UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04642

Virtus Variable Insurance Trust

(Exact name of registrant as specified in charter)

One Financial Plaza

Hartford, CT 06103-4506

(Address of principal executive offices) (Zip code)

Jennifer S. Fromm, Esq.

Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-4506

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800)367-5877

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

ANNUAL REPORT

VIRTUS VARIABLE INSURANCE TRUST

| Virtus Duff & Phelps International Series |

| Virtus Duff & Phelps Real Estate Securities Series |

| Virtus KAR Capital Growth Series |

| Virtus KAR Small-Cap Growth Series |

| Virtus KAR Small-Cap Value Series* |

| Virtus Newfleet Multi-Sector Intermediate Bond Series |

| Virtus Rampart Enhanced Core Equity Series |

| Virtus Strategic Allocation Series |

*Prospectus supplement applicable to this Series appears at the back of this annual report.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, you may no longer receive paper copies of the Series’ shareholder reports from your insurance company unless you specifically request paper copies from the insurance company. If your insurance company elects to use this method of delivery, the shareholder reports will be made available on a website, and the insurance company will notify you by mail each time a report is posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the insurance company electronically by following the instructions provided by the insurance company.

You may elect to receive all future shareholder reports in paper free of charge from the insurance company. (Please note that the Series will incur additional expenses when printing and mailing any paper shareholder reports, and Series expenses pass indirectly to all shareholders.) You can do so by contacting the insurance company. Your election to receive reports in paper likely will apply to all of the funds available in your insurance product, but you should ask your insurance company whether this is the case.

Not FDIC Insured • No Bank Guarantee • May Lose Value

Table of Contents

Message to Shareholders

| 1 |

Disclosure of Fund Expenses

| 2 |

Key Investment Terms

| 4 |

| Series | Series

Summary | Schedule

of

Investments |

Virtus Duff & Phelps International Series (“Duff & Phelps International Series”)

| 7 | 28 |

Virtus Duff & Phelps Real Estate Securities Series (“Duff & Phelps Real Estate Security Series”)

| 9 | 30 |

Virtus KAR Capital Growth Series (“KAR Capital Growth Series”)

| 12 | 31 |

Virtus KAR Small-Cap Growth Series (“KAR Small-Cap Growth Series”)

| 15 | 33 |

Virtus KAR Small-Cap Value Series (“KAR Small-Cap Value Series”)

| 17 | 34 |

Virtus Newfleet Multi-Sector Intermediate Bond Series (“Newfleet Multi-Sector Intermediate Bond Series”)

| 19 | 35 |

Virtus Rampart Enhanced Core Equity Series (“Rampart Enhanced Core Equity Series”)

| 21 | 47 |

Virtus Strategic Allocation Series (“Strategic Allocation Series”)

| 24 | 54 |

Statements of Assets and Liabilities

| | 64 |

Statements of Operations

| | 67 |

Statements of Changes in Net Assets

| | 70 |

Financial Highlights

| | 73 |

Notes to Financial Statements

| | 77 |

Report of Independent Registered Public Accounting Firm

| | 91 |

Tax Information Notice

| | 92 |

Consideration of Advisory and Subadvisory Agreements by the Board of Trustees

| | 93 |

Fund Management Tables

| | 97 |

Proxy Voting Procedures and Voting Record (Form N-PX)

The subadvisers vote proxies, if any, relating to portfolio securities in accordance with procedures that have been approved by the Board of Trustees of the Trust (“Trustees”, or the “Board”). You may obtain a description of these procedures, along with information regarding how the Series voted proxies during the most recent 12-month period ended June 30, free of charge, by calling toll-free 1-800-243-1574. This information is also available through the Securities and Exchange Commission’s (the “SEC”) website at http://www.sec.gov.

Form N-Q Information

The Trust files a complete schedule of portfolio holdings for each Series with the SEC for the first and third quarters of each fiscal year on Form N-Q. Form N-Q is available on the SEC’s website at http://www.sec.gov. Form N-Q may be reviewed and copied at the SEC’s Public Reference Room. Information on the operation of the SEC’s Public Reference Room can be obtained by calling toll-free 1-800-SEC-0330.

To Virtus Variable Insurance Trust Investors:

I am pleased to present this annual report that reviews the performance of your series for the 12 months ended December 31, 2018.

U.S. economic growth and strong corporate earnings were consistent themes for much of 2018, which began on an optimistic note following the sweeping tax overhaul signed into law at the end of 2017. As growth heated up, inflation fears ushered in the return of volatility after being conspicuously absent for more than a year. At the same time, the persistent strength of the economy moved the Federal Reserve to hike interest rates four times during 2018, ending at 2.50% as of December 20, the highest level in more than a decade. Volatility spiked dramatically in December amid investor fears of rising interest rates and a potential global growth slowdown.

Despite a positive start to 2018, world equity markets turned negative in the last few months of the year, giving back their gains from the previous nine months. For the 12 months ended December 31, 2018, U.S. large-cap stocks, as measured by the S& P 500® Index, declined 4.38%, while small-cap stocks lost 11.01%, as measured by the Russell 2000® Index. Internationally, developed markets were down 13.79%, as measured by the MSCI EAFE® Index (net), while emerging markets declined 14.58%, as measured by the MSCI Emerging Markets Index.

In fixed income markets, the yield on the 10-year Treasury steadily climbed, to reach 2.69% at December 31, 2018, up from 2.40% at December 31, 2017. The broader U.S. fixed income market, as represented by the Bloomberg Barclays U.S. Aggregate Bond Index, which tracks Treasuries and other investment-grade debt securities, was flat, with a return of 0.01% for the 12 months. Non-investment grade bonds slipped into negative territory and declined 2.08%, as measured by the Bloomberg Barclays U.S. Corporate High Yield Bond Index.

These last few months of market uncertainty serve as a reminder of the importance of portfolio diversification, including exposure to traditional and alternative asset classes. While diversification cannot guarantee a profit or prevent a loss, owning a variety of asset classes may cushion your portfolio against inevitable market fluctuations. Your financial advisor can help you ensure that your variable investment portfolio is adequately diversified across asset classes and investment strategies.

On behalf of our investment affiliates, thank you for entrusting the Virtus Funds with your assets. Should you have questions about your account or require assistance, please visit Virtus.com, or call our customer service team at 800-367-5877. We appreciate your business and remain committed to your long-term financial success.

Sincerely,

George R. Aylward

President, Virtus Mutual Funds

February 2019

Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above.

