UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04033

Sit Mutual Funds II, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code:

(612) 332-3223

Date of fiscal year end: March 31, 2016

Date of reporting period: September 30, 2015

Item 1: Reports to Stockholders

|

|

| Sit Mutual Funds |

BOND FUNDS SEMI-ANNUAL REPORT TABLE OF CONTENTS |

This document must be preceded or accompanied by a Prospectus.

CHAIRMAN’S LETTER

November 4, 2015

Dear fellow shareholders:

We are not alone in having spent a lot of time talking and writing about the Federal Funds rate lately. While it has been the focus of two of our recent shareholder letters, it was also, for a moment when the Federal Reserve (Fed) met on September 17th, headline news in most national news outlets. As we have discussed previously, the Fed Funds rate takes on a lot of significance because it is the major policy lever that the Fed uses to influence the economy.

What happened in September was that the Fed declined to raise rates from the very low level that they have been at since the financial crisis. This inaction took a good number of market participants by surprise and in this letter we will try to explain some of the arguments over whether or not to raise rates as well as what the issue means to us and our funds as investors and fixed income managers.

Reasons to Hike

While there are lots of reasons to hike (an old joke comes to mind about querying five economists and getting six responses…) it is hopefully not simplifying the argument too much to say that the reasons essentially fall into two camps: labor conditions and policy normalization. Note that these are not mutually exclusive ideas; many people simultaneously stress the importance of both rationales.

The “labor conditions” camp notes that rates have been held low in part to encourage recovery from the disastrously high unemployment levels seen in the aftermath of the financial crisis. They further note that the US economy is now much nearer to 5% unemployment than 10%. Thus, they argue that with the substantial improvement in the major indicator of labor market conditions - as well as strengthening in other indicators, such as underemployment and prime age employment population ratio - the policy of low rates is no longer necessary or prudent. This argument is concerned with a potential increase in inflation that could result from waiting to raise rates until the economy is “overheating” which can happen if employment growth is pursued beyond “full employment” levels.

The “policy normalization” camp is worried that the “extraordinary” measures that the Fed took are no longer necessary now that the US economy is no longer in an extraordinary crisis. Their main worry is that extremely low rates distort market forces. For example, the availability of very low rates to finance investments can potentially encourage excess leverage and risk taking. Thus, they argue that it is better for the Fed to increase rates sooner rather than later or risk any number of hard to predict consequences. These consequences certainly include increased market volatility but proponents are often more focused on difficult to summarize concerns about market structure and behavior.

Reasons Not to Hike

Similar to the reasons to hike, there are two broad themes advanced by those advocating that the Fed delay longer before raising rates: labor conditions and inflation. Similar to the reasons to hike, the ideas are not mutually exclusive.

While it may seem confusing that “labor conditions” could be used as a reason both for and against a hike, this is possible because the two sides chose different metrics to measure labor market health. Those looking for reasons not to hike can point to the low employment-population ratio or the fact that there is very little evidence of upward pressure on wages. Thus, they argue that the Fed should wait longer before raising rates because there is still slack in the labor market.

The “inflation” camp has a very simple to understand argument: many measures of inflation do not currently show much evidence of increasing inflation. This argument is based on the idea that increasing rates is a tool used to slow down the economy to keep it from overheating but that the sign typically associated with an overheating economy is increasing inflation. Thus, they argue that the economy is not currently overheating and that raising rates is unnecessary or even counterproductive.

Essentially, the overriding concern of those who do not want the Fed to hike rates is this: they believe the risks associated with hiking rates - primarily, slowing down the recovery of the labor market and the growth of economy - outweigh what they view as the potential benefits.

Strategy

While not even the regional Fed presidents are sure when the Fed will finally raise rates, we do expect that the Fed will raise rates sooner rather than later. We believe that many of the underlying fundamentals of the economy are strong and that the major concerns of the “no hike” camp will slowly be resolved as the economy continues to grow. That being said, we also believe that as long as core inflation remains below target that interest rates will not rise drastically. We have adjusted our Funds accordingly and believe that they are well-positioned for the eventual gradual increase in rates by the Fed while continuing to earn substantial levels of current income.

The U.S. Government Securities Fund remains focused on seasoned, high coupon agency-backed securities which should continue to provide long-term income stability and principal preservation as mortgage rates increase from near all-time lows. The Sit Quality Income Fund’s SEC yield of 1.37% remains attractive relative to the benchmark, especially given our focus on shorter than benchmark duration.

| | |

2 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

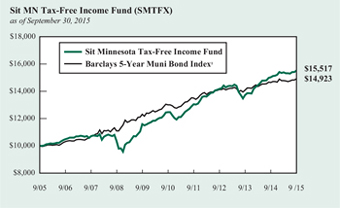

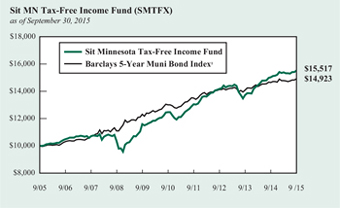

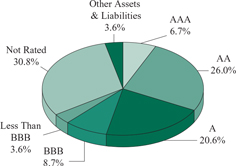

The tax-exempt fixed income strategy employed in managing both the Tax-Free Income Fund and the Minnesota Tax-Free Income Fund will continue to focus heavily on the use of high coupon bonds and bonds structured with put, call, sinking fund, and prepayment provisions that provide regular cash flow. Our investment strategy focuses on income, the primary source of return over longer periods of time, which will continue to deliver positive performance. We continue to focus on sectors and security structures that provide incremental yield, while using diversification to help manage credit risk.

We appreciate your continued interest in the Sit family of funds.

|

With best wishes, |

|

Roger J. Sit |

Chairman and President Sit Mutual Funds

|

Sit U.S. Government Securities Fund |

OBJECTIVE & STRATEGY

The objective of the U.S. Government Securities Fund is to provide high current income and safety of principal, which it seeks to attain by investing solely in debt obligations issued, guaranteed or insured by the U.S. government or its agencies or its instrumentalities.

Agency mortgage securities and U.S. Treasury securities are the principal holdings in the Fund. The mortgage securities that the Fund purchases consist of pass-through securities including those issued by Government National Mortgage Association (GNMA), Federal National Mortgage Association (FNMA), and Federal Home Loan Mortgage Corporation (FHLMC).

The Sit U.S. Government Securities Fund provided a return of +0.42% during the 6-month period ended September 30, 2015, compared to the return of the Barclays Intermediate Government Bond Index of +0.77% The Fund’s 30-day SEC yield was 2.35% and its 12-month distribution rate was 1.91%.

During the 6-month period, the Fund benefitted from the high level of income provided by its position in higher coupon government agency mortgages. Mortgage prepayments were stable throughout the period as short-term interest rates were relatively unchanged while longer term treasury rates moved modestly higher. The Fund’s position in Treasury futures and options that are used to reduce the Fund’s interest rate risk detracted from performance, however, the Fund’s strong income return more than offset this underperformance; resulting in positive absolute performance for the Fund. Recently, the anticipation of the Federal Reserve’s first increase in the Fed Funds rate since lowering the target rate to 0.25% in 2008 has been the main driver of bond prices. The capital markets were prepared for the Federal Reserve to announce the first rate hike after its September meeting, however, the Federal Reserve disappointed and it appears the first rate hike will not come until 2016.

As the bond market continues to anticipate the eventual increase in the Fed Funds rate, we expect short term interest rates to begin to move higher while longer term rates remain relatively unchanged. Current economic growth coupled with low inflation expectations should prevent long term interest rates from moving much higher, resulting in a flattening of the yield curve. The Fund’s high coupon mortgages should continue to produce an income advantage in this environment as prepayments are likely to remain stable or potentially slow.

We continue to position the Fund defensively against a rise in short-term interest rates. We continue to focus on seasoned, high coupon agency mortgage securities as they provide a high level of income

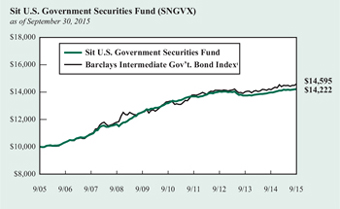

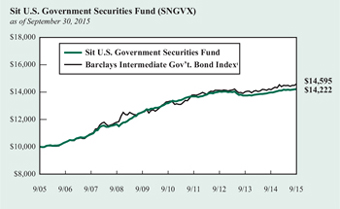

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the Barclays Intermediate Government Bond Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 The Barclays Intermediate Government Bond Index is a sub-index of the Barclays Government Bond Index covering issues with remaining maturities of between three and five years. The Barclays Government Bond Index is an index that measures the performance of all public U.S. government obligations with remaining maturities of one year or more. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index. This is the Fund’s primary index.

with relatively stable prices. This high level of income and stability of principal has been a fundamental focus of the Fund since its inception.

| | | | |

| Michael C. Brilley | | Bryce A. Doty, CFA | | |

| Senior Portfolio Managers | | |

Mark H. Book, CFA | | |

| Portfolio Manager | | | | |

| | |

4 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of September 30, 2015

| | | | | | | | | | | | | | | |

| | | Sit U.S.

Government

Securities

Fund | | Barclays

Inter. Gov’t

Bond Index1 | | Lipper

U.S.

Gov’t Fund

Index2 |

Six Months | | | | 0.42 | % | | | | 0.77 | % | | | | n/a | |

One Year | | | | 1.83 | | | | | 3.00 | | | | | 3.07 | % |

Five Years | | | | 1.53 | | | | | 1.88 | | | | | 2.53 | |

Ten Years | | | | 3.58 | | | | | 3.85 | | | | | 4.08 | |

Since Inception (6/2/87) | | | | 5.66 | | | | | 5.87 | | | | | 5.70 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains and all fee waivers. Without the fee waivers total return and yield figures would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

1 The Barclays Intermediate Government Bond Index is a sub-index of the Barclays Government Bond Index covering issues with remaining maturities of between three and five years. The Barclays Government Bond Index is an index that measures the performance of all public U.S. government obligations with remaining maturities of one year or more. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index.

2 The Lipper returns are obtained from Lipper Analytical Services, Inc., a large independent evaluator of mutual funds.

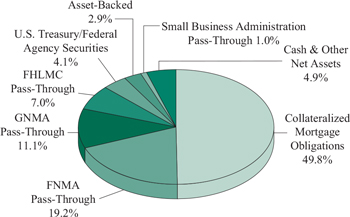

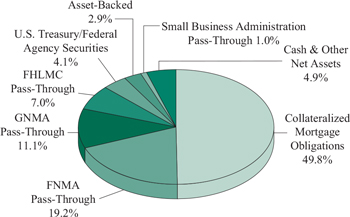

FUND DIVERSIFICATION

Based on total net assets as of September 30, 2015. Subject to change.

