UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| 222 West Adams Street, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Michelle R. Seitz

William Blair Funds

222 West Adams Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimates and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (ss) 3507.

| Item 1. | February 24, 2017 Annual Reports transmitted to shareholders. |

| |

| | |

| | |

| | |

| | |

| | December 31, 2016 |

William Blair Funds Annual Report | |

Table of Contents

| December 31, 2016 | William Blair Funds | 1 |

The views expressed in the commentary for each Fund reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The portfolio management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Statements involving predictions, assessments, analyses, or outlook for individual securities, industries, market sectors, and/or markets involve risks and uncertainties, and there is no guarantee they will come to pass.

This report is submitted for the general information of the shareholders of William Blair Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by a prospectus of William Blair Funds. Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

| 2 | Annual Report | December 31, 2016 |

Performance as of December 31, 2016—Class N Shares (Unaudited)

| | | | | | | | | 10 yr | | | | Overall |

| | | | | | | | | (or since | | Inception | | Morningstar |

| | | 1 yr | | 3 yr | | 5 yr | | inception) | | Date | | Rating |

| | | | | | | | | | | | | | | | | |

| Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | (0.98 | ) | | 3.59 | | | 11.66 | | | 6.65 | | | 3/20/1946 | | *** |

| Morningstar Large Growth | | 3.23 | | | 5.70 | | | 12.94 | | | 6.91 | | | | | Among 1,315 |

| Russell 3000® Growth Index | | 7.39 | | | 8.27 | | | 14.44 | | | 8.28 | | | | | Large Growth Funds |

| S&P 500® Index | | 11.96 | | | 8.87 | | | 14.66 | | | 6.95 | | | | | |

| | | | | | | | | | | | | | | | | |

| Large Cap Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 1.97 | | | 7.65 | | | 14.44 | | | 6.98 | | | 12/27/1999 | | **** |

| Morningstar Large Growth | | 3.23 | | | 5.70 | | | 12.94 | | | 6.91 | | | | | Among 1,315 |

| Russell 1000® Growth Index | | 7.08 | | | 8.55 | | | 14.50 | | | 8.33 | | | | | Large Growth Funds |

| | | | | | | | | | | | | | | | | |

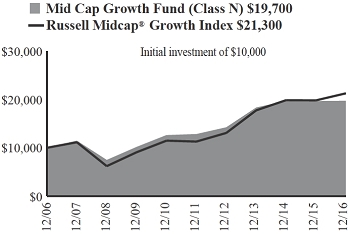

| Mid Cap Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 0.23 | | | 2.46 | | | 8.97 | | | 7.02 | | | 2/1/2006 | | *** |

| Morningstar Mid-Cap Growth | | 6.03 | | | 4.03 | | | 11.79 | | | 6.79 | | | | | Among 588 |

| Russell Midcap® Growth Index | | 7.33 | | | 6.23 | | | 13.51 | | | 7.83 | | | | | Mid-Cap Growth Funds |

| | | | | | | | | | | | | | | | | |

| Mid Cap Value Fund | | | | | | | | | | | | | | | | |

| Class N | | 14.49 | | | 7.49 | | | 13.14 | | | 10.96 | | | 5/3/2010 | | *** |

| Morningstar Mid-Cap Blend | | 14.14 | | | 5.89 | | | 13.32 | | | — | | | | | Among 371 |

| Russell Midcap® Value Index | | 20.00 | | | 9.45 | | | 15.70 | | | 12.48 | | | | | Mid-Cap Blend Funds |

| | | | | | | | | | | | | | | | | |

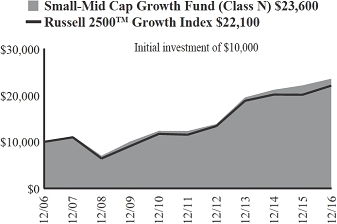

| Small-Mid Cap Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 6.45 | | | 6.41 | | | 13.85 | | | 8.94 | | | 12/29/2003 | | **** |

| Morningstar Mid-Cap Growth | | 6.03 | | | 4.03 | | | 11.79 | | | 6.79 | | | | | Among 588 |

| Russell 2500TM Growth Index | | 9.73 | | | 5.45 | | | 13.88 | | | 8.24 | | | | | Mid-Cap Growth Funds |

| | | | | | | | | | | | | | | | | |

| Small-Mid Cap Value Fund | | | | | | | | | | | | | | | | |

| Class N | | 20.69 | | | 6.96 | | | 13.30 | | | 14.16 | | | 12/15/2011 | | *** |

| Morningstar Small Blend | | 20.78 | | | 5.89 | | | 13.52 | | | — | | | | | Among 626 |

| Russell 2500® Value Index | | 25.20 | | | 8.22 | | | 15.04 | | | 15.82 | | | | | Small Blend Funds |

| | | | | | | | | | | | | | | | | |

| Small Cap Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 18.89 | | | 5.25 | | | 16.04 | | | 6.45 | | | 12/27/1999 | | *** |

| Morningstar Small Growth | | 11.20 | | | 3.55 | | | 12.33 | | | 7.08 | | | | | Among 599 |

| Russell 2000® Growth Index | | 11.32 | | | 5.05 | | | 13.74 | | | 7.76 | | | | | Small Growth Funds |

| | | | | | | | | | | | | | | | | |

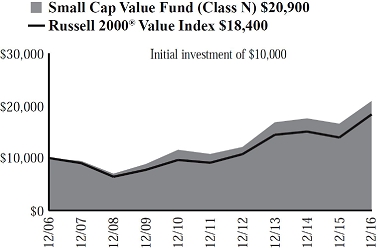

| Small Cap Value Fund | | | | | | | | | | | | | | | | |

| Class N | | 26.19 | | | 7.50 | | | 14.19 | | | 7.66 | | | 12/23/1996 | | **** |

| Morningstar Small Blend | | 20.78 | | | 5.89 | | | 13.52 | | | 6.79 | | | | | Among 626 |

| Russell 2000® Value Index | | 31.74 | | | 8.31 | | | 15.07 | | | 6.26 | | | | | Small Blend Funds |

| December 31, 2016 | William Blair Funds | 3 |

Performance as of December 31, 2016—Class N Shares (Unaudited)—continued

| | | | | | | | | 10 yr | | | | Overall |

| | | | | | | | | (or since | | Inception | | Morningstar |

| | | 1 yr | | 3 yr | | 5 yr | | inception) | | Date | | Rating |

| | | | | | | | | | | | | | | | | |

| Global Leaders Fund | | | | | | | | | | | | | | | | |

| Class N | | 0.62 | | | 2.28 | | | 8.68 | | | 2.34 | | | 10/15/2007 | | *** |

| Morningstar World Stock | | 5.54 | | | 2.10 | | | 9.24 | | | — | | | | | Among 848 |

| MSCI ACW IMI (net) | | 8.36 | | | 3.25 | | | 9.61 | | | 2.47 | | | | | World Stock Funds |

| | | | | | | | | | | | | | | | | |

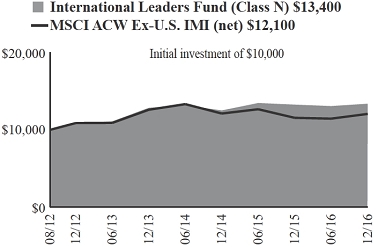

| International Leaders Fund | | | | | | | | | | | | | | | | |

| Class N | | 0.88 | | | 1.35 | | | — | | | 6.86 | | | 8/16/2012 | | ***** |

| Morningstar Foreign Large Growth | | (2.14 | ) | | (1.83 | ) | | — | | | — | | | | | Among 312 |

| MSCI ACW Ex-U.S. IMI (net) | | 4.41 | | | (1.44 | ) | | — | | | 4.37 | | | | | Foreign Large Growth Funds |

| | | | | | | | | | | | | | | | | |

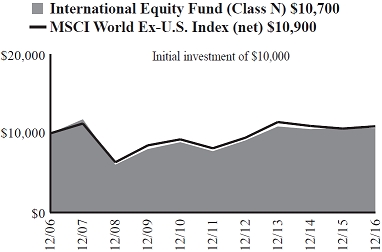

| International Equity Fund | | | | | | | | | | | | | | | | |

| Class N | | (0.27 | ) | | (0.62 | ) | | 6.63 | | | 0.64 | | | 5/24/2004 | | *** |

| Morningstar Foreign Large Growth | | (2.14 | ) | | (1.83 | ) | | 6.15 | | | 1.43 | | | | | Among 312 |

| MSCI World Ex-U.S. Index (net) | | 2.75 | | | (1.59 | ) | | 6.07 | | | 0.86 | | | | | Foreign Large Growth Funds |

| | | | | | | | | | | | | | | | | |

| International Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | (2.88 | ) | | (2.12 | ) | | 6.58 | | | 1.24 | | | 10/1/1992 | | *** |

| Morningstar Foreign Large Growth | | (2.14 | ) | | (1.83 | ) | | 6.15 | | | 1.43 | | | | | Among 312 |

| MSCI ACW Ex-U.S. IMI (net) | | 4.41 | | | (1.44 | ) | | 5.35 | | | 1.22 | | | | | Foreign Large Growth Funds |

| | | | | | | | | | | | | | | | | |

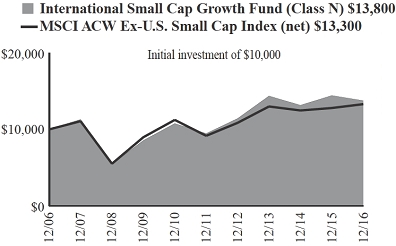

| International Small Cap Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | (4.60 | ) | | (1.42 | ) | | 7.79 | | | 3.25 | | | 11/1/2005 | | *** |

| Morningstar Foreign Small/Mid Growth | | (2.98 | ) | | (0.63 | ) | | 8.87 | | | 3.12 | | | | | Among 107 |

