UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file Number 811-04471

Value Line Aggressive Income Trust

(Exact name of registrant as specified in charter)

220 East 42nd Street, New York, N.Y. 10017

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 212-907-1500

Date of fiscal year end: January 31, 2010

Date of reporting period: January 31, 2010

Item I. Reports to Stockholders.

A copy of the Annual Report to Stockholders for the period ended 1/31/10 is included with this Form.

| | | | | | |

| | | | | | |

| INVESTMENT ADVISER | | EULAV Asset Management, LLC | | A N N U A L R E P O R T | |

| | | 220 East 42nd Street | | J a n u a r y 3 1 , 2 0 1 0 | |

| | | New York, NY 10017-5891 | | | |

| | | | | | |

| DISTRIBUTOR | | EULAV Securities, Inc. 220 East 42nd Street New York, NY 10017-5891 | | | |

| | | | | | |

| CUSTODIAN BANK | | State Street Bank and Trust Co. 225 Franklin Street Boston, MA 02110 | | | |

| | | | | | |

| SHAREHOLDER | | State Street Bank and Trust Co. | | | |

| SERVICING AGENT | | c/o BFDS P.O. Box 219729 Kansas City, MO 64121-9729 | | | |

| | | | | | |

| INDEPENDENT | | PricewaterhouseCoopers LLP | | Value Line Aggressive Income Trust | |

REGISTERED PUBLIC ACCOUNTING FIRM LEGAL COUNSEL | | 300 Madison Avenue New York, NY 10017 Peter D. Lowenstein, Esq. 496 Valley Road Cos Cob, CT 06807-0272 | | |

| | | | | |

| DIRECTORS | | Joyce E. Heinzerling Francis C. Oakley David H. Porter Paul Craig Roberts Thomas T. Sarkany Nancy-Beth Sheerr Daniel S. Vandivort | | |

| | | | | | |

| OFFICERS | | Mitchell E. Appel President Howard A. Brecher Vice President and Secretary Michael J. Wagner Chief Compliance Officer Emily D. Washington Treasurer | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| This audited report is issued for information to shareholders. It is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of the Trust (obtainable from the Distributor). | | | |

| #00071695 | | | |

Value Line Aggressive Income Trust

| To Our Value Line Aggressive |

To Our Shareholders (unaudited):

Enclosed is your annual report for the period ended January 31, 2010. I encourage you to carefully review this report, which includes our economic observations, your Trust’s performance data and highlights, schedule of investment holdings, and financial statements.

For the twelve months ended January 31, 2010, the total return of the Value Line Aggressive Income Trust was 28.92%. During the past year, high-yield fixed income securities posted their strongest returns in the roughly 20-year history of the category. The Federal stimulus programs, both fiscal and monetary, began to take hold in 2009 and helped thaw the frozen credit environment. With improved liquidity and yield spreads at record levels, investors began to move back into the riskier assets classes. While default rates increased to 12% last year, the level was contained by many of the U.S. Government’s bailout and guarantee programs. As the economy looks to grow in the year ahead, and banks extend some of the maturities of their most leveraged loan s, the default rate is expected to drop back to its historical norm in the mid-single digits in 2010.

Given the uncertain investment environment in 2009, the Trust took a very conservative investment stance. As it has traditionally done, it limited its investment holdings in the lowest rated securities (CCC and below) due to their historically high default rates. We also underweighted the financial sector given our concerns about continued bad debt problems in both the residential and commercial real estate areas. These sectors proved to be the strongest return segments, with CCC and below rated issues providing nearly twice the return of the overall industry. In addition, the Trust held a cash position in the high-single digit area, given potential liquidity concerns, which also proved to be a drag on performance. During the past year, the Trust trailed the returns of the average High Yield Bond Fund, as measured by Lipper Inc., which gained 41.44%, and the Barclay’s Capital U.S. Corporate High Yield Index, a proxy for the overall high-yield market, which rose 58.21% for the same period. Despite this one year lag, the Trust remains competitive with its peer group over the last 3- and 5-year periods.

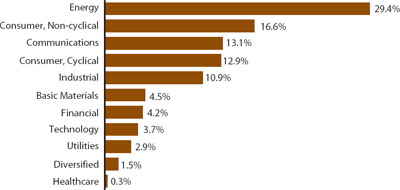

The Trust continues to seek good risk/reward investment opportunities in an effort to maintain the current yield of the Trust in a falling rate environment. Energy-related securities continue to account for the largest sector weighting of the Trust. While commodity prices in this sector can be volatile, we still like this investment segment considering its strong cash flows and earnings potential. Preserving capital in difficult market environments, while allowing for an attractive dividend yield, remains our goal. We thank you for your continued investment with us.

| | Sincerely, |

| | |

| | /s/ Mitchell Appel |

| | Mitchell Appel, President |

| | March 18, 2010 |

| | |

| (1) | The Lipper High Current Yield Bond Funds Average aims at high (relative) current yield from fixed income securities, has no quality or maturity restrictions, and tends to invest in lower grade debt issues. An investment cannot be made in Peer Group Average. |

| | |

| (2) | The Barclays Capital U.S. Corporate High Yield Index is representative of the broad based fixed-income market. It includes non-investment grade corporate bonds. The returns for the Index do not reflect charges, expenses, or taxes, and it is not possible to directly invest in this unmanaged Index. |

Value Line Aggressive Income Trust

| Income Trust Shareholders |

Economic Observations (unaudited)

The recession, which commenced in the latter stages of 2007 and proved to be long and severe, most likely ended in the third quarter of last year, although the National Bureau of Economic Research, which assigns dates to the beginning and end of recessions, has yet to determine the exact conclusion of the recent downturn. In all, the business contraction—which produced a succession of quarterly declines in the nation’s gross domestic product along with countless additional upheavals—apparently concluded with the restoration of a modest 2.2% rise in GDP in the third quarter of 2009. The nascent up cycle was underpinned initially by strengthening consumer spending, lesser declines in housing construction and home sales (with that ailing se ctor boosted by government assistance for first-time home buyers), and an irregular comeback in business spending.

Going forward, the upturn should be supported by further, but uneven, improvement in consumer and industrial activity. It is worth noting that the prospective rate of GDP growth in the year upcoming should be, at an estimated 2.5%-3.0%, well below the historical norm of 3.0%-4.0%. The problem is that there is just too much overall weakness in certain critical sectors—notably housing and employment—to generate the greater levels of consumer spending needed for significantly higher levels of economic growth, in our opinion.

The long and painful recession was traceable to several events, beginning with sharp declines in housing construction, home sales, and real estate prices. We also experienced a large reduction in credit availability, a high level of bank failures, increasing foreclosures and bank repossessions, a multi-decade high in unemployment, weak retail activity, and trendless manufacturing. Unfortunately, several of these problems are likely to stay with us for some time—notably the weakness in housing and employment. Such continuing difficulties underscore why we expect below-trend rates of U.S. GDP growth though 2010. Encouragingly, though, most business barometers are now either stabilizing or improving selectively. It is much the same overseas, where seve re business declines had been seen earlier across Europe and Asia. Those prior setbacks, which generally got under way several months after our own reversal commenced, have also largely run their course. Following this initially moderate business recovery stateside, we would look for sufficient brightening in housing and employment to help underpin a more substantial economic recovery in 2011 and through the middle years of the next decade. By then, in fact, we would expect GDP growth to average a fairly sustainable 3.0%-3.5%.

Inflation, which moved up sharply last year, following dramatic gains in oil, food, and commodity prices, has moved onto a more irregular path recently. Going forward, we expect pricing to chart an uneven path, with further up-and-down swings in oil and commodities being the norm, as the economy’s expansion matures. On average, we think that pricing will increase less sharply over the next year or two than it did before the 2007-2009 recession. Looking further out, we expect pricing pressures to evolve later on in the business up cycle—as is only natural, as demand for labor and materials increases. The Federal Reserve, meanwhile, continues to express support for an accommodative monetary approach. As a result, we believe that it is unlikely t o start raising interest rates until well into 2010, and to do so rather gently once it does finally opt to tighten the credit reins. Clearly, the risks to the sustainability of the economic up cycle appear too great for the Fed to consider tightening aggressively anytime soon.

Overall, we see a comparatively benign period ahead for the equity and fixed-income markets over the next year or so.

