UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | |

| | Investment Company Act file number | 811-05038 | |

| | | |

| | Clearwater Investment Trust | |

| | (Exact name of registrant as specified in charter) | |

| | | |

| | 2000 Wells Fargo Place, 30 East 7th Street,

Saint Paul, Minnesota 55101-4930 | |

| | (Address of principal executive offices) (Zip code) | |

Stephen G. Simon

Fiduciary Counselling, Inc.

2000 Wells Fargo Place, 30 E. 7th Street

Saint Paul, Minnesota 55101-4930

Copy to:

| | John O’Hanlon, Esq.

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110 | |

| | (Name and address of agent for service) | |

| Registrant’s telephone number,including area code: | | 651-228-0935 |

| Date of fiscal year end: | December 31 |

| | |

| Date of reporting period: | December 31, 2015 |

Item 1. Reports to Stockholders

CLEARWATER INVESTMENT TRUST

Clearwater Core Equity Fund

Clearwater Small Companies Fund

Clearwater Tax-Exempt Bond Fund

Clearwater International Fund

Annual Report

for the year ended

December 31, 2015

Letter to Shareholders

(unaudited)

February 25, 2016

This annual report provides information regarding the performance and holdings of the Clearwater Investment Trust mutual funds (“the Funds”) for the year ended December 31, 2015. During 2015, the Clearwater Small Companies Fund, the Clearwater Tax-Exempt Bond Fund, and the Clearwater International Fund outperformed their respective benchmarks while the Clearwater Core Equity Fund underperformed its benchmark.

We encourage you to read this annual report as it contains important information about the Funds. The Funds’ investment manager, the Clearwater Management Company, and the portfolio managers who act as subadvisers to the Funds provide commentary in the next section, titled Management Discussion of Clearwater Funds’ Performance. Additionally, this report includes information describing the contract renewal process in November and December 2015, during which the Board of Trustees reviewed the services provided, performance, and fees charged by the Clearwater Management Company and that of each subadviser to the Funds. Effective January 29, 2015, the Trust terminated Heartland Advisers, Inc. and Knightsbridge Asset Management, LLC as subadvisers to the Clearwater Core Equity Fund. Effective as of February 3, 2015 and February 4, 2015, respectively, the Trust engaged AQR Capital Management, LLC and O’Shaughnessy Asset Management, LLC as subadvisers to the Clearwater Core Equity Fund.

The Funds’ updated annual Prospectus will be mailed to you at the beginning of May 2016. This annual update of the Prospectus and the related Statement of Additional Information, which is available by request to your Financial Consultant at Fiduciary Counselling, Inc., includes a detailed discussion of the investment objectives and risks of investing in each Fund. We believe this will help you better understand how your shareholder assets are invested and managed. For additional information that is available at this time, please see the Clearwater Mutual Funds’ current Prospectus and Statement of Additional Information.

We hope the information disclosed within this annual report is helpful in understanding the 2015 results of each of the Funds. We appreciate your continued confidence and your choice to invest with us.

| Justin H. Weyerhaeuser | James E. Johnson |

| President | Chairman |

| Clearwater Investment Trust | Clearwater Investment Trust |

Management Discussion of Clearwater Funds’ Performance

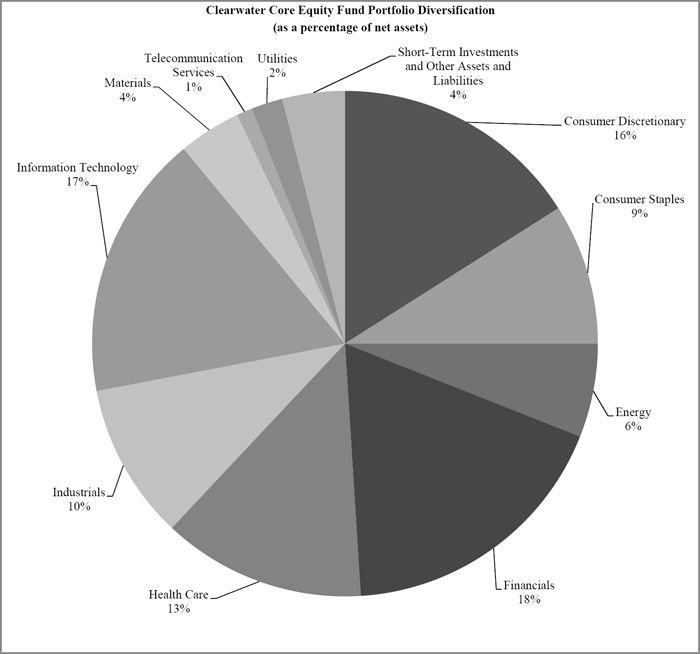

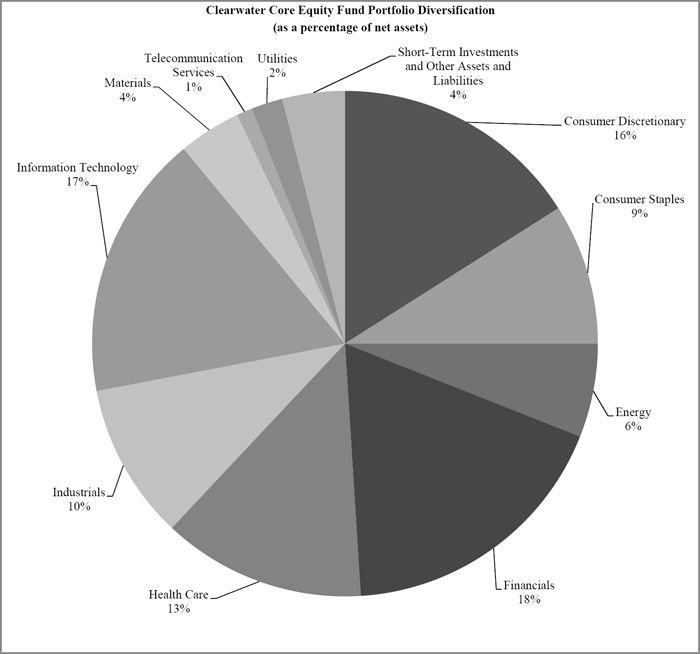

Clearwater Core Equity Fund

The Clearwater Core Equity Fund seeks long-term growth of capital. Current income, to the extent income is produced by the stocks held by the Fund, is a secondary objective. Under normal market conditions, the Clearwater Core Equity Fund pursues its investment objective by investing at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in equity securities of U.S. companies. The Clearwater Core Equity Fund’s assets are managed in a “multi-manager, multi-style” approach. The Core Equity Fund has four subadvisers. Parametric Portfolio Associates LLC, (“Parametric”), with approximately 60% of the Fund’s assets, manages its portion of the Fund’s assets to mirror the Russell 1000® Index as closely as possible without requiring the Fund to realize taxable gains. The remaining 40% of the Fund’s assets are divided among AQR Capital Management, LLC (“AQR”), O’Shaughnessy Asset Management, LLC (“OSAM”), and Osterweis Capital Management, LLC (“Osterweis”), who all utilize an active management style.

2015 Market Overview:

Domestic large capitalization equities achieved a very modest positive return in 2015. The dominant factors influencing share prices were modest yet persistent growth of the U.S. economy, falling commodity prices, including a 30% decline in the price of crude oil, and the strengthening of the U.S. dollar against most foreign currencies. In mid-December, the U.S. Federal Reserve (the “Fed”) announced that it would raise short-term interest rates by 0.25%. Corporate earnings fell year-over-year mostly due to plunging profits in the energy sector and the negative impact of a stronger dollar on export-sensitive companies.

2015 Performance and 2016 Outlook:

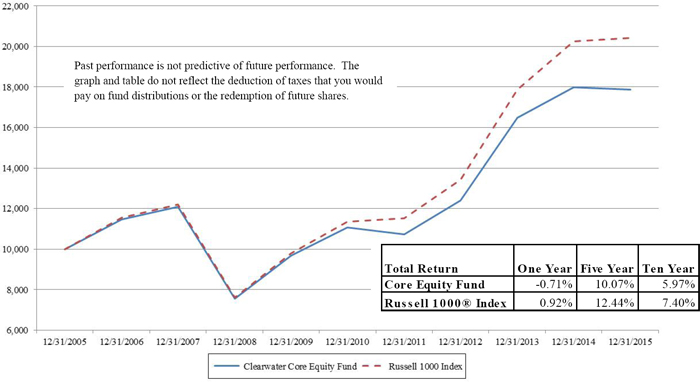

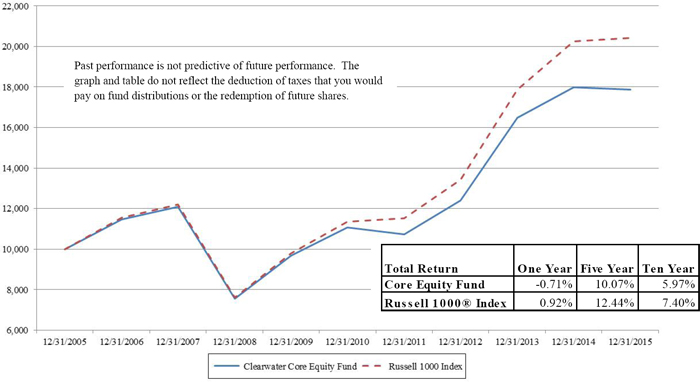

The Clearwater Core Equity Fund declined 0.7%, net of fees, in 2015 compared to a gain of 0.9% for the Russell 1000® Index, the Fund’s benchmark. Parametric, the subadviser that follows a tax-managed passive strategy, slightly outperformed the Fund’s benchmark while Osterweis, one of the active managers, significantly underperformed. During February, the Fund’s performance was negatively impacted by 0.6% when two other managers, Knightsbridge Asset Management LLC and Heartland Advisers, Inc., were terminated and replaced by two new active managers, AQR and OSAM.

Each of the three “active” subadvisers comment on the performance of their respective portfolios and their outlook for the next year in the paragraphs below. For comparison of the subadvisers’ capabilities, performance is shown gross of fees. The Fund pays a single advisory fee to Clearwater Management Company, which in turn pays the subadvisers out of its advisory fee.

Although the overall performance of the Clearwater Core Equity Fund is measured against its benchmark, as stated above, each of the underlying subadvisers may manage their portfolio of the Fund against a different benchmark that aligns more closely with their particular strategy. In each section below, the subadvisers discuss the performance of their portfolios with respect to the benchmark against which their particular portfolio is managed.

