UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

One Financial Center, Boston, Massachusetts | | 02111 |

(Address of principal executive offices) | | (Zip code) |

|

James R. Bordewick, Jr., Esq. Columbia Management Advisors, LLC One Financial Center Boston, MA 02111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-617-426-3750 | |

|

Date of fiscal year end: | August 31 | |

|

Date of reporting period: | August 31, 2009 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Management®

Annual Report

August 31, 2009

Columbia Funds

g Columbia International Stock Fund

g Columbia Mid Cap Growth Fund

g Columbia Small Cap Growth Fund I

g Columbia Technology Fund

g Columbia Balanced Fund

g Columbia Oregon Intermediate Municipal Bond Fund

g Columbia Conservative High Yield Fund

| NOT FDIC INSURED | | May Lose Value | |

|

| NOT BANK ISSUED | | No Bank Guarantee | |

|

Table of Contents

| Economic Update | | | 1 | | |

|

| Columbia International Stock Fund | | | 3 | | |

|

| Columbia Mid Cap Growth Fund | | | 8 | | |

|

| Columbia Small Cap Growth Fund I | | | 13 | | |

|

| Columbia Technology Fund | | | 18 | | |

|

| Columbia Balanced Fund | | | 23 | | |

|

Columbia Oregon Intermediate

Municipal Bond Fund | | | 28 | | |

|

Columbia Conservative

High Yield Fund | | | 33 | | |

|

| Financial Statements | | | | | |

|

| Investment Portfolios | | | 38 | | |

|

Statements of Assets and

Liabilities | | | 82 | | |

|

| Statements of Operations | | | 86 | | |

|

Statements of Changes in

Net Assets | | | 90 | | |

|

| Financial Highlights | | | 101 | | |

|

| Notes to Financial Statements | | | 135 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 155 | | |

|

| Federal Income Tax Information | | | 156 | | |

|

| Fund Governance | | | 157 | | |

|

Important Information About

This Report | | | 161 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholder:

We are pleased to provide this shareholder report detailing your fund's performance, portfolio holdings and financial statements. We hope this information is helpful in monitoring your investments as we work through these challenging economic times. We recognize that you have entrusted us with your money and want you to know that our professional investment teams work to interpret the latest economic and market trends with the goal of optimizing portfolio construction for our clients.

The first half of 2009 was defined by extremes. The multiyear lows we witnessed in the early months gave way to a stunning rally for the U.S. financial markets in the spring. A global market rebound may be underway, thanks to the massive fiscal and aggressive monetary policies of governments around the world. As of the June 30 market close, the S&P 500® Index1 was trading at nearly 16.6 times its 2009 Wall Street consensus earnings estimates with a sharp increase of nearly 36% since March 9. More mixed economic news has yet to provide the all-clear signal for investors, although economic activity has started to firm up. We believe this challenging economic environment makes it even more important to work with professional money managers while continuing to invest for l ife events like retirement, college planning, home improvements and career changes.

Retirement income planning has become an increasingly significant focus in the lives of millions of Americans. Recent economic conditions make it even more important to manage short-term obligations such as mortgages, monthly bills and credit card debt while also taking the steps necessary to prepare for or maximize retirement benefits. Better nutrition and medical services can result in U.S. citizens living longer, healthier lives. This means the risk of outliving one's assets in retirement is very real without proper planning. Financial security and retirement planning is an ongoing process that requires active management of your savings, investments and risks. We encourage you to review your retirement plan regularly so you'll be better able to meet your retirement needs in the future.

We recognize that economic uncertainty creates great challenges for many investors. Our professional investment teams work diligently to help investors navigate through difficult markets. Thank you for your business and for the opportunity to work together towards your investment goals.

Sincerely,

J. Kevin Connaughton

President, Columbia Funds

On September 29, 2009, Bank of America Corporation entered into an agreement to sell a portion of the asset management business of Columbia Management Group, LLC. Please see Note 13 of the Notes to Financial Statements for additional information.

Past performance is no guarantee of future results.

1The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Economic Update – Columbia Funds

During the 12-month period that began September 1, 2008 and ended August 31, 2009, the U.S. economy faced the worst financial crisis since the Great Depression, then steadied itself as steps taken by a new administration began to show results in the second half of the period. Economic growth, as measured by gross domestic product, contracted by more than 6% in the second half of 2008. The decline for the first half of 2009 is expected to have been less severe, and hopes for a late 2009 recovery have been encouraged by the Federal Reserve Board (the Fed) Chairman Bernanke. The lapse from growth has resulted in the longest—and most severe—recession in nearly three decades.

The labor market shed more than six million jobs between 2008 and 2009, raising the unemployment rate to 9.7% and virtually wiping out all of the jobs gained since the last recession. Manufacturing activity slowed and consumer spending declined. The beleaguered housing market continued to lose ground as prices fell and inventories rose. However, mortgage purchase applications increased late in the period, buoyed by low interest rates and an $8,000 first-time home buyer tax credit. Late in 2008, consumer confidence, as measured by the Conference Board, plummeted to its lowest point ever. However, it has since stabilized and turned higher near the end of the period.

Troubles that began in the U.S. subprime mortgage market resulted in a meltdown within the U.S. financial sector that claimed several major institutions in 2008 and led others to seek bailouts, restructuring or both. New rigorous lending standards severely limited access to credit, further hampering economic growth. In this environment, a new administration sought to stabilize the financial system, address economic woes and introduce sweeping health care reform. Stimulus spending began to flow into the economy, raising hopes that growth would be restored in the second half of 2009. In December 2008, the Fed lowered a key short-term borrowing rate—the federal funds rate—to between zero and 0.25%—a record low. In light of protracted economic weakness, we believe the Fed is unlikely to tighten its reins on money until the economy and the labor markets stabilize.

