UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-5075

Thrivent Mutual Funds

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

David S. Royal, Secretary

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

Registrant's telephone number, including area code: (612) 340-4249

Date of fiscal year end: December 31

Date of reporting period: December 31, 2006

Item 1. Report to Stockholders

Table of Contents

| President’s Letter | 1 |

| Economic and Market Overview | 2 |

| Portfolio Perspective | |

| Thrivent Real Estate Securities Fund | 4 |

| Thrivent Diversified Income Plus Fund | 6 |

| Shareholder Expense Example | 8 |

| Report of Independent Registered Public | |

| Accounting Firm | 10 |

| Schedules of Investments | |

| Thrivent Real Estate Securities Fund | 11 |

| Thrivent Diversified Income Plus Fund | 13 |

| Statement of Assets and Liabilities | 23 |

| Statement of Operations | 24 |

| Statement of Changes in Net Assets | 25 |

| Notes to Financial Statements | 26 |

| Financial Highlights | 36 |

| Additional Information | 38 |

| Trustees and Officers of | |

| Thrivent Mutual Funds | 41 |

Dear Shareholder:

We are pleased to provide you with the annual report for the period ended Dec. 31, 2006, for the Thrivent Real Estate Securities and Thrivent Diversified Income Plus Funds. In this report, you will find detailed information about both Funds, including performance highlights, overall market conditions and management strategies during the one-year period. In addition, Thrivent Financial’s chief investment officer, Russ Swansen, reviews the larger economic environment in his Economic and Market Overview.

Market Drama Calls for Calm

The past year’s market dynamics were fascinating to watch unfold. Like a dramatic play with multiple acts, the markets started the “first act” of 2006 very strong spurred on by healthy economic numbers and strong corporate profits. By the second quarter, rising interest rates around the globe and the potential for slower economic growth had market participants running for cover with negative returns for both the broad stock and bond markets as a result. As in most dramas, there is always a temptation to allow emotion to cloud sound long-term investment programs. This proved too much for some investors who left the stock market for temporary “safer havens” despite often having a well thought out, long-term strategy.

As so often is the case, this kind of market timing was detrimental to these investors’ fund performance. The 2006 market “drama” had a final act built off Federal Reserve monetary policy that led to a halt in short-term interest rate hikes, lower oil prices and continued strong corporate earnings. Broad stock market indexes such as the S&P 500 rose dramatically from below-water returns in June to record very strong performance from August through the end of 2006, surprising many investment management professionals and causing many “market timers” to miss this substantial portfolio growth opportunity.

Lessons Learned

The financial markets refuse to follow a script. Professionals admit that market timing, or knowing when to exit and enter the stock market, is a difficult, if not impossible pursuit. 2006 left many of these pros (as well as market timing investors) who called for a second half bear market scratching their heads. Why do so many individual investors, even seasoned experts, succumb to the temptation? The great majority of investors are much better off setting a long-term strategy with a financial representative and sticking to it regardless of near-term market conditions.

The Thrivent Asset Allocation Funds may be an ideal way to take the emotion and complexity out of investing. Well-balanced with a variety of different asset classes, these simple, smart solutions are designed to meet your financial goals without a lot of head scratching and second guessing.

By the way, congratulations if you stuck to your plan — 2006 was a good year for disciplined investors!

Our Commitment to You

We remain committed to providing our shareholders with the guidance and solutions they need to prepare for retirement and achieve their goals. Thank you for continuing to turn to us for your financial solutions. We very much value you and your business.

Pamela J. Moret

Trustee and President

Thrivent Mutual Funds

1

Most major stock indices posted double-digit returns during the one-year period ended Dec. 31, 2006, as a cooling economy and falling commodities prices brightened investors’ outlook for inflation and interest rates. Although bond returns were pressured by further Federal Reserve (Fed) interest rate hikes early in the period, most types of bonds provided positive returns due to an easing of inflation worries and a pause in Fed tightening later in the period.

U.S. Economy

The nation’s gross domestic product moderated from a 5.6% annual growth rate in the first quarter to 2.6% and 2.0% in the second and third quarter and 3.5% in the fourth quarter. One of the most visible signs of the slowdown was a sharp pullback in the housing market, though sales of existing and new homes improved slightly late in the period.

The high cost of oil and other commodities was an intermittent concern for investors, weighing on stock prices particularly during mid-summer. However, an easing in energy prices late in the year shifted inflation sentiment dramatically and provided a strong boost to stock and bond markets.

Although economic growth slowed during the period, the labor market continued to add jobs. The unemployment rate sank to a five-year low of 4.4% in October and ended the year at 4.5% — a rate considered “full employment” by many economists.

Inflation & Monetary Policy

Overall inflation declined during the period, largely due to a pullback in energy prices. The Consumer Price Index (CPI) rose at a rate of 2.5% for the 12 months ended Dec. 31, 2006, compared with an increase of 3.4% for all of 2005. However, “core” inflation — excluding the more volatile prices of food and energy - rose 2.6% for the year ended Dec. 31, compared with a 2.2% core rate for all of 2005. The index for energy, which rose 17.1% in 2005, increased 2.9% during the 12-month period ended Dec. 31, 2006.

Noting that inflation was still a concern, the Federal Reserve’s Federal Reserve Open Market Committee (FOMC) continued raising its target for the federal funds rate through June 29, bringing the rate to 5.25% . But in the face of a slowing economy and an accelerating pullback in housing, policymakers left rates steady for the remainder of the year. The Fed continued to indicate its wariness of inflation, however, a possible sign that it may not begin cutting rates any time soon.

Equity Performance

Stocks gained in the first quarter as investors cheered strong economic and corporate profit growth and declining energy prices. But a broad pullback occurred in the second quarter in response to renewed concerns about inflation, interest rates, expensive energy and a slumping housing market. Investors’ mood reversed yet again in July as worries about inflation and interest rates fell with the prices of commodities and dwindling prospects of further Fed rate hikes. Stocks climbed throughout the second half, with the Dow Jones Industrials setting several all-time highs and other equity indices setting multi-year highs.

Small-company stocks outperformed large-company issues during the period. The Russell 2000 Index of small-company stocks posted an 18.37% total return, while the S&P 500 Index of large-company stocks recorded a 15.78% return. Value stocks outperformed growth stocks. During the period, the Russell 1000 Value Index returned 22.22%, while the Russell 1000 Growth Index posted a return of 9.07% .

Sectors that performed best during the period included telecommunications services, energy, consumer discretionary, and utilities, while health care, information technology, industrials, and consumer staples advanced at a more moderate rate. Real estate investment trusts (REITs) performed well during the period, with the NAREIT Equity REIT Index posting a 35.05% return.

Foreign stocks generally continued to outperform most domestic issues. The Morgan Stanley Capital International Europe, Australasia, Far East (EAFE) Index posted a 26.86% total return in dollar terms.

2

Fixed Income Performance

Bond returns were pressured by continued Federal Reserve interest rate hikes during much of the period. But in August — after 17 consecutive rate increases — policymakers moved to the sidelines. The pause brightened investors’ inflation and interest rate outlook dramatically, boosting the prices of most types of bonds.

During the year, yields on shorter-term securities rose more than yields on longer-term bonds. The result was an inverted yield curve (the differences among the yields of different maturities of similar credit quality) for much of the period, an atypical situation in which shorter-term bonds provided higher yields than longer-term bonds. The two-year Treasury yield increased from 4.40% to 4.81% during the period, the 10-year yield increased from 4.39% to 4.71%, and the 30-year Treasury yield rose from 4.54% to 4.81%.

Despite the headwind of rising rates during the first half of the year, most bond sectors provided positive returns. The Lehman Brothers Aggregate Bond Index of the broad U.S. bond market posted a 4.33% total return for the 12 months ended Dec. 31, 2006. Municipal bonds fared better in this environment, with the Lehman Brothers Municipal Bond Index posting a total return of 4.84% during the period. The Lehman Brothers Government/Corporate 1-3 Year Bond Index registered a 4.25% total return.

Below-investment-grade corporate bonds were stronger U.S. market performers during the period. The Lehman Brothers U.S. Corporate High Yield Bond Index registered an 11.84% total return.

Outlook

We think economic growth will remain slow over the next few months, with inflation continuing to ease from the higher levels of 2006. This will provide the “soft landing” sought by the Federal Reserve after more than two years of consecutive interest rate hikes.

Gross domestic product growth should continue at a 2% to 2.5% annual rate, keeping the economy out of recession that concerns some market watchers. Energy and commodities prices should continue to ease, and the housing pullback should moderate. Both of these factors will support consumer spending. Businesses, with plenty of cash on their balance sheets, are investing in productive assets.

Although we don’t expect more Fed interest rate increases in the near future, we don’t expect policymakers to ease rates any time soon either. The stock and bond markets have priced in expectations of lower rates in the first half of 2007, and, in the absence of an unexpected slowdown in the economy, we don’t agree.

The potential for the markets to be surprised by a lack of lower rates in early 2007 makes us cautious on more volatile segments of the stock and bond markets in the near term. Also, with the potential for further weakness in energy and commodities prices, and uncertainty in the housing market, there is a possibility that the economy could slow more than we expect or even enter a recession.

As always, your best strategy is to work with your Thrivent Investment Management registered representative to create an investment program based on your goals, diversify your portfolio and remain focused on the long term.

3

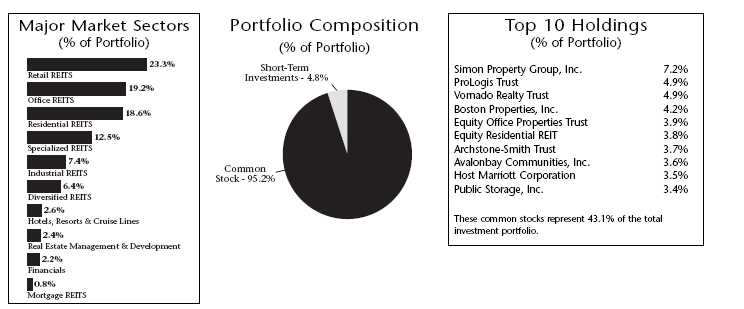

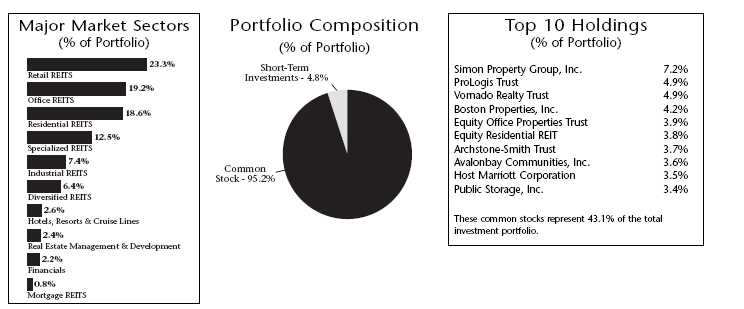

How did the Fund perform during the one-year period ended Dec. 31, 2006?

