Washington, D.C. 20549

Item 1. Reports to Stockholders

Annual report Delaware Select Growth Fund

April 30, 2011 U.S. growth equity mutual fund |

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and, if available, the summary prospectus carefully before investing. |

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit www.delawareinvestments.com/edelivery. |

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware Select Growth Fund at www.delawareinvestments.com.

Manage your investments online

- 24-hour access to your account information

- Obtain share prices

- Check your account balance and recent transactions

- Request statements or literature

- Make purchases and redemptions

Delaware Management Holdings, Inc. and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services.

Investments in Delaware Select Growth Fund are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including their subsidiaries or related companies (Macquarie Group), and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Fund, the repayment of capital from the Fund, or any particular rate of return.

| Table of contents | | |

| Portfolio management review | | 1 |

| Performance summary | | 4 |

| Disclosure of Fund expenses | | 8 |

| Security type/sector allocation and | | |

| top 10 equity holdings | | 10 |

| Statement of net assets | | 12 |

| Statement of operations | | 18 |

| Statements of changes in net assets | | 20 |

| Financial highlights | | 22 |

| Notes to financial statements | | 32 |

| Report of independent registered | | |

| public accounting firm | | 45 |

| Other Fund information | | 46 |

| Board of trustees/directors and | | |

| officers addendum | | 48 |

| About the organization | | 58 |

Unless otherwise noted, views expressed herein are current as of April 30, 2011, and subject to change.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Fund’s distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2011 Delaware Management Holdings, Inc.

All third-party trademarks cited are the property of their respective owners.

| Portfolio management review |

| Delaware Select Growth Fund | May 10, 2011 |

| Performance preview (for the year ended April 30, 2011) | | | | |

| Delaware Select Growth Fund (Class A shares) | | 1-year return | | +31.41% |

| Russell 3000® Growth Index (benchmark) | | 1-year return | | +21.62% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Select Growth Fund, please see the table on page 4.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. |

As the Fund’s fiscal year got under way, equities markets demonstrated that economic recoveries can be volatile for investors. Major market indices saw significant volatility, and officially fell into “market correction” territory for several months. Investor sentiment grew particularly uneasy with the massive expansion of government debt across the developed world. Many investors focused keenly on a slowly evolving series of sovereign debt crises across southern Europe, as markets around the globe reacted almost daily to news from Greece, Portugal, and Spain (among other countries). Within this environment, many investors simply fled the typical risk assets.

Beginning in early September 2010, and continuing through the end of the Fund’s fiscal year, however, investor sentiment started to improve as the global economy showed slow but steady signs of gaining traction. Though equity markets remained volatile during this period, the U.S. stock market managed to notch strong gains as investors cheered signs of renewed manufacturing activity and improved consumer confidence. During this period, many investors seemed to turn their focus away from the sovereign debt concerns that had occupied their attention in previous months. Instead, they looked to improving corporate earnings and focused on the Federal Reserve’s November 2010 announcement that it would engage in a second round of quantitative easing, commonly called QE2. The plan involved the Fed purchasing up to $600 billion of Treasury notes and bonds in order to accelerate economic growth in the United States.

A second major policy announcement occurred in early December when President Obama announced that he had negotiated a compromise agreement with Congressional Republicans to extend the Bush-era tax cuts that included stimulus measures like keeping unemployment benefits in place for the long-term unemployed, cutting payroll taxes for all workers, and maintaining tax breaks on dividends and capital gains while lowering the estate tax. Equity investors largely celebrated this “double dose” of stimulus, believing that it could provide a firmer footing under what was a slowly improving U.S. economy.

Amid these improvements, however, the economy continued to face a series of headwinds. For example, many employers remained reluctant to add to payrolls throughout the fiscal year, and unemployment continued to hover near 9%. Issues such as sharp increases in food and energy prices and a still-slow housing market also nagged many investors during the period. At the same time, political turmoil in the Middle East and North Africa, along with the tragic

1

Portfolio management review

Delaware Select Growth Fund

earthquake, tsunami, and subsequent nuclear crisis in Japan added to investors’ sense of uncertainty as the Fund’s fiscal year came to a close. (Source: Dow Jones.)

Within the Fund

For its fiscal year ended April 30, 2011, Delaware Select Growth Fund (Class A shares) returned +31.41% at net asset value and +23.84% at maximum offer price (both figures reflect all distributions reinvested). The Fund outperformed its benchmark, the Russell 3000 Growth Index, which advanced +21.62% for the same period. For the complete annualized performance of Delaware Select Growth Fund, please see the table on page 4.

Priceline was the strongest contributor to the Fund’s overall return. The company’s “name your own price” model became more popular during the uncertain economic times, as bargain basement shoppers looked for travel discounts. Though the domestic online travel industry has become increasingly competitive, the company has continued to experience strong growth and recently beat analysts’ profit forecasts. Some investors grew nervous about the company’s European operations when the sovereign debt crisis emerged in 2010 — however, we chose to add shares on the weakness. This decision resulted in a significant contribution to the Fund’s performance.

Weight Watchers International was another strong contributor to the Fund. We believe the company’s offerings fit in well with the growing need for weight management products and services. The company’s move to include more online customers was also a positive development — we have been encouraged in recent years to see the company’s mix of customers broaden beyond physical meetings. Further, Weight Watchers has improved its balance sheet by significantly reducing its debt position.

Another contributor to the Fund was VeriFone Systems. This manufacturer of payment terminals benefited from several developments in the electronic payments ecosystem. First, the company’s revenues bounced back with the broader recovery in consumer spending because many of its terminals are located in retail and restaurant locations. Second, the company is participating in an upgrade cycle driven by customer and merchant demand for more secure payment networks to battle fraud. And finally, we believe the company is well positioned to participate in the emerging industry of mobile payment systems (using smartphones for electronic payment transactions).

Both of our education stocks, Apollo Group and Strayer Education, detracted from Fund performance during the Fund’s fiscal year. The stocks suffered along with the rest of the education industry, because of increased scrutiny on federal loans that help finance education. We believe the regulation risk is overstated by the markets and that valuations are attractive for both stocks as a result. In the case of Apollo — a relatively new position in the Fund — we believe senior management changes made in recent years, together with corresponding internal process improvements, should bear fruit for the company as it looks to re-emerge as a leaner entity with a keener focus on profitable growth. We initiated the position in the Fund when education stocks broadly sold off.

2

Finally, IntercontinentalExchange also detracted from Fund performance as its futures exchanges and clearing houses faced ongoing uncertainties in the enhanced regulatory environment for derivatives. Trading for these complex and sophisticated securities was lackluster early in the fiscal year as many investors tried to make heads or tails of the expanded rules. For the Fund’s fiscal year, the company’s stock enjoyed a positive return, though it lagged many of the Fund’s other holdings and the benchmark. We continued to hold the stock in the Fund as of the end of the fiscal year.

It’s important to note that, regardless of the economic outcome, we remain consistent in our long-term investment philosophy: We want to own what we view as strong secular growth companies, with solid business models and competitive positions that have the potential to deliver shareholder value in a variety of market environments.

