UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05075

Thrivent Mutual Funds

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

Michael W. Kremenak, Secretary and Chief Legal Officer

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 844-4198

Date of fiscal year end: December 31

Date of reporting period: December 31, 2015

| Item 1. | Report to Stockholders |

TABLEOF CONTENTS

Dear Shareholder:

It has been a productive year for your Thrivent Mutual Funds.

Before reviewing some of the accomplishments, I’d like to thank all of you who voted in our trustee elections. Our shareholder meeting was held August 14 at our offices in Minneapolis, and a few of you attended in person. It was a delight to speak face-to-face and hear your thoughts about your Funds and Thrivent Financial.

I know it can be an imposition to receive a proxy statement in the mail asking you to vote your shares. I also understand that most of you would prefer not to be called at home by someone asking you to vote. We appreciate it when you take the time to participate in the governance of your Thrivent Mutual Funds. When you vote promptly, you reduce the need for us to do additional soliciting of voters to achieve a legally required quorum, which helps hold down the costs of your Funds.

Beyond all that, your participation in these votes is critical to the management of the Funds. Unlike many other companies, mutual funds aren’t required to elect directors or trustees annually. (Some mutual funds are corporations and have directors. Some, like Thrivent Mutual Funds, are trusts and have trustees. There’s no practical difference from a shareholder’s perspective.) But mutual funds are legally required to have a majority of their trustees elected by shareholders. Although your board can appoint some new trustees as needed—to replace a trustee who is retiring, for example—every so often it must call a shareholder meeting to elect trustees, simply to comply with the law.

Because mailing proxy materials and holding shareholder meetings creates costs for your Funds, and because we’d rather not impose on you more frequently than necessary, we always try to combine trustee elections with other items that require a shareholder vote. At our shareholder meeting in August, shareholders approved changes to the investment advisory fee structure for our flagship Asset Allocation Funds. We’ve heard from you, our shareholders, that you prefer simple, transparent fees, and that’s what these changes are intended to accomplish. They also are expected to result in lower net annual operating expenses for the Asset Allocation Funds, which would benefit all of their shareholders.

In my last president’s letter, I wrote about the 10-year anniversary of the Asset Allocation Funds, which were launched on June 30, 2005. We continue to be proud of these Funds, which we believe offer a simple, all-in-one investment solution for many investors, one that is aligned with each investor’s tolerance for risk.

The performance of the Asset Allocation Funds has been competitive. Lipper, a Thomson Reuters company, is a well-known firm that tracks and compares mutual fund performance. Each of our four Asset Allocation Funds ranked above its Lipper peer group average for the one- and three-year periods ended December 31, 2015. Overall, 86% of our Funds ranked above their respective Lipper peer group averages for the one-year period, and 68% ranked above their respective Lipper peer group averages for the three-year period.

There will be periods, of course, in which our Funds, including the Asset Allocation Funds, underperform relative to their peers. You can be certain, however, that we will always take a long-term view of performance and seek to provide consistently competitive returns over time. I look forward to updating you on our progress.

Many thanks to each of you for your confidence in Thrivent Mutual Funds. Best wishes to you and yours in 2016.

Sincerely,

David S. Royal

President

Thrivent Mutual Funds

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Performance as of December 31, 2015 Class A (Annualized Total Returns) | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Expense Ratio | |

| | POP | | | NAV | | | POP | | | NAV | | | POP | | | NAV | | | POP | | | NAV | | | NET | | | GROSS | |

Thrivent Aggressive Allocation Fund | | | -6.31 | % | | | -0.86 | % | | | 7.90 | % | | | 9.97 | % | | | 6.18 | % | | | 7.38 | % | | | 4.81 | % | | | 5.41 | % | | | 1.26 | %* | | | 1.53 | % |

Thrivent Moderately Aggressive Allocation Fund | | | -6.46 | % | | | -0.98 | % | | | 6.23 | % | | | 8.26 | % | | | 5.49 | % | | | 6.68 | % | | | 4.65 | % | | | 5.24 | % | | | 1.16 | %* | | | 1.44 | % |

Thrivent Moderate Allocation Fund | | | -6.29 | % | | | -0.87 | % | | | 4.40 | % | | | 6.39 | % | | | 4.58 | % | | | 5.77 | % | | | 4.46 | % | | | 5.05 | % | | | 1.08 | %* | | | 1.32 | % |

Thrivent Moderately Conservative Allocation Fund | | | -6.39 | % | | | -0.95 | % | | | 2.35 | % | | | 4.29 | % | | | 3.25 | % | | | 4.42 | % | | | 3.91 | % | | | 4.50 | % | | | 1.04 | %* | | | 1.21 | % |

| | | | | | | | |

Lipper Rankings as of December 31, 2015 | | 1-Year | | 3-Year | | 5-Year | | 10-Year |

Thrivent Aggressive Allocation Fund - Lipper (Mixed-Asset Target Alloc. Agg. Gro. Funds) | | 29

(49 of 171) | | 34

(53 of 156) | | 49

(60 of 122) | | 24

(21 of 88) |

Thrivent Moderately Aggressive Allocation Fund - Lipper (Mixed-Asset Target Alloc. Growth Funds) | | 43

(210 of 495) | | 43

(197 of 461) | | 56

(227 of 408) | | 50

(152 of 307) |

Thrivent Moderate Allocation Fund - Lipper (Mixed-Asset Target Alloc. Moderate Funds) | | 27

(151 of 569) | | 33

(170 of 516) | | 42

(181 of 438) | | 40

(128 of 319) |

Thrivent Moderately Conservative Allocation Fund - Lipper (Mixed-Asset Target Alloc. Consv. Funds) | | 32

(112 of 360) | | 22

(69 of 326) | | 44

(117 of 269) | | 36

(66 of 185) |

POP=Public Offering Price, which includes 5.5% max sales charge. NAV=Net Asset Value, no sales charge.

2

| * | The Adviser has contractually agreed, for as long as the current fee structure is in place, to waive certain investment advisory fees associated with the Fund. Refer to the expense table in the Fund’s prospectus. |

All rankings are based on total return and do not reflect sales charges. The lower the Lipper percentile ranking, the better the fund performance against its peers. Source for ranking is Lipper Inc. After analyzing each fund’s holdings and prospectus objectives, Lipper assigns the fund to a category or peer group called a Lipper classification. Once total return data has been calculated, Lipper ranks the relative performance of all funds in a particular classification against their respective peer group constituents, and then calculates percentile rankings based on those numerical rankings.

Performance data cited represents past performance and should not be viewed as an indication of future results. Investment return and principal value of the investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Call 800-847-4836 or visit Thrivent- Funds.com for performance results current to the most recent month-end.

Risks: The Asset Allocation Funds invest in other Thrivent Mutual Funds and in directly held equity and debt instruments. Each Fund is subject to its own fees and expenses and the expenses of the other funds in which it invests, and is subject to all of the risks of the other funds in which it invests. The value of each Fund is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. Each Fund may incur losses due to incorrect assessments of investments by its investment adviser. Foreign investments involve addition-al risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. The use of derivatives (such as futures and swaps) involves additional risks and transaction costs, which could leave each Fund in a worse position than if it had not used these instruments.

Investing in a mutual fund involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the fund, which investors should read and consider carefully before investing. Prospectuses are available from a Thrivent Financial representative or at ThriventFunds.com.

3

Dear Shareholder:

Financial markets delivered mixed results in 2015, pressured by slowing economic growth in China and plunging oil prices. The investment outlook is generally positive, although many of the issues that weighed on markets in 2015 could temper returns again in 2016.

Economic Review

The U.S. economy continued its slow but persistent recovery in 2015, expanding at a 2.2% average annual pace through the first three quarters of the year. Gains from strong consumer spending and a vibrant housing market were offset in part by sluggish business spending and exports. The job market improved. Employers created more than 2.6 million nonfarm jobs, and the unemployment rate fell to 5.0% from 5.7%.

Inflation and interest rates remained low, although the Federal Reserve, after holding short-term interest rates near 0% for seven years to help the economy, raised them by a quarter of a percentage point in December.

China grew 7% year-over-year in the first two quarters of the year, then 6.9% in the third. That far exceeded growth rates in the developed world—the euro area grew 0.3% in the third quarter, while Japan contracted 0.8%—but it was still the slowest rate of growth for China since the 2008 financial crisis. Investors worried this slowdown could derail other economies; they also blamed it for reducing demand for oil and other commodities that China had been consuming at a prodigious rate when it was growing faster. Crude oil prices fell to about $37 a barrel by year-end from above $100 in 2014.

Market Review

Judging strictly by market averages, U.S. stocks had an unremarkable year. The S&P 500 Index fell 14.97 points, or 0.7%, its first price decline since 2011, but still posted a positive total return of 1.38% after factoring in reinvested dividends. However, these numbers don’t reflect how volatile the stock market became as the year wore on, highlighted by an 11% plunge in the S&P 500 Index in August after China devalued its currency. Energy stocks were among the index’s worst performers, down nearly 24% in price, while consumer discretionary stocks rose 8.4%.

Japan’s Nikkei Stock Average rose 10.63% on a price basis, as Japan’s central bank bought financial assets to prop up the economy. In Europe, the Euro Stoxx 50 Index of blue chip stocks posted a total return of -4.47%, although that loss, reflecting returns to dollar-based investors, was largely due to declines in the value of the euro against the dollar. In euro terms, the index actually earned 6.42%. The MSCI Emerging Markets Index lost -14.92%.