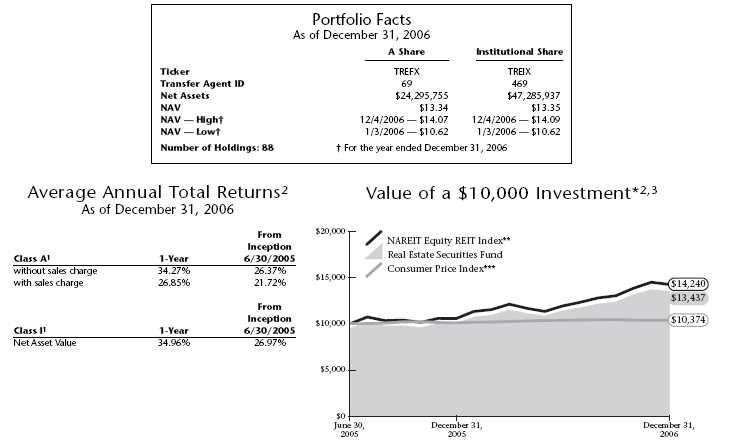

Thrivent Real Estate Securities Fund returned 34.27% during the one-year period ended Dec. 31, 2006. The Fund’s peer group, as represented by the Lipper Inc. Real Estate Category, reported a median return of 34.91% . The Fund’s market benchmark, the NAREIT Equity REIT Index, returned 35.06% . During this performance period, a modest cash position held in the Fund was the primary reason the Fund return was below that of the Index. Sector allocation and security selection decisions both contributed positively to performance results, as summarized below.

What factors impacted performance?

REIT stocks performed exceptionally well over the last 12 months due to strong rental demand for commercial and multifamily residential properties, and limited new supply. In addition, continued investment demand for real estate from both institutional and individual investors helped REIT stocks continue their strong performance record.

Thrivent Real Estate Securities Fund maintained exposure in each of the primary property types (office, industrial, apartments, and retail shopping centers) during the period. The office and apartment sectors were the best performing sectors of the primary property types within the REIT market over the past year. We concentrated our office exposure in REITs that own properties in high barrier to entry markets, specifically New York City, Washington D.C., and California. These markets currently enjoy low vacancy rates and strong rental demand, allowing property owners to increase rental rates for both new leases and renewals. In addition, we anticipated favorable trends in occupancy and rental rates in the apartment market, and steadily increased our allocation to this property type during the year.

Security selection within the office, apartment and retail shopping center sectors contributed positively to performance. Stocks that performed exceptionally within the Fund included Equity Office Properties, Class A office property owner in major U.S. cities, SL Green Realty Corp, a New York City-focused office REIT, AvalonBay Communities Inc, a luxury apartment developer and manager in coastal markets, and Simon Property Group, the largest owner of regional malls in the United States.

What is your outlook?

We anticipate slower economic growth in 2007 as a result of the declining demand for new single family homes, and weakening housing prices in many of the previously

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

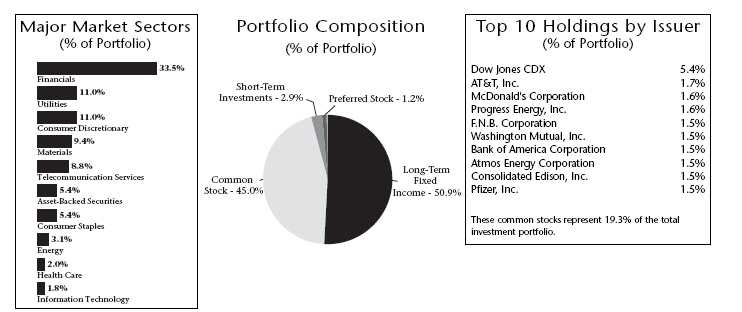

Quoted Major Market Sectors, Portfolio Composition and Top 10 Holdings are subject to change.

Major Market Sectors and Top 10 Holdings exclude short-term investments and collateral held for securities loaned.

4

booming housing markets. This housing slowdown is likely to have a direct impact on related industries including household goods and building products. Consumer spending in general may also be affected as a result of homeowners feeling less wealthy due to the deterioration in price appreciation trends for single family homes. However, we do not believe that weakness in the housing sector will be enough to trigger a recession in 2007.

Demand for commercial real estate and multifamily residential properties should continue to be steady as long as job growth remains positive in 2007. We continue to overweight REITs that operate in high barrier to entry markets (primarily the coastal areas), although we do maintain a geographically diverse portfolio with exposure across the entire United States. We believe that favorable trends will continue for office REITs with property exposure in New York City, Washington D.C. and California.

We also expect the U.S. apartment market to remain firm as a result of low vacancy rates and housing affordability issues in many parts of the country. While the shopping center sector may be perceived less favorably if consumer spending weakens, we believe that “Class A” malls-those malls in prime locations that generate the highest sales per square foot-will continue to be in strong demand.

1 Class A performance has been restated to reflect the maximum sales charge of 5.5% . Institutional Class shares have no sales load and are for institutional shareholders only.

2 Past performance is not an indication of future results. Annualized total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Periods of less than one year are not annualized. Investing in a mutual fund involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. The Fund primarily invests in real estate-related industries; as a consequence, the Fund may be subject to greater price volatility than a fund investing in a broad range of industries. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Please read your prospectus carefully.

3 Performance of other classes will be greater or less than the line shown based on the differences in fees paid by shareholders in the different classes.

* As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Consumer Price Index and NAREIT Equity REIT Index do not reflect any such charges. If you were to purchase any of the above individual stocks or funds represented in these Indexes, any charges you would pay would reduce your total return as well.

** The NAREIT Equity REIT Index is an unmanaged capitalization-weighted index of all equity real estate investment trusts. It is not possible to invest directly in this Index. The performance of this Index does not reflect deductions for fees, expanses or taxes.

*** The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index.

5

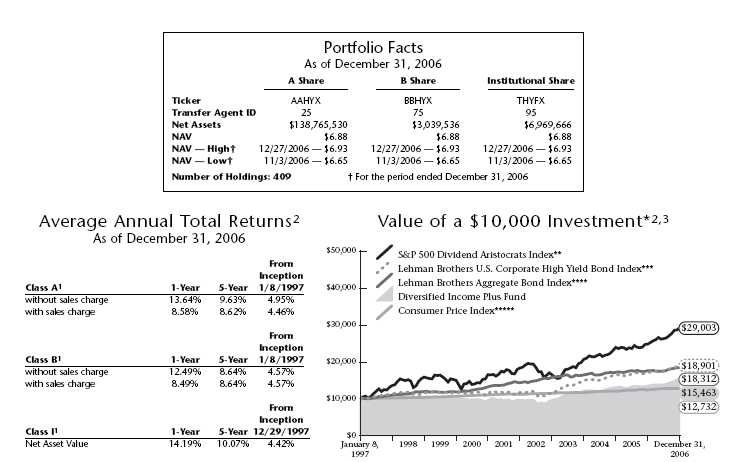

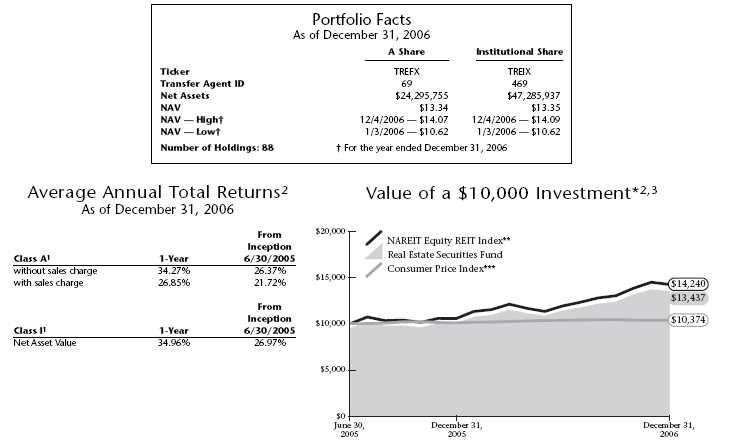

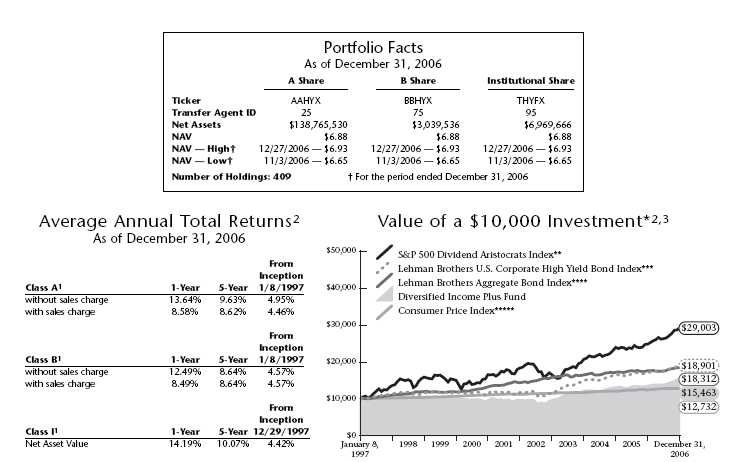

Thrivent Diversified Income Plus Fund (formerly known as High Yield Fund II) recently changed its fiscal year end from October 31 to December 31. Shareholders recently received a report on the year ended Oct. 31, 2006. The following commentary and returns reflect the period from Oct. 31 through Dec. 31, 2006.

Prior to June 30, 2006, the Fund was named Thrivent High Yield Fund II and invested primarily (i.e., at least 80% of its net assets) in high-risk, high-yield bonds commonly referred to as “junk bonds.*” On June 30, 2006, the Fund adopted its current name and its current strategy, which includes the ability to invest in a more diversified portfolio of income-producing securities, such as dividend-producing equities, REIT stocks and other income-producing securities.

How did the Fund perform during the two-month period ended Dec. 31, 2006?

