UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer 5228 Ameriprise Financial Center Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | May 31 | |

|

Date of reporting period: | May 31, 2011 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Strategic Income Fund

Annual Report for the Period Ended May 31, 2011

Not FDIC insured • No bank guarantee • May lose value

Table of Contents

| Fund Profile | | | 1 | | |

|

| Performance Information | | | 2 | | |

|

| Understanding Your Expenses | | | 3 | | |

|

| Portfolio Managers' Report | | | 4 | | |

|

| Portfolio of Investments | | | 6 | | |

|

Statement of Assets and

Liabilities | | | 30 | | |

|

| Statement of Operations | | | 32 | | |

|

Statement of Changes in

Net Assets | | | 33 | | |

|

| Financial Highlights | | | 35 | | |

|

| Notes to Financial Statements | | | 43 | | |

|

Report of Independent Registered

Public Accounting Firm | | | 55 | | |

|

| Fund Governance | | | 56 | | |

|

| Shareholder Meeting Results | | | 61 | | |

|

Important Information About

This Report | | | 65 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholder:

The Columbia Management story began over 100 years ago, and today, we are one of the nation's largest dedicated asset managers. The recent acquisition by Ameriprise Financial, Inc. brings together the talents, resources and capabilities of Columbia Management with those of RiverSource Investments, Threadneedle (acquired by Ameriprise in 2003) and Seligman Investments (acquired by Ameriprise in 2008) to build a best-in-class asset management business that we believe is truly greater than its parts.

RiverSource Investments traces its roots to 1894 when its then newly-founded predecessor, Investors Syndicate, offered a face-amount savings certificate that gave small investors the opportunity to build a safe and secure fund for retirement, education or other special needs. A mutual fund pioneer, Investors Syndicate launched Investors Mutual Fund in 1940. In the decades that followed, its mutual fund products and services lineup grew to include a full spectrum of styles and specialties. More than 110 years later, RiverSource continues to be a trusted financial products leader.

Threadneedle, a leader in global asset management and one of Europe's largest asset managers, offers sophisticated international experience from a dedicated U.K. management team. Headquartered in London, it is named for Threadneedle Street in the heart of the city's financial district, where British investors pioneered international and global investing. Threadneedle was acquired in 2003 and today operates as an affiliate of Columbia Management.

Seligman Investments' beginnings date back to the establishment of the investment firm J. & W. Seligman & Co. in 1864. In the years that followed, Seligman played a major role in the geographical expansion and industrial development of the United States. In 1874, President Ulysses S. Grant named Seligman as fiscal agent for the U.S. Navy—an appointment that would last through World War I. Seligman helped finance the westward path of the railroads and the building of the Panama Canal. The firm organized its first investment company in 1929 and began managing its first mutual fund in 1930. In 2008, J. & W. Seligman & Co. Incorporated was acquired and Seligman Investments became an offering brand of RiverSource Investments, LLC.

We are proud of the rich and distinctive history of these firms, the strength and breadth of products and services they offer, and the combined cultures of pioneering spirit and forward thinking. Together we are committed to providing more for our shareholders than ever before.

> A singular focus on our shareholders

Our business is asset management, so investors are our first priority. We dedicate our resources to identifying timely investment opportunities and provide a comprehensive choice of equity, fixed-income and alternative investments to help meet your individual needs.

> First-class research and thought leadership

We are dedicated to helping you take advantage of today's opportunities and anticipate tomorrow's. We stay abreast of the latest investment trends and ideas, using our collective insight to evaluate events and transform them into solutions you can use.

> A disciplined investment approach

We aren't distracted by passing fads. Our teams adhere to a rigorous investment process that helps ensure the integrity of our products and enables you and your financial advisor to match our solutions to your objectives with confidence.

When you choose Columbia Management, you can be confident that we will take the time to understand your needs and help you and your financial advisor identify the solutions that are right for you. Because at Columbia Management, we don't consider ourselves successful unless you are.

Sincerely,

J. Kevin Connaughton

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the funds, visit www.columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2011 Columbia Management Investment Advisers, LLC. All rights reserved.

Fund Profile – Columbia Strategic Income Fund

Summary

g For the 12-month period that ended May 31, 2011, the fund's Class A shares returned 13.21% without sales charge.

g The fund outperformed the Barclays Capital Government/Credit Bond Index1 and a blended benchmark that consists of 35% Barclays Capital Aggregate Bond Index, 35% JP Morgan Global High Yield Index, 15% Citigroup Non-U.S. World Government Bond Index—Unhedged and 15% JP Morgan EMBI Global Diversified Index;2 and its peer group, the Lipper Multi-Sector Income Funds Classification.3

g Sector allocations were the biggest contributors to outperformance, especially overweights in high-yield bonds and bank loans and underweights in U.S. Treasury securities and agency mortgage-backed securities.

Portfolio Management

Colin J. Lundgren, CFA, lead manager, has co-managed the fund since 2010 and has been associated with the fund's adviser or its predecessors since 1986.

Brian Lavin, CFA has co-managed the fund since 2010 and has been associated with the fund's adviser or its predecessors since 1994.

Gene R. Tannuzzo, CFA has co-managed the fund since 2010 and has been associated with the fund's adviser or its predecessors since 2003.

1The Barclays Capital Government/Credit Bond Index is an index that tracks the performance of U.S. government and corporate bonds rated investment grade or better, with maturities of at least one year.

2The Barclays Capital Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity. The JPMorgan Global High Yield Index is designed to mirror the investable universe of the U.S. dollar global high yield corporate debt market, including domestic and international issues. The Citigroup Non-U.S. World Government Bond Index—Unhedged is calculated on a market-weighted basis and includes all fixed-rate bonds with a remaining maturity of one year or longer and with amounts outstanding of at least the equivalent of U.S. $25 million. The index excludes floating or variable rate bonds, securities aimed principally at non-institutional investors and private placement-type securities. The JPMorgan Emerging Markets Bond Index Global ("EMBI Global") tracks total returns for traded external debt instruments in the emerging markets and is an expanded version of the JPMorgan Emerging Markets Bond Index Plus ("EMBI+"). As with EMBI+, the EMBI Global includes U.S. dollar-denominated Brady bonds, loans and Eurobonds with an outstanding face value of at least $500 million. It covers more of the eligible instruments than the EMBI+ by relaxing somewhat the strict EMBI+ limits on secondary market trading liquidity.

3Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustments for the effect of sales loads.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Summary

1-year return as of 05/31/11

| | | | +13.21% | |

|

|  | | | Class A shares

(without sales charge) | |

|

| | | | +6.04% | |

|

|  | | | Barclays Capital Government/

Credit Bond Index | |

|

| | | | +12.50% | |

|

|  | | | Blended Benchmark | |

|

1

Performance Information – Columbia Strategic Income Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

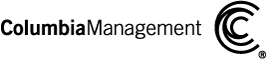

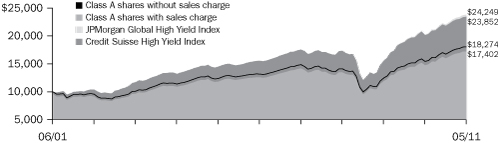

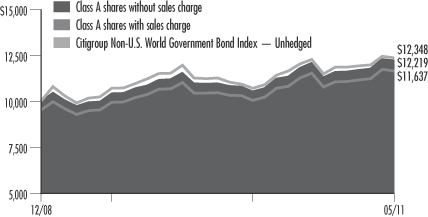

Performance of a $10,000 investment 06/01/01 – 05/31/11

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Strategic Income Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Performance of a $10,000 investment 06/01/01 – 05/31/11 ($)

| Sales charge | | without | | with | |

| Class A | | | 21,054 | | | | 20,059 | | |

| Class B | | | 19,542 | | | | 19,542 | | |

| Class C | | | 19,857 | | | | 19,857 | | |

| Class R | | | n/a | | | | n/a | | |

| Class R4 | | | n/a | | | | n/a | | |

| Class R5 | | | n/a | | | | n/a | | |

| Class W | | | n/a | | | | n/a | | |

| Class Z | | | 21,484 | | | | n/a | | |

Average annual total return as of 05/31/11 (%)

| Share class | | A | | B | | C | | R | | R4 | | R5 | | W | | Z | |

| Inception | | 04/21/77 | | 05/15/92 | | 07/01/97 | | 09/27/10 | | 03/07/11 | | 03/07/11 | | 09/27/10 | | 01/29/99 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | without | | without | | without | | without | |

| 1-year | | | 13.21 | | | | 7.85 | | | | 12.37 | | | | 7.37 | | | | 12.72 | | | | 11.72 | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 13.46 | | |

| 5-year | | | 7.37 | | | | 6.34 | | | | 6.57 | | | | 6.26 | | | | 6.72 | | | | 6.72 | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 7.64 | | |

| 10-year/Life | | | 7.73 | | | | 7.21 | | | | 6.93 | | | | 6.93 | | | | 7.10 | | | | 7.10 | | | | 5.86 | | | | 2.62 | | | | 2.68 | | | | 5.53 | | | | 7.95 | | |

The "with sales charge" returns include the maximum initial sales charge of 4.75% for Class A shares and the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Z, Class R4 and Class R5 shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class R shares are sold at net asset value with a distribution fee and Class W shares are sold at net asset value with a service fee. Class R, Class R4, Class R5, Class W and Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

Class R and Class W shares commenced operations on September 27, 2010. And, Class R4 and R5 shares commenced operations on March 7, 2011, the date of their inception.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

2

Understanding Your Expenses – Columbia Strategic Income Fund

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

As a shareholder of the underlying funds in which it invests, the fund will bear its allocable share of the costs and expenses of these underlying funds. These costs and expenses are not included in the fund's annualized expense ratios used to calculate the expense information below.

