Fidelity's Broadly Diversified International Equity Funds

Fidelity® Diversified International Fund

Fidelity® International Capital Appreciation Fund

Fidelity® Overseas Fund

Fidelity® Worldwide Fund

Annual Report

October 31, 2019

Includes Fidelity and Fidelity Advisor share classes

See the inside front cover for important information about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2019 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Fidelity® Diversified International Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended October 31, 2019 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® Diversified International Fund | 16.02% | 5.13% | 6.52% |

| Class K | 16.14% | 5.26% | 6.67% |

The initial offering of Class K shares took place on May 9, 2008. Returns prior to May 9, 2008 are those of Fidelity® Diversified International Fund, the original class of the fund.

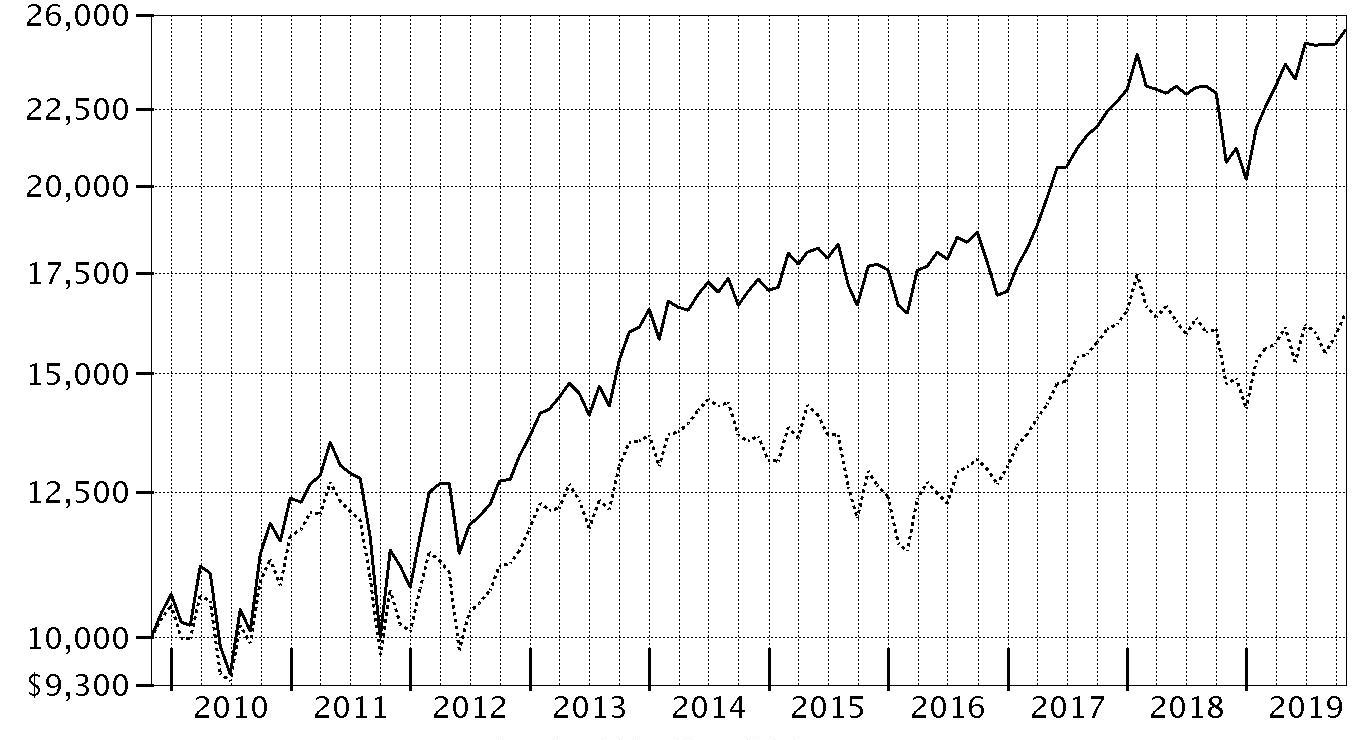

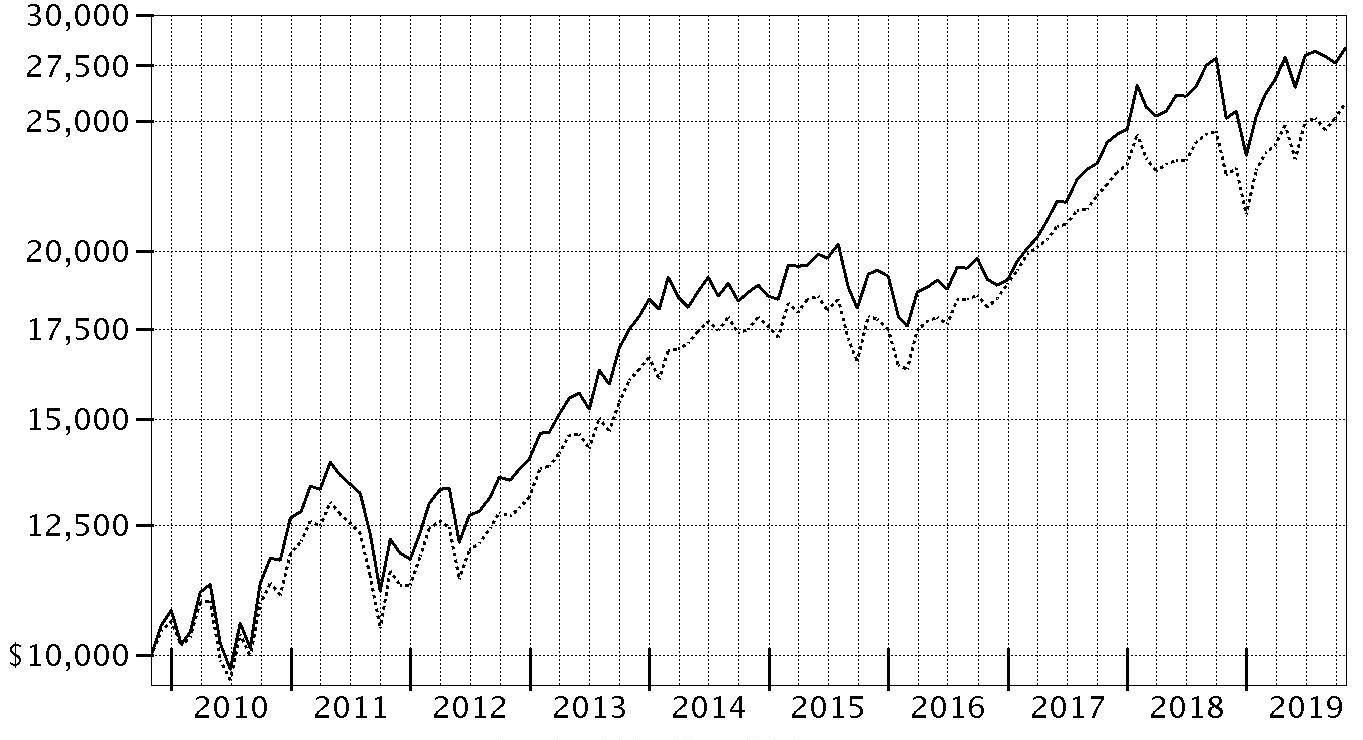

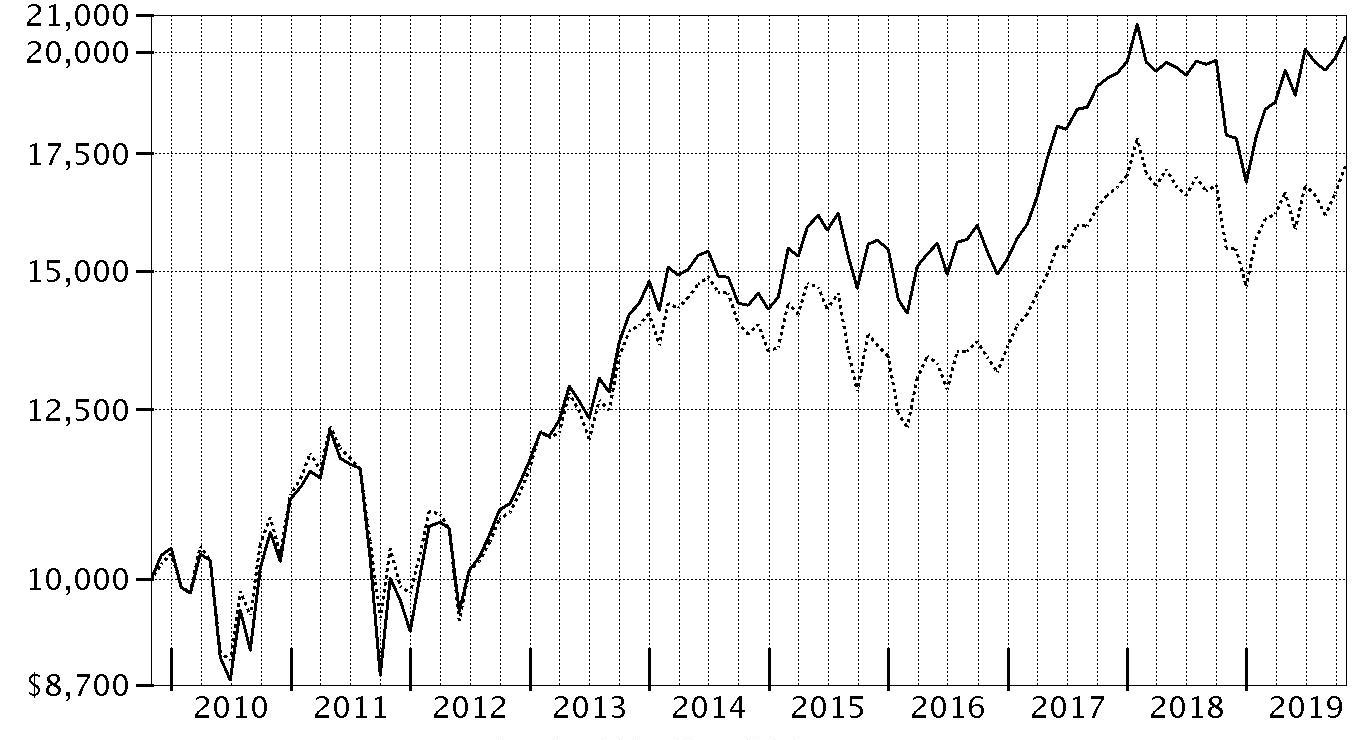

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Diversified International Fund, a class of the fund, on October 31, 2009.

The chart shows how the value of your investment would have changed, and also shows how the MSCI EAFE Index performed over the same period.

| Period Ending Values |

| $18,801 | Fidelity® Diversified International Fund |

| $17,206 | MSCI EAFE Index |

Fidelity® Diversified International Fund

Management's Discussion of Fund Performance

Market Recap: The MSCI ACWI (All Country World Index) ex USA Index gained 11.47% for the 12 months ending October 31, 2019, as international stocks reflected a confluence of factors, including escalating trade tension, and moderating but still positive global economic growth. Currency fluctuations were largely modest and varied by region, muting the overall impact on international equity returns. In late December, the U.S. Federal Reserve shifted from raising interest rates to a more dovish policy in 2019, joining many foreign central banks. In June, international stocks rose 6.03%, as policy stimulus in China stabilized that country’s economic growth. The Fed cut its policy rate in July for the first time since 2008. However, the index returned -1.21% for the month, followed by -3.08% in August. In September, the Fed cut its policy rate another quarter point, citing concerns about slowing economic growth and muted inflation, and did the same in October, leading to monthly gains of 2.59% and 3.49%, respectively. For the full 12 months, the growth-oriented information technology sector (+22%) led the way, followed by utilities (+20%) and real estate (+18%), two high-dividend-yielding categories. Conversely, energy was roughly flat, while materials (+6%) and communication services (7%) also lagged. By region, Asia Pacific ex Japan (+16%), Europe ex U.K (+13%), Canada (+12%) and emerging markets (+12%) fared best. Meanwhile, the U.K. (+7%) and Japan (+10%) trailed the broader market.

Comments from Portfolio Manager Bill Bower: For the fiscal year, the fund gained 16.02%, handily outperforming the 11.30% result of benchmark MSCI EAFE Index. Favorable stock selection was the primary driver of the fund’s outperformance the past 12 months, as our picks in 10 of 11 equity sectors outperformed the index. By sector, the biggest contribution to the fund’s relative result came from picks in the financials sector, followed by choices in information technology and industrials. Regionally, choices in emerging markets added the most value, with notable outperformance in China and India. Stock picking in the non-benchmark U.S. region, along with Japan, also contributed meaningfully. In terms of individual stocks, an overweighted stake in Japanese optical