Stocks retreated, then rebounded

Against a weakening economic backdrop, the U.S. stock market lost 18.25% for the 12-month period, as measured by the S&P 500® Index. Losses affected the stocks of companies of all sizes and investment style categories, as measured by their respective Russell indices.1 Stock markets outside the U.S. suffered losses that were nearly as substantial. The MSCI EAFE Index,2 a broad gauge of stock market performance in

1The Russell 1000 Index tracks the performance of 1,000 of the largest U.S. companies, based on market capitalization. The Russell MidCap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represents approximately 25% of the total market capitalization of the Russell 1000 Index. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

2The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index is a capitalization-weighted index that tracks the total return of common stocks in 21 developed-market countries within Europe, Australasia and the Far East.

Summary

For the 12-month period that ended August 31, 2009

g Stocks lost ground, as measured by the S&P 500® Index and the MSCI EAFE Index, but cut their losses in a rebound that began half way through the period.

| S&P Index | | MSCI Index | |

|

| |  | |

|

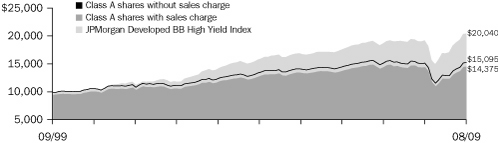

g As investors appeared to exhibit more tolerance for risk, the Barclays Capital Aggregate Bond Index delivered positive results. High-yield bonds rebounded strongly, as measured by the JPMorgan Developed BB High Yield Index.

Barclays

Aggregate Index | | JPMorgan

Index | |

|

| |  | |

|

1

Economic Update (continued) – Columbia Funds

foreign developed markets, lost 14.95% (in U.S. dollars) for the period. Emerging stock markets were also caught in the downdraft, but bounced back stronger than domestic or developed world markets in 2009. The MSCI Emerging Markets Index3 returned negative 9.95% (in U.S. dollars).

Bonds outperformed stocks

As investors sought refuge from a volatile stock market, the highest quality sectors of the U.S. bond market delivered modest gains. During the first half of the period, Treasury prices rose and yields declined sharply as the economy faltered and stock market volatility increased. As hopes for a recovery materialized in the second half of the period, yields rose and Treasuries lagged riskier segments of the bond market. The benchmark 10-year U.S. Treasury yield began the period at 3.8%, declined to 2.2% in December 2008, then rose to end the period at 3.4%. In this environment, the Barclays Capital Aggregate Bond Index4 (formerly the Lehman Brothers Aggregate Bond Index) returned 7.94%. High-yield bond prices fell sharply in 2008 as economic prospects weakened and default fears rose, then rebounded strongly in 2009. For the 12-month period, the JPMorgan Developed BB High Yield Index5 returned 6.51%.

Past performance is no guarantee of future results.

3The Morgan Stanley Capital International Emerging Markets Index (MSCI EMI) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of June 2006, the MSCI Emerging Markets Index consisted of the following 25 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

4The Barclays Capital Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment-grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

5The JPMorgan Developed BB High Yield Index is designed to mirror the investable universe of the U.S. dollar developed, BB-rated, high yield corporate debt market.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

2

Fund Profile – Columbia International Stock Fund

Summary

g For the 12-month period that ended August 31, 2009, the fund's Class A shares returned negative 16.59% without sales charge.

g The MSCI EAFE Index1 returned negative 14.95%. The MSCI All Country World ex U.S. Index GD (gross of dividends) and ND (net of dividends)2 returned negative 13.96% and negative 14.41%, respectively. The average return of the fund's peer group, the Lipper International Multi-Cap Core Funds Classification,3 returned negative 15.59%.

g A focus on stocks that are sensitive to economic changes generally accounted for the underperformance relative to the fund's benchmarks.

Portfolio Management

Fred Copper is the lead manager of the fund and has managed or co-managed the fund since October 2005 and has been associated with the advisor or its predecessors or affiliate organizations since 2005.

Jasmine (Weili) Huang has co-managed the fund since May 2006 and has been associated with the advisor or its predecessors or affiliate organizations since 2003.

Timothy R. Anderson has co-managed the fund since May 2006 and has been associated with the advisor or its predecessors or affiliate organizations since 2006.

Paul J. DiGiacomo has co-managed the fund since May 2006 and has been associated with the advisor or its predecessors or affiliate organizations since 2006.

Daisuke Nomoto has co-managed the fund since May 2006 and has been associated with the advisor or its predecessors or affiliate organizations since 2005.

1The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index is a capitalization-weighted index that tracks the total return of common stocks in 21 developed-market countries within Europe, Australasia and the Far East.

2The Morgan Stanley Capital International (MSCI) All Country (AC) World ex U.S. Index tracks global stock market performance that includes developed and emerging markets but excludes the U.S. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

3Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

1-year return as of 08/31/09

| | –16.59% | |

|

| |  | | | Class A shares

(without sales charge) | |

|

| | | | | –14.95% | |

|

| |  | | | MSCI EAFE Index | |

|

| | | | | –14.41% | |

|

| |  | | | MSCI All Country World ex

U.S. Index (ND) | |

|

| | | | | –13.96% | |

|

| |  | | | MSCI All Country World ex

U.S. Index (GD) | |

|

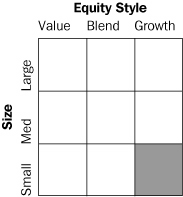

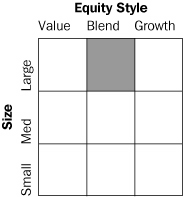

Morningstar Style BoxTM

The Morningstar Style BoxTM reveals a fund's investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend or growth). Information shown is based on the most recent data provided by Morningstar.

3

Performance Information – Columbia International Stock Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Annual operating expense ratio (%)*

| Class A | | | 1.52 | | |

| Class B | | | 2.27 | | |

| Class C | | | 2.27 | | |

| Class Y | | | 1.06 | | |

| Class Z | | | 1.27 | | |

* The annual operating expense ratio is as stated in the fund's prospectus that is current as of the date of this report and includes the expenses incurred by the investment companies in which the fund invests. Differences in expense ratios disclosed elsewhere in this report may result from including expenses incurred by the investment companies, fee waivers and expense reimbursements as well as different time periods used in calculating the ratios.

