UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-03981 |

| |

| Exact name of registrant as specified in charter: | | Prudential World Fund, Inc. |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2011 |

| |

| Date of reporting period: | | 10/31/2011 |

Item 1 – Reports to Stockholders

PRUDENTIAL INVESTMENTS»MUTUAL FUNDS

PRUDENTIAL INTERNATIONAL EQUITY FUND

ANNUAL REPORT · OCTOBER 31, 2011

Fund Type

International stock

Objective

Long-term growth of capital

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Prudential Investments, Prudential, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

December 15, 2011

Dear Shareholder:

After leading Prudential Investments for the past eight years, I have decided to retire at the end of 2011 from my positions as President of Prudential Investments and President and Director of the Prudential International Equity Fund (the Fund). Effective January 1, 2012, I will become Chairman of Prudential Investments and act as an advisor to the business during 2012 to help facilitate a smooth transition to my successor, Stuart Parker.

Stuart, who will become President of Prudential Investments and President and Director of the Fund on January 1, 2012, previously served as the Executive Vice President of Retail Mutual Fund Distribution at Prudential Investments. With more than 20 years of investment industry experience, Stuart brings a deep understanding of the needs and challenges facing today’s investors.

We hope you find the annual report for the Fund informative. We recognize that ongoing market volatility may make it a difficult time to be an investor. We continue to believe a prudent response to uncertainty is to maintain a diversified portfolio, including stock and bond mutual funds consistent with your tolerance for risk, time horizon, and financial goals.

Your financial professional can help you create a diversified investment plan that reflects your personal investor profile and risk tolerance. Keep in mind that diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets. We encourage you to call your financial professional before making any investment decision.

Prudential Investments provides a wide range of mutual funds to choose from that can help you make progress toward your financial goals. Our funds offer the experience, resources, and professional discipline of Prudential Financial’s affiliated asset managers.

Finally, I’ve been privileged to have had the opportunity to help you address your investment needs, and I thank you for choosing the Prudential Investments family of mutual funds.

Sincerely,

Judy A. Rice, President

Prudential International Equity Fund

| | | | |

| Prudential International Equity Fund | | | 1 | |

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852. Class A and Class L shares have a maximum initial sales charge of 5.50% and 5.75%, respectively. Gross operating expenses: Class A, 1.64%; Class B, 2.34%; Class C, 2.34%; Class F, 2.09%; Class L, 1.84%; Class M, 2.34%; Class X, 2.34%; Class Z, 1.34%. Net operating expenses: Class A, 1.64%; Class B, 2.34%; Class C, 2.34%; Class F, 2.09%; Class L, 1.84%; Class M, 2.34%; Class X, 2.34%; Class Z, 1.34%.

| | | | | | | | | | | | | | | | |

Cumulative Total Returns (Without Sales Charges) as of 10/31/11 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | –5.61 | % | | | –23.19 | % | | | 52.42 | % | | | — | |

Class B | | | –6.27 | | | | –25.83 | | | | 41.53 | | | | — | |

Class C | | | –6.27 | | | | –25.83 | | | | 41.54 | | | | — | |

Class F | | | –6.05 | | | | N/A | | | | N/A | | | | –28.57% (12/18/06) | |

Class L | | | –5.62 | | | | N/A | | | | N/A | | | | –28.15 (3/19/07) | |

Class M | | | –6.27 | | | | N/A | | | | N/A | | | | –29.92 (3/19/07) | |

Class X | | | –6.27 | | | | N/A | | | | N/A | | | | –29.92 (3/19/07) | |

Class Z | | | –5.30 | | | | –22.23 | | | | 55.69 | | | | — | |

MSCI EAFE ND Index | | | –4.08 | | | | –11.50 | | | | 74.62 | | | | — | |

Lipper Average | | | –5.53 | | | | –12.63 | | | | 63.13 | | | | — | |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns (With Sales Charges) as of 9/30/11 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | –15.65 | % | | | –7.35 | % | | | 3.12 | % | | | — | |

Class B | | | –15.76 | | | | –7.14 | | | | 2.94 | | | | — | |

Class C | | | –12.25 | | | | –6.97 | | | | 2.95 | | | | — | |

Class F | | | –15.55 | | | | N/A | | | | N/A | | | | –8.84% (12/18/06) | |

Class L | | | –16.17 | | | | N/A | | | | N/A | | | | –10.21 (3/19/07) | |

Class M | | | –16.63 | | | | N/A | | | | N/A | | | | –9.86 (3/19/07) | |

Class X | | | –16.63 | | | | N/A | | | | N/A | | | | –10.05 (3/19/07) | |

Class Z | | | –10.57 | | | | –6.09 | | | | 3.94 | | | | — | |

MSCI EAFE ND Index | | | –9.36 | | | | –3.46 | | | | 5.03 | | | | — | |

Lipper Average | | | –10.77 | | | | –3.92 | | | | 4.15 | | | | — | |

| | |

| 2 | | Visit our website at www.prudentialfunds.com |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns (With Sales Charges) as of 10/31/11 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | –10.80 | % | | | –6.21 | % | | | 3.72 | % | | | — | |

Class B | | | –10.90 | | | | –5.97 | | | | 3.53 | | | | — | |

Class C | | | –7.19 | | | | –5.80 | | | | 3.54 | | | | — | |

Class F | | | –10.68 | | | | N/A | | | | N/A | | | | –6.85% (12/18/06) | |

Class L | | | –11.05 | | | | N/A | | | | N/A | | | | –8.09 (3/19/07) | |

Class M | | | –11.82 | | | | N/A | | | | N/A | | | | –7.77 (3/19/07) | |

Class X | | | –11.82 | | | | N/A | | | | N/A | | | | –7.96 (3/19/07) | |

Class Z | | | –5.30 | | | | –4.90 | | | | 4.53 | | | | — | |

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns (Without Sales Charges) as of 10/31/11 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | –5.61 | % | | | –5.14 | % | | | 4.30 | % | | | — | |

Class B | | | –6.27 | | | | –5.80 | | | | 3.53 | | | | — | |

Class C | | | –6.27 | | | | –5.80 | | | | 3.54 | | | | — | |

Class F | | | –6.05 | | | | N/A | | | | N/A | | | | –6.67% (12/18/06) | |

Class L | | | –5.62 | | | | N/A | | | | N/A | | | | –6.90 (3/19/07) | |

Class M | | | –6.27 | | | | N/A | | | | N/A | | | | –7.40 (3/19/07) | |

Class X | | | –6.27 | | | | N/A | | | | N/A | | | | –7.40 (3/19/07) | |

Class Z | | | –5.30 | | | | –4.90 | | | | 4.53 | | | | — | |

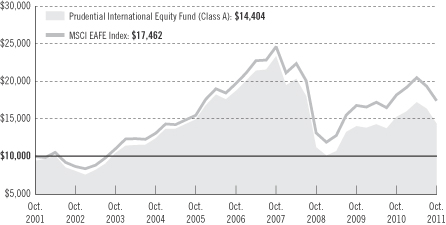

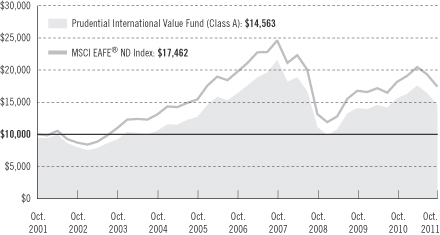

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Prudential International Equity Fund (Class A shares) with a similar investment in the MSCI EAFE ND Index by portraying the initial account values at the beginning of the

| | | | |

| Prudential International Equity Fund | | | 3 | |

Your Fund’s Performance (continued)

10-year period for Class A shares (October 31, 2001) and the account values at the end of the current fiscal year (October 31, 2011) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) the maximum applicable front-end sales charge was deducted from the initial $10,000 investment in Class A shares; (b) all recurring fees (including management fees) were deducted; and (c) all dividends and distributions were reinvested. The line graph provides information for Class A shares only. As indicated in the tables provided earlier, performance for Class B, Class C, Class F, Class L, Class M, Class X, and Class Z shares will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without the distribution and service (12b-1) fee waiver of 0.05% for Class A shares in effect through February 29, 2012, the returns shown in the graph and for Class A shares in the tables would have been lower.

Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

Inception returns are provided for any share class with less than 10 calendar years of returns.

