UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-5225

Oppenheimer Quest for Value Funds

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: October 31

Date of reporting period: 10/31/2016

Item 1. Reports to Stockholders.

Table of Contents

Class A Shares1

AVERAGE ANNUAL TOTAL RETURNS AT 10/31/16

| | | | | | | | | | | | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

| | | |

Class A Shares of the Fund without Sales Charge | | | 2.72 | % | | | 5.56 | % | | | 2.67% | |

| | | |

Class A Shares of the Fund with Sales Charge | | | -3.19 | | | | 4.32 | | | | 2.06 | |

| | | |

S&P 500 Index | | | 4.51 | | | | 13.57 | | | | 6.70 | |

| | | |

Reference Index 1 | | | 3.53 | | | | 6.64 | | | | 4.54 | |

| | | |

MSCI All Country World Index | | | 2.05 | | | | 8.03 | | | | 3.78 | |

| | | |

Bloomberg Barclays Global Aggregate Bond Index, Hedged | | | 5.17 | | | | 4.08 | | | | 4.58 | |

| | | |

Reference Index 2 | | | 3.93 | | | | 5.84 | | | | 4.85 | |

| | | |

Russell 1000 Index | | | 4.26 | | | | 13.51 | | | | 6.83 | |

| | | |

MSCI All County World Index (ex-U.S.) | | | 0.22 | | | | 3.64 | | | | 1.61 | |

| | | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.37 | | | | 2.90 | | | | 4.64 | |

| | | |

Bloomberg Barclays Multiverse Index (ex-U.S.) | | | 6.40 | | | | -0.54 | | | | 3.29 | |

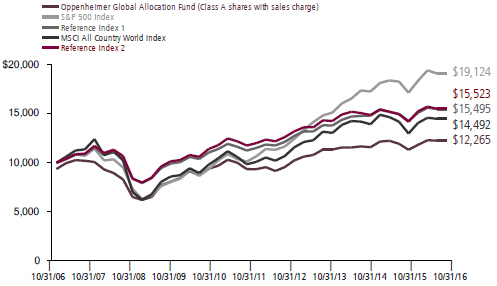

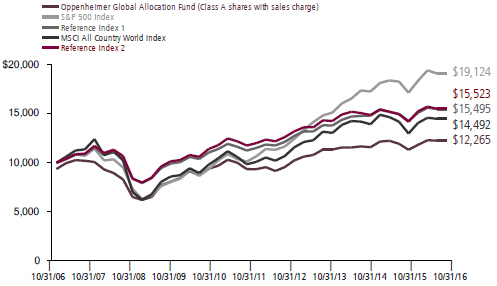

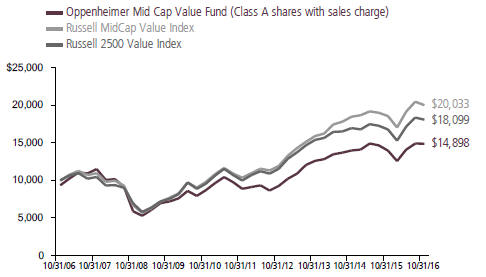

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most

2 OPPENHEIMER GLOBAL ALLOCATION FUND

recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

1. The Fund has changed its benchmark from Reference Index 2 (30% Russell 1000 Index /30% MSCI All Country World Index (ex-U.S.) / 20% Bloomberg Barclays U.S. Aggregate Bond Index / 20% Bloomberg Barclays Multiverse Index (ex-U.S.) to Reference Index 1 (60% MSCI All Country World Index /40% Bloomberg Barclays Global Aggregate Bond Index, Hedged), which it believes is a more appropriate measure of the Fund’s performance. The Fund will not show performance for the Reference Index 2 (or for the indices comprising the Reference Index 2) in its next annual report.

3 OPPENHEIMER GLOBAL ALLOCATION FUND

Fund Performance Discussion

The Fund’s Class A shares (without sales charge) produced a return of 2.72% during the reporting period. The Fund underperformed its Reference Index (the “Reference Index”), a customized weighted index currently comprised of 60% of the MSCI All Country World Index and 40% of the Bloomberg Barclays Global Aggregate Bond Index, Hedged, which returned 3.53%.

MARKET OVERVIEW

Markets were volatile this reporting period. One of the most significant events during the period was the United Kingdom’s (“UK”) vote to leave the European Union (“EU”). Although the UK still has not initiated the formal process to leave the EU, the vote initially raised the level of uncertainty in global markets. Within days of the result, there were sharp moves across all markets. Perhaps the most significant movers were government bonds, where yields fell sharply,

despite already being well below historical levels.

Markets staged an impressive rebound in July, as investor fears receded, particularly over the immediate implications of June’s Brexit vote. We saw central bank action remain supportive with the Bank of England and the European Central Bank (“ECB”) making forceful statements outlining intentions to backstop market sentiment. Central bank

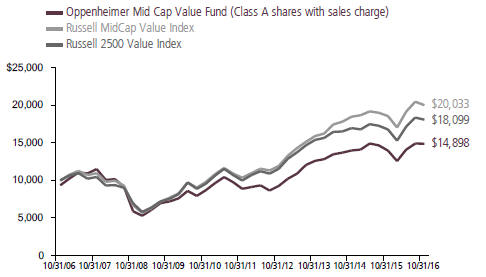

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

4 OPPENHEIMER GLOBAL ALLOCATION FUND

activity was not just apparent after the Brexit vote, but played a large role throughout the period.

In June, the ECB started to purchase European corporate bonds, marking another ‘Rubicon crossed’ in the central bank’s unconventional monetary policy moves. The purchasing program started more aggressively than had been expected, buying at the upper end of the 5-10 billion euro per month range.

Two key policy meetings in the third quarter were closely watched, one with the U.S. Federal Reserve (“Fed”) and the other from the Bank of Japan (“BoJ”). The Fed was not expected to hike rates and they met this expectation. However the details were mixed, with 3 dissenters voting in favor of a hike. The overall message was dovish, though a December hike remains a possibility.

The BoJ’s meeting was perhaps even more eagerly anticipated, with a growing view that the unprecedented monetary policy experiment from the last few years has failed to generate the promised inflation. Expectations varied widely, from a further rate cut (to more deeply negative), to expansion of the quantitative easing program, to no change to policy. In the end, the bank opted for what amounted to a fine-tuning of policy: It left its rates unchanged, but announced a new policy of ‘yield curve control’, where it would keep the 10-year Japanese Government Bond yield anchored around 0%, and target a modestly positively sloping yield curve.

FUND REVIEW

During the reporting period, the equity security selection component of the Fund’s investment process was the largest detractor from relative performance, driven mostly by international and domestic strategies. Our global developed equity strategy had underperformance relative to the MSCI All Country World Index during the period driven by poor stock selection within the Financials and Information Technology sectors. Our domestic large-cap growth strategy underperformed the Russell 1000 Growth Index, with poor stock selection within the Information Technology and Health Care sectors.

Our overweight duration posture versus the Reference Index was a big contributor during the period. Last year, we anticipated that U.S. Treasuries would be an attractive hedge against renewed market volatility, given their positive yield (relative to option based hedging strategies, where we would typically pay a premium for protection). Given our general concerns about global growth and a lack of discernible inflation, we believed developed market government bonds, particularly long-dated U.S. Treasuries, offered an attractive hedge in an uncertain environment. This duration hedge worked extremely well as volatility picked up in the first part of 2016 and yields on Treasuries fell substantially. With the significant move in yields, we reduced this exposure but remain neutral duration versus the Reference Index.

5 OPPENHEIMER GLOBAL ALLOCATION FUND

With most developed markets past their cyclical peaks, we have sought to enhance portfolio diversification through investments in income assets. Lower volatility coupled with a dovish Fed make for a favorable environment for income assets. At period end, we maintained broad exposure to income assets with a preference for loans, event-linked bonds, and high yield. During the period, we reduced our high yield exposure in favor of loans because of their attractive valuations, a step-up in credit quality, and less interest rate and sector risk than high yield bonds. Within the U.S., we favor credit over equities given the advanced stage of the business cycle and lower volatility. With sluggish earnings growth, we don’t expect meaningful equity upside. Together, we believe these income generating assets provide attractive sources of return with less severe ups and downs than equities.

Our active currency overlay has been a contributor to relative performance. We have actively managed currency both to hedge downside risk and take advantage of potential opportunities. To take advantage of the upside, we have a bias to higher-yielding emerging currencies versus lower-yielding developed currencies. This positioning added to performance as emerging currencies outperformed developed currencies. We remain modestly underweight the pound versus the Reference Index, as well as the euro, Swiss franc, and Canadian dollar, neutral the U.S. dollar and Japanese yen, and overweight a basket of higher yielding emerging currencies.

The Fund’s return shaping strategies, which are designed to improve the overall risk profile of the Fund, were a neutral contributor to performance during the period. Under normal circumstances, we expect return shaping strategies to cost money, like any insurance premium, and commensurately enhance returns or partially protect principal in environments of extreme market volatility. These strategies are often used as an efficient way to access upside market participation, especially when we are running lower levels of risk. With implied volatility higher than realized volatility across a number of assets (implying a relatively high cost of portfolio protection), we preferred to reduce risk through our asset allocation overlays, and had limited exposure to hedging strategies through options.

STRATEGY & OUTLOOK

Overall, we are underweight equities relative to the Reference Index and prefer to own diversified income sources as an attractive alternative to equities. With most developed equity market valuations relatively full in comparison to history, we have a preference for emerging market equities, where we see cheaper relative valuations, signs of economic recovery across countries, and improving risk sentiment. In terms of the macro environment, we are seeing a relatively weaker economic picture as our macro regime framework continues to indicate that most of the developed economies are past cyclical peaks. Most central banks, excluding the U.S., are trying to counterbalance this by supportive

6 OPPENHEIMER GLOBAL ALLOCATION FUND

monetary policy, but the long-term effects seem to be dissipating. Finally, risks remain somewhat elevated, with the economic drag from Brexit, weakness in European financials, the ongoing structural transition in China, and uncertainty surrounding the direction of Fed policy.

