UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-04087 |

Manning & Napier Fund, Inc.

|

| (Exact name of registrant as specified in charter) |

| | |

| 290 Woodcliff Drive, Fairport, NY | | 14450 |

| (Address of principal executive offices) | | (Zip Code) |

B. Reuben Auspitz 290 Woodcliff Drive, Fairport, NY 14450

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 585-325-6880

Date of fiscal year end: December 31, 2008

Date of reporting period: January 1, 2008 through December 31, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

| ITEM 1: | REPORTS TO STOCKHOLDERS |

Manning & Napier Fund, Inc.

| | | | |

| SMALL CAP SERIES | | | | | Annual Report - December 31, 2008 |

Management Discussion and Analysis (unaudited)

Dear Shareholders:

2008 was the worst year for small company stocks since 1973 and a difficult year for the Small Cap Series, as well. The Series finished the year down 50.68%, underperforming the Standard & Poor’s (S&P) 500 Total Return Index (down 36.99%) as well as the Russell 2000® Index (down 33.79%), which is the key benchmark measuring the performance of small company stocks. The Small Cap Series continues to post a positive annualized return of 0.91% over the current market cycle (since October 1, 1002), but trails the Russell 2000® Index, which has posted a 6.61% annualized return over the market cycle.

While most of the absolute losses occurred during the final quarter of the year, the majority of the Series’ underperformance relative to the Russell 2000® Index occurred during the first three quarters of the year. Apart from overall market weakness, the Series’ performance was hurt by a sizeable position in Energy companies, which was the worst performing sector within the Russell 2000® Index, as well as weak performance from select investments in the Health Care and Information Technology sectors.

We believe the credit crisis and the manner in which it affected some of our holdings was likely the most significant factor driving our underperformance in 2008. We maintained an underweight position in financial services companies, especially banks and insurance companies, due to the growing impact of the credit crisis on banks, insurance companies and other financial services firms. We would have expected this approach to have generally served us well in this time of financial crisis. Surprisingly, this was not the case. Despite the high profile problems at large financial services companies like Bear Stearns and Lehman Brothers, smaller financial institutions did not have as much exposure to troubled assets, tended to stick to traditional lending activities and actually performed relatively well in 2008. As a result, the financial services component of the Russell 2000® Index actually outperformed the rest of the Index by over 10%, and the Series’ underweight position in financial services companies was a drag on relative performance.

Making matters worse, the problems at large financial companies resulted in a significant curtailment of liquidity and capital availability which is often critical to the operations of smaller companies. The Small Cap Series held positions in a number of companies across a variety of industries that depended on access to capital and liquidity for ongoing financing of business activities. As the credit crisis gained momentum, many of these holdings experienced more severe stock price declines than we expected.

In response to market conditions, we made a number of portfolio adjustments, particularly in the second half of the year. Specifically, we have reduced the number of positions we hold and focused on larger, more financially stable companies that attempt to leverage key investment themes such as health care information technology, enterprise IT resource optimization and security, beneficiaries of environmental regulations, and cable. We are also focusing on several industries experiencing weak demand and low returns; these conditions often lead to supply curtailments which serve to tighten capacity and lead to improved returns when demand recovers. In the current environment, we are finding many industries that fit this strategy, including trucking, airlines, energy and retail.

While 2008 was a difficult year for investors, we recognize that our job is to remain focused on company-specific fundamentals. In a year where emotion - a crisis of confidence - was a strong driver of returns no matter the market, we are not surprised that our fundamentals-based approach produced disappointing returns. However, looking back over our 38-year history, this approach has served our clients well over the long-term.

As always, we appreciate your business.

Sincerely,

Manning & Napier Advisors, Inc.

Performance Update as of December 31, 2008 (unaudited)

| | | | | | | | | | |

| | | Average Annual Total Returns

As of December 31, 2008 | | |

| | | One

Year | | Five

Year | | Ten

Year | | Since

Inception1 | | |

Manning & Napier Fund, Inc. - Small Cap Series2 | | -50.68% | | -6.31% | | 1.92% | | 4.64% | | |

Standard & Poor’s (S&P) 500 Total Return Index3 | | -36.99% | | -2.18% | | -1.38% | | 6.85% | | |

Russell 2000® Index3 | | -33.79% | | -0.93% | | 3.02% | | 7.23% | | |

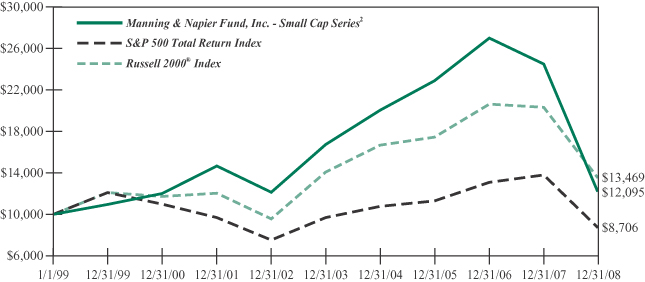

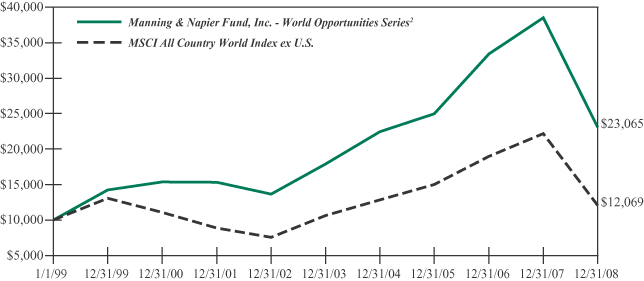

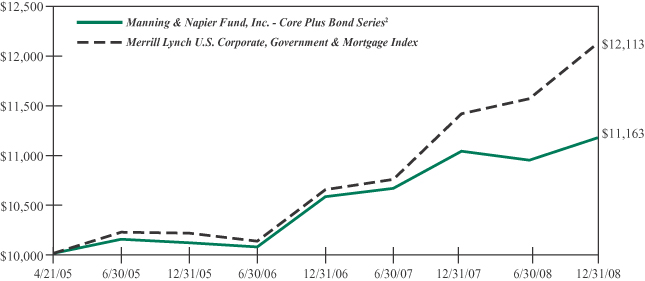

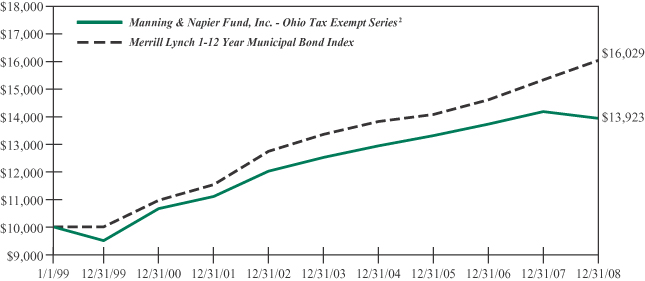

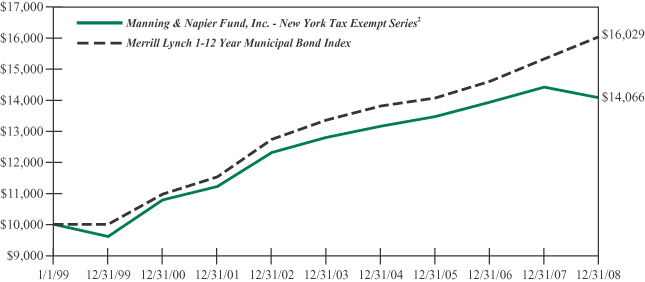

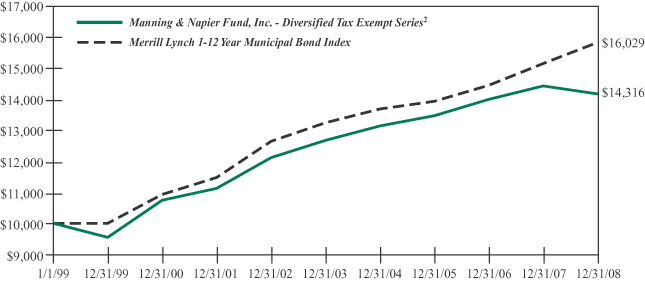

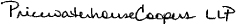

The following graph compares the value of a $10,000 investment in the Manning & Napier Fund, Inc. - Small Cap Series for the ten years ended December 31, 2008 to the S&P 500 Total Return Index and the Russell 2000® Index.

1Performance numbers for the Series and Indices are calculated from April 30, 1992, the Series’ current activation date.

2The Series’ performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The Series’ performance is historical and may not be indicative of future results. The performance returns shown are inclusive of the net expense ratio of the Series. For the year ended December 31, 2008, this net expense ratio was 1.15%. The gross expense ratio, which does not account for any voluntary or contractual waivers currently in effect, was 1.15% for the year ended December 31, 2008.

3The S&P 500 Total Return Index is an unmanaged capitalization-weighted measure of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and the Over-the-Counter market. The Index returns assume daily reinvestment of dividends. The Russell 2000® Index is an unmanaged index that consists of 2,000 U.S. small-capitalization stocks. The Index returns are based on a market capitalization-weighted average of relative price changes of the component stocks plus dividends whose reinvestments are compounded daily. Both Indices’ returns, unlike Series returns, do not reflect any fees or expenses.

Shareholder Expense Example (unaudited)

As a shareholder of the Series, you may incur two types of costs: (1) transaction costs, including potential wire charges on redemptions and (2) ongoing costs, including management fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2008 to December 31, 2008).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as potential wire charges on redemptions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | |

| | | Beginning

Account Value

7/1/08 | | Ending

Account Value

12/31/08 | | Expenses Paid

During Period*

7/1/08-12/31/08 |

Actual | | $ | 1,000.00 | | $ | 624.80 | | $ | 4.74 |

Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | $ | 1,019.30 | | $ | 5.89 |

*Expenses are equal to the Series’ annualized expense ratio (for the six-month period) of 1.16%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses are based on the most recent fiscal half year; therefore, the expense ratio stated above may differ from the expense ratio stated in the financial highlights, which is based on one-year data.

