UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

One Financial Center, Boston, Massachusetts | | 02111 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer 5228 Ameriprise Financial Center Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | October 31, 2010 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia California Tax-Exempt Fund

Annual Report for the Period Ended October 31, 2010

Not FDIC insured • No bank guarantee • May lose value

Table of Contents

| Fund Profile | | | 1 | | |

|

| Economic Update | | | 2 | | |

|

| Performance Information | | | 4 | | |

|

| Understanding Your Expenses | | | 5 | | |

|

| Portfolio Manager's Report | | | 6 | | |

|

| Investment Portfolio | | | 8 | | |

|

Statement of Assets and

Liabilities | | | 16 | | |

|

| Statement of Operations | | | 18 | | |

|

Statement of Changes in

Net Assets | | | 19 | | |

|

| Financial Highlights | | | 21 | | |

|

| Notes to Financial Statements | | | 25 | | |

|

Report of Independent Registered

Public Accounting Firm | | | 33 | | |

|

| Federal Income Tax Information | | | 34 | | |

|

| Fund Governance | | | 35 | | |

|

Board Consideration and Approval

of Advisory Agreements | | | 40 | | |

|

Summary of Management Fee

Evaluation by Independent

Fee Consultant | | | 44 | | |

|

Important Information About

This Report | | | 49 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholder:

The Columbia Management story began over 100 years ago, and today, we are one of the nation's largest dedicated asset managers. The recent acquisition by Ameriprise Financial, Inc. brings together the talents, resources and capabilities of Columbia Management with those of RiverSource Investments, Threadneedle (acquired by Ameriprise in 2003) and Seligman Investments (acquired by Ameriprise in 2008) to build a best-in-class asset management business that we believe is truly greater than its parts.

RiverSource Investments traces its roots to 1894 when its then newly-founded predecessor, Investors Syndicate, offered a face-amount savings certificate that gave small investors the opportunity to build a safe and secure fund for retirement, education or other special needs. A mutual fund pioneer, Investors Syndicate launched Investors Mutual Fund in 1940. In the decades that followed, its mutual fund products and services lineup grew to include a full spectrum of styles and specialties. More than 110 years later, RiverSource continues to be a trusted financial products leader.

Threadneedle, a leader in global asset management and one of Europe's largest asset managers, offers sophisticated international experience from a dedicated U.K. management team. Headquartered in London, it is named for Threadneedle Street in the heart of the city's financial district, where British investors pioneered international and global investing. Threadneedle was acquired in 2003 and today operates as an affiliate of Columbia Management.

Seligman Investments' beginnings date back to the establishment of the investment firm J. & W. Seligman & Co. in 1864. In the years that followed, Seligman played a major role in the geographical expansion and industrial development of the United States. In 1874, President Ulysses S. Grant named Seligman as fiscal agent for the U.S. Navy—an appointment that would last through World War I. Seligman helped finance the westward path of the railroads and the building of the Panama Canal. The firm organized its first investment company in 1929 and began managing its first mutual fund in 1930. In 2008, J. & W. Seligman & Co. Incorporated was acquired and Seligman Investments became an offering brand of RiverSource Investments, LLC.

We are proud of the rich and distinctive history of these firms, the strength and breadth of products and services they offer, and the combined cultures of pioneering spirit and forward thinking. Together we are committed to providing more for our shareholders than ever before.

> A singular focus on our shareholders

Our business is asset management, so investors are our first priority. We dedicate our resources to identifying timely investment opportunities and provide a comprehensive choice of equity, fixed-income and alternative investments to help meet your individual needs.

> First-class research and thought leadership

We are dedicated to helping you take advantage of today's opportunities and anticipate tomorrow's. We stay abreast of the latest investment trends and ideas, using our collective insight to evaluate events and transform them into solutions you can use.

> A disciplined investment approach

We aren't distracted by passing fads. Our teams adhere to a rigorous investment process that helps ensure the integrity of our products and enables you and your financial advisor to match our solutions to your objectives with confidence.

When you choose Columbia Management, you can be confident that we will take the time to understand your needs and help you and your financial advisor identify the solutions that are right for you. Because at Columbia Management, we don't consider ourselves successful unless you are.

Sincerely,

J. Kevin Connaughton

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the funds, visit www.columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2010 Columbia Management Investment Advisers, LLC. All rights reserved.

Fund Profile – Columbia California Tax-Exempt Fund

Summary

g For the 12-month period that ended October 31, 2010, the fund's Class A shares returned 9.52% without sales charge.

g The fund outperformed its benchmarks, the Barclays Capital California Municipal Bond Index1 and the broader Barclays Capital Municipal Bond Index,2 as well as the average return of the funds in its peer group, the Lipper California Municipal Debt Funds Classification.3

g Allocations to lower quality and longer-maturity bonds helped the fund outperform its benchmarks and peer group.

Portfolio Management

Catherine Stienstra has managed the fund since October 2010 and has been associated with Columbia Management Investment Advisers, LLC or its predecessors since 2007.

1The Barclays Capital California Municipal Bond Index is a subset of the Barclays Capital Municipal Bond Index consisting solely of bonds issued by obligors located in the state of California.

2The Barclays Capital Municipal Bond Index is considered representative of the broad market for investment-grade, tax-exempt bonds with a maturity of at least one year.

3Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Summary

1-year return as of 10/31/10

| | +9.52% | |

|

| |  | | | Class A shares

(without sales charge) | |

|

| | +7.78% | |

|

| |  | | | Barclays Capital

Municipal Bond Index | |

|

| | +8.98% | |

|

| |  | | | Barclays Capital

California Municipal Bond Index | |

|

1

Economic Update – Columbia California Tax-Exempt Fund

Summary

For the 12-month period that ended October 31, 2010

g Modest economic growth and relatively low interest rates boosted bond market returns. The Barclays Capital Aggregate Bond Index delivered solid results. High-yield bonds kept pace with stocks, as measured by the JPMorgan Developed BB High Yield Index.

Barclays

Aggregate Index | | JPMorgan

Index | |

|

| |  | |

|

g The U.S. stock market, as measured by the S&P 500 Index, delivered solid returns, despite a summer correction. Emerging market stocks, as measured by the MSCI Emerging Markets Index (Net), outperformed U.S stocks as well as stock markets in developed foreign markets, as measured by the MSCI EAFE Index (Net).

S&P Index | | MSCI Emerging

Markets Index | |

|

| |  | |

|

MSCI EAFE

Index | |

| |

|

| | | |

|

Although economic growth, as measured by gross domestic product (GDP), advanced a solid 5.0% in the last quarter of 2009, it remained sluggish into 2010. GDP expanded by 3.7% in the first quarter, 1.7% in the second quarter and 2.0% in the third quarter of 2010. Yet, fears that the economy could sink back into recession have diminished and most key indicators remain positive.

Consumer spending on cars, clothing and other goods generally trended higher throughout the year, with a solid pickup in September 2010. Personal income also moved higher. Consumer confidence, as measured by the Conference Board Consumer Confidence Index, gained ground in the first half of 2010. However, the index fell sharply during the summer before edging higher again in October 2010. The widely-followed measure of consumer attitudes toward the economy continues to hover near its historical low. Consumers continue to indicate they are concerned about business conditions and job prospects.

The housing market—another bellwether for the consumer sector—showed a glimmer of improvement in the final months of the 12-month period. Although both new and existing home sales fell during the summer after a federal tax credit for new and repeat homebuyers expired, both picked up in September 2010. Distressed properties continued to pressure prices. The national median price of existing homes fell slightly over the one-year period, while the median price of new homes rose slightly. The inventory of unsold new homes rose over the one-year period, though it stabilized somewhat in September and October.

News on the job front was mostly positive in 2010, but the number of new jobs added to the economy fell short of expectations. A good portion of the jobs added in March, April and May were temporary, government-sponsored census positions, which began to unwind in June, July and August. However, private sector payroll employment trended modestly higher, massive layoffs declined and in October, labor market growth turned positive with the addition of 151,000 new jobs.

Reports from the business side of the economy were generally positive. A key measure of the nation's manufacturing situation—the Institute for Supply Management's Index—trended generally higher. Industrial production declined slightly in August and September, while the amount of manufacturing capacity utilized—a key measure of the health of the manufacturing sector—inched higher.

Bonds delivered solid returns

As the economy strengthened, bonds delivered solid returns. The Barclays Capital Aggregate Bond Index1 returned 8.01%. The high-yield bond market kept pace with the stock market during the period. For the 12 months covered by this report, the JPMorgan Developed BB High Yield Index2 returned 16.85%. The Treasury market was

1The Barclays Capital Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

2The JPMorgan Developed BB High Yield Index is an unmanaged index designed to mirror the investable universe of the U.S. dollar developed, BB-rated, high yield corporate debt market.