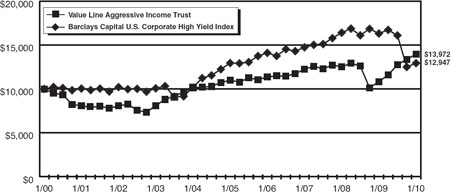

Value Line Aggressive Income Trust

The following graph compares the performance of the Value Line Aggressive Income Trust to that of the Barclays Capital U.S. Corporate High Yield Index. The Value Line Aggressive Income Trust is a professionally managed mutual fund, while the Indices are not available for investment and are unmanaged. The returns for the Indices do not reflect charges, expenses or taxes, but do include the reinvestment of dividends. The comparison is shown for illustrative purposes only.

Comparison of a Change in Value of a $10,000 Investment in the

Value Line Aggressive Income Trust and the Barclays Capital

U.S. Corporate High Yield Index*

Performance Data: **

| | | | | | | | | |

| | | Average Annual Total Return | | | Growth of an Assumed Investment of $10,000 | |

| | | | | | | | | |

| 1 year ended 1/31/10 | | | 28.92 | % | | $ | 12,892 | |

| 5 years ended 1/31/10 | | | 4.89 | % | | $ | 12,698 | |

| 10 years ended 1/31/10 | | | 3.40 | % | | $ | 13,972 | |

| | |

| * | The Barclays Capital U.S. Corporate High Yield Index is representative of the broad based fixed-income market. It includes non-investment grade corporate bonds. The returns for the Index do not reflect charges, expenses, or taxes, which are deducted from the Trust’s returns, and it is not possible to directly invest in this unmanaged Index. |

| | |

| ** | The performance data quoted represent past performance and are no guarantee of future performance. The average annual total returns and growth of an assumed investment of $10,000 include dividends reinvested and capital gains distributions accepted in shares. The investment return and principal value of an investment will fluctuate so that an investment, when redeemed, may be worth more or less than its original cost. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on trust distributions or the redemption of trust shares. |

Value Line Aggressive Income Trust

| |

| |

| TRUST EXPENSES (unaudited): |

Example

As a shareholder of the Trust, you incur ongoing costs, including management fees, distribution and service (12b-1) fees, and other Trust expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Trust and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2009 through January 31, 2010).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Trust’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Trust’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Trust and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | |

| | | Beginning account value 8/1/09 | | | Ending account value 1/31/10 | | | Expenses paid during period 8/1/09 thru 1/31/10* | |

| | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,093.74 | | | $ | 6.41 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.08 | | | $ | 6.18 | |

| | |

| * | Expenses are equal to the Trust’s annualized expense ratio of 1.21% multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. This expense ratio may differ from the expense ratio shown in the Financial Highlights. |

Value Line Aggressive Income Trust

| |

| Portfolio Highlights at January 31, 2010 (unaudited) |

Ten Largest Holdings

| | | | | | | | | | |

| Issue | | Principal Amount | | | Value | | | Percentage of Net Assets | |

| Williams Companies, Inc., Senior Notes, 7.13%, 9/1/11 | | $ | 600,000 | | | $ | 657,000 | | | | 1.7 | % |

Ferrellgas Escrow LLC/Ferrellgas Finance Escrow Corp., Senior Notes, 6.75%, 5/1/14 | | $ | 600,000 | | | $ | 591,000 | | | | 1.6 | % |

| Principal Financial Group, Inc., Senior Notes, 7.88%, 5/15/14 | | $ | 500,000 | | | $ | 572,293 | | | | 1.5 | % |

| Nabors Industries, Inc., Guaranteed Senior Notes, 6.15%, 2/15/18 | | $ | 495,000 | | | $ | 529,234 | | | | 1.4 | % |

| Plains Exploration & Production Co., Senior Notes, 7.75%, 6/15/15 | | $ | 500,000 | �� | | $ | 510,000 | | | | 1.4 | % |

| Whiting Petroleum Corp., Senior Notes, 7.25%, 5/1/13 | | $ | 500,000 | | | $ | 506,250 | | | | 1.3 | % |

| Encore Acquisition Co., Senior Subordinated Notes, 6.25%, 4/15/14 | | $ | 500,000 | | | $ | 501,875 | | | | 1.3 | % |

| KCS Energy, Inc., Senior Notes, 7.13%, 4/1/12 | | $ | 500,000 | | | $ | 498,750 | | | | 1.3 | % |

| EchoStar DBS Corp., Senior Notes, 6.63%, 10/1/14 | | $ | 500,000 | | | $ | 496,250 | | | | 1.3 | % |

| Gulfmark Offshore, Inc., Guaranteed Notes, 7.75%, 7/15/14 | | $ | 500,000 | | | $ | 496,250 | | | | 1.3 | % |

| Asset Allocation – Percentage of Total Net Assets |

| |

| Sector Weightings – Percentage of Total Investment Securities |

| | Value Line Aggressive Income Trust |

| | |

| Schedule of Investments | January 31, 2010 |

| | | | | | | | |

Principal Amount | | | | Value | |

| CORPORATE BONDS & NOTES (76.1%) | | | | |

| | | | | |

| | | | BASIC MATERIALS (3.0%) | | | | |

| $ | 400,000 | | Dow Chemical Co. (The), Senior Notes, 8.55%, 5/15/19 | | $ | 478,368 | |

| | 300,000 | | Freeport-McMoRan Copper & Gold, Inc., Senior Notes, 8.25%, 4/1/15 | | | 324,750 | |

| | 346,000 | | United States Steel Corp., Senior Notes, 5.65%, 6/1/13 | | | 345,296 | |

| | | | | | | 1,148,414 | |

| | | | | | | | |

| | | | COMMUNICATIONS (10.3%) | | | | |

| | 400,000 | | American Tower Corp., Senior Notes, 7.00%, 10/15/17 | | | 444,500 | |

| | 350,000 | | Cricket Communications, Inc., 9.38%, 11/1/14 | | | 348,250 | |

| | 300,000 | | Crown Castle International Corp., Senior Notes, 9.00%, 1/15/15 | | | 325,125 | |

| | 350,000 | | DirecTV Holdings LLC/Direc TV Financing Co., Senior Notes, 6.38%, 6/15/15 | | | 362,687 | |

| | 500,000 | | EchoStar DBS Corp., Senior Notes, 6.63%, 10/1/14 | | | 496,250 | |

| | 400,000 | | Hughes Network Systems LLC, Senior Notes, 9.50%, 4/15/14 | | | 409,000 | |

| | 350,000 | | MetroPCS Wireless, Inc., Senior Notes, 9.25%, 11/1/14 | | | 352,188 | |

| | 400,000 | | Qwest Corp., Senior Notes, 8.88%, 3/15/12 | | | 429,500 | |

| | 350,000 | | Sprint Capital Corp., 8.38%, 3/15/12 | | | 356,125 | |

| | 350,000 | | Windstream Corp., Senior Notes, 8.13%, 8/1/13 | | | 367,500 | |

| | | | | | | 3,891,125 | |

| | | | | | | | |

| | | | CONSUMER, CYCLICAL (11.5%) | | | | |

| | 350,000 | | AmeriGas Partners L.P., Senior Notes, 7.25%, 5/20/15 | | | 355,250 | |

| | 500,000 | | Boyd Gaming Corp., Senior Subordinated Notes, 6.75%, 4/15/14 | | | 462,500 | |

