UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIESInvestment Company Act file number: 811-5075

Thrivent Real Estate Securities Fund

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

James M. Odland, Secretary

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

|

Registrant's telephone number, including area code: (612) 340-7215

Date of fiscal year end: December 31

Date of reporting period: December 31, 2005

Item 1. Report to Stockholders

|

Table of Contents

| President’s Letter | 1 |

| Economic and Market Overview | 2 |

| Portfolio Perspective | 4 |

| Shareholder Expense Example | 6 |

| Report of Independent Registered Public | |

| Accounting Firm | 7 |

| Schedule of Investments | 8 |

| Statement of Assets and Liabilities | 11 |

| Statement of Operations | 12 |

| Statement of Changes in Net Assets | 13 |

| Notes to Financial Statements | 14 |

| Financial Highlights | 20 |

| Additional Information | 22 |

| Trustees and Officers of | |

| Thrivent Mutual Funds | 23 |

| Supplements to the Prospectus | 28 |

Dear Member:

We are pleased to provide you with the annual report for the Thrivent Real Estate Securities Fund for the period ended Dec. 31, 2005. In this report, you will find detailed information about your investment, including a summary prepared by the portfolio manager on his performance and management strategies for the fund and period. In addition, Russell Swansen, Thrivent Financial’s chief investment officer, summarizes the overall market and economic environment over the past year.

In previous letters, I have often highlighted integrity and commitment to you, our member, as a common thread running through our organization--from our customer service areas to our portfolio managers. On the investment management side, we seek to align our investment discipline with our investors’ best interests by striving for consistent, long-term performance, taking risk management seriously in our pursuit of potential market rewards and adhering to a consistent approach that supports sound asset allocation. These various facets of investing are signatures of a more sophisticated, institutional-quality asset management philosophy, and I am delighted to say that since we implemented these strategies and new approach, our investment performance results have shown marked improvement.

Strong Investment Performance Follows New Approach

Just over two years ago, Thrivent Financial for Lutherans welcomed our new chief investment officer, Russ Swansen, to the organization. Russ and his team implemented an institutional money management approach throughout 2004 and 2005 which has provided our members with strong results. For example, 80% of our internally-managed portfolios bettered their respective Lipper, Inc. peer group medians for the one-year period ended Dec. 31, 2005. That is a high outperformance percentage when one takes into account that many firms consider anything above 60% to be strong results. Even more importantly, our products’ three-year track records have greatly improved, with more than 60% of our internally-managed products outpacing their respective Lipper, Inc. medians. Given 15% of our internally-managed products outperformed over the five-year period and 33% outperformed over the 10-year period, the improvement is even more impressive.

A Smart and Simple Strategy

If you like the idea of strong investment performance, built on a foundation of trust, with your interests placed first, but find investing time consuming and complex, you should consider our new suite of four asset allocation portfolios designed to provide a simple one-step investment solution. An attractive combination of professional, institutional-quality money management, lower-than-average fees and guidance from a financial professional who lives in your community have made these products very popular with investors after less than one year. We’re excited to offer what we call A Simple Choice for Smart Investing! Talk with your Thrivent registered representative for more information.

Our Ongoing Commitment to You

As a member-owned organization, Thrivent Financial for Lutherans is uniquely designed and positioned to serve the financial and fraternal needs of one entity--you, our valued member. Many of you have one thing foremost on your minds at this point in your life--retirement. Our investment management philosophy is squarely focused on sound asset allocation strategies, striving for strong investment performance and meaningful advice that can provide a clear roadmap to the retirement of your dreams. Whether saving for that retirement, sharing your success with your church or community, or leaving a legacy to the next generation, we stand ready to assist you each step of the way.

I want to personally wish you the best in 2006. Thank you for continuing to turn to us for your financial solutions. We very much value your business.

Sincerely,

Pamela J. Moret

President and Trustee

Thrivent Mutual Funds

1

December 31, 2005

Russell W. Swansen

Senior Vice President and

Chief Investment Officer

|

Economic and Market Review

Stocks and bonds generally provided positive returns during the one-year period ended Dec. 31, 2005, despite skyrocketing energy prices, devastating hurricanes, and rising interest rates. U.S. and foreign stocks benefited from solid economic growth and rising corporate profits. Despite repeated interest rate hikes by the Federal Reserve (the Fed), bonds generally managed modest positive returns.

U.S. Economy

Gross domestic product growth slowed from a 3.8% annual pace in the first quarter to 3.3% in the second quarter, then accelerated to 4.1% in the third quarter--surprising many economists who expected a slowdown due to the Gulf Coast storms. Preliminary data for the fourth quarter indicate a growth rate of 1.1% in the period, a marked deceleration from prior quarters and perhaps reflecting some of the lagging effects of storms and rising energy prices of the third quarter.

The labor market improved as the unemployment rate declined to 4.9% over the period, and the housing market generally enjoyed robust sales activity and rising prices. Sales of new and existing homes began moderating during the fourth quarter, however.

Inflation & Monetary Policy

Inflation accelerated slightly during the period, due mainly to rising energy prices. The Consumer Price Index rose at a 3.4% annual rate during 2005, compared with an increase of 3.3% in 2004. “Core” inflation--which excludes prices of food and energy--rose at a more modest 2.2% during 2005, the same as the previous year.

While core inflation remained relatively tame during the period, the Federal Reserve continued its program of increasing short-term interest rates, indicating that prior levels of interest rates were too low given the robust growth in the economy. On Dec. 13, the Fed raised its target for the federal funds rate by a quarter point to 4.25%, the 13th consecutive increase since June 2004.

With its December rate increase the Fed omitted the word “accommodative” used previously in describing its monetary policy, which may mean that it now sees rates at a neutral level--neither accommodative nor restrictive. But it also indicated that “some further measured policy firming is likely to be needed.”

In another change at the Fed, President Bush nominated former Princeton University economist Ben Bernanke to succeed Alan Greenspan as chairman of the Federal Reserve Board. The financial markets’ reaction to the choice of Bernanke, who is widely respected by economists and investors, was positive.

Equity Performance

Stocks were buffeted by the mixed circumstances of a period of fundamentally sound economic and profit growth counterbalanced by a surge in commodity prices and the stirring of inflation risks. A resurgence in oil prices early in the new year turned stock prices downward until the end of April. Strong corporate profits and confidence that the Fed would succeed against inflation inspired a summer-long rally that, surprisingly, continued even after Hurricane Katrina. As fall began, investors refocused on worries about higher infla-tion and interest rates and a slowdown in corporate profits. But a surge in November--fueled by higher consumer spending, incomes, and corporate profits--lifted several indexes to their highs for the year.

Large-cap stocks modestly outperformed small-cap issues during the period. The S&P 500 Index of large-cap stocks posted a 4.92% total return, while the Russell 2000 Index of small-cap stocks recorded a 4.64% return. Investors generally also favored value stocks over growth stocks during the period, with the Russell 1000 Value Index returning 7.05% while the Russell 1000 Growth Index registered a 5.26% total return.

Sectors that performed best during the period included energy, utilities, and health care, while telecommunications services, consumer discretionary, and industrials did worst. Although energy and utilities stocks lost ground in the fourth quarter, they still were the top performers by far for the entire year.

Foreign stocks generally outperformed domestic issues, measured in both local currency and dollar returns. The Morgan Stanley Capital International Europe, Australasia, and the Far East (EAFE) Index posted a 14.02% total return during the period.

2

Fixed Income Performance

With the headwind of ongoing hikes in short-term benchmark rates by the Fed, most bond sectors offered modest total returns during the period. Yields on short-term securities rose more than yields on intermediate- and longer-term bonds, continuing the “flattening” of the yield curve that began in early 2004.

In late December, the yield curve “inverted” slightly, with some intermediate-term Treasury securities yielding less than shorter-term Treasuries. This rarely occurs, since investors usually require higher yields for assuming the risk of higher inflation in future years.

The Lehman Brothers Aggregate Bond Index of the broad U.S. bond market posted a 2.43% total return for the 12 months ended Dec. 31, 2005. During the period, the credit ratings of General Motors and Ford, which are two of the largest corporate bond issuers, were downgraded to below investment grade. Municipal bonds fared better than other types of securities in this environment, with the Lehman Brothers Municipal Bond Index posting a total return of 3.51% during the period.