and glass products manufacturer Hoya (+58%) helped more than any other investment the past year. A large position in photolithography systems manufacturer ASML (+54%) also helped. Conversely, being underweighted in the higher-dividend-yielding and strong-performing utilities and real estate sectors held back the fund’s performance relative to the index. At the stock level, not owning Switzerland-based food and beverage manufacturer Nestle (+29%), an index constituent, weighed on the fund’s relative result. An overweighting in Norway-based oil & gas company Equinor (-26%) also hurt this period. Elsewhere, a cash position of roughly 4%, on average, also detracted in an uptrending market.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® Diversified International Fund

Investment Summary (Unaudited)

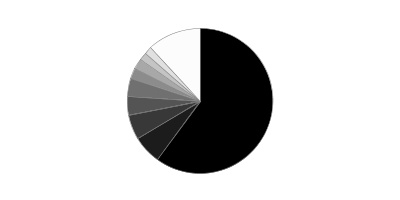

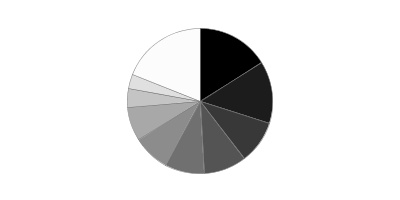

Geographic Diversification (% of fund's net assets)

| As of October 31, 2019 |

| | Japan | 17.2% |

| | Germany | 11.2% |

| | United Kingdom | 10.9% |

| | United States of America* | 8.1% |

| | France | 7.8% |

| | Netherlands | 7.0% |

| | Switzerland | 6.3% |

| | India | 4.2% |

| | Canada | 3.1% |

| | Other | 24.2% |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

Asset Allocation as of October 31, 2019

| | % of fund's net assets |

| Stocks | 97.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

Top Ten Stocks as of October 31, 2019

| | % of fund's net assets |

| SAP SE (Germany, Software) | 2.4 |

| Roche Holding AG (participation certificate) (Switzerland, Pharmaceuticals) | 2.2 |

| ASML Holding NV (Netherlands, Semiconductors & Semiconductor Equipment) | 1.9 |

| AIA Group Ltd. (Hong Kong, Insurance) | 1.8 |

| AstraZeneca PLC (United Kingdom) (United Kingdom, Pharmaceuticals) | 1.7 |

| Hoya Corp. (Japan, Health Care Equipment & Supplies) | 1.7 |

| Unilever NV (Netherlands, Personal Products) | 1.5 |

| Keyence Corp. (Japan, Electronic Equipment & Components) | 1.5 |

| LVMH Moet Hennessy Louis Vuitton SE (France, Textiles, Apparel & Luxury Goods) | 1.3 |

| HDFC Bank Ltd. (India, Banks) | 1.2 |

| | 17.2 |

Top Market Sectors as of October 31, 2019

| | % of fund's net assets |

| Financials | 19.1 |

| Information Technology | 16.0 |

| Industrials | 15.9 |

| Health Care | 14.2 |

| Consumer Discretionary | 8.7 |

| Consumer Staples | 8.7 |

| Materials | 5.7 |

| Communication Services | 3.9 |

| Energy | 2.9 |

| Utilities | 2.0 |

Fidelity® Diversified International Fund

Schedule of Investments October 31, 2019

Showing Percentage of Net Assets

| Common Stocks - 97.9% | | | |

| | | Shares | Value |

| Australia - 1.1% | | | |

| CSL Ltd. | | 520,302 | $91,758,543 |

| Magellan Financial Group Ltd. | | 1,615,631 | 53,587,161 |

|

| TOTAL AUSTRALIA | | | 145,345,704 |

|

| Bailiwick of Jersey - 0.8% | | | |

| Experian PLC | | 2,280,900 | 71,736,809 |

| Ferguson PLC | | 425,195 | 36,308,819 |

|

| TOTAL BAILIWICK OF JERSEY | | | 108,045,628 |

|

| Belgium - 0.9% | | | |

| KBC Groep NV | | 1,712,828 | 120,120,738 |

| Bermuda - 1.8% | | | |

| China Gas Holdings Ltd. | | 4,719,000 | 20,102,658 |

| Credicorp Ltd. (United States) | | 240,700 | 51,519,428 |

| Hiscox Ltd. | | 2,460,300 | 47,453,679 |

| IHS Markit Ltd. (a) | | 957,800 | 67,065,156 |

| Marvell Technology Group Ltd. | | 1,909,900 | 46,582,461 |

|

| TOTAL BERMUDA | | | 232,723,382 |

|

| Brazil - 0.8% | | | |

| BM&F BOVESPA SA | | 3,061,000 | 36,925,865 |

| Notre Dame Intermedica Participacoes SA | | 1,656,844 | 24,787,593 |

| Rumo SA (a) | | 6,466,900 | 36,764,822 |

|

| TOTAL BRAZIL | | | 98,478,280 |

|

| Canada - 3.1% | | | |

| Alimentation Couche-Tard, Inc. Class B (sub. vtg.) | | 4,806,762 | 144,155,416 |