3

| Performance summary |

| Delaware Select Growth Fund | April 30, 2011 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| Fund performance1,2 | | Average annual total returns through April 30, 2011 |

| | | 1 year | | 5 years | | 10 years | | Lifetime |

| Class A (Est. May 16, 1994) | | | | | | | | |

| Excluding sales charge | | +31.41% | | +6.21% | | +3.97% | | n/a |

| Including sales charge | | +23.84% | | +4.96% | | +3.35% | | n/a |

| Class B (Est. April 16, 1996) | | | | | | | | |

| Excluding sales charge | | +30.45% | | +5.42% | | +3.34% | | n/a |

| Including sales charge | | +26.45% | | +5.05% | | +3.34% | | n/a |

| Class C (Est. May 20, 1994) | | | | | | | | |

| Excluding sales charge | | +30.41% | | +5.42% | | +3.19% | | n/a |

| Including sales charge | | +29.41% | | +5.42% | | +3.19% | | n/a |

| Class R (Est. June 2, 2003) | | | | | | | | |

| Excluding sales charge | | +31.10% | | +5.95% | | n/a | | +8.74% |

| Including sales charge | | +31.10% | | +5.95% | | n/a | | +8.74% |

| Institutional Class shares (Est. Aug. 28, 1997) | | | | | | |

| Excluding sales charge | | +31.73% | | +6.47% | | +4.22% | | n/a |

| Including sales charge | | +31.73% | | +6.47% | | +4.22% | | n/a |

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. The current expenses for each class are listed on the “Fund expense ratios” table below. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of up to 5.75%, and have an annual distribution and service fee of up to 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class B shares may only be purchased through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B shares. Class B shares have a contingent deferred sales charge that declines from 4.00%

4

to zero depending on the period of time the shares are held. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are only available for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of up to 0.60% of average daily net assets, which has been limited contractually to 0.50% from Aug. 27, 2010, through Aug. 28, 2011.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

Instances of high double-digit returns are unusual, cannot be sustained, and were primarily achieved during favorable market conditions.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses from exceeding 1.24% of the Fund’s average daily net assets from Aug. 27, 2010, through Aug. 28, 2011. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | | Class A | | Class B | | Class C | | Class R | | Institutional Class |

| Total annual operating expenses | | 1.73% | | 2.48% | | 2.48% | | 2.08% | | 1.48% |

| (without fee waivers) | | | | | | | | | | |

| Net expenses | | 1.49% | | 2.24% | | 2.24% | | 1.74% | | 1.24% |

| (including fee waivers, if any) | | | | | | | | | | |

| Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual | | Contractual |

5

Performance summary

Delaware Select Growth Fund

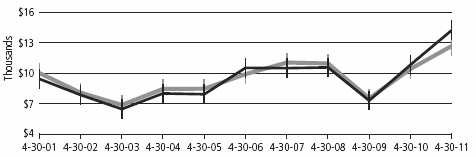

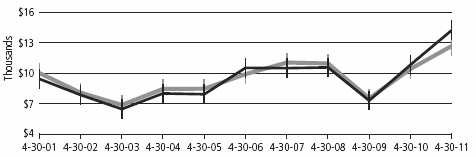

Performance of a $10,000 investment1

Average annual total returns from April 30, 2001, through April 30, 2011

| For period beginning April 30, 2001, through April 30, 2011 | Starting value | Ending value |

| | Delaware Select Growth Fund — Class A Shares | $9,425 | $14,199 |

| | Russell 3000 Growth Index | $10,000 | $12,650 |

1 The “Performance of $10,000 investment” graph assumes $10,000 invested in Class A shares of the Fund on April 30, 2001, and includes the effect of a 5.75% front-end sales charge and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Current expenses are listed in the “Fund expense ratios” table on page 5. Please note additional details on pages 4 through 6.

The chart also assumes $10,000 invested in the Russell 3000 Growth Index as of April 30, 2001. The Russell 3000 Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000 companies with higher price-to-book ratios and higher forecasted growth values.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | | Nasdaq symbols | | CUSIPs | |

| Class A | | | DVEAX | | | 928931104 | |

| Class B | | | DVEBX | | | 928931849 | |

| Class C | | | DVECX | | | 928931203 | |

| Class R | | | DFSRX | | | 928931740 | |

| Institutional Class | | | VAGGX | | | 928931757 | |

6

Disclosure of Fund expenses

For the six-month period from November 1, 2010 to April 30, 2011

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from November 1, 2010 to April 30, 2011.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect. The expenses shown in the table assume reinvestment of all dividends and distributions.

8

Delaware Select Growth Fund

Expense analysis of an investment of $1,000

| | | Beginning | | Ending | | | | Expenses |

| | | Account Value | | Account Value | | Annualized | | Paid During Period |

| | | 11/1/10 | | 4/30/11 | | Expense Ratio | | 11/1/10 to 4/30/11* |

| Actual Fund return | | | | | | | | | | | | | | | | | |

| Class A | | | $ | 1,000.00 | | | | $ | 1,195.60 | | | 1.49% | | | $ | 8.11 | |

| Class B | | | | 1,000.00 | | | | | 1,191.50 | | | 2.24% | | | | 12.17 | |

| Class C | | | | 1,000.00 | | | | | 1,191.30 | | | 2.24% | | | | 12.17 | |

| Class R | | | | 1,000.00 | | | | | 1,194.30 | | | 1.74% | | | | 9.47 | |

| Institutional Class | | | | 1,000.00 | | | | | 1,197.20 | | | 1.24% | | | | 6.76 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | |

| Class A | | | $ | 1,000.00 | | | | $ | 1,017.41 | | | 1.49% | | | $ | 7.45 | |

| Class B | | | | 1,000.00 | | | | | 1,013.69 | | | 2.24% | | | | 11.18 | |

| Class C | | | | 1,000.00 | | | | | 1,013.69 | | | 2.24% | | | | 11.18 | |

| Class R | | | | 1,000.00 | | | | | 1,016.17 | | | 1.74% | | | | 8.70 | |

| Institutional Class | | | | 1,000.00 | | | | | 1,018.65 | | | 1.24% | | | | 6.21 | |

*“Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

9

| Security type/sector allocation and | |

| top 10 equity holdings | |

| Delaware Select Growth Fund | As of April 30, 2011 |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type/sector | Percentage of net assets |

| Common Stock² | 96.15 | % |

| Consumer Discretionary | 24.74 | % |

| Consumer Staples | 4.04 | % |

| Energy | 4.43 | % |

| Financial Services | 15.15 | % |

| Healthcare | 13.15 | % |

| Materials & Processing | 4.67 | % |

| Producer Durables | 2.09 | % |

| Technology | 26.54 | % |

| Utilities | 1.34 | % |

| Preferred Stock | 2.02 | % |

| Short-Term Investments | 2.18 | % |

| Securities Lending Collateral | 16.67 | % |

| Total Value of Securities | 117.02 | % |

| Obligation to Return Securities Lending Collateral | (16.98 | %) |

| Other Liabilities Net of Receivables and Other Assets | (0.04 | %) |

| Total Net Assets | 100.00 | % |

²Narrow industries are utilized for compliance purposes for diversification whereas broad sectors are used for financial reporting.