Thrivent Diversified Income Plus Fund returned 3.50% during the two-month period ended Dec. 31, 2006. This compares with the Fund’s primary benchmarks, including the S&P 500 Dividend Aristocrats Index, which returned 1.83%; the Lehman Brothers Aggregate Bond Index, which returned 0.57%; and the Lehman Brothers U.S. Corporate High Yield Bond Index, which returned 2.80% for the same two-month time frame.

What factors affected the Fund’s performance?

In the equity portion, both a large relative allocation to real estate investment trusts (REITs) and stock selection within that sector contributed to returns. This proved to be the best-performing element in the equity component for the period. REITs continued their surprisingly strong run due to robust demand from investors who value the favorable dividend yield the sector typically provides.

Next, the equity component’s focus on traditionally high-dividend-paying stocks issued by companies in the utilities and financial services sectors significantly supported performance.

The fixed-income component, which comprised primarily high-yield bonds, delivered strong performance due to good security selection and an allocation to hybrid securities, a new sector of the fixed-income market that is similar in structure to preferred stock.

Based on our belief that energy credits generally had peaked in value, we sold many of our energy bonds, enabling us to reap solid gains for the Fund. Investments in the cable industry also helped performance.

Our underweighting in the lowest-rated high-yield credits —CCC-rated and distressed/defaulted credits — detracted from performance.

*High-yield bonds carry greater volatility and risk than investment-grade bonds.

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

Quoted Major Market Sectors, Portfolio Composition and Top 10 Holdings by Issuer are subject to change.

Major Market Sectors and Top 10 Holdings by Issuer exclude short-term investments and collateral held for securities loaned.

6

What is your outlook?

Our outlook for the Fund is positive, particularly given its strong start and favorable performance versus its peer group median. In general, we believe that higher-dividend-paying securities will remain in favor among investors, particularly as interest rates stabilize. On the fixed-income side, our outlook for high-yield bonds is somewhat cautious, given our expectations for only a mild slowdown in U.S. economy growth, as opposed to an outright recession, which we believe is unlikely given the strength of current economic fundamentals. Our active management of the Fund, coupled with the generally favorable macro conditions we anticipate, should bode well for the Fund given its highly diversified composition and pursuit of attractive, steady income.

1 Class A performance reflects the maximum sales charge of 4.5% . Class B performance reflects the maximum contingent deferred sales charge (CDSC) of 5%, declining 1% each year during the first five years and then converting to Class A shares after the fifth year. Institutional Class shares have no sales load and are for institutional shareholders only.

2 Past performance is not an indication of future results. Annualized total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. Investing in a mutual fund involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit www.thrivent.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder wou ld pay on distributions or redemptions. Please read your prospectus carefully.

3 Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes.

* As you compare performance, please note that the Fund’s performance reflects the maximum 4.5% sales charge, while the S&P 500 Dividend Aristocrats Index, the Lehman Brothers Aggregate Bond Index, the Lehman Brothers U.S. Corporate High Yield Bond Index and the Consumer Price Index do not reflect any such charges. If you were to purchase any of the above individual stocks or funds represented in these Indexes, any charges you would pay would reduce your total return as well.

** The S&P 500 Dividend Aristocrats Index is an index which measures the performance of large-capitalization companies within the S&P 500 that have followed a managed dividends policy of consistently increasing dividends every year for at least 25 years. The index portfolio has both capital growth and dividend income characteristics, is equal-weighted and is broadly diversified across sectors. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. The composition of the S&P 500 Dividend Aristocrats Index serves as a better reflection of the Fund’s current strategy than does the Lehman Brothers U.S. Corporate High Yield Bond Index.

*** The Lehman Brothers U.S. Corporate High Yield Bond Index is an index which measures the performance of fixed-rate non-investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes.

**** The Lehman Brothers Aggregate Bond Index is an index that measures the performance of U.S. investment grade bonds. It is not possible to invest directly in the Index. The performance of the Index does not reflect deductions for fees, expenses or taxes. The composition of the Lehman Brothers Aggregate Bond Index serves as a better reflection of the Fund’s current strategy than does the Lehman Brothers High Yield Bond Index.

***** The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index.

7

Shareholder Expense Example

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2006, through December 31, 2006, for Real Estate Securities Fund and from November 1, 2006, through December 31, 2006, for Diversified Income Plus Fund.

Actual Expenses

In the table below, the first section provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid. A small account fee of $12 is charged to Class A and Class B shareholder accounts if the value falls below stated account minimums. This fee is not included in the table below. If it were, the expenses you paid during the period would have been higher and the ending account value would have been lower.

Hypothetical Example for Comparison Purposes

In the table below, the second section provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. A small account fee of $12 is charged to Class A and Class B shareholder accounts if the value falls below stated account minimums. This fee is not included in the table below. If it were, the expenses you paid during the period would have been higher and the ending account value would have been lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | Ending | Expenses | |

| | Account | Account | Paid During | Annualized |

| | Value | Value | Period * | Expense |

| | 7/1/2006 | 12/31/2006 | 7/1/2006 — 12/31/2006 | Ratio |

|

| Thrivent Real Estate Securities Fund | | | |

| Actual | | | | |

| Class A | $1,000 | $1,184 | $1.74 | 0.32% |

| Institutional Class | $1,000 | $1,186 | ($0.46) | (0.08%) |

| Hypothetical ** | | | | |

| Class A | $1,000 | $1,024 | $1.61 | 0.32% |

| Institutional Class | $1,000 | $1,026 | ($0.43) | (0.08%) |

8

| | Beginning | Ending | Expenses | |

| | Account | Account | Paid During | Annualized |

| | Value | Value | Period *** | Expense |

| | 11/1/2006 | 12/31/2006 | 11/1/2006 — 12/31/2006 | Ratio |

|

| Thrivent Diversified Income Plus Fund | | | |

| Actual | | | | |

| Class A | $1,000 | $1,035 | $1.84 | 1.08% |

| Class B | $1,000 | $1,033 | $3.69 | 2.17% |

| Institutional Class | $1,000 | $1,036 | $1.12 | 0.66% |

| Hypothetical ** | | | | |

| Class A | $1,000 | $1,007 | $1.81 | 1.08% |

| Class B | $1,000 | $1,005 | $3.64 | 2.17% |

| Institutional Class | $1,000 | $1,007 | $1.11 | 0.66% |

* Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

** Assuming 5% total return before expenses

*** Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 61/365 to reflect the 2 month period.

9

Report of Independent Registered Public Accounting Firm

To the Shareholders and Trustees of

the Thrivent Mutual Funds:

In our opinion, the accompanying statements of assets and liabilities, including the schedules of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Thrivent Real Estate Securities Fund and the Thrivent Diversified Income Plus Fund (the “Funds”) at December 31, 2006, the results of each of their operations, changes in each of their net assets and their financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2006 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

February 16, 2007

10

| Real Estate Securities Fund |

| Schedule of Investments as of December 31, 2006 |

| | | | | |

| Shares | Common Stock (96.0%) | Value | Shares | Common Stock (96.0%) | Value |

|

| |

| Consumer Discretionary (2.6%) | | 5,000 | Forest City Enterprises * | $292,000 |

| 17,500 | Hilton Hotels Corporation | $610,750 | 36,800 | General Growth Properties, Inc. | 1,922,064 |

| 1 | InterContinental Hotels Group plc | 13 | 10,000 | Health Care Property | |

| 20,000 | Starwood Hotels & Resorts | | | Investors, Inc. | 368,200 |

| | Worldwide, Inc. | 1,250,000 | 6,000 | Health Care REIT, Inc. * | 258,120 |

|

| |

| | Total Consumer | | 4,000 | Healthcare Realty Trust, Inc. | 158,160 |

| | Discretionary | 1,860,763 | 5,667 | Highland Hospitality Corporation | 80,755 |

|

| |

| | | | 11,200 | Highwoods Properties, Inc. | 456,512 |

| Financials (93.4%) | | 6,500 | Home Properties, Inc. | 385,255 |

| 9,200 | Alexandria Real Estate | | 103,983 | Host Marriott Corporation | 2,552,783 |

| | Equities, Inc. * | 923,680 | 15,000 | HRPT Properties Trust * | 185,250 |

| 23,100 | AMB Property Corporation | 1,353,891 | 5,017 | Inland Real Estate Corporation * | 93,918 |

| 5,062 | American Campus | | 3,800 | Innkeepers USA Trust | 58,900 |

| | Communities, Inc. | 144,115 | 10,000 | iShares Dow Jones U.S. Real | |

| 12,600 | Apartment Investment & | | | Estate Index Fund * | 838,300 |

| | Management Company | 705,852 | 6,000 | iStar Financial, Inc. | 286,920 |

| 45,393 | Archstone-Smith Trust | 2,642,327 | 6,000 | Kilroy Realty Corporation | 468,000 |

| 19,900 | Avalonbay Communities, Inc. | 2,587,995 | 48,389 | Kimco Realty Corporation * | 2,175,086 |

| 13,500 | BioMed Realty Trust, Inc. | 386,100 | 6,000 | Kite Realty Group Trust | 111,720 |

| 26,800 | Boston Properties, Inc. | 2,998,384 | 10,200 | LaSalle Hotel Properties | 467,670 |

| 22,081 | Brandywine Realty Trust * | 734,193 | 10,200 | Liberty Property Trust * | 501,228 |

| 8,800 | BRE Properties, Inc. * | 572,176 | 15,600 | Macerich Company | 1,350,492 |

| 35,800 | Brookfield Properties Corporation | 1,408,014 | 10,200 | Mack-Cali Realty Corporation * | 520,200 |

| 14,200 | Camden Property Trust | 1,048,670 | 10,000 | Maguire Properties, Inc. | 400,000 |

| 6,500 | CBL & Associates Properties, Inc. | 281,775 | 7,000 | Medical Properties Trust, Inc. | 107,100 |

| 3,500 | Colonial Properties Trust | 164,080 | 4,317 | Mid-America Apartment | |

| 17,100 | Corporate Office Properties | | | Communities, Inc. | 247,105 |

| | Trust * | 863,037 | 6,000 | National Retail Properties, Inc. | 137,700 |

| 3,600 | Crystal River Capital, Inc. * | 91,908 | 14,200 | Nationwide Health | |

| 24,700 | Developers Diversified Realty | | | Properties, Inc. * | 429,124 |

| | Corporation * | 1,554,865 | 10,000 | New Plan Excel Realty Trust, Inc. | 274,800 |

