UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | | 811-04547 |

| | | |

| Exact name of registrant as specified in charter: | | Voyageur Mutual Funds III |

| | | |

| Address of principal executive offices: | | 2005 Market Street |

| | Philadelphia, PA 19103 |

| | | |

| Name and address of agent for service: | | David F. Connor, Esq. |

| | 2005 Market Street |

| | Philadelphia, PA 19103 |

| | | |

| Registrant’s telephone number, including area code: | | (800) 523-1918 |

| | | |

| Date of fiscal year end: | | April 30 |

| | | |

| Date of reporting period: | | April 30, 2012 |

Item 1. Reports to Stockholders

Annual report Delaware Large Cap Core Fund

April 30, 2012 U.S. core equity mutual fund |

The Fund is available only to certain residents of certain states. Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and, if available, its summary prospectus, which may be obtained by visiting www.delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and, if available, the summary prospectus carefully before investing. |

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit www.delawareinvestments.com/edelivery. |

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware Large Cap Core Fund at www.delawareinvestments.com.

Manage your investments online

- 24-hour access to your account information

- Obtain share prices

- Check your account balance and recent transactions

- Request statements or literature

- Make purchases and redemptions

Delaware Management Holdings, Inc. and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services.

Investments in Delaware Large Cap Core Fund are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including their subsidiaries or related companies (Macquarie Group), and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Fund, the repayment of capital from the Fund, or any particular rate of return.

| Table of contents | |

| Portfolio management review | 1 |

| Performance summary | 4 |

| Disclosure of Fund expenses | 8 |

| Security type/sector allocation and | |

| top 10 equity holdings | 10 |

| Statement of net assets | 12 |

| Statement of operations | 16 |

| Statements of changes in net assets | 17 |

| Financial highlights | 18 |

| Notes to financial statements | 22 |

| Report of independent registered | |

| public accounting firm | 32 |

| Other Fund information | 33 |

| Board of trustees/directors and | |

| officers addendum | 34 |

| About the organization | 44 |

Unless otherwise noted, views expressed herein are current as of April 30, 2012, and subject to change.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Fund’s distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2012 Delaware Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

| Portfolio management review |

| Delaware Large Cap Core Fund | | May 8, 2012 |

| Performance preview (for the year ended April 30, 2012) |

| Delaware Large Cap Core Fund (Class A shares) | 1-year return | | +7.04% |

| S&P 500® Index (benchmark) | 1-year return | | +4.76% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Large Cap Core Fund, please see the table on page 4.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

In a volatile year for equities, the broad U.S. stock market, as measured by the S&P 500 Index, finished the Fund’s fiscal year ended April 30, 2012, in modestly positive territory.

As the fiscal year was getting under way, however, investors might not have been expecting this outcome, given the serious macroeconomic challenges that began to develop in spring 2011:

- The sovereign debt crisis in Europe resurfaced, centered in Greece once again, and threatened to spill into more-influential European economies including Italy and Spain (and perhaps the United States and the global economy as well).

- Several lackluster economic reports renewed concerns about decelerating U.S. economic growth.

- In China, questions remained about whether the country’s economy would orchestrate a so-called “soft landing,” or whether a harder landing would have serious negative consequences for the global economy.

These conditions led to a tough start for stock prices, but by early October 2011 the stage was set for stronger performance. Improving employment reports and housing market data suggested that the U.S. economic recovery was on relatively firmer ground, while easier monetary policy became nearly universal around the world.

Perhaps most importantly from the overall perspective of investors, in late 2011 the European Central Bank implemented a plan to make loans directly to European banks, which increased the market’s confidence that a near-term banking crisis had been averted. Combined with relatively healthy U.S. corporate earnings, stock prices rebounded nicely off their previous lows and generally rose during the rest of the fiscal year. (Source: Bloomberg.)

Fund performance

For its fiscal year ended April 30, 2012, Delaware Large Cap Core Fund (Class A shares) returned +7.04% at net asset value and +0.89% at maximum offer price (both figures reflect all distributions reinvested). In comparison, the Fund’s benchmark, the S&P 500 Index, rose 4.76% during the same period. For the complete annualized performance of Delaware Large Cap Core Fund, please see the table on page 4.

1

Portfolio management review

Delaware Large Cap Core Fund

Strength in the technology and consumer discretionary sectors

The Fund’s significant outperformance versus the benchmark index was driven primarily by stock selection in the technology sector and, to a lesser extent, the consumer discretionary sector.

Much of the technology sector’s relative outperformance came from the strong results of consumer electronics and personal computer manufacturer Apple, in which the Fund held an overweight position. The stock advanced more than 66% during the fiscal year, as Apple continued to benefit from strong revenue growth in its major product categories, especially the iPhone mobile device and the iPad tablet. Despite the company’s soaring share price, we still held the stock at the end of the Fund’s fiscal year, considering Apple attractively valued relative to its projected earnings growth. The Fund’s leading contributor in both the consumer discretionary sector and overall was retailer Macy’s. In our view, the company’s skillful business execution has allowed it to successfully increase its market share and generate favorable sales growth, which we believe has been recognized by investors.

Challenges in the energy sector

In contrast, the biggest detractor from Fund returns was stock selection in the energy sector, most notably independent energy producer Newfield Exploration. The shares struggled after earnings were pressured by declining production levels and a partial shift in the company’s exploration business from gas to oil amid historically low natural gas prices. Despite the rough year for Newfield, whose shares lost nearly half of their value, we maintained the Fund’s position in the stock, given the company’s long-term potential and inexpensive valuation compared to its peers.

Another energy sector underperformer was Hess. The global integrated energy company’s shares were hampered by news of disappointing energy production from North Dakota’s Bakken shale region. At the end of the Fund’s fiscal year, we continued to see potential in the stock and believed Hess remained positioned to see better production results in the future.

Applying our bottom-up approach

As we do in all types of market conditions, we maintained a stock-by-stock focus on companies we believed were in competitive positions and exhibited reasonable valuations, good long-term growth prospects, and effective management teams.

One area in which the Fund remained overweight during its fiscal year was the technology sector — specifically, we saw opportunity in the software industry. The Fund was also overweight in basic materials, investing in certain chemical companies that we believed could potentially benefit from low natural gas prices. Natural gas is a key raw material in chemical production, and the lower raw material costs could provide a good backdrop for earnings growth. On the other hand, the Fund remained underweight in financial stocks during its fiscal year, even as relatively low valuations in the sector prompted us to consider investment opportunities in financial companies appearing to offer, in our view, improving performance prospects at a reasonable price.

2

Elsewhere, we modestly increased the Fund’s exposure to underpriced cyclical stocks during the course of its fiscal year, as the 2011 summer selloff created an attractive entry point for many of these names. New holdings that we initiated positions in include eBay, a leading e-commerce and payments company and Dow Chemical Company, a diversified manufacturer. We sold CBS during the fiscal year as it performed relatively well and reached our price target. Management at CBS did an excellent job of exceeding expectations on revenues and earnings, while returning more cash to shareholders via buybacks and dividends. Recently, we also began looking at healthcare and consumer staples stocks, where valuations appear increasingly attractive to us relative to the broad market.

