UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04367 |

|

Columbia Funds Series Trust I |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer 5228 Ameriprise Financial Center Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | September 30, 2011 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Dividend Income Fund

Annual Report for the Period Ended September 30, 2011

Not FDIC insured • No bank guarantee • May lose value

Table of Contents

| Fund Profile | | | 1 | | |

|

| Performance Information | | | 2 | | |

|

| Understanding Your Expenses | | | 3 | | |

|

| Portfolio Managers' Report | | | 4 | | |

|

| Portfolio of Investments | | | 6 | | |

|

Statement of Assets and

Liabilities | | | 13 | | |

|

| Statement of Operations | | | 15 | | |

|

Statement of Changes in

Net Assets | | | 16 | | |

|

| Financial Highlights | | | 18 | | |

|

| Notes to Financial Statements | | | 26 | | |

|

Report of Independent Registered

Public Accounting Firm | | | 35 | | |

|

| Federal Income Tax Information | | | 36 | | |

|

| Fund Governance | | | 37 | | |

|

Important Information About

This Report | | | 45 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholders,

Economic momentum slowed in the third quarter of 2011, raising the odds of recession and making the U.S. economy more susceptible to financial shocks. The unemployment rate remained stalled as growing uncertainty continued to weigh on prospective employers. Monthly indicators for the manufacturing and service sectors also showed signs of slowing. Equity and high-yield bond markets fell sharply as investor confidence was shaken by Europe's lingering debt crisis, a heated debate in Washington over fiscal deficits (which eventually led to a downgrade of U.S. government debt) and tepid economic growth. The U.S. stock market experienced its worst quarter in two years during the third quarter of 2011, with volatility and selling pressure reminiscent of the market selloff in 2008, as macro-economic concerns continued to mount.

During its September meeting, the Federal Reserve Board announced that it was prepared to purchase longer term securities and sell shorter term securities in an effort to keep long-term interest rates down. Their hope is that lower long-term borrowing rates will stimulate business investment and hiring. However, the question remains as to whether monetary policy alone will be enough to resuscitate growth in the current environment.

Despite this challenging and volatile economic backdrop, I believe Columbia Management remains strong and steadfast. Columbia Management is the eighth largest manager of long-term mutual fund assets with $325 billion under management as of September 30, 2011. The past year has been one of considerable change for the organization as we worked diligently to align products, services and resources in the integration of Columbia Management with RiverSource Investments. The incredible line-up of talent, resources and capabilities that has resulted is highlighted by the success of our products. As of September 30, 2011, Columbia Management offers 54 funds rated 4 and 5 stars by Morningstar. Additionally, The Wall Street Journal has named two Columbia funds "Category Kings" in its "Investing in Funds: A Quarterly Analysis" issue dated October 5, 2011 in recognition for their one-year performance as of September 30, 2011.

For more information about these and other funds offered by Columbia Management, including detailed, up-to-date fund performance and portfolio information, please visit us online at columbiamanagement.com. Other information and resources available on our website include:

g timely economic analysis and market commentary

g quarterly fund commentaries

g Columbia Management Investor, a quarterly newsletter for shareholders

Thank you for your continued support of the Columbia Funds. We look forward to serving your investment needs for many years to come.

Best Regards,

J. Kevin Connaughton

President, Columbia Funds

All ratings are Class Z as of 9/30/2011. Out of 118 Z-share Columbia funds rated by Morningstar, 8 funds received a 5-star Overall Rating and 46 funds received a 4-star Overall Rating. The Overall Morningstar Rating for a retail mutual fund is derived from a weighted average of the performance figures associated with its 3-, 5- and 10-year (if applicable) Morningstar Rating metrics. For share classes that do not have a 3-, 5-, or 10-year actual performance history, the fund's independent Morningstar Rating metric is then compared against the retail mutual fund universe breakpoints to determine its hypothetical rating.

For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

The Morningstar RatingTM is for Class Z shares only; other classes may have different performance characteristics and may have different ratings. ©2011 Morningstar, Inc. All Rights Reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

The Wall Street Journal "Category Kings" methodology: Top-performing funds in each category ranked by one-year total returns (changes in net asset values and reinvested distributions) for the period ended September 30, 2011.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the funds, visit www.columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2011 Columbia Management Investment Advisers, LLC. All rights reserved.

Fund Profile – Columbia Dividend Income Fund

Summary

g For the 12-month period that ended September 30, 2011, the fund's Class A shares returned 2.56% without sales charge.

g The fund outperformed its benchmark, the Russell 1000 Index.1

g A tilt toward quality and superior stock selection in the financial sector helped build the fund's strong relative performance.

Portfolio Management

Richard E. Dahlberg has co-managed the fund since October 2003 and has been associated with the advisor since May 2010. Prior to joining the advisor, Mr. Dahlberg was associated with the fund's previous advisor or its predecessors since 2003.

Scott L. Davis has co-managed the fund since November 2001 and has been associated with the advisor since May 2010. Prior to joining the advisor, Mr. Davis was associated with the fund's previous advisor or its predecessors since 1985.

Michael S. Barclay has co-managed the fund since March 2011 and has been associated with the advisor since May 2010. Prior to joining the advisor, Mr. Barclay was associated with the fund's previous advisor or its predecessors since 2006.

David L. King has co-managed the fund since March 2011 and has been associated with the advisor since May 2010. Prior to joining the advisor, Mr. King was associated with the fund's previous advisor or its predecessors since 2010.

1The Russell 1000 Index measures the performance of 1,000 of the largest U.S. companies, based on market capitalization.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Summary

1-year return as of 09/30/11

| | | | +2.56% | |

|

|  | | | Class A shares

(without sales charge) | |

|

| | | | +0.91% | |

|

|  | | | Russell 1000 Index | |

|

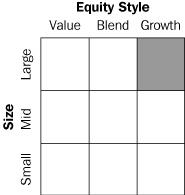

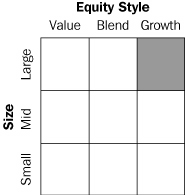

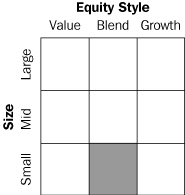

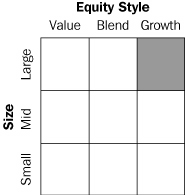

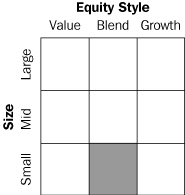

Morningstar Style BoxTM

The Morningstar Style BoxTM is based on the fund's portfolio holdings as of period end. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2011 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

1

Performance Information – Columbia Dividend Income Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

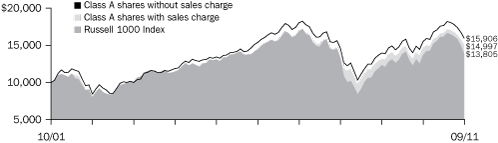

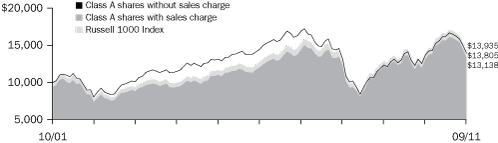

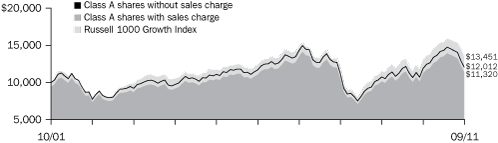

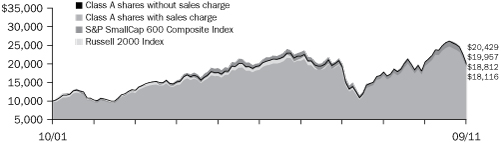

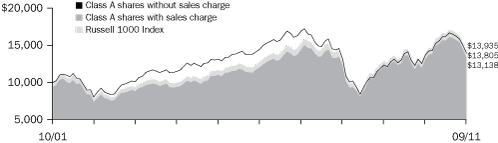

Performance of a $10,000 investment 10/01/01 – 09/30/11

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Dividend Income Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Performance of a $10,000 investment 10/01/01 – 09/30/11 ($)

| Sales charge | | without | | with | |

| Class A | | | 15,906 | | | | 14,997 | | |

| Class B | | | 14,761 | | | | 14,761 | | |

| Class C | | | 14,751 | | | | 14,751 | | |

| Class I | | | n/a | | | | n/a | | |

| Class R | | | 15,780 | | | | n/a | | |

| Class T | | | 15,843 | | | | 14,937 | | |

| Class W | | | n/a | | | | n/a | | |

| Class Z | | | 16,388 | | | | n/a | | |

Average annual total return as of 09/30/11 (%)

