UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

One Financial Center, Boston, Massachusetts | | 02111 |

(Address of principal executive offices) | | (Zip code) |

|

James R. Bordewick, Jr., Esq. Columbia Management Advisors, LLC One Financial Center Boston, MA 02111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-617-426-3750 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | September 30, 2009 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Management®

Annual Report

September 30, 2009

Stock Funds

g Columbia Asset Allocation Fund

g Columbia Large Cap Growth Fund

g Columbia Disciplined Value Fund

g Columbia Contrarian Core Fund

g Columbia Small Cap Core Fund

| NOT FDIC INSURED | | May Lose Value | |

|

| NOT BANK ISSUED | | No Bank Guarantee | |

|

Table of contents

| Economic Update | | | 1 | | |

|

| Columbia Asset Allocation Fund | | | 3 | | |

|

| Columbia Large Cap Growth Fund | | | 8 | | |

|

| Columbia Disciplined Value Fund | | | 13 | | |

|

| Columbia Contrarian Core Fund | | | 18 | | |

|

| Columbia Small Cap Core Fund | | | 23 | | |

|

| Financial Statements | |

|

| Investment Portfolios | | | 28 | | |

|

Statements of Assets and

Liabilities | | | 64 | | |

|

| Statements of Operations | | | 66 | | |

|

Statements of Changes in

Net Assets | | | 68 | | |

|

| Financial Highlights | | | 75 | | |

|

| Notes to Financial Statements | | | 103 | | |

|

Report of Independent

Registered Public Accounting

Firm | | | 120 | | |

|

| Federal Income Tax Information | | | 121 | | |

|

| Fund Governance | | | 122 | | |

|

Important Information About

This Report | | | 129 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholder:

We are pleased to provide this shareholder report detailing your fund's performance, portfolio holdings and financial statements. We hope this information is helpful in monitoring your investments as we work through these challenging economic times. We recognize that you have entrusted us with your money and want you to know that our professional investment teams work to interpret the latest economic and market trends with the goal of optimizing portfolio construction for our clients.

The first half of 2009 was defined by extremes. The multiyear lows we witnessed in the early months gave way to a stunning rally for the U.S. financial markets in the spring. A global market rebound may be underway, thanks to the massive fiscal and aggressive monetary policies of governments around the world. In the third quarter, the S&P 500 Index1 was up 15.61%. We believe this challenging economic environment makes it even more important to work with professional money managers while continuing to invest for life events like retirement, college planning, home improvements and career changes.

Retirement income planning has become an increasingly significant focus in the lives of millions of Americans. Recent economic conditions make it even more important to manage short-term obligations such as mortgages, monthly bills and credit card debt while also taking the steps necessary to prepare for or maximize retirement benefits. Better nutrition and medical services can result in U.S. citizens living longer, healthier lives. This means the risk of outliving one's assets in retirement is very real without proper planning. Financial security and retirement planning is an ongoing process that requires active management of your savings, investments and risks. We encourage you to review your retirement plan regularly so you'll be better able to meet your retirement needs in the future.

We recognize that economic uncertainty creates great challenges for many investors. Our professional investment teams work diligently to help investors navigate through difficult markets. Thank you for your business and for the opportunity to work together towards your investment goals.

Sincerely,

J. Kevin Connaughton

President, Columbia Funds

On September 29, 2009, Bank of America Corporation entered into an agreement to sell a portion of the asset management business of Columbia Management Group, LLC. Please see Note 4 of the Notes to Financial Statements for additional information.

Past performance is no guarantee of future results.

1The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the funds may not match those in an index.

Economic Update – Stock Funds

During the 12-month period that began October 1, 2008 and ended September 30, 2009, the U.S. economy faced the worst financial crisis since the Great Depression, then steadied itself as steps taken by a new administration began to show results in the second half of the period. Economic growth, as measured by gross domestic product (GDP), contracted by approximately 6% between October 2008 and March 2009. The lapse from growth resulted in the longest and most severe recession in nearly three decades. However, growth turned positive in the third quarter ended September 30, 2009. The initial estimate of third quarter GDP was 3.5%.

The labor market shed more than seven million jobs between 2008 and 2009, raising the unemployment rate to 9.8% and wiping out all of the jobs gained since the last recession. Manufacturing activity slowed through most of the period, but it turned up in July and August, as did consumer spending. The beleaguered housing market showed some signs of stabilizing. Pending home sales, a leading indicator of housing activity increased for eight straight months to end the period, buoyed by low interest rates and an $8,000 first-time homebuyer tax credit. Existing home sales rose, but gave back some of their strong gains late in the period. The inventory of unsold houses also fell sharply over the period. Late in 2008, consumer confidence, as measured by the Conference Board,1 plummeted to its lowest point ever. However, it has since stabilized and turned higher near the end of the period.

Troubles that began in the U.S. subprime mortgage market resulted in a meltdown within the U.S. financial sector that claimed several major institutions in 2008 and led others to seek bailouts, restructuring or both. New rigorous lending standards severely limited access to credit, further hampering economic growth. In this environment, a new administration sought to stabilize the financial system, address economic woes and introduce sweeping health care reform. Stimulus spending began to flow into the economy, raising hopes that growth would be restored. In December 2008, the Federal Reserve Board (the Fed) lowered a key short-term borrowing rate—the federal funds rate—to between zero and 0.25%—a record low. In light of protracted economic weakness and virtually no inflation, the Fed made no further change to the federal funds rate during the period.

Stocks retreated, then rebounded

Against a weakening economic backdrop, the U.S. stock market lost 6.91% for the 12-month period, as measured by the S&P 500® Index. Losses affected the stocks of companies of all sizes and investment style categories, as measured by their respective Russell indices.2 Stock markets outside the U.S. were modestly to significantly higher than the U.S. market. The MSCI EAFE Index,3 a broad gauge of stock market performance in foreign developed markets, gained 3.23% (in U.S. dollars) for the period.

