |

| | | 181,490,323 |

| | | |

Net change in unrealized appreciation (depreciation) on: | | | |

Investments | | | 8,214,256 |

Foreign currencies | | | 255,127 |

Financial futures contracts | | | 917,547 |

| | | |

| | | 9,386,930 |

| | | |

Net gain on investments and foreign currency transactions | | | 190,877,253 |

| | | |

Net Increase In Net Assets Resulting From Operations | | $ | 205,500,286 |

| | | |

See Notes to Financial Statements.

| | |

| 26 | | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended October 31, | |

| | | 2007 | | | 2006 | |

Increase (Decrease) In Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 14,623,033 | | | $ | 4,095,439 | |

Net realized gain on investments and foreign currency transactions | | | 181,490,323 | | | | 19,004,077 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | 9,386,930 | | | | 48,931,280 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 205,500,286 | | | | 72,030,796 | |

| | | | | | | | |

| | |

Dividends from net investment income (Note 1) | | | | | | | | |

Class A | | | (1,073,236 | ) | | | (223,315 | ) |

Class B | | | (374,594 | ) | | | — | |

Class C | | | (114,787 | ) | | | — | |

Class Z | | | (4,300,460 | ) | | | (1,403,752 | ) |

| | | | | | | | |

| | | (5,863,077 | ) | | | (1,627,067 | ) |

| | | | | | | | |

| | |

Series share transactions (net of share conversions) (Note 6) | | | | | | | | |

Net proceeds from shares sold | | | 165,224,236 | | | | 103,089,748 | |

Net asset value of shares issued in connection with mergers (Note 8) | | | 638,140,587 | | | | — | |

Net asset value of shares issued in reinvestment of dividends | | | 5,775,611 | | | | 1,617,011 | |

Cost of shares reacquired | | | (203,229,861 | ) | | | (78,038,521 | ) |

| | | | | | | | |

Net increase in net assets from Series share transactions | | | 605,910,573 | | | | 26,668,238 | |

| | | | | | | | |

Total increase | | | 805,547,782 | | | | 97,071,967 | |

| | |

Net Assets | | | | | | | | |

Beginning of year | | | 370,849,544 | | | | 273,777,577 | |

| | | | | | | | |

End of year(a) | | $ | 1,176,397,326 | | | $ | 370,849,544 | |

| | | | | | | | |

(a) Includes undistributed net investment income of: | | $ | 13,689,008 | | | $ | 4,159,706 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| Dryden International Equity Fund | | 27 |

Notes to Financial Statements

Prudential World Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as an open-end, diversified management investment company and currently consists of two series: Dryden International Equity Fund (the “Series”) and Strategic Partners International Value Fund. These financial statements relate to the Dryden International Equity Fund. The financial statements of the other series are not presented herein. The Series commenced investment operations in March 2000. The investment objective of the Series is to achieve long-term growth of capital. The Series seeks to achieve its objective primarily through investment in equity-related securities of foreign issuers.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Fund and the Series in the preparation of its financial statements.

Securities Valuation: Securities listed on a securities exchange (other than options on securities and indices) are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and ask prices, or at the last bid price on such day in the absence of an asked price. Securities traded via Nasdaq are valued at the official closing price provided by Nasdaq. Securities that are actively traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI” or “Manager”), in consultation with the subadvisers, to be over-the-counter, are valued at market value using prices provided by an independent pricing agent or principal market maker. Options on securities and indices traded on an exchange are valued at the last sale price as of the close of trading on the applicable exchange or, if there was no sale, at the mean between the most recently quoted bid and asked prices on such exchange. Futures contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading on such exchange or board of trade or, if there was no sale on the applicable commodities exchange or board of trade on such day, at the mean between the most recently quoted bid and asked prices on such exchange or board of trade or at the last bid price in the absence of an asked price. Prices may be obtained from independent pricing services which use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. Securities for which reliable market quotations are not readily available, or whose values have been affected by events occurring after the close of the security’s foreign market and before the Funds’ normal pricing time, are valued at fair value in accordance with the Board

| | |

| 28 | | Visit our website at www.jennisondryden.com |

of Directors’ approved fair valuation procedures. When determining the fair valuation of securities some of the factors influencing the valuation include, the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values. As of October 31, 2007, 142 securities representing $341,761,508 and 29.6% of the total market value were fair valued in accordance with the policies adopted by the Board of Directors.