As we look ahead, we expect a continuation in this year’s seesaw behavior, in which global markets alternate between risk-on and risk-off. This muted growth outlook coupled with lack of consistent direction is causing a high degree of financial market uncertainty that may persist for some time. With this type

of backdrop, we believe in being somewhat cautious with our risk posture and focusing on higher risk-adjusted return assets and relative value opportunities across assets and currencies instead of large directional positions. Finally, with a choppy market backdrop, we think a dynamic asset allocation approach is well suited to navigate the short-term market risks. In terms of opportunities, cyclical and policy divergence are leading to some very interesting trends that we expect to exhibit some persistence over time and a flexible mandate is well equipped to capitalize on.

| | | | | | | | | | |

| |  | |

| |  |

| | Mark Hamilton Portfolio Manager | | | Benjamin Rockmuller, CFA Portfolio Manager |

| | | |

| |  | |

| |  |

| | Alessio de Longis, CFA Portfolio Manager | | | Dokyoung Lee, CFA Portfolio Manager |

7 OPPENHEIMER GLOBAL ALLOCATION FUND

Top Holdings and Allocations

TOP TEN COMMON STOCK HOLDINGS

| | | | |

Apple, Inc. | | | 1.1% | |

Alphabet, Inc., Cl. C | | | 1.0 | |

SAP SE | | | 0.8 | |

Alphabet, Inc., Cl. A | | | 0.7 | |

Facebook, Inc., Cl. A | | | 0.7 | |

Citigroup, Inc. | | | 0.7 | |

Comcast Corp., Cl. A | | | 0.6 | |

Airbus Group SE | | | 0.6 | |

S&P Global, Inc. | | | 0.5 | |

LVMH Moet Hennessy Louis Vuitton SE | | | 0.5 | |

Portfolio holdings and allocations are subject to change. Percentages are as of October 31, 2016, and are based on net assets. For more current Fund holdings, please visit oppenheimerfunds.com.

TOP TEN COMMON STOCK INDUSTRIES

| | | | |

Internet Software & Services | | | 3.8% | |

Commercial Banks | | | 3.1 | |

Software | | | 2.4 | |

Food Products | | | 2.2 | |

Oil, Gas & Consumable Fuels | | | 2.1 | |

Insurance | | | 2.0 | |

Capital Markets | | | 2.0 | |

Textiles, Apparel & Luxury Goods | | | 1.9 | |

Hotels, Restaurants & Leisure | | | 1.8 | |

Pharmaceuticals | | | 1.8 | |

Portfolio holdings and allocations are subject to change. Percentages are as of October 31, 2016, and are based on net assets.

PORTFOLIO ALLOCATION

| | | | |

| Common Stocks | | | 61.6% | |

| Investment Companies | | | | |

Oppenheimer Institutional Government Money Market Fund | | | 1.6 | |

Oppenheimer Master Event- Linked Bond Fund, LLC | | | 5.3 | |

Oppenheimer Master Loan Fund, LLC | | | 7.6 | |

Oppenheimer Senior Floating Rate Fund | | | 2.7 | |

PowerShares Senior Loan Portfolio Exchange Traded Fund | | | 5.2 | |

| U.S. Government Obligations | | | 11.1 | |

| Foreign Government Obligations | | | 4.5 | |

| Preferred Stocks | | | 0.4 | |

| Rights, Warrants and Certificates | | | —* | |

| Non-Convertible Corporate Bonds and Notes | | | —* | |

| Short-Term Notes | | | —* | |

| * | Represents a value of less than 0.05%. |

Portfolio holdings and allocations are subject to change. Percentages are as of October 31, 2016, and are based on the total market value of investments.

8 OPPENHEIMER GLOBAL ALLOCATION FUND

TOP TEN GEOGRAPHICAL HOLDINGS

| | | | |

United States | | | 60.9% | |

France | | | 4.9 | |

Japan | | | 4.6 | |

United Kingdom | | | 3.5 | |

Germany | | | 3.2 | |

Switzerland | | | 2.4 | |

China | | | 2.3 | |

India | | | 2.0 | |

Canada | | | 1.9 | |

Brazil | | | 1.5 | |

Portfolio holdings and allocation are subject to change. Percentages are as of October 31, 2016, and are based on total market value of investments.

REGIONAL ALLOCATION

| | | | |

U.S./Canada | | | 62.8% | |

Europe | | | 18.5 | |

Asia | | | 12.9 | |

Latin America | | | 3.1 | |

Emerging Europe | | | 1.6 | |

Middle East/Africa | | | 1.1 | |

Portfolio holdings and allocation are subject to change. Percentages are as of October 31, 2016, and are based on total market value of investments.

9 OPPENHEIMER GLOBAL ALLOCATION FUND

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 10/31/2016

| | | | | | | | | | |

| | | Inception

Date | | 1-Year | | 5-Year | | 10-Year | | |

Class A (QVGIX) | | 11/1/91 | | 2.72% | | 5.56% | | 2.67% | | |

Class B (QGRBX) | | 9/1/93 | | 1.99 | | 4.73 | | 2.18 | | |

Class C (QGRCX) | | 9/1/93 | | 1.97 | | 4.80 | | 1.93 | | |

Class I (QGRIX) | | 2/28/12 | | 3.18 | | 5.65* | | N/A | | |

Class R (QGRNX) | | 3/1/01 | | 2.51 | | 5.30 | | 2.42 | | |

Class Y (QGRYX) | | 5/1/00 | | 2.97 | | 5.89 | | 3.01 | | |

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 10/31/2016

| | | | | | | | | | |

| | | Inception

Date | | 1-Year | | 5-Year | | 10-Year | | |

Class A (QVGIX) | | 11/1/91 | | -3.19% | | 4.32% | | 2.06% | | |

Class B (QGRBX) | | 9/1/93 | | -3.01 | | 4.39 | | 2.18 | | |

Class C (QGRCX) | | 9/1/93 | | 0.97 | | 4.80 | | 1.93 | | |

Class I (QGRIX) | | 2/28/12 | | 3.18 | | 5.65* | | N/A | | |

Class R (QGRNX) | | 3/1/01 | | 2.51 | | 5.30 | | 2.42 | | |

Class Y (QGRYX) | | 5/1/00 | | 2.97 | | 5.89 | | 3.01 | | |

| |

| *Shows performance since inception. | | |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800. CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75%; for Class B shares, the contingent deferred sales charge of 5% (1-year) and 2% (5-year); and for Class C shares, the contingent deferred sales charge (“CDSC”) of 1% for the 1-year period. There is no sales charge for Class I, Class R and Class Y shares. Because Class B shares convert to Class A shares 72 months after purchase, the 10-year return for Class B shares uses Class A performance for the period after conversion. See Fund prospectuses and summary prospectuses for more information on share classes and sales charges.

The Fund’s performance is compared to the performance of the S&P 500 Index, Reference Index 1 (60% MSCI All Country World Index / 40% Bloomberg Barclays Global Aggregate Bond Index, Hedged), the MSCI All Country World Index, the Bloomberg Barclays Global Aggregate Bond Index, Hedged, Reference Index 2 (30% Russell 1000 Index / 30% MSCI All Country World Index (ex-U.S.) / 20% Bloomberg Barclays U.S. Aggregate Bond Index / 20% Bloomberg Barclays Multiverse Index (ex-U.S.) the Russell 1000 Index, the MSCI All Country World Index (ex-U.S.), the Bloomberg Barclays U.S. Aggregate Bond Index, and the Bloomberg Barclays Multiverse Index (ex-U.S.). The Fund has changed its benchmark from Reference Index 2 to Reference Index 1, which it believes is a more appropriate measure of the Fund’s

10 OPPENHEIMER GLOBAL ALLOCATION FUND

performance. The Fund will not show performance for Reference Index 2 (or for the indices that comprise Reference Index 2) in its next annual report.

The S&P 500 Index is a broad-based measure of domestic stock performance. The MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Bloomberg Barclays Global Aggregate Bond Index provides a broad-based measure of global investment grade fixed-rate debt markets. The index is comprised of several other Bloomberg Barclays indexes that measure fixed income performance of regions around the world while hedging the currency back to the U.S. dollar. The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. The MSCI All Country World Index (ex U.S.) is designed to measure global developed and emerging equity market performance excluding the United States. The Bloomberg Barclays U.S. Aggregate Bond Index is an index of U.S dollar-denominated, investment-grade U.S. corporate government and mortgage-backed securities. The Bloomberg Barclays Multiverse Index (ex-U.S.) provides a broad-based measure of the global fixed-income bond market. The indices are unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the indices. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

11 OPPENHEIMER GLOBAL ALLOCATION FUND

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended October 31, 2016.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended October 31, 2016” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

12 OPPENHEIMER GLOBAL ALLOCATION FUND

| | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | Beginning Account Value May 1, 2016 | | | | | | Ending Account Value October 31, 2016 | | | Expenses Paid During 6 Months Ended October 31, 2016 | |

Class A | | $ | 1,000.00 | | | | | | | $ | 1,036.80 | | | | | | | $ | 6.57 | | | | | |

Class B | | | 1,000.00 | | | | | | | | 1,032.80 | | | | | | | | 10.63 | | | | | |

Class C | | | 1,000.00 | | | | | | | | 1,033.00 | | | | | | | | 10.43 | | | | | |

Class I | | | 1,000.00 | | | | | | | | 1,038.60 | | | | | | | | 4.06 | | | | | |

Class R | | | 1,000.00 | | | | | | | | 1,035.60 | | | | | | | | 7.86 | | | | | |

Class Y | | | 1,000.00 | | | | | | | | 1,038.00 | | | | | | | | 5.29 | | | | | |

| | | | | | |

| Hypothetical | | | | | | | | | | | | | | | | | | | | | | | | |

(5% return before expenses) | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | 1,000.00 | | | | | | | | 1,018.70 | | | | | | | | 6.52 | | | | | |

Class B | | | 1,000.00 | | | | | | | | 1,014.73 | | | | | | | | 10.54 | | | | | |

Class C | | | 1,000.00 | | | | | | | | 1,014.93 | | | | | | | | 10.33 | | | | | |

Class I | | | 1,000.00 | | | | | | | | 1,021.17 | | | | | | | | 4.02 | | | | | |

Class R | | | 1,000.00 | | | | | | | | 1,017.44 | | | | | | | | 7.79 | | | | | |

Class Y | | | 1,000.00 | | | | | | | | 1,019.96 | | | | | | | | 5.24 | | | | | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended October 31, 2016 are as follows:

| | | | | | | | |

| Class | | Expense Ratios | | | | |

Class A | | | 1.28 | % | | | | |

Class B | | | 2.07 | | | | | |

Class C | | | 2.03 | | | | | |

Class I | | | 0.79 | | | | | |

Class R | | | 1.53 | | | | | |

Class Y | | | 1.03 | | | | | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Consolidated Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

