UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FormN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number:811-04015

Eaton Vance Mutual Funds Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617)482-8260

(Registrant’s Telephone Number)

January 31

Date of Fiscal Year End

January 31, 2020

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Emerging Markets Debt Fund

Annual Report

January 31, 2020

Important Note. Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (eatonvance.com/funddocuments), and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you are a direct investor, you may elect to receive shareholder reports and other communications from the Fund electronically by signing up for e-Delivery at eatonvance.com/edelivery. If you own your shares through a financial intermediary (such as a broker-dealer or bank), you must contact your financial intermediary to sign up.

You may elect to receive all future Fund shareholder reports in paper free of charge. If you are a direct investor, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-262-1122. If you own these shares through a financial intermediary, you must contact your financial intermediary or follow instructions included with this disclosure, if applicable, to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Eaton Vance funds held directly or to all funds held through your financial intermediary, as applicable.

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund is considered to be a commodity pool operator under CFTC regulations. The Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor. The CFTC has neither reviewed nor approved the Fund’s investment strategies.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial intermediary. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Annual ReportJanuary 31, 2020

Eaton Vance

Emerging Markets Debt Fund

Table of Contents

| | | | |

Management’s Discussion of Fund Performance | | | 2 | |

| |

Performance | | | 3 | |

| |

Fund Profile | | | 3 | |

| |

Endnotes and Additional Disclosures | | | 4 | |

| |

Fund Expenses | | | 5 | |

| |

Financial Statements | | | 6 | |

| |

Report of Independent Registered Public Accounting Firm | | | 23 | |

| |

Federal Tax Information | | | 24 | |

| |

Management and Organization | | | 25 | |

| |

Important Notices | | | 28 | |

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Management’s Discussion of Fund Performance1

Economic and Market Conditions

U.S. dollar-denominated emerging market (EM) debt delivered strong performance for the 12-month period ended January 31, 2020. Bond prices trended upward for the majority of the period, with the J.P. Morgan Emerging Market Bond Index (EMBI) Global Diversified (the Index),2 a broad measure of the asset class, returning 11.85%.

Several factors drove the performance of EM debt, with the largest contributor being actions taken by multiple central banks of developed economies. Dovish remarks about interest rates by the U.S. Federal Reserve (the Fed) early in the period were followed by the Fed’s first federal funds rate reduction in over a decade on July 31, 2019, and two additional rate cuts in September and October. By end of the third quarter, 60 central banks around the world had lowered interest rates. Falling rates on developed-market sovereign debt made dollar-denominated, higher interest EM debt look more attractive by comparison, and the EM debt asset class saw strong inflows that put upward pressure on prices during the period.

Aided by improvement in economic fundamentals in a number of EM countries, spreads — the difference in yields between U.S. Treasurys and EM bonds — tightened during the period, providing an additional boost in value for existing EM bonds. The Fed and European Central Bank also restarted their bond-buying programs during the period, injecting money into global markets. EM debt was one asset class that benefited as investors looked for places to invest those additional funds. Other factors that supported the EM-debt rally included relatively attractive valuations, a largely flat U.S. dollar, and oil prices that were volatile, but ended the period up only marginally.

Following a difficult 2018 for EM bonds, compelling valuations early in the period helped make the asset class attractive to investors. Relative to overseas currencies, the value of the U.S. dollar was generally flat during the period, making the dollar a relatively benign factor for EM debt issuers. By comparison, a rising dollar may make dollar-denominated EM debt more difficult for EM issuers to repay. Similarly, the effect of oil prices was also relatively benign during the period. The price of Brent Crude, the benchmark for non-U.S.-produced oil, rose less than 6% during the period. This was helpful for oil exporters such as Mexico and Brazil, but small enough not to be a challenge for oil importers such as India and China during the period.

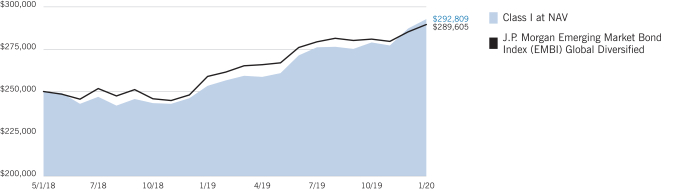

Fund Performance

For the 12-month period ended January 31, 2020, Eaton Vance Emerging Markets Debt Fund (the Fund) returned 15.57% for Class I shares at net asset value (NAV), outperforming its benchmark, the Index, which returned 11.85%.

On a regional basis, the largest contributors to Fund performance versus the Index were security selections in Eastern Europe, Africa, and the Middle East. In Eastern Europe, an overweight holding in Ukrainian sovereign debt was the Fund’s largest single-country position and the largest country contributor to

performance, relative to the Index. The April 21, 2019 landslide election of President Volodymyr Zelensky — generally viewed as a political outsider in a country known for corruption among its political class and billionaire oligarchs — was widely seen as a turning point toward fiscal responsibility, the rule of law, and a more free-market economy. Following the election, Ukrainian sovereign bonds, which had defaulted as recently as 2015, rallied strongly during the period as their yield spread to U.S. Treasurys declined by nearly two-thirds. A declining yield spread — the difference in yield between a bond and U.S. Treasurys — generally indicates increased investor confidence that a bond will be repaid.

In Africa, the Fund’s overweight position in Egyptian sovereign debt helped relative results as well during the period. Egyptian bonds rallied in response to progress on financial reforms instituted with the help of the International Monetary Fund. In the Middle East, underweighting Lebanese sovereign debt — and the sell-off of that debt during the period — also contributed to relative Fund performance, as Lebanon’s insolvent central bank proved incapable of making most loan payments.

The Fund’s use of derivatives contributed to returns versus the Index during the period. Interest rate futures and swaps, which were used to manage interest-rate exposures, positively impacted performance. Currency forwards, generally used to hedge euro exposure in the Fund’s euro-denominated holdings, contributed as well. Sovereign credit default swaps also contributed to performance versus the Index during the period.

In contrast, the Fund’s U.S. duration positioning and exposure to Latin American debt detracted from performance versus the Index during the period. The Fund’s average duration, or sensitivity to interest-rate changes, was generally less than that of the Index during the period. As a result, the Fund benefited less than the Index from falling interest rates.

In Latin America, the Fund’s overweight position in Argentinian sovereign debt negatively impacted relative results. Early in the period, it was widely expected that Argentina’s then-president, Mauricio Macri, would be competitive in the August 11 primary election and win the general election in October. Macri had instituted positive economic reforms that had helped Argentinian bond performance. But after Marci lost the primary election to populist Alberto Fernández by a large margin, bond prices plummeted in anticipation of less investor-friendly policies under a new government. By period-end, Argentinian bonds held by the Fund were sold.

On an individual country basis, the Fund’s position in Turkish sovereign debt detracted from relative performance during the period as well. Turkish bonds sold off as investors appeared to lose confidence in the ability of the country’s central bank to protect the value of its currency and positively affect the economy.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

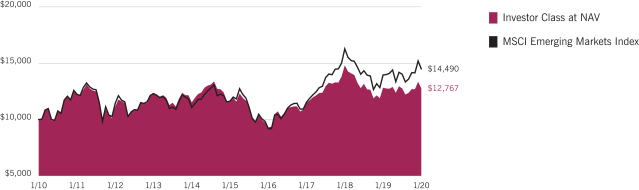

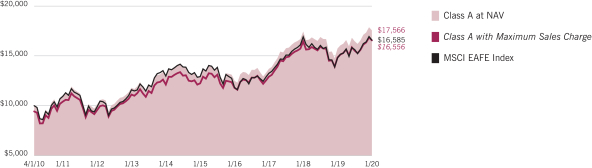

Performance2,3

Portfolio Managers John R. Baur, Michael A. Cirami, CFA and Eric A. Stein, CFA

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | One Year | | | Five Years | | | Since