AQR Commentary

2015 Performance: AQR began managing a portion of the Clearwater Core Equity Fund (the “Portfolio”) on February 12, 2015. For the period from the Portfolio’s inception until December 31, 2015 the Russell 1000® Index (the “benchmark”) returned (0.1%) while the Portfolio had a return of 0.5% (gross of fees), outperforming the benchmark by 0.6%. Stock selection within sectors contributed positively to performance while sector selection detracted from performance. The Portfolio performed best in the Energy sector where both sector selection and stock selection outperformed for the period.

2016 Outlook: In terms of sector positioning, we are currently overweight in Financials while being underweight in Health Care. Tactically, we are now underweight value in the U.S.

OSAM Commentary

2015 Performance: OSAM began managing a portion of the Clearwater Core Equity Fund (the “Portfolio”) on February 13, 2015. For the period from the Portfolio’s inception in February 2015 until December 31, 2015, the Portfolio outperformed slightly, returning (4.2%) (gross of fees) while the Russell 1000® Value Index (the “benchmark”) returned (4.5%). The Portfolio benefited from stock selection within sectors, but this was offset by negative sector allocation effects. For the period, overweight allocations to Energy and Materials and an underweight to Health Care detracted from returns. However, stock selection within Energy was a strong contributor, with the strategy owning mainly downstream refinery companies. Additionally, Cameron International, a Portfolio holding, received an acquisition offer from Schlumberger at a 76% premium, spiking the stock price. The Portfolio also benefited from picks within Consumer Staples.

2016 Outlook: For 2015 the S&P 500® rode the performance of a very small group of momentum stocks. The top ten stocks by contribution to total return—Amazon, Microsoft, Alphabet (2 share classes), G.E., Facebook, Home Depot, Starbucks, McDonald’s and Netflix—were up an average of 53.5% during 2015. The remaining stocks in the index were down an average of 3.5%. In terms of contribution to the S&P 500®’s total return, the top ten stocks added more than 3%, while the rest of the S&P 500® had a negative contribution. This scenario—where the top ten stocks in the S&P 500® contribute more to the market’s return than the remaining 490 stocks—is uncommon. Over the past 50 years, it has happened just 20% of the time (in one year periods that the market is up). This means that 80% of the time, the bottom 490 stocks contribute more to the market’s total return than the top 10. Not so in 2015. Strategies that emphasize value—like ours—have missed the return boost provided by this narrow group of leaders because these leaders have performed so well despite very expensive prices (the Portfolio held Home Depot and Starbucks, which had cheaper valuations than others listed above). We think that it is more useful, looking forward to 2016, to describe why we generally haven’t owned stocks like these and, in most cases, why we won’t in the future. To see why we don’t own the expensive names which led the market in 2015, let’s consider the value factor. Our value factor measures stocks based on their sales, earnings and cash flows in relation to price. From 1964-2015, the cheapest stocks by this measure have outperformed the market, on average, while expensive stocks have underperformed. The cheapest 10% of stocks have outperformed by 5.1%, annualized, and average performance deteriorates as stocks get more expensive, down to the lowest decile which have underperformed by 6.4% annualized. In this case, we define the market as an equal-weighted universe of stocks trading on the NYSE, AMEX and NASDAQ exchanges with an inflation-adjusted market capitalization greater than the market average (approximately $7 billion currently). Could 2015’s top names continue to lead the market in 2016? Of course it is possible. But given our view of their extremely expensive average valuation, we will continue to avoid these names. We believe long term success comes from building a portfolio around proven stock selection factors—measured using key selection criteria like Quality, Valuation, Momentum, and Shareholder Yield.

Osterweis Commentary

2015 Performance: For the year ended December 31, 2015, the portion of the Clearwater Core Equity Fund managed by Osterweis (the “Portfolio”) generated a total return of (5.0%) (gross of fees) versus 1.4% for the S&P 500® Index (the “S&P 500®” or the “benchmark”). The U.S. and global economies appeared to soften in the second half of 2015. It seemed that deflationary trends were rattling markets worldwide. Nearly all non-U.S. equities and bonds, commodities and currencies registered losses for U.S. investors. This made the past year a difficult period in which to generate positive investment returns in equities and most other publicly traded securities. It looks like investors have migrated to an ever shrinking number of companies that are still seeing robust growth. This has led to a very narrow stock market in which the vast majority of performance in the broader indices was driven by a small handful of richly valued “growth champions.” In 2015, we estimate that the top ten S&P 500 contributors gained an average of 53% while all the other stocks in the index averaged a negative return.

After starting 2015 on a strong note, the Portfolio was buffeted beginning mid-year by the trends discussed above. In response, we pared back the number of holdings and refocused on the less cyclical, larger and better capitalized holdings in the Portfolio. Even with these actions, the Portfolio lagged the S&P 500® as a handful of mega-cap U.S. growth stocks drove much of the performance in the market. Strategies like ours that hold a range of companies from small to large, value to growth and U.S. as well as non-U.S. have had trouble keeping up. Besides the general behavior of the market, certain specific issues within the Portfolio also proved challenging this year. For one, Valeant Pharmaceuticals sold off dramatically in fall 2015 as it became an object of considerable controversy. We owned Valeant in the Portfolio for about five years and over time the company’s management delivered increased sales and earnings, successfully fulfilling our investment thesis. We decided to exit the position in October, when we became concerned that the company’s growth may well face considerable obstacles in the months and quarters ahead. Although the stock performed very well for the Portfolio over the long term, the drop from its high hurt this year’s performance. Another factor behind our weak performance in 2015 was our position in energy-related stocks. We focused holdings on non-commodity energy companies that we believed had the potential to grow and prosper simply based on volume growth. This led us to infrastructure companies such as pipeline and storage facilities. These stocks got hit just as hard as many of the commodity producers over the past year even though our companies continued to grow volumes, earnings, cash flows and distributions as expected. On the positive side, our security selection in Information Technology added considerable value, and within the overall Portfolio ten stocks garnered double digit returns during a year when the average return of the S&P 500® members was negative.

2016 Outlook: While we are mindful of the potential risks of deflation, we think the U.S. expansion has further room to run for a number of reasons. We believe corporate profits are unlikely to fall off a cliff, but their composition may shift (e.g., away from energy, materials and industrials and towards U.S. consumer-oriented companies). Current stock valuations do not appear excessive to us, broadly speaking, but we believe that valuations are getting stretched for certain premier consumer-growth companies. Our guess is that the Fed’s interest rate normalization will be slow and deliberate. We don’t think that rising rates will pose a real risk to the stock market for some time. That said, risk is always our chief concern. We continue to invest selectively in a group of companies that we believe should be able to grow despite a sluggish global economic environment and a strong U.S. dollar.

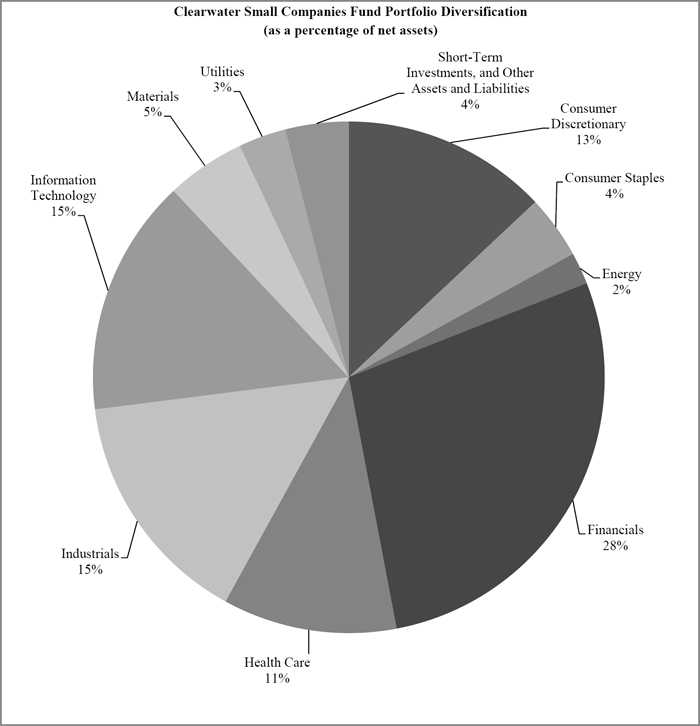

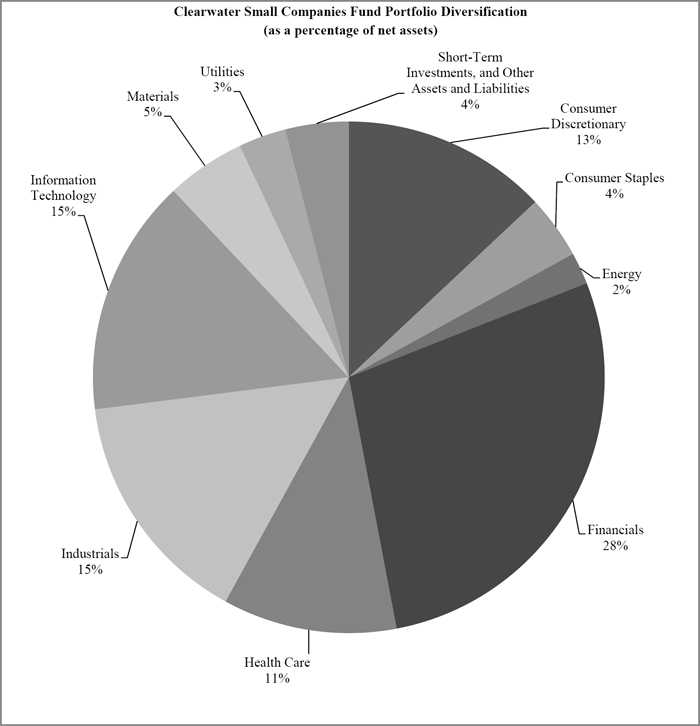

Clearwater Small Companies Fund

The Clearwater Small Companies Fund seeks long-term growth of capital. Current income is a secondary objective. Under normal market conditions, the Fund normally invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in equity securities of small companies. The Fund defines “small companies” as issuers with market capitalizations no greater than $5 billion at the time of purchase. Equity securities consist primarily of exchange-traded common and preferred stocks and convertible securities. The Fund uses a “multi-style, multi-manager” approach with two subadvisers who employ distinct investment styles: Kennedy Capital Management Inc. (“Kennedy”) and Keeley Asset Management Corp. (“Keeley”). At the period ending December 31, 2015 Kennedy and Keeley respectively managed approximately 75% and 25% of the Fund balances.

