UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-852 |

|

FPA PARAMOUNT FUND, INC. |

(Exact name of registrant as specified in charter) |

|

11601 WILSHIRE BLVD., SUITE 1200, LOS ANGELES, CALIFORNIA | | 90025 |

(Address of principal executive offices) | | (Zip code) |

|

J. RICHARD ATWOOD,

11601 WILSHIRE BLVD., SUITE 1200, LOS ANGELES, CALIFORNIA 90025 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 310-473-0225 | |

|

Date of fiscal year end: | SEPTEMBER 30 | |

|

Date of reporting period: | SEPTEMBER 30, 2014 | |

| | | | | | | | | |

Item 1. Report to Stockholders.

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

FPA PARAMOUNT FUND, INC.

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders:

During the third quarter of 2014, the Fund declined 9.01% compared to the MSCI All Country World Index's (Net) (the "Index") decline of 2.30%. For calendar year 2014 to date, the Fund has declined 5.57% versus a gain of 3.73% for the Index.

Market Commentary

In order to properly put this year's performance in context, we think it is important to review our approach to adding new investments and the impact this can have on the portfolio. The parts of the investment process we control are the research we conduct, our forecasts for a business and the price we are willing to pay to own a portion of it. The portfolio is then constructed to concentrate assets on our best ideas. This means new investments can enter as large positions because respective weightings are based on estimated discounts to intrinsic value. After a prolonged market rise, it is even more likely that new additions receive large initial weights.1

The part of the process we do not control is market sentiment. As value investors, we are often interested in high-quality companies in sectors most out of favor. Our new purchases this quarter are discussed later in more detail but as examples, Prada is falling on concerns about Chinese consumer demand, the slowdown in Brazil weighs on Hypermarcas, and ALS is exposed to commodity price weakness. In each case, we aren't ignoring the reasons for their current price weakness, but as we value the businesses on a normalized basis, we believe our forecasts for each adequately reflect these issues. After we've made a purchase at an attractively discounted valuation, however, there is nothing to stop Mr. Market's pessimism from pushing prices down further.

That is what happened in the third quarter as price declines in several of our newest positions had a meaningful impact on the Fund's performance. As regular readers know, we focus on the long term, and we do not consider short-term over- or under-performance versus the Index to be particularly meaningful. Instead of viewing the price declines as indications of a change in business values, we found that after additional assessment, our estimates of intrinsic value for the affected companies did not meaningfully change. As a result, we were able to use the weakness to build even larger positions based on the increased discounts. We are encouraged that these positions now embed greater latent performance potential, and the degree of undervaluation for the portfolio overall has increased as a result. That said, we are under no illusion that discounts could not widen further.

Portfolio Commentary

Key Performers

Our best performer in the quarter was Ross Stores, which is the number two U.S. off-price apparel and home goods retailer.2 With a 650-person merchant team, Ross opportunistically buys excess vendor merchandise very close to "need". Historically, this has lowered the risk of markdowns from off-trend or ill-timed purchases and reduced economic sensitivity. The model has produced returns on capital employed of nearly thirty percent over the last decade. Senior management is long-tenured, and we believe appropriately allocates cash flow to fund organic growth through store expansion. The balance sheet is consistently net cash, and only 1.5x Net Debt-to-EBITDA if

1 The existing portfolio could be trading at less of a discount after a period of market appreciation.

2 The company's sales account for approximately one-quarter of the estimated $40 billion market.

1

FPA PARAMOUNT FUND, INC.

LETTER TO SHAREHOLDERS

Continued

off-balance sheet store leases are included.3 As a result of the increased share price, we recently exited our position due to a reduced margin of safety.4

Our worst performing holding in the quarter was Fugro, which was down over 40% (in U.S. currency) following the release of a profit warning in July indicating material asset impairments and a significant contraction in operating margin. The company was one of our largest holdings and thus was a meaningful detractor to quarterly performance. Based in Holland, Fugro is a world-leading provider of geotechnical and geophysical analyses for resource projects, with large exposure to the oil and gas sector. When we initiated our investment in the company, we thought Fugro was an interesting collection of small businesses, with a history of good organic growth, solid returns, high free cash flow generation, a healthy balance sheet, and the potential for operational improvements. As the company was working through some of these issues, however, it failed to recognize some of the cyclical shifts taking place in its underlying markets, and ran into a number of operational challenges that compounded with softening business conditions. The slowdown in oil and gas, and in particular offshore exploration and production, where Fugro generates a significant portion of its profits, will likely continue to put negative pressure on the company's results in the short-term. Longer-term, however, we expect market conditions to improve as depleting fields ultimately need to be replaced with new offshore resources. We also expect management to take actions to adjust both operating expenses and capital expenditures. Lower interim free cash flows translate into a reduction in enterprise value, but far smaller than the share price correction, which implies a greater discount to intrinsic value. As a result, we have substantially added to our position and maintain a large investment in the company.

Activity

After struggling for much of the last year to find high-quality companies selling at significant discounts to our estimate of intrinsic value, the tide turned this quarter. Businesses exposed to mining, energy or luxury goods, and to Europe, Australia and many emerging markets frequently experienced significant corrections. In addition to the significant position increases previously mentioned, we purchased four new portfolio positions — Prada, Hypermarcas, ALS and one we have not disclosed as we are still in the process of buying. The combination of all these purchases represented 23% of Fund assets at quarter end.

Based in Italy, Prada is a global luxury fashion retailer with a strong position in leather goods. Hypermarcas, based in Brazil, is the third-largest pharmaceutical company and second-largest consumer branded-goods company in the Brazilian market. Based in Australia, ALS is a global testing, inspection and certification company serving minerals, environmental, energy and industrial customers. All three companies experienced price declines this year that caused them to trade at meaningful discounts to our estimates of intrinsic value, which created the opportunity for us to become shareholders.

3 Net Debt to EBITDA is a measurement of leverage, calculated as a company's interest-bearing liabilities minus cash or cash equivalents, divided by its EBITDA. EBITDA (Earnings before Interest, Tax, Depreciation and Amortization ) is essentially net income with interest, taxes, depreciation, and amortization added back to it, and can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions.

4 Margin of safety — buying with a "margin of safety," a phrase popularized by Benjamin Graham and Warren Buffett, is when a security is purchased for less than its estimated value. This helps protect against permanent capital loss in the case of an unexpected event or analytical mistake. A purchase made with a margin of safety does not guarantee the security will not decline in price.

2

FPA PARAMOUNT FUND, INC.

LETTER TO SHAREHOLDERS

Continued

Turning to companies exiting the portfolio, in addition to Ross Stores, we also sold out of Arca Continental this quarter. Arca is the second-largest Coca-Cola bottler in Latin America and one of the largest in the world. We think Arca is a well-run, high-quality company with limited financial risk. Here too, recent increases in the share price caused us to exit our position due to a reduced margin of safety.

Portfolio Profile

In line with our investment approach, the Fund's overall profile is little changed. We owned 34 companies at the end of the quarter. This remains within the range of the 25 to 50 businesses that we would expect to own at any given point in time. The top ten holdings represented about 41% of Fund assets, and position sizes are based on the relative discount to intrinsic value of each (largest weightings correspond to the largest discounts). Most of the positions are still large-caps (median $15 billion), including several considered mega-caps. As always, those holdings are based on each company's combination of quality and discount to intrinsic value, and not a focus on specific market capitalization.

Companies domiciled in Europe and the U.S. continue to represent most of our investments, with Asia Pacific making up the balance. Where a company is domiciled generally matters little to us, however. Since many of these are large companies, they typically conduct business on a global basis. That means they often generate significant amounts of their cash flows outside their home countries, rendering traditional country classification less useful.