| Share class | | A | | B | | C | | I | | R | | T | | W | | Z | |

| Inception | | 11/25/02 | | 11/25/02 | | 11/25/02 | | 09/27/10 | | 03/28/08 | | 03/04/98 | | 09/27/10 | | 03/04/98 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | without | | without | | with | | without | | without | |

| 1-year | | | 2.56 | | | | -3.34 | | | | 1.74 | | | | -3.26 | | | | 1.74 | | | | 0.74 | | | | 3.02 | | | | 2.30 | | | | 2.51 | | | | -3.39 | | | | 2.57 | | | | 2.82 | | |

| 5-year | | | 0.68 | | | | -0.51 | | | | -0.06 | | | | -0.43 | | | | -0.08 | | | | -0.08 | | | | n/a | | | | 0.52 | | | | 0.64 | | | | -0.54 | | | | n/a | | | | 0.95 | | |

| 10-year/Life | | | 4.75 | | | | 4.14 | | | | 3.97 | | | | 3.97 | | | | 3.96 | | | | 3.96 | | | | 2.91 | | | | 4.67 | | | | 4.71 | | | | 4.09 | | | | 2.46 | | | | 5.06 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A and Class T shares and the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the Investment Manager and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class I and Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class R shares are sold at net asset value with a distribution (Rule 12b-1) fee. Class W shares are sold at net asset value with a service (Rule 12b-1) fee. Class I, Class R, Class W and Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectuses for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Class A, Class B, Class C, Class T and Class Z share performance information includes returns of Retail A shares (for Class A and Class T shares), Retail B shares (for Class B and Class C shares) and Trust shares (for Class Z shares) of Galaxy Strategic Equity Fund, the predecessor to the Fund and a series of the Galaxy Fund (the "Predecessor Fund"), for periods prior to November 25, 2002, the date on which Class A, Class B, Class C, Class T and Class Z shares were initially offered by the Fund. Class R share performance information includes returns of Class A shares for the period from November 25, 2002 through March 27, 2008, and the returns of Retail A shares for periods prior thereto. These returns shown for all share classes reflect any differences in sales charges, but have not been restated to reflect any differences in expenses between the Predecessor Fund share classes (and, in the case of Class R shares, Class A shares) and the corresponding newer share classes. If differences in expenses had been reflected, the returns shown for periods prior to November 25, 2002 would be lower for Class B and Class C shares, and the returns shown for periods prior to March 28, 2008 would be lower for Class R shares.

Class I and Class W shares were initially offered on September 27, 2010.

2

Understanding Your Expenses – Columbia Dividend Income Fund

As a shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and service (Rule 12b-1) fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses

To illustrate these ongoing costs, we provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See the "Compare with other funds" information with details on using the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would have been higher.

04/01/11 – 09/30/11

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 900.70 | | | | 1,019.95 | | | | 4.86 | | | | 5.16 | | | | 1.02 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 897.10 | | | | 1,016.14 | | | | 8.47 | | | | 9.00 | | | | 1.78 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 897.00 | | | | 1,016.24 | | | | 8.37 | | | | 8.90 | | | | 1.76 | | |

| Class I | | | 1,000.00 | | | | 1,000.00 | | | | 902.60 | | | | 1,021.76 | | | | 3.15 | | | | 3.35 | | | | 0.66 | | |

| Class R | | | 1,000.00 | | | | 1,000.00 | | | | 899.60 | | | | 1,018.75 | | | | 6.00 | | | | 6.38 | | | | 1.26 | | |

| Class T | | | 1,000.00 | | | | 1,000.00 | | | | 901.20 | | | | 1,019.65 | | | | 5.15 | | | | 5.47 | | | | 1.08 | | |

| Class W | | | 1,000.00 | | | | 1,000.00 | | | | 900.70 | | | | 1,020.16 | | | | 4.67 | | | | 4.96 | | | | 0.98 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 901.90 | | | | 1,021.21 | | | | 3.67 | | | | 3.90 | | | | 0.77 | | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from the underlying funds in which the Fund may invest (also referred to as "acquired funds"), including affiliated and non-affiliated pooled investments vehicles (including mutual funds and exchange traded funds).

Had the Investment Manager and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

3

Portfolio Managers' Report – Columbia Dividend Income Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Net asset value per share

as of 09/30/11 ($)

| Class A | | | 12.16 | | |

| Class B | | | 11.89 | | |

| Class C | | | 11.88 | | |

| Class I | | | 12.18 | | |

| Class R | | | 12.17 | | |

| Class T | | | 12.17 | | |

| Class W | | | 12.16 | | |

| Class Z | | | 12.17 | | |

Distributions declared per share

10/01/10 – 09/30/11 ($)

| Class A | | | 0.28 | | |

| Class B | | | 0.19 | | |

| Class C | | | 0.19 | | |

| Class I | | | 0.33 | | |

| Class R | | | 0.25 | | |

| Class T | | | 0.28 | | |

| Class W | | | 0.28 | | |

| Class Z | | | 0.32 | | |

For the 12-month period that ended September 30, 2011, the fund's Class A shares returned 2.56% without sales charge. The fund's benchmark, the Russell 1000 Index, returned 0.91% for the same period. In a volatile period, the fund gained this performance advantage with a tilt toward quality and superior stock selection in the financials sector.

A dim global economic outlook hampered stocks

As the impact of Japan's natural disasters spread through the global supply chain and Europe scrambled once again to prop up debtor nations—notably Greece—the pace of economic growth slowed worldwide. In the United States, spring and summer storms caused massive disruptions across the Midwest, the South and states along the eastern seaboard. In Washington, wrangling intensified over the budget deficit and the federal debt ceiling. Slowing job growth in the final months of the period further weakened investor confidence.

Against this backdrop, the U.S. economy expanded at a modest 1.6% rate over the past 12 months, as measured by gross domestic product. Growth was solid in the fourth quarter of 2010 but faltered dramatically in 2011 as the housing market continued its five-year slide and the unemployment rate remained disturbingly high. Personal consumption was flat, consumer confidence remained low and a recent downtick in manufacturing activity further dampened economic prospects.

Strong results in most sectors

Over the 12-month period, the fund outperformed its benchmark in all major sectors except energy and utilities. In financials, we avoided troubled commercial and investment banks, which aided relative returns. Among these, we sold Morgan Stanley and purchased CME (0.6% of net assets), parent of the Chicago Mercantile Exchange, which fared better than Morgan Stanley for the period. American Express (1.1% of net assets) proved resilient despite a gloomy economic backdrop, thanks to its relatively affluent client base. Real estate investment trust Digital Realty (0.6% of net assets) enjoyed strong demand for its specialized properties, buildings designed specifically around the needs of technology firms.

IBM (3.3% of net assets) led gainers in the technology sector. IBM's product mix is no longer dominated by computer hardware. The company continues to execute its business plans successfully and is prospering in the services and software arena. Intel (1.9% of net assets) also moved higher as demand for its chips expanded, while Accenture's (1.4% of net assets) management consulting and outsourcing businesses produced solid results. Our sale of Hewlett Packard sidestepped much of the stock's downturn. We avoided a major networking company, which was a very weak performer, and that also aided results.

Bristol Myers Squibb (2.8% of net assets), a biopharmaceutical innovator, launched new drugs with strong profit potential, making it the fund's leading performer over the period. However,

4

Portfolio Managers' Report (continued) – Columbia Dividend Income Fund

Merck (2.2% of net assets) fell when its new product pipeline weakened. Verizon (3.1% of net assets) was another of the fund's best performers, thanks to strong gains in its wireless business. In consumer stocks, Philip Morris International (3.0% of net assets) saw overseas sales and profits grow. McDonald's (1.9% of net assets) introduced revised menu offerings that caught on with consumers as households sought lower-cost dining options.

Transocean (0.7% of net assets), which owned the drilling rig involved in the disastrous BP-Gulf of Mexico explosion and oil spill, declined sharply. Portfolio holdings involved in oil and gas exploration also disappointed as energy prices fell, while integrated energy holdings such as ExxonMobil and Chevron (2.8% and 2.2% of net assets, respectively) were positive contributors. In utilities, the absence of some strong performing issues hurt returns.

Quality may be best strategy in weak economy

Current near-recessionary conditions are likely to persist while adverse employment prospects and fears of foreclosure restrain consumer demand, and households forego nonessential outlays to concentrate on reducing debt. Meanwhile, the housing industry, normally a vigorous engine of economic activity, is just beginning to stir. Europe's sovereign debt crisis continues to worry investors while in Washington, the United States' own financial woes continue to multiply.

To address this challenging economic outlook, we focused even more rigorously on very high quality issues. All four of the stocks that Standard and Poor's ranks as AAA equities—Automatic Data Processing (0.9% of net assets), ExxonMobil, Johnson & Johnson (2.0% of net assets) and Microsoft (2.4% of net assets)—are represented in the portfolio. Meanwhile, continued strong cash flow into the fund allows us to pursue attractive opportunities while valuations appear attractive on the kinds of high quality, dividend-paying firms that we emphasize.