2015 Market Overview:

Domestic small capitalization equities recorded single digit losses over the period. Domestic large capitalization equities achieved a very modest positive return in 2015. The dominant factors influencing share prices were modest yet persistent growth of the U.S. economy, falling commodity prices, including a 30% decline in the price of crude oil, and the strengthening of the U.S. dollar against most foreign currencies. In mid-December, the U.S. Federal Reserve (the “Fed”) announced that it would raise short-term interest rates by 0.25%. Corporate earnings fell year-over-year mostly due to plunging profits in the energy sector and the negative impact a stronger dollar had on export-sensitive companies.

2015 Performance and 2016 Outlook:

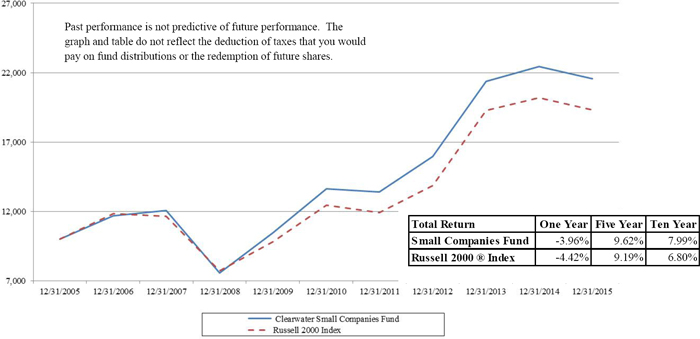

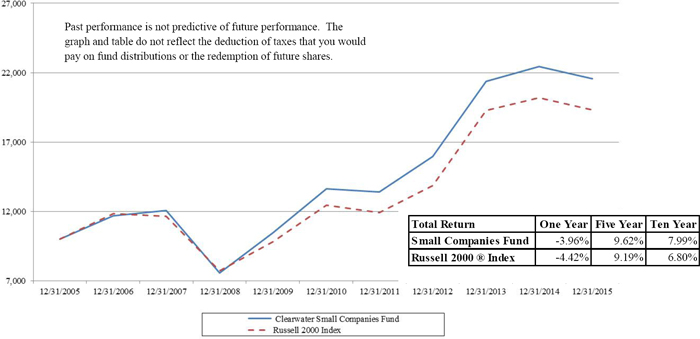

The Clearwater Small Companies Fund fell 4.0%, net of fees, during 2015 compared to a loss of 4.4% for the Russell 2000® Index, the Fund’s benchmark. The slight outperformance was driven primarily by good stock selection and secondarily by sector weighting.

The two subadvisers to the Fund comment on the performance of their specific portfolios and their outlook for the next year in the paragraphs below. For comparison of the subadvisers’ capabilities, performance is shown gross of fees. The Fund pays a single advisory fee to Clearwater Management Company, which in turn pays the subadvisers out of its advisory fee.

Although the overall performance of the Clearwater Small Companies Fund is measured against its benchmark, as stated above, each of the underlying subadvisers may manage their portfolio of the Fund against a different benchmark that aligns more closely with their particular strategy. In each section below, the subadvisers discuss the performance of their portfolios with respect to the benchmark against which their particular portfolio is managed.

Kennedy Commentary

2015 Performance: For the year ended December 31, 2015, the portion of the Clearwater Small Companies Fund managed by Kennedy (the “Portfolio”) returned (1.5%) (gross of fees), outperforming the (4.4%) return of the Fund’s benchmark, the Russell 2000® Index. Within Kennedy’s Portfolio are two “sub-portfolios”; one focused on small companies, and one focused on microcap companies. The small companies sub-portfolio returned (2.6%) (gross of fees) versus the (4.4%) return of its benchmark, the Russell 2000® Index, while the microcap sub-portfolio returned 1.0% (gross of fees) versus the (5.2%) return of its benchmark, the Russell Microcap® Index. Stock selection had a positive impact on the Portfolio’s relative performance vs. the Fund’s benchmark, the Russell 2000® Index, during the year, particularly in the Financials, Consumer Discretionary, Industrials, and Energy sectors. Stock selection for the year detracted from performance in the Healthcare, Information Technology, and Materials sectors.

2016 Outlook: We expect the domestic economy in 2016 to be similar to 2015. Although January 1, 2016 started a new year, we see many of the same forces at play. A strong domestic currency, coupled with limited economic growth, is in our view unlikely to lead to outsized organic revenue growth for many companies. As is typically our mantra, we must strive to find those companies that we believe can create secular growth through product differentiation and through intelligent use of capital and operating cash flow. While we do not believe that Fed tightening will help spur an economic recovery, it might not be as detrimental to corporations as typically assumed. Long-term borrowing rates remain decidedly favorable for most companies. Additionally, the U.S. consumer is relatively fit. The household debt service ratio, which we believe captures the health of the consumer, remains at positive levels unseen since at least 1980. Consumer sentiment measures paint an optimistic picture, and low gasoline prices help. Overall, we believe the Portfolio exhibits strong risk-return characteristics, characterized by expected long-term earnings growth rates commensurate with the benchmark, but with what we believe to be attractive valuations. In seeking outperformance, we keep a watchful eye on cash flow returns on investment – not only those generated by our companies but those priced in by the market.

Keeley Commentary

2015 Performance: For the year ended December 31, 2015, the portion of the Clearwater Small Companies Fund managed by Keeley (the “Portfolio”) slightly outperformed its benchmark, the Russell 2000® Value Index (the “benchmark”). The Portfolio returned (7.2%) (gross of fees) versus (7.5%) for the benchmark.

For the year, the Portfolio benefited from overall stock selection, yet was hurt by various sector weights. The only sector allocation that helped the Portfolio in 2015 was Energy, which held a relative underweight versus the benchmark. Of the other sectors, the most significant negative performance came from overweights in Materials, Consumer Discretionary, and Industrials, as well as our underweights in Financials and Health Care. From a stock selection perspective, positive performance was generated in Materials, Consumer Discretionary, Consumer

Staples, Industrials and Utilities. Weak stock selection and underperformance was generated in Technology, Financials, Energy and Health Care.

2016 Outlook: Generally speaking, 2015 was a difficult year for U.S. small cap investors. However, the last negative year for small cap value stocks prior to 2015 was 2011, when the Russell 2000® Value Index dropped 5.5%. While years such as 2015 are difficult, we believe that market dislocations and sporadic volatility often help identify attractive, long-term opportunities. In the small-cap value space in which we operate, we focus our attention on specific, change-driven catalysts that have the potential to help companies become better than they are today. These catalysts are often driven by ownership changes, operating changes, balance sheet or capital restructurings and marketplace shifts. Looking forward, we intend to continue investing in select companies that we believe will strive to create value in each of these areas, resulting in benefits from these restructuring catalysts.

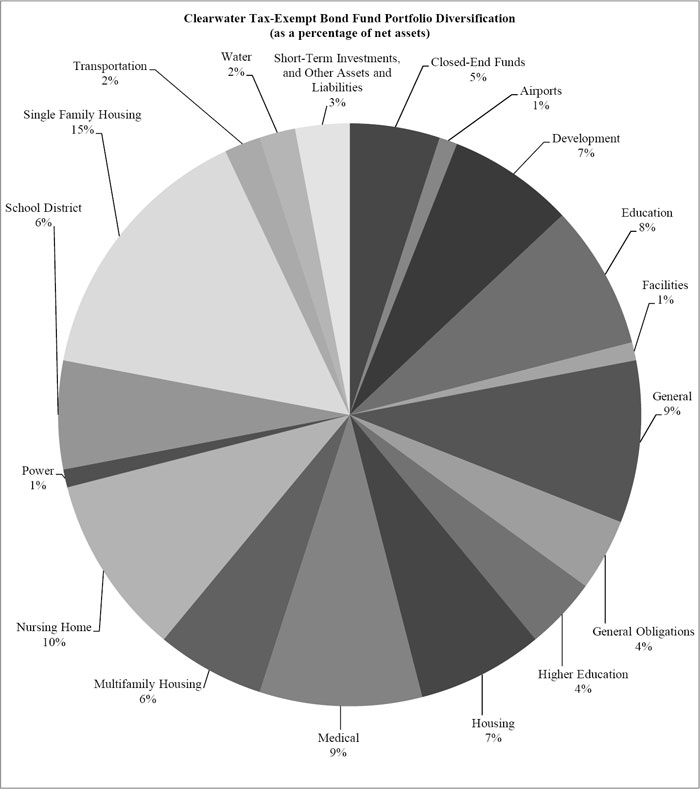

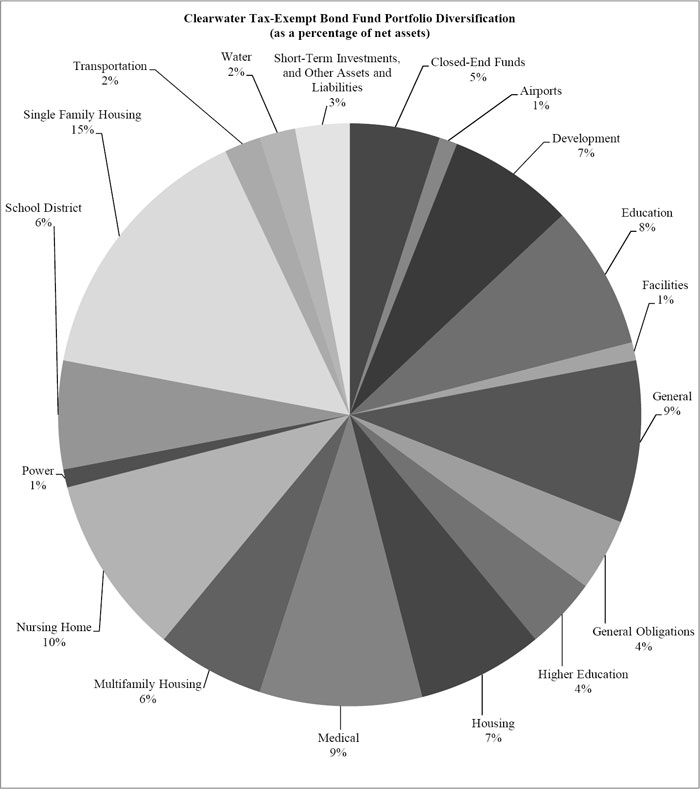

Clearwater Tax-Exempt Bond Fund

The Clearwater Tax-Exempt Bond Fund seeks high current income that is exempt from U.S. federal income tax, consistent with preservation of capital. Under normal market conditions, the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in tax-exempt bonds, which are debt obligations issued by or for the U.S. states, territories and possessions and the District of Columbia. The interest on these securities is generally exempt from both U.S. regular federal income tax and U.S. federal alternative minimum tax. However, the Fund may invest up to 20% of its assets in securities that generate interest income subject to federal alternative minimum tax for individuals. The Fund invests in both revenue bonds, which are backed by and payable only from the revenues derived from a specific facility or specific revenue source, and in general obligation bonds, which are secured by the full faith, credit and taxation power of the issuing municipality. The Fund’s subadviser, Sit Fixed Income Advisers II, LLC (“Sit”), provides day to day management for the Fund. It should be noted that the Fund is not a money market fund and is not intended to be a money market fund substitute. Under normal market conditions, the Fund’s investments may be more susceptible than a money market fund to interest rate risk and credit risks relevant to the Fund’s investments.