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Investment Services Corp., your account balance is available online at www.columbiamanagement.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account may be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

12/01/10 – 05/31/11

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,060.70 | | | | 1,019.95 | | | | 5.14 | | | | 5.04 | | | | 1.00 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,056.80 | | | | 1,016.21 | | | | 8.97 | | | | 8.80 | | | | 1.75 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,059.20 | | | | 1,016.95 | | | | 8.21 | | | | 8.05 | | | | 1.60 | | |

| Class R | | | 1,000.00 | | | | 1,000.00 | | | | 1,062.60 | | | | 1,018.95 | | | | 6.17 | | | | 6.04 | | | | 1.20 | | |

| Class R4 | | | 1,000.00 | | | | 1,000.00 | | | | 1,026.20 | * | | | 1,020.49 | | | | 2.10 | * | | | 4.48 | | | | 0.89 | | |

| Class R5 | | | 1,000.00 | | | | 1,000.00 | | | | 1,026.80 | * | | | 1,021.79 | | | | 1.49 | * | | | 3.18 | | | | 0.63 | | |

| Class W | | | 1,000.00 | | | | 1,000.00 | | | | 1,060.60 | | | | 1,020.54 | | | | 4.52 | | | | 4.43 | | | | 0.88 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,062.80 | | | | 1,021.19 | | | | 3.86 | | | | 3.78 | | | | 0.75 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the Investment Manager and/or any of its affiliates not waived fees or reimbursed a portion of expenses, account value at the end of the period would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

*For the period March 7, 2011 through May 31, 2011. Class R4 shares and Class R5 shares commenced operations on March 7, 2011.

3

Portfolio Managers' Report – Columbia Strategic Income Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Net asset value per share

as of 05/31/11 ($)

| Class A | | | 6.16 | | |

| Class B | | | 6.16 | | |

| Class C | | | 6.17 | | |

| Class R | | | 6.19 | | |

| Class R4 | | | 6.09 | | |

| Class R5 | | | 6.09 | | |

| Class W | | | 6.16 | | |

| Class Z | | | 6.09 | | |

Distributions declared per share

06/01/10 – 05/31/11 ($)

| Class A | | | 0.43 | | |

| Class B | | | 0.38 | | |

| Class C | | | 0.39 | | |

| Class R | | | 0.32 | | |

| Class R4 | | | 0.08 | | |

| Class R5 | | | 0.08 | | |

| Class W | | | 0.33 | | |

| Class Z | | | 0.44 | | |

30-day SEC yields

as of 05/31/11 (%)

| Class A | | | 4.41 | | |

| Class B | | | 3.88 | | |

| Class C | | | 4.02 | | |

| Class R | | | 4.95 | | |

| Class R4 | | | 4.71 | | |

| Class R5 | | | 4.95 | | |

| Class W | | | 4.85 | | |

| Class Z | | | 4.88 | | |

The 30-day SEC yields reflect the fund's earning power net of expenses, expressed as an annualized percentage of the public offering price per share at the end of the period.

Had the Investment Manager and/or any of its affiliates not waived fees or reimbursed a portion of expenses, the 30-day SEC yields would have been lower.

For the 12-month period that ended May 31, 2011, the fund's Class A shares returned 13.21% without sales charge. This was higher than the 6.04% return of the Barclays Capital Government/Credit Bond Index and the 12.50% gain of the fund's blended benchmark, which consists of 35% Barclays Capital Aggregate Bond Index, 35% JPMorgan Global High Yield Index, 15% Citigroup Non-U.S. World Government Bond Index—Unhedged and 15% JPMorgan EMBI Global Diversified Index. The fund also outpaced the 11.24% advance of its peer group, the Lipper Multi-Sector Income Funds Classification. Sector allocations were the biggest contributors to outperformance, especially overweights in high-yield bonds and bank loans and underweights in U.S. Treasury securities and agency mortgage-backed securities.

During the past 12 months, the fund's turnover increased as the new portfolio management team aligned the fund's holdings to fit with our investment outlook. We would expect that under normal market conditions, the fund's turnover would generally be lower than that which occurred during this transition period.

A sluggish expansion

During the 12 months that ended May 31, 2011, global economic growth shifted, as a relatively fast-paced recovery began to lose some steam midway through the period. The impact of higher oil prices, continued concerns about highly indebted eurozone governments and unresolved turmoil in the Middle East and North Africa, as well as the loss of output and supply-chain disruptions from an earthquake, tsunami and nuclear disaster in Japan, have clearly put a dent in the outlook for global growth. A stalemate over the U.S. debt limit and uncertainties associated with the end of the Fed's latest round of large-scale Treasury purchases, known as QE2 (the QE for quantitative easing), also buffeted the markets. However, we believe that any softness should be limited as fundamental adjustments occurring in the global economy have the potential to support a stronger expansion of private spending ahead, raising hopes that the outlook will brighten in the second half of the year, especially in the United States.

Global monetary conditions remain highly accommodative. However, the trend is starting to turn. The European Central Bank (ECB) raised short-term interest rates in April 2011, and more hikes are expected. If the ECB raises short-term rates too quickly, it could complicate the debt crisis in the periphery of the eurozone. In the United States, we believe that the Fed's Federal Open Market Committee is poised to increase the federal funds rate to 0.75% in the year ahead.

Strong returns despite market volatility

Global bonds performed well despite a shifting economic environment and unforeseen challenges. As economic data slowed throughout the summer of 2010, investors moved toward sectors that historically have provided a safer haven, including U.S. government bonds. To revive economic growth, the Federal Reserve initiated a second round of large-scale asset purchases. Economic data began to improve in the manufacturing and services sectors with clear signs that hiring was starting to pick up. Investors became more willing to take on added risk for higher returns, benefiting high-yield bonds and emerging market debt. This momentum continued through the first quarter of 2011, before rising gasoline prices and supply chain disruptions triggered by the earthquake and tsunami in Japan led to weakening economic data. Although investors shifted back toward higher-quality sectors late in the period, higher-risk assets finished the year well ahead of U.S. and foreign government issues.

Biggest boost from high-yield sector

The Fund benefited from having an overweight (roughly 45% of assets at period end) versus the blended benchmark in high-yield bonds and bank loans, which were the strongest performers in

4

Portfolio Managers' Report (continued) – Columbia Strategic Income Fund

the fixed-income market over the past year. The Fund's high-yield portfolio also modestly outperformed the JPMorgan Global High Yield Index's 18.04% return. Within the sector, the strongest gains came from the lowest-quality issues—with CCC- and B-rated bonds returning 22.75% and 18.94%, respectively—and financials, which climbed over 20% within the JPMorgan index. Both segments benefited as an improving economy lowered the risk of defaults. Underweights in both CCC issues and financials modestly hindered relative results, but were more than offset by overweights in BB and B rated securities, as well as in the energy, telecommunications and cable/satellite industries.

More contributions from sector allocations and positioning

An overweight in emerging markets and an underweight in U.S. investment grade securities further aided performance. In the emerging market segment, strong country and currency selection led to gains that nicely outpaced the 12.52% return of the JPMorgan EMBI Global Diversified Index. Performance benefited from a focus on Latin America and Russia as well as currencies in Brazil, Mexico and Indonesia. Having less exposure than the blended index to the U.S. investment grade sector also was positive. In addition, investments in this segment outperformed the 5.84% return of the Barclays Capital Aggregate Bond Index, thanks to the Fund's bias toward investment-grade corporate bonds and commercial mortgage-backed securities—which are bonds issued for large-scale commercial projects, such as office parks and retail shopping malls. Decisions regarding duration, a measure of interest-rate sensitivity, and maturity allocations gave an added boost to performance. Finally, the Fund had below-average exposure—about 10% at period end—to government bonds in foreign developed markets, with notable underweights in Europe and Japan. Returns in this segment were modestly ahead of the 15.39% gain posted by the Citigroup Non-U.S. World Government Bond Index—Unhedged.

Rationale for future

We believe some of the weather-related factors that slowed economic growth this past spring will subside, leading to stronger growth later this year. Given our expectation of a rise in interest rates, we plan to keep the Fund's sensitivity to interest-rate changes shorter than that of the blended benchmark, which should help preserve principal. Going forward, we also may look for opportunities to reduce our stake in high-yield and investment grade corporate bonds, where valuations are no longer as compelling as they once were.

Portfolio characteristics and holdings are subject to change and may not be representative of current characteristics and holdings. The outlook for the fund may differ from that presented for other Columbia Funds.

Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa.

Investments in high-yield bonds (sometimes referred to as "junk" bonds) offer the potential for high current income and attractive total return, but involve certain risks. Changes in economic conditions or other circumstances may adversely affect a high-yield bond issuer's ability to make principal and interest payments.

Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility.