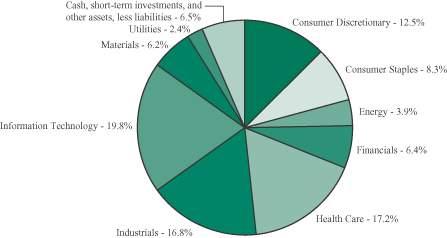

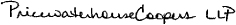

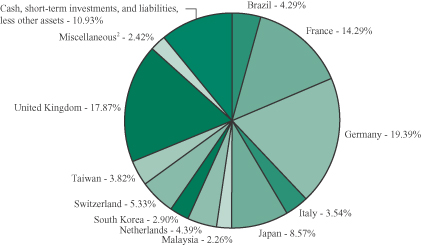

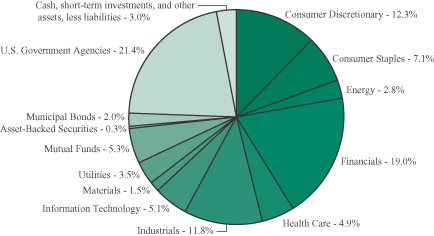

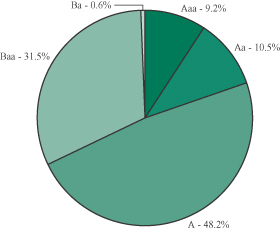

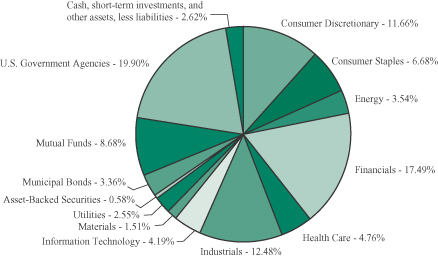

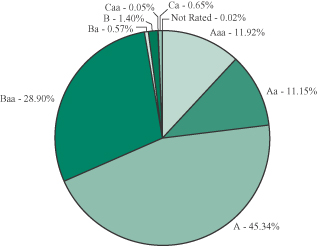

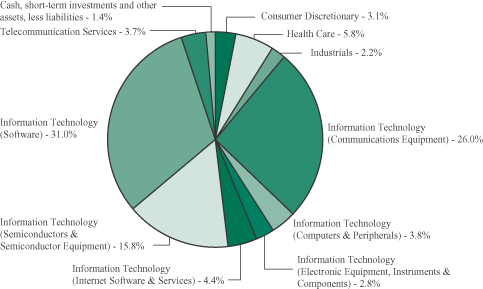

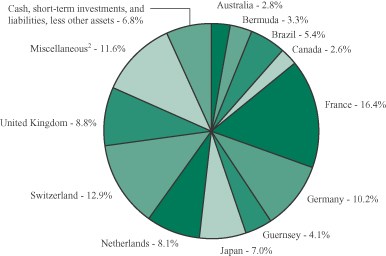

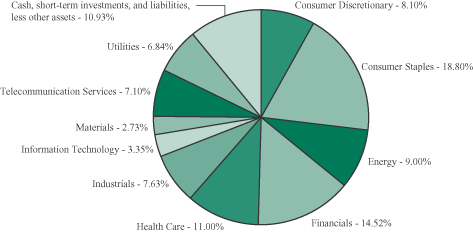

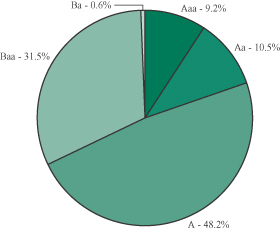

Portfolio Composition as of December 31, 2008 (unaudited)

Sector Allocation1

1As a percentage of net assets.

Market Capitalization

| | |

Average | | $1,136 Million |

Median | | 873 Million |

Weighted Average | | 1,170 Million |

Top Ten Stock Holdings2

| | |

Netlogic Microsystems, Inc. | | 3.5% |

Mediacom Communications Corp. - Class A | | 3.3% |

Riverbed Technology, Inc. | | 3.2% |

Owens Corning, Inc. | | 3.1% |

Eclipsys Corp. | | 2.7% |

Calgon Carbon Corp. | | 2.6% |

Rodobens Negocios Imobiliarios S.A. (Brazil) | | 2.5% |

Mirant Corp. | | 2.4% |

Dean Foods Co. | | 2.4% |

Cerner Corp. | | 2.3% |

2As a percentage of total investments.

Investment Portfolio - December 31, 2008

| | | | | |

| | | Shares | | Value

(Note 2) |

| | | | | |

| | |

COMMON STOCKS - 93.5% | | | | | |

| | |

Consumer Discretionary - 12.5% | | | | | |

Auto Components - 1.4% | | | | | |

Hankook Tire Co. Ltd. (South Korea) (Note 7) | | 140,910 | | $ | 1,711,865 |

| | | | | |

Diversified Consumer Services - 1.3% | | | | | |

Jackson Hewitt Tax Service, Inc. | | 98,270 | | | 1,541,856 |

| | | | | |

Household Durables - 2.5% | | | | | |

Rodobens Negocios Imobiliarios S.A. (Brazil) (Note 7) | | 885,350 | | | 2,981,552 |

| | | | | |

Media - 3.5% | | | | | |

Charter Communications, Inc. - Class A* | | 4,523,830 | | | 370,049 |

Mediacom Communications Corp. - Class A* | | 907,190 | | | 3,900,917 |

| | | | | |

| | | | | 4,270,966 |

| | | | | |

Specialty Retail - 3.8% | | | | | |

Dick’s Sporting Goods, Inc.* | | 156,100 | | | 2,202,571 |

Tractor Supply Co.* | | 64,630 | | | 2,335,728 |

| | | | | |

| | | | | 4,538,299 |

| | | | | |

Total Consumer Discretionary | | | | | 15,044,538 |

| | | | | |

Consumer Staples - 8.3% | | | | | |

Beverages - 0.5% | | | | | |

National Beverage Corp.* | | 74,400 | | | 669,600 |

| | | | | |

Food & Staples Retailing - 2.2% | | | | | |

BJ’s Wholesale Club, Inc.* | | 76,310 | | | 2,614,381 |

| | | | | |

Food Products - 4.5% | | | | | |

Dean Foods Co.* | | 159,930 | | | 2,873,942 |

Sanderson Farms, Inc. | | 43,020 | | | 1,486,771 |

Tootsie Roll Industries, Inc. | | 40,500 | | | 1,037,205 |

| | | | | |

| | | | | 5,397,918 |

| | | | | |

Personal Products - 1.1% | | | | | |

Alberto-Culver Co. | | 53,000 | | | 1,299,030 |

| | | | | |

Total Consumer Staples | | | | | 9,980,929 |

| | | | | |

Energy - 3.9% | | | | | |

Energy Equipment & Services - 2.5% | | | | | |

Calfrac Well Services Ltd. (Canada) (Note 7) | | 132,210 | | | 931,961 |

Dril-Quip, Inc.* | | 54,370 | | | 1,115,129 |

Trican Well Service Ltd. (Canada) (Note 7) | | 144,080 | | | 929,247 |

| | | | | |

| | | | | 2,976,337 |

| | | | | |

Oil, Gas & Consumable Fuels - 1.4% | | | | | |

Edge Petroleum Corp.* | | 1,138,140 | | | 180,964 |

| | |

| The accompanying notes are an integral part of the financial statements. | | 5 |

Investment Portfolio - December 31, 2008

| | | | | |

| | | Shares | | Value

(Note 2) |

| | | | | |

| | |

COMMON STOCKS (continued) | | | | | |

| | |

Energy (continued) | | | | | |

Oil, Gas & Consumable Fuels (continued) | | | | | |

Forest Oil Corp.* | | 45,980 | | $ | 758,210 |

Mariner Energy, Inc.* | | 70,511 | | | 719,212 |

| | | | | |

| | | | | 1,658,386 |

| | | | | |

Total Energy | | | | | 4,634,723 |

| | | | | |

Financials - 6.4% | | | | | |

Capital Markets - 2.1% | | | | | |

Federated Investors, Inc. | | 73,000 | | | 1,238,080 |

Janus Capital Group, Inc. | | 157,860 | | | 1,267,616 |

| | | | | |

| | | | | 2,505,696 |

| | | | | |

Commercial Banks - 2.5% | | | | | |

Potomac Bancshares, Inc. | | 13,208 | | | 125,476 |

TCF Financial Corp. | | 132,480 | | | 1,809,677 |

Wilmington Trust Corp. | | 46,940 | | | 1,043,946 |

| | | | | |

| | | | | 2,979,099 |

| | | | | |

Insurance - 0.7% | | | | | |

First American Corp. | | 30,720 | | | 887,501 |

| | | | | |

Thrifts & Mortgage Finance - 1.1% | | | | | |

First Niagara Financial Group, Inc. | | 85,160 | | | 1,377,037 |

| | | | | |

Total Financials | | | | | 7,749,333 |

| | | | | |

Health Care - 17.2% | | | | | |

Biotechnology - 1.1% | | | | | |

Medarex, Inc.* | | 95,520 | | | 533,002 |

Senomyx, Inc.* | | 268,405 | | | 748,850 |

| | | | | |

| | | | | 1,281,852 |

| | | | | |

Health Care Equipment & Supplies - 6.9% | | | | | |

Abaxis, Inc.* | | 87,380 | | | 1,400,701 |

The Cooper Companies, Inc. | | 161,460 | | | 2,647,944 |

Inverness Medical Innovations, Inc.* | | 140,260 | | | 2,652,317 |

OraSure Technologies, Inc.* | | 436,500 | | | 1,606,320 |

| | | | | |

| | | | | 8,307,282 |

| | | | | |

Health Care Providers & Services - 1.8% | | | | | |

Diagnosticos da America S.A. (Brazil) (Note 7) | | 230,120 | | | 2,219,261 |

| | | | | |

Health Care Technology - 5.0% | | | | | |

Cerner Corp.* | | 72,150 | | | 2,774,167 |

Eclipsys Corp.* | | 226,090 | | | 3,208,217 |

| | | | | |

| | | | | 5,982,384 |

| | | | | |

| | |

| 6 | | The accompanying notes are an integral part of the financial statements. |