PORTFOLIO SUMMARY

| | |

| |

Net Asset Value 9/30/15: | | $11.04 Per Share |

Net Asset Value 3/31/15: | | $11.09 Per Share |

Total Net Assets: | | $604.4 Million |

Effective Duration 3: | | 0.2 Years |

3 Duration is a measure of estimated price sensitivity relative to changes in interest rates. Portfolios with longer durations are typically more sensitive to changes in interest rates. For example, if interest rates rise by 1%, the fair value of a security with an effective duration of 5 years would decrease by 5%, with all other factors being constant. The correlation between duration and price sensitivity is greater for securities rated investment-grade than it is for securities rated below investment-grade. Duration estimates are based on assumptions by the Adviser and are subject to a number of limitations. Effective duration is calculated based on historical price changes of securities held by the Fund, and therefore is a more accurate estimate of price sensitivity provided interest rates remain within their historical range.

ESTIMATED AVERAGE LIFE

| | | | |

| |

0-1 Year | | | 4.9% | |

1-5 Years | | | 92.2% | |

5-10 Years | | | 1.9% | |

10-20 Years | | | 0.0% | |

20+ Years | | | 1.0% | |

The table represents the Adviser’s estimates of the dollar weighted average life of the portfolio’s securities, which differ from their stated maturities. The Fund’s average stated maturity was 18.2 years as of September 30, 2015.

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2015

Sit U.S. Government Securities Fund

| | | | | | | | |

| | | | |

Principal

Amount ($) | | Coupon Rate (%) | | Maturity Date | | | Fair Value ($) |

|

Mortgage Pass-Through Securities - 38.3% |

Federal Home Loan Mortgage Corporation - 7.0% |

| 522,318 | | 4.00 | | | 7/1/25 | | | 559,343 |

| 267,777 | | 5.82 | | | 10/1/37 | | | 299,401 |

| 60,554 | | 6.38 | | | 12/1/26-12/1/27 | | | 68,845 |

| 11,946,265 | | 6.50 | | | 11/1/27-9/1/39 | | | 13,946,572 |

| 443,702 | | 6.88 | | | 2/17/31 | | | 520,078 |

| 17,427,597 | | 7.00 | | | 8/1/27-1/1/39 | | | 20,470,826 |

| 59,284 | | 7.38 | | | 12/17/24 | | | 68,285 |

| 1,586,341 | | 7.50 | | | 1/1/31-10/1/38 | | | 1,816,078 |

| 75,328 | | 7.95 | | | 10/1/25-11/1/25 | | | 76,274 |

| 674,662 | | 8.00 | | | 5/1/31-1/1/37 | | | 785,263 |

| 4,735 | | 8.25 | | | 12/1/17 | | | 4,750 |

| 1,304,474 | | 8.50 | | | 10/1/19-3/1/31 | | | 1,519,359 |

| 1,143,303 | | 9.00 | | | 11/1/25-5/1/31 | | | 1,251,214 |

| 12,503 | | 9.25 | | | 2/1/18-3/1/19 | | | 12,555 |

| 196,340 | | 9.50 | | | 12/17/21 | | | 218,370 |

| 200 | | 9.75 | | | 12/1/16 | | | 200 |

| 717,199 | | 10.00 | | | 9/1/20-7/1/30 | | | 757,418 |

| 39,702 | | 10.50 | | | 6/1/19 | | | 43,565 |

| 28,492 | | 11.00 | | | 8/25/20 | | | 28,419 |

| | | | | | | | |

| | | |

| | | | | | | | 42,446,815 |

| | | | | | | | |

|

Federal National Mortgage Association - 19.2% |

| 2,375 | | 3.24 | | | 3/1/19 | 1 | | 2,421 |

| 1,346,122 | | 5.50 | | | 12/1/32 | | | 1,504,528 |

| 1,159,629 | | 5.61 | | | 11/1/22 | | | 1,260,634 |

| 2,977,470 | | 5.96 | | | 6/1/28 | | | 3,399,499 |

| 2,282,396 | | 6.00 | | | 9/1/28-10/1/39 | | | 2,582,532 |

| 462,300 | | 6.15 | | | 6/1/33 | 1 | | 521,170 |

| 4,846,053 | | 6.17 | | | 11/1/43 | | | 5,492,564 |

| 35,831,805 | | 6.50 | | | 1/1/22-6/1/40 | | | 41,159,139 |

| 2,805,508 | | 6.95 | | | 6/1/40 | | | 3,303,501 |

| 71,915 | | 6.95 | | | 8/1/21 | 1 | | 73,048 |

| 33,249,258 | | 7.00 | | | 6/1/17-5/1/39 | | | 39,511,796 |

| 5,202,125 | | 7.50 | | | 6/1/22-2/1/38 | | | 6,102,899 |

| 50,781 | | 7.62 | | | 12/1/16 | | | 52,120 |

| 122,299 | | 7.95 | | | 9/15/20 | | | 135,913 |

| 2,902,279 | | 8.00 | | | 4/1/16-3/1/38 | | | 3,467,524 |

| 235,293 | | 8.08 | | | 11/15/31 | | | 283,206 |

| 72,793 | | 8.14 | | | 7/20/30 | | | 82,289 |

| 35,777 | | 8.27 | | | 7/20/28 | | | 38,750 |

| 74,785 | | 8.33 | | | 7/15/20 | | | 82,381 |

| 2,734,171 | | 8.50 | | | 2/1/16-1/1/37 | | | 3,299,581 |

| 36,404 | | 8.51 | | | 9/15/30 | | | 42,125 |

| 1,230,050 | | 9.00 | | | 10/1/19-2/1/38 | | | 1,427,623 |

| 30,960 | | 9.02 | | | 3/15/22 | | | 31,953 |

| 55,137 | | 9.17 | | | 5/15/28 | | | 62,896 |

| 1,123,724 | | 9.50 | | | 3/1/20-8/1/31 | | | 1,302,704 |

| 222,762 | | 9.66 | | | 8/20/25 | | | 255,465 |

| 18,158 | | 9.68 | | | 7/15/20 | | | 18,632 |

| | | | | | | | |

| | | | |

Principal

Amount ($) | | Coupon Rate (%) | | Maturity Date | | | Fair Value ($) |

| | | |

| 260,718 | | 10.00 | | | 2/1/28-6/1/30 | | | 308,211 |

| 11,840 | | 10.04 | | | 8/15/20 | | | 11,982 |

| 56,890 | | 10.50 | | | 6/1/28 | | | 61,520 |

| | | | | | | | |

| | | |

| | | | | | | | 115,878,606 |

| | | | | | | | |

|

Government National Mortgage Association - 11.1% |

| 19,356,559 | | 4.00 | | | 12/15/24-12/20/31 | | | 20,832,309 |

| 2,266,251 | | 4.25 | | | 10/20/31-3/20/37 | | | 2,453,533 |

| 3,415,613 | | 4.75 | | | 9/20/31 | | | 3,757,025 |

| 2,099,893 | | 5.50 | | | 9/15/25-5/15/29 | | | 2,365,804 |

| 6,185,752 | | 5.75 | | | 2/15/29-10/20/31 | | | 6,980,410 |

| 95,620 | | 5.76 | | | 5/20/33 | | | 106,592 |

| 1,652,080 | | 6.00 | | | 6/15/23-11/20/34 | | | 1,864,255 |

| 304,009 | | 6.20 | | | 3/15/32 | | | 348,577 |

| 1,900,192 | | 6.25 | | | 12/15/23-4/15/29 | | | 2,168,576 |

| 720,356 | | 6.35 | | | 4/20/30-6/20/31 | | | 819,793 |

| 254,595 | | 6.38 | | | 8/15/26-4/15/28 | | | 290,068 |

| 98,344 | | 6.49 | | | 4/20/32 | | | 112,685 |

| 16,079,044 | | 6.50 | | | 11/15/23-4/20/43 | | | 18,660,667 |

| 347,071 | | 6.91 | | | 7/20/26-2/20/27 | | | 383,473 |

| 3,935,718 | | 7.00 | | | 5/15/24-1/20/39 | | | 4,561,265 |

| 127,807 | | 7.02 | | | 4/20/26 | | | 136,768 |

| 222,372 | | 7.10 | | | 5/20/25 | | | 242,654 |

| 121,538 | | 7.15 | | | 4/20/27 | | | 130,384 |

| 360,728 | | 7.50 | | | 1/20/38-3/15/39 | | | 428,882 |

| 494,996 | | 8.00 | | | 6/20/31 | | | 605,529 |

| | | | | | | | |

| | | |

| | | | | | | | 67,249,249 |

| | | | | | | | |

|

Small Business Administration - 1.0% |

| 5,402,194 | | 5.33 | | | 8/25/36-9/25/36 | | | 5,861,409 |

| | | | | | | | |

| |

Total Mortgage Pass-Through Securities

(cost: $224,159,889) | | | 231,436,079 |

| | | | | | | | |

|

U.S. Treasury / Federal Agency Securities - 4.1% |

U.S. Treasury Floating Rate Note: | | | |

| 19,000,000 | | 0.08 | | | 7/31/17 | 1 | | 18,980,430 |

U.S. Treasury Strips: | | | |

| 13,700,000 | | 2.95 | | | 5/15/44 | 6 | | 5,762,837 |

| | | | | | | | |

| |

Total U.S. Treasury / Federal Agency Securities

(cost: $24,856,581) | | | 24,743,267 |

| | | | | | | | |

|

Collateralized Mortgage Obligations - 49.8% |

Federal Home Loan Mortgage Corporation - 16.6% |

| 2,664 | | 4.63 | | | 3/25/44 | 1 | | 2,660 |

| 9,888,554 | | 6.00 | | | 9/15/21-6/15/37 | | | 11,358,201 |

| 648,841 | | 6.10 | | | 7/25/32 | 1 | | 751,711 |

| 92,250 | | 6.25 | | | 5/15/29 | | | 101,906 |

| 20,974,801 | | 6.50 | | | 9/15/23-10/25/43 | | | 24,535,570 |

| 887,372 | | 6.50 | | | 9/25/43 | 1 | | 1,067,865 |

| 68,334 | | 6.70 | | | 9/15/23 | | | 77,525 |

| 377,255 | | 6.95 | | | 3/15/28 | | | 433,644 |

| 38,304,410 | | 7.00 | | | 12/15/20-9/25/43 | | | 43,169,844 |

| 12,406,556 | | 7.50 | | | 10/15/21-9/25/43 | | | 14,705,550 |

| 2,669,261 | | 8.00 | | | 7/15/21-1/15/30 | | | 3,095,032 |

See accompanying notes to financial statements.