Inception | |

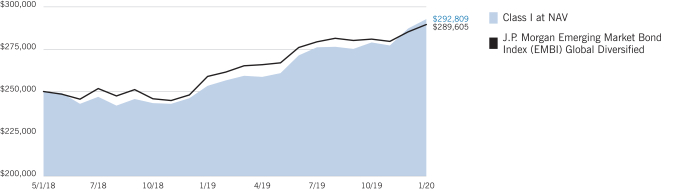

Class I at NAV | | | 05/01/2018 | | | | 05/01/2018 | | | | 15.57 | % | | | — | | | | 9.43 | % |

J.P. Morgan Emerging Market Bond Index (EMBI) Global | | | — | | | | — | | | | 11.85 | % | | | 6.36 | % | | | 8.75 | % |

Diversified | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios4 | | | | | | | | | | | | | | Class I | |

Gross | | | | | | | | | | | | | | | | | | | 3.09 | % |

Net | | | | | | | | | | | | | | | | | | | 0.85 | |

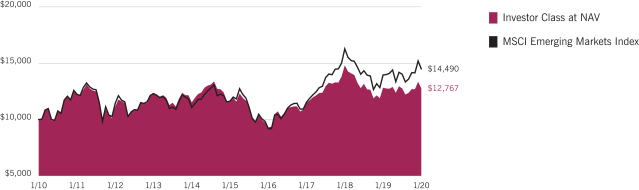

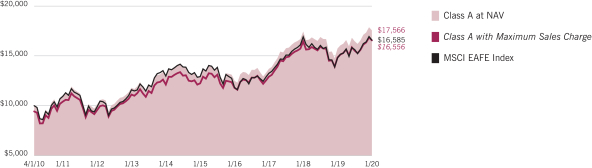

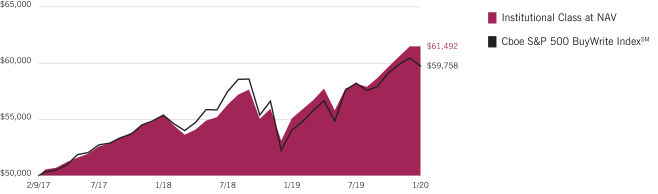

Growth of $250,000

This graph shows the change in value of a hypothetical investment of $250,000 in Class I of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

Fund Profile

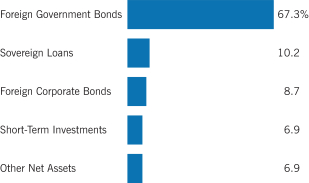

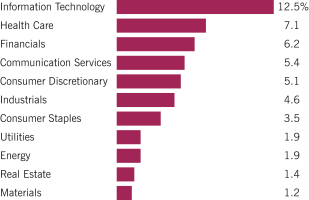

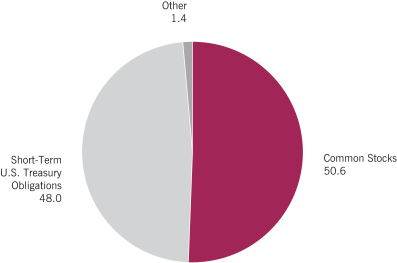

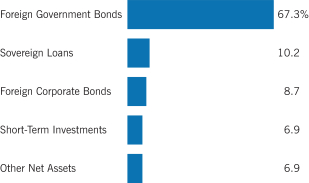

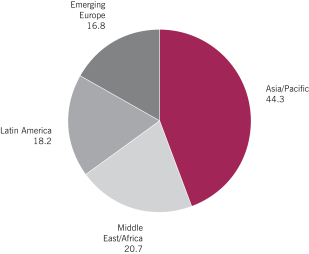

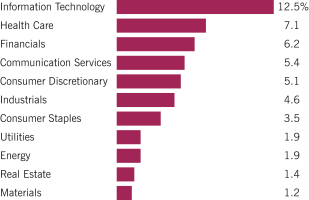

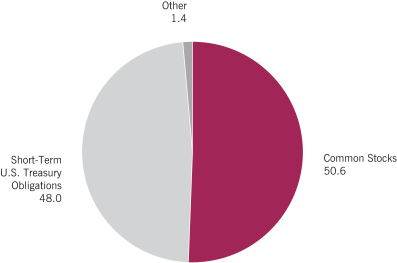

Asset Allocation (% of net assets)5

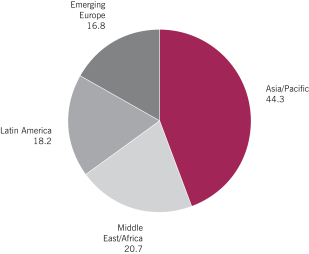

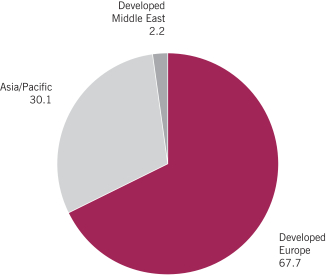

Foreign Currency Exposure (% of net assets)6

| | | | | | | | | | |

| | | |

Ukraine | | | 12.1 | % | | Bahamas | | | 2.6 | % |

| | | |

Egypt | | | 10.7 | | | Jordan | | | 2.6 | |

| | | |

Nigeria | | | 6.7 | | | Mexico | | | 2.6 | |

| | | |

Kenya | | | 6.4 | | | Angola | | | 2.5 | |

| | | |

El Salvador | | | 5.3 | | | Pakistan | | | 2.5 | |

| | | |

Tanzania | | | 4.8 | | | Fiji | | | 2.4 | |

| | | |

Indonesia | | | 4.3 | | | Ghana | | | 2.4 | |

| | | |

Costa Rica | | | 3.5 | | | Benin | | | 2.0 | |

| | | |

Barbados | | | 3.4 | | | Ecuador | | | 2.0 | |

| | | |

Colombia | | | 2.9 | | | Vietnam | | | 1.8 | |

| | | |

Bahrain | | | 2.7 | | | | | | | |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Endnotes and Additional Disclosures

| 1 | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 2 | J.P. Morgan Emerging Market Bond Index (EMBI) Global Diversified is a market-cap weighted index that measures USD-denominated Brady Bonds, Eurobonds, and traded loans issued by sovereign entities. Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2019, J.P. Morgan Chase & Co. All rights reserved. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 3 | Class I shares are offered at net asset value (NAV). Total Returns are historical and are calculated by determining the percentage change in NAV with all distributions reinvested. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. |

| 4 | Source: Fund prospectus. Net expense ratio reflects a contractual expense reimbursement that continues through 5/31/20. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| 5 | Other Net Assets represents other assets less liabilities and includes any investment type that represents less than 1% of net assets. |

| 6 | Excludes cash and cash equivalents. |

| | Fund profile subject to change due to active management. |

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Fund Expenses

Example: As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2019 – January 31, 2020).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(8/1/19) | | | Ending

Account Value

(1/31/20) | | | Expenses Paid

During Period*

(8/1/19 – 1/31/20) | | | Annualized

Expense

Ratio | |

| | | |

Actual | | | | | | | | | | | | | |

Class I | | $ | 1,000.00 | | | $ | 1,060.40 | | | $ | 4.41 | ** | | | 0.85 | % |

| | | | |

Hypothetical* | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | |

Class I | | $ | 1,000.00 | | | $ | 1,020.90 | | | $ | 4.33 | ** | | | 0.85 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on July 31, 2019. |

| ** | Absent an allocation of certain expenses to an affiliate, expenses would be higher. |

