UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04367

|

| Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter)

|

| 225 Franklin Street, Boston, Massachusetts 02110 |

(Address of principal executive offices) (Zip code)

|

Scott R. Plummer 5228 Ameriprise Financial Center Minneapolis, MN 55474 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-612-671-1947

Date of fiscal year end: March 31

Date of reporting period: March 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Corporate Income Fund

Annual Report for the Period Ended March 31, 2011

Table of contents

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President’s Message

Dear Shareholder:

The Columbia Management story began over 100 years ago, and today, we are one of the nation’s largest dedicated asset managers. The recent acquisition by Ameriprise Financial, Inc. brings together the talents, resources and capabilities of Columbia Management with those of RiverSource Investments, Threadneedle (acquired by Ameriprise in 2003) and Seligman Investments (acquired by Ameriprise in 2008) to build a best-in-class asset management business that we believe is truly greater than its parts.

RiverSource Investments traces its roots to 1894 when its then newly-founded predecessor, Investors Syndicate, offered a face-amount savings certificate that gave small investors the opportunity to build a safe and secure fund for retirement, education or other special needs. A mutual fund pioneer, Investors Syndicate launched Investors Mutual Fund in 1940. In the decades that followed, its mutual fund products and services lineup grew to include a full spectrum of styles and specialties. More than 110 years later, RiverSource continues to be a trusted financial products leader.

Threadneedle, a leader in global asset management and one of Europe’s largest asset managers, offers sophisticated international experience from a dedicated U.K. management team. Headquartered in London, it is named for Threadneedle Street in the heart of the city’s financial district, where British investors pioneered international and global investing. Threadneedle was acquired in 2003 and today operates as an affiliate of Columbia Management.

Seligman Investments’ beginnings date back to the establishment of the investment firm J. & W. Seligman & Co. in 1864. In the years that followed, Seligman played a major role in the geographical expansion and industrial development of the United States. In 1874, President Ulysses S. Grant named Seligman as fiscal agent for the U.S. Navy — an appointment that would last through World War I. Seligman helped finance the westward path of the railroads and the building of the Panama Canal. The firm organized its first investment company in 1929 and began managing its first mutual fund in 1930. In 2008, J. & W. Seligman & Co. Incorporated was acquired and Seligman Investments became an offering brand of RiverSource Investments, LLC.

We are proud of the rich and distinctive history of these firms, the strength and breadth of products and services they offer, and the combined cultures of pioneering spirit and forward thinking. Together we are committed to providing more for our shareholders than ever before.

| n | | A singular focus on our shareholders. Our business is asset management, so investors are our first priority. We dedicate our resources to identifying timely investment opportunities and provide a comprehensive choice of equity, fixed-income and alternative investments to help meet your individual needs. |

| n | | First-class research and thought leadership. We are dedicated to helping you take advantage of today’s opportunities and anticipate tomorrow’s. We stay abreast of the latest investment trends and ideas, using our collective insight to evaluate events and transform them into solutions you can use. |

| n | | A disciplined investment approach. We aren’t distracted by passing fads. Our teams adhere to a rigorous investment process that helps ensure the integrity of our products and enables you and your financial advisor to match our solutions to your objectives with confidence. |

When you choose Columbia Management, you can be confident that we will take the time to understand your needs and help you and your financial advisor identify the solutions that are right for you. Because at Columbia Management, we don’t consider ourselves successful unless you are.

Sincerely,

J. Kevin Connaughton

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the funds, visit www.columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2011 Columbia Management Investment Advisers, LLC. All rights reserved.

Fund Profile – Columbia Corporate Income Fund

Summary

| n | | For the 12-month period that ended March 31, 2011, the fund’s Class A shares returned 7.43% without sales charge. |

| n | | The fund’s return was higher than the return of the Barclays Capital Credit Bond Index1 and slightly lower than the return of its blended benchmark2 and the average return of the funds in its peer group, the Lipper Corporate Debt Funds BBB-Rated Classification.3 |

| n | | The fund had more exposure than the Barclays Capital Credit Bond Index to financials and preferred securities, which contributed to its outperformance relative to that measure. The fund’s allocation to high-yield securities also bolstered performance. |

Portfolio Management

Brian Lavin has co-managed the fund since 2010 and has been associated with the fund’s adviser or the fund’s previous adviser or its predecessors since 1994.

Tom Murphy has co-managed the fund since 2011 and has been associated with the fund’s adviser or its predecessors since 2002.

Tim Doubek has co-managed the fund since 2011 and has been associated with the fund’s adviser or its predecessors since 2001.

| 1 | The Barclays Capital Credit Bond Index is an index of publicly issued investment grade, corporate securities and dollar-denominated SEC registered global debentures. |

| 2 | A weighted custom composite of the Barclays Capital Credit Bond Index (85%) and JPMorgan Global High Yield Index (15%) established by the advisor. The JPMorgan Global High Yield Index is designed to mirror the investable universe of the U.S. dollar global high yield corporate debt market including domestic and international issues. |

| 3 | Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads. |

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates

Summary

1-year return as of 03/31/11

| | |

| |

| | 7.43% Class A shares (without sales charge) |

| |

| | 7.01% Barclays Capital Credit Bond Index |

| |

| | 8.12% Blended Benchmark |

1

Economic Update – Columbia Corporate Income Fund

Summary

For the 12-month period that ended March 31, 2011

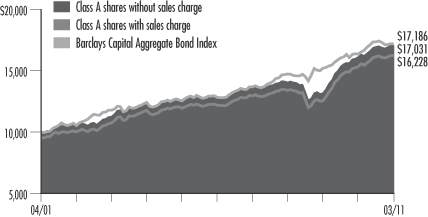

| | n | | Strengthening economic growth and rising interest rates kept a lid on most bond market sectors. The Barclays Capital Aggregate Bond Index delivered modest results. However, high-yield bonds were strong performers, as measured by the JPMorgan Developed BB High Yield Index. | |

| | |

Barclays

Aggregate Index | | JPMorgan

Index |

| |

| |

|

5.12% | | 13.04% |

| | n | | The U.S. stock market, as measured by the S&P 500 Index, delivered solid returns, despite a summer 2010 correction. Foreign stock market returns were also positive, as measured by the MSCI EAFE Index (Net). | |

| | |

| S&P Index | | MSCI Index |

| |

| |

|

15.65% | | 10.42% |

The U.S. economy continued to expand at a solid but uneven pace over the past 12 months, as measured by gross domestic product (GDP). Although lackluster second quarter 2010 GDP growth raised fears that the economy was losing steam and might lapse back into recession, the pace picked up in the third quarter of 2010, inspiring confidence among consumers, businesses and investors. GDP expanded by 2.6% in the third quarter and 3.1% in the fourth quarter. With the Federal Reserve Board (the Fed) providing additional monetary stimulus to shore up economic growth and the extension of key tax cuts for the next two years, expectations are for continued growth in 2011. However, early estimates of first quarter 2011 growth place it just under 2.0%, a disappointment after two strong quarters and a pick-up in employment.

Consumer spending on cars, clothing and other goods generally trended higher during the 12-month period, accelerating in the fourth quarter. Holiday spending rose 5.5% between November 5, 2010 and December 24, 2010, in all retail categories, excluding automobiles, compared with the same period in 2009, according to MasterCard Advisors’ SpendingPulse, which tracks spending on all transactions including cash. Personal income surged in January 2011 as payroll tax cuts kicked in. The personal savings rate edged higher, ending February 2011, the last month for which data was available, at 5.8%.

News on the job front was increasingly positive. A good portion of the jobs added in March, April and May of 2010 were temporary, government-sponsored census positions, which began to unwind in June, July and August of 2010. However, private sector payroll employment began to trend higher in the third quarter, massive layoffs declined and job growth turned solidly positive, with the addition of 444,000 new jobs in the first quarter of 2011.

Despite some glimmers of improvement early in 2010, the housing market remained troublesome throughout the period. Both new and existing home sales fell after a federal tax credit for new and repeat homebuyers expired. Distressed properties pressured prices and foreclosures continued — another drag on prices. The inventory of unsold homes ended the period higher than it started, at 8.9 and 8.6 months for both new and existing homes, respectively, according to the National Association of Realtors and a joint release from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development. The new year brought more disappointing news: Existing home sales fell in January 2011 after three months of sustained improvement. Tight credit and weak appraisals were cited as possible reasons for the decline.

Reports from the business side of the economy were generally positive. A key measure of the nation’s manufacturing situation — the Institute for Supply Management’s Index — took a somewhat surprising turn higher in the final months of the period. Technology spending rose 12% in 2010, according to the NPD Group, a national marketing research firm. Purchases of computers, networking and software returned to prerecession levels. Industrial production rose over the period, and manufacturing capacity utilized, per the report issued by the Fed — a key measure of the health of the manufacturing sector — also edged higher.

2

Economic Update (continued) – Columbia Corporate Income Fund

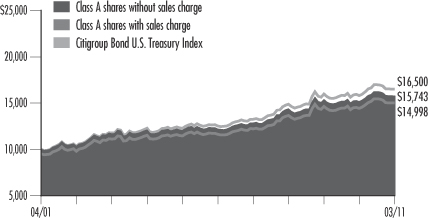

Bonds delivered modest returns

As the economy strengthened and interest rates edged higher, most bond sectors delivered modest returns. The Barclays Capital Aggregate Bond Index1 returned 5.12%. High-yield bonds led the fixed-income markets. For the 12 months covered by this report, the JPMorgan Developed BB High Yield Index2 returned 13.04% as default fears abated and investors grew more comfortable with risk. Despite rising yields in the second half of the period, the Treasury market was also positive. The Barclays Capital U.S. Treasury Index3 returned 4.53%. However, municipal bonds struggled in the second half of the period, as interest rates inched higher and issue supply surged ahead of the year-end expiration of the Build America Bonds program. The Barclays Capital Municipal Bond Index4 gained 1.63% for the period. Despite positive economic activity, the Fed kept a key short-term interest rate — the federal funds rate — close to zero, reflecting ongoing concerns about employment and the housing market.