Portfolio characteristics and holdings are subject to change periodically and may not be representative of current characteristics and holdings. The outlook for the fund may differ from those presented for other Columbia Funds.

Equity securities are subject to stock market fluctuations that occur in response to economic and business developments.

Dividend payments are not guaranteed. The amount of a dividend payment, if any, can vary over time.

Value stocks are stocks of companies that may have experienced adverse business or industry developments or may be subject to special risks that have caused the stocks to be out of favor. If the manager's assessment of a company's prospects is wrong, the price of its stock may not approach the value the manager has placed on it.

Portfolio Breakdown1

as of 09/30/11 (%)

| Common Stocks | | | 94.3 | | |

| Consumer Discretionary | | | 8.9 | | |

| Consumer Staples | | | 12.9 | | |

| Energy | | | 11.4 | | |

| Financials | | | 12.6 | | |

| Health Care | | | 12.2 | | |

| Industrials | | | 8.6 | | |

| Information Technology | | | 11.6 | | |

| Materials | | | 4.9 | | |

| Telecommunication Services | | | 6.3 | | |

| Utilities | | | 4.9 | | |

| Convertible Preferred Stocks | | | 0.8 | | |

| Energy | | | 0.1 | | |

| Financials | | | 0.7 | | |

| Exchange-Traded Funds | | | 1.7 | | |

| Other2 | | | 3.2 | | |

1Percentages indicated are based upon total investments (excluding Investments of Cash Collateral Received for Securities on Loan). The Fund's portfolio composition is subject to change.

2Cash & Cash Equivalents.

5

Portfolio of Investments – Columbia Dividend Income Fund

September 30, 2011

(Percentages represent value of investments compared to net assets)

| Issuer | | | | Shares | | Value | |

| Common Stocks 94.0% | |

| CONSUMER DISCRETIONARY 8.9% | |

| Hotels, Restaurants & Leisure 1.9% | |

| McDonald's Corp. | | | | | 835,200 | | | $ | 73,347,264 | | |

| Leisure Equipment & Products 0.6% | |

| Mattel, Inc.(a) | | | | | 941,225 | | | | 24,368,315 | | |

| Media 2.2% | |

| McGraw-Hill Companies, Inc. (The)(a) | | | | | 615,600 | | | | 25,239,600 | | |

| Meredith Corp.(a) | | | | | 791,400 | | | | 17,917,296 | | |

| Time Warner, Inc.(a) | | | | | 1,398,325 | | | | 41,907,800 | | |

| Total | | | 85,064,696 | | |

| Multiline Retail 1.6% | |

| Nordstrom, Inc.(a) | | | | | 518,750 | | | | 23,696,500 | | |

| Target Corp. | | | | | 825,600 | | | | 40,487,424 | | |

| Total | | | 64,183,924 | | |

| Specialty Retail 2.6% | |

| Home Depot, Inc. | | | | | 1,695,175 | | | | 55,720,402 | | |

| Limited Brands, Inc. | | | | | 572,725 | | | | 22,055,640 | | |

| TJX Companies, Inc. | | | | | 394,250 | | | | 21,869,048 | | |

| Total | | | 99,645,090 | | |

| TOTAL CONSUMER DISCRETIONARY | | | 346,609,289 | | |

| CONSUMER STAPLES 12.9% | |

| Beverages 2.2% | |

| Coca-Cola Co. (The) | | | | | 614,025 | | | | 41,483,529 | | |

| Diageo PLC, ADR(a)(b) | | | | | 565,375 | | | | 42,928,924 | | |

| Total | | | 84,412,453 | | |

| Food & Staples Retailing 0.9% | |

| Wal-Mart Stores, Inc.(a) | | | | | 641,125 | | | | 33,274,387 | | |

| Food Products 2.8% | |

| General Mills, Inc.(a) | | | | | 787,675 | | | | 30,301,857 | | |

| HJ Heinz Co.(a) | | | | | 1,127,375 | | | | 56,909,890 | | |

| JM Smucker Co. (The)(a) | | | | | 314,175 | | | | 22,900,216 | | |

| Total | | | 110,111,963 | | |

| Household Products 2.7% | |

| Kimberly-Clark Corp. | | | | | 581,300 | | | | 41,278,113 | | |

| Procter & Gamble Co. (The) | | | | | 1,014,700 | | | | 64,108,746 | | |

| Total | | | 105,386,859 | | |

| Tobacco 4.3% | |

| Altria Group, Inc. | | | | | 1,912,500 | | | | 51,274,125 | | |

| Philip Morris International, Inc. | | | | | 1,897,400 | | | | 118,359,812 | | |

| Total | | | 169,633,937 | | |

| TOTAL CONSUMER STAPLES | | | 502,819,599 | | |

| ENERGY 11.4% | |

| Energy Equipment & Services 1.3% | |

| Schlumberger Ltd.(a)(b) | | | | | 416,975 | | | | 24,905,917 | | |

| Transocean Ltd. (b) | | | | | 549,725 | | | | 26,243,871 | | |

| Total | | | 51,149,788 | | |

| Oil, Gas & Consumable Fuels 10.1% | |

| Chevron Corp. | | | | | 944,975 | | | | 87,429,087 | | |

| ConocoPhillips | | | | | 623,050 | | | | 39,451,526 | | |

| EnCana Corp. (b) | | | | | 941,750 | | | | 18,091,017 | | |

| Exxon Mobil Corp.(a) | | | | | 1,527,100 | | | | 110,913,273 | | |

| Kinder Morgan, Inc. | | | | | 713,200 | | | | 18,464,748 | | |

| Issuer | | | | Shares | | Value | |

| Common Stocks (continued) | |

| ENERGY (cont.) | |

| Oil, Gas & Consumable Fuels (cont.) | |

| Murphy Oil Corp.(a) | | | | | 234,925 | | | $ | 10,374,288 | | |

| Occidental Petroleum Corp.(a) | | | | | 397,750 | | | | 28,439,125 | | |

| Penn West Petroleum Ltd. (b) | | | | | 815,350 | | | | 12,042,720 | | |

| Royal Dutch Shell PLC, ADR (b) | | | | | 1,121,350 | | | | 68,985,452 | | |

| Total | | | 394,191,236 | | |

| TOTAL ENERGY | | | 445,341,024 | | |

| FINANCIALS 12.5% | |

| Capital Markets 2.0% | |

| BlackRock, Inc.(a) | | | | | 249,925 | | | | 36,991,399 | | |

| Northern Trust Corp.(a) | | | | | 649,550 | | | | 22,721,259 | | |

| T Rowe Price Group, Inc. | | | | | 387,525 | | | | 18,512,069 | | |

| Total | | | 78,224,727 | | |

| Commercial Banks 2.5% | |

| PNC Financial Services Group, Inc. | | | | | 693,000 | | | | 33,395,670 | | |

| U.S. Bancorp(a) | | | | | 1,520,550 | | | | 35,793,747 | | |

| Wells Fargo & Co. | | | | | 1,186,225 | | | | 28,611,747 | | |

| Total | | | 97,801,164 | | |

| Consumer Finance 1.1% | |

| American Express Co. | | | | | 940,125 | | | | 42,211,613 | | |

| Diversified Financial Services 2.1% | |

| CME Group, Inc. | | | | | 87,925 | | | | 21,664,720 | | |

| JPMorgan Chase & Co.(a) | | | | | 2,041,050 | | | | 61,476,426 | | |

| Total | | | 83,141,146 | | |

| Insurance 3.2% | |

| Arthur J Gallagher & Co. | | | | | 1,056,925 | | | | 27,797,127 | | |

| Chubb Corp. (The)(a) | | | | | 463,025 | | | | 27,776,870 | | |

| MetLife, Inc. | | | | | 928,425 | | | | 26,005,184 | | |

| Progressive Corp. (The) | | | | | 553,075 | | | | 9,822,612 | | |

| RenaissanceRe Holdings Ltd.(a)(b) | | | | | 160,250 | | | | 10,223,950 | | |

| Unum Group(a) | | | | | 1,037,150 | | | | 21,738,664 | | |

| Total | | | 123,364,407 | | |

| Real Estate Investment Trusts (REITs) 1.1% | |

| Digital Realty Trust, Inc.(a) | | | | | 402,650 | | | | 22,210,174 | | |

| Public Storage | | | | | 201,325 | | | | 22,417,539 | | |

| Total | | | 44,627,713 | | |

| Thrifts & Mortgage Finance 0.5% | |

| People's United Financial, Inc.(a) | | | | | 1,841,250 | | | | 20,990,250 | | |

| TOTAL FINANCIALS | | | 490,361,020 | | |

| HEALTH CARE 12.1% | |

| Biotechnology 0.8% | |

| Amgen, Inc. | | | | | 548,150 | | | | 30,120,843 | | |

| Pharmaceuticals 11.3% | |

| Abbott Laboratories(a) | | | | | 1,425,400 | | | | 72,894,956 | | |

| Bristol-Myers Squibb Co.(a) | | | | | 3,515,125 | | | | 110,304,622 | | |

| Johnson & Johnson | | | | | 1,239,500 | | | | 78,968,545 | | |

| Merck & Co., Inc. | | | | | 2,617,100 | | | | 85,605,341 | | |

| Pfizer, Inc. | | | | | 5,415,375 | | | | 95,743,830 | | |

| Total | | | 443,517,294 | | |

| TOTAL HEALTH CARE | | | 473,638,137 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