| | |

6 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

| | | | | | | | |

| | | | |

Principal Amount ($) | | Coupon Rate (%) | | Maturity Date | | | Fair Value ($) |

| | | |

| 33,839 | | 8.25 | | | 6/15/22 | | | 38,032 |

| 179,384 | | 8.30 | | | 11/15/20 | | | 199,368 |

| 400,596 | | 8.50 | | | 10/15/22-3/15/32 | | | 462,885 |

| 105,040 | | 9.00 | | | 12/15/19 | | | 111,752 |

| 3,599 | | 9.15 | | | 10/15/20 | | | 3,855 |

| 127,218 | | 9.50 | | | 2/15/20 | | | 137,251 |

| | | | | | | | |

| | | |

| | | | | | | | 100,252,651 |

| | | | | | | | |

|

Federal National Mortgage Association - 24.2% |

| 17,967,934 | | 4.50 | | | 6/25/21-4/25/39 | | | 19,132,853 |

| 549,660 | | 4.55 | | | 6/25/43 | | | 600,450 |

| 1,637,492 | | 5.81 | | | 8/25/43 | | | 1,877,198 |

| 3,258,901 | | 6.00 | | | 7/25/36 | | | 3,729,160 |

| 2,697,924 | | 6.32 | | | 8/25/47 | 1 | | 3,078,224 |

| 3,614,999 | | 6.39 | | | 2/25/42 | 1 | | 4,239,942 |

| 538,485 | | 6.44 | | | 12/25/42 | 1 | | 629,879 |

| 1,336,014 | | 6.48 | | | 9/25/37 | 1 | | 1,513,804 |

| 13,990,201 | | 6.50 | | | 8/20/28-11/25/42 | | | 15,564,540 |

| 2,996,158 | | 6.52 | | | 10/25/42 | 1 | | 3,437,369 |

| 781,085 | | 6.70 | | | 2/25/45 | 1 | | 924,240 |

| 10,237,102 | | 6.75 | | | 6/25/32-4/25/37 | | | 11,615,530 |

| 91,046 | | 6.85 | | | 12/18/27 | | | 105,258 |

| 1,183,741 | | 6.91 | | | 8/25/37 | 1 | | 1,291,989 |

| 20,351,709 | | 7.00 | | | 1/25/21-3/25/45 | | | 24,135,382 |

| 31,899,140 | | 7.50 | | | 8/20/27-1/25/48 | | | 38,098,560 |

| 1,358,373 | | 7.50 | | | 6/19/41 | 1 | | 1,589,423 |

| 1,211,363 | | 8.00 | | | 7/25/22-7/25/44 | | | 1,396,122 |

| 679,028 | | 8.20 | | | 11/25/37 | 1 | | 832,582 |

| 621,229 | | 8.29 | | | 11/25/37 | 1 | | 714,886 |

| 1,185,524 | | 8.50 | | | 1/25/21-6/25/30 | | | 1,405,945 |

| 52,877 | | 8.67 | | | 10/25/42 | 1 | | 65,324 |

| 26,676 | | 8.70 | | | 12/25/19 | | | 29,414 |

| 9,016 | | 8.75 | | | 9/25/20 | | | 9,591 |

| 38,766 | | 8.95 | | | 10/25/20 | | | 42,913 |

| 1,708,204 | | 9.00 | | | 7/25/19-10/25/30 | | | 2,001,426 |

| 12,009 | | 9.05 | | | 12/25/18 | | | 12,591 |

| 21,979 | | 9.25 | | | 1/25/20 | | | 24,068 |

| 507,430 | | 9.34 | | | 6/25/32 | 1 | | 574,341 |

| 726,275 | | 9.50 | | | 12/25/18-12/25/41 | | | 856,710 |

| 84,744 | | 9.60 | | | 3/25/20 | | | 94,120 |

| 2,573,652 | | 10.47 | | | 7/25/37 | 1 | | 2,765,039 |

| 3,201,801 | | 10.51 | | | 9/25/42-6/25/44 | 1 | | 3,967,086 |

| 81,188 | | 13.60 | | | 3/25/39 | 1 | | 109,072 |

| | | | | | | | |

| | | |

| | | | | | | | 146,465,031 |

| | | | | | | | |

|

Government National Mortgage Association - 5.8% |

| 3,904,000 | | 6.00 | | | 11/20/33 | | | 4,599,966 |

| 2,813,556 | | 6.12 | | | 1/1/39 | | | 3,286,585 |

| 4,724,528 | | 6.29 | | | 12/20/40 | 1 | | 5,404,960 |

| 3,239,935 | | 6.38 | | | 5/20/43 | | | 3,746,175 |

| 795,787 | | 6.50 | | | 9/20/28 | | | 894,299 |

| 1,424,432 | | 6.66 | | | 9/20/44 | 1 | | 1,680,923 |

| 372,212 | | 6.86 | | | 3/16/41 | 1 | | 411,769 |

| | | | | | | | |

| | | | |

Principal Amount ($) | | Coupon Rate (%) | | Maturity Date | | | Fair Value ($) |

| | | |

| 3,014,359 | | 6.87 | | | 8/20/40 | | | 3,624,767 |

| 1,490,957 | | 6.98 | | | 6/20/45 | 1 | | 1,749,000 |

| 6,909,691 | | 7.00 | | | 9/16/23-5/20/42 | | | 7,386,236 |

| 758,200 | | 7.19 | | | 12/20/33 | 1 | | 902,812 |

| 113,331 | | 7.50 | | | 5/16/27 | | | 130,578 |

| 33,137 | | 8.50 | | | 2/20/32 | | | 40,756 |

| 730,414 | | 9.00 | | | 3/16/30 | | | 894,428 |

| | | | | | | | |

| | | |

| | | | | | | | 34,753,254 |

| | | | | | | | |

|

Vendee Mortgage Trust - 3.2% |

| 4,476,137 | | 6.50 | | | 8/15/31 | | | 5,206,620 |

| 1,566,890 | | 6.50 | | | 10/15/31 | | | 1,878,945 |

| 1,211,458 | | 6.75 | | | 2/15/26 | | | 1,408,355 |

| 2,037,294 | | 7.00 | | | 3/15/28 | | | 2,449,683 |

| 1,224,634 | | 7.25 | | | 9/15/22-9/15/25 | | | 1,385,590 |

| 3,489,777 | | 7.69 | | | 3/15/25 | 1 | | 4,055,773 |

| 1,950,855 | | 7.75 | | | 5/15/22-9/15/24 | | | 2,246,142 |

| 341,991 | | 8.00 | | | 2/15/25 | | | 402,176 |

| 160,893 | | 8.29 | | | 12/15/26 | | | 193,967 |

| | | | | | | | |

| | | |

| | | | | | | | 19,227,251 |

| | | | | | | | |

| |

Total Collateralized Mortgage Obligations

(cost: $294,588,250) | | | 300,698,187 |

| | | | | | | | |

|

Asset-Backed Securities - 2.9% |

Federal Home Loan Mortgage Corporation - 0.5% |

| 2,525 | | 6.09 | | | 9/25/29 | 1 | | 2,527 |

| 222,597 | | 6.28 | | | 10/27/31 | 14 | | 252,167 |

| 2,192,238 | | 7.16 | | | 7/25/29 | | | 2,493,057 |

| | | | | | | | |

| | | |

| | | | | | | | 2,747,751 |

| | | | | | | | |

|

Federal National Mortgage Association - 0.7% |

| 34,120 | | 0.53 | | | 11/25/32 | 1 | | 33,307 |

| 352,238 | | 4.72 | | | 10/25/33 | 14 | | 379,722 |

| 401,136 | | 5.15 | | | 9/26/33 | 14 | | 439,108 |

| 2,213,178 | | 5.66 | | | 2/25/33 | 14 | | 2,434,874 |

| 109,319 | | 6.47 | | | 10/25/31 | 14 | | 113,325 |

| 752,945 | | 6.59 | | | 10/25/31 | 14 | | 817,639 |

| 142,763 | | 6.64 | | | 5/25/32 | 1 | | 148,346 |

| 27,204 | | 6.83 | | | 7/25/31 | 14 | | 27,869 |

| 15,830 | | 7.80 | | | 6/25/26 | 1 | | 15,733 |

| | | | | | | | |

| | | |

| | | | | | | | 4,409,923 |

| | | | | | | | |

|

Small Business Administration - 1.7% |

| 5,108,112 | | 5.87 | | | 7/1/28 | | | 5,785,590 |

| 1,417,916 | | 7.13 | | | 10/1/20 | | | 1,526,939 |

| 1,712,679 | | 7.33 | | | 8/1/20 | | | 1,847,803 |

| 1,189,163 | | 8.03 | | | 5/1/20 | | | 1,281,656 |

| | | | | | | | |

| | | |

| | | | | | | | 10,441,988 |

| | | | | | | | |

| |

Total Asset-Backed Securities

(cost: $17,347,826) | | | 17,599,662 |

| | | | | | | | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2015

Sit U.S. Government Securities Fund (Continued)

| | | | | | | | |

| |

Principal Amount ($) /

Contracts | | | | | | Fair Value($) | |

| |

| | |

| Put Options Purchased 10 - 0.0% | | | | | | |

| 250 | | U.S. Treasury 5 Year Future

Put Options: $120.25 strike

November 2015 expiration | | $ | | | 64,453 | |

| | | | | | | | |

| | |

Total Put Options Purchased

(cost: $170,927) | | | | | 64,453 | |

| | | | | | | | |

| | |

Total Investments in Securities - 95.1%

(cost: $561,123,473) | | | | | 574,541,648 | |

| | | | | | | | |

| | |

Call Options Written 10 - (1.2%) | | | | | | |

| (1,200) | | U.S. Treasury 2 Year Future Call Options: $108.25 strike November 2015 expiration | | | | | (3,056,250 | ) |

| (1,800) | | U.S. Treasury 2 Year Future Call Options: $108.50 strike December 2015 expiration | | | | | (3,712,500 | ) |

| (400) | | U.S. Treasury 2 Year Future Call Options: $109.00 strike November 2015 expiration | | | | | (418,750 | ) |

| | | | | | | | |

| | |

Total Call Options Written

(premiums received: $6,066,742) | | | | | (7,187,500 | ) |

| | | | | | | | |

| | |

Other Assets and Liabilities, net - 6.1% | | | | | 37,015,055 | |

| | | | | | | | |

| | |

Total Net Assets - 100.0% | | $ | | | 604,369,203 | |

| | | | | | | | |

| 1 | | Variable rate security. Rate disclosed is as of September 30, 2015. |

| 6 | | Zero coupon or convertible capital appreciation bond, for which the rate disclosed is either the effective yield on purchase date or the coupon rate to be paid upon conversion to coupon paying, respectively. |

| 10 | The amount of $18,000,000 in cash was segregated with the broker to cover margin requirements for derivative transactions as of September 30, 2015. |

| 14 | Step Coupon: A bond that pays an initial coupon rate for the first period and then a higher coupon rate for the following periods. Rate disclosed is as of September 30, 2015. |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

See accompanying notes to financial statements.

| | |

8 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

For a detailed list of security holdings, refer to our company website at www.sitfunds.com.

