UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04087

--------------------------------------------------

Manning & Napier Fund, Inc.

------------------------------------------------------------------------------------

(Exact name of registrant as specified in charter)

290 Woodcliff Drive, Fairport, NY 14450

------------------------------------------------------------------------------------

(Address of principal executive offices)(Zip Code)

B. Reuben Auspitz 290 Woodcliff Drive, Fairport, NY 14450

------------------------------------------------------------------------------------

(Name and address of agent for service)

Registrant’s telephone number, including area code: 585-325-6880

----------------------------------

Date of fiscal year end: December 31, 2011

------------------------------------------------------------

Date of reporting period: January 1, 2011 through December 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. | REPORTS TO STOCKHOLDERS. |

Life Sciences Series

Management Discussion and Analysis

(unaudited)

Dear Shareholders:

Volatility was a constant theme throughout much of 2011. Over the past year, substantial equity market swings were driven in large part by macroeconomic developments and a series of external shocks, including Standard & Poor’s downgrade of the U.S. credit rating, the European sovereign debt crisis, political unrest in the Middle East, and March’s tsunami disaster in Japan. The accumulation of these events bred widespread uncertainty and has continued to weigh heavily on investor confidence both domestically and abroad. Throughout the year, market action was largely driven by emotion, and in general investors sought stability over growth.

Despite such volatility, U.S. equities, as measured by the S&P 500 Index, ended the year with positive returns of 2.12%. For the twelve months ending December 31, 2011, the S&P 500 Health Care Index earned 12.74%, significantly outpacing the overall equities market. The Life Sciences Series, however, underperformed in 2011 and lost 7.33% for the year.

While short-term performance is negative on an absolute and relative basis, we’ve found that measuring performance over market cycles demonstrates a manager’s ability to add value through varying types of environments, both good and bad. The S&P Health Care Index had an annualized return of 5.35% for the current market cycle (since October 1, 2002). Meanwhile, the Life Sciences Series has handily outperformed over the current market cycle, with an annualized return of 7.89%.

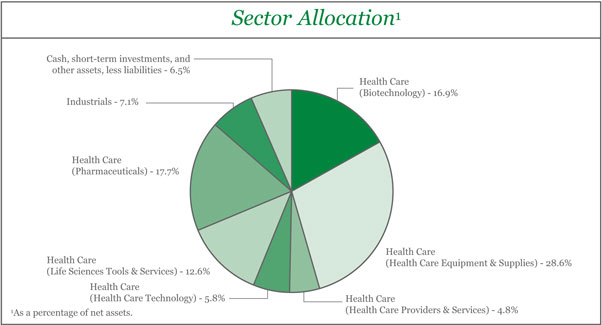

With strong consideration to both top-down industry themes and an analysis of company-by-company fundamentals, we have positioned the portfolio with regard to the risks and opportunities presented by the upcoming challenges in healthcare. For instance, we maintain a significant underweight to large pharmaceutical companies as compared to the benchmark. As governments across the developed world make budget cuts in an attempt to improve deficits, these cutbacks are putting pressure on the reimbursement rates for drug companies, which is creating a headwind for profits in addition to the pending “patent cliff” many of these companies face. Instead, we continue to maintain a relatively large thematic exposure to the Life Science Tools and Diagnostics industries. We believe new products from companies in these sub-sectors are likely to improve the quality and delivery of health care.

Throughout 2011, stock selection decisions were the primary drivers of underperformance, with individual holdings within the Biotechnology and Health Care Providers & Services industries being the largest negative contributors to performance. Further diving into the Series’ underperformance, as the broader markets corrected and investors experienced a flight to stable, dividend-paying stocks, the Series’ relatively high exposure to small-mid cap healthcare companies hurt results, as did a lack of investment in large cap pharmaceutical and managed care companies, which drove the benchmark’s performance. While industries such as pharmaceuticals outperformed as investors hid in larger, higher dividend yielding stocks, we continue to believe that many of these areas have poor long-term growth prospects relative to other areas such as Life Science Tools & Diagnostics within the Life Sciences sector.

Manning & Napier feels strongly that in this slow economic growth environment, it is important to focus on those companies with strong organic growth drivers. As a result, we continue to identify and pursue companies that we believe are well positioned for the long-term and meet the requirements of our investment strategies and pricing disciplines. Amid a muted economic backdrop, we are focusing on high-quality companies with sustainable competitive advantages that are winning the battle for growth. Many of these companies have displayed an ability to successfully compete and gain market share in faster growing foreign markets. Given our view of the enduring nature of the current slow growth environment, we’re also investing in companies that are less dependent on the economy and/or government spending as a significant source of revenue.

Ultimately, Manning & Napier believes that fundamentals are the driver of long-term returns. With more than 40 years of experience investing based on company-specific fundamentals, Manning & Napier continues to carefully build our portfolios on a security by security basis. We believe that maintaining discipline and staying true to our active management investment philosophy will best aid us in helping our clients meet their long-term investment objectives.

As always, we appreciate your business.

Sincerely,

Manning & Napier Advisors, LLC

1

Life Sciences Series

Performance Update as of December 31, 2011

(unaudited)

| | | | | | | | |

| | | AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2011 |

| | | ONE YEAR1 | | FIVE YEAR | | TEN YEAR | | SINCE

INCEPTION2 |

Manning & Napier Fund, Inc. - Life Sciences Series3 | | -7.33% | | 1.81% | | 4.39% | | 10.79% |