Like stocks, bonds delivered mixed results, with lower-risk and intermediate-term assets generally performing best. The Barclays U.S. Aggregate Bond Index, dominated by U.S. Treasury bonds and other government-backed securities, earned 0.55%, and the Barclays Municipal Bond Index earned 3.3%. The Barclays U.S. Corporate High Yield Bond Index, home to many below-investment-grade energy bonds, lost 4.47%.

Our Outlook

The U.S. economy looks poised to continue growing in the 2% range in 2016. We anticipate growth of about 1% for Japan, 2% for the euro area, 3% for the U.K., and 6% for China.

The Fed likely will continue to nudge short-term interest rates higher, albeit at a modest pace with minimal disruptions to financial markets. Inflation could edge slightly higher if, as expected, oil prices begin to stabilize.

Overall, we anticipate modestly positive returns from financial assets, absent any material worsening in China’s economy or further weakness in oil prices. European stocks have an opportunity to outperform U.S. shares. Both were expensive heading into 2016, but corporate profit margins had more room to grow in Europe. Emerging market stocks are cheaper than stocks in developed economies, but look riskier pending improvements in commodities prices.

Select sectors of the bond market appear promising—despite the prospect of higher short-term interest rates—including investment-grade corporate bonds and municipal bonds. High-yield bonds will likely remain depressed until the oil market shows signs of stabilizing.

If you are concerned about the investment outlook, we encourage you to contact your Thrivent Financial representative. He or she can help keep your portfolio aligned with your goals and tolerance for risk. Meanwhile, thank you for the trust you have placed in our entire team of professionals at Thrivent Asset Management.

Sincerely,

Russell W. Swansen

Chief Investment Officer

Thrivent Mutual Funds

4

(This page intentionally left blank)

5

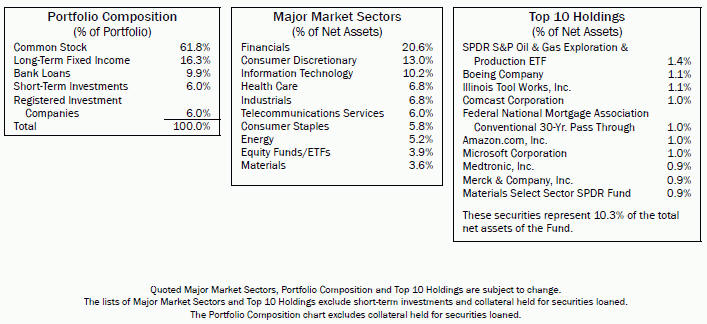

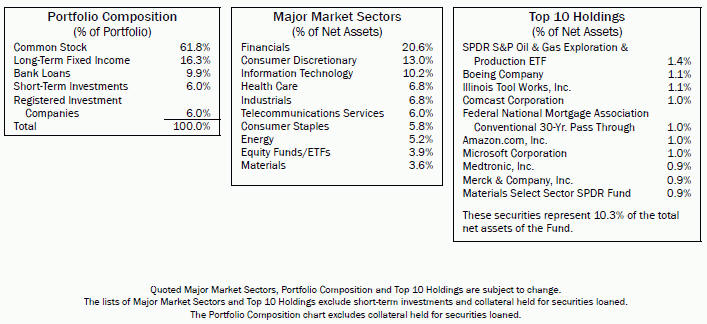

THRIVENT GROWTHAND INCOME PLUS FUND

Stephen D. Lowe, CFA, Darren M. Bagwell, CFA, Mark L. Simenstad, CFA, Noah J. Monson, CFA, Reginald L. Pfeifer, CFA, Portfolio Co-Managers

Thrivent Growth and Income Plus Fund seeks long-term capital growth and income.

The Fund invests in debt securities and equity securities. The value of the Fund is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Fund may incur losses due to incorrect assessments of investments by its investment adviser. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. Leveraged loans, REITs, preferred securities, sovereign debt, and mortgage-related and other asset-backed securities are subject to additional risks. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards; these risks are magnified for investments in emerging markets. An ETF is subject to additional fees and expenses, tracking error, and the risks of the underlying investments that it holds. The use of derivatives (such as futures and swaps) involves additional risks and transaction costs, which could leave the Fund in a worse position than if it had not used these instruments.

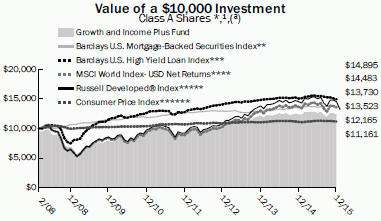

How did the Fund perform during the 12-month period ended December 31, 2015?

Thrivent Growth and Income Plus Fund earned a return of -1.03%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Growth category, of -1.25%. The Fund’s market benchmarks, the MSCI World Index-USD Net Returns, the Barclays U.S. High Yield Loan Index and the Barclays U.S. Mortgage-Backed Securities Index, earned returns of -0.87%, -0.82% and 1.51%, respectively.

What factors affected the Fund’s performance?

The investment climate became increasingly risk-averse as the year wore on amid concerns about slowing economic growth in China, a steep slide in oil prices, and the prospect of higher short-term interest rates in the U.S. The Fund, which allocates about 70% of its assets to equities and 30% to fixed-income securities, generated modestly positive returns before expenses from both groups.

The equity portion of the Fund was invested in three sectors: international equities, domestic equities and real estate investment trusts (REITs). In all three, the Fund outperformed industry benchmarks. International holdings benefited from a focus on low-volatility stocks of companies with consistent earnings, solid free cash flow, and low debt. Domestic stock holdings benefited from strong security selection, with technology and health care stocks posting the largest absolute and relative returns. REITs also benefited from strong security selection, with data centers, multi-family apartments and self-storage REITs among the sector’s best performers.

Fixed-income markets were driven primarily by two factors in 2015: expectations that the Fed would raise short-term interest rates, which it did by a quarter of a percentage point in December; and the slump in oil prices. The Fed’s move constrained returns at the short end of the yield curve, while the slide in oil prices, which was linked to concerns about China’s economic stamina, pressured returns for below-investment-grade credits, particularly among energy issues in the high-yield sector.

By contrast, the Fund’s high-yield holdings generated modestly positive returns (before Fund expenses), largely by virtue of being concentrated in the sector’s higher-rated bonds. Elsewhere, the Fund’s securitized assets outperformed their benchmark due both to favorable security selection and a material allocation to nonagency mortgage-backed securities, which substantially outperformed the agency mortgage-backed securities that dominate the sector’s benchmark.

The Fund underperformed its benchmarks for investment-grade corporate bonds, leveraged loans and emerging-market bonds. Performance in the loan sector lagged due to an overweighted position in poor-performing energy, mining and metals issues. Returns on investment-grade corporate bonds lagged due to being underweighted in the banking industry, which did relatively well, and overweighted in BBB-rated securities, which did not. In emerging markets, the Fund suffered from having little exposure to Ukraine and Russia, both of which performed well after hostilities between those two countries eased.

What is your outlook?

Stocks in most developed economies were expensive as 2015 drew to a close. European shares could outperform U.S. shares in 2016 as corporate profit margins have more room to grow in Europe. Emerging market stocks are cheaper than stocks in developed markets, but still riskier pending improvements in commodities prices. REITs look reasonably attractive, not only because they are generating strong funds from operations but also because they will become their own investment sector in 2016 under the Global Industry Classification Standard, which could broaden their appeal to institutional investors.

While no single sector of the fixed-income markets stands out as dramatically undervalued, the Fund’s broad diversification provides a range of opportunities for profits in some sectors to offset losses in others. For example, floating-rate leveraged loans hold their value better than fixed-rate bonds when interest rates are rising, and returns on securitized assets are driven by different factors than those impacting the high-yield sector. Half the Fund’s fixed-income assets are invested in leveraged bank loans, high-yield bonds and emerging market bonds, all of which will be sensitive to commodities price trends.

Overall, we expect modestly positive returns from financial assets in 2016, with risk greater to the downside than the upside—especially if China’s slowing growth weighs on other economies, or if commodities prices fail to improve.