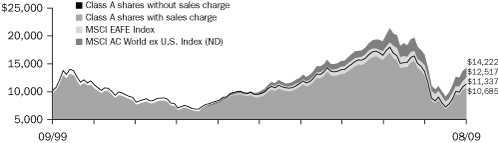

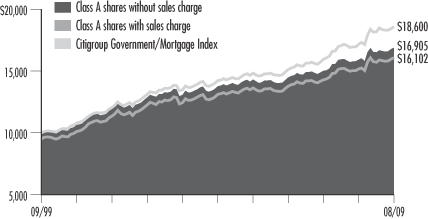

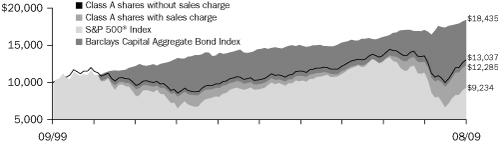

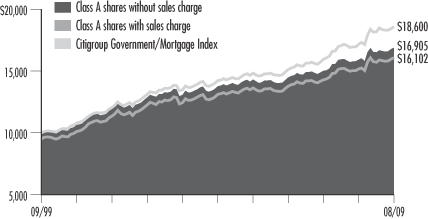

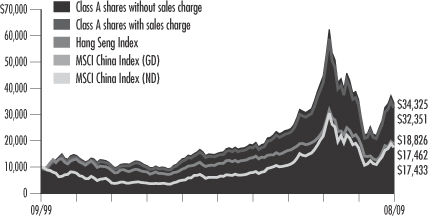

Performance of a $10,000 investment 09/01/99 – 08/31/09

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia International Stock Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index is a capitalization-weighted index that tracks the total return of common stocks in 21 developed-market countries within Europe, Australasia and the Far East. The MSCI All Country (AC) World ex U.S. Index is an index of global stock market performance that includes developed and emerging markets but excludes the U.S. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance of a $10,000 investment 09/01/99 – 08/31/09 ($)

| Sales charge | | without | | with | |

| Class A | | | 11,337 | | | | 10,685 | | |

| Class B | | | 10,744 | | | | 10,744 | | |

| Class C | | | 10,788 | | | | 10,788 | | |

| Class Y | | | 11,635 | | | | n/a | | |

| Class Z | | | 11,635 | | | | n/a | | |

Average annual total return as of 08/31/09 (%)

| Share class | | A | | B | | C | | Y | | Z | |

| Inception | | 11/01/02 | | 11/01/02 | | 10/13/03 | | 07/15/09 | | 10/01/92 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | without | |

| 1-year | | | –16.59 | | | | –21.38 | | | | –17.26 | | | | –21.20 | | | | –17.24 | | | | –18.03 | | | | –16.29 | | | | –16.29 | | |

| 5-year | | | 3.69 | | | | 2.47 | | | | 2.95 | | | | 2.65 | | | | 2.95 | | | | 2.95 | | | | 4.00 | | | | 4.00 | | |

| 10-year | | | 1.26 | | | | 0.66 | | | | 0.72 | | | | 0.72 | | | | 0.76 | | | | 0.76 | | | | 1.53 | | | | 1.53 | | |

Average annual total return as of 09/30/09 (%)

| Share class | | A | | B | | C | | Y | | Z | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | without | |

| 1-year | | | 2.31 | | | | –3.57 | | | | 1.57 | | | | –3.27 | | | | 1.56 | | | | 0.59 | | | | 2.63 | | | | 2.63 | | |

| 5-year | | | 4.04 | | | | 2.81 | | | | 3.30 | | | | 2.99 | | | | 3.30 | | | | 3.30 | | | | 4.35 | | | | 4.35 | | |

| 10-year | | | 1.40 | | | | 0.80 | | | | 0.85 | | | | 0.85 | | | | 0.89 | | | | 0.89 | | | | 1.66 | | | | 1.66 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares in the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Y and Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class Y and Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Class A, Class B, Class C and Class Y are newer classes of shares. Class A, Class B and Class Y share performance information includes the performance of Class Z shares (the oldest existing share class) for periods prior to their inception. Class C share performance information includes returns of Class B shares for the period from November 1, 2002 through October 12, 2003, and the returns of Class Z shares for periods prior thereto. These returns reflect differences in sales charges, but have not been restated to reflect any differences in expenses (such as distribution and service (Rule 12b-1) fees) between Class Z shares and the newer classes of shares. If differences in expenses had been reflected, the returns shown for periods prior to the incepton of Class A, Class B, and Class C shares would have been lower, since these classes of shares are subject to distribution and service (Rule 12b-1) fees, and the returns shown for the periods prior to the inception of Class Y shares would have been higher. Class A and Class B shares were initially offered on November 1, 2002, Class C shares were initially offered on October 13, 2003, Class Y shares were initially offered on July 15, 2009 and Class Z shares were initially offered on October 1, 1992.

4

Understanding Your Expenses – Columbia International Stock Fund

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing costs of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account generally will be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

03/01/09 – 08/31/09

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,572.62 | | | | 1,018.15 | | | | 9.08 | | | | 7.12 | | | | 1.40 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,567.32 | | | | 1,014.37 | | | | 13.91 | | | | 10.92 | | | | 2.15 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,566.92 | | | | 1,014.37 | | | | 13.91 | | | | 10.92 | | | | 2.15 | | |

| Class Y | | | 1,000.00 | | | | 1,000.00 | | | | 1,123.30 | * | | | 1,020.21 | | | | 1.38 | * | | | 5.04 | | | | 0.99 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,576.00 | | | | 1,019.41 | | | | 7.47 | | | | 5.85 | | | | 1.15 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the investment advisor and/or any of its affiliates not waived fees or reimbursed a portion of expenses for all Classes except Class Y, account value at the end of the period would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

*For the period July 15, 2009 through August 31, 2009. Class Y shares commenced operations on July 15, 2009.