| | | | |

S&P 500 Total Return Index4 | | 2.12% | | -0.24% | | 2.93% | | 1.14% |

| | | | |

S&P 500 Health Care Index4 | | 12.74% | | 2.86% | | 2.27% | | 2.54% |

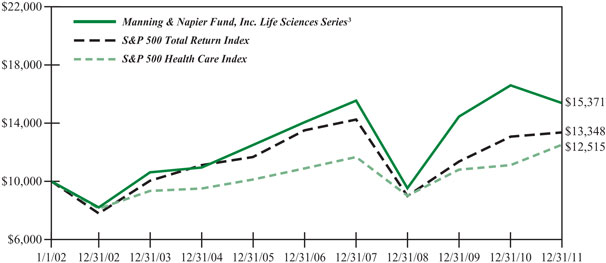

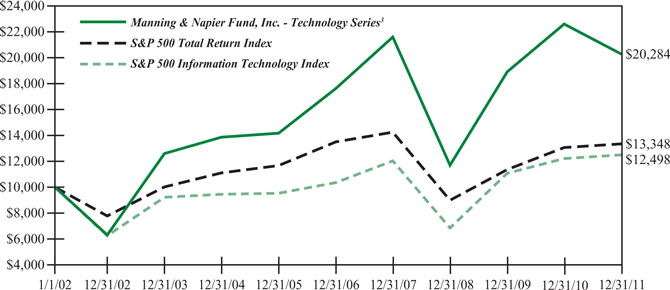

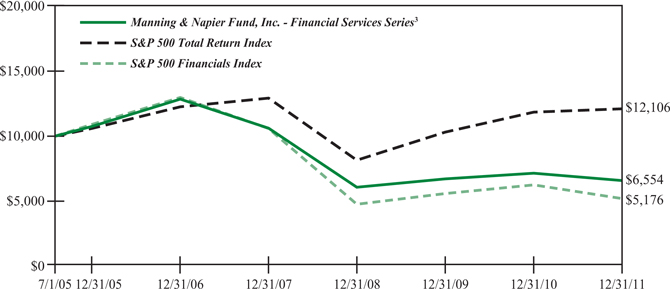

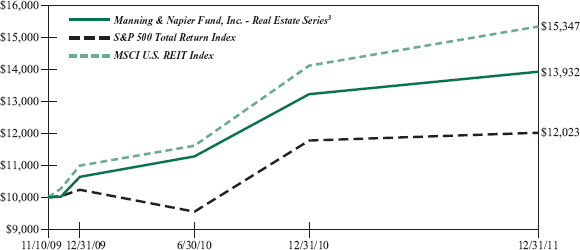

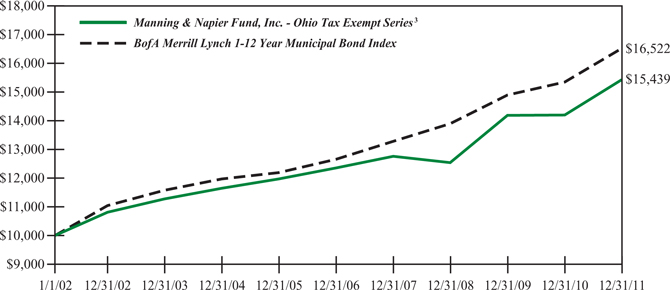

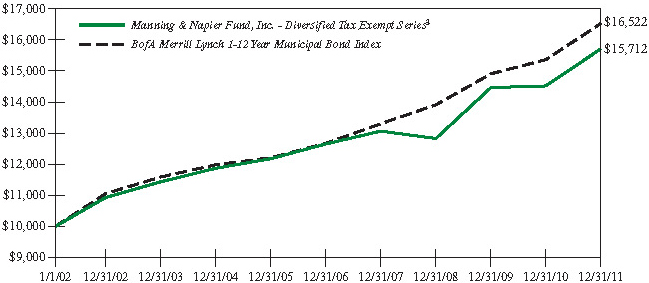

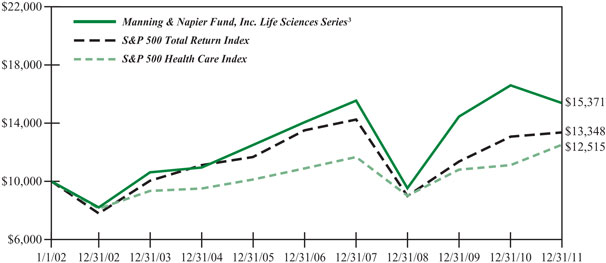

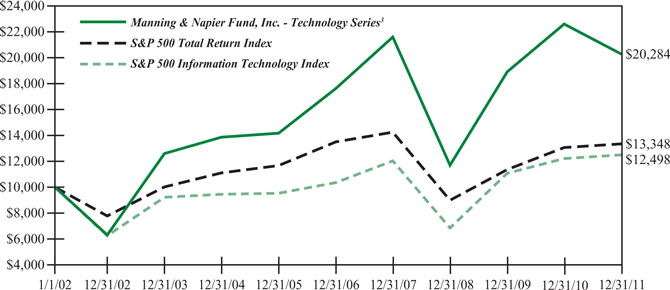

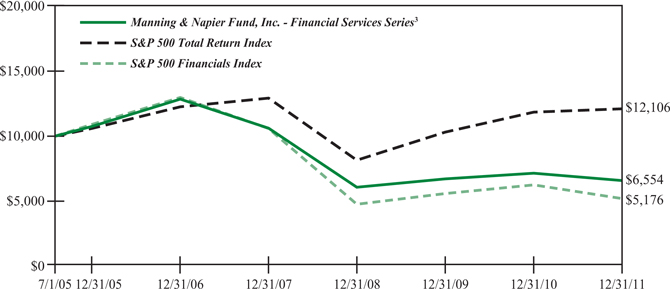

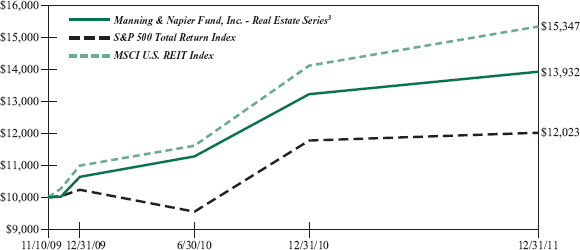

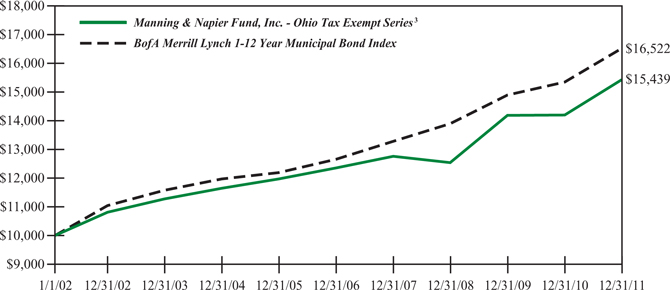

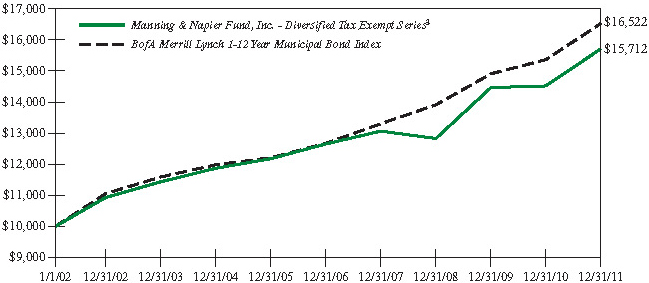

The following graph compares the value of a $10,000 investment in the Manning & Napier Fund, Inc. - Life Sciences Series for the ten years ended December 31, 2011 to the S&P 500 Total Return Index and the S&P 500 Health Care Index.

1The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

2Performance numbers for the Series and Indices are calculated from November 5, 1999, the Series’ current activation date.

3The Series’ performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The Series’ performance is historical and may not be indicative of future results. The performance returns shown are inclusive of the net expense ratio of the Series. For the year ended December 31, 2011, this net expense ratio was 1.11%. The gross expense ratio, which does not account for any voluntary or contractual waivers currently in effect, was 1.11% for the year ended December 31, 2011.

4The S&P 500 Total Return Index is an unmanaged capitalization-weighted measure of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and the Over-the-Counter market. The S&P 500 Health Care Index, a sub-index of the S&P 500 Total Return Index, includes the stocks of companies involved in the business of health care related products and services. Both Indices’ returns assume daily reinvestment of dividends and, unlike Series returns, do not reflect any fees or expenses.

2

Life Sciences Series

Shareholder Expense Example

(unaudited)

As a shareholder of the Series, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2011 to December 31, 2011).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | |

| | | BEGINNING ACCOUNT VALUE 7/1/11 | | ENDING ACCOUNT VALUE 12/31/11 | | EXPENSES PAID DURING PERIOD* 7/1/11-12/31/11 |

Actual | | $1,000.00 | | $ 857.70 | | $5.34 |

Hypothetical | | | | | | |

(5% return before expenses) | | $1,000.00 | | $1,019.46 | | $5.80 |

*Expenses are equal to the Series’ annualized expense ratio (for the six-month period) of 1.14%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses are based on the most recent fiscal half year; therefore, the expense ratio stated above may differ from the expense ratio stated in the financial highlights, which is based on one-year data.

3

Life Sciences Series

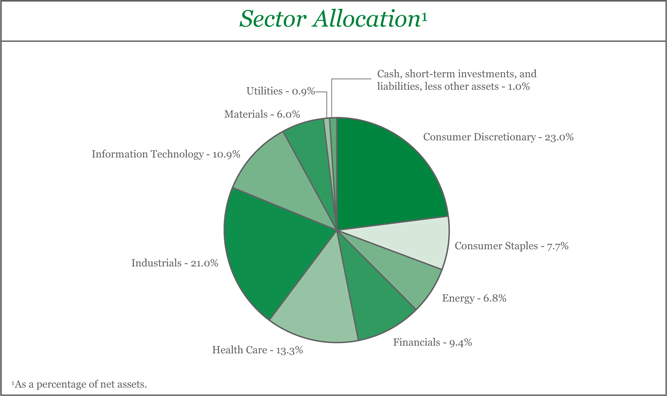

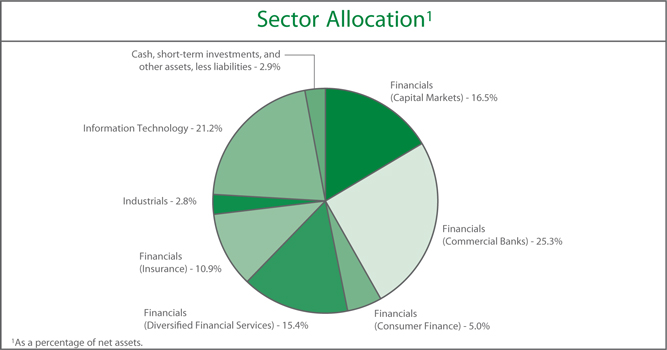

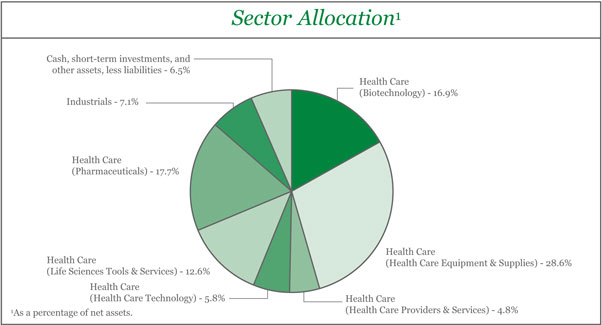

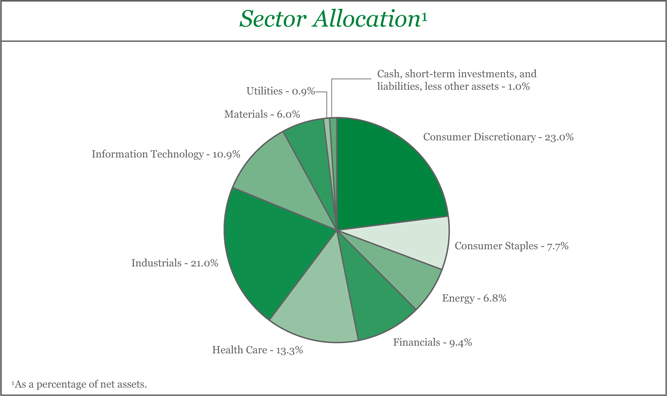

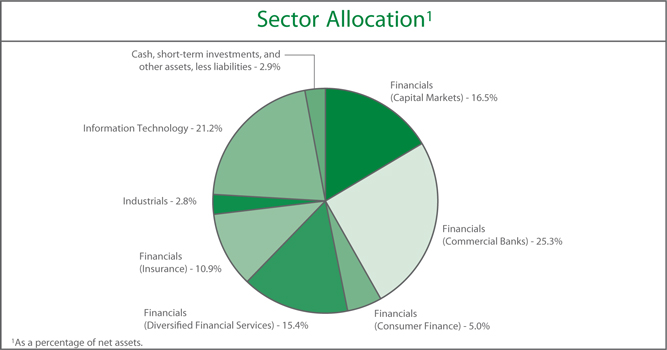

Portfolio Composition as of December 31, 2011

(unaudited)