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

6

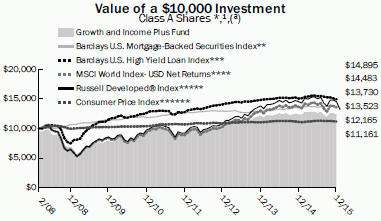

Average Annual Total Returns1

As of December 31, 2015

| | | | | | | | | | | | |

Class A2 | | 1-Year | | | 5 Years | | | From

Inception

2/29/2008 | |

without sales charge | | | -1.03% | | | | 5.97% | | | | 3.27% | |

with sales charge | | | -6.44% | | | | 4.78% | | | | 2.53% | |

| | | |

Institutional Class3 | | 1-Year | | | 5 Years | | | From

Inception

2/29/2008 | |

Net Asset Value | | | -0.77% | | | | 6.37% | | | | 3.64% | |

| 1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit ThriventFunds.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT (847-4836) or visit ThriventFunds.com for performance results current to the most recent month-end. |

| 2 | Class A performance with sales charge reflects the maximum sales charge of 5.5%. |

| 3 | Institutional Class shares have no sales load and are available to institutional shareholders and certain Thrivent sponsored programs. Effective February 1, 2016, Institutional Class shares were renamed Class S shares. |

| (a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

| * | Effective February 28, 2015, the Russell Developed® Index was replaced with the MSCI World Index—USD Net Returns. The Adviser made this benchmark change because it believes that this Index is a more appropriate benchmark for the Fund. Thus the Russell Developed® Index will not be shown in shareholder reports of the Fund for fiscal periods ended December 31, 2016. As you compare performance, please note that the Fund’s performance reflects the maximum 5.5% sales charge, while the Indexes shown do not reflect any such charges, deductions for fees, expenses or taxes. If you were to purchase any of the above individual stocks or funds represented in those indices, any charges you would pay would reduce your total return as well. |

| ** | The Barclays U.S. Mortgage-Backed Securities Index (MBS) is formed by grouping the universe of over 600,000 individual fixed-rate U.S. government agency MBS pools into approximately 3,500 generic types of securities. It is not possible to invest directly in the Index. |

| *** | The Barclays U.S. High Yield Loan Index measures U.S. Dollar denominated syndicated term loans. It is not possible to invest directly in the Index. |

| **** | The MSCI World Index—USD Net Returns is an index that represents large and mid-cap stock performance across developed market countries throughout the world. It is not possible to invest directly in the Index. |

| ***** | The Russell Developed® Index measures the performance of the investable securities in developed countries globally. It is not possible to invest directly in the Index. |

| ****** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

7

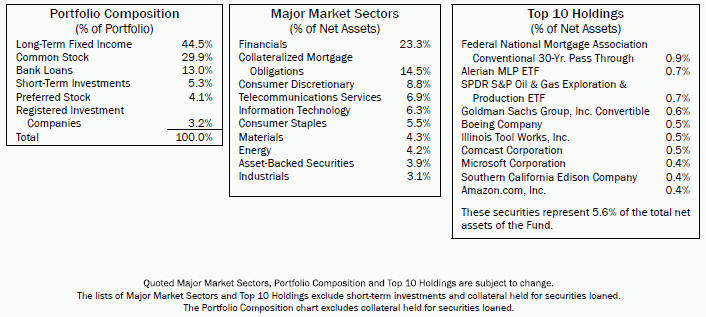

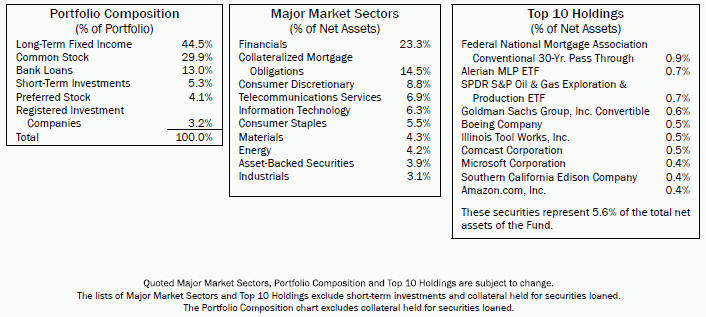

THRIVENT DIVERSIFIED INCOME PLUS FUND

Mark L. Simenstad, CFA, Stephen D. Lowe, CFA, Darren M. Bagwell, CFA, Noah J. Monsen, CFA, Reginald L. Pfeifer, CFA, Portfolio Co-Managers

Thrivent Diversified Income Plus Fund seeks to maximize income while maintaining prospects for capital appreciation.

The Fund invests in debt securities and equity securities. The value of the Fund is influenced by factors impacting the overall market, certain asset classes, certain investment styles, and specific issuers. The Fund may incur losses due to incorrect assessments of investments by its investment adviser. Bond prices generally fall as interest rates rise. Credit risk is the risk that an issuer of a debt security may not pay its debt, and high yield securities are subject to increased credit risk as well as liquidity risk. Leveraged loans, REITs, preferred securities, sovereign debt, and mortgage-related and other asset-backed securities are subject to additional risks. Foreign investments involve additional risks, including currency fluctuations, liquidity, political, economic and market instability, and different legal and accounting standards; these risks are magnified for investments in emerging markets. An ETF is subject to additional fees and expenses, tracking error, and the risks of the underlying investments that it holds. The use of derivatives (such as futures and swaps) involves additional risks and transaction costs, which could leave the Fund in a worse position than if it had not used these instruments.

How did the Fund perform during the 12-month period ended December 31, 2015?

Thrivent Diversified Income Plus Fund earned a return of -0.62%, compared with the median return of its peer group, the Lipper Mixed-Asset Target Allocation Conservative category, of -1.56%. The Fund’s market benchmarks, the MSCI World Index-USD Net Returns, the Barclays U.S. High Yield Loan Index and the Barclays U.S. Mortgage-Backed Securities Index, earned returns of -0.87%, -0.82% and 1.51%, respectively.

What factors affected the Fund’s performance?

The investing climate became increasingly risk-averse over the year as investors focused on slowing economic growth in China and plunging oil prices. Investors also were weighing the prospect of higher short-term interest rates, which became a reality in December when the Federal Reserve raised short-term rates a quarter of a percentage point. That pressured bond returns at the short end of the yield curve. Meanwhile, the slide in oil prices, which was linked to concerns about China’s economic stamina, pressured returns for below-investment-grade credits, particularly among energy issues in the high-yield sector.

The Fund allocates about 70% of its assets to fixed-income securities and 30% to equities, and in 2015 generated modestly positive returns, before expenses, from both groups.

The Fund’s high-yield bonds outperformed their benchmark, generating modestly positive returns (before Fund expenses), largely by virtue of being concentrated in higher-rated securities within that sector. The Fund’s securitized assets—mainly mortgage-backed securities—also outperformed their benchmark and generated positive returns. This was due both to favorable security selection and a material allocation to nonagency mortgage-backed securities, which substantially outperformed the agency mortgage-backed securities that dominate the sector’s benchmark.

The Fund underperformed its benchmarks for investment-grade corporate bonds, leveraged loans and emerging-market bonds. Performance in the loan sector lagged due to an overweighted position in poor-performing energy, mining and metals issues. Returns on investment-grade corporate bonds lagged due to being underweighted in the banking industry, which did relatively well, and overweighted in BBB-rated securities, which did not. In emerging markets, the Fund suffered from having little exposure to Ukraine and Russia, both of which performed well after hostilities between those two countries eased.

The equity portion of the Fund was invested in three sectors: international equities, domestic equities and real estate investment trusts (REITs). In all three, the Fund outperformed industry benchmarks. International holdings benefited from a focus on low-volatility stocks issued by companies with consistent earnings, solid free cash flow, and low debt. Domestic stock holdings benefited from strong security selection, with technology and health care stocks posting the largest absolute and relative returns. REITs also benefited from strong security selection, with data centers, multi-family apartments and self-storage REITs among the sector’s best performers.

What is your outlook?

While no single sector of the fixed-income markets stands out as dramatically undervalued, the Fund’s broad diversification provides a range of opportunities to generate profit in some sectors to offset losses in others. For example, floating-rate leveraged loans hold their value better than fixed-rate bonds when interest rates are rising, and returns on securitized assets are driven by different factors than those impacting high-yield bonds. Half the Fund’s fixed-income assets are invested in leveraged bank loans, high-yield bonds and emerging market bonds, all of which will be sensitive to commodities price trends.

Stocks in most developed economies were expensive as 2015 drew to a close. Because corporate profit margins have more room to grow, European shares could outperform U.S. shares in 2016. Stocks in emerging markets are cheaper than developed markets, but still riskier pending improvements in commodities prices. REITs look reasonably attractive, not only because they are generating strong funds from operations but also because they will become their own investment sector in 2016 under the Global Industry Classification Standard, which could broaden their appeal to institutional investors.

Overall, we expect modestly positive returns from financial assets in 2016, with risk greater to the downside than the upside—especially if China’s slowing growth weighs on other economies, or if commodities prices fail to improve.

Quoted Fund performance is for Class A shares and does not reflect a sales charge.