Although high yield bonds were hurt by an investor flight to quality earlier in the period, the sector modestly outperformed many other bonds sectors for the entire 12 months. The Lehman U.S. High Yield Bond Index registered a 2.74% total return.

Outlook

We believe the U.S. economy will grow at a somewhat slower pace over the next year. In 2005, a combination of relatively low interest rates and strong housing prices prompted aggressive borrowing by consumers as they were able to leverage housing capital to supplement current incomes and spending. This is unlikely to be repeated in 2006.

We think oil prices have likely peaked in the near term and will stabilize or even decline somewhat during 2006. Inflation will likely moderate with prices rising around 2% to 3% on a core basis, excluding volatile food and energy prices. Nevertheless, this will encourage the Fed to continue its policy of measured interest rate hikes.

Our outlook for U.S. stocks is moderately positive. We are mindful, however, that equity valuations remain higher than historical averages, and we expect that price volatility will continue as investors sort through positive and negative economic news. Bond returns will feel the drag of rising interest rates until the Fed has completed its tightening campaign. Investors will remain sensitive to signs of rising inflation or a slowing economy.

As always, your best strategy is to work with your Thrivent Investment Management registered representative to create an investment plan based on your goals, diversify your portfolio, and remain focused on the long term.

3

Thrivent Real Estate

Securities Fund

|

Reginald L. Pfeifer, Portfolio Manager

The Thrivent Real Estate Securities Fund seeks to provide long-term capital appreciation and high current income by investing primarily in the equity securities of companies in the real estate industry.

The Fund is subject to risks arising from the fact that it concentrates its investments in only one industry. Real estate security prices are influenced by the underlying value of properties owned by the company, which may be influenced by the supply and demand for space and other factors. The real estate industry is cyclical, and the underlying value of securities issued by companies doing business in the real estate industry may be illiquid and fluctuate in value. These and other risks are described in the Fund’s prospectus.

How did Thrivent Real Estate Securities Fund perform for the six-month period ended Dec. 31, 2005?

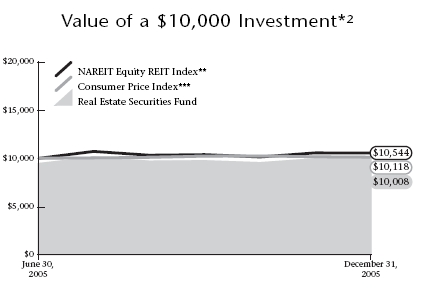

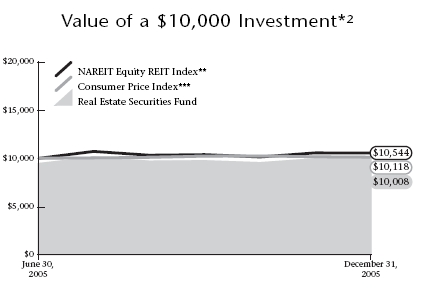

Thrivent Real Estate Securities Fund generated a positive, competitive return in its first six months since inception on June 30, 2005. For the six-month period ended Dec. 31, 2005, the Fund generated a net return of 5.90%, while its peer group, the Lipper Real Estate Funds Category, returned 6.95% . The Fund’s benchmark, the NAREIT Equity REIT Index, delivered 5.44% for the same timeframe. We attribute the fact that the Fund trailed the median return of its peer group primarily to the transaction costs (i.e. brokerage commissions, transaction charges) incurred to establish new investments in the Fund. As assets increase, we are confident that these costs will diminish as a percentage of total assets, and expect the Fund’s costs and expenses to fall more in line with those of its peer group.

What market conditions were present during the period?

U.S. stocks closed out 2005 on a constructive note, rallying in the fourth quarter and generally lifting the major indices to positive territory for the period. The Dow Jones Industrial Average ended the period with a modest positive return as did the technology heavy NASDAQ Composite. Broader, more diversified indices fared better with the S&P 500 Index achieving mid single digit returns.

With the exception of a correction in the first quarter of 2005, real estate investment trust (REIT) stocks enjoyed steady overall demand and strong performance for the year, outperforming the broad U.S. equity markets for the sixth consecutive year. In terms of sectors, regional malls were once again a performance leader, outperforming all other property types except the self-storage sector. Office, industrial, and apartment REITs also performed well throughout the year. Conversely, health care REITs, which generally have long-term fixed rate leases, did not perform as well as property types that were able to generate steadily increasing rental income.

What factors affected the Fund’s performance?

The most prominent contributor to absolute and relative performance versus the benchmark was individual security selection. Our stock selection was particularly beneficial within the office REITs sector, followed by industrial, shopping center, and apartment REITs, respectively.

Second, absolute performance was positively impacted by our overweighted exposure versus benchmark to industrial properties, which were up 14.3% (within the Index) during the second half of 2005. On the other hand, our decision to underweight our exposure to health care REITs, which delivered negative performance for the six-month period, also contributed strongly to our performance results.

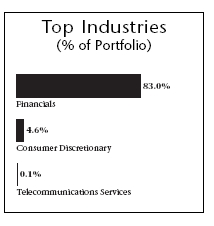

| Top 10 Holdings | |

| (% of Portfolio) | |

| |

| Simon Property Group, Inc. | 5.6% |

| ProLogis Trust | 3.8% |

| General Growth Properties, Inc. | 3.1% |

| Vornado Realty Trust | 3.0% |

| Avalonbay Communities, Inc. | 2.8% |

| Boston Properties, Inc. | 2.8% |

| Equity Residential REIT | 2.5% |

| Archstone-Smith Trust | 2.5% |

| Starwood Hotels & Resorts Worldwide, Inc. | 2.5% |

| Host Marriott Corporation | 2.3% |

| |

| These common stocks represent 30.9% of the total | |

| investment portfolio. | |

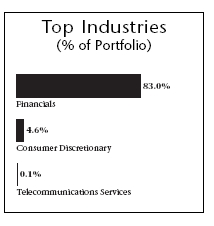

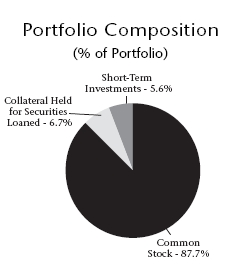

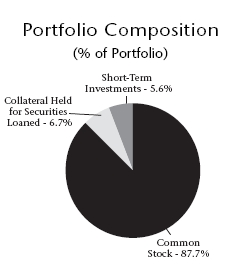

Quoted Top Industries, Portfolio Composition and Top 10 Holdings are subject to change.

The lists of Top Industries and Top 10 Holdings exclude short-term investments and collateral held for securities loaned.

4

The fact that we maintained exposure to mortgage REITs, as well as to companies engaged in real estate lending, had a modest negative impact on Fund performance. However, since this exposure averaged just 1% of total assets, the overall impact these holdings had on our returns was minimal.

What is your outlook?

We believe that regional mall, shopping center, and lodging properties currently offer the most favorable risk/return characteristics. These property types currently enjoy strong demand, limited new supply, increasing occupancies and rising rental rates. In addition, they are attractively valued in comparison to the other sectors of the REIT market. We have positioned our office sector holdings in those companies with exposure to the strongest markets, which currently are New York City, Washington D.C. and Southern California. Finally, we anticipate favorable improvement in the multifamily property sector, which is beginning to show strong fundamental improvement and a renewed ability to increase rents. We maintain a positive outlook for real estate investments in general, and REIT stocks specifically, given their attractive income, appreciation and portfolio diversification benefits.

| | Portfolio Facts | |

| | As of December 31, 2005 | |

| | A Share | Institutional Share |

| | ------------------ | ------------------ |

| Ticker | TREFX | TREIX |

| Transfer Agent ID | 69 | 469 |

| Net Assets | $9,958,343 | $14,939,796 |

| NAV | $10.42 | $10.42 |

| NAV -- High† | 8/2/2005 -- $10.77 | 8/2/2005 -- $10.77 |

| NAV -- Low† | 10/13/2005 -- $9.53 | 10/13/2005 -- $9.53 |

| Number of Holdings: 170 | † For the period ended December 31, 2005 |

| Average Annual Total Returns2 |

| As of December 31, 2005 | |

| |

| | From |

| | Inception |

| Class A1 | 6/30/2005 |

|

| without sales charge | 5.90% |

| with sales charge | 0.09% |

| |

| | From |

| | Inception |

| Institutional Class1 | 6/30/2005 |

|

| total return | 6.11% |

1 Class A performance has been restated to reflect the maximum sales charge of 5.5% . Institutional Class shares have no sales load and are for institutional shareholders only.

