UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5344

William Blair Funds

(Exact name of registrant as specified in charter)

| 150 North Riverside Plaza, Chicago, IL | | 60606 |

| (Address of principal executive offices) | | (Zip Code) |

Stephanie G. Braming, Principal Executive Officer

William Blair Funds

150 North Riverside Plaza, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-1600

Date of fiscal year end: December 31

Date of reporting period: December 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A Registrant is not required to respond to the collection of information contained in Form N-CSR unless the form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimates and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (ss) 3507.

Item 1. December 31, 2017 Annual Reports transmitted to shareholders

| |

| | |

| | |

| | |

| | |

| | December 31, 2017 |

William Blair Funds Annual Report | |

| December 31, 2017 | William Blair Funds | 1 |

The views expressed in the commentary for each Fund reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The portfolio management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Statements involving predictions, assessments, analyses, or outlook for individual securities, industries, market sectors, and/or markets involve risks and uncertainties, and there is no guarantee they will come to pass.

This report is submitted for the general information of the shareholders of William Blair Funds. It is not authorized for distribution to prospective Fund investors unless accompanied or preceded by the Fund’s prospectus. Please carefully consider a Fund’s investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Fund’s prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

| 2 | Annual Report | December 31, 2017 |

Performance through December 31, 2017—Class N Shares (Unaudited)

| | | | | | | | | | | | 10 yr | | | | Overall |

| | | | | | | | | | | | (or since | | Inception | | Morningstar |

| | 1 yr | | 3 yr | | 5 yr | | inception) | | Date | | Rating |

| | | | | | | | | | | | | | | | | |

| Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 24.35 | | | 9.05 | | | 13.28 | | | 7.66 | | | 3/20/1946 | | *** |

| Morningstar Large Growth | | 27.67 | | | 11.06 | | | 15.29 | | | 8.31 | | | | | Among 1,216 |

| Russell 3000® Growth Index | | 29.59 | | | 13.51 | | | 17.16 | | | 9.93 | | | | | Large Growth Funds |

| S&P 500® Index | | 21.83 | | | 11.41 | | | 15.79 | | | 8.50 | | | | | |

| | | | | | | | | | | | | | | | | |

| Large Cap Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 30.88 | | | 12.63 | | | 16.78 | | | 8.92 | | | 12/27/1999 | | **** |

| Morningstar Large Growth | | 27.67 | | | 11.06 | | | 15.29 | | | 8.31 | | | | | Among 1,216 |

| Russell 1000�� Growth Index | | 30.21 | | | 13.79 | | | 17.33 | | | 10.00 | | | | | Large Growth Funds |

| | | | | | | | | | | | | | | | | |

| Mid Cap Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 20.88 | | | 6.54 | | | 10.86 | | | 7.59 | | | 2/1/2006 | | *** |

| Morningstar Mid-Cap Growth | | 23.91 | | | 9.40 | | | 13.73 | | | 7.67 | | | | | Among 562 |

| Russell Midcap® Growth Index | | 25.27 | | | 10.30 | | | 15.30 | | | 9.10 | | | | | Mid-Cap Growth Funds |

| | | | | | | | | | | | | | | | | |

| Small-Mid Cap Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 28.57 | | | 12.66 | | | 16.99 | | | 10.42 | | | 12/29/2003 | | ***** |

| Morningstar Mid-Cap Growth | | 23.91 | | | 9.40 | | | 13.73 | | | 7.67 | | | | | Among 562 |

| Russell 2500TM Growth Index | | 24.46 | | | 10.88 | | | 15.47 | | | 9.62 | | | | | Mid-Cap Growth Funds |

| | | | | | | | | | | | | | | | | |

| Small-Mid Cap Value Fund | | | | | | | | | | | | | | | | |

| Class N | | 9.59 | | | 8.61 | | | 12.82 | | | 13.39 | | | 12/15/2011 | | *** |

| Morningstar Small Blend | | 12.28 | | | 8.71 | | | 12.99 | | | — | | | | | Among 652 |

| Russell 2500TM Value Index | | 10.36 | | | 9.30 | | | 13.27 | | | 14.90 | | | | | Small Blend Funds |

| | | | | | | | | | | | | | | | | |

| Small Cap Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 26.70 | | | 12.91 | | | 17.67 | | | 9.24 | | | 12/27/1999 | | **** |

| Morningstar Small Growth | | 21.50 | | | 9.97 | | | 13.96 | | | 8.42 | | | | | Among 609 |

| Russell 2000® Growth Index | | 22.17 | | | 10.28 | | | 15.21 | | | 9.19 | | | | | Small Growth Funds |

| | | | | | | | | | | | | | | | | |

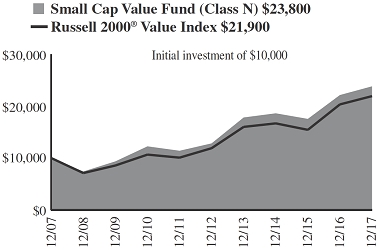

| Small Cap Value Fund | | | | | | | | | | | | | | | | |

| Class N | | 7.57 | | | 8.55 | | | 13.17 | | | 9.07 | | | 12/23/1996 | | **** |

| Morningstar Small Blend | | 12.28 | | | 8.71 | | | 12.99 | | | 8.13 | | | | | Among 652 |

| Russell 2000® Value Index | | 7.84 | | | 9.55 | | | 13.01 | | | 8.17 | | | | | Small Blend Funds |

| | | | | | | | | | | | | | | | | |

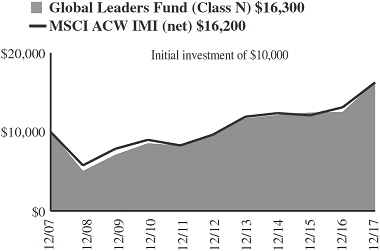

| Global Leaders Fund | | | | | | | | | | | | | | | | |

| Class N | | 30.31 | | | 10.35 | | | 11.00 | | | 5.01 | | | 10/15/2007 | | *** |

| Morningstar World Stock | | 23.61 | | | 8.89 | | | 10.76 | | | 4.80 | | | | | Among 720 |

| MSCI ACW IMI (net) | | 23.95 | | | 9.52 | | | 11.00 | | | 4.97 | | | | | World Large Stock Funds |

| | | | | | | | | | | | | | | | | |

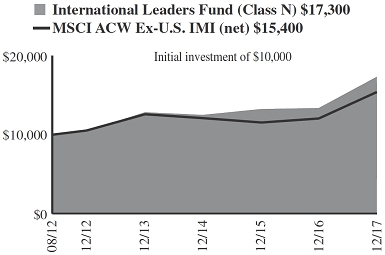

| International Leaders Fund | | | | | | | | | | | | | | | | |

| Class N | | 29.65 | | | 11.51 | | | 9.89 | | | 10.77 | | | 8/16/2012 | | **** |

| Morningstar Foreign Large Growth | | 30.87 | | | 9.04 | | | 8.51 | | | — | | | | | Among 330 |

| MSCI ACW Ex-U.S. IMI (net) | | 27.81 | | | 8.38 | | | 7.22 | | | 8.37 | | | | | Foreign Large Growth Funds |

| December 31, 2017 | William Blair Funds | 3 |

Performance through December 31, 2017—Class N Shares (Unaudited)—continued

| | | | | | | | | | | | 10 yr | | | | Overall |

| | | | | | | | | | | | (or since | | Inception | | Morningstar |

| | | 1 yr | | | 3 yr | | 5 yr | | inception) | | Date | | Rating |

| | | | | | | | | | | | | | | | | |

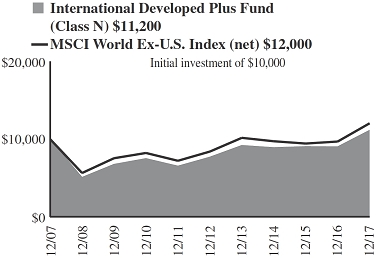

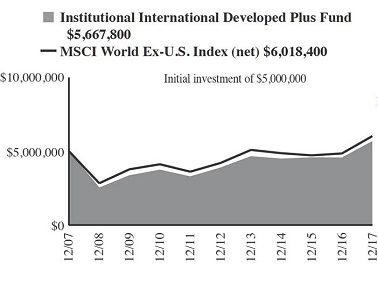

| International Developed Plus Fund | | | | | | | | | | | | | | | | |

| Class N | | 23.43 | | | 7.72 | | | 7.67 | | | 1.12 | | | 5/24/2004 | | ** |

| Morningstar Foreign Large Growth | | 30.87 | | | 9.04 | | | 8.51 | | | 2.75 | | | | | Among 330 |

| MSCI World Ex-U.S. Index (net) | | 24.21 | | | 7.36 | | | 7.46 | | | 1.87 | | | | | Foreign Large Growth Funds |

| | | | | | | | | | | | | | | | | |

| International Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 29.11 | | | 7.74 | | | 7.50 | | | 2.14 | | | 10/1/1992 | | ** |

| Morningstar Foreign Large Growth | | 30.87 | | | 9.04 | | | 8.51 | | | 2.75 | | | | | Among 330 |

| MSCI ACW Ex-U.S. IMI (net) | | 27.81 | | | 8.38 | | | 7.22 | | | 2.20 | | | | | Foreign Large Growth Funds |

| | | | | | | | | | | | | | | | | |

| International Small Cap Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 32.17 | | | 11.41 | | | 9.76 | | | 4.87 | | | 11/1/2005 | | *** |

| Morningstar Foreign Small/Mid Growth | | 36.19 | | | 12.55 | | | 11.33 | | | 5.27 | | | | | Among 112 |

| MSCI ACW Ex-U.S. Small Cap Index (net) | | 31.65 | | | 11.96 | | | 10.03 | | | 4.69 | | | | | Foreign Small/Mid Growth Funds |

