UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Caroline Kraus, Esq. | | Copies to: |

| Goldman, Sachs & Co. | | Geoffrey R.T. Kenyon, Esq. |

| 200 West Street | | Dechert LLP |

| New York, New York 10282 | | 100 Oliver Street |

| | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2014

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Semi-Annual Report | | | | April 30, 2014 |

| | |

| | | | Retirement Portfolio Completion Fund |

Goldman Sachs Retirement Portfolio Completion Fund

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Investment Process | | | 2 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 3 | |

| |

Schedule of Investments | | | 9 | |

| |

Financial Statements | | | 13 | |

| |

Financial Highlights | | | 16 | |

| |

Notes to the Financial Statements | | | 18 | |

| |

Other Information | | | 32 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Fund. For additional information concerning the risks applicable to the Fund, please see the Fund’s Prospectus.

The Goldman Sachs Retirement Portfolio Completion Fund is designed to provide retirement investors of all ages with access to the following asset classes that are typically underrepresented in retirement savings portfolios (the “Underlying Asset Classes”): U.S. inflation linked government bonds, global real estate investment trusts (“global REITs”), commodities, emerging markets equity, emerging markets sovereign credit, North American high yield corporate credit and Hedge Fund Industry Beta (i.e., the component of hedge fund returns that is attributable to market risk exposure, rather than manager skill). Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risk of default by a counterparty; and liquidity risk. Over-the-counter transactions are subject to less government regulation and supervision. The Fund’s equity investments are subject to market risk, which means that the value of its investments may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. The securities of mid- and small-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. The market value of inflation protected securities is not guaranteed, and will fluctuate in response to changes in real interest rates. Investing in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. REITs whose underlying properties are concentrated in a particular industry or geographic region are also subject to risks affecting such industries and regions. The securities of REITs involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements because of interest rate changes, economic conditions and other factors. Exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The Fund’s investments in other investment companies (including exchange-traded funds and money market funds) and publicly-traded partnerships (“PTPs”) subject it to additional expenses. Risks of PTPs may include potential lack of liquidity and limitations on voting and distribution rights. Foreign and emerging market securities may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. At times, the Fund may be unable to sell certain of its illiquid portfolio investments without a substantial drop in price, if at all. The Fund is “non-diversified” and may be more susceptible than “diversified” funds to adverse developments affecting any single issuer held in its portfolio and to greater losses because of these developments.

1

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

What Differentiates Goldman Sachs Retirement Portfolio Completion Fund’s Investment Process?

The Fund is designed to provide retirement investors of all ages with access to certain asset classes that are typically underrepresented in retirement savings portfolios (the “Underlying Asset Classes”). Our investment process is driven by three main objectives: broad diversification in a single fund, lower expected volatility and inflation protection and cost efficiency through passive implementation of most asset classes.

| n | | Comprehensive evaluation of a range of asset classes based on the following investment criteria — under-representation in a typical retirement investor’s portfolio, liquidity of the asset class, tax suitability, correlation with inflation, correlation with core asset classes, strong historical performance and efficient implementation. |

| n | | The Fund uses a risk parity approach for portfolio construction, targeting roughly equal contribution to overall risk from each Underlying Asset Class, and adjusting over time as market conditions evolve. |

| n | | To ensure diversification, we place minimum and maximum allocation constraints on all asset classes within the portfolio. |

| n | | Passive exposure to most of the Underlying Asset Classes means lower transaction costs, reduced manager selection risk and access to Goldman Sachs Asset Management, L.P.’s (“GSAM”) expertise in replicating index exposure for alternative asset classes. |

| n | | GSAM has created a proprietary performance benchmark, the Retirement Portfolio Completion Benchmark (the “RPC Benchmark”)2, that is externally calculated by a third party and seeks to provide a means of measuring the performance of the Underlying Asset Classes, collectively, and the Fund. |

| | | Diversification does not protect an investor from market risk and does not ensure a profit. |

| 1 | | With the exception of the Hedge Fund Industry Beta asset class, the Fund employs a passive investment approach with respect to achieving exposure to its Underlying Asset Classes. GSAM determines the allocations to each asset class. It then employs a passive investment approach with respect to achieving exposure to those asset classes (other than Hedge Fund Industry Beta). That is, GSAM utilizes an index as a reference for making investments in the asset classes (other than Hedge Fund Industry Beta) and does not attempt to exceed the performance of these indices. |

| 2 | | The Retirement Portfolio Completion Benchmark (the “RPC Benchmark”) is proprietary to GSAM and employs a rules-based methodology that is similar to that used to manage the Fund. Its methodology, construction, component indices and/or weightings assigned to component indices may change from time to time at the discretion of GSAM. One of the component indices of the RPC Benchmark is the Goldman Sachs Absolute Return Tracker Index (“GS-ART Index”). An affiliate of GSAM is the sponsor of the GS-ART Index, and the Quantitative Investment Strategies (“QIS”) team, which manages the Fund, also manages the algorithm used by the GS-ART Index. |

2

PORTFOLIO RESULTS

Goldman Sachs Retirement Portfolio Completion Fund

Investment Objective and Principal Strategy

The Fund seeks long-term capital appreciation. It is designed to provide retirement investors of all ages (i.e., both those who are approaching or planning for retirement and those who are currently retired) with access to certain asset classes that are typically underrepresented in retirement savings portfolios (the “Underlying Asset Classes”). The Fund may also be used by non-retirement investors seeking exposure to the Underlying Asset Classes. The Underlying Asset Classes are U.S. inflation linked government bonds, global real estate investment trusts (“global REITs”), commodities, emerging markets equities, emerging markets sovereign credit, North American high yield corporate credit and hedge fund industry beta (i.e., the component of hedge fund returns that is attributable to market risk exposure, rather than manager skill). The Fund’s Investment Adviser believes that the Underlying Asset Classes may provide return, risk and correlation characteristics complementary to a portfolio of more traditional investments, such as large-cap equities or investment grade fixed income. The Fund currently intends to gain exposure to the Underlying Asset Classes through the use of certain securities and derivatives, and its assets will be allocated among the Underlying Asset Classes according to a proprietary rules-based, quantitative methodology.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Investment Strategies Team discusses the Goldman Sachs Retirement Portfolio Completion Fund’s (the “Fund”) performance and positioning for the six-month period ended April 30, 2014 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class A, C, Institutional, IR and R Shares generated cumulative total returns, without sales charges, of 1.65%, 1.26%, 1.75%, 1.74% and 1.45%, respectively. These returns compare to the 5.74% cumulative total return of the Fund’s blended benchmark, which is comprised 60% of the S&P 500® Index (with dividends reinvested) and 40% of the Barclays U.S. Aggregate Bond Index (with all income reinvested), during the same period. The S&P 500® Index and the Barclays U.S. Aggregate Bond Index generated cumulative total returns of 8.36% and 1.74%, respectively, during the Reporting Period. |

| | | The Fund also uses a proprietary benchmark, the Goldman Sachs Retirement Portfolio Completion Benchmark (“RPC Benchmark”), which generated a cumulative total return of 2.41% during the Reporting Period. At the end of the Reporting Period, the RPC Benchmark was comprised of the following indexes: Dow Jones Global Select Real Estate Securities Index (7.0%), Barclays U.S. Government Inflation-Linked Bond Index (20.0%), Dow Jones Emerging Markets Total Stock Market Index (6.4%), Dow Jones-UBS Roll Select Commodity Index (11.4%), Markit CDX North American High Yield 5-Year (15.5%), Markit CDX Emerging Markets 5-Year (20.0%) and Goldman Sachs Absolute Return Tracker Index (19.7%). |

| Q | | What economic and market factors most influenced the Underlying Asset Classes during the Reporting Period? |

| A | | During November and December 2013, the first two months of the Reporting Period, global developed markets equities, as represented by the MSCI World Index,1 posted robust gains, with the markets enjoying a strong finish to a second straight calendar year of positive returns. In the U.S., the S&P 500® Index made record highs during December 2013, as the Federal Reserve (the “Fed”) confirmed it would begin tapering asset purchases beginning in January 2014 — a signal of confidence in the U.S. economy. The U.S. Gross Domestic Product (“GDP”) grew at an annualized rate of 4.1% during the third calendar quarter, up from previous estimates and at the fastest pace in two years. In Japan, the Nikkei 225 Stock Average2 closed 2013 at a six-year high, reflecting optimism about Prime Minister Shinzo Abe’s bold reforms and stimulus. Also, Japan’s consumer price index |

| 1 | | The MSCI World Index is an index of large-cap and mid-cap stocks across 23 developed markets countries. These countries are Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the U.K. and the U.S. |

| 2 | | The Nikkei 225 Stock Average is the leading and most respected index of Japanese stocks. It is a price-weighted index comprised of Japan’s top 225 blue chip companies on the Tokyo Stock Exchange. |

3

PORTFOLIO RESULTS

| | steadily increased in the fourth calendar quarter, boosting confidence that the country’s economy was on a path to achieve an inflation target of 2%. Meanwhile, European equities markets, particularly those in Eurozone peripheral countries, continued to benefit from the European Central Bank’s commitment to easy monetary policy. |

| | | In the first quarter of 2014, global developed markets equities edged higher. The S&P 500® Index ended March 2014 near a record high, as positive factory activity data suggested U.S. economic growth was gaining traction after a harsh winter. Europe’s economic recovery continued, as evidenced by a positive purchasing managers’ index (“PMI”) and positive factory output data. At the same time, Europe’s unemployment appeared to have bottomed, though disinflation remained a potential threat. |

| | | After declining sharply at the beginning of April 2014, global developed markets equities rallied to finish the month marginally higher. In the U.S., the S&P 500® Index made fresh highs in early April but subsequently declined, with the information technology and health care sectors underperforming during April overall. However, the appetite for mergers and acquisitions and initial public offerings in both these sectors remained strong. In Europe, economic data and bond market performance suggested its economic recovery was broadening. The Euro-area Flash Services Composite PMI recorded its highest level since 2011, while the bond markets of European peripheral countries continued to normalize. (Flash Services Composite PMI is an early estimate of the Services PMI for a region, designed to provide an accurate advance indication of the final Services PMI data. As flash PMIs are among the first economic indicators for each month, providing evidence of changing economic conditions ahead of comparable government statistics, they can have a significant effect on currency markets.) Meanwhile, Japanese equities declined during April, the first month of a much-anticipated consumption tax increase that was widely expected to obscure certain economic data in the near term. Other Japanese macroeconomic data, including wage growth as well as business and consumer sentiment, also disappointed expectations. |

| | | Bonds were weak overall during the Reporting Period, with the Barclays U.S. Aggregate Index posting a return of 1.74% and the Barclays Global Aggregate Bond Index a return of 2.05% (U.S. dollar hedged). |

| | | Overall, among the asset classes in which the Fund invests, commodities and global real estate investment trusts (“REITs”) were leading performers, largely because investors favored riskier securities during the Reporting Period. North American high yield corporate credit and hedge funds, as well as emerging markets sovereign credit and Treasury inflation-protected securities (“TIPS”), also generated positive returns, though to a lesser extent. Conversely, emerging markets equities performed poorly during the Reporting Period, as concerns over slowing economic growth, high inflation and election uncertainty, weighed on many emerging markets. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund underperformed its blended benchmark during the Reporting Period largely as a result of its allocations to emerging markets equities. It was also hampered by its lack of exposure to U.S. equities in which it does not invest as part of its investment process. The S&P 500® Index gained 8.36% during the Reporting Period as a whole. |

| | | On the positive side, the Fund benefited from its strategic allocation to commodities (accomplished through investments in publicly traded partnerships) and global REITs. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund may use derivatives and similar instruments, in addition to buying securities directly, to gain exposure to the Underlying Asset Classes. During the Reporting Period, the Fund used indexed credit default swaps to gain exposure to emerging markets sovereign credit and North American high yield corporate credit. In addition, during the Reporting Period, the Goldman Sachs Absolute Tracker Fund (through which the Fund gains exposure to hedge fund industry beta) used exchange-traded index futures contracts, commodity index-linked structured notes, currency forward contracts and swap contracts to attempt to enhance portfolio return and for hedging purposes. |

| Q | | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | | We allocate the Fund’s assets among the Underlying Asset Classes according to a proprietary rules-based, quantitative methodology and then employ a passive investment approach with respect to achieving exposure to those Underlying Asset Classes (other than hedge fund industry beta). The Fund’s Underlying Asset Class allocations are rebalanced semi- annually in September and March. During the March 2014 |

4

PORTFOLIO RESULTS

| | rebalance, the Fund’s assets were allocated 19.8% to emerging markets sovereign credit, 20.0% to hedge fund industry beta and 20.0% to TIPS. In addition, the rebalance resulted in allocations of 15.6% to North American high yield corporate credit, 11.3% to commodities (accomplished through investments in publicly traded partnerships), 6.9% to global REITs and 6.4% to emerging markets equities. |

| Q | | How was the Fund positioned at the end of the Reporting Period? |

| A | | At the end of the Reporting Period, the Fund had 19.6% of its net assets in emerging markets debt and 20.2% in TIPS. It had 19.9% of its net assets in hedge fund industry beta and 15.5% in North American high yield corporate credit. The Fund also had 11.4% of its net assets invested in commodities, accomplished through investments in publicly traded partnerships. In addition, the Fund had 7.0% of its net assets invested in global REITs and 6.4% in emerging markets equities. |

| | | Going forward, we continue to have confidence in our systematic investment process. We believe non-traditional asset classes can provide return, risk and correlation characteristics that are complementary to a portfolio of more traditional investments, such as large-cap equities and investment grade fixed income. |

5

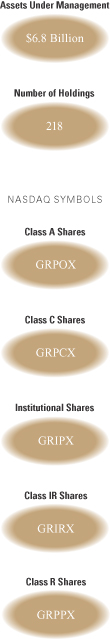

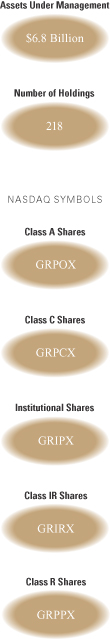

FUND BASICS

Retirement Portfolio Completion Fund

as of April 30, 2014

| | | | | | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2013–

April 30, 2014 | | Fund Total

Return

(based on

NAV)1 | | | Retirement

Portfolio

Completion

Composite

Index2,4,5 | | | RPC

Benchmark3 | | | S&P 500

Index4 | | | Barclays U.S.

Aggregate

Bond Index5 | |

| | Class A | | | 1.65 | % | | | 5.74 | % | | | 2.41 | % | | | 8.36 | % | | | 1.74 | % |

| | Class C | | | 1.26 | | | | 5.74 | | | | 2.41 | | | | 8.36 | | | | 1.74 | |

| | Institutional | | | 1.75 | | | | 5.74 | | | | 2.41 | | | | 8.36 | | | | 1.74 | |

| | Class IR | | | 1.74 | | | | 5.74 | | | | 2.41 | | | | 8.36 | | | | 1.74 | |

| | | Class R | | | 1.45 | | | | 5.74 | | | | 2.41 | | | | 8.36 | | | | 1.74 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Retirement Portfolio Completion Composite Index is comprised of the S&P® 500 Index (60%) and the Barclays U.S. Aggregate Bond Index (40%). The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | 3 | | The RPC Benchmark is proprietary to GSAM and employs a rules-based methodology that is similar to that used to manage the Fund. Its methodology, construction, component indices and/or weightings assigned to component indices may change from time to time at the discretion of GSAM. As of 4/30/2014, the RPC Benchmark is comprised of the following indices: Dow Jones Global Select Real Estate Securities Index (7.0%), Barclays U.S. Government Inflation-Linked Bond Index (20.0%), Dow Jones Emerging Markets Index (6.4%), Dow Jones-UBS Roll Select Commodity Index (11.4%), Markit CDX North American High Yield (15.5%), Markit CDX Emerging Markets (20.0%) and Goldman Sachs Absolute Return Tracker Index (“GS-ART Index”) (19.7%). An affiliate of GSAM is the sponsor of the GS-ART Index and the Quantitative Investment Strategies team, which manages the Fund, also manages the algorithm used by the GS-ART Index. See the Fund’s Prospectus for additional details. |

The RPC Benchmark is the property of Goldman Sachs Asset Management, which has contracted with S&P Dow Jones Indices LLC or its affiliates (“S&P Dow Jones”) to independently maintain and calculate the RPC Benchmark based on objective pre-agreed methodology. S&P Dow Jones shall have no liability for any errors or omissions in calculating the RPC Benchmark. The Fund is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, its affiliates or their third party licensors and neither S&P Dow Jones Indices LLC, its affiliates nor their its third party licensors make any representation regarding the advisability of investing in the Fund.

| | 4 | | The S&P 500 Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. |

| | 5 | | The Barclays U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

6

FUND BASICS

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS4 |

| | | For the period ended 3/31/14 | | 1 Year | | | Since Inception | | | Inception Date |

| | Class A | | | -2.88 | % | | | -0.83 | % | | 9/28/12 |

| | Class C | | | -0.75 | | | | 0.97 | | | 9/28/12 |

| | Institutional | | | 1.45 | | | | 2.12 | | | 9/28/12 |

| | Class IR | | | 1.24 | | | | 1.96 | | | 9/28/12 |

| | | Class R | | | 0.75 | | | | 1.50 | | | 9/28/12 |

| | 4 | | The Standardized Total Returns are average annual total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 3.75% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Class IR and Class R Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS5 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.91 | % | | | 13.55 | % |

| | Class C | | | 1.65 | | | | 11.94 | |

| | Institutional | | | 0.51 | | | | 11.04 | |

| | Class IR | | | 0.65 | | | | 13.39 | |

| | | Class R | | | 1.16 | | | | 11.46 | |

| | 5 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. The Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2015, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

7

FUND BASICS

| | | | | | | | | | |

| | TOP TEN EQUITY HOLDINGS AS OF 4/30/14‡ |

| | | Holding | | % of

Net Assets | | | Line of Business | | Country |

| | Goldman Sachs Absolute Return Tracker Fund – Institutional Shares | | | 20.0 | % | | Investment Company | | United States |

| | PowerShares DB Commodity Index Tracking Fund | | | 11.4 | | | Exchange Traded Fund | | United States |

| | Vanguard MSCI Emerging Markets ETF | | | 4.3 | | | Exchange Traded Fund | | United States |

| | Simon Property Group, Inc. | | | 0.4 | | | Real Estate Investment Trusts | | Spain |

| | Brookfield Asset Management, Inc. Class A | | | 0.2 | | | Real Estate Management &

Development | | Switzerland |

| | Mitsui Fudosan Co. Ltd. | | | 0.2 | | | Real Estate Management &

Development | | United Kingdom |

| | Unibail-Rodamco SE | | | 0.2 | | | Real Estate Investment Trusts | | Belgium |

| | Public Storage | | | 0.2 | | | Real Estate Investment Trusts | | France |

| | ProLogis, Inc. | | | 0.2 | | | Real Estate Investment Trusts | | Switzerland |

| | | Equity Residential | | | 0.2 | | | Real Estate Investment Trusts | | Luxembourg |

| | ‡ | | The top 10 holdings may not be representative of the Fund’s future investments. |

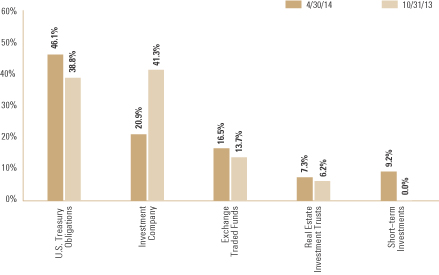

|

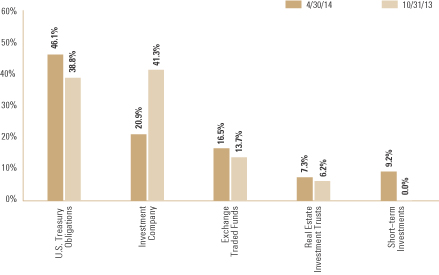

| PORTFOLIO COMPOSITION6 |

| As of April 30, 2014 |

| | 6 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of the Fund’s market value investments. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

8

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

Schedule of Investments

April 30, 2014 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Common Stocks – 7.0% | |

| | Real Estate Investment Trusts – 5.8% | |

| | 34 | | | Acadia Realty Trust | | $ | 922 | |

| | 35 | | | Alexandria Real Estate Equities, Inc. | | | 2,584 | |

| | 53 | | | American Campus Communities, Inc. | | | 2,025 | |

| | 83 | | | Apartment Investment & Management Co. Class A | | | 2,559 | |

| | 9 | | | Artis Real Estate Investment Trust | | | 131 | |

| | 1,655 | | | Ascendas Real Estate Investment Trust | | | 3,029 | |

| | 6 | | | Ashford Hospitality Prime, Inc. | | | 92 | |

| | 30 | | | Ashford Hospitality Trust, Inc. | | | 308 | |

| | 45 | | | Associated Estates Realty Corp. | | | 755 | |

| | 67 | | | AvalonBay Communities, Inc. | | | 9,149 | |

| | 8 | | | Befimmo SCA Sicafi | | | 583 | |

| | 164 | | | Beni Stabili SpA | | | 147 | |

| | 64 | | | Big Yellow Group PLC | | | 556 | |

| | 96 | | | BioMed Realty Trust, Inc. | | | 2,006 | |

| | 6 | | | Boardwalk Real Estate Investment Trust | | | 338 | |

| | 84 | | | Boston Properties, Inc. | | | 9,840 | |

| | 76 | | | Brandywine Realty Trust | | | 1,106 | |

| | 562 | | | British Land Co. PLC | | | 6,566 | |

| | 153 | | | BWP Trust | | | 356 | |

| | 9 | | | Calloway Real Estate Investment Trust | | | 220 | |

| | 41 | | | Camden Property Trust | | | 2,808 | |

| | 8 | | | Canadian Apartment Properties REIT | | | 154 | |

| | 6 | | | Canadian Real Estate Investment Trust | | | 247 | |

| | 751 | | | CapitaCommercial Trust | | | 961 | |

| | 1,161 | | | Capital Property Fund | | | 1,171 | |

| | 1,803 | | | CapitaMall Trust | | | 2,874 | |

| | 97 | | | CBL & Associates Properties, Inc. | | | 1,762 | |

| | 1,379 | | | CFS Retail Property Trust Group | | | 2,582 | |

| | 1,000 | | | Champion | | | 471 | |

| | 60 | | | Charter Hall Retail | | | 216 | |

| | 9 | | | Cofinimmo | | | 1,103 | |

| | 49 | | | Columbia Property Trust, Inc. | | | 1,389 | |

| | 55 | | | CommonWealth | | | 1,398 | |

| | 48 | | | Corio NV | | | 2,249 | |

| | 33 | | | Corporate Office Properties Trust | | | 883 | |

| | 127 | | | Cousins Properties, Inc. | | | 1,477 | |

| | 85 | | | CubeSmart | | | 1,581 | |

| | 206 | | | DCT Industrial Trust, Inc. | | | 1,611 | |

| | 140 | | | DDR Corp. | | | 2,404 | |

| | 41 | | | Derwent London PLC | | | 1,886 | |

| | 2,759 | | | Dexus Property Group | | | 2,919 | |

| | 78 | | | DiamondRock Hospitality Co. | | | 957 | |

| | 64 | | | Digital Realty Trust, Inc. | | | 3,418 | |

| | 70 | | | Douglas Emmett, Inc. | | | 1,932 | |

| | 155 | | | Duke Realty Corp. | | | 2,716 | |

| | 23 | | | DuPont Fabros Technology, Inc. | | | 557 | |

| | 12 | | | EastGroup Properties, Inc. | | | 759 | |

| | 51 | | | Education Realty Trust, Inc. | | | 520 | |

| | 34 | | | Equity Lifestyle Properties, Inc. | | | 1,424 | |

| | 29 | | | Equity One, Inc. | | | 653 | |

| | 183 | | | Equity Residential | | | 10,878 | |

| | 29 | | | Essex Property Trust, Inc. | | | 5,025 | |

| | 19 | | | Eurocommercial Properties NV | | | 872 | |

| | 51 | | | Extra Space Storage, Inc. | | | 2,669 | |

| | 34 | | | Federal Realty Investment Trust | | | 3,996 | |

| | |

| | | | | | | | |

| | Common Stocks – (continued) | |

| | Real Estate Investment Trusts – (continued) | |

| | 98 | | | FelCor Lodging Trust, Inc. | | $ | 905 | |

| | 40 | | | First Industrial Realty Trust, Inc. | | | 735 | |

| | 26 | | | Fonciere Des Regions | | | 2,641 | |

| | 389 | | | Fountainhead Property Trust | | | 294 | |

| | 38 | | | Franklin Street Properties Corp. | | | 463 | |

| | 1 | | | Fukuoka REIT Co. | | | 1,609 | |

| | 14 | | | Gecina SA | | | 1,884 | |

| | 293 | | | General Growth Properties, Inc. | | | 6,730 | |

| | 47 | | | Glimcher Realty Trust | | | 479 | |

| | 898 | | | Goodman Group | | | 4,171 | |

| | 592 | | | Goodman Property Trust | | | 508 | |

| | 769 | | | GPT Group | | | 2,806 | |

| | 192 | | | Great Portland Estates PLC | | | 2,036 | |

| | 648 | | | Growthpoint Properties Ltd. | | | 1,498 | |

| | 140 | | | H&R Real Estate Investment Trust | | | 2,948 | |

| | 380 | | | Hammerson PLC | | | 3,667 | |

| | 251 | | | HCP, Inc. | | | 10,507 | |

| | 159 | | | Health Care REIT, Inc. | | | 10,031 | |

| | 62 | | | Healthcare Realty Trust, Inc. | | | 1,559 | |

| | 57 | | | Hersha Hospitality Trust | | | 331 | |

| | 40 | | | Highwoods Properties, Inc. | | | 1,614 | |

| | 30 | | | Home Properties, Inc. | | | 1,848 | |

| | 73 | | | Hospitality Properties Trust | | | 2,194 | |

| | 415 | | | Host Hotels & Resorts, Inc. | | | 8,902 | |

| | 41 | | | Inland Real Estate Corp. | | | 428 | |

| | 365 | | | Intu Properties PLC | | | 1,803 | |

| | 417 | | | Investa Office Fund | | | 1,298 | |

| | 77 | | | Is Gayrimenkul Yatirim Ortakligi AS | | | 50 | |

| | 1 | | | Japan Excellent, Inc. | | | 1,328 | |

| | 1 | | | Japan Prime Realty Investment Corp. | | | 3,519 | |

| | 1 | | | Japan Real Estate Investment Corp. | | | 5,302 | |

| | 1 | | | Japan Retail Fund Investment Corp. | | | 2,011 | |

| | 46 | | | Kilroy Realty Corp. | | | 2,740 | |

| | 234 | | | Kimco Realty Corp. | | | 5,363 | |

| | 569 | | | Kiwi Income Property Trust | | | 564 | |

| | 300 | | | KLCC Property Holdings Bhd | | | 611 | |

| | 47 | | | Klepierre | | | 2,156 | |

| | 392 | | | Land Securities Group PLC | | | 7,042 | |

| | 54 | | | LaSalle Hotel Properties | | | 1,786 | |

| | 69 | | | Liberty Property Trust | | | 2,588 | |

| | 9 | | | LTC Properties, Inc. | | | 348 | |

| | 36 | | | Mack-Cali Realty Corp. | | | 733 | |

| | 660 | | | Mapletree Logistics Trust | | | 580 | |

| | 14 | | | Mercialys SA | | | 322 | |

| | 41 | | | Mid-America Apartment Communities, Inc. | | | 2,856 | |

| | 1 | | | Mori Hills REIT Investment Corp. | | | 1,334 | |

| | 1 | | | Nippon Building Fund, Inc. | | | 5,544 | |

| | 1 | | | Orix JREIT, Inc. | | | 1,272 | |

| | 51 | | | Parkway Properties, Inc. | | | 962 | |

| | 43 | | | Pebblebrook Hotel Trust | | | 1,481 | |

| | 26 | | | Pennsylvania Real Estate Investment Trust | | | 430 | |

| | 61 | | | Piedmont Office Realty Trust, Inc. Class A | | | 1,074 | |

| | 24 | | | Post Properties, Inc. | | | 1,205 | |

| | 272 | | | ProLogis, Inc. | | | 11,051 | |

| | 9 | | | PS Business Parks, Inc. | | | 772 | |

| | 78 | | | Public Storage | | | 13,690 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 9 |

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

Schedule of Investments (continued)

April 30, 2014 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

| | Common Stocks – (continued) | |

| | Real Estate Investment Trusts – (continued) | |

| | 19 | | | Ramco-Gershenson Properties Trust | | $ | 313 | |

| | 53 | | | Regency Centers Corp. | | | 2,779 | |

| | 143 | | | RioCan Real Estate Investment Trust | | | 3,553 | |

| | 342 | | | Segro PLC | | | 2,024 | |

| | 105 | | | Senior Housing Properties Trust | | | 2,464 | |

| | 137 | | | Shaftesbury PLC | | | 1,532 | |

| | 167 | | | Simon Property Group, Inc. | | | 28,924 | |

| | 50 | | | SL Green Realty Corp. | | | 5,235 | |

| | 18 | | | Sovran Self Storage, Inc. | | | 1,366 | |

| | 1,074 | | | Starhill Global REIT | | | 695 | |

| | 17 | | | Sun Communities, Inc. | | | 775 | |

| | 84 | | | Sunstone Hotel Investors, Inc. | | | 1,202 | |

| | 1,753 | | | Suntec Real Estate Investment Trust | | | 2,403 | |

| | 56 | | | Tanger Factory Outlet Centers, Inc. | | | 1,998 | |

| | 30 | | | Taubman Centers, Inc. | | | 2,185 | |

| | 1,085 | | | The Link REIT | | | 5,402 | |

| | 81 | | | The Macerich Co. | | | 5,258 | |

| | 1 | | | Tokyu REIT, Inc. | | | 1,278 | |

| | 136 | | | UDR, Inc. | | | 3,517 | |

| | 52 | | | Unibail-Rodamco SE | | | 14,053 | |

| | 1 | | | United Urban Investment Corp. | | | 1,509 | |

| | 4 | | | Vastned Retail NV | | | 206 | |

| | 161 | | | Ventas, Inc. | | | 10,639 | |

| | 95 | | | Vornado Realty Trust | | | 9,747 | |

| | 28 | | | Washington Real Estate Investment Trust | | | 685 | |

| | 64 | | | Weingarten Realty Investors | | | 1,997 | |

| | 17 | | | Wereldhave NV | | | 1,430 | |

| | 1,061 | | | Westfield Group | | | 10,827 | |

| | 1,723 | | | Westfield Retail Trust | | | 5,119 | |

| | 49 | | | Workspace Group PLC | | | 475 | |

| | | | | | | | |

| | | | | | | 393,987 | |

| | |

| | Real Estate Management & Development – 1.2% | |

| | 71 | | | Aeon Mall Co. Ltd. | | | 1,693 | |

| | 37 | | | Atrium European Real Estate Ltd.* | | | 213 | |

| | 2,900 | | | Ayala Land, Inc. | | | 1,965 | |

| | 300 | | | BR Malls Participacoes SA | | | 2,582 | |

| | 340 | | | Brookfield Asset Management, Inc. Class A | | | 14,272 | |

| | 90 | | | Brookfield Property Partners LP | | | 1,737 | |

| | 28 | | | BUWOG AG* | | | 514 | |

| | 28 | | | CA Immobilien Anlagen AG* | | | 534 | |

| | 352 | | | Capital & Counties Properties PLC | | | 1,986 | |

| | 1,782 | | | Capitaland Ltd. | | | 4,561 | |

| | 105 | | | Castellum AB | | | 1,790 | |

| | 700 | | | Central Pattana PCL | | | 983 | |

| | 58 | | | Fabege AB | | | 815 | |

| | 22 | | | First Capital Realty, Inc. | | | 360 | |

| | 71 | | | Forest City Enterprises, Inc. Class A* | | | 1,343 | |

| | 1,797 | | | Global Logistic Properties Ltd. | | | 4,095 | |

| | 81 | | | Globe Trade Centre SA* | | | 203 | |

| | 131 | | | Grainger PLC | | | 473 | |

| | 194 | | | Hang Lung Group Ltd. | | | 1,054 | |

| | 1,593 | | | Hang Lung Properties Ltd. | | | 4,751 | |

| | 287 | | | Hongkong Land Holdings Ltd. | | | 2,011 | |

| | 199 | | | Hulic Co. Ltd. | | | 2,400 | |

| | 172 | | | Hysan Development Co. Ltd. | | | 738 | |

| | |

| | | | | | | | |

| | Common Stocks – (continued) | |

| | Real Estate Management & Development – (continued) | |

| | 576 | | | Immofinanz Immobilien Anlagen AG* | | $ | 2,135 | |

| | 259 | | | Kerry Properties Ltd. | | | 853 | |

| | 56 | | | Kungsleden AB | | | 457 | |

| | 475 | | | Mitsui Fudosan Co. Ltd. | | | 14,061 | |

| | 52 | | | NTT Urban Development Corp. | | | 457 | |

| | 151 | | | Precinct Properties New Zealand Ltd. | | | 133 | |

| | 22 | | | PSP Swiss Property AG* | | | 2,114 | |

| | 500 | | | Robinsons Land Corp. | | | 251 | |

| | 3,900 | | | SM Prime Holdings, Inc. | | | 1,432 | |

| | 29 | | | Swiss Prime Site AG* | | | 2,438 | |

| | 218 | | | Tokyu Fudosan Holdings Corp.* | | | 1,585 | |

| | 221 | | | Wheelock & Co. Ltd. | | | 912 | |

| | | | | | | | |

| | | | | | | 77,901 | |

| | |

| | TOTAL COMMON STOCKS | | | | |

| | (Cost $435,162) | | $ | 471,888 | |

| | |

| | | | | | | | | | |

Principal

Amount | | Interest Rate | | Maturity

Date | | | Value | |

| U.S. Treasury Obligations – 44.1% | |

United States Treasury Bill(a) | |

| $1,627,000 | | 0.000% | | | 07/24/14 | | | $ | 1,626,943 | |

United States Treasury Inflation Protected Securities | |

| 31,414 | | 0.500 | | | 04/15/15 | | | | 32,018 | |

| 27,758 | | 1.875 | | | 07/15/15 | | | | 29,064 | |

| 27,204 | | 2.000 | | | 01/15/16 | | | | 28,857 | |

| 56,367 | | 0.125 | | | 04/15/16 | | | | 57,997 | |

| 32,548 | | 2.500 | | | 07/15/16 | | | | 35,513 | |

| 27,938 | | 2.375 | | | 01/15/17 | | | | 30,631 | |

| 64,081 | | 0.125 | | | 04/15/17 | | | | 66,113 | |

| 21,521 | | 2.625 | | | 07/15/17 | | | | 24,140 | |

| 25,773 | | 1.625 | | | 01/15/18 | | | | 28,064 | |

| 70,072 | | 0.125 | | | 04/15/18 | | | | 72,010 | |

| 22,861 | | 1.375 | | | 07/15/18 | | | | 24,908 | |

| 21,868 | | 2.125 | | | 01/15/19 | | | | 24,543 | |

| 23,088 | | 1.875 | | | 07/15/19 | | | | 25,863 | |

| 28,225 | | 1.375 | | | 01/15/20 | | | | 30,708 | |

| 48,439 | | 1.250 | | | 07/15/20 | | | | 52,609 | |

| 54,730 | | 1.125 | | | 01/15/21 | | | | 58,570 | |

| 52,079 | | 0.625 | | | 07/15/21 | | | | 54,072 | |

| 59,120 | | 0.125 | | | 01/15/22 | | | | 58,519 | |

| 58,187 | | 0.125 | | | 07/15/22 | | | | 57,587 | |

| 57,971 | | 0.125 | | | 01/15/23 | | | | 56,730 | |

| 57,498 | | 0.375 | | | 07/15/23 | | | | 57,534 | |

| 21,128 | | 0.625 | | | 01/15/24 | | | | 21,455 | |

| 48,570 | | 2.375 | | | 01/15/25 | | | | 57,897 | |

| 33,118 | | 2.000 | | | 01/15/26 | | | | 38,282 | |

| 26,774 | | 2.375 | | | 01/15/27 | | | | 32,308 | |

| 24,652 | | 1.750 | | | 01/15/28 | | | | 27,814 | |

| 33,383 | | 3.625 | | | 04/15/28 | | | | 46,120 | |

| 21,868 | | 2.500 | | | 01/15/29 | | | | 27,041 | |

| 38,556 | | 3.875 | | | 04/15/29 | | | | 55,346 | |

| 9,258 | | 3.375 | | | 04/15/32 | | | | 13,058 | |

| 22,808 | | 2.125 | | | 02/15/40 | | | | 28,108 | |

| |

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

| | | | | | | | | | |

Principal

Amount | | Interest Rate | | Maturity

Date | | | Value | |

| | | | | | | | | | |

| U.S. Treasury Obligations – (continued) | |

United States Treasury Inflation Protected Securities – (continued) | |

| $35,375 | | 2.125% | | | 02/15/41 | | | $ | 43,788 | |

| 33,245 | | 0.750 | | | 02/15/42 | | | | 30,035 | |

| 32,674 | | 0.625 | | | 02/15/43 | | | | 28,421 | |

| 12,087 | | 1.375 | | | 02/15/44 | | | | 12,775 | |

| |

| TOTAL U.S. TREASURY OBLIGATIONS | |

| (Cost $3,026,716) | | | | | | $ | 2,995,441 | |

| |

| | | | | | | | |

Shares | | | Description | | Value | |

| | Exchange Traded Funds – 15.8% | |

| | 71 | | | iShares Dow Jones US Real Estate Index Fund | | $ | 4,947 | |

| | 29,290 | | | PowerShares DB Commodity Index Tracking Fund – PTP* | | | 773,549 | |

| | 116 | | | SPDR Dow Jones International Real Estate ETF | | | 4,954 | |

| | 7,138 | | | Vanguard MSCI Emerging Markets ETF | | | 292,230 | |

| | |

| | TOTAL EXCHANGE TRADED FUNDS | |

| | (Cost $1,077,807) | | $ | 1,075,680 | |

| | |

| | | | | | | | |

| | Investment Company(b) – 20.0% | |

| | 145,877 | | | Goldman Sachs Absolute Return Tracker Fund – Institutional Shares | | | | |

| | (Cost $1,357,649) | | $ | 1,356,653 | |

| | |

| | | | | | | | | | |

Principal Amount | | | Interest Rate | | Maturity Date | | Value | |

| | Short-term Investment(c) – 8.8% | |

| | Repurchase Agreement – 8.8% | | | | |

| Joint Repurchase Agreement Account II | |

| $ | 600,000 | | | 0.056% | | 05/01/14 | | $ | 600,000 | |

| | (Cost $600,000) | | | | | | |

| | |

| | TOTAL INVESTMENTS – 95.7% | | | | |

| | (Cost $6,497,334) | | | | $ | 6,499,662 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 4.3% | | | 289,004 | |

| | |

| | NET ASSETS – 100.0% | | $ | 6,788,666 | |

| | |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

* | | Non-income producing security. |

(a) | | Issued with a zero coupon. Income is recognized through the accretion of discount. |

(b) | | Represents an Affiliated Fund. |

(c) | | Joint repurchase agreement was entered into on April 30, 2014. Additional information appears on page 12. |

| | |

|

Investment Abbreviations: |

ETF | | —Exchange Traded Fund |

REIT | | —Real Estate Investment Trust |

PTP | | —Publicly Traded Partnership |

|

|

| ADDITIONAL INVESTMENT INFORMATION |

SWAP CONTRACTS — At April 30, 2014, the Fund had outstanding swap contracts with the following terms:

CENTRALLY CLEARED CREDIT DEFAULT SWAP CONTRACTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Market Value | |

| Referenced Obligation | | Notional

Amount

(000s) | | | Rates Received

(Paid) | | | Termination

Date | | | Credit

Spread at

April 30,

2014(a) | | | Upfront

Payments

Made (Received) | | | Unrealized

Gain (Loss) | |

Protection Sold: | | | | | | | | | | | | | | | | | | | | | | | | |

CDX Emerging Markets Index 20 | | $ | 1,340 | | | | 5.000 | % | | | 06/20/19 | | | | 2.943 | % | | $ | 114,325 | | | $ | 29,468 | |

CDX North America High Yield Index 21 | | | 1,060 | | | | 5.000 | | | | 06/20/19 | | | | 3.358 | | | | 75,416 | | | | 4,732 | |

| | |

| TOTAL | | | $ | 189,741 | | | $ | 34,200 | |

| | (a) | | Credit spread on the Referenced Obligation, together with the term of the swap contract, are indicators of payment/performance risk. The likelihood of a credit event occurring which would require a fund to make a payment or otherwise be required to perform under the swap contract is generally greater as the credit spread and the term of the swap contract increase. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

Schedule of Investments (continued)

April 30, 2014 (Unaudited)

|

| ADDITIONAL INVESTMENT INFORMATION (continued) |

TOTAL RETURN SWAP CONTRACTS ON EQUITY INDICES(b)

| | | | | | | | | | | | | | | | | | |

| Counterparty | |

Referenced Obligation | | Notional

Amount

(000s) | | | Rate Received

(Paid) | | | Termination

Date | | | Unrealized

Gain (Loss)* | |

Bank of America Securities LLC | | MSCI Emerging Markets Net TR Index | | $ | 147 | | | | 0.580 | % | | | 07/03/14 | | | $ | 422 | |

| | (b) | | The Fund receives quarterly payments based on any positive quarterly return of the Referenced Obligation. The Fund makes payments on any negative quarterly return of such Referenced Obligation. |

| | * | | There are no upfront payments on the swap contract(s), therefore the unrealized gain (loss) on the swap contracts is equal to their market value. |

JOINT REPURCHASE AGREEMENT ACCOUNT II — At April 30, 2014, the Fund had undivided interests in the Joint Repurchase Agreement Account II, with a maturity date of May 1, 2014, as follows:

| | | | | | | | |

| Principal Amount | | Maturity Value | | | Collateral Allocation Value | |

$600,000 | | $ | 600,001 | | | $ | 614,802 | |

REPURCHASE AGREEMENTS — At April 30, 2014, the Principal Amount of the Fund’s interest in the Joint Repurchase Agreement Account II was as follows:

| | | | | | | | |

| Counterparty | | Interest

Rate | | | Principal

Amounts | |

BNP Paribas Securities Co. | | | 0.060 | % | | $ | 123,644 | |

Citigroup Global Capital Markets, Inc. | | | 0.060 | | | | 92,191 | |

Merrill Lynch & Co., Inc. | | | 0.050 | | | | 149,176 | |

TD Securities USA LLC | | | 0.050 | | | | 75,922 | |

TD Securities USA LLC | | | 0.060 | | | | 75,922 | |

Wells Fargo Securities LLC | | | 0.060 | | | | 83,145 | |

| TOTAL | | | | | | $ | 600,000 | |

At April 30, 2014, the Joint Repurchase Agreement Account II was fully collateralized by:

| | | | | | | | |

| Issuer | | Interest Rates | | | Maturity Dates | |

Federal Farm Credit Banks | | | 0.155 to 0.181 | % | | | 10/01/15 to 06/03/16 | |

Federal Home Loan Bank | | | 5.375 | | | | 05/18/16 | |

Federal Home Loan Bank Discount Notes | | | 0.000 | | | | 10/24/14 | |

Federal Home Loan Mortgage Corp. | | | 0.500 to 6.000 | | | | 04/17/15 to 05/01/44 | |

Federal National Mortgage Association | | | 1.375 to 7.000 | | | | 03/01/15 to 05/01/44 | |

Government National Mortgage Association | | | 3.000 to 9.000 | | | | 06/15/20 to 03/20/44 | |

U.S. Treasury Coupon-Only Stripped Security | | | 0.000 | | | | 05/15/23 | |

U.S. Treasury Notes | | | 0.250 to 7.500 | | | | 02/28/15 to 11/15/16 | |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

Statement of Assets and Liabilities

April 30, 2014 (Unaudited)

| | | | | | |

| | | | | | |

| | Assets: | |

| | Investments of unaffiliated issuers, at value (cost $5,139,685) | | $ | 5,143,009 | |

| | Investments of affiliated issuers, at value (cost $1,357,649) | | | 1,356,653 | |

| | Cash | | | 34,120 | |

| | Foreign currencies, at value (cost $2,363) | | | 2,381 | |

| | Receivables: | | | | |

| | Collateral on certain derivative contracts(a) | | | 302,520 | |

| | Reimbursement from investment adviser | | | 36,815 | |

| | Fund shares sold | | | 23,850 | |

| | Dividends and interest | | | 4,540 | |

| | Unrealized gain on swap contracts | | | 422 | |

| | Variation margin on certain derivative contracts | | | 1,505 | |

| | Other assets | | | 6,188 | |

| | Total assets | | | 6,912,003 | |

| | | | | | |

| | Liabilities: | |

| | Payables: | | | | |

| | Amounts owed to affiliates | | | 2,008 | |

| | Accrued expenses | | | 121,329 | |

| | Total liabilities | | | 123,337 | |

| | | | | | |

| | Net Assets: | |

| | Paid-in capital | | | 6,662,718 | |

| | Distributions in excess of net investment income | | | (3,208 | ) |

| | Accumulated net realized gain | | | 92,215 | |

| | Net unrealized gain | | | 36,941 | |

| | | NET ASSETS | | $ | 6,788,666 | |

| | | Net Assets: | | | | |

| | | Class A | | $ | 139,213 | |

| | | Class C | | | 10,287 | |

| | | Institutional | | | 6,596,917 | |

| | | Class IR | | | 31,945 | |

| | | Class R | | | 10,304 | |

| | | Total Net Assets | | $ | 6,788,666 | |

| | | Shares Outstanding $0.001 par value (unlimited shares authorized): | | | | |

| | | Class A | | | 13,653 | |

| | | Class C | | | 1,021 | |

| | | Institutional | | | 643,812 | |

| | | Class IR | | | 3,123 | |

| | | Class R | | | 1,015 | |

| | | Net asset value, offering and redemption price per share:(b) | | | | |

| | | Class A | | | $10.20 | |

| | | Class C | | | 10.08 | |

| | | Institutional | | | 10.25 | |

| | | Class IR | | | 10.23 | |

| | | Class R | | | 10.16 | |

| | (a) | | Represents initial margin on swaps transactions. |

| | (b) | | Maximum public offering price per share for Class A Shares is $10.60. At redemption, Class C shares may be subject to a contingent deferred sales charge, assessed on the amount equal to the lesser of the current net asset value or the original purchase price of the shares. |

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

Statement of Operations

For the Six Months Ended April 30, 2014 (Unaudited)

| | | | | | |

| | | | | | |

| | Investment income: | |

| | Dividends (net of foreign withholding taxes of $586) | | $ | 9,169 | |

| | Interest | | | 5,820 | |

| | Total investment income | | | 14,989 | |

| | | | | | |

| | Expenses: | |

| | Printing and mailing costs | | | 50,542 | |

| | Professional fees | | | 46,254 | |

| | Custody, accounting and administrative services | | | 36,211 | |

| | Management fees | | | 13,436 | |

| | Trustee fees | | | 11,686 | |

| | Registration fees | | | 11,067 | |

| | Transfer Agent fees(a) | | | 1,320 | |

| | Distribution and Service fees(a) | | | 223 | |

| | Other | | | 4,533 | |

| | Total expenses | | | 175,272 | |

| | Less — expense reductions | | | (163,294 | ) |

| | Net expenses | | | 11,978 | |

| | NET INVESTMENT INCOME | | | 3,011 | |

| | | | | | |

| | Realized and unrealized gain (loss): | |

| | Capital gain distributions from Affiliated Underlying Funds | | | 62,275 | |

| | Net realized gain (loss) from: | | | | |

| | Investments — unaffiliated issuers | | | (2,945 | ) |

| | Investments — affiliated issuers | | | (2,388 | ) |

| | Swap contracts | | | 38,793 | |

| | Net change in unrealized gain on: | | | | |

| | Investments — unaffiliated issuers | | | 65,805 | |

| | Investments — affiliated issuers | | | (42,107 | ) |

| | Swap contracts | | | 7,692 | |

| | Net realized and unrealized gain | | | 127,125 | |

| | NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 130,136 | |

| | (a) | | Class specific Distribution and Service and Transfer Agent fees were as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Distribution and Service Fees | | | Transfer Agent Fees | |

Class A | | | Class C | | | Class R | | | Class A | | | Class C | | | Institutional | | | Class IR | | | Class R | |

| | 147 | | | | 50 | | | | 26 | | | | 112 | | | | 9 | | | | 1,161 | | | | 29 | | | | 9 | |

| | |

| 14 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

Statements of Changes in Net Assets

| | | | | | | | | | |

| | | | | For the

Six Months Ended

April 30, 2014

(Unaudited) | | | For the

Fiscal Year Ended

October 31, 2013 | |

| | From operations: | |

| | Net investment income | | $ | 3,011 | | | $ | 5,460 | |

| | Net realized gain and capital gain distributions | | | 95,735 | | | | 68,492 | |

| | Net change in unrealized gain | | | 31,390 | | | | 17,468 | |

| | Net increase in net assets resulting from operations | | | 130,136 | | | | 91,420 | |

| | | | | | | | | | |

| | Distributions to shareholders: | |

| | From net investment income | | | | | | | | |

| | Institutional Shares | | | (507 | ) | | | (3,954 | ) |

| | Class IR Shares | | | — | | | | (10 | ) |

| | From net realized gains | | | | | | | | |

| | Class A Shares | | | (1,583 | ) | | | — | |

| | Class C Shares | | | (144 | ) | | | — | |

| | Institutional Shares | | | (77,239 | ) | | | — | |

| | Class IR Shares | | | (439 | ) | | | — | |

| | Class R Shares | | | (144 | ) | | | — | |

| | Total distributions to shareholders | | | (80,056 | ) | | | (3,964 | ) |

| | | | | | | | | | |

| | From share transactions: | |

| | Proceeds from sales of shares | | | 2,912,479 | | | | 1,068,619 | |

| | Reinvestment of distributions | | | 80,056 | | | | 3,964 | |

| | Cost of shares redeemed | | | (322,062 | ) | | | (79,242 | ) |

| | Net increase in net assets resulting from share transactions | | | 2,670,473 | | | | 993,341 | |

| | TOTAL INCREASE | | | 2,720,553 | | | | 1,080,797 | |

| | | | | | | | | | |

| | Net assets: | |

| | Beginning of period | | | 4,068,113 | | | | 2,987,316 | |

| | End of period | | $ | 6,788,666 | | | $ | 4,068,113 | |

| | Distributions in excess of net investment income | | $ | (3,208 | ) | | $ | (5,712 | ) |

| | |

| The accompanying notes are an integral part of these financial statements. | | 15 |

GOLDMAN SACHS RETIREMENT COMPLETION PORTFOLIO

Financial Highlights

Selected Data for a Share Outstanding Throughout Each Period

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Income (loss) from

investment operations | | | Distributions

to shareholders | |

| | | Year - Share Class | | Net asset

value,

beginning

of period | | | Net

investment

income (loss)(a) | | | Net realized

and unrealized

gain (loss) | | | Total from

investment

operations | | | From net

investment

income | | | From net

realized

gains | | | Total

distributions | |

| | FOR THE SIX MONTHS ENDED APRIL 30, (UNAUDITED) | |

| | 2014 - A | | $ | 10.18 | | | $ | (0.01 | ) | | $ | 0.17 | | | $ | 0.16 | | | $ | — | | | $ | (0.14 | ) | | $ | (0.14 | ) |

| | 2014 - C | | | 10.10 | | | | (0.05 | ) | | | 0.17 | | | | 0.12 | | | | — | | | | (0.14 | ) | | | (0.14 | ) |

| | 2014 - Institutional | | | 10.21 | | | | 0.01 | | | | 0.17 | | | | 0.18 | | | | — | (f) | | | (0.14 | ) | | | (0.14 | ) |

| | 2014 - IR | | | 10.20 | | | | — | (f) | | | 0.17 | | | | 0.17 | | | | — | | | | (0.14 | ) | | | (0.14 | ) |

| | 2014 - R | | | 10.16 | | | | (0.03 | ) | | | 0.17 | | | | 0.14 | | | | — | | | | (0.14 | ) | | | (0.14 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FOR THE FISCAL YEARS ENDED OCTOBER 31, | |

| | 2013 - A | | | 9.95 | | | | (0.02 | ) | | | 0.25 | | | | 0.23 | | | | — | | | | — | | | | — | |

| | 2013 - C | | | 9.95 | | | | (0.10 | ) | | | 0.25 | | | | 0.15 | | | | — | | | | — | | | | — | |

| | 2013 - Institutional | | | 9.96 | | | | 0.02 | | | | 0.24 | | | | 0.26 | | | | (0.01 | ) | | | — | | | | (0.01 | ) |

| | 2013 - IR | | | 9.96 | | | | — | (f) | | | 0.25 | | | | 0.25 | | | | (0.01 | ) | | | — | | | | (0.01 | ) |

| | 2013 - R | | | 9.95 | | | | (0.05 | ) | | | 0.26 | | | | 0.21 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FOR THE PERIOED ENDED OCTOBER 31, | |

| | 2012 - A (Commenced September 28, 2012) | | | 10.00 | | | | — | (f) | | | (0.05 | ) | | | (0.05 | ) | | | — | | | | — | | | | — | |

| | 2012 - C (Commenced September 28, 2012) | | | 10.00 | | | | — | (f) | | | (0.05 | ) | | | (0.05 | ) | | | — | | | | — | | | | — | |

| | 2012 - Institutional (Commenced September 28, 2012) | | | 10.00 | | | | 0.01 | | | | (0.05 | ) | | | (0.04 | ) | | | — | | | | — | | | | — | |

| | 2012 - IR (Commenced September 28, 2012) | | | 10.00 | | | | 0.01 | | | | (0.05 | ) | | | (0.04 | ) | | | — | | | | — | | | | — | |

| | 2012 - R (Commenced September 28, 2012) | | | 10.00 | | | | — | (f) | | | (0.05 | ) | | | (0.05 | ) | | | — | | | | — | | | | — | |

| | (a) | | Calculated based on the average shares outstanding methodology. |

| | (b) | | Assumes investment at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, a complete redemption of the investment at the net asset value at the end of the period and no sales or redemption charges. Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns for periods less than one full year are not annualized. |

| | (c) | | Expense ratios exclude the expenses of the Underlying Funds in which the Portfolio invests. |

| | (d) | | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| | (f) | | Amount is less than $0.005 per share. |

| | |

| 16 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS RETIREMENT COMPLETION PORTFOLIO

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net asset

value, end

of period | | | | | Total

return(b) | | | | | Net assets,

end of

period

(in 000s) | | | | | Ratio of

net expenses

to average

net assets(c) | | | | | Ratio of

total expenses

to average

net assets(c) | | | | | Ratio of

net investment

income (loss)

to average

net assets | | | | | Portfolio

turnover

rate(d) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 10.20 | | | | | | 1.65 | % | | | | $ | 139 | | | | | | 0.79 | %(e) | | | | | 6.28 | %(e) | | | | | (0.26 | )%(e) | | | | | 7 | % |

| | | 10.08 | | | | | | 1.26 | | | | | | 10 | | | | | | 1.53 | (e) | | | | | 7.13 | (e) | | | | | (1.05 | )(e) | | | | | 7 | |

| | | 10.25 | | | | | | 1.75 | | | | | | 6,597 | | | | | | 0.39 | (e) | | | | | 5.86 | (e) | | | | | 0.11 | (e) | | | | | 7 | |

| | | 10.23 | | | | | | 1.74 | | | | | | 32 | | | | | | 0.54 | (e) | | | | | 6.13 | (e) | | | | | (0.07 | )(e) | | | | | 7 | |

| | | 10.16 | | | | | | 1.45 | | | | | | 10 | | | | | | 1.03 | (e) | | | | | 6.63 | (e) | | | | | (0.55 | )(e) | | | | | 7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 10.18 | | | | | | 2.35 | | | | | | 100 | | | | | | 0.75 | | | | | | 24.14 | | | | | | (0.20 | ) | | | | | 16 | |

| | | 10.10 | | | | | | 1.51 | | | | | | 10 | | | | | | 1.49 | | | | | | 22.53 | | | | | | (0.96 | ) | | | | | 16 | |

| | | 10.21 | | | | | | 2.75 | | | | | | 3,917 | | | | | | 0.35 | | | | | | 21.63 | | | | | | 0.17 | | | | | | 16 | |

| | | 10.20 | | | | | | 2.51 | | | | | | 31 | | | | | | 0.49 | | | | | | 23.98 | | | | | | 0.01 | | | | | | 16 | |

| | | 10.16 | | | | | | 2.11 | | | | | | 10 | | | | | | 1.00 | | | | | | 22.05 | | | | | | (0.47 | ) | | | | | 16 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 9.95 | | | | | | (0.50 | ) | | | | | 10 | | | | | | 0.73 | (e) | | | | | 22.73 | (e) | | | | | 0.37 | (e) | | | | | 1 | |

| | | 9.95 | | | | | | (0.50 | ) | | | | | 10 | | | | | | 1.47 | (e) | | | | | 23.46 | (e) | | | | | (0.37 | )(e) | | | | | 1 | |

| | | 9.96 | | | | | | (0.40 | ) | | | | | 2,948 | | | | | | 0.34 | (e) | | | | | 22.33 | (e) | | | | | 0.77 | (e) | | | | | 1 | |

| | | 9.96 | | | | | | (0.40 | ) | | | | | 10 | | | | | | 0.52 | (e) | | | | | 22.49 | (e) | | | | | 0.60 | (e) | | | | | 1 | |

| | | 9.95 | | | | | | (0.50 | ) | | | | | 10 | | | | | | 0.99 | (e) | | | | | 22.98 | (e) | | | | | 0.12 | (e) | | | | | 1 | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 17 |

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

Notes to Financial Statements

April 30, 2014 (Unaudited)

Goldman Sachs Trust (the “Trust”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. Goldman Sachs Retirement Portfolio Completion Fund (the “Fund”) is a non-diversified fund and currently offers five classes of shares: Class A, Class C, Institutional, Class IR and Class R.

Class A shares are sold with a front-end sales charge of up to 3.75%. Class C Shares are sold with a contingent deferred sales charge (“CDSC”) of 1.00% which is imposed on redemptions made within 12 months of purchase.

Goldman Sachs Asset Management, L.P. (“GSAM”), an affiliate of Goldman, Sachs & Co. (“Goldman Sachs”), serves as investment adviser to the Fund pursuant to a management agreement (the “Agreement”) with the Trust.

|

| 2. SIGNIFICANT ACCOUNTING POLICIES |

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and require management to make estimates and assumptions that may affect the reported amounts and disclosures. Actual results may differ from those estimates and assumptions.

A. Investment Valuation — The Fund’s valuation policy is to value investments at fair value.

B. Investment Income and Investments — Investment income includes interest income and dividend income, net of any foreign withholding taxes, less any amounts reclaimable. Interest income is accrued daily and adjusted for amortization of premiums and accretion of discounts. Dividend income is recognized on ex-dividend date or, for certain foreign securities, as soon as such information is obtained subsequent to the ex-dividend date. Investment transactions are reflected on trade date. Realized gains and losses are calculated using identified cost. Investment transactions are recorded on the following business day for daily net asset value (“NAV”) calculations. Any foreign capital gains tax is accrued daily based upon net unrealized gains, and is payable upon sale of such investments. Distributions received from the Fund’s investments in United States (“U.S.”) real estate investment trusts (“REITs”) may be characterized as ordinary income, net capital gain or a return of capital. A return of capital is recorded by the Fund as a reduction to the cost basis of the REIT.

For derivative contracts, realized gains and losses are recorded upon settlement of the contract. Upfront payments are made or received upon entering into a swap agreement and are reflected in the Statement of Assets and Liabilities. Upfront payments are recognized over the contract’s term/event as realized gains or losses, with the exception of forward starting interest rate swaps whose realized gains or losses are recognized from the effective start date. For securities with paydown provisions, principal payments received are treated as a proportionate reduction to the cost basis of the securities, and excess or shortfall amounts are recorded as gains or losses. For treasury inflation protected securities (“TIPS”), adjustments to principal due to inflation/deflation are reflected as increases/decreases to interest income with a corresponding adjustment to cost.

C. Class Allocations and Expenses — Investment income, realized and unrealized gain (loss), and non-class specific expenses of the Fund are allocated daily based upon the proportion of net assets of each class. Class specific expenses, where applicable, are borne by the respective share classes and include Distribution and Service, Transfer Agent and Service and Shareholder Administration fees. Non-class specific expenses directly incurred by the Fund are charged to the Fund, while such expenses incurred by the Trust are allocated across the Fund on a straight-line and/or pro-rata basis depending upon the nature of the expenses.

18

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

|

| 2. SIGNIFICANT ACCOUNTING POLICIES (continued) |

D. Federal Taxes and Distributions to Shareholders — It is the Fund’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies (mutual funds) and to distribute each year substantially all of its investment company taxable income and capital gains to its shareholders. Accordingly, the Fund is not required to make any provisions for the payment of federal income tax. Distributions to shareholders are recorded on the ex-dividend date. Income and capital gains distributions, if any, are declared and paid annually.

Net capital losses are carried forward to future fiscal years and may be used to the extent allowed by the Code to offset any future capital gains. Losses that are carried forward will retain their character as either short-term or long-term capital losses. Utilization of capital loss carryforwards will reduce the requirement of future capital gains distributions.

The characterization of distributions to shareholders for financial reporting purposes is determined in accordance with federal income tax rules, which may differ from GAAP. The source of the Fund’s distributions may be shown in the accompanying financial statements as either from net investment income, net realized gain or capital. Certain components of the Fund’s net assets on the Statement of Assets and Liabilities reflect permanent GAAP/tax differences based on the appropriate tax character.

E. Foreign Currency Translation — The accounting records and reporting currency of the Fund is maintained in U.S. dollars. Assets and liabilities denominated in foreign currencies are translated into U.S. dollars using the current exchange rates at the close of each business day. The effect of changes in foreign currency exchange rates on investments is included within net realized and unrealized gain (loss) on investments. Changes in the value of other assets and liabilities as a result of fluctuations in foreign exchange rates are included in the Statements of Operations within net change in unrealized gain (loss) on foreign currency transactions. Transactions denominated in foreign currencies are translated into U.S. dollars on the date the transaction occurred, the effects of which are included within net realized gain (loss) on foreign currency transactions.

| | |

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS | | |

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The levels used for classifying investments are not necessarily an indication of the risk associated with investing in these investments. The three levels of the fair value hierarchy are described below:

Level 1 — Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 — Quoted prices in markets that are not active or financial instruments for which significant inputs are observable (including, but not limited to, quoted prices for similar investments, interest rates, foreign exchange rates, volatility and credit spreads), either directly or indirectly;

Level 3 — Prices or valuations that require significant unobservable inputs (including GSAM’s assumptions in determining fair value measurement).

19

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

Notes to Financial Statements (continued)

April 30, 2014 (Unaudited)

|

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued) |

The Trustees have adopted Valuation Procedures that govern the valuation of the portfolio investments held by the Fund, including investments for which market quotations are not readily available. The Trustees have delegated to GSAM day-to-day responsibility for implementing and maintaining internal controls and procedures related to the valuation of the Fund’s portfolio investments. To assess the continuing appropriateness of pricing sources and methodologies, GSAM regularly performs price verification procedures and issues challenges as necessary to third party pricing vendors or brokers, and any differences are reviewed in accordance with the Valuation Procedures.

A. Level 1 and Level 2 Fair Value Investments — The valuation techniques and significant inputs used in determining the fair values for investments classified as Level 1 and Level 2 are as follows:

Equity Securities — Equity securities and investment companies traded on a U.S. securities exchange or the NASDAQ system, or those located on certain foreign exchanges, including but not limited to the Americas, are valued daily at their last sale price or official closing price on the principal exchange or system on which they are traded. If no sale occurs, equity securities and exchange traded investment companies are valued at the last bid price for long positions and at the last ask price for short positions. Investments in investment companies (other than those that are exchange traded) are valued at the NAV on the valuation date. To the extent these investments are actively traded, they are classified as Level 1 of the fair value hierarchy, otherwise they are generally classified as Level 2.

Unlisted equity securities for which market quotations are available are valued at the last sale price on the valuation date, or if no sale occurs, at the last bid price. Securities traded on certain foreign securities exchanges are valued daily at fair value determined by an independent fair value service (if available) under Valuation Procedures approved by the Trustees and consistent with applicable regulatory guidance. The independent fair value service takes into account multiple factors including, but not limited to, movements in the securities markets, certain depositary receipts, futures contracts and foreign currency exchange rates that have occurred subsequent to the close of the foreign securities exchange. These investments are generally classified as Level 2 of the fair value hierarchy.

Debt Securities — Debt securities for which market quotations are readily available are valued daily on the basis of quotations supplied by dealers or an independent pricing service approved by the Trustees. The pricing services may use valuation models or matrix pricing, which consider: (i) yield or price with respect to bonds that are considered comparable in characteristics such as rating, interest rate and maturity date or (ii) quotations from securities dealers to determine current value. Short-term debt obligations that mature in sixty days or less and that do not exhibit signs of credit deterioration are valued at amortized cost, which approximates fair value. With the exception of treasury securities of G8 countries (not held in money market funds), which are generally classified as Level 1, these investments are generally classified as Level 2 of the fair value hierarchy.

i. Treasury Inflation Protected Securities — TIPS are treasury securities in which the principal amount is adjusted daily to keep pace with inflation, as measured by the U.S. Consumer Pricing Index for Urban Consumers. The repayment of the original bond principal upon maturity is guaranteed by the full faith and credit of the U.S. Government.

20

GOLDMAN SACHS RETIREMENT PORTFOLIO COMPLETION FUND

|

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued) |

Derivative Contracts — A derivative is an instrument whose value is derived from underlying assets, indices, reference rates or a combination of these factors.

Exchange-traded derivatives, including futures contracts, typically fall within Level 1 of the fair value hierarchy. Over-the-counter (“OTC”) and centrally cleared derivatives are valued using market transactions and other market evidence, including market-based inputs to models, calibration to market-clearing transactions, broker or dealer quotations, or other alternative pricing sources. Where models are used, the selection of a particular model to value OTC and centrally cleared derivatives depends upon the contractual terms of, and specific risks inherent in, the instrument, as well as the availability of pricing information in the market. Valuation models require a variety of inputs, including contractual terms, market prices, yield curves, credit curves, measures of volatility, voluntary and involuntary prepayment rates, loss severity rates and correlations of such inputs. For OTC and centrally cleared derivatives that trade in liquid markets, model inputs can generally be verified and model selection does not involve significant management judgment. OTC and centrally cleared derivatives are classified within Level 2 of the fair value hierarchy when significant inputs are corroborated by market evidence.

i. Swap Contracts — Bilateral swap contracts are agreements in which a Fund and a counterparty agree to exchange periodic payments on a specified notional amount or make a net payment upon termination. Bilateral swap transactions are privately negotiated in the OTC market and payments are settled through direct payments between a Fund and the counterparty. By contrast, certain swap transactions are subject to mandatory central clearing. These swaps are executed through a derivatives clearing member (“DCM”), acting in an agency capacity, and submitted to a central counterparty (“CCP”) (“centrally cleared swaps”), in which case all payments are settled with the CCP through the DCM. Swaps are marked-to-market daily using pricing vendor quotations, counterparty or clearinghouse prices or model prices, and the change in value, if any, is recorded as an unrealized gain or loss. Upon entering into a swap contract, a Fund is required to satisfy an initial margin requirement by delivering cash or securities to the counterparty (or in some cases, segregated in a triparty account on behalf of the counterparty), which can be adjusted by any mark-to-market gains or losses pursuant to bilateral or centrally cleared arrangements. For centrally cleared swaps the daily change in valuation, if any, is recorded as a receivable or payable for variation margin.