2 Past performance is not an indication of future results. Annualized total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. Investing in a mutual fund involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. The Fund primarily invests in real estate-related industries; as a consequence, the Fund may be subject to greater price volatility than a fund investing in a broad range of industries. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Please read your prospectus carefully.

* As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index and NAREIT Equity REIT Index do not reflect any such charges. If you were to purchase any of the above individual stocks or funds represented in these Indexes, any charges you would pay would reduce your total return as well.

** The NAREIT Equity REIT Index is an unmanaged capitalization-weighted index of all equity real estate investment trusts. It is not possible to invest directly in this Index. The performance of this Index does not reflect deductions for fees, expanses or taxes.

*** The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index.

5

Shareholder Expense Example

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2005 through December 31, 2005.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. A small account fee of $12 is charged to Class A shareholder accounts if the value falls below the stated account minimum of $1,000. This fee is not included in the table below. If it were, the expenses you paid during the period would have been higher and the ending account value would have been lower.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small account fee of $12 is charged to Class A shareholder accounts if the value falls below the stated account minimum of $1,000. This fee is not included in the table below. If it were, the expenses you paid during the period would have been higher and the ending account value would have been lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | Ending | Expenses | |

| | Account | Account | Paid During | Annualized |

| | Value | Value | Period * | Expense |

| | 7/1/05 | 12/31/05 | 7/1/2005 -- 12/31/2005 | Ratio |

| ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| Thrivent Real Estate Securities Fund | | | |

| Actual | | | | |

| Class A | $1,000 | $1,059 | $5.50 | 1.06% |

| Institutional Class | $1,000 | $1,061 | $1.61 | 0.31% |

| Hypothetical ** | | | | |

| Class A | $1,000 | $1,020 | $5.40 | 1.06% |

| Institutional Class | $1,000 | $1,024 | $1.58 | 0.31% |

*Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

**Assuming 5% total return before expenses.

6

PricewaterhouseCoopers LLP

225 South Sixth Street

Suite 1400

Minneapolis, MN 55402

Telephone (612) 596 6000

|

Report of Independent Registered Public Accounting Firm

To the Shareholders and Trustees of

Thrivent Mutual Funds:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statement of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Thrivent Real Estate Securities Fund (one of the funds constituting the Thrivent Mutual Funds, hereafter referred to as the “Fund”) at December 31, 2005, the results of its operations, changes in its net assets and financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2005 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

February 16, 2006

7

Real Estate Securities Fund

Schedule of Investments as of December 31, 2005(a)

|

| Shares | Common Stock (87.7%) | Value | Shares | Common Stock (87.7%) | Value |

|

| Consumer Discretionary (4.6%) | | | | |

| 300 | D.R. Horton, Inc. | $10,719 | 4,700 | CBL & Associates Properties, Inc.(c) | $185,697 |

| 700 | Fairmont Hotels & Resorts, Inc. | 29,687 | 2,200 | Cedar Shopping Centers, Inc.(c) | 30,954 |

| 1,300 | Great Wolf Resorts, Inc.(b,c) | 13,403 | 2,600 | CenterPoint Properties Trust | 128,648 |

| 200 | Harrah’s Entertainment, Inc. | 14,258 | 500 | CentraCore Properties Trust | 13,435 |

| 15,100 | Hilton Hotels Corporation | 364,061 | 500 | Cogdell Spencer, Inc. | 8,445 |

| 2,000 | InterContinental Hotels Group plc(c) | 28,900 | 2,700 | Colonial Properties Trust | 113,346 |

| 2,100 | Jameson Inns, Inc.(b,c) | 4,515 | 2,100 | Columbia Equity Trust, Inc. | 33,915 |

| 4,200 | La Quinta Corporation(b) | 46,788 | 1,400 | Commercial Net Lease Realty, Inc. | 28,518 |

| 600 | Lodgian, Inc.(b) | 6,438 | 5,900 | Corporate Office Properties Trust | 209,686 |

| 900 | Marriott International, Inc. | 60,273 | 300 | Countrywide Financial | |

| 400 | Orient Express Hotels, Ltd. | 12,608 | | Corporation | 10,257 |

| 10,600 | Starwood Hotels & Resorts | | 3,400 | Cousins Properties, Inc. | 96,220 |

| | Worldwide, Inc. | 676,916 | 3,500 | Crescent Real Estate | |

|

| |

| | Total Consumer | | | Equities Company(c) | 69,370 |

| | Discretionary | 1,268,566 | 700 | Deerfield Triarc | |

|

| |

| | | | | Capital Corporation(c) | 9,590 |

| Financials (83.0%) | | 9,600 | Developers Diversified | |

| 3,100 | Acadia Realty Trust | 62,155 | | Realty Corporation | 451,392 |

| 900 | Agree Realty Corporation | 26,010 | 1,600 | DiamondRock | |

| 3,500 | Alexandria Real Estate | | | Hospitality Company(c) | 19,136 |

| | Equities, Inc. | 281,750 | 2,500 | Digital Realty Trust, Inc. | 56,575 |

| 9,000 | AMB Property Corporation | 442,530 | 5,300 | Duke Realty Corporation | 177,020 |

| 2,500 | American Campus | | 5,100 | Eagle Hospitality Properties | |

| | Communities, Inc. | 62,000 | | Trust, Inc.(c) | 38,913 |

| 2,300 | American Financial Realty Trust | 27,600 | 2,500 | EastGroup Properties, Inc. | 112,900 |

| 4,200 | Apartment Investment & | | 1,900 | Education Realty Trust, Inc.(c) | 24,491 |

| | Management Company | 159,054 | 900 | Entertainment Properties Trust | 36,675 |

| 16,200 | Archstone-Smith Trust | 678,618 | 2,400 | Equity Inns, Inc. | 32,520 |

| 5,800 | Arden Realty Group, Inc. | 260,014 | 2,500 | Equity Lifestyle Properties, Inc. | 111,250 |

| 2,100 | Ashford Hospitality Trust(c) | 22,029 | 18,900 | Equity Office Properties Trust | 573,237 |

| 1,800 | Associated Estates | | 2,400 | Equity One, Inc.(c) | 55,488 |

| | Realty Corporation | 16,272 | 17,900 | Equity Residential REIT | 700,248 |

| 8,700 | Avalonbay Communities, Inc. | 776,475 | 3,200 | Essex Property Trust, Inc. | 295,040 |

| 600 | Bedford Property Investors, Inc.(c) | 13,164 | 3,400 | Extra Space Storage, Inc.(c) | 52,360 |

| 5,900 | BioMed Realty Trust, Inc. | 143,960 | 100 | Federal Home Loan | |

| 300 | BNP Residential Properties, Inc. | 4,800 | | Mortgage Corporation | 6,535 |

| 10,300 | Boston Properties, Inc. | 763,539 | 300 | Federal National | |

| 6,100 | Brandywine Realty Trust(c) | 170,251 | | Mortgage Association | 14,643 |

| 3,700 | BRE Properties, Inc. | 168,276 | 4,900 | Federal Realty Investment Trust | 297,185 |

| 800 | Brookfield Asset Management, Inc. | 40,264 | 900 | FelCor Lodging Trust, Inc.(c) | 15,489 |

| 14,500 | Brookfield Properties Corporation | 426,590 | 1,500 | Feldman Mall Properties, Inc.(c) | 18,015 |

| 5,600 | Camden Property Trust | 324,352 | 200 | First American Corporation | 9,060 |

| 400 | Capital Trust, Inc.(c) | 11,712 | 1,300 | First Industrial Realty Trust, Inc.(c) | 50,050 |

| 6,000 | CarrAmerica Realty Corporation | 207,780 | 2,700 | First Potomac Realty Trust | 71,820 |

| 400 | CB Richard Ellis Group, Inc.(b) | 23,540 | 3,000 | Forest City Enterprises | 113,790 |

The accompanying notes to the financial statements are an integral part of this schedule.