13 OPPENHEIMER GLOBAL ALLOCATION FUND

CONSOLIDATED STATEMENT OF INVESTMENTS October 31, 2016

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks—60.7% | | | | | | | | |

Consumer Discretionary—10.4% | | | | | | | | |

Auto Components—0.7% | | | | | | | | |

Adient plc1 | | | 9,909 | | | $ | 450,958 | |

Bridgestone Corp. | | | 64,100 | | | | 2,388,751 | |

Continental AG | | | 13,894 | | | | 2,662,804 | |

Delphi Automotive plc | | | 12,930 | | | | 841,355 | |

Koito Manufacturing Co. Ltd. | | | 4,300 | | | | 224,193 | |

Valeo SA | | | 82,667 | | | | 4,762,577 | |

| | | | | | | 11,330,638 | |

| | | | | | | | | |

Automobiles—0.6% | | | | | | | | |

Astra International Tbk PT | | | 1,250,500 | | | | 786,444 | |

Bayerische Motoren Werke AG | | | 13,418 | | | | 1,169,076 | |

Hero MotoCorp Ltd. | | | 48,967 | | | | 2,458,537 | |

Suzuki Motor Corp. | | | 64,100 | | | | 2,275,207 | |

Tata Motors Ltd., Sponsored ADR | | | 60,490 | | | | 2,383,911 | |

| | | | | | | 9,073,175 | |

| | | | | | | | | |

Diversified Consumer Services—0.3% | | | | | | | | |

Dignity plc | | | 38,581 | | | | 1,251,797 | |

Estacio Participacoes SA | | | 132,700 | | | | 769,510 | |

Kroton Educacional SA | | | 137,554 | | | | 685,185 | |

New Oriental Education & Technology Group, Inc., Sponsored ADR1 | | | 23,580 | | | | 1,182,065 | |

| | | | | | | 3,888,557 | |

| | | | | | | | | |

Hotels, Restaurants & Leisure—1.8% | | | | | | | | |

Accor SA | | | 34,740 | | | | 1,320,193 | |

Carnival Corp. | | | 108,870 | | | | 5,345,517 | |

Cedar Fair LP2 | | | 8,683 | | | | 493,628 | |

China Lodging Group Ltd., Sponsored ADR | | | 15,560 | | | | 669,236 | |

Domino’s Pizza Group plc | | | 399,870 | | | | 1,664,239 | |

Galaxy Entertainment Group Ltd. | | | 278,000 | | | | 1,141,416 | |

Genting Bhd | | | 735,800 | | | | 1,374,029 | |

Genting Malaysia Bhd | | | 453,100 | | | | 513,823 | |

International Game Technology plc | | | 58,084 | | | | 1,668,172 | |

Jollibee Foods Corp. | | | 135,080 | | | | 663,912 | |

Las Vegas Sands Corp. | | | 16,590 | | | | 960,229 | |

McDonald’s Corp. | | | 29,530 | | | | 3,324,192 | |

Melco Crown Entertainment Ltd., ADR | | | 68,310 | | | | 1,143,509 | |

Sands China Ltd. | | | 809,600 | | | | 3,513,533 | |

Starbucks Corp. | | | 9,510 | | | | 504,696 | |

Whitbread plc | | | 27,624 | | | | 1,222,072 | |

William Hill plc | | | 398,312 | | | | 1,441,719 | |

| | | | | | | 26,964,115 | |

| | | | | | | | | |

Household Durables—0.7% | | | | | | | | |

Newell Brands, Inc. | | | 13,360 | | | | 641,547 | |

SEB SA | | | 18,830 | | | | 2,772,139 | |

Sony Corp. | | | 149,200 | | | | 4,721,214 | |

Whirlpool Corp. | | | 16,990 | | | | 2,545,442 | |

| | | | | | | 10,680,342 | |

14 OPPENHEIMER GLOBAL ALLOCATION FUND

| | | | | | | | |

| | | Shares | | | Value | |

Internet & Direct Marketing Retail—0.7% | | | | | | | | |

Amazon.com, Inc.1 | | | 5,866 | | | $ | 4,633,084 | |

Ctrip.com International Ltd., ADR1 | | | 40,050 | | | | 1,768,207 | |

JD.com, Inc., ADR1 | | | 89,621 | | | | 2,325,665 | |

Priceline Group, Inc. (The)1 | | | 850 | | | | 1,253,096 | |

Rakuten, Inc. | | | 37,500 | | | | 433,057 | |

| | | | | | | 10,413,109 | |

| | | | | | | | | |

Leisure Products—0.2% | | | | | | | | |

Hasbro, Inc. | | | 3,740 | | | | 311,953 | |

Nintendo Co. Ltd. | | | 13,400 | | | | 3,249,269 | |

| | | | | | | 3,561,222 | |

| | | | | | | | | |

Media—1.8% | | | | | | | | |

Comcast Corp., Cl. A | | | 150,032 | | | | 9,274,978 | |

DISH Network Corp., Cl. A1 | | | 11,440 | | | | 669,926 | |

Grupo Televisa SAB, Sponsored ADR | | | 51,580 | | | | 1,265,257 | |

ProSiebenSat.1 Media SE | | | 39,655 | | | | 1,709,076 | |

SES SA, Cl. A, FDR | | | 68,640 | | | | 1,578,450 | |

SKY Perfect JSAT Holdings, Inc. | | | 225,900 | | | | 1,120,666 | |

Sky plc | | | 176,910 | | | | 1,767,292 | |

Technicolor SA | | | 264,210 | | | | 1,543,914 | |

Walt Disney Co. (The) | | | 46,580 | | | | 4,317,500 | |

Zee Entertainment Enterprises Ltd. | | | 420,852 | | | | 3,270,024 | |

| | | | | | | 26,517,083 | |

| | | | | | | | | |

Multiline Retail—0.3% | | | | | | | | |

Dollarama, Inc. | | | 48,795 | | | | 3,646,256 | |

Hudson’s Bay Co. | | | 120,281 | | | | 1,477,843 | |

| | | | | | | 5,124,099 | |

| | | | | | | | | |

Specialty Retail—1.4% | | | | | | | | |

AutoZone, Inc.1 | | | 2,720 | | | | 2,018,675 | |

CarMax, Inc.1 | | | 16,850 | | | | 841,489 | |

Dufry AG1 | | | 9,790 | | | | 1,190,324 | |

Fast Retailing Co. Ltd. | | | 2,500 | | | | 843,504 | |

Home Depot, Inc. (The) | | | 37,740 | | | | 4,604,657 | |

Industria de Diseno Textil SA | | | 159,585 | | | | 5,577,549 | |

Lowe’s Cos., Inc. | | | 9,470 | | | | 631,175 | |

O’Reilly Automotive, Inc.1 | | | 4,530 | | | | 1,197,913 | |

Tiffany & Co. | | | 38,860 | | | | 2,853,101 | |

TJX Cos., Inc. (The) | | | 12,886 | | | | 950,343 | |

| | | | | | | 20,708,730 | |

| | | | | | | | | |

Textiles, Apparel & Luxury Goods—1.9% | | | | | | | | |

adidas AG | | | 12,334 | | | | 2,022,809 | |

Brunello Cucinelli SpA | | | 34,701 | | | | 687,193 | |

Burberry Group plc | | | 152,027 | | | | 2,744,040 | |

Christian Dior SE | | | 9,380 | | | | 1,810,917 | |

Cie Financiere Richemont SA | | | 24,814 | | | | 1,595,102 | |

Hermes International | | | 4,771 | | | | 1,934,140 | |

Kering | | | 30,938 | | | | 6,868,222 | |

LVMH Moet Hennessy Louis Vuitton SE | | | 42,540 | | | | 7,737,936 | |

15 OPPENHEIMER GLOBAL ALLOCATION FUND

| | |

| CONSOLIDATED STATEMENT OF INVESTMENTS Continued | | |

| | | |

| | | | | | | | |

| | | Shares | | | Value | |

Textiles, Apparel & Luxury Goods (Continued) | | | | | | | | |

Pandora AS | | | 13,714 | | | $ | 1,784,286 | |

Prada SpA | | | 441,500 | | | | 1,548,265 | |

Tod’s SpA | | | 9,126 | | | | 533,713 | |

VF Corp. | | | 2,410 | | | | 130,646 | |

| | | | | | | 29,397,269 | |

| | | | | | | | | |

Consumer Staples—6.3% | | | | | | | | |

Beverages—1.6% | | | | | | | | |

Ambev SA, ADR | | | 129,120 | | | | 761,808 | |

Anadolu Efes Biracilik Ve Malt Sanayii AS | | | 77,625 | | | | 474,446 | |

Anheuser-Busch InBev SA/NV | | | 12,409 | | | | 1,424,178 | |

Coca-Cola Amatil Ltd. | | | 156,917 | | | | 1,138,592 | |

Coca-Cola Co. (The) | | | 20,250 | | | | 858,600 | |

Coca-Cola European Partners plc | | | 51,460 | | | | 1,978,122 | |

Constellation Brands, Inc., Cl. A | | | 7,740 | | | | 1,293,509 | |

Diageo plc | | | 34,783 | | | | 926,053 | |

Dr Pepper Snapple Group, Inc. | | | 8,970 | | | | 787,476 | |

Fomento Economico Mexicano SAB de CV | | | 108,447 | | | | 1,039,831 | |

Fomento Economico Mexicano SAB de CV, Sponsored ADR | | | 3,710 | | | | 354,936 | |