A summary of the levels for the Fund’s investments as of September 30, 2015 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | | |

| | | Investment in Securities |

| | | Level 1 | | Level 2 | | Level 3 | | |

| | | Quoted

Price ($) | | Other significant

observable inputs ($) | | Significant

unobservable inputs ($) | | Total ($) |

Assets | | | | | | | | | | | | | | | | | |

Mortgage Pass-Through Securities | | | | — | | | | | 231,436,079 | | | | | — | | | 231,436,079 |

U.S. Treasury / Federal Agency Securities | | | | — | | | | | 24,743,267 | | | | | — | | | 24,743,267 |

Collateralized Mortgage Obligations | | | | — | | | | | 300,698,187 | | | | | — | | | 300,698,187 |

Asset-Backed Securities | | | | — | | | | | 17,599,662 | | | | | — | | | 17,599,662 |

Put Options Purchased | | | | 64,453 | | | | | — | | | | | — | | | 64,453 |

| | | | 64,453 | | | | | 574,477,195 | | | | | — | | | 574,541,648 |

Liabilities | | | | | | | | | | | | | | | | | |

Call Options Written | | | | (7,187,500) | | | | | — | | | | | — | | | (7,187,500) |

For the reporting period, there were no transfers between levels 1, 2 and 3.

See accompanying notes to financial statements.

OBJECTIVE & STRATEGY

The objective of the Quality Income Fund is to provide high current income and safety of principal, which it seeks to attain by investing at least 80% of its assets in debt securities issued by the U.S. government and its agencies, debt securities issued by corporations, mortgage and other asset-backed securities. The Fund invests at least 50% of its assets in U.S. government debt securities, which are securities issued, guaranteed or insured by the U.S. government, its agencies or instrumentalities.

The Sit Quality Income Fund provided a return of -0.16% during the 6-month period ended September 30, 2015, compared to the return of the Barclays 1-3 year Government/Credit Bond Index of +0.43%.The Fund’s 30-day SEC yield was 1.37% and its 12-month distribution rate was 0.83%.

During the 6-month period, the Fund benefitted from the income advantage primarily produced by its holdings in non-agency residential mortgage and taxable municipal bonds. Corporate bonds also provided positive return but relatively less than the other sectors as prices were impacted by reduced demand. Mortgage-backed securities underperformed during the period as higher interest rate expectations and decreasing purchase activity from the Federal Reserve caused prices to fall. U.S. Treasuries provided minimal impact on Fund returns. In an effort to maintain price stability, we incorporate futures and options to offset interest rate risk. This component of the Fund can have a negative impact on performance in periods of relatively stable interest rates, as experienced in this reporting period.

Looking forward, we expect continued gains in employment and modest economic growth. We believe these factors will lead the Federal Reserve to increase short-term rates. This will likely cause the yield curve to flatten further, as longer term yields will be relatively more stable as the inflationary pressures are removed. We have positioned the Fund defensively, in both credit quality and interest rate sensitivity to maximize return potential while preserving income. We focus on a mix of Treasury, agency and credit sectors that provide relatively high levels of income and stable prices. The dual goals of principal stability and income are the primary objectives of the Fund.

| | |

| Michael C. Brilley | | Mark H. Book, CFA |

| Bryce A. Doty, CFA | | Chris M. Rasmussen, CFA |

| Senior Portfolio Managers | | Portfolio Managers |

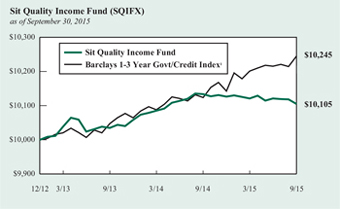

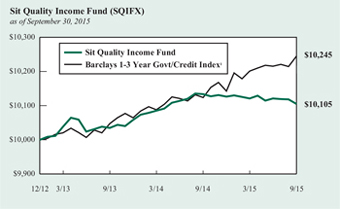

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the Barclays 1-3 Year Government/Credit Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 The Barclays 1-3 Year Government/Credit Index is an unmanaged index of Treasury or government agency securities and investment grade corporate debt securities with maturities of one to three years. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index.

| | |

10 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of September 30, 2015

| | | | | | | | | | | | | | | |

| | | Sit Quality

Income Fund | | Barclays

1-3 Year

Government/Credit

Index1 | | Lipper

Short

Investment

Grade Bond

Index2 |

Six Months | | | | -0.16 | % | | | | 0.43 | % | | | | n/a | |

One Year | | | | -0.28 | | | | | 1.19 | | | | | 0.68 | % |

Since Inception (12/31/12) | | | | 0.38 | | | | | 0.88 | | | | | 0.88 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains and all fee waivers. Without the fee waivers total return and yield figures would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for the periods greater than one year are compounded average annual rates of return.

1 The Barclays 1-3 Year Government/Credit Index is an unmanaged index of Treasury or government agency securities and investment grade corporate debt securities with maturities of one to three years. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index.

2 The Lipper returns are obtained from Lipper Analytical Services, Inc., a large independent evaluator of mutual funds.

FUND DIVERSIFICATION

| | | | |

| |

U.S. Treasury/Federal Agency Securities | | | 37.3% | |

Corporate Bonds | | | 14.3% | |

Asset Backed (Non-Agency) | | | 14.2% | |

Mortgage Pass-Through (Agency) | | | 11.3% | |

Taxable Municipal Bonds | | | 10.4% | |

Collateralized Mortgage Obligations (Non-Agency) | | | 7.7% | |

Put Options Purchased | | | 0.1% | |

Other Net Assets | | | 4.7% | |

| |

Based on total net assets as of September 30, 2015. Subject to change.

PORTFOLIO SUMMARY

| | |

| |

Net Asset Value 9/30/15: | | $9.87 Per Share |

Net Asset Value 3/31/15: | | $9.94 Per Share |

Total Net Assets: | | $73.0 Million |

Average Maturity: | | 8.5 Years |

Effective Duration 3: | | 0.5 Years |

3 Duration is a measure of estimated price sensitivity relative to changes in interest rates. Portfolios with longer durations are typically more sensitive to changes in interest rates. For example, if interest rates rise by 1%, the fair value of a security with an effective duration of 5 years would decrease by 5%, with all other factors being constant. The correlation between duration and price sensitivity is greater for securities rated investment-grade than it is for securities rated below investment-grade. Duration estimates are based on assumptions by the Adviser and are subject to a number of limitations. Effective duration is calculated based on historical price changes of securities held by the Fund, and therefore is a more accurate estimate of price sensitivity provided interest rates remain within their historical range.

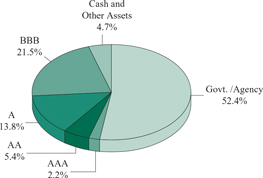

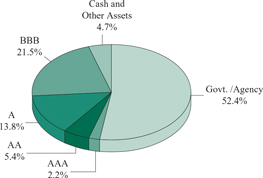

QUALITY RATINGS (% of Total Net Assets)

Lower of Moody’s, S&P, Fitch or Duff & Phelps ratings used.

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2015

Sit Quality Income Fund

| | | | | | | | | | | | |

| |

| | | | |

Principal Amount ($) | | Name of Issuer | | Coupon

Rate (%) | | Maturity

Date | | | Fair Value ($) | |

| |

Asset-Backed Securities - 14.4% | | | | | | | | | | |

Agency - 0.2% | | | | | | | | | | |

| 135,394 | | FNMA REMICS, Series 2001-W2, Class AS5 14 | | 6.47 | | | 10/25/31 | | | | 140,356 | |

| | | | | | | | | | | | |

Non-Agency - 14.2% | | | | | | | | | | |

| 141,199 | | Ace Securities Corp. Home Equity Loan Trust Series 2004-SD1 1 | | 0.68 | | | 11/25/33 | | | | 140,009 | |

| 172,906 | | Aegis Asset Backed Securities Trust, Series 2005-2, Class M1 1 | | 0.61 | | | 6/25/35 | | | | 171,534 | |

| 797,092 | | Bear Stearns Asset Backed Securities Trust 2005-SD2, Class 1A2 1 | | 0.66 | | | 3/25/35 | | | | 791,240 | |

| 51,331 | | Bear Stearns Asset Backed Securities Trust, Series 2005-SD2, Class 1A3 1 | | 0.59 | | | 3/25/35 | | | | 50,890 | |

| 102,684 | | Centex Home Equity Loan Trust, Series 2004-A, Class AF4 14 | | 5.01 | | | 8/25/32 | | | | 102,782 | |

| 310,000 | | Centex Home Equity Loan Trust, Series 2004-A, Class AF5 14 | | 5.43 | | | 1/25/34 | | | | 314,329 | |

| 421,344 | | Centex Home Equity Loan Trust, Series 2004-D, Class AF4 14 | | 4.68 | | | 6/25/32 | | | | 428,138 | |

| 221,543 | | Centex Home Equity Loan Trust, Series 2004-D, Class AF6 14 | | 4.67 | | | 9/25/34 | | | | 226,898 | |

| 213,282 | | Centex Home Equity Loan Trust, Series 2005-C, Class AF5 14 | | 5.05 | | | 6/25/35 | | | | 216,796 | |

| 175,992 | | Chase Funding Trust, Series 2004-2, Class 1A4 | | 5.32 | | | 2/26/35 | | | | 178,196 | |

| 156,640 | | CIT Home Equity Loan Trust 2003-1, Class A4 14 | | 3.93 | | | 3/20/32 | | | | 158,751 | |

| 250,395 | | CIT Home Equity Loan Trust, Series 2003-1, Class A6 14 | | 4.06 | | | 10/20/32 | | | | 256,558 | |

| 401,394 | | Citifinancial Mortgage Securities, Inc., Series 2004-1, Class AF3 14 | | 3.77 | | | 4/25/34 | | | | 406,715 | |

| 67,186 | | Conseco Financial Corp., Series 1997-3, Class A6 | | 7.32 | | | 3/15/28 | | | | 70,163 | |

| 24,917 | | Conseco Financial Corp., Series 1997-4, Class A7 1 | | 7.36 | | | 2/15/29 | | | | 25,169 | |

| 23,452 | | Conseco Financial Corp., Series 1997-6, Class A6 | | 6.90 | | | 1/15/29 | | | | 24,115 | |

| 77,975 | | Conseco Financial Corp., Series 1997-6, Class A7 | | 7.14 | | | 1/15/29 | | | | 80,286 | |

| 67,627 | | Conseco Financial Corp., Series 1997-7, Class A7 1 | | 6.96 | | | 7/15/28 | | | | 69,328 | |

| 168,697 | | Conseco Financial Corp., Series 1998-1, Class A6 1 | | 6.33 | | | 11/1/29 | | | | 172,327 | |