| | | | | | | | | | | | | | | | | |

| Emerging Markets Leaders Fund | | | | | | | | | | | | | | | | |

| Class N | | 41.68 | | | 7.08 | | | 4.48 | | | 4.75 | | | 5/3/2010 | | *** |

| Morningstar Diversified Emerging Markets | | 34.17 | | | 7.95 | | | 4.09 | | | — | | | | | Among 647 |

| MSCI Emerging Markets Index (net) | | 37.28 | | | 9.10 | | | 4.35 | | | 4.33 | | | | | Diversified Emerging Markets Funds |

| | | | | | | | | | | | | | | | | |

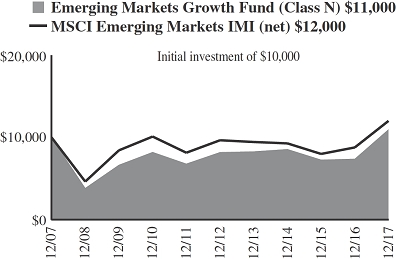

| Emerging Markets Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 48.53 | | | 8.60 | | | 6.00 | | | 0.94 | | | 6/6/2005 | | *** |

| Morningstar Diversified Emerging Markets | | 34.17 | | | 7.95 | | | 4.09 | | | 1.63 | | | | | Among 647 |

| MSCI Emerging Markets IMI (net) | | 36.83 | | | 9.01 | | | 4.47 | | | 1.85 | | | | | Diversified Emerging Markets Funds |

| | | | | | | | | | | | | | | | | |

| Emerging Markets Small Cap Growth Fund | | | | | | | | | | | | | | | | |

| Class N | | 40.09 | | | 7.47 | | | 10.58 | | | 13.25 | | | 10/24/2011 | | **** |

| Morningstar Diversified Emerging Markets | | 34.17 | | | 7.95 | | | 4.09 | | | — | | | | | Among 647 |

| MSCI Emerging Markets Small Cap Index (net) | | 33.84 | | | 8.44 | | | 5.41 | | | 6.65 | | | | | Diversified Emerging Markets Funds |

| | | | | | | | | | | | | | | | | |

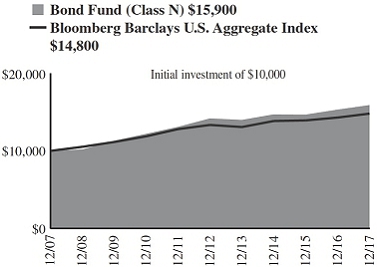

| Bond Fund | | | | | | | | | | | | | | | | |

| Class N | | 3.83 | | | 2.64 | | | 2.31 | | | 4.74 | | | 5/1/2007 | | **** |

| Morningstar Intermediate-Term Bond | | 3.71 | | | 2.22 | | | 2.05 | | | 4.06 | | | | | Among 847 |

| Bloomberg Barclays U.S. Aggregate Index | | 3.54 | | | 2.24 | | | 2.10 | | | 4.01 | | | | | Intermediate-Term Bond Funds |

| | | | | | | | | | | | | | | | | |

| Income Fund | | | | | | | | | | | | | | | | |

| Class N | | 1.46 | | | 1.42 | | | 1.14 | | | 2.98 | | | 10/1/1990 | | **** |

| Morningstar Short-Term Bond | | 1.73 | | | 1.47 | | | 1.15 | | | 2.31 | | | | | Among 462 |

| Bloomberg Barclays Intermediate Government/Credit Bond Index | | 2.14 | | | 1.76 | | | 1.50 | | | 3.32 | | | | | Short-Term Bond Funds |

| 4 | Annual Report | December 31, 2017 |

Performance through December 31, 2017—Class N Shares (Unaudited)—continued

| | | | | | | | | | | | 10 yr | | | | Overall |

| | | | | | | | | | | | (or since | | Inception | | Morningstar |

| | | 1 yr | | 3 yr | | 5 yr | | inception) | | Date | | Rating |

| | | | | | | | | | | | | | | | | |

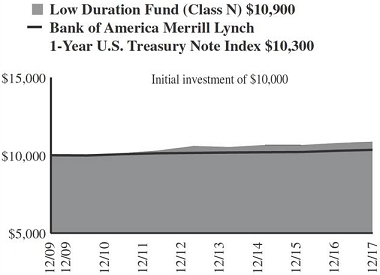

| Low Duration Fund | | | | | | | | | | | | | | | | |

| Class N | | 0.84 | | | 0.67 | | | 0.52 | | | 1.03 | | | 12/1/2009 | | ** |

| Morningstar Ultrashort Bond | | 1.44 | | | 1.02 | | | 0.80 | | | — | | | | | Among 141 |

| Bank of America Merrill Lynch 1-Year U.S. Treasury Note Index | | 0.57 | | | 0.49 | | | 0.38 | | | 0.42 | | | | | Ultrashort Bond Funds |

| | | | | | | | | | | | | | | | | |

| Macro Allocation Fund | | | | | | | | | | | | | | | | |

| Class N | | 5.06 | | | 0.16 | | | 3.13 | | | 5.26 | | | 11/29/2011 | | *** |

| Morningstar Multialternative | | 5.14 | | | 1.79 | | | 2.65 | | | — | | | | | Among 286 |

| Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index | | 0.86 | | | 0.41 | | | 0.27 | | | 0.24 | | | | | Multialternative Funds |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or a loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers, performance would be lower. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. International and emerging markets investing involves special risk considerations, including currency fluctuations, lower liquidity, economic and political risk. As interest rates rise, bond prices will typically fall and bond funds may become more volatile. Class N shares are available to the general public without a sales load.

Morningstar RatingsTM are as of 12/31/2017 and are subject to change every month. The ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each Category receive 5 stars, the next 22.5% receive 4 stars, the middle 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. The 3/5/10 year Morningstar ratings were as follows: Growth Fund **/**/*** and Large Cap Growth Fund ****/****/***, out of 1,216/1,109/787 large growth funds; Mid Cap Growth Fund **/**/*** and Small-Mid Cap Growth Fund *****/*****/***** out of 562/490/362 mid-cap growth funds; Small Cap Growth Fund ****/*****/***, out of 609/544/406 small growth funds; Small- Mid Cap Value Fund ***/***/NA and Small Cap Value Fund ***/***/**** out of 652/558/400 small blend funds; Global Leaders Fund ***/***/*** out of 720/589/333 world large stock funds; International Developed Plus Fund **/***/**, International Growth Fund **/**/**, and International Leaders Fund ****/****/NA out of 330/289/206 foreign large growth funds; International Small Cap Growth Fund ***/**/*** out of 112/106/62 foreign small/mid growth funds; Emerging Markets Leaders Fund **/***/NA, Emerging Markets Growth Fund ***/****/**, and Emerging Markets Small Cap Growth Fund ***/******/NA out of 647/467/186 diversified emerging markets funds; Bond Fund ****/***/**** out of 847/778/554 intermediate-term bond funds; Income Fund ***/***/**** out of 462/399/257 short-term bond funds; Low Duration Fund **/**/NA out of 141/110/NA ultrashort bond funds; and Macro Allocation Fund **/***/NA out of 286/163/NA multialternative funds.

Please carefully consider a Fund’s investment objectives, risks, charges, and expenses before investing. This and other information is contained in the Fund’s prospectus, which you may obtain by calling 1-800-742-7272. Read it carefully before you invest or send money.

| December 31, 2017 | William Blair Funds | 5 |

U.S. Growth Market Review and Outlook

Growth style indices posted exceptionally strong returns for 2017. Improving economic data and solid corporate earnings growth supported a steady market advance throughout the year. Housing data indicated rising activity levels and prices, Purchasing Manager Index (“PMI”) levels suggested strength in the manufacturing sector, and unemployment neared historic lows. With rising stock and housing prices bolstering consumer net worth, confidence rose accordingly. Corporations were broadly upbeat as, in aggregate, they reported healthy earnings growth and issued forward-looking guidance that topped expectations. Furthermore, in the fourth quarter corporations indicated plans to increase capital expenditures. Not surprisingly given tight labor markets, the U.S. Federal Reserve (“Fed”) voted to raise the federal funds rate three times in 2017 and reiterated expectations for as many increases in 2018. With below-average volatility and stable inflationary expectations, equity market valuation multiples expanded, adding to 2017 returns.

The U.S. tax reform bill was signed into law in late December, notably cutting the corporate statutory tax rate to 21% from 35%. In addition, the bill allows for faster depreciation of capital investments than was previously allowed, further increasing the likelihood that higher capital spending will come to fruition. While the bill is positive for U.S. corporations, the same was not true in terms of the short-term impact on the Funds’ relative performance as stocks with higher tax rates outperformed somewhat indiscriminately on the news. Over time, we believe the market will differentiate between companies that can retain the benefit of the tax reduction and those that will lose the benefit to competitive forces. Given our bias toward companies with strong competitive positions, unique products and services, and pricing power, we feel well positioned longer-term in this regard.

As we look forward, several factors could provide continued support for equities, although contrary to the somewhat euphoric market sentiment of late, they are not without risk. While the Fed has embarked upon a path of monetary policy renormalization and U.S. short-term interest rates have begun to rise, global interest rates remain low by historic standards. Moreover, other measures of stress in the financial markets, such as high yield bond spreads, remain near cycle lows. Globally, solid economic growth rates, high corporate earnings and strengthening PMIs are other indicators of a broadly supportive environment for equities. Specifically within the U.S., corporations stand to benefit from the reduction of the corporate tax rate and the administration’s emphasis on deregulation. However, it remains to be seen how long those measures can sustain the current expansion, or if they will have a more meaningful impact on economic growth in the next expansion. As Republican control of the U.S. House and Senate potentially weakens in 2018, politicians’ attention could shift to midterm elections rather than on any legislative agenda. Lack of further progress on pro-growth initiatives and a flattening yield curve within the U.S. could dampen optimism about the sustainability of economic growth, while a potential geopolitical conflict in the Korean Peninsula remains a significant risk globally. For the time being, however, we appear to be in the midst of a classic “Goldilocks” economy, at least as it relates to the financial markets.