6

Columbia Dividend Income Fund

September 30, 2011

(Percentages represent value of investments compared to net assets)

| Issuer | | | | Shares | | Value | |

| Common Stocks (continued) | |

| INDUSTRIALS 8.5% | |

| Aerospace & Defense 3.1% | |

| Honeywell International, Inc. | | | | | 1,058,975 | | | $ | 46,499,592 | | |

| Raytheon Co. | | | | | 777,425 | | | | 31,773,360 | | |

| United Technologies Corp. | | | | | 613,400 | | | | 43,158,824 | | |

| Total | | | 121,431,776 | | |

| Commercial Services & Supplies 0.7% | |

| Waste Management, Inc.(a) | | | | | 889,000 | | | | 28,945,840 | | |

| Electrical Equipment 0.6% | |

| Emerson Electric Co. | | | | | 537,475 | | | | 22,203,092 | | |

| Industrial Conglomerates 1.0% | |

| General Electric Co. | | | | | 2,518,575 | | | | 38,383,083 | | |

| Machinery 2.5% | |

| Deere & Co.(a) | | | | | 475,525 | | | | 30,704,649 | | |

| Dover Corp.(a) | | | | | 583,150 | | | | 27,174,790 | | |

| Illinois Tool Works, Inc.(a) | | | | | 381,550 | | | | 15,872,480 | | |

| Parker Hannifin Corp. | | | | | 397,450 | | | | 25,091,019 | | |

| Total | | | 98,842,938 | | |

| Road & Rail 0.6% | |

| Norfolk Southern Corp. | | | | | 404,050 | | | | 24,655,131 | | |

| TOTAL INDUSTRIALS | | | 334,461,860 | | |

| INFORMATION TECHNOLOGY 11.6% | |

| IT Services 5.5% | |

| Accenture PLC, Class A(b) | | | | | 1,012,000 | | | | 53,312,160 | | |

| Automatic Data Processing, Inc.(a) | | | | | 728,075 | | | | 34,328,737 | | |

| International Business Machines Corp. | | | | | 729,800 | | | | 127,736,894 | | |

| Total | | | 215,377,791 | | |

| Office Electronics 0.6% | |

| Canon, Inc., ADR(a)(b) | | | | | 522,650 | | | | 23,655,139 | | |

| Semiconductors & Semiconductor Equipment 3.1% | |

| Intel Corp. | | | | | 3,557,675 | | | | 75,885,208 | | |

| Linear Technology Corp.(a) | | | | | 594,525 | | | | 16,438,616 | | |

| Texas Instruments, Inc.(a) | | | | | 1,093,325 | | | | 29,137,111 | | |

| Total | | | 121,460,935 | | |

| Software 2.4% | |

| Microsoft Corp. | | | | | 3,699,200 | | | | 92,073,088 | | |

| TOTAL INFORMATION TECHNOLOGY | | | 452,566,953 | | |

| MATERIALS 4.9% | |

| Chemicals 3.2% | |

| EI du Pont de Nemours & Co. | | | | | 551,775 | | | | 22,054,447 | | |

| International Flavors & Fragrances, Inc.(a) | | | | | 442,900 | | | | 24,899,838 | | |

| RPM International, Inc.(a) | | | | | 928,075 | | | | 17,355,002 | | |

| Sherwin-Williams Co. (The) | | | | | 837,700 | | | | 62,257,864 | | |

| Total | | | 126,567,151 | | |

| Containers & Packaging 0.6% | |

| Sonoco Products Co. | | | | | 770,300 | | | | 21,745,569 | | |

| Metals & Mining 1.1% | |

| BHP Billiton Ltd., ADR(a)(b) | | | | | 282,725 | | | | 18,784,249 | | |

| Nucor Corp.(a) | | | | | 744,875 | | | | 23,567,845 | | |

| Total | | | 42,352,094 | | |

| TOTAL MATERIALS | | | 190,664,814 | | |

| Issuer | | | | Shares | | Value | |

| Common Stocks (continued) | |

| TELECOMMUNICATION SERVICES 6.3% | |

| Diversified Telecommunication Services 6.3% | |

| AT&T, Inc. | | | | | 4,026,300 | | | $ | 114,830,076 | | |

| Verizon Communications, Inc. | | | | | 3,321,700 | | | | 122,238,560 | | |

| Windstream Corp.(a) | | | | | 780,100 | | | | 9,095,966 | | |

| Total | | | 246,164,602 | | |

| TOTAL TELECOMMUNICATION SERVICES | | | 246,164,602 | | |

| UTILITIES 4.9% | |

| Electric Utilities 2.3% | |

| American Electric Power Co., Inc. | | | | | 792,775 | | | | 30,141,306 | | |

| Entergy Corp.(a) | | | | | 175,125 | | | | 11,609,036 | | |

| NextEra Energy, Inc. | | | | | 291,000 | | | | 15,719,820 | | |

| PPL Corp.(a) | | | | | 1,133,125 | | | | 32,339,388 | | |

| Total | | | 89,809,550 | | |

| Gas Utilities 0.6% | |

| National Fuel Gas Co.(a) | | | | | 467,875 | | | | 22,776,155 | | |

| Multi-Utilities 2.0% | |

| PG&E Corp.(a) | | | | | 503,275 | | | | 21,293,565 | | |

| Public Service Enterprise Group, Inc. | | | | | 851,350 | | | | 28,409,550 | | |

| Sempra Energy | | | | | 563,325 | | | | 29,011,237 | | |

| Total | | | 78,714,352 | | |

| TOTAL UTILITIES | | | 191,300,057 | | |

Total Common Stocks

(Cost: $3,543,685,574) | | $ | 3,673,927,355 | | |

| Convertible Preferred Stocks 0.8% | |

| ENERGY 0.1% | |

| Oil, Gas & Consumable Fuels 0.1% | |

| Apache Corp., 6.000% | | | | | 90,150 | | | | 4,653,994 | | |

| TOTAL ENERGY | | | 4,653,994 | | |

| FINANCIALS 0.7% | |

| Commercial Banks 0.5% | |

| Fifth Third Bancorp, 8.500% | | | | | 165,475 | | | | 21,366,959 | | |

| Diversified Financial Services 0.2% | |

| Citigroup, Inc., 7.500% | | | | | 76,200 | | | | 6,109,716 | | |

| TOTAL FINANCIALS | | | 27,476,675 | | |

Total Convertible Preferred Stocks

(Cost: $40,014,961) | | $ | 32,130,669 | | |

| Exchange-Traded Funds 1.7% | |

| SPDR S&P 500 ETF Trust(a) | | | | | 573,350 | | | | 64,886,020 | | |

Total Exchange-Traded Funds

(Cost: $75,150,345) | | $ | 64,886,020 | | |

| Money Market Fund 3.2% | |

| Columbia Short-Term Cash Fund, 0.125%(c)(d) | | | | | 123,514,676 | | | | 123,514,676 | | |

Total Money Market Fund

(Cost: $123,514,676) | | $ | 123,514,676 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

