UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4108

Oppenheimer Variable Account Funds

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S. Gabinet

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: December 31

Date of reporting period: 12/31/2014

| Item 1. | Reports to Stockholders. |

December 31, 2014

| | | | |

| | | |

| | | Oppenheimer Discovery Mid Cap Growth Fund/VA A Series of Oppenheimer Variable Account Funds | | Annual Report |

ANNUAL REPORT

Listing of Top Holdings

Fund Performance Discussion

Financial Statements

PORTFOLIO MANAGERS: Ronald J. Zibelli, Jr., CFA and Justin Livengood, CFA

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED 12/31/14

| | | | | | | | | | | | | | | | |

| | | Inception Date | | 1-Year | | | 5-Year | | | 10-Year | | | |

Non-Service Shares | | 8/15/86 | | | 5.78 | % | | | 16.64 | % | | | 6.01 | % | | |

Service Shares | | 10/16/00 | | | 5.53 | | | | 16.34 | | | | 5.73 | | | |

Russell Midcap Growth Index | | | | | 11.90 | | | | 16.94 | | | | 9.43 | | | |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, call us at 1.800.988.8287. The Fund’s total returns should not be expected to be the same as the returns of other funds, whether or not both funds have the same portfolio managers and/or similar names. The Fund’s total returns include changes in share price and reinvested distributions but do not include the charges associated with the separate account products that offer this Fund. Such performance would have been lower if such charges were taken into account.

TOP TEN COMMON STOCK HOLDINGS

| | |

SBA Communications Corp., Cl. A | | 2.3% |

O’Reilly Automotive, Inc. | | 2.2 |

Marriott International, Inc., Cl. A | | 2.0 |

Chipotle Mexican Grill, Inc., Cl. A | | 1.9 |

Sherwin-Williams Co. (The) | | 1.9 |

Palo Alto Networks, Inc. | | 1.8 |

ServiceNow, Inc. | | 1.8 |

Hanesbrands, Inc. | | 1.8 |

Wabtec Corp. | | 1.7 |

Polaris Industries, Inc. | | 1.6 |

Portfolio holdings and allocations are subject to change. Percentages are as of December 31, 2014, and are based on net assets. For more current Fund holdings, please visit oppenheimerfunds.com.

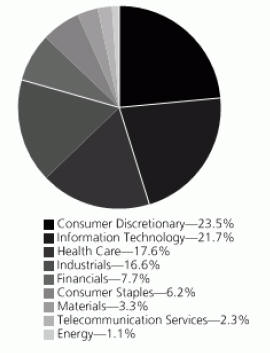

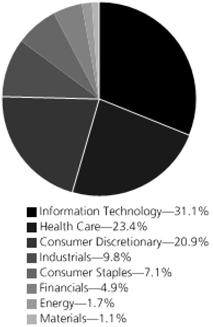

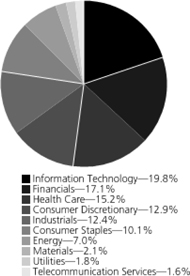

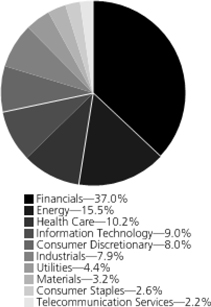

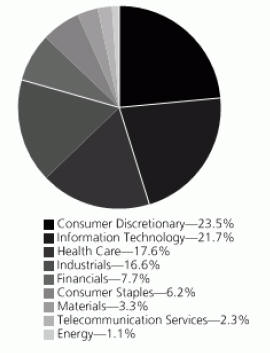

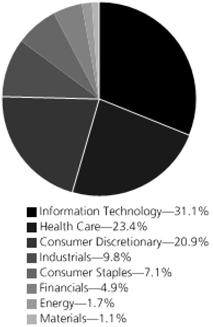

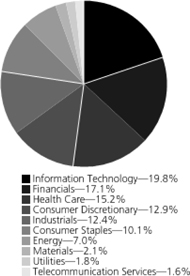

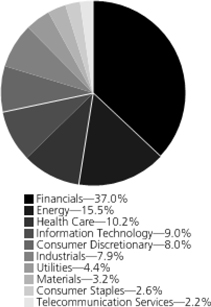

SECTOR ALLOCATION

Portfolio holdings and allocations are subject to change. Percentages are as of December 31, 2014, and are based on the total market value of common stocks.

|

| 2 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

Fund Performance Discussion

The Fund’s Non-Service shares produced a return of 5.78% during the reporting period, underperforming the Russell Midcap Growth Index’s (the “Index”) return of 11.90% and the Lipper VA Midcap Growth peer group’s return of 8.70% over the same period. The Fund’s underperformance versus the Index stemmed from weaker relative stock selection in the information technology, health care and financials sectors. The Fund outperformed the Index in the consumer discretionary and materials sectors due to stronger relative stock selection.

The investment environment changed significantly during the reporting period. In late 2013 and early 2014, high-quality growth companies continued to outperform the broader market as they had over the previous few years. But in March 2014, the tone of the market changed abruptly where companies with larger market capitalizations and lower valuations began to materially outperform small cap and mid cap companies with higher valuations. Our investment style, which favors high-quality, high-growth companies that often have above average valuations, underperformed meaningfully from mid-March to mid-May despite little or no change to the underlying fundamentals of the companies we own.

For the 3-year, 5-year and 10-year periods ended December 31, 2014, the Fund’s Non-Service shares produced average annual returns of 18.76%, 16.64% and 6.01%, respectively. Over those same periods, the Index generated returns of 20.71%, 16.94% and 9.43%, while the Lipper VA Mid-Cap Growth peer group produced returns of 17.52%, 12.98% and 6.84%, respectively.

MARKET OVERVIEW

Domestic equities were among the top performing asset classes in 2014, outperforming foreign equities, including those domiciled in Europe, Japan and emerging markets. In the U.S., the Federal Reserve (the “Fed”) began tapering its most recent quantitative easing (“QE”) program in January 2014 and completed the process at the end of October, thereby ending the program’s purchases. The Fed reduced its monthly bond purchases in steady $10 billion increments, which helped reduce market volatility and enabled investors to prepare for a post-QE market environment. Although data in the U.S. softened for the first quarter, partially attributed to cold weather effects across much of the country, it was positive in the second and third quarters of 2014, with Gross Domestic Product (“GDP”) growing at 4.6% and an estimated 5.0%, respectively.

Outside of the U.S., the positive data points that had emerged in Europe in 2013 and early 2014 largely reversed themselves later in the reporting period and the European Central Bank (the “ECB”) came under even greater pressure to provide a credible plan to boost growth and avoid deflation. In response, the ECB adopted a number of policies designed to stimulate growth. In Japan, which has been mired in economic weakness for years, the Abe administration has adopted even more aggressive economic policies with the Bank of Japan (the “BoJ”) executing a massive QE program. However, the results have not been particularly impressive, with that economy slipping back into recession in the third quarter of 2014 following the consumption tax increase. Emerging markets’ economic growth was mixed, as certain regions such as Eastern Europe and the Middle East remained burdened by geopolitical turmoil. Many commodity producing emerging market economies also struggled as prices for most commodities fell. Countries such as India and Indonesia have benefited from business-friendly new administrations.

TOP INDIVIDUAL CONTRIBUTORS

Top performing stocks for the Fund this reporting period included Illumina, Inc., GoPro, Inc. and Palo Alto Networks, Inc. Illumina, a leading developer of genetic analysis tools, reported strong financial results during the reporting period, raised full year guidance and announced a series of innovative new products. GoPro is a developer of mountable and wearable cameras and accessories. The company had a successful initial public offering and reported strong financial results. We exited our position during the reporting period. Palo Alto Networks provides next generation enterprise network security platforms. The company reported strong revenue and earnings growth during the year, as the many well-publicized data security breaches from major corporations led to strong demand for Palo Alto’s more advanced security solutions.

TOP INDIVIDUAL DETRACTORS

Detractors from performance this reporting period included Nu Skin Enterprises, Inc., Stratasys Ltd. and Tractor Supply Co. Nu Skin Enterprises, a major direct seller of personal care products and nutritional supplements, sold off sharply following a critical article published in China Daily, a state-owned periodical. This caused investors to worry about the company’s operations in China, an important piece of Nu Skin’s strategic growth plan. Stratasys Ltd., one of the leading makers of 3D printers, issued earnings per share guidance that was moderately below consensus estimates due partly to higher than expected operating

|

| 3 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

expenses and share count. We exited our positions in Nu Skin and Stratasys during the reporting period. Tractor Supply, an operator of retail farm and ranch stores, experienced declines early in the reporting period after reporting fourth-quarter 2013 comps below analysts’ expectations, due partly to deflationary pressure in feed-related products.

STRATEGY & OUTLOOK

The outlook for the equity markets in 2015 is mixed. Recent U.S. economic data is solid and positioned to benefit from the recent drop in oil and gasoline prices. However European economies continue to struggle, growth in China continues to slow, and many emerging markets will face headwinds given their positions as exporters of commodities such as oil. Interest rate and currency volatility may be elevated in 2015 as the Fed prepares to raise short-term interest rates in the U.S. while central banks in Japan, China and the European Union move the opposite direction with easier monetary policies.

We believe our long-term investment process is well-suited for this uncertain environment. We continue to seek dynamic mid-cap companies with what we view as above average growth opportunities, structurally attractive industry segments and strong management teams. The Fund has produced positive investment performance for more than a decade with experience across multiple economic cycles.

Investors should consider the Fund’s investment objective, risks, charges and expenses carefully before investing. The Fund’s prospectus and summary prospectus contain this and other information about the Fund, and may be obtained by asking your financial advisor or calling us at 1.800.988.8287. Read prospectuses and summary prospectuses carefully before investing.

