UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811- 04813 | |||||

|

| |||||

| Dreyfus Investment Funds |

| ||||

| (Exact name of Registrant as specified in charter) |

| ||||

|

|

| ||||

|

c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 |

| ||||

| (Address of principal executive offices) (Zip code) |

| ||||

|

|

| ||||

| Michael A. Rosenberg, Esq. 200 Park Avenue New York, New York 10166 |

| ||||

| (Name and address of agent for service) |

| ||||

| ||||||

Registrant's telephone number, including area code: | (212) 922-6000 | |||||

|

| |||||

Date of fiscal year end:

| 9/30 |

| ||||

Date of reporting period: | 9/30/10 |

| ||||

The following N-CSR relates only to the Registrant’s series listed below and does not affect the other series of the Registrant, which have a different fiscal year end and, therefore, different N-CSR reporting requirements. Separate N-CSR Forms will be filed for those series, as appropriate.

Dreyfus/The Boston Company Emerging Markets Core Equity Fund

Dreyfus/The Boston Company International Core Equity Fund

Dreyfus/The Boston Company Large Cap Core Fund

Dreyfus/The Boston Company Small Cap Growth Fund

Dreyfus/The Boston Company Small Cap Tax-Sensitive Equity Fund

Dreyfus/The Boston Company Small Cap Value Fund

Dreyfus/The Boston Company Small/Mid Growth Fund

Dreyfus/Standish Intermediate Tax Exempt Bond Fund

Dreyfus/Newton International Equity Fund

| Dreyfus/The Boston |

| Company Emerging |

| Markets Core Equity Fund |

ANNUAL REPORT September 30, 2010

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Contents | |

THE FUND | |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 14 | Statement of Assets and Liabilities |

| 15 | Statement of Operations |

| 16 | Statement of Changes in Net Assets |

| 18 | Financial Highlights |

| 21 | Notes to Financial Statements |

| 34 | Report of Independent Registered Public Accounting Firm |

| 35 | Important Tax Information |

| 36 | Board Members Information |

| 38 | Officers of the Fund |

FOR MORE INFORMATION | |

Back Cover |

Dreyfus/The Boston

Company Emerging

Markets Core Equity Fund

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

This annual report for Dreyfus/The Boston Company Emerging Markets Core Equity Fund covers the 12-month period from October 1, 2009, through September 30, 2010.

Although a double-dip recession remains an unlikely scenario in most parts of the world in our analysis, recent uncertainty regarding the breadth and strength of the global economic recovery has led to bouts of weakness in some of the riskier asset classes, including international stocks. Former engines of growth appear stalled as large parts of the developed world remain indebted and burdened by weak housing markets. While some look to the developing world as an engine of economic growth, most emerging economies don’t yet have the demand infrastructure needed to support large-scale imports capable of meaningfully lifting global economic activity.

Uncertainty will probably remain in the broader financial markets until we see a persistent improvement in economic growth; but we currently are optimistic regarding the prospects for some equities. Higher-quality companies with healthy balance sheets, higher credit ratings and strong cash flows are currently priced at a discount, in our view. However, we continue to believe that selectivity will be a key to success in the stock market, as investors appear set to potentially reward fundamentally sound companies relative to those with questionable financial profiles and business strategies. During these market conditions, we suggest that you meet with your financial advisor regularly to review your global portfolio allocation in today’s slow-growth economic environment as well as your needs, goals and attitudes toward risk.

For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

October 15, 2010

2

DISCUSSION OF FUND PERFORMANCE

For the period of October 1, 2009, through September 30, 2010, as provided by Sean P. Fitzgibbon, CFA, and Jay Malikowski, Portfolio Managers

Fund and Market Performance Overview

For the 12-month period ended September 30, 2010, Dreyfus/The Boston Company Emerging Markets Core Equity Fund’s Class A shares produced a total return of 18.85%, Class C shares returned 17.95% and Class I shares returned 19.73%.1 In comparison, the fund’s benchmark, the Morgan Stanley Capital International Emerging Markets Index (the “MSCI EM Index”), produced a total return of 20.22% for the same period.2 Emerging markets stocks posted significant gains during the reporting period despite relative weakness in developed markets stemming from a sluggish global economic recovery. The fund produced lower returns than its benchmark, primarily due to mild shortfalls in the telecommunications and energy sectors, which offset above-average results in the consumer discretionary and industrials sectors.

The Fund’s Investment Approach

The fund seeks long-term growth of capital. To pursue this goal, the fund normally invests at least 80% of its assets in equity securities of companies that are located in foreign countries represented in the MSCI EM Index. The fund may invest up to 20% of its net assets in fixed income securities and may invest in preferred stocks of any credit quality if common stocks of the relevant company are not available.The fund employs a “bottom-up” investment approach, which emphasizes individual stock selection.

Emerging Markets Fare Well Despite Sluggish Global Economy

Robust economic growth in the emerging markets supported global manufacturing activity over the first half of the reporting period, fueling improved confidence among businesses, consumers and investors throughout the world. However, investor sentiment deteriorated in May 2010 due to a sovereign debt crisis in Europe, where Greece found itself unable to finance a heavy debt load. In addition, global investors worried that efforts to forestall inflationary pressures in China might dampen a key engine of global economic growth. An appreciating currency hurt

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

exports in Japan, and high unemployment levels weighed on the United States. The sovereign debt crisis was especially hard on banking stocks, particularly those exposed to Europe’s more indebted economies. Energy stocks throughout the world were punished by the catastrophic oil spill in the Gulf of Mexico early in the reporting period, as investors reacted to uncertainty regarding potential liabilities and regulatory scrutiny of offshore drilling activity.

In contrast, companies in the emerging markets had relatively little exposure to these adverse developments. Instead, robust economic growth and higher stock prices in the emerging markets were supported by the ongoing build-out of industrial infrastructures in China, India and other nations with low-cost labor and manufacturing resources, as well as the expansion of a growing middle class of domestic consumers. Therefore, while macroeconomic factors sparked declines in developed markets during the spring and summer of 2010, the emerging markets generally continued to advance.

Stock Selections Produced Mixed Results

Although the fund participated to a substantial degree in the emerging markets’ overall gains, results from its energy holdings were undermined by Russian integrated oil producers Gazprom and LUKOIL. Gazprom’s earnings suffered due to stubbornly low natural gas prices, while LUKOIL was unable to meet production targets during the reporting period. Similarly, in the telecommunications sector, Russian mobile telephone carrier VimpelCom declined when shareholders expressed discontent regarding recent acquisitions in Italy and Algeria. The fund’s investments in Latin America also generally lagged market averages, mainly due to the fund’s emphasis on Brazil and positioning in Petroleo Brasileiro (Petrobras) where a worse than expected capital raise hurt the performance of Petrobras’ stock.