Sit has provided the commentary below regarding the Clearwater Tax-Exempt Bond Fund. The Fund pays a single advisory fee to Clearwater Management Company, which in turn pays the subadviser out of its advisory fee.

Sit Commentary

2015 Market Overview: Tax-exempt fixed income markets experienced a tale of two halves in 2015, as the U.S. Treasury and tax-exempt yield curves flattened modestly, and fund flows into tax-exempt bond funds remained modestly positive. Supply of municipal bonds entered the market at a record rate in the first half of 2015, but slowed somewhat in the second half, although still finishing the year with the fifth largest supply on record. This large amount of supply was very manageable to absorb, however, given that approximately three quarters of it was refinancing of existing debt and that fund inflows into tax-exempt bond funds were concentrated in long-term and high yield tax-exempt funds. Credit fundamentals are in our view generally sound and spreads tightened further during the year. State and local government tax collections continued to improve from the low recession-driven levels of 2008 and 2009, and have now exceeded pre-recession levels, such that even though assistance from the federal government’s stimulus programs is no longer helping, state and local government finances remain generally on the upswing, with the notable exceptions of Chicago and the states of Illinois, New Jersey and Pennsylvania. Nonetheless, concerns are rising about states with heavy concentrations in the oil and gas industries. Puerto Rico related debt was volatile throughout the year, taking a major downturn in mid-year as the Governor warned that Puerto Rico would not be able to honor all of its debt obligations. While a few minor issues did experience defaults, the vast majority of required payments were made timely and in full. We believe that more volatility is likely in 2016 as Puerto Rico continues to suffer a recession and it attempts to restructure some of its debt. The U.S. Federal Reserve (the “Fed”) remained quite accommodative, despite its move to raise the federal funds rate by 25 basis

points in December 2015. Concerns about tax reform and a potential reduction of the value of the municipal bond tax exemption remain but had little overall effect on the market.

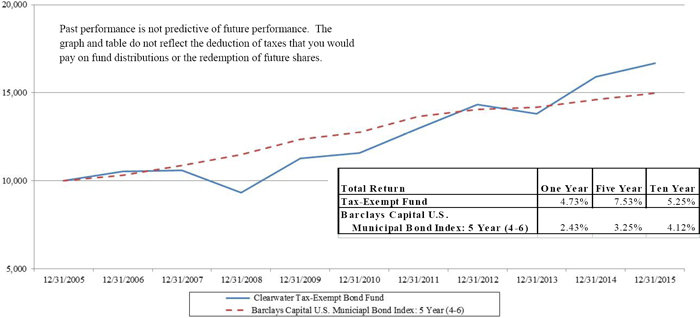

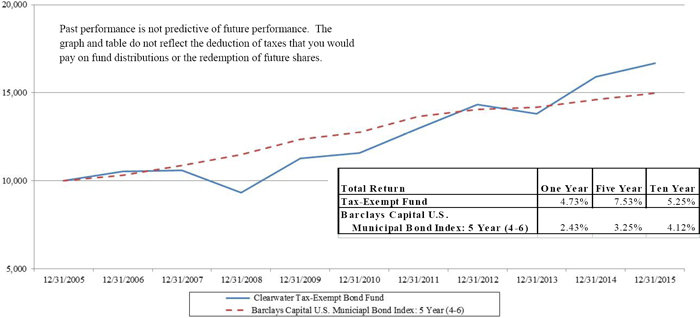

2015 Performance: For the year ended December 31, 2015, the Clearwater Tax-Exempt Bond Fund (the “Fund”) returned 4.7%, (net of fees) compared to its benchmark, the Barclays Capital U.S. Municipal Bond Index: 5 Year (4-6) (the “benchmark”), which returned 2.4% over the same period. Given the Fed’s accommodative policies, the Fund maintained its average life duration, a measure of the Fund’s sensitivity to changes in interest rates, at 5.6 years during 2015 to take advantage of the steep tax-exempt yield curve. For comparison, the Fund’s benchmark had duration of 3.9 years at December 31, 2014, and it remained there throughout the year. The Fund’s longer duration was the primary reason for its outperformance during 2015. Revenue bonds modestly outperformed general obligation bonds during 2015, with revenue bonds returning 3.6% for the year, while general obligation bonds returned 3.1%. Furthermore, lower quality issues (especially lower investment grade and non-rated issues) significantly outperformed those of higher credit quality, as investors sought yield. The Fund’s performance, due to its heavy emphasis on revenue bonds, its considerably longer duration and its meaningful exposure to lower quality issues, outperformed that of its benchmark in 2015.

2016 Outlook: We believe that the U.S. Presidential election will dominate headlines and perhaps add some political risk to the market in 2016, depending on who is nominated for each party and what his or her tax plan may be. We expect U.S. growth in 2016 to accelerate from its tepid pace in later 2015 and for inflation to remain subdued. The pace of increase in single-family housing starts has moderated, and underemployment, despite some improvement, remains elevated, and wage growth remains slow. The economy has been able to muddle through the decline in oil prices and global uncertainty over the past year but in our view doesn’t seem able to accelerate to a consistently higher level of growth as is typical after most recessions. We believe that interest rates, while likely to remain low in absolute terms, will likely rise, especially on the short end, as the Fed hiked in December 2015 and has signaled it intends to continue raising short-term interest rates in 2016. We expect the Treasury yield curve to remain relatively steep, with yields rising more on the short and intermediate portions of the curve, while the tax-exempt curve flattens similarly, with short-term and intermediate rates rising some and long-term tax-exempt yields rising less as supply continues at a still manageable level and most state and local government finances continue to improve, helping tax-exempt bonds outperform. One important consideration for the market will in our view be the performance of the equity markets. If they weaken, we believe it should be a positive for bonds, but if they rally strongly, more money could move out of fixed income into equities, again creating negative pressure on the bond market. We expect revenue bonds to continue their strong relative performance in 2016, as investor focus remains on yield. We believe that Puerto Rico related concerns will weigh on the market, however, and could produce some volatility. Furthermore, potential problems with budgets and funding retirement pension and healthcare obligations still persist in other places, especially the city of Chicago and the State of Illinois (although local officials in and around Chicago seem to be making some positive changes), and remain the subject of many of the negative media reports about the municipal market. We believe that the Fund’s longer duration and its use of revenue and non-rated bonds have positioned it opportunistically for the economic and interest rate environment that we expect in 2016, although we do expect to shorten duration modestly during the year.

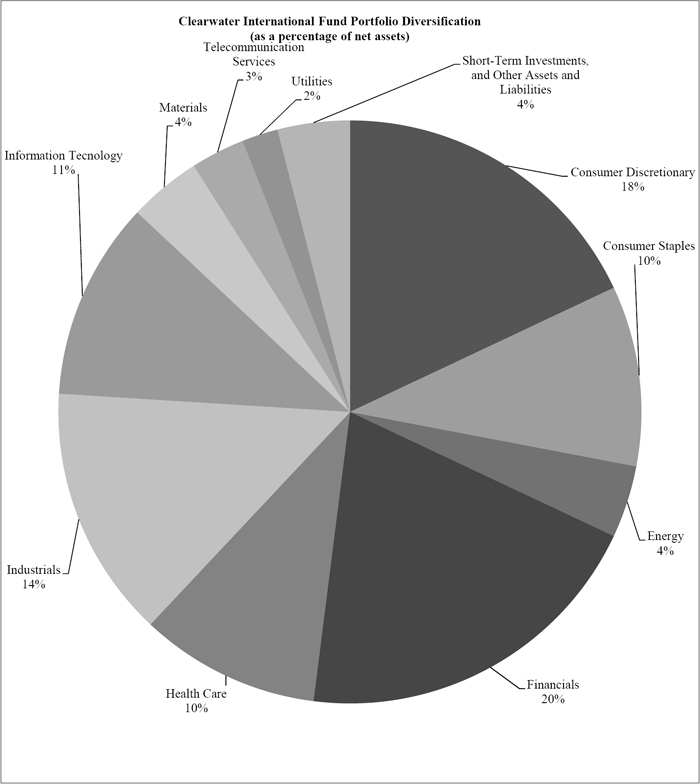

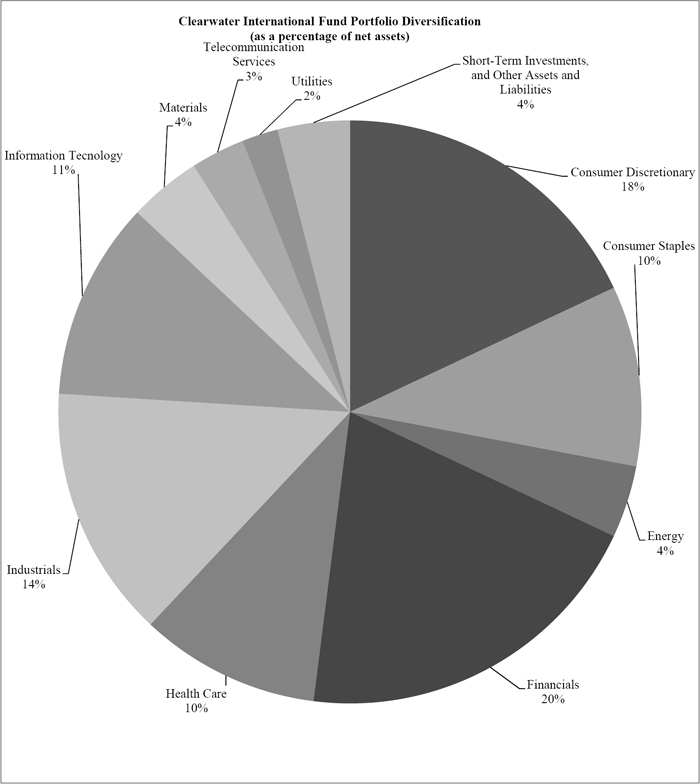

Clearwater International Fund

The Clearwater International Fund seeks long-term growth of capital. The Fund generally invests at least 80% of the value of its net assets, plus the amount of any borrowings for investment purposes, in equity securities of companies organized or located outside the United States and doing a substantial amount of business outside the United States. The Fund diversifies its investments among a number of different countries throughout the world, and may invest in companies of any size. The Fund does not intend to invest more than 20% of its net assets in the equity securities of developing or emerging market issuers. The Fund uses a “multi-style, multi-manager” approach. The Fund’s adviser allocates portions of the Fund’s assets among subadvisers who employ distinct investment styles. The Fund currently has five subadvisers. Parametric Portfolio Associates LLC (“Parametric”) manages its portion of the portfolio (approximately 50%) to mirror the MSCI World Ex USA Index (net) as closely as possible without requiring the Fund to realize taxable gains. The Fund also has four sub-advisers who

utilize an active management style and each manage approximately 12.5% of the Fund: Artisan Partners Limited Partnership (“Artisan Partners”), Denver Investments (“Denver”), Templeton Investment Counsel, LLC (“Templeton”) and WCM Investment Management (“WCM”).