The average annual total returns take into account applicable sales charges. Class A and Class L shares are subject to a maximum front-end sales charge of 5.50% and 5.75%, respectively, and a 12b-1 fee of up to 0.30% and 0.50%, respectively, annually. All investors who purchase Class A and Class L shares in an amount of $1 million or more and sell these shares within 12 months of purchase are subject to a contingent deferred sales charge (CDSC) of 1%. Under certain limited circumstances, an exchange may be made from Class A to Class Z shares of the Fund. Class B and Class F shares are subject to a declining CDSC of 5%, 4%, 3%, 2%, 1%, and 1%, respectively, for the first six years after purchase and 12b-1 fees of 1% and 0.75%, respectively, annually. Approximately seven years after purchase, Class B and Class F will automatically convert to Class A shares on a quarterly basis. Class C shares are not subject to a front-end sales charge, but charge a CDSC of 1% for Class C shares sold within 12 months from the date of purchase and an annual 12b-1 fee of 1%. Class M and Class X shares purchased are not subject to a front-end sales charge, but charge a CDSC of 6% and a 12b-1 fee of 1%. The CDSC for Class M shares declines by 1% annually to 2% in the fifth and sixth year after purchase, 1% in the seventh year and 0% in the eighth year after purchase. The CDSC for Class X shares declines by 1% annually to 4% in the third and fourth year after purchase, 3% in the fifth year after purchase, 2% in the sixth and seventh year after purchase, 1% in the eighth year after purchase and 0% in the ninth and tenth year after purchase. Class M and Class X shares convert to Class A shares on a monthly basis approximately eight years and ten years, respectively, after purchase. The returns in the tables and graph reflect the share class expense structure in effect at the close of the fiscal period. The returns in the tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

| | |

| 4 | | Visit our website at www.prudentialfunds.com |

Benchmark Definitions

Morgan Stanley Capital International Europe, Australasia, and Far East ND Index

The Morgan Stanley Capital International Europe, Australasia, and Far East Net Dividend (MSCI EAFE ND) Index is an unmanaged, weighted index of performance that reflects stock price movements of developed-country markets in Europe, Australasia, and the Far East. The ND version of the MSCI EAFE Index reflects the impact of the maximum withholding taxes on reinvested dividends. MSCI EAFE ND Index Closest Month-End to Inception cumulative total returns as of 10/31/11 are –16.68% for Class F, and –19.94% for Class L, Class M, and Class X. MSCI EAFE ND Index Closest Month-End to Inception average annual total returns as of 9/30/11 are –5.62% for Class F, and –6.75% for Class L, Class M, and Class X.

Lipper International Large-Cap Core Funds Average

The Lipper International Large-Cap Core Funds Average (Lipper Average) represents returns based on an average return of all funds in the Lipper International Large-Cap Core Funds category. Funds in the Lipper Average invest at least 75% of their equity assets in companies strictly outside of the United States with market capitalizations (on a three-year weighted basis) greater than the 250th largest company in the S&P Developed ex-U.S. Broad Market Index (BMI). Large-Cap Core funds typically have an average price-to-cash-flow ratio, price-to-book ratio, and three-year sales-per-share-growth value compared with the S&P Developed ex-U.S. BMI. Lipper Average Closest Month-End to Inception cumulative total returns as of 10/31/11 are –17.83% for Class F, and –20.60% for Class L, Class M, and Class X. Lipper Average Closest Month-End to Inception average annual total returns as of 9/30/11 are –6.07% for Class F, and –7.11% for Class L, Class M, and Class X.

Investors cannot invest directly in an index or average. The returns for the Index and the Lipper Average would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | | |

Five Largest Holdings in Long-Term Portfolio expressed as a percentage of net assets as of 10/31/11 | | | | |

Total SA, Oil, Gas & Consumable Fuels | | | 1.7 | % |

Novartis AG, Pharmaceuticals | | | 1.6 | |

Sanofi, Pharmaceuticals | | | 1.4 | |

Vodafone Group PLC, Wireless Telecommunication Services | | | 1.4 | |

Roche Holding AG, Pharmaceuticals | | | 1.4 | |

Holdings are subject to change.

| | | | |

Five Largest Industries in Long-Term Portfolio expressed as a percentage of net assets as of 10/31/11 | |

Commercial Banks | | | 11.2 | % |

Oil, Gas & Consumable Fuels | | | 8.7 | |

Pharmaceuticals | | | 7.8 | |

Metals & Mining | | | 6.9 | |

Insurance | | | 4.9 | |

Industry weightings are subject to change.

| | | | |

| Prudential International Equity Fund | | | 5 | |

Strategy and Performance Overview

How did the Fund perform?

Prudential International Equity Fund’s Class A shares declined 5.61% for the 12-month reporting period ended October 31, 2011, underperforming the 4.08% decline of the Morgan Stanley Capital International Europe, Australasia, and Far East Net Dividend Index (MSCI EAFE ND Index). The Class A shares were in line with the 5.53% decline of the Lipper International Large-Cap Core Funds Average.

How is the Fund managed?

Quantitative Management Associates LLC (QMA) tries to outperform the MSCI EAFE ND Index by actively managing the Fund via a quantitative process that evaluates more than 1,000 stocks. Investing in shares of both slowly and rapidly growing companies limits the Fund’s exposure to any particular style of investing and may reduce its volatility relative to the MSCI EAFE ND Index.

When selecting stocks of slowly growing companies, QMA emphasizes attractive valuations and invests more heavily in shares that are priced cheaply relative to their firms’ earnings prospects and book values. When selecting stocks of more rapidly growing companies, QMA places a heavier emphasis on “news” or signals about their future growth prospects. For example, upward revisions in earnings forecasts by Wall Street analysts are used as an indication of good news.

As part of its strategy, the Fund seeks to remain fully invested. In order to accomplish this and to efficiently manage the Fund, QMA utilizes futures contracts based on equity market indexes to provide liquidity for the Fund. The futures contracts are used to equitize cash that has accrued, enabling the Fund to efficiently process large cash flows without requiring it to maintain large cash positions. During the reporting period, the Fund’s exposure to futures contracts did not have a material impact on its performance.

How did international stock markets perform?

International stock markets finished a turbulent period in the red in U.S. dollar terms, as measured by the MSCI EAFE ND Index, which gauges stock markets of economically developed nations other than the United States and Canada.

| | • | | International equity markets got off to a volatile start. A sharp decline for November 2010, caused largely by a flare-up in a sovereign-debt crisis in the geographically peripheral nations of the euro zone, was followed by a large gain for December. Stock prices soared on expectations that a moderate global economic recovery would continue and on pro-growth developments in the United States, such as an agreement in Washington to extend tax cuts. |

| | • | | The stock rally initially continued, with gains in three of the first four months of 2011. Markets, however, remained volatile driven by headline-grabbing developments. Growing political upheaval hurt economic growth in some |

| | |

| 6 | | Visit our website at www.prudentialfunds.com |

| | nations in the Middle East and North Africa and threatened the stability of the global oil supply. Natural disasters occurred in Japan, Southeast Asia, and the United States. Those in Japan and Thailand disrupted global supply lines for critical automobile and electronics components, among other consequences. |

| | • | | The remainder of the period saw the MSCI EAFE ND Index experience five consecutive monthly declines (the largest in September) before rebounding sharply in October. Stock prices were hit hard by fears of recession in several developed economies and the worsening sovereign-debt turmoil. Concerns about a systemic shock to the world’s financial system increased as European leaders failed to contain the region’s debt crisis. |

| | • | | Individual markets turned in a mixed performance. Several suffered double-digit declines such as Greece, which lost the most due to fear it might default on its debt. Some other euro participants such as Italy and Portugal also saw double-digit declines. Meanwhile, New Zealand scored a double-digit increase, the largest of the period. The United Kingdom and Switzerland posted small gains, somewhat buffered from the euro crisis but exposed to the threat of a financial system meltdown. Two markets not in the MSCI EAFE ND Index, the United States and Canada, delivered a single-digit gain and a slight loss, respectively. |

How did international stock markets sectors perform?

The sectors also turned in a mixed performance for the period, in U.S. dollar terms.

| | • | | Utilities suffered the largest decline. The next largest loss was in the financials sector, particularly banks and diversified financials. Telecommunications services, information technology, materials, industrials, and consumer discretionary all delivered single-digit losses. Three sectors posted gains, including energy and the defensive consumer staples and healthcare sectors. |

Among slowly growing companies, which stocks or related group of stocks contributed most and detracted most from the Fund’s return?

Among slowly growing companies, a few of the largest contributors to the Fund’s return were British American Tobacco, GlaxoSmithKline, and Legal & General Group. All of these had significant gains for the reporting period. The largest detractors were primarily financial firms, including Natixis, Resona Holdings, and 3i Group, all of which suffered considerable losses.

Among rapidly growing companies, which stocks or related group of stocks contributed most and detracted most from the Fund’s return?