| Cenovus Energy, Inc. (Canada) | | 3,954,884 | 33,690,531 |

| Constellation Software, Inc. | | 59,822 | 59,083,025 |

| Fairfax India Holdings Corp. (a)(b) | | 2,487,700 | 28,111,010 |

| Franco-Nevada Corp. | | 389,900 | 37,832,526 |

| Kirkland Lake Gold Ltd. | | 776,800 | 36,477,929 |

| Waste Connection, Inc. (Canada) | | 280,800 | 25,937,384 |

| Wheaton Precious Metals Corp. | | 1,284,700 | 36,011,787 |

|

| TOTAL CANADA | | | 401,299,608 |

|

| Cayman Islands - 1.9% | | | |

| Alibaba Group Holding Ltd. sponsored ADR (a) | | 591,500 | 104,500,305 |

| Anta Sports Products Ltd. | | 5,332,000 | 52,158,271 |

| Tencent Holdings Ltd. | | 1,732,700 | 70,283,367 |

| Zai Lab Ltd. ADR (a) | | 477,727 | 16,142,395 |

|

| TOTAL CAYMAN ISLANDS | | | 243,084,338 |

|

| China - 1.0% | | | |

| Kweichow Moutai Co. Ltd. (A Shares) | | 371,060 | 62,104,165 |

| Ping An Insurance Group Co. of China Ltd. (H Shares) | | 4,772,500 | 55,083,197 |