5

Portfolio Managers' Report – Columbia International Stock Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Net asset value per share

as of 08/31/09 ($)

| Class A | | | 11.15 | | |

| Class B | | | 10.72 | | |

| Class C | | | 10.78 | | |

| Class Y | | | 11.30 | | |

| Class Z | | | 11.30 | | |

Distributions declared per share

09/01/08 – 08/31/09 ($)

| Class A | | | 0.42 | | |

| Class B | | | 0.42 | | |

| Class C | | | 0.42 | | |

| Class Y | | | — | | |

| Class Z | | | 0.42 | | |

For the 12-month period that ended August 31, 2009, Columbia International Stock Fund Class A shares returned negative 16.59% without sales charge. In a difficult period for the equity markets worldwide, the fund fell somewhat further than the MSCI EAFE Index, which returned negative 14.95%; the MSCI All Country World ex U.S. Index GD (gross of dividends), which returned negative 13.96% and the MSCI All Country World ex U.S. Index ND (net of dividends), which returned negative 14.41%. As of August 31, 2009 and going forward, fund performance will only be compared to the MSCI All Country World ex U.S. Index ND, which includes the impact of an estimated withholding tax on dividend reinvestment in its return. The fund's return was also lower than the negative 15.59% average return of its peer group, the Lipper International Multi-Cap Core Funds Classification. The fund's shortfall against its benchmarks occurred mostly in the first six months of the period, when it was focused on stocks that are sensitive to changes in the economy. Commodity and industrial names were particularly hard hit during this time and were among the biggest detractors from return.

The markets in transition

During the first six months of the period, from September 2008 through February 2009, we witnessed the near-collapse of the U.S. financial system, paralysis in the credit markets, a rise in unemployment and a decline in investor confidence that resulted in a sharp sell-off in international stocks. As central banks and governments took measures to stabilize the credit markets and stimulate economic growth, investors returned to the equity markets. In the last six months of the period, from early March through August, equity prices rose dramatically.

Emphasis on China, investments in Turkey aided returns

Although the Chinese market declined dramatically early in the period, it reached new highs as the year wore on, and the fund's emphasis on China was positive for return. Dongfeng Motor Group, which rose because of a huge run-up in auto sales, was a particularly noteworthy performer. We took profits and sold the stock.

Because a worldwide credit crisis started in the United States, we believed it would be the first country to recover from it. With that in mind, we built an out-of-index position in U.S. stocks. However, the U.S. market performed generally in line with the other countries in the EAFE index and provided no particular benefit to return. We added investments in Turkey, purchasing Turkiye Is Bankasi, a large financial institution, and Turk Hava Yollari A.O. (Turkish Airlines). Both delivered strong results.

Agriculture a developing theme

In many areas in the world, continuing population growth has raised concerns about the shortage of clean water and arable land and the long-term ability to produce sufficient amounts of food. To take advantage of companies that we believe are seeking solutions to these problems, we favored certain agricultural businesses. Viterra in Canada, one of the biggest grain companies in the world, is an example of an agricultural holding that benefited performance.

6

Portfolio Managers' Report (continued) – Columbia International Stock Fund

Positive results in a disappointing period

Other companies that aided results included Paddy Power, a gaming company in Ireland. UK-based Brit Insurance Holdings was helpful, as insurance companies outside the United States did not experience the steep declines of many other financial institutions. Banco Bilbao Vizcaya Argentaria, one of Spain's largest banks, also enhanced returns because of its exposure to Latin America, a region that was less affected by the credit crisis. In the defensive telecommunications sector, Bezeq Israeli Telecommunication's valuation and double-digit yield were attractive, and the company was a noteworthy performer.

Disappointments from a range of sectors

Stocks that disappointed included ING Groep, a global financial services company in the Netherlands, and OPAP, a Greek gaming company that suffered on concerns that the government may levy taxes on winnings. Both stocks remain in the portfolio. Technip, a French oil service company, was hit hard early in the period when commodity-related stocks struggled, and we sold it.

A positive investment backdrop

Until the financial system is back to full strength, the job market strengthens and inflation accelerates, we feel that central banks and governments are likely to maintain monetary policy that accommodates and stimulates growth. This situation should be constructive for stocks. Even though equities have recovered significantly from their lowest levels, we believe they continue to be attractively valued.

Portfolio holdings and characteristics are subject to change periodically and may not be representative of current holdings and characteristics. The outlook for this fund may differ from that presented for other Columbia Funds.

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

International investing may involve certain risks, including currency fluctuations, risks associated with possible differences in financial accounting standards and other monetary and political risks. Significant levels of foreign taxes, including potentially confiscatory levels of taxation and withholding taxes, may also apply to some foreign investments.

Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility.

Top 5 countries

as of 08/31/09 (%)

| Japan | | | 22.8 | | |

| United Kingdom | | | 16.6 | | |

| France | | | 10.6 | | |

| Switzerland | | | 8.1 | | |

| USA | | | 6.4 | | |

Top 10 holdings

as of 08/31/09 (%)

| Banco Santander | | | 2.2 | | |

| Total | | | 2.1 | | |

| Nestle | | | 2.0 | | |

| BHP Billiton | | | 1.8 | | |

Banco Bibao

Vizcaya Argentina | | | 1.8 | | |

| Roche Holdings | | | 1.7 | | |

| Sanofi-Aventis | | | 1.6 | | |

| Barclays | | | 1.6 | | |

| AstraZeneca | | | 1.5 | | |

| BASF | | | 1.4 | | |

Holdings discussed in this report

as of 08/31/09 (%)

| Turkiye Is Bankasi | | | 0.5 | | |

| Turk Hava Yollari A.O. | | | 0.5 | | |

| Viterra | | | 0.7 | | |

| Paddy Power | | | 0.6 | | |

| Brit Insurance Holdings | | | 0.9 | | |

Banco Bilbao

Vizcaya Argentaria | | | 1.8 | | |

Bezeq Israeli

Telecommunications | | | 0.8 | | |

| ING Groep | | | 0.9 | | |

| OPAP | | | 0.9 | | |

The fund is actively managed and the composition of its portfolio will change over time. Information provided is calculated as a percentage of net assets.