Investment Portfolio - December 31, 2008

| | | | | |

| | | Shares | | Value

(Note 2) |

| | | | | |

| | |

COMMON STOCKS (continued) | | | | | |

| | |

Health Care (continued) | | | | | |

Life Sciences Tools & Services - 2.4% | | | | | |

Exelixis, Inc.* | | 114,340 | | $ | 573,987 |

PerkinElmer, Inc. | | 168,150 | | | 2,338,966 |

| | | | | |

| | | | | 2,912,953 |

| | | | | |

Total Health Care | | | | | 20,703,732 |

| | | | | |

Industrials - 16.8% | | | | | |

Airlines - 4.0% | | | | | |

Continental Airlines, Inc. - Class B* | | 70,960 | | | 1,281,538 |

Delta Air Lines, Inc.* | | 122,070 | | | 1,398,922 |

JetBlue Airways Corp.* | | 302,490 | | | 2,147,679 |

| | | | | |

| | | | | 4,828,139 |

| | | | | |

Building Products - 3.1% | | | | | |

Owens Corning, Inc.* | | 213,450 | | | 3,692,685 |

| | | | | |

Commercial Services & Supplies - 1.2% | | | | | |

Tomra Systems ASA (Norway) (Note 7) | | 434,340 | | | 1,464,828 |

| | | | | |

Electrical Equipment - 1.2% | | | | | |

General Cable Corp.* | | 78,630 | | | 1,390,965 |

| | | | | |

Machinery - 1.9% | | | | | |

FreightCar America, Inc. | | 128,590 | | | 2,349,339 |

| | | | | |

Road & Rail - 4.4% | | | | | |

Heartland Express, Inc. | | 134,640 | | | 2,121,926 |

Knight Transportation, Inc. | | 137,200 | | | 2,211,664 |

Old Dominion Freight Line, Inc.* | | 32,190 | | | 916,127 |

| | | | | |

| | | | | 5,249,717 |

| | | | | |

Trading Companies & Distributors - 1.0% | | | | | |

Rush Enterprises, Inc. - Class A* | | 143,130 | | | 1,226,624 |

| | | | | |

Total Industrials | | | | | 20,202,297 |

| | | | | |

Information Technology - 19.8% | | | | | |

Communications Equipment - 7.9% | | | | | |

BigBand Networks, Inc.* | | 228,580 | | | 1,261,762 |

Blue Coat Systems, Inc.* | | 248,700 | | | 2,089,080 |

Infinera Corp.* | | 258,930 | | | 2,320,013 |

Riverbed Technology, Inc.* | | 333,100 | | | 3,794,009 |

| | | | | |

| | | | | 9,464,864 |

| | | | | |

Electronic Equipment, Instruments & Components - 1.0% | | | |

LoJack Corp.* | | 307,110 | | | 1,265,293 |

| | | | | |

IT Services - 2.3% | | | | | |

Online Resources Corp.* | | 575,570 | | | 2,728,202 |

| | | | | |

| | |

| The accompanying notes are an integral part of the financial statements. | | 7 |

Investment Portfolio - December 31, 2008

| | | | | | |

| | | Shares/ Principal Amount | | Value

(Note 2) |

| | | | | | |

| | |

COMMON STOCKS (continued) | | | | | | |

| | |

Information Technology (continued) | | | | | | |

Semiconductors & Semiconductor Equipment - 3.5% | | | |

Netlogic Microsystems, Inc.* | | | 190,770 | | $ | 4,198,848 |

| | | | | | |

Software - 5.1% | | | | | | |

THQ, Inc.* | | | 270,400 | | | 1,132,976 |

TIBCO Software, Inc.* | | | 478,190 | | | 2,481,806 |

UbiSoft Entertainment S.A.* (France) (Note 7) | | | 128,160 | | | 2,484,895 |

| | | | | | |

| | | | | | 6,099,677 |

| | | | | | |

Total Information Technology | | | | | | 23,756,884 |

| | | | | | |

Materials - 6.2% | | | | | | |

Chemicals - 4.6% | | | | | | |

Calgon Carbon Corp.* | | | 201,650 | | | 3,097,344 |

The Scotts Miracle-Gro Co. - Class A | | | 80,530 | | | 2,393,352 |

| | | | | | |

| | | | | | 5,490,696 |

| | | | | | |

Containers & Packaging - 1.6% | | | | | | |

Bemis Co., Inc. | | | 81,100 | | | 1,920,448 |

| | | | | | |

Total Materials | | | | | | 7,411,144 |

| | | | | | |

Utilities - 2.4% | | | | | | |

Independent Power Producers & Energy Traders - 2.4% | | | |

Mirant Corp.* | | | 153,310 | | | 2,892,960 |

| | | | | | |

TOTAL COMMON STOCKS

(Identified Cost $163,142,134) | | | | | | 112,376,540 |

| | | | | | |

| | |

SHORT-TERM INVESTMENTS - 5.0% | | | | | | |

Dreyfus Cash Management, Inc. - Institutional Shares | | | 4,021,689 | | | 4,021,689 |

Fannie Mae Discount Note, 3/3/2009 | | $ | 2,000,000 | | | 1,999,766 |

| | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Identified Cost $6,021,351) | | | | | | 6,021,455 |

| | | | | | |

TOTAL INVESTMENTS - 98.5%

(Identified Cost $169,163,485) | | | | | | 118,397,995 |

| | |

OTHER ASSETS, LESS LIABILITIES - 1.5% | | | | | | 1,764,298 |

| | | | | | |

NET ASSETS - 100% | | | | | $ | 120,162,293 |

| | | | | | |

*Non-income producing security

| | |

| 8 | | The accompanying notes are an integral part of the financial statements. |

Statement of Assets and Liabilities

December 31, 2008

| | | | |

ASSETS: | | | | |

| | | | |

| |

Investments, at value (identified cost $169,163,485) (Note 2) | | $ | 118,397,995 | |

Receivable for securities sold | | | 2,263,242 | |

Receivable for fund shares sold | | | 40,827 | |

Dividends receivable | | | 35,091 | |

Foreign tax reclaims receivable | | | 6,466 | |

| | | | |

TOTAL ASSETS | | | 120,743,621 | |

| | | | |

| LIABILITIES: | | | | |

| |

Accrued management fees (Note 3) | | | 97,060 | |

Accrued fund accounting and transfer agent fees (Note 3) | | | 8,085 | |

Accrued Chief Compliance Officer service fees (Note 3) | | | 477 | |

Payable for fund shares repurchased | | | 432,348 | |

Audit fees payable | | | 31,130 | |

Other payables and accrued expenses | | | 12,228 | |

| | | | |

TOTAL LIABILITIES | | | 581,328 | |

| | | | |

TOTAL NET ASSETS | | $ | 120,162,293 | |

| | | | |

NET ASSETS CONSIST OF: | | | | |

| |

Capital stock | | $ | 241,073 | |

Additional paid-in-capital | | | 242,032,911 | |

Accumulated net investment loss | | | (92,455 | ) |

Accumulated net realized loss on investments, foreign currency and other assets and liabilities | | | (71,253,037 | ) |

Net unrealized depreciation on investments and other assets and liabilities | | | (50,766,199 | ) |

| | | | |

TOTAL NET ASSETS | | $ | 120,162,293 | |

| | | | |

NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - CLASS A ($120,162,293/24,107,295 shares) | | $ | 4.98 | |

| | | | |

| | |

| The accompanying notes are an integral part of the financial statements. | | 9 |

Statement of Operations

For the Year Ended December 31, 2008

| | | | |

INVESTMENT INCOME: | | | | |

| | | | |

| |

Dividends (net of foreign tax withheld, $34,908) | | $ | 1,054,673 | |

Interest | | | 103,403 | |

| | | | |

Total Investment Income | | | 1,158,076 | |

| | | | |

| EXPENSES: | | | | |

| |

Management fees (Note 3) | | | 1,526,890 | |

Fund accounting and transfer agent fees (Note 3) | | | 106,546 | |

Directors’ fees (Note 3) | | | 12,599 | |

Chief Compliance Officer service fees (Note 3) | | | 4,301 | |

Custodian fees | | | 19,700 | |

Miscellaneous | | | 78,591 | |

| | | | |

Total Expenses | | | 1,748,627 | |

| | | | |

NET INVESTMENT LOSS | | | (590,551 | ) |

| | | | |

| REALIZED AND UNREALIZED LOSS ON INVESTMENTS: | | | | |

| |

Net realized loss on - | | | | |

Investments | | | (71,253,037 | ) |

Foreign currency and other assets and liabilities | | | (93,206 | ) |

| | | | |

| | | (71,346,243 | ) |

| | | | |

| |

Net change in unrealized depreciation on - | | | | |

Investments | | | (26,248,498 | ) |

Foreign currency and other assets and liabilities | | | (1,137 | ) |

| | | | |

| | | (26,249,635 | ) |

| | | | |

| |

NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (97,595,878 | ) |

| | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (98,186,429 | ) |

| | | | |

| | |

| 10 | | The accompanying notes are an integral part of the financial statements. |