Maturity breakdown

as of 05/31/11 (%)

| 0-1 year | | | 2.7 | | |

| 1-3 years | | | 11.0 | | |

| 3-5 years | | | 18.6 | | |

| 5-7 years | | | 29.7 | | |

| 7-10 years | | | 22.8 | | |

| 10-15 years | | | 3.8 | | |

| 15-20 years | | | 1.4 | | |

| 20-30 years | | | 5.9 | | |

| 30 years and over | | | 0.5 | | |

| Other | | | 3.6 | | |

Portfolio structure

as of 05/31/11 (%)

| US High Yield | | | 44.5 | | |

| US Investment Grade | | | 26.9 | | |

| Foreign Emerging Markets | | | 18.6 | | |

| Foreign Developed | | | 10.0 | | |

Quality breakdown

as of 05/31/11 (%)

| AAA | | | 19.7 | | |

| AA | | | 2.2 | | |

| A | | | 5.5 | | |

| BBB | | | 17.3 | | |

| BB | | | 19.6 | | |

| B | | | 27.4 | | |

| CCC | | | 6.5 | | |

| CC | | | 0.3 | | |

| D | | | 0.0 | * | |

| Non-Rated | | | 1.5 | | |

* Rounds to less than 0.1%.

The fund is actively managed and the composition of its portfolio will change over time. Maturity breakdown, portfolio structure and quality breakdown are calculated as a percentage of total investments. Ratings shown in the quality breakdown are assigned to individual bonds by taking the lower of the ratings available from one of the following nationally recognized rating agencies: Standard & Poor's or Moody's Investor Services. If a security is rated by only one of the two agencies, that rating is used. If a security is not rated by either of the two agencies, it is designated as Non-Rated. Ratings are relative and subjective and are not absolute standards of quality. The credit quality of the fund's investments does not remove market risk.

5

Portfolio of Investments – Columbia Strategic Income Fund

May 31, 2011

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) 52.3% | |

| Aerospace & Defense 1.0% | |

ADS Tactical, Inc.

Senior Secured(b) | |

| 04/01/18 | | | 11.000 | % | | $ | 4,725,000 | | | $ | 5,032,125 | | |

| Huntington Ingalls Industries, Inc.(b) | |

| 03/15/18 | | | 6.875 | % | | | 1,708,000 | | | | 1,780,590 | | |

| 03/15/21 | | | 7.125 | % | | | 2,262,000 | | | | 2,360,962 | | |

Kratos Defense & Security Solutions, Inc.

Senior Secured | |

| 06/01/17 | | | 10.000 | % | | | 2,590,000 | | | | 2,849,000 | | |

Kratos Defense & Security Solutions, Inc.(b)

Senior Secured | |

| 06/01/17 | | | 10.000 | % | | | 3,344,000 | | | | 3,678,400 | | |

| Oshkosh Corp. | |

| 03/01/17 | | | 8.250 | % | | | 672,000 | | | | 732,480 | | |

| 03/01/20 | | | 8.500 | % | | | 383,000 | | | | 421,300 | | |

| TransDigm, Inc.(b) | |

| 12/15/18 | | | 7.750 | % | | | 1,545,000 | | | | 1,641,563 | | |

| Total | | | 18,496,420 | | |

| Automotive 1.2% | |

Accuride Corp.

Senior Secured | |

| 08/01/18 | | | 9.500 | % | | | 785,000 | | | | 861,538 | | |

| Allison Transmission, Inc.(b) | |

| 05/15/19 | | | 7.125 | % | | | 1,349,000 | | | | 1,345,628 | | |

Chrysler Group LLC/Co-Issuer, Inc.(b)

Senior Secured | |

| 06/15/19 | | | 8.000 | % | | | 1,382,000 | | | | 1,375,090 | | |

| 06/15/21 | | | 8.250 | % | | | 2,355,000 | | | | 2,349,112 | | |

Dana Holding Corp.

Senior Unsecured | |

| 02/15/19 | | | 6.500 | % | | | 600,000 | | | | 597,000 | | |

| 02/15/21 | | | 6.750 | % | | | 4,800,000 | | | | 4,800,000 | | |

Delphi Corp.(b)

Senior Notes | |

| 05/15/19 | | | 5.875 | % | | | 956,000 | | | | 952,415 | | |

| 05/15/21 | | | 6.125 | % | | | 637,000 | | | | 638,593 | | |

International Automotive Components Group SL

Senior Secured(b)(c)(d) | |

| 06/01/18 | | | 9.125 | % | | | 536,000 | | | | 548,060 | | |

| Lear Corp. | |

| 03/15/18 | | | 7.875 | % | | | 3,307,000 | | | | 3,629,432 | | |

| 03/15/20 | | | 8.125 | % | | | 762,000 | | | | 838,200 | | |

| Tenneco, Inc. | |

| 08/15/18 | | | 7.750 | % | | | 496,000 | | | | 524,520 | | |

Visteon Corp.

Senior Notes(b) | |

| 04/15/19 | | | 6.750 | % | | | 3,036,000 | | | | 2,944,920 | | |

| Total | | | 21,404,508 | | |

| Banking 1.5% | |

BES Investimento do Brasil SA

Senior Unsecured(b) | |

| 03/25/15 | | | 5.625 | % | | | 2,000,000 | | | | 1,973,388 | | |

BanColombia SA

Senior Notes(b)(c)(d) | |

| 06/03/21 | | | 5.950 | % | | | 2,000,000 | | | | 2,007,500 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Banking (cont.) | |

Bank of America Corp.

Senior Notes | |

| 05/13/21 | | | 5.000 | % | | $ | 11,210,000 | | | $ | 11,189,418 | | |

Citigroup, Inc.

Senior Unsecured | |

| 01/15/15 | | | 6.010 | % | | | 15,000 | | | | 16,629 | | |

| 08/09/20 | | | 5.375 | % | | | 785,000 | | | | 827,128 | | |

| JPMorgan Chase & Co. | |

| 05/10/21 | | | 4.625 | % | | | 2,400,000 | | | | 2,408,580 | | |

| Lloyds Banking Group PLC(b)(d)(e) | |

| 11/29/49 | | | 6.267 | % | | | 1,316,000 | | | | 1,075,830 | | |

Morgan Stanley

Senior Unsecured | |

| 01/25/21 | | | 5.750 | % | | | 6,895,000 | | | | 7,211,191 | | |

Santander U.S. Debt SA Unipersonal

Bank Guaranteed(b)(d) | |

| 10/07/15 | | | 3.781 | % | | | 1,800,000 | | | | 1,778,265 | | |

| Total | | | 28,487,929 | | |

| Brokerage 0.4% | |

E*Trade Financial Corp.

Senior Notes | |

| 06/01/16 | | | 6.750 | % | | | 2,460,000 | | | | 2,460,000 | | |

Senior Unsecured

12/01/15 | | | 7.875 | % | | | 2,180,000 | | | | 2,248,125 | | |

Senior Unsecured PIK

11/30/17 | | | 12.500 | % | | | 2,830,000 | | | | 3,403,075 | | |

| Total | | | 8,111,200 | | |

| Building Materials 0.7% | |

Building Materials Corp. of America

Senior Notes(b) | |

| 05/01/21 | | | 6.750 | % | | | 4,932,000 | | | | 4,968,990 | | |

Euramax International, Inc.

Senior Secured(b) | |

| 04/01/16 | | | 9.500 | % | | | 2,005,000 | | | | 2,055,125 | | |

| Gibraltar Industries, Inc. | |

| 12/01/15 | | | 8.000 | % | | | 1,525,000 | | | | 1,566,938 | | |

| Interface, Inc. | |

| 12/01/18 | | | 7.625 | % | | | 665,000 | | | | 711,550 | | |

Norcraft Companies LP/Finance Corp.

Secured | |

| 12/15/15 | | | 10.500 | % | | | 1,690,000 | | | | 1,774,500 | | |

| Nortek, Inc.(b) | |

| 04/15/21 | | | 8.500 | % | | | 1,815,000 | | | | 1,731,056 | | |

| Total | | | 12,808,159 | | |

| Chemicals 1.5% | |

| CF Industries, Inc. | |

| 05/01/18 | | | 6.875 | % | | | 5,125,000 | | | | 5,880,937 | | |

| 05/01/20 | | | 7.125 | % | | | 81,000 | | | | 94,973 | | |

| Celanese U.S. Holdings LLC | |

| 10/15/18 | | | 6.625 | % | | | 250,000 | | | | 263,438 | | |

Senior Notes

06/15/21 | | | 5.875 | % | | | 410,000 | | | | 419,225 | | |

| Chemtura Corp.(b) | |

| 09/01/18 | | | 7.875 | % | | | 922,000 | | | | 1,000,370 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

6

Columbia Strategic Income Fund

May 31, 2011

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Chemicals (cont.) | |

Dow Chemical Co. (The)

Senior Unsecured | |

| 11/15/20 | | | 4.250 | % | | $ | 1,690,000 | | | $ | 1,671,824 | | |

Hexion U.S. Finance Corp./Nova Scotia ULC

Senior Secured | |

| 02/01/18 | | | 8.875 | % | | | 1,303,000 | | | | 1,399,096 | | |

Lyondell Chemical Co.

Senior Secured(b) | |

| 11/01/17 | | | 8.000 | % | | | 5,041,000 | | | | 5,708,932 | | |

MacDermid, Inc.

Senior Subordinated Notes(b) | |

| 04/15/17 | | | 9.500 | % | | | 1,325,000 | | | | 1,397,875 | | |

| Nalco Co.(b) | |

| 01/15/19 | | | 6.625 | % | | | 3,935,000 | | | | 4,087,481 | | |

NOVA Chemicals Corp.(d)

Senior Unsecured | |

| 11/01/16 | | | 8.375 | % | | | 1,095,000 | | | | 1,223,663 | | |

| 11/01/19 | | | 8.625 | % | | | 1,870,000 | | | | 2,117,775 | | |

| Polypore International, Inc.(b) | |

| 11/15/17 | | | 7.500 | % | | | 2,310,000 | | | | 2,454,375 | | |

| Total | | | 27,719,964 | | |

| Construction Machinery 1.5% | |

Case New Holland, Inc.