| Yantai Jereh Oilfield Services (A Shares) | | 1,675,100 | 7,285,593 |

|

| TOTAL CHINA | | | 124,472,955 |

|

| Denmark - 1.5% | | | |

| DSV A/S | | 947,500 | 91,938,108 |

| Netcompany Group A/S (a)(b) | | 498,865 | 21,239,072 |

| ORSTED A/S (b) | | 927,800 | 81,384,021 |

|

| TOTAL DENMARK | | | 194,561,201 |

|

| France - 7.8% | | | |

| Amundi SA (b) | | 938,813 | 67,011,721 |

| Capgemini SA | | 886,200 | 99,776,846 |

| Danone SA | | 1,032,100 | 85,500,509 |

| Dassault Systemes SA | | 205,600 | 31,197,038 |

| Edenred SA | | 415,345 | 21,864,658 |

| Essilor International SA | | 146,100 | 22,290,921 |

| Kering SA | | 73,964 | 42,087,444 |

| Legrand SA | | 670,000 | 52,292,625 |

| LVMH Moet Hennessy Louis Vuitton SE | | 401,538 | 171,479,224 |

| Pernod Ricard SA | | 218,300 | 40,294,284 |

| Sanofi SA | | 1,391,532 | 128,281,377 |

| SR Teleperformance SA | | 520,400 | 117,937,711 |

| VINCI SA | | 1,145,000 | 128,468,062 |

|

| TOTAL FRANCE | | | 1,008,482,420 |

|

| Germany - 11.2% | | | |

| adidas AG | | 451,102 | 139,287,128 |

| Allianz SE | | 550,200 | 134,371,335 |

| Bayer AG | | 1,138,976 | 88,357,427 |

| Deutsche Borse AG | | 730,400 | 113,109,523 |

| Deutsche Post AG | | 2,252,819 | 79,774,067 |

| Hannover Reuck SE | | 479,700 | 84,959,495 |

| Linde PLC | | 758,934 | 150,031,329 |

| Morphosys AG (a) | | 110,100 | 11,990,886 |

| Morphosys AG sponsored ADR (a) | | 706,473 | 19,230,195 |

| MTU Aero Engines Holdings AG | | 73,500 | 19,624,707 |

| RWE AG | | 3,404,000 | 103,757,832 |

| SAP SE | | 2,358,489 | 312,503,292 |

| Scout24 AG (b) | | 853,700 | 52,795,698 |

| Symrise AG | | 758,900 | 73,027,493 |

| Vonovia SE | | 1,443,600 | 76,815,346 |

|

| TOTAL GERMANY | | | 1,459,635,753 |

|

| Hong Kong - 2.0% | | | |

| AIA Group Ltd. | | 22,693,400 | 225,985,979 |

| Techtronic Industries Co. Ltd. | | 3,732,000 | 29,165,635 |

|

| TOTAL HONG KONG | | | 255,151,614 |

|

| India - 4.2% | | | |

| Axis Bank Ltd. | | 5,610,005 | 58,084,159 |

| HDFC Bank Ltd. | | 9,011,094 | 156,016,120 |

| Housing Development Finance Corp. Ltd. | | 4,267,447 | 127,982,441 |

| Kotak Mahindra Bank Ltd. | | 2,399,205 | 53,175,208 |

| Reliance Industries Ltd. | | 6,755,912 | 139,147,622 |

| Tech Mahindra Ltd. | | 1,291,800 | 13,441,411 |

|

| TOTAL INDIA | | | 547,846,961 |

|

| Indonesia - 1.1% | | | |

| PT Bank Central Asia Tbk | | 32,234,100 | 72,150,478 |

| PT Bank Rakyat Indonesia Tbk | | 231,774,100 | 69,447,695 |

|

| TOTAL INDONESIA | | | 141,598,173 |

|

| Ireland - 2.7% | | | |

| CRH PLC | | 2,053,100 | 74,842,192 |

| DCC PLC (United Kingdom) | | 213,589 | 20,020,023 |

| Kerry Group PLC Class A | | 739,600 | 89,416,546 |

| Kingspan Group PLC (Ireland) | | 1,565,800 | 81,134,805 |

| Ryanair Holdings PLC sponsored ADR (a) | | 1,065,199 | 79,506,453 |

|

| TOTAL IRELAND | | | 344,920,019 |

|

| Italy - 1.4% | | | |

| Enel SpA | | 8,674,900 | 67,233,635 |

| FinecoBank SpA | | 3,025,500 | 34,080,836 |

| Moncler SpA | | 652,500 | 25,135,907 |

| Recordati SpA | | 1,214,800 | 51,037,819 |

|

| TOTAL ITALY | | | 177,488,197 |

|

| Japan - 17.2% | | | |

| Astellas Pharma, Inc. | | 816,200 | 14,008,191 |

| Bandai Namco Holdings, Inc. | | 598,200 | 36,782,831 |

| Daikin Industries Ltd. | | 655,000 | 91,673,563 |

| Hoya Corp. | | 2,472,800 | 218,539,214 |

| Iriso Electronics Co. Ltd. | | 201,800 | 9,977,482 |

| Itochu Corp. | | 3,412,900 | 71,356,514 |

| Kao Corp. | | 1,278,000 | 102,749,522 |

| Keyence Corp. | | 299,920 | 189,638,341 |

| KH Neochem Co. Ltd. | | 666,700 | 16,235,445 |

| Minebea Mitsumi, Inc. | | 7,492,700 | 142,297,986 |

| Misumi Group, Inc. | | 1,584,600 | 39,834,883 |

| Nabtesco Corp. | | 583,100 | 18,562,873 |

| Nidec Corp. | | 190,700 | 28,075,957 |

| Nitori Holdings Co. Ltd. | | 632,200 | 96,227,877 |

| Oracle Corp. Japan | | 208,500 | 18,326,353 |

| ORIX Corp. | | 6,775,900 | 106,482,553 |

| PALTAC Corp. | | 380,300 | 18,340,160 |

| Persol Holdings Co., Ltd. | | 2,504,500 | 48,106,489 |

| Recruit Holdings Co. Ltd. | | 3,838,300 | 127,562,230 |

| Renesas Electronics Corp. (a) | | 8,738,603 | 59,157,524 |

| ROHM Co. Ltd. | | 167,500 | 13,270,828 |

| Shin-Etsu Chemical Co. Ltd. | | 1,033,800 | 115,269,974 |

| Shiseido Co. Ltd. | | 1,096,700 | 90,420,667 |

| SMC Corp. | | 257,700 | 111,337,019 |

| SoftBank Corp. | | 934,900 | 35,962,252 |

| Sony Corp. | | 1,428,000 | 86,921,145 |

| Suzuki Motor Corp. | | 1,114,600 | 52,624,853 |

| Tokyo Electron Ltd. | | 373,600 | 75,690,830 |

| Tsuruha Holdings, Inc. | | 907,914 | 102,129,938 |

| Welcia Holdings Co. Ltd. | | 1,025,700 | 58,937,015 |

| Yahoo! Japan Corp. | | 12,903,900 | 39,727,472 |

|

| TOTAL JAPAN | | | 2,236,227,981 |

|

| Korea (South) - 0.7% | | | |

| LG Chemical Ltd. | | 92,218 | 24,230,776 |

| SK Hynix, Inc. | | 925,080 | 64,818,601 |

|

| TOTAL KOREA (SOUTH) | | | 89,049,377 |

|

| Luxembourg - 0.7% | | | |

| B&M European Value Retail SA | | 15,530,263 | 74,493,718 |

| Globant SA (a) | | 135,900 | 12,674,034 |

|

| TOTAL LUXEMBOURG | | | 87,167,752 |

|

| Mexico - 0.1% | | | |

| Grupo Financiero Banorte S.A.B. de CV Series O | | 2,270,200 | 12,391,599 |

| Netherlands - 7.0% | | | |

| Adyen BV (a)(b) | | 16,499 | 11,581,800 |

| ASML Holding NV | | 957,800 | 250,914,866 |

| Ferrari NV | | 167,500 | 26,798,289 |

| Heineken NV (Bearer) | | 617,000 | 62,937,294 |

| InterXion Holding NV (a) | | 438,200 | 38,658,004 |

| Koninklijke Philips Electronics NV | | 2,333,700 | 102,389,030 |

| NXP Semiconductors NV | | 946,500 | 107,598,120 |

| Unilever NV | | 3,316,957 | 195,883,344 |

| Wolters Kluwer NV | | 1,571,400 | 115,705,492 |

|

| TOTAL NETHERLANDS | | | 912,466,239 |

|

| New Zealand - 0.3% | | | |

| Ryman Healthcare Group Ltd. | | 5,313,328 | 43,914,398 |

| Norway - 1.4% | | | |

| Adevinta ASA: | | | |

| rights 11/12/19 (a) | | 2,876,500 | 439,788 |

| Class B | | 4,309,600 | 49,206,244 |

| Equinor ASA | | 3,449,500 | 63,804,956 |

| Schibsted ASA (A Shares) | | 2,331,100 | 68,441,359 |

|

| TOTAL NORWAY | | | 181,892,347 |

|

| South Africa - 0.1% | | | |

| Capitec Bank Holdings Ltd. | | 212,000 | 19,262,881 |

| Spain - 0.7% | | | |

| Amadeus IT Holding SA Class A | | 230,600 | 17,061,864 |

| Cellnex Telecom SA (a) | | 366,210 | 15,790,059 |

| Cellnex Telecom SA (b) | | 1,208,300 | 52,098,873 |

| Masmovil Ibercom SA (a) | | 183,865 | 4,248,939 |

|

| TOTAL SPAIN | | | 89,199,735 |

|

| Sweden - 2.3% | | | |

| ASSA ABLOY AB (B Shares) | | 3,991,700 | 94,796,406 |

| Coor Service Management Holding AB (b) | | 937,622 | 8,011,207 |

| EQT AB (a) | | 821,500 | 7,881,744 |

| Ericsson (B Shares) | | 7,659,000 | 66,930,398 |

| Hexagon AB (B Shares) | | 1,024,200 | 52,282,919 |

| Indutrade AB | | 1,152,300 | 35,467,502 |

| Svenska Handelsbanken AB (A Shares) | | 2,986,900 | 29,975,967 |

|

| TOTAL SWEDEN | | | 295,346,143 |

|

| Switzerland - 6.3% | | | |

| Alcon, Inc. (Switzerland) (a) | | 1,627,120 | 96,093,270 |

| Julius Baer Group Ltd. | | 1,209,040 | 53,540,682 |

| Lonza Group AG | | 201,877 | 72,647,070 |

| Medacta Group SA (b) | | 166,000 | 13,562,696 |

| Roche Holding AG (participation certificate) | | 946,724 | 284,922,251 |

| Sika AG | | 879,231 | 151,069,087 |

| Sonova Holding AG Class B | | 204,990 | 46,961,723 |

| Swiss Re Ltd. | | 752,840 | 78,832,612 |

| Temenos Group AG | | 178,190 | 25,423,459 |

|

| TOTAL SWITZERLAND | | | 823,052,850 |

|

| Taiwan - 0.9% | | | |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | | 2,349,300 | 121,294,359 |

| United Kingdom - 10.9% | | | |

| Aon PLC | | 326,400 | 63,047,424 |

| Ascential PLC (b) | | 4,875,073 | 22,051,721 |

| AstraZeneca PLC (United Kingdom) | | 2,306,139 | 224,888,376 |

| Beazley PLC | | 4,587,800 | 34,854,561 |

| Big Yellow Group PLC | | 1,397,400 | 20,671,594 |

| BP PLC sponsored ADR | | 2,983,400 | 113,100,694 |

| Coca-Cola European Partners PLC | | 958,200 | 51,273,282 |

| Compass Group PLC | | 3,766,288 | 100,273,988 |

| InterContinental Hotel Group PLC | | 687,440 | 41,600,255 |

| Lloyds Banking Group PLC | | 88,374,500 | 65,008,967 |

| London Stock Exchange Group PLC | | 1,569,100 | 141,405,459 |

| M&G PLC (a) | | 8,198,881 | 22,706,459 |

| Network International Holdings PLC (b) | | 4,564,382 | 31,986,475 |

| Ocado Group PLC (a) | | 977,112 | 16,821,180 |

| Prudential PLC | | 8,198,881 | 143,208,521 |

| RELX PLC (Euronext N.V.) | | 5,017,099 | 120,640,501 |

| Rentokil Initial PLC | | 11,212,300 | 66,010,911 |

| Smith & Nephew PLC | | 3,816,100 | 81,917,976 |

| Standard Chartered PLC (United Kingdom) | | 6,388,957 | 58,014,307 |

|

| TOTAL UNITED KINGDOM | | | 1,419,482,651 |

|

| United States of America - 6.0% | | | |

| 10X Genomics, Inc. (a) | | 21,000 | 1,218,000 |

| Alphabet, Inc. Class C (a) | | 56,803 | 71,578,028 |

| Amgen, Inc. | | 215,900 | 46,040,675 |

| Becton, Dickinson & Co. | | 222,100 | 56,857,600 |

| Boston Scientific Corp. (a) | | 1,563,328 | 65,190,778 |

| Coty, Inc. Class A | | 3,260,260 | 38,112,439 |

| IQVIA Holdings, Inc. (a) | | 443,400 | 64,035,828 |

| Marsh & McLennan Companies, Inc. | | 626,900 | 64,959,378 |

| MasterCard, Inc. Class A | | 468,100 | 129,574,761 |

| Microsoft Corp. | | 561,100 | 80,444,907 |

| The Booking Holdings, Inc. (a) | | 12,600 | 25,814,502 |

| Visa, Inc. Class A | | 721,600 | 129,065,376 |

|

| TOTAL UNITED STATES OF AMERICA | | | 772,892,272 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $9,003,168,742) | | | 12,706,895,555 |

|

| Money Market Funds - 1.9% | | | |

| Fidelity Cash Central Fund 1.83% (c) | | | |

| (Cost $252,253,559) | | 252,230,144 | 252,280,590 |

| TOTAL INVESTMENT IN SECURITIES - 99.8% | | | |

| (Cost $9,255,422,301) | | | 12,959,176,145 |

| NET OTHER ASSETS (LIABILITIES) - 0.2% | | | 22,156,348 |

| NET ASSETS - 100% | | | $12,981,332,493 |

| Forward Foreign Currency Contracts | | | | | | |

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation/(Depreciation) |

| JPY | 1,000,000 | USD | 9,182 | State Street Bank And Trust Co. | 11/13/19 | $83 |

| TOTAL FORWARD FOREIGN CURRENCY CONTRACTS | | | | | | $83 |

| | | | | | Unrealized Appreciation | 83 |

Currency Abbreviations

JPY – Japanese yen

USD – U.S. dollar

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Legend

(a) Non-income producing

(b) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $389,834,294 or 3.0% of net assets.