8

| Real Estate Securities Fund | | | | |

| Schedule of Investments as of December 31, 2005(a) | | | | |

| |

| Shares | Common Stock (87.7%) | Value | Shares | Common Stock (87.7%) | Value |

|

| Financials -- continued | | 3,700 | Nationwide Health | |

| 18,200 | General Growth Properties, Inc. | $855,218 | | Properties, Inc.(c) | $79,180 |

| 100 | Getty Realty Corporation | 2,629 | 200 | New Century | |

| 1,500 | Glenborough Realty Trust, Inc.(c) | 27,150 | | Financial Corporation(c) | 7,214 |

| 2,600 | Glimcher Realty Trust(c) | 63,232 | 3,900 | New Plan Excel Realty Trust, Inc. | 90,402 |

| 1,000 | Global Signal, Inc. | 43,160 | 2,100 | Newcastle Investment | |

| 2,300 | GMH Communities Trust | 35,673 | | Corporation(c) | 52,185 |

| 900 | Gramercy Capital Corporation(c) | 20,502 | 200 | Newkirk Realty Trust, Inc. | 3,100 |

| 3,300 | Health Care | | 3,500 | NorthStar Realty | |

| | Property Investors, Inc. | 84,348 | | Finance Corporation(c) | 35,665 |

| 1,800 | Health Care REIT, Inc. | 61,020 | 1,400 | Omega Healthcare Investors, Inc. | 17,626 |

| 2,100 | Healthcare Realty Trust, Inc. | 69,867 | 4,100 | Pan Pacific Retail Properties, Inc. | 274,249 |

| 2,600 | Heritage Property | | 900 | Parkway Properties, Inc. | 36,126 |

| | Investment Trust(c) | 86,840 | 2,200 | Penn Real Estate Investment | |

| 3,600 | Hersha Hospitality Trust(c) | 32,436 | | Trust(c) | 82,192 |

| 3,900 | Highland Hospitality Corporation | 43,095 | 1,000 | Plum Creek Timber | |

| 3,000 | Highwoods Properties, Inc. | 85,350 | | Company, Inc. | 36,050 |

| 2,900 | Home Properties, Inc. | 118,320 | 3,700 | Post Properties, Inc. | 147,815 |

| 1,900 | Hospitality Properties Trust | 76,190 | 4,900 | Prentiss Properties Trust | 199,332 |

| 34,200 | Host Marriott Corporation | 648,090 | 22,208 | ProLogis Trust | 1,037,558 |

| 4,500 | HRPT Properties Trust | 46,575 | 2,300 | PS Business Parks, Inc. | 113,160 |

| 1,200 | Inland Real Estate Corporation(c) | 17,748 | 8,500 | Public Storage, Inc. | 575,620 |

| 3,500 | Innkeepers USA Trust | 56,000 | 800 | RAIT Investment Trust(c) | 20,736 |

| 3,400 | iStar Financial, Inc. | 121,210 | 1,700 | Ramco-Gershenson | |

| 2,200 | Jer Investors Trust, Inc.(c) | 37,290 | | Properties Trust(c) | 45,305 |

| 100 | Jones Lang LaSalle, Inc. | 5,035 | 300 | Rayonier, Inc. REIT | 11,955 |

| 3,300 | Kilroy Realty Corporation | 204,270 | 1,100 | Realty Income Corporation | 23,782 |

| 13,700 | Kimco Realty Corporation | 439,496 | 8,400 | Reckson Associates Realty | |

| 4,900 | Kite Realty Group Trust | 75,803 | | Corporation | 302,232 |

| 1,800 | KKR Financial Corporation | 43,182 | 8,000 | Regency Centers Corporation | 471,600 |

| 4,100 | LaSalle Hotel Properties | 150,552 | 4,000 | Republic Property Trust(b,c) | 48,000 |

| 2,800 | Lexington Corporate | | 300 | Saul Centers, Inc. | 10,830 |

| | Properties Trust | 59,640 | 4,800 | Senior Housing Property Trust(c) | 81,168 |

| 5,500 | Liberty Property Trust(c) | 235,675 | 2,500 | Shurgard Storage Centers, Inc. | 141,775 |

| 200 | LTC Properties, Inc.(c) | 4,206 | 20,000 | Simon Property Group, Inc. | 1,532,599 |

| 6,000 | Macerich Company | 402,840 | 6,500 | SL Green Realty Corporation | 496,535 |

| 4,700 | Mack-Cali Realty Corporation | 203,040 | 1,700 | Sovran Self Storage, Inc. | 79,849 |

| 4,800 | Maguire Properties, Inc. | 148,320 | 6,400 | Spirit Finance Corporation | 72,640 |

| 1,000 | Medical Properties Trust, Inc. | 9,780 | 700 | St. Joe Company(c) | 47,054 |

| 3,000 | MeriStar Hospitality | | 3,900 | Strategic Hotel Capital, Inc.(c) | 80,262 |

| | Corporation(b) | 28,200 | 1,400 | Sun Communities, Inc. | 43,960 |

| 2,300 | Mid-America Apartment | | 3,000 | Sunstone Hotel Investors, Inc. | 79,710 |

| | Communities, Inc. | 111,550 | 2,500 | Tanger Factory Outlet | |

| 6,000 | Mills Corporation | 251,640 | | Centers, Inc. | 71,850 |

| 1,100 | MortgageIT Holdings, Inc.(c) | 15,026 | 5,000 | Taubman Centers, Inc. | 173,750 |

| 500 | National Health Investors, Inc.(c) | 12,980 | 100 | Thornburg Mortgage, Inc.(c) | 2,620 |

| |

| |

| The accompanying notes to the financial statements are an integral part of this schedule. | |

|

9

| Real Estate Securities Fund | | | | | |

| Schedule of Investments as of December 31, 2005(a) | | | | |

| |

| Shares | Common Stock (87.7%) | Value | Shares | Common Stock (87.7%) | Value |

|

| |

| 2,800 | Town & Country Trust(c) | $94,668 | Health Care (d) | | |

| 9,600 | Trizec Properties, Inc. | 220,032 | 200 | American Retirement Corporation(b,c) | $5,026 |

| 1,000 | Trustreet Properties, Inc.(c) | 14,620 | 200 | Brookdale Senior Living, Inc.(c) | 5,962 |

|

|

| 10,000 | United Dominion | | | Total Health Care | 10,988 |

|

|

| | Realty Trust, Inc. | 234,400 | | | | |

| 100 | Universal Health | | Industrials (d) | | |

| | Realty Income Trust | 3,134 | 100 | Alexander & Baldwin, Inc. | 5,424 |

| 600 | Urstadt Biddle Properties(c) | 9,726 | 400 | Cendant Corporation | 6,900 |

|

|

| 3,400 | U-Store-It Trust | 71,570 | | Total Industrials | 12,324 |

|

|

| 8,000 | Ventas, Inc. | 256,160 | | | | |

| 9,800 | Vornado Realty Trust | 818,006 | Telecommunications Services (0.1%) | |

| 400 | Washington Real Estate | | 700 | American Tower Corporation(b) | 18,970 |

|

|

| | Investment Trust | 12,140 | | Total Telecommunications | |

| 2,500 | Weingarten Realty Investors | 94,525 | | Services | | 18,970 |

|

|

| 900 | Windrose Medical | | | | | |

|

|

| | Properties Trust | 13,374 | | Total Common Stock | |

| 1,300 | Winston Hotels, Inc.(c) | 12,870 | | (cost $23,508,005) | 24,209,585 |

|

| |

|

| | Total Financials | 22,898,737 | | | | |

|

| |

| |

| | | | | Interest | Maturity | |

| Shares | Collateral Held for Securities Loaned (6.7%) | Rate(e) | Date | Value |

|

| 1,836,403 | Thrivent Financial Securities Lending Trust | | 4.300% | N/A | $1,836,403 |

|

|

| | | Total Collateral Held for Securities Loaned | |

| | | (cost $1,836,403) | | | 1,836,403 |

|

|

| |

| |

| Shares or | | | | | | |

| Principal | | | | Interest | Maturity | |

| Amount | Short-Term Investments (5.6%) | | Rate(e) | Date | Value |

|

| $1,550,000 | Federal Home Loan Mortgage Corporation | | 2.266% | 1/3/2006 | $1,549,712 |

| 6,941 | Thrivent Money Market Fund | | | 3.940 | N/A | 6,941 |

|

|

| | | Total Short-Term Investments (at amortized cost) | 1,556,653 |

|

|

| | | Total Investments (cost $26,901,061) | | $27,602,641 |

|

|

(a) The categories of investments are shown as a percentage of total investments.

