UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04098

Name of Registrant: Vanguard Chester Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Anne E. Robinson, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2016 – September 30, 2017

Item 1: Reports to Shareholders

|

| Annual Report | September 30, 2017 |

| Vanguard PRIMECAP Fund |

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control. We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Performance at a Glance. | 1 |

| Chairman’s Perspective. | 3 |

| Advisor’s Report. | 7 |

| Fund Profile. | 10 |

| Performance Summary. | 12 |

| Financial Statements. | 14 |

| Your Fund’s After-Tax Returns. | 27 |

| About Your Fund’s Expenses. | 28 |

| Trustees Approve Advisory Arrangement. | 30 |

| Glossary. | 32 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Nautical images have been part of Vanguard’s rich heritage since its start in 1975. For an incoming ship, a lighthouse offers a beacon and safe path to shore. You can similarly depend on Vanguard to put you first––and light the way––as you strive to meet your financial goals. Our client focus and low costs, stemming from our unique ownership structure, assure that your interests are paramount.

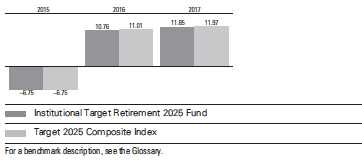

Your Fund’s Performance at a Glance

• Vanguard PRIMECAP Fund returned nearly 24% for the 12 months ended September 30, 2017, exceeding the return of more than 18% for its benchmark, the Standard and Poor’s 500 Index, and the more than 19% average return of its multi-capitalization growth fund peers.

• Growth stocks outpaced their value counterparts for the period. The PRIMECAP

Fund posted gains in seven of the nine sectors in which it maintained exposure.

• PRIMECAP Management Company, the fund’s advisor, traditionally invests most heavily in the information technology and health care sectors. The fund’s technology stocks climbed nearly 38%, well ahead of those in the benchmark, and contributed about 13 percentage points to results. Although the fund’s health care stocks posted gains of about 11% and added about 2 percentage points to results, they were the biggest detractor from relative performance.

• Over the decade ended September 30, 2017, the fund’s average annual return of about 10% outpaced its comparative standards by more than 2 percentage points.

| |

| Total Returns: Fiscal Year Ended September 30, 2017 | |

| | Total |

| | Returns |

| Vanguard PRIMECAP Fund | |

| Investor Shares | 23.75% |

| Admiral™ Shares | 23.83 |

| S&P 500 Index | 18.61 |

| Multi-Cap Growth Funds Average | 19.24 |

Multi-Cap Growth Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements.

| |

| Total Returns: Ten Years Ended September 30, 2017 | |

| | Average |

| | Annual Return |

| PRIMECAP Fund Investor Shares | 10.05% |

| S&P 500 Index | 7.44 |

| Multi-Cap Growth Funds Average | 6.53 |

| Multi-Cap Growth Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

1

| | | |

| Expense Ratios | | | |

| Your Fund Compared With Its Peer Group | | | |

| | Investor | Admiral | Peer Group |

| | Shares | Shares | Average |

| PRIMECAP Fund | 0.39% | 0.32% | 1.23% |

The fund expense ratios shown are from the prospectus dated January 27, 2017, and represent estimated costs for the current fiscal year. For the fiscal year ended September 30, 2017, the fund’s expense ratios were 0.39% for Investor Shares and 0.32% for Admiral Shares. The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures information through year-end 2016.

Peer group: Multi-Cap Growth Funds.

2

Chairman’s Perspective

Bill McNabb

Chairman and Chief Executive Officer

Dear Shareholder,

Our investors depend on Vanguard to be a responsible steward of their assets. This includes our obvious responsibilities—managing the funds, offering investment perspectives and advice, and assisting with questions and transactions.

But because a long-term perspective informs every aspect of our investment approach, we also work on your behalf in less obvious ways, such as by advocating for responsible governance among the companies in which Vanguard funds invest. Vanguard’s index funds are essentially permanent owners of thousands of publicly traded companies, and we have a special obligation to be engaged stewards actively focused on the long term.

Simply put, we believe that well-governed companies are more likely to perform well over the long run.

Although Vanguard has always been an advocate for strong corporate governance, we have expanded our efforts recently as our investor base continues to grow. Our Investment Stewardship team has doubled in size since 2015, and we continue to add analysts, researchers, and operations team members. The team guides our engagement activities and our funds’ proxy voting by analyzing corporate governance practices in companies around the world.

3

Our four Investment Stewardship pillars

As we evaluate company responsiveness to governance matters, including environmental and social concerns, we focus on four key areas—what we call our Investment Stewardship pillars:

• The board: A high-functioning, well-composed, independent, diverse, and experienced board with effective ongoing evaluation practices.

• Governance structures: Provisions and structures that empower shareholders and protect their rights.

• Appropriate compensation: Pay that incentivizes relative outperformance over the long term.

• Risk oversight: Effective, integrated, and ongoing oversight of relevant industry-and company-specific risks.

Guided by these pillars, our Investment Stewardship team conducted more than 950 engagements, or discussions, with company directors and leaders worldwide during the 12 months ended June 30, 2017.

| | | |

| Market Barometer | | | |

| | | Average Annual Total Returns |

| | Periods Ended September 30, 2017 |

| | One Year | Three Years | Five Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 18.54% | 10.63% | 14.27% |

| Russell 2000 Index (Small-caps) | 20.74 | 12.18 | 13.79 |

| Russell 3000 Index (Broad U.S. market) | 18.71 | 10.74 | 14.23 |

| FTSE All-World ex US Index (International) | 19.49 | 5.11 | 7.35 |

| |

| Bonds | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | 0.07% | 2.71% | 2.06% |

| Bloomberg Barclays Municipal Bond Index | | | |

| (Broad tax-exempt market) | 0.87 | 3.19 | 3.01 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.64 | 0.28 | 0.18 |

| |

| CPI | | | |

| Consumer Price Index | 2.23% | 1.22% | 1.30% |

4

We also cast more than 171,000 votes on behalf of Vanguard funds at more than 18,000 shareholder meetings.

Gender diversity on boards and climate risk

As we engage with companies, we are devoting increased attention to two specific topics. The first is gender diversity on boards. It’s no secret that the right combination of talent, skills, and experience leads to better results, so we pay close attention to how company boards are structured and managed, and how they evolve.

In recent years, a growing body of research has demonstrated that greater diversity on boards can lead to improved governance and company performance. We are advocating for boards to incorporate diverse perspectives and experience into their strategic planning and decision-making. One example of our commitment to more diverse boards is our participation in the 30% Club, a global coalition working to increase the representation of women in boardrooms and leadership roles.

The second issue is climate risk. We will continue to engage with companies to understand their responses to this risk. Regardless of one’s perspective on the issue, the potential is real for changing regulations, demographics, and consumption behavior to affect business results for companies in many sectors.