Senior Notes(b) | |

| 12/01/17 | | | 7.875 | % | | | 4,786,000 | | | | 5,354,337 | | |

| Columbus McKinnon Corp.(b) | |

| 02/01/19 | | | 7.875 | % | | | 806,000 | | | | 834,210 | | |

| Manitowoc Co., Inc. (The) | |

| 02/15/18 | | | 9.500 | % | | | 2,200,000 | | | | 2,431,000 | | |

| 11/01/20 | | | 8.500 | % | | | 1,950,000 | | | | 2,120,625 | | |

Neff Rental LLC/Finance Corp.

Secured(b) | |

| 05/15/16 | | | 9.625 | % | | | 2,441,000 | | | | 2,437,949 | | |

| RSC Equipment Rental, Inc./Holdings III LLC | |

| 02/01/21 | | | 8.250 | % | | | 1,235,000 | | | | 1,275,138 | | |

| United Rentals North America, Inc. | |

| 12/15/19 | | | 9.250 | % | | | 6,935,000 | | | | 7,749,862 | | |

| 09/15/20 | | | 8.375 | % | | | 4,775,000 | | | | 4,966,000 | | |

| Xerium Technologies, Inc.(b) | |

| 06/15/18 | | | 8.875 | % | | | 1,615,000 | | | | 1,615,000 | | |

| Total | | | 28,784,121 | | |

| Consumer Cyclical Services 0.2% | |

Garda World Security Corp.

Senior Unsecured(b)(d) | |

| 03/15/17 | | | 9.750 | % | | | 1,540,000 | | | | 1,667,050 | | |

| West Corp.(b) | |

| 01/15/19 | | | 7.875 | % | | | 2,790,000 | | | | 2,866,725 | | |

| Total | | | 4,533,775 | | |

| Consumer Products 0.6% | |

| Central Garden and Pet Co. | |

| 03/01/18 | | | 8.250 | % | | | 3,015,000 | | | | 3,180,825 | | |

Libbey Glass, Inc.

Senior Secured | |

| 02/15/15 | | | 10.000 | % | | | 2,700,000 | | | | 2,943,000 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Consumer Products (cont.) | |

| NBTY, Inc.(b) | |

| 10/01/18 | | | 9.000 | % | | $ | 310,000 | | | $ | 332,475 | | |

Spectrum Brands Holdings, Inc.

Senior Secured(b) | |

| 06/15/18 | | | 9.500 | % | | | 4,559,000 | | | | 5,083,285 | | |

| Total | | | 11,539,585 | | |

| Diversified Manufacturing 0.5% | |

Amsted Industries, Inc.

Senior Notes(b) | |

| 03/15/18 | | | 8.125 | % | | | 1,500,000 | | | | 1,593,750 | | |

CPM Holdings, Inc.

Senior Secured(b) | |

| 09/01/14 | | | 10.875 | % | | | 2,419,000 | | | | 2,636,710 | | |

Pinafore LLC/Inc.

Secured(b) | |

| 10/01/18 | | | 9.000 | % | | | 520,000 | | | | 569,400 | | |

| SPX Corp.(b) | |

| 09/01/17 | | | 6.875 | % | | | 2,325,000 | | | | 2,487,750 | | |

WireCo WorldGroup

Senior Unsecured(b) | |

| 05/15/17 | | | 9.500 | % | | | 1,490,000 | | | | 1,583,125 | | |

| Total | | | 8,870,735 | | |

| Electric 4.3% | |

AES Corp. (The)

Senior Unsecured | |

| 03/01/14 | | | 7.750 | % | | | 3,625,000 | | | | 3,969,375 | | |

CMS Energy Corp.

Senior Unsecured | |

| 12/15/15 | | | 6.875 | % | | | 1,615,000 | | | | 1,828,038 | | |

Calpine Corp.

Senior Secured(b) | |

| 02/15/21 | | | 7.500 | % | | | 2,050,000 | | | | 2,132,000 | | |

| CenterPoint Energy Houston Electric LLC | |

| 03/01/14 | | | 7.000 | % | | | 675,000 | | | | 776,309 | | |

Consolidated Edison Co. of New York, Inc.

Senior Unsecured | |

| 04/01/38 | | | 6.750 | % | | | 895,000 | | | | 1,086,065 | | |

Dominion Resources, Inc.

Senior Unsecured | |

| 08/15/19 | | | 5.200 | % | | | 3,319,000 | | | | 3,655,842 | | |

Duke Energy Corp.

Senior Unsecured | |

| 09/15/14 | | | 3.950 | % | | | 3,390,000 | | | | 3,612,903 | | |

| 04/01/15 | | | 3.350 | % | | | 7,000,000 | | | | 7,283,885 | | |

Duke Energy Ohio, Inc.

1st Mortgage | |

| 04/01/19 | | | 5.450 | % | | | 3,030,000 | | | | 3,435,790 | | |

Edison Mission Energy

Senior Unsecured | |

| 05/15/17 | | | 7.000 | % | | | 3,720,000 | | | | 3,078,300 | | |

Energy Future Holdings Corp.

Senior Secured(e) | |

| 01/15/20 | | | 10.000 | % | | | 3,200,000 | | | | 3,464,505 | | |

Energy Future Intermediate Holding Co. LLC/Finance, Inc.

Senior Secured | |

| 12/01/20 | | | 10.000 | % | | | 338,000 | | | | 367,628 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

7

Columbia Strategic Income Fund

May 31, 2011

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Electric (cont.) | |

Florida Power Corp.

1st Mortgage | |

| 06/15/38 | | | 6.400 | % | | $ | 1,270,000 | | | $ | 1,505,264 | | |

GenOn Energy, Inc.

Senior Unsecured | |

| 10/15/18 | | | 9.500 | % | | | 1,567,000 | | | | 1,649,267 | | |

Ipalco Enterprises, Inc.

Senior Secured(b) | |

| 04/01/16 | | | 7.250 | % | | | 2,415,000 | | | | 2,710,837 | | |

| Kansas City Power & Light Co. | |

| 04/01/19 | | | 7.150 | % | | | 835,000 | | | | 1,007,101 | | |

| Majapahit Holding BV(b)(d) | |

| 06/29/37 | | | 7.875 | % | | | 2,780,000 | | | | 3,224,800 | | |

| NRG Energy, Inc.(b) | |

| 05/15/19 | | | 7.625 | % | | | 3,428,000 | | | | 3,423,715 | | |

| Nevada Power Co. | |

| 01/15/15 | | | 5.875 | % | | | 3,740,000 | | | | 4,209,938 | | |

| 05/15/18 | | | 6.500 | % | | | 9,575,000 | | | | 11,230,173 | | |

| 04/01/36 | | | 6.650 | % | | | 950,000 | | | | 1,119,098 | | |

Pacific Gas & Electric Co.

Senior Unsecured | |

| 10/01/20 | | | 3.500 | % | | | 5,005,000 | | | | 4,811,567 | | |

| Sierra Pacific Power Co. | |

| 05/15/16 | | | 6.000 | % | | | 2,535,000 | | | | 2,921,666 | | |

Texas Competitive Electric Holdings Co. LLC/Finance, Inc.

Senior Secured(b) | |

| 10/01/20 | | | 11.500 | % | | | 904,000 | | | | 915,300 | | |

TransAlta Corp.

Senior Unsecured(d) | |

| 05/15/18 | | | 6.650 | % | | | 6,340,000 | | | | 7,308,955 | | |

| Total | | | 80,728,321 | | |

| Entertainment 0.4% | |

| AMC Entertainment, Inc. | |

| 06/01/19 | | | 8.750 | % | | | 1,935,000 | | | | 2,077,706 | | |

AMC Entertainment, Inc.(b)

Senior Subordinated Notes | |

| 12/01/20 | | | 9.750 | % | | | 2,535,000 | | | | 2,690,269 | | |

Cinemark U.S.A., Inc.

Senior Subordinated Notes(b)(c) | |

| 06/15/21 | | | 7.375 | % | | | 452,000 | | | | 452,000 | | |

| Regal Cinemas Corp. | |

| 07/15/19 | | | 8.625 | % | | | 1,148,000 | | | | 1,228,360 | | |

| Six Flags, Inc.(b)(g)(h)(i) | |

| 06/01/14 | | | 9.625 | % | | | 1,557,000 | | | | — | | |

| Speedway Motorsports, Inc. | |

| 02/01/19 | | | 6.750 | % | | | 1,048,000 | | | | 1,063,720 | | |

Vail Resorts, Inc.

Senior Subordinated Notes(b) | |

| 05/01/19 | | | 6.500 | % | | | 523,000 | | | | 534,114 | | |

| Total | | | 8,046,169 | | |

| Environmental 0.2% | |

Clean Harbors, Inc.

Senior Secured | |

| 08/15/16 | | | 7.625 | % | | | 1,800,000 | | | | 1,921,500 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Environmental (cont.) | |

Clean Harbors, Inc.(b)

Senior Secured | |

| 08/15/16 | | | 7.625 | % | | $ | 805,000 | | | $ | 859,338 | | |

| Total | | | 2,780,838 | | |

| Food and Beverage 2.3% | |

ARAMARK Holdings Corp.

Senior Notes PIK(b) | |

| 05/01/16 | | | 8.625 | % | | | 1,649,000 | | | | 1,686,102 | | |

| Anheuser-Busch InBev Worldwide, Inc.(d) | |

| 11/15/14 | | | 5.375 | % | | | 15,959,000 | | | | 17,869,771 | | |

ConAgra Foods, Inc.