| MSCI ACW Ex-U.S. | | | | | | | | | | | | | | | | Foreign Small/Mid Growth Funds |

| Small Cap Index (net) | | 3.91 | | | 0.76 | | | 7.74 | | | 2.90 | | | | | |

| | | | | | | | | | | | | | | | | |

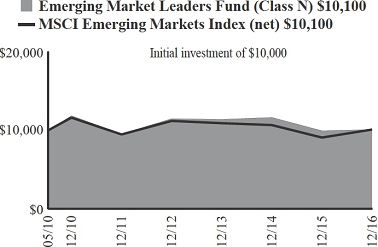

| Emerging Markets Leaders Fund | | | | | | | | | | | | | | | | |

| Class N | | 1.42 | | | (3.98 | ) | | 1.13 | | | 0.12 | | | 5/3/2010 | | *** |

| Morningstar Diversified Emerging | | | | | | | | | | | | | | | | Among 606 |

| Markets | | 8.47 | | | (3.18 | ) | | 1.61 | | | — | | | | | Diversified Emerging Markets Funds |

| MSCI Emerging Markets Index (net) | | 11.19 | | | (2.55 | ) | | 1.28 | | | 0.12 | | | | | |

| | | | | | | | | | | | | | | | | |

| Emerging Markets Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 1.49 | | | (3.75 | ) | | 1.69 | | | 0.18 | | | 6/6/2005 | | *** |

| Morningstar Diversified Emerging | | | | | | | | | | | | | | | | Among 606 |

| Markets | | 8.47 | | | (3.18 | ) | | 1.61 | | | 1.32 | | | | | Diversified Emerging Markets Funds |

| MSCI Emerging Markets IMI (net) | | 9.90 | | | (2.40 | ) | | 1.54 | | | 2.07 | | | | | |

| | | | | | | | | | | | | | | | | |

| Emerging Markets Small Cap Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | (5.33 | ) | | 0.46 | | | 9.64 | | | 8.70 | | | 10/24/2011 | | ***** |

| Morningstar Diversified Emerging | | | | | | | | | | | | | | | | Among 606 |

| Markets | | 8.47 | | | (3.18 | ) | | 1.61 | | | — | | | | | Diversified Emerging Markets Funds |

| MSCI Emerging Markets Small Cap Index (net) | | 2.28 | | | (1.27 | ) | | 3.51 | | | 2.09 | | | | | |

| 4 | Annual Report | December 31, 2016 |

Performance as of December 31, 2016—Class N Shares (Unaudited)—continued

| | | | | | | | | 10 yr | | | | Overall |

| | | | | | | | | (or since | | Inception | | Morningstar |

| | | 1 yr | | 3 yr | | 5 yr | | inception) | | Date | | Rating |

| | | | | | | | | | | | | | | | | |

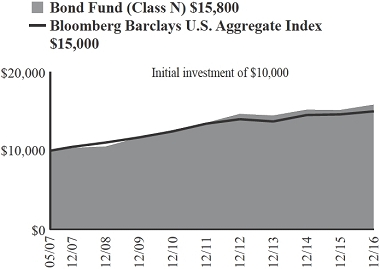

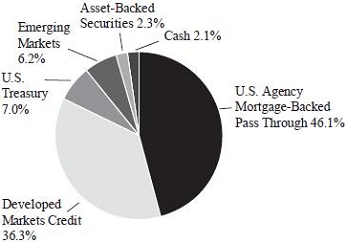

| Bond Fund | | | | | | | | | | | | | | | | |

| Class N | | 4.40 | | | 3.06 | | | 3.18 | | | 4.86 | | | 5/1/2007 | | **** |

| Morningstar Intermediate-Term Bond | | 3.23 | | | 2.73 | | | 2.61 | | | — | | | | | Among 869 |

| Bloomberg Barclays U.S. Aggregate Bond Index | | 2.65 | | | 3.03 | | | 2.23 | | | 4.28 | | | | | Intermediate-Term Bond Funds |

| | | | | | | | | | | | | | | | | |

| Income Fund | | | | | | | | | | | | | | | | |

| Class N | | 2.44 | | | 1.96 | | | 2.03 | | | 2.94 | | | 10/1/1990 | | **** |

| Morningstar Short-Term Bond | | 2.08 | | | 1.06 | | | 1.46 | | | 2.55 | | | | | Among 445 |

| Bloomberg Barclays Intermediate | | | | | | | | | | | | | | | | Short-Term Bond Funds |

| Government/Credit Bond Index | | 2.08 | | | 2.09 | | | 1.85 | | | 3.84 | | | | | |

| | | | | | | | | | | | | | | | | |

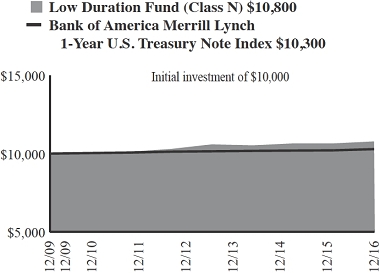

| Low Duration Fund | | | | | | | | | | | | | | | | |

| Class N | | 1.16 | | | 0.79 | | | 0.90 | | | 1.06 | | | 12/1/2009 | | *** |

| Morningstar Ultrashort Bond | | 1.41 | | | 0.67 | | | 0.95 | | | — | | | | | Among 128 |

| Bank of America Merrill Lynch | | | | | | | | | | | | | | | | Ultrashort Bond Funds |

| 1-Year U.S. Treasury Note Index | | 0.76 | | | 0.36 | | | 0.32 | | | 0.40 | | | | | |

| | | | | | | | | | | | | | | | | |

| Macro Allocation Fund | | | | | | | | | | | | | | | | |

| Class N | | 2.01 | | | (0.64 | ) | | 4.85 | | | 5.30 | | | 11/29/2011 | | *** |

| Morningstar Multialternative | | 1.38 | | | 0.61 | | | 3.14 | | | — | | | | | Among 239 |

| Bank of America Merrill Lynch | | | | | | | | | | | | | | | | Multialternative Funds |

| 3-Month U.S. Treasury Bill Index | | 0.33 | | | 0.14 | | | 0.12 | | | 0.12 | | | | | |

| Long-Term Comparative Index | | 3.68 | | | 2.36 | | | 3.84 | | | 3.85 | | | | | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or a loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. International and emerging markets investing involves special risk considerations, including currency fluctuations, lower liquidity, economic and political risk. As interest rates rise, bond prices will typically fall and bond funds may become more volatile. Class N shares are available to the general public without a sales load.

Morningstar RatingsTM are as of 12/31/2016 and are subject to change every month. The ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each Category receive 5 stars, the next 22.5% receive 4 stars, the middle 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. The 3/5/10 year Morningstar ratings were as follows: Growth Fund **/**/*** and Large Cap Growth Fund ****/****/***, out of 1,315/1,154/809 large growth funds; Mid Cap Growth Fund ***/**/*** and Small-Mid Cap Growth Fund ****/****/**** out of 588/504/368 mid-cap growth funds; Mid Cap Value Fund ***/***/NA, out of 371/332/NA mid-cap blend funds; Small Cap Growth Fund ***/*****/**, out of 599/531/389 small growth funds; Small-Mid Cap Value Fund ***/*** /NA and Small Cap Value Fund ***/***/**** out of 626/534/360 small blend funds; Global Leaders Fund ***/***/NA out of 848/669/NA world stock funds; International Equity Fund ****/***/**, International Growth Fund ***/***/**, and International Leaders Fund *****/NA/NA out of 312/260/182 foreign large growth funds; International Small Cap Growth Fund ***/***/*** out of 107/97/55 foreign small/mid growth funds; Emerging Markets Leaders Fund ***/***/NA, Emerging Markets Growth Fund ***/***/**, and Emerging Markets Small Cap Growth *****/*****/NA out of 606/425/173 diversified emerging markets funds; Bond Fund ****/****/NA out of 869/759/NA intermediate-term bond funds; Income Fund ****/****/*** out of 445/357/252 short-term bond funds; Low Duration Fund ****/***/NA out of 128/91/NA ultrashort bond funds; and Macro Allocation Fund **/****/NA out of 239/141/NA multialternative funds.

Please carefully consider the Funds’ investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Funds’ prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

| December 31, 2016 | William Blair Funds | 5 |

U.S. Growth Market Review and Outlook

The strength of U.S. equity market returns in 2016 masked some sharp but short-lived downdrafts during the year. This dynamic resulted in a style environment where both more defensive and more cyclical areas of the market exhibited leadership at different times over the course of the year.

In the first six weeks of 2016, the market declined precipitously, driven by concern that the U.S. could be headed into a recession given weakness in the manufacturing segment of the economy, falling oil prices and persistent headwinds from global economic growth challenges. In this environment, equity investors gravitated toward the perceived safety of high dividend yielding stocks (a dominant factor in the performance of larger cap indices during this period) and away from more speculative areas of the market such as biotechnology (a dominant factor in the performance of smaller-cap indices during this period). The mid-February market reversal, wherein leadership shifted to more cyclical companies, was spurred by further easing of monetary policy by foreign central banks and improving macroeconomic data points globally. From that point forward, with only a brief pause following the results of the Brexit vote, generally positive U.S. economic data carried the market higher.

While fourth quarter returns were positive overall, the market softened somewhat in October, likely due to anxiety ahead of the U.S. presidential election as a solid third quarter earnings season indicated health among U.S. corporations. The surprise election of Donald Trump, whose proposed policies of lower taxes, increased fiscal spending and looser regulations are generally perceived as reflationary and pro-U.S. growth, provided a tailwind for more economically sensitive areas of the market. At the same time, U.S. economic data surpassed expectations. U.S. retail sales, housing starts, unemployment claims and wages were all among positively trending data points. Accordingly, 10 year Treasury yields moved higher as investor confidence rose. With a backdrop of continued low unemployment, rising wages and inflation moving higher, the Federal Reserve, in what had become a widely anticipated move, raised the federal funds rate by 25 basis points in December.