2015 Market Overview:

International developed market equities recorded single digit losses during 2015. The dominant factors influencing share prices included weak economic growth in Europe and Japan, ultra-easy monetary policies from the European Central Bank and the Bank of Japan, the impact of slowing growth in China, and some unnerving geo-political events highlighted by a crisis in the Ukraine, Greece’s uncertain status in the Eurozone, and mass migration of refugees from the Middle East. Currency adjustments adversely impacted returns in 2015 as the Euro fell 11.4% and the Japanese Yen 0.5% against the U.S. dollar. These currency losses lower the returns shown to shareholders because the Clearwater International Fund reports its results in U.S. dollars, after currency adjustments have taken place.

2015 Performance and 2016 Outlook:

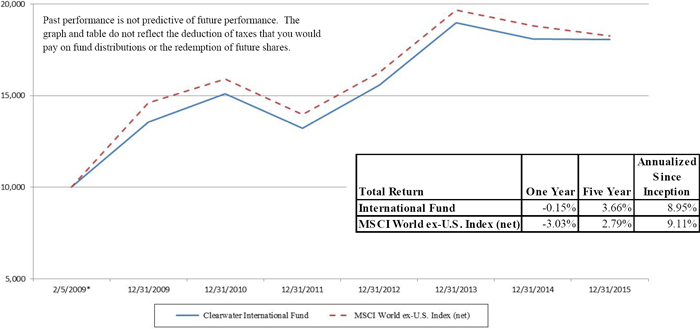

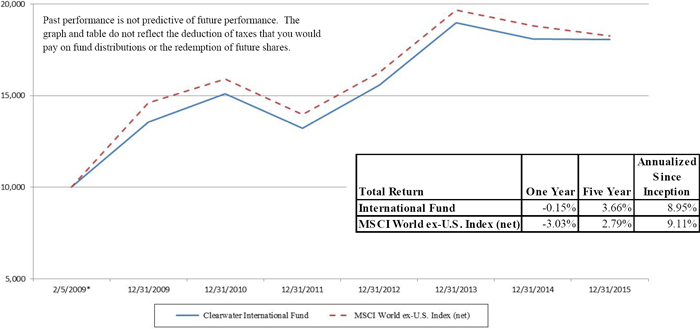

The Clearwater International Fund fell 0.2%, net of fees, during 2015 compared to a loss of 3.0% for the MSCI World ex-U.S. Index (net), the Fund’s benchmark. All five of the Fund’s subadvisers outperformed the Fund’s benchmark.

Each of the three “active” sub-advisers comment on the performance of their specific portions of the portfolio and provide market outlook for the next year in the paragraphs below. For comparison of the subadvisers’ capabilities, performance is shown gross of fees. The Fund pays a single advisory fee to Clearwater Management Company, which in turn pays the subadvisers out of its advisory fee.

Although the overall performance of the Clearwater International Fund is measured against its benchmark, as stated above, each of the underlying subadvisers may manage their portfolio of the Fund against a different benchmark that aligns more closely with their particular strategy. In each section below, the subadvisers will discuss the performance of their portfolios with respect to the benchmark against which their particular portfolio is managed.

Artisan Partners Commentary

2015 Performance: For the year ended December 31, 2015, the portion of the Clearwater International Fund managed by Artisan (the “Portfolio”) returned (0.6%) (gross of fees) slightly outperforming the MSCI EAFE Index (net) (“the benchmark”),which returned (0.8%) over the same period. Performance of the following stocks had a positive impact on the Portfolio during the period: leading global facility services provider ISS; global insurance firm Arch Capital Group; Japanese household products company Kao Corp; China’s leading private provider of test preparation and afterschool tutoring, New Oriental Education & Technology Group; and supplier of chemicals to the electronics industry, Alent PLC. Notable detractors in the period included: leading UK-based retail and commercial banking franchise, Royal Bank of Scotland; Brazil’s leading telecommunications firm, Telefonica Brasil; UK food retailer TESCO plc; UK-based engineering company Amec Foster Wheeler; and global supplier of semiconductor equipment, Applied Materials.

2016 Outlook: Over the last twelve months, the Portfolio’s discount to intrinsic value has widened to what we believe are reasonable levels. Notwithstanding any potential turmoil from an end to the continued central bank economic subsidies that have resulted in generally fair to inflated asset values and enhanced economic activity, Artisan believes the Portfolio is positioned today to generate decent returns. We have increased the Portfolio’s exposure to banks, which appear to us to be better capitalized, have significantly greater liquidity, hold lower risk assets and trade at or near historically low valuations.

Denver Commentary

2015 Performance: For the year ended December 31, 2015, the portion of the Clearwater International Fund managed by Denver (the “Portfolio”) returned 2.8% (gross of fees), trailing its benchmark, the MSCI EAFE Small Cap Index (net) (the “benchmark”), which returned 9.6%. Similar to the Portfolio, the broader comparative MSCI ACWI ex USA Small-Cap Index returned in the low single digits, 2.6%, as both were impacted by their emerging market and Canada components. The Portfolio’s investments in Japan and the United Kingdom were sources of positive performance. Stock selection in Japan was a notable contributor as several Japanese stocks added to the Portfolio this year were strong performers. The Portfolio’s overweighted positions in Hong Kong, Canada and Brazil were primary performance detractors. Stock selection in Hong Kong and Israel also detracted as holdings in these markets underperformed the respective components of the benchmark. Portfolio holdings Webjet Ltd., Rightmove PLC and SMS Co., Ltd. were standout performers for the year. Among the Portfolio’s holdings that weathered the year with more difficulty were Slater & Gordon Ltd, Home Capital Group Inc. and Totvs S.A. We reduced our exposure to Slater & Gordon given uncertainty surrounding the potential impact of proposed regulation. We concluded that fundamental deterioration had too greatly altered the relative upside opportunity in Home Capital and after many years of meaningful contribution to the Portfolio’s return, we exited the stock. As the Brazilian economy slowed, so too did Totvs revenues; the increased economic sensitivity and lower upside led us to exit our position in Totvs.

2016 Outlook: We committed a significant share of our time this year to research trips in Europe, Asia, South America, Australia and Israel to check in with management of current holdings and to more thoroughly vet potential investment candidates. We consequently added several new stocks to the Portfolio, among them companies based in Japan, Australia and the UK. In turn, we trimmed or exited positions we felt offered less relative growth upside. We performed an in-depth analysis of the drivers of our performance to identify and understand areas for potential improvement. While we always remain true to our disciplined, bottom-up research process, we may periodically make adjustments to fine-tune the fundamental strength and valuation profile of the Portfolio. This led us, based on our identification of investment opportunities, to: 1) gradually decrease the Portfolio’s exposure to Hong Kong holdings with consumer discretionary focus in China in particular; 2) reduce the Portfolio’s direct or indirect exposure to the natural resources and commodities sectors; and 3) add companies embodying strong growth characteristics yet trading at what we believe to be attractive valuations in the countries noted above. Additionally, though we will continue to invest in a concentrated portfolio of approximately forty companies, we have reduced the weightings in our top holdings to broaden the Portfolio’s exposure.

Templeton Commentary

2015 Performance: For the year ended December 31, 2015, the portion of the Clearwater International Fund managed by Templeton (the “Portfolio”) returned 2.7% (gross of fees) which was slightly trailing its benchmark, the MSCI All-Country World ex-U.S. Small Cap Index (net), (the “benchmark”), which returned 3.0% over the same period. The Portfolio’s performance was driven by stock selection in the Consumer Staples, Energy and Industrials sectors. Greggs, a vertically integrated retail baker in the UK and a leading player in the take-away sandwich and savories market, was the top stock contributor. Greggs reported strong financial results during the period attributable to new product offerings and renovated stores, evidence that its food-on-the-go offer is resonating with customers. Stock selection in Financials, Information Technology and Consumer Discretionary detracted from relative performance for the year. South Korea-based BNK Financial Group was the top detractor for the year, underperforming on general weakness in the South Korean market. However, BNK’s operating performance has improved, and we believe its focus away from growth and toward profitability and decreasing risk is a positive. Regionally, stock selection in Europe contributed to relative performance for the year. The long-term case for investing in select opportunities in Europe remains attractive, in our view. Regional leaders have shown pragmatism managing through periodic crises and we believe Europe’s corporate sector remains lowly valued at a depressed point in the earnings cycle, creating scope for both earnings recovery and multiple re-rating. Stock selection in Asia detracted from relative performance.

2016 Outlook: A critical lesson we have learned through decades of investing in global equities markets is that returns generally tend to accrue to value strategies intermittently, with long-term performance a journey of peaks

and valleys. We buy on pessimism, and the market can remain at odds with our portfolios for a considerable time. But empirical evidence shows that historically when the value cycle has turned, it has often done so swiftly. We think being properly positioned for these turns is essential to potentially capturing the long-term benefits of the value investment discipline. At the onset of 2016, we are witnessing historic extremes in the discount afforded to value relative to growth, quality and safety. While this environment has been (and may remain) painful to value investors for some time, we believe the normalization of these extremes represents the most compelling opportunity in equity markets today.

