| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-00781) |

| | |

| Exact name of registrant as specified in charter: | The Putnam Fund for Growth and Income |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | John W. Gerstmayr, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | October 31, 2012 |

| | |

| Date of reporting period: | November 1, 2011 — April 30, 2012 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

The Putnam

Fund for Growth

and Income

Semiannual report

4 | 30 | 12

| | | |

| Message from the Trustees | 1 | | |

| | |

| About the fund | 2 | | |

| | |

| Performance snapshot | 4 | | |

| | |

| Interview with your fund’s portfolio manager | 5 | | |

| | |

| Your fund’s performance | 10 | | |

| | |

| Your fund’s expenses | 12 | | |

| | |

| Terms and definitions | 14 | | |

| | |

| Other information for shareholders | 15 | | |

| | |

| Financial statements | 16 | | |

| | |

Consider these risks before investing: Value stocks may fail to rebound, and the market may not favor value-style investing. Income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies in which the fund invests. The prices of stocks may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market conditions and factors related to a specific issuer or industry.

Message from the Trustees

Dear Fellow Shareholder:

Since the start of 2012, the economic picture and market performance worldwide have been mixed and volatile, punctuated by periodic worries over Europe’s unresolved sovereign-debt troubles and China’s efforts to maintain its robust economic growth. The U.S. economy has shown signs of gathering steam, but continues to face the dual headwinds of tepid jobs growth and a burgeoning federal debt.

Putnam’s portfolio managers and analysts are trained to uncover opportunities that often emerge in this type of environment, while also seeking to guard against downside risk. During these times, your financial advisor also can be a valuable resource, helping you to maintain a long-term focus and a balanced investment approach.

In other news, please join us in welcoming the return of Elizabeth T. Kennan to the Board of Trustees. Dr. Kennan, who served as a Trustee from 1992 until 2010, has rejoined the Board, effective January 1, 2012. Dr. Kennan is a Partner of Cambus-Kenneth Farm (thoroughbred horse breeding and general farming), and is also President Emeritus of Mount Holyoke College.

We would also like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

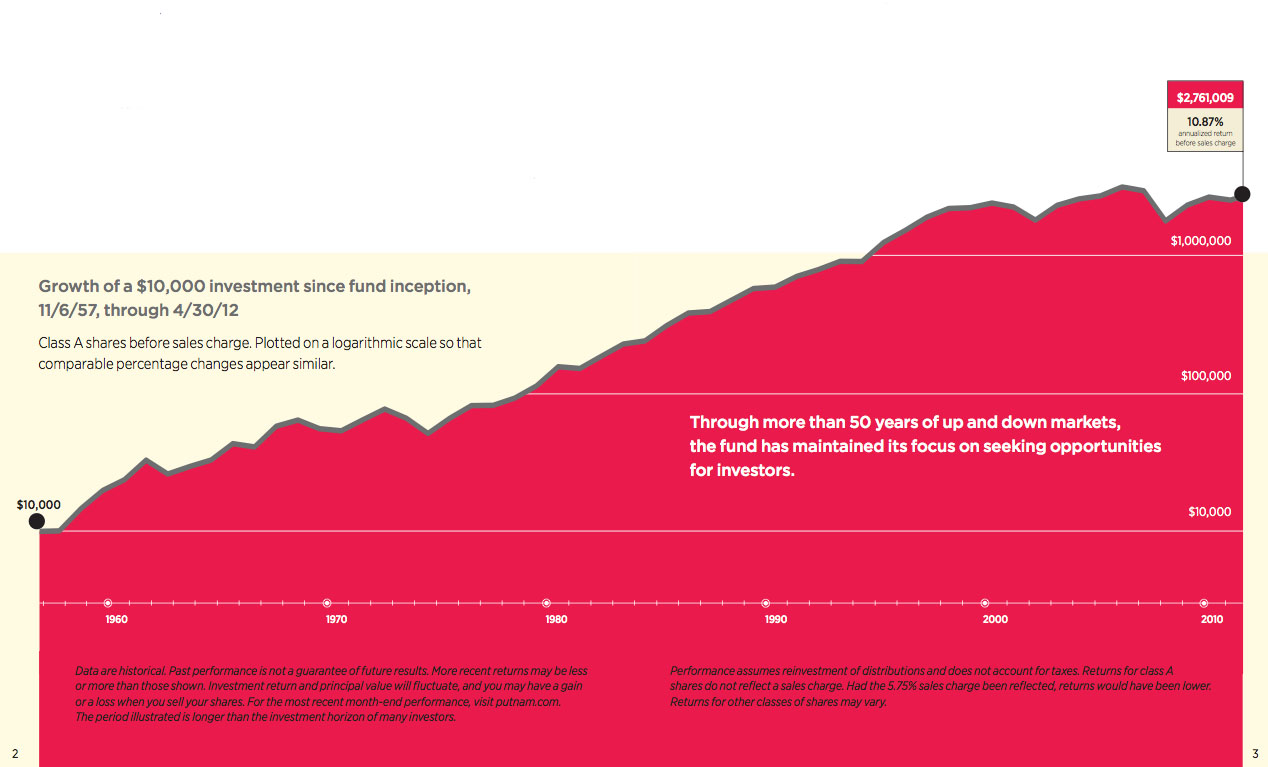

About the fund

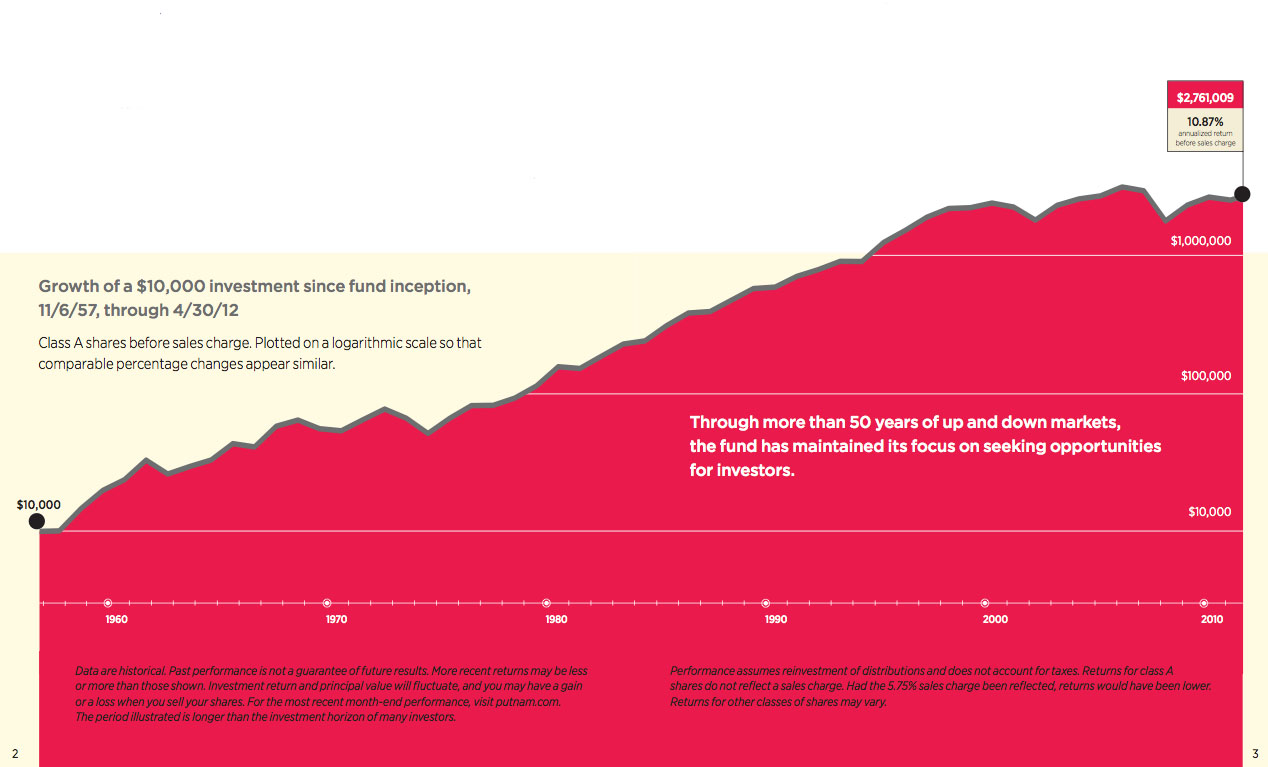

Pursuing capital growth for over 50 years

In November 1957 — almost 20 years to the day after Putnam Investments was founded with the launch of The George Putnam Fund of Boston — Putnam launched its second mutual fund: The Putnam Fund for Growth and Income.