We want to ensure that such business and regulatory risks are sufficiently disclosed so investors can value companies appropriately. In the past year, we have voted for shareholder proposals at several energy companies that called for management to improve its climate risk assessment and planning, and we will consider supporting similar proposals if we believe they are beneficial to long-term shareholder value. When a proposal from a shareholder presents a strong case for change, we’re more than willing to fully consider it. And even if the case falls short, these proposals often catalyze a discussion that generates meaningful change over time.

In addition to considering activists’ proposals, we consult research providers and our own network of experts. When we detect material risks to a company’s long-term value (such as bad leadership, poor disclosure, misaligned compensation structures, or threats to shareholder rights), we act with our voice and our vote.

Our stewardship reflects our mission

But we don’t act as independent agents with our own agenda. Every time we speak with a company chairman, CEO, or director, we’re acutely aware of the role we play in representing the economic interests of more than 20 million Vanguard investors. So you can expect us to speak out when we detect threats to the economic interests of our shareholders.

5

We take positions on these matters not because they are inherently good or noble but because they are tied to the long-term economic value of your funds’ investments.

You trust us to represent your interests across the globe. You can be confident we act on that responsibility with the seriousness and dedication it deserves.

To learn more about our Investment Stewardship program, including how our funds have voted, visit https://about. vanguard.com/investment-stewardship/.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

October 13, 2017

6

Advisor’s Report

For the fiscal year ended September 30, 2017, Vanguard PRIMECAP Fund returned 23.75% for Investor Shares and 23.83% for Admiral Shares, exceeding the 18.61% return of the fund’s benchmark, the Standard & Poor’s 500 Index, and the 19.24% average return of the fund’s multi-capitalization growth fund competitors. Relative to the index, sector allocation and stock selection added to returns.

The fund’s information technology and industrial holdings contributed to relative results, while its health care holdings underperformed and its underweight position in financials detracted. Underweight positions in consumer staples, energy, real estate, telecommunication services, and utilities helped relative performance and more than offset unfavorable selection in consumer discretionary.

The investment environment

The investment environment has recently been favorable for actively managed growth funds, in large part because of the outperformance of the “FAANG” (Facebook, Amazon, Apple, Netflix, and Google) stocks, which are widely held among growth fund managers. A similar phenomenon occurred in 2015, only to reverse itself in 2016. Bank stocks and semiconductor and related equipment stocks also outperformed significantly during the fiscal year.

Energy stocks underperformed, as the price of a barrel of West Texas Intermediate crude oil declined from $54 at the end of 2016 to $52 on September 30, 2017. Despite attempts by the Organization of Petroleum Exporting Countries (OPEC) and Russia to prop up oil prices by constraining production, U.S. production proved to be more resilient than expected at recent prices. This resilience stems from continued improvements in fracking-related technologies that have significantly lowered the threshold oil price at which wells in certain regions can be profitable. Absent a geopolitical shock in the Middle East, we do not expect oil prices to increase significantly on a sustained basis, which explains our large underweighting in energy stocks.

Outlook for U.S equities

Even after a strong, multiyear run, U.S. equities currently trade for less than 18x forward earnings per share, a reasonable valuation by historical standards. We believe this valuation compares favorably with that of bonds, with the 10-year U.S. Treasury bond yielding approximately 2.3% at the end of the year. After holding flat at about $119 per share for three consecutive years, S&P 500 Index operating earnings per share are expected to grow 10% in 2017 to $131 per share, with double-digit growth forecast for 2018. Ongoing growth in earnings per share could support further S&P 500 Index stock price appreciation.

7

We are constructive on the U.S. economic outlook. The current political environment could lead to deregulation and lower taxes, which would support greater economic growth and corporate profits. Furthermore, we believe the U.S. banking system is far better capitalized than it was before the last financial crisis, as evidenced by the strong performance of most of the largest banks in recent government stress tests.

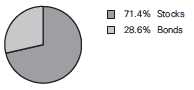

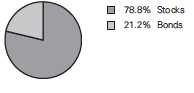

Portfolio update

The portfolio remains heavily overweighted in information technology, health care, and industrial stocks, with these sectors accounting for 77% of average assets, compared with 46% in the S&P 500 Index. The portfolio’s most significant underweights are in consumer staples, energy, real estate, and utilities, which collectively accounted for 1% of average assets, compared with 22% in the index. The portfolio is also significantly underweighted in financials, materials, and telecommunication services, which represented 9% of average assets, compared with 20% in the index.

Within information technology, the fund is most overweighted in semiconductor and semiconductor equipment stocks (12% versus 3% for the index). Over the past 12 months, the fund’s semiconductor and semiconductor equipment holdings returned 53%, led by NVIDIA (+162%), Micron (+121%), KLA-Tencor (+56%), and Texas Instruments (+31%).

In health care, the fund is most overweighted in biotechnology and pharmaceutical stocks, whose 21% combined weighting was more than double their weighting in the S&P 500 Index. The index’s health care sector underperformed during the period, returning 15%; our health care holdings returned 11%. In addition to pricing concerns, biotechnology and pharmaceutical stocks were negatively impacted by a lull in industry productivity (as measured by Food and Drug Administration approvals) and the failure of a couple of high-profile drug candidates in clinical trials.

The fund is also significantly overweighted in industrial stocks (18% versus 10% for the index) because of its investments in transportation stocks (12% versus the index’s 2%). The fund’s transportation holdings (primarily airlines) returned 31%.

As of September 30, 2017, the fund’s top ten holdings represented 38% of assets.

Advisor perspectives

After two consecutive years of underper-formance, the portfolio’s health care holdings appear attractively valued, and we are especially enthusiastic about the outlook for our health care portfolio. Health care stocks currently trade at a discount to the S&P 500 Index, even though the industry’s fundamental outlook, strengthened by favorable demographics

8

and rising living standards in emerging-market countries, remains bright. We believe that company innovation will be rewarded. Furthermore, the FDA appears to be pursuing a more constructive agenda on the pace of new drug approvals, albeit with more focus on low-cost biologics.

The fund’s information technology holdings, particularly in semiconductors and related equipment, have added significantly to relative results over the past couple of years. Although technology stocks currently trade at a modest premium to the S&P 500 Index, we believe that demand for semiconductors, software, and other technology products and services will continue to outpace demand for goods and services more broadly, as advances in automation and artificial intelligence add ever-greater value to an array of products and services.

Finally, we remain optimistic about the fund’s airline holdings, which continue to trade at valuation multiples far below average. Although prices have come under pressure as ultra-low-cost carriers attempt to gain market share from legacy players, we expect that these legacy players will respond rationally and that their competitive positions will be sustained.

Conclusion

As bottom-up stock pickers, we spend our time searching for opportunities to invest in stocks with long-term prospects we find to be materially better than market prices would seem to imply. Our approach often results in portfolios that bear little resemblance to market indexes creating the possibility for substantial deviations in relative performance. For example, our relative returns were significantly negative during the first half of calendar 2016, when the fund’s overweighted sectors and industries underperformed, and we expect to experience similar conditions in the future. We nonetheless believe that this approach can generate superior results for shareholders over the long term.