The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

8

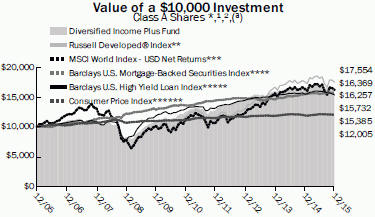

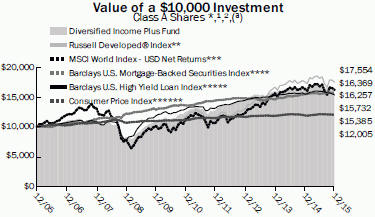

Average Annual Total Returns1,2

As of December 31, 2015

| | | | | | | | | | | | |

Class A3 | | 1-Year | | | 5 Years | | | 10 Years | |

without sales charge | | | -0.62% | | | | 5.70% | | | | 5.54% | |

with sales charge | | | -5.03% | | | | 4.73% | | | | 5.06% | |

| | | |

Institutional Class4 | | 1-Year | | | 5 Years | | | 10 Years | |

Net Asset Value | | | -0.19% | | | | 6.03% | | | | 5.91% | |

| 1 | Past performance is not an indication of future results. Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. To obtain a prospectus, contact a registered representative or visit ThriventFunds.com. At various times, the Fund’s adviser waived its management fee and/or reimbursed Fund expenses. Had the adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Call 800-THRIVENT (847-4836) or visit ThriventFunds.com for performance results current to the most recent month-end. |

| 2 | Prior to July 3, 2006, the Fund, as a high yield fund, invested primarily in junk bonds. |

| 3 | Class A performance with sales charge reflects the maximum sales charge of 4.5%. |

| 4 | Institutional Class shares have no sales load and are available to institutional shareholders and certain Thrivent sponsored programs. Effective February 1, 2016, Institutional Class shares were renamed Class S shares. |

| (a) | Performance of other classes will be greater or less than the line shown based on the differences in loads and fees paid by shareholders investing in the different classes. |

| * | Effective February 28, 2015, the Russell Developed® Index was replaced with the MSCI World Index—USD Net Returns. The Adviser made this benchmark change because it believes that this Index is a more appropriate benchmark for the Fund. Thus the Russell Developed® Index will not be shown in shareholder reports of the Fund for fiscal periods ended December 31, 2016. As you compare performance, please note that the Fund’s performance reflects the maximum 4.5% sales charge, while the Russell Developed Index, the Barclays U.S. Mortgage-Backed Securities Index and the Consumer Price Index do not reflect any such charges, deductions for fees, expenses or taxes. If you were to purchase any of the above individual stocks or funds represented in those indices, any charges you would pay would reduce your total return as well. |

| ** | The Russell Developed® Index measures the performance of the investable securities in the developed countries globally. It is not possible to invest directly in the Index. |

| *** | The MSCI World Index—USD Net Returns is an index that represents large and mid-cap stock performance across developed market countries throughout the world. It is not possible to invest directly in the Index. |

| **** | The Barclays U.S. Mortgage-Backed Securities Index (MBS) is formed by grouping the universe of over 600,000 individual fixed-rate U.S. government agency MBS pools into approximately 3,500 generic types of securities. It is not possible to invest directly in the Index. |

| ***** | The Barclays U.S. High Yield Loan Index measures U.S. Dollar denominated syndicated term loans. It is not possible to invest directly in the Index. |

| ****** | The Consumer Price Index is an inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food and transportation. It is not possible to invest directly in the Index. |

9

SHAREHOLDER EXPENSE EXAMPLE

(unaudited)

As a shareholder of a Fund, you incur, depending on the Fund and share class, two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in your Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2015 through December 31, 2015.

Actual Expenses

In the table below, the first section, labeled “Actual,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number from the appropriate Class line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid. A small account fee of $12 may be charged to Class A shareholder accounts if the value falls to an amount of $2,000 or less, in the case of a non-qualified account, and $1,000 or less, in the case of a qualified account. This fee is not included in the table below. If it were and you were assessed such a fee, the expenses you paid during the period would have been higher and the ending account value would have been lower.

Hypothetical Example for Comparison Purposes

In the table below, the second section, labeled “Hypothetical,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small account fee of $12 may be charged to Class A shareholder accounts if the value falls to an amount of $2,000 or less, in the case of a non-qualified account, and $1,000 or less, in the case of a qualified account. This fee is not included in the table below. If it were and you were assessed such a fee, the expenses you paid during the period would have been higher and the ending account value would have been lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

7/1/2015 | | | Ending

Account

Value

12/31/2015 | | | Expenses

Paid

During

Period

7/1/2015-

12/31/2015* | | | Annualized

Expense

Ratio | |

Thrivent Growth and Income Plus Fund | | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000 | | | $ | 974 | | | $ | 5.72 | | | | 1.15 | % |

Institutional Class | | $ | 1,000 | | | $ | 975 | | | $ | 3.98 | | | | 0.80 | % |

Hypothetical** | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.85 | | | | 1.15 | % |

Institutional Class | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.08 | | | | 0.80 | % |

Thrivent Diversified Income Plus Fund | | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000 | | | $ | 977 | | | $ | 4.88 | | | | 0.98 | % |

Institutional Class | | $ | 1,000 | | | $ | 980 | | | $ | 3.46 | | | | 0.69 | % |

Hypothetical** | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000 | | | $ | 1,020 | | | $ | 4.98 | | | | 0.98 | % |

Institutional Class | | $ | 1,000 | | | $ | 1,022 | | | $ | 3.53 | | | | 0.69 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| ** | Assuming 5% annualized total return before expenses. |

10

Report of lndependent Registered Public Accounting Firm

To the Trustees and Shareholders of Thrivent Diversified Income Plus Fund and Thrivent Growth and Income Plus Fund:

In our opinion, the accompanying statements of assets and liabilities, including the summary schedules of investments of Thrivent Diversified Income Plus Fund and Thrivent Growth and Income Plus Fund (constituting part of the Thrivent Mutual Funds) (hereafter referred to as the “Funds”), and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Funds at December 31, 2015, the results of each of their operations for the year then ended, the changes in each of their net assets for each of the two years in the period then ended and their financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2015 by correspondence with the custodian, agent banks, transfer agent and brokers provides a reasonable basis for our opinion.

February 18, 2016

PricewaterhouseCoopers LLP, Suite 1400, 225 South Sixth Street, Minneapolis, MN 55402

T: (612) 596 6000, F: (612) 373 7160, www.pwc.com/us

11

GROWTHAND INCOME PLUS FUND

Summary Schedule of Investments as of December 31, 2015

| | | | | | | | | | | | |

Principal Amount | | | Bank Loans (10.2%) | | Value | | | % of Net

Assets | |

| Basic Materials (0.5%) | | | | | | | | |

| | | | Other Securities^ | | $ | 373,686 | | | | 0.5 | % |

| | | | | | | | | | | | |

| | | | Total | | | 373,686 | | | | | |

| | | | | | | | | | | | |

| | |

| Capital Goods (0.5%) | | | | | | | | |

| | | | Other Securities^ | | | 356,625 | | | | 0.5 | % |

| | | | | | | | | | | | |

| | | | Total | | | 356,625 | | | | | |

| | | | | | | | | | | | |

| | |

| Communications Services (3.6%) | | | | | | | | |

| | | | Other Securities^ | | | 2,657,579 | | | | 3.6 | % |

| | | | | | | | | | | | |

| | | | Total | | | 2,657,579 | | | | | |

| | | | | | | | | | | | |

| | |

| Consumer Cyclical (1.9%) | | | | | | | | |

| | | | Other Securities^ | | | 1,370,394 | | | | 1.9 | % |

| | | | | | | | | | | | |

| | | | Total | | | 1,370,394 | | | | | |

| | | | | | | | | | | | |

| | |

| Consumer Non-Cyclical (1.2%) | | | | | | | | |

| | | | Other Securities^ | | | 922,497 | | | | 1.2 | % |

| | | | | | | | | | | | |

| | | | Total | | | 922,497 | | | | | |

| | | | | | | | | | | | |

| | |

| Energy (0.5%) | | | | | | | | |

| | | | Other Securities^ | | | 343,532 | | | | 0.5 | % |

| | | | | | | | | | | | |

| | | | Total | | | 343,532 | | | | | |

| | | | | | | | | | | | |

| | |

| Financials (0.7%) | | | | | | | | |

| | | | Other Securities^ | | | 524,130 | | | | 0.7 | % |

| | | | | | | | | | | | |

| | | | Total | | | 524,130 | | | | | |

| | | | | | | | | | | | |

| | |

| Technology (0.6%) | | | | | | | | |

| | | | Other Securities^ | | | 424,172 | | | | 0.6 | % |

| | | | | | | | | | | | |

| | | | Total | | | 424,172 | | | | | |

| | | | | | | | | | | | |

| | |

| Transportation (0.4%) | | | | | | | | |

| | | | Other Securities^ | | | 315,220 | | | | 0.4 | % |

| | | | | | | | | | | | |

| | | | Total | | | 315,220 | | | | | |

| | | | | | | | | | | | |

| | |

| Utilities (0.3%) | | | | | | | | |

| | | | Other Securities^ | | | 222,609 | | | | 0.3 | % |

| | | | | | | | | | | | |

| | | | Total | | | 222,609 | | | | | |

| | | | | | | | | | | | |

| | | | Total Bank Loans (cost $8,031,853) | | | 7,510,444 | | | | | |

| | | | | | | | | | | | |

| | | |

Shares | | | Common Stock (63.3%) | | | | | | |

| Consumer Discretionary (10.0%) | | | | | | | | |

| | 1,070 | | | Amazon.com, Inc.a | | | 723,202 | | | | 1.0 | % |

| | 820 | | | AutoZone, Inc.a | | | 608,366 | | | | 0.8 | % |

| | 13,288 | | | Comcast Corporation | | | 749,842 | | | | 1.0 | % |

| | 9,380 | | | NIKE, Inc. | | | 586,250 | | | | 0.8 | % |

| | 6,734 | | | Starbucks Corporation | | | 404,242 | | | | 0.6 | % |

| | | | Other Securities^ | | | 4,282,063 | | | | 5.8 | % |

| | | | | | | | | | | | |

| | | | Total | | | 7,353,965 | | | | | |

| | | | | | | | | | | | |

| | |

| Consumer Staples (3.7%) | | | | | | | | |

| | 3,508 | | | Anheuser-Busch InBev NV ADR | | | 438,500 | | | | 0.6 | % |

| | 9,600 | | | Coca-Cola Company | | | 412,416 | | | | 0.6 | % |

| | 6,900 | | | Imperial Tobacco Group plc | | | 364,444 | | | | 0.5 | % |

| | | | Other Securities^ | | | 1,491,099 | | | | 2.0 | % |

| | | | | | | | | | | | |

| | | | Total | | | 2,706,459 | | | | | |

| | | | | | | | | | | | |

| | |

| Energy (4.0%) | | | | | | | | |

| | 6,000 | | | EOG Resources, Inc. | | | 424,740 | | | | 0.6 | % |

| | 12,900 | | | Spectra Energy Corporation | | | 308,826 | | | | 0.4 | % |

| | 7,710 | | | Total SA ADR | | | 346,565 | | | | 0.5 | % |

| | 57,140 | | | Weatherford International, Ltd.a | | | 479,405 | | | | 0.6 | % |