All of these changes took place at the margins of the Fund’s portfolio, and we believe the Fund’s strong performance during its fiscal year stemmed largely from the overall consistency of the sector allocations. We intend to continue our rigorous approach to stock selection, seeking to deliver competitive long-term performance.

3

| Performance summary | |

| Delaware Large Cap Core Fund | April 30, 2012 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| Fund performance1,2 | Average annual total returns through April 30, 2012 |

| 1 year | | 3 years | | 5 years | | Lifetime | |

| Class A (Est. Aug. 31, 2006) | | | | | | | | |

| Excluding sales charge | +7.04% | | +18.76% | | +0.70% | | +3.10% | |

| Including sales charge | +0.89% | | +16.46% | | -0.49% | | +2.02% | |

| Institutional Class (Est. Aug. 31, 2006) | | | | | | | | |

| Excluding sales charge | +7.04% | | +18.76% | | +0.70% | | +3.10% | |

| Including sales charge | +7.04% | | +18.76% | | +0.70% | | +3.10% | |

Class C and R shares had not commenced operations as of April 30, 2012.

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. The current expenses for each class are listed on the “Fund expense ratios” table on page 5. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of up to 5.75%, and have an annual distribution and service fee of up to 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C and R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of up to 1.00% and 0.60%, respectively, of average daily net assets, but such fees are currently subject to a voluntary waiver, which may be terminated or modified at any time. No Class C or R shares were available during the periods shown.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

4

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses from exceeding 0.95% of the Fund’s average daily net assets from Aug. 26, 2011, until the voluntary cap is discontinued. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | | Class C | | Class R | | Institutional Class | |

| Total annual operating expenses | 3.60% | | 4.35% | | 3.95% | | 3.35% | |

| (without fee waivers) | | | | | | | | |

| Net expenses | 0.95% | | 0.95% | | 0.95% | | 0.95% | |

| (including fee waivers, if any) | | | | | | | | |

| Type of waiver | Voluntary | | Voluntary | | Voluntary | | Voluntary | |

5

Performance summary

Delaware Large Cap Core Fund

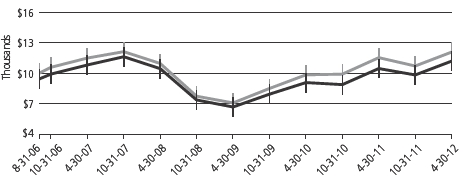

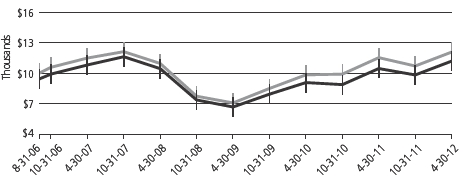

Performance of a $10,000 investment1

Average annual total returns from Aug. 31, 2006 (Fund’s inception) through April 30, 2012

| For period beginning Aug. 31, 2006, through April 30, 2012 | Starting value | | Ending value |

| S&P 500 Index | $10,000 | | | $12,093 |

| Delaware Large Cap Core Fund — Class A shares | $9,425 | | | $11,203 |

1 The “Performance of a $10,000 investment” graph assumes $10,000 invested in Class A shares of the Fund on Aug. 31, 2006, and includes the effect of a 5.75% front-end sales charge and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Current expenses are listed in the “Fund expense ratios” table on page 5. Please note additional details on pages 4 through 6.

The chart also assumes $10,000 invested in the S&P 500 Index as of Aug. 31, 2006. The S&P 500 Index measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the U.S. stock market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | Nasdaq symbols | | CUSIPs | |

| Class A | | | DDCAX | | | 246118582 | |

| Institutional Class | | | DDCIX | | | 246118558 | |

6

Disclosure of Fund expenses

For the six-month period from November 1, 2011 to April 30, 2012

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from November 1, 2011 to April 30, 2012.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect. The expenses shown in the table assume reinvestment of all dividends and distributions.

8

Delaware Large Cap Core Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 11/1/11 | | 4/30/12 | | Expense Ratio | | 11/1/11 to 4/30/12* |

| Actual Fund return | | | | | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | | $ | 1,138.70 | | | 0.95 | % | | $ | 5.05 | |

| Institutional Class | | | 1,000.00 | | | | 1,138.70 | | | 0.95 | % | | | 5.05 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | |

| Class A | | $ | 1,000.00 | | | $ | 1,020.14 | | | 0.95 | % | | $ | 4.77 | |

| Institutional Class | | | 1,000.00 | | | | 1,020.14 | | | 0.95 | % | | | 4.77 | |

*“Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period).

9

Security type/sector allocation and

top 10 equity holdings |

| Delaware Large Cap Core Fund | As of April 30, 2012 |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type/sector | Percentage of net assets |

| Common Stock | 98.69 | % |

| Basic Materials | 4.15 | % |

| Business Services | 1.03 | % |

| Capital Goods | 9.25 | % |

| Communication Services | 3.05 | % |

| Consumer Discretionary | 5.47 | % |

| Consumer Services | 0.96 | % |

| Consumer Staples | 8.98 | % |

| Credit Cyclicals | 1.52 | % |

| Energy | 11.43 | % |

| Financials | 9.40 | % |

| Healthcare | 13.54 | % |

| Media | 3.19 | % |

| Technology | 24.45 | % |

| Transportation | 2.27 | % |

| Short-Term Investments | 2.12 | % |

| Total Value of Securities | 100.81 | % |

| Liabilities Net of Receivables and Other Assets | (0.81 | %) |

| Total Net Assets | 100.00 | % |

10

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| Top 10 equity holdings | Percentage of net assets |