7

Fund Profile – Columbia Mid Cap Growth Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

1-year return as of 08/31/09

| | | | | –22.38% | |

|

| |  | | | Class A shares

(without sales charge) | |

|

| | | | | –20.21% | |

|

| |  | | | Russell MidCap Growth Index | |

|

| | | | | –19.92% | |

|

| |  | | | Russell MidCap Index | |

|

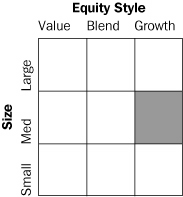

Morningstar Style BoxTM

The Morningstar Style BoxTM reveals a fund's investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend or growth). Information shown is based on the most recent data provided by Morningstar.

Summary

g For the 12-month period that ended August 31, 2009, the fund's Class A shares returned negative 22.38% without sales charge.

g The fund, its benchmarks—the Russell MidCap Growth Index and the Russell MidCap Index1—and the average return of the fund's peer group, the Lipper Mid-Cap Growth Funds Classification,2 all lost 19% or more during the period.

g The fund's emphasis on quality held back results relative to these comparative measures as stocks rebounded in 2009, led by more volatile, less consistent companies.

Portfolio Management

Wayne M. Collette has co-managed the fund since February 2006 and has been associated with the advisor or its predecessors or affiliate organizations since 2001.

George J. Myers has co-managed the fund since February 2006 and has been associated with the advisor or its predecessors or affiliate organizations since 2004.

Lawrence W. Lin has co-managed the fund since October 2007 and has been associated with the advisor or its predecessors or affiliate organizations since 2006.

Brian D. Neigut has co-managed the fund since October 2007 and has been associated with the advisor or its predecessors or affiliate organizations since 2007.

1The Russell MidCap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The stocks are also members of the Russell 1000 Growth Index. The Russell MidCap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represents approximately 25% of the total market capitalization of the Russell 1000 Index. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

2Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

8

Performance Information – Columbia Mid Cap Growth Fund

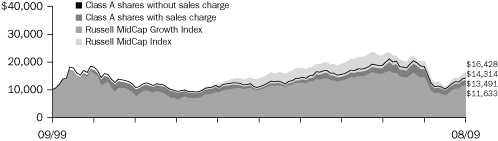

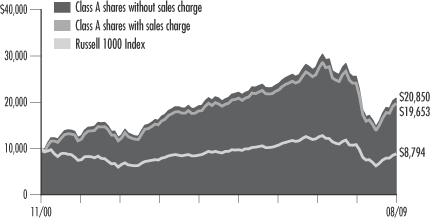

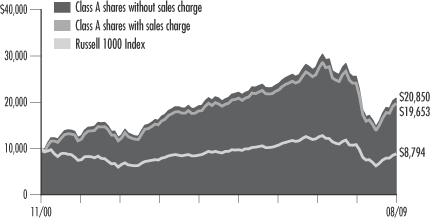

Performance of a $10,000 investment 09/01/99 – 08/31/09

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Mid Cap Growth Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. The Russell MidCap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The stocks are also members off the Russell 1000 Growth Index. The Russell MidCap Index measures the performance of the 800 smallest companies in the Russell 1000 Index. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance of a $10,000 investment 09/01/99 – 08/31/09 ($)

| Sales charge | | without | | with | |

| Class A | | | 14,314 | | | | 13,491 | | |

| Class B | | | 13,605 | | | | 13,605 | | |

| Class C | | | 13,630 | | | | 13,630 | | |

| Class R | | | 14,186 | | | | n/a | | |

| Class T | | | 14,308 | | | | 13,485 | | |

| Class Y | | | 14,621 | | | | n/a | | |

| Class Z | | | 14,621 | | | | n/a | | |

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Annual operating expense ratio (%)*

| Class A | | | 1.29 | | |

| Class B | | | 2.04 | | |

| Class C | | | 2.04 | | |

| Class R | | | 1.54 | | |

| Class T | | | 1.34 | | |

| Class Y | | | 0.87 | | |

| Class Z | | | 1.04 | | |

* The annual operating expense ratio is as stated in the fund's prospectus that is current as of the date of this report. Differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and expense reimbursements as well as different time periods used in calculating the ratios.

Average annual total return as of 08/31/09 (%)

| Share class | | A | | B | | C | | R | | T | | Y | | Z | |

| Inception | | 11/01/02 | | 11/01/02 | | 10/13/03 | | 01/23/06 | | 11/01/02 | | 07/15/09 | | 11/20/85 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | without | | with | | without | | without | |

| 1-year | | | –22.38 | | | | –26.83 | | | | –22.93 | | | | –26.64 | | | | –22.96 | | | | –23.70 | | | | –22.57 | | | | –22.41 | | | | –26.86 | | | | –22.16 | | | | –22.16 | | |

| 5-year | | | 5.67 | | | | 4.42 | | | | 4.90 | | | | 4.57 | | | | 4.89 | | | | 4.89 | | | | 5.48 | | | | 5.61 | | | | 4.37 | | | | 5.93 | | | | 5.93 | | |

| 10-year | | | 3.65 | | | | 3.04 | | | | 3.13 | | | | 3.13 | | | | 3.15 | | | | 3.15 | | | | 3.56 | | | | 3.65 | | | | 3.04 | | | | 3.87 | | | | 3.87 | | |

