UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05010

Mutual Fund and Variable Insurance Trust

(Exact name of registrant as specified in charter)

36 North New York Avenue

Huntington, NY 11743

(Address of principal executive offices) (Zip code)

Gemini Fund Services, LLC

17605 Wright Street

Omaha, Nebraska 68130

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-631-629-4237

Date of fiscal year end: December 31

Date of reporting period: December 31, 2017

| Item 1. | Reports to Shareholders. |

Annual Shareholder Report

| December 31, 2017 |

| CLASS A SHARES |

| CLASS C SHARES |

| INSTITUTIONAL SHARES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

January 31, 2018

Rational Dividend Capture Fund

Dear Fellow Shareholders,

The Rational Dividend Capture Fund (the “Fund”) seeks total return on investment, with dividend income an important component of that return. The Fund focuses on high dividend paying stocks that also are attractively valued to provide an attractive return over a full market cycle. We define a full market cycle as both a bear market and a bull market. It is expected that this strategy will underperform when such sectors like technology are very strong, but outperform when the more aggressive sectors of the market are weak. The dividend yield provides a nice consistent stream of income and stability to the long-term returns. An appropriate benchmark for this strategy is not a simple question, it has characteristics of both an equity portfolio but also the yield more resembling the bond market historically. Many of the higher yielding sectors of the market had very negative returns in 2017, such as the energy sectors and telecommunications. Business Development Companies and REITs also underperformed significantly. Lastly, value-oriented stocks, also significantly underperformed growth stocks, and in fact have done so 3 of the last four years. We believe the value stocks and yield oriented stocks are very attractive on a historical basis relative to the market and in particular the growth or the momentum sectors. We are confident in the long-term potential of the Fund and strategy, particularly relative to more aggressive types of investments given where the markets are versus their long-term norms.

Investment Strategy

The Fund normally invests at least 80% of its net assets in dividend paying stocks, including preferred stocks and real estate investment trusts (“REITs”).

The Fund uses a value approach to identify attractive, dividend paying stocks. The discipline focuses on cash flows or earnings of companies, their growth rate, and the valuation of their stock prices. As an example, the manager likes to buy REITs below their real estate value or operating companies below their intrinsic value, to gain from the appreciation of the stock overtime and collect an attractive dividend yield. Stocks are sold when the fundamentals deteriorate, become too highly valued, or when there may be a better alternative including cash.

As part of the investment process, the Fund invests in both preferred stocks and common stocks.

Fund Performance

The Rational Dividend Capture Fund had a tough year, significantly underperforming its S&P 500 Total Return Index benchmark with a -1.99% (Institutional Class) return versus 21.83% for the benchmark. As we mentioned, the sectors- in which the Fund invests, in order to get an attractive dividend yield and appreciation, performed poorly in 2017. The technology sector was an extremely strong performer in 2017, driven by securities that do not fit the investment criteria of the Fund. What typically happens in the late stage of a market cycle is the momentum or speculative stocks perform very strongly and the value and income stocks lag considerably relative to the market. This is exactly what happened in 2017. It is the expectation of management that the volatility of the markets is going to rise significantly in 2018, having an attractive dividend yield and having a cash reserve will help cushion the potential downside. Additionally, the cash can be invested opportunistically. Bear markets are always difficult to predict. Bear markets occur due to recessions, or in the case of the 1987 crash it was due to rising interest rates, high valuations, too much bullish sentiment, too much margin debt, and a weak dollar, we have similar conditions currently. This strategy maybe a nice way of weathering the storm or benefitting from a resumption of value stocks due to stronger economic growth.

The Fund’s total annualized returns through 12/31/17 as compared to the S&P 500 Total Return Index were as follows:

| | | | | Since Inception |

| | 1 Year | 5 Years | 10 Years | (02/28/01) |

| Class A | -2.24% | 5.69% | 4.46% | 5.57% |

| Institutional | -1.99% | 5.97% | 4.72% | 5.82% |

| Class A with Sales Charge | -6.88% | 4.67% | 3.96% | 5.26% |

| S&P 500 Total Return Index1 | 21.83% | 15.79% | 8.50% | 6.77% |

| | | | | |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

We are much encouraged by the recent fiscal stimulus to accelerate the growth of the U.S. Economy improving the fundamentals of the sectors in which the Fund typically focuses. We are confident in the long-term success of the strategy. Successful investing requires a long-term outlook focused on objective criteria that create value. We have adopted this outlook for the Fund, and we are glad that you have decided to share in our vision.

Sincerely,

Patrick Adams and Rick Garcia

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Dividend Capture Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index. |

4210-NLD-2/14/2018

| Rational Dividend Capture Fund |

| PORTFOLIO REVIEW |

| December 31, 2017 |

| |

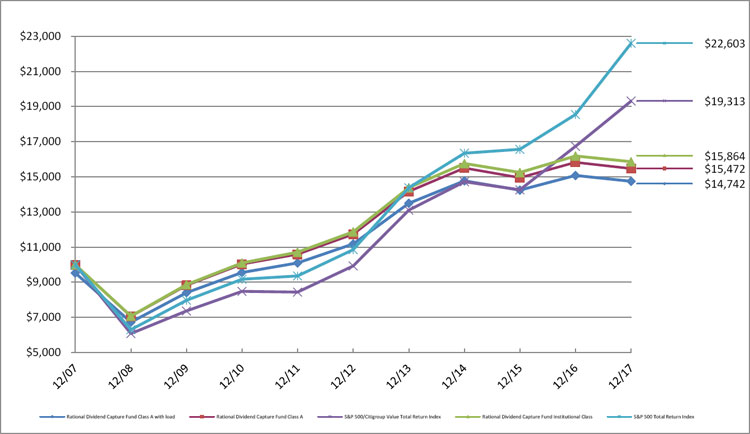

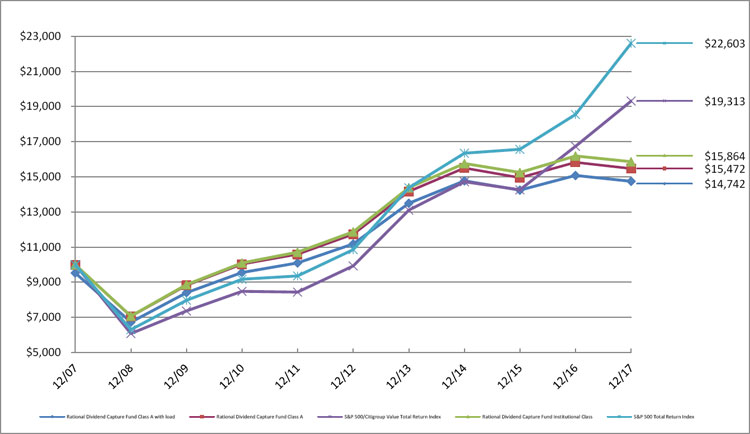

The Fund’s performance figures* for each of the periods ended December 31, 2017, compared to its benchmarks:

| | | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since 1/2/2014(a) |

| Class A | -2.24% | 5.69% | 4.46% | N/A |

| Class A with load | -6.88% | 4.67% | 3.96% | N/A |

| Class C | -2.68% | N/A | N/A | 1.88% |

| Institutional Class | -1.99% | 5.97% | 4.72% | N/A |

| S&P 500 Total Return Index (b) | 21.83% | 15.79% | 8.50% | 12.24% |

| S&P 500/Citigroup Value Total Return Index (c) | 15.36% | 14.24% | 6.80% | 10.44% |

| | | | | |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2017 prospectus, the total annual operating expense are 1.43% for Institutional Class shares, 1.68% for A shares and 2.18% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

| (a) | Inception date is January 2, 2014 for Class C and the Benchmarks. |

| (b) | The “S&P 500 Total Return Index”, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

| (c) | The S&P 500/Citigroup Value Total Return Index uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings. Investors cannot invest directly in an Index. |

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry | | % of Net Assets | |

| REITs | | | 18.7 | % |

| Business Development Companies | | | 13.9 | % |

| Oil & Gas | | | 9.6 | % |

| Exchange Traded Funds | | | 8.2 | % |

| Pharmaceuticals | | | 7.9 | % |

| Retail | | | 7.7 | % |

| Diversified Financial Services | | | 5.4 | % |

| Telecommunications | | | 5.4 | % |

| Semiconductors | | | 3.6 | % |

| Food | | | 3.4 | % |

| Other/Short-Term Investments | | | 16.2 | % |

| | | | 100.0 | % |

| | | | | |

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

January 31, 2018

Rational Risk Managed Emerging Markets Fund

Dear Fellow Shareholders,

The Rational Risk Managed Emerging Markets Fund (the “Fund”) seeks to offer investors a compelling opportunity to exploit the potential excess returns over the MSCI Emerging Markets Total Return Index through using a combination of fundamental top-down macro analysis, fundamental and quantitative stock selection and currency hedging (which is generally done using an algorithmic model). This seeks to allow investors to take emerging markets exposure while potentially hedging against currency risk.

Fund Performance

During 2017, the Fund underperformed relative to the index. This was mainly due to our FX hedging overlay that in a strong trending market got whipsawed, which cost performance. The Fund’s pure equity exposure outperformed the market. The Fund’s holding in Chinese Tech and Consumer did very well during the year, as did the holdings in commodity related themes, including Sberbank, the largest bank in Russia. Global growth continued to inch higher and in combination with low inflation and a weak US dollar, set the stage for strong emerging market performance.