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Portfolio of Investments

| | | | | | | | | | | | |

| Foreign Government Bonds — 67.3% | |

| Security | | | | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Angola — 2.5% | |

| | | |

Republic of Angola, 8.25%, 5/9/28(1) | | | USD | | | | 200 | | | $ | 215,939 | |

| | | |

Total Angola | | | | | | | | | | $ | 215,939 | |

|

| Bahamas — 2.6% | |

| | | |

Commonwealth of Bahamas, 5.75%, 1/16/24(1) | | | USD | | | | 200 | | | $ | 217,752 | |

| | | |

Total Bahamas | | | | | | | | | | $ | 217,752 | |

|

| Bahrain — 2.7% | |

| | | |

Bahrain Government International Bond, 7.00%, 1/26/26(1) | | | USD | | | | 200 | | | $ | 234,610 | |

| | | |

Total Bahrain | | | | | | | | | | $ | 234,610 | |

|

| Barbados — 3.4% | |

| | | |

Government of Barbados, 6.50%, 2/1/21(2) | | | USD | | | | 17 | | | $ | 16,691 | |

| | | |

Government of Barbados, 6.50%, 10/1/29(2) | | | USD | | | | 271 | | | | 274,929 | |

| | | |

Total Barbados | | | | | | | | | | $ | 291,620 | |

|

| Benin — 2.0% | |

| | | |

Benin Government International Bond, 5.75%, 3/26/26(1) | | | EUR | | | | 150 | | | $ | 172,541 | |

| | | |

Total Benin | | | | | | | | | | $ | 172,541 | |

|

| Colombia — 2.9% | |

| | | |

Republic of Colombia, 5.00%, 6/15/45 | | | USD | | | | 200 | | | $ | 243,487 | |

| | | |

Total Colombia | | | | | | | | | | $ | 243,487 | |

|

| Costa Rica — 3.5% | |

| | | |

Costa Rica Government International Bond, 7.158%, 3/12/45(1) | | | USD | | | | 280 | | | $ | 300,915 | |

| | | |

Total Costa Rica | | | | | | | | | | $ | 300,915 | |

|

| Ecuador — 2.0% | |

| | | |

Republic of Ecuador, 7.875%, 3/27/25(1) | | | USD | | | | 200 | | | $ | 171,650 | |

| | | |

Total Ecuador | | | | | | | | | | $ | 171,650 | |

|

| Egypt — 10.7% | |

| | | |

Arab Republic of Egypt, 8.15%, 11/20/59(1) | | | USD | | | | 200 | | | $ | 219,444 | |

| | | |

Arab Republic of Egypt, 8.50%, 1/31/47(1) | | | USD | | | | 400 | | | | 458,693 | |

| | | |

Arab Republic of Egypt, 8.70%, 3/1/49(1) | | | USD | | | | 200 | | | | 231,053 | |

| | | |

Total Egypt | | | | | | | | | | $ | 909,190 | |

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount

(000’s omitted) | | | Value | |

|

| El Salvador — 5.3% | |

| | | |

Republic of El Salvador, 7.125%, 1/20/50(1) | | | USD | | | | 200 | | | $ | 219,587 | |

| | | |

Republic of El Salvador, 7.65%, 6/15/35(1) | | | USD | | | | 200 | | | | 233,189 | |

| | | |

Total El Salvador | | | | | | | | | | $ | 452,776 | |

|

| Fiji — 2.4% | |

| | | |

Republic of Fiji, 6.625%, 10/2/20(1) | | | USD | | | | 200 | | | $ | 201,000 | |

| | | |

Total Fiji | | | | | | | | | | $ | 201,000 | |

|

| Ghana — 2.4% | |

| | | |

Ghana Government International Bond, 8.95%, 3/26/51(1) | | | USD | | | | 200 | | | $ | 205,058 | |

| | | |

Total Ghana | | | | | | | | | | $ | 205,058 | |

|

| Jordan — 2.6% | |

| | | |

Jordan Government International Bond, 7.375%, 10/10/47(1) | | | USD | | | | 200 | | | $ | 220,377 | |

| | | |

Total Jordan | | | | | | | | | | $ | 220,377 | |

|

| Kenya — 2.5% | |

| | | |

Republic of Kenya, 7.25%, 2/28/28(1) | | | USD | | | | 200 | | | $ | 216,472 | |

| | | |

Total Kenya | | | | | | | | | | $ | 216,472 | |

|

| Nigeria — 5.2% | |

| | | |

Republic of Nigeria, 7.875%, 2/16/32(1) | | | USD | | | | 200 | | | $ | 209,675 | |

| | | |

Republic of Nigeria, 8.747%, 1/21/31(1) | | | USD | | | | 207 | | | | 231,861 | |

| | | |

Total Nigeria | | | | | | | | | | $ | 441,536 | |

|

| Pakistan — 2.5% | |

| | | |

Pakistan Government International Bond, 6.875%, 12/5/27(1) | | | USD | | | | 200 | | | $ | 211,850 | |

| | | |

Total Pakistan | | | | | | | | | | $ | 211,850 | |

|

| Ukraine — 12.1% | |

| | | |

Ukraine Government International Bond, 0.00%,GDP-Linked, 5/31/40(1)(2)(3) | | | USD | | | | 289 | | | $ | 287,194 | |

| | | |

Ukraine Government International Bond, 9.75%, 11/1/28(1) | | | USD | | | | 600 | | | | 748,535 | |

| | | |

Total Ukraine | | | | | | | | | | $ | 1,035,729 | |

| |

Total Foreign Government Bonds

(identified cost $5,263,300) | | | $ | 5,742,502 | |

| | | | |

| | 6 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Portfolio of Investments — continued

| | | | | | | | | | | | |

| Foreign Corporate Bonds — 8.7% | |

| Security | | | | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Indonesia — 4.3% | |

| | | |

Perusahaan Listrik Negara PT, 5.25%, 10/24/42(1) | | | USD | | | | 320 | | | $ | 364,299 | |

| | | |

Total Indonesia | | | | | | | | | | $ | 364,299 | |

|

| Mexico — 2.6% | |

| | | |

Petroleos Mexicanos, 6.50%, 3/13/27 | | | USD | | | | 200 | | | $ | 217,404 | |

| | | |

Total Mexico | | | | | | | | | | $ | 217,404 | |

|

| Vietnam — 1.8% | |

| | | |

Debt and Asset Trading Corp., 1.00%, 10/10/25(1) | | | USD | | | | 200 | | | $ | 156,000 | |

| | | |

Total Vietnam | | | | | | | | | | $ | 156,000 | |

| |

Total Foreign Corporate Bonds

(identified cost $657,352) | | | $ | 737,703 | |

|

| Sovereign Loans — 10.2% | |

| Borrower | | | | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Kenya — 3.9% | |

| | | |

Republic Government of Kenya, Term Loan, 8.37%, (6 mo. USD LIBOR + 6.45%), Maturing June 29, 2025(4) | | | | | | $ | 325 | | | $ | 327,757 | |

| | | |

Total Kenya | | | | | | | | | | $ | 327,757 | |

|

| Nigeria — 1.5% | |

| | | |

Bank of Industry Limited, Term Loan, 7.85%, (3 mo. USD LIBOR + 6.00%), Maturing April 11, 2021(4)(5) | | | | | | $ | 125 | | | $ | 128,379 | |

| | | |

Total Nigeria | | | | | | | | | | $ | 128,379 | |

|

| Tanzania — 4.8% | |

| | | |

Government of the United Republic of Tanzania, Term Loan, 7.09%, (6 mo. USD LIBOR + 5.20%), Maturing June 23, 2022(4) | | | | | | $ | 400 | | | $ | 412,358 | |

| | | |

Total Tanzania | | | | | | | | | | $ | 412,358 | |

| |

Total Sovereign Loans

(identified cost $846,223) | | | $ | 868,494 | |

| | | | | | | | | | |

| Short-Term Investments— 6.9% | |

| Description | | | | Units | | | Value | |

| | | |

Eaton Vance Cash Reserves Fund, LLC, 1.74%(6) | | | | | 588,958 | | | $ | 589,017 | |

| |

Total Short-Term Investments

(identified cost $588,982) | | | $ | 589,017 | |

| |

Total Investments — 93.1%

(identified cost $7,355,857) | | | $ | 7,937,716 | |

| |

Other Assets, Less Liabilities — 6.9% | | | $ | 592,271 | |

| |

Net Assets — 100.0% | | | $ | 8,529,987 | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

| (1) | Security exempt from registration under Regulation S of the Securities Act of 1933, which exempts from registration securities offered and sold outside the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933. At January 31, 2020, the aggregate value of these securities is $5,727,694 or 67.1% of the Fund’s net assets. |

| (2) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from registration (normally to qualified institutional buyers). At January 31, 2020, the aggregate value of these securities is $578,814 or 6.8% of the Fund’s net assets. |