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $11,088,430 |

| Fidelity Securities Lending Cash Central Fund | 1,826,007 |

| Total | $12,914,437 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2019, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $482,623,800 | $336,650,709 | $145,973,091 | $-- |

| Consumer Discretionary | 1,133,637,998 | 477,229,394 | 656,408,604 | -- |

| Consumer Staples | 1,123,914,421 | 622,072,605 | 501,841,816 | -- |

| Energy | 357,029,396 | 210,596,181 | 146,433,215 | -- |

| Financials | 2,490,749,182 | 832,133,737 | 1,658,615,445 | -- |

| Health Care | 1,864,773,311 | 585,796,528 | 1,278,976,783 | -- |

| Industrials | 2,078,979,377 | 1,239,901,003 | 839,078,374 | -- |

| Information Technology | 2,090,194,446 | 1,331,257,987 | 758,936,459 | -- |

| Materials | 715,028,538 | 508,680,927 | 206,347,611 | -- |

| Real Estate | 97,486,940 | 97,486,940 | -- | -- |

| Utilities | 272,478,146 | 185,141,853 | 87,336,293 | -- |

| Money Market Funds | 252,280,590 | 252,280,590 | -- | -- |

| Total Investments in Securities: | $12,959,176,145 | $6,679,228,454 | $6,279,947,691 | $-- |

| Derivative Instruments: | | | | |

| Assets | | | | |

| Forward Foreign Currency Contracts | $83 | $-- | $83 | $-- |

| Total Assets | $83 | $-- | $83 | $-- |

| Total Derivative Instruments: | $83 | $-- | $83 | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of October 31, 2019. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value |

| | Asset | Liability |

| Foreign Exchange Risk | | |

| Forward Foreign Currency Contracts(a) | $83 | $0 |

| Total Foreign Exchange Risk | 83 | 0 |

| Total Value of Derivatives | $83 | $0 |

(a) Gross value is presented in the Statement of Assets and Liabilities in the unrealized appreciation/depreciation on forward foreign currency contracts line-items.

See accompanying notes which are an integral part of the financial statements.

Fidelity® Diversified International Fund

Financial Statements

Statement of Assets and Liabilities

| | | October 31, 2019 |

| Assets | | |

Investment in securities, at value — See accompanying schedule:

Unaffiliated issuers (cost $9,003,168,742) | $12,706,895,555 | |

| Fidelity Central Funds (cost $252,253,559) | 252,280,590 | |

| Total Investment in Securities (cost $9,255,422,301) | | $12,959,176,145 |

| Foreign currency held at value (cost $455,427) | | 462,145 |

| Receivable for investments sold | | 27,083,926 |

| Unrealized appreciation on forward foreign currency contracts | | 83 |

| Receivable for fund shares sold | | 5,845,645 |

| Dividends receivable | | 41,897,171 |

| Distributions receivable from Fidelity Central Funds | | 435,264 |

| Prepaid expenses | | 24,184 |

| Other receivables | | 2,035,753 |

| Total assets | | 13,036,960,316 |

| Liabilities | | |

| Payable for investments purchased | $19,681,046 | |

| Payable for fund shares redeemed | 15,278,295 | |

| Accrued management fee | 7,475,178 | |

| Other affiliated payables | 1,540,477 | |

| Other payables and accrued expenses | 11,652,827 | |

| Total liabilities | | 55,627,823 |

| Net Assets | | $12,981,332,493 |

| Net Assets consist of: | | |

| Paid in capital | | $9,360,098,688 |

| Total accumulated earnings (loss) | | 3,621,233,805 |

| Net Assets | | $12,981,332,493 |

| Net Asset Value and Maximum Offering Price | | |

| Diversified International: | | |

| Net Asset Value, offering price and redemption price per share ($8,734,681,557 ÷ 225,905,199 shares) | | $38.67 |

| Class K: | | |

| Net Asset Value, offering price and redemption price per share ($4,246,650,936 ÷ 109,986,134 shares) | | $38.61 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Year ended October 31, 2019 |

| Investment Income | | |

| Dividends | | $276,108,487 |

| Non-Cash dividends | | 22,537,974 |

| Income from Fidelity Central Funds (including $1,826,007 from security lending) | | 12,914,437 |

| Income before foreign taxes withheld | | 311,560,898 |

| Less foreign taxes withheld | | (22,397,356) |

| Total income | | 289,163,542 |

| Expenses | | |

| Management fee | | |

| Basic fee | $88,360,511 | |

| Performance adjustment | (13,546,450) | |

| Transfer agent fees | 16,875,129 | |

| Accounting and security lending fees | 1,912,998 | |

| Custodian fees and expenses | 1,283,942 | |

| Independent trustees' fees and expenses | 76,645 | |

| Registration fees | 99,082 | |

| Audit | 150,440 | |

| Legal | 60,570 | |

| Miscellaneous | 99,082 | |

| Total expenses before reductions | 95,371,949 | |

| Expense reductions | (805,899) | |

| Total expenses after reductions | | 94,566,050 |

| Net investment income (loss) | | 194,597,492 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 78,486,525 | |

| Redemptions in-kind with affiliated entities | 187,169,018 | |

| Fidelity Central Funds | 13,696 | |

| Foreign currency transactions | (1,541,981) | |

| Total net realized gain (loss) | | 264,127,258 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers (net of increase in deferred foreign taxes of $9,352,890) | 1,507,851,516 | |

| Fidelity Central Funds | 111,993 | |

| Forward foreign currency contracts | 83 | |

| Assets and liabilities in foreign currencies | 691,162 | |

| Total change in net unrealized appreciation (depreciation) | | 1,508,654,754 |

| Net gain (loss) | | 1,772,782,012 |

| Net increase (decrease) in net assets resulting from operations | | $1,967,379,504 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Year ended October 31, 2019 | Year ended October 31, 2018 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $194,597,492 | $228,505,229 |

| Net realized gain (loss) | 264,127,258 | 1,827,251,570 |

| Change in net unrealized appreciation (depreciation) | 1,508,654,754 | (3,417,451,891) |

| Net increase (decrease) in net assets resulting from operations | 1,967,379,504 | (1,361,695,092) |

| Distributions to shareholders | (905,624,719) | (992,277,149) |

| Share transactions - net increase (decrease) | (2,354,610,292) | (3,220,213,051) |

| Total increase (decrease) in net assets | (1,292,855,507) | (5,574,185,292) |

| Net Assets | | |

| Beginning of period | 14,274,188,000 | 19,848,373,292 |

| End of period | $12,981,332,493 | $14,274,188,000 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Diversified International Fund

| Years ended October 31, | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $35.72 | $41.39 | $34.28 | $36.07 | $36.22 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .50 | .50 | .41 | .39 | .36 |

| Net realized and unrealized gain (loss) | 4.77 | (4.05) | 7.15 | (1.71) | .80 |

| Total from investment operations | 5.27 | (3.55) | 7.56 | (1.32) | 1.16 |

| Distributions from net investment income | (.43) | (.43) | (.38) | (.33)B | (.40) |

| Distributions from net realized gain | (1.89) | (1.69) | (.07) | (.14)B | (.92) |

| Total distributions | (2.32) | (2.12) | (.45) | (.47) | (1.31)C |

| Redemption fees added to paid in capitalA | – | – | –D | –D | –D |

| Net asset value, end of period | $38.67 | $35.72 | $41.39 | $34.28 | $36.07 |

| Total ReturnE | 16.02% | (9.05)% | 22.38% | (3.70)% | 3.29% |

| Ratios to Average Net AssetsF,G | | | | | |

| Expenses before reductions | .75% | .81% | .94% | 1.05% | 1.00% |

| Expenses net of fee waivers, if any | .75% | .80% | .94% | 1.05% | .99% |

| Expenses net of all reductions | .75% | .79% | .93% | 1.05% | .99% |

| Net investment income (loss) | 1.42% | 1.27% | 1.10% | 1.15% | .98% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $8,734,682 | $9,275,299 | $11,349,633 | $10,990,703 | $13,059,983 |

| Portfolio turnover rateH,I | 37% | 30% | 37% | 24% | 31% |

A Calculated based on average shares outstanding during the period.