(b) Non-income producing security.

(c) All or a portion of the security is on loan as discussed in item 2(H) of the Notes to Financial Statements.

(d) The market value of the denoted categories of investments represents less than 0.1% of the total investments of the Thrivent Real Estate Securities Fund.

(e) The interest rate shown reflects the yield, coupon rate or, for securities purchased at a discount, the discount rate at the date of purchase.

The accompanying notes to the financial statements are an integral part of this schedule.

10

| Thrivent Mutual Funds | |

| Statement of Assets and Liabilities | |

| |

| | Real Estate |

| As of December 31, 2005 | Securities Fund |

|

| Assets | |

| Investments at cost | $26,901,061 |

| Investments in securities at market value | 25,759,297 |

| Investments in affiliates at market value | 1,843,344 |

|

| Investments at market value | 27,602,641 |

| Cash | 3,886 |

| Dividends and interest receivable | 113,528 |

| Prepaid expenses | 21,550 |

| Receivable for investments sold | 110,040 |

| Receivable for fund shares sold | 138,054 |

| Receivable from affiliate | 6,132 |

|

| Total Assets | 27,995,831 |

| Liabilities | |

| Distributions payable | 1,088 |

| Accrued expenses | 11,953 |

| Payable for investments purchased | 1,248,171 |

| Payable upon return of collateral for securities loaned | 1,836,403 |

| Payable for fund shares redeemed | 77 |

|

| Total Liabilities | 3,097,692 |

| Net Assets | |

| Capital stock (beneficial interest) | 24,264,350 |

| Accumulated undistributed net investment income/(loss) | (1,398) |

| Accumulated undistributed net realized gain/(loss) on | |

| investments and foreign currency transactions | (66,393) |

| Net unrealized appreciation/(depreciation) on: | |

| Investments | 701,580 |

|

| Total Net Assets | $24,898,139 |

| Class A Share Capital | $9,958,343 |

| Shares of beneficial interest outstanding (class A) | 955,937 |

| Net asset value per share | $10.42 |

| Maximum public offering price | $11.03 |

| Class I Share Capital | $14,939,796 |

| Shares of beneficial interest outstanding (class I) | 1,433,377 |

| Net asset value per share | $10.42 |

The accompanying notes to the financial statements are an integral part of this statement.

11

| Thrivent Mutual Funds | |

| Statement of Operations | |

| |

| |

| | Real Estate |

| For the Year Ended December 31, 2005(a) | Securities Fund |

|

| Investment Income | |

| Dividends | $240,255 |

| Taxable interest | 16,661 |

| Income from securities loaned | 435 |

| Income from affiliated investments | 3,507 |

| Foreign dividend tax withholding | (543) |

|

| Total Investment Income | 260,315 |

| |

| Expenses | |

| Adviser fees | 59,559 |

| Accounting and pricing fees | 9,852 |

| Administrative service fees | 1,489 |

| Amortization of offering costs | 15,288 |

| Audit and legal fees | 17,493 |

| Custody fees | 18,055 |

| Distribution expense Class A | 9,902 |

| Insurance expense | 1,786 |

| Printing and postage expense Class A | 3,894 |

| Printing and postage expense Class I | 195 |

| SEC and state registration expenses | 902 |

| Transfer agent fee Class A | 5,507 |

| Transfer agent fee Class I | 64 |

| Trustees’ fees | 1,369 |

| Other expenses | 1,574 |

|

| Total Expenses Before Reimbursement | 146,929 |

| |

| Less: | |

| Reimbursement from adviser | (94,002) |

| Custody earnings credit | (325) |

|

| Total Net Expenses | 52,602 |

|

| |

| Net Investment Income/(Loss) | 207,713 |

| |

| Realized and Unrealized Gains/(Losses) on | |

| Investments and Foreign Currency Transactions | |

| Net realized gains/(losses) on: | |

| Investments | 34,301 |

| Change in net unrealized appreciation/(depreciation) on: | |

| Investments | 701,580 |

|

| |

| Net Realized and Unrealized Gains/(Losses) on | |

|

| Investments and Foreign Currency Transactions | 735,881 |

|

| Net Increase/(Decrease) in Net Assets Resulting | |

|

| From Operations | $943,594 |

|

| (a) For the period from June 30, 2005 (inception) to December 31, 2005 | |

The accompanying notes to the financial statements are an integral part of this statement.

12

Thrivent Mutual Funds

Statement of Changes in Net Assets

| | Real Estate |

| | Securities Fund |

| | ---------------------------------------- |

| For the Year Ended | 12/31/2005(a) |

|

| Operations | |

| Net investment income/(loss) | $207,713 |

| Net realized gains/(losses) on: | |

| Investments | 34,301 |

| Change in net unrealized appreciation/(depreciation) on: | |

| Investments | 701,580 |

|

| |

| Net Change in Net Assets Resulting | |

|

| From Operations | 943,594 |

| |

| Distributions to Shareholders | |

| From net investment income | (224,399) |

| From net realized gains | (100,694) |

| From return of capital | (28,084) |

|

| Total Distributions to Shareholders | (353,177) |

|

| Capital Stock Transactions | 24,307,722 |

|

| Net Increase/(Decrease) in Net Assets | 24,898,139 |

|

| Net Assets, Beginning of Period | -- |

|

| Net Assets, End of Period | $24,898,139 |

| |

| (a) Since fund inception, June 30, 2005 | |

The accompanying notes to the financial statements are an integral part of this statement.

13

NOTES TO FINANCIAL STATEMENTS

As of December 31, 2005

|

(1) ORGANIZATION

Thrivent Mutual Funds (the “Trust”) was organized as a Massachusetts Business Trust on March 10, 1987 and is registered as an open-end management investment company under the Investment Company Act of 1940. The Trust is divided into thirty separate series (the “Funds”), each with its own investment objective and policies. The Trust currently consists of four allocation funds, eighteen equity funds, seven fixed-income funds, and one money market fund. The Trust commenced operations on July 16, 1987.

Thrivent Real Estate Securities Fund (the “Fund”) commenced operations on June 30, 2005. The other Funds of the Trust are presented under separate annual reports.

The Fund offers two classes of shares: Class A and Institutional Class. The two classes of shares differ principally in their respective distribution expenses and arrangements. Class A shares have a 0.25% annual 12b-1 fee and a maximum front-end sales load of 5.50% . Institutional Class shares are offered at net asset value and have no annual 12b-1 fees. The two classes of shares have identical rights to earnings, assets and voting privileges, except for class specific expenses and exclusive rights to vote on matters affecting only an individual class.

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust enters into contracts with vendors and others that provide general damage clauses. The Trust’s maximum exposure under these contracts is unknown, as this would involve future claims that may be made against the Trust. However, based on experience, the Trust expects the risk of loss to be remote.

(2) SIGNIFICANT ACCOUNTING POLICIES

(A) Valuation of Investments -- Securities traded on U.S. or foreign securities exchanges or included in a national market system are valued at the official closing price at the close of each business day. Over-the-counter securities and listed securities for which no price is readily available are valued at the current bid price considered best to represent the value at that time. Security prices are based on quotes that are obtained from an independent pricing service approved by the Board of Trustees. The pricing service, in determining values of fixed-income securities, takes into consideration such factors as current quotations by broker/dealers, coupon, maturity, quality, type of issue, trading characteristics, and other yield and risk factors it deems relevant in determining valuations. Securities which cannot be valued by the approved pricing service are valued using valuations obtained from dealers that make markets in the securities. Exchange listed options and futures contracts are valued at the last quoted sales price. Short-term securities with maturities of 60 days or less are valued at amortized cost. Mutual funds are valued at their net asset value at the close of each business day.

All securities for which market values are not readily available or deemed unreliable are appraised at fair value as determined in good faith under the direction of the Board of Trustees.

(B) Federal Income Taxes -- No provision has been made for income taxes because the Fund’s policy is to qualify as regulated investment companies under the Internal Revenue Code and distribute substantially all taxable income on a timely basis. It is also the intention of the Fund to distribute an amount sufficient to avoid imposition of any federal excise tax. The Fund, accordingly, anticipates paying no federal taxes, and therefore, no federal tax provision is recorded. The Fund is treated as a separate taxable entity for federal income tax purposes. The Fund may utilize earnings and profits distributed to shareholders on the redemption of shares as part of the dividend paid deduction.