2

Economic Update (continued) – Columbia California Tax-Exempt Fund

also positive. As the yield on the 10-year U.S. Treasury, a common bellwether for the bond market, fell over the 12-month period (bond prices and yields move in opposite directions), the Barclays Capital U.S. Treasury Index3 returned 7.20%. Municipal bonds performed in line with taxable bonds, as investors sought to shelter income ahead of expected tax increases. The Barclays Capital Municipal Bond Index4 gained 7.78% for the period. Despite positive economic activity, the Federal Reserve Board (the Fed) kept a key short-term interest rate—the federal funds rate—close to zero.

Stock rally regains its footing

Against a strengthening economic backdrop, a stock market rally that began early in 2009 continued into the spring of 2010. But during the early summer months, a debt crisis brewing in Europe raised concerns among U.S. investors, as did mixed signals on the economy, and some of the stock market's earlier gains vanished. Then, in September and October, investors reversed course and bid stocks sharply higher. The S&P 500 Index5 returned 16.52% for the 12-month period.

Outside the United States, stock market returns were mixed. The MSCI EAFE Index (Net),6 a broad gauge of stock market performance in foreign developed markets, returned 8.36% (in U.S. dollars) for the period, as concerns about the impact of a bailout for weak eurozone economies weighed on the markets. Emerging stock markets were more resilient. The MSCI Emerging Markets Index (Net)7 returned 23.56% (in U.S. dollars) for the 12-month period.

Past performance is no guarantee of future results.

3The Barclays Capital U.S. Treasury Index includes public obligations of the U.S. Treasury. Treasury bills are excluded by the maturity constraint. In addition, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS, are excluded. STRIPS are excluded from the index because their inclusion would result in double-counting.

4The Barclays Capital Municipal Bond Index is considered representative of the broad market for investment-grade, tax-exempt bonds with a maturity of at least one year.

5The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

6The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index (Net) is a free float- adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. As of May 27, 2010, the MSCI EAFE Index (Net) consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

7The Morgan Stanley Capital International Emerging Markets (MSCI EM) Index (Net) is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. As of May 27, 2010, the MSCI EM Index (Net) consisted of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

3

Performance Information – Columbia California Tax-Exempt Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

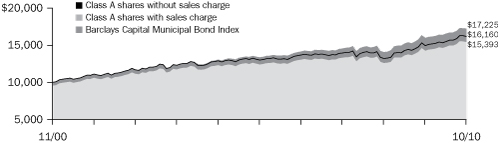

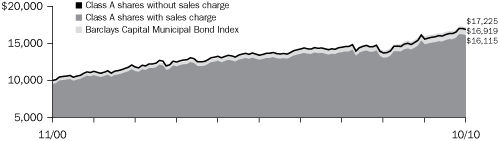

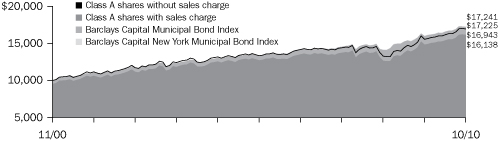

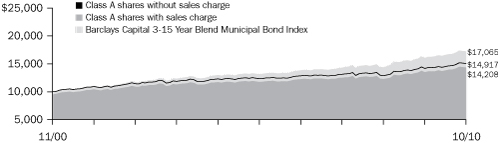

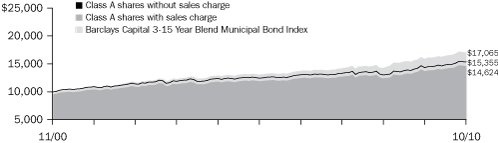

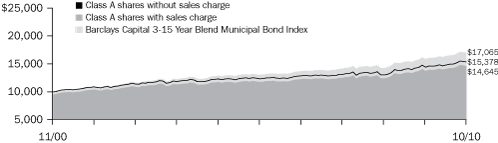

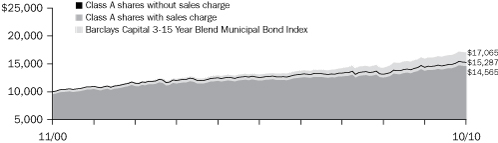

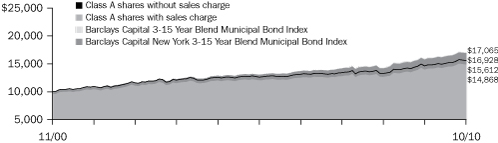

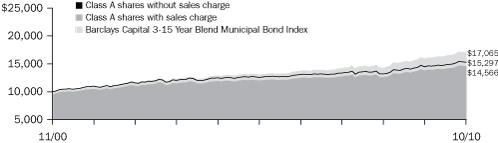

Performance of a $10,000 investment 11/01/00 – 10/31/10

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia California Tax-Exempt Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Performance of a $10,000 investment 11/01/00 – 10/31/10 ($)

| Sales charge | | without | | with | |

| Class A | | | 16,506 | | | | 15,722 | | |

| Class B | | | 15,324 | | | | 15,324 | | |

| Class C | | | 15,782 | | | | 15,782 | | |

| Class Z | | | 16,707 | | | | n/a | | |

Average annual total return as of 10/31/10 (%)

| Share class | | A | | B | | C | | Z | |

| Inception | | 06/16/86 | | 08/04/92 | | 08/01/97 | | 09/19/05 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | |

| 1-year | | | 9.52 | | | | 4.32 | | | | 8.71 | | | | 3.71 | | | | 9.03 | | | | 8.03 | | | | 9.78 | | |

| 5-year | | | 4.75 | | | | 3.73 | | | | 3.97 | | | | 3.62 | | | | 4.27 | | | | 4.27 | | | | 4.99 | | |

| 10-year | | | 5.14 | | | | 4.63 | | | | 4.36 | | | | 4.36 | | | | 4.67 | | | | 4.67 | | | | 5.27 | | |

The "with sales charge" returns include the maximum initial sales charge of 4.75% for Class A shares and the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year, and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class Z shares have limited eligibility and the investment minimum requirements may vary. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. Please see the Fund's prospectus for details.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

The returns shown for the fund's Class Z shares include the returns of the fund's Class A shares for periods prior to September 19, 2005, the date on which the fund's Class Z shares were first offered. The returns shown have been adjusted to reflect the fact that Class Z shares are sold without sales charges. The returns shown have not been adjusted to reflect any differences in expenses such as distribution and service (Rule 12b-1) fees between Class Z and Class A shares of the fund.

4

Understanding Your Expenses – Columbia California Tax-Exempt Fund

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Investment Services Corp., your account balance is available online at www.columbiamanagement.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account may be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

05/01/10 – 10/31/10

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,049.90 | | | | 1,020.97 | | | | 4.34 | | | | 4.28 | | | | 0.84 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,046.00 | | | | 1,017.19 | | | | 8.20 | | | | 8.08 | | | | 1.59 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,047.50 | | | | 1,018.70 | | | | 6.66 | | | | 6.56 | | | | 1.29 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,051.10 | | | | 1,022.18 | | | | 3.10 | | | | 3.06 | | | | 0.60 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the investment advisor and/or any of its affiliates not waived fees or reimbursed a portion of expenses, account value at the end of the period would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

5

Portfolio Manager's Report – Columbia California Tax-Exempt Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Net asset value per share

as of 10/31/10 ($)

| Class A | | | 7.64 | | |

| Class B | | | 7.64 | | |

| Class C | | | 7.64 | | |

| Class Z | | | 7.64 | | |

Distributions declared per share

11/01/09 – 10/31/10 ($)

| Class A | | | 0.34 | | |

| Class B | | | 0.28 | | |

| Class C | | | 0.31 | | |

| Class Z | | | 0.36 | | |

A portion of the fund's income may be subject to the alternative minimum tax. The fund may at times purchase tax-exempt securities at a discount. Some, or all, of this discount may be included in the fund's ordinary income, and is taxable when distributed. Distributions include $0.02 per share of taxable realized gains.

Top 5 sectors

as of 10/31/10 (%)

| Local General Obligations | | | 10.9 | | |

| Special Property Tax | | | 10.7 | | |

| State General Obligations | | | 10.6 | | |

| Refunded/Escrowed | | | 10.5 | | |

| Hospitals | | | 7.9 | | |

Quality breakdown

as of 10/31/10 (%)

| AAA | | | 11.2 | | |

| AA | | | 34.4 | | |

| A | | | 36.7 | | |

| BBB | | | 8.8 | | |

| BB | | | 0.4 | | |

| Non-Rated | | | 8.5 | | |

For the 12-month period that ended October 31, 2010, the fund's Class A shares returned 9.52% without sales charge. That was higher than the 8.98% gain of the Barclays Capital California Municipal Bond Index as well as the 7.78% advance of the broader Barclays Capital Municipal Bond Index. The fund also gained more than the 8.57% average return of the funds in its peer group, the Lipper California Municipal Debt Funds Classification. The fund benefited from an emphasis on lower quality and longer-maturity bonds, which outperformed higher quality and shorter-maturity issues.