1The Conference Board is a not-for-profit global independent membership organization. It conducts research, convenes conferences, makes forecasts, assesses trends and publishes information and analyses.

2The Russell 1000 Index tracks the performance of 1,000 of the largest U.S. companies, based on market capitalization. The Russell MidCap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represents approximately 25% of the total market capitalization of the Russell 1000 Index. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

3The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index is a capitalization-weighted index that tracks the total return of common stocks in 21 developed-market countries within Europe, Australasia and the Far East.

Summary

For the 12-month period that ended September 30, 2009

g Domestic stocks lost ground, as measured by the S&P 500® Index, but cut their losses in a rebound that began half way through the period. International stocks moved higher, as measured by the MSCI EAFE Index.

| S&P Index | | MSCI Index | |

|

| |  | |

|

g As investors appeared to exhibit more tolerance for risk, the Barclays Capital Aggregate Bond Index delivered solid results. High-yield bonds rebounded strongly, as measured by the JPMorgan Developed BB High Yield Index.

Barclays

Aggregate

Index | | JPMorgan

Index | |

|

| |  | |

|

1

Economic Update (continued) – Stock Funds

Emerging stock markets were also caught in the downdraft, but bounced back stronger than domestic or developed world markets in 2009. The MSCI EMI4 returned 19.07% (in U.S. dollars).

Bonds outperformed domestic stocks

As investors sought refuge from a volatile stock market, the highest-quality sectors of the U.S. bond market delivered solid gains. During the first half of the period, Treasury prices rose and yields declined sharply as the economy faltered and stock market volatility increased. As hopes for a recovery materialized in the second half of the period, yields rose and Treasuries lagged behind riskier segments of the bond market. The benchmark 10-year U.S. Treasury yield began the period at 3.8%, declined to 2.2% in December 2008, then rose to end the period at 3.3%. In this environment, the Barclays Capital Aggregate Bond Index5 returned 10.56%. High-yield bond prices fell sharply in 2008 as economic prospects weakened and default fears rose, then rebounded strongly in 2009. For the 12-month period, the JPMorgan Developed BB High Yield Index6 returned 16.36%.

Past performance is no guarantee of future results.

4The Morgan Stanley Capital International Emerging Markets Index (MSCI EMI) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of June 2006, the MSCI Emerging Markets Index consisted of the following 25 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

5The Barclays Capital Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs, and total return performance of fixed-rate, publicly placed, dollar-denominated, and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

6The JPMorgan Developed BB High Yield Index is an unmanaged index designed to mirror the investable universe of the U.S. dollar developed, BB-rated, high yield corporate debt market.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

2

Fund Profile – Columbia Asset Allocation Fund

Summary

g For the 12-month period that ended September 30, 2009, the fund's Class A shares returned 2.63% without sales charge.

g The fund outperformed the average return of its peer group, the Lipper Mixed-Asset Target Allocation Growth Funds Classification1, which was 0.73%. Its equity benchmark, the S&P 500® Index2, returned negative 6.91%. Its fixed income benchmark, the Barclays Capital Aggregate Bond Index3, returned 10.56%.

g Both the fund's large-cap and small-cap value positions beat their benchmarks, as did the fund's investment-grade bond portfolio. We believe that exposure to emerging-markets stocks and high-yield bonds, both of which were strong performers during the rally, also helped performance relative to the peer group.

Portfolio Management

Anwiti Bahuguna, PhD, has co-managed the fund since 2009 and has been associated with the advisor or its predecessors since 2002.

Colin Moore has co-managed the fund since 2008 and has been associated with the advisor or its predecessors since 2002.

Kent M. Peterson, PhD, has co-managed the fund since 2009 and has been associated with the advisor or its predecessors since January 2006.

Marie M. Schofield has co-managed the fund since 2009 and has been associated with the advisor or its predecessors since 1990.

1Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

2The Standard & Poor's (S&P) 500® Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

3The Barclays Capital Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated, and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

1-year return as of 09/30/09

| | +2.63% | |

|

| |  | | | Class A shares

(without sales charge) | |

|

| | –6.91% | |

|

| |  | | | S&P 500® Index | |

|

| | +10.56% | |

|

| |  | | | Barclays Capital

Aggregate Bond Index | |

|

3

Performance Information – Columbia Asset Allocation Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Annual operating expense ratio (%)*

| Class A | | | 1.29 | | |

| Class B | | | 2.04 | | |

| Class C | | | 2.04 | | |

| Class T | | | 1.34 | | |

| Class Z | | | 1.04 | | |

* The annual operating expense ratio is as stated in the fund's prospectus that is current as of the date of this report. Differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and expense reimbursements as well as different time periods used in calculating the ratios.

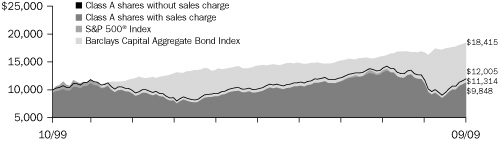

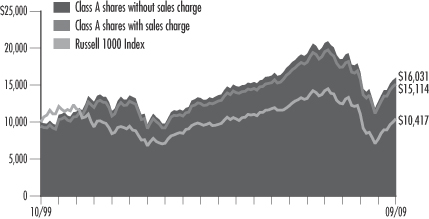

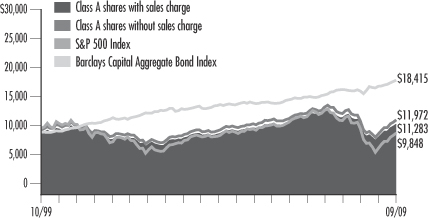

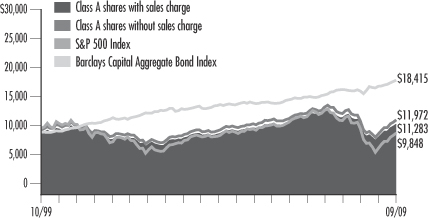

Performance of a $10,000 investment 10/01/99 – 09/30/09

| |

|

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Asset Allocation Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. The Standard & Poor's (S&P) 500® Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. The Barclays Capital Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs, and total return performance of fixed-rate, publicly placed, dollar-denominated, and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance of a $10,000 investment 10/01/99 – 09/30/09 ($)