| | | | | | | | | | |

Top Ten Stock Holdings2 | |

Insulet Corp. | | | 6.1% | | | Sonic Healthcare Ltd. (Australia) | | | 3.6% | |

Myriad Genetics, Inc. | | | 5.7% | | | BioMerieux (France) | | | 3.6% | |

Dendreon Corp. | | | 5.1% | | | Optimer Pharmaceuticals, Inc. | | | 3.4% | |

UCB S.A. (Belgium) | | | 4.9% | | | Abaxis, Inc. | | | 3.3% | |

The Advisory Board Co. | | | 4.1% | | | Computer Programs & Systems, Inc. | | | 3.2% | |

2 As a percentage of total investments. | | | | | | | | | | |

4

Life Sciences Series

Investment Portfolio - December 31, 2011

| | | | | | | | |

| | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS - 93.5% | | | | | | | | |

| | |

Health Care - 86.4% | | | | | | | | |

Biotechnology - 16.9% | | | | | | | | |

BioMarin Pharmaceutical, Inc.* | | | 182,190 | | | $ | 6,263,692 | |

Dendreon Corp.* | | | 1,318,000 | | | | 10,016,800 | |

Exact Sciences Corp.* | | | 717,752 | | | | 5,828,146 | |

Myriad Genetics, Inc.* | | | 531,000 | | | | 11,119,140 | |

| | | | | | | | |

| | |

| | | | | | | 33,227,778 | |

| | | | | | | | |

Health Care Equipment & Supplies - 28.6% | | | | | | | | |

Abaxis, Inc.* | | | 232,500 | | | | 6,433,275 | |

Alere, Inc.*1,2 | | | 122,000 | | | | 2,816,980 | |

Alere, Inc. | | | 77,190 | | | | 1,782,317 | |

BioMerieux (France)3 | | | 97,796 | | | | 6,979,879 | |

DexCom, Inc.* | | | 387,310 | | | | 3,605,856 | |

Endologix, Inc.* | | | 36,100 | | | | 414,428 | |

HeartWare International, Inc.* | | | 89,510 | | | | 6,176,190 | |

Insulet Corp.* | | | 633,070 | | | | 11,920,708 | |

Quidel Corp.* | | | 355,000 | | | | 5,371,150 | |

Sirona Dental Systems, Inc.* | | | 128,100 | | | | 5,641,524 | |

Thoratec Corp.* | | | 148,000 | | | | 4,966,880 | |

| | | | | | | | |

| | |

| | | | | | | 56,109,187 | |

| | | | | | | | |

Health Care Providers & Services - 4.8% | | | | | | | | |

China Cord Blood Corp. - ADR (Hong Kong)* | | | 894,000 | | | | 2,369,100 | |

Sonic Healthcare Ltd. (Australia)3 | | | 614,000 | | | | 7,077,104 | |

| | | | | | | | |

| | |

| | | | | | | 9,446,204 | |

| | | | | | | | |

Health Care Technology - 5.8% | | | | | | | | |

Cerner Corp.* | | | 84,050 | | | | 5,148,063 | |

Computer Programs & Systems, Inc. | | | 123,000 | | | | 6,286,530 | |

| | | | | | | | |

| | |

| | | | | | | 11,434,593 | |

| | | | | | | | |

Life Sciences Tools & Services - 12.6% | | | | | | | | |

Luminex Corp.* | | | 284,000 | | | | 6,029,320 | |

Oxford Nanopore Technologies Ltd. (United Kingdom)*1,4,5 | | | 40,905 | | | | 5,805,547 | |

QIAGEN N.V. - ADR (Netherlands)* | | | 273,000 | | | | 3,770,130 | |

Sequenom, Inc.* | | | 985,000 | | | | 4,383,250 | |

WuXi PharmaTech (Cayman), Inc. - ADR (China)* | | | 423,880 | | | | 4,679,635 | |

| | | | | | | | |

| | |

| | | | | | | 24,667,882 | |

| | | | | | | | |

Pharmaceuticals - 17.7% | | | | | | | | |

Allergan, Inc. | | | 62,000 | | | | 5,439,880 | |

Green Cross Corp. (South Korea)3 | | | 31,500 | | | | 3,996,031 | |

Hikma Pharmaceuticals plc (United Kingdom)3 | | | 390,000 | | | | 3,750,421 | |

Optimer Pharmaceuticals, Inc.* | | | 546,000 | | | | 6,683,040 | |

Strides Arcolab Ltd. (India)3 | | | 715,750 | | | | 5,403,188 | |

The accompanying notes are an integral part of the financial statements.

5

Life Sciences Series

Investment Portfolio - December 31, 2011

| | | | | | | | |

| | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Health Care (continued) | | | | | | | | |

Pharmaceuticals (continued) | | | | | | | | |

UCB S.A. (Belgium)3 | | | 228,939 | | | $ | 9,604,689 | |

| | | | | | | | |

| | |

| | | | | | | 34,877,249 | |

| | | | | | | | |

Total Health Care | | | | | | | 169,762,893 | |

| | | | | | | | |

| | |

Industrials - 7.1% | | | | | | | | |

Professional Services - 7.1% | | | | | | | | |

The Advisory Board Co.* | | | 109,000 | | | | 8,088,890 | |

Qualicorp S.A. (Brazil)* | | | 665,000 | | | | 5,971,720 | |

| | | | | | | | |

| | |

Total Industrials | | | | | | | 14,060,610 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS | | | | | | | | |

(Identified Cost $186,358,433) | | | | | | | 183,823,503 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENTS - 5.9% | | | | | | | | |

Dreyfus Cash Management, Inc. - Institutional Shares6 , 0.05%, | | | | | | | | |

(Identified Cost $11,492,275) | | | 11,492,275 | | | | 11,492,275 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS - 99.4% | | | | | | | | |

(Identified Cost $197,850,708) | | | | | | | 195,315,778 | |

OTHER ASSETS, LESS LIABILITIES - 0.6% | | | | | | | 1,234,510 | |

| | | | | | | | |

| | |

NET ASSETS - 100% | | | | | | $ | 196,550,288 | |

| | | | | | | | |

ADR - American Depository Receipt

*Non-income producing security

1Restricted securities - Investment in security that is restricted as to public resale under the Securities Act of 1933, as amended. These securities amount to $8,622,527, or 4.4% of the Series’ net assets as of December 31, 2011.

2This security was acquired on February 3, 2006 at a cost of $2,978,020 ($24.41 per share) and has been determined to be liquid under guidelines established by the Board of Directors.

3A factor from a third party vendor was applied to determine the security’s fair value following the close of local trading.

4This security was acquired on April 26, 2011 at a cost of $6,149,543 ($150.34 per share) and has been determined to be illiquid under guidelines established by the Board of Directors.

5Security has been valued at fair value as determined in good faith by the Advisor (see Note 2 to the financial statements).

6Rate shown is the current yield as of December 31, 2011.

The accompanying notes are an integral part of the financial statements.