10

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| Top 10 equity holdings | Percentage of net assets |

| Apple | 8.36 | % |

| MasterCard Class A | 4.69 | % |

| priceline.com | 4.44 | % |

| Apollo Group Class A | 3.83 | % |

| Medco Health Solutions | 3.19 | % |

| Polycom | 3.12 | % |

| Peet’s Coffee & Tea | 3.12 | % |

| Perrigo | 3.03 | % |

| Allergan | 2.99 | % |

| Weight Watchers International | 2.86 | % |

11

| Statement of net assets | |

| Delaware Select Growth Fund | April 30, 2011 |

| | | Number of shares | | Value |

| Common Stock – 96.15%² | | | | |

| Consumer Discretionary – 24.74% | | | | |

| *† | Apollo Group Class A | 474,750 | | $ | 19,004,243 |

| *† | Ctrip.com International ADR | 268,800 | | | 13,095,936 |

| † | DineEquity | 56,600 | | | 2,828,302 |

| | Intertek Group | 87,900 | | | 3,120,098 |

| † | Interval Leisure Group | 252,300 | | | 4,054,461 |

| *† | ITT Educational Services | 171,550 | | | 12,305,282 |

| | Lowe’s | 283,400 | | | 7,439,250 |

| | LVMH Moet Hennessy Louis Vuitton | 20,775 | | | 3,731,726 |

| * | NIKE Class B | 35,050 | | | 2,885,316 |

| *† | priceline.com | 40,230 | | | 22,006,212 |

| * | Ritchie Bros Auctioneers | 106,300 | | | 3,324,001 |

| * | Staples | 87,800 | | | 1,856,092 |

| * | Strayer Education | 103,300 | | | 12,796,804 |

| | Weight Watchers International | 182,400 | | | 14,181,600 |

| | | | | | 122,629,323 |

| Consumer Staples – 4.04% | | | | |

| *† | Peet’s Coffee & Tea | 332,700 | | | 15,463,896 |

| | Whole Foods Market | 72,300 | | | 4,537,548 |

| | | | | | 20,001,444 |

| Energy – 4.43% | | | | |

| * | Core Laboratories | 65,695 | | | 6,305,406 |

| * | Energy Transfer Equity | 45,000 | | | 2,068,650 |

| * | EOG Resources | 106,950 | | | 12,075,725 |

| | Williams | 45,000 | | | 1,492,650 |

| | | | | | 21,942,431 |

| Financial Services – 15.15% | | | | |

| † | Affiliated Managers Group | 47,900 | | | 5,224,932 |

| | Bank of New York Mellon | 56,906 | | | 1,647,998 |

| | BM&FBovespa | 443,200 | | | 3,325,830 |

| *† | CB Richard Ellis Group Class A | 114,300 | | | 3,052,953 |

| | CME Group | 26,850 | | | 7,941,425 |

| | Heartland Payment Systems | 235,500 | | | 4,700,580 |

| † | IntercontinentalExchange | 115,225 | | | 13,867,329 |

| | MasterCard Class A | 84,300 | | | 23,257,526 |

| *† | MSCI Class A | 135,100 | | | 4,791,997 |

| * | Visa Class A | 93,300 | | | 7,288,596 |

| | | | | | 75,099,166 |

12

| | | Number of shares | | Value |

| Common Stock (continued) | | | | |

| Healthcare – 13.15% | | | | |

| † | ABIOMED | 126,000 | | $ | 2,189,880 |

| * | Allergan | 186,250 | | | 14,818,050 |

| *† | athenahealth | 86,000 | | | 3,975,780 |

| † | Gilead Sciences | 109,850 | | | 4,266,574 |

| † | Medco Health Solutions | 266,250 | | | 15,796,612 |

| | Novo Nordisk ADR | 71,200 | | | 9,070,168 |

| * | Perrigo | 166,458 | | | 15,041,145 |

| | | | | | 65,158,209 |

| Materials & Processing – 4.67% | | | | |

| * | BHP Billiton ADR | 18,750 | | | 1,898,250 |

| | Brasil Brokers Participacoes | 827,200 | | | 4,478,170 |

| | Freeport-McMoRan Copper & Gold | 89,700 | | | 4,936,191 |

| | Monsanto | 9,400 | | | 639,576 |

| | Newmont Mining | 65,200 | | | 3,821,372 |

| | Syngenta ADR | 104,500 | | | 7,392,330 |

| | | | | | 23,165,889 |

| Producer Durables – 2.09% | | | | |

| * | Caterpillar | 36,100 | | | 4,166,301 |

| | Expeditors International Washington | 66,200 | | | 3,592,674 |

| | Nalco Holding | 89,300 | | | 2,608,453 |

| | | | | | 10,367,428 |

| Technology – 26.54% | | | | |

| *† | Adobe Systems | 282,700 | | | 9,484,585 |

| † | Apple | 118,950 | | | 41,421,959 |

| † | Crown Castle International | 288,700 | | | 12,373,682 |

| * | FLIR Systems | 61,800 | | | 2,176,596 |

| † | Google Class A | 10,700 | | | 5,821,870 |

| *† | Intuit | 148,000 | | | 8,222,880 |

| † | Polycom | 258,500 | | | 15,466,055 |

| | QUALCOMM | 228,400 | | | 12,982,256 |

| † | SBA Communications Class A | 147,500 | | | 5,697,925 |

| † | Teradata | 121,850 | | | 6,813,852 |

| *† | VeriFone Systems | 101,432 | | | 5,560,502 |

| | VeriSign | 149,500 | | | 5,525,520 |

| | | | | | 131,547,682 |

13

Statement of net assets

Delaware Select Growth Fund

| | | | Number of shares | | Value |

| Common Stock (continued) | | | | | | |

| Utilities – 1.34% | | | | | | |

| *† | j2 Global Communications | | | 225,100 | | $ | 6,631,446 |

| | | | | | | | 6,631,446 |

| Total Common Stock (cost $343,095,567) | | | | | | 476,543,018 |

| | |

| Preferred Stock – 2.02% | | | | | | |

| =† | MiaSole Series F | | | 2,310,286 | | | 10,000,073 |

| Total Preferred Stock (cost $10,000,073) | | | | | | 10,000,073 |

| | |

| | | | Principal amount | | | |

| ≠Short-Term Investments – 2.18% | | | | | | |

| Discount Notes – 2.18% | | | | | | |

| | Federal Home Loan Bank | | | | | | |

| | 0.001% 5/2/11 | | $ | 8,869,784 | | | 8,869,784 |

| | 0.03% 5/3/11 | | | 89,830 | | | 89,830 |

| | 0.037% 5/23/11 | | | 114,983 | | | 114,982 |

| | 0.04% 5/9/11 | | | 1,566,885 | | | 1,566,882 |

| | 0.05% 5/16/11 | | | 89,830 | | | 89,830 |

| | 0.06% 6/7/11 | | | 85,339 | | | 85,338 |

| Total Short-Term Investments (cost $10,816,641) | | | | | | 10,816,646 |

| | |

| Total Value of Securities Before Securities | | | | | | |

| | Lending Collateral – 100.35% (cost $363,912,281) | | | | | | 497,359,737 |

| | |

| | | | Number of shares | | | |

| Securities Lending Collateral** – 16.67% | | | | | | |

| | Investment Companies | | | | | | |

| | BNY Mellon SL DBT II Liquidating Fund | | | 1,026,573 | | | 997,007 |

| | Delaware Investments Collateral Fund No. 1 | | | 81,634,400 | | | 81,634,400 |

| | @†Mellon GSL Reinvestment Trust II | | | 1,489,816 | | | 0 |

| Total Securities Lending Collateral (cost $84,150,789) | | | | | | 82,631,407 |