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the

Year Ended

12/31/08 | | | For the

Year Ended

12/31/07 | |

| | | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

| | |

| OPERATIONS: | | | | | | | | |

| | |

Net investment loss | | $ | (590,551 | ) | | $ | (153,161 | ) |

Net realized gain (loss) on investments and foreign currency | | | (71,346,243 | ) | | | 25,830,490 | |

Net change in unrealized depreciation on investments and foreign currency | | | (26,249,635 | ) | | | (45,239,311 | ) |

| | | | | | | | |

Net decrease from operations | | | (98,186,429 | ) | | | (19,561,982 | ) |

| | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS (Note 8): | | | | | | | | |

| | |

From net realized gain on investments | | | (1,696,201 | ) | | | (24,981,501 | ) |

| | | | | | | | |

| CAPITAL STOCK ISSUED AND REPURCHASED: | | | | | | | | |

| | |

Net increase from capital share transactions (Note 5) | | | 35,046,424 | | | | 54,050,690 | |

| | | | | | | | |

Net increase (decrease) in net assets | | | (64,836,206 | ) | | | 9,507,207 | |

| | |

| NET ASSETS: | | | | | | | | |

| | |

Beginning of year | | | 184,998,499 | | | | 175,491,292 | |

| | | | | | | | |

End of year (including accumulated net investment loss of $92,455 and $499, respectively) | | $ | 120,162,293 | | | $ | 184,998,499 | |

| | | | | | | | |

| | |

| The accompanying notes are an integral part of the financial statements. | | 11 |

Financial Highlights

| | | | | | | | | | |

| | | For the Years Ended |

| | | 12/31/08 | | 12/31/07 | | 12/31/06 | | 12/31/05 | | 12/31/04 |

| | | | | | | | | | |

| Per share data (for a share outstanding throughout each year): | | | | | | | | | | |

Net asset value - Beginning of year | | $10.21 | | $13.08 | | $13.66 | | $15.01 | | $13.12 |

| | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | |

Net investment loss | | (0.02) | | (0.01) | | (0.05) | | (0.07) | | (0.07) |

Net realized and unrealized gain (loss) on investments | | (5.12) | | (1.25) | | 2.55 | | 2.20 | | 2.66 |

| | | | | | | | | | |

Total from investment operations | | (5.14) | | (1.26) | | 2.50 | | 2.13 | | 2.59 |

| | | | | | | | | | |

| | | | | |

Less distributions to shareholders: | | | | | | | | | | |

From net realized gain on investments | | (0.09) | | (1.61) | | (3.08) | | (3.48) | | (0.70) |

| | | | | | | | | | |

Net asset value - End of year | | $4.98 | | $10.21 | | $13.08 | | $13.66 | | $15.01 |

| | | | | | | | | | |

Net assets - End of year (000’s omitted) | | $120,162 | | $184,998 | | $175,491 | | $154,416 | | $169,438 |

| | | | | | | | | | |

Total return1 | | (50.68%) | | (9.32%) | | 18.06% | | 14.11% | | 19.81% |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | |

Expenses | | 1.15% | | 1.14% | | 1.16% | | 1.19% | | 1.22%* |

Net investment loss | | (0.39%) | | (0.08%) | | (0.40%) | | (0.51%) | | (0.54%) |

Portfolio turnover | | 68% | | 64% | | 85% | | 55% | | 61% |

| | | | | | | | | | |

|

*The investment advisor did not impose all of its management fee and is not eligible to recoup any expenses that have been waived or reimbursed in prior years. If these expenses had been incurred by the Series, the expense ratio (to average net assets) for the year ended 12/31/04 would have been increased by 0.01%. |

1Represents aggregate total return for the year indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived during the year ended 12/31/04.

| | |

| 12 | | The accompanying notes are an integral part of the financial statements. |

Notes to Financial Statements

Small Cap Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The Series’ investment objective is to provide long-term growth by investing principally in the common stocks of companies with small market capitalizations.

The Series is authorized to issue five classes of shares (Class A, B, D, E and Z). Currently, only Class A shares have been issued. Each class of shares is substantially the same, except that class-specific distribution and shareholder servicing expenses are borne by the specific class of shares to which they relate.

The Fund’s Advisor is Manning & Napier Advisors, Inc. (the “Advisor”). Shares of the Series are offered to investors, clients and employees of the Advisor and its affiliates. The total authorized capital stock of the Fund consists of 5.0 billion shares of common stock each having a par value of $0.01. As of December 31, 2008, 4.5 billion shares have been designated in total among 28 series, of which 87.5 million have been designated as Small Cap Series Class A common stock.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Security Valuation

Portfolio securities, including domestic equities, foreign equities, exchange-traded funds and options, listed on an exchange other than the NASDAQ National Market System are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ National Market System are valued in accordance with the NASDAQ Official Closing Price.

Securities for which representative valuations or prices are not available from the Fund’s pricing service may be valued at fair value. Due to the inherent uncertainty of valuations of such securities, the fair value may differ significantly from the values that would have been used had a ready market for such securities existed. If trading or events occurring after the close of the principal market in which securities are traded are expected to materially affect the value of those securities, then they may be valued at their fair value, taking this trading or these events into account. Fair value is determined in good faith by the Advisor under procedures approved by and under the general supervision and responsibility of the Fund’s Board of Directors (the “Board”).

Short-term investments that mature in sixty days or less are valued at amortized cost, which approximates market value. Investments in open-end investment companies are valued at their net asset value per share on valuation date, with the exception of exchange-traded funds, which are valued at the closing price on the exchange.

In September 2006, FASB Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”) was issued, effective for fiscal years beginning after November 15, 2007. This standard clarifies the definition of fair value for financial reporting, establishes a framework for measuring fair value and requires additional disclosures about the use of fair

Notes to Financial Statements

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

Security Valuation (continued)

value measurements. FAS 157 became effective for the Series as of January 1, 2008, the beginning of its current fiscal year. The three levels of the fair value hierarchy under FAS 157 are described below:

Level 1 - quoted prices in active markets for identical securities

Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 - significant unobservable inputs (including the Series’ own assumptions in determining the fair value of investments.)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Series’ assets as of December 31, 2008:

| | | | | | |

Valuation Inputs | | Investments In

Securities | | Other Financial

Instruments* |

| | | | | | |

Level 1 - Quoted Prices | | $ | 116,398,229 | | $ | — |

Level 2 - Other Significant Observable Inputs | | | 1,999,766 | | | — |

Level 3 - Significant Unobservable Inputs | | | — | | | — |

| | | | | | |

Total | | $ | 118,397,995 | | $ | — |

| | | | | | |

*Other financial instruments are derivative instruments not reflected in the Investment Portfolio, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation/depreciation on the instrument. As of December 31, 2008, the Series did not hold any derivative instruments.

There were no Level 3 securities held by the Series as of December 31, 2007 or December 31, 2008.

Security Transactions, Investment Income and Expenses

Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date, except that if the ex-dividend date has passed, certain dividends from foreign securities are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Interest income, including amortization of premium and accretion of discounts using the effective interest method, is earned from settlement date and accrued daily.

Expenses are recorded on an accrual basis. Most expenses of the Fund can be attributed to a specific series. Expenses which cannot be directly attributed are apportioned among the series in the Fund in such a manner as deemed equitable by the Fund’s Board, taking into consideration, among other things, the nature and type of expense.

The Series uses the identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

Foreign Currency Translation

The books and records of the Series are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the current exchange rates. Purchases and sales of investment securities and income and expenses are translated on the respective dates of such transactions. The Series does not isolate realized and unrealized gains and losses attributable to changes in the exchange rates from gains and losses

Notes to Financial Statements

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

Foreign Currency Translation (continued)

that arise from changes in the market value of investments. Such fluctuations are included with net realized and unrealized gain or loss on investments. Net realized foreign currency gains and losses represent foreign currency gains and losses between trade date and settlement date on securities transactions, gains and losses on disposition of foreign currencies and the difference between the amount of income and foreign withholding taxes recorded on the books of the Series and the amounts actually received or paid.

Federal Taxes

The Series’ policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Series is not subject to federal income tax or excise tax to the extent that the Series distributes to shareholders each year its taxable income, including any net realized gains on investments, in accordance with requirements of the Internal Revenue Code. Accordingly, no provision for federal income tax or excise tax has been made in the financial statements.

On June 29, 2007, the Series adopted Financial Accounting Standards Board Interpretation No. 48 - Accounting for Uncertainty in Income Taxes (“FIN 48”). FIN 48 prescribes the minimum recognition threshold a tax position must meet in connection with accounting for uncertainties in income tax positions taken or expected to be taken by an entity before being measured and recognized in the financial statements. Management has determined that the adoption of FIN 48 did not have a material impact on the Series’ financial statements. The Series files income tax returns in the U.S. federal jurisdiction, various states and foreign jurisdictions, as required. No income tax returns are currently under investigation. The statute of limitations on the Series’ tax returns remains open for the years ended December 31, 2005 through December 31, 2008.

Additionally, based on the Fund’s understanding of the tax rules and rates related to income, gains and transactions for foreign jurisdictions in which it invests, the Series will provide for foreign taxes, and where appropriate, deferred foreign tax.

Distributions of Income and Gains

Distributions to shareholders of net investment income and net realized gains are made annually. An additional distribution may be necessary to avoid taxation of the Series. Distributions are recorded on the ex-dividend date.

Indemnifications

The Fund’s organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Other

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Notes to Financial Statements

| 3. | TRANSACTIONS WITH AFFILIATES |

The Fund has an Investment Advisory Agreement (the “Agreement”) with the Advisor, for which the Series pays a fee, computed daily and payable monthly, at an annual rate of 1.00% of the Series’ average daily net assets.