The fund achieved better relative results in the consumer discretionary sector, where Chinese automotive retailer Great Wall Motor restructured during the downturn, enabling it to accelerate earnings growth in the recovery. Korean auto parts producer Hyundai Mobis gained value after boosting sales both in Korea and overseas markets when car and truck production recovered from depressed levels worldwide. In Thailand, food producers fared well, as Charoen Pokphand Foods expanded into underserved markets and noodle maker Indofood Sukses Makmur gained market share. In the industrials sector, Chinese diesel

4

engines manufacturer Weichai Power benefited from rising demand for its products from package delivery service companies. In India, automaker Tata Motors achieved higher profits and market share after acquiring the Land Rover brand.

Finding Opportunities in Growing Markets

Although near-term prospects for stocks in other regions of the world are uncertain, we remain optimistic regarding the emerging markets, particularly those nations where domestic consumption and incomes are rising and household debt levels remain relatively low.We recently found a number of compelling opportunities meeting our criteria in China and India, where equity valuations have become more attractive. Conversely, we have grown more cautious regarding information technology companies, as the cycle for semiconductors appears to have peaked and some products may suffer from overcapacity.

October 15, 2010

| Equity funds are subject generally to market, market sector, market liquidity, issuer and investment | |

| style risks, among other factors, to varying degrees, all of which are more fully described in the | |

| fund’s prospectus. | |

| The fund’s performance will be influenced by political, social and economic factors affecting | |

| investments in foreign companies.These special risks include exposure to currency fluctuations, less | |

| liquidity, less developed or less efficient trading markets, lack of comprehensive company | |

| information, political instability and differing auditing and legal standards. Investments in foreign | |

| currencies are subject to the risk that those currencies will decline in value relative to the U.S. | |

| dollar, or, in the case of hedged positions, that the U.S. dollar will decline relative to the currency | |

| being hedged. | |

| Emerging markets tend to be more volatile than the markets of more mature economies, and | |

| generally have less diverse and less mature economic structures and less stable political systems than | |

| those of developed countries. | |

| 1 | Total return includes reinvestment of dividends and any capital gains paid, and does not take into |

| consideration the maximum initial sales charge in the case of Class A shares, or the applicable | |

| contingent deferred sales charges imposed on redemptions in the case of Class C shares. Had these | |

| charges been reflected, returns would have been lower. Past performance is no guarantee of future | |

| results. Share price and investment return fluctuate such that upon redemption, fund shares may be | |

| worth more or less than their original cost.The fund’s returns reflect the absorption of certain fund | |

| expenses by The Dreyfus Corporation pursuant to an agreement in effect through February 1, | |

| 2011, at which time it may be extended, terminated or modified. Had these expenses not been | |

| absorbed, the fund’s returns would have been lower. | |

| 2 | SOURCE: LIPPER INC. – Reflects reinvestment of net dividends and, where applicable, capital |

| gain distributions.The Morgan Stanley Capital International Emerging Markets Index is a free | |

| float-adjusted market capitalization weighted index that is designed to measure the equity | |

| performance in global emerging markets.The index consists of 26 MSCI emerging market national | |

| indices. MSCI Indices reflect investable opportunities for global investors by taking into account local | |

| market restrictions on share ownership by foreigners. Investors cannot invest directly in any index. |

The Fund 5

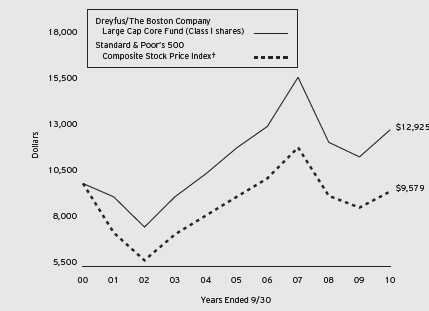

FUND PERFORMANCE

Comparison of change in value of $10,000 investment in Dreyfus/The Boston Company Emerging Markets Core Equity Fund Class I shares and the Morgan Stanley Capital International Emerging Markets Index

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance. |

| The above graph compares a $10,000 investment made in Class I shares of Dreyfus/The Boston Company Emerging |

| Markets Core Equity Fund on 7/10/06 (inception date) to a $10,000 investment made in the Morgan Stanley Capital |

| International Emerging Markets Index (the “Index”) on that date.All dividends and capital gain distributions are |

| reinvested. For comparative purposes, the value of the Index on 6/30/06 is used as the beginning value on 7/10/06. |

| The fund’s performance shown in the line graph takes into account all applicable fees and expenses for Class I shares. |

| Performance for Class A and Class C shares will vary from the performance of Class I shares shown above due to |

| differences in charges and expenses.The Index is a free float-adjusted market capitalization weighted index that is |

| designed to measure the equity performance in global emerging markets. Unlike a mutual fund, the Index is not subject to |

| charges, fees and other expenses. Investors cannot invest directly in any index.These factors can contribute to the Index |

| potentially outperforming the fund. Further information relating to fund performance, including expense reimbursements, if |

| applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report. |

6

| Average Annual Total Returns as of 9/30/10 | |||

| Inception | From | ||

| Date | 1 Year | Inception | |

| Class A shares | |||

| with maximum sales charge (5.75%) | 3/31/09 | 11.99% | 10.76%†† |

| without sales charge | 3/31/09 | 18.85% | 12.33%†† |

| Class C shares | |||

| with applicable redemption charge † | 3/31/09 | 16.95% | 12.02%†† |

| without redemption | 3/31/09 | 17.95% | 12.02%†† |

| Class I shares | 7/10/06 | 19.73% | 12.57% |

| Morgan Stanley Capital International | |||

| Emerging Markets Index††† | 6/30/06 | 20.22% | 11.47% |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| † | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| date of purchase. | |

| †† | The total return performance figures presented for Class A and Class C shares of the fund reflect the performance of |

| the fund’s Class I shares for periods prior to 3/31/09 (the inception date for Class A and Class C shares), adjusted | |

| to reflect the applicable sales load for each share class. | |

| ††† The Index date is based on the life of Class I shares. For comparative purposes, the value of the Index as of the | |

| month end 6/30/06 is used as the beginning value on 7/10/06 (the inception date for Class I shares). | |

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus/The Boston Company Emerging Markets Core Equity Fund from April 1, 2010 to September 30, 2010. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended September 30, 2010

| Class A | Class C | Class I | |

| Expenses paid per $1,000† | $ 11.76 | $ 15.66 | $ 7.86 |

| Ending value (after expenses) | $1,085.70 | $1,082.60 | $1,090.80 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended September 30, 2010

| † Expenses are equal to the fund’s annualized expense ratio of 2.25% for Class A, 3.00% for Class C and 1.50% |