14

| | | | |

| Total Value of Securities – 117.02% | | | |

| (cost $448,063,070) | $ | 579,991,144 | © |

| Obligation to Return Securities | | | |

| Lending Collateral** – (16.98%) | | (84,150,789 | ) |

| Other Liabilities Net of Receivables | | | |

| and Other Assets – (0.04%) | | (208,948 | ) |

| Net Assets Applicable to 13,791,961 | | | |

| Shares Outstanding – 100.00% | $ | 495,631,407 | |

| |

| Net Asset Value – Delaware Select Growth Fund | | | |

| Class A ($267,562,594 / 7,284,464 Shares) | | | $36.73 | |

| Net Asset Value – Delaware Select Growth Fund | | | |

| Class B ($31,712,913 / 981,827 Shares) | | | $32.30 | |

| Net Asset Value – Delaware Select Growth Fund | | | |

| Class C ($71,800,389 / 2,247,147 Shares) | | | $31.95 | |

| Net Asset Value – Delaware Select Growth Fund | | | |

| Class R ($4,607,302 / 128,125 Shares) | | | $35.96 | |

| Net Asset Value – Delaware Select Growth Fund | | | |

| Institutional Class ($119,948,209 / 3,150,398 Shares) | | | $38.07 | |

| |

| Components of Net Assets at April 30, 2011: | | | |

| Shares of beneficial interest (unlimited authorization – no par) | $ | 492,719,881 | |

| Accumulated net investment loss | | (185,549 | ) |

| Accumulated net realized loss on investments | | (128,830,769 | ) |

| Net unrealized appreciation of investments and foreign currencies | | 131,927,844 | |

| Total net assets | $ | 495,631,407 | |

15

Statement of net assets

Delaware Select Growth Fund

| | |

| ² | Narrow industries are utilized for compliance purposes for diversification whereas broad sectors are used for financial reporting. |

| † | Non income producing security. |

| * | Fully or partially on loan. |

| = | Security is being fair valued in accordance with the Fund’s fair valuation policy. At April 30, 2011, the aggregate amount of fair valued securities was $10,000,073, which represented 2.02% of the Fund’s net assets. See Note 1 in “Notes to financial statements.” |

| ** | See Note 10 in “Notes to financial statements.” |

| ≠ | The rate shown is the effective yield at the time of purchase. |

| @ | Illiquid security. At April 30, 2011, the aggregate amount of illiquid securities was $0, which represented 0.00% of the Fund’s net assets. See Note 11 in “Notes to financial statements.” |

| © | Includes $82,340,722 of securities loaned. |

ADR — American Depositary Receipts

| Net Asset Value and Offering Price Per Share – | | |

| Delaware Select Growth Fund | | |

| Net asset value Class A (A) | $ | 36.73 |

| Sales charges (5.75% of offering price) (B) | | 2.24 |

| Offering price | $ | 38.97 |

| (A) | | Net asset value per share, as illustrated, is the amount which would be paid upon redemption or repurchase of shares. |

| (B) | | See the current prospectus for purchase of $50,000 or more. |

See accompanying notes, which are an integral part of the financial statements.

16

| Statement of operations | |

| Delaware Select Growth Fund | Year Ended April 30, 2011 |

| Investment Income: | | | | | | | |

| Dividends | $ | 3,234,446 | | | | | |

| Securities lending income | | 599,170 | | | | | |

| Interest | | 16,645 | | | | | |

| Foreign tax withheld | | (56,583 | ) | | $ | 3,793,678 | |

| |

| Expenses: | | | | | | | |

| Management fees | | 2,662,388 | | | | | |

| Dividend disbursing and transfer agent fees and expenses | | 1,472,334 | | | | | |

| Distribution expenses – Class A | | 502,306 | | | | | |

| Distribution expenses – Class B | | 227,862 | | | | | |

| Distribution expenses – Class C | | 483,192 | | | | | |

| Distribution expenses – Class R | | 17,123 | | | | | |

| Reports and statements to shareholders | | 163,171 | | | | | |

| Accounting and administration expenses | | 139,906 | | | | | |

| Legal fees | | 95,596 | | | | | |

| Registration fees | | 80,499 | | | | | |

| Dues and services | | 31,203 | | | | | |

| Audit and tax | | 28,894 | | | | | |

| Trustees’ fees | | 18,533 | | | | | |

| Custodian fees | | 15,253 | | | | | |

| Insurance fees | | 15,045 | | | | | |

| Pricing fees | | 6,474 | | | | | |

| Consulting fees | | 4,914 | | | | | |

| Trustees’ expenses | | 2,045 | | | | 5,966,738 | |

| Less fees waived | | | | | | (245,129 | ) |

| Less expense paid indirectly | | | | | | (2,692 | ) |

| Less waived distribution expenses – Class R | | | | | | (2,854 | ) |

| Total operating expenses | | | | | | 5,716,063 | |

| Net Investment Loss | | | | | | (1,922,385 | ) |

18

| Net Realized and Unrealized Gain (Loss) on Investments | | | |

| and Foreign Currencies: | | | |

| Net realized gain (loss) on: | | | |

| Investments | $ | 51,022,529 | |

| Foreign currencies | | (236,804 | ) |

| Foreign currency exchange contracts | | (8,875 | ) |

| Net realized gain | | 50,776,850 | |

| Net change in unrealized appreciation/depreciation of | | | |

| investments and foreign currencies | | 59,499,333 | |

| Net Realized and Unrealized Gain on Investments | | | |

| and Foreign Currencies | | 110,276,183 | |

| |

| Net Increase in Net Assets Resulting from Operations | $ | 108,353,798 | |

See accompanying notes, which are an integral part of the financial statements.

19

Statements of changes in net assets

Delaware Select Growth Fund

| | Year Ended |

| | 4/30/11 | | 4/30/10 |

| Increase (Decrease) in Net Assets from Operations: | | | | | | | |

| Net investment loss | $ | (1,922,385 | ) | | $ | (2,429,980 | ) |

| Net realized gain on investments and | | | | | | | |

| foreign currencies | | 50,776,850 | | | | 38,783,458 | |

| Net change in unrealized appreciation/depreciation | | | | | | | |

| of investments and foreign currencies | | 59,499,333 | | | | 63,092,292 | |

| Net increase in net assets resulting from operations | | 108,353,798 | | | | 99,445,770 | |