PRIMECAP Management Company

October 17, 2017

9

PRIMECAP Fund

Fund Profile

As of September 30, 2017

| | |

| Share-Class Characteristics | |

| | Investor | Admiral |

| | Shares | Shares |

| Ticker Symbol | VPMCX | VPMAX |

| Expense Ratio1 | 0.39% | 0.32% |

| 30-Day SEC Yield | 1.13% | 1.20% |

| | | |

| Portfolio Characteristics | | |

| | | | DJ |

| | | | U.S. |

| | | | Total |

| | | | Market |

| | | S&P 500 | FA |

| | Fund | Index | Index |

| Number of Stocks | 134 | 505 | 3,808 |

| Median Market Cap | $73.6B | $92.1B | $61.4B |

| Price/Earnings Ratio | 22.3x | 22.3x | 21.9x |

| Price/Book Ratio | 3.9x | 3.0x | 2.9x |

| Return on Equity | 18.4% | 16.0% | 15.1% |

| Earnings Growth | | | |

| Rate | 12.3% | 9.3% | 9.6% |

| Dividend Yield | 1.5% | 1.9% | 1.8% |

| Foreign Holdings | 9.8% | 0.0% | 0.0% |

| Turnover Rate | 8% | — | — |

| Short-Term Reserves | 5.6% | — | — |

| | | |

| Sector Diversification (% of equity exposure) |

| | | | DJ |

| | | | U.S. Total |

| | | S&P 500 | Market |

| | Fund | Index FA | Index |

| Consumer Discretionary | 8.2% | 11.9% | 12.3% |

| Consumer Staples | 0.3 | 8.2 | 7.3 |

| Energy | 0.9 | 6.1 | 5.8 |

| Financials | 7.4 | 14.6 | 15.0 |

| Health Care | 24.7 | 14.5 | 14.0 |

| Industrials | 18.7 | 10.2 | 10.8 |

| Information Technology | 37.5 | 23.2 | 22.3 |

| Materials | 1.7 | 3.0 | 3.4 |

| Real Estate | 0.0 | 3.0 | 4.0 |

| Telecommunication | | | |

| Services | 0.6 | 2.2 | 2.0 |

| Utilities | 0.0 | 3.1 | 3.1 |

Sector categories are based on the Global Industry Classification Standard (“GICS”), except for the “Other” category (if applicable), which includes securities that have not been provided a GICS classification as of the effective reporting period.

| | |

| Volatility Measures | | |

| | | DJ |

| | | U.S. Total |

| | S&P 500 | Market |

| | Index | FA Index |

| R-Squared | 0.88 | 0.89 |

| Beta | 1.04 | 1.03 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

1 The expense ratios shown are from the prospectus dated January 27, 2017, and represent estimated costs for the current fiscal year. For the fiscal year ended September 30, 2017, the expense ratios were 0.39% for Investor Shares and 0.32% for Admiral Shares.

10

PRIMECAP Fund

| | |

| Ten Largest Holdings (% of total net assets) |

| Biogen Inc. | Biotechnology | 4.9% |

| Alphabet Inc. | Internet Software & | |

| | Services | 4.4 |

| Eli Lilly & Co. | Pharmaceuticals | 4.2 |

| Adobe Systems Inc. | Application Software | 3.9 |

| Texas Instruments Inc. | Semiconductors | 3.8 |

| Amgen Inc. | Biotechnology | 3.8 |

| Microsoft Corp. | Systems Software | 3.8 |

| FedEx Corp. | Air Freight & | |

| | Logistics | 3.7 |

| Southwest Airlines Co. | Airlines | 3.3 |

| Alibaba Group Holding | Internet Software & | |

| Ltd. | Services | 2.5 |

| Top Ten | | 38.3% |

The holdings listed exclude any temporary cash investments and equity index products.