We are grateful for your confidence as shareholders of the FPA Paramount Fund, and look forward to continuing to serve your interests.

Respectfully submitted,

| |

| |

Gregory Herr

Portfolio Manager | | Pierre O. Py

Portfolio Manager | |

October 14, 2014 | | | | | |

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on current management expectations, they are considered "forward-looking statements" which may or may not be accurate over the long term. While we believe we have a reasonable basis for our comments, and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

3

FPA PARAMOUNT FUND, INC.

HISTORICAL PERFORMANCE

(Unaudited)

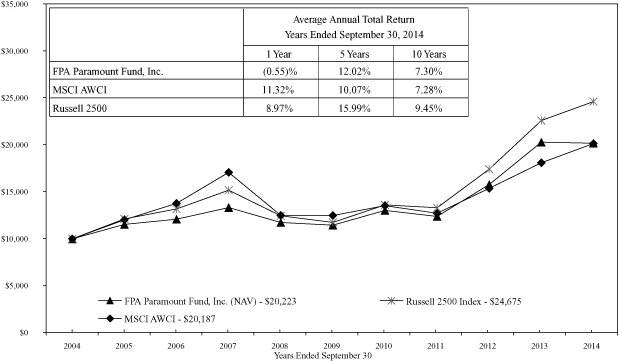

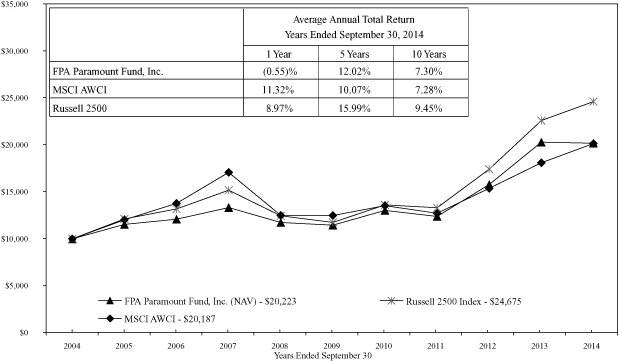

Change in Value of a $10,000 Investment in FPA Paramount Fund, Inc. vs. MSCI AWCI and Russell 2500 Index from October 1, 2004 to September 30, 2014

The MSCI All Country World NR Index is a float-adjusted market capitalization index that is designed to measure the combined equity market performance of developed and emerging markets. The Russell 2500 Index consists of the 2,500 smallest companies in the Russell 3000 total capitalization U.S. universe. This index is considered a measure of small to medium-capitalization U.S. stock performance. The MSCI AWCI Index is the Fund's current benchmark. The Russell 2500 Index had been the Fund's primary benchmark. These indexes do not reflect any commissions or fees which would be incurred by an investor purchasing the stocks it represents. The performance of the Fund and of the Indexes is computed on a total return basis, which includes reinvestment of all distributions.

Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. This data represents past performance, and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at www.fpafunds.com or by calling toll-free, 1-800-982-4372. As of the most recent prospectus, the expense ratio is 0.92% (see notes to financial statements). Information regarding the Fund's redemption fees can be found on page 14.

The Prospectus details the Fund's objective and policies, charges, and other matters of interest to prospective investors. Please read the prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpafunds.com, by email at crm@fpafunds.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

4

FPA PARAMOUNT FUND, INC.

PORTFOLIO SUMMARY

September 30, 2014

(Unaudited)

Common Stocks | | | | | | | 83.3 | % | |

Consumer Non-Durables | | | 21.9 | % | | | | | |

Technology | | | 19.8 | % | | | | | |

Business Services & Supplies | | | 18.8 | % | | | | | |

Health Care | | | 9.9 | % | | | | | |

Producer Durable Goods | | | 4.0 | % | | | | | |

Human Resources | | | 3.0 | % | | | | | |

Basic Materials | | | 2.7 | % | | | | | |

Retailing | | | 1.7 | % | | | | | |

Other Common Stocks | | | 1.5 | % | | | | | |

Short-Term Corporate Notes | | | | | 17.3 | % | |

Other Assets and Liabilities, net | | | | | (0.6 | )% | |

Net Assets | | | | | 100.0 | % | |

MAJOR PORTFOLIO CHANGES

Six Months Ended September 30, 2014

(Unaudited)

| | Shares | |

NET PURCHASES | |

Common Stocks | |

| Adidas AG (1) | | | 230,000 | | |

| ALS Ltd (1) | | | 450,000 | | |

| Fugro NV | | | 245,000 | | |

| Hypermarcas S.A. (1) | | | 1,150,000 | | |

| Michael Page International plc | | | 402,300 | | |

| Oracle Corporation | | | 269,200 | | |

| PRADA S.p.A. (1) | | | 1,350,000 | | |

| TNT Express N.V. (1) | | | 1,900,000 | | |

NET SALES | |

Common Stocks | |

| Aggreko plc. | | | 350,001 | | |

| Arca Continental SAB (2) | | | 1,351,800 | | |

| Brambles Limited | | | 875,000 | | |

| G4S plc | | | 2,150,000 | | |

| Incitec Pivot Limited | | | 4,357,600 | | |

| Ross Stores Inc. (2) | | | 63,000 | | |

| Taiwan Semiconductor Mfg Ltd Spd ADR | | | 535,000 | | |

| Zebra Technologies Corporation (2) | | | 94,100 | | |

(1) Indicates new commitment to portfolio

(2) Indicates elimination from portfolio

5

FPA PARAMOUNT FUND, INC.

PORTFOLIO OF INVESTMENTS

September 30, 2014

COMMON STOCKS | | Shares | | Fair

Value | |

CONSUMER NON-DURABLES — 21.9% | |

Adidas AG (Germany) | | | 230,000 | | | $ | 17,133,091 | | |

Christian Dior S.A. (France) | | | 39,400 | | | | 6,603,444 | | |

Danone (France) | | | 155,600 | | | | 10,415,708 | | |

Diageo plc (Great Britain) | | | 351,400 | | | | 10,168,321 | | |

McDonald's Corp. | | | 68,500 | | | | 6,494,485 | | |

Nestlé S.A. (Switzerland) | | | 45,000 | | | | 3,311,249 | | |

Pernod Ricard S.A. (France) | | | 37,400 | | | | 4,234,252 | | |

PRADA S.p.A. (Hong Kong) | | | 1,350,000 | | | | 8,197,605 | | |

| | | $ | 66,558,155 | | |

TECHNOLOGY — 19.8% | |

Accenture plc (Class A) (Ireland) | | | 54,375 | | | $ | 4,421,775 | | |

Cisco Systems, Inc. | | | 375,000 | | | | 9,438,750 | | |

Maxim Integrated Products, Inc. | | | 164,700 | | | | 4,980,528 | | |

Microsoft Corporation | | | 223,300 | | | | 10,352,188 | | |

Oracle Corporation | | | 467,500 | | | | 17,895,900 | | |

SAP AG (Germany) | | | 141,150 | | | | 10,188,278 | | |

Taiwan Semiconductor Mfg Ltd Spd ADR | | | 148,000 | | | | 2,986,640 | | |

| | | $ | 60,264,059 | | |

BUSINESS SERVICES & SUPPLIES — 18.8% | |

Aggreko plc (Great Britain) | | | 395,907 | | | $ | 9,935,128 | | |

ALS Ltd (Australia) | | | 450,000 | | | | 2,090,142 | | |

Brambles Ltd (Australia) | | | 250,100 | | | | 2,084,283 | | |

Fugro NV (Netherlands) | | | 530,750 | | | | 16,064,635 | | |

G4S plc (Great Britain) | | | 1,727,450 | | | | 7,020,529 | | |

Publicis Groupe (France) | | | 70,950 | | | | 4,872,087 | | |

Sodexo (France) | | | 30,300 | | | | 2,965,073 | | |

TNT Express N.V. (Netherlands) | | | 1,900,000 | | | | 12,032,130 | | |

| | | $ | 57,064,007 | | |

HEALTH CARE — 9.9% | |

CVS Health Corporation | | | 66,300 | | | $ | 5,276,817 | | |

Hypermarcas S.A. (Brazil) | | | 1,150,000 | | | | 8,298,515 | | |

Laboratory Corporation of America Holdings* | | | 99,500 | | | | 10,124,125 | | |