Average annual total return as of 09/30/09 (%)

| Share class | | A | | B | | C | | R | | T | | Y | | Z | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | without | | with | | without | | without | |

| 1-year | | | –2.04 | | | | –7.65 | | | | –2.80 | | | | –7.48 | | | | –2.79 | | | | –3.73 | | | | –2.31 | | | | –2.09 | | | | –7.74 | | | | –1.85 | | | | –1.85 | | |

| 5-year | | | 6.23 | | | | 4.98 | | | | 5.45 | | | | 5.12 | | | | 5.45 | | | | 5.45 | | | | 6.03 | | | | 6.18 | | | | 4.93 | | | | 6.48 | | | | 6.48 | | |

| 10-year | | | 4.22 | | | | 3.60 | | | | 3.68 | | | | 3.68 | | | | 3.70 | | | | 3.70 | | | | 4.12 | | | | 4.21 | | | | 3.60 | | | | 4.43 | | | | 4.43 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A and T shares and the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Y and Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class R shares are sold at net asset value with distribution (Rule 12b-1) fees. Class R, Class Y and Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Class A, Class B, Class C, Class R, Class T and Class Y are newer classes of shares. Class A, Class B, Class T and Class Y share performance information includes the performance of Class Z shares (the oldest existing share class) for periods prior to their inception. Class C share performance information includes returns of Class B shares for the period from November 1, 2002 through October 12, 2003, and the returns of Class Z shares for periods prior thereto. Class R share performance information includes returns of Class A shares for the period from November 1, 2002 through January 22, 2006, and the returns of Class Z share for periods prior thereto. These returns reflect differences in sales charges, but have not been restated to reflect any differences in expenses (such as distribution and service (Rule 12b-1) fees) between Class Z shares and the newer classes of shares. If differences in expenses had been reflected, the ret urns shown for Class A, Class B, Class R and Class T shares for periods during which Class Z share returns are included would have een lower, since the newer classes of shares are subject to distribution and service (Rule 12b-1) fees, and the returns shown for the periods prior to the inception of Class Y shares would have been higher. Class A and Class B shares were initially offered on November 1, 2002, Class C shares were initially offered on October 13, 2003, Class R shares were initially offered on January 23, 2006, Class T shares were initially offered on November 1, 2002, Class Y shares were initially offered on July 15, 2009 and Class Z shares were initially offered on November 20, 1985.

9

Understanding Your Expenses – Columbia Mid Cap Growth Fund

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account generally will be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing costs of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

03/01/09 – 08/31/09

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,396.28 | | | | 1,019.06 | | | | 7.37 | | | | 6.21 | | | | 1.22 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,391.79 | | | | 1,015.27 | | | | 11.88 | | | | 10.01 | | | | 1.97 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,391.59 | | | | 1,015.27 | | | | 11.88 | | | | 10.01 | | | | 1.97 | | |

| Class R | | | 1,000.00 | | | | 1,000.00 | | | | 1,394.72 | | | | 1,017.80 | | | | 8.87 | | | | 7.48 | | | | 1.47 | | |

| Class T | | | 1,000.00 | | | | 1,000.00 | | | | 1,396.28 | | | | 1,018.80 | | | | 7.67 | | | | 6.46 | | | | 1.27 | | |

| Class Y | | | 1,000.00 | | | | 1,000.00 | | | | 1,111.20 | * | | | 1,020.87 | | | | 1.19 | * | | | 4.38 | | | | 0.86 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,398.10 | | | | 1,020.32 | | | | 5.86 | | | | 4.94 | | | | 0.97 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

*For the period July 15, 2009 through August 31, 2009. Class Y shares commenced operations on July 15, 2009.

10

Portfolio Managers' Report – Columbia Mid Cap Growth Fund

For the 12-month period that ended August 31, 2009, Columbia Mid Cap Growth Fund Class A shares returned negative 22.38% without sales charge. The fund lost more than its benchmarks, the Russell MidCap Growth Index, which returned negative 20.21%, and the Russell MidCap Index, which returned negative 19.92% for the same period. The fund's return also was slightly lower than the negative 21.46% average return of its peer group, the Lipper Mid-Cap Growth Funds Classification. The fund's focus on higher quality helped it outperform during the severe market slump in 2008. However, the fund underperformed during this 12-month period, primarily because lower quality stocks with less earnings consistency led the market's recovery in 2009.

Technology, health care and industrials selections disappointed

A slowing economy held back returns of several information technology, health care and industrials holdings. In technology, a weak market for semiconductor chips reduced demand for semiconductor equipment producer MEMC Electronic Materials. We retained a reduced position in the stock because we think MEMC has the potential to improve in an economic upturn. However, we sold two other disappointing technology holdings—video game developers Activision Blizzard and Ubisoft Entertainment. After revenues of both companies slowed in 2008, the lack of attractive new products led to lagging demand in 2009. In health care, contract research organizations (CROs) Covance and Charles River Laboratories International underperformed amid investor concerns that a slowing economy would limit pharmaceutical research and development spending. We sold both holdings. The slump in energy development in late 2008 hurt two energy-related industria ls holdings. We kept a position in McDermott International, which produces equipment used in oil exploration and production, because we think it should do well when energy activity increases. However, we sold SunPower, which manufactures solar energy systems, because of its uncertain prospects.

Energy, financials and utility holdings outperformed

Good stock selection in the energy, financials and utilities sectors helped support relative results. Two significant investments among the fund's energy sector investments were exploration and production companies Whiting Petroleum and SandRidge Energy. Both companies featured proven reserves and strong balance sheets, which helped them outperform when energy stocks began recovering after their 2008 slump. We took profits and sold the position in Whiting but retained an investment in SandRidge. In the financials sector, two real estate-related companies showed strength after the market hit its lows in March 2009. Bargain-hunting by investors helped lift valuations of CB Richard Ellis Group, a commercial real estate marketing company, and Alexandria Real Estate Equities, a real estate investment trust (REIT) that invests principally in laboratory properties. In the utilities group, AES, a U.S.-based power company with operations in 29 countries, showed strength as emerging markets began recovering.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Net asset value per share

as of 08/31/09 ($)

| Class A | | | 17.58 | | |

| Class B | | | 16.59 | | |

| Class C | | | 16.63 | | |

| Class R | | | 17.42 | | |

| Class T | | | 17.58 | | |

| Class Y | | | 17.98 | | |

| Class Z | | | 17.98 | | |

Distributions declared per share

09/01/08 – 08/31/09 ($)