| |

| Capital Share Transactions: | | | | | | | |

| Proceeds from shares sold: | | | | | | | |

| Class A | | 28,801,020 | | | | 18,629,185 | |

| Class B | | 246,675 | | | | 206,648 | |

| Class C | | 4,870,828 | | | | 1,799,685 | |

| Class R | | 2,326,802 | | | | 252,368 | |

| Institutional Class | | 52,556,873 | | | | 90,342,397 | |

| |

| Net assets from merger*: | | | | | | | |

| Class A | | 82,721,925 | | | | — | |

| Class B | | 19,198,198 | | | | — | |

| Class C | | 33,357,785 | | | | — | |

| Class R | | 2,388,873 | | | | — | |

| Institutional Class | | 3,408,127 | | | | — | |

| | | 229,877,106 | | | | 111,230,283 | |

20

| | Year Ended |

| | 4/30/11 | | 4/30/10 |

| Capital Share Transactions (continued): | | | | | | | |

| Cost of shares repurchased: | | | | | | | |

| Class A | $ | (54,500,106 | ) | | $ | (26,291,216 | ) |

| Class B | | (9,619,554 | ) | | | (11,280,764 | ) |

| Class C | | (10,754,776 | ) | | | (5,500,832 | ) |

| Class R | | (1,896,421 | ) | | | (405,510 | ) |

| Institutional Class | | (14,816,398 | ) | | | (113,200,890 | ) |

| | | (91,587,255 | ) | | | (156,679,212 | ) |

| Increase (decrease) in net assets derived from | | | | | | | |

| capital share transactions | | 138,289,851 | | | | (45,448,929 | ) |

| Net Increase in Net Assets | | 246,643,649 | | | | 53,996,841 | |

| |

| Net Assets: | | | | | | | |

| Beginning of year | | 248,987,758 | | | | 194,990,917 | |

| End of year (including accumulated net investment | | | | | | | |

| loss of $185,549 and $92,972 respectively) | $ | 495,631,407 | | | $ | 248,987,758 | |

*See note 7 in “Notes to financial statements.”

See accompanying notes, which are an integral part of the financial statements.

21

Financial highlights

Delaware Select Growth Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment loss1 |

| Net realized and unrealized gain (loss) on investments and foreign currencies |

| Total from investment operations |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment loss to average net assets |

| Ratio of net investment loss to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

22

| | Year Ended | |

| | | 4/30/11 | | 4/30/10 | | 4/30/09 | | 4/30/08 | | 4/30/07 | |

| | | $27.950 | | | $18.860 | | | $27.300 | | | $27.110 | | | $27.180 | | |

| | | |

| | | | | | | | | | | | | | | | | |

| | | (0.139 | ) | | (0.209 | ) | | (0.041 | ) | | (0.119 | ) | | (0.193 | ) | |

| | | 8.919 | | | 9.299 | | | (8.399 | ) | | 0.309 | | | 0.123 | | |

| | | 8.780 | | | 9.090 | | | (8.440 | ) | | 0.190 | | | (0.070 | ) | |

| | | |

| | | $36.730 | | | $27.950 | | | $18.860 | | | $27.300 | | | $27.110 | | |

| | | |

| | | 31.41% | | | 48.20% | | | (30.92% | ) | | 0.70% | | | (0.26% | ) | |

| | | |

| | | |

| | | $267,563 | | | $150,016 | | | $106,919 | | | $157,366 | | | $160,170 | | |

| | | 1.51% | | | 1.50% | | | 1.49% | | | 1.48% | | | 1.50% | | |

| | | | | | | | | | | | | | | | | |

| | | 1.58% | | | 1.73% | | | 1.85% | | | 1.62% | | | 1.64% | | |

| | | (0.45% | ) | | (0.89% | ) | | (0.20% | ) | | (0.42% | ) | | (0.77% | ) | |

| | | | | | | | | | | | | | | | | |

| | | (0.52% | ) | | (1.12% | ) | | (0.56% | ) | | (0.56% | ) | | (0.91% | ) | |

| | | 41% | | | 49% | | | 66% | | | 61% | | | 51% | | |

23

Financial highlights

Delaware Select Growth Fund Class B

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment loss1 |

| Net realized and unrealized gain (loss) on investments and foreign currencies |

| Total from investment operations |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment loss to average net assets |

| Ratio of net investment loss to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

24

| | | Year Ended | |

| | | 4/30/11 | | 4/30/10 | | 4/30/09 | | 4/30/08 | | 4/30/07 | |

| | | $24.760 | | | $16.830 | | | $24.550 | | | $24.560 | | | $24.810 | | |

| | | | | | | | | | | | | | | | | |

| | |

| | | (0.333 | ) | | (0.355 | ) | | (0.182 | ) | | (0.304 | ) | | (0.365 | ) | |

| | | 7.873 | | | 8.285 | | | (7.538 | ) | | 0.294 | | | 0.115 | | |

| | | 7.540 | | | 7.930 | | | (7.720 | ) | | (0.010 | ) | | (0.250 | ) | |

| | |

| | | $32.300 | | | $24.760 | | | $16.830 | | | $24.550 | | | $24.560 | | |

| | |

| | | 30.45% | | | 47.12% | | | (31.45% | ) | | (0.04% | ) | | (1.01% | ) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | $31,713 | | | $15,012 | | | $19,222 | | | $67,344 | | | $126,866 | | |

| | | 2.26% | | | 2.25% | | | 2.24% | | | 2.23% | | | 2.25% | | |

| | | | | | | | | | | | | | | | | |

| | | 2.33% | | | 2.48% | | | 2.60% | | | 2.37% | | | 2.39% | | |

| | | (1.20% | ) | | (1.64% | ) | | (0.95% | ) | | (1.17% | ) | | (1.52% | ) | |

| | | | | | | | | | | | | | | | | |

| | | (1.27% | ) | | (1.87% | ) | | (1.31% | ) | | (1.31% | ) | | (1.66% | ) | |

| | | 41% | | | 49% | | | 66% | | | 61% | | | 51% | | |

25

Financial highlights

Delaware Select Growth Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment loss1 |

| Net realized and unrealized gain (loss) on investments and foreign currencies |

| Total from investment operations |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment loss to average net assets |

| Ratio of net investment loss to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

26

| | | Year Ended | |

| | | 4/30/11 | | 4/30/10 | | 4/30/09 | | 4/30/08 | | 4/30/07 | |

| | | $24.500 | | | $16.650 | | | $24.290 | | | $24.300 | | | $24.540 | | |

| | |

| | |

| | | (0.329 | ) | | (0.357 | ) | | (0.173 | ) | | (0.302 | ) | | (0.362 | ) | |

| | | 7.779 | | | 8.207 | | | (7.467 | ) | | 0.292 | | | 0.122 | | |

| | | 7.450 | | | 7.850 | | | (7.640 | ) | | (0.010 | ) | | (0.240 | ) | |

| | |

| | | $31.950 | | | $24.500 | | | $16.650 | | | $24.290 | | | $24.300 | | |

| | |

| | | 30.41% | | | 47.15% | | | (31.45% | ) | | (0.04% | ) | | (0.98% | ) | |

| | | | | | | | | | | | | | | | | |

| | |

| | | $71,800 | | | $29,502 | | | $23,030 | | | $44,972 | | | $59,271 | | |

| | | 2.26% | | | 2.25% | | | 2.24% | | | 2.23% | | | 2.25% | | |

| | | | | | | | | | | | | | | | | |

| | | 2.33% | | | 2.48% | | | 2.60% | | | 2.37% | | | 2.39% | | |

| | | (1.20% | ) | | (1.64% | ) | | (0.95% | ) | | (1.17% | ) | | (1.52% | ) | |

| | | | | | | | | | | | | | | | | |

| | | (1.27% | ) | | (1.87% | ) | | (1.31% | ) | | (1.31% | ) | | (1.66% | ) | |

| | | 41% | | | 49% | | | 66% | | | 61% | | | 51% | | |

27

Financial highlights

Delaware Select Growth Fund Class R

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment loss1 |

| Net realized and unrealized gain (loss) on investments and foreign currencies |

| Total from investment operations |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment loss to average net assets |

| Ratio of net investment loss to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during all of the periods shown reflects waivers by the manager and distributor. Performance would have been lower had the waivers not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