Principal Amount | | | | | Value | |

| | | | | | | | |

| $ | 210,000 | | Dillard’s, Inc., Senior Notes, 7.85%, 10/1/12 | | $ | 211,050 | |

| | 600,000 | | Ferrellgas Escrow LLC/ Ferrellgas Finance Escrow Corp., Senior Notes, 6.75%, 5/1/14 | | | 591,000 | |

| | 500,000 | | Ford Motor Co., Global Landmark Securities, Senior Notes, 7.45%, 7/16/31 | | | 445,000 | |

| | 350,000 | | Goodyear Tire & Rubber Co. (The), Senior Notes, 10.50%, 5/15/16 | | | 379,750 | |

| | 400,000 | | Inergy LP/Inergy Finance Corp., Senior Notes, 8.25%, 3/1/16 | | | 409,000 | |

| | 444,000 | | Payless ShoeSource, Inc., Senior Subordinated Notes, 8.25%, 8/1/13 | | | 453,435 | |

| | 350,000 | | Phillips-Van Heusen Corp., Senior Notes, 7.25%, 2/15/11 | | | 350,875 | |

| | 300,000 | | Royal Caribbean Cruises Ltd., Senior Notes, 6.88%, 12/1/13 | | | 297,000 | |

| | 400,000 | | Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp., Senior Mortgage Notes, 6.63%, 12/1/14 | | | 383,000 | |

| | | | | | | 4,337,860 | |

| | | | | | | | |

| | | | CONSUMER, NON-CYCLICAL (11.3%) | | | | |

| | 400,000 | | Bausch & Lomb, Inc., Senior Notes, 9.88%, 11/1/15 | | | 420,000 | |

| | 300,000 | | Chiquita Brands International, Inc., Senior Notes, 7.50%, 11/1/14 | | | 294,000 | |

| | 450,000 | | Community Health Systems, Inc., Senior Notes, 8.88%, 7/15/15 | | | 465,188 | |

| | 400,000 | | Constellation Brands, Inc., Senior Notes, 7.25%, 5/15/17 | | | 401,500 | |

| | 300,000 | | Dean Foods Co., Senior Notes, 7.00%, 6/1/16 | | | 292,500 | |

| | 300,000 | | Humana, Inc., Senior Notes, 6.45%, 6/1/16 | | | 315,318 | |

See Notes to Financial Statements.

| Value Line Aggressive Income Trust | |

| | |

| | January 31, 2010 |

Principal Amount | | | | | Value | |

| $ | 350,000 | | Inverness Medical Innovations, Inc., Senior Subordinated Notes, 9.00%, 5/15/16 | | $ | 357,875 | |

| | 300,000 | | NBTY, Inc., Senior Subordinated Notes, 7.13%, 10/1/15 | | | 303,000 | |

| | 350,000 | | Psychiatric Solutions, Inc., Senior Subordinated Notes, 7.75%, 7/15/15 | | | 335,125 | |

| | 300,000 | | Reynolds American, Inc., Senior Secured Notes, 6.75%, 6/15/17 | | | 319,860 | |

| | 400,000 | | SUPERVALU, Inc., Senior Notes, 7.50%, 11/15/14 | | | 401,000 | |

| | 350,000 | | Tyson Foods, Inc., Senior Notes, 7.85%, 4/1/16 | | | 367,500 | |

| | | | | | | 4,272,866 | |

| | | | | | | | |

| | | | DIVERSIFIED (1.3%) | | | | |

| | 500,000 | | Leucadia National Corp., Senior Notes, 7.13%, 3/15/17 | | | 492,500 | |

| | | | | | | | |

| | | | ENERGY (24.1%) | | | | |

| | 400,000 | | Allis-Chalmers Energy, Inc., Senior Notes, 9.00%, 1/15/14 | | | 388,000 | |

| | 350,000 | | Arch Western Finance LLC, Guaranteed Senior Notes, 6.75%, 7/1/13 | | | 346,500 | |

| | 400,000 | | Bill Barrett Corp., Senior Notes, 9.88%, 7/15/16 | | | 430,000 | |

| | 300,000 | | Chesapeake Energy Corp., Senior Notes, 7.50%, 6/15/14 | | | 304,500 | |

| | 350,000 | | Cimarex Energy Co., Senior Notes, 7.13%, 5/1/17 | | | 348,687 | |

| | 400,000 | | Complete Production Services, Inc., Senior Notes, 8.00%, 12/15/16 | | | 396,000 | |

| | 350,000 | | Dynegy Holdings, Inc., Senior Notes, 7.50%, 6/1/15 | | | 313,250 | |

| | 500,000 | | Encore Acquisition Co., Senior Subordinated Notes, 6.25%, 4/15/14 | | | 501,875 | |

| | 300,000 | | Frontier Oil Corp., 8.50%, 9/15/16 | | | 313,500 | |

Principal Amount | | | | Value | |

| $ | 500,000 | | KCS Energy, Inc., Senior Notes, 7.13%, 4/1/12 | | $ | 498,750 | |

| | 300,000 | | McMoRan Exploration Co., Senior Notes, 11.88%, 11/15/14 | | | 327,000 | |

| | 495,000 | | Nabors Industries, Inc., Guaranteed Senior Notes, 6.15%, 2/15/18 | | | 529,234 | |

| | 400,000 | | Newfield Exploration Co., Senior Notes, 6.63%, 9/1/14 | | | 404,000 | |

| | 250,000 | | North American Energy Partners, Inc., Senior Notes, 8.75%, 12/1/11 | | | 249,375 | |

| | 400,000 | | Peabody Energy Corp., Senior Notes, 7.38%, 11/1/16 | | | 425,000 | |

| | 300,000 | | PetroHawk Energy Corp., Senior Notes, 7.88%, 6/1/15 | | | 307,500 | |

| | 428,000 | | PetroQuest Energy, Inc., Senior Notes, 10.38%, 5/15/12 | | | 436,560 | |

| | 500,000 | | Plains Exploration & Production Co., Senior Notes, 7.75%, 6/15/15 | | | 510,000 | |

| | 325,000 | | Regency Energy Partners L.P./Regency Energy Finance Corp., Senior Notes, 8.38%, 12/15/13 | | | 339,625 | |

| | 350,000 | | Tesoro Corp., Notes, 6.50%, 6/1/17 | | | 333,375 | |

| | 250,000 | | W&T Offshore, Inc., Senior Notes, 8.25%, 6/15/14 (1) | | | 240,000 | |

| | 500,000 | | Whiting Petroleum Corp., Senior Notes, 7.25%, 5/1/13 | | | 506,250 | |

| | 600,000 | | Williams Companies, Inc., Senior Notes, 7.13%, 9/1/11 | | | 657,000 | |

| | | | | | | 9,105,981 | |

| | | | | | | | |

| | | | FINANCIAL (2.3%) | | | | |

| | 300,000 | | Ford Motor Credit Co. LLC, Senior Notes, 8.00%, 12/15/16 | | | 301,779 | |

| | 500,000 | | Principal Financial Group, Inc., Senior Notes, 7.88%, 5/15/14 | | | 572,293 | |

| | | | | | | 874,072 | |

See Notes to Financial Statements.

| | Value Line Aggressive Income Trust |

| | |

| Schedule of Investments | |

Principal Amount | | | | Value | |

| | | | INDUSTRIAL (7.9%) | | | | |

| $ | 350,000 | | Alliant Techsystems, Inc., Senior Subordinated Notes, 6.75%, 4/1/16 | | $ | 349,125 | |

| | 400,000 | | Baldor Electric Co., Senior Notes, 8.63%, 2/15/17 | | | 407,000 | |

| | 350,000 | | Case New Holland, Inc., Senior Notes, 7.13%, 3/1/14 | | | 350,000 | |

| | 400,000 | | General Cable Corp., Senior Notes, 7.13%, 4/1/17 | | | 393,000 | |

| | 500,000 | | Gulfmark Offshore, Inc., Guaranteed Notes, 7.75%, 7/15/14 | | | 496,250 | |

| | 400,000 | | L-3 Communications Corp., Senior Subordinated Notes, 5.88%, 1/15/15 | | | 405,000 | |

| | 200,000 | | Ryder System, Inc., Senior Notes, 4.63%, 4/1/10 | | | 200,539 | |

| | 400,000 | | Terex Corp., Senior Subordinated Notes, 8.00%, 11/15/17 | | | 382,000 | |

| | | | | | | 2,982,914 | |

| | | | | | | | |

| | | | TECHNOLOGY (1.8%) | | | | |

| | 81,000 | | Broadridge Financial Solutions, Inc., Senior Notes, 6.13%, 6/1/17 | | | 82,212 | |

| | 350,000 | | First Data Corp., Senior Notes, 9.88%, 9/24/15 | | | 312,375 | |

| | 300,000 | | Seagate Technology HDD Holdings, 6.80%, 10/1/16 | | | 298,875 | |

| | | | | | | 693,462 | |

| | | | | | | | |

| | | | UTILITIES (2.6%) | | | | |

| | 400,000 | | NRG Energy, Inc., Senior Notes, 7.38%, 2/1/16 | | | 398,000 | |

| | 350,000 | | RRI Energy, Inc., Senior Notes, 7.63%, 6/15/14 | | | 336,000 | |

| | 300,000 | | Texas Competitive Electric Holdings Co. LLC, 10.25%, 11/1/15 | | | 234,749 | |

| | | | | | | 968,749 | |

| | | | TOTAL CORPORATE BONDS & NOTES (76.1%)