| Apple | 7.16 | % |

| Pfizer | 3.22 | % |

| Microsoft | 3.03 | % |

| United Technologies | 2.60 | % |

| Schlumberger | 2.58 | % |

| Merck | 2.48 | % |

| QUALCOMM | 2.44 | % |

| Chevron | 2.35 | % |

| Procter & Gamble | 2.31 | % |

| CVS Caremark | 2.14 | % |

11

| Statement of net assets |

| Delaware Large Cap Core Fund | April 30, 2012 |

| | | | Number of shares | | Value |

| Common Stock – 98.69% | | | | | |

| Basic Materials – 4.15% | | | | | |

| Allegheny Technologies | | 490 | | $ | 21,041 |

| Celanese Series A | | 520 | | | 25,198 |

| | Cliffs Natural Resources | | 260 | | | 16,188 |

| Eastman Chemical | | 410 | | | 22,128 |

| | | | | | 84,555 |

| Business Services – 1.03% | | | | | |

| Towers Watson Class A | | 320 | | | 20,928 |

| | | | | | 20,928 |

| Capital Goods – 9.25% | | | | | |

| Caterpillar | | 410 | | | 42,136 |

| Deere | | 390 | | | 32,120 |

| Fluor | | 360 | | | 20,790 |

| Honeywell International | | 670 | | | 40,642 |

| United Technologies | | 650 | | | 53,066 |

| | | | | | 188,754 |

| Communication Services – 3.05% | | | | | |

| AT&T | | 1,220 | | | 40,150 |

| Vodafone Group ADR | | 790 | | | 21,986 |

| | | | | | 62,136 |

| Consumer Discretionary – 5.47% | | | | | |

| DSW Class A | | 180 | | | 10,127 |

| Macy’s | | 1,020 | | | 41,840 |

| Nordstrom | | 550 | | | 30,723 |

| Target | | 500 | | | 28,970 |

| | | | | | 111,660 |

| Consumer Services – 0.96% | | | | | |

| McDonald’s | | 200 | | | 19,490 |

| | | | | | 19,490 |

| Consumer Staples – 8.98% | | | | | |

| CVS Caremark | | 980 | | | 43,728 |

| General Mills | | 590 | | | 22,945 |

| Jarden | | 470 | | | 19,707 |

| Kimberly-Clark | | 260 | | | 20,402 |

| Procter & Gamble | | 740 | | | 47,093 |

| Starbucks | | 510 | | | 29,264 |

| | | | | | 183,139 |

12

| | | | Number of shares | | Value |

| Common Stock (continued) | | | | | |

| Credit Cyclicals – 1.52% | | | | | |

| Ford Motor | | 2,740 | | $ | 30,907 |

| | | | | | | 30,907 |

| Energy – 11.43% | | | | | |

| Chevron | | 450 | | | 47,953 |

| Exxon Mobil | | 410 | | | 35,399 |

| Hess | | 580 | | | 30,241 |

| † | Newfield Exploration | | 340 | | | 12,206 |

| † | Noble | | 790 | | | 30,067 |

| Occidental Petroleum | | 270 | | | 24,629 |

| Schlumberger | | 710 | | | 52,640 |

| | | | | | 233,135 |

| Financials – 9.40% | | | | | |

| AFLAC | | 420 | | | 18,917 |

| BlackRock | | 100 | | | 19,158 |

| Capital One Financial | | 390 | | | 21,637 |

| † | IntercontinentalExchange | | 160 | | | 21,286 |

| JPMorgan Chase | | 860 | | | 36,963 |

| Prudential Financial | | 590 | | | 35,719 |

| Wells Fargo | | 1,140 | | | 38,110 |

| | | | | | 191,790 |

| Healthcare – 13.54% | | | | | |

| † | Celgene | | 470 | | | 34,273 |

| † | Express Scripts | | 650 | | | 36,264 |

| † | Gilead Sciences | | 470 | | | 24,445 |

| Merck | | 1,290 | | | 50,620 |

| Pfizer | | 2,864 | | | 65,671 |

| Thermo Fisher Scientific | | 440 | | | 24,486 |

| UnitedHealth Group | | 720 | | | 40,428 |

| | | | | | 276,187 |

| Media – 3.19% | | | | | |

| Comcast Special Class A | | 1,390 | | | 41,464 |

| Viacom Class B | | 510 | | | 23,659 |

| | | | | | 65,123 |

13

Statement of net assets

Delaware Large Cap Core Fund

| | | | Number of shares | | Value |

| Common Stock (continued) | | | | | | |

| Technology – 24.45% | | | | | | |

| Accenture Class A | | | 460 | | $ | 29,877 |

| † | Apple | | | 250 | | | 146,059 |

| | Avago Technologies | | | 560 | | | 19,309 |

| † | Citrix Systems | | | 140 | | | 11,986 |

| † | Cognizant Technology Solutions Class A | | | 390 | | | 28,595 |

| † | Dell | | | 950 | | | 15,552 |

| † | eBay | | | 310 | | | 12,726 |

| † | EMC | | | 1,360 | | | 38,366 |

| † | Google Class A | | | 70 | | | 42,366 |

| Intel | | | 930 | | | 26,412 |

| Microsoft | | | 1,930 | | | 61,799 |

| QUALCOMM | | | 780 | | | 49,795 |

| † | Symantec | | | 960 | | | 15,859 |

| | | | | | | 498,701 |

| Transportation – 2.27% | | | | | | |

| Hunt (J.B.) Transport | | | 350 | | | 19,366 |

| Union Pacific | | | 240 | | | 26,985 |

| | | | | | | 46,351 |

| Total Common Stock (cost $1,593,905) | | | | | | 2,012,856 |

| |

| | | Principal amount | | | |

| Short-Term Investments – 2.12% | | | | | | |

| ≠Discount Notes – 0.55% | | | | | | |

| Federal Home Loan Bank | | | | | | |

| 0.11% 5/25/12 | | $ | 8,323 | | | 8,323 |

| 0.115% 6/29/12 | | | 3,046 | | | 3,046 |

| | | | | | | 11,369 |

| Repurchase Agreements – 1.57% | | | | | | |

| Bank of America 0.17%, dated 4/30/12, to be | | | | | | |

| repurchased on 5/1/12, repurchase price $7,882 | | | | | | |

| (collateralized by U.S. government obligations | | | | | | |

| 2.25%-4.125% 1/31/15-5/15/15; market value $8,040) | | | 7,882 | | | 7,882 |

| BNP Paribas 0.17%, dated 4/30/12, to be repurchased on | | | | | | |

| 5/1/12, repurchase price $24,118 (collateralized by | | | | | | |

| U.S. government obligations 0.00%-2.375% | | | | | | |

| 7/26/12-10/31/16; market value $24,600) | | | 24,118 | | | 24,118 |

| | | | | | | 32,000 |

| Total Short-Term Investments (cost $43,369) | | | | | | 43,369 |

14

| | | | | |

| Total Value of Securities – 100.81% | | | | |

| (cost $1,637,274) | | $ | 2,056,225 | |

| Liabilities Net of Receivables | | | | |

| and Other Assets – (0.81%) | | | (16,583 | ) |

| Net Assets Applicable to 221,172 | | | | |

| Shares Outstanding – 100.00% | | $ | 2,039,642 | |

| |

| Net Asset Value – Delaware Large Cap Core Fund | | | | |

| Class A ($14,513 / 1,574 Shares) | | | | $9.22 | |

| Net Asset Value – Delaware Large Cap Core Fund | | | | |

| Institutional Class ($2,025,129 / 219,598 Shares) | | | | $9.22 | |

| | |

| Components of Net Assets at April 30, 2012: | | | | |

| Shares of beneficial interest (unlimited authorization – no par) | | $ | 1,954,416 | |

| Undistributed net investment income | | | 2,960 | |

| Accumulated net realized loss on investments | | | (336,685 | ) |

| Net unrealized appreciation on investments | | | 418,951 | |

| Total net assets | | $ | 2,039,642 | |

†Non income producing security.

≠The rate shown is the effective yield at the time of purchase.

| Net Asset Value and Offering Price Per Share – | | | | |

| Delaware Large Cap Core Fund | | | | |

| Net asset value Class A (A) | | $ | 9.22 | |

| Sales charge (5.75% of offering price) (B) | | | 0.56 | |

| Offering price | | $ | 9.78 | |

| (A) | Net asset value per share, as illustrated, is the amount which would be paid upon redemption or repurchase of shares. |

| (B) | See the current prospectus for purchases of $50,000 or more. |

ADR — American Depositary Receipt

See accompanying notes, which are an integral part of the financial statements.