7

Columbia Dividend Income Fund

September 30, 2011

(Percentages represent value of investments compared to net assets)

| Issuer | | Effective

Yield | | Par/

Principal/

Shares | | Value | |

| Investments of Cash Collateral Received for Securities on Loan 9.0% | |

| Asset-Backed Commercial Paper 1.0% | |

| Alpine Securitization | |

| 10/12/11 | | | 0.200 | % | | $ | 4,999,250 | | | $ | 4,999,250 | | |

| Aspen Funding Corp. | |

| 10/13/11 | | | 0.330 | % | | | 3,998,863 | | | | 3,998,863 | | |

| Atlantis One | |

| 12/21/11 | | | 0.350 | % | | | 8,992,125 | | | | 8,992,125 | | |

| Cancara Asset Securitisation LLC | |

| 10/20/11 | | | 0.270 | % | | | 4,998,725 | | | | 4,998,725 | | |

| Gemini Securitization Corporation (FKA Twin Towers) | |

| 10/06/11 | | | 0.300 | % | | | 1,999,517 | | | | 1,999,517 | | |

| Regency Markets No. 1 LLC | |

| 10/18/11 | | | 0.250 | % | | | 4,998,889 | | | | 4,998,889 | | |

| Rheingold Securitization | |

| 10/11/11 | | | 0.500 | % | | | 2,999,542 | | | | 2,999,542 | | |

| Royal Park Investments Funding Corp. | |

| 10/27/11 | | | 0.750 | % | | | 4,997,187 | | | | 4,997,187 | | |

| Total | | | 37,984,098 | | |

| Certificates of Deposit 1.9% | |

| ABM AMRO Bank N.V. | |

| 10/12/11 | | | 0.310 | % | | | 4,998,709 | | | | 4,998,709 | | |

| Bank of Montreal | |

| 11/14/11 | | | 0.250 | % | | | 5,000,000 | | | | 5,000,000 | | |

| Commerzbank AG | |

| 10/05/11 | | | 0.180 | % | | | 10,000,000 | | | | 10,000,000 | | |

| Credit Suisse | |

| 11/17/11 | | | 0.300 | % | | | 5,000,000 | | | | 5,000,000 | | |

| Deutsche Bank AG | |

| 10/03/11 | | | 0.170 | % | | | 5,000,000 | | | | 5,000,000 | | |

| DnB NOR ASA | |

| 11/23/11 | | | 0.300 | % | | | 10,000,000 | | | | 10,000,000 | | |

| Nordea Bank AB | |

| 12/09/11 | | | 0.310 | % | | | 5,000,000 | | | | 5,000,000 | | |

| Pohjola Bank PLC | |

| 10/12/11 | | | 0.650 | % | | | 5,000,000 | | | | 5,000,000 | | |

| Royal Bank of Canada | |

| 10/14/11 | | | 0.210 | % | | | 5,001,644 | | | | 5,001,644 | | |

| Skandinaviska Enskilda Banken | |

| 10/11/11 | | | 0.250 | % | | | 4,000,000 | | | | 4,000,000 | | |

| Svenska Handelsbanken | |

| 11/23/11 | | | 0.300 | % | | | 5,000,063 | | | | 5,000,063 | | |

| Swedbank AB | |

| 10/24/11 | | | 0.260 | % | | | 5,000,000 | | | | 5,000,000 | | |

| Union Bank of Switzerland | |

| 11/28/11 | | | 0.350 | % | | | 2,000,000 | | | | 2,000,000 | | |

| United Overseas Bank Ltd. | |

| 10/28/11 | | | 0.270 | % | | | 5,000,000 | | | | 5,000,000 | | |

| Total | | | 76,000,416 | | |

| Commercial Paper 0.4% | |

| KELLS FUNDING, LLC | |

| 10/17/11 | | | 0.310 | % | | | 4,998,622 | | | | 4,998,622 | | |

| Macquarie Bank Ltd. | |

| 12/29/11 | | | 0.471 | % | | | 9,987,859 | | | | 9,987,859 | | |

| Suncorp Metway Ltd. | |

| 11/28/11 | | | 0.380 | % | | | 1,998,543 | | | | 1,998,543 | | |

| Total | | | 16,985,024 | | |

| Issuer | | Effective

Yield | | Par/

Principal/

Shares | | Value | |

| Investments of Cash Collateral Received for Securities on Loan (continued) | |

| Repurchase Agreements 5.7% | |

Cantor Fitzgerald & Co.

dated 09/30/2011, matures 10/03/2011,

repurchase price $65,000,758(e) | |

| | | | 0.140 | % | | $ | 65,000,000 | | | $ | 65,000,000 | | |

Citigroup Global Markets, Inc.

dated 09/30/2011, matures 10/03/2011,

repurchase price $15,000,113(e) | |

| | | | 0.090 | % | | | 15,000,000 | | | | 15,000,000 | | |

G.X. Clarke and Company

dated 09/30/2011, matures 10/03/2011,

repurchase price $15,000,225(e) | |

| | | | 0.180 | % | | | 15,000,000 | | | | 15,000,000 | | |

Mizuho Securities USA, Inc.

dated 09/30/2011, matures 10/03/2011,

repurchase price $10,000,133(e) | |

| | | | 0.160 | % | | | 20,000,000 | | | | 20,000,000 | | |

Natixis Financial Products, Inc.

dated 09/30/2011, matures 10/03/2011,

repurchase price $30,000,225(e) | |

| | | | 0.090 | % | | | 30,000,000 | | | | 30,000,000 | | |

Nomura Securities

dated 09/30/2011, matures 10/03/2011,

repurchase price $25,000,313(e) | |

| | | | 0.150 | % | | | 25,000,000 | | | | 25,000,000 | | |

Pershing LLC

dated 09/30/2011, matures 10/03/2011,

repurchase price $14,500,218(e) | |

| | | | 0.180 | % | | | 14,500,000 | | | | 14,500,000 | | |

Royal Bank of Canada

dated 09/30/2011, matures 10/03/2011,

repurchase price $37,538,090(e) | |

| | | | 0.080 | % | | | 37,537,840 | | | | 37,537,840 | | |

| Total | | | 222,037,840 | | |

Total Investments of Cash Collateral Received for Securities

on Loan

(Cost: $353,007,378) | | $ | 353,007,378 | | |

Total Investments

(Cost: $4,135,372,934) | | $ | 4,247,466,098 | | |

| Other Assets & Liabilities, Net | | | (339,960,330 | ) | |

| Net Assets | | $ | 3,907,505,768 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

8

Columbia Dividend Income Fund

September 30, 2011

| Notes to Portfolio of Investments | |

(a) At September 30, 2011, security was partially or fully on loan.

(b) Represents a foreign security. At September 30, 2011, the value of foreign securities, excluding short-term securities, amounted to $299,173,399 or 7.66% of net assets.

(c) The rate shown is the seven-day current annualized yield at September 30, 2011.

(d) Investments in affiliates during the year ended September 30, 2011:

| Issuer | | Beginning

Cost | | Purchase

Cost | | Sales Cost/

Proceeds

from Sales | | Realized

Gain/Loss | | Ending

Cost | | Dividends

or Interest

Income | | Value | |

Columbia Short-Term

Cash Fund | | $ | — | | | $ | 509,360,957 | | | $ | (385,846,281 | ) | | $ | — | | | $ | 123,514,676 | | | $ | 37,160 | | | $ | 123,514,676 | | |

(e) The table below represents securities received as collateral for repurchase agreements. This collateral, which is generally high quality short-term obligations, is deposited with the Fund's custodian and, pursuant to the terms of the repurchase agreement, must have an aggregate market value greater than or equal to the repurchase price plus accrued interest at all times. The value of securities and/or cash held as collateral for repurchase agreements is monitored on a daily basis to ensure the existence of the proper level of collateral.

Cantor Fitzgerald & Co. (0.140%)

| Security Description | | Value | |

| Fannie Mae Interest Strip | | $ | 452,323 | | |

| Fannie Mae Pool | | | 39,774,937 | | |

| Fannie Mae REMICS | | | 2,807,665 | | |

| Federal Home Loan Banks | | | 632,909 | | |

| Freddie Mac Non Gold Pool | | | 13,587,447 | | |

| Freddie Mac REMICS | | | 3,344,943 | | |

| Freddie Mac Strips | | | 1,262,691 | | |

| Ginnie Mae I Pool | | | 714,593 | | |

| Ginnie Mae II Pool | | | 683,014 | | |

| Government National Mortgage Association | | | 946,829 | | |

| United States Treasury Note/Bond | | | 2,092,649 | | |

| Total Market Value of Collateral Securities | | $ | 66,300,000 | | |

Citigroup Global Markets, Inc. (0.090%)

| Security Description | | Value | |

| Fannie Mae REMICS | | $ | 5,928,786 | | |

| Freddie Mac Reference REMIC | | | 107,093 | | |

| Freddie Mac REMICS | | | 8,123,245 | | |

| Government National Mortgage Association | | | 1,140,876 | | |

| Total Market Value of Collateral Securities | | $ | 15,300,000 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