The new administration will take office with the U.S. economy moving into the latter half of its eighth year of expansion and the Fed poised to enact further interest rate increases. In terms of Republican initiatives, lower regulatory burden, higher fiscal spending and lower taxes are generally considered to be favorable for economic growth. However, it remains to be seen how quickly the new administration’s proposed policies can be implemented. While more restrictive monetary policy in the U.S. could hinder economic growth, the Fed has thus far exhibited a cautious pace of rate increases relative to a more normalized cycle and global central bank policies remain stimulative. Conversely, Trump’s proposed policies reinforce already rising inflation, increasing the potential that the Fed could move too slowly in raising rates. Additional risks in the U.S. include potential geo-political missteps and trade ramifications from protectionist policies.

Absolute valuations moved up with the market during the year. For instance, the S&P 500 Index forward price-to-earnings multiple expand from 16.2 to 17.5 times earnings over the course of 2016. However, as of December 31, 2016, growth style indices were trading at only modest premiums to historical median levels. At the same time, relative to value indices, growth style indices were trading considerably below historical median premiums. Given this backdrop, our general view is that opportunity remains for U.S. growth equities. Further, the prospect of lower corporate taxes, repatriation of overseas cash, reduced regulations, and fiscal stimulus could lead to positive earnings revisions. Conversely, potentially offsetting factors include continued strength in the U.S. dollar and wage inflation.

As always, we believe broad investor focus on near-term events creates opportunities for investors such as ourselves who analyze companies over a long-term time horizon in an effort to achieve excess returns. We remain focused on identifying companies with durable growth drivers, independent of policy outcomes, whose stocks present compelling risk/reward opportunities.

| 6 | Annual Report | December 31, 2016 |

U.S. Value Market Review and Outlook

The domestic equity markets delivered positive returns in 2016, though there was a significant dispersion of returns between growth and value style indices. Following several years of outperformance by growth stock indices, value indices considerably outperformed during the year.

Investors experienced one of the worst starts to a new year on record for the domestic equity markets as investor sentiment during the first six weeks of 2016 seemed hysterically negative and recessionary fears ran rampant. Concerns over slowing U.S. and global growth, further weakening of commodities, strengthening of the U.S. dollar, and renewed fears of a slowdown in China pushed most equity markets into correction territory. The mid-February reversal was spurred by better domestic economic data helping to alleviate investor angst of an impending recession. Also, dovish comments by the Federal Reserve helped spark a risk-on rally from mid-February through the end of the third quarter, with a slight pause following the results of the Brexit vote. This rally was led by smaller, lower quality, and less expensive stocks.

The hard-charging domestic equity markets paused briefly in October after posting robust returns since the mid-February lows as U.S. economic expansion continued to progress, albeit at a slow and uneven pace. Similar to what transpired at the end of the second quarter following the surprising Brexit vote, market volatility spiked in early November heading into the U.S. presidential election. Better economic data and generally perceived reflationary and pro-growth policy initiatives, including increased fiscal spending, tax reform, and deregulation, helped push volatility back to near-historic lows and ultimately ignited a post-election rally that propelled the equity markets higher in the fourth quarter. The post-election rally was primarily driven by smaller cap stocks that are expected to be beneficiaries of the pro-growth initiatives of the newly elected president. The decision by OPEC ministers to cut oil production more than anticipated helped drive oil prices higher, further fueling the strong market returns during the fourth quarter.

With all of the post-election rhetoric focused on the protectionist, pro-growth initiatives of President-elect Trump and an improved U.S. economic outlook, domestic interest rates rose along with the U.S. dollar. With the backdrop of continued low unemployment, rising wages, and inflation appearing to perk up, the Federal Reserve raised the federal funds rate by 25 basis points in December.

The improvement in domestic economic data continues to support the view that U.S. economic expansion is progressing. With Donald Trump taking office early in 2017, the prospects for lower taxes, repatriation of overseas cash, increased fiscal spending, deregulation, and higher interest rates could lead to positive earnings revisions, further extending this market cycle. Some potential offsetting factors to these policy initiatives include continued strength of the U.S. dollar and wage inflation. Investor optimism is high for Trump’s pro-growth initiatives; however, there is the possibility for investor disappointment resulting from the gap between what is anticipated and actual policy results, which could lead to increased market volatility. Volatility continues to be at or near historic lows and we continue to anticipate higher volatility going forward given the uncertainty created by Brexit, concerns over a slowdown in China, policies and priorities of the newly elected U.S. president, and geopolitical tensions. There is a strong correlation between volatility and the performance of high quality companies, and higher volatility should benefit our strategy given our higher quality bias within the Funds.

While the Federal Reserve was able to squeeze in only one interest rate increase late in the year, we continue to believe that the Fed will be prudent with future rate increases and that the trajectory of interest rates will be lower than they would during a more normalized cycle. The beneficiaries of the universally accommodative monetary policy and ample liquidity during the current bull market have been the more highly leveraged companies. However, if interest rates rise faster than expected and lending standards continue to tighten, companies with conservative balance sheets and sufficient cash cushions, or those generating ample free cash flow should fare better than companies reliant on the capital markets to grow. This could provide a tailwind for our strategy as these higher quality companies with better balance sheets and solid cash flows should outperform under this scenario.

While we are cognizant of these macroeconomic variables, we are persistently seeking to identify attractive risk reward opportunities based on individual company fundamentals. From our bottom up perspective, we remain constructive on corporate earnings, albeit against a backdrop of lower revenue growth and increasing margin pressure from higher wages. As always, our focus remains on identifying quality companies at discount prices and corporate transformation opportunities, and we continue to find good ideas across all sectors. Given our investment approach, we believe the Funds are well-suited to withstand a variety of market scenarios and add value over the long-term.

| December 31, 2016 | William Blair Funds | 7 |

| | Growth Fund |

| | |

| | The Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

David C. Fording

John F. Jostrand | The William Blair Growth Fund (Class N shares) posted a 0.98% decrease, net of fees, for the twelve months ended December 31, 2016. By comparison, the Fund’s benchmark index, the Russell 3000® Growth Index (the “Index”), increased 7.39%. Underperformance for 2016 versus the Index was due to a combination of style and stock-specific factors. From a style perspective, there were headwinds early in the year when investor preference for high dividend-yielding stocks dominated the market. While the preference for dividend yield was most pronounced at the beginning of the year, relative performance of high dividend-yielding stocks did not subside for the remainder of 2016 and high dividend-yielding stocks materially outperformed low dividend-yielding stocks in 2016. More economically-sensitive areas of the market also outperformed for the year, particularly in the third quarter and following the U.S. presidential election. The Fund tends to be significantly underweight high dividend- yielding and more economically-sensitive companies, preferring sustainable growth companies with substantial reinvestment opportunities that enable superior, durable long-term growth. From a stock-specific perspective, the largest detractor from the Fund’s relative performance was healthcare technology solutions provider Cerner after the company reported financial results below consensus expectations late in the year amid lower IT spending by hospitals, the company’s primary customers. Grocery retailer Kroger was a top detractor from relative performance for the year. The company experienced deflationary pressures on items such as milk, eggs and meat which negatively affected company earnings for much of 2016. However, fears of further deflation eased following the U.S. presidential election, and the stock was able to recover. Other top detractors from the Fund’s relative performance were Red Hat (Information Technology), BorgWarner (Consumer Discretionary) and Mead Johnson Nutrition (Consumer Staples). Top contributors for the year were rail operator Union Pacific and semiconductor manufacturer Texas Instruments. Union Pacific outperformed the Index mostly in the second half of 2016 due to improving trends in its underlying business. The stock performed particularly well following the election as investors gravitated to companies that would benefit the most from an improvement in the U.S. economy. Other top contributors to relative performance were Akamai Technologies (Information Technology), Vantiv (Information Technology) and NeuStar (Information Technology). Please refer to the U.S. Growth Market Review and Outlook relating to the Fund on page 6. |

| 8 | Annual Report | December 31, 2016 |

Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Return at 12/31/2016 |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| | | | | | | | | | | | | |

| Class N | | | (0.98 | )% | | | 3.59 | % | | | 11.66 | % | | | 6.65 | % |

| Class I | | | (0.69 | ) | | | 3.93 | | | | 12.02 | | | | 7.01 | |

| Russell 3000® Growth Index | | | 7.39 | | | | 8.27 | | | | 14.44 | | | | 8.28 | |

| S&P 500® Index | | | 11.96 | | | | 8.87 | | | | 14.66 | | | | 6.95 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair Investment Management, LLC and William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500® Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on December 31, 2016. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