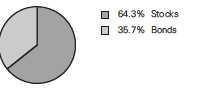

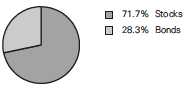

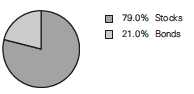

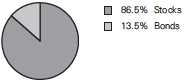

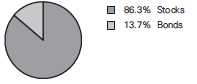

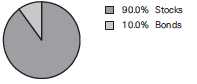

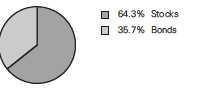

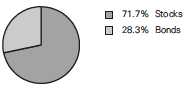

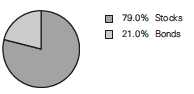

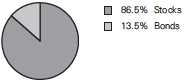

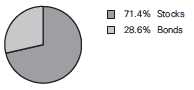

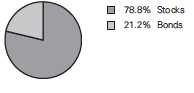

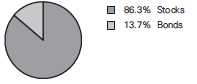

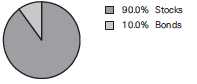

Investment Focus

11

PRIMECAP Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

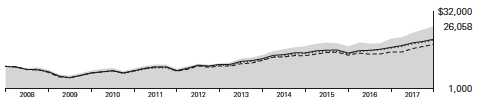

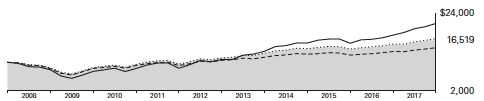

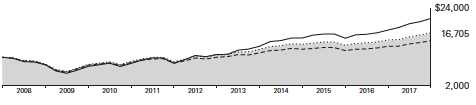

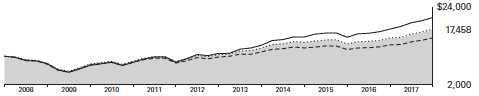

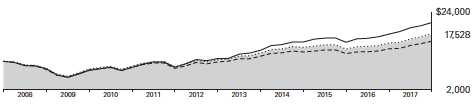

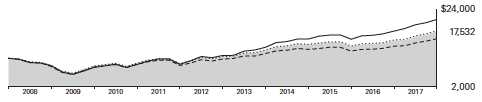

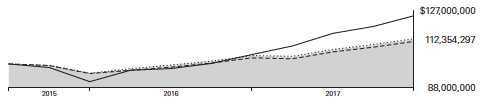

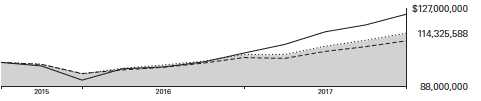

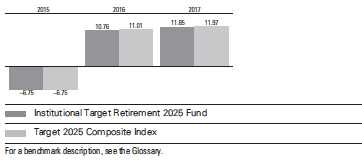

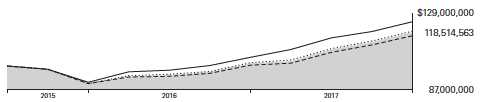

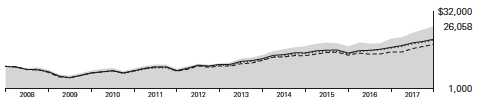

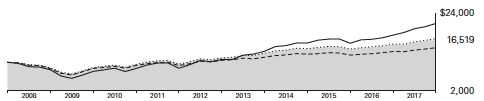

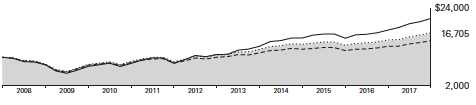

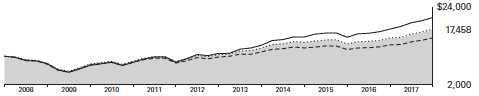

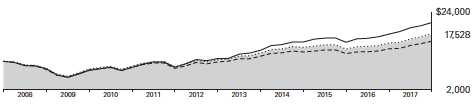

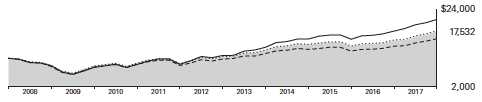

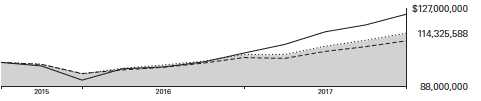

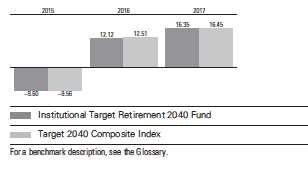

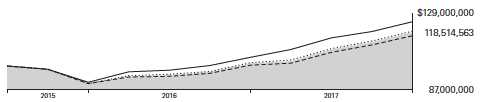

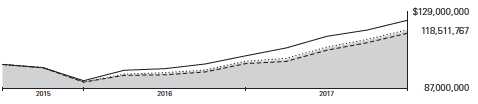

Cumulative Performance: September 30, 2007, Through September 30, 2017

Initial Investment of $10,000

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended September 30, 2017 | |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| PRIMECAP Fund*Investor Shares | 23.75% | 18.44% | 10.05% | $26,058 |

| S&P 500 Index | 18.61 | 14.22 | 7.44 | 20,488 |

| Multi-Cap Growth Funds Average | 19.24 | 13.13 | 6.53 | 18,825 |

| Dow Jones U.S. Total Stock Market | | | | |

| Float Adjusted Index | 18.67 | 14.15 | 7.64 | 20,887 |

Multi-Cap Growth Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

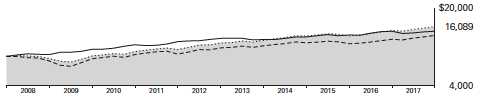

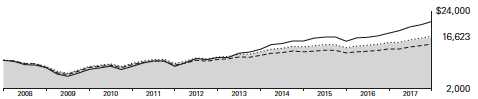

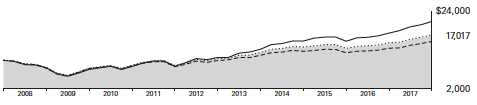

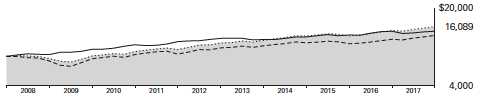

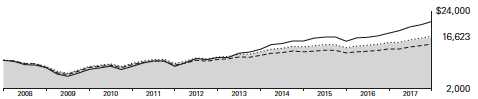

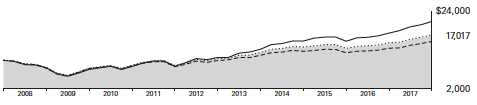

| | | | |

| | | | | Final Value |

| | One | Five | Ten | of a $50,000 |

| | Year | Years | Years | Investment |

| PRIMECAP Fund Admiral Shares | 23.83% | 18.53% | 10.15% | $131,465 |

| S&P 500 Index | 18.61 | 14.22 | 7.44 | 102,442 |

| Dow Jones U.S. Total Stock Market Float | | | | |

| Adjusted Index | 18.67 | 14.15 | 7.64 | 104,435 |

See Financial Highlights for dividend and capital gains information.

12

PRIMECAP Fund

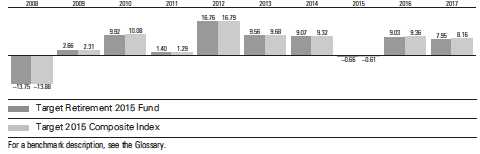

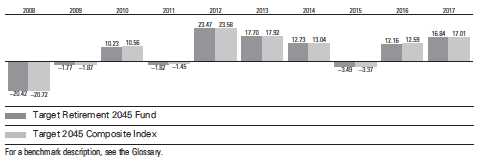

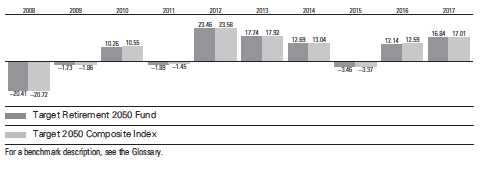

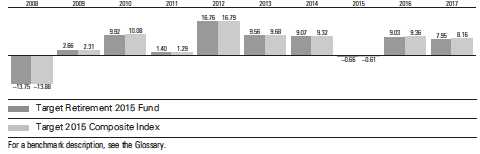

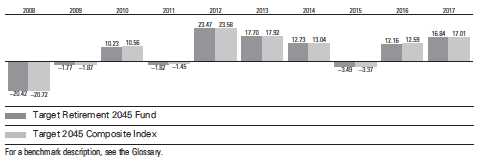

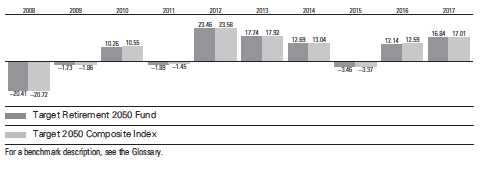

Fiscal-Year Total Returns (%): September 30, 2007, Through September 30, 2017

13

PRIMECAP Fund

Financial Statements

Statement of Net Assets

As of September 30, 2017

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| Common Stocks (94.4%) | | |

| Consumer Discretionary (7.7%) | |

| ^ | Sony Corp. ADR | 17,513,600 | 653,958 |

| | Ross Stores Inc. | 9,002,300 | 581,279 |

| | TJX Cos. Inc. | 6,940,100 | 511,694 |

| | Carnival Corp. | 7,246,300 | 467,894 |

| | L Brands Inc. | 10,574,873 | 440,020 |

| | Walt Disney Co. | 3,700,000 | 364,709 |

| | Royal Caribbean | | |

| | Cruises Ltd. | 3,046,333 | 361,112 |

| 1 | Mattel Inc. | 19,667,900 | 304,459 |

| * | Amazon.com Inc. | 194,765 | 187,237 |

| | Whirlpool Corp. | 900,358 | 166,062 |

| | Comcast Corp. Class A | 1,922,900 | 73,993 |

| | Marriott International | | |

| | Inc. Class A | 490,300 | 54,060 |

| * | Charter | | |

| | Communications Inc. | | |

| | Class A | 136,000 | 49,425 |

| | VF Corp. | 751,500 | 47,773 |

| | Lowe’s Cos. Inc. | 534,500 | 42,728 |

| | MGM Resorts | | |

| | International | 1,294,600 | 42,191 |

| | CBS Corp. Class B | 600,000 | 34,800 |

| | Newell Brands Inc. | 555,000 | 23,682 |

| | Las Vegas Sands Corp. | 361,500 | 23,194 |

| | Hilton Worldwide | | |

| | Holdings Inc. | 295,366 | 20,513 |

| | Bed Bath & Beyond Inc. | 728,670 | 17,102 |

| * | AutoZone Inc. | 11,900 | 7,082 |

| | Adient plc | 69,700 | 5,854 |

| * | Netflix Inc. | 25,100 | 4,552 |

| | | | 4,485,373 |

| Consumer Staples (0.3%) | | |

| | CVS Health Corp. | 2,108,665 | 171,477 |

| | Constellation Brands | | |

| | Inc. Class A | 5,600 | 1,117 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| | Philip Morris | | |