Strong gains for municipal bonds

The past year was a good one for municipal bonds nationwide, thanks to a decline in interest rates and a favorable supply/demand situation. Demand for municipal issuance was particularly strong, as investors began to anticipate higher tax rates and the expiration of certain tax credits. Many municipal issuers also benefited from credit upgrades as Moody's Investor Services, a well-known credit rating agency, applied its global ratings scale to the municipal market. Meanwhile, tax-exempt supply—especially for bonds with maturities of 20 years or more—tightened, as more issuers turned to the popular Build America Bonds (BABs) Program, which gives municipalities a federal subsidy for issuing taxable debt.

Bias toward longer-maturity, lower quality issues

While we managed the fund for total return, we also sought to add yield. An overweight and strong issue selection in bonds with 20-30 year maturities as well as 10-15 year maturities especially helped performance. Over the year, we added to the fund's stake in bonds with 20-year and longer maturities. Having more sensitivity to interest rate changes than either of the Barclays indices also meant bonds in the fund experienced more price appreciation as interest rates declined. Exposure to lower quality bonds, especially BBB rated1 bonds and below investment-grade quality bonds, further aided performance. We believed lower quality issues would benefit as credit spreads—the yield difference between low and high quality bonds—narrowed in a slow and prolonged economic recovery. An underweight in A rated issues, compared with the benchmark, hampered relative results.

Gains from certain sector allocations

Overweights as well as strong issue selection in several sectors that performed well also boosted performance. For example, special tax bonds—which are bonds backed by revenues from sales or fuel taxes—did well for the fund, as did hospital, education and pre-refunded securities. Pre-refunding occurs when an issuer sells new bonds and invests the proceeds in U.S. Treasury securities that are pledged to pay off older, usually higher-rate, debt. By contrast, an underweight in California state general obligation (GO) bonds detracted from results, as the sector rebounded from the depressed levels it had reached in 2009. Having less exposure than the index to the transportation sector, which includes bonds issued for toll roads, turnpikes and bridge authorities, further hindered relative performance.

1The credit quality ratings represent those of one of the following nationally recognized rating agencies: Standard & Poor's or Moody's Investor Services. If a security is rated by only one of the two agencies, that rating is used. If a security is not rated by either of the two agencies, it is designated as Non-Rated. Ratings are relative and subjective and are not absolute standards of quality. The credit quality of the fund's investment does not remove market risk.

6

Portfolio Manager's Report (continued) – Columbia California Tax-Exempt Fund

Challenging outlook for California

California was hit hard by the recent recession, and recovery has been slow, as evidenced by a 12.4% unemployment rate in September 2010—well above the 9.6% national average. Going forward, a contraction in personal income growth and a weak housing market are likely to increase the state's budgetary problems. In addition, the recent passage of Proposition 26 is expected to make it more difficult for state and local governments to raise revenue. On the positive side, California remains a leader in international trade, technology and manufacturing. Future budgets should be easier to pass, as voters recently passed Proposition 25, which allows the legislature to approve the state budget with a simple majority vote. A weak U.S. dollar also could boost international demand, in turn benefiting the state's technology and manufacturing sectors. Going forward, we plan to maintain an underweight relative to the index in state GOs due to our concerns about the state's fiscal health, but may look for opportunities to add to investments in the hospital and education sectors.

Portfolio characteristics and holdings are subject to change and may not be representative of current characteristics and holdings. The outlook for the fund may differ from that presented for other Columbia Funds.

Tax-exempt investing offers current tax-exempt income, but it also involves certain risks. The value of the fund will be affected by interest rate changes and the creditworthiness of issues held in the fund. When interest rates go up, bond prices generally drop and vice versa. Interest income from certain tax-exempt bonds may be subject to certain state and local taxes and, if applicable, the alternative minimum tax. Any capital gains distributed are taxable to the investor.

Single-state municipal bond funds pose additional risks due to limited geographical diversification.

Maturity breakdown

as of 10/31/10 (%)

| 1-3 years | | | 0.3 | | |

| 3-5 years | | | 3.9 | | |

| 5-7 years | | | 2.9 | | |

| 7-10 years | | | 16.9 | | |

| 10-15 years | | | 17.9 | | |

| 15-20 years | | | 12.0 | | |

| 20-25 years | | | 21.0 | | |

| 25 years and over | | | 22.1 | | |

| Cash & Equivalents | | | 3.0 | | |

The fund is actively managed and the composition of its portfolio will change over time. Maturity breakdown, top sectors and quality breakdown are calculated as a percentage of net assets. Ratings shown in the quality breakdown are assigned to individual bonds by taking the lower of the ratings available from one of the following nationally recognized rating agencies: Standard & Poor's or Moody's Investor Services. If a security is rated by only one of the two agencies, that rating is used. If a security is not rated by either of the two agencies, it is designated as Non-Rated. Ratings are relative and subjective and are not absolute standards of quality. The fund's credit quality does not remove market risk.

30-day SEC yields

as of 10/31/10 (%)

| Class A | | | 3.37 | | |

| Class B | | | 2.79 | | |

| Class C | | | 3.09 | | |

| Class Z | | | 3.79 | | |

The 30-day SEC yields reflect the fund's earning power, net of expenses, expressed as an annualized percentage of the public offering price per share at the end of the period. Had the investment advisor and/or any of its affiliates not waived fees or reimbursed a portion of expenses, the 30-day SEC yields would have been reduced.

Taxable equivalent SEC yields

as of 10/31/10 (%)

| Class A | | | 5.80 | | |

| Class B | | | 4.80 | | |

| Class C | | | 5.31 | | |

| Class Z | | | 6.51 | | |

Taxable-equivalent SEC yields are calculated assuming a federal tax rate of 35.0% and a California state income tax rate of 10.55%. These tax rates do not reflect the phase out of exemptions or the reduction of the otherwise allowable deductions that occur when adjusted gross income exceeds certain levels. Your taxable-equivalent yield may be different depending on your tax bracket.

7

Investment Portfolio – Columbia California Tax-Exempt Fund

October 31, 2010

| Municipal Bonds – 95.8% | |

| | | Par ($) | | Value ($) | |

| Education – 8.2% | |

| Education – 7.3% | |

| CA Educational Facilities Authority | |

| California College of Arts, | |

Series 2005:

5.000% 06/01/26 | | | 1,000,000 | | | | 951,070 | | |

| 5.000% 06/01/35 | | | 1,500,000 | | | | 1,341,945 | | |

| California Lutheran University, | |

Series 2008,

5.750% 10/01/38 | | | 3,000,000 | | | | 3,121,680 | | |

| University of Southern California: | |

Series 2007 A,

4.500% 10/01/33 | | | 4,500,000 | | | | 4,505,175 | | |

Series 2009,

5.000% 10/01/39 | | | 1,425,000 | | | | 1,511,953 | | |

| Woodbury University, | |

Series 2006,

5.000% 01/01/25 | | | 1,830,000 | | | | 1,779,181 | | |

| CA Statewide Communities Development Authority | |

| San Francisco Art Institute, | |

Series 2002,

7.375% 04/01/32 | | | 1,750,000 | | | | 1,483,248 | | |

| CA University of California | |

| Series 2007, | |

Insured: AGMC

4.500% 05/15/35 | | | 4,000,000 | | | | 3,906,920 | | |

| Series 2009 A, | |

| 6.000% 11/01/40 | | | 2,000,000 | | | | 2,246,120 | | |

| Series 2009 O, | |

| 5.250% 05/15/39 | | | 4,000,000 | | | | 4,352,760 | | |

| Series 2010 A, | |

| 5.000% 11/01/30 | | | 2,995,000 | | | | 3,157,179 | | |

| Education Total | | | 28,357,231 | | |

| Prep School – 0.9% | |

| CA Statewide Communities Development Authority | |

| College for Certain LLC, | |

Series 2010,

GTY AGMT: PCSD Guaranty Pool LLC

6.000% 07/01/30 | | | 2,000,000 | | | | 2,059,620 | | |

| Crossroads School for Arts & Sciences, | |

Series 1998,

6.000% 08/01/28 (a) | | | 1,595,000 | | | | 1,595,016 | | |

| Prep School Total | | | 3,654,636 | | |

| Education Total | | | 32,011,867 | | |

| | | Par ($) | | Value ($) | |

| Health Care – 8.8% | |

| Continuing Care Retirement – 0.9% | |

| CA Health Facilities Financing Authority | |

| Episcopal Senior Communities, | |

Series 2010 B,

6.000% 02/01/32 | | | 2,000,000 | | | | 2,065,720 | | |

| CA Statewide Communities Development Authority | |

| American Baptist Homes West, | |

Series 2010,

GTY AGMT: American Baptist Homes Foundation

6.250% 10/01/39 | | | 1,500,000 | | | | 1,522,425 | | |

| Continuing Care Retirement Total | | | 3,588,145 | | |

| Hospitals – 7.9% | |

| CA Health Facilities Financing Authority | |

| Catholic Healthcare West: | |

Series 2009 A,

6.000% 07/01/39 | | | 1,000,000 | | | | 1,088,670 | | |

Series 2009 E,

5.625% 07/01/25 | | | 1,125,000 | | | | 1,221,705 | | |

| Cedars-Sinai Medical Center, | |

Series 2005:

5.000% 11/15/27 | | | 1,500,000 | | | | 1,533,480 | | |

| 5.000% 11/15/34 | | | 2,500,000 | | | | 2,516,550 | | |

| Kaiser Hospitals Foundation, | |

Series 2006,

5.250% 04/01/39 | | | 2,000,000 | | | | 2,014,920 | | |

| Sutter Health, | |

Series 2007 A,

5.000% 11/15/42 | | | 3,000,000 | | | | 2,938,890 | | |

| CA Infrastructure & Economic Development Bank | |

| Kaiser Assistance Corp., | |

Series 2001 A,

5.550% 08/01/31 | | | 2,500,000 | | | | 2,561,925 | | |

| CA Kaweah Delta Health Care District | |

| Series 2006, | |

| 4.500% 06/01/34 | | | 3,500,000 | | | | 2,995,090 | | |

| CA Municipal Finance Authority | |

| Series 2007, | |

| 5.250% 02/01/37 | | | 2,500,000 | | | | 2,373,600 | | |

| CA Rancho Mirage Joint Powers Financing Authority | |

| Eisenhower Medical Center, | |

Series 2007 A,

5.000% 07/01/47 | | | 2,500,000 | | | | 2,223,500 | | |

| CA Sierra View Local Health Care District | |

| Series 2007, | |

| 5.250% 07/01/37 | | | 1,500,000 | | | | 1,455,900 | | |

See Accompanying Notes to Financial Statements.

8

Columbia California Tax-Exempt Fund

October 31, 2010

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

| CA Statewide Communities Development Authority | |

| Cottage Health Obligator Group, | |

Series 2010,

5.250% 11/01/30 | | | 1,000,000 | | | | 1,045,940 | | |

| Kaiser Foundation Hospitals, Inc., | |

Series 2007 A,

4.750% 04/01/33 | | | 2,000,000 | | | | 1,932,960 | | |

| CA Torrance | |

| Torrance Memorial Medical Center, | |

Series 2010 A,

5.000% 09/01/40 | | | 1,000,000 | | | | 989,220 | | |

| CA Turlock Health Facility | |

| Emanuel Medical Center, Inc.: | |

Series 2004,

5.000% 10/15/13 | | | 940,000 | | | | 993,147 | | |

Series 2007 A,

5.000% 10/15/22 | | | 2,780,000 | | | | 2,762,653 | | |

| Hospitals Total | | | 30,648,150 | | |

| Health Care Total | | | 34,236,295 | | |

| Housing – 1.0% | |

| Multi-Family – 0.4% | |

| CA Statewide Communities Development Authority | |

| Oracle Communities Rialto 360 Corp., | |

Series 2002 E-1,

5.375% 07/01/32 | | | 2,000,000 | | | | 1,659,460 | | |

| Multi-Family Total | | | 1,659,460 | | |

| Single-Family – 0.6% | |

| CA Housing Finance Agency | |

| Series 2006 K, AMT, | |

| 4.625% 08/01/26 | | | 2,500,000 | | | | 2,274,700 | | |

| CA Rural Home Mortgage Finance Authority | |

| Series 1997 A-2, AMT, | |

Guarantor: GNMA

7.000% 09/01/29 | | | 5,000 | | | | 5,072 | | |

| Series 1998 B-5, AMT, | |

Guarantor: FNMA

6.350% 12/01/29 | | | 40,000 | | | | 41,889 | | |

| Series 2000 B, AMT, | |

Guarantor: FNMA

7.300% 06/01/31 | | | 30,000 | | | | 30,835 | | |

| Series 2000 D, AMT, | |

Guarantor: GNMA

7.100% 06/01/31 | | | 30,000 | | | | 31,082 | | |

| Single-Family Total | | | 2,383,578 | | |

| Housing Total | | | 4,043,038 | | |

| | | Par ($) | | Value ($) | |

| Industrials – 1.2% | |

| Oil & Gas – 1.2% | |

| CA M-S-R Energy Authority | |

| Series 2009 B, | |

| 7.000% 11/01/34 | | | 1,000,000 | | | | 1,226,250 | | |

| CA Southern California Public Power Authority | |

| Series 2007 A, | |

| 5.000% 11/01/33 | | | 3,385,000 | | | | 3,255,253 | | |

| Oil & Gas Total | | | 4,481,503 | | |

| Industrials Total | | | 4,481,503 | | |

| Other – 12.9% | |

| Other – 0.8% | |

| CA Infrastructure & Economic Development Bank | |

| Walt Disney Family Museum, | |

Series 2008,

GTY AGMT: Walt & Lilly Disney Foundation

5.250% 02/01/38 | | | 3,050,000 | | | | 3,125,518 | | |

| Other Total | | | 3,125,518 | | |

| Refunded/Escrowed (b) – 10.5% | |

| CA Central Unified School District | |

| Series 1993, | |

Escrowed to Maturity,

Insured: AMBAC

(c) 03/01/18 | | | 20,065,000 | | | | 16,966,161 | | |

| CA Health Facilities Financing Authority | |

| Series 1998 A, | |

Escrowed to Maturity,

Insured: AGMC

5.000% 06/01/24 | | | 3,000,000 | | | | 3,009,570 | | |

| CA Metropolitan Water District of Southern California | |

| Series 1993 A, | |

Escrowed to Maturity,

5.750% 07/01/21 | | | 2,865,000 | | | | 3,446,452 | | |

| CA Pomona | |

| Single Family Mortgage Revenue, | |

Series 1990 B,

Escrowed to Maturity,

Guarantor: GNMA

7.500% 08/01/23 | | | 1,000,000 | | | | 1,324,720 | | |

| CA Redding | |

| Series 1992 A, IFRN, | |

Escrowed to Maturity,

Insured: NPFGC

10.003% 07/01/22

(11/02/10) (d)(e) | | | 480,000 | | | | 673,603 | | |

See Accompanying Notes to Financial Statements.

9

Columbia California Tax-Exempt Fund

October 31, 2010

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

| CA Riverside County | |

| Series 1989 A, AMT, | |

Escrowed to Maturity,

Guarantor: GNMA

7.800% 05/01/21 | | | 2,500,000 | | | | 3,533,450 | | |

| CA San Joaquin Hills Transportation Corridor Agency | |

| Series 1993, | |

Escrowed to Maturity,

(c) 01/01/20 | | | 15,400,000 | | | | 11,987,360 | | |

| Refunded/Escrowed Total | | | 40,941,316 | | |

| Tobacco – 1.6% | |

| CA Golden State Tobacco Securitization Corp. | |

| Series 2007 A-1, | |

| 5.000% 06/01/33 | | | 7,500,000 | | | | 6,176,850 | | |

| Tobacco Total | | | 6,176,850 | | |

| Other Total | | | 50,243,684 | | |

| Resource Recovery – 0.5% | |

| Disposal – 0.5% | |

| CA Pollution Control Financing Authority | |

| Series 2002 A, AMT, | |

GTY AGMT: Waste Management, Inc.