28

| | | Year Ended | |

| | | 4/30/11 | | 4/30/10 | | 4/30/09 | | 4/30/08 | | 4/30/07 | |

| | | $27.430 | | | $18.550 | | | $26.930 | | | $26.810 | | | $26.940 | | |

| | |

| | |

| | | (0.222 | ) | | (0.265 | ) | | (0.092 | ) | | (0.188 | ) | | (0.257 | ) | |

| | | 8.752 | | | 9.145 | | | (8.288 | ) | | 0.308 | | | 0.127 | | |

| | | 8.530 | | | 8.880 | | | (8.380 | ) | | 0.120 | | | (0.130 | ) | |

| | |

| | | $35.960 | | | $27.430 | | | $18.550 | | | $26.930 | | | $26.810 | | |

| | |

| | | 31.10% | | | 47.87% | | | (31.12% | ) | | 0.45% | | | (0.48% | ) | |

| | |

| | |

| | | $4,607 | | | $807 | | | $671 | | | $1,266 | | | $1,432 | | |

| | | 1.76% | | | 1.75% | | | 1.74% | | | 1.73% | | | 1.75% | | |

| | | | | | | | | | | | | | | | | |

| | | 1.93% | | | 2.08% | | | 2.20% | | | 1.97% | | | 1.99% | | |

| | | (0.70% | ) | | (1.14% | ) | | (0.45% | ) | | (0.67% | ) | | (1.02% | ) | |

| | | | | | | | | | | | | | | | | |

| | | (0.87% | ) | | (1.47% | ) | | (0.91% | ) | | (0.91% | ) | | (1.26% | ) | |

| | | 41% | | | 49% | | | 66% | | | 61% | | | 51% | | |

29

Financial highlights

Delaware Select Growth Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income (loss)1 |

| Net realized and unrealized gain (loss) on investments and foreign currencies |

| Total from investment operations |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment income (loss) to average net assets |

| Ratio of net investment loss to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

30

| | |

| | | Year Ended | |

| | | 4/30/11 | | 4/30/10 | | 4/30/09 | | 4/30/08 | | 4/30/07 | |

| | | $28.900 | | | $19.450 | | | $28.090 | | | $27.820 | | | $27.820 | | |

| | |

| | |

| | | (0.063 | ) | | (0.150 | ) | | 0.010 | | | (0.048 | ) | | (0.128 | ) | |

| | | 9.233 | | | 9.600 | | | (8.650 | ) | | 0.318 | | | 0.128 | | |

| | | 9.170 | | | 9.450 | | | (8.640 | ) | | 0.270 | | | 0.000 | | |

| | |

| | | $38.070 | | | $28.900 | | | $19.450 | | | $28.090 | | | $27.820 | | |

| | |

| | | 31.73% | | | 48.59% | | | (30.76% | ) | | 0.97% | | | 0.00% | | |

| | |

| | |

| | | $119,948 | | | $53,651 | | | $45,149 | | | $26,079 | | | $35,399 | | |

| | | 1.26% | | | 1.25% | | | 1.24% | | | 1.23% | | | 1.25% | | |

| | | | | | | | | | | | | | | | | |

| | | 1.33% | | | 1.48% | | | 1.60% | | | 1.37% | | | 1.39% | | |

| | | (0.20% | ) | | (0.64% | ) | | 0.05% | | | (0.17% | ) | | (0.52% | ) | |

| | | | | | | | | | | | | | | | | |

| | | (0.27% | ) | | (0.87% | ) | | (0.31% | ) | | (0.31% | ) | | (0.66% | ) | |

| | | 41% | | | 49% | | | 66% | | | 61% | | | 51% | | |

31

| Notes to financial statements | |

| Delaware Select Growth Fund | | April 30, 2011 |

Voyageur Mutual Funds III (Trust) is organized as a Delaware statutory trust and offers two series: Delaware Large Cap Core Fund and Delaware Select Growth Fund. These financial statements and the related notes pertain to Delaware Select Growth Fund (Fund). The Trust is an open-end investment company. The Fund is considered diversified under the Investment Company Act of 1940, as amended, and offers Class A, Class B, Class C, Class R and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of up to 5.75%. Class A share purchases of $1,000,000 or more will incur a contingent deferred sales charge (CDSC) of 1% if redeemed during the first year and 0.50% during the second year, provided that Delaware Distributors, L.P. (DDLP) paid a financial advisor a commission on the purchase of those shares. Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges. Prior to June 1, 2007, Class B shares were sold with a CDSC that declined from 4% to zero depending upon the period of time the shares were held. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. Class C shares are sold with a CDSC of 1%, if redeemed during the first twelve months. Class R and Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors.

The investment objective of the Fund is to seek long-term capital appreciation, which the Fund attempts to achieve by investing primarily in equity securities of companies the manager believes have the potential for sustainable free cash flow growth.

1. Significant Accounting Policies

The following accounting policies are in accordance with U.S. generally accepted accounting principles (U.S. GAAP) and are consistently followed by the Fund.

Security Valuation — Equity securities, except those traded on the Nasdaq Stock Market, Inc. (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the New York Stock Exchange (NYSE) on the valuation date. Securities traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If on a particular day an equity security does not trade, then the mean between the bid and ask prices will be used. Securities listed on a foreign exchange are valued at the last quoted sales price on the valuation date. Short-term debt securities are valued at market value. U.S. government and agency securities are valued at the mean between the bid and ask prices. Investment company securities are valued at net asset value per share. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Fund’s Board of Trustees (Board). In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. The Fund may use fair value pricing more frequently for securities traded primarily in non-U.S. markets because, among other things, most foreign markets close well before the Fund values its securities generally as of 4:00 p.m. Eastern time. The earlier close of these foreign markets gives rise to the possibility

32

that significant events, including broad market moves, government actions or pronouncements, aftermarket trading, or news events may have occurred in the interim. To account for this, the Fund may frequently value foreign securities using fair value prices based on third-party vendor modeling tools (international fair value pricing).

Federal Income Taxes — No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years (April 30, 2008 – April 30, 2011), and has concluded that no provision for federal income tax is required in the Fund’s financial statements.

Class Accounting — Investment income, common expenses and realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Foreign Currency Transactions — Transactions denominated in foreign currencies are recorded at the prevailing exchange rates on the valuation date in accordance with the Fund’s prospectus. The value of all assets and liabilities denominated in foreign currencies is translated into U.S. dollars at the exchange rate of such currencies against the U.S. dollar daily. Transaction gains or losses resulting from changes in exchange rates during the reporting period or upon settlement of the foreign currency transaction are reported in operations for the current period. The Fund generally does not isolate that portion of realized gains and losses on investments which are due to changes in foreign exchange rates from that which are due to changes in market prices. The changes are included with the net realized and unrealized gain or loss on investments. The Fund reports certain foreign currency related transactions as components of realized gains (losses) for financial reporting purposes, whereas such components are treated as ordinary income (loss) for federal income tax purposes.