Putnam’s founders carefully debated the merits of adding a fund whose primary focus would be stock investments. They believed that the balanced approach of The George Putnam Fund of Boston, which owned a mix of stocks and bonds, was still the most prudent choice for most individuals. However, the advent of state tax-exempt bonds was making it more advantageous for some investors to balance their own portfolios. Furthermore, many financial advisors had been urging Putnam to introduce a stock fund to meet this growing need.

The fund was launched in a favorable environment for stock investors. Confidence in stocks, which had been severely shaken by the 1929 crash and the Great Depression that followed, had finally been renewed by the early 1950s. Fueled by the optimism of new technologies and the race to space, the 1960s were generally good years for investors. Then came the stagflation-plagued 1970s when the stock market moved sideways for most of the decade.

The fund benefited from the rallies that dominated the 1980s and 1990s. There were bumps in the road, such as the recession of the early 1990s, and, more recently, the bear markets of 2000–2002 and 2007–2009.

True to its roots, the fund continues to focus on long-term growth opportunities among large companies, with appropriate attention to managing downside risk.

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 5 and 10–12 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark, the Russell 1000 Value Index, and the fund’s Lipper peer group were introduced on 12/31/78 and 12/31/59, respectively, which post-date the inception of the fund’s class A shares.

† Returns for the six-month period are not annualized, but cumulative.

4

Interview with your fund’s portfolio manager

Bob, what can you tell us about the investing environment for the six months ended April 30, 2012?

After a volatile and challenging 2011, conditions became significantly less turbulent during this six-month period. Investors worldwide began to feel a bit more confident about the prospects for continued global economic growth, and they appeared to be less preoccupied with macroeconomic issues. With the exception of the first and final months of the period — which were fairly volatile — U.S. stocks staged an impressive recovery. In the first three months of 2012, stocks posted their strongest first-quarter gains in over a decade. The largest advances were from stocks of cyclical companies, which tend to perform better in an improving economy. Cyclical stocks had struggled through most of last year, as investors — nervous about weakening economic growth — favored more defensive stocks, which are often perceived as a safe haven. As investor confidence improved, we were pleased to see more economically sensitive stocks — such as those of financial companies — among the top performers.

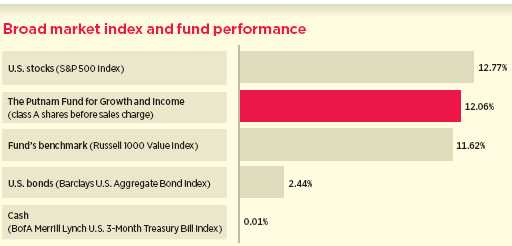

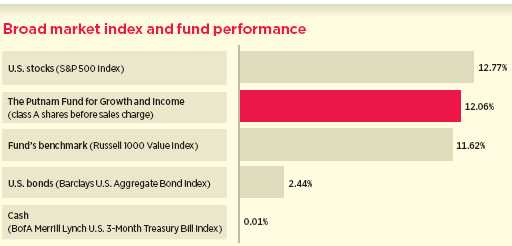

The fund outperformed both its benchmark and its Lipper peer group average for the period. What was your strategy for positioning the fund?

The fund performed well because of our pro-cyclical focus. We had positioned the

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 4/30/12. See pages 4 and 10–12 for additional fund performance information. Index descriptions can be found on page 14.

5

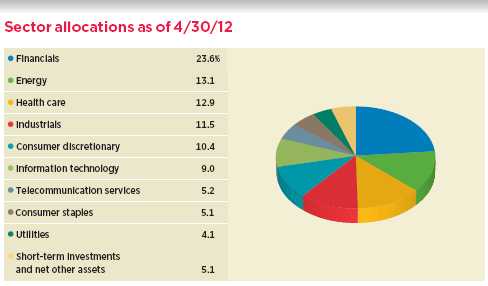

portfolio with a bias toward companies that should benefit from an improving economy, and we placed less emphasis on defensive stocks. We believed that this strategy would pay off once investors began to worry less about issues affecting the broader world markets and focused on individual companies, their fundamental strengths, and their growth potential. From a sector perspective, the three that performed best were cyclical: consumer discretionary, financials, and industrials. Among the weaker-performing sectors were consumer staples and utilities, which are typically more defensive in nature. The fund had underweight exposure to these sectors compared to its benchmark, which helped relative performance.

I am also pleased to report that the fund’s outperformance was due in large part to our stock selection in almost every sector — defensive or cyclical. For example, even though the fund had an underweight position in the consumer staples sector, that portion of the portfolio did well because we owned stocks that performed well. Our stock selection struggled somewhat in the energy sector. As natural gas prices declined dramatically, the energy sector was volatile and a poor performer. In this environment, the most defensive energy stocks performed best, and the fund did not have significant exposure to them.

Within the fund’s portfolio, what strategies or stocks drove returns for the period?

As active fund managers, we have the flexibility to not own a stock that is included in our benchmark index — or to own less of it than the index. During the period, fund performance was helped by our decision to maintain a smaller position versus our benchmark in Procter & Gamble. This stock struggled as the consumer products company dealt with heightened competition and lost some of its market share, and it was beneficial to have minimal exposure to it. Also contributing to the fund’s performance was our decision to not hold the stock of Berkshire Hathaway, the holding company engaged in a diverse range of businesses under the leadership of CEO Warren Buffet. We viewed

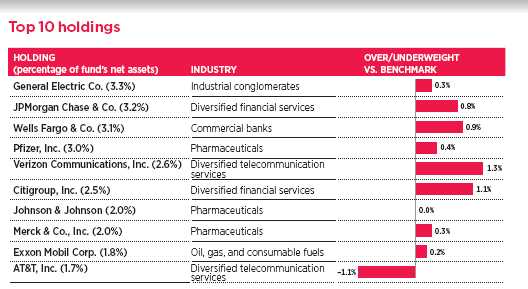

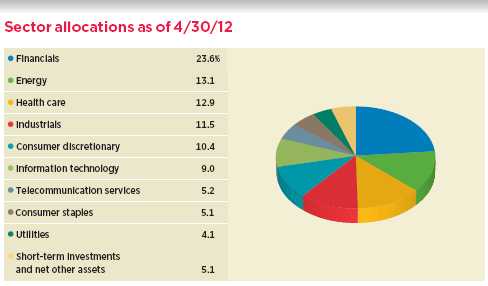

Allocations are represented as a percentage of the fund’s net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any. Holdings and allocations may vary over time.

6

this as a defensive stock that we believed would not outperform in a recovering market.

We also have the flexibility to invest in stocks that are not in our benchmark at all, and several of the period’s top performers fall into this category. Among them was the stock of Apple, one of the world’s largest companies and the creator of such iconic products as the iPhone and iPad. As a rapidly growing technology company, Apple may not be considered by some investors to be a value stock. However, an important component of a value investing strategy is targeting stocks that are attractively priced. Based on our analysis and measurements such as its price-to-earnings ratio, we believed that Apple stock was inexpensive enough to include in the fund’s portfolio.

Microsoft was another out-of-benchmark stock that was among the portfolio highlights for the period. Although this software giant has a mature business model, it continues to deliver solid revenue growth for an attractive share price, in our view. Its stock performed well during the period, due in part to enthusiasm about the upcoming release of the company’s Windows 8 operating system. Finally, the fund’s overweight position in bank holding company Wells Fargo was a contributor to performance as confidence in the U.S. financial system improved. As one of the biggest mortgage lenders in the country, Wells Fargo has also benefited from an increase in mortgage refinancing activity.

Which stocks held back performance?

The fund’s position in Hess, a global energy company, dampened performance for the period. Hess felt the effects of volatility in the energy sector as natural gas prices

This table shows the fund’s top 10 holdings by percentage of the fund’s net assets as of 4/30/12. Short-term holdings are excluded. Holdings will vary over time.

7

plummeted. In addition, Hess announced that its oil production would fall short of its 2012 target. Another detractor was Baxter International, a health-care equipment and supplies company. The stock faced two headwinds during the period: As a defensive stock, it was not favored by investors in the pro-cyclical environment, and the company was dealing with declining revenue growth.

Another disappointment for the period was the stock of Unisys, a global information technology company that has been struggling with weaker overall revenue growth. By late April, however, Unisys stock began to rebound, and it remained in the portfolio at period-end, as did the fund’s positions in Hess and Baxter International.

What is your outlook for the markets and the fund?