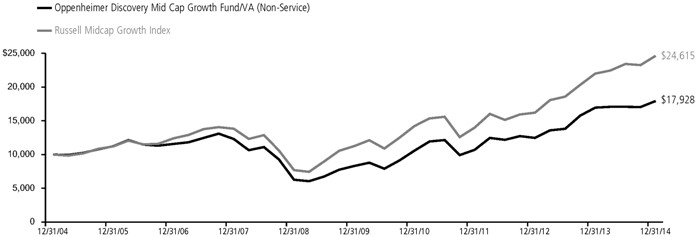

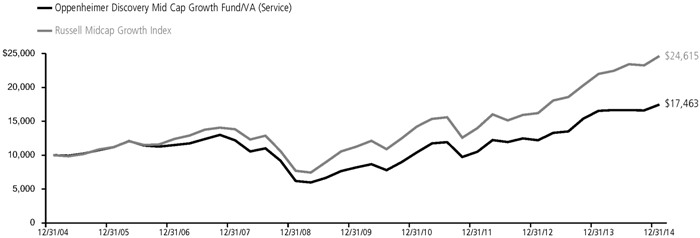

Total returns include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

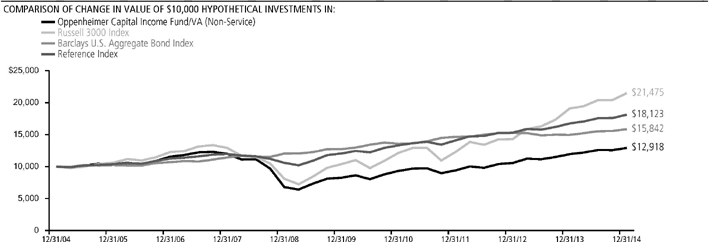

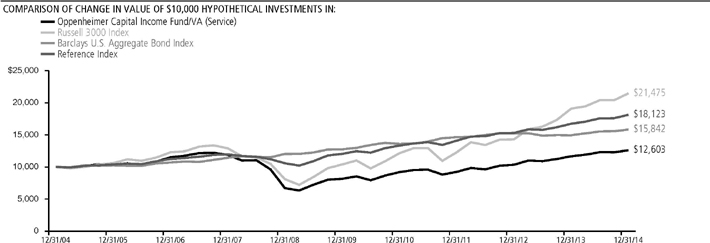

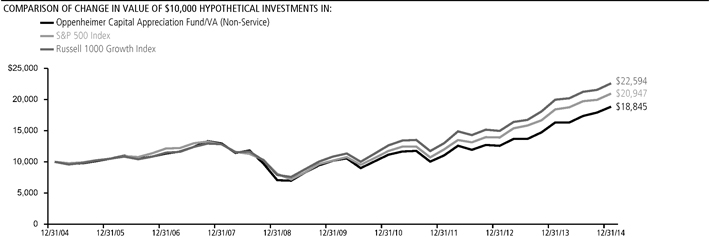

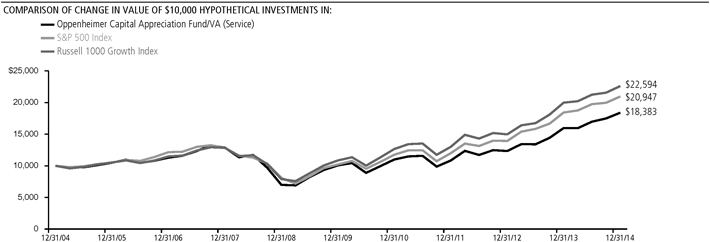

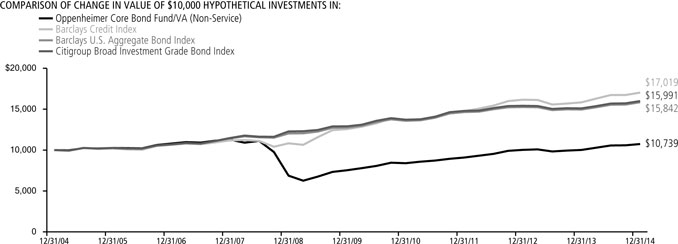

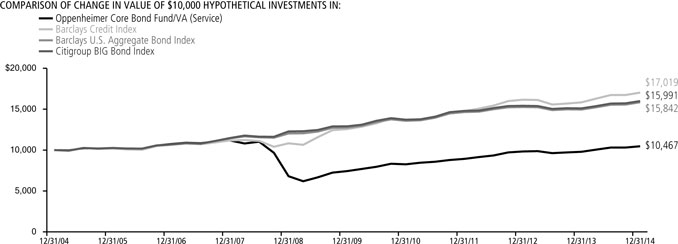

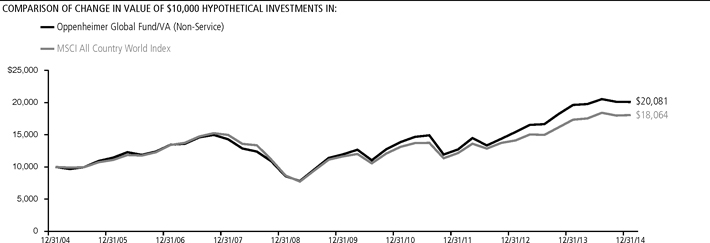

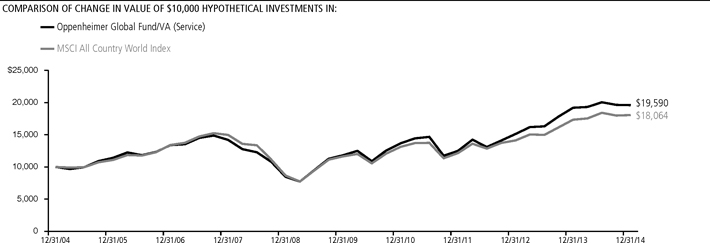

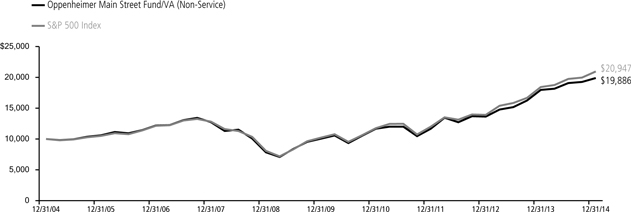

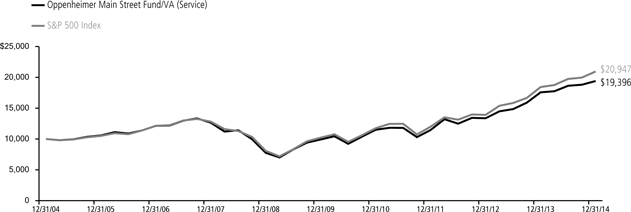

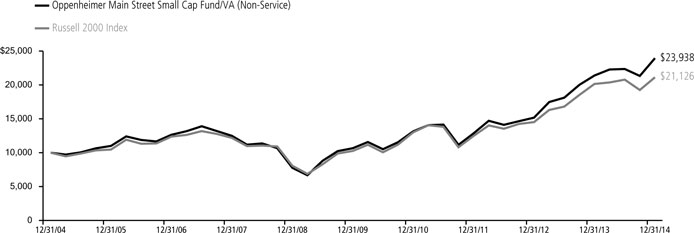

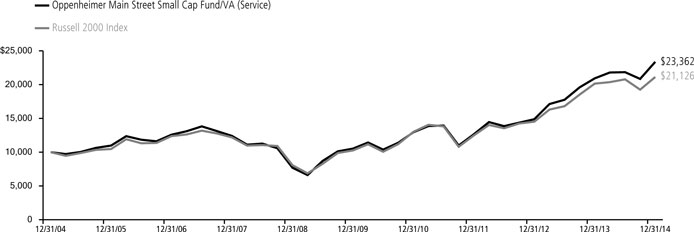

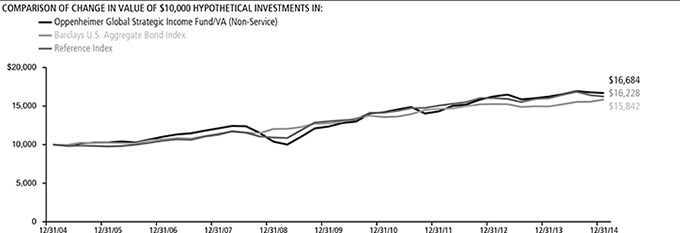

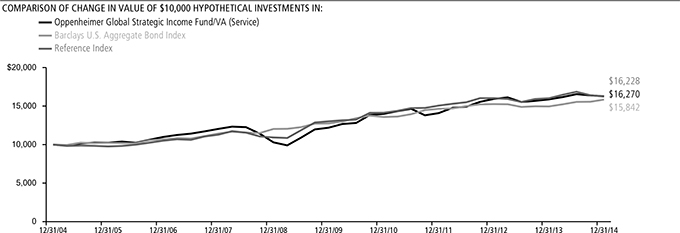

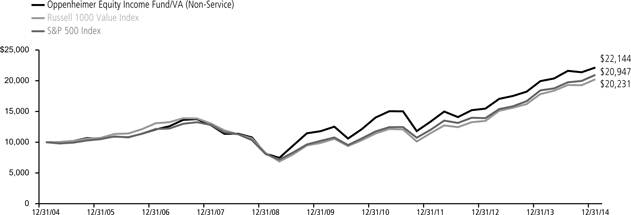

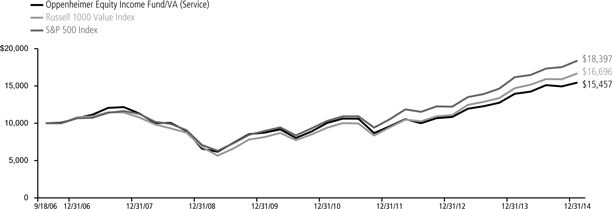

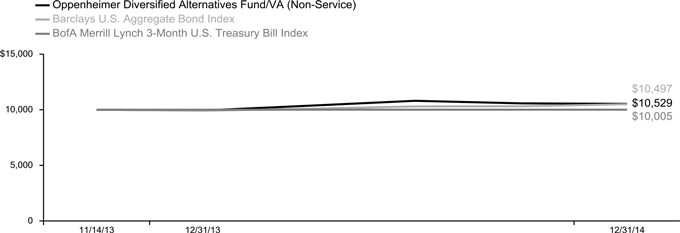

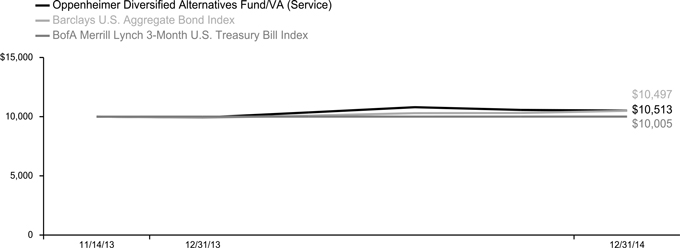

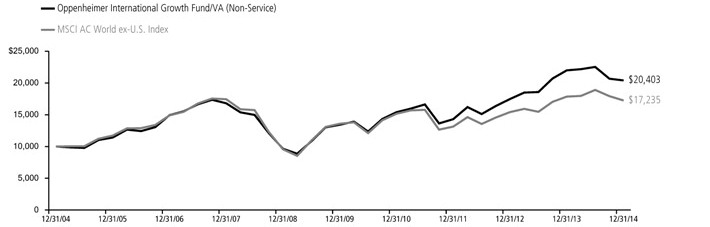

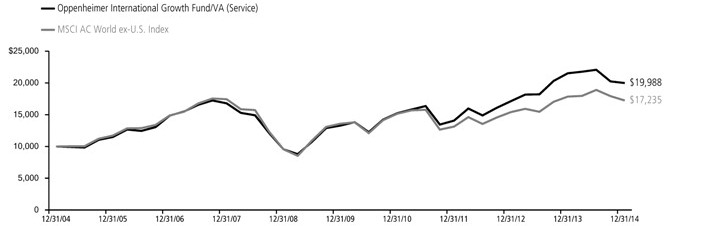

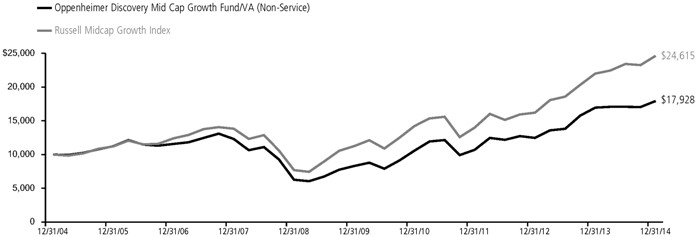

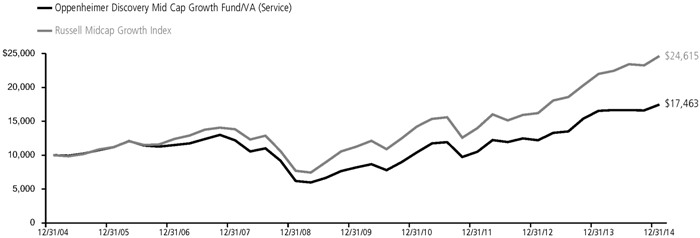

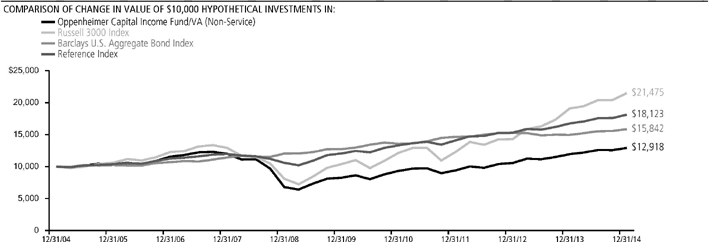

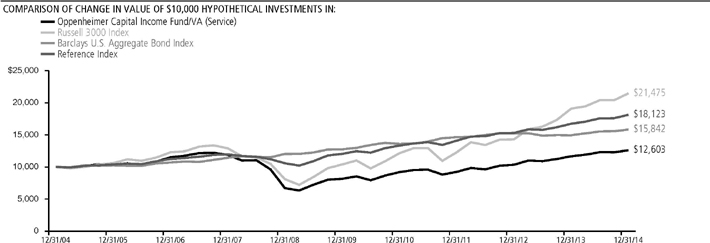

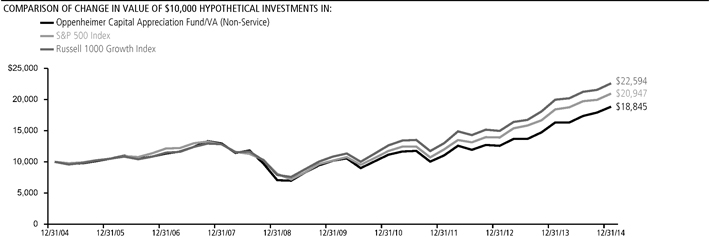

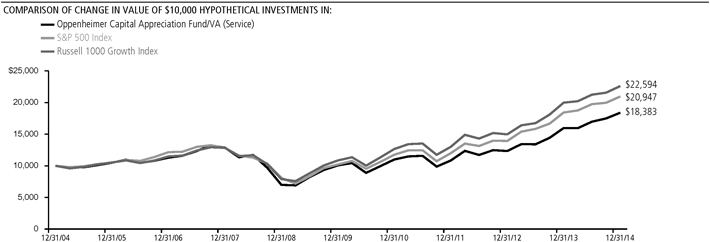

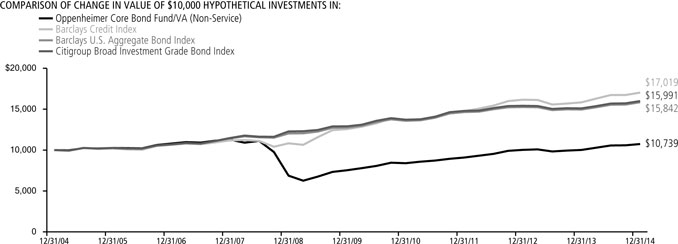

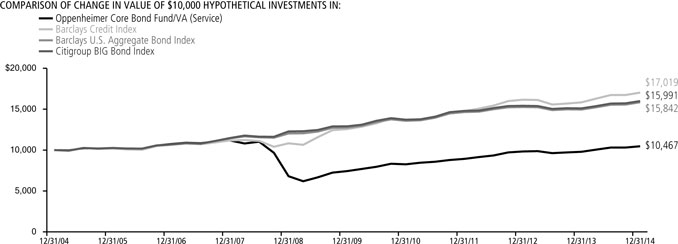

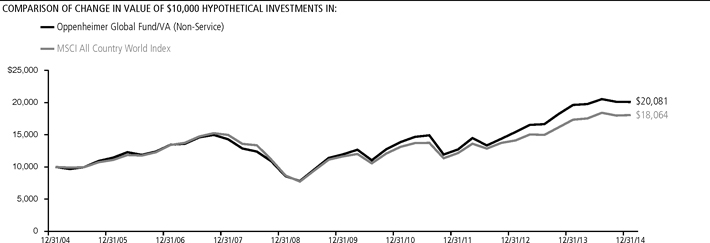

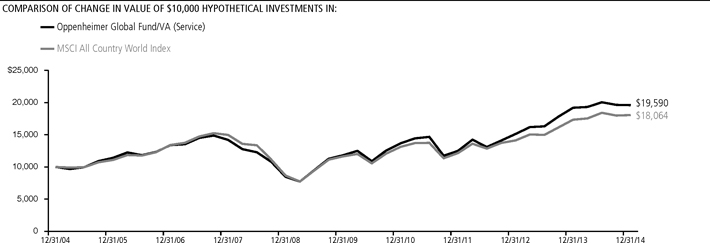

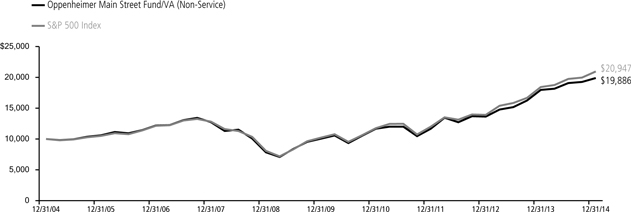

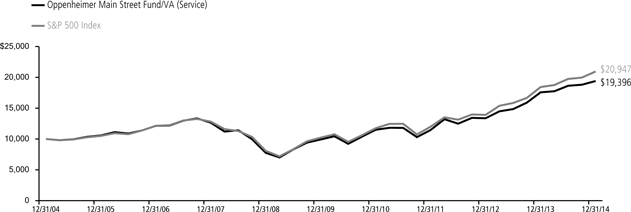

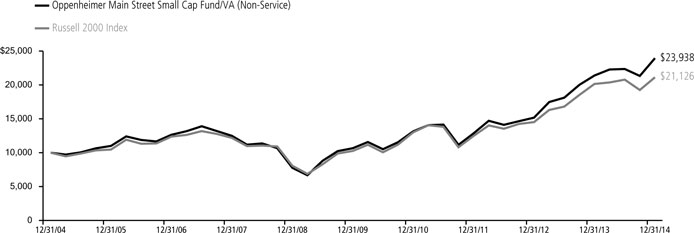