| Class A | | | 0.49 | | |

| Class B | | | 0.49 | | |

| Class C | | | 0.49 | | |

| Class R | | | 0.49 | | |

| Class T | | | 0.49 | | |

| Class Y | | | — | | |

| Class Z | | | 0.49 | | |

11

Portfolio Managers' Report (continued) – Columbia Mid Cap Growth Fund

Top 5 sectors

as of 08/31/09 (%)

| Information Technology | | | 22.3 | | |

| Consumer Discretionary | | | 17.3 | | |

| Industrials | | | 15.2 | | |

| Health Care | | | 13.6 | | |

| Financials | | | 7.8 | | |

Top 10 holdings

as of 08/31/09 (%)

| Express Scripts | | | 1.6 | | |

| Life Technologies | | | 1.4 | | |

| GameStop | | | 1.4 | | |

| Precision Castparts | | | 1.3 | | |

| Illumina | | | 1.3 | | |

| CommScope | | | 1.2 | | |

| Avon | | | 1.2 | | |

| Waddell & Reed Financial | | | 1.2 | | |

| ICON | | | 1.1 | | |

| CF Industries Holdings | | | 1.1 | | |

Holdings discussed in this report

as of 08/31/09 (%)

| MEMC Electronic Materials | | | 0.4 | | |

| McDermott International | | | 1.1 | | |

| SandRidge Energy | | | 0.6 | | |

| CB Richard Ellis Group | | | 0.7 | | |

Alexandria Real Estate

Equities | | | 0.5 | | |

| AES Corp. | | | 1.1 | | |

The fund is actively managed and the composition of its portfolio will change over time. Information provided is calculated as a percentage of net assets.

Positioned for an economic rebound

Starting in the early months of 2009, when we began to take a more positive view of the outlook for the economy and the stock market, we have gradually shifted the portfolio to place greater emphasis on economically sensitive companies. The fund's sector weights remain very close to those of the Russell MidCap Growth Index, but we have placed greater emphasis on quality companies that we believe could benefit from a global economic rebound. For example, we increased holdings among companies positioned to benefit from an increase in discretionary spending. In the industrials and materials groups, we have looked for opportunities in industries such as steel and fertilizers with exposure to growing emerging markets. We expect to continue to increase exposure incrementally to more cyclically sensitive companies. We intend to remain sensitive to stock valuations and to take care in assessing the risk/reward tradeoffs in our stock sel ection.

Portfolio holdings and characteristics are subject to change periodically and may not be representative of current holdings and characteristics. The outlook for this fund may differ from that presented for other Columbia Funds.

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

Investing in mid-cap stocks may present special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

12

Fund Profile – Columbia Small Cap Growth Fund I

Summary

g For the 12-month period that ended August 31, 2009, the fund's Class A shares returned negative 25.16% without sales charge.

g The fund, its benchmarks—the Russell 2000 Growth Index and the Russell 2000 Index1—and the average return of the fund's peer group, the Lipper Small-Cap Growth Funds Classification,2 all lost 21% or more during the 12-month period.

g The fund's focus on higher quality stocks with strong balance sheets hindered relative performance as lower quality, more volatile stocks led the market's rebound in the second half of the period.

Portfolio Management

Wayne M. Collette has co-managed the fund since February 2006 and has been associated with the advisor or its predecessors or affiliate organizations since 2001.

George J. Myers has co-managed the fund since February 2006 and has been associated with the advisor or its predecessors or affiliate organizations since 2004.

Lawrence W. Lin has co-managed the fund since October 2007 and has been associated with the advisor or its predecessors or affiliate organizations since 2006.

Brian D. Neigut has co-managed the fund since October 2007 and has been associated with the advisor or its predecessors or affiliate organizations since 2007.

1The Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

2Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

1-year return as of 08/31/09

| | –25.16% | |

|

| |  | | | Class A shares

(without sales charge) | |

|

| | | | | –22.02% | |

|

| |  | | | Russell 2000 Growth Index | |

|

| | | | | –21.29% | |

|

| |  | | | Russell 2000 Index | |

|

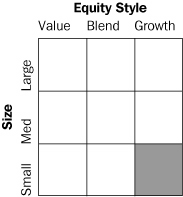

Morningstar Style BoxTM

The Morningstar Style BoxTM reveals a fund's investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend or growth). Information shown is based on the most recent data provided by Morningstar.

13

Performance Information – Columbia Small Cap Growth Fund I

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Annual operating expense ratio (%)*

| Class A | | | 1.38 | | |

| Class B | | | 2.13 | | |

| Class C | | | 2.13 | | |

| Class Y | | | 1.00 | | |

| Class Z | | | 1.13 | | |

* The annual operating expense ratio is as stated in the fund's prospectus that is current as of the date of this report. Differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and expense reimbursements as well as different time periods used in calculating the ratios.

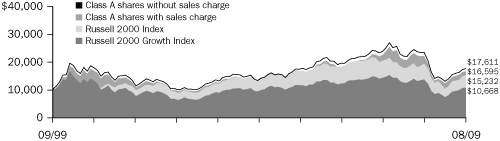

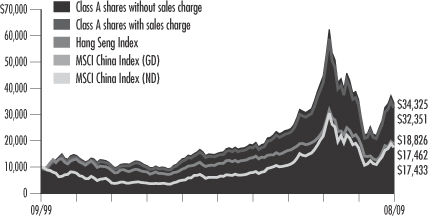

Performance of a $10,000 investment 09/01/99 – 08/31/09 ($)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Small Cap Growth Fund I during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. The Russell 2000 Growth Index measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, ta xes or other expenses of investing. Securities in the fund may not match those in an index.