6

Life Sciences Series

Statement of Assets and Liabilities

December 31, 2011

| | | | |

ASSETS: | | | | |

| |

Investments, at value (identified cost $197,850,708) (Note 2) | | $ | 195,315,778 | |

Cash | | | 40,013 | |

Receivable for securities sold | | | 1,124,663 | |

Receivable for fund shares sold | | | 408,099 | |

Foreign tax reclaims receivable | | | 97,312 | |

Dividends receivable | | | 40,415 | |

| | | | |

| |

TOTAL ASSETS | | | 197,026,280 | |

| | | | |

| |

LIABILITIES: | | | | |

| |

Accrued management fees (Note 3) | | | 165,559 | |

Accrued fund accounting and administration fees (Note 3) | | | 9,229 | |

Accrued transfer agent fees (Note 3) | | | 3,219 | |

Accrued directors’ fees (Note 3) | | | 537 | |

Accrued Chief Compliance Officer service fees (Note 3) | | | 251 | |

Payable for fund shares repurchased | | | 191,333 | |

Accrued foreign capital gains tax (Note 2) | | | 39,319 | |

Other payables and accrued expenses | | | 66,545 | |

| | | | |

| |

TOTAL LIABILITIES | | | 475,992 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 196,550,288 | |

| | | | |

| |

NET ASSETS CONSIST OF: | | | | |

| |

Capital stock | | $ | 179,437 | |

Additional paid-in-capital | | | 195,978,304 | |

Undistributed net investment income | | | — | |

Accumulated net realized gain on investments, foreign currency and translation of other assets and liabilities | | | 2,963,364 | |

Net unrealized depreciation on investments (net of foreign capital gains tax of $39,319), foreign currency and translation of other assets and liabilities | | | (2,570,817 | ) |

| | | | |

| |

TOTAL NET ASSETS | | $ | 196,550,288 | |

| | | | |

| |

NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - | | | | |

CLASS A ($196,550,288/17,943,678 shares) | | $ | 10.95 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

7

Life Sciences Series

Statement of Operations

For the Year Ended December 31, 2011

| | | | |

INVESTMENT INCOME: | | | | |

| |

Dividends (net of foreign taxes withheld, $149,775) | | $ | 1,291,911 | |

| | | | |

| |

EXPENSES: | | | | |

| |

Management fees (Note 3) | | | 2,530,562 | |

Fund accounting and administration fees (Note 3) | | | 64,972 | |

Transfer agent fees (Note 3) | | | 19,831 | |

Directors’ fees (Note 3) | | | 7,128 | |

Chief Compliance Officer service fees (Note 3) | | | 2,552 | |

Custodian fees | | | 67,896 | |

Miscellaneous | | | 111,021 | |

| | | | |

| |

Total Expenses | | | 2,803,962 | |

| | | | |

| |

NET INVESTMENT LOSS | | | (1,512,051 | ) |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

| |

Net realized gain (loss) on- | | | | |

Investments | | | 29,539,214 | |

Foreign currency and translation of other assets and liabilities (net of Brazilian tax of $118,469) | | | (254,686 | ) |

| | | | |

| |

| | | 29,284,528 | |

| | | | |

| |

Net change in unrealized appreciation (depreciation) on- | | | | |

Investments (net of change in accrued foreign capital gains tax of $39,319) | | | (51,273,293 | ) |

Foreign currency and translation of other assets and liabilities | | | (12,880 | ) |

| | | | |

| |

| | | (51,286,173 | ) |

| | | | |

| |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | | | (22,001,645 | ) |

| | | | |

| |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (23,513,696 | ) |

| | | | |

The accompanying notes are an integral part of the financial statements.

8

Life Sciences Series

Statements of Changes in Net Assets

| | | | | | | | |

| | | FOR THE YEAR ENDED

12/31/11 | | | FOR THE YEAR ENDED

12/31/10 | |

| | |

INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

| | |

OPERATIONS: | | | | | | | | |

| | |

Net investment loss | | $ | (1,512,051 | ) | | $ | (1,088,986 | ) |

Net realized gain (loss) on investments and foreign currency | | | 29,284,528 | | | | 18,233,679 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | (51,286,173 | ) | | | 17,294,176 | |

| | | | | | | | |

| | |

Net increase (decrease) from operations | | | (23,513,696 | ) | | | 34,438,869 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

(Note 9): | | | | | | | | |

| | |

From net realized gain on investments | | | (5,663,104 | ) | | | — | |

| | | | | | | | |

| | |

CAPITAL STOCK ISSUED AND REPURCHASED: | | | | | | | | |

| | |

Net decrease from capital share transactions (Note 5) | | | (21,836,822 | ) | | | (59,818,922 | ) |

| | | | | | | | |

| | |

Net decrease in net assets | | | (51,013,622 | ) | | | (25,380,053 | ) |

| | |

NET ASSETS: | | | | | | | | |

| | |

Beginning of year | | | 247,563,910 | | | | 272,943,963 | |

| | | | | | | | |

| | |

End of year (including accumulated net investment loss of $0 and $20,942, respectively) | | $ | 196,550,288 | | | $ | 247,563,910 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

9

Life Sciences Series

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | FOR THE YEARS ENDED | |

| | | 12/31/11 | | | 12/31/10 | | | 12/31/09 | | | 12/31/08 | | | 12/31/07 | |

Per share data (for a share outstanding throughout each year): | | | | | | | | | | | | | | | | | | | | |

Net asset value - Beginning of year | | $ | 12.18 | | | $ | 10.61 | | | $ | 6.99 | | | $ | 11.54 | | | $ | 11.41 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.07) | 1 | | | (0.04) | 1 | | | (0.05) | 1 | | | (0.06) | | | | (0.08) | |

Net realized and unrealized gain (loss) on investments | | | (0.84) | | | | 1.61 | | | | 3.67 | | | | (4.38) | | | | 1.25 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total from investment operations | | | (0.91) | | | | 1.57 | | | | 3.62 | | | | (4.44) | | | | 1.17 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

From net realized gain on investments | | | (0.32) | | | | — | | | | — | | | | (0.11) | | | | (1.04) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value - End of year | | $ | 10.95 | | | $ | 12.18 | | | $ | 10.61 | | | $ | 6.99 | | | $ | 11.54 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets - End of year | | | | | | | | | | | | | | | | | | | | |

(000’s omitted) | | $ | 196,550 | | | $ | 247,564 | | | $ | 272,944 | | | $ | 182,704 | | | $ | 299,669 | |

| | | | | | | | | | | | | | | | | | | | |

Total return2 | | | (7.33%) | | | | 14.80% | | | | 51.79% | | | | (38.77%) | | | | 10.62% | |

Ratios (to average net assets)/ Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Expenses* | | | 1.11% | | | | 1.09% | | | | 1.11% | | | | 1.12% | | | | 1.12% | |

Net investment loss | | | (0.60%) | | | | (0.41%) | | | | (0.55%) | | | | (0.65%) | | | | (0.75%) | |

Portfolio turnover | | | 84% | | | | 67% | | | | 95% | | | | 94% | | | | 95% | |

|

| * For certain periods presented, the investment advisor did not impose all or a portion of its management fees and/or other fees. If these expenses had been incurred by the Series, the expense ratio (to average net assets) would have increased by the following | |

amount: | | | | | | | | | | | | | | | | | | | | |

| | | N/A | | | | 0.00% | 3 | | | 0.01% | | | | N/A | | | | N/A | |

1Calculated based on average shares outstanding during the year.

2 Represents aggregate total return for the year indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during certain periods.

3Less than 0.01%.

The accompanying notes are an integral part of the financial statements.

10

Life Sciences Series

Notes to Financial Statements

Life Sciences Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end management investment company.

The Series’ investment objective is to provide long-term growth by investing principally in the common stocks of companies in the life sciences industry.

The Fund’s Advisor is Manning & Napier Advisors, LLC (the “Advisor”). Prior to October 1, 2011, Manning & Napier Advisors, Inc. acted as the investment advisor to the Fund. Effective October 1, 2011, the investment advisory business of Manning & Napier Advisors, Inc. was transferred to Manning & Napier Advisors, LLC, which then became the investment advisor to the Fund. The Advisor assumed all rights and responsibilities of Manning & Napier Advisors, Inc. with respect to the investment advisory agreement with the Fund. The appointment of the Advisor did not change the portfolio management team, investment strategies, investment advisory fees charged to the series of the Fund or the terms of the investment advisory agreement (other than the identity of the advisor).

Shares of the Series are offered to advisory clients and employees of the Advisor and its affiliates. The total authorized capital stock of the Fund consists of 15.0 billion shares of common stock each having a par value of $0.01. As of December 31, 2011, 8.2 billion shares have been designated in total among 34 series, of which 100 million have been designated as Life Sciences Series Class A common stock.

| 2. | Significant Accounting Policies |

Security Valuation

Portfolio securities, including domestic equities, foreign equities, warrants and options, listed on an exchange other than the NASDAQ National Market System are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ National Market System are valued in accordance with the NASDAQ Official Closing Price.

Short-term investments that mature in sixty days or less are valued at amortized cost, which approximates fair value. Investments in open-end investment companies are valued at their net asset value per share on valuation date.

Volume and level of activity in established markets for an asset or liability are evaluated to determine whether recent transactions and quoted prices are determinative of fair value. Where there have been significant decreases in volume and level of activity, further analysis and adjustment may be necessary to estimate fair value. The Series measures fair value in these instances by the use of inputs and valuation techniques which may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry and/or expectation of future cash flows. As a result of trading in relatively thin markets and/or markets that experience significant volatility, the prices used by the Series to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material.