My general view has not changed since the close of the fund’s fiscal year six months ago. I believe we will continue to see a slow but self-sustaining global economic recovery, and stocks across many sectors should continue to offer attractive investment opportunities. However, any discussion of outlook must take into account the market’s recent rally — stocks have rebounded nearly 30% since their lows in October 2011. In light of this, I would characterize my outlook as slightly less enthusiastic, and consequently I have made some adjustments to manage risk in the portfolio.

One of the biggest positives for the stock market has been the strength of U.S. corporate earnings. Since 2007, corporate costs have been pared back, inventories have been aggressively managed, and debt has been refinanced at historically low interest rates. Many companies have built up substantial reserves of cash to carry them through tough times. However, while earnings growth remains strong — we just wrapped up another powerful earnings season — it is beginning to decelerate. And in the coming year, we believe earnings growth is likely to be more modest. In a less-robust environment,

This chart shows the fund’s largest allocation shifts, by percentage, over the past six months. Weightings are shown as a percentage of net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any. Holdings will vary over time.

8

it is important to be cautious and selective in your investment choices, which is exactly how we approach our stock selection for the fund’s portfolio.

Thank you, Bob, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Robert D. Ewing is Co-Head of U.S. Equities at Putnam. He has a B.S. in Finance and Economics from Boston College. A CFA charterholder, he joined Putnam in 2008 and has been in the investment industry since 1990.

IN THE NEWS

Gasoline prices have dropped in recent weeks from the year-to-date high of $3.94 reached on April 2. As of June 4, 2012, the average price of a gallon of regular gasoline fell to $3.61, the U.S. Energy Information Administration reported. Driving the price declines were waning concerns over Iran’s nuclear program as well as sluggish demand from slow-growing economies in the United States and Europe. Meanwhile, the crude oil supply situation has improved, with some refineries that were slated for closure now coming back online. The recent drop in prices at the pump has led analysts to recalibrate their price predictions for the summer driving season. Just months ago, some predicted that gas prices could shoot above $4 a gallon and reach $5 by the summer. Now those price increases appear unlikely. Because high gas prices can hinder economic growth, falling prices could help by putting more money back into consumers’ pockets.

9

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended April 30, 2012, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R and class Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 4/30/12

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/6/57) | (4/27/92) | (7/26/99) | (5/1/95) | (1/21/03) | (6/15/94) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 10.87% | 10.75% | 9.86% | 9.86% | 10.04% | 10.04% | 10.14% | 10.07% | 10.59% | 10.96% |

|

| 10 years | 29.20 | 21.76 | 19.78 | 19.78 | 19.87 | 19.87 | 22.85 | 18.54 | 25.99 | 32.45 |

| Annual average | 2.60 | 1.99 | 1.82 | 1.82 | 1.83 | 1.83 | 2.08 | 1.72 | 2.34 | 2.85 |

|

| 5 years | –13.40 | –18.38 | –16.67 | –18.03 | –16.60 | –16.60 | –15.55 | –18.51 | –14.49 | –12.35 |

| Annual average | –2.84 | –3.98 | –3.58 | –3.90 | –3.57 | –3.57 | –3.32 | –4.01 | –3.08 | –2.60 |

|

| 3 years | 60.05 | 50.86 | 56.52 | 53.52 | 56.57 | 56.57 | 57.73 | 52.22 | 58.88 | 61.23 |

| Annual average | 16.97 | 14.69 | 16.11 | 15.36 | 16.12 | 16.12 | 16.40 | 15.03 | 16.69 | 17.26 |

|

| 1 year | –1.77 | –7.45 | –2.53 | –7.37 | –2.47 | –3.44 | –2.30 | –5.73 | –2.04 | –1.51 |

|

| 6 months | 12.06 | 5.62 | 11.62 | 6.62 | 11.63 | 10.63 | 11.73 | 7.82 | 11.92 | 12.17 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

Recent performance may have benefited from one or more legal settlements.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

10

Comparative index returns For periods ended 4/30/12

| | |

| | | Lipper Large-Cap Value Funds |

| | Russell 1000 Value Index | category average* |

|

| Annual average (life of fund) | —† | —† |

|

| 10 years | 60.32% | 48.37% |

| Annual average | 4.83 | 3.97 |

|

| 5 years | –8.33 | –7.88 |

| Annual average | –1.73 | –1.70 |

|

| 3 years | 65.65 | 57.31 |

| Annual average | 18.32 | 16.27 |

|

| 1 year | 1.03 | –0.48 |

|

| 6 months | 11.62 | 11.18 |

|

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, and 10-year periods ended 4/30/12, there were 540, 527, 469, 418, and 252 funds, respectively, in this Lipper category.

† The fund’s benchmark, the Russell 1000 Value Index, and the fund’s Lipper peer group were introduced on 12/31/78 and 12/31/59, respectively, which post-date the inception of the fund’s class A shares.

Fund price and distribution information For the six-month period ended 4/30/12

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 2 | 2 | 2 | 2 | 2 | 2 |

|

| Income | $0.130 | $0.080 | $0.082 | $0.098 | $0.114 | $0.146 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.130 | $0.080 | $0.082 | $0.098 | $0.114 | $0.146 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 10/31/11 | $12.79 | $13.57 | $12.56 | $12.74 | $12.69 | $13.15 | $12.72 | $12.82 |

|

| 4/30/12 | 14.19 | 15.06 | 13.93 | 14.13 | 14.07 | 14.58 | 14.11 | 14.22 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Current yield (end of period) | charge | charge | value | value | charge | charge | value | value |

|

| Current dividend rate 1 | 1.21% | 1.14%�� | 0.49% | 0.51% | 0.74% | 0.71% | 0.96% | 1.43% |

|

| Current 30-day SEC yield 2 | N/A | 1.18 | 0.51 | 0.51 | N/A | 0.73 | 1.00 | 1.49 |

|

1 Most recent distribution, excluding capital gains, annualized and divided by the fund’s share price before or after sales charge at period-end.

2 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

11

Fund performance as of most recent calendar quarter

Total return for periods ended 3/31/12

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/6/57) | (4/27/92) | (7/26/99) | (5/1/95) | (1/21/03) | (6/15/94) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 10.92% | 10.80% | 9.91% | 9.91% | 10.09% | 10.09% | 10.19% | 10.12% | 10.64% | 11.01% |

|

| 10 years | 24.43 | 17.25 | 15.32 | 15.32 | 15.30 | 15.30 | 18.22 | 14.10 | 21.29 | 27.50 |

| Annual average | 2.21 | 1.60 | 1.44 | 1.44 | 1.43 | 1.43 | 1.69 | 1.33 | 1.95 | 2.46 |

|

| 5 years | –8.47 | –13.71 | –11.91 | –13.34 | –11.87 | –11.87 | –10.79 | –13.90 | –9.64 | –7.32 |

| Annual average | –1.75 | –2.91 | –2.50 | –2.82 | –2.50 | –2.50 | –2.26 | –2.95 | –2.01 | –1.51 |

|

| 3 years | 81.52 | 71.14 | 77.43 | 74.43 | 77.46 | 77.46 | 78.88 | 72.55 | 80.11 | 83.03 |

| Annual average | 21.99 | 19.61 | 21.06 | 20.38 | 21.07 | 21.07 | 21.39 | 19.94 | 21.67 | 22.32 |

|

| 1 year | 2.40 | –3.46 | 1.61 | –3.39 | 1.62 | 0.62 | 1.82 | –1.78 | 2.15 | 2.67 |

|

| 6 months | 28.42 | 21.06 | 27.88 | 22.87 | 27.77 | 26.77 | 27.95 | 23.46 | 28.12 | 28.50 |

|

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual operating expenses for the fiscal year | | | | | | |

| ended 10/31/11 | 1.10% | 1.85% | 1.85% | 1.60% | 1.35% | 0.85% |

|

| Annualized expense ratio for the six-month period | | | | | | |

| ended 4/30/12 | 1.11% | 1.86% | 1.86% | 1.61% | 1.36% | 0.86% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

12

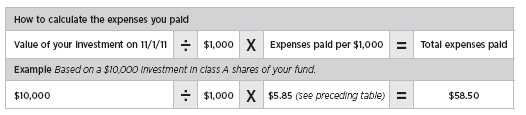

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from November 1, 2011, to April 30, 2012. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $5.85 | $9.79 | $9.79 | $8.48 | $7.17 | $4.54 |

|

| Ending value (after expenses) | $1,120.60 | $1,116.20 | $1,116.30 | $1,117.30 | $1,119.20 | $1,121.70 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/12. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