15

| Statement of operations | |

| Delaware Large Cap Core Fund | Year Ended April 30, 2012 |

| Investment Income: | | | | | | | | |

| Dividends | | $ | 34,521 | | | | | |

| Interest | | | 27 | | | | | |

| Foreign tax withheld | | | (12 | ) | | $ | 34,536 | |

| |

| Expenses: | | | | | | | | |

| Reports and statements to shareholders | | | 15,565 | | | | | |

| Management fees | | | 12,008 | | | | | |

| Audit and tax | | | 10,103 | | | | | |

| Registration fees | | | 3,905 | | | | | |

| Dividend disbursing and transfer agent fees and expenses | | | 2,717 | | | | | |

| Dues and services | | | 2,209 | | | | | |

| Pricing fees | | | 1,526 | | | | | |

| Accounting and administration expenses | | | 726 | | | | | |

| Custodian fees | | | 367 | | | | | |

| Legal fees | | | 229 | | | | | |

| Trustees’ fees | | | 96 | | | | | |

| Insurance fees | | | 33 | | | | | |

| Distribution expenses – Class A | | | 33 | | | | | |

| Consulting fees | | | 28 | | | | | |

| Trustees’ expenses | | | 11 | | | | 49,556 | |

| Less fees waived | | | | | | | (31,974 | ) |

| Less waived distribution expenses – Class A | | | | | | | (33 | ) |

| Total operating expenses | | | | | | | 17,549 | |

| Net Investment Income | | | | | | | 16,987 | |

| |

| Net Realized and Unrealized Gain: | | | | | | | | |

| Net realized gain on investments | | | | | | | 74,759 | |

| Net change in unrealized appreciation of investments | | | | | | | 43,491 | |

| Net Realized and Unrealized Gain | | | | | | | 118,250 | |

| |

| Net Increase in Net Assets Resulting from Operations | | | | | | $ | 135,237 | |

See accompanying notes, which are an integral part of the financial statements.

16

Statements of changes in net assets

Delaware Large Cap Core Fund

| | Year Ended |

| | 4/30/12 | | 4/30/11 |

| Increase in Net Assets from Operations: | | | | | | | | |

| Net investment income | | $ | 16,987 | | | $ | 11,365 | |

| Net realized gain | | | 74,759 | | | | 110,803 | |

| Net change in unrealized appreciation | | | 43,491 | | | | 125,243 | |

| Net increase in net assets resulting from operations | | | 135,237 | | | | 247,411 | |

| |

| Dividends and Distributions to Shareholders from: | | | | | | | | |

| Net investment income: | | | | | | | | |

| Class A | | | (113 | ) | | | (68 | ) |

| Institutional Class | | | (15,686 | ) | | | (9,525 | ) |

| | | | (15,799 | ) | | | (9,593 | ) |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Class A | | | — | | | | 489 | |

| |

| Net asset value of shares issued upon reinvestment | | | | | | | | |

| of dividends and distributions: | | | | | | | | |

| Class A | | | 113 | | | | 68 | |

| Institutional Class | | | 15,686 | | | | 9,525 | |

| | | | 15,799 | | | | 10,082 | |

| Cost of shares repurchased: | | | | | | | | |

| Class A | | | (502 | ) | | | (18,484 | ) |

| | | | (502 | ) | | | (18,484 | ) |

| Increase (decrease) in net assets derived from capital | | | | | | | | |

| share transactions | | | 15,297 | | | | (8,402 | ) |

| Net Increase in Net Assets | | | 134,735 | | | | 229,416 | |

| |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 1,904,907 | | | | 1,675,491 | |

| End of year (including undistributed net investment income | | | | | | | | |

| of $2,960 and $1,772, respectively) | | $ | 2,039,642 | | | $ | 1,904,907 | |

See accompanying notes, which are an integral part of the financial statements.

17

Financial highlights

Delaware Large Cap Core Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain on investments |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment income to average net assets |

| Ratio of net investment income (loss) to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during all of the periods shown reflects waivers by the manager and distributor. Performance would have been lower had the waivers not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

18

| Year Ended |

| 4/30/12 | | 4/30/11 | | 4/30/10 | | 4/30/09 | | 4/30/08 | |

| $8.690 | | | $7.590 | | | $5.630 | | | $8.930 | | | $9.700 | | |

| | |

| | |

| 0.077 | | | 0.052 | | | 0.038 | | | 0.081 | | | 0.073 | | |

| 0.525 | | | 1.092 | | | 1.978 | | | (3.293 | ) | | (0.368 | ) | |

| 0.602 | | | 1.144 | | | 2.016 | | | (3.212 | ) | | (0.295 | ) | |

| | |

| | |

| (0.072 | ) | | (0.044 | ) | | (0.056 | ) | | (0.088 | ) | | (0.067 | ) | |

| | — | | | — | | | — | | | — | | | (0.408 | ) | |

| | (0.072 | ) | | (0.044 | ) | | (0.056 | ) | | (0.088 | ) | | (0.475 | ) | |

| | |

| $9.220 | | | $8.690 | | | $7.590 | | | $5.630 | | | $8.930 | | |

| | |

| 7.04% | | | 15.12% | | | 35.93% | | | (36.04% | ) | | (3.36% | ) | |

| | |

| | |

| $15 | | | $14 | | | $31 | | | $10 | | | $32 | | |

| 0.95% | | | 0.95% | | | 0.95% | | | 0.95% | | | 0.95% | | |

| | |

| 2.93% | | | 3.60% | | | 3.05% | | | 1.87% | | | 3.03% | | |

| 0.92% | | | 0.69% | | | 0.56% | | | 1.20% | | | 0.77% | | |

| | |

| (1.06% | ) | | (1.96% | ) | | (1.54% | ) | | 0.28% | | | (1.31% | ) | |

| 41% | | | 46% | | | 65% | | | 38% | | | 30% | | |

19

Financial highlights

Delaware Large Cap Core Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain on investments |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets |

| prior to fees waived and expense paid indirectly |

| Ratio of net investment income to average net assets |

| Ratio of net investment income (loss) to average net assets |

| prior to fees waived and expense paid indirectly |

| Portfolio turnover |

1 The average shares outstanding method has been applied for per share information. |

2 Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

20

| Year Ended |

| 4/30/12 | | 4/30/11 | | 4/30/10 | | 4/30/09 | | 4/30/08 | |

| $8.690 | | | $7.600 | | | $5.630 | | | $8.930 | | | $9.700 | | |

| | |

| | |

| 0.077 | | | 0.052 | | | 0.038 | | | 0.081 | | | 0.073 | | |

| 0.525 | | | 1.082 | | | 1.988 | | | (3.293 | ) | | (0.368 | ) | |

| 0.602 | | | 1.134 | | | 2.026 | | | (3.212 | ) | | (0.295 | ) | |

| | |

| | |

| (0.072 | ) | | (0.044 | ) | | (0.056 | ) | | (0.088 | ) | | (0.067 | ) | |

| �� | | | — | | | — | | | — | | | (0.408 | ) | |

| (0.072 | ) | | (0.044 | ) | | (0.056 | ) | | (0.088 | ) | | (0.475 | ) | |

| | |

| $9.220 | | | $8.690 | | | $7.600 | | | $5.630 | | | $8.930 | | |

| | |

| 7.04% | | | 15.12% | | | 36.11% | | | (36.04% | ) | | (3.36% | ) | |

| | |

| | |

| $2,025 | | | $1,891 | | | $1,644 | | | $1,418 | | | $2,219 | | |

| 0.95% | | | 0.95% | | | 0.95% | | | 0.95% | | | 0.95% | | |

| | |

| 2.68% | | | 3.35% | | | 2.80% | | | 1.62% | | | 2.78% | | |

| 0.92% | | | 0.69% | | | 0.56% | | | 1.20% | | | 0.77% | | |

| | |

| (0.81% | ) | | (1.71% | ) | | (1.29% | ) | | 0.53% | | | (1.06% | ) | |

| 41% | | | 46% | | | 65% | | | 38% | | | 30% | | |

21

| Notes to financial statements | |

| Delaware Large Cap Core Fund | | April 30, 2012 |

Voyageur Mutual Funds III (Trust) is organized as a Delaware statutory trust and offers two series: Delaware Large Cap Core Fund and Delaware Select Growth Fund. These financial statements and the related notes pertain to Delaware Large Cap Core Fund (Fund). The Trust is an open-end investment company. The Fund is considered diversified under the Investment Company Act of 1940, as amended, and offers Class A, Class C, Class R and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of up to 5.75%. Class A share purchases of $1,000,000 or more will incur a contingent deferred sales charge (CDSC) of 1% if redeemed during the first year and 0.50% during the second year, provided that Delaware Distributors, L.P. (DDLP) paid a financial advisor a commission on the purchase of those shares. Class C shares are sold with a CDSC of 1%, if redeemed during the first twelve months. Class R and Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. As of April 30, 2012, Class C and Class R have not commenced operations.

The investment objective of the Fund is to seek long-term capital appreciation.

1. Significant Accounting Policies

The following accounting policies are in accordance with U.S. generally accepted accounting principles (U.S. GAAP) and are consistently followed by the Fund.

Security Valuation — Equity securities, except those traded on the Nasdaq Stock Market, Inc. (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the New York Stock Exchange (NYSE) on the valuation date. Securities traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If on a particular day an equity security does not trade, then the mean between the bid and ask prices will be used, which approximates fair value. Short-term debt securities are valued using the evaluated mean. U.S. government and agency securities are valued at the mean between the bid and ask prices, which approximates fair value. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Fund’s Board of Trustees (Board). In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. The Fund may use fair value pricing more frequently for securities traded primarily in non-U.S. markets because, among other things, most foreign markets close well before the Fund values its securities, generally as of 4:00 p.m. Eastern time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, government actions or pronouncements, aftermarket trading, or news events may have occurred in the interim. To account for this, the Fund may frequently value foreign securities using fair value prices based on third-party vendor modeling tools (international fair value pricing).

Federal Income Taxes — No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in

22

the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years (April 30, 2009–April 30, 2012), and has concluded that no position for federal income tax is required in the Fund’s financial statements.

Class Accounting — Investment income, common expenses and realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Repurchase Agreements — The Fund may purchase certain U.S. government securities subject to the counterparty’s agreement to repurchase them at an agreed upon date and price. The counterparty will be required on a daily basis to maintain the value of the collateral subject to the agreement at not less than the repurchase price (including accrued interest). The agreements are conditioned upon the collateral being deposited under the Federal Reserve book-entry system with the Fund’s custodian or a third party sub-custodian. In the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings. All open repurchase agreements as of the date of this report were entered into on April 30, 2012.

Use of Estimates — The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the fair value of investments, the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

Other — Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Investments® Family of Funds are generally allocated amongst such funds on the basis of average net assets. Management fees and some other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. The Fund declares and pays dividends from net investment income and distributions from net realized gain on investments, if any, annually. The Fund may distribute income dividends and capital gains more frequently, if necessary for tax purposes. Dividends and distributions, if any, are recorded on the ex-dividend date.

The Fund may receive earnings credits from its custodian when positive cash balances are maintained, which are used to offset custody fees. There were no earnings credits for the year ended April 30, 2012.

23

Notes to financial statements

Delaware Large Cap Core Fund

1. Significant Accounting Policies (continued)

The Fund may receive earnings credits from its transfer agent when positive cash balances are maintained, which are used to offset transfer agent fees. There were no earnings credits for the year ended April 30, 2012.

2. Investment Management, Administration Agreements and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays Delaware Management Company (DMC), a series of Delaware Management Business Trust and the investment manager, an annual fee which is calculated daily at the rate of 0.65% on the first $500 million of average daily net assets of the Fund, 0.60% on the next $500 million, 0.55% on the next $1.5 billion and 0.50% on average daily net assets in excess of $2.5 billion.

DMC has voluntarily agreed to waive all or a portion, if any, of its management fees and reimburse the Fund to the extent necessary to ensure that total annual operating expenses (excluding any 12b-1 plan and certain other expenses) do not exceed 0.95% of the Fund’s average daily net assets until such time as the voluntary expense cap is discontinued. This waiver and reimbursement may be discontinued at any time because it is voluntary. This waiver and reimbursement applies only to expenses paid directly by the Fund.

Delaware Service Company, Inc. (DSC), an affiliate of DMC, provides fund accounting and financial administration oversight services to the Fund. For these services, the Fund pays DSC fees based on the aggregate daily net assets of the Delaware Investments® Family of Funds at the following annual rate: 0.0050% of the first $30 billion; 0.0045% of the next $10 billion; 0.0040% of the next $10 billion; and 0.0025% of aggregate average daily net assets in excess of $50 billion. The fees payable to DSC under the service agreement described above are allocated among all Funds in the Delaware Investments® Family of Funds on a relative net asset value basis. For the year ended April 30, 2012, the Fund was charged $91 for these services.

DSC also provides dividend disbursing and transfer agency services. Effective July 18, 2011, the Fund pays DSC a monthly asset-based fee for these services. Prior to July 18, 2011, the Fund paid DSC a monthly fee based on the number of shareholder accounts for dividend disbursing and transfer agent services.

Pursuant to a distribution agreement and distribution plan, the Fund pays DDLP, the distributor and an affiliate of DMC, an annual distribution and service fee not to exceed 0.25% of the average daily net assets of the Class A shares, 1.00% of the average daily net assets of Class C shares and 0.60% of the average daily net assets of Class R shares. Institutional Class shares pay no distribution and services expenses. DDLP has voluntarily agreed to waive all distribution and service fees. The distributor’s waivers may be discontinued at any time because it is voluntary.