Securities for which representative valuations or prices are not available from the Series’ pricing service may be valued at fair value as determined in good faith by the Advisor under procedures approved by and under the general supervision and responsibility of the Fund’s Board of Directors (the “Board”). Due to the inherent uncertainty of valuations of such securities, the fair value may differ significantly from the values that would have been used had a ready market for such securities existed. If trading or events occurring after the close of the principal market in which securities are traded are expected to materially affect the value of those securities, then they may be valued at their fair value, taking this trading or these events into account. In accordance with the procedures approved by the Board, the values of certain securities trading outside the U.S. were adjusted following the close of local trading using a factor from a third party vendor. The third party vendor uses statistical analyses and quantitative models, which consider among other things subsequent movement and changes in the prices of indices, securities and exchange rates in other markets, to determine the factors which are used to adjust local market prices. The value of

11

Life Sciences Series

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

Security Valuation (continued)

securities used for net asset value calculation under these procedures may differ from published prices for the same securities. It is the Fund’s policy to classify each foreign equity security where a factor from a third party vendor is provided as a Level 2 security.

Various inputs are used in determining the value of the Series’ assets or liabilities carried at fair value. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical assets and liabilities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Level 3 includes significant unobservable inputs (including the Series’ own assumptions in determining the fair value of investments). A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the valuation levels used for major security types as of December 31, 2011 in valuing the Series’ assets or liabilities carried at fair value:

| | | | | | | | | | | | | | | | |

| DESCRIPTION | | TOTAL | | | LEVEL 1 | | | LEVEL 2 | | | LEVEL 3 | |

Assets: | | | | | | | | | | | | | | | | |

Equity securities*: | | | | | | | | | | | | | | | | |

Health Care | | $ | 169,762,893 | | | $ | 127,146,034 | | | $ | 36,811,312 | | | $ | 5,805,547** | |

Industrials | | | 14,060,610 | | | | 14,060,610 | | | | — | | | | — | |

Mutual funds | | | 11,492,275 | | | | 11,492,275 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total assets | | $ | 195,315,778 | | | $ | 152,698,919 | | | $ | 36,811,312 | | | $ | 5,805,547 | |

| | | | | | | | | | | | | | | | |

The following table is a reconciliation of Level 3 investments for which significant unobservable inputs were used to determine fair value:

| | | | | | | | |

| LEVEL 3 RECONCILIATION | | EQUITY

SECURITIES | | | PREFERRED

SECURITIES | |

Balance as of December 31, 2010 (market value)*** | | $ | — | | | $ | — | |

Net realized gain (loss) | | | (95,898 | ) | | | (2,312,500 | ) |

Change in unrealized appreciation (depreciation)**** | | | (248,098 | ) | | | 2,312,500 | |

Purchases | | | 6,149,543 | | | | | |

Sales*** | | | — | | | | — | |

Transfers in | | | — | | | | | |

Transfers out | | | — | | | | — | |

| | | | | | | | |

Balance as of December 31, 2011 (market value) | | $ | 5,805,547 | | | $ | — | |

| | | | | | | | |

*Includes common stock, warrants and rights. Please see the Investment Portfolio for foreign securities where a factor from a third party vendor was applied to determine the security’s fair value following the close of local trading. Such securities are included in Level 2 in the table above.

**Amount represents the Series’ investment in Oxford Nanopore Technologies Ltd. (“Oxford”). Oxford is initially valued at transaction price, which is considered the best initial estimate of fair value. Subsequently, the Series’ uses, or will use, other methodologies and significant inputs to determine fair value. Such methodologies and significant inputs include: subsequent rounds of financing for Oxford; recent transactions in similar instruments; discounted cash flow techniques; third-party appraisals; industry multiples and public comparables; and Oxford’s current financial performance compared to projected performance.

***Included securities valued at $0 as of the beginning of the year, which were written off during the year.

12

Life Sciences Series

Notes to Financial Statements (continued)

| 2. | Significant Accounting Policies (continued) |

Security Valuation (continued)

****The change in unrealized appreciation (depreciation) on securities still held at December 31, 2011 was ($343,996).

The Fund’s policy is to recognize transfers in and transfers out of the valuation levels as of the beginning of the reporting period. There were no transfers between Level 1 and Level 2 during the year ended December 31, 2011.

Recent Accounting Standard

In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2011-04, “Fair Value Measurements (Topic 820) - Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs” (“ASU 2011-04”). ASU 2011-04 clarifies the application of existing fair value measurement requirements, changes certain principles related to measuring fair value, and requires additional disclosures about fair value measurements.

Required disclosures are expanded under the new guidance, especially for fair value measurements that are categorized within Level 3 of the fair value hierarchy, for which quantitative information about the unobservable inputs used, and a narrative description of the valuation processes in place and sensitivity of recurring Level 3 measurements to changes in unobservable inputs will be required.

ASU 2011-04 is effective for interim and annual periods beginning after December 15, 2011 and is to be applied prospectively. Management is currently assessing the impact of this guidance, but does not expect it to have a material impact on the Series’ financial statements.

Security Transactions, Investment Income and Expenses

Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date, except that if the ex-dividend date has passed, certain dividends from foreign securities are recorded as soon as the Series is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair value of the securities received. Interest income, including amortization of premium and accretion of discounts using the effective interest method, is earned from settlement date and accrued daily.

Expenses are recorded on an accrual basis. Most expenses of the Fund can be attributed to a specific series. Expenses which cannot be directly attributed are apportioned among the series in the Fund in such a manner as deemed equitable by the Fund’s Board, taking into consideration, among other things, the nature and type of expense.

The Series uses the identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

Foreign Currency Translation

The books and records of the Series are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the current exchange rates. Purchases and sales of investment securities and income and expenses are translated on the respective dates of such transactions. The Series does not isolate realized and unrealized gains and losses attributable to changes in the exchange rates from gains and losses that arise from changes in the fair value of investments. Such fluctuations are included with net realized and unrealized gain or loss on investments. Net realized foreign currency gains and losses represent foreign currency gains and losses between trade date and settlement date on securities transactions, gains and losses on disposition of foreign currencies and the difference between the amount of income and foreign withholding taxes recorded on the books of the Series and the amounts actually received or paid.

Restricted Securities

Restricted securities are purchased in private placement transactions, are not registered under the Securities Act of 1933, as amended, and may have contractual restrictions on resale. Information regarding restricted securities is included at the end of the Series’ Investment Portfolio.

13

Life Sciences Series

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

Illiquid Securities

A security may be considered illiquid if so deemed in good faith by the Advisor under procedures approved by and under the general supervision and responsibility of the Fund’s Board. Securities that are illiquid are marked with the applicable footnote on the Investment Portfolio.

Affiliated Companies

The 1940 Act defines “affiliated companies” to include securities in which a series owns 5% or more of the outstanding voting securities of the issuer.

The following transactions were effected in securities of affiliated companies for the year ended December 31, 2011:

| | | | | | | | | | | | | | | | |

| NAME OF ISSUER | | VALUE AT

12/31/10 | | PURCHASE

COST | | SALES

PROCEEDS | | VALUE AT

12/31/11 | | SHARES HELD AT

12/31/11 | | DIVIDEND

INCOME

12/31/10

THROUGH

12/31/11 | | NET REALIZED

GAIN (LOSS)

12/31/10

THROUGH

12/31/11 | |

Avalon HealthCare Holdings, | | | | | | | | | | | | | | | | |

Inc. - Series D | | $ — | | $ — | | $ — | | $ — | | — | | $ — | | $ | (2,312,500) | |

Avalon HealthCare Holdings, Inc. | | — | | — | | — | | — | | — | | — | | | (76,718) | |

Avalon HealthCare Holdings, | | | | | | | | | | | | | | | | |

Inc. - Warrants | | | | | | | | | | | | | | | | |

2/27/2014 | | — | | — | | — | | — | | — | | — | | | (19,180) | |

| | | | | | | | | | | | | | | | |

| | $ — | | $ — | | $ — | | $ — | | — | | $ — | | $ | (2,408,398) | |

| | | | | | | | | | | | | | | | |

Federal Taxes

The Series’ policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Series is not subject to federal income tax or excise tax to the extent that the Series distributes to shareholders each year its taxable income, including any net realized gains on investments, in accordance with requirements of the Internal Revenue Code. Accordingly, no provision for federal income tax or excise tax has been made in the financial statements.

Management evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. At December 31, 2011, the Series has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken in future tax returns.

