Exhibit (17)(a)(ii)

EATON VANCE FLORIDA PLUS INSURED MUNICIPALS FUND

EATON VANCE HAWAII MUNICIPALS FUND

EATON VANCE HIGH YIELD MUNICIPALS FUND

EATON VANCE KANSAS MUNICIPALS FUND

Supplement to Prospectuses dated April 1, 2007

EATON VANCE HIGH YIELD MUNICIPALS FUND - CLASS I SHARES

Supplement to Prospectus dated May 8, 2007

EATON VANCE CALIFORNIA LIMITED MATURITY MUNICIPALS FUND

EATON VANCE FLORIDA PLUS LIMITED MATURITY MUNICIPALS FUND

EATON VANCE MASSACHUSETTS LIMITED MATURITY MUNICIPALS FUND

EATON VANCE NATIONAL LIMITED MATURITY MUNICIPALS FUND

EATON VANCE NEW JERSEY LIMITED MATURITY MUNICIPALS FUND

EATON VANCE NEW YORK LIMITED MATURITY MUNICIPALS FUND

EATON VANCE OHIO LIMITED MATURITY MUNICIPALS FUND

EATON VANCE PENNSYLVANIA LIMITED MATURITY MUNICIPALS FUND

Supplement to Prospectuses dated August 1, 2007

EATON VANCE ARIZONA MUNICIPALS FUND

EATON VANCE COLORADO MUNICIPALS FUND

EATON VANCE CONNECTICUT MUNICIPALS FUND

EATON VANCE MICHIGAN MUNICIPALS FUND

EATON VANCE MINNESOTA MUNICIPALS FUND

EATON VANCE NEW JERSEY MUNICIPALS FUND

EATON VANCE PENNSYLVANIA MUNICIPALS FUND

Supplement to Prospectus dated October 5, 2007

EATON VANCE ALABAMA MUNICIPALS FUND

EATON VANCE ARKANSAS MUNICIPALS FUND

EATON VANCE CALIFORNIA MUNICIPALS FUND

EATON VANCE FLORIDA PLUS MUNICIPALS FUND

EATON VANCE GEORGIA MUNICIPALS FUND

EATON VANCE KENTUCKY MUNICIPALS FUND

EATON VANCE LOUISIANA MUNICIPALS FUND

EATON VANCE MARYLAND MUNICIPALS FUND

EATON VANCE MASSACHUSETTS MUNICIPALS FUND

EATON VANCE MISSISSIPPI MUNICIPALS FUND

EATON VANCE MISSOURI MUNICIPALS FUND

EATON VANCE NEW YORK MUNICIPALS FUND

EATON VANCE NORTH CAROLINA MUNICIPALS FUND

EATON VANCE OHIO MUNICIPALS FUND

EATON VANCE OREGON MUNICIPALS FUND

EATON VANCE RHODE ISLAND MUNICIPALS FUND

EATON VANCE SOUTH CAROLINA MUNICIPALS FUND

EATON VANCE TENNESSEE MUNICIPALS FUND

EATON VANCE VIRGINIA MUNICIPALS FUND

EATON VANCE WEST VIRGINIA MUNICIPALS FUND

Supplement to Prospectuses dated December 1, 2007

EATON VANCE NATIONAL MUNICIPALS FUND

Supplement to Prospectus dated February 1, 2008 |

1. The following replaces the last two paragraphs under "Restrictions on Excessive Trading and Market Timing" under "Purchasing Shares":

The Boards of Trustees of the Eaton Vance funds have adopted policies to discourage short-term trading and market timing and to seek to minimize their potentially detrimental effects. Pursuant to these policies, if an investor (through one or more accounts) makes more than one round-trip exchange (exchanging from one fund to another fund and back again) within

90 days, it will be deemed to constitute market timing or excessive trading. Under the policies, each Fund or its principal underwriter will reject or cancel a purchase order, suspend or terminate the exchange privilege or terminate the ability of an investor to invest in the Eaton Vance funds if the Fund or the principal underwriter determines that a proposed transaction involves market timing or excessive trading that it believes is likely to be detrimental to the Fund. Each Fund and its principal underwriter use reasonable efforts to detect market timing and excessive trading activity, but they cannot ensure that they will be able to identify all cases of market timing and excessive trading. Each Fund or its principal underwriter may also reject or cancel any purchase order (including an exchange) from an investor or group of investors for any other reason. Decisions to reject or cancel purchase orders (including exchanges) in a Fund are inherently subjective and will be made in a manner believed to be in the best interest of a Fund’s shareholders. No Eaton Vance fund has any arrangement to permit market timing.

The following fund share transactions generally are exempt from the market timing and excessive trading policy described above because each Fund and the principal underwriter believe they generally do not raise market timing or excessive trading concerns:

•transactions made pursuant to a systematic purchase plan or as the result of automatic reinvestment of dividends or distributions, or initiated by the Fund (e. g. for failure to meet applicable account minimums);

•transactions made by participants in employer sponsored retirement plans involving participant payroll or employer contributions or loan repayments, redemptions as part of plan terminations or at the direction of the plan, mandatory retirement distributions, or rollovers;

•transactions made by asset allocation and wrap programs where the adviser to the program directs transactions in the accounts participating in the program in concert with changes in a model portfolio; or

•transactions in shares of Eaton Vance Cash Management Fund, Eaton Vance Money Market Fund, Eaton Vance Tax Free Reserves, Eaton Vance Institutional Short Term Income Fund and Eaton Vance Institutional Short Term Treasury Fund.

It may be difficult for a Fund or the principal underwriter to identify market timing or excessive trading in omnibus accounts traded through financial intermediaries. The Funds and the principal underwriter have provided guidance to financial intermediaries (such as banks, broker-dealers, insurance companies and retirement administrators) concerning the application of the Eaton Vance funds’ market timing and excessive trading policies to Fund shares held in omnibus accounts maintained and administered by such intermediaries, including guidance concerning situations where market timing or excessive trading is considered to be detrimental to a Fund. Each Fund or its principal underwriter may rely on a financial intermediary’s policy to restrict market timing and excessive trading if it believes that policy is likely to prevent market timing that is likely to be detrimental to each Fund. Such policy may be more or less restrictive than a Fund’s policy. Although each Fu nd or the principal underwriter review trading activity at the omnibus account level for activity that indicates potential market timing or excessive trading activity, the Funds and the principal underwriter typically will not request or receive individual account data unless suspicious trading activity is identified. Each Fund and the principal underwriter generally rely on the financial intermediaries to monitor trading activity in good faith in accordance with their own or Fund policies. Each Fund and the principal underwriter cannot ensure that these financial intermediaries will in all cases apply the policies of the Funds or their own policies, as the case may be, to accounts under their control.

May 15, 2008

COMBPS

Eaton Vance

National Municipals

Fund |

| A mutual fund providing tax-exempt income |

Prospectus Dated

February 1, 2008 |

| | The Securities and Exchange Commission has not approved or disapproved these securities or

determined whether this prospectus is truthful or complete. Any representation to the contrary is a

criminal offense. |

| Information in this prospectus | | | | | | |

| | | Page | | | | Page |

|

| Fund Summary | | 2 | | Sales Charges | | 11 |

| Investment Objective & Principal Policies and Risks | | 5 | | Redeeming Shares | | 13 |

| Management and Organization | | 7 | | Shareholder Account Features | | 13 |

| Valuing Shares | | 7 | | Tax Information | | 15 |

| Purchasing Shares | | 8 | | Financial Highlights | | 16 |

|

This prospectus contains important information about the Fund and the services

available to shareholders. Please save it for reference. |

Fund Summary

Investment Objective and Principal Strategies |

Eaton Vance National Municipals Fund’s investment objective is to provide current income exempt from regular federal income tax. Under normal market circumstances, the Fund invests at least 80% of its net assets in municipal obligations that are exempt from such taxes. The Fund primarily invests in investment grade municipal obligations (those rated BBB or Baa or higher), but may also invest in lower rated obligations. The Fund normally invests in municipal obligations with maturities of ten years or more.