Among rapidly growing companies, shares of DeNA (a social game firm based in Japan), Royal Dutch Shell, and Mitsubishi Electric rose and were among the largest contributors to the Fund’s return. A few of the largest detractors were shares of Peugeot, BNP Paribas, and Metso Corp. (an engineering firm based in Finland), all of which suffered sharp losses for the period.

| | | | |

| Prudential International Equity Fund | | | 7 | |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on May 1, 2011, at the beginning of the period, and held through the six-month period ended October 31, 2011. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of Prudential Investments funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs

| | |

| 8 | | Visit our website at www.prudentialfunds.com |

of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

Prudential International

Equity Fund | | Beginning Account

Value

May 1, 2011 | | | Ending Account

Value

October 31, 2011 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| | | | | | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 836.30 | | | | 1.59 | % | | $ | 7.36 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,017.19 | | | | 1.59 | % | | $ | 8.08 | |

| | | | | | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | | $ | 834.60 | | | | 2.29 | % | | $ | 10.59 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,013.66 | | | | 2.29 | % | | $ | 11.62 | |

| | | | | | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 834.60 | | | | 2.29 | % | | $ | 10.59 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,013.66 | | | | 2.29 | % | | $ | 11.62 | |

| | | | | | | | | | | | | | | | | | |

| Class F | | Actual | | $ | 1,000.00 | | | $ | 834.60 | | | | 2.04 | % | | $ | 9.43 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,014.92 | | | | 2.04 | % | | $ | 10.36 | |

| | | | | | | | | | | | | | | | | | |

| Class L | | Actual | | $ | 1,000.00 | | | $ | 837.70 | | | | 1.79 | % | | $ | 8.29 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,016.18 | | | | 1.79 | % | | $ | 9.10 | |

| | | | | | | | | | | | | | | | | | |

| Class M | | Actual | | $ | 1,000.00 | | | $ | 834.60 | | | | 2.29 | % | | $ | 10.59 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,013.66 | | | | 2.29 | % | | $ | 11.62 | |

| | | | | | | | | | | | | | | | | | |

| Class X | | Actual | | $ | 1,000.00 | | | $ | 834.60 | | | | 2.29 | % | | $ | 10.59 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,013.66 | | | | 2.29 | % | | $ | 11.62 | |

| | | | | | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 838.70 | | | | 1.29 | % | | $ | 5.98 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,018.70 | | | | 1.29 | % | | $ | 6.56 | |

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2011, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2011 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | | | |

| Prudential International Equity Fund | | | 9 | |

Portfolio of Investments

as of October 31, 2011

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | |

LONG-TERM INVESTMENTS 99.4% | | | | |

COMMON STOCKS 98.2% | | | | |

| |

Australia 7.7% | | | | |

| 277,927 | | Asciano Ltd. | | $ | 444,298 | |

| 110,268 | | Australia & New Zealand Banking Group Ltd. | | | 2,491,654 | |

| 67,582 | | Bendigo and Adelaide Bank Ltd. | | | 667,326 | |

| 104,274 | | BHP Billiton Ltd. | | | 4,081,753 | |

| 49,654 | | Caltex Australia Ltd. | | | 689,591 | |

| 5,943 | | Coca-Cola Amatil Ltd. | | | 76,717 | |

| 32,557 | | Commonwealth Bank of Australia | | | 1,672,450 | |

| 482,173 | | Fairfax Media Ltd. | | | 467,539 | |

| 354,385 | | GPT Group | | | 1,169,572 | |

| 48,378 | | Iluka Resources Ltd. | | | 804,267 | |

| 72,299 | | Industrea Ltd. | | | 96,980 | |

| 158,061 | | Mirvac Group | | | 206,978 | |

| 40,600 | | National Australia Bank Ltd. | | | 1,084,399 | |

| 14,313 | | OZ Minerals Ltd. | | | 171,881 | |

| 175,045 | | QR National Ltd. | | | 604,776 | |

| 6,632 | | Ramsay Health Care Ltd. | | | 130,367 | |

| 25,011 | | Rio Tinto Ltd. | | | 1,795,637 | |

| 50,518 | | Santos Ltd. | | | 682,275 | |

| 437,095 | | SP AusNet | | | 455,752 | |

| 585,712 | | Stockland | | | 1,934,137 | |

| 85,209 | | Telstra Corp. Ltd. | | | 276,667 | |

| 56,720 | | Westfield Group | | | 456,616 | |

| 55,466 | | Westpac Banking Corp. | | | 1,287,153 | |

| 17,216 | | Woolworths Ltd. | | | 430,361 | |

| 34,763 | | WorleyParsons Ltd. | | | 1,008,984 | |

| | | | | | |

| | | | | 23,188,130 | |

| |

Austria 0.2% | | | | |

| 126,863 | | IMMOFINANZ AG | | | 416,538 | |

| 3,085 | | Raiffeisen Bank International AG(a) | | | 85,616 | |

| 7,090 | | Voestalpine AG | | | 243,605 | |

| | | | | | |

| | | | | 745,759 | |

| |

Belgium 0.5% | | | | |

| 1,939 | | Delhaize Group SA | | | 126,656 | |

| 7,258 | | Groupe Bruxelles Lambert SA | | | 557,898 | |

| 34,134 | | KBC Groep NV | | | 756,952 | |

| | | | | | |

| | | | | 1,441,506 | |

See Notes to Financial Statements.

| | | | |

| Prudential International Equity Fund | | | 11 | |

Portfolio of Investments

as of October 31, 2011 continued

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

Brazil 1.8% | | | | |

| 3,200 | | Banco do Brasil SA, ADR | | $ | 49,344 | |

| 79,800 | | Centrais Eletricas Brasileiras SA, ADR | | | 794,010 | |

| 36,700 | | Centrais Eletricas Brasileiras SA (Class B Stock), ADR(a) | | | 511,965 | |

| 27,200 | | Cia de Bebidas das Americas, ADR | | | 917,184 | |

| 10,000 | | Cia de Saneamento Basico do Estado de Sao Paulo, ADR | | | 542,600 | |

| 18,600 | | Petroleo Brasileiro SA (Class A Stock), ADR(a) | | | 470,394 | |

| 28,500 | | Tele Norte Leste Participacoes SA, ADR | | | 309,225 | |

| 36,100 | | Vale SA, ADR | | | 917,301 | |

| 43,600 | | Vale SA (Preference) (Class A Stock), ADR(a) | | | 1,028,960 | |

| | | | | | |

| | | | | 5,540,983 | |

| |

Chile 0.2% | | | | |

| 8,800 | | Cia Cervecerias Unidas SA, ADR(a) | | | 504,064 | |

| |

China 0.4% | | | | |

| 357,500 | | Bank of Communications Co. Ltd. (Class H Stock) | | | 245,700 | |

| 254,000 | | China Petroleum & Chemical Corp. (Class H Stock) | | | 240,216 | |

| 583,000 | | Longfor Properties Co. Ltd. | | | 747,230 | |

| | | | | | |

| | | | | 1,233,146 | |

| |

Denmark 0.9% | | | | |

| 13 | | A.P. Moller - Maersk A/S (Class A Stock) | | | 83,697 | |

| 55 | | A.P. Moller - Maersk A/S (Class B Stock) | | | 371,953 | |

| 4,943 | | Coloplast A/S (Class B Stock) | | | 718,820 | |

| 14,060 | | Novo Nordisk A/S (Class B Stock) | | | 1,492,700 | |

| | | | | | |

| | | | | 2,667,170 | |

| |

Egypt | | | | |

| 1,203 | | Orascom Construction Industries, GDR | | | 49,323 | |

| |

Finland 0.9% | | | | |

| 9,095 | | Kone OYJ (Class B Stock) | | | 500,742 | |

| 7,461 | | Orion OYJ (Class B Stock) | | | 155,263 | |

| 26,376 | | Pohjola Bank PLC (Class A Stock) | | | 303,282 | |

| 28,023 | | Sampo OYJ (Class A Stock) | | | 770,267 | |

| 160,177 | | Stora Enso OYJ (Class R Stock) | | | 1,013,862 | |

| | | | | | |

| | | | | 2,743,416 | |

| |

France 8.3% | | | | |

| 82,176 | | AXA SA | | | 1,321,714 | |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.prudentialfunds.com |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

France (cont’d.) | | | | |

| 27,760 | | BNP Paribas SA | | $ | 1,239,620 | |

| 8,302 | | Bouygues SA | | | 310,069 | |

| 1,464 | | Casino Guichard Perrachon SA | | | 137,085 | |

| 6,575 | | Christian Dior SA | | | 927,626 | |

| 19,383 | | Cie Generale des Etablissements Michelin (Class B Stock) | | | 1,403,527 | |

| 28,201 | | France Telecom SA | | | 507,021 | |

| 4,964 | | GDF Suez | | | 139,849 | |

| 414,954 | | Natixis | | | 1,315,093 | |

| 39,640 | | Peugeot SA | | | 862,499 | |

| 584 | | Remy Cointreau SA | | | 47,843 | |

| 62,356 | | Safran SA | | | 2,036,300 | |

| 60,644 | | Sanofi | | | 4,338,413 | |

| 27,629 | | Schneider Electric SA | | | 1,622,366 | |

| 23,118 | | Societe Generale SA | | | 661,909 | |

| 300 | | Societe Internationale de Plantations d’Heveas SA | | | 32,808 | |

| 4,616 | | Technip SA | | | 436,475 | |

| 98,622 | | Total SA | | | 5,145,824 | |

| 9,217 | | Vinci SA | | | 451,987 | |

| 83,636 | | Vivendi SA | | | 1,868,966 | |

| | | | | | |

| | | | | 24,806,994 | |

| |

Germany 7.0% | | | | |

| 19,732 | | Allianz SE | | | 2,195,425 | |

| 44,521 | | BASF SE | | | 3,249,848 | |

| 12,823 | | Bayer AG | | | 816,979 | |

| 10,397 | | Bayerische Motoren Werke AG | | | 844,591 | |

| 59,652 | | Commerzbank AG(b) | | | 145,655 | |

| 20,586 | | Daimler AG | | | 1,045,544 | |

| 49,967 | | Deutsche Bank AG | | | 2,066,064 | |

| 24,501 | | Deutsche Lufthansa AG | | | 332,884 | |

| 38,148 | | Deutsche Post AG | | | 578,649 | |

| 83,275 | | E.ON AG | | | 2,008,175 | |

| 37,086 | | Hannover Rueckversicherung AG | | | 1,825,913 | |

| 4,597 | | Henkel AG & Co. KGaA | | | 224,471 | |

| 12,365 | | Lanxess AG | | | 722,190 | |

| 24,802 | | RWE AG | | | 1,057,233 | |

| 9,999 | | SAP AG | | | 604,619 | |

| 26,054 | | Siemens AG | | | 2,731,004 | |

| 12,070 | | Suedzucker AG | | | 352,567 | |

See Notes to Financial Statements.