The Series files income tax returns in the U.S. federal jurisdiction, various states and foreign jurisdictions, as required. No income tax returns are currently under investigation. The statute of limitations on the Series’ tax returns remains open for the years ended December 31, 2008 through December 31, 2011. The Series is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Foreign Taxes

Based on the Series’ understanding of the tax rules and rates related to income, gains and currency purchase/repatriation transactions for foreign jurisdictions in which it invests, the Series will provide for foreign taxes, and where appropriate, deferred foreign tax. The Series is subject to a tax imposed on short term capital gains on securities of issuers domiciled in India. The Series records an estimated deferred tax liability for securities that have been held for less than a year at the end of the reporting period, assuming those positions were disposed of at the end of the period. This amount is reported in Accrued foreign capital gains tax in the accompanying Statement of Assets and Liabilities. Realized losses on the sale of securities of issuers domiciled in India can be carried forward for eight years to offset potential future short term realized capital gains.

14

Life Sciences Series

Notes to Financial Statements (continued)

| 2. | Significant Accounting Policies (continued) |

Distributions of Income and Gains

Distributions to shareholders of net investment income and net realized gains are made annually. An additional distribution may be necessary to avoid taxation of the Series. Distributions are recorded on the ex-dividend date.

Indemnifications

The Fund’s organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Other

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

| 3. | Transactions with Affiliates |

The Fund has an Investment Advisory Agreement (the “Agreement”) with the Advisor, for which the Series pays a fee, computed daily and payable monthly, at an annual rate of 1.00% of the Series’ average daily net assets.

Under the Agreement, personnel of the Advisor provide the Series with advice and assistance in the choice of investments and the execution of securities transactions, and otherwise maintain the Series’ organization. The Advisor also provides the Fund with necessary office space and fund administration and support services. The salaries of all officers of the Fund (except a percentage of the Fund’s Chief Compliance Officer’s salary, which is paid by the Fund), and of all Directors who are “affiliated persons” of the Fund, or of the Advisor, and all personnel of the Fund, or of the Advisor, performing services relating to research, statistical and investment activities, are paid by the Advisor. Each “non-affiliated” Director receives an annual stipend, which is allocated among all the active series of the Fund. In addition, these Directors also receive a fee per Board meeting attended plus a fee for each committee meeting attended.

Manning & Napier Investor Services, Inc., a registered broker-dealer affiliate of the Advisor, acts as distributor for the Fund’s shares. The services of Manning & Napier Investor Services, Inc. are provided at no additional cost to the Series.

The Advisor did not waive any fees for the year ended December 31, 2011. The Advisor is not eligible to recoup any expenses that have been waived or reimbursed in prior years.

The Advisor has agreements with BNY Mellon Investment Servicing (U.S.) Inc. (“BNY”) under which BNY serves as sub-accountant services agent and sub-transfer agent. The Fund pays the Advisor an annual fee related to fund accounting and administration of 0.0175% on the first $3 billion of average daily net assets (excluding Target Series); 0.015% on the next $3 billion of average daily net assets (excluding Target Series); and 0.01% of the average daily net assets in excess of $6 billion (excluding Target Series); plus a base fee of $25,500 per series. Transfer Agent fees are charged to the Fund on a per account basis. Additionally, certain transaction and cusip-based fees and out-of-pocket expenses, including charges for reporting relating to the Fund’s compliance program, are charged.

Expenses not directly attributable to a series are allocated based on each series’ relative net assets or number of accounts, depending on the expense.

15

Life Sciences Series

Notes to Financial Statements (continued)

4. Purchases and Sales of Securities

For the year ended December 31, 2011, purchases and sales of securities, other than U.S. Government securities and short-term securities, were $201,756,785 and $235,100,091, respectively. There were no purchases or sales of U.S. Government securities.

| 5. | Capital Stock Transactions |

Transactions in shares of Life Sciences Series were:

| | | | | | | | | | | | | | | | |

| | | FOR THE YEAR

ENDED 12/31/11 | | | | | | FOR THE YEAR

ENDED 12/31/10 | | | | |

| | | | SHARES | | | | AMOUNT | | | | SHARES | | | | AMOUNT | |

Sold | | | 3,884,766 | | | $ | 48,098,558 | | | | 2,426,114 | | | $ | 26,545,889 | |

Reinvested | | | 532,612 | | | | 5,608,399 | | | | — | | | | — | |

Repurchased | | | (6,803,872 | ) | | | (75,543,779 | ) | | | (7,813,236 | ) | | | (86,364,811 | ) |

| | | | | | | | | | | | | | | | | |

Total | | | (2,386,494 | ) | | $ | (21,836,822 | ) | | | (5,387,122 | ) | | $ | (59,818,922 | ) |

| | | | | | | | | | | | | | | | | |

Substantially all of the Series’ shares represent investments by fiduciary accounts over which the Advisor has sole investment discretion.

The Series may trade in instruments including written and purchased options, forward foreign currency exchange contracts and futures contracts and other derivatives in the normal course of investing activities to assist in managing exposure to various market risks. The Series may be subject to various elements of risk, which may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. These risks include: the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate or index, counterparty credit risk related to over the counter derivative counterparties’ failure to perform under contract terms, liquidity risk related to the lack of a liquid market for these contracts allowing the fund to close out its position(s) and documentation risk relating to disagreement over contract terms. No such investments were held by the Series as of December 31, 2011.

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in securities of domestic companies and the U.S. Government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of comparable domestic companies and the U.S. Government.

| 8. | Life Sciences Securities |

The Series may focus its investments in certain related life sciences industries; hence, the Series may subject itself to a greater degree of risk than a series that is more diversified.

| 9. | Federal Income Tax Information |

The amount and characterization of certain income and capital gains to be distributed are determined in accordance with federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing book and tax treatments in the timing of the recognition of net investment income or gains and losses, including net operating losses and foreign currency gains and losses. The Series may periodically make reclassifications among its capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations without impacting the Series’ net asset value. For the year ended December 31, 2011, amounts were reclassified within the capital accounts to reduce Additional Paid in Capital by $1,787,682, increase Undistributed Net Investment Income by $1,532,993 and increase Accumulated Net Realized Gain on Investments, Foreign Currency and

16

Life Sciences Series

Notes to Financial Statements (continued)

| 9. | Federal Income Tax Information (continued) |

Translation of Other Assets and Liabilities by $254,689. The reclassification relates to foreign currency gains and losses and net operating losses. Any such reclassifications are not reflected in the financial highlights.

The tax character of distributions paid were as follows:

| | | | | | | | |

| | | | | FOR THE YEAR | | FOR THE YEAR | | |

| | | | ENDED 12/31/11 | | ENDED 12/31/10 | | |

| | Long-term capital gains | | $5,663,104 | | $— | | |

At December 31, 2011, the tax basis of components of distributable earnings and the net unrealized depreciation based on the identified cost of investments for federal income tax purposes were as follows:

| | | | | | |

Cost for federal income tax purposes | | $ | 197,850,708 | | | |

Unrealized appreciation | | | 17,226,042 | | | |

Unrealized depreciation | | | (19,760,972 | ) | | |

| | | | | | |

Net unrealized depreciation | | $ | (2,534,930 | ) | | |

| | | | | | |

| | |

Undistributed long-term gains | | $ | 2,963,364 | | | |

The Regulated Investment Company Modernization Act of 2010 (the “Act”) was enacted on December 22, 2010. The Act made changes to several tax rules including the unlimited carryover of future capital losses, which will retain their character as short-term and/or long term losses. Prior to the Act, net capital losses incurred by the Series were carried forward for eight years and treated as short-term losses. The Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

As of December 31, 2011, the Series did not have pre or post-enactment net capital loss carryfowards.

The capital loss carryover utilized in the current year was $20,419,145.

17

Life Sciences Series

Report of Independent Registered Public Accounting Firm

To the Board of Directors of Manning & Napier Fund, Inc. and Shareholders of Life Sciences Series:

In our opinion, the accompanying statement of assets and liabilities, including the investment portfolio, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Life Sciences Series (a series of Manning & Napier Fund, Inc., hereafter referred to as the “Series”) at December 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Series’ management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2011 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

New York, New York

February 22, 2012

18

Life Sciences Series

Supplemental Tax Information

(unaudited)

All designations are based on financial information available as of the date of this annual report and, accordingly are subject to change.

The Series hereby reports $5,663,104 as capital gains for its taxable year ended December 31, 2011, or if different, the maximum allowable under tax law.

19

Life Sciences Series

Renewal of Investment Advisory Agreement

(unaudited)

At the Manning & Napier Fund, Inc. (the “Fund”) Board of Directors’ (the “Board”) meeting, held on November 18, 2011, the Investment Advisory Agreement (the “Agreement”) between the Fund and Manning & Napier Advisors, LLC (the “Advisor”) was reviewed by the Board for renewal. In connection with the decision whether to renew the Agreement, a variety of material was prepared for and reviewed by the Board.