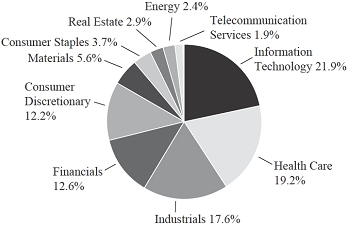

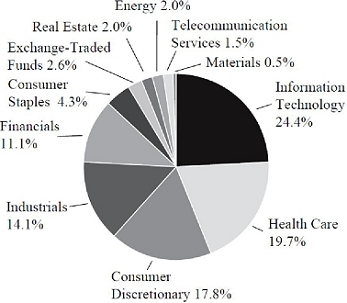

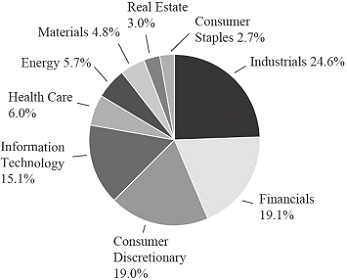

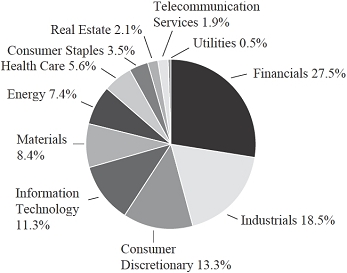

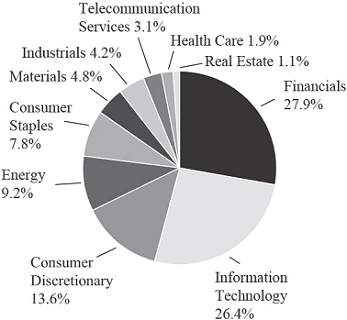

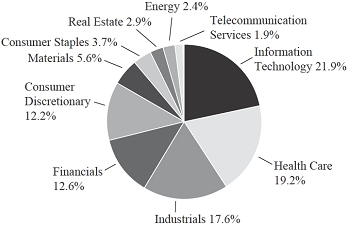

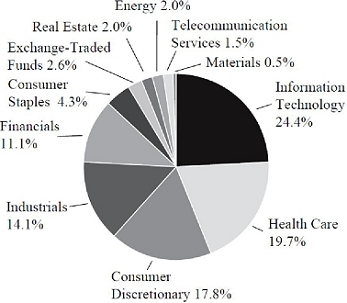

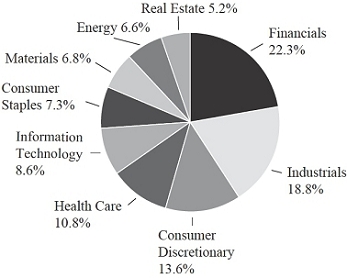

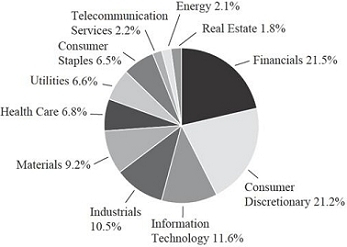

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| December 31, 2016 | William Blair Funds | 9 |

Growth Fund

Portfolio of Investments, December 31, 2016 (all dollar amounts in thousands)

| | Issuer | |

Shares | | | Value | |

| | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—35.1% | | | | | | | | |

| * | Adobe Systems, Inc. | | | 81,300 | | | $ | 8,370 | |

| * | Akamai Technologies, Inc. | | | 174,487 | | | | 11,635 | |

| * | Alphabet, Inc. Class “A” | | | 51,680 | | | | 40,954 | |

| | Booz Allen Hamilton Holding Corporation | | | 129,522 | | | | 4,672 | |

| * | CoStar Group, Inc. | | | 28,357 | | | | 5,345 | |

| | CSRA, Inc. | | | 275,807 | | | | 8,782 | |

| * | Facebook, Inc. | | | 155,700 | | | | 17,913 | |

| * | Guidewire Software, Inc. | | | 78,800 | | | | 3,887 | |

| | j2 Global, Inc. | | | 89,300 | | | | 7,305 | |

| | Mastercard, Inc. | | | 198,600 | | | | 20,505 | |

| | Microsoft Corporation | | | 563,600 | | | | 35,022 | |

| * | Red Hat, Inc. | | | 186,706 | | | | 13,013 | |

| | Texas Instruments, Inc. | | | 197,200 | | | | 14,390 | |

| * | Vantiv, Inc. | | | 188,039 | | | | 11,211 | |

| | | | | | | | | 203,004 | |

| | Health Care—17.8% | | | | | | | | |

| * | Align Technology, Inc. | | | 39,900 | | | | 3,836 | |

| * | Allergan plc† | | | 35,700 | | | | 7,497 | |

| * | Biogen, Inc. | | | 39,800 | | | | 11,286 | |

| * | BioMarin Pharmaceutical, Inc. | | | 57,600 | | | | 4,772 | |

| | Bristol-Myers Squibb Co. | | | 260,100 | | | | 15,200 | |

| * | Cerner Corporation | | | 261,800 | | | | 12,401 | |

| | Danaher Corporation | | | 152,900 | | | | 11,902 | |

| * | Edwards Lifesciences Corporation | | | 75,553 | | | | 7,079 | |

| * | Mednax, Inc. | | | 157,830 | | | | 10,521 | |

| | Shire plc—ADR | | | 34,000 | | | | 5,793 | |

| | Zoetis, Inc. | | | 233,600 | | | | 12,505 | |

| | | | | | | | | 102,792 | |

| | Consumer Discretionary—16.2% | | | | | | | | |

| * | Amazon.com, Inc. | | | 32,100 | | | | 24,071 | |

| | Dollar General Corporation | | | 184,200 | | | | 13,644 | |

| | Hanesbrands, Inc. | | | 268,079 | | | | 5,782 | |

| | Lowe’s Cos., Inc. | | | 248,700 | | | | 17,688 | |

| | Newell Brands, Inc. | | | 198,600 | | | | 8,867 | |

| | Starbucks Corporation | | | 215,200 | | | | 11,948 | |

| * | Steven Madden, Ltd. | | | 80,901 | | | | 2,892 | |

| | Vail Resorts, Inc. | | | 13,695 | | | | 2,209 | |

| | VF Corporation | | | 122,100 | | | | 6,514 | |

| | | | | | | | | 93,615 | |

| | Industrials—11.1% | | | | | | | | |

| | BWX Technologies, Inc. | | | 116,500 | | | | 4,625 | |

| | Fastenal Co. | | | 185,800 | | | | 8,729 | |

| | Raytheon Co. | | | 72,400 | | | | 10,281 | |

| | The Dun & Bradstreet Corporation | | | 76,200 | | | | 9,244 | |

| | TransDigm Group, Inc. | | | 35,580 | | | | 8,858 | |

| | Union Pacific Corporation | | | 146,400 | | | | 15,179 | |

| * | Verisk Analytics, Inc. | | | 90,020 | | | | 7,307 | |

| | | | | | | | | 64,223 | |

| | Issuer | | Shares or

Principal

Amount | | | Value | |

| | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Consumer Staples—9.2% | | | | | | | | |

| | Costco Wholesale Corporation | | | 102,800 | | | $ | 16,460 | |

| * | Herbalife, Ltd.† | | | 69,200 | | | | 3,331 | |

| | Mead Johnson Nutrition Co. | | | 139,300 | | | | 9,857 | |

| * | Sprouts Farmers Market, Inc. | | | 192,600 | | | | 3,644 | |

| | The Kroger Co. | | | 425,300 | | | | 14,677 | |

| | Tyson Foods, Inc. | | | 85,300 | | | | 5,261 | |

| | | | | | | | | 53,230 | |

| | Financials—7.2% | | | | | | | | |

| * | Affiliated Managers Group, Inc. | | | 31,200 | | | | 4,533 | |

| | Intercontinental Exchange, Inc. | | | 318,900 | | | | 17,992 | |

| * | Signature Bank | | | 47,600 | | | | 7,150 | |

| | Willis Towers Watson plc† | | | 94,800 | | | | 11,592 | |

| | | | | | | | | 41,267 | |

| | Energy—1.5% | | | | | | | | |

| | Schlumberger, Ltd.† | | | 104,600 | | | | 8,781 | |

| | Materials—1.4% | | | | | | | | |

| | PPG Industries, Inc. | | | 82,828 | | | | 7,849 | |

| | Total Common Stocks—99.5%

(cost $475,512) | | | | | | | 574,761 | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.030% dated 12/30/16, due 1/3/17, repurchase price $4,823, collateralized by U.S. Treasury Bond, 3.375%, due 5/15/44 | | $ | 4,823 | | | | 4,823 | |

| | Total Repurchase Agreement—0.8%

(cost $4,823) | | | | | | | 4,823 | |

| | Total Investments—100.3%

(cost $480,335) | | | | | | | 579,584 | |

| | Liabilities, plus cash and other assets—(0.3)% | | | | | | | (1,778 | ) |

| | Net assets—100.0% | | | | | | $ | 577,806 | |

ADR = American Depository Receipt

* = Non-income producing securities

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| 10 | Annual Report | December 31, 2016 |

| | Large Cap Growth Fund |

| | |

| | The Large Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

James S. Golan

David P. Ricci

| The William Blair Large Cap Growth Fund (Class N shares) posted a 1.97% increase, net of fees, for the twelve months ended December 31, 2016. By comparison, the Fund’s benchmark index, the Russell 1000® Growth Index (the “Index”), increased 7.08%. Underperformance for 2016 versus the Index was primarily due to style headwinds. Headwinds were most pronounced early in the year when investor preference for high dividend-yielding stocks dominated the market. While this preference was concentrated mainly in January and February, relative performance of high dividend-yielding stocks did not subside for the remainder of 2016 and high dividend-yielding stocks materially outperformed low dividend-yielding stocks in 2016. Cheaper and more cyclical areas of the market also outperformed for the year, particularly following the U.S. presidential election. The Fund tends to be significantly underweight high dividend-yielding, low valuation and low growth companies, preferring companies with substantial reinvestment opportunities that enable superior, durable long-term growth. From a stock-specific perspective, the largest detractor from the Fund’s relative performance was grocery retailer Kroger. The company experienced deflationary pressures on items such as milk, eggs and meat which negatively affected company earnings for much of 2016. However, as stated above, fears of further deflation eased following the U.S. presidential election, and the stock was able to recover. Healthcare technology solutions provider Cerner was also a top detractor from the Fund’s relative performance for the year after reporting financial results below consensus expectations late in the year amid lower IT spending by hospitals, the company’s primary customers. Other top detractors were Apple (Information Technology), Red Hat (Information Technology) and Chipotle Mexican Grill (Consumer Discretionary). Top contributors to the Fund’s performance were rail operator Union Pacific and semiconductor manufacturer Texas Instruments. Union Pacific outperformed the Index mostly in the second half of 2016 due to improving trends in its underlying business. The stock performed particularly well following the election as investors gravitated to companies that would benefit the most from an improvement in the U.S. economy. Texas Instruments outperformed the Index for the year after several consecutive quarters in which it reported earnings that beat consensus expectations, primarily driven by continued improvement in operating margins. The Fund’s positions in IDEXX Laboratories and UnitedHealth Group were the primary drivers of positive stock selection effect in the Heath Care sector, and the Fund’s position in Schlumberger (Energy) was also a top contributor to the Fund’s performance. Please refer to the U.S. Growth Market Review and Outlook relating to the Fund on page 6. |

| December 31, 2016 | William Blair Funds | 11 |

Large Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Return at 12/31/2016 | | | | | | |

| | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year |

| Class N | | | 1.97 | % | | | 7.65 | % | | | 14.44 | % | | | 6.98 | % |

| Class I | | | 2.22 | | | | 7.92 | | | | 14.75 | | | | 7.23 | |

| Russell 1000® Growth Index | | | 7.08 | | | | 8.55 | | | | 14.50 | | | | 8.33 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair Investment Management, LLC and William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000® Growth Index consists of large capitalization companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on December 31, 2016. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