B The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

C Total distributions of $1.31 per share is comprised of distributions from net investment income of $.397 and distributions from net realized gain of $.917 per share.

D Amount represents less than $.005 per share.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

I Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Fidelity Diversified International Fund Class K

| Years ended October 31, | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $35.68 | $41.35 | $34.25 | $36.04 | $36.20 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .55 | .55 | .45 | .44 | .40 |

| Net realized and unrealized gain (loss) | 4.74 | (4.05) | 7.15 | (1.71) | .80 |

| Total from investment operations | 5.29 | (3.50) | 7.60 | (1.27) | 1.20 |

| Distributions from net investment income | (.47) | (.48) | (.43) | (.38)B | (.45) |

| Distributions from net realized gain | (1.89) | (1.69) | (.07) | (.14)B | (.92) |

| Total distributions | (2.36) | (2.17) | (.50) | (.52) | (1.36)C |

| Redemption fees added to paid in capitalA | – | –D | –D | –D | –D |

| Net asset value, end of period | $38.61 | $35.68 | $41.35 | $34.25 | $36.04 |

| Total ReturnE | 16.14% | (8.95)% | 22.55% | (3.57)% | 3.40% |

| Ratios to Average Net AssetsF,G | | | | | |

| Expenses before reductions | .63% | .69% | .82% | .92% | .87% |

| Expenses net of fee waivers, if any | .63% | .69% | .81% | .92% | .87% |

| Expenses net of all reductions | .63% | .67% | .81% | .92% | .86% |

| Net investment income (loss) | 1.54% | 1.39% | 1.22% | 1.28% | 1.10% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $4,246,651 | $4,998,889 | $8,498,740 | $8,608,956 | $10,143,540 |

| Portfolio turnover rateH,I | 37% | 30% | 37% | 24% | 31% |

A Calculated based on average shares outstanding during the period.

B The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

C Total distributions of $1.36 per share is comprised of distributions from net investment income of $.446 and distributions from net realized gain of $.917 per share.

D Amount represents less than $.005 per share.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

I Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended October 31, 2019

1. Organization.

Fidelity Diversified International Fund (the Fund) is a fund of Fidelity Investment Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Diversified International and Class K shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. The Fund's investments in emerging markets can be subject to social, economic, regulatory, and political uncertainties and can be extremely volatile.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date ranged from less than .005% to .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

The U.S. dollar value of foreign currency contracts is determined using currency exchange rates supplied by a pricing service and are categorized as Level 2 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of October 31, 2019 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan) for the Fund, certain independent Trustees have elected to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees of $1,596,468 are included in the accompanying Statement of Assets and Liabilities in other receivables and other payables and accrued expenses, respectively.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of October 31, 2019, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, capital loss carryforwards, passive foreign investment companies (PFIC), certain deemed distributions, redemptions in kind, deferred trustees compensation and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $3,827,477,149 |

| Gross unrealized depreciation | (195,302,835) |

| Net unrealized appreciation (depreciation) | $3,632,174,314 |

| Tax Cost | $9,327,001,831 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $182,010,129 |

| Capital loss carryforward | $(181,640,726) |

| Net unrealized appreciation (depreciation) on securities and other investments | $3,631,813,762 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. Under the Regulated Investment Company Modernization Act of 2010 (the Act), the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and such capital losses are required to be used prior to any losses that expire. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of fiscal period end and is subject to adjustment.

| No expiration | |

| Short-term | $(181,640,726) |

The tax character of distributions paid was as follows:

| | October 31, 2019 | October 31, 2018 |

| Ordinary Income | $172,128,327 | $ 221,765,143 |

| Long-term Capital Gains | 733,496,392 | 770,512,006 |

| Total | $905,624,719 | $ 992,277,149 |

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including foreign currency contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

The Fund used derivatives to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risk:

| Foreign Exchange Risk | Foreign exchange rate risk relates to fluctuations in the value of an asset or liability due to changes in currency exchange rates.

|

The Fund is also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that the Fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to the Fund.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Forward Foreign Currency Contracts. Forward foreign currency contracts represent obligations to purchase or sell foreign currency on a specified future date at a price fixed at the time the contracts are entered into. The Fund used forward foreign currency contracts to facilitate transactions in foreign-denominated securities and to manage exposure to certain foreign currencies.

Forward foreign currency contracts are valued daily and fluctuations in exchange rates on open contracts are recorded as unrealized appreciation or (depreciation) and reflected in the Statement of Assets and Liabilities. When the contract is closed, the Fund realizes a gain or loss equal to the difference between the closing value and the value at the time it was opened. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on forward foreign currency contracts during the period is presented in the Statement of Operations.

Any open forward foreign currency contracts at period end are presented in the Schedule of Investments under the caption "Forward Foreign Currency Contracts." The contract amount and unrealized appreciation (depreciation) reflects each contract's exposure to the underlying currency at period end and is representative of volume of activity during the period.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and in-kind transactions, aggregated $4,711,798,222 and $5,958,145,237, respectively.

Unaffiliated Redemptions In-Kind. During the period, 18,179,740 shares of the Fund were redeemed in-kind for investments and cash with a value of $627,237,242. The net realized gain of $175,534,803 on investments delivered through in-kind redemptions is included in the accompanying Statement of Operations. The amount of the in-kind redemptions is included in share transactions in the accompanying Statement of Changes in Net Assets as well as the Notes to Financial Statements. The Fund recognized no gain or loss for federal income tax purposes.

Prior Fiscal Year Unaffiliated Redemptions In-Kind. During the prior period, 64,249,823 shares of the Fund were redeemed in-kind for investments and cash with a value of $2,569,847,364. The Fund had a net realized gain of $907,269,340 on investments delivered through in-kind redemptions. The amount of the in-kind redemptions is included in share transactions in the accompanying Statement of Changes in Net Assets as well as the Notes to Financial Statements. The Fund recognized no gain or loss for federal income tax purposes.

6. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .424% of the Fund's average net assets and an annualized group fee rate that averaged .24% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of +/- .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of Diversified International as compared to its benchmark index, the MSCI EAFE Index, over the same 36 month performance period. For the reporting period, the total annual management fee rate, including the performance adjustment, was .56% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of Diversified International. FIIOC receives an asset-based fee of Class K's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| | Amount | % of Class-Level Average Net Assets |

| Diversified International | $14,858,934 | .17 |

| Class K | 2,016,195 | .05 |

| | $16,875,129 | |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Prior to April 1, 2019, FSC had a separate agreement with the Fund for administration of the security lending program, based on the number and duration of lending transactions. For the period, the total fees paid for accounting and administration of securities lending were equivalent to an annual rate of .01%.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $17,559 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

Affiliated Redemptions In-Kind. During the period, 14,735,066 shares of the Fund were redeemed in-kind for investments and cash with a value of $563,382,003. The net realized gain of $187,169,018 on investments delivered through in-kind redemptions is included in the accompanying Statement of Operations. The amount of the in-kind redemptions is included in share transactions in the accompanying Statement of Changes in Net Assets as well as the Notes to Financial Statements. The Fund recognized no gain or loss for federal income tax purposes.

7. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $35,835 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

8. Security Lending.

The Fund lends portfolio securities from time to time in order to earn additional income. For equity securities, lending agents are used, including National Financial Services (NFS), an affiliate of the Fund. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of daily lending revenue, for its services as lending agent. The Fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. At period end, there were no security loans outstanding. Total fees paid by the Fund to NFS, as lending agent, amounted to $389. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. During the period, there were no securities loaned to NFS.

9. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $687,327 for the period. In addition, through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, custodian credits reduced the Fund's expenses by $13,329.