Representatives of the Advisor attended the meeting and presented additional oral and written information to the Board to assist the Board in its considerations. The discussion immediately below outlines the materials and information presented to the Board in connection with the Board’s 2011 Annual Review of the Agreement and the conclusions made by the Directors when determining to continue the Agreement.

| | • | | The Board considered the services provided by the Advisor under the Agreement including, among others: deciding what securities to purchase and sell for each Series; arranging for the purchase and sale of such securities by placing orders with broker-dealers; administering the affairs of the Fund (including the books and records of the Fund not maintained by third party service providers such as the custodian or sub-transfer agent); arranging for the insurance coverage for the Fund; and supervising the preparation of tax returns, SEC filings (including registration statements) and reports to shareholders for the Fund. The Board also considered the nature and quality of such services provided under the Agreement in light of the Advisor’s services provided to the Fund for 25 years. The Board discussed the quality of these services with representatives from the Advisor and concluded that the Advisor was performing its services to the Fund required under the Agreement in a reasonable manner. |

| | • | | The Board considered the investment performance of the various Series of the Fund. The investment performance for each Series was reviewed on a cumulative basis since inception and on a one year basis. In addition, annualized performance for the following time periods was considered: inception, three year, five year, ten year, and current market cycle. A market cycle includes periods of both rising and falling markets. Returns for established benchmark indices for each Series were provided for each time period. The Board noted that the various Series were competitive against their respective benchmarks and/or peer groups over various time periods, but in particular over the full market cycle period relevant for the Series. In addition, the Board considered at the meeting (and considers on a quarterly basis) a peer group performance analysis consisting of Morningstar universes of mutual funds with similar investment objectives. The Board discussed the performance with representatives from the Advisor and concluded that the investment performance of each of the Fund’s Series was reasonable based on the Fund’s actual performance and comparative performance, especially performance over the current market cycle. |

| | • | | The Board considered the costs of the Advisor’s services and the profits of the Advisor as they relate to the Advisor’s services to the Fund under the Agreement. In reviewing the Advisor’s costs and profits, the Board discussed the Advisor’s revenues generated from the Fund (on both an actual and adjusted basis) and its expenses associated with providing the services under the Agreement. In addition, the Board reviewed the Advisor’s expenses associated with Fund activities outside of the Agreement (such as expense reimbursements pursuant to expense caps and payments made by the Advisor to third party platforms on which shares of the Fund are available for purchase). It was noted by representatives of the Advisor that 10 of the 29 active Series of the Fund are currently experiencing expenses above the capped expense ratios. After discussing the above costs and profits, the Board concluded that the Advisor’s profitability relating to its services provided under the Agreement was reasonable. |

| | • | | The Board considered the fees and expenses of the various Series of the Fund. The Advisor presented the advisory fees and total expenses for each Series, including the advisory fee adjusted for any expense waivers or reimbursements (either contractual or voluntary) paid by the Advisor. The advisory fees and expense ratios of each Series were compared to an average (on both a mean and median basis) of similar funds as disclosed on the Morningstar database. Representatives of the Advisor discussed with the Board the levels of its advisory fee for each Series of the Fund and as compared to the median and mean advisory fees for similar funds as listed on Morningstar. Expense ratios for every Series, except the Pro-Blend’s Class R and Class C, and Target Class R and Class C (and a few Class K), are currently below the median and mean for similar funds as listed on Morningstar. Based on their review of the information provided, the Board concluded that the fees and expenses of each Series of the Fund were reasonable on a comparative basis. |

20

Life Sciences Series

Renewal of Investment Advisory Agreement

(unaudited)

| | • | | The Board also considered the other benefits the Advisor derives from its relationship with the Fund. Such other benefits include certain research products provided by soft dollars. Given the level of soft dollar transactions involving the Fund, the Board concluded that these additional benefits to the Advisor were reasonable. |

| | • | | In addition to the factors described above, the Board considered the Advisor’s personnel, investment strategies, policies and procedures relating to compliance with personal securities transactions, and reputation, expertise and resources in domestic and foreign financial markets. The Board concluded that these factors support the conclusion that the Advisor performs its services in a reasonable manner. |

| | • | | The Board did not consider economies of scale at this time because of the multiple uses of the Fund (for the Advisor’s discretionary investment account clients in addition to direct investors), the current profitability of the Advisor’s services to the Fund under the Agreement, and the overall size of the Fund complex. |

Based on the Board’s deliberations and their evaluation of the information described above, the Board, including a majority of Directors that are not “interested persons” as defined in the Investment Company Act of 1940, concluded that the compensation under the Agreement was fair and reasonable in light of the services and expenses and such other matters as the Directors considered to be relevant in the exercise of their reasonable judgment. Accordingly, the Board approved the renewal of the Agreement. In the course of their deliberations, the Directors did not identify any particular information that was all important or controlling.

21

Life Sciences Series

Directors’ and Officers’ Information

(unaudited)

The Statement of Additional Information provides additional information about the Fund’s directors and officers and can be obtained without charge by calling 1-800-466-3863, at www.manningnapieradvisors.com, or on the EDGAR Database on the SEC Internet web site

(http:// www.sec.gov). The following chart shows certain information about the Fund’s officers and directors, including their principal occupations during the last five years. Unless specific dates are provided, the individuals have held the listed positions for longer than five years.

Interested Director/Officer

| | |

| Name: | | B. Reuben Auspitz* |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 64 |

| Current Position(s) Held with Fund: | | Principal Executive Officer, President, Chairman & Director |

| Term of Office1 & Length of Time Served: | | Indefinite - Director since 1984; Vice President 1984 - 2003; President since 2004; Principal Executive Officer since 2002 |

| Principal Occupation(s) During Past 5 Years: | | Executive Vice President; Executive Group Member**; Chief Compliance Officer since 2004; Vice Chairman since June 2010; Co-Executive Director from 2003-2010 - Manning & Napier Advisors, LLC, President; Director - Manning & Napier Investor Services, Inc. Holds or has held one or more of the following titles for various subsidiaries and affiliates: President, Vice President, Director, Chairman, Treasurer, Chief Compliance Officer or Member. |

| Number of Portfolios Overseen within Fund Complex: | | 34 |

| Other Directorships Held Outside Fund Complex: | | N/A |

| |

Independent Directors | | |

| Name: | | Stephen B. Ashley |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 71 |

| Current Position(s) Held with Fund: | | Director, Audit Committee Member, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 1996 |

| Principal Occupation(s) During Past 5 Years: | | Chairman, Director, President & Chief Executive Officer, The Ashley Group (property management and investment). Chairman (non-executive) |

| | 2004-2008; Director 1995-2008 - Fannie Mae (mortgage) |

| Number of Portfolios Overseen within Fund Complex: | | 34 |

| Other Directorships Held Outside Fund Complex: | | The Ashley Group (1995-2008) |

| | | Genesee Corporation (1987-2007) |

| |

| Name: | | Peter L. Faber |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 73 |

| Current Position(s) Held with Fund: | | Director, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 1987 |

| Principal Occupation(s) During Past 5 Years: | | Senior Counsel since 2006, Partner (1995 - 2006) - McDermott, Will & Emery LLP (law firm) |

| Number of Portfolios Overseen within Fund Complex: | | 34 |

| Other Directorships Held Outside Fund Complex: | | Partnership for New York City, Inc. (non-profit) |

| | New York Collegium (non-profit) |

| | | Boston Early Music Festival (non-profit) |

| |

| Name: | | Harris H. Rusitzky |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 77 |

| Current Position(s) Held with Fund: | | Director, Audit Committee Member, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 1985 |

| Principal Occupation(s) During Past 5 Years: | | President, The Greening Group (business consultants) since 1994; |

| | Partner, The Restaurant Group (restaurants) since 2006 |

| Number of Portfolios Overseen within Fund Complex: | | 34 |

| Other Directorships Held Outside Fund Complex: | | N/A |

22

Life Sciences Series

Directors’ and Officers’ Information

(unaudited)