The Fund’s total annualized returns through 12/31/17 as compared to the S&P 500 Total Return Index were as follows:

| | | | Since Inception |

| | 1 Year | 5 Years | (12/30/2009) |

| Class A | 33.38% | 6.37% | 4.69% |

| Institutional | 33.79% | 6.61% | 4.96% |

| Class A with Sales Charge | 27.13% | 5.35% | 4.06% |

| MSCI Emerging Markets TR Index1 | 37.28% | 4.35% | 4.58% |

| | | | |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

We believe that the Fund is currently positioned to do very well versus the market and the peer group. We have identified exciting long-term macro and structural themes in consumption trends, business cycle and specific country reform stories. Our stock selection has positioned the Fund to withstand the expected future volatility due to favorable valuations, quality factors and structural trends that are not dependent on the global cycle.

Sincerely,

The Cambridge Strategy (Asset Management) Limited

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about

the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The MSCI Emerging Markets Index captures large and mid-cap representation across 24 Emerging Markets (EM) countries. With 846 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. |

4212-NLD-2/14/2018

| Rational Risk Managed Emerging Markets Fund |

| PORTFOLIO REVIEW |

| December 31, 2017 |

| |

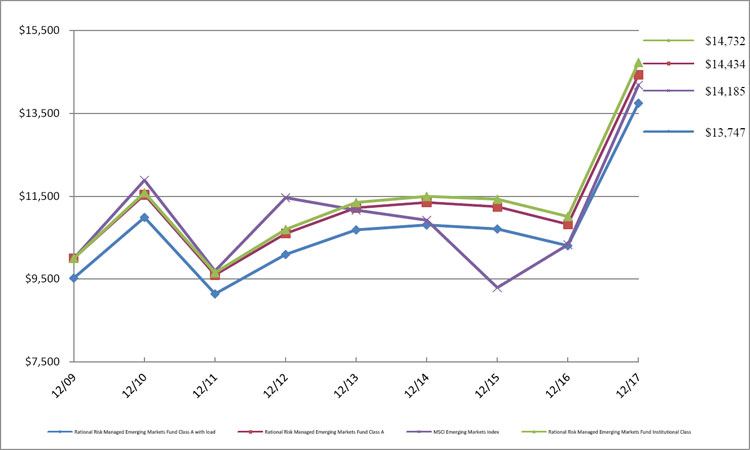

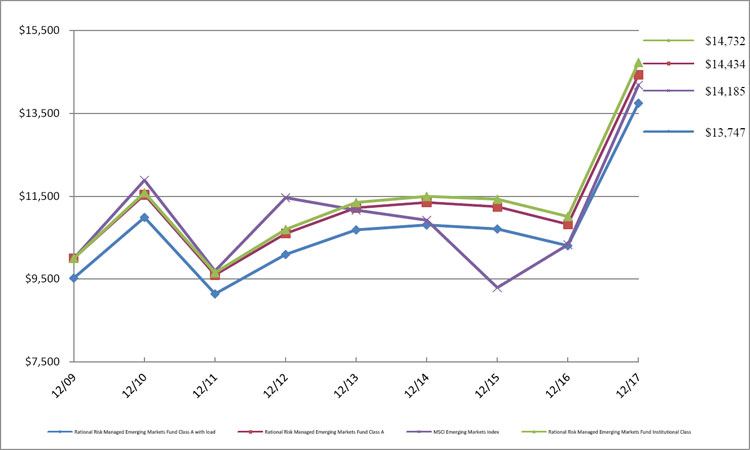

The Fund’s performance figures* for each of the periods ended December 31, 2017, compared to its benchmark:

| | | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | Since 12/30/2009(a) | Since 5/31/2016(b) |

| Class A | 33.38% | 6.37% | 4.69% | N/A |

| Class A with load | 27.13% | 5.35% | 4.06% | N/A |

| Class C | 32.43% | N/A | N/A | 17.59% |

| Institutional Class | 33.79% | 6.61% | 4.96% | N/A |

| MSCI Emerging Markets Index (c) | 37.28% | 4.35% | 4.58% | 28.68% |

| | | | | |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2017 prospectus, the total annual operating expense are 3.13% for Institutional Class shares, 3.38% for A shares and 3.88% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

| (a) | Inception date is December 30, 2009 for Class A, Institutional Class and the Benchmark. |

| (b) | Inception date is May 31, 2016 for Class C and the Benchmark. |

| (c) | The MSCI Emerging Markets Index consists of 23 countries representing 10% of world market capitalization. The Index is available for a number of regions, market segments/sizes and covers approximately 85% of the free float-adjusted market capitalization in each of the 23 countries. |

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry | | % of Net Assets | |

| Banks | | | 18.1 | % |

| Internet | | | 14.8 | % |

| Semiconductors | | | 10.4 | % |

| Insurance | | | 7.5 | % |

| Retail | | | 3.9 | % |

| Oil & Gas | | | 3.7 | % |

| Auto Parts & Equipment | | | 3.4 | % |

| Media | | | 3.4 | % |

| Gas | | | 3.2 | % |

| Equity - Exchange Traded Funds | | | 3.1 | % |

| Other/Short-Term Investments | | | 28.5 | % |

| | | | 100.0 | % |

| | | | | |

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

January 31, 2018

Rational Hedged Return Fund

Dear Fellow Shareholders,

The Rational Hedged Return Fund (the “Fund”) seeks total returns consisting of capital appreciation and income by making investments in long and short call and put options on futures contracts on the S&P 500 Index, as well as cash, and cash equivalents. From the start of 2017 through December 4th, the Fund’s prior managers used a different strategy to manage the Fund and performed in-line with its category. On December 5th, Warrington Asset Management LLC was engaged as the Fund’s Sub-Advisor. From then until the end of the year, the Fund outperformed the IQ Hedge Long/ Short Beta Total Return Index, but lagged slightly behind the S&P 500.

Investment Strategy

The new Sub Advisor’s strategy seeks to achieve its investment objective in three ways: (1) Premium Collection – the Fund collects premiums on options it sells; (2) Volatility Trading – the Fund may enter into positions designed to hedge or profit from either an increase or a decrease in Index volatility; and (3) Trend Following – the Fund may increase or decrease the balance of puts and calls based on trending market direction. The Fund is designed to produce returns that are not correlated with equity market returns. The Fund employs strict risk management procedures, supported by both technical and fundamental analysis, that are intended to provide consistency of returns and to mitigate the extent of losses.

Fund Performance

The Hedged Return Fund generated a 2017 return of 3.59% in Class A (after new Sub-Advisor assumed management, the Fund returned 0.70%), versus 5.77% for its S&P GSCI benchmark and 11.96% for its IQ Hedge Long/ Short Beta Total Return Index benchmark.

The Fund performed in-line with its category until the strategy change in December. After the change, the returns were also in-line with the new benchmarks, and helped the Fund to end the year with good overall performance. After some weakness at the start of December, the S&P Index resumed its relentless climb higher. Warrington chose to limit the call option exposure in the Fund as the prices did not accurately account for the substantial risk we perceived of the market continuing to rise. We held a standard allocation of put options as the prices of those positions fairly compensated for the risks they presented. The Fund’s worst monthly return (which occurred prior to the new Sub Advisor’s engagement) for the year was -12.18% whereas the S&P was +0.12% and the IQ Hedge Long/ Short Beta Total Return Index was +0.28%.

The Fund’s total annualized returns through 12/31/17 as compared to the S&P GSCI TR Index were as follows:

| | | | | | Since Inception |

| | 1 Year | 3 Years | 5 Years | 10 Years | (05/01/07) |

| Class A | 3.59% | -2.25% | -2.92% | -4.69% | -3.53% |

| Institutional | 3.50% | -2.34% | -2.83% | -4.53% | -3.36% |

| Class A with Sales Charge | -1.41% | -3.85% | -3.86% | -5.16% | -3.97% |

| S&P GSCI1 | 5.77% | -7.52% | -12.16% | -10.16% | -7.48% |

| | | | | | |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-

end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

After performing in-line with the Fund’s category through December 4th, the Fund altered its strategy and hired a new Sub-Advisor on December 5th. The new Sub-Advisor, Warrington Asset Management, LLC, brings extensive experience, with over 20 years of successfully trading options for clients throughout a variety of market conditions. Warrington’s options-focused investment management provides diversification and non-correlation for traditional portfolios. Warrington will look to continue its many years of investment success in this new arena. The results from December were encouraging, as the transition was seamless and the Sub-Advisor was able to quickly implement its trading strategies into the Fund.