| Sales charge | | without | | with | |

| Class A | | | 12,005 | | | | 11,314 | | |

| Class B | | | 11,155 | | | | 11,155 | | |

| Class C | | | 11,155 | | | | 11,155 | | |

| Class T | | | 11,938 | | | | 11,251 | | |

| Class Z | | | 12,331 | | | | n/a | | |

Average annual total return as of 09/30/09 (%)

| Share class | | A | | B | | C | | T | | Z | |

| Inception | | 11/01/98 | | 11/01/98 | | 11/18/02 | | 12/30/91 | | 12/30/91 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 1-year | | | 2.63 | | | | –3.29 | | | | 1.79 | | | | –3.21 | | | | 1.79 | | | | 0.79 | | | | 2.50 | | | | –3.41 | | | | 3.21 | | |

| 5-year | | | 3.24 | | | | 2.02 | | | | 2.45 | | | | 2.15 | | | | 2.45 | | | | 2.45 | | | | 3.17 | | | | 1.95 | | | | 3.57 | | |

| 10-year | | | 1.84 | | | | 1.24 | | | | 1.10 | | | | 1.10 | | | | 1.10 | | | | 1.10 | | | | 1.79 | | | | 1.19 | | | | 2.12 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A and Class T shares and the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Class A, Class B, Class C, Class T and Class Z share performance information includes returns of Prime A shares (for Class A shares), Prime B shares (for Class B and Class C shares), Retail A shares (for Class T shares) and Trust shares (for Class Z shares) of Galaxy Asset Allocation Fund, the predecessor to the Fund and a series of the Galaxy Fund (the "Predecessor Fund"), for periods prior to November 18, 2002, the date on which Class A, Class B, Class C, Class T and Class Z shares were initially offered by the Fund. These returns shown for all share classes reflect any differences in sales charges, but have not been restated to reflect any differences in expenses between the Predecessor Fund share classes and the corresponding newer share classes. If differences in expenses had been reflected, the returns shown for periods prior to November 18, 2002 would be lower for Class A, Class B and Class C shares.

4

Understanding Your Expenses – Columbia Asset Allocation Fund

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing costs of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account generally will be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

04/01/09 – 09/30/09

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,261.31 | | | | 1,019.05 | | | | 6.80 | | | | 6.07 | | | | 1.20 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,254.60 | | | | 1,015.29 | | | | 11.02 | | | | 9.85 | | | | 1.95 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,254.60 | | | | 1,015.29 | | | | 11.02 | | | | 9.85 | | | | 1.95 | | |

| Class T | | | 1,000.00 | | | | 1,000.00 | | | | 1,258.51 | | | | 1,018.80 | | | | 7.08 | | | | 6.33 | | | | 1.25 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,261.51 | | | | 1,020.31 | | | | 5.39 | | | | 4.81 | | | | 0.95 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the investment advisor and/or any of its affiliates not waived fees or reimbursed a portion of expenses, account value at the end of the period would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

5

Portfolio Managers' Report – Columbia Asset Allocation Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Net asset value per share

as of 09/30/09 ($)

| Class A | | | 12.61 | | |

| Class B | | | 12.60 | | |

| Class C | | | 12.60 | | |

| Class T | | | 12.61 | | |

| Class Z | | | 12.66 | | |

Distributions declared per share

10/01/08 – 09/30/09 ($)

| Class A | | | 0.25 | | |

| Class B | | | 0.17 | | |

| Class C | | | 0.17 | | |

| Class T | | | 0.24 | | |

| Class Z | | | 0.28 | | |

For the 12-month period that ended September 30, 2009, the fund's Class A shares returned 2.63% without sales charge. That was higher than the average return of the fund's peer group, the Lipper Mixed-Asset Target Allocation Growth Funds Classification, which was 0.73%. The fund's equity benchmark, the S&P 500® Index, returned negative 6.91%. The fund's fixed income benchmark, the Barclays Capital Aggregate Bond Index, returned 10.56%. Outperformance from investment-grade bonds, as well as small-cap value and large-cap value stocks, aided results. Investments in high-yield bonds, as well as in emerging-markets stocks, also helped performance, particularly in the second half of the period.

Turnaround by emerging-markets stocks and high-yield bonds

The investment market rout that began in the fall of 2008 continued into March, driven by deteriorating economic data, concerns over large financial company balance sheets, frozen credit markets, a weak housing market and rising unemployment. However, in the spring of 2009, stocks took off, buoyed by hopes that an economic recovery would be fueled by unprecedented fiscal and monetary stimulus. Bonds also rallied, benefiting from historically low interest rates and a growing sense of confidence among investors. Higher-risk sectors, including emerging-markets stocks and high-yield bonds, led the rebound. Despite substantial gains in the second half of the period, equities closed the fiscal year in negative territory, lagging the positive returns posted by bonds.