| | | | |

| Prudential International Equity Fund | | | 13 | |

Portfolio of Investments

as of October 31, 2011 continued

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

Germany (cont’d.) | | | | |

| 799 | | Volkswagen AG | | $ | 124,951 | |

| | | | | | |

| | | | | 20,926,762 | |

| |

Hong Kong 4.9% | | | | |

| 336,000 | | Agile Property Holdings Ltd. | | | 302,862 | |

| 459,000 | | Agricultural Bank of China Ltd. (Class H Stock) | | | 206,006 | |

| 81,500 | | ASM Pacific Technology Ltd. | | | 894,942 | |

| 524,000 | | Belle International Holdings Ltd. | | | 1,027,683 | |

| 44,200 | | Cheung Kong Holdings Ltd. | | | 547,900 | |

| 92,000 | | Cheung Kong Infrastructure Holdings Ltd. | | | 492,818 | |

| 288,000 | | China Citic Bank Corp. Ltd. (Class H Stock) | | | 154,723 | |

| 208,000 | | China Overseas Land & Investment Ltd. | | | 384,881 | |

| 331,000 | | China Shanshui Cement Group Ltd. | | | 253,538 | |

| 55,000 | | CNOOC Ltd. | | | 103,970 | |

| 1,673,000 | | Country Garden Holdings Co. Ltd. | | | 662,404 | |

| 1,211,000 | | Evergrande Real Estate Group Ltd. | | | 523,720 | |

| 444,000 | | Franshion Properties (China) Ltd. | | | 91,194 | |

| 350,000 | | Galaxy Entertainment Group Ltd.(b) | | | 707,817 | |

| 380,750 | | Great Wall Motor Co. Ltd. (Class H Stock) | | | 517,025 | |

| 272,800 | | Guangzhou R&F Properties Co. Ltd. (Class H Stock) | | | 265,083 | |

| 40,500 | | Kerry Properties Ltd. | | | 148,632 | |

| 128,000 | | KWG Property Holding Ltd. | | | 55,209 | |

| 600,000 | | Lenovo Group Ltd. | | | 403,383 | |

| 366,500 | | Lifestyle International Holdings Ltd. | | | 981,135 | |

| 195,000 | | Orient Overseas International Ltd. | | | 880,082 | |

| 225,600 | | Sands China Ltd.(b) | | | 677,970 | |

| 71,000 | | Shanghai Industrial Holdings Ltd. | | | 232,457 | |

| 192,000 | | Singamas Container Holdings Ltd. | | | 43,352 | |

| 1,002,000 | | SJM Holdings Ltd. | | | 1,717,483 | |

| 226,900 | | Wheelock & Co. Ltd. | | | 666,652 | |

| 657,600 | | Wynn Macau Ltd. | | | 1,842,515 | |

| | | | | | |

| | | | | 14,785,436 | |

| |

India | | | | |

| 3,000 | | Dr. Reddy’s Laboratories Ltd., ADR(a) | | | 99,450 | |

| |

Israel 0.3% | | | | |

| 16,492 | | Bank Hapoalim BM | | | 63,924 | |

| 17,500 | | Israel Chemicals Ltd. | | | 207,509 | |

| 9,177 | | NICE Systems Ltd.(b) | | | 326,827 | |

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.prudentialfunds.com |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

Israel (cont’d.) | | | | |

| 7,370 | | Teva Pharmaceutical Industries Ltd. | | $ | 300,463 | |

| 3,400 | | Teva Pharmaceutical Industries Ltd., ADR | | | 138,890 | |

| | | | | | |

| | | | | 1,037,613 | |

| |

Italy 2.7% | | | | |

| 532,092 | | Enel SpA | | | 2,510,463 | |

| 94,578 | | ENI SpA | | | 2,090,544 | |

| 139,556 | | Pirelli & C. SpA | | | 1,231,639 | |

| 21,197 | | Snam Rete Gas SpA | | | 103,615 | |

| 1,000,000 | | Telecom Italia SpA | | | 1,244,277 | |

| 852,592 | | Telecom Italia SpA-RSP | | | 894,759 | |

| | | | | | |

| | | | | 8,075,297 | |

| |

Japan 20.0% | | | | |

| 98,200 | | AEON Co. Ltd. | | | 1,284,332 | |

| 2,300 | | Ain Pharmaciez, Inc. | | | 94,583 | |

| 253,000 | | All Nippon Airways Co. Ltd. | | | 761,782 | |

| 193,000 | | Aozora Bank Ltd. | | | 487,909 | |

| 6,400 | | Arisawa Manufacturing Co. Ltd. | | | 29,061 | |

| 261,200 | | Asahi Kasei Corp. | | | 1,549,004 | |

| 21,600 | | Bridgestone Corp. | | | 506,457 | |

| 39,800 | | Canon, Inc. | | | 1,806,833 | |

| 210 | | Central Japan Railway Co. | | | 1,786,474 | |

| 18,000 | | Chiyoda Corp. | | | 207,283 | |

| 105,000 | | Cosmo Oil Co. Ltd. | | | 262,677 | |

| 153,000 | | Daido Steel Co. Ltd. | | | 927,141 | |

| 97,000 | | Daiwa House Industry Co. Ltd. | | | 1,215,496 | |

| 35,500 | | Dena Co. Ltd. | | | 1,532,237 | |

| 63 | | Dr. Ci:Labo Co. Ltd. | | | 338,963 | |

| 24,400 | | East Japan Railway Co. | | | 1,479,332 | |

| 16,100 | | FANUC Corp. | | | 2,603,213 | |

| 100 | | Fujitsu Ltd. | | | 535 | |

| 30,000 | | Gree, Inc. | | | 968,075 | |

| 17,100 | | Hamamatsu Photonics KK | | | 650,604 | |

| 483,100 | | Hitachi Ltd. | | | 2,588,589 | |

| 9,000 | | Hitachi Metals Ltd. | | | 102,071 | |

| 9,800 | | Idemitsu Kosan Co. Ltd. | | | 916,678 | |

| 20,000 | | Isuzu Motors Ltd. | | | 84,776 | |

| 187,200 | | ITOCHU Corp. | | | 1,851,492 | |

| 8,000 | | JGC Corp. | | | 225,377 | |

See Notes to Financial Statements.

| | | | |

| Prudential International Equity Fund | | | 15 | |

Portfolio of Investments

as of October 31, 2011 continued

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

Japan (cont’d.) | | | | |

| 380,150 | | JX Holdings, Inc. | | $ | 2,214,330 | |

| 18,500 | | Kamigumi Co. Ltd. | | | 161,540 | |

| 57,600 | | Kao Corp. | | | 1,511,099 | |

| 24 | | KDDI Corp. | | | 175,809 | |

| 6,100 | | Konami Corp. | | | 198,774 | |

| 83,500 | | Kuraray Co. Ltd. | | | 1,168,901 | |

| 1,500 | | MACNICA, Inc. | | | 31,696 | |

| 110,722 | | Marubeni Corp. | | | 644,465 | |

| 35,400 | | Marui Group Co. Ltd. | | | 275,208 | |

| 97,000 | | Mitsubishi Chemical Holdings Corp. | | | 588,002 | |

| 50,000 | | Mitsubishi Corp. | | | 1,028,348 | |

| 35,000 | | Mitsubishi Electric Corp. | | | 323,862 | |

| 720,500 | | Mitsubishi UFJ Financial Group, Inc. | | | 3,131,248 | |

| 81,400 | | Mitsui & Co. Ltd. | | | 1,187,994 | |

| 136,000 | | Mitsui Chemicals, Inc. | | | 446,038 | |

| 518,900 | | Mizuho Financial Group, Inc. | | | 726,299 | |

| 5,100 | | Nabtesco Corp. | | | 111,698 | |

| 29,500 | | Namco Bandai Holdings, Inc. | | | 427,738 | |

| 113,900 | | NHK Spring Co. Ltd. | | | 1,042,444 | |

| 65,100 | | Nikon Corp. | | | 1,457,660 | |

| 32,000 | | Nippon Express Co. Ltd. | | | 123,710 | |

| 41,000 | | Nippon Meat Packers, Inc. | | | 511,043 | |

| 80,100 | | Nippon Steel Corp. | | | 208,838 | |

| 55,100 | | Nippon Telegraph & Telephone Corp. | | | 2,826,401 | |

| 88,400 | | Nissan Motor Co. Ltd. | | | 812,816 | |

| 10,000 | | Nisshin Seifun Group, Inc. | | | 122,905 | |

| 17,270 | | ORIX Corp. | | | 1,507,244 | |

| 9,400 | | Otsuka Corp. | | | 652,963 | |

| 4,100 | | Pola Orbis Holdings, Inc. | | | 109,622 | |

| 298,300 | | Resona Holdings, Inc. | | | 1,337,125 | |

| 1,700 | | Sanrio Co. Ltd. | | | 84,003 | |

| 8,900 | | Sega Sammy Holdings, Inc. | | | 193,504 | |

| 27,000 | | Sekisui House Ltd. | | | 241,695 | |

| 9,400 | | Seven & I Holdings Co. Ltd. | | | 250,846 | |

| 344,700 | | Shinsei Bank Ltd. | | | 378,854 | |

| 45,700 | | SoftBank Corp. | | | 1,483,223 | |

| 29,200 | | Sumitomo Corp. | | | 361,530 | |

| 82,200 | | Sumitomo Mitsui Financial Group, Inc. | | | 2,297,615 | |

| 193,000 | | Sumitomo Mitsui Trust Holdings, Inc. | | | 660,470 | |

| 100,000 | | Tokyu Land Corp. | | | 420,965 | |

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.prudentialfunds.com |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