(C) Income and Expenses -- Estimated expenses are accrued daily. The Fund is charged for those expenses that are directly attributable to it. Expenses that are not directly attributable to the Fund are allocated among all appropriate Funds in proportion to their respective net assets, number of shareholder accounts or other reasonable basis. Net investment income, expenses which are not class-specific and realized and unrealized gains and losses are allocated directly to each class based upon the relative net asset value of outstanding shares, or the value of dividend eligible shares, as appropriate for each class of shares.

Interest income is accrued daily and is determined on the basis of interest or discount earned on all debt securities, including accretion of market discount and original issue discount and amortization of premium. Dividend income is recorded on the ex-dividend date. For preferred stock payment-in-kind securities, income is recorded on the ex-dividend date in the amount of the value received.

14

Notes to Financial Statements

As of December 31, 2005

|

(D) Custody Earnings Credit -- The Fund has a deposit arrangement with the custodian whereby interest earned on uninvested cash balances is used to pay a portion of custodian fees. This deposit arrangement is an alternative to overnight investments.

(E) Distributions to Shareholders -- Net investment income is distributed to each shareholder as a dividend. Dividends from the Fund are declared and distributed quarterly. It is possible that such dividends may be reclassified as return of capital or capital gains after year end. Such determination can not be made until tax information is received from the real estate investments of the Fund. Net realized gains from securities transactions, if any, are distributed at least annually.

(F) Options -- The Fund may buy put and call options and write covered put and call options. The Fund may use such derivative instruments as hedges to facilitate buying or selling securities or to provide protection against adverse movements in security prices or interest rates. Option contracts are valued daily and unrealized appreciation or depreciation is recorded. The Fund will realize a gain or loss upon expiration or closing of the option transaction. When an option is exercised, the proceeds upon sale for a written call option or the cost of a security for purchased put and call options is adjusted by the amount of premium received or paid. During the period ended December 31, 2005, the Fund did not participate in this type of investment.

(G) Financial Futures Contracts -- The Fund may use futures contracts to manage the exposure to interest rate and market fluctuations. Gains or losses on futures contracts can offset changes in the yield of securities. When a futures contract is opened, cash or other investments equal to the required “initial margin deposit” are pledged to the broker. Additional securities held by the Fund may be earmarked as collateral for open futures contracts. The futures contract’s daily change in value (“variation margin”) is either paid to or received from the broker, and is recorded as an unrealized gain or loss. When the contract is closed, realized gain or loss is recorded equal to the difference between the value of the contract when opened and the value of the contract when closed. During the period ended December 31, 2005, the Fund did not participate in this type of investment.

(H) Securities Lending -- The Trust has entered into Securities Lending Agreement (the “Agreement”) with State Street Bank and Trust Company (“State Street Bank”). The Agreement authorizes State Street Bank to lend securities to authorized borrowers on behalf of the Funds. Pursuant to the Agreement, all loaned securities are collateralized by cash equal to at least 102% of the value of the loaned securities. All cash collateral received is invested in Thrivent Financial Securities Lending Trust. Amounts earned on investments in Thrivent Financial Securities Lending Trust, net of rebates and other securities lending expenses, are included in Income from Securities Loaned on the Statement of Operations. As payment for its services, State Street Bank receives a portion of the fee income and earnings on the collateral. By investing any cash collateral it receives in these transactions, the Fund could realize additional gains or losses. If the borrower fails to return the securities and the invested collateral has declined in value, the Fund could lose money. The Agreement grants and transfers to State Street Bank a lien upon collateralized assets in the possession of State Street Bank. As of December 31, 2005, $1,785,836 of securities were on loan.

(I) When-Issued and Delayed Delivery Transactions --

The Fund may purchase or sell securities on a when-issued or delayed-delivery basis. These transactions involve a commitment by the Fund to purchase or sell securities for a predetermined price or yield, with payment and delivery taking place beyond the customary settlement period. When delayed delivery purchases are outstanding, the Fund will designate liquid assets in an amount sufficient to meet the purchase price. When purchasing a security on a delayed delivery basis, the Fund assumes the rights and risks of ownership of the security, including the risk of price and yield fluctuations, and takes such fluctuations into account when determining its net asset value. The Fund may dispose of a delayed delivery transaction after it is entered into, and may sell when-issued securities before they are delivered, which may result in a capital gain or loss. When the Fund has sold a security on a delayed delivery basis, the Fund does not participate in future gains and losses with respect to the security.

(J) Credit Risk -- The Fund may be susceptible to credit risk to the extent an issuer defaults on its payment obligation. The Fund’s policy is to monitor the creditworthiness of issuers. Interest receivables on defaulted securities are monitored for ability to collect payments in default and are adjusted accordingly.

15

Notes to Financial Statements

As of December 31, 2005

|

(K) Accounting Estimates -- The preparation of finan-cial statements in conformity with accounting principles generally accepted in the United States of America require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the finan-cial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from these estimates.

(L) Other -- For financial statement purposes, investment security transactions are accounted for on the trade date. Realized gains or losses on sales are determined on a specific cost identification basis, which is the same basis used for federal income tax purposes.

(3) FEES AND COMPENSATION PAID TO AFFILIATES

(A) Investment Advisory Fees -- The Trust has entered into an Investment Advisory Agreement with Thrivent Investment Management Inc. (Thrivent Investment Mgt.), (“the Adviser”). Thrivent Investment Mgt. is a wholly owned subsidiary of Thrivent Financial for Lutherans (Thrivent Financial). Under the Investment Advisory Agreement, the Fund pays a fee for investment advisory services. The fee is accrued daily and paid monthly. The annual rate of fees under the Investment Advisory Agreement was 0.80% of the average daily net assets of the Fund. Effective January 1, 2006, the Adviser changed from Thrivent Investment Mgt. to Thrivent Asset Management, LLC.

The Adviser has contractually agreed, through at least June 30, 2006, to reimburse expenses by 0.80% of the average daily net assets of the Fund. Additionally, the Adviser has agreed to voluntarily reimburse expenses by 0.50% of the average daily net assets of the Fund. This voluntary expense reimbursement may be discontinued at any time.

The Fund may invest cash in Thrivent Money Market Fund, subject to certain limitations. These related-party transactions are subject to the same terms as non-related party transactions except that, to avoid duplicate investment advisory fees, Thrivent Investment Mgt. reimburses an amount equal to the smaller of the amount of the advisory fee for the Fund or the amount of the advisory fee, which is charged to the Fund for its investment in the Thrivent Money Market Fund.

(B) Distribution Plan -- Thrivent Investment Mgt. is also the Trust’s distributor. The Trust has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Investment Company Act of 1940. Class A shares have a Rule 12b-1 fee of 0.25% of average net assets.

(C) Sales Charges and Other Fees -- For the period ended December 31, 2005, Thrivent Investment Mgt. received aggregate fees for underwriting concessions of $32,959 from the Fund.

The Trust has entered into an accounting services agreement with Thrivent Financial pursuant to which Thrivent Financial provides certain accounting personnel and services. For the period ended December 31, 2005, Thrivent Financial received aggregate fees for accounting personnel and services of $9,000 from the Fund.

The Trust has entered into an agreement with Thrivent Investment Mgt. to provide certain administrative personnel and services to the Fund. For the period ended December 31, 2005, Thrivent Investment Mgt. received aggregate fees for administrative services of $1,489 from the Fund.

The Trust has entered into an agreement with Thrivent Financial Investor Services Inc. (Thrivent Investor Services) to provide the Fund with transfer agent services. For the period ended December 31, 2005, Thrivent Investor Services received aggregate fees for transfer agent services of $5,608 from the Fund.

Each Trustee is eligible to participate in a deferred compensation plan with respect to these fees. Participants in the plan may designate their deferred Trustee’s fees as if invested in any one of the Funds. The value of each Trustee’s deferred compensation account will increase or decrease as if it were invested in shares of the selected Funds. The deferred fees remain in the Fund until distribution in accordance with the plan. The deferred fee liability is an unsecured liability.

Those Trustees not participating in the above plan received $605 in fees from the Trust for the period ended December 31, 2005. No remuneration has been paid by the Trust to any of the Officers or affiliated Trustees of the Trust. In addition, the Trust reimbursed unaffiliated Trustees for reasonable expenses incurred in relation to attendance at the meetings.