Strength from corporate bond sector

Over the year, we increased the fund's fixed-income allocation from roughly 40% of assets to 48%. More than one-third of assets were in investment-grade corporate bonds, which posted strong positive gains that outperformed the return of the Barclays index. Exposure to high-yield bonds was also positive, although behind the 16.36% return of the JPMorgan Global High Yield Index.1

Gained ground from large-cap and value stocks

The fund benefited from having between 30% and 40% of its assets in large-cap stocks, which were not down as much as small-cap stocks for the period. The fund's large-cap holdings were split equally between the growth and value disciplines. Within large cap, growth stocks held up much better than value stocks. The fund picked up ground from its large-cap value holdings, which were not down as much as their benchmark, the Russell 1000 Value Index.2 The portfolio's large-cap growth allocation, however, was down slightly more than the modest decline of its benchmark, the Russell 1000 Growth Index.3 We kept 10% of assets in mid- and small-cap stocks and 10% in overseas markets, with an overweight in emerging markets that proved helpful. Most of these

1The JPMorgan Global High Yield Index is designed to mirror the investable universe of the U.S. dollar global high yield corporate debt market, including domestic and international issues.

2The Russell 1000 Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values.

3The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

6

Portfolio Managers' Report (continued) – Columbia Asset Allocation Fund

positions trailed their respective benchmarks, with the exception of small-cap value, which held up better than the negative 12.61% return of the Russell 2000 Value Index.4

Strategic changes to fund allocations

As economic data began to stabilize late in the period, we decided to reduce the fund's overweights in areas that had led the rebound, namely small-cap and emerging-markets equities. Late in the period, the fund gained the ability to invest in Treasury Inflation Protected Securities (TIPS) as well as commodity-related derivative instruments, futures, exchange-traded funds (ETFs) and third-party advised mutual funds. We hope to use these less traditional asset classes to reduce portfolio risk, particularly in periods of financial turmoil. At period end, the fund had a small stake in TIPS as well as commodity ETFs, contributing to a shift in positioning from 60% equities/40% fixed income and cash early on to 52% equities/ 45% fixed-income and cash/3% commodities at period end.

Portfolio holdings and characteristics are subject to change periodically and may not be representative of current holdings and characteristics. The outlook for the fund may differ from those presented for other Columbia Funds.

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

Investments in high-yield or "junk" bonds offer the potential for higher income than investments in investment-grade bonds, but also involve a higher degree of risk. Changes in economic conditions or other circumstances may adversely affect a high-yield bond issuer's ability to make timely principal and interest payments. High-yield bonds issued by foreign entities have greater potential risks, including less regulation, currency fluctuations, economic instability and political developments.

The fund may be subject to the same types of risks associated with direct ownership of real estate, including the decline of property values due to general, local and regional economic conditions.

International investing may involve certain risks, including currency fluctuations, risks associated with possible differences in financial accounting standards and other monetary and political risks. Significant levels of foreign taxes, including potentially confiscatory levels of taxation and withholding taxes, may also apply to some foreign investments.

4The Russell 2000 Value Index tracks the performance of those Russell 2000 Index companies with lower price-to-book ratios and lower forecasted growth values.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Top 5 equity sectors

as of 09/30/09 (%)

| Financials | | | 9.4 | | |

| Information Technology | | | 8.7 | | |

| Industrials | | | 5.7 | | |

| Health Care | | | 5.7 | | |

| Consumer Discretionary | | | 5.7 | | |

Top 10 equity holdings

as of 09/30/09 (%)

| JPMorgan Chase & Co. | | | 0.9 | | |

| Microsoft Corp. | | | 0.6 | | |

| Exxon Mobil Corp. | | | 0.6 | | |

| International Business | |

| Machines | | | 0.6 | | |

| Goldman Sachs Group | | | 0.6 | | |

| Philip Morris International | | | 0.6 | | |

| Apple | | | 0.5 | | |

| EMC | | | 0.5 | | |

| United Technologies | | | 0.5 | | |

| J.C. Penney | | | 0.5 | | |

Portfolio structure

as of 09/30/09 (%)

| Common Stocks | | | 51.4 | | |

Corporate Fixed-Income

Bonds & Notes | | | 13.5 | | |

| Mortgage-Backed Securities | | | 11.9 | | |

Government & Agency

Obligations | | | 7.7 | | |

Commercial Mortgage-

Backed Securities | | | 4.1 | | |

Collateralized Mortgage

Obligations | | | 2.8 | | |

| Commodities | | | 2.5 | | |

| Asset-Backed Securities | | | 1.4 | | |

| Convertible Preferred Stock | | | 0.2 | | |

| Investment Company | | | 0.1 | | |

| Preferred Stock | | | 0.1 | | |

| Convertible Bond | | | 0.0 | * | |

| Rights | | | 0.0 | * | |

| Purchased Put Options | | | 0.0 | * | |

Cash Equivalent, Net Other

Assets & Liabilities | | | 4.3 | | |

* Rounds to less than 0.1%

The fund is actively managed and the composition of its portfolio will change over time. Information provided is calculated as a percentage of net assets.

7

Fund Profile – Columbia Large Cap Growth Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

1-year return as of 09/30/09

| | –3.97% | |

|

| |  | | | Class A shares

(without sales charge) | |

|

| | –1.85% | |

|

| |  | | | Russell 1000 Growth Index | |

|

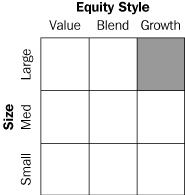

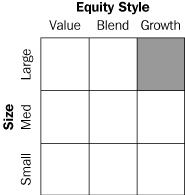

Morningstar Style BoxTM

The Morningstar Style BoxTM reveals a fund's investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend or growth). Information shown is based on the most recent data provided by Morningstar.

Summary

g For the 12-month period that ended September 30, 2009, the fund's Class A shares returned negative 3.97% without sales charge.

g The fund underperformed its benchmark, the Russell 1000 Growth Index1, and the average return of its peer group, the Lipper Large-Cap Growth Funds Classification.2

g Stock selection in the energy, telecommunications and consumer discretionary sectors detracted from relative performance. Stock selection in utilities, information technology and financials contributed positively to relative returns.

Portfolio Management

John T. Wilson, lead manager, has co-managed the fund since August 2005 and has been associated with the advisor or its predecessors since July 2005.