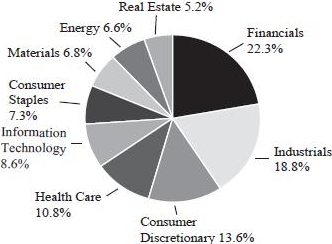

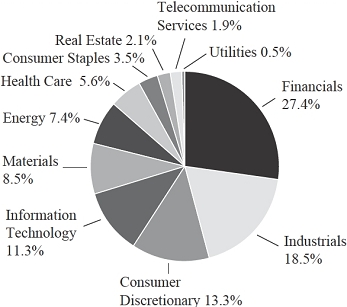

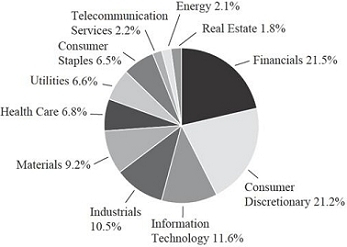

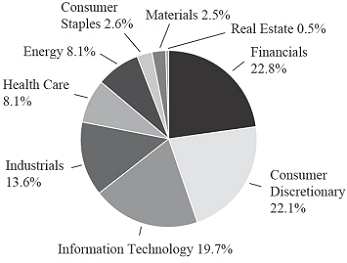

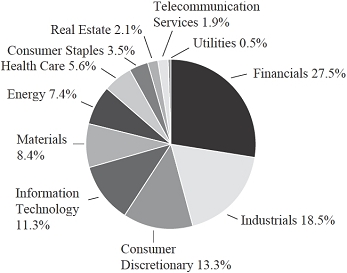

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 12 | Annual Report | December 31, 2016 |

Large Cap Growth Fund

Portfolio of Investments, December 31, 2016 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | |

| | Common Stocks | | | | | | | | |

| | | | | | | | | | |

| | Information Technology—32.5% | | | | | | | | |

| | Accenture plc† | | | 21,770 | | | $ | 2,550 | |

| * | Adobe Systems, Inc. | | | 34,320 | | | | 3,533 | |

| * | Alphabet, Inc. Class “A” | | | 6,940 | | | | 5,500 | |

| * | Alphabet, Inc. Class “C” | | | 4,466 | | | | 3,447 | |

| * | Facebook, Inc. | | | 38,560 | | | | 4,436 | |

| | Mastercard, Inc. | | | 48,710 | | | | 5,029 | |

| | Microsoft Corporation | | | 123,330 | | | | 7,664 | |

| * | Red Hat, Inc. | | | 44,780 | | | | 3,121 | |

| | Texas Instruments, Inc. | | | 61,430 | | | | 4,483 | |

| | | | | | | | | 39,763 | |

| | Health Care—19.0% | | | | | | | | |

| * | Biogen, Inc. | | | 14,100 | | | | 3,998 | |

| | Bristol-Myers Squibb Co. | | | 54,270 | | | | 3,172 | |

| * | Cerner Corporation | | | 49,200 | | | | 2,331 | |

| | Danaher Corporation | | | 32,850 | | | | 2,557 | |

| * | IDEXX Laboratories, Inc. | | | 11,521 | | | | 1,351 | |

| | UnitedHealth Group, Inc. | | | 33,860 | | | | 5,419 | |

| | Zoetis, Inc. | | | 83,390 | | | | 4,464 | |

| | | | | | | | | 23,292 | |

| | Consumer Discretionary—17.9% | | | | | | | | |

| * | Amazon.com, Inc. | | | 8,550 | | | | 6,411 | |

| * | Chipotle Mexican Grill, Inc. | | | 5,500 | | | | 2,075 | |

| * | O’Reilly Automotive, Inc. | | | 12,560 | | | | 3,497 | |

| | Starbucks Corporation | | | 81,470 | | | | 4,523 | |

| | The Home Depot, Inc. | | | 40,390 | | | | 5,416 | |

| | | | | | | | | 21,922 | |

| | Industrials—10.9% | | | | | | | | |

| | Fortive Corporation | | | 36,250 | | | | 1,944 | |

| | TransDigm Group, Inc. | | | 11,780 | | | | 2,933 | |

| | Union Pacific Corporation | | | 56,260 | | | | 5,833 | |

| * | Verisk Analytics, Inc. | | | 31,860 | | | | 2,586 | |

| | | | | | | | | 13,296 | |

| | Consumer Staples—9.6% | | | | | | | | |

| | Mead Johnson Nutrition Co. | | | 42,060 | | | | 2,976 | |

| * | Monster Beverage Corporation | | | 50,750 | | | | 2,250 | |

| | The Estee Lauder Cos., Inc. | | | 19,850 | | | | 1,518 | |

| | The Kroger Co. | | | 144,000 | | | | 4,970 | |

| | | | | | | | | 11,714 | |

| | Financials—3.6% | | | | | | | | |

| * | Affiliated Managers Group, Inc. | | | 17,860 | | | | 2,595 | |

| | Intercontinental Exchange, Inc. | | | 31,120 | | | | 1,756 | |

| | | | | | | | | 4,351 | |

| | Telecommunication Services—2.1% | | | | | | | | |

| * | SBA Communications Corporation | | | 24,530 | | | | 2,533 | |

| | Materials—1.8% | | | | | | | | |

| | PPG Industries, Inc. | | | 23,380 | | | | 2,215 | |

| | Issuer | | Shares or

Principal

Amount | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | | | | | | | | | |

| | Energy—1.5% | | | | | | | | |

| | Schlumberger, Ltd.† | | | 22,560 | | | $ | 1,894 | |

| | Total Common Stocks—98.9%

(cost $106,780) | | | | | | | 120,980 | |

| | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.030% dated 12/30/16, due 1/3/17, repurchase price $1,176, collateralized by U.S. Treasury Bond, 3.375%, due 5/15/44 | | $ | 1,176 | | | | 1,176 | |

| | Total Repurchase Agreement—1.0%

(cost $1,176) | | | | | | | 1,176 | |

| | Total Investments—99.9%

(cost $107,956) | | | | | | | 122,156 | |

| | Cash and other assets, less liabilities—0.1% | | | | | | | 179 | |

| | Net assets—100.0% | | | | | | $ | 122,335 | |

† = U.S. listed foreign security

* = Non-income producing securities

See accompanying Notes to Financial Statements.

| December 31, 2016 | William Blair Funds | 13 |

| | Mid Cap Growth Fund |

| | |

| | The Mid Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Daniel Crowe

Robert C. Lanphier, IV

David P. Ricci

| The William Blair Mid Cap Growth Fund (Class N shares) posted a 0.23% increase, net of fees, for the twelve months ended December 31, 2016. By comparison, the Fund’s benchmark index, the Russell Midcap® Growth Index (the “Index”), increased 7.33%. Underperformance for 2016 versus the Index was due to a combination of style and stock-specific factors. From a style perspective, there were headwinds early in the year when investor preference for high dividend-yielding stocks dominated the market. While the preference for dividend yield was most pronounced at the beginning of the year, relative performance of high dividend-yielding stocks did not subside for the remainder of 2016 and high dividend-yielding stocks materially outperformed low dividend-yielding stocks in 2016. More economically-sensitive areas of the market also outperformed for the year, particularly in the third quarter and following the U.S. presidential election. The Fund tends to be significantly underweight high dividend yielding and more economically-sensitive companies, preferring sustainable growth companies with substantial reinvestment opportunities that enable superior, durable long-term growth. From a stock-specific perspective, the largest detractor from the Fund’s relative performance was apparel company Hanesbrands. The stock underperformed the Index for the year as issues related to inventory restocking and soft organic growth were exacerbated by concerns late in the year regarding risks related to international manufacturing. Drugmaker Perrigo was also a top detractor for the year. CEO turnover and weakness in its European consumer healthcare business were the primary causes for the stock lagging in 2016. Other top detractors from relative performance were Cerner (Health Care), Mead Johnson Nutrition (Consumer Staples) and Red Hat (Information Technology). Top contributors to relative performance for the year were trucking company Old Dominion Freight Line and aggregates producer Vulcan Materials. Old Dominion Freight Line outperformed the Index mainly due to better-than-expected earnings in the latter half of the year. Also, the stock outperformed the index as investors gravitated towards more economically-sensitive stocks. Vulcan Materials outperformed the Index after reporting strong volumes and pricing mid-year and amid investor optimism late in 2016 that infrastructure spending in the U.S will likely rise in the short to intermediate term. Other top contributors to the Fund’s relative performance were Akamai Technologies (Information Technology), Vantiv (Information Technology) and Align Technology (Health Care). Please refer to the U.S. Growth Market Review and Outlook relating to the Fund on page 6. |

| 14 | Annual Report | December 31, 2016 |

Mid Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Return at 12/31/2016 |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Class N | | | 0.23 | % | | | 2.46 | % | | | 8.97 | % | | | 7.02 | % |

| Class I | | | 0.48 | | | | 2.72 | | | | 9.25 | | | | 7.30 | |

| Russell Midcap® Growth Index | | | 7.33 | | | | 6.23 | | | | 13.51 | | | | 7.83 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in medium capitalization companies involves special risks, including higher volatility and lower liquidity. Medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair Investment Management, LLC and William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell Midcap® Growth Index is an index that is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market.