| 463,185 | | Countrywide Asset-Backed Certificates, Series 2004-S1, Class A3 14 | | 5.12 | | | 2/25/35 | | | | 471,343 | |

| 457,585 | | First Alliance Mortgage Loan Trust, Series 1997-4, Class A2 14 | | 7.63 | | | 4/20/29 | | | | 464,247 | |

| 417,099 | | HSBC Home Equity Loan Trust USA, Series 2007-2, Class A4 1 | | 0.52 | | | 7/20/36 | | | | 414,351 | |

| 118,287 | | Irwin Home Equity Loan Trust, Series 2005-1, Class 2A3 14 | | 5.32 | | | 6/25/35 | | | | 117,122 | |

| 519,760 | | Irwin Whole Loan Home Equity Trust 2003-B, Class M 1 | | 3.19 | | | 11/25/32 | | | | 523,274 | |

| 1,142,319 | | Irwin Whole Loan Home Equity Trust, Series 2003-D, Class M1 1 | | 1.29 | | | 11/25/28 | | | | 1,118,188 | |

| 1,623,773 | | Irwin Whole Loan Home Equity Trust, Series 2005-A, Class M1 1 | | 1.05 | | | 6/25/34 | | | | 1,567,277 | |

| 414,732 | | Irwin Whole Loan Home Equity Trust, Series 2005-C, Class 1M2 14 | | 5.75 | | | 4/25/30 | | | | 427,617 | |

| 37,283 | | New Century Home Equity Loan Trust, Series 2003-5, Class AI7 1 | | 5.15 | | | 11/25/33 | | | | 38,142 | |

| 213,260 | | NovaStar Mortgage Funding Trust, Series 2004-2, Class M2 1 | | 1.21 | | | 9/25/34 | | | | 211,007 | |

| 594,749 | | Popular ABS Mortgage Pass-Through Trust Series 2005-1, Class AF5 14 | | 5.23 | | | 5/25/35 | | | | 600,490 | |

| 101,534 | | Popular ABS Mortgage Pass-Through Trust, Series 2004-4, Class AF4 1 | | 4.63 | | | 9/25/34 | | | | 102,179 | |

| 71,511 | | Residential Asset Mortgage Products Trust, Series 2003-RZ5, Class A7 14 | | 5.47 | | | 9/25/33 | | | | 73,609 | |

| 83,728 | | Residential Asset Mortgage Products Trust, Series 2003-RZ3, Class A6 14 | | 3.90 | | | 3/25/33 | | | | 85,287 | |

| 26,716 | | Residential Asset Mortgage Products Trust, Series 2004-RS12, Class A16 | | 4.55 | | | 12/25/34 | | | | 26,987 | |

| 217,715 | | Residential Asset Mortgage Products Trust, Series 2004-RZ1, Class A11 1 | | 0.67 | | | 3/25/34 | | | | 217,029 | |

| 51,439 | | Residential Asset Securities Corp., Series 2004-KS2, Class AI4 1 | | 4.18 | | | 12/25/31 | | | | 51,387 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 10,393,760 | |

| | | | | | | | | | | | |

Total Asset-Backed Securities

(cost: $10,550,911) | | | | | | | | | 10,534,116 | |

| | | | | | | | | | | | |

Collateralized Mortgage Obligations - 26.9% | | | | | | | | | | |

Agency - 19.2% | | | | | | | | | | |

| 916,593 | | FHLMC Multifamily Structured Pass Through Certificates, Series K007, Class A1 | | 3.34 | | | 12/25/19 | | | | 949,003 | |

| 349,999 | | FHLMC Multifamily Structured Pass Through Certificates, Series K016. Class A1 | | 2.06 | | | 10/25/20 | | | | 356,759 | |

| 40,364 | | FHLMC REMICS, Series 2627, Class MC | | 4.50 | | | 6/15/18 | | | | 41,684 | |

| 128,319 | | FHLMC REMICS, Series 2631, Class LC | | 4.50 | | | 6/15/18 | | | | 132,907 | |

| 61,605 | | FHLMC REMICS, Series 2646, Class MT | | 3.50 | | | 11/15/32 | | | | 62,726 | |

| 236,182 | | FHLMC REMICS, Series 2685, Class ND | | 4.00 | | | 10/15/18 | | | | 243,591 | |

| 241,036 | | FHLMC REMICS, Series 2776, Class CG | | 5.00 | | | 4/15/19 | | | | 253,098 | |

See accompanying notes to financial statements.

| | |

12 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

| | | | | | | | | | | | |

| |

| | | | |

Principal Amount ($) | | Name of Issuer | | Coupon

Rate (%) | | Maturity

Date | | | Fair Value ($) | |

| |

159,410 | | FHLMC REMICS, Series 2877, Class JD | | 4.50 | | | 3/15/19 | | | | 165,265 | |

| 4,163 | | FHLMC REMICS, Series 3634, Class EA | | 4.00 | | | 11/15/23 | | | | 4,167 | |

| 62,262 | | FHLMC REMICS, Series 3637, Class LJ | | 3.50 | | | 2/15/25 | | | | 64,502 | |

| 10,871 | | FHLMC REMICS, Series 3711, Class AG | | 3.00 | | | 8/15/23 | | | | 10,880 | |

| 225,982 | | FHLMC REMICS, Series 3777, Class DA | | 3.50 | | | 10/15/24 | | | | 234,091 | |

| 642,094 | | FHLMC REMICS, Series 3812, Class LV | | 4.00 | | | 4/15/22 | | | | 675,928 | |

| 224,680 | | FHLMC REMICS, Series 3815, Class BD | | 3.00 | | | 10/15/20 | | | | 229,799 | |

| 1,289,469 | | FHLMC REMICS, Series 3817, Class GA | | 3.50 | | | 6/15/24 | | | | 1,333,592 | |

| 3,214 | | FNMA REMICS, Series 2001-53, Class GB | | 5.00 | | | 9/25/16 | | | | 3,218 | |

| 80,311 | | FNMA REMICS, Series 2002-94, Class HQ | | 4.50 | | | 1/25/18 | | | | 82,683 | |

| 165,976 | | FNMA REMICS, Series 2003-52, Class NA | | 4.00 | | | 6/25/23 | | | | 174,693 | |

| 119,358 | | FNMA REMICS, Series 2004-101, Class BH | | 5.00 | | | 1/25/20 | | | | 124,188 | |

| 225,575 | | FNMA REMICS, Series 2005-19, Class PA | | 5.50 | | | 7/25/34 | | | | 243,390 | |

| 30,632 | | FNMA REMICS, Series 2005-24, Class A | | 4.50 | | | 7/25/32 | | | | 30,837 | |

| 60,910 | | FNMA REMICS, Series 2005-68, Class PC | | 5.50 | | | 7/25/35 | | | | 65,020 | |

| 499,358 | | FNMA REMICS, Series 2008-18, Class NB | | 4.50 | | | 5/25/20 | | | | 517,397 | |

| 876,751 | | FNMA REMICS, Series 2008-29, Class CA | | 4.50 | | | 9/25/35 | | | | 902,999 | |

| 228,506 | | FNMA REMICS, Series 2008-65, Class CD | | 4.50 | | | 8/25/23 | | | | 239,937 | |

| 979,598 | | FNMA REMICS, Series 2009-13, Class NX | | 4.50 | | | 3/25/24 | | | | 1,033,658 | |

| 158,871 | | FNMA REMICS, Series 2009-71, Class MB | | 4.50 | | | 9/25/24 | | | | 168,421 | |

| 76,899 | | FNMA REMICS, Series 2009-76, Class MA | | 4.00 | | | 9/25/24 | | | | 78,874 | |

| 548,011 | | FNMA REMICS, Series 2009-87, Class A | | 4.50 | | | 12/25/38 | | | | 568,239 | |

| 157,296 | | FNMA REMICS, Series 2009-88, Class DA | | 4.50 | | | 10/25/20 | | | | 163,951 | |

| 459,882 | | FNMA REMICS, Series 2010-144, Class YG | | 2.25 | | | 11/25/23 | | | | 467,154 | |

| 99,931 | | FNMA REMICS, Series 2010-28, Class DA | | 5.00 | | | 9/25/28 | | | | 104,278 | |

| 219,075 | | FNMA REMICS, Series 2011-16, Class GE | | 2.75 | | | 3/25/26 | | | | 223,643 | |

| 323,944 | | FNMA REMICS, Series 2011-42, Class BJ | | 3.00 | | | 8/25/25 | | | | 333,961 | |

| 140,031 | | FNMA REMICS, Series 2011-46, Class A | | 3.00 | | | 5/25/24 | | | | 143,658 | |

| 1,000,632 | | FNMA REMICS, Series 2011-48, Class VJ | | 5.00 | | | 5/25/40 | | | | 1,031,523 | |

| 321,121 | | FNMA REMICS, Series 2011-9, Class HC | | 3.25 | | | 3/25/24 | | | | 328,082 | |

| 91,818 | | FNMA REMICS, Series 2012-19, Class GH | | 3.00 | | | 11/25/30 | | | | 95,558 | |

| 123,462 | | GNMA, Series 2004-53, Class CK | | 5.00 | | | 8/20/32 | | | | 127,189 | |

| 143,045 | | GNMA, Series 2007-48, Class FM 1 | | 0.47 | | | 4/20/37 | | | | 143,164 | |

| 137,175 | | GNMA, Series 2009-10, Class PA | | 4.50 | | | 12/20/38 | | | | 146,208 | |

| 62,802 | | GNMA, Series 2009-104, Class XM | | 5.00 | | | 3/20/36 | | | | 62,902 | |

| 865,014 | | GNMA, Series 2009-108, Class NB | | 3.00 | | | 4/20/37 | | | | 878,679 | |

| 381,353 | | GNMA, Series 2010-107, Class L | | 4.00 | | | 4/20/36 | | | | 387,766 | |

| 12,744 | | GNMA, Series 2010-108, Class BH | | 2.25 | | | 12/20/36 | | | | 12,773 | |

| 110,169 | | GNMA, Series 2010-61, Class DA | | 4.00 | | | 12/20/23 | | | | 113,274 | |

| 7,786 | | GNMA, Series 2010-61, Class EA | | 5.00 | | | 9/20/31 | | | | 7,784 | |

| 220,297 | | Vendee Mortgage Trust, Series 1993-1, Class ZB | | 7.25 | | | 2/15/23 | | | | 250,399 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 14,013,492 | |

| | | | | | | | | | | | |

Non-Agency - 7.7% | | | | | | | | | | |

| 8,737 | | Alternative Loan Trust, Series 2003-20CB, Class 1A2 | | 5.50 | | | 10/25/33 | | | | 8,746 | |

| 19,751 | | Banc of America Mortgage Trust, Series 2004-3, Class 1A26 | | 5.50 | | | 4/25/34 | | | | 20,107 | |

| 1,350,406 | | Bear Stearns Trust, Series 2004-10, Class 1A1 1 | | 0.87 | | | 9/25/34 | | | | 1,343,536 | |

| 1,627,626 | | CHL Mortgage Pass-Through Trust, Series 2003-56, Class 6A1 1 | | 2.56 | | | 12/25/33 | | | | 1,637,035 | |

| 75,609 | | Deutsche Mortgage Securities, Inc. Mortgage Loan Trust, Series 2004-1, Class 2A1 | | 4.75 | | | 10/25/18 | | | | 76,303 | |

| 280,165 | | Deutsche Mortgage Securities, Inc. Mortgage Loan Trust, Series 2004-1, Class 2A3 | | 4.75 | | | 10/25/18 | | | | 281,393 | |

| 108,468 | | GSR Mortgage Loan Trust 2005-5F, Class 8A1 1 | | 0.69 | | | 6/25/35 | | | | 105,591 | |

| 36,676 | | Master Asset Securitization Trust, Series 2003-4, Class CA1 | | 8.00 | | | 5/25/18 | | | | 37,822 | |

| 89,645 | | MASTR Alternative Loan Trust, Series 2003-4, Class 2A1 | | 6.25 | | | 6/25/33 | | | | 94,764 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2015