Roger R. Sullivan has co-managed the fund since June 2005 and has been associated with the advisor or its predecessors since January 2005.

1The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

2Lipper, Inc. a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

8

Performance Information – Columbia Large Cap Growth Fund

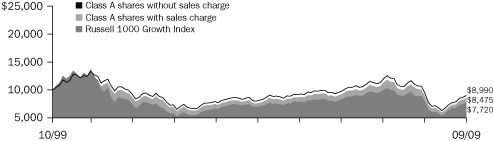

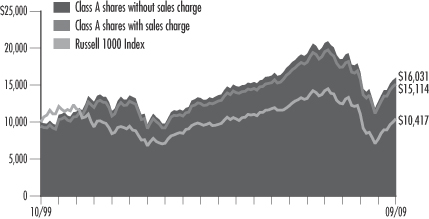

Performance of a $10,000 investment 10/01/99 – 09/30/09

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Large Cap Growth Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance of a $10,000 investment 10/01/99 – 09/30/09 ($)

| Sales charge | | without | | with | |

| Class A | | | 8,990 | | | | 8,475 | | |

| Class B | | | 8,313 | | | | 8,313 | | |

| Class C | | | 8,322 | | | | 8,322 | | |

| Class E | | | 8,960 | | | | 8,557 | | |

| Class F | | | 8,313 | | | | 8,313 | | |

| Class T | | | 8,888 | | | | 8,376 | | |

| Class Y | | | 9,201 | | | | n/a | | |

| Class Z | | | 9,201 | | | | n/a | | |

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Annual operating expense ratio (%)*

| Class A | | | 1.18 | | |

| Class B | | | 1.93 | | |

| Class C | | | 1.93 | | |

| Class E | | | 1.28 | | |

| Class F | | | 1.93 | | |

| Class T | | | 1.23 | | |

| Class Y | | | 0.68 | | |

| Class Z | | | 0.93 | | |

* The annual operating expense ratio is as stated in the fund's prospectus that is current as of the date of this report and includes the expenses incurred by the investment companies in which the fund invests. Differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and expense reimbursements as well as different time periods used in calculating the ratios.

Average annual total return as of 09/30/09 (%)

| Share class | | A | | B | | C | | E | | F | | T | | Y | | Z | |

| Inception | | 11/01/98 | | 11/01/98 | | 11/18/02 | | 09/22/06 | | 09/22/06 | | 12/14/90 | | 07/15/09 | | 12/14/90 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | | with | | without | | without | |

| 1-year | | | –3.97 | | | | –9.47 | | | | –4.68 | | | | –9.45 | | | | –4.68 | | | | –5.63 | | | | –4.09 | | | | –8.40 | | | | –4.69 | | | | –9.45 | | | | –4.02 | | | | –9.51 | | | | –3.71 | | | | –3.71 | | |

| 5-year | | | 2.01 | | | | 0.81 | | | | 1.26 | | | | 0.89 | | | | 1.24 | | | | 1.24 | | | | 1.94 | | | | 1.00 | | | | 1.25 | | | | 0.88 | | | | 1.96 | | | | 0.76 | | | | 2.27 | | | | 2.27 | | |

| 10-year | | | –1.06 | | | | –1.64 | | | | –1.83 | | | | –1.83 | | | | –1.82 | | | | –1.82 | | | | –1.09 | | | | –1.55 | | | | –1.83 | | | | –1.83 | | | | –1.17 | | | | –1.76 | | | | –0.83 | | | | –0.83 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A and Class T shares, 4.50% for Class E shares and the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B and Class F shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Y and Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class Y and Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Class A, Class B, Class C, Class T and Class Z share performance information includes returns of Prime A shares (for Class A shares), Prime B shares (for Class B and Class C shares), Retail A shares (for Class T shares) and Trust shares (for Class Z shares) of Galaxy Equity Growth Fund, the predecessor to the Fund and a series of the Galaxy Fund (the "Predecessor Fund"), for periods prior to November 18, 2002, the date on which Class A, Class B, Class C, Class T and Class Z shares were initially offered by the Fund. Class E and Class F share performance information includes returns of Class A shares (for Class E shares) and Class B shares (for Class F shares) for the period from November 18, 2002 through September 21, 2006, and the returns of Prime A shares (for Class E shares) and Prime B shares (for Class F shares) for periods prior thereto. These returns shown for all share classes reflect any differences in sales charges, bu t have not been restated to reflect any differences in expenses between the Predecessor Fund share classes and the corresponding newer share classes. If differences in expenses had been reflected, the returns shown for periods prior to November 18, 2002 would be lower for Class A, Class B and Class C shares.

The returns for Class Y shares include the returns for Class Z shares for the period from November 18, 2002 until July 15, 2009, and Trust share of the predecessor Fund for periods prior thereto. The returns shown have not been adjusted to reflect any differences in expenses between Class Y shares and Class Z shares. If differences in expenses had been reflected, the returns shown would be higher. Class Y shares were initially offered on July 15, 2009.

9

Understanding Your Expenses – Columbia Large Cap Growth Fund

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account generally will be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing costs of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

04/01/09 – 09/30/09

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,323.68 | | | | 1,019.65 | | | | 6.29 | | | | 5.47 | | | | 1.08 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,318.62 | | | | 1,015.89 | | | | 10.64 | | | | 9.25 | | | | 1.83 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,318.42 | | | | 1,015.89 | | | | 10.64 | | | | 9.25 | | | | 1.83 | | |

| Class E | | | 1,000.00 | | | | 1,000.00 | | | | 1,322.68 | | | | 1,019.15 | | | | 6.87 | | | | 5.97 | | | | 1.18 | | |

| Class F | | | 1,000.00 | | | | 1,000.00 | | | | 1,317.82 | | | | 1,015.89 | | | | 10.63 | | | | 9.25 | | | | 1.83 | | |

| Class T | | | 1,000.00 | | | | 1,000.00 | | | | 1,322.88 | | | | 1,019.40 | | | | 6.58 | | | | 5.72 | | | | 1.13 | | |

| Class Y | | | 1,000.00 | | | | 1,000.00 | | | | 1,128.10 | * | | | 1,021.91 | | | | 1.43 | * | | | 3.19 | | | | 0.63 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,325.09 | | | | 1,020.91 | | | | 4.84 | | | | 4.20 | | | | 0.83 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

*For the period from July 15, 2009 through September 30, 2009. Class Y shares commenced operations on July 15, 2009.