WCM Commentary

2015 Performance: For the year ended December 31, 2015, the portion of the Clearwater International Fund managed by WCM (the “Portfolio”) returned 7.4% (gross of fees) outperforming its benchmark, the MSCI All-Country World ex-U.S. Index (net), (the “benchmark”), which returned (5.3%) over the same period. Outperformance for 2015 is attributable to both allocation and selection, with strong stock selection driving the bulk of our returns. From an allocation standpoint, the biggest contributors to the Portfolio’s outperformance were our overweights to Consumer Staples and Health Care, the top two performing sectors in the benchmark, as well as our underweights to Financials and Energy, the fourth and first worst performing sectors in the benchmark, respectively, over the period. There were no material detractors due to allocation.

Regarding selection, which accounted for roughly 75% of the Portfolio’s total outperformance, the biggest contributors to outperformance were found within Materials, Health Care, and Technology. The only material detractor from performance came from Industrials.

2016 Outlook: We continue to expect market volatility to be the norm. Rather than trying to predict macro events, we think our time is best served preparing for the various outcome scenarios and teeing up our watch list to capitalize on the opportunities that emerge. Most important, we believe our quality growth approach—which we define as growing moats backed by superior cultures and secular tailwinds—is most conducive to volatile environments such as these.

Comparison of the Change in Value of a $10,000 Investment in the

Clearwater Core Equity Fund and the Russell 1000® Index

Comparison of the Change in Value of a $10,000 Investment in the

Clearwater Small Companies Fund and the Russell 2000® Index

Comparison of the Change in Value of a $10,000 Investment in the

Clearwater Tax-Exempt Bond Fund and the Barclays Capital U.S. Municipal Bond Index: 5 Year (4-6)

Comparison of the Change in Value of a $10,000 Investment in the

Clearwater International Fund and the MSCI World ex-U.S. Index (net)

* Clearwater International Fund inception date.

Fund Expense Example

(unaudited)

As a shareholder of the Clearwater Core Equity Fund, Clearwater Small Companies Fund, Clearwater Tax-Exempt Bond Fund, and Clearwater International Fund (the “Funds”), you incur costs, including management fees and other Fund expenses. This Example is intended to help you to understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. In addition to the ongoing costs which the Funds pay directly, you as a shareholder indirectly bear the expenses of any outside exchange traded funds or mutual funds in which the Funds invest. (These are also referred to as “acquired funds” and those indirect expenses represent the Funds’ pro rata portion of the cumulative expense charged by the acquired funds.)

The Example provided is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period ended December 31, 2015.

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period July 1, 2015 through December 31, 2015” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Funds and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the second section of the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you compare the relative total costs of the Funds to other mutual funds that charge transaction costs and/or sales charges or redemption fees.

| Actual returns | Beginning Account Value July 1, 2015 | Ending Account

Value December 31,

2015 | Expenses Paid During the

Period July 1, 2015 through

December 31, 2015 * |

| Core Equity Fund | $1,000.00 | $980.20 | $2.00 |

| Small Companies Fund | $1,000.00 | $909.80 | $4.72 |

| Tax-Exempt Bond Fund | $1,000.00 | $1,048.10 | $1.76 |

| International Fund | $1,000.00 | $947.20 | $3.39 |

Hypothetical 5% return

(before expenses)

| Core Equity Fund | $1,000.00 | $1,023.19 | $2.04 |

| Small Companies Fund | $1,000.00 | $1,020.27 | $4.99 |

| Tax-Exempt Bond Fund | $1,000.00 | $1,023.49 | $1.73 |

| International Fund | $1,000.00 | $1,021.73 | $3.52 |

| * | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expense ratios for the most recent one-half year period may differ from expense ratios based on one-year data in the Financial Highlights. |

The annualized expense ratios are as follows:

| Core Equity Fund | 0.40% |

| Small Companies Fund | 0.98% |

| Tax-Exempt Bond Fund | 0.34% |

| International Fund | 0.69% |

Quarterly Portfolio Schedule of Investments

The Funds file a complete schedule of their portfolio holdings as of the close of the first and third quarters of their fiscal years with the Securities and Exchange Commission (the “SEC”) on Form N-Q. Shareholders may request copies of Form N-Q free of charge by calling the Transfer Agent toll free at 1-855-684-9144 or by sending a written request to: The Northern Trust Company, P.O. Box 4766, Chicago, IL 60680-4766 Attn: Clearwater Investment Trust Funds. These filings are also available on the SEC’s Internet site at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information about the public reference room may be obtained by calling 1-800-SEC-0330.

Voting Proxies on Fund Portfolio Securities

The Funds have established Proxy Voting Policies and Procedures (“Policies”) that the Funds use to determine how to vote proxies relating to portfolio securities. They also report, on Form N-PX, how the Funds voted any such proxies during the most recent 12-month period ended June 30. Shareholders may request copies of the Policies or Form N-PX free of charge by calling Fiduciary Counselling, Inc. toll free at 1-888-228-0935 or by sending a written request to: Fiduciary Counselling, Inc., 30 East 7th Street, Suite 2000, St. Paul, MN 55101 Attn: Clearwater Investment Trust Funds. Form N-PX is also available from the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

EXECUTIVE OFFICERS AND TRUSTEES

Information about the Independent Trustees

| | | | | | | | | | | | | | | | | |

| Name and Age | | | Positions Held

With the Funds | | | Term of Office | | | Principal Occupation

or Employment During

the Last Five Years | | | Number of

Portfolios in

the Fund

Complex to Be

Overseen by

the Trustee | | | Other

Directorships

Held by the

Trustee

During the

Last 5 Years | |

James E. Johnson (73)

30 East 7th Street

Saint Paul,

Minnesota 55101 | | | Trustee, Chairman of the Board, Chairman of the Audit Committee | | | As Trustee:

Tenure: 5 years

Term: Indefinite As Chairman:

Tenure: May 2013 – Present

Term: Indefinite As Chairman of the Audit Committee:

Tenure: January 2016 – Present

Term: Indefinite | | | Retired as Executive Vice President, Securian Financial Group, Inc. in 2010, Securian Financial Group, Inc. (1968-2010) | | | 4 | | | None | |

| | | | | | | | | | | | | | | | | |

Charles W. Rasmussen (49)1

30 East 7th Street

Saint Paul,

Minnesota 55101 | | | Trustee, Chairman of the Nominating Committee | | | As Trustee:

Tenure: 16 years

Term: Indefinite As Chairman of the Nominating Committee:

Tenure: 5 Years

Term: Indefinite | | | President and Chief Executive Officer, P&G Manufacturing, Inc. (air filtration equipment, 2002-Present) | | | 4 | | | None | |

| | | | | | | | | | | | | | | | | |

Laura E. Rasmussen (52)1

30 East 7th Street

Saint Paul,

Minnesota 55101 | | | Trustee | | | Tenure: 16 years

Term: Indefinite | | | Business Owner, 3 Kittens Needle Arts (textile sales, 2006-Present) | | | 4 | | | None | |

| | | | | | | | | | | | | | | | | |

Lindsay Schack (38)

30 East 7th Street

Saint Paul, Minnesota

55101 | | | Trustee | | | Tenure: November 2015 – Present

Term: Indefinite | | | Owner and Architect, LS Architecture (2013 – Present), Architect, Tuya Studios, Inc. (architectural services, 2011 – 2012), Project Designer, Montana State University (2007 – 2011), Adjunct Faculty, Montana State University School of Architecture (2007 – 2013) | | | 4 | | | None | |

| | |

| 1 | Mr. Rasmussen and Ms. Rasmussen are spouses-in-law. |

Information about the Funds’ Executive Officers and Interested Trustees

| | | | | | | | | | | | | | | | | |

| Name and Age | | | Positions Held

With the Funds | | | Term of Office | | | Principal Occupation

or Employment During

the Last Five Years | | | Number of

Portfolios in

the Fund

Complex to Be

Overseen by

the Trustee | | | Other

Directorships

Held by the

Trustee

During the

Last 5 Years | |

Sara G. Dent (57)2

30 East 7th Street

Saint Paul,

Minnesota 55101 | | | Trustee, Secretary | | | As Trustee:

Tenure: December 2013 – Present

Term: Indefinite As Secretary:

Tenure: June 2015 – Present

Term: Reappointed Annually | | | Private Investor | | | 4 | | | None | |

| | | | | | | | | | | | | | | | | |

Justin H.

Weyerhaeuser (42)3

30 East 7th Street

Saint Paul,

Minnesota 55101 | | | Trustee, President and Treasurer | | | Tenure: 7 years

Term: Indefinite As President and Treasurer:

Tenure: May 2013 – Present

Term: Reappointed Annually | | | Private Investor (February 2013-Present), Attorney, Davis Graham &Stubbs LLP (law firm, November 2011-February 2013), Husch Blackwell (law firm, July 2011-November 2011), Jacobs Chase Attorneys (2009-July 2011), Volunteer Attorney, ACLU of Colorado (2007-2009) | | | 4 | | | None | |

| | | | | | | | | | | | | | | | | |

Stephen G. Simon (47)

30 East 7th Street

Saint Paul,

Minnesota 55101 | | | Chief Compliance Officer | | | Tenure: March 2014 – Present

Term: Reappointed Annually | | | Chief Compliance Officer, Fiduciary Counselling, Inc. (February 2014- Present), Chief Compliance Officer, Clearwater Management Company (March 2014- Present), Chief Compliance Officer, Allianz Investment Management, LLC (2004- February 2014) | | | N/A | | | N/A | |

| | | | | | | | | | | | | | | | | |

Shari L. Clifford (47)

30 East 7th Street

Saint Paul,

Minnesota 55101 | | | Assistant Treasurer | | | Tenure: March 2014 – Present

Term: Reappointed Annually | | | Chief Financial Officer and Treasurer, Fiduciary Counselling, Inc. (February 2014-Present), Controller and Finance Director, Woodbury Financial Services, Inc. | | | N/A | | | N/A | |

| | |

| 2 | Ms. Sara G. Dent is an interested Trustee due to her mother’s level of ownership of voting securities in two of the Funds in the Trust. |

| | |

| 3 | Mr. Justin H. Weyerhaeuser is an interested Trustee due to his position as the Funds’ President and Treasurer. |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | (November 2007-February 2014) | | | | | | | |

Brianne Mitchell (33)

30 East 7th Street

Saint Paul,

Minnesota 55101 | | | Assistant Secretary | | | Tenure: December 2014 – Present

Term: Reappointed Annually | | | Senior Compliance Analyst, Fiduciary Counselling, Inc. (July 2014-Present), Legal & Compliance Analyst, Highbridge Capital Management (June 2013- June 2014), Assoc. General Counsel & Asst. Director of Compliance, Catterton Management Company (January 2011- June 2013) | | | N/A | | | N/A | |

Marcia Lucas (48)

The Northern Trust

Company 50 South

LaSalle Street

Chicago, IL 60603 | | | Assistant Secretary | | | Tenure: March 2011 – Present

Term: Reappointed Annually | | | The Northern Trust Company, Vice President (2011-Present), Second Vice President (2010- 2011), Partner, Michael Best & Friedrich LLP (2005-2008) | | | N/A | | | N/A | |

Additional information about the Trustees is available in the Funds’ Statement of Additional Information (“SAI”). The SAI is available, without charge, upon request, by contacting the transfer agent at 1-855-684-9144 or writing the Funds at The Northern Trust Company, P.O. Box 4766, Chicago, IL 60680-4766. The Funds do not have an internet website.