Repurchase Agreements — The Fund may invest in a pooled cash account along with other members of the Delaware Investments® Family of Funds pursuant to an exemptive order issued by the Securities and Exchange Commission. The aggregate daily balance of the pooled cash account is invested in repurchase agreements secured by obligations of the U.S government. The respective collateral is held by the Fund’s custodian bank until the maturity of the respective repurchase agreements. Each repurchase agreement is at least 102% collateralized. However, in the event of default or bankruptcy by the counterparty to the agreement, realization of the collateral may be subject to legal proceedings. At April 30, 2011, the Fund held no investments in repurchase agreements.

33

Notes to financial statements

Delaware Select Growth Fund

1. Significant Accounting Policies (continued)

Use of Estimates — The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

Other — Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Investments® Family of Funds are generally allocated amongst such funds on the basis of average net assets. Management fees and some other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Taxable non-cash dividends are recorded as dividend income. Foreign dividends are also recorded on the ex-dividend date or as soon after the ex-dividend date that the Fund is aware of such dividends, net of all non-rebatable tax withholdings. Withholding taxes on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The Fund declares and pays dividends from net investment income and distributions from net realized gain on investments, if any, annually. Dividends and distributions, if any, are recorded on the ex-dividend date. The Fund may distribute income dividends and capital gains more frequently, if necessary for tax purposes.

Subject to seeking best execution, the Fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the Fund in cash. Such commission rebates are included in realized gain on investments in the accompanying financial statements and totaled $7,522 for the year ended April 30, 2011. In general, best execution refers to many factors, including the price paid or received for a security, the commission charged, the promptness and reliability of execution, the confidentiality and placement accorded the order, and other factors affecting the overall benefit obtained by the Fund on the transaction.

The Fund may receive earnings credits from its custodian when positive cash balances are maintained, which are used to offset custody fees. There were no earnings credits for the year ended April 30, 2011.

The Fund receives earnings credits from its transfer agent when positive cash balances are maintained, which are used to offset transfer agent fees. The expense paid under this arrangement is included in dividend disbursing and transfer agent fees and expenses on the statement of operations with the corresponding expense offset shown as “expense paid indirectly.” For the year ended April 30, 2011, the Fund earned $2,692 under this agreement.

34

2. Investment Management, Administration Agreements and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays Delaware Management Company (DMC), a series of Delaware Management Business Trust and the investment manager, an annual fee which is calculated daily at the rate of 0.75% on the first $500 million of average daily net assets of the Fund, 0.70% on the next $500 million, 0.65% on the next $1.5 billion, and 0.60% on average daily net assets in excess of $2.5 billion.

Effective August 27, 2010, DMC has contractually agreed to waive that portion, if any, of its management fee and reimburse the Fund to the extent necessary to prevent total annual fund operating expenses (excluding any 12b-1 plan expenses, taxes, interest, inverse floater program expenses, short sale and dividend interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) from exceeding 1.24% of the Fund’s average daily net assets through October 24, 2011. Prior to August 27, 2010, DMC had voluntarily agreed to waive its management fees to the extent necessary to ensure that total annual expenses (excluding any 12b-1 plan expenses, taxes, interest, inverse floater program expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) did not exceed 1.25% of average daily net assets of the Fund. These waivers and reimbursements may only be terminated by agreement of the Manager and the Fund.

Delaware Service Company, Inc. (DSC), an affiliate of DMC, provides fund accounting and financial administration oversight services to the Fund. For these services, the Fund pays DSC fees based on the aggregate daily net assets of the Delaware Investments® Family of Funds at the following annual rate: 0.0050% of the first $30 billion; 0.0045% of the next $10 billion; 0.0040% of the next $10 billion; and 0.0025% of aggregate average daily net assets in excess of $50 billion. The fees payable to DSC under the service agreement described above are allocated among all Funds in the Delaware Investments® Family of Funds on a relative net asset value basis. For the year ended April 30, 2011, the Fund was charged $17,627 for these services.

DSC also provides dividend disbursing and transfer agency services. The Fund pays DSC a monthly fee based on the number of shareholder accounts for dividend disbursing and transfer agent services.

Pursuant to a distribution agreement and distribution plan, the Fund pays DDLP, the distributor and an affiliate of DMC, an annual distribution and service fee not to exceed 0.25% of the average daily net assets of the Class A shares, 1.00% of the average daily net assets of the Class B and Class C shares and 0.60% of the average daily net assets of the Class R shares. Institutional Class shares pay no distribution and service expenses. DDLP has contracted to limit the Class R shares’ 12b-1 fees through August 28, 2011 to no more than 0.50% of average daily net assets.

35

Notes to financial statements

Delaware Select Growth Fund

2. Investment Management, Administration Agreements and Other Transactions with Affiliates (continued)

At April 30, 2011, the Fund had liabilities payable to affiliates as follows:

| Investment management fee payable to DMC | $ | 299,780 |

| Dividend disbursing, transfer agent and fund accounting | | |

| oversight fees and other expenses payable to DSC | | 62,152 |

| Distribution fees payable to DDLP | | 139,451 |

| Other expenses payable to DMC and affiliates* | | 26,931 |

* DMC, as part of its administrative services, pays operating expenses on behalf of the Fund and is reimbursed on a periodic basis. Expenses include items such as printing of shareholder reports, fees for audit, legal and tax services, registration fees and trustees’ fees.

As provided in the investment management agreement, the Fund bears the cost of certain legal and tax services, including internal legal and tax services provided to the Fund by DMC and/or its affiliates’ employees. For the year ended April 30, 2011, the Fund was charged $2,869 for internal legal and tax services provided by DMC and/or its affiliates’ employees.

For the year ended April 30, 2011, DDLP earned $26,706 for commissions on sales of the Fund’s Class A shares. For the year ended April 30, 2011, DDLP received gross CDSC commissions of $0, $25,532 and $1,375 on redemption of the Fund’s Class A, Class B and Class C shares, respectively, and these commissions were entirely used to offset up-front commissions previously paid by DDLP to broker/dealers on sales of those shares.

Trustees’ fees include expenses accrued by the Fund for each Trustee’s retainer and meeting fees. Certain officers of DMC, DSC and DDLP are officers and/or Trustees of the Trust. These officers and Trustees are paid no compensation by the Fund.

3. Investments

For the year ended April 30, 2011, the Fund made purchases of $144,930,494 and sales of $150,846,903 of investment securities other than short-term investments.

At April 30, 2011, the cost of investments for federal income tax purposes was $449,874,496. At April 30, 2011, net unrealized appreciation was $130,116,648, of which $139,298,481 related to unrealized appreciation of investments and $9,181,833 related to unrealized depreciation of investments.