| 5,000 | DiamondRock Hospitality | | 4,000 | Newcastle Investment | |

| | Company * | 90,050 | | Corporation * | 125,280 |

| 6,700 | Digital Realty Trust, Inc. | 229,341 | 5,000 | NorthStar Realty Finance | |

| 11,700 | Duke Realty Corporation | 478,530 | | Corporation | 82,850 |

| 5,800 | EastGroup Properties, Inc. | 310,648 | 5,000 | Omega Healthcare Investors, Inc. | 88,600 |

| 9,500 | Equity Inns, Inc. | 151,620 | 58,208 | ProLogis Trust | 3,537,300 |

| 6,000 | Equity Lifestyle Properties, Inc. | 326,580 | 2,900 | PS Business Parks, Inc. | 205,059 |

| 58,747 | Equity Office Properties Trust | 2,829,843 | 25,188 | Public Storage, Inc. | 2,455,830 |

| 3,000 | Equity One, Inc. * | 79,980 | 2,000 | Realty Income Corporation | 55,400 |

| 54,700 | Equity Residential REIT | 2,776,025 | 9,500 | Reckson Associates Realty | |

| 7,400 | Essex Property Trust, Inc. * | 956,450 | | Corporation | 433,200 |

| 11,500 | Extra Space Storage, Inc. | 209,990 | 16,600 | Regency Centers Corporation | 1,297,622 |

| 12,900 | Federal Realty Investment Trust | 1,096,500 | 10,000 | Senior Housing Property Trust * | 244,800 |

| 2,500 | First Industrial Realty Trust, Inc. * | 117,225 | 51,400 | Simon Property Group, Inc. | 5,206,306 |

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

|

| 11 |

| Real Estate Securities Fund | | | | | | |

| Schedule of Investments as of December 31, 2006 | | | | | |

| |

| Shares | Common Stock (96.0%) | Value | Shares | Common Stock (96.0%) | Value |

|

| |

| Financials — continued | | | 30,100 | United Dominion Realty | |

| 14,500 | SL Green Realty Corporation | $1,925,310 | | | Trust, Inc. * | | $956,879 |

| 12,000 | SPDR DJ Wilshire International | | | 5,000 | U-Store-It Trust | | 102,750 |

| | Real Estate ETF # | 759,120 | | 21,000 | Ventas, Inc. | | 888,720 |

| 15,500 | Spirit Finance Corporation | 193,285 | | 29,000 | Vornado Realty Trust | 3,523,500 |

| 1,837 | Sun Communities, Inc. | 59,445 | | 8,500 | Weingarten Realty Investors * | 391,935 |

|

|

| 11,700 | Sunstone Hotel Investors, Inc. | 312,741 | | | Total Financials | 66,872,514 |

|

|

| 5,000 | Tanger Factory Outlet | | | | | | |

|

|

| | Centers, Inc. * | 195,400 | | | Total Common Stock | |

| 11,600 | Taubman Centers, Inc. | 589,976 | | | (cost $56,806,594) | 68,733,277 |

|

|

| |

| | | | | Interest | Maturity | |

| Shares | Collateral Held for Securities Loaned (14.5%) | Rate (+) | Date | Value |

|

| 10,395,975 | Thrivent Financial Securities Lending Trust | | 5.280% | N/A | $10,395,975 |

|

|

| | | Total Collateral Held for Securities Loaned | |

| | | (cost $10,395,975) | | | | 10,395,975 |

|

|

| |

| |

| Shares or | | | | | | | |

| Principal | | | | Interest | Maturity | |

| Amount | Short-Term Investments (4.9%) | | Rate (+) | Date | Value |

|

| 2,501,574 | Thrivent Money Market Fund | | | 5.030% | N/A | $2,501,574 |

| $1,000,000 | Windmill Funding Corporation | | | 5.310 | 1/2/2007 | 999,852 |

|

|

| | | Total Short-Term Investments (at amortized cost) | 3,501,426 |

|

|

| | | Total Investments (cost $70,703,995) 115.4% | $82,630,678 |

|

|

| | | Other Assets and Liabilities, Net (15.4%) | | (11,048,986) |

|

|

| | | Total Net Assets 100.0% | | | $71,581,692 |

|

|

# Non-income producing security.

* All or a portion of the security is on loan as discussed in item 2(K) of the Notes to Financial Statements.

+ The interest rate shown reflects the yield, coupon rate or, for securities purchased at a discount, the discount rate at the date of purchase.

Definitions:

REIT – Real Estate Investment Trust, is a company that buys, develops, manages and/or sells real estate assets.

Gross unrealized appreciation and depreciation of investments were as follows:

| Gross unrealized appreciation | $11,761,042 |

| Gross unrealized depreciation | (45,735) |

|

|

| Net unrealized appreciation (depreciation) | $11,715,307 |

| Cost for federal income tax purposes | $70,915,371 |

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

|

| 12 |

| Diversified Income Plus Fund |

| Schedule of Investments as of December 31, 2006 |

| | | | | |

| Shares | Common Stock (45.5%) | Value | Shares | Common Stock (45.5%) | Value |

|

| |

| Consumer Discretionary (3.6%) | | 436 | Capital One Financial Corporation | $33,494 |

| 5,400 | Bandag, Inc. * | $272,322 | 800 | CBL & Associates Properties, Inc. | 34,680 |

| 5,000 | Genuine Parts Company * | 237,150 | 20,200 | Citigroup, Inc. | 1,125,140 |

| 30,000 | La-Z-Boy, Inc. * | 356,100 | 4,600 | Colonial Properties Trust | 215,648 |

| 2,000 | Leggett & Platt, Inc. * | 47,800 | 9,200 | Comerica, Inc. | 539,856 |

| 53,400 | McDonald’s Corporation | 2,367,222 | 14,400 | Commerce Group, Inc. | 428,400 |

| 4,200 | Polaris Industries, Inc. * | 196,686 | 2,600 | Community Banks, Inc. * | 72,176 |

| 46,900 | ServiceMaster Company * | 614,859 | 24,000 | Corus Bankshares, Inc. * | 553,680 |

| 4,700 | Stanley Works * | 236,363 | 14,100 | Crescent Real Estate Equities | |

| 27,200 | Superior Industries | | | Company * | 278,475 |

| | International, Inc. * | 524,144 | 4,300 | Developers Diversified Realty | |

| 9,900 | Talbots, Inc. * | 238,590 | | Corporation * | 270,685 |

| 3,100 | VF Corporation | 254,448 | 3,800 | DiamondRock Hospitality Company * | 68,438 |

|

| |

| | Total Consumer | | 1,500 | Digital Realty Trust, Inc. | 51,345 |

| | Discretionary | 5,345,684 | 7,100 | Duke Realty Corporation * | 290,390 |

|

| |

| | | | 2,000 | Entertainment Properties Trust * | 116,880 |

| Consumer Staples (3.0%) | | 200 | Equity One, Inc. * | 5,332 |

| 18,500 | Altria Group, Inc. ‡ | 1,587,670 | 7,500 | Equity Residential REIT * | 380,625 |

| 11,400 | ConAgra Foods, Inc. * | 307,800 | 4,400 | Extra Space Storage, Inc. * | 80,344 |

| 1,600 | Kimberly-Clark Corporation | 108,720 | 122,200 | F.N.B. Corporation * | 2,232,594 |

| 12,700 | Lancaster Colony Corporation * | 562,737 | 4,600 | Feldman Mall Properties, Inc. * | 57,500 |

| 15,200 | Procter & Gamble Company | 976,904 | 29,000 | Fiduciary/Claymore MLP | |

| 17,600 | Universal Corporation | 862,576 | | Opportunity Fund | 658,300 |

|

| |

| | Total Consumer Staples | 4,406,407 | 23,200 | Fifth Third Bancorp * | 949,576 |

|

| |

| | | | 159,800 | First Commonwealth Financial | |

| Energy (1.2%) | | | Corporation * | 2,146,114 |

| 12,900 | Chevron Corporation ‡ | 948,537 | 8,500 | First Industrial Realty | |

| 23,300 | Kayne Anderson MLP Investment | | | Trust, Inc. * | 398,565 |

| | Company * | 768,434 | 83,500 | FirstMerit Corporation * | 2,015,690 |

|

| |

| | Total Energy | 1,716,971 | 6,900 | Franklin Street Properties | |

|

| |

| | | | | Corporation * | 145,245 |

| Financials (24.6%) | | 5,100 | General Growth Properties, Inc. * | 266,373 |

| 1,700 | Agree Realty Corporation | 58,429 | 20,800 | Glimcher Realty Trust * | 555,568 |

| 18,200 | American Financial Realty Trust * | 208,208 | 200 | Global Signal, Inc. | 10,534 |

| 3,900 | Apartment Investment & | | 7,615 | Harleysville National | |

| | Management Company * | 218,478 | | Corporation * | 147,046 |

| 750 | Arcadia Financial, Ltd., Stock | | 13,700 | Health Care Property | |

| | Warrants #^ | 0 | | Investors, Inc. | 504,434 |

| 4,400 | Archstone-Smith Trust * | 256,124 | 14,000 | Health Care REIT, Inc. * | 602,280 |

| 54,300 | Arthur J. Gallagher & Company * | 1,604,565 | 7,500 | Healthcare Realty Trust, Inc. * | 296,550 |

| 600 | Avalonbay Communities, Inc. | 78,030 | 4,000 | Highwoods Properties, Inc. | 163,040 |

| 41,100 | Bank of America Corporation ‡ | 2,194,329 | 2,900 | Home Properties, Inc. | 171,883 |

| 8,500 | BB&T Corporation | 373,405 | 12,600 | Hospitality Properties Trust | 598,878 |

| 500 | BioMed Realty Trust, Inc. | 14,300 | 13,500 | Host Marriott Corporation * | 331,425 |

| 3,900 | Boston Properties, Inc. | 436,332 | 33,300 | HRPT Properties Trust * | 411,255 |

| 5,700 | Brandywine Realty Trust * | 189,525 | 8,400 | Independent Bank Corporation | 212,436 |

| 300 | Camden Property Trust * | 22,155 | 2,100 | Inland Real Estate Corporation * | 39,312 |