As we approach the ninth anniversary of the current bull market and following a particularly strong year for equities, absolute valuations are elevated relative to historical standards; however, they do not appear egregious against the backdrop of low interest rates, low inflation and narrow high yield bond spreads. While corporate profit margins remain high, one notable risk to margins going forward is pressure from rising wages. This will be of pressing concern for companies with more labor-intensive businesses and companies in more competitive industries with low barriers to entry that are unable to pass higher costs through to their customers. We continue to focus our attention on identifying durable businesses with significant competitive advantages and robust growth prospects that present compelling risk/reward opportunities. We believe portfolios with these underlying characteristics are well positioned to deliver outperformance for our clients over the long term.

| 6 | Annual Report | December 31, 2017 |

U.S. Value Market Review and Outlook

Improving economic data and solid corporate earnings growth supported a steady market advance throughout the year, assisted by momentum from President Trump’s pro-growth initiatives. In the fourth quarter, the domestic equity market continued to gravitate higher, driven by strong corporate earnings growth and solid domestic economic data. The magnitude and breadth of the strong earnings announcements suggest that the results more than offset the impact from the hurricane disruptions in the third quarter, as evidenced by the above-consensus 3% GDP reported during the quarter. In addition to strong corporate earnings and solid economic data, continued momentum on tax reform helped support market returns as the final proposal seemed to be relatively in-line with expectations. In December, the Federal Reserve (Fed) seemed to demonstrate confidence in the sustainability of an improving domestic economy as it continued with its rate normalization process and raised the Federal Funds rate at what was outgoing Fed Chair Janet Yellen’s last meeting. While new Fed Chair Jay Powell was widely expected to replace Yellen, his formal selection was a relative non-event for the market. Although there were a number of headline concerns related to geopolitical instability and political posturing on tax reform issues, these concerns were more than offset by the strong corporate earnings results, solid domestic economic data, and the ultimate agreement on tax reform during the quarter.

As the nine-year anniversary of the current bull market approaches, many question how much longer this economic cycle can last. While solid domestic economic data and strong corporate earnings growth fueled the positive equity returns in 2017, tax reform, more specifically a lower corporate tax rate, and increased fiscal spending may be the catalysts that help extend this economic cycle. Tax reform is poised to provide a one-time benefit to earnings per share growth, particularly for smaller cap stocks, that will result in lower multiples and take some of the valuation risk out of the market.

The low and invariable interest rate environment experienced the last few years may have allowed a number of marginal companies, particularly those with higher debt levels, to survive and compete for market share longer than they would have otherwise and helped keep inflation low. A more normalized interest rate environment may benefit higher quality companies as these marginal companies, who struggle to generate the cash flow necessary to service their debt, get squeezed out.

The U.S. economy continues to be subject to a number of risks, including a monetary policy mistake by the Fed, a major geopolitical conflict, or a deceleration of global growth which could alter the trajectory of the positive economic momentum in the U.S. While we are mindful of these variables, we are persistently seeking to identify attractive risk reward opportunities based on individual company fundamentals. From our bottom up perspective, we remain constructive on corporate earnings. Although many companies may face increasing margin pressure from higher wages, some of this will be offset by a lower corporate tax rate. As always, our focus remains on identifying quality companies at discount prices and corporate transformation opportunities, and we continue to find good ideas across sectors. Given our investment approach, we believe our portfolios are well-suited to withstand a variety of market scenarios and add value over the long-term.

| December 31, 2017 | William Blair Funds | 7 |

| | Growth Fund |

| | |

| | The Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

David C. Fording

John F. Jostrand | The William Blair Growth Fund (Class N shares) posted a 24.35% increase, net of fees, for the twelve months ended December 31, 2017. By comparison, the Fund’s benchmark index, the Russell 3000® Growth Index (the “Index”), increased 29.59%. The Fund was unable to keep pace with the robust return of the Index in 2017. Style dynamics for the year were mixed, as our emphasis on companies with more durable business models and lower volatility than their peers was a headwind in the robust market environment. Mostly offsetting this headwind was our bias towards higher growth companies which was a tailwind for the year. Also, our typical underweight to mega caps was a modest headwind. On a stock specific basis, the top contributor to the Fund’s relative performance was cloud-based enterprise software provider Red Hat. Red Hat outperformed due to strong business results throughout the year as high demand for its products came from companies shifting to cloud IT infrastructures. Align Technology, a medical device company that focuses on clear aligner therapy (Invisalign), also reported strong business results throughout the year, and was a top contributor to the Fund’s performance. The company reported strong revenue growth and sales volume growth in each quarter this year, and saw growth amongst teenagers, an important market for the company, accelerate. Other top contributors were Progressive (Financials), MasterCard (Information Technology) and Amazon.com (Consumer Discretionary). The top detractor from the Fund’s performance for the year was grocery retailer Kroger, which underperformed due to food price deflation, improved competitor execution and a significant disruption to the industry with Amazon.com’s acquisition of Whole Foods Market. Diversified consumer products company Newell Brands was also a top detractor from the Fund’s performance after growth slowed in the second half of the year as retailers reduced inventories to deal with the shifting retail landscape in which more consumers are buying products online. Other top detractors from the Fund’s performance during the year were Allergan (Health Care), Starbucks (Consumer Discretionary) and Schlumberger (Energy), as well as not owning Apple (Information Technology), the largest position in the Index. Please refer to the U.S. Growth Market Review and Outlook relating to the Fund on page 6. |

| 8 | Annual Report | December 31, 2017 |

Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Return through 12/31/2017 |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Class N | | | 24.35 | % | | | 9.05 | % | | | 13.28 | % | | | 7.66 | % |

| Class I | | | 24.64 | | | | 9.37 | | | | 13.64 | | | | 8.01 | |

| Russell 3000® Growth Index | | | 29.59 | | | | 13.51 | | | | 17.16 | | | | 9.93 | |

| S&P 500® Index | | | 21.83 | | | | 11.41 | | | | 15.79 | | | | 8.50 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair Investment Management, LLC and William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Growth Index consists of large, medium, and small capitalization companies with above average price-to-book ratios and forecasted growth rates. The index is weighted by market capitalization and large/medium/small companies make up approximately 80%/15%/5% of the index.

The S&P 500® Index indicates broad larger capitalization equity market performance.

This report identifies the Fund’s investments on December 31, 2017. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

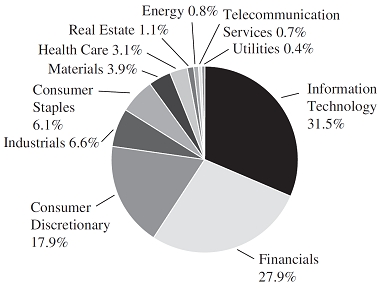

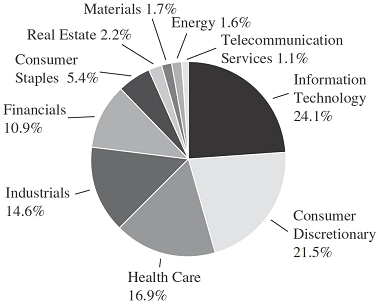

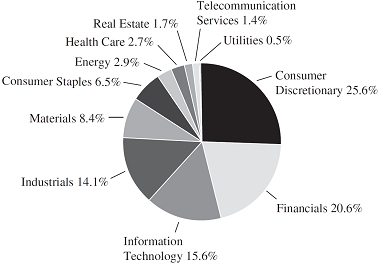

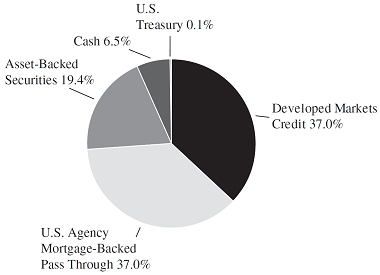

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| December 31, 2017 | William Blair Funds | 9 |

Growth Fund

Portfolio of Investments, December 31, 2017 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—38.9% | | | | | | | | |