Patterson Companies, Inc. | | | 157,000 | | | | 6,504,510 | | |

| | | $ | 30,203,967 | | |

PRODUCER DURABLES — 4.0% | |

Joy Global, Inc. | | | 95,000 | | | $ | 5,181,300 | | |

SKF AB B Shares (Sweden) | | | 181,000 | | | | 3,779,552 | | |

WABCO Holdings, Inc.* | | | 34,100 | | | | 3,101,395 | | |

| | | $ | 12,062,247 | | |

6

FPA PARAMOUNT FUND, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

COMMON STOCKS — Continued | | Shares or

Principal

Amount | | Fair

Value | |

HUMAN RESOURCES — 3.0% | |

Michael Page International plc (Great Britain) | | | 1,334,022 | | | $ | 9,052,540 | | |

BASIC MATERIALS — 2.7% | |

Incitec Pivot Limited (Australia) | | | 3,401,483 | | | $ | 8,069,338 | | |

RETAILING — 1.7% | |

eBay Inc.* | | | 94,000 | | | $ | 5,323,220 | | |

OTHER COMMON STOCKS — 1.5% | | | | $ | 4,652,246 | | |

| TOTAL COMMON STOCKS — 83.3% (Cost $270,464,706) | | | | $ | 253,249,779 | | |

| SHORT-TERM INVESTMENTS — 17.3% (Cost $52,684,222) | |

Exxon Mobil Corporation — 0.06% 10/03/14 | | $ | 16,000,000 | | | $ | 15,999,947 | | |

General Electric Company— 0.06% 10/30/14 | | | 15,000,000 | | | | 14,999,275 | | |

State Street Bank Repurchase Agreement — 0% 10/01/14

(Dated 9/30/2014, repurchase price of $21,685,000, collateralized by

$20,365,000 principal amount U.S. Treasury Bonds — 3.625% 2043,

fair value $22,121,481) | | | 21,685,000 | | | | 21,685,000 | | |

TOTAL SHORT-TERM INVESTMENTS | | | | $ | 52,684,222 | | |

| TOTAL INVESTMENTS — 100.6% (Cost $323,148,928) | | $ | 305,934,001 | | |

Other assets and liabilities, net — (0.06)% | | | | | (2,005,952 | ) | |

NET ASSETS — 100.0% | | $ | 303,928,049 | | |

*Non-income producing security

See notes to financial statements.

7

FPA PARAMOUNT FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2014

ASSETS | |

Investments at value: | |

Investment securities — at fair value

(identified cost $270,464,706) | | $ | 253,249,779 | | | | | | |

Short-term investment — at amortized cost

(maturities 60 days or less) | | | 52,684,222 | | | $ | 305,934,001 | | |

Cash | | | | | | | 493 | | |

Receivable for: | |

Dividends | | $ | 600,076 | | | | | | |

Capital stock sold | | | 19,142 | | | | 619,218 | | |

| | | | | | | $ | 306,553,712 | | |

LIABILITIES | |

Payable for: | |

Investment securities purchased | | $ | 2,257,268 | | | | | | |

Advisory fees and financial services | | | 291,862 | | | | | | |

Capital stock repurchased | | | 46,533 | | | | | | |

Accrued expenses | | | 30,000 | | | $ | 2,625,663 | | |

NET ASSETS | | | | | | $ | 303,928,049 | | |

SUMMARY OF SHAREHOLDERS' EQUITY | |

Capital Stock — par value $0.25 per share: authorized

100,000,000 shares; outstanding 17,393,747 shares | | | | | | $ | 4,348,437 | | |

Additional Paid-in Capital | | | | | | | 308,125,473 | | |

Undistributed net realized gain on investments | | | | | | | 5,820,307 | | |

Undistributed net investment income | | | | | | | 2,848,759 | | |

Unrealized depreciation of investments | | | | | | | (17,214,927 | ) | |

NET ASSETS | | | | $ | 303,928,049 | | |

NET ASSET VALUE | |

Offering and redemption price per share | | | | $ | 17.47 | | |

See notes to financial statements.

8

FPA PARAMOUNT FUND, INC.

STATEMENT OF OPERATIONS

September 30, 2014

INVESTMENT INCOME | |

Dividends | | | | $ | 6,131,419 | | |

Interest | | | | | 22,459 | | |

| | | | | $ | 6,153,878 | | |

EXPENSES | |

Advisory fees | | $ | 2,982,234 | | | | | | |

Financial services | | | 311,411 | | | | | | |

Transfer agent fees and expenses | | | 131,469 | | | | | | |

Directors fees and expenses | | | 100,389 | | | | | | |

Reports to shareholders | | | 55,046 | | | | | | |

Registration fees | | | 51,782 | | | | | | |

Custodian fees and expenses | | | 49,916 | | | | | | |

Audit and tax services fees | | | 44,000 | | | | | | |

Line of credit | | | 38,021 | | | | | | |

Legal fees | | | 28,473 | | | | | | |

Other fees and expenses | | | 8,090 | | | | | | |

| | | $ | 3,800,831 | | | | |

Reimbursement from Adviser | | | (495,712 | ) | | | 3,305,119 | | |

Net investment income | | | | $ | 2,848,759 | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |

Net realized gain on investments: | |

Proceeds from sales of investment securities | | $ | 278,855,104 | | | | | | |

Cost of investment securities sold | | | 198,378,616 | | | | | | |

Net realized gain on investments | | | | | | $ | 80,476,488 | | |

Change in unrealized appreciation of investments: | |

Unrealized appreciation at beginning of year | | $ | 69,312,081 | | | | | | |

Unrealized depreciation at end of year | | | (17,214,927 | ) | | | | | |

Change in unrealized appreciation of investments | | | | | | | (86,527,008 | ) | |

Net realized and unrealized gain (loss) on investments | | | | $ | (6,050,520 | ) | |

NET CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | | | | $ | (3,201,761 | ) | |

See notes to financial statements.