9

Columbia Dividend Income Fund

September 30, 2011

| Notes to Portfolio of Investments (continued) | |

G.X. Clarke and Company (0.180%)

| Security Description | | Value | |

| Fannie Mae Interest Strip | | $ | 5,840 | | |

| Fannie Mae Pool | | | 37,845 | | |

| Fannie Mae REMICS | | | 5,045 | | |

| Federal Farm Credit Bank | | | 1,459,353 | | |

| Federal Home Loan Banks | | | 4,373,713 | | |

| Federal Home Loan Mortgage Corp | | | 2,968,447 | | |

| Federal National Mortgage Association | | | 2,386,911 | | |

| Freddie Mac Coupon Strips | | | 52,758 | | |

| Freddie Mac Gold Pool | | | 8,125 | | |

| Freddie Mac REMICS | | | 370,157 | | |

| Government National Mortgage Association | | | 62,208 | | |

| United States Treasury Bill | | | 580,484 | | |

| United States Treasury Note/Bond | | | 2,431,335 | | |

| United States Treasury Strip Coupon | | | 449,089 | | |

| United States Treasury Strip Principal | | | 108,872 | | |

| Total Market Value of Collateral Securities | | $ | 15,300,182 | | |

Mizuho Securities USA, Inc. (0.160%)

| Security Description | | Value | |

| Fannie Mae Grantor Trust | | $ | 196,727 | | |

| Fannie Mae Pool | | | 6,493,425 | | |

| Fannie Mae REMICS | | | 4,226,477 | | |

| Fannie Mae Whole Loan | | | 34,895 | | |

| Federal Home Loan Bank of Chicago | | | 41,504 | | |

| Federal Home Loan Mortgage Corp. Structured Pass Through Securities | | | 218,611 | | |

| Freddie Mac Gold Pool | | | 3,588,223 | | |

| Freddie Mac REMICS | | | 5,515,405 | | |

| Ginnie Mae II Pool | | | 84,733 | | |

| Total Market Value of Collateral Securities | | $ | 20,400,000 | | |

Natixis Financial Products, Inc. (0.090%)

| Security Description | | Value | |

| Fannie Mae Interest Strip | | $ | 8,036,099 | | |

| Fannie Mae Pool | | | 15,969,150 | | |

| Fannie Mae REMICS | | | 13,123 | | |

| Freddie Mac Gold Pool | | | 4,674,189 | | |

| Freddie Mac Non Gold Pool | | | 214,093 | | |

| Freddie Mac REMICS | | | 121,992 | | |

| Freddie Mac Strips | | | 989,114 | | |

| Government National Mortgage Association | | | 582,470 | | |

| Total Market Value of Collateral Securities | | $ | 30,600,230 | | |

Nomura Securities (0.150%)

| Security Description | | Value | |

| Ginnie Mae I Pool | | $ | 20,914,591 | | |

| Ginnie Mae II Pool | | | 4,585,409 | | |

| Total Market Value of Collateral Securities | | $ | 25,500,000 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

10

Columbia Dividend Income Fund

September 30, 2011

| Notes to Portfolio of Investments (continued) | |

Pershing LLC (0.180%)

| Security Description | | Value | |

| Fannie Mae Pool | | $ | 4,032,931 | | |

| Fannie Mae REMICS | | | 2,559,185 | | |

| Fannie Mae Whole Loan | | | 28,821 | | |

| Fannie Mae-Aces | | | 56,081 | | |

| Freddie Mac REMICS | | | 4,771,222 | | |

| Ginnie Mae I Pool | | | 2,304,699 | | |

| Government National Mortgage Association | | | 1,037,061 | | |

| Total Market Value of Collateral Securities | | $ | 14,790,000 | | |

Royal Bank of Canada (0.080%)

| Security Description | | Value | |

| Fannie Mae Pool | | $ | 15,533,717 | | |

| Freddie Mac Gold Pool | | | 9,486,928 | | |

| Freddie Mac Non Gold Pool | | | 2,325,521 | | |

| Freddie Mac REMICS | | | 10,942,431 | | |

| Total Market Value of Collateral Securities | | $ | 38,288,597 | | |

| Abbreviation Legend | |

ADR American Depositary Receipt

Generally accepted accounting principles (GAAP) require disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category.

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

• Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

• Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

• Level 3 — Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment's fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

The Accompanying Notes to Financial Statements are an integral part of this statement.

11

Columbia Dividend Income Fund

September 30, 2011

| Fair Value Measurements (continued) | |

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

The following table is a summary of the inputs used to value the Fund's investments as of September 30, 2011:

| | | Fair value at September 30, 2011 | |

| Description(a) | | Level 1

quoted prices

in active

markets for

identical assets | | Level 2

other

significant

observable

inputs(b) | | Level 3

significant

unobservable

inputs | | Total | |

| Equity Securities | |

| Common Stocks | |

| Consumer Discretionary | | $ | 346,609,289 | | | $ | — | | | $ | — | | | $ | 346,609,289 | | |

| Consumer Staples | | | 502,819,599 | | | | — | | | | — | | | | 502,819,599 | | |

| Energy | | | 445,341,024 | | | | — | | | | — | | | | 445,341,024 | | |

| Financials | | | 490,361,020 | | | | — | | | | — | | | | 490,361,020 | | |

| Health Care | | | 473,638,137 | | | | — | | | | — | | | | 473,638,137 | | |

| Industrials | | | 334,461,860 | | | | — | | | | — | | | | 334,461,860 | | |

| Information Technology | | | 452,566,953 | | | | — | | | | — | | | | 452,566,953 | | |

| Materials | | | 190,664,814 | | | | — | | | | — | | | | 190,664,814 | | |

| Telecommunication Services | | | 246,164,602 | | | | — | | | | — | | | | 246,164,602 | | |

| Utilities | | | 191,300,057 | | | | — | | | | — | | | | 191,300,057 | | |

| Convertible Preferred Stocks | |

| Energy | | | — | | | | 4,653,994 | | | | — | | | | 4,653,994 | | |

| Financials | | | — | | | | 27,476,675 | | | | — | | | | 27,476,675 | | |

| Total Equity Securities | | | 3,673,927,355 | | | | 32,130,669 | | | | — | | | | 3,706,058,024 | | |

| Other | |

| Exchange-Traded Funds | | | 64,886,020 | | | | — | | | | — | | | | 64,886,020 | | |

| Affiliated Money Market Fund(c) | | | 123,514,676 | | | | — | | | | — | | | | 123,514,676 | | |

| Investments of Cash Collateral Received for Securities on Loan | | | — | | | | 353,007,378 | | | | — | | | | 353,007,378 | | |

| Total Other | | | 188,400,696 | | | | 353,007,378 | | | | — | | | | 541,408,074 | | |

| Total | | $ | 3,862,328,051 | | | $ | 385,138,047 | | | $ | — | | | $ | 4,247,466,098 | | |

The Fund's assets assigned to the Level 2 input category are generally valued using the market approach, in which a security's value is determined through reference to prices and information from market transactions for similar or identical assets.

(a) See the Portfolio of Investments for all investment classifications not indicated in the table.

(b) There were no significant transfers between Levels 1 and 2 during the period.

(c) Money market fund that is a sweep investment for cash balances in the Fund at September 30, 2011.

The Accompanying Notes to Financial Statements are an integral part of this statement.

12

Statement of Assets and Liabilities – Columbia Dividend Income Fund

September 30, 2011

| Assets | |

| Investments, at value* | |

| Unaffiliated issuers (identified cost $3,658,850,880) | | $ | 3,770,944,044 | | |

| Affiliated issuers (identified cost $123,514,676) | | | 123,514,676 | | |

| Investment of cash collateral received for securities on loan | |

| Short-term securities (identified cost $130,969,538) | | | 130,969,538 | | |

| Repurchase agreements (identified cost $222,037,840) | | | 222,037,840 | | |

| Total investments (identified cost $4,135,372,934) | | | 4,247,466,098 | | |

| Receivable for: | |

| Capital shares sold | | | 33,926,489 | | |

| Dividends | | | 10,134,170 | | |

| Interest | | | 48,387 | | |

| Reclaims | | | 20,870 | | |

| Expense reimbursement due from Investment Manager | | | 1,023 | | |

| Prepaid expense | | | 81,246 | | |

| Trustees' deferred compensation plan | | | 110,145 | | |

| Total assets | | | 4,291,788,428 | | |

| Liabilities | |

| Due upon return of securities on loan | | | 353,007,378 | | |

| Payable for: | |

| Investments purchased | | | 26,187,173 | | |

| Capital shares purchased | | | 3,739,112 | | |

| Investment management fees | | | 59,949 | | |

| Distribution and service fees | | | 14,292 | | |

| Transfer agent fees | | | 962,263 | | |

| Administration fees | | | 5,359 | | |

| Chief compliance officer expenses | | | 1,150 | | |

| Other expenses | | | 195,839 | | |

| Trustees' deferred compensation plan | | | 110,145 | | |

| Total liabilities | | | 384,282,660 | | |

| Net assets applicable to outstanding capital stock | | $ | 3,907,505,768 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