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

|

| 13 |

| Diversified Income Plus Fund | | | | |

| Schedule of Investments as of December 31, 2006 | | | | |

| |

| Shares | Common Stock (45.5%) | Value | Shares | Common Stock (45.5%) | Value |

|

| |

| Financials — continued | | 100 | Tanger Factory Outlet | |

| 7,300 | iStar Financial, Inc. * | $349,086 | | Centers, Inc. * | $3,908 |

| 5,245 | Kimco Realty Corporation * | 235,763 | 16,830 | Tortoise Energy Infrastructure | |

| 100 | LaSalle Hotel Properties * | 4,585 | | Corporation * | 585,516 |

| 14,900 | Lexington Corporate Properties | | 6,600 | Trustreet Properties, Inc. | 111,210 |

| | Trust * | 334,207 | 4,200 | United Dominion Realty | |

| 7,200 | Liberty Property Trust * | 353,808 | | Trust, Inc. * | 133,518 |

| 19,100 | Longview Fibre Company | 419,245 | 2,800 | U-Store-It Trust * | 57,540 |

| 1,000 | Macerich Company | 86,570 | 1,900 | Valley National Bancorp * | 50,369 |

| 4,700 | Mack-Cali Realty Corporation * | 239,700 | 3,600 | Ventas, Inc. | 152,352 |

| 400 | Maguire Properties, Inc. * | 16,000 | 5,000 | Vornado Realty Trust | 607,500 |

| 1,600 | Mercury General Corporation | 84,368 | 48,700 | Washington Mutual, Inc. | 2,215,363 |

| 1,400 | Mid-America Apartment | | 1,100 | Washington Real Estate | |

| | Communities, Inc. | 80,136 | | Investment Trust * | 44,000 |

| 1,000 | Mills Corporation * | 20,000 | 2,000 | Weingarten Realty Investors * | 92,220 |

| 21,700 | National City Corporation * | 793,352 | 3,500 | WesBanco, Inc. * | 117,355 |

|

|

| 4,223 | National penn Bancshares, Inc. * | 85,516 | | Total Financials | 36,580,799 |

|

|

| 9,300 | National Retail Properties, Inc. * | 213,435 | | | |

| 8,900 | Nationwide Health | | Health Care (1.9%) | |

| | Properties, Inc. | 268,958 | 13,600 | Merck & Company, Inc. | 592,960 |

| 2,700 | New Plan Excel Realty | | 6,000 | Meridian Bioscience, Inc. | 147,180 |

| | Trust, Inc. * | 74,196 | 83,100 | Pfizer, Inc. | 2,152,290 |

|

|

| 26,300 | Old National Bancorp * | 497,596 | | Total Health Care | 2,892,430 |

|

|

| 4,900 | Old Republic International | | | | |

| | Corporation | 114,072 | Industrials (1.6%) | |

| 13,300 | Omega Healthcare | | 3,000 | A.O. Smith Corporation | 112,680 |

| | Investors, Inc. * | 235,676 | 4,800 | Avery Dennison Corporation * | 326,064 |

| 900 | Park National Corporation * | 89,100 | 3,300 | Badger Meter, Inc. * | 91,410 |

| 3,400 | Pennsylvania Real Estate | | 23,400 | Briggs & Stratton Corporation * | 630,630 |

| | Investment Trust | 133,892 | 13,200 | General Electric Company | 491,172 |

| 4,700 | ProLogis Trust * | 285,619 | 16,800 | Masco Corporation * | 501,816 |

| 702 | Public Storage, Inc. | 68,445 | 4,700 | McGrath Rentcorp * | 143,961 |

| 11,800 | Realty Income Corporation * | 326,860 | 3,700 | Tennant Company | 107,300 |

|

|

| 1,600 | Reckson Associates Realty | | | Total Industrials | 2,405,033 |

|

|

| | Corporation * | 72,960 | | | |

| 12,758 | Regions Financial Corporation | 477,149 | Information Technology (0.2%) | |

| 1,000 | Sandy Spring Bancorp, Inc. * | 38,180 | 2,400 | Linear Technology Corporation * | 72,768 |

| 9,900 | Senior Housing Property Trust * | 242,352 | 6,600 | Paychex, Inc. | 260,964 |

|

|

| 6,600 | Simon Property Group, Inc. | 668,514 | | Total Information | |

| 6,500 | Sky Financial Group, Inc. * | 185,510 | | Technology | 333,732 |

|

|

| 100 | SL Green Realty Corporation | 13,278 | | | |

| 2,600 | Sovran Self Storage, Inc. | 148,928 | Materials (1.5%) | |

| 37,700 | Spirit Finance Corporation * | 470,119 | 2,200 | Bemis Company, Inc. | 74,756 |

| 23,900 | Sterling Bancorp * | 470,830 | 3,000 | PPG Industries, Inc. * | 192,630 |

| 12,000 | Sun Communities, Inc. | 388,320 | 52,000 | RPM International, Inc. | 1,086,280 |

| 500 | Sunstone Hotel Investors, Inc. | 13,365 | 24,700 | Sonoco Products Company | 940,082 |

|

|

| 25,900 | Susquehanna Bancshares, Inc. * | 696,192 | | Total Materials | 2,293,748 |

|

|

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

|

| 14 |

| Diversified Income Plus Fund | | | | | |

| Schedule of Investments as of December 31, 2006 | | | | |

| |

| Shares | Common Stock (45.5%) | Value | Shares | Preferred Stock (1.2%) | Value |

|

| |

| Telecommunications Services (1.7%) | | Energy (0.3%) | | |

| 68,600 | AT&T, Inc. *‡ | $2,452,450 | 10,000 | Goldman Sachs Group, Inc., | |

| 500 | Unifi Communications, Inc., | | | Convertible #¿ | $299,690 |

| | Stock Warrants #^ƒ | 0 | 2,750 | Lehman Brothers Holdings, Inc., | |

|

| |

| | Total Telecommunications | | | Convertible #¿ | 199,430 |

|

|

| | Services | 2,452,450 | | Total Energy | 499,120 |

|

| |

|

| |

| Utilities (6.2%) | | Financials (0.7%) | | |

| 68,400 | Atmos Energy Corporation *‡ | 2,182,644 | 11,745 | Simon Property Group, Inc., | |

| 45,400 | Consolidated Edison, Inc. * | 2,182,378 | | Convertible # | | 956,043 |

|

|

| 20,100 | Otter Tail Corporation * | 626,316 | | Total Financials | 956,043 |

|

|

| 17,000 | Peoples Energy Corporation * | 757,690 | | | | |

| 47,500 | Progress Energy, Inc. * | 2,331,300 | Utilities (0.2%) | | |

| 28,600 | Vectren Corporation * | 808,808 | 3,505 | CenterPoint Energy, Inc., | |

| 6,100 | WPS Resources Corporation * | 329,583 | | Convertible | | 134,757 |

|

| |

| | Total Utilities | 9,218,719 | 720 | NRG Energy, Inc., Convertible # | 194,130 |

|

| |

|

| | | | | Total Utilities | 328,887 |

|

| |

|

| | Total Common Stock | | | | | |

|

|

| | (cost $63,720,718) | 67,645,973 | | Total Preferred Stock | |

|

| |

| | | | | (cost $1,685,683) | 1,784,050 |

|

|

| |

| Principal | | | Interest | Maturity | |

| Amount | Long-Term Fixed Income (48.4%) | Rate | Date | Value |

|

| |

| Asset-Backed Securities (5.4%) | | | | | |

| $7,850,000 | Dow Jones CDX * | | 8.375% | 12/29/2011 | $8,021,130 |

|

|

| | | Total Asset-Backed Securities | | 8,021,130 |

|

|

| |

| Basic Materials (3.8%) | | | | | |

| 180,000 | Abitibi-Consolidated, Inc. *‡ | | 8.550 | 8/1/2010 | 171,000 |

| 100,000 | Abitibi-Consolidated, Inc. * | | 7.750 | 6/15/2011 | 89,750 |

| 250,000 | Ainsworth Lumber Company, Ltd. *†‡ | 9.110 | 3/30/2007 | 211,250 |

| 120,000 | AK Steel Corporation ‡ | | 7.750 | 6/15/2012 | 120,900 |

| 150,000 | Aleris International, Inc. | | 9.000 | 12/15/2014 | 150,750 |

| 110,000 | Aleris International, Inc. | | 10.000 | 12/15/2016 | 110,275 |

| 130,000 | Appleton Papers, Inc. | | 8.125 | 6/15/2011 | 132,600 |

| 220,000 | Arch Western Finance, LLC * | | 6.750 | 7/1/2013 | 218,350 |

| 143,000 | BCP Caylux Holdings Luxembourg SCA | 9.625 | 6/15/2014 | 158,015 |

| 120,000 | Buckeye Technologies, Inc. | | 8.000 | 10/15/2010 | 120,000 |

| 210,000 | Chaparral Steel Company | | 10.000 | 7/15/2013 | 234,412 |

| 220,000 | Crystal US Holdings 3, LLC/Crystal | | | | |

| | US Sub 3 Corporation *> | | Zero Coupon | 10/1/2009 | 188,100 |

| 190,000 | Domtar, Inc. | | 7.125 | 8/1/2015 | 186,200 |

| 190,000 | Drummond Company, Inc. * | | 7.375 | 2/15/2016 | 186,200 |

| 145,000 | Equistar Chemicals, LP | | 10.625 | 5/1/2011 | 154,425 |

| 320,000 | FMG Finance, Pty. Ltd. * | | 10.625 | 9/1/2016 | 343,200 |

| 120,000 | Georgia-Pacific Corporation | | 8.125 | 5/15/2011 | 126,000 |

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

|

| 15 |

| Diversified Income Plus Fund | | | |

| Schedule of Investments as of December 31, 2006 | | | |

| |

| Principal | | Interest | Maturity | |

| Amount | Long-Term Fixed Income (48.4%) | Rate | Date | Value |

|

| Basic Materials — continued | | | |

| $70,000 | Georgia-Pacific Corporation | 7.000% | 1/15/2015 | $69,825 |

| 190,000 | Georgia-Pacific Corporation | 7.125 | 1/15/2017 | 189,525 |

| 300,000 | Graphic Packaging International Corporation * | 9.500 | 8/15/2013 | 316,500 |

| 210,000 | Griffin Coal Mining Company, Pty. Ltd. * | 9.500 | 12/1/2016 | 216,300 |