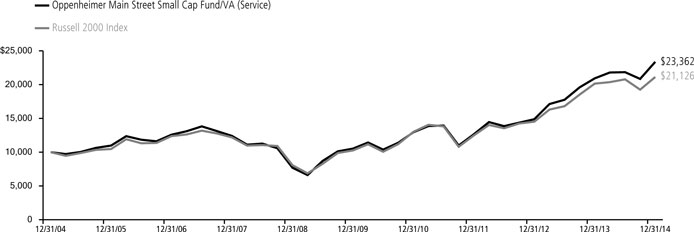

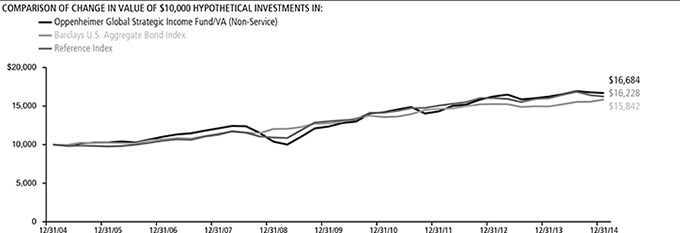

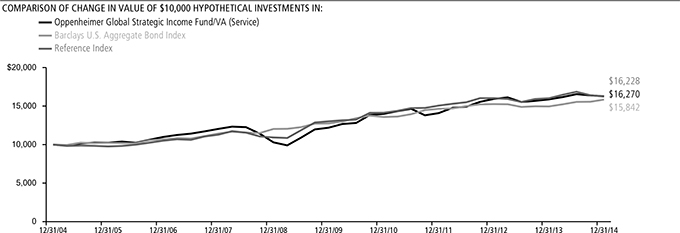

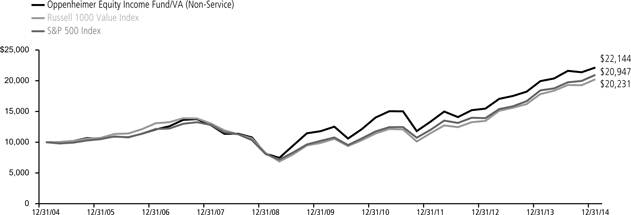

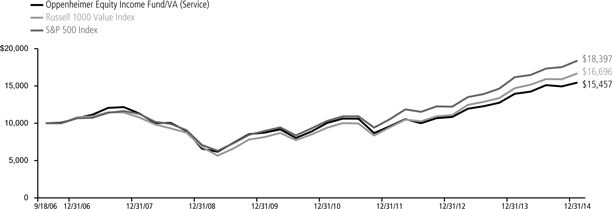

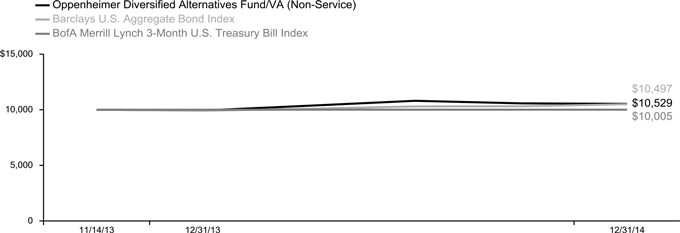

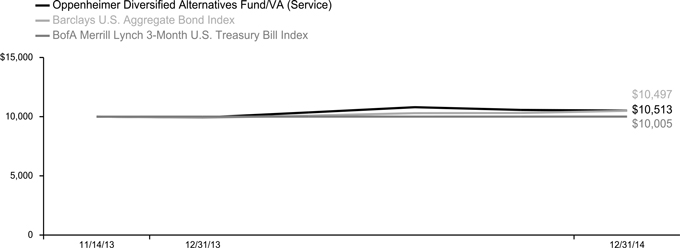

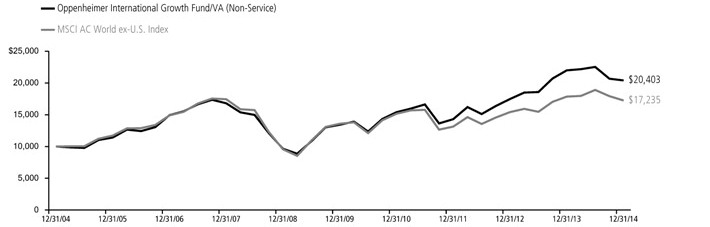

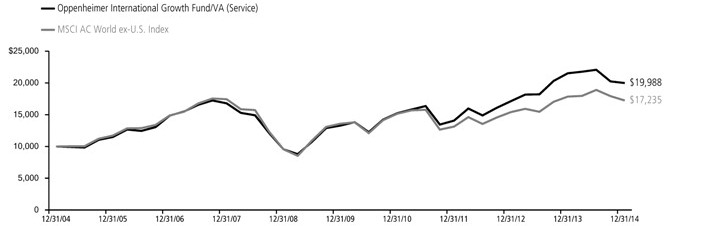

Comparing the Fund’s Performance to the Market. The graphs that follow show the performance of a hypothetical $10,000 investment in each share class of the Fund held until December 31, 2014. Performance is measured over a ten-fiscal-year period for both Classes. Performance information does not reflect charges that apply to separate accounts investing in the Fund. If these charges were taken into account, performance would be lower. The graphs assume that all dividends and capital gains distributions were reinvested in additional shares.

The Fund’s performance is compared to the performance of the Russell Midcap® Growth Index, which measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

|

| 4 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, call us at 1.800.988.8287. The Fund’s total returns should not be expected to be the same as the returns of other funds, whether or not both funds have the same portfolio managers and/or similar names. The Fund’s total returns include changes in share price and reinvested distributions but do not include the charges associated with the separate account products that offer this Fund. Such performance would have been lower if such charges were taken into account.

|

| 5 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended December 31, 2014.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes.

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any charges associated with the separate accounts that offer this Fund. Therefore, the “hypothetical” lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these separate account charges were included your costs would have been higher.

| | | | | | | | | | | | | | |

| Actual | | Beginning

Account Value

July 1, 2014 | | | | Ending Account Value

December 31, 2014 | | | | Expenses Paid During 6 Months Ended

December 31, 2014 | | | | |

Non-Service shares | | $ 1,000.00 | | | | $ 1,050.40 | | | | $ 4.14 | | | | |

Service shares | | 1,000.00 | | | | 1,049.20 | | | | 5.44 | | | | |

| | | | | | | |

Hypothetical (5% return before expenses) | | | | | | | | | | | | | | |

Non-Service shares | | 1,000.00 | | | | 1,021.17 | | | | 4.08 | | | | |

Service shares | | 1,000.00 | | | | 1,019.91 | | | | 5.36 | | | | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended December 31, 2014 are as follows:

| | | | |

| Class | | Expense Ratios | | |

Non-Service shares | | 0.80% | |

Service shares | | 1.05 | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

|

| 6 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

STATEMENT OF INVESTMENTS December 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks—98.4% | | | | | | | | |