The Fund may concentrate in certain types of municipal obligations (such as industrial development bonds, housing bonds, hospital bonds or utility bonds), so Fund shares could be affected by events that adversely affect a particular sector. The Fund may purchase derivative instruments (such as inverse floaters, futures contracts and options thereon, interest rate swaps, and forward rate contracts), bonds that do not make regular payments of interest, bonds issued on a when-issued basis and municipal leases. The portfolio manager may also trade securities to minimize taxable capital gains to shareholders. A portion of the Fund’s distributions generally will be subject to alternative minimum tax.

Obligations with maturities of ten years or more may offer higher yields than obligations with shorter maturities, but they are subject to greater fluctuations in value when interest rates change. When interest rates rise, or when the supply of suitable bonds exceeds the market demand, the value of Fund shares typically will decline. The Fund’s yield will also fluctuate over time.

Because obligations rated BBB or Baa and obligations rated below BBB or Baa (so-called "junk bonds") are more sensitive to the financial soundness of their issuers than higher quality obligations, Fund shares may fluctuate more in value than shares of a fund investing solely in higher quality obligations. Obligations rated BBB or Baa have speculative characteristics, while lower rated obligations are predominantly speculative.

The Fund’s use of derivatives may expose the Fund to increased risk of principal loss due to imperfect correlation, failure of the counterparty and unexpected price or interest rate movements. Inverse floaters are volatile and involve leverage risk. Bonds that do not make regular interest payments may experience greater volatility in response to interest rate changes. When-issued securities are subject to the risk that when delivered to the Fund they will be worth less than the price the Fund agreed to pay for them. Municipal leases often require a legislative appropriation of funds for payment. If the necessary appropriation is not made, the issuer of the lease may not be able to meet its obligations.

The Fund is not a complete investment program and you may lose money by investing in the Fund. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

2

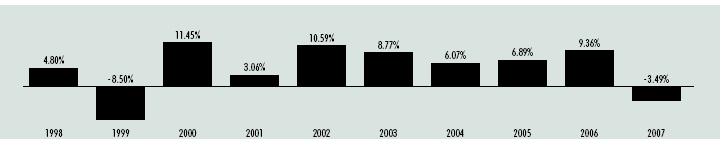

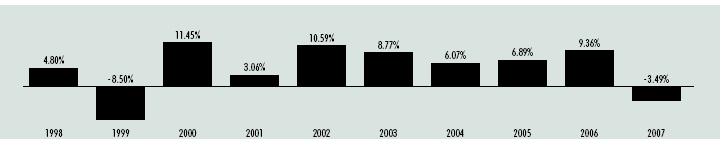

Performance Information. The following bar chart and table provide information about the Fund’s performance for each calendar year through December 31, 2007. The returns in the bar chart are for Class B shares and do not reflect a sales charge. If the sales charge was reflected, the returns would be lower. The table contains returns for Class A, Class B, Class C and Class I shares and a comparison to the performance of a national index of municipal obligations. Returns in the table for Class B shares are shown before and after the reduction of taxes. Although past performance (both before and after taxes) is no guarantee of future results, this performance information demonstrates the risk that the value of your investment will change.

During the ten years ended December 31, 2007, the highest quarterly total return for Class B was 7.41% for the quarter ended September 30, 2002, and the lowest quarterly return was –3.03% for the quarter ended December 31, 1999. For the 30 days ended September 30, 2007, the SEC yield and SEC tax-equivalent yield (assuming a federal income tax rate of 35.00%) for Class A shares were 4.16% and 6.40%, respectively, for Class B shares were 3.62% and 5.57%, respectively, for Class C shares were 3.62% and 5.57%, respectively, and for Class I shares were 4.63% and 7.12%, respectively. A lower tax rate would result in lower tax-equivalent yields. For current yield information call 1-800-225-6265.

| | | One | | Five | | Ten |

| Average Annual Total Return as of December 31, 2007 | | Year | | Years | | Years |

|

| Class A Return Before Taxes | | –7.42% | | 5.03% | | 4.82% |

| Class B Return Before Taxes | | –8.14% | | 5.08% | | 4.71% |

| Class B Return After Taxes on Distributions | | –8.15% | | 5.08% | | 4.71% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | | –4.00% | | 5.04% | | 4.73% |

| Class C Return Before Taxes | | –4.42% | | 5.28% | | 4.53% |

| Class I Return Before Taxes | | –2.52% | | 6.33% | | 5.62% |

| Lehman Brothers Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | | 3.36% | | 4.30% | | 5.18% |

These returns reflect the maximum sales charge for Class A (4.75%) and any applicable contingent deferred sales charge ("CDSC") for Class B and Class C. The Lehman Brothers Municipal Bond Index is an unmanaged market index of municipal bonds. Investors cannot invest directly in an Index. (Source for Lehman Brothers Municipal Bond Index: Lipper, Inc.) Total returns are historical and are calculated by determining the percentage change in net asset value or public offering price with all distributions reinvested. The Fund's past performance (both before and after taxes) is no guarantee of future results. Investment return and principal value of Fund shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund's current performance may be lower or higher than the quoted return. Fund performance during certain periods reflects the strong bond market performance and/or the strong performance of bonds held during those periods. This performance is not typical and may not be repeated. For the Fund’s performance as of the most recent month-end, please refer to www.eatonvance.com.

After-tax returns are calculated using certain assumptions. After-tax returns are calculated using the highest historical individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold Fund shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns for other Classes of shares will vary from the after-tax returns presented for Class B shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

3

Fund Fees and Expenses. These tables describe the fees and expenses that you may pay if you buy and hold shares.

| Shareholder Fees (fees paid directly from your investment) | | Class A | | Class B | | Class C | | Class I |

|

| Maximum Sales Charge (Load) (as a percentage of offering price) | | 4.75% | | None | | None | | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of net asset value | | | | | | | | |

| at time of purchase or time of redemption) | | None | | 5.00% | | 1.00% | | None |

| Maximum Sales Charge (Load) Imposed on Reinvested Distributions | | None | | None | | None | | None |

| Exchange Fee | | None | | None | | None | | None |

| |

| Annual Fund Operating Expenses (expenses that are deducted from Fund assets) | | Class A | | Class B | | Class C | | Class I |

|

| Management Fees | | 0.32% | | 0.32% | | 0.32% | | 0.32% |

| Distribution and Service (12b-1) Fees | | 0.25% | | 1.00% | | 1.00% | | n/a |

| Other Expenses (including Interest Expense)* | | 0.69% | | 0.69% | | 0.69% | | 0.69% |

| Interest Expense | | 0.62% | | 0.62% | | 0.62% | | 0.62% |

| Other Expenses (excluding Interest Expense) | | 0.07% | | 0.07% | | 0.07% | | 0.07% |

| Total Annual Fund Operating Expenses | | 1.26% | | 2.01% | | 2.01% | | 1.01% |

| * | "Other Expenses" includes interest expense relating to the Fund’s liability with respect to floating rate notes held by third parties in conjunction with inverse floater securities transactions by the Fund. The Fund also records offsetting interest income in an amount equal to this expense relating to the municipal obligations underlying such transactions, and as a result net asset value and performance have not been affected by this expense. Had this expense not been included, total "Other Expenses" would have been in the amounts described in each table above as "Other Expenses (excluding Interest Expense)". See "Investment Objective & Principal Policies and Risks" for a description of these transactions. |

| |

Example. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the operating expenses remain the same as stated in the Fund Fees and Expenses tables above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

|

| Class A shares | | $597 | | $ | | 856 | | $1,134 | | $1,925 |

| Class B shares* | | $704 | | $1,030 | | $1,283 | | $2,144 |

| Class C shares | | $304 | | $ | | 630 | | $1,083 | | $2,338 |

| Class I shares | | $103 | | $ | | 322 | | $ 558 | | $1,236 |

You would pay the following expenses if you did not redeem your shares: | | | | | | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

|

| Class A shares | | $597 | | $856 | | $1,134 | | $1,925 |

| Class B shares* | | $204 | | $630 | | $1,083 | | $2,144 |

| Class C shares | | $204 | | $630 | | $1,083 | | $2,338 |

| Class I shares | | $103 | | $322 | | $ 558 | | $1,236 |

* Reflects the expenses of Class A shares after eight years because Class B shares automatically convert to Class A shares after eight years.