| | | | Other Securities^ | | | 1,418,966 | | | | 1.9 | % |

| | | | | | | | | | | | |

| | | | Total | | | 2,978,502 | | | | | |

| | | | | | | | | | | | |

| | |

| Financials (18.1%) | | | | | | | | |

| | 2,900 | | | Allianz SE | | | 511,209 | | | | 0.7 | % |

| | 18,430 | | | Charles Schwab Corporation | | | 606,900 | | | | 0.8 | % |

| | 10,100 | | | Citigroup, Inc. | | | 522,675 | | | | 0.7 | % |

| | 1,590 | | | Intercontinental Exchange, Inc. | | | 407,453 | | | | 0.6 | % |

| | 7,602 | | | MetLife, Inc. | | | 366,492 | | | | 0.5 | % |

| | 1,318 | | | Public Storage, Inc. | | | 326,469 | | | | 0.5 | % |

| | 2,624 | | | Simon Property Group, Inc. | | | 510,211 | | | | 0.7 | % |

| | 3,200 | | | Swiss Re AG | | | 312,532 | | | | 0.4 | % |

| | 13,250 | | | Synchrony Financiala | | | 402,933 | | | | 0.6 | % |

| | | | Other Securities^ | | | 9,326,457 | | | | 12.6 | % |

| | | | | | | | | | | | |

| | | | Total | | | 13,293,331 | | | | | |

| | | | | | | | | | | | |

| | |

| Health Care (6.8%) | | | | | | | | |

| | 13,070 | | | Abbott Laboratories | | | 586,974 | | | | 0.8 | % |

| | 1,670 | | | Allergan plca | | | 521,875 | | | | 0.7 | % |

| | 2,030 | | | Amgen, Inc. | | | 329,530 | | | | 0.5 | % |

| | 8,630 | | | Medtronic, Inc. | | | 663,820 | | | | 0.9 | % |

| | 12,490 | | | Merck & Company, Inc. | | | 659,722 | | | | 0.9 | % |

| | | | Other Securities^ | | | 2,246,849 | | | | 3.0 | % |

| | | | | | | | | | | | |

| | | | Total | | | 5,008,770 | | | | | |

| | | | | | | | | | | | |

| | |

| Industrials (6.8%) | | | | | | | | |

| | 5,690 | | | Boeing Company | | | 822,717 | | | | 1.1 | % |

| | 8,650 | | | Illinois Tool Works, Inc. | | | 801,682 | | | | 1.1 | % |

| | 7,550 | | | Ingersoll-Rand plc | | | 417,440 | | | | 0.6 | % |

| | 4,700 | | | Macquarie Infrastructure Corporation | | | 341,220 | | | | 0.5 | % |

| | | | Other Securities^ | | | 2,601,402 | | | | 3.5 | % |

| | | | | | | | | | | | |

| | | | Total | | | 4,984,461 | | | | | |

| | | | | | | | | | | | |

| | |

| Information Technology (9.1%) | | | | | | | | |

| | 4,720 | | | Alibaba Group Holding, Ltd. ADRa | | | 383,594 | | | | 0.5 | % |

| | 530 | | | Alphabet, Inc., Class Aa | | | 412,345 | | | | 0.6 | % |

| | 521 | | | Alphabet, Inc., Class Ca | | | 395,377 | | | | 0.5 | % |

| | 4,780 | | | Apple, Inc. | | | 503,143 | | | | 0.7 | % |

| | 15,550 | | | Cisco Systems, Inc. | | | 422,260 | | | | 0.6 | % |

| | 14,488 | | | EMC Corporation | | | 372,052 | | | | 0.5 | % |

| | 3,190 | | | MasterCard, Inc. | | | 310,578 | | | | 0.4 | % |

| | 12,950 | | | Microsoft Corporation | | | 718,466 | | | | 1.0 | % |

| | 8,250 | | | Visa, Inc. | | | 639,788 | | | | 0.9 | % |

| | 7,550 | | | Xilinx, Inc. | | | 354,624 | | | | 0.5 | % |

| | | | Other Securities^ | | | 2,215,200 | | | | 2.9 | % |

| | | | | | | | | | | | |

| | | | Total | | | 6,727,427 | | | | | |

| | | | | | | | | | | | |

| | |

| Materials (1.8%) | | | | | | | | |

| | | | Other Securities^ | | | 1,354,470 | | | | 1.8 | % |

| | | | | | | | | | | | |

| | | | Total | | | 1,354,470 | | | | | |

| | | | | | | | | | | | |

| | |

| Telecommunications Services (1.4%) | | | | | | | | |

| | | | Other Securities^ | | | 1,052,420 | | | | 1.4 | % |

| | | | | | | | | | | | |

| | | | Total | | | 1,052,420 | | | | | |

| | | | | | | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

12

GROWTHAND INCOME PLUS FUND

Summary Schedule of Investments as of December 31, 2015

| | | | | | | | | | | | |

Shares | | | Common Stock (63.3%) | | Value | | | % of Net

Assets | |

| Utilities (1.6%) | | | | | | | | |

| | 14,400 | | | Brookfield Infrastructure Partners, LP | | $ | 545,904 | | | | 0.8 | % |

| | | | Other Securities^ | | | 611,732 | | | | 0.8 | % |

| | | | | | | | | | | | |

| | | | Total | | | 1,157,636 | | | | | |

| | | | | | | | | | | | |

| | | | Total Common Stock (cost $47,537,403) | | | 46,617,441 | | | | | |

| | | | | | | | | | | | |

| | | |

Principal Amount | | | Long-Term Fixed Income (16.7%) | | | | | | |

| Asset-Backed Securities (0.1%) | | | | | | | | |

| | | | Other Securities^ | | | 78,456 | | | | 0.1 | % |

| | | | | | | | | | | | |

| | | | Total | | | 78,456 | | | | | |

| | | | | | | | | | | | |

| | |

| Basic Materials (0.2%) | | | | | | | | |

| | | | Other Securities^ | | | 169,839 | | | | 0.2 | % |

| | | | | | | | | | | | |

| | | | Total | | | 169,839 | | | | | |

| | | | | | | | | | | | |

| | |

| Capital Goods (0.6%) | | | | | | | | |

| | | | Other Securities^ | | | 479,036 | | | | 0.6 | % |

| | | | | | | | | | | | |

| | | | Total | | | 479,036 | | | | | |

| | | | | | | | | | | | |

| | |

| Collateralized Mortgage Obligations (2.7%) | | | | | | | | |

| | | | Other Securities^ | | | 1,928,787 | | | | 2.7 | % |

| | | | | | | | | | | | |

| | | | Total | | | 1,928,787 | | | | | |

| | | | | | | | | | | | |

| | |

| Communications Services (1.0%) | | | | | | | | |

| | | | Other Securities^ | | | 746,968 | | | | 1.0 | % |

| | | | | | | | | | | | |

| | | | Total | | | 746,968 | | | | | |

| | | | | | | | | | | | |

| | |

| Consumer Cyclical (1.1%) | | | | | | | | |

| | | | Other Securities^ | | | 794,530 | | | | 1.1 | % |

| | | | | | | | | | | | |

| | | | Total | | | 794,530 | | | | | |

| | | | | | | | | | | | |

| | |

| Consumer Non-Cyclical (0.9%) | | | | | | | | |

| | | | Other Securities^ | | | 662,353 | | | | 0.9 | % |

| | | | | | | | | | | | |

| | | | Total | | | 662,353 | | | | | |

| | | | | | | | | | | | |

| | |

| Energy (0.7%) | | | | | | | | |

| | | | Other Securities^ | | | 486,027 | | | | 0.7 | % |

| | | | | | | | | | | | |

| | | | Total | | | 486,027 | | | | | |

| | | | | | | | | | | | |

| | |

| Financials (1.8%) | | | | | | | | |

| | | | Goldman Sachs Group, Inc. Convertible | | | | | | | | |

| $ | 375,000 | | | 0.500%, 9/24/2022 | | | 387,911 | | | | 0.6 | % |

| | | | Other Securities^ | | | 917,344 | | | | 1.2 | % |

| | | | | | | | | | | | |

| | | | Total | | | 1,305,255 | | | | | |

| | | | | | | | | | | | |

| | |

| Foreign Government (3.6%) | | | | | | | | |

| | | | Other Securities^ | | | 2,625,149 | | | | 3.6 | % |

| | | | | | | | | | | | |

| | | | Total | | | 2,625,149 | | | | | |

| | | | | | | | | | | | |

| | |

| Mortgage-Backed Securities (2.6%) | | | | | | | | |

| | | | Federal National Mortgage Association Conventional 30- Yr. Pass Through | | | | | | | | |