| * | Acxiom Corporation | | | 86,271 | | | $ | 2,378 | |

| * | Adobe Systems, Inc. | | | 23,705 | | | | 4,154 | |

| * | Alphabet, Inc. Class “A” | | | 22,668 | | | | 23,879 | |

| | Booz Allen Hamilton Holding Corporation | | | 89,789 | | | | 3,424 | |

| * | CoStar Group, Inc. | | | 19,798 | | | | 5,879 | |

| | CSRA, Inc. | | | 102,182 | | | | 3,057 | |

| * | Facebook, Inc. Class “A” | | | 75,987 | | | | 13,409 | |

| * | Guidewire Software, Inc. | | | 38,427 | | | | 2,854 | |

| | Mastercard, Inc. Class “A” | | | 102,615 | | | | 15,532 | |

| * | MaxLinear, Inc. | | | 112,141 | | | | 2,963 | |

| | Microsoft Corporation | | | 284,141 | | | | 24,305 | |

| | National Instruments Corporation | | | 78,553 | | | | 3,270 | |

| * | Red Hat, Inc. | | | 87,039 | | | | 10,453 | |

| | Texas Instruments, Inc. | | | 77,503 | | | | 8,094 | |

| * | Ultimate Software Group, Inc. | | | 15,695 | | | | 3,425 | |

| * | Vantiv, Inc. Class “A” | | | 91,888 | | | | 6,758 | |

| * | Yelp, Inc. | | | 87,137 | | | | 3,656 | |

| | | | | | | | | 137,490 | |

| | Consumer Discretionary—18.4% | | | | | | | | |

| * | Amazon.com, Inc. | | | 16,139 | | | | 18,874 | |

| * | CarMax, Inc. | | | 34,638 | | | | 2,221 | |

| | Domino’s Pizza, Inc. | | | 23,597 | | | | 4,459 | |

| * | Grand Canyon Education, Inc. | | | 42,756 | | | | 3,828 | |

| * | Laureate Education, Inc. | | | 183,305 | | | | 2,486 | |

| * | Live Nation Entertainment, Inc. | | | 76,637 | | | | 3,262 | |

| | Newell Brands, Inc. | | | 108,894 | | | | 3,365 | |

| | Six Flags Entertainment Corporation | | | 79,668 | | | | 5,303 | |

| | Starbucks Corporation | | | 186,829 | | | | 10,730 | |

| * | Steven Madden, Ltd. | | | 65,185 | | | | 3,044 | |

| * | The Michaels Cos., Inc. | | | 162,799 | | | | 3,938 | |

| | Vail Resorts, Inc. | | | 16,670 | | | | 3,542 | |

| | | | | | | | | 65,052 | |

| | Health Care—15.5% | | | | | | | | |

| * | Align Technology, Inc. | | | 9,417 | | | | 2,092 | |

| | Allergan plc† | | | 21,108 | | | | 3,453 | |

| * | BioMarin Pharmaceutical, Inc. | | | 28,143 | | | | 2,510 | |

| | Bristol-Myers Squibb Co. | | | 57,261 | | | | 3,509 | |

| | Danaher Corporation | | | 85,838 | | | | 7,967 | |

| * | Ligand Pharmaceuticals, Inc. | | | 18,631 | | | | 2,551 | |

| | Teleflex, Inc. | | | 14,288 | | | | 3,555 | |

| | UnitedHealth Group, Inc. | | | 59,318 | | | | 13,077 | |

| * | Veeva Systems, Inc. | | | 56,936 | | | | 3,147 | |

| | West Pharmaceutical Services, Inc. | | | 22,039 | | | | 2,175 | |

| | Zoetis, Inc. | | | 149,593 | | | | 10,777 | |

| | | | | | | | | 54,813 | |

| | | | Shares or | | | | |

| | | | Principal | | | | |

| | Issuer | | Amount | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Industrials—12.4% | | | | | | | | |

| | BWX Technologies, Inc. | | | 84,052 | | | $ | 5,084 | |

| | Fastenal Co. | | | 107,486 | | | | 5,879 | |

| | Raytheon Co. | | | 38,968 | | | | 7,320 | |

| | The Dun & Bradstreet Corporation | | | 28,901 | | | | 3,422 | |

| * | The Middleby Corporation | | | 23,164 | | | | 3,126 | |

| | Union Pacific Corporation | | | 57,586 | | | | 7,722 | |

| * | Verisk Analytics, Inc. | | | 76,929 | | | | 7,385 | |

| | Wabtec Corporation | | | 48,493 | | | | 3,949 | |

| | | | | | | | | 43,887 | |

| | Financials—8.3% | | | | | | | | |

| | Affiliated Managers Group, Inc. | | | 15,262 | | | | 3,133 | |

| | East West Bancorp, Inc. | | | 71,116 | | | | 4,326 | |

| | Intercontinental Exchange, Inc. | | | 155,655 | | | | 10,983 | |

| | The Progressive Corporation | | | 197,762 | | | | 11,138 | |

| | | | | | | | | 29,580 | |

| | Consumer Staples—4.8% | | | | | | | | |

| | Costco Wholesale Corporation | | | 31,932 | | | | 5,943 | |

| * | Monster Beverage Corporation | | | 94,497 | | | | 5,981 | |

| | The Estee Lauder Cos., Inc. | | | 38,751 | | | | 4,931 | |

| | | | | | | | | 16,855 | |

| | Materials—1.3% | | | | | | | | |

| | Ball Corporation | | | 123,723 | | | | 4,683 | |

| | Total Common Stocks—99.6%

(cost $248,216) | | | | | | | 352,360 | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.200% dated 12/29/17, due 1/2/18, repurchase price $2,716, collateralized by U.S. Treasury Note, 2.000%, due 8/15/25 | | | $2,716 | | | | 2,716 | |

| | Total Repurchase Agreement—0.8%

(cost $2,716) | | | | | | | 2,716 | |

| | Total Investments—100.4%

(cost $250,932) | | | | | | | 355,076 | |

| | Liabilities, plus cash and other assets—(0.4)% | | | | | | | (1,342 | ) |

| | Net assets—100.0% | | | | | | $ | 353,734 | |

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| 10 | Annual Report | December 31, 2017 |

| | Large Cap Growth Fund |

| | |

| | The Large Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

James S. Golan

David P. Ricci | The William Blair Large Cap Growth Fund (Class N shares) posted a 30.88% increase, net of fees, for the twelve months ended December 31, 2017. By comparison, the Fund’s benchmark index, the Russell 1000® Growth Index (the “Index”), increased 30.21%. Despite the robust return of the Index in 2017, the Fund outperformed the Index for the year. The Fund’s relative returns were largely the result of stock-specific dynamics, as style factors were mostly offsetting. Stock selection in Information Technology was the largest positive contributor from a sector perspective as our positions in Red Hat, Adobe Systems and MasterCard were top contributors. Cloud-based enterprise software provider Red Hat is benefitting from companies shifting to more agile cloud IT infrastructures, while creative software provider Adobe Systems continues to find additional services to sell to its customer base and capitalize on its near monopoly status in creative software. The Fund outperformed in the Information Technology sector despite not owning technology company Apple, the largest position in the Index and a strong relative performer. Other top contributors to the Fund’s performance for the year were Amazon.com (Consumer Discretionary) and Estee Lauder (Consumer Staples). The top detractor for the year was grocery retailer Kroger, which underperformed due to food price deflation, improved competitor execution and a significant disruption to the industry when Amazon.com announced it would acquire Whole Foods Market. Stock selection in the Consumer Discretionary sector also detracted from the Fund’s performance. Auto parts retailer O’Reilly Automotive was the top detractor in the sector and declined in part due to the risk of e-commerce competition negatively impacting margins in the future. Other top detractors were Chipotle Mexican Grill (Consumer Discretionary), Starbucks (Consumer Discretionary) and Schlumberger (Energy). From a style perspective, our higher growth bias, and resulting lower dividend yield exposure, was a tailwind. Mostly offsetting the higher growth benefit was our emphasis on companies with more consistent fundamentals, which was a headwind as companies with more volatile fundamentals outperformed, typical for a strong up market. Please refer to the U.S. Growth Market Review and Outlook relating to the Fund on page 6. |

| December 31, 2017 | William Blair Funds | 11 |

Large Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Return through 12/31/2017 |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Class N | | | 30.88 | % | | | 12.63 | % | | | 16.78 | % | | | 8.92 | % |

| Class I | | | 31.29 | | | | 12.91 | | | | 17.07 | | | | 9.21 | |

| Russell 1000® Growth Index | | | 30.21 | | | | 13.79 | | | | 17.33 | | | | 10.00 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair Investment Management, LLC and William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 1000® Growth Index consists of large capitalization companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on December 31, 2017. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

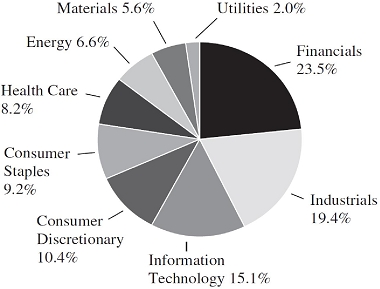

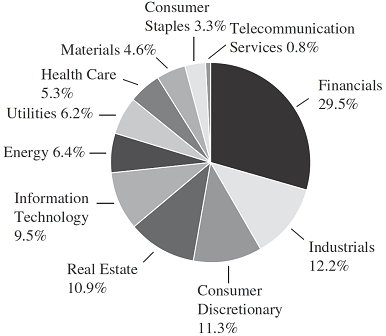

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 12 | Annual Report | December 31, 2017 |

Large Cap Growth Fund

Portfolio of Investments, December 31, 2017 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—37.7% | | | | | | | | |