Investments in mutual funds are valued at their net asset value as of the close of the New York Stock Exchange on the date of valuation.

Short-term securities which mature in 60 days or less are valued at amortized cost, which approximates market value. The amortized cost method includes valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. Short-term debt securities that mature in more than 60 days are valued at current market quotations.

Foreign Currency Translation: The books and records of the Series are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities-at the current rates of exchange.

(ii) purchases and sales of investment securities, income and expenses-at the rate of exchange prevailing on the respective dates of such transactions.

The Series does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long term securities held at the end of the fiscal year. Similarly, the Series does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of portfolio securities sold during the fiscal year. Accordingly, realized foreign currency gains or losses are included in the reported net realized gains or losses on investment transactions.

| | |

| Dryden International Equity Fund | | 29 |

Notes to Financial Statements

continued

Net realized gains or losses on foreign currency transactions represent net foreign exchange gains or losses from holdings of foreign currencies, currency gains or losses realized between the trade and settlement dates on security transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Series’ books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities (other than investments) at fiscal year end exchange rates are reflected as a component of net unrealized appreciation (depreciation) on foreign currencies.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin as a result of, among other factors, the possibility of political or economic instability, or the level of governmental supervision and regulation of foreign securities markets.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains or losses from security and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Expenses are recorded on the accrual basis.

Net investment income or loss (other than distribution fees which are charged directly to the respective class) and unrealized and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Financial Futures Contracts: A financial futures contract is an agreement to purchase (long) or sell (short) an agreed amount of securities at a set price for delivery on a future date. Upon entering into a financial futures contract, the Fund is required to pledge to the broker an amount of cash and/or other assets equal to a certain percentage of the contract amount. This amount is known as the “initial margin.” Subsequent payments, known as “variation margin,” are made or received by the Fund each day, depending on the daily fluctuations in the value of the underlying security. Such variation margin is recorded for financial statement purposes on a daily basis as unrealized gain or loss. When the contract expires or is closed, the gain or loss is realized and is presented in the Statement of Operations as net realized gain or loss on financial futures transactions. The Fund invests in financial futures contracts in

| | |

| 30 | | Visit our website at www.jennisondryden.com |

order to hedge its existing portfolio securities, or securities the Fund intends to purchase, against fluctuations in value caused by changes in prevailing interest rates or market conditions. Should interest rates move unexpectedly, the Fund may not achieve the anticipated benefits of the financial futures contracts and may realize a loss. The use of futures transactions involves the risk of imperfect correlation in movements in the price of futures contracts, interest rates and the underlying hedged assets.

Financial futures contracts involve elements of both market and credit risk in excess of the amounts reflected on the Statement of Assets and Liabilities.

Dividends and Distributions: The Series expects to pay dividends of net investment income and distributions of net realized capital and currency gains, if any, annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations which may differ from generally accepted accounting principles, are recorded on the ex-dividend date.

Taxes: For federal income tax purposes, each Series in the Fund is treated as a separate taxpaying entity. It is each Series’ policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net investment income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required.

Withholding taxes on foreign dividends are recorded net of reclaimable amounts, at the time the related income is earned.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Fund has a management agreement for the Series with PI. Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadviser’s performance of such services. PI entered into a subadvisory agreement with Quantitative Management Associates LLC (QMA). The subadvisory agreement provides that QMA furnishes investment advisory services in connection with the management of the Series. In connection therewith, QMA is obligated to keep certain books and records of the Series. PI pays for the services of QMA, the cost of compensation of officers of the Series, occupancy and certain clerical and bookkeeping costs of the Series. The Series bears all other costs and expenses.

| | |

| Dryden International Equity Fund | | 31 |

Notes to Financial Statements

continued

The management fee paid to PI is computed daily and payable monthly, at an annual rate of .85 of 1% of the average daily net assets of the Series up to and including $300 million, .75 of 1% of the average daily net assets in excess of $300 million up to and including $1.5 billion and .70 of 1% of the Series’ average daily net assets over $1.5 billion. PI contractually agreed to subsidize and or cap the annual operating expenses so that annual operation expenses (exclusive of distribution and service (12b-1) fees) do not exceed 1.25% of the Series net assets. The effective management fee was .78% for the year ended October 31, 2007.