| (3) | Amounts payable in respect of the security are contingent upon and determined by reference to Ukraine’s GDP and Real GDP Growth Rate. Principal amount represents the notional amount used to calculate payments due to the security holder and does not represent an entitlement for payment. |

| (4) | Variable rate security. The stated interest rate represents the rate in effect at January 31, 2020. |

| (5) | Loan is subject to scheduled mandatory prepayments. Maturity date shown reflects the final maturity date. |

| (6) | Affiliated investment company, available to Eaton Vance portfolios and funds, which invests in high quality, U.S. dollar denominated money market instruments. The rate shown is the annualizedseven-day yield as of January 31, 2020. |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Portfolio of Investments — continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Centrally Cleared Forward Foreign Currency Exchange Contracts | |

| | | | | |

| Currency Purchased | | | | Currency Sold | | Settlement

Date | | | | | | Value/Unrealized

Appreciation

(Depreciation) | |

| | | | | | | | |

| USD | | 155,475 | | | | EUR | | | 139,188 | | | | | | 4/9/20 | | | | | | | $ | 492 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | $ | 492 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Forward Foreign Currency Exchange Contracts | |

| | | | | |

| Currency Purchased | | | Currency Sold | | | Counterparty | | Settlement

Date | | | Unrealized Appreciation | | | Unrealized (Depreciation) | |

| | | | | | | |

| EUR | | | 102,821 | | | USD | | | 114,742 | | | Goldman Sachs International | | | 2/24/20 | | | $ | — | | | $ | (570 | ) |

| | | | | | | |

| USD | | | 114,580 | | | EUR | | | 102,821 | | | Goldman Sachs International | | | 2/24/20 | | | | 407 | | | | — | |

| | |

| | | | $ | 407 | | | $ | (570 | ) |

| | | | | | | | | | | | | | | | | | | | |

| Futures Contracts | | | | | | | | | | | | | | | |

| | | | | |

| Description | | Number of

Contracts | | | Position | | | Expiration

Date | | | Notional

Amount | | | Value/Unrealized

Appreciation

(Depreciation) | |

| | | | | |

Interest Rate Futures | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Euro-Bobl | | | 1 | | | | Short | | | | 3/6/20 | | | $ | (149,677 | ) | | $ | (932 | ) |

| | | | | |

| U.S.5-Year Treasury Note | | | 20 | | | | Long | | | | 3/31/20 | | | | 2,406,406 | | | | 23,436 | |

| | | | | |

| U.S.10-Year Treasury Note | | | 18 | | | | Long | | | | 3/20/20 | | | | 2,369,812 | | | | 33,709 | |

| | | | | |

| U.S. Long Treasury Bond | | | 3 | | | | Long | | | | 3/20/20 | | | | 490,594 | | | | 11,152 | |

| | | | | |

| U.S. Ultra-Long Treasury Bond | | | 5 | | | | Long | | | | 3/20/20 | | | | 968,438 | | | | 24,837 | |

| | | | | |

| | | | | | | | | | | | | | | | | | | $ | 92,202 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Centrally Cleared Interest Rate Swaps | |

| | | | | | | |

Notional

Amount

(000’s omitted) | | | Fund

Pays/Receives

Floating Rate | | Floating Rate | | Annual

Fixed Rate | | Termination

Date | | | Value | | | Unamortized

Upfront

Receipts

(Payments) | | | Unrealized

Appreciation

(Depreciation) | |

| | | | | | | | |

| EUR | | | 50 | | | Receives | | 6-month EURIBOR (pays semi-annually) | | (0.53)%

(pays annually) | | | 8/22/24 | | | $ | 564 | | | $ | — | | | $ | 564 | |

| | | | | | | | |

| USD | | | 200 | | | Receives | | 3-month USD-LIBOR

(pays quarterly) | | 3.06%

(pays semi-annually) | | | 10/2/23 | | | | (14,100 | ) | | | (18 | ) | | | (14,118 | ) |

| | | | | | | | |

| USD | | | 19 | | | Pays | | 3-month USD-LIBOR

(pays quarterly) | | 2.36%

(pays semi-annually) | | | 4/29/24 | | | | 927 | | | | — | | | | 927 | |

| | | | | | | | |

| USD | | | 35 | | | Pays | | 3-monthUSD-LIBOR

(pays quarterly) | | 2.33%

(pays semi-annually) | | | 4/30/24 | | | | 1,661 | | | | — | | | | 1,661 | |

| | | | | | | | |

| USD | | | 203 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.44%

(pays semi-annually) | | | 9/26/24 | | | | (1,649 | ) | | | — | | | | (1,649 | ) |

| | | | | | | | |

| USD | | | 197 | | | Receives | | 3-monthUSD-LIBOR (pays quarterly) | | 1.74%

(pays semi-annually) | | | 12/16/26 | | | | (4,798 | ) | | | — | | | | (4,798 | ) |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Portfolio of Investments — continued

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Centrally Cleared Interest Rate Swaps (continued) | |

| | | | | | | |

Notional

Amount

(000’s omitted) | | | Fund

Pays/Receives

Floating Rate | | Floating Rate | | Annual

Fixed Rate | | Termination

Date | | | Value | | | Unamortized

Upfront

Receipts

(Payments) | | | Unrealized

Appreciation

(Depreciation) | |

| | | | | | | | |

| USD | | | 145 | | | Receives | | 3-month USD-LIBOR (pays quarterly) | | 2.63%

(pays semi-annually) | | | 3/25/29 | | | $ | (15,959 | ) | | $ | 1,259 | | | $ | (14,700 | ) |

| | | | | | | | |

| USD | | | 300 | | | Pays | | 3-monthUSD-LIBOR (pays quarterly) | | 2.34%

(pays semi-annually) | | | 5/17/29 | | | | 23,893 | | | | — | | | | 23,893 | |

| | | | | | | | |

| USD | | | 438 | | | Receives | | 3-monthUSD-LIBOR (pays quarterly) | | 2.09%

(pays semi-annually) | | | 7/15/29 | | | | (25,109 | ) | | | 141 | | | | (24,968 | ) |

| | | | | | | | |

| USD | | | 190 | | | Receives | | 3-monthUSD-LIBOR (pays quarterly) | | 1.35%

(pays semi-annually) | | | 9/6/29 | | | | 1,129 | | | | — | | | | 1,129 | |

| | | | | | | | |

| USD | | | 194 | | | Receives | | 3-monthUSD-LIBOR (pays quarterly) | | 1.66% (pays semi-annually) | | | 9/16/29 | | | | (4,441 | ) | | | — | | | | (4,441 | ) |

| | | | | | | | |

| USD | | | 150 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.69%

(pays semi-annually) | | | 10/22/29 | | | | (4,014 | ) | | | — | | | | (4,014 | ) |

| | | | | | | | |

| USD | | | 185 | | | Pays | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.70%

(pays semi-annually) | | | 10/24/29 | | | | 5,104 | | | | — | | | | 5,104 | |

| | | | | | | | |

| USD | | | 220 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.74%

(pays semi-annually) | | | 12/12/29 | | | | (5,735 | ) | | | — | | | | (5,735 | ) |

| | | | | | | | |

| USD | | | 150 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.74%

(pays semi-annually) | | | 12/12/29 | | | | (4,011 | ) | | | — | | | | (4,011 | ) |

| | | | | | | | |

| USD | | | 42 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.78%

(pays semi-annually) | | | 1/28/40 | | | | (1,068 | ) | | | — | | | | (1,068 | ) |

| | | | | | | | |

| USD | | | 170 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.71%

(pays semi-annually) | | | 2/3/40 | | | | (2,219 | ) | | | — | | | | (2,219 | ) |

| | | | | | | | |

| USD | | | 95 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 2.88%

(pays semi-annually) | | | 1/31/49 | | | | (26,587 | ) | | | (48 | ) | | | (26,635 | ) |

| | | | | | | | |

| USD | | | 125 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 2.54%

(pays semi-annually) | | | 5/17/49 | | | | (25,636 | ) | | | — | | | | (25,636 | ) |

| | | | | | | | |

| USD | | | 116 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 2.21%

(pays semi-annually) | | | 8/1/49 | | | | (15,352 | ) | | | — | | | | (15,352 | ) |