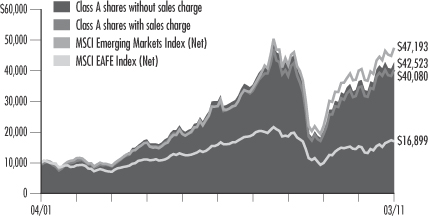

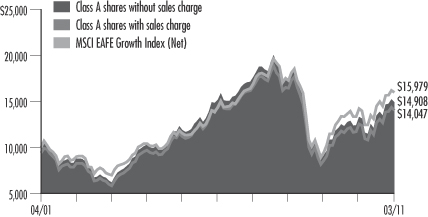

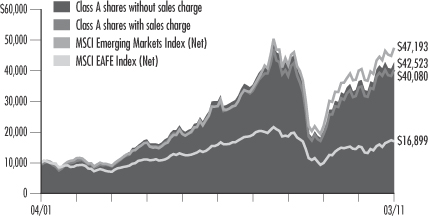

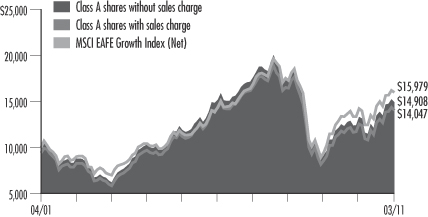

Stocks moved higher despite summer 2010 decline

Against a strengthening economic backdrop, stock prices continued to rally despite a summer 2010 setback linked to a debt crisis brewing in Europe, which raised concerns among U.S. investors. These fears were short-lived and stocks regained their footing. In this environment, the S&P 500 Index5 returned 15.65% for the 12 months through March 31, 2011. Outside the United States, stock markets also delivered solid gains. The MSCI EAFE Index (Net),6 a broad gauge of stock market performance in foreign developed markets, returned 10.42% (in U.S. dollars) for the 12-month period, as concerns about the impact of a bailout for weak euro zone economies eased yet continued to restrain market performance. Emerging stock markets were strong. The MSCI Emerging Markets Index (Net)7 returned 18.46% (in U.S. dollars) for the 12-month period.

Past performance is no guarantee of future results.

| 1 | The Barclays Capital Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity. |

| 2 | The JPMorgan Developed BB High Yield Index is an unmanaged index designed to mirror the investable universe of the U.S. dollar developed, BB-rated, high yield corporate debt market. |

| 3 | The Barclays Capital U.S. Treasury Index includes public obligations of the U.S. Treasury. Treasury bills are excluded by the maturity constraint. In addition, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS, are excluded. STRIPS are excluded from the index because their inclusion would result in double-counting. |

| 4 | The Barclays Capital Municipal Bond Index is considered representative of the broad market for investment-grade, tax-exempt bonds with a maturity of at least one year |

| 5 | The Standard & Poor’s (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks. |

| 6 | The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index (Net) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. As of December 31, 2010, the MSCI EAFE Index (Net) consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. |

| 7 | The Morgan Stanley Capital International Emerging Markets (MSCI EM) Index (Net) is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. As of December 31, 2010, the MSCI EM Index (Net) consisted of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey. |

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

3

Performance Information – Columbia Corporate Income Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

| | | | |

| Net asset value per share | |

|

As of 03/31/11 ($) | |

Class A | | | 9.71 | |

Class B | | | 9.71 | |

Class C | | | 9.71 | |

Class I | | | 9.71 | |

Class W | | | 9.71 | |

Class Z | | | 9.71 | |

| | | | |

| Distributions declared per share | |

|

04/01/10 – 03/31/11 ($) | |

Class A | | | 0.51 | |

Class B | | | 0.44 | |

Class C | | | 0.46 | |

Class I | | | 0.27 | |

Class W | | | 0.26 | |

Class Z | | | 0.54 | |

|

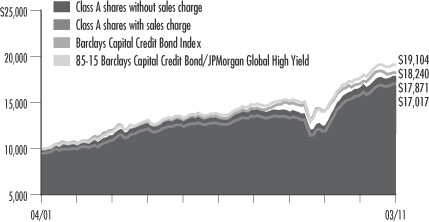

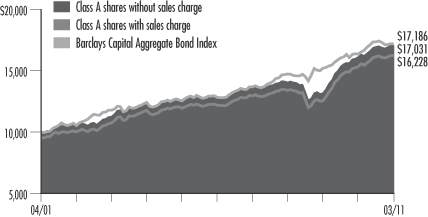

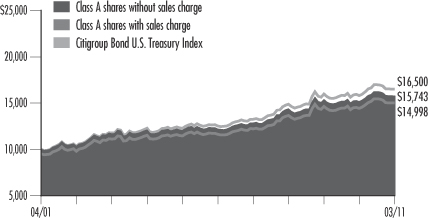

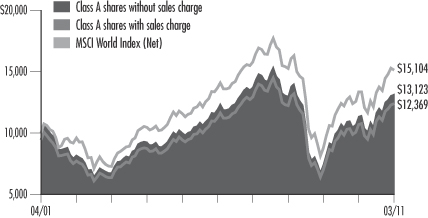

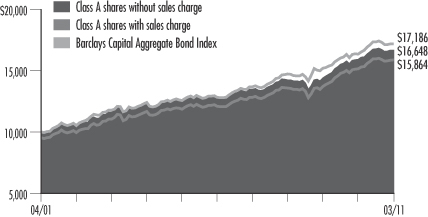

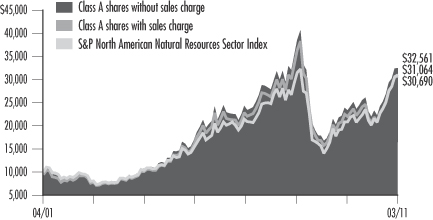

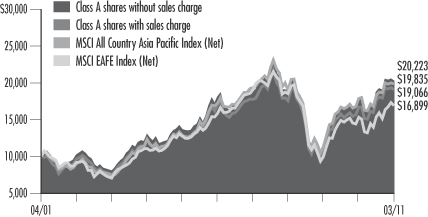

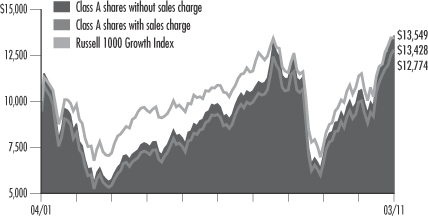

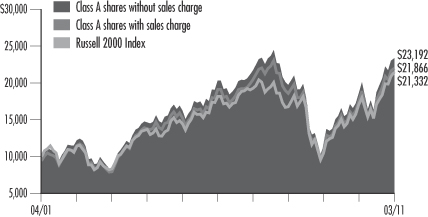

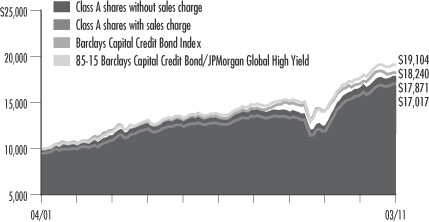

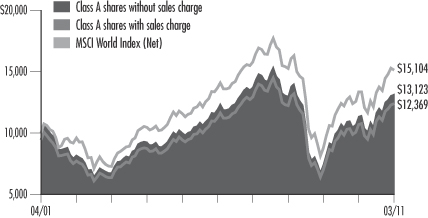

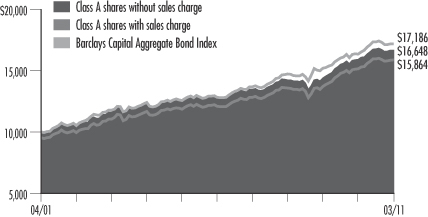

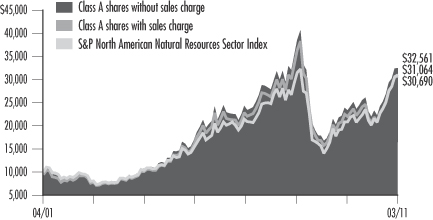

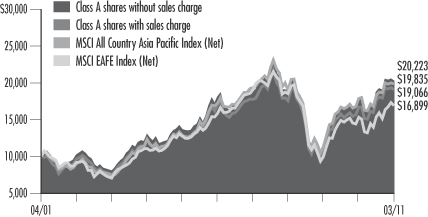

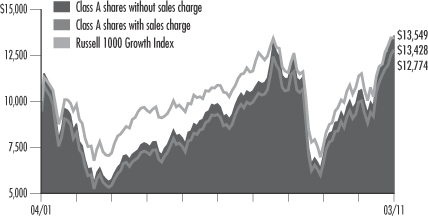

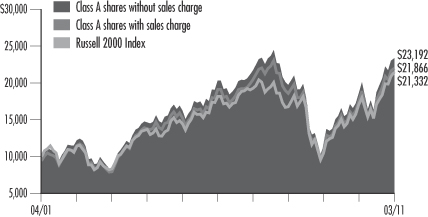

| Performance of a $10,000 investment 04/01/01 – 03/31/11 |

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Corporate Income Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

| | | | | | | | |

| Performance of a $10,000 investment 04/01/01 – 03/31/11 ($) | |

| | |

| Sales charge | | without | | | With | |

Class A | | | 17,871 | | | | 17,017 | |

Class B | | | 16,743 | | | | 16,743 | |

Class C | | | 16,959 | | | | 16,959 | |

Class I | | | n/a | | | | n/a | |

Class W | | | n/a | | | | n/a | |

Class Z | | | 18,376 | | | | n/a | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average annual total return as of 3/31/11 (%) | |

| | | | | | |

| Share class | | A | | | B | | | C | | | I | | | W | | | Z | |

| Inception | | 07/31/00 | | | 07/15/02 | | | 07/15/02 | | | 9/27/10 | | | 9/27/10 | | | 03/05/86 | |

| Sales charge | | without | | | with | | | without | | | with | | | without | | | with | | | without | | | without | | | without | |

1-year | | | 7.43 | | | | 2.28 | | | | 6.64 | | | | 1.64 | | | | 6.79 | | | | 5.79 | | | | n/a | | | | n/a | | | | 7.70 | |

5-year | | | 6.04 | | | | 5.01 | | | | 5.25 | | | | 4.92 | | | | 5.41 | | | | 5.41 | | | | n/a | | | | n/a | | | | 6.30 | |

10-year/Life | | | 5.98 | | | | 5.46 | | | | 5.29 | | | | 5.29 | | | | 5.42 | | | | 5.42 | | | | 1.50 | | | | 1.31 | | | | 6.27 | |

The “with sales charge” returns include the maximum initial sales charge of 4.75% for Class A shares and the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The “without sales charge” returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume the reinvestment of distributions. Class I and Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class W shares are sold at net asset value with a service (Rule 12b-1) fee. Class I, Class W and Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

Class I and Class W shares were initially offered by the fund on September 27, 2010, the date of their inception.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Class B and Class C shares performance information includes returns of the Class A shares. These returns shown for these share classes reflect any difference in sales charges, but have not been restated to reflect any difference in expenses, such as distribution and service (rule 12b-1) fees, between Class A and the corresponding newer share classes. If differences in expenses had been reflected, the returns shown for periods prior to the inception of the newer share classes of shares would have been lower. Class A shares were initially offered on July 31, 2000, Class B shares and Class C shares were initially offered on July 15, 2002, and Class Z shares were initially offered on March 5, 1986.