Senior Unsecured | |

| 10/01/28 | | | 7.000 | % | | | 855,000 | | | | 925,970 | | |

| Cott Beverages, Inc. | |

| 11/15/17 | | | 8.375 | % | | | 1,150,000 | | | | 1,230,500 | | |

| 09/01/18 | | | 8.125 | % | | | 1,106,000 | | | | 1,186,185 | | |

| Darling International, Inc.(b) | |

| 12/15/18 | | | 8.500 | % | | | 490,000 | | | | 534,100 | | |

| Dean Foods Co. | |

| 06/01/16 | | | 7.000 | % | | | 69,000 | | | | 69,173 | | |

Dean Foods Co.(b)

Senior Notes | |

| 12/15/18 | | | 9.750 | % | | | 1,343,000 | | | | 1,447,083 | | |

Kraft Foods, Inc.

Senior Unsecured | |

| 02/01/18 | | | 6.125 | % | | | 13,232,000 | | | | 15,220,015 | | |

| MHP SA(b)(d) | |

| 04/29/15 | | | 10.250 | % | | | 2,692,000 | | | | 2,951,512 | | |

| Total | | | 43,120,411 | | |

| Gaming 1.9% | |

Boyd Gaming Corp.

Senior Notes(b) | |

| 12/01/18 | | | 9.125 | % | | | 2,746,000 | | | | 2,859,272 | | |

Caesars Entertainment Operating Co., Inc.

Secured | |

| 12/15/18 | | | 10.000 | % | | | 4,254,000 | | | | 3,934,950 | | |

FireKeepers Development Authority

Senior Secured(b) | |

| 05/01/15 | | | 13.875 | % | | | 2,800,000 | | | | 3,286,500 | | |

| MGM Resorts International | |

| 06/01/16 | | | 7.500 | % | | | 995,000 | | | | 975,100 | | |

Senior Secured

03/15/20 | | | 9.000 | % | | | 3,907,000 | | | | 4,356,305 | | |

Senior Unsecured

03/01/18 | | | 11.375 | % | | | 2,005,000 | | | | 2,305,750 | | |

Penn National Gaming, Inc.

Senior Subordinated Notes | |

| 08/15/19 | | | 8.750 | % | | | 626,000 | | | | 683,123 | | |

| Pinnacle Entertainment, Inc. | |

| 08/01/17 | | | 8.625 | % | | | 2,405,000 | | | | 2,645,500 | | |

Pokagon Gaming Authority

Senior Notes(b) | |

| 06/15/14 | | | 10.375 | % | | | 2,246,000 | | | | 2,304,958 | | |

| Seminole Indian Tribe of Florida(b) | |

| 10/01/20 | | | 7.804 | % | | | 2,875,000 | | | | 2,906,855 | | |

Senior Secured

10/01/20 | | | 6.535 | % | | | 1,235,000 | | | | 1,266,616 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

8

Columbia Strategic Income Fund

May 31, 2011

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Gaming (cont.) | |

| Seneca Gaming Corp.(b) | |

| 12/01/18 | | | 8.250 | % | | $ | 1,952,000 | | | $ | 2,049,600 | | |

Shingle Springs Tribal Gaming Authority

Senior Notes(b) | |

| 06/15/15 | | | 9.375 | % | | | 4,620,000 | | | | 3,349,500 | | |

Tunica-Biloxi Gaming Authority

Senior Unsecured(b) | |

| 11/15/15 | | | 9.000 | % | | | 2,012,000 | | | | 2,006,970 | | |

| Total | | | 34,930,999 | | |

| Gas Distributors 0.1% | |

Energy Transfer Equity LP

Senior Secured | |

| 10/15/20 | | | 7.500 | % | | | 1,666,000 | | | | 1,807,610 | | |

| Gas Pipelines 2.1% | |

El Paso Corp.

Senior Unsecured | |

| 06/15/14 | | | 6.875 | % | | | 2,970,000 | | | | 3,373,834 | | |

| 06/01/18 | | | 7.250 | % | | | 3,803,000 | | | | 4,449,510 | | |

| 09/15/20 | | | 6.500 | % | | | 4,284,000 | | | | 4,787,370 | | |

| Enterprise Products Operating LLC | |

| 02/01/16 | | | 3.200 | % | | | 2,170,000 | | | | 2,213,333 | | |

Kinder Morgan Energy Partners LP

Senior Unsecured | |

| 01/15/38 | | | 6.950 | % | | | 670,000 | | | | 760,855 | | |

| Nisource Finance Corp. | |

| 09/15/17 | | | 5.250 | % | | | 8,415,000 | | | | 9,201,281 | | |

| Plains All American Pipeline LP/Finance Corp. | |

| 05/01/19 | | | 8.750 | % | | | 2,715,000 | | | | 3,496,882 | | |

| Regency Energy Partners LP/Finance Corp. | |

| 06/01/16 | | | 9.375 | % | | | 1,740,000 | | | | 1,974,900 | | |

| 12/01/18 | | | 6.875 | % | | | 1,289,000 | | | | 1,353,450 | | |

| 07/15/21 | | | 6.500 | % | | | 3,198,000 | | | | 3,213,990 | | |

Southern Natural Gas Co.

Senior Unsecured | |

| 03/01/32 | | | 8.000 | % | | | 885,000 | | | | 1,129,926 | | |

Southern Star Central Corp.

Senior Unsecured | |

| 03/01/16 | | | 6.750 | % | | | 1,695,000 | | | | 1,733,137 | | |

TransCanada PipeLines Ltd.

Senior Unsecured(d) | |

| 01/15/39 | | | 7.625 | % | | | 575,000 | | | | 743,898 | | |

| Total | | | 38,432,366 | | |

| Health Care 2.2% | |

AMGH Merger Sub, Inc.

Senior Secured(b) | |

| 11/01/18 | | | 9.250 | % | | | 690,000 | | | | 738,300 | | |

American Renal Associates Holdings, Inc.

Senior Unsecured PIK(b) | |

| 03/01/16 | | | 9.750 | % | | | 535,000 | | | | 553,725 | | |

American Renal Holdings, Inc.

Senior Secured | |

| 05/15/18 | | | 8.375 | % | | | 998,000 | | | | 1,042,910 | | |

| CDRT Merger Sub, Inc.(b) | |

| 06/01/19 | | | 8.125 | % | | | 1,462,000 | | | | 1,474,792 | | |

| CHS/Community Health Systems, Inc. | |

| 07/15/15 | | | 8.875 | % | | | 1,228,000 | | | | 1,267,910 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Health Care (cont.) | |

ConvaTec Healthcare E SA

Senior Unsecured(b)(d) | |

| 12/15/18 | | | 10.500 | % | | $ | 4,610,000 | | | $ | 4,978,800 | | |

HCA, Inc.

Senior Secured | |

| 09/15/20 | | | 7.250 | % | | | 9,915,000 | | | | 10,807,350 | | |

| Hanger Orthopedic Group, Inc. | |

| 11/15/18 | | | 7.125 | % | | | 1,779,000 | | | | 1,823,475 | | |

| Healthsouth Corp. | |

| 02/15/20 | | | 8.125 | % | | | 1,694,000 | | | | 1,865,517 | | |

| 09/15/22 | | | 7.750 | % | | | 369,000 | | | | 393,908 | | |

| InVentiv Health, Inc.(b) | |

| 08/15/18 | | | 10.000 | % | | | 4,586,000 | | | | 4,769,440 | | |

| LifePoint Hospitals, Inc.(b) | |

| 10/01/20 | | | 6.625 | % | | | 1,002,000 | | | | 1,039,575 | | |

| Multiplan, Inc.(b) | |

| 09/01/18 | | | 9.875 | % | | | 2,699,000 | | | | 2,921,667 | | |

| Radnet Management, Inc. | |

| 04/01/18 | | | 10.375 | % | | | 455,000 | | | | 473,200 | | |

STHI Holding Corp.

Secured(b) | |

| 03/15/18 | | | 8.000 | % | | | 751,000 | | | | 773,530 | | |

Tenet Healthcare Corp.

Senior Secured | |

| 07/01/19 | | | 8.875 | % | | | 1,265,000 | | | | 1,407,313 | | |

| Vanguard Health Holding Co. II LLC/Inc. | |

| 02/01/18 | | | 8.000 | % | | | 2,300,000 | | | | 2,397,750 | | |

| Vanguard Health Holding Co. II LLC/Inc.(b) | |

| 02/01/18 | | | 8.000 | % | | | 1,835,000 | | | | 1,917,575 | | |

| 02/01/19 | | | 7.750 | % | | | 185,000 | | | | 190,550 | | |

| Total | | | 40,837,287 | | |

| Healthcare Insurance 0.1% | |

WellPoint, Inc.

Senior Unsecured | |

| 02/15/19 | | | 7.000 | % | | | 960,000 | | | | 1,164,648 | | |

| Home Construction 0.3% | |

| Beazer Homes U.S.A., Inc. | |

| 06/15/18 | | | 9.125 | % | | | 135,000 | | | | 127,069 | | |

| K Hovnanian Enterprises, Inc. | |

| 10/15/15 | | | 11.875 | % | | | 422,000 | | | | 342,875 | | |

Senior Secured

10/15/16 | | | 10.625 | % | | | 1,835,000 | | | | 1,844,175 | | |

Shea Homes LP/Funding Corp.