VIRTUS VARIABLE INSURANCE TRUST

DISCLOSURE OF FUND EXPENSES (Unaudited)

FOR THE SIX-MONTH PERIOD OFJuly 1, 2018 TODecember 31, 2018

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of a Virtus Variable Insurance Trust Series (each, a “Series”), you may incur ongoing costs, including investment advisory fees and other expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in a Series and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period. The Annualized Expense Ratios may be different from the expense ratios in the Financial Highlights which are for the fiscal year ended December 31, 2018.

Please note that the expenses shown in the accompanying tables are meant to highlight your ongoing costs only and do not reflect additional fees and expenses associated with the annuity or life insurance policy through which you invest. Therefore, the accompanying tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if the annuity or life insurance policy costs were included, your costs would have been higher. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | Beginning

Account Value

July 1, 2018 | | Ending

Account value

December 31, 2018 | | Annualized

Expense

Ratio | | Expenses

Paid

During

Period* |

Duff & Phelps International Series

| | | | | | | | |

| | Class A | $ 1,000.00 | | $ 835.60 | | $ 1.18 | | $ 5.46 |

| | Class I | 1,000.00 | | 836.50 | | 0.93 | | 4.30 |

Duff & Phelps Real Estate Securities Series

| | | | | | | | |

| | Class A | 1,000.00 | | 926.70 | | 1.16 | | 5.63 |

| | Class I | 1,000.00 | | 927.40 | | 0.91 | | 4.42 |

KAR Capital Growth Series

| | | | | | | | |

| | Class A | 1,000.00 | | 846.30 | | 1.03 | | 4.79 |

KAR Small-Cap Growth Series

| | | | | | | | |

| | Class A | 1,000.00 | | 896.80 | | 1.19 | | 5.69 |

| | Class I | 1,000.00 | | 897.90 | | 0.94 | | 4.50 |

KAR Small-Cap Value Series

| | | | | | | | |

| | Class A | 1,000.00 | | 851.70 | | 1.20 | | 5.60 |

Newfleet Multi-Sector Intermediate Bond Series

| | | | | | | | |

| | Class A | 1,000.00 | | 991.70 | | 0.93 | | 4.67 |

| | Class I | 1,000.00 | | 993.30 | | 0.68 | | 3.42 |

Rampart Enhanced Core Equity Series

| | | | | | | | |

| | Class A | 1,000.00 | | 912.40 | | 0.98 | | 4.72 |

Strategic Allocation Series

| | | | | | | | |

| | Class A | 1,000.00 | | 903.30 | | 0.98 | | 4.70 |

| * | Expenses are equal to the relevant Series’ annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (184) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

For Series which may invest in other funds, the annualized expense ratios noted above do not reflect fees and expenses associated with the underlying funds. If such fees and expenses had been included, the expense ratios would have been higher.

You can find more information about a Series’ expenses in the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs, refer to that Series’ prospectus.

VIRTUS VARIABLE INSURANCE TRUST

DISCLOSURE OF FUND EXPENSES (Unaudited) (Continued)

FOR THE SIX-MONTH PERIOD OFJuly 1, 2018 TODecember 31, 2018

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on each Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not your Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other mutual funds.

| | | Beginning

Account Value

July 1, 2018 | | Ending

Account value

December 31, 2018 | | Annualized

Expense

Ratio | | Expenses

Paid

During

Period* |

Duff & Phelps International Series

| | | | | | | | |

| | Class A | $ 1,000.00 | | $ 1,019.26 | | $ 1.18 | | $ 6.01 |

| | Class I | 1,000.00 | | 1,020.52 | | 0.93 | | 4.74 |

Duff & Phelps Real Estate Securities Series

| | | | | | | | |

| | Class A | 1,000.00 | | 1,019.36 | | 1.16 | | 5.90 |

| | Class I | 1,000.00 | | 1,020.62 | | 0.91 | | 4.63 |

KAR Capital Growth Series

| | | | | | | | |

| | Class A | 1,000.00 | | 1,020.01 | | 1.03 | | 5.24 |

KAR Small-Cap Growth Series

| | | | | | | | |

| | Class A | 1,000.00 | | 1,019.21 | | 1.19 | | 6.06 |

| | Class I | 1,000.00 | | 1,020.47 | | 0.94 | | 4.79 |

KAR Small-Cap Value Series

| | | | | | | | |

| | Class A | 1,000.00 | | 1,019.16 | | 1.20 | | 6.11 |

Newfleet Multi-Sector Intermediate Bond Series

| | | | | | | | |

| | Class A | 1,000.00 | | 1,020.52 | | 0.93 | | 4.74 |

| | Class I | 1,000.00 | | 1,021.78 | | 0.68 | | 3.47 |

Rampart Enhanced Core Equity Series

| | | | | | | | |

| | Class A | 1,000.00 | | 1,020.27 | | 0.98 | | 4.99 |

Strategic Allocation Series

| | | | | | | | |

| | Class A | 1,000.00 | | 1,020.27 | | 0.98 | | 4.99 |

| * | Expenses are equal to the relevant Series’ annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (184) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

For Series which may invest in other funds, the annualized expense ratios noted above do not reflect fees and expenses associated with the underlying funds. If such fees and expenses had been included, the expense ratios would have been higher.

You can find more information about a Series’ expenses in the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs, refer to that Series’ prospectus.

VIRTUS VARIABLE INSURANCE TRUST

KEY INVESTMENT TERMS (Unaudited)

December 31, 2018

American Depositary Receipt (“ADR”)

Represents shares of foreign companies traded in U.S. dollars on U.S. exchanges that are held by a U.S. bank or a trust. Foreign companies use ADRs in order to make it easier for Americans to buy their shares.

Bloomberg Barclays U.S. Aggregate Bond Index

The Bloomberg Barclays U.S. Aggregate Bond Index measures the U.S. investment-grade fixed-rate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Bloomberg Barclays U.S. Corporate High Yield Bond Index

The Bloomberg Barclays U.S. Corporate High Yield Bond Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Composite Index for Strategic Allocation Series

The Composite Index for Strategic Allocation Series consists of 45% Russell 1000® Growth Index (a market capitalization-weighted index of growth-oriented stocks of the 1,000 largest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies, calculated on a total return basis with dividends reinvested), 15% MSCI EAFE® Index (net) (a free float-adjusted market capitalization-weighted index that measures developed foreign market equity performance, excluding the U.S. and Canada, calculated on a total return basis with net dividends reinvested) and 40% Bloomberg Barclays U.S. Aggregate Bond Index (an index that measures the U.S. investment grade fixed rate bond market, calculated on a total return basis). The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. Performance of the Composite Index for Strategic Allocation Series prior to 9/7/2016 represents an allocation consisting of 60% S&P 500® Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index.

Exchange-Traded Fund (“ETF”)

An open-end fund that is traded on a stock exchange. Most ETFs have a portfolio of stocks or bonds that track a specific market index.