| 220,000 | Huntsman International, LLC | 7.875 | 11/13/2014 | 221,650 |

| 100,000 | Jefferson Smurfit Corporation | 8.250 | 10/1/2012 | 97,500 |

| 200,000 | Lyondell Chemical Company | 10.500 | 6/1/2013 | 220,000 |

| 260,000 | Lyondell Chemical Company | 8.250 | 9/15/2016 | 273,000 |

| 180,000 | Momentive Performance Materials, Inc. | 11.500 | 12/1/2016 | 176,400 |

| 90,000 | Mosaic Global Holdings, Inc. | 7.625 | 12/1/2016 | 93,262 |

| 440,000 | Mosaic Global Holdings, Inc., Convertible | 7.375 | 12/1/2014 | 451,550 |

| 130,000 | Peabody Energy Corporation, Convertible * | 4.750 | 12/15/2066 | 123,988 |

| 140,000 | PNA Group, Inc. | 10.750 | 9/1/2016 | 144,725 |

| 220,000 | Ryerson, Inc. * | 8.250 | 12/15/2011 | 218,350 |

|

|

| | Total Basic Materials | | 5,714,002 |

|

|

| |

| Capital Goods (3.9%) | | | |

| 80,000 | Ahern Rentals, Inc. | 9.250 | 8/15/2013 | 83,400 |

| 620,000 | Allied Waste North America, Inc. ‡ | 7.875 | 4/15/2013 | 639,375 |

| 490,000 | Amsted Industries, Inc. | 10.250 | 10/15/2011 | 524,300 |

| 100,000 | Ashtead Capital, Inc. | 9.000 | 8/15/2016 | 107,000 |

| 190,000 | Ball Corporation | 6.625 | 3/15/2018 | 189,050 |

| 210,000 | Berry Plastics Holding Corporation | 8.875 | 9/15/2014 | 213,150 |

| 150,000 | Browning-Ferris Industries, Inc. | 9.250 | 5/1/2021 | 159,000 |

| 150,000 | Browning-Ferris Industries, Inc. | 7.400 | 9/15/2035 | 140,250 |

| 210,000 | Case New Holland, Inc. | 9.250 | 8/1/2011 | 222,338 |

| 220,000 | Consolidated Container Company, LLC > | Zero Coupon | 6/15/2007 | 222,750 |

| 170,000 | Covalence Specialty Materials Corporation | 10.250 | 3/1/2016 | 155,550 |

| 150,000 | Crown Americas, Inc. | 7.625 | 11/15/2013 | 154,500 |

| 150,000 | Crown Americas, Inc. | 7.750 | 11/15/2015 | 155,625 |

| 520,000 | Da-Lite Screen Company, Inc. | 9.500 | 5/15/2011 | 540,800 |

| 610,000 | Fastentech, Inc. | 11.500 | 5/1/2011 | 642,025 |

| 130,000 | Graham Packaging Company, Inc. * | 9.875 | 10/15/2014 | 131,300 |

| 105,000 | Invensys plc * | 9.875 | 3/15/2011 | 112,612 |

| 60,000 | K&F Acquisition, Inc. | 7.750 | 11/15/2014 | 61,800 |

| 49,000 | Mueller Group, Inc. | 10.000 | 5/1/2012 | 53,288 |

| 143,000 | Mueller Holdings, Inc. > | Zero Coupon | 4/15/2009 | 128,700 |

| 100,000 | Owens-Brockway Glass Container, Inc. * | 8.250 | 5/15/2013 | 103,375 |

| 320,000 | Owens-Illinois, Inc. * | 7.500 | 5/15/2010 | 321,200 |

| 260,000 | Plastipak Holdings, Inc. | 8.500 | 12/15/2015 | 270,400 |

| 120,000 | RBS Global, Inc./Rexnord Corporation | 9.500 | 8/1/2014 | 124,800 |

| 40,000 | RBS Global, Inc./Rexnord Corporation | 11.750 | 8/1/2016 | 41,800 |

| 140,000 | Rental Services Corporation | 9.500 | 12/1/2014 | 144,550 |

| 120,000 | United Rentals North America, Inc. | 6.500 | 2/15/2012 | 118,500 |

| 100,000 | United Rentals North America, Inc. * | 7.000 | 2/15/2014 | 98,125 |

|

|

| | Total Capital Goods | | 5,859,563 |

|

|

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

|

| 16 |

| Diversified Income Plus Fund | | | | |

| Schedule of Investments as of December 31, 2006 | | | | |

| |

| Principal | | | Interest | Maturity | |

| Amount | Long-Term Fixed Income (48.4%) | | Rate | Date | Value |

|

| Communications Services (7.2%) | | | | |

| $150,000 | American Cellular Corporation | | 10.000% | 8/1/2011 | $158,625 |

| 660,000 | American Tower Corporation ‡ | | 7.125 | 10/15/2012 | 678,150 |

| 380,000 | American Towers, Inc. * | | 7.250 | 12/1/2011 | 393,300 |

| 70,000 | Cablevision Systems Corporation * | | 8.000 | 4/15/2012 | 68,775 |

| 849,788 | CCH I, LLC * | | 11.000 | 10/1/2015 | 872,094 |

| 180,000 | Centennial Communications Corporation * | | 8.125 | 2/1/2014 | 184,725 |

| 170,000 | Charter Communications Holdings, LLC * | | 8.750 | 11/15/2013 | 176,588 |

| 175,000 | Charter Communications Operating, LLC | | 8.000 | 4/30/2012 | 181,781 |

| 240,000 | Citizens Communications Company * | | 9.250 | 5/15/2011 | 265,500 |

| 160,000 | Cricket Communications, Inc. | | 9.375 | 11/1/2014 | 168,800 |

| 99,000 | Dex Media West, LLC/Dex Media West Finance Company | 9.875 | 8/15/2013 | 107,910 |

| 240,000 | Dobson Cellular Systems | | 9.875 | 11/1/2012 | 261,600 |

| 210,000 | Idearc, Inc. | | 8.000 | 11/15/2016 | 213,150 |

| 90,000 | Intelsat Bermuda, Ltd. | | 9.250 | 6/15/2016 | 96,750 |

| 900,000 | Intelsat Bermuda, Ltd. | | 11.250 | 6/15/2016 | 987,750 |

| 280,000 | Intelsat Intermediate, Inc. *> | Zero Coupon | 2/1/2010 | 212,800 |

| 200,000 | Intelsat Subsidiary Holding Company, Ltd. | | 8.625 | 1/15/2015 | 208,000 |

| 240,000 | Kabel Deutschland GmbH * | | 10.625 | 7/1/2014 | 266,100 |

| 120,000 | Lamar Media Corporation | | 6.625 | 8/15/2015 | 118,950 |

| 370,000 | Level 3 Financing, Inc. | | 9.250 | 11/1/2014 | 377,400 |

| 170,000 | MetroPCS Wireless, Inc. | | 9.250 | 11/1/2014 | 177,650 |

| 220,000 | Morris Publishing Group, LLC | | 7.000 | 8/1/2013 | 208,450 |

| 380,000 | NTL Cable plc | | 9.125 | 8/15/2016 | 401,375 |

| 190,000 | PRIMEDIA, Inc. *† | | 10.749 | 2/15/2007 | 197,600 |

| 230,000 | Quebecor World, Inc. | | 9.750 | 1/15/2015 | 231,438 |

| 110,000 | Qwest Communications International, Inc. † | | 8.874 | 2/15/2007 | 111,375 |

| 280,000 | Qwest Communications International, Inc. | | 7.250 | 2/15/2011 | 286,300 |

| 90,000 | Qwest Communications International, Inc. | | 7.500 | 2/15/2014 | 92,700 |

| 40,000 | Qwest Corporation † | | 8.610 | 3/15/2007 | 43,300 |

| 640,000 | Qwest Corporation | | 7.875 | 9/1/2011 | 681,600 |

| 70,000 | Qwest Corporation | | 7.625 | 6/15/2015 | 74,900 |

| 700,000 | R.H. Donnelley Corporation | | 6.875 | 1/15/2013 | 671,125 |

| 160,000 | R.H. Donnelley Corporation | | 8.875 | 1/15/2016 | 168,000 |

| 205,000 | Rogers Wireless Communications, Inc. * | | 7.500 | 3/15/2015 | 222,425 |

| 120,000 | Rural Cellular Corporation * | | 9.750 | 1/15/2010 | 123,300 |

| 120,000 | Rural Cellular Corporation | | 9.875 | 2/1/2010 | 127,650 |

| 280,000 | Time Warner Telecom Holdings, Inc. | | 9.250 | 2/15/2014 | 299,250 |

| 200,000 | Valor Telecommunications Enterprises, LLC | | 7.750 | 2/15/2015 | 215,250 |

| 290,000 | Videotron Ltee | | 6.875 | 1/15/2014 | 291,812 |

|

|

| | Total Communications Services | | 10,624,248 |

|

|

| |

| Consumer Cyclical (7.3%) | | | | |

| 330,000 | Allied Security Escrow Corporation | | 11.375 | 7/15/2011 | 338,250 |

| 270,000 | American Casino & Entertainment Properties, LLC | | 7.850 | 2/1/2012 | 275,738 |