Certain Officers and non-independent Trustees of the Fund are officers and directors of Thrivent Investment Mgt. and Thrivent Investor Services; however, they receive no compensation from the Fund.

16

Notes to Financial Statements

As of December 31, 2005

(4) TAX INFORMATION

Distributions are based on amounts calculated in accordance with the applicable federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America. To the extent that these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassifications.

On the Statement of Assets and Liabilities, as a result of permanent book-to-tax differences, reclassification adjustments were made to increase Accumulated Net Investment Income/(Loss) by $15,288, and to decrease Trust Capital by $15,288.

During the short year ended December 31, 2005, the Fund distributed $236,840 of Ordinary Income, $88,253 of Long-Term Capital Gain and $28,084 of Return of Capital.

At December 31, 2005, the cost for federal income tax purposes, unrealized appreciation on investments, unrealized depreciation on investments, and net unrealized appreciation were $26,967,454, $919,857, ($284,670), and $635,187, respectively.

(5) DISTRIBUTIONS BY CLASS

Distributions to shareholders, by class, for the period ended December 31, 2005, were $94,915 and $129,484 from net investment income, $40,464 and $60,230 from net realized gains and $12,575 and $15,509 from return of capital for Class A and Institutional Class, respectively.

(6) SECURITY TRANSACTIONS

(A) Purchases and Sales of Investment Securities -- During the period ended December 31, 2005, there were $25,878,230 in purchases and $2,270,269 sales in other than short-term securities. All purchases were in non U.S. Government obligations.

(B) Investments in High-Yielding Securities -- The Fund may invest in high-yielding securities. These securities will typically be in the lower rating categories or will be non-rated and generally will involve more risk than securities in the higher rating categories. Lower rated or unrated securities are more likely to react to developments affecting market risk and credit risk than are more highly rated securities, which react primarily to movements in the general level of interest rates.

(C) Investments in Options and Futures Contracts -- The movement in the price of the security underlying an option or futures contract may not correlate perfectly with the movement in the prices of the portfolio securities being hedged. A lack of correlation could render the Fund’s hedging strategy unsuccessful and could result in a loss to the Fund. In the event that a liquid secondary market would not exist, the Fund could be prevented from entering into a closing transaction, which could result in additional losses to the Fund.

(7) INVESTMENTS IN AFFILIATES

Affiliated issuers, as defined under the Investment Company Act of 1940, include those in which the Fund’s holdings of an issuer represent 5% or more of the outstanding voting securities of an issuer, or any affiliated mutual fund. A summary of transactions for the year ended December 31, 2005, in the Thrivent Money Market Fund and Thrivent Securities Lending Trust, are as follows:

| | Gross | Gross | Balance of | | Dividend Income |

| | Purchases and | Sales and | Shares Held | Value | June 30, 2005 – |

| Portfolio | Additions | Reductions | December 31, 2005 | December 31, 2005 | December 31 2005 |

|

| Thrivent Money Market | $4,637,006 | $4,630,065 | 6,941 | $6,941 | $3,507 |

| Thrivent Securities Lending Trust | 4,539,250 | 2,702,847 | 1,836,403 | 1,836,403 | N/A |

17

Notes to Financial Statements

As of December 31, 2005

|

(8) RELATED PARTY TRANSACTIONS

As of December 31, 2005, a related party held 503,448, or 21.1%, of the Fund’s outstanding shares. The related party increased its ownership to 1,113,994, or 44.0%, of the Fund’s outstanding shares on January 19, 2006.

(9) SHARES OF BENEFICIAL INTEREST

The Declaration of Trust permits the Trust to issue an unlimited number of full and fractional shares of beneficial interest of the Fund. During the period, transactions in Fund shares were as follows:

| | Class A | Institutional Class |

| | ------------------------------------------------------------------------------------------- | ------------------------------------------------------------------------------------------- |

| Period Ended December 31, 20051 | Shares | Amount | Shares | Amount |

| --------------------------------------------------------- | ---------------- | ---------------- | ---------------- | ---------------- |

| Sold | 1,061,731 | $10,774,484 | 1,439,461 | $14,698,842 |

| Dividends and distributions reinvested | 14,279 | 147,802 | 19,717 | 204,666 |

| Redeemed | (120,073) | (1,242,007) | (25,801) | (276,065) |

| | ---------------- | ---------------- | ---------------- | ---------------- |

| Net change | 955,937 | $ 9,680,279 | 1,433,377 | $14,627,443 |

| | =========== | =========== | =========== | =========== |

1Fund’s inception was June 30, 2005

18

This page intentionally left blank.

19

Thrivent Mutual Funds

Financial Highlights

|

| | F O R A S H A R E O U T S T A N D I N G T H R O U G H O U T E A C H P E R I O D(a) |

| -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| |

| | | | | | | Less Distributions | |

| | | Income from Investment Operations | | from | |

| | ---------------------------------------------------------------------------------------------------------- | -------------------------------------------------------------------------- |

| | Net Asset | | Net Realized | | | Net | |

| | Value, | Net | and Unrealized | Total from | Net | Realized | Net |

| | Beginning Investment | Gain (Loss) on | Investment | Investment | Gain on | Return of |

| | of Period | Income | Investments(b) | Operations | Income | Investments | Capital |

| ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| REAL ESTATE SECURITIES FUND | | | | | | |

| Class A Shares | | | | | | | |

| Period Ended 12/31/2005(e) | $10.00 | $0.11 | $0.48 | $0.59 | $(0.11) | $(0.04) | (0.02) |

| Class I Shares | | | | | | | |

| Period Ended 12/31/2005(e) | $10.00 | 0.12 | 0.49 | 0.61 | (0.13) | (0.04) | (0.02) |

(a) All per share amounts have been rounded to the nearest cent.

(b) The amount shown may not correlate with the change in aggregate gains and losses of portfolio securities due to the timing of sales and redemptions of fund shares.

(c) Total investment return assumes dividend reinvestment and does not reflect any deduction for sales charges. Not annualized for periods less than one year.

The accompanying notes to the financial statements are an integral part of this schedule.

20

Thrivent Mutual Funds

Financial Highlights -- continued

|

| | | | | R A T I O S / S U P P L E M E N T A L D A T A | | |

| ------------------------------------------------ | ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| | | | | | | Ratios to Average | |

| | | | | | | Net Assets Before Expenses | |

| | | | | Ratios to Average Net | Waived, Credited or Paid | |

| | | | | Assets(d) | Indirectly(d) | |

| | Net Asset | | | --------------------------------------------------------------- | -------------------------------------------------------------------------------- |

| | Value, | | Net Assets | | Net | | Net | Portfolio |

| Total | End of | Total | End of Period | | Investment | | Investment | Turnover |

| Distributions | Period | Return(c) | (in millions) | Expenses | Income (Loss) | Expenses | Income (Loss) | Rate |

| ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| |

| $(0.17) | $10.42 | 5.90% | $10.0 | 1.06% | 2.30% | 2.30% | 1.07% | 16% |

| |

| |

| (0.19) | 10.42 | 6.11% | $14.9 | 0.31% | 3.34% | 1.61% | 2.04% | 16% |

(d) Computed on an annualized basis for periods less than one year.

(e) Since fund inception, June 30, 2005.

The accompanying notes to the financial statements are an integral part of this schedule.

21

Additional Information

(unaudited)

Proxy Voting

The policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities are attached to the Trust’s Statement of Additional Information. You may request a free copy of the Statement of Additional Information or the report of how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 by calling 1-800-847-4836. You also may review the Statement of Additional Information or the report of how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 at the Thrivent Financial web site (www.thrivent.com) or the SEC web site (www.sec.gov).

Quarterly Schedule of Portfolio Holdings

The Trust files its Schedule of Portfolio Holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. You may request a free copy of the Trust’s Forms N-Q by calling 1-800-847-4836. The Trust’s Forms N-Q also are available on the Thrivent Financial web site (www.thrivent.com) or the SEC web site (www.sec.gov). You also may review and copy the Forms N-Q for the Trust at the SEC’s Public Reference Room in Washington, DC. You may get information about the operation of the Public Reference Room by calling 1-202-551-8090.

Shareholder Notification of Federal Tax Information

The following information is provided solely to satisfy the requirements set forth by the Internal Revenue Code. Shareholders will be provided information regarding their distributions in February 2006.