Senior Secured(b) | |

| 05/15/19 | | | 8.625 | % | | | 2,645,000 | | | | 2,674,756 | | |

| Total | | | 4,988,875 | | |

| Independent Energy 4.8% | |

Anadarko Petroleum Corp.

Senior Unsecured | |

| 09/15/16 | | | 5.950 | % | | | 3,875,000 | | | | 4,378,060 | | |

Berry Petroleum Co.

Senior Subordinated Notes | |

| 11/01/16 | | | 8.250 | % | | | 335,000 | | | | 350,913 | | |

Senior Unsecured

06/01/14 | | | 10.250 | % | | | 535,000 | | | | 617,925 | | |

| 11/01/20 | | | 6.750 | % | | | 760,000 | | | | 784,700 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

9

Columbia Strategic Income Fund

May 31, 2011

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Independent Energy (cont.) | |

| Brigham Exploration Co. | |

| 10/01/18 | | | 8.750 | % | | $ | 2,510,000 | | | $ | 2,754,725 | | |

| Brigham Exploration Co.(b) | |

| 06/01/19 | | | 6.875 | % | | | 406,000 | | | | 406,000 | | |

| Carrizo Oil & Gas, Inc.(b) | |

| 10/15/18 | | | 8.625 | % | | | 4,144,000 | | | | 4,371,920 | | |

| Chaparral Energy, Inc.(b) | |

| 10/01/20 | | | 9.875 | % | | | 928,000 | | | | 1,032,400 | | |

| 09/01/21 | | | 8.250 | % | | | 2,408,000 | | | | 2,492,280 | | |

| Chesapeake Energy Corp. | |

| 08/15/20 | | | 6.625 | % | | | 6,050,000 | | | | 6,360,062 | | |

| 02/15/21 | | | 6.125 | % | | | 2,376,000 | | | | 2,417,580 | | |

| Comstock Resources, Inc. | |

| 10/15/17 | | | 8.375 | % | | | 357,000 | | | | 376,635 | | |

| 04/01/19 | | | 7.750 | % | | | 664,000 | | | | 673,960 | | |

| Concho Resources, Inc. | |

| 01/15/21 | | | 7.000 | % | | | 3,343,000 | | | | 3,501,792 | | |

| 01/15/22 | | | 6.500 | % | | | 771,000 | | | | 774,855 | | |

| Continental Resources, Inc. | |

| 04/01/21 | | | 7.125 | % | | | 1,813,000 | | | | 1,912,715 | | |

| EXCO Resources, Inc. | |

| 09/15/18 | | | 7.500 | % | | | 4,716,000 | | | | 4,739,580 | | |

| Goodrich Petroleum Corp.(b) | |

| 03/15/19 | | | 8.875 | % | | | 1,677,000 | | | | 1,689,578 | | |

Hilcorp Energy I LP/Finance Co.

Senior Notes(b) | |

| 02/15/20 | | | 8.000 | % | | | 2,375,000 | | | | 2,529,375 | | |

Laredo Petroleum, Inc.

Senior Notes(b) | |

| 02/15/19 | | | 9.500 | % | | | 4,452,000 | | | | 4,741,380 | | |

| Linn Energy LLC/Finance Corp.(b) | |

| 05/15/19 | | | 6.500 | % | | | 3,170,000 | | | | 3,170,000 | | |

| MEG Energy Corp.(b)(d) | |

| 03/15/21 | | | 6.500 | % | | | 2,200,000 | | | | 2,216,500 | | |

NAK Naftogaz Ukraine

Government Guaranteed(d) | |

| 09/30/14 | | | 9.500 | % | | | 5,625,000 | | | | 6,175,712 | | |

Newfield Exploration Co.

Senior Subordinated Notes | |

| 04/15/16 | | | 6.625 | % | | | 3,810,000 | | | | 3,938,587 | | |

| 02/01/20 | | | 6.875 | % | | | 2,095,000 | | | | 2,220,700 | | |

Nexen, Inc.(d)

Senior Unsecured | |

| 03/10/35 | | | 5.875 | % | | | 960,000 | | | | 942,896 | | |

| 07/30/39 | | | 7.500 | % | | | 1,080,000 | | | | 1,264,769 | | |

Oasis Petroleum, Inc.

Senior Notes(b) | |

| 02/01/19 | | | 7.250 | % | | | 1,209,000 | | | | 1,212,023 | | |

| Petrohawk Energy Corp. | |

| 08/15/18 | | | 7.250 | % | | | 4,170,000 | | | | 4,373,287 | | |

| Petrohawk Energy Corp.(b) | |

| 06/01/19 | | | 6.250 | % | | | 6,420,000 | | | | 6,339,750 | | |

QEP Resources, Inc.

Senior Unsecured | |

| 03/01/21 | | | 6.875 | % | | | 2,810,000 | | | | 3,020,750 | | |

| Range Resources Corp. | |

| 05/15/19 | | | 8.000 | % | | | 1,115,000 | | | | 1,218,138 | | |

| 08/01/20 | | | 6.750 | % | | | 2,335,000 | | | | 2,463,425 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Independent Energy (cont.) | |

| Southwestern Energy Co. | |

| 02/01/18 | | | 7.500 | % | | $ | 1,595,000 | | | $ | 1,824,281 | | |

| Venoco, Inc.(b) | |

| 02/15/19 | | | 8.875 | % | | | 2,728,000 | | | | 2,762,100 | | |

| Total | | | 90,049,353 | | |

| Integrated Energy 0.1% | |

| Lukoil International Finance BV(b)(d) | |

| 11/09/20 | | | 6.125 | % | | | 2,300,000 | | | | 2,388,914 | | |

| Life Insurance 0.3% | |

| ING Groep NV(d)(e) | |

| 12/29/49 | | | 5.775 | % | | | 6,658,000 | | | | 6,191,940 | | |

| Media Cable 2.3% | |

| CCO Holdings LLC/Capital Corp. | |

| 01/15/19 | | | 7.000 | % | | | 5,180,000 | | | | 5,290,075 | | |

| 04/30/20 | | | 8.125 | % | | | 3,202,000 | | | | 3,474,170 | | |

CSC Holdings LLC

Senior Unsecured | |

| 02/15/19 | | | 8.625 | % | | | 346,000 | | | | 398,765 | | |

Cablevision Systems Corp.

Senior Unsecured | |

| 09/15/17 | | | 8.625 | % | | | 2,354,000 | | | | 2,654,135 | | |

Cequel Communications Holdings I LLC/Capital Corp.

Senior Unsecured(b) | |

| 11/15/17 | | | 8.625 | % | | | 4,010,000 | | | | 4,260,625 | | |

| Comcast Corp. | |

| 08/15/37 | | | 6.950 | % | | | 3,430,000 | | | | 3,949,449 | | |

| DIRECTV Holdings LLC/Financing Co., Inc. | |

| 06/15/15 | | | 6.375 | % | | | 335,000 | | | | 342,956 | | |

| DISH DBS Corp. | |

| 09/01/19 | | | 7.875 | % | | | 7,899,000 | | | | 8,600,036 | | |

| DISH DBS Corp.(b) | |

| 06/01/21 | | | 6.750 | % | | | 5,998,000 | | | | 6,057,980 | | |

Insight Communications Co., Inc.

Senior Notes(b) | |

| 07/15/18 | | | 9.375 | % | | | 1,755,000 | | | | 1,965,600 | | |

Kabel BW Erste Beteiligungs GmbH/Co. KG

Senior Secured(b)(d) | |

| 03/15/19 | | | 7.500 | % | | | 1,265,000 | | | | 1,329,661 | | |

Quebecor Media, Inc.

Senior Unsecured(d) | |

| 03/15/16 | | | 7.750 | % | | | 3,150,000 | | | | 3,268,125 | | |

| Time Warner Cable, Inc. | |

| 05/01/17 | | | 5.850 | % | | | 405,000 | | | | 453,162 | | |

| 02/01/20 | | | 5.000 | % | | | 650,000 | | | | 675,435 | | |

| Total | | | 42,720,174 | | |

| Media Non-Cable 3.6% | |

Belo Corp.

Senior Unsecured | |

| 11/15/16 | | | 8.000 | % | | | 2,625,000 | | | | 2,890,781 | | |

| CMP Susquehanna Corp.(b)(g)(i) | |

| 05/15/14 | | | 3.417 | % | | | 175,000 | | | | 161,000 | | |

| Clear Channel Communications, Inc.(b) | |

| 03/01/21 | | | 9.000 | % | | | 5,000,000 | | | | 5,012,500 | | |

| Clear Channel Worldwide Holdings, Inc. | |

| 12/15/17 | | | 9.250 | % | | | 6,590,000 | | | | 7,199,575 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

10

Columbia Strategic Income Fund

May 31, 2011

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Media Non-Cable (cont.) | |

Cumulus Media, Inc.

Senior Notes(b) | |

| 05/01/19 | | | 7.750 | % | | $ | 506,000 | | | $ | 506,000 | | |

Entravision Communications Corp.