This report identifies the Fund’s investments on December 31, 2016. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

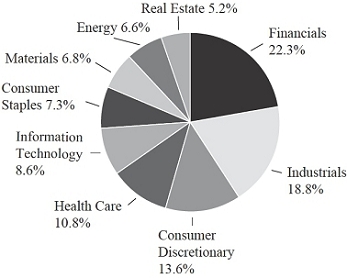

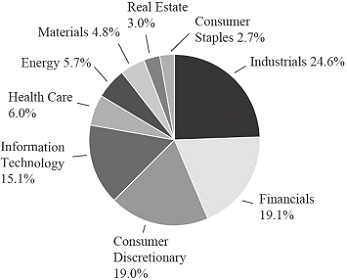

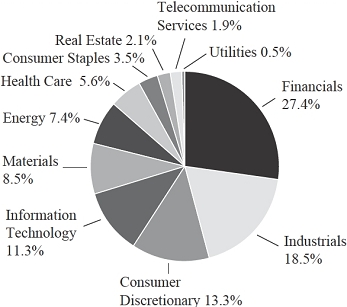

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term secuities.

| December 31, 2016 | William Blair Funds | 15 |

Mid Cap Growth Fund

Portfolio of Investments, December 31, 2016 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | |

| | Common Stocks | | | | | | | | |

| | | | | | | | | | |

| | Information Technology—25.0% | | | | | | | | |

| * | Akamai Technologies, Inc. | | | 53,979 | | | $ | 3,599 | |

| * | Arista Networks, Inc. | | | 10,700 | | | | 1,035 | |

| | Booz Allen Hamilton Holding Corporation | | | 69,300 | | | | 2,500 | |

| * | Check Point Software Technologies, Ltd.† | | | 29,900 | | | | 2,525 | |

| * | CoStar Group, Inc. | | | 21,092 | | | | 3,976 | |

| | CSRA, Inc. | | | 109,400 | | | | 3,483 | |

| * | Genpact, Ltd.† | | | 99,952 | | | | 2,433 | |

| * | Guidewire Software, Inc. | | | 43,020 | | | | 2,122 | |

| * | IPG Photonics Corporation | | | 12,200 | | | | 1,204 | |

| | MAXIMUS, Inc. | | | 42,211 | | | | 2,355 | |

| * | Red Hat, Inc. | | | 64,430 | | | | 4,491 | |

| * | Vantiv, Inc. | | | 70,824 | | | | 4,223 | |

| | | | | | | | | 33,946 | |

| | Consumer Discretionary—20.1% | | | | | | | | |

| | BorgWarner, Inc. | | | 43,743 | | | | 1,725 | |

| | Dollar General Corporation | | | 29,865 | | | | 2,212 | |

| | Hanesbrands, Inc. | | | 137,500 | | | | 2,966 | |

| | Newell Brands, Inc. | | | 83,200 | | | | 3,715 | |

| * | O’Reilly Automotive, Inc. | | | 12,684 | | | | 3,531 | |

| * | Panera Bread Co. | | | 6,382 | | | | 1,309 | |

| | Ross Stores, Inc. | | | 59,500 | | | | 3,903 | |

| | Six Flags Entertainment Corporation | | | 55,380 | | | | 3,321 | |

| | Tractor Supply Co. | | | 48,900 | | | | 3,707 | |

| | Vail Resorts, Inc. | | | 5,411 | | | | 873 | |

| | | | | | | | | 27,262 | |

| | Health Care—17.1% | | | | | | | | |

| * | ABIOMED, Inc. | | | 9,700 | | | | 1,093 | |

| * | Align Technology, Inc. | | | 14,680 | | | | 1,411 | |

| * | BioMarin Pharmaceutical, Inc. | | | 25,531 | | | | 2,115 | |

| * | Centene Corporation | | | 50,700 | | | | 2,865 | |

| * | Cerner Corporation | | | 35,300 | | | | 1,672 | |

| | DENTSPLY SIRONA, Inc. | | | 25,559 | | | | 1,475 | |

| | HealthSouth Corporation | | | 34,000 | | | | 1,402 | |

| * | Mednax, Inc. | | | 51,760 | | | | 3,450 | |

| * | Mettler-Toledo International, Inc. | | | 4,775 | | | | 1,999 | |

| | Perrigo Co. plc† | | | 14,500 | | | | 1,207 | |

| * | Veeva Systems, Inc. | | | 32,500 | | | | 1,323 | |

| | Zoetis, Inc. | | | 58,300 | | | | 3,121 | |

| | | | | | | | | 23,133 | |

| | Industrials—14.7% | | | | | | | | |

| * | Copart, Inc. | | | 62,700 | | | | 3,474 | |

| | Equifax, Inc. | | | 10,400 | | | | 1,230 | |

| * | Old Dominion Freight Line, Inc. | | | 34,686 | | | | 2,976 | |

| | The Dun & Bradstreet Corporation | | | 13,800 | | | | 1,674 | |

| * | The Middleby Corporation | | | 17,470 | | | | 2,250 | |

| | TransDigm Group, Inc. | | | 9,175 | | | | 2,284 | |

| * | Verisk Analytics, Inc. | | | 46,280 | | | | 3,757 | |

| | Wabtec Corporation | | | 27,500 | | | | 2,283 | |

| | | | | | | | | 19,928 | |

| | Issuer | | Shares or

Principal

Amount | | | Value | |

| | |

| | Common Stocks—(continued) | | | | | | | | |

| | | | | | | | | | |

| | Financials—8.6% | | | | | | | | |

| * | Affiliated Managers Group, Inc. | | | 8,955 | | | $ | 1,301 | |

| | East West Bancorp, Inc. | | | 26,900 | | | | 1,367 | |

| | Intercontinental Exchange, Inc. | | | 26,875 | | | | 1,516 | |

| | Nasdaq, Inc. | | | 25,500 | | | | 1,712 | |

| * | Signature Bank | | | 26,456 | | | | 3,974 | |

| | Willis Towers Watson plc† | | | 14,190 | | | | 1,735 | |

| | | | | | | | | 11,605 | |

| | Materials—5.7% | | | | | | | | |

| * | Axalta Coating Systems, Ltd.† | | | 59,500 | | | | 1,619 | |

| | Ball Corporation | | | 47,200 | | | | 3,543 | |

| | Vulcan Materials Co. | | | 20,800 | | | | 2,603 | |

| | | | | | | | | 7,765 | |

| | Consumer Staples—4.9% | | | | | | | | |

| * | Herbalife, Ltd.† | | | 17,700 | | | | 852 | |

| | Mead Johnson Nutrition Co. | | | 38,200 | | | | 2,703 | |

| | Tyson Foods, Inc. | | | 49,900 | | | | 3,078 | |

| | | | | | | | | 6,633 | |

| | Telecommunication Services—1.8% | | | | | | | | |

| * | SBA Communications Corporation | | | 23,850 | | | | 2,463 | |

| | Energy—0.9% | | | | | | | | |

| * | Concho Resources, Inc. | | | 9,520 | | | | 1,262 | |

| | Total Common Stocks—98.8%

(cost $118,887) | | | | | | | 133,997 | |

| | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.030% dated 12/30/16, due 1/3/17, repurchase price $352, collateralized by U.S. Treasury Bond, 3.375%, due 5/15/44 | | $ | 352 | | | | 352 | |

| | Total Repurchase Agreement—0.2%

(cost $352) | | | | | | | 352 | |

| | Total Investments—99.0%

(cost $119,239) | | | | | | | 134,349 | |

| | Cash and other assets, less liabilities—1.0% | | | | | | | 1,309 | |

| | Net assets—100.0% | | | | | | $ | 135,658 | |

* = Non-income producing securities

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| 16 | Annual Report | December 31, 2016 |

| | Mid Cap Value Fund |

| | |

| | The Mid Cap Value Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Chad M. Kilmer

Mark T. Leslie

David S. Mitchell

| The William Blair Mid Cap Value Fund (Class N shares) posted a 14.49% increase, net of fees, for the twelve months ended December 31, 2016. By comparison, the Fund’s benchmark index, the Russell Midcap® Value Index (the “Index”), increased 20.00%. The Fund’s underperformance relative to the Index was driven by a combination of style factors and stock selection. The risk-on rally that began in mid-February continued on through the end of the year, led by smaller cap stocks and companies with slower growth. As such, our relative value style, which typically has a higher growth profile than the Index and an underweight to deep value stocks, was a headwind for the Fund. In addition, the worst performing stocks over the twelve months heading into the back half of 2016 rallied and the Fund’s lack of exposure to this segment was a headwind. At the sector level, Consumer Discretionary was the most significant detractor from the Fund’s relative performance due to stock selection within Specialized Consumer Services, Homebuilding, and Housewares & Specialties. Within the Real Estate sector, stock selection in Real Estate Services and Retail REITs contributed to the Fund’s underperformance. In general, REITs underperformed the rest of the market for the year due to the move up in interest rates during the back half of the year. The Industrials sector also detracted from the Fund’s relative performance during the year, mainly driven by the Fund’s lack of exposure to Airline stocks, which benefitted from better economic data and travel estimates given the pickup in business confidence. Broadly speaking, our higher quality bias and lack of exposure to the more cyclically exposed companies contributed to the Fund’s relative underperformance within Industrials as well. Financials was the most significant sector contributor to the Fund’s relative performance for the year due to stock selection within Property & Casualty Insurance. The Fund’s lack of exposure to Biotech and Pharmaceutical stocks contributed to the Fund’s outperformance within the Health Care sector during the period. With our focus on free cash flow and return on invested capital, most companies in these industries fail to meet our criteria. Looking specifically at stock selection, the Fund’s largest detractors from relative performance were Jones Lang LaSalle (Real Estate), Kroger (Consumer Staples), and H&R Block (Consumer Discretionary). Offsetting these detractors were our investments in Steel Dynamics (Materials), Patterson-UTI Energy (Energy), and Belden (Information Technology), which contributed to the Fund’s relative performance. Please refer to the U.S. Value Market Review and Outlook relating to the Fund on page 7. |

| December 31, 2016 | William Blair Funds | 17 |

Mid Cap Value Fund

Performance Highlights (Unaudited)

| Average Annual Total Return at 12/31/2016 |

| | | 1 Year | | 3 Year | | 5 Year | | Since

Inception(a) |

| Class N | | | 14.49 | % | | | 7.49 | % | | | 13.14 | % | | | 10.96 | % |

| Class I | | | 14.75 | | | | 7.78 | | | | 13.43 | | | | 11.24 | |

| Russell Midcap® Value Index | | | 20.00 | | | | 9.45 | | | | 15.70 | | | | 12.48 | |

| (a) | For the period from May 3, 2010 (Commencement of Operations) to December 31, 2016. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in medium capitalization companies involves special risks, including higher volatility and lower liquidity. Medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair Investment Management, LLC and William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell Midcap® Value Index consists of mid-capitalization companies with below average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on December 31, 2016. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