(Cost $27,002,008) | | | 28,767,943 | |

Principal Amount | | | | Value | |

| CONVERTIBLE CORPORATE BONDS & NOTES (10.8%) | | | | |

| | | | | | | | |

| | | | BASIC MATERIALS (1.0%) | | | | |

| $ | 400,000 | | Ferro Corp., Senior Notes, 6.50%, 8/15/13 | | $ | 366,000 | |

| | | | | | | | |

| | | | COMMUNICATIONS (1.4%) | | | | |

| | 300,000 | | Interpublic Group of Cos., Inc., Senior Notes, 4.25%, 3/15/23 | | | 296,250 | |

| | 250,000 | | NII Holdings, Inc. 3.13%, 6/15/12 | | | 229,063 | |

| | | | | | | 525,313 | |

| | | | | | | | |

| | | | CONSUMER, NON-CYCLICAL (3.5%) | | | | |

| | 250,000 | | Charles River Laboratories International, Inc., Senior Notes, 2.25%, 6/15/13 | | | 246,562 | |

| | 200,000 | | LifePoint Hospitals, Inc., Senior Subordinated Debentures, 3.25%, 8/15/25 | | | 180,500 | |

| | 250,000 | | LifePoint Hospitals, Inc., Senior Subordinated Debentures, 3.50%, 5/15/14 | | | 226,563 | |

| | 400,000 | | Medtronic, Inc., Senior Notes, 1.63%, 4/15/13 | | | 410,500 | |

| | 300,000 | | Omnicare, Inc., 3.25%, 12/15/35 | | | 244,500 | |

| | | | | | | 1,308,625 | |

| | | | | | | | |

| | | | ENERGY (0.7%) | | | | |

| | 300,000 | | Global Industries Ltd., Senior Debentures, 2.75%, 8/1/27 | | | 190,500 | |

| | 100,000 | | Helix Energy Solutions Group, Inc., Senior Notes, 3.25%, 12/15/25 | | | 90,375 | |

| | | | | | | 280,875 | |

| | | | FINANCIAL (1.0%) | | | | |

| | 400,000 | | NASDAQ OMX Group, Inc. (The), Senior Notes, 2.50%, 8/15/13 | | | 378,000 | |

See Notes to Financial Statements.

| Value Line Aggressive Income Trust | |

| | |

| | January 31, 2010 |

Principal Amount | | | | Value | |

| | | | INDUSTRIAL (1.8%) | | | | |

| $ | 400,000 | | AGCO Corp., Senior Subordinated Notes, 1.25%, 12/15/36 | | $ | 408,500 | |

| | 350,000 | | Suntech Power Holdings Co., Ltd., Senior Notes, 3.00%, 3/15/13 | | | 269,937 | |

| | | | | | | 678,437 | |

| | | | TECHNOLOGY (1.4%) | | | | |

| | 350,000 | | Micron Technology, Inc., Senior Notes, 1.88%, 6/1/14 | | | 304,938 | |

| | 300,000 | | SanDisk Corp., Senior Notes, 1.00%, 5/15/13 | | | 242,625 | |

| | | | | | | 547,563 | |

| | | | TOTAL CONVERTIBLE CORPORATE BONDS & NOTES (10.8%)

(Cost $3,641,990) | | | 4,084,813 | |

| | Shares | | | | | Value | |

| COMMON STOCKS (1.9%) | | | | |

| | | | | |

| | | | ENERGY (1.4%) | | | | |

| | 10,000 | | Boardwalk Pipeline Partners L.P. | | | 294,800 | |

| | 2,500 | | Energy Transfer Partners L.P. | | | 111,850 | |

| | 2,000 | | Plains All American Pipeline, L.P. | | | 106,180 | |

| | | | | | | 512,830 | |

| | | | FINANCIALS (0.3%) | | | | |

| | 3,000 | | Equity Residential | | | 96,150 | |

| | | | | | | | |

| | | | HEALTH CARE (0.2%) | | | | |

| | 5,000 | | Pfizer, Inc. | | | 93,300 | |

| | | | | | | | |

| | | | TOTAL COMMON STOCKS (2) (1.9%)

(Cost $570,124) | | | 702,280 | |

| Shares | | | | Value | |

| PREFERRED STOCKS (0.2%) | | | | |

| | | | | |

| | | | FINANCIALS (0.2%) | | | | |

| | | | | | | | |

| | 3,000 | | Health Care REIT, Inc. Series F, 7.625% | | $ | 73,500 | |

| | | | TOTAL PREFERRED STOCKS (2) (0.2%)

(Cost $75,000) | | | 73,500 | |

| | | | TOTAL INVESTMENT SECURITIES (3) (89.0%)

(Cost $31,289,122) | | | 33,628,536 | |

Principal Amount | | | | Value | |

| REPURCHASE AGREEMENT (9.5%) | | | | |

| | | | | |

| $ | 3,600,000 | | With Morgan Stanley, 0.08%, dated 01/29/10, due 02/01/10, delivery value $3,600,024 (collateralized by $3,590,000 U.S. Treasury Notes 4.75%, due 02/15/10, with a value of $3,673,555) | | | 3,600,000 | |

| | | | TOTAL REPURCHASE AGREEMENTS (3) (9.5%)

(Cost $3,600,000) | | | 3,600,000 | |

| | | | | | | | |

| CASH AND OTHER ASSETS IN EXCESS OF LIABILITIES (1.5%) | | | 558,184 | |

| | | | | | |

| NET ASSETS (100%) | | $ | 37,786,720 | |

| | | | | | |

NET ASSET VALUE OFFERING AND REDEMPTION PRICE, PER OUTSTANDING SHARE

($37,786,720 ÷ 8,034,470 shares outstanding) | | $ | 4.70 | |

| (1) | Pursuant to Rule 144A under the Securities Act of 1933, this security can only be sold to qualified institutional investors. |

| (2) | Values determined based on Level 1 inputs established by FASB ASC 820-10, Fair Value Measurements and Disclosures. |

| (3) | Unless otherwise indicated, the values of the Portfolio are determined based on Level 2 inputs established by FASB ASC 820-10, Fair Value Measurements and Disclosures. |

See Notes to Financial Statements.

Value Line Aggressive Income Trust

| | | | | |

Statement of Assets and Liabilities at January 31, 2010 | | | | |

| | | | | |

| Assets: | | | | |

Investment securities, at value

(Cost - $31,289,122) | | $ | 33,628,536 | |

Repurchase agreement

(Cost - $3,600,000) | | | 3,600,000 | |

| Cash | | | 71,672 | |

| Interest and dividends receivable | | | 584,783 | |

| Receivable for trust shares sold | | | 27,500 | |

| Prepaid expenses | | | 17,828 | |

| Total Assets | | | 37,930,319 | |

| Liabilities: | | | | |

| Payable for trust shares redeemed | | | 62,021 | |

| Dividends payable to shareholders | | | 32,338 | |

| Accrued expenses: | | | | |

| Advisory fee | | | 14,690 | |

| Service and distribution plan fees | | | 4,897 | |

| Other | | | 29,653 | |

| Total Liabilities | | | 143,599 | |

| Net Assets | | $ | 37,786,720 | |

| Net assets consist of: | | | | |

| Shares of beneficial interest, at $0.01 par value (authorized unlimited, outstanding 8,034,470 shares) | | $ | 80,345 | |

| Additional paid-in capital | | | 43,896,633 | |

| Distributions in excess of net investment income | | | (32,419 | ) |

| Accumulated net realized loss on investments and foreign currency | | | (8,497,253 | ) |

| Net unrealized appreciation of investments and foreign currency translations | | | 2,339,414 | |