4

Understanding Your Expenses – Columbia Corporate Income Fund

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund’s expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the fund’s actual operating expenses and total return for the period. The amount listed in the “Hypothetical” column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund’s actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing costs of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

| | n | | For shareholders who receive their account statements from Columbia Management Investment Services Corp., your account balance is available online at www.columbiamanagement.com or by calling Shareholder Services at 800.345.6611. | |

| | n | | For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance. | |

| | 1. | Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6. | |

| | 2. | In the section of the table below titled “Expenses paid during the period,” locate the amount for your share class. You will find this number in the column labeled “Actual.” Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period. | |

If the value of your account falls below the minimum initial investment requirement applicable to you, your account may be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 10/01/10 – 3/31/11 | | | | | | | | | | | | | | | | |

| | | | |

| | | Account value at the

beginning of the period ($) | | | Account value at the

end of the period ($) | | | Expenses paid

during the period ($) | | | Fund’s annualized

expense ratio (%) | |

| | | Actual | | | Hypothetical | | | Actual | | | Hypothetical | | | Actual | | | Hypothetical | | | Actual | |

Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,011.70 | | | | 1,020.19 | | | | 4.76 | | | | 4.78 | | | | 0.95 | |

Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,007.90 | | | | 1,016.45 | | | | 8.51 | | | | 8.55 | | | | 1.70 | |

Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,008.70 | | | | 1,017.20 | | | | 7.76 | | | | 7.80 | | | | 1.55 | |

Class I | | | 1,000.00 | | | | 1,000.00 | | | | 1,013.50 | | | | 1,021.69 | | | | 3.26 | | | | 3.28 | | | | 0.65 | |

Class W | | | 1,000.00 | | �� | | 1,000.00 | | | | 1,011.70 | | | | 1,020.19 | | | | 4.76 | | | | 4.78 | | | | 0.95 | |

Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,012.90 | | | | 1,021.44 | | | | 3.51 | | | | 3.53 | | | | 0.70 | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund’s most recent fiscal half-year and divided by 365.

Had the Investment Manager and/or any of its affiliates not waived fees or reimbursed a portion of expenses, account value at the end of the period would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

5

Portfolio Managers’ Report – Columbia Corporate Income Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

| | | | |

| 30-day SEC yields | |

| |

as of 03/31/11 (%) | | | | |

Class A | | | 4.04 | |

Class B | | | 3.54 | |

Class C | | | 3.68 | |

Class I | | | 4.61 | |

Class W | | | 4.29 | |

Class Z | | | 4.54 | |

The 30-day SEC yields reflect the fund’s earning power, net of expenses, expressed as an annualized percentage of the public offering price per share at the end of the period.

Had the Investment Manager and/or any of its affiliates not waived fees or reimbursed a portion of expenses, the 30-day SEC yields would have been lower.

| | | | |

| Portfolio structure | |

| |

as of 03/31/11 (%) | | | | |

Corporate Fixed-Income Bonds & Notes | | | 85.3 | |

Government & Agency Obligations | | | 5.4 | |

Asset-Backed Securities | | | 3.0 | |

Municipal Bonds | | | 2.7 | |

Preferred Stocks | | | 1.4 | |

Commercial Mortgage-Backed Securities | | | 0.9 | |

Common Stock | | | 0.1 | |

Collateralized Mortgage Obligations | | | 0.0 | * |

Mortgage-Backed Securities | | | 0.0 | * |

Warrants | | | 0.0 | * |

Short-Term Obligation | | | 5.9 | |

Other Assets & Liabilities, Net | | | (4.7 | ) |

| | * | Rounds to less than 0.1% of net assets. |

For the 12-month period that ended March 31, 2011, the fund’s Class A shares returned 7.43% without sales charge. The fund’s return was higher than the 7.01% return of the Barclays Capital Credit Bond Index and slightly lower than the 8.12% return of its blended benchmark, which is a weighted custom composite of the Barclays Capital Credit Bond Index (85%) and JPMorgan Global High Yield Index (15%). The average return of the funds in its peer group, the Lipper Corporate Debt Funds BBB-Rated Classification, was 8.15% for the 12-month period.

The fund had more exposure than the Barclays Capital Credit Bond Index to financials and preferred securities, which contributed to its outperformance relative to that measure. The fund’s allocation to high-yield securities also bolstered performance. The Federal Reserve Board’s (the Fed’s) highly accommodative monetary policies worked to expand liquidity in the economy, much of which found its way into higher-risk assets, such as stocks and corporate bonds. Riskier segments of the bond market outperformed higher-quality Treasuries for the period.

Sector allocation, security selection aided returns

The fund’s overweight stake in investment-grade bonds, combined with strong security selection in the financials sector and among preferred issues, generally accounted for the fund’s performance advantage over the Barclays benchmark. The best results for the period were in the intermediate quality tier, where the fund had strong representation.

Holdings of certain bonds in euro zone banks benefited from better financial positions and more conservative operating policies. In this regard, the bonds of Barclays Bank, Lloyds and ING rose. The fund had more exposure than the benchmark to the telecommunications sector, which aided performance, thanks to gains by both AT&T and Verizon. Both companies benefited from improving business activity. Issuance of new telecommunications bonds was low, and that helped bolster prices. Lower vacancies brightened the outlook for Brandywine Realty, a real estate investment trust, pushing its securities higher.

The fund held fewer non-corporate issues than the index, which hampered results somewhat as yields fell and prices rose on Treasury debt.

Looking ahead

Core inflation, which does not take into account food and energy prices, remains benign. Wages and salaries are relatively stable, so there is little upward pressure on prices in the current environment. The global economic outlook looks positive overall, and the recent restructuring of banks should help them maintain momentum. Against that backdrop, the Fed’s goal is to keep interest rates relatively low in the five-to-seven year range, that portion of the yield curve that tends to influence mortgage rates. (The yield curve is a graphic depiction of yields from short-term to long-term and points in between.) This policy has aided non-Treasury segments of the bond market, and we expect that policy to persist. As a result, we have made few changes to the fund’s positioning for the period ahead. However, we will begin to rethink positioning once the Fed begins to shift its policies and rates move higher, a point that, in our opinion is still six to 12 months away.

6

Portfolio Managers’ Report (continued) – Columbia Corporate Income Fund

Portfolio characteristics and holdings are subject to change periodically and may not be representative of current characteristics and holdings. The outlook for the fund may differ from that presented for other Columbia Funds.

Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa.

Investments in high-yield bonds (sometimes referred to as “junk” bonds) offer the potential for high current income and attractive total return, but involve certain risks. Changes in economic conditions or other circumstances may adversely affect a high-yield bond issuer’s ability to make principal and interest payments.

| | | | |

| Quality breakdown | |

| |

as of 03/31/11 (%) | | | | |

Cash and Equivalents | | | 0.2 | |

Treasury | | | 5.0 | |

Agency | | | 0.1 | |

AAA | | | 4.7 | |

AA | | | 11.7 | |

A | | | 26.3 | |

BBB | | | 36.9 | |

BB | | | 7.7 | |

B | | | 6.2 | |

CCC | | | 0.9 | |

Non-Rated | | | 0.3 | |

| | | | |

| Maturity breakdown | |

| |

as of 03/31/11 (%) | | | | |

0-1 year | | | 1.9 | |

1-2 year | | | 4.3 | |

2-3 years | | | 3.6 | |

3-4 years | | | 4.1 | |

4-5 years | | | 12.3 | |

5-6 years | | | 5.5 | |

6-7 years | | | 10.0 | |

7-8 years | | | 7.2 | |

8-9 years | | | 7.5 | |

9-10 years | | | 8.4 | |

10-20 years | | | 3.8 | |

20 -30 years | | | 28.4 | |

30 years and over | | | 2.8 | |

Cash and Equivalents | | | 0.2 | |

Portfolio structure is calculated as a percentage of net assets.

Quality and maturity breakdowns are calculated as a percentage of total investments.

Ratings shown in the quality breakdown are assigned to individual bonds by taking the lower of the ratings available from one of the following nationally recognized rating agencies: Standard & Poor’s or Moody’s Investor Services. If a security is rated by only one of the two agencies, that rating is used. If a security is not rated by either of the two agencies, it is designated as Non-Rated. Ratings are relative and subjective and are not absolute standards of quality. The credit quality of the fund’s investments does not remove market risk.

The fund is actively managed and the composition of its portfolio will change over time.