Sincerely,

Scott Kimple and Mark Adams

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P GSCI (Goldman Sachs Commodity Index) Total Return Index by Standard & Poor’s Corp. measures general price movements and inflation in the world economy. The S&P GSCI is calculated primarily on a world production-weighted basis and is comprised of the principal physical commodities that are the subject of active, liquid futures markets. The Rational Hedged Return Fund may or may not purchase the types of securities represented by the S&P GSCI Total Return Index. |

3219-NLD-2/14/2018

| Rational Hedged Return Fund (Formerly, Rational Real Strategies Fund) |

| PORTFOLIO REVIEW |

| December 31, 2017 |

| |

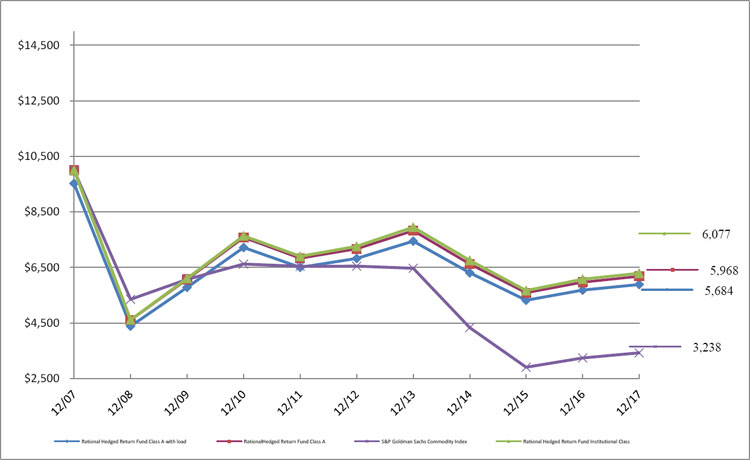

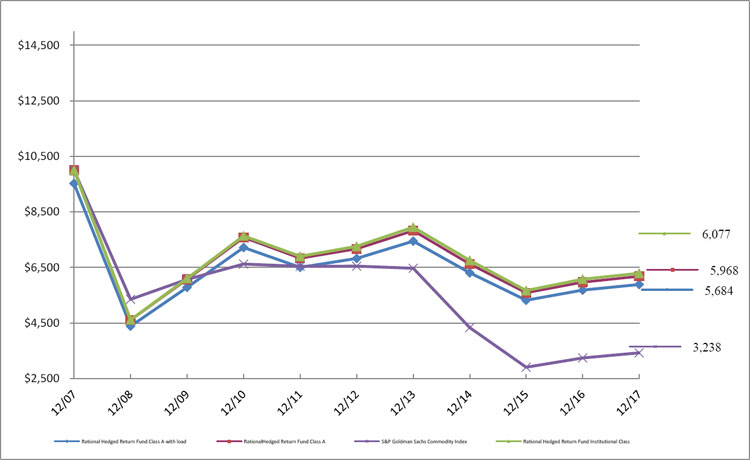

The Fund’s performance figures* for each of the periods ended December 31, 2017, compared to its benchmark:

| | | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since 5/31/2016(a) |

| Class A | 3.59% | -2.92% | -4.69% | N/A |

| Class A with load | -1.41% | -3.86% | -5.16% | N/A |

| Class C | 3.02% | N/A | N/A | 5.40% |

| Institutional Class | 3.50% | -2.83% | -4.53% | N/A |

| S&P Goldman Sachs Commodity Index (b) | 5.77% | -12.16% | -10.16% | 4.54% |

| | | | | |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s December 5, 2017 prospectus, the total annual operating expense are 3.61% for Institutional Class shares, 3.86% for A shares and 4.36% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

| (a) | Inception date is May 31, 2016 for Class C and the Benchmark. |

| (b) | The S&P Goldman Sachs Commodity Index® (“S&P GSCI”) measures general price movements and inflation in the world economy. The S&P GSCI is calculated primarily on a world production-weighted basis and is comprised of the principal physical commodities that are the subject of active, liquid futures markets. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry ^ | | % of Net Assets | |

| Short-Term Investments | | | 48.2 | % |

| Other/Short-term Investments | | | 51.8 | % |

| | | | 100.0 | % |

| | | | | |

^ Does not include derivatives in which the Fund invests.

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

January 31, 2018

Rational Dynamic Brands Fund

Dear Fellow Shareholders,

The Rational Dynamic Brands Fund (the “Fund”) seeks long-term capital appreciation by investing in a focused group (25-50 holdings) of the most attractive & relevant brands contained in the Alpha Brands Consumer Spending Index (the “Index”). Security selection is driven by a combination of fundamental and technical factors. In times of economic turmoil or unusually high equity valuations where equity risk is deemed high, the Fund may also invest in cash and cash equivalents and in asset classes that have historically been safe havens when equities were experiencing drawdowns. De-risking decisions are driven by: current equity trend, economic growth profile, consumer health, equity valuations, technical analysis, FED policy, interest rates, credit spreads, and asset class volatility trends.

Investment Strategy

The Fund normally pursues its investment objective by investing primarily in equity securities contained in the Alpha Brands Consumer Spending Index. The Index contains 200 leading and relevant Brands across all sectors and approximately 70 consumption-focused sub-industries. The Fund expects to be invested primarily in U.S. companies with market capitalizations above $1 billion, although it may invest without limit in companies of any market capitalization so long as the companies are included in the Brands Index. The Fund may invest in non-U.S. equities so long as those equities are included in the Index.

The Fund is managed as a Core + Tactical approach where Core brands will typically hold higher portfolio weights than tactical brands. Core brands can be identified as the most attractive brands from a secular growth perspective and using 3 multi-factor screens to identify the top ranked Growth (operating kings), Value & Dividend (sustainable yielders) and Price Momentum opportunities from the 200 index constituents. The companies chosen from the core screens will often be the leading brand(s) navigating through large, sustainable secular growth markets with large total addressable market opportunities. Tactical brands will typically hold smaller portfolio weights and are more thematic in nature. Tactical buys are often driven by attractive technical set-ups that appear to offer short-term upside from out of favor brands from within the index. Tactical opportunities are often contrarian in nature and complement Core ideas well. They are often follow-on ideas from within attractive industries where the Investment Committee has determined greater exposure is warranted. The final part of the investment process determines how exposed to equities the Investment Committee believes is prudent. Exposures are determined by such factors as: current equity trend, economic growth profile, consumer health, equity valuations, technical analysis, FED policy, interest rates, credit spreads, and asset class volatility trends.

Fund Performance

On 10/17/17, the Rational Defensive Growth Fund was converted and renamed the Rational Dynamic Brands Fund. Since Accuvest took over as the sub-advisor for the fund, performance has been strong on a relative and absolute basis. Consumer stocks have performed well driven by the wealth effect as well as enthusiasm over personal and corporate tax reform. The Rational Dynamic Brands Fund gained +5.71% since being converted to the Brands

portfolio. Over the same timeframe, the S&P 500 index was up +4.89%. Outperformance was driven mostly by overweight position in Technology and Consumer Discretionary sectors.

The Fund is currently overweight growth Brands and the top sector holdings are Technology, Consumer Discretionary and Consumer Staples. These allocations were driven by the fundamental and technical work done via the investment process highlighted in this document.

The Fund will typically be overweight the leading consumer discretionary and staples brands given its focus on consumer spending but has no mandate to do so on an ongoing basis.

The Fund’s total annualized returns through 12/31/17 as compared to the S&P 500 Total Return Index were as follows:

| | | | | Since Inception |

| | 1 Year | 5 Years | 10 Years | (09/29/02) |

| Class A | 14.30% | 7.16% | 5.83% | 10.02% |

| Institutional | 14.66% | 7.48% | 6.13% | 10.32% |

| Class A with Sales Charge | 9.01% | 6.12% | 5.32% | 9.67% |

| S&P 500 Total Return Index1 | 21.83% | 15.79% | 8.50% | 10.23% |

| | | | | |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

Consumer spending is the key driver of U.S. economic growth as well as global growth. Investing in the most relevant and powerful brands offers investors a dedicated allocation to American Consumerism through a well-researched list of the leading brands. Our goal is to track a lifetime of spending via the leading brands winning our mind and wallet-share. As we enter 2018, our view of the consumer sector is positive and economic growth appears on strong footing. As the economic data changes, so too will our allocations to the leading brands. We have many tools at our disposal to help protect capital when we see evidence of an economic slowdown. Successful investing requires a long-term outlook focused on objective criteria that creates value. We have adopted this outlook for the Rational Dynamic Brands Fund, and we are glad that you have decided to share in our vision.

Sincerely,

David Garff, Eric Clark, and James Calhoun

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | The S&P 500 Total Return Index® (“S&P 500 TR”) is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an Index. For additional disclosure relating to the S&P 500 TR, please see “Additional Disclaimers” in the Fund’s Prospectus. |

4216-NLD-2/15/2018

| Rational Dynamic Brands Fund (Formerly, Rational Defensive Growth Fund) |

| PORTFOLIO REVIEW |

| December 31, 2017 |

| |

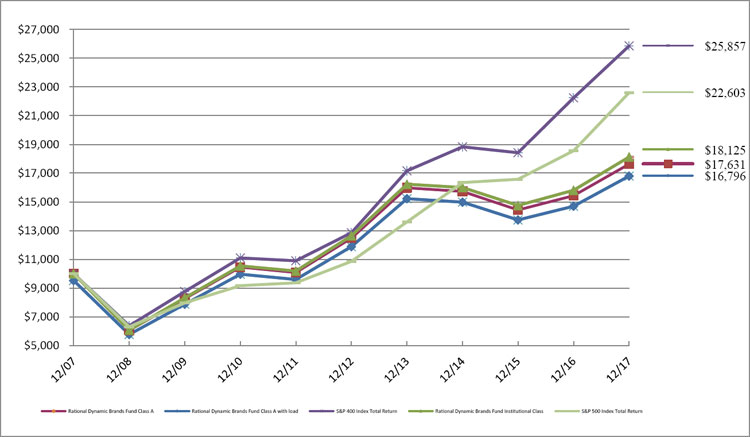

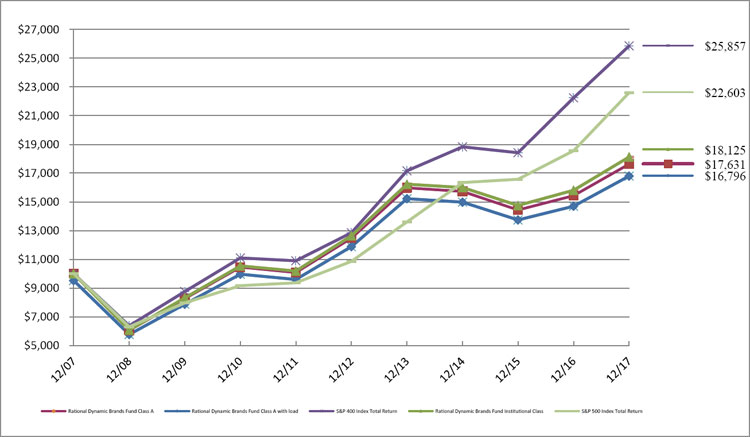

The Fund’s performance figures* for each of the periods ended December 31, 2017, compared to its benchmark:

| | | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since 1/2/2014(a) |

| Class A | 14.30% | 7.16% | 5.83% | N/A |

| Class A with load | 9.01% | 6.12% | 5.32% | N/A |

| Class C | 14.03% | N/A | N/A | 2.32% |

| Institutional Class | 14.66% | 7.48% | 6.13% | N/A |

| S&P 400 Index Total Return (b) | 16.24% | 15.01% | 9.97% | 11.11% |

| S&P 500 Index Total Return (c) | 21.83% | 15.79% | 8.50% | 12.24% |

| | | | | |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s October 17, 2017 prospectus, the total annual operating expense are 1.76% for Institutional Class shares, 2.01% for A shares and 2.51% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. |

| (a) | Inception date is January 2, 2014 for Class C and corresponding Benchmark. |

| (b) | The S&P 400 is a capitalization-weighted index comprised of common stocks representing major industries in the mid-range of the U.S. stock market. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

| (c) | The “S&P 500 Total Return Index”, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

Comparison of the Change in Value of a $10,000 Investment

| Top 10 Holdings by Industry | | % of Net Assets | |

| Internet | | | 17.5 | % |

| Retail | | | 17.4 | % |

| Software | | | 9.0 | % |

| Beverages | | | 8.9 | % |

| Telecommunications | | | 6.0 | % |

| Banks | | | 5.0 | % |

| Pharmaceuticals | | | 5.0 | % |

| Semiconductors | | | 4.0 | % |

| Computers | | | 3.9 | % |

| Media | | | 3.9 | % |

| Other/Short-Term Investments | | | 19.4 | % |

| | | | 100.0 | % |

| | | | | |

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

January 31, 2018

Rational Strategic Allocation Fund

Dear Fellow Shareholders,

The Rational Strategic Allocation Fund (the “Fund”) seeks current income and moderate appreciation of capital by investing in a combination of mutual funds and exchange-traded funds (“ETFs”). During 2017, the Fund achieved strong gains, but underperformed its Balanced Allocation Indices Blend (“BAIB”) benchmark with a 11.61% return (Class A) versus 14.25% for the benchmark. The Fund benefited from its allocation to emerging markets equity and from our expansion into equity ETF strategies. The Fund underperformed its benchmark due its allocation to MLP (Master Limited Partnership) equity.

Investment Strategy

The Fund seeks to achieve its objective by investing in a combination of underlying mutual funds and ETFs. We invest in equity, income and uncorrelated investment strategies. We select underlying funds using a fundamental research process, including a top-down analysis of market conditions and investment category historical performance during various market conditions. We also perform a bottom-up analysis of each potential fund for investment, including investment allocations, investment valuations and characteristics, positioning, historical performance during various market conditions and that Fund’s portfolio manager’s outlook.

Fund Performance

During 2017, the Fund returned 11.61%, trailing its BAIB benchmark’s return of 14.25%. The Fund benefited from its allocation to emerging markets equity as this was one of the best performing global asset classes in 2017 due to steady global economic expansion and relatively low levels of geo-political volatility. The Fund also benefited from increased allocations to equity ETF strategies. The Fund’s exposure to MLP equity detracted from performance. Energy was one of two S&P 500 Index sectors that had a negative return in 2017. Stocks in the energy sector sold off during the first half of 2017 as OPEC production cuts kept the price of WTI crude under pressure. Despite a rally in energy prices in the second half of 2017, stocks in the energy sector still finished the year negative.

The Fund’s total annualized returns through 12/31/17 as compared to the Balanced Allocation Indices Blend and the S&P 500 Total Return Index were as follows:

| | | | | Since Inception |

| | 1 Year | 3 Years | 5 Years | (07/30/09) |

| Class A | 11.61% | 5.81% | 6.46% | 6.76% |

| Class A with Sales Charge | 6.30% | 4.10% | 5.43% | 6.14% |

| Balanced Allocation Indices Blend | 14.25% | 7.89% | 10.33% | 10.71% |

| S&P 500 Total Return Index | 21.83% | 11.41% | 15.79% | 14.96% |

| | | | | |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

The Fund achieved strong gains in 2017 consistent with our investment objective. The majority of the holdings performed to our expectations and the Fund benefited from our increased allocations to equity ETF strategies. Successful investing requires a long-term outlook focused on objective criteria that create value. We have adopted this outlook for the Fund, and we are glad that you have decided to share in our vision.

Sincerely,

David Miller and Michael Schoonover

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. The Rational Strategic Allocation Fund may or may not purchase the types of securities represented by the S&P 500 Total Return Index.

The Balanced Allocation Indices Blend (“BAIB”) is a custom blended index comprised of the following two indices with their noted respective weightings: Standard & Poor’s 500 Index® (“S&P 500”) (60%) and the Bloomberg Barclays U.S. Aggregate Bond Index (40%). The Barclays U.S. Aggregate Index is comprised of securities from the Barclays Government/Corporate Bond Index, Mortgage Securities Index and the Asset Based Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indices are rebalanced monthly by market capitalization. The index is unmanaged and, unlike the Fund, is not affected by cash flows. The S&P 500 is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Investments cannot be made in an index. For additional disclosure relating to the S&P 500, please see “Additional Disclaimers” in this Prospectus.

3201-NLD-2/13/2018

| Rational Strategic Allocation Fund |

| PORTFOLIO REVIEW |

| December 31, 2017 |

| |

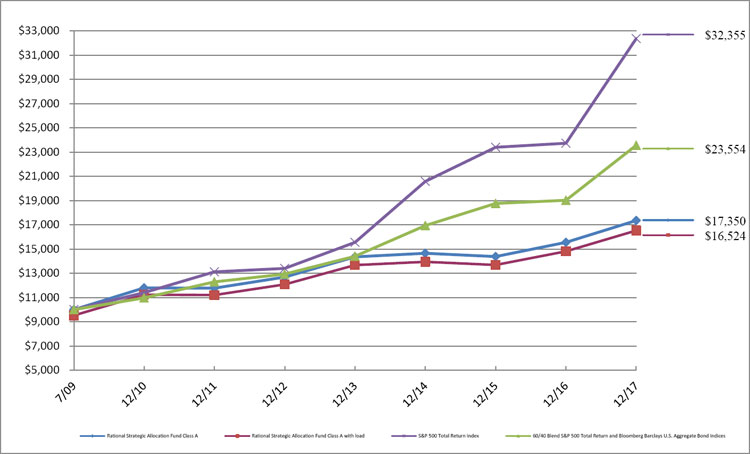

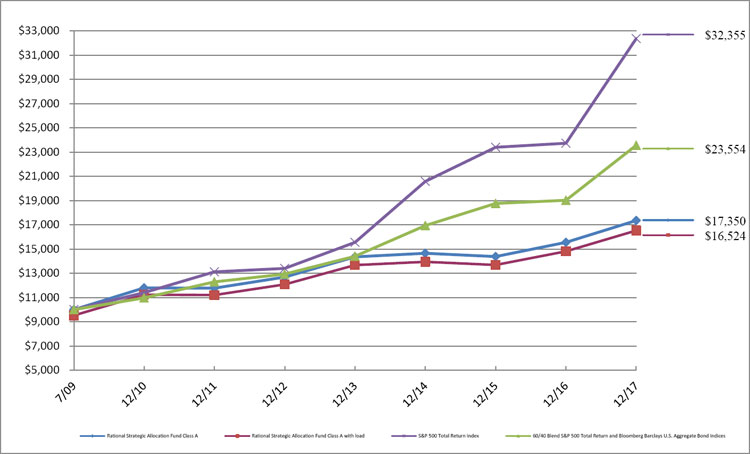

The Fund’s performance figures* for each of the periods ended December 31, 2017, compared to its benchmarks:

| | | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | Since 7/30/2009(a) | Since 5/31/2016(b) |

| Class A | 11.61% | 6.46% | 6.76% | N/A |

| Class A with load | 6.30% | 5.43% | 6.14% | N/A |

| Class C | 10.80% | N/A | N/A | 9.72% |

| Institutional Class | 11.95% | N/A | N/A | 10.80% |

| S&P 500 Total Return Index (c) | 21.83% | 15.79% | 14.96% | 18.96% |

| BAIB Index (d) | 14.25% | 10.33% | 10.71% | 11.86% |

| | | | | |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2017 prospectus, the total annual operating expense are 2.00% for Institutional Class shares, 2.25% for A shares and 2.75% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. |

| (a) | Inception date is July 30, 2009 for Class A and the Benchmarks. |

| (b) | Inception date is May 31, 2016 for Class C, Institutional Class and the Benchmarks. |

| (c) | The “S&P 500 Total Return Index”, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

| (d) | The Balanced Allocation Indices Blend (“BAIB”) is a custom blended index comprised of the following two indices with their noted respective weightings: Standard & Poor’s 500 Index® (“S&P 500”) (60%) and the Bloomberg Barclays U.S. Aggregate Bond Index (40%). The Barclays U.S. Aggregate Index is comprised of securities from the Barclays Government/Corporate Bond Index, Mortgage Securities Index and the Asset Based Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indices are rebalanced monthly by market capitalization. The index is unmanaged and, unlike the Fund, is not affected by cash flows. The S&P 500 is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Investments cannot be made in an index. For additional disclosure relating to the S&P 500, please see “Additional Disclaimers” in this Prospectus. |