4

Investment Objective & Principal Policies and Risks

The investment objective of the Fund is to provide current income exempt from regular federal income tax. The Fund seeks to achieve its objective by investing primarily (i.e., at least 80% of its net assets during periods of normal market conditions) in municipal obligations, the interest on which is exempt from regular federal income tax which, in accordance with the Fund’s investment objective, the Fund seeks to avoid. This is a fundamental policy of the Fund which only may be changed with shareholder approval. For purposes of the policy, "net assets" includes any borrowings for investment purposes. The Fund’s investment objective and certain other policies may be changed by the Trustees without shareholder approval. Shareholders will receive 60 days’ notice of any material change in the investment objective.

At least 65% of net assets will normally be invested in municipal obligations rated at least investment grade at the time of investment (which are those rated Baa or higher by Moody’s Investors Service, Inc. (“Moody’s”), or BBB or higher by either Standard & Poor’s Ratings Group (“S&P”) or Fitch Ratings (“Fitch”)) or, if unrated, determined by the investment adviser to be of at least investment grade quality. The balance of net assets may be invested in municipal obligations rated below investment grade and in unrated municipal obligations considered to be of comparable quality by the investment adviser. Municipal obligations rated Baa or BBB have speculative characteristics, while lower quality obligations are predominantly speculative. Also, changes in economic conditions or other circumstances are more likely to reduce the capacity of issuers of lower-rated obligations to make principal and interest payments. Lower rated oblig ations also may be subject to greater price volatility than higher rated obligations. The Fund will not invest more than 10% of its assets in obligations rated below B by Moody’s, S&P or Fitch, or unrated obligations considered to be of comparable quality by the investment adviser.

Municipal obligations include bonds, notes and commercial paper issued by a municipality, a group of municipalities or participants in qualified issues of tax-exempt debt for a wide variety of both public and private purposes. Municipal obligations also include municipal leases and participations in municipal leases. The obligation of the issuer to meet its obligations under such leases is often subject to the appropriation by the appropriate legislative body, on an annual or other basis, of funds for the payment of the obligations. Certain municipal obligations may be purchased on a “when-issued” basis, which means that payment and delivery occur on a future settlement date. The price and yield of such securities are generally fixed on the date of commitment to purchase.

The investment adviser’s process for selecting securities for purchase and sale is research intensive and emphasizes the creditworthiness of the issuer or other person obligated to repay the obligation.

The interest on municipal obligations is (in the opinion of the issuer’s counsel) exempt from regular federal income tax. Interest income from certain types of municipal obligations generally will be subject to the federal alternative minimum tax (the “AMT”) for individuals. Distributions to corporate investors may also be subject to the AMT. The Fund may not be suitable for investors subject to the AMT.

Although the Fund may invest in securities of any maturity, it is expected that the Fund will normally acquire securities with maturities of ten years or more at the time of investment. Many obligations permit the issuer at its option to “call,” or redeem, its securities. As such, the effective maturity of an obligation may be less than ten years as the result of call provisions. The effective maturity of an obligation is its likely redemption date after consideration of any call or redemption features. If an issuer calls securities during a time of declining interest rates, it may not be possible to reinvest the proceeds in securities providing the same investment return as the securities redeemed. The average maturity of the Fund’s holdings may vary depending on market conditions.

The Fund may invest 25% or more of its total assets in municipal obligations in the same sector (such as leases, housing finance, public housing, municipal utilities, hospital and health facilities or industrial development). This may make the Fund more susceptible to adverse economic, political or regulatory occurrences or adverse court decisions affecting a particular sector.

The net asset value of the Fund’s shares will change in response to changes in prevailing interest rates and changes in the value of securities held by the Fund. The value of securities held will be affected by the credit quality of the issuer of the obligation, and general economic and business conditions that affect the specific economic sector of the issuer as well as any change to the tax treatment of securities held by the Fund. Changes by rating agencies in the rating assigned to an obligation may also affect the value of that obligation. To the extent that securities held by the Fund are insured as to principal and interest payments by insurers whose claims-paying ability rating is downgraded by Moody’s, S&P or Fitch, the value of such securities may be affected. The increased presence of non-traditional participants in the municipal markets may lead to greater volatility in the markets.

The Fund may purchase derivative instruments, which derive their value from another instrument, security or index. For example, the Fund may invest in residual interests of a trust (the ”trust”) that holds municipal securities (“inverse floaters”).

5

The trust will also issue floating rate notes to third parties that may be senior to the Fund’s inverse floaters. The Fund receives interest payments on inverse floaters that bear an inverse relationship to the interest rate paid on the floating rate notes. As a result of Financial Accounting Standards Statement No. 140 (“FAS 140”), interest paid by the trust to the floating rate note holders may be reflected as income in the Fund’s financial statements with an offsetting expense for the interest paid by the trust to the floating rate note holders. Inverse floaters involve leverage risk and will involve greater risk than an investment in a fixed rate bond. Because changes in the interest rate paid to the floating rate note holders inversely affects the interest paid on the inverse floater, the value and income of an inverse floater are generally more volatile than that of a fixed rate bond. Inverse floaters have varying degrees of liquidity, and the market for t hese securities is relatively volatile. These securities tend to underperform the market for fixed rate bonds in a rising long-term interest rate environment, but tend to outperform the market for fixed rate bonds when long-term interest rates decline. While inverse floaters expose the Fund to leverage risk, they do not constitute borrowings for purposes of the Fund’s restrictions on borrowings.

The Fund may also purchase and sell various kinds of financial futures contracts and options thereon to hedge against changes in interest rates or as a substitute for the purchase of portfolio securities. The Fund may also enter into interest rate swaps, forward rate contracts and credit derivatives, which may include credit default swaps, total return swaps or credit options, as well as purchase an instrument that has greater or lesser credit risk than the municipal bonds underlying the instrument. The use of derivative instruments for both hedging and investment purposes involves a risk of loss or depreciation due to a variety of factors including counterparty risk, unexpected market, interest rate or securities price movements, and tax and regulatory constraints. The use of derivatives is highly specialized and engaging in derivative transactions for purposes other than hedging is speculative. Derivative hedging transactions may not be effective because of imperfect correlations , i.e. offsetting markets which do not experience price changes in perfect correlation with each other, and other factors.

The Fund may invest in zero coupon bonds, which do not require the issuer to make periodic interest payments. The values of these bonds are subject to greater fluctuation in response to changes in market interest rates than bonds which pay interest currently. The Fund accrues income on these investments and is required to distribute that income each year. The Fund may be required to sell securities to obtain cash needed for income distributions.

The limited liquidity of certain securities in which the Fund may invest (including those eligible for resale under Rule 144A of the Securities Act of 1933) could affect their market prices, thereby adversely affecting net asset value and the ability to pay income. The amount of publicly available information about certain municipal obligations may be limited and the investment performance of the Fund may be more dependent on the portfolio manager’s analysis than if this were not the case.

The Fund may borrow amounts up to one-third of the value of its total assets (including borrowings), but it will not borrow more than 5% of the value of its total assets except to satisfy redemption requests or for other temporary purposes. Such borrowings would result in increased expense to the Fund and, while they are outstanding, would magnify increases or decreases in the value of Fund shares. No Fund will purchase additional investment securities while outstanding borrowings exceed 5% of the value of its total assets.

During unusual market conditions, the Fund may temporarily invest up to 50% of its total assets in cash or cash equivalents, which is not consistent with the Fund’s investment objective. While temporarily invested, the Fund may not achieve its objective, and interest income from temporary investments may be taxable. The Fund might not use all of the strategies and techniques or invest in all of the types of securities described in this Prospectus or the Statement of Additional Information. While at times the Fund may use alternative investment strategies in an effort to limit its losses, it may choose not to do so.