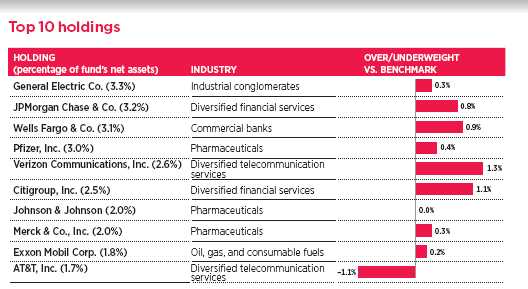

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended April 30, 2012, use the following calculation method. To find the value of your investment on November 1, 2011, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $5.57 | $9.32 | $9.32 | $8.07 | $6.82 | $4.32 |

|

| Ending value (after expenses) | $1,019.34 | $1,015.61 | $1,015.61 | $1,016.86 | $1,018.10 | $1,020.59 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/12. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

13

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

Russell 1000 Value Index is an unmanaged index of those companies in the large-cap Russell 1000 Index chosen for their value orientation.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

14

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2011, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of April 30, 2012, Putnam employees had approximately $350,000,000 and the Trustees had approximately $80,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

15

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

16

The fund’s portfolio 4/30/12 (Unaudited)

| | |

| COMMON STOCKS (98.5%)* | Shares | Value |

|

| Aerospace and defense (4.5%) | | |

| Embraer SA ADR (Brazil) | 944,400 | $32,714,016 |

|

| General Dynamics Corp. | 128,200 | 8,653,500 |

|

| Honeywell International, Inc. | 1,092,600 | 66,277,116 |

|

| L-3 Communications Holdings, Inc. | 261,600 | 19,238,064 |

|

| Northrop Grumman Corp. | 530,900 | 33,595,352 |

|

| United Technologies Corp. | 568,000 | 46,371,520 |

|

| | | 206,849,568 |

| Air freight and logistics (0.2%) | | |

| FedEx Corp. S | 103,500 | 9,132,840 |

|

| | | 9,132,840 |

| Airlines (0.3%) | | |

| Delta Air Lines, Inc. † | 1,081,500 | 11,853,240 |

|

| | | 11,853,240 |

| Auto components (0.5%) | | |

| American Axle & Manufacturing Holdings, Inc. † S | 1,221,700 | 11,838,273 |

|

| Johnson Controls, Inc. S | 360,800 | 11,534,776 |

|

| | | 23,373,049 |

| Automobiles (0.4%) | | |

| Ford Motor Co. | 1,474,800 | 16,635,744 |

|

| | | 16,635,744 |

| Beverages (0.8%) | | |

| Beam, Inc. | 73,400 | 4,167,652 |

|

| Coca-Cola Enterprises, Inc. | 1,060,200 | 31,933,224 |

|

| | | 36,100,876 |

| Biotechnology (0.4%) | | |

| Amgen, Inc. | 136,000 | 9,670,960 |

|

| Cubist Pharmaceuticals, Inc. † | 65,900 | 2,786,252 |

|

| Dendreon Corp. † S | 379,300 | 4,418,845 |

|

| | | 16,876,057 |

| Building products (0.4%) | | |

| Fortune Brands Home & Security, Inc. † | 444,519 | 10,108,362 |

|

| Owens Corning, Inc. † S | 263,700 | 9,058,095 |

|

| | | 19,166,457 |

| Capital markets (4.4%) | | |

| Bank of New York Mellon Corp. (The) S | 885,400 | 20,939,710 |

|

| Blackstone Group LP (The) | 909,100 | 12,327,396 |

|

| Charles Schwab Corp. (The) | 821,000 | 11,740,300 |

|

| Goldman Sachs Group, Inc. (The) | 425,893 | 49,041,579 |

|

| KKR & Co. LP | 780,577 | 11,021,747 |

|

| Legg Mason, Inc. | 325,200 | 8,477,964 |

|

| Morgan Stanley | 1,805,600 | 31,200,768 |

|

| State Street Corp. | 1,247,000 | 57,636,340 |

|

| | | 202,385,804 |

| Chemicals (1.9%) | | |

| Celanese Corp. Ser. A | 203,000 | 9,837,380 |

|

| Dow Chemical Co. (The) S | 1,304,900 | 44,210,012 |

|

| E.I. du Pont de Nemours & Co. | 243,200 | 13,001,472 |

|

| LyondellBasell Industries NV Class A (Netherlands) | 474,100 | 19,807,898 |

|

| Tronox, Inc. † | 12,453 | 2,330,579 |

|

| | | 89,187,341 |

17

| | |

| COMMON STOCKS (98.5%)* cont. | Shares | Value |

|

| Commercial banks (4.7%) | | |

| Fifth Third Bancorp | 1,125,900 | $16,021,557 |

|

| First Horizon National Corp. | 1,081,600 | 9,929,088 |

|

| KeyCorp | 601,400 | 4,835,256 |

|

| SunTrust Banks, Inc. | 335,000 | 8,133,800 |

|

| U.S. Bancorp | 1,049,700 | 33,768,849 |

|

| Wells Fargo & Co. | 4,314,079 | 144,219,661 |

|

| | | 216,908,211 |

| Communications equipment (2.2%) | | |

| Cisco Systems, Inc. | 3,466,457 | 69,849,109 |

|

| Juniper Networks, Inc. † | 586,300 | 12,564,409 |

|

| Polycom, Inc. † | 780,000 | 10,350,600 |

|

| Qualcomm, Inc. | 149,600 | 9,550,464 |

|

| | | 102,314,582 |

| Computers and peripherals (2.2%) | | |

| Apple, Inc. † | 69,000 | 40,312,560 |

|

| Hewlett-Packard Co. | 1,928,400 | 47,747,184 |

|

| SanDisk Corp. † | 403,400 | 14,929,834 |

|

| | | 102,989,578 |

| Construction and engineering (0.7%) | | |

| Fluor Corp. S | 313,800 | 18,121,950 |

|

| KBR, Inc. | 395,500 | 13,391,630 |

|

| | | 31,513,580 |

| Consumer finance (0.4%) | | |

| Capital One Financial Corp. | 293,500 | 16,283,380 |

|

| | | 16,283,380 |

| Diversified consumer services (0.1%) | | |

| Apollo Group, Inc. Class A † S | 165,300 | 5,821,866 |

|

| | | 5,821,866 |

| Diversified financial services (7.1%) | | |

| Bank of America Corp. | 7,688,217 | 62,351,440 |

|

| Citigroup, Inc. | 3,457,380 | 114,231,835 |

|

| JPMorgan Chase & Co. | 3,419,882 | 146,986,528 |