24

At April 30, 2012, the Fund had liabilities payable to affiliates as follows:

| Investment Management fees payable to DMC | $ | 867 |

| Dividend disbursing, transfer agent and fund accounting | | |

| oversight fees and other expenses payable to DSC | | 46 |

| Other expenses payable to DMC and affiliates* | | 9 |

*DMC, as part of its administrative services, pays operating expenses on behalf of the Fund and is reimbursed on a periodic basis. Expenses include items such as printing of shareholder reports, fees for audit, legal and tax services, registration fees and trustees’ fees.

As provided in the investment management agreement, the Fund bears the cost of certain legal and tax services, including internal legal and tax services provided to the Fund by DMC and/or its affiliates’ employees. For the year ended April 30, 2012, the Fund was charged $ 55 for internal legal and tax services provided by DMC and/or its affiliates’ employees.

Trustees’ fees include expenses accrued by the Fund for each Trustee’s retainer and meeting fees. Certain officers of DMC, DSC and DDLP are officers and/or Trustees of the Trust. These officers and Trustees are paid no compensation by the Fund.

3. Investments

For the year ended April 30, 2012, the Fund made purchases of $758,993 and sales of $755,472 of investment securities other than short-term investments.

At April 30, 2012, the cost of investments for federal income tax purposes was $1,645,279. At April 30, 2012, net unrealized appreciation was $410,946, of which $447,989 related to unrealized appreciation of investments and $37,043 related to unrealized depreciation of investments.

U.S. GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions. A three level hierarchy for fair value measurements has been established based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The Fund’s investment in its entirety is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three level hierarchy of inputs is summarized below.

| Level 1 | – | inputs are quoted prices in active markets for identical investments (e.g., equity securities, open-end investment companies, futures contracts, options contracts) |

25

Notes to financial statements

Delaware Large Cap Core Fund

3. Investments (continued)

| Level 2 | – | other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs) (e.g., debt securities, government securities, swap contracts, foreign currency exchange contracts, foreign securities utilizing international fair value pricing, broker-quoted securities, fair value securities) |

| | | |

| Level 3 | – | inputs are significant unobservable inputs (including the Fund’s own assumptions used to determine the fair value of investments) (e.g., broker-quoted securities, fair valued securities) |

The following table summarizes the valuation of the Fund’s investments by fair value hierarchy levels as of April 30, 2012:

| | Level 1 | | Level 2 | | Total |

| Common Stock | | $ | 2,012,856 | | $ | — | | $ | 2,012,856 |

| Short-Term Investments | | | — | | | 43,369 | | | 43,369 |

| Total | | $ | 2,012,856 | | $ | 43,369 | | $ | 2,056,225 |

There were no unobservable inputs used to value investments at the beginning or end of the year. During the year ended April 30, 2012, there were no transfers between Level 1 investments, Level 2 investments or Level 3 investments that had a material impact to the Fund. The Fund’s policy is to recognize transfers between levels at the beginning of the reporting period.

In May 2011, the Financial Accounting Standards Board (FASB) issued ASU No. 2011-04 modifying Topic 820, Fair Value Measurements and Disclosures. ASU No. 2011-04 requires reporting entities to disclose i) the amounts of any transfers between Level 1 and Level 2, and the reasons for the transfers, ii) for Level 3 fair value measurements, iii) quantitative information about significant unobservable inputs used, iv) a description of the valuation processes used by the reporting entity and v) a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs if a change in those inputs might result in a significantly higher or lower fair value measurement. The effective date of ASU No. 2011-04 is for interim and annual periods beginning after December 15, 2011. Management is currently evaluating the implications of this guidance and the impact it will have on the financial statement amounts and footnote disclosures, if any.

26

4. Dividend and Distribution Information

Income and long-term capital gain distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. Additionally, distributions from net short-term gains on sales of investment securities are treated as ordinary income for federal income tax purposes. The tax character of dividends and distributions paid during the years ended April 30, 2012 and 2011 was as follows:

| Year Ended |

| 4/30/12 | | 4/30/11 |

| Ordinary income | $15,799 | | $9,593 |

5. Components of Net Assets on a Tax Basis

As of April 30, 2012, the components of net assets on a tax basis were as follows:

| Shares of beneficial interest | $ | 1,954,416 | |

| Undistributed ordinary income | | 2,960 | |

| Qualified late year ordinary loss deferral | | (15,013 | ) |

| Capital loss carryforwards | | (313,667 | ) |

| Unrealized appreciation | | 410,946 | |

| Net assets | $ | 2,039,642 | |

The difference between book basis and tax basis components of net assets is primarily attributable to tax deferral of losses on wash sales.

For federal income tax purposes, capital loss carryforwards may be carried forward and applied against future capital gains. $88,528 was utilized in 2012. Capital loss carryforwards remaining at April 30, 2012, if not utilized in future years, will expire as follows: $12,264 expires in 2017 and $301,403 expires in 2018.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the Act) was enacted, which changed various technical rules governing the tax treatment of regulated investment companies. The changes are generally effective for taxable years beginning after the date of enactment. Under the Act, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after the date of enactment for an unlimited period. However, any losses incurred during those future taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years, which carry an expiration date. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital loss carryforwards will retain their character as either short-term or long-term capital losses rather than being considered all short-term as permitted under previous regulation.

27

Notes to financial statements

Delaware Large Cap Core Fund

6. Capital Shares

| | Year Ended |

| | 4/30/12 | | 4/30/11 |

| Shares sold: | | | | | | |

| Class A | | — | | | 59 | |

| |

| Shares issued upon reinvestment of dividends and distributions: | | | | | | |

| Class A | | 14 | | | 8 | |

| Institutional Class | | 1,935 | | | 1,192 | |

| | | 1,949 | | | 1,259 | |

| |

| Shares repurchased: | | | | | | |

| Class A | | (59 | ) | | (2,574 | ) |

| | | (59 | ) | | (2,574 | ) |

| |

| Net increase (decrease) | | 1,890 | | | (1,315 | ) |

As of April 30, 2012, management believes the following shareholders held of record 5% or more of the outstanding shares of each Class of the Trust. Management has no knowledge of beneficial ownership.

The Manager and its affiliates may provide the initial seed capital in connection with the creation of a Delaware Investments® product, such as the Delaware Large Cap Core Fund. To the extent that the Manager or its affiliates maintain such seed capital in a Delaware Investments product, the Manager or its affiliates may engage in a total return swap or other hedge on its investment for the sole purpose of limiting the volatility of earnings of the Manager and its corporate parents. Neither the Manager nor its affiliates seek to profit by hedging the seed-capital investments in the Delaware Investments products, and the total return swap or other hedge is not expected to have any effect on the investment performance of any Delaware Investments product.

| Fund Name | | Class | | Shareholder Name and Address | | Total Shares | | Percentage |

| Delaware Large Cap | | A | | Bruce A. Green & | | 1,189.114 | | 75.56 | % |

| Core Fund Class A | | | | Lynn H. Green JT WROS | | | | | |

| | | | Nashville TN 37221 | | | | | |

| Delaware Large Cap | | A | | Craig P. Brown | | 381.377 | | 24.23 | % |

| Core Fund Class A | | | | Ardmore PA 19003 | | | | | |

| Delaware Large Cap | | I | | Delaware Management | | 219,595.672 | | 100.00 | % |

| Core Fund Class I | | | | Holdings Corporation* | | | | | |

| | | | 2005 Market St. Fl. 9 | | | | | |

| | | | Philadelphia PA 19103-7094 | | | | | |

*Affiliated party.