The Fund’s investment policies include a fundamental investment provision allowing the Fund to invest substantially all of its investable assets in one or more open-end management investment companies having substantially the same investment policies and restrictions as the Fund. Any such company or companies would be advised by the Fund’s investment adviser (or an affiliate) and the Fund would not pay directly any advisory fee with respect to the assets so invested. The Fund will indirectly bear its proportionate share of any management fees paid by investment companies in which it invests in addition to the advisory fee paid by the Fund. The Fund may initiate investments in one or more investment companies at any time without shareholder approval.

6

Management and Organization

Management. The Fund’s investment adviser is Boston Management and Research (“BMR”), a subsidiary of Eaton Vance Management (“Eaton Vance”), with offices at The Eaton Vance Building, 255 State Street, Boston, MA 02109. Eaton Vance has been managing assets since 1924 and managing mutual funds since 1931. Eaton Vance and its subsidiaries currently manage over $160 billion on behalf of mutual funds, institutional clients and individuals.

The investment adviser manages the investments of the Fund. Under its investment advisory agreement with the Fund, BMR receives a monthly advisory fee equal to the aggregate of a daily asset based fee and a daily income based fee. The fees are applied on the basis of the following categories.

| | | | | Annual | | Daily |

| Category | | Daily Net Assets | | Asset Rate | | Income Rate |

|

| 1 | | up to $500 million | | 0.300% | | 3.00% |

| 2 | | $500 million but less than $1 billion | | 0.275% | | 2.75% |

| 3 | | $1 billion but less than $1.5 billion | | 0.250% | | 2.50% |

| 4 | | $1.5 billion but less than $2 billion | | 0.225% | | 2.25% |

| 5 | | $2 billion but less than $3 billion | | 0.200% | | 2.00% |

| 6 | | $3 billion and over | | 0.175% | | 1.75% |

On September 30, 2007, the Fund had net assets of $6,293,707,922. For the fiscal year ended September 30, 2007, the Fund paid BMR advisory fees equivalent to 0.32% of the Fund’s average net assets for such year.

The Fund’s most recent shareholder report provides information regarding the basis for the Trustees’ approval of the Fund’s investment advisory agreement.

Thomas M. Metzold is the portfolio manager of the Fund (since December 1993). Mr. Metzold also manages other Eaton Vance portfolios, has managed Eaton Vance portfolios for more than five years, and is Vice President of Eaton Vance and BMR.

The Statement of Additional Information provides additional information about the portfolio manager’s compensation, other accounts managed by the portfolio manager, and the portfolio manager’s ownership of Fund shares.

Eaton Vance serves as the administrator of the Fund, providing the Fund with administrative services and related office facilities. Eaton Vance does not currently receive a fee for serving as administrator.

Eaton Vance also serves as the sub-transfer agent for the Fund. For the sub-transfer agency services it provides, Eaton Vance receives an aggregate fee based upon the actual expenses it incurs in the performance of sub-transfer agency services. This fee is paid to Eaton Vance by the Fund’s transfer agent from the fees the transfer agent receives from the Eaton Vance funds.

Organization. The Fund is a series of Eaton Vance Municipals Trust (the "Trust"), a Massachusetts business trust. The Fund offers multiple classes of shares. Each Class represents a pro rata interest in the Fund but is subject to different expenses and rights. The Fund does not hold annual shareholder meetings but may hold special meetings for matters that require shareholder approval (such as electing or removing trustees, approving management or advisory contracts or changing investment policies that may only be changed with shareholder approval).

Valuing Shares

The Fund values its shares once each day only when the New York Stock Exchange is open for trading (typically Monday through Friday), as of the close of regular trading on the Exchange (normally 4:00 p.m. eastern time). The purchase price of Fund shares is their net asset value (plus a sales charge for Class A shares), which is derived from the value of Fund holdings. When purchasing or redeeming Fund shares through an investment dealer, your investment dealer must communicate your order to the principal underwriter by a specific time each day in order for the purchase price or the redemption price to be based on that day’s net asset value per share. It is the investment dealer’s responsibility to transmit orders promptly. The Fund may accept purchase and redemption orders as of the time of their receipt by certain investment dealers (or their designated intermediaries).

The Trustees have adopted procedures for valuing investments and have delegated to the investment adviser the daily valuation of such investments. Municipal obligations owned by the Fund are normally valued on the basis of valuations furnished by a pricing service. The pricing service considers various factors relating to bonds and market transactions to determine value. In certain situations, the investment adviser may use the fair value of a security if market prices are unavailable or deemed unreliable. A security that is fair valued may be valued at a price higher or lower than actual market

7

quotations or the value determined by other funds using their own fair valuation procedures. The investment adviser expects to use fair value pricing for municipal obligations under limited circumstances, such as when an obligation is not priced by the pricing service or is in default. Eaton Vance has established a Valuation Committee that oversees the valuation of investments.

Purchasing Shares

Class A, Class B and Class C Shares |

You may purchase shares through your investment dealer or by mailing an account application form to the transfer agent (see back cover for address). You may request an account application by calling 1-800-262-1122. Your initial investment must be at least $1,000.

After your initial investment, additional investments may be made at any time by sending a check payable to the order of the Fund or the transfer agent directly to the transfer agent (see back cover for address). Please include your name and account number and the name of the Fund and Class of shares with each investment.

You may make automatic investments of $50 or more each month or each quarter from your bank account. You can establish bank automated investing on the account application or by calling 1-800-262-1122. The minimum initial investment amount and Fund policy of redeeming accounts with low account balances are waived for bank automated investing accounts, certain group purchase plans (including proprietary fee-based programs sponsored by broker-dealers) and for persons affiliated with Eaton Vance and certain Fund service providers (as described in the Statement of Additional Information).

Purchases will be executed at the net asset value next determined after their receipt in good order by the Fund’s transfer agent. The Fund’s transfer agent or your investment dealer must receive your purchase in good order no later than the close of regular trading on the New York Stock Exchange (normally 4:00 p.m. eastern time) for your purchase to be effected at that day’s net asset value. If you purchase shares through an investment dealer (which includes brokers, dealers and other financial institutions), that dealer may charge you a fee for executing the purchase for you. The Fund may suspend the sale of its shares at any time and any purchase order may be refused.

Class I shares are offered to clients of financial intermediaries who (i) charge such clients an ongoing fee for advisory, investment, consulting or similar services, or (ii) have entered into an agreement with the principal underwriter to offer Class I shares through a no-load network or platform. Such clients may include individuals, corporations, endowments, foundations and qualified plans (including tax-deferred retirement plans and profit sharing plans). Class I shares are also offered to investment and institutional clients of Eaton Vance and its affiliates and certain persons affiliated with Eaton Vance and certain fund service providers. Your initial investment must be at least $250,000. Subsequent investments of any amount may be made at any time. The minimum initial investment is waived for persons affiliated with Eaton Vance, its affiliates and certain Fund service providers (as described in the Statement of Additional Information). The initial minimum investment also is waived for individual accounts of a financial intermediary that charges an ongoing fee for its services or offers Class I shares through a no-load network or platform (in each case, as described above), provided the aggregate value of such accounts invested in Class I shares of the Fund is at least $250,000 (or is anticipated by the principal underwriter to reach $250,000) and for corporations, endowments, foundations and qualified plans with assets of at least $100 million.

Class I shares may be purchased through an investment dealer or by requesting your bank to transmit immediately available funds (Federal Funds) by wire. To make an initial investment by wire, you must telephone the Fund Order Department at 1-800-262-1122 to advise of your action and to be assigned an account number. An account application form then must be promptly forwarded to the transfer agent (see back cover for address). You may request a current account application by calling 1-800-262-1122. Additional investments may be made at any time through the same wire procedure. The Fund Order Department must be advised by telephone of each transmission.

Purchases will be executed at the net asset value next determined after their receipt in good order by the Fund’s transfer agent. The Fund’s transfer agent or your investment dealer must receive your purchase in good order no later than the close of regular trading on the New York Stock Exchange (normally 4:00 p.m. eastern time) for your purchase to be effected at that day’s net asset value. If you purchase shares through an investment dealer, that dealer may charge you a fee for executing the purchase for you. The Fund may suspend the sale of its shares at any time and any purchase order may be refused.