Sit Quality Income Fund (Continued)

| | | | | | | | | | | | |

| |

| | | | |

Principal Amount ($) | | Name of Issuer | | Coupon

Rate (%) | | Maturity

Date | | | Fair Value ($) | |

| |

222,096 | | MASTR Alternative Loan Trust, Series 2003-5, Class 4A1 | | 5.50 | | | 7/25/33 | | | | 236,065 | |

| 320,689 | | MASTR Alternative Loan Trust, Series 2003-8, Class 3A1 | | 5.50 | | | 12/25/33 | | | | 340,122 | |

| 116,000 | | MASTR Asset Securitization Trust, Series 2005-2, Class 1A3 | | 5.35 | | | 11/25/35 | | | | 117,777 | |

| 173,079 | | Prime Mortgage Trust, Series 2004-CL1, Class 1A1 | | 6.00 | | | 2/25/34 | | | | 181,740 | |

| 28,030 | | RAAC Trust, Series 2004-SP3, Class AI5 1 | | 4.89 | | | 12/25/32 | | | | 28,617 | |

| 3,888 | | Residential Funding Mortgage Securities I Trust, Series 2003-S13, Class A3 | | 5.50 | | | 6/25/33 | | | | 3,880 | |

| 227,409 | | Sequoia Mortgage Trust, Series 2012-1, Class 2A1 1 | | 3.47 | | | 1/25/42 | | | | 231,868 | |

| 325,053 | | Structured Asset Securities, Corp. Mortgage Loan Trust, Series 2005-GEL3, Class M3 1 | | 0.99 | | | 6/25/35 | | | | 322,385 | |

| 350,769 | | Structured Asset Securities, Corp. Mortgage Pass-Through Certificates, Series 2003-22A, Class 3A 1 | | 2.49 | | | 6/25/33 | | | | 360,114 | |

| 114,267 | | WaMu Mortgage Pass Through Certificates, Series 2002-AR2 Class A 1 | | 1.89 | | | 2/27/34 | | | | 111,543 | |

| 93,909 | | WaMu Mortgage Pass Through Certificates, Series 2004-CB2, Class 7A | | 5.50 | | | 8/25/19 | | | | 96,201 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,635,609 | |

| | | | | | | | | | | | |

Total Collateralized Mortgage Obligations

(cost: $19,642,647) | | | | | | | | | 19,649,101 | |

| | | | | | | | | | | | |

Corporate Bonds - 14.3% | | | | | | | | | | |

| 907,699 | | Aircraft Certificate Owner Trust 2003 4 | | 7.00 | | | 9/20/22 | | | | 962,161 | |

| 390,716 | | America West Airlines 2000-1 Pass Through Trust | | 8.06 | | | 7/2/20 | | | | 445,416 | |

| 500,000 | | Bank One Corp. 14 | | 8.53 | | | 3/1/19 | | | | 592,225 | |

| 350,000 | | Caterpillar Financial Services Corp. | | 7.15 | | | 2/15/19 | | | | 408,606 | |

| 800,000 | | Diamond Offshore Drilling, Inc. | | 5.88 | | | 5/1/19 | | | | 832,000 | |

| 500,000 | | Hancock Holdings Co. (Subordinated) | | 5.88 | | | 4/1/17 | | | | 526,820 | |

| 500,000 | | JB Hunt Transport Services, Inc. | | 2.40 | | | 3/15/19 | | | | 504,066 | |

| 500,000 | | Jersey Central Power & Light Co. | | 4.80 | | | 6/15/18 | | | | 531,578 | |

| 700,000 | | Lender Processing Services, Inc./Black Knight Lending Solutions, Inc. | | 5.75 | | | 4/15/23 | | | | 741,125 | |

| 1,000,000 | | Manufacturers & Traders Trust Co. (Subordinated) 1 | | 5.63 | | | 12/1/21 | | | | 1,005,000 | |

| 500,000 | | Nationwide Mutual Insurance Co. 1, 4 | | 2.63 | | | 12/15/24 | | | | 489,073 | |

| 730,722 | | Northwest Airlines 2002-1 Class G-2 Pass Through Trust | | 6.26 | | | 11/20/21 | | | | 760,389 | |

| 500,000 | | Omnicom Group, Inc. | | 6.25 | | | 7/15/19 | | | | 571,778 | |

| 325,000 | | Progress Energy, Inc. | | 7.05 | | | 3/15/19 | | | | 376,145 | |

| 800,000 | | Prudential Financial, Inc. 1 | | 2.87 | | | 8/10/18 | | | | 822,000 | |

| 500,000 | | SBA Tower Trust 4 | | 2.24 | | | 4/16/18 | | | | 496,697 | |

| 314,255 | | Virgin Australia 2013-1A Trust 4 | | 5.00 | | | 10/23/23 | | | | 326,825 | |

| | | | | | | | | | | | |

Total Corporate Bonds

(cost: $10,478,341) | | | | | | | | | 10,391,904 | |

| | | | | | | | | | | | |

Mortgage Pass-Through Securities - 11.3% | | | | | | | | | | |

Federal Home Loan Mortgage Corporation - 2.9% | | | | | | | | | | |

| 81,324 | | Freddie Mac | | 3.50 | | | 7/1/26 | | | | 86,247 | |

| 69,304 | | Freddie Mac | | 4.50 | | | 1/1/18 | | | | 71,791 | |

| 51,447 | | Freddie Mac | | 4.50 | | | 5/1/19 | | | | 53,326 | |

| 112,056 | | Freddie Mac | | 4.50 | | | 6/1/19 | | | | 116,307 | |

| 81,455 | | Freddie Mac | | 4.50 | | | 6/1/19 | | | | 84,438 | |

| 117,292 | | Freddie Mac | | 4.50 | | | 1/1/21 | | | | 121,981 | |

| 75,166 | | Freddie Mac | | 4.50 | | | 12/1/21 | | | | 78,392 | |

| 124,858 | | Freddie Mac | | 4.50 | | | 10/1/23 | | | | 135,273 | |

| 116,199 | | Freddie Mac | | 4.50 | | | 7/1/26 | | | | 120,763 | |

| 66,289 | | Freddie Mac | | 5.00 | | | 3/1/18 | | | | 68,921 | |

| 65,057 | | Freddie Mac | | 5.00 | | | 10/1/18 | | | | 67,797 | |

| 91,326 | | Freddie Mac | | 5.00 | | | 8/1/19 | | | | 95,366 | |

| 37,939 | | Freddie Mac | | 5.00 | | | 10/1/25 | | | | 41,533 | |

See accompanying notes to financial statements.

| | |

14 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

| | | | | | | | | | | | |

| |

| | | | |

Principal Amount ($) | | Name of Issuer | | Coupon

Rate (%) | | Maturity

Date | | | Fair Value ($) | |

| |

72,378 | | Freddie Mac | | 5.50 | | | 9/1/17 | | | | 74,563 | |

| 104,881 | | Freddie Mac | | 5.50 | | | 4/1/19 | | | | 109,573 | |

| 47,172 | | Freddie Mac | | 5.50 | | | 10/1/19 | | | | 49,932 | |

| 96,545 | | Freddie Mac | | 5.50 | | | 7/1/20 | | | | 101,655 | |

| 83,830 | | Freddie Mac | | 5.50 | | | 12/1/20 | | | | 88,739 | |

| 79,340 | | Freddie Mac | | 5.50 | | | 1/1/21 | | | | 84,493 | |

| 163,795 | | Freddie Mac | | 5.50 | | | 3/1/21 | | | | 176,435 | |

| 85,959 | | Freddie Mac | | 5.50 | | | 3/1/21 | | | | 92,878 | |

| 90,063 | | Freddie Mac | | 5.50 | | | 10/1/21 | | | | 94,934 | |

| 16,279 | | Freddie Mac | | 6.00 | | | 8/1/16 | | | | 16,458 | |

| 63,679 | | Freddie Mac | | 6.00 | | | 9/1/23 | | | | 71,575 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,103,370 | |

| | | | | | | | | | | | |

Federal National Mortgage Association - 7.9% | | | | | | | | | | |

| 282,655 | | Fannie Mae | | 2.75 | | | 11/1/17 | | | | 291,022 | |

| 263,576 | | Fannie Mae | | 3.00 | | | 8/1/21 | | | | 275,762 | |

| 1,000,000 | | Fannie Mae | | 3.15 | | | 9/1/18 | | | | 1,052,970 | |

| 494,053 | | Fannie Mae | | 3.18 | | | 12/1/17 | | | | 497,396 | |

| 106,286 | | Fannie Mae | | 3.50 | | | 10/1/21 | | | | 112,300 | |

| 44,945 | | Fannie Mae | | 4.00 | | | 10/1/31 | | | | 48,446 | |

| 709,525 | | Fannie Mae | | 4.69 | | | 2/1/20 | | | | 783,691 | |

| 184,069 | | Fannie Mae | | 5.21 | | | 5/1/19 | | | | 189,173 | |

| 650,808 | | Fannie Mae | | 5.31 | | | 2/1/19 | | | | 727,057 | |

| 339,126 | | Fannie Mae | | 5.39 | | | 1/1/18 | | | | 353,439 | |

| 1,282,463 | | Fannie Mae | | 5.51 | | | 4/1/17 | | | | 1,361,908 | |

| 60,454 | | Fannie Mae | | 6.00 | | | 5/1/23 | | | | 64,047 | |

| 30,545 | | Fannie Mae | | 6.50 | | | 2/1/19 | | | | 34,893 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,792,104 | |