| for Class I, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half |

| year period). |

| Class A | Class C | Class I | |

| Expenses paid per $1,000† | $ 11.36 | $ 15.12 | $ 7.59 |

| Ending value (after expenses) | $1,013.79 | $1,010.03 | $1,017.55 |

8

STATEMENT OF INVESTMENTS

September 30, 2010

| Common Stocks—86.2% | Shares | Value ($) | |

| Bermuda—.4% | |||

| Central European Media Enterprises, Cl. A | 2,560 | a,b | 63,872 |

| Brazil—4.6% | |||

| Banco do Brasil | 9,400 | 178,500 | |

| Fleury | 11,400 | 141,489 | |

| Gafisa | 16,800 | 129,574 | |

| Obrascon Huarte Lain Brasil | 2,300 | 72,045 | |

| Rossi Residencial | 16,800 | 160,851 | |

| Totvs | 1,000 | 76,773 | |

| 759,232 | |||

| China—7.4% | |||

| Bank of China, Cl. H | 297,000 | 155,795 | |

| China Construction Bank, Cl. H | 216,000 | 189,306 | |

| China Petroleum & Chemical, Cl. H | 266,000 | 235,870 | |

| China Vanadium Titano-Magnetite Mining | 323,000 | 149,451 | |

| Great Wall Motor, Cl. H | 60,000 | 162,395 | |

| Industrial & Commercial Bank of China, Cl. H | 173,000 | 128,877 | |

| Weichai Power, Cl. H | 12,000 | 126,823 | |

| Zhejiang Expressway, Cl. H | 66,000 | 62,267 | |

| 1,210,784 | |||

| Hong Kong—7.8% | |||

| China Agri-Industries Holdings | 157,481 | 223,266 | |

| China Minsheng Bank, Cl. H | 122,500 | 109,730 | |

| China Mobile | 44,500 | 455,676 | |

| CNOOC | 122,000 | 236,489 | |

| Guangdong Investment | 150,000 | 78,298 | |

| Hutchison Whampoa | 8,000 | 74,650 | |

| Tianjin Development Holdings | 124,000 | b | 95,891 |

| 1,274,000 | |||

| Hungary—1.7% | |||

| MOL Hungarian Oil and Gas | 1,330 | b | 139,766 |

| OTP Bank | 5,130 b | 134,680 | |

| 274,446 | |||

| India—11.1% | |||

| Apollo Tyres | 82,250 | 148,356 | |

| Balrampur Chini Mills | 46,110 | 95,073 | |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

| Common Stocks (continued) | Shares | Value ($) |

| India (continued) | ||

| Bank of Baroda | 7,840 | 152,281 |

| Canara Bank | 9,200 | 119,292 |

| Chambal Fertilizers & Chemicals | 68,940 | 105,631 |

| Oil & Natural Gas | 4,070 | 126,946 |

| Oriental Bank Of Commerce | 16,341 | 167,647 |

| Sintex Industries | 15,880 | 136,288 |

| SpiceJet | 74,240 b | 123,582 |

| Tata Consultancy Services | 13,480 | 276,755 |

| Tata Motors | 9,200 | 224,661 |

| Union Bank of India | 7,030 | 60,749 |

| Welspun | 13,950 | 83,464 |

| 1,820,725 | ||

| Indonesia—2.3% | ||

| Astra International | 22,500 | 142,941 |

| Bank Mandiri | 125,500 | 101,244 |

| Indofood Sukses Makmur | 209,000 | 127,625 |

| 371,810 | ||

| Malaysia—1.7% | ||

| Axiata Group | 57,700 b | 81,868 |

| Hong Leong Bank | 19,800 | 58,432 |

| Tenaga Nasional | 48,300 | 138,000 |

| 278,300 | ||

| Mexico—2.4% | ||

| America Movil, ADR, Ser. L | 4,190 | 223,453 |

| Fomento Economico Mexicano, ADR | 3,380 | 171,467 |

| 394,920 | ||

| Poland—1.0% | ||

| Getin Holding | 20,360 b | 75,645 |

| KGHM Polska Miedz | 2,230 | 89,987 |

| 165,632 | ||

| Russia—6.5% | ||

| Gazprom, ADR | 16,190 | 339,828 |

| LUKOIL, ADR | 6,000 | 340,800 |

| Magnitogorsk Iron & Steel Works, GDR | 5,030 c,d | 65,239 |

| MMC Norilsk Nickel, ADR | 8,902 | 151,779 |

| VimpelCom, ADR | 11,440 b | 169,884 |

| 1,067,530 |

10

| Common Stocks (continued) | Shares | Value ($) |

| South Africa—6.7% | ||

| African Rainbow Minerals | 4,020 | 96,892 |

| Aveng | 25,940 | 161,887 |

| FirstRand | 49,640 | 152,832 |

| Gold Fields | 6,450 | 97,718 |

| Metropolitan Holdings | 25,348 | 59,640 |

| MTN Group | 19,244 | 347,870 |

| Sasol | 4,090 | 183,592 |

| 1,100,431 | ||

| South Korea—15.6% | ||

| Busan Bank | 11,620 | 143,180 |

| Chong Kun Dang Pharmaceutical | 2,320 | 49,035 |

| Daegu Bank | 8,230 | 108,266 |

| Daehan Steel | 4,690 | 35,784 |

| Hana Financial Group | 3,280 | 97,084 |

| Hyosung | 1,464 | 157,923 |

| Hyundai Mipo Dockyard | 631 | 104,314 |

| Hyundai Mobis | 1,543 | 347,776 |

| Korea Electric Power | 3,780 b | 97,463 |

| KT | 3,220 | 129,054 |

| Kukdo Chemical | 1,400 | 50,585 |

| POSCO | 491 | 222,193 |

| Samsung Electronics | 733 | 499,488 |

| Shinhan Financial Group | 2,840 | 108,718 |

| SK Energy | 901 | 114,971 |

| SK Holdings | 846 | 87,920 |

| Woori Finance Holdings | 4,780 | 59,527 |

| Youngone | 8,316 | 71,692 |

| Youngone Holdings | 2,594 | 68,589 |

| 2,553,562 | ||

| Taiwan—8.3% | ||

| Advanced Semiconductor Engineering | 88,892 | 71,844 |

| Asia Cement | 53,169 | 54,204 |

| Chunghwa Telecom | 29,000 | 64,978 |

| CTCI | 115,000 | 126,442 |

| Fubon Financial Holding | 93,195 | 114,698 |

| HON HAI Precision Industry | 57,240 | 215,281 |

| HTC | 8,300 | 188,362 |

The Fund 11

STATEMENT OF INVESTMENTS (continued)