Comparison of the Change in Value of a $10,000 Investment

| Top Holdings | | % of Net Assets | |

| Equity Funds - Mutual Funds | | | 30.1 | % |

| Debt Funds - Mutual Funds | | | 29.2 | % |

| Equity Funds - Exchange Traded Funds | | | 23.6 | % |

| Asset Allocation Funds - Mutual Funds | | | 15.2 | % |

| Other/Short-Term Investments | | | 1.9 | % |

| | | | 100.0 | % |

| | | | | |

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

January 31, 2018

Rational Dynamic Momentum Fund

Dear Fellow Shareholders,

The Rational Dynamic Momentum Fund (“the Fund”) commenced trading in October 2016 after conversion from its predecessor Chesapeake Fund LLC which opened in 1994. The Fund seeks to provide investors capital appreciation uncorrelated to global equity markets.

The Fund’s total annualized returns through 12/31/17 as compared to the S&P 500 Total Return Index and BarclayHedge CTA Index were as follows:

| | 1 Year | 5 Years | 10 Years | Inception1 |

| Institutional Class | 3.85 | 8.01 | 3.68 | 6.32 |

| BarclayHedge CTA Index2 | 0.69 | 0.77 | 1.91 | 4.49 |

| S&P 500 Total Return Index3 | 21.83 | 15.79 | 8.50 | 9.71 |

| Class A | 3.57 | n/a | n/a | 0.53 |

| Class C | 2.83 | n/a | n/a | -0.07 |

| BarclayHedge CTA Index2 | 0.69 | n/a | n/a | -0.38 |

| S&P 500 Total Return Index3 | 21.83 | n/a | n/a | -0.38 |

| Class A w/ Sales Charge | -1.34 | n/a | n/a | -3.31 |

| | | | | |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

Below, please find the yearly summary broken down by month:

January

Performance in January was positive led by a strong showing in commodities. In metals, increased demand from China along with a sagging US dollar offered support to our long copper, lead and zinc positions. Softs were also profitable backed by gains in coffee and sugar. Dry weather in Brazil lead to higher coffee prices while a fall in India’s sugar production boosted sugar prices.

Financials contributed to the month’s gains as well with the Dow Jones Industrial Average finally eclipsing the twenty thousand-mark intra month. While in currencies, profits were attributed to our short euro positions against the Canadian dollar, Australian dollar and Norwegian krone.

February

Performance was positive in February, supported by significant moves in foreign exchange and equity markets. In currencies, the possible unraveling of the European Union (EU) proved beneficial to our portfolio, with sterling cross rates pressured by Britain’s exit of the EU. Meanwhile, the euro moved lower due to France’s upcoming presidential election uncertainty. Marine La Pen, the right-wing candidate has been climbing in the polls recently and has stated she wants France to leave the EU and return to the franc.

In equities, the rally was seen across the board as investors continued to focus on President Trump’s proposed tax reform and infrastructure stimulus plans. While most commodities had a relatively flat month, we did experience losses in some of the grains. Wheat prices rallied during the month due to a USDA report which called for lower wheat stockpiles. Poor weather was also forecast which would negatively impact the harvest and was detrimental to our short position.

March

March 2017 was an interesting month. There was some speculation as to what the Fed may do in March’s meeting, with the consensus being that there would be a rate hike. The world was not disappointed as the Fed raised interest rates by 25 basis points. The Fed further stated that the markets should only expect two further interest rate hikes in 2017 which added to the weakness of the dollar in March. After experiencing months of downward pressure, the Mexican Peso rallied in March. This had a negative impact on the portfolio. Rumors for this rally centered around the US not planning to impose tariffs on Mexican exports.

Commodities also did not perform well in March. Long exposure in soybeans came under pressure due to heavy competition from Brazil. They had a very large crop and were active sellers. Losses also came from the cocoa and cattle markets. Gains in silver and palladium were not able to offset much of these losses.

April

Performance in April was relatively flat. There appeared to be some global activity this month including US President Trump advocating for a weaker dollar and the state of the French elections. As a result of this, the dollar was weak against most currencies in April which had negative implications on the portfolio. The rally in bond prices also had a negative impact on performance.

Gains in meats, softs, and stocks were able to offset most of the losses. Cattle and cocoa were the month’s best performers. The June 2017 cattle futures contract closed near its contract high’s primarily due to stronger-than-expected demand for beef. Cocoa prices slipped in April mostly due to disappointing demand, and thus our short positions benefited from this.

May

Performance in May was subdued. Similar to April, US dollar weakness was one of the main themes. Many of the major global currencies hit yearly highs against the US dollar. The commodities had a negative impact on performance. However, some interesting movements in soybeans and cattle helped to lessen the loss. Weakness in grains, particularly in soybeans, continued in May. Uncertainty in Brazil and weather seem to be two contributors to the soybean sell-off. Cattle prices continue to rally mostly due to increased demand.

The sector that performed the best in May was the stock sector. Stocks, both domestic and overseas, continued to rally. As we approach summer, it will be interesting to see how the markets will adjust to various world events.

June

Performance in June 2017 was slightly negative. The currency and the grain sectors had the greatest negative impacts on the portfolio. With currencies, gains from our New Zealand Dollar/USD and USD/Swedish Krona positions were not great enough to offset the losses in the Ruble/USD and Canadian dollar/USD positions. In the grains, losses primarily came from the wheat and soybean markets. Dry weather concerns in the US North plains pushed soybean prices higher. Weather coupled with a drop-in crop rating seem to be fueling the rally in wheat.

The softs and metals sectors proved to be profitable in June. Cocoa, coffee and sugar prices have been falling all year, and the trend continued in June. The leader of the metals sector was copper. Supply concerns in Chile along with

increased demand from China has pushed copper prices higher.

July

Performance was lower in July. Commodities had the greatest negative impact on performance. Crude oil prices rallied due to various factors such as renewed production-curb commitments from OPEC members as well as Venezuela’s uncertainty, a weaker U.S. dollar, and declining US inventories. Cocoa prices rallied due to increased demand. Growing concerns of a supply deficit in the coffee market pushed prices higher. Positive performance resulting from higher prices in copper and palladium did help offset some of the losses in the commodity sector.

Gains in the currency sector helped to offset most of the losses in commodities. The falling US dollar seem to be a central theme in July. Low inflation as well as political risk in the US seem to be weighing heavy on the Greenback

August

August proved to be a profitable month. The markets were somewhat volatile due to the events of North Korea, and thus, holding a diversified portfolio proved beneficial to our holdings. Continued weakness in the US dollar also benefited the portfolio, while some small losses from our fixed income positions were offset by profits from the stock sector.

Overall, the commodities were profitable. The biggest losses came the meats sector led by our long positions in cattle and hogs. However, these losses were more than offset by the gains in the metals and softs sectors. In the metals, our long positions in high grade copper and palladium led the way. In the softs sector, weaker prices in coffee and cocoa benefited our short positions. We continue to believe that our long-term trend-following approach coupled with our trading a diversified portfolio helped to successfully navigate the volatility of August.

September

Performance in September was lower. The weakness in the dollar in recent months did not continue in September as the Fed’s desire to continue raising interest rates fueled a rally, hurting performance. Even though we did profit in our Ruble and British Pound positions, their gains could not offset the losses incurred in our USD/Swedish Krona, Australian Dollar, and Mexican Peso positions.

The Fund had profits from the fixed income sector led by our short position in the three-month Canadian Bankers Acceptances. In commodities, the metals proved to be the most challenging. Gains in our short positions in platinum and silver could not overcome the losses in our long gold and copper positions.

October

October’s performance was very strong as the stock and commodity sectors led the way and more than offset the slight losses experienced by the currency sector. The dollar rally continued in October as a myriad of events in October helped to sustain the rally. Optimism from the likelihood of tax cuts, an interest rate hike in December and better than expected GDP data were some reasons.

Much of the stock rally was led by tech sector. In the commodities, most of the positive performance came from metals. Increased demand in the US and China helped push copper prices higher. Palladium prices continued its multi-month climb higher, partly due to rising auto sales in China and also by added demand in the US by those replacing their automobiles lose in the recent hurricanes. In the meats sector, soaring cattle prices in October also benefited the portfolio.

November

November was a profitable month led mostly by currencies and stocks. The commodities had a negative impact, but losses in this sector were more than offset by the profits in the other sectors. With the currencies, the strength in the British Pound, Euro and Mexican Peso against the US dollar helped the portfolio.