5.000% 01/01/22 | | | 2,000,000 | | | | 2,045,820 | | |

| Disposal Total | | | 2,045,820 | | |

| Resource Recovery Total | | | 2,045,820 | | |

| Tax-Backed – 43.4% | |

| Local Appropriated – 6.4% | |

| CA Anaheim Public Financing Authority | |

| Series 1997 C, | |

Insured: AGMC

6.000% 09/01/14 | | | 2,000,000 | | | | 2,316,060 | | |

| CA Los Angeles County Schools | |

| Regionalized Business Services Corp., | |

Series 1999 A,

Insured: AMBAC:

(c) 08/01/16 | | | 1,945,000 | | | | 1,518,714 | | |

| (c) 08/01/17 | | | 1,980,000 | | | | 1,452,785 | | |

| CA Modesto | |

| Certificates of Participation, | |

Series 1993 A,

Insured: AMBAC

5.000% 11/01/23 | | | 2,235,000 | | | | 2,259,943 | | |

| | | Par ($) | | Value ($) | |

| CA Oakland Joint Powers Financing Authority | |

| Series 2008 B, | |

Insured: AGC

5.000% 08/01/22 | | | 3,000,000 | | | | 3,232,380 | | |

| CA Pico Rivera Public Financing Authority | |

| Series 2009, | |

| 5.500% 09/01/31 | | | 1,500,000 | | | | 1,571,505 | | |

| CA San Joaquin County | |

| Certificates of Participation, | |

Series 1993,

Insured: NPFGC

5.500% 11/15/13 | | | 1,750,000 | | | | 1,818,705 | | |

| CA Santa Ana Financing Authority | |

| Series 1994 A, | |

Insured: NPFGC

6.250% 07/01/18 | | | 6,035,000 | | | | 7,041,216 | | |

| CA Victor Elementary School District | |

| Series 1996, | |

Insured: NPFGC

6.450% 05/01/18 | | | 3,345,000 | | | | 3,624,475 | | |

| Local Appropriated Total | | | 24,835,783 | | |

| Local General Obligations – 10.9% | |

| CA Cabrillo Unified School District | |

| Series 1996 A, | |

Insured: AMBAC

(c) 08/01/15 | | | 3,000,000 | | | | 2,532,060 | | |

| CA Central Valley Schools Financing Authority | |

| Series 1998 A, | |

Insured: NPFGC

6.450% 02/01/18 | | | 1,000,000 | | | | 1,150,110 | | |

| CA Coast Community College District | |

| Series 2005, | |

Insured: NPFGC

(c) 08/01/22 | | | 4,000,000 | | | | 2,317,040 | | |

| CA Culver City School Facilities Financing Authority | |

| Series 2005, | |

Insured: AGMC:

5.500% 08/01/25 | | | 655,000 | | | | 798,989 | | |

| 5.500% 08/01/26 | | | 1,750,000 | | | | 2,142,315 | | |

CA East Side Union High School District

Santa Clara County | |

| Series 2003 B, | |

Insured: NPFGC

5.250% 08/01/26 | | | 2,010,000 | | | | 2,086,460 | | |

See Accompanying Notes to Financial Statements.

10

Columbia California Tax-Exempt Fund

October 31, 2010

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

| CA Golden West Schools Financing Authority | |

| Series 2006, | |

Insured: AMBAC

5.500% 08/01/24 | | | 1,825,000 | | | | 2,119,500 | | |

| CA Grossmont Union High School District | |

| Series 2006, | |

Insured: NPFGC

(c) 08/01/28 | | | 5,000,000 | | | | 1,833,700 | | |

| CA Jefferson Union High School District | |

| Series 2000 A, | |

Insured: NPFGC

6.450% 08/01/25 | | | 1,000,000 | | | | 1,212,160 | | |

| CA Lafayette | |

| Series 2002, | |

| 5.125% 07/15/25 | | | 1,995,000 | | | | 2,085,194 | | |

| CA Manteca Unified School District | |

| Series 2006, | |

Insured: NPFGC

(c) 08/01/32 | | | 5,440,000 | | | | 1,315,120 | | |

| CA New Haven Unified School District | |

| Series 2002, | |

Insured: AGMC

12.000% 08/01/17 | | | 1,565,000 | | | | 2,530,417 | | |

| CA Poway Unified School District | |

| Series 2009 A, | |

| (c) 08/01/24 | | | 6,770,000 | | | | 3,301,187 | | |

| CA Rocklin Unified School District | |

| Series 1995 C, | |

Insured: NPFGC

(c) 07/01/20 | | | 6,920,000 | | | | 4,686,501 | | |

| CA San Marino Unified School District | |

| Series 1998 B, | |

| 5.000% 06/01/23 | | | 1,000,000 | | | | 1,175,970 | | |

| CA San Mateo Union High School District | |

| Series 2002 B, | |

Insured: NPFGC

(c) 09/01/26 | | | 4,005,000 | | | | 1,860,403 | | |

| CA Saratoga | |

| Series 2001, | |

Insured: NPFGC

5.250% 08/01/31 | | | 2,000,000 | | | | 2,026,540 | | |

| CA Simi Valley Unified School District | |

| Series 1998, | |

Insured: AMBAC

5.250% 08/01/22 | | | 925,000 | | | | 982,082 | | |

| | | Par ($) | | Value ($) | |

| CA South San Francisco Unified School District | |

| Series 2006, | |

Insured: NPFGC

5.250% 09/15/22 | | | 1,500,000 | | | | 1,825,860 | | |

| CA Tahoe-Truckee Unified School District | |

| Series 1999 1-A, | |

Insured: FGIC

(c) 08/01/23 | | | 3,780,000 | | | | 1,874,011 | | |

| Series 1999 2-A, | |

Insured: FGIC

(c) 08/01/24 | | | 2,965,000 | | | | 1,379,614 | | |

| CA Union Elementary School District | |

| Series 1999 A, | |

Insured: NPFGC

(c) 09/01/19 | | | 1,750,000 | | | | 1,220,048 | | |

| Local General Obligations Total | | | 42,455,281 | | |

| Special Non-Property Tax – 1.4% | |

| CA Carson Redevelopment Agency | |

| Tax Allocation Housing, | |

Series 2010 A,

5.000% 10/01/30 | | | 3,200,000 | | | | 3,097,920 | | |

| PR Commonwealth of Puerto Rico Highway & Transportation Authority | |

| Series 1998 A, | |

Insured: NPFGC

4.750% 07/01/38 | | | 2,250,000 | | | | 2,153,047 | | |

| Special Non-Property Tax Total | | | 5,250,967 | | |

| Special Property Tax – 10.7% | |

| CA Carson | |

| Series 1992, | |

| 7.375% 09/02/22 | | | 115,000 | | | | 115,163 | | |

| CA Cerritos Public Financing Authority | |

| Series 1993 A, | |

Insured: AMBAC

6.500% 11/01/23 | | | 2,000,000 | | | | 2,343,500 | | |

| CA Elk Grove Unified School District | |

| Series 1995 A, | |

Insured: AMBAC:

(c) 12/01/18 | | | 2,720,000 | | | | 1,790,032 | | |

| 6.500% 12/01/24 | | | 3,000,000 | | | | 3,339,750 | | |

| CA Inglewood Redevelopment Agency | |

| Series 1998 A, | |

Insured: AMBAC

5.250% 05/01/23 | | | 1,000,000 | | | | 1,002,560 | | |

See Accompanying Notes to Financial Statements.