In addition, during the period the investment adviser reimbursed and/or waived a portion of fund-level operating expenses in the amount of $105,243.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Year ended

October 31, 2019 | Year ended

October 31, 2018 |

| Distributions to shareholders | | |

| Diversified International | $589,277,164 | $578,499,998 |

| Class K | 316,347,555 | 413,777,151 |

| Total | $905,624,719 | $992,277,149 |

11. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Year ended October 31, 2019 | Year ended October 31, 2018 | Year ended October 31, 2019 | Year ended October 31, 2018 |

| Diversified International | | | | |

| Shares sold | 27,702,187 | 29,835,455 | $976,921,173 | $1,174,373,008 |

| Reinvestment of distributions | 16,919,211 | 13,661,964 | 546,998,101 | 537,871,482 |

| Shares redeemed | (78,402,082)(a),(b) | (57,997,016)(c) | (2,804,225,170)(a),(b) | (2,309,553,360)(c) |

| Net increase (decrease) | (33,780,684) | (14,499,597) | $(1,280,305,896) | $(597,308,870) |

| Class K | | | | |

| Shares sold | 17,427,136 | 29,277,888 | $617,045,574 | $1,163,459,637 |

| Reinvestment of distributions | 9,807,521 | 10,532,806 | 316,292,568 | 413,728,634 |

| Shares redeemed | (57,363,841)(a) | (105,246,564)(c) | (2,007,642,538)(a) | (4,200,092,452)(c) |

| Net increase (decrease) | (30,129,184) | (65,435,870) | $(1,074,304,396) | $(2,622,904,181) |

(a) Amount includes in-kind redemptions (see the Unaffiliated Redemptions In-Kind note for additional details).

(b) Amount includes in-kind redemptions (see the Affiliated Redemptions In-Kind note for additional details).

(c) Amount includes in-kind redemptions (see the Prior Fiscal Year Redemptions In-Kind note for additional details).

12. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Fidelity® International Capital Appreciation Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended October 31, 2019 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® International Capital Appreciation Fund | 22.45% | 8.34% | 9.77% |