28

7. Line of Credit

The Fund, along with certain other funds in the Delaware Investments® Family of Funds (Participants), was a participant in a $50,000,000 revolving line of credit to be used for temporary or emergency purposes as an additional source of liquidity to fund redemptions of investor shares. Under the agreement, the Participants were charged an annual commitment fee, which was allocated across the Participants on the basis of each Participant’s allocation of the entire facility. The Participants were permitted to borrow up to a maximum of one third of their net assets under the agreement. On August 1, 2011, the Fund, along with other Participants, entered into an amendment to the agreement for a $100,000,000 revolving line of credit. The line of credit under the agreement expired on November 15, 2011.

On November 15, 2011, the Fund, along with the other Participants, entered into an amendment to the agreement for a $125,000,000 revolving line of credit. The agreement is to be used as described above and operates in substantially the same manner as the original agreement. The agreement expires on November 13, 2012. The Fund had no amounts outstanding as of April 30, 2012, or at any time during the year then ended.

8. Securities Lending

The Fund, along with other funds in the Delaware Investments® Family of Funds, may lend its securities pursuant to a security lending agreement (Lending Agreement) with The Bank of New York Mellon (BNY Mellon). At the time a security is loaned, the borrower must post collateral equal to the required percentage of the market value of the loaned security, including any accrued interest. The required percentage is: (i) 102% with respect to U.S. securities and foreign securities that are denominated and payable in U.S. dollars; and (ii) 105% with respect to foreign securities. With respect to each loan, if on any business day the aggregate market value of securities collateral plus cash collateral held is less than the aggregate market value of the securities which are the subject of such loan, the borrower will be notified to provide additional collateral by the end of the following business day which, together with the collateral already held, will be not less than the applicable initial collateral requirements for such security loan. If the aggregate market value of securities collateral and cash collateral held with respect to a security loan exceeds the applicable initial collateral requirement, upon request of the borrower BNY Mellon must return enough collateral to the borrower by the end of the following business day to reduce the value of the remaining collateral to the applicable initial collateral requirement for such security loan. As a result of the foregoing, the value of the collateral held with respect to a loaned security may be temporarily more or less than the value of the security on loan.

Cash collateral received is generally invested in the Delaware Investments Collateral Fund No. 1 (Collective Trust) established by BNY Mellon for the purpose of investment on behalf of funds managed by DMC that participate in BNY Mellon’s securities lending program. The Collective Trust may invest in U.S. government securities and high quality corporate debt, asset-backed and other money market securities and in repurchase agreements collateralized by such securities, provided that the Collective Trust will generally have a dollar-weighted average portfolio maturity

29

Notes to financial statements

Delaware Large Cap Core Fund

8. Securities Lending (continued)

of 60 days or less. The Fund can also accept U.S. government securities and letters of credit (non-cash collateral) in connection with securities loans. In the event of default or bankruptcy by the lending agent, realization and/or retention of the collateral may be subject to legal proceedings. In the event the borrower fails to return loaned securities and the collateral received is insufficient to cover the value of the loaned securities and provided such collateral shortfall is not the result of investment losses, the lending agent has agreed to pay the amount of the shortfall to the Fund or, at the discretion of the lending agent, replace the loaned securities. The Fund continues to record dividends or interest, as applicable, on the securities loaned and is subject to changes in value of the securities loaned that may occur during the term of the loan. The Fund has the right under the Lending Agreement to recover the securities from the borrower on demand. With respect to security loans collateralized by non-cash collateral, the Fund receives loan premiums paid by the borrower. With respect to security loans collateralized by cash collateral, the earnings from the collateral investments are shared among the Fund, the security lending agent and the borrower. The Fund records security lending income net of allocations to the security lending agent and the borrower.

The Collective Trust used for the investment of cash collateral received from borrowers of securities seeks to maintain a net asset value per unit of $1.00, but there can be no assurance that it will always be able to do so. The Fund may incur investment losses as a result of investing securities lending collateral in the Collective Trust or another collateral investment pool. This could occur if an investment in a collateral investment pool defaulted or if it were necessary to liquidate assets in the collateral investment pool to meet returns on outstanding security loans at a time when the collateral investment pool’s net asset value per unit was less than $1.00. Under those circumstances, the Fund may not receive an amount from the collateral investment pool that is equal in amount to the collateral the Fund would be required to return to the borrower of the securities and the Fund would be required to make up this shortfall. During the year ended April 30, 2012, the Fund had no securities out on loan.

9. Credit and Market Risk

The Fund may invest up to 15% of its net assets in illiquid securities, which may include securities with contractual restrictions on resale, securities exempt from registration under Rule 144A of the Securities Act of 1933, as amended, and other securities which may not be readily marketable. The relative illiquidity of these securities may impair the Fund from disposing of them in a timely manner and at a fair price when it is necessary or desirable to do so. While maintaining oversight, the Fund’s Board has delegated to DMC the day-to-day functions of determining whether individual securities are liquid for purposes of the Fund’s limitation on investments in illiquid securities. Securities eligible for resale pursuant to Rule 144A, which are determined to be liquid, are not subject to the Fund’s 15% limit on investment in illiquid securities. As of April 30, 2012, there were no Rule 144A securities and no securities have been determined to be illiquid under the Fund’s Liquidity Procedures.

30

10. Contractual Obligations

The Fund enters into contracts in the normal course of business that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts. Management has reviewed the Fund’s existing contracts and expects the risk of loss to be remote.

11. Subsequent Events

Management has determined that no material events or transactions occurred subsequent to April 30, 2012 that would require recognition or disclosure in the Fund’s financial statements.

12. Tax Information (Unaudited)

The information set forth below is for the Fund’s fiscal year as required by federal income tax laws. Shareholders, however, must report distributions on a calendar year basis for income tax purposes, which may include distributions for portions of two fiscal years of a fund. Accordingly, the information needed by shareholders for income tax purposes will be sent to them in January of each year. Please consult your tax advisor for proper treatment of this information.

All designations are based on financial information available as of the date of this annual report and, accordingly are subject to change. For any and all items requiring designation, it is the intention of the Fund to designate the maximum amount permitted under the Internal Revenue Code and the regulations thereunder.

For the fiscal year ended April 30, 2012, the Fund designates distributions paid during the year as follows:

| (A) | Ordinary Income distributions (Tax Basis)* | 100 | % |

| (B) | Long-term capital gain distributions (Tax Basis) | 0 | % |

| Total distributions (Tax Basis) | 100 | % |

| (C) | Qualifying dividends1 | 100 | % |

(A) and (B) are based on a percentage of the Fund’s total distributions. (C) is based on percentage of the Fund’s ordinary income distributions.