| | International Inc. | 6,600 | 733 |

| | Altria Group Inc. | 7,100 | 450 |

| | | | 173,777 |

| Energy (0.9%) | | |

| | EOG Resources Inc. | 1,897,700 | 183,583 |

| | Schlumberger Ltd. | 2,462,600 | 171,791 |

| ^,* | Transocean Ltd. | 7,875,679 | 84,742 |

| | Noble Energy Inc. | 2,185,600 | 61,984 |

| | National Oilwell Varco | | |

| | Inc. | 375,000 | 13,399 |

| | Pioneer Natural | | |

| | Resources Co. | 2,800 | 413 |

| | | | 515,912 |

| Financials (6.9%) | | |

| | JPMorgan Chase & Co. | 11,143,500 | 1,064,316 |

| | Charles Schwab Corp. | 19,502,375 | 853,034 |

| | Wells Fargo & Co. | 11,264,200 | 621,221 |

| | Marsh & McLennan | | |

| | Cos. Inc. | 6,510,976 | 545,685 |

| | US Bancorp | 3,475,000 | 186,225 |

| | Discover Financial | | |

| | Services | 2,539,971 | 163,777 |

| | Progressive Corp. | 3,356,300 | 162,512 |

| | Citigroup Inc. | 1,841,463 | 133,948 |

| | Bank of America Corp. | 4,817,432 | 122,074 |

| | CME Group Inc. | 896,318 | 121,612 |

| | Travelers Cos. Inc. | 287,601 | 35,237 |

| | American Express Co. | 372,100 | 33,660 |

| | Chubb Ltd. | 41,133 | 5,864 |

| | | | 4,049,165 |

| Health Care (23.4%) | | |

| * | Biogen Inc. | 9,206,500 | 2,882,739 |

| | Eli Lilly & Co. | 28,411,102 | 2,430,286 |

| | Amgen Inc. | 11,834,500 | 2,206,542 |

| | Roche Holding AG | 4,968,100 | 1,269,946 |

| | Novartis AG ADR | 12,847,965 | 1,102,998 |

| * | Boston Scientific Corp. | 27,869,860 | 812,964 |

14

PRIMECAP Fund

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| ^ | AstraZeneca plc ADR | 22,838,704 | 773,775 |

| | Thermo Fisher | | |

| | Scientific Inc. | 2,595,400 | 491,050 |

| | Medtronic plc | 5,476,300 | 425,892 |

| | Abbott Laboratories | 5,938,768 | 316,893 |

| * | Bioverativ Inc. | 4,642,348 | 264,939 |

| * | BioMarin | | |

| | Pharmaceutical Inc. | 1,320,100 | 122,862 |

| | Bristol-Myers Squibb | | |

| | Co. | 1,794,700 | 114,394 |

| | Merck & Co. Inc. | 1,487,300 | 95,232 |

| | Johnson & Johnson | 696,600 | 90,565 |

| | Agilent Technologies | | |

| | Inc. | 1,169,600 | 75,088 |

| | Sanofi ADR | 1,008,000 | 50,188 |

| | Zimmer Biomet | | |

| | Holdings Inc. | 334,000 | 39,108 |

| | Stryker Corp. | 180,000 | 25,564 |

| | GlaxoSmithKline plc | | |

| | ADR | 560,000 | 22,736 |

| | AbbVie Inc. | 26,700 | 2,372 |

| | | | 13,616,133 |

| Industrials (17.6%) | | |

| | FedEx Corp. | 9,561,326 | 2,156,844 |

| 1 | Southwest Airlines Co. | 34,011,000 | 1,903,936 |

| | Airbus SE | 11,248,558 | 1,070,815 |

| | American Airlines | | |

| | Group Inc. | 20,718,700 | 983,931 |

| | Caterpillar Inc. | 5,488,800 | 684,508 |

| | Delta Air Lines Inc. | 11,558,000 | 557,327 |

| * | United Continental | | |

| | Holdings Inc. | 8,198,100 | 499,100 |

| | Deere & Co. | 3,242,800 | 407,263 |

| | Alaska Air Group Inc. | 4,996,700 | 381,098 |

| | Honeywell | | |

| | International Inc. | 2,330,000 | 330,254 |

| | United Parcel Service | | |

| | Inc. Class B | 2,121,970 | 254,827 |

| | Boeing Co. | 868,700 | 220,832 |

| | Union Pacific Corp. | 1,874,100 | 217,339 |

| | Siemens AG | 1,150,000 | 162,277 |

| | CSX Corp. | 2,610,000 | 141,619 |

| | Textron Inc. | 1,976,416 | 106,489 |

| | Pentair plc | 1,030,000 | 69,999 |

| | United Technologies | | |

| | Corp. | 495,000 | 57,460 |

| | Rockwell Automation | | |

| | Inc. | 180,200 | 32,113 |

| | TransDigm Group Inc. | 108,600 | 27,764 |

| | Safran SA | 150,000 | 15,329 |

| * | Herc Holdings Inc. | 142,000 | 6,977 |

| | | | 10,288,101 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| Information Technology (35.4%) | |