Consumer Discretionary—23.1% | | | | | | | | |

Auto Components—1.0% | | | | | | | | |

Delphi Automotive plc | | | 99,350 | | | $ | 7,224,732 | |

Hotels, Restaurants & Leisure—5.3% | |

Chipotle Mexican Grill, Inc., Cl. A1 | | | 20,150 | | | | 13,792,877 | |

Domino’s Pizza, Inc. | | | 106,930 | | | | 10,069,598 | |

Marriott International, Inc., Cl. A | | | 180,640 | | | | 14,095,339 | |

| | | | | | | | 37,957,814 | |

Household Durables—1.0% | | | | | | | | |

Harman International Industries, Inc. | | | 68,230 | | | | 7,280,823 | |

Leisure Products—1.6% | | | | | | | | |

Polaris Industries, Inc. | | | 76,300 | | | | 11,539,612 | |

Multiline Retail—1.5% | | | | | | | | |

Dollar Tree, Inc.1 | | | 150,350 | | | | 10,581,633 | |

Specialty Retail—9.3% | | | | | | | | |

Foot Locker, Inc. | | | 131,790 | | | | 7,403,962 | |

L Brands, Inc. | | | 105,520 | | | | 9,132,756 | |

O’Reilly Automotive, Inc.1 | | | 80,910 | | | | 15,584,884 | |

Ross Stores, Inc. | | | 113,840 | | | | 10,730,559 | |

Tiffany & Co. | | | 66,860 | | | | 7,144,660 | |

Tractor Supply Co. | | | 114,850 | | | | 9,052,477 | |

Ulta Salon, Cosmetics & Fragrance, Inc.1 | | | 56,110 | | | | 7,173,102 | |

| | | | | | | | 66,222,400 | |

Textiles, Apparel & Luxury Goods—3.4% | |

Hanesbrands, Inc. | | | 112,806 | | | | 12,591,406 | |

Under Armour, Inc., Cl. A1 | | | 168,130 | | | | 11,416,027 | |

| | | | | | | | 24,007,433 | |

Consumer Staples—6.1% | | | | | | | | |

Beverages—0.9% | | | | | | | | |

Constellation Brands, Inc., Cl. A1 | | | 66,980 | | | | 6,575,427 | |

Food Products—5.2% | | | | | | | | |

Hain Celestial Group, Inc. (The)1 | | | 119,320 | | | | 6,955,163 | |

Hormel Foods Corp. | | | 135,280 | | | | 7,048,088 | |

Keurig Green Mountain, Inc. | | | 54,610 | | | | 7,230,091 | |

Mead Johnson Nutrition Co., Cl. A | | | 88,140 | | | | 8,861,595 | |

WhiteWave Foods Co. (The), Cl. A1 | | | 203,790 | | | | 7,130,612 | |

| | | | | | | | 37,225,549 | |

Energy—1.1% | | | | | | | | |

Oil, Gas & Consumable Fuels—1.1% | |

Concho Resources, Inc.1 | | | 37,590 | | | | 3,749,602 | |

Memorial Resource Development Corp.1 | | | 142,059 | | | | 2,561,324 | |

Range Resources Corp. | | | 28,010 | | | | 1,497,135 | |

| | | | | | | | 7,808,061 | |

Financials—7.6% | | | | | | | | |

Capital Markets—2.9% | | | | | | | | |

Affiliated Managers Group, Inc.1 | | | 26,860 | | | | 5,700,767 | |

Lazard Ltd., Cl. A | | | 95,210 | | | | 4,763,356 | |

Raymond James Financial, Inc. | | | 111,260 | | | | 6,374,085 | |

TD Ameritrade Holding Corp. | | | 101,190 | | | | 3,620,578 | |

| | | | | | | | 20,458,786 | |

Commercial Banks—2.0% | | | | | | | | |

Signature Bank1 | | | 65,650 | | | | 8,269,274 | |

SVB Financial Group1 | | | 53,430 | | | | 6,201,620 | |

| | | | | | | | 14,470,894 | |

Diversified Financial Services—1.0% | |

Moody’s Corp. | | | 72,649 | | | | 6,960,501 | |

Real Estate Investment Trusts (REITs)—0.7% | |

Host Hotels & Resorts, Inc., Cl. REIT | | | 222,780 | | | | 5,295,481 | |

| | | | | | | | |

| | | Shares | | | Value | |

Real Estate Management & Development—1.0% | |

CBRE Group, Inc., Cl. A1 | | | 205,159 | | | $ | 7,026,696 | |

Health Care—17.4% | | | | | | | | |

Biotechnology—3.1% | | | | | | | | |

Alnylam Pharmaceuticals, Inc.1 | | | 35,450 | | | | 3,438,650 | |

Incyte Corp.1 | | | 48,100 | | | | 3,516,591 | |

Medivation, Inc.1 | | | 58,990 | | | | 5,875,994 | |

Vertex Pharmaceuticals, Inc.1 | | | 77,890 | | | | 9,253,332 | |

| | | | | | | | 22,084,567 | |

Health Care Equipment & Supplies—4.0% | |

Cooper Cos., Inc. (The) | | | 44,390 | | | | 7,195,175 | |

DexCom, Inc.1 | | | 96,030 | | | | 5,286,451 | |

Edwards Lifesciences Corp.1 | | | 86,110 | | | | 10,968,692 | |

STERIS Corp. | | | 74,210 | | | | 4,812,519 | |

| | | | | | | | 28,262,837 | |

Health Care Providers & Services—6.7% | |

AmerisourceBergen Corp., Cl. A | | | 116,530 | | | | 10,506,345 | |

Brookdale Senior Living, Inc.1 | | | 150,550 | | | | 5,520,668 | |

Centene Corp.1 | | | 89,720 | | | | 9,317,422 | |

Team Health Holdings, Inc.1 | | | 119,580 | | | | 6,879,437 | |

Universal Health Services, Inc., Cl. B | | | 92,270 | | | | 10,265,960 | |

VCA, Inc.1 | | | 110,750 | | | | 5,401,278 | |

| | | | | | | | 47,891,110 | |

Health Care Technology—1.1% | | | | | | | | |

Cerner Corp.1 | | | 123,010 | | | | 7,953,827 | |

Life Sciences Tools & Services—1.2% | |

Illumina, Inc.1 | | | 46,368 | | | | 8,558,605 | |

Pharmaceuticals—1.3% | | | | | | | | |

Akorn, Inc.1 | | | 99,960 | | | | 3,618,552 | |

Jazz Pharmaceuticals plc1 | | | 33,620 | | | | 5,504,603 | |

| | | | | | | | 9,123,155 | |

Industrials—16.3% | | | | | | | | |

Airlines—2.2% | | | | | | | | |

Southwest Airlines Co. | | | 227,220 | | | | 9,615,950 | |

Spirit Airlines, Inc.1 | | | 82,050 | | | | 6,201,339 | |

| | | | | | | | 15,817,289 | |

Building Products—2.1% | | | | | | | | |

A.O. Smith Corp. | | | 134,700 | | | | 7,598,427 | |

Lennox International, Inc. | | | 75,900 | | | | 7,215,813 | |

| | | | | | | | 14,814,240 | |

Electrical Equipment—1.2% | | | | | | | | |

Acuity Brands, Inc. | | | 62,770 | | | | 8,792,194 | |

Industrial Conglomerates—1.0% | | | | | | | | |

Carlisle Cos., Inc. | | | 79,180 | | | | 7,145,203 | |

Machinery—4.8% | | | | | | | | |

Middleby Corp. (The)1 | | | 108,770 | | | | 10,779,107 | |

Snap-on, Inc. | | | 83,859 | | | | 11,466,880 | |

Wabtec Corp. | | | 138,970 | | | | 12,075,103 | |

| | | | | | | | 34,321,090 | |

Professional Services—1.5% | | | | | | | | |

Robert Half International, Inc. | | | 184,500 | | | | 10,771,110 | |

Road & Rail—1.5% | | | | | | | | |

Old Dominion Freight Line, Inc.1 | | | 134,500 | | | | 10,442,580 | |

Trading Companies & Distributors—2.0% | |

HD Supply Holdings, Inc.1 | | | 296,820 | | | | 8,753,222 | |

United Rentals, Inc.1 | | | 52,590 | | | | 5,364,706 | |

| | | | | | | 14,117,928 | |

|

| 7 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

STATEMENT OF INVESTMENTS Continued

| | | | | | | | |

| | | Shares | | | Value | |

Information Technology—21.3% | |

Communications Equipment—2.9% | |

F5 Networks, Inc.1 | | | 63,510 | | | $ | 8,285,832 | |

Palo Alto Networks, Inc.1 | | | 103,700 | | | | 12,710,509 | |

| | | | | | | | 20,996,341 | |

Electronic Equipment, Instruments, & Components—1.0% | |

Amphenol Corp., Cl. A | | | 134,900 | | | | 7,258,969 | |

Internet Software & Services—2.9% | |

CoStar Group, Inc.1 | | | 49,790 | | | | 9,142,938 | |

LendingClub Corp.1 | | | 156,610 | | | | 3,962,233 | |

LinkedIn Corp., Cl. A1 | | | 33,850 | | | | 7,775,683 | |

| | | | | | | | 20,880,854 | |

IT Services—1.8% | |

Fiserv, Inc.1 | | | 98,110 | | | | 6,962,867 | |

Gartner, Inc.1 | | | 66,250 | | | | 5,578,912 | |

| | | | | | | | 12,541,779 | |

Semiconductors & Semiconductor Equipment—5.4% | |

Applied Materials, Inc. | | | 221,740 | | | | 5,525,761 | |

Avago Technologies Ltd., Cl. A | | | 86,900 | | | | 8,741,271 | |

Lam Research Corp. | | | 131,270 | | | | 10,414,962 | |

NXP Semiconductors NV1 | | | 112,450 | | | | 8,591,180 | |

Skyworks Solutions, Inc. | | | 73,400 | | | | 5,336,914 | |

| | | | | | | | 38,610,088 | |

Software—7.3% | |

Electronic Arts, Inc.1 | | | 115,290 | | | | 5,420,359 | |

Mobileye NV1 | | | 54,410 | | | | 2,206,870 | |

NetSuite, Inc.1 | | | 84,707 | | | | 9,247,463 | |

| | | | | | | | |

| | | Shares | | | Value | |

Software (Continued) | |

ServiceNow, Inc.1 | | | 185,680 | | | $ | 12,598,388 | |

Tableau Software, Inc., Cl. A1 | | | 132,040 | | | | 11,191,711 | |

Ultimate Software Group, Inc. (The)1 | | | 51,350 | | | | 7,538,950 | |

Workday, Inc., Cl. A1 | | | 46,840 | | | | 3,822,612 | |

| | | | | | | | 52,026,353 | |

Materials—3.2% | |

Chemicals—1.8% | |

Sherwin-Williams Co. (The) | | | 50,960 | | | | 13,404,518 | |

Construction Materials—0.9% | |

Vulcan Materials Co. | | | 96,660 | | | | 6,353,462 | |

Containers & Packaging—0.5% | |

Crown Holdings, Inc.1 | | | 71,740 | | | | 3,651,566 | |

Telecommunication Services—2.3% | |

Wireless Telecommunication Services—2.3% | |

SBA Communications Corp., Cl. A1 | | | 145,670 | | | | 16,134,409 | |

Total Common Stocks (Cost $535,555,700) | | | | 702,589,916 | |

Investment Company—1.6% | |

Oppenheimer Institutional Money Market Fund, Cl. E, 0.10%2,3 (Cost $11,090,218) | | | 11,090,218 | | | | 11,090,218 | |

Total Investments, at Value (Cost $546,645,918) | | | 100.0 | % | | | 713,680,134 | |

Net Other Assets (Liabilities) | | | (0.0 | ) | | | (201,300 | ) |

Net Assets | | | 100.0 | % | | $ | 713,478,834 | |

| | | | |

| | | | |

Footnotes to Statement of Investments

1. Non-income producing security.

2. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the period ended December 31, 2014, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | |

| | | Shares December 31, 2013 | | | Gross Additions | | | Gross Reductions | | | Shares December 31, 2014 | |

Oppenheimer Institutional Money Market Fund, Cl. E | | | 5,136,594 | | | | 330,549,038 | | | | 324,595,414 | | | | 11,090,218 | |

| | | | |

| | | | | | | | | Value | | | Income | |

Oppenheimer Institutional Money Market Fund, Cl. E | | | | | | | | | | $ | 11,090,218 | | | $ | 15,147 | |

3. Rate shown is the 7-day yield as of December 31, 2014.

See accompanying Notes to Financial Statements.

|

| 8 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

STATEMENT OF ASSETS AND LIABILITIES December 31, 2014

| | | | |

Assets | | | | |

Investments, at value—see accompanying statement of investments: | | | | |

Unaffiliated companies (cost $535,555,700) | | $ | 702,589,916 | |

Affiliated companies (cost $11,090,218) | | | 11,090,218 | |

| | | | |

| | | | 713,680,134 | |

Cash | | | 499,999 | |

Receivables and other assets: | | | | |

Investments sold | | | 3,518,321 | |

Dividends | | | 212,384 | |

Shares of beneficial interest sold | | | 81,681 | |

Other | | | 42,771 | |

| | | | |

Total assets | | | 718,035,290 | |

Liabilities | | | | |

Payables and other liabilities: | | | | |

Shares of beneficial interest redeemed | | | 3,108,859 | |

Investments purchased | | | 1,344,607 | |

Trustees’ compensation | | | 41,557 | |

Shareholder communications | | | 32,456 | |

Distribution and service plan fees | | | 6,645 | |

Other | | | 22,332 | |

| | | | |

Total liabilities | | | 4,556,456 | |

Net Assets | | $ | 713,478,834 | |

| | | | |

| | |

Composition of Net Assets | | | | |

Par value of shares of beneficial interest | | $ | 9,066 | |

Additional paid-in capital | | | 483,280,573 | |

Accumulated net investment income | | | 6,401 | |

Accumulated net realized gain on investments | | | 63,148,578 | |

Net unrealized appreciation on investments | | | 167,034,216 | |

| | | | |

Net Assets | | $ | 713,478,834 | |

| | | | |

|

| | |

Net Asset Value Per Share | | | | |

Non-Service Shares: | | | | |

Net asset value, redemption price per share and offering price per share (based on net assets of $682,514,620 and 8,659,562 shares of beneficial interest outstanding) | | | $78.82 | |

Service Shares: | | | | |

| Net asset value, redemption price per share and offering price per share (based on net assets of $30,964,214 and 406,306 shares of beneficial interest outstanding) | | | $76.21 | |