7

Investment Portfolio – Columbia Corporate Income Fund

March 31, 2011

Corporate Fixed-Income Bonds & Notes – 85.3%

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Basic Materials – 3.8% | |

| Chemicals – 1.4% | |

| CF Industries, Inc. | | | | | |

6.875% 05/01/18 | | | 435,000 | | | | 487,200 | |

7.125% 05/01/20 | | | 153,000 | | | | 173,273 | |

| |

| Chemtura Corp. | | | | | |

7.875% 09/01/18 (a) | | | 102,000 | | | | 107,865 | |

| |

| Dow Chemical Co. | | | | | |

4.250% 11/15/20 | | | 2,185,000 | | | | 2,086,747 | |

5.900% 02/15/15 | | | 1,800,000 | | | | 1,995,046 | |

8.550% 05/15/19 | | | 378,000 | | | | 477,809 | |

9.400% 05/15/39 | | | 220,000 | | | | 326,670 | |

| |

| Hexion U.S. Finance Corp./Hexion Nova Scotia Finance ULC | | | | | |

8.875% 02/01/18 | | | 780,000 | | | | 824,850 | |

9.000% 11/15/20 (a) | | | 110,000 | | | | 114,056 | |

| |

| Lubrizol Corp. | | | | | |

8.875% 02/01/19 | | | 715,000 | | | | 918,951 | |

| |

| Lyondell Chemical Co. | | | | | |

8.000% 11/01/17 (a) | | | 499,000 | | | | 551,395 | |

| |

| MacDermid, Inc. | | | | | |

9.500% 04/15/17 (a) | | | 270,000 | | | | 286,537 | |

| |

| Momentive Performance Materials, Inc. | | | | | |

9.000% 01/15/21 (a) | | | 180,000 | | | | 186,075 | |

| |

| Nalco Co. | | | | | |

6.625% 01/15/19 (a) | | | 385,000 | | | | 396,069 | |

| |

| NOVA Chemicals Corp. | | | | | |

8.375% 11/01/16 | | | 360,000 | | | | 395,100 | |

8.625% 11/01/19 | | | 345,000 | | | | 385,969 | |

| |

| Rain CII Carbon LLC & CII Carbon Corp. | | | | | |

8.000% 12/01/18 (a) | | | 205,000 | | | | 218,837 | |

| | | | | | | | |

Chemicals Total | | | | | | | 9,932,449 | |

| |

| Forest Products & Paper – 0.1% | | | | | |

| Cascades, Inc. | | | | | |

7.750% 12/15/17 | | | 370,000 | | | | 390,813 | |

7.875% 01/15/20 | | | 205,000 | | | | 216,275 | |

| |

| Verso Paper Holdings LLC/Verso Paper, Inc. | | | | | |

8.750% 02/01/19 (a) | | | 133,000 | | | | 138,320 | |

| | | | | | | | |

Forest Products & Paper Total | | | | | | | 745,408 | |

| |

| Iron/Steel – 1.5% | | | | | |

| ArcelorMittal | | | | | |

6.750% 03/01/41 | | | 2,976,000 | | | | 2,916,602 | |

7.000% 10/15/39 | | | 5,633,000 | | | | 5,648,074 | |

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| JMC Steel Group | | | | | |

8.250% 03/15/18 (a) | | | 113,000 | | | | 115,543 | |

| |

| Nucor Corp. | | | | | |

5.000% 06/01/13 | | | 1,110,000 | | | | 1,194,084 | |

| |

| United States Steel Corp. | | | | | |

7.000% 02/01/18 | | | 454,000 | | | | 471,592 | |

7.375% 04/01/20 | | | 78,000 | | | | 81,705 | |

| | | | | | | | |

Iron/Steel Total | | | | | | | 10,427,600 | |

| |

| Metals & Mining – 0.8% | | | | | |

| FMG Resources August 2006 Pty Ltd. | | | | | |

6.375% 02/01/16 (a) | | | 410,000 | | | | 413,075 | |

6.875% 02/01/18 (a) | | | 117,000 | | | | 121,972 | |

7.000% 11/01/15 (a) | | | 373,000 | | | | 384,764 | |

| |

| Freeport-McMoRan Copper & Gold, Inc. | | | | | |

8.375% 04/01/17 | | | 180,000 | | | | 198,450 | |

| |

| Noranda Aluminum Acquisition Corp. | | | | | |

PIK, | | | | | | | | |

5.193% 05/15/15 (05/15/11) (b)(c) | | | 945,000 | | | | 891,023 | |

| |

| Novelis, Inc. | | | | | |

8.375% 12/15/17 (a) | | | 280,000 | | | | 303,100 | |

8.750% 12/15/20 (a) | | | 275,000 | | | | 302,500 | |

| |

| Vale Overseas Ltd. | | | | | |

6.875% 11/21/36 | | | 2,850,000 | | | | 3,034,854 | |

| | | | | | | | |

Metals & Mining Total | | | | | | | 5,649,738 | |

| | | | | | | | |

Basic Materials Total | | | | | | | 26,755,195 | |

| | | | | | | | |

| Communications – 10.0% | | | | | |

| Advertising – 0.2% | | | | | |

| Interpublic Group of Companies, Inc. | | | | | |

6.250% 11/15/14 | | | 100,000 | | | | 109,250 | |

10.000% 07/15/17 | | | 380,000 | | | | 452,200 | |

| |

| inVentiv Health, Inc. | | | | | |

10.000% 08/15/18 (a) | | | 345,000 | | | | 358,800 | |

| |

| Visant Corp. | | | | | |

10.000% 10/01/17 | | | 303,000 | | | | 327,240 | |

| | | | | | | | |

Advertising Total | | | | | | | 1,247,490 | |

| | |

| Media – 3.5% | | | | | | | | |

| Belo Corp. | | | | | | | | |

8.000% 11/15/16 | | | 360,000 | | | | 392,400 | |

| | |

| Bresnan Broadband Holdings LLC | | | | | | | | |

8.000% 12/15/18 (a) | | | 10,000 | | | | 10,600 | |

| | |

| Cablevision Systems Corp. | | | | | | | | |

8.625% 09/15/17 | | | 555,000 | | | | 617,437 | |

See Accompanying Notes to Financial Statements.

8

Columbia Corporate Income Fund

March 31, 2011

Corporate Fixed-Income Bonds & Notes (continued)

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Communications (continued) | | | | | |

| CCO Holdings LLC/CCO Holdings Capital Corp. | | | | | | | | |

7.000% 01/15/19 | | | 315,000 | | | | 322,875 | |

8.125% 04/30/20 | | | 565,000 | | | | 614,438 | |

| | |

| Cequel Communications Holdings I LLC & Cequel Capital Corp. | | | | | | | | |

8.625% 11/15/17 (a) | | | 425,000 | | | | 443,063 | |

| | |

| Clear Channel Communications, Inc. | | | | | | | | |

9.000% 03/01/21 (a) | | | 700,000 | | | | 698,250 | |

| |

| Clear Channel Worldwide Holdings, Inc. | | | | | |

9.250% 12/15/17 | | | 695,000 | | | | 761,894 | |

| | |

| CMP Susquehanna Corp. | | | | | | | | |

3.312% 05/15/14 (05/09/11) (a)(b)(c)(d) | | | 30,000 | | | | 17,700 | |

| | |

| Comcast Corp. | | | | | | | | |

6.950% 08/15/37 | | | 2,850,000 | | | | 3,102,749 | |

| | |

| DirecTV Holdings LLC | | | | | | | | |

6.375% 06/15/15 | | | 1,070,000 | | | | 1,106,112 | |

| | |

| DISH DBS Corp. | | | | | | | | |

7.875% 09/01/19 | | | 450,000 | | | | 487,125 | |

| | |

| Entravision Communications Corp. | | | | | | | | |

8.750% 08/01/17 | | | 445,000 | | | | 473,925 | |

| | |

| Gray Television, Inc. | | | | | | | | |

10.500% 06/29/15 | | | 343,000 | | | | 364,866 | |

| | |

| Insight Communications Co., Inc. | | | | | | | | |

9.375% 07/15/18 (a) | | | 155,000 | | | | 172,050 | |

| |

| Kabel BW Erste Beteiligungs GmbH/Kabel Baden-Wurttemberg GmbH & Co. KG | | | | | |

7.500% 03/15/19 (a) | | | 160,000 | | | | 163,936 | |

| | |

| NBC Universal Media, LLC | | | | | | | | |

5.950% 04/01/41 (a) | | | 2,130,000 | | | | 2,041,109 | |

| | |

| News America, Inc. | | | | | | | | |

6.150% 02/15/41 (a) | | | 3,395,000 | | | | 3,366,631 | |

6.400% 12/15/35 | | | 1,435,000 | | | | 1,476,398 | |

6.550% 03/15/33 | | | 500,000 | | | | 525,139 | |

| | |

| Salem Communications Corp. | | | | | | | | |

9.625% 12/15/16 | | | 401,000 | | | | 433,080 | |

| |

| Sinclair Television Group, Inc. | | | | | |

9.250% 11/01/17 (a) | | | 507,000 | | | | 565,305 | |

| |

| Sirius XM Radio, Inc. | | | | | |

8.750% 04/01/15 (a) | | | 260,000 | | | | 292,500 | |

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Time Warner Cable, Inc. | | | | | |