Federal Reserve (the “Fed”)

The Central Bank of the U.S., responsible for controlling the money supply, interest rates, and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member board, the system includes 12 regional Federal Reserve Banks, 25 branches, and all national and state banks that are part of the system.

FTSE NAREIT Equity REITs Index

The FTSE NAREIT Equity REITs Index is a free-float market capitalization-weighted index measuring equity tax-qualified real estate investment trusts, which meet minimum size and liquidity criteria, that are listed on the New York Stock Exchange, the American Stock Exchange and the NASDAQ National Market System. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

London Interbank Offered Rate (LIBOR)

A benchmark rate that some of the world’s leading banks charge each other for short-term loans and that serves as the first step to calculating interest rates on various loans throughout the world.

MSCI EAFE® Index (net)

The MSCI EAFE® (Europe, Australasia, Far East) Index (net) is a free float-adjusted market capitalization-weighted index that measures developed foreign market equity performance, excluding the U.S. and Canada. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

MSCI Emerging Markets Index (net)

The MSCI Emerging Markets Index (net) is a free float-adjusted market capitalization-weighted index designed to measure equity market performance in the global emerging markets. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

VIRTUS VARIABLE INSURANCE TRUST

KEY INVESTMENT TERMS (Unaudited) (Continued)December 31, 2018

Payment-in-Kind Security (“PIK”)

A bond which pays interest in the form of additional bonds, or preferred stock which pays dividends in the form of additional preferred stock.

Price-Earnings Ratio (“P/E Ratio”)

The price-to-earnings ratio indicates the dollar amount an investor can expect to invest in a company in order to receive one dollar of that company’s earnings. This is why the P/E is sometimes referred to as the price multiple because it shows how much investors are willing to pay per dollar of earnings.

Real Estate Investment Trust (“REIT”)

A publicly traded company that owns, develops, and operates income-producing real estate such as apartments, office buildings, hotels, shopping centers, and other commercial properties.

Russell 1000® Growth Index

The Russell 1000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the 1,000 largest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Russell 2000® Growth Index

The Russell 2000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the smallest 2,000 companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Russell 2000®Index

The Russell 2000® Index is a market capitalization-weighted index of the 2,000 smallest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Russell 2000® Value Index

The Russell 2000® Value Index is a market capitalization-weighted index of value-oriented stocks of the smallest 2,000 companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Same Store Net Operating Income Growth (“Same Store NOI Growth”)

Same Store NOI Growth means the growth in revenue generated by a retail chain’s existing outlets over a certain period (often a fiscal quarter or a particular shopping season), compared to an identical period in the past. For REITs the calculation is simply the growth in net operating income for properties that have been open for longer than one year. Net operating income is the annual income generated by an income-producing property after taking into account all income collected from operations, and deducting all expenses incurred from operations.

S&P 500® Index

The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

S&P 500® Growth Index

The S&P 500® Growth Index represents the growth companies of the S&P 500® Index, tracking the growth companies of the S&P 500® Index as identified by three factors: three year earnings per share growth rate, three year sales per share growth rate, and momentum (12-month change in price). The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

VIRTUS VARIABLE INSURANCE TRUST

KEY INVESTMENT TERMS (Unaudited) (Continued)December 31, 2018

Sponsored ADR (American Depositary Receipt)

An ADR which is issued with the cooperation of the company whose stock will underlie the ADR. Sponsored ADRs generally carry the same rights normally given to stockholders, such as voting rights. ADRs must be sponsored to be able to trade on a major U.S. exchange such as the New York Stock Exchange (“NYSE”).

Treasury Yield

The return on investment, expressed as a percentage, on the U.S. government’s debt obligations (bonds, notes and bills). The Treasury yield is considered a bellwether of the U.S. economy; the higher the yields on 10-, 20- and 30-year Treasuries, the better the economic outlook.

U.S. Dollar Index®

The U.S. Dollar Index® is a geometrically-averaged calculation of the following six currencies weighted against the U.S. dollar: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc. The index is compiled by ICE Futures U.S., Inc. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Yankee bonds

Yankee bonds are dollar-denominated instruments issued in the U.S. market by foreign branches of U.S. banks and U.S. branches of foreign banks.

Duff & Phelps International Series

Series Summary (Unaudited)

Portfolio Manager Commentary by Duff & Phelps Investment Management Co. (“Duff & Phelps”)

The Series is diversified and has an investment objective of high total return consistent with reasonable risk.There is no guarantee that the Fund will meet its objective.

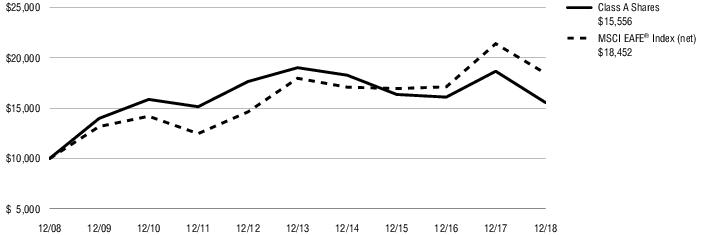

| ■ | For the fiscal year ended December 31, 2018, the Series’ Class A shares at NAV returned -16.67% and Class I shares at NAV returned -16.44%. For the same period, the MSCI EAFE® Index (net), which serves as the Series’ broad-based and style-specific benchmark appropriate for comparison, returned -13.79%. |

All performance figures assume reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please visit Virtus.com for performance data current to the most recent month-end.

How did the international equity markets perform during the fiscal year ended December 31, 2018?

International equity markets, as represented by the MSCI EAFE® Index (net), delivered a return of -13.79% for the 12-month period. The third quarter was the only one with positive returns, and the fourth quarter ended the year with an emphatically negative exclamation point. Investors worried about multiple factors including a potential slowdown in economic growth and corporate profits, uncertainty surrounding U.S. Federal Reserve (the “Fed”) policy, unresolved U.S.-China trade issues, a lower commodity market led downward by oil, and poor year-end liquidity.

What factors affected the Series’ performance during its fiscal year?

Both sector allocation and security selection detracted from the Series’ performance for the fiscal year ended December 31, 2018, with security

selection having a slightly greater impact. On a sector performance basis, only one of the 11 market sectors posted positive returns, exemplifying the widespread nature of international equity market turmoil during the period.

The Series’ health care holdings had a challenging year, detracting 1.57% on a relative basis for the 12-month period. This was due primarily to unfavorable security selection (particularly Bayer and Allergan) and the adverse effect of being underweight the sector as it outperformed the index. The second largest detractor at the sector level was industrials, also primarily due to security selection (especially Easyjet and Golden Ocean). The third largest detractor was utilities, due to both security selection and the Series’ underweight position.