10

Portfolio Managers' Report – Columbia Large Cap Growth Fund

For the 12-month period that ended September 30, 2009, the fund's Class A shares returned negative 3.97% without sales charge. The fund's benchmark, the Russell 1000 Growth Index, returned negative 1.85%. The average return of funds in its peer group, the Lipper Large Cap Growth Funds Classification, was negative 2.72%. In a period of heightened volatility, stock selection detracted from performance relative to the index. In a changing market environment, we continued to maintain a high level of diversification, emphasizing companies with strong balance sheets, low debt and ample free cash flow.

Stock selection across several sectors detracted from returns

In the energy sector, Hess (0.7% of net assets) and Schlumberger were disappointments. Hess, an oil exploration and production company, owned part of a substantial oil find off the coast of Brazil. Investors turned more cautious on the short-term prospects for these Brazilian operations. Schlumberger, an oil field service company, lost ground as the price of oil declined. We maintained the fund's position in Hess but sold Schlumberger.

In the telecommunication services sector, NII Holdings, a Latin American mobile service provider, pushed returns lower. Demand for texting and other data usage has become strong in Latin America. As a result, that market has become increasingly competitive. This "Darwinian" environment created investor concern about future market share and profitability for NII, and we sold the stock.

A weak economy drove consumer discretionary shares lower, and three fund holdings were caught in this decline: Urban Outfitters, Wynn Resorts—both of which we sold—and Lowe's (1.1% of net assets). We held onto Lowe's because we believe its prospects should improve as the economy strengthens and the housing market stabilizes.

Utilities, information technology and financial stocks were positive contributors

Certain stocks in the utilities, information technology and financials sectors helped offset losses elsewhere in the portfolio. In utilities, AES (1.0% of net assets), one of the world's largest power companies, soared. Generating power in 29 countries—primarily emerging markets—the company benefited from the deployment of stimulus money as emerging market countries rebuilt their infrastructures. Economic recoveries in emerging market countries, such as China, have exceeded our expectations.

In the technology sector, Apple (3.4 of net assets) shares climbed, as iPhone sales were strong even in the face of a weak economy. Despite its strong gains, we believe Apple has more room for growth. EMC (1.3 of net assets), the data storage giant, also gave returns a lift. EMC benefited from the anticipation of an improvement in technology spending. Search engine Google (3.0% of net assets) also did well, gaining market share at the expense of weaker competitors.

In the financials sector, the fund gained ground from positions in both Goldman Sachs Group and Morgan Stanley (0.8% and 1.5% of net assets, respectively), which also gained market share at the expense of weaker competitors. Both companies generated solid revenues and demonstrated their intent to come out ahead after the recent financial meltdown. Additionally, Goldman paid back money it received from the federal government's Troubled Asset Relief Program (TARP).

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Net asset value per share

as of 09/30/09 ($)

| Class A | | | 18.77 | | |

| Class B | | | 17.30 | | |

| Class C | | | 17.31 | | |

| Class E | | | 18.73 | | |

| Class F | | | 17.29 | | |

| Class T | | | 18.64 | | |

| Class Y | | | 19.20 | | |

| Class Z | | | 19.20 | | |

Distributions declared per share

10/01/08 – 09/30/09 ($)

| Class A | | | 0.02 | | |

| Class E | | | — | * | |

| Class Z | | | 0.06 | | |

* Round to less than $0.01.

11

Portfolio Managers' Report (continued) – Columbia Large Cap Growth Fund

Top 5 sectors

as of 09/30/09 (%)

| Information Technology | | | 33.3 | | |

| Health Care | | | 15.1 | | |

| Consumer Staples | | | 12.9 | | |

| Industrials | | | 11.3 | | |

| Consumer Discretionary | | | 11.1 | | |

Top 10 holdings

as of 09/30/09 (%)

| Microsoft | | | 3.9 | | |

| Apple | | | 3.4 | | |

| Google | | | 3.0 | | |

| Cisco Systems | | | 2.6 | | |

| Philip Morris International | | | 2.6 | | |

| International Business | |

| Machines | | | 2.5 | | |

| Hewlett-Packard | | | 2.3 | | |

| QUALCOMM | | | 2.0 | | |

| United Technologies | | | 1.9 | | |

| Procter & Gamble | | | 1.8 | | |

The fund is actively managed and the composition of its portfolio will change over time. Information provided is calculated as a percentage of net assets.

Looking ahead

Moving forward, we intend to invest with sensitivity to the economic rebound but we are mindful that valuations have risen as the result of the market's sharp rally. Although we expect the economy to improve, the driver of future economic growth remains unclear. We believe that unemployment is likely to remain high and the stimulus package is limited in its ability to aid the employment picture. In this environment, we plan to focus on individual stock selection with an eye to avoiding overpaying for stocks that could benefit from directional growth and managing downside risk.

Portfolio holdings and characteristics are subject to change periodically and may not be representative of current holdings and characteristics. The outlook for the fund may differ from those presented for other Columbia Funds.

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

International investing may involve certain risks, including currency fluctuations, risks associated with possible differences in financial accounting standards and other monetary and political risks. Significant levels of foreign taxes, including potentially confiscatory levels of taxation and withholding taxes, may also apply to some foreign investments.