Approval of Investment Management and Subadvisory Agreements

Approval of Subadvisory Agreement – Keeley Asset Management Corp. (Small Companies Fund)

At an in-person meeting on September 11, 2015, the Trust’s Board of Trustees (the “Board” or “Trustees”) considered a new subadvisory agreement for Keeley Asset Management Corp. (“Keeley”) (the “New Keeley Agreement”) that would take effect following an anticipated change in control of Keeley and termination of the current subadvisory agreement (the “June Keeley Agreement”). The Board noted that it had approved the June Keeley Agreement in June 2015 following the death of the controlling shareholder of Keeley, which constituted a change in control of Keeley and termination of the then-current subadvisory agreement (the “Prior Keeley Agreement”). In connection with its September 11, 2015 meeting, the Board was informed that Keeley was anticipated to undergo a second change in control as a result of a transaction by which the outstanding shares of Keeley’s parent company would be transferred to a new limited liability company, TA KAMCO LLC, which would be controlled by TA Associates, a current minority owner of Keeley (the “Transaction”). The Board was further informed that TA Associates planned to issue non-voting equity to Keeley’s key employees following the Transaction.

At their September 11, 2015 meeting, the Trustees considered the approval of the New Keeley Agreement for an initial two-year period. The Trustees considered a number of factors, including those discussed below, that they believed to be relevant. No single factor determined whether or not the agreement would be approved but rather the totality of factors considered was determinative. Following an analysis and discussion of the factors described below, the Trustees, including all of the Trustees who are not “interested persons” of the Trust (the “Independent Trustees”), approved the New Keeley Agreement.

In considering the approval of the New Keeley Agreement, the Trustees considered that the terms and conditions of the New Keeley Agreement are substantially identical to the terms and conditions of the June Keeley Agreement and Prior Keeley Agreement.

Among other things, the Trustees considered: (i) information about the anticipated impact of the change in control on the nature, quality and extent of services provided to the Fund and its shareholders, including compliance services; (ii) information about the anticipated impact of the change in control on the management structure and personnel of Keeley; (iii) that there would be no changes to the portfolio management team that is primarily responsible for the day-to-day management of the Fund in connection with the Transaction; and (iv) that the fees payable to Keeley under the New Keeley Agreement would not differ from those under the June Keeley Agreement or the Prior Keeley Agreement.

The Trustees also considered that they had performed a full review of the Prior Keeley Agreement in December 2014 and had determined to renew the Prior Keeley Agreement. The Trustees determined that the information they had considered with respect to the following factors in connection with their renewal of the Prior Keeley Agreement and their conclusions regarding those factors were applicable to their decision to approve the New Keeley Agreement: (i) the nature, extent and quality of services to be provided; (ii) investment performance; (iii) comparative fees and cost of services provided; (iv) management profitability; and (v) economies of scale.

Based on the factors described above, the Trustees, including all of the Independent Trustees, concluded that the subadvisory fee was fair and reasonable in view of the investment performance and quality of services provided. In reaching this conclusion, no single factor was considered determinative.

Approval of Investment Management and Subadvisory Agreements (All Funds)

Clearwater Management Company, Inc. (“CMC”) is responsible for managing the investment programs and strategies for the Core Equity Fund, Small Companies Fund, Tax-Exempt Bond Fund, and International Fund (collectively, “the Funds”). CMC also provides other administrative services to the Funds and these services, as well as its investment management services, are provided to the Funds under an agreement (the “Management Agreement”). CMC conducts due diligence when selecting each subadviser (collectively, the “Subadvisers”) for the Funds and oversees the performance of the Subadvisers. The Subadvisers provide portfolio management and related services for the Funds under individual subadvisory agreements (the “Subadvisory Agreements”).

The Trustees met periodically throughout the year to address a broad range of agenda items. For example, at each regularly scheduled meeting, the Trustees reviewed information about the investment performance and financial results of the Funds. On an annual basis, the Trustees, including the Independent Trustees, consider the renewal of the Management Agreement and the Subadvisory Agreements. In addition, the Trustees may periodically consider the retention of new subadvisers.

At their in-person meetings on November 14 and December 5, 2015, the Trustees considered the renewal of the Management Agreement and the Subadvisory Agreements for AQR Capital Management, LLC, Artisan Partners Limited Partnership, Denver Investments, Fiduciary Counselling, Inc. (“FCI”), Keeley, Kennedy Capital Management, Inc., O’Shaughnessy Asset Management, LLC, Osterweis Capital Management, LLC (“Osterweis”), Parametric Portfolio Associates LLC, Sit Fixed Income Advisors II, LLC, Templeton Investment Counsel, LLC, and WCM Investment Management. At the November 14 and December 5, 2015 meetings, the Trustees also considered a new Subadvisory Agreement for Osterweis that would take effect following an anticipated change in control of Osterweis in January 2016 and termination of the current Subadvisory Agreement.

Prior to the November 14, 2015 meeting, the Trustees requested, received, and reviewed written responses from CMC and the Subadvisers to questions posed to them on behalf of the Trustees and supporting materials relating to those questions and responses. The information presented at the meeting, including performance and expense data obtained from independent sources, was designed to assist the Trustees in making their determination as to the renewal of the Management Agreement and Subadvisory Agreements. At this meeting, counsel to the Funds reviewed with the Trustees the various factors relevant to their consideration of the Management Agreement and Subadvisory Agreements, and the Trustees’ responsibilities related to their review. In response to requests from the Trustees for certain additional information following review of the materials provided for the November 14, 2015 meeting, CMC and certain of the Subadvisers provided supplemental information in connection with the December 5, 2015 meeting.

At the November 14 and December 5, 2015 meetings, the Trustees considered a number of factors, including those discussed below, that they believed to be relevant. No single factor determined whether or not an agreement would be approved but rather the totality of factors considered was determinative. Following an analysis and discussion of the factors described below, the Trustees, including all of the Independent Trustees, approved the renewal of the Management Agreement and the Subadvisory Agreements, including the current Subadvisory Agreement with Osterweis, for an additional one-year period, and approved the new Subadvisory Agreement with Osterweis for a two-year period from its anticipated effective date.

Nature, Extent, and Quality of Services Provided

The Trustees considered information presented as to the nature, extent, and quality of services provided by CMC and the Subadvisers, as well as their investment expertise, resources, and capabilities. The Trustees considered the quality of the Subadvisers previously recommended by CMC, as well as the ongoing work performed by CMC to recommend enhancements to individual fund management or creation of new funds. The Trustees reviewed information regarding the financial condition of CMC and the Subadvisers related to their ongoing ability to provide services specified under the Management Agreement and Subadvisory Agreements. The Trustees considered that FCI provides, in addition to investment management services, certain services related to due diligence, performance reporting, compliance, and other administrative functions which support the investment management services and Subadviser oversight services provided by CMC. Based on their analysis of the data presented, the Trustees concluded that they were generally satisfied with the nature and quality of the services being provided under the Management Agreement and respective Subadvisory Agreements.

Investment Performance

The Trustees reviewed specific information as to the investment performance of the Funds as compared to the performance of their respective benchmark indices and peer groups over various periods of time. On a quarterly basis, the Trustees reviewed reports summarizing the net assets, redemptions, and purchases of shares of the Funds. The Trustees concluded that they were generally satisfied with CMC’s and the Subadvisers’ investment performance to date.

Comparative Fees and Cost of Services Provided

The Trustees reviewed the fees paid to CMC and the Subadvisers. The Trustees reviewed reports describing both the management fees charged by CMC and the total expense ratios of the Funds in comparison to those of similarly situated funds. In addition, on a quarterly basis, the Trustees reviewed information as to the expense ratios of the Funds compared to the median expense ratio of a peer group of funds with comparable investment strategies. The Trustees also reviewed information provided by each of the Subadvisers as to fees they charge to other clients, as applicable. The Trustees noted the ongoing efforts of CMC to reduce expenses charged to shareholders through oversight of service providers and by voluntarily waiving certain fees payable to CMC as specified in the Funds’ prospectus. In this regard, the Board considered that, effective March 16, 2015, CMC has voluntarily agreed to waive (i) the management fee for the Core Equity Fund from the contractual fee of 0.90% to 0.40%; (ii) the management fee for the Small Companies Fund from the contractual fee of 1.35% to 0.98%; (iii) the management fee for the Tax-Exempt Bond Fund from the contractual fee of 0.60% to 0.34%; and (iv) the management fee for the International Fund from the contractual fee of 1.00% to 0.69%.

Management Profitability

The Trustees reviewed CMC’s level of profitability with respect to the Funds, particularly noting CMC’s payment of fees and expenses typically absorbed by mutual fund shareholders. The Trustees concluded that profitability levels for CMC were reasonable. The Trustees considered that the Subadvisers are each independent firms and the subadvisory fees charged are the result of arm’s length bargaining between them and CMC under the supervision of the Trustees.

Economies of Scale

The Trustees considered whether economies of scale might be realized by CMC as the Funds’ assets grow and whether there also might be benefits from such growth for the Funds’ shareholders. The Trustees

noted that the Funds have been in operation for a number of years and, based on their distribution strategy, the Funds will probably not see significant increases in size. However, the Trustees determined that they would continue to monitor the assets of the Funds and consider whether there were additional opportunities to realize benefits from economies of scale for shareholders in the future.

Based on the factors described above, the Trustees, including all of the Independent Trustees, concluded that the investment management fees and subadvisory fees were fair and reasonable in view of the investment performance and quality of services provided. In reaching this conclusion, no single factor was considered determinative.

Federal Tax Information

(unaudited)

Qualified Dividend Income. Under the Jobs and Growth Tax Relief Reconciliation Act of 2003 (the “Act”), 100.00% of ordinary dividends paid during the fiscal year ended December 31, 2015 for the Core Equity Fund, 100.00% of ordinary dividends paid during the fiscal year ended December 31, 2015 for the Small Companies Fund, and 100.00% of ordinary dividends paid during the fiscal year ended December 31, 2015 for the International Fund are designated as “qualified dividend income”, as defined in the Act, subject to reduced tax rates in 2015.