| | 705,000 | | | 3.500%, 1/1/2046b | | | 727,365 | | | | 1.0 | % |

| | 475,000 | | | 4.000%, 1/1/2046b | | | 502,632 | | | | 0.7 | % |

| | 250,000 | | | 4.500%, 1/1/2046b | | | 269,969 | | | | 0.4 | % |

| | | | Other Securities^ | | | 416,076 | | | | 0.5 | % |

| | | | | | | | | | | | |

| | | | Total | | | 1,916,042 | | | | | |

| | | | | | | | | | | | |

| | |

| Technology (0.5%) | | | | | | | | |

| | | | Other Securities^ | | | 395,877 | | | | 0.5 | % |

| | | | | | | | | | | | |

| | | | Total | | | 395,877 | | | | | |

| | | | | | | | | | | | |

| | |

| Transportation (0.2%) | | | | | | | | |

| | | | Other Securities^ | | | 122,063 | | | | 0.2 | % |

| | | | | | | | | | | | |

| | | | Total | | | 322,063 | | | | | |

| | | | | | | | | | | | |

| | |

| U.S. Government and Agencies (0.2%) | | | | | | | | |

| | | | Other Securities^ | | | 150,939 | | | | 0.2 | % |

| | | | | | | | | | | | |

| | | | Total | | | 350,939 | | | | | |

| | | | | | | | | | | | |

| | |

| Utilities (0.5%) | | | | | | | | |

| | | | Other Securities^ | | | 404,535 | | | | 0.5 | % |

| | | | | | | | | | | | |

| | | | Total | | | 304,535 | | | | | |

| | | | | | | | | | | | |

| | | | Total Long-Term Fixed Income (cost $12,568,855) | | | 12,265,856 | | | | | |

| | | | | | | | | | | | |

| | | |

Shares | | | Registered Investment Companies (6.2%) | | | | | | |

| Equity Funds/ETFs (3.9%) | | | | | | | | |

| | 11,514 | | | iShares S&P U.S. Preferred Stock Index Fund | | | 447,319 | | | | 0.6 | % |

| | 14,890 | | | Materials Select Sector SPDR Fund | | | 646,524 | | | | 0.9 | % |

| | 34,200 | | | SPDR S&P Oil & Gas Exploration & Production ETF | | | 1,033,524 | | | | 1.4 | % |

| | 13,410 | | | Utilities Select Sector SPDR Fund | | | 580,385 | | | | 0.8 | % |

| | | | Other Securities^ | | | 161,438 | | | | 0.2 | % |

| | | | | | | | | | | | |

| | | | Total | | | 2,869,190 | | | | | |

| | | | | | | | | | | | |

| | |

| Fixed Income Funds/ETFs (2.3%) | | | | | | | | |

| | 11,300 | | | SPDR Barclays High Yield Bond ETF | | | 383,183 | | | | 0.5 | % |

| | 7,145 | | | Vanguard Short-Term Corporate Bond ETF | | | 564,384 | | | | 0.8 | % |

| | | | Other Securities^ | | | 722,803 | | | | 1.0 | % |

| | | | | | | | | | | | |

| | | | Total | | | 3,670,370 | | | | | |

| | | | | | | | | | | | |

| | | | Total Registered Investment Companies (cost $5,014,192) | | | 4,539,560 | | | | | |

| | | | | | | | | | | | |

| | | |

Shares or Principal Amount | | | Short-Term Investments (6.1%)c | | | | | | |

| | | | Federal National Mortgage Association Discount Notes | | | | | | | | |

| | 100,000 | | | 0.100%, 1/4/2016d | | | 99,999 | | | | 0.2 | % |

| | | | Thrivent Cash Management Trust | | | | | | | | |

| | 4,226,851 | | | 0.220% | | | 4,226,851 | | | | 5.7 | % |

| | | | Other Securities^ | | | 199,958 | | | | 0.2 | % |

| | | | | | | | | | | | |

| | | | Total Short-Term Investments (at amortized cost) | | | 4,526,808 | | | | | |

| | | | | | | | | | | | |

| | | | Total Investments (cost $77,679,111) 102.5% | | $ | 75,460,109 | | | | | |

| | | | | | | | | | | | |

| | | | Other Assets and Liabilities, Net (2.5%) | | | (1,835,283 | ) | | | | |

| | | | | | | | | | | | |

| | | | Total Net Assets 100.0% | | $ | 73,624,826 | | | | | |

| | | | | | | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

13

GROWTHAND INCOME PLUS FUND

Summary Schedule of Investments as of December 31, 2015

| ^ | The Summary Schedule of Investments shows the 50 largest holdings in unaffiliated issuers, any holding or issuer that exceeds 1% of net assets and all affiliated holdings as of the report date. The remaining securities held are grouped by category as “Other securities”. |

| a | Non-income producing security. |

| b | Denotes investments purchased on a when-issued or delayed delivery basis. |

| c | The interest rate shown reflects the yield, coupon rate or the discount rate at the date of purchase. |

| d | All or a portion of the security is held on deposit with the counterparty and pledged as the initial margin deposit for open futures contracts. |

Definitions:

| | | | |

| ADR | | - | | American Depositary Receipt, which are certificates for an underlying foreign security’s shares held by an issuing U.S. depository bank. |

| ETF | | - | | Exchange Traded Fund. |

Unrealized Appreciation (Depreciation)

Gross unrealized appreciation and depreciation of investments, based on cost for federal income tax purposes, were as follows:

| | | | |

Gross unrealized appreciation | | $ | 2,419,479 | |

Gross unrealized depreciation | | | (4,913,446 | ) |

| | | | |

Net unrealized appreciation (depreciation) | | ($ | 2,493,967 | ) |

Cost for federal income tax purposes | | $ | 77,954,076 | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

14

GROWTHAND INCOME PLUS FUND

Summary Schedule of Investments as of December 31, 2015

Fair Valuation Measurements

The following table is a summary of the inputs used, as of December 31, 2015, in valuing Growth and Income Plus Fund’s assets carried at fair value.

| | | | | | | | | | | | | | | | |

Investments in Securities | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

Bank Loans | | | | | | | | | | | | | | | | |

Basic Materials | | | 373,686 | | | | — | | | | 300,541 | | | | 73,145 | |

Capital Goods | | | 356,625 | | | | — | | | | 356,625 | | | | — | |

Communications Services | | | 2,657,579 | | | | — | | | | 2,485,529 | | | | 172,050 | |

Consumer Cyclical | | | 1,370,394 | | | | — | | | | 1,370,394 | | | | — | |

Consumer Non-Cyclical | | | 922,497 | | | | — | | | | 883,889 | | | | 38,608 | |

Energy | | | 343,532 | | | | — | | | | 153,141 | | | | 190,391 | |

Financials | | | 524,130 | | | | — | | | | 524,130 | | | | — | |

Technology | | | 424,172 | | | | — | | | | 423,913 | | | | 259 | |

Transportation | | | 315,220 | | | | — | | | | 315,220 | | | | — | |

Utilities | | | 222,609 | | | | — | | | | 222,609 | | | | — | |

Common Stock | | | | | | | | | | | | | | | | |

Consumer Discretionary | | | 7,353,965 | | | | 5,442,742 | | | | 1,911,223 | | | | — | |

Consumer Staples | | | 2,706,459 | | | | 1,043,439 | | | | 1,663,020 | | | | — | |

Energy | | | 2,978,502 | | | | 2,634,757 | | | | 343,745 | | | | — | |

Financials | | | 13,293,331 | | | | 9,535,690 | | | | 3,757,641 | | | | — | |

Health Care | | | 5,008,770 | | | | 3,917,586 | | | | 1,091,184 | | | | — | |

Industrials | | | 4,984,461 | | | | 3,094,314 | | | | 1,890,147 | | | | — | |

Information Technology | | | 6,727,427 | | | | 5,910,561 | | | | 816,866 | | | | — | |

Materials | | | 1,354,470 | | | | 433,742 | | | | 920,728 | | | | — | |

Telecommunications Services | | | 1,052,420 | | | | 161,135 | | | | 891,285 | | | | — | |

Utilities | | | 1,157,636 | | | | 850,238 | | | | 307,398 | | | | — | |

Long-Term Fixed Income | | | | | | | | | | | | | | | | |

Asset-Backed Securities | | | 78,456 | | | | — | | | | 78,456 | | | | — | |

Basic Materials | | | 169,839 | | | | — | | | | 169,839 | | | | — | |

Capital Goods | | | 479,036 | | | | — | | | | 479,036 | | | | — | |

Collateralized Mortgage Obligations | | | 1,928,787 | | | | — | | | | 1,928,787 | | | | — | |

Communications Services | | | 746,968 | | | | — | | | | 746,968 | | | | — | |

Consumer Cyclical | | | 794,530 | | | | — | | | | 794,530 | | | | — | |

Consumer Non-Cyclical | | | 662,353 | | | | — | | | | 662,353 | | | | — | |

Energy | | | 486,027 | | | | — | | | | 486,027 | | | | — | |

Financials | | | 1,305,255 | | | | — | | | | 917,344 | | | | 387,911 | |

Foreign Government | | | 2,625,149 | | | | — | | | | 2,625,149 | | | | — | |

Mortgage-Backed Securities | | | 1,916,042 | | | | — | | | | 1,916,042 | | | | — | |