13

Statement of Assets and Liabilities (continued) – Columbia Dividend Income Fund

September 30, 2011

| Represented by | |

| Paid-in capital | | $ | 3,877,750,532 | | |

| Undistributed net investment income | | | 244,845 | | |

| Accumulated net realized loss | | | (82,580,153 | ) | |

| Unrealized appreciation (depreciation) on: | |

| Investments | | | 112,093,164 | | |

| Foreign currency translations | | | (2,620 | ) | |

| Total — representing net assets applicable to outstanding capital stock | | $ | 3,907,505,768 | | |

| *Value of securities on loan | | $ | 337,968,064 | | |

| Net assets applicable to outstanding shares | |

| Class A | | $ | 1,103,389,063 | | |

| Class B | | $ | 15,658,703 | | |

| Class C | | $ | 181,874,776 | | |

| Class I | | $ | 249,778,367 | | |

| Class R | | $ | 13,101,098 | | |

| Class T | | $ | 72,421,349 | | |

| Class W | | $ | 43,524,999 | | |

| Class Z | | $ | 2,227,757,413 | | |

| Shares outstanding | |

| Class A | | | 90,708,942 | | |

| Class B | | | 1,316,713 | | |

| Class C | | | 15,303,895 | | |

| Class I | | | 20,513,927 | | |

| Class R | | | 1,076,390 | | |

| Class T | | | 5,952,759 | | |

| Class W | | | 3,577,908 | | |

| Class Z | | | 183,076,851 | | |

| Net asset value per share | |

| Class A(a) | | $ | 12.16 | | |

| Class B | | $ | 11.89 | | |

| Class C | | $ | 11.88 | | |

| Class I | | $ | 12.18 | | |

| Class R | | $ | 12.17 | | |

| Class T(a) | | $ | 12.17 | | |

| Class W | | $ | 12.16 | | |

| Class Z | | $ | 12.17 | | |

(a) The maximum offering price per share for Class A is $12.90 and Class T is $12.91. The offering price is calculated by dividing the net asset value by 1.0 minus the maximum sales charge of 5.75%.

The Accompanying Notes to Financial Statements are an integral part of this statement.

14

Statement of Operations – Columbia Dividend Income Fund

Year ended September 30, 2011

| Net investment income | |

| Income: | |

| Dividends | | $ | 113,036,547 | | |

| Interest | | | 51,726 | | |

| Dividends from affiliates | | | 37,160 | | |

| Income from securities lending — net | | | 77,258 | | |

| Foreign taxes withheld | | | (712,700 | ) | |

| Total income | | | 112,489,991 | | |

| Expenses: | |

| Investment management fees | | | 20,026,109 | | |

| Distribution fees | |

| Class B | | | 146,783 | | |

| Class C | | | 1,164,658 | | |

| Class R | | | 62,372 | | |

| Service fees | |

| Class A | | | 2,530,486 | | |

| Class B | | | 48,928 | | |

| Class C | | | 388,219 | | |

| Class W | | | 75,979 | | |

| Shareholder service fee — Class T | | | 247,391 | | |

| Transfer agent fees | |

| Class A | | | 1,717,159 | | �� |

| Class B | | | 33,068 | | |

| Class C | | | 261,871 | | |

| Class R | | | 20,120 | | |

| Class T | | | 138,140 | | |

| Class W | | | 48,902 | | |

| Class Z | | | 3,385,803 | | |

| Administration fees | | | 2,133,693 | | |

| Compensation of board members | | | 118,135 | | |

| Pricing and bookkeeping fees | | | 108,964 | | |

| Custodian fees | | | 90,644 | | |

| Printing and postage fees | | | 300,001 | | |

| Registration fees | | | 202,000 | | |

| Professional fees | | | 179,437 | | |

| Chief compliance officer expenses | | | 3,661 | | |

| Other | | | 81,646 | | |

| Total expenses | | | 33,514,169 | | |

| Fees waived or expenses reimbursed by Investment Manager and its affiliates | | | (1,966,047 | ) | |

| Expense reductions | | | (12,184 | ) | |

| Total net expenses | | | 31,535,938 | | |

| Net investment income | | | 80,954,053 | | |

| Realized and unrealized gain (loss) — net | |

| Net realized gain (loss) on: | |

| Investments | | | 16,568,991 | | |

| Foreign currency transactions | | | 1,298 | | |

| Net realized gain | | | 16,570,289 | | |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments | | | (125,200,605 | ) | |

| Foreign currency translations | | | (2,620 | ) | |

| Net change in unrealized depreciation | | | (125,203,225 | ) | |

| Net realized and unrealized loss | | | (108,632,936 | ) | |

| Net decrease in net assets from operations | | $ | (27,678,883 | ) | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

15

Statement of Changes in Net Assets – Columbia Dividend Income Fund

| Year ended September 30, | | 2011 | | 2010(a) | |

| Operations | |

| Net investment income | | $ | 80,954,053 | | | $ | 53,954,403 | | |

| Net realized gain | | | 16,570,289 | | | | 43,830,633 | | |

| Net change in unrealized appreciation (depreciation) | | | (125,203,225 | ) | | | 114,609,413 | | |

| Net change in net assets resulting from operations | | | (27,678,883 | ) | | | 212,394,449 | | |

| Distributions to shareholders from: | |

| Net investment income | |

| Class A | | | (22,582,632 | ) | | | (15,010,735 | ) | |

| Class B | | | (274,525 | ) | | | (408,584 | ) | |

| Class C | | | (2,356,214 | ) | | | (1,243,004 | ) | |

| Class I | | | (3,517,020 | ) | | | — | | |

| Class R | | | (247,636 | ) | | | (90,437 | ) | |

| Class T | | | (1,721,136 | ) | | | (1,868,788 | ) | |

| Class W | | | (740,376 | ) | | | — | | |

| Class Z | | | (49,919,726 | ) | | | (36,042,620 | ) | |

| Total distributions to shareholders | | | (81,359,265 | ) | | | (54,664,168 | ) | |

| Increase in net assets from share transactions | | | 1,492,699,841 | | | | 671,056,299 | | |

| Total increase in net assets | | | 1,383,661,693 | | | | 828,786,580 | | |

| Net assets at beginning of year | | | 2,523,844,075 | | | | 1,695,057,495 | | |

| Net assets at end of year | | $ | 3,907,505,768 | | | $ | 2,523,844,075 | | |

| Undistributed net investment income | | $ | 244,845 | | | $ | 648,759 | | |

(a) Class I and Class W shares are for the period from September 27, 2010 (commencement of operations) through September 30, 2010.

The Accompanying Notes to Financial Statements are an integral part of this statement.

16

Statement of Changes in Net Assets (continued) – Columbia Dividend Income Fund

| Year ended September 30, | | 2011 | | 2010(a) | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

| Capital stock activity | |

| Class A shares | |

| Subscriptions | | | 48,175,528 | | | | 634,891,354 | | | | 27,619,891 | | | | 326,418,937 | | |

| Distributions reinvested | | | 1,446,142 | | | | 18,598,042 | | | | 1,091,127 | | | | 12,956,124 | | |

| Redemptions | | | (18,973,244 | ) | | | (248,181,551 | ) | | | (11,936,159 | ) | | | (140,954,594 | ) | |

| Net increase | | | 30,648,426 | | | | 405,307,845 | | | | 16,774,859 | | | | 198,420,467 | | |

| Class B shares | |

| Subscriptions | | | 342,782 | | | | 4,373,503 | | | | 287,214 | | | | 3,327,780 | | |

| Distributions reinvested | | | 15,508 | | | | 195,603 | | | | 28,145 | | | | 326,729 | | |

| Redemptions | | | (823,282 | ) | | | (10,545,800 | ) | | | (1,094,271 | ) | | | (12,733,090 | ) | |

| Net decrease | | | (464,992 | ) | | | (5,976,694 | ) | | | (778,912 | ) | | | (9,078,581 | ) | |

| Class C shares | |

| Subscriptions | | | 9,101,453 | | | | 116,817,556 | | | | 4,345,783 | | | | 50,314,346 | | |

| Distributions reinvested | | | 132,150 | | | | 1,655,855 | | | | 78,265 | | | | 908,798 | | |

| Redemptions | | | (1,871,114 | ) | | | (23,806,169 | ) | | | (914,304 | ) | | | (10,483,246 | ) | |

| Net increase | | | 7,362,489 | | | | 94,667,242 | | | | 3,509,744 | | | | 40,739,898 | | |

| Class I shares | |

| Subscriptions | | | 24,078,342 | | | | 320,170,838 | | | | 206 | | | | 2,500 | | |

| Distributions reinvested | | | 276,223 | | | | 3,516,952 | | | | — | | | | — | | |

| Redemptions | | | (3,840,844 | ) | | | (50,294,066 | ) | | | — | | | | — | | |

| Net increase | | | 20,513,721 | | | | 273,393,724 | | | | 206 | | | | 2,500 | | |

| Class R shares | |

| Subscriptions | | | 742,217 | | | | 9,640,024 | | | | 758,691 | | | | 9,240,343 | | |