Heineken NV | | | 28,086 | | | | 2,312,150 | |

Molson Coors Brewing Co., Cl. B | | | 9,570 | | | | 993,462 | |

Nigerian Breweries plc | | | 712,630 | | | | 329,905 | |

PepsiCo, Inc. | | | 47,130 | | | | 5,052,336 | |

Pernod Ricard SA | | | 40,040 | | | | 4,759,468 | |

| | | | | | | 24,484,872 | |

| | | | | | | | | |

Food & Staples Retailing—1.0% | | | | | | | | |

Alimentation Couche-Tard, Inc., Cl. B | | | 38,673 | | | | 1,942,732 | |

BIM Birlesik Magazalar AS | | | 32,845 | | | | 533,729 | |

Costco Wholesale Corp. | | | 4,625 | | | | 683,899 | |

CP ALL PCL | | | 1,495,600 | | | | 2,594,588 | |

Magnit PJSC | | | 18,155 | | | | 3,047,169 | |

Spar Group Ltd. (The) | | | 118,131 | | | | 1,673,168 | |

Walgreens Boots Alliance, Inc. | | | 21,350 | | | | 1,766,286 | |

Wal-Mart de Mexico SAB de CV | | | 122,353 | | | | 258,805 | |

Wal-Mart Stores, Inc. | | | 29,140 | | | | 2,040,383 | |

Whole Foods Market, Inc. | | | 22,550 | | | | 637,940 | |

| | | | | | | 15,178,699 | |

| | | | | | | | | |

Food Products—2.2% | | | | | | | | |

Aryzta AG1 | | | 38,157 | | | | 1,674,602 | |

Barry Callebaut AG1 | | | 1,457 | | | | 1,814,376 | |

ConAgra Foods, Inc. | | | 9,790 | | | | 471,682 | |

Danone SA | | | 72,975 | | | | 5,049,412 | |

Kraft Heinz Co. (The) | | | 48,100 | | | | 4,278,495 | |

Mondelez International, Inc., Cl. A | | | 121,910 | | | | 5,478,635 | |

Nestle SA | | | 88,149 | | | | 6,389,142 | |

Saputo, Inc. | | | 70,790 | | | | 2,543,859 | |

Tingyi Cayman Islands Holding Corp. | | | 480,000 | | | | 517,027 | |

Unilever plc | | | 114,940 | | | | 4,806,805 | |

16 OPPENHEIMER GLOBAL ALLOCATION FUND

| | | | | | | | |

| | | Shares | | | Value | |

Food Products (Continued) | | | | | | | | |

Want Want China Holdings Ltd. | | | 1,066,000 | | | $ | 650,063 | |

| | | | | | | 33,674,098 | |

| | | | | | | | | |

Household Products—0.6% | | | | | | | | |

Colgate-Palmolive Co. | | | 65,440 | | | | 4,669,799 | |

Kimberly-Clark de Mexico SAB de CV, Cl. A | | | 17,499 | | | | 37,709 | |

Procter & Gamble Co. (The) | | | 20,500 | | | | 1,779,400 | |

Reckitt Benckiser Group plc | | | 22,463 | | | | 2,008,641 | |

| | | | | | | 8,495,549 | |

| | | | | | | | | |

Personal Products—0.0% | | | | | | | | |

LG Household & Health Care Ltd. | | | 496 | | | | 355,398 | |

| | | | | | | | | |

Tobacco—0.9% | | | | | | | | |

Japan Tobacco, Inc. | | | 85,200 | | | | 3,242,757 | |

KT&G Corp. | | | 28,292 | | | | 2,788,680 | |

Philip Morris International, Inc. | | | 42,350 | | | | 4,084,234 | |

Swedish Match AB | | | 101,860 | | | | 3,541,106 | |

| | | | | | | 13,656,777 | |

| | | | | | | | | |

Energy—2.5% | | | | | | | | |

Energy Equipment & Services—0.4% | | | | | | | | |

Halliburton Co. | | | 5,573 | | | | 256,358 | |

Schlumberger Ltd. | | | 12,117 | | | | 947,913 | |

Technip SA | | | 81,720 | | | | 5,400,056 | |

| | | | | | | 6,604,327 | |

| | | | | | | | | |

Oil, Gas & Consumable Fuels—2.1% | | | | | | | | |

Apache Corp. | | | 18,980 | | | | 1,128,930 | |

Chevron Corp. | | | 65,594 | | | | 6,870,971 | |

CNOOC Ltd. | | | 883,000 | | | | 1,111,734 | |

Concho Resources, Inc.1 | | | 7,855 | | | | 997,114 | |

ConocoPhillips | | | 17,598 | | | | 764,633 | |

Enbridge, Inc. | | | 28,156 | | | | 1,215,495 | |

EOG Resources, Inc. | | | 2,811 | | | | 254,171 | |

Hess Corp. | | | 18,450 | | | | 885,047 | |

HollyFrontier Corp. | | | 36,158 | | | | 902,142 | |

Koninklijke Vopak NV | | | 36,333 | | | | 1,833,401 | |

Magellan Midstream Partners LP2 | | | 36,120 | | | | 2,428,348 | |

Newfield Exploration Co.1 | | | 12,311 | | | | 499,703 | |

Noble Energy, Inc. | | | 45,996 | | | | 1,585,482 | |

Novatek OJSC, Sponsored GDR | | | 22,100 | | | | 2,357,444 | |

Phillips 66 | | | 8,481 | | | | 688,233 | |

Pioneer Natural Resources Co. | | | 1,812 | | | | 324,384 | |

Repsol SA | | | 53,525 | | | | 748,025 | |

Suncor Energy, Inc. | | | 131,940 | | | | 3,960,839 | |

Total SA | | | 59,200 | | | | 2,832,980 | |

| | | | | | | 31,389,076 | |

| | | | | | | | | |

Financials—9.7% | | | | | | | | |

Capital Markets—2.0% | | | | | | | | |

Bank of New York Mellon Corp. (The) | | | 85,500 | | | | 3,699,585 | |

17 OPPENHEIMER GLOBAL ALLOCATION FUND

| | |

| CONSOLIDATED STATEMENT OF INVESTMENTS Continued | | |

| | | |

| | | | | | | | |

| | | Shares | | | Value | |

Capital Markets (Continued) | | | | | | | | |

BlackRock, Inc., Cl. A | | | 1,030 | | | $ | 351,477 | |

Charles Schwab Corp. (The) | | | 22,740 | | | | 720,858 | |

CME Group, Inc., Cl. A | | | 49,130 | | | | 4,917,913 | |

Credit Suisse Group AG1 | | | 49,116 | | | | 684,573 | |

Goldman Sachs Group, Inc. (The) | | | 14,420 | | | | 2,570,221 | |

ICAP plc | | | 313,897 | | | | 1,859,695 | |

Intercontinental Exchange, Inc. | | | 2,930 | | | | 792,243 | |

Nasdaq, Inc. | | | 21,070 | | | | 1,347,848 | |

S&P Global, Inc. | | | 67,370 | | | | 8,209,034 | |

Tullett Prebon plc | | | 98,590 | | | | 427,653 | |

UBS Group AG | | | 318,048 | | | | 4,496,423 | |

| | | | | | | 30,077,523 | |

| | | | | | | | | |

Commercial Banks—3.1% | | | | | | | | |

3SBio, Inc.1,3 | | | 60,000 | | | | 59,952 | |

Australia & New Zealand Banking Group Ltd. | | | 69,200 | | | | 1,462,081 | |

Banco Bilbao Vizcaya Argentaria SA | | | 306,575 | | | | 2,209,496 | |

Bank Mandiri Persero Tbk PT | | | 724,100 | | | | 635,623 | |

Bank of America Corp. | | | 281,410 | | | | 4,643,265 | |

Bank Pekao SA | | | 25,158 | | | | 776,090 | |

BDO Unibank, Inc. | | | 18,900 | | | | 44,030 | |

BOC Hong Kong Holdings Ltd. | | | 565,000 | | | | 2,017,686 | |

Citigroup, Inc. | | | 202,940 | | | | 9,974,501 | |

Commercial International Bank Egypt SAE | | | 123,370 | | | | 712,716 | |

Credicorp Ltd. | | | 660 | | | | 98,129 | |

Grupo Aval Acciones y Valores SA, ADR | | | 109,430 | | | | 896,232 | |

Grupo Financiero Banorte SAB de CV | | | 198,632 | | | | 1,171,762 | |

Grupo Financiero Inbursa SAB de CV | | | 558,626 | | | | 910,305 | |

ICICI Bank Ltd., Sponsored ADR | | | 687,260 | | | | 5,697,385 | |

JPMorgan Chase & Co. | | | 61,510 | | | | 4,260,182 | |

Kotak Mahindra Bank Ltd. | | | 81,370 | | | | 1,001,321 | |

Lloyds Banking Group plc | | | 625,440 | | | | 437,396 | |

Sberbank of Russia PJSC, Sponsored ADR | | | 107,620 | | | | 1,018,909 | |

Societe Generale SA | | | 48,130 | | | | 1,873,312 | |

Sumitomo Mitsui Financial Group, Inc. | | | 39,100 | | | | 1,359,125 | |

Sumitomo Mitsui Trust Holdings, Inc. | | | 43,600 | | | | 1,473,005 | |

SunTrust Banks, Inc. | | | 46,160 | | | | 2,087,817 | |

US Bancorp | | | 48,730 | | | | 2,181,155 | |

Zenith Bank plc | | | 4,422,114 | | | | 206,753 | |

| | | | | | | 47,208,228 | |

| | | | | | | | | |

Consumer Finance—0.6% | | | | | | | | |

Ally Financial, Inc. | | | 167,840 | | | | 3,032,869 | |

American Express Co. | | | 36,210 | | | | 2,405,068 | |

Discover Financial Services | | | 40,890 | | | | 2,303,334 | |

Synchrony Financial | | | 46,880 | | | | 1,340,299 | |

| | | | | | | 9,081,570 | |

| | | | | | | | | |

Diversified Financial Services—0.9% | | | | | | | | |

Berkshire Hathaway, Inc., Cl. B1 | | | 35,210 | | | | 5,080,803 | |

BM&FBovespa SA-Bolsa de Valores Mercadorias e Futuros | | | 246,000 | | | | 1,448,872 | |

18 OPPENHEIMER GLOBAL ALLOCATION FUND

| | | | | | | | |

| | | Shares | | | Value | |

Diversified Financial Services (Continued) | | | | | | | | |

Grupo de Inversiones Suramericana SA | | | 60,454 | | | $ | 779,707 | |

Hong Kong Exchanges & Clearing Ltd. | | | 25,794 | | | | 681,789 | |

ING Groep NV | | | 203,143 | | | | 2,670,720 | |

Kinnevik AB, Cl. B | | | 55,789 | | | | 1,409,399 | |

Moscow Exchange (The) | | | 247,876 | | | | 456,778 | |

ORIX Corp. | | | 46,100 | | | | 733,375 | |

| | | | | | | 13,261,443 | |

| | | | | | | | | |

Insurance—2.0% | | | | | | | | |

AIA Group Ltd. | | | 388,400 | | | | 2,451,076 | |

Allianz SE | | | 20,572 | | | | 3,206,171 | |

American International Group, Inc. | | | 50,390 | | | | 3,109,063 | |

Aon plc | | | 7,800 | | | | 864,474 | |

China Pacific Insurance Group Co. Ltd., Cl. H | | | 252,600 | | | | 913,461 | |

Dai-ichi Life Holdings, Inc. | | | 158,100 | | | | 2,316,589 | |

FNF Group | | | 45,350 | | | | 1,628,519 | |

Marsh & McLennan Cos., Inc. | | | 19,160 | | | | 1,214,552 | |

MetLife, Inc. | | | 73,670 | | | | 3,459,543 | |

Old Mutual plc | | | 397,029 | | | | 973,398 | |

Ping An Insurance Group Co. of China Ltd., Cl. H | | | 266,000 | | | | 1,404,275 | |