Senior Secured | |

| 08/01/17 | | | 8.750 | % | | | 2,375,000 | | | | 2,523,438 | | |

| Intelsat Jackson Holdings SA(b)(d) | |

| 04/01/19 | | | 7.250 | % | | | 2,390,000 | | | | 2,407,925 | | |

| 10/15/20 | | | 7.250 | % | | | 2,430,000 | | | | 2,436,075 | | |

| 04/01/21 | | | 7.500 | % | | | 2,390,000 | | | | 2,419,875 | | |

Intelsat Luxembourg SA(b)(d)

PIK | |

| 02/04/17 | | | 11.500 | % | | | 1,631,000 | | | | 1,767,596 | | |

Intelsat Luxembourg SA(d)

PIK | |

| 02/04/17 | | | 11.500 | % | | | 1,627,000 | | | | 1,763,261 | | |

Interpublic Group of Companies, Inc. (The)

Senior Unsecured | |

| 07/15/17 | | | 10.000 | % | | | 1,200,000 | | | | 1,431,000 | | |

| News America, Inc. | |

| 12/15/35 | | | 6.400 | % | | | 150,000 | | | | 158,849 | | |

| Nielsen Finance LLC/Co.(b) | |

| 10/15/18 | | | 7.750 | % | | | 3,437,000 | | | | 3,703,368 | | |

RR Donnelley & Sons Co.

Senior Unsecured | |

| 06/15/20 | | | 7.625 | % | | | 710,000 | | | | 720,359 | | |

RR Donnelley & Sons Co.(c)

Senior Notes | |

| 05/15/18 | | | 7.250 | % | | | 1,047,000 | | | | 1,059,880 | | |

Salem Communications Corp.

Secured | |

| 12/15/16 | | | 9.625 | % | | | 3,892,000 | | | | 4,185,645 | | |

Sinclair Television Group, Inc.

Secured(b) | |

| 11/01/17 | | | 9.250 | % | | | 6,816,000 | | | | 7,616,880 | | |

| TCM Sub LLC(b) | |

| 01/15/15 | | | 3.550 | % | | | 4,660,000 | | | | 4,910,586 | | |

| Univision Communications, Inc.(b) | |

| 05/15/21 | | | 8.500 | % | | | 4,980,000 | | | | 5,067,150 | | |

Senior Secured

11/01/20 | | | 7.875 | % | | | 3,885,000 | | | | 4,079,250 | | |

| XM Satellite Radio, Inc.(b) | |

| 11/01/18 | | | 7.625 | % | | | 4,511,000 | | | | 4,792,937 | | |

| Total | | | 66,813,930 | | |

| Metals 1.8% | |

| Alpha Natural Resources, Inc.(c) | |

| 06/01/19 | | | 6.000 | % | | | 1,289,000 | | | | 1,300,279 | | |

| 06/01/21 | | | 6.250 | % | | | 1,289,000 | | | | 1,314,780 | | |

ArcelorMittal

Senior Unsecured(d) | |

| 03/01/21 | | | 5.500 | % | | | 4,590,000 | | | | 4,624,007 | | |

Calcipar SA

Senior Secured(b)(d) | |

| 05/01/18 | | | 6.875 | % | | | 2,680,000 | | | | 2,773,800 | | |

| Consol Energy, Inc. | |

| 04/01/17 | | | 8.000 | % | | | 375,000 | | | | 410,625 | | |

| 04/01/20 | | | 8.250 | % | | | 4,420,000 | | | | 4,906,200 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Metals (cont.) | |

| FMG Resources August 2006 Proprietary Ltd.(b)(d) | |

| 11/01/15 | | | 7.000 | % | | $ | 4,198,000 | | | $ | 4,432,864 | | |

| 02/01/16 | | | 6.375 | % | | | 1,945,000 | | | | 1,966,881 | | |

| 02/01/18 | | | 6.875 | % | | | 1,711,000 | | | | 1,787,995 | | |

JMC Steel Group

Senior Notes(b) | |

| 03/15/18 | | | 8.250 | % | | | 1,036,000 | | | | 1,069,670 | | |

| Novelis, Inc.(d) | |

| 12/15/20 | | | 8.750 | % | | | 2,835,000 | | | | 3,132,675 | | |

Rain CII Carbon LLC/Corp.

Senior Secured(b) | |

| 12/01/18 | | | 8.000 | % | | | 2,430,000 | | | | 2,606,175 | | |

United States Steel Corp.

Senior Unsecured | |

| 02/01/18 | | | 7.000 | % | | | 3,819,000 | | | | 3,981,308 | | |

| Total | | | 34,307,259 | | |

| Non-Captive Consumer 0.6% | |

General Motors Financial Co., Inc.

Senior Notes(b)(c) | |

| 06/01/18 | | | 6.750 | % | | | 739,000 | | | | 744,619 | | |

SLM Corp.

Senior Notes | |

| 01/25/16 | | | 6.250 | % | | | 2,065,000 | | | | 2,162,986 | | |

Senior Unsecured

03/25/20 | | | 8.000 | % | | | 3,057,000 | | | | 3,371,272 | | |

Springleaf Finance Corp.

Senior Unsecured | |

| 12/15/17 | | | 6.900 | % | | | 4,222,000 | | | | 4,010,900 | | |

| Total | | | 10,289,777 | | |

| Non-Captive Diversified 3.4% | |

| Ally Financial, Inc. | |

| 03/15/20 | | | 8.000 | % | | | 13,008,000 | | | | 14,357,580 | | |

| 09/15/20 | | | 7.500 | % | | | 3,430,000 | | | | 3,691,537 | | |

| Ally Financial, Inc.(b) | |

| 12/01/17 | | | 6.250 | % | | | 2,930,000 | | | | 3,018,363 | | |

CIT Group, Inc.

Secured | |

| 05/01/17 | | | 7.000 | % | | | 15,990,000 | | | | 16,049,962 | | |

CIT Group, Inc.(b)

Secured | |

| 04/01/18 | | | 6.625 | % | | | 2,630,000 | | | | 2,814,100 | | |

Ford Motor Credit Co. LLC

Senior Unsecured | |

| 01/15/20 | | | 8.125 | % | | | 6,025,000 | | | | 7,075,646 | | |

| 02/01/21 | | | 5.750 | % | | | 2,311,000 | | | | 2,328,961 | | |

General Electric Capital Corp.

Senior Unsecured | |

| 01/10/39 | | | 6.875 | % | | | 3,830,000 | | | | 4,499,756 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

11

Columbia Strategic Income Fund

May 31, 2011

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Non-Captive Diversified (cont.) | |

International Lease Finance Corp.

Senior Unsecured | |

| 03/15/17 | | | 8.750 | % | | $ | 2,560,000 | | | $ | 2,899,200 | | |

| 09/01/17 | | | 8.875 | % | | | 3,210,000 | | | | 3,651,375 | | |

| 05/15/19 | | | 6.250 | % | | | 1,215,000 | | | | 1,219,573 | | |

| 12/15/20 | | | 8.250 | % | | | 1,965,000 | | | | 2,205,713 | | |

| Total | | | 63,811,766 | | |

| Oil Field Services 0.6% | |

Offshore Group Investments Ltd.(b)(c)(d)

Senior Secured | |

| 08/01/15 | | | 11.500 | % | | | 1,050,000 | | | | 1,149,728 | | |

Offshore Group Investments Ltd.(d)

Senior Secured | |

| 08/01/15 | | | 11.500 | % | | | 4,885,000 | | | | 5,385,713 | | |

| Oil States International, Inc.(b)(c) | |

| 06/01/19 | | | 6.500 | % | | | 3,163,000 | | | | 3,182,769 | | |

Trinidad Drilling Ltd.

Senior Unsecured(b)(d) | |

| 01/15/19 | | | 7.875 | % | | | 1,913,000 | | | | 2,051,175 | | |

| Weatherford International Ltd.(d) | |

| 03/15/13 | | | 5.150 | % | | | 14,000 | | | | 14,870 | | |

| Total | | | 11,784,255 | | |

| Other Industry 0.1% | |

| Aquilex Holdings LLC/Finance Corp. | |

| 12/15/16 | | | 11.125 | % | | | 1,365,000 | | | | 1,344,525 | | |

| Interline Brands, Inc. | |

| 11/15/18 | | | 7.000 | % | | | 1,094,000 | | | | 1,119,983 | | |

| Total | | | 2,464,508 | | |

| Packaging 0.6% | |

ARD Finance SA

Senior Secured(b)(d) | |

| 06/01/18 | | | 11.125 | % | | | 649,000 | | | | 678,205 | | |

| Ardagh Packaging Finance PLC(b)(d) | |

| 10/15/20 | | | 9.125 | % | | | 1,715,000 | | | | 1,886,500 | | |

Senior Secured

10/15/17 | | | 7.375 | % | | | 790,000 | | | | 843,325 | | |

| Reynolds Group Issuer, Inc./LLC(b) | |

| 04/15/19 | | | 9.000 | % | | | 2,255,000 | | | | 2,393,119 | | |

| 02/15/21 | | | 8.250 | % | | | 2,439,000 | | | | 2,481,682 | | |

Senior Secured

04/15/19 | | | 7.125 | % | | | 1,961,000 | | | | 2,039,440 | | |

| Total | | | 10,322,271 | | |

| Paper 0.4% | |

| Cascades, Inc.(d) | |

| 12/15/17 | | | 7.750 | % | | | 3,715,000 | | | | 3,937,900 | | |

| Graphic Packaging International, Inc. | |

| 10/01/18 | | | 7.875 | % | | | 564,000 | | | | 611,940 | | |

Verso Paper Holdings LLC/Inc.

Secured(b) | |

| 02/01/19 | | | 8.750 | % | | | 2,678,000 | | | | 2,678,000 | | |

| Total | | | 7,227,840 | | |

| Pharmaceuticals 0.6% | |

Grifols, Inc.