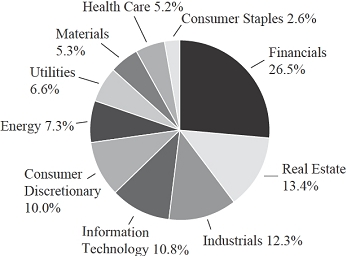

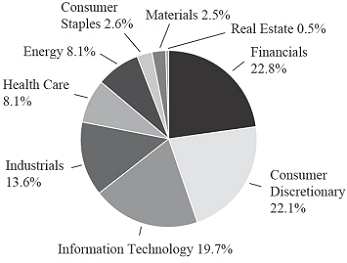

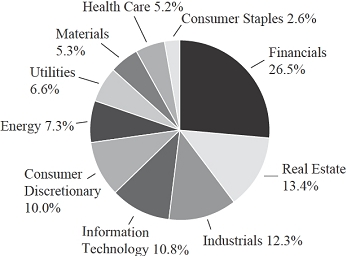

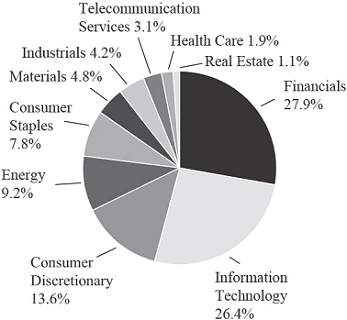

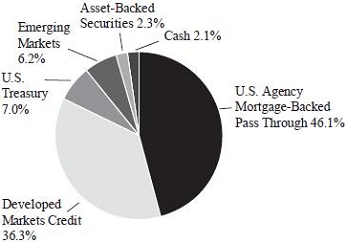

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 18 | Annual Report | December 31, 2016 |

Mid Cap Value Fund

Portfolio of Investments, December 31, 2016 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | |

| | Common Stocks | | | | | | | | |

| | |

| | Financials—20.9% | | | | | | | | |

| | Allied World Assurance Co. Holdings, Ltd.† | | | 813 | | | $ | 44 | |

| | Ameriprise Financial, Inc. | | | 231 | | | | 26 | |

| * | Arch Capital Group, Ltd.† | | | 458 | | | | 39 | |

| | Assured Guaranty, Ltd.† | | | 920 | | | | 35 | |

| * | E*TRADE Financial Corporation | | | 1,149 | | | | 40 | |

| | East West Bancorp, Inc. | | | 1,037 | | | | 53 | |

| | FNF Group | | | 798 | | | | 27 | |

| | Hanover Insurance Group, Inc. | | | 438 | | | | 40 | |

| | Hartford Financial Services Group, Inc. | | | 885 | | | | 42 | |

| | Northern Trust Corporation | | | 609 | | | | 54 | |

| | PacWest Bancorp | | | 853 | | | | 46 | |

| | Principal Financial Group, Inc. | | | 684 | | | | 40 | |

| * | Signature Bank | | | 162 | | | | 24 | |

| | SunTrust Banks, Inc. | | | 695 | | | | 38 | |

| * | SVB Financial Group | | | 231 | | | | 40 | |

| | Zions Bancorporation | | | 988 | | | | 42 | |

| | | | | | | | | 630 | |

| | Real Estate—13.6% | | | | | | | | |

| | American Campus Communities, Inc. | | | 920 | | | | 46 | |

| | Boston Properties, Inc. | | | 208 | | | | 26 | |

| | DDR Corporation | | | 1,942 | | | | 30 | |

| | Douglas Emmett, Inc. | | | 585 | | | | 21 | |

| * | Equity Commonwealth | | | 699 | | | | 21 | |

| | Equity Residential | | | 436 | | | | 28 | |

| | Essex Property Trust, Inc. | | | 184 | | | | 43 | |

| | General Growth Properties, Inc. | | | 1,393 | | | | 35 | |

| | National Retail Properties, Inc. | | | 664 | | | | 29 | |

| | Pebblebrook Hotel Trust | | | 477 | | | | 14 | |

| | Prologis, Inc. | | | 642 | | | | 34 | |

| | SL Green Realty Corporation | | | 202 | | | | 22 | |

| | Taubman Centers, Inc. | | | 371 | | | | 27 | |

| | Ventas, Inc. | | | 514 | | | | 32 | |

| | | | | | | | | 408 | |

| | Industrials—11.8% | | | | | | | | |

| | Carlisle Cos., Inc. | | | 307 | | | | 34 | |

| | Fortune Brands Home & Security, Inc. | | | 550 | | | | 29 | |

| | Hubbell, Inc. | | | 270 | | | | 32 | |

| | Ingersoll-Rand plc† | | | 498 | | | | 37 | |

| | Johnson Controls International plc† | | | 1,122 | | | | 46 | |

| | Kansas City Southern | | | 447 | | | | 38 | |

| | Manpowergroup, Inc. | | | 250 | | | | 22 | |

| | Parker Hannifin Corporation | | | 327 | | | | 46 | |

| * | United Continental Holdings, Inc. | | | 508 | | | | 37 | |

| | Wabtec Corporation | | | 407 | | | | 34 | |

| | | | | | | | | 355 | |

| | Energy—10.5% | | | | | | | | |

| | Baker Hughes, Inc. | | | 720 | | | | 47 | |

| | Cimarex Energy Co. | | | 254 | | | | 34 | |

| * | Gulfport Energy Corporation | | | 1,160 | | | | 25 | |

| | Hess Corporation | | | 644 | | | | 40 | |

| | Noble Energy, Inc. | | | 1,091 | | | | 41 | |

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | |

| | Common Stocks—(continued) | | | | | | | | |

| | | | | | | | | | |

| | Energy—(continued) | | | | | | | | |

| | Patterson-UTI Energy, Inc. | | | 1,174 | | | $ | 32 | |

| | Pioneer Natural Resources Co. | | | 243 | | | | 44 | |

| | Range Resources Corporation | | | 681 | | | | 23 | |

| * | Rice Energy, Inc. | | | 930 | | | | 20 | |

| * | Whiting Petroleum Corporation | | | 813 | | | | 10 | |

| | | | | | | | | 316 | |

| | Utilities—9.9% | | | | | | | | |

| | American Water Works Co., Inc. | | | 545 | | | | 39 | |

| | Atmos Energy Corporation | | | 517 | | | | 38 | |

| | CMS Energy Corporation | | | 939 | | | | 39 | |

| | Eversource Energy | | | 817 | | | | 45 | |

| | Pinnacle West Capital Corporation | | | 523 | | | | 41 | |

| | WEC Energy Group, Inc. | | | 819 | | | | 48 | |

| | Xcel Energy, Inc. | | | 1,167 | | | | 48 | |

| | | | | | | | | 298 | |

| | Information Technology—8.6% | | | | | | | | |

| * | Akamai Technologies, Inc. | | | 565 | | | | 38 | |

| | Belden, Inc. | | | 540 | | | | 40 | |

| * | Cadence Design Systems, Inc. | | | 1,753 | | | | 44 | |

| * | CommScope Holding Co., Inc. | | | 898 | | | | 34 | |

| * | Genpact, Ltd.† | | | 792 | | | | 19 | |

| | Juniper Networks, Inc. | | | 915 | | | | 26 | |

| * | NXP Semiconductors N.V.† | | | 210 | | | | 21 | |

| | TE Connectivity, Ltd.† | | | 536 | | | | 37 | |

| | | | | | | | | 259 | |

| | Consumer Discretionary—8.4% | | | | | | | | |

| | Darden Restaurants, Inc. | | | 517 | | | | 37 | |

| | Dick’s Sporting Goods, Inc. | | | 616 | | | | 33 | |

| | Leggett & Platt, Inc. | | | 737 | | | | 36 | |

| * | MGM Resorts International | | | 1,233 | | | | 35 | |

| | Newell Brands, Inc. | | | 849 | | | | 38 | |

| | Vail Resorts, Inc. | | | 258 | | | | 42 | |

| | VF Corporation | | | 594 | | | | 32 | |

| | | | | | | | | 253 | |

| | Materials—6.6% | | | | | | | | |

| | Carpenter Technology Corporation | | | 1,069 | | | | 39 | |

| | Eastman Chemical Co. | | | 623 | | | | 47 | |

| | FMC Corporation | | | 783 | | | | 44 | |

| | Steel Dynamics, Inc. | | | 1,916 | | | | 68 | |

| | | | | | | | | 198 | |

| | Health Care—5.6% | | | | | | | | |

| | CIGNA Corporation | | | 173 | | | | 23 | |

| * | Hologic, Inc. | | | 875 | | | | 35 | |

| * | Mednax, Inc. | | | 493 | | | | 33 | |

| * | Mettler-Toledo International, Inc. | | | 101 | | | | 43 | |

| | Zimmer Biomet Holdings, Inc. | | | 351 | | | | 36 | |

| | | | | | | | | 170 | |

| | Consumer Staples—4.0% | | | | | | | | |

| | Conagra Brands, Inc. | | | 758 | | | | 30 | |

| | Ingredion, Inc. | | | 336 | | | | 42 | |

| * | Lamb Weston Holdings, Inc. | | | 252 | | | | 10 | |

| | The Kroger Co. | | | 1,103 | | | | 38 | |

| | | | | | | | | 120 | |

See accompanying Notes to Financial Statements.