| Common Stocks (continued) | Shares | Value ($) | |

| Taiwan (continued) | |||

| Lite-On Technology | 206 | 259 | |

| Powertech Technology | 38,500 | 123,850 | |

| Taishin Financial Holdings | 253,463 | b | 113,582 |

| Taiwan Semiconductor Manufacturing, ADR | 28,749 | 291,515 | |

| 1,365,015 | |||

| Thailand—2.5% | |||

| Asian Property Development | 323,700 | 74,211 | |

| Bangchak Petroleum | 156,700 | 75,189 | |

| Banpu | 3,600 | 78,262 | |

| Charoen Pokphand Foods | 76,200 | 56,757 | |

| Kasikornbank | 32,200 | 126,987 | |

| 411,406 | |||

| Turkey—4.2% | |||

| Arcelik | 17,860 | 98,156 | |

| Haci Omer Sabanci Holding | 21,587 | 111,923 | |

| KOC Holding | 25,780 | 122,970 | |

| Turkiye Halk Bankasi | 16,550 | 153,310 | |

| Turkiye Is Bankasi, Cl. C | 47,621 | 202,460 | |

| 688,819 | |||

| United States—2.0% | |||

| AsiaInfo-Linkage | 4,740 a,b | 93,520 | |

| iShares MSCI Emerging Markets Index Fund | 5,100 | 228,327 | |

| 321,847 | |||

| Total Common Stocks | |||

| (cost $10,975,941) | 14,122,331 | ||

| Preferred Stocks—13.0% | |||

| Brazil | |||

| Banco Bradesco | 17,275 | 346,317 | |

| Banco do Estado do Rio Grande do Sul | 8,500 | 85,603 | |

| Bradespar | 5,700 | 136,436 | |

| Cia de Bebidas das Americas | 1,400 | 169,663 | |

| Cia Paranaense de Energia, Cl. B | 10,100 | 222,355 | |

| Itau Unibanco Holding | 9,924 | 237,367 | |

| Marfrig Alimentos | 9,300 | 94,759 | |

| Petroleo Brasileiro | 14,700 | 237,094 | |

| Usinas Siderurgicas de Minas Gerais, Cl. A | 4,350 | 58,360 | |

12

| Preferred Stocks (continued) | Shares | Value ($) |

| Brazil (continued) | ||

| Vale, Cl. A | 18,700 | 511,708 |

| Vivo Participacoes | 1,300 | 35,496 |

| Total Preferred Stocks | ||

| (cost $1,349,179) | 2,135,158 | |

| Investment of Cash Collateral | ||

| for Securities Loaned—.9% | ||

| Registered Investment Company; | ||

| Dreyfus Institutional Cash Advantage Fund | ||

| (cost $144,550) | 144,550 e | 144,550 |

| Total Investments (cost $12,469,670) | 100.1% | 16,402,039 |

| Liabilities, Less Cash and Receivables | (.1%) | (14,360) |

| Net Assets | 100.0% | 16,387,679 |

ADR—American Depository Receipts

GDR—Global Depository Receipts

| a Security, or portion thereof, on loan.At September 30, 2010, the market value of the fund's securities on loan was |

| $140,042 and the market value of the collateral held by the fund was $144,550. |

| b Non-income producing security. |

| c The valuation of this security has been determined in good faith by management under the direction of the Board of |

| Trustees.At September 30, 2010, the value of this security amounted to $65,239 or 0.4% of net assets. |

| d Security exempt from registration under Rule 144A of the Securities Act of 1933.This security may be resold in |

| transactions exempt from registration, normally to qualified institutional buyers.At September 30, 2010, this securitiy |

| had a market value of $65,239 or 0.4% of net assets. |

| e Investment in affiliated money market mutual fund. |

| Portfolio Summary (Unaudited)† | |||

| Value (%) | Value (%) | ||

| Financial | 23.9 | Consumer Staples | 5.7 |

| Energy | 12.9 | Utilities | 3.3 |

| Materials | 12.6 | Exchange Traded Funds | 1.4 |

| Information Technology | 11.2 | Health Care | 1.2 |

| Industrial | 9.3 | Money Market Investments | .9 |

| Telecommunication Services | 9.2 | ||

| Consumer Discretionary | 8.5 | 100.1 | |

| † Based on net assets. | |||

| See notes to financial statements. | |||

The Fund 13

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2010

| Cost | Value | ||

| Assets ($): | |||

| Investments in securities—See Statement of Investments (including | |||

| securities on loan, valued at $140,042)—Note 1(c): | |||

| Unaffiliated issuers | 12,325,120 | 16,257,489 | |

| Affiliated issuers | 144,550 | 144,550 | |

| Cash denominated in foreign currencies | 180,472 | 182,647 | |

| Dividends and interest receivable | 22,012 | ||

| Receivable for shares of Beneficial Interest subscribed | 6,952 | ||

| Prepaid expenses | 19,801 | ||

| 16,633,451 | |||

| Liabilities ($): | |||

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | 20,998 | ||

| Cash overdraft due to Custodian | 41,622 | ||

| Liability for securities on loan—Note 1(c) | 144,550 | ||

| Accrued expenses | 38,602 | ||

| 245,772 | |||

| Net Assets ($) | 16,387,679 | ||

| Composition of Net Assets ($): | |||

| Paid-in capital | 15,420,835 | ||

| Accumulated distributions in excess of investment income—net | (23,114) | ||

| Accumulated net realized gain (loss) on investments | (2,944,928) | ||

| Accumulated net unrealized appreciation (depreciation) | |||

| on investments and foreign currency transactions | 3,934,886 | ||

| Net Assets ($) | 16,387,679 | ||

| Net Asset Value Per Share | |||

| Class A | Class C | Class I | |

| Net Assets ($) | 152,455 | 257,685 | 15,977,539 |

| Shares Outstanding | 5,649 | 9,777 | 596,339 |

| Net Asset Value Per Share ($) | 26.99 | 26.36 | 26.79 |

| See notes to financial statements. | |||

14

STATEMENT OF OPERATIONS

Year Ended September 30, 2010

| Investment Income ($): | |

| Income: | |

| Cash dividends (net of $45,498 foreign taxes withheld at source): | |

| Unaffiliated issuers | 362,549 |

| Affiliated issuers | 72 |

| Income from securities lending—Note 1(c) | 1,010 |

| Total Income | 363,631 |

| Expenses: | |

| Investment advisory fee—Note 3(a) | 177,199 |

| Custodian fees—Note 3(c) | 126,168 |

| Registration fees | 55,039 |

| Accounting and administrative fees—Note 3(a) | 45,000 |

| Shareholder servicing costs—Note 3(c) | 32,899 |

| Professional fees | 25,580 |

| Prospectus and shareholders' reports | 14,970 |

| Distribution fees—Note 3(b) | 1,573 |

| Trustees' fees and expenses—Note 3(d) | 1,255 |

| Interest expense—Note 2 | 297 |

| Miscellaneous | 16,627 |

| Total Expenses | 496,607 |

| Less—expense reimbursement from The Dreyfus | |

| Corporation due to undertaking—Note 3(a) | (250,935) |

| Less—reduction in fees due to earnings credits—Note 3(c) | (1) |

| Net Expenses | 245,671 |

| Investment Income—Net | 117,960 |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | |

| Net realized gain (loss) on investments and foreign currency transactions | 2,686,493 |

| Net realized gain (loss) on forward foreign currency exchange contracts | (26,816) |