|

| | | 323,569,803 |

| Diversified telecommunication services (4.9%) | | |

| AT&T, Inc. S | 2,325,000 | 76,515,750 |

|

| CenturyLink, Inc. S | 769,800 | 29,683,488 |

|

| Verizon Communications, Inc. | 2,964,759 | 119,716,968 |

|

| | | 225,916,206 |

| Electric utilities (1.6%) | | |

| Edison International | 596,000 | 26,229,960 |

|

| Entergy Corp. | 239,115 | 15,676,379 |

|

| FirstEnergy Corp. S | 198,800 | 9,307,816 |

|

| Great Plains Energy, Inc. S | 688,341 | 14,055,923 |

|

| PPL Corp. | 335,400 | 9,173,190 |

|

| | | 74,443,268 |

| Electronic equipment, instruments, and components (0.4%) | | |

| Corning, Inc. S | 678,600 | 9,737,910 |

|

| TE Connectivity, Ltd. (Switzerland) | 197,200 | 7,189,912 |

|

| | | 16,927,822 |

18

| | |

| COMMON STOCKS (98.5%)* cont. | Shares | Value |

|

| Energy equipment and services (2.7%) | | |

| Baker Hughes, Inc. S | 379,800 | $16,752,978 |

|

| Cameron International Corp. † | 474,400 | 24,313,000 |

|

| Halliburton Co. | 243,200 | 8,322,304 |

|

| Oil States International, Inc. † | 93,500 | 7,440,730 |

|

| Schlumberger, Ltd. | 477,739 | 35,419,569 |

|

| Transocean, Ltd. (Switzerland) | 379,500 | 19,123,005 |

|

| Weatherford International, Ltd. (Switzerland) † | 831,895 | 11,871,142 |

|

| | | 123,242,728 |

| Food and staples retail (1.0%) | | |

| CVS Caremark Corp. | 687,500 | 30,676,250 |

|

| Wal-Mart Stores, Inc. S | 293,600 | 17,295,976 |

|

| | | 47,972,226 |

| Food products (0.6%) | | |

| Post Holdings, Inc. † | 170,300 | 5,066,425 |

|

| Sara Lee Corp. | 935,100 | 20,609,604 |

|

| | | 25,676,029 |

| Health-care equipment and supplies (2.8%) | | |

| Baxter International, Inc. | 980,500 | 54,329,505 |

|

| Boston Scientific Corp. † | 1,516,087 | 9,490,705 |

|

| Covidien PLC (Ireland) | 601,972 | 33,246,914 |

|

| St. Jude Medical, Inc. | 234,300 | 9,072,096 |

|

| Stryker Corp. | 377,400 | 20,594,718 |

|

| | | 126,733,938 |

| Health-care providers and services (2.2%) | | |

| Aetna, Inc. | 995,400 | 43,837,416 |

|

| CIGNA Corp. | 696,600 | 32,203,818 |

|

| Lincare Holdings, Inc. | 307,300 | 7,498,120 |

|

| WellPoint, Inc. | 226,200 | 15,340,884 |

|

| | | 98,880,238 |

| Hotels, restaurants, and leisure (0.6%) | | |

| Carnival Corp. S | 365,100 | 11,862,099 |

|

| Vail Resorts, Inc. S | 162,300 | 6,618,594 |

|

| Wyndham Worldwide Corp. | 197,380 | 9,936,109 |

|

| | | 28,416,802 |

| Household durables (0.8%) | | |

| D.R. Horton, Inc. S | 820,200 | 13,410,270 |

|

| Jarden Corp. | 132,100 | 5,538,953 |

|

| Newell Rubbermaid, Inc. | 1,034,600 | 18,829,720 |

|

| | | 37,778,943 |

| Household products (0.7%) | | |

| Colgate-Palmolive Co. | 46,500 | 4,600,710 |

|

| Procter & Gamble Co. (The) | 438,300 | 27,893,412 |

|

| | | 32,494,122 |

| Independent power producers and energy traders (0.9%) | | |

| AES Corp. (The) † | 2,221,900 | 27,818,188 |

|

| Calpine Corp. † | 786,700 | 14,750,625 |

|

| | | 42,568,813 |

| Industrial conglomerates (4.7%) | | |

| General Electric Co. | 7,615,020 | 149,102,092 |

|

| Tyco International, Ltd. | 1,194,842 | 67,066,481 |

|

| | | 216,168,573 |

19

| | |

| COMMON STOCKS (98.5%)* cont. | Shares | Value |

|

| Insurance (6.8%) | | |

| ACE, Ltd. | 406,900 | $30,912,193 |

|

| Aflac, Inc. | 965,600 | 43,490,624 |

|

| Allstate Corp. (The) | 1,864,600 | 62,147,118 |

|

| Assured Guaranty, Ltd. (Bermuda) | 1,088,080 | 15,428,974 |

|

| Chubb Corp. (The) S | 194,575 | 14,217,595 |

|

| Everest Re Group, Ltd. | 187,620 | 18,593,142 |

|

| Hartford Financial Services Group, Inc. (The) S | 1,314,800 | 27,019,140 |

|

| Marsh & McLennan Cos., Inc. | 253,700 | 8,486,265 |

|

| MetLife, Inc. | 1,404,187 | 50,592,858 |

|

| Prudential Financial, Inc. | 307,500 | 18,616,050 |

|

| XL Group PLC | 930,500 | 20,015,055 |

|

| | | 309,519,014 |

| IT Services (0.5%) | | |

| IBM Corp. S | 55,700 | 11,534,356 |

|

| Unisys Corp. † | 510,212 | 9,520,556 |

|

| | | 21,054,912 |

| Leisure equipment and products (0.3%) | | |

| Hasbro, Inc. | 388,100 | 14,258,794 |

|

| | | 14,258,794 |

| Machinery (0.5%) | | |

| Stanley Black & Decker, Inc. | 157,200 | 11,500,752 |

|

| Timken Co. | 176,300 | 9,962,713 |

|

| | | 21,463,465 |

| Media (4.4%) | | |

| Comcast Corp. Class A | 1,949,300 | 59,122,269 |

|

| DISH Network Corp. Class A | 494,900 | 15,821,953 |

|

| Interpublic Group of Companies, Inc. (The) | 1,490,300 | 17,600,443 |

|

| News Corp. Class A S | 957,100 | 18,759,160 |

|

| Time Warner Cable, Inc. | 182,180 | 14,656,381 |

|

| Time Warner, Inc. | 1,336,500 | 50,065,290 |

|

| Walt Disney Co. (The) S | 619,200 | 26,693,712 |

|

| | | 202,719,208 |

| Metals and mining (1.4%) | | |

| Alcoa, Inc. | 675,200 | 6,569,696 |

|

| Barrick Gold Corp. (Canada) | 184,000 | 7,443,073 |

|

| Freeport-McMoRan Copper & Gold, Inc. Class B (Indonesia) | 583,438 | 22,345,675 |