5.850% 05/01/17 | | | 1,070,000 | | | | 1,170,258 | |

5.875% 11/15/40 | | | 3,910,000 | | | | 3,674,028 | |

| |

| Univision Communications, Inc. | | | | | |

7.875% 11/01/20 (a) | | | 355,000 | | | | 376,300 | |

8.500% 05/15/21 (a) | | | 485,000 | | | | 500,763 | |

| |

| XM Satellite Radio, Inc. | | | | | |

7.625% 11/01/18 (a) | | | 389,000 | | | | 410,395 | |

| | | | | | | | |

Media Total | | | | | | | 24,581,326 | |

| |

| Telecommunication Services – 6.3% | | | | | |

| AT&T, Inc. | | | | | |

5.625% 06/15/16 | | | 1,575,000 | | | | 1,761,886 | |

6.550% 02/15/39 | | | 2,125,000 | | | | 2,214,756 | |

| |

| Avaya, Inc. | | | | | |

7.000% 04/01/19 (a) | | | 205,000 | | | | 199,875 | |

9.750% 11/01/15 | | | 126,000 | | | | 128,048 | |

| |

| British Telecommunications PLC | | | | | |

5.950% 01/15/18 | | | 5,565,000 | | | | 6,139,380 | |

|

| Cellco Partnership/Verizon Wireless Capital LLC | |

5.550% 02/01/14 | | | 2,685,000 | | | | 2,948,237 | |

| |

| Cincinnati Bell, Inc. | | | | | |

8.250% 10/15/17 | | | 405,000 | | | | 408,037 | |

8.375% 10/15/20 | | | 124,000 | | | | 121,830 | |

| |

| Clearwire Communications LLC/Clearwire Finance, Inc. | | | | | |

12.000% 12/01/15 (a) | | | 195,000 | | | | 210,213 | |

12.000% 12/01/17 (a) | | | 220,000 | | | | 235,125 | |

| |

| CommScope, Inc. | | | | | |

8.250% 01/15/19 (a) | | | 173,000 | | | | 180,785 | |

| |

| Cricket Communications, Inc. | | | | | |

7.750% 05/15/16 | | | 380,000 | | | | 403,750 | |

| |

| Crown Castle International Corp. | | | | | |

9.000% 01/15/15 | | | 310,000 | | | | 341,775 | |

| |

| Frontier Communications Corp. | | | | | |

8.500% 04/15/20 | | | 250,000 | | | | 270,937 | |

| |

| Integra Telecom Holdings, Inc. | | | | | |

10.750% 04/15/16 (a) | | | 159,000 | | | | 172,515 | |

| |

| Intelsat Jackson Holdings SA | | | | | |

7.250% 10/15/20 (a) | | | 815,000 | | | | 816,019 | |

| |

| ITC Deltacom, Inc. | | | | | |

10.500% 04/01/16 | | | 217,000 | | | | 239,242 | |

| |

| Level 3 Financing, Inc. | | | | | |

8.750% 02/15/17 | | | 400,000 | | | | 397,000 | |

See Accompanying Notes to Financial Statements.

9

Columbia Corporate Income Fund

March 31, 2011

Corporate Fixed-Income Bonds & Notes (continued)

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Communications (continued) | | | | | |

9.250% 11/01/14 | | | 115,000 | | | | 117,588 | |

9.375% 04/01/19 (a) | | | 115,000 | | | | 111,263 | |

| |

| MetroPCS Wireless, Inc. | | | | | |

6.625% 11/15/20 | | | 205,000 | | | | 204,744 | |

7.875% 09/01/18 | | | 365,000 | | | | 390,550 | |

| |

| Nextel Communications, Inc. | | | | | |

7.375% 08/01/15 | | | 142,000 | | | | 142,533 | |

| |

| Nielsen Finance LLC/Nielsen Finance Co. | | | | | |

7.750% 10/15/18 (a) | | | 589,000 | | | | 631,702 | |

11.500% 05/01/16 | | | 146,000 | | | | 171,915 | |

| |

| NII Capital Corp. | | | | | |

7.625% 04/01/21 | | | 250,000 | | | | 255,625 | |

10.000% 08/15/16 | | | 210,000 | | | | 239,400 | |

| |

| PAETEC Holding Corp. | | | | | |

8.875% 06/30/17 | | | 435,000 | | | | 468,712 | |

9.875% 12/01/18 (a) | | | 205,000 | | | | 216,275 | |

| |

| Quebecor Media, Inc. | | | | | |

7.750% 03/15/16 | | | 615,000 | | | | 638,063 | |

| |

| Qwest Corp. | | | | | |

7.500% 06/15/23 | | | 400,000 | | | | 401,000 | |

| |

| SBA Telecommunications, Inc. | | | | | |

8.250% 08/15/19 | | | 205,000 | | | | 226,525 | |

| |

| Sprint Capital Corp. | | | | | |

6.875% 11/15/28 | | | 285,000 | | | | 262,912 | |

| |

| Sprint Nextel Corp. | | | | | |

8.375% 08/15/17 | | | 1,108,000 | | | | 1,234,035 | |

| |

| Telefonica Emisiones SAU | | | | | |

5.134% 04/27/20 | | | 4,045,000 | | | | 4,024,605 | |

6.221% 07/03/17 | | | 730,000 | | | | 796,386 | |

6.421% 06/20/16 | | | 1,855,000 | | | | 2,061,272 | |

| |

| tw telecom holdings, inc. | | | | | |

8.000% 03/01/18 | | | 210,000 | | | | 226,538 | |

| |

| Verizon Communications, Inc. | | | | | |

3.000% 04/01/16 | | | 10,380,000 | | | | 10,327,114 | |

4.600% 04/01/21 | | | 745,000 | | | | 741,811 | |

| |

| Virgin Media Finance PLC | | | | | |

9.500% 08/15/16 | | | 540,000 | | | | 614,250 | |

| |

| West Corp. | | | | | |

7.875% 01/15/19 (a) | | | 250,000 | | | | 255,000 | |

| |

| Wind Acquisition Finance SA | | | | | |

7.250% 02/15/18 (a) | | | 220,000 | | | | 231,000 | |

11.750% 07/15/17 (a)(d)(e) | | | 592,000 | | | | 1,184 | |

11.750% 07/15/17 (a) | | | 592,000 | | | | 680,800 | |

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Windstream Corp. | | | | | |

7.750% 10/15/20 | | | 700,000 | | | | 719,250 | |

8.125% 09/01/18 | | | 290,000 | | | | 309,575 | |

| | | | | | | | |

Telecommunication Services Total | | | | | | | 43,891,037 | |

| | | | | | | | |

Communications Total | | | | | | | 69,719,853 | |

| | | | | | | | |

| Consumer Cyclical – 4.2% | |

| Airlines – 0.3% | |

| Continental Airlines, Inc. | |

7.461% 04/01/15 | | | 2,310,205 | | | | 2,333,307 | |

| | | | | | | | |

Airlines Total | | | | | | | 2,333,307 | |

| |

| Auto Manufacturers – 0.1% | | | | | |

| Oshkosh Corp. | | | | | |

8.500% 03/01/20 | | | 384,000 | | | | 430,560 | |

| | | | | | | | |

Auto Manufacturers Total | | | | | | | 430,560 | |

| |

| Auto Parts & Equipment – 0.3% | | | | | |

| Accuride Corp. | | | | | |

9.500% 08/01/18 | | | 70,000 | | | | 77,875 | |

| |

| Dana Holding Corp. | | | | | |

6.500% 02/15/19 | | | 65,000 | | | | 64,513 | |

6.750% 02/15/21 | | | 571,000 | | | | 569,572 | |

| |

| Lear Corp. | | | | | |

7.875% 03/15/18 | | | 230,000 | | | | 250,700 | |

8.125% 03/15/20 | | | 425,000 | | | | 467,500 | |

| |

| Pinafore LLC/Pinafore, Inc. | | | | | |

9.000% 10/01/18 (a) | | | 45,000 | | | | 48,600 | |

| |

| Tenneco, Inc. | | | | | |

7.750% 08/15/18 | | | 47,000 | | | | 50,173 | |

| |

| TRW Automotive, Inc. | | | | | |

7.000% 03/15/14 (a) | | | 305,000 | | | | 332,450 | |

| |

| Visteon Corp. | | | | | |

6.750% 04/15/19 | | | 165,000 | | | | 165,000 | |

| | | | | | | | |

Auto Parts & Equipment Total | | | | | | | 2,026,383 | |

| |

| Entertainment – 0.4% | | | | | |

| AMC Entertainment, Inc. | | | | | |

8.750% 06/01/19 | | | 350,000 | | | | 379,750 | |

9.750% 12/01/20 (a) | | | 230,000 | | | | 246,100 | |

| |

| Boyd Gaming Corp. | | | | | |

9.125% 12/01/18 (a) | | | 681,000 | | | | 699,727 | |

| |

| Pinnacle Entertainment, Inc. | | | | | |

8.625% 08/01/17 | | | 210,000 | | | | 228,900 | |

8.750% 05/15/20 | | | 69,000 | | | | 71,760 | |

| |

| Shingle Springs Tribal Gaming Authority | | | | | |

9.375% 06/15/15 (a) | | | 875,000 | | | | 577,500 | |

See Accompanying Notes to Financial Statements.

10

Columbia Corporate Income Fund

March 31, 2011

Corporate Fixed-Income Bonds & Notes (continued)

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Consumer Cyclical (continued) | |

| Six Flags, Inc. | | | | | |

9.625% 06/01/14 (a)(d)(e)(f) | | | 259,000 | | | | — | |

| |

| Speedway Motorsports, Inc. | | | | | |

6.750% 02/01/19 (a) | | | 104,000 | | | | 104,780 | |

8.750% 06/01/16 | | | 400,000 | | | | 438,000 | |

| |

| Tunica-Biloxi Gaming Authority | | | | | |

9.000% 11/15/15 (a) | | | 198,000 | | | | 196,020 | |

| | | | | | | | |

Entertainment Total | | | | | | | 2,942,537 | |

| |

| Home Builders – 0.1% | | | | | |

| Beazer Homes USA, Inc. | | | | | |

9.125% 06/15/18 | | | 155,000 | | | | 157,325 | |

| |

| K Hovnanian Enterprises, Inc. | | | | | |

10.625% 10/15/16 | | | 190,000 | | | | 201,875 | |

11.875% 10/15/15 | | | 230,000 | | | | 218,500 | |

| | | | | | | | |

Home Builders Total | | | | | | | 577,700 | |

| |

| Home Furnishings – 0.0% | | | | | |

| Norcraft Companies LP/Norcraft Finance Corp. | | | | | |

10.500% 12/15/15 | | | 145,000 | | | | 155,150 | |

| |

| Sealy Mattress Co. | | | | | |

10.875% 04/15/16 (a) | | | 42,000 | | | | 47,723 | |

| | | | | | | | |

Home Furnishings Total | | | | | | | 202,873 | |

| |

| Housewares – 0.1% | | | | | |

| Libbey Glass, Inc. | | | | | |

10.000% 02/15/15 | | | 450,000 | | | | 490,500 | |

| | | | | | | | |

Housewares Total | | | | | | | 490,500 | |

| |

| Lodging – 0.5% | | | | | |

| MGM Resorts International | | | | | |

9.000% 03/15/20 | | | 500,000 | | | | 550,000 | |

11.375% 03/01/18 | | | 445,000 | | | | 493,950 | |

| |

| Penn National Gaming, Inc. | | | | | |

8.750% 08/15/19 | | | 500,000 | | | | 551,875 | |

| |

| Pokagon Gaming Authority | | | | | |

10.375% 06/15/14 (a) | | | 226,000 | | | | 233,910 | |

| |

| Seminole Indian Tribe of Florida | | | | | |

6.535% 10/01/20 (a) | | | 65,000 | | | | 63,874 | |

7.804% 10/01/20 (a) | | | 505,000 | | | | 499,304 | |

| |

| Seneca Gaming Corp. | | | | | |

8.250% 12/01/18 (a) | | | 175,000 | | | | 180,250 | |

| |

| Wyndham Worldwide Corp. | | | | | |

6.000% 12/01/16 | | | 100,000 | | | | 105,964 | |

7.375% 03/01/20 | | | 395,000 | | | | 435,487 | |

| | | | | | | | |

Lodging Total | | | | | | | 3,114,614 | |

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Office Furnishings – 0.0% | | | | | |