8

Restrictions on Excessive Trading and Market Timing. The Fund is not intended for excessive trading or market timing. Market timers seek to profit by rapidly switching money into a fund when they expect the share price of the fund to rise and taking money out of the fund when they expect those prices to fall. By realizing profits through short-term trading, shareholders that engage in rapid purchases and sales or exchanges of a fund’s shares may dilute the value of shares held by long-term shareholders. Volatility resulting from excessive purchases and sales or exchanges of fund shares, especially involving large dollar amounts, may disrupt efficient portfolio management. In particular, excessive purchases and sales or exchanges of a fund’s shares may cause a fund to have difficulty implementing its investment strategies, may force the fund to sell portfolio securities at inopportune times to raise cash or may cause increased expenses (such as i ncreased brokerage costs, realization of taxable capital gains without attaining any investment advantage or increased administrative costs).

A fund that invests in securities that are, among other things, thinly traded, traded infrequently or relatively illiquid (including certain municipal obligations) is susceptible to the risk that the current market price for such securities may not accurately reflect current market values. A shareholder may seek to engage in short-term trading to take advantage of these pricing differences (commonly referred to as “price arbitrage”). The investment adviser is authorized to use the fair value of a security if prices are unavailable or are deemed unreliable (see “Valuing Shares”). The use of fair value pricing and the restrictions on excessive trading and market timing described below are intended to reduce a shareholder’s ability to engage in price arbitrage to the detriment of the Fund.

The Boards of Trustees of the Eaton Vance funds have adopted policies to discourage short-term trading and market timing and to seek to minimize their potentially detrimental effects. Pursuant to these policies, if an investor (through one or more accounts) makes more than two round-trip exchanges (exchanging from one fund to another fund and back again) within 12 months, it will be deemed to constitute market timing or excessive trading. Under the policies, the Fund or its principal underwriter will reject or cancel a purchase order, suspend or terminate the exchange privilege or terminate the ability of an investor to invest in the Eaton Vance funds if the Fund or the principal underwriter determines that a proposed transaction involves market timing or excessive trading that it believes is likely to be detrimental to the Fund. The Fund and its principal underwriter cannot ensure that they will be able to identify all cases of market timing and excessive trading, although they be lieve they have adequate procedures in place to attempt to do so. The Fund or its principal underwriter may also reject or cancel any purchase order (including an exchange) from an investor or group of investors for any other reason. Decisions to reject or cancel purchase orders (including exchanges) in the Fund are inherently subjective and will be made in a manner believed to be in the best interest of the Fund’s shareholders. No Eaton Vance fund has any arrangement to permit market timing.

The Fund and the principal underwriter have provided guidance to financial intermediaries (such as banks, broker-dealers, insurance companies and retirement administrators) concerning the application of the Eaton Vance funds’ market timing and excessive trading policies to Fund shares held in omnibus accounts maintained and administered by such intermediaries, including guidance concerning situations where market timing or excessive trading is considered to be detrimental to the Fund. The Fund or its principal underwriter may rely on a financial intermediary’s policy to restrict market timing and excessive trading if it believes that policy is likely to prevent market timing that is likely to be detrimental to the Fund. Such policy may be more or less restrictive than the Fund’s policy. The Fund and the principal underwriter cannot ensure that these financial intermediaries will in all cases apply the policies of the Fund or their own policies, as the case may be, to accounts under their control.

Choosing a Share Class. The Fund offers different classes of shares. The different classes of shares represent investments in the same portfolio of securities, but the classes are subject to different sales charges and expenses and will likely have different share prices due to differences in class expenses. In choosing the class of shares that suits your investment needs, you should consider:

- how long you expect to own your shares;

- how much you intend to invest;

- the sales charge and total operating expenses associated with owning each class; and

- whether you qualify for a reduction or waiver of any applicable sales charges (see “Reducing or Eliminating Class A Sales Charges” under “Sales Charges” below).

Each investor’s considerations are different. You should speak with your investment dealer to help you decide which class of shares is best for you. Set forth below is a brief description of each class of shares offered by the Fund.

Class A shares are offered at net asset value plus a front-end sales charge of up to 4.75% . This charge is deducted from the amount you invest. The Class A sales charge is reduced for purchases of $25,000 or more. The sales charge applicable to your purchase may be reduced under the right of accumulation or a statement of intention,

9

which are described in “Reducing or Eliminating Class A Sales Charges” under “Sales Charges” below. Some investors may be eligible to purchase Class A shares at net asset value under certain circumstances, which are also described below. Class A shares pay distribution and service fees equal to 0.25% annually of average daily net assets. Returns on Class A Shares are generally higher than returns on Class B and Class C shares because Class A has lower annual expenses than those classes

Class B shares are offered at net asset value with no front-end sales charge. If you sell your Class B shares within six years of purchase, you generally will be subject to a contingent deferred sales charge or “CDSC”. The amount of the CDSC applicable to a redemption of Class B shares decreases over six years, as described in the CDSC schedule in “Contingent Deferred Sales Charge” under “Sales Charges” below. The CDSC is deducted from your redemption proceeds. Under certain circumstances, the Class B CDSC may be waived (such as in the case of the death of the shareholder). See “CDSC Waivers” under “Sales Charges” below. Class B shares pay distribution fees and service fees equal to 1.00% annually of average daily net assets. Returns on Class B shares are generally lower than returns on Class A shares because Class B has higher annual expenses than Class A. Because the sales charge applicable to Class A sh ares is reduced for larger purchases and Class A has lower operating expenses, purchasing Class B shares may not be appropriate if you are investing a large amount.

Orders for Class B shares of one or more Eaton Vance funds will be refused when the total value of the purchase (including the aggregate value of all Eaton Vance fund shares held within the purchasing shareholder’s account) is $100,000 or more. Investors considering cumulative purchases of $100,000 or more, or who, after a purchase of shares, would own shares of Eaton Vance funds with a current market value of $100,000 or more, should consider whether Class A shares would be more advantageous and consult their investment dealer.

Class C shares are offered at net asset value with no front-end sales charge. If you sell your Class C shares within one year of purchase, you generally will be subject to a CDSC. The CDSC is deducted from your redemption proceeds. Under certain circumstances, the Class C CDSC may be waived (such as certain redemptions from tax-deferred retirement plan accounts). See “CDSC Waivers” under “Sales Charges” below. Class C shares pay distribution fees and service fees equal to 1.00% annually of average daily net assets. Returns on Class C shares are generally lower than returns on Class A shares because Class C has higher annual expenses than Class A.

Orders for Class C shares of one or more Eaton Vance funds will be refused when the total value of the purchase (including the aggregate value of all Eaton Vance fund shares held within the purchasing shareholder’s account) is $1,000,000 or more. Investors considering cumulative purchases of $1,000,000 or more, or who, after a purchase of shares, would own shares of Eaton Vance funds with a current market value of $1,000,000 or more, should consider whether Class A shares would be more advantageous and consult their investment dealer.

Class I shares are offered to clients of financial intermediaries who charge such clients an ongoing fee for advisory, investment, consulting or similar services. Such clients may include individuals, corporations, endowments, foundations and qualified plans (as described above). Class I shares are also offered to investment and institutional clients of Eaton Vance and its affiliates and certain persons affiliated with Eaton Vance and certain fund service providers. Class I shares do not pay distribution or service fees. Returns on Class I shares generally are higher than returns on other classes because Class I has lower annual expenses.

Payments to Investment Dealers. In addition to payments disclosed under "Sales Charges" below, the principal underwriter, out of its own resources, may make cash payments to certain investment dealers who provide marketing support, transaction processing and/or administrative services and, in some cases, include some or all Eaton Vance funds in preferred or specialized selling programs. Payments made by the principal underwriter to an investment dealer may be significant and are typically in the form of fees based on Fund sales, assets, transactions processed and/or accounts attributable to that investment dealer. Investment dealers also may receive amounts from the principal underwriter in connection with educational or due diligence meetings that include information concerning Eaton Vance funds. The principal underwriter may pay or allow other promotional incentives or payments to investment dealers to the extent permitted by applicable laws and regulations.