|

| Nucor Corp. S | 317,300 | 12,441,333 |

|

| Rio Tinto PLC (United Kingdom) | 214,871 | 11,969,611 |

|

| U.S. Steel Corp. S | 155,900 | 4,416,647 |

|

| | | 65,186,035 |

| Multiline retail (0.9%) | | |

| Macy’s, Inc. | 283,900 | 11,645,578 |

|

| Target Corp. | 488,400 | 28,297,896 |

|

| | | 39,943,474 |

| Multi-utilities (1.6%) | | |

| Ameren Corp. | 856,300 | 28,078,077 |

|

| CMS Energy Corp. | 350,000 | 8,046,500 |

|

| National Grid PLC (United Kingdom) | 883,144 | 9,538,307 |

|

| PG&E Corp. S | 577,400 | 25,509,532 |

|

| | | 71,172,416 |

20

| | |

| COMMON STOCKS (98.5%)* cont. | Shares | Value |

|

| Oil, gas, and consumable fuels (10.3%) | | |

| Anadarko Petroleum Corp. | 141,400 | $10,351,894 |

|

| Apache Corp. | 416,022 | 39,913,151 |

|

| BP PLC ADR (United Kingdom) | 154,816 | 6,720,563 |

|

| Cabot Oil & Gas Corp. Class A | 445,800 | 15,665,412 |

|

| Chevron Corp. | 693,200 | 73,867,392 |

|

| ConocoPhillips | 244,600 | 17,520,698 |

|

| CONSOL Energy, Inc. S | 209,900 | 6,977,076 |

|

| Energen Corp. | 132,900 | 6,961,302 |

|

| Exxon Mobil Corp. | 955,292 | 82,479,911 |

|

| Hess Corp. | 755,800 | 39,407,412 |

|

| Marathon Oil Corp. | 1,538,400 | 45,136,656 |

|

| Noble Energy, Inc. | 373,000 | 37,046,360 |

|

| Nordic American Tankers, Ltd. (Norway) S | 328,900 | 4,775,628 |

|

| Occidental Petroleum Corp. | 177,914 | 16,229,315 |

|

| Royal Dutch Shell PLC ADR (United Kingdom) | 632,309 | 45,235,386 |

|

| Southwestern Energy Co. † S | 347,600 | 10,977,208 |

|

| Total SA ADR (France) S | 371,500 | 17,872,865 |

|

| | | 477,138,229 |

| Paper and forest products (0.4%) | | |

| International Paper Co. | 488,500 | 16,271,935 |

|

| | | 16,271,935 |

| Personal products (0.3%) | | |

| Avon Products, Inc. | 695,800 | 15,029,280 |

|

| | | 15,029,280 |

| Pharmaceuticals (7.6%) | | |

| Abbott Laboratories | 209,500 | 13,001,570 |

|

| Johnson & Johnson | 1,427,900 | 92,942,011 |

|

| Merck & Co., Inc. | 2,311,291 | 90,695,059 |

|

| Pfizer, Inc. | 5,970,945 | 136,913,769 |

|

| Teva Pharmaceutical Industries, Ltd. ADR (Israel) | 299,100 | 13,680,834 |

|

| | | 347,233,243 |

| Real estate investment trusts (REITs) (0.3%) | | |

| Chimera Investment Corp. | 2,300,200 | 6,647,578 |

|

| MFA Financial, Inc. | 1,237,100 | 9,129,798 |

|

| | | 15,777,376 |

| Road and rail (0.3%) | | |

| Hertz Global Holdings, Inc. † | 804,300 | 12,394,263 |

|

| | | 12,394,263 |

| Semiconductors and semiconductor equipment (1.5%) | | |

| Advanced Micro Devices, Inc. † S | 2,061,500 | 15,172,640 |

|

| Intel Corp. | 697,000 | 19,794,800 |

|

| Lam Research Corp. † S | 156,700 | 6,526,555 |

|

| Novellus Systems, Inc. † | 189,200 | 8,845,100 |

|

| Texas Instruments, Inc. | 560,200 | 17,892,788 |

|

| | | 68,231,883 |

| Software (2.2%) | | |

| Microsoft Corp. | 2,363,800 | 75,688,876 |

|

| Oracle Corp. | 830,000 | 24,393,700 |

|

| | | 100,082,576 |

21

| | | |

| COMMON STOCKS (98.5%)* cont. | | Shares | Value |

|

| Specialty retail (2.1%) | | | |

| American Eagle Outfitters, Inc. | | 1,028,800 | $18,528,688 |

|

| Best Buy Co., Inc. S | | 719,500 | 15,879,365 |

|

| Lowe’s Cos., Inc. | | 1,415,000 | 44,530,050 |

|

| Office Depot, Inc. † S | | 3,601,600 | 10,948,864 |

|

| Staples, Inc. S | | 433,600 | 6,677,440 |

|

| | | | 96,564,407 |

| Tobacco (1.7%) | | | |

| Altria Group, Inc. S | | 461,400 | 14,861,694 |

|

| Lorillard, Inc. | | 178,400 | 24,135,736 |

|

| Philip Morris International, Inc. | | 436,800 | 39,097,968 |

|

| | | | 78,095,398 |

| Wireless telecommunication services (0.3%) | | | |

| Vodafone Group PLC ADR (United Kingdom) S | | 519,400 | 14,454,902 |

|

| | | | 14,454,902 |

| | | | |

| Total common stocks (cost $4,054,985,684) | | | $4,514,772,494 |

|

| |

| CONVERTIBLE PREFERRED STOCKS (0.3%)* | | Shares | Value |

|

| General Motors Co. Ser. B, $2.375 cv. pfd. | | 315,309 | $12,316,758 |

|

| Total convertible preferred stocks (cost $10,591,296) | | | $12,316,758 |

|

| |

| PURCHASED OPTIONS | Expiration date/ | Contract | |

| OUTSTANDING (—%)* | strike price | amount | Value |

|

| Pfizer, Inc. (Put) | May-12/$22.00 | 1,198,130 | $203,682 |

|

| Total purchased options outstanding (cost $275,570) | | | $203,682 |

|

| |

| SHORT-TERM INVESTMENTS (6.7%)* | | Shares | Value |

|

| Putnam Cash Collateral Pool, LLC 0.20% d | | 242,295,260 | $242,295,260 |

|

| Putnam Money Market Liquidity Fund 0.10% e | | 66,429,407 | 66,429,407 |

|

| Total short-term investments (cost $308,724,667) | | | $308,724,667 |

|

| |

| TOTAL INVESTMENTS | | | |

|

| Total investments (cost $4,374,577,217) | | | $4,836,017,601 |

Key to holding’s abbreviations

ADR American Depository Receipts: represents ownership of foreign securities on deposit with a custodian bank

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from November 1, 2011 through April 30, 2012 (the reporting period). Within the following notes to the portfolio, references to “ASC 820” represent Accounting Standards Codification ASC 820 Fair Value Measurements and Disclosures.

* Percentages indicated are based on net assets of $4,583,356,641.

† Non-income-producing security.

d See Note 1 to the financial statements regarding securities lending. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

e See Note 6 to the financial statements regarding investments in Putnam Money Market Liquidity Fund. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

S Security on loan, in part or in entirety, at the close of the reporting period.

22

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| | | |

| | | Valuation inputs | |

|

| Investments in securities: | Level 1 | Level 2 | Level 3 |

|

| Common stocks: | | | |

|

| Consumer discretionary | $465,512,287 | $— | $— |

|

| Consumer staples | 235,367,931 | — | — |

|

| Energy | 600,380,957 | — | — |

|

| Financials | 1,084,443,588 | — | — |

|

| Health care | 589,723,476 | — | — |

|

| Industrials | 528,541,986 | — | — |

|

| Information technology | 411,601,353 | — | — |

|

| Materials | 170,645,311 | — | — |

|

| Telecommunication services | 240,371,108 | — | — |

|

| Utilities | 188,184,497 | — | — |

|

| Total common stocks | 4,514,772,494 | — | — |

| | | | |

| Convertible preferred stocks | — | 12,316,758 | — |

|

| Purchased options outstanding | — | 203,682 | — |

|

| Short-term investments | 66,429,407 | 242,295,260 | — |

|

| Totals by level | $4,581,201,901 | $254,815,700 | $— |

The accompanying notes are an integral part of these financial statements.

23

Statement of assets and liabilities 4/30/12 (Unaudited)

| |

| ASSETS | |

|

| Investment in securities, at value, including $235,378,590 of securities on loan (Note 1): | |

| Unaffiliated issuers (identified cost $4,065,852,550) | $4,527,292,934 |

| Affiliated issuers (identified cost $308,724,667) (Notes 1 and 6) | 308,724,667 |

|

| Dividends, interest and other receivables | 6,063,011 |

|

| Receivable for shares of the fund sold | 599,757 |

|

| Receivable for investments sold | 3,237,751 |

|

| Total assets | 4,845,918,120 |

| |

| LIABILITIES | |

|

| Payable for investments purchased | 8,364,738 |

|

| Payable for shares of the fund repurchased | 5,733,928 |

|

| Payable for compensation of Manager (Note 2) | 1,815,680 |

|

| Payable for investor servicing fees (Note 2) | 1,055,791 |

|

| Payable for custodian fees (Note 2) | 17,375 |

|

| Payable for Trustee compensation and expenses (Note 2) | 1,670,165 |

|

| Payable for administrative services (Note 2) | 52,199 |

|

| Payable for distribution fees (Note 2) | 1,028,319 |

|

| Collateral on securities loaned, at value (Note 1) | 242,295,260 |

|

| Other accrued expenses | 528,024 |

|

| Total liabilities | 262,561,479 |

| | |

| Net assets | $4,583,356,641 |

|

| |

| REPRESENTED BY | |

|

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $6,201,851,959 |

|

| Undistributed net investment income (Note 1) | 2,580,024 |

|

| Accumulated net realized loss on investments and foreign currency transactions (Note 1) | (2,082,515,726) |

|

| Net unrealized appreciation of investments | 461,440,384 |

|

| Total — Representing net assets applicable to capital shares outstanding | $4,583,356,641 |

| |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

|

| Net asset value and redemption price per class A share | |

| ($4,365,527,566 divided by 307,720,406 shares) | $14.19 |

|

| Offering price per class A share (100/94.25 of $14.19)* | $15.06 |

|

| Net asset value and offering price per class B share ($100,429,508 divided by 7,208,062 shares)** | $13.93 |

|

| Net asset value and offering price per class C share ($38,228,608 divided by 2,706,084 shares)** | $14.13 |

|

| Net asset value and redemption price per class M share ($33,108,730 divided by 2,353,148 shares) | $14.07 |

|

| Offering price per class M share (100/96.50 of $14.07)* | $14.58 |

|

| Net asset value, offering price and redemption price per class R share | |

| ($3,526,214 divided by 249,904 shares) | $14.11 |

|

| Net asset value, offering price and redemption price per class Y share | |

| ($42,536,015 divided by 2,991,590 shares) | $14.22 |

|

* On single retail sales of less than $50,000. On sales of $50,000 or more the offering price is reduced.

** Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

The accompanying notes are an integral part of these financial statements.

24

Statement of operations Six months ended 4/30/12 (Unaudited)

| |

| INVESTMENT INCOME | |

|

| Dividends (net of foreign tax of $478,175) | $59,792,751 |

|

| Interest (including interest income of $20,276 from investments in affiliated issuers) (Note 6) | 20,691 |

|

| Securities lending (Note 1) | 390,641 |

|

| Total investment income | 60,204,083 |

| |

| EXPENSES | |

|

| Compensation of Manager (Note 2) | 10,800,212 |

|

| Investor servicing fees (Note 2) | 7,375,932 |

|

| Custodian fees (Note 2) | 19,733 |

|

| Trustee compensation and expenses (Note 2) | 201,193 |

|

| Administrative services (Note 2) | 84,439 |

|

| Distribution fees — Class A (Note 2) | 5,297,932 |

|

| Distribution fees — Class B (Note 2) | 522,235 |

|

| Distribution fees — Class C (Note 2) | 183,495 |

|

| Distribution fees — Class M (Note 2) | 123,791 |

|

| Distribution fees — Class R (Note 2) | 8,296 |

|

| Other | 640,102 |

|

| Total expenses | 25,257,360 |

|

| Expense reduction (Note 2) | (234,910) |

|

| Net expenses | 25,022,450 |

| | |

| Net investment income | 35,181,633 |

|

| |

| Net realized gain on investments (Notes 1 and 3) | 133,357,374 |

|

| Net realized gain on foreign currency transactions (Note 1) | 6,250 |

|

| Net unrealized appreciation of investments during the period | 339,319,440 |

|

| Net gain on investments | 472,683,064 |

| | |

| Net increase in net assets resulting from operations | $507,864,697 |

|

The accompanying notes are an integral part of these financial statements.