Senior Secured(b) | |

| 02/01/18 | | | 8.250 | % | | | 2,604,000 | | | | 2,740,710 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Pharmaceuticals (cont.) | |

| Mylan, Inc.(b) | |

| 11/15/18 | | | 6.000 | % | | $ | 2,774,000 | | | $ | 2,850,285 | | |

| Valeant Pharmaceuticals International(b)(d) | |

| 10/01/17 | | | 6.750 | % | | | 1,050,000 | | | | 1,039,500 | | |

| 10/01/20 | | | 7.000 | % | | | 1,639,000 | | | | 1,606,220 | | |

| Warner Chilcott Co./Finance LLC(b) | |

| 09/15/18 | | | 7.750 | % | | | 3,296,000 | | | | 3,436,080 | | |

| Total | | | 11,672,795 | | |

| Railroads 0.2% | |

CSX Corp.

Senior Unsecured | |

| 04/15/41 | | | 5.500 | % | | | 2,765,000 | | | | 2,768,835 | | |

Union Pacific Corp.

Senior Unsecured | |

| 08/15/18 | | | 5.700 | % | | | 1,440,000 | | | | 1,653,885 | | |

| Total | | | 4,422,720 | | |

| Refining 0.2% | |

United Refining Co.

Senior Secured(b) | |

| 02/28/18 | | | 10.500 | % | | | 2,677,000 | | | | 2,710,463 | | |

| REITs —% | |

Duke Realty LP

Senior Unsecured | |

| 08/15/19 | | | 8.250 | % | | | 200 | | | | 246 | | |

| Retailers 0.7% | |

Asbury Automotive Group, Inc.

Subordinated Notes(b) | |

| 11/15/20 | | | 8.375 | % | | | 320,000 | | | | 335,200 | | |

| Ltd Brands, Inc. | |

| 04/01/21 | | | 6.625 | % | | | 1,405,000 | | | | 1,464,713 | | |

Needle Merger Sub Corp.

Senior Unsecured(b) | |

| 03/15/19 | | | 8.125 | % | | | 474,000 | | | | 479,925 | | |

QVC, Inc.(b)

Senior Secured | |

| 04/15/17 | | | 7.125 | % | | | 1,025,000 | | | | 1,091,625 | | |

| 10/15/20 | | | 7.375 | % | | | 2,652,000 | | | | 2,844,270 | | |

| Rite Aid Corp. | |

| 06/15/17 | | | 9.500 | % | | | 820,000 | | | | 752,350 | | |

Senior Secured

08/15/20 | | | 8.000 | % | | | 1,000,000 | | | | 1,076,250 | | |

Toys R Us, Inc.

Senior Unsecured | |

| 10/15/18 | | | 7.375 | % | | | 5,440,000 | | | | 5,440,000 | | |

| Total | | | 13,484,333 | | |

| Sovereign 0.2% | |

Morgan Stanley

Senior Unsecured(d) | |

| 10/22/20 | | | 11.500 | % | | BRL | 6,285,000 | | | | 4,063,191 | | |

| Supranational 0.4% | |

European Investment Bank

Senior Unsecured(d) | |

| 06/20/17 | | | 1.400 | % | | JPY | 400,000,000 | | | | 5,095,542 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

12

Columbia Strategic Income Fund

May 31, 2011

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Supranational (cont.) | |

International Finance Corp.

Senior Unsecured(d) | |

| 02/28/13 | | | 7.500 | % | | AUD | 2,675,000 | | | $ | 2,967,692 | | |

| Total | | | 8,063,234 | | |

| Technology 2.0% | |

Amkor Technology, Inc.

Senior Unsecured | |

| 05/01/18 | | | 7.375 | % | | $ | 1,843,000 | | | | 1,921,327 | | |

Amkor Technology, Inc.(b)

Senior Unsecured | |

| 06/01/21 | | | 6.625 | % | | | 3,087,000 | | | | 3,032,977 | | |

| CDW LLC/Finance Corp(b) | |

| 04/01/19 | | | 8.500 | % | | | 2,779,000 | | | | 2,806,790 | | |

| Cardtronics, Inc. | |

| 09/01/18 | | | 8.250 | % | | | 2,465,000 | | | | 2,686,850 | | |

| CommScope, Inc.(b) | |

| 01/15/19 | | | 8.250 | % | | | 693,000 | | | | 725,918 | | |

| First Data Corp. | |

| 09/24/15 | | | 9.875 | % | | | 1,558,000 | | | | 1,608,635 | | |

| 09/24/15 | | | 9.875 | % | | | 152,000 | | | | 156,560 | | |

| First Data Corp.(b) | |

| 01/15/21 | | | 12.625 | % | | | 5,150,000 | | | | 5,600,625 | | |

Senior Secured

06/15/19 | | | 7.375 | % | | | 1,330,000 | | | | 1,349,950 | | |

| 08/15/20 | | | 8.875 | % | | | 3,210,000 | | | | 3,482,850 | | |

Freescale Semiconductor, Inc.

Senior Secured(b) | |

| 04/15/18 | | | 9.250 | % | | | 1,775,000 | | | | 1,979,125 | | |

| Interactive Data Corp.(b) | |

| 08/01/18 | | | 10.250 | % | | | 3,755,000 | | | | 4,177,437 | | |

NXP BV/Funding LLC

Senior Secured(b)(d) | |

| 08/01/18 | | | 9.750 | % | | | 1,349,000 | | | | 1,554,723 | | |

| SunGard Data Systems, Inc. | |

| 11/15/18 | | | 7.375 | % | | | 3,488,000 | | | | 3,557,760 | | |

iGate Corp.

Senior Notes(b) | |

| 05/01/16 | | | 9.000 | % | | | 1,747,000 | | | | 1,790,675 | | |

| Total | | | 36,432,202 | | |

| Transportation Services 0.6% | |

| Avis Budget Car Rental LLC/Finance, Inc. | |

| 01/15/19 | | | 8.250 | % | | | 2,370,000 | | | | 2,455,913 | | |

| ERAC U.S.A. Finance LLC(b) | |

| 10/01/20 | | | 5.250 | % | | | 1,150,000 | | | | 1,223,169 | | |

| 10/15/37 | | | 7.000 | % | | | 147,000 | | | | 167,184 | | |

| Hertz Corp. (The)(b) | |

| 10/15/18 | | | 7.500 | % | | | 2,435,000 | | | | 2,526,312 | | |

| 04/15/19 | | | 6.750 | % | | | 1,865,000 | | | | 1,883,650 | | |

| 01/15/21 | | | 7.375 | % | | | 2,316,000 | | | | 2,397,060 | | |

| Total | | | 10,653,288 | | |

| Wireless 2.5% | |

Clearwire Communications LLC/Finance, Inc.(b)

Secured | |

| 12/01/17 | | | 12.000 | % | | | 904,000 | | | | 986,490 | | |

Senior Secured

12/01/15 | | | 12.000 | % | | | 1,073,000 | | | | 1,176,276 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes(a) (continued) | |

| Wireless (cont.) | |

Cricket Communications, Inc.

Senior Secured | |

| 05/15/16 | | | 7.750 | % | | $ | 921,000 | | | $ | 978,563 | | |

Cricket Communications, Inc.(b)

Senior Notes | |

| 10/15/20 | | | 7.750 | % | | | 1,321,000 | | | | 1,302,836 | | |

EH Holding Corp.(b)(c)

Senior Secured | |

| 06/15/19 | | | 6.500 | % | | | 2,973,000 | | | | 3,006,446 | | |

Senior Unsecured

06/15/21 | | | 7.625 | % | | | 3,260,000 | | | | 3,333,350 | | |

| MetroPCS Wireless, Inc. | |

| 09/01/18 | | | 7.875 | % | | | 1,695,000 | | | | 1,824,244 | | |

| 11/15/20 | | | 6.625 | % | | | 2,090,000 | | | | 2,084,775 | | |

| NII Capital Corp. | |

| 04/01/21 | | | 7.625 | % | | | 2,000,000 | | | | 2,122,500 | | |

| Nextel Communications, Inc. | |

| 08/01/15 | | | 7.375 | % | | | 1,384,000 | | | | 1,392,650 | | |

| SBA Telecommunications, Inc. | |

| 08/15/19 | | | 8.250 | % | | | 1,540,000 | | | | 1,695,925 | | |

| Sprint Capital Corp. | |

| 11/15/28 | | | 6.875 | % | | | 3,030,000 | | | | 2,939,100 | | |

Sprint Nextel Corp.

Senior Unsecured | |

| 08/15/17 | | | 8.375 | % | | | 9,850,000 | | | | 11,105,875 | | |

United States Cellular Corp.

Senior Unsecured | |

| 12/15/33 | | | 6.700 | % | | | 1,850,000 | | | | 1,876,703 | | |

| Wind Acquisition Finance SA(b)(d) | |

| 07/15/17 | | | 11.750 | % | | | 7,102,000 | | | | 8,256,075 | | |

Senior Secured

02/15/18 | | | 7.250 | % | | | 2,570,000 | | | | 2,724,200 | | |

| Total | | | 46,806,008 | | |

| Wirelines 3.3% | |

AT&T, Inc.

Senior Unsecured | |

| 02/15/39 | | | 6.550 | % | | | 4,130,000 | | | | 4,556,435 | | |

BellSouth Corp.

Senior Unsecured | |

| 09/15/14 | | | 5.200 | % | | | 2,205,000 | | | | 2,446,271 | | |

| Cincinnati Bell, Inc. | |

| 10/15/17 | | | 8.250 | % | | | 3,980,000 | | | | 4,054,625 | | |

Embarq Corp.