Certain investment dealers that maintain “street name” or omnibus accounts provide sub-accounting, recordkeeping and/ or administrative services to the Eaton Vance funds and are compensated for such services by the funds. As used in this prospectus, the term “investment dealer” includes any broker, dealer, bank (including bank trust departments), registered investment adviser, financial planner, retirement plan administrator, their designated intermediaries and any other firm having a selling, administration or similar agreement with the principal underwriter or its affiliates.

10

Sales Charges

Class A Front-End Sales Charge. Class A shares are offered at net asset value per share plus a sales charge that is determined by the amount of your investment. The current sales charge schedule is:

| | | Sales Charge* | | Sales Charge* | | Dealer Commission |

| | | as Percentage of | | as Percentage of Net | | as Percentage of |

| Amount of Purchase | | Offering Price | | Amount Invested | | Offering Price |

|

| Less than $25,000 | | 4.75% | | 4.99% | | 4.50% |

| $25,000 but less than $100,000 | | 4.50% | | 4.71% | | 4.25% |

| $100,000 but less than $250,000 | | 3.75% | | 3.90% | | 3.50% |

| $250,000 but less than $500,000 | | 3.00% | | 3.09% | | 2.75% |

| $500,000 but less than $1,000,000 | | 2.00% | | 2.04% | | 2.00% |

| $1,000,000 or more | | 0.00** | | 0.00** | | 0.75% |

| * | Because the offering price per share is rounded to two decimal places, the actual sales charge you pay on a purchase of Class A shares may be more or less than your total purchase amount multiplied by the applicable sales charge percentage. |

| |

| ** | No sales charge is payable at the time of purchase on investments of $1 million or more. A CDSC of 1.00% will be imposed on such investments (as described below) in the event of redemptions within 18 months of purchase. |

| |

The principal underwriter may pay commissions of up to 1.00% on sales of Class A shares made at net asset value through the Eaton Vance Supplemental Retirement Account.

Reducing or Eliminating Class A Sales Charges. Front-end sales charges on purchases of Class A shares may be reduced under the right of accumulation or under a statement of intention. To receive a reduced sales charge, you must inform your investment dealer or the Fund at the time you purchase shares that you qualify for such a reduction. If you do not let your investment dealer or the Fund know you are eligible for a reduced sales charge at the time of purchase, you will not receive the discount to which you may otherwise be entitled.

Under the right of accumulation, the sales charge you pay is reduced if the current market value of your holdings in the Fund or any other Eaton Vance fund (based on the current maximum public offering price) plus your new purchase total $25,000 or more. Class A, Advisers Class, Class B, Class C, Class I and/or Class R shares of the Fund or other Eaton Vance funds, as well as shares of Eaton Vance Money Market Fund, owned by you may be included for this purpose. Shares of Eaton Vance Cash Management Fund and Eaton Vance Tax Free Reserves cannot be included under the right of accumulation. Shares owned by you, your spouse and children under age twenty-one may be combined for purposes of the right of accumulation, including shares held for the benefit of any of you in omnibus or “street name” accounts. In addition, shares held in a trust or fiduciary account of which any of the foregoing persons is the sole beneficiary (including retirement accounts) may be combined for pur poses of the right of accumulation. Shares purchased and/or owned in a SEP, SARSEP and SIMPLE IRA plan also may be combined for purposes of the right of accumulation for the plan and its participants. You may be required to provide documentation to establish your ownership of shares included under the right of accumulation (such as account statements for you, your spouse and children or marriage certificates, birth certificates and/or trust or other fiduciary-related documents).

Under a statement of intention, purchases of $25,000 or more made over a 13-month period are eligible for reduced sales charges. Shares eligible under the right of accumulation (other than those included in employer-sponsored retirement plans) may be included to satisfy the amount to be purchased under a statement of intention. Under a statement of intention, the principal underwriter may hold 5% of the dollar amount to be purchased in escrow in the form of shares registered in your name until you satisfy the statement or the 13-month period expires. A statement of intention does not obligate you to purchase (or the Fund to sell) the full amount indicated in the statement.

Class A shares are offered at net asset value (without a sales charge) to clients of financial intermediaries who (i) charge an ongoing fee for advisory, investment, consulting or similar services, or (ii) have entered into an agreement with the principal underwriter to offer Class A shares through a no-load network or platform. Such clients may include individuals, corporations, endowments and foundations. Class A shares also are offered at net asset value to investment and institutional clients of Eaton Vance and its affiliates; certain persons affiliated with Eaton Vance; and to certain fund service providers as described in the Statement of Additional Information. Class A shares may also be purchased at net asset value

11

pursuant to the reinvestment privilege and exchange privilege and when distributions are reinvested. See “Shareholder Account Features” for details.

Contingent Deferred Sales Charge. Class A, Class B and Class C shares are subject to a CDSC on certain redemptions. Class A shares purchased at net asset value in amounts of $1 million or more are subject to a 1.00% CDSC if redeemed within 18 months of purchase. In addition, Class A shares purchased through the Eaton Vance Supplemental Retirement Account (regardless of the amount of the purchase) are subject to a CDSC equal to 1% if redeemed within one year of purchase and a CDSC of 0.50% if redeemed within two years of purchase. Class C shares are subject to a 1.00% CDSC if redeemed within one year of purchase. Class B shares are subject to the following CDSC schedule:

| Year of Redemption After Purchase | | CDSC | | CDSCs are based on the lower of the net asset value at |

| First or Second | | 5% | | the time of purchase or at the time of redemption. |

| Third | | 4% | | Shares acquired through the reinvestment of |

| Fourth | | 3% | | distributions are exempt from the CDSC. Redemptions |

| Fifth | | 2% | | are made first from shares that are not subject to a |

| Sixth | | 1% | | CDSC. |

| Seventh or following | | 0% | | |

The sales commission payable to investment dealers in connection with sales of Class B and Class C shares is described under “Distribution and Service Fees” below.

CDSC Waivers. CDSCs are waived for certain redemptions pursuant to a Withdrawal Plan (see “Shareholder Account Features”). The CDSC is also waived following the death of a beneficial owner of shares (a death certificate and other applicable documents may be required).

Conversion Feature. After eight years, Class B shares automatically convert to Class A shares. Class B shares acquired through the reinvestment of distributions convert in proportion to shares not so acquired.

Distribution and Service Fees. Class A, Class B and Class C shares have in effect plans under Rule 12b-1 that allow the Fund to pay distribution fees for the sale and distribution of shares (so-called “12b-1 fees”) and service fees for personal and/or shareholder account services. Class B and Class C shares pay distribution fees to the principal underwriter of 0.75% of average daily net assets annually. Because these fees are paid from Fund assets on an ongoing basis, they will increase your cost over time and may cost you more than paying other types of sales charges. The principal underwriter compensates investment dealers on sales of Class B and Class C shares (except exchange transactions and reinvestments) in an amount equal to 4% and 1%, respectively, of the purchase price of the shares. After the first year, investment dealers also receive 0.75% of the value of Class C shares in annual distribution fees. Class B and Class C shares also pa y service fees to the principal underwriter equal to 0.25% of average daily net assets annually. Class A shares pay distribution and service fees equal to 0.25% of average daily net assets annually. After the sale of shares, the principal underwriter receives the Class A distribution and service fees and the Class B and Class C service fees for one year and thereafter investment dealers generally receive them based on the value of shares sold by such dealers for shareholder servicing performed by such investment dealers. Distribution and service fees are subject to the limitations contained in the sales charge rule of the Financial Industry Regulatory Authority.

More information about sales charges is available free of charge on the Eaton Vance website at www.eatonvance.com and in the Statement of Additional Information. Please consult the Eaton Vance website for any updates to sales charge information before making a purchase of Fund shares.