Japan (cont’d.) | | | | |

| 53,000 | | Toshiba Corp. | | $ | 231,154 | |

| 116,000 | | Tosoh Corp. | | | 377,022 | |

| 4,000 | | Totetsu Kogyo Co. Ltd. | | | 34,246 | |

| 110,000 | | TOTO Ltd. | | | 914,649 | |

| 40,434 | | Toyota Motor Corp. | | | 1,342,440 | |

| 16,800 | | Toyota Tsusho Corp. | | | 265,109 | |

| 15,700 | | UNY Co. Ltd. | | | 141,625 | |

| 17,600 | | Valor Co. Ltd. | | | 261,760 | |

| 6,200 | | West Japan Railway Co. | | | 262,716 | |

| 6,080 | | Yamada Denki Co. Ltd. | | | 437,242 | |

| | | | | | |

| | | | | 59,967,462 | |

| |

Mexico 0.3% | | | | |

| 32,800 | | America Movil SAB de CV, (Ser. L), ADR(a) | | | 833,776 | |

| |

Netherlands 5.0% | | | | |

| 6,808 | | ASML Holding NV | | | 285,589 | |

| 3,417 | | Delta Lloyd NV | | | 60,001 | |

| 4,651 | | Heineken Holding NV | | | 198,966 | |

| 265,354 | | ING Groep NV(b) | | | 2,287,611 | |

| 111,784 | | Koninklijke Ahold NV | | | 1,428,193 | |

| 91,290 | | Koninklijke KPN NV | | | 1,195,253 | |

| 61,723 | | PostNL NV | | | 312,528 | |

| 112,445 | | Royal Dutch Shell PLC (Class A Stock) | | | 3,983,325 | |

| 103,366 | | Royal Dutch Shell PLC (Class B Stock) | | | 3,708,576 | |

| 22,023 | | SBM Offshore NV | | | 483,898 | |

| 27,412 | | Unilever NV | | | 946,363 | |

| | | | | | |

| | | | | 14,890,303 | |

| |

Norway 0.3% | | | | |

| 37,944 | | DnB NOR ASA | | | 438,898 | |

| 15,071 | | Statoil ASA | | | 382,413 | |

| 1,118 | | Yara International ASA | | | 52,869 | |

| | | | | | |

| | | | | 874,180 | |

| |

Portugal 0.3% | | | | |

| 86,277 | | EDP Renovaveis SA(b) | | | 515,394 | |

| 22,116 | | Jeronimo Martins SGPS SA | | | 379,242 | |

| | | | | | |

| | | | | 894,636 | |

See Notes to Financial Statements.

| | | | |

| Prudential International Equity Fund | | | 17 | |

Portfolio of Investments

as of October 31, 2011 continued

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

Russia 1.0% | | | | |

| 9,147 | | MMC Norilsk Nickel OJSC, ADR | | $ | 176,080 | |

| 3,549 | | NovaTek OAO, GDR | | | 495,184 | |

| 11,832 | | Sberbank of Russia, ADR | | | 127,194 | |

| 16,457 | | Severstal OAO, GDR | | | 240,359 | |

| 3,628 | | Sistema JSFC, GDR | | | 61,767 | |

| 44,021 | | Uralkali OJSC, GDR | | | 1,896,947 | |

| | | | | | |

| | | | | 2,997,531 | |

| |

Singapore 1.7% | | | | |

| 98,000 | | China Minzhong Food Corp. Ltd.(b) | | | 80,785 | |

| 74,000 | | Golden Agri-Resources Ltd. | | | 37,882 | |

| 33,000 | | Jardine Cycle & Carriage Ltd. | | | 1,186,287 | |

| 21,400 | | SembCorp Industries Ltd. | | | 70,554 | |

| 79,000 | | StarHub Ltd. | | | 176,819 | |

| 88,000 | | STX OSV Holdings Ltd. | | | 77,869 | |

| 226,300 | | UOL Group Ltd. | | | 800,025 | |

| 353,000 | | Wilmar International Ltd. | | | 1,524,193 | |

| 1,413,000 | | Yangzijiang Shipbuilding Holdings Ltd. | | | 1,046,585 | |

| | | | | | |

| | | | | 5,000,999 | |

| |

South Africa 0.4% | | | | |

| 18,500 | | AngloGold Ashanti Ltd., ADR | | | 836,385 | |

| 800 | | Kumba Iron Ore Ltd., ADR | | | 47,544 | |

| 10,200 | | Sasol Ltd., ADR | | | 461,448 | |

| | | | | | |

| | | | | 1,345,377 | |

| |

South Korea 1.1% | | | | |

| 2,220 | | Hyundai Motor Co., GDR(b) | | | 68,046 | |

| 6,500 | | KB Financial Group, Inc., ADR(a) | | | 253,825 | |

| 114,200 | | LG Display Co. Ltd., ADR | | | 1,148,852 | |

| 1,950 | | Samsung Electronics Co. Ltd., GDR | | | 851,651 | |

| 400 | | Samsung Electronics Co. Ltd., GDR, PFD | | | 115,503 | |

| 9,500 | | Shinhan Financial Group Co. Ltd., ADR | | | 756,200 | |

| 2,300 | | SK Telecom Co. Ltd., ADR | | | 34,017 | |

| | | | | | |

| | | | | 3,228,094 | |

| |

Spain 3.0% | | | | |

| 4,662 | | Amadeus IT Holding SA (Class A Stock) | | | 87,862 | |

| 149,474 | | Banco Bilbao Vizcaya Argentaria SA | | | 1,345,254 | |

| 172,100 | | Banco Santander SA | | | 1,456,631 | |

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.prudentialfunds.com |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

Spain (cont’d.) | | | | |

| 5,604 | | Enagas SA | | $ | 110,194 | |

| 41,974 | | Gas Natural SDG SA | | | 780,209 | |

| 185,000 | | Iberdrola SA | | | 1,338,470 | |

| 922 | | Inditex SA | | | 83,699 | |

| 29,550 | | Mapfre SA | | | 107,974 | |

| 12,161 | | Red Electrica Corp. SA | | | 585,835 | |

| 149,184 | | Telefonica SA | | | 3,170,401 | |

| | | | | | |

| | | | | 9,066,529 | |

| |

Sweden 1.9% | | | | |

| 9,743 | | Atlas Copco AB (Class A Stock) | | | 211,808 | |

| 4,271 | | Axis Communications AB | | | 94,875 | |

| 230,478 | | Nordea Bank AB | | | 2,092,942 | |

| 6,096 | | Scania AB (Class B Stock) | | | 102,291 | |

| 290,700 | | Skandinaviska Enskilda Banken AB (Class A Stock) | | | 1,822,372 | |

| 14,635 | | SKF AB (Class B Stock) | | | 324,341 | |

| 5,671 | | Telefonaktiebolaget LM Ericsson (Class B Stock) | | | 59,112 | |

| 68,058 | | Volvo AB (Class B Stock) | | | 847,097 | |

| | | | | | |

| | | | | 5,554,838 | |

| |

Switzerland 7.2% | | | | |

| 26,594 | | ABB Ltd. | | | 500,643 | |

| 7,604 | | Aryzta AG | | | 366,651 | |

| 29,385 | | Cie Financiere Richemont SA | | | 1,673,905 | |

| 7,539 | | Credit Suisse Group AG | | | 217,433 | |

| 1,665 | | Geberit AG | | | 340,988 | |

| 7 | | Lindt & Spruengli AG | | | 257,769 | |

| 67,722 | | Nestle SA | | | 3,916,884 | |

| 83,696 | | Novartis AG | | | 4,715,038 | |

| 43,026 | | OC Oerlikon Corp. AG(b) | | | 257,655 | |

| 26,030 | | Roche Holding AG | | | 4,270,727 | |

| 1,011 | | Swatch Group AG (The) (Bearer) | | | 425,617 | |

| 15,007 | | Swatch Group AG (The) (Registered) | | | 1,106,621 | |

| 5,691 | | Swiss Life Holding AG | | | 698,953 | |

| 64,283 | | UBS AG(b) | | | 812,422 | |

| 8,565 | | Zurich Financial Services AG | | | 1,973,749 | |

| | | | | | |

| | | | | 21,535,055 | |

See Notes to Financial Statements.