| | Accenture plc† | | | 45,350 | | | $ | 6,943 | |

| * | Adobe Systems, Inc. | | | 31,970 | | | | 5,602 | |

| * | Alphabet, Inc. Class “A” | | | 8,830 | | | | 9,302 | |

| * | Alphabet, Inc. Class “C” | | | 4,816 | | | | 5,039 | |

| * | Facebook, Inc. | | | 53,380 | | | | 9,419 | |

| | Intuit, Inc. | | | 26,000 | | | | 4,102 | |

| | Mastercard, Inc. | | | 54,780 | | | | 8,292 | |

| | Microsoft Corporation | | | 177,150 | | | | 15,153 | |

| * | Red Hat, Inc. | | | 51,020 | | | | 6,128 | |

| | Texas Instruments, Inc. | | | 65,250 | | | | 6,815 | |

| | | | | | | | | 76,795 | |

| | Health Care—14.3% | | | | | | | | |

| * | Biogen, Inc. | | | 13,090 | | | | 4,170 | |

| | Danaher Corporation | | | 52,470 | | | | 4,870 | |

| | Stryker Corporation | | | 18,660 | | | | 2,889 | |

| | UnitedHealth Group, Inc. | | | 43,640 | | | | 9,621 | |

| | Zoetis, Inc. | | | 105,660 | | | | 7,612 | |

| | | | | | | | | 29,162 | |

| | Consumer Discretionary—13.8% | | | | | | | | |

| * | Amazon.com, Inc. | | | 9,990 | | | | 11,683 | |

| * | Netflix, Inc. | | | 13,900 | | | | 2,668 | |

| | Starbucks Corporation | | | 124,240 | | | | 7,135 | |

| | The Home Depot, Inc. | | | 18,060 | | | | 3,423 | |

| | Vail Resorts, Inc. | | | 14,820 | | | | 3,149 | |

| | | | | | | | | 28,058 | |

| | Industrials—13.0% | | | | | | | | |

| * | Copart, Inc. | | | 56,450 | | | | 2,438 | |

| | Fortive Corporation | | | 54,690 | | | | 3,957 | |

| | Raytheon Co. | | | 17,520 | | | | 3,291 | |

| | TransDigm Group, Inc. | | | 11,200 | | | | 3,076 | |

| | Union Pacific Corporation | | | 59,080 | | | | 7,922 | |

| * | Verisk Analytics, Inc. | | | 59,760 | | | | 5,737 | |

| | | | | | | | | 26,421 | |

| | Financials—8.3% | | | | | | | | |

| | Affiliated Managers Group, Inc. | | | 25,670 | | | | 5,269 | |

| | Intercontinental Exchange, Inc. | | | 61,870 | | | | 4,365 | |

| | The Progressive Corporation | | | 128,870 | | | | 7,258 | |

| | | | | | | | | 16,892 | |

| | Consumer Staples—6.3% | | | | | | | | |

| * | Monster Beverage Corporation | | | 114,470 | | | | 7,245 | |

| | The Estee Lauder Cos., Inc. | | | 44,660 | | | | 5,682 | |

| | | | | | | | | 12,927 | |

| | Materials—3.4% | | | | | | | | |

| | PPG Industries, Inc. | | | 33,760 | | | | 3,944 | |

| | Praxair, Inc. | | | 19,950 | | | | 3,086 | |

| | | | | | | | | 7,030 | |

| | | | Shares or | | | | |

| | | | Principal | | | | |

| | Issuer | | Amount | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Real Estate—2.1% | | | | | | | | |

| * | SBA Communications Corporation | | | 25,940 | | | $ | 4,238 | |

| | Energy—0.8% | | | | | | | | |

| | EOG Resources, Inc. | | | 14,250 | | | | 1,538 | |

| | Total Common Stocks—99.7%

(cost $148,532) | | | | | | | 203,061 | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.200% dated 12/29/17, due 1/2/18, repurchase price $390, collateralized by U.S. Treasury Note, 2.000%, due 8/15/25 | | | $390 | | | | 390 | |

| | Total Repurchase Agreement—0.2%

(cost $390) | | | | | | | 390 | |

| | Total Investments—99.9%

(cost $148,922) | | | | | | | 203,451 | |

| | Cash and other assets, less liabilities—0.1% | | | | | | | 112 | |

| | Net assets—100.0% | | | | | | $ | 203,563 | |

† = U.S. listed foreign security

* = Non-income producing security

See accompanying Notes to Financial Statements.

| December 31, 2017 | William Blair Funds | 13 |

| | Mid Cap Growth Fund |

| | |

| | The Mid Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Daniel Crowe

Robert C. Lanphier, IV

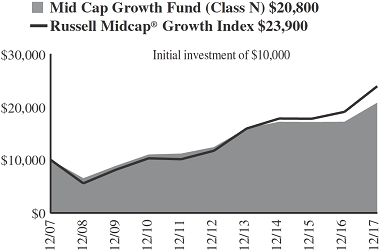

David P. Ricci | The William Blair Mid Cap Growth Fund (Class N shares) posted a 20.88% increase, net of fees, for the twelve months ended December 31, 2017. By comparison, the Fund’s benchmark index, the Russell Midcap® Growth Index (the “Index”), increased 25.27%. The Fund was unable to keep pace with the robust return of the Index in 2017. Style dynamics for the year were mixed as our emphasis on companies with more durable business models and better control of their destiny, compared to their peers, was a headwind in the robust market environment, while our bias towards higher growth companies was a tailwind. The Fund’s underweight to the Semiconductor industry detracted meaningfully from performance. We are often underweight Semiconductors due to the more commodity-like nature of many semiconductor products, and the limited pricing power and cyclicality of the businesses. On a stock specific basis, stock selection in the Consumer Discretionary sector, in particular the Fund’s positions in O’Reilly Automotive, Newell Brands and Tractor Supply, detracted from the Fund’s performance. Both O’Reilly Automotive and Tractor Supply declined in part due to the risk of potential competition from e-commerce. Newell Brands failed to meet consensus expectations for core organic sales growth as retailers reduced inventories, which caused the company to be negatively impacted in the short term. Other top detractors were Ball Corporation (Materials) and Signature Bank (Financials). Conversely, top contributors to the Fund’s performance were cloud-based enterprise software provider Red Hat and online vehicle auction platform Copart. Red Hat outperformed due to strong business results throughout the year as high demand for its products came from companies shifting to more agile cloud IT infrastructures. Copart saw positive trends in its business with a higher average selling price for cars and a greater number of cars in its inventory. Other top contributors were Centene and Align Technology, both of which contributed to positive stock selection in Health Care, and Costar Group (Information Technology). Please refer to the U.S. Growth Market Review and Outlook relating to the Fund on page 6. |

| 14 | Annual Report | December 31, 2017 |

Mid Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Return through 12/31/2017 |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Class N | | | 20.88 | % | | | 6.54 | % | | | 10.86 | % | | | 7.59 | % |

| Class I | | | 21.18 | | | | 6.78 | | | | 11.13 | | | | 7.87 | |

| Russell Midcap® Growth Index | | | 25.27 | | | | 10.30 | | | | 15.30 | | | | 9.10 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in medium capitalization companies involves special risks, including higher volatility and lower liquidity. Medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair Investment Management, LLC and William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell Midcap® Growth Index is an index that is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market.

This report identifies the Fund’s investments on December 31, 2017. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

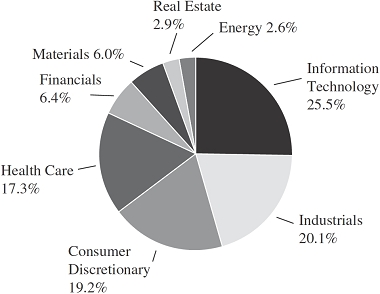

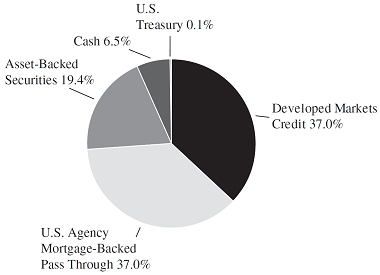

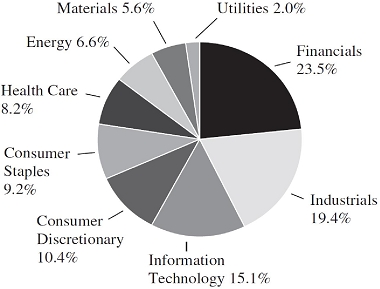

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| December 31, 2017 | William Blair Funds | 15 |

Mid Cap Growth Fund

Portfolio of Investments, December 31, 2017 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—25.4% | | | | | | | | |

| | Analog Devices, Inc. | | | 12,380 | | | $ | 1,102 | |

| * | Arista Networks, Inc. | | | 4,198 | | | | 989 | |

| | Booz Allen Hamilton Holding Corporation | | | 45,324 | | | | 1,728 | |

| * | Coherent, Inc. | | | 2,920 | | | | 824 | |

| * | CoStar Group, Inc. | | | 7,434 | | | | 2,207 | |

| | CSRA, Inc. | | | 28,770 | | | | 861 | |

| * | Guidewire Software, Inc. | | | 21,395 | | | | 1,589 | |

| | j2 Global, Inc. | | | 10,400 | | | | 780 | |

| | MAXIMUS, Inc. | | | 20,381 | | | | 1,459 | |

| | Microchip Technology, Inc. | | | 12,675 | | | | 1,114 | |

| * | Red Hat, Inc. | | | 19,505 | | | | 2,343 | |

| * | Take-Two Interactive Software, Inc. | | | 6,450 | | | | 708 | |

| * | Ultimate Software Group, Inc. | | | 7,995 | | | | 1,745 | |

| * | Vantiv, Inc. | | | 30,489 | | | | 2,242 | |

| | | | | | | | | 19,691 | |

| | Industrials—20.0% | | | | | | | | |

| | BWX Technologies, Inc. | | | 36,534 | | | | 2,210 | |

| * | Copart, Inc. | | | 63,705 | | | | 2,751 | |

| | Equifax, Inc. | | | 16,585 | | | | 1,956 | |

| | Fortive Corporation | | | 20,345 | | | | 1,472 | |

| * | The Middleby Corporation | | | 14,345 | | | | 1,936 | |

| * | Verisk Analytics, Inc. | | | 27,000 | | | | 2,592 | |

| | Wabtec Corporation | | | 15,105 | | | | 1,230 | |

| | Xylem, Inc. | | | 19,735 | | | | 1,346 | |

| | | | | | | | | 15,493 | |

| | Consumer Discretionary—19.1% | | | | | | | | |

| | Aptiv plc† | | | 9,065 | | | | 769 | |

| * | CarMax, Inc. | | | 17,760 | | | | 1,139 | |

| | Domino’s Pizza, Inc. | | | 9,360 | | | | 1,769 | |

| | Hanesbrands, Inc. | | | 50,175 | | | | 1,049 | |

| * | Live Nation Entertainment, Inc. | | | 28,920 | | | | 1,231 | |

| | Newell Brands, Inc. | | | 29,530 | | | | 912 | |

| | Ross Stores, Inc. | | | 31,590 | | | | 2,535 | |

| | Six Flags Entertainment Corporation | | | 30,440 | | | | 2,026 | |

| | Tractor Supply Co. | | | 17,460 | | | | 1,305 | |

| * | Ulta Salon Cosmetics & Fragrance, Inc. | | | 4,340 | | | | 971 | |

| | Vail Resorts, Inc. | | | 5,425 | | | | 1,153 | |

| | | | | | | | | 14,859 | |

| | Health Care—17.2% | | | | | | | | |

| * | ABIOMED, Inc. | | | 5,480 | | | | 1,027 | |

| * | Align Technology, Inc. | | | 4,935 | | | | 1,096 | |

| * | BioMarin Pharmaceutical, Inc. | | | 12,456 | | | | 1,111 | |

| * | Centene Corporation | | | 17,153 | | | | 1,730 | |

| * | Charles River Laboratories International, Inc. | | | 6,530 | | | | 715 | |

| | Encompass Health Corporation | | | 21,710 | | | | 1,073 | |

| * | IDEXX Laboratories, Inc. | | | 5,080 | | | | 794 | |

| * | Mettler-Toledo International, Inc. | | | 1,115 | | | | 691 | |

| | Teleflex, Inc. | | | 4,345 | | | | 1,081 | |

| * | Veeva Systems, Inc. | | | 20,345 | | | | 1,125 | |

| | West Pharmaceutical Services, Inc. | | | 8,350 | | | | 824 | |

| | Zoetis, Inc. | | | 29,270 | | | | 2,108 | |

| | | | | | | | | 13,375 | |

| | | | Shares or | | | | |

| | | | Principal | | | | |

| | Issuer | | Amount | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Financials—6.4% | | | | | | | | |