11

Columbia California Tax-Exempt Fund

October 31, 2010

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

| CA Lancaster Financing Authority | |

| Series 2003, | |

Insured: NPFGC

5.125% 02/01/17 | | | 1,270,000 | | | | 1,369,797 | | |

| CA Long Beach Bond Finance Authority | |

| Series 2006 C, | |

Insured: AMBAC

5.500% 08/01/31 | | | 3,250,000 | | | | 3,151,947 | | |

| CA Los Angeles Community Redevelopment Agency | |

| Series 1998 C, | |

Insured: NPFGC

5.375% 07/01/18 | | | 1,665,000 | | | | 1,786,445 | | |

| CA Los Angeles County Public Works Financing Authority | |

| Series 1996 A, | |

Insured: AGMC

5.500% 10/01/18 | | | 2,265,000 | | | | 2,618,612 | | |

| CA Oakdale Public Financing Authority | |

| Series 2004, | |

| 5.375% 06/01/33 | | | 1,500,000 | | | | 1,400,565 | | |

| CA Oakland Redevelopment Agency | |

| Series 1992, | |

Insured: AMBAC

5.500% 02/01/14 | | | 5,725,000 | | | | 5,825,932 | | |

| CA Oceanside Community Facilities District | |

| Series 2004, | |

| 5.875% 09/01/34 | | | 1,000,000 | | | | 910,090 | | |

| CA Orange County Community Facilities District | |

| Series 2004 A, | |

| 5.625% 08/15/34 | | | 850,000 | | | | 826,582 | | |

| CA Rancho Cucamonga Redevelopment Agency | |

| Series 2007 A, | |

Insured: NPFGC

5.000% 09/01/34 | | | 1,000,000 | | | | 936,480 | | |

| CA Redwood City Community Facilities District No. 1 | |

| Series 2003 B, | |

| 5.950% 09/01/28 | | | 750,000 | | | | 755,543 | | |

| CA Riverside County Public Financing Authority | |

| Series 1991 A, | |

| 8.000% 02/01/18 | | | 20,000 | | | | 20,039 | | |

| CA San Bernardino Joint Powers Financing Authority | |

| Series 1998 A, | |

Insured: AMBAC

5.750% 07/01/14 | | | 985,000 | | | | 1,084,061 | | |

| | | Par ($) | | Value ($) | |

| Series 2005 A, | |

Insured: AGMC

5.750% 10/01/24 | | | 2,420,000 | | | | 2,749,193 | | |

| CA San Diego Redevelopment Agency | |

| Series 2001, | |

Insured: AGMC

(c) 09/01/20 | | | 3,630,000 | | | | 2,269,077 | | |

| CA San Francisco City & County Redevelopment Agency | |

| Series 2009 C, | |

| 6.500% 08/01/39 | | | 1,000,000 | | | | 1,088,940 | | |

| Series 2009, | |

| 6.500% 08/01/32 | | | 500,000 | | | | 550,375 | | |

| CA Sulphur Springs Union School District | |

| Series 2002-1-A, | |

| 6.000% 09/01/33 | | | 1,500,000 | | | | 1,364,535 | | |

| CA West Covina Redevelopment Agency | |

| Series 1996, | |

| 6.000% 09/01/17 | | | 3,665,000 | | | | 4,164,979 | | |

| Special Property Tax Total | | | 41,464,197 | | |

| State Appropriated – 3.4% | |

| CA Public Works Board | |

| Series 1993 A, | |

Insured: AMBAC

5.000% 12/01/19 | | | 6,000,000 | | | | 6,245,160 | | |

| Series 2004 A, | |

| 5.500% 06/01/19 | | | 1,500,000 | | | | 1,573,185 | | |

| Series 2009, | |

| 6.125% 11/01/29 | | | 5,000,000 | | | | 5,439,750 | | |

| State Appropriated Total | | | 13,258,095 | | |

| State General Obligations – 10.6% | |

| CA State | |

| Series 2000, | |

| 5.625% 05/01/26 | | | 160,000 | | | | 162,074 | | |

| Series 2003, | |

| 5.250% 02/01/20 | | | 1,250,000 | | | | 1,430,325 | | |

| Series 2005, | |

| 4.625% 05/01/29 | | | 2,000,000 | | | | 1,971,860 | | |

| Series 2006, | |

| 4.500% 10/01/36 | | | 2,500,000 | | | | 2,382,225 | | |

| Series 2007, | |

| 4.500% 08/01/26 | | | 2,500,000 | | | | 2,444,625 | | |

| 5.000% 12/01/31 | | | 3,500,000 | | | | 3,558,310 | | |

| Series 2008, | |

| 5.000% 08/01/34 | | | 2,500,000 | | | | 2,517,375 | | |

| 5.125% 04/01/33 | | | 3,500,000 | | | | 3,557,085 | | |

See Accompanying Notes to Financial Statements.

12

Columbia California Tax-Exempt Fund

October 31, 2010

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

| Series 2009: | |

| 5.000% 10/01/29 | | | 4,000,000 | | | | 4,118,800 | | |

| 5.500% 11/01/39 | | | 4,965,000 | | | | 5,265,134 | | |

| 6.000% 04/01/35 | | | 4,000,000 | | | | 4,473,080 | | |

| Series 2010, | |

| 5.500% 03/01/40 | | | 4,800,000 | | | | 5,098,416 | | |

| PR Commonwealth of Puerto Rico | |

| Series 2004 A: | |

| 5.250% 07/01/21 | | | 2,000,000 | | | | 2,073,060 | | |

| 5.250% 07/01/22 | | | 2,000,000 | | | | 2,065,840 | | |

| State General Obligations Total | | | 41,118,209 | | |

| Tax-Backed Total | | | 168,382,532 | | |

| Transportation – 7.1% | |

| Air Transportation – 0.0% | |

| CA Statewide Communities Development Authority | |

| United Airlines, Inc., | |

Series 2001,

07/01/39 (f) | | | 2,000,000 | | | | 75,000 | | |

| Air Transportation Total | | | 75,000 | | |

| Airports – 2.9% | |

| CA County of Orange | |

| Series 2009 A, | |

| 5.250% 07/01/39 | | | 2,500,000 | | | | 2,643,350 | | |

| CA County of Sacramento | |

| Series 2008 B, AMT, | |

Insured: AGMC

5.250% 07/01/39 | | | 1,000,000 | | | | 1,013,150 | | |

| CA Los Angeles Department of Airports | |

| Series 2009 A, | |

| 5.000% 05/15/34 | | | 1,000,000 | | | | 1,036,560 | | |

| Series 2010 B, | |

| 5.000% 05/15/35 | | | 2,215,000 | | | | 2,236,707 | | |

| CA San Diego County Regional Airport Authority | |

| Series 2005, AMT, | |

Insured: AMBAC

5.250% 07/01/20 | | | 750,000 | | | | 823,598 | | |

| Series 2010 A, | |

| 5.000% 07/01/34 | | | 1,650,000 | | | | 1,712,716 | | |

| CA San Francisco City & County Airports Commission | |

| Series 2008 34E, AMT, | |

Insured: AGMC

5.750% 05/01/25 | | | 1,500,000 | | | | 1,685,280 | | |

| Airports Total | | | 11,151,361 | | |

| | | Par ($) | | Value ($) | |

| Ports – 1.3% | |

| CA San Francisco Port Commission | |

| Series 2010 A, | |

| 5.125% 03/01/40 | | | 5,000,000 | | | | 5,105,700 | | |

| Ports Total | | | 5,105,700 | | |

| Toll Facilities – 2.2% | |

| CA Bay Area Toll Authority | |

| Series 2008 F-1, | |

| 5.125% 04/01/47 | | | 2,500,000 | | | | 2,617,975 | | |

| CA Foothill-Eastern Transportation Corridor Agency | |

| Series 1995 A, | |

Insured: NPFGC

5.000% 01/01/35 | | | 2,000,000 | | | | 1,807,660 | | |

| Series 1999, | |

| 5.750% 01/15/40 | | | 4,000,000 | | | | 3,946,120 | | |

| Toll Facilities Total | | | 8,371,755 | | |

| Transportation – 0.7% | |

| CA Los Angeles Harbor Department | |

| Series 2009 B, | |

| 5.250% 08/01/39 | | | 2,500,000 | | | | 2,658,450 | | |

| Transportation Total | | | 2,658,450 | | |

| Transportation Total | | | 27,362,266 | | |

| Utilities – 12.7% | |

| Investor Owned – 1.8% | |

| CA Chula Vista Industrial Development Authority | |

| San Diego Gas & Electric Co.: | |

Series 1996 B, AMT,

5.500% 12/01/21 | | | 2,000,000 | | | | 2,121,180 | | |

| Series 2004 D, | |

| 5.875% 01/01/34 | | | 1,000,000 | | | | 1,128,140 | | |

| Series 2005 D, AMT, | |

| 5.000% 12/01/27 | | | 3,500,000 | | | | 3,617,950 | | |

| Investor Owned Total | | | 6,867,270 | | |

| Joint Power Authority – 0.5% | |

| CA Infrastructure & Economic Development Bank | |

| California Independent System Operator Corp., | |

Series 2009 A,

6.250% 02/01/39 | | | 2,000,000 | | | | 2,142,720 | | |

| Joint Power Authority Total | | | 2,142,720 | | |

| Municipal Electric – 2.6% | |

| CA Los Angeles Department of Water & Power | |

| Series 2008, | |

| 5.250% 07/01/38 | | | 1,750,000 | | | | 1,882,423 | | |

See Accompanying Notes to Financial Statements.