| * | Adobe Systems Inc. | 15,135,270 | 2,257,880 |

| | Texas Instruments Inc. | 24,942,300 | 2,235,828 |

| | Microsoft Corp. | 29,460,500 | 2,194,513 |

| * | Alibaba Group Holding | | |

| | Ltd. ADR | 8,316,073 | 1,436,269 |

| | NVIDIA Corp. | 7,634,800 | 1,364,873 |

| * | Alphabet Inc. Class A | 1,325,334 | 1,290,504 |

| * | Alphabet Inc. Class C | 1,344,255 | 1,289,288 |

| * | Micron Technology Inc. | 31,031,700 | 1,220,477 |

| | KLA-Tencor Corp. | 6,310,400 | 668,902 |

| 1 | NetApp Inc. | 14,494,500 | 634,279 |

| | HP Inc. | 31,484,885 | 628,438 |

| | Hewlett Packard | | |

| | Enterprise Co. | 41,526,254 | 610,851 |

| | Cisco Systems Inc. | 15,161,950 | 509,896 |

| | Intuit Inc. | 3,570,000 | 507,440 |

| | Intel Corp. | 11,093,000 | 422,421 |

| | QUALCOMM Inc. | 8,085,450 | 419,150 |

| | Activision Blizzard Inc. | 5,600,000 | 361,256 |

| | Visa Inc. Class A | 3,322,300 | 349,639 |

| | Oracle Corp. | 5,874,400 | 284,027 |

| | Analog Devices Inc. | 2,756,500 | 237,528 |

| | Telefonaktiebolaget | | |

| | LM Ericsson ADR | 38,989,804 | 224,191 |

| | DXC Technology Co. | 2,526,268 | 216,956 |

| | Corning Inc. | 5,600,700 | 167,573 |

| 1 | Plantronics Inc. | 3,672,300 | 162,389 |

| | Micro Focus | | |

| | International plc ADR | 4,414,685 | 140,828 |

| * | BlackBerry Ltd. | 10,737,500 | 120,045 |

| | Mastercard Inc. | | |

| | Class A | 833,000 | 117,620 |

| * | Dell Technologies Inc. | | |

| | Class V | 1,250,600 | 96,559 |

| * | Altaba Inc. | 1,307,300 | 86,596 |

| | Apple Inc. | 547,500 | 84,381 |

| * | eBay Inc. | 2,058,300 | 79,162 |

| * | Entegris Inc. | 2,638,372 | 76,117 |

| * | PayPal Holdings Inc. | 1,095,900 | 70,171 |

| * | salesforce.com Inc. | 538,400 | 50,297 |

| * | Keysight Technologies | | |

| | Inc. | 375,600 | 15,648 |

| | Applied Materials Inc. | 241,800 | 12,595 |

| | Western Digital Corp. | 134,550 | 11,625 |

| * | Rambus Inc. | 551,897 | 7,368 |

| | | | 20,663,580 |

| Materials (1.6%) | | |

| | Monsanto Co. | 6,012,625 | 720,433 |

| | Praxair Inc. | 902,100 | 126,059 |

| * | DowDuPont Inc. | 671,700 | 46,502 |

| ^ | Potash Corp. of | | |

| | Saskatchewan Inc. | 636,900 | 12,254 |

| | | | 905,248 |

15

PRIMECAP Fund

| | |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Telecommunication Services (0.6%) | |

| AT&T Inc. | 8,439,742 | 330,585 |

| * T-Mobile US Inc. | 275,600 | 16,993 |

| | | 347,578 |

| Total Common Stocks | | |

| (Cost $23,104,852) | | 55,044,867 |

| Temporary Cash Investment (5.7%) | |

| Money Market Fund (5.7%) | | |

| 2,3 Vanguard Market | | |

| Liquidity Fund, 1.223% | | |

| (Cost $3,318,311) | 33,179,549 | 3,318,618 |

| Total Investments (100.1%) | | |

| (Cost $26,423,163) | | 58,363,485 |

| Other Assets and Liabilities (-0.1%) | |

| Other Assets | | 216,306 |

| Liabilities 3 | | (265,541) |

| | | (49,235) |

| Net Assets (100%) | | 58,314,250 |

| |

| | | Amount |

| | | ($000) |

| Statement of Assets and Liabilities | |

| Assets | | |

| Investments in Securities, at Value | |

| Unaffiliated Issuers | | 52,039,804 |

| Affiliated Vanguard Funds | | 3,318,618 |

| Other Affiliated Issuers | | 3,005,063 |

| Total Investments in Securities | 58,363,485 |

| Investment in Vanguard | | 3,552 |

| Receivables for Investment | | |

| Securities Sold | | 24,034 |

| Receivables for Accrued Income | 47,390 |

| Receivables for Capital Shares Issued | 136,691 |

| Other Assets | | 4,639 |

| Total Assets | | 58,579,791 |

| Liabilities | | |

| Payables for Investment Securities | |

| Purchased | | (7,905) |

| Collateral for Securities on Loan | (57,795) |

| Payables to Investment Advisor | (26,098) |

| Payables for Capital Shares Redeemed | (110,393) |

| Payables to Vanguard | | (59,359) |

| Other Liabilities | | (3,991) |

| Total Liabilities | | (265,541) |

| Net Assets | | 58,314,250 |

| |

| At September 30, 2017, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 23,321,012 |

| Undistributed Net Investment Income | 440,228 |

| Accumulated Net Realized Gains | 2,611,224 |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 31,940,322 |

| Foreign Currencies | 1,464 |

| Net Assets | 58,314,250 |

| |

| Investor Shares—Net Assets | |

| Applicable to 60,699,762 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 7,699,128 |

| Net Asset Value Per Share— | |

| Investor Shares | $126.84 |

| |

| Admiral Shares—Net Assets | |

| Applicable to 385,065,098 outstanding |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 50,615,122 |

| Net Asset Value Per Share— | |

| Admiral Shares | $131.45 |

• See Note A in Notes to Financial Statements.

^ Includes partial security positions on loan to broker-dealers.

The total value of securities on loan is $56,128,000.

* Non-income-producing security.

1 Considered an affiliated company of the fund as the fund owns more than 5% of the outstanding voting securities of such company.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 Includes $57,795,000 of collateral received for securities on loan.

ADR—American Depositary Receipt.

See accompanying Notes, which are an integral part of the Financial Statements.

16

PRIMECAP Fund

| |

| Statement of Operations | |

| |

| | Year Ended |

| | September 30, 2017 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1 | 808,899 |

| Interest | 22,761 |

| Securities Lending—Net | 700 |

| Total Income | 832,360 |

| Expenses | |

| Investment Advisory Fees—Note B | 98,407 |

| The Vanguard Group—Note C | |

| Management and Administrative—Investor Shares | 13,969 |

| Management and Administrative—Admiral Shares | 53,783 |

| Marketing and Distribution—Investor Shares | 1,034 |

| Marketing and Distribution—Admiral Shares | 2,445 |

| Custodian Fees | 544 |

| Auditing Fees | 35 |

| Shareholders’ Reports and Proxy—Investor Shares | 267 |

| Shareholders’ Reports and Proxy—Admiral Shares | 364 |

| Trustees’ Fees and Expenses | 97 |

| Total Expenses | 170,945 |

| Net Investment Income | 661,415 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 2,953,426 |

| Foreign Currencies | (2,409) |

| Realized Net Gain (Loss) | 2,951,017 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 7,554,549 |

| Foreign Currencies | 1,795 |

| Change in Unrealized Appreciation (Depreciation) | 7,556,344 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 11,168,776 |

| 1 Dividends are net of foreign withholding taxes of $16,178,000. | |

See accompanying Notes, which are an integral part of the Financial Statements.