| | | | |

| Prudential International Equity Fund | | | 19 | |

Portfolio of Investments

as of October 31, 2011 continued

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

Taiwan 0.2% | | | | |

| 3,000 | | Chunghwa Telecom Co. Ltd., ADR | | $ | 100,890 | |

| 27,800 | | Taiwan Semiconductor Manufacturing Co. Ltd., ADR(a) | | | 350,836 | |

| | | | | | |

| | | | | 451,726 | |

| |

Thailand 1.0% | | | | |

| 450,000 | | Charoen Pokphand Foods PCL | | | 442,683 | |

| 582,700 | | CP ALL PCL | | | 890,631 | |

| 100,400 | | Kasikornbank PCL | | | 405,469 | |

| 42,900 | | Kasikornbank PCL, NVDR | | | 171,036 | |

| 1,350,000 | | Krung Thai Bank PCL | | | 667,317 | |

| 10,000 | | PTT PCL | | | 93,171 | |

| 59,200 | | Siam Commercial Bank PCL | | | 218,029 | |

| 15,300 | | Thai Oil PCL, NVDR | | | 28,632 | |

| | | | | | |

| | | | | 2,916,968 | |

| |

United Kingdom 18.7% | | | | |

| 306,318 | | 3i Group PLC | | | 1,009,578 | |

| 29,110 | | Anglo American PLC | | | 1,067,186 | |

| 81,542 | | AstraZeneca PLC | | | 3,914,758 | |

| 243,454 | | Aviva PLC | | | 1,328,177 | |

| 22,932 | | Babcock International Group PLC | | | 259,167 | |

| 284,803 | | BAE Systems PLC | | | 1,262,998 | |

| 198,008 | | Balfour Beatty PLC | | | 798,804 | |

| 8,030 | | BG Group PLC | | | 174,122 | |

| 110,232 | | BHP Billiton PLC | | | 3,471,145 | |

| 544,292 | | BP PLC | | | 4,005,350 | |

| 86,871 | | British American Tobacco PLC | | | 3,983,058 | |

| 158,970 | | BT Group PLC | | | 479,648 | |

| 10,000 | | Burberry Group PLC | | | 214,676 | |

| 119,574 | | Diageo PLC | | | 2,474,673 | |

| 42,892 | | Fresnillo PLC | | | 1,162,842 | |

| 145,199 | | GlaxoSmithKline PLC | | | 3,258,604 | |

| 320,689 | | HSBC Holdings PLC | | | 2,798,107 | |

| 44,612 | | Imperial Tobacco Group PLC | | | 1,625,075 | |

| 83,859 | | Invensys PLC | | | 303,383 | |

| 1,207,482 | | ITV PLC(b) | | | 1,237,207 | |

| 272,224 | | Kingfisher PLC | | | 1,127,848 | |

| 1,461,828 | | Legal & General Group PLC | | | 2,575,168 | |

| 47,450 | | National Grid PLC | | | 471,749 | |

| 55,000 | | Next PLC | | | 2,254,237 | |

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.prudentialfunds.com |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

United Kingdom (cont’d.) | | | | |

| 1,058,609 | | Old Mutual PLC | | $ | 1,861,173 | |

| 2,814 | | Petrofac Ltd. | | | 64,640 | |

| 5,914 | | Randgold Resources Ltd. | | | 646,798 | |

| 43,292 | | Reckitt Benckiser Group PLC | | | 2,222,163 | |

| 168,783 | | Rexam PLC | | | 935,562 | |

| 50,392 | | Rio Tinto PLC | | | 2,726,149 | |

| 5,950 | | SSE PLC | | | 128,557 | |

| 23,477 | | Tesco PLC | | | 151,366 | |

| 23,833 | | TUI Travel PLC | | | 65,217 | |

| 54,052 | | Unilever PLC | | | 1,811,829 | |

| 1,547,333 | | Vodafone Group PLC | | | 4,296,452 | |

| | | | | | |

| | | | | 56,167,466 | |

| |

United States 0.3% | | | | |

| 7,767 | | Millicom International Cellular SA | | | 856,595 | |

| | | | | | |

| | Total common stocks

(cost $280,423,261) | | | 294,426,584 | |

| | | | | | |

EXCHANGE TRADED FUNDS 0.2% | | | | |

| |

United States | | | | |

| 7,500 | | iShares MSCI Emerging Markets Index Fund(a) | | | 306,000 | |

| 7,500 | | Vanguard MSCI Emerging Markets ETF | | | 311,175 | |

| | | | | | |

| | Total exchange traded funds

(cost $628,125) | | | 617,175 | |

| | | | | | |

PREFERRED STOCKS 1.0% | | | | |

| |

Germany 1.0% | | | | |

| 2,692 | | Bayerische Motoren Werke AG | | | 146,506 | |

| 15,886 | | Henkel AG & Co. KGaA | | | 944,345 | |

| 4,481 | | Porsche Automobil Holding SE | | | 261,041 | |

| 8,712 | | Volkswagen AG | | | 1,517,192 | |

| | | | | | |

| | Total preferred stocks

(cost $2,690,116) | | | 2,869,084 | |

| | | | | | |

| | Total long-term investments

(cost $283,741,502) | | | 297,912,843 | |

| | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential International Equity Fund | | | 21 | |

Portfolio of Investments

as of October 31, 2011 continued

| | | | | | |

Principal

Amount (000) | | Description | | Value (Note 1) | |

| | | | | | |

SHORT-TERM INVESTMENTS 1.8% | | | | |

| |

United States Government Security 0.2% | | | | |

| $ 520 | | U.S. Treasury Bills

0.020%, 12/15/11

(cost $519,943)(c)(d) | | $ | 519,984 | |

| | | | | | |

| | |

| Shares | | | | | |

| |

Affiliated Money Market Mutual Fund 1.6% | | | | |

| 4,912,148 | | Prudential Investment Portfolios 2 - Prudential Core Taxable Money Market Fund

(cost $4,912,148; includes $4,911,672 of cash collateral received for securities on loan) (Note 3)(e)(f) | | | 4,912,148 | |

| | | | | | |

| | Total short-term investments

(cost $5,432,091) | | | 5,432,132 | |

| | | | | | |

| | Total Investments 101.2%

(cost $289,173,593; Note 5) | | | 303,344,975 | |

| | Liabilities in excess of other assets(g) (1.2%) | | | (3,603,725 | ) |

| | | | | | |

| | Net Assets 100.0% | | $ | 299,741,250 | |

| | | | | | |

The following abbreviations are used in the portfolio descriptions:

ADR—American Depositary Receipt

ETF—Exchange Traded Fund

GDR—Global Depositary Receipt

NVDR—Non-Voting Depositary Receipt

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $4,630,905; cash collateral of $4,911,672 (included in liabilities) was received with which the Series purchased highly liquid short-term investments. |

| (b) | Non-income producing security. |

| (c) | Represents security, or a portion thereof, segregated as collateral for financial futures contracts. |

| (d) | Rate quoted represents yield-to-maturity as of purchase date. |

| (e) | Prudential Investments LLC, the manager of the Series, also serves as manager of the Prudential Investment Portfolios 2 - Prudential Core Taxable Money Market Fund. |

| (f) | Represents security, or a portion thereof, purchased with cash collateral received for securities on loan. |

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.prudentialfunds.com |

| (g) | Includes net unrealized appreciation (depreciation) on the following derivative contracts held at reporting period end: |

Open futures contracts outstanding at October 31, 2011:

| | | | | | | | | | | | | | | | | | | | |

Number of

Contracts | | | Type | | Expiration

Date | | | Value at

October 31,

2011 | | | Value at

Trade

Date | | | Unrealized

Appreciation | |

| | | | Long Positions: | | | | | | | | | | | | | | | | |

| | 45 | | | DJ Euro Stoxx 50 Index | | | Dec. 2011 | | | $ | 1,486,924 | | | $ | 1,301,409 | | | $ | 185,515 | |

| | 3 | | | FTSE 100 Index | | | Dec. 2011 | | | | 267,160 | | | | 252,455 | | | | 14,705 | |

| | 12 | | | MSCI Taiwan Index | | | Nov. 2011 | | | | 320,880 | | | | 315,900 | | | | 4,980 | |

| | 11 | | | SPI 200 Futures Index | | | Dec. 2011 | | | | 1,241,595 | | | | 1,173,749 | | | | 67,846 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 273,046 | |

| | | | | | | | | | | | | | | | | | | | |

Various inputs are used in determining the value of the Series’ investments. These inputs are summarized in the three broad levels listed below.

Level 1—quoted prices generally for securities actively traded on a regulated securities exchange and for open-end mutual funds which trade at daily net asset value.