13

Columbia California Tax-Exempt Fund

October 31, 2010

| Municipal Bonds (continued) | |

| | | Par ($) | | Value ($) | |

| CA Modesto Irrigation District | |

| Certificates of Participation, | |

Series 2004 B,

5.500% 07/01/35 | | | 2,000,000 | | | | 2,141,800 | | |

| CA Sacramento Municipal Utility District | |

| Series 1997 K, | |

Insured: AMBAC

5.250% 07/01/24 | | | 2,220,000 | | | | 2,524,828 | | |

| Series 2001 N, | |

Insured: NPFGC

5.000% 08/15/28 | | | 2,000,000 | | | | 2,016,620 | | |

PR Commonwealth of Puerto Rico

Electric Power Authority | |

| Series 2008 WW, | |

| 5.000% 07/01/28 | | | 1,500,000 | | | | 1,554,015 | | |

| Municipal Electric Total | | | 10,119,686 | | |

| Water & Sewer – 7.8% | |

| CA Big Bear Lake | |

| Series 1996, | |

Insured: NPFGC

6.000% 04/01/15 | | | 1,350,000 | | | | 1,483,947 | | |

| CA Chino Basin Regional Financing Authority | |

| Inland Empire Utilities Agency, | |

Series 2008 A,

Insured: AMBAC

5.000% 11/01/38 | | | 2,000,000 | | | | 2,048,640 | | |

| CA Lodi | |

| Series 2007 A, | |

Insured: AGMC

5.000% 10/01/37 | | | 1,250,000 | | | | 1,273,375 | | |

| CA Los Angeles Department of Water & Power | |

| Series 2001 A: | |

| 5.125% 07/01/41 | | | 3,000,000 | | | | 3,025,320 | | |

| Insured: FGIC | |

| 5.125% 07/01/41 | | | 3,000,000 | | | | 3,025,320 | | |

| CA Los Angeles | |

| Series 2009 A, | |

| 5.000% 06/01/39 | | | 4,000,000 | | | | 4,213,840 | | |

| CA Manteca Financing Authority | |

| Series 2003 B, | |

Insured: NPFGC

5.000% 12/01/33 | | | 575,000 | | | | 575,765 | | |

| CA Metropolitan Water District of Southern California | |

| Series 1993 A, | |

| 5.750% 07/01/21 | | | 3,635,000 | | | | 4,428,775 | | |

| | | Par ($) | | Value ($) | |

| CA Pico Rivera Water Authority | |

| Series 1999 A, | |

Insured: NPFGC

5.500% 05/01/29 | | | 2,000,000 | | | | 2,208,440 | | |

| CA San Diego Public Facilities Financing Authority | |

| Series 2009 B, | |

| 5.375% 08/01/34 | | | 2,000,000 | | | | 2,173,600 | | |

| Series 2009, | |

| 5.250% 05/15/39 | | | 3,000,000 | | | | 3,218,790 | | |

| CA Santa Clara Valley Water District | |

| Series 2006, | |

Insured: AGMC

4.250% 06/01/30 | | | 2,500,000 | | | | 2,514,750 | | |

| Water & Sewer Total | | | 30,190,562 | | |

| Utilities Total | | | 49,320,238 | | |

Total Municipal Bonds

(cost of $348,327,218) | | | 372,127,243 | | |

| Municipal Preferred Stock – 0.4% | |

| | | Shares | | | |

| Housing – 0.4% | |

| Multi-Family – 0.4% | |

| Munimae Tax-Exempt Bond Subsidiary LLC | |

| Series 2004 A-2, | |

| 4.900% 06/30/49 (g) | | | 2,000,000 | | | | 1,639,940 | | |

| Multi-Family Total | | | 1,639,940 | | |

| Housing Total | | | 1,639,940 | | |

Total Municipal Preferred Stock

(cost of $2,000,000) | | | 1,639,940 | | |

| Common Stock – 0.0% | |

| Industrials – 0.0% | |

| Airlines – 0.0% | |

| United Continental Holdings, Inc. (h) | | | 374 | | | | 10,861 | | |

| Airlines Total | | | 10,861 | | |

| Industrials Total | | | 10,861 | | |

Total Common Stock

(cost of $7,783) | | | 10,861 | | |

| Investment Companies – 3.3% | |

| BofA California Tax-Exempt | |

Reserves, Capital Class

(7 day yield of 0.1520%) (i) | | | 6,038,323 | | | | 6,038,323 | | |

See Accompanying Notes to Financial Statements.

14

Columbia California Tax-Exempt Fund

October 31, 2010

| Investment Companies (continued) | |

| | | Shares | | Value ($) | |

| Dreyfus General California | |

Municipal Money Market Fund

(7 day yield of 0.000%) | | | 6,561,898 | | | | 6,561,898 | | |

Total Investment Companies

(cost of $12,600,221) | | | 12,600,221 | | |

Total Investments – 99.5%

(cost of $362,935,222) (j) | | | 386,378,265 | | |

| Other Assets & Liabilities, Net – 0.5% | | | 1,890,522 | | |

| Net Assets – 100.0% | | | 388,268,787 | | |

Notes to Investment Portfolio:

(a) Denotes a restricted security, which is subject to restrictions on resale under federal securities laws or in transactions exempt from registration. At October 31, 2010, the value of this security amounted to $1,595,016 which represents 0.4% of net assets. Additional information on this restricted security is as follows

| Security | | Acquisition

Date | | Acquisition

Cost | |

CA Statewide Communities

Development Authority;

Crossroads School for

Arts & Sciences, Series 1998,

6.000% 08/01/28 | | | 08/21/98 | | | $ | 1,595,000 | | |

(b) The Fund has been informed that each issuer has placed direct obligations of the U.S. Government in an irrevocable trust, solely for the payment of principal and interest.

(c) Zero coupon bond.

(d) Parenthetical date represents the next interest rate reset date for the security.

(e) The interest rate shown on floating rate or variable rate securities reflects the rate at October 31, 2010.

(f) Position reflects anticipated residual bankruptcy claims. Income is not being accrued.

(g) Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2010, the value of this security, which is illiquid, represents 0.4% of net assets.

| Security | | Acquisition

Date | | Par | | Cost | | Value | |

Munimae Tax-Exempt

Bond Subsidiary LLC;

Series 2004 A-2,

4.900% 06/30/49 | | | 10/15/04 | | | $ | 2,000,000 | | | $ | 2,000,000 | | | $ | 1,639,940 | | |

(h) Non-income producing.

(i) Investments in affiliates during the year ended October 31, 2010:

| Affiliate | | Value,

beginning

of period | | Purchases | | Sales

Proceeds | | Dividend

Income | | Value,

end of

period | |

BofA California

Tax-Exempt

Reserves,

Capital Class*

(7 day yield of

0.1520%) | | $ | 3,256,484 | | | $ | 32,919,931 | | | $ | (35,680,415 | ) | | $ | 1,322 | | | $ | – | | |

* As of May 1, 2010, this company was no longer an affiliate of the Fund. The above table reflects activity for the period from November 1, 2009 through April 30, 2010.

(j) Cost for federal income tax purposes is $362,810,264.

The following table summarizes the inputs used, as of October 31, 2010, in valuing the Fund's assets:

| Description | | Quoted Prices

(Level 1) | | Other

Significant

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total | |

Total Municipal

Bonds | | $ | – | | | $ | 372,127,243 | | | $ | – | | | $ | 372,127,243 | | |

Total Municipal

Preferred Stock | | | – | | | | 1,639,940 | | | | – | | | | 1,639,940 | | |

| Total Common Stock | | | 10,861 | | | | – | | | | – | | | | 10,861 | | |

Total Investment

Companies | | | 12,600,221 | | | | – | | | | – | | | | 12,600,221 | | |

| Total Investments | | $ | 12,611,082 | | | $ | 373,767,183 | | | $ | – | | | $ | 386,378,265 | | |

For more information on valuation inputs, and their aggregation into the levels used in the table above, please refer to the Security Valuation section in the accompanying Notes to Financial Statements.

At October 31, 2010, the composition of the Fund by revenue source is as follows:

| Holdings by Revenue Source (unaudited) | | % of

Net Assets | |

| Tax-Backed | | | 43.4 | | |

| Utilities | | | 12.7 | | |

| Refunded/Escrowed | | | 10.5 | | |

| Health Care | | | 8.8 | | |

| Education | | | 8.2 | | |

| Transportation | | | 7.1 | | |

| Tobacco | | | 1.6 | | |

| Housing | | | 1.4 | | |

| Industrials | | | 1.2 | | |

| Other | | | 0.8 | | |

| Resource Recovery | | | 0.5 | | |

| | | | 96.2 | | |

| Investment Companies | | | 3.3 | | |

| Other Assets & Liabilities, Net | | | 0.5 | | |

| | | | 100.0 | | |

| Acronym | | Name | |

| AGC | | Assured Guaranty Corp. | |

|

| AGMC | | Assured Guaranty Municipal Corp. | |

|

| AMBAC | | Ambac Assurance Corp. | |

|

| AMT | | Alternative Minimum Tax | |

|

| FGIC | | Financial Guaranty Insurance Co. | |

|

| FNMA | | Federal National Mortgage Association | |

|

| GNMA | | Government National Mortgage Association | |

|

| GTY AGMT | | Guaranty Agreement | |

|

| IFRN | | Inverse Floating Rate Note | |

|

| NPFGC | | National Public Finance Guarantee Corp. | |

|

See Accompanying Notes to Financial Statements.

15

Statement of Assets and Liabilities – Columbia California Tax-Exempt Fund

October 31, 2010

| | | | | ($) | |

| Assets | | Investments, at identified cost | | | 362,935,222 | | |

| | | Investments, at value | | | 386,378,265 | | |

| | | Cash | | | 784 | | |

| | | Receivable for: | | | | | |

| | | Fund shares sold | | | 953,260 | | |

| | | Interest | | | 4,925,078 | | |

| | | Expense reimbursement due from investment advisor | | | 3,045 | | |

| | | Trustees' deferred compensation plan | | | 45,380 | | |

| | | Prepaid expenses | | | 4,511 | | |

| | | Total Assets | | | 392,310,323 | | |

| Liabilities | | Payable for: | | | | | |

| | | Investments purchased | | | 2,228,312 | | |

| | | Fund shares repurchased | | | 603,708 | | |

| | | Distributions | | | 808,130 | | |

| | | Investment advisory fee | | | 166,169 | | |

| | | Pricing and bookkeeping fees | | | 11,578 | | |

| | | Transfer agent fee | | | 17,666 | | |

| | | Trustees' fees | | | 18,018 | | |

| | | Custody fee | | | 2,800 | | |

| | | Distribution and service fees | | | 74,583 | | |

| | | Chief compliance officer expenses | | | 97 | | |

| | | Trustees' deferred compensation plan | | | 45,380 | | |

| | | Other liabilities | | | 65,095 | | |

| | | Total Liabilities | | | 4,041,536 | | |

| | | Net Assets | | | 388,268,787 | | |

| Net Assets Consist of | | Paid-in capital | | | 358,069,486 | | |

| | | Undistributed net investment income | | | 248,466 | | |

| | | Accumulated net realized gain | | | 6,507,792 | | |

| | | Net unrealized appreciation (depreciation) on investments | | | 23,443,043 | | |

| | | Net Assets | | | 388,268,787 | | |

See Accompanying Notes to Financial Statements.