9

FPA PARAMOUNT FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS

| | | For the Year Ended September 30, | |

| | | 2014 | | 2013 | |

CHANGE IN NET ASSETS | |

Operations: | |

Net investment income | | $ | 2,848,759 | | | | | | | $ | 383,845 | | | | | | |

Net realized gain on investments | | | 80,476,488 | | | | | | | | 37,363,777 | | | | | | |

Change in unrealized appreciation

(depreciation) of investments | | | (86,527,008 | ) | | | | | | | 33,118,739 | | | | | | |

Change in net assets resulting from operations | | | | | | $ | (3,201,761 | ) | | | | | | $ | 70,866,361 | | |

Distributions to shreholders from: | |

Net investment income | | | — | | | | | | | $ | (383,845 | ) | | | | | |

Net realized gains | | $ | (101,793,458 | ) | | $ | (101,793,458 | ) | | | (107,391 | ) | | $ | (491,236 | ) | |

Capital Stock transactions: | |

Proceeds from Capital Stock sold | | $ | 116,197,881 | | | | | | | $ | 40,981,481 | | | | | | |

Proceeds from shares issued to shareholders

upon reinvestment of dividends and

distributions | | | 96,041,355 | | | | | | | | 456,967 | | | | | | |

Cost of Capital Stock repurchased* | | | (129,361,231 | ) | | | 82,878,005 | | | | (44,926,327 | ) | | | (3,487,879 | ) | |

Total change in net assets | | | | | | $ | (22,117,214 | ) | | | | | | $ | 66,887,246 | | |

NET ASSETS | |

Beginning of year | | | | | | | 326,045,263 | | | | | | | | 259,158,017 | | |

End of year | | | | | | $ | 303,928,049 | | | | | | | $ | 326,045,263 | | |

CHANGE IN CAPITAL STOCK

OUTSTANDING | |

Shares of Capital Stock sold | | | | | | | 6,088,690 | | | | | | | | 1,707,058 | | |

Shares issued to shareholders upon

reinvestment of dividends and distributions | | | | | | | 4,865,802 | | | | | | | | 21,147 | | |

Shares of Capital Stock repurchased | | | | | | | (6,258,232 | ) | | | | | | | (1,986,960 | ) | |

Change in Capital Stock outstanding | | | | | | | 4,696,260 | | | | | | | | (258,755 | ) | |

* Net of redemption fees of $10,550 and $13,216 for the years ended September 30, 2014 and 2013, respectively.

See notes to financial statements.

10

FPA PARAMOUNT FUND, INC.

FINANCIAL HIGHLIGHTS

Selected Data for Each Share of Capital Stock Outstanding Throughout Each Year

| | | Year Ended September 30, | |

| | | 2014 | | 2013 | | 2012 | | 2011 | | 2010 | |

Per share operating performance: | |

Net asset value at beginning of year | | $ | 25.68 | | | $ | 20.00 | | | $ | 15.68 | | | $ | 16.55 | | | $ | 14.55 | | |

Income from investment operations: | |

Net investment income | | $ | 0.16 | | | $ | 0.03 | | | | — | * | | $ | 0.02 | | | $ | 0.03 | | |

Net realized and unrealized gain (loss)

on investments | | | (0.01 | ) | | | 5.69 | | | $ | 4.32 | | | | (0.83 | ) | | | 1.97 | | |

Total from investment operations | | $ | 0.15 | | | $ | 5.72 | | | $ | 4.32 | | | $ | (0.81 | ) | | $ | 2.00 | | |

Less distributions: | |

| From net investment income | | | — | | | $ | (0.03 | ) | | | — | | | $ | (0.06 | ) | | | — | | |

From net realized gains | | $ | (8.36 | ) | | | (0.01 | ) | | | — | | | | — | | | | — | | |

| | | $ | (8.36 | ) | | $ | (0.04 | ) | | | — | | | $ | (0.06 | ) | | | — | | |

| Redemption fees | | | — | * | | | — | * | | | — | * | | | — | * | | | — | * | |

Net asset value at end of year | | $ | 17.47 | | | $ | 25.68 | | | $ | 20.00 | | | $ | 15.68 | | | $ | 16.55 | | |

Total investment return** | | | (0.55 | )% | | | 28.64 | % | | | 27.55 | % | | | (4.95 | )% | | | 13.75 | % | |

Ratios/supplemental data: | |

Net assets at end of year (in $000's) | | $ | 303,928 | | | $ | 326,045 | | | $ | 259,158 | | | $ | 223,910 | | | $ | 238,656 | | |

Ratio of expenses to average net assets: | |

Before reimbursement from Investment Adviser | | | 1.22 | % | | | 0.92 | % | | | 0.94 | % | | | 0.93 | % | | | 0.95 | % | |

After reimbursement from Investment Adviser | | | 1.06 | % | | | 0.92 | % | | | 0.94 | % | | | 0.93 | % | | | 0.95 | % | |

Ratio of net investment income to average

net assets: | |

Before reimbursement from Investment Adviser | | | 0.76 | % | | | 0.13 | % | | | 0.01 | % | | | 0.08 | % | | | 0.20 | % | |

After reimbursement from Investment Adviser | | | 0.92 | % | | | 0.13 | % | | | 0.01 | % | | | 0.08 | % | | | 0.20 | % | |

Portfolio turnover rate | | | 113 | % | | | 19 | % | | | 6 | % | | | 10 | % | | | 3 | % | |

* Rounds to less than $0.01 per share.

** Return is based on net asset value per share, adjusted for reinvestment of distributions.

See notes to financial statements.

11

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS

September 30, 2014

NOTE 1 — Significant Accounting Policies

FPA Paramount Fund, Inc. (the "Fund") is registered under the Investment Company Act of 1940, as a non-diversified, open-end management investment company. The Fund's primary investment objective is high total investment return, including capital appreciation and income. The Fund qualifies as an investment company pursuant to Financial Accounting Standards Codification (ASC) No. 946, Financial Services — Investment Companies. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

A. Security Valuation

The Fund's investments are reported at fair value as defined by accounting principles generally accepted in the United States of America. The Fund generally determines its net asset value as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open. Further discussion of valuation methods, inputs and classifications can be found under Note 7.

B. Securities Transactions and Related Investment Income

Securities transactions are accounted for on the date the securities are purchased or sold. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income and expenses are recorded on an accrual basis. The books and records of the Fund are maintained in U.S. dollars as follows: (1) the foreign currency market value of investment securities, and other assets and liabilities stated in foreign currencies, are translated using the daily spot rate; and (2) purchases, sales, income and expenses are translated at the rate of exchange prevailing on the respective dates of such transactions. The resultant exchange gains and losses are included in net realized or net unrealized gain (loss) on investments in the statement of operations.

C. Use of Estimates

The preparation of the financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported. Actual results could differ from those estimates.

NOTE 2 — Risk Considerations

Investing in the Fund may involve certain risks including, but not limited to, those described below.

Market Risk: Because the values of the Fund's investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund or the Fund could underperform other investments.

Common Stocks and Foreign Securities: The prices of common stocks and other securities held by the Fund may decline in response to certain events taking place around the world, including those directly involving companies whose securities are owned by the Fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency, interest rate and commodity price fluctuations. Since the Fund invests in foreign securities, it will be subject to risks not typically associated with domestic securities. Foreign investments, especially those of companies in emerging markets, can be riskier, less liquid, harder to value, and more volatile than investments in the United States. Adverse political and economic developments or changes in the value of foreign currency can make it more difficult for the Fund to value the securities. Differences in tax and accounting standards, difficulties in obtaining information about foreign companies, restrictions on receiving investment proceeds from a foreign country, confiscatory foreign tax laws, and potential difficulties in enforcing contractual obligations, can all add to the risk and volatility of foreign

12

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Continued

investments. The financial problems in global economies over the past several years, including the European sovereign debt crisis, may continue to cause high volatility in global financial markets.

Risks Associated with Non-Diversification: The Fund is non-diversified, which generally means that it may invest a greater percentage of its total assets in the securities of fewer issuers than a "diversified" fund. This increases the risk that a change in the value of any one investment held by the Fund could affect the overall value of the Fund more than it would affect that of a diversified fund holding a greater number of investments. Accordingly, the Fund's value will likely be more volatile than the value of a more diversified fund.