Level 2—other significant observable inputs (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds, foreign currency exchange rates, and amortized cost) generally for debt securities, swaps, forward foreign currency contracts and for foreign stocks priced using vendor modeling tools.

Level 3—significant unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of October 31, 2011 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Australia | | $ | — | | | $ | 23,188,130 | | | $ | — | |

Austria | | | — | | | | 745,759 | | | | — | |

Belgium | | | — | | | | 1,441,506 | | | | — | |

See Notes to Financial Statements.

| | | | |

| Prudential International Equity Fund | | | 23 | |

Portfolio of Investments

as of October 31, 2011 continued

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Common Stocks (continued) | | | | | | | | | | | | |

Brazil | | $ | 5,540,983 | | | $ | — | | | $ | — | |

Chile | | | 504,064 | | | | — | | | | — | |

China | | | — | | | | 1,233,146 | | | | — | |

Denmark | | | — | | | | 2,667,170 | | | | — | |

Egypt | | | 49,323 | | | | — | | | | — | |

Finland | | | — | | | | 2,743,416 | | | | — | |

France | | | — | | | | 24,806,994 | | | | — | |

Germany | | | — | | | | 20,926,762 | | | | — | |

Hong Kong | | | — | | | | 14,785,436 | | | | — | |

India | | | 99,450 | | | | — | | | | — | |

Israel | | | 138,890 | | | | 898,723 | | | | — | |

Italy | | | — | | | | 8,075,297 | | | | — | |

Japan | | | 123,644 | | | | 59,843,818 | | | | — | |

Mexico | | | 833,776 | | | | — | | | | — | |

Netherlands | | | — | | | | 14,890,303 | | | | — | |

Norway | | | — | | | | 874,180 | | | | — | |

Portugal | | | — | | | | 894,636 | | | | — | |

Russia | | | 303,274 | | | | 2,694,257 | | | | — | |

Singapore | | | — | | | | 5,000,999 | | | | — | |

South Africa | | | 1,345,377 | | | | — | | | | — | |

South Korea | | | 3,160,048 | | | | 68,046 | | | | — | |

Spain | | | — | | | | 9,066,529 | | | | — | |

Sweden | | | — | | | | 5,554,838 | | | | — | |

Switzerland | | | — | | | | 21,535,055 | | | | — | |

Taiwan | | | 451,726 | | | | — | | | | — | |

Thailand | | | 2,311,831 | | | | 605,137 | | | | — | |

United Kingdom | | | — | | | | 56,167,466 | | | | — | |

United States | | | — | | | | 856,595 | | | | — | |

Exchange Traded Funds | | | | | | | | | | | | |

United States | | | 617,175 | | | | — | | | | — | |

Preferred Stocks | | | | | | | | | | | | |

Germany | | | — | | | | 2,869,084 | | | | — | |

United States Government Security | | | — | | | | 519,984 | | | | — | |

Affiliated Money Market Mutual Fund | | | 4,912,148 | | | | — | | | | — | |

| | | | | | | | | | | | |

| | | 20,391,709 | | | | 282,953,266 | | | | — | |

Other Financial Instruments* | | | | | | | | | | | | |

Futures Contracts | | | 273,046 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | $ | 20,664,755 | | | $ | 282,953,266 | | | $ | — | |

| | | | | | | | | | | | |

| * | Other financial instruments are derivative instruments not reflected in the Portfolio of Investments, such as futures, forwards and swap contracts, which are recorded at the unrealized appreciation/depreciation on the instrument. |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.prudentialfunds.com |

Fair value of Level 2 investments at October 31, 2010 was $0. $255,881,131 was transferred into Level 2 from Level 1 at October 31, 2011 as a result of using third-party vendor modeling tools to reflect any significant market movements between the time at which the Series valued its securities and the earlier closing of foreign markets.

It is the Series’ policy to recognize transfers in and transfers out at the fair value as of the beginning of period.

The industry classification of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2011 were as follows:

| | | | |

Commercial Banks | | | 11.2 | % |

Oil, Gas & Consumable Fuels | | | 8.7 | |

Pharmaceuticals | | | 7.8 | |

Metals & Mining | | | 6.9 | |

Insurance | | | 4.9 | |

Diversified Telecommunication Services | | | 4.3 | |

Food Products | | | 3.5 | |

Chemicals | | | 3.4 | |

Electric Utilities | | | 2.9 | |

Wireless Telecommunication Services | | | 2.6 | |

Automobiles | | | 2.5 | |

Real Estate Management & Development | | | 2.4 | |

Machinery | | | 2.2 | |

Food & Staples Retailing | | | 1.9 | |

Tobacco | | | 1.9 | |

Trading Companies & Distributors | | | 1.8 | |

Hotels, Restaurants & Leisure | | | 1.7 | |

Affiliated Money Market Mutual Fund (including 1.6% of collateral received for securities on loan) | | | 1.6 | |

Diversified Financial Services | | | 1.6 | |

Road & Rail | | | 1.6 | |

Electronic Equipment, Instruments & Components | | | 1.5 | |

Auto Components | | | 1.4 | |

Beverages | | | 1.4 | |

Capital Markets | | | 1.4 | |

Textiles, Apparel & Luxury Goods | | | 1.4 | |

Real Estate Investment Trusts | | | 1.3 | |

Multiline Retail | | | 1.2 | |

Aerospace & Defense | | | 1.1 | |

Household Products | | | 1.1 | |

Industrial Conglomerates | | | 1.0 | |

Specialty Retail | | | 0.9 | |

Electrical Equipment | | | 0.8 | |

Internet Software & Services | | | 0.8 | % |

Semiconductors & Semiconductor Equipment | | | 0.8 | |

Construction & Engineering | | | 0.7 | |

Energy Equipment & Services | | | 0.7 | |

Leisure Equipment & Products | | | 0.7 | |

Personal Products | | | 0.7 | |

Media | | | 0.6 | |

Multi-Utilities | | | 0.6 | |

Office Electronics | | | 0.6 | |

Airlines | | | 0.4 | |

Building Products | | | 0.4 | |

Distributors | | | 0.4 | |

Marine | | | 0.4 | |

Software | | | 0.4 | |

Air Freight & Logistics | | | 0.3 | |

Containers & Packaging | | | 0.3 | |

Gas Utilities | | | 0.3 | |

Paper & Forest Products | | | 0.3 | |

Computers & Peripherals | | | 0.2 | |

Exchange Traded Funds | | | 0.2 | |

Healthcare Equipment & Supplies | | | 0.2 | |

Independent Power Producers & Energy Traders | | | 0.2 | |

IT Services | | | 0.2 | |

United States Government Security | | | 0.2 | |

Water Utilities | | | 0.2 | |

Commercial Services & Supplies | | | 0.1 | |

Communications Equipment | | | 0.1 | |

Construction Materials | | | 0.1 | |

Household Durables | | | 0.1 | |

Transportation Infrastructure | | | 0.1 | |

| | | | |

| | | 101.2 | |

Liabilities in excess of other assets | | | (1.2 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

See Notes to Financial Statements.

| | | | |

| Prudential International Equity Fund | | | 25 | |

Portfolio of Investments

as of October 31, 2011 continued

The Series invested in derivative instruments during the reporting period. The primary type of risk associated with these derivative instruments is equity risk. The effect of such derivative instruments on the Series’ financial position and financial performance as reflected in the Statement of Assets and Liabilities and Statement of Operations is presented in the summary below.

Fair values of derivative instruments as of October 31, 2011 as presented in the Statement of Assets and Liabilities:

| | | | | | | | | | | | |

Derivatives not designated

as hedging instruments,

carried at fair value | | Asset Derivatives | | | Liability Derivatives | |

| | Balance

Sheet Location | | Fair

Value | | | Balance

Sheet Location | | Fair

Value | |

| Equity contracts | | Due to broker—variation margin | | $ | 273,046 | * | | — | | $ | — | |

| | | | | | | | | | | | |

| * | Includes cumulative appreciation/depreciation on futures contracts as reported in Portfolio of Investments. Only unsettled variation margin receivable (payable) is reported within the Statement of Assets and Liabilities. |

The effects of derivative instruments on the Statement of Operations for the year ended October 31, 2011 are as follows:

| | | | | | | | | | | | |

Amount of Realized Gain or (Loss) on Derivatives Recognized in Income | |

Derivatives not designated as hedging

instruments, carried at fair value | | Futures | | | Rights | | | Total | |

Equity contracts | | $ | (899,402 | ) | | $ | 251,130 | | | $ | (648,272 | ) |

| | | | | | | | | | | | |

|

Change in Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income | |

Derivatives not designated as hedging

instruments, carried at fair value | | Futures | | | Rights | | | Total | |

Equity contracts | | $ | 198,679 | | | $ | (3,661 | ) | | $ | 195,018 | |

| | | | | | | | | | | | |

For the year ended October 31, 2011, the average value at trade date for futures contracts was $3,779,533.