Under the Agreement, personnel of the Advisor provide the Series with advice and assistance in the choice of investments and the execution of securities transactions, and otherwise maintain the Series’ organization. The Advisor also provides the Fund with necessary office space and fund administration and support services. The salaries of all officers of the Fund (except a percentage of the Fund’s Chief Compliance Officer’s salary, which is paid by the Fund), and of all Directors who are “affiliated persons” of the Fund, or of the Advisor, and all personnel of the Fund, or of the Advisor, performing services relating to research, statistical and investment activities, are paid by the Advisor. Each “non-affiliated” Director receives an annual stipend, which is allocated among all the active series of the Fund. In addition, these Directors also receive a fee per Board meeting attended for each active series of the Fund plus a fee for each committee meeting attended.

Manning & Napier Investor Services, Inc., a registered broker-dealer affiliate of the Advisor, acts as distributor for the Fund’s shares. The services of Manning & Napier Investor Services, Inc. are provided at no additional cost to the Series.

For fund accounting and transfer agent services, through October 31, 2008, the Fund paid the Advisor an annual fee of 0.11% of the Fund’s average daily net assets up to $900 million, 0.07% of the Fund’s average daily net assets between $900 million and $1.5 billion, and 0.04% of the Fund’s average daily net assets over $1.5 billion. Effective November 1, 2008, the fee rates are as follows: 0.055% of the Fund’s average daily net assets up to $4.5 billion, 0.03% of the Fund’s average daily net assets between $4.5 billion and $7.5 billion, and 0.02% of the Fund’s average daily net assets over $7.5 billion. Additionally, certain transaction and account-based fees and out-of-pocket expenses, including charges for reporting relating to the Fund’s compliance program, are charged. Expenses not directly attributable to a series are allocated based on each series’ relative net assets or number of accounts, depending on the expense. The Advisor has an agreement with Citi Fund Services Ohio, Inc. (“Citi”) under which Citi serves as sub-accountant and sub-transfer agent.

| 4. | PURCHASES AND SALES OF SECURITIES |

For the year ended December 31, 2008, purchases and sales of securities, other than United States Government securities and short-term securities, were $130,095,440 and $99,189,138, respectively. There were no purchases or sales of United States Government securities.

| 5. | CAPITAL STOCK TRANSACTIONS |

Transactions in Class A shares of Small Cap Series were:

| | | | | | | | | | | | | | |

| | | For the Year

Ended 12/31/08 | | | For the Year

Ended 12/31/07 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| | | | | | | | | | | | | | |

Sold | | 9,626,461 | | | $ | 62,628,594 | | | 2,951,632 | | | $ | 38,717,750 | |

Reinvested | | 210,004 | | | | 1,675,830 | | | 2,455,169 | | | | 24,508,650 | |

Repurchased | | (3,840,314 | ) | | | (29,258,000 | ) | | (712,445 | ) | | | (9,175,710 | ) |

| | | | | | | | | | | | | | |

Total | | 5,996,151 | | | $ | 35,046,424 | | | 4,694,356 | | | $ | 54,050,690 | |

| | | | | | | | | | | | | | |

Approximately 85% of the Series’ shares represent investments by fiduciary accounts over which the Advisor has sole investment discretion.

Notes to Financial Statements

The Series may trade in financial instruments with off-balance sheet risk in the normal course of its investing activities to assist in managing exposure to various market risks. These financial instruments include written options, forward foreign currency exchange contracts and futures contracts and may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. No such investments were held by the Series on December 31, 2008.

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in securities of domestic companies and the United States Government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of comparable domestic companies and the United States Government.

| 8. | FEDERAL INCOME TAX INFORMATION |

The amount and characterization of certain income and capital gains to be distributed are determined in accordance with federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing book and tax treatments in the timing of the recognition of net investment income or gains and losses, including net operating losses, the tax practice known as equalization, foreign currency gains and losses and Post-October losses. The Series may periodically make reclassifications among its capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations, without impacting the Series’ net asset value. Any such reclassifications are not reflected in the financial highlights.

The tax character of distributions paid were as follows:

| | | | | | |

| | | For the Year

Ended 12/31/08 | | For the Year

Ended 12/31/07 |

| | | | | | |

Ordinary income | | $ | 242,042 | | $ | 11,710,286 |

Long-term capital gains | | | 1,454,159 | | | 13,271,215 |

For the year ended December 31, 2008, the Series elected to defer $30,186,055 and $92,455 of capital and currency losses, respectively, attributable to Post-October losses.

At December 31, 2008, the tax basis components of distributable earnings and the net unrealized depreciation based on identified cost for federal income tax purposes were as follows:

| | | | |

Cost for federal income tax purposes | | $ | 169,163,485 | |

Unrealized appreciation | | $ | 3,870,761 | |

Unrealized depreciation | | | (54,636,251 | ) |

| | | | |

Net unrealized depreciation | | $ | (50,765,490 | ) |

Capital loss carryover | | | 41,066,982 | |

The capital loss carryover, disclosed above, available to the extent allowed by tax law to offset future net capital gain, if any, will expire on December 31, 2016.

Notes to Financial Statements

| 9. | RECENT ACCOUNTING PRONOUNCEMENTS |

In September 2008, FASB Staff Position No. FAS 133-1 and FIN 45-4, “Disclosures about Credit Derivatives and Certain Guarantees: An Amendment of FASB Statement No. 133 and FASB Interpretation No. 45” (the “Position”) was issued and is effective for fiscal years and interim periods beginning after November 15, 2008. The Position amends FASB Statement No. 133 (“FAS 133”), Accounting for Derivative Instruments and Hedging Activities, and also amends FASB Interpretation No. 45 (“FIN 45”), Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others. The amendments to FAS 133 include required disclosure for (i) the nature and terms of the credit derivative, reasons for entering into the credit derivative, the events or circumstances that would require the seller to perform under the credit derivative, and the current status of the payment performance risk of the credit derivative, (ii) the maximum potential amount of future payments (undiscounted) the seller could be required to make under the credit derivative, (iii) the fair value of the credit derivative, and (iv) the nature of any recourse provisions and assets held either as collateral or by third parties. The amendments to FIN 45 require additional disclosures about the current status of the payment/performance risk of a guarantee. At this time, Management is evaluating the implications of FAS 133-1 and FIN 45-4, but they are not expected to materially impact the Series’ financial statements.

In March 2008, FASB Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities (“FAS 161”) was issued and is effective for fiscal years and interim periods beginning after November 15, 2008. FAS 161 requires enhanced disclosures about the Series’ derivative and hedging activities, including how such activities are accounted for and their effect on the Series’ financial position and performance. Management is currently evaluating the impact of the adoption of FAS 161, but it is not expected to materially impact the Series’ financial statements.

Report of Independent Registered Public Accounting Firm

To the Board of Directors of Manning & Napier Fund, Inc. and Shareholders of Small Cap Series:

In our opinion, the accompanying statement of assets and liabilities, including the investment portfolio, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Small Cap Series (a series of Manning & Napier Fund, Inc., hereafter referred to as the “Series”) at December 31, 2008, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Series’ management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2008 by correspondence with the custodian, provide a reasonable basis for our opinion.

Columbus, Ohio

February 13, 2009

Supplemental Tax Information (unaudited)

For federal income tax purposes, the Series designates for the current fiscal year $29,069 or, if different, the maximum amount allowable under the tax law as qualified dividend income.

Pursuant to Section 852 of the Internal Revenue Code, as amended, the Series hereby designates $1,454,159 as capital gains for its taxable year ended December 31, 2008.

Renewal of Investment Advisory Agreement (unaudited)

At the Manning & Napier Fund, Inc. (the “Fund”) Board of Directors’ (the “Board”) meeting, held on November 5, 2008, the Investment Advisory Agreement (the “Agreement”) between the Fund and Manning & Napier Advisors, Inc. (the “Advisor”) was reviewed by the Board for renewal. In connection with the decision whether to renew the Agreement, a variety of material was prepared for and reviewed by the Board.

Representatives of the Advisor attended the meeting and presented additional oral and written information to the Board to assist the Board in its considerations. The discussion immediately below outlines the materials and information presented to the Board in connection with the Board’s 2008 Annual Review of the Agreement and the conclusions made by the Directors when determining to continue the Agreement.

| | • | | The Board considered the services provided by the Advisor under the Agreement including, among others: deciding what securities to purchase and sell for each Series; arranging for the purchase and sale of such securities by placing orders with broker-dealers; administering the affairs of the Fund (including the books and records of the Fund not maintained by third party service providers such as the custodian or sub-transfer agent); arranging for the insurance coverage for the Fund; and supervising the preparation of tax returns, SEC filings (including registration statements) and reports to shareholders for the Fund. The Board also considered the nature and quality of such services provided under the Agreement in light of the Advisor’s services provided to the Fund for 22 years. The Board discussed the quality of these services with representatives from the Advisor and concluded that the Advisor was performing its services to the Fund required under the Agreement in a reasonable manner. |

| | • | | The Board considered the investment performance of the various Series of the Fund. The investment performance for each Series was reviewed on a cumulative basis since inception and on a one year basis. In addition, annualized performance for the following time periods was considered: inception, three year, five year, ten year, and current market cycle. A market cycle includes periods of both rising and falling markets. Returns for established benchmark indices for each Series were provided for each time period. The Board noted that the various Series were competitive against their respective benchmarks and/or peer groups over various time periods, but in particular over the full market cycle period relevant for the Series. In addition, the Board considered at the meeting (and considers on a quarterly basis) a peer group performance analysis consisting of Morningstar universes of mutual funds with similar investment objectives. The Board discussed the performance with representatives from the Advisor and concluded that the investment performance of each of the Fund’s Series was reasonable based on the Fund’s actual performance and comparative performance, especially performance over the current market cycle. |

| | • | | The Board considered the costs of the Advisor’s services and the profits of the Advisor as they relate to the Advisor’s services to the Fund under the Agreement. In reviewing the Advisor’s costs and profits, the Board discussed the Advisor’s revenues generated from the Fund (on both an actual and adjusted basis) and its expenses associated with providing the services under the Agreement. In addition, the Board reviewed the Advisor’s expenses associated with Fund activities outside of the Agreement (such as expense reimbursements pursuant to expense caps and payments made by the Advisor to third party platforms on which shares of the Fund are available for purchase). It was noted by representatives of the Advisor that 15 of the 25 active Series of the Fund are |