See accompanying Notes to Financial Statements.

|

| 9 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

STATEMENT OF OPERATIONS For the Year Ended December 31, 2014

| | | | |

Investment Income | | | | |

Dividends: | | | | |

Unaffiliated companies (net of foreign withholding taxes of $ 7,351) | | | $ 2,910,770 | |

Affiliated companies | | | 15,147 | |

| | | | |

Total investment income | | | 2,925,917 | |

|

| | |

Expenses | | | | |

Management fees | | | 5,106,401 | |

Distribution and service plan fees: | | | | |

Service shares | | | 82,084 | |

Transfer and shareholder servicing agent fees: | | | | |

Non-Service shares | | | 686,474 | |

Service shares | | | 32,838 | |

Shareholder communications: | | | | |

Non-Service shares | | | 51,428 | |

Service shares | | | 2,447 | |

Trustees’ compensation | | | 30,718 | |

Custodian fees and expenses | | | 5,482 | |

Other | | | 55,787 | |

| | | | |

Total expenses | | | 6,053,659 | |

Less reduction to custodian expenses | | | (14 | ) |

Less waivers and reimbursements of expenses | | | (216,514 | ) |

| | | | |

Net expenses | | | 5,837,131 | |

Net Investment Loss | | | (2,911,214 | ) |

|

| | |

Realized and Unrealized Gain (Loss) | | | | |

Net realized gain on investments from unaffiliated companies | | | 120,740,276 | |

Net change in unrealized appreciation/depreciation on investments | | | (78,732,569 | ) |

Net Increase in Net Assets Resulting from Operations | | | $ 39,096,493 | |

| | | | |

See accompanying Notes to Financial Statements.

|

| 10 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended December 31, 2014 | | | Year Ended December 31, 2013 | |

Operations | | | | | | | | |

Net investment loss | | $ | (2,911,214 | ) | | $ | (1,689,339 | ) |

Net realized gain | | | 120,740,276 | | | | 122,245,177 | |

Net change in unrealized appreciation/depreciation | | | (78,732,569 | ) | | | 79,850,119 | |

Net increase in net assets resulting from operations | | | 39,096,493 | | | | 200,405,957 | |

Dividends and/or Distributions to Shareholders | | | | | | | | |

Dividends from net investment income: | | | | | | | | |

Non-Service shares | | | — | | | | (73,101 | ) |

Service shares | | | — | | | | — | |

| | | — | | | | (73,101 | ) |

Beneficial Interest Transactions | | | | | | | | |

Net decrease in net assets resulting from beneficial interest transactions: | | | | | | | | |

Non-Service shares | | | (80,362,833 | ) | | | (22,913,255 | ) |

Service shares | | | (7,209,426 | ) | | | (10,340,669 | ) |

| | | (87,572,259 | ) | | | (33,253,924 | ) |

Net Assets | | | | | | | | |

Total increase (decrease) | | | (48,475,766 | ) | | | 167,078,932 | |

Beginning of period | | | 761,954,600 | | | | 594,875,668 | |

End of period (including accumulated net investment income (loss) of $6,401 and $(53,163), respectively) | | $ | 713,478,834 | | | $ | 761,954,600 | |

See accompanying Notes to Financial Statements.

|

| 11 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Non-Service Shares | | Year Ended

December 31,

2014 | | | Year Ended

December 31,

2013 | | | Year Ended

December 31,

2012 | | | Year Ended December 30,

20111 | | | Year Ended

December 31,

2010 | |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 74.51 | | | $ | 54.80 | | | $ | 47.06 | | | $ | 46.55 | | | $ | 36.52 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)2 | | | (0.29) | | | | (0.16) | | | | 0.01 | | | | (0.26) | | | | (0.11) | |

Net realized and unrealized gain | | | 4.60 | | | | 19.88 | | | | 7.73 | | | | 0.77 | | | | 10.14 | |

| | | | |

Total from investment operations | | | 4.31 | | | | 19.72 | | | | 7.74 | | | | 0.51 | | | | 10.03 | |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | 0.00 | | | | (0.01) | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Net asset value, end of period | | $ | 78.82 | | | $ | 74.51 | | | $ | 54.80 | | | $ | 47.06 | | | $ | 46.55 | |

| | | | |

| | | | | |

Total Return, at Net Asset Value3 | | | 5.78% | | | | 35.98% | | | | 16.45% | | | | 1.09% | | | | 27.46% | |

| |

| | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 682,515 | | | $ | 725,406 | | | $ | 558,934 | | | $ | 543,020 | | | $ | 611,872 | |

Average net assets (in thousands) | | $ | 688,259 | | | $ | 618,970 | | | $ | 575,072 | | | $ | 605,083 | | | $ | 548,739 | |

Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.39)% | | | | (0.24)% | | | | 0.03% | | | | (0.53)% | | | | (0.29)% | |

Total expenses5 | | | 0.83% | | | | 0.84% | | | | 0.85% | | | | 0.84% | | | | 0.85% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.80% | | | | 0.80% | | | | 0.80% | | | | 0.80% | | | | 0.76% | |

Portfolio turnover rate | | | 113% | | | | 84% | | | | 66% | | | | 91% | | | | 95% | |

1. December 30, 2011 represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods less than one full year. Total return information does not reflect expenses that apply at the separate account level or to related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | | | |

Year Ended December 31, 2014 | | | 0.83 | % | | | | |

Year Ended December 31, 2013 | | | 0.84 | % | | | |

Year Ended December 31, 2012 | | | 0.85 | % | | | |

Year Ended December 30, 2011 | | | 0.84 | % | | | |

Year Ended December 31, 2010 | | | 0.85 | % | | | |

See accompanying Notes to Financial Statements.

|

| 12 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

| | | | | | | | | | | | | | | | | | | | |

| Service Shares | | Year Ended

December 31,

2014 | | | Year Ended

December 31,

2013 | | | Year Ended

December 31,

2012 | | | Year Ended

December 30,

20111 | | | Year Ended

December 31,

2010 | |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 72.22 | | | $ | 53.25 | | | $ | 45.84 | | | $ | 45.46 | | | $ | 35.75 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss2 | | | (0.46) | | | | (0.30) | | | | (0.12) | | | | (0.37) | | | | (0.20) | |

Net realized and unrealized gain | | | 4.45 | | | | 19.27 | | | | 7.53 | | | | 0.75 | | | | 9.91 | |

| | | | |

Total from investment operations | | | 3.99 | | | | 18.97 | | | | 7.41 | | | | 0.38 | | | | 9.71 | |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Net asset value, end of period | | $ | 76.21 | | | $ | 72.22 | | | $ | 53.25 | | | $ | 45.84 | | | $ | 45.46 | |

| | | | |

| | | | | |

Total Return, at Net Asset Value3 | | | 5.53% | | | | 35.62% | | | | 16.17% | | | | 0.83% | | | | 27.16% | |

| |

| | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 30,964 | | | $ | 36,549 | | | $ | 35,942 | | | $ | 35,773 | | | $ | 32,669 | |

Average net assets (in thousands) | | $ | 32,927 | | | $ | 35,905 | | | $ | 37,842 | | | $ | 37,775 | | | $ | 27,552 | |

Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.64)% | | | | (0.49)% | | | | (0.22)% | | | | (0.78)% | | | | (0.53)% | |

Total expenses5 | | | 1.08% | | | | 1.09% | | | | 1.10% | | | | 1.09% | | | | 1.10% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.05% | | | | 1.05% | | | | 1.05% | | | | 1.05% | | | | 1.01% | |

Portfolio turnover rate | | | 113% | | | | 84% | | | | 66% | | | | 91% | | | | 95% | |

1. December 30, 2011 represents the last business day of the Fund’s reporting period.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods less than one full year. Total return information does not reflect expenses that apply at the separate account level or to related insurance products. Inclusion of these charges would reduce the total return figures for all periods shown. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| | | | | | | | |

Year Ended December 31, 2014 | | | 1.08 | % | | | | |

Year Ended December 31, 2013 | | | 1.09 | % | | | |

Year Ended December 31, 2012 | | | 1.10 | % | | | |

Year Ended December 30, 2011 | | | 1.09 | % | | | |

Year Ended December 31, 2010 | | | 1.10 | % | | | |

See accompanying Notes to Financial Statements.

|

| 13 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

NOTES TO FINANCIAL STATEMENTS December 31, 2014

1. Organization

Oppenheimer Discovery Mid-Cap Growth Fund/VA (the “Fund”), a separate series of Oppenheimer Variable Account Funds, is a diversified open-end management investment company registered under the Investment Company Act of 1940 (“1940 Act”), as amended. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds Inc. (“OFI” or the “Sub-Adviser”). The Manager has entered into a sub-advisory agreement with OFI. Shares of the Fund are sold only to separate accounts of life insurance companies.

The Fund offers two classes of shares. Both classes are sold at their offering price, which is the net asset value per share, to separate investment accounts of participating insurance companies as an underlying investment for variable life insurance policies, variable annuity contracts or other investment products. The class of shares designated as Service shares is subject to a distribution and service plan. Both classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class.

The following is a summary of significant accounting policies consistently followed by the Fund.

2. Significant Accounting Policies

Security Valuation. All investments in securities are recorded at their estimated fair value, as described in Note 3.

Allocation of Income, Expenses, Gains and Losses. Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles, are recorded on the ex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as deemed necessary by the Manager.

Investment Income. Dividend income is recorded on the ex-dividend date or upon ex-dividend notification in the case of certain foreign dividends where the ex-dividend date may have passed. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is recognized on an accrual basis. Discount and premium, which are included in interest income on the Statement of Operations, are amortized or accreted daily.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdrafts, to the extent they are not offset by positive cash balances maintained by the Fund, at a rate equal to the Federal Funds Rate plus 0.50%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications. The Fund’s organizational documents provide current and former Trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Federal Taxes. The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income, including any net realized gain on investments not offset by capital loss carryforwards, if any, to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remain open for the three preceding fiscal reporting period ends.