| Net Realized Gain (Loss) | 2,659,677 |

| Net unrealized appreciation (depreciation) on | |

| investments and foreign currency transactions | 103,468 |

| Net unrealized appreciation (depreciation) on | |

| forward foreign currency exchange contracts | 297 |

| Net Unrealized Appreciation (Depreciation) | 103,765 |

| Net Realized and Unrealized Gain (Loss) on Investments | 2,763,442 |

| Net Increase in Net Assets Resulting from Operations | 2,881,402 |

| See notes to financial statements. | |

The Fund 15

STATEMENT OF CHANGES IN NET ASSETS

| Year Ended September 30, | ||

| 2010 | 2009a | |

| Operations ($): | ||

| Investment income—net | 117,960 | 175,825 |

| Net realized gain (loss) on investments | 2,659,677 | (5,429,445) |

| Net unrealized appreciation | ||

| (depreciation) on investments | 103,765 | 6,970,600 |

| Net Increase (Decrease) in Net Assets | ||

| Resulting from Operations | 2,881,402 | 1,716,980 |

| Dividends to Shareholders from ($): | ||

| Investment income—net: | ||

| Class C Shares | (2,360) | — |

| Class I Shares | (218,041) | (189,770) |

| Net realized gain on investments: | ||

| Class I Shares | — | (620,343) |

| Total Dividends | (220,401) | (810,113) |

| Beneficial Interest Transactions ($): | ||

| Net proceeds from shares sold: | ||

| Class A Shares | 127,583 | 17,539 |

| Class C Shares | 53,392 | 159,324 |

| Class I Shares | 1,420,351 | 21,038,573 |

| Dividends reinvested: | ||

| Class C Shares | 2,139 | — |

| Class I Shares | 137,480 | 613,697 |

| Cost of shares redeemed: | ||

| Class A Shares | (13,885) | — |

| Class C Shares | (8,496) | — |

| Class I Shares | (4,780,001) | (21,275,819) |

| Increase (Decrease) in Net Assets from | ||

| Beneficial Interest Transactions | (3,061,437) | 553,314 |

| Total Increase (Decrease) in Net Assets | (400,436) | 1,460,181 |

| Net Assets ($): | ||

| Beginning of Period | 16,788,115 | 15,327,934 |

| End of Period | 16,387,679 | 16,788,115 |

| Undistributed (distributions in excess of) | ||

| investment income—net | (23,114) | 133,280 |

16

| Year Ended September 30, | ||

| 2010 | 2009a | |

| Capital Share Transactions: | ||

| Class A | ||

| Shares sold | 5,107 | 1,095 |

| Shares redeemed | (553) | — |

| Net Increase (Decrease) in Shares Outstanding | 4,554 | 1,095 |

| Class C | ||

| Shares sold | 2,190 | 7,867 |

| Shares issued for dividends reinvested | 89 | — |

| Shares redeemed | (369) | — |

| Net Increase (Decrease) in Shares Outstanding | 1,910 | 7,867 |

| Class I | ||

| Shares sold | 59,386 | 903,194 |

| Shares issued for dividends reinvested | 5,719 | 44,521 |

| Shares redeemed | (200,276) | (934,915) |

| Net Increase (Decrease) in Shares Outstanding | (135,171) | 12,800 |

| a The fund changed to a multiple class fund on March 31, 2009.The existing shares were redesignated as Class I |

| shares and the fund commenced offering Class A and Class C shares. |

See notes to financial statements.

The Fund 17

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| Year Ended September 30, | ||

| Class A Shares | 2010 | 2009a |

| Per Share Data ($): | ||

| Net asset value, beginning of period | 22.70 | 13.55 |

| Investment Operations: | ||

| Investment income—netb | .17 | .14 |

| Net realized and unrealized | ||

| gain (loss) on investments | 4.12 | 9.01 |

| Total from Investment Operations | 4.29 | 9.15 |

| Net asset value, end of period | 26.99 | 22.70 |

| Total Return (%)c | 18.85 | 67.60d |

| Ratios/Supplemental Data (%): | ||

| Ratio of total expenses to average net assets | 3.69 | 11.21e |

| Ratio of net expenses to average net assets | 2.25 | 2.00e |

| Ratio of net investment income | ||

| to average net assets | .71 | 1.56e |

| Portfolio Turnover Rate | 102.30 | 157.45f |

| Net Assets, end of period ($ x 1,000) | 152 | 25 |

| a | From March 31, 2009 (commencement of initial offering) to September 30, 2009. |

| b | Based on average shares outstanding at each month end. |

| c | Exclusive of sales charge. |

| d | Not annualized. |

| e | Annualized. |

| f | Represents portfolio turnover rate for the fund for the year. |

See notes to financial statements.

18

| Year Ended September 30, | ||

| Class C Shares | 2010 | 2009a |

| Per Share Data ($): | ||

| Net asset value, beginning of period | 22.62 | 13.55 |

| Investment Operations: | ||

| Investment (loss)—netb | (.13) | (.03) |

| Net realized and unrealized | ||

| gain (loss) on investments | 4.17 | 9.10 |

| Total from Investment Operations | 4.04 | 9.07 |

| Distributions: | ||

| Dividends from investment income—net | (.30) | — |

| Net asset value, end of period | 26.36 | 22.62 |

| Total Return (%)c | 17.95 | 66.94d |

| Ratios/Supplemental Data (%): | ||

| Ratio of total expenses to average net assets | 4.18 | 3.80e |

| Ratio of net expenses to average net assets | 3.00 | 2.75e |

| Ratio of net investment (loss) | ||

| to average net assets | (.57) | (.35)e |

| Portfolio Turnover Rate | 102.30 | 157.45f |

| Net Assets, end of period ($ x 1,000) | 258 | 178 |

| a | From March 31, 2009 (commencement of initial offering) to September 30, 2009. |

| b | Based on average shares outstanding at each month end. |

| c | Exclusive of sales charge. |

| d | Not annualized. |

| e | Annualized. |

| f | Represents portfolio turnover rate for the fund for the year. |

See notes to financial statements.

The Fund 19

FINANCIAL HIGHLIGHTS (continued)

| Year Ended September 30, | |||||

| Class I Shares | 2010 | 2009a | 2008 | 2007 | 2006b |

| Per Share Data ($): | |||||

| Net asset value, beginning of period | 22.67 | 21.33 | 33.24 | 20.55 | 20.00 |

| Investment Operations: | |||||

| Investment income—netc | .18 | .24 | .35 | .31 | .06 |

| Net realized and unrealized | |||||

| gain (loss) on investments | 4.26 | 2.21 | (8.86) | 12.62 | .49 |

| Total from Investment Operations | 4.44 | 2.45 | (8.51) | 12.93 | .55 |

| Distributions: | |||||

| Dividends from investment income—net | (.32) | (.26) | (.26) | (.24) | — |

| Dividends from net realized | |||||

| gain on investments | — | (.85) | (3.14) | — | — |

| Total Distributions | (.32) | (1.11) | (3.40) | (.24) | — |

| Net asset value, end of period | 26.79 | 22.67 | 21.33 | 33.24 | 20.55 |

| Total Return (%) | 19.73 | 14.90 | (28.51) | 63.25 | 2.75d |

| Ratios/Supplemental Data (%): | |||||

| Ratio of total expenses | |||||

| to average net assets | 3.07 | 3.50 | 2.74 | 3.18 | 8.64e |

| Ratio of net expenses | |||||

| to average net assets | 1.50 | 1.43 | 1.45 | 1.45 | 1.45e |

| Ratio of net investment income | |||||

| to average net assets | .75 | 1.43 | 1.21 | 1.15 | 1.31e |

| Portfolio Turnover Rate | 102.30 | 157.45 | 128 | 76 | 31d |

| Net Assets, end of period ($ x 1,000) | 15,978 | 16,585 | 15,328 | 13,671 | 5,693 |

| a The fund commenced offering three classes of shares on March 31, 2009.The existing shares were redesignated as |

| Class I shares. |

| b From July 10, 2006 (commencement of operations) to September 30, 2006. |

| c Based on average shares outstanding at each month end. |

| d Not annualized. |

| e Annualized. |

See notes to financial statements.