Investing in growth stocks incurs the possibility of losses because their prices are sensitive to changes in current or expected earnings.

12

Fund Profile – Columbia Disciplined Value Fund

Summary

g For the 12-month period that ended September 30, 2009, the fund's Class A shares returned negative 7.72% without sales charge.

g In a period of extreme market volatility, the fund held up better than its benchmark, the Russell 1000 Value Index,1 and the average return of its peer group, the Lipper Large-Cap Value Funds Classification.2

g The fund's defensive positioning helped relative returns as economic fears drove stock prices down during the first six months of the period. Holdings in telecommunications, health care and consumer staples produced positive results.

Portfolio Management

Brian M. Condon has managed the fund since 2009 and has been associated with the advisor or its predecessors since 1999.

1The Russell 1000 Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

2Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

1-year return as of 09/30/09

| | –7.72% | |

|

| |  | | | Class A shares

(without sales charge) | |

|

| | –10.62% | |

|

| |  | | | Russell 1000 Value Index | |

|

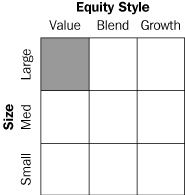

Morningstar Style BoxTM

The Morningstar Style BoxTM reveals a fund's investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend or growth). Information shown is based on the most recent data provided by Morningstar.

13

Performance Information – Columbia Disciplined Value Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Annual operating expense ratio (%)*

| Class A | | | 1.25 | | |

| Class B | | | 2.00 | | |

| Class C | | | 2.00 | | |

| Class T | | | 1.30 | | |

| Class Z | | | 1.00 | | |

* The annual operating expense ratio is as stated in the fund's prospectus that is current as of the date of this report. Differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and expense reimbursements as well as different time periods used in calculating the ratios.

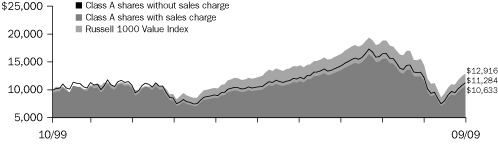

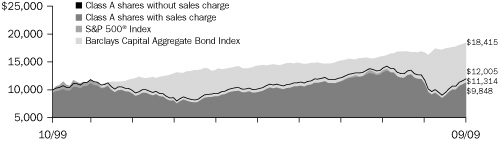

Performance of a $10,000 investment 10/01/99 – 09/30/09

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Disciplined Value Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. The Russell 1000 Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance of a $10,000 investment 10/01/99 – 09/30/09 ($)

| Sales charge | | without | | with | |

| Class A | | | 11,284 | | | | 10,633 | | |

| Class B | | | 10,459 | | | | 10,459 | | |

| Class C | | | 10,432 | | | | 10,432 | | |

| Class T | | | 11,226 | | | | 10,579 | | |

| Class Z | | | 11,621 | | | | n/a | | |

Average annual total return as of 09/30/09 (%)

| Share class | | A | | B | | C | | T | | Z | |

| Inception | | 11/25/02 | | 11/25/02 | | 11/25/02 | | 09/01/88 | | 09/01/88 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | with | | without | |

| 1-year | | | –7.72 | | | | –13.01 | | | | –8.33 | | | | –12.85 | | | | –8.35 | | | | –9.26 | | | | –7.77 | | | | –13.05 | | | | –7.49 | | |

| 5-year | | | 1.33 | | | | 0.13 | | | | 0.60 | | | | 0.31 | | | | 0.58 | | | | 0.58 | | | | 1.26 | | | | 0.06 | | | | 1.57 | | |

| 10-year | | | 1.21 | | | | 0.62 | | | | 0.45 | | | | 0.45 | | | | 0.42 | | | | 0.42 | | | | 1.16 | | | | 0.56 | | | | 1.51 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A and Class T shares and the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Class A, Class B, Class C, Class T and Class Z share performance information includes returns of Retail A shares (for Class A and Class T shares), Retail B shares (for Class B and Class C shares) and Trust shares (for Class Z shares) of Galaxy Equity Value Fund, the predecessor to the Fund and a series of the Galaxy Fund (the "Predecessor Fund"), for periods prior to November 25, 2002, the date on which Class A, Class B, Class C, Class T and Class Z shares were initially offered by the Fund. These returns shown for all share classes reflect any differences in sales charges, but have not been restated to reflect any differences in expenses between the Predecessor Fund share classes and the corresponding newer share classes. If differences in expenses had been reflected, the returns shown for periods prior to November 25, 2002 would be lower for Class B and Class C shares.

14

Understanding Your Expenses – Columbia Disciplined Value Fund

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing costs of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account generally will be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

04/01/09 – 09/30/09

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,404.40 | | | | 1,018.80 | | | | 7.53 | | | | 6.33 | | | | 1.25 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,398.59 | | | | 1,015.04 | | | | 12.03 | | | | 10.10 | | | | 2.00 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,398.29 | | | | 1,015.04 | | | | 12.02 | | | | 10.10 | | | | 2.00 | | |

| Class T | | | 1,000.00 | | | | 1,000.00 | | | | 1,402.00 | | | | 1,018.55 | | | | 7.83 | | | | 6.58 | | | | 1.30 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,403.60 | | | | 1,020.05 | | | | 6.03 | | | | 5.06 | | | | 1.00 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

15

Portfolio Manager's Report – Columbia Disciplined Value Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Net asset value per share

as of 09/30/09 ($)

| Class A | | | 9.52 | | |

| Class B | | | 8.97 | | |

| Class C | | | 8.94 | | |

| Class T | | | 9.52 | | |

| Class Z | | | 9.77 | | |

Distributions declared per share

10/01/08 – 09/30/09 ($)

| Class A | | | 0.16 | | |

| Class B | | | 0.10 | | |

| Class C | | | 0.10 | | |

| Class T | | | 0.16 | | |

| Class Z | | | 0.18 | | |

For the 12-month period that ended September 30, 2009, the fund's Class A shares returned negative 7.72% without sales charge. The fund held up better than both its benchmark, the Russell 1000 Value Index, which returned negative 10.62%, and the negative 7.92% average return of the Lipper Large-Cap Value Funds Classification. As fear and risk aversion gripped investors during the first half of the period, the fund's defensive positioning helped relative results. Holdings in the telecommunications, health care and consumer staples areas were positive contributors, while disappointments came from areas dependent on consumer spending and economic stability, including the consumer discretionary, technology and industrials sectors.