Renewal of Investment Advisory Agreement (unaudited)

| | currently experiencing expenses above the capped expense ratios. After discussing the above costs and profits, the Board concluded that the Advisor’s profitability relating to its services provided under the Agreement was reasonable. |

| | • | | The Board considered the fees and expenses of the various Series of the Fund. The Advisor presented the advisory fees and total expenses for each Series, including the advisory fee adjusted for any expense waivers or reimbursements (either contractual or voluntary) paid by the Advisor. The advisory fees and expense ratios of each Series were compared to an average (on both a mean and median basis) of similar funds as disclosed on the Morningstar database. Representatives of the Advisor discussed with the Board the levels of its advisory fee for each Series of the Fund and as compared to the median and mean advisory fees for similar funds as listed on Morningstar. Expense ratios for every Series, except the High Yield Bond Series, Global Fixed Income Series and the Target Series Class R and Class C, are currently below the median and mean for similar funds as listed on Morningstar. Based on their review of the information provided, the Board concluded that the fees and expenses of each Series of the Fund were reasonable on a comparative basis. |

| | • | | The Board also considered the other benefits the Advisor derives from its relationship with the Fund. Such other benefits include certain research products provided by soft dollars. Given the level of soft dollar transactions involving the Fund, the Board concluded that these additional benefits to the Advisor were reasonable. |

| | • | | In addition to the factors described above, the Board considered the Advisor’s personnel, investment strategies, policies and procedures relating to compliance with personal securities transactions, and reputation, expertise and resources in domestic and foreign financial markets. The Board concluded that these factors support the conclusion that the Advisor performs its services in a reasonable manner. |

| | • | | The Board did not consider economies of scale at this time because of the multiple uses of the Fund (for the Advisor’s discretionary investment account clients in addition to direct investors), the current profitability of the Advisor’s services to the Fund under the Agreement, and the overall size of the Fund complex. |

Based on the Board’s deliberations and their evaluation of the information described above, the Board, including a majority of Directors that are not “interested persons” as defined in the Investment Company Act of 1940, concluded that the compensation under the Agreement was fair and reasonable in light of the services and expenses and such other matters as the Directors considered to be relevant in the exercise of their reasonable judgment. Accordingly, the Board approved the renewal of the Agreement. In the course of their deliberations, the Directors did not identify any particular information that was all important or controlling.

Directors’ and Officers’ Information (unaudited)

The Statement of Additional Information provides additional information about the Fund’s directors and officers and can be obtained without charge by calling 1-800-466-3863, at www.manningnapieradvisors.com, or on the EDGAR Database on the SEC Internet web site (http://www.sec.gov). The following chart shows certain information about the Fund’s officers and directors, including their principal occupations during the last five years. Unless specific dates are provided, the individuals have held the listed positions for longer than five years.

INTERESTED DIRECTOR/OFFICER

| | |

| Name: | | B. Reuben Auspitz* |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 61 |

| Current Position(s) Held with Fund: | | Principal Executive Officer, President, Chairman & Director |

| Term of Office1 & Length of Time Served: | | Indefinite - Director since 1984; Vice President 1984 - 2003; President since 2004; Principal Executive Officer since 2002 |

| Principal Occupation(s) During Past 5 Years: | | Executive Vice President; Co-Executive Director; Executive Group Member**; Chief Compliance Officer since 2004 - Manning & Napier Advisors, Inc. President; Director - Manning & Napier Investor Services, Inc. Holds or has held one or more of the following titles for various subsidiaries and affiliates: President, Vice President, Director, Chairman, Treasurer, Chief Compliance Officer or Member. |

| Number of Portfolios Overseen within Fund Complex: | | 28 |

| Other Directorships Held Outside Fund Complex: | | N/A |

| |

| INDEPENDENT DIRECTORS | | |

| |

| Name: | | Stephen B. Ashley |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 68 |

| Current Position(s) Held with Fund: | | Director, Audit Committee Member, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 1996 |

| Principal Occupation(s) During Past 5 Years: | | Chairman, Director, President & Chief Executive Officer, The Ashley Group (property management and investment). Chairman (non-executive) 2004-2008; Director 1995-2008 - Fannie Mae (mortgage) |

| Number of Portfolios Overseen within Fund Complex: | | 28 |

| Other Directorships Held Outside Fund Complex: | | The Ashley Group |

| Name: | | Peter L. Faber |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 70 |

| Current Position(s) Held with Fund: | | Director, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 1987 |

| Principal Occupation(s) During Past 5 Years: | | Senior Counsel, McDermott, Will & Emery LLP (law firm) |

| Number of Portfolios Overseen within Fund Complex: | | 28 |

| Other Directorships Held Outside Fund Complex: | | Partnership for New York City, Inc. |

| | New York Collegium |

| | | Boston Early Music Festival |

| Name: | | Harris H. Rusitzky |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 73 |

| Current Position(s) Held with Fund: | | Director, Audit Committee Member, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 1985 |

| Principal Occupation(s) During Past 5 Years: | | President, The Greening Group (business consultants); Partner, The Restaurant Group (restaurants) |

| Number of Portfolios Overseen within Fund Complex: | | 28 |

| Other Directorships Held Outside Fund Complex: | | N/A |

Directors’ and Officers’ Information (unaudited)

| | |

| |

| INDEPENDENT DIRECTORS (continued) | | |

| |

| Name: | | Paul A. Brooke |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 63 |

| Current Position(s) Held with Fund: | | Director, Audit Committee Member, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 2007 |

| Principal Occupation(s) During Past 5 Years: | | Chairman & CEO, Alsius Corp. (investments); Managing Member, PMSV Holdings LLC (investments) |

| Number of Portfolios Overseen within Fund Complex: | | 28 |

| Other Directorships Held Outside Fund Complex: | | Incyte Corp. |

| | ViroPharma, Inc. |

| | HLTH Corp. |

| | Cheyne Captial International |

| | MPM Bio-equities |

| | GMP Companies |

| | | HoustonPharma |

| |

| OFFICERS | | |

| |

| Name: | | Jeffrey S. Coons, Ph.D., CFA |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 45 |

| Current Position(s) Held with Fund: | | Vice President |

| Term of Office1 & Length of Time Served: | | Since 2004 |

| Principal Occupation(s) During Past 5 Years: | | Co-Director of Research since 2002 & Executive Group Member**, Manning & Napier Advisors, Inc. Holds one or more of the following titles for various subsidiaries and affiliates: President, Director, Treasurer or Senior Trust Officer. |

| Number of Portfolios Overseen within Fund Complex: | | 28 |

| Other Directorships Held Outside Fund Complex: | | N/A |

| Name: | | Christine Glavin |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 42 |

| Current Position(s) Held with Fund: | | Principal Financial Officer, Chief Financial Officer |

| Term of Office1 & Length of Time Served: | | Principal Financial Officer since 2002; Chief Financial Officer since 2001 |

| Principal Occupation(s) During Past 5 Years: | | Fund Reporting Manager, Manning & Napier Advisors, Inc. |

| Number of Portfolios Overseen within Fund Complex: | | 28 |

| Other Directorships Held Outside Fund Complex: | | N/A |

| Name: | | Jodi L. Hedberg |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 41 |

| Current Position(s) Held with Fund: | | Corporate Secretary, Chief Compliance Officer, Anti-Money Laundering Compliance Officer |

| Term of Office1 & Length of Time Served: | | Corporate Secretary since 1997; Chief Compliance Officer since 2004 |

| Principal Occupation(s) During Past 5 Years: | | Director of Compliance, Manning & Napier Advisors, Inc. and affiliates; Corporate Secretary, Manning & Napier Investor Services, Inc. since 2006 |

| Number of Portfolios Overseen within Fund Complex: | | 28 |

| Other Directorships Held Outside Fund Complex: | | N/A |

*Interested Director, within the meaning of the Investment Company Act of 1940 by reason of his position with the Fund’s investment advisor and distributor. Mr. Auspitz serves as the Executive Vice President and Director, Manning & Napier Advisors, Inc. and President and Director, Manning & Napier Investor Services, Inc., the Fund’s distributor.

**The Executive Group performs the duties of the Office of the Chief Executive of Manning & Napier Advisors, Inc.

1The term of office for President, Vice President, Chief Financial Officer, and Corporate Secretary is one year and until their respective successors are chosen and qualified. All other officers’ terms are indefinite.

(THISPAGEINTENTIONALLYLEFTBLANK)

Literature Requests (unaudited)

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, upon request:

| | |

By phone | | 1-800-466-3863 |

On the Securities and Exchange Commission’s (SEC) web site | | http://www.sec.gov |

Proxy Voting Record

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available, without charge, upon request:

| | |

By phone | | 1-800-466-3863 |

On the SEC’s web site | | http://www.sec.gov |

Quarterly Portfolio Holdings

The Series’ complete schedule of portfolio holdings for the 1st and 3rd quarters of each fiscal year are provided on Form N-Q, and are available, without charge, upon request:

| | |

By phone | | 1-800-466-3863 |

On the SEC’s web site | | http://www.sec.gov |

The Series’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Prospectus and Statement of Additional Information (SAI)

The prospectus and SAI provide additional information about each Series, including charges, expenses and risks. These documents are available, without charge, upon request:

| | |

By phone | | 1-800-466-3863 |

On the SEC’s web site | | http://www.sec.gov |

On the Advisor’s web site | | http://www.manningnapieradvisors.com |

Additional information available at www.manningnapieradvisors.com

1. Fund Holdings - Month-End

2. Fund Holdings - Quarter-End

3. Shareholder Report - Annual

4. Shareholder Report - Semi-Annual

Manning & Napier Fund, Inc.

| | | | |

| LIFE SCIENCES SERIES | | | | | Annual Report - December 31, 2008 |

Management Discussion and Analysis (unaudited)

Dear Shareholders:

Market conditions in 2008 were extremely challenging; the Life Sciences Series achieved a return that was below the return of the Standard & Poor’s (S&P) 500 Health Care Index for the first time in nine years. The Series also underperformed the S&P 500 Total Return Index. Over the calendar year 2008, the Life Sciences Series generated a total return of -38.77%, versus the -22.81% return of the S&P 500 Health Care Index and the -36.99% return of the S&P 500 Total Return Index. However, performance over the full market cycle (since 10/1/02) remains competitive, both on an absolute basis and as compared to the benchmarks. The Series’ average annualized total return from October 1, 2002 through December 31, 2008 was 3.64%, which exceeds the 2.48% average annualized total return of the S&P 500 Health Care Index and narrowly beats the 3.63% average annualized total return of the S&P 500 Total Return Index.