25

Statement of changes in net assets

| | |

| INCREASE (DECREASE) IN NET ASSETS | Six months ended 4/30/12* | Year ended 10/31/11 |

|

| Operations: | | |

| Net investment income | $35,181,633 | $55,932,573 |

|

| Net realized gain on investments | | |

| and foreign currency transactions | 133,363,624 | 584,047,107 |

|

| Net unrealized appreciation (depreciation) of investments | 339,319,440 | (467,501,278) |

|

| Net increase in net assets resulting from operations | 507,864,697 | 172,478,402 |

|

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | | |

|

| Class A | (41,365,279) | (51,130,098) |

|

| Class B | (648,460) | (467,457) |

|

| Class C | (228,598) | (132,685) |

|

| Class M | (247,560) | (224,970) |

|

| Class R | (28,093) | (30,264) |

|

| Class Y | (480,126) | (732,673) |

|

| Increase in capital from settlement payments (Note 8) | — | 2,193,206 |

|

| Decrease from capital share transactions (Note 4) | (283,538,208) | (640,363,565) |

|

| Total increase (decrease) in net assets | 181,328,373 | (518,410,104) |

| |

| NET ASSETS | | |

|

| Beginning of period | 4,402,028,268 | 4,920,438,372 |

|

| End of period (including undistributed net investment | | |

| income of $2,580,024 and $10,396,507, respectively) | $4,583,356,641 | $4,402,028,268 |

|

* Unaudited

The accompanying notes are an integral part of these financial statements.

26

|

| This page left blank intentionally. |

27

Financial highlights (For a common share outstanding throughout the period)

| | | | | | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | LESS DISTRIBUTIONS: | | RATIOS AND SUPPLEMENTAL DATA: |

|

| | | | | | | | | | | | | | | | Ratio | |

| | Net asset | Net | Net realized | | From | From | | | | | | | | Ratio | of net investment | |

| | value, | investment | and unrealized | Total from | net | net realized | From | | | | | | Net assets, | of expenses | income (loss) | |

| | beginning | income | gain (loss) | investment | investment | gain | return | Total | Redemption | Non-recurring | Net asset value, | Total return at | net end of period | to average | to average | Portfolio |

| Period ended | of period | (loss) a | on investments | operations | income | on investments | of capital | distributions | fees | reimbursements | end of period | asset value (%) b | (in thousands) | net assets (%) c | net assets (%) | turnover (%) |

|

| Class A | | | | | | | | | | | | | | | | |

| April 30, 2012** | $12.79 | .11 | 1.42 | 1.53 | (.13) | — | — | (.13) | — | — | $14.19 | 12.06* | $4,365,528 | .55* | .80* | 14* |

| October 31, 2011 | 12.56 | .16 | .21 | .37 | (.15) | — | — | (.15) | — | .01 d | 12.79 | 2.99 | 4,176,494 | 1.10 | 1.17 | 45 |

| October 31, 2010 | 11.15 | .12 | 1.40 | 1.52 | (.11) | — | — | (.11) | — e | — | 12.56 | 13.65 | 4,607,805 | 1.16 | .99 | 48 |

| October 31, 2009 | 10.09 | .15 | 1.11 f,g | 1.26 | (.20) | — | — e | (.20) | — e | — e,h | 11.15 | 12.99 f,g | 4,631,517 | 1.21 i | 1.52 i | 57 |

| October 31, 2008 | 20.26 | .24 | (7.27) | (7.03) | (.31) | (2.83) | — | (3.14) | — e | — | 10.09 | (40.22) | 4,754,294 | 1.00 i | 1.71 i | 35 |

| October 31, 2007 | 21.72 | .23 | 1.09 | 1.32 | (.20) | (2.58) | — | (2.78) | — e | — | 20.26 | 6.47 | 10,937,114 | .92 i | 1.14 i | 57 |

|

| Class B | | | | | | | | | | | | | | | | |

| April 30, 2012** | $12.56 | .06 | 1.39 | 1.45 | (.08) | — | — | (.08) | — | — | $13.93 | 11.62* | $100,430 | .92* | .44* | 14* |

| October 31, 2011 | 12.34 | .06 | .19 | .25 | (.04) | — | — | (.04) | — | .01 d | 12.56 | 2.14 | 108,621 | 1.85 | .41 | 45 |

| October 31, 2010 | 10.95 | .03 | 1.38 | 1.41 | (.02) | — | — | (.02) | — e | — | 12.34 | 12.85 | 159,231 | 1.91 | .27 | 48 |

| October 31, 2009 | 9.91 | .08 | 1.09 f,g | 1.17 | (.13) | — | — e | (.13) | — e | — e,h | 10.95 | 12.11 f,g | 226,198 | 1.96 i | .85 i | 57 |

| October 31, 2008 | 19.94 | .13 | (7.14) | (7.01) | (.19) | (2.83) | — | (3.02) | — e | — | 9.91 | (40.68) | 319,813 | 1.75 i | .96 i | 35 |

| October 31, 2007 | 21.40 | .08 | 1.07 | 1.15 | (.03) | (2.58) | — | (2.61) | — e | — | 19.94 | 5.68 | 1,020,630 | 1.67 i | .40 i | 57 |

|

| Class C | | | | | | | | | | | | | | | | |

| April 30, 2012** | $12.74 | .06 | 1.41 | 1.47 | (.08) | — | — | (.08) | — | — | $14.13 | 11.63* | $38,229 | .92* | .43* | 14* |

| October 31, 2011 | 12.51 | .06 | .21 | .27 | (.05) | — | — | (.05) | — | .01 d | 12.74 | 2.21 | 36,035 | 1.85 | .42 | 45 |

| October 31, 2010 | 11.10 | .03 | 1.40 | 1.43 | (.02) | — | — | (.02) | — e | — | 12.51 | 12.88 | 37,264 | 1.91 | .24 | 48 |

| October 31, 2009 | 10.05 | .07 | 1.11 f,g | 1.18 | (.13) | — | — e | (.13) | — e | — e,h | 11.10 | 12.07 f,g | 37,309 | 1.96 i | .76 i | 57 |

| October 31, 2008 | 20.17 | .13 | (7.23) | (7.10) | (.19) | (2.83) | — | (3.02) | — e | — | 10.05 | (40.64) | 36,166 | 1.75 i | .96 i | 35 |

| October 31, 2007 | 21.63 | .08 | 1.08 | 1.16 | (.04) | (2.58) | — | (2.62) | — e | — | 20.17 | 5.66 | 85,618 | 1.67 i | .39 i | 57 |

|

| Class M | | | | | | | | | | | | | | | | |

| April 30, 2012** | $12.69 | .07 | 1.41 | 1.48 | (.10) | — | — | (.10) | — | — | $14.07 | 11.73* | $33,109 | .80* | .55* | 14* |

| October 31, 2011 | 12.46 | .09 | .21 | .30 | (.08) | — | — | (.08) | — | .01 d | 12.69 | 2.48 | 33,357 | 1.60 | .67 | 45 |

| October 31, 2010 | 11.06 | .06 | 1.39 | 1.45 | (.05) | — | — | (.05) | — e | — | 12.46 | 13.09 | 38,209 | 1.66 | .49 | 48 |

| October 31, 2009 | 10.01 | .10 | 1.10 f,g | 1.20 | (.15) | — | — e | (.15) | — e | — e,h | 11.06 | 12.40 f,g | 39,681 | 1.71 i | 1.00 i | 57 |

| October 31, 2008 | 20.11 | .17 | (7.21) | (7.04) | (.23) | (2.83) | — | (3.06) | — e | — | 10.01 | (40.50) | 36,633 | 1.50 i | 1.21 i | 35 |

| October 31, 2007 | 21.57 | .13 | 1.08 | 1.21 | (.09) | (2.58) | — | (2.67) | — e | — | 20.11 | 5.95 | 92,307 | 1.42 i | .64 i | 57 |

|

| Class R | | | | | | | | | | | | | | | | |

| April 30, 2012** | $12.72 | .09 | 1.41 | 1.50 | (.11) | — | — | (.11) | — | — | $14.11 | 11.92* | $3,526 | .68* | .67* | 14* |