| Net Assets | | $ | 37,786,720 | |

Net Asset Value, Offering and Redemption Price per Outstanding Share

($37,786,720 ÷ 8,034,470 shares outstanding) | | $ | 4.70 | |

Statement of Operations for the Year Ended January 31, 2010 | | | | |

| | | | | |

| Investment Income: | | | | |

| Interest (net of foreign withholding tax of $516) | | $ | 2,643,554 | |

| Dividends (net of foreign withholding tax of $97) | | | 40,400 | |

| Total Income | | | 2,683,954 | |

| Expenses: | | | | |

| Advisory fee | | | 263,476 | |

| Service and distribution plan fees | | | 87,825 | |

| Printing and postage | | | 48,672 | |

| Registration and filing fees | | | 35,526 | |

| Transfer agent fees | | | 34,945 | |

| Custodian fees | | | 32,604 | |

| Auditing and legal fees | | | 27,453 | |

| Trustees’ fees and expenses | | | 3,428 | |

| Insurance | | | 3,226 | |

| Other | | | 9,210 | |

| Total Expenses Before Custody Credits and Fees Waived | | | 546,365 | |

| Less: Service and Distribution Plan Fees Waived | | | (35,130 | ) |

| Less: Advisory Fees Waived | | | (115,354 | ) |

| Less: Custody Credits | | | (15 | ) |

| Net Expenses | | | 395,866 | |

| Net Investment Income | | | 2,288,088 | |

| Net Realized and Unrealized Gain/ (Loss) on Investments and Foreign Exchange Transactions: | | | | |

| Net Realized Loss | | | (1,479,744 | ) |

| Change in Net Unrealized Appreciation/(Depreciation) | | | 8,228,511 | |

| Increase from payment by affiliate | | | 4,043 | |

| Net Realized Loss and Change in Net Unrealized Appreciation/ (Depreciation) on Investments and Foreign Exchange Transactions | | | 6,752,810 | |

| Net Increase in Net Assets from Operations | | $ | 9,040,898 | |

See Notes to Financial Statements.

| Value Line Aggressive Income Trust |

| |

Statement of Changes in Net Assets for the Years Ended January 31, 2010 and 2009 |

| | | Year Ended January 31, 2010 | | | Year Ended January 31, 2009 | |

| Operations: | | | | | | |

| Net investment income | | $ | 2,288,088 | | | $ | 2,094,843 | |

| Net realized loss on investments and foreign currency | | | (1,479,744 | ) | | | (1,051,210 | ) |

| Change in net unrealized appreciation/(depreciation) | | | 8,228,511 | | | | (5,295,392 | ) |

| Increase from payment by affiliate | | | 4,043 | | | | — | |

| Net increase/(decrease) in net assets from operations | | | 9,040,898 | | | | (4,251,759 | ) |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Net investment income | | | (2,273,909 | ) | | | (2,074,111 | ) |

| | | | | | | | | |

| Trust Share Transactions: | | | | | | | | |

| Proceeds from sale of shares | | | 14,135,221 | | | | 3,664,679 | |

| Proceeds from reinvestment of dividends to shareholders | | | 1,856,215 | | | | 1,585,465 | |

| Cost of shares redeemed* | | | (10,895,800 | ) | | | (5,459,613 | ) |

| Net increase/(decrease) in net assets from trust share transactions | | | 5,095,636 | | | | (209,469 | ) |

| Total Increase/(Decrease) in Net Assets | | | 11,862,625 | | | | (6,535,339 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 25,924,095 | | | | 32,459,434 | |

| End of year | | $ | 37,786,720 | | | $ | 25,924,095 | |

| Distributions in excess of net investment income, at end of year | | $ | (32,419 | ) | | $ | (36,918 | ) |

* Net of redemption fees (see Note 1K and Note 2).

See Notes to Financial Statements.

Value Line Aggressive Income Trust

| Notes to Financial Statements |

1. Significant Accounting Policies

Value Line Aggressive Income Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The primary investment objective of the Trust is to maximize current income through investment in a diversified portfolio of high-yield fixed-income securities. As a secondary investment objective, the Trust will seek capital appreciation, but only when consistent with its primary objective. Lower rated or unrated (i.e., high-yield) securities are more likely to react to developments affecting market risk (general market liquidity) and credit risk (issuers’ inability to meet principal and interest payments on their obligations) than are more highly rated securities, whic h react primarily to movements in the general level of interest rates. The ability of issuers of debt securities held by the Trust to meet their obligations may be affected by economic developments in a specific industry.

The following significant accounting principles are in conformity with generally accepted accounting principles for investment companies. Such policies are consistently followed by the Trust in the preparation of its financial statements. Generally accepted accounting principles may require management to make estimates and assumptions that affect the reported amounts and disclosure in the financial statements. Actual results may differ from those estimates.

(A) Security Valuation: The Trustees have determined that the value of bonds and other fixed income corporate securities be calculated on the valuation date by reference to valuations obtained from an independent pricing service that determines valuations for normal institutional-size trading units of debt securities, without exclusive reliance upon quoted prices. This service takes into account appropriate factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data in determining valuations. Securities, other than bonds and other fixed income securities, not priced in this manner are valued at the midpoint between the latest available and representative bid and asked prices or, when stock valuations are used, at the latest quoted sale price as of the regular close of business of the New York Stock Exchange on the valuation date. Other assets and securities for which market valuations are not readily available are valued at their fair value as the Trustees may determine. In addition, the Trust may use the fair value of a security when the closing price on the primary exchange where the security is traded no longer reflects the value of a security due to factors affecting one or more relevant securities markets or the specific issuer. Short term instruments with maturities of 60 days or less, at the date of purchase, are valued at amortized cost which approximates market value.

(B) Fair Value Measurements: In accordance with Financial Accounting Standards Board Accounting Standards Codification (FASB ASC 820-10), Fair Value Measurements and Disclosures, (formerly Statement of Financial Accounting Standards (“SFAS”) No. 157), the Trust discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurement) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (level 3 measurements). FASB ASC 820-10-35-39 to 55 provides three levels of the fair value hierarchy as follows:

| | |

| ● | Level 1 – Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Trust has the ability to access at the measurement date; |

| | |

| ● | Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active; |

| | |

| ● | Level 3 – Inputs that are unobservable. |

Value Line Aggressive Income Trust

During the year ended January 31, 2010, the Trust adopted the authoritative guidance included in FASB ASC 820-10, Fair Value Measurements and Disclosures, on determining fair value when the volume and level of activity for the asset or liability have significantly decreased and identifying transactions that are not orderly (formerly FSP FAS 157-4). FASB ASC 820-10-35-51A to 51H indicates that if an entity determines that either the volume and/or level of activity for an asset or liability has significantly decreased (from normal conditions for that asset or liability) or price quotations or observable inputs are not associated with orderly transactions, increased analysis and management judgment will be required to estimate fair value.

Valuation techniques such as an income approach might be appropriate to supplement or replace a market approach in those circumstances. It provides a list of factors to determine whether there has been a significant decrease in relation to normal market activity. Regardless, however, of the valuation technique and inputs used, the objective for the fair value measurement in those circumstances is unchanged from what it would be if markets were operating at normal activity levels and/or transactions were orderly; that is, to determine the current exit price as promulgated by FASB ASC 820-10.

The following is a summary of the inputs used as of January 31, 2010 in valuing the Trust’s investments carried at value:

| | | | | | | | | | | | | |

| Investments in Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Corporate Bonds & Notes | | $ | 0 | | | $ | 28,767,943 | | | $ | 0 | | | $ | 28,767,943 | |

| Convertible Corporate Bonds & Notes | | | 0 | | | | 4,084,813 | | | | 0 | | | | 4,084,813 | |

| Short Term Investments | | | 0 | | | | 3,600,000 | | | | 0 | | | | 3,600,000 | |

| Common Stocks | | | 702,280 | | | | 0 | | | | 0 | | | | 702,280 | |

| Preferred Stocks | | | 73,500 | | | | 0 | | | | 0 | | | | 73,500 | |

| Total Investments in Securities | | $ | 775,780 | | | $ | 36,452,756 | | | $ | 0 | | | $ | 37,228,536 | |

For the year ended January 31, 2010, there were no Level 3 investments. The types of inputs used to value each security are identified in the Schedule of Investments, which also includes a breakdown of the Schedule’s investments by category.

(C) Repurchase Agreements: In connection with repurchase agreements, the Trust’s custodian takes possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, it is the Trust’s policy to mark-to-market the collateral on a daily basis to ensure the adequacy of the collateral. In the event of default of the obligation to repurchase, the Trust has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, in the event of default or bankruptcy by the other party to t he agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings.