| December 31, 2016 | William Blair Funds | 19 |

Mid Cap Value Fund

Portfolio of Investments, December 31, 2016 (all dollar amounts in thousands)

| | | | |

| Issuer | | Value | |

| | | | |

Total Common Stocks—99.9%

(cost $2,385) | | $ | 3,007 | |

Total Investments—99.9%

(cost $2,385) | | | 3,007 | |

| Cash and other assets, less liabilities—0.1% | | | 2 | |

| Net assets—100.0% | | $ | 3,009 | |

† = U.S. listed foreign security

* = Non-income producing securities

See accompanying Notes to Financial Statements.

| 20 | Annual Report | December 31, 2016 |

| | Small-Mid Cap Growth Fund |

| | |

| | The Small-Mid Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Karl W. Brewer

Daniel Crowe  Robert C. Lanphier, IV | The William Blair Small-Mid Cap Growth Fund (Class N shares) posted a 6.45% increase, net of fees, for the twelve months ended December 31, 2016. By comparison, the Fund’s benchmark index, the Russell 2500TM Growth Index (the “Index”), increased 9.73%. Underperformance for 2016 versus the Index was mostly due to individual stock dynamics as style factors were largely offsetting. From a style perspective, the Fund’s typical larger market cap profile relative to the Index was a headwind to performance as the smaller end of the Fund’s capitalization range outperformed. Further, more economically-sensitive areas of the market outperformed for the year. This dynamic was a headwind to the Fund’s investment style as the Fund’s emphasis on companies with durable growth drivers typically results in a portfolio with less cyclicality than the Index. The impact of these style headwinds was most pronounced in the third quarter, during which the Fund underperformed by more than it did for the year as a whole. Mostly offsetting the aforementioned headwinds was a benefit from the Fund’s typical underweight to Biotechnology and Pharmaceuticals, which underperformed in 2016 following several years of strong returns. From a stock-specific perspective, Information Technology was an area of weakness for the year, including the Fund’s positions in Guidewire Software and Cvent. Given the stock’s higher valuation multiple and several sources of near-term business uncertainty, Guidewire Software underperformed. Other notable detractors from relative performance included Jones Lang LaSalle (Real Estate), Centene (Health Care) and Tractor Supply Company (Consumer Discretionary). Shares of Jones Lang LaSalle declined as investors began to fear a peak in earnings associated with extended strength in the commercial real estate market. Conversely, stock selection within the Health Care sector contributed positively to the Fund’s relative returns. IDEXX Laboratories and Align Technology were among the top Health Care sector contributors. Shares of IDEXX Laboratories advanced following the company’s successful transition to a direct selling model and an acceleration in organic growth. Other strong performing holdings included Old Dominion Freight Line (Industrials), Nu Skin Enterprises (Consumer Staples) and Diamondback Energy (Energy). Old Dominion Freight Line outperformed the Index due to better-than-expected earnings in the latter half of the year and as investors gravitated towards more economically-sensitive stocks. Please refer to the U.S. Growth Market Review and Outlook relating to the Fund on page 6. |

| December 31, 2016 | William Blair Funds | 21 |

Small-Mid Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Return at 12/31/2016 |

| | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Class N | | | 6.45 | % | | | 6.41 | % | | | 13.85 | % | | | 8.94 | % |

| Class I | | | 6.72 | | | | 6.68 | | | | 14.12 | | | | 9.22 | |

| Russell 2500TM Growth Index | | | 9.73 | | | | 5.45 | | | | 13.88 | | | | 8.24 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Smaller and medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair Investment Management, LLC and William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2500TM Growth Index measures the performance of those Russell 2500 companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on December 31, 2016. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

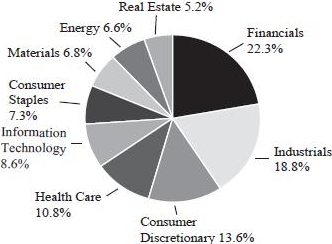

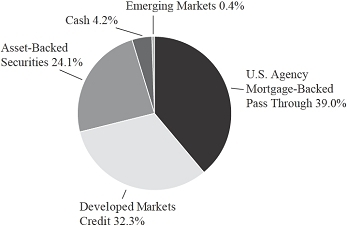

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 22 | Annual Report | December 31, 2016 |

Small-Mid Cap Growth Fund

Portfolio of Investments, December 31, 2016 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | | | | | | | | | |

| | Information Technology—21.2% | | | | | | | | |

| * | 2U, Inc. | | | 494,745 | | | $ | 14,916 | |

| * | Akamai Technologies, Inc. | | | 301,730 | | | | 20,119 | |

| * | Arista Networks, Inc. | | | 143,590 | | | | 13,895 | |

| | Booz Allen Hamilton Holding Corporation | | | 767,248 | | | | 27,675 | |

| * | CoStar Group, Inc. | | | 165,440 | | | | 31,184 | |

| | CSRA, Inc. | | | 680,540 | | | | 21,668 | |

| * | Guidewire Software, Inc. | | | 469,264 | | | | 23,149 | |

| | j2 Global, Inc. | | | 361,315 | | | | 29,556 | |

| | MAXIMUS, Inc. | | | 485,750 | | | | 27,100 | |

| * | Pandora Media, Inc. | | | 632,333 | | | | 8,246 | |

| * | Take-Two Interactive Software, Inc. | | | 321,990 | | | | 15,871 | |

| * | Vantiv, Inc. | | | 387,720 | | | | 23,116 | |

| * | WNS Holdings, Ltd.—ADR | | | 412,280 | | | | 11,358 | |

| | | | | | | | | 267,853 | |

| | Health Care—18.6% | | | | | | | | |

| * | ABIOMED, Inc. | | | 149,118 | | | | 16,803 | |

| * | Akorn, Inc. | | | 812,296 | | | | 17,733 | |

| * | Align Technology, Inc. | | | 137,883 | | | | 13,255 | |

| * | Amedisys, Inc. | | | 293,344 | | | | 12,505 | |

| * | Cambrex Corporation | | | 401,270 | | | | 21,649 | |

| * | Centene Corporation | | | 361,340 | | | | 20,419 | |

| * | Exact Sciences Corporation | | | 1,154,070 | | | | 15,418 | |

| * | Glaukos Corporation | | | 381,550 | | | | 13,087 | |

| | HealthSouth Corporation | | | 378,664 | | | | 15,616 | |

| * | IDEXX Laboratories, Inc. | | | 104,502 | | | | 12,255 | |

| * | Ligand Pharmaceuticals, Inc. | | | 236,229 | | | | 24,003 | |

| * | Mettler-Toledo International, Inc. | | | 62,930 | | | | 26,340 | |

| * | Repligen Corporation | | | 101,935 | | | | 3,142 | |

| * | Veeva Systems, Inc. | | | 540,600 | | | | 22,002 | |

| | | | | | | | | 234,227 | |

| | Industrials—17.0% | | | | | | | | |

| | BWX Technologies, Inc. | | | 566,930 | | | | 22,507 | |

| * | Copart, Inc. | | | 430,360 | | | | 23,846 | |

| | HEICO Corporation | | | 226,630 | | | | 15,388 | |

| | Hexcel Corporation | | | 357,650 | | | | 18,398 | |

| * | Old Dominion Freight Line, Inc. | | | 422,101 | | | | 36,212 | |

| * | SiteOne Landscape Supply, Inc. | | | 279,190 | | | | 9,696 | |

| | The Dun & Bradstreet Corporation | | | 112,670 | | | | 13,669 | |

| * | The Middleby Corporation | | | 167,662 | | | | 21,597 | |

| | The Toro Co. | | | 292,556 | | | | 16,369 | |

| | TransDigm Group, Inc. | | | 86,015 | | | | 21,414 | |

| | Wabtec Corporation | | | 188,140 | | | | 15,619 | |

| | | | | | | | | 214,715 | |

| | Financials—12.2% | | | | | | | | |

| * | Affiliated Managers Group, Inc. | | | 155,431 | | | | 22,584 | |

| | Bank of the Ozarks, Inc. | | | 470,750 | | | | 24,757 | |

| | CBOE Holdings, Inc. | | | 174,110 | | | | 12,865 | |

| * | Encore Capital Group, Inc. | | | 399,491 | | | | 11,445 | |

| | FactSet Research Systems, Inc. | | | 94,854 | | | | 15,502 | |

| | FirstCash, Inc. | | | 304,323 | | | | 14,303 | |

| | Iberiabank Corporation | | | 108,890 | | | | 9,120 | |

| | OM Asset Management plc† | | | 641,858 | | | | 9,307 | |

| * | Signature Bank | | | 178,370 | | | | 26,791 | |

| | Virtu Financial, Inc. | | | 420,212 | | | | 6,702 | |

| | | | | | | | | 153,376 | |

| | Issuer | | Shares/

Principal

Amount | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | | | | | | | | | |

| | Consumer Discretionary—11.8% | | | | | | | | |

| | Cable One, Inc. | | | 12,230 | | | $ | 7,604 | |

| | DeVry Education Group, Inc. | | | 503,570 | | | | 15,711 | |