On the positive side, the Series’ financial sector investments contributed 0.71% to relative performance for the year, due to favorable security selection (particularly DBS Group and China Construction Bank). The second largest contributor at the sector level was consumer staples, due to security selection (especially Mowi). The third largest contributor was consumer discretionary, also due to security selection.

Going into the fourth quarter of the fiscal year, the best relative values were to be found in high quality cyclically oriented companies. These stocks were poised to benefit the most from a sustained global growth trend, and we positioned the Series’ holdings to exploit this trend accordingly. Unfortunately, market sentiment turned on a dime in the fourth quarter, in a way that few market pundits had predicted.

As the year ended, a litany of fears around U.S.-China relations, Fed policy, and the sustainability of global economic fundamentals dramatically reversed market sentiment. Volatility spiked during the fourth quarter of 2018, with the more cyclical names bearing the brunt.

The preceding information is the opinion of portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as

investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Derivatives:Investments in derivatives such as futures, options, forwards, and swaps may increase volatility or cause a loss greater than the principal investment.

Equity Securities:The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk.

Foreign & Emerging Markets:Investing internationally, especially in emerging markets, involves additional risks such as currency, political, accounting, economic, and market risk.

Prospectus:For additional information on risks, please see the Series’ prospectus.

Asset Allocations

The following table presents asset allocations within certain sectors as a percentage of total investments as of December 31, 2018.

| Financials | 26% |

| Industrials | 19 |

| Information Technology | 14 |

| Energy | 9 |

| Consumer Discretionary | 8 |

| Materials | 7 |

| Consumer Staples | 6 |

| Other | 11 |

| Total | 100% |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

Duff & Phelps International Series(Continued)

Average Annual Total Returns1for periods ended 12/31/18

| | | 1 Year | 5 Years | 10 Years | Since

inception | Inception

date |

| Class A Shares at NAV2 | -16.67% | -3.94% | 4.52% | —% | — |

| Class I Shares at NAV2 | -16.44 | -3.70 | — | -3.07 | 4/30/13 |

| MSCI EAFE® Index (net) | -13.79 | 0.53 | 6.32 | 2.333 | — |

| Series Expense Ratios4: Class A Shares: Gross 1.21%, Net 1.18%; Class I Shares: Gross 0.96%, Net 0.93%. | | | | | | |

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not reflect any fees or expenses associated with the separate insurance products. |

| 3 | The since inception index return is from the inception date of Class I shares. |

| 4 | The expense ratios of the Series, are set forth according to the prospectus for the Series effective April 30, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expenses: Expenses reduced by a contractual fee waiver, in effect through April 30, 2020. Gross Expenses: Do not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with underlying funds. |

Growth of $10,000for periods ended 12/31

This chart assumes an initial investment of $10,000 made on December 31, 2008 for Class A shares. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

Duff & Phelps Real Estate Securities Series

Series Summary (Unaudited)

Portfolio Manager Commentary by Duff & Phelps Investment Management Co.

The Series is diversified and has investment objectives of capital appreciation and income with approximately equal emphasis.There is no guarantee that the Fund will meet its objectives.

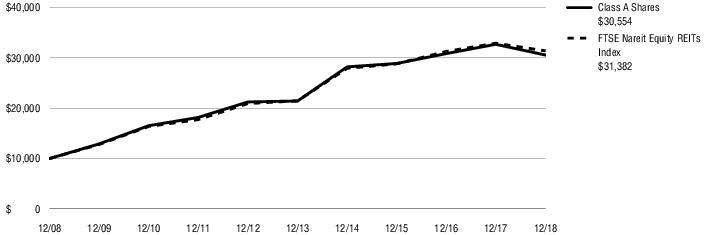

| ■ | For the fiscal year ended December 31, 2018, the Series’ Class A shares at NAV returned -6.53% and Class I shares at NAV returned -6.36%. For the same period, the FTSE NAREIT Equity REITs Index, which serves as the Series’ broad-based and style-specific benchmark appropriate for comparison, returned -4.62%. |

All performance figures assume reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please visit Virtus.com for performance data current to the most recent month-end.

How did the markets perform during the Series’ fiscal year ended December 31, 2018?

In a challenging environment for financial markets, real estate investment trusts (REITs), as measured by the FTSE Nareit Equity REITs Index, outperformed the broader market in the fourth quarter, including in the month of December, and finished roughly in line with the broader market for the year. For the quarter, the S&P 500® Index delivered a -13.5% return, while REITs delivered a -6.7% return. The month of December was the worst finish for the broader market since World War II. For the full year, REITs delivered a -4.6% return versus -4.4% for the S&P 500®Index.

Numerous economic and geopolitical factors contributed to the tough finish to the year for the broader market and, to a lesser extent, for REITs. These included the impact of trade tariffs on the global economy and China in particular, broader market concerns about earnings growth, the Federal Reserve’s (the Fed’s) December actions and messaging, confidence in elected officials, and the U.S. government shutdown.

There had been some expectation that the Fed would appear more accommodative to global growth concerns, including the negative impact from trade tariffs with China, at its December meeting. Instead, the Fed elected to increase rates for the fourth time in 2018 despite the growth concerns. It also articulated two probable rate increases in 2019, as well as ongoing unwinding of its balance sheet.

The fourth quarter equity market selloff led to significant discounts for REITs versus private market valuations. At the same time, capital continued to be raised for private real estate funds, boosting the potential of mergers and acquisitions (M&A), as real estate is now priced notably cheaper on Wall Street than it is on Main Street.

While growth rates in earnings for the broader market were called into question, REITs had a solid third quarter earnings season. Most companies beat or raised 2018 earnings guidance, or both. As measured by Evercore ISI, REITs posted same store net operating income growth of 3.1% in the third quarter of 2018, a level of organic growth which has been consistent over the past four quarters. This visible organic growth highlights the durable cash flow and earnings drivers for REITs. In addition, REITs continued to prune their portfolios by selling properties to private real estate funds at attractive prices. This allowed them to strengthen their balance sheets further, while positioning themselves to redeploy capital into new opportunities such as redevelopment, development, acquisitions, or share buybacks.

What factors affected the Series’ performance during its fiscal year?

For the fiscal year, the Series benefited from security selection. Property sector allocation detracted and led the Series to lag its style-specific benchmark for the fiscal year ended December 31, 2018.

Freestanding retail, manufactured homes, and health care delivered the best total returns over the 12-month period. The bottom-performing property sectors for the year included shopping centers, office, and data centers.