Repurchase Agreements: Repurchase agreements permit the Fund to maintain liquidity and earn income over periods of time as short as overnight. Repurchase agreements held by the Fund are fully collateralized by U.S. Government securities, or securities issued by U.S. Government agencies, or securities that are within the three highest credit categories assigned by established rating agencies (Aaa, Aa, or A by Moody's or AAA, AA or A by Standard & Poor's) or, if not rated by Moody's or Standard & Poor's, are of equivalent investment quality as determined by the Adviser. Such collateral is in the possession of the Fund's custodian. The collateral is evaluated daily to ensure its market value equals or exceeds the current market value of the repurchase agreements including accrued interest. In the event of default on the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation.

The Fund may enter into repurchase agreements, under the terms of a Master Repurchase Agreement ("MRA"). The MRA permits the Fund, under certain circumstances including an event of default (such as bankruptcy or insolvency), to offset payables and/or receivables under the MRA with collateral held and/or posted to the counterparty and create one single net payment due to or from the Fund. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against such a right of offset in the event of a MRA counterparty's bankruptcy or insolvency. Pursuant to the terms of the MRA, the Fund receives securities as collateral with a market value in excess of the repurchase price to be received by the Fund upon the maturity of the repurchase transaction. Upon a bankruptcy or insolvency of the MRA counterparty, the Fund recognizes a liability with respect to such excess collateral to reflect the Fund's obligation under bankruptcy law to return the excess to the counterparty. Repurchase agreements outstanding at the end of the period are listed in the Fund's Portfolio of Investments.

NOTE 3 — Purchases of Investment Securities

Cost of purchases of investment securities (excluding short-term investments with maturities of 60 days or less at the time of purchase) aggregated $335,534,166 for the year ended September 30, 2014. Realized gains or losses are based on the specific identification method.

NOTE 4 — Federal Income Tax

No provision for federal income tax is required because the Fund has elected to be taxed as a "regulated investment company" under the Internal Revenue Code and intends to maintain this qualification and to distribute each year to its shareholders, in accordance with the minimum distribution requirements of the Code, its taxable net investment income and taxable net realized gains on investments.

Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax reporting basis, which may differ from financial reporting. For federal income tax purposes, the components of distributable earnings at September 30, 2014 were as follows:

Undistributed Ordinary Income | | $ | 5,697,185 | | |

Undistributed Net Realized Gains | | $ | 2,971,881 | | |

13

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Continued

The tax status of dividends and distributions paid during the fiscal years ended September 30, 2014 and 2013 were as follows:

| | 2014 | | 2013 | |

Dividends from ordinary income | | $ | 1,115,345 | | | $ | 383,845 | | |

Distributions from long-term capital gains | | | 100,678,113 | | | | 107,391 | | |

The cost of investment securities held at September 30, 2014, was $270,464,706 for federal income tax purposes. Gross unrealized appreciation and depreciation for all investments at September 30, 2014, for federal income tax purposes was $9,902,705 and $27,117,632, respectively resulting in net unrealized depreciation of $17,214,927. As of and during the year ended September 30, 2014, the Fund did not have any liability for unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The Fund is not subject to examination by U.S. federal tax authorities for years ended on or before September 30, 2011 or by state tax authorities for years ended on or before September 30, 2010.

NOTE 5 — Advisory Fees and Other Affiliated Transactions

Pursuant to an Investment Advisory Agreement (the "Agreement") approved by shareholders on November 15, 2013, advisory fees were paid by the Fund to First Pacific Advisors, LLC (the "Adviser"). Under the terms of this Agreement, the Fund pays the Adviser a monthly fee calculated at the annual rate of 1% of the Fund's average daily net assets. In addition, the Fund pays the Adviser an amount equal to 0.10% of the average daily net assets for each fiscal year in reimbursement for the provision of financial services to the Fund. In addition, the Adviser has contractually agreed to reimburse expenses in excess of 1.32% of the average net assets of the Fund (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) through January 31, 2015. In addition, The Adviser agreed to waive the increase in the advisory fee rate for the first six months (through May 15, 2014) and charge an amount equal to the prior fee rate calculated at the annual rate of 0.75% of the first $50 million of the Fund's average daily net assets and 0.65% of the average daily net assets in excess of $50 million, during that period.

For the year ended September 30, 2014, the Fund paid aggregate fees of $100,000 to all Directors who are not affiliated persons of the Adviser. Certain officers of the Fund are also officers of the Adviser.

NOTE 6 — Redemption Fees

A redemption fee of 2% applies to redemptions within 90 days of purchase for certain purchases made by persons eligible to purchase shares without an initial sales charge. For the year ended September 30, 2014, the Fund collected $10,550 in redemption fees. The impact of these fees is less than $0.01 per share.

NOTE 7 — Disclosure of Fair Value Measurements

The Fund uses the following methods and inputs to establish the fair value of its assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market in which the security trades. Securities that are unlisted and fixed-income and

14

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Continued

convertible securities listed on a national securities exchange for which the over-the-counter market more accurately reflects the securities' value in the judgment of the Fund's officers, are valued at the most recent bid price. Short-term corporate notes with maturities of 60 days or less at the time of purchase are valued at amortized cost, which approximates fair value.

Securities for which representative market quotations are not readily available or are considered unreliable by the Adviser are valued as determined in good faith under procedures adopted by authority of the Fund's Board of Trustees. Various inputs may be reviewed in order to make a good faith determination of a security's value. These inputs include, but are not limited to, the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations of investments that would have been used had greater market activity occurred.

The Fund classifies its assets based on three valuation methodologies. Level 1 values are based on quoted market prices in active markets for identical assets. Level 2 values are based on significant observable market inputs, such as quoted prices for similar assets and quoted prices in inactive markets or other market observable inputs. Level 3 values are based on significant unobservable inputs that reflect the Fund's determination of assumptions that market participants might reasonably use in valuing the assets. The valuation levels are not necessarily an indication of the risk associated with investing in those securities. The following table presents the valuation levels of the Fund's investments as of September 30, 2014:

| | | Level 1(3) | | Level 2(3) | | Level 3(3) | | Total | |

Common Stocks(1) | | $ | 253,249,779 | | | | — | | | | — | | | $ | 253,249,779 | | |

Short-Term Investments(2) | | | — | | | $ | 52,684,222 | | | | — | | | | 52,684,222 | | |

| | | $ | 253,249,779 | | | $ | 52,684,222 | | | | — | | | $ | 305,934,001 | | |

(1) All common stocks are classified under Level 1. The Portfolio of Investments provides further information on major security types.

(2) Comprised solely of short-term investments with maturities of 60 days or less that are valued at amortized cost.

(3) Transfers of investments between different levels of the fair value hierarchy are recorded at market value as of the end of the reporting period. There were no transfers between Levels 1, 2, or 3 during the year ended September 30, 2014.

NOTE 8 — Line of Credit

The Fund, along with FPA Perennial Fund, Inc. (another mutual fund managed by the Adviser), has collectively entered into an agreement that enables them to participate in a $50 million unsecured line of credit with State Street Bank and Trust. Borrowings will be made solely to temporarily finance the repurchase of Capital Stock. Interest is charged to each Fund based on its borrowings at a rate per annum equal to the Overnight LIBOR Rate plus 0.625%. In addition, the Fund and FPA Perennial Fund, Inc. pay a commitment fee of 0.125% per annum on any unused portion of the line of credit. During the year ended September 30, 2014, the Fund had no borrowings under the agreement.