12

Redeeming Shares

You can redeem shares in any of the following ways:

| By Mail | | Send your request to the transfer agent along with any certificates and stock |

| | | powers. The request must be signed exactly as your account is registered and |

| | | signature guaranteed. You can obtain a signature guarantee at banks, savings and |

| | | loan institutions, credit unions, securities dealers, securities exchanges, clearing |

| | | agencies and registered securities associations that participate in the Securities |

| | | Transfer Association’s Medallion Program. Only signature guarantees issued in |

| | | accordance with the Securities Transfer Association’s Medallion Guarantee |

| | | Program (STAMP) will be accepted. You may be asked to provide additional |

| | | documents if your shares are registered in the name of a corporation, partnership |

| | | or fiduciary. |

| By Telephone | | You can redeem up to $100,000 per account (which may include shares of one or |

| | | more Eaton Vance funds) per day by calling 1-800-262-1122 Monday through |

| | | Friday, 8:00 a.m. to 7:00 p.m. (eastern time). Proceeds of a telephone redemption |

| | | can be mailed only to the account address. Shares held by corporations, trusts or |

| | | certain other entities and shares that are subject to fiduciary arrangements cannot |

| | | be redeemed by telephone. |

If you redeem shares, your redemption price will be based on the net asset value per share next computed after the redemption request is received in good order by the Fund’s transfer agent. Your redemption proceeds will be paid in cash within seven days, reduced by the amount of any applicable CDSC and any federal income tax required to be withheld. Payments will be sent by mail. However, if you have given complete written authorization in advance, you may request that the redemption proceeds be wired directly to your bank account. The bank designated may be any bank in the United States. The request may be made by calling 1-800-262-1122 or by sending a signature guaranteed letter of instruction to the transfer agent (see back cover for address). Corporations, trusts and other entities may need to provide additional documentation. You may be required to pay the costs of such transaction by the Fund or your bank. No costs are currently charged by the Fund. The Fund may suspend or terminate the expedited payment procedure upon at least 30 days notice.

If you recently purchased shares, the proceeds of a redemption will not be sent until the purchase check (including a certified or cashier’s check) has cleared. If the purchase check has not cleared, redemption proceeds may be delayed up to 15 days from the purchase date. If your account value falls below $750 (other than due to market decline), you may be asked either to add to your account or redeem it within 60 days. If you take no action, your account will be redeemed and the proceeds sent to you.

While redemption proceeds are normally paid in cash, redemptions may be paid by distributing marketable securities. If you receive securities, you could incur brokerage or other charges in converting the securities to cash.

Shareholder Account Features

Once you purchase shares, the transfer agent establishes an account for you.

Distributions. You may have your Fund distributions paid in one of the following ways:

| •Full Reinvest Option | | Dividends and capital gains are reinvested in additional shares. This option will be |

| | | assigned if you do not specify an option. |

| •Partial Reinvest Option | | Dividends are paid in cash and capital gains are reinvested in additional shares. |

| •Cash Option | | Dividends and capital gains are paid in cash. |

| •Exchange Option | | Class A, Class B and Class C dividends and/or capital gains are reinvested in |

| | | additional shares of any class of another Eaton Vance fund chosen by you, subject |

| | | to the terms of that fund’s prospectus. Before selecting this option, you must |

| | | obtain a prospectus of the other fund and consider its objectives, risks, and charges |

| | | and expenses carefully. |

13

Information about the Fund. From time to time, you may be mailed the following:

•Semiannual and annual reports containing a list of portfolio holdings as of the end of the second and fourth fiscal quarters, respectively, performance information and financial statements.

•Periodic account statements, showing recent activity and total share balance.

•Form 1099 and tax information needed to prepare your income tax returns.

•Proxy materials, in the event a shareholder vote is required.

•Special notices about significant events affecting your Fund.

The Fund will file with the Securities and Exchange Commission (“SEC”) a list of its portfolio holdings as of the end of the first and third fiscal quarters on Form N-Q. The Fund’s annual and semiannual reports (as filed on Form N-CSR) and each Form N-Q may be viewed on the SEC’s website (www.sec.gov). The most recent fiscal quarter end holdings may also be viewed on the Eaton Vance website (www.eatonvance.com). Portfolio holdings information that is filed with the SEC is posted on the Eaton Vance website approximately 60 days after the end of the quarter to which it relates. Portfolio holdings information as of each calendar quarter end is posted to the website 30 days after such quarter end. The Fund also posts information about certain portfolio characteristics (such as top ten holdings and asset allocation) as of the most recent calendar quarter end on the Eaton Vance website approximately ten business days after the calendar quarter end.

The Eaton Vance funds have established policies and procedures with respect to the disclosure of portfolio holdings and other information concerning Fund characteristics. A description of these policies and procedures is provided in the Statement of Additional Information. Such policies and procedures regarding disclosure of portfolio holdings are designed to prevent the misuse of material, non-public information about the funds.

Withdrawal Plan. You may redeem shares on a regular monthly or quarterly basis by establishing a systematic withdrawal plan. Withdrawals will not be subject to any applicable CDSC if they are, in the aggregate, less than or equal to 12% annually of the greater of either the initial account balance or the current account balance. Because purchases of Class A shares are generally subject to an initial sales charge, Class A shareholders should not make withdrawals from their accounts while also making purchases.

Exchange Privilege. You may exchange your Fund shares for shares of the same Class of another Eaton Vance fund, or in the case of Class B and Class C shares, Eaton Vance Money Market Fund. Exchanges are made at net asset value. If your shares are subject to a CDSC, the CDSC will continue to apply to your new shares at the same CDSC rate. For purposes of the CDSC, your shares will continue to age from the date of your original purchase of Fund shares.

Before exchanging, you should read the prospectus of the new fund carefully. Exchanges are subject to the terms applicable to purchases of the new fund’s shares as set forth in its prospectus. If you wish to exchange shares, write to the transfer agent (see back cover for address) or call 1-800-262-1122. Periodic automatic exchanges are also available. The exchange privilege may be changed or discontinued at any time. You will receive 60 days’ notice of any material change to the privilege. This privilege may not be used for “market timing”. If an account (or group of accounts) makes more than two round-trip exchanges (exchanged from one fund to another and back again) within 12 months, it will be deemed to be market timing. As described under “Purchasing Shares”, the exchange privilege may be terminated for market timing accounts or for other reasons.

Reinvestment Privilege. If you redeem shares, you may reinvest at net asset value all or any portion of the redemption proceeds in the same class of shares of the Fund you redeemed from, provided that the reinvestment occurs within 60 days of the redemption, and the privilege has not been used more than once in the prior 12 months. Under these circumstances your account will be credited with any CDSC paid in connection with the redemption. Any CDSC period applicable to the shares you acquire upon reinvestment will run from the date of your original share purchase. Reinvestment requests must be in writing. At the time of a reinvestment, you or your financial intermediary must notify the Fund or the transfer agent that you are reinvesting redemption proceeds in accordance with this privilege. If you reinvest, your purchase will be at the next determined net asset value following receipt of your request.

Telephone and Electronic Transactions. You can redeem or exchange shares by telephone as described in this prospectus. In addition, certain transactions may be conducted through the Internet. The transfer agent and the principal underwriter have procedures in place to authenticate telephone and electronic instructions (such as using security codes or verifying personal account information). As long as the transfer agent and principal underwriter follow reasonable procedures, they will not be responsible for unauthorized telephone or electronic transactions and you bear the risk of possible loss resulting from these transactions. You may decline the telephone redemption option on the account application. Telephone instructions are recorded.

14

“Street Name” Accounts. If your shares are held in a “street name” account at an investment dealer, that dealer (and not the Fund or its transfer agent) will perform all recordkeeping, transaction processing and distribution payments. Because the Fund will have no record of your transactions, you should contact your investment dealer to purchase, redeem or exchange shares, to make changes in your account, or to obtain account information. You will not be able to utilize a number of shareholder features, such as telephone transactions, directly with the Fund. If you transfer shares in a “street name” account to an account with another investment dealer or to an account directly with the Fund, you should obtain historical information about your shares prior to the transfer.