More defensive areas within the broader market outperformed for the fourth quarter and the year, just as they did within REITs. Health care cash flows and price-earnings ratios moved considerably higher amid a combination of downward earnings

estimates, operator and supply challenges, and some events which became catalysts. Health care faced operator challenges within senior housing and skilled nursing facilities, increased labor costs and margin pressures, and excess supply concerns in senior housing. Catalysts beyond a move to a defensive environment included M&A, portfolio transformations, and operator renegotiations, even if dilutive. Freestanding retail also experienced expansion of price-earnings ratios, and took advantage of share appreciation to issue equity to fund acquisitions, experiencing modest downward earnings revisions on the year.

The most significant individual positive contributor to relative performance during the Series’ fiscal year was an underweight allocation to and security selection within regional malls, which lagged, followed by an overweight allocation and security selection in the outperforming manufactured homes sector. Security selection within data centers was the Series’ third largest positive contributor.

The most significant detractor from relative performance during the Series’ fiscal year was an underweight allocation and security selection within health care, which struggled as mentioned above. The second largest detractor was an underweight allocation and security selection within freestanding retail, as the sector outperformed materially in the defensive environment. Lodging was the third largest detractor due to security selection and a modest overweight allocation, as the sector lagged in the defensive environment of late 2018.

The preceding information is the opinion of portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Equity Securities:The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk.

Industry/Sector Concentration:A series that focuses its investments in a particular industry or sector will

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

Duff & Phelps Real Estate Securities Series(Continued)

be more sensitive to conditions that affect that industry or sector than a non-concentrated series.

Real Estate:The Series may be negatively affected by factors specific to the real estate market, including interest rates, leverage, property, and management.

Prospectus:For additional information on risks, please see the Series’ prospectus.

Asset Allocations

The following table presents asset allocations within certain sectors as a percentage of total investments as of December 31, 2018.

| Apartments | 21% |

| Office | 19 |

| Industrial | 12 |

| Data Centers | 9 |

| Lodging / Resorts | 8 |

| Self Storage | 8 |

| Shopping Centers | 7 |

| Other (includes short-term investment) | 16 |

| Total | 100% |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

Duff & Phelps Real Estate Securities Series(Continued)

Average Annual Total Returns1for periods ended 12/31/18

| | | 1 Year | 5 Years | 10 Years | Since

inception | Inception

date |

| Class A Shares at NAV2 | -6.53% | 7.35% | 11.82% | —% | — |

| Class I Shares at NAV2 | -6.36 | 7.61 | — | 4.62 | 4/30/13 |

| FTSE NAREIT Equity REITs Index | -4.62 | 7.90 | 12.12 | 4.713 | — |

| Series Expense Ratios4: Class A Shares: Gross 1.21%, Net 1.16%; Class I Shares: Gross 0.96%, Net 0.91%. | | | | | | |

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not reflect any fees or expenses associated with the separate insurance products. |

| 3 | The since inception index return is from the inception date of Class I shares. |

| 4 | The expense ratios of the Series, are set forth according to the prospectus for the Series effective April 30, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expenses: Expenses reduced by a contractual fee waiver, in effect through April 30, 2020. Gross Expenses: Do not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with underlying funds. |

Growth of $10,000for periods ended 12/31

This chart assumes an initial investment of $10,000 made on December 31, 2008 for Class A shares. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

KAR Capital Growth Series

Series Summary (Unaudited)

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

The Series is diversified and has an investment objective of long-term growth of capital.There is no guarantee that the Fund will meet its objective.

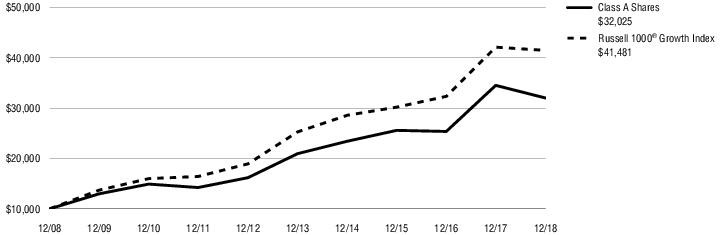

| ■ | For the fiscal year ended December 31, 2018, the Series’ Class A shares at NAV returned -7.25%. For the same period, the Russell 1000® Growth Index, which serves as the Series’ broad- based and style-specific benchmark appropriate for comparison, returned -1.51%. |

All performance figures assume reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please visit Virtus.com for performance data current to the most recent month-end.

How did the markets perform during the Series’ fiscal year ended December 31, 2018?

The year 2018 proved to be challenging for investors. After a strong 2017, global equity markets began 2018 on a positive note, but experienced a dramatic change in sentiment in the latter half of the year. The last three months were particularly tough, with the stock market suffering notably. Virtually all domestic equity categories saw fourth-quarter returns wipe out their gains from the first nine months of the year.

The S&P 500® Index closed the year in negative territory at -4.38%, a sharp reversal of its double-digit gains in 2017. The S&P 500® Growth Index was flat for the year (-0.01%), outperforming its value counterpart, which fell 8.95%. International stocks fared poorly as well, with the MSCI EAFE® Index down 13.79% and the MSCI Emerging Markets Index losing 14.58% for the year.

The Russell 1000® Growth Index fell 1.51% in 2018, again a stark turnaround from its 2017 gain in excess of 30%. The utilities sector was the best performer, up 9.15%. Other positive sectors included consumer discretionary (5.22%) and information technology (4.48%). Sectors that saw losses were energy

(-29.91%), materials (-14.61%), and communication services (-11.11%).

Throughout 2018, a disconnect became apparent between the market’s expectations for growth in 2019-2020 and those of the Federal Reserve (the Fed). Equity, bond, and commodity investors priced in much slower growth—perhaps even a recession—for this year and next, while the Fed focused on immediate conditions, which were primarily still solid.

What factors affected the Series’ performance during its fiscal year?

The Series underperformed the Russell 1000® Growth Index for the 12 months ended December 31, 2018. Performance was hurt by weak stock selection in the consumer discretionary and consumer staples sectors. Losses were partially offset by strong stock selection in industrials and materials.

The stocks that contributed the most to the year’s gains were Workday and Paycom Software.

Cloud providers like Workday have disrupted the market once dominated by SAP and Oracle by lowering total cost of ownership while improving performance and functionality through regular updates delivered in the cloud. After spending years to build up its capabilities to offer financials, and after buying Adaptive Insights to offer planning, Workday now has a complete suite of enterprise resource planning (ERP) capabilities.

After a lull in new sales office openings in 2017, Paycom ramped them up in 2018, which contributed to a re-acceleration of growth. Paycom also has developed a differentiated mobile offering that increases user engagement, which we believe drives customer value and retention, as well as the potential to sell more products.

The holdings that detracted the most from performance were Facebook and NVIDIA.