| | | | | | | | | | | | |

Government National Mortgage Association - 0.5% | | | | | | | | | | |

| 68,714 | | Ginnie Mae 1 | | 1.63 | | | 10/20/34 | | | | 71,414 | |

| 102,360 | | Ginnie Mae 1 | | 1.75 | | | 4/20/33 | | | | 105,775 | |

| 34,890 | | Ginnie Mae 1 | | 3.50 | | | 4/20/42 | | | | 36,384 | |

| 152,893 | | Ginnie Mae | | 5.00 | | | 9/15/24 | | | | 162,179 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 375,752 | |

| | | | | | | | | | | | |

Total Mortgage Pass-Through Securities

(cost: $8,131,217) | | | | | | | | | 8,271,226 | |

| | | | | | | | | | | | |

Taxable Municipal Bonds - 10.4% | | | | | | | | | | |

| 800,000 | | Atlanta Downtown Development Authority 17 | | 6.88 | | | 2/1/21 | | | | 907,200 | |

| 960,000 | | Colorado Housing & Finance Authority | | 4.00 | | | 11/1/31 | | | | 1,010,045 | |

| 800,000 | | Fuller Road Management Corp. | | 5.40 | | | 9/1/17 | | | | 803,056 | |

| 500,000 | | Industry Public Facilities Authority | | 2.79 | | | 1/1/19 | | | | 513,470 | |

| 740,000 | | Iowa Finance Authority 17 | | 1.77 | | | 1/1/18 | | | | 741,606 | |

| 250,000 | | La Paz County Industrial Development Authority | | 4.25 | | | 12/1/15 | | | | 250,910 | |

| 370,000 | | Milwaukee Redevelopment Authority | | 3.00 | | | 8/1/18 | | | | 376,075 | |

| 500,000 | | Multistate Liquidating Trust No. 1 4, 17 | | 1.39 | | | 12/15/18 | | | | 501,529 | |

| 500,000 | | New Jersey Sports & Exposition Authority | | 6.08 | | | 3/1/23 | | | | 535,190 | |

| 490,000 | | Rhode Island Housing & Mortgage Finance Corp. | | 4.00 | | | 10/1/39 | | | | 513,339 | |

| 1,100,000 | | Skyway Concession Co., LLC 1, 4 | | 0.71 | | | 6/30/26 | | | | 893,750 | |

| 545,000 | | Texas Department of Housing & Community Affairs 17 | | 4.80 | | | 7/1/19 | | | | 561,099 | |

| | | | | | | | | | | | |

Total Taxable Municipal Bonds

(cost: $7,620,837) | | | | | | | | | 7,607,269 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2015

Sit Quality Income Fund (Continued)

| | | | | | | | | | | | |

| |

Principal Amount ($)/

Contracts | | Name of Issuer | | Coupon

Rate (%) | | Maturity

Date | | | Fair Value ($) | |

| |

U.S. Treasury / Federal Agency Securities - 17.9% | | | | | | | | | | |

Other Federal Agency Securities - 0.8% | | | | | | | | | | |

| 212,000 | | Comenity Capital Bank 12 | | 0.75 | | | 5/10/16 | | | | 212,468 | |

| 250,000 | | GE Capital Bank 12 | | 0.80 | | | 11/2/15 | | | | 250,133 | |

| 125,000 | | State Bank of India 12 | | 0.85 | | | 10/19/15 | | | | 125,034 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 587,635 | |

| | | | | | | | | | | | |

U.S. Treasury Note - 17.1% | | | | | | | | | | |

| 3,500,000 | | U.S. Treasury Floating Rate Note 1 | | 0.09 | | | 7/31/17 | | | | 3,496,395 | |

| 1,325,000 | | U.S. Treasury Note | | 0.88 | | | 9/15/16 | | | | 1,331,176 | |

| 6,600,000 | | U.S. Treasury Note | | 0.88 | | | 6/15/17 | | | | 6,632,056 | |

| 1,000,000 | | U.S. Treasury Note | | 1.75 | | | 10/31/20 | | | | 1,015,625 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 12,475,252 | |

| | | | | | | | | | | | |

Total U.S. Treasury / Federal Agency Securities

(cost: $13,056,336) | | | | | | | | | 13,062,887 | |

| | | | | | | | | | | | |

Put Options Purchased 10 - 0.1% | | | | | | | | | | |

| 49 | | U.S. Treasury 2 Year Future: Put Options: $ 109.125 strike, November 2015 expiration | | | | | | | | | 1,531 | |

| 50 | | U.S. Treasury 2 Year Future: Put Options: $ 109.375 strike, November 2015 expiration | | | | | | | | | 6,250 | |

| 94 | | U.S. Treasury 5 Year Future: Put Options: $ 120.25 strike, November 2015 expiration | | | | | | | | | 24,234 | |

| | | | | | | | | | | | |

Total Put Options Purchased

(cost: $98,009) | | | | | | | | | 32,015 | |

| | | | | | | | | | | | |

Total Investments in Securities - 95.3%

(cost: $69,578,298) | | | | | | | | | 69,548,518 | |

| | | | | | | | | | | | |

Other Assets and Liabilities, net - 4.7% | | | | | | | | | 3,424,536 | |

| | | | | | | | | | | | |

Total Net Assets - 100.0% | | | | | | | | | $72,973,054 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| |

| 1 | | Variable rate security. Rate disclosed is as of September 30, 2015. |

| 4 | | 144A Restricted Security. The total value of such securities as of September 30, 2015 was $3,670,035 and represented 5.0% of net assets. These securities have been determined to be liquid by the Adviser in accordance with guidelines established by the Board of Directors. |

| 10 | | The amount of $1,000,000 in cash was segregated with the broker to cover margin requirements for derivative transactions as of September 30, 2015. |

| 12 | | Certificate of Deposit. Investments up to $250,000 are insured by the Federal Deposit Insurance Corporation. |

| 14 | | Step Coupon: A bond that pays an initial coupon rate for the first period and then a higher coupon rate for the following periods. Rate disclosed is as of September 30, 2015. |

| 17 | | Security that is either an absolute and unconditional obligation of the United States Government or is collateralized by securities, loans, or leases guaranteed by the U.S. Government or its agencies or instrumentalities. |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

Short futures contracts outstanding as of September 30, 2015 were as follows:

| | | | | | | | | | | | |

| Contracts | | Type | | Expiration Date | | Notional

Amount | | | Unrealized

Depreciation | |

| |

Short Futures: | | | | | | | | | | | | |

137 | | U.S. Treasury 2 Year Futures 10 | | December 2015 | | | $30,007,274 | | | | $(74,704) | |

8 | | U.S. Treasury 5 Year Futures 10 | | December 2015 | | | 1,928,250 | | | | (8,596) | |

| | | | | | | | | | | | |

| | | | | | | | | | | $(83,300) | |

See accompanying notes to financial statements.

| | |

16 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

A summary of the levels for the Fund’s investments as of September 30, 2015 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | | |

| | | Investment in Securities |

| | | Level 1

Quoted

Price ($) | | Level 2

Other Significant

Observable Inputs ($) | | Level 3

Other Significant

Observable Inputs ($) | | Total ($) |

Assets | | | | | | | | | | | | | | | | | |

Asset-Backed Securities | | — | | | | 10,534,116 | | | | | — | | | | | 10,534,116 | |

Collateralized Mortgage Obligations | | — | | | | 19,649,101 | | | | | — | | | | | 19,649,101 | |

Corporate Bonds | | — | | | | 10,391,904 | | | | | — | | | | | 10,391,904 | |

Mortgage Pass-Through Securities | | — | | | | 8,271,226 | | | | | — | | | | | 8,271,226 | |

Taxable Municipal Bonds | | — | | | | 7,607,269 | | | | | — | | | | | 7,607,269 | |

U.S. Treasury / Federal Agency Securities | | — | | | | 13,062,887 | | | | | — | | | | | 13,062,887 | |

Put Options Purchased | | 32,015 | | | | — | | | | | — | | | | | 32,015 | |

| | 32,015 | | | | 69,516,503 | | | | | — | | | | | 69,548,518 | |

Liabilities | | | | | | | | | | | | | | | | | |

Futures | | (83,300) | | | | — | | | | | — | | | | | (83,300 | ) |

| | (83,300) | | | | — | | | | | — | | | | | (83,300 | ) |

For the reporting period, there were no transfers between levels 1, 2 and 3.

See accompanying notes to financial statements.

OBJECTIVE & STRATEGY

The objective of the Tax-Free Income Fund is to provide a high level of current income that is exempt from federal income tax, consistent with preservation of capital, by investing primarily in investment-grade municipal securities.

Such municipal securities generate interest income that is exempt from both federal regular income tax and federal alternative minimum tax. During normal market conditions, the Fund invests 100% of its net assets in such tax-exempt municipal securities.

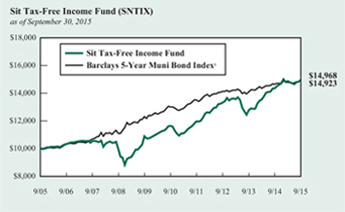

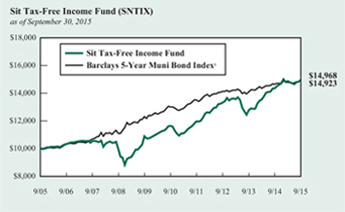

The Sit Tax-Free Income Fund provided a return of +0.60% for the 6-month period ended September 30, 2015, which compared to a return of +0.99% for the benchmark Barclays 5-Year Municipal Bond Index. The Fund’s 30-day SEC yield was 3.12%, which compared to a yield of 1.53% for the benchmark index. The Fund’s 12-month distribution rate was 3.73%.

The tax-exempt yield curve steepened during the six month period, as shorter tax-exempt municipal yields decreased slightly and longer tax-exempt municipal yields increased modestly. As a result, the Barclays 5-Year Municipal Bond Index was the strongest performing maturity segment of the broader Barclays Municipal Bond Index. Credit spreads increased slightly during the period, particularly for BBB-rated credits. Puerto Rico issues were weaker during the period, due to increased concern regarding the Commonwealth’s willingness and ability to pay. States with weaker economies or fiscal concerns such as underfunded pensions and budget problems generally underperformed states with stronger economic and fiscal situations. Specifically, state and local government issuers from Illinois and New Jersey had markedly weaker returns than issuers in other states. Year-to-date municipal bond issuance through September, almost $300 billion, is the most since 2010. However, secondary trading of municipal bonds remains lighter than usual and new issues have been readily absorbed by investors. Overall municipal fund flows were modestly negative throughout much of the period, although intermediate funds generally fared better than longer-term and high yield funds.