Technology | | | 395,877 | | | | — | | | | 395,877 | | | | — | |

Transportation | | | 122,063 | | | | — | | | | 122,063 | | | | — | |

U.S. Government and Agencies | | | 150,939 | | | | — | | | | 150,939 | | | | — | |

Utilities | | | 404,535 | | | | — | | | | 404,535 | | | | — | |

Registered Investment Companies | | | | | | | | | | | | | | | | |

Equity Funds/ETFs | | | 2,869,190 | | | | 2,869,190 | | | | — | | | | — | |

Fixed Income Funds/ETFs | | | 1,670,370 | | | | 1,670,370 | | | | — | | | | — | |

Short-Term Investments | | | 4,526,808 | | | | 4,226,851 | | | | 299,957 | | | | — | |

| | | | | | | | | | | | | | | | |

Total | | $ | 75,460,109 | | | $ | 41,790,615 | | | $ | 32,807,130 | | | $ | 862,364 | |

| | | | | | | | | | | | | | | | |

| | | | |

Other Financial Instruments | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

Asset Derivatives | | | | | | | | | | | | | | | | |

Futures Contracts | | | 10,629 | | | | 10,629 | | | | — | | | | — | |

Credit Default Swaps | | | 5,862 | | | | — | | | | 5,862 | | | | — | |

| | | | | | | | | | | | | | | | |

Total Asset Derivatives | | $ | 16,491 | | | $ | 10,629 | | | $ | 5,862 | | | $ | — | |

| | | | | | | | | | | | | | | | |

Liability Derivatives | | | | | | | | | | | | | | | | |

Futures Contracts | | | 5,343 | | | | 5,343 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total Liability Derivatives | | $ | 5,343 | | | $ | 5,343 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

There were no significant transfers between Levels during the period ended December 31, 2015. Transfers between Levels are identified as of the end of the period.

The accompanying Notes to Financial Statements are an integral part of this schedule.

15

GROWTHAND INCOME PLUS FUND

Summary Schedule of Investments as of December 31, 2015

The following table presents Growth and Income Plus Fund’s futures contracts held as of December 31, 2015. Investments totaling $199,973 were pledged as the initial margin deposit for these contracts.

| | | | | | | | | | | | | | | | | | |

Futures Contracts | | Number of

Contracts

Long/(Short) | | | Expiration

Date | | Notional

Principal

Amount | | | Value | | | Unrealized

Gain/(Loss) | |

2-Yr. U.S. Treasury Bond Futures | | | (19 | ) | | March 2016 | | ($ | 4,133,035 | ) | | ($ | 4,127,453 | ) | | $ | 5,582 | |

5-Yr. U.S. Treasury Bond Futures | | | 13 | | | March 2016 | | | 1,540,642 | | | | 1,538,164 | | | | (2,478 | ) |

10-Yr. U.S. Treasury Bond Futures | | | (6 | ) | | March 2016 | | | (756,685 | ) | | | (755,438 | ) | | | 1,247 | |

30-Yr. U.S. Treasury Bond Futures | | | 2 | | | March 2016 | | | 306,178 | | | | 307,500 | | | | 1,322 | |

S&P 500 Mini-Futures | | | 3 | | | March 2016 | | | 308,175 | | | | 305,310 | | | | (2,865 | ) |

Ultra Long Term U.S. Treasury Bond Futures | | | 2 | | | March 2016 | | | 314,897 | | | | 317,375 | | | | 2,478 | |

Total Futures Contracts | | | | | | | | | | | | | | | | $ | 5,286 | |

The following table presents Growth and Income Plus Fund’s swaps contracts held as of December 31, 2015. Investments totaling $99,983 were pledged as collateral under the agreement between the counterparty, the custodian and the fund for open swap contracts.

| | | | | | | | | | | | | | | | | | | | |

Credit Default Swaps and Counterparty | | Buy/Sell Protection1 | | | Termination

Date | | | Notional

Principal

Amount2 | | | Value3 | | | Unrealized

Gain/(Loss) | |

CDX HY 24, 5 Year, at 5.00%; CS First Boston Corporation | | | Buy | | | | 6/20/2020 | | | $ | 247,500 | | | $ | 5,862 | | | $ | 5,862 | |

Total Credit Default Swaps | | | | | | | | | | | | | | $ | 5,862 | | | $ | 5,862 | |

| 1 | As the buyer of protection, Growth and Income Plus Fund pays periodic fees in return for payment by the seller which is contingent upon an adverse credit event occurring in the underlying issuer or reference entity. As the seller of protection, Growth and Income Plus Fund collects periodic fees from the buyer and profits if the credit of the underlying issuer or reference entity remains stable or improves while the swap is outstanding, but the seller in a credit default swap contract would be required to pay the amount of credit loss, determined as specified in the agreement, to the buyer in the event of an adverse credit event in the reference entity. |

| 2 | The maximum potential amount of future payments Growth and Income Plus Fund could be required to make as the seller or receive as the buyer of protection. |

| 3 | The values for credit indexes (CDX or LCDX) serve as an indicator of the current status of the payment/performance risk and represent the liability or profit for the credit default swap contract had the contract been closed as of the reporting date. When protection has been sold, the value of the swap will increase when the swap spread declines representing an improvement in the reference entity’s credit worthiness. The value of the swap will decrease when the swap spread increases representing a deterioration in the reference entity’s credit worthiness. When protection has been purchased, the value of the swap will increase when the swap spread increases representing a deterioration in the reference entity’s credit worthiness. The value of the swap will decrease when the swap spread declines representing an improvement in the reference entity’s credit worthiness. |

The following table summarizes the fair value and Statement of Assets and Liabilities location, as of December 31, 2015, for Growth and Income Plus Fund’s investments in financial derivative instruments by primary risk exposure as discussed under item (2) Significant Accounting Policies of the Notes to Financial Statements.

| | | | | | |

Derivatives by risk category | | Statement of Assets and Liabilities Location | | Fair Value | |

Asset Derivatives | | | | | | |

Interest Rate Contracts | | | | | | |

Futures* | | Net Assets - Net unrealized appreciation/(depreciation) on Futures contracts | | $ | 10,629 | |

Total Interest Rate Contracts | | | 10,629 | |

Credit Contracts | | | | | | |

Credit Default Swaps | | Net Assets -Net unrealized appreciation/(depreciation) on Swap agreements | | | 5,862 | |

Total Credit Contracts | | | | | 5,862 | |

| | | | | | |

Total Asset Derivatives | | | | $ | 16,491 | |

| | | | | | |

Liability Derivatives | | | | | | |

Interest Rate Contracts | | | | | | |

Futures* | | Net Assets - Net unrealized appreciation/(depreciation) on Futures contracts | | | 2,478 | |

Total Interest Rate Contracts | | | 2,478 | |

Equity Contracts | | | | | | |

Futures* | | Net Assets - Net unrealized appreciation/(depreciation) on Futures contracts | | | 2,865 | |

Total Equity Contracts | | | | | 2,865 | |

| | | | | | |

Total Liability Derivatives | | | | $ | 5,343 | |

| | | | | | |

| * | Includes cumulative appreciation/depreciation of futures contracts as reported in the Schedule of Investments. Only current day’s variation margin is reported within the Statement of Assets and Liabilities. |

The accompanying Notes to Financial Statements are an integral part of this schedule.

16

GROWTHAND INCOME PLUS FUND

Summary Schedule of Investments as of December 31, 2015

The following table summarizes the net realized gains/(losses) and Statement of Operations location, for the period ended December 31, 2015, for Growth and Income Plus Fund’s investments in financial derivative instruments by primary risk exposure.

| | | | | | |

Derivatives by risk category | | Statement of Operations Location | | Realized Gains/(Losses)

recognized in Income | |

Interest Rate Contracts | | | | | | |

Futures | | Net realized gains/(losses) on Futures contracts | | | 19,141 | |

Total Interest Rate Contracts | | | | | 19,141 | |

Equity Contracts | | | | | | |

Futures | | Net realized gains/(losses) on Futures contracts | | | 139,636 | |

Total Equity Contracts | | | | | 139,636 | |

Credit Contracts | | | | | | |

Credit Default Swaps | | Net realized gains/(losses) on Swap agreements | | | (2,875 | ) |

Total Credit Contracts | | | | | (2,875 | ) |

| | | | | | |

Total | | | | $ | 155,902 | |

| | | | | | |

The following table summarizes the change in net unrealized appreciation/(depreciation) and Statement of Operations location, for the period ended December 31, 2015, for Growth and Income Plus Fund’s investments in financial derivative instruments by primary risk exposure.

| | | | | | |

Derivatives by risk category | | Statement of Operations Location | | Change in unrealized

appreciation/(depreciation)

recognized in Income | |

Interest Rate Contracts | | | | | | |

Futures | | Change in net unrealized appreciation/(depreciation) on Futures contracts | | | (26,656 | ) |

Total Interest Rate Contracts | | | | | (26,656 | ) |

Equity Contracts | | | | | | |

Futures | | Change in net unrealized appreciation/(depreciation) on Futures contracts | | | (61,470 | ) |