| | | | | | | | |

| USD | | | 90 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.57%

(pays semi-annually) | | | 8/29/49 | | | | 1,789 | | | | — | | | | 1,789 | |

| | | | | | | | |

| USD | | | 99 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.65%

(pays semi-annually) | | | 9/9/49 | | | | 45 | | | | — | | | | 45 | |

| | | | | | | | |

| USD | | | 7 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.70%

(pays semi-annually) | | | 9/12/49 | | | | (77 | ) | | | — | | | | (77 | ) |

| | | | | | | | |

| USD | | | 72 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.89%

(pays semi-annually) | | | 10/24/49 | | | | (4,143 | ) | | | — | | | | (4,143 | ) |

| | | | | | | | |

| USD | | | 110 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.87%

(pays semi-annually) | | | 10/25/49 | | | | (5,810 | ) | | | — | | | | (5,810 | ) |

| | | | | | | | |

| USD | | | 98 | | | Receives | | 3-monthUSD-LIBOR

(pays quarterly) | | 1.97%

(pays semi-annually) | | | 11/15/49 | | | | (6,970 | ) | | | — | | | | (6,970 | ) |

| | | | | | | | |

| USD | | | 25 | | | Receives | | 3-monthUSD-LIBOR (pays quarterly) | | 2.05%

(pays semi-annually) | | | 12/30/49 | | | | (2,286 | ) | | | — | | | | (2,286 | ) |

| | | | | | | | |

| USD | | | 50 | | | Receives | | 3-monthUSD-LIBOR (pays quarterly) | | 1.90%

(pays semi-annually) | | | 1/8/50 | | | | (2,763 | ) | | | — | | | | (2,763 | ) |

| | | | | | | | |

Total | | | | | | | | | | | | | | | | $ | (137,615 | ) | | $ | 1,334 | | | $ | (136,281 | ) |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Portfolio of Investments — continued

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Centrally Cleared Credit Default Swaps — Sell Protection | |

| | | | | | | |

| Reference Entity | | Notional Amount*

(000’s omitted) | | | Contract

Annual

Fixed Rate** | | Termination

Date | | | Current

Market

Annual

Fixed Rate*** | | | Value | | | Unamortized Upfront Receipts (Payments) | | | Unrealized Appreciation (Depreciation) | |

| | | | | | | |

| Brazil | | $ | 250 | | | 1.00%

(pays quarterly)(1) | | | 12/20/24 | | | | 1.04 | % | | $ | (209 | ) | | $ | (289 | ) | | $ | (498 | ) |

| | | | | | | |

| Mexico | | | 200 | | | 1.00%

(pays quarterly)(1) | | | 12/20/24 | | | | 0.84 | | | | 1,755 | | | | 914 | | | | 2,669 | |

| | | | | | | |

| Russia | | | 200 | | | 1.00%

(pays quarterly)(1) | | | 12/20/24 | | | | 0.64 | | | | 3,597 | | | | (1,756 | ) | | | 1,841 | |

| | | | | | | |

| Turkey | | | 85 | | | 1.00%

(pays quarterly)(1) | | | 6/20/20 | | | | 0.37 | | | | 310 | | | | 1,082 | | | | 1,392 | |

| | | | | | | |

| Turkey | | | 190 | | | 1.00%

(pays quarterly)(1) | | | 12/20/24 | | | | 2.39 | | | | (11,714 | ) | | | 22,411 | | | | 10,697 | |

| | | | | | | |

Total | | $ | 925 | | | | | | | | | | | | | $ | (6,261 | ) | | $ | 22,362 | | | $ | 16,101 | |

| * | If the Fund is the seller of credit protection, the notional amount is the maximum potential amount of future payments the Fund could be required to make if a credit event, as defined in the credit default swap agreement, were to occur. At January 31, 2020, such maximum potential amount for all open credit default swaps in which the Fund is the seller was $925,000. |

| ** | The contract annual fixed rate represents the fixed rate of interest received by the Fund (as a seller of protection) on the notional amount of the credit default swap contract. |

| *** | Current market annual fixed rates, utilized in determining the net unrealized appreciation or depreciation as of period end, serve as an indicator of the market’s perception of the current status of the payment/performance risk associated with the credit derivative. The current market annual fixed rate of a particular reference entity reflects the cost, as quoted by the pricing vendor, of selling protection against default of that entity as of period end and may include upfront payments required to be made to enter into the agreement. The higher the fixed rate, the greater the market perceived risk of a credit event involving the reference entity. A rate identified as “Defaulted” indicates a credit event has occurred for the reference entity. |

| (1) | Upfront payment is exchanged with the counterparty as a result of the standardized trading coupon. |

Abbreviations:

| | | | |

| | |

| EURIBOR | | – | | Euro Interbank Offered Rate |

| | |

| GDP | | – | | Gross Domestic Product |

| | |

| LIBOR | | – | | London Interbank Offered Rate |

Currency Abbreviations:

| | | | |

| | |

| EUR | | – | | Euro |

| | |

| USD | | – | | United States Dollar |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Statement of Assets and Liabilities

| | | | |

| Assets | | January 31, 2020 | |

| |

Unaffiliated investments, at value (identified cost, $6,766,875) | | $ | 7,348,699 | |

| |

Affiliated investment, at value (identified cost, $588,982) | | | 589,017 | |

| |

Cash | | | 479 | |

| |

Deposits for derivatives collateral — | | | | |

| |

Financial futures contracts | | | 75,465 | |

| |

Centrally cleared derivatives | | | 410,112 | |

| |

Foreign currency, at value (identified cost, $47,049) | | | 47,441 | |

| |

Interest receivable | | | 120,758 | |

| |

Dividends receivable from affiliated investment | | | 1,258 | |

| |

Receivable for investments sold | | | 512,429 | |

| |

Receivable for variation margin on open financial futures contracts | | | 16,517 | |

| |

Receivable for open forward foreign currency exchange contracts | | | 407 | |

| |

Receivable for closed swap contracts | | | 461 | |

| |

Receivable from affiliate | | | 23,970 | |

| |

Total assets | | $ | 9,147,013 | |

| |

| Liabilities | | | | |

| |

Payable for investments purchased | | $ | 509,895 | |

| |

Payable for variation margin on open centrally cleared derivatives | | | 8,775 | |

| |

Payable for open forward foreign currency exchange contracts | | | 570 | |

| |

Payable for closed swap contracts | | | 574 | |

| |

Payable to affiliate: | | | | |

| |

Investment adviser and administration fee | | | 4,687 | |

| |

Accrued expenses | | | 92,525 | |

| |

Total liabilities | | $ | 617,026 | |

| |

Net Assets | | $ | 8,529,987 | |

| |

| Sources of Net Assets | | | | |

| |

Paid-in capital | | $ | 8,028,519 | |

| |

Distributable earnings | | | 501,468 | |

| |

Total | | $ | 8,529,987 | |

| |

| Class I Shares | | | | |

| |

Net Assets | | $ | 8,529,987 | |

| |

Shares Outstanding | | | 803,087 | |

| |

Net Asset Value, Offering Price and Redemption Price Per Share | | | | |

| |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 10.62 | |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Statement of Operations

| | | | |

| Investment Income | | Year Ended

January 31, 2020 | |

| |

Interest | | $ | 481,871 | |

| |

Dividends from affiliated investment | | | 9,589 | |

| |

Total investment income | | $ | 491,460 | |

| |

| Expenses | | | | |

| |

Investment adviser and administration fee | | $ | 53,436 | |

| |

Trustees’ fees and expenses | | | 910 | |

| |

Custodian fee | | | 42,348 | |

| |

Transfer and dividend disbursing agent fees | | | 285 | |

| |

Legal and accounting services | | | 89,869 | |

| |

Printing and postage | | | 7,613 | |

| |

Registration fees | | | 27,175 | |

| |

Miscellaneous | | | 3,319 | |

| |

Total expenses | | $ | 224,955 | |

| |

Deduct — | | | | |

| |

Allocation of expenses to affiliate | | $ | 154,660 | |

| |

Total expense reductions | | $ | 154,660 | |

| |

Net expenses | | $ | 70,295 | |

| |

Net investment income | | $ | 421,165 | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