| | Affiliated Managers Group, Inc. | | | 4,830 | | | $ | 991 | |

| | East West Bancorp, Inc. | | | 21,560 | | | | 1,312 | |

| | The Progressive Corporation | | | 47,035 | | | | 2,649 | |

| | | | | | | | | 4,952 | |

| | Materials—6.0% | | | | | | | | |

| * | Axalta Coating Systems, Ltd.† | | | 25,735 | | | | 833 | |

| | Ball Corporation | | | 57,220 | | | | 2,165 | |

| | Vulcan Materials Co. | | | 12,735 | | | | 1,635 | |

| | | | | | | | | 4,633 | |

| | | | | | | | | | |

| | Real Estate—2.9% | | | | | | | | |

| * | SBA Communications Corporation | | | 13,605 | | | | 2,223 | |

| | Energy—2.6% | | | | | | | | |

| * | Concho Resources, Inc. | | | 13,285 | | | | 1,996 | |

| | Total Common Stocks—99.6%

(cost $61,613) | | | | | | | 77,222 | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.200% dated 12/29/17, due 1/2/18, repurchase price $560, collateralized by U.S. Treasury Note, 2.000%, due 8/15/25 | | | $560 | | | | 560 | |

| | Total Repurchase Agreement—0.7%

(cost $560) | | | | | | | 560 | |

| | Total Investments—100.3%

(cost $62,173) | | | | | | | 77,782 | |

| | Liabilities, plus cash and other assets—(0.3)% | | | | | | | (247 | ) |

| | Net assets—100.0% | | | | | | $ | 77,535 | |

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| 16 | Annual Report | December 31, 2017 |

| | Small-Mid Cap Growth Fund |

| | |

| | The Small-Mid Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Daniel Crowe

Robert C. Lanphier, IV | The William Blair Small-Mid Cap Growth Fund (Class N shares) posted a 28.57% increase, net of fees, for the twelve months ended December 31, 2017.By comparison, the Fund’s benchmark index, the Russell 2500TM Growth Index (the “Index”), increased 24.46%. The Fund outperformed the Index during 2017. While style factors provided a tailwind, the majority of outperformance was the result of strong stock selection. The Fund benefitted from positive stock selection in several sectors during the year, most notably in Health Care. Positions in Exact Sciences and Align Technology were standout contributors from the sector. Exact Sciences’ colorectal screening test, Cologuard, is increasingly being viewed as the standard of care in colorectal cancer screening, while Align Technology’s clear aligner therapy, Invisalign, gained global share from traditional wires and brackets in both the adult and teen markets. Other top individual contributors to the Fund’s performance included Information Technology sector holdings 2U, Take-Two Interactive Software and Arista Networks. From a style perspective, our higher growth and larger market cap biases were tailwinds. This was partially offset by a headwind resulting from our emphasis on companies with more durable fundamentals, as companies with higher volatility fundamentals outperformed, a common dynamic in strong up markets such as 2017. The Fund’s top individual detractors for the period were Consumer Discretionary companies Tractor Supply and Universal Electronics. Tractor Supply encountered weather-driven issues and concern about margins due to increased e-commerce investment, while Universal Electronics was hampered by delays in production and delivery of new remote control technology during the year. Other notable 2017 detractors included j2 Global (Information Technology), Acadia Healthcare (Health Care) and Signature Bank (Financials). Please refer to the U.S. Growth Market Review and Outlook relating to the Fund on page 6. |

| December 31, 2017 | William Blair Funds | 17 |

Small-Mid Cap Growth Fund

Performance Highlights (Unaudited)

| Average Annual Total Return through 12/31/2017 | |

| | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year |

| Class N | | | 28.57 | % | | | 12.66 | % | | | 16.99 | % | | | 10.42 | % |

| Class I | | | 28.90 | | | | 12.94 | | | | 17.30 | | | | 10.71 | |

| Russell 2500TM Growth Index | | | 24.46 | | | | 10.88 | | | | 15.47 | | | | 9.62 | |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Smaller and medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair Investment Management, LLC and William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2500TM Growth Index measures the performance of those Russell 2500 companies with above average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on December 31, 2017. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

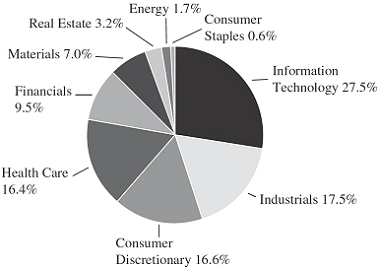

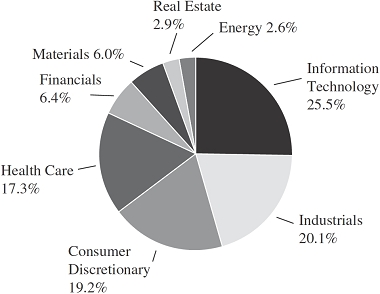

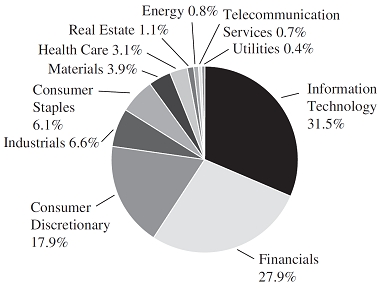

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| 18 | Annual Report | December 31, 2017 |

Small-Mid Cap Growth Fund

Portfolio of Investments, December 31, 2017 (all dollar amounts in thousands)

| | | | | | | | |

| | | | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks | | | | | | | | |

| | Information Technology—26.8% | | | | | | | | |

| * | 2U, Inc. | | | 403,195 | | | $ | 26,010 | |

| * | Arista Networks, Inc. | | | 88,955 | | | | 20,956 | |

| | Booz Allen Hamilton Holding Corporation | | | 923,946 | | | | 35,230 | |

| * | Coherent, Inc. | | | 67,542 | | | | 19,062 | |

| * | CoStar Group, Inc. | | | 163,335 | | | | 48,502 | |

| | CSRA, Inc. | | | 558,418 | | | | 16,708 | |

| * | Euronet Worldwide, Inc. | | | 259,892 | | | | 21,901 | |

| * | Guidewire Software, Inc. | | | 451,432 | | | | 33,523 | |

| | j2 Global, Inc. | | | 227,626 | | | | 17,079 | |

| | MAXIMUS, Inc. | | | 427,393 | | | | 30,593 | |

| * | MaxLinear, Inc. | | | 770,279 | | | | 20,351 | |

| | National Instruments Corporation | | | 468,602 | | | | 19,508 | |

| | Nice, Ltd.—ADR | | | 156,700 | | | | 14,402 | |

| * | Rogers Corporation | | | 210,827 | | | | 34,137 | |

| * | Take-Two Interactive Software, Inc. | | | 266,181 | | | | 29,221 | |

| * | Vantiv, Inc. Class “A” | | | 466,891 | | | | 34,340 | |

| * | WEX, Inc. | | | 255,979 | | | | 36,152 | |

| * | Yelp, Inc. | | | 619,371 | | | | 25,989 | |

| | | | | | | | | 483,664 | |

| | Industrials—17.0% | | | | | | | | |

| | BWX Technologies, Inc. | | | 855,942 | | | | 51,776 | |

| * | Copart, Inc. | | | 1,354,628 | | | | 58,506 | |

| | HEICO Corporation | | | 341,395 | | | | 26,987 | |

| | Hexcel Corporation | | | 431,119 | | | | 26,665 | |

| * | SiteOne Landscape Supply, Inc. | | | 275,137 | | | | 21,103 | |

| * | Teledyne Technologies, Inc. | | | 148,352 | | | | 26,874 | |

| | The Dun & Bradstreet Corporation | | | 129,835 | | | | 15,374 | |

| * | The Middleby Corporation | | | 264,385 | | | | 35,679 | |

| | The Toro Co. | | | 209,589 | | | | 13,672 | |

| * | TransUnion | | | 537,526 | | | | 29,542 | |

| | | | | | | | | 306,178 | |

| | Consumer Discretionary—16.1% | | | | | | | | |

| | Adtalem Global Education, Inc. | | | 683,954 | | | | 28,760 | |

| | Cable One, Inc. | | | 14,689 | | | | 10,331 | |

| | Domino’s Pizza, Inc. | | | 218,432 | | | | 41,275 | |

| * | Grand Canyon Education, Inc. | | | 347,760 | | | | 31,135 | |

| * | Hilton Grand Vacations, Inc. | | | 635,622 | | | | 26,664 | |

| * | Live Nation Entertainment, Inc. | | | 626,699 | | | | 26,679 | |

| | Six Flags Entertainment Corporation | | | 640,294 | | | | 42,624 | |

| * | The Michaels Cos., Inc. | | | 1,161,960 | | | | 28,108 | |

| | Tractor Supply Co. | | | 292,956 | | | | 21,898 | |

| * | Universal Electronics, Inc. | | | 334,295 | | | | 15,795 | |

| | Vail Resorts, Inc. | | | 84,034 | | | | 17,855 | |

| | | | | | | | | 291,124 | |

| | Health Care—15.9% | | | | | | | | |

| * | ABIOMED, Inc. | | | 149,145 | | | | 27,951 | |

| * | Cambrex Corporation | | | 484,530 | | | | 23,258 | |

| * | Charles River Laboratories International, Inc. | | | 258,527 | | | | 28,296 | |

| * | DexCom, Inc. | | | 369,984 | | | | 21,233 | |

| | Encompass Health Corporation | | | 536,232 | | | | 26,495 | |

| * | Exact Sciences Corporation | | | 325,456 | | | | 17,100 | |

| * | Glaukos Corporation | | | 383,972 | | | | 9,849 | |

| * | Horizon Pharma plc† | | | 1,775,639 | | | | 25,924 | |

| * | IDEXX Laboratories, Inc. | | | 118,828 | | | | 18,582 | |

| | | | Shares or | | | | |

| | | | Principal | | | | |

| | Issuer | | Amount | | | Value | |

| | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Health Care — (continued) | | | | | | | | |

| * | Ligand Pharmaceuticals, Inc. | | | 249,180 | | | $ | 34,120 | |

| * | Repligen Corporation | | | 352,962 | | | | 12,806 | |

| * | Veeva Systems, Inc. | | | 410,762 | | | | 22,707 | |

| | West Pharmaceutical Services, Inc. | | | 195,369 | | | | 19,277 | |

| | | | | | | | | 287,598 | |

| | Financials—9.2% | | | | | | | | |

| | Affiliated Managers Group, Inc. | | | 110,245 | | | | 22,628 | |

| | Bank of the Ozarks, Inc. | | | 682,122 | | | | 33,049 | |

| | Cboe Global Markets, Inc. | | | 209,541 | | | | 26,107 | |

| | East West Bancorp, Inc. | | | 228,034 | | | | 13,871 | |

| * | Encore Capital Group, Inc. | | | 481,060 | | | | 20,253 | |

| | FirstCash, Inc. | | | 366,515 | | | | 24,721 | |

| | OM Asset Management plc† | | | 773,552 | | | | 12,957 | |

| | Virtu Financial, Inc. | | | 712,601 | | | | 13,040 | |

| | | | | | | | | 166,626 | |

| | Materials—6.8% | | | | | | | | |

| * | Axalta Coating Systems, Ltd.† | | | 606,919 | | | | 19,640 | |

| | Ball Corporation | | | 903,696 | | | | 34,205 | |

| | Celanese Corporation | | | 288,488 | | | | 30,891 | |

| | Martin Marietta Materials, Inc. | | | 171,285 | | | | 37,861 | |

| | | | | | | | | 122,597 | |

| | Real Estate—3.1% | | | | | | | | |

| | Colliers International Group, Inc.† | | | 206,759 | | | | 12,478 | |

| | FirstService Corporation† | | | 260,800 | | | | 18,235 | |

| | Jones Lang LaSalle, Inc. | | | 166,765 | | | | 24,837 | |

| | | | | | | | | 55,550 | |

| | Energy—1.7% | | | | | | | | |

| * | Carrizo Oil & Gas, Inc. | | | 298,717 | | | | 6,357 | |

| * | Diamondback Energy, Inc. | | | 188,550 | | | | 23,804 | |

| | | | | | | | | 30,161 | |

| | Consumer Staples—0.6% | | | | | | | | |

| | Nu Skin Enterprises, Inc. | | | 160,458 | | | | 10,948 | |

| | | | | | | | | | |

| | Total Common Stocks—97.2%

(cost $1,414,047) | | | | | | | 1,754,446 | |

| | | | | | | | | | |

| | Repurchase Agreement | | | | | | | | |

| | Fixed Income Clearing Corporation, 0.200% dated 12/29/17, due 1/2/18, repurchase price $53,624, collateralized by U.S.Treasury Note, 2.000%, due 8/15/25 | | | $53,623 | | | | 53,623 | |

| | Total Repurchase Agreement—3.0%

(cost $53,623) | | | | | | | 53,623 | |

| | Total Investments—100.2%

(cost $1,467,670) | | | | | | | 1,808,069 | |

| | Liabilities, plus cash and other assets—(0.2)% | | | | | | | (3,061 | ) |

| | Net assets—100.0% | | | | | | $ | 1,805,008 | |

* = Non-income producing security

† = U.S. listed foreign security

See accompanying Notes to Financial Statements.

| December 31, 2017 | William Blair Funds | 19 |

| | Small-Mid Cap Value Fund |

| | |

| | The Small-Mid Cap Value Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

Chad M. Kilmer

Mark T. Leslie

David S. Mitchell | The William Blair Small-Mid Cap Value Fund (Class N shares) posted a 9.59% increase, net of fees, for the twelve months ended December 31, 2017. By comparison, the Fund’s benchmark index, the Russell 2500TM Value Index (the “Index”), increased 10.36%. While style factors were more normalized in 2017, the Fund’s higher growth profile relative to the Index provided a modest tailwind during the period that was somewhat offset by its underweight to the deeper value stocks within the Index. At the sector level, stock selection within the Semiconductors and the Fund’s lack of exposure to cyclical stocks within the Information Technology sector contributed to the Fund’s relative underperformance within the sector. We feel comfortable with the Fund’s lack of exposure to cyclical stocks within the Information Technology sector given current valuations and where we are in the market cycle. The Fund’s relative underperformance within the Real Estate sector was the result of stock selection within Retail REITs and Residential REITs. Broad-based stock selection within the Consumer Discretionary sector was the largest contributor to the Fund’s relative performance. Notable sub-industry contributors within the Consumer Discretionary sector were Automobile Manufacturers, Restaurants, and Footwear. While the Fund’s lack of exposure to Mortgage REITs provided a modest headwind within the Financials sector, this was more than offset by strong stock selection within Property & Casualty Insurance and Regional Banks, resulting in the Fund’s relative outperformance within the Financials sector. Looking specifically at stock selection, the Fund’s largest detractors from relative performance were Oasis Petroleum (Energy), Gulfport Energy (Energy), and PDC Energy (Energy). The largest contributors to relative performance were the Fund’s investments in Cadence Design Systems (Information Technology), Thor Industries (Consumer Discretionary), and lululemon athletica (Consumer Discretionary). Please refer to the U.S. Value Market Review and Outlook relating to the Fund on page 7. |

| 20 | Annual Report | December 31, 2017 |

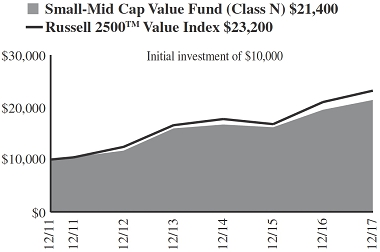

Small-Mid Cap Value Fund

Performance Highlights (Unaudited)

| Average Annual Total Return through 12/31/2017 |

| | | 1 Year | | 3 Year | | 5 Year | | Since

Inception(a) |

| Class N | | | 9.59 | % | | | 8.61 | % | | | 12.82 | % | | | 13.39 | % |

| Class I | | | 9.84 | | | | 8.89 | | | | 13.12 | | | | 13.69 | |

| Russell 2500TM Value Index | | | 10.36 | | | | 9.30 | | | | 13.27 | | | | 14.90 | |

| | |

| (a) | Since inception is for the period from December 15, 2011 (Commencement of Operations) to December 31, 2017. |

Performance cited represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the data quoted. Results shown are average annual total returns, which assume reinvestment of dividends and capital gains. Investment returns and principal will fluctuate and you may have a gain or loss when you sell shares. For the most current month-end performance information, please call 1-800-742-7272, or visit our Web site at www.williamblairfunds.com. Investing in smaller and medium capitalization companies involves special risks, including higher volatility and lower liquidity. Smaller and medium capitalization stocks are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition. From time to time, the investment adviser may waive fees or reimburse expenses for the Fund. Without these waivers/reimbursements, performance would be lower. Class N shares are available to the general public without a sales load. Class I shares are available to certain institutional investors and advisory clients of William Blair Investment Management, LLC and William Blair & Company, L.L.C., without a sales load or distribution (12b-1) or service fees.

The performance highlights and graph presented above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 2500TM Value Index consists of mid-capitalization companies with below average price-to-book ratios and forecasted growth rates.

This report identifies the Fund’s investments on December 31, 2017. These holdings are subject to change. Not all stocks in the Fund performed the same, nor is there any guarantee that these stocks will perform as well in the future. Market forecasts provided in this report may not necessarily come to pass.

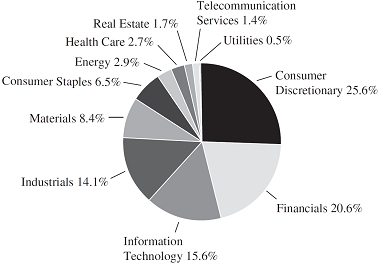

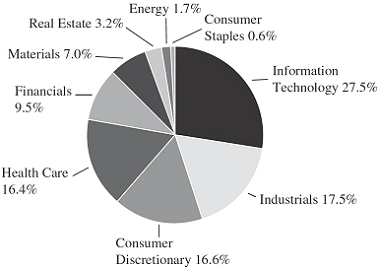

Sector Diversification (Unaudited)

The sector diversification shown is based on the total long-term securities.

| December 31, 2017 | William Blair Funds | 21 |

Small-Mid Cap Value Fund

Portfolio of Investments, December 31, 2017 (all dollar amounts in thousands)

| | | | | | | |

| | | | | | |

| | Issuer | | Shares | | | Value | |

| | |

| | Common Stocks | | | | | | | | |

| | Financials—21.7% | | | | | | | | |

| | American Financial Group, Inc. | | | 333 | | | $ | 36 | |

| | CNO Financial Group, Inc. | | | 1,455 | | | | 36 | |

| * | E*TRADE Financial Corporation | | | 1,205 | | | | 60 | |

| | East West Bancorp, Inc. | | | 798 | | | | 49 | |

| | First American Financial Corporation | | | 737 | | | | 41 | |

| | FNB Corporation | | | 2,516 | | | | 35 | |

| | Hancock Holding Co. | | | 862 | | | | 43 | |

| | Hanover Insurance Group, Inc. | | | 402 | | | | 43 | |

| | Home BancShares, Inc. | | | 1,791 | | | | 42 | |

| | Iberiabank Corporation | | | 426 | | | | 33 | |

| | PacWest Bancorp | | | 892 | | | | 45 | |

| | Radian Group, Inc. | | | 2,262 | | | | 47 | |

| | Renasant Corporation | | | 609 | | | | 25 | |

| | Sandy Spring Bancorp, Inc. | | | 618 | | | | 24 | |

| | Selective Insurance Group, Inc. | | | 801 | | | | 47 | |

| | Sterling Bancorp | | | 1,793 | | | | 44 | |

| * | SVB Financial Group | | | 186 | | | | 43 | |

| * | Western Alliance Bancorp | | | 586 | | | | 33 | |

| | WSFS Financial Corporation | | | 843 | | | | 40 | |

| | Zions Bancorporation | | | 456 | | | | 23 | |

| | | | | | | | | 789 | |

| | Industrials—14.4% | | | | | | | | |

| | Brady Corporation | | | 1,251 | | | | 47 | |

| | EMCOR Group, Inc. | | | 439 | | | | 36 | |

| | Fortune Brands Home & Security, Inc. | | | 677 | | | | 46 | |

| | Interface, Inc. | | | 2,179 | | | | 55 | |

| | Lennox International, Inc. | | | 251 | | | | 52 | |

| | Manpowergroup, Inc. | | | 321 | | | | 41 | |

| | Old Dominion Freight Line, Inc. | | | 432 | | | | 57 | |

| | Owens Corning | | | 604 | | | | 56 | |

| | Spirit AeroSystems Holdings, Inc. | | | 578 | | | | 50 | |

| | Terex Corporation | | | 976 | | | | 47 | |

| | Wabtec Corporation | | | 457 | | | | 37 | |

| | | | | | | | | 524 | |

| | Real Estate—13.3% | | | | | | | | |

| | Acadia Realty Trust | | | 1,537 | | | | 42 | |

| | American Assets Trust, Inc. | | | 1,134 | | | | 43 | |

| | American Campus Communities, Inc. | | | 1,122 | | | | 46 | |

| | Camden Property Trust | | | 433 | | | | 40 | |

| | Douglas Emmett, Inc. | | | 885 | | | | 36 | |

| | Education Realty Trust, Inc. | | | 626 | | | | 22 | |

| * | Equity Commonwealth | | | 1,461 | | | | 45 | |

| | Healthcare Realty Trust, Inc. | | | 1,349 | | | | 43 | |

| | Highwoods Properties, Inc. | | | 734 | | | | 37 | |

| | National Retail Properties, Inc. | | | 1,041 | | | | 45 | |

| | Pebblebrook Hotel Trust | | | 1,211 | | | | 45 | |

| | Terreno Realty Corporation | | | 1,099 | | | | 39 | |

| | | | | | | | | 483 | |

| | Consumer Discretionary—12.1% | | | | | | | | |

| | Adtalem Global Education, Inc. | | | 1,038 | | | | 44 | |

| | Children’s Place, Inc. | | | 282 | | | | 41 | |

| * | Dave & Buster’s Entertainment, Inc. | | | 658 | | | | 36 | |

| | | | | | | |

| | | | | | |

| | Issuer | | Shares | | | Value | |

| | |

| | Common Stocks—(continued) | | | | | | | | |

| | Consumer Discretionary — (continued) | |

| | Dunkin’ Brands Group, Inc. | | | 797 | | | $ | 51 | |

| * | Grand Canyon Education, Inc. | | | 446 | | | | 40 | |

| * | Lululemon Athletica, Inc. | | | 705 | | | | 56 | |

| | Meredith Corporation | | | 496 | | | | 33 | |

| | Thor Industries, Inc. | | | 347 | | | | 52 | |

| | Vail Resorts, Inc. | | | 147 | | | | 31 | |

| | Wolverine World Wide, Inc. | | | 1,775 | | | | 57 | |

| | | | | | | | | 441 | |

| | Information Technology—8.9% | | | | | | | | |

| * | Acxiom Corporation | | | 1,599 | | | | 44 | |

| | Belden, Inc. | | | 556 | | | | 43 | |

| | Booz Allen Hamilton Holding Corporation | | | 926 | | | | 35 | |

| * | Cadence Design Systems, Inc. | | | 808 | | | | 34 | |

| | CSRA, Inc. | | | 1,617 | | | | 48 | |

| * | F5 Networks, Inc. | | | 364 | | | | 48 | |

| * | Inphi Corporation | | | 923 | | | | 34 | |

| | j2 Global, Inc. | | | 521 | | | | 39 | |

| | | | | | | | | 325 | |

| | Energy—7.0% | | | | | | | | |

| * | Exterran Corporation | | | 692 | | | | 22 | |

| * | Gulfport Energy Corporation | | | 2,555 | | | | 32 | |

| * | Helix Energy Solutions Group, Inc. | | | 3,287 | | | | 25 | |

| * | Parsley Energy, Inc. | | | 1,301 | | | | 38 | |

| | Patterson-UTI Energy, Inc. | | | 1,454 | | | | 33 | |

| * | PDC Energy, Inc. | | | 719 | | | | 37 | |

| | Range Resources Corporation | | | 2,266 | | | | 39 | |

| | Targa Resources Corporation | | | 551 | | | | 27 | |

| | | | | | | | | 253 | |

| | Utilities—6.6% | | | | | | | | |

| | Atmos Energy Corporation | | | 575 | | | | 49 | |

| | IDACORP, Inc. | | | 490 | | | | 45 | |

| | NiSource, Inc. | | | 1,844 | | | | 47 | |

| | ONE Gas, Inc. | | | 634 | | | | 47 | |

| | Pinnacle West Capital Corporation | | | 618 | | | | 53 | |

| | | | | | | | | 241 | |

| | Materials—6.0% | | | | | | | | |

| | Carpenter Technology Corporation | | | 865 | | | | 44 | |

| | FMC Corporation | | | 399 | | | | 38 | |

| | Minerals Technologies, Inc. | | | 420 | | | | 29 | |

| | PolyOne Corporation | | | 945 | | | | 41 | |

| | Sensient Technologies Corporation | | | 376 | | | | 28 | |

| | Steel Dynamics, Inc. | | | 935 | | | | 40 | |

| | | | | | | | | 220 | |

| | Health Care—5.4% | | | | | | | | |

| | CONMED Corporation | | | 344 | | | | 17 | |

| | Encompass Health Corporation | | | 705 | | | | 35 | |

| * | Hologic, Inc. | | | 738 | | | | 31 | |

| * | Integer Holdings Corporation | | | 357 | | | | 16 | |

| * | Magellan Health, Inc. | | | 329 | | | | 32 | |

| * | Mednax, Inc. | | | 524 | | | | 28 | |

| | PerkinElmer, Inc. | | | 514 | | | | 38 | |

| | | | | | | | | 197 | |

See accompanying Notes to Financial Statements.

| 22 | Annual Report | December 31, 2017 |

Small-Mid Cap Value Fund

Portfolio of Investments, December 31, 2017 (all dollar amounts in thousands)

| | | | | | | |

| | | | | | |

| | Issuer | | Shares | | | Value | |

| | | | | | | | | | |

| | Common Stocks—(continued) | | | | | | | | |

| | Consumer Staples—3.0% | | | | | | | | |

| | Ingredion, Inc. | | | 283 | | | $ | 40 | |

| | J&J Snack Foods Corporation | | | 193 | | | | 29 | |

| | Lamb Weston Holdings, Inc. | | | 737 | | | | 42 | |

| | | | | | | | | 111 | |

| | Total Common Stocks—98.4%

(cost $2,750) | | | | | | | 3,584 | |

| | Total Investments—98.4%

(cost $2,750) | | | | | | | 3,584 | |

| | Cash and other assets, less liabilities—1.6% | | | | | | | 59 | |

| | Net assets—100.0% | | | | | | $ | 3,643 | |

* = Non-income producing security

See accompanying Notes to Financial Statements.

| December 31, 2017 | William Blair Funds | 23 |

| | Small Cap Growth Fund |

| | |

| | The Small Cap Growth Fund seeks long-term capital appreciation. |

| | |

| | AN OVERVIEW FROM THE PORTFOLIO MANAGERS |

| | |

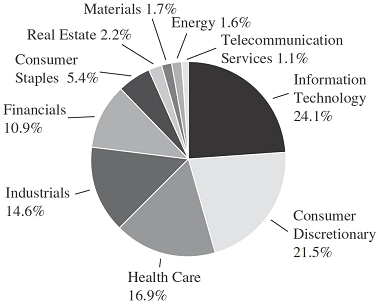

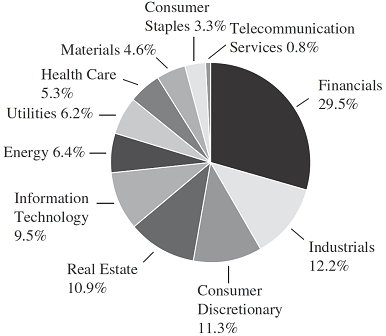

Michael P. Balkin