NOTE 9 — Collateral Requirements

The Fund has implemented the disclosure requirements pursuant to FASB Accounting Standards Update No. 2011-11, Disclosures about Offsetting Assets and Liabilities, that requires disclosures to make financial statements that are prepared under U.S. GAAP more comparable to those prepared under International Financial

15

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Continued

Reporting Standards. Under this guidance the Fund discloses both gross and net information about instruments and transactions eligible for offset such as instruments and transactions subject to an agreement similar to a master netting arrangement. In addition, the Fund discloses collateral received and posted in connection with master netting agreements or similar arrangements.

The following table presents the Fund's repurchase agreements by counterparty net of amounts available for offset under an ISDA Master agreement or similar agreements and net of the related collateral received or pledged by the Fund as of September 30, 2014, are as follows:

| Counterparty | | Gross Assets

in the Statement of

Assets and Liabilities | | Collateral

Received | | Assets (Liabilities)

Available for Offset | | Net Amount

of Assets* | |

State Street Bank

and Trust Company | | $ | 21,685,000 | | | $ | 21,685,000 | ** | | | — | | | | — | | |

* Represents the net amount receivable from the counterparty in the event of default.

** Collateral with a value of $22,121,481 has been received in connection with a master repurchase agreement. Excess of collateral received from the individual master repurchase agreement is not shown for financial reporting purposes.

16

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

TO THE SHAREHOLDERS AND

BOARD OF DIRECTORS OF FPA PARAMOUNT FUND, INC.

We have audited the accompanying statement of assets and liabilities of FPA Paramount Fund, Inc. (the "Fund"), including the portfolio of investments, as of September 30, 2014, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of September 30, 2014, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of FPA Paramount Fund, Inc. as of September 30, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended in conformity with accounting principles generally accepted in the United States of America.

Los Angeles, California

November 14, 2014

17

FPA PARAMOUNT FUND, INC.

RENEWAL OF INVESTMENT ADVISORY AGREEMENT

(Unaudited)

Approval of the Advisory Agreement. At a meeting of the Board of Directors held on August 11, 2014, the Directors approved the continuation of the advisory agreement between the Fund and the Adviser for an additional one-year period through September 30, 2015, on the recommendation of the Independent Directors, who met in executive session on August 11, 2014 prior to the Board meeting to review and discuss the proposed continuation of the advisory agreement. The following paragraphs summarize the material information and factors considered by the Board and the Independent Directors as well as the Directors' conclusions relative to such factors.

Nature, Extent and Quality of Services. The Board and the Independent Directors considered information provided by the Adviser in response to their requests, as well as information provided throughout the year regarding the Adviser and its staffing in connection with the Fund, including the Fund's portfolio managers and the senior analysts on their team, the scope of accounting, administrative, shareholder and other services supervised and provided by the Adviser, and the absence of any significant service problems reported to the Board. The Board and the Independent Directors noted the experience, length of service and the reputation of the Fund's portfolio managers, Gregory A. Herr, who has managed the Fund since 2011, Pierre O. Py, who has managed the Fund since 2011, Victor Liu, who joined the Adviser in 2013, and Jason Dempsey, who joined the Adviser in 2013. The Board and the Independent Directors noted that the Fund's increased allocations to non-U.S. securities have increased the complexity of the services to be provided by FPA, which has incurred additional costs and responsibilities for researching and trading securities, overseeing service providers and other matters, and they noted the nature, extent and quality of these services provided by FPA to other FPA Funds that invest in non-U.S. securities. The Board and the Independent Directors concluded that the nature, extent and quality of services provided by the Adviser, would benefit the Fund and its shareholders.

Investment Performance. The Board and the Independent Directors reviewed the overall investment performance of the Fund. The Directors also received information from an independent consultant, Lipper, regarding the Fund's performance relative to a peer group of global multi-cap core funds and global multi-cap growth funds selected by Lipper (the "Peer Group"). The Board and the Independent Directors discussed the Fund's relative investment performance when compared to the Peer Group. They also noted that Morningstar gave the Fund a "Neutral" Analyst Rating due to the change in the portfolio management team on September 1, 2013. They recognized that the new strategy did not have a track record, but that Mr. Py had produced strong returns for another FPA Fund investing in non-U.S. securities, and that Mr. Herr had been a member of the team providing portfolio management services to the Fund since 2007. The Board and the Independent Directors concluded that the Adviser's continued management of the Fund should benefit the Fund and its shareholders.

Advisory Fees and Fund Expenses; Comparison with Peer Group and Institutional Fees. The Board and the Independent Directors considered information provided by the Adviser regarding the Fund's advisory fees and total expense levels, noting that the Adviser is waiving a portion of the Fund's advisory fee in order to maintain a maximum limit of the Fund's expense ratio. The Board and the Independent Directors reviewed comparative information regarding fees and expenses for the Peer Group. The Board and the Independent Directors noted that the Fund's advisory fees and overall expense ratio were near the average of those for the Peer Group. They noted that FPA believed that the fee was competitive within the industry for similar global funds and recognized the increased complexity of managing a global fund. The Directors also noted that many funds in the universe charge fees for outside administration and similar services in addition to the advisory fee, and considered amounts paid or reimbursed to the Adviser for financial services. In addition, the Directors noted that the fee rate charged to the Fund is the same as the fee rate proposed to be charged by the Adviser on the institutional accounts managed in a similar style by the portfolio managers, although they recognized FPA did not currently have any such accounts. The Board and the Independent Directors noted that the advisory fee is consistent with advisory fees charged by FPA to another FPA Fund investing in non-U.S. securities, and they noted that FPA had initially

18

FPA PARAMOUNT FUND, INC.

RENEWAL OF INVESTMENT ADVISORY AGREEMENT (Continued)

(Unaudited)

proposed this consistency to create a proper alignment of internal incentives for the portfolio management team. The Board and the Independent Directors concluded that the continued payment of advisory fees and expenses by the Fund to the Adviser was fair and reasonable and should continue to benefit the Fund and its shareholders.

Adviser Profitability and Costs. The Board and the Independent Directors considered information provided by the Adviser regarding the Adviser's costs in providing services to the Fund, the profitability of the Adviser and the benefits to the Adviser from its relationship to the Fund, including amounts paid or reimbursed to the Adviser for financial services. They reviewed and considered the Adviser's representations regarding its assumptions and methods of allocating certain costs, such as personnel costs, which constitute the Adviser's largest operating cost, with respect to the provision of investment advisory and financial services. Although the Board was not provided with information relating to individuals' compensation levels or amounts, the Independent Directors discussed with the Adviser the process through which individuals' compensation is determined and then reviewed by the management committee of the Adviser, as well as the Adviser's methods for determining that the compensation levels are at appropriate levels to attract and retain the personnel necessary to provide high quality professional investment advice. In evaluating the Adviser's profitability, they considered a portion of the compensation of the Adviser's principals that could be deemed a form of profit, and they excluded certain distribution and marketing-related expenses. The Board and the Independent Directors recognized that the Adviser is entitled under the law to earn a reasonable level of profits for the services that it provides to the Fund. The Board and the Independent Directors concluded that the Adviser's level of profitability from its relationship with the Fund did not indicate that the Adviser's compensation was unreasonable or excessive.