The Fund’s modest underperformance during this period was primarily due to industry positioning. Despite earning a positive absolute return, the Fund’s significant overweight position in single family housing bonds lagged the benchmark return. Also, the Fund’s position in closed-end mutual funds earned a negative return during the period. Together, these two industry segments total over 28% of the Fund and were the primary reason for its underperformance. Transportation revenue, insured revenue, healthcare revenue, and utility revenue bonds also lagged the benchmark return for the period. Conversely, multi-family revenue, other revenue, education/student loan revenue, and general obligation bonds were areas of emphasis that all outperformed the benchmark return. Although credit spreads widened, the Fund’s positions in bonds rated BBB and below produced the strongest returns during the period. While different than overall market trends in terms of credit, the Fund benefitted from its 22% position in non-rated bonds which tended to outperform rated

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the Barclays 5-Year Municipal Bond Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 The Barclays 5-Year Municipal Bond Index is the 5 year (4-6) component of the Municipal Bond Index, an unmanaged, rules-based, market-value-weighted index for the long-term tax-exempt bond market. The index includes bonds with a minimum credit rating of BBB. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index. This is the Fund’s primary index.

credits of similar quality during the period. Lastly, the Fund’s average credit quality increased to A from A- during the last six months.

The Fund’s duration remains longer than its benchmark; however, we do anticipate modest shortening over the next six to twelve months. Our strategy continues to emphasize income as the primary driver of returns over the long-run; as a result, the Fund continues to possess a substantial income advantage over the benchmark. Also, relative valuations, particularly for intermediate and long tax-exempt municipals, remain attractive when expressed as a percentage of comparable maturity U.S. Treasury Bonds. We remain diversified on a geographic and issuer basis in order to manage credit risk within the Fund. Because of these factors, we believe the Fund is attractively positioned for the current environment.

Michael C. Brilley

Paul J. Jungquist, CFA

Senior Portfolio Managers

| | |

18 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

| | | | | | | | | | | | |

as of September 30, 2015 | | | | | | | | | |

| | | Sit

Tax-Free

Income

Fund | | | Barclays

5-Year Muni

Bond Index1 | | | Lipper

General

Muni. Bond

Fund Index2 | |

| |

Six Months | | | 0.60% | | | | 0.99% | | | | n/a | |

One Year | | | 4.33 | | | | 1.85 | | | | 3.18% | |

Five Years | | | 5.17 | | | | 2.79 | | | | 4.53 | |

Ten Years | | | 4.12 | | | | 4.08 | | | | 4.43 | |

Since Inception (9/29/88) | | | 5.34 | | | | 5.30 | | | | 5.76 | |

| |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains and all fee waivers. Without the fee waivers total return and yield figures would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

1 The Barclays 5-Year Municipal Bond Index is the 5 year (4-6) component of the Municipal Bond Index, an unmanaged, rules-based, market-value-weighted index for the long-term tax-exempt bond market. The index includes bonds with a minimum credit rating of BBB. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index.

2 The Lipper returns are obtained from Lipper Analytical Services, Inc., a large independent evaluator of mutual funds.

FUND DIVERSIFICATION

| | | | |

Single Family Mortgage | | | 22.4% | |

Multifamily Mortgage | | | 18.7% | |

Other Revenue | | | 11.8% | |

Education/Student Loan | | | 8.1% | |

Insured | | | 7.4% | |

Investment Companies | | | 6.3% | |

General Obligation | | | 5.9% | |

Hospital/Health Care | | | 5.2% | |

Sectors less than 5% | | | 7.9% | |

Cash & Other Net Assets | | | 6.3% | |

| |

Based on total net assets as of September 30, 2015. Subject to change.

PORTFOLIO SUMMARY

| | | | |

Net Asset Value 9/30/15: | | $9.57 Per Share | | |

Net Asset Value 3/31/15: | | $9.68 Per Share | | |

Total Net Assets: | | $160.0 Million | | |

Average Maturity: | | 16.8 Years | | |

Effective Duration 3: | | 5.5 Years | | |

3 Duration is a measure of estimated price sensitivity relative to changes in interest rates. Portfolios with longer durations are typically more sensitive to changes in interest rates. For example, if interest rates rise by 1%, the fair value of a security with an effective duration of 5 years would decrease by 5%, with all other factors being constant. The correlation between duration and price sensitivity is greater for securities rated investment-grade than it is for securities rated below investment-grade. Duration estimates are based on assumptions by the Adviser and are subject to a number of limitations. Effective duration is calculated based on historical price changes of securities held by the Fund, and therefore is a more accurate estimate of price sensitivity provided interest rates remain within their historical range.

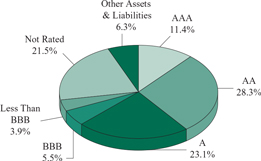

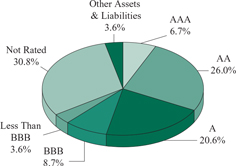

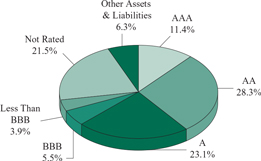

QUALITY RATINGS (% of Total Net Assets)

Lower of Moody’s, S&P, Fitch or Duff & Phelps ratings used.

| | | | | | |

| Adviser’s Assessment of Non-Rated Securities: |

AAA | | | 0.0% | | | |

AA | | | 1.4 | | | |

A | | | 0.2 | | | |

BBB | | | 1.8 | | | |

BB | | | 13.4 | | | |

<BB | | | 4.7 | | | |

| | | | | | |

Total | | | 21.5% | | | |

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2015

Sit Tax-Free Income Fund

| | | | | | | | | | | | |

| |

| | | | |

Principal Amount ($) | | Name of Issuer | | Coupon

Rate (%) | | Maturity

Date | | | Fair Value ($) | |

| |

Municipal Bonds - 87.4% | | | | | | | | | | |

Alabama - 0.3% | | | | | | | | | | |

| 400,000 | | Birmingham-Baptist Medical Centers Special Care Facs. Financing Auth. Rev. | | 5.00 | | | 11/15/30 | | | | 400,296 | |

| | | | | | | | | | | | |

Alaska - 2.4% | | | | | | | | | | |

| 750,000 | | AK Hsg. Finance Corp. Mtg. Rev. | | 4.13 | | | 12/1/37 | | | | 760,380 | |

| 640,000 | | AK Hsg. Finance Corp. Mtg. Rev. | | 4.25 | | | 12/1/40 | | | | 649,312 | |

| 500,000 | | AK Hsg. Finance Corp. Mtg. Rev. (G.O. of Corp. Insured) | | 4.50 | | | 12/1/35 | | | | 514,130 | |

| 500,000 | | AK Hsg. Finance Corp. Rev. (State Capital Proj.) | | 4.00 | | | 6/1/36 | | | | 505,470 | |

| 250,000 | | AK Industrial Dev. & Export Auth. Rev. (Boys & Girls Home) 2, 5, 15 | | 5.50 | | | N/A | | | | 62,505 | |

| 250,000 | | AK Industrial Dev. & Export Auth. Rev. (GTR Fairbanks Community Hospital Foundation) | | 5.00 | | | 4/1/33 | | | | 270,102 | |

| 460,000 | | Koyukuk Health Facility Rev. (Tanana Chief’s Conf. Health Care) | | 7.00 | | | 10/1/23 | | | | 519,280 | |

| 550,000 | | North Slope Borough Service Area Rev. | | 5.25 | | | 6/30/34 | | | | 604,422 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,885,601 | |

| | | | | | | | | | | | |

Arizona - 1.8% | | | | | | | | | | |

| 843,598 | | AZ Health Facs. Auth. Rev. (New Arizona Family Proj.) | | 5.25 | | | 7/1/27 | | | | 946,576 | |

| 125,000 | | Flagstaff Industrial Dev. Auth. Rev. (Sr. Living Community Proj.) | | 5.50 | | | 7/1/22 | | | | 125,129 | |

| 400,000 | | Peoria Industrial Dev. Auth. Rev. (Sierra Winds Life Care Community) | | 5.25 | | | 11/15/29 | | | | 404,748 | |

| 5,000 | | Pima Co. Industrial Dev. Auth. Education Rev. (AZ Charter Schools Proj.) | | 6.70 | | | 7/1/21 | | | | 5,021 | |

| 75,000 | | Pima Co. Industrial Dev. Auth. Education Rev. (Choice Education & Dev. Corp. Proj.) | | 6.00 | | | 6/1/16 | | | | 76,085 | |

| 400,000 | | Pima Co. Industrial Dev. Auth. Education Rev. (Coral Academy Science Proj.) | | 6.38 | | | 12/1/18 | | | | 420,688 | |

| 325,000 | | Pima Co. Industrial Dev. Auth. Education Rev. (Tucson Country Day School Proj.) | | 5.00 | | | 6/1/22 | | | | 317,596 | |

| 500,000 | | Quechan Indian Tribe of Fort Yuma Rev. (Tribal Economic Dev.) | | 9.75 | | | 5/1/25 | | | | 560,880 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,856,723 | |

| | | | | | | | | | | | |

Arkansas - 0.7% | | | | | | | | | | |

| 320,000 | | Arkansas Dev. Finance Auth. | | 5.00 | | | 2/1/33 | | | | 353,638 | |

| 300,000 | | Henderson State University Rev. (BAM Insured) | | 4.00 | | | 11/1/29 | | | | 317,640 | |

| 150,000 | | Rogers Rev. (Sales & Use Tax) | | 4.13 | | | 11/1/31 | | | | 156,602 | |

| 300,000 | | Russellville Rev. (Water & Sewer) (AGM Insured) | | 5.00 | | | 7/1/32 | | | | 340,548 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,168,428 | |

| | | | | | | | | | | | |

California - 9.1% | | | | | | | | | | |

| 300,000 | | Agua Caliente Band of Cahuilla Indians Rev. 4 | | 6.00 | | | 7/1/18 | | | | 297,387 | |

| 300,000 | | CA Health Facs. Finance Auth. Rev. (El Camino Hospital) | | 5.00 | | | 2/1/35 | | | | 333,540 | |

| 500,000 | | CA School Facs. Finance Auth. Rev. (Azusa Unified School District) (AGM Insured) 6 | | 6.00 | | | 8/1/29 | | | | 589,945 | |

| 160,000 | | CA Statewide Communities Dev. Auth. Rev. (Lancer Plaza Proj.) | | 5.13 | | | 11/1/23 | | | | 165,995 | |

| 500,000 | | CA Statewide Communities Dev. Auth. Rev. (Provident Group - Pomona Property) | | 5.60 | | | 1/15/36 | | | | 518,410 | |

| 400,000 | | Carlsbad Unified School District G.O. Capital Appreciation 6 | | 6.13 | | | 8/1/31 | | | | 386,108 | |

| 1,000,000 | | Colton Joint Unified School District G.O. (AGM Insured) 6 | | 5.80 | | | 8/1/35 | | | | 853,480 | |