Progressive Corp. (The) | | | 67,800 | | | | 2,136,378 | |

Prudential plc | | | 379,421 | | | | 6,186,196 | |

Sul America SA | | | 93,060 | | | | 561,800 | |

| | | | | | | 30,425,495 | |

| | | | | | | | | |

Real Estate Investment Trusts (REITs)—0.3% | | | | | | | | |

Crown Castle International Corp. | | | 11,640 | | | | 1,059,123 | |

Digital Realty Trust, Inc. | | | 4,760 | | | | 444,727 | |

HCP, Inc. | | | 31,420 | | | | 1,076,135 | |

Mid-America Apartment Communities, Inc. | | | 16,650 | | | | 1,544,287 | |

Simon Property Group, Inc. | | | 6,430 | | | | 1,195,723 | |

| | | | | | | 5,319,995 | |

| | | | | | | | | |

Real Estate Management & Development—0.5% | | | | | | | | |

Ayala Land, Inc. | | | 416,000 | | | | 311,440 | |

DLF Ltd. | | | 1,391,232 | | | | 3,132,148 | |

Emaar Properties PJSC | | | 29,198 | | | | 55,325 | |

Global Logistic Properties Ltd. | | | 362,000 | | | | 461,890 | |

Hang Lung Group Ltd. | | | 136,500 | | | | 523,305 | |

SM Prime Holdings, Inc. | | | 1,532,103 | | | | 851,176 | |

SOHO China Ltd. | | | 671,000 | | | | 346,612 | |

Vonovia SE | | | 51,374 | | | | 1,812,044 | |

Wallace Theater Holdings, Inc.1,3 | | | 430 | | | | 4 | |

| | | | | | | 7,493,944 | |

| | | | | | | | | |

Thrifts & Mortgage Finance—0.3% | | | | | | | | |

Housing Development Finance Corp. Ltd. | | | 239,224 | | | | 4,944,828 | |

| | | | | | | | | |

Health Care—6.5% | | | | | | | | |

Biotechnology—1.4% | | | | | | | | |

ACADIA Pharmaceuticals, Inc.1 | | | 47,150 | | | | 1,099,066 | |

Amgen, Inc. | | | 12,040 | | | | 1,699,566 | |

19 OPPENHEIMER GLOBAL ALLOCATION FUND

| | |

| CONSOLIDATED STATEMENT OF INVESTMENTS Continued | | |

| | | |

| | | | | | | | |

| | | Shares | | | Value | |

Biotechnology (Continued) | | | | | | | | |

Biocon Ltd. | | | 3,370 | | | $ | 46,865 | |

Biogen, Inc.1 | | | 11,410 | | | | 3,196,854 | |

BioMarin Pharmaceutical, Inc.1 | | | 16,000 | | | | 1,288,320 | |

Bluebird Bio, Inc.1 | | | 10,150 | | | | 484,663 | |

Celgene Corp.1 | | | 26,666 | | | | 2,724,732 | |

Circassia Pharmaceuticals plc1 | | | 348,434 | | | | 346,332 | |

CSL Ltd. | | | 27,300 | | | | 2,082,560 | |

Gilead Sciences, Inc. | | | 32,130 | | | | 2,365,732 | |

Grifols SA | | | 97,429 | | | | 1,925,380 | |

Ionis Pharmaceuticals, Inc.1 | | | 26,560 | | | | 690,029 | |

MacroGenics, Inc.1 | | | 32,170 | | | | 762,107 | |

Regeneron Pharmaceuticals, Inc.1 | | | 1,050 | | | | 362,271 | |

Sage Therapeutics, Inc.1 | | | 18,580 | | | | 808,973 | |

Vertex Pharmaceuticals, Inc.1 | | | 11,375 | | | | 862,908 | |

| | | | | | | 20,746,358 | |

| | | | | | | | | |

Health Care Equipment & Supplies—1.3% | | | | | | | | |

Baxter International, Inc. | | | 24,820 | | | | 1,181,184 | |

Boston Scientific Corp.1 | | | 96,940 | | | | 2,132,680 | |

Coloplast AS, Cl. B | | | 23,330 | | | | 1,626,181 | |

CR Bard, Inc. | | | 3,400 | | | | 736,712 | |

Danaher Corp. | | | 28,994 | | | | 2,277,479 | |

Essilor International SA | | | 14,274 | | | | 1,601,879 | |

Intuitive Surgical, Inc.1 | | | 510 | | | | 342,761 | |

Medtronic plc | | | 14,830 | | | | 1,216,357 | |

Sonova Holding AG | | | 12,045 | | | | 1,614,677 | |

Stryker Corp. | | | 11,190 | | | | 1,290,766 | |

William Demant Holding AS1 | | | 69,845 | | | | 1,299,205 | |

Zimmer Biomet Holdings, Inc. | | | 37,080 | | | | 3,908,232 | |

| | | | | | | 19,228,113 | |

| | | | | | | | | |

Health Care Providers & Services—1.7% | | | | | | | | |

Aetna, Inc. | | | 46,520 | | | | 4,993,922 | |

Anthem, Inc. | | | 25,050 | | | | 3,052,593 | |

Apollo Hospitals Enterprise Ltd. | | | 38,315 | | | | 766,844 | |

Cardinal Health, Inc. | | | 13,490 | | | | 926,628 | |

Express Scripts Holding Co.1 | | | 53,300 | | | | 3,592,420 | |

Humana, Inc. | | | 13,690 | | | | 2,348,246 | |

Laboratory Corp. of America Holdings1 | | | 7,560 | | | | 947,570 | |

McKesson Corp. | | | 10,470 | | | | 1,331,470 | |

Mediclinic International plc | | | 1,900 | | | | 21,042 | |

Sinopharm Group Co. Ltd., Cl. H | | | 246,600 | | | | 1,198,043 | |

Sonic Healthcare Ltd. | | | 82,422 | | | | 1,281,196 | |

UnitedHealth Group, Inc. | | | 44,320 | | | | 6,263,746 | |

| | | | | | | 26,723,720 | |

| | | | | | | | | |

Health Care Technology—0.1% | | | | | | | | |

Cerner Corp.1 | | | 30,630 | | | | 1,794,305 | |

| | | | | | | | | |

Life Sciences Tools & Services—0.2% | | | | | | | | |

Agilent Technologies, Inc. | | | 19,740 | | | | 860,072 | |

20 OPPENHEIMER GLOBAL ALLOCATION FUND

| | | | | | | | |

| | | Shares | | | Value | |

Life Sciences Tools & Services (Continued) | | | | | | | | |

Charles River Laboratories International, Inc.1 | | | 3,570 | | | $ | 270,892 | |

Lonza Group AG1 | | | 10,861 | | | | 2,047,781 | |

Samsung Biologics Co. Ltd.1 | | | 765 | | | | 90,924 | |

Thermo Fisher Scientific, Inc. | | | 3,940 | | | | 579,298 | |

| | | | | | | 3,848,967 | |

| | | | | | | | | |

Pharmaceuticals—1.8% | | | | | | | | |

Allergan plc1 | | | 7,160 | | | | 1,496,010 | |

Bayer AG | | | 24,014 | | | | 2,380,170 | |

Bristol-Myers Squibb Co. | | | 5,891 | | | | 299,911 | |

Dr. Reddy’s Laboratories Ltd. | | | 22,460 | | | | 1,118,165 | |

Eli Lilly & Co. | | | 15,840 | | | | 1,169,626 | |

Galenica AG | | | 1,314 | | | | 1,315,750 | |

Glenmark Pharmaceuticals Ltd. | | | 28,530 | | | | 399,484 | |

Johnson & Johnson | | | 30,410 | | | | 3,527,256 | |

Merck & Co., Inc. | | | 57,710 | | | | 3,388,731 | |

Mylan NV1 | | | 29,110 | | | | 1,062,515 | |

Novo Nordisk AS, Cl. B | | | 42,297 | | | | 1,508,797 | |

Pfizer, Inc. | | | 58,710 | �� | | | 1,861,694 | |

Roche Holding AG | | | 15,627 | | | | 3,585,953 | |

Shire plc | | | 19,180 | | | | 1,083,088 | |

Sun Pharmaceutical Industries Ltd. | | | 34,712 | | | | 386,998 | |

Teva Pharmaceutical Industries Ltd., Sponsored ADR | | | 40,070 | | | | 1,712,592 | |