20

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus/The Boston Company Emerging Markets Core Equity Fund (the “fund”) is a separate diversified series of Dreyfus Investment Funds (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering twelve series, including the fund.The fund’s investment objective is to seek long-term growth of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares.The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Class A, Class C and Class I. Class A shares are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) on Class C shares redeemed within one year of purchase. Class I shares are sold primarily to bank trust departments and other financial service providers (including The Bank of NewYork Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus), acting on behalf of customers having a qualified trust or investment account or relationship at such institution, and bear no distribution or shareholder services fees. Class I shares are offere d without a front-end sales charge or CDSC. Other differences between the classes include the services offered to, the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

As of September 30, 2010, MBC Investments Corp., an indirect subsidiary of BNY Mellon, held 738 Class A and Class C shares of the fund.

The Fund 21

NOTES TO FINANCIAL STATEMENTS (continued)

The Trust accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value.When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securi-

22

ties and other appropriate indicators, such as prices of relevant ADRs and futures contracts. For other securities that are fair valued by the Board of Trustees, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward foreign currency exchange contracts (“forward contracts”) are valued at the forward rate.

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for

identical investments.

Level 2—other significant observable inputs (including quoted

prices for similar investments, interest rates, prepayment speeds,

credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s

own assumptions in determining the fair value of investments).

The Fund 23

NOTES TO FINANCIAL STATEMENTS (continued)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of September 30, 2010 in valuing the fund’s investments:

| Level 1— | Level 2—Other | Level 3— | ||

| Unadjusted | Significant | Significant | ||

| Quoted | Observable | Unobservable | ||

| Prices | Inputs | Inputs | Total | |

| Assets ($) | ||||

| Investments in Securities: | ||||

| Equity Securities— | ||||

| Foreign† | 15,963,923 | 65,239 | — | 16,029,162 |

| Mutual Funds/ | ||||

| Exchange | ||||

| Traded Funds | 372,877 | — | — | 372,877 |

| † See Statement of Investments for country and industry classification. | ||||

In January 2010, FASB issued Accounting Standards Update ("ASU") No. 2010-06 "Improving Disclosures about Fair Value Measurements". The portions of ASU No. 2010-06 which require reporting entities to prepare new disclosures surrounding amounts and reasons for significant transfers in and out of Level 1 and Level 2 fair value measurements as well as inputs and valuation techniques used to measure fair value for both recurring and nonrecurring fair value measurements that fall in either Level 2 or Level 3 have been adopted by the fund. No significant transfers between Level 1 or Level 2 fair value measurements occurred at September 30, 2010. The remaining portion of ASU No. 2010-06 requires reporting entities to make new disclosures about information on purchases, sales, issuances and settlements on a gross basis in the reconciliation of activity in Level 3 fair value measurements. These new and revised disclosures are required to be implemented for fiscal years beginning after December 15, 2010. Management is currently evaluating the impact that the adoption of this remaining portion of ASU No. 2010-06 may have on the fund's financial statement disclosures.

24

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on investments are included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Manager, U.S. Government and Agency securities or letters of credit. The fund is

The Fund 25

NOTES TO FINANCIAL STATEMENTS (continued)

entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner. During the period ended September 30, 2010, The Bank of New York Mellon earned $544 from lending portfolio securities, pursuant to the securities lending agreement.

Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S. These risks include revaluation of currencies, high rates of inflation, repatriation restrictions on income and capital, and adverse political and economic developments. Moreover, securities issued in these markets may be less liquid, subject to government ownership controls and delayed settlements, and their prices may be more volatile than those of comparable securities in the U.S.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

The fund may invest in shares of certain affiliated investment companies also advised or managed by Dreyfus. Investments in affiliated investment companies for the period ended September 30, 2010 were as follows:

| Affiliated | |||||

| Investment | Value | Value | Net | ||

| Company | 9/30/2009 ($) | Purchases ($) | Sales ($) 9/30/2010 ($) | Assets (%) | |

| Dreyfus | |||||

| Institutional | |||||

| Preferred | |||||

| Plus Money | |||||

| Market Fund | 220,220 | 4,657,119 | 4,877,339 | — | — |

| Dreyfus | |||||

| Institutional | |||||

| Cash Advantage | |||||

| Fund | — | 6,261,213 | 6,116,663 | 144,550 | .9 |

| Total | 220,220 | 10,918,332 | 10,994,002 | 144,550 | .9 |

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends

26

from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). Prior to January 1, 2010, the fund paid dividends from investment income-net semi-annually.To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended September 30, 2010, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the four-year period ended September 30, 2010 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At September 30, 2010, the components of accumulated earnings on tax basis were as follows: undistributed ordinary income $61,103, accumulated capital losses $2,045,216 and unrealized appreciation $2,950,957.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to September 30, 2010. If not applied, $1,300,051 of the carryover expires in fiscal 2017 and $745,165 expires in fiscal 2018.

The Fund 27

NOTES TO FINANCIAL STATEMENTS (continued)

The tax character of distributions paid to shareholders during the fiscal periods ended September 30, 2010 and September 30, 2009 were as follows: ordinary income $220,401 and $200,787 and long-term capital gains $0 and $609,326, respectively.

During the period ended September 30, 2010, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign currency gains and losses, passive foreign investment companies and Thailand capital gain taxes, the fund decreased accumulated undistributed investment income-net by $53,953 and increased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $225 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended September 30, 2010 was approximately $21,400, with a related weighted average annualized interest rate of 1.39%.

NOTE 3—Investment Advisory Fee and Other Transactions with Affiliates:

(a) Pursuant to an investment advisory agreement with the Manager, the investment advisory fee is computed at the annual rate of 1.10% of the value of the fund’s average daily net assets and is payable monthly. The Manager has agreed, until February 1, 2011, to waive receipt of its fees and/or assume the expenses of the fund so that the direct

28

expenses of Class A, Class C and Class I shares (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest, brokerage commissions, acquired fund fees and extraordinary expenses) do not exceed 2.00%, 2.00% and 1.50%, respectively, of the value of such class’ average daily net assets. The expense reimbursement, pursuant to the undertaking, amounted to $250,935 during the period ended September 30, 2010.

The Trust entered into an agreement with The Bank of New York Mellon pursuant to which The Bank of New York Mellon provides administration and fund accounting services for the fund. For these services, the fund pays The Bank of NewYork Mellon a fixed fee plus asset and transaction based fees, as well as out-of-pocket expenses. Pursuant to this agreement, the fund was charged $45,000 during the period ended September 30, 2010 for administration and fund accounting services.