Procedures for Opening New Accounts. To help the government fight the funding of terrorism and money laundering activities, federal law requires the Fund to obtain, verify and record information that identifies each person who opens a Fund account, and the Fund has designated an anti-money laundering compliance officer. When you open an account, the transfer agent or your investment dealer will ask you for your name, address, date of birth and other identifying information. You also may be asked to produce a copy of your driver’s license and other identifying documents. If a person fails to provide the information requested, any application by that person to open a new account will be rejected. Moreover, if the transfer agent or the investment dealer is unable to verify the identity of a person based on information provided by that person, it may take additional steps including, but not limited to, requesting additional information from the person, c losing the person’s account or reporting the matter to the appropriate federal authorities. If your account is closed for this reason, your shares may be automatically redeemed. If the Fund’s net asset value has decreased since your purchase, you will lose money as a result of this redemption.

Account Questions. If you have any questions about your account or the services available, please call Eaton Vance Shareholder Services at 1-800-262-1122, or write to the transfer agent (see back cover for address).

The Fund declares dividends daily and ordinarily pays distributions monthly. Different Classes will distribute different dividend amounts. Your account will be credited with dividends beginning on the business day after the day when the funds used to purchase your Fund shares are collected by the transfer agent. For tax purposes, the entire monthly distribution of the Fund’s daily dividends ordinarily will constitute federally tax-exempt income to you. Distribution of any net realized gains will be made once each year (usually in December). The exemption of “exempt-interest dividend” income from regular federal income taxation does not necessarily result in similar exemptions from such income under the state or local tax laws.

The Fund may invest a portion of its assets in securities that generate income that is not exempt from federal income tax. Taxes on distributions of capital gains are determined by how long the Fund owned the investments that generated them, rather than how long a shareholder has owned his or her shares in the Fund. Distributions of any taxable income and net short-term capital gains will be taxable as ordinary income. Distributions of any long-term capital gains are taxable as long-term capital gains. Distributions of interest on certain municipal obligations are a tax preference item under the AMT provisions applicable to individuals and corporations, and all tax-exempt distributions may affect a corporation’s AMT liability. The Fund’s distributions will be treated as described above for federal income tax purposes whether they are paid in cash or reinvested in additional shares. A redemption of Fund shares, including an exchange for shares of another fund, is a taxable transaction.

Shareholders, particularly corporations, recipients of social security or railroad retirement benefits and those subject to alternative minimum tax, should consult with their advisers concerning the applicability of federal, state, local and other taxes to an investment.

15

Financial Highlights

The financial highlights are intended to help you understand the Fund’s financial performance for the past five years. Certain information in the tables reflect the financial results for a single Fund share. The total returns in the table represent the rate an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all distributions and not taking into account a sales charge). This information has been audited by Deloitte & Touche LLP, an independent registered public accounting firm. The report of Deloitte & Touche LLP and the Fund’s financial statements are incorporated herein by reference and included in the Fund’s annual report, which is available on request.

| | | | | | | | | Year Ended September 30, | | | | | | | | |

| |

|

| | | | | 2007(1) | | | | | | | | | | 2006(1) | | |

| |

|

| | | Class A | | Class B | | | | Class C | | Class I | | Class A | | Class B | | Class C | | Class I |

|

| |

| Net asset value - Beginning of year | | $ 11.780 | | $ 11.780 | | $ | | 11.780 | | $ 11.780 | | $ 11.270 | | $ 11.270 | | $ 11.270 | | $11.270 |

| |

| Income (loss) from operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | $ 0.521 | | $ 0.434 | | $ | | 0.431 | | $ 0.549 | | $ | | 0.565 | | $ 0.478 | | $ 0.480 | | $ 0.601 |

| Net realized and unrealized gain (loss) | | (0.290) | | (0.290) | | | | (0.287) | | (0.289) | | | | 0.478 | | 0.480 | | 0.478 | | 0.471 |

| Total income from operations | | $ 0.231 | | $ 0.144 | | $ | | 0.144 | | $ 0.260 | | $ | | 1.043 | | $ 0.958 | | $ 0.958 | | $ 1.072 |

| |

| Less distributions | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | $ (0.521) | | $ (0.434) | | $ | | (0.434) | | $ (0.550) | | $ | | (0.533) | | $ (0.448) | | $ (0.448) | | $ (0.562) |

| Total distributions | | $ (0.521) | | $ (0.434) | | $ | | (0.434) | | $ (0.550) | | $ | | (0.533) | | $ (0.448) | | $ (0.448) | | $ (0.562) |

| Contingent deferred sales charges | | — | | — | | | | — | | — | | | | — | | — | | — | | — |

| Net asset value - End of year | | $ 11.490 | | $ 11.490 | | $ | | 11.490 | | $ 11.490 | | $ 11.780 | | $ 11.780 | | $ 11.780 | | $11.780 |

| Total Return(2) | | 1.95% | | 1.20% | | | | 1.20% | | 2.20% | | | | 9.50% | | 8.69% | | 8.69% | | 9.77% |

| |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s omitted) | | $4,647,177 | | $173,176 | | $1,334,054 | | $139,301 | | $3,259,363 | | $140,593 | | $783,143 | | $82,723 |

| Ratios (As a percentage of average daily net assets): | | | | | | | | | | | | | | | | | | | | |

| Expenses excluding interest and fees | | 0.64%(5) | | 1.39%(5) | | | | 1.39%(5) | | 0.39%(5) | | | | 0.72% | | 1.47% | | 1.47% | | 0.47% |

| Interest and fee expense(7) | | 0.62% | | 0.62% | | | | 0.62% | | 0.62% | | | | 0.61% | | 0.61% | | 0.61% | | 0.61% |

| Total expenses before custodian fee reduction | | 1.26%(5) | | 2.01%(5) | | | | 2.01%(5) | | 1.01%(5) | | | | 1.33% | | 2.08% | | 2.08% | | 1.08% |

| Expenses after custodian fee reduction excluding interest | | | | | | | | | | | | | | | | | | | | |

| and fees | | 0.63%(5) | | 1.38%(5) | | | | 1.38%(5) | | 0.38%(5) | | | | 0.71% | | 1.46% | | 1.46% | | 0.46% |

| Net investment income | | 4.44% | | 3.69% | | | | 3.68% | | 4.68% | | | | 4.93% | | 4.17% | | 4.18% | | 5.22% |

| Portfolio Turnover of the Portfolio(8) | | — | | — | | | | — | | — | | | | — | | — | | — | | — |

| Portfolio Turnover of the Fund | | 65% | | 65% | | | | 65% | | 65% | | | | 58% | | 58% | | 58% | | 58% |

(See footnotes on last page.)

16

Financial Highlights (continued)

| | | | | | | | | Year Ended September 30, | | | | | | |

| |

|

| | | | | 2005(1) | | | | | | 2004(1) | | |

| |

|

| | | Class A | | Class B | | Class C | | Class I | | Class A | | Class B | | Class C | | Class I |

|

| |

| Net asset value - Beginning of year | | $ 10.920 | | $10.920 | | $ 10.920 | | $10.920 | | $ 10.840 | | $10.850 | | $ 10.840 | | $10.850 |

| |

| Income (loss) from operations | | | | | | | | | | | | | | | | |

| Net investment income | | $ 0.574 | | $ 0.482 | | $ 0.486 | | $ 0.590 | | $ 0.654 | | $ 0.598 | | $ 0.565 | | $ 0.673 |

| Net realized and unrealized gain (loss) | | 0.355 | | 0.364 | | 0.360 | | 0.368 | | 0.079 | | 0.063 | | 0.087 | | 0.078 |

| Total income from operations | | $ 0.929 | | $ 0.846 | | $ 0.846 | | $ 0.958 | | $ 0.733 | | $ 0.661 | | $ 0.652 | | $ 0.751 |

| |

| Less distributions | | | | | | | | | | | | | | | | |

| From net investment income | | $ (0.579) | | $ (0.496) | | $ (0.496) | | $ (0.608) | | $ (0.653) | | $ (0.595) | | $ (0.572) | | $ (0.681) |

| Total distributions | | $ (0.579) | | $ (0.496) | | $ (0.496) | | $ (0.608) | | $ (0.653) | | $ (0.595) | | $ (0.572) | | $ (0.681) |

| Contingent deferred sales charges | | — | | — | | — | | — | | — | | $ 0.004 | | — | | — |