Economies of Scale and Sharing of Economies of Scale. The Board and the Independent Directors considered whether there have been economies of scale with respect to the management of the Fund, whether the Fund has appropriately benefited from any economies of scale, and whether the proposed fee rate is reasonable in relation to the Fund's asset levels and any economies of scale that may exist. The Board and the Independent Directors considered the Adviser's representation that its internal costs of providing investment management services to the Fund have increased significantly in recent years as a result of a number of factors, including the Adviser's substantial investment in additional professional resources. The Board and the Independent Directors considered information regarding the Adviser's representation that such increased costs have also included a significant investment in the portfolio management team and analysts, administrative personnel and systems that enhance the quality of services provided to the Fund. They considered the Adviser's representation that it would invest in additional investment analysts supporting the investment team and strategy. The Board and the Independent Directors also considered the Adviser's willingness to close funds to new investors when it believed that a fund may have limited capacity to grow or that it otherwise would benefit fund shareholders. The Board and the Independent Directors also noted that asset levels of the Fund are currently lower than they were last year, yet the Adviser has continued to make investments in personnel servicing the Fund.

The Board and the Independent Directors recognized that the advisory fee rate schedule for the Fund does not have breakpoints. They considered that many mutual funds have breakpoints in the advisory fee structure as a means by which to share in the benefits of potential economies of scale as a fund's assets grow. They also considered that not all funds have breakpoints in their fee structures and that breakpoints are not the exclusive means of sharing potential economies of scale. The Board and the Independent Directors considered the Adviser's statement that it believes that breakpoints currently were no longer appropriate for the Fund given the ongoing investments the Adviser is making in its business and its proposed investments for the benefit of the Fund, uncertainties regarding the direction of the economy, rising inflation, increasing costs for personnel and systems, and growth or contraction in the Fund's assets, all of which could negatively impact the Adviser. The Board and the Independent Trustees concluded that the Fund is benefitting from the ongoing investments made by the

19

FPA PARAMOUNT FUND, INC.

RENEWAL OF INVESTMENT ADVISORY AGREEMENT (Continued)

(Unaudited)

Adviser in its team of personnel serving the Fund and in its service infrastructure, and that in light of these investments, the addition of breakpoints to the Fund's advisory fee structure was not warranted at current asset levels.

Ancillary Benefits. The Board and the Independent Directors considered other actual and potential benefits to the Adviser from managing the Fund, including the acquisition and use of research services with commissions generated by the Fund, in concluding that the contractual advisory and other fees are fair and reasonable for the Fund. They noted that the Adviser does not have any affiliates that benefit from the Adviser's relationship to the Fund. The Board and the Independent Directors observed that FPA does not earn common ancillary benefits such as affiliated custody fees, affiliated transfer agency fees, affiliated brokerage commissions, profits from rule 12b-1 fees, "contingent deferred sales commissions," or "float" benefits on short-term cash.

Conclusions. The Board and the Independent Directors determined that the Fund continues to benefit from the services of the portfolio management team. In addition, the Board and the Independent Directors agreed that the Fund continues to receive high quality accounting, administrative, shareholder and other ancillary services from the Adviser. The Board and the Independent Directors concluded that the current advisory fee rate is reasonable and fair to the Fund and its shareholders in light of the nature and quality of the services currently provided by the Adviser and the Adviser's profitability and costs. The Board and the Independent Directors also stated their intention to continue monitoring the factors relevant to the Adviser's compensation, such as changes in the Fund's asset levels, changes in portfolio management personnel and the cost and quality of the services provided by the Adviser to the Fund. On the basis of the foregoing, and without assigning particular weight to any single factor, none of which was dispositive, the Board and the Independent Directors concluded that it would be in the best interests of the Fund to continue to be advised and managed by the Adviser and determined to approve the continuation of the current Advisory Agreement for another one-year period through September 30, 2015.

20

FPA PARAMOUNT FUND, INC.

SHAREHOLDER EXPENSE EXAMPLE

September 30, 2014 (unaudited)

Fund Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including advisory and administrative fees; shareholder service fees; and other Fund expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the year and held for the entire year.

Actual Expenses

The information in the table under the heading "Actual Performance" provides information about actual account values and actual expenses. You may use the information in this column, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000= 8.6), then multiply the result by the number in the first column in the row entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading "Hypothetical Performance (5% return before expenses)" provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values

and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading "Hypothetical Performance (5% return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Actual

Performance | | Hypothetical

Performance

(5% return

before

expenses) | |

Beginning Account Value

March 31, 2014 | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account Value

September 30, 2014 | | $ | 927.80 | | | $ | 1,019.06 | | |

Expenses Paid During

Period* | | $ | 5.65 | | | $ | 5.94 | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.17%, multiplied by the average account value over the period and prorated for the six-months ended September 30, 2014 (183/365 days).

21

FPA PARAMOUNT FUND, INC.

DIRECTOR AND OFFICER INFORMATION

| Name, Age & Address | | Positions(s)

With Fund/

Years Served | | Principal Occupation(s)

During the Past 5 Years | | Portfolios in

Fund Complex

Overseen | | Other

Directorships | |

Allan M. Rudnick – (73)† | | Director and Chairman*

Years Served: 2 | | Private Investor. Co-Founder, formerly Chief Executive Officer, Chairman and Chief Investment Officer of Kayne Anderson Rudnick Investment Management from 1989 to 2007. | | | 7 | | | | |

Thomas P. Merrick – (77)† | | Director*

Years Served: 6 | | Private consultant. President of Strategic Planning Consultants for more than the past five years. Former Executive Committee member and Vice President of Fluor Corporation, responsible for strategic planning, from 1993 to 1998. | | | 7 | | | | |

Alfred E. Osborne, Jr. – (69)† | | Director*

Years Served: 1 | | Senior Associate Dean of the John E. Anderson School of Management at UCLA. | | | 7 | | | Wedbush, Inc., Nuverra Environmental Solutions, and Kaiser Aluminum, Inc. | |

A. Robert Pisano – (71)† | | Director*

Years Served: 2 | | Retired. Formerly President and Chief Operating Officer of the Motion Picture Association of America, Inc. from 2005 to 2011. | | | 7 | | | Entertainment Partners, Resources Global Professionals, and The Motion Picture and Television Fund | |

Patrick B. Purcell – (71)† | | Director*

Years Served: 2 | | Retired. Formerly Executive Vice President, Chief Financial and Administrative Officer of Paramount Pictures from 1983 to 1998. | | | 7 | | | The Motion Picture and Television Fund | |

Eric S. Ende – (70) | | Director*

Years Served: 12 | | Partner of the Adviser. | | | 3 | | | | |

Gregory A. Herr – (42) | | Co-President and Co-Chief Investment Officer

Years Served: 3 | | Managing Director (2013) and Vice President (2007-2012) of the Adviser since 2007. | | | | | |

Pierre O. Py – (38) | | Co-President and Co-Chief Investment Officer

Years Served: 3 | | Managing Director (2013), Vice President (2011-2012) and Portfolio Manager of the Adviser since 2011. Formerly an international investment analyst at Harris Associates L.P. from 2005 to 2010. | | | | | |

J. Richard Atwood – (54) | | Treasurer

Years Served: 17 | | Managing Partner of the Adviser. | | | | | |

22

FPA PARAMOUNT FUND, INC.

DIRECTOR AND OFFICER INFORMATION

Continued

| Name, Age & Address | | Positions(s)

With Fund/

Years Served | | Principal Occupation(s)

During the Past 5 Years | | Portfolios in

Fund Complex

Overseen | | Other

Directorships | |

Leora R. Weiner – (43) | | Chief Compliance Officer

Years Served: <1 | | Managing Director, General Counsel and Chief Compliance Officer of the Adviser since 2014. Formerly Managing Director, General Counsel and Chief Compliance Officer of Tradewinds Global Investors, LLC from 2008-2014. | | | | | |

Sherry Sasaki – (59) | | Secretary

Years Served: 32 | | Assistant Vice President and Secretary of the Adviser. | | | | | |

E. Lake Setzler – (47) | | Assistant Treasurer

Years Served: 8 | | Senior Vice President and Controller of the Adviser. | | | | | |

Michael P. Gomez – (29) | | Assistant Vice President

Years Served: 2 | | Assistant Vice President of the Adviser since 2010. Formerly In-Charge Associate of PricewaterhouseCoopers from 2007 to 2010. | | | | | |

* Directors serve until their resignation, removal or retirement.