Valeant Pharmaceuticals International, Inc.1 | | | 31,930 | | | | 569,631 | |

| | | | | | | 26,866,371 | |

| | | | | | | | | |

Industrials—8.3% | | | | | | | | |

Aerospace & Defense—1.1% | | | | | | | | |

Airbus Group SE | | | 151,060 | | | | 8,969,517 | |

Embraer SA, Sponsored ADR | | | 51,670 | | | | 1,105,221 | |

Lockheed Martin Corp. | | | 12,246 | | | | 3,017,170 | |

Rolls-Royce Holdings plc1 | | | 154,492 | | | | 1,372,639 | |

United Technologies Corp. | | | 16,200 | | | | 1,655,640 | |

| | | | | | | 16,120,187 | |

| | | | | | | | | |

Air Freight & Couriers—0.5% | | | | | | | | |

FedEx Corp. | | | 4,040 | | | | 704,253 | |

Royal Mail plc | | | 457,262 | | | | 2,745,348 | |

United Parcel Service, Inc., Cl. B | | | 27,260 | | | | 2,937,537 | |

XPO Logistics, Inc.1 | | | 39,090 | | | | 1,287,234 | |

| | | | | | | 7,674,372 | |

| | | | | | | | | |

Airlines—0.2% | | | | | | | | |

Delta Air Lines, Inc. | | | 31,760 | | | | 1,326,615 | |

Japan Airlines Co. Ltd. | | | 32,900 | | | | 969,770 | |

Southwest Airlines Co. | | | 3,490 | | | | 139,775 | |

| | | | | | | 2,436,160 | |

| | | | | | | | | |

Building Products—0.2% | | | | | | | | |

A.O. Smith Corp. | | | 5,390 | | | | 243,466 | |

Allegion plc | | | 6,390 | | | | 407,938 | |

21 OPPENHEIMER GLOBAL ALLOCATION FUND

| | |

| CONSOLIDATED STATEMENT OF INVESTMENTS Continued | | |

| | | |

| | | | | | | | |

| | | Shares | | | Value | |

Building Products (Continued) | | | | | | | | |

Assa Abloy AB, Cl. B | | | 140,443 | | | $ | 2,551,668 | |

| | | | | | | 3,203,072 | |

| | | | | | | | | |

Commercial Services & Supplies—0.8% | | | | | | | | |

Aggreko plc | | | 63,566 | | | | 623,055 | |

Edenred | | | 81,484 | | | | 1,889,820 | |

Johnson Controls International plc | | | 99,106 | | | | 3,995,954 | |

KAR Auction Services, Inc. | | | 18,850 | | | | 802,633 | |

Prosegur Cia de Seguridad SA | | | 348,437 | | | | 2,530,459 | |

Republic Services, Inc., Cl. A | | | 15,600 | | | | 821,028 | |

Waste Connections, Inc. | | | 15,092 | | | | 1,135,069 | |

Waste Management, Inc. | | | 8,570 | | | | 562,706 | |

| | | | | | | 12,360,724 | |

| | | | | | | | | |

Construction & Engineering—0.5% | | | | | | | | |

Boskalis Westminster | | | 58,758 | | | | 1,894,111 | |

CIMIC Group Ltd. | | | 51,000 | | | | 1,147,714 | |

FLSmidth & Co. AS | | | 16,382 | | | | 594,904 | |

Vinci SA | | | 47,820 | | | | 3,457,097 | |

| | | | | | | 7,093,826 | |

| | | | | | | | | |

Electrical Equipment—1.4% | | | | | | | | |

ABB Ltd.1 | | | 37,532 | | | | 772,303 | |

Acuity Brands, Inc. | | | 1,680 | | | | 375,598 | |

Eaton Corp. plc | | | 28,560 | | | | 1,821,271 | |

Emerson Electric Co. | | | 24,120 | | | | 1,222,402 | |

Legrand SA | | | 28,830 | | | | 1,627,975 | |

Mitsubishi Electric Corp. | | | 125,000 | | | | 1,691,791 | |

Nidec Corp. | | | 73,100 | | | | 7,086,886 | |

Philips Lighting NV1,3 | | | 67,017 | | | | 1,571,107 | |

Prysmian SpA | | | 39,246 | | | | 978,090 | |

Rockwell Automation, Inc. | | | 1,310 | | | | 156,833 | |

Schneider Electric SE | | | 57,350 | | | | 3,853,061 | |

| | | | | | | 21,157,317 | |

| | | | | | | | | |

Industrial Conglomerates—0.8% | | | | | | | | |

3M Co. | | | 16,420 | | | | 2,714,226 | |

General Electric Co. | | | 212,300 | | | | 6,177,930 | |

Jardine Strategic Holdings Ltd. | | | 42,072 | | | | 1,473,652 | |

Siemens AG | | | 10,359 | | | | 1,176,004 | |

SM Investments Corp. | | | 89,494 | | | | 1,241,941 | |

| | | | | | | 12,783,753 | |

| | | | | | | | | |

Machinery—0.9% | | | | | | | | |

Aalberts Industries NV | | | 71,646 | | | | 2,261,095 | |

Atlas Copco AB, Cl. A | | | 73,622 | | | | 2,156,049 | |

Caterpillar, Inc. | | | 7,990 | | | | 666,846 | |

Deere & Co. | | | 30,510 | | | | 2,694,033 | |

FANUC Corp. | | | 8,100 | | | | 1,517,665 | |

Fortive Corp. | | | 2,440 | | | | 124,562 | |

Ingersoll-Rand plc | | | 3,790 | | | | 255,029 | |

Kubota Corp. | | | 20,300 | | | | 327,224 | |

22 OPPENHEIMER GLOBAL ALLOCATION FUND

| | | | | | | | |

| | | Shares | | | Value | |

Machinery (Continued) | | | | | | | | |

Parker-Hannifin Corp. | | | 9,690 | | | $ | 1,189,448 | |

Pentair plc | | | 15,430 | | | | 850,656 | |

Stanley Black & Decker, Inc. | | | 3,230 | | | | 367,703 | |

Wabtec Corp. | | | 6,440 | | | | 497,876 | |

Weir Group plc (The) | | | 31,967 | | | | 663,570 | |

| | | | | | | 13,571,756 | |

| | | | | | | | | |

Professional Services—0.8% | | | | | | | | |

Experian plc | | | 120,987 | | | | 2,323,222 | |

Intertek Group plc | | | 38,920 | | | | 1,626,493 | |

Nielsen Holdings plc | | | 78,760 | | | | 3,545,775 | |

Recruit Holdings Co. Ltd. | | | 84,800 | | | | 3,411,934 | |

SGS SA | | | 589 | | | | 1,193,493 | |

| | | | | | | 12,100,917 | |

| | | | | | | | | |

Road & Rail—0.3% | | | | | | | | |

Canadian National Railway Co. | | | 30,900 | | | | 1,942,683 | |

Canadian Pacific Railway Ltd. | | | 18,000 | | | | 2,573,280 | |

| | | | | | | 4,515,963 | |

| | | | | | | | | |

Trading Companies & Distributors—0.6% | | | | | | | | |

Brenntag AG | | | 70,873 | | | | 3,791,391 | |

Bunzl plc | | | 84,697 | | | | 2,273,795 | |

Travis Perkins plc | | | 89,976 | | | | 1,465,374 | |

Wolseley plc | | | 33,467 | | | | 1,739,019 | |

| | | | | | | 9,269,579 | |

| | | | | | | | | |

Transportation Infrastructure—0.2% | | | | | | | | |

Airports of Thailand PCL | | | 15,800 | | | | 171,951 | |

Beijing Capital International Airport Co. Ltd., Cl. H | | | 946,000 | | | | 991,633 | |

DP World Ltd. | | | 74,172 | | | | 1,331,131 | |

Grupo Aeroportuario del Sureste SAB de CV, Cl. B | | | 31,792 | | | | 506,122 | |

| | | | | | | 3,000,837 | |

| | | | | | | | | |

Information Technology—12.1% | | | | | | | | |

Communications Equipment—0.2% | | | | | | | | |

Cisco Systems, Inc. | | | 60,030 | | | | 1,841,721 | |

Nokia OYJ | | | 350,224 | | | | 1,563,332 | |

Telefonaktiebolaget LM Ericsson, Cl. B | | | 19,706 | | | | 95,869 | |

| | | | | | | 3,500,922 | |

| | | | | | | | | |

Electronic Equipment, Instruments, & Components—1.4% | | | | | | | | |

Corning, Inc. | | | 33,040 | | | | 750,339 | |

Hoya Corp. | | | 56,800 | | | | 2,371,442 | |

Keyence Corp. | | | 9,550 | | | | 7,010,188 | |

Kyocera Corp. | | | 46,800 | | | | 2,276,601 | |

Murata Manufacturing Co. Ltd. | | | 44,500 | | | | 6,206,293 | |

Spectris plc | | | 36,327 | | | | 910,638 | |

TE Connectivity Ltd. | | | 18,720 | | | | 1,176,926 | |

| | | | | | | 20,702,427 | |

| | | | | | | | | |

Internet Software & Services—3.8% | | | | | | | | |

Alibaba Group Holding Ltd., Sponsored ADR1 | | | 61,293 | | | | 6,232,885 | |

23 OPPENHEIMER GLOBAL ALLOCATION FUND

| | |

| CONSOLIDATED STATEMENT OF INVESTMENTS Continued | | |

| | | |

| | | | | | | | |

| | | Shares | | | Value | |

Internet Software & Services (Continued) | | | | | | | | |

Alphabet, Inc., Cl. A1 | | | 13,689 | | | $ | 11,086,721 | |

Alphabet, Inc., Cl. C1 | | | 18,762 | | | | 14,719,540 | |

Baidu, Inc., Sponsored ADR1 | | | 28,320 | | | | 5,008,675 | |

eBay, Inc.1 | | | 28,700 | | | | 818,237 | |

Facebook, Inc., Cl. A1 | | | 83,620 | | | | 10,953,384 | |

MercadoLibre, Inc. | | | 690 | | | | 115,927 | |

NAVER Corp. | | | 1,501 | | | | 1,124,007 | |

Tencent Holdings Ltd. | | | 180,685 | | | | 4,784,492 | |

Twitter, Inc.1 | | | 75,140 | | | | 1,348,763 | |

United Internet AG | | | 29,641 | | | | 1,217,516 | |

Yahoo Japan Corp. | | | 270,300 | | | | 1,037,765 | |

| | | | | | | 58,447,912 | |

| | | | | | | | | |

IT Services—1.4% | | | | | | | | |

Amadeus IT Group SA, Cl. A | | | 50,844 | | | | 2,398,821 | |

Amdocs Ltd. | | | 52,250 | | | | 3,054,013 | |

Cielo SA | | | 9,900 | | | | 100,489 | |

Cognizant Technology Solutions Corp., Cl. A1 | | | 15,250 | | | | 783,087 | |

Earthport plc1 | | | 867,954 | | | | 183,218 | |

First Data Corp., Cl. A1 | | | 47,820 | | | | 669,002 | |

Infosys Ltd. | | | 146,684 | | | | 2,201,479 | |

Mastercard, Inc., Cl. A | | | 22,670 | | | | 2,426,143 | |

PayPal Holdings, Inc.1 | | | 128,820 | | | | 5,366,641 | |

Tata Consultancy Services Ltd. | | | 28,745 | | | | 1,028,544 | |

Visa, Inc., Cl. A | | | 13,212 | | | | 1,090,122 | |

Xerox Corp. | | | 138,780 | | | | 1,355,881 | |

| | | | | | | 20,657,440 | |

| | | | | | | | | |

Semiconductors & Semiconductor Equipment—1.6% | | | | | | | | |

Applied Materials, Inc. | | | 55,170 | | | | 1,604,343 | |

ASML Holding NV | | | 17,606 | | | | 1,862,753 | |

Broadcom Ltd. | | | 20,677 | | | | 3,520,879 | |

Infineon Technologies AG | | | 302,235 | | | | 5,423,573 | |

Maxim Integrated Products, Inc. | | | 100,320 | | | | 3,975,681 | |

Micron Technology, Inc.1 | | | 16,736 | | | | 287,190 | |

NXP Semiconductors NV1 | | | 8,800 | | | | 880,000 | |

SK Hynix, Inc. | | | 44,299 | | | | 1,578,667 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 673,000 | | | | 4,017,017 | |