| Interface, Inc. | | | | | |

7.625% 12/01/18 (a) | | | 56,000 | | | | 59,080 | |

| | | | | | | | |

Office Furnishings Total | | | | | | | 59,080 | |

| |

| Retail – 2.4% | | | | | |

| CVS Pass-Through Trust | | | | | |

5.298% 01/11/27 (a) | | | 1,597,790 | | | | 1,614,530 | |

6.036% 12/10/28 | | | 2,136,141 | | | | 2,199,606 | |

8.353% 07/10/31 (a) | | | 7,076,121 | | | | 8,455,328 | |

| |

| Ltd. Brands, Inc. | | | | | |

6.625% 04/01/21 | | | 175,000 | | | | 178,937 | |

7.000% 05/01/20 | | | 500,000 | | | | 529,375 | |

| |

| Macy’s Retail Holdings, Inc. | | | | | |

5.350% 03/15/12 | | | 645,000 | | | | 664,350 | |

| |

| McDonald’s Corp. | | | | | |

5.700% 02/01/39 | | | 1,265,000 | | | | 1,341,913 | |

| |

| Michaels Stores, Inc. | | | | | |

11.375% 11/01/16 | | | 65,000 | | | | 70,850 | |

| |

| NBTY, Inc. | | | | | |

9.000% 10/01/18 (a) | | | 30,000 | | | | 32,550 | |

| |

| Needle Merger Sub Corp. | | | | | |

8.125% 03/15/19 (a) | | | 242,000 | | | | 244,420 | |

| |

| QVC, Inc. | | | | | |

7.125% 04/15/17 (a) | | | 55,000 | | | | 57,544 | |

7.375% 10/15/20 (a) | | | 50,000 | | | | 52,063 | |

7.500% 10/01/19 (a) | | | 405,000 | | | | 425,250 | |

| |

| Rite Aid Corp. | | | | | |

8.000% 08/15/20 | | | 330,000 | | | | 349,387 | |

| |

| Toys R Us Property Co. II, LLC | | | | | |

8.500% 12/01/17 | | | 200,000 | | | | 215,000 | |

| |

| Toys R Us, Inc. | | | | | |

7.375% 10/15/18 | | | 420,000 | | | | 421,050 | |

| | | | | | | | |

Retail Total | | | | | | | 16,852,153 | |

| | | | | | | | |

Consumer Cyclical Total | | | | | | | 29,029,707 | |

| | | | | | | | |

| Consumer Non-cyclical – 6.2% | |

| Beverages – 1.3% | | | | | |

| Anheuser-Busch InBev Worldwide, Inc. | | | | | |

7.200% 01/15/14 | | | 3,935,000 | | | | 4,470,424 | |

7.750% 01/15/19 | | | 460,000 | | | | 565,942 | |

8.000% 11/15/39 | | | 1,860,000 | | | | 2,486,197 | |

| |

| Cott Beverages, Inc. | | | | | |

8.125% 09/01/18 | | | 101,000 | | | | 107,817 | |

8.375% 11/15/17 | | | 105,000 | | | | 112,087 | |

See Accompanying Notes to Financial Statements.

11

Columbia Corporate Income Fund

March 31, 2011

Corporate Fixed-Income Bonds & Notes (continued)

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Consumer Non-cyclical (continued) | |

| PepsiCo, Inc. | | | | | |

4.500% 01/15/20 | | | 1,175,000 | | | | 1,225,952 | |

| | | | | | | | |

Beverages Total | | | | | | | 8,968,419 | |

| |

| Biotechnology – 0.0% | | | | | |

| STHI Holding Corp. | | | | | |

8.000% 03/15/18 (a) | | | 93,000 | | | | 96,255 | |

| | | | | | | | |

Biotechnology Total | | | | | | | 96,255 | |

| |

| Commercial Services – 0.8% | | | | | |

| Avis Budget Car Rental LLC/Avis Budget Finance, Inc. | | | | | |

8.250% 01/15/19 | | | 300,000 | | | | 314,250 | |

| |

| Brickman Group Holdings, Inc. | | | | | |

9.125% 11/01/18 (a) | | | 20,000 | | | | 21,450 | |

| |

| Cardtronics, Inc. | | | | | |

8.250% 09/01/18 | | | 225,000 | | | | 244,406 | |

| |

| Garda World Security Corp. | | | | | |

9.750% 03/15/17 (a) | | | 162,000 | | | | 174,555 | |

| |

| Hertz Corp. | | | | | |

6.750% 04/15/19 (a) | | | 260,000 | | | | 257,725 | |

7.375% 01/15/21 (a) | | | 301,000 | | | | 307,773 | |

7.500% 10/15/18 (a) | | | 220,000 | | | | 227,700 | |

| |

| Interactive Data Corp. | | | | | |

10.250% 08/01/18 (a) | | | 355,000 | | | | 398,487 | |

| |

| Iron Mountain, Inc. | | | | | |

8.000% 06/15/20 | | | 100,000 | | | | 106,000 | |

| |

| President & Fellows of Harvard College | | | | | |

4.875% 10/15/40 | | | 1,490,000 | | | | 1,423,784 | |

6.500% 01/15/39 (a) | | | 490,000 | | | | 589,592 | |

| |

| RSC Equipment Rental, Inc./RSC Holdings III LLC | | | | | |

8.250% 02/01/21 (a) | | | 120,000 | | | | 124,800 | |

9.500% 12/01/14 | | | 345,000 | | | | 361,388 | |

| |

| United Rentals North America, Inc. | | | | | |

8.375% 09/15/20 | | | 425,000 | | | | 444,125 | |

9.250% 12/15/19 | | | 611,000 | | | | 681,265 | |

10.875% 06/15/16 | | | 74,000 | | | | 85,470 | |

| | | | | | | | |

Commercial Services Total | | | | | | | 5,762,770 | |

| |

| Food – 1.6% | | | | | |

| ConAgra Foods, Inc. | | | | | |

7.000% 10/01/28 | | | 2,130,000 | | | | 2,289,009 | |

| |

| Dean Foods Co. | | | | | |

7.000% 06/01/16 | | | 8,000 | | | | 7,630 | |

9.750% 12/15/18 (a) | | | 148,000 | | | | 151,885 | |

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Kraft Foods, Inc. | | | | | |

6.500% 02/09/40 | | | 6,450,000 | | | | 6,842,983 | |

| |

| Kroger Co. | | | | | |

8.000% 09/15/29 | | | 1,371,000 | | | | 1,700,838 | |

| | | | | | | | |

Food Total | | | | | | | 10,992,345 | |

| |

| Healthcare Products – 0.0% | | | | | |

| Hanger Orthopedic Group, Inc. | | | | | | | | |

7.125% 11/15/18 | | | 162,000 | | | | 165,240 | |

| | | | | | | | |

Healthcare Products Total | | | | | | | 165,240 | |

| |

| Healthcare Services – 1.0% | | | | | |

| American Renal Holdings Co., Inc. | | | | | | | | |

8.375% 05/15/18 | | | 55,000 | | | | 58,025 | |

PIK, | | | | | |

9.750% 03/01/16 (a) | | | 60,000 | | | | 58,950 | |

| |

| Apria Healthcare Group, Inc. | | | | | |

11.250% 11/01/14 | | | 348,000 | | | | 374,970 | |

| |

| Capella Healthcare, Inc. | | | | | |

9.250% 07/01/17 (a) | | | 40,000 | | | | 43,000 | |

| |

| HCA, Inc. | | | | | |

7.250% 09/15/20 | | | 1,062,000 | | | | 1,136,340 | |

7.875% 02/15/20 | | | 326,000 | | | | 354,525 | |

| |

| Healthsouth Corp. | | | | | |

7.750% 09/15/22 | | | 27,000 | | | | 28,080 | |

8.125% 02/15/20 | | | 177,000 | | | | 191,160 | |

10.750% 06/15/16 | | | 270,000 | | | | 287,550 | |

| |

| LifePoint Hospitals, Inc. | | | | | |

6.625% 10/01/20 (a) | | | 90,000 | | | | 92,250 | |

| |

| Multiplan, Inc. | | | | | |

9.875% 09/01/18 (a) | | | 214,000 | | | | 230,050 | |

| |

| Radiation Therapy Services, Inc. | | | | | |

9.875% 04/15/17 | | | 134,000 | | | | 136,680 | |

| |

| Radnet Management, Inc. | | | | | |

10.375% 04/01/18 | | | 50,000 | | | | 50,562 | |

| |

| Roche Holdings, Inc. | | | | | |

6.000% 03/01/19 (a) | | | 1,275,000 | | | | 1,445,176 | |

| |

| Tenet Healthcare Corp. | | | | | |

8.875% 07/01/19 | | | 420,000 | | | | 478,800 | |

| |

| UnitedHealth Group, Inc. | | | | | |

6.000% 02/15/18 | | | 1,370,000 | | | | 1,523,769 | |

| |

| Vanguard Health Holding Co. II, LLC/Vanguard Holding Co. II, Inc. | | | | | |

7.750% 02/01/19 (a) | | | 111,000 | | | | 112,387 | |

8.000% 02/01/18 | | | 200,000 | | | | 204,750 | |

See Accompanying Notes to Financial Statements.