Telecommunications, health care and consumer holdings helped relative returns

The strongest performing sectors in the fund's portfolio were telecommunications and health care. Both generated positive results in an otherwise difficult period. Wireless provider Sprint Nextel (1.4% of net assets) and Internet and digital phone provider Qwest Communications International (0.3% of net assets) benefited from their defensively positioned, subscription-based business models and delivered solid gains for the period. Diversified global pharmaceutical company Mylan produced strong results in response to tentative FDA approval of a new HIV drug. We sold the stock. Health insurer UnitedHealth Group and Endo Pharmaceuticals Holding (1.7% and 0.8% of net assets, respectively) also made a substantial contribution to positive returns during the period, as an aging populace drove rising demand for health care services and products. In a weak economy, a perceived safe haven in the food products industry drove returns at glo bal agribusiness concern Bunge (sold during the year) and processed foods maker Del Monte Foods (0.4% of net assets).

Declines in consumer discretionary, technology and industrials holdings detracted

Sectors exposed to the weakened economic environment and slowing consumer spending were among the hardest hit during the period. As a result, holdings in consumer discretionary, technology and industrials detracted from the fund's returns. Media stocks CBS and Gannett were hurt as a downturn in advertising revenues threatened earnings. We sold both stocks. We also eliminated positions in retailers American Eagle Outfitters and Macy's, which saw poor results as consumer spending weakened. Slowing demand and increased pricing competition hurt computer hard-drive maker Seagate Technology, and we sold the stock. The economically sensitive industrials sector was also hit hard during the period. Northrop Grumman faced defense spending headwinds, while Ryder Systems and Tyco International were affected by slowing industrial production. We eliminated all three positions. Balance sheet issues in the troubled banking sector detracted from results at Wells Fargo, U.S. Bancorp and Goldman Sachs Group (3.6%, 2.5% and 2.7% of net assets, respectively).

16

Portfolio Manager's Report (continued) – Columbia Disciplined Value Fund

Focused on quality and valuation in a volatile market environment

The stock market experienced large swings over the 12-month period. Fear and risk aversion characterized the first half, causing credit markets to seize up and stock prices to move substantially lower. Central banks and governments responded with fiscal and monetary stimulus on a global basis. As liquidity worked its way through the financial system, risk aversion abated and investors began to focus on the reflationary effects of the massive policy response. Consequently, the stock market rallied in the last half of the period. Going forward, the strength and sustainability of the nascent economic recovery will be the main challenge for the stock market. Against this backdrop, we continue to follow a disciplined, quantitative approach to stock selection, emphasizing both quality and valuation. Within each sector, we seek stocks with a catalyst that may lead to improved valuations, believing that this is a sound approach over the long term.

Portfolio holdings and characteristics are subject to change periodically and may not be representative of current holdings and characteristics. The outlook for the fund may differ from those presented for other Columbia Funds.

Equity investments are affected by stock market fluctuations that occur in response to economic and business developments.

Investments in small- and mid-cap stocks may present special risks. They tend to be more volatile and tend to be less liquid than the stocks of larger companies. Small-cap stocks often have narrower markets, limited financial resources and tend to be more thinly traded than stocks of larger companies.

Value stocks are securities of companies that may have experienced adverse business or industry developments or may be subject to special risks that have caused the stocks to be out of favor. The market value of a portfolio security may not meet the manager's future value assessment of such security, or may decline.

Top 5 sectors

as of 09/30/09 (%)

| Financials | | | 25.3 | | |

| Energy | | | 18.2 | | |

| Industrials | | | 10.6 | | |

| Consumer Discretionary | | | 9.4 | | |

| Health Care | | | 9.2 | | |

Top 10 holdings

as of 09/30/09 (%)

| JPMorgan Chase | | | 4.9 | | |

| Exxon Mobil | | | 4.7 | | |

| Chevron | | | 4.2 | | |

| Pfizer | | | 3.7 | | |

| Wells Fargo | | | 3.6 | | |

| General Electric | | | 3.2 | | |

| Goldman Sachs Group | | | 2.7 | | |

| AT&T | | | 2.6 | | |

| Apache | | | 2.4 | | |

| Home Depot | | | 2.1 | | |

The fund is actively managed and the composition of its portfolio will change over time. Information provided is calculated as a percentage of net assets

17

Fund Profile – Columbia Contrarian Core Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

1-year return as of 09/30/09

| | | –0.28% | |

|

| |  | | | Class A shares

(without sales charge) | |

|

| | | –6.14% | |

|

| |  | | | Russell 1000 Index | |

|

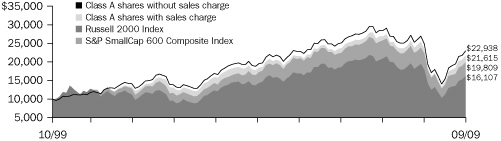

Morningstar Style BoxTM

The Morningstar Style BoxTM reveals a fund's investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend or growth). Information shown is based on the most recent data provided by Morningstar.

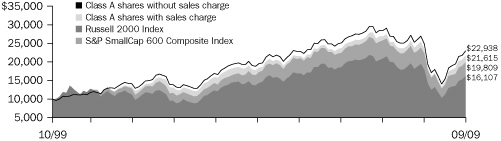

Summary