| |

Net realized gain (loss) — | | | | |

| |

Investment transactions | | $ | (193,712 | ) |

| |

Investment transactions — affiliated investment | | | (3 | ) |

| |

Financial futures contracts | | | 386,618 | |

| |

Swap contracts | | | (208,389 | ) |

| |

Foreign currency transactions | | | (1,029 | ) |

| |

Forward foreign currency exchange contracts | | | 56,839 | |

| |

Net realized gain | | $ | 40,324 | |

| |

Change in unrealized appreciation (depreciation) — | | | | |

| |

Investments | | $ | 757,921 | |

| |

Investments — affiliated investment | | | 35 | |

| |

Financial futures contracts | | | 21,889 | |

| |

Swap contracts | | | (55,450 | ) |

| |

Foreign currency | | | 874 | |

| |

Forward foreign currency exchange contracts | | | 2,934 | |

| |

Net change in unrealized appreciation (depreciation) | | $ | 728,203 | |

| |

Net realized and unrealized gain | | $ | 768,527 | |

| |

Net increase in net assets from operations | | $ | 1,189,692 | |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Statements of Changes in Net Assets

| | | | | | | | |

| Increase (Decrease) in Net Assets | | Year Ended

January 31, 2020 | | | Period Ended January 31, 2019(1) | |

| | |

From operations — | | | | | | | | |

| | |

Net investment income | | $ | 421,165 | | | $ | 229,194 | |

| | |

Net realized gain | | | 40,324 | | | | 51,145 | |

| | |

Net change in unrealized appreciation (depreciation) | | | 728,203 | | | | (173,687 | ) |

| | |

Net increase in net assets from operations | | $ | 1,189,692 | | | $ | 106,652 | |

| | |

Distributions to shareholders | | $ | (562,574 | ) | | $ | (235,680 | ) |

| | |

Total distributions to shareholders | | $ | (562,574 | ) | | $ | (235,680 | ) |

| | |

Transactions in shares of beneficial interest — | | | | | | | | |

| | |

Proceeds from sale of shares | | $ | 23,743 | | | $ | 8,007,500 | |

| | |

Net asset value of shares issued to shareholders in payment of distributions declared | | | 654 | | | | — | |

| | |

Net increase in net assets from Fund share transactions | | $ | 24,397 | | | $ | 8,007,500 | |

| | |

Net increase in net assets | | $ | 651,515 | | | $ | 7,878,472 | |

| | |

| Net Assets | | | | | | | | |

| | |

At beginning of period | | $ | 7,878,472 | | | $ | — | |

| | |

At end of period | | $ | 8,529,987 | | | $ | 7,878,472 | |

| (1) | For the period from the start of business, May 1, 2018, to January 31, 2019. |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Financial Highlights

| | | | | | | | |

| | | Class I | |

| | | Year Ended January 31, 2020 | | | Period Ended

January 31, 2019(1) | |

| | |

Net asset value — Beginning of period | | $ | 9.840 | | | $ | 10.000 | |

|

| Income (Loss) From Operations | |

| | |

Net investment income(2) | | $ | 0.526 | | | $ | 0.286 | |

| | |

Net realized and unrealized gain (loss) | | | 0.956 | | | | (0.151 | ) |

| | |

Total income from operations | | $ | 1.482 | | | $ | 0.135 | |

|

| Less Distributions | |

| | |

From net investment income | | $ | (0.577 | ) | | $ | (0.219 | ) |

| | |

From net realized gain | | | (0.125 | ) | | | (0.076 | ) |

| | |

Total distributions | | $ | (0.702 | ) | | $ | (0.295 | ) |

| | |

Net asset value — End of period | | $ | 10.620 | | | $ | 9.840 | |

| | |

Total Return(3)(4) | | | 15.57 | % | | | 1.34 | %(5) |

|

| Ratios/Supplemental Data | |

| | |

Net assets, end of period (000’s omitted) | | $ | 8,530 | | | $ | 7,878 | |

| | |

Ratios (as a percentage of average daily net assets): | | | | | | | | |

| | |

Expenses(4) | | | 0.85 | % | | | 0.85 | %(6) |

| | |

Net investment income | | | 5.12 | % | | | 3.92 | %(6) |

| | |

Portfolio Turnover | | | 187 | % | | | 82 | %(5) |

| (1) | For the period from the start of business, May 1, 2018, to January 31, 2019. |

| (2) | Computed using average shares outstanding. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (4) | The investment adviser and administrator reimbursed certain operating expenses (equal to 1.88% and 2.24% of average daily net assets for the year ended January 31, 2020 and the period ended January 31, 2019, respectively). Absent this reimbursement, total return would be lower. |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Notes to Financial Statements

1 Significant Accounting Policies

Eaton Vance Emerging Markets Debt Fund (the Fund) is anon-diversified series of Eaton Vance Mutual Funds Trust (the Trust). The Trust is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as anopen-end management investment company. The Fund commenced operations on May 1, 2018. The Fund’s investment objective is total return. The Fund offers Class I shares, which are sold at net asset value and are not subject to a sales charge.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946.

A Investment Valuation — The following methodologies are used to determine the market value or fair value of investments.

Debt Obligations.Debt obligations are generally valued on the basis of valuations provided by third party pricing services, as derived from such services’ pricing models. Inputs to the models may include, but are not limited to, reported trades, executable bid and ask prices, broker/dealer quotations, prices or yields of securities with similar characteristics, interest rates, anticipated prepayments, benchmark curves or information pertaining to the issuer, as well as industry and economic events. The pricing services may use a matrix approach, which considers information regarding securities with similar characteristics to determine the valuation for a security.Short-term debt obligations purchased with a remaining maturity of sixty days or less for which a valuation from a third party pricing service is not readily available may be valued at amortized cost, which approximates fair value.

Derivatives. Financial futures contracts are valued at the closing settlement price established by the board of trade or exchange on which they are traded. Forward foreign currency exchange contracts are generally valued at the mean of the average bid and average ask prices that are reported by currency dealers to a third party pricing service at the valuation time. Such third party pricing service valuations are supplied for specific settlement periods and the Fund’s forward foreign currency exchange contracts are valued at an interpolated rate between the closest preceding and subsequent settlement period reported by the third party pricing service. Swaps are normally valued using valuations provided by a third party pricing service. Such pricing service valuations are based on the present value of fixed and projected floating rate cash flows over the term of the swap contract, and in the case of credit default swaps, based on credit spread quotations obtained from broker/dealers and expected default recovery rates determined by the pricing service using proprietary models. Future cash flows on swaps are discounted to their present value using swap rates provided by electronic data services or by broker/dealers.

Foreign Securities and Currencies.Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rate quotations supplied by a third party pricing service. The pricing service uses a proprietary model to determine the exchange rate. Inputs to the model include reported trades and implied bid/ask spreads.

Affiliated Fund.The Fund may invest in Eaton Vance Cash Reserves Fund, LLC (Cash Reserves Fund), an affiliated investment company managed by Eaton Vance Management (EVM). While Cash Reserves Fund is not a registered money market mutual fund, it conducts all of its investment activities in accordance with the requirements of Rule2a-7 under the 1940 Act. Investments in Cash Reserves Fund are valued at the closing net asset value per unit on the valuation day. Cash Reserves Fund generally values its investment securities based on available market quotations provided by a third party pricing service.

Fair Valuation.Investments for which valuations or market quotations are not readily available or are deemed unreliable are valued at fair value using methods determined in good faith by or at the direction of the Trustees of the Fund in a manner that most fairly reflects the security’s “fair value”, which is the amount that the Fund might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial statements, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

B Investment Transactions — Investment transactions for financial statement purposes are accounted for on a trade date basis. Realized gains and losses on investments sold are determined on the basis of identified cost.

C Income — Interest income is recorded on the basis of interest accrued, adjusted for amortization of premium or accretion of discount. Dividend income is recorded on theex-dividend date for dividends received in cash and/or securities.

D Federal Taxes — The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary.