Corporate Dividends-Received Deduction. 100.00%, 37.45% and 0.11% of the dividends distributed during the fiscal year ended December 31, 2015, for the Core Equity, Small Companies and International Funds, respectively, qualify for the dividends-received deduction for corporate shareholders.

Capital Gain Distribution. The following Funds made capital gain distributions in December 2015, and hereby designated these long-term capital gain distributions as follows:

| | | | | |

| Fund | | Long-Term Capital Gain | |

| | | | | |

| Core Equity(1) | | $ | 37,447,878 | |

| Small Companies(2) | | | 32,947,975 | |

| Tax-Exempt Bond | | | 1,682,556 | |

| International | | | 2,640,682 | |

| | |

| (1) | During the fiscal year 2015, Core Equity Fund designated long-term capital gain distributions in the amount of $39,583,976. Core Equity Fund utilized equalization accounting for tax purposes, whereby a portion of redemption payments were treated as distributions of long-term capital gain. As a result the Fund paid long-term capital gain distributions in the amount of $37,447,878. |

| | |

| (2) | During the fiscal year 2015, Small Companies Fund designated long-term capital gain distributions in the amount of $33,005,107. Small Companies Fund utilized equalization accounting for tax purposes, whereby a portion of redemption payments were treated as distributions of long-term capital gain. As a result the Fund paid long-term capital gain distributions in the amount of $32,947,975. |

Clearwater Investment Trust

Financial Statements

For the Fiscal Year Ended December 31, 2015

Table of Contents

Financial Statements:

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders

Clearwater Investment Trust:

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Clearwater Core Equity Fund, Clearwater Small Companies Fund, Clearwater Tax-Exempt Bond Fund and the Clearwater International Fund (collectively, the “Funds”), as of December 31, 2015, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2015, by correspondence with the custodian, transfer agent (of underlying funds) and brokers, or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Clearwater Core Equity Fund, Clearwater Small Companies Fund, Clearwater Tax-Exempt Bond Fund and the Clearwater International Fund as of December 31, 2015, the results of their operations for the year then ended, the changes in their net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

/s/ KPMG LLP

Minneapolis, Minnesota

February 25, 2016

CLEARWATER INVESTMENT TRUST

Statements of Assets and Liabilities

December 31, 2015

| | | | | | | | | | | | | | | | | |

| | Core Equity

Fund | | | Small Companies

Fund | | | Tax-Exempt

Bond Fund | | | International

Fund | |

| Assets | | | | | | | | | | | | | | | | |

| Investments in securities, at fair value (identified cost: $267,093,223 Core Equity Fund; $284,159,304 Small Companies Fund; $483,559,949 Tax-Exempt Bond Fund; $393,931,634 International Fund) | | $ | 489,737,389 | | | | 304,434,197 | | | | 510,674,481 | | | | 486,984,152 | |

| Foreign currencies, at value (cost: $190,315) | | | - | | | | - | | | | - | | | | 190,426 | |

| Cash | | | 1,609 | | | | - | | | | - | | | | - | |

| Receivable for securities sold | | | 1,221,658 | | | | 1,323,540 | | | | - | | | | 772 | |

| Receivable for shares of beneficial interest sold | | | 2,640,000 | | | | 843,000 | | | | 468,000 | | | | 4,247,700 | |

| Receivable for variation margin on futures contracts | | | 28,287 | | | | - | | | | - | | | | - | |

| Accrued dividend and interest receivable | | | 542,075 | | | | 344,270 | | | | 5,175,177 | | | | 623,518 | |

| Foreign tax reclaim receivable | | | 34,761 | | | | 845 | | | | - | | | | 1,208,006 | |

| Unrealized appreciation on forward foreign currency exchange contracts | | | - | | | | - | | | | - | | | | 51,181 | |

| Total assets | | | 494,205,779 | | | | 306,945,852 | | | | 516,317,658 | | | | 493,305,755 | |

| Liabilities | | | | | | | | | | | | | | | | |

| Payables for investment securities purchased | | | 1,280,139 | | | | 6,813,235 | | | | 3,000,000 | | | | 1,216,400 | |

| Accrued investment advisory fee | | | 507,917 | | | | 752,457 | | | | 433,412 | | | | 859,836 | |

| Payable for dividend distribution | | | - | | | | - | | | | 111,302 | | | | - | |

| Unrealized depreciation on forward foreign currency exchange contracts | | | - | | | | - | | | | - | | | | 45,312 | |

| Total liabilities | | | 1,788,056 | | | | 7,565,692 | | | | 3,544,714 | | | | 2,121,548 | |

| Net assets | | $ | 492,417,723 | | | | 299,380,160 | | | | 512,772,944 | | | | 491,184,207 | |

| Capital | | | | | | | | | | | | | | | | |

| Capital stock and additional paid-in capital (authorized unlimited number of shares at no par value for each Fund: 13,844,056, 17,422,910, 50,490,556 and 35,023,182 shares, respectively) | | $ | 268,902,334 | | | | 275,500,070 | | | | 485,559,116 | | | | 402,722,768 | |

| Undistributed (overdistributed) net investment income | | | 300,012 | | | | - | | | | 112,785 | | | | (1,183,615 | ) |

| Accumulated net realized gain (loss) from investments and foreign currency transactions | | | 571,331 | | | | 3,605,196 | | | | (13,489 | ) | | | (3,267,532 | ) |

| Unrealized appreciation of investments and translation of assets and liabilities in foreign currencies | | | 222,644,046 | | | | 20,274,894 | | | | 27,114,532 | | | | 92,912,586 | |

| Net assets | | $ | 492,417,723 | | | | 299,380,160 | | | | 512,772,944 | | | | 491,184,207 | |

| Net asset value per share of outstanding capital stock | | $ | 35.57 | | | | 17.18 | | | | 10.16 | | | | 14.02 | |

See accompanying notes to financial statements.

CLEARWATER INVESTMENT TRUST

Statements of Operations

Year ended December 31, 2015

| | | | | | | | | | | | | | | | | |

| | | Core Equity

Fund | | | Small Companies

Fund | | | Tax-Exempt

Bond Fund | | | International

Fund | |

| Investment income: | | | | | | | | | | | | | | | | |

| Income: | | | | | | | | | | | | | | | | |

| Dividends (net of foreign taxes withheld of $56,024, $7,075, $0 and $1,104,327, respectively) | | $ | 10,167,825 | | | | 3,825,212 | | | | 1,754,357 | | | | 12,989,612 | |

| Interest | | | - | | | | - | | | | 21,461,251 | | | | - | |

| Total income | | | 10,167,825 | | | | 3,825,212 | | | | 23,215,608 | | | | 12,989,612 | |

| Expenses: | | | | | | | | | | | | | | | | |

| Investment advisory fee | | | 4,706,539 | | | | 4,353,615 | | | | 3,045,115 | | | | 5,075,868 | |

| Voluntary fee reduction | | | (2,505,518 | ) | | | (1,219,793 | ) | | | (1,329,903 | ) | | | (1,593,500 | ) |

| Total net expenses | | | 2,201,021 | | | | 3,133,822 | | | | 1,715,212 | | | | 3,482,368 | |

| Net investment income | | | 7,966,804 | | | | 691,390 | | | | 21,500,396 | | | | 9,507,244 | |

| Net realized gain (loss) on: | | | | | | | | | | | | | | | | |

| Security transactions | | | 40,279,358 | | | | 39,821,655 | | | | 2,120,557 | | | | 634,398 | |

| Futures contracts | | | (10,606 | ) | | | - | | | | - | | | | - | |

| Forward foreign currency exchange contracts | | | - | | | | - | | | | - | | | | 475,193 | |

| Foreign currency transactions | | | (2,211 | ) | | | - | | | | - | | | | 72,791 | |

| Net increase (decrease) in unrealized appreciation/depreciation on: | | | | | | | | | | | | | | | | |

| Security transactions | | | (52,001,563 | ) | | | (53,057,897 | ) | | | (474,940 | ) | | | (11,879,338 | ) |

| Forward foreign currency exchange contracts | | | - | | | | - | | | | - | | | | (508,234 | ) |

| Translation of other assets and liabilities denominated in foreign currencies | | | 1,320 | | | | - | | | | - | | | | (43,057 | ) |

| Net gain (loss) on investments | | | (11,733,702 | ) | | | (13,236,242 | ) | | | 1,645,617 | | | | (11,248,247 | ) |

| Net increase (decrease) in net assets resulting from operations | | $ | (3,766,898 | ) | | | (12,544,852 | ) | | | 23,146,013 | | | | (1,741,003 | ) |

See accompanying notes to financial statements.

CLEARWATER INVESTMENT TRUST

Statements of Changes in Net Assets

Years ended December 31, 2015 and 2014

| | | | | | | | | | | | | | | | | |

| | | Core Equity Fund | | | Small Companies Fund | |

| | | 12/31/2015 | | | 12/31/2014 | | | 12/31/2015 | | | 12/31/2014 | |

| Operations: | | | | | | | | | | | | | | | | |

| Net investment income | | $ | 7,966,804 | | | | 7,989,905 | | | | 691,390 | | | | 815,686 | |

| Net realized gain | | | 40,266,541 | | | | 17,023,383 | | | | 39,821,655 | | | | 36,427,294 | |

| Net increase (decrease) in unrealized appreciation/depreciation | | | (52,000,243 | ) | | | 22,275,634 | | | | (53,057,897 | ) | | | (20,342,867 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (3,766,898 | ) | | | 47,288,922 | | | | (12,544,852 | ) | | | 16,900,113 | |

| Distributions to shareholders from: | | | | | | | | | | | | | | | | |

| Net investment income | | | (7,757,756 | ) | | | (8,347,216 | ) | | | (876,975 | ) | | | (637,608 | ) |

| Net realized gain | | | (39,583,976 | ) | | | (16,626,561 | ) | | | (35,922,516 | ) | | | (47,231,708 | ) |

| Total distributions to shareholders | | | (47,341,732 | ) | | | (24,973,777 | ) | | | (36,799,491 | ) | | | (47,869,316 | ) |

| Equalization: | | | | | | | | | | | | | | | | |

| Net equalization | | | 2,237,640 | | | | - | | | | 1,600,313 | | | | - | |

| Capital share transactions: | | | | | | | | | | | | | | | | |