| October 31, 2011 | 12.50 | .12 | .20 | .32 | (.11) | — | — | (.11) | — | .01 d | 12.72 | 2.65 | 3,151 | 1.35 | .92 | 45 |

| October 31, 2010 | 11.09 | .09 | 1.40 | 1.49 | (.08) | — | — | (.08) | — e | — | 12.50 | 13.45 | 3,554 | 1.41 | .74 | 48 |

| October 31, 2009 | 10.04 | .12 | 1.11 f,g | 1.23 | (.18) | — | — e | (.18) | — e | — e,h | 11.09 | 12.69 f,g | 3,579 | 1.46 i | 1.21 i | 57 |

| October 31, 2008 | 20.19 | .20 | (7.24) | (7.04) | (.28) | (2.83) | — | (3.11) | — e | — | 10.04 | (40.38) | 2,905 | 1.25 i | 1.44 i | 35 |

| October 31, 2007 | 21.65 | .18 | 1.09 | 1.27 | (.15) | (2.58) | — | (2.73) | — e | — | 20.19 | 6.23 | 1,717 | 1.17 i | .87 i | 57 |

|

| Class Y | | | | | | | | | | | | | | | | |

| April 30, 2012** | $12.82 | .13 | 1.42 | 1.55 | (.15) | — | — | (.15) | — | — | $14.22 | 12.17* | $42,536 | .43* | .94* | 14* |

| October 31, 2011 | 12.59 | .20 | .20 | .40 | (.18) | — | — | (.18) | — | .01 d | 12.82 | 3.26 | 44,370 | .85 | 1.45 | 45 |

| October 31, 2010 | 11.17 | .15 | 1.41 | 1.56 | (.14) | — | — | (.14) | — e | — | 12.59 | 13.99 | 74,376 | .91 | 1.24 | 48 |

| October 31, 2009 | 10.12 | .20 | 1.08 f,g | 1.28 | (.23) | — | — e | (.23) | — e | — e,h | 11.17 | 13.15 f,g | 79,716 | .96 i | 2.37 i | 57 |

| October 31, 2008 | 20.31 | .27 | (7.28) | (7.01) | (.35) | (2.83) | — | (3.18) | — e | — | 10.12 | (40.06) | 654,582 | .75 i | 1.96 i | 35 |

| October 31, 2007 | 21.76 | .29 | 1.09 | 1.38 | (.25) | (2.58) | — | (2.83) | — e | — | 20.31 | 6.78 | 1,185,123 | .67 i | 1.39 i | 57 |

|

See notes to financial highlights at the end of this section.

The accompanying notes are an integral part of these financial statements.

Financial highlights (Continued)

* Not annualized.

** Unaudited.

a Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

b Total return assumes dividend reinvestment and does not reflect the effect of sales charges.

c Includes amounts paid through expense offset and brokerage/service arrangements (Note 2).

d Reflects a non-recurring reimbursement related to restitution amounts in connection with a distribution plan approved by the Securities and Exchange Commission (the SEC) which amounted to $0.01 per share outstanding on July 21, 2011. Also reflects a non-recurring reimbursement related to short-term trading related lawsuits, which amounted to less than $0.01 per share outstanding on May 11, 2011 (Note 8).

e Amount represents less than $0.01 per share.

f Reflects a non-recurring litigation payment received by the fund from Enron Corporation which amounted to $0.05 per share outstanding on December 29, 2008. This payment resulted in an increase to total returns of 0.51% for the year ended October 31, 2009.

g Reflects a non-recurring litigation payment received by the fund from Tyco International, Ltd. which amounted to $0.07 per share outstanding on March 13, 2009. This payment resulted in an increase to total returns of 0.71% for the year ended October 31, 2009.

h Reflects a non-recurring reimbursement pursuant to a settlement between the SEC and Bear Stearns & Co., Inc. and Bear Stearns Securities Corp., which amounted to less than $0.01 per share outstanding as of May 21, 2009.

i Reflects an involuntary contractual expense limitation in effect during the period. For periods prior to October 31, 2009, certain fund expenses were waived in connection with investments in Putnam Prime Money Market Fund. As a result of such limitation and/or waivers, the expenses of each class reflect a reduction of the following amounts:

| |

| | Percentage of |

| | average net assets |

|

| October 31, 2009 | 0.02% |

|

| October 31, 2008 | <0.01 |

|

| October 31, 2007 | <0.01 |

|

The accompanying notes are an integral part of these financial statements.

30

Notes to financial statements 4/30/12 (Unaudited)

Within the following Notes to financial statements, references to “State Street” represent State Street Bank and Trust Company, references to “the SEC” represent the Securities and Exchange Commission and references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC. Unless otherwise noted, the “reporting period” represents the period from November 1, 2011 through April 30, 2012.

The Putnam Fund for Growth and Income (the fund) is a Massachusetts business trust, which is registered under the Investment Company Act of 1940, as amended, as a diversified open-end management investment company. The investment objective of the fund is to seek capital growth and current income. The fund invests mainly in common stocks of large U.S. companies, with a focus on value stocks that offer the potential for capital growth, current income, or both.

The fund offers class A, class B, class C, class M, class R and class Y shares. Class A and class M shares are sold with a maximum front-end sales charge of 5.75% and 3.50%, respectively, and generally do not pay a contingent deferred sales charge. Class B shares, which convert to class A shares after approximately eight years, do not pay a front-end sales charge and are subject to a contingent deferred sales charge if those shares are redeemed within six years of purchase. Class C shares have a one-year 1.00% contingent deferred sales charge and do not convert to class A shares. Class R shares, which are not available to all investors, are sold at net asset value. The expenses for class A, class B, class C, class M and class R shares may differ based on the distribution fee of each class, which is identified in Note 2. Class Y shares, which are sold at net asset value, are generally subject to the same expenses as class A, class B, class C, class M and class R shares, but do not bear a distribution fee. Class Y shares are not available to all investors.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

Note 1: Significant accounting policies

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

Investment income, realized and unrealized gains and losses and expenses of the fund are borne pro-rata based on the relative net assets of each class to the total net assets of the fund, except that each class bears expenses unique to that class (including the distribution fees applicable to such classes). Each class votes as a class only with respect to its own distribution plan or other matters on which a class vote is required by law or determined by the Trustees. If the fund were liquidated, shares of each class would receive their pro-rata share of the net assets of the fund. In addition, the Trustees declare separate dividends on each class of shares.

Security valuation Investments for which market quotations are readily available are valued at the last reported sales price on their principal exchange, or official closing price for certain markets, and are classified as Level 1 securities. If no sales are reported, as in the case of some securities traded over-the-counter, a security is valued at its last reported bid price and is generally categorized as a Level 2 security.

Investments in other open-end investment companies (excluding exchange traded funds), which are classified as Level 1 securities, are based on their net asset value. The net asset value of an investment company equals the total value of its assets less its liabilities and divided by the number of its outstanding shares. Shares are only valued as of the close of regular trading on the New York Stock Exchange each day that the exchange is open.

Many securities markets and exchanges outside the U.S. close prior to the close of the New York Stock Exchange and therefore the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the close of the New York Stock Exchange. Accordingly, on certain days, the fund will fair value foreign equity securities taking into account multiple factors including movements in the

31

U.S. securities markets, currency valuations and comparisons to the valuation of American Depository Receipts, exchange-traded funds and futures contracts. These securities, which will generally represent a transfer from a Level 1 to a Level 2 security, will be classified as Level 2. The number of days on which fair value prices will be used will depend on market activity and it is possible that fair value prices will be used by the fund to a significant extent. Securities quoted in foreign currencies, if any, are translated into U.S. dollars at the current exchange rate.

To the extent a pricing service or dealer is unable to value a security or provides a valuation that Putnam Management does not believe accurately reflects the security’s fair value, the security will be valued at fair value by Putnam Management. Certain investments, including certain restricted and illiquid securities and derivatives, are also valued at fair value following procedures approved by the Trustees. These valuations consider such factors as significant market or specific security events such as interest rate or credit quality changes, various relationships with other securities, discount rates, U.S. Treasury, U.S. swap and credit yields, index levels, convexity exposures and recovery rates. These securities are classified as Level 2 or as Level 3 depending on the priority of the significant inputs.

Such valuations and procedures are reviewed periodically by the Trustees. The fair value of securities is generally determined as the amount that the fund could reasonably expect to realize from an orderly disposition of such securities over a reasonable period of time. By its nature, a fair value price is a good faith estimate of the value of a security in a current sale and does not reflect an actual market price, which may be different by a material amount.