U.S. GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions. A three level hierarchy for fair value measurements has been established based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own

36

assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The Fund’s investment in its entirety is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three level hierarchy of inputs is summarized below.

| Level 1 | – | inputs are quoted prices in active markets for identical investments (e.g., equity securities, open-end investment companies, futures contracts, options contracts) |

| | | |

| Level 2 | – | other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs) (e.g., debt securities, government securities, swap contracts, foreign currency exchange contracts, foreign securities utilizing international fair value pricing) |

| | | |

| Level 3 | – | inputs are significant unobservable inputs (including the Fund’s own assumptions used to determine the fair value of investments) (e.g., broker-quoted securities, fair valued securities) |

The following table summarizes the valuation of the Fund’s investments by fair value hierarchy levels as of April 30, 2011:

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Common Stock | $ | 476,543,018 | | $ | — | | $ | — | | $ | 476,543,018 |

| Preferred Stock | | — | | | — | | | 10,000,073 | | | 10,000,073 |

| Short-Term Investments | | — | | | 10,816,646 | | | — | | | 10,816,646 |

| Securities Lending Collateral | | — | | | 82,631,407 | | | — | | | 82,631,407 |

| Total | $ | 476,543,018 | | $ | 93,448,053 | | $ | 10,000,073 | | $ | 579,991,144 |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | | | Securities | | | | |

| | Preferred | | Lending | | | | |

| | Stock | | Collateral | | Total |

| Balance as of 4/30/10 | $ | — | | $ | 42,011 | | | $ | 42,011 | |

| Purchases | | 10,000,073 | | | 580,728 | * | | | 10,580,801 | |

| Sales | | — | | | (79,405 | ) | | | (79,405 | ) |

| Net change in unrealized appreciation/depreciation | | — | | | (543,334 | ) | | | (543,334 | ) |

| Balance as of 4/30/11 | $ | 10,000,073 | | $ | — | | | $ | 10,000,073 | |

| Net change in unrealized appreciation/depreciation | | | | | | | | | | |

| on investments still held as of 4/30/11 | $ | — | | $ | (63,317 | ) | | $ | (63,317 | ) |

*Securities were received as part of the Fund Merger with Delaware Growth Equity Fund on October 22, 2010. See Note 7.

37

Notes to financial statements

Delaware Select Growth Fund

3. Investments (continued)

During the year ended April 30, 2011, there were no transfers between Level 1 investments, Level 2 investments or Level 3 investments that had a material impact to the Fund. This does not include transfers between Level 1 investments and Level 2 investments due to the Fund utilizing international fair value pricing during the year.

4. Dividend and Distribution Information

Income and long-term capital gain distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. Additionally, distributions from net gains on foreign currency transactions and net short-term gains on sales of investment securities are treated as ordinary income for federal income tax purposes. There were no dividends and distributions paid for the years ended April 30, 2011 and 2010.

5. Components of Net Assets on a Tax Basis

As of April 30, 2011, the components of net assets on a tax basis were as follows:

| Shares of beneficial interest | $ | 492,719,881 | |

| Post-October currency losses | | (185,549 | ) |

| *Capital loss carryforwards | | (127,019,343 | ) |

| Unrealized appreciation of investments | | | |

| and foreign currencies | | 130,116,418 | |

| Net assets | $ | 495,631,407 | |

*The amount of this loss which can be utilized in subsequent years is subject to an annual limitation in accordance with the Internal Revenue Code due to the Fund merger with Delaware Growth Equity Fund on October 22, 2010. See Note 7.

The difference between book basis and tax basis components of net assets is primarily attributable to tax deferral of losses on wash sales.

Post-October currency losses represent losses realized on foreign currency transactions from November 1, 2010 through April 30, 2011 that, in accordance with federal income tax regulations, the Fund has elected to defer and treat as having arisen in the following year.

For financial reporting purposes, capital accounts are adjusted to reflect the tax character of permanent book/tax differences. Reclassifications are primarily due to tax treatment of net operating losses, capital loss carryforward expired and gain (loss) on foreign currency transactions. Results of operations and net assets were not affected by these reclassifications. For the year ended April 30, 2011, the Fund recorded the reclassifications as follows:

| Accumulated net investment loss | $ | 1,829,808 | |

| Accumulated net realized loss | | 136,309,555 | |

| Paid-in capital | | (138,139,363 | ) |

38

For federal income tax purposes, capital loss carryforwards may be carried forward and applied against future capital gains. In 2011, $49,853,829 was utilized and $136,063,876 expired. Capital loss carryforwards remaining at April 30, 2011 will expire as follows: $18,530,411 expires in 2012, $68,111,595 expires in 2016, $32,537,385 expires in 2017 and $7,839,952 expires in 2018.

6. Capital Shares

Transactions in capital shares were as follows:

| | | Year Ended |

| | | 4/30/11 | | 4/30/10 |

| Shares sold: | | | | | | |

| Class A | | 909,753 | | | 799,379 | |

| Class B | | 9,368 | | | 9,629 | |

| Class C | | 172,362 | | | 86,267 | |

| Class R | | 75,891 | | | 10,157 | |

| Institutional Class | | 1,650,110 | | | 3,745,535 | |

| |

| Shares from merger*: | | | | | | |

| Class A | | 2,723,804 | | | — | |

| Class B | | 716,083 | | | — | |

| Class C | | 1,257,835 | | | — | |

| Class R | | 80,244 | | | — | |

| Institutional Class | | 108,401 | | | — | |

| | | 7,703,851 | | | 4,650,967 | |

| | | | | | | |

| Shares repurchased: | | | | | | |

| Class A | | (1,716,503 | ) | | (1,102,488 | ) |

| Class B | | (349,864 | ) | | (545,493 | ) |

| Class C | | (387,457 | ) | | (265,058 | ) |

| Class R | | (57,423 | ) | | (16,910 | ) |

| Institutional Class | | (464,549 | ) | | (4,210,692 | ) |

| | | (2,975,796 | ) | | (6,140,641 | ) |

| Net increase (decrease) | | 4,728,055 | | | (1,489,674 | ) |

*See Note 7

For the years ended April 30, 2011 and 2010, 169,653 Class B shares were converted to 149,782 Class A shares valued at $4,566,472 and 363,005 Class B shares were converted to 322,972 Class A shares valued at $7,518,237, respectively. The respective amounts are included in Class B redemptions and Class A subscriptions in the table above and the statements of changes in net assets.

39

Notes to financial statements

Delaware Select Growth Fund

7. Fund Merger

On October 22, 2010, the Fund acquired all of the assets of the Delaware Growth Equity Fund (Acquired Fund), an open-end investment company, in exchange for the shares of the Fund (Acquiring Fund) pursuant to a Plan and Agreement of Reorganization (Reorganization). The shareholders of the Acquired Fund received shares of the respective class of the Acquiring Fund equal to the aggregate net asset value of their share in the Acquired Fund prior to the Reorganization, as shown in the following table:

| | | Acquiring | | Acquired | | | |

| | | Fund | | Fund | | | |

| | | Shares | | Shares | | Value |

| Class A | | 2,723,804 | | 5,262,114 | | $ | 82,721,925 |

| Class B | | 716,083 | | 1,320,132 | | | 19,198,198 |

| Class C | | 1,257,835 | | 2,294,132 | | | 33,357,785 |

| Class R | | 80,244 | | 153,925 | | | 2,388,873 |

| Institutional Class | | 108,401 | | 211,333 | | | 3,408,127 |

The Reorganization was treated as a non-taxable event and, accordingly, the Acquired Fund’s basis in securities acquired reflected historical cost basis as of the date of transfer. The net assets, net unrealized appreciation and accumulated net realized loss of the Acquired Fund as of the close of business on October 22, 2010, were as follows:

| Net assets | $ | 141,074,908 | |

| Accumulated net realized loss | | (80,224,466 | ) |

| Net unrealized appreciation | | 22,458,953 | |

The net assets of the Acquiring Fund before the acquisition were $281,943,240. The net assets of the Acquiring Fund immediately following the acquisition were $423,018,148.