(D) Distributions: It is the policy of the Trust to distribute all of its net investment income to shareholders. Dividends from net investment income will be declared daily and paid monthly. Net realized capital gains, if any, are distributed to shareholders annually or more frequently if necessary to comply with the Internal Revenue Code. Income dividends and capital gains distributions are automatically reinvested in additional shares of the Trust unless the shareholder has requested otherwise. Income earned by the Trust on weekends, holidays and other days on which the Trust is closed for business is declared as a dividend on the next day on which the Trust is open for business.

(E) Federal Income Taxes: It is the Trust’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies, including the distribution requirements of the Tax Reform Act of 1986, and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

Value Line Aggressive Income Trust

| Notes to Financial Statements |

(F) Foreign Currency Translation: The books and records of the Trust are maintained in U.S. dollars. Assets and liabilities which are denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. The Trust does not isolate changes in the value of investments caused by foreign exchange rate differences from the changes due to other circumstances.

Income and expenses are translated to U.S. dollars based upon the rates of exchange on the respective dates of such transactions.

Net realized foreign exchange gains or losses arise from currency fluctuations realized between the trade and settlement dates on securities transactions, the differences between the U.S. dollar amounts of dividends, interest, and foreign withholding taxes recorded by the Trust and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investments, at the end of the fiscal period, resulting from changes in the exchange rates. The effect of the change in foreign exchange rates on the value of investments is included in realized gain/loss on investments and change in net unrealized appreciation/ depreciation on investments.

(G) Representations and Indemnifications: In the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

(H) Security Transactions: Securities transactions are recorded on a trade date basis. Realized gains and losses from security transactions are recorded on the identified-cost basis. Interest income, adjusted for amortization of discount and premium, is earned from settlement date and recognized on the accrual basis. Dividend income is recorded on the ex-dividend date.

(I) Accounting for Real Estate Investment Trusts: The Trust owns shares of Real Estate Investment Trusts (“REITs”) which report information on the source of their distributions annually. Distributions received from REITs during the year which represent a return of capital are recorded as a reduction of cost and distributions which represent a capital gain dividend are recorded as a realized long-term capital gain on investments.

(J) Foreign Taxes: The Trust may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Trust will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

(K) Redemption Fee: The Trust charges a 2% redemption fee on shares held for less than 120 days. Such fees are retained by the Trust and accounted for as paid in capital.

Value Line Aggressive Income Trust

(L) Other: On November 4, 2009, the Securities and Exchange Commission (“SEC”), Value Line, Inc. (“VLI”), Value Line Securities, Inc., currently, EULAV Securities, Inc. (“ESI” or the “Distributor”), Jean B. Buttner, former Chairman, President and Chief Executive Officer of VLI and David Henigson, a former Director and Officer of VLI, settled a matter related to brokerage commissions charged by ESI to certain Value Line mutual funds (“Funds”), from 1986 through November of 2004. The matter also involved alleged misleading disclosures provided by VLI to the Boards of Directors/Trustees and shareholders of the Funds regarding such brokerage com missions. VLI agreed to pay disgorgement in the amount of $24,168,979 (representing disgorgement of commissions received), prejudgment interest of $9,536,786, and a civil penalty in the amount of $10,000,000. Also as part of the settlement, Mrs. Buttner and Mr. Henigson each agreed to pay a civil penalty, are barred from association with any broker, dealer or investment adviser, and are prohibited from serving as an employee, officer, director, member of an advisory board, investment adviser or depositor of, or principal underwriter for, a registered investment company or affiliated person of such investment adviser, depositor, or principal underwriter, subject to a limited exception (limited in scope and for a one-year period) for Mrs. Buttner. Pursuant to Section 308(a) of the Sarbanes-Oxley Act of 2002, a fund will be created for VLI’s disgorgement, interest and penalty (“Fair Fund”). VLI will bear all co sts associated with any Fair Fund distribution, including retaining a third-party consultant approved by the SEC staff to administer any Fair Fund distribution. VLI informed the Funds’ Board that it has paid the settlement, continues to have adequate liquid assets, and that the resolution of this matter will not have a materially adverse effect on the ability of EULAV Asset Management LLC (“EULAV” or the “Adviser”), the Funds’ investment adviser, or ESI, the Funds’ distributor, to perform their respective contracts with the Funds.

On March 11, 2010, VLI and the Boards of Trustees/Directors of the Value Line Funds entered into an agreement pursuant to which VLI will reimburse the Funds in the aggregate amount of $917,302 for various expenses incurred by the Funds in connection with the SEC matter referred to above. The receivable for this expense reimbursement was accrued on March 11, 2010 by the applicable Funds that incurred the expenses and will be paid by VLI in twelve equal monthly installments commencing April 1, 2010. The Aggressive Income Trust accrued $2,853 in expense reimbursements from VLI.

(M) Subsequent Events: Management has evaluated all subsequent transactions and events through the date on which these financial statements were issued. On March 11, 2010, with an effective date of June 1, 2010, the Adviser contractually agreed to waive 0.20% of the advisory fee for a one year period and the Distributor waives 0.10% of the Rule 12b-1 fee.

2. Trust Share Transactions and Distributions to Shareholders

Transactions in shares of beneficial interest in the Trust were as follows:

| | | Year Ended January 31, 2010 | | | Year Ended January 31, 2009 | |

| Shares sold | | | 3,455,006 | | | | 860,199 | |

| Shares issued to shareholders in reinvestment of dividends and distributions | | | 427,536 | | | | 366,094 | |

| Shares redeemed | | | (2,514,225 | ) | | | (1,275,156 | ) |

| Net increase/(decrease) | | | 1,368,317 | | | | (48,863 | ) |

| Dividends per share from net investment income | | $ | 0.2812 | | | $ | 0.3140 | |

Redemption fees of $24,940 and $5,692 were retained by the Trust for the year ended January 31, 2010 and the year ended January 31, 2009, respectively.

| | Value Line Aggressive Income Trust |

| | |

| Notes to Financial Statements | |

3. Purchases and Sales of Securities

Purchases and sales of investment securities, excluding short-term securities, were as follows:

| | | | | |

| | | Year Ended January 31, 2010 | |

| Purchases: | | | | |

| Investment Securities | | $ | 20,299,360 | |

| Sales: | | | | |

| Investment Securities | | $ | 15,730,704 | |

4. Income Taxes

At January 31, 2010, information on the tax components of capital is as follows:

| | | | | |

| Cost of investments for tax purposes | | $ | 34,887,527 | |

| Gross tax unrealized appreciation | | $ | 2,527,943 | |

| Gross tax unrealized depreciation | | $ | (186,934 | ) |

| Net tax unrealized appreciation on investments | | $ | 2,341,009 | |

| Undistributed ordinary income | | $ | — | |

| Capital loss carryforward, expires | | | | |

| January 31, 2011 | | $ | (5,624,767 | ) |

| January 31, 2017 | | $ | (911,547 | ) |

| January 31, 2018 | | $ | (1,962,534 | ) |

During the year ended January 31, 2010, as permitted under federal income tax regulations, the Trust elected to defer $82 of post-October net currency losses to the next taxable year.

During the year ended January 31, 2010, $20,653,696 of the Trust’s capital loss carryforwards expired.

To the extent future capital gains are offset by capital losses, the Trust does not anticipate distributing any such gains to shareholders. It is uncertain whether the Trust will be able to realize the benefits of the losses before they expire.

The tax composition of dividends to shareholders for the years ended January 31, 2010 and January 31, 2009 were as follows:

| | | | | | | |

| | | 2010 | | | 2009 | |

| Ordinary income | | $ | 2,273,909 | | | $ | 2,074,111 | |

Permanent book-tax differences relating to the classifications of certain distributions and income in the current year were reclassified within the composition of the net asset accounts. The Trust increased distributions in excess of net investment income by $9,680, decreased accumulated realized loss on investments by $20,666,985 and decreased additional paid-in-capital by $20,657,305. Net assets were not affected by these reclassifications. These reclassifications are primarily due to differing treatments for tax purposes of foreign currency, expired capital loss carryforward, interest write-off, investments in partnerships, investment in securities, distributions in excess and consent payments.