The relative underperformance of the Series versus the benchmarks in 2008 was due in large part to the weak performance of our small-cap holdings. There were several reasons for the broader decline of small-cap stocks, including capital rotation into what were perceived as less risky large-cap stocks, as well as general credit and financing concerns around the small-cap companies. In addition, there was an unprecedented amount of forced selling and redemptions by institutional and retail investors, especially in the fourth quarter, with an exaggerated impact on small-cap equities due to liquidity. Smaller companies in general were disproportionately punished by investors, with what we regard as fundamentally solid companies often being indiscriminately sold.

We believe the fundamentals of our small-cap holdings remain largely sound; therefore, we are continuing to hold them despite what we believe to be exaggerated short-term worries in the marketplace. However, in response to market conditions, we made certain portfolio adjustments throughout the course of the year. For example, we placed a higher emphasis on more financially stable companies that fit within our long-term investment themes such as diagnostics, life science tools, and healthcare information technology. We also decreased the Series’ exposure to small-cap holdings that were failing to track our investment thesis positively.

The Series also continues to invest in companies related to our long-term themes that we believe have secular (non-cyclical) tailwinds and that we believe to be less exposed to government scrutiny and pricing pressure than some other companies. Existing and new products and services from our thematic investments are intended to improve the quality of healthcare while, at the same time, increasing efficiency in the delivery of care.

We believe it is prudent to remain disciplined in our investment approach and philosophy, which we have followed in a variety of market conditions for over 38 years. While 2008 was a difficult year for investors, we recognize that our job is to remain focused on company-specific fundamentals. In a year where emotion - a crisis of confidence - was a strong driver of returns no matter the market, we are not surprised that our fundamentals-based approach produced disappointing returns. However, looking back over our history, this approach has served our clients well over the long-term.

As always, we appreciate your business.

Sincerely,

Manning & Napier Advisors, Inc.

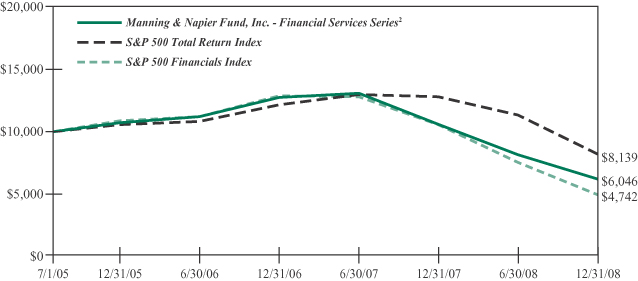

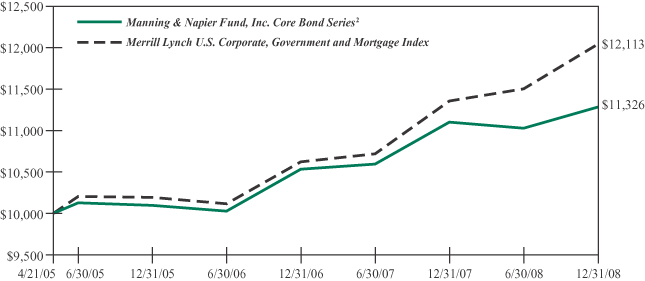

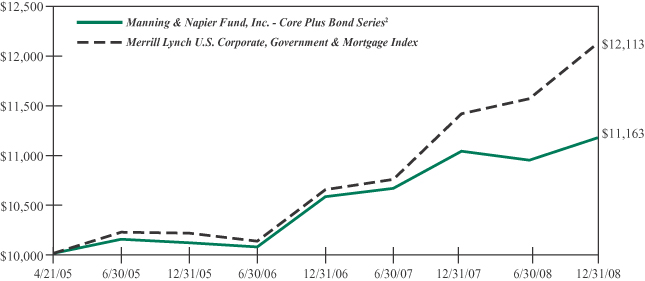

Performance Update as of December 31, 2008 (unaudited)

| | | | | | | | |

| | | Average Annual Total Returns

As of December 31, 2008 | | |

| | | One

Year | | Five

Year | | Since

Inception1 | | |

Manning & Napier Fund, Inc. - Life Sciences Series2 | | -38.77% | | -2.16% | | 8.72% | | |

Standard & Poor’s (S&P) 500 Total Return Index3 | | -36.99% | | -2.18% | | -2.78% | | |

Standard & Poor’s (S&P) 500 Health Care Index3 | | -22.81% | | -0.73% | | -0.26% | | |

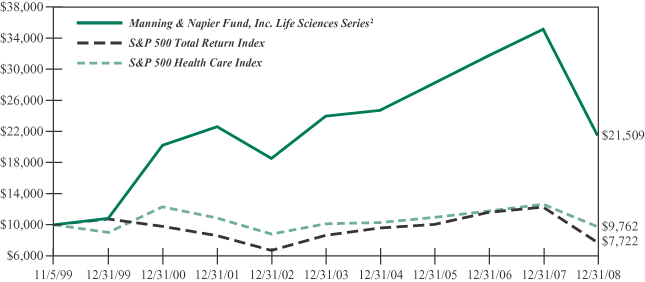

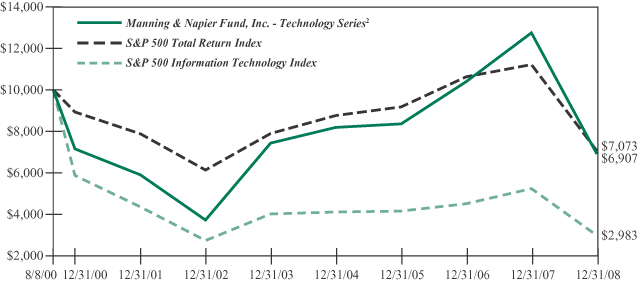

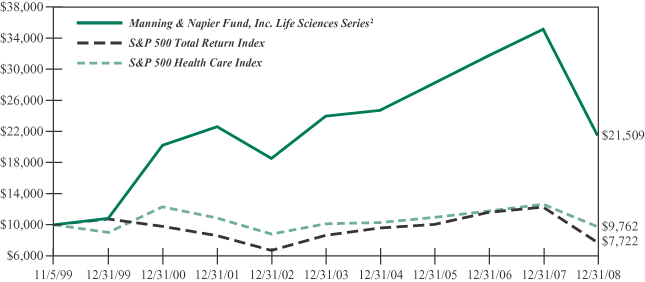

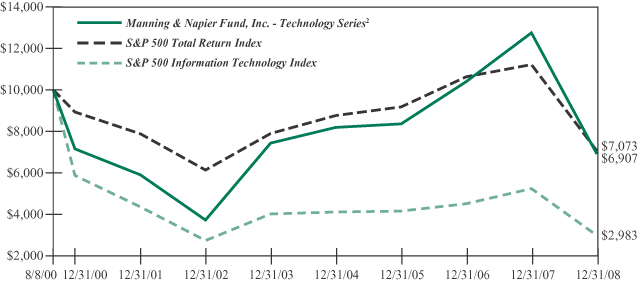

The following graph compares the value of a $10,000 investment in the Manning & Napier Fund, Inc. - Life Sciences Series from its current activation1 (11/5/99) to present (12/31/08) to the S&P 500 Total Return Index and the S&P 500 Health Care Index.

1Performance numbers for the Series and Indices are calculated from November 5, 1999, the Series’ current activation date.

2The Series’ performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The Series’ performance is historical and may not be indicative of future results. The performance returns shown are inclusive of the net expense ratio of the Series. For the year ended December 31, 2008, this net expense ratio was 1.12%. The gross expense ratio, which does not account for any voluntary or contractual waivers currently in effect, was 1.12% for the year ended December 31, 2008.

3The S&P 500 Total Return Index is an unmanaged capitalization-weighted measure of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and the Over-the-Counter market. The S&P 500 Health Care Index, a sub-index of the S&P 500 Total Return Index, includes the stocks of companies involved in the business of health care related products and services. Both Indices’ returns assume daily reinvestment of dividends and, unlike Series returns, do not reflect any fees or expenses.

Shareholder Expense Example (unaudited)

As a shareholder of the Series, you may incur two types of costs: (1) transaction costs, including potential wire charges on redemptions and (2) ongoing costs, including management fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2008 to December 31, 2008).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as potential wire charges on redemptions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | |

| | | Beginning

Account Value

7/1/08 | | Ending

Account Value

12/31/08 | | Expenses Paid

During Period*

7/1/08-12/31/08 |

Actual | | $ | 1,000.00 | | $ | 744.50 | | $ | 4.96 |

Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | $ | 1,019.46 | | $ | 5.74 |

*Expenses are equal to the Series’ annualized expense ratio (for the six-month period) of 1.13%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Expenses are based on the most recent fiscal half year; therefore, the expense ratio stated above may differ from the expense ratio stated in the financial highlights, which is based on one-year data.