As of January 31, 2020, the Fund had no uncertain tax positions that would require financial statement recognition,de-recognition, or disclosure. The Fund files a U.S. federal income tax return annually after its fiscalyear-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Notes to Financial Statements — continued

E Foreign Currency Translation — Investment valuations, other assets, and liabilities initially expressed in foreign currencies are translated each business day into U.S. dollars based upon current exchange rates. Purchases and sales of foreign investment securities and income and expenses denominated in foreign currencies are translated into U.S. dollars based upon currency exchange rates in effect on the respective dates of such transactions. Recognized gains or losses on investment transactions attributable to changes in foreign currency exchange rates are recorded for financial statement purposes as net realized gains and losses on investments. That portion of unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

F Unfunded Loan Commitments — The Fund may enter into certain loan agreements all or a portion of which may be unfunded. The Fund is obligated to fund these commitments at the borrower’s discretion. These commitments, if any, are disclosed in the accompanying Portfolio of Investments.

G Use of Estimates — The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

H Indemnifications — Under the Trust’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Under Massachusetts law, if certain conditions prevail, shareholders of a Massachusetts business trust (such as the Trust) could be deemed to have personal liability for the obligations of the Trust. However, the Trust’s Declaration of Trust contains an express disclaimer of liability on the part of Fund shareholders and theBy-laws provide that the Trust shall assume, upon request by the shareholder, the defense on behalf of any Fund shareholders. Moreover, theBy-laws also provide for indemnification out of Fund property of any shareholder held personally liable solely by reason of being or having been a shareholder for all loss or expense arising from such liability. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

I Financial Futures Contracts — Upon entering into a financial futures contract, the Fund is required to deposit with the broker, either in cash or securities, an amount equal to a certain percentage of the contract amount (initial margin). Subsequent payments, known as variation margin, are made or received by the Fund each business day, depending on the daily fluctuations in the value of the underlying security, and are recorded as unrealized gains or losses by the Fund. Gains (losses) are realized upon the expiration or closing of the financial futures contracts. Should market conditions change unexpectedly, the Fund may not achieve the anticipated benefits of the financial futures contracts and may realize a loss. Futures contracts have minimal counterparty risk as they are exchange traded and the clearinghouse for the exchange is substituted as the counterparty, guaranteeing counterparty performance.

J Forward Foreign Currency Exchange Contracts — The Fund may enter into forward foreign currency exchange contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date. The forward foreign currency exchange contracts are adjusted by the daily exchange rate of the underlying currency and any gains or losses are recorded as unrealized until such time as the contracts have been closed. While forward foreign currency exchange contracts are privately negotiated agreements between the Fund and a counterparty, certain contracts may be “centrally cleared”, whereby all payments made or received by the Fund pursuant to the contract are with a central clearing party (CCP) rather than the original counterparty. The CCP guarantees the performance of the original parties to the contract. Upon entering into centrally cleared contracts, the Fund is required to deposit with the CCP, either in cash or securities, an amount of initial margin determined by the CCP, which is subject to adjustment. For centrally cleared contracts, the daily change in valuation is recorded as a receivable or payable for variation margin and settled in cash with the CCP daily. Risks may arise upon entering these contracts from the potential inability of counterparties to meet the terms of their contracts and from movements in the value of a foreign currency relative to the U.S. dollar. In the case of centrally cleared contracts, counterparty risk is minimal due to protections provided by the CCP.

K Interest Rate Swaps —Pursuant to interest rate swap agreements, the Fund either makes floating-rate payments to the counterparty (or CCP in the case of centrally cleared swaps) based on a benchmark interest rate in exchange for fixed-rate payments or the Fund makes fixed-rate payments to the counterparty (or CCP in the case of a centrally cleared swap) in exchange for payments on a floating benchmark interest rate. Payments received or made, including amortization of upfront payments/receipts, are recorded as realized gains or losses. During the term of the outstanding swap agreement, changes in the underlying value of the swap are recorded as unrealized gains or losses. For centrally cleared swaps, the daily change in valuation is recorded as a receivable or payable for variation margin and settled in cash with the CCP daily. The value of the swap is determined by changes in the relationship between two rates of interest. The Fund is exposed to credit loss in the event ofnon-performance by the swap counterparty. In the case of centrally cleared swaps, counterparty risk is minimal due to protections provided by the CCP. Risk may also arise from movements in interest rates.

L Credit Default Swaps — When the Fund is the buyer of a credit default swap contract, the Fund is entitled to receive the par (or other agreed-upon) value of a referenced debt obligation (or basket of debt obligations) from the counterparty (or CCP in the case of a centrally cleared swap) to the contract if a credit event by a third party, such as a U.S. or foreign corporate issuer or sovereign issuer, on the debt obligation occurs. In return, the Fund pays the counterparty a periodic stream of payments over the term of the contract provided that no credit event has occurred. If no credit event occurs, the Fund would have spent the stream of payments and received no proceeds from the contract. When the Fund is the seller of a credit default swap contract, it receives the stream of payments, but is obligated to pay to the buyer of the protection an amount up to the notional amount of the swap and in certain instances take delivery of securities of the reference entity upon the occurrence of a credit event, as defined under the terms of that particular swap agreement. Credit events are contract specific but may include bankruptcy, failure to pay, restructuring, obligation acceleration and repudiation/moratorium. If the Fund is a seller of protection and a credit event occurs, the maximum potential amount of future payments that the Fund could be required to make would be an amount equal to the notional amount of the agreement. This potential amount would be partially offset by any recovery value

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Notes to Financial Statements — continued

of the respective referenced obligation, or net amount received from the settlement of a buy protection credit default swap agreement entered into by the Fund for the same referenced obligation. As the seller, the Fund may create economic leverage to its portfolio because, in addition to its total net assets, the Fund is subject to investment exposure on the notional amount of the swap. The interest fee paid or received on the swap contract, which is based on a specified interest rate on a fixed notional amount, is accrued daily as a component of unrealized appreciation (depreciation) and is recorded as realized gain upon receipt or realized loss upon payment. The Fund also records an increase or decrease to unrealized appreciation (depreciation) in an amount equal to the daily valuation. For centrally cleared swaps, the daily change in valuation is recorded as a receivable or payable for variation margin and settled in cash with the CCP daily. For financial reporting purposes, unamortized upfront payments or receipts, if any, are netted with unrealized appreciation or depreciation on swap contracts to determine the market value of swaps as presented in Notes 6 and 10. The Fund segregates assets in the form of cash or liquid securities in an amount equal to the notional amount of the credit default swaps of which it is the seller. The Fund segregates assets in the form of cash or liquid securities in an amount equal to any unrealized depreciation of the credit default swaps of which it is the buyer,marked-to-market on a daily basis. These transactions involve certain risks, including the risk that the seller may be unable to fulfill the transaction. In the case of centrally cleared swaps, counterparty risk is minimal due to protections provided by the CCP.

2 Distributions to Shareholders and Income Tax Information

It is the present policy of the Fund to make monthly distributions of all or substantially all of its net investment income and to distribute annually all or substantially all of its net realized capital gains. Distributions to shareholders are recorded on theex-dividend date. Shareholders may reinvest income and capital gain distributions in additional shares of the Fund at the net asset value as of theex-dividend date or, at the election of the shareholder, receive distributions in cash. Distributions to shareholders are determined in accordance with income tax regulations, which may differ from U.S. GAAP. As required by U.S. GAAP, only distributions in excess of tax basis earnings and profits are reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified topaid-in capital. For tax purposes, distributions from short-term capital gains are considered to be from ordinary income.