Texas Instruments, Inc. | | | 24,480 | | | | 1,734,408 | |

| | | | | | | 24,884,511 | |

| | | | | | | | | |

Software—2.4% | | | | | | | | |

Activision Blizzard, Inc. | | | 34,940 | | | | 1,508,360 | |

Adobe Systems, Inc.1 | | | 29,730 | | | | 3,196,272 | |

AVEVA Group plc | | | 14,840 | | | | 333,845 | |

Dassault Systemes | | | 24,738 | | | | 1,960,366 | |

Electronic Arts, Inc.1 | | | 19,000 | | | | 1,491,880 | |

Gemalto NV | | | 24,726 | | | | 1,339,840 | |

Intuit, Inc. | | | 39,350 | | | | 4,278,919 | |

Microsoft Corp. | | | 84,120 | | | | 5,040,470 | |

Oracle Corp. | | | 39,970 | | | | 1,535,647 | |

24 OPPENHEIMER GLOBAL ALLOCATION FUND

| | | | | | | | |

| | | Shares | | | Value | |

Software (Continued) | | | | | | | | |

SAP SE | | | 131,842 | | | $ | 11,612,844 | |

Synopsys, Inc.1 | | | 21,660 | | | | 1,284,655 | |

Temenos Group AG1 | | | 39,566 | | | | 2,551,666 | |

| | | | | | | 36,134,764 | |

| | | | | | | | | |

Technology Hardware, Storage & Peripherals—1.3% | | | | | | | | |

Apple, Inc. | | | 145,611 | | | | 16,532,673 | |

Western Digital Corp. | | | 42,090 | | | | 2,459,740 | |

| | | | | | | 18,992,413 | |

| | | | | | | | | |

Materials—2.1% | | | | | | | | |

Chemicals—1.2% | | | | | | | | |

Akzo Nobel NV | | | 32,444 | | | | 2,095,070 | |

Albemarle Corp. | | | 3,250 | | | | 271,538 | |

Asian Paints Ltd. | | | 15,950 | | | | 256,974 | |

Eastman Chemical Co. | | | 19,130 | | | | 1,375,638 | |

EI du Pont de Nemours & Co. | | | 17,740 | | | | 1,220,335 | |

Essentra plc | | | 169,466 | | | | 1,057,842 | |

Linde AG | | | 30,412 | | | | 5,017,079 | |

Novozymes AS, Cl. B | | | 43,017 | | | | 1,597,317 | |

PPG Industries, Inc. | | | 15,080 | | | | 1,404,400 | |

Sherwin-Williams Co. (The) | | | 1,320 | | | | 323,215 | |

Sika AG | | | 366 | | | | 1,758,440 | |

Syngenta AG1 | | | 4,211 | | | | 1,676,796 | |

| | | | | | | 18,054,644 | |

| | | | | | | | | |

Construction Materials—0.3% | | | | | | | | |

Indocement Tunggal Prakarsa Tbk PT | | | 371,500 | | | | 467,861 | |

James Hardie Industries plc | | | 142,100 | | | | 2,118,031 | |

Semen Indonesia Persero Tbk PT | | | 221,000 | | | | 166,547 | |

UltraTech Cement Ltd. | | | 13,428 | | | | 799,099 | |

Vulcan Materials Co. | | | 12,510 | | | | 1,416,132 | |

| | | | | | | 4,967,670 | |

| | | | | | | | | |

Containers & Packaging—0.2% | | | | | | | | |

CCL Industries, Inc., Cl. B | | | 10,031 | | | | 1,783,937 | |

WestRock Co. | | | 12,370 | | | | 571,370 | |

| | | | | | | 2,355,307 | |

Metals & Mining—0.4% | | | | | | | | |

Alrosa PJSC | | | 655,951 | | | | 917,784 | |

Glencore plc1 | | | 255,570 | | | | 778,869 | |

Goldcorp, Inc. | | | 137,710 | | | | 2,093,192 | |

Newcrest Mining Ltd. | | | 43,900 | | | | 765,557 | |

Real Gold Mining Ltd.1 | | | 273,000 | | | | 352 | |

Silver Wheaton Corp. | | | 44,620 | | | | 1,075,788 | |

Zijin Mining Group Co. Ltd., Cl. H | | | 1,388,000 | | | | 440,481 | |

| | | | | | | 6,072,023 | |

| | | | | | | | | |

Telecommunication Services—2.2% | | | | | | | | |

Diversified Telecommunication Services—1.2% | | | | | | | | |

BT Group plc | | | 335,198 | | | | 1,540,459 | |

25 OPPENHEIMER GLOBAL ALLOCATION FUND

| | |

| CONSOLIDATED STATEMENT OF INVESTMENTS Continued | | |

| | | |

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

Diversified Telecommunication Services (Continued) | | | | | | | | | | | | |

Iliad SA | | | | | | | 7,570 | | | $ | 1,587,244 | |

Inmarsat plc | | | | | | | 91,909 | | | | 787,793 | |

Koninklijke KPN NV | | | | | | | 374,395 | | | | 1,220,201 | |

Nippon Telegraph & Telephone Corp. | | | | | | | 125,900 | | | | 5,599,870 | |

Spark New Zealand Ltd. | | | | | | | 906,667 | | | | 2,373,086 | |

Telstra Corp. Ltd. | | | | | | | 337,394 | | | | 1,276,134 | |

Verizon Communications, Inc. | | | | | | | 73,500 | | | | 3,535,350 | |

| | | | | | | | | | | 17,920,137 | |

| | | | | | | | | | | | | |

Wireless Telecommunication Services—1.0% | | | | | | | | | | | | |

China Mobile Ltd. | | | | | | | 195,500 | | | | 2,239,404 | |

KDDI Corp. | | | | | | | 156,000 | | | | 4,744,138 | |

Rogers Communications, Inc., Cl. B | | | | | | | 61,755 | | | | 2,484,381 | |

SK Telecom Co. Ltd. | | | | | | | 9,355 | | | | 1,832,872 | |

T-Mobile US, Inc.1 | | | | | | | 29,110 | | | | 1,447,640 | |

Vodafone Group plc | | | | | | | 1,166,959 | | | | 3,204,144 | |

| | | | | | | | | | | 15,952,579 | |

| | | | | | | | | | | | | |

Utilities—0.6% | | | | | | | | | | | | |

Electric Utilities—0.5% | | | | | | | | | | | | |

Edison International | | | | | | | 39,060 | | �� | | 2,870,129 | |

PG&E Corp. | | | | | | | 65,470 | | | | 4,066,996 | |

| | | | | | | | | | | 6,937,125 | |

| | | | | | | | | | | | |

Gas Utilities—0.1% | | | | | | | | | | | | |

AmeriGas Partners LP2 | | | | | | | 29,385 | | | | 1,403,134 | |

Total Common Stocks (Cost $867,232,544) | | | | | | | | | | | 920,789,466 | |

| | | | | | | | | | | | |

Preferred Stocks—0.4% | | | | | | | | | | | | |

Bayerische Motoren Werke (BMW) AG, Preference | | | | | | | 45,059 | | | | 3,420,337 | |

Lojas Americanas SA, Preference | | | | | | | 401,014 | | | | 2,600,561 | |

Zee Entertainment Enterprises Ltd., 6% Cum. Non-Cv. | | | | | | | 1,175,581 | | | | 168,980 | |

Total Preferred Stocks (Cost $4,768,880) | | | | | | | | | | | 6,189,878 | |

| | | | | | | | | | | | |

| | | | | | Units | | | | |

Rights, Warrants and Certificates—0.0% | | | | | | | | | | | | |

Genting Bhd Wts., Strike Price 7.96MYR, Exp. 12/18/181 (Cost $77,776) | | | | 123,800 | | | | 37,774 | |

| | | | | | | | | |

| | | | | | Principal Amount | | | | |

U.S. Government Obligations—11.0% | | | | | | | | | | | | |

United States Treasury Bonds, 2.875%, 8/15/454 | | | | | | $ | 61,480,000 | | | | 65,252,843 | |

United States Treasury Nts., 1.625%, 2/15/264,5 | | | | | | | 102,828,000 | | | | 101,199,205 | |

Total U.S. Government Obligations (Cost $163,095,947) | | | | | | | | | | | 166,452,048 | |

| | | | | | | | | | | | |

Foreign Government Obligations—4.4% | | | | | | | | | | | | |

Argentine Republic Sr. Unsec. Nts., 16%, 10/17/23 | | | ARS | | | | 4,825,000 | | | | 320,582 | |

Argentine Republic Unsec. Nts., 2.50%, 7/22/216 | | | ARS | | | | 8,915,000 | | | | 637,773 | |

Federative Republic of Brazil Nota Do Tesouro Nacional Unsec. Nts.: | | | | | | | | | | | | |

9.762%, 1/1/21 | | | BRL | | | | 25,965,000 | | | | 7,812,542 | |

10.00%, 1/1/19 | | | BRL | | | | 12,160,000 | | | | 3,838,190 | |

10.00%, 1/1/23 | | | BRL | | | | 6,580,000 | | | | 1,947,888 | |

12.90%, 8/15/22 | | | BRL | | | | 1,200,000 | | | | 1,121,294 | |

26 OPPENHEIMER GLOBAL ALLOCATION FUND

| | | | | | | | | | |

| | | | | Principal Amount | | | Value | |

Foreign Government Obligations (Continued) | | | | | | | | | | |

Hungary Unsec. Bonds: | | | | | | | | | | |

Series 20/A, 7.50%, 11/12/20 | | HUF | | | 116,700,000 | | | $ | 511,435 | |

Series 25/B, 5.50%, 6/24/25 | | HUF | | | 460,000,000 | | | | 1,964,403 | |

Hungary Unsec. Nts., Series 18/A, 5.50%, 12/20/18 | | HUF | | | 326,800,000 | | | | 1,277,736 | |

Malaysia Sr. Unsec. Nts., Series 0315, 3.659%, 10/15/20 | | MYR | | | 11,670,000 | | | | 2,812,331 | |

Republic of Chile Sr. Unsec. Bonds, 5.50%, 8/5/20 | | CLP | | | 350,500,000 | | | | 571,450 | |

Republic of Colombia Sr. Unsec. Bonds: | | | | | | | | | | |

Series B, 7.00%, 5/4/22 | | COP | | | 2,000,000,000 | | | | 671,512 | |

Series B, 7.50%, 8/26/26 | | COP | | | 2,700,000,000 | | | | 909,452 | |

Series B, 7.75%, 9/18/30 | | COP | | | 950,000,000 | | | | 324,657 | |

Series B, 10.00%, 7/24/24 | | COP | | | 2,400,000,000 | | | | 939,997 | |

Republic of Colombia Sr. Unsec. Nts., Series B, 7%, 9/11/19 | | COP | | | 3,185,000,000 | | | | 1,076,110 | |

Republic of Indonesia Treasury Bonds: | | | | | | | | | | |

Series FR59, 7.00%, 5/15/27 | | IDR | | | 23,300,000,000 | | | | 1,739,939 | |

Series FR61, 7.00%, 5/15/22 | | IDR | | | 44,900,000,000 | | | | 3,435,734 | |

Series FR72, 8.25%, 5/15/36 | | IDR | | | 28,900,000,000 | | | | 2,312,235 | |

Series FR73, 8.75%, 5/15/31 | | IDR | | | 18,650,000,000 | | | | 1,599,072 | |

Republic of Peru Sr. Unsec. Bonds: | | | | | | | | | | |

6.35%, 8/12/283 | | PEN | | | 8,335,000 | | | | 2,555,560 | |

6.95%, 8/12/313 | | PEN | | | 760,000 | | | | 246,171 | |

7.84%, 8/12/203 | | PEN | | | 2,180,000 | | | | 718,625 | |

8.20%, 8/12/263 | | PEN | | | 2,255,000 | | | | 796,591 | |

Republic of Poland Unsec. Bonds, Series 0726, 2.50%, 7/25/26 | | PLN | | | 6,960,000 | | | | 1,687,200 | |

Republic of Poland Unsec. Nts., Series 0721, 1.75%, 7/25/21 | | PLN | | | 9,710,000 | | | | 2,400,757 | |

Republic of South Africa Sr. Unsec. Bonds, Series R208, 6.75%, 3/31/21 | | ZAR | | | 42,700,000 | | | | 3,009,510 | |

Republic of South Africa Unsec. Bonds: | | | | | | | | | | |

Series 2023, 7.75%, 2/28/23 | | ZAR | | | 4,700,000 | | | | 337,796 | |

Series 2030, 8.00%, 1/31/30 | | ZAR | | | 22,280,000 | | | | 1,514,567 | |

Series 2037, 8.50%, 1/31/37 | | ZAR | | | 16,550,000 | | | | 1,134,648 | |

Series R186, 10.50%, 12/21/26 | | ZAR | | | 16,975,000 | | | | 1,403,057 | |

Republic of Turkey Unsec. Nts.: | | | | | | | | | | |

8.50%, 7/10/19 | | TRY | | | 1,165,000 | | | | 371,306 | |

8.80%, 11/14/18 | | TRY | | | 1,100,000 | | | | 354,892 | |

10.60%, 2/11/26 | | TRY | | | 1,400,000 | | | | 475,460 | |

10.70%, 2/17/21 | | TRY | | | 1,470,000 | | | | 494,949 | |

Romania Unsec. Bonds, 5.95%, 6/11/21 | | RON | | | 2,840,000 | | | | 804,633 | |

Romania Unsec. Nts., 5.90%, 7/26/17 | | RON | | | 4,770,000 | | | | 1,210,694 | |