12

Columbia Corporate Income Fund

March 31, 2011

Corporate Fixed-Income Bonds & Notes (continued)

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Consumer Non-cyclical (continued) | |

8.000% 02/01/18 (a) | | | 165,000 | | | | 169,125 | |

| | | | | | | | |

Healthcare Services Total | | | | | | | 6,976,149 | |

| |

| Household Products/Wares – 0.3% | | | | | |

| Central Garden & Pet Co. | | | | | |

8.250% 03/01/18 | | | 300,000 | | | | 313,500 | |

| |

| Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC | | | | | |

6.875% 02/15/21 (a) | | | 180,000 | | | | 180,900 | |

7.125% 04/15/19 (a) | | | 541,000 | | | | 554,525 | |

7.750% 10/15/16 (a) | | | 243,000 | | | | 257,580 | |

8.250% 02/15/21 (a) | | | 274,000 | | | | 271,945 | |

9.000% 04/15/19 (a) | | | 200,000 | | | | 207,000 | |

| |

| Spectrum Brands Holdings, Inc. | | | | | |

9.500% 06/15/18 (a) | | | 419,000 | | | | 460,900 | |

| | | | | | | | |

Household Products/Wares Total | �� | | | | | | 2,246,350 | |

| |

| Pharmaceuticals – 1.2% | | | | | |

| ConvaTec Healthcare E SA | | | | | |

10.500% 12/15/18 (a) | | | 400,000 | | | | 420,000 | |

| |

| Giant Funding Corp. | | | | | |

8.250% 02/01/18 (a) | | | 257,000 | | | | 263,425 | |

| |

| Mylan, Inc. | | | | | |

6.000% 11/15/18 (a) | | | 200,000 | | | | 200,000 | |

| |

| Novartis Securities Investment Ltd. | | | | | |

5.125% 02/10/19 | | | 4,215,000 | | | | 4,562,729 | |

| |

| Valeant Pharmaceuticals International | | | | | |

6.750% 10/01/17 (a) | | | 95,000 | | | | 93,575 | |

7.000% 10/01/20 (a) | | | 158,000 | | | | 153,260 | |

| |

| Warner Chilcott Co., LLC/Warner Chilcott Finance LLC | | | | | |

7.750% 09/15/18 (a) | | | 296,000 | | | | 310,060 | |

| |

| Wyeth | | | | | |

6.500% 02/01/34 | | | 1,810,000 | | | | 2,079,665 | |

| | | | | | | | |

Pharmaceuticals Total | | | | | | | 8,082,714 | |

| | | | | | | | |

Consumer Non-cyclical Total | | | | | | | 43,290,242 | |

| | | | | | | | |

| Energy – 11.4% | | | | | |

| Coal – 0.2% | | | | | |

| Arch Coal, Inc. | | | | | | | | |

7.250% 10/01/20 | | | 525,000 | | | | 562,406 | |

| |

| Consol Energy, Inc. | | | | | |

8.000% 04/01/17 | | | 215,000 | | | | 235,425 | |

8.250% 04/01/20 | | | 435,000 | | | | 482,306 | |

| | | | | | | | |

Coal Total | | | | | | | 1,280,137 | |

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Oil & Gas – 6.6% | | | | | |

| Anadarko Petroleum Corp. | | | | | | | | |

6.200% 03/15/40 | | | 7,760,000 | | | | 7,496,889 | |

| |

| Berry Petroleum Co. | | | | | |

6.750% 11/01/20 | | | 70,000 | | | | 72,100 | |

8.250% 11/01/16 | | | 30,000 | | | | 31,725 | |

10.250% 06/01/14 | | | 55,000 | | | | 63,800 | |

| |

| Brigham Exploration Co. | | | | | |

8.750% 10/01/18 (a) | | | 360,000 | | | | 401,400 | |

| |

| Canadian Natural Resources Ltd. | | | | | |

6.250% 03/15/38 | | | 1,580,000 | | | | 1,701,598 | |

| |

| Carrizo Oil & Gas, Inc. | | | | | |

8.625% 10/15/18 (a) | | | 377,000 | | | | 401,505 | |

| |

| Chaparral Energy, Inc. | | | | | |

8.250% 09/01/21 (a) | | | 210,000 | | | | 216,300 | |

9.875% 10/01/20 (a) | | | 97,000 | | | | 107,670 | |

| |

| Chesapeake Energy Corp. | | | | | |

6.125% 02/15/21 | | | 190,000 | | | | 196,175 | |

6.625% 08/15/20 | | | 731,000 | | | | 776,687 | |

| |

| Comstock Resources, Inc. | | | | | |

7.750% 04/01/19 | | | 74,000 | | | | 75,295 | |

8.375% 10/15/17 | | | 33,000 | | | | 34,238 | |

| |

| Concho Resources, Inc./Midland TX | | | | | |

7.000% 01/15/21 | | | 183,000 | | | | 192,608 | |

8.625% 10/01/17 | | | 500,000 | | | | 552,500 | |

| |

| Continental Resources, Inc. | | | | | |

7.125% 04/01/21 | | | 361,000 | | | | 383,562 | |

| |

| Denbury Resources, Inc. | | | | | |

8.250% 02/15/20 | | | 500,000 | | | | 557,500 | |

| |

| Devon Energy Corp. | | | | | |

6.300% 01/15/19 | | | 735,000 | | | | 861,396 | |

| |

| EXCO Resources, Inc. | | | | | |

7.500% 09/15/18 | | | 476,000 | | | | 483,735 | |

| |

| Gazprom International SA | | | | | |

7.201% 02/01/20 (a) | | | 1,449,045 | | | | 1,575,837 | |

| |

| Goodrich Petroleum Corp. | | | | | |

8.875% 03/15/19 (a) | | | 185,000 | | | | 185,000 | |

| |

| Hess Corp. | | | | | |

7.300% 08/15/31 | | | 2,640,000 | | | | 3,095,300 | |

| |

| Hilcorp Energy I LP/Hilcorp Finance Co. | | | | | |

7.625% 04/15/21 (a) | | | 278,000 | | | | 291,205 | |

7.750% 11/01/15 (a) | | | 320,000 | | | | 331,200 | |

See Accompanying Notes to Financial Statements.

13

Columbia Corporate Income Fund

March 31, 2011

Corporate Fixed-Income Bonds & Notes (continued)

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Energy (continued) | | | | | |

| Laredo Petroleum, Inc. | | | | | |

9.500% 02/15/19 (a) | | | 509,000 | | | | 529,996 | |

| |

| MEG Energy Corp. | | | | | |

6.500% 03/15/21 (a) | | | 270,000 | | | | 274,388 | |

| |

| Nexen, Inc. | | | | | |

5.875% 03/10/35 | | | 1,875,000 | | | | 1,779,737 | |

7.500% 07/30/39 | | | 1,015,000 | | | | 1,142,913 | |

| | |

| Oasis Petroleum, Inc. | | | | | | | | |

7.250% 02/01/19 (a) | | | 139,000 | | | | 141,085 | |

| | |

| PetroHawk Energy Corp. | | | | | | | | |

7.250% 08/15/18 (a) | | | 187,000 | | | | 192,143 | |

7.250% 08/15/18 | | | 170,000 | | | | 175,100 | |

7.875% 06/01/15 | | | 320,000 | | | | 339,200 | |

| | |

| Qatar Petroleum | | | | | | | | |

5.579% 05/30/11 (a) | | | 116,760 | | | | 117,368 | |

| | |

| QEP Resources, Inc. | | | | | | | | |

6.875% 03/01/21 | | | 255,000 | | | | 267,750 | |

| | |

| Quicksilver Resources, Inc. | | | | | | | | |

8.250% 08/01/15 | | | 93,000 | | | | 96,953 | |

| | |

| Range Resources Corp. | | | | | | | | |

6.750% 08/01/20 | | | 220,000 | | | | 234,025 | |

7.500% 05/15/16 | | | 205,000 | | | | 212,688 | |

8.000% 05/15/19 | | | 105,000 | | | | 115,763 | |

| | |

| Ras Laffan Liquefied Natural Gas Co., Ltd. III | | | | | | | | |

5.832% 09/30/16 (a) | | | 537,920 | | | | 576,650 | |

5.838% 09/30/27 (a) | | | 1,200,000 | | | | 1,203,324 | |

| | |

| Shell International Finance BV | | | | | | | | |

5.500% 03/25/40 | | | 3,865,000 | | | | 3,916,663 | |

| | |

| Southwestern Energy Co. | | | | | | | | |

7.500% 02/01/18 | | | 2,280,000 | | | | 2,584,950 | |

| | |

| Talisman Energy, Inc. | | | | | | | | |

5.850% 02/01/37 | | | 4,845,000 | | | | 4,813,890 | |

7.750% 06/01/19 | | | 5,616,000 | | | | 6,852,565 | |

| | |

| United Refining Co. | | | | | | | | |

10.500% 02/28/18 (a) | | | 299,000 | | | | 299,000 | |

| | |

| Venoco, Inc. | | | | | | | | |

8.875% 02/15/19 (a) | | | 57,000 | | | | 57,000 | |

| | | | | | | | |

Oil & Gas Total | | | | | | | 46,008,376 | |

| | |

| Oil & Gas Services – 0.4% | | | | | | | | |

| Aquilex Holdings LLC/Aquilex Finance Corp. | | | | | |

11.125% 12/15/16 | | | 113,000 | | | | 119,356 | |

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Key Energy Services, Inc. | | | | | | | | |