Hyper-negative headlines continued to haunt social media titan Facebook. Following the Cambridge Analytica scandal, in which the company allowed unauthorized access to information on users and their friends, Facebook disclosed it had suffered a data breach, and a high-ranking Facebook executive was seen at Brett Kavanaugh’s incendiary Senate committee hearing. In the fourth quarter of 2018, Facebook also admitted it had allowed other

companies to read users’ private messages, and was slapped with a lawsuit from Washington D.C.’s attorney general. It was highly encouraging that, in the most recent quarter, the negative headlines did not seem to be affecting advertising spend or user engagement. We bought back a small amount of the shares we had sold.

NVIDIA is the dominant player in the duopolistic graphics processing unit (GPU) market. Its roots are in the still-healthy gaming market, but NVIDIA now has three new and powerful long-term growth drivers: datacenters, auto, and virtual reality (VR). While the largest and most sophisticated tech companies were reorienting their businesses around GPU-enabled artificial intelligence (AI), NVIDIA’s gaming segment appeared to be struggling under tough competition from the crypto-currency mining boom. GPU chips are key components of mining rigs, and the company twice underestimated how much cryptos were driving sales of gaming chips.

The preceding information is the opinion of portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Equity Securities:The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk.

Industry/Sector Concentration:A series that focuses its investments in a particular industry or sector will be more sensitive to conditions that affect that industry or sector than a non-concentrated series.

Limited Number of Investments:Because the Series has a limited number of securities, it may be more susceptible to factors adversely affecting its securities than a less concentrated series.

Prospectus:For additional information on risks, please see the Series’ prospectus.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

KAR Capital Growth Series(Continued)

Asset Allocations

The following table presents asset allocations within certain sectors as a percentage of total investments as of December 31, 2018.

| Consumer Discretionary | 27% |

| Information Technology | 24 |

| Communication Services | 14 |

| Health Care | 10 |

| Industrials | 8 |

| Financials | 8 |

| Consumer Staples | 3 |

| Other | 6 |

| Total | 100% |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

KAR Capital Growth Series(Continued)

Average Annual Total Returns1for periods ended 12/31/18

| | | 1 Year | 5 Years | 10 Years |

| Class A Shares at NAV2 | -7.25% | 8.84% | 12.34% |

| Russell 1000® Growth Index | -1.51 | 10.40 | 15.29 |

| Series Expense Ratios3: Class A Shares: Gross 1.13%, Net 1.03%. | | | | |

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not reflect any fees or expenses associated with the separate insurance products. |

| 3 | The expense ratios of the Series, are set forth according to the prospectus for the Series effective April 30, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expenses: Expenses reduced by a contractual fee waiver, in effect through April 30, 2020. Gross Expenses: Do not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with underlying funds. |

Growth of $10,000for periods ended 12/31

This chart assumes an initial investment of $10,000 made on December 31, 2008 for Class A shares. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

KAR Small-Cap Growth Series

Series Summary (Unaudited)

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

The Series is diversified and has an investment objective of long-term capital growth.There is no guarantee that the Fund will meet its objective.

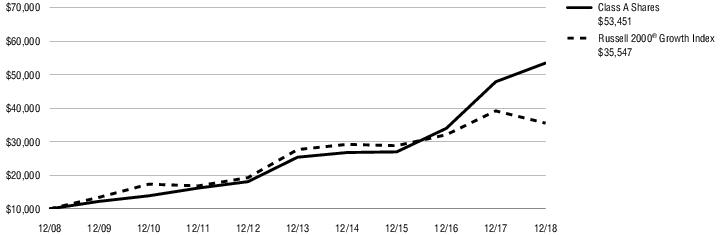

| ■ | For the fiscal year ended December 31, 2018, the Series’ Class A shares at NAV returned 11.66% and Class I shares at NAV returned 11.95%. For the same period, the Russell 2000® Growth Index, which serves as the Series’ broad-based and style-specific benchmark appropriate for comparison, returned -9.31%. |

All performance figures assume reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please visit Virtus.com for performance data current to the most recent month-end.

How did the markets perform during the Series’ fiscal year ended December 31, 2018?

The year 2018 proved to be challenging for investors. After a strong 2017, global equity markets began 2018 on a positive note, but experienced a dramatic change in sentiment in the latter half of the year. The last three months were particularly tough, with the stock market suffering notably. Virtually all domestic equity categories saw fourth-quarter returns wipe out their gains from the first nine months of the year.

The S&P 500® Index closed the year in negative territory at -4.38%, a sharp reversal of its double-digit gains in 2017. The S&P 500® Growth Index was flat for the year (-0.01%), outperforming its value counterpart, which fell 8.95%. International stocks fared poorly as well, with the MSCI EAFE® Index down 13.79% and the MSCI Emerging Markets Index losing 14.58% for the year.

The Russell 2000® Growth Index fell 9.31% in 2018. Energy was the worst performing sector within the index, losing 44.80%. Other detractors included materials & processing (-26.85%) and producer

durables (-16.88%). Technology was the only sector that posted a positive return for the year.

Throughout 2018, a disconnect became apparent between the market’s expectations for growth in 2019-2020 and those of the Federal Reserve (the Fed). Equity, bond, and commodity investors priced in much slower growth—perhaps even a recession—for this year and next, while the Fed focused on immediate conditions, which were primarily still solid.

What factors affected the Series’ performance during its fiscal year?

The Series outperformed the Russell 2000®Growth Index for the 12 months ended December 31, 2018. The Series beat the benchmark in every sector category, including in technology and producer durables, thanks to strong stock selection.

From an individual stock perspective, the holdings that contributed the most to performance were Autohome and Fox Factory.

Autohome’s shares rose on high profit growth after management exited an unprofitable business segment. The company’s core subscription and advertising businesses continued to prosper during the period.

The Fox business continued to perform well as it posted revenue growth in each of its reportable segments and expanded its gross margins. We believe the growth indicates that the company has a strong brand and investors endorse its efforts to drive ongoing growth by pursuing premium and higher performance products.

The stocks that detracted the most from performance were Omega Flex and Emerald Expositions Events.

Shares of Omega Flex lagged due to investor concerns about the company’s exposure to the slowing residential housing construction segment. In October 2018, Omega Flex once again reported excellent operating results driven by solid top-line growth and margin expansion. Omega Flex remained a solid free-cash-flow generator, maintaining a cash-rich, debt-free balance sheet and returning excess cash to shareholders in the form of regular cash dividends. Our investment thesis in Omega Flex remains intact, and we continue to hold the stock.

Emerald encountered organic revenue shrinkage in the third quarter of 2018, and structural issues surfaced regarding the cost to attend traditional tradeshows relative to the value they provide. As e-commerce and direct-to-consumer platforms influence distribution models, we believe the value proposition and competitive stance of tradeshows has deteriorated. We exited our position in the stock.