17

PRIMECAP Fund

| | |

| Statement of Changes in Net Assets | | |

| |

| | Year Ended September 30, |

| | 2017 | 2016 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 661,415 | 641,839 |

| Realized Net Gain (Loss) | 2,951,017 | 2,232,245 |

| Change in Unrealized Appreciation (Depreciation) | 7,556,344 | 4,416,438 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 11,168,776 | 7,290,522 |

| Distributions | | |

| Net Investment Income | | |

| Investor Shares | (92,535) | (86,405) |

| Admiral Shares | (531,693) | (426,673) |

| Realized Capital Gain1 | | |

| Investor Shares | (269,344) | (370,752) |

| Admiral Shares | (1,457,828) | (1,709,108) |

| Total Distributions | (2,351,400) | (2,592,938) |

| Capital Share Transactions | | |

| Investor Shares | (1,160,090) | (945,771) |

| Admiral Shares | 3,216,264 | 1,174,655 |

| Net Increase (Decrease) from Capital Share Transactions | 2,056,174 | 228,884 |

| Total Increase (Decrease) | 10,873,550 | 4,926,468 |

| Net Assets | | |

| Beginning of Period | 47,440,700 | 42,514,232 |

| End of Period2 | 58,314,250 | 47,440,700 |

1 Includes fiscal 2017 and 2016 short-term gain distributions totaling $54,261,000 and $0, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $440,228,000 and $425,507,000.

See accompanying Notes, which are an integral part of the Financial Statements.

18

PRIMECAP Fund

Financial Highlights

| | | | | |

| Investor Shares | | | | | |

| |

| For a Share Outstanding | | | Year Ended September 30, |

| Throughout Each Period | 2017 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $107.60 | $96.99 | $104.16 | $87.83 | $69.39 |

| Investment Operations | | | | | |

| Net Investment Income | 1.3981 | 1.401 | 1.329 | 1.124 | 1.033 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 23.145 | 15.103 | (1.631) | 19.812 | 19.093 |

| Total from Investment Operations | 24.543 | 16.504 | (. 302) | 20.936 | 20.126 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (1.356) | (1.114) | (1.160) | (.836) | (.965) |

| Distributions from Realized Capital Gains | (3.947) | (4.780) | (5.708) | (3.770) | (.721) |

| Total Distributions | (5.303) | (5.894) | (6.868) | (4.606) | (1.686) |

| Net Asset Value, End of Period | $126.84 | $107.60 | $96.99 | $104.16 | $87.83 |

| |

| Total Return2 | 23.75% | 17.40% | -0.76% | 24.72% | 29.63% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $7,699 | $7,588 | $7,741 | $13,273 | $13,059 |

| Ratio of Total Expenses to Average Net Assets | 0.39% | 0.39% | 0.40% | 0.44% | 0.45% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 1.22% | 1.37% | 1.33% | 1.17% | 1.32% |

| Portfolio Turnover Rate | 8% | 6% | 9% | 11% | 5% |

1 Calculated based on average shares outstanding.

2 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

19

PRIMECAP Fund

Financial Highlights

| | | | | |

| Admiral Shares | | | | | |

| |

| For a Share Outstanding | | | Year Ended September 30, |

| Throughout Each Period | 2017 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $111.52 | $100.53 | $108.08 | $91.15 | $72.03 |

| Investment Operations | | | | | |

| Net Investment Income | 1.5281 | 1.532 | 1.550 | 1.286 | 1.178 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 23.981 | 15.645 | (1.784) | 20.536 | 19.769 |

| Total from Investment Operations | 25.509 | 17.177 | (.234) | 21.822 | 20.947 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (1.491) | (1.236) | (1.403) | (.983) | (1.079) |

| Distributions from Realized Capital Gains | (4.088) | (4.951) | (5.913) | (3.909) | (.748) |

| Total Distributions | (5.579) | (6.187) | (7.316) | (4.892) | (1.827) |

| Net Asset Value, End of Period | $131.45 | $111.52 | $100.53 | $108.08 | $91.15 |

| |

| Total Return2 | 23.83% | 17.48% | -0.69% | 24.85% | 29.73% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $50,615 | $39,852 | $34,773 | $30,982 | $23,129 |

| Ratio of Total Expenses to Average Net Assets | 0.32% | 0.33% | 0.34% | 0.35% | 0.36% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 1.29% | 1.43% | 1.39% | 1.26% | 1.41% |

| Portfolio Turnover Rate | 8% | 6% | 9% | 11% | 5% |

1 Calculated based on average shares outstanding.

2 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

20

PRIMECAP Fund

Notes to Financial Statements

Vanguard PRIMECAP Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers two classes of shares: Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (September 30, 2014–2017), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled on the next business day. The fund further mitigates its counterparty risk by entering into

21

PRIMECAP Fund

securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counter-party risk, in the event of a default, the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Net Assets for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

6. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3.1 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

The fund had no borrowings outstanding at September 30, 2017, or at any time during the period then ended.

7. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses), shareholder reporting, and the proxy. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. PRIMECAP Management Company provides investment advisory services to the fund for a fee calculated at an annual percentage rate of average net assets. For the year ended September 30, 2017, the investment advisory fee represented an effective annual rate of 0.19% of the fund’s average net assets.

22

PRIMECAP Fund

C. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At September 30, 2017, the fund had contributed to Vanguard capital in the amount of $3,552,000, representing 0.01% of the fund’s net assets and 1.42% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments valued with significant unobservable inputs are noted on the Statement of Net Assets.

The following table summarizes the market value of the fund’s investments as of September 30,

2017, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 52,526,500 | 2,518,367 | — |

| Temporary Cash Investments | 3,318,618 | — | — |

| Total | 55,845,118 | 2,518,367 | — |

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

During the year ended September 30, 2017, the fund realized $175,022,000 of net capital gains resulting from in-kind redemptions—in which shareholders exchanged fund shares for securities held by the fund rather than for cash. Because such gains are not taxable to the fund, and are not distributed to shareholders, they have been reclassified from accumulated net realized gains to paid-in capital.

23

PRIMECAP Fund

The fund used a tax accounting practice to treat a portion of the price of capital shares redeemed during the year as distributions from net investment income and realized capital gains. Accordingly, the fund has reclassified $20,057,000 from undistributed net investment income and $84,587,000 from accumulated net realized gains to paid-in capital.

For tax purposes, at September 30, 2017, the fund had $596,162,000 of ordinary income and $2,510,915,000 of long-term capital gains available for distribution.

At September 30, 2017, the cost of investment securities for tax purposes was $26,423,163,000. Net unrealized appreciation of investment securities for tax purposes was $31,940,322,000, consisting of unrealized gains of $32,826,209,000 on securities that had risen in value since their purchase and $885,887,000 in unrealized losses on securities that had fallen in value since their purchase.

F. During the year ended September 30, 2017, the fund purchased $4,830,472,000 of investment securities and sold $6,010,137,000 of investment securities, other than temporary cash investments. Purchases and sales include $791,746,000 and $250,034,000, respectively, in connection with in-kind purchases and redemptions of the fund’s capital shares.