Russian Federation Unsec. Bonds, Series 6212, 7.05%, 1/19/28 | | RUB | | | 18,000,000 | | | | 257,290 | |

Russian Federation Unsec. Nts.: | | | | | | | | | | |

Series 6210, 6.80%, 12/11/19 | | RUB | | | 3,200,000 | | | | 48,107 | |

Series 6216, 6.70%, 5/15/19 | | RUB | | | 338,600,000 | | | | 5,137,967 | |

United Mexican States Sr. Unsec. Bonds: | | | | | | | | | | |

Series M, 5.75%, 3/5/26 | | MXN | | | 50,000,000 | | | | 2,556,140 | |

Series M, 8.00%, 12/7/23 | | MXN | | | 3,800,000 | | | | 223,106 | |

Series M20, 8.50%, 5/31/29 | | MXN | | | 17,020,000 | | | | 1,054,457 | |

Series M20, 10.00%, 12/5/24 | | MXN | | | 19,950,000 | | | | 1,314,550 | |

Series M30, 8.50%, 11/18/38 | | MXN | | | 5,880,000 | | | | 373,214 | |

27 OPPENHEIMER GLOBAL ALLOCATION FUND

| | |

| CONSOLIDATED STATEMENT OF INVESTMENTS Continued | | |

| | | |

| | | | | | | | | | | | |

| | | | | | Principal Amount | | | Value | |

Foreign Government Obligations (Continued) | | | | | | | | | | | | |

United Mexican States Unsec. Bonds, Series M30, 10%, 11/20/36 | | | MXN | | | | 2,750,000 | | | $ | 197,766 | |

Total Foreign Government Obligations (Cost $67,132,789) | | | | | | | | | | | 66,503,345 | |

| | | | | | | | | | | | |

Non-Convertible Corporate Bond and Note—0.0% | | | | | | | | | | | | |

Omnicare, Inc., 4.75% Sr. Unsec. Nts., 12/1/22 (Cost $211,231) | | | | | | | 210,000 | | | | 232,039 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Short-Term Note—0.0% | | | | | | | | | | | | |

Letras del Banco Central de la Republica Argentina, 24.36%, 1/18/177 (Cost $663,696) | | | ARS | | | | 10,610,000 | | | | 664,617 | |

| | | | | | | | | | | | |

| | | | | | | Shares | | | | | |

Investment Companies—22.0% | | | | | | | | | | | | |

Oppenheimer Institutional Government Money Market Fund, Cl. E, 0.28%8,9 | | | | 23,914,591 | | | | 23,914,591 | |

Oppenheimer Master Event-Linked Bond Fund, LLC8 | | | | | | | 4,921,101 | | | | 78,768,555 | |

Oppenheimer Master Loan Fund, LLC8 | | | | | | | 7,213,775 | | | | 114,111,539 | |

Oppenheimer Senior Floating Rate Fund, Cl. I8 | | | | | | | 4,985,986 | | | | 40,087,324 | |

PowerShares Senior Loan Portfolio Exchange Traded Fund | | | | | | | 3,351,165 | | | | 77,680,005 | |

Total Investment Companies (Cost $332,528,206) | | | | | | | | | | | 334,562,014 | |

| | | | | | | | | | | | | |

Total Investments, at Value (Cost $1,435,711,069) | | | | | | | 98.5% | | | | 1,495,431,181 | |

Net Other Assets (Liabilities) | | | | | | | 1.5 | | | | 22,586,602 | |

Net Assets | | | | | | | 100.0% | | | $ | 1,518,017,783 | |

| | | | | | | | |

Footnotes to Consolidated Statement of Investments

1. Non-income producing security.

2. Security is a Master Limited Partnership.

3. Represents securities sold under Rule 144A, which are exempt from registration under the Securities Act of 1933, as amended. These securities have been determined to be liquid under guidelines established by the Board of Trustees. These securities amount to $5,948,010 or 0.39% of the Fund’s net assets at period end.

4. All or a portion of the security position is held in accounts at a futures clearing merchant and pledged to cover margin requirements on open futures contracts and written options on futures, if applicable. The aggregate market value of such securities is $21,530,010. See Note 6 of the accompanying Consolidated Notes.

5. All or a portion of the security position is held in segregated accounts and pledged to cover margin requirements under certain derivative contracts. The aggregate market value of such securities is $1,669,135. See Note 6 of the accompanying Consolidated Notes.

6. Denotes an inflation-indexed security: coupon or principal are indexed to a consumer price index.

7. Zero coupon bond reflects effective yield on the original acquisition date.

8. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the reporting period, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the reporting period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | |

| | | Shares | | | | | | | | | Shares | |

| | | October 30, | | | Gross | | | Gross | | | October 31, | |

| | | 2015a | | | Additions | | | Reductions | | | 2016 | |

| Oppenheimer Institutional Government Money Market Fund, Cl. Eb | | | 26,662,924 | | | | 860,641,741 | | | | 863,390,074 | | | | 23,914,591 | |

| Oppenheimer Master Event-Linked Bond Fund, LLC | | | 5,734,430 | | | | — | | | | 813,329 | | | | 4,921,101 | |

| Oppenheimer Master Loan Fund, LLC | | | 5,674,937 | | | | 1,538,838 | | | | — | | | | 7,213,775 | |

28 OPPENHEIMER GLOBAL ALLOCATION FUND

Footnotes to Consolidated Statement of Investments (Continued)

| | | | | | | | | | | | | | | | |

| | | Shares | | | | | | | Shares |

| | | October 30, | | | Gross | | Gross | | October 31, |

| | | 2015a | | | Additions | | Reductions | | 2016 |

Oppenheimer Senior Floating Rate Fund, Cl. I | | | — | | | | 6,984,308 | | | | 1,998,322 | | | | 4,985,986 | |

| | | | |

| | | | | | | | | | Realized Gain |

| | | | | | Value | | Income | | (Loss) |

Oppenheimer Institutional Government Money Market Fund, Cl. Eb | | | | | | $ | 23,914,591 | | | $ | 261,936 | | | $ | — | |

Oppenheimer Master Event-Linked Bond Fund, LLC | | | | 78,768,555 | | | | 5,034,656 | c | | | (1,030,431 | )c |

Oppenheimer Master Loan Fund, LLC | | | | | | | 114,111,539 | | | | 5,441,043 | d | | | (2,690,290 | )d |

Oppenheimer Senior Floating Rate Fund, Cl. I | | | | 40,087,324 | | | | 503,104 | | | | 339,715 | |

| | | | | | | | |

Total | | | | | | $ | 256,882,009 | | | $ | 11,240,739 | | | $ | (3,381,006 | ) |

| | | | | | | | |

a. Represents the last business day of the Fund’s reporting period.

b. Prior to September 28, 2016, this fund was named Oppenheimer Institutional Money Market Fund.

c. Represents the amount allocated to the Fund from Oppenheimer Master Event-linked Bond Fund, LLC.

d. Represents the amount allocated to the Fund from Oppenheimer Master Loan Fund, LLC.

9. Rate shown is the 7-day yield at period end.

Distribution of investments representing geographic holdings, as a percentage of total investments at value, is as follows:

| | | | | | | | | | | | | | | | |

| Geographic Holdings (Unaudited) | | Value | | | | | | Percent | | | | |

United States | | $ | 911,240,226 | | | | | | | | 60.9% | | | | | |

France | | | 75,190,677 | | | | | | | | 4.9 | | | | | |

Japan | | | 68,632,279 | | | | | | | | 4.6 | | | | | |

United Kingdom | | | 55,401,431 | | | | | | | | 3.5 | | | | | |

Germany | | | 46,620,893 | | | | | | | | 3.2 | | | | | |

Switzerland | | | 36,317,196 | | | | | | | | 2.4 | | | | | |

China | | | 31,844,261 | | | | | | | | 2.3 | | | | | |

India | | | 30,061,586 | | | | | | | | 2.0 | | | | | |

Canada | | | 27,875,354 | | | | | | | | 1.9 | | | | | |

Brazil | | | 22,753,359 | | | | | | | | 1.5 | | | | | |

Netherlands | | | 19,940,448 | | | | | | | | 1.3 | | | | | |

Spain | | | 15,389,731 | | | | | | | | 1.0 | | | | | |

Russia | | | 13,241,448 | | | | | | | | 0.9 | | | | | |

Hong Kong | | | 12,945,965 | | | | | | | | 0.9 | | | | | |

Mexico | | | 11,263,960 | | | | | | | | 0.8 | | | | | |

Indonesia | | | 11,143,456 | | | | | | | | 0.7 | | | | | |

Sweden | | | 9,754,091 | | | | | | | | 0.7 | | | | | |

Australia | | | 9,153,835 | | | | | | | | 0.6 | | | | | |

South Africa | | | 9,093,789 | | | | | | | | 0.6 | | | | | |

Denmark | | | 8,410,691 | | | | | | | | 0.6 | | | | | |

South Korea | | | 7,770,548 | | | | | | | | 0.5 | | | | | |

Colombia | | | 5,597,666 | | | | | | | | 0.4 | | | | | |

Poland | | | 4,864,046 | | | | | | | | 0.3 | | | | | |

Malaysia | | | 4,737,957 | | | | | | | | 0.3 | | | | | |

Peru | | | 4,415,076 | | | | | | | | 0.3 | | | | | |

Taiwan | | | 4,017,017 | | | | | | | | 0.3 | | | | | |

29 OPPENHEIMER GLOBAL ALLOCATION FUND

| | |

| CONSOLIDATED STATEMENT OF INVESTMENTS Continued | | |

| | | |

| | | | | | | | | | | | | | | | |

| Geographic Holdings (Unaudited) (Continued) | | Value | | | | | Percent | | | |

| |

Singapore | | $ | 3,982,770 | | | | | | | | 0.3 | % | | | | |

Hungary | | | 3,753,574 | | | | | | | | 0.3 | | | | | |

Italy | | | 3,747,260 | | | | | | | | 0.3 | | | | | |

Ireland | | | 3,652,078 | | | | | | | | 0.2 | | | | | |

Philippines | | | 3,112,498 | | | | | | | | 0.2 | | | | | |

Thailand | | | 2,766,539 | | | | | | | | 0.2 | | | | | |

Turkey | | | 2,704,782 | | | | | | | | 0.2 | | | | | |

New Zealand | | | 2,373,086 | | | | | | | | 0.2 | | | | | |

Romania | | | 2,015,327 | | | | | | | | 0.1 | | | | | |

Argentina | | | 1,738,899 | | | | | | | | 0.1 | | | | | |