The Fund designates 6% of dividends declared from net investment income as dividends qualifying for the 70% dividends received deduction for corporations, and 6% as qual-ified dividend income for individuals under the Jobs and Growth Tax Relief Reconciliation Act of 2003 for the tax period ending December 31, 2005.

The Fund designates the $88,253 as distributions of long-term capital gains. This amount may include earnings and profits distributed to shareholders on the redemption of shares as part of the dividend paid deduction.

22

Board of Trustees and Officers

The following table provides information about the Trustees and Officers of the Trust. Each Trustee oversees each of 30 series of the Trust and also serves as:

* Director of Thrivent Series Fund, Inc., a registered investment company consisting of 31 Portfolios that serve as underlying funds for variable contracts issued by Thrivent Financial for Lutherans (“Thrivent Financial”) and Thrivent Life Insurance Company (“TLIC”) and investment options in the retirement plan offered by Thrivent Financial

* Trustee of Thrivent Financial Securities Lending Trust, a registered investment company consisting of one Portfolio that serves as a cash collateral fund for a securities lending program sponsored by Thrivent Financial.

The 30 series of the Trust, 31 Portfolios of Thrivent Series Fund, Inc., and Thrivent Financial Securities Lending Trust are referred to herein as the “Fund Complex.” The Statement of Additional Information includes additional information about the Trustees and is available, without charge, by calling 1-800-847-4836.

| Interested Trustee1 | | | | |

| | | Number of | | |

| | | Series and/or | | |

| | Position | Portfolios in | Principal | |

| | with Trust | Fund Complex | Occupation | Other |

| Name, Address, | and Length | Overseen | During the | Directorships |

| and Age | of Service2 | by Trustee | Past 5 Years | Held by Trustee |

|

| Pamela J. Moret | President since 2002 | 62 | Executive Vice President, | Director, Lutheran World |

| 625 Fourth Avenue South | and Trustee since 2004 | Marketing and Products, | Relief; Director, Minnesota |

| Minneapolis, MN | | | Thrivent Financial since | Public Radio |

| Age 50 | | | 2002; Senior Vice | |

| | | | President, Products, | |

| | | | American Express | |

| | | | Financial Advisors from | |

| | | | 2000 to 2001; Vice | |

| | | | President, Variable Assets, | |

| | | | American Express | |

| | | | Financial Advisors | |

| | | | from 1996 to 2000 | |

23

| Board of Trustees and Officers | |

| |

| |

| Independent Trustees3 | | | | |

| | | Number of | | |

| | | Series and/or | | |

| | Position | Portfolios in | Principal | |

| | with Trust | Fund Complex | Occupation | Other |

| Name, Address, | and Length | Overseen | During the | Directorships |

| and Age | of Service2 | by Trustee | Past 5 Years | Held by Trustee |

|

| F. Gregory Campbell | Trustee since 1992 | 62 | President, Carthage | Director, National |

| 625 Fourth Avenue South | | | College | Association of Independent |

| Minneapolis, MN | | | | Colleges and Universities; |

| Age 66 | | | | Director, Johnson Family |

| | | | | Funds, Inc., an investment |

| | | | | company consisting of four |

| | | | | portfolios; Director, |

| | | | | Kenosha Hospital and |

| | | | | Medical Center Board; |

| | | | | Director, Prairie School |

| | | | | Board; Director, United |

| | | | | Health Systems Board |

| |

| Herbert F. Eggerding, Jr. | Lead Trustee | 62 | Management consultant | None |

| 625 Fourth Avenue South | since 2003 | | to several privately | |

| Minneapolis, MN | | | owned companies | |

| Age 68 | | | | |

| |

| Noel K. Estenson | Trustee since 2004 | 62 | Retired; previously | None |

| 625 Fourth Avenue South | | | President and Chief | |

| Minneapolis, MN | | | Executive Officer, Cenex | |

| Age 67 | | | Harvest State (farm supply | |

| | | | and marketing and | |

| | | | food business) | |

| |

| Richard L. Gady | Trustee since 1987 | 62 | Retired; previously Vice | Director, International |

| 625 Fourth Avenue South | | | President, Public | Agricultural Marketing |

| Minneapolis, MN | | | Affairs and Chief | Association |

| Age 62 | | | Economist, Conagra, | |

| | | | Inc. (agribusiness) | |

| |

| Richard A. Hauser | Trustee since 2004 | 62 | President, National Legal | Director, The Washington |

| 625 Fourth Avenue South | | | Center for the Public | Hospital Center |

| Minneapolis, MN | | | Interest, since 2004; | |

| Age 62 | | | General Counsel, U.S. | |

| | | | Department of Housing | |

| | | | and Urban Development, | |

| | | | 2001 to 2004; Partner, | |

| | | | Baker & Hosteller, | |

| | | | 1986 to 2001 | |

| |

| Connie M. Levi | Trustee since 2004 | 62 | Retired | Director, Norstan, Inc. |

| 625 Fourth Avenue South | | | | |

| Minneapolis, MN | | | | |

| Age 66 | | | | |

|

| 24 | | | | |

| Board of Trustees and Officers | |

| |

| |

| Independent Trustees3 -- continued | | | | | |

| | | | | Number of | | |

| | | | | Series and/or | | |

| | | Position | | Portfolios in | Principal | |

| | | with Trust | | Fund Complex | | Occupation | Other |

| Name, Address, | and Length | | Overseen | During the | Directorships |

| and Age | of Service2 | | by Trustee | Past 5 Years | Held by Trustee |

|

| Edward W. Smeds | Chairman and Trustee | 62 | | Retired | Chairman of Carthage |

| 625 | Fourth Avenue South | since 1999 | | | | | College Board |

| Minneapolis, MN | | | | | | |

| Age | 70 | | | | | | |

| |

| Executive Officers | | | | | | |

| | | Position with Trust | | | |

| Name, Address, | and Length | | | | |

| and Age | of Service2 | | Principal Occupation During the Past 5 Years |

|

| Pamela J. Moret | President since 2002 | | Executive Vice President, Marketing and Products, Thrivent |

| 625 | Fourth Avenue South | | | | Financial since 2002; Senior Vice President, Products, |

| Minneapolis, MN | | | | American Express Financial Advisors from 2000 to 2001; Vice |

| Age | 50 | | | | President, Variable Assets, American Express Financial Advisors |

| | | | | | from 1996 to 2000 | |

| |

| James M. Odland | Secretary and Chief Legal | Vice President, Office of the General Counsel, Thrivent |

| 625 | Fourth Avenue South | Officer since 2005 | | Financial for Lutherans since 2005; Senior Securities Counsel, |

| Minneapolis, MN | | | | Allianz Life Insurance Company from January 2005 to |

| Age | 50 | | | | August 2005; Vice President and Chief Legal Officer, |

| | | | | | Woodbury Financial Services, Inc., from September 2003 to |

| | | | | | January 2005; Vice President and Group Counsel, Corporate |

| | | | | | Practice Group, American Express Financial Advisors, Inc., |

| | | | | | from 2001 to 2003 | |

| |

| Katie S. Kloster | Vice President and Chief | Vice President and Rule 38a-1 Chief Compliance Officer, |

| 625 | Fourth Avenue South | Compliance Officer | | since 2004; previously Vice President and Comptroller of |

| Minneapolis, MN | since 2004 | | | Thrivent Financial | |

| Age | 41 | | | | | | |

| |

| Gerard V. Vaillancourt | Treasurer and Principal | Head of Mutual Fund Accounting, Thrivent Financial since |

| 625 | Fourth Avenue South | Financial Officer | | 2005; Director, Fund Accounting Administration, Thrivent |

| Minneapolis, MN | since 2005 | | | Financial from 2002 to 2005; Manager, Portfolio Compliance, |

| Age | 38 | | | | Lutheran Brotherhood from 2001 to 2002; Manager, Fund |

| | | | | | Accounting, Minnesota Life from 2000 to 2001 |

| |

| Russell W. Swansen | Vice President since 2004 | Senior Vice President and Chief Investment Officer, Thrivent |

| 625 | Fourth Avenue South | | | | Financial since 2004; Managing Director, Colonade Advisors, |

| Minneapolis, MN | | | | LLC, from 2001 to 2003; President and Chief Investment |

| Age | 48 | | | | Officer of PPM America from 1999 to 2000 |

25

| Board of Trustees and Officers |

| |

| |