| 180,000 | Beazer Homes USA, Inc. * | | 8.625 | 5/15/2011 | 185,400 |

| 190,000 | Beazer Homes USA, Inc. * | | 8.125 | 6/15/2016 | 201,400 |

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

|

| 17 |

| Diversified Income Plus Fund | | | |

| Schedule of Investments as of December 31, 2006 | | | |

| |

| Principal | | Interest | Maturity | |

| Amount | Long-Term Fixed Income (48.4%) | Rate | Date | Value |

|

| Consumer Cyclical — continued | | | |

| $350,000 | Bon-Ton Stores, Inc. * | 10.250% | 3/15/2014 | $357,875 |

| 190,000 | Buffets, Inc. | 12.500 | 11/1/2014 | 191,425 |

| 490,000 | Buhrmann U.S., Inc. ‡ | 7.875 | 3/1/2015 | 477,750 |

| 250,000 | Circus & Eldorado Joint Venture/Silver Legacy | | | |

| | Capital Corporation | 10.125 | 3/1/2012 | 262,500 |

| 150,000 | Dollarama Group, LP † | 11.120 | 6/15/2007 | 149,438 |

| 360,000 | Dollarama Group, LP * | 8.875 | 8/15/2012 | 372,600 |

| 230,000 | Ford Motor Credit Company † | 9.824 | 1/16/2007 | 243,740 |

| 80,000 | Ford Motor Credit Company | 9.750 | 9/15/2010 | 85,105 |

| 170,000 | Ford Motor Credit Company * | 7.000 | 10/1/2013 | 162,347 |

| 360,000 | Ford Motor Credit Company * | 8.000 | 12/15/2016 | 355,734 |

| 310,000 | Gaylord Entertainment Company | 6.750 | 11/15/2014 | 307,675 |

| 310,000 | General Motors Corporation * | 8.250 | 7/15/2023 | 288,300 |

| 340,000 | Group 1 Automotive, Inc. | 8.250 | 8/15/2013 | 348,500 |

| 260,000 | Hanesbrands, Inc. † | 8.735 | 6/15/2007 | 264,550 |

| 370,000 | Harrah’s Operating Company, Inc. * | 6.500 | 6/1/2016 | 331,280 |

| 226,000 | Host Marriott, LP, Convertible | 3.250 | 4/15/2024 | 335,045 |

| 820,000 | IAAI Finance Corporation | 11.000 | 4/1/2013 | 926,600 |

| 220,000 | Jean Coutu Group (PJC), Inc. | 7.625 | 8/1/2012 | 231,550 |

| 250,000 | K. Hovnanian Enterprises, Inc. * | 7.500 | 5/15/2016 | 251,250 |

| 160,000 | KB Home | 6.250 | 6/15/2015 | 149,463 |

| 250,000 | Majestic Star Casino, LLC | 9.500 | 10/15/2010 | 262,500 |

| 280,000 | MGM MIRAGE | 5.875 | 2/27/2014 | 259,000 |

| 330,000 | NCL Corporation * | 10.625 | 7/15/2014 | 330,000 |

| 210,000 | NCO Group, Inc. † | 10.244 | 2/15/2007 | 208,425 |

| 260,000 | Poster Financial Group, Inc. | 8.750 | 12/1/2011 | 269,750 |

| 100,000 | Sally Holdings, LLC | 9.250 | 11/15/2014 | 101,875 |

| 170,000 | Sally Holdings, LLC * | 10.500 | 11/15/2016 | 173,400 |

| 210,000 | Six Flags, Inc. * | 9.625 | 6/1/2014 | 194,775 |

| 270,000 | Station Casinos, Inc. | 6.875 | 3/1/2016 | 242,325 |

| 115,000 | TRW Automotive, Inc. | 9.375 | 2/15/2013 | 123,338 |

| 360,000 | Tunica Biloxi Gaming Authority | 9.000 | 11/15/2015 | 372,600 |

| 180,000 | Turning Stone Resort Casino Enterprise | 9.125 | 9/15/2014 | 184,050 |

| 150,000 | United Auto Group, Inc. | 7.750 | 12/15/2016 | 150,750 |

| 242,000 | Universal City Florida Holding Company I/II † | 10.121 | 2/1/2007 | 249,865 |

| 180,000 | VICORP Restaurants, Inc. | 10.500 | 4/15/2011 | 172,800 |

| 210,000 | Warnaco, Inc. | 8.875 | 6/15/2013 | 223,125 |

| 323,000 | WMG Holdings Corporation > | Zero Coupon | 12/15/2009 | 258,400 |

|

|

| | Total Consumer Cyclical | | 10,870,493 |

|

|

| |

| Consumer Non-Cyclical (2.4%) | | | |

| 110,000 | DaVita, Inc. | 7.250 | 3/15/2015 | 112,200 |

| 130,000 | Elan Finance Corporation, Ltd. | 7.750 | 11/15/2011 | 126,912 |

| 120,000 | Elan Finance plc/Elan Finance Corporation † | 9.374 | 2/15/2007 | 119,100 |

| 210,000 | HCA, Inc. | 9.250 | 11/15/2016 | 224,962 |

| 170,000 | HCA, Inc. | 9.625 | 11/15/2016 | 182,750 |

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

|

| 18 |

| Diversified Income Plus Fund | | | | |

| Schedule of Investments as of December 31, 2006 | | | | |

| |

| Principal | | | Interest | Maturity | |

| Amount | Long-Term Fixed Income (48.4%) | | Rate | Date | Value |

|

| Consumer Non-Cyclical — continued | | | | |

| $240,000 | IASIS Healthcare, LLC (IASIS Capital Corporation) * | 8.750% | 6/15/2014 | $243,000 |

| 315,000 | Jostens Holding Corporation > | Zero Coupon | 12/1/2008 | 277,988 |

| 230,000 | Michael Foods, Inc. | | 8.000 | 11/15/2013 | 238,625 |

| 210,000 | Multiplan, Inc. | | 10.375 | 4/15/2016 | 208,950 |

| 150,000 | Smithfield Foods, Inc. * | | 8.000 | 10/15/2009 | 156,750 |

| 160,000 | Stater Brothers Holdings, Inc. | | 8.125 | 6/15/2012 | 162,400 |

| 170,000 | Supervalu, Inc. | | 7.500 | 11/15/2014 | 177,259 |

| 260,000 | Triad Hospitals, Inc. | | 7.000 | 5/15/2012 | 264,550 |

| 180,000 | Triad Hospitals, Inc. | | 7.000 | 11/15/2013 | 181,125 |

| 230,000 | US Oncology Holdings, Inc. † | | 10.675 | 3/15/2007 | 236,325 |

| 120,000 | US Oncology, Inc. | | 9.000 | 8/15/2012 | 126,600 |

| 220,000 | Vanguard Health Holding Company II, LLC | | 9.000 | 10/1/2014 | 222,750 |

| 250,000 | Ventas Realty, LP/Ventas Capital Corporation * | | 6.500 | 6/1/2016 | 256,250 |

| 85,000 | Warner Chilcott Corporation | | 8.750 | 2/1/2015 | 87,125 |

|

|

| | Total Consumer Non-Cyclical | | 3,605,621 |

|

|

| |

| Energy (1.6%) | | | | |

| 110,000 | Chesapeake Energy Corporation * | | 6.375 | 6/15/2015 | 108,900 |

| 200,000 | Chesapeake Energy Corporation | | 6.250 | 1/15/2018 | 192,500 |

| 220,000 | Denbury Resources, Inc. | | 7.500 | 12/15/2015 | 224,400 |

| 170,000 | Hornbeck Offshore Services, Inc. | | 6.125 | 12/1/2014 | 162,138 |

| 650,000 | Ocean Rig Norway AS | | 8.375 | 7/1/2013 | 692,250 |

| 300,000 | OPTI Canada, Inc. | | 8.250 | 12/15/2014 | 308,250 |

| 90,000 | Pioneer Natural Resources Company * | | 5.875 | 7/15/2016 | 82,996 |

| 210,000 | Western Oil Sands, Inc. | | 8.375 | 5/1/2012 | 233,100 |

| 280,000 | Whiting Petroleum Corporation * | | 7.250 | 5/1/2012 | 280,700 |

| 60,000 | Whiting Petroleum Corporation | | 7.250 | 5/1/2013 | 60,150 |

|

|

| | | | Total Energy | | 2,345,384 |

|

|

| |

| Financials (8.1%) | | | | |

| 130,000 | ACE Cash Express, Inc. | | 10.250 | 10/1/2014 | 131,625 |

| 336,000 | Archstone-Smith Operating Trust, Convertible * | | 4.000 | 7/15/2036 | 358,260 |

| 300,000 | AXA SA | | 6.463 | 12/14/2018 | 296,203 |

| 267,000 | Boston Properties, Inc., Convertible | | 3.750 | 5/15/2036 | 309,386 |

| 232,000 | Brandywine Realty Trust, Convertible | | 3.875 | 10/15/2026 | 231,420 |

| 275,000 | BRE Properties, Inc., Convertible | | 4.125 | 8/15/2026 | 294,718 |

| 580,000 | Capital One Capital III * | | 7.686 | 8/15/2036 | 656,884 |

| 325,000 | Developers Diversified Realty Corporation, Convertible | 3.500 | 8/15/2011 | 344,500 |

| 332,000 | Duke Realty, LP, Convertible | | 3.750 | 12/1/2011 | 328,680 |

| 870,000 | EOP Operating, LP, Convertible | | 4.000 | 7/15/2026 | 1,034,212 |

| 400,000 | ERP Operating, LP, Convertible | | 3.850 | 8/15/2026 | 410,560 |

| 110,000 | Essex Portfolio, LP, Convertible | | 3.625 | 11/1/2025 | 142,312 |

| 145,000 | First Industrial, LP, Convertible | | 4.625 | 9/15/2011 | 152,250 |

| 186,000 | Forest City Enterprises, Inc., Convertible | | 3.625 | 10/15/2011 | 197,569 |

| 400,000 | FTI Consulting, Inc. | | 7.625 | 6/15/2013 | 413,000 |

| 710,000 | General Motors Acceptance Corporation, LLC | | 6.875 | 9/15/2011 | 728,246 |

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

|

| 19 |

| Diversified Income Plus Fund | | | | |

| Schedule of Investments as of December 31, 2006 | | | | |

| |

| Principal | | | Interest | Maturity | |

| Amount | Long-Term Fixed Income (48.4%) | | Rate | Date | Value |

|

| Financials — continued | | | | |

| $580,000 | J.P. Morgan Chase Capital XX | | 6.550% | 9/29/2036 | $598,912 |

| 580,000 | Lincoln National Corporation *> | | 7.000 | 5/17/2016 | 614,734 |

| 295,000 | Morgan Stanley, Convertible ¿ | | 16.500 | 1/18/2007 | 295,000 |

| 116,000 | National Retail Properties, Inc., Convertible | | 3.950 | 9/15/2026 | 119,625 |

| 429,000 | New Plan Excel Realty Trust, Convertible | | 3.700 | 9/15/2026 | 427,391 |

| 580,000 | Rabobank Capital Funding Trust | | 5.254 | 10/21/2016 | 559,210 |

| 580,000 | RBS Capital Trust I | | 5.512 | 9/30/2014 | 573,271 |

| 203,000 | Tanger Properties, LP, Convertible * | | 3.750 | 8/15/2026 | 236,749 |

| 133,000 | United Dominion Realty Trust, Inc., Convertible | | 4.000 | 12/15/2035 | 156,109 |

| 667,000 | Vornado Realty Trust, Convertible | | 3.625 | 11/15/2026 | 666,166 |

| 244,000 | Vornado Realty, LP, Convertible * | | 3.875 | 4/15/2025 | 337,940 |

| 580,000 | Wachovia Capital Trust III | | 5.800 | 3/15/2011 | 584,788 |

| 300,000 | Washington Mutual Preferred Funding | | 6.665 | 12/15/2016 | 300,804 |