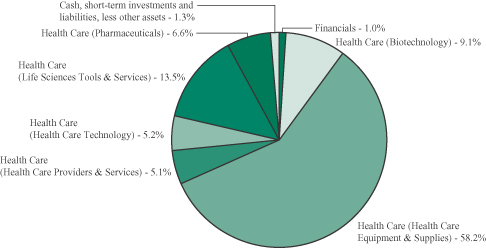

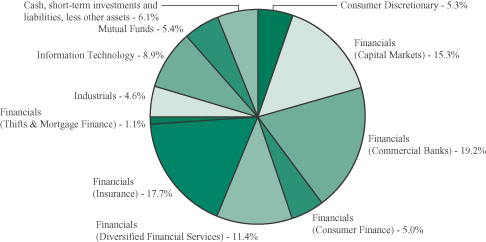

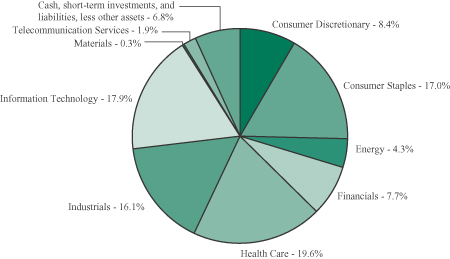

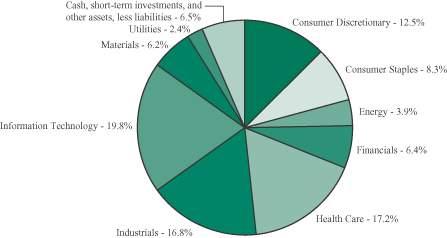

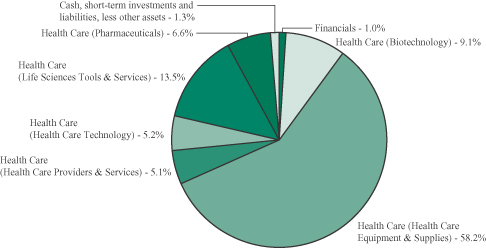

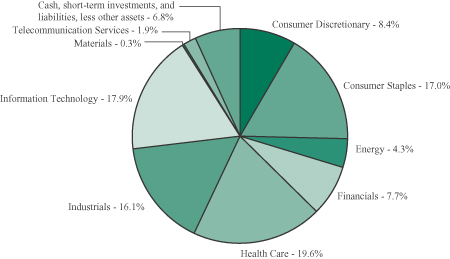

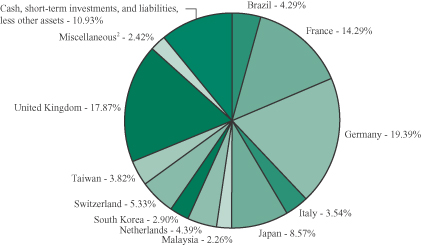

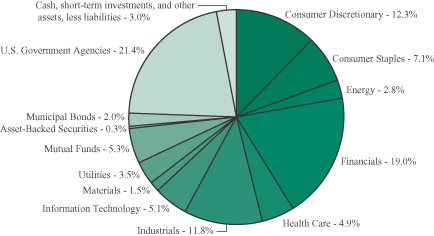

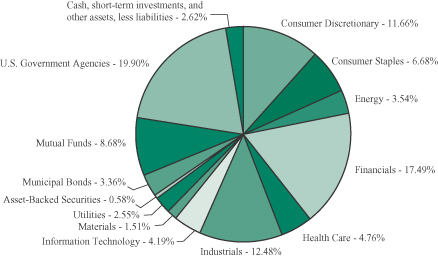

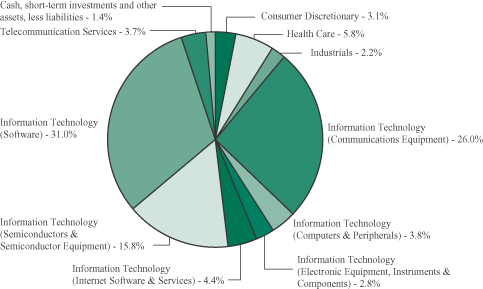

Portfolio Composition as of December 31, 2008 (unaudited)

Sector Allocation1

1As a percentage of net assets.

Top Ten Stock Holdings2

| | | | | | |

Mylan, Inc. | | 6.6% | | Covidien Ltd. (Bermuda) | | 4.3% |

Inverness Medical Innovations, Inc. | | 5.3% | | Luminex Corp. | | 4.1% |

Eclipsys, Corp. | | 5.2% | | Celera Corp. | | 4.0% |

bioMerieux (France) | | 4.7% | | Sonic Healthcare Ltd. (Australia) | | 3.8% |

Beckman Coulter, Inc. | | 4.7% | | Synthes, Inc. | | 3.6% |

2As a percentage of total investments.

Investment Portfolio - December 31, 2008

| | | | | |

| | | Shares | | Value

(Note 2) |

| | | | | |

| | |

COMMON STOCKS - 97.6% | | | | | |

| | |

Health Care - 97.6% | | | | | |

Biotechnology - 9.1% | | | | | |

Celera Corp.* | | 665,100 | | $ | 7,402,563 |

Cepheid, Inc.* | | 343,000 | | | 3,560,340 |

Genomic Health, Inc.* | | 205,000 | | | 3,993,400 |

QLT, Inc.* (Canada) (Note 7) | | 690,000 | | | 1,662,900 |

| | | | | |

| | | | | 16,619,203 |

| | | | | |

Health Care Equipment & Supplies - 58.2% | | | | | |

Abaxis, Inc.* | | 265,000 | | | 4,247,950 |

Align Technology, Inc.* | | 675,000 | | | 5,906,250 |

Alsius Corp.*1,6 | | 196,317 | | | 113,864 |

AtriCure, Inc.* | | 234,000 | | | 519,480 |

Beckman Coulter, Inc. | | 195,000 | | | 8,568,300 |

bioMerieux (France) (Note 7) | | 104,252 | | | 8,693,946 |

C.R. Bard, Inc. | | 58,200 | | | 4,903,932 |

The Cooper Companies, Inc. | | 100,000 | | | 1,640,000 |

Covidien Ltd. (Bermuda) (Note 7) | | 220,000 | | | 7,972,800 |

DENTSPLY International, Inc. | | 135,000 | | | 3,812,400 |

Dexcom, Inc.* | | 1,323,200 | | | 3,652,032 |

ev3, Inc.* | | 514,800 | | | 3,140,280 |

Gen-Probe, Inc.* | | 127,000 | | | 5,440,680 |

IDEXX Laboratories, Inc.* | | 97,000 | | | 3,499,760 |

Inverness Medical Innovations, Inc.* | | 395,000 | | | 7,469,450 |

Inverness Medical Innovations, Inc.*2,3 | | 122,000 | | | 2,307,020 |

Micrus Endovascular Corp.* | | 283,194 | | | 3,287,882 |

Nobel Biocare Holding AG (Switzerland) (Note 7) | | 60,000 | | | 1,208,008 |

OraSure Technologies, Inc.* | | 1,246,000 | | | 4,585,280 |

Orthofix International N.V.* (Netherlands) (Note 7) | | 311,815 | | | 4,780,124 |

Sirona Dental Systems, Inc.* | | 385,000 | | | 4,042,500 |

STAAR Surgical Co.* | | 1,116,000 | | | 2,656,080 |

Straumann Holding AG (Switzerland) (Note 7) | | 22,917 | | | 3,995,774 |

Synthes, Inc. | | 53,000 | | | 6,645,549 |

Zimmer Holdings, Inc.* | | 78,000 | | | 3,152,760 |

| | | | | |

| | | | | 106,242,101 |

| | | | | |

Health Care Providers & Services - 5.1% | | | | | |

Diagnosticos da America S.A. (Brazil) (Note 7) | | 250,000 | | | 2,410,982 |

Sonic Healthcare Ltd. (Australia) (Note 7) | | 680,000 | | | 6,900,859 |

| | | | | |

| | | | | 9,311,841 |

| | | | | |

Health Care Technology - 5.2% | | | | | |

Eclipsys Corp.* | | 670,000 | | | 9,507,300 |

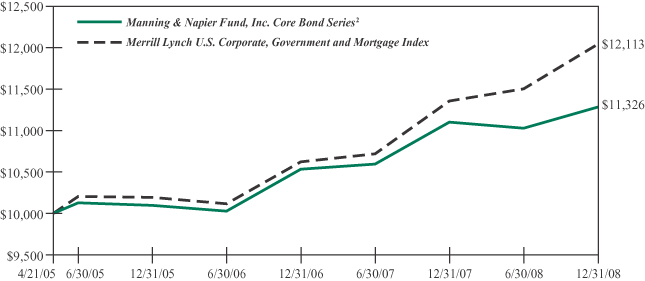

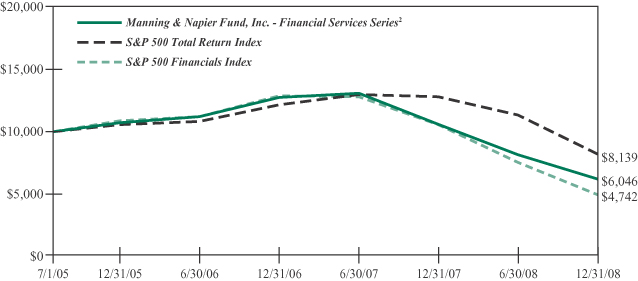

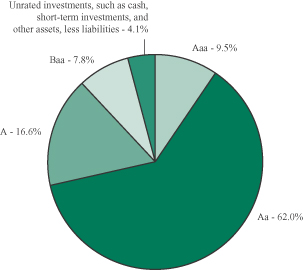

| | | | | |