1 Qualifying dividends represent dividends which qualify for the corporate dividends received deduction.

*For the fiscal year ended April 30, 2012, certain dividends paid by the Fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003, and as extended by Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010. The Fund intends to designate up to 100% to be taxed at a maximum rate of 15%. Complete information will be computed and reported in conjunction with your 2012 Form 1099-DIV.

31

Report of independent

registered public accounting firm

To the Board of Trustees of Voyageur Mutual Funds III Trust

and the Shareholders of Delaware Large Cap Core Fund:

In our opinion, the accompanying statement of net assets, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Delaware Large Cap Core Fund (one of a series constituting the Voyageur Mutual Funds III Trust, hereafter referred to as the “Fund”) at April 30, 2012, the results of its operations for the year then ended and the changes in its net assets and the financial highlights for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at April 30, 2012 by correspondence with the custodian and brokers, provides a reasonable basis for our opinion. The financial highlights for each of the three years in the period ended April 30, 2010 were audited by other independent accountants whose report dated June 18, 2010 expressed an unqualified opinion on those statements.

PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

June 18, 2012

32

Other Fund information

(Unaudited)

Delaware Large Cap Core Fund

Change in Independent Registered Public Accounting Firm

Due to independence matters under the Securities and Exchange Commission’s auditor independence rules relating to the January 4, 2010 acquisition of Delaware Investments (including DMC, DDLP and DSC) by Macquarie Group, Ernst & Young LLP (E&Y) has resigned as the independent registered public accounting firm for Voyageur Mutual Funds III (the Trust) effective June 28, 2010. At a meeting held on February 18, 2010, the Board of Trustees of the Trust, upon recommendation of the Audit Committee, selected PricewaterhouseCoopers LLP (PwC) to serve as the independent registered public accounting firm for the Trust for the fiscal year ending April 30, 2011. During the fiscal years ended April 30, 2010 and 2009, E&Y’s audit reports on the financial statements of the Trust did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles. In addition, there were no disagreements between the Trust and E&Y on accounting principles, financial statements disclosures or audit scope, which, if not resolved to the satisfaction of E&Y, would have caused them to make reference to the disagreement in their reports. Neither the Trust nor anyone on its behalf has consulted with PwC at any time prior to their selection with respect to the application of accounting principles to a specified transaction, either completed or proposed or the type of audit opinion that might be rendered on the Trust’s financial statements.

33

Board of trustees/directors and officers addendum

Delaware Investments® Family of Funds

A mutual fund is governed by a Board of Trustees/Directors (“Trustees”), which has oversight responsibility for the management of a fund’s business affairs. Trustees establish procedures and oversee and review the performance of the investment manager, the distributor, and others who perform services for the fund. The independent fund trustees, in particular, are advocates

| Name, Address, | | Position(s) | | Length of |

| and Birth Date | | Held with Fund(s) | | Time Served |

| Interested Trustees | | | | |

| | | | | |

| Patrick P. Coyne1 | | Chairman, President, | | Chairman and Trustee |

| 2005 Market Street | | Chief Executive Officer, | | since August 16, 2006 |

| Philadelphia, PA 19103 | | and Trustee | | |

| April 1963 | | | | President and |

| | | | | Chief Executive Officer |

| | | | | since August 1, 2006 |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

1 Patrick P. Coyne is considered to be an “Interested Trustee” because he is an executive officer of the Fund’s(s’) investment advisor.

34

for shareholder interests. Each trustee has served in that capacity since he or she was elected to or appointed to the Board of Trustees, and will continue to serve until his or her retirement or the election of a new trustee in his or her place. The following is a list of the Trustees and Officers with certain background and related information.

| Number of Portfolios in | |

| Principal Occupation(s) | Fund Complex Overseen | Other Directorships |

| During Past 5 Years | by Trustee or Officer | Held by Trustee or Officer |

| |

| |

| Patrick P. Coyne has served in | 73 | Director and Audit |

| various executive capacities | | Committee Member |

| at different times at | | Kaydon Corp. |

| Delaware Investments.2 | | |

| | Board of Governors Member |

| | Investment Company |

| | Institute (ICI) |

| |

| | Finance Committee Member |

| | St. John Vianney Roman |

| | Catholic Church |

| |

| | Board of Trustees |

| | Agnes Irwin School |

| |

| | Member of Investment |

| | Committee |

| | Cradle of Liberty Council, |

| | BSA |

| | (2007–2010) |

| | |

| | |

| | |

2 Delaware Investments is the marketing name for Delaware Management Holdings, Inc. and its subsidiaries, including the Fund’s(s’) investment advisor, principal underwriter, and its transfer agent.

35

Board of trustees/directors and officers addendum

Delaware Investments® Family of Funds

| Name, Address, | | Position(s) | | Length of |

| and Birth Date | | Held with Fund(s) | | Time Served |

| Independent Trustees | | | | |

| | | | | |

| Thomas L. Bennett | | Trustee | | Since March 2005 |

| 2005 Market Street | | | | |

| Philadelphia, PA 19103 | | | | |

| October 1947 | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| John A. Fry | | Trustee | | Since January 2001 |

| 2005 Market Street | | | | |

| Philadelphia, PA 19103 | | | | |

| May 1960 | | | | |

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Anthony D. Knerr | | Trustee | | Since April 1990 |

| 2005 Market Street | | | | |

| Philadelphia, PA 19103 | | | | |

| December 1938 | | | | |

| |

| Lucinda S. Landreth | | Trustee | | Since March 2005 |

| 2005 Market Street | | | | |

| Philadelphia, PA 19103 | | | | |

| June 1947 | | | | |

| |

36

| | Number of Portfolios in | | |

| Principal Occupation(s) | | Fund Complex Overseen | | Other Directorships |

| During Past 5 Years | | by Trustee or Officer | | Held by Trustee or Officer |

| |

| |

| Private Investor | | 73 | | Chairman of Investment |

| (March 2004–Present) | | | | Committee |

| | | | Pennsylvania Academy of |

| Investment Manager | | | | Fine Arts |

| Morgan Stanley & Co. | | | | |

| (January 1984–March 2004) | | | | Investment Committee and |

| | | | Governance Committee |

| | | | Member |

| | | | Pennsylvania Horticultural |

| | | | Society |

| |

| | | | Director |

| | | | Bryn Mawr Bank Corp. (BMTC) |

| | | | (2007–2011) |

| |

| President | | 73 | | Board of Governors Member — |

| Drexel University | | | | NASDAQ OMX PHLX LLC |

| (August 2010–Present) | | | | |

| | | | Director and Audit |

| President | | | | Committee Member |

| Franklin & Marshall College | | | | Community Health Systems |

| (July 2002–July 2010) | | | | |

| | | | Director — U.S. SQUASH |

| |

| | | | Director — Ecore |

| | | | International |

| | | | (2009–2010) |

| |

| | | | Director — Allied |