The preceding information is the opinion of portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Equity Securities:The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk.

Industry/Sector Concentration:A series that focuses its investments in a particular industry or sector will be more sensitive to conditions that affect that industry or sector than a non-concentrated series.

Limited Number of Investments:Because the Series has a limited number of securities, it may be more susceptible to factors adversely affecting its securities than a less concentrated series.

Prospectus:For additional information on risks, please see the Series’ prospectus.

Asset Allocations

The following table presents asset allocations within certain sectors as a percentage of total investments as of December 31, 2018.

| Information Technology | 23% |

| Communication Services | 19 |

| Industrials | 18 |

| Financials | 18 |

| Consumer Discretionary | 9 |

| Health Care | 6 |

| Consumer Staples | 5 |

| Other (includes securities lending collateral) | 2 |

| Total | 100% |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

KAR Small-Cap Growth Series(Continued)

Average Annual Total Returns1for periods ended 12/31/18

| | | 1 Year | 5 Years | 10 Years | Since

inception | Inception

date |

| Class A Shares at NAV2 | 11.66% | 16.05% | 18.25% | —% | — |

| Class I Shares at NAV2 | 11.95 | 16.35 | — | 19.07 | 4/30/13 |

| Russell 2000® Growth Index | -9.31 | 5.13 | 13.52 | 9.073 | — |

| Series Expense Ratios4: Class A Shares: Gross 1.31%, Net 1.20%; Class I Shares: Gross 1.06%, Net 0.95%. | | | | | | |

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not reflect any fees or expenses associated with the separate insurance products. |

| 3 | The since inception index return is from the inception date of Class I shares. |

| 4 | The expense ratios of the Series, are set forth according to the prospectus for the Series effective April 30, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expenses: Expenses reduced by a contractual fee waiver, in effect through April 30, 2020. Gross Expenses: Do not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with underlying funds. |

Growth of $10,000for periods ended 12/31

This chart assumes an initial investment of $10,000 made on December 31, 2008 for Class A shares. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

KAR Small-Cap Value Series

Series Summary (Unaudited)

Portfolio Manager Commentary by Kayne Anderson Rudnick Investment Management, LLC

The Series is diversified and has an investment objective of long-term capital appreciation.There is no guarantee that the Fund will meet its objective.

| ■ | For the fiscal year ended December 31, 2018, the Series’ Class A shares at NAV returned -15.88%. For the same period, the Russell 2000® Value Index, which serves as the Series’ broad-based and style-specific benchmark appropriate for comparison, returned -12.86%. |

All performance figures assume reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please visit Virtus.com for performance data current to the most recent month-end.

How did the markets perform during the Series’ fiscal year ended December 31, 2018?

The year 2018 proved to be challenging for investors. After a strong 2017, global equity markets began 2018 on a positive note, but experienced a dramatic change in sentiment in the latter half of the year. The last three months were particularly tough, with the stock market suffering notably. Virtually all domestic equity categories saw fourth-quarter returns wipe out their gains from the first nine months of the year.

The S&P 500® Index closed the year in negative territory at -4.38%, a sharp reversal of its double-digit gains in 2017. The S&P 500® Growth Index was flat for the year (-0.01%), outperforming its value counterpart, which fell 8.95%. International stocks fared poorly as well, with the MSCI EAFE® Index down 13.79% and the MSCI Emerging Markets Index losing 14.58% for the year.

The Russell 2000® Value Index fell 12.87% in 2018. All sectors within the index except utilities posted losses, led by energy, which declined 35.37%. Other sectors that exhibited weakness included materials & processing (-27.38%) and consumer staples (-23.36%). The utilities category was up 2.87%.

Throughout 2018, a disconnect became apparent between the market’s expectations for growth in 2019-2020 and those of the Federal Reserve (the Fed). Equity, bond, and commodity investors priced in much slower growth—perhaps even a recession—for this year and next, while the Fed focused on immediate conditions, which were primarily still solid.

What factors affected the Series’ performance during its fiscal year?

The Series underperformed the Russell 2000® Value Index for the 12 months ended December 31, 2018. Weak stock selection in the consumer discretionary and health care sectors detracted from performance, while strong stock selection in consumer staples and producer durables made a positive contribution to performance.

The companies that contributed the most to performance were WD-40 and First Financial Bankshares.

Throughout 2018, WD-40 reported strong operating results with sales growth and relatively stable profitability, despite significant inflation in raw materials costs. The company made advances in both mix and price by promoting its Specialist line, which is targeted to industrial-grade users of the company’s flagship product.

First Financial’s shares held up well throughout the year despite the broader market volatility as the company continued to report steady earnings growth with pristine credit quality.

The stocks that detracted the most from performance were Thor Industries and Scotts Miracle-Gro.

Thor’s shares came under pressure due to industry fears of a top in the current recreational vehicle (RV) cycle, as evidenced by increased inventories at dealers and reduced volume of unit sales from original equipment manufacturers. In the fourth quarter of 2018, Thor’s revenues, as well as its towable and motorized product order backlog, decreased by double-digit percentages. We believe the competitive dynamics and positioning of the company remain intact, and we continue to hold the stock.

Scotts Miracle-Gro declined due to a historically late lawn-and-garden season, which impacted the core U.S. consumer segment. California’s new cannabis

licensing laws affected the company’s hydroponic segment by temporarily disrupting cannabis-grower customers. We see both events as one-time in nature, however, and view the company’s brand and distribution advantages as intact. Therefore, we remain shareholders.

The preceding information is the opinion of portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Equity Securities:The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk.

Industry/Sector Concentration:A series that focuses its investments in a particular industry or sector will be more sensitive to conditions that affect that industry or sector than a non-concentrated series.

Limited Number of Investments:Because the Series has a limited number of securities, it may be more susceptible to factors adversely affecting its securities than a less concentrated series.

Prospectus:For additional information on risks, please see the Series’ prospectus.