Total Equity Contracts | | | | | (61,470 | ) |

Credit Contracts | | | | | | |

Credit Default Swaps | | Change in net unrealized appreciation/(depreciation) on Swap agreements | | | 5,862 | |

Total Credit Contracts | | | | | 5,862 | |

| | | | | | |

Total | | | | ($ | 82,264 | ) |

| | | | | | |

The following table presents Growth and Income Plus Fund’s average volume of derivative activity during the period ended December 31, 2015.

| | | | | | | | | | | | | | | | |

Derivative Risk Category | | Futures

(Notional)* | | | Futures

(Percentage of

Average Net Assets) | | | Swaps

(Notional)* | | | Swaps

(Percentage of

Average Net Assets) | |

Equity Contracts | | $ | 823,190 | | | | 1.1 | % | | | N/A | | | | N/A | |

Interest Rate | | | | | | | | | | | | | | | | |

Contracts | | | 7,617,758 | | | | 9.9 | | | | N/A | | | | N/A | |

Credit Contracts | | | N/A | | | | N/A | | | $ | 6,776 | | | | <0.1 | % |

| * | Notional amount represents long or short, or both, derivative positions held by the Fund. |

Investment in Affiliates

Affiliated issuers, as defined under the Investment Company Act of 1940, include those in which the Fund’s holdings of an issuer represent 5% or more of the outstanding voting securities of an issuer, any affiliated mutual fund, or a company which is under common ownership or control with the Fund.

A summary of transactions for the fiscal year to date, in Growth and Income Plus Fund, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

Fund | | Value

December 31,

2014 | | | Gross

Purchases | | | Gross Sales | | | Shares Held at

December 31,

2015 | | | Value

December 31,

2015 | | | Income Earned

January 1, 2015 -

December 31, 2015 | |

Cash Management Trust- Short Term Investment | | $ | 6,347,729 | | | $ | 59,422,951 | | | $ | 61,543,829 | | | | 4,226,851 | | | $ | 4,226,851 | | | $ | 3,381 | |

Total Value and Income Earned | | $ | 6,347,729 | | | | | | | | | | | | | | | $ | 4,226,851 | | | $ | 3,381 | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

17

DIVERSIFIED INCOME PLUS FUND

Summary Schedule of Investments as of December 31, 2015

| | | | | | | | | | | | |

Principal Amount | | | Bank Loans (13.1%) | | Value | | | % of Net

Assets | |

| Basic Materials (0.7%) | | | | | | | | |

| | | | Other Securities^ | | $ | 5,072,793 | | | | 0.7 | % |

| | | | | | | | | | | | |

| | | | Total | | | 5,072,793 | | | | | |

| | | | | | | | | | | | |

| | |

| Capital Goods (0.5%) | | | | | | | | |

| | | | Other Securities^ | | | 3,204,525 | | | | 0.5 | % |

| | | | | | | | | | | | |

| | | | Total | | | 3,204,525 | | | | | |

| | | | | | | | | | | | |

| | |

| Communications Services (4.1%) | | | | | | | | |

| | | | Other Securities^ | | | 28,305,463 | | | | 4.1 | % |

| | | | | | | | | | | | |

| | | | Total | | | 28,305,463 | | | | | |

| | | | | | | | | | | | |

| | |

| Consumer Cyclical (2.4%) | | | | | | | | |

| | | | Other Securities^ | | | 16,696,225 | | | | 2.4 | % |

| | | | | | | | | | | | |

| | | | Total | | | 16,696,225 | | | | | |

| | | | | | | | | | | | |

| | |

| Consumer Non-Cyclical (1.8%) | | | | | | | | |

| | | | Other Securities^ | | | 12,495,931 | | | | 1.8 | % |

| | | | | | | | | | | | |

| | | | Total | | | 12,495,931 | | | | | |

| | | | | | | | | | | | |

| | |

| Energy (0.7%) | | | | | | | | |

| | | | Other Securities^ | | | 5,151,123 | | | | 0.7 | % |

| | | | | | | | | | | | |

| | | | Total | | | 5,151,123 | | | | | |

| | | | | | | | | | | | |

| | |

| Financials (0.9%) | | | | | | | | |

| | | | Other Securities^ | | | 6,464,805 | | | | 0.9 | % |

| | | | | | | | | | | | |

| | | | Total | | | 6,464,805 | | | | | |

| | | | | | | | | | | | |

| | |

| Technology (1.0%) | | | | | | | | |

| | | | Avago Technologies Cayman Finance, Ltd., Term Loan | | | | | | | | |

| | $2,250,000 | | | 0.000%, 11/13/2022a,b,c | | | 2,223,292 | | | | 0.3 | % |

| | | | Other Securities^ | | | 4,871,886 | | | | 0.7 | % |

| | | | | | | | | | | | |

| | | | Total | | | 7,095,178 | | | | | |

| | | | | | | | | | | | |

| | |

| Transportation (0.6%) | | | | | | | | |

| | | | Other Securities^ | | | 4,125,090 | | | | 0.6 | % |

| | | | | | | | | | | | |

| | | | Total | | | 4,125,090 | | | | | |

| | | | | | | | | | | | |

| | |

| Utilities (0.4%) | | | | | | | | |

| | | | Other Securities^ | | | 2,418,309 | | | | 0.4 | % |

| | | | | | | | | | | | |

| | | | Total | | | 2,418,309 | | | | | |

| | | | | | | | | | | | |

| | | | Total Bank Loans (cost $98,368,414) | | | 91,029,442 | | | | | |

| | | | | | | | | | | | |

| | | |

Principal Amount | | | Long-Term Fixed Income (45.0%) | | | | | | |

| Asset-Backed Securities (3.9%) | | | | | | | | |

| | | | Other Securities^ | | | 26,890,128 | | | | 3.9 | % |

| | | | | | | | | | | | |

| | | | Total | | | 26,890,128 | | | | | |

| | | | | | | | | | | | |

| | |

| Basic Materials (0.6%) | | | | | | | | |

| | | | Other Securities^ | | | 4,155,884 | | | | 0.6 | % |

| | | | | | | | | | | | |

| | | | Total | | | 4,155,884 | | | | | |

| | | | | | | | | | | | |

| | |

| Capital Goods (1.4%) | | | | | | | | |

| | | | Other Securities^ | | | 9,590,065 | | | | 1.4 | % |

| | | | | | | | | | | | |

| | | | Total | | | 9,590,065 | | | | | |

| | | | | | | | | | | | |

| | |

| Collateralized Mortgage Obligations (14.5%) | | | | | | | | |

| | | | Alternative Loan Trust | | | | | | | | |

| | 1,719,387 | | | 5.500%, 5/25/2035 | | | 1,725,047 | | | | 0.2 | % |

| | | | Countrywide Alternative Loan Trust | | | | | | | | |

| $ | 2,065,647 | | | 0.822% - 6.000%, 2/25/2035 - 4/25/2036d | | | 1,870,758 | | | | 0.3 | % |

| | | | Countrywide Home Loan Mortgage Pass Through Trust | | | | | | | | |

| | 2,868,126 | | | 2.706% - 2.725%, 11/25/2035 - 2/20/2036 | | | 2,459,298 | | | | 0.4 | % |

| | | | Federal National Mortgage Association | | | | | | | | |

| | 12,266,756 | | | 2.500% - 3.500%, 2/25/2028 - 1/25/2033e | | | 1,348,524 | | | | 0.2 | % |

| | | | J.P. Morgan Alternative Loan Trust | | | | | | | | |

| | 2,152,086 | | | 6.500%, 3/25/2036 | | | 1,861,793 | | | | 0.3 | % |

| | | | RALI Trust | | | | | | | | |

| | 2,590,023 | | | 0.602%, 11/25/2036d | | | 1,881,405 | | | | 0.3 | % |

| | | | Washington Mutual Mortgage Pass Through Certificates | | | | | | | | |

| | 2,751,932 | | | 1.007%, 2/25/2047d | | | 1,972,577 | | | | 0.3 | % |

| | | | Wells Fargo Mortgage Backed Securities Trust | | | | | | | | |

| | 2,130,204 | | | 2.731%, 7/25/2036 | | | 2,087,257 | | | | 0.3 | % |

| | | | Other Securities^ | | | 85,792,928 | | | | 12.2 | % |

| | | | | | | | | | | | |

| | | | Total | | | 100,999,587 | | | | | |

| | | | | | | | | | | | |

| | |

| Commercial Mortgage-Backed Securities (0.4%) | | | | | | | | |

| | | | Other Securities^ | | | 2,788,122 | | | | 0.4 | % |

| | | | | | | | | | | | |

| | | | Total | | | 2,788,122 | | | | | |

| | | | | | | | | | | | |

| | |

| Communications Services (2.2%) | | | | | | | | |

| | | | Other Securities^ | | | 15,263,966 | | | | 2.2 | % |

| | | | | | | | | | | | |

| | | | Total | | | 15,263,966 | | | | | |

| | | | | | | | | | | | |

| | |

| Consumer Cyclical (2.1%) | | | | | | | | |

| | | | Other Securities^ | | | 14,660,081 | | | | 2.1 | % |

| | | | | | | | | | | | |

| | | | Total | | | 14,660,081 | | | | | |

| | | | | | | | | | | | |