See Notes to Financial Statements.

| | |

| 26 | | Visit our website at www.prudentialfunds.com |

Financial Statements

| | |

| OCTOBER 31, 2011 | | ANNUAL REPORT |

Prudential International Equity Fund

Statement of Assets and Liabilities

as of October 31, 2011

| | | | |

Assets | | | | |

Investments at value, including securities on loan of $4,630,905: | | | | |

Unaffiliated Investments (cost $284,261,445) | | $ | 298,432,827 | |

Affiliated Investments (cost $4,912,148) | | | 4,912,148 | |

Foreign currency, at value (cost $766,571) | | | 776,699 | |

Receivable for investments sold | | | 1,578,807 | |

Dividends and interest receivable | | | 786,042 | |

Foreign tax reclaim receivable | | | 602,338 | |

Receivable for Series shares sold | | | 22,357 | |

Prepaid expenses | | | 5,604 | |

| | | | |

Total assets | | | 307,116,822 | |

| | | | |

| |

Liabilities | | | | |

Payable to broker for collateral for securities on loan (Note 3) | | | 4,911,672 | |

Loan payable | | | 1,354,000 | |

Payable for Series shares reacquired | | | 360,990 | |

Accrued expenses | | | 277,775 | |

Management fee payable | | | 212,519 | |

Affiliated transfer agent fee payable | | | 93,177 | |

Distribution fee payable | | | 83,248 | |

Due to broker—variation margin | | | 82,191 | |

| | | | |

Total liabilities | | | 7,375,572 | |

| | | | |

| |

Net Assets | | $ | 299,741,250 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 525,232 | |

Paid-in capital in excess of par | | | 531,578,763 | |

| | | | |

| | | 532,103,995 | |

Undistributed net investment income | | | 4,069,143 | |

Accumulated net realized loss on investment and foreign currency transactions | | | (250,936,488 | ) |

Net unrealized appreciation on investments and foreign currencies | | | 14,504,600 | |

| | | | |

Net assets, October 31, 2011 | | $ | 299,741,250 | |

| | | | |

See Notes to Financial Statements.

| | |

| 28 | | Visit our website at www.prudentialfunds.com |

| | | | |

Class A | | | | |

Net asset value and redemption price per share

($214,609,853 ÷ 37,486,838 shares of common stock issued and outstanding) | | $ | 5.72 | |

Maximum sales charge (5.50% of offering price) | | | 0.33 | |

| | | | |

Maximum offering price to public | | $ | 6.05 | |

| | | | |

| |

Class B | | | | |

Net asset value, offering price and redemption price per share

($6,719,458 ÷ 1,221,612 shares of common stock issued and outstanding) | | $ | 5.50 | |

| | | | |

| |

Class C | | | | |

Net asset value, offering price and redemption price per share

($21,309,980 ÷ 3,875,333 shares of common stock issued and outstanding) | | $ | 5.50 | |

| | | | |

| |

Class F | | | | |

Net asset value, offering price and redemption price per share

($1,572,040 ÷ 285,568 shares of common stock issued and outstanding) | | $ | 5.50 | |

| | | | |

| |

Class L | | | | |

Net asset value and redemption price per share

($8,644,344 ÷ 1,509,580 shares of common stock issued and outstanding) | | $ | 5.73 | |

Maximum sales charge (5.75% of offering price) | | | 0.35 | |

| | | | |

Maximum offering price to public | | $ | 6.08 | |

| | | | |

| |

Class M | | | | |

Net asset value, offering price and redemption price per share

($743,156 ÷ 135,109 shares of common stock issued and outstanding) | | $ | 5.50 | |

| | | | |

| |

Class X | | | | |

Net asset value, offering price and redemption price per share

($1,569,382 ÷ 285,347 shares of common stock issued and outstanding) | | $ | 5.50 | |

| | | | |

| |

Class Z | | | | |

Net asset value, offering price and redemption price per share

($44,573,037 ÷ 7,723,850 shares of common stock issued and outstanding) | | $ | 5.77 | |

| | | | |

See Notes to Financial Statements.

| | | | |

| Prudential International Equity Fund | | | 29 | |

Statement of Operations

Year Ended October 31, 2011

| | | | |

Net Investment Income | | | | |

Income | | | | |

Unaffiliated dividend (net of foreign withholding taxes of $1,578,150) | | $ | 10,744,179 | |

Affiliated income from securities loaned, net | | | 82,904 | |

Affiliated dividend income | | | 675 | |

Unaffiliated interest income | | | 665 | |

| | | | |

Total income | | | 10,828,423 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 2,884,387 | |

Distribution fee—Class A | | | 743,573 | |

Distribution fee—Class B | | | 83,203 | |

Distribution fee—Class C | | | 251,274 | |

Distribution fee—Class F | | | 18,318 | |

Distribution fee—Class L | | | 50,947 | |

Distribution fee—Class M | | | 17,683 | |

Distribution fee—Class X | | | 23,505 | |

Transfer agent’s fees and expenses (including affiliated expense of $431,400) (Note 3) | | | 1,031,000 | |

Custodian’s fees and expenses | | | 279,000 | |

Reports to shareholders | | | 116,000 | |

Registration fees | | | 105,000 | |

Legal fees and expenses | | | 79,000 | |

Audit fee | | | 29,000 | |

Directors’ fees | | | 18,000 | |

Insurance | | | 8,000 | |

Loan interest expense (Note 7) | | | 2,761 | |

Miscellaneous | | | 60,385 | |

| | | | |

Total expenses | | | 5,801,036 | |

| | | | |

Net investment income | | | 5,027,387 | |

| | | | |

|

Realized And Unrealized Gain (Loss) On Investment, Futures And Foreign Currency Transactions | |

Net realized gain (loss) on: | | | | |

Investment transactions | | | 18,199,019 | |

Foreign currency transactions | | | (224,830 | ) |

Financial futures transactions | | | (899,402 | ) |

| | | | |

| | | 17,074,787 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | (40,137,901 | ) |

Foreign currencies | | | (88,091 | ) |

Financial futures contracts | | | 198,679 | |

| | | | |

| | | (40,027,313 | ) |

| | | | |

Net loss on investments and foreign currencies | | | (22,952,526 | ) |

| | | | |

Net Decrease In Net Assets Resulting From Operations | | $ | (17,925,139 | ) |

| | | | |

See Notes to Financial Statements.

| | |

| 30 | | Visit our website at www.prudentialfunds.com |

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended October 31, | |

| | | 2011 | | | 2010 | |

Increase (Decrease) In Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 5,027,387 | | | $ | 7,116,368 | |

Net realized gain (loss) on investment and foreign currency transactions | | | 17,074,787 | | | | (25,360,327 | ) |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | (40,027,313 | ) | | | 31,177,215 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (17,925,139 | ) | | | 12,933,256 | |

| | | | | | | | |

| | |

Dividends from net investment income (Note 1) | | | | | | | | |

Class A | | | (4,571,474 | ) | | | (4,729,701 | ) |

Class B | | | (110,787 | ) | | | (120,437 | ) |

Class C | | | (320,075 | ) | | | (351,530 | ) |

Class F | | | (47,027 | ) | | | (73,250 | ) |

Class L | | | (171,721 | ) | | | (189,123 | ) |

Class M | | | (33,226 | ) | | | (75,237 | ) |

Class X | | | (35,242 | ) | | | (67,157 | ) |

Class Z | | | (949,745 | ) | | | (4,587,489 | ) |

| | | | | | | | |

| | | (6,239,297 | ) | | | (10,193,924 | ) |

| | | | | | | | |

| | |

Series share transactions (Net of share conversions) (Note 6) | | | | | | | | |

Net proceeds from shares sold | | | 19,235,595 | | | | 46,181,096 | |

Net asset value of shares issued in reinvestment of dividends | | | 6,069,976 | | | | 9,997,085 | |

Cost of shares reacquired | | | (64,297,912 | ) | | | (277,348,125 | ) |

| | | | | | | | |

Net decrease in net assets from Series share transactions | | | (38,992,341 | ) | | | (221,169,944 | ) |

| | | | | | | | |

| | |

Capital Contributions (Note 6) | | | | | | | | |

Proceeds from regulatory settlement | | | 1,399,459 | | | | 4,717,145 | |

| | | | | | | | |

Total decrease | | | (61,757,318 | ) | | | (213,713,467 | ) |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 361,498,568 | | | | 575,212,035 | |

| | | | | | | | |

End of year(a) | | $ | 299,741,250 | | | $ | 361,498,568 | |

| | | | | | | | |

(a) Includes undistributed net investment income of: | | $ | 4,069,143 | | | $ | 5,112,695 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential International Equity Fund | | | 31 | |

Notes to Financial Statements

Prudential World Fund, Inc. (the “Fund”) is an open-end management investment company, registered under the Investment Company Act of 1940, as amended, (“1940 Act”) and currently consists of three series: Prudential International Equity Fund (the “Series”), Prudential International Value Fund and Prudential Emerging Markets Debt Local Currency Fund. These financial statements relate to the Prudential International Equity Fund. The financial statements of the other series are not presented herein. The Series commenced investment operations in March 2000. The investment objective of the Series is to achieve long-term growth of capital. The Series seeks to achieve its objective primarily through investment in equity-related securities of foreign issuers.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Fund and the Series in the preparation of its financial statements.