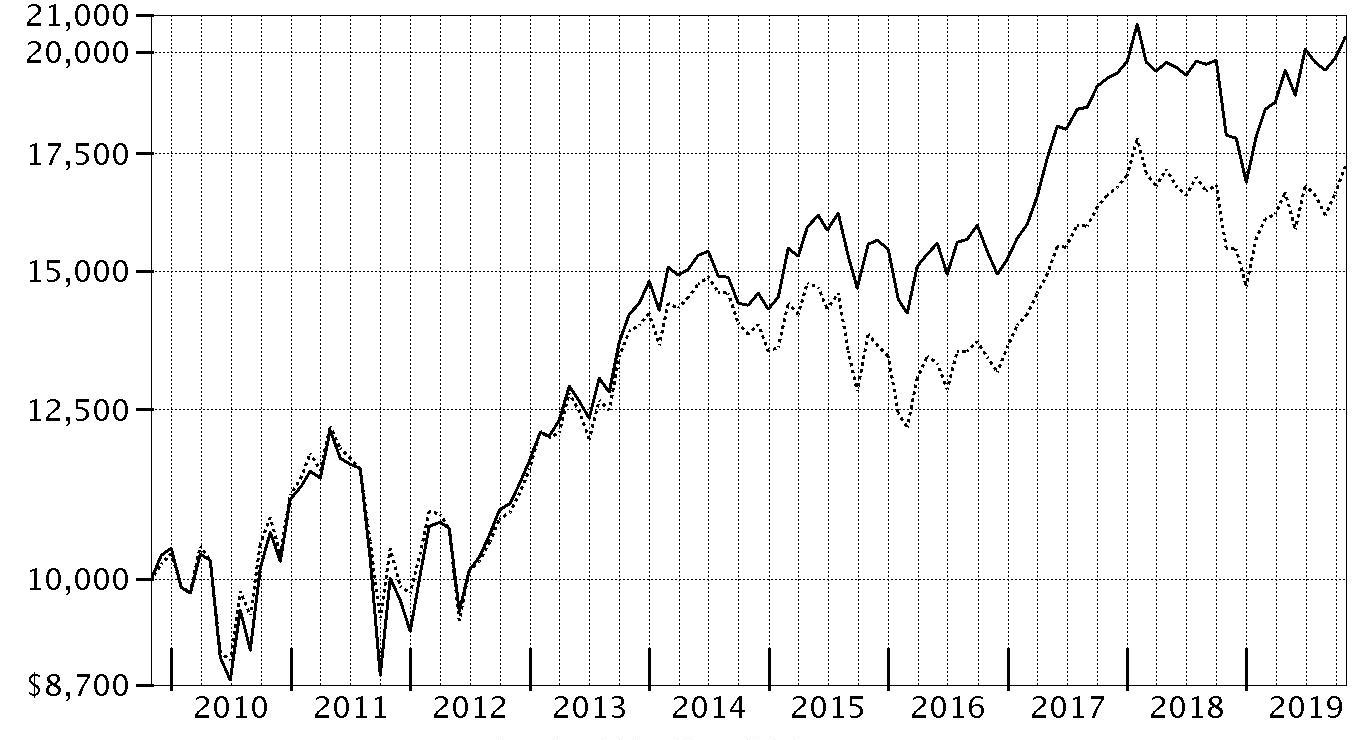

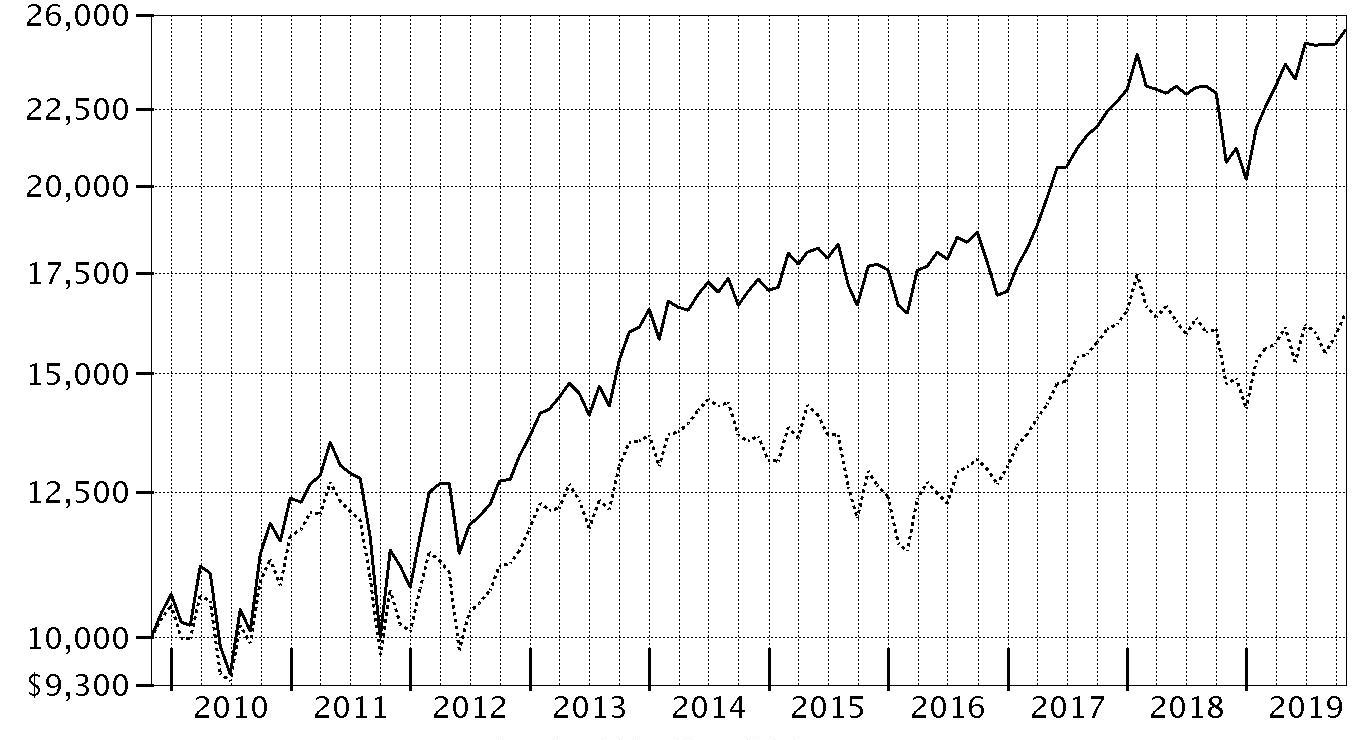

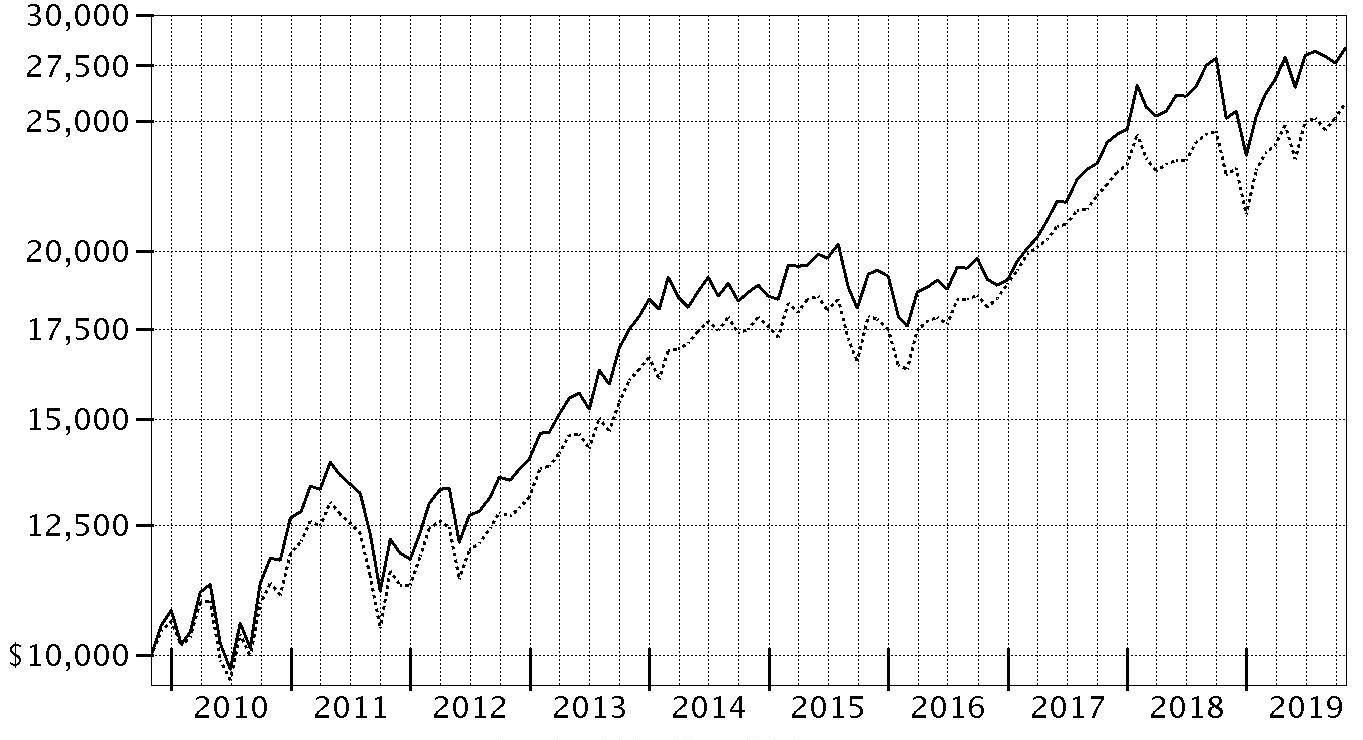

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® International Capital Appreciation Fund on October 31, 2009.

The chart shows how the value of your investment would have changed, and also shows how the MSCI ACWI (All Country World Index) ex USA Index performed over the same period.

| Period Ending Values |

| $25,409 | Fidelity® International Capital Appreciation Fund |

| $16,440 | MSCI ACWI (All Country World Index) ex USA Index |

Fidelity® International Capital Appreciation Fund

Management's Discussion of Fund Performance

Market Recap: The MSCI ACWI (All Country World Index) ex USA Index gained 11.47% for the 12 months ending October 31, 2019, as international stocks reflected a confluence of factors, including escalating trade tension, and moderating but still positive global economic growth. Currency fluctuations were largely modest and varied by region, muting the overall impact on international equity returns. In late December, the U.S. Federal Reserve shifted from raising interest rates to a more dovish policy in 2019, joining many foreign central banks. In June, international stocks rose 6.03%, as policy stimulus in China stabilized that country’s economic growth. The Fed cut its policy rate in July for the first time since 2008. However, the index returned -1.21% for the month, followed by -3.08% in August. In September, the Fed cut its policy rate another quarter point, citing concerns about slowing economic growth and muted inflation, and did the same in October, leading to monthly gains of 2.59% and 3.49%, respectively. For the full 12 months, the growth-oriented information technology sector (+22%) led the way, followed by utilities (+20%) and real estate (+18%), two high-dividend-yielding categories. Conversely, energy was roughly flat, while materials (+6%) and communication services (7%) also lagged. By region, Asia Pacific ex Japan (+16%), Europe ex U.K (+13%), Canada (+12%) and emerging markets (+12%) fared best. Meanwhile, the U.K. (+7%) and Japan (+10%) trailed the broader market.

Comments from Portfolio Manager Sammy Simnegar: For the year, the fund gained 22.45%, well ahead of the 11.47%advance of the benchmark MSCI ACWI (All Country World Index) ex USA Index. Stock selection in financials, industrials and consumer-oriented sectors all contributed meaningfully to performance versus the benchmark the past 12 months, as did a sizable overweighting in information technology. Geographically, positioning in Continental Europe proved rewarding, particularly in France, Germany and the Netherlands. In emerging markets, exposure to China and India stood out. The fund’s top relative contributor was B3 (Brasil Bolsa Balcao), Brazil’s stock exchange. The fund also benefited from overweighted exposure to two China-based liquor manufacturers, Kweichow Moutai and Wuliangye Yibin – both sold by period end – as well as out-of-benchmark positions in two suppliers of commercial and military aircraft parts, TransDigm Group and Heico. Conversely, picks in the retailing segment of consumer discretionary and the fund's positioning in semiconductors & semiconductor equipment detracted modestly, as did a cash position averaging about 2%. A non-benchmark stake in MercadoLibre, a Latin American operator of e-commerce marketplaces, was the portfolio's largest relative detractor. Overweighting Taiwan Semiconductor Manufacturing and Belgium-based Umicore – a producer of electric-vehicle battery cathodes that I sold from the fund – also hurt.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® International Capital Appreciation Fund

Investment Summary (Unaudited)

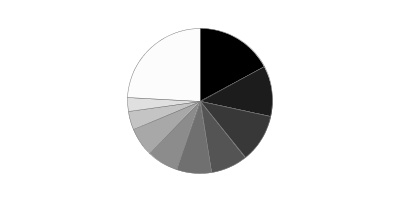

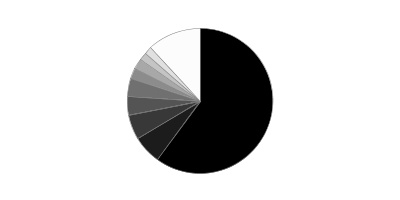

Geographic Diversification (% of fund's net assets)

| As of October 31, 2019 |

| | France | 13.0% |

| | United Kingdom | 9.1% |

| | Canada | 8.7% |

| | Germany | 6.4% |

| | Switzerland | 6.4% |

| | Japan | 6.2% |

| | Cayman Islands | 5.9% |

| | Netherlands | 5.7% |

| | United States of America* | 5.3% |

| | Other | 33.3% |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

Asset Allocation as of October 31, 2019

| | % of fund's net assets |

| Stocks | 97.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.8 |

Top Ten Stocks as of October 31, 2019

| | % of fund's net assets |

| Nestle SA (Reg. S) (Switzerland, Food Products) | 2.5 |

| Alibaba Group Holding Ltd. sponsored ADR (Cayman Islands, Internet & Direct Marketing Retail) | 2.1 |

| Tencent Holdings Ltd. (Cayman Islands, Interactive Media & Services) | 1.9 |

| Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan, Semiconductors & Semiconductor Equipment) | 1.9 |

| Unilever NV (Netherlands, Personal Products) | 1.5 |

| SAP SE (Germany, Software) | 1.5 |

| LVMH Moet Hennessy Louis Vuitton SE (France, Textiles, Apparel & Luxury Goods) | 1.5 |

| AIA Group Ltd. (Hong Kong, Insurance) | 1.4 |

| ASML Holding NV (Netherlands) (Netherlands, Semiconductors & Semiconductor Equipment) | 1.4 |

| Diageo PLC (United Kingdom, Beverages) | 1.3 |

| | 17.0 |

Top Market Sectors as of October 31, 2019

| | % of fund's net assets |

| Industrials | 22.9 |

| Information Technology | 18.9 |

| Consumer Discretionary | 14.3 |

| Consumer Staples | 13.3 |

| Financials | 13.0 |

| Materials | 4.9 |

| Communication Services | 3.0 |

| Health Care | 2.8 |

| Utilities | 2.2 |

| Real Estate | 1.9 |

Fidelity® International Capital Appreciation Fund

Schedule of Investments October 31, 2019

Showing Percentage of Net Assets

| Common Stocks - 97.2% | | | |