| 70,000 | Washington Real Estate Investment Trust, Convertible | 3.875 | 9/15/2026 | 70,262 |

| 363,000 | Weingarten Realty Investors, Convertible | | 3.950 | 8/1/2026 | 383,800 |

| 100,000 | Wells Fargo & Company, Convertible † | | 5.121 | 2/1/2007 | 100,323 |

|

|

| | Total Financials | | | | 12,054,909 |

|

|

| |

| Technology (1.6%) | | | | |

| 180,000 | Avago Technologies Finance Pte † | | 10.869 | 3/1/2007 | 188,325 |

| 110,000 | Electronic Data Systems Corporation, Convertible * | 3.875 | 7/15/2023 | 116,738 |

| 230,000 | Freescale Semiconductor, Inc. | | 9.125 | 12/15/2014 | 228,562 |

| 180,000 | Freescale Semiconductor, Inc. * | | 10.125 | 12/15/2016 | 180,225 |

| 117,000 | Intel Corporation, Convertible | | 2.950 | 12/15/2035 | 105,885 |

| 230,000 | MagnaChip Semiconductor SA/MagnaChip | | | | |

| | Semiconductor Finance Company † | | 8.610 | 3/15/2007 | 197,800 |

| 110,000 | NXP BV/NXP Funding, LLC † | | 8.122 | 1/16/2007 | 111,650 |

| 320,000 | Seagate Technology HDD Holdings | | 6.800 | 10/1/2016 | 321,600 |

| 130,000 | SunGard Data Systems, Inc. | | 9.125 | 8/15/2013 | 136,500 |

| 130,000 | SunGard Data Systems, Inc. * | | 10.250 | 8/15/2015 | 138,775 |

| 280,000 | UGS Corporation | | 10.000 | 6/1/2012 | 305,200 |

| 150,000 | Unisys Corporation * | | 6.875 | 3/15/2010 | 147,375 |

| 190,000 | Xerox Corporation * | | 7.625 | 6/15/2013 | 199,500 |

|

|

| | Total Technology | | | | 2,378,135 |

|

|

| |

| Transportation (1.5%) | | | | |

| 220,000 | CHC Helicopter Corporation | | 7.375 | 5/1/2014 | 212,025 |

| 180,000 | Delta Air Lines, Inc. = | | 7.920 | 11/18/2010 | 179,325 |

| 80,000 | Hertz Corporation | | 8.875 | 1/1/2014 | 83,800 |

| 140,000 | Hertz Corporation | | 10.500 | 1/1/2016 | 154,000 |

| 214,000 | H-Lines Finance Holding Corporation > | Zero Coupon | 4/1/2008 | 199,020 |

| 410,000 | Horizon Lines, LLC | | 9.000 | 11/1/2012 | 430,500 |

| 210,000 | Kansas City Southern de Mexico SA de CV | | 7.625 | 12/1/2013 | 210,000 |

| 260,000 | Navios Maritime Holdings, Inc. | | 9.500 | 12/15/2014 | 261,300 |

| 556,931 | Piper Jaffray Equipment Trust Securities | | 6.750 | 4/1/2011 | 552,754 |

|

|

| | Total Transportation | | | | 2,282,724 |

|

|

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

|

| 20 |

| Diversified Income Plus Fund | | | |

| Schedule of Investments as of December 31, 2006 | | | |

| |

| Principal | | Interest | Maturity | |

| Amount | Long-Term Fixed Income (48.4%) | Rate | Date | Value |

|

| U.S. Government (1.1%) | | | |

| $1,606,140 | U.S. Treasury Notes, TIPS * | 2.000% | 7/15/2014 | $1,558,897 |

|

|

| | Total U.S. Government | | | 1,558,897 |

|

|

| |

| Utilities (4.5%) | | | |

| 105,000 | AES Corporation ‡ | 8.875 | 2/15/2011 | 112,612 |

| 240,000 | AES Corporation ‡ | 8.750 | 5/15/2013 | 257,100 |

| 260,000 | AmeriGas Partners, LP | 7.250 | 5/20/2015 | 263,250 |

| 210,000 | Calpine Generating Company, LLC †= | 11.099 | 1/1/2007 | 221,550 |

| 190,000 | Calpine Generating Company, LLC †= | 14.370 | 4/1/2007 | 204,250 |

| 490,000 | Colorado Interstate Gas Company | 6.800 | 11/15/2015 | 509,493 |

| 100,000 | Consumers Energy Company | 6.300 | 2/1/2012 | 100,500 |

| 150,000 | Dynegy Holdings, Inc. | 6.875 | 4/1/2011 | 150,000 |

| 170,000 | Dynegy Holdings, Inc. * | 8.375 | 5/1/2016 | 178,500 |

| 170,000 | Edison Mission Energy | 7.500 | 6/15/2013 | 177,650 |

| 180,000 | Edison Mission Energy | 7.750 | 6/15/2016 | 190,800 |

| 290,000 | Energy Transfer Partners, LP * | 6.625 | 10/15/2036 | 298,604 |

| 590,000 | Enterprise Products Operating, LP > | 8.375 | 8/1/2016 | 639,092 |

| 140,000 | Midwest Generation, LLC | 8.750 | 5/1/2034 | 151,900 |

| 100,000 | Mirant North America, LLC | 7.375 | 12/31/2013 | 101,500 |

| 260,000 | Mission Energy Holding Company | 13.500 | 7/15/2008 | 286,650 |

| 460,000 | NRG Energy, Inc. | 7.375 | 2/1/2016 | 462,300 |

| 170,000 | Pacific Energy Partners, LP/Pacific | | | |

| | Energy Finance Corporation | 7.125 | 6/15/2014 | 174,456 |

| 200,000 | Pacific Energy Partners, LP/Pacific | | | |

| | Energy Finance Corporation | 6.250 | 9/15/2015 | 195,528 |

| 145,000 | Reliant Energy Resources Corporation | 6.750 | 12/15/2014 | 141,738 |

| 210,000 | SemGroup, LP | 8.750 | 11/15/2015 | 211,050 |

| 230,000 | Southern Natural Gas Company | 7.350 | 2/15/2031 | 253,172 |

| 150,000 | Southern Star Central Corporation | 6.750 | 3/1/2016 | 149,625 |

| 570,000 | Williams Companies, Inc. | 8.125 | 3/15/2012 | 617,025 |

| 410,000 | Williams Companies, Inc. | 8.750 | 3/15/2032 | 463,300 |

| 170,000 | Williams Partners, LP | 7.250 | 2/1/2017 | 173,400 |

|

|

| | Total Utilities | | | 6,685,045 |

|

|

| | Total Long-Term Fixed Income (cost $70,892,998) | | | 72,000,151 |

|

|

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

|

| 21 |

| Diversified Income Plus Fund | | | |

| Schedule of Investments as of December 31, 2006 | | | |

| |

| | | Interest | Maturity | |

| Shares | Collateral Held for Securities Loaned (25.6%) | Rate (+) | Date | Value |

|

| 38,151,784 | Thrivent Financial Securities Lending Trust | 5.280% | N/A | $38,151,784 |

|

|

| | Total Collateral Held for Securities Loaned | |

| | (cost $38,151,784) | | | 38,151,784 |

|

|

| |

| Shares or | | | | |

| Principal | | Interest | Maturity | |

| Amount | Short-Term Investments (4.5%) | Rate (+) | Date | Value |

|

| $2,320,000 | Federal Home Loan Mortgage Corporation | 4.891% | 1/2/2007 | $2,319,686 |

| 400,000 | Federal National Mortgage Association ‡ | 5.180 | 2/7/2007 | 397,883 |

| 3,915,178 | Thrivent Money Market Fund | 5.030 | N/A | 3,915,178 |

|

|

| | Total Short-Term Investments (at amortized cost) | 6,632,747 |

|

|

| | Total Investments (cost $181,083,930) 125.2% | $186,214,705 |

|

|

| | Other Assets and Liabilities, Net (25.2%) | | (37,439,973) |

|

|

| | Total Net Assets 100.0% | | | $148,774,732 |

|

|

| | Number of | | Notional | | |

| | Contracts | Expiration | Principal | | Unrealized |

| Futures | Long/(Short) | Date | Amount | Value | Gain/(Loss) |

|

| 10-Yr. U.S. Treasury Bond Futures | (28) | March 2007 | ($3,047,772) | ($3,009,125) | $38,647 |

| S&P 500 Mini-Futures | 36 | March 2007 | $2,573,896 | $2,571,120 | ($2,776) |

# Non-income producing security.

* All or a portion of the security is on loan as discussed in item 2(K) of the Notes to Financial Statements.

+ The interest rate shown reflects the yield, coupon rate or, for securities purchased at a discount, the discount rate at the date of purchase

^ Security is fair valued as discussed in item 2(A) of the Notes to Financial Statements.

> Denotes step coupon bonds for which the current interest rate and next scheduled reset date are shown.

† Denotes variable rate obligations for which the current yield and next scheduled reset date are shown.

‡ At December 31, 2006, $654,983 of investments were held on deposit with the counterparty and pledged as the initial margin deposit for open financial futures contracts and an unfunded loan commitment. In addition, $9,731,717 and $1,026,485 of investments were earmarked as collateral to cover open financial futures contracts and an unfunded loan commitment, respectively. This unfunded loan commitment is discussed in item 2(R) of the Notes to Financial Statements.

ƒ Denotes restricted securities. Restricted securities are investment securities which cannot be offered for public sale without first being registered under the Securities Act of 1933. These securities have been valued from the date of acquisition through December 31, 2006, by obtaining quotations from brokers active with these securities. The following table indicates the acquisition date and cost of restricted securities in the Diversified Income Plus Portfolio owned as of December 31, 2006.

| | Acquisition | |

| Security | Date | Cost |

|

| Unifi Communications, Inc., Stock Warrants | 2/14/1997 | $6,525 |

| = In bankruptcy. | | |

| ¿ These securities are Equity-Linked Structured Securities as discussed in item 2(N) of the Notes to Financial Statements. | |

Definitions:

REIT — Real Estate Investment Trust, is a company that buys, develops, manages and/or sells real estate assets.

TIPS — Treasury Inflation Protected Security

| Gross unrealized appreciation and depreciation of investments were as follows: | |

| Gross unrealized appreciation | | $5,715,572 | |

| Gross unrealized depreciation | | (855,109) | |

| |

| |