The surging stock market continued in November partially fueled by the strong prospects of a major tax overhaul. In fixed income, the notion of higher interest rates helped our short positions. In November, three of the four major sectors benefited the portfolio which led to this month’s positive performance.

December

The year ended on a solid note in December. All major sectors exhibited positive performance, led by currencies and the commodities. In the currencies, the dollar’s continued weakness seemed to be the trend. Expectations that the European economy will continue to expand coupled with the tapering of the economic stimulus pushed the Euro higher.

In the commodities, the metals and energy prices continued to climb in December. The positive performance in the metals was led by aluminum and copper, while long positions in heating oil also benefited the portfolio.

In the fixed income sector, higher interest rate was again the theme, as the Fed raised rates by 25 basis points. Stocks also contributed to the month’s gains.

Sincerely,

Jerry Parker, Jr and Michael Ivie

Portfolio Managers

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| 1 | Inception: Institutional 02/01/1994, Class A & C 09/30/2016. Performance shown before 09/30/2016 is for the Fund’s predecessor, the Chesapeake Diversified Program. |

| 2 | Barclay CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. There are currently 522 programs included in the calculation of the Barclay CTA Index for 2017. The Index is equally weighted and rebalanced at the beginning of each year. |

| 3 | The S&P 500 Total Return Index® (“S&P 500 TR”) is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Indices are unmanaged and, unlike the Fund, are not affected by cash flows. It is not possible to invest directly in an Index. For additional disclosure relating to the S&P 500 TR, please see “Additional Disclaimers” in the Fund’s Prospectus. |

3211-NLD-2/13/2018

| Rational Dynamic Momentum Fund |

| PORTFOLIO REVIEW |

| December 31, 2017 |

| |

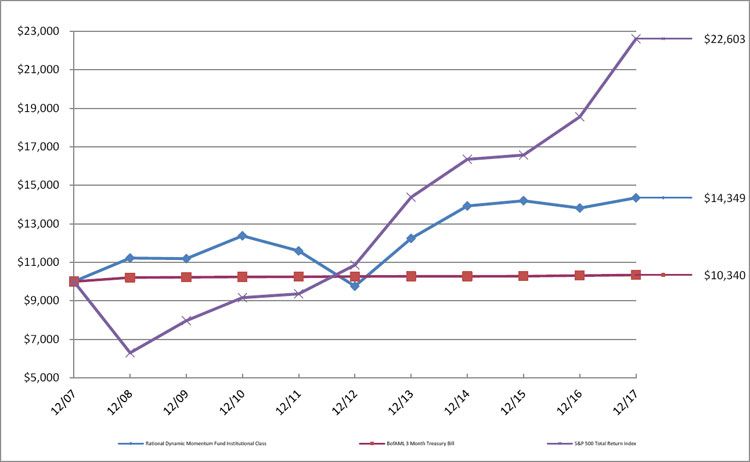

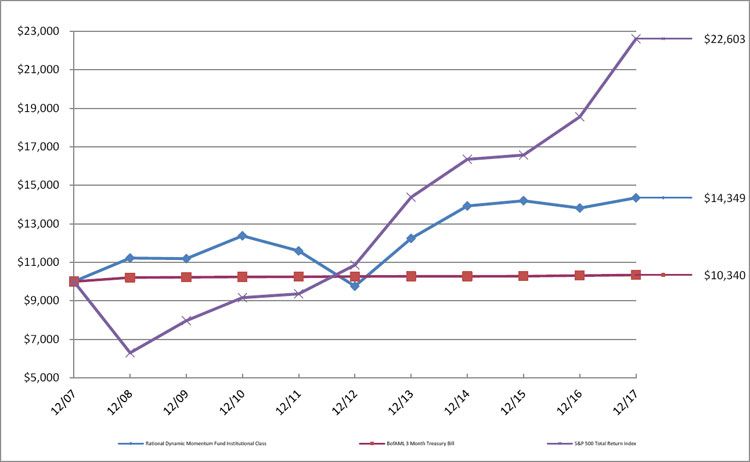

The Fund’s performance figures* for each of the periods ended December 31, 2017, compared to its benchmarks:

| | | Annualized | Annualized | Annualized |

| | 1 Year Return | 5 Year Return | 10 Year Return | Since 9/30/2016(a) |

| Class A | 3.57% | N/A | N/A | 0.53% |

| Class A with load | -1.34% | N/A | N/A | -3.31% |

| Class C | 2.83% | N/A | N/A | -0.07% |

| Institutional Class | 3.85% | 8.01% | 3.68% | N/A% |

| BofAML 3 Month Treasury Bill (b) | 0.85% | 0.27% | 0.39% | 0.75% |

| S&P 500 Total Return Index (c) | 21.83% | 15.79% | 8.50% | 20.65% |

| | | | | |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s May 1, 2017 prospectus, the total annual operating expense are 2.39% for Institutional Class shares, 2.64% for A shares and 3.14% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 5.75%. |

| (a) | Inception date is May 31, 2016 for Class A, Class C and the Benchmarks. |

| (b) | BofA Merrill Lynch 3-Month U.S. Treasury Bill Index “BofAML 3-Month T-Bill,” is an index of short-term U.S. Government securities maturing in 90 days. Investors cannot invest directly in an Index. |

| (c) | The “S&P 500 Total Return Index”, a registered trademark of McGraw-Hill Co., Inc., is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an Index. |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Asset Type ^ | | % of Net Assets | |

| Short-Term Investments | | | 82.0 | % |

| Other/Cash & Equivalents | | | 18.0 | % |

| | | | 100.0 | % |

| | | | | |

^ Does not include derivatives in which the Fund invests.

Please refer to the Consolidated Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

January 31, 2018

Rational Iron Horse Fund

Dear Fellow Shareholders,

The Rational Iron Horse (the “Fund”) was up 8.61% for Class A during the last fiscal year ended December 31, 2017. During that same period the S&P 500 was up 21.83% and the CBOE S&P 500 BuyWrite Index (BXM) was up 13.00%. The Fund could not keep pace with both indexes because of the lack of volatility and the fact that the Fund is individual stock picking over passive indexing.

Fund Performance

In a rapid market rise covered calls tend to lag general market indexes. Volatility compression was also a major explanation for this period’s performance. We believe that the volatility could increase in the coming quarters, and potentially that would be beneficial for our single stock option strategy, as we seek more income.

During the last 12 months, the Fund was mostly equal weighted relative to the S&P 500 sector. The covered call strategies the Fund utilizes seek to do well in a sideways to lower trending market. This is what the Fund managers’ long-term experience in managing covered call strategies has taught.

The Fund’s total annualized returns through 12/31/17 as compared to the S&P 500 Total Return Index were as follows:

| | 1 Year | 5 Years | Since Inception1 |

| Class A | 8.61% | 6.51% | 5.62% |

| Institutional | 8.84% | 6.81% | 7.30% |

| Class A with Sales Charge | 2.40% | 5.25% | 4.66% |

| S&P 500 Total Return Index2 | 21.83% | 15.79% | 13.46% |

| | | | |

The Fund’s maximum sales charge for Class “A” shares is 4.75%. Investments in mutual funds involve risks. Performance is historic and does not guarantee future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month- end performance information or the Fund’s prospectus please call the Fund, toll free at 1-800-253-0412. You can also obtain a prospectus at www.RationalMF.com.

Summary

Our covered call strategy on average seeks to run at 50-60% of the market risk. When the market trends upward like it has over the last year, a covered call strategy can tend to underperform a long only strategy. The goal of the strategy is not to outperform the market on every market interval, but to seek a good total return with less risk than the market.

Sincerely,

The Iron Horse Fund Team

This report is intended for the Fund’s shareholders. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Fund prospectus. To obtain a prospectus or other information about the Fund, please visit www.RationalMF.com or call 1-800-253-0412. Please read the prospectus carefully before investing.

| (1) | Inception date A Share: 7/7/2011. Inception date Institutional Share: 11/16/2011. |

| (2) | The S&P 500 Total Return Index by Standard & Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track, and individuals cannot invest directly in any index, although individuals may invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. |

4211-NLD-2/14/2018

| Rational Iron Horse Fund |

| PORTFOLIO REVIEW |

| December 31, 2017 |

| |

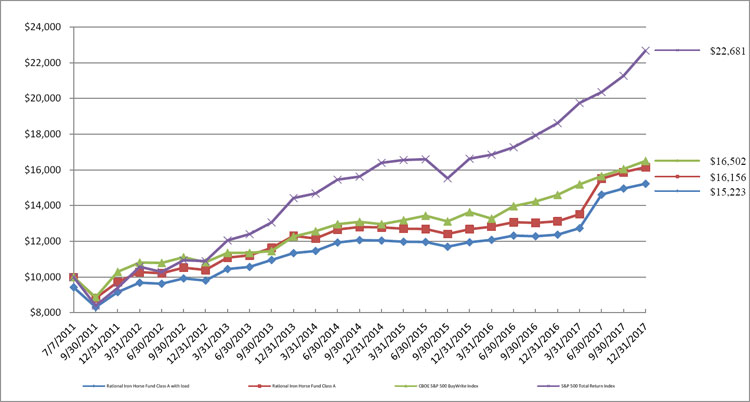

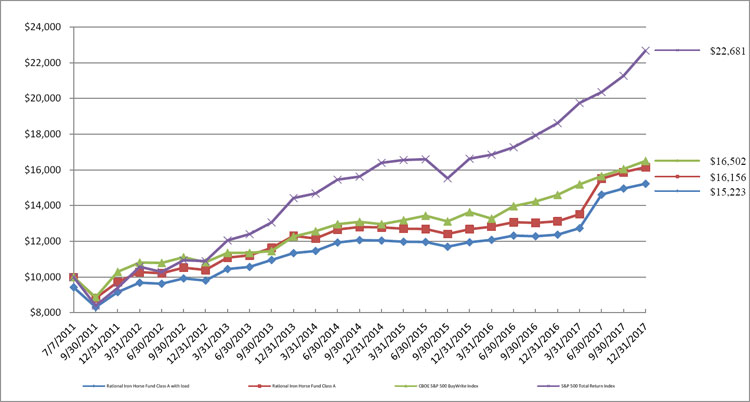

The Fund’s performance figures* for the periods ended December 31, 2017, as compared to its benchmarks:

| | | | Annualized | Annualized | Annualized | |

| | 9 Month Return | One Year Return | Five Year Return | Since 7/7/2011(a) | Since 11/16/2011(b) | Since 4/10/2017 (c) |

| Class A | 5.47% | 8.61% | 6.51% | 5.62% | N/A | N/A |

| Class A with Load | (0.58)% | 2.40% | 5.25% | 4.66% | N/A | N/A |

| Institutional Class | 5.69% | 8.84% | 6.81% | N/A | 7.30% | N/A |

| Class C | N/A | N/A | N/A | N/A | N/A | 4.89% |

| S&P 500 Total Return Index (d) | 14.86% | 21.83% | 15.79% | 13.46% | 15.85% | 15.06% |

| CBOE S&P Buy Write Index (e) | 8.64% | 13.00% | 8.78% | 8.03% | 8.79% | 8.58% |

| | | | | | | |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. Per the fee table in the Fund’s August 1, 2017 prospectus, the total annual operating expense are 1.95% for Institutional Class shares, 2.20% for A shares and 2.70% for C shares before fee waivers. See the financial highlights for current expense ratios. For performance information current to the most recent month-end, please call toll-free 1-800-253-0412. Class A shares are subject to a maximum load of 4.75%. Class A shares are subject to a maximum load of 5.75%. |

| (a) | Inception date is July 7, 2011. |

| (b) | Inception date is November 16, 2011. |

| (c) | Inception date is April 10, 2017 |

| (d) | The S&P 500 Total Return Index is an unmanaged free-float capitalization-weighted index which measures the performance of 500 large-cap common stocks actively traded in the United States. Index returns assume reinvestment of dividends. Investors may not invest in the index directly; unlike the Fund’s returns, the index does not reflect any fees or expenses. |

| (e) | The CBOE S&P 500 BuyWrite Index (BXM) is a benchmark index designed to track the performance of a hypothetical buy-write strategy on the S&P 500 Index. The BXM is a passive total return index based on (1) buying an S&P 500 stock index portfolio, and (2) “writing” (or selling) the near-term S&P 500 Index “covered” call option, generally on the third Friday of each month. Index returns assume the reinvestment of dividends. Investors may not invest in the index directly; unlike the Fund’s returns, the index does not reflect any fees or expenses. |

Comparison of the Change in Value of a $10,000 Investment

| Top Ten Holdings by Industry ^ | | % of Net Assets | |

| Banks | | | 12.0 | % |

| Computers | | | 8.5 | % |

| Pharmaceuticals | | | 8.5 | % |

| Oil & Gas | | | 8.2 | % |

| Internet | | | 7.0 | % |

| Telecommunications | | | 4.5 | % |

| Apparel | | | 3.8 | % |

| Retail | | | 3.6 | % |

| Food | | | 3.5 | % |

| Aerospace/Defense | | | 3.1 | % |

| Other/Short-Term Investments | | | 37.3 | % |

| | | | 100.0 | % |

| | | | | |

^ Does not include derivatives in which the Fund invests.

Please refer to the Portfolio of Investments in this shareholder report for a detailed analysis of the Fund’s holdings.

| RATIONAL DIVIDEND CAPTURE FUND |

| PORTFOLIO OF INVESTMENTS |

| December 31, 2017 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS - 88.8% | | | | |

| | | | | BANKS - 2.1% | | | | |

| | 13,000 | | | Bank of America Corp. | | $ | 383,760 | |

| | 3,410 | | | JPMorgan Chase & Co. | | | 364,665 | |

| | | | | | | | 748,425 | |

| | | | | BUSINESS DEVELOPMENT COMPANIES - 13.9% | | | | |

| | 124,200 | | | Apollo Investment Corp. | | | 702,972 | |

| | 93,700 | | | FS Investment Corp. | | | 688,695 | |

| | 313,500 | | | Medley Capital Corp. | | | 1,636,470 | |

| | 101,400 | | | Oaktree Speciality Lending Corp. | | | 495,846 | |

| | 99,800 | | | PennantPark Investment Corp. | | | 689,618 | |

| | 33,600 | | | Solar Capital Ltd. | | | 679,056 | |

| | | | | | | | 4,892,657 | |

| | | | | COMPUTERS - 1.0% | | | | |

| | 2,400 | | | International Business Machines Corp. | | | 368,208 | |

| | | | | | | | | |

| | | | | DIVERSIFIED FINANCIAL SERVICES - 5.4% | | | | |

| | 65,334 | | | Arlington Asset Investment Corp. | | | 769,635 | |

| | 96,700 | | | Five Oaks Investment Corp. | | | 386,800 | |

| | 113,213 | | | Medley Management, Inc. | | | 735,884 | |

| | | | | | | | 1,892,319 | |

| | | | | ENTERTAINMENT - 3.0% | | | | |

| | 71,765 | | | AMC Entertainment Holdings, Inc. | | | 1,083,652 | |

| | | | | | | | | |

| | | | | FOOD - 3.4% | | | | |

| | 6,140 | | | JM Smucker Co. | | | 762,834 | |

| | 6,200 | | | Kellogg Co. | | | 421,476 | |

| | | | | | | | 1,184,310 | |

| | | | | IRON/STEEL - 1.1% | | | | |

| | 6,140 | | | Nucor Corp. | | | 390,381 | |

| | | | | | | | | |

| | | | | MEDIA - 1.4% | | | | |

| | 4,600 | | | Walt Disney Co. | | | 494,546 | |

| | | | | | | | | |

| | | | | MISCELLANEOUS MANUFACTURING - 2.5% | | | | |

| | 51,270 | | | General Electric Co. | | | 894,661 | |

| | | | | | | | | |

| | | | | OIL & GAS - 9.6% | | | | |

| | 62,700 | | | Alliance Resource Partners LP | | | 1,235,190 | |

| | 11,710 | | | Anadarko Petroleum Corp. | | | 628,124 | |

| | 26,590 | | | BP PLC | | | 1,117,578 | |

| | 62,325 | | | Nabors Industries Ltd. | | | 425,680 | |

| | | | | | | | 3,406,572 | |

| | | | | PHARMACEUTICALS - 7.9% | | | | |

| | 44,440 | | | GlaxoSmithKline PLC | | | 1,576,287 | |

| | 21,300 | | | Merck & Co, Inc. | | | 1,198,551 | |

| | | | | | | | 2,774,838 | |

| | | | | PIPELINES- 2.1% | | | | |

| | 18,000 | | | Plains All American Pipeline LP | | | 371,520 | |

| | 7,600 | | | Western Gas Partners LP | | | 365,484 | |

| | | | | | | | 737,004 | |

| | | | | REITS - 18.7% | | | | |

| | 44,340 | | | CBL & Associates Properties, Inc. | | | 250,964 | |

| | 138,330 | | | CYS Investments, Inc. | | | 1,110,790 | |

| | 56,830 | | | Global Medical REIT,Inc. | | | 466,006 | |

| | 66,880 | | | Independence Realty Trust, Inc. | | | 674,819 | |

| | 202,630 | | | New Senior Investment Group, Inc. | | | 1,531,883 | |

| | 12,700 | | | Omega Healthcare Investors, Inc. | | | 349,758 | |

| | 17,910 | | | Senior Housing Properties Trust | | | 342,976 | |

| | 64,342 | | | Uniti Group, Inc. | | | 1,144,644 | |

| | 50,015 | | | Whitestone REIT | | | 720,716 | |

| | | | | | | | 6,592,556 | |

See accompanying notes to consolidated financial statements.