Independent Directors (continued)

| | |

| Name: | | Paul A. Brooke |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 65 |

| Current Position(s) Held with Fund: | | Director, Audit Committee Member, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 2007 |

| Principal Occupation(s) During Past 5 Years: | | Chairman & CEO, Alsius Corp. (investments); Managing Member, PMSV Holdings LLC (investments) |

| Number of Portfolios Overseen within Fund Complex: | | 34 |

| Other Directorships Held Outside Fund Complex: | | Incyte Corp. (2000-present) |

| | ViroPharma, Inc. (2000-present) |

| | HLTH Corp. (2000-present) |

| | Cheyne Capital International (2000-present) |

| | MPM Bio-equities (2000-present) |

| | GMP Companies (2000-present) |

| | | HoustonPharma (2000-present) |

| |

Officers | | |

| |

| Name: | | Ryan Albano |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 30 |

| Current Position(s) Held with Fund: | | Assistant Chief Financial Officer |

| Term of Office1 & Length of Time Served: | | Since 2011 |

| Principal Occupation(s) During Past 5 Years: | | Fund Reporting Manager since 2011 – Manning & Napier Advisors, LLC; |

| | Manager (2004-2011) – KPMG LLP |

| Number of Portfolios Overseen within Fund Complex: | | 34 |

| Other Directorships Held Outside Fund Complex: | | N/A |

| | | |

| Name: | | Jeffrey S. Coons, Ph.D., CFA |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 48 |

| Current Position(s) Held with Fund: | | Vice President |

| Term of Office1 & Length of Time Served: | | Since 2004 |

| Principal Occupation(s) During Past 5 Years: | | President since 2010, Co-Director of Research since 2002, Executive Group Member** since 2003, - Manning & Napier Advisors, LLC |

| | Holds one or more of the following titles for various subsidiaries and affiliates: President, Director, Treasurer or Senior Trust Officer. |

| Number of Portfolios Overseen within Fund Complex: | | 34 |

| Other Directorships Held Outside Fund Complex: | | N/A |

| | | |

| Name: | | Elizabeth Craig |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 25 |

| Current Position(s) Held with Fund: | | Assistant Corporate Secretary |

| Term of Office1 & Length of Time Served: | | Since 2011 |

| Principal Occupation(s) During Past 5 Years: | | Mutual Fund Compliance Specialist since 2009 - Manning & Napier |

| | Advisors, LLC |

| Number of Portfolios Overseen within Fund Complex: | | 34 |

| Other Directorships Held Outside Fund Complex: | | N/A |

| |

| Name: | | Christine Glavin |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 45 |

| Current Position(s) Held with Fund: | | Principal Financial Officer, Chief Financial Officer |

| Term of Office1 & Length of Time Served: | | Principal Financial Officer since 2002; Chief Financial Officer since 2001 |

| Principal Occupation(s) During Past 5 Years: | | Director of Fund Reporting, Manning & Napier Advisors, LLC since 1997 |

| Number of Portfolios Overseen within Fund Complex: | | 34 |

| Other Directorships Held Outside Fund Complex: | | N/A |

23

Life Sciences Series

Directors’ and Officers’ Information

(unaudited)

Officers (continued)

| | |

| Name: | | Jodi L. Hedberg |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 44 |

| Current Position(s) Held with Fund: | | Corporate Secretary, Chief Compliance Officer, Anti-Money Laundering Compliance Officer |

| Term of Office1 & Length of Time Served: | | Corporate Secretary since 1997; Chief Compliance Officer since 2004 |

| Principal Occupation(s) During Past 5 Years: | | Director of Compliance, Manning & Napier Advisors, LLC and affiliates since 1990 (title change in 2005 from Compliance Manager to Director of Compliance); Corporate Secretary, Manning & Napier Investor Services, Inc. since 2006 |

| Number of Portfolios Overseen within Fund Complex: | | 34 |

| Other Directorships Held Outside Fund Complex: | | N/A |

| |

| Name: | | Richard Yates |

| Address: | | 290 Woodcliff Drive |

| | Fairport, NY 14450 |

| Age: | | 46 |

| Current Position(s) Held with Fund: | | Chief Legal Officer |

| Term of Office1 & Length of Time Served: | | Chief Legal Officer since 2004 |

| Principal Occupation(s) During Past 5 Years: | | Counsel - Manning & Napier Advisors, LLC & affiliates since 2000; Holds one or more of the following titles for various affiliates; Director or Corporate Secretary |

| Number of Portfolios Overseen within Fund Complex: | | 34 |

| Other Directorships Held Outside Fund Complex: | | N/A |

*Interested Director, within the meaning of the Investment Company Act of 1940 by reason of his position with the Fund’s investment advisor and distributor. Mr. Auspitz serves as the Executive Vice President and Director, Manning & Napier Advisors, LLC and President and Director, Manning & Napier Investor Services, Inc., the Fund’s distributor.

**Prior to June 2010, the Executive Group, consisting of senior executive employee-owners, performed the duties of the Office of the Chief Executive of the Advisor. Effective June 2010, the Executive Group serves as an advisory board to the Chief Executive Officer.

1The term of office for President, Vice President, Chief Financial Officer, Assistant Chief Financial Officer, and Corporate Secretary is one year and until their respective successors are chosen and qualified. All other officers’ terms are indefinite.

24

Life Sciences Series

Literature Requests

(unaudited)

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, upon request:

| | | | | | |

| By phone | | 1-800-466-3863 | | | | |

| On the Securities and Exchange | | | | | | |

Commission’s (SEC) web site | | http://www.sec.gov | | | | |

Proxy Voting Record

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available, without charge, upon request:

| | | | | | |

| By phone | | 1-800-466-3863 | | | | |

| On the SEC’s web site | | http://www.sec.gov | | | | |

Quarterly Portfolio Holdings

The Series’ complete schedule of portfolio holdings for the 1st and 3rd quarters of each fiscal year are provided on Form N-Q, and are available, without charge, upon request:

| | | | | | |

| By phone | | 1-800-466-3863 | | | | |

| On the SEC’s web site | | http://www.sec.gov | | | | |

The Series’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Prospectus and Statement of Additional Information (SAI)

The prospectus and SAI provide additional information about each Series, including charges, expenses and risks. These documents are available, without charge, upon request:

| | | | | | |

| By phone | | 1-800-466-3863 | | | | |

| On the SEC’s web site | | http://www.sec.gov | | | | |

| On our web site | | http://www.manning-napier.com | | | | |

Additional information available at www.manning-napier.com

| 1. | Fund Holdings - Month-End |

| 2. | Fund Holdings - Quarter-End |

| 3. | Shareholder Report - Annual |

| 4. | Shareholder Report - Semi-Annual |

The Fund also offers electronic notification or “e-delivery” when certain documents are available on-line to be downloaded or reviewed. Direct shareholders can elect to receive electronic notification when shareholder reports, prospectus updates, and/or statements are available. If you do not currently have on-line access to your account, you can establish access by going to www.manning-napier.com, click on “Login” in the top corner of the page, and follow the prompts to self-enroll. Once enrolled, you can set your electronic notification preferences by clicking on the Account Options tab located within the green toolbar and then select E-Delivery Option. Should you have any questions on either how to establish on-line access or how to update your account settings, please contact Investor Services at 1-800-466-3863.

MNLFS-12/11-AR

| | | | |

| |

| | |

|

|

| | SMALL CAP SERIES | | |

| | |

| www.manning-napier.com | |  | | |

Small Cap Series

Management Discussion and Analysis

(unaudited)

Dear Shareholders:

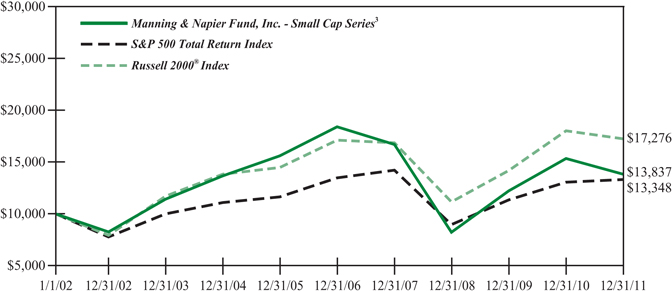

Volatility was a constant theme throughout much of 2011. Over the past year, substantial equity market swings were driven in large part by macroeconomic developments and a series of external shocks, including Standard & Poor’s downgrade of the U.S. credit rating, the European sovereign debt crisis, political unrest in the Middle East, and March’s tsunami disaster in Japan. The accumulation of these events bred widespread uncertainty and has continued to weigh heavily on investor confidence both domestically and abroad. Throughout the year, market action was largely driven by emotion, and in general investors sought stability over growth.

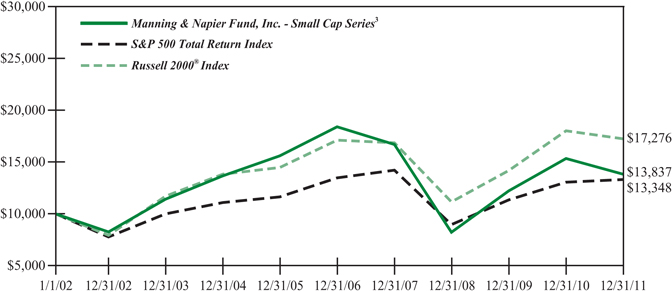

Despite such volatility, major domestic equity indices earned positive returns for the year, with the S&P 500 Index finishing the year up 2.12% and the Russell 1000 finishing up 1.5%. Yet those index returns were mainly driven by a handful of primarily large, slow growth, high dividend paying companies. Indeed, large cap companies generally outperformed their smaller cap counterparts during the risk adverse environment of 2011. For the twelve months ending December 31, 2011, the Russell 2000 Index, which includes smaller capitalization companies, experienced a loss of 4.18%. Similarly, the Small Cap Series earned negative returns in 2011, falling 10.01% and trailing its benchmark.