| Distributions reinvested | | | 15,585 | | | | 200,423 | | | | 6,868 | | | | 81,266 | | |

| Redemptions | | | (388,469 | ) | | | (5,161,722 | ) | | | (117,253 | ) | | | (1,359,907 | ) | |

| Net increase | | | 369,333 | | | | 4,678,725 | | | | 648,306 | | | | 7,961,702 | | |

| Class T shares | |

| Subscriptions | | | 150,886 | | | | 1,961,263 | | | | 784,478 | | | | 9,235,572 | | |

| Distributions reinvested | | | 109,642 | | | | 1,414,376 | | | | 146,661 | | | | 1,740,293 | | |

| Redemptions | | | (938,084 | ) | | | (12,332,826 | ) | | | (898,540 | ) | | | (10,598,500 | ) | |

| Net increase (decrease) | | | (677,556 | ) | | | (8,957,187 | ) | | | 32,599 | | | | 377,365 | | |

| Class W shares | |

| Subscriptions | | | 4,878,494 | | | | 64,001,093 | | | | 206 | | | | 2,500 | | |

| Distributions reinvested | | | 58,168 | | | | 740,317 | | | | — | | | | — | | |

| Redemptions | | | (1,358,960 | ) | | | (17,428,109 | ) | | | — | | | | — | | |

| Net increase | | | 3,577,702 | | | | 47,313,301 | | | | 206 | | | | 2,500 | | |

| Class Z shares | |

| Subscriptions | | | 86,848,555 | | | | 1,140,726,956 | | | | 62,622,462 | | | | 742,481,198 | | |

| Distributions reinvested | | | 1,553,333 | | | | 19,960,237 | | | | 971,154 | | | | 11,539,013 | | |

| Redemptions | | | (36,526,580 | ) | | | (478,414,308 | ) | | | (27,195,653 | ) | | | (321,389,763 | ) | |

| Net increase | | | 51,875,308 | | | | 682,272,885 | | | | 36,397,963 | | | | 432,630,448 | | |

| Total net increase | | | 113,204,431 | | | | 1,492,699,841 | | | | 56,584,971 | | | | 671,056,299 | | |

(a) Class I and Class W shares are for the period from September 27, 2010 (commencement of operations) through September 30, 2010.

The Accompanying Notes to Financial Statements are an integral part of this statement.

17

Financial Highlights – Columbia Dividend Income Fund

The following tables are intended to help you understand the Fund's financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total returns assume reinvestment of all dividends and distributions. Total returns do not reflect payment of sales charges, if any, and are not annualized for periods of less than one year.

| | | Year ended Sept. 30, | |

| | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| Class A | |

| Per share data | |

| Net asset value, beginning of period | | $ | 12.12 | | | $ | 11.18 | | | $ | 12.01 | | | $ | 15.35 | | | $ | 13.45 | | |

| Income from investment operations: | |

| Net investment income | | | 0.29 | | | | 0.28 | | | | 0.29 | | | | 0.31 | | | | 0.28 | | |

| Net realized and unrealized gain (loss) | | | 0.03 | (a) | | | 0.94 | | | | (0.86 | ) | | | (3.18 | ) | | | 2.02 | | |

| Total from investment operations | | | 0.32 | | | | 1.22 | | | | (0.57 | ) | | | (2.87 | ) | | | 2.30 | | |

| Less distributions to shareholders from: | |

| Net investment income | | | (0.28 | ) | | | (0.28 | ) | | | (0.27 | ) | | | (0.31 | ) | | | (0.27 | ) | |

| Net realized gains | | | — | | | | — | | | | — | | | | (0.16 | ) | | | (0.13 | ) | |

| Total distributions to shareholders | | | (0.28 | ) | | | (0.28 | ) | | | (0.27 | ) | | | (0.47 | ) | | | (0.40 | ) | |

| Proceeds from regulatory settlement | | | — | | | | — | | | | 0.01 | | | | — | | | | — | | |

| Net asset value, end of period | | $ | 12.16 | | | $ | 12.12 | | | $ | 11.18 | | | $ | 12.01 | | | $ | 15.35 | | |

| Total return | | | 2.56 | % | | | 11.02 | % | | | (4.33 | %) | | | (19.06 | %) | | | 17.31 | % | |

| Ratios to average net assets(b) | |

| Expenses prior to fees waived or expenses reimbursed | | | 1.09 | % | | | 1.07 | % | | | 1.11 | % | | | 1.11 | % | | | 1.12 | % | |

| Net expenses after fees waived or expenses reimbursed(c) | | | 1.03 | %(d) | | | 1.05 | %(d) | | | 1.05 | %(d) | | | 1.05 | %(d) | | | 1.05 | %(d) | |

| Net investment income | | | 2.23 | %(d) | | | 2.41 | %(d) | | | 2.88 | %(d) | | | 2.24 | %(d) | | | 1.90 | %(d) | |

| Supplemental data | |

| Net assets, end of period (in thousands) | | $ | 1,103,389 | | | $ | 728,219 | | | $ | 483,916 | | | $ | 278,122 | | | $ | 370,358 | | |

| Portfolio turnover | | | 20 | % | | | 17 | % | | | 23 | % | | | 16 | % | | | 21 | % | |

| Notes to Financial Highlights | |

(a) Calculation of the net gain per share (both realized and unrealized) does not correlate to the aggregate realized and unrealized loss presented in the Statement of Operations due to the timing of sales and repurchases of Fund shares in relation to fluctuations in the market value of the portfolio.

(b) In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in the reported expense ratios.

(c) The Investment Manager and certain of its affiliates agreed to waive/reimburse certain fees and expenses, if applicable.

(d) The benefits derived from expense reductions had an impact of less than 0.01%.

The Accompanying Notes to Financial Statements are an integral part of this statement.

18

Financial Highlights (continued) – Columbia Dividend Income Fund

| | | Year ended Sept. 30, | |

| | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| Class B | |

| Per share data | |

| Net asset value, beginning of period | | $ | 11.86 | | | $ | 10.94 | | | $ | 11.75 | | | $ | 15.03 | | | $ | 13.17 | | |

| Income from investment operations: | |

| Net investment income | | | 0.19 | | | | 0.19 | | | | 0.21 | | | | 0.20 | | | | 0.16 | | |

| Net realized and unrealized gain (loss) | | | 0.03 | (a) | | | 0.93 | | | | (0.82 | ) | | | (3.11 | ) | | | 1.99 | | |

| Total from investment operations | | | 0.22 | | | | 1.12 | | | | (0.61 | ) | | | (2.91 | ) | | | 2.15 | | |

| Less distributions to shareholders from: | |

| Net investment income | | | (0.19 | ) | | | (0.20 | ) | | | (0.20 | ) | | | (0.21 | ) | | | (0.16 | ) | |

| Net realized gains | | | — | | | | — | | | | — | | | | (0.16 | ) | | | (0.13 | ) | |

| Total distributions to shareholders | | | (0.19 | ) | | | (0.20 | ) | | | (0.20 | ) | | | (0.37 | ) | | | (0.29 | ) | |

| Proceeds from regulatory settlement | | | — | | | | — | | | | 0.00 | (b) | | | — | | | | — | | |

| Net asset value, end of period | | $ | 11.89 | | | $ | 11.86 | | | $ | 10.94 | | | $ | 11.75 | | | $ | 15.03 | | |

| Total return | | | 1.74 | % | | | 10.24 | % | | | (4.97 | %) | | | (19.71 | %) | | | 16.49 | % | |

| Ratios to average net assets(c) | |

| Expenses prior to fees waived or expenses reimbursed | | | 1.85 | % | | | 1.82 | % | | | 1.86 | % | | | 1.86 | % | | | 1.87 | % | |

| Net expenses after fees waived or expenses reimbursed(d) | | | 1.79 | %(e) | | | 1.80 | %(e) | | | 1.80 | %(e) | | | 1.80 | %(e) | | | 1.80 | %(e) | |

| Net investment income | | | 1.48 | %(e) | | | 1.67 | %(e) | | | 2.18 | %(e) | | | 1.48 | %(e) | | | 1.16 | %(e) | |

| Supplemental data | |

| Net assets, end of period (in thousands) | | $ | 15,659 | | | $ | 21,126 | | | $ | 28,006 | | | $ | 31,307 | | | $ | 52,937 | | |

| Portfolio turnover | | | 20 | % | | | 17 | % | | | 23 | % | | | 16 | % | | | 21 | % | |

| Notes to Financial Highlights | |

(a) Calculation of the net gain per share (both realized and unrealized) does not correlate to the aggregate realized and unrealized loss presented in the Statement of Operations due to the timing of sales and repurchases of Fund shares in relation to fluctuations in the market value of the portfolio.

(b) Rounds to less than $0.01.