5. Investment Advisory Fee, Service and Distribution Fees and Transactions With Affiliates

An advisory fee of $263,476 was paid or payable to EULAV Asset Management, LLC (the “Adviser”) for the year ended January 31, 2010. This was computed at an annual rate of 0.75% on the first $100 million of the Trust’s average daily net assets during the period, and 0.50% on the average daily net assets in excess thereof prior to any fee waivers. The Adviser provides research, investment programs, supervision of the investment portfolio and pays costs of administrative services and office space. The Adviser also provides persons, satisfactory to the Trust’s Trustees, to act as officers of the Trust and pays their salaries. Effective June 1, 2007 and 2008, the Adviser contractually agreed to reduce the Trust’s advisory fee by 0.40% for one year periods. Effective June 1, 2009, the Adviser contractually agreed to waive 0.30% of the advisory fee for a one year period. The fees waived amounted to $115,354 for the year ended January 31, 2010. The Adviser has no right to recoup previously waived amounts.

The Trust has a Service and Distribution Plan (the “Plan”), adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, which compensates EULAV Securities, Inc. (the “Distributor”) for advertising, marketing and distributing the Trust’s shares and for servicing the Trust’s shareholders at an annual rate of 0.25% of the Trust’s average daily net assets. Fees amounting to $87,825 before fee waivers were accrued under the Plan for the year ended January 31, 2010. Effective June 1, 2007, 2008 and 2009, the Distributor contractually agreed to reduce the 12b-1 fee by 0.10% for one year periods. The fees waived amounted to $35,130 for the year ended January 31, 2010. The Distributor has no right to recoup previou sly waived amounts.

| Value Line Aggressive Income Trust | |

| | |

| | January 31, 2010 |

For the year ended December 31, 2010, the Trust’s expenses were reduced by $15 under a custody credit arrangement with the custodian.

Direct expenses of the Trust are charged to the Trust while common expenses of the Value Line Funds are allocated proportionately based upon the Funds’ respective net assets. The Trust bears all other costs and expenses.

Certain officers, employees and a director of Value Line and affiliated companies are also officers and a Trustee of the Trust. At January 31, 2010, the officers and Trustees as a group owned 654 shares of beneficial interest in the Trust, representing less than 1% of the outstanding shares.

| | Value Line Aggressive Income Trust |

| | |

| Financial Highlights | |

Selected data for a share of beneficial interest outstanding throughout each year:

| | | | | | | | | | | | | | | | |

| | | Years Ended January 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Net asset value, beginning of year | | $ | 3.89 | | | $ | 4.83 | | | $ | 5.06 | | | $ | 5.01 | | | $ | 5.16 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.28 | | | | 0.32 | | | | 0.34 | | | | 0.32 | | | | 0.31 | |

| Net gains or (losses) on securities (both realized and unrealized) | | | 0.81 | | | | (0.95 | ) | | | (0.23 | ) | | | 0.05 | | | | (0.15 | ) |

| Total from investment operations | | | 1.09 | | | | (0.63 | ) | | | 0.11 | | | | 0.37 | | | | 0.16 | |

| Redemption fees | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.00 | (3) | | | 0.00 | (3) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.28 | ) | | | (0.31 | ) | | | (0.34 | ) | | | (0.32 | ) | | | (0.31 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 4.70 | | | $ | 3.89 | | | $ | 4.83 | | | $ | 5.06 | | | $ | 5.01 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 28.92 | % | | | (13.42 | )% | | | 2.14 | % | | | 7.80 | % | | | 3.32 | % |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in thousands) | | $ | 37,787 | | | $ | 25,924 | | | $ | 32,459 | | | $ | 37,340 | | | $ | 43,761 | |

Ratio of expenses to average net assets(1) | | | 1.56 | % | | | 1.50 | % | | | 1.28 | % | | | 1.50 | % | | | 1.45 | % |

Ratio of expenses to average net assets(2) | | | 1.13 | % | | | 0.98 | % | | | 0.77 | % | | | 1.04 | % | | | 1.45 | % |

| Ratio of net investment income to average net assets | | | 6.51 | % | | | 7.17 | % | | | 6.76 | % | | | 6.54 | % | | | 6.19 | % |

| Portfolio turnover rate | | | 51 | % | | | 39 | % | | | 30 | % | | | 31 | % | | | 27 | % |

| (1) | Ratio reflects expenses grossed up for custody credit arrangement and grossed up for the waiver of a portion of the advisory fee by the Adviser and a portion of the service and distribution plan fees by the Distributor. The ratio of expenses to average net assets, net of custody credits, but exclusive of the waiver of a portion of the advisory fee by the Adviser and the waiver of the service and distribution plan fees by the Distributor, would have been 1.48%, 1.27% and 1.49% for the years ended January 31, 2009, 2008 and 2007, respectively, and would have been unchanged for the other years shown. |

| | |

| (2) | Ratio reflects expenses net of the waiver of a portion of the advisory fee by the Adviser and a portion of the service and distribution plan fees by the Distributor and net of the custody credit arrangement. |

| | |

| (3) | Amount is less than $.01 per share. |

See Notes to Financial Statements.

| Value Line Aggressive Income Trust |

| |

| Report of Independent Registered Public Accounting Firm |

To the Board of Trustees and Shareholders of Value Line Aggressive Income Trust

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Value Line Aggressive Income Trust (the “Trust”) at January 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statem ents”) are the responsibility of the Trust’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at January 31, 2010 by correspondence with the custodian, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

March 26, 2010

| Value Line Aggressive Income Trust |

| |

| Federal Tax Notice (unaudited) |

For corporate taxpayers 0.17% of the ordinary income distributions paid during the fiscal year ended January 31, 2010 qualify for the corporate dividends received deduction. During the fiscal year ended January 31, 2010, 0.33% of the ordinary income distributions are treated as qualified dividends. |

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Trust’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Trust voted these proxies for the 12-month period ended June 30 is available through the Trust’s website at http://www.vlfunds.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-243-2729.

| Value Line Aggressive Income Trust |

| |

| Management of the Trust |

MANAGEMENT INFORMATION

The business and affairs of the Trust are managed by the Trust’s officers under the direction of the Board of Trustees. The following table sets forth information on each Trustee and Officer of the Trust. Each Trustee serves as a director or trustee of each of the 14 Value Line Funds. Each Trustee serves until his or her successor is elected and qualified.

| Name, Address, and DOB | | Position | | Length of Time Served | | Principal Occupation During the Past 5 Years | | Other Directorships Held by Trustee |

| Interested Trustee* | | | | | | | | |

Thomas T. Sarkany DOB: June 1946 | | Trustee | | Since 2008 | | Mutual Fund Marketing Director of EULAV Securities, Inc. (the “Distributor”), formerly Value Line Securities, Inc. Secretary of Value Line, Inc. since November 2009 and a Director since February 2010. | | Value Line, Inc. |

| Non-Interested Trustees | | | | | | | | |

Joyce E. Heinzerling 500 East 77th Street New York, NY 10162 DOB: January 1956 | | Trustee | | Since 2008 | | President, Meridian Fund Advisers LLC. (consultants) since April 2009; General Counsel, Archery Capital LLC (private investment fund) until April 2009. | | Burnham Investors Trust, since 2004 (4 funds). |

Francis C. Oakley 54 Scott Hill Road Williamstown, MA 01267 DOB: October 1931 | | Trustee (Lead Independent Trustee since 2008) | | Since 2000 | | Professor of History, Williams College, (1961-2002). Professor Emeritus since 2002; President Emeritus since 1994 and President, (1985-1994); Chairman (1993-1997) and Interim President (2002-2003) of the American Council of Learned Societies. Trustee since 1997 and Chairman of the Board since 2005, National Humanities Center. | | None |

David H. Porter 5 Birch Run Drive Saratoga Springs, NY 12866 DOB: October 1935 | | Trustee | | Since 1997 | | Professor, Skidmore College since 2008; Visiting Professor of Classics, Williams College, (1999-2008); President Emeritus, Skidmore College since 1999 and President, (1987-1998). | | None |

Paul Craig Roberts 169 Pompano St. Panama City Beach, FL 32413 DOB: April 1939 | | Trustee | | Since 1986 | | Chairman, Institute for Political Economy. | | None |

Nancy-Beth Sheerr 1409 Beaumont Drive Gladwyne, PA 19035 DOB: March 1949 | | Trustee | | Since 1996 | | Senior Financial Adviser, Veritable L.P. (Investment adviser). | | None |

| Value Line Aggressive Income Trust |

| |

| Management of the Trust |

| Name, Address, and DOB | | Position | | Length of Time Served | | Principal Occupation During the Past 5 Years | | Other Directorships Held by Trustee |