† Audit Committee member

Additional information on the Directors is available in the Statement of Additional Information. Each of the above individuals can be contacted at 11601 Wilshire Blvd,. Suite 1200, Los Angeles, CA 90025.

23

(This page has been left blank intentionally.)

(This page has been left blank intentionally.)

INVESTMENT ADVISER

First Pacific Advisors, LLC

11601 Wilshire Boulevard, Suite 1200

Los Angeles, CA 90025

DISTRIBUTOR

UMB Distribution Services, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212-3948

COUNSEL

K&L Gates LLP

San Francisco, California

TICKER SYMBOL: FPRAX

CUSIP: 302546106

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Deloitte & Touche LLP

Los Angeles, California

CUSTODIAN

State Street Bank and Trust Company

Boston, Massachusetts

TRANSFER & SHAREHOLDER SERVICE AGENT

UMB Fund Services, Inc.

P.O. Box 2175

Milwaukee, WI 53201-2175

or

235 West Galena Street

Milwaukee, WI 53212-3948

(800) 638-3060

This report has been prepared for the information of shareholders of FPA Paramount Fund, Inc., and is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

The Fund's complete proxy voting record for the 12 months ended June 30, 2014 is available without charge, upon request by calling (800) 982-4372 and on the SEC's website at www.sec.gov.

The Fund's schedule of portfolio holdings, filed the first and third quarter of the Fund's fiscal year on Form N-Q with the SEC, is available on the SEC's website at www.sec.gov. Form N-Q is available at the SEC's Public Reference Room in Washington, D.C., and information on the operations of the Public Reference Room may be obtained by calling (202) 551-8090. To obtain Form N-Q from the Fund, shareholders can call (800) 982-4372.

Additional information about the Fund is available online at www.fpafunds.com. This information includes, among other items, holdings, top sectors, and performance, and is updated on or about the 15th business day after the end of each quarter.

Item 2. Code of Ethics.

(a) The registrant has adopted a code of ethics that applies to the registrant’s principal executive and financial officers.

(b) Not Applicable

(c) During the period covered by this report, there were not any amendments to the provisions of the code of ethics adopted in 2(a) above.

(d) During the period covered by this report, there were not any implicit or explicit waivers to the provisions of the code of ethics adopted in 2(a).

(e) Not Applicable

(f) A copy of the registrant’s code of ethics is filed as an exhibit to this Form N-CSR. Upon request, any person may obtain a copy of this code of ethics, without charge, by calling (800) 982-4372.

Item 3. Audit Committee Financial Expert.

The registrant’s board of directors has determined that Patrick B. Purcell, a member of the registrant’s audit committee and board of directors, is an “audit committee financial expert” and is “independent,” as those terms are defined in this Item. This designation will not increase the designee’s duties, obligations or liability as compared to his duties, obligations and liability as a member of the audit committee and of the board of directors. This designation does not affect the duties, obligations or liability of any other member of the audit committee or the board of directors.

Item 4. Principal Accountant Fees and Services.

| | | | 2013 | | 2014 | |

(a) | | Audit Fees | | $ | 36,000 | | $ | 36,720 | |

(b) | | Audit Related Fees | | -0- | | -0- | |

(c) | | Tax Fees | | $ | 8,000 | | $ | 8,160 | |

(d) | | All Other Fees | | -0- | | -0- | |

(e)(1) Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. The audit committee shall pre-approve all audit and permissible non-audit services that the committee considers compatible with maintaining the independent auditors’ independence. The pre-approval requirement will extend to all non-audit services provided to the registrant, the adviser, and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant, if the engagement relates directly to the operations and financial

reporting of the registrant; provided, however, that an engagement of the registrant’s independent auditors to perform attest services for the registrant, the adviser or its affiliates required by generally accepted auditing standards to complete the examination of the registrant’s financial statements (such as an examination conducted in accordance with Statement on Standards for Attestation Engagements Number 16, or a successor statement, issued by the American Institute of Certified Public Accountants), will be deem pre-approved if: (i) the registrant’s independent auditors inform the audit committee of the engagement, (ii) the registrant’s independent auditors advise the audit committee at least annually that the performance of this engagement will not impair the independent auditor’s independence with respect to the registrant, and (iii) the audit committee receives a copy of the independent auditor’s report prepared in connection with such services. The committee may delegate to one or more committee members the authority to review and pre-approve audit and permissible non-audit services. Actions taken under any such delegation will be reported to the full committee at its next meeting.

(e)(2) Disclose the percentage of services described in each of paragraphs (b) – (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. 100% of the services provided to the registrant described in paragraphs (b) – (d) of this Item were pre-approved by the audit committee pursuant to paragraph (e)(1) of this Item. There were no services provided to the investment adviser or any entity controlling, controlled by or under common control with the adviser described in paragraphs (b) – (d) of this Item that were required to be pre-approved by the audit committee.

(f) If greater than 50%, disclose the percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees. All services performed on the engagement to audit the registrant’s financial statements for the most recent fiscal year end were performed by the principal accountant’s full-time, permanent employees.

(g) Disclose the aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant. None.

(h) Disclose whether the registrant’s audit committee of the board of directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence. Not Applicable.

Item 5. Audit Committee of Listed Registrants. Not Applicable.

Item 6. Schedule of Investments. The schedule of investments is included as part of the report to stockholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. Not Applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies. Not Applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. Not Applicable.

Item 10. Submission of Matters to a Vote of Security Holders. There has been no material change to the procedures by which shareholders may recommend nominees to the registrant’s board of directors.

Item 11. Controls and Procedures.

(a) The principal executive officer and principal financial officer of the registrant have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) are effective based on their evaluation of the disclosure controls and procedures as of a date within 90 days of the filing date of this report.

(b) There have been no significant changes in the registrant’s internal controls over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or is reasonably likely to materially affect, the registrant’s internal controls over financial reporting.

Item 12. Exhibits.

(a)(1) Code of ethics as applies to the registrant’s officers and directors, as required to be disclosed under Item 2 of Form N-CSR. Attached hereto as Ex.99.CODE.ETH.

(a)(2) Separate certification for the registrant’s principal executive officer and principal financial officer, as required by Rule 30a-2(a) under the Investment Company Act of 1940. Attached hereto.

(a)(3) Not Applicable

(b) Separate certification for the registrant’s principal executive officer and principal financial officer, as required by Rule 30a-2(b) under the Investment Company Act of 1940. Attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

FPA PARAMOUNT FUND, INC.

By: | /s/ J. RICHARD ATWOOD | |

J. Richard Atwood, Treasurer | |

(Principal Executive Officer) | |

Date: November 21, 2014

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

FPA PARAMOUNT FUND, INC.

By: | /s/ J. RICHARD ATWOOD | |

J. Richard Atwood, Treasurer | |

(Principal Executive Officer) | |

Date: November 21, 2014

By: | /s/ E. LAKE SETZLER III | |

E. Lake Setzler III, Assistant Treasurer | |

(Principal Financial Officer) | |

Date: November 21, 2014