Asset Allocations

The following table presents asset allocations within certain sectors as a percentage of total investments as of December 31, 2018.

| Industrials | 23% |

| Financials | 18 |

| Information Technology | 16 |

| Consumer Discretionary | 11 |

| Real Estate | 11 |

| Consumer Staples | 7 |

| Materials | 5 |

| Other | 9 |

| Total | 100% |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

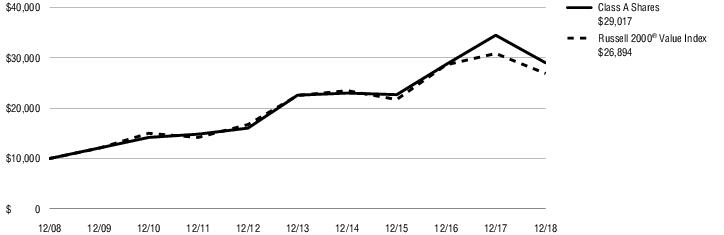

KAR Small-Cap Value Series(Continued)

Average Annual Total Returns1for periods ended 12/31/18

| | | 1 Year | 5 Years | 10 Years |

| Class A Shares at NAV2 | -15.88% | 5.14% | 11.24% |

| Russell 2000® Value Index | -12.86 | 3.61 | 10.40 |

| Series Expense Ratios3: Class A Shares: Gross 1.34%, Net 1.10%. | | | | |

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not reflect any fees or expenses associated with the separate insurance products. |

| 3 | The expense ratios of the Series, are set forth according to the prospectus for the Series effective December 1, 2018, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expenses: Expenses reduced by a contractual fee waiver, in effect through April 30, 2020. Gross Expenses: Do not reflect the effect of the fee waiver. Expense ratios include fees and expenses associated with underlying funds. |

Growth of $10,000for periods ended 12/31

This chart assumes an initial investment of $10,000 made on December 31, 2008 for Class A shares. Returns shown include the reinvestment of all distributions at net asset value, and the change in share price for the stated period.

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

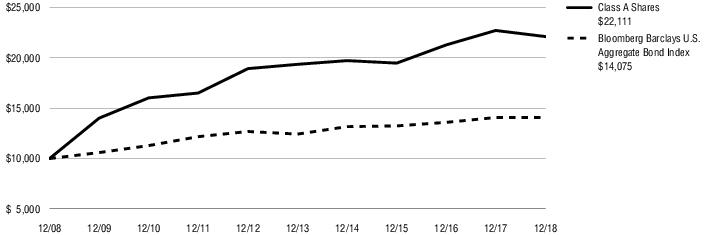

Newfleet Multi-Sector Intermediate Bond Series

Series Summary (Unaudited)

Portfolio Manager Commentary by Newfleet Asset Management, LLC

The Series is diversified and has an investment objective of long-term total return.There is no guarantee that the Fund will meet its objective.

| ■ | For the fiscal year ended December 31, 2018, the Series’ Class A shares at NAV returned -2.66% and Class I shares at NAV returned -2.51%. For the same period, the Bloomberg Barclays U.S. Aggregate Bond Index, which serves as the broad-based and style-specific benchmark index appropriate for comparison, returned 0.01%. |

All performance figures assume reinvestment of distributions and exclude the effect of fees and expenses associated with the variable life insurance or annuity product through which you invest. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please visit Virtus.com for performance data current to the most recent month-end.

How did the markets perform during the Series’ fiscal year ended December 31, 2018?

The 12-month period presented multiple challenges, including several bouts of elevated volatility. The final quarter of 2018 witnessed a meaningful mispricing of asset classes that tend to demonstrate price volatility. Fixed income investors, like all market participants, continued to wrestle with volatility brought on by geopolitical developments, trade rhetoric, mixed global economic signals, and central banks’ attempts to normalize monetary policy via policy rate increases and balance sheet adjustments. Oil prices corrected during the period, driven by fears of slowing global growth and signs of excess supply. U.S. economic data stayed on a positive trend, which contrasted with other global economies. Primary inflation readings remained in check, but pressure in key components such as wages started to build.

U.S. Treasuries performed well, while spread sector performance was mixed during the 12-month period. Sectors within the securitized products universe generally outperformed, while the corporate and emerging markets sectors lagged. Within most spread sectors, assets with short and intermediate

duration and those with higher credit ratings outperformed on a total return basis. The corporate high quality and emerging markets high yield sectors were the largest underperformers during the period.

As anticipated, the Federal Reserve (the Fed) raised its target rate 0.25% on four separate occasions during the 12 months to a range of 2.25% to 2.50%.

Over the last 12 months, yields increased across the yield curve, more pronounced at the front end, and overall the curve flattened.

What factors affected the Series’ performance during its fiscal year?

The outperformance of U.S. Treasuries relative to most fixed income spread sectors, as well as the general risk-off environment late in the period, were the key drivers of the Series’ underperformance for the fiscal year ended December 31, 2018.

During the fiscal year, the Series’ underweight to U.S. Treasuries and allocations to emerging markets high yield, corporate high yield, and high yield bank loans were the largest detractors from performance.

Among fixed income sectors, the Series’ allocations to asset-backed securities and residential mortgage-backed securities were the largest positive contributors to performance for the fiscal year.

The preceding information is the opinion of portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

ABS/MBS:Changes in interest rates can cause both extension and prepayment risks for asset- and mortgage-backed securities. These securities are also subject to risks associated with the repayment of underlying collateral.

Bank Loans:Loans may be unsecured or not fully collateralized, may be subject to restrictions on resale and/or trade infrequently on the secondary market. Loans can carry significant credit and call risk, can be difficult to value and have longer settlement times than other investments, which can make loans relatively illiquid at times.

Credit & Interest:Debt securities are subject to various risks, the most prominent of which are credit and interest rate risk. The issuer of a debt security may fail to make interest and/or principal payments. Values of debt securities may rise or fall in response to changes in interest rates, and this risk may be enhanced with longer-term maturities.

Foreign & Emerging Markets:Investing internationally, especially in emerging markets, involves additional risks such as currency, political, accounting, economic, and market risk.

High Yield-High Risk Fixed Income

Securities:There is a greater level of credit risk and price volatility involved with high yield securities than investment grade securities.

Prospectus:For additional information on risks, please see the Series’ prospectus.

Asset Allocations

The following table presents asset allocations within certain sectors as a percentage of total investments as of December 31, 2018.

| Corporate Bonds and Notes | | 44% |

| Financials | 13% | |

| Energy | 7 | |

| Materials | 5 | |

| All other Corporate Bonds and Notes | 19 | |

| Mortgage-Backed Securities | | 17 |

| Leveraged Loans | | 12 |

| Asset-Backed Securities | | 10 |

| Foreign Government Securities | | 7 |

| U.S. Government Securities | | 5 |

| Preferred Stocks | | 2 |

| Other (includes securities lending collateral) | | 3 |

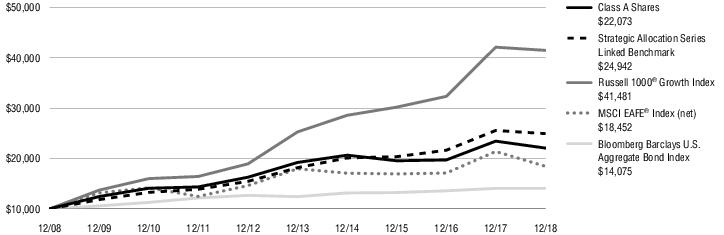

| Total | | 100% |