Daniel S. Vandivort 59 Indian Head Road Riverside, CT 06878 DOB: July 1954 | | Trustee | | Since 2008 | | President, Chief Investment Officer, Weiss, Peck and Greer/Robeco Investment Management 2005-2007; Managing Director, Weiss, Peck and Greer, 1995-2005. | | None |

| Officers | | | | | | | | |

Mitchell E. Appel DOB: August 1970 | | President | | Since 2008 | | President of each of the Value Line Funds since June 2008; Chief Financial Officer of Value Line since April 2008 and from September 2005 to November 2007; Treasurer from June 2005 to September 2005; Director since February 2010; Chief Financial Officer of XTF Asset Management from November 2007 to April 2008; Chief Financial Officer of Circle Trust Company from 2003 through May 2005; Chief Financial Officer of the Distributor since April 2008 and President since February 2009; President of the Adviser since February 2009. |

Howard A. Brecher DOB: October 1953 | | Vice President and Secretary | | Since 2008 | | Vice President and Secretary of each of the Value Line Funds since June 2008; Vice President and Secretary of Value Line until November 2009; Director of Value Line; Acting Chairman and Acting CEO of Value Line since November 2009; Secretary and Treasurer of the Adviser since February 2009; Vice President, Secretary, Treasurer, General Counsel and a Director of Arnold Bernhard & Co., Inc. |

Michael J. Wagner DOB: November 1950 | | Chief Compliance Officer | | Since 2009 | | Chief Compliance Officer of each of the Value Line Funds since June 2009; President of Northern Lights Compliance Services, LLC (formerly Fund Compliance Services, LLC (2006-present) and Senior Vice President (2004-2006) and Chief Operations Officer (2003-2006) of Gemini Fund Services, LLC; Director of Constellation Trust Company until 2008. |

Emily D. Washington DOB: January 1979 | | Treasurer | | Since 2008 | | Treasurer and Chief Financial Officer (Principal Financial and Accounting Officer) of each of the Value Line Funds since August 2008; Associate Director of Mutual Fund Accounting at Value Line until August 2008. |

| * | Mr. Sarkany is an “interested person” as defined in the Investment Company Act of 1940 by virtue of his position with the Distributor. |

Unless otherwise indicated, the address for each of the above officers is c/o Value Line Funds, 220 East 42nd Street, New York, NY 10017.

| The Trust’s Statement of Additional Information (SAI) includes additional information about the Trust’s Trustees and is available, without charge, upon request by calling 1-800-243-2729 or on the Fund’s website, www.vlfunds.com. |

| Value Line Aggressive Income Trust |

| |

| The Value Line Family of Funds |

1950 — The Value Line Fund seeks long-term growth of capital. Current income is a secondary objective.

1952 — Value Line Income and Growth Fund’s primary investment objective is income, as high and dependable as is consistent with reasonable risk. Capital growth to increase total return is a secondary objective.

1956 — Value Line Premier Growth Fund seeks long-term growth of capital. No consideration is given to current income in the choice of investments.

1972 — Value Line Larger Companies Fund’s sole investment objective is to realize capital growth.

1979 — Value Line U.S. Government Money Market Fund**, a money market fund, seeks to secure as high a level of current income as is consistent with maintaining liquidity and preserving capital. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

1981 — Value Line U.S. Government Securities Fund seeks maximum income without undue risk to capital. Under normal conditions, at least 80% of the value of its net assets will be invested in securities issued or guaranteed by the U.S. Government and its agencies and instrumentalities.

1983 — Value Line Centurion Fund* seeks long-term growth of capital.

1984 — The Value Line Tax Exempt Fund seeks to provide investors with the maximum income exempt from federal income taxes while avoiding undue risk to principal. The fund may be subject to state and local taxes and the Alternative Minimum Tax (if applicable).

1985 — Value Line Convertible Fund seeks high current income together with capital appreciation primarily from convertible securities ranked 1, 2 or 3 for the year-ahead performance by the Value Line Convertible Ranking System.

1986 — Value Line Aggressive Income Trust seeks to maximize current income.

1987 — Value Line New York Tax Exempt Trust seeks to provide New York taxpayers with the maximum income exempt from New York State, New York City and federal income taxes while avoiding undue risk to principal. The Trust may be subject to state and local taxes and the Alternative Minimum Tax (if applicable).

1987 — Value Line Strategic Asset Management Trust* seeks to achieve a high total investment return consistent with reasonable risk.

1993 — Value Line Emerging Opportunities Fund invests in US common stocks of small capitalization companies, with its primary objective being long-term growth of capital.

1993 — Value Line Asset Allocation Fund seeks high total investment return, consistent with reasonable risk. The Fund invests in stocks, bonds and money market instruments utilizing quantitative modeling to determine the asset mix.

| | |

| * | Only available through the purchase of Guardian Investor, a tax deferred variable annuity, or ValuePlus, a variable life insurance policy. |

| | |

| ** | Effective August 19, 2009, The Value Line Cash Fund, Inc. changed its name to the Value Line U.S. Government Money Market Fund, Inc. |

For more complete information about any of the Value Line Funds, including charges and expenses, send for a prospectus from EULAV Securities, Inc., 220 East 42nd Street, New York, New York 10017-5891 or call 1-800-243-2729, 9am–5pm CST, Monday–Friday, or visit us at www.vlfunds.com. Read the prospectus carefully before you invest or send money.

Item 2. Code of Ethics

(a) The Registrant has adopted a Code of Ethics that applies to its principal executive officer, and principal financial officer and principal accounting officer.

(f) Pursuant to item 12(a), the Registrant is attaching as an exhibit a copy of its Code of Ethics that applies to its principal executive officer, and principal financial officer and principal accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1)The Registrant has an Audit Committee Financial Expert serving on its Audit Committee.

(2) The Registrant’s Board has designated Daniel S. Vandivort, a member of the Registrant’s Audit Committee, as the Registrant’s Audit Committee Financial Expert. Mr. Vandivort is an independent director who has served as President, Chief Investment Officer to Weis, Peck and Greer/Robeco Investment Management. He has also previously served as Managing Director for Weis, Peck and Greer (1995-2005).

A person who is designated as an “audit committee financial expert” shall not make such person an "expert" for any purpose, including without limitation under Section 11 of the Securities Act of 1933 or under applicable fiduciary laws, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities that are greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and Board of Trustees in the absence of such designation or identification.

Item 4. Principal Accountant Fees and Services

| | (a) | Audit Fees 2010 $ 9,169 |

| | | |

| | (b) | Audit-Related fees – None. |

| | | |

| | (c) | Tax Preparation Fees 2010 $4,668 |

| | | |

| | (d) | All Other Fees – None |

| | | |

| | (e) | (1) Audit Committee Pre-Approval Policy. All services to be performed for the Registrant by PricewaterhouseCoopers LLP must be pre-approved by the audit committee. |

| | | |

| | (e) | (2) Not applicable. |

| | | |

| | (f) | Not applicable. |

| | | |

| | (g) | Aggregate Non-Audit Fees 2010 $ 2,350 |

| | | |

| | (h) | Not applicable. |

Item 11. Controls and Procedures.

| | (a) | The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in rule 30a-2(c) under the Act (17 CFR 270.30a-2(c) ) based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report, are appropriately designed to ensure that material information relating to the registrant is made known to such officers and are operating effectively. |

| | | |

| | (b) | The registrant’s principal executive officer and principal financial officer have determined that there have been no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including corrective actions with regard to significant deficiencies and material weaknesses. |

Item 12. Exhibits.

| | (a) | Code of Business Conduct and Ethics for Principal Executive and Senior Financial Officers attached hereto as Exhibit 99.COE |

| | | |

| | (b) | (1) Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2) attached hereto as Exhibit 99.CERT. |

| | | |

| | | (2) Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 attached hereto as Exhibit 99.906.CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| By | /s/ Mitchell E. Appel | |

| | Mitchell E. Appel, President |

| | | |

| | | |

| Date: | April 5, 2010 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Mitchell E. Appel | |

| | Mitchell E. Appel, President, Principal Executive Officer |

| | | |

| | | |

| By: | /s/ Emily D. Washington | |

| | Emily D. Washington, Treasurer, Principal Financial Officer |

| | | |

| | | |

| Date: | April 5, 2010 | |