The Series has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”) which acts as the distributor of Class A, Class B, Class C, Class F, Class L, Class M, Class X, and Class Z shares of the Series. The Series compensates PIMS for distributing and servicing the Series’ Class A, Class B, Class C, Class F, Class L, Class M and Class X shares, pursuant to a plan of distribution, (the “Class A, B, C, F, L, M and X Plans”), regardless of expenses actually incurred by PIMS. The distribution fees are accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor for Class Z shares of the Series.

Pursuant to the Class A, B, C, F, L, M and X Plans, the Series compensates PIMS for distribution related activities at an annual rate of up to .30 of 1%, 1%, 1%, .75 of 1%, ..50 of 1%, 1%, and 1% of the average daily net assets of the Class A, B, C, F, L, M, and X shares, respectively. For the year ended October 31, 2007, PIMS contractually agreed to limit such fees to .25 of 1% of the average daily net assets of the Class A shares.

PIMS has advised the Series that they received approximately $428,000 in front-end sales charges resulting from sales of Class A shares during the year ended October 31, 2007. From these fees, PIMS paid such sales charges to broker-dealers, which in turn paid commissions to salespersons and incurred other distribution costs.

PIMS has advised the Series that for the year ended October 31, 2007 it received approximately $2,000, $35,100, $2,000, $27,600, $52,200 and $23,500 in contingent deferred sales charges imposed upon redemptions by certain Class A, Class B, Class C, Class F, Class M, and Class X shareholders, respectively.

PI, QMA and PIMS are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

| | |

| 32 | | Visit our website at www.jennisondryden.com |

Note 3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent’s fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

The Series pays networking fees to affiliated and unaffiliated broker/dealers, including fees relating to the services of First Clearing, LLC (“First Clearing”), an affiliate of Pl. These networking fees are payments made to broker/dealers that clear mutual fund transactions through a national clearing system. For the year ended October 31, 2007, the Series incurred approximately $312,400 in total networking fees, of which approximately $170,700 was paid to First Clearing. These amounts are included in transfer agents’s fees and expenses on the Statement of Operations.

The Series invests in the Taxable Money Market Series (the “Portfolio”), a portfolio of the Dryden Core Investment Fund, pursuant to an exemptive order received from the Securities and Exchange Commission. The Portfolio is a money market mutual fund registered under the Investment Company Act of 1940, as amended, and managed by PI.

Note 4. Portfolio Securities

Purchases and sales of investment securities, other than short-term investments, for the year ended October 31, 2007 aggregated $1,044,429,247 and $1,065,224,394, respectively.

Note 5. Tax Information

Distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting

principles, are recorded on the ex-dividends date. In order to present undistributed net investment income, accumulated net realized loss on investments and foreign currency transactions and paid-in capital in excess of par on the Statement of Assets and Liabilities that more closely represent their tax character, certain adjustments have been made to paid-in-capital in excess of par, undistributed net investment income and accumulated net realized loss on investments and foreign currency transactions. For the year ended October 31, 2007, the adjustments were to increase undistributed net investment income by $769,346, increase accumulated net realized loss on investments and foreign currency transactions by $152,351,665 and increase paid-in-capital in excess of par by $151,582,319, due to the difference in the treatment for book and tax purposes of certain transactions involving foreign

| | |

| Dryden International Equity Fund | | 33 |

Notes to Financial Statements

continued

currencies, passive foreign investment companies, reclassification of disallowed wash sales due to reorganization, reclassification of capital loss carryforward due to reorganization, reclassification of deferred director’s compensation due to reorganization and other book to tax adjustments. Net investment income, net realized gains and net assets were not affected by this change.

As of October 31, 2007, the Series had undistributed ordinary income of $14,544,567 and undistributed long-term capital gains of $42,217,132 on a tax basis.