(b) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of the average daily net assets of Class C shares. During the period ended September 30, 2010, Class C shares were charged $1,573 pursuant to the Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at the annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended September 30, 2010, Class A and Class C shares were charged $197 and $524, respectively, pursuant to the Shareholder Services Pla n.

The Fund 29

NOTES TO FINANCIAL STATEMENTS (continued)

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended September 30, 2010, the fund was charged $444 pursuant to the transfer agency agreement, which is included in Shareholder servicing costs in the Statement of Operations.

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates The Bank of New York Mellon under cash management agreements for performing cash management services related to fund subscriptions and redemptions. During the period ended September 30, 2010, the fund was charged $196 pursuant to the cash management agreements, which is included in Shareholder servicing costs in the Statement of Operations.These fees were partially offset by earnings credits of $1.

The fund also compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended September 30, 2010, the fund was charged $126,168 pursuant to the custody agreement.

During the period ended September 30, 2010, the fund was charged $6,380 for services performed by the Chief Compliance Officer.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: investment advisory fees $16,535, Rule 12b-1 distribution plan fees $152, shareholder services plan fees $77, custodian fees $26,600, chief compliance officer fees $1,783 and transfer agency per account fees $235, which are offset against an expense reimbursement currently in effect in the amount of $24,384.

30

(d) Prior to January 1, 2010, eachTrustee received $45,000 per year, plus $6,000 for each joint Board meeting of the Trust,The Dreyfus/Laurel Funds, Inc.,The Dreyfus/Laurel Funds Trust,The Dreyfus/Laurel Tax-Free Municipal Funds and Dreyfus Funds, Inc. (collectively, the “Board Group Open-End Funds”) attended, $2,000 for separate in-person committee meetings attended which were not held in conjunction with a regularly scheduled Board meeting and $1,500 for Board meetings and separate committee meetings attended that were conducted by telephone. Effective January 1, 2010, the Board Group Open-End Funds will pay each Trustee who is not an “interested person” of the Trust (as defined in the Act) $60,000 per annum, plus $7,000 per joint Board Group Open-End Funds Board meeting attended, $2,500 for separate in - -person committee meetings attended which are not held in conjunction with a regularly scheduled Board meeting and $2,000 for Board meetings and separate committee meetings attended that are conducted by telephone.The Board Group Open-End Funds also reimburse each Trustee who is not an “interested person” of theTrust (as defined in the Act) for travel and out-of-pocket expenses.With respect to Board meetings, the Chairman of the Board receives an additional 25% of such compensation (with the exception of reimbursable amounts). With respect to compensation committee meetings prior to January 1, 2010, the Chair of the compensation committee received $900 per compensation committee meeting, and, effective January 1, 2010, the Chair of each of the Board’s committees, unless the Chair also serves as Chair of the Board, will receive $1,350 per applicable committee meeting. In the event that there is an in-person joint committee meeting or a joint telephone meeting of the Board Group Open-End Funds a nd Dreyfus High Yield Strategies Fund, the $2,000 or $1,500 fee (prior to January 1, 2010) or the $2,500 or $2,000 fee (effective January 1, 2010), as applicable, is allocated between the Board Group Open-End Funds and

The Fund 31

NOTES TO FINANCIAL STATEMENTS (continued)

Dreyfus HighYield Strategies Fund.These fees and expenses are charged and allocated to each series based on net assets.

(e) A 2% redemption fee is charged and retained by the fund on certain shares redeemed within sixty days following the date of issuance, subject to exceptions, including redemptions made through the use of the fund’s exchange privilege. During the period ended September 30, 2010, redemption fees charged and retained by the fund amounted to $20.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and forward contracts, during the period ended September 30, 2010, amounted to $16,186,361 and $19,369,787, respectively.

The provisions of ASC Topic 815 “Derivatives and Hedging” require qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments and disclosures about credit-risk-related contingent features in derivative agreements. The disclosure requirements distinguish between derivatives, which are accounted for as “hedges” and those that do not qualify for hedge accounting. Because investment companies value their derivatives at fair value and recognize changes in fair value through the Statement of Operations, they do not qualify for such accounting. Accordingly, even though a fund’s investments in derivatives may represent economic hedges, they are considered to be non-hedge transactions for purposes of this disclosure.

The following summarizes the average market value and percentage of average net assets of derivatives outstanding for the period ended September 30, 2010:

| Average | ||

| Value ($) | Net Assets (%) | |

| Forward contracts | 70,616 | .44 |

32

Forward Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle foreign currency transactions or as a part of its investment strategy. When executing forward contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward contracts, the fund incurs a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract decreases between those dates. With respect to purchases of forward contracts, the fund incurs a loss if the value of the contract decreases between the date the fo rward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract increases between those dates. Any realized gain or loss which occurred during the period is reflected in the Statement of Operations.The fund is exposed to foreign currency risk as a result of changes in value of underlying financial instruments. The fund is also exposed to credit risk associated with counterparty nonperformance on these forward contracts, which is typically limited to the unrealized gain on each open contract. At September 30, 2010, there were no forward contracts outstanding.

At September 30, 2010, the cost of investments for federal income tax purposes was $13,453,599; accordingly, accumulated net unrealized appreciation on investments was $2,948,440 consisting of $4,171,940 gross unrealized appreciation and $1,223,500 gross unrealized depreciation.

The Fund 33

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Shareholders Dreyfus/The Boston Company Emerging Markets Core Equity Fund:

We have audited the accompanying statement of assets and liabilities of Dreyfus/The Boston Company Emerging Markets Core Equity Fund (the “Fund”), a series of Dreyfus Investment Funds, including the statement of investments as of September 30, 2010, the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights for each of the years in the two-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.The financial highlights for each of the years or periods in the three-year period ended September 30, 2008 were audited by other independent registered public accountants whose report thereon, dated November 28, 2008, expressed an unqualified opinion on those financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2010 by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received.An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus/The Boston Company Emerging Markets Core Equity Fund as of September 30, 2010, the results of its operations for the year then ended, and the changes in its net assets and the financial highlights for each of the years in the two-year period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

November 24, 2010

34

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund elects to provide each shareholder with their portion of the fund’s income sourced from foreign countries and taxes paid from foreign countries. The fund designates the maximum amount allowable but not less than $407,329 as income sourced from foreign countries for the fiscal year ended September 30, 2010 in accordance with Section 853(c)(2) of the Internal Revenue Code and also the fund designates the maximum amount allowable but not less than $74,354 as taxes paid from foreign countries for the fiscal year ended September 30, 2010 in accordance with Section 853(a) of the Internal Revenue Code.Where required by federal tax rules, shareholders will receive notification of their proportionate share of foreign sourced income and foreign taxes paid for the 2010 calendar year with Form 1099-DIV which will be mailed by early 2011. Also, the fund designates the maximum amount allo wable, but not less than $147,671 as ordinary income dividends paid during the fiscal year ended September 30, 2010 as qualified dividend income in accordance with Section 854(b)(1)(B) of the Internal Revenue Code.