| RATIONAL DIVIDEND CAPTURE FUND |

| PORTFOLIO OF INVESTMENTS (Continued) |

| December 31, 2017 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS - 88.8% (Continued) | | | | |

| | | | | RETAIL - 7.7% | | | | |

| | 5,140 | | | CVS Health Corp. | | $ | 372,650 | |

| | 7,600 | | | Kohl’s Corp. | | | 412,148 | |

| | 14,490 | | | Macy’s, Inc. | | | 365,003 | |

| | 114,100 | | | Office Depot, Inc. | | | 403,914 | |

| | 6,025 | | | Target Corp. | | | 393,131 | |

| | 10,600 | | | Walgreens Boots Alliance, Inc. | | | 769,772 | |

| | | | | | | | 2,716,618 | |

| | | | | SEMICONDUCTORS - 3.6% | | | | |

| | 8,050 | | | Intel Corp. | | | 371,588 | |

| | 14,205 | | | Qualcomm, Inc. | | | 909,404 | |

| | | | | | | | 1,280,992 | |

| | | | | TELECOMMUNICATIONS - 5.4% | | | | |

| | 40,400 | | | CenturyLink, Inc. | | | 673,873 | |

| | 26,000 | | | Frontier Communications Corp. | | | 175,760 | |

| | 108,500 | | | Telefonica SA | | | 1,050,280 | |

| | | | | | | | 1,899,913 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $30,824,973) | | | 31,357,652 | |

| | | | | | | | | |

| | | | | EXCHANGE TRADED FUNDS - 8.2% | | | | |

| | | | | EQUITY FUNDS - 8.2% | | | | |

| | 67,400 | | | Proshares UltraPro Short QQQ | | | 1,449,774 | |

| | 125,800 | | | Proshares UltraPro Short S&P 500 | | | 1,430,346 | |

| | | | | TOTAL EXCHANGE TRADED FUNDS (Cost - $3,099,905) | | | 2,880,120 | |

| | | | | | Coupon | | Maturity | | | |

| | | | | PREFERRED STOCKS - 2.1% | | | | | | | | |

| | | | | FINANCIAL SERVICES - 1.0% | | | | | | | | |

| | 14,400 | | | Ladenburg Thalmann Financial Services, Inc. | | 6.500% | | 11/30/2027 | | | 354,802 | |

| | | | | | | | | | | | | |

| | | | | REAL ESTATE - 1.1% | | | | | | | | |

| | 13,800 | | | Innovative Industrial Properties, Inc. | | 9.000% | | Perpetual | | | 385,572 | |

| | | | | TOTAL PREFERRED STOCKS (Cost -$705,000) | | | | | | | 740,374 | |

| | | | | | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS - 1.0% | | | | | | | | |

| | 362,219 | | | Federated Treasury Obligations Fund, Institutional Class, 1.15% * | | | | 362,219 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost $362,219) | | | | | 362,219 | |

| | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS (Cost $34,992,097) - 100.1% (a) | | | | $ | 35,340,365 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (0.1)% | | | | | (25,838 | ) |

| | | | | NET ASSETS - 100.0% | | | | | | $ | 35,314,527 | |

PLC - Public Limited Company.

REIT - Real Estate Investment Trust

| * | Rate shown represents the rate at December 31, 2017, and is subject to change and resets daily. |

| (a) | Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $35,180,279 and differs from fair value by net unrealized appreciation (depreciation) of securities as follows: |

| Unrealized appreciation: | | $ | 2,049,700 | |

| Unrealized depreciation: | | | (1,889,614 | ) |

| Net unrealized appreciation: | | $ | 160,086 | |

See accompanying notes to consolidated financial statements.

| RATIONAL RISK MANAGED EMERGING MARKETS FUND |

| PORTFOLIO OF INVESTMENTS |

| December 31, 2017 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS - 93.7% | | | | |

| | | | | ADVERTISING - 1.8% | | | | |

| | 8,200 | | | Smiles SA | | $ | 187,628 | |

| | | | | | | | | |

| | | | | AUTO PARTS & EQUIPMENT - 3.4% | | | | |

| | 801 | | | Mando Corp. | | | 230,824 | |

| | 49,000 | | | Nexteer Automotive Group Ltd. | | | 116,779 | |

| | | | | | | | 347,603 | |

| | | | | BANKS - 18.1% | | | | |

| | 11,300 | | | Banco do Brasil SA * | | | 108,398 | |

| | 3,000 | | | Banco Macro SA | | | 347,640 | |

| | 1,834 | | | Bancolombia SA | | | 72,736 | |

| | 16,000 | | | BOC Hong Kong Holdings Ltd. | | | 81,097 | |

| | 19,759 | | | Commercial International Bank Egypt SAE | | | 85,853 | |

| | 24,158 | | | FirstRand Ltd. * | | | 131,309 | |

| | 17,700 | | | Grupo Financiero Banorte SAB de CV | | | 97,158 | |

| | 1,700 | | | HDFC Bank Ltd. | | | 172,839 | |

| | 2,690 | | | OTP Bank PLC | | | 111,357 | |

| | 25,337 | | | Sberbank of Russia PJSC * | | | 428,955 | |

| | 39,000 | | | Yes Bank Ltd | | | 192,564 | |

| | | | | | | | 1,829,906 | |

| | | | | DIVERSIFIED FINANCIAL SERVICES - 1.9% | | | | |

| | 43,500 | | | CITIC Securities Co Ltd. | | | 89,752 | |

| | 2,232 | | | Hana Financial Group, Inc. | | | 103,829 | |

| | | | | | | | 193,581 | |

| | | | | ELECTRONICS - 0.8% | | | | |

| | 24,700 | | | Hon Hai Precision Industry Co. Ltd. | | | 79,017 | |

| | | | | | | | | |

| | | | | FOOD - 3.0% | | | | |

| | 8,868 | | | Gruma SAB de CV | | | 112,460 | |

| | 5,000 | | | X5 Retail Group NV * | | | 188,850 | |

| | | | | | | | 301,310 | |

| | | | | FOREST PRODUCTS & PAPER - 1.2% | | | | |

| | 21,600 | | | Suzano Papel e Celulose SA | | | 121,509 | |

| | | | | | | | | |

| | | | | GAS - 3.2% | | | | |

| | 53,000 | | | China Resources Gas Group Limited | | | 192,318 | |

| | 19,000 | | | ENN Energy Holdings Ltd. | | | 135,578 | |

| | | | | | | | 327,896 | |

| | | | | HEALTHCARE-PRODUCTS - 0.9% | | | | |

| | 4,300 | | | Aspen Pharmacare Holdings Ltd. | | | 96,444 | |

| | | | | | | | | |

| | | | | INSURANCE - 7.5% | | | | |

| | 28,000 | | | China Life Insurance Co. Ltd. | | | 87,983 | |

| | 39,000 | | | Ping An Insurance Group Co of China Ltd. | | | 406,081 | |

| | 8,467 | | | Vienna Insurance Group AG Wiener Versicherung | | | 261,750 | |

| | | | | | | | 755,814 | |

| | | | | INTERNET - 14.8% | | | | |

| | 2,630 | | | Alibaba Group Holding Ltd. - ADR * | | | 453,491 | |

| | 400 | | | Baozun, Inc *. | | | 93,684 | |

| | 8 | | | China Literature Limited * | | | 85 | |

| | 2,100 | | | Ctrip.com International Ltd. * | | | 92,610 | |

| | 6,600 | | | JD.com, Inc. * | | | 273,372 | |

| | 224 | | | NCSoft Corp. | | | 93,634 | |

| | 9,384 | | | Tencent Holdings, Ltd. | | | 487,646 | |

| | | | | | | | 1,494,522 | |

| | | | | IRON/STEEL - 3.0% | | | | |

| | 200 | | | Angang Steel Co Ltd. | | | 183 | |

| | 47,740 | | | Eregli Demir ve Celik Fabrikalari TAS | | | 126,198 | |

| | 10,000 | | | Vale SA | | | 122,300 | |

| | 4,951 | | | Vale SA * | | | 60,064 | |

| | | | | | | | 308,745 | |

See accompanying notes for consolidated financial statements.

| RATIONAL RISK MANAGED EMERGING MARKETS FUND |

| PORTFOLIO OF INVESTMENTS (Continued) |

| December 31, 2017 |

| Shares | | | | | Value | |

| | | | | COMMON STOCKS - 93.7% (Continued) | | | | |

| | | | | LEISURE TIME - 1.2% | | | | |

| | 2,100 | | | Hero MotoCorp Ltd. * | | $ | 124,536 | |

| | | | | | | | | |

| | | | | MEDIA - 3.4% | | | | |

| | 1,233 | | | Naspers Ltd., Class N | | | 343,915 | |

| | | | | | | | | |

| | | | | MINING - 1.9% | | | | |

| | 15,773 | | | KAZ Minerals PLC * | | | 190,492 | |

| | | | | | | | | |

| | | | | MISCELLANEOUS MANUFACTURING - 1.5% | | | | |

| | 285 | | | Largan Precision Co. Ltd. * | | | 38,500 | |

| | 8,700 | | | Sunny Optical Technology Group Co. Ltd. | | | 111,244 | |

| | | | | | | | 149,744 | |

| | | | | OIL & GAS - 3.7% | | | | |

| | 655 | | | SK Innovation Co. Ltd. | | | 125,120 | |

| | 10,700 | | | YPF SA | | | 245,137 | |

| | | | | | | | 370,257 | |

| | | | | PHARMACEUTICALS - 0.5% | | | | |

| | 700 | | | China Biologic Products Holdings, Inc. * | | | 55,139 | |

| | | | | | | | | |

| | | | | REAL ESTATE - 3.0% | | | | |

| | 116,700 | | | Ayala Land, Inc. | | | 104,263 | |

| | 24,100 | | | Global Logistic Properties Ltd. | | | 60,725 | |

| | 56,000 | | | Longfor Properties Co Ltd. | | | 140,343 | |

| | | | | | | | 305,331 | |

| | | | | RETAIL - 3.9% | | | | |

| | 40,000 | | | ANTA Sports Products Ltd. | | | 181,495 | |

| | 2,590 | | | CCC S.A. * | | | 212,054 | |

| | | | | | | | 393,549 | |

| | | | | SEMICONDUCTORS - 10.4% | | | | |

| | 209 | | | Samsung Electronics Co Ltd. | | | 497,437 | |

| | 2,995 | | | SK Hynix, Inc. | | | 214,019 | |