6.750% 03/01/21 | | | 187,000 | | | | 190,272 | |

| |

| Trinidad Drilling Ltd. | | | | | |

7.875% 01/15/19 (a) | | | 191,000 | | | | 201,943 | |

| |

| Weatherford International Ltd. | | | | | |

5.125% 09/15/20 | | | 555,000 | | | | 551,090 | |

7.000% 03/15/38 | | | 1,520,000 | | | | 1,609,949 | |

| | | | | | | | |

Oil & Gas Services Total | | | | | | | 2,672,610 | |

| |

| Pipelines – 4.2% | | | | | |

| Copano Energy LLC/Copano Energy Finance Corp. | |

7.125% 04/01/21 (g) | | | 130,000 | | | | 131,625 | |

| |

| El Paso Corp. | | | | | |

6.500% 09/15/20 (a) | | | 658,000 | | | | 708,995 | |

7.250% 06/01/18 | | | 255,000 | | | | 286,556 | |

7.750% 01/15/32 | | | 300,000 | | | | 336,174 | |

| |

| Energy Transfer Equity LP | | | | | |

7.500% 10/15/20 | | | 305,000 | | | | 332,450 | |

| |

| Energy Transfer Partners LP | | | | | |

6.000% 07/01/13 | | | 1,620,000 | | | | 1,759,965 | |

| |

| Enterprise Products Operating LLC | | | | | |

5.950% 02/01/41 | | | 6,265,000 | | | | 6,093,715 | |

| |

| Kinder Morgan Energy Partners LP | | | | | |

5.625% 02/15/15 | | | 1,025,000 | | | | 1,130,973 | |

6.500% 09/01/39 | | | 1,695,000 | | | | 1,737,168 | |

6.950% 01/15/38 | | | 1,320,000 | | | | 1,422,951 | |

|

| Plains All American Pipeline LP/PAA Finance Corp. | |

5.750% 01/15/20 | | | 1,215,000 | | | | 1,300,384 | |

6.500% 05/01/18 | | | 2,130,000 | | | | 2,394,380 | |

8.750% 05/01/19 | | | 545,000 | | | | 681,822 | |

| |

| Regency Energy Partners LP/Regency Energy Finance Corp. | | | | | |

6.875% 12/01/18 | | | 622,000 | | | | 660,875 | |

9.375% 06/01/16 | | | 110,000 | | | | 125,125 | |

| |

| Southern Natural Gas Co. | | | | | |

8.000% 03/01/32 | | | 1,750,000 | | | | 2,135,443 | |

| |

| Southern Star Central Corp. | | | | | |

6.750% 03/01/16 | | | 65,000 | | | | 65,975 | |

| |

| TransCanada Pipelines Ltd. | | | | | |

6.350% 05/15/67 (05/15/17) (b)(c) | | | 7,670,000 | | | | 7,701,263 | |

| |

| Williams Companies, Inc. | | | | | |

7.875% 09/01/21 | | | 107,000 | | | | 133,157 | |

| | | | | | | | |

Pipelines Total | | | | | | | 29,138,996 | |

| | | | | | | | |

Energy Total | | | | | | | 79,100,119 | |

See Accompanying Notes to Financial Statements.

14

Columbia Corporate Income Fund

March 31, 2011

Corporate Fixed-Income Bonds & Notes (continued)

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Financials – 35.7% | | | | | | | | |

| Banks – 19.8% | | | | | | | | |

| Bank of New York Mellon Corp. | | | | | | | | |

4.150% 02/01/21 | | | 13,670,000 | | | | 13,508,639 | |

| | |

| Barclays Bank PLC | | | | | | | | |

3.900% 04/07/15 | | | 965,000 | | | | 998,230 | |

5.000% 09/22/16 | | | 1,800,000 | | | | 1,908,326 | |

6.860% 09/29/49 (a)(c) | | | 2,360,000 | | | | 2,206,600 | |

7.375% 06/29/49 (a)(c) | | | 700,000 | | | | 700,000 | |

7.434% 09/29/49 (a)(c) | | | 4,095,000 | | | | 4,095,000 | |

| | |

| Capital One Capital IV | | | | | | | | |

6.745% 02/17/37 (c) | | | 6,895,000 | | | | 6,920,856 | |

| | |

| Capital One Capital V | | | | | | | | |

10.250% 08/15/39 | | | 7,145,000 | | | | 7,752,325 | |

| | |

| Capital One Financial Corp. | | | | | | | | |

7.375% 05/23/14 | | | 255,000 | | | | 292,687 | |

| | |

| Chinatrust Commercial Bank | | | | | | | | |

5.625% 12/29/49 (03/17/15) (a)(b)(c) | | | 825,000 | | | | 807,711 | |

| | |

| CIT Group, Inc. | | | | | | | | |

6.625% 04/01/18 (a) | | | 305,000 | | | | 309,575 | |

7.000% 05/01/17 | | | 1,695,000 | | | | 1,697,119 | |

| | |

| Discover Bank/Greenwood DE | | | | | | | | |

8.700% 11/18/19 | | | 705,000 | | | | 844,634 | |

| | |

| Discover Financial Services | | | | | | | | |

10.250% 07/15/19 | | | 545,000 | | | | 701,125 | |

| | |

| Fifth Third Bank/Ohio | | | | | | | | |

0.424% 05/17/13 (05/17/11) (b)(c) | | | 1,065,000 | | | | 1,046,937 | |

| | |

| HSBC USA, Inc. | | | | | | | | |

5.000% 09/27/20 | | | 4,470,000 | | | | 4,389,048 | |

| | |

| ING Bank NV | | | | | | | | |

4.000% 03/15/16 (a) | | | 3,660,000 | | | | 3,654,887 | |

| | |

| JPMorgan Chase & Co. | | | | | | | | |

7.900% 04/29/49 (04/30/18) (b)(c) | | | 1,915,000 | | | | 2,095,221 | |

| | |

| JPMorgan Chase Capital XVII | | | | | | | | |

5.850% 08/01/35 | | | 2,190,000 | | | | 2,113,315 | |

| | |

| JPMorgan Chase Capital XX | | | | | | | | |

6.550% 09/15/66 | | | 1,850,000 | | | | 1,880,329 | |

| |

| JPMorgan Chase Capital XXIII | | | | | |

1.313% 05/15/77 (05/16/11) (b)(c) | | | 2,755,000 | | | | 2,280,327 | |

| |

| JPMorgan Chase Capital XXV | | | | | |

6.800% 10/01/37 | | | 8,185,000 | | | | 8,227,022 | |

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Lloyds Banking Group PLC | | | | | |

6.267% 12/31/49 (11/14/16) (a)(b)(c) | | | 1,720,000 | | | | 1,388,900 | |

6.657% 01/29/49 (a) | | | 2,296,000 | | | | 1,836,800 | |

| |

| Lloyds TSB Bank PLC | | | | | |

4.375% 01/12/15 (a) | | | 5,928,000 | | | | 6,037,804 | |

| |

| Merrill Lynch & Co., Inc. | | | | | |

5.700% 05/02/17 (h) | | | 2,215,000 | | | | 2,298,689 | |

| |

| PNC Funding Corp. | | | | | |

3.625% 02/08/15 | | | 1,870,000 | | | | 1,933,294 | |

| |

| Santander U.S. Debt SA Unipersonal | | | | | |

3.724% 01/20/15 (a) | | | 1,695,000 | | | | 1,639,150 | |

3.781% 10/07/15 (a) | | | 3,515,000 | | | | 3,377,698 | |

| |

| State Street Corp. | | | | | |

2.875% 03/07/16 | | | 1,455,000 | | | | 1,445,397 | |

4.956% 03/15/18 | | | 11,715,000 | | | | 12,071,839 | |

| |

| SunTrust Preferred Capital I | | | | | |

5.853% 12/31/49 (12/15/11) (b)(c) | | | 545,000 | | | | 433,275 | |

| |

| U.S. Bancorp | | | | | |

3.442% 02/01/16 | | | 11,875,000 | | | | 11,839,054 | |

| |

| USB Capital XIII Trust | | | | | |

6.625% 12/15/39 | | | 8,715,000 | | | | 9,123,472 | |

| |

| Wachovia Capital Trust III | | | | | |

5.570% 03/29/49 (06/15/11) (b)(c) | | | 540,000 | | | | 495,450 | |

| |

| Wells Fargo & Co. | | | | | |

3.676% 06/15/16 | | | 12,565,000 | | | | 12,639,259 | |

| |

| Wells Fargo Capital X | | | | | |

5.950% 12/01/86 | | | 2,740,000 | | | | 2,697,944 | |

| | | | | | | | |

Banks Total | | | | | | | 137,687,938 | |

| |

| Diversified Financial Services – 2.4% | | | | | |

| Ally Financial, Inc. | | | | | |

6.250% 12/01/17 (a) | | | 265,000 | | | | 269,969 | |

7.500% 09/15/20 (a) | | | 220,000 | | | | 232,100 | |

8.000% 03/15/20 | | | 1,060,000 | | | | 1,154,075 | |

| |

| E*Trade Financial Corp. | | | | | |

7.375% 09/15/13 | | | 75,000 | | | | 75,281 | |

7.875% 12/01/15 | | | 695,000 | | | | 703,687 | |

PIK, | | | | | |

12.500% 11/30/17 | | | 250,000 | | | | 298,125 | |

| Eaton Vance Corp. | | | | | |

6.500% 10/02/17 | | | 1,830,000 | | | | 2,072,803 | |

| |

| Ford Motor Credit Co., LLC | | | | | |

5.750% 02/01/21 | | | 545,000 | | | | 538,186 | |

See Accompanying Notes to Financial Statements.

15

Columbia Corporate Income Fund

March 31, 2011

Corporate Fixed-Income Bonds & Notes (continued)

| | | | | | | | |

| | | Par ($) | | | Value ($) | |

| Financials (continued) | | | | | | | | |

7.000% 04/15/15 | | | 140,000 | | | | 151,540 | |

7.500% 08/01/12 | | | 1,150,000 | | | | 1,226,206 | |

| |

| General Electric Capital Corp. | | | | | |

4.375% 09/16/20 | | | 2,860,000 | | | | 2,779,348 | |

4.625% 01/07/21 | | | 3,300,000 | | | | 3,249,913 | |

| |

| HSBC Finance Capital Trust IX | | | | | |

5.911% 11/30/35 (c) | | | 985,000 | | | | 943,137 | |

| |

| International Lease Finance Corp. | | | | | |

8.250% 12/15/20 | | | 175,000 | | | | 191,844 | |

8.875% 09/01/17 | | | 295,000 | | | | 334,087 | |

9.000% 03/15/17 (a) | | | 231,000 | | | | 259,875 | |

| |

| Lehman Brothers Holdings, Inc. | | | | | |