The tax components of capital shown in the following table represent distribution requirements the Fund must satisfy under the income tax regulations, losses the Fund may be able to offset against income and gains realized in future years and unrealized appreciation or depreciation of securities and other investments for federal income tax purposes.

|

| 14 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

2. Significant Accounting Policies (Continued)

| | | | | | | | | | | | |

Undistributed

Net Investment

Income | | Undistributed

Long-Term

Gain | | | Accumulated

Loss

Carryforward1,2 | | | Net Unrealized

Appreciation

Based on cost of

Securities and

Other Investments

for Federal Income

Tax Purposes | |

$— | | | $64,118,337 | | | | $— | | | | $166,112,406 | |

1. During the fiscal year ended December 31, 2014, the Fund utilized $50,885,832 of capital loss carryforward to offset capital gains realized in that fiscal year.

2. During the fiscal year ended December 31, 2013, the Fund utilized $121,849,981 of capital loss carryforward to offset capital gains realized in that fiscal year.

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

Accordingly, the following amounts have been reclassified for December 31, 2014. Net assets of the Fund were unaffected by the reclassifications.

| | | | | | | | |

Increase

to Paid-in Capital | | Reduction

to Accumulated

Net Investment

Loss | | | Reduction

to Accumulated Net

Realized Gain

on Investments3 | |

$2,366,836 | | | $2,970,778 | | | | $5,337,614 | |

3. $5,337,614, all of which was long-term capital gain, was distributed in connection with Fund share redemptions.

The tax character of distributions paid during the years ended December 31, 2014 and December 31, 2013 was as follows:

| | | | | | | | |

| | | Year Ended

December 31, 2014 | | | Year Ended

December 31, 2013 | |

Distributions paid from: | | | | | | | | |

Ordinary income | | $ | — | | | $ | 73,101 | |

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes as of December 31, 2014 are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized gain or loss.

| | | | |

Federal tax cost of securities | | $ | 547,567,728 | |

| | | | |

Gross unrealized appreciation | | $ | 167,190,337 | |

Gross unrealized depreciation | | | (1,077,931 | ) |

| | | | |

Net unrealized appreciation | | $ | 166,112,406 | |

| | | | |

Use of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

3. Securities Valuation

The Fund calculates the net asset value of its shares as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M. Eastern time, on each day the Exchange is open for trading.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a “fair valuation” for any security for which market quotations are not “readily available.” The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

Valuation Methods and Inputs

Securities are valued using unadjusted quoted market prices, when available, as supplied primarily by third party pricing services or dealers.

The following methodologies are used to determine the market value or the fair value of the types of securities described below:

Securities traded on a registered U.S. securities exchange (including exchange-traded derivatives other than futures and futures options) are valued based on the last sale price of the security reported on the principal exchange on which it is traded, prior to the time when the Fund’s assets are valued. In the absence of a sale, the security is valued at the last sale price on the prior trading day, if it is within the spread of the current day’s closing “bid”

|

| 15 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

NOTES TO FINANCIAL STATEMENTS Continued

3. Securities Valuation (Continued)

and “asked” prices, and if not, at the current day’s closing bid price. A security of a foreign issuer traded on a foreign exchange, but not listed on a registered U.S. securities exchange, is valued based on the last sale price on the principal exchange on which the security is traded, as identified by the third party pricing service used by the Manager, prior to the time when the Fund’s assets are valued. If the last sale price is unavailable, the security is valued at the most recent official closing price on the principal exchange on which it is traded. If the last sales price or official closing price for a foreign security is not available, the security is valued at the mean between the bid and asked price per the exchange or, if not available from the exchange, obtained from two dealers. If bid and asked prices are not available from either the exchange or two dealers, the security is valued by using one of the following methodologies (listed in order of priority): (1) using a bid from the exchange, (2) the mean between the bid and asked price as provided by a single dealer, or (3) a bid from a single dealer.

Shares of a registered investment company that are not traded on an exchange are valued at that investment company’s net asset value per share.

Corporate and government debt securities (of U.S. or foreign issuers) and municipal debt securities, event-linked bonds, loans, mortgage-backed securities, collateralized mortgage obligations, and asset-backed securities are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers who may use matrix pricing methods to determine the evaluated prices.

Short-term money market type debt securities with a remaining maturity of sixty days or less are valued at cost adjusted by the amortization of discount or premium to maturity (amortized cost), which approximates market value. Short-term debt securities with a remaining maturity in excess of sixty days are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers.

A description of the standard inputs that may generally be considered by the third party pricing vendors in determining their evaluated prices is provided below.

| | |

Security Type | | Standard inputs generally considered by third-party pricing vendors |

| Corporate debt, government debt, municipal, mortgage-backed and asset-backed securities | | Reported trade data, broker-dealer price quotations, benchmark yields, issuer spreads on comparable securities, the credit quality, yield, maturity, and other appropriate factors. |

Loans | | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. |

Event-linked bonds | | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. |

If a market value or price cannot be determined for a security using the methodologies described above, or if, in the “good faith” opinion of the Manager, the market value or price obtained does not constitute a “readily available market quotation,” or a significant event has occurred that would materially affect the value of the security the security is fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a security. Fair value determinations by the Manager are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined. Those fair valuation standardized methodologies include, but are not limited to, valuing securities at the last sale price or initially at cost and subsequently adjusting the value based on: changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, such methodologies use observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Fund can obtain the fair value assigned to a security if it were to sell the security.

To assess the continuing appropriateness of security valuations, the Manager, or its third party service provider who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities, and sale prices to the current day prices and challenges those prices exceeding certain tolerance levels with the third party pricing service or broker source. For those securities valued by fair valuations, whether through a standardized fair valuation methodology or a fair valuation determination, the Valuation Committee reviews and affirms the reasonableness of the valuations based on such methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs are used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

1) Level 1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

2) Level 2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.)

3) Level 3-significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or liability).

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

|

| 16 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

3. Securities Valuation (Continued)

The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities as of December 31, 2014 based on valuation input level:

| | | | | | | | | | | | | | | | |

| | | Level 1—

Unadjusted

Quoted Prices | | | Level 2—

Other Significant

Observable Inputs | | | Level 3—

Significant

Unobservable

Inputs | | | Value | |

Assets Table | | | | | | | | | | | | | | | | |

Investments, at Value: | | | | | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | | | | | |

Consumer Discretionary | | $ | 164,814,447 | | | $ | — | | | $ | — | | | $ | 164,814,447 | |

Consumer Staples | | | 43,800,976 | | | | — | | | | — | | | | 43,800,976 | |

Energy | | | 7,808,061 | | | | — | | | | — | | | | 7,808,061 | |

Financials | | | 54,212,358 | | | | — | | | | — | | | | 54,212,358 | |

Health Care | | | 123,874,101 | | | | — | | | | — | | | | 123,874,101 | |

Industrials | | | 116,221,634 | | | | — | | | | — | | | | 116,221,634 | |

Information Technology | | | 152,314,384 | | | | — | | | | — | | | | 152,314,384 | |

Materials | | | 23,409,546 | | | | — | | | | — | | | | 23,409,546 | |

Telecommunication Services | | | 16,134,409 | | | | — | | | | — | | | | 16,134,409 | |

Investment Company | | | 11,090,218 | | | | — | | | | — | | | | 11,090,218 | |

| | | | |

Total Assets | | $ | 713,680,134 | | | $ | — | | | $ | — | | | $ | 713,680,134 | |

| | | | |

Forward currency exchange contracts and futures contracts, if any, are reported at their unrealized appreciation/depreciation at measurement date, which represents the change in the contract’s value from trade date. All additional assets and liabilities included in the above table are reported at their market value at measurement date.

4. Investments and Risks

Investment in Oppenheimer Institutional Money Market Fund. The Fund is permitted to invest daily available cash balances in an affiliated money market fund. The Fund may invest the available cash in Class E shares of Oppenheimer Institutional Money Market Fund (“IMMF”) to seek current income while preserving liquidity or for defensive purposes. IMMF is a registered open-end management investment company, regulated as a money market fund under the 1940 Act. The Manager is the investment adviser of IMMF, and the Sub-Adviser provides investment and related advisory services to IMMF. When applicable, the Fund’s investment in IMMF is included in the Statement of Investments. Shares of IMMF are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of IMMF’s Class E expenses, including its management fee. The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in IMMF.

Equity Security Risk. Stocks and other equity securities fluctuate in price. The value of the Fund’s portfolio may be affected by changes in the equity markets generally. Equity markets may experience significant short-term volatility and may fall sharply at times. Different markets may behave differently from each other and U.S. equity markets may move in the opposite direction from one or more foreign stock markets.

The prices of individual equity securities generally do not all move in the same direction at the same time and a variety of factors can affect the price of a particular company’s securities. These factors may include, but are not limited to, poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company’s sector or industry, or changes in government regulations affecting the company or its industry.

5. Shares of Beneficial Interest

The Fund has authorized an unlimited number of $0.001 par value shares of beneficial interest of each class. Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | | | |

| | | Year Ended December 31, 2014 | | | Year Ended December 31, 2013 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Non-Service Shares | | | | | | | | | | | | | | | | |

Sold | | | 416,592 | | | $ | 31,353,214 | | | | 1,267,875 | | | $ | 87,221,834 | |

Dividends and/or distributions reinvested | | | — | | | | — | | | | 1,176 | | | | 73,101 | |

Redeemed | | | (1,493,014 | ) | | | (111,716,047 | ) | | | (1,732,026 | ) | | | (110,208,190 | ) |

| | | | |

Net decrease | | | (1,076,422 | ) | | $ | (80,362,833 | ) | | | (462,975 | ) | | $ | (22,913,255 | ) |

| | | | |

| | | | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | | | | |

Sold | | | 42,402 | | | $ | 3,058,524 | | | | 78,939 | | | $ | 4,862,175 | |

Dividends and/or distributions reinvested | | | — | | | | — | | | | — | | | | — | |

Redeemed | | | (142,155 | ) | | | (10,267,950 | ) | | | (247,872 | ) | | | (15,202,844 | ) |

| | | | |

Net decrease | | | (99,753 | ) | | $ | (7,209,426 | ) | | | (168,933 | ) | | $ | (10,340,669 | ) |

| | | | |

|

| 17 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

NOTES TO FINANCIAL STATEMENTS Continued

6. Purchases and Sales of Securities

The aggregate cost of purchases and proceeds from sales of securities, other than short-term obligations and investments in IMMF, for the year ended December 31, 2014 were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

Investment securities | | $ | 801,427,778 | | | $ | 896,249,700 | |

7. Fees and Other Transactions with Affiliates

Management Fees. Under the investment advisory agreement, the Fund pays the Manager a management fee based on the daily net assets of the Fund at an annual rate as shown in the following table:

| | | | |

| Fee Schedule | | | |

Up to $200 million | | | 0.75 | % |

Next $200 million | | | 0.72 | |

Next $200 million | | | 0.69 | |

Next $200 million | | | 0.66 | |

Next $700 million | | | 0.60 | |

Over $1.5 billion | | | 0.58 | |

The Fund’s management fee for the fiscal year ended December 31, 2014 was 0.71% of average annual net assets before any applicable waivers.