16

Statement of Assets and Liabilities (continued) – Columbia California Tax-Exempt Fund

October 31, 2010

| Class A | | Net assets | | $ | 259,552,086 | | |

| | | Shares outstanding | | | 33,957,833 | | |

| | | Net asset value per share | | $ | 7.64 | (a) | |

| | | Maximum sales charge | | | 4.75 | % | |

| | | Maximum offering price per share ($7.64/0.9525) | | $ | 8.02 | (b) | |

| Class B | | Net assets | | $ | 2,095,073 | | |

| | | Shares outstanding | | | 274,098 | | |

| | | Net asset value and offering price per share | | $ | 7.64 | (a) | |

| Class C | | Net assets | | $ | 32,080,328 | | |

| | | Shares outstanding | | | 4,197,124 | | |

| | | Net asset value and offering price per share | | $ | 7.64 | (a) | |

| Class Z | | Net assets | | $ | 94,541,300 | | |

| | | Shares outstanding | | | 12,369,050 | | |

| | | Net asset value, offering and redemption price per share | | $ | 7.64 | | |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

(b) On sales of $50,000 or more the offering price is reduced.

See Accompanying Notes to Financial Statements.

17

Statement of Operations – Columbia California Tax-Exempt Fund

For the Year Ended October 31, 2010

| | | | | ($) | |

| Investment Income | | Interest | | | 20,008,766 | | |

| | | Dividends | | | 1,633 | | |

| | | Dividends from affiliates | | | 1,322 | | |

| | | Total Investment Income | | | 20,011,721 | | |

| Expenses | | Investment advisory fee | | | 1,967,168 | | |

| | | Distribution fee: | | | | | |

| | | Class B | | | 27,125 | | |

| | | Class C | | | 226,264 | | |

| | | Service fee: | | | | | |

| | | Class A | | | 633,303 | | |

| | | Class B | | | 8,666 | | |

| | | Class C | | | 72,626 | | |

| | | Transfer agent fee | | | 135,144 | | |

| | | Pricing and bookkeeping fees | | | 119,982 | | |

| | | Trustees' fees | | | 31,729 | | |

| | | Custody fee | | | 16,673 | | |

| | | Chief compliance officer expenses | | | 1,184 | | |

| | | Other expenses | | | 190,786 | | |

| | | Total Expenses | | | 3,430,650 | | |

| | | Fees waived or expenses reimbursed by investment advisor | | | (101,265 | ) | |

| | | Fees waived by distributor—Class C | | | (90,562 | ) | |

| | | Expense reductions | | | (18 | ) | |

| | | Net Expenses | | | 3,238,805 | | |

| | | Net Investment Income | | | 16,772,916 | | |

| Net Realized and Unrealized Gain (Loss) on Investments | | Net realized gain on investments | | | 6,876,102 | | |

| | | Net change in unrealized appreciation (depreciation) on investments | | | 12,436,214 | | |

| | | Net Gain | | | 19,312,316 | | |

| | | Net Increase Resulting from Operations | | | 36,085,232 | | |

See Accompanying Notes to Financial Statements.

18

Statement of Changes in Net Assets – Columbia California Tax-Exempt Fund

| | | | | Year Ended October 31, | |

| Increase (Decrease) in Net Assets | | | | 2010 ($) | | 2009 ($) | |

| Operations | | Net investment income | | | 16,772,916 | | | | 17,753,420 | | |

| | | Net realized gain on investments and futures contracts | | | 6,876,102 | | | | 1,409,988 | | |

| | | Net change in unrealized appreciation (depreciation)

on investments | | | 12,436,214 | | | | 32,648,383 | | |

| | | Net increase resulting from operations | | | 36,085,232 | | | | 51,811,791 | | |

| Distributions to Shareholders | | From net investment income: | | | | | | | | | |

| | | Class A | | | (11,166,443 | ) | | | (11,572,607 | ) | |

| | | Class B | | | (126,799 | ) | | | (293,974 | ) | |

| | | Class C | | | (1,142,842 | ) | | | (989,586 | ) | |

| | | Class Z | | | (4,333,792 | ) | | | (4,892,289 | ) | |

| | | From net realized gains: | | | | | | | | | |

| | | Class A | | | (826,388 | ) | | | (266,708 | ) | |

| | | Class B | | | (15,401 | ) | | | (9,730 | ) | |

| | | Class C | | | (91,505 | ) | | | (22,700 | ) | |

| | | Class Z | | | (316,727 | ) | | | (111,582 | ) | |

| | | Total distributions to shareholders | | | (18,019,897 | ) | | | (18,159,176 | ) | |

| | | Net Capital Stock Transactions | | | (36,941,425 | ) | | | (28,962,294 | ) | |

| | | Increase from regulatory settlements | | | — | | | | 5,166 | | |

| | | Total increase (decrease) in net assets | | | (18,876,090 | ) | | | 4,695,487 | | |

| Net Assets | | Beginning of period | | | 407,144,877 | | | | 402,449,390 | | |

| | | End of period | | | 388,268,787 | | | | 407,144,877 | | |

| | | Undistributed net investment income at end of period | | | 248,466 | | | | 291,317 | | |

See Accompanying Notes to Financial Statements.

19

Statement of Changes in Net Assets (continued) – Columbia California Tax-Exempt Fund

| | | Capital Stock Activity | |

| | | Year Ended

October 31, 2010 | | Year Ended

October 31, 2009 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

| Class A | |

| Subscriptions | | | 1,392,238 | | | | 10,378,058 | | | | 3,895,993 | | | | 27,313,561 | | |

| Distributions reinvested | | | 1,040,628 | | | | 7,728,471 | | | | 1,117,396 | | | | 7,849,044 | | |

| Redemptions | | | (4,865,004 | ) | | | (36,310,861 | ) | | | (7,870,780 | ) | | | (54,925,863 | ) | |

| Net decrease | | | (2,432,138 | ) | | | (18,204,332 | ) | | | (2,857,391 | ) | | | (19,763,258 | ) | |

| Class B | |

| Subscriptions | | | 22,274 | | | | 163,983 | | | | 61,966 | | | | 433,630 | | |

| Distributions reinvested | | | 11,349 | | | | 84,002 | | | | 26,255 | | | | 183,234 | | |

| Redemptions | | | (496,255 | ) | | | (3,678,684 | ) | | | (803,739 | ) | | | (5,672,592 | ) | |

| Net decrease | | | (462,632 | ) | | | (3,430,699 | ) | | | (715,518 | ) | | | (5,055,728 | ) | |

| Class C | |

| Subscriptions | | | 920,606 | | | | 6,878,960 | | | | 1,423,590 | | | | 9,936,545 | | |

| Distributions reinvested | | | 67,717 | | | | 501,874 | | | | 71,416 | | | | 501,907 | | |

| Redemptions | | | (754,660 | ) | | | (5,611,874 | ) | | | (796,791 | ) | | | (5,531,093 | ) | |

| Net increase | | | 233,663 | | | | 1,768,960 | | | | 698,215 | | | | 4,907,359 | | |

| Class Z | |

| Subscriptions | | | 1,776,504 | | | | 13,286,453 | | | | 2,684,063 | | | | 18,895,881 | | |

| Distributions reinvested | | | 43,356 | | | | 320,208 | | | | 50,465 | | | | 351,519 | | |

| Redemptions | | | (4,144,983 | ) | | | (30,682,015 | ) | | | (4,082,983 | ) | | | (28,298,067 | ) | |

| Net decrease | | | (2,325,123 | ) | | | (17,075,354 | ) | | | (1,348,455 | ) | | | (9,050,667 | ) | |

See Accompanying Notes to Financial Statements.

20

Financial Highlights – Columbia California Tax-Exempt Fund

Selected data for a share outstanding throughout each period is as follows:

| | | Year Ended October 31, | |

| Class A Shares | | 2010 | | 2009 | | 2008 | | 2007 | | 2006 | |

| Net Asset Value, Beginning of Period | | $ | 7.30 | | | $ | 6.71 | | | $ | 7.55 | | | $ | 7.74 | | | $ | 7.59 | | |

| Income from Investment Operations: | |