Performance of a $10,000 investment 09/01/99 – 08/31/09 ($)

| Sales charge | | without | | with | |

| Class A | | | 17,611 | | | | 16,595 | | |

| Class B | | | 17,134 | | | | 17,134 | | |

| Class C | | | 17,134 | | | | 17,134 | | |

| Class Y | | | 17,780 | | | | n/a | | |

| Class Z | | | 17,780 | | | | n/a | | |

Average annual total return as of 08/31/09 (%)

| Share class | | A | | B | | C | | Y | | Z | |

| Inception | | 11/01/05 | | 11/01/05 | | 11/01/05 | | 07/15/09 | | 10/01/96 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | without | |

| 1-year | | | –25.16 | | | | –29.47 | | | | –25.70 | | | | –29.42 | | | | –25.65 | | | | –26.39 | | | | –24.97 | | | | –24.97 | | |

| 5-year | | | 5.71 | | | | 4.47 | | | | 5.13 | | | | 4.82 | | | | 5.13 | | | | 5.13 | | | | 5.91 | | | | 5.91 | | |

| 10-year | | | 5.82 | | | | 5.20 | | | | 5.53 | | | | 5.53 | | | | 5.53 | | | | 5.53 | | | | 5.92 | | | | 5.92 | | |

Average annual total return as of 09/30/09 (%)

| Share class | | A | | B | | C | | Y | | Z | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | without | |

| 1-year | | | –8.26 | | | | –13.53 | | | | –8.94 | | | | –13.50 | | | | –8.91 | | | | –9.82 | | | | –8.01 | | | | –8.01 | | |

| 5-year | | | 5.94 | | | | 4.69 | | | | 5.34 | | | | 5.03 | | | | 5.33 | | | | 5.33 | | | | 6.15 | | | | 6.15 | | |

| 10-year | | | 6.37 | | | | 5.74 | | | | 6.07 | | | | 6.07 | | | | 6.07 | | | | 6.07 | | | | 6.48 | | | | 6.48 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Y and Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class Y shares and Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Class A, Class B, Class C and Class Y are newer classes of shares. Class A, Class B and Class Y share performance information includes the performance of Class Z shares (the oldest existing share class) for periods prior to their inception. These returns reflect differences in sales charges, but have not been restated to reflect any differences in expenses (such as distribution and service (Rule 12b-1) fees) between Class Z shares and the newer classes of shares. If differences in expenses had been reflected, the returns shown for periods prior to the incepton of Class A, Class B, and Class C shares would have been lower, since these classes of shares are subject to distribution and service (Rule 12b-1) fees, and the returns shown for the periods prior to the inception of Class Y shares would have been higher. Class A, Class B and Class C shares were initially offered on November 1, 2005, Class Y shares were initially offered on July 15, 2009 and Class Z shares were initially offered on October 1, 1996.

14

Understanding Your Expenses – Columbia Small Cap Growth Fund I

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing costs of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account generally will be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

03/01/09 – 08/31/09

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,350.20 | | | | 1,018.40 | | | | 8.00 | | | | 6.87 | | | | 1.35 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,345.01 | | | | 1,014.62 | | | | 12.41 | | | | 10.66 | | | | 2.10 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,345.01 | | | | 1,014.62 | | | | 12.41 | | | | 10.66 | | | | 2.10 | | |

| Class Y | | | 1,000.00 | | | | 1,000.00 | | | | 1,093.20 | * | | | 1,020.01 | | | | 1.42 | * | | | 5.24 | | | | 1.03 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,351.41 | | | | 1,019.66 | | | | 6.52 | | | | 5.60 | | | | 1.10 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the investment advisor and/or any of its affiliates not waived fees or reimbursed a portion of expenses for all Classes except Class Y, account value at the end of the period would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

*For the period July 15, 2009 through August 31, 2009. Class Y shares commenced operations on July 15, 2009.

15

Portfolio Managers' Report – Columbia Small Cap Growth Fund I

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Net asset value per share

as of 08/31/09 ($)

| Class A | | | 20.82 | | |

| Class B | | | 20.35 | | |

| Class C | | | 20.35 | | |

| Class Y | | | 21.00 | | |

| Class Z | | | 21.00 | | |

For the 12-month period that ended August 31, 2009, Columbia Small Cap Growth Fund I Class A shares returned negative 25.16% without sales charge. The fund lagged its benchmarks, the Russell 2000 Growth Index, which returned negative 22.02%, and the Russell 2000 Index, which returned negative 21.29%, for the same period. The fund's return also was lower than the negative 21.47% average return of its peer group, the Lipper Small-Cap Growth Funds Classification. The focus on higher quality small-cap companies with strong balance sheets helped the fund outperform in a falling stock market in late 2008 and early 2009. However, the fund's quality focus led to underperformance relative to its benchmarks for the period, as more volatile stocks led the market recovery in the spring of 2009.

Health care, technology and industrials holdings detracted

Stock selection in the health care, technology and industrials groups detracted from results relative to the Russell 2000 Growth Index. In health care, ICON, a contract research organization, and CardioNet and Masimo, two companies that provide outpatient monitoring devices and services, were disappointments. ICON's stock declined when investors feared that a weakened economy would limit research and development spending by the pharmaceuticals industry. We retained a position in the stock because we believe that the corporation is well positioned competitively going forward. We also retained an investment in Masimo, but have liquidated the CardioNet position. Both CardioNet and Masimo fell amid investor concerns about their vulnerability to changing reimbursement policies from potential health care industry reforms. We maintained a reduced position in Vocus, a company that offers on-demand public relations software to corporatio ns, many of which have suffered from the effects of a weakening economy. Among the fund's industrial holdings, detractors included Hexcel and Bucyrus International. We liquidated a position in Hexcel, which manufactures composite materials used by the aerospace industry, where demand has fallen off. However, we maintained a position in Bucyrus, a manufacturer of mining equipment, where we see potential gains in an economic recovery.

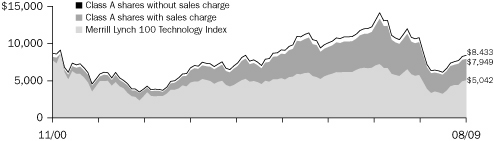

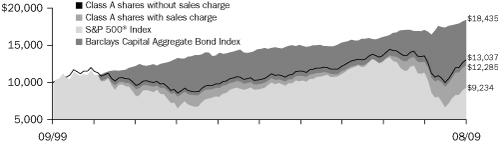

Consumer discretionary, energy and financials holdings outperformed