Sub-Adviser Fees. The Manager has retained the Sub-Adviser to provide the day-to-day portfolio management of the Fund. Under the Sub-Advisory Agreement, the Manager pays the Sub-Adviser an annual fee in monthly installments, equal to a percentage of the investment management fee collected by the Manager from the Fund, which shall be calculated after any investment management fee waivers. The fee paid to the Sub-Adviser is paid by the Manager, not by the Fund.

Transfer Agent Fees. OFI Global (the “Transfer Agent”) serves as the transfer and shareholder servicing agent for the Fund. The Fund pays the Transfer Agent a fee based on annual net assets. Fees incurred and average net assets for each class with respect to these services are detailed in the Statement of Operations and Financial Highlights, respectively.

Sub-Transfer Agent Fees. The Transfer Agent has retained Shareholder Services, Inc., a wholly-owned subsidiary of OFI (the “Sub-Transfer Agent”), to provide the day-to-day transfer agent and shareholder servicing of the Fund. Under the Sub-Transfer Agency Agreement, the Transfer Agent pays the Sub-Transfer Agent an annual fee in monthly installments, equal to a percentage of the transfer agent fee collected by the Transfer Agent from the Fund, which shall be calculated after any applicable fee waivers. The fee paid to the Sub-Transfer Agent is paid by the Transfer Agent, not by the Fund.

Trustees’ Compensation. The Fund’s Board of Trustees (“Board”) has adopted a compensation deferral plan for Independent Trustees that enables Trustees to elect to defer receipt of all or a portion of the annual compensation they are entitled to receive from the Fund. For purposes of determining the amount owed to the Trustee under the plan, deferred amounts are treated as though equal dollar amounts had been invested in shares of the Fund or in other Oppenheimer funds selected by the Trustee. The Fund purchases shares of the funds selected for deferral by the Trustee in amounts equal to his or her deemed investment, resulting in a Fund asset equal to the deferred compensation liability. Such assets are included as a component of “Other” within the asset section of the Statement of Assets and Liabilities. Deferral of Trustees’ fees under the plan will not affect the net assets of the Fund and will not materially affect the Fund’s assets, liabilities or net investment income per share. Amounts will be deferred until distributed in accordance with the compensation deferral plan.

Distribution and Service Plan for Service Shares. The Fund has adopted a Distribution and Service Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act for Service shares to pay OppenheimerFunds Distributor, Inc. (the “Distributor”), for distribution related services, personal service and account maintenance for the Fund’s Service shares. Under the Plan, payments are made periodically at an annual rate of 0.25% of the daily net assets of Service shares of the Fund. The Distributor currently uses all of those fees to compensate sponsors of the insurance product that offers Fund shares, for providing personal service and maintenance of accounts of their variable contract owners that hold Service shares. These fees are paid out of the Fund’s assets on an on-going basis and increase operating expenses of the Service shares, which results in lower performance compared to the Fund’s shares that are not subject to a service fee. Fees incurred by the Fund under the Plan are detailed in the Statement of Operations.

Waivers and Reimbursements of Expenses. The Manager has contractually agreed to limit the Fund’s expenses after payments, waivers and/or reimbursements and reduction to custodian expenses, excluding expenses incurred directly or indirectly by the Fund as a result of investments in other investment companies, wholly-owned subsidiaries and pooled investment vehicles; so that those expenses, as percentages of daily net assets, will not exceed the annual rate of 0.80% for Non-Service shares and 1.05% for Service shares. During the year ended December 31, 2014, the Manager waived fees and/or reimbursed the Fund $189,852 and $8,922 for Non-Service and Service shares, respectively.

The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in IMMF. During the year ended December 31, 2014, the Manager waived fees and/or reimbursed the Fund $17,740 for IMMF management fees.

These undertakings may be modified or terminated as set forth according to the terms in the prospectus.

|

| 18 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

8. Pending Litigation

In 2009, seven class action lawsuits were filed in the U.S. District Court for the District of Colorado against OppenheimerFunds, Inc. (“OFI”), OppenheimerFunds Distributor, Inc., the Fund’s principal underwriter and distributor (the “Distributor”), and certain funds (but not including the Fund) advised by OFI Global Asset Management, Inc. and distributed by the Distributor (the “Defendant Funds”). The lawsuits also named as defendants certain officers and current and former trustees of the respective Defendant Funds. The lawsuits raised claims under federal securities laws and alleged, among other things, that the disclosure documents of the respective Defendant Funds contained misrepresentations and omissions and that the respective Defendant Funds’ investment policies were not followed. The plaintiffs in these actions sought unspecified damages, equitable relief and awards of attorneys’ fees and litigation expenses. The Defendant Funds’ Boards of Trustees also engaged counsel to represent the Funds and the present and former Independent Trustees named in those suits. In March 2014, the parties in six of these lawsuits executed stipulations and agreements of settlement resolving those actions. In July 2014, the court entered an order and final judgment approving the settlements as fair, reasonable and adequate. The settlements do not resolve a seventh outstanding lawsuit relating to Oppenheimer Rochester California Municipal Fund (the “California Fund Suit”). OFI believes the California Fund Suit is without legal merit and is defending the suit vigorously. While it is premature to render any opinion as to the outcome in the California Fund Suit, or whether any costs that OFI may bear in defending the California Fund Suit might not be reimbursed by insurance, OFI believes the California Fund Suit should not impair the ability of OFI or the Distributor to perform their respective duties to the Fund, and that the outcome of the California Fund Suit should not have any material effect on the operations of any of the Oppenheimer funds.

|

| 19 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Trustees and Shareholders of Oppenheimer Variable Account Funds:

We have audited the accompanying statement of assets and liabilities of Oppenheimer Discovery Mid Cap Growth Fund/VA (a separate series of Oppenheimer Variable Account Funds), including the statement of investments, as of December 31, 2014, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2014, by correspondence with the custodian, transfer agent and brokers, or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Oppenheimer Discovery Mid Cap Growth Fund/VA as of December 31, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

KPMG LLP

Denver, Colorado

February 13, 2015

|

| 20 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

FEDERAL INCOME TAX INFORMATION Unaudited

In early 2015, if applicable, shareholders of record received information regarding all dividends and distributions paid to them by the Fund during calendar year 2014.

The foregoing information is presented to assist shareholders in reporting distributions received from the Fund to the Internal Revenue Service. Because of the complexity of the federal regulations which may affect your individual tax return and the many variations in state and local tax regulations, we recommend that you consult your tax advisor for specific guidance.

|

| 21 OPPENHEIMER DISCOVERY MID CAP GROWTH FUND/VA |

BOARD APPROVAL OF THE FUND’S INVESTMENT ADVISORY AND SUB-ADVISORY AGREEMENTS Unaudited

The Fund has entered into an investment advisory agreement with OFI Global Asset Management, Inc. (“OFI Global” or the “Adviser”), a wholly-owned subsidiary of OppenheimerFunds, Inc. (“OFI” or the “Sub-Adviser”) (“OFI Global” and “OFI” together the “Managers”) and OFI Global has entered into a sub-advisory agreement with OFI whereby OFI provides investment sub-advisory services to the Fund (collectively, the “Agreements”). Each year, the Board of Trustees (the “Board”), including a majority of the independent Trustees, is required to determine whether to renew the Agreements. The Investment Company Act of 1940, as amended, requires that the Board request and evaluate, and that the Managers provide, such information as may be reasonably necessary to evaluate the terms of the Agreements. The Board employs an independent consultant to prepare a report that provides information, including comparative information that the Board requests for that purpose. In addition to in-person meetings focused on this evaluation, the Board receives information throughout the year regarding Fund services, fees, expenses and performance.

The Adviser, Sub-Adviser and the independent consultant provided information to the Board on the following factors: (i) the nature, quality and extent of the Managers’ services, (ii) the investment performance of the Fund and the Managers, (iii) the fees and expenses of the Fund, including comparative expense information, (iv) the profitability of the Managers and their affiliates, including an analysis of the cost of providing services, (v) whether economies of scale are realized as the Fund grows and whether fee levels reflect these economies of scale for Fund investors and (vi) other benefits to the Managers from their relationship with the Fund. The Board was aware that there are alternatives to retaining the Managers.

Outlined below is a summary of the principal information considered by the Board as well as the Board’s conclusions.

Nature, Quality and Extent of Services. The Board considered information about the nature, quality and extent of the services provided to the Fund and information regarding the Managers’ key personnel who provide such services. The Sub-Adviser’s duties include providing the Fund with the services of the portfolio managers and the Sub-Adviser’s investment team, who provide research, analysis and other advisory services in regard to the Fund’s investments; securities trading services; oversight of third-party service providers; monitoring compliance with applicable Fund policies and procedures and adherence to the Fund’s investment restrictions; and risk management. The Managers are responsible for providing certain administrative services to the Fund as well. Those services include providing and supervising all administrative and clerical personnel who are necessary in order to provide effective corporate administration for the Fund; compiling and maintaining records with respect to the Fund’s operations; preparing and filing reports required by the Securities and Exchange Commission; preparing periodic reports regarding the operations of the Fund for its shareholders; preparing proxy materials for shareholder meetings; and preparing the registration statements required by Federal and state securities laws for the sale of the Fund’s shares. The Managers also provide the Fund with office space, facilities and equipment.