The tax character of distributions declared for the year ended January 31, 2020 and the period ended January 31, 2019 was as follows:

| | | | | | | | |

| | | Year Ended

January 31, 2020 | | | Period Ended

January 31, 2019 | |

| | |

Ordinary income | | $ | 510,625 | | | $ | 235,680 | |

| | |

Long-term capital gains | | $ | 51,949 | | | $ | — | |

As of January 31, 2020, the components of distributable earnings (accumulated loss) on a tax basis were as follows:

| | | | |

| | |

Undistributed ordinary income | | $ | 45,749 | |

| |

Net unrealized appreciation | | $ | 455,719 | |

The cost and unrealized appreciation (depreciation) of investments, including open derivative contracts, of the Fund at January 31, 2020, as determined on a federal income tax basis, were as follows:

| | | | |

| |

Aggregate cost | | $ | 7,351,543 | |

| |

Gross unrealized appreciation | | $ | 621,045 | |

| |

Gross unrealized depreciation | | | (165,633 | ) |

| |

Net unrealized appreciation | | $ | 455,412 | |

3 Investment Adviser and Administration Fee and Other Transactions with Affiliates

The investment adviser and administration fee is earned by EVM as compensation for investment advisory and administrative services rendered to the Fund. The fee is computed at an annual rate of 0.65% of the Fund’s average daily net assets up to $500 million and is payable monthly. On net assets of $500 million and over, the annual fee is reduced. For the year ended January 31, 2020, the investment adviser and administration fee amounted to $53,436 or 0.65% of the Fund’s average daily net assets. The Fund invests its cash in Cash Reserves Fund. EVM does not currently receive a fee for advisory services provided to Cash Reserves Fund.

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Notes to Financial Statements — continued

EVM has agreed to reimburse the Fund’s expenses to the extent that total annual operating expenses (relating to ordinary operating expenses only) exceed 0.85% of the Fund’s average daily net assets for Class I. This agreement may be changed or terminated after May 31, 2020. Pursuant to this agreement, EVM was allocated $154,660 of the Fund’s operating expenses for the year ended January 31, 2020.

EVM providessub-transfer agency and related services to the Fund pursuant to aSub-Transfer Agency Support Services Agreement. For the year ended January 31, 2020, EVM earned $72 from the Fund pursuant to such agreement, which is included in transfer and dividend disbursing agent fees on the Statement of Operations.

Trustees and officers of the Fund who are members of EVM’s organization receive remuneration for their services to the Fund out of the investment adviser and administration fee. Trustees of the Fund who are not affiliated with EVM may elect to defer receipt of all or a percentage of their annual fees in accordance with the terms of the Trustees Deferred Compensation Plan. For the year ended January 31, 2020, no significant amounts have been deferred. Certain officers and Trustees of the Fund are officers of EVM.

4 Purchases and Sales of Investments

Purchases and sales of investments, other than short-term obligations, aggregated $13,502,348 and $13,700,923, respectively, for the year ended January 31, 2020.

5 Shares of Beneficial Interest

The Trust’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value) in one or more series (such as the Fund). Transactions in Fund shares were as follows:

| | | | | | | | |

| | | Year Ended

January 31, 2020 | | | Period Ended

January 31, 2019(1) | |

| | |

Sales | | | 2,254 | | | | 800,770 | |

| | |

Issued to shareholders electing to receive payments of distributions in Fund shares | | | 63 | | | | — | |

| | |

Net increase | | | 2,317 | | | | 800,770 | |

| (1) | For the period from the start of business, May 1, 2018, to January 31, 2019. |

At January 31, 2020, EVM owned 99.6% of the outstanding shares of the Fund.

6 Financial Instruments

The Fund may trade in financial instruments withoff-balance sheet risk in the normal course of its investing activities. These financial instruments may include forward foreign currency exchange contracts, financial futures contracts and swap contracts and may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. The notional or contractual amounts of these instruments represent the investment the Fund has in particular classes of financial instruments and do not necessarily represent the amounts potentially subject to risk. The measurement of the risks associated with these instruments is meaningful only when all related and offsetting transactions are considered. A summary of obligations under these financial instruments at January 31, 2020 is included in the Portfolio of Investments. At January 31, 2020, the Fund had sufficient cash and/or securities to cover commitments under these contracts.

In the normal course of pursuing its investment objective, the Fund is subject to the following risks:

Credit Risk: The Fund enters into credit default swap contracts to enhance total return and/or as a substitute for the purchase or sale of securities.

Foreign Exchange Risk: The Fund engages in forward foreign currency exchange contracts to enhance total return and/or to seek to hedge against fluctuations in currency exchange rates.

Interest Rate Risk: The Fund utilizes various interest rate derivatives including interest rate futures contracts and interest rate swaps to enhance total return, to seek to hedge against fluctuations in interest rates, and/or to change the effective duration of its portfolio.

The Fund enters intoover-the-counter (OTC) derivatives that may contain provisions whereby the counterparty may terminate the contract under certain conditions, including but not limited to a decline in the Fund’s net assets below a certain level over a certain period of time, which would trigger a payment by the Fund for those derivatives in a liability position. At January 31, 2020, the fair value of derivatives with credit-related contingent features in a net liability position was $570. At January 31, 2020, there were no assets pledged by the Fund for such liability.

Eaton Vance

Emerging Markets Debt Fund

January 31, 2020

Notes to Financial Statements — continued

The OTC derivatives in which the Fund invests are subject to the risk that the counterparty to the contract fails to perform its obligations under the contract. To mitigate this risk, the Fund has entered into an International Swaps and Derivatives Association, Inc. Master Agreement (“ISDA Master Agreement”) or similar agreement with substantially all its derivative counterparties. An ISDA Master Agreement is a bilateral agreement between the Fund and a counterparty that governs certain OTC derivatives and typically contains, among other things,set-off provisions in the event of a default and/or termination event as defined under the relevant ISDA Master Agreement. Under an ISDA Master Agreement, the Fund may, under certain circumstances, offset with the counterparty certain derivative financial instruments’ payables and/or receivables with collateral held and/or posted and create one single net payment. The provisions of the ISDA Master Agreement typically permit a single net payment in the event of default including the bankruptcy or insolvency of the counterparty. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against the right of offset in bankruptcy or insolvency. Certain ISDA Master Agreements allow counterparties to OTC derivatives to terminate derivative contracts prior to maturity in the event the Fund’s net assets decline by a stated percentage or the Fund fails to meet the terms of its ISDA Master Agreements, which would cause the counterparty to accelerate payment by the Fund of any net liability owed to it.

The collateral requirements for derivatives traded under an ISDA Master Agreement are governed by a Credit Support Annex to the ISDA Master Agreement. Collateral requirements are determined at the close of business each day and are typically based on changes in market values for each transaction under an ISDA Master Agreement and netted into one amount for such agreement. Generally, the amount of collateral due from or to a counterparty is subject to a minimum transfer threshold amount before a transfer is required, which may vary by counterparty. Collateral pledged for the benefit of the Fund and/or counterparty is held in segregated accounts by the Fund’s custodian and cannot be sold,re-pledged, assigned or otherwise used while pledged. The portion of such collateral representing cash, if any, is reflected as deposits for derivatives collateral and, in the case of cash pledged by a counterparty for the benefit of the Fund, a corresponding liability on the Statement of Assets and Liabilities. Securities pledged by the Fund as collateral, if any, are identified as such in the Portfolio of Investments.

The fair value of open derivative instruments (not considered to be hedging instruments for accounting disclosure purposes) by risk exposure at January 31, 2020 was as follows:

| | | | | | | | | | | | | | | | |

| | | Fair Value | |

| Statement of Assets and Liabilities Caption | | Credit | | | Foreign

Exchange | | | Interest

Rate | | | Total | |

| | | | |

Not applicable | | $ | 5,662 | * | | $ | 492 | * | | $ | 128,246 | * | | $ | 134,400 | |

| | | | |

Receivable for open forward foreign currency exchange contracts | | | — | | | | 407 | | | | — | | | | 407 | |

| | | | |

Total Asset Derivatives | | $ | 5,662 | | | $ | 899 | | | $ | 128,246 | | | $ | 134,807 | |

| | | | |

Derivatives not subject to master netting or similar agreements | | $ | 5,662 | | | $ | 492 | | | $ | 128,246 | | | $ | 134,400 | |

| | | | |

Total Asset Derivatives subject to master netting or similar agreements | | $ | — | | | $ | 407 | | | $ | — | | | $ | 407 | |

| | | | |

Not applicable | | $ | (11,923 | )* | | $ | — | | | $ | (173,659 | )* | | $ | (185,582 | ) |

| | | | |