The Fund 35

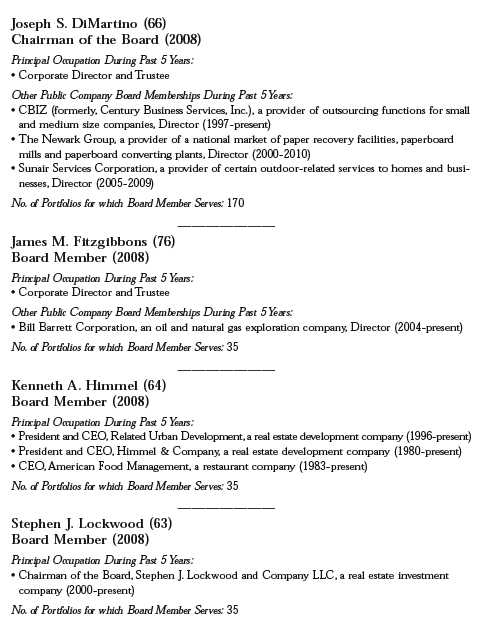

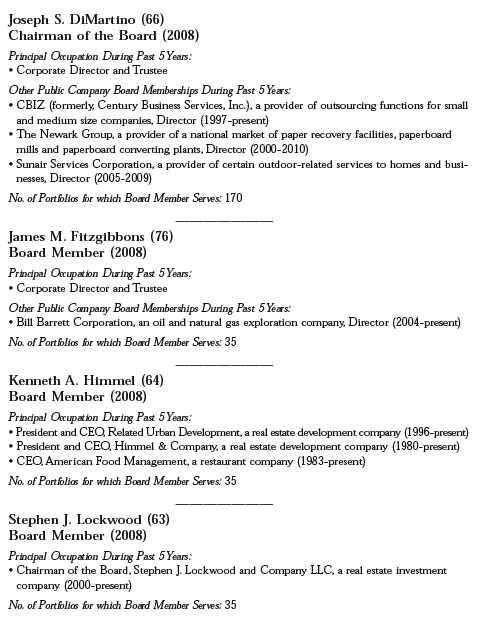

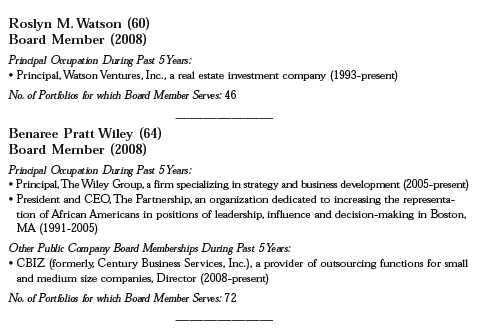

BOARD MEMBERS INFORMATION (Unaudited)

36

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, NewYork, NewYork 10166.Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-554-4611.

The Fund 37

OFFICERS OF THE FUND (Unaudited)

BRADLEY J. SKAPYAK, President since

January 2010.

Chief Operating Officer and a director of the Manager since June 2009. From April 2003 to June 2009, Mr. Skapyak was the head of the Investment Accounting and Support Department of the Manager. He is an officer of 76 investment companies (comprised of 170 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since February 1988.

PHILLIP N. MAISANO, Executive Vice

President since December 2008.

Chief Investment Officer,Vice Chair and a director of the Manager, and an officer of 76 investment companies (comprised of 170 portfolios) managed by the Manager. Mr. Maisano also is an officer and/or Board member of certain other investment management subsidiaries of The Bank of New York Mellon Corporation, each of which is an affiliate of the Manager. He is 63 years old and has been an employee of the Manager since November 2006. Prior to joining the Manager, Mr. Maisano served as Chairman and Chief Executive Officer of EACM Advisors, an affiliate of the Manager, since August 2004.

MICHAEL A. ROSENBERG, Vice President

and Secretary since December 2008.

Assistant General Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since October 1991.

KIESHA ASTWOOD, Vice President and

Assistant Secretary since January 2010.

Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. She is 37 years old and has been an employee of the Manager since July 1995.

JAMES BITETTO, Vice President and

Assistant Secretary since

December 2008.

Senior Counsel of BNY Mellon and Secretary of the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since December 1996.

JONI LACKS CHARATAN, Vice President

and Assistant Secretary since

December 2008.

Senior Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. She is 54 years old and has been an employee of the Manager since October 1988.

JOSEPH M. CHIOFFI, Vice President and

Assistant Secretary since

December 2008.

Senior Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 48 years old and has been an employee of the Manager since June 2000.

KATHLEEN DENICHOLAS, Vice President

and Assistant Secretary since

January 2010.

Senior Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. She is 35 years old and has been an employee of the Manager since February 2001.

38

JANETTE E. FARRAGHER, Vice President

and Assistant Secretary since

December 2008.

Assistant General Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. She is 47 years old and has been an employee of the Manager since February 1984.

JOHN B. HAMMALIAN, Vice President

and Assistant Secretary since

December 2008.

Managing Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since February 1991.

M. CRISTINA MEISER, Vice President and

Assistant Secretary since January 2010.

Senior Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. She is 40 years old and has been an employee of the Manager since August 2001.

ROBERT R. MULLERY, Vice President

and Assistant Secretary since

December 2008.

Managing Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 58 years old and has been an employee of the Manager since May 1986.

JEFF PRUSNOFSKY, Vice President

and Assistant Secretary since

December 2008.

Managing Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 45 years old and has been an employee of the Manager since October 1990.

JAMES WINDELS, Treasurer since

December 2008.

Director –Mutual Fund Accounting of the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since April 1985.

RICHARD CASSARO, Assistant Treasurer

since December 2008.

Senior Accounting Manager –Money Market and Municipal Bond Funds of the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since September 1982.

GAVIN C. REILLY, Assistant Treasurer

since December 2008.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 42 years old and has been an employee of the Manager since April 1991.

ROBERT ROBOL, Assistant Treasurer

since December 2008.

Senior Accounting Manager – Fixed Income Funds of the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 46 years old and has been an employee of the Manager since October 1988.

ROBERT SALVIOLO, Assistant Treasurer

since December 2008.

Senior Accounting Manager – Equity Funds the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 43 years old and has been an employee of the Manager since June 1989.

The Fund 39

OFFICERS OF THE FUND (Unaudited) (continued)

ROBERT SVAGNA, Assistant Treasurer

since December 2008.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 43 years old and has been an employee of the Manager since November 1990.

JOSEPH W. CONNOLLY, Chief Compliance

Officer since December 2008.

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (77 investment companies, comprised of 195 portfolios). From November 2001 through March 2004, Mr. Connolly was first Vice-President, Mutual Fund Servicing for Mellon Global Securities Services. In that capacity, Mr. Connolly was responsible for managing Mellon’s Custody, Fund Accounting and Fund Administration services to third-party mutual fund clients. He is 53 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

NATALIA GRIBAS, Anti-Money Laundering

Compliance Officer since July 2010.

Anti-Money Laundering Compliance Officer of the Distributor, and the Anti-Money Laundering Compliance Officer of 73 investment companies (comprised of 191 portfolios) managed by the Manager. She is 40 years old and has been an employee of the Distributor since September 2008.

40

For More Information

| Telephone Call your financial representative or 1-800-554-4611 |

| Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144 |