G. Capital share transactions for each class of shares were:

| | | | |

| | | | Year Ended September 30, |

| | | 2017 | | 2016 |

| | Amount | Shares | Amount | Shares |

| | ($000) | (000) | ($000) | (000) |

| Investor Shares | | | | |

| Issued | 573,721 | 5,070 | 501,353 | 5,081 |

| Issued in Lieu of Cash Distributions | 353,911 | 3,324 | 448,254 | 4,430 |

| Redeemed | (2,087,722) | (18,215) | (1,895,378) | (18,802) |

| Net Increase (Decrease)—Investor Shares | (1,160,090) | (9,821) | (945,771) | (9,291) |

| Admiral Shares | | | | |

| Issued | 4,401,870 | 36,653 | 3,167,275 | 30,714 |

| Issued in Lieu of Cash Distributions | 1,880,344 | 17,051 | 2,027,098 | 19,341 |

| Redeemed | (3,065,950) | (26,006) | (4,019,718) | (38,593) |

| Net Increase (Decrease)—Admiral Shares | 3,216,264 | 27,698 | 1,174,655 | 11,462 |

24

PRIMECAP Fund

H. Certain of the fund’s investments are in companies that are considered to be affiliated companies of the fund because the fund owns more than 5% of the outstanding voting securities of the company or the issuer is another member of The Vanguard Group. Transactions during the period in securities of these companies were as follows:

| | | | | | | | |

| | | | | | Current Period Transactions | |

| | Sept. 30, | | Proceeds | Realized | | | Capital | Sept. 30, |

| | 2016 | | from | Net | Change in | | Gain | 2017 |

| Market | Purchases | Securities | Gain | Unrealized | | Distributions | Market |

| | Value | at Cost | Sold | (Loss) | App. (Dep.) | Income | Received | Value |

| | ($000) | ($000) | ($000) | ($000) | ($000) | ($000) | ($000) | ($000) |

| Mattel Inc. | — | 378,660 | — | — | (74,201) | 2,520 | — | 304,459 |

| NetApp Inc. | 505,263 | 17,674 | 2,879 | 1,081 | 113,140 | 10,847 | — | 634,279 |

| Plantronics Inc. | 188,043 | 3,011 | 972 | 935 | (28,628) | 2,166 | — | 162,389 |

| Southwest | | | | | | | | |

| Airlines Co. | 1,306,611 | 59,326 | 38,868 | 27,388 | 549,479 | 15,052 | — | 1,903,936 |

| Vanguard Market | | | | | | | | |

| Liquidity Fund | 1,902,618 | NA1 | NA1 | 39 | 153 | 22,761 | — | 3,318,618 |

| Total | 3,902,535 | | | 29,443 | 559,943 | 53,346 | — | 6,323,681 |

| 1 Not applicable—purchases and sales are for temporary cash investment purposes. | | | |

I. Management has determined that no material events or transactions occurred subsequent to September 30, 2017, that would require recognition or disclosure in these financial statements.

25

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Vanguard Chester Funds and the Shareholders of Vanguard PRIMECAP Fund

In our opinion, the accompanying statement of net assets and statement of assets and liabilities, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard PRIMECAP Fund (constituting a separate portfolio of Vanguard Chester Funds, hereafter referred to as the “Fund”) as of September 30, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities as of September 30, 2017 by correspondence with the custodian and brokers and by agreement to the underlying ownership records of the transfer agent, provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

November 13, 2017

Special 2017 tax information (unaudited) for Vanguard PRIMECAP Fund

This information for the fiscal year ended September 30, 2017, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $1,754,351,000 as capital gain dividends (20% rate gain distributions) to shareholders during the fiscal year.

For nonresident alien shareholders, 100% of short-term capital gain dividends distributed by the fund are qualified short-term capital gains.

The fund distributed $624,228,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 85.5% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

26

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2017. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

The table shows returns for Investor Shares only; returns for other share classes will differ. Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

| | | |

| Average Annual Total Returns: PRIMECAP Fund Investor Shares | | | |

| Periods Ended September 30, 2017 | | | |

| | One | Five | Ten |

| | Year | Years | Years |

| Returns Before Taxes | 23.75% | 18.44% | 10.05% |

| Returns After Taxes on Distributions | 22.35 | 17.16 | 9.09 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 14.28 | 14.72 | 8.04 |

27

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

28

| | | |

| Six Months Ended September 30, 2017 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| PRIMECAP Fund | 3/31/2017 | 9/30/2017 | Period |

| Based on Actual Fund Return | | | |

| Investor Shares | $1,000.00 | $1,115.18 | $2.07 |

| Admiral Shares | 1,000.00 | 1,115.59 | 1.70 |

| Based on Hypothetical 5% Yearly Return | | | |

| Investor Shares | $1,000.00 | $1,023.11 | $1.98 |

| Admiral Shares | 1,000.00 | 1,023.46 | 1.62 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.39% for Investor Shares and 0.32% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (183/365).

29

Trustees Approve Advisory Arrangement

The board of trustees of Vanguard PRIMECAP Fund has renewed the fund’s investment advisory arrangement with PRIMECAP Management Company (PRIMECAP). The board determined that renewing the fund’s advisory arrangement was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisory oversight and product management. The Portfolio Review Department met regularly with the advisor and made monthly presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received monthly reports, which included a Market and Economic Report, a Fund Dashboard Monthly Summary, and a Fund Performance Report.

Prior to their meeting, the trustees were provided with a memo and material that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board reviewed the quality of the fund’s investment management services over both the short and long term, and took into account the organizational depth and stability of the advisor. The board considered that PRIMECAP, founded in 1983, is recognized for its long-term approach to growth equity investing. Five experienced portfolio managers are responsible for separate subportfolios, and each portfolio manager employs a fundamental, research-driven approach in seeking to identify companies with long-term growth potential that the market has yet to appreciate. The multi-counselor approach employed by PRIMECAP is designed to emphasize individual decision-making and enable the portfolio managers to invest in their highest-conviction ideas. The advisor’s fundamental research focuses on developing opinions independent from Wall Street’s consensus and maintaining a long-term horizon. PRIMECAP has managed the fund since its inception in 1984.

The board concluded that the advisor’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance compared with a relevant benchmark index and peer group. The board concluded that the performance was such that the advisory arrangement should continue. Information about the fund’s most recent performance can be found in the Performance Summary section of this report.

30

Cost

The board concluded that the fund’s expense ratio was well below the average expense ratio charged by funds in its peer group and that the fund’s advisory fee rate was also well below its peer-group average. Information about the fund’s expense ratio appears in the About Your Fund’s Expenses section of this report as well as in the Financial Statements section, which also includes information about the fund’s advisory fee rate.

The board did not consider the profitability of PRIMECAP in determining whether to approve the advisory fee, because PRIMECAP is independent of Vanguard and the advisory fee is the result of arm’s-length negotiations.

The benefit of economies of scale

The board concluded that the fund’s shareholders benefit from economies of scale because of breakpoints in the fund’s advisory fee schedule. The breakpoints reduce the effective rate of the fee as the fund’s assets increase.

The board will consider whether to renew the advisory arrangement again after a one-year period.

31

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (for bonds), its actual income (for asset-backed securities), or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. A fund’s total annual operating expenses expressed as a percentage of the fund’s average net assets. The expense ratio includes management and administrative expenses, but does not include the transaction costs of buying and selling portfolio securities.

Foreign Holdings. The percentage of a fund represented by securities or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

32

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

33

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard and Poor’s, a division of McGraw-Hill Companies, Inc. (“S&P”), and is licensed for use by Vanguard. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classification